| Delaware | 1-8923 | 34-1096634 | ||||||||||||||||||

| (State or other jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||||||||||||||

| 4500 Dorr Street, | Toledo, | Ohio | 43615 | |||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common stock, $1.00 par value per share | WELL | New York Stock Exchange | ||||||||||||

| Guarantee of 4.800% Notes due 2028 issued by Welltower OP LLC | WELL/28 | New York Stock Exchange | ||||||||||||

| Guarantee of 4.500% Notes due 2034 issued by Welltower OP LLC | WELL/34 | New York Stock Exchange | ||||||||||||

| WELLTOWER INC. | |||||

| By: | /s/ Matthew McQueen | ||||

| Name: | Matthew McQueen | ||||

| Title: | Executive Vice President – General Counsel & Corporate Secretary | ||||

Page 1 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

Page 2 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

Page 3 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

Page 4 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

| Consolidated Balance Sheets (unaudited) | ||||||||||||||

| (in thousands) | ||||||||||||||

| March 31, | ||||||||||||||

| 2024 | 2023 | |||||||||||||

| Assets | ||||||||||||||

| Real estate investments: | ||||||||||||||

| Land and land improvements | $ | 4,754,699 | $ | 4,324,541 | ||||||||||

| Buildings and improvements | 37,841,775 | 34,161,466 | ||||||||||||

| Acquired lease intangibles | 2,158,915 | 1,990,830 | ||||||||||||

| Real property held for sale, net of accumulated depreciation | 422,225 | 215,583 | ||||||||||||

| Construction in progress | 1,342,410 | 1,121,446 | ||||||||||||

| Less accumulated depreciation and intangible amortization | (9,537,562) | (8,417,151) | ||||||||||||

| Net real property owned | 36,982,462 | 33,396,715 | ||||||||||||

| Right of use assets, net | 348,892 | 322,896 | ||||||||||||

| Real estate loans receivable, net of credit allowance | 1,426,094 | 954,156 | ||||||||||||

| Net real estate investments | 38,757,448 | 34,673,767 | ||||||||||||

| Other assets: | ||||||||||||||

| Investments in unconsolidated entities | 1,719,646 | 1,596,413 | ||||||||||||

| Goodwill | 68,321 | 68,321 | ||||||||||||

| Cash and cash equivalents | 2,388,488 | 571,902 | ||||||||||||

| Restricted cash | 89,847 | 66,894 | ||||||||||||

| Straight-line rent receivable | 469,976 | 357,359 | ||||||||||||

| Receivables and other assets | 1,059,859 | 1,159,233 | ||||||||||||

| Total other assets | 5,796,137 | 3,820,122 | ||||||||||||

| Total assets | $ | 44,553,585 | $ | 38,493,889 | ||||||||||

| Liabilities and equity | ||||||||||||||

| Liabilities: | ||||||||||||||

| Unsecured credit facility and commercial paper | $ | — | $ | — | ||||||||||

| Senior unsecured notes | 12,171,913 | 12,486,229 | ||||||||||||

| Secured debt | 2,033,232 | 2,474,837 | ||||||||||||

| Lease liabilities | 381,320 | 415,169 | ||||||||||||

| Accrued expenses and other liabilities | 1,419,212 | 1,521,499 | ||||||||||||

| Total liabilities | 16,005,677 | 16,897,734 | ||||||||||||

| Redeemable noncontrolling interests | 300,915 | 392,195 | ||||||||||||

| Equity: | ||||||||||||||

| Common stock | 592,637 | 497,928 | ||||||||||||

| Capital in excess of par value | 35,105,097 | 27,160,014 | ||||||||||||

| Treasury stock | (114,842) | (112,925) | ||||||||||||

| Cumulative net income | 9,272,190 | 8,830,623 | ||||||||||||

| Cumulative dividends | (17,126,302) | (15,815,926) | ||||||||||||

| Accumulated other comprehensive income | (180,837) | (111,559) | ||||||||||||

| Total Welltower Inc. stockholders’ equity | 27,547,943 | 20,448,155 | ||||||||||||

| Noncontrolling interests | 699,050 | 755,805 | ||||||||||||

| Total equity | 28,246,993 | 21,203,960 | ||||||||||||

| Total liabilities and equity | $ | 44,553,585 | $ | 38,493,889 | ||||||||||

Page 5 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

| Consolidated Statements of Income (unaudited) | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||

| March 31, | |||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||

| Resident fees and services | $ | 1,360,274 | $ | 1,131,685 | |||||||||||||||||||

| Rental income | 417,652 | 384,059 | |||||||||||||||||||||

| Interest income | 52,664 | 36,405 | |||||||||||||||||||||

| Other income | 29,151 | 8,580 | |||||||||||||||||||||

| Total revenues | 1,859,741 | 1,560,729 | |||||||||||||||||||||

| Expenses: | |||||||||||||||||||||||

| Property operating expenses | 1,096,913 | 957,753 | |||||||||||||||||||||

| Depreciation and amortization | 365,863 | 339,112 | |||||||||||||||||||||

| Interest expense | 147,318 | 144,403 | |||||||||||||||||||||

| General and administrative expenses | 53,318 | 44,371 | |||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | (3,054) | 930 | |||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | 6 | 5 | |||||||||||||||||||||

| Provision for loan losses, net | 1,014 | 777 | |||||||||||||||||||||

| Impairment of assets | 43,331 | 12,629 | |||||||||||||||||||||

| Other expenses | 14,131 | 22,745 | |||||||||||||||||||||

| Total expenses | 1,718,840 | 1,522,725 | |||||||||||||||||||||

| Income (loss) from continuing operations before income taxes | |||||||||||||||||||||||

| and other items | 140,901 | 38,004 | |||||||||||||||||||||

| Income tax (expense) benefit | (6,191) | (3,045) | |||||||||||||||||||||

| Income (loss) from unconsolidated entities | (7,783) | (7,071) | |||||||||||||||||||||

| Gain (loss) on real estate dispositions, net | 4,707 | 747 | |||||||||||||||||||||

| Income (loss) from continuing operations | 131,634 | 28,635 | |||||||||||||||||||||

| Net income (loss) | 131,634 | 28,635 | |||||||||||||||||||||

| Less: | Net income (loss) attributable to noncontrolling interests (1) |

4,488 | 2,962 | ||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 127,146 | $ | 25,673 | |||||||||||||||||||

| Average number of common shares outstanding: | |||||||||||||||||||||||

| Basic | 574,049 | 492,061 | |||||||||||||||||||||

| Diluted | 577,530 | 494,494 | |||||||||||||||||||||

| Net income (loss) attributable to common stockholders per share: | |||||||||||||||||||||||

| Basic | $ | 0.22 | $ | 0.05 | |||||||||||||||||||

Diluted(2) |

$ | 0.22 | $ | 0.05 | |||||||||||||||||||

| Common dividends per share | $ | 0.61 | $ | 0.61 | |||||||||||||||||||

(1) Includes amounts attributable to redeemable noncontrolling interests. | |||||||||||||||||||||||

(2) Includes adjustment to the numerator for income (loss) attributable to OP Units and DownREIT Units. | |||||||||||||||||||||||

Page 6 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

| FFO Reconciliations | Exhibit 1 | ||||||||||||||||||||||||||||

| (in thousands, except per share data) | Three Months Ended | ||||||||||||||||||||||||||||

| March 31, | |||||||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 127,146 | $ | 25,673 | |||||||||||||||||||||||||

| Depreciation and amortization | 365,863 | 339,112 | |||||||||||||||||||||||||||

| Impairments and losses (gains) on real estate dispositions, net | 38,624 | 11,882 | |||||||||||||||||||||||||||

Noncontrolling interests(1) |

(11,996) | (13,327) | |||||||||||||||||||||||||||

Unconsolidated entities(2) |

37,066 | 22,722 | |||||||||||||||||||||||||||

| NAREIT FFO attributable to common stockholders | 556,703 | 386,062 | |||||||||||||||||||||||||||

Normalizing items, net(3) |

28,505 | 33,471 | |||||||||||||||||||||||||||

| Normalized FFO attributable to common stockholders | $ | 585,208 | $ | 419,533 | |||||||||||||||||||||||||

| Average diluted common shares outstanding | 577,530 | 494,494 | |||||||||||||||||||||||||||

| Per diluted share data attributable to common stockholders: | |||||||||||||||||||||||||||||

Net income (loss)(4) |

$ | 0.22 | $ | 0.05 | |||||||||||||||||||||||||

| NAREIT FFO | $ | 0.96 | $ | 0.78 | |||||||||||||||||||||||||

| Normalized FFO | $ | 1.01 | $ | 0.85 | |||||||||||||||||||||||||

| Normalized FFO Payout Ratio: | |||||||||||||||||||||||||||||

| Dividends per common share | $ | 0.61 | $ | 0.61 | |||||||||||||||||||||||||

| Normalized FFO attributable to common stockholders per share | $ | 1.01 | $ | 0.85 | |||||||||||||||||||||||||

| Normalized FFO payout ratio | 60% | 72% | |||||||||||||||||||||||||||

Other items:(5) |

|||||||||||||||||||||||||||||

Net straight-line rent and above/below market rent amortization(6) |

$ | (35,004) | $ | (33,384) | |||||||||||||||||||||||||

Non-cash interest expenses(7) |

9,386 | 5,878 | |||||||||||||||||||||||||||

| Recurring cap-ex, tenant improvements, and lease commissions | (51,616) | (36,913) | |||||||||||||||||||||||||||

| Stock-based compensation | 11,342 | 9,124 | |||||||||||||||||||||||||||

| (1) Represents noncontrolling interests' share of net FFO adjustments. | |||||||||||||||||||||||||||||

| (2) Represents Welltower's share of net FFO adjustments from unconsolidated entities. | |||||||||||||||||||||||||||||

| (3) See Exhibit 2. | |||||||||||||||||||||||||||||

| (4) Includes adjustment to the numerator for income (loss) attributable to OP Units and DownREIT Units. | |||||||||||||||||||||||||||||

| (5) Amounts presented net of noncontrolling interests' share and including Welltower's share of unconsolidated entities. | |||||||||||||||||||||||||||||

| (6) Excludes normalized other impairment (see Exhibit 2). | |||||||||||||||||||||||||||||

| (7) Excludes normalized foreign currency loss (gain) (see Exhibit 2). | |||||||||||||||||||||||||||||

Page 7 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

| Normalizing Items | Exhibit 2 | |||||||||||||||||||

| (in thousands, except per share data) | Three Months Ended | |||||||||||||||||||

| March 31, | ||||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | $ | (3,054) | (1) | $ | 930 | |||||||||||||||

| Loss (gain) on extinguishment of debt, net | 6 | 5 | ||||||||||||||||||

| Provision for loan losses, net | 1,014 | (2) | 777 | |||||||||||||||||

| Income tax benefits | — | (246) | ||||||||||||||||||

| Other impairment | 9,356 | (3) | — | |||||||||||||||||

| Other expenses | 14,131 | (4) | 22,745 | |||||||||||||||||

| Casualty losses, net of recoveries | 2,158 | (5) | 4,487 | |||||||||||||||||

| Foreign currency loss (gain) | 609 | (6) | (227) | |||||||||||||||||

| Normalizing items attributable to noncontrolling interests and unconsolidated entities, net | 4,285 | (7) | 5,000 | |||||||||||||||||

| Net normalizing items | $ | 28,505 | $ | 33,471 | ||||||||||||||||

| Average diluted common shares outstanding | 577,530 | 494,494 | ||||||||||||||||||

| Net normalizing items per diluted share | $ | 0.05 | $ | 0.07 | ||||||||||||||||

| (1) Primarily related to mark-to-market of the equity warrants received as part of the Safanad/HC-One transactions. | ||||||||||||||||||||

| (2) Primarily related to reserves for loan losses under the current expected credit losses accounting standard. | ||||||||||||||||||||

| (3) Represents the write off of straight-line rent receivable balances relating to leases placed on cash recognition. | ||||||||||||||||||||

| (4) Primarily related to non-capitalizable transaction costs. | ||||||||||||||||||||

| (5) Primarily relates to casualty losses net of any insurance recoveries. | ||||||||||||||||||||

| (6) Primarily relates to foreign currency gains and losses related to accrued interest on intercompany loans and third party debt denominated in a foreign currency. | ||||||||||||||||||||

| (7) Primarily related to hypothetical liquidation at book value adjustments related to in substance real estate investments. | ||||||||||||||||||||

| Outlook Reconciliation: Year Ending December 31, 2024 | Exhibit 3 | |||||||||||||||||||||||||||||||

| (in millions, except per share data) | Prior Outlook | Current Outlook | ||||||||||||||||||||||||||||||

| Low | High | Low | High | |||||||||||||||||||||||||||||

| FFO Reconciliation: | ||||||||||||||||||||||||||||||||

| Net income attributable to common stockholders | $ | 694 | $ | 785 | $ | 879 | $ | 957 | ||||||||||||||||||||||||

