Document

Annual

Information

Form

For the Year

Ended December 31, 2024

February 19, 2025

2100 – 733 Seymour Street

Vancouver, British Columbia

V6B 0S6

www.panamericansilver.com

PAN AMERICAN SILVER CORP.

ANNUAL INFORMATION FORM

WHAT’S INSIDE

IMPORTANT INFORMATION ABOUT THIS DOCUMENT

This annual information form (“AIF”) provides important information about Pan American Silver Corp. It describes our business, including our goals and strategy, our history, our operations and development projects, our mineral reserves and mineral resources, our approach to environmental, social and governance (“ESG”) matters, the regulatory environment that we operate in, the risks we face, and the market for our products, among other things.

|

|

|

|

|

|

|

|

|

We have prepared this document to meet the requirements of Canadian securities laws, which are different from what U.S. securities laws require. |

|

Throughout this document, the term Pan American means Pan American Silver Corp. and the terms Company, we, us, and our mean Pan American and its subsidiaries. |

Reporting Currency and Financial Information

Unless we have specified otherwise, all references to dollar amounts or $ or USD are United States dollars. Any references to CAD or CAD$ are Canadian dollars.

All financial information presented in this AIF was prepared in accordance with IFRS Accounting Standards as issued by the International Accounting Standards Board (“IFRS”).

The term “Silver Segment” for 2024 used within is comprised of the La Colorada, Cerro Moro, Huaron, and San Vicente mines, while the “Gold Segment” was comprised of the Jacobina, El Peñon, Dolores, Shahuindo, La Arena, Timmins West and Bell Creek, and the Minera Florida mines. The contributions from the La Arena mine are for the period January 1, 2024, to November 30, 2024, unless otherwise stated.

Non-GAAP Measures

This AIF refers to various non-generally accepted accounting principles (“non-GAAP”) measures, such as cash costs per ounce sold, net of by-product credits (“Cash Costs”), all-in sustaining costs per ounce sold (“AISC”), working capital, net cash, and total debt. Readers should refer to the section entitled “Alternative Performance (Non-GAAP) Measures” in our management’s discussion and analysis for the year ended December 31, 2024 (the “2024 MD&A”) for a detailed description and reconciliation of these non-GAAP measures. The 2024 MD&A is available under our SEDAR+ profile at www.sedarplus.ca and on our website at www.panamericansilver.com.

Per Ounce Measures - Cash Costs and AISC

Cash Costs and AISC are non-GAAP financial measures that do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies.

Pan American produces by-product metals incidentally to our silver and gold mining activities. We have adopted the practice of calculating a performance measure with the net cost of producing an ounce of silver and gold, our primary payable metals, after deducting revenues gained from incidental by-product production. This performance measurement has been commonly used in the mining industry for many years and was developed as a relatively simple way of comparing the net production costs of the primary metal for a specific period against the prevailing market price of that metal.

Cash costs per ounce metrics, net of by-product credits, are used extensively in our internal decision-making processes. We believe the metric is also useful to investors because it facilitates comparison, on a mine-by-mine basis, notwithstanding the unique mix of incidental by-product production at each mine, of our operations’ relative performance on a period-by-period basis, and against the operations of our peers in the silver and gold industry. Cash costs per ounce is conceptually understood and widely reported in the mining industry.

We believe that AISC, also calculated net of by-products, is a comprehensive measure of the full cost of operating our business, given it includes the cost of replacing silver and gold ounces through exploration, the cost of ongoing capital investments (sustaining capital), as well as other items that affect our consolidated cash flow.

Silver Segment Cash Costs and AISC are calculated net of credits for realized revenues from all metals other than silver (“silver segment by-product credits”) and are calculated per ounce of silver sold. Gold Segment Cash Costs and AISC are calculated net of credits for realized revenues from all metals other than gold (“gold segment by-product credits”) and are calculated per ounce of gold sold.

Working Capital

Working capital is a non-GAAP financial measure calculated as current assets less current liabilities. Working capital does not have any standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other companies. Pan American and certain investors use this information to evaluate whether Pan American is able to meet its current obligations using its current assets.

Total Debt

Total debt is a non-GAAP measure calculated as the total current and non-current portions of: long-term debt (including amounts drawn on the Sustainability-Linked Credit Facility (“SL-Credit Facility”)), lease liabilities, and loans payable. Total debt does not have any standardized meaning prescribed by GAAP and is therefore unlikely to be comparable to similar measures presented by other companies. The Company and certain investors use this information to evaluate the financial debt leverage of the Company.

Glossary of Terms

The glossary of terms under “Glossary of Terms” contains definitions of certain scientific or technical terms used in this AIF that might be useful for your understanding.

Conversion Table

In this AIF, metric units are used with respect to mineral properties unless otherwise indicated. Conversion rates from imperial to metric units and from metric to imperial units are provided in the table set out below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Imperial Measure = Metric Unit |

|

Metric Unit = Imperial Measure |

| 2.47 acres |

1 hectare |

|

0.405 hectares |

1 acre |

| 3.28 feet |

1 metre |

|

0.305 metres |

1 foot |

| 0.621 miles |

1 kilometre |

|

1.609 kilometres |

1 mile |

| 0.032 ounces (troy) |

1 gram |

|

31.1 grams |

1 ounce (troy) |

| 1.102 tons (short) |

1 tonne |

|

0.907 tonnes |

1 ton (short) |

| 0.029 ounces (troy)/ton (short) |

1 gram/tonne |

|

34.28 grams/tonne |

1 ounce (troy)/ton (short) |

| 2205 pounds |

1 tonne |

|

0.454 kilograms |

1 pound |

Caution About Forward-Looking Information

This AIF includes statements and information about our expectations for the future. When we discuss our strategy, plans and future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking information or forward-looking statements under Canadian securities laws and the United States Private Securities Litigation Reform Act of 1995. We refer to such forward-looking information and forward-looking statements together in this AIF as forward-looking information.

Key things to understand about the forward-looking information in this AIF are:

•It typically includes words and phrases about the future, such as believe, estimate, anticipate, expect, plan, intend, predict, goal, target, forecast, project, scheduled, potential, strategy and proposed (see examples starting on page

4).

•It is based on a number of material assumptions, including, but not limited to, those we have listed below, that may prove to be incorrect.

•Actual results and events may be significantly different from what we currently expect, because of, among other things, the risks associated with our business. We list a number of these material risks below under “Material Risks and Assumptions”. We recommend you also review other parts of this AIF, including "Risks

Related to Our Business" starting on page

62, and our 2024 MD&A, which includes a discussion of other material risks that could cause our actual results to differ from our current expectations.

Forward-looking information is designed to help you understand management’s current views of our near- and longer-term prospects. It may not be appropriate for other purposes. We do not intend to update forward-looking information unless we are required to do so by applicable securities laws.

