| 001-14543 | 91-1287341 | |||||||

| (Commission File Number) |

(IRS Employer Identification No.) |

|||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, no par value | TBI | New York Stock Exchange | ||||||

| Item 2.02. | Results of Operations and Financial Condition. | ||||

| Item 7.01. | Regulation FD Disclosure. | ||||

| Item 9.01. | Financial Statements and Exhibits. | ||||

| Exhibit Number |

Exhibit Description | Filed Herewith | ||||||

| 99.1 | X | |||||||

| 99.2 | X | |||||||

| 99.3 | X | |||||||

| 104 | Cover page interactive data file - The cover page from this Current Report on Form 8-K is formatted as Inline XBRL | X | ||||||

| TRUEBLUE, INC. | ||||||||||||||

| (Registrant) | ||||||||||||||

| Date: | April 24, 2023 | By: | /s/ Derrek L. Gafford | |||||||||||

| Derrek L. Gafford | ||||||||||||||

| Chief Financial Officer and Executive Vice President | ||||||||||||||

13 weeks ended |

|||||||||||

| (in thousands, except per share data) | Mar 26, 2023 | Mar 27, 2022 | |||||||||

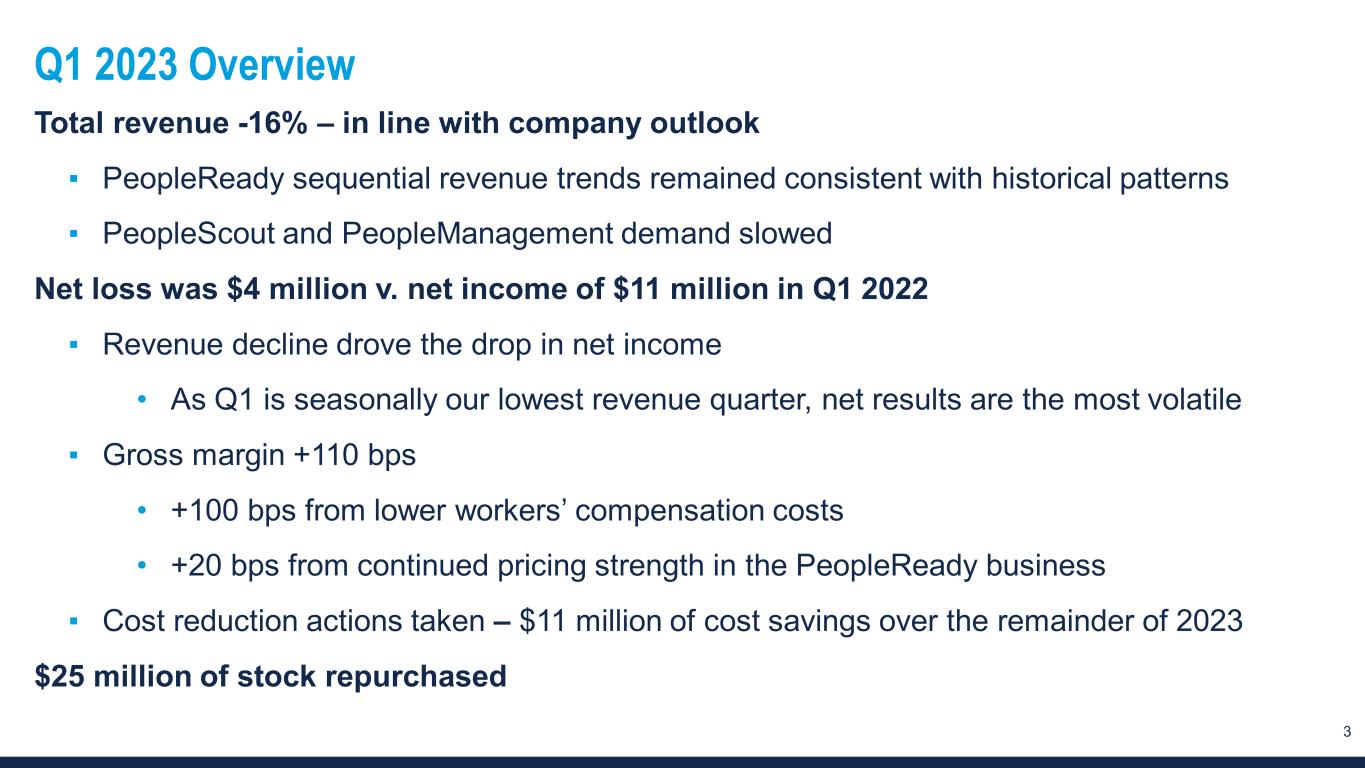

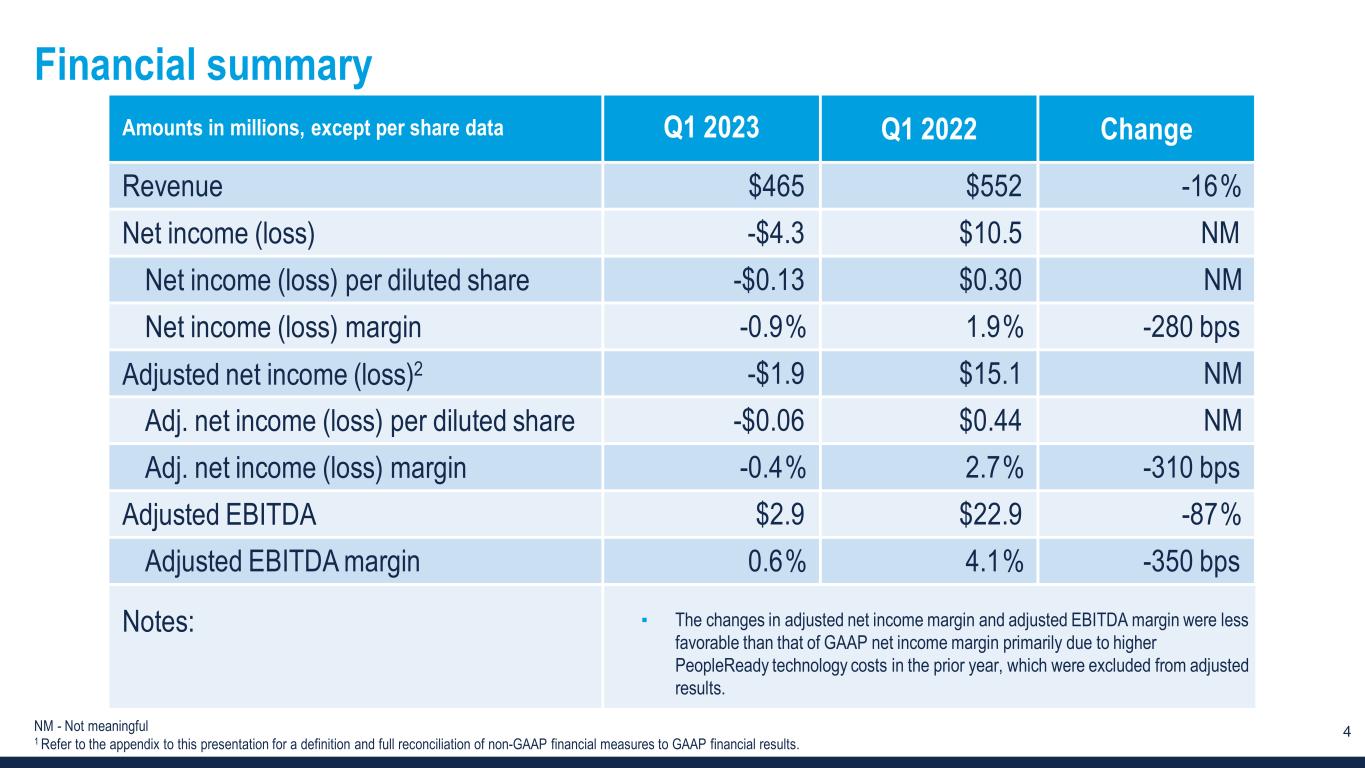

| Revenue from services | $ | 465,288 | $ | 551,515 | |||||||

| Cost of services | 342,175 | 411,670 | |||||||||

| Gross profit | 123,113 | 139,845 | |||||||||

| Selling, general and administrative expense | 122,645 | 120,568 | |||||||||

| Depreciation and amortization | 6,411 | 7,287 | |||||||||

| Income (loss) from operations | (5,943) | 11,990 | |||||||||

| Interest expense and other income, net | 1,014 | 505 | |||||||||

| Income (loss) before tax expense | (4,929) | 12,495 | |||||||||

| Income tax expense (benefit) | (640) | 1,976 | |||||||||

| Net income (loss) | $ | (4,289) | $ | 10,519 | |||||||

| Net (loss) income per common share: | |||||||||||

| Basic | $ | (0.13) | $ | 0.31 | |||||||

| Diluted | $ | (0.13) | $ | 0.30 | |||||||

| Weighted average shares outstanding: | |||||||||||

