Document

Exhibit 99.1

|

|

|

|

|

|

|

|

|

FOR IMMEDIATE RELEASE |

|

|

Contact: Brian Hall, CFO |

Phone: (574) 535-1125 |

E Mail: LCII@lci1.com |

|

|

LCI INDUSTRIES REPORTS FOURTH QUARTER AND FULL YEAR FINANCIAL RESULTS

Leveraging diversification and operational flexibility to navigate headwinds

Full Year 2022 Highlights

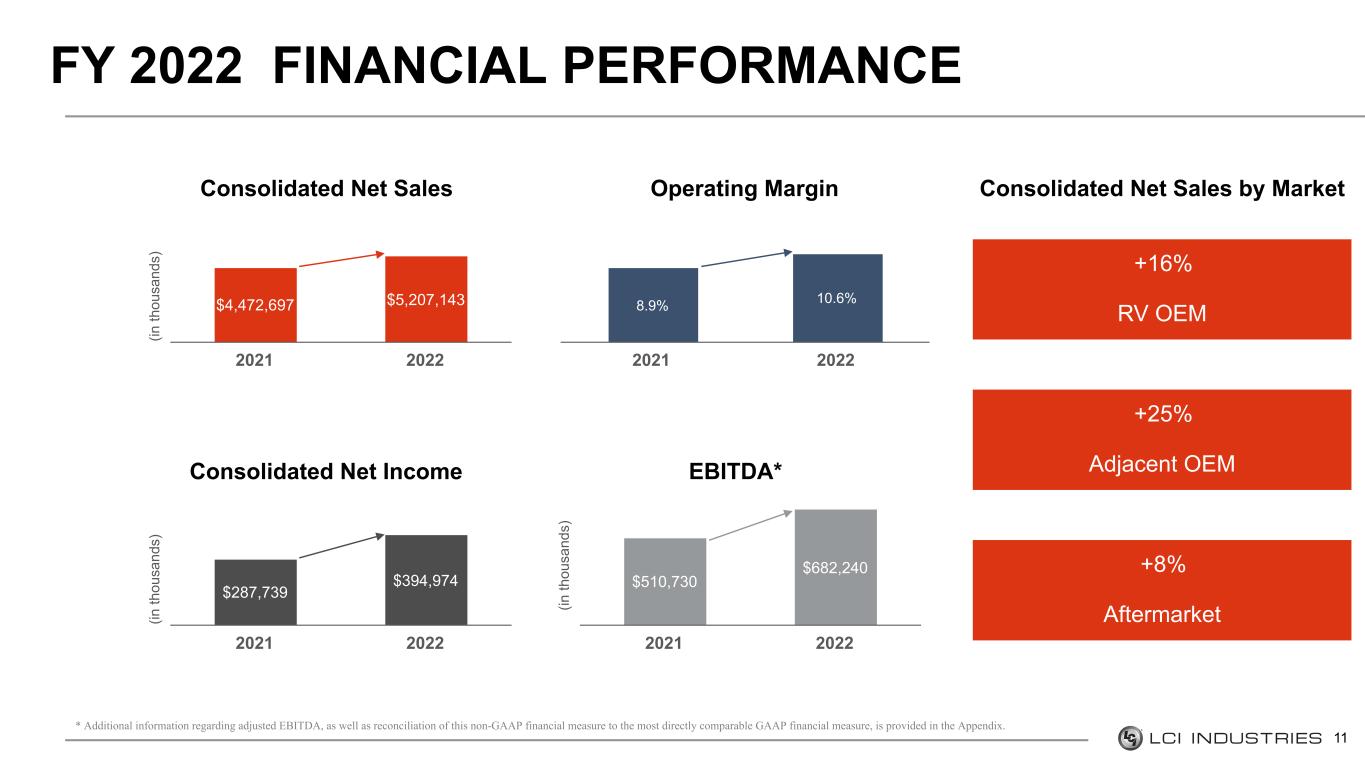

•Record net sales of $5.2 billion, up 16% year-over-year

• Record net income of $395.0 million, or $15.48 per diluted share, up $107.2 million, or 37%, year-over-year

• EBITDA of $682.2 million, up $171.5 million, or 34%, year-over-year

• Completed four strategic acquisitions for a combined cash purchase price of $108.5 million