Examples of Forward-Looking Information in this AIF:

•the price of silver, gold and other metals and assumed foreign exchange rates;

•the accuracy of mineral reserve and mineral resource estimates at the La Colorada, Shahuindo, El Peñon Jacobina and Escobal mines, as well as other projects and properties;

•estimated production rates for silver and other payable metals we produce, timing of production and estimated cash and total costs of production;

•our anticipated operating cash flow and the estimated cost and availability of funding for working capital requirements and capital replacement, improvement or remediation programs, care and maintenance programs, and for future construction and development projects;

•the outcome of the International Labour Organization Convention No. 169 (“ILO 169”) consultation process in Guatemala with respect to the Escobal mine, the resolution of other matters ordered by the courts in Guatemala, and our anticipated engagement with local communities and the Xinka population;

•the sufficiency of our liquid assets to satisfy our 2025 working capital requirements, to fund currently planned capital expenditures (including both sustaining and project capital) for existing operations, and to discharge liabilities as they come due;

•our ability to take advantage of further strategic opportunities as they are identified and become available;

•the results of the recent preliminary economic assessment (“PEA”) relating to the La Colorada skarn project and any anticipated results therefrom, including any anticipated production, internal rates of return, project and other project economics or metrics;

•the Escobal and Manantial Espejo mines and the Navidad project remaining on care and maintenance;

•our ability to successfully restart the Escobal mine if the ILO 169 consultation-related suspension ends;

•our ability to obtain necessary permits and licenses, including for current or future operations, project development and expansion;

•the potential future successful development of the Navidad project, the La Colorada skarn project and other development projects;

•the possibility that the current joint venture agreement relating to the San Vicente mine will need to be renegotiated;

•the effects of laws, regulations and government policies affecting our operations, including, without limitation, expectations relating to or the effect of certain highly restrictive laws and regulations applicable to mining in the Province of Chubut, Argentina;

•the estimates of expected or anticipated economic returns from a mining project, as reflected in PEAs, pre-feasibility, and feasibility studies or other reports prepared in relation to development of projects;

•that we will continue to oppose the SEDATU (as defined below) process relating to La Colorada property’s surface lands;

•our expectation that UNDRIP and the UNDRIP Act (as those terms are defined below) are likely to result in more robust consultation processes with potentially affected Indigenous peoples;

•estimated exploration expenditures to be incurred on our various exploration properties;

•compliance with environmental, health, safety, and other regulations;

•our goal to continue to be a responsible company, committed to sustainable development and conducting our activities in an environmentally and socially responsible manner, including the development and implementation of policies and practices in support of these goals, and our ability to achieve future environmental, social and governance targets and goals;

•our plan to meet climate-related goals and the anticipated nature and effect of climate-related risks;

•our ability to manage physical and transition risks related to climate change and successfully adapt our business strategy to a low carbon global economy;

•the pursuit of legal and commercial avenues to collect amounts owing to us under our contracts;

•estimated future closure, reclamation and remediation costs;

•estimated future care and maintenance costs;

•our belief that we are well positioned to take advantage of strategic opportunities as they become available;

•forecast capital and non-operating spending;

•future income tax rates;

•the continued appropriateness of our dividend policy and our ability to pay future dividends;

•future sales of the metals, concentrates or other products produced by us, the availability and location of refining facilities and sales counterparts, and any plans and expectations with respect to hedging;

•our ability to maintain relationships of trust with our stakeholders and community support for our activities;

•continued access to necessary infrastructure, including, without limitation, access to power, water, lands and roads to carry on activities as planned;

•expectations with respect to any future pandemics on our operations, and assumptions related thereto;

•that we will be, or will continue to be, the world’s premier silver producer and one of the world’s leading silver mining companies;

•our intention to acquire or discover silver resources that have the potential to be developed economically and to add meaningfully to our production profile while lowering consolidated costs of production; and

•the results of investment and development activities at our material mineral properties.

Material Risks and Assumptions:

The forward-looking information in this AIF reflects our current views with respect to future events and are based upon a number of assumptions and estimates that, while considered reasonable by us, are inherently subject to significant business, economic, competitive, political, environmental, and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by forward-looking information in this AIF and documents incorporated by reference herein, and we have made assumptions based on or related to many of these factors.

Such factors include, without limitation:

•fluctuations in spot and forward markets for silver, gold, base metals, and certain other commodities (such as natural gas, fuel oil and electricity);

•restrictions on mining in the jurisdictions in which we operate;

•laws and regulations governing our operation, exploration, and development activities, including international laws and legal norms, such as those relating to Indigenous peoples and human rights;

•our ability to obtain or renew the licenses and permits necessary for the operation and expansion of our existing operations and for the development, construction, and commencement of new operations, including the license and export permits necessary to operate the Escobal mine which are currently suspended or have not been renewed;

•risks relating to our operations in Canada, Mexico, Peru, Bolivia, Argentina, Guatemala, Brazil, Chile and other foreign jurisdictions where we may operate;

•inherent risks associated with tailings facilities and heap leach operations, including failure or leakages;

•work stoppages or other impacts of roadblocks, civil unrest, riots, terrorism, and other similar events;

•relations with and claims by Indigenous peoples, local communities, and non-governmental organizations;

•the speculative nature of mineral exploration and development;

•diminishing quantities or grades of mineral reserves as properties are mined;

•the inability to determine, with certainty, the production of metals and cost estimates, or the prices to be received before mineral reserves or mineral resources are actually mined;

•inadequate or unreliable infrastructure (such as roads, bridges, power sources and water supplies);

•environmental incidents, regulations and legislation;

•our ability to obtain, maintain, and, when necessary, defend challenges to mining rights, surface rights or other access that are necessary for continuing and future operations and planned developments, including with respect to the La Colorada and Shahuindo properties;

•risks and hazards associated with the business of mineral exploration, development, and mining (including environmental hazards, potential unintended releases of contaminants, industrial accidents, unusual or unexpected geological or structural formations, pressures, cave-ins, and flooding);

•reclamation and ongoing post-closure monitoring and maintenance requirements;

•the effects of climate change, extreme weather events, water scarcity, and seismic events, and the effectiveness of strategies to deal with these issues, including risks and strategies related to the transition to a low-carbon global economy;

•risks relating to the creditworthiness and financial condition of our suppliers, refiners, and other parties;

•fluctuations in currency markets (such as the Peruvian nuevo sol (“PEN”), Mexican peso (“MXN”), Argentine peso (“ARS”), the Bolivian boliviano (“BOB”), Chilean Peso (“CLP”), Brazilian Real (“BRL”) and the Guatemalan quetzal (“GTQ”) and CAD versus the USD);

•the volatility of the metals markets, and its potential to impact our ability to meet our financial obligations;

•the inability to recruit and retain qualified personnel, or maintain positive relationships with our employees;

•disputes as to the validity of mining or exploration titles, claims or rights, which constitute most of our property holdings;

•our ability to maintain the required credit ratings and satisfy the requirements in respect of Pan American, Yamana Gold Inc. (“Yamana”) and the $500 million principal, 2.63% interest senior notes due August 2031 and $283 million principal, 4.625% interest senior notes due December 2027 (collectively, the “Senior Notes”);

•our ability to complete and successfully integrate acquisitions and to complete any desired dispositions;

•increased competition in the mining industry for properties and equipment;

•limited supply of materials and supply chain disruptions;

•the effectiveness of our internal control over financial reporting;

•claims and legal proceedings arising in the ordinary course of business activities, including the class action claims and derivative claims, such as those initiated against Tahoe Resources Inc. (“Tahoe”);

•the impact of pandemics on our operations and financial performance;

•the impact of fiscal and economic policies of other nations, including barriers to trade such as import and export restrictions and direct and indirect taxation; and

•those factors identified under “Risks Related to our Business” in this AIF and the documents incorporated by reference herein, if any.

You should not attribute undue certainty to forward-looking information. Although we have attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as described. We do not intend to update forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such information, other than as required by applicable securities laws.

Please see “Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources” on page

7 of this AIF.

Scientific and Technical Information

Christopher Emerson, FAusIMM, our VP, Exploration and Geology, and Martin Wafforn, P. Eng., our Senior VP, Technical Services, Safety and Process Optimization, have reviewed and approved the scientific and technical information in this AIF. Scientific and technical disclosure in this AIF for our material properties is based on reports prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) (collectively, the “Technical Reports”). The Technical Reports have been filed on SEDAR+ at www.sedarplus.ca. The technical information in this AIF has been updated with more current information where applicable, such updated information having been prepared under the supervision of, or reviewed by, Christopher Emerson and Martin Wafforn. Mineral reserve and mineral resource estimates in this AIF relating to the La Colorada, Shahuindo, El Peñon, Jacobina and Escobal mines have been reviewed and approved by Christopher Emerson and Martin Wafforn. Scientific and technical information relating to current and planned exploration programs set out in this AIF are prepared and/or designed and carried out under the supervision of, or were reviewed by, Christopher Emerson.

