| 001-14543 | 91-1287341 | |||||||

| (Commission File Number) |

(IRS Employer Identification No.) |

|||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, no par value | TBI | New York Stock Exchange | ||||||

| Item 2.02. | Results of Operations and Financial Condition. | ||||

| Item 7.01. | Regulation FD Disclosure. | ||||

| Item 9.01. | Financial Statements and Exhibits. | ||||

| Exhibit Number |

Exhibit Description | Filed Herewith | ||||||

| 99.1 | X | |||||||

| 99.2 | X | |||||||

| 99.3 | X | |||||||

| 104 | Cover page interactive data file - The cover page from this Current Report on Form 8-K is formatted as Inline XBRL | X | ||||||

| TRUEBLUE, INC. | ||||||||||||||

| (Registrant) | ||||||||||||||

| Date: | November 3, 2025 | By: | /s/ Carl R. Schweihs |

|||||||||||

Carl R. Schweihs |

||||||||||||||

Chief Financial Officer and Executive Vice President |

||||||||||||||

13 weeks ended |

39 weeks ended |

||||||||||||||||||||||

| (in thousands, except per share data) | Sep 28, 2025 | Sep 29, 2024 | Sep 28, 2025 | Sep 29, 2024 | |||||||||||||||||||

| Revenue from services | $ | 431,266 | $ | 382,357 | $ | 1,197,819 | $ | 1,181,440 | |||||||||||||||

| Cost of services | 333,374 | 282,320 | 920,021 | 877,594 | |||||||||||||||||||

| Gross profit | 97,892 | 100,037 | 277,798 | 303,846 | |||||||||||||||||||

| Selling, general and administrative expense | 91,728 | 99,973 | 276,147 | 303,928 | |||||||||||||||||||

| Depreciation and amortization | 6,310 | 6,967 | 18,661 | 22,616 | |||||||||||||||||||

| Goodwill and intangible asset impairment charge | — | — | 200 | 59,674 | |||||||||||||||||||

| Loss from operations | (146) | (6,903) | (17,210) | (82,372) | |||||||||||||||||||

Interest and other income (expense), net |

(1,059) | 521 | 2,037 | 3,861 | |||||||||||||||||||

| Loss before tax expense | (1,205) | (6,382) | (15,173) | (78,511) | |||||||||||||||||||

| Income tax expense | 711 | 1,253 | 1,251 | 35,532 | |||||||||||||||||||

| Net loss | $ | (1,916) | $ | (7,635) | $ | (16,424) | $ | (114,043) | |||||||||||||||