| Basic | 32,292 | 33,929 | |||||||||

| Diluted | 32,292 | 34,544 | |||||||||

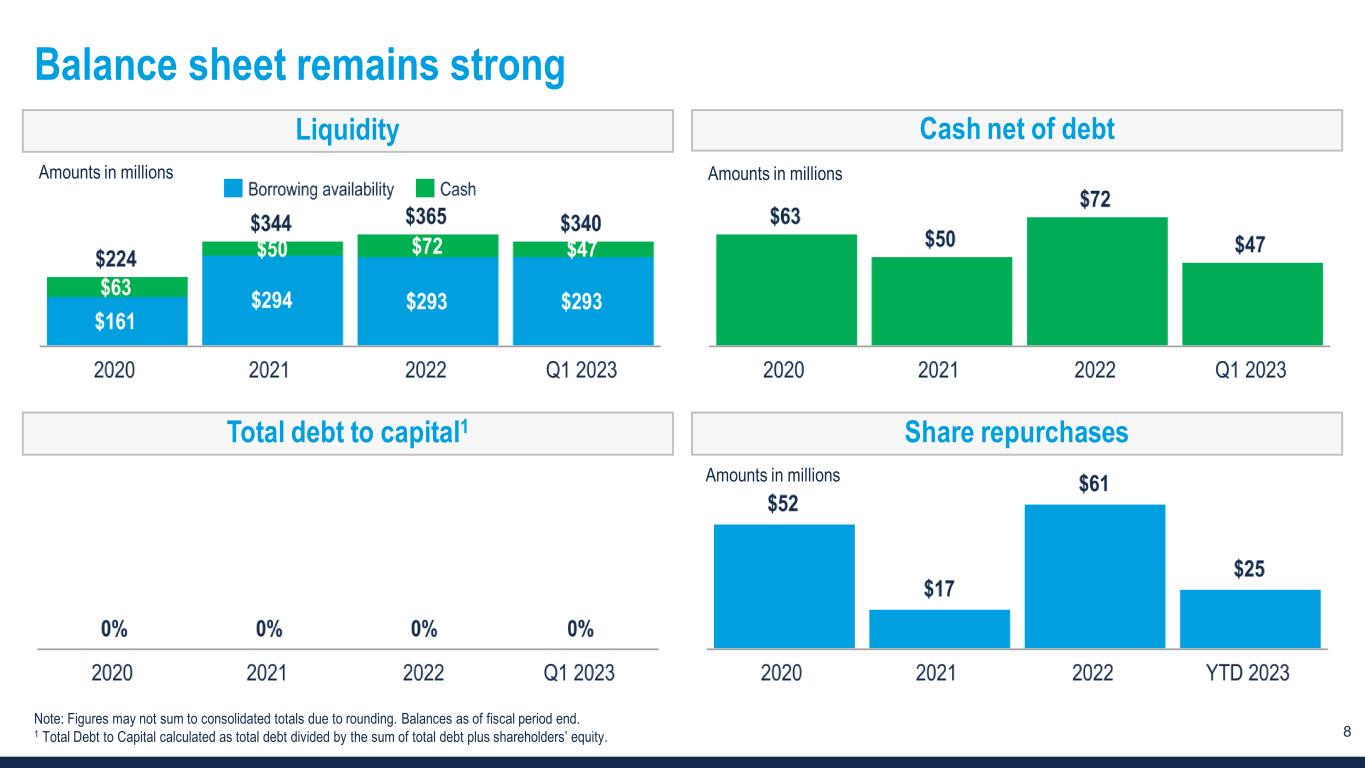

| (in thousands) | Mar 26, 2023 | Dec 25, 2022 | |||||||||

| ASSETS | |||||||||||

| Cash and cash equivalents | $ | 47,223 | $ | 72,054 | |||||||

| Accounts receivable, net | 282,014 | 314,275 | |||||||||

| Other current assets | 42,062 | 43,883 | |||||||||

| Total current assets | 371,299 | 430,212 | |||||||||

| Property and equipment, net | 97,972 | 95,823 | |||||||||

| Restricted cash and investments | 212,840 | 213,734 | |||||||||

| Goodwill and intangible assets, net | 108,731 | 109,989 | |||||||||

| Other assets, net | 166,271 | 169,650 | |||||||||

| Total assets | $ | 957,113 | $ | 1,019,408 | |||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||

| Accounts payable and other accrued expenses | $ | 63,967 | $ | 76,644 | |||||||

| Accrued wages and benefits | 81,095 | 92,237 | |||||||||

| Current portion of workers’ compensation claims reserve | 46,543 | 50,005 | |||||||||

| Other current liabilities | 23,291 | 23,989 | |||||||||

| Total current liabilities | 214,896 | 242,875 | |||||||||

| Workers’ compensation claims reserve, less current portion | 192,884 | 201,005 | |||||||||

| Other long-term liabilities | 81,710 | 79,213 | |||||||||

| Total liabilities | 489,490 | 523,093 | |||||||||

| Shareholders’ equity | 467,623 | 496,315 | |||||||||

| Total liabilities and shareholders’ equity | $ | 957,113 | $ | 1,019,408 | |||||||

13 weeks ended |

|||||||||||

| (in thousands) | Mar 26, 2023 | Mar 27, 2022 | |||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | $ | (4,289) | $ | 10,519 | |||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||

| Depreciation and amortization | 6,411 | 7,287 | |||||||||

| Provision for credit losses | 1,382 | 989 | |||||||||

| Stock-based compensation | 2,630 | 3,812 | |||||||||