The Technical Reports are as follows:

•a report relating to the La Colorada property entitled “Amended NI 43-101 Technical Report for the La Colorada Property, Zacatecas, Mexico”, dated effective December 18, 2023, by M. Wafforn, C. Emerson, P. Mollison, A. Delgado, and M. Andrews;

•a report relating to the Shahuindo mine entitled “Technical Report for the Shahuindo Mine, Cajabamba, Peru” dated effective November 30, 2022, by M. Wafforn, C. Emerson, and A. Delgado (the “Shahuindo Technical Report”);

•a report relating to the Jacobina mine entitled “NI 43-101 Technical Report for the Jacobina Gold Mine, Bahia State, Brazil” dated effective June 30, 2023, by M. Wafforn, C. Passos, A. Delgado, C. Iturralde, and M. Andrews (the “Jacobina Technical Report”);

•a report relating to the El Peñon mine entitled “NI 43-101 Technical Report for the El Peñon Gold-Silver Mine, Antofagasta Region, Chile” dated effective June 30, 2024, by M. Andrews, J. Avendaño, A. Delgado, C. Emerson, and C. Iturralde (the “El Peñon Technical Report”); and

•a report relating to the Escobal mine entitled “Escobal Mine Guatemala: NI 43-101 Feasibility Study, Southeastern Guatemala” dated effective November 5, 2014, by M3 Engineering & Technology Corp., with authors C. Huss, T. Drielick, D. Roth, P. Tietz, M. Blattman, and J. Caldwell.

Each of Martin Wafforn, P. Eng., Christopher Emerson, FAusIMM, Americo Delgado, P.Eng., Camila Passos, P.Geo., Carlos Iturralde, P.Eng., Peter Mollison, P.Eng., Matthew Andrews, FAusIMM, Jimmy Avendaño, Registered Member CMC, Conrad Huss, P.Eng., Thomas Drielick, P.Eng., Daniel Roth, P.Eng., Paul Tietz, C.P.G., Matthew Blattman, P.Eng., and Jack Caldwell, P.Eng. is or was, in relation to the Technical Reports, a “Qualified Person” as defined in NI 43-101. A “Qualified Person” means an engineer or geoscientist with a university degree, or equivalent accreditation, in an area of geoscience, or engineering, relating to mineral exploration or mining, with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these, that is relevant to his or her professional degree or area of practice, has experience relevant to the subject matter of the mineral project, and is a member in good standing of a professional association.

Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources

Unless otherwise indicated, all reserve and resource estimates included in this AIF and the documents incorporated by reference herein have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) — CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (the “SEC”), and reserve and resource information included herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, this AIF and the documents incorporated by reference herein use the terms “measured resources,” “indicated resources” and “inferred resources” as defined in accordance with NI 43-101 and the CIM Standards. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral resources, or inferred mineral resources that Pan American reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies, except in rare cases. While the above terms under the U.S. Rules are “substantially similar” to the standards under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that Pan American may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had Pan American prepared the reserve or resource estimates under the standards adopted under the U.S. Rules.

CORPORATE STRUCTURE

Incorporation

Pan American is the continuing corporation of Pan American Energy Corporation, which was incorporated under the Company Act (British Columbia) on March 7, 1979. Pan American underwent two name changes, the last occurring on April 11, 1995, when the present name of Pan American Silver Corp. was adopted. Amendments to the constating documents of Pan American to that date had been limited to name changes and capital alterations. In May 2006, we amended our memorandum and articles in connection with Pan American’s required transition under the Business Corporations Act (British Columbia). In January 2019, we obtained shareholder approval to increase our authorized share capital from 200,000,000 to 400,000,000 common shares without par value (“Common Shares”), and in May 2023, we obtained shareholder approval to increase our authorized share capital from 400,000,000 to 800,000,000 Common Shares.

As of the date of this AIF, Pan American’s head office is situated at 2100-733 Seymour Street, Vancouver, British Columbia, Canada, V6B 0S6 and our registered and records offices are situated at 1200 Waterfront Centre, 200 Burrard Street, Vancouver, British Columbia, Canada, V7X 1T2. Our website is www.panamericansilver.com.

Capital Structure

Pan American’s authorized share capital consists of 800,000,000 Common Shares and there were 363,040,341 Common Shares issued and outstanding as at December 31, 2024. The holders of Common Shares are entitled to: (i) one vote per Common Share at all meetings of shareholders; (ii) receive dividends as and when declared by the directors of Pan American; and (iii) receive a pro rata share of the assets of Pan American available for distribution to the shareholders in the event of the liquidation, dissolution or winding-up of Pan American. There are no pre-emptive, conversion or redemption rights attached to the Common Shares.

In February 2019, Pan American acquired Tahoe (the “Tahoe Acquisition”) and issued 313,887,490 contingent value rights (each, a “CVR”) to Tahoe shareholders. Each CVR has a term of ten years and is exchangeable for 0.0497 of a Common Share upon first commercial shipment of concentrate following restart of operations at the Escobal mine. The CVRs are not entitled to any voting or dividend rights, and the CVRs do not represent any equity or ownership interest in Pan American or any of its affiliates.

Credit Rating

In March 2023, Pan American. received an investment grade rating by both Moody’s Investors Service (“Moody’s) and S&P Global Ratings (“S&P Global”). With respect to Moody’s, Pan American was assigned a long-term issuer rating of Baa3, and S&P Global assigned a long-term issuer rating of BBB- to Pan American. The same rating was provided in respect of the Senior Notes, noting that Pan American is a guarantor of such Senior Notes. The ratings took into account a variety of matters relating to Pan American, including business risk, financial risk, and other matters in reaching its conclusions, including making certain assumptions. There have been no changes to the S&P Global and Moody’s credit ratings to date.

Moody’s long-term credit ratings are on a rating scale that ranges from Aaa to C, which represents the range from highest to lowest quality of such securities rated. Moody’s “Baa” rating is the fourth highest rating of nine rating categories. Obligations rated “Baa” are judged to be medium-grade and subject to moderate credit risk and as such may possess certain speculative characteristics. Moody’s appends numerical modifiers from 1 to 3 to its long-term ratings, which indicate where the obligation ranks within its generic rating category. The modifier 1 indicates that the obligation ranks in the higher end of its generic rating category, the modifier 2 indicates a midrange ranking and the modifier 3 indicates a ranking in the lower end of that generic rating category.

With respect to their initial rating of Pan American, Moody’s identified certain factors or considerations as giving rise to unusual risks associated with the credit rating of Pan American. These include: its smaller scale when compared to other investment grade peers; Pan American’s concentration in gold and silver and the related sensitivity to precious metal prices and price volatility; exposure to Latin America with elevated geopolitical risk; and the high-cost nature of the standalone gold mining operations. Moody’s further indicated that the rating could be negatively affected by a deterioration in operating performance or liquidity, if the adjusted debt to EBITDA ratio is sustained above 2.5x, if free cash flow remains negative, if the cash flow from operations less dividends to debt ratio is maintained below 30% and EBIT margin is below 10% on a standard basis.

S&P Global’s long-term credit ratings are on a rating scale that ranges from AAA to D, which represents the range from highest to lowest quality of such securities rated. S&P Global’s “BBB” rating is the fourth highest rating of 10 major rating categories. Ratings AAA to BBB- are considered investment grade, and BB+ to D are considered speculative grade. A “BBB” rating indicates that the obligor has adequate capacity to meet its financial commitments but is more subject to adverse economic conditions. S&P uses “+” or “–” designations to indicate the relative standing of securities within a particular rating category.