• Returned $126.8 million to shareholders through $102.7 million of dividends and $24.1 million in share repurchases

Fourth Quarter 2022 Highlights

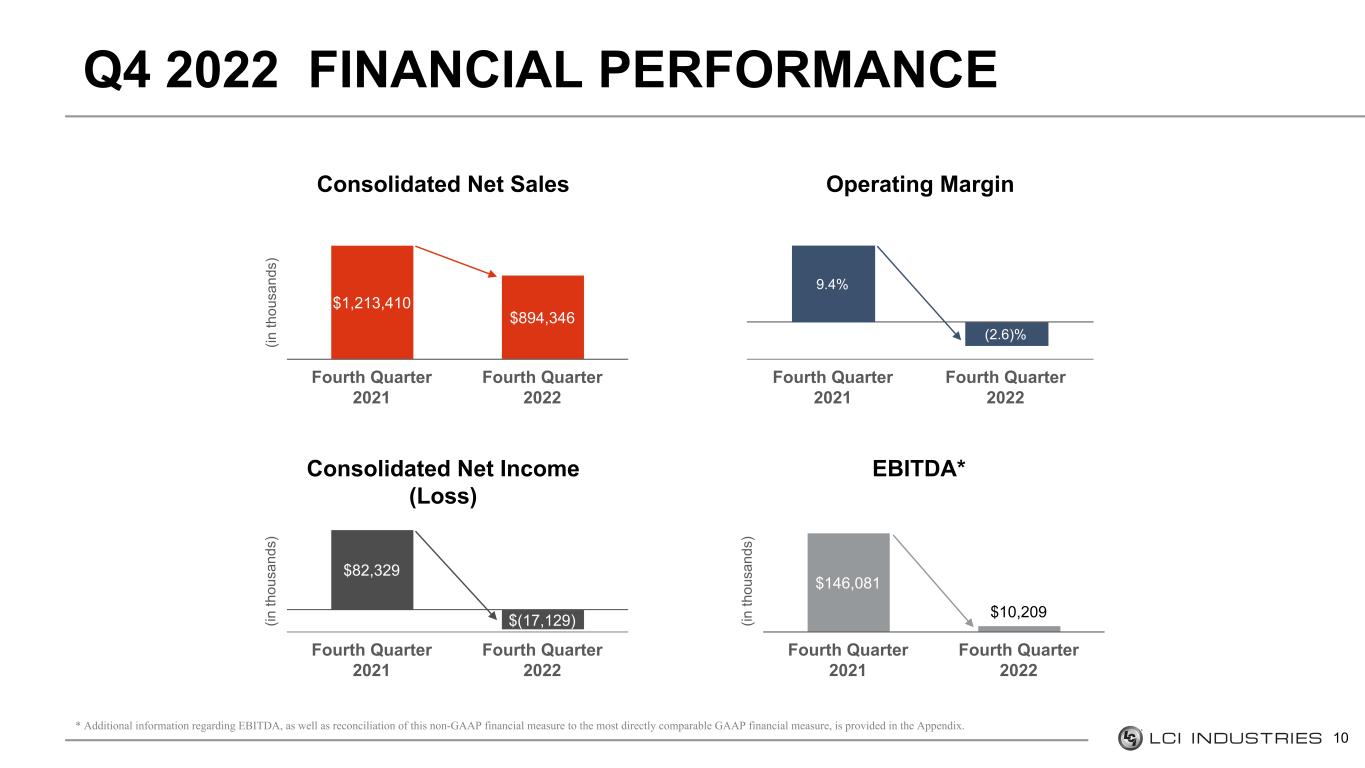

•Net sales of $894.3 million in the fourth quarter, down $319.1 million, or 26%, year-over-year

•Net loss of $17.1 million, or $(0.68) per diluted share, in the fourth quarter, down $99.5 million, or 121%, year-over-year