| Deferred income taxes | (47) | 1,258 | |||||||||

| Non-cash lease expense | 3,140 | 3,281 | |||||||||

| Other operating activities | 20 | 2,608 | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Accounts receivable | 31,025 | 27,702 | |||||||||

| Income taxes receivable and payable | (2,512) | (1,252) | |||||||||

| Other assets | 6,462 | 4,267 | |||||||||

| Accounts payable and other accrued expenses | (11,937) | (13,257) | |||||||||

| Accrued wages and benefits | (11,143) | (19,031) | |||||||||

| Workers’ compensation claims reserve | (11,583) | 168 | |||||||||

| Operating lease liabilities | (3,316) | (3,319) | |||||||||

| Other liabilities | 2,908 | 1,410 | |||||||||

| Net cash provided by operating activities | 9,151 | 26,442 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (8,081) | (5,779) | |||||||||

| Purchases of restricted held-to-maturity investments | (2,305) | — | |||||||||

| Maturities of restricted held-to-maturity investments | 2,010 | 6,034 | |||||||||

| Net cash (used in) provided by investing activities | (8,376) | 255 | |||||||||

| Cash flows from financing activities: | |||||||||||

| Purchases and retirement of common stock | (24,718) | (36,326) | |||||||||

| Net proceeds from employee stock purchase plans | 315 | 319 | |||||||||

| Common stock repurchases for taxes upon vesting of restricted stock | (2,377) | (3,970) | |||||||||

| Net change in revolving credit facility | — | 4,000 | |||||||||

| Other | (45) | (72) | |||||||||

| Net cash used in financing activities | (26,825) | (36,049) | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 9 | (57) | |||||||||

| Net change in cash, cash equivalents, and restricted cash | (26,041) | (9,409) | |||||||||

| Cash, cash equivalents and restricted cash, beginning of period | 135,631 | 103,185 | |||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | 109,590 | $ | 93,776 | |||||||