Impairments and losses (gains) on real estate dispositions, net(1,2) |

(78) | (78) | (154) | (154) | ||||||||||||||||||||||||||||

Depreciation and amortization(1) |

1,636 | 1,636 | 1,638 | 1,638 | ||||||||||||||||||||||||||||

| NAREIT FFO attributable to common stockholders | 2,252 | 2,343 | 2,363 | 2,441 | ||||||||||||||||||||||||||||

Normalizing items, net(1,3) |

— | — | 29 | 29 | ||||||||||||||||||||||||||||

| Normalized FFO attributable to common stockholders | $ | 2,252 | $ | 2,343 | $ | 2,392 | $ | 2,470 | ||||||||||||||||||||||||

| Diluted per share data attributable to common stockholders: | ||||||||||||||||||||||||||||||||

| Net income | $ | 1.21 | $ | 1.37 | $ | 1.48 | $ | 1.61 | ||||||||||||||||||||||||

| NAREIT FFO | $ | 3.94 | $ | 4.10 | $ | 3.97 | $ | 4.10 | ||||||||||||||||||||||||

| Normalized FFO | $ | 3.94 | $ | 4.10 | $ | 4.02 | $ | 4.15 | ||||||||||||||||||||||||

Other items:(1) |

||||||||||||||||||||||||||||||||

| Net straight-line rent and above/below market rent amortization | $ | (138) | $ | (138) | $ | (138) | $ | (138) | ||||||||||||||||||||||||

| Non-cash interest expenses | 36 | 36 | 48 | 48 | ||||||||||||||||||||||||||||

| Recurring cap-ex, tenant improvements, and lease commissions | (226) | (226) | (235) | (235) | ||||||||||||||||||||||||||||

| Stock-based compensation | 39 | 39 | 40 | 40 | ||||||||||||||||||||||||||||

| (1) Amounts presented net of noncontrolling interests' share and Welltower's share of unconsolidated entities. | ||||||||||||||||||||||||||||||||

| (2) Includes estimated gains on projected dispositions. | ||||||||||||||||||||||||||||||||

| (3) See Exhibit 2. | ||||||||||||||||||||||||||||||||

Page 8 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

| SSNOI Reconciliation | Exhibit 4 | |||||||||||||||||||||||||

| (in thousands) | Three Months Ended | |||||||||||||||||||||||||

| March 31, | ||||||||||||||||||||||||||

| 2024 | 2023 | % growth | ||||||||||||||||||||||||

| Net income (loss) | $ | 131,634 | $ | 28,635 | ||||||||||||||||||||||

| Loss (gain) on real estate dispositions, net | (4,707) | (747) | ||||||||||||||||||||||||

| Loss (income) from unconsolidated entities | 7,783 | 7,071 | ||||||||||||||||||||||||

| Income tax expense (benefit) | 6,191 | 3,045 | ||||||||||||||||||||||||

| Other expenses | 14,131 | 22,745 | ||||||||||||||||||||||||

| Impairment of assets | 43,331 | 12,629 | ||||||||||||||||||||||||

| Provision for loan losses, net | 1,014 | 777 | ||||||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | 6 | 5 | ||||||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | (3,054) | 930 | ||||||||||||||||||||||||

| General and administrative expenses | 53,318 | 44,371 | ||||||||||||||||||||||||

| Depreciation and amortization | 365,863 | 339,112 | ||||||||||||||||||||||||

| Interest expense | 147,318 | 144,403 | ||||||||||||||||||||||||

| Consolidated NOI | 762,828 | 602,976 | ||||||||||||||||||||||||

NOI attributable to unconsolidated investments(1) |

32,090 | 26,354 | ||||||||||||||||||||||||

NOI attributable to noncontrolling interests(2) |

(22,796) | (25,057) | ||||||||||||||||||||||||

| Pro rata NOI | 772,122 | 604,273 | ||||||||||||||||||||||||

Non-cash NOI attributable to same store properties |

(11,530) | (28,727) | ||||||||||||||||||||||||

NOI attributable to non-same store properties |

(222,298) | (101,335) | ||||||||||||||||||||||||

Currency and ownership adjustments(3) |

(713) | 3,779 | ||||||||||||||||||||||||

Normalizing adjustments, net(4) |

1,558 | (545) | ||||||||||||||||||||||||

| Same Store NOI (SSNOI) | $ | 539,139 | $ | 477,445 | 12.9% | |||||||||||||||||||||

| Seniors Housing Operating | 266,907 | 212,749 | 25.5% | |||||||||||||||||||||||

| Seniors Housing Triple-net | 93,740 | 90,310 | 3.8% | |||||||||||||||||||||||

| Outpatient Medical | 119,184 | 116,879 | 2.0% | |||||||||||||||||||||||

| Long-Term/Post-Acute Care | 59,308 | 57,507 | 3.1% | |||||||||||||||||||||||

Total SSNOI |

$ | 539,139 | $ | 477,445 | 12.9% | |||||||||||||||||||||

| (1) Represents Welltower's interests in joint ventures where Welltower is the minority partner. | ||||||||||||||||||||||||||

| (2) Represents minority partners' interests in joint ventures where Welltower is the majority partner. | ||||||||||||||||||||||||||

| (3) Includes adjustments to reflect consistent property ownership percentages and foreign currency exchange rates for properties in the U.K. and Canada. | ||||||||||||||||||||||||||

| (4) Includes other adjustments described in the accompanying Supplement. | ||||||||||||||||||||||||||

Page 9 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

| Reconciliation of SHO SS RevPOR Growth | Exhibit 5 | ||||||||||||||||

| (in thousands except SS RevPOR) | Three Months Ended | ||||||||||||||||

| March 31, | |||||||||||||||||

| 2024 | 2023 | ||||||||||||||||

| Consolidated SHO revenues | $ | 1,366,760 | $ | 1,136,681 | |||||||||||||

Unconsolidated SHO revenues attributable to WELL(1) |

63,581 | 59,581 | |||||||||||||||

SHO revenues attributable to noncontrolling interests(2) |

(43,523) | (52,518) | |||||||||||||||

SHO pro rata revenues(3) |

1,386,818 | 1,143,744 | |||||||||||||||

| Non-cash and non-RevPOR revenues on same store properties | (1,295) | (1,935) | |||||||||||||||

| Revenues attributable to non-same store properties | (381,958) | (239,416) | |||||||||||||||

Currency and ownership adjustments(4) |

(1,317) | 6,049 | |||||||||||||||

SHO SS RevPOR revenues(5) |

$ | 1,002,248 | $ | 908,442 | |||||||||||||

Average occupied units/month(6) |

59,502 | 57,143 | |||||||||||||||

SHO SS RevPOR(7) |

$ | 5,630 | $ | 5,373 | |||||||||||||

| SS RevPOR YOY growth | 4.8 | % | |||||||||||||||

(1) Represents Welltower's interests in joint ventures where Welltower is the minority partner. |

|||||||||||||||||

| (2) Represents minority partners' interests in joint ventures where Welltower is the majority partner. | |||||||||||||||||

| (3) Represents SHO revenues at Welltower pro rata ownership. | |||||||||||||||||

(4) Includes where appropriate adjustments to reflect consistent property ownership percentages, to translate Canadian properties at a USD/CAD rate of 1.36 and to translate UK properties at a GBP/USD rate of 1.25. |

|||||||||||||||||

| (5) Represents SS SHO RevPOR revenues at Welltower pro rata ownership. | |||||||||||||||||

| (6) Represents average occupied units for SS properties on a pro rata basis. | |||||||||||||||||

| (7) Represents pro rata SS average revenues generated per occupied room per month. | |||||||||||||||||

Page 10 of 11 |

||||||||

| 1Q24 | Earnings Release | April 29, 2024 | |||||||||

| Net Debt to Adjusted EBITDA Reconciliation | Exhibit 6 | ||||||||||||||||||||||

| (in thousands) | Three Months Ended | ||||||||||||||||||||||

| March 31, 2024 | |||||||||||||||||||||||

| Net income (loss) | $ | 131,634 | |||||||||||||||||||||

| Interest expense | 147,318 | ||||||||||||||||||||||

| Income tax expense (benefit) | 6,191 | ||||||||||||||||||||||

| Depreciation and amortization | 365,863 | ||||||||||||||||||||||

| EBITDA | 651,006 | ||||||||||||||||||||||

| Loss (income) from unconsolidated entities | 7,783 | ||||||||||||||||||||||

| Stock-based compensation | 11,342 | ||||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | 6 | ||||||||||||||||||||||

| Loss (gain) on real estate dispositions, net | (4,707) | ||||||||||||||||||||||

| Impairment of assets | 43,331 | ||||||||||||||||||||||

| Provision for loan losses, net | 1,014 | ||||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | (3,054) | ||||||||||||||||||||||

| Other expenses | 14,131 | ||||||||||||||||||||||

| Casualty losses, net of recoveries | 2,158 | ||||||||||||||||||||||

Other impairment(1) |

9,356 | ||||||||||||||||||||||

| Adjusted EBITDA | $ | 732,366 | |||||||||||||||||||||

Total debt(2) |

$ | 14,285,686 | |||||||||||||||||||||

| Cash and cash equivalents and restricted cash | (2,478,335) | ||||||||||||||||||||||

| Net debt | $ | 11,807,351 | |||||||||||||||||||||

| Adjusted EBITDA annualized | $ | 2,929,464 | |||||||||||||||||||||

| Net debt to Adjusted EBITDA ratio | 4.03x | ||||||||||||||||||||||

| (1) Represents the write off of straight-line rent receivable balances for leases placed on cash recognition. | |||||||||||||||||||||||

(2) Amounts include unamortized premiums/discounts, other fair value adjustments and financing lease liabilities. Excludes operating lease liabilities related to ASC 842 of $300,779,000 for the three months ended March 31, 2024. |

|||||||||||||||||||||||

| Net Debt to Consolidated Enterprise Value | Exhibit 7 | |||||||||||||||||||

| (in thousands, except share price) | ||||||||||||||||||||

| March 31, 2024 | December 31, 2023 | |||||||||||||||||||

| Common shares outstanding | 590,934 | 564,241 | ||||||||||||||||||

| Period end share price | $ | 93.44 | $ | 90.17 | ||||||||||||||||

| Common equity market capitalization | $ | 55,216,873 | $ | 50,877,611 | ||||||||||||||||

| Net debt | $ | 11,807,351 | $ | 13,739,143 | ||||||||||||||||

Noncontrolling interests(1) |

999,965 | 967,351 | ||||||||||||||||||

| Consolidated enterprise value | $ | 68,024,189 | $ | 65,584,105 | ||||||||||||||||

| Net debt to consolidated enterprise value | 17.4 | % | 20.9 | % | ||||||||||||||||

| (1) Includes amounts attributable to both redeemable noncontrolling interests and noncontrolling interests as reflected on our consolidated balance sheets. | ||||||||||||||||||||

