Document

|

|

|

PAN AMERICAN SILVER CORP. |

|

|

|

|

|

|

|

Pan American Silver Corp.

2100 – 733 Seymour Street

Vancouver, B.C. Canada

V6B 056

|

Amended NI 43-101 Technical Report

for the La Colorada Property,

Zacatecas, Mexico

|

|

|

|

|

|

|

Effective Date: |

December 18, 2023 |

| Signature Date: |

March 22, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

Authors: |

[Signed] |

|

[Signed] |

|

Martin Wafforn, P.Eng.

Senior Vice President, Technical Services and Process Optimization

Pan American Silver Corp.

|

|

Christopher Emerson, FAusIMM

Vice President, Exploration and Geology

Pan American Silver Corp.

|

|

|

|

|

|

[Signed] |

|

[Signed] |

|

Peter Mollison, P.Eng.

Senior Director, Mine Engineering

Pan American Silver Corp.

|

|

Americo Delgado, P.Eng.

Vice President, Mineral Processing, Tailings, and Dams

Pan American Silver Corp.

|

|

|

|

|

|

[Signed] |

|

|

|

Matthew Andrews, FAusIMM

Vice President, Environment

Pan American Silver Corp.

|

|

|

Effective Date: December 18, 2023 Page 2

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 3

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 4

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 5

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 6

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 7

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 8

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 9

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 10

|

|

|

PAN AMERICAN SILVER CORP. |

Effective Date: December 18, 2023 Page 11

|

|

|

PAN AMERICAN SILVER CORP. |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Technical Report (as defined herein) contains or incorporates by reference “forward-looking statements” and “forward-looking information” under applicable Canadian securities legislation and within the meaning of the United States Private Securities Litigation Reform Act of 1995. Forward-looking information includes, but is not limited to: cash flow forecasts; projected capital; operating and exploration expenditures; targeted cost reductions; mine life and production rates; mineral grades; infrastructure, capital, operating and sustaining costs; the future price of gold, silver, zinc and lead; potential mineralization and metal or mineral recoveries; estimates of mineral resources and mineral reserves and the realization of such mineral resources and mineral reserves; the ability to replace mineral reserves; information pertaining to potential improvements to financial and operating performance and mine life at the La Colorada Property (as defined herein) that may result from expansion projects or other initiatives, including but not limited to the Skarn Project (as defined herein); the timing and expected outcomes of optimization projects; maintenance and renewal of permits or mineral tenure; estimates of mine closure obligations; leverage ratios; and information with respect to Pan American’s (as defined herein) strategy, plans or future financial, or operating performance. Forward-looking statements are characterized by words such as “plan,” “expect”, “budget”, “target”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur, including the negative connotations of such terms. Forward-looking statements are statements that are not historical facts and are based on the opinions, assumptions and estimates of Qualified Persons (as defined herein), considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include, but are not limited to: the impact of general domestic and foreign business, economic and political conditions, including but not limited to the impact of the 2023 Decree (as defined herein); legal proceedings brought against the La Colorada Property or Pan American, including but not limited to the legal proceeding brought before the SEDATU (as defined herein); global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions; fluctuating metal and commodity prices (such as gold, silver, zinc, lead, diesel fuel, natural gas and electricity); currency exchange rates (such as the Mexican peso and the Canadian dollar versus the United States dollar); changes in interest rates; possible variations in ore grade or recovery rates; the speculative nature of mineral exploration and development; changes in mineral production performance, exploitation and exploration successes; diminishing quantities or grades of mineral reserves; increased costs, delays, suspensions, and technical challenges associated with the construction of capital projects; operating or technical difficulties in connection with mining or development activities, including disruptions in the maintenance or provision of required infrastructure and information technology systems; damage to Pan American’s or the La Colorada Property’s reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the handling of environmental matters or dealings with community groups, whether true or not; risk of loss due to acts of war, terrorism, sabotage, crime and civil disturbances; risks associated with infectious diseases, including COVID-19; risks associated with nature and climatic conditions; uncertainty regarding whether the La Colorada Property will meet Pan American’s capital allocation objectives; the impact of inflation; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices, expropriation or nationalization of property in Mexico, including but not limited to the 2023 Decree; failure to comply with environmental and health and safety laws and regulations; timing of receipt of, or failure to comply with, necessary permits and approvals; changes in project parameters as plans continue to be refined; changes in project development, construction, production and commissioning time frames; contests over title to properties or over access to water, power, and other required infrastructure; increased costs and physical risks including extreme weather events and resource shortages related to climate change; availability and increased costs associated with mining inputs and labor; the possibility of project cost overruns or unanticipated costs and expenses, potential impairment charges, higher prices for fuel, steel, power, labour, and other consumables

Effective Date: December 18, 2023 Page 12

|

|

|

PAN AMERICAN SILVER CORP. |

contributing to higher costs; unexpected changes in mine life; final pricing for concentrate sales; unanticipated results of future studies; seasonality and unanticipated weather changes; costs and timing of the development of new deposits; success of exploration activities; risks related to relying on local advisors and consultants in foreign jurisdictions; unanticipated reclamation expenses; limitations on insurance coverage; timing and possible outcome of pending and outstanding litigation and labour disputes, including but not limited to the proceeding brought before the SEDATU; risks related to enforcing legal rights in foreign jurisdictions, vulnerability of information systems and risks related to global financial conditions. In addition, there are risks and hazards associated with the business of mineral exploration, development, and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding, failure of plant, equipment, or processes to operate as anticipated (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks), as well as those risk factors discussed or referred to herein and in Pan American’s Annual Information Form filed with the securities regulatory authorities in all of the provinces and territories of Canada and available under Pan American’s profile at www.sedarplus.ca, and Pan American’s Annual Report on Form 40-F filed with the United States Securities and Exchange Commission. Although Pan American has attempted to identify important factors that could cause actual actions, events, or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events, or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Pan American undertakes no obligation to update forward-looking statements if circumstances or management’s estimates, assumptions, or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking statements. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding Pan American’s expected financial and operational performance and results as at and for the periods ended on the dates presented in Pan American’s plans and objectives and may not be appropriate for other purposes.

Cautionary Note to United States Investors Concerning Estimates of Mineral Reserves and Mineral Resources

This technical report has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements promulgated by the Securities and Exchange Commission (SEC). For example, the terms “Mineral Reserve”, “Proven Mineral Reserve”, “Probable Mineral Reserve”, “Mineral Resource”, “Measured Mineral Resource”, “Indicated Mineral Resource” and “Inferred Mineral Resource” are Canadian mining terms as defined in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves, May 2014 (the CIM Definition Standards), adopted by the CIM Council, as amended. These definitions differ from the definitions in the disclosure requirements promulgated by the SEC. Accordingly, information contained in this technical report may not be comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

Effective Date: December 18, 2023 Page 13

|

|

|

PAN AMERICAN SILVER CORP. |

List of Abbreviations

Units of measurement used in this technical report conform to the metric system. All currency in this report is listed in US dollars (US$) unless noted otherwise.

|

|

|

|

|

|

| ° |

degrees |

| > |

greater than |

| < |

less than |

| % |

percent |

| 3D |

three-dimensional |

| Ag |

silver |

| Au |

gold |

| AAS |

atomic absorption spectrometry |

| BC |

block caving |

| BEV |

battery electric vehicle |

| CAF |

cut and fill |

| CFE |

Comisión Federal de Electricidad, the national power utility |

| CFM |

cubic foot per minute |

| cm |

centimetre |

cm3 |

cubic centimetre |

| CRD |

carbon replacement deposits |

| CRM |

certified reference materials |

| CV |

coefficient of variation |

| d |

day |

| dmt |

dry metric tonne |

| E |

east |

| EIS |

environmental impact statement (“EIS”) |

| ELOS |

estimated equivalent linear overbreak slough |

| FS |

feasiblity study |

| FTSF |

filtered tailings storage facility |

| g |

gram |

| g/t |

gram per tonne |

| GCT |

Guerrero Composite Terrane |

| GPM |

gallon per minute |

| GW |

Gigawatt (1,000,000,000 (One Billion) Watts) |

| h |

hour |

| ha |

hectare |

| hp |

horsepower |

| ICP |

inductively coupled plasma |

|

|

|

|

|

|

| ID2 |

inverse distance squared or to the power of two |

| IFC |

International Finance Corporation |

| IS |

intermediate sulphidation |

| k |

kilo (thousand) |

| km |

kilometre |

| koz |

kilo-ounce |

| ktpd |

kilo-tonne per day |

| kV |

kilovolt |

| kg |

kilogram |

| LCT |

locked cycle test |

| LHD |

load-haul-dump |

| LHOS |

long-hole stoping |

| LOM |

life of mine |

| LS |

low sulphidation |

| LVC |

Lower Volcanic Complex |

| LWID |

length-weighted inverse distance |

| m |

metre |

m3 |

cubic metre |

| M |

mega, million |

| Ma |

mega annum, millions of years ago |

| MAC |

Mining Association of Canada |

| masl |

metres above sea level |

| mm |

millimetre |

| Moz |

million ounces |

| MRMR |

mining rock mass rating |

| MSB |

Mexican Silver Belt |

| MSO |

mineable shape optimizer |

| MT |

magnetotelluric |

| N |

north |

| NN |

nearest-neighbour |

| NPV |

net present value |

| NSR |

net smelter return |

| OEM |

original equipment manufacturer |

| OK |

ordinary kriging |

| oz |

Troy ounce (31.1035 g) |

| Pb |

lead |

|

|

|

|

|

|

| PEA |

preliminary economic assessment |

| PF |

powder factor |

| PFS |

pre-feasibility study |

| PGCA |

Power Geotechnical Cellular Automata, a Deswik software) |

| ppm |

parts per million |

| PRC |

Production Rate Curves |

| PS |

Performance Standards |

| QAQC |

quality assurance and quality control |

| QC |

quality control |

| QP |

qualified person |

| RMR |

rock mass rating |

ROCASIMP |

La Colorada simplified logging code |

| ROM |

run of mine |

| RPD |

relative percent difference |

| RPEE |

reasonable prospect of eventual economic extraction |

| s |

second |

| S |

south |

| SAG |

semi-autogenous grinding |

| SEDATU |

Mexico’s Federal Secretariat of Agrarian, Territorial, and Urban Development |

| SLC |

sublevel caving |

| SLS |

sublevel long-hole stoping |

| SMO |

Sierra Madre Occidental |

SRCE |

standard reclamation cost estimator |

| SSR |

single-shot slot raising |

| t |

metric tonne |

| tpd |

tonnes per calendar day |

| TSF |

tailings storage facility |

| TSM |

Towards Sustainable Mining |

| US$ |

United States dollar |

| UVS |

Upper Volcanic Supergroup |

| VOD |

ventilation-on-demand |

| W |

west |

| wmt |

wet metric tonne |

| Zn |

zinc |

Effective Date: December 18, 2023 Page 14

|

|

|

PAN AMERICAN SILVER CORP. |

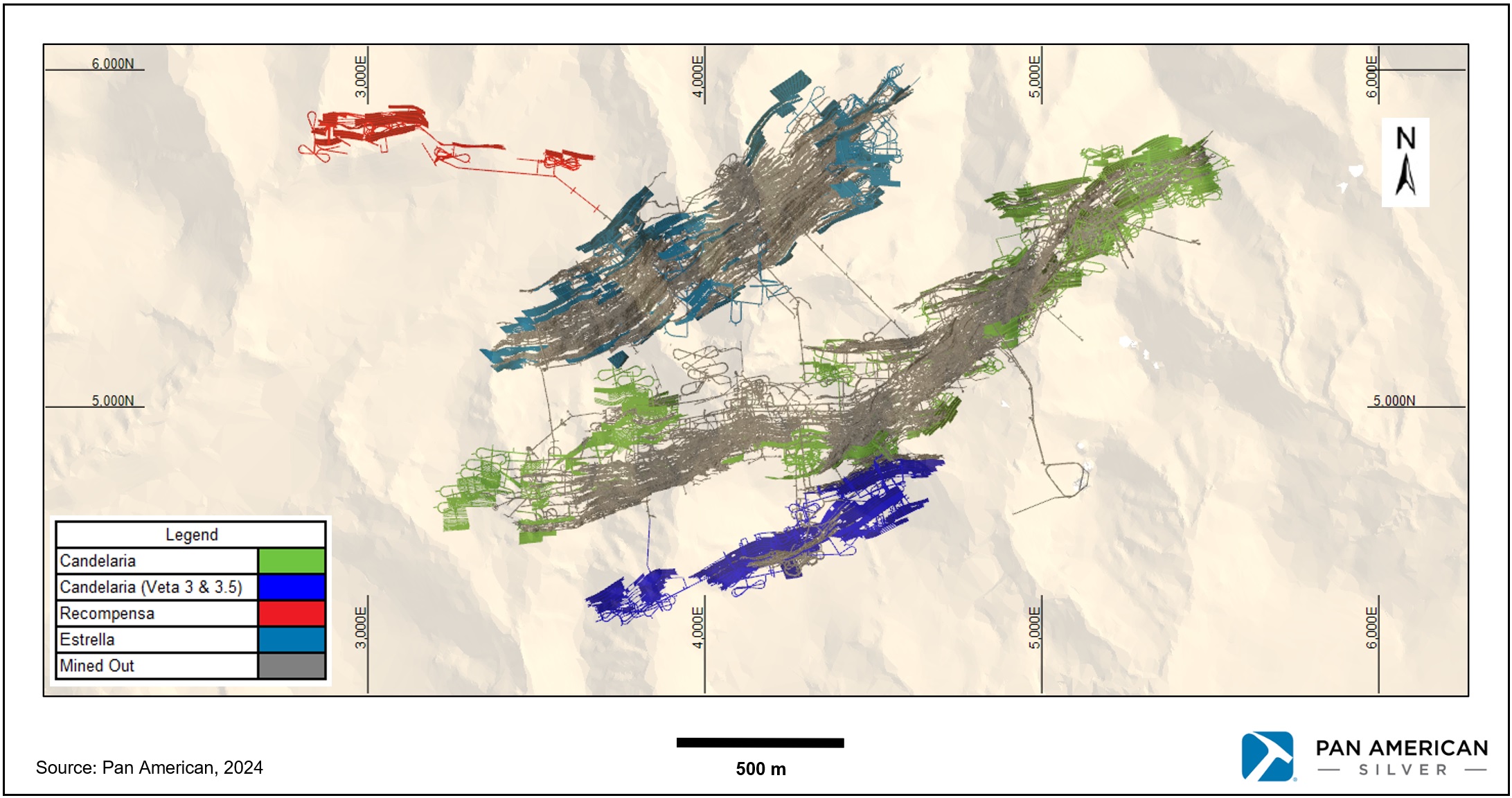

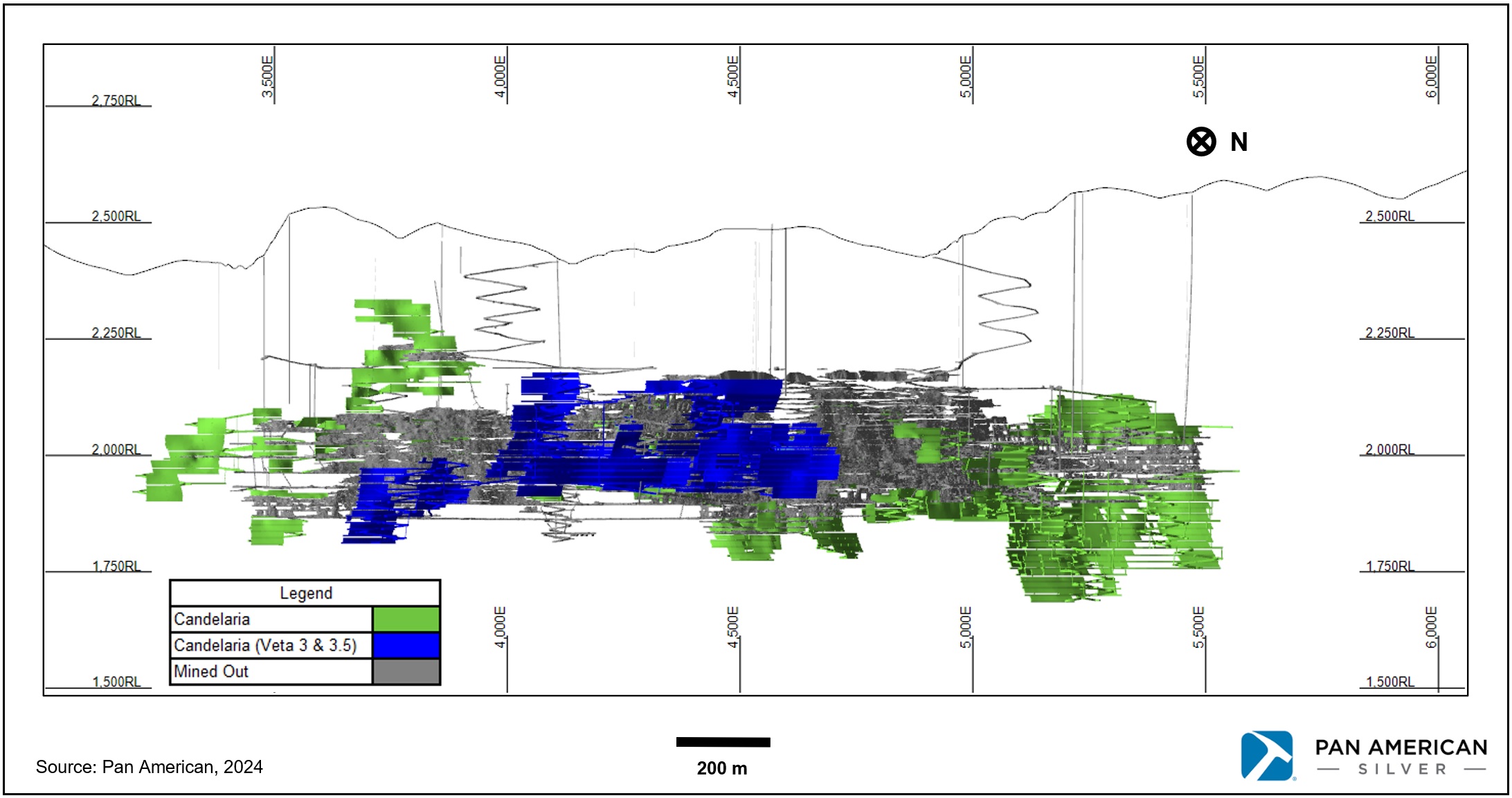

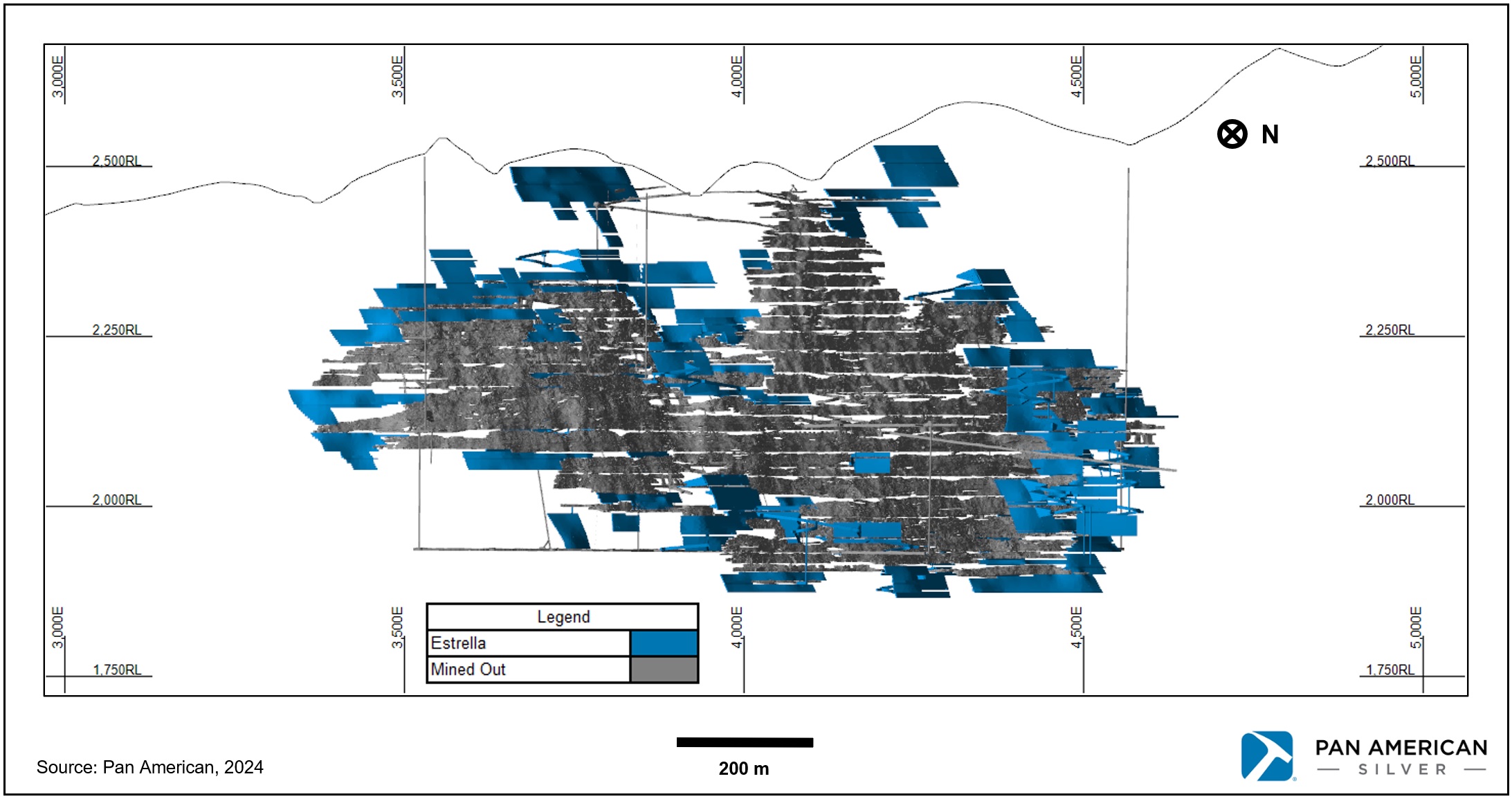

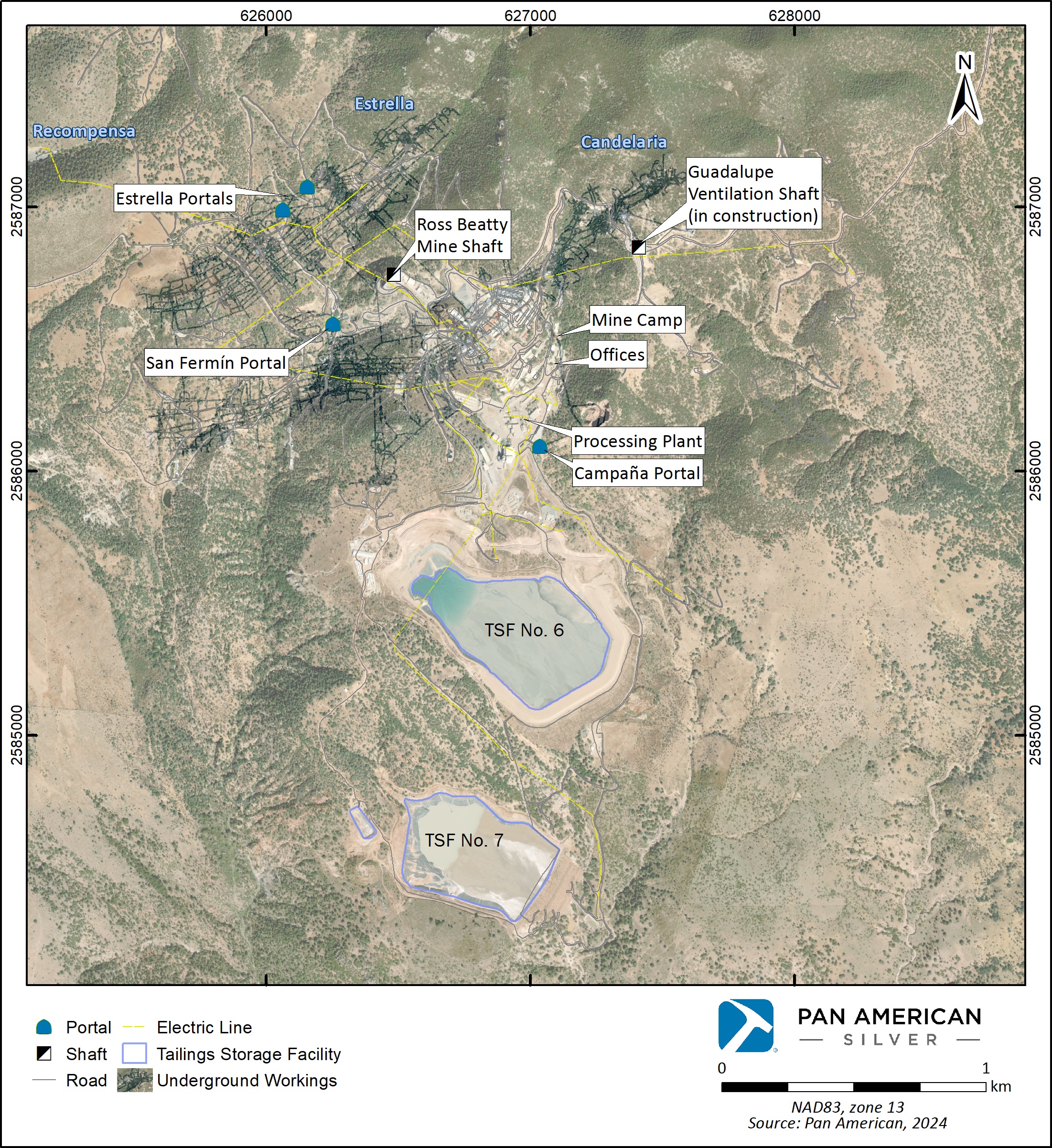

1Summary

Pan American Silver Corp. (Pan American) holds a 100% interest in the 56 mining concessions (totaling approximately 8,840 hectares) that comprise the La Colorada property (the La Colorada Property) located in Zacatecas, Mexico, through its subsidiary, Plata Panamericana S.A. de C.V. (Plata). A collection of three underground silver-lead-zinc mines named Candelaria, Estrella, and Recompensa (collectively, the La Colorada Vein Mine) are located within the La Colorada Property. Currently, underground mining at the La Colorada Vein Mine is conducted at the Candelaria and Estrella mines, whereas no mining is currently taking place at the Recompensa mine. The La Colorada Property also hosts the large polymetallic skarn exploration project (the Skarn Project) discovered in 2018 through brownfield exploration near the La Colorada Vein Mine.

With nearly 30 years of experience in the Americas, Pan American is a Canadian-based leader in producing precious metals in the region. Pan American operates mines that produce silver and gold in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. In addition, Pan American owns the Escobal Mine in Guatemala, which is not currently in operation. Pan American has earned a reputation for excellence in sustainability performance, operational efficiency, and financial prudence.