In providing its initial rating, S&P Global identified a number of factors and considerations that could have an impact Pan American’s rating. For example, S&P Global indicated that their rating could be negatively impacted if the adjusted debt to EBITDA ratio approaches 3x, noting that the following items could affect that ratio: lower-than-forecast precious metal prices; negative conclusion from the permitting process at Escobal resulting in the mine not likely returning to operations in 2024; and increased spend on capital expenditure projects, especially in a lower price environment. S&P Global also noted that operating cash flow generation of precious metal producers, such as Pan American, is sensitive to swings in underlying commodity prices and such swings would likely result in high-volatility cash flow and leverage metrics, and that operating cash flow generation is an important component in the ratings analysis for Pan American. It was further noted that Pan American’s relatively conservative approach to managing its balance sheet and financial policy were key credit considerations, and that environmental and social risks were moderately negative considerations.

Pan American pays an annual fee to Moody’s and S&P Global for the provision of a credit rating. No other fees were paid to Moody’s or S&P Global in 2024. Pan American subscribes to two additional platform services in connection with its investor relations activities that are provided by an S&P Global affiliated company, but these did not generate fees in 2024.

Ratings are intended to provide investors with an independent view of credit quality. A credit rating or a stability rating is not a recommendation to buy, sell or hold securities and does not address the market price or suitability of a specific security for a particular investor. Credit ratings may not reflect the potential impact of all risks on the value of securities. In addition, real or anticipated changes in the rating assigned to a security will generally affect the market value of that security. Investors cannot be assured that a rating will remain in effect for any given period of time or that a rating will not be revised or withdrawn entirely by a rating agency in the future. Each rating should be evaluated independently of any other rating. The foregoing summary of considerations from the Moody’s and S&P Global ratings are not exhaustive and the reports from Moody’s and S&P Global should be consulted for their full analysis.

Subsidiaries

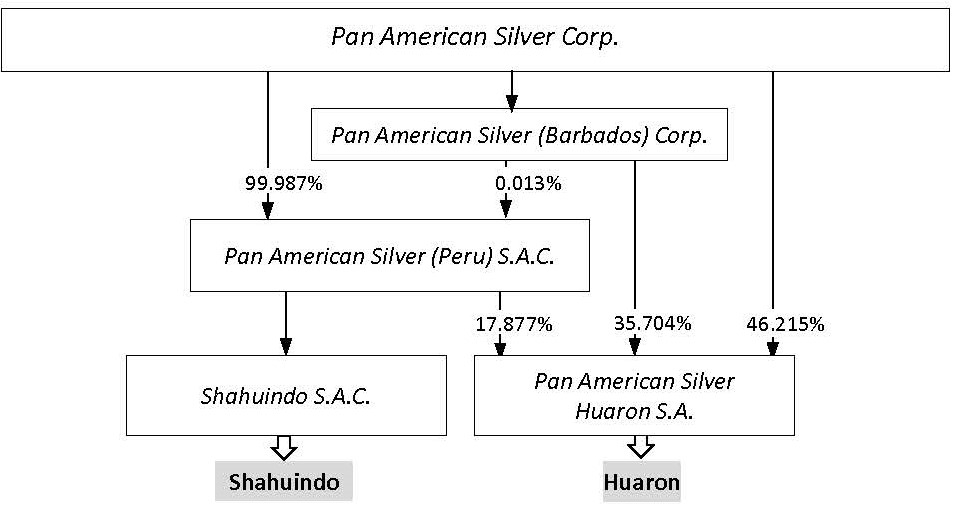

A significant portion of our business is carried on through various subsidiaries. The table below lists our significant subsidiaries, or in some cases subsidiaries that hold interests in significant subsidiaries, and their jurisdiction of organization, and the chart following shows the structure of our organization as it relates specifically to our significant operations and properties. Not all of our mines are material properties for the purposes of NI 43-101, and we do not consider all of our property interests to be significant to the Company. This information is provided as at December 31, 2024.

|

|

|

|

|

|

| Name of Subsidiary |

Jurisdiction |

| 0799714 B.C. Ltd. |

British Columbia |

| Aquiline Resources Inc. (“Aquiline”) |

British Columbia |

| Yamana Gold Inc. |

British Columbia |

| 6855237 Canada Inc. |

Canada |

| Corner Bay Silver Inc. (“Corner Bay”) |

Canada |

| Lake Shore Gold Corp. (“Lake Shore”) |

Canada |

| Minefinders Corporation Ltd. (“Minefinders”) |

Ontario |

| Estelar Resources S.A. |

Argentina |

| Minera Triton Argentina S.A. |

Argentina |

| Minera Argenta S.A. |

Argentina |

| Yamana Argentina Servicios S.A. |

Argentina |

| Pan American Silver (Barbados) Corp. |

Barbados |

| Aquiline Holdings Inc. |

Barbados |

| PASCAP Insurance (Barbados) Ltd. |

Barbados |

| Escobal Resources Holdings Ltd. |

Barbados |

| Yamana Gold (Barbados) Inc. |

Barbados |

| Jacobina Mineração e Comércio Ltda. (“JMC”) |

Brazil |

| Yamana Desenvolvimento Mineral Ltda. |

Brazil |

| Pan American Silver (Bolivia) S.A. (“PASB”) |

Bolivia |

| Minera Florida Ltda. (“Florida”) |

Chile |

| Minera Meridian Ltda. (“Minera Meridian”) |

Chile |

| Minera Yamana Chile SpA |

Chile |

| Pan American Silver Guatemala, S.A. (“PASG”), formerly Minera San Rafael S.A. |

Guatemala |

| PASMEX, S.A. de C.V. |

Mexico |

| Plata Panamericana S.A. de C.V. (“Plata Panamericana”) |

Mexico |

| Compañía Minera Dolores, S.A. de C.V. |

Mexico |

| Minera Minefinders S.A. de C.V. |

Mexico |

| Pan American (Netherlands) B.V. |

Netherlands |

| Yamana International Holdings B.V. |

Netherlands |

| Yamana Jacobina Holdings B.V. |

Netherlands |

| Yamana Santa Cruz Holdings B.V. |

Netherlands |

| Pan American Silver (Peru) S.A.C. |

Peru |

| Pan American Silver Huaron S.A. |

Peru |

| Shahuindo S.A.C. (“Shahuindo SAC”) |

Peru |

Corporate Organization by Material Mineral Property Location

The following charts depict the corporate organizational structure of our significant subsidiaries as they relate to the country of our significant mineral properties, including our material properties, as at December 31, 2024, and identify the main property asset interests (including non-material properties, as applicable) held by the respective entities1.

Argentina Properties

Bolivia Properties

Brazil Properties

Canada Properties

Chile Properties

Guatemala Properties

Mexico Properties

Peru Properties

Note:

1In some jurisdictions in which we operate, laws require that an entity must have more than one shareholder. For those jurisdictions, a nominal interest may be held by an affiliated entity and minority interests of less than 0.0001% held by affiliated entities are not shown in the charts. Percentages shown indicate ownership of common shares, preferred shares, and other voting interests, but do not include holdings of investment shares in Peru or other non-voting shares. Percentages are rounded (in most cases, to a maximum of four decimal places).

2Fomento Minero de Santa Cruz S.E. holds subordinated preferred shares in Estelar Resources S.A. equal to 5%.

3Urion Holdings (Malta) Ltd. holds a 5% interest in Pan American Silver Bolivia S.A.

GENERAL DEVELOPMENT OF THE BUSINESS

Business of Pan American

We are principally engaged in the operation and development of, and exploration for, silver and gold producing properties and assets. Our principal products are silver and gold, although we also produce and sell zinc, lead, and copper. As at December 31, 2024, we operated mines and developed mining projects in Mexico, Peru, Canada, Argentina, Brazil, Chile and Bolivia, and had control over non-producing assets in each of those jurisdictions, in addition to Guatemala and the United States.

