0000764065false00007640652023-08-132023-08-13

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 13, 2023

CLEVELAND-CLIFFS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ohio |

|

1-8944 |

|

34-1464672 |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 200 Public Square, |

Suite 3300, |

Cleveland, |

Ohio |

44114-2315 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant's telephone number, including area code: (216) 694-5700

|

|

|

Not Applicable |

(Former name or former address, if changed since last report) |

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☒ |

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

| Common Shares, par value $0.125 per share |

|

CLF |

|

New York Stock Exchange |

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter). |

| Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

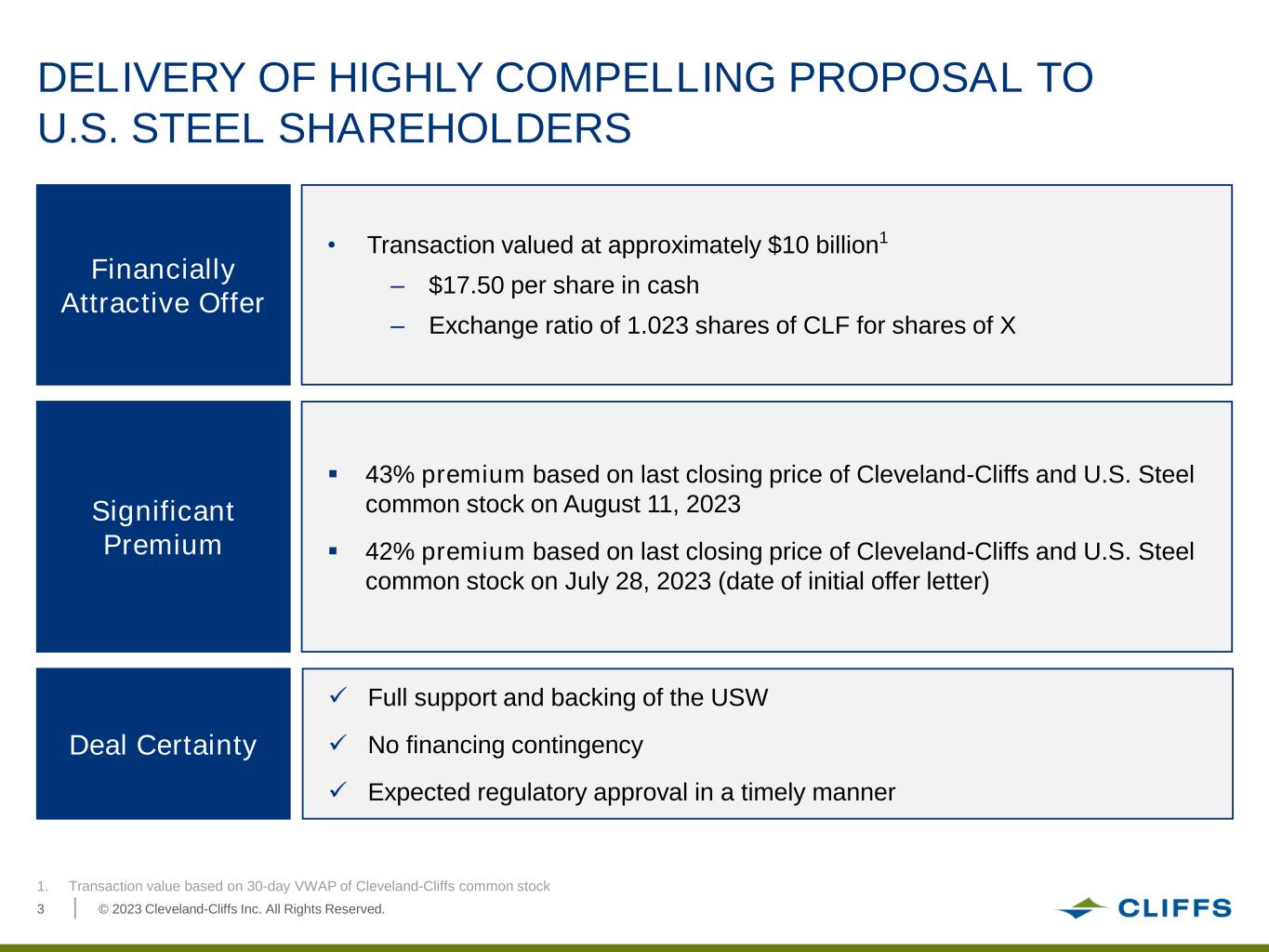

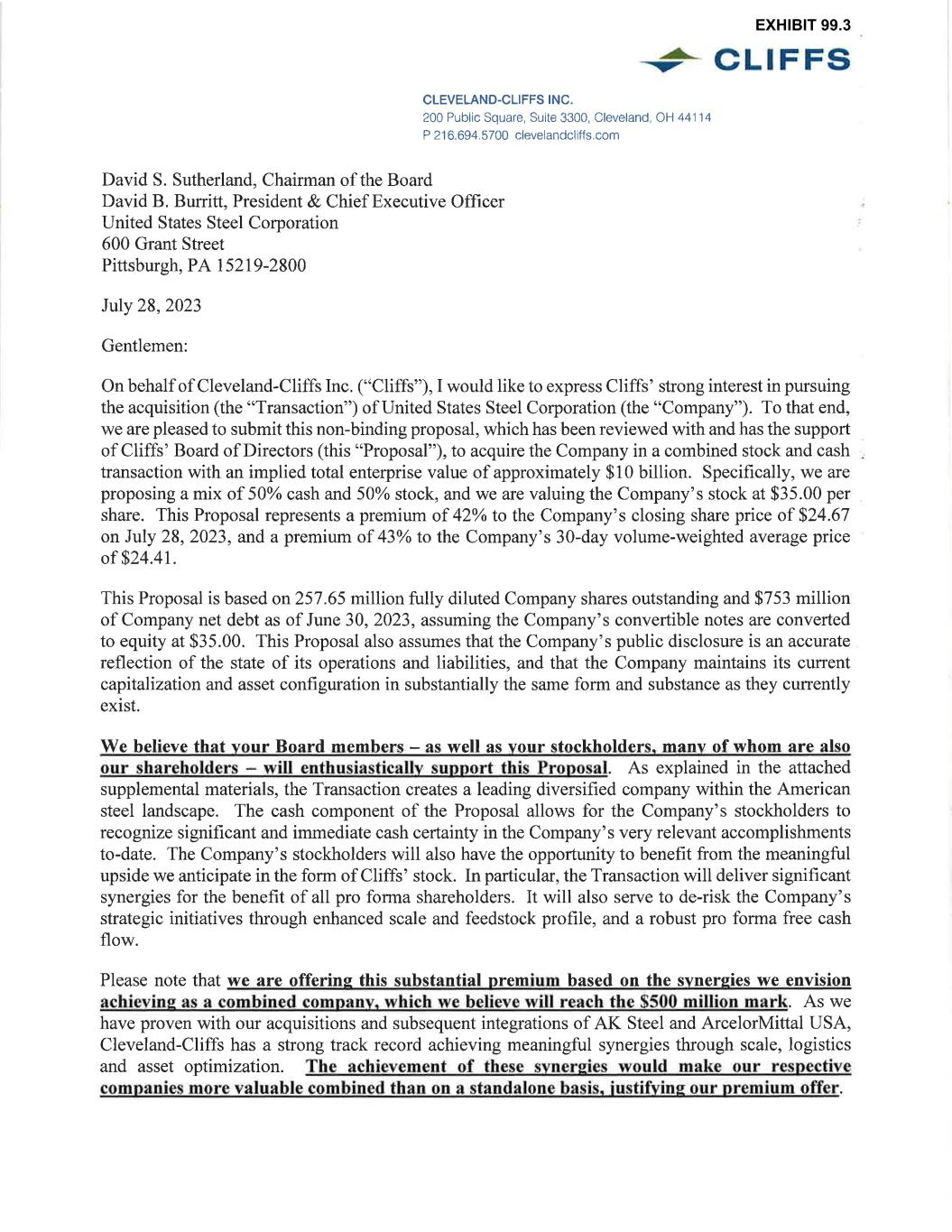

On August 13, 2023, Cleveland-Cliffs Inc. (the “Company” or “Cliffs”) issued a press release confirming that it delivered to the board of directors of United States Steel Corporation (“U.S. Steel”) a proposal to acquire all of the outstanding shares of U.S. Steel for a per share consideration of $17.50 in cash and 1.023 shares of Cliffs common stock. A copy of the press release, attached hereto as Exhibit 99.1, and the accompanying presentation slides referenced in the press release, attached hereto as Exhibit 99.2, are incorporated herein by reference.

The Company is publicly providing all four letters of correspondence between Cliffs and U.S. Steel related to the proposal. Copies of the following letters are attached hereto as Exhibit 99.3 and incorporated herein by reference:

1.July 28, 2023: Initial offer letter from Lourenco Goncalves to David Sutherland and David Burritt

2.August 7, 2023: Response letter from David Burritt to Lourenco Goncalves

3.August 11, 2023: Proposal clarification letter from Lourenco Goncalves to David Sutherland and David Burritt

4.August 13, 2023: Rejection letter from David Burritt to Lourenco Goncalves

Moelis & Company LLC, Wells Fargo, J.P. Morgan, UBS, MUFG and Truist Securities are acting as financial advisors to Cleveland-Cliffs and Davis Polk & Wardwell LLP is serving as legal counsel.

Forward Looking Statements

This report and the accompanying materials contain statements that constitute “forward-looking statements” within the meaning of the federal securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry, our business or a transaction with U.S. Steel, are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward-looking statements are the following: the risk that a transaction with U.S. Steel may not be consummated; the risk that a transaction with U.S. Steel may be less accretive than expected, or may be dilutive, to Cliffs’ earnings per share, which may negatively affect the market price of Cliffs common shares; the possibility that Cliffs and U.S. Steel will incur significant transaction and other costs in connection with a potential transaction, which may be in excess of those anticipated by Cliffs; the risk that the financing transactions to be undertaken in connection with a transaction have a negative impact on the combined company’s credit profile or financial condition; the risk that Cliffs may fail to realize the benefits expected from a transaction; the risk that the combined company may be unable to achieve anticipated synergies or that it may take longer than expected to achieve those synergies; the risk that any announcements relating to, or the completion of, a transaction could have adverse effects on the market price of Cliffs common shares; and the risk related to any unforeseen liability and future capital expenditure of Cliffs related to a transaction.

For additional factors affecting the business of Cliffs, refer to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2022, and other filings with the U.S. Securities and Exchange Commission (the “SEC”).

Important Information for Investors and Shareholders

This report relates to a proposal that Cliffs has made for an acquisition of U.S. Steel. In furtherance of this proposal and subject to future developments, Cliffs may file one or more registration statements, proxy statements, tender offer statements or other documents with the SEC. This report is not a substitute for any proxy statement, registration statement, tender offer statement or other document Cliffs may file with the SEC in connection with the proposed transaction.

Investors and security holders of Cliffs are urged to read the proxy statement(s), registration statement, tender offer statement and/or other documents filed with the SEC carefully in their entirety if and when they become available, as they will contain important information about the proposed transaction. Any definitive proxy statement(s) (if and when available) will be mailed to shareholders of Cliffs. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Cliffs through the website maintained by the SEC at http://www.sec.gov.

This report shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This report is neither a solicitation of a proxy nor a substitute for any proxy statement or other filing that may be made with the SEC. Nonetheless, Cliffs and its directors and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Cliffs is set forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 14, 2023, and its proxy statement for its 2023 annual meeting of shareholders, which was filed with the SEC on April 3, 2023.