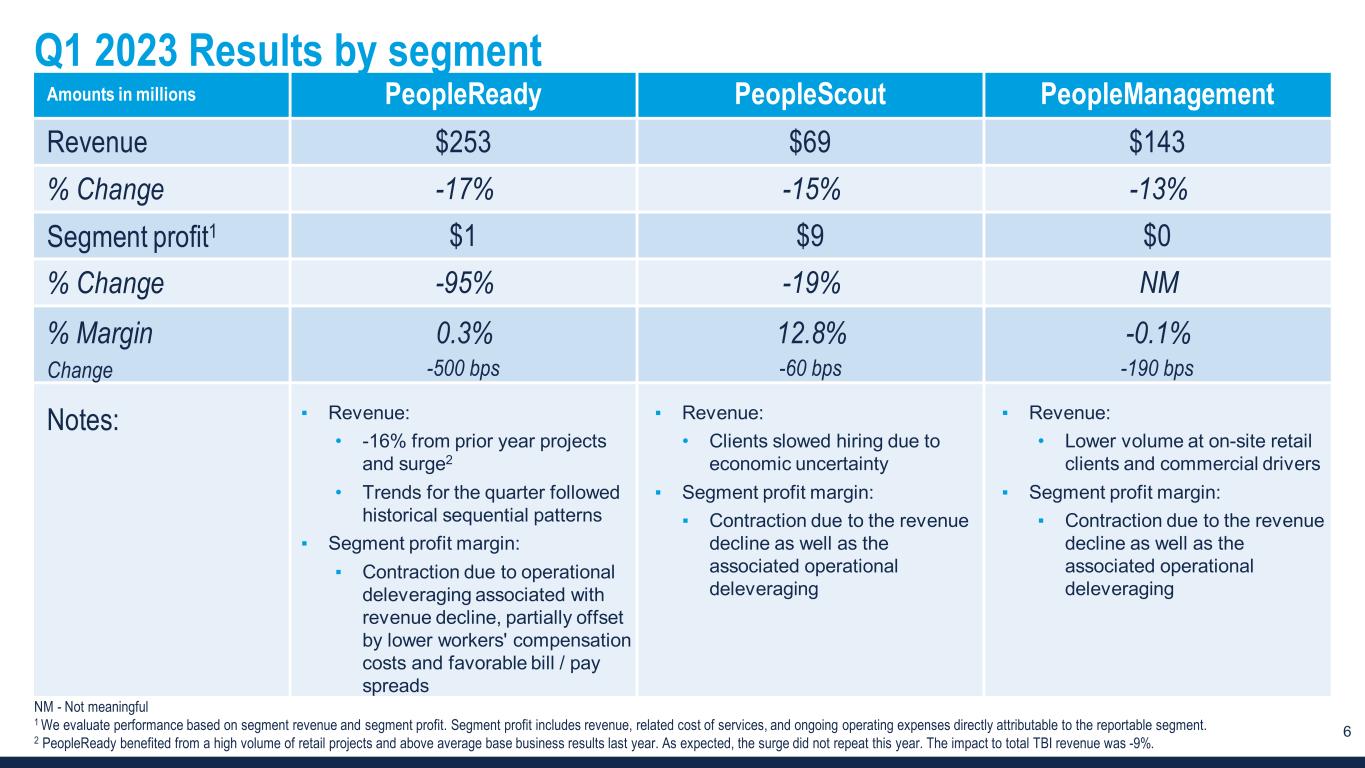

13 weeks ended |

|||||||||||

| (in thousands) | Mar 26, 2023 | Mar 27, 2022 | |||||||||

| Revenue from services: | |||||||||||

| PeopleReady | $ | 252,628 | $ | 305,690 | |||||||

| PeopleScout | 69,476 | 82,006 | |||||||||

| PeopleManagement | 143,184 | 163,819 | |||||||||

| Total company | $ | 465,288 | $ | 551,515 | |||||||

Segment profit (loss) (1): |

|||||||||||

| PeopleReady | $ | 872 | $ | 16,219 | |||||||

| PeopleScout | 8,923 | 10,972 | |||||||||

| PeopleManagement | (202) | 2,979 | |||||||||

| Total segment profit | 9,593 | 30,170 | |||||||||

| Corporate unallocated expense | (6,708) | (7,298) | |||||||||

Total company Adjusted EBITDA (2) |

2,885 | 22,872 | |||||||||

| Third-party processing fees for hiring tax credits (3) | (120) | (162) | |||||||||