Pan American completed the Yamana Acquisition on March 31, 2023, acquiring four operating mines in Chile, Argentina and Brazil, as well as interests in exploration and development projects in Argentina, Chile, and Brazil, including a 56.25% interest in the Minera Agua Rica Alumbrera project (the “MARA Project”) in Argentina. As required under Part 8 of National Instrument 51-102 – Continuous Disclosure Obligations (“NI 51-102”), Pan American filed a Form 51-102F4 Business Acquisition Report dated June 9, 2023, in respect of the Yamana Acquisition. Pan American subsequently divested its interests in the MARA Project to Glencore International AG on September 20, 2023. Pan American also divested its interest in the Morococha mine in Peru, the Agua de la Falda project (and Jeronimo mine) in Chile in 2023.

In 2024, Pan American continued with its goal of divesting assets that do not align with its portfolio objectives. The Company completed the sale of the La Arena mine and La Arena II project in Peru in December 2024, and also divested the COSE and Joaquin mines that formerly comprised part of the larger Manantial Espejo mine in Argentina, which is now in closure.

The Escobal mine continues to be a non-operating asset as a result of the suspension of its mining license in July 2017, pending, among other things, the successful completion of an ILO 169 consultation process with Xinka communities. The consultation process is being led by Guatemala’s Ministry of Energy and Mines (the “Guatemala MEM”). With the change in the government of Guatemala in early 2024, advancement of the consultation process slowed, but remains ongoing. In addition to supporting the consultation process, we believe that it is important to engage with local communities and the Xinka people in an effort to build long-lasting, trusting relationships for the benefit of all stakeholders.

The following map depicts the location of our operating mines and certain of our exploration and non-operating projects as at December 31, 2024.

Corporate Strategy and Objectives

Our mission is to be the world’s premier silver producer with a reputation for excellence in discovery, engineering, innovation and sustainable development. We will continue to strengthen our position as one of the world’s leading primary silver mining companies by acquiring or discovering silver resources that have the potential to be developed economically and to add meaningfully to our production profile while, ideally, lowering consolidated unit costs of production.

The key objectives of our strategy are to:

|

|

|

|

|

|

| Strategy Objective |

Implementation |

| Increase production |

Our long-term growth over the years has been accomplished through a combination of acquisition, exploration, development and expansion efforts. The Tahoe Acquisition in February 2019 and the Yamana Acquisition in March 2023 contributed significantly to our production, particularly gold.

In 2024, we produced 21.1 million ounces of silver, which was more than the 20.4 million ounces produced in 2023. Gold production was 892,500 ounces, similar to the 882,900 ounces produced in 2023. Production for 2024 included production from La Arena up to November 30, 2024.

|

| Replace or increase mineral reserves and mineral resources |

Pan American has, over its lifespan, often achieved replacement or growth in its mineral reserves and mineral resources on an annual basis. This has been accomplished through exploration and acquisitions. The Company invests in mine and near-mine exploration programs throughout the silver and gold price cycles and to replace and, if feasible, add to our mineral reserves and mineral resources.

Effective June 30, 2024, our proven and probable silver and gold mineral reserves were approximately 468.0 million ounces and 6.7 million ounces, respectively, as compared to the 486.8 million ounces of silver and 7.7 million ounces of gold as at June 30, 2023. Our measured and indicated mineral resources (excluding mineral reserves) were approximately 1,142.2 million ounces of silver and 10.2 million ounces of gold effective the end of June 2024, compared to 945.0 million ounces of silver and 16.1 million ounces of gold estimated as at June 30, 2023. The foregoing estimates for 2024 do not include the La Arena mine or the La Arena II project, which was sold in December 2024, or the Joaquin mine that was sold in October 2024. Gold and copper mineral resources, in particular, were impacted by the La Arena sale.

Please refer to the complete mineral resource and mineral reserve information for each of our material properties under the heading “Mineral Reserve and Mineral Resource Estimate Information” in this AIF, and to the “Reserves & Resources” page of our website at www.panamericansilver.com for additional information.

|

| Acquire additional properties |

We actively investigate and evaluate strategic opportunities to acquire promising production, development and exploration properties primarily in those jurisdictions where we are presently active, while focusing on adding low-cost production and long-life reserves.

In March 2023, we completed the Yamana Acquisition and we acquired four operating mines in Chile, Argentina and Brazil as well as exploration and development projects in Argentina, Chile and Brazil.

In February 2019, we acquired all of the issued and outstanding shares of Tahoe pursuant to the Tahoe Acquisition. Among other assets, Tahoe owned two mines in each of Peru and Canada, as well as the Escobal mine in Guatemala. Operations at the Escobal mine are currently suspended pending the completion of an ILO 169 consultation process and further engagement with local communities and Indigenous peoples, as well as the renewal of certain other permits.

In addition to the Yamana Acquisition and the Tahoe Acquisition, we acquired the Dolores mine and the La Bolsa property by virtue of acquiring Minefinders in 2012, and the Navidad property pursuant to our acquisition of Aquiline in 2010.

Please refer to the section of this AIF entitled “Risks Related to Our Business” starting on page 62 for more information about the risks relating to our business and our mining properties, particularly with respect to the Escobal mine, and to our website at www.panamericansilver.com for additional information. |

|

|

|

|

|

|

| Maintain strong financial performance from mining operations |

In an effort to ensure we continue to have a strong and prosperous business, financial performance is monitored against targets for operating earnings and cash flow from operations, as well as against operating measures such as production and AISC. |

| Continue to be a responsible company, committed to sustainable development |

We are committed to operating our business in accordance with the highest standards of governance and ethics, and the principles of sustainable development. We also place a high priority and particular emphasis on the health and safety of our personnel. We have operations in a number of countries and across diverse cultures that have the potential to both positively and negatively impact their host communities and nearby populations. Our goal is to minimize the negative impacts and maximize the benefits garnered to local populations, while at the same time achieving success from a business perspective. We conscientiously strive to operate within a framework of moral principles and values and to engage and interact regularly, and in an open and honest way, with governments, shareholders, employees and other stakeholders. We have adopted board-level corporate policies that formalize how we must conduct our business and interact with stakeholders and others. These policies include our: Global Code of Ethical Conduct, Global Anti-Corruption Policy, Environmental Policy, Social Sustainability Policy, Global Human Rights Policy, and Health and Safety Policy. We have also adopted a Supplier Code of Conduct setting out the expectations we have of our suppliers.

We are implementing the Towards Sustainable Mining (“TSM”) protocols and frameworks of the Mining Association of Canada (“MAC”), a world-class management standard designed to enhance our community engagement processes, drive industry-leading environmental practices and reinforce our commitment to the safety and health of our employees and surrounding communities. By implementing TSM at our operations within and outside of Canada, we are voluntarily exceeding MAC’s membership requirements and setting a consistently high performance standard across all of our operating jurisdictions.

As part of our commitment to driving global sustainable development and contributing to the United Nations Sustainable Development Goals, we became signatories of the United Nations Global Compact in 2020 and we formed a high-level and multidisciplinary group to guide the implementation and communication of our progress in the 10 principles established in the UN Global Compact. We also became members of the World Gold Council in 2023, an organization that, among other things, advocates for responsible gold production and helps shape policies for sustainable gold mining among its members and across the industry.

We are aware that our business is in many ways dependent on various stakeholders, and we view establishing relationships of mutual trust and respect as important. By building such relationships and conducting ourselves in a transparent manner, we can further the exchange of information, address specific concerns of stakeholders and work cooperatively and effectively towards achieving mutual goals. We report annually on our sustainability performance in accordance with the Global Reporting Initiative Standards and have begun to align our reporting with the Sustainability Accounting Standards Board (“SASB”) and Taskforce on Climate-related Financial Disclosures (“TCFD”) reporting frameworks. Our current TCFD disclosure for the year-ended 2023 has been incorporated into our 2023 Sustainability Report and is available on Pan American’s website at www.panamericansilver.com, and future reports will similarly be posted to our website.

|

Note:

1 Cash Costs and AISC are non-GAAP financial measures and do not have standardized meanings prescribed by IFRS. For additional information, please see “Non-GAAP Measures” on page

2 of this AIF.