•EBITDA of $10.2 million, down $135.9 million, or 93%, year-over-year

Channel Categories

RV OEM

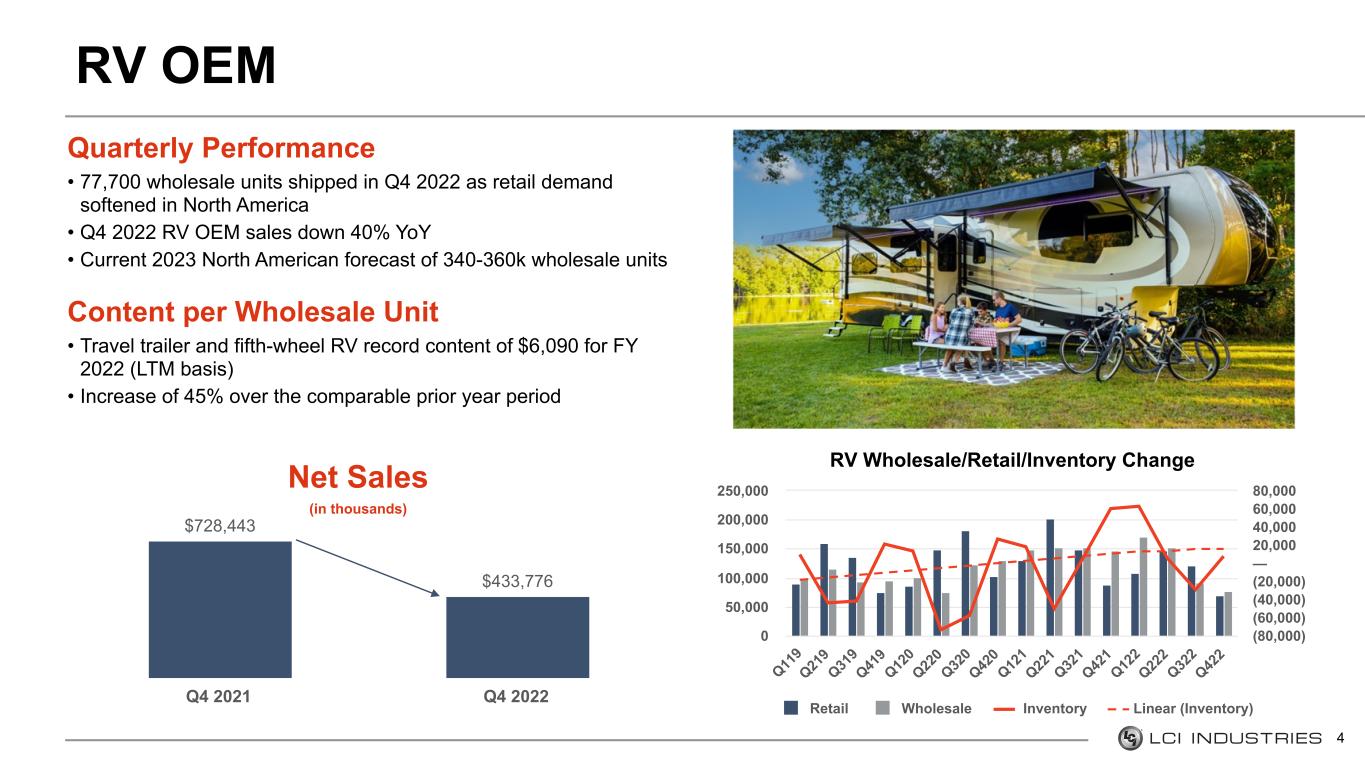

•Net sales of $433.8 million in the fourth quarter, down $294.7 million, or 40%, year-over-year, driven by a nearly 47% decline in North American industry wholesale shipments for the quarter compared to same quarter in 2021

•Content per North American travel trailer and fifth-wheel RV for the twelve months ended December 31, 2022, increased 45% year-over-year to a record $6,090