| Amortization of software as a service assets (4) | (868) | (747) | |||||||||

| PeopleReady technology upgrade costs (5) | (32) | (2,550) | |||||||||

| Other adjustments, net (6) | (1,397) | (136) | |||||||||

EBITDA (2) |

468 | 19,277 | |||||||||

| Depreciation and amortization | (6,411) | (7,287) | |||||||||

| Interest expense and other income, net | 1,014 | 505 | |||||||||

| Income (loss) before tax expense | (4,929) | 12,495 | |||||||||

| Income tax benefit (expense) | 640 | (1,976) | |||||||||

| Net income (loss) | $ | (4,289) | $ | 10,519 | |||||||

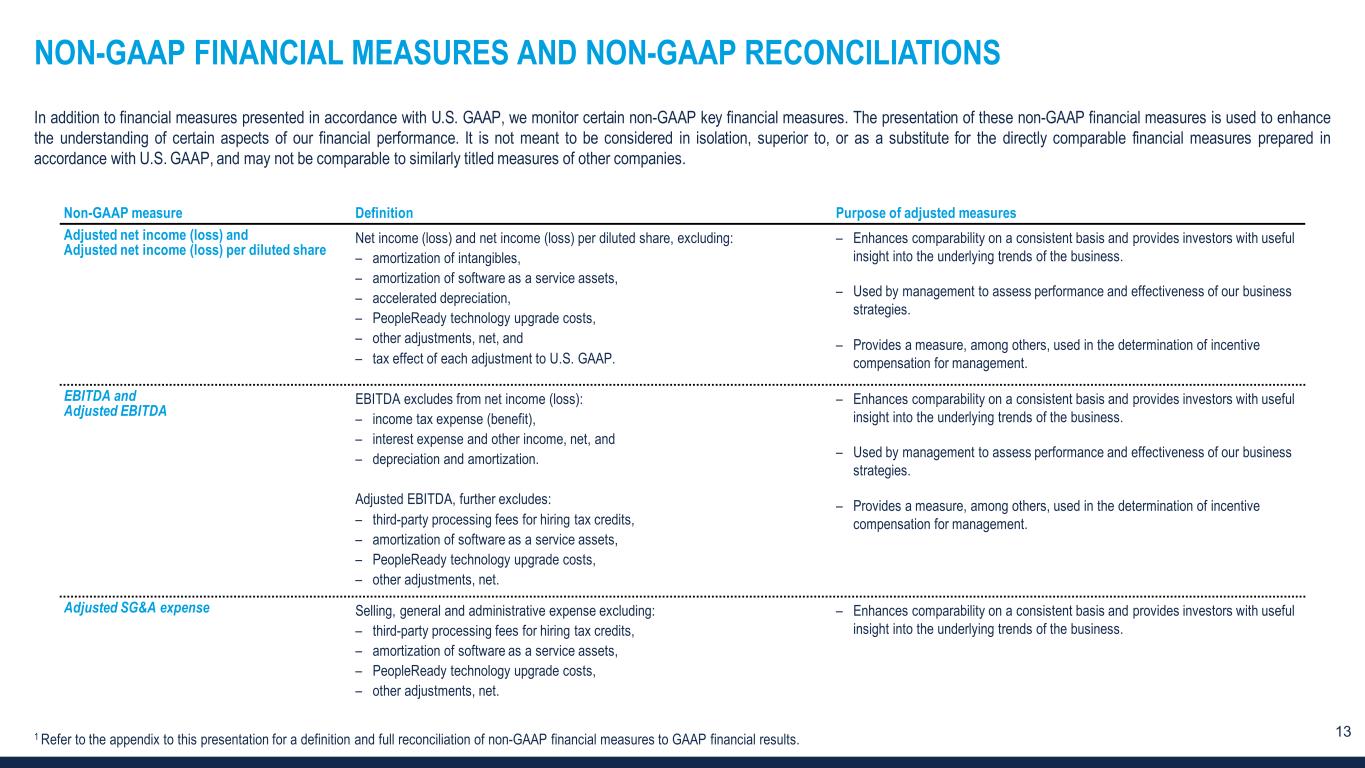

| Non-GAAP measure | Definition | Purpose of adjusted measures | ||||||||||||

| Adjusted net income (loss) and Adjusted net income (loss) per diluted share |

Net income (loss) and net income (loss) per diluted share, excluding:

–amortization of intangibles,

–amortization of software as a service assets,

–accelerated depreciation,

–PeopleReady technology upgrade costs,

–other adjustments, net, and

–tax effect of each adjustment to U.S. GAAP.

|

–Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

–Used by management to assess performance and effectiveness of our business strategies.

–Provides a measure, among others, used in the determination of incentive compensation for management.

|

||||||||||||

| EBITDA and Adjusted EBITDA |

EBITDA excludes from net income (loss):

–income tax expense (benefit),

–interest expense and other income, net, and

–depreciation and amortization.

Adjusted EBITDA, further excludes:

–third-party processing fees for hiring tax credits,

–amortization of software as a service assets,

–PeopleReady technology upgrade costs,

–other adjustments, net.

|

–Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

–Used by management to assess performance and effectiveness of our business strategies.

–Provides a measure, among others, used in the determination of incentive compensation for management.

|

||||||||||||

| Adjusted SG&A expense |

Selling, general and administrative expense excluding:

–third-party processing fees for hiring tax credits,

–amortization of software as a service assets,

–PeopleReady technology upgrade costs,

–other adjustments, net.