| Net loss per common share: | |||||||||||||||||||||||

| Basic | $ | (0.06) | $ | (0.26) | $ | (0.55) | $ | (3.75) | |||||||||||||||

| Diluted | $ | (0.06) | $ | (0.26) | $ | (0.55) | $ | (3.75) | |||||||||||||||

| Weighted average shares outstanding: | |||||||||||||||||||||||

| Basic | 29,896 | 29,704 | 29,817 | 30,384 | |||||||||||||||||||

| Diluted | 29,896 | 29,704 | 29,817 | 30,384 | |||||||||||||||||||

| (in thousands) | Sep 28, 2025 | Dec 29, 2024 | |||||||||

| ASSETS | |||||||||||

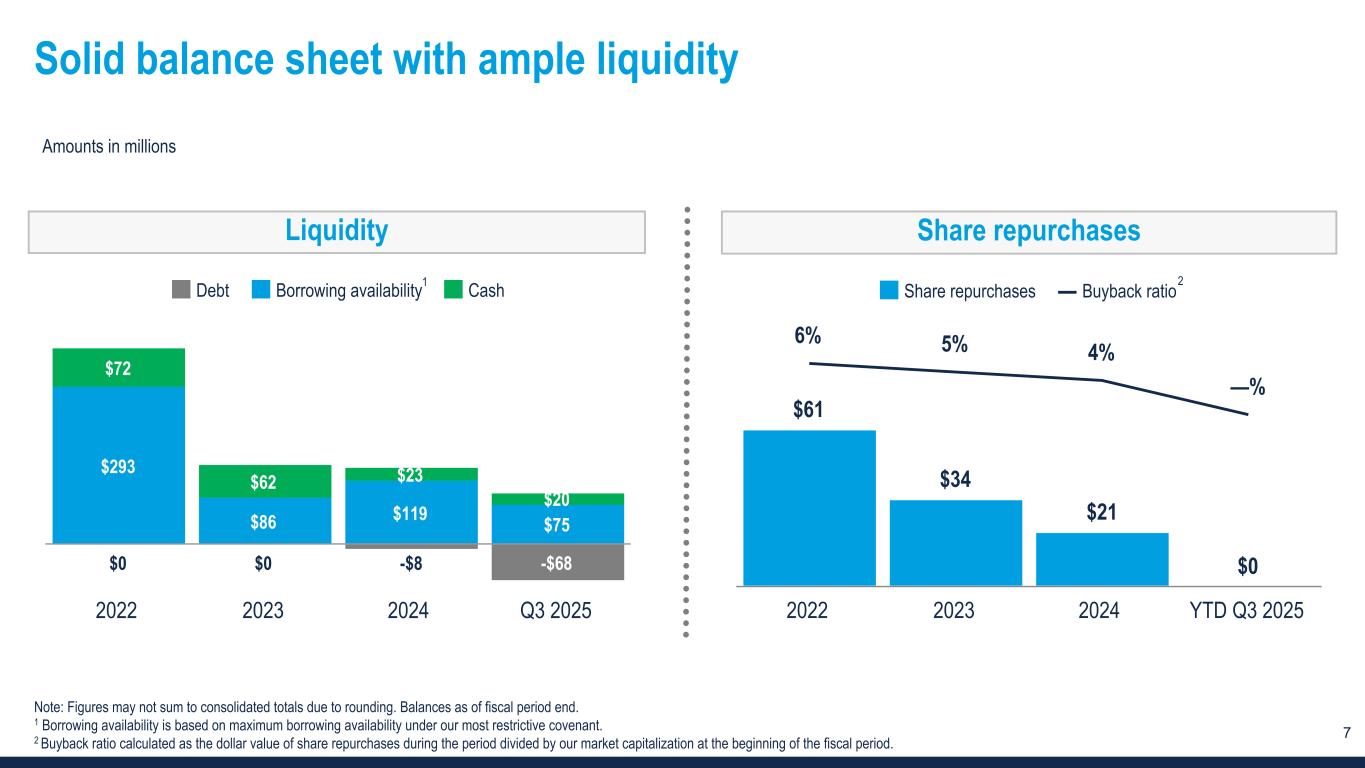

| Cash and cash equivalents | $ | 19,893 | $ | 22,536 | |||||||

| Accounts receivable, net | 251,873 | 214,704 | |||||||||

| Other current assets | 41,476 | 39,853 | |||||||||

| Total current assets | 313,242 | 277,093 | |||||||||

| Property and equipment, net | 81,843 | 89,602 | |||||||||

Restricted cash, cash equivalents and investments |

149,691 | 179,916 | |||||||||

| Goodwill and intangible assets, net | 61,027 | 30,406 | |||||||||

| Other assets, net | 84,724 | 98,359 | |||||||||

| Total assets | $ | 690,527 | $ | 675,376 | |||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||

| Accounts payable and other accrued expenses | $ | 39,447 | $ | 45,599 | |||||||

| Accrued wages and benefits | 67,395 | 61,380 | |||||||||

| Current portion of workers’ compensation claims reserve | 27,805 | 34,729 | |||||||||

| Other current liabilities | 21,055 | 18,417 | |||||||||

| Total current liabilities | 155,702 | 160,125 | |||||||||

| Workers’ compensation claims reserve, less current portion | 75,090 | 105,063 | |||||||||

| Long-term debt, less current portion | 68,200 | 7,600 | |||||||||

| Other long-term liabilities | 87,196 | 87,229 | |||||||||

| Total liabilities | 386,188 | 360,017 | |||||||||

| Shareholders’ equity | 304,339 | 315,359 | |||||||||

| Total liabilities and shareholders’ equity | $ | 690,527 | $ | 675,376 | |||||||