Key Developments Over the Last Three Financial Years

|

|

|

|

|

|

| Year |

Key Developments |

| 2024 |

•Produced 21.1 million ounces of silver and a Company record 892.5 thousand ounces of gold, led by silver production from the La Colorada vein mine (the “La Colorada mine”) of 4.9 million ounces and gold production of 196.7 thousand ounces from the Jacobina mine. 2024 was the first full year of production from the mines acquired in the Yamana Acquisition, but only included production from the La Arena mine up to November 30, 2024, prior to its sale.

•We sold the La Arena mine and the La Arena II copper-gold project in Peru, as well as the COSE and Joaquin mines in Argentina that comprised part of the now-closed Manantial Espejo mine. Like the dispositions of other assets in 2023, these sales yielded significant cash proceeds, as well as certain mineral production royalties and potential future deferred cash payments.

•The ventilation infrastructure was completed at the La Colorada mine in July 2024, providing much needed ventilation improvements.

•Initiated a normal course issuer bid and repurchased approximately 1.7 million shares.

•Completed the construction of a new tailings filtration plant and storage facility for filtered tailings at the Huaron mine in Peru and a backfill paste plant at the Bell Creek mine in Ontario.

•Concluded mining activities at the Dolores mine in Mexico, with the mine entering the residual leaching phase.

•Exploration successfully replaced mine production and expanded mineral reserves at the Jacobina, La Colorada, Huaron and Minera Florida mines. In addition, an estimated 1.2 million ounces of gold were added to inferred mineral resources at Jacobina.

•Completed infill and near site exploration drilling in excess of 500,000 metres in 2024 with a specific focus on the La Colorada mine and La Colorada skarn project where over 85,000 meters of drilling was performed.

|

| 2023 |

•Completed the Yamana Acquisition, resulting in the addition of four producing mines into Pan American’s portfolio which are expected to contribute significantly to our silver and gold production.

•Transferred our listing of common shares in the United States from the NASDAQ to the New York Stock Exchange (the “NYSE”).

•Announced the results of the PEA completed with respect to the La Colorada skarn project, including increases to the estimated mineral resources of the project.

•Produced 20.4 million ounces of silver and a Company record 882.9 thousand ounces of gold, led by silver production from the La Colorada mine of 4.4 million ounces and gold production of 147.8 thousand ounces from the Jacobina mine in the nine months since its acquisition by us

•Sold our interests in the MARA Project in Argentina, the Agua de la Falda project in Chile, and the Morococha mine in Peru, as well as certain non-controlling equity interests, which resulted in significant cash proceeds being paid to Pan American, as well as retaining certain mineral production royalties.

•We temporarily suspended operations for approximately 11 days at the La Colorada mine due to security concerns at the mine site and the surrounding area.

•We successfully amended the Facility (as defined below) to both increase the available credit, as well as extend the term of the Facility.

•We obtained an investment grade credit rating from Moody's and S&P Global in connection with the Senior Notes.

•We increased our authorized capital to 800,000,000 Common Shares, which will allow greater flexibility for further business development opportunities as well as other potential strategic initiatives.

•At La Colorada mine, we completed nearly 30,000 metres of exploration drilling on the vein structures.

•The La Colorada skarn project drilling continued to infill and extend the mineralisation on the 902 ore body. The new mineral resource estimate released with the PEA at the end of the year increased by 14% with 240,000 metres included.

•The sinking of a new concrete-lined ventilation shaft above the skarn deposit was largely completed by the end of 2023, with the installation of extraction fans expected by mid-2024.

•We completed more than 80,000 metres of drilling over the year at Jacobina

|

| 2022 |

•Announced the proposed Arrangement between Pan American, Yamana and Agnico Eagle, which is expected to be transformative for Pan American in terms of scale, provide meaningful increases in our production of gold and silver, increase our financial flexibility, and enhance our ability to advance internal growth projects, such as the La Colorada skarn project.

•Produced 18.5 million ounces of silver and 552,500 ounces of gold. Despite ventilation issues at the La Colorada mine, it continued to lead our silver production with 5.9 million ounces of silver produced in 2022. Huaron and Manantial Espejo followed with 3.7 million and 3.5 million ounces respectively. Shahuindo led gold production with 151,400 ounces of gold produced, followed closely by the Dolores mine and the Timmins West and Bell Creek mines (combined) with 136,900 and 134,600 ounces of gold produced, respectively.

•We successfully completed 77,745 metres of underground and surface drilling on the La Colorada skarn project during 2022, discovering and extending the high-grade silver mineralization zone located to the west of the main skarn resource.

|

|

|

|

|

|

|

|

•We released an updated mineral resource estimate on the La Colorada skarn project in September 2022 assuming a sub level caving underground mining method and updated the mineral resource estimate.

•Completed 25,000 metres of drilling at Huaron in 2022. Successful exploration drilling to the southeastern portion of the deposit at shallower depths has identified new structures.

•The La Colorada mine had a very successful year for exploration with almost a 50% increase in the inferred mineral resource for silver ounces while replacing 108% of the mined production with new mineral reserves. The increase in inferred mineral resources came from the Candelaria mine and the discovery of new veins as well as along strike and down dip projection of the known veins and mineralisation.

•The pre-consultation phase of the ILO 169 consultation process relating to the Escobal mine in Guatemala was concluded and the process advanced to the consultation phase.

•We placed the Morococha operation on care and maintenance and began exploring strategic alternatives for it.

•As part of our continued commitment to ESG practices and responsibilities, in May 2022 we released our 2030 greenhouse gas emissions reduction goal to reduce our emissions by 30% from the 2019 baseline by 2030.

|

|

|

Outlook for 2025

In 2025, we expect to produce between 20.0 and 21.0 million ounces of silver and between 735,000 and 800,000 ounces of gold, with Silver Segment AISC of between $16.25 and $18.25 per ounce of silver and Gold Segment AISC of $1,525 and $1,625 per ounce of gold. The Escobal mine is assumed to remain on care and maintenance during 2025, as the Guatemala MEM conducts the court-mandated ILO 169 consultation process.

In 2025, we plan on incurring project capital expenditures of approximately $90.0 million to $100.0 million, relating primarily to: (i) expenditures at the La Colorada skarn project for infill and exploration drilling and engineering work, particularly in de-watering and geotechnical studies, (ii) investments at the La Colorada vein mine for exploration, mine infrastructure and mine equipment leases related to the expansion of the eastern zone of the mine to allow for future access to prospective higher grade zones, (iii) investments at Timmins for the construction of a new tailings storage facility and exploration activities at satellite deposits, (iv) expenditures at Huaron related to settling final accounts payable for the construction of the filtration plant and storage facility for filter tailings, as well as lease payments for the tailings filtration plant equipment and (iv) investments at Jacobina to advance on a mine and plant optimization study that will evaluate alternative mining methods and production rates with the aim of maximizing the mine's long-term economics and sustainability.

We expect to spend approximately $270.0 to $285.0 million on sustaining capital in 2025, largely on waste dumps, leach pads and tailings storage facilities, exploration, site infrastructure and mine equipment overhauls and replacements.

Exploration and project development expense in 2025 is expected to total approximately $15.0 million to $20.0 million for regional exploration, property holding costs and project development expenses, including 25,000 metres of drilling. Expenditures relating to near-mine exploration and mineral reserve replacement are included in sustaining and project capital estimates and are anticipated to total: (i) $62.0 million for 340,000 metres of near-mine exploration drilling for mineral reserve replacement; and (ii) $18 million for 60,000 meters of project capital drilling at Timmins (Whitney/ Samson), La Colorada skarn, and La Colorada East veins expansion.