Any information concerning U.S. Steel contained in this report has been taken from, or based upon, publicly available information. Although Cliffs does not have any information that would indicate that any information contained in this report that has been taken from such documents is inaccurate or incomplete, Cliffs does not take any responsibility for the accuracy or completeness of such information. To date, Cliffs has not had access to the books and records of U.S. Steel.

|

|

|

|

|

|

|

|

|

| Item 9.01. |

|

Financial Statements and Exhibits. |

|

|

|

|

|

|

|

|

|

Exhibit

Number |

|

Description |

|

|

|

|

Cleveland-Cliffs Inc. published a news release on August 13, 2023 captioned, “Cleveland-Cliffs Proposes to Acquire U.S. Steel.” |

|

|

Presentation slides, dated August 2023. |

|

|

Letters of correspondence between Cleveland-Cliffs Inc. and United States Steel Corporation. |

| 101 |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 |

|

The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CLEVELAND-CLIFFS INC. |

|

|

|

|

| Date: |

August 14, 2023 |

By: |

/s/ James D. Graham |

|

|

Name: |

James D. Graham |

|

|

Title: |

Executive Vice President, Human Resources, Chief Legal and Administrative Officer & Secretary |

EX-99.1

2

a202308138-kex991.htm

EX-99.1

a202308138-kex991

NEWS RELEASE Cleveland-Cliffs Proposes to Acquire U.S. Steel Creates the Only American Steel Company Among the Top 10 Steelmakers in the World and One of the World’s Top 4 outside of China Provides Customers and Workers a Stronger and More Innovative American Steel Producer, With Scale to be Internationally Competitive Provides U.S. Steel Shareholders an Immediate and Substantial Premium of 43% and Significant Upside Potential from the Combined Company Combined Company Expected to Generate Synergies of Approximately $500 Million Proposal Provides a Clear Roadmap to Completion, including the Strong Support and Backing of the USW CLEVELAND – August 13, 2023 – Cleveland-Cliffs Inc. (NYSE: CLF) (“Cleveland-Cliffs” or “Cliffs”) is publicly announcing a previously private offer that it had presented to the Board of the United States Steel Corporation (NYSE:X) (“U.S. Steel”) on July 28, 2023. That offer, which was reiterated in writing to the U.S. Steel Board on August 11, 2023, proposed acquiring 100% of the outstanding stock of U.S. Steel for a per share value of $17.50 in cash and 1.023 shares of Cliffs stock. On July 28, 2023, this implied a total consideration value of $35.00 per share of U.S. Steel stock, which represented a 42% premium to U.S. Steel’s share price as of the market close on July 28, 2023. As of the close of market on Friday, August 11, 2023, this offer represents a 43% premium to U.S. Steel’s share price. Notwithstanding the compelling economic terms of Cliffs’ offer, it was rejected as being “unreasonable” by the Board of Directors of U.S. Steel via a letter Cliffs received today, August 13, 2023. As such, Cliffs feels compelled to make its offer publicly known for the direct benefit of all of U.S. Steel’s stockholders and also make it known that Cliffs stands ready to engage on this offer immediately. Under the terms of the United Steelworkers’ (USW) collective bargaining agreement with U.S. Steel, the USW has the right to counter this proposal. On this matter, the USW has affirmed in writing to Cliffs that it endorses the transaction and will not exercise this right. Furthermore, the USW has also stated that it will not endorse anyone other than Cliffs for a transaction. The letter EXHIBIT 99.1

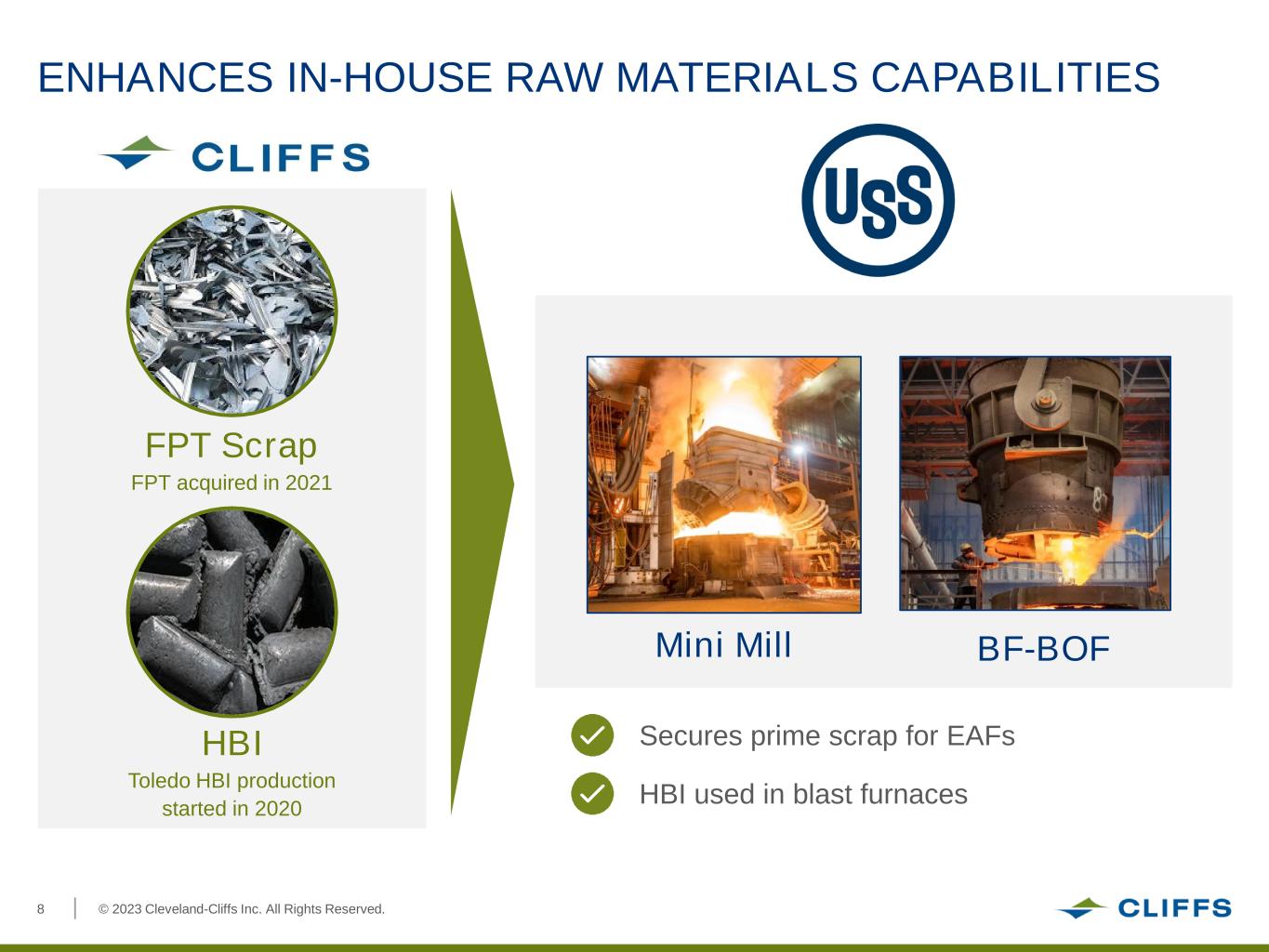

of support from the USW related to the transaction can be found on Cliffs’ website at www.clevelandcliffs.com. To provide context to the above proposal, Lourenco Goncalves, Chairman, President and Chief Executive Officer of Cleveland-Cliffs said, “On July 28th I approached U.S. Steel’s CEO and Board with a written proposal to acquire U.S. Steel for a substantial premium, valuing the company at $35.00 per share with 50% cash and 50% stock. After two weeks without any substantive engagement from U.S. Steel with respect to the economic terms contained in our compelling proposal, U.S. Steel’s board of directors rejected our proposal, calling it ‘unreasonable.’ As such, I believe it necessary to now make our proposal public to help expedite substantive engagement between our two companies. Although we are now public, I do look forward to continuing to engage with U.S. Steel on a potential transaction, as I am convinced that the value potential and competitiveness to come out of a combination of our two iconic American companies is exceptional.” Mr. Goncalves continued, “The numerous benefits we are excited about include the combination of our complementary U.S.-based footprint, our ability to leverage our in-house metallics capabilities, and enhancing our shared focus on emissions reduction. With these benefits, combined with our experience of extracting meaningful synergies from previous acquisitions, we expect to create a lower-cost, more innovative, and stronger domestic supplier for our customers across all segments. Furthermore, the transaction provides immediate multiple expansion to U.S. Steel stockholders, while simultaneously de-risking U.S. Steel’s future capital spend with our substantial expected free cash flow and very healthy balance sheet. We also plan to ramp up capital returns to shareholders and implement a dividend upon completion of the transaction.” Presentation slides that expand on the compelling strategic rationale of Cliffs’ proposal can be found on Cliffs’ website at www.clevelandcliffs.com. Mr. Goncalves concluded, “Most importantly, our proposal has the full support of the United Steelworkers union. This is a testament to our unwavering commitment to our employees -- which would number approximately 40,500 pro forma for the transaction -- as well as to the communities in which we operate. We have proven in our previous M&A transactions our strong track record of significant value creation and our ability to grow the business through the addition of thousands of union jobs. Finally, with this transaction we will create the only American member of the Top 10 steel companies in the World, joining a select group of just three other companies outside of

China -- one European, one Japanese and one Korean. We believe that having Cleveland-Cliffs as a world-class, internationally competitive steel company is critical for our country to retain its economic leadership and to regain its manufacturing independence.” As was noted in the letter that Cliffs sent to U.S. Steel on July 28, 2023, Cliffs remains prepared to engage immediately in substantive discussions with U.S. Steel to work towards a mutually acceptable definitive agreement and is ready to commit all necessary resources to finalize documentation. The proposed transaction has the unanimous approval of Cliffs’ Board of Directors and is not subject to any financing condition. Several tier 1 U.S. and international banks have advised in writing that they are highly confident that they will be able to arrange the necessary debt financing for the proposed transaction. In addition, based on review by outside counsel, Cliffs believes the proposed transaction would receive regulatory approval in a timely manner. Moelis & Company LLC, Wells Fargo, J.P. Morgan and UBS are acting as financial advisors to Cliffs and Davis Polk & Wardwell LLP is serving as legal counsel. About Cleveland-Cliffs Inc. Cleveland-Cliffs is the largest flat-rolled steel producer in North America. Founded in 1847 as a mine operator, Cliffs also is the largest manufacturer of iron ore pellets in North America. The Company is vertically integrated from mined raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling, and tubing. Cleveland-Cliffs is the largest supplier of steel to the automotive industry in North America and serves a diverse range of other markets due to its comprehensive offering of flat-rolled steel products. Headquartered in Cleveland, Ohio, Cleveland-Cliffs employs approximately 27,000 people across its operations in the United States and Canada. Forward-Looking Statements This release contains statements that constitute "forward-looking statements" within the meaning of the federal securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry, our business or a transaction with United States Steel Corporation (U.S. Steel), are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward- looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward- looking statements are the following: the risk that a transaction with U.S. Steel may not be consummated; the risk that a transaction with U.S. Steel may be less accretive than expected, or may be dilutive, to Cliffs’

earnings per share, which may negatively affect the market price of Cliffs common shares; the possibility that Cliffs and U.S. Steel will incur significant transaction and other costs in connection with a potential transaction, which may be in excess of those anticipated by Cliffs; the risk that the financing transactions to be undertaken in connection with a transaction have a negative impact on the combined company’s credit profile or financial condition; the risk that Cliffs may fail to realize the benefits expected from a transaction; the risk that the combined company may be unable to achieve anticipated synergies or that it may take longer than expected to achieve those synergies; the risk that any announcements relating to, or the completion of, a transaction could have adverse effects on the market price of Cliffs common shares; and the risk related to any unforeseen liability and future capital expenditure of Cliffs related to a transaction. For additional factors affecting the business of Cliffs, refer to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2022, and other filings with the U.S. Securities and Exchange Commission. Important Information for Investors and Stockholders This communication relates to a proposal which Cliffs has made for an acquisition of U.S. Steel. In furtherance of this proposal and subject to future developments, Cliffs may file one or more registration statements, proxy statements, tender offer statements or other documents with the Securities and Exchange Commission (“SEC”). This communication is not a substitute for any proxy statement, registration statement, tender offer statement or other document Cliffs may file with the SEC in connection with the proposed transaction. Investors and security holders of Cliffs are urged to read the proxy statement(s), registration statement, tender offer statement and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Cliffs, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Cliffs through the website maintained by the SEC at http://www.sec.gov. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filing that may be made with the SEC. Nonetheless, Cliffs and its directors and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Cliffs is set forth in its Annual Report on Form 10- K for the year ended December 31, 2022, which was filed with the SEC on February 14, 2023, and its proxy statement for its 2023 annual meeting of shareholders, which was filed with the SEC on April 4, 2023. Any information concerning U.S. Steel contained in this filing has been taken from, or based upon, publicly available information. Although Cliffs does not have any information that would indicate that any information contained in this filing that has been taken from such documents is inaccurate or incomplete, Cliffs does not take any responsibility for the accuracy or completeness of such information. To date, Cliffs has not had access to the books and records of U.S. Steel.