Page 11 of 11 |

||||||||

| Table of Contents | |||||

Overview |

|||||

Portfolio |

|||||

Investment |

|||||

Financial |

|||||

Glossary |

|||||

Supplemental Reporting Measures |

|||||

Forward Looking Statements and Risk Factors |

|||||

Overview |

|||||

| (dollars and occupancy at Welltower pro rata ownership; dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||

Portfolio Composition(1) |

Beds/Unit Mix | ||||||||||||||||||||||||||||||||||||||||||||||

| Average Age | Properties | Total | Wellness Housing | Independent Living | Assisted Living | Memory Care | Long-Term/ Post-Acute Care | ||||||||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 17 | 994 | 120,401 | 20,767 | 45,676 | 37,958 | 15,370 | 630 | |||||||||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 18 | 360 | 27,842 | — | 5,001 | 13,671 | 8,791 | 379 | |||||||||||||||||||||||||||||||||||||||

| Outpatient Medical | 18 | 450 | 26,680,153 | (2) | n/a | n/a | n/a | n/a | n/a | ||||||||||||||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 32 | 292 | 37,225 | — | — | 1,022 | — | 36,203 | |||||||||||||||||||||||||||||||||||||||

| Total | 19 | 2,096 | |||||||||||||||||||||||||||||||||||||||||||||

| NOI Performance | Same Store(3) |

In-Place Portfolio(4) |

||||||||||||||||||||||||||||||||||||||||||

| Properties | 1Q23 NOI | 1Q24 NOI | % Change | Properties | Annualized In-Place NOI |

% of Total | ||||||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 665 | $ | 212,749 | $ | 266,907 | 25.5 | % | 899 | $ | 1,344,032 | 51.5 | % | ||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 332 | 90,310 | 93,740 | 3.8 | % | 357 | 407,064 | 15.6 | % | |||||||||||||||||||||||||||||||||||

| Outpatient Medical | 378 | 116,879 | 119,184 | 2.0 | % | 422 | 526,384 | 20.2 | % | |||||||||||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 195 | 57,507 | 59,308 | 3.1 | % | 259 | 332,320 | 12.7 | % | |||||||||||||||||||||||||||||||||||

| Total | 1,570 | $ | 477,445 | $ | 539,139 | 12.9 | % | 1,937 | $ | 2,609,800 | 100.0 | % | ||||||||||||||||||||||||||||||||

| Portfolio Performance | Facility Revenue Mix | ||||||||||||||||||||||||||||||||||||||||

Stable Portfolio(5) |

Occupancy | EBITDAR Coverage(6) |

EBITDARM Coverage(6) |

Private Pay | Medicaid | Medicare | Other Government(7) |

||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 83.9 | % | n/a | n/a | 97.6 | % | 1.0 | % | 0.4 | % | 1.0 | % | |||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 83.2 | % | 1.02 | 1.23 | 88.6 | % | 4.2 | % | 0.5 | % | 6.7 | % | |||||||||||||||||||||||||||||

| Outpatient Medical | 94.2 | % | n/a | n/a | 100.0 | % | — | — | — | ||||||||||||||||||||||||||||||||

Long-Term/Post-Acute Care (8) |

79.3 | % | 1.23 | 1.62 | 27.6 | % | 47.7 | % | 24.7 | % | — | % | |||||||||||||||||||||||||||||

| Total | 1.06 | 1.31 | 93.0 | % | 3.9 | % | 1.7 | % | 1.4 | % | |||||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||

In-Place NOI Diversification(1) | |||||||||||||||||||||||||||||||||||||||||

| By Partner: | Total Properties | Seniors Housing Operating | Seniors Housing Triple-net |

Outpatient Medical |

Long-Term/ Post-Acute Care | Total | % of Total | ||||||||||||||||||||||||||||||||||

| Cogir Management Corporation | 105 | $ | 176,880 | $ | — | $ | — | $ | — | $ | 176,880 | 6.8 | % | ||||||||||||||||||||||||||||

| Sunrise Senior Living | 91 | 170,568 | — | — | — | 170,568 | 6.5 | % | |||||||||||||||||||||||||||||||||

| Integra Healthcare Properties | 147 | — | — | — | 156,272 | 156,272 | 6.0 | % | |||||||||||||||||||||||||||||||||

| Avery Healthcare | 91 | 76,420 | 69,700 | — | — | 146,120 | 5.6 | % | |||||||||||||||||||||||||||||||||

| Oakmont Management Group | 63 | 112,844 | — | — | — | 112,844 | 4.3 | % | |||||||||||||||||||||||||||||||||

| Aspire | 53 | — | — | — | 84,572 | 84,572 | 3.2 | % | |||||||||||||||||||||||||||||||||

| Belmont Village | 21 | 81,564 | — | — | — | 81,564 | 3.1 | % | |||||||||||||||||||||||||||||||||

| Sagora Senior Living | 43 | 56,396 | 24,492 | — | — | 80,888 | 3.1 | % | |||||||||||||||||||||||||||||||||

| StoryPoint Senior Living | 81 | 51,360 | 25,832 | — | — | 77,192 | 3.0 | % | |||||||||||||||||||||||||||||||||

| Atria Senior Living | 91 | 76,808 | — | — | — | 76,808 | 2.9 | % | |||||||||||||||||||||||||||||||||

| Remaining | 1,151 | 541,192 | 287,040 | 526,384 | 91,476 | 1,446,092 | 55.5 | % | |||||||||||||||||||||||||||||||||

| Total | 1,937 | $ | 1,344,032 | $ | 407,064 | $ | 526,384 | $ | 332,320 | $ | 2,609,800 | 100.0 | % | ||||||||||||||||||||||||||||

| By Country: | |||||||||||||||||||||||||||||||||||||||||

| United States | 1,674 | $ | 1,061,112 | $ | 327,168 | $ | 526,384 | $ | 325,496 | $ | 2,240,160 | 85.8 | % | ||||||||||||||||||||||||||||

| United Kingdom | 129 | 118,344 | 76,472 | — | — | 194,816 | 7.5 | % | |||||||||||||||||||||||||||||||||

| Canada | 134 | 164,576 | 3,424 | — | 6,824 | 174,824 | 6.7 | % | |||||||||||||||||||||||||||||||||

| Total | 1,937 | $ | 1,344,032 | $ | 407,064 | $ | 526,384 | $ | 332,320 | $ | 2,609,800 | 100.0 | % | ||||||||||||||||||||||||||||

| By MSA: | |||||||||||||||||||||||||||||||||||||||||

| Los Angeles | 74 | $ | 90,316 | $ | 20,580 | $ | 42,336 | $ | 2,220 | $ | 155,452 | 6.0 | % | ||||||||||||||||||||||||||||

| New York / New Jersey | 76 | 74,284 | 14,412 | 38,764 | 3,608 | 131,068 | 5.0 | % | |||||||||||||||||||||||||||||||||

| Dallas | 71 | 62,816 | 6,608 | 29,960 | 4,496 | 103,880 | 4.0 | % | |||||||||||||||||||||||||||||||||

| Greater London | 49 | 72,720 | 17,380 | — | — | 90,100 | 3.5 | % | |||||||||||||||||||||||||||||||||

| Washington D.C. | 40 | 44,668 | 6,648 | 12,424 | 18,548 | 82,288 | 3.2 | % | |||||||||||||||||||||||||||||||||

| Houston | 38 | 13,044 | 3,684 | 48,516 | — | 65,244 | 2.5 | % | |||||||||||||||||||||||||||||||||

| Philadelphia | 45 | 13,036 | 5,476 | 20,920 | 23,756 | 63,188 | 2.4 | % | |||||||||||||||||||||||||||||||||

| Montréal | 25 | 56,364 | — | — | — | 56,364 | 2.2 | % | |||||||||||||||||||||||||||||||||

| Chicago | 49 | 30,064 | 6,400 | 10,204 | 5,944 | 52,612 | 2.0 | % | |||||||||||||||||||||||||||||||||

| San Francisco | 24 | 29,476 | 11,012 | 1,600 | 4,044 | 46,132 | 1.8 | % | |||||||||||||||||||||||||||||||||

| Raleigh | 13 | 9,320 | 29,736 | 3,200 | — | 42,256 | 1.6 | % | |||||||||||||||||||||||||||||||||

| Charlotte | 29 | 7,308 | 10,412 | 23,840 | — | 41,560 | 1.6 | % | |||||||||||||||||||||||||||||||||

| San Diego | 17 | 20,012 | 7,084 | 9,740 | 2,980 | 39,816 | 1.5 | % | |||||||||||||||||||||||||||||||||

| Seattle | 30 | 19,472 | 3,656 | 15,304 | 336 | 38,768 | 1.5 | % | |||||||||||||||||||||||||||||||||

| Tampa | 37 | 860 | 3,624 | 5,968 | 27,904 | 38,356 | 1.5 | % | |||||||||||||||||||||||||||||||||

| Miami | 41 | 2,372 | 1,416 | 15,196 | 13,780 | 32,764 | 1.3 | % | |||||||||||||||||||||||||||||||||

| Minneapolis | 21 | 328 | 18,344 | 13,856 | — | 32,528 | 1.2 | % | |||||||||||||||||||||||||||||||||

| Pittsburgh | 27 | 16,164 | 4,900 | 3,764 | 7,324 | 32,152 | 1.2 | % | |||||||||||||||||||||||||||||||||

| Baltimore | 16 | 5,528 | 1,776 | 12,596 | 11,900 | 31,800 | 1.2 | % | |||||||||||||||||||||||||||||||||

| Boston | 20 | 21,404 | 5,412 | 2,492 | — | 29,308 | 1.1 | % | |||||||||||||||||||||||||||||||||

| Remaining | 1,195 | 754,476 | 228,504 | 215,704 | 205,480 | 1,404,164 | 53.7 | % | |||||||||||||||||||||||||||||||||

| Total | 1,937 | $ | 1,344,032 | $ | 407,064 | $ | 526,384 | $ | 332,320 | $ | 2,609,800 | 100.0 | % | ||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars, units and occupancy at Welltower pro rata ownership; dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | |||||||||||||||||||||||||||||||||||

Total Portfolio Performance(1) |

1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 | ||||||||||||||||||||||||||||||

| Properties | 885 | 886 | 883 | 915 | 935 | ||||||||||||||||||||||||||||||

| Units | 89,240 | 89,932 | 90,953 | 99,387 | 101,395 | ||||||||||||||||||||||||||||||

| Total occupancy | 79.0 | % | 79.6 | % | 80.7 | % | 82.2 | % | 82.5 | % | |||||||||||||||||||||||||

| Total revenues | $ | 1,143,744 | $ | 1,178,975 | $ | 1,221,753 | $ | 1,287,666 | $ | 1,386,818 | |||||||||||||||||||||||||

| Operating expenses | 894,981 | 902,068 | 933,463 | 982,077 | 1,034,982 | ||||||||||||||||||||||||||||||

| NOI | $ | 248,763 | $ | 276,907 | $ | 288,290 | $ | 305,589 | $ | 351,836 | |||||||||||||||||||||||||

| NOI margin | 21.7 | % | 23.5 | % | 23.6 | % | 23.7 | % | 25.4 | % | |||||||||||||||||||||||||

| Recurring cap-ex | $ | 26,848 | $ | 32,791 | $ | 31,685 | $ | 49,297 | $ | 37,104 | |||||||||||||||||||||||||

| Other cap-ex | $ | 45,557 | $ | 66,002 | $ | 68,281 | $ | 85,506 | $ | 70,428 | |||||||||||||||||||||||||