Adjacent Industries OEM

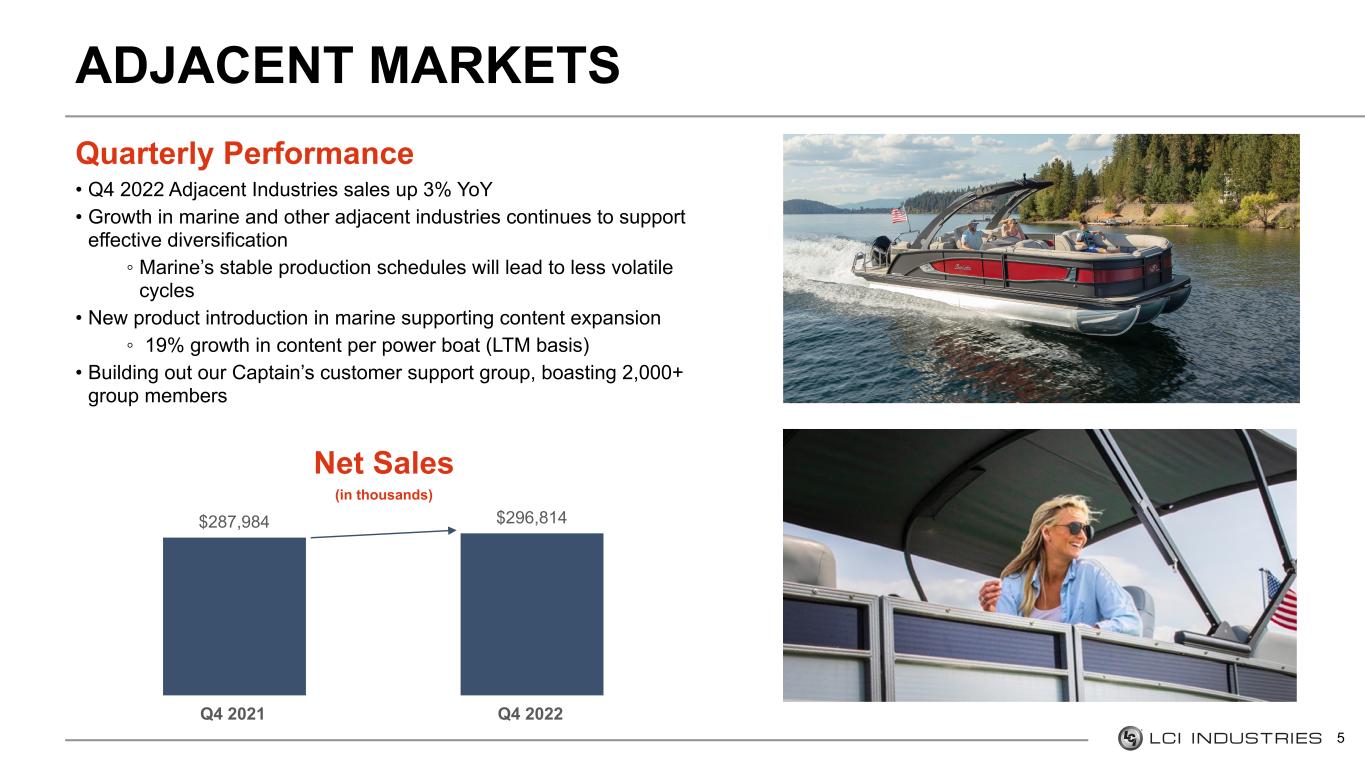

•Net sales of $296.8 million in the fourth quarter, up $8.8 million, or 3%, year-over-year

•North American marine OEM net sales in the fourth quarter of $108.7 million, up 4% year-over-year

•Content per North American power boat for the twelve months ended December 31, 2022, increased 19% year-over-year to $1,712

Aftermarket

•Net sales of $163.8 million in the fourth quarter, down $33.2 million, or 17%, year-over-year

•Decline in automotive aftermarket sales partially offset by strength in RV aftermarket sales

Elkhart, Indiana - February 14, 2023 - LCI Industries (NYSE: LCII) which, through its wholly-owned subsidiary, Lippert Components, Inc. ("Lippert"), supplies a broad array of highly engineered components for the leading original equipment manufacturers ("OEMs") in the recreation and transportation product markets, and the related aftermarkets of those industries, today reported fourth quarter and full year 2022 results.

“In fiscal 2022, we achieved record net sales while expanding margins, a testament to our experienced leadership team, enhanced operations, and flexible cost structure. Though we faced headwinds, primarily in the fourth quarter as OEMs implemented production shutdowns, the diversification of our businesses and actions to flex staffing helped mitigate the impact on earnings.

We expect these efforts will limit margin pressure as we move through 2023, but we did incur severance-related and inventory reserve costs in the fourth quarter. Despite persistent macro-economic headwinds, we remain confident for the future as millions of campers continue to enjoy the outdoor lifestyle,” commented Jason Lippert, LCI Industries’ President and Chief Executive Officer.