Source: Cleveland-Cliffs Inc. MEDIA CONTACT: Patricia Persico Senior Director, Corporate Communications (216) 694-5316 INVESTOR CONTACT: James Kerr Manager, Investor Relations (216) 694-7719

EX-99.2

3

a202308138-kex992.htm

EX-99.2

a202308138-kex992

© 2023 Cleveland-Cliffs Inc. All Rights Reserved. CLEVELAND-CLIFFS AND U.S. STEEL Creation of a New Leader in Steel AUGUST 2023 EXHIBIT 99.2

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.2 FORWARD-LOOKING STATEMENTS AND IMPORTANT INFORMATION This presentation contains statements that constitute "forward-looking statements" within the meaning of the federal securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry, our business or a transaction with United States Steel Corporation (U.S. Steel), are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward-looking statements are the following: the risk that a transaction with U.S. Steel may not be consummated; the risk that a transaction with U.S. Steel may be less accretive than expected, or may be dilutive, to Cliffs’ earnings per share, which may negatively affect the market price of Cliffs common shares; the possibility that Cliffs and U.S. Steel will incur significant transaction and other costs in connection with a potential transaction, which may be in excess of those anticipated by Cliffs; the risk that the financing transactions to be undertaken in connection with a transaction have a negative impact on the combined company’s credit profile or financial condition; the risk that Cliffs may fail to realize the benefits expected from a transaction; the risk that the combined company may be unable to achieve anticipated synergies or that it may take longer than expected to achieve those synergies; the risk that any announcements relating to, or the completion of, a transaction could have adverse effects on the market price of Cliffs common shares; and the risk related to any unforeseen liability and future capital expenditure of Cliffs related to a transaction. For additional factors affecting the business of Cliffs, refer to Part I – Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2022, and other filings with the U.S. Securities and Exchange Commission. IMPORTANT INFORMATION FOR INVESTORS AND STOCKHOLDERS This communication relates to a proposal which Cliffs has made for an acquisition of U.S. Steel. In furtherance of this proposal and subject to future developments, Cliffs may file one or more registration statements, proxy statements, tender offer statements or other documents with the Securities and Exchange Commission (“SEC”). This communication is not a substitute for any proxy statement, registration statement, tender offer statement or other document Cliffs may file with the SEC in connection with the proposed transaction. Investors and security holders of Cliffs are urged to read the proxy statement(s), registration statement, tender offer statement and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Cliffs, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Cliffs through the website maintained by the SEC at http://www.sec.gov. This document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filing that may be made with the SEC. Nonetheless, Cliffs and its directors and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Cliffs is set forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 14, 2023, and its proxy statement for its 2023 annual meeting of shareholders, which was filed with the SEC on April 4, 2023. Any information concerning U.S. Steel contained in this filing has been taken from, or based upon, publicly available information. Although Cliffs does not have any information that would indicate that any information contained in this filing that has been taken from such documents is inaccurate or incomplete, Cliffs does not take any responsibility for the accuracy or completeness of such information. To date, Cliffs has not had access to the books and records of U.S. Steel. FORWARD-LOOKING STATEMENTS

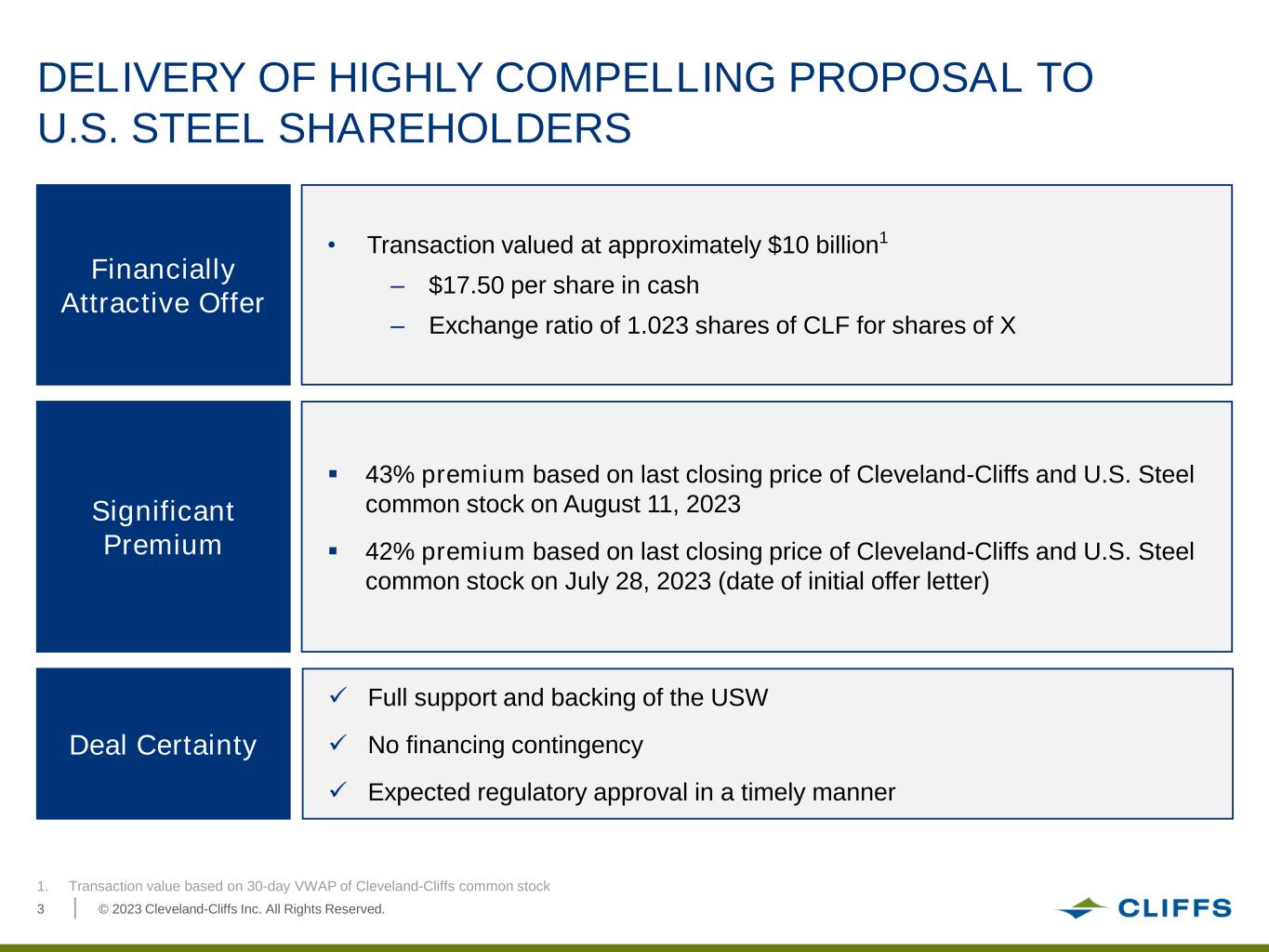

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.3 1. Transaction value based on 30-day VWAP of Cleveland-Cliffs common stock DELIVERY OF HIGHLY COMPELLING PROPOSAL TO U.S. STEEL SHAREHOLDERS • Transaction valued at approximately $10 billion1 – $17.50 per share in cash – Exchange ratio of 1.023 shares of CLF for shares of X 43% premium based on last closing price of Cleveland-Cliffs and U.S. Steel common stock on August 11, 2023 42% premium based on last closing price of Cleveland-Cliffs and U.S. Steel common stock on July 28, 2023 (date of initial offer letter) Financially Attractive Offer Significant Premium Full support and backing of the USW No financing contingency Expected regulatory approval in a timely manner Deal Certainty

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.4 Creates the only American steel company to be a member of the Top 10 steelmakers in the world Provides customers and employees a stronger, more innovative, and more competitive domestic U.S. steel producer Union support, limited diligence needs, significant shareholder overlap and financing certainty minimize execution risk Complementary capabilities with iron ore, DRI, scrap and integrated/EAF steelmaking form ideal combination Shared focus on aggressive emissions reduction more rapidly achieved with combined footprint Offer delivers estimated synergies of ~$500 million, provides immediate multiple expansion to U.S. Steel stockholders and de-risks U.S. Steel’s capital spend CREATION OF A NEW LEADER IN STEEL… PF 2022 Revenue: $44.1 Billion Note: Financials per SEC filings

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.5 …AND THE ONLY U.S. COMPANY IN THE TOP 10 GLOBAL PRODUCERS OF STEEL Global Steel Production – Top 20 Steel Producers (million metric tons) Source: Association for Iron & Steel Technology and World Steel Association Note: Reflects 2022 production; IMIDRO and NLMK are estimates 1. Includes tonnage of Xinyu Steel 2. Includes 60% AM/NS India (former Essar Steel) 3. Includes tonnage of Benxi Steel 4. Includes Nippon Steel Stainless Steel Corp.; Sanyo Special Steel, Ovako, 40% of AM/NS India and 31.4% of USIMINAS 5. Former Valin Group 6. Estimated tonnage of Mobarakeh Steel, Esfahan Steel, Khuzestan Steel and NISCO 132 69 56 44 41 41 39 37 34 31 30 29 28 26 26 23 21 20 19 18 18 C h in a B a o w u A rc e lo rM it ta l A n s te e l N ip p o n S te e l S h a g a n g H B IS P O S C O J ia n lo n g S h o u g a n g C lif fs P ro F o rm a T a ta S te e l S h a n g d o n g S te e l D e lo n g S te e l H u n a n S te e l J F E S te e l J S W S te e l N u c o r F a n g d a S te e l H y u n d a i S te e l L iu z h o u S te e l IM ID R O 1 2 3 4 5 6 Sole U.S. producer in Top 10

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.6 THE MOST DYNAMIC, COMPETITIVE STEELMAKER IN NORTH AMERICA North America Steel Shipments (million net tons)1 1. Represents CY2022A North America steel shipments (in net tons) for each producer listed, except where otherwise noted 2. Excludes U.S. Steel Europe segment shipments of 3.8Mnt 3. Nucor figure reflects third-party shipments from steel mills division; Steel Dynamics figure reflects third-party shipments from steel operations division; Commercial Metals figure reflects LTM 11/30/2022 steel shipments 4. Represents North America steel shipments for each of ArcelorMittal, Gerdau and SSAB. Represents Mexico steel shipments for Ternium 5. Reflects CY2022A seaborne imports per the International Trade Administration U.S. Steel Monitor 6. Represents CY2022A North American net sales; Commercial Metals reflects LTM 11/30/2022 net sales; figures in USD using applicable foreign exchange rate as of 12/31/2022 North American Sales6 $39,811 $41,512 $22,261 $13,774 $8,828 $5,883 $7,462 $2,559 $2,509 $2,248 $3,085 NA 53 2 4 4 3 44 3

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.7 DELIVERS HIGHLY COMPLEMENTARY OPERATIONAL FOOTPRINT IN NORTH AMERICA Iron Ore Metallics BF-BOFs EAFs Finishing/ Downstream Hibbing 7.0Mt Minorca 3.0Mt UTAC 6.0Mt Northshore 5.0Mt Tilden 7.0Mt Minntac 13.5Mt Keetac 5.3Mt Burns Harbor 5.0Mt Indiana Harbor 4.0Mt Cleveland 3.4Mt Middletown 3.0Mt Dearborn 3.0Mt Riverdale 0.7Mt Toledo HBI 1.9Mt FPT Scrap 3.0Mt Gary Works 7.5Mt Mon Valley 2.9Mt Granite City 2.8Mt Mansfield 0.5Mt Butler 0.4Mt Steelton 0.3Mt Coatesville 0.2Mt Fairfield 0.9Mt Big River 1 3.3Mt Big River 2 growth project Standalone Finishing Assets 10 facilities Tubular and Stamping 12 facilities Standalone Finishing Assets 8 facilities Tubular 5 facilities Gary Pig Iron 0.4Mt Annual capacity noted in italics Note: Iron ore and metallics figures represent gross tons and steel figures represent net tons; steel capacities represent crude steelmaking 1. Represents 2022A production