Same Store Performance(2) |

1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 | ||||||||||||||||||||||||||||||

| Properties | 665 | 665 | 665 | 665 | 665 | ||||||||||||||||||||||||||||||

| Units | 71,396 | 71,396 | 71,397 | 71,340 | 71,341 | ||||||||||||||||||||||||||||||

| Occupancy | 80.0 | % | 80.8 | % | 82.2 | % | 83.5 | % | 83.4 | % | |||||||||||||||||||||||||

| Same store revenues | $ | 909,268 | $ | 935,048 | $ | 962,566 | $ | 980,403 | $ | 1,003,135 | |||||||||||||||||||||||||

| Compensation | 405,757 | 411,465 | 419,371 | 428,978 | 427,507 | ||||||||||||||||||||||||||||||

| Utilities | 49,419 | 41,362 | 48,072 | 44,909 | 49,072 | ||||||||||||||||||||||||||||||

| Food | 35,847 | 37,503 | 38,155 | 39,878 | 39,180 | ||||||||||||||||||||||||||||||

| Repairs and maintenance | 26,274 | 27,565 | 29,135 | 28,582 | 28,457 | ||||||||||||||||||||||||||||||

| Property taxes | 36,782 | 36,190 | 36,125 | 35,034 | 37,359 | ||||||||||||||||||||||||||||||

| All other | 142,440 | 149,249 | 149,454 | 157,684 | 154,653 | ||||||||||||||||||||||||||||||

| Same store operating expenses | 696,519 | 703,334 | 720,312 | 735,065 | 736,228 | ||||||||||||||||||||||||||||||

| Same store NOI | $ | 212,749 | $ | 231,714 | $ | 242,254 | $ | 245,338 | $ | 266,907 | |||||||||||||||||||||||||

| Same store NOI margin % | 23.4 | % | 24.8 | % | 25.2 | % | 25.0 | % | 26.6 | % | |||||||||||||||||||||||||

| Year over year NOI growth rate | 25.5 | % | |||||||||||||||||||||||||||||||||

| Year over year revenue growth rate | 10.3 | % | |||||||||||||||||||||||||||||||||

Partners(3) |

Properties | Pro Rata Units | Welltower Ownership %(4) |

Top Markets | 1Q24 NOI | % of Total | ||||||||||||||||||||||||||||||||

| Cogir Management Corporation | 105 | 15,533 | 85.6 | % | Southern California | $ | 32,634 | 9.3 | % | |||||||||||||||||||||||||||||

| Sunrise Senior Living | 91 | 8,096 | 96.1 | % | Northern California | 19,709 | 5.6 | % | ||||||||||||||||||||||||||||||

| Oakmont Management Group | 63 | 6,557 | 100.0 | % | New York / New Jersey | 18,426 | 5.2 | % | ||||||||||||||||||||||||||||||

| Belmont Village | 21 | 2,804 | 95.0 | % | Greater London, UK | 18,191 | 5.2 | % | ||||||||||||||||||||||||||||||

| Atria Senior Living | 91 | 10,728 | 100.0 | % | Dallas | 15,365 | 4.4 | % | ||||||||||||||||||||||||||||||

| Avery Healthcare | 41 | 3,245 | 97.6 | % | Montréal | 15,074 | 4.3 | % | ||||||||||||||||||||||||||||||

| Legend Senior Living | 40 | 3,198 | 93.8 | % | Washington D.C. | 12,611 | 3.6 | % | ||||||||||||||||||||||||||||||

| Brandywine Living | 29 | 2,722 | 100.0 | % | Toronto | 8,200 | 2.3 | % | ||||||||||||||||||||||||||||||

| Sagora Senior Living | 21 | 3,194 | 99.6 | % | Chicago | 7,401 | 2.1 | % | ||||||||||||||||||||||||||||||

| StoryPoint Senior Living | 60 | 6,973 | 100.0 | % | Boston | 5,637 | 1.6 | % | ||||||||||||||||||||||||||||||

| Care UK | 26 | 1,870 | 100.0 | % | Top Markets | 153,248 | 43.6 | % | ||||||||||||||||||||||||||||||

| Clover | 36 | 3,950 | 90.4 | % | All Other | 198,588 | 56.4 | % | ||||||||||||||||||||||||||||||

| Pegasus | 30 | 3,348 | 99.7 | % | Total | $ | 351,836 | 100.0 | % | |||||||||||||||||||||||||||||

| Senior Resource Group | 12 | 1,258 | 46.6 | % | ||||||||||||||||||||||||||||||||||

| Remaining | 233 | 24,595 | ||||||||||||||||||||||||||||||||||||

| Total | 899 | 98,071 | ||||||||||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||||||||

| Payment Coverage Stratification | |||||||||||||||||||||||||||||||||||||||||||||||

EBITDARM Coverage(1) |

EBITDAR Coverage(1) |

||||||||||||||||||||||||||||||||||||||||||||||

| % of In-Place NOI | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | Seniors Housing Triple-net | Long-Term/ Post- Acute Care | Total | Weighted Average Maturity | Number of Leases | |||||||||||||||||||||||||||||||||||||

| <.85x | 0.4 | % | — | % | 0.4 | % | 9 | 2 | 2.6 | % | — | % | 2.6 | % | 9 | 4 | |||||||||||||||||||||||||||||||

| .85x-.95x | — | % | — | % | — | % | — | — | 1.5 | % | 1.3 | % | 2.8 | % | 5 | 5 | |||||||||||||||||||||||||||||||

| .95x-1.05x | 2.3 | % | — | % | 2.3 | % | 9 | 2 | 2.6 | % | — | % | 2.6 | % | 17 | 4 | |||||||||||||||||||||||||||||||

| 1.05x-1.15x | 1.9 | % | 0.4 | % | 2.3 | % | 5 | 4 | 3.5 | % | 3.0 | % | 6.5 | % | 8 | 5 | |||||||||||||||||||||||||||||||

| 1.15x-1.25x | 2.1 | % | 0.9 | % | 3.0 | % | 11 | 3 | 2.9 | % | — | % | 2.9 | % | 10 | 2 | |||||||||||||||||||||||||||||||

| 1.25x-1.35x | 5.7 | % | 0.1 | % | 5.8 | % | 8 | 5 | — | % | — | % | — | % | — | — | |||||||||||||||||||||||||||||||

| >1.35 | 1.2 | % | 4.3 | % | 5.5 | % | 17 | 13 | 0.5 | % | 1.4 | % | 1.9 | % | 15 | 9 | |||||||||||||||||||||||||||||||

| Total | 13.6 | % | 5.7 | % | 19.3 | % | 11 | 29 | 13.6 | % | 5.7 | % | 19.3 | % | 11 | 29 | |||||||||||||||||||||||||||||||

Revenue and Lease Maturity(2) |

||||||||||||||||||||||||||||||||||||||

| Rental Income | ||||||||||||||||||||||||||||||||||||||

| Year | Seniors Housing Triple-net |

Outpatient Medical | Long-Term / Post-Acute Care | Interest Income |

Total Revenues |

% of Total | ||||||||||||||||||||||||||||||||

| 2024 | $ | 13,495 | $ | 50,449 | $ | — | $ | 39,088 | $ | 103,032 | 6.9 | % | ||||||||||||||||||||||||||

| 2025 | 5,837 | 40,593 | 720 | 16,667 | 63,817 | 4.3 | % | |||||||||||||||||||||||||||||||

| 2026 | 3,304 | 49,666 | 9,287 | 40,118 | 102,375 | 6.8 | % | |||||||||||||||||||||||||||||||

| 2027 | — | 45,040 | 1,232 | 11,953 | 58,225 | 3.9 | % | |||||||||||||||||||||||||||||||

| 2028 | — | 46,576 | 6,404 | 103,633 | 156,613 | 10.4 | % | |||||||||||||||||||||||||||||||

| 2029 | 1,035 | 42,595 | — | 3,322 | 46,952 | 3.1 | % | |||||||||||||||||||||||||||||||

| 2030 | 42,330 | 39,955 | 29,031 | 361 | 111,677 | 7.4 | % | |||||||||||||||||||||||||||||||

| 2031 | 6,571 | 52,905 | 4,430 | 233 | 64,139 | 4.3 | % | |||||||||||||||||||||||||||||||

| 2032 | 94,226 | 44,474 | — | 351 | 139,051 | 9.3 | % | |||||||||||||||||||||||||||||||

| 2033 | 55,028 | 32,495 | — | — | 87,523 | 5.8 | % | |||||||||||||||||||||||||||||||

| Thereafter | 154,579 | 129,182 | 280,219 | 1,718 | 565,698 | 37.8 | % | |||||||||||||||||||||||||||||||

| $ | 376,405 | $ | 573,930 | $ | 331,323 | $ | 217,444 | $ | 1,499,102 | 100.0 | % | |||||||||||||||||||||||||||

| Weighted Avg Maturity Years | 10 | 7 | 14 | 3 | 9 | |||||||||||||||||||||||||||||||||

| Portfolio | |||||

| (dollars, square feet and occupancy at Welltower pro rata ownership; dollars in thousands except per square feet) | ||||||||||||||||||||||||||||||||

| Outpatient Medical | ||||||||||||||||||||||||||||||||

Total Portfolio Performance(1) |

1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 | |||||||||||||||||||||||||||

| Properties | 419 | 420 | 422 | 426 | 427 | |||||||||||||||||||||||||||

| Square feet | 20,188,159 | 20,236,315 | 20,748,969 | 21,043,557 | 21,148,949 | |||||||||||||||||||||||||||

| Occupancy | 94.0 | % | 94.4 | % | 94.5 | % | 94.5 | % | 94.2 | % | ||||||||||||||||||||||

| Total revenues | $ | 185,190 | $ | 186,802 | $ | 195,136 | $ | 192,822 | $ | 203,849 | ||||||||||||||||||||||

| Operating expenses | 58,977 | 59,358 | 63,831 | 55,060 | 65,162 | |||||||||||||||||||||||||||

| NOI | $ | 126,213 | $ | 127,444 | $ | 131,305 | $ | 137,762 | $ | 138,687 | ||||||||||||||||||||||

| NOI margin | 68.2 | % | 68.2 | % | 67.3 | % | 71.4 | % | 68.0 | % | ||||||||||||||||||||||

| Revenues per square foot | $ | 36.69 | $ | 36.92 | $ | 37.62 | $ | 36.65 | $ | 38.55 | ||||||||||||||||||||||

| NOI per square foot | $ | 25.01 | $ | 25.19 | $ | 25.31 | $ | 26.19 | $ | 26.23 | ||||||||||||||||||||||

| Recurring cap-ex | $ | 10,666 | $ | 7,400 | $ | 18,340 | $ | 21,106 | $ | 14,512 | ||||||||||||||||||||||

| Other cap-ex | $ | 5,118 | $ | 4,397 | $ | 8,545 | $ | 10,151 | $ | 7,826 | ||||||||||||||||||||||

Same Store Performance(2) |

1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 | |||||||||||||||||||||||||||

| Properties | 378 | 378 | 378 | 378 | 378 | |||||||||||||||||||||||||||

| Occupancy | 94.7 | % | 94.9 | % | 95.0 | % | 94.8 | % | 94.7 | % | ||||||||||||||||||||||

| Same store revenues | $ | 172,500 | $ | 171,576 | $ | 174,464 | $ | 167,390 | $ | 176,084 | ||||||||||||||||||||||

| Same store operating expenses | 55,621 | 53,748 | 56,714 | 47,070 | 56,900 | |||||||||||||||||||||||||||

| Same store NOI | $ | 116,879 | $ | 117,828 | $ | 117,750 | $ | 120,320 | $ | 119,184 | ||||||||||||||||||||||

| NOI margin | 67.8 | % | 68.7 | % | 67.5 | % | 71.9 | % | 67.7 | % | ||||||||||||||||||||||

| Year over year NOI growth rate | 2.0 | % | ||||||||||||||||||||||||||||||

|

Portfolio Diversification

by Tenant(3)

|

Rental Income | % of Total | Quality Indicators | ||||||||||||||||||||

| Kelsey-Seybold | $ | 45,543 | 7.9 | % | Health system affiliated properties as % of NOI(3) |