“Our team’s deep industry knowledge and experience navigating fluctuating production schedules will guide us in 2023, during which we anticipate production levels will normalize. Although we expect strong organic growth within RV, we believe this down cycle will be different than the last as our marine, adjacent and aftermarket markets continue to support our diversification strategy,” Lippert continued. “I would like to thank all our Lippert team members for the hard work and dedication they showed throughout the year, driving our business forward. I am excited for the growth opportunities ahead, as we leverage our culture and innovations to deliver value for our customers and shareholders.”

“I also want to thank our teams for their role in delivering incredible progress for Lippert throughout 2022. We look forward to the year to come as we continue to drive operational efficiencies, cultural initiatives, and innovation to facilitate Lippert’s performance into the future,” commented Ryan Smith, Group President – North America.

Full Year 2022 Results

Consolidated net sales for the full year 2022 were $5.2 billion, an increase of 16% from full year 2021 net sales of $4.5 billion. Net income for the full year 2022 was $395.0 million, or $15.48 per diluted share, compared to net income of $287.7 million, or $11.32 per diluted share, for the full year 2021. EBITDA for the year ended December 31, 2022 was $682.2 million, compared to EBITDA of $510.7 million for the year ended December 31, 2021. Additional information regarding EBITDA, as well as reconciliations of this non-GAAP financial measure to the most directly comparable GAAP financial measure of net income (loss), is provided in the "Supplementary Information - Reconciliation of Non-GAAP Measures" section below.

The increase in year-over-year net sales for the full year 2022 was primarily driven by price realization, acquisitions, and an increase in net sales to OEMs in adjacent industries, partially offset by decreased North American RV wholesale shipments. Net sales from acquisitions completed in 2021 and 2022 contributed approximately $219 million in 2022.

Fourth Quarter 2022 Results

Consolidated net sales for the fourth quarter of 2022 were $894.3 million, a decrease of 26 percent from 2021 fourth quarter net sales of $1.2 billion. Net loss in the fourth quarter of 2022 was $17.1 million, or $(0.68) per diluted share, compared to net income of $82.3 million, or $3.22 per diluted share, in the fourth quarter of 2021. EBITDA in the fourth quarter of 2022 was $10.2 million, compared to EBITDA of $146.1 million in the fourth quarter of 2021. Additional information regarding EBITDA, as well as a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure on net income (loss), is provided in the "Supplementary Information - Reconciliation of Non-GAAP Measures" section below.

The decrease in year-over-year net sales for the fourth quarter of 2022 was primarily driven by decreased North American RV wholesale shipments, partially offset by price realization, acquisitions, and an increase in net sales to OEMs in adjacent industries. Net sales from acquisitions completed in the twelve months ended December 31, 2022 contributed approximately $21 million in the fourth quarter of 2022.

The Company's average product content per travel trailer and fifth-wheel RV for the twelve months ended December 31, 2022, increased $1,893 to $6,090, compared to $4,197 for the twelve months ended December 31, 2021. The content increase in towables was primarily a result of organic growth, including pricing and new product introductions, market share gains, and acquisitions.

January 2023 Results

January 2023 consolidated net sales were approximately $273 million, down 48 percent from January 2022, primarily due to an approximate 80 percent decline North American RV production compared to January 2022. January 2023 results were favorably impacted by our diversification efforts outside of the North American RV market, which made up 69 percent of January 2023 consolidated net sales.

Income Taxes

The Company's effective tax rate was 24.8 percent and 45.2 percent for the year and quarter ended December 31, 2022, respectively, compared to 24.7 percent and 24.1 percent for the year and quarter ended December 31, 2021, respectively. Due to the loss in the 2022 fourth quarter, discrete adjustments had a proportionally larger impact on the tax rate.