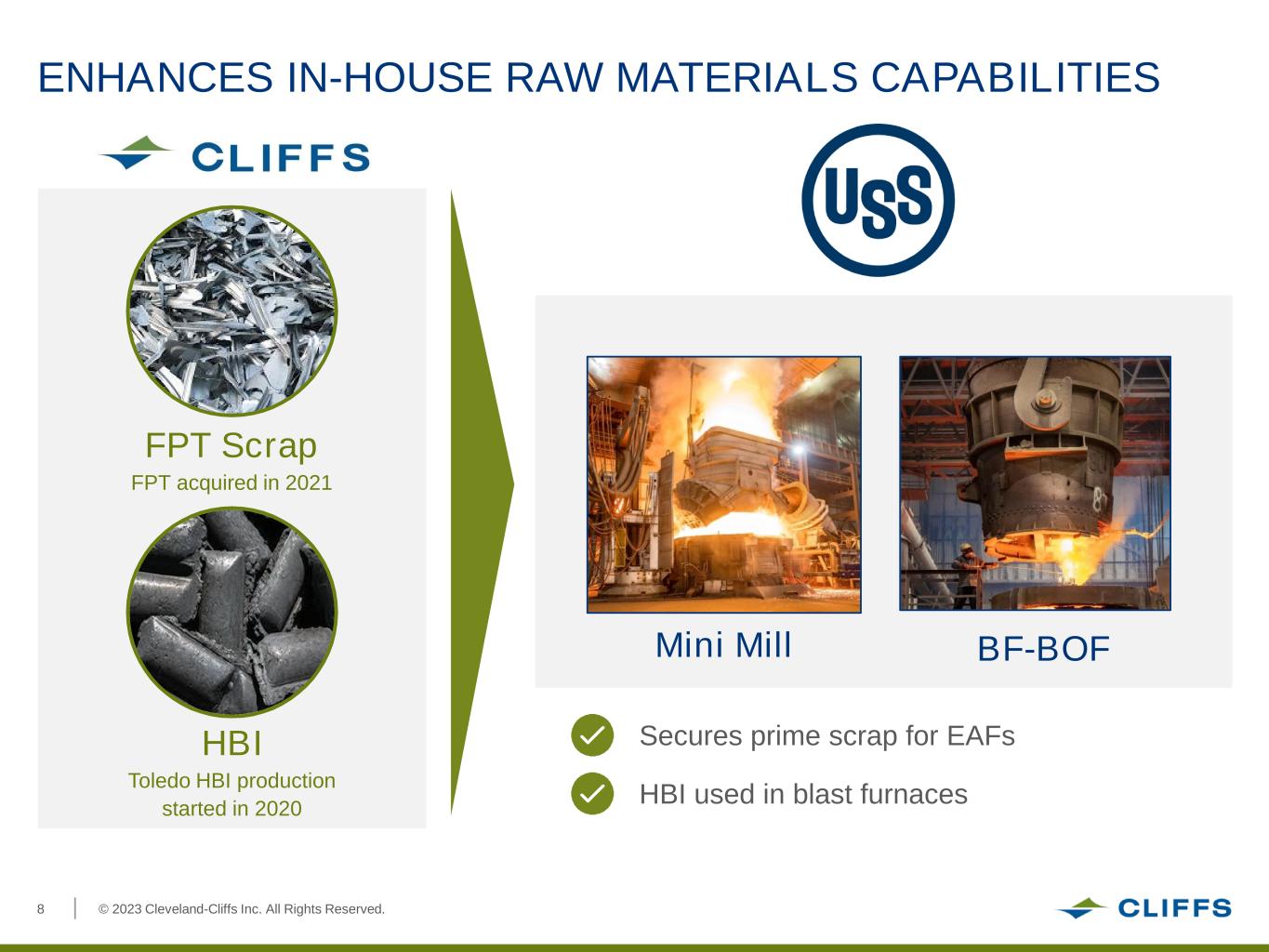

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.8 ENHANCES IN-HOUSE RAW MATERIALS CAPABILITIES FPT Scrap FPT acquired in 2021 HBI Toledo HBI production started in 2020 Mini Mill BF-BOF Secures prime scrap for EAFs HBI used in blast furnaces

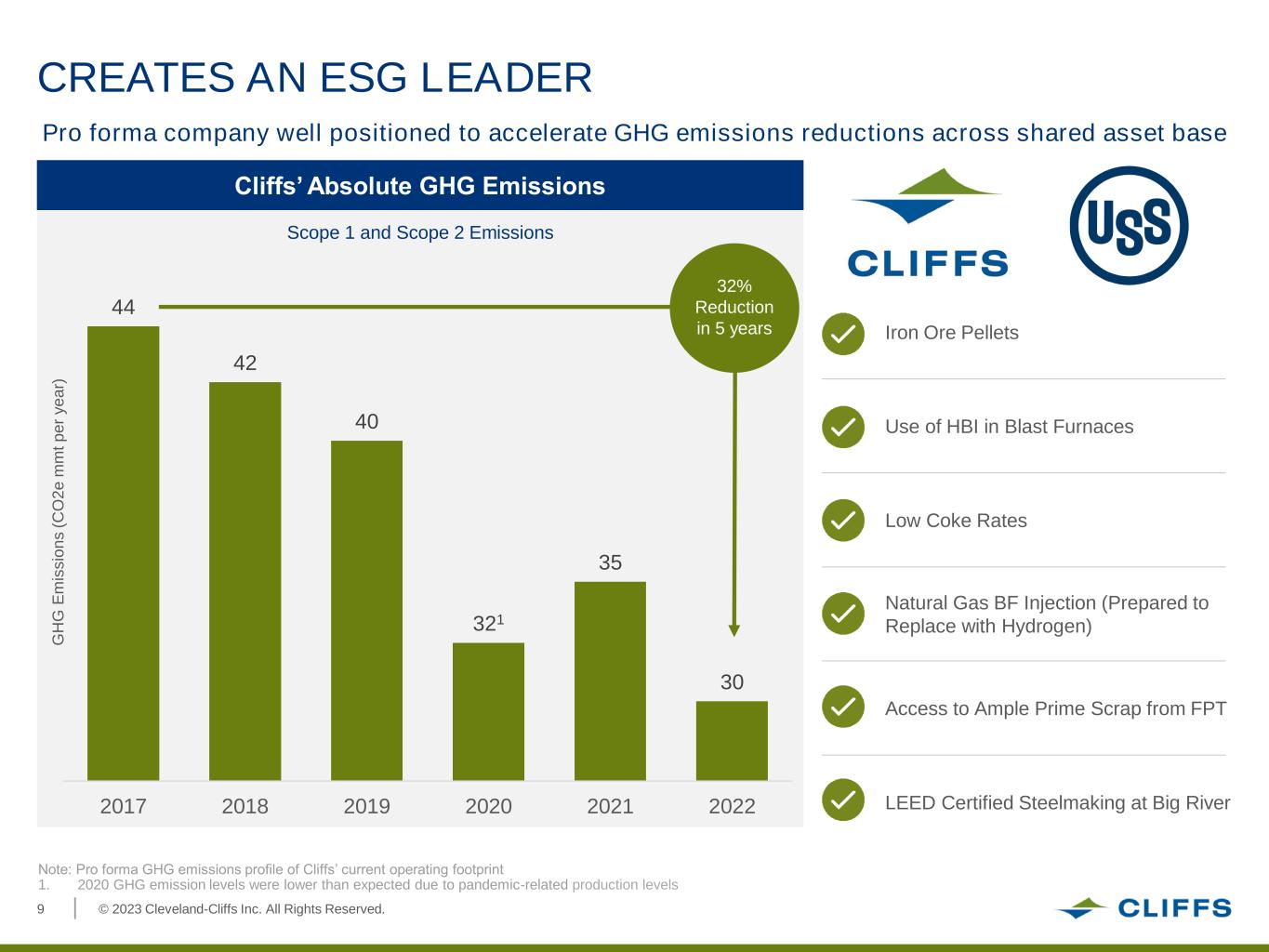

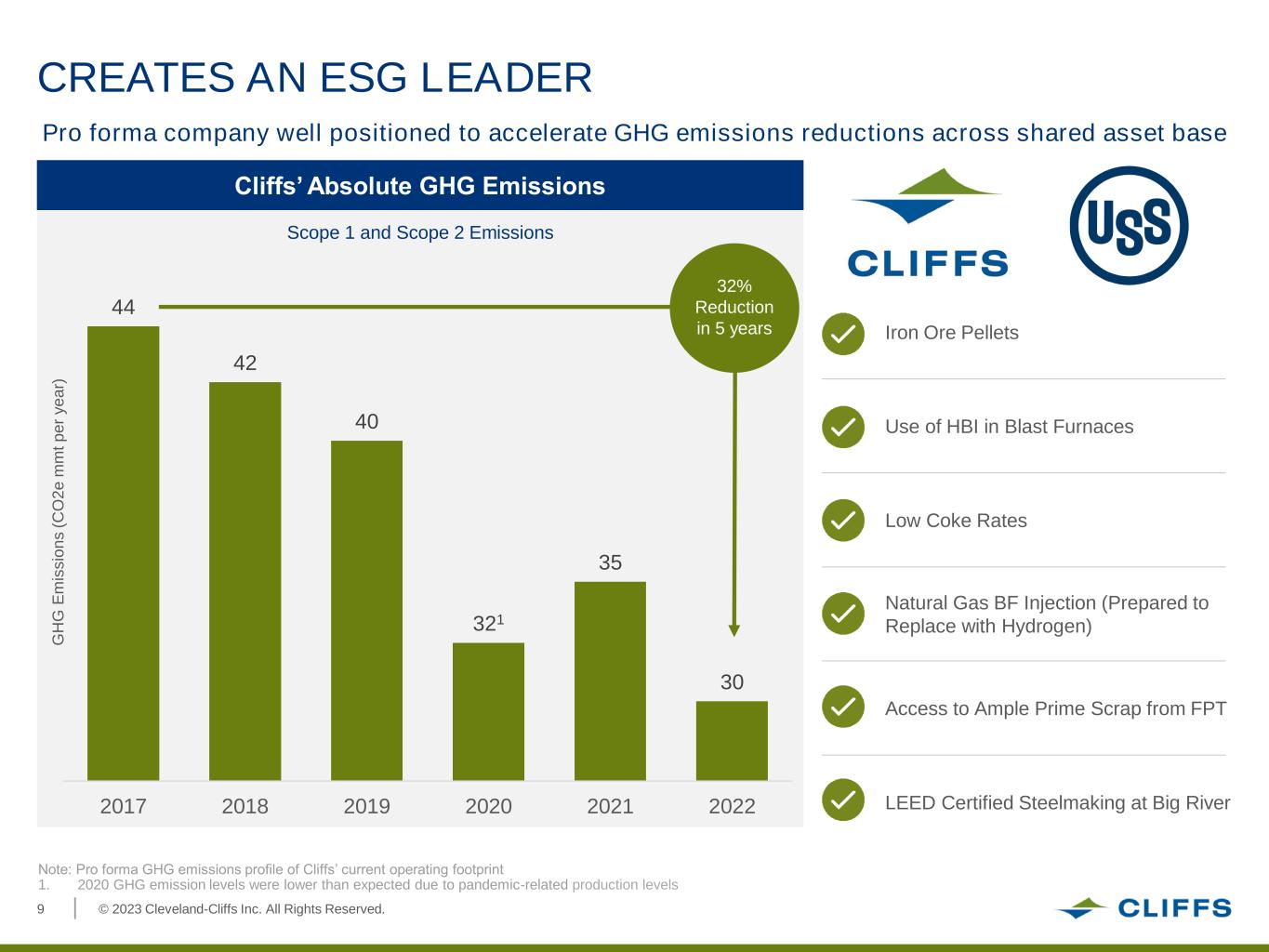

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.9 44 42 40 321 35 30 2017 2018 2019 2020 2021 2022 G H G E m is s io n s ( C O 2 e m m t p e r y e a r) CREATES AN ESG LEADER Scope 1 and Scope 2 Emissions Note: Pro forma GHG emissions profile of Cliffs’ current operating footprint 1. 2020 GHG emission levels were lower than expected due to pandemic-related production levels Iron Ore Pellets Use of HBI in Blast Furnaces Low Coke Rates Natural Gas BF Injection (Prepared to Replace with Hydrogen) Access to Ample Prime Scrap from FPT LEED Certified Steelmaking at Big River Cliffs’ Absolute GHG Emissions 32% Reduction in 5 years Pro forma company well positioned to accelerate GHG emissions reductions across shared asset base

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.10 DELIVERS SIGNIFICANT VALUE CREATION POTENTIAL ~$500 million in synergies Cost Synergies Investment Synergies Multiple Expansion Significant synergies from asset and capex optimization Procurement savings (healthcare, raw materials, supplies and freight, among others) SG&A and channel efficiencies as a result of complementary operating platforms Reduction of corporate and public company costs Enhanced financial and capital markets profile and robust FCF substantially de-risk U.S. Steel’s multi-year strategic initiatives Potential for trading multiple expansion as a result of stronger financial position and growth to drive shareholder value Both companies’ shareholders will be direct beneficiaries of the significant synergies in the pro forma company and valuation uplift potential going forward