88.9 | % | ||||||||||||||||

| UnitedHealth | 18,404 | 3.2 | % | Health system affiliated tenants as % of rental income(3) |

60.4 | % | |||||||||||||||||

| Common Spirit Health | 17,976 | 3.1 | % | Investment grade tenants as % of rental income | 55.6 | % | |||||||||||||||||

| Novant Health | 17,485 | 3.0 | % | Retention (trailing twelve months)(3) |

92.7 | % | |||||||||||||||||

| Providence Health & Services | 16,739 | 2.9 | % | In-house managed properties as % of square feet(3,4) |

86.0 | % | |||||||||||||||||

| Remaining portfolio | 457,783 | 79.9 | % | Average remaining lease term (years)(3) |

6.6 | ||||||||||||||||||

| Total | $ | 573,930 | 100.0 | % | Average building size (square feet)(3) |

59,095 | |||||||||||||||||

| Average age (years) | 18 | ||||||||||||||||||||||

Expirations(3) |

2024 | 2025 | 2026 | 2027 | 2028 | Thereafter | ||||||||||||||||||||||||||||||||

| Occupied square feet | 1,696,000 | 1,335,971 | 1,785,862 | 1,588,107 | 1,652,794 | 11,863,093 | ||||||||||||||||||||||||||||||||

| % of occupied square feet | 8.5 | % | 6.7 | % | 9.0 | % | 8.0 | % | 8.3 | % | 59.5 | % | ||||||||||||||||||||||||||

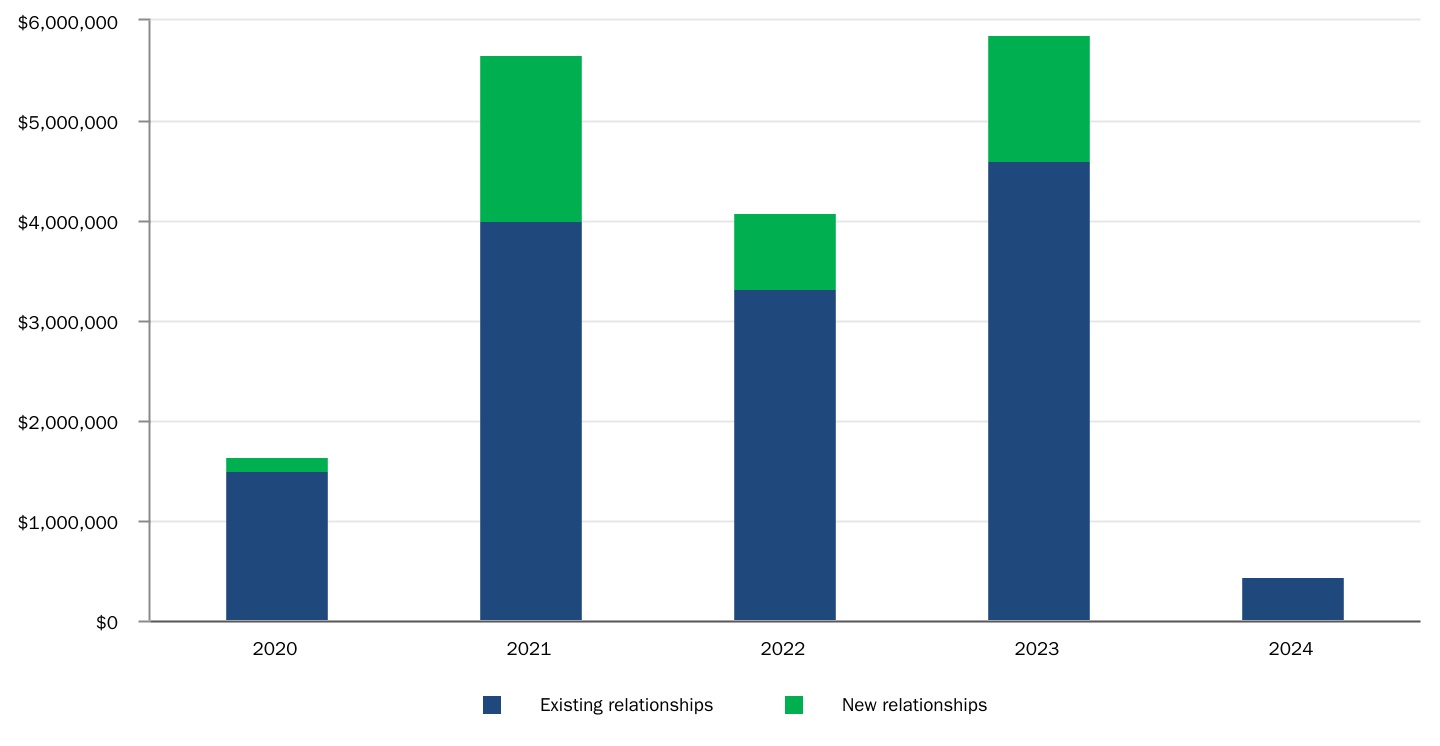

| Investment | |||||

Detail of Acquisitions/JVs(1) |

||||||||||||||||||||||||||||||||||||||

| 2020 | 2021 | 2022 | 2023 | 1Q24 | 20-24 Total | |||||||||||||||||||||||||||||||||

| Count | 12 | 35 | 27 | 52 | 3 | 129 | ||||||||||||||||||||||||||||||||

| Total | $ | 910,217 | $ | 4,101,534 | $ | 2,785,739 | $ | 4,222,706 | $ | 61,034 | $ | 12,081,230 | ||||||||||||||||||||||||||

| Low | 6,201 | 5,000 | 6,485 | 2,950 | 6,786 | 2,950 | ||||||||||||||||||||||||||||||||

| Median | 48,490 | 45,157 | 66,074 | 65,134 | 23,753 | 48,875 | ||||||||||||||||||||||||||||||||

| High | 235,387 | 1,576,642 | 389,149 | 644,443 | 30,495 | 1,576,642 | ||||||||||||||||||||||||||||||||

| Investment Timing | |||||||||||||||||||||||||||||

Acquisitions and Loan Funding(2) |

Yield | Construction Conversions(3) |

Year 1 Yield | Dispositions and Loan Repayments | Yield | ||||||||||||||||||||||||

| January | $ | 66,655 | 6.7 | % | $ | 98,565 | 5.5 | % | $ | 77,834 | 4.2 | % | |||||||||||||||||

| February | 75,547 | 6.9 | % | 47,853 | 1.3 | % | 29,050 | 7.0 | % | ||||||||||||||||||||

| March | 65,732 | 6.8 | % | 19,185 | 0.6 | % | 110 | 7.5 | % | ||||||||||||||||||||

| Total | $ | 207,934 | 6.8 | % | $ | 165,603 | 3.7 | % | $ | 106,994 | 5.0 | % | |||||||||||||||||

| Investment | |||||

| (dollars in thousands at Welltower pro rata ownership, except per bed / unit / square foot) | ||||||||||||||||||||||||||||||||

| Gross Investment Activity | ||||||||||||||||||||||||||||||||

| First Quarter 2024 | ||||||||||||||||||||||||||||||||

| Properties | Beds / Units / Square Feet | Investment Per Bed / Unit / SqFt |

Pro Rata Amount |

Yield | ||||||||||||||||||||||||||||

Acquisitions and Loan Funding(1) |

||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 3 | 363 | units | $ | 168,138 | $ | 61,034 | |||||||||||||||||||||||||

| Loan funding | 146,900 | |||||||||||||||||||||||||||||||

Total acquisitions and loan funding(2) |

3 | 207,934 | 6.8 | % | ||||||||||||||||||||||||||||

Development Funding(3) |

||||||||||||||||||||||||||||||||

| Development projects: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 37 | 6,298 | units | 162,798 | ||||||||||||||||||||||||||||

| Outpatient Medical | 14 | 1,154,635 | sf | 73,130 | ||||||||||||||||||||||||||||

| Total development projects | 51 | 235,928 | ||||||||||||||||||||||||||||||

| Redevelopment and expansion projects: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 3 | 293 | units | 2,371 | ||||||||||||||||||||||||||||

| Outpatient Medical | 2 | 24,097 | sf | 2,996 | ||||||||||||||||||||||||||||

| Total redevelopment and expansion projects | 5 | 5,367 | ||||||||||||||||||||||||||||||

| Total development funding | 56 | 241,295 | 7.1 | % | ||||||||||||||||||||||||||||

| Total gross investments | 449,229 | 6.9 | % | |||||||||||||||||||||||||||||

Dispositions and Loan Repayments(4) |

||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 10 | 907 | units | 281,147 | 70,522 | |||||||||||||||||||||||||||

| Loan repayments | 36,472 | |||||||||||||||||||||||||||||||

Total dispositions and loan repayments(5) |

10 | 106,994 | 5.0 | % | ||||||||||||||||||||||||||||

| Net investments (dispositions) | $ | 342,235 | ||||||||||||||||||||||||||||||

| Investment | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||

Development Summary(1) |

|||||||||||||||||||||||||||||||||||||||||

| Unit Mix | |||||||||||||||||||||||||||||||||||||||||

| Facility MSA | Total | Wellness Housing | Independent Living | Assisted Living | Memory Care | Commitment Amount | Future Funding | Estimated Conversion(2) |

|||||||||||||||||||||||||||||||||

| Seniors Housing Operating | |||||||||||||||||||||||||||||||||||||||||

| Phoenix, AZ | 204 | 204 | — | — | — | $ | 51,179 | $ | 2,870 | 4Q23 - 2Q24 | |||||||||||||||||||||||||||||||

| San Diego, CA | 96 | — | — | 56 | 40 | 42,340 | 656 | 2Q24 | |||||||||||||||||||||||||||||||||

| Houston, TX | 130 | 130 | — | — | — | 34,216 | 603 | 3Q23 - 2Q24 | |||||||||||||||||||||||||||||||||

| Hartford, CT | 128 | 128 | — | — | — | 22,058 | — | 2Q24 | |||||||||||||||||||||||||||||||||

| Hartford, CT | 122 | 122 | — | — | — | 20,650 | — | 2Q24 | |||||||||||||||||||||||||||||||||

| Cincinnati, OH | 122 | 122 | — | — | — | 15,602 | 1,474 | 2Q24 | |||||||||||||||||||||||||||||||||

| Washington D.C. | 302 | — | 190 | 89 | 23 | 157,660 | 17,116 | 3Q24 | |||||||||||||||||||||||||||||||||

| Vancouver, BC | 85 | — | — | 45 | 40 | 58,597 | 2,635 | 3Q24 | |||||||||||||||||||||||||||||||||

| Dallas, TX | 55 | 55 | — | — | — | 17,280 | 1,538 | 1Q24 - 3Q24 | |||||||||||||||||||||||||||||||||

| Norwich, UK | 80 | — | — | 52 | 28 | 9,669 | 2,903 | 3Q24 | |||||||||||||||||||||||||||||||||

| Boston, MA | 160 | — | 82 | 37 | 41 | 149,274 | 23,904 | 4Q24 | |||||||||||||||||||||||||||||||||

| Kansas City, MO | 265 | 265 | — | — | — | 70,864 | 29,820 | 4Q24 | |||||||||||||||||||||||||||||||||

| Miami, FL | 91 | — | — | 55 | 36 | 69,951 | 24,185 | 4Q24 | |||||||||||||||||||||||||||||||||

| Phoenix, AZ | 199 | 199 | — | — | — | 51,794 | 2,312 | 2Q24 - 4Q24 | |||||||||||||||||||||||||||||||||