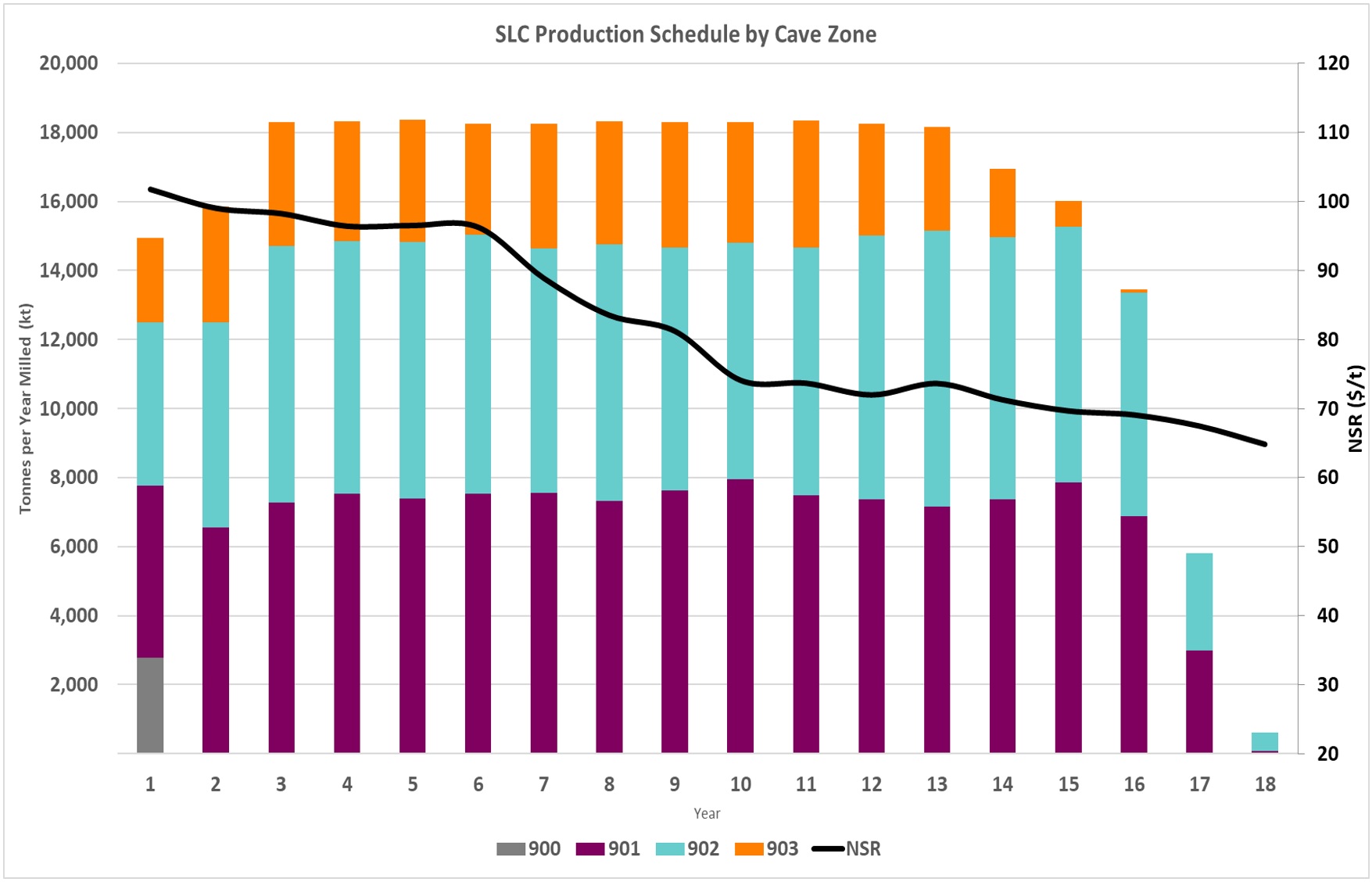

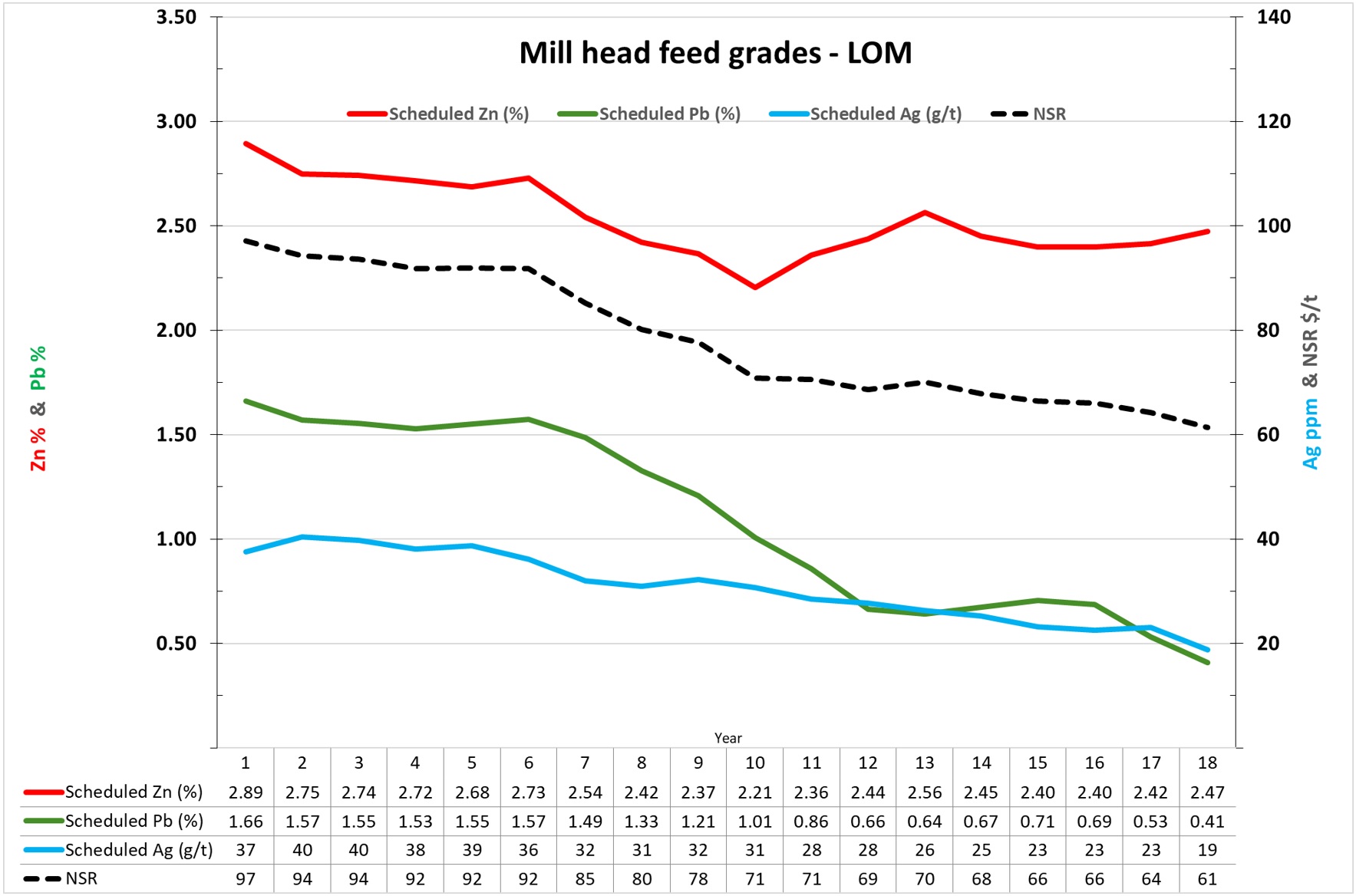

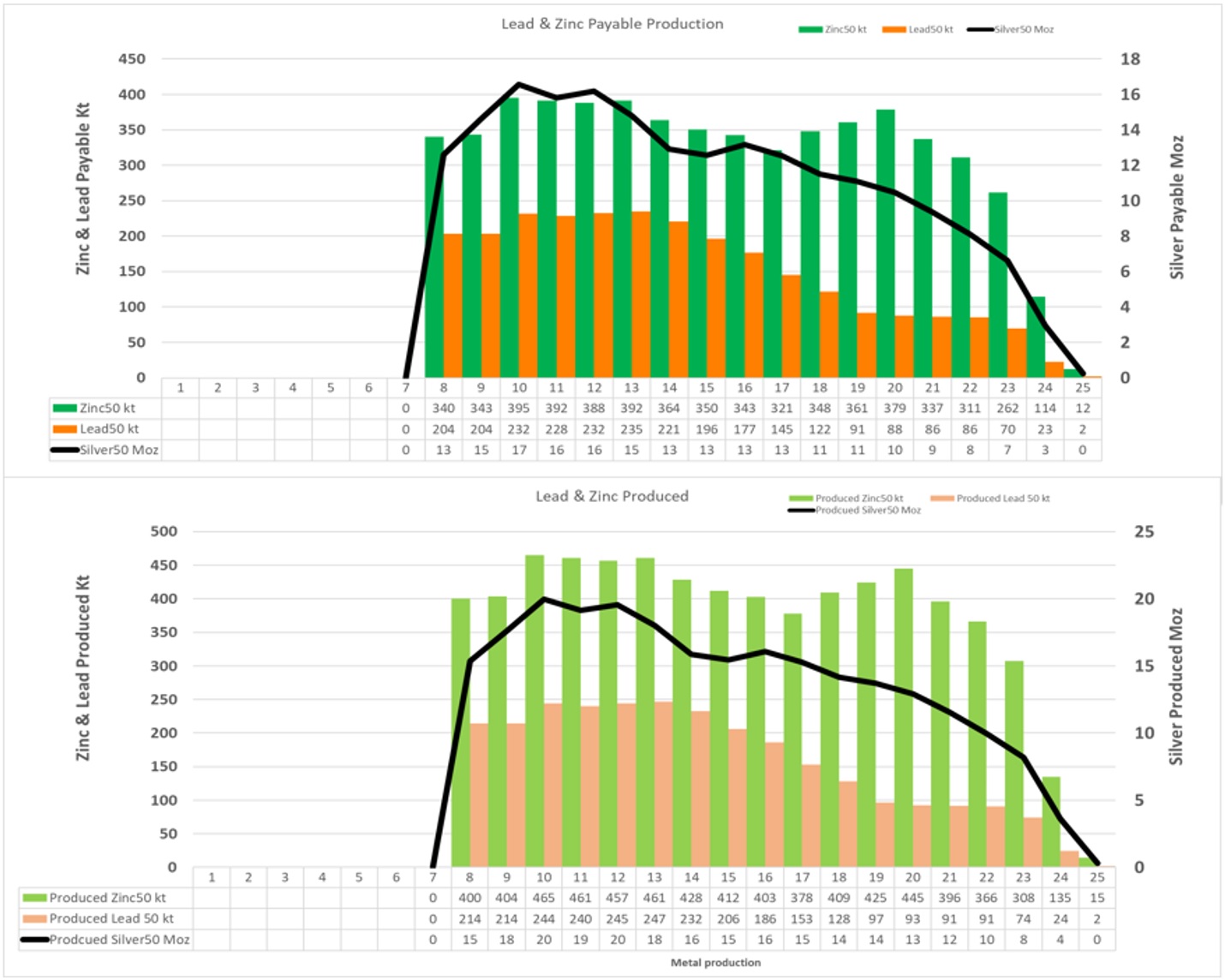

This technical report was prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). It presents the mineral resource and mineral reserve estimates for the La Colorada Vein Mine as of June 30, 2023, describes the current mining operation, and summarizes the LOM plan and cost estimates. The technical report also describes the results of the preliminary economic assessment (PEA) of the Skarn Project, disclosed on December 18, 2023, and includes an updated mineral resource estimate for the Skarn Project. The PEA considers a 50,000 tpd sublevel cave mining method and a conventional 50,000 tpd capacity selective zinc and lead flotation processing plant and filtered tailings storage facility. Annual production is estimated to average 17.2 Moz of silver, 427 kt of zinc and 218 kt of lead during the first 10 years of an estimated 17-year mine life.

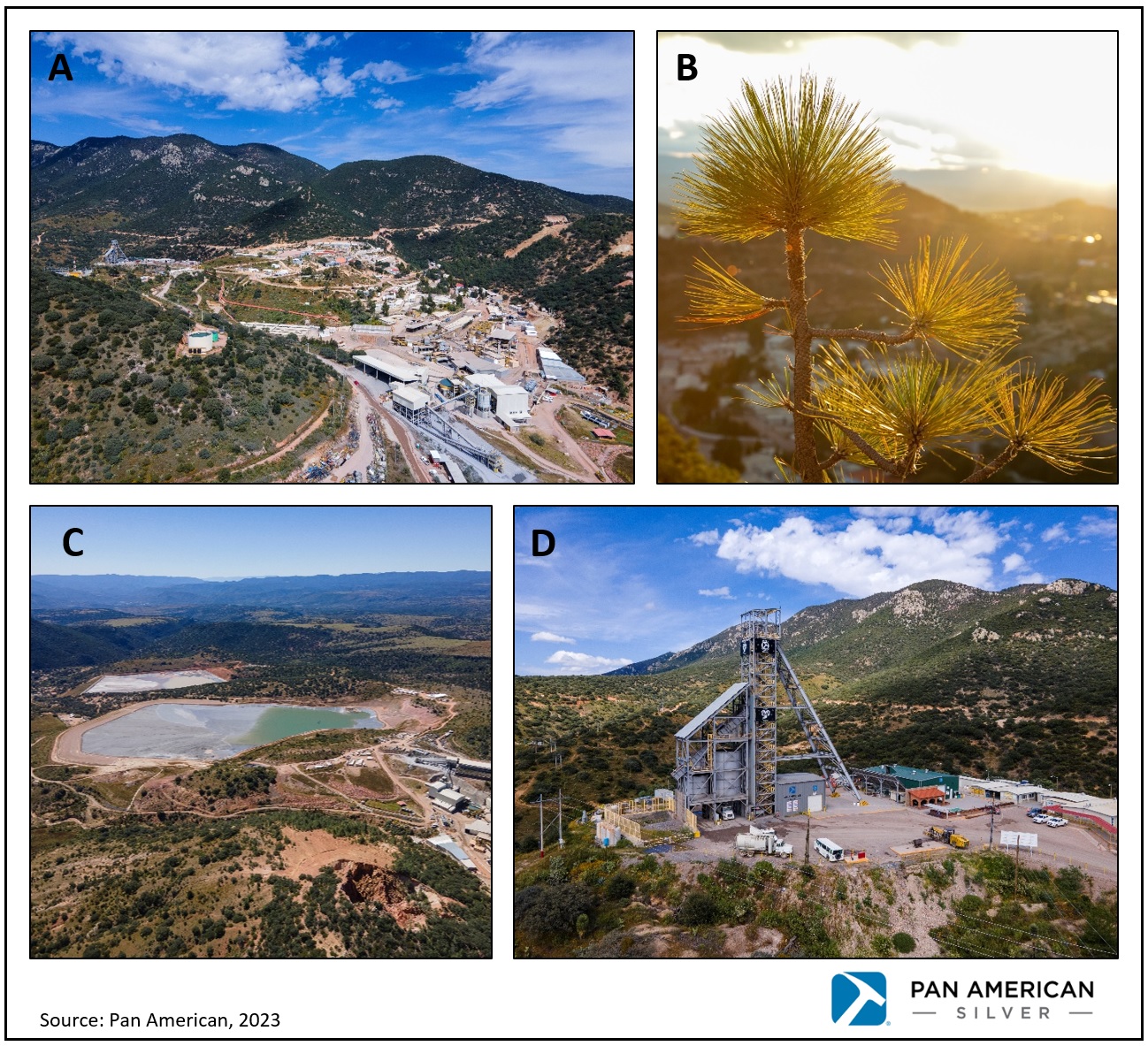

1.1Property Description and Ownership

The North American Cordillera hosts the La Colorada Property, which lies within the Sierra Madre Occidental mountains. The area’s landscape consists of broad flat valleys and narrow, relatively low mountain ranges and hills with altitudes between 2,100 and 2,550 metres above sea level. The area has a dry to semi-dry climate.

The La Colorada Vein Mine has three underground mines that extract oxide and sulphide ores: Candelaria, Estrella, and Recompensa (no mining is currently taking place at the Recompensa mine). Near the mine, brownfield exploration in 2018 discovered the large polymetallic Skarn Project. The La Colorada Property consists of 56 mining concessions covering about 8,840 hectares, including some exploration concessions outside the mining area. The mining concessions controlled by Pan American contain the mineral reserves, mineral resources, all known mineralized zones, mine workings, processing plant, effluent management and treatment systems, and tailings disposal areas.

The La Colorada Vein Mine workings are covered by about 1,300 ha of surface rights that Pan American owns or has access to. Pan American is buying 2,000 ha of private land and planning to rent another 2,800 ha of ejido land to secure surface rights for the Skarn Project.

The surface infrastructure includes the plant processing facilities, tailings and waste rock storage facilities, offices and workshops, accommodation camps, change houses, warehouses, fuel and lubricant facilities, water and diesel tanks, surface electrical distribution, air compressors, explosive magazine, water treatment plants, sludge settling

Effective Date: December 18, 2023 Page 15

|

|

|

PAN AMERICAN SILVER CORP. |

ponds and piping, surface ventilation fans, mine portals, run-of-mine ore stockpiles, domestic waste landfill, roads, surface grading and drainage, security gates and fencing, and satellite communication equipment.

The La Colorada Property has a long history of mining since 1925. Several mining operations have exploited the area until 1997, when Pan American acquired an option agreement with Minas La Colorada S.A. de C.V. (MLC). The production data before Pan American’s involvement are unknown. Pan American began small-scale production in January 2001 from surface stockpiles and underground development headings. Full-scale production commenced in mid-2003. From 2001 to 2023, Pan American has produced more than 98 Moz of silver, 149 kt of zinc, and 78 kt of lead.

There are no known significant environmental liabilities on or related to the La Colorada Property. There are no known environmental issues that could materially impact Pan American’s activities on the La Colorada Property. To the best of Pan American and the qualified person’s knowledge, all permits and licences required to conduct activities on the La Colorada Property have been obtained and are currently in good standing.