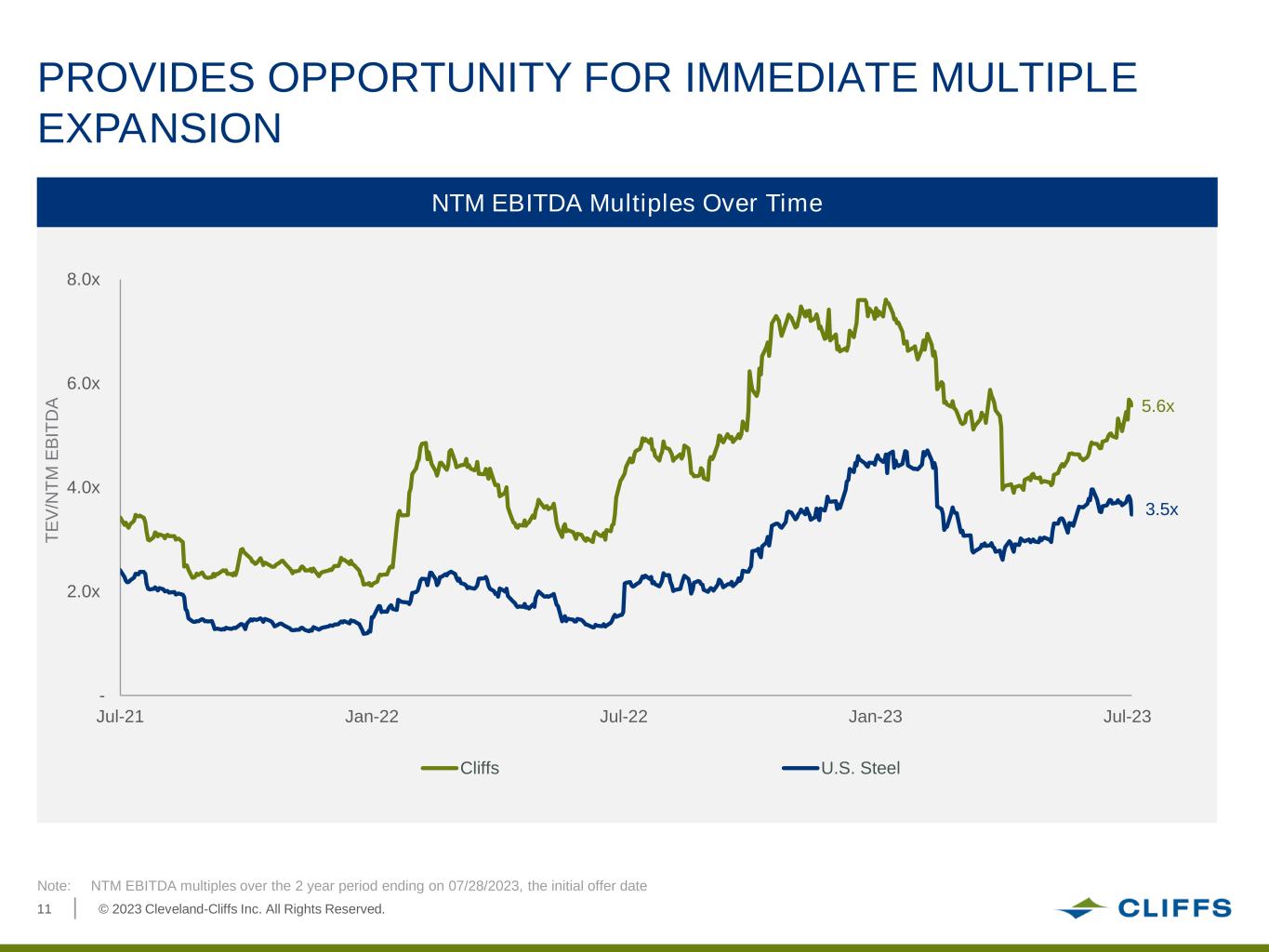

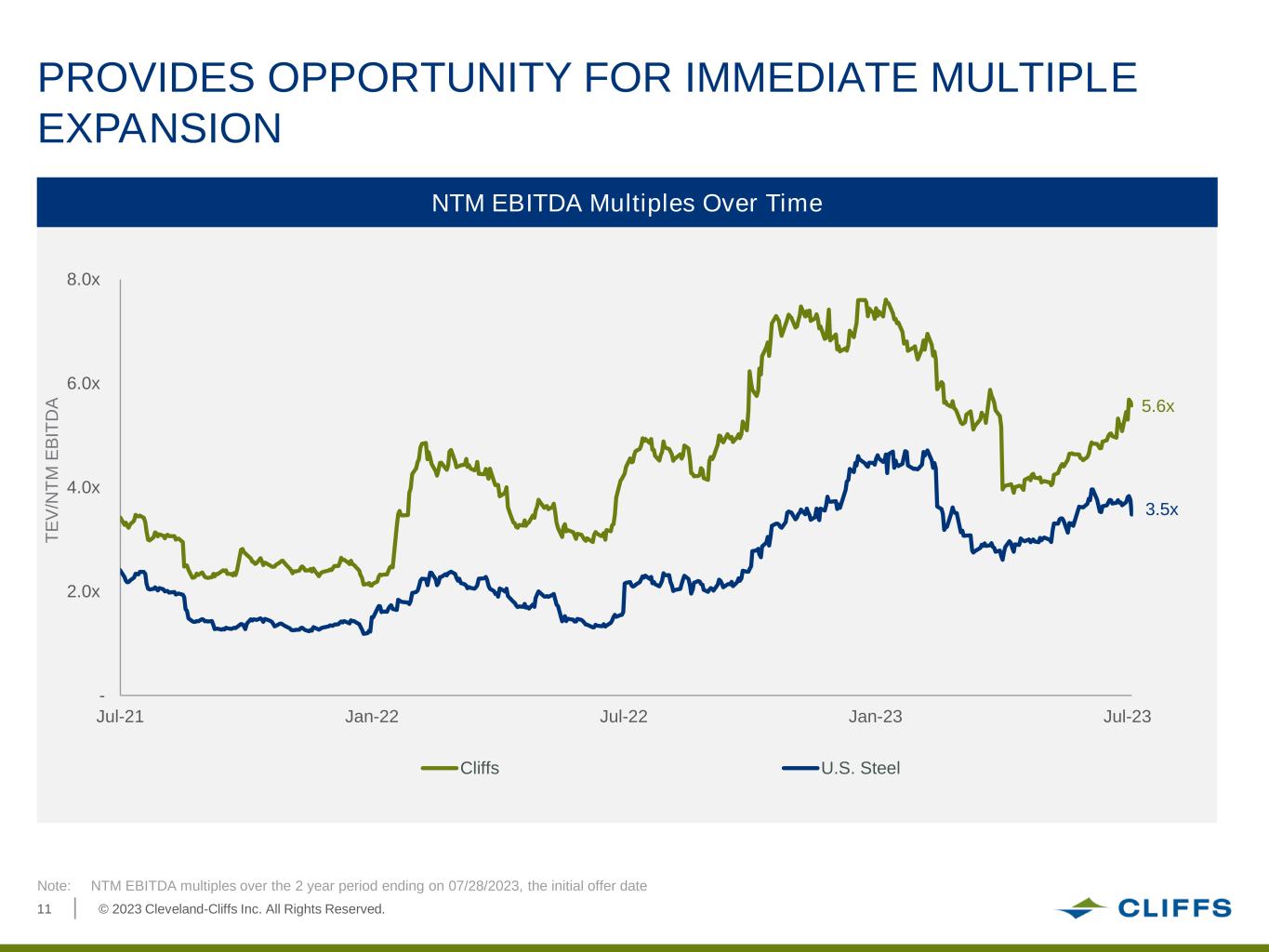

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.11 PROVIDES OPPORTUNITY FOR IMMEDIATE MULTIPLE EXPANSION NTM EBITDA Multiples Over Time Note: NTM EBITDA multiples over the 2 year period ending on 07/28/2023, the initial offer date 5.6x 3.5x - 2.0x 4.0x 6.0x 8.0x Jul-21 Jan-22 Jul-22 Jan-23 Jul-23 Cliffs U.S. Steel T E V /N T M E B IT D A