39 weeks ended |

|||||||||||

| (in thousands) | Sep 28, 2025 | Sep 29, 2024 | |||||||||

| Cash flows from operating activities: | |||||||||||

| Net loss | $ | (16,424) | $ | (114,043) | |||||||

Adjustments to reconcile net loss to net cash used in operating activities: |

|||||||||||

Depreciation and amortization (inclusive of depreciation included in cost of services) |

21,657 | 22,616 | |||||||||

| Goodwill and intangible asset impairment charge | 200 | 59,674 | |||||||||

| Provision for credit losses | 1,119 | 1,577 | |||||||||

| Stock-based compensation | 5,629 | 5,676 | |||||||||

| Deferred income taxes | (356) | 34,694 | |||||||||

| Non-cash lease expense | 8,291 | 9,145 | |||||||||

| Other operating activities | (3,643) | (5,052) | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | (24,411) | 25,802 | |||||||||

| Income taxes receivable and payable | 3,151 | 219 | |||||||||

| Other assets | 5,233 | 8,719 | |||||||||

| Accounts payable and other accrued expenses | (7,693) | (18,771) | |||||||||

| Accrued wages and benefits | (4,355) | (15,640) | |||||||||

| Workers’ compensation claims reserve | (36,898) | (30,069) | |||||||||

| Operating lease liabilities | (8,614) | (9,236) | |||||||||

| Other liabilities | 3,440 | 1,500 | |||||||||

Net cash used in operating activities |

(53,674) | (23,189) | |||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (12,552) | (18,874) | |||||||||

| Acquisition of business, net of cash acquired | (30,181) | — | |||||||||

| Proceeds from business divestiture, net | 400 | 2,928 | |||||||||

| Payments for company-owned life insurance | (2) | (4,000) | |||||||||

| Purchases of restricted held-to-maturity investments | (3,935) | (10,180) | |||||||||

| Maturities of restricted held-to-maturity investments | 30,178 | 28,688 | |||||||||

Net cash used in investing activities |

(16,092) | (1,438) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Purchases and retirement of common stock | — | (21,301) | |||||||||

| Net proceeds from employee stock purchase plans | 363 | 564 | |||||||||

| Common stock repurchases for taxes upon vesting of restricted stock | (973) | (2,221) | |||||||||

| Net change in revolving credit facility | 60,600 | — | |||||||||

| Other | (401) | (1,807) | |||||||||

Net cash provided by (used in) financing activities |

59,589 | (24,765) | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash and cash equivalents | (134) | (638) | |||||||||

| Net change in cash, cash equivalents, and restricted cash and cash equivalents | (10,311) | (50,030) | |||||||||

| Cash, cash equivalents and restricted cash and cash equivalents, beginning of period | 61,100 | 99,306 | |||||||||

| Cash, cash equivalents and restricted cash and cash equivalents, end of period | $ | 50,789 | $ | 49,276 | |||||||