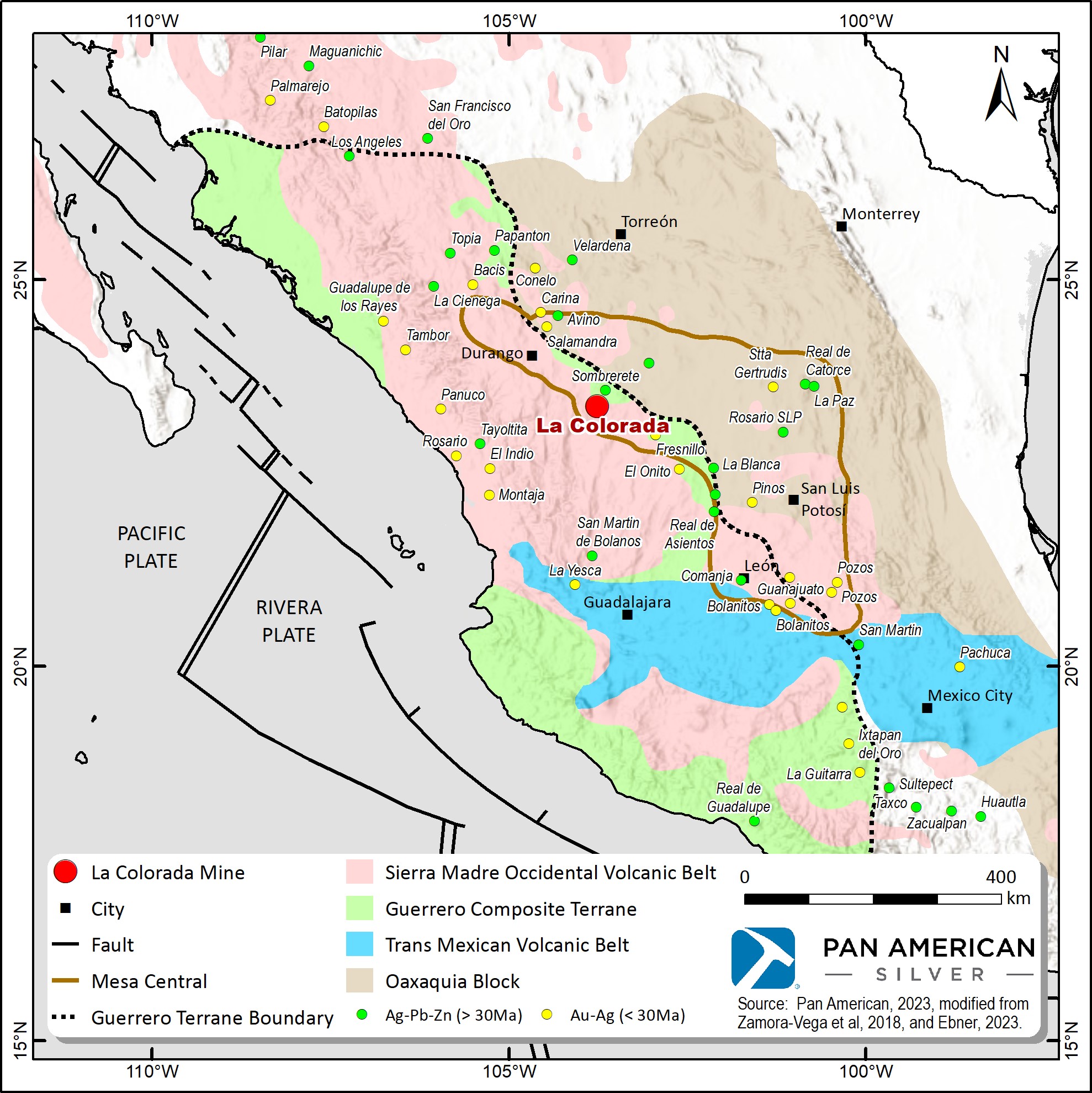

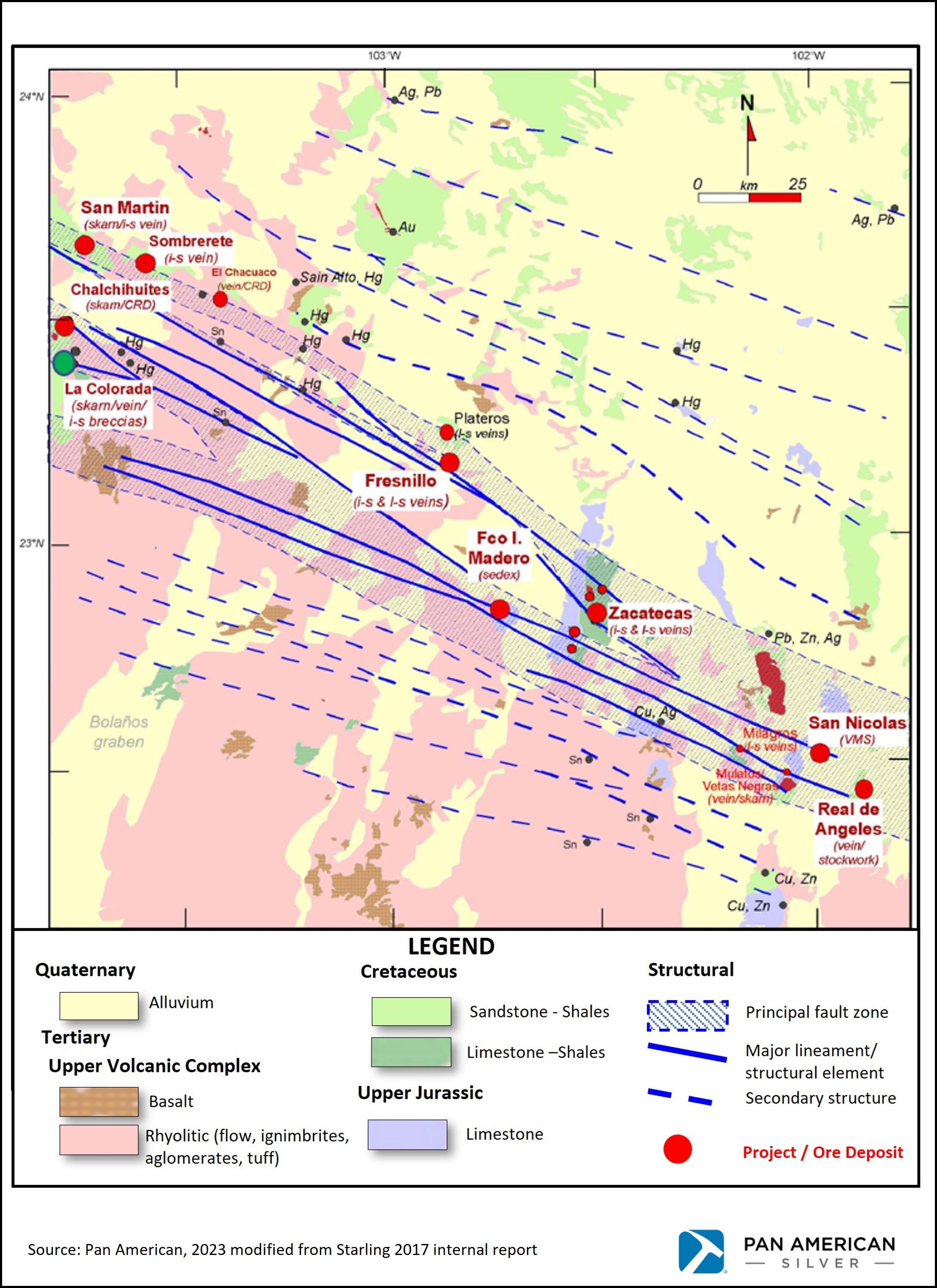

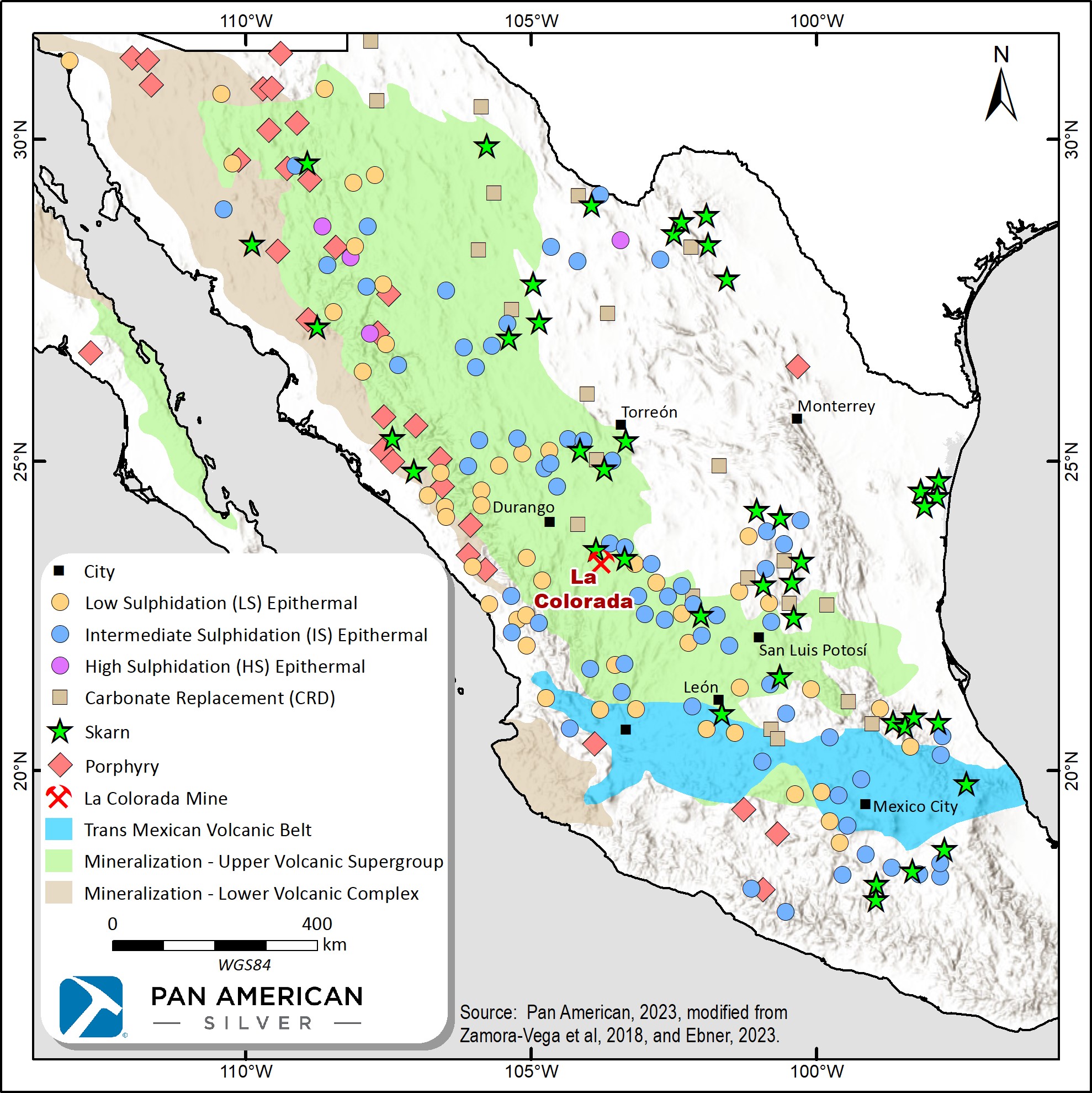

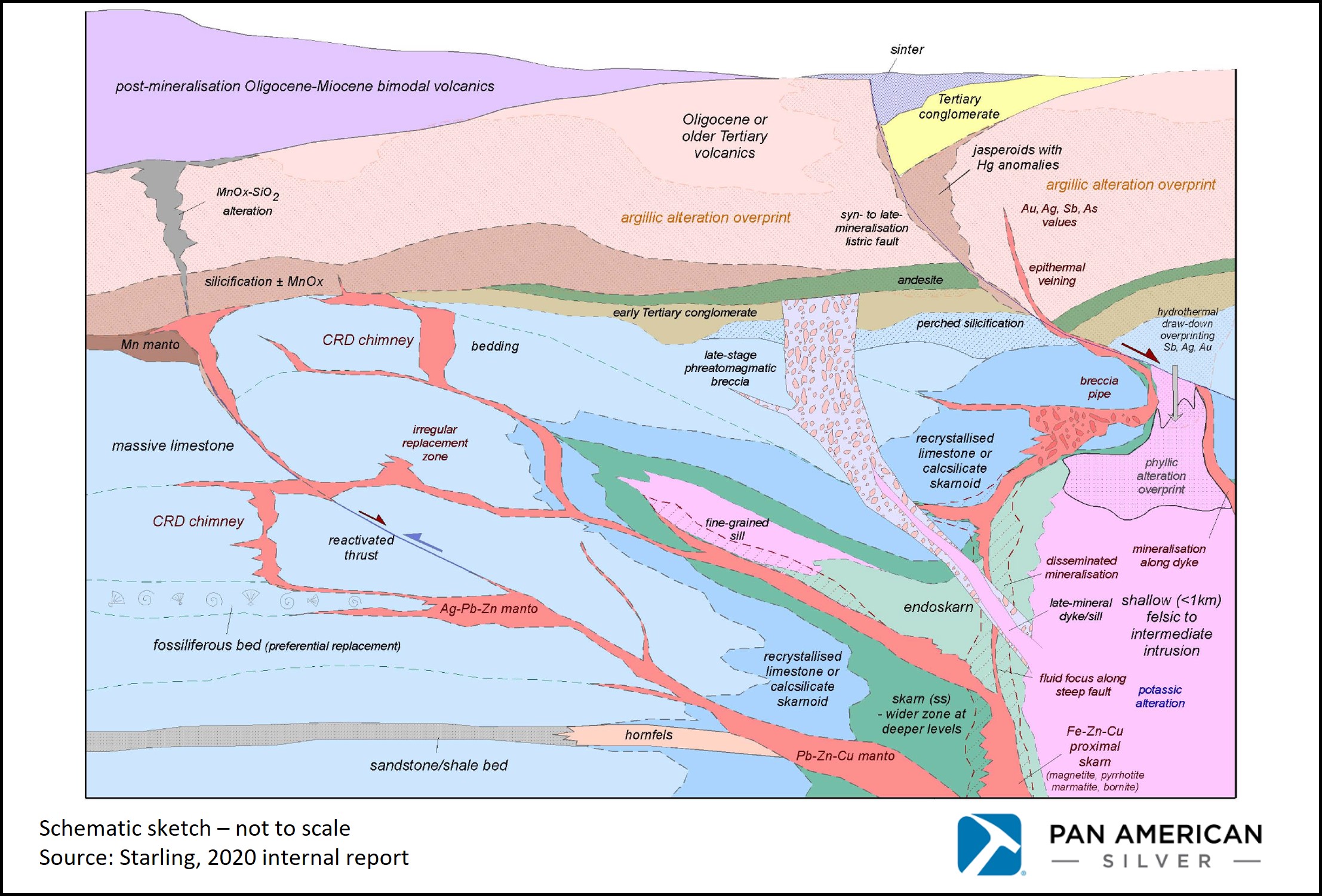

1.2Geology and Mineralization

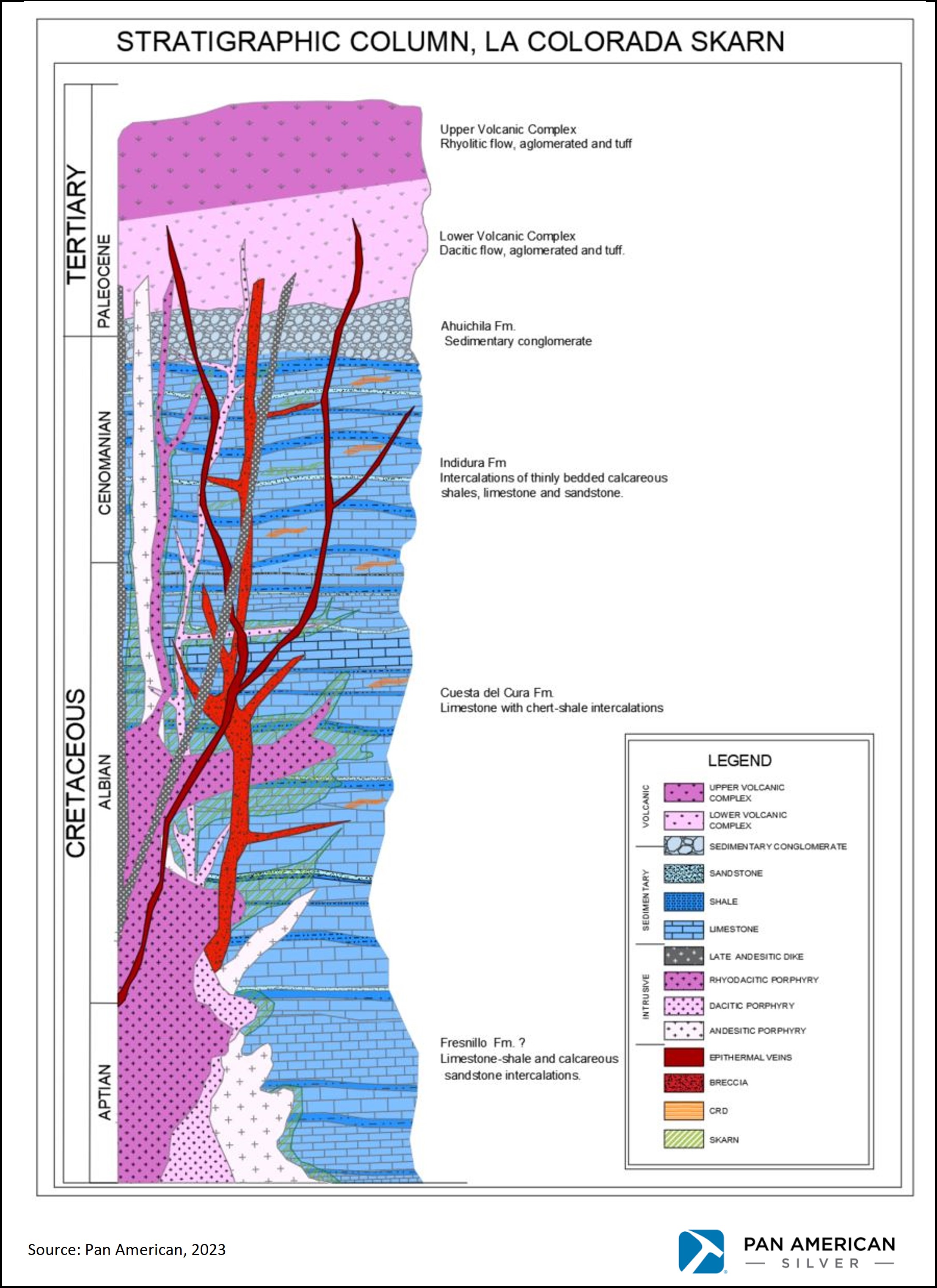

The La Colorada Property is located in the Zacatecas mining district, within the Mexican Silver Belt. Many of the major deposits in the silver belt are located within the Sierra Madre Occidental mountains and associated volcanic belt. The region contains epithermal Ag-Pb-Zn ± Au ± Cu vein, and polymetallic skarn, carbon replacement deposits (CRD), and porphyry deposits. Epithermal intermediate-sulphidation Ag-Pb-Zn vein, CRD, and polymetallic skarn mineralization has been identified at the La Colorada Property. The upper portions of the epithermal vein system have been the historical focus of the currently operating La Colorada Vein Mine, while the skarn and CRD mineralization is currently being defined and characterized by ongoing drilling and technical studies at the Skarn Project.

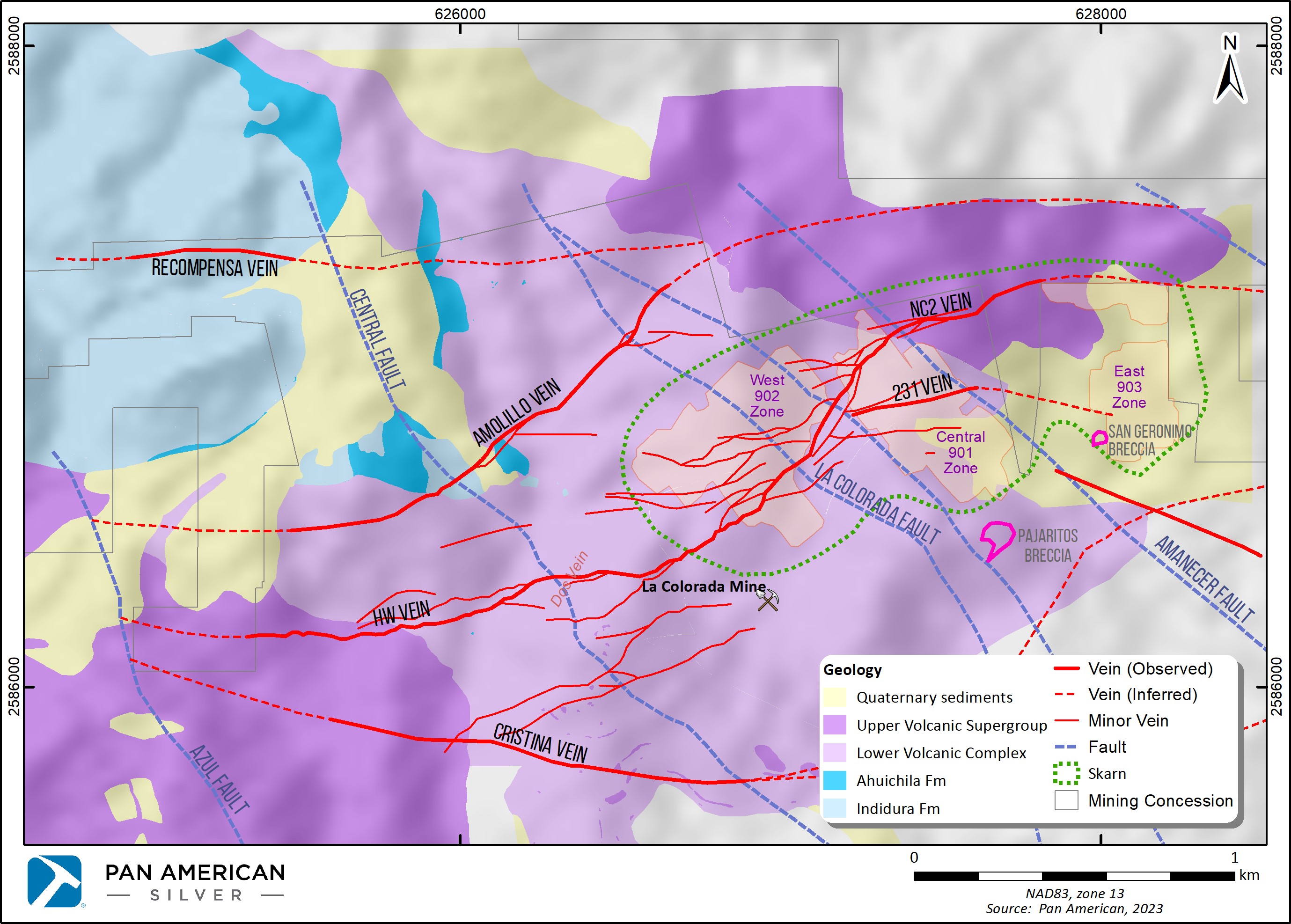

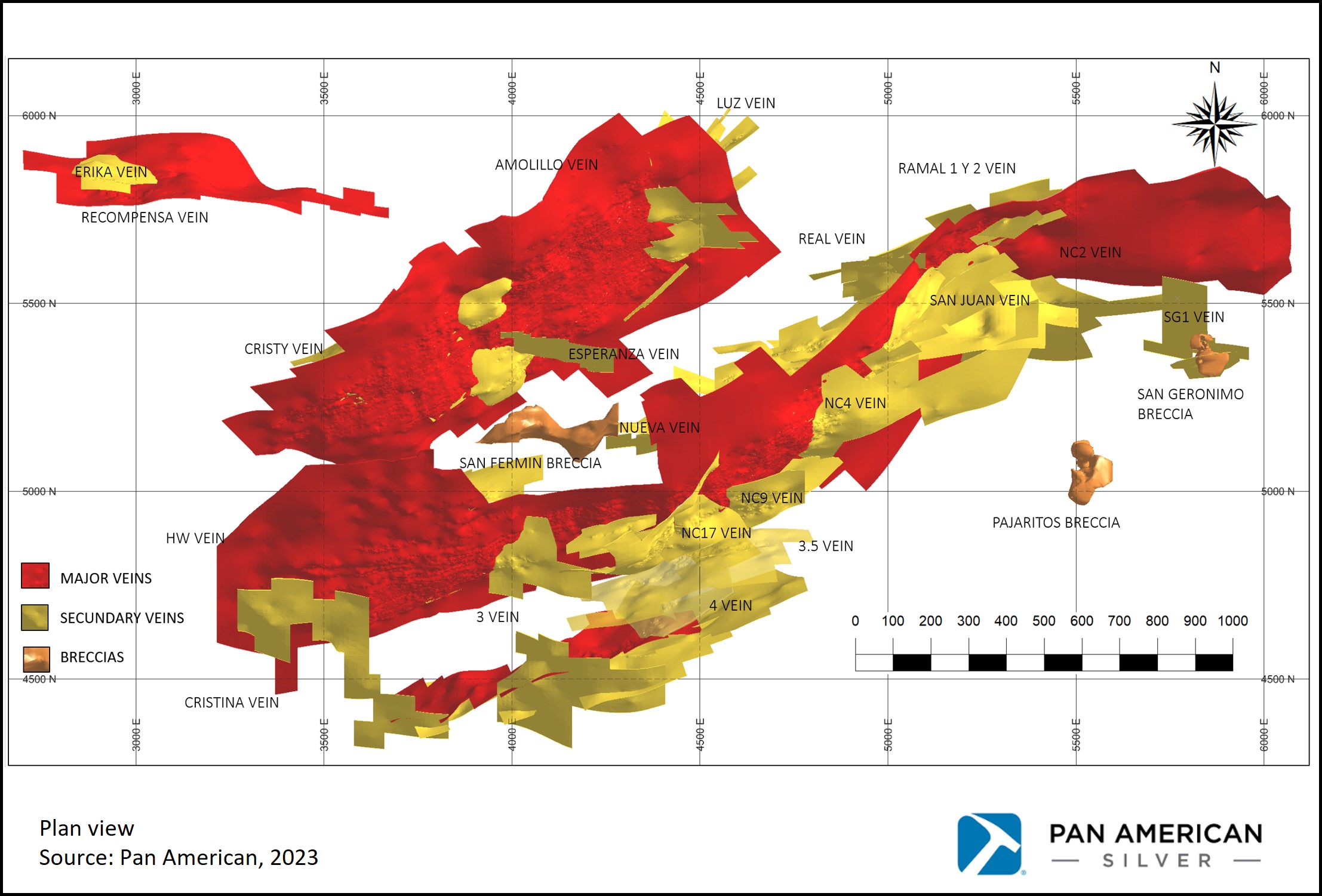

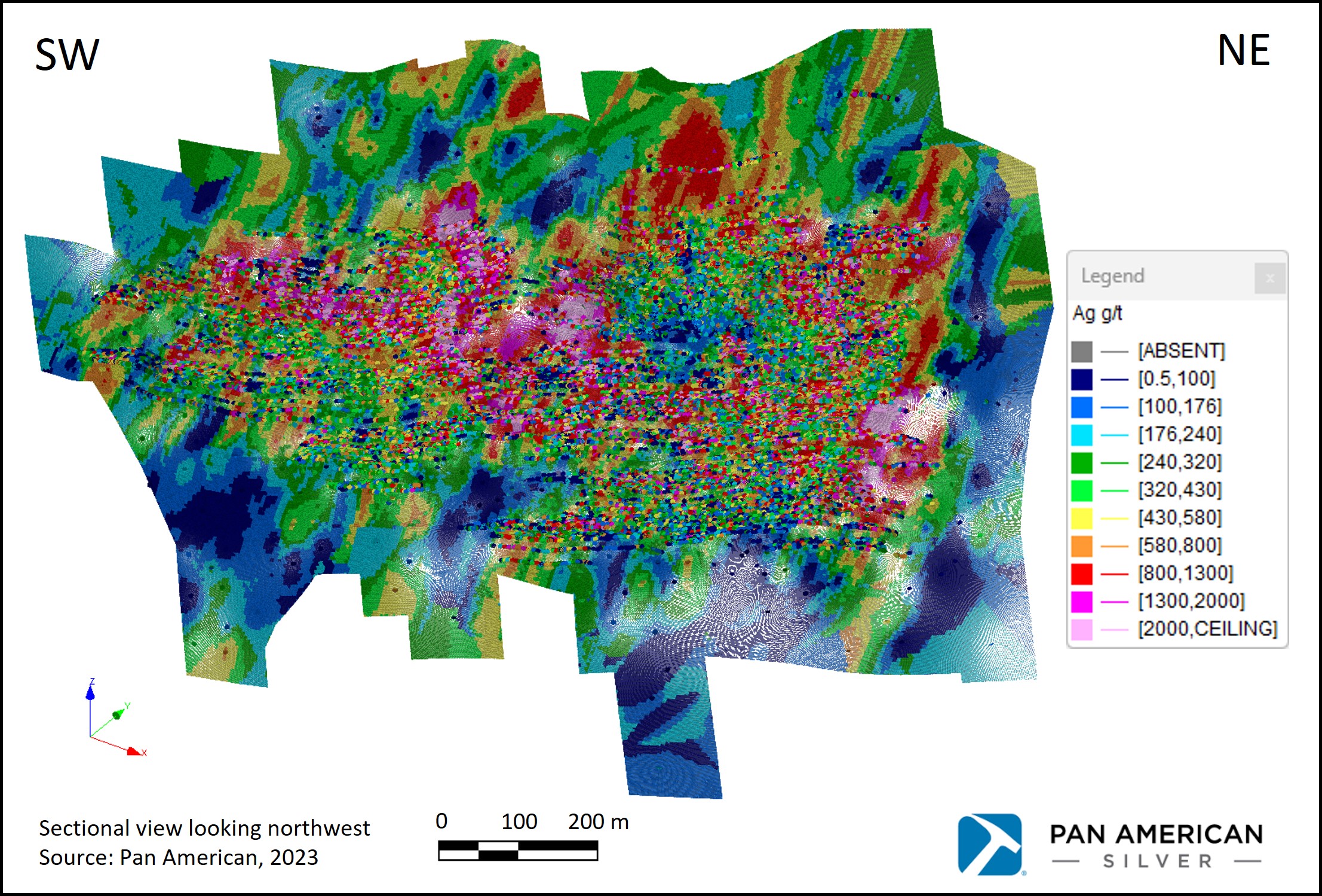

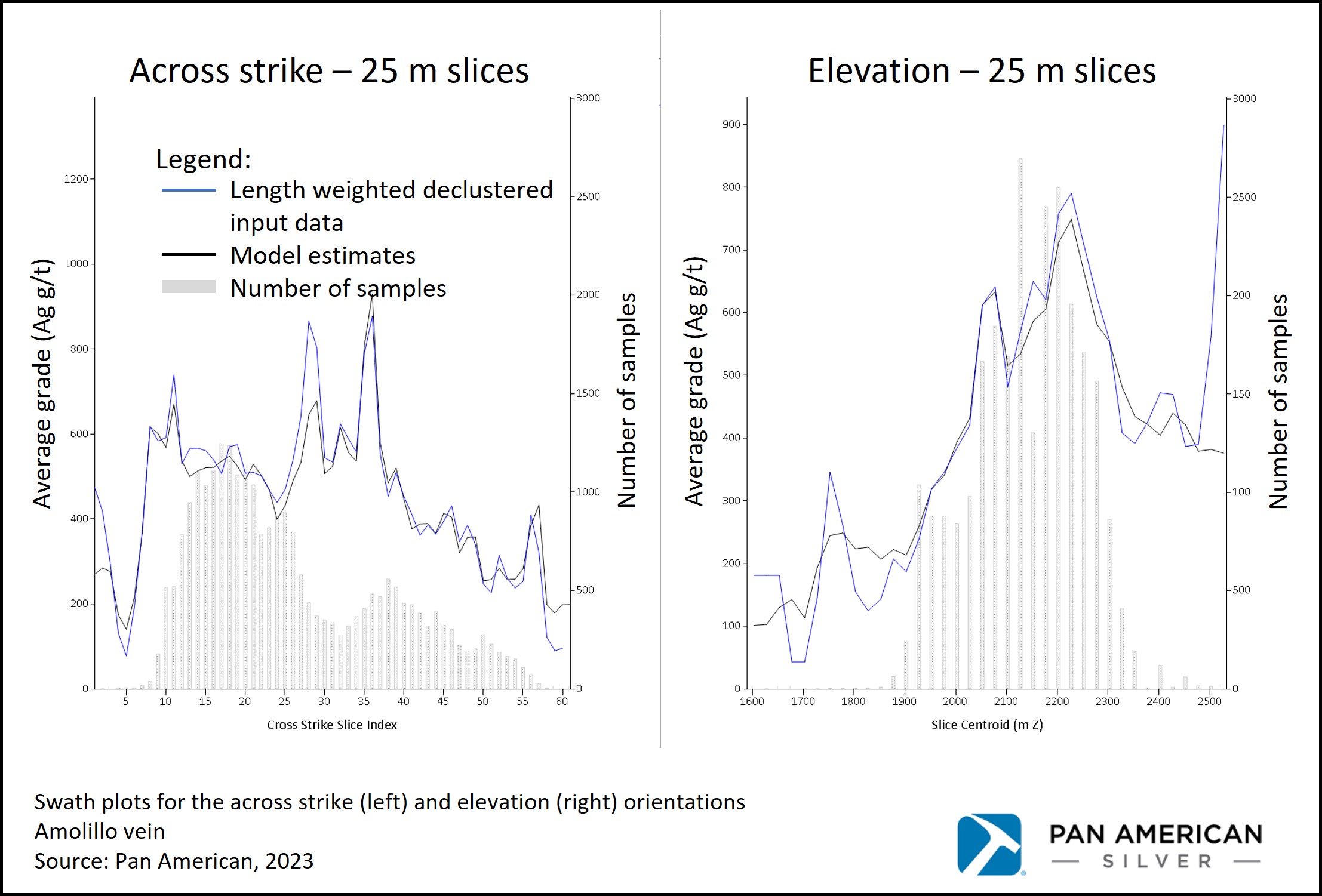

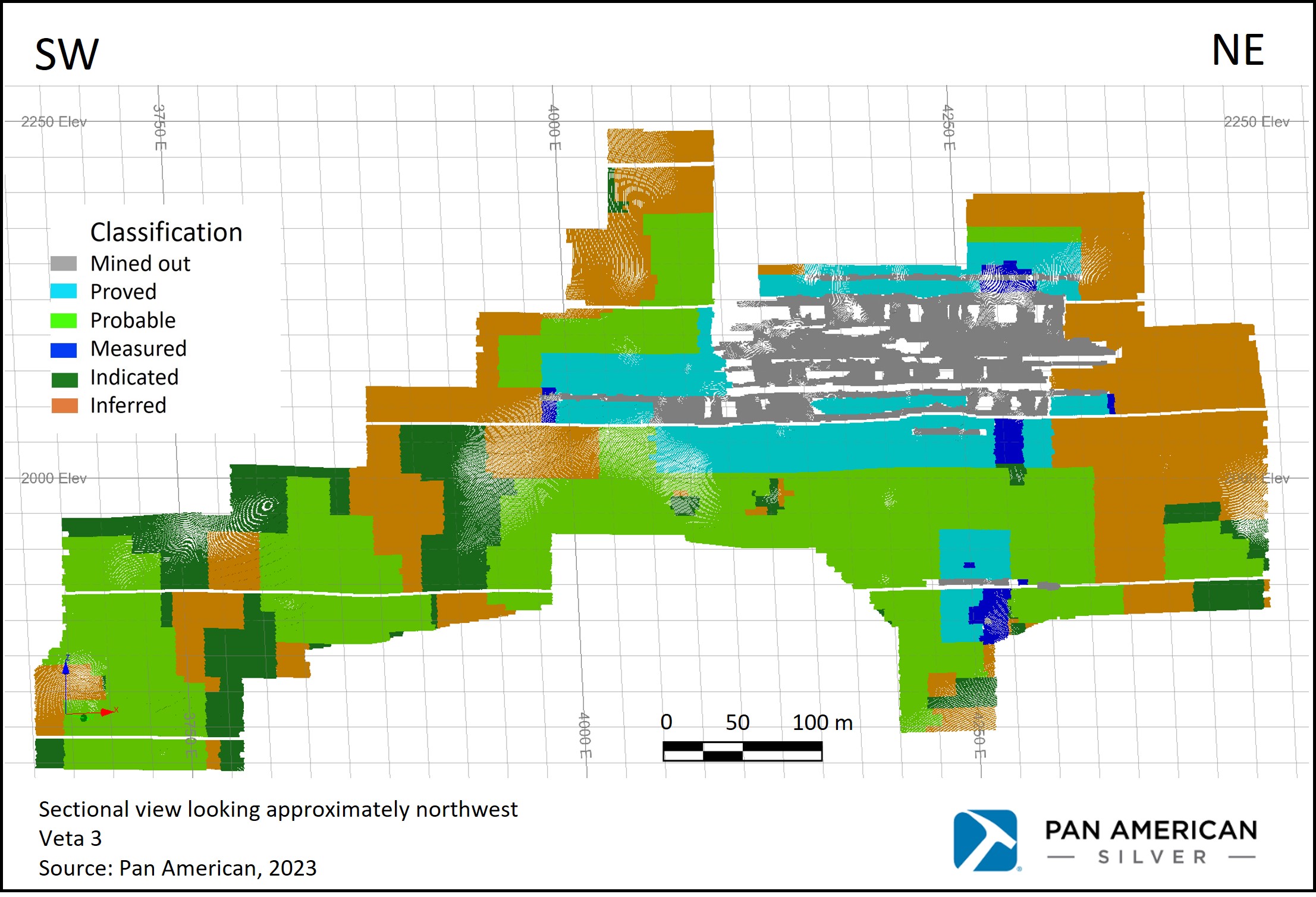

At the La Colorada Vein Mine there are three ENE to E–W-trending principal vein structures which, from NW to SE, are named Recompensa, Amolillo and NC-HW. Each vein has second-order sub-parallel splays and duplexes; there are also several NW- to WNW-trending veins. In general, the principal veins are strongly brecciated, locally oxidized, and often exhibit irregular vein boundaries. Most of the mineralization of economic significance is hosted in quartz veins that average 1 to 2 m wide but that can be significantly wider. The vein fillings consist of quartz, calcite, and locally barite and rhodochrosite. Galena, sphalerite, pyrite, native silver, and silver sulphosalts are present in unoxidized veins. The major mineralized veins are strongly brecciated and locally oxidized. Veta 3 runs parallel to the HW and NC series, strikes for over 900 m towards the northeast, dips 75° to the northwest, and extends for about 400 m down dip. The average vein width is 1.7 m.