| Tampa, FL | 206 | 206 | — | — | — | 49,646 | 13,139 | 2Q24 - 4Q24 | |||||||||||||||||||||||||||||||||

| Sacramento, CA | 100 | — | — | 70 | 30 | 43,815 | 15,869 | 4Q24 | |||||||||||||||||||||||||||||||||

| Kansas City, MO | 134 | 134 | — | — | — | 20,980 | — | 4Q24 | |||||||||||||||||||||||||||||||||

| Little Rock, AR | 283 | 283 | — | — | — | 13,456 | 3,430 | 3Q24 - 4Q24 | |||||||||||||||||||||||||||||||||

| Cambridge, UK | 70 | — | — | 45 | 25 | 10,284 | 4,999 | 4Q24 | |||||||||||||||||||||||||||||||||

| San Jose, CA | 685 | 509 | — | 143 | 33 | 175,381 | 4,242 | 1Q25 | |||||||||||||||||||||||||||||||||

| Washington D.C. | 137 | — | 53 | 47 | 37 | 120,793 | 33,549 | 1Q25 | |||||||||||||||||||||||||||||||||

| Chattanooga, TN | 243 | 243 | — | — | — | 62,116 | 46,838 | 3Q24 - 1Q25 | |||||||||||||||||||||||||||||||||

| San Jose, CA | 158 | — | — | 158 | — | 61,929 | 29,042 | 1Q25 | |||||||||||||||||||||||||||||||||

| Phoenix, AZ | 110 | 110 | — | — | — | 40,195 | 18,520 | 3Q24 - 1Q25 | |||||||||||||||||||||||||||||||||

| Columbus, OH | 409 | 409 | — | — | — | 82,069 | 36,815 | 2Q25 | |||||||||||||||||||||||||||||||||

| Sherman, TX | 237 | 237 | — | — | — | 75,618 | 43,779 | 3Q24 - 2Q25 | |||||||||||||||||||||||||||||||||

| Naples, FL | 188 | 188 | — | — | — | 52,568 | 19,356 | 4Q24 - 2Q25 | |||||||||||||||||||||||||||||||||

| London, UK | 62 | — | — | 40 | 22 | 8,903 | 5,339 | 3Q25 | |||||||||||||||||||||||||||||||||

| Dallas, TX | 141 | 141 | — | — | — | 47,261 | 36,580 | 4Q24 - 4Q25 | |||||||||||||||||||||||||||||||||

| Brighton and Hove, UK | 70 | — | — | 45 | 25 | 11,023 | 7,101 | 4Q25 | |||||||||||||||||||||||||||||||||

| Birmingham, UK | 77 | — | — | 18 | 59 | 18,375 | 14,765 | 1Q26 | |||||||||||||||||||||||||||||||||

| Killeen, TX | 256 | 256 | — | — | — | 68,505 | 44,591 | 4Q23 - 3Q26 | |||||||||||||||||||||||||||||||||

| Tallahassee, FL | 206 | 206 | — | — | — | 48,469 | 44,089 | 4Q25 - 3Q26 | |||||||||||||||||||||||||||||||||

Various(3) |

272 | 76 | 196 | — | — | 28,569 | 11,016 | 1Q24 - 4Q24 | |||||||||||||||||||||||||||||||||

| Subtotal | 6,083 | 4,223 | 521 | 900 | 439 | 1,811,089 | 543,075 | ||||||||||||||||||||||||||||||||||

| Outpatient Medical | Rentable Square Ft | Preleased % | Health System Affiliation | Commitment Amount | Future Funding | Estimated Conversion | |||||||||||||||||||||||||||||||||||

| Houston, TX | 156,462 | 100 | % | Yes | 113,125 | 32,982 | 1Q24 - 2Q24 | ||||||||||||||||||||||||||||||||||

| Oklahoma City, OK | 134,285 | 100 | % | Yes | 88,912 | 7,774 | 2Q24 | ||||||||||||||||||||||||||||||||||

| Santa Fe, NM | 90,000 | 100 | % | Yes | 45,977 | 18,027 | 3Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 51,134 | 100 | % | Yes | 28,723 | 14,616 | 3Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 135,255 | 100 | % | Yes | 86,559 | 49,790 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 111,803 | 100 | % | Yes | 78,282 | 48,942 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 36,248 | 100 | % | Yes | 32,991 | 17,698 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 50,323 | 100 | % | Yes | 30,156 | 18,480 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Dallas, TX | 12,000 | 100 | % | Yes | 6,330 | 4,279 | 4Q24 | ||||||||||||||||||||||||||||||||||

| Houston, TX | 116,000 | 100 | % | Yes | 76,800 | 65,719 | 1Q25 | ||||||||||||||||||||||||||||||||||

| Durango, CO | 33,290 | 100 | % | Yes | 24,112 | 19,556 | 3Q24 - 1Q25 | ||||||||||||||||||||||||||||||||||

| Oklahoma City, OK | 47,636 | 100 | % | Yes | 40,543 | 29,976 | 2Q25 | ||||||||||||||||||||||||||||||||||

| Dallas, TX | 141,269 | 59 | % | Yes | 57,896 | 54,724 | 3Q25 | ||||||||||||||||||||||||||||||||||

| Subtotal | 1,115,705 | 710,406 | 382,563 | ||||||||||||||||||||||||||||||||||||||

| Total Development Projects | $ | 2,521,495 | $ | 925,638 | |||||||||||||||||||||||||||||||||||||

| Investment | |||||

| (dollars in thousands at Welltower pro rata ownership) | |||||||||||||||||||||||||||||||||||||||||

Development Funding Projections(1) |

|||||||||||||||||||||||||||||||||||||||||

| Projected Future Funding | |||||||||||||||||||||||||||||||||||||||||

| Projects | Beds / Units / Square Feet | Stable Yields(2) |

2024 Funding | Funding Thereafter | Total Unfunded Commitments | Committed Balances | |||||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 35 | 6,083 | 7.3 | % | $ | 351,697 | $ | 191,378 | $ | 543,075 | $ | 1,811,089 | |||||||||||||||||||||||||||||

| Outpatient Medical | 13 | 1,115,705 | 6.3 | % | 308,716 | 73,847 | 382,563 | 710,406 | |||||||||||||||||||||||||||||||||

| Total | 48 | 7.0 | % | $ | 660,413 | $ | 265,225 | $ | 925,638 | $ | 2,521,495 | ||||||||||||||||||||||||||||||

Development Project Conversion Estimates(1) |

||||||||||||||||||||||||||||||||||||||||||||

| Quarterly Conversions | Annual Conversions | |||||||||||||||||||||||||||||||||||||||||||

| Amount | Year 1 Yields(2) |

Stable Yields(2) |

Amount | Year 1 Yields(2) |

Stable Yields(2) |

|||||||||||||||||||||||||||||||||||||||

| 1Q24 actual | $ | 162,557 | 3.7 | % | 6.6 | % | 2024 actual | $ | 162,557 | 3.7 | % | 6.6 | % | |||||||||||||||||||||||||||||||

| 2Q24 estimate | 388,082 | 2.9 | % | 6.5 | % | 2024 estimate | 1,448,939 | 1.9 | % | 7.1 | % | |||||||||||||||||||||||||||||||||

| 3Q24 estimate | 317,906 | 0.6 | % | 7.7 | % | 2025 estimate | 937,207 | 2.9 | % | 6.8 | % | |||||||||||||||||||||||||||||||||

| 4Q24 estimate | 742,951 | 2.0 | % | 7.1 | % | 2026 estimate | 135,349 | — | % | 8.0 | % | |||||||||||||||||||||||||||||||||

| 1Q25 estimate | 561,326 | 4.0 | % | 7.0 | % | Total | $ | 2,684,052 | 2.3 | % | 7.0 | % | ||||||||||||||||||||||||||||||||

| 2Q25 estimate | 250,798 | 1.7 | % | 6.3 | % | |||||||||||||||||||||||||||||||||||||||

| 3Q25 estimate | 66,799 | 0.7 | % | 6.9 | % | |||||||||||||||||||||||||||||||||||||||

| 4Q25 estimate | 58,284 | (0.3) | % | 7.2 | % | |||||||||||||||||||||||||||||||||||||||

| 1Q26 estimate | 18,375 | (3.4) | % | 10.9 | % | |||||||||||||||||||||||||||||||||||||||

| 3Q26 estimate | 116,974 | 0.5 | % | 7.5 | % | |||||||||||||||||||||||||||||||||||||||

| Total | $ | 2,684,052 | 2.3 | % | 7.0 | % | ||||||||||||||||||||||||||||||||||||||

| Unstabilized Properties | ||||||||||||||||||||||||||||||||||||||

| 12/31/2023 Properties | Stabilizations | Construction Conversions(3) |

Acquisitions/ Dispositions | 03/31/2024 Properties | Beds / Units | |||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 44 | (2) | 1 | — | 43 | 6,194 | ||||||||||||||||||||||||||||||||

| Seniors Housing Triple-net | 10 | (3) | — | — | 7 | 934 | ||||||||||||||||||||||||||||||||

| Total | 54 | (5) | 1 | — | 50 | 7,128 | ||||||||||||||||||||||||||||||||

| Occupancy | 12/31/2023 Properties | Stabilizations | Construction Conversions(3) |

Acquisitions/ Dispositions | Progressions | 03/31/2024 Properties | ||||||||||||||||||||||||||||||||

| 0% - 50% | 21 | — | — | — | (5) | 16 | ||||||||||||||||||||||||||||||||

| 50% - 70% | 21 | (1) | 1 | — | (1) | 20 | ||||||||||||||||||||||||||||||||

| 70% + | 12 | (4) | — | — | 6 | 14 | ||||||||||||||||||||||||||||||||

| Total | 54 | (5) | 1 | — | — | 50 | ||||||||||||||||||||||||||||||||

| Occupancy | 03/31/2024 Properties | Months In Operation | Revenues | % of Total Revenues(4) |

Gross Investment Balance | % of Total Gross Investment | ||||||||||||||||||||||||||||||||

| 0% - 50% | 16 | 11 | $ | 88,874 | 1.2 | % | $ | 866,877 | 1.8 | % | ||||||||||||||||||||||||||||

| 50% - 70% | 20 | 24 | 172,291 | 2.3 | % | 938,069 | 2.0 | % | ||||||||||||||||||||||||||||||

| 70% + | 14 | 29 | 165,498 | 2.2 | % | 559,736 | 1.2 | % | ||||||||||||||||||||||||||||||

| Total | 50 | 21 | $ | 426,663 | 5.7 | % | $ | 2,364,682 | 5.0 | % | ||||||||||||||||||||||||||||

| Financial | |||||

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||

| Components of NAV | ||||||||||||||||||||

| Stabilized NOI | Pro rata beds/units/square feet | |||||||||||||||||||

Seniors Housing Operating(1) |

$ | 1,344,032 | 98,071 | units | ||||||||||||||||

| Seniors Housing Triple-net | 407,064 | 26,144 | units | |||||||||||||||||

| Outpatient Medical | 526,384 | 20,935,057 | square feet | |||||||||||||||||

| Long-Term/Post-Acute Care | 332,320 | 31,554 | beds | |||||||||||||||||

Total In-Place NOI(2) |

2,609,800 | |||||||||||||||||||

Incremental stabilized NOI(3) |

116,098 | |||||||||||||||||||

| Total stabilized NOI | $ | 2,725,898 | ||||||||||||||||||

| Obligations | ||||||||||||||||||||

Lines of credit and commercial paper(4) |

$ | — | ||||||||||||||||||

Senior unsecured notes(4) |

12,328,089 | |||||||||||||||||||

Secured debt(4) |

2,905,614 | |||||||||||||||||||

| Financing lease liabilities | 80,541 | |||||||||||||||||||

| Total debt | $ | 15,314,244 | ||||||||||||||||||

| Add (Subtract): | ||||||||||||||||||||

Other liabilities (assets), net(5) |

$ | 424,081 | ||||||||||||||||||

| Cash and cash equivalents and restricted cash | (2,478,335) | |||||||||||||||||||

| Net obligations | $ | 13,259,990 | ||||||||||||||||||

| Other Assets | ||||||||||||||||||||

Land parcels(6) |

$ | 427,215 | Effective Interest Rate(9) |

|||||||||||||||||

Real estate loans receivable(7) |

2,147,555 | 11.0% | ||||||||||||||||||

Non-real estate loans receivable(8) |

290,619 | 10.7% | ||||||||||||||||||

Joint venture real estate loans receivables(10) |

269,190 | 5.8% | ||||||||||||||||||

Property dispositions(11) |

1,043,796 | |||||||||||||||||||

Development properties:(12) |

||||||||||||||||||||

| Current balance | 1,606,448 | |||||||||||||||||||

| Unfunded commitments | 933,157 | |||||||||||||||||||

| Committed balances | $ | 2,539,605 | ||||||||||||||||||

| Projected yield | 7.0 | % | ||||||||||||||||||

| Projected NOI | $ | 177,772 | ||||||||||||||||||

Common Shares Outstanding(13) |

593,424 | |||||||||||||||||||

| Unearned revenues | $ | 369,726 | ||||||

| Below market tenant lease intangibles, net | 21,202 | |||||||

| Deferred taxes, net | (29,848) | |||||||

| Intangible assets, net | (153,211) | |||||||

| Other non-cash liabilities / (assets), net | 6,015 | |||||||

| Total non-cash liabilities/(assets), net | $ | 213,884 | ||||||

| Financial | |||||

| (dollars in thousands at Welltower pro rata ownership) | ||||||||||||||||||||||||||||||||