|

–Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. |

||||||||||||

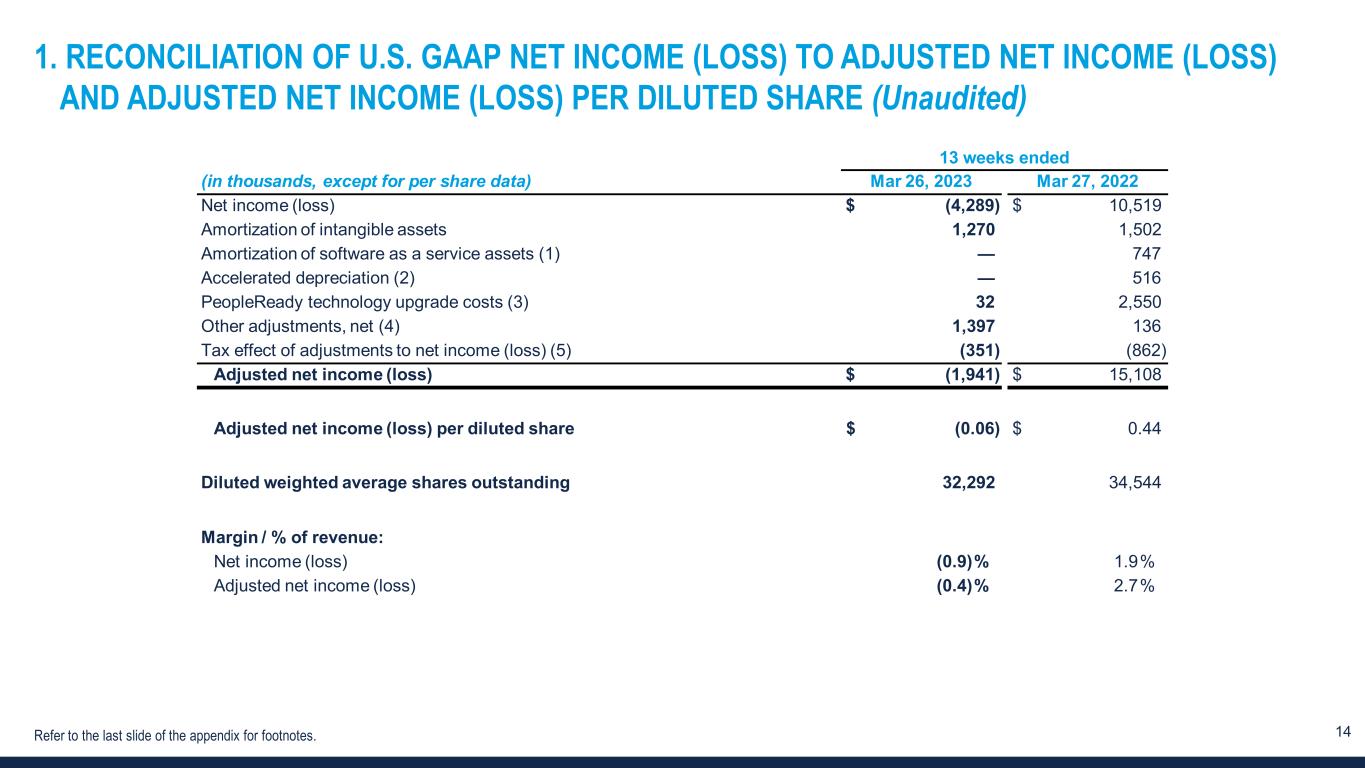

13 weeks ended |

|||||||||||

| (in thousands, except for per share data) | Mar 26, 2023 | Mar 27, 2022 | |||||||||