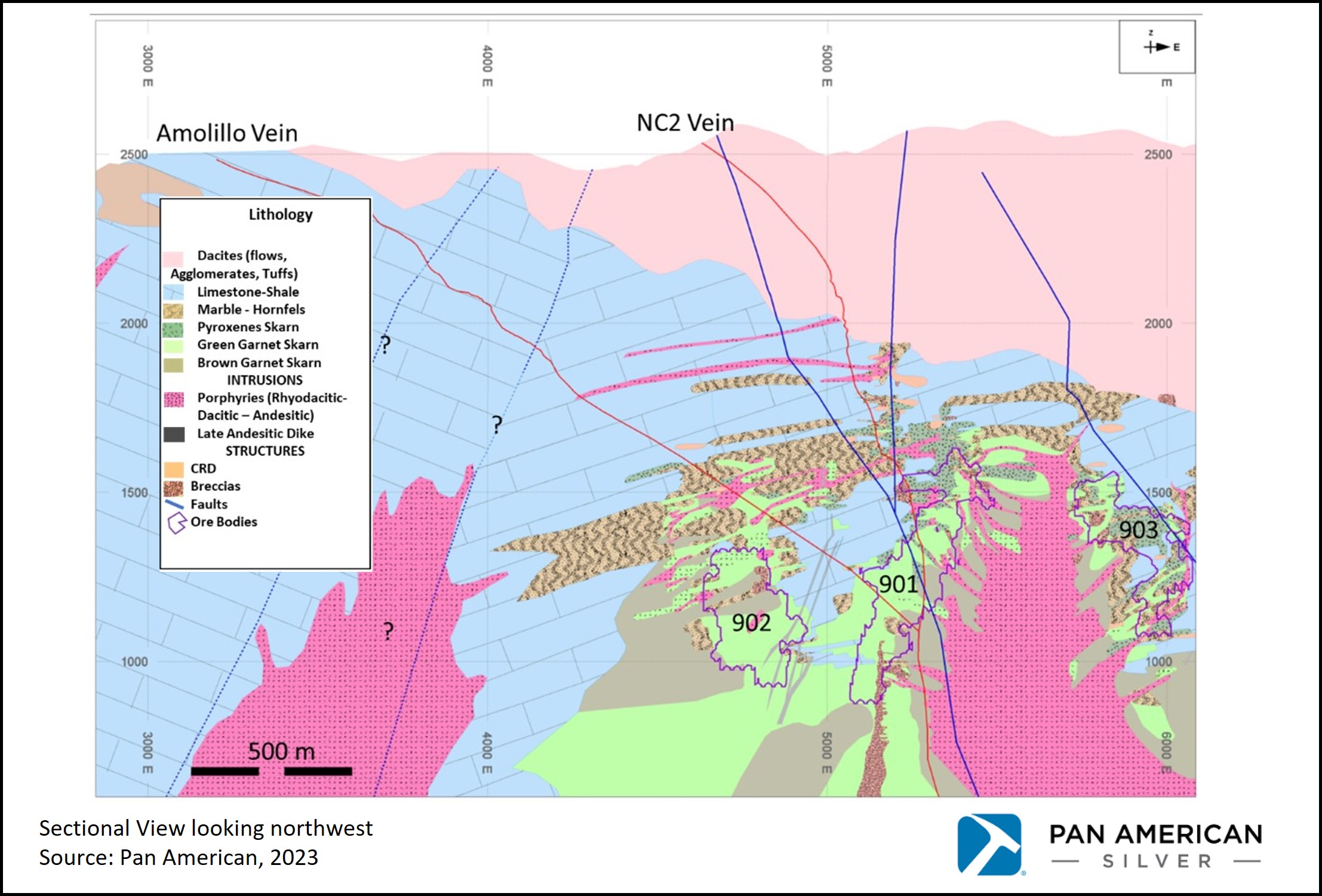

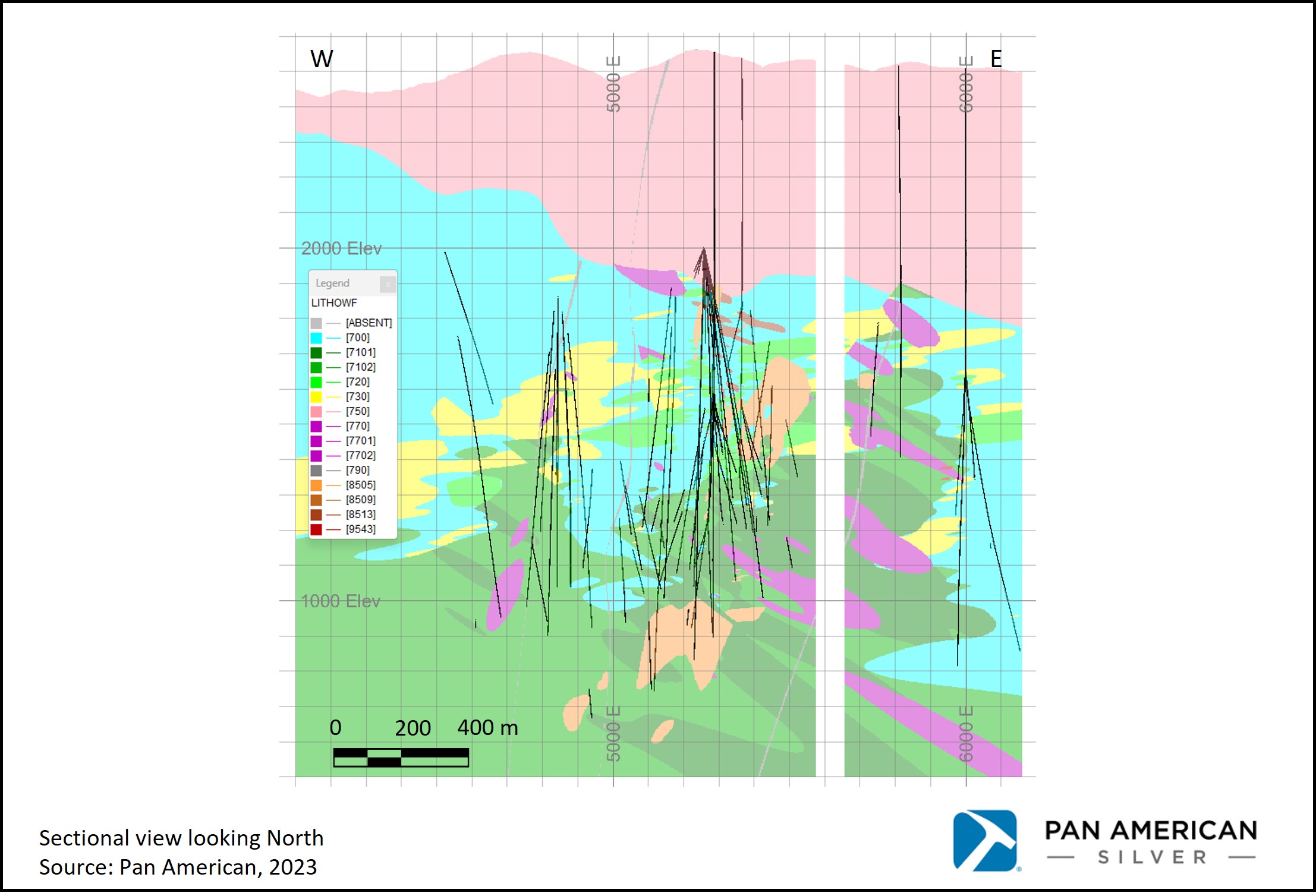

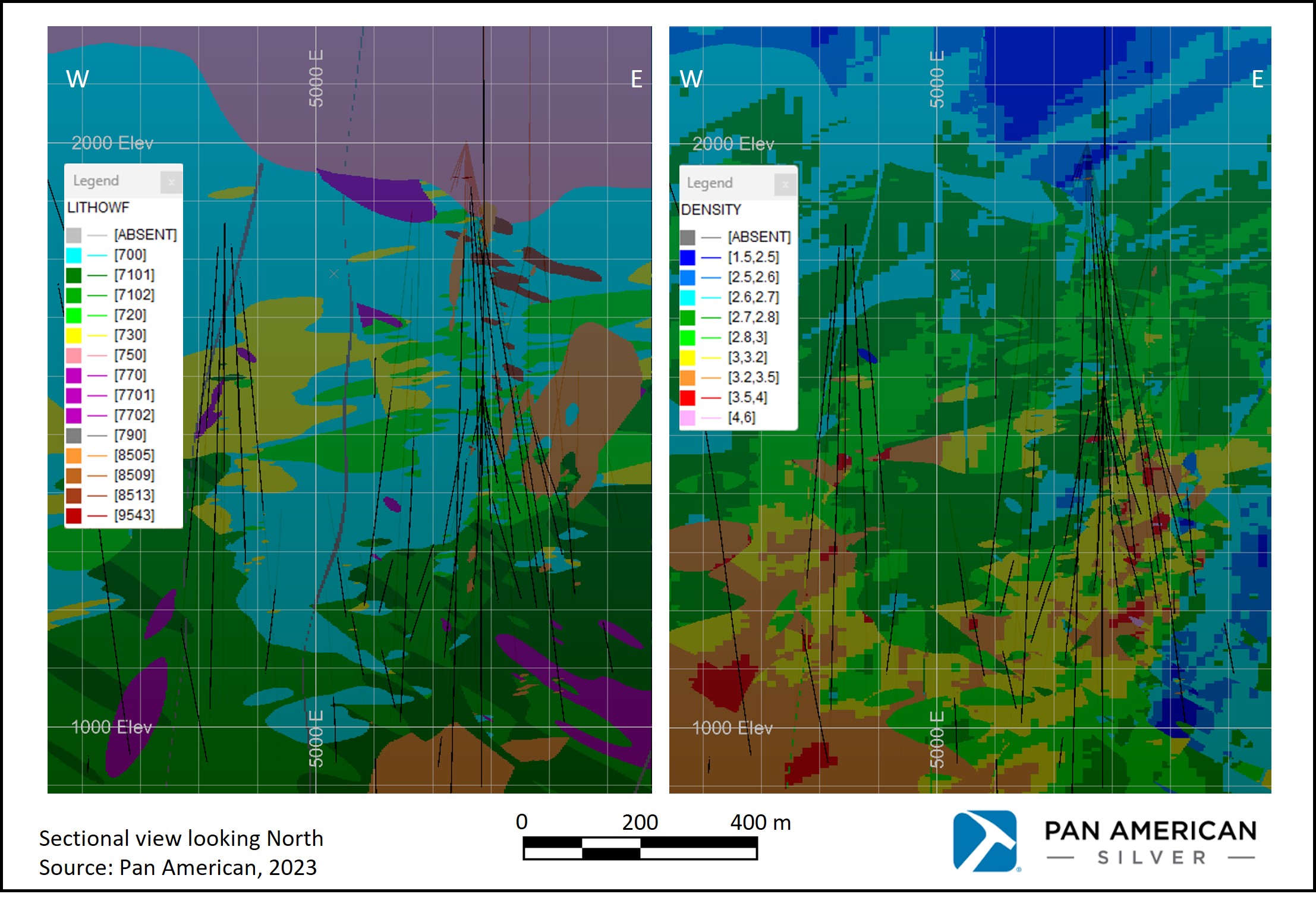

At the Skarn Project, faults acted as a conduit for the intrusion of several porphyries and their associated hydrothermal fluids. To date, two intrusive centres with similar characteristics have been identified: the main intrusive centre located between zones 901 and 903 of the Skarn Project; and a second centre north of the Skarn Project’s 902 zone. Emplacement of the intrusions fractured the sedimentary rocks, increasing the porosity and permeability of the limestone host rocks which were metamorphosed where in contact with the hot fluids. The evolution of the skarn system begins with contact metamorphism that in its early phase gives rise to the occurrence of marble, calc-silicate hornfels and recrystallized limestone. The final stage of skarn development is a distal phase consisting of CRD replacement bodies and veinlets of carbonate with sulphides.

Effective Date: December 18, 2023 Page 16

|

|

|

PAN AMERICAN SILVER CORP. |

1.3Exploration Status

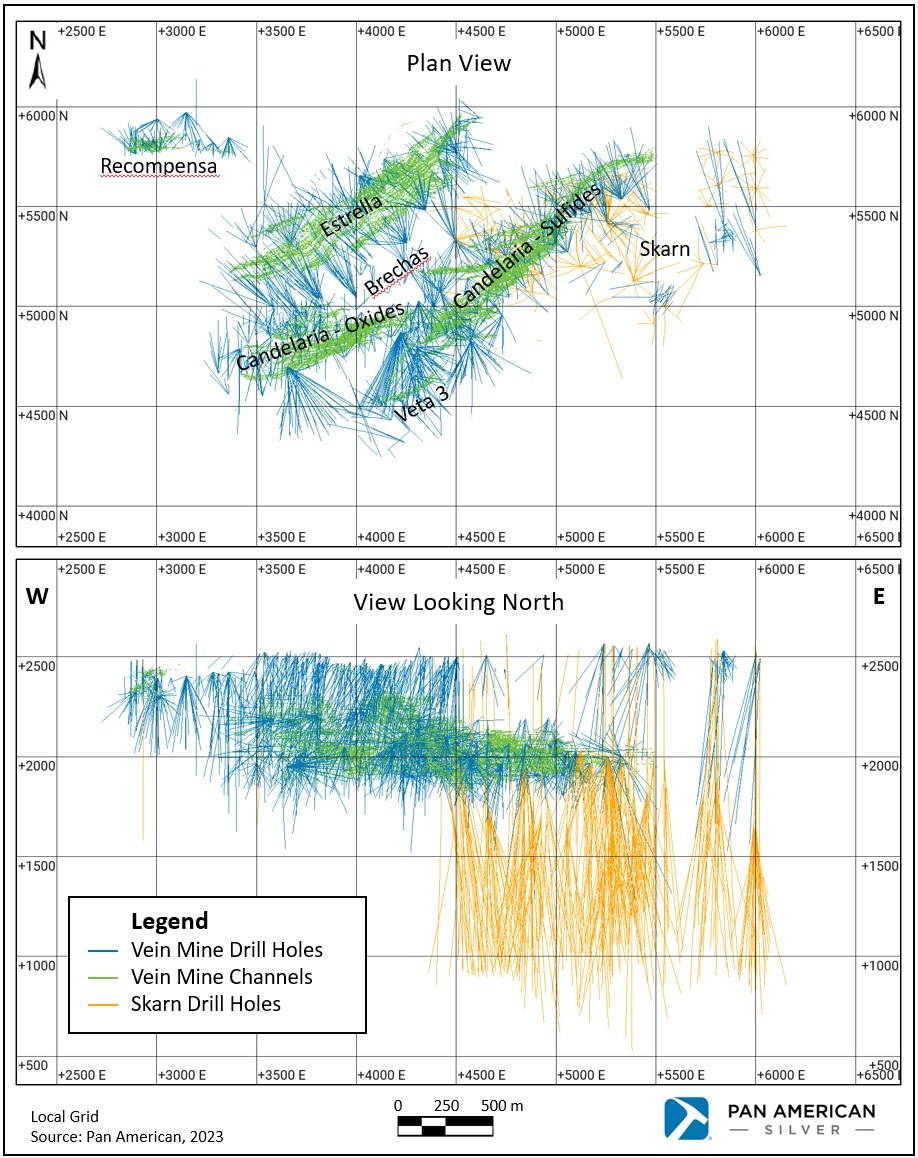

Before Pan American acquired the La Colorada Property, it had been exploited for many years without any systematic exploration work. The main structures were identified by underground mining before Pan American’s involvement. Pan American started to systematically test the zones that contain silver, gold, lead, and zinc in 1997 and has continued to drill since then to increase the mineral resource and compensate for the depletion of mineral reserves. MLC, the previous owner, drilled 131 core drill holes for a total of 8,665 m. As of June 2023, more than 757,000 m were drilled at the La Colorada Property in both the La Colorada Vein Mine areas (Recompensa, Estrella, and Candelaria) and the Skarn Project. This includes 342 drill holes (for 282,555 m) that target the Skarn Project, of which 181 drill holes (126,697 m) were directional drilling from existing drill holes to reach the target depths.

1.4Mineral Resource and Mineral Reserve Estimates

Mineral resource estimates were carried out separately for the La Colorada Vein Mine and the Skarn Project. The La Colorada Vein Mine mineral resource consists of 64 mineralized zones, each estimated separately. Annual updates are carried out on those mineralized zones that have have been mined or drilled significantly since their previous estimate. The Skarn Project is updated when significant additional drilling information becomes available and is herein the focus of a PEA.

The combined mineral resource for the La Colorada Vein Mine and the Skarn Project is tabulated below in Table 1-1. The effective date of the mineral resource is June 30, 2023, for the La Colorada Vein Mine and December 18, 2023, for the Skarn Project. Mineral resources exclude those mineral resources that were converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves.

Table 1-1: Mineral resource statement for the combined La Colorada Vein Mine and Skarn Project

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Classification |

Tonnes (Mt) |

Ag Grade (g/t) |

Ag Metal (Moz) |

Au Grade (g/t) |

Au Metal (Moz) |

Pb Grade (%) |

Pb Metal (Mt) |

Zn Grade (%) |

Zn Metal (Mt) |

La Colorada Vein Mine |

| Measured |

0.7 |

153 |

3.58 |

0.13 |

0.00 |

0.64 |

0.00 |

1.18 |

0.01 |

| Indicated |

2.5 |

182 |

14.62 |

0.19 |

0.02 |

0.87 |

0.02 |

1.41 |

0.04 |

| M+I |

3.2 |

175 |

18.19 |

0.18 |

0.02 |

0.82 |

0.03 |

1.36 |

0.04 |

| Inferred |

14.7 |

174 |

82.23 |

0.20 |

0.09 |

0.94 |

0.14 |

1.67 |

0.25 |

Skarn Project |

| Indicated |

173.6 |

33 |

183.18 |

- |

- |

1.32 |

2.29 |

2.79 |

4.84 |

| Inferred |

103.6 |

35 |

116.18 |

- |

- |

1.03 |

1.07 |

2.47 |

2.56 |

| Total |

| Measured |

0.7 |

153 |

3.58 |

0.13 |

0.00 |

0.64 |

0.00 |

1.18 |

0.01 |

| Indicated |

176.1 |

35 |

197.80 |

0.00 |

0.02 |

1.31 |

2.31 |

2.77 |

4.88 |

| M+I |

176.8 |

35 |

201.38 |

0.00 |

0.02 |

1.31 |

2.31 |

2.76 |

4.89 |

| Inferred |

118.3 |

52 |

198.41 |

0.02 |

0.09 |

1.02 |

1.21 |

2.37 |

2.80 |

1.Numbers may not add up due to rounding.

2.Mineral resources exclude those mineral resources that were converted to mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

3.Mineral resources were estimated in accordance with the guidelines laid out in the CIM Mineral Resource and Mineral Reserves Estimation Best Practice Guidelines (November 2019) and classified according to the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) guidelines.

Effective Date: December 18, 2023 Page 17

|

|

|

PAN AMERICAN SILVER CORP. |

4.For the La Colorada Vein Mine, the vein, hanging wall and footwall zones were combined into a practical mining width that includes a minimum dilution of 40 cm, or 35 cm of each hanging wall and footwall for cut and fill or long-hole stoping mining methods respectively. A minimum mining width of 2.6 m was used for cut and fill and 2.2 m for long-hole mining areas.

5.For the La Colorada Vein Mine, the diluted mining interval was reported above an economic cut-off grade that was calculated using a price of US$19 per ounce of silver US$1,300 per ounce of gold, US$2,600 per tonne of zinc, and US$2,000 per tonne of lead. Economic cut-off grades used for reporting the resource vary for each vein as a function of oxidation, depth, mining method, and geotechnical and processing variables.

6.The La Colorada Vein Mine’s listed lead and zinc grades are averages for the deposit. However, the only payable base metals are those from concentrates produced from the sulphide ores, not those from the doré produced from the oxide ores.

7.The effective date for the mineral resource estimate for the La Colorada Vein Mine is June 30, 2023.

8.Prices used to report the Skarn Project mineral resources were: US$22 per ounce of silver, US$2,800 per tonne of zinc, and US$2,200 per tonne of lead.

9.For the Skarn Project mineral resource, an estimated NSR (in US$/t) was calculated using metallurgical recoveries, obtained from metallurgical testing, of 87.4% silver, 88% lead and 93% zinc with mineral concentrates containing 67% Pb in the lead concentrate and 60% Zn in the zinc concentrate. Estimates for transport, payability, and refining/selling costs, based on experience and long-term views of the marketing, treatment, and refining of these types of mineral concentrates, were included.

10.Reasonable prospects for eventual economic extraction were assessed for the Skarn Project by determining the total in-situ tonnes and metal grades constrained inside volumes that were based on a SLC mining method. To determine the constraining SLC shapes, an initial elevated cut-off value of $50/t NSR was applied. Geotechnical, geometry and caving rules were then applied to ensure that practical mining shapes and sequences were achieved. Each level, each zone was individually tested for overall economics, and then tested as part of the caving sequence. The resulting constraining shapes were then considered as practical mining outlines. The tonnes and grades are inclusive of the must-take low-grade material within the volume. No other mining recovery, ring recovery, dilution, or mineral losses have been applied. Additional material outside the SLC shapes but within the development volumes that is above a cut-off grade of $10/t NSR was included in the resource.

11.The effective date of the Skarn Project mineral resources estimate is December 18, 2023. The geological model was completed in December 2022 and results from diamond drilling conducted in 2023 are therefore not included in this estimate.

12.The mineral resource estimates for the La Colorada Vein Mine and Skarn Project were prepared under the supervision, or reviewed by Christopher Emerson, FAusIMM, who is a qualified person as that term is defined in NI 43-101.

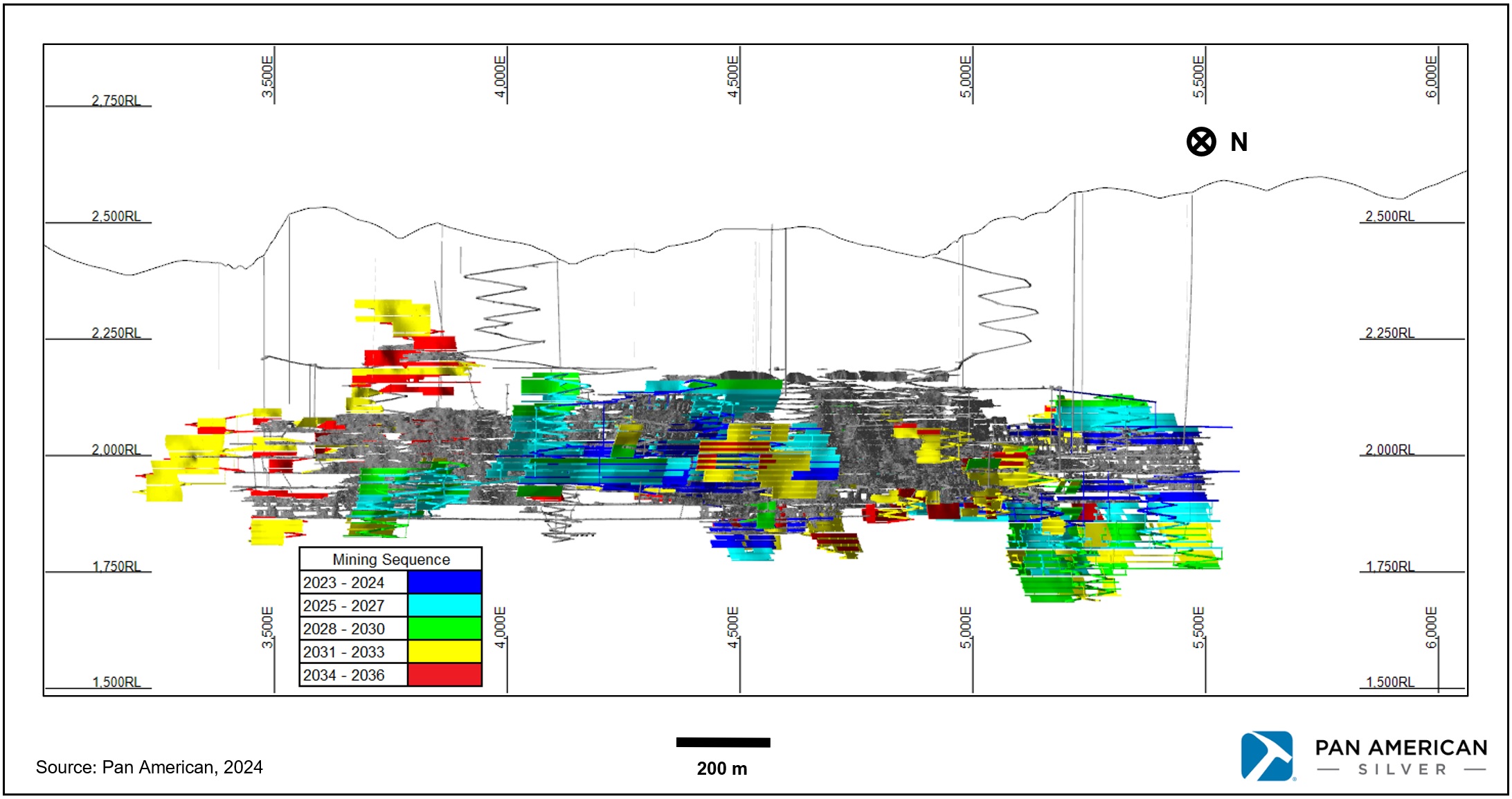

Pan American updates mineral reserve estimates on an annual basis following reviews of metal price trends, operational performance and incurred costs for the previous year, the results of diamond drilling and underground channel sampling conducted during the year, and production and cost forecasts over the LOM. The mineral reserve statement of the La Colorada Vein Mine as of June 30, 2023, is presented in Table 1-2.