13 weeks ended |

|||||||||||

| (in thousands) | Sep 28, 2025 | Sep 29, 2024 | |||||||||

| Revenue from services: | |||||||||||

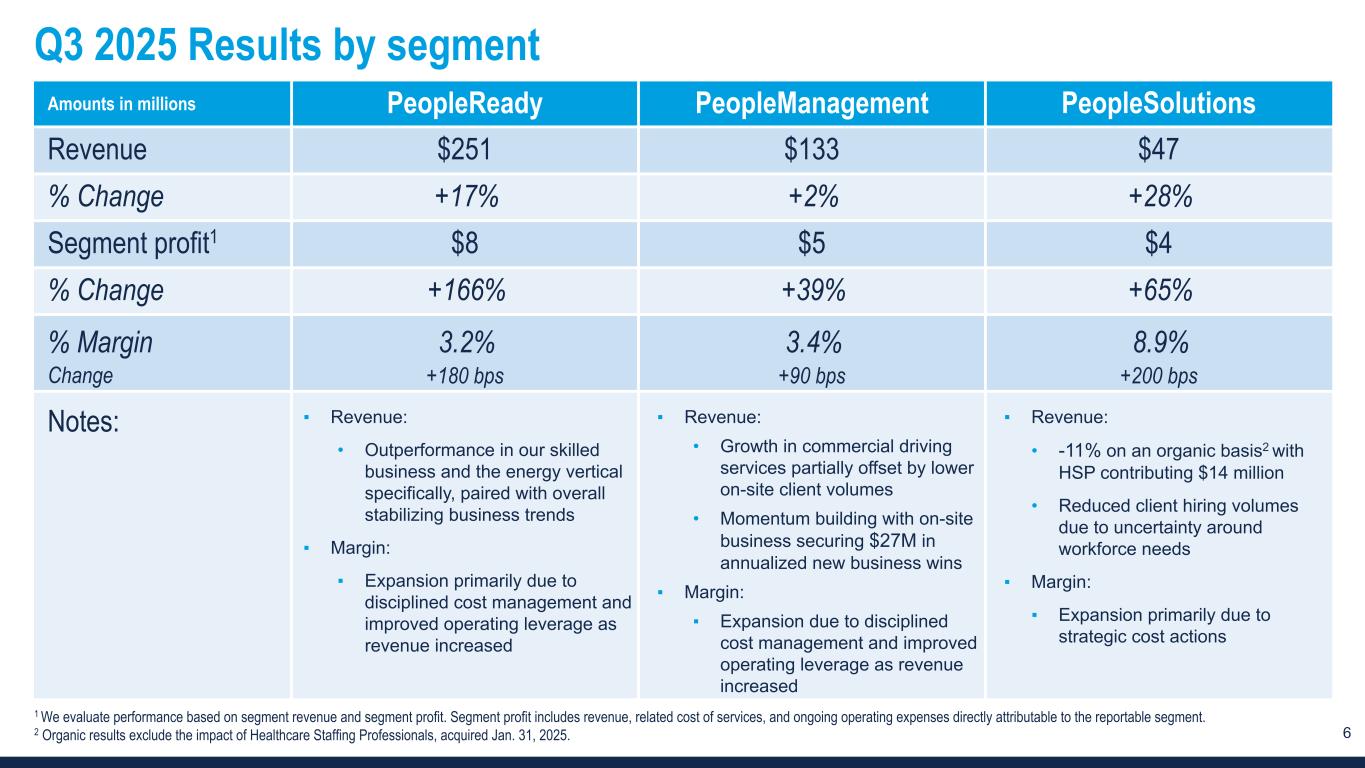

| PeopleReady | $ | 251,436 | $ | 214,792 | |||||||

| PeopleManagement | 132,863 | 130,852 | |||||||||

PeopleSolutions (1) |

46,967 | 36,713 | |||||||||

| Total company | $ | 431,266 | $ | 382,357 | |||||||

Segment profit (2): |

|||||||||||

| PeopleReady | $ | 8,099 | $ | 3,043 | |||||||

| PeopleManagement | 4,552 | 3,278 | |||||||||

PeopleSolutions |

4,185 | 2,542 | |||||||||

| Total segment profit | 16,836 | 8,863 | |||||||||

| Corporate unallocated expense | (6,194) | (4,184) | |||||||||

Total company Adjusted EBITDA (3) |

10,642 | 4,679 | |||||||||

Third-party processing fees for hiring tax credits (4) |

(60) | 30 | |||||||||

Amortization of software as a service assets (5) |

(1,063) | (1,615) | |||||||||

| Acquisition/integration costs | (42) | — | |||||||||

Workforce reduction costs (6) |

(527) | (2,809) | |||||||||

PeopleReady technology upgrade costs (7) |