Net Operating Income(1) |

||||||||||||||||||||||||||||||||

| 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 | ||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | ||||||||||||||||||||||||||||||||

| Resident fees and services | $ | 1,138,916 | $ | 1,173,630 | $ | 1,216,368 | $ | 1,280,154 | $ | 1,379,295 | ||||||||||||||||||||||

| Interest income | 2,318 | 1,850 | 1,928 | 2,968 | 4,716 | |||||||||||||||||||||||||||

| Other income | 2,510 | 3,495 | 3,457 | 4,544 | 2,807 | |||||||||||||||||||||||||||

| Total revenues | 1,143,744 | 1,178,975 | 1,221,753 | 1,287,666 | 1,386,818 | |||||||||||||||||||||||||||

| Seniors Housing Triple-net | ||||||||||||||||||||||||||||||||

| Rental income | 119,786 | 118,115 | 110,705 | 115,615 | 110,967 | |||||||||||||||||||||||||||

| Interest income | 31,540 | 32,657 | 33,523 | 36,150 | 35,478 | |||||||||||||||||||||||||||

| Other income | 1,675 | 1,202 | 1,168 | 924 | 955 | |||||||||||||||||||||||||||

| Total revenues | 153,001 | 151,974 | 145,396 | 152,689 | 147,400 | |||||||||||||||||||||||||||

| Outpatient Medical | ||||||||||||||||||||||||||||||||

| Rental income | 182,044 | 185,133 | 192,732 | 190,211 | 200,593 | |||||||||||||||||||||||||||

| Interest income | 91 | 95 | 98 | 382 | 852 | |||||||||||||||||||||||||||

| Other income | 3,055 | 1,574 | 2,306 | 2,229 | 2,404 | |||||||||||||||||||||||||||

| Total revenues | 185,190 | 186,802 | 195,136 | 192,822 | 203,849 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | ||||||||||||||||||||||||||||||||

| Rental income | 80,423 | 75,766 | 77,516 | 96,146 | 104,046 | |||||||||||||||||||||||||||

| Interest income | 6,367 | 8,264 | 10,981 | 15,784 | 15,823 | |||||||||||||||||||||||||||

| Other income | 193 | 65,490 | 315 | 6 | 244 | |||||||||||||||||||||||||||

| Total revenues | 86,983 | 149,520 | 88,812 | 111,936 | 120,113 | |||||||||||||||||||||||||||

| Corporate | ||||||||||||||||||||||||||||||||

| Other income | 5,147 | 16,807 | 33,802 | 30,021 | 28,729 | |||||||||||||||||||||||||||

| Total revenues | 5,147 | 16,807 | 33,802 | 30,021 | 28,729 | |||||||||||||||||||||||||||

| Total | ||||||||||||||||||||||||||||||||

| Rental income | 382,253 | 379,014 | 380,953 | 401,972 | 415,606 | |||||||||||||||||||||||||||

| Resident fees and services | 1,138,916 | 1,173,630 | 1,216,368 | 1,280,154 | 1,379,295 | |||||||||||||||||||||||||||

| Interest Income | 40,316 | 42,866 | 46,530 | 55,284 | 56,869 | |||||||||||||||||||||||||||

| Other Income | 12,580 | 88,568 | 41,048 | 37,724 | 35,139 | |||||||||||||||||||||||||||

| Total revenues | 1,574,065 | 1,684,078 | 1,684,899 | 1,775,134 | 1,886,909 | |||||||||||||||||||||||||||

| Property operating expenses: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 894,981 | 902,068 | 933,463 | 982,077 | 1,034,982 | |||||||||||||||||||||||||||

| Seniors Housing Triple-net | 7,917 | 7,996 | 7,849 | 6,662 | 7,559 | |||||||||||||||||||||||||||

| Outpatient Medical | 58,977 | 59,358 | 63,831 | 55,060 | 65,162 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 4,040 | 2,827 | 2,386 | 3,298 | 3,448 | |||||||||||||||||||||||||||

| Corporate | 3,877 | 4,135 | 3,980 | 5,957 | 3,636 | |||||||||||||||||||||||||||

| Total property operating expenses | 969,792 | 976,384 | 1,011,509 | 1,053,054 | 1,114,787 | |||||||||||||||||||||||||||

| Net operating income: | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | 248,763 | 276,907 | 288,290 | 305,589 | 351,836 | |||||||||||||||||||||||||||

| Seniors Housing Triple-net | 145,084 | 143,978 | 137,547 | 146,027 | 139,841 | |||||||||||||||||||||||||||

| Outpatient Medical | 126,213 | 127,444 | 131,305 | 137,762 | 138,687 | |||||||||||||||||||||||||||

| Long-Term/Post-Acute Care | 82,943 | 146,693 | 86,426 | 108,638 | 116,665 | |||||||||||||||||||||||||||

| Corporate | 1,270 | 12,672 | 29,822 | 24,064 | 25,093 | |||||||||||||||||||||||||||

| Net operating income | $ | 604,273 | $ | 707,694 | $ | 673,390 | $ | 722,080 | $ | 772,122 | ||||||||||||||||||||||

| Financial | |||||

| (dollars in thousands) | ||||||||||||||

Leverage and EBITDA Reconciliations(1) |

||||||||||||||

| Twelve Months Ended | Three Months Ended | |||||||||||||

| March 31, 2024 | March 31, 2024 | |||||||||||||

| Net income (loss) | $ | 461,138 | $ | 131,634 | ||||||||||

| Interest expense | 610,761 | 147,318 | ||||||||||||

| Income tax expense (benefit) | 9,510 | 6,191 | ||||||||||||

| Depreciation and amortization | 1,427,852 | 365,863 | ||||||||||||

| EBITDA | 2,509,261 | 651,006 | ||||||||||||

| Loss (income) from unconsolidated entities | 54,154 | 7,783 | ||||||||||||

| Stock-based compensation | 38,829 | 11,342 | ||||||||||||

| Loss (gain) on extinguishment of debt, net | 8 | 6 | ||||||||||||

| Loss (gain) on real estate dispositions, net | (71,858) | (4,707) | ||||||||||||

| Impairment of assets | 66,799 | 43,331 | ||||||||||||

| Provision for loan losses, net | 10,046 | 1,014 | ||||||||||||

| Loss (gain) on derivatives and financial instruments, net | (6,104) | (3,054) | ||||||||||||

| Other expenses | 99,727 | 14,131 | ||||||||||||

Leasehold interest termination(2) |

(65,485) | — | ||||||||||||

| Casualty losses, net of recoveries | 7,778 | 2,158 | ||||||||||||

Other impairment(3) |

25,998 | 9,356 | ||||||||||||

| Total adjustments | 159,892 | 81,360 | ||||||||||||

| Adjusted EBITDA | $ | 2,669,153 | $ | 732,366 | ||||||||||

| Interest Coverage Ratios | ||||||||||||||

| Interest expense | $ | 610,761 | $ | 147,318 | ||||||||||

| Capitalized interest | 54,173 | 13,809 | ||||||||||||

| Non-cash interest expense | (27,695) | (9,284) | ||||||||||||

| Total interest | $ | 637,239 | $ | 151,843 | ||||||||||

| EBITDA | $ | 2,509,261 | $ | 651,006 | ||||||||||

| Interest coverage ratio | 3.94 | x | 4.29 | x | ||||||||||

| Adjusted EBITDA | $ | 2,669,153 | $ | 732,366 | ||||||||||

| Adjusted Interest coverage ratio | 4.19 | x | 4.82 | x | ||||||||||

| Fixed Charge Coverage Ratios | ||||||||||||||

| Total interest | $ | 637,239 | $ | 151,843 | ||||||||||

| Secured debt principal amortization | 51,021 | 11,887 | ||||||||||||

| Total fixed charges | $ | 688,260 | $ | 163,730 | ||||||||||

| EBITDA | $ | 2,509,261 | $ | 651,006 | ||||||||||

| Fixed charge coverage ratio | 3.65 | x | 3.98 | x | ||||||||||

| Adjusted EBITDA | $ | 2,669,153 | $ | 732,366 | ||||||||||

| Adjusted Fixed charge coverage ratio | 3.88 | x | 4.47 | x | ||||||||||

| Net Debt to EBITDA Ratios | ||||||||||||||

Total debt(4) |

$ | 14,285,686 | ||||||||||||

| Less: cash and cash equivalents and restricted cash | (2,478,335) | |||||||||||||

| Net debt | $ | 11,807,351 | ||||||||||||

| EBITDA Annualized | $ | 2,604,024 | ||||||||||||

| Net debt to EBITDA ratio | 4.53 | x | ||||||||||||

| Adjusted EBITDA Annualized | $ | 2,929,464 | ||||||||||||

| Net debt to Adjusted EBITDA ratio | 4.03 | x | ||||||||||||

| Financial | |||||

| (in thousands except share price) | |||||||||||||||||

Leverage and Current Capitalization(1) | |||||||||||||||||

| % of Total | |||||||||||||||||

| Book capitalization | |||||||||||||||||

Lines of credit and commercial paper(2) |

$ | — | — | % | |||||||||||||

Long-term debt obligations(2)(3) |

14,285,686 | 35.40 | % | ||||||||||||||

| Cash and cash equivalents and restricted cash | (2,478,335) | (6.14) | % | ||||||||||||||

| Net debt to consolidated book capitalization | $ | 11,807,351 | 29.26 | % | |||||||||||||

Total equity(4) |

28,547,908 | 70.74 | % | ||||||||||||||

| Consolidated book capitalization | $ | 40,355,259 | 100.00 | % | |||||||||||||

Joint venture debt, net(5) |

834,838 | ||||||||||||||||

| Total book capitalization | $ | 41,190,097 | |||||||||||||||

| Undepreciated book capitalization | |||||||||||||||||

Lines of credit and commercial paper(2) |

$ | — | — | % | |||||||||||||

Long-term debt obligations(2)(3) |

14,285,686 | 28.64 | % | ||||||||||||||

| Cash and cash equivalents and restricted cash | (2,478,335) | (4.97) | % | ||||||||||||||

| Net debt to consolidated undepreciated book capitalization | $ | 11,807,351 | 23.67 | % | |||||||||||||

| Accumulated depreciation and amortization | 9,537,562 | 19.12 | % | ||||||||||||||