Table 1-2: Mineral reserve statement for the La Colorada Vein Mine as at June 30, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Category |

Tonnes

(Mt)

|

Silver Grade

(g/t Ag)

|

Gold Grade

(g/t Au)

|

Lead Grade

(% Pb)

|

Zinc Grade

(% Zn)

|

Contained Silver

(Moz)

|

Contained Gold

(koz)

|

Contained Lead

(kt)

|

Contained Zinc

(kt)

|

| Proven |

5.0 |

296 |

0.21 |

1.25 |

2.15 |

47.2 |

33.8 |

61.9 |

106.6 |

| Probable |

4.2 |

292 |

0.19 |

1.26 |

2.22 |

39.1 |

25.3 |

52.5 |

92.7 |

| Total |

9.2 |

294 |

0.20 |

1.25 |

2.18 |

86.3 |

59.2 |

114.5 |

199.3 |

1.Mineral reserves have been estimated by the La Colorada technical services team under the supervision of Martin Wafforn, Senior Vice President, Technical Services and Optimization at Pan American Silver Corp., and a qualified person as defined by National Instrument 43-101. The mineral reserve estimate conforms to the CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014) guidelines.

Effective Date: December 18, 2023 Page 18

|

|

|

PAN AMERICAN SILVER CORP. |

2.Mineral reserves are reported by zone at variable cut-off values ranging from US$97.65/t to US$166.71/t. Metal price assumptions of US$19/oz for silver, US$1,300/oz for gold, US$2,000/t for lead and US$2,600/t for zinc were used in the estimation. Processing recovery assumptions for oxides are of 82.03% for silver and 45.68% for gold. Processing recovery assumptions for sulphides are of 93.10% for silver, 55.11% for gold, 84.62% for lead and 84.46% for zinc. Mine operating cost assumptions vary by zone and range from US$56.15/t to US$102.50/t, depending on the mining method, hauling distances, and lateral development requirements. Processing cost assumptions, including tailings disposal costs, are of US$14.58/t for sulphides and US$43.36/t for oxides, while G&A cost assumption are of US$20.85/t.

3.Mineral reserves are stated at a mill feed reference point and account for minimum mining widths, diluting material, and mining losses.

4.All selective mining units converted to mineral reserves contain a majority proportion of measured and indicated mineral resources.

5.Numbers may not add up due to rounding.

1.5Mining and Processing Methods

The Candelaria and Estrella mines are the only active underground operations at the La Colorada Property (the Recompensa mine is currently not in operation). The mining methods vary depending on the local geology and vein inclination. They can be either cut-and-fill (breasting) or sublevel long-hole stoping (SLS). The main access ramps and haulage drifts have a dimension of 3.5 m by 3.5 m and a maximum slope of 15%. Below level 408, they are enlarged to 4.0 m by 4.5 m to allow for bigger equipment and more mechanization at deeper levels. Electric hydraulic jumbo drills and hand-held drills are both used for the development mining to access the ore. Scooptrams are used for tramming ore and backfill to and from stopes, and haul trucks are used for underground haulage. Development waste is hauled to stopes to be utilized as backfill, and ore is hauled to ore passes or to one of the rock-breaker grizzlies at the shaft. Ore is hoisted to surface using a shaft with a capacity in excess of 2,300 tpd and is hauled to the mill crusher stockpile. When required, ore can also be hauled to the surface using the two access ramps present in each mine.

The processing plant has two different circuits for processing sulphide and oxide ores. The sulphide ore goes through a conventional flotation circuit that can process 2,000 tpd. It involves crushing, grinding, and selective lead and zinc froth flotation to produce lead and zinc concentrates. The metallurgical recoveries for the sulphide circuit in 2023 are 93% for silver, 58% for gold, 86% for lead, and 84% for zinc. The oxide ore goes through a conventional cyanide leach process that can process 400 tpd. It involves crushing, grinding, leaching, Merrill-Crowe zinc precipitation, and smelting of the precipitate to produce doré. The metallurgical recoveries for the oxide circuit in 2023 are around 82% for silver and 43% for gold.

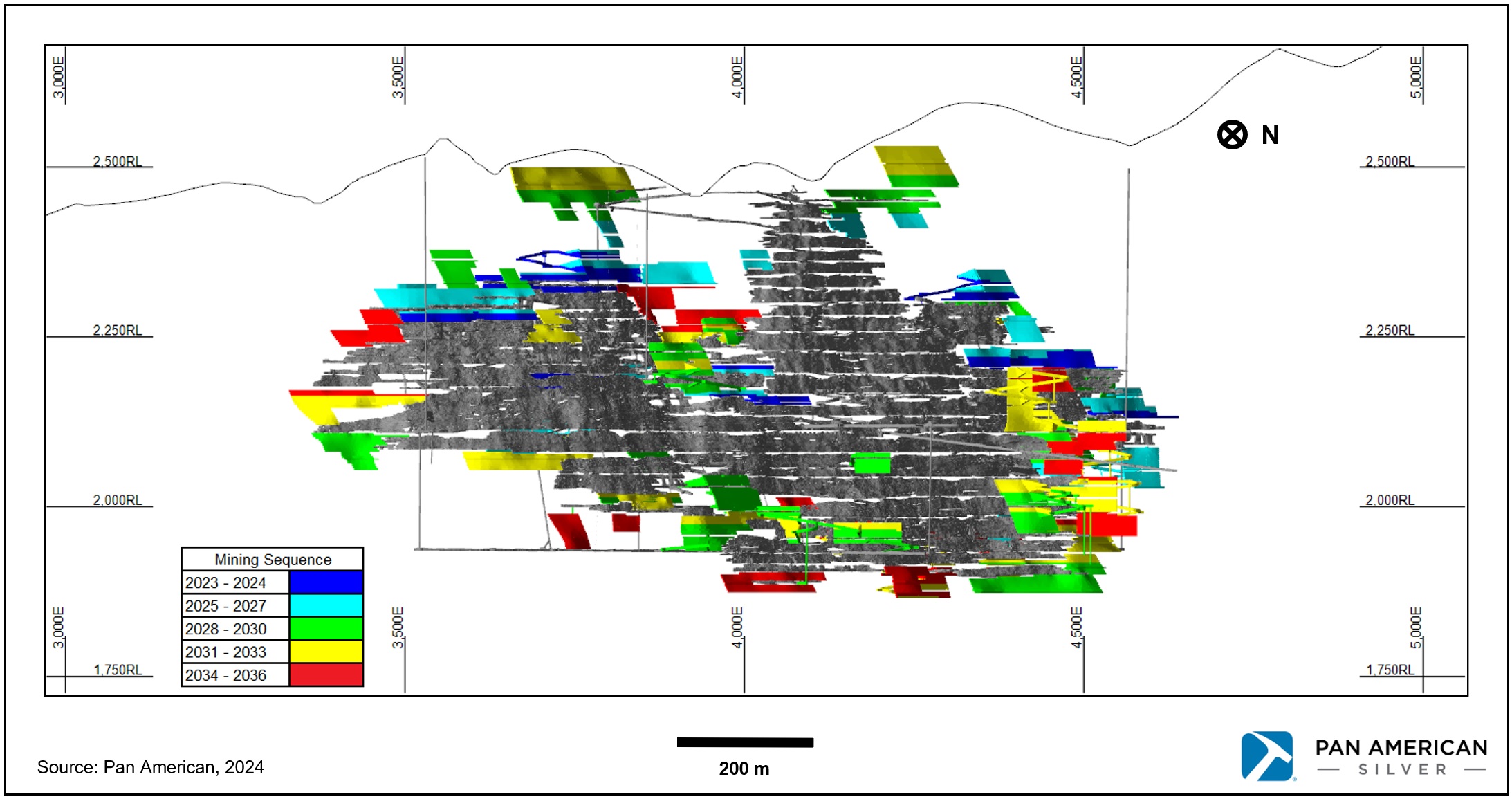

The mineral reserve inventory of the La Colorada Vein Mine as of June 30, 2023, forms the basis of the LOM plan. The LOM plan involves an integrated operation where oxide and sulphide ore from the Candelaria and Estrella underground mines are processed at their respective plants, with about 95% of the ore tonnes going to the sulphide ore plant. The LOM plan covers the period from July 2023 to 2035 at target production levels, followed by a gradual decrease in production in 2036, the final year of the plan. To optimize the value of the mineral reserves, lower-grade ore is mined later where feasible, resulting in an average annual silver production of 6.5 Moz from 2024 to 2029 and 5.8 Moz from 2030 to 2035, assuming expected metallurgical recoveries.

Effective Date: December 18, 2023 Page 19

|

|

|

PAN AMERICAN SILVER CORP. |

1.6Environmental Studies, Permitting, and Social or Community Impact

An environmental impact statement (“EIS”) and a risk assessment of the existing La Colorada Vein Mine on the La Colorada Property were submitted to the Mexican environmental authorities in 1999. The EIS described the impact of proposed development and mining activities and provided conceptual plans for closure and remediation. The EIS was approved by the Mexican authorities in 1999 and an update of the EIS was approved in 2010. In 2013, the Mexican authorities approved a modification to the existing environmental permits to allow the expansion of the La Colorada Vein Mine and process plant to up to 2,000 tpd. A subsequent permit modification application to expand the plant production was approved in early 2015.

The environmental initiatives at the site aim to secure and restore the historical tailings facilities. In the qualified person’s opinion, there are no known environmental issues that could materially impact Pan American’s ability to extract the mineral resources or mineral reserves.

Pan American’s social performance strategy for local communities focuses on building trust and respect for human rights, managing its commitments and impacts, and, above all, improving the social and health conditions of the community while ensuring a safe environment. Pan American is dedicated to creating value by providing essential resources to local communities in a sustainable manner.

A closure cost estimate for the La Colorada Vein Mine is prepared according to the US State of Nevada’s approved Standard Reclamation Cost Estimator (SRCE) methodology. It is updated every year for unit costs and discount rates, and every other year for physical disturbance estimates, if necessary. Pan American’s current present value estimate of site reclamation costs is approximately US $7.0 million, effective December 31, 2022. No reclamation bond is required under Mexican law.