— | (65) | |||||||||

| Other adjustments, net (8) | (1,751) | (156) | |||||||||

EBITDA (2) |

7,199 | 64 | |||||||||

| Depreciation and amortization (9) | (7,345) | (6,967) | |||||||||

Interest and other income (expense), net |

(1,059) | 521 | |||||||||

| Loss before tax expense | (1,205) | (6,382) | |||||||||

| Income tax expense | (711) | (1,253) | |||||||||

| Net loss | $ | (1,916) | $ | (7,635) | |||||||

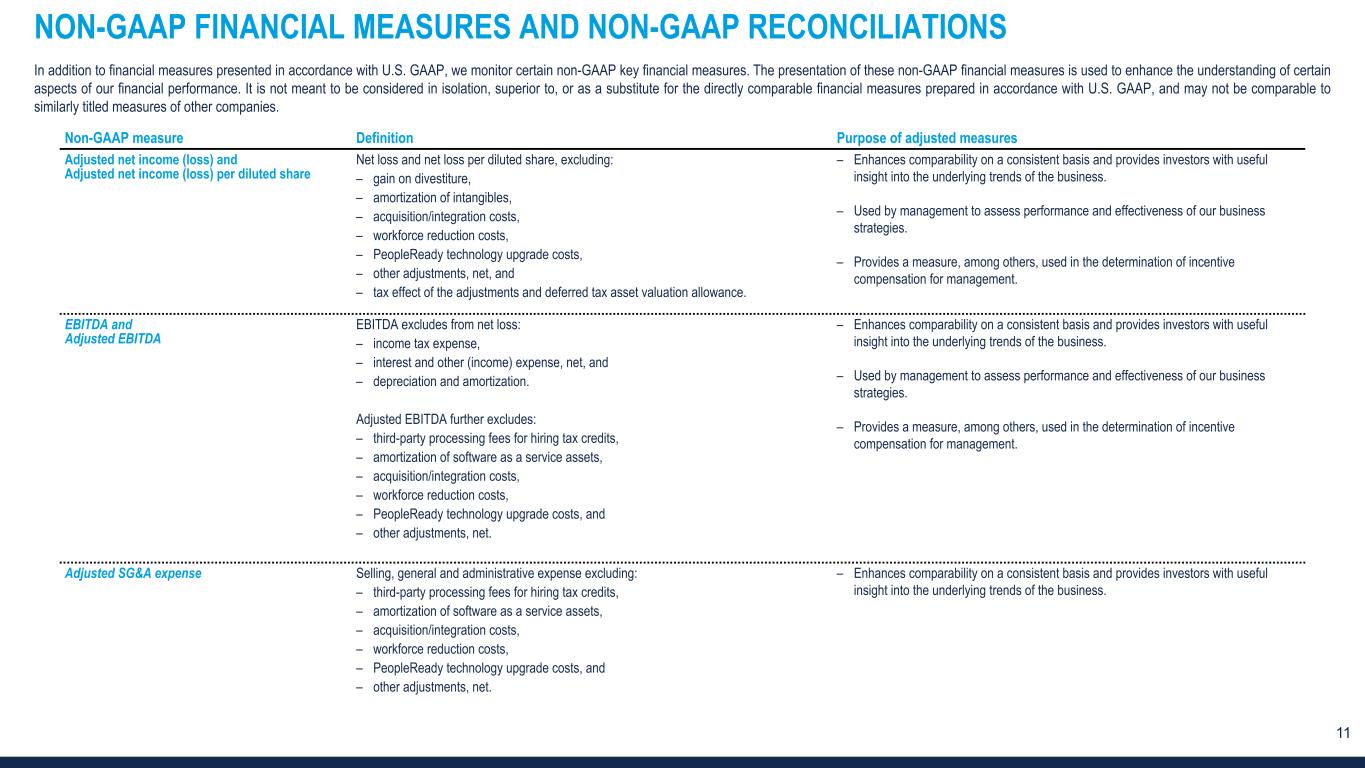

| Non-GAAP measure | Definition | Purpose of adjusted measures | ||||||||||||

| Adjusted net income (loss) and Adjusted net income (loss) per diluted share |

Net loss and net loss per diluted share, excluding:

–gain on divestiture,

–amortization of intangibles,

–acquisition/integration costs,

–workforce reduction costs,

–PeopleReady technology upgrade costs,

–other adjustments, net, and

–tax effect of the adjustments and deferred tax asset valuation allowance.

|

–Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

–Used by management to assess performance and effectiveness of our business strategies.