| Net income (loss) | $ | (4,289) | $ | 10,519 | |||||||

| Amortization of intangible assets | 1,270 | 1,502 | |||||||||

| Amortization of software as a service assets (1) | — | 747 | |||||||||

| Accelerated depreciation (2) | — | 516 | |||||||||

| PeopleReady technology upgrade costs (3) | 32 | 2,550 | |||||||||

| Other adjustments, net (4) | 1,397 | 136 | |||||||||

| Tax effect of adjustments to net income (loss) (5) | (351) | (862) | |||||||||

| Adjusted net income (loss) | $ | (1,941) | $ | 15,108 | |||||||

| Adjusted net income (loss) per diluted share | $ | (0.06) | $ | 0.44 | |||||||

| Diluted weighted average shares outstanding | 32,292 | 34,544 | |||||||||

| Margin / % of revenue: | |||||||||||

| Net income (loss) | (0.9)% | 1.9% | |||||||||

| Adjusted net income (loss) | (0.4)% | 2.7% | |||||||||

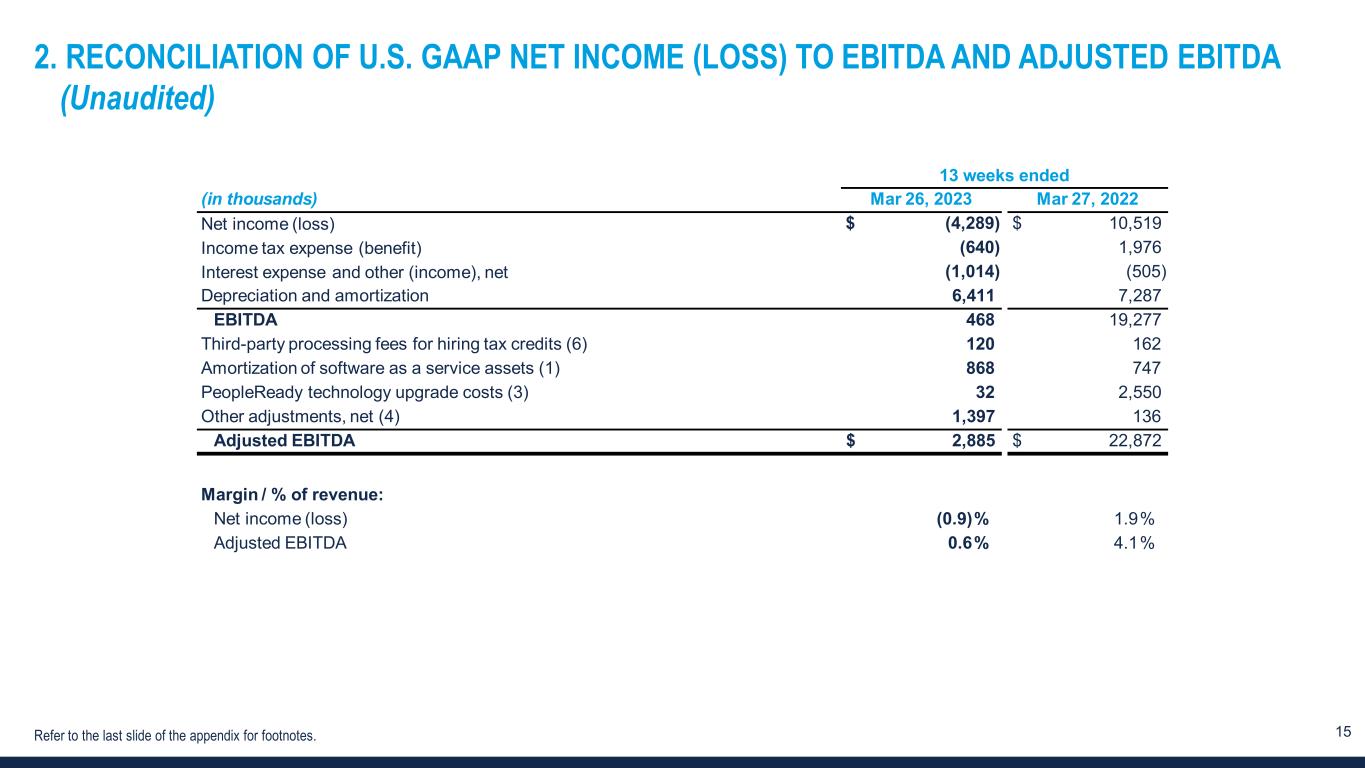

13 weeks ended |

|||||||||||

| (in thousands) | Mar 26, 2023 | Mar 27, 2022 | |||||||||

| Net income (loss) | $ | (4,289) | $ | 10,519 | |||||||

| Income tax expense (benefit) | (640) | 1,976 | |||||||||

| Interest expense and other (income), net | (1,014) | (505) | |||||||||

| Depreciation and amortization | 6,411 | 7,287 | |||||||||

| EBITDA | 468 | 19,277 | |||||||||