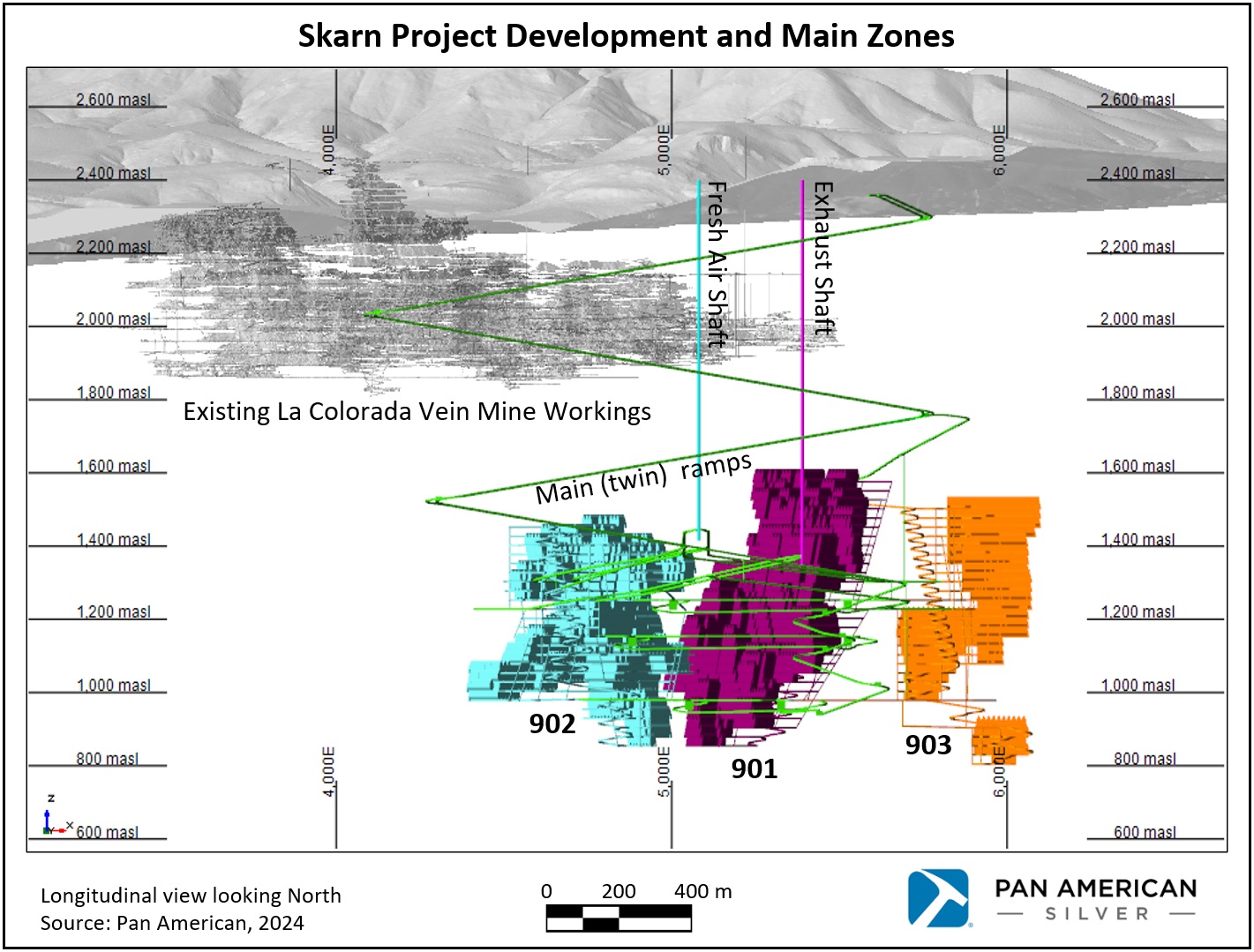

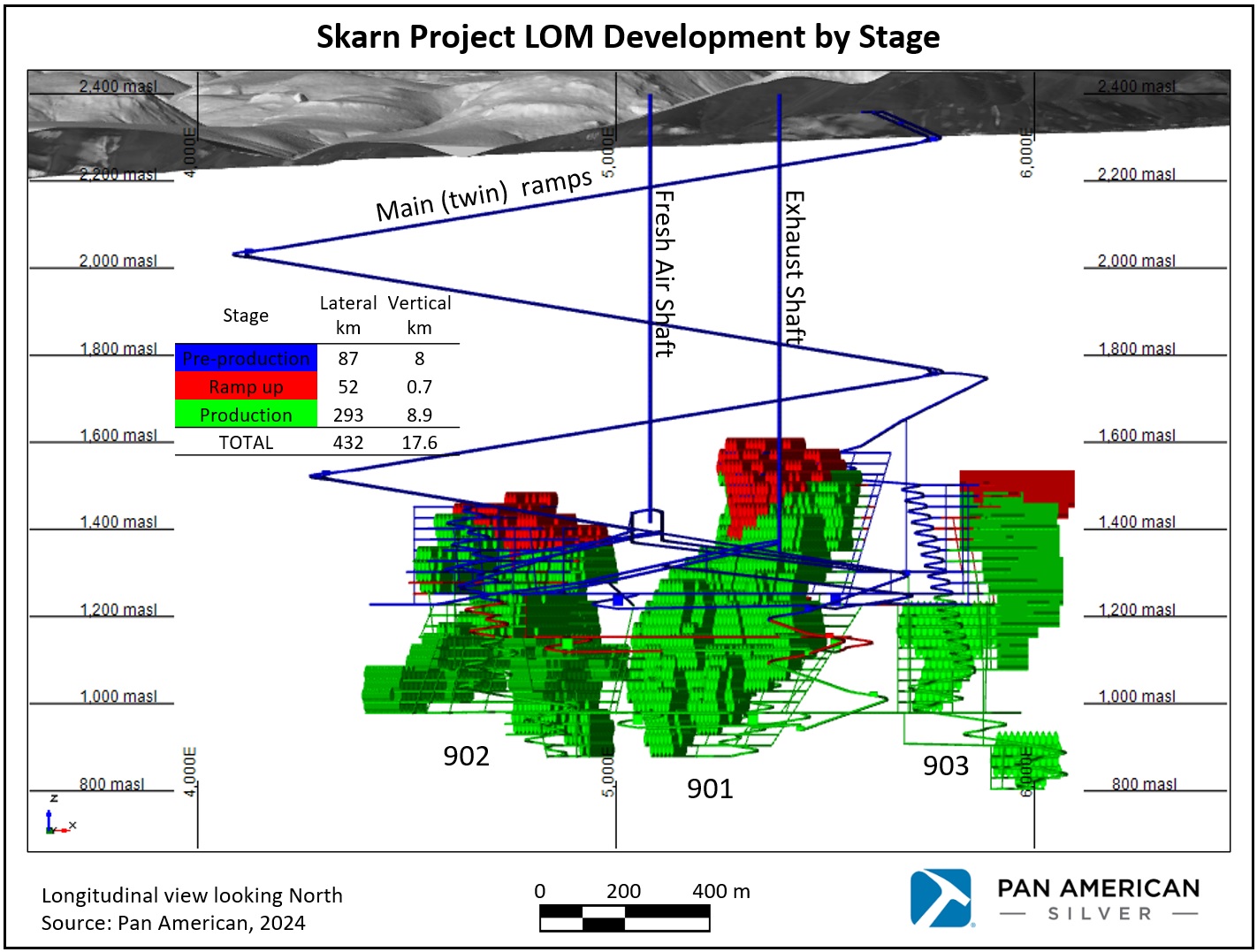

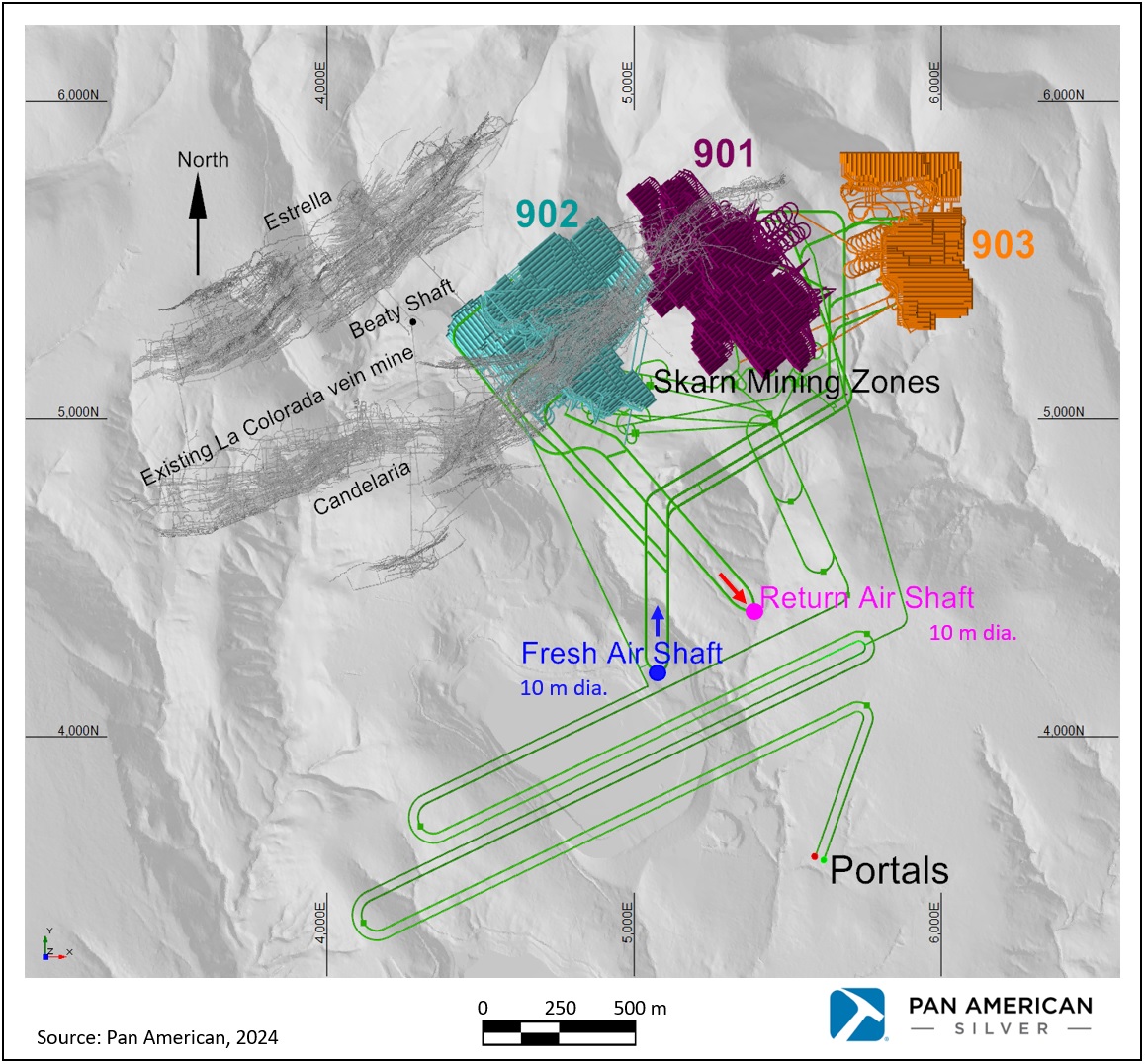

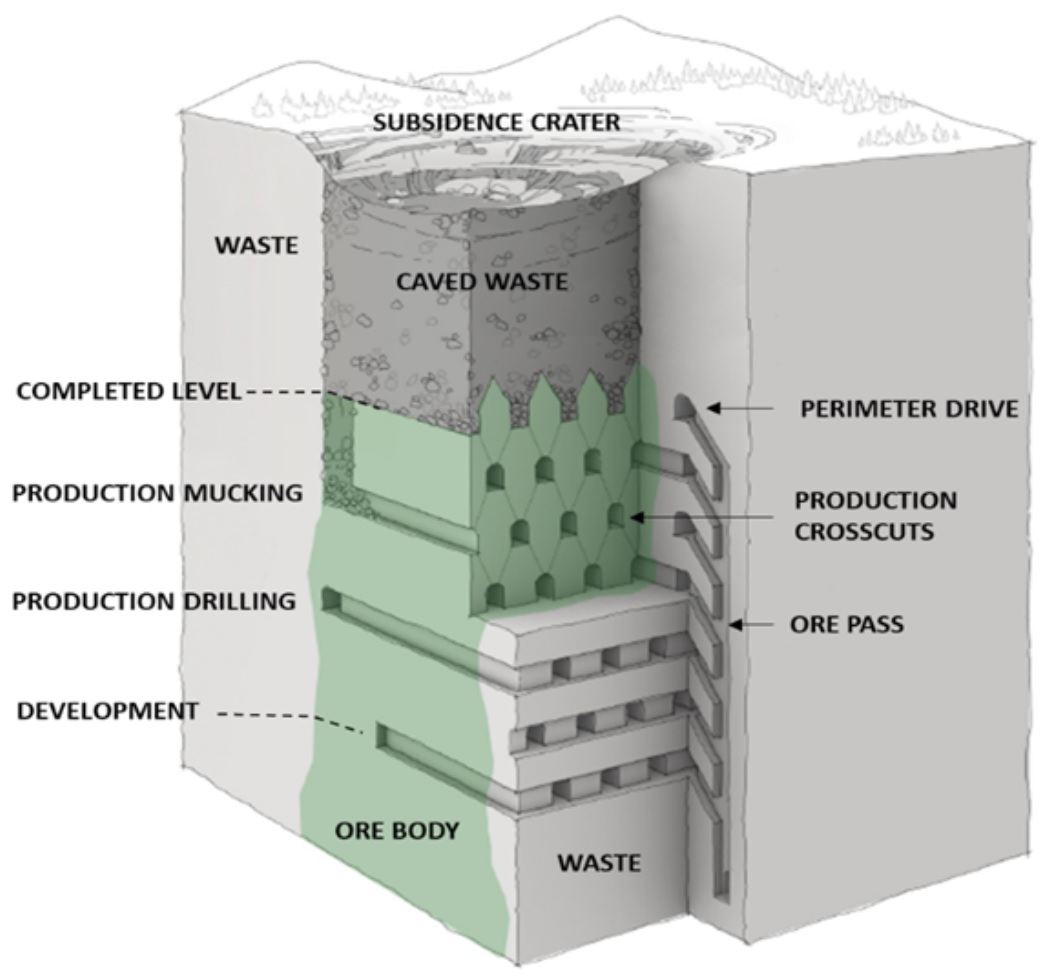

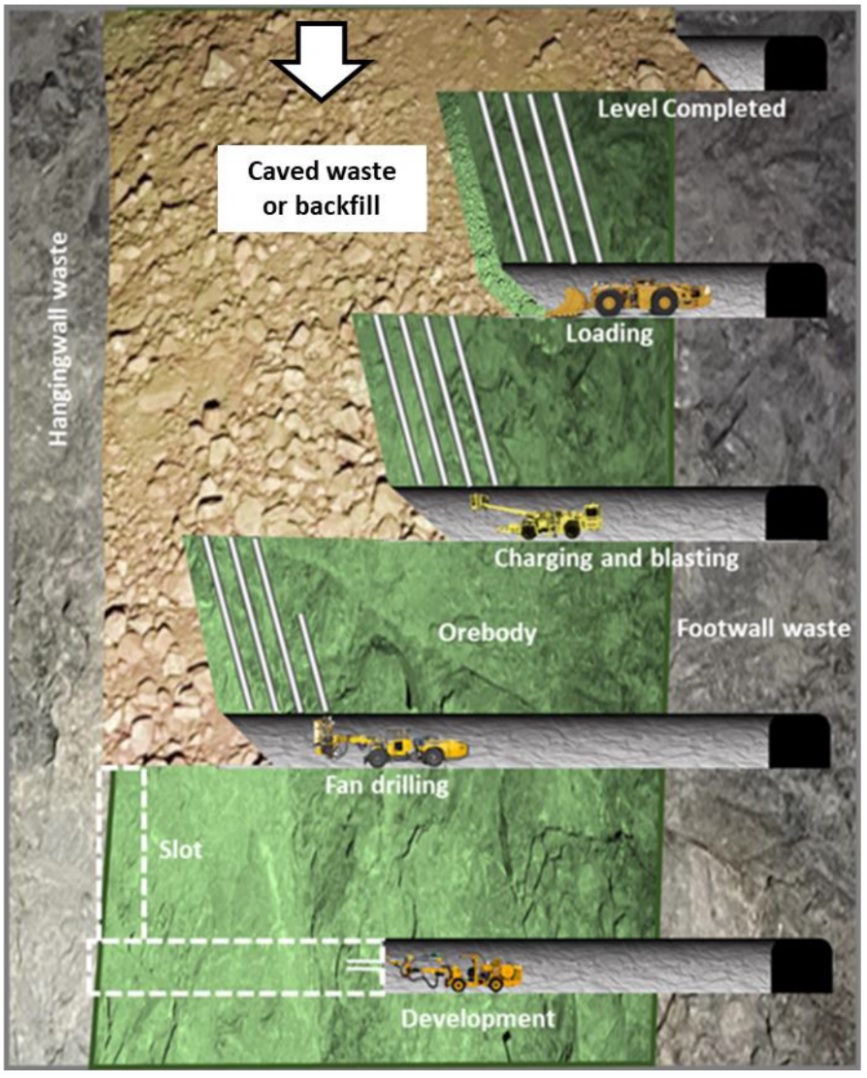

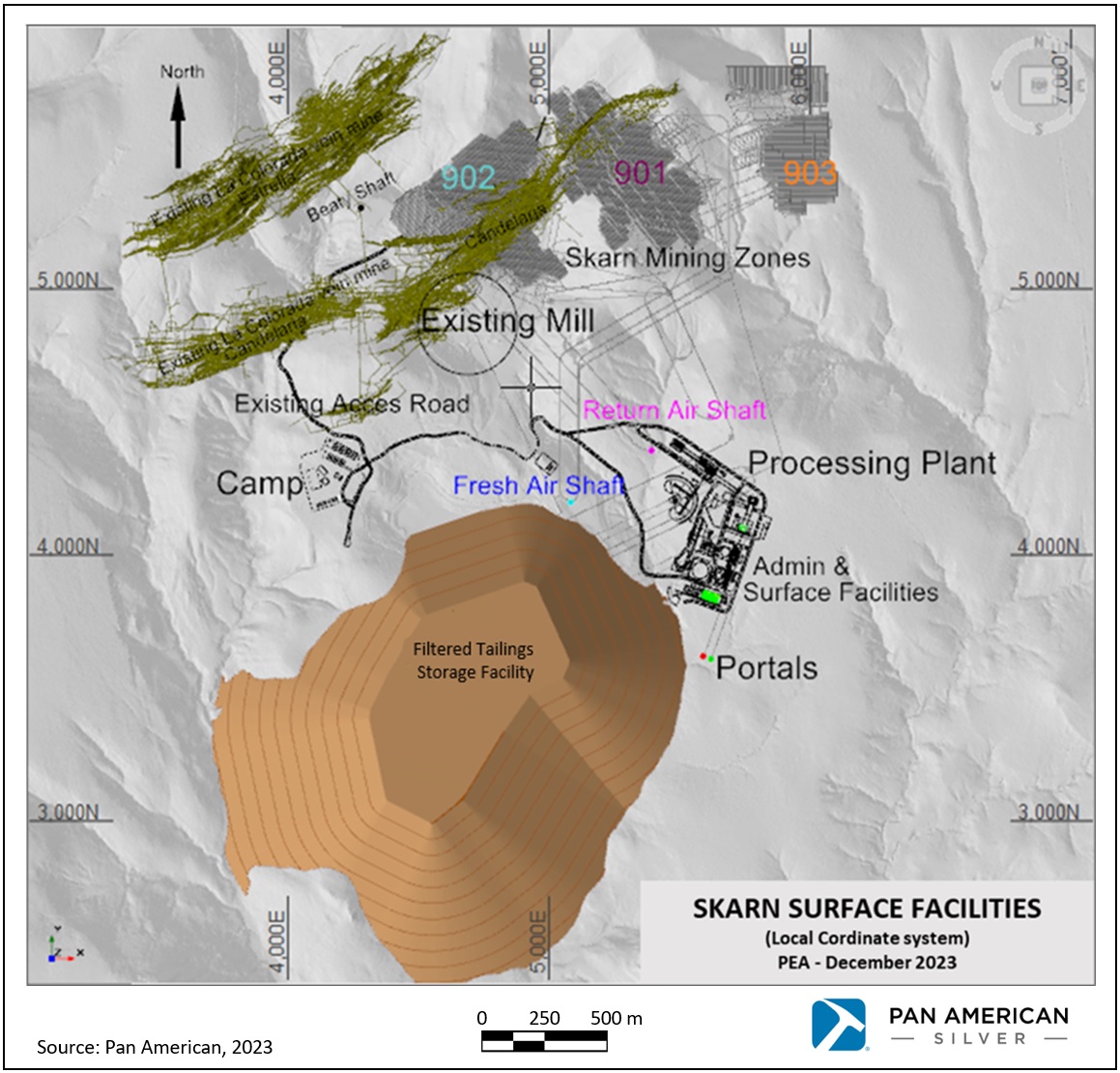

1.7Skarn Project Preliminary Economic Assessment

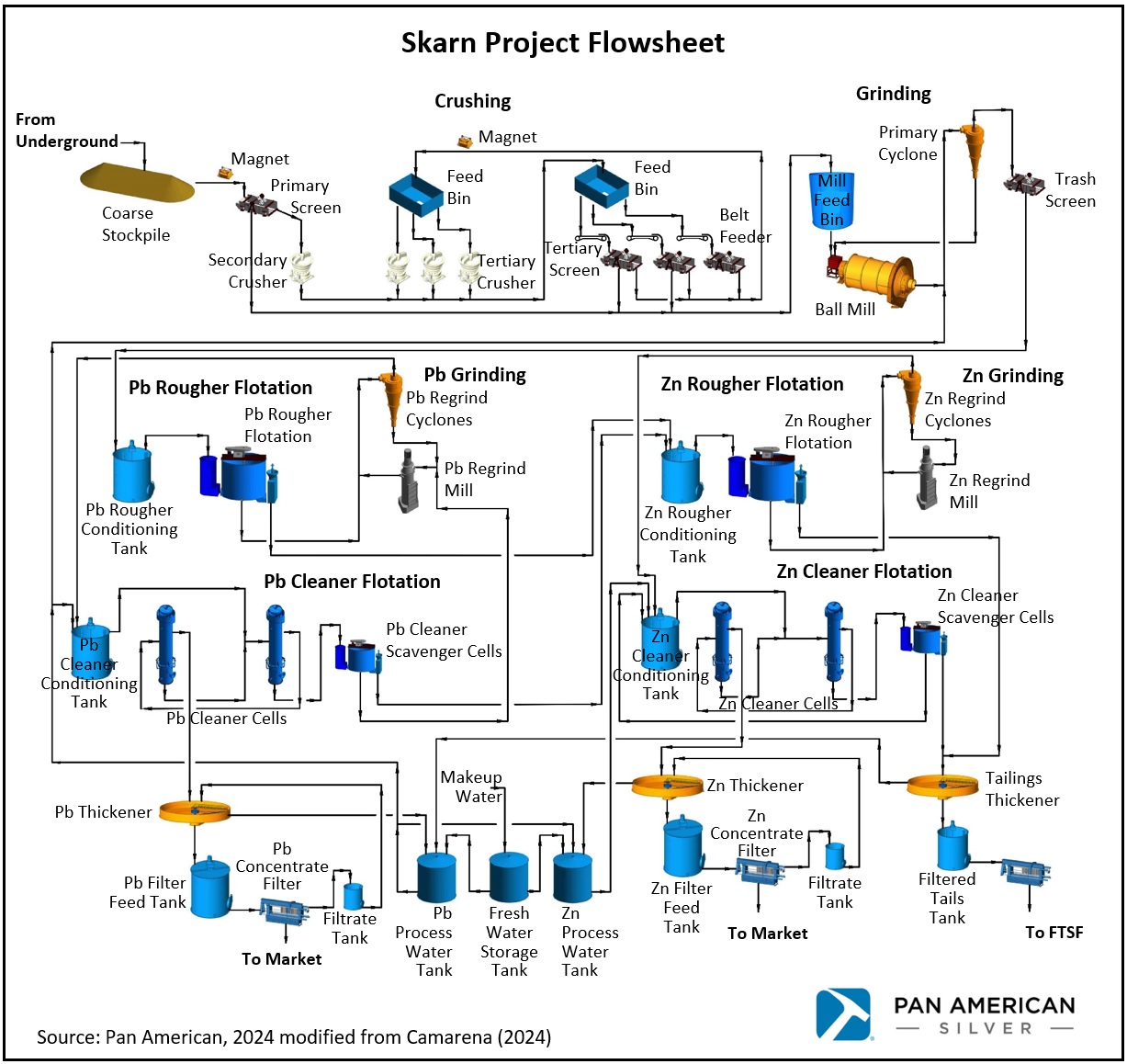

The Skarn Project PEA project proposes to develop a mine that uses a sublevel cave (SLC) mining method with a capacity of 50,000 tpd. The mine at the Skarn Project would be accessed by decline ramps and two ventilation shafts. The development phase would last six years after permit approval. A 50,000 tpd capacity processing plant using selective zinc and lead flotation and a filtered tailings storage facility would produce silver-bearing mineral concentrates at an average rate of 2,003 tpd of zinc concentrate grading 59% zinc and 846 tpd of lead concentrate grading 61% lead.

The average annual production for the first 10 years of operation would be 17.2 Moz of silver, 427 kt of zinc, and 218 kt of lead. The Skarn Project LOM is estimated at 17 years; this estimate does not include the 2023 drill results.

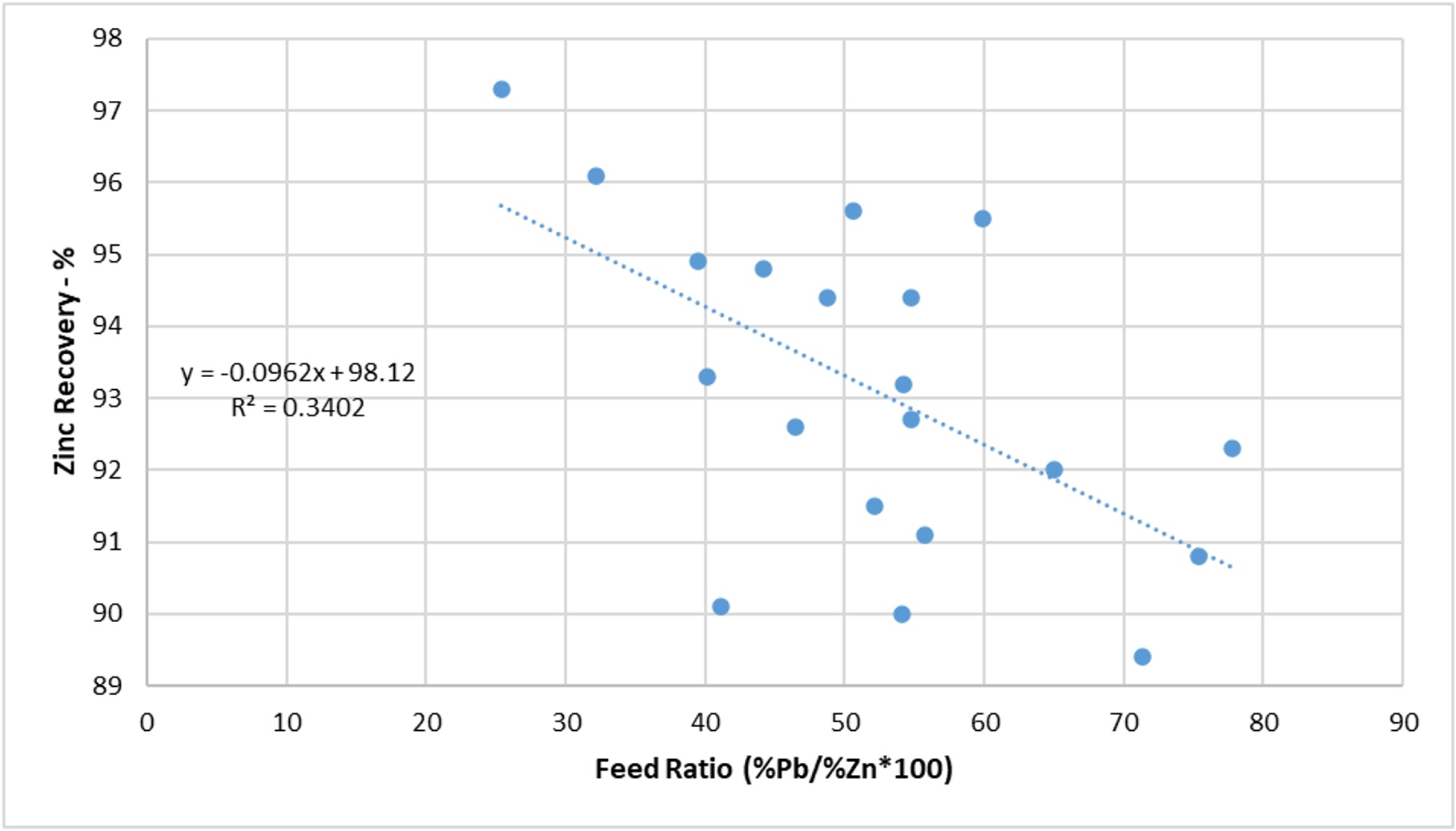

The following metallurgical test work programs have been conducted: mineralogical analysis, detailed comminution, flotation, and thickening and filtration of the tailings. The proposed processing plant is expected to produce high-grade zinc concentrate and a lead concentrate with high silver content, which can both be easily sold to market. The average zinc recovery over the LOM is 93.7% with a concentrate grade of 59% zinc and 97 g/t silver, while the average lead recovery is 84.3% with a concentrate grade of 61% lead and 1,438 g/t silver. The overall silver recovery is 84.8%, with most of it (72.5%) in the lead concentrate.

Over the LOM, the average unit operating cost (which covers mine, mill, and general and administrative costs) is estimated at US$40.88 per tonne.

The Skarn Project requires an initial capital cost of US$2,829 million, which will be spent over six years, most of it during mill construction in the fourth and fifth years. The initial investment is expected to be recovered in 4.3

Effective Date: December 18, 2023 Page 20

|

|

|

PAN AMERICAN SILVER CORP. |

years. The existing La Colorada Vein Mine’s operation will continue during the construction and development phase of the Skarn Project. The total LOM sustaining capital is estimated at US$951 million.

The cumulative after-tax cash flow is estimated at US$5,689 million. The after-tax net present value (NPV) is US$1,087 million at an 8% discount rate with an after-tax internal rate of return (IRR) of 14%, an NPV of US$1,572 million at a 6.5% discount rate, and an NPV of US$2,182 million at a 5% discount rate, using average LOM metal prices of US$2,800 per tonne zinc, US$2,200 per tonne of lead and US$22 per ounce of silver.

The proposed SLC mining method has been identified as a technically viable method of developing the Skarn Project. Future expansion and better definition of the mineralization could complement and expand the initial SLC mining inventory. Expanded SLC and block cave mining methods will be further evaluated in future studies.

Permits would be required to develop the Skarn Project, a new processing facility, a filtered tailings storage facility, and other surface infrastructure. Some current permits for the La Colorada Vein Mine are expected to benefit the Skarn Project in development and operations. The Skarn Project will also likely be subject to additional authorizations, consultations, and agreements in the normal course of business, as well as other risks and uncertainties.

The Skarn Project design will leverage the existing infrastructure at the La Colorada Property whenever feasible. The new facilities and the Skarn Project will be designed with a focus on automation, electrification, energy efficiency, and renewable energy sources to reduce the carbon footprint of the Skarn Project.

The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

1.8 Conclusions and Recommendations

Pan American conducts infill and near mine exploration drilling at the La Colorada Vein Mine to update the mineral resource and mineral reserve estimates on an annual basis following reviews of metal price trends, treatment and refining charge trends for base metal concentrates, operational performance and costs experienced in the previous year, and forecasts of production and costs over the LOM.

The La Colorada Vein Mine geology and mineralization continues to change as the deposit deepens with the structures housed within the limestone and the mineralogy becoming more base metal rich. The deep drilling shows the epithermal veins becoming less continuous and more sporadic. This change is reflected in the current mineral resource and mineral reserve estimates. Previous drilling on Recompensa and NC2 veins has indicated the extension of mineralization to the east. Continuous infill drilling to test vein grades and thickness’ is paramount to support efficient production and enable good reconciliation. Surface exploration and drilling has now defined the vein system over a 1.5 km by 3.0 km area and the potential to find additional new veins and extensions to existing veins remains the focus of the geology team on site.

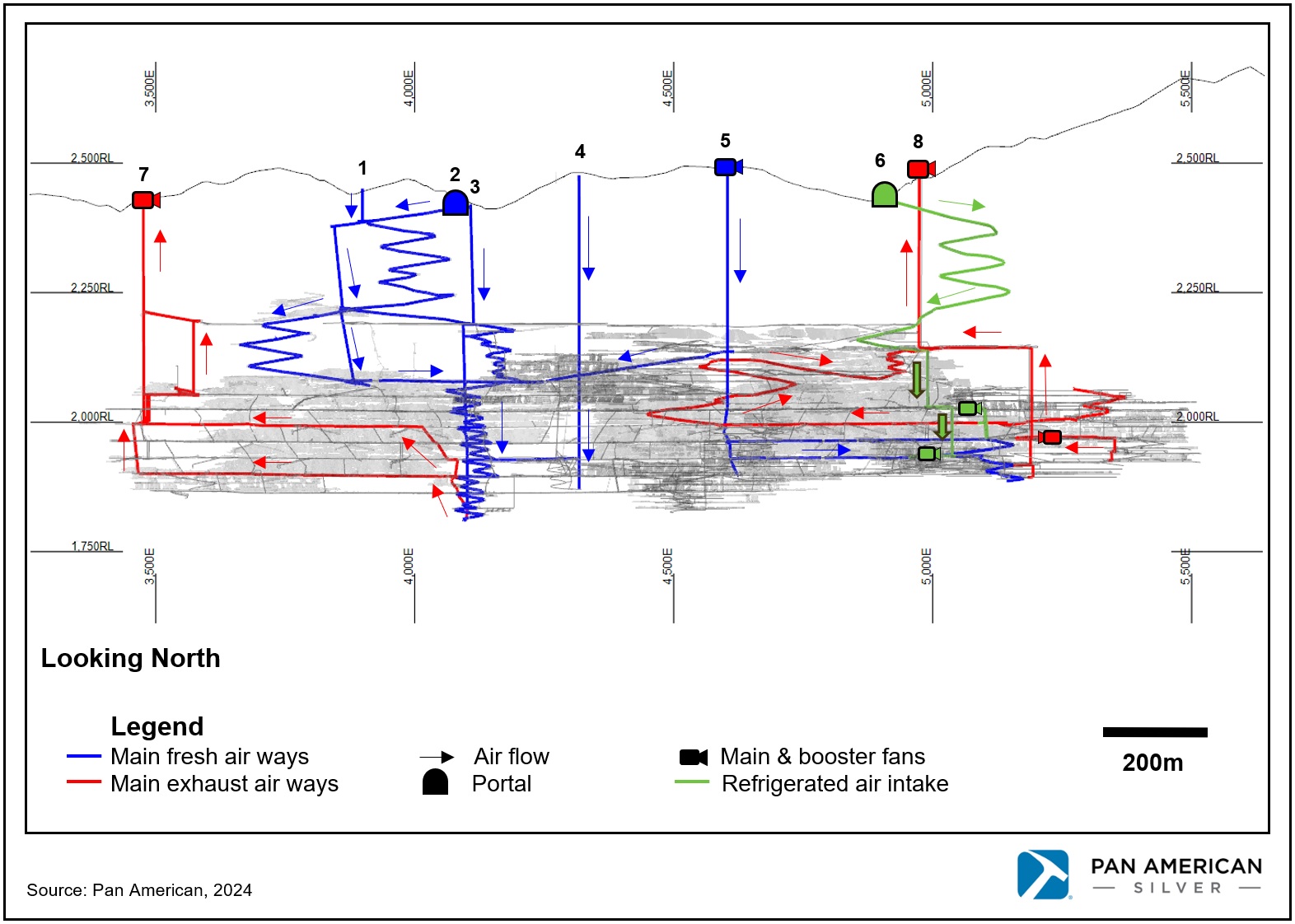

The mining parameters for the La Colorada Vein Mine are well established over many years of mining and are adjusted from time to time as required based on physical measurements in the mine and reconciliation results. The assumptions made for the La Colorada Vein Mine cut-off grade and for the LOM operating cost are based on an expected return to full capacity within a reasonable period of time following the completion of the Guadalupe ventilation shaft and associated ventilation infrastructure. If the anticipated higher production rate is not met, the unit costs can be expected to be higher than those assumed and lead to a reduction in the mineral reserves.

Effective Date: December 18, 2023 Page 21

|

|

|

PAN AMERICAN SILVER CORP. |

The metallurgical assumption used for the mineral resources and mineral reserves estimates for the La Colorada Vein Mine are based on operational plant performance and are confirmed by bench-scale testing of representative samples of the planned monthly mine feed. This work has confirmed that the optimum processing method is selective lead/zinc sulphide flotation for sulphide ore and cyanidation for oxide ore.

The deep drilling and discovery of the Skarn Project deposit in 2018 highlighted the potential extent of the hydrothermal system and identified an intrusive porphyry (Cu-Mo-Ag-rich), metamorphic endoskarn and exoskarn mineralized zone. The limestone host rock for subsequent sulphide retrograde emplacement of zinc, in the form of sphalerite accompanied by galena, pyrite, chalcopyrite and minor magnetite. Sulphide textures vary from disseminated and patchy to semi massive and massive. The carbonate replacement style high grade mineralization is seen associated to the distal portions of the system. There appears to be multiple pulses of intrusions and differentiation as the system evolved over time.

The skarn mineralization sits between 700 m and 1,900 m below surface, extending some 1,800 m in a NE-SW direction and 650 m in a NW-SE direction. Skarn geometry is dependent on the shape of the causative intrusion, the composition and orientation of the stratigraphy, and the lithological contacts that generate permeability in the host rock. Skarn mineralization is well developed in the retrograde stages in skarn layers ranging from a few centimeters to tens and hundreds of meters thick.

Continued exploration and studies of the La Colorada Vein Mine and the Skarn Project will increase the footprint and knowledge of the respective deposits. Further understanding of the transition between the skarn-CRD and intermediate sulphidation veins could identify vectors in the epithermal environment which could allow for the identification of future exploration targets.

The PEA has shown the Skarn Project to be potentially economic and indicates it could be successfully mined by sublevel caving methods and the materials processed by standard crushing, grinding and flotation techniques to produce high quality saleable concentrates. The mining method involves a top-down sequence and has the benefit to the NPV by delivering the higher margin materials to processing earlier in the mine life. The PEA is preliminary in nature, it includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA will be realized.

The 50 ktpd processing rate, with associated ramp- up and ramp down periods results in a 17-year LOM. 285 Mt of mill feed will be delivered in that 17-year period. Payable quantities of 202 Moz of silver, 5.75 Mt of zinc and 2.64 Mt of lead will be recovered into concentrates. The two main products produced are a zinc concentrate and a silver-rich lead concentrate. The only payable metals are zinc, lead and silver. Although low grades of gold and copper are present in the concentrates, they are not payable at this stage.