–Provides a measure, among others, used in the determination of incentive compensation for management.

|

||||||||||||

| EBITDA and Adjusted EBITDA |

EBITDA excludes from net loss:

–income tax expense,

–interest and other (income) expense, net, and

–depreciation and amortization.

Adjusted EBITDA further excludes:

–third-party processing fees for hiring tax credits,

–amortization of software as a service assets,

–acquisition/integration costs,

–workforce reduction costs,

–PeopleReady technology upgrade costs, and

–other adjustments, net.

|

–Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

–Used by management to assess performance and effectiveness of our business strategies.

–Provides a measure, among others, used in the determination of incentive compensation for management.

|

||||||||||||

| Adjusted SG&A expense |

Selling, general and administrative expense excluding:

–third-party processing fees for hiring tax credits,

–amortization of software as a service assets,

–acquisition/integration costs,

–workforce reduction costs,

–PeopleReady technology upgrade costs, and

–other adjustments, net.

|

–Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. |

||||||||||||

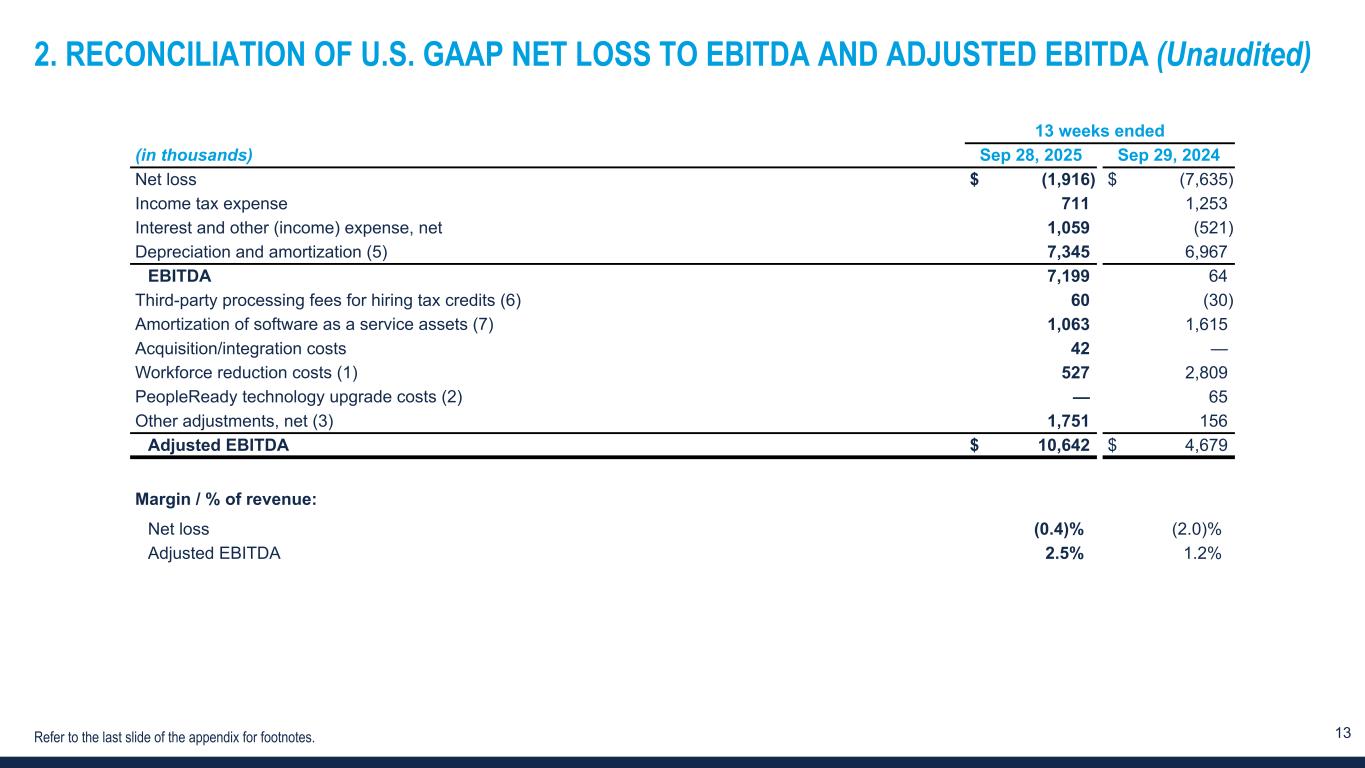

13 weeks ended |

|||||||||||

| (in thousands, except for per share data) | Sep 28, 2025 | Sep 29, 2024 | |||||||||

| Net loss | $ | (1,916) | $ | (7,635) | |||||||

Gain on divestiture |

— | 29 | |||||||||

| Amortization of intangible assets | 650 | 672 | |||||||||

| Acquisition/integration costs | 42 | — | |||||||||

Workforce reduction costs (1) |

527 | 2,809 | |||||||||

PeopleReady technology upgrade costs (2) |

— | 65 | |||||||||

| Other adjustments, net (3) | 1,751 | 156 | |||||||||

| Tax effect of adjustments and deferred tax asset valuation allowance (4) | — | 573 | |||||||||

| Adjusted net income (loss) | $ | 1,054 | $ | (3,331) | |||||||

| Adjusted net income (loss) per diluted share | $ | 0.03 | $ | (0.11) | |||||||