Estimated reclamation expenditures in 2025 are expected to be between $28.0 million to $34.5 million at Dolores, Alamo Dorado, Jacobina, and other properties. In 2025, we also expect to spend $20.5 million to $24.0 million for care and maintenance at Escobal, Manantial Espejo, and Navidad.

Annual corporate general and administrative expense, including share-based compensation, is forecast to be between $80.0 million and $85.0 million in 2025.

Cash Costs and AISC are non-GAAP financial measures and do not have a standardized meaning prescribed by IFRS. For additional information, please see “Non-GAAP Measures” on beginning on page 2.

Please refer to the section of this AIF entitled “Risks Related to Our Business” starting on page

62 for more information about the risks relating to our business and our mining properties.

NARRATIVE DESCRIPTION OF THE BUSINESS

Principal Products and Operations

Our principal products and sources of sales are silver and gold doré and silver-bearing zinc, lead, and copper concentrates. In 2024, the La Colorada, Cerro Moro, Dolores, Huaron, Jacobina, El Peñon, Minera Florida, Shahuindo, La Arena, Timmins West, Bell Creek, and San Vicente mines accounted for all of our production of concentrates and doré.

Our approximate revenue by product category for the financial years ended December 31, 2024, and December 31, 2023, was as follows:

|

|

|

|

|

|

|

|

|

| Product Revenue |

2024 |

2023 |

|

($millions) |

($millions) |

| Silver and Gold Doré |

2,369.1 |

1,954.4 |

| Zinc Concentrate |

101.3 |

83.2 |

| Lead Concentrate |

201.8 |

163.5 |

| Copper Concentrate |

71.7 |

54.6 |

| Silver Concentrate |

75.0 |

60.4 |

| Total |

2,818.9 |

2,316.1 |

Consolidated production from the Silver Segment mines for the year ended December 31, 2024, was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SILVER SEGMENT

MINES

|

La Colorada |

Cerro Moro |

Huaron |

San Vicente1 |

Total4 |

Tonnes Milled4 |

590,000 |

411,900 |

934,200 |

378,700 |

2,314,800 |

| Grade |

|

|

|

|

|

| Silver - g/t |

277.45 |

240.02 |

141.95 |

281.37 |

|

| Gold - g/t |

- |

6.18 |

- |

- |

|

| Zinc % |

2.34% |

- |

2.48% |

2.92% |

|

| Lead % |

1.39% |

- |

1.63% |

0.31% |

|

| Copper % |

- |

- |

0.60% |

0.20% |

|

| Production |

|

|

|

|

|

Ounces Silver2 |

4,877,800 |

2,968,600 |

3,518,700 |

3,109,500 |

14,474,600 |

Ounces Gold2 |

2,600 |

77,500 |

100 |

- |

80,100 |

Tonnes Zinc3 |

11,370 |

- |

18,080 |

9,590 |

39,040 |

Tonnes Lead3 |

7,040 |

- |

11,240 |

910 |

19,200 |

Tonnes Copper3 |

210 |

- |

4,460 |

570 |

5,240 |

___________

Notes:

1 San Vicente data represents our 95% interest in mine production based on ownership of the operating entity.

2 Rounded to the nearest hundred.

3 Rounded to the nearest ten.

4 Totals may not match due to rounding.

Consolidated production from the Gold Segment mines for the year ended December 31, 2024, was as follows:

______________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GOLD SEGMENT

MINES

|

Jacobina |

El Peñon |

Timmins1 |

Shahuindo |

La Arena2 |

Minera Florida |

Dolores |

Total5 |

Tonnes Milled3 |

3,147,300 |

1,362,900 |

1,594,800 |

13,024,600 |

9,580,900 |

998,100 |

7,250,800 |

36,959,400 |

| Grade |

|

|

|

|

|

|

|

|

| Silver - g/t |

- |

103.21 |

- |

6.77 |

0.56 |

25.89 |

15.37 |

|

| Gold - g/t |

2.02 |

3.07 |

2.49 |

0.47 |

0.34 |

2.67 |

0.34 |

|

| Zinc % |

- |

- |

- |

- |

- |

0.82% |

- |

|

| Lead % |

- |

- |

- |

- |

- |

0.29% |

- |

|

| Copper % |

- |

- |

- |

- |

- |

- |

- |

|

| Production |

|

|

|

|

|

|

|

|

Ounces Silver3 |

3,980 |

3,869,600 |

15,400 |

278,500 |

38,000 |

646,100 |

1,735,200 |

6,586,800 |

Ounces Gold3 |

196,700 |

126,800 |

123,700 |

135,200 |

77,400 |

80,300 |

72,300 |

812,300 |

Tonnes Zinc4 |

- |

- |

- |

- |

- |

6,100 |

- |

6,100 |

Tonnes Lead4 |

- |

- |

- |

- |

- |

1,630 |

- |

1,630 |

Tonnes Copper4 |

- |

- |

- |

- |

- |

- |

- |

- |

Notes:

1Timmins refers to the Timmins West and Bell Creek mines.

2La Arena production is from January 1, 2024, to November 30, 2024.

3Rounded to the nearest hundred.

4Rounded to the nearest ten.

5Totals may not add due to rounding.

Additional segmented information is set forth in Note 28 to Pan American’s Audited Consolidated Financial Statements for the year ended December 31, 2024, and further information on individual mine performance and other metrics is presented in the 2024 MD&A under the heading “2024 Operating Performance”.

Silver and Gold Doré

Our principal buyers of silver and gold doré produced from our La Colorada, Dolores, Shahuindo, La Arena, Timmins, Jacobina, Cerro Moro, El Peñon and Minera Florida mines, once refined, are international bullion banks and traders, except for the gold produced from La Colorada, which is sold to Maverix Metals Inc. (“Maverix”) pursuant to the Maverix Gold Stream (as defined below) discussed on page 27. During our ownership of the La Arena mine in 2024, the gold production from the mine continued to be committed under an off-take agreement with a third-party that provided financing in respect of the original construction of the asset. Additionally, the Company inherited a silver stream arrangement between Yamana and Sandstorm Gold Ltd. (“Sandstorm”) whereby Yamana agreed to deliver 20% of the silver produced at Cerro Moro to Sandstorm, up to a maximum of 1.2 million ounces of silver annually, for consideration of 30% of the spot price of silver at the time each ounce of silver is delivered. When 7.0 million ounces of silver have been delivered to Sandstorm, the silver stream will reduce to 9.0% of the silver produced for the life of the mine. As at December 31, 2024, the Company had delivered 6.7 million ounces to Sandstorm. Silver and gold doré are delivered to refineries in Canada, Mexico, Switzerland, and the United States, and subsequently transferred to the accounts of our buyers.

Zinc, Lead, Copper and Silver Concentrates

The majority of our concentrate production is sold to international concentrate traders and smelters. Concentrate production from the La Colorada mine is delivered to the buyers at various ports and smelting facilities in Mexico. Concentrate production from the Huaron mine is delivered to the buyers at the port of Callao, Peru, with the exception of a portion of the zinc concentrate which is delivered to the Cajamarquilla smelting facility in Peru. Concentrate production from the San Vicente mine is delivered to the buyers at ports in Chile and Peru.

Concentrate production from the Minera Florida mine is delivered to the buyers at various ports in Chile. From these ports, the concentrates are shipped by the buyers to various international locations.

Employees and Contractors

At the end of 2024, we had approximately 9,000 employees and about 7,800 contractors. The majority of those employees and contractors were working at our operations in South and Central America, Mexico and Canada. Our Peruvian operations had the largest workforce with approximately 4,400 employees and contractors as of December 31, 2024, while our Mexican operations had approximately 2,300 total employees and contractors. Our Argentina and Brazil operations had approximately 1,500 and 2,800 employees and contractors, respectively. There were approximately 3,800 employees and contractors in Chile, approximately 300 employees and contractors in Guatemala, and approximately 640 employees and contractors in Bolivia. In Canada, our operations had about 960 employees and contractors, and approximately 150 employees worked for Pan American’s offices in Vancouver, British Columbia and Toronto, Ontario, at year-end.