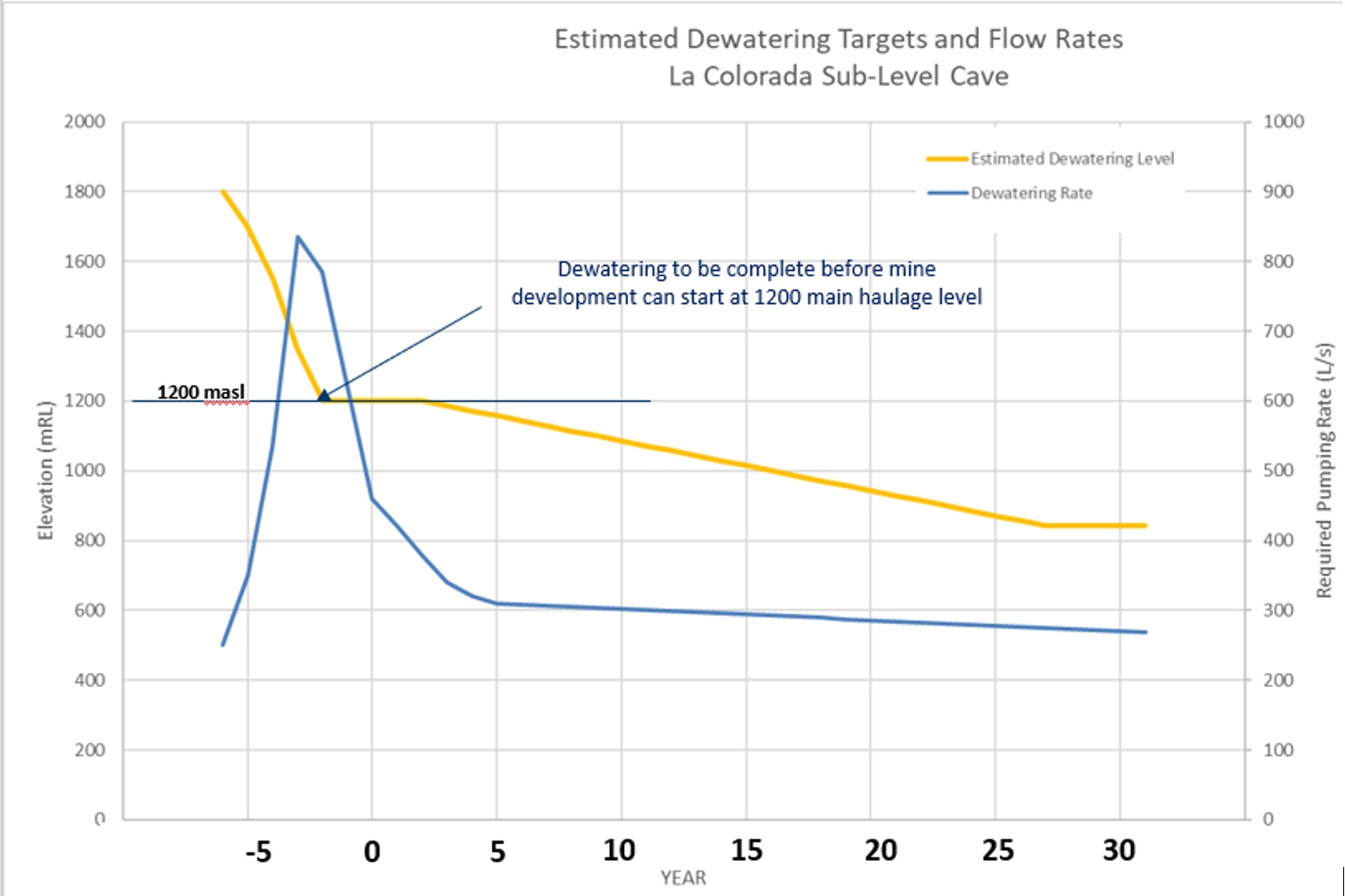

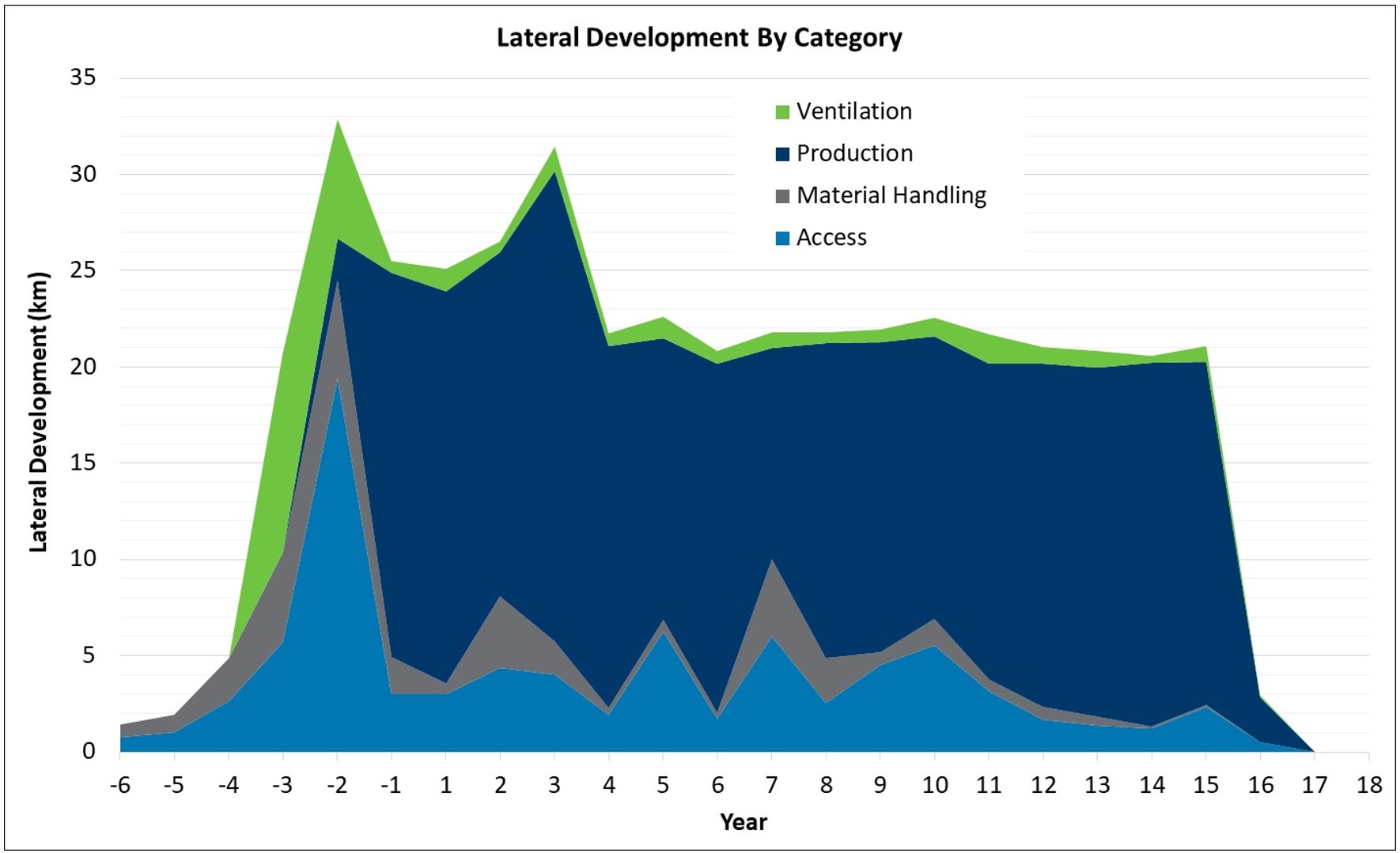

The depth and geometry characteristics of the Skarn Project deposit require a six-year pre-production construction and development period to establish the access, ventilation, haulage and processing infrastructure prior to commissioning and establishing steady state operations.

The PEA uses the most recent mineral resource estimate which is based on drilling completed up until November 2022. There are no mineral reserves reported from the Skarn Project at this time, as the current level of studies do not support mineral reserve estimations. A future pre-feasibility study (PFS) would be required (as a minimum) prior to the declaration of any mineral reserve estimates.

The results of the PEA support progressing the exploration to further delineate the lateral and depth extents of the Skarn Project mineral resources. The potential joint venture agreement with respect to certain adjacent mineral concessions would offer an opportunity to incorporate additional materials outside of the current boundaries of

Effective Date: December 18, 2023 Page 22

|

|

|

PAN AMERICAN SILVER CORP. |

the La Colorada Property, and to optimize the PEA mining shapes by expanding the current concession boundaries that constrain and truncate the current geometry.

The LOM plans developed are at a suitable level of detail for a PEA study. The designs and schedules have enabled various trade off studies and scenarios to be analyzed to ensure realistic and appropriate timings and rates were used. The design and schedule scenarios tested the practicality of the mining sequences, production rates, development rates, and highlight the risks and opportunities in areas such as materials handling and ventilation.

Some opportunities exist to optimize the shaft and ramp locations, expand some footprints, and gain more tonnes per vertical metre. There is moderate potential to lower development costs that would be dependent on factors such as ventilation and equipment sizing. Some of the risks highlighted are the quantity of mine lateral development and the required offset from the cave zones, particularly for the ventilation networks. Stress induced from mining, and the associated interaction with the off-footprint development are areas for future studies.

The Skarn Project is in an area with a high geothermal gradient, meaning that the in-situ rock temperatures are high and increase at a steady rate with mining depth. Ventilation and water management processes will need to be adequate to mitigate these conditions and establish a safe working environment.

Based on test work conducted between 2019 and 2023, the Skarn Project is expected to have very good metallurgical performance, producing high-grade zinc and lead concentrates with high metal recoveries. Test samples used in the work programs were representative of the mineralogy and grades of the Skarn Project and the samples used were widely dispersed across the mineralized body. The mineral processing of the materials mined is by standard flotation and there are no known issues with being able to produce saleable concentrates. Zinc and lead concentrates will be the two concentrate products exported from the site and they will contain payable zinc, lead, and silver metal. Tails will be stored in a filtered tailings storage facility adjacent to the processing plant and located entirely on La Colorada Property.

The capital and operating costs are adequate for a PEA level of study. Detailed estimates are required at the next stage of project development. There is opportunity to decrease operating costs with increased mineral resources on each level, however the capital costs are unlikely to have any significant decreases.

The current inflationary climate with respect to costs and the strength of the Mexican Peso are risks and opportunities for the Skarn Project. All costs and revenues for the PEA in Section 24 are expressed in 2023 US dollars, unless expressly stated otherwise. A contingency level of 30% was applied to some areas of the estimate. Other areas, where direct quotes were received, had a lesser contingency applied. Given Pan American’s recent history of executing capital projects in Mexico in the past 8 years (two mine shafts, one underground mine, one flotation plant, one agglomeration plant, one refrigeration plant) the capital estimate is considered reasonable for PEA purposes.

Environmental monitoring programs at the current La Colorada Vein Mine provide sound baseline data. Additional baseline studies are being conducted and will evolve as the Skarn Project evolves. The Skarn Project will be developed in accordance with all governmental and regulatory requirements.

The results of the Skarn Project PEA (see Section 24) in this technical report are subject to variations in future development and operational conditions including, but not limited to, the following:

•Assumptions related to commodity prices and foreign exchange rates.

•Unanticipated inflation of capital or operating costs.

•Significant changes in recovery or processing parameters.

Effective Date: December 18, 2023 Page 23

|

|

|

PAN AMERICAN SILVER CORP. |

•Geological and structural modelling and interpretation of the mineralization.

•Geotechnical assumptions, stress, seismicity, inrush and cavability of the mining zones.

•Inventory dilution or loss, and flow model calibration.

•Throughput and recovery rate assumptions.

•Changes in regulatory requirements that may affect the development, operation, tails disposal or future closure plans.

•Changes in closure plan costs.

•Changes in permitting or approvals requirements.

•Changes in downstream treatment and smelter charges and costs.

•Criminal and organized crime activity in some regions of Mexico.

The PEA economic analysis for the Skarn Project has estimated a positive cash flow, and a positive NPV(8%) after taking into account the operating, capital, and taxation costs. The metals prices used were US$2800/t for zinc, US$2200/t for lead and US$22.00/oz for silver.

In the opinion of the qualified persons, and considering the preliminary nature of the Skarn Project PEA, there are no known or reasonably foreseen issues, risks or impediments that would prevent the Skarn Project from advancing to a PFS study once the mineral resources are further delineated and a new mineral resource model is prepared.

Based on the information presented in this technical report, the qualified persons recommend the following action items.

Exploration

Ongoing exploration drilling is of paramount importance to the replacement of mineral resources and mineral reserves and generating new mineral resources. In 2024, Pan American plans to invest between US$10 and US$11 million on drilling between 40,000 m and 50,000 m of drilling on the La Colorada Vein Mine and the Skarn Project. The drilling of the epithermal veins should focus on the extensions east of the current underground La Colorada Vein Mine as well as splay and down dip extensions of known veins within the Estrella and Candelaria mines. The infill and exploration drilling of the Skarn Project should concentrate on the mineralization zones 902, 903, and west-northwest portion of 902 respectively.

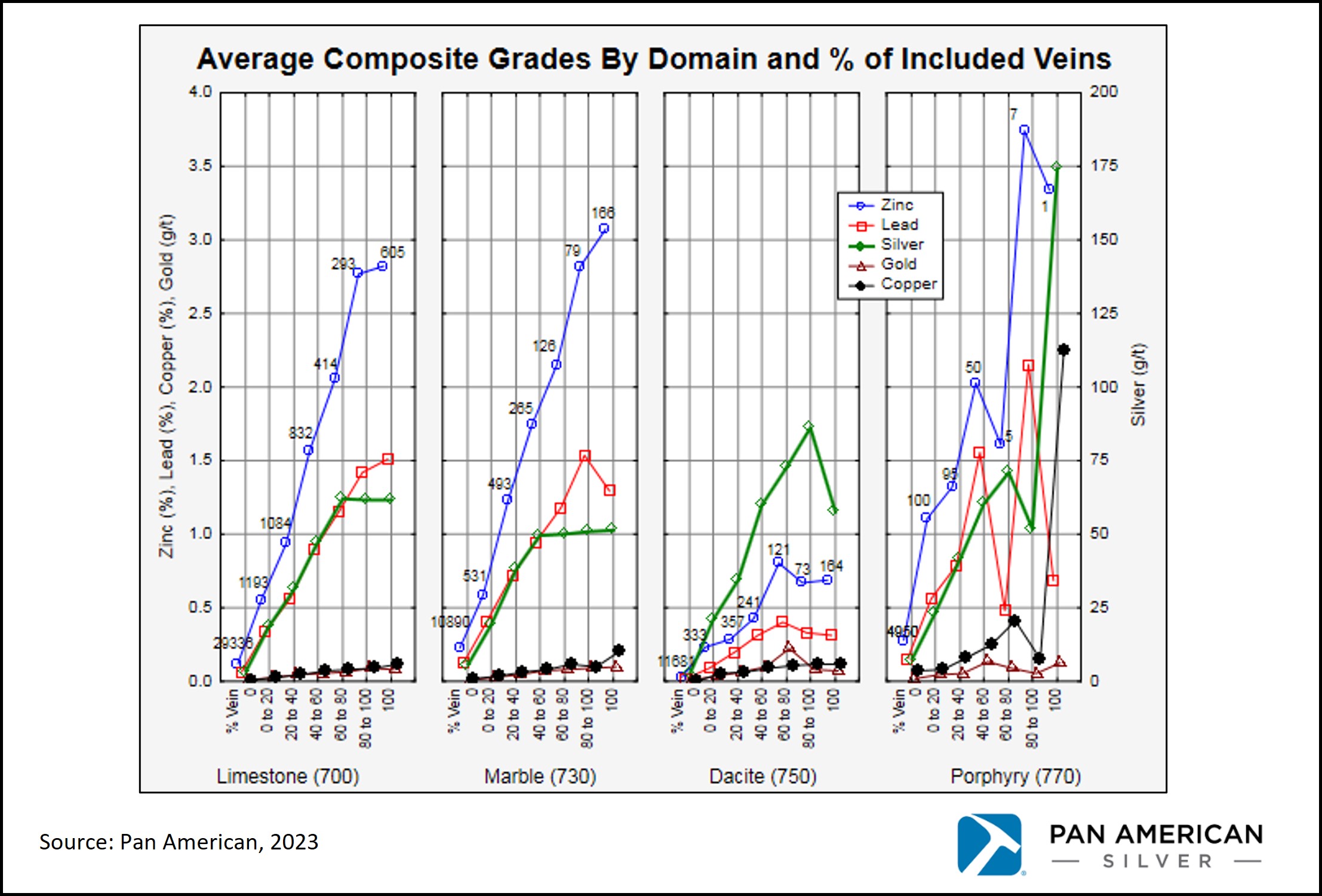

The study of mineralization within the limestone lithology units at the Skarn Project above the current mineral resource estimate is required. The geological modeling of the interlayered skarn within the limestone means that logged skarn units are included in the limestone unit. The geological misclassifications are a concern in unmineralized or poorly mineralized lithologies because the geologically misclassified material tends to be associated with significantly higher grades than those typically found in the logging unit assigned to that material (correctly classified). The presence of epithermal veins, which are associated with high grades and cut through all lithologies, also pose modelling challenges. Due to their small size and the unlikelihood of confidently linking intercepts between drill holes. Including these geological misclassifications and vein intercepts without control could potentially result in overestimation of the grade for the unmineralized units. Therefore, additional sampling and modeling of the limestone and the effect of any mineralized material present is required to better understand and develop a modeling strategy which more accurately represents the grade distribution.

Effective Date: December 18, 2023 Page 24

|

|

|

PAN AMERICAN SILVER CORP. |

The La Colorada Vein Mine

For the La Colorada Vein Mine, it is recommended that once the Guadalupe ventilation shaft is commissioned, and proper ventilation and refrigeration conditions in the deep east zone of the Candelaria mine are restored, production is gradually increased at the La Colorada Vein Mine to design rates.

Once production has been stabilized at sustainable rates and the deeper levels of the Candelaria mine are accessed, the La Colorada Vein Mine cost model and cut-off grade calculations should be updated. This should consider new operational conditions and requirements such as haulage cycles, ground support, ventilation and dewatering; and revenue and cost drivers such metal prices, consumable prices, and salary rates.

Finally, the mineral resources and mineral reserves should be updated considering the new cut-off grades. This will likely impact the reported inventories. However, it will also allow to support a new mine plan that optimizes the La Colorada Vein Mine production strategy for the new operating conditions.

The Skarn Project

Sublevel caving was selected as the mining method at a rate of 50,000 tpd. It is recommended to consider sublevel caving and block caving in the next scenarios when an updated mineral resource model is next completed.

A potential joint venture on the properties not controlled by Pan American offers opportunities to expand the current footprint of the La Colorada Property. Finalization and further development of such a joint venture is recommended to practically unlock more mineable areas.

Drilling programs should focus on delineation of the extents of the mineralized zones to achieve a broader area of inferred or indicated mineral resources classification within an updated mineral resource estimate. Detailed drilling and conversion to a measured mineral resource classification is not recommended or necessary at this stage, primarily due to the nature of the bulk mining methods employed. The focus should be on defining the broader extents of the mineralized zones of the Skarn Project, and this will assist in locating LOM infrastructure and surface facilities.

Mineral resource, structural, hydrology, geotechnical, and cost models should be updated before commencing the next round of mine method selection and optimisation studies.

It is recommended to prepare various trade-off studies in parallel with the preparation of the mineral resource models, including but not limited to mining methods, materials handling, automation, ventilation and key surface infrastructure locations.

Additional metallurgical test work and a trade-off study include pressure filtration testing of additional tailings samples to determine variability, and a future trade-off to study the option of a SAG mill for mineral processing for the Skarn Project are recommended. Concentrate transport options should be studied to include options for rail transport, and options for site road accesses from the main highways.

It is recommended to advance environmental and social baseline and permitting for additional development infrastructure to support feasibility studies and access to the Skarn Project. It is also recommended to continue to implement longer term permitting strategy for the Skarn Project, process plant, filtered tailings storage facility, and associated infrastructure.

It is recommended that Pan American undertakes a PFS once all relevant data is available. The timing of a PFS will depend on the availability of the updated mineral resource model, and the above-mentioned associated trade-off studies. Study costs, including G&A, of US$60M are included in the capital estimates to advance the project to a PFS level of detail and into any potential construction phase.

Effective Date: December 18, 2023 Page 25

|

|

|

PAN AMERICAN SILVER CORP. |

2Introduction

The La Colorada mine (the La Colorada Vein Mine) is a collection of three underground silver-lead-zinc mines located in Zacatecas, Mexico, approximately 100 km south of the city of Durango and 155 km northwest of the city of Zacatecas. Pan American Silver Corp. (Pan American) holds a 100% interest in the 56 mining concessions (totaling approximately 8,840 hectares) that comprise the La Colorada property (the La Colorada Property) through its subsidiary, Plata Panamericana S.A. de C.V. (Plata). La Colorada Property currently operates the La Colorada Vein Mine which is comprised of two underground operating mines (Candelaria, Estrella) and one non-operational mine (Recompensa). The La Colorada Property also hosts the large polymetallic skarn exploration project (the Skarn Project) discovered in 2018 through brownfield exploration near the La Colorada Vein Mine.

Pan American is a Canadian-based leading producer of precious metals in the Americas that operates silver and gold mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil. Pan American also owns the Escobal Mine in Guatemala, which is not currently in operation. Pan American has been operating in the Americas for nearly three decades, earning an industry-leading reputation for sustainability performance, operational excellence, and prudent financial management.

Pan American’s assets also include the following operations:

•100% ownership of the Jacobina underground gold mine in the state of Bahia of northeastern Brazil.

•100% ownership of the El Peñón underground gold-silver mine near Antofagasta in northern Chile.

•100% ownership of the Timmins operation in northeastern Ontario, consisting of two underground gold mines—the Timmins West Mine and the Bell Creek Mine—which both feed the Bell Creek mill.

•100% ownership of the Shahuindo open-pit gold mine in Cajamarca, Peru.

•100% ownership of the La Arena open-pit gold mine in La Libertad, Peru.

•100% ownership of the Huaron underground silver-zinc-copper-lead mine in Pasco, Peru.

•100% ownership of the Cerro Moro underground and open-pit gold-silver mine located in Santa Cruz Province, Argentina.

•100% ownership of the Minera Florida underground gold-silver mine located south of Santiago, Chile.

•95% ownership of the San Vicente underground silver-zinc-copper-lead mine in Potosí, Bolivia.

•100% ownership of the Escobal silver-gold-lead-zinc underground mine, in Santa Rosa, Guatemala. The operation is currently on care and maintenance pending completion of an ILO 169 consultation.

This technical report was prepared in accordance with NI 43-101; it documents the mineral resource and mineral reserve estimates for the La Colorada Vein Mine as of June 30, 2023. This technical report also describes the results of the preliminary economic assessment (PEA) of the Skarn Project, disclosed on December 18, 2023, and includes an updated mineral resource estimate for the Skarn Project. The PEA considers a 50,000 tpd sublevel cave mining method and a conventional 50,000 tpd capacity selective zinc and lead flotation processing plant and filtered tailings storage facility. Annual production is estimated to average 17.2 Moz of silver, 427 kt of zinc and 218 kt of lead during the first 10 years of an estimated 17-year mine life.

This technical report was prepared by Pan American following the guidelines of NI 43-101 and Form 43-101F1. The mineral resource and mineral reserve estimates reported herein were prepared in conformity with generally accepted standards set out in the CIM Mineral Resource and Mineral Reserves Estimation Best Practices Guidelines

Effective Date: December 18, 2023 Page 26

|

|

|

PAN AMERICAN SILVER CORP. |

(November 2019) and were classified according to CIM Definition Standards for Mineral Resources and Mineral Reserves (May 2014).

2.1Sources of Information

The qualified persons, as such term is defined in NI 43-101, for this technical report are Martin Wafforn, P.Eng.; Christopher Emerson, FAusIMM; Peter Mollison, P.Eng, Americo Delgado, P.Eng.; and Matthew Andrews, FAusIMM, all full-time employees of Pan American. Table 2-1 lists the qualified persons, their responsibilities, and personal inspections on the La Colorada Property.

Table 2-1: Qualified persons and personal inspections

|

|

|

| Qualified Persons |

| Martin Wafforn, P.Eng., Senior Vice President, Technical Services and Process Optimization |

Responsible for Sections: 4: Property Description and Location; 5: Accessibility, Climate, Local Resources, Infrastructure and Physiography; 15: Mineral Reserve Estimates; 16: Mining Methods; 18: Project Infrastructure (excluding 18.2); 19: Market Studies and Contracts; 21: Capital and Operating Costs; 22: Economic Analysis |

Personal Inspection: Visited the La Colorada Property on numerous occasions including most recently between September 11 and 12, 2023. |

| Christopher Emerson, FAusIMM, Vice President, Exploration and Geology |

Responsible for Sections: 6: History; 7: Geological Setting and Mineralization; 8: Deposit Types, 9: Exploration; 10: Drilling; 11: Sample Preparation, Analyzes and Security; 14: Mineral Resource Estimates; 23: Adjacent Properties. |

Personal Inspection: Visited the La Colorada Property on numerous occasions including most recently between February 8 and 11, 2023. |

| Peter Mollison, P.Eng., Senior Director, Mine Engineering |

Responsible for Sections: 24: Other relevant data and information (Skarn Project PEA excluding 24.1.1.5, 24.1.3, 24.1.4, and 24.1.5). |

Personal Inspection: Visited the La Colorada Property on multiple occasions since 2017, and most recently between February 7 and 10, 2023 |

| Americo Delgado, P.Eng., Vice President, Mineral Processing, Tailings, and Dams |

Responsible for Sections: 13: Mineral Processing and Metallurgical Testing; 17: Recovery Methods; 18.2: Mine, Processing and Tailings Facilities; 24.1.1.5 Skarn Project PEA Surface Facilities; 24.1.3 Skarn Project PEA Project Surface Infrastructure; 24.1.4 Skarn Project PEA Recovery Method. |

Personal Inspection: Visited the La Colorada Property on multiple occasions since 2012 and most recently between March 11 and 13, 2020. |

| Matthew Andrews, FAusIMM, Vice President, Environment |

Responsible for Sections: 20: Environmental Studies, Permitting and Social or Community Impact; 24.1.5 Skarn Project PEA Environmental Studies, Permitting and Social or Community Impact |

Personal Inspection: Visited the La Colorada Property on multiple occasions since 2011 and most recently between September 23 and 24, 2022. |

Shared Responsibility by all Qualified Persons for Related Disclosure in Sections: 1: Summary; 2: Introduction; 3: Reliance on Other Experts; 12: Data Verification; 25: Interpretation and Conclusions; 26: Recommendations; 27: References. |

In preparation of this technical report, the qualified persons reviewed technical documents and reports on the La Colorada Property supplied by on-site personnel and consultants. The documentation reviewed, and other sources of information, are listed at the end of this technical report in Section 27- References.

Effective Date: December 18, 2023 Page 27

|

|

|

PAN AMERICAN SILVER CORP. |

The most recent technical report on the La Colorada Property was compiled by Pan American with an effective date of December 31, 2019 (Wafforn et al., 2019). This 2019 Pan American report served as the foundation for this current technical report which updates the information as of an effective date of December 18, 2023.

Effective Date: December 18, 2023 Page 28

|

|

|

PAN AMERICAN SILVER CORP. |

3Reliance on Other Experts

The qualified persons have relied on information derived from Pan American’s internal records for information regarding legal matters related to land title and tenure information, and taxes (including royalties and other government levies or interests) applicable to revenue or income from the La Colorada Property, as described in Sections 4, 16, 19, 21, 22, and 24.

The qualified persons have not performed an independent verification of the land title and tenure information, as summarized in Section 4 of this technical report, nor have they verified the legality of any underlying agreement(s) that may exist concerning the permits or other agreement(s) between third parties, as summarized in Section 4 of this technical report. For these matters, the qualified persons of this technical report have relied on information provided by Pan American.

Except for the purposes legislated under applicable securities laws, any use of this technical report by any third party is at that party’s sole risk.

Effective Date: December 18, 2023 Page 29

|

|

|

PAN AMERICAN SILVER CORP. |

4Property Description and Location

4.1Location

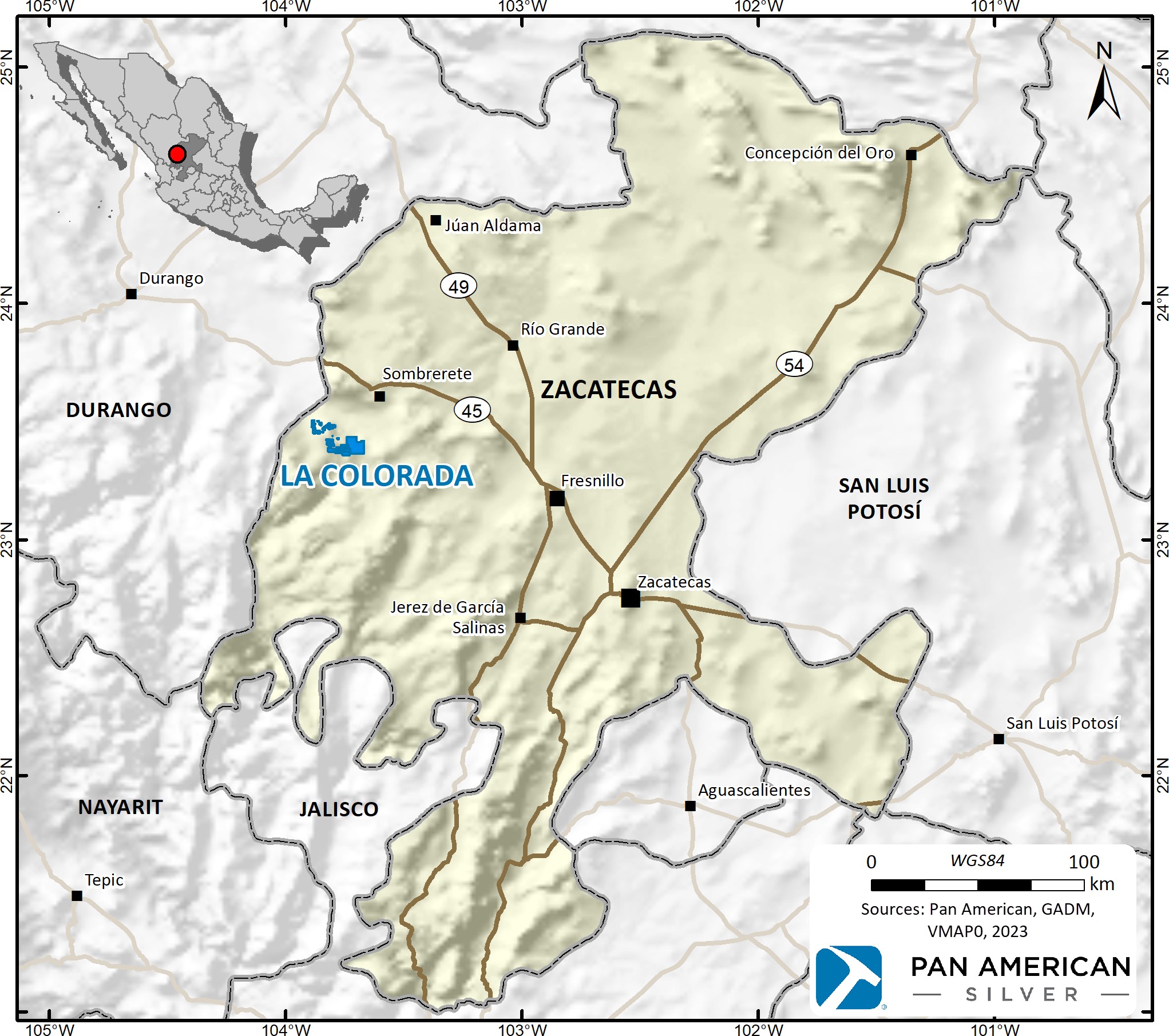

The La Colorada Property is located in the Chalchihuites district of Zacatecas State, Mexico (Figure 4-1). It is approximately 100 km southeast of the city of Durango and 155 km northwest of the city of Zacatecas. The centre of the La Colorada Property is located at approximately 23° 22’ N lat. and 103° 45’ W long.