| Third-party processing fees for hiring tax credits (6) | 120 | 162 | |||||||||

| Amortization of software as a service assets (1) | 868 | 747 | |||||||||

| PeopleReady technology upgrade costs (3) | 32 | 2,550 | |||||||||

| Other adjustments, net (4) | 1,397 | 136 | |||||||||

| Adjusted EBITDA | $ | 2,885 | $ | 22,872 | |||||||

| Margin / % of revenue: | |||||||||||

| Net income (loss) | (0.9)% | 1.9% | |||||||||

| Adjusted EBITDA | 0.6% | 4.1% | |||||||||

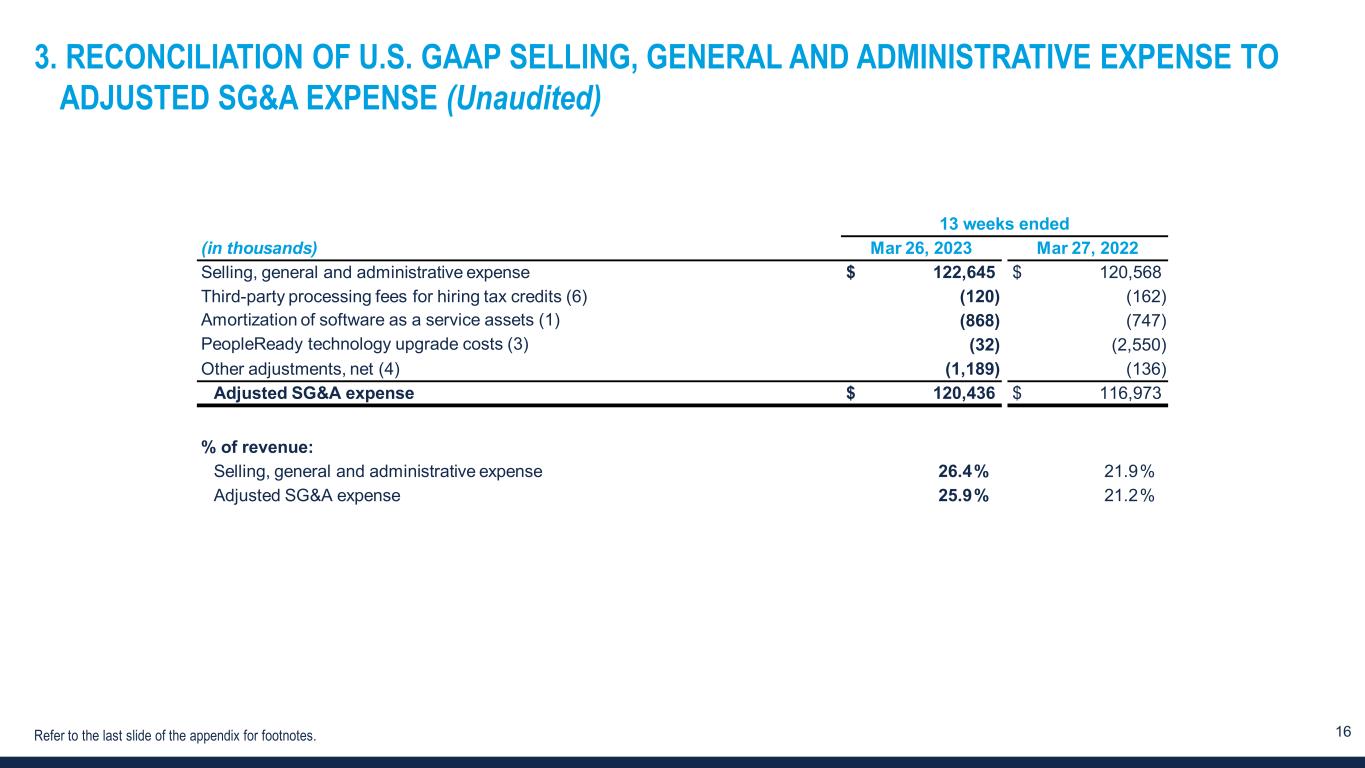

13 weeks ended |

|||||||||||

| (in thousands) | Mar 26, 2023 | Mar 27, 2022 | |||||||||

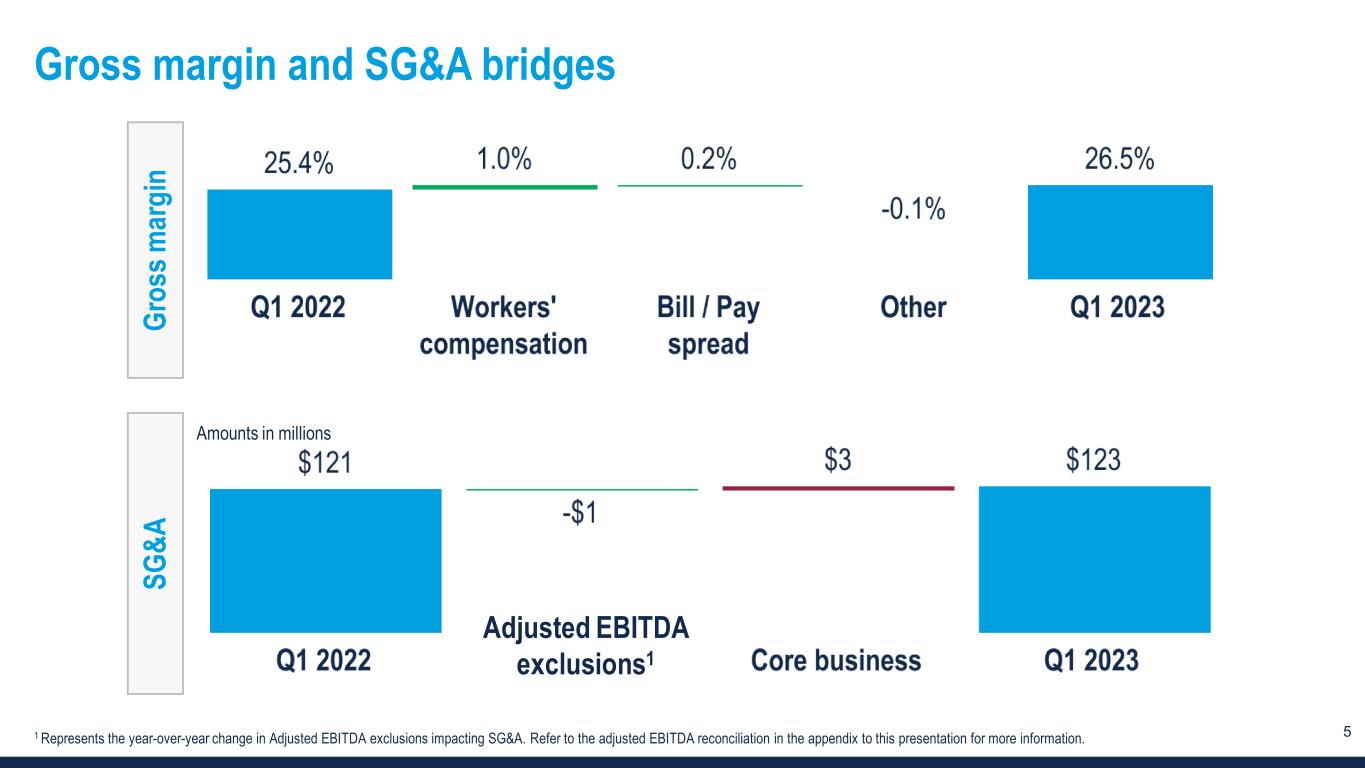

| Selling, general and administrative expense | $ | 122,645 | $ | 120,568 | |||||||

| Third-party processing fees for hiring tax credits (6) | (120) | (162) | |||||||||

| Amortization of software as a service assets (1) | (868) | (747) | |||||||||

| PeopleReady technology upgrade costs (3) | (32) | (2,550) | |||||||||

| Other adjustments, net (4) | (1,189) | (136) | |||||||||

| Adjusted SG&A expense | $ | 120,436 | $ | 116,973 | |||||||

| % of revenue: | |||||||||||

| Selling, general and administrative expense | 26.4% | 21.9% | |||||||||

| Adjusted SG&A expense | 25.9% | 21.2% | |||||||||