| Diluted weighted average shares outstanding | 30,283 | 29,704 | |||||||||

| Margin / % of revenue: | |||||||||||

| Net loss | (0.4)% | (2.0)% | |||||||||

| Adjusted net income (loss) | 0.2% | (0.9)% | |||||||||

13 weeks ended |

|||||||||||

| (in thousands) | Sep 28, 2025 | Sep 29, 2024 | |||||||||

| Net loss | $ | (1,916) | $ | (7,635) | |||||||

| Income tax expense | 711 | 1,253 | |||||||||

Interest and other (income) expense, net |

1,059 | (521) | |||||||||

| Depreciation and amortization (5) | 7,345 | 6,967 | |||||||||

| EBITDA | 7,199 | 64 | |||||||||

| Third-party processing fees for hiring tax credits (6) | 60 | (30) | |||||||||

| Amortization of software as a service assets (7) | 1,063 | 1,615 | |||||||||

| Acquisition/integration costs | 42 | — | |||||||||

Workforce reduction costs (1) |

527 | 2,809 | |||||||||

PeopleReady technology upgrade costs (2) |

— | 65 | |||||||||

| Other adjustments, net (3) | 1,751 | 156 | |||||||||

| Adjusted EBITDA | $ | 10,642 | $ | 4,679 | |||||||

| Margin / % of revenue: | |||||||||||

| Net loss | (0.4)% | (2.0)% | |||||||||

| Adjusted EBITDA | 2.5% | 1.2% | |||||||||

13 weeks ended |

|||||||||||

| (in thousands) | Sep 28, 2025 | Sep 29, 2024 | |||||||||

| Selling, general and administrative expense | $ | 91,728 | $ | 99,973 | |||||||

| Third-party processing fees for hiring tax credits (6) | (60) | 30 | |||||||||

| Amortization of software as a service assets (7) | (1,063) | (1,615) | |||||||||

| Acquisition/integration costs | (42) | — | |||||||||

Workforce reduction costs (1) |

(374) | (2,601) | |||||||||

PeopleReady technology upgrade costs (2) |

— | (65) | |||||||||

| Other adjustments, net (3) | (1,751) | (156) | |||||||||

| Adjusted SG&A expense | $ | 88,438 | $ | 95,566 | |||||||

| % of revenue: | |||||||||||

| Selling, general and administrative expense | 21.3% | 26.1% | |||||||||

| Adjusted SG&A expense | 20.5% | 25.0% | |||||||||