Figure 4-1: The La Colorada Property location

The La Colorada Vein Mine produces oxide and sulphide ores from three separate underground mines: Candelaria, Estrella, and Recompensa (no mining is currently taking place at the Recompensa mine). The La Colorada Property also hosts the Skarn Project, a large polymetallic skarn deposit discovered in 2018 through brownfield exploration near the La Colorada Vein Mine.

Effective Date: December 18, 2023 Page 30

|

|

|

PAN AMERICAN SILVER CORP. |

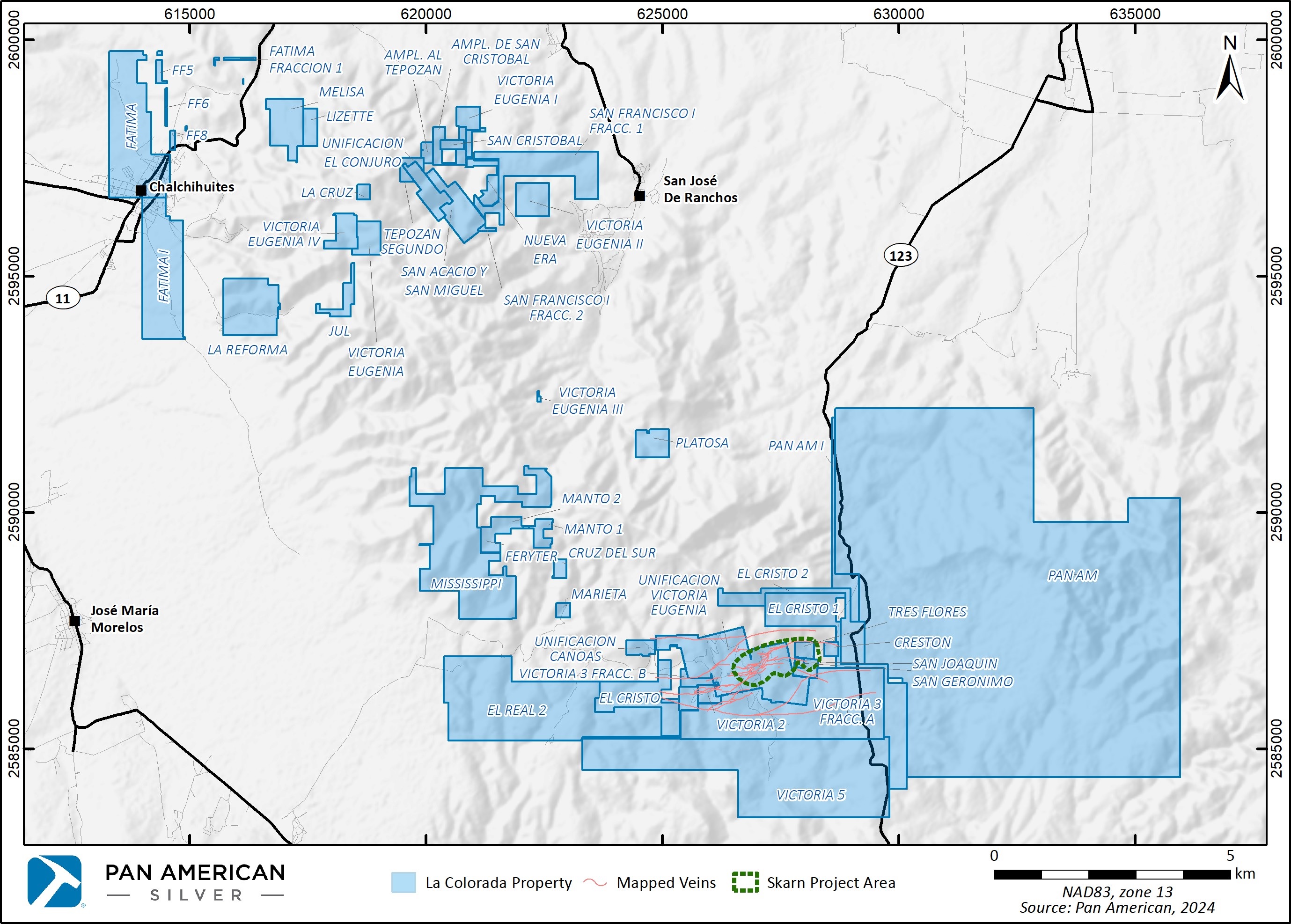

4.2Issuer’s Interest, Mineral Tenure, and Surface Rights

Pan American owns 100% of the La Colorada Property through its wholly owned subsidiary, Plata Panamericana S. A. de C.V. (Plata). The La Colorada Property, including certain exploration concessions outside the mining area, is comprised of 56 mining concessions totalling approximately 8,840 hectares (Figure 4-2 and Table 4-1). Pan American entered into a Memorandum of Understanding with respect to certain adjacent mineral concessions which would allow Pan American to access certain high-grade silver veins in the future, and has negotiated preliminary terms for a joint venture arrangement on certain adjacent mineral concessions, which would allow it to utilize these concessions for the Skarn Project.

On May 8, 2023, the Mexican government enacted a decree to reform various provisions of the mining law (the 2023 Decree), which was published in the Official Gazette and became law on May 9, 2023. Prior to the 2023 Decree, all concessions in Mexico had a lifespan of 50 years from the date of issue, with a potential to renew for an additional 50 years. Among other things, the 2023 Decree could reduce the renewal terms of current concessions, and the terms and renewal terms of future concessions, however, the impact of the 2023 Decree and its applicability to the La Colorada Property is uncertain. For further information regarding the 2023 Degree, please see Section 4.6.

Figure 4-2: Mining concessions

Effective Date: December 18, 2023 Page 31

|

|

|

PAN AMERICAN SILVER CORP. |

Pan American pays an annual fee to maintain the concessions in good standing, and, to Pan American and the qualified person’s knowledge, Pan American has met all necessary obligations to retain the La Colorada Property. Pan American has control over, or rights in respect of, approximately 1,300 ha of surface rights that cover the main workings of the La Colorada Vein Mine. Pan American has acquired or is in the process of acquiring further surface rights related to the Skarn Project consisting of 2,000 ha of private land and leasing an additional 2,800 ha of ejido land. Plata is currently the owner of 18 of the 21 properties and continues negotiations for the remaining properties.

The mineral reserves, mineral resources, mine workings, processing plant, effluent management and treatment systems, and tailings disposal areas are all located within the mining concessions controlled by Pan American.

Table 4-1 shows the term of the concessions granted to Pan American. The 2023 Decree, if applicable, may impact the renewal terms of these concessions and the term of any future mining concessions.

Table 4-1: Mining concessions

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pan American Mining Concessions |

| Concession Name |

Title |

Area (Ha) |

Expiry Date |

Concession Name |

Title |

Area (Ha) |

Expiry Date |

| Ampl. De San Cristobal |

T-170097 |

29.1 |

15/03/2032 |

Marieta |

T-171833 |

9 |

14/06/2033 |

| Ampliacion Al Tepozan |

T-182730 |

10.8 |

15/08/2038 |

Melisa |

T-217670 |

69.6 |

05/08/2052 |

| Creston |

T-213594 |

9 |

17/05/2051 |

Mississippi |

T-195070 |

432.1 |

24/08/2042 |

| Cruz Del Sur |

T-170155 |

11.1 |

16/03/2032 |

Nueva Era |

T-214659 |

29.7 |

25/10/2051 |

| El Cristo |

T-228944 |

119.7 |

20/02/2057 |

Pan Am |

T-233733 |

4,332.6 |

24/10/2061 |

| El Cristo 1 |

T-229247 |

224 |

26/03/2057 |

Pan Am I |

T-244604 |

53.1 |

03/11/2065 |

| El Cristo 2 |

T-230727 |

98.5 |

04/10/2057 |

Platosa |

T-216290 |

41 |

29/04/2052 |

| El Real |

T-214498 |

20 |

01/10/2051 |

San Acacio Y San Miguel |

T-179719 |

73.1 |

11/12/2036 |

| El Real 2 |

T-228945 |

561.3 |

20/02/2057 |

San Cristobal |

T-170095 |

10 |

15/03/2032 |

| Eureka |

T-244603 |

0.6 |

03/11/2065 |

San Francisco |

T-221728 |

7.8 |

29/01/2048 |

| Fatima |

T-233977 |

288.4 |

12/05/2059 |

San Francisco I Fracc. 1 |

T-223953 |

165.5 |

14/03/2055 |

| Fatima Fraccion |

T-234041 |

0.1 |

21/05/2059 |

San Francisco I Fracc. 2 |

T-223952 |

3.3 |

14/03/2055 |

| Fatima Fraccion 1 |

T-234042 |

3.5 |

21/05/2059 |

San Geronimo |

T-172102 |

4 |

25/09/2033 |

| Fatima Fraccion 2 |

T-234043 |

0.8 |

21/05/2059 |

San Joaquin |

T-172103 |

16 |

25/09/2033 |

| Fatima Fraccion 4 |

T-234044 |

0.9 |

21/05/2059 |

Tepozan Segundo |

T-163260 |

13.5 |

03/09/2028 |

| Fatima Fraccion 5 |

T-234045 |

7.1 |

21/05/2059 |

Tres Flores |

T-229893 |

13.6 |

25/06/2057 |

| Fatima Fraccion 6 |

T-234046 |

2.8 |

21/05/2059 |

Unificacion Canoas |

T-211969 |

18.5 |

15/03/2032 |

| Fatima Fraccion 7 |

T-234047 |

0.3 |

21/05/2059 |

Unificacion El Conjuro |

T-170592 |

44.9 |

01/06/2032 |

| Fatima Fraccion 8 |

T-234048 |

4 |

21/05/2059 |

Unificacion Victoria Eugenia |

T-188078 |

285.6 |

21/11/2040 |

| Fatima I |

T-233147 |

241.2 |

11/12/2058 |

Victoria 2 |

T-217628 |

16.7 |

05/08/2052 |

| Feryter |

T-192967 |

38.3 |

18/12/2041 |

Victoria 3 Fracc. A |

T-217629 |

459.3 |

05/08/2052 |

| Jul |

T-232538 |

24.7 |

25/08/2058 |

Victoria 3 Fracc. B |

T-217630 |

14.2 |

05/08/2052 |

| La Cruz |

T-211085 |

8.5 |

30/03/2050 |

Victoria 5 |

T-226310 |

693.4 |

05/12/2055 |

| La Libertad |

T-244944 |

3 |

30/05/2066 |

Victoria Eugenia |

T-211587 |

36.1 |

15/06/2050 |

| La Reforma |

T-218667 |

135.6 |

02/12/2052 |

Victoria Eugenia I |

T-204862 |

23.3 |

12/05/2047 |

| Lizette |

T-221172 |

23.4 |

02/12/2053 |

Victoria Eugenia Ii |

T-211166 |

49 |

10/04/2050 |

| Manto 1 |

T-238175 |

19.5 |

08/08/2061 |

Victoria Eugenia Iii |

T-204756 |

1.1 |

24/04/2047 |

| Manto 2 |

T-238757 |

0.9 |

24/10/2061 |

Victoria Eugenia Iv |

T-217627 |

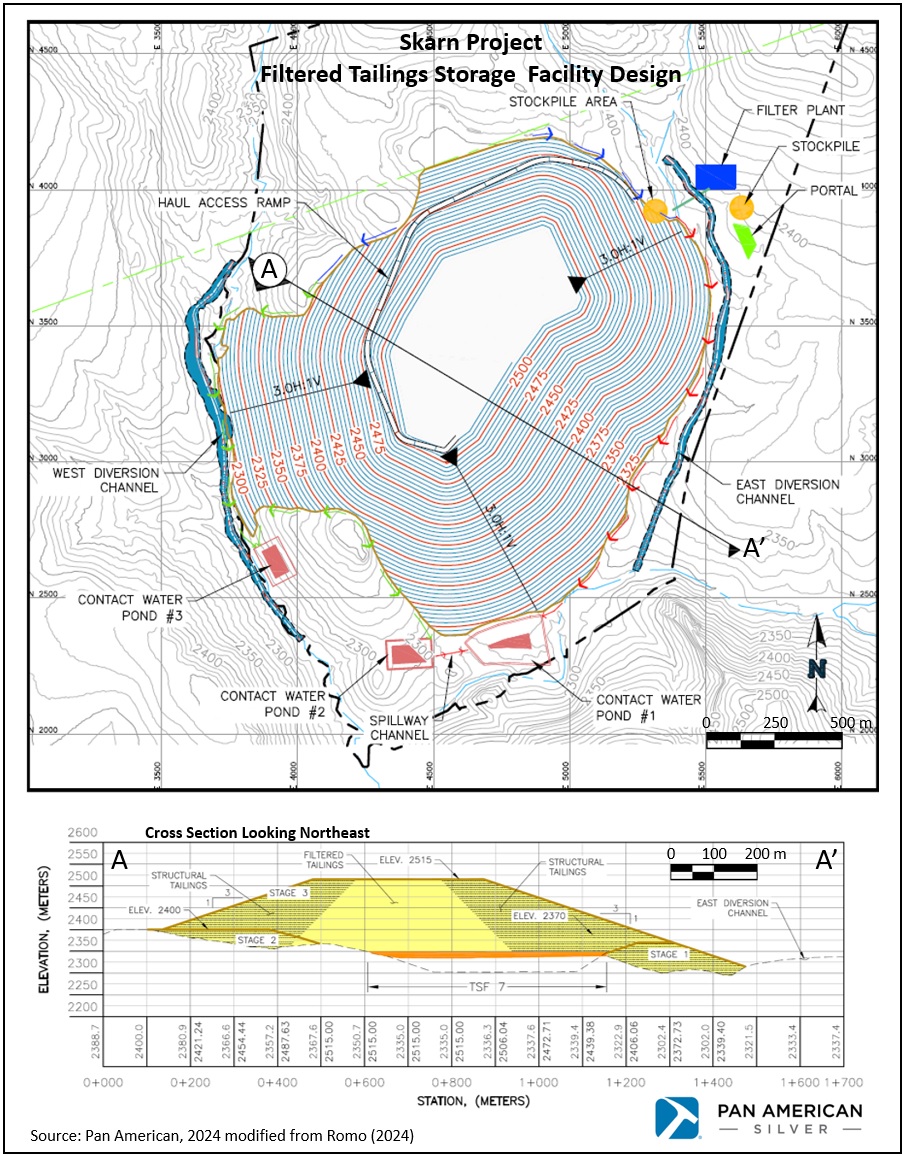

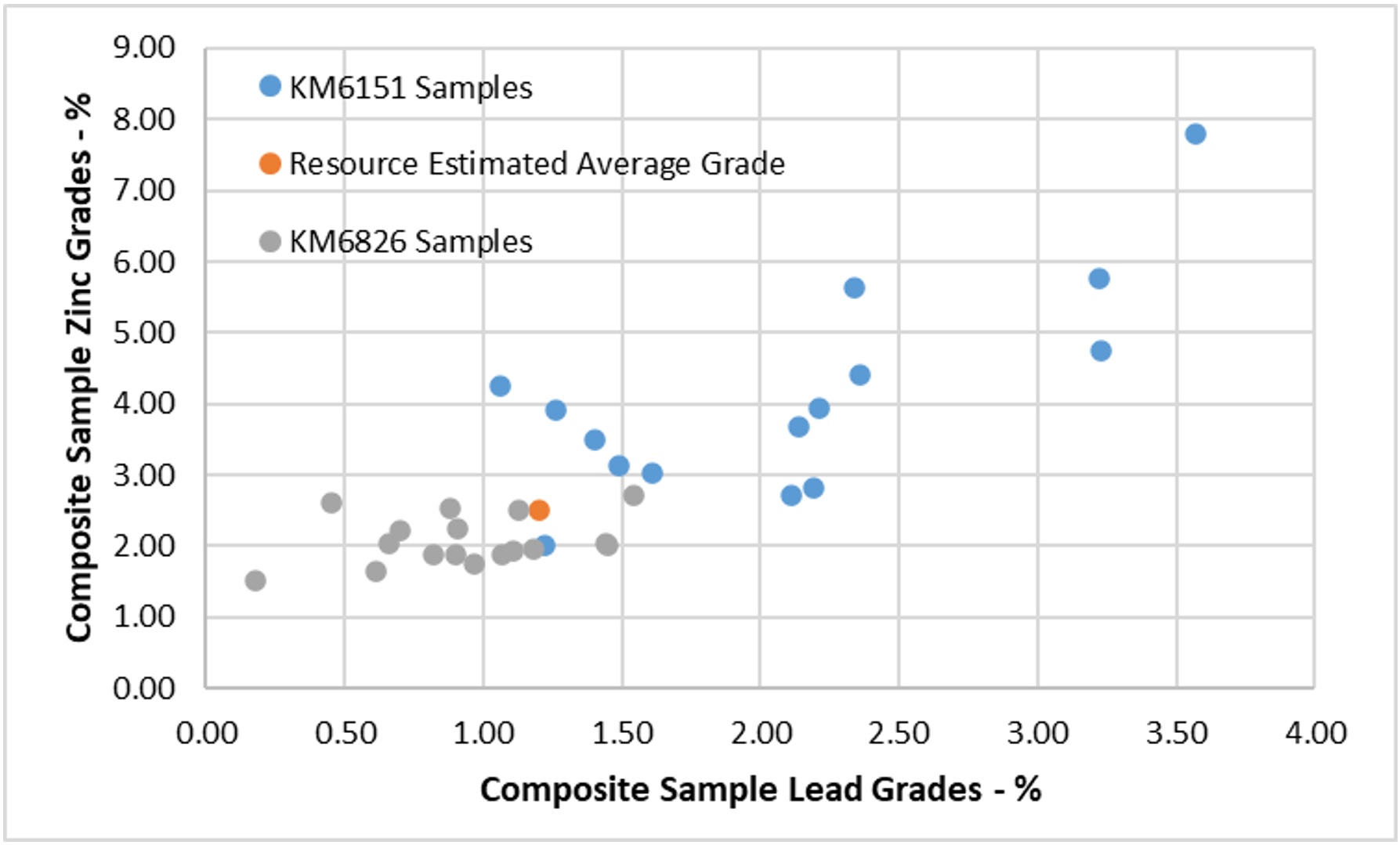

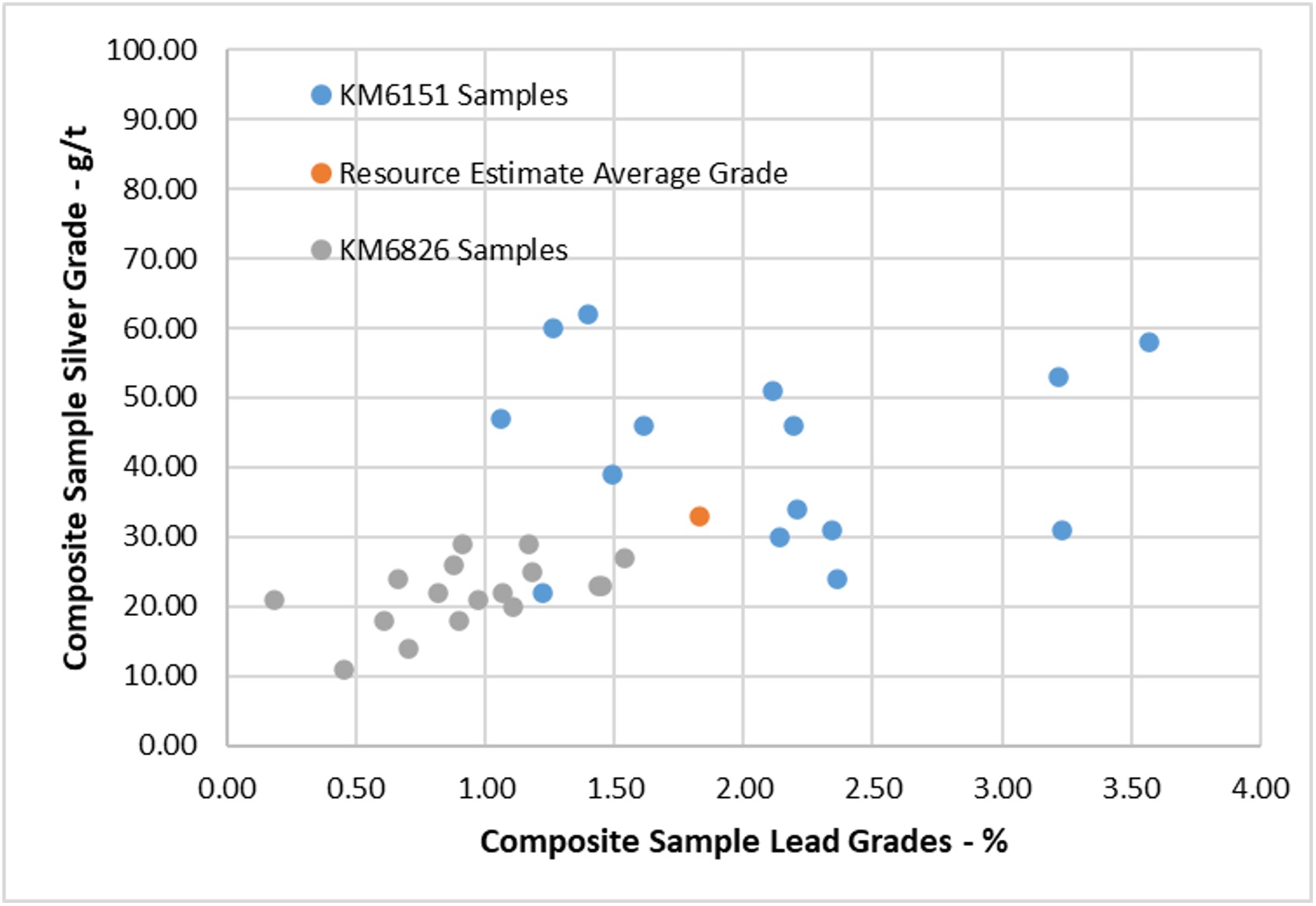

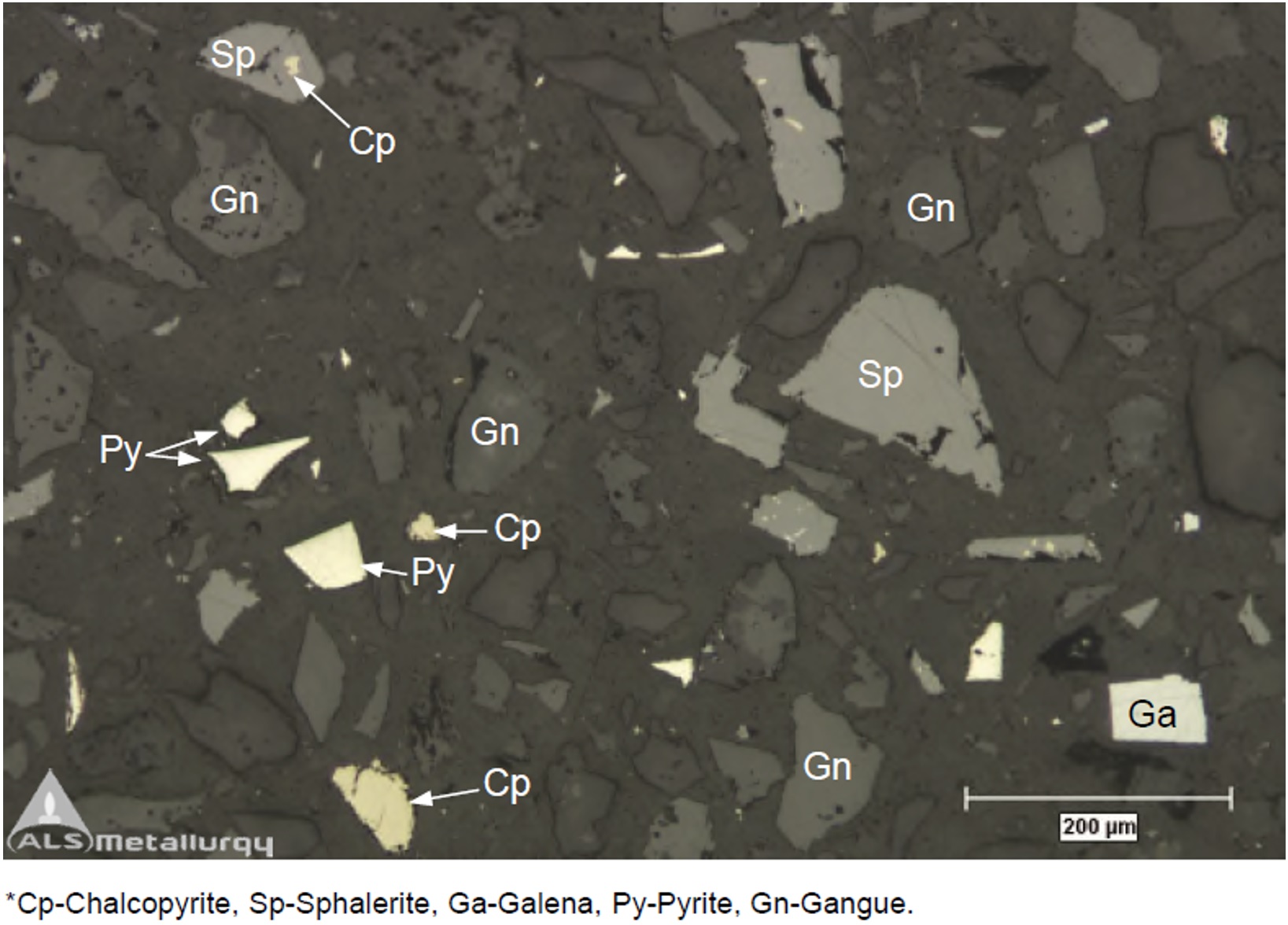

36.9 |