Protecting the health, safety and wellbeing of our employees, contractors, suppliers, and community partners where we operate is always a priority for us. We are saddened to report that there were two fatal accidents at our operations and projects in 2024. We achieved a lost time injury frequency of 0.26 per million hours worked and a lost time injury severity of 37, which were higher than our goals and poorer than our results from 2023.

In 2022, we joined the Mining Safety Roundtable, a group of participating companies that are committed to eliminating fatalities and major safety incidents by sharing strategies and best practices to address mining industry hazards and risks. We are advancing several safety initiatives, including working with third-party consultants to incorporate innovative safety concepts, the expansion of our training programs related to the technical abilities of our workforce, focusing on the development of leadership skills, and raising even greater awareness and prioritization of safety. In 2024, we also continued our work on our Critical Risk Management program that we intend to progressively implement at our operations in the next few years. Please refer to the Sustainability page of our website at www.panamericansilver.com for further information on our health and safety programs.

Research and Development

While we conduct feasibility work and operational enhancement evaluations in order to improve production processes and exploration and mining operations, we do not, in the normal course, embark on any research and development activities in relation to products or services. Costs associated with this work would usually be expensed as incurred. As such, we did not incur any significant research and development costs during 2022, 2023 or 2024.

Working Capital and Liquidity Position

As at December 31, 2024, we had cash and cash equivalents and short-term investment balances of $887.3 million and working capital of $1,033.5 million. Total debt of $803.3 million included $94.5 million related to lease liabilities, $13.4 million carrying value of construction loans and two Senior Notes carried at $695.4 million. The Company repaid a net $6.7 million of debt related to construction loans.

On April 15, 2015, we entered into the Facility, a $300 million senior secured revolving line of credit available for general corporate purposes, including acquisitions, and originally had a four-year term. We amended the Facility on a number of occasions between 2015 and 2021, primarily to increase availability and extended the term, but also to add sustainability-linked pricing adjustment feature in 2021. The Facility was amended twice in 2023, the first on March 30, 2023, when it was increased from its previous $500.0 million to $750.0 million and a temporary term loan feature of $500.0 million was added to complete the Yamana Acquisition, and the second on November 24, 2023, retaining the $750 million availability, but with a $250 million accordion feature and a maturity date of November 24, 2028. As of December 31, 2024, the Company was in compliance with all financial covenants under the Facility, which was undrawn. The borrowing costs under the Facility are based on the Company's credit ratings from Moody's and S&P Global's at either: (i) SOFR plus 1.25% to 2.40% or; (ii) The Bank of Nova Scotia's Base Rate on USD denominated commercial loans plus 0.15% to 1.30%.

Under the ratings-based pricing, undrawn amounts under the Facility are subject to a stand-by fee of 0.23% to 0.46% per annum, dependent on Pan American's credit rating and subject to pricing adjustments based on sustainability performance ratings and scores.

Pan American paid a standby fee of 0.32% on the Facility during the year ended December 31, 2024. The facility was undrawn in 2024.

Upon closing of the Yamana Acquisition, Pan American effectively assumed Yamana’s obligations with respect to the Senior Notes. We completed successful consent solicitations with respect to the Senior Notes to amend the reporting covenant of the indenture governing the Senior Notes. As a result, for so long as the Senior Notes are guaranteed by Pan American or any other entity that directly or indirectly controls Yamana, reports of Pan American or of such other controlling entity may be provided in lieu of reports of Yamana.

Our financial position as at December 31, 2024, and the operating cash flows that are expected over the next twelve months lead management to believe that our liquid assets and available credit from the Facility are sufficient to satisfy our 2024 working capital requirements, fund currently planned capital expenditures (including both sustaining and project capital) for existing operations, and to discharge liabilities as they come due. We also remain well positioned to take advantage of further strategic opportunities as they are identified and become available.

Environment, Social and Governance

Safe production, the environmentally sound development and operation of assets, and fostering positive long-term relationships with employees, shareholders, communities, and local governments are fundamental to our strategy.

We have implemented several policies relating to the environment and sustainability, including an Environmental Policy, a Social Sustainability Policy, a Health and Safety Policy, a Human Rights Policy, and an Inclusion and Diversity Policy in which we accept our corporate responsibility to practice environmental stewardship, community engagement and development, and provide a safe, healthy, respectful, open and inclusive workplace for our employees. We also joined the BlackNorth Initiative in June 2020 as part of our commitment to inclusion and diversity and to support the fight against racism. Our Global Code of Ethical Conduct, Global Anti-Corruption Policy, and Supplier Code of Conduct, which are available on our website (www.panamericansilver.com), further formalize our commitment to operating ethically. Our directors, officers, executives, and senior management provide annual certifications in connection with the Global Code of Ethical Conduct, Global Anti-Corruption Policy, and Human Rights Policy, and we provide related training across our organization. We have also adopted Global Guidelines Regarding Tax Matters, which we confirm our commitment to complying to tax laws and regulations and being accurate, timely and transparent with our tax filings and tax planning. We comply with relevant industry standards, legislation and regulations in the countries where we carry on business.

We believe that it is important to include ESG matters in our corporate goals. Two of the most important areas reflected in our corporate performance goals relate to safety and the environment. Safety is a critical aspect of our business and an important component in our ESG programs, and plays a significant role in our performance. As noted above under the heading “Employees and Contractors”, 2024 was a challenging year for the Company in terms of its safety performance because the Company experienced two fatalities. While the Company achieved low lost-time injury frequency and severity, the loss of the lives of two of our co-workers was of paramount importance to us and we will learn what we can from these events and strive to prevent similar tragedies in the future. In 2024 we also added a 3rd safety goal referred to as Corrective and Preventative Actions (“CAPAs”). CAPAs encourage our employees to develop innovative actions or solutions with the goal of minimizing the possibilities of incident reoccurrence. All CAPAs are assessed and allocated a score that is approved by the HSE committee, which in the aggregate contributes to the Company’s overall corporate annual incentive program. The Company also had no significant environmental incidents during the year. We have also established corporate goals relating to inclusion and diversity and remain committed to increasing the representation of women in our workforce. We were able to meet our corporate performance goals established in that regard with respect to hiring and retention of women. In addition to our corporate performance goals, we have also established various ESG-related performance indicators and objectives to measure and monitor the performance progress of the key environmental and social sustainability activities at our operations. These are discussed below in more detail.

Through our membership in MAC, we continued to implement the TSM performance system, a world class management standard designed to help mining companies responsibly drive sustainability performance and manage risk. In 2024, we achieved or maintained Level A or higher for all indicators of the TSM protocols at all operations, except for Huaron and Dolores (as a result of each mine experiencing a fatality during the year) and Cerro Moro. We are implementing action plans to achieve Level A or higher in 2025 for these sites and maintain Level A or higher at all other sites. In 2024, TSM external verification was completed by a third-party at four operations: Cerro Moro, Huaron, La Colorada, and San Vicente.

During 2024, reviews of the social performance of our operations were led by our Senior Vice President of Corporate Affairs and Sustainability, and our Vice President, Social Sustainability, Inclusion and Diversity. Reviews of our environmental performance were led by our Vice President, Environment, and our reviews of our tailings facilities were led by our Vice President, Mineral Processing, Tailings and Dams. The reviews typically include in-person inspections of our mine sites and surrounding areas with key operations and corporate team personnel, reviews of monitoring programs, critical controls and operating procedures, and evaluation of the principal environmental and social issues related to each of these operations.