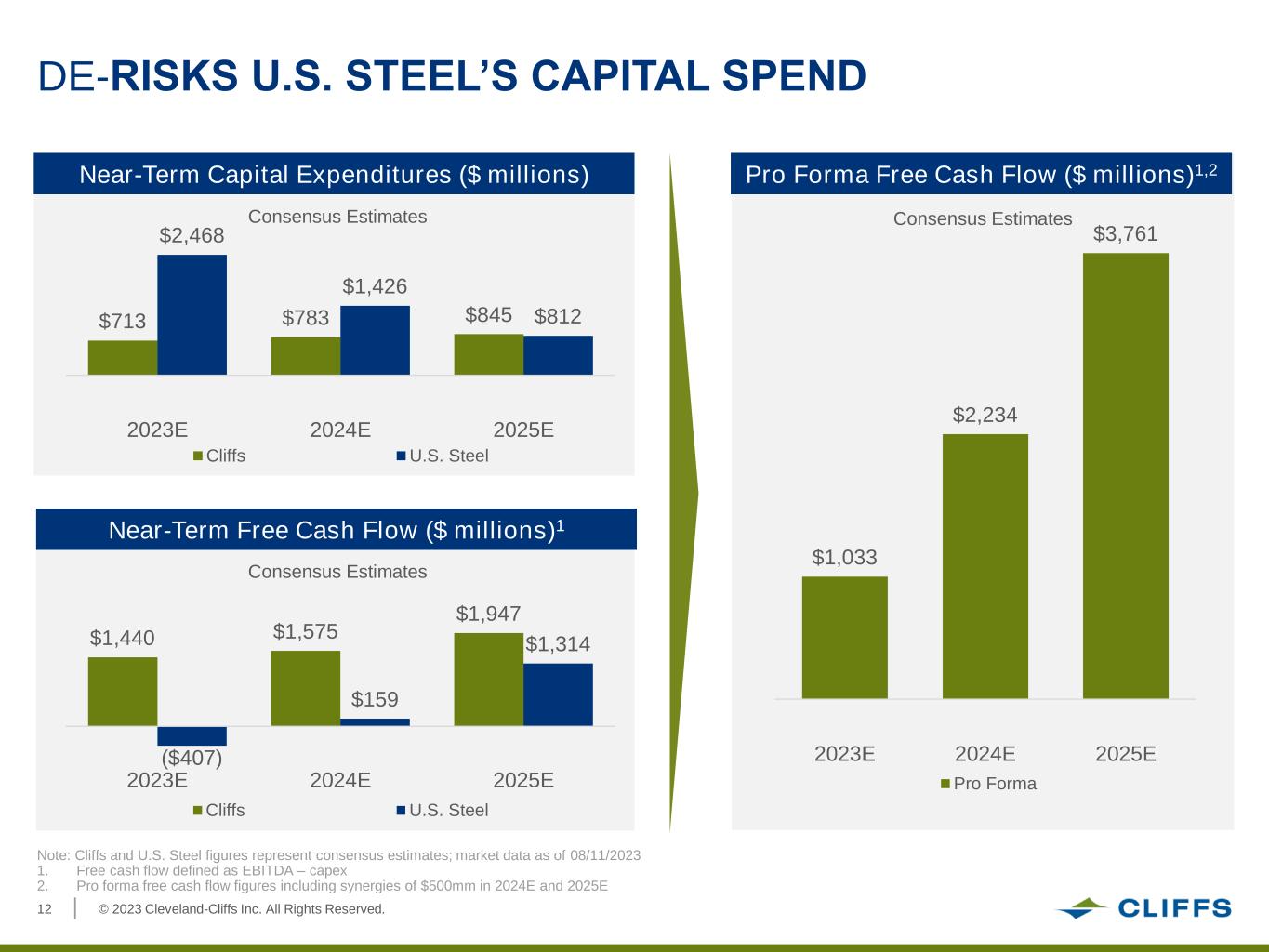

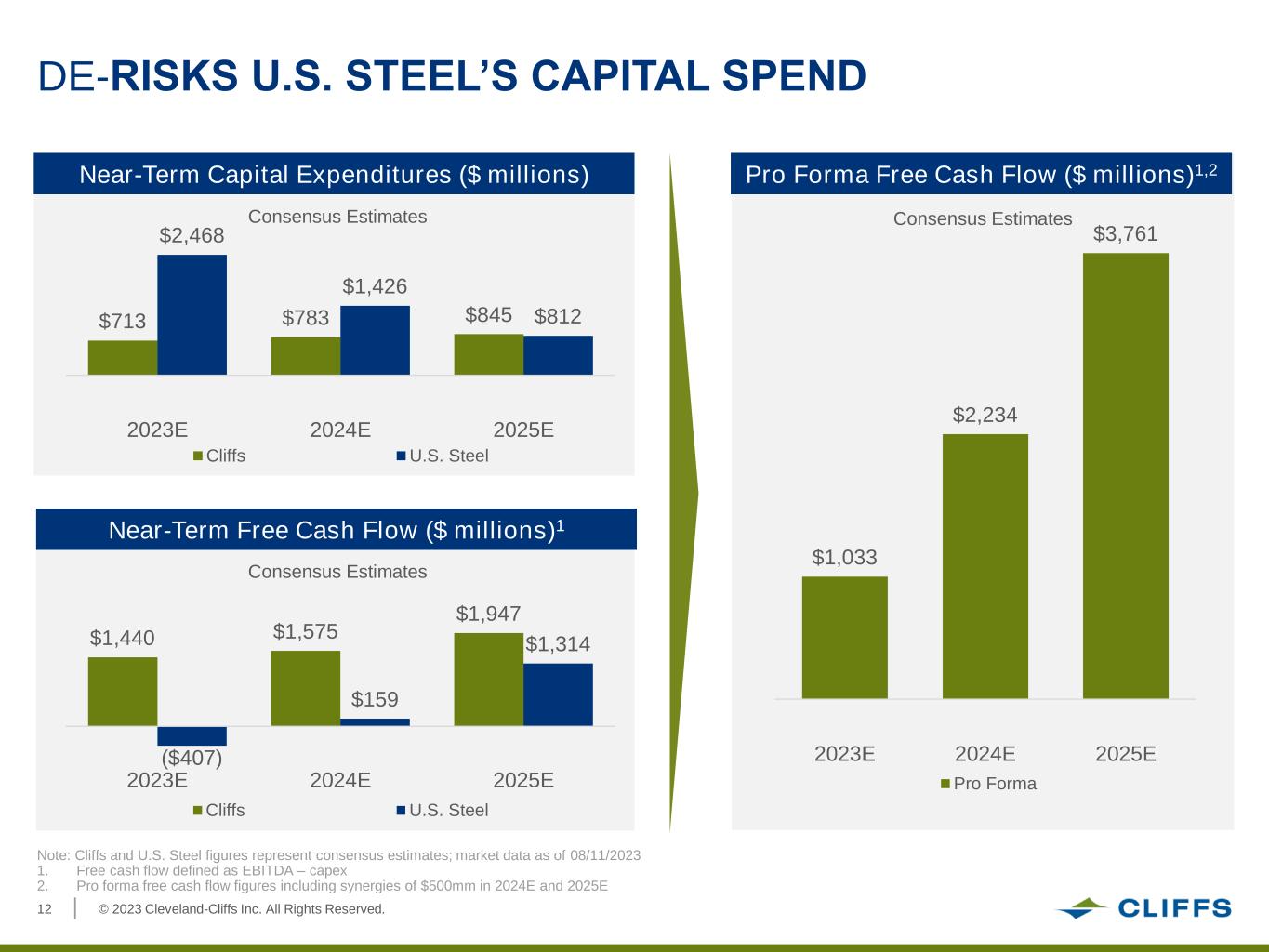

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.12 DE-RISKS U.S. STEEL’S CAPITAL SPEND Near-Term Capital Expenditures ($ millions) Note: Cliffs and U.S. Steel figures represent consensus estimates; market data as of 08/11/2023 1. Free cash flow defined as EBITDA – capex 2. Pro forma free cash flow figures including synergies of $500mm in 2024E and 2025E Near-Term Free Cash Flow ($ millions)1 Pro Forma Free Cash Flow ($ millions)1,2 Consensus Estimates Consensus Estimates Consensus Estimates $1,440 $1,575 $1,947 ($407) $159 $1,314 2023E 2024E 2025E Cliffs U.S. Steel $713 $783 $845 $2,468 $1,426 $812 2023E 2024E 2025E Cliffs U.S. Steel $1,033 $2,234 $3,761 2023E 2024E 2025E Pro Forma

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.13 Cliffs expects to maintain existing credit ratings IMPROVED BALANCE SHEET AND FINANCIAL PROFILE Net Leverage1 2.5x ~2.1x Cliffs Pro Forma 1. LTM 06/30/2023 leverage (pro forma includes synergies) Significant pro forma FCF profile to pay down debt in the immediate term Intention to maintain Cliffs’ track record of strong (and improving) credit ratings EPS accretive in year one Strong Pro Forma Profile ~16% reduction

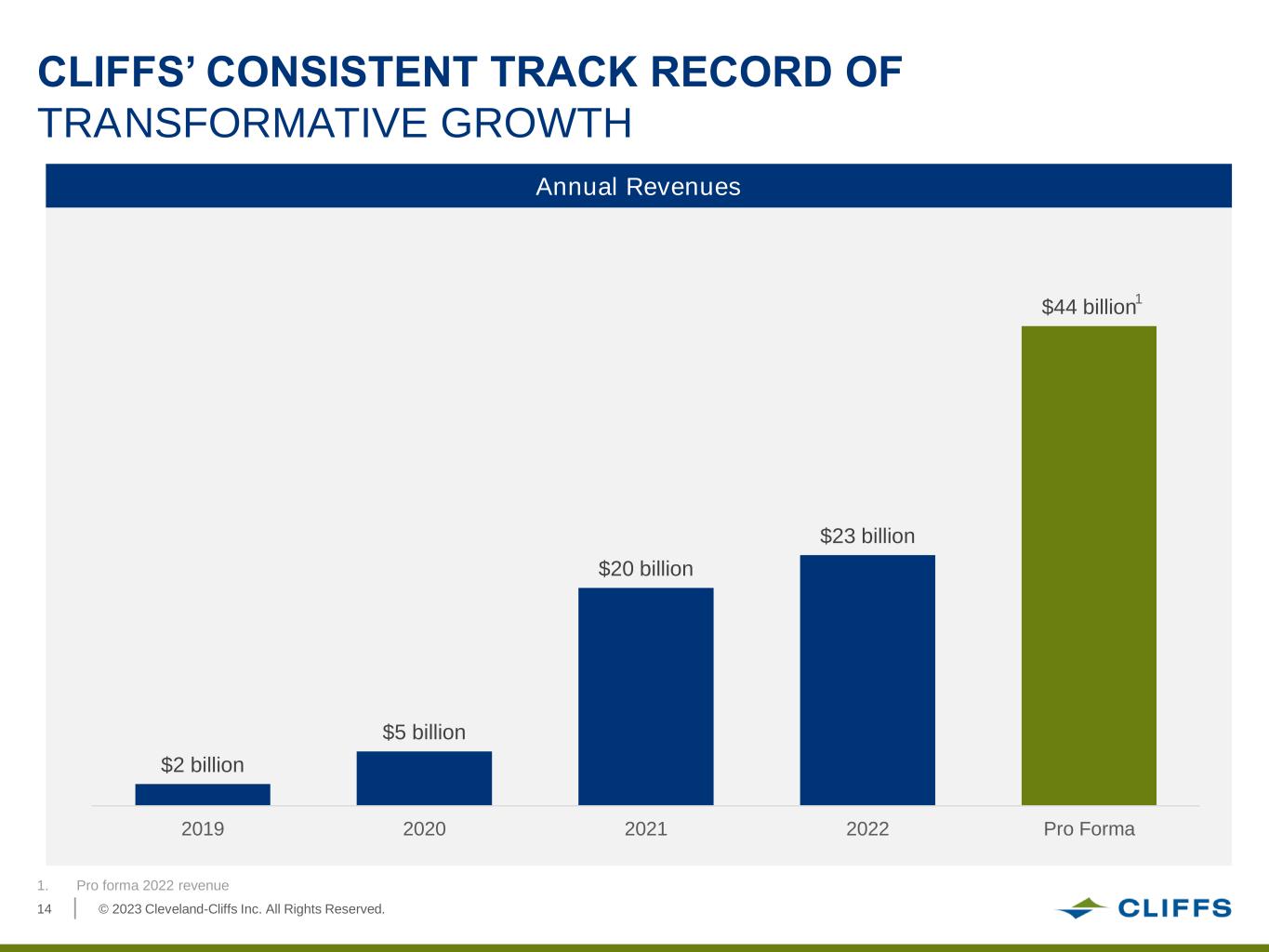

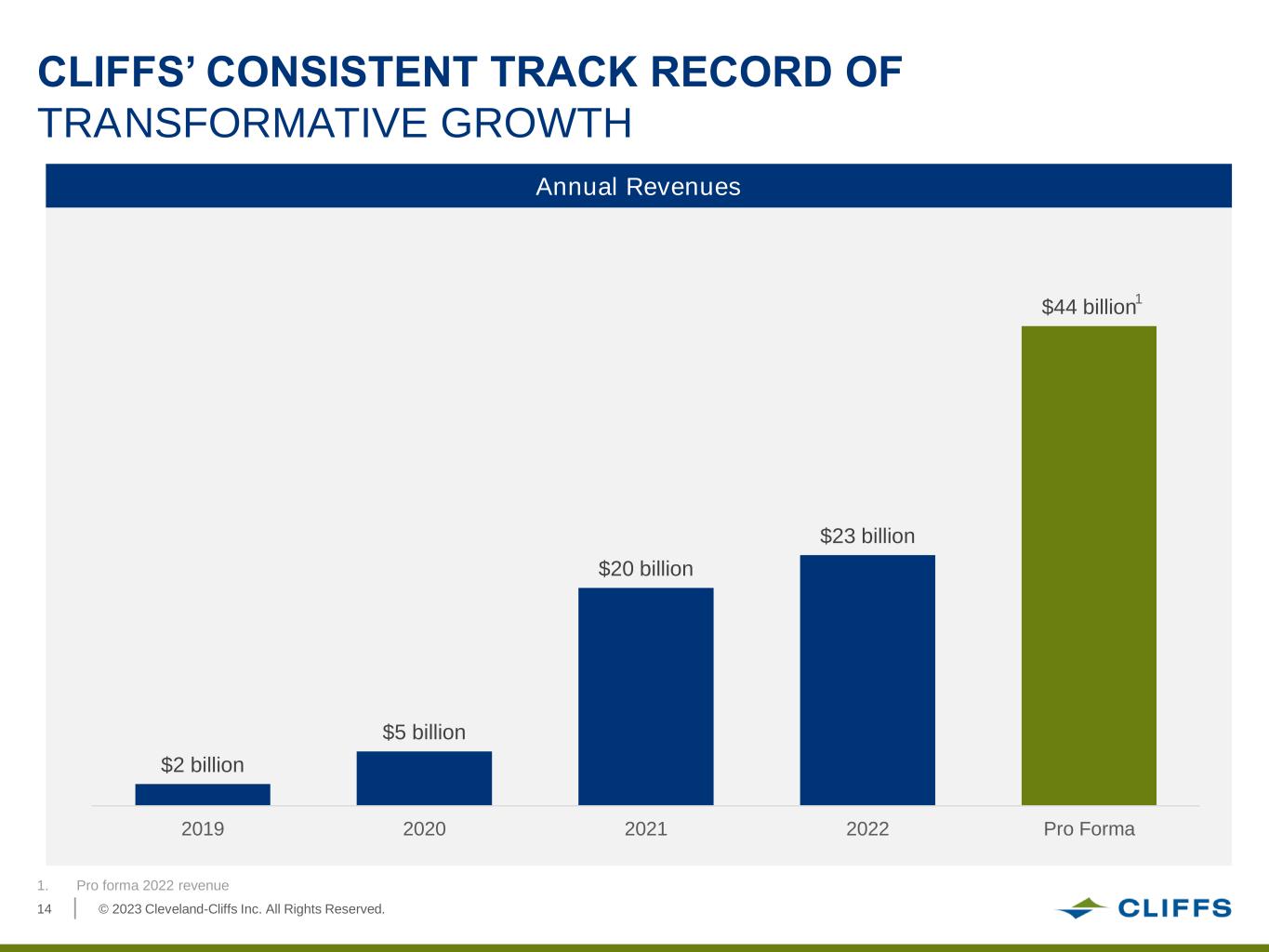

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.14 10X growth over 2 years Annual Revenues $2 billion $5 billion $20 billion $23 billion $44 billion 2019 2020 2021 2022 Pro Forma CLIFFS’ CONSISTENT TRACK RECORD OF TRANSFORMATIVE GROWTH 1 1. Pro forma 2022 revenue