Total equity(4) |

28,547,908 | 57.21 | % | ||||||||||||||

| Consolidated undepreciated book capitalization | $ | 49,892,821 | 100.00 | % | |||||||||||||

Joint venture debt, net(5) |

834,838 | ||||||||||||||||

| Total undepreciated book capitalization | $ | 50,727,659 | |||||||||||||||

| Enterprise value | |||||||||||||||||

Lines of credit and commercial paper(2) |

$ | — | — | % | |||||||||||||

Long-term debt obligations(2)(3) |

14,285,686 | 21.00 | % | ||||||||||||||

| Cash and cash equivalents and restricted cash | (2,478,335) | (3.64) | % | ||||||||||||||

| Net debt to consolidated enterprise value | $ | 11,807,351 | 17.36 | % | |||||||||||||

| Common shares outstanding | 590,934 | ||||||||||||||||

| Period end share price | 93.44 | ||||||||||||||||

| Common equity market capitalization | $ | 55,216,873 | 81.17 | % | |||||||||||||

Noncontrolling interests(4) |

999,965 | 1.47 | % | ||||||||||||||

| Consolidated enterprise value | $ | 68,024,189 | 100.00 | % | |||||||||||||

Joint venture debt, net(5) |

834,838 | ||||||||||||||||

| Total enterprise value | $ | 68,859,027 | |||||||||||||||

| Secured debt as % of total assets | |||||||||||||||||

Secured debt(2) |

$ | 2,033,232 | 3.76 | % | |||||||||||||

Gross asset value(6) |

$ | 54,091,147 | |||||||||||||||

| Total debt as % of gross asset value | |||||||||||||||||

Total debt(2)(3) |

$ | 14,285,686 | 26.41 | % | |||||||||||||

Gross asset value(6) |

$ | 54,091,147 | |||||||||||||||

| Unsecured debt as % of unencumbered assets | |||||||||||||||||

Unsecured debt(2) |

$ | 12,171,913 | 25.07 | % | |||||||||||||

Unencumbered gross assets(7) |

$ | 48,557,528 | |||||||||||||||

| Financial | |||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Debt Maturities and Scheduled Principal Amortization(1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year | Lines of Credit and Commercial Paper(2) |

Senior Unsecured Notes(3,4,5,6,7) |

Consolidated Secured Debt | Share of Unconsolidated Secured Debt | Noncontrolling Interests' Share of Consolidated Secured Debt | Combined Debt(8) |

% of Total | Wtd. Avg. Interest Rate (9) |

|||||||||||||||||||||||||||||||||||||||||||||

| 2024 | $ | — | $ | — | $ | 307,236 | $ | 143,300 | $ | (50,027) | $ | 400,509 | 2.63 | % | 4.75 | % | |||||||||||||||||||||||||||||||||||||

| 2025 | — | 1,260,000 | 379,484 | 507,757 | (32,087) | 2,115,154 | 13.88 | % | 4.03 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2026 | — | 700,000 | 152,652 | 48,961 | (20,132) | 881,481 | 5.79 | % | 4.03 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2027 | — | 1,906,204 | 206,191 | 118,661 | (33,157) | 2,197,899 | 14.43 | % | 4.66 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2028 | — | 2,480,035 | 105,956 | 26,112 | (15,013) | 2,597,090 | 17.05 | % | 3.79 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2029 | — | 1,050,000 | 318,012 | 36,367 | (1,150) | 1,403,229 | 9.21 | % | 3.81 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2030 | — | 750,000 | 57,066 | 34,356 | (124) | 841,298 | 5.52 | % | 3.13 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2031 | — | 1,350,000 | 6,978 | 33,415 | (130) | 1,390,263 | 9.13 | % | 2.77 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2032 | — | 1,050,000 | 47,952 | 3,929 | (135) | 1,101,746 | 7.23 | % | 3.38 | % | |||||||||||||||||||||||||||||||||||||||||||

| 2033 | — | — | 395,502 | 7,229 | (35,360) | 367,371 | 2.41 | % | 4.88 | % | |||||||||||||||||||||||||||||||||||||||||||

| Thereafter | — | 1,781,850 | 93,747 | 66,997 | (4,931) | 1,937,663 | 12.74 | % | 5.04 | % | |||||||||||||||||||||||||||||||||||||||||||

| Totals | $ | — | $ | 12,328,089 | $ | 2,070,776 | $ | 1,027,084 | $ | (192,246) | $ | 15,233,703 | 100.00 | % | |||||||||||||||||||||||||||||||||||||||

Weighted Avg. Interest Rate(9) |

— | 3.94 | % | 4.62 | % | 3.66 | % | 3.91 | % | 4.02 | % | ||||||||||||||||||||||||||||||||||||||||||

| Weighted Avg. Maturity Years | — | 6.3 | 4.8 | 4.4 | 3.7 | 6.0 | |||||||||||||||||||||||||||||||||||||||||||||||

% Floating Rate Debt(8) |

100.00 | % | 5.63 | % | 23.15 | % | 0.88 | % | 16.13 | % | 7.56 | % | |||||||||||||||||||||||||||||||||||||||||

Debt by Local Currency(1) | |||||||||||||||||||||||||||||||||||||||||||||||

Lines of Credit and Commercial Paper(2) |

Senior Unsecured Notes(3,4,5,6,7) |

Consolidated Secured Debt | Share of Unconsolidated Secured Debt | Noncontrolling Interests' Share of Consolidated Secured Debt | Combined Debt(8) |

Investment Hedges(10) |

|||||||||||||||||||||||||||||||||||||||||

| United States | $ | — | $ | 10,595,000 | $ | 1,354,921 | $ | 764,284 | $ | (40,963) | $ | 12,673,242 | $ | — | |||||||||||||||||||||||||||||||||

| United Kingdom | — | 1,326,885 | — | — | — | 1,326,885 | 2,098,637 | ||||||||||||||||||||||||||||||||||||||||

| Canada | — | 406,204 | 715,855 | 262,800 | (151,283) | 1,233,576 | 1,920,236 | ||||||||||||||||||||||||||||||||||||||||

| Totals | $ | — | $ | 12,328,089 | $ | 2,070,776 | $ | 1,027,084 | $ | (192,246) | $ | 15,233,703 | $ | 4,018,873 | |||||||||||||||||||||||||||||||||

| Glossary | |||||

| Supplemental Reporting Measures | |||||

| Supplemental Reporting Measures | |||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Non-GAAP Reconciliations | |||||||||||||||||||||||||||||||||||||||||

| NOI Reconciliation | 1Q23 | 2Q23 | 3Q23 | 4Q23 | 1Q24 | ||||||||||||||||||||||||||||||||||||

| Net income (loss) | $ | 28,635 | $ | 106,342 | $ | 134,722 | $ | 88,440 | $ | 131,634 | |||||||||||||||||||||||||||||||

| Loss (gain) on real estate dispositions, net | (747) | 2,168 | (71,102) | 1,783 | (4,707) | ||||||||||||||||||||||||||||||||||||

| Loss (income) from unconsolidated entities | 7,071 | 40,332 | 4,031 | 2,008 | 7,783 | ||||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 3,045 | 3,503 | 4,584 | (4,768) | 6,191 | ||||||||||||||||||||||||||||||||||||

| Other expenses | 22,745 | 11,069 | 38,220 | 36,307 | 14,131 | ||||||||||||||||||||||||||||||||||||

| Impairment of assets | 12,629 | 1,086 | 7,388 | 14,994 | 43,331 | ||||||||||||||||||||||||||||||||||||

| Provision for loan losses, net | 777 | 2,456 | 4,059 | 2,517 | 1,014 | ||||||||||||||||||||||||||||||||||||

| Loss (gain) on extinguishment of debt, net | 5 | 1 | 1 | — | 6 | ||||||||||||||||||||||||||||||||||||

| Loss (gain) on derivatives and financial instruments, net | 930 | 1,280 | 2,885 | (7,215) | (3,054) | ||||||||||||||||||||||||||||||||||||

| General and administrative expenses | 44,371 | 44,287 | 46,106 | 44,327 | 53,318 | ||||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 339,112 | 341,945 | 339,314 | 380,730 | 365,863 | ||||||||||||||||||||||||||||||||||||

| Interest expense | 144,403 | 152,337 | 156,532 | 154,574 | 147,318 | ||||||||||||||||||||||||||||||||||||

| Consolidated net operating income | 602,976 | 706,806 | 666,740 | 713,697 | 762,828 | ||||||||||||||||||||||||||||||||||||

NOI attributable to unconsolidated investments(1) |

26,354 | 25,150 | 29,488 | 30,785 | 32,090 | ||||||||||||||||||||||||||||||||||||

NOI attributable to noncontrolling interests(2) |

(25,057) | (24,262) | (22,838) | (22,402) | (22,796) | ||||||||||||||||||||||||||||||||||||

Pro rata net operating income (NOI)(3) |

$ | 604,273 | $ | 707,694 | $ | 673,390 | $ | 722,080 | $ | 772,122 | |||||||||||||||||||||||||||||||

| In-Place NOI Reconciliation | ||||||||||||||||||||||||||||||||||||||

| At Welltower pro rata ownership | Seniors Housing Operating | Seniors Housing Triple-net | Outpatient Medical | Long-Term /Post-Acute Care |

Corporate | Total | ||||||||||||||||||||||||||||||||

| Revenues | $ | 1,386,818 | $ | 147,400 | $ | 203,849 | $ | 120,113 | $ | 28,729 | $ | 1,886,909 | ||||||||||||||||||||||||||

| Property operating expenses | (1,034,982) | (7,559) | (65,162) | (3,448) | (3,636) | (1,114,787) | ||||||||||||||||||||||||||||||||

NOI(3) |

351,836 | 139,841 | 138,687 | 116,665 | 25,093 | 772,122 | ||||||||||||||||||||||||||||||||

| Adjust: | ||||||||||||||||||||||||||||||||||||||

| Interest income | (4,716) | (35,478) | (852) | (15,823) | — | (56,869) | ||||||||||||||||||||||||||||||||

| Other income | (2,666) | (106) | 35 | (244) | (24,087) | (27,068) | ||||||||||||||||||||||||||||||||

| Sold / held for sale | (7,329) | (17) | (1,229) | 191 | — | (8,384) | ||||||||||||||||||||||||||||||||

Non operational(4) |

3,581 | 1 | (1,018) | (643) | — | 1,921 | ||||||||||||||||||||||||||||||||

Non In-Place NOI(5) |

(6,289) | (2,475) | (4,046) | (17,066) | (1,006) | (30,882) | ||||||||||||||||||||||||||||||||

Timing adjustments(6) |

1,591 | — | 19 | — | — | 1,610 | ||||||||||||||||||||||||||||||||

| Total adjustments | (15,828) | (38,075) | (7,091) | (33,585) | (25,093) | (119,672) | ||||||||||||||||||||||||||||||||

| In-Place NOI | 336,008 | 101,766 | 131,596 | 83,080 | — | 652,450 | ||||||||||||||||||||||||||||||||

| Annualized In-Place NOI | $ | 1,344,032 | $ | 407,064 | $ | 526,384 | $ | 332,320 | $ | — | $ | 2,609,800 | ||||||||||||||||||||||||||

| Same Store Property Reconciliation | ||||||||||||||||||||||||||||||||

| Seniors Housing Operating | Seniors Housing Triple-net |

Outpatient Medical | Long-Term /Post-Acute Care |

Total | ||||||||||||||||||||||||||||

| Total properties | 994 | 360 | 450 | 292 | 2,096 | |||||||||||||||||||||||||||

Recent acquisitions/ development conversions(7) |

(69) | (11) | (40) | (58) | (178) | |||||||||||||||||||||||||||