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.15 1. Transaction details can be found in SEC Filings 2. Represents total enterprise value; ArcelorMittal USA enterprise value includes assumption of pension/OPEB liabilities and working capital PROVEN ABILITY TO DELIVER ADDITIONAL JOBS AND RE-INVEST IN CRITICAL MATERIALS Transaction Value2 2020 2020 $3.0 billion Electrical Steel $3.3 billion Tinplate USA1 $120 million Overachieved $150 million Overachieved 1 Net Job Creation Re-investment in Critical Niche Materials For U.S. Supply Chain Cost Synergies Planned vs. Achieved ~1,700 new jobs added

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.16 COMMITMENT TO CAPITAL RETURNS Significant Share Repurchase Program Since 2022 Announced $1 billion share repurchase program in 2022 Repurchased 12.5 million shares in 2022 ~$666 million remaining under current repurchase program1 S h a re C o u n t E v o lu ti o n 2 1. As of Q2 2023 2. Represents diluted shares outstanding 12% reduction585 514 Q2 2021 Q2 2023 million shares million shares Initiating a $0.05 per share quarterly dividend in conjunction with the transaction Will deliver ~$155 million in annual dividend to all shareholders Meaningful Quarterly Dividend Going Forward

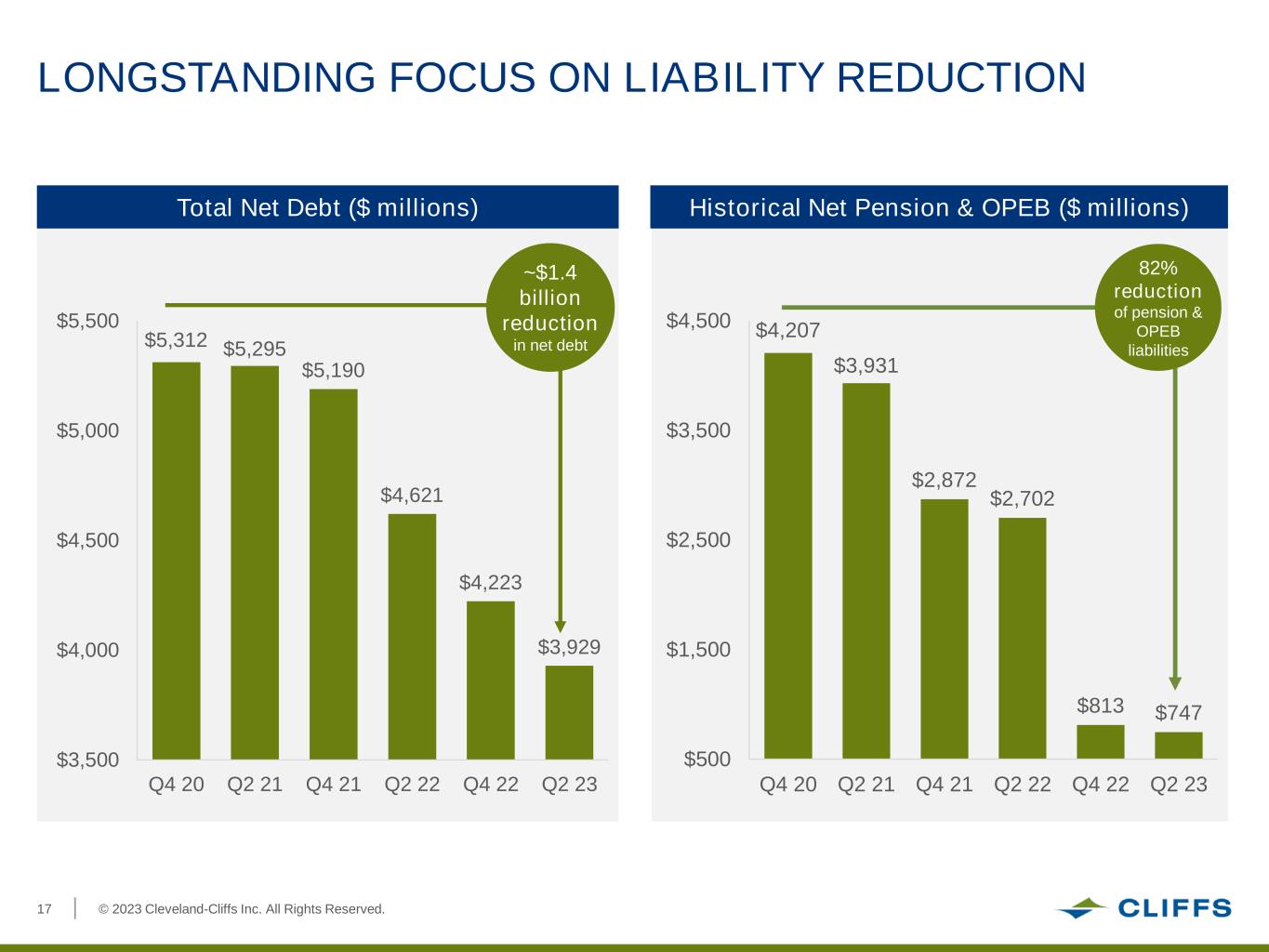

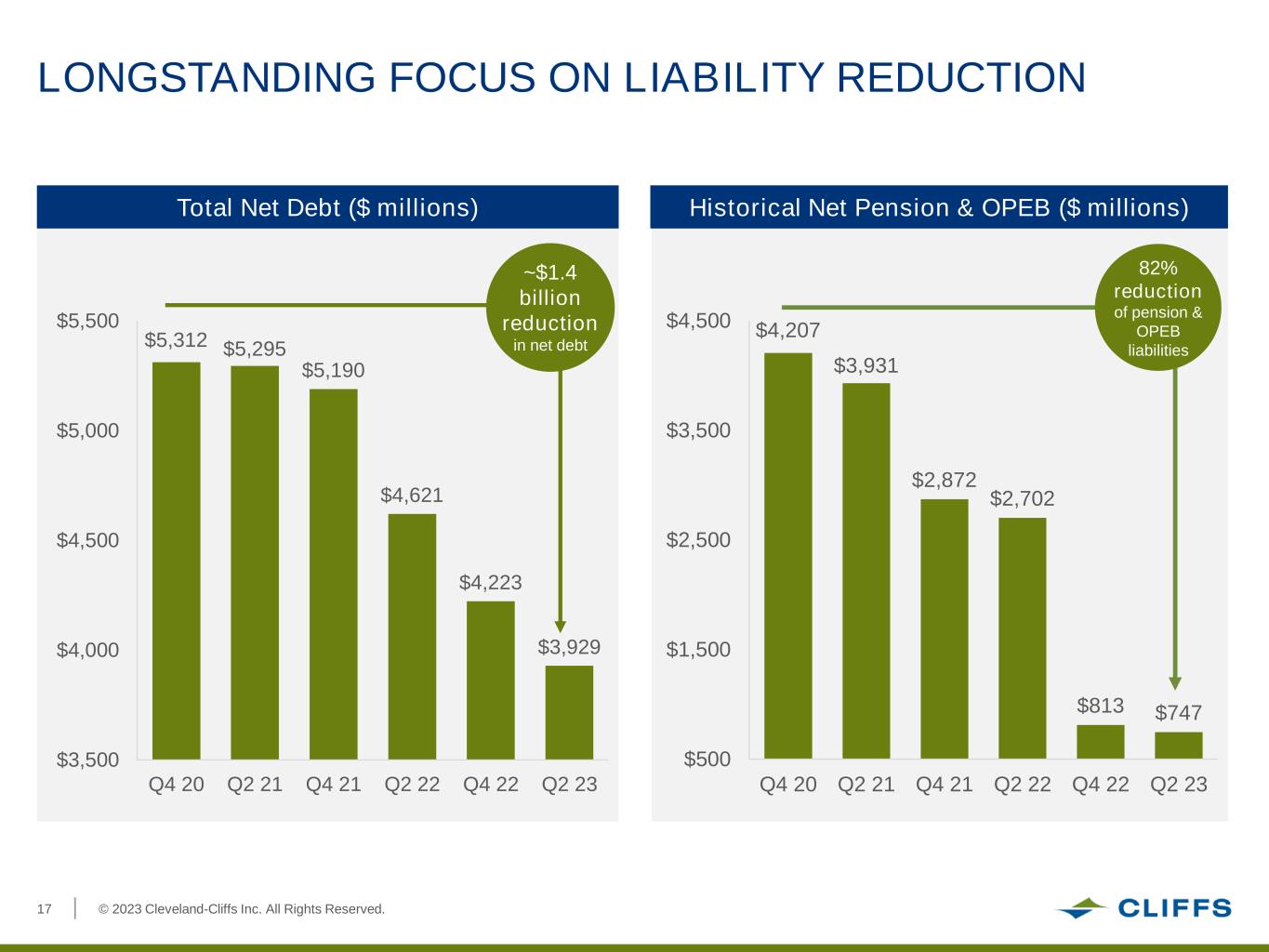

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.17 $5,312 $5,295 $5,190 $4,621 $4,223 $3,929 $3,500 $4,000 $4,500 $5,000 $5,500 Q4 20 Q2 21 Q4 21 Q2 22 Q4 22 Q2 23 LONGSTANDING FOCUS ON LIABILITY REDUCTION Total Net Debt ($ millions) Historical Net Pension & OPEB ($ millions) ~$1.4 billion reduction in net debt $4,207 $3,931 $2,872 $2,702 $813 $747 $500 $1,500 $2,500 $3,500 $4,500 Q4 20 Q2 21 Q4 21 Q2 22 Q4 22 Q2 23 82% reduction of pension & OPEB liabilities

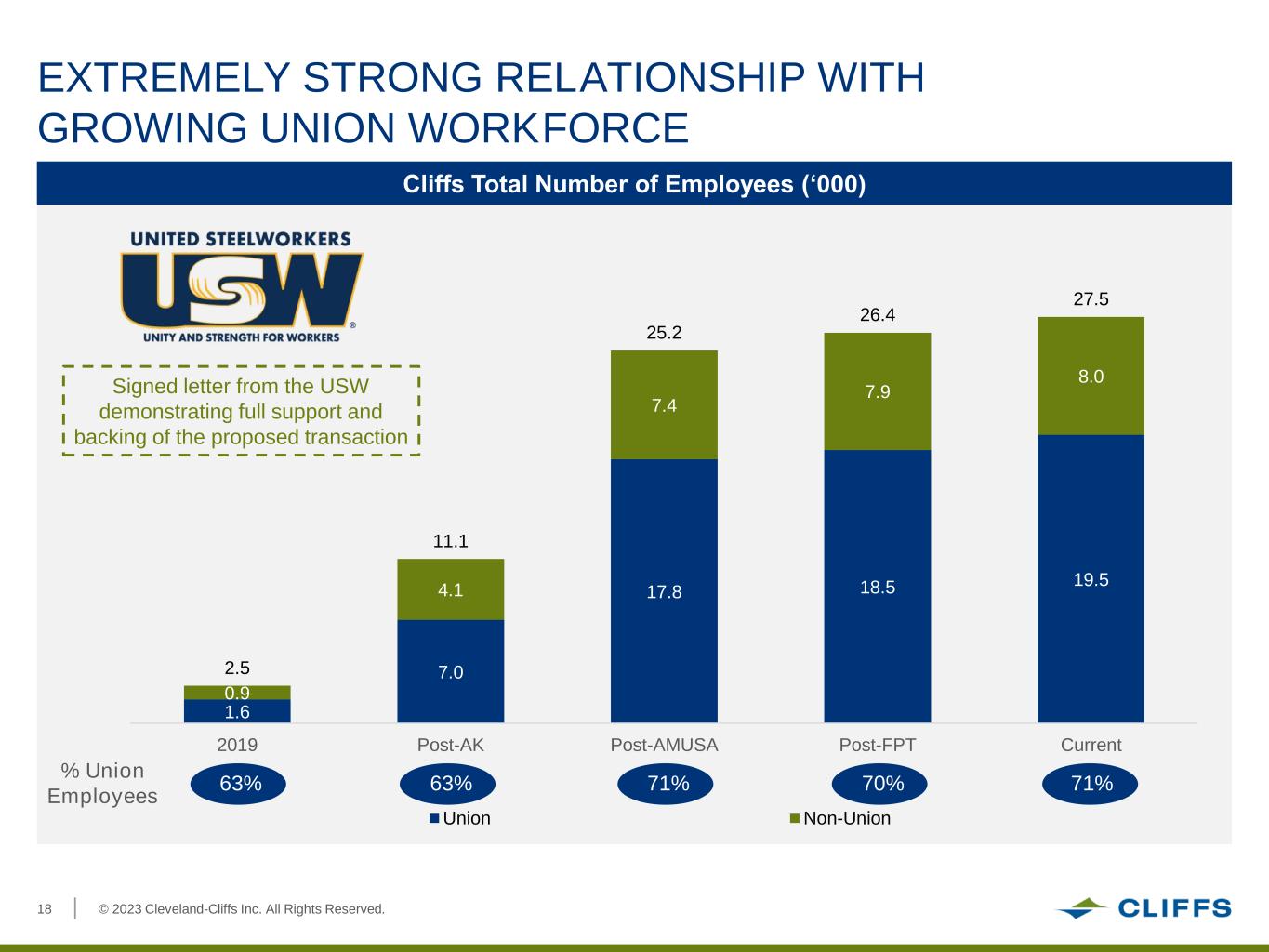

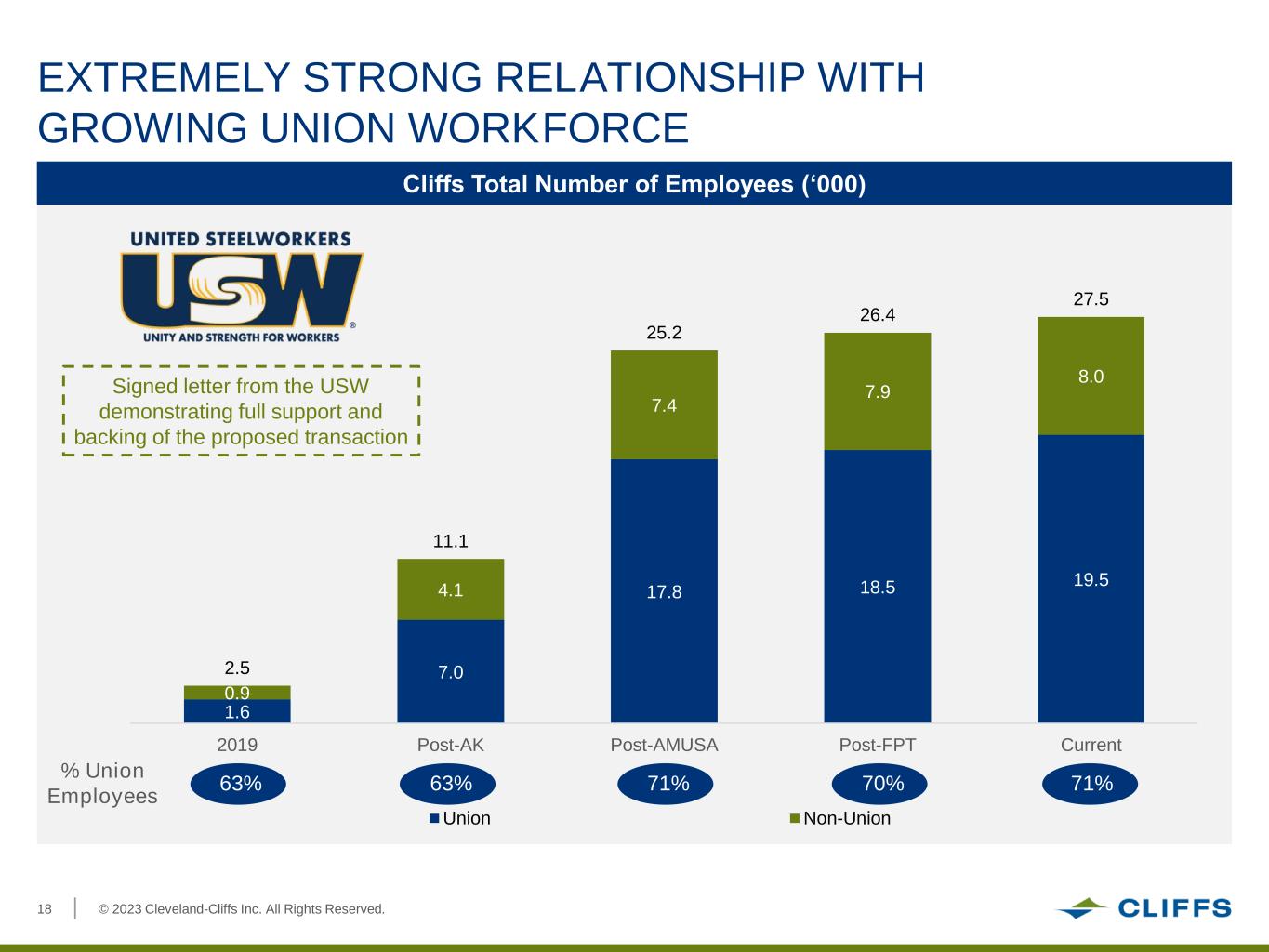

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.18 EXTREMELY STRONG RELATIONSHIP WITH GROWING UNION WORKFORCE Cliffs Total Number of Employees (‘000) 1.6 7.0 17.8 18.5 19.5 0.9 4.1 7.4 7.9 8.0 2.5 11.1 25.2 26.4 27.5 2019 Post-AK Post-AMUSA Post-FPT Current Union Non-Union % Union Employees 63% 63% 71% 70% 71% Signed letter from the USW demonstrating full support and backing of the proposed transaction

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.19 FULL SUPPORT AND BACKING OF THE USW

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.20 CLEAR ROADMAP TO COMPLETION 1. Top 3 and 15 Cliffs shareholders own 24% and 36% of U.S. Steel, respectively 2. Customary public company legal due diligence needed to get to definitive agreement Proposed transaction has the full support and backing of the USW Minimal private-side business due diligence required2 60% overlap across all institutional shareholders1 Signed highly confident letters from several tier 1 U.S. and international banks Unanimous support of Cliffs Board Regulatory approval expected in timely manner Substantial time and effort already expended with key advisors in place

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.21 CLIFFS’ PROPOSAL IS COMPELLING FOR ALL STAKEHOLDERS Combination provides a stronger foundation for critical infrastructure and national security, along with accelerated job creation and economic impact Domestic Economic Security Unwavering commitment to all employees, as evidenced by the full support of the USW and strong track record of growing Cliffs’ hourly workforce Employees Significant U.S.-based footprint with ~40,5001 employees across 16 states Communities 1. U.S. Steel active North American employees and Cliffs U.S. employees as of 12/31/2022 Customers Broad-based steelmaking capability set, with particular excellence in value-add steels critical to the U.S. economy Shareholders Delivery of ~$500 million of annual synergies, a de-risked financial profile and strong capital returns going forward Creates a top 10 steel company in the world

© 2023 Cleveland-Cliffs Inc. All Rights Reserved.

EX-99.3

4

a202308138-kex993.htm

EX-99.3

a202308138-kex993

EXHIBIT 99.3

United States Steel Corporation David B. Burritt 600 Grant Street, Suite 6100 President & Chief Executive Officer Pittsburgh, PA 15219-2800 (412) 433-1130 Lourenco Goncalves Chairman, President and Chief Executive Officer Cleveland-Cliffs Inc. 200 Public Square, Suite 3300 Cleveland, OH 44114 CONFIDENTIAL - SENT VIA EMAIL August 7, 2023 Dear Lourenco, I am writing to you on behalf of United States Steel Corporation (the “Company”) in response to Cleveland-Cliffs Inc.’s proposal letter dated July 28, 2023. Since receiving your proposal, the Company’s Board has met, with the assistance of our financial advisors, Barclays and Goldman Sachs, and our legal advisors, Milbank and Wachtell, to evaluate the merits and risks of your proposal. Additionally, our financial advisors have had a clarifying discussion with your financial advisors, and our legal counsel has connected with your counsel to discuss Davis Polk’s regulatory analysis of the proposal. Based on this preliminary work, we would like to execute a Non-Disclosure Agreement in order to evaluate if the proposal, including price, consideration mix, regulatory risk and execution, is in the best interest of our stockholders. For a transaction with significant stock consideration, we need to conduct customary due diligence on your forecast and strategy to evaluate the upsides you cite and the inherent risks. In addition, we would need to be highly confident that the deal would receive the required regulatory clearances on a timely basis and in a manner that would not adversely impact the value of your proposal. We understand from the call with your counsel that your regulatory analysis is still at a preliminary stage. We appreciate that Davis Polk has acknowledged they have further work to do on their analysis in a number of important areas, including the competitive dynamics in several of the product overlaps, anticipated customer reactions and risk and scope of potential remedies. We would like to hear and understand where they come out on these analyses and are willing to cooperate with them in working through these issues. In an effort to proceed without delay, I have attached a draft mutual Non-Disclosure Agreement (“NDA”) which we are prepared to execute immediately. The draft will look familiar. It is substantially similar to the form of NDA that our companies previously signed on two separate occasions. Our Board of Directors takes its fiduciary duties very seriously and hopes to conduct this review expeditiously with the full support of our teams and advisors. Once the NDA is in place, our respective advisors can arrange a plan to complete the full review of your proposal and respond accordingly. We look forward to discussing the plan. Sincerely, David B. Burritt President & Chief Executive Officer CC: David S. Sutherland Board Chair, United States Steel Corporation Board of Directors Duane D. Holloway United States Steel Corporation, SVP, General Counsel, and Chief Ethics & Compliance Officer James D. Graham Cleveland-Cliffs Inc., EVP, Human Resources, Chief Legal and Administrative Officer & Secretary

United States Steel Corporation David B. Burritt 600 Grant Street, Suite 6100 President & Chief Executive Officer Pittsburgh, PA 15219-2800 (412) 433-1130 Lourenco Goncalves Chairman, President and Chief Executive Officer Cleveland-Cliffs Inc. 200 Public Square, Suite 3300 Cleveland, OH 44114 August 13, 2023 Dear Lourenco, I am writing on behalf of United States Steel Corporation (the “Company”) in response to Cleveland-Cliffs Inc.’s proposal letter dated July 28, 2023 and further updated on August 11, 2023. Since receiving your initial proposal, the Company’s Board has met multiple times, with the assistance of our financial advisors, Barclays and Goldman Sachs, and our legal advisors, Milbank and Wachtell, to evaluate the merits and risks of your proposal. At my and the Board’s direction, our advisors indicated our willingness to enter into an NDA with you on August 7, 2023, so that we could have further clarity on several key issues, including valuation of the stock component of your proposal, regulatory risk and timing as well as the prospects for the combined company. We discussed with your counsel questions that would need to be better understood in order for both of us to appropriately assess the antitrust risk of your proposal; and while your counsel agreed that this would need to be analyzed, and was amenable to our proposal to work on this together, this still has not happened. After multiple conversations about, and our team’s engagement in good faith negotiations over, the terms of the NDA, we were shocked to receive a letter on Friday, August 11th stating that you refused to sign the nearly completed NDA unless we agree to the economic terms of your proposal in advance. As you well know, our Board – or any board – could not, consistent with its fiduciary duties, agree to a proposal of which 50% is represented by your stock without conducting a thorough and completely customary due diligence process, to evaluate the risks and potential upsides and downsides inherent in the transaction, including the stock component. Doing otherwise would be tantamount to accepting a price without knowing what it in fact represents. Nor could our Board agree to your “headline price” without appropriate discussion – under NDA – regarding the contribution of U. S. Steel to the value of the combined businesses. Pushing our Board to do so is in essence a demand that it breach its fiduciary duties. The Company, led by the Board and management team, has made significant progress transforming the Company into a customer-centric, world-competitive Best for All® steelmaker as we continue to win in strategic markets, move down the cost curve and move up the talent curve. This proven strategy has provided customers with profitable steel solutions for people and the planet, while rewarding our stockholders. At this juncture, we cannot determine whether your unsolicited proposal properly reflects the full and fair value of the Company. CONFIDENTIAL - SENT VIA EMAIL

United States Steel Corporation David B. Burritt 600 Grant Street, Suite 6100 President & Chief Executive Officer Pittsburgh, PA 15219-2800 (412) 433-1130 For all of the above reasons, the Board has no choice but to reject your unreasonable proposal. The U. S. Steel Board remains committed to maximizing value for stockholders, and to that end has decided to initiate a formal review process to evaluate strategic alternatives. If you would like to engage in that process, we invite you to reach out to our financial and legal representatives and welcome you to join our process. Sincerely, David Burritt President & Chief Executive Officer CC: David S. Sutherland Board Chair, United States Steel Corporation Board of Directors Duane D. Holloway United States Steel Corporation, SVP, General Counsel, and Chief Ethics & Compliance Officer