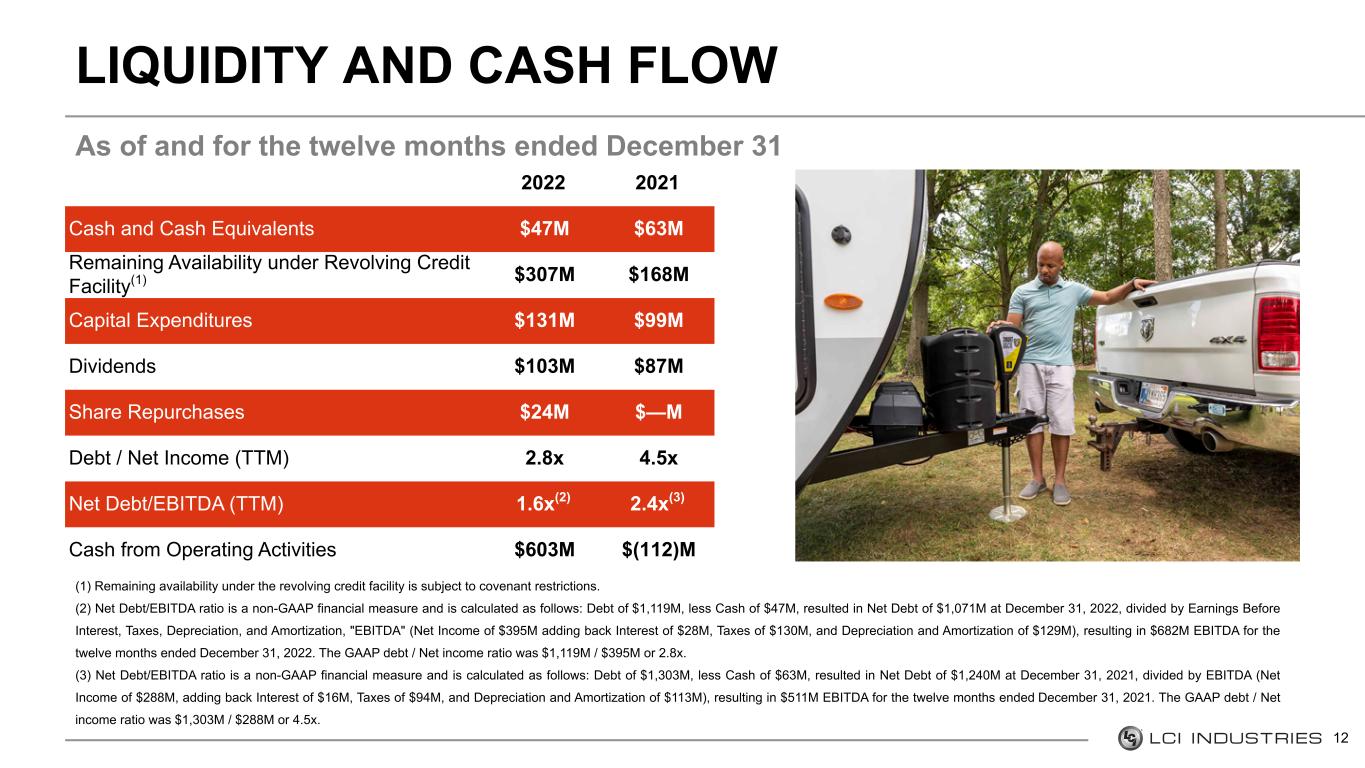

Balance Sheet and Other Items

At December 31, 2022, the Company's cash and cash equivalents balance was $47.5 million, compared to $62.9 million at December 31, 2021. The Company used $130.6 million for capital expenditures, $102.7 million for dividend payments to shareholders, $108.5 million for acquisitions, and $24.1 million for share repurchases in the twelve months ended December 31, 2022. The Company also made $105.3 million in net repayments under its revolving credit facility and $73.0 million in repayments under its shelf loan, term loan, and other borrowings in the twelve months ended December 31, 2022.

The Company's outstanding long-term indebtedness, including current maturities, was $1.1 billion at December 31, 2022, and the Company remained in compliance with its debt covenants. The Company believes its current liquidity is adequate to meet operating needs for the foreseeable future.

Conference Call & Webcast

LCI Industries will host a conference call to discuss its fourth quarter and full-year results on Tuesday, February 14, 2023, at 8:30 a.m. Eastern time, which may be accessed by dialing (844) 200-6205 for participants in the U.S. and (226) 828-7575 for those in Canada or (929) 526-1599 for participants outside the U.S./Canada using the required conference ID 537233. Due to the high volume of companies reporting earnings at this time, please be prepared for hold times of up to 15 minutes when dialing in to the call. In addition, an online, real-time webcast, as well as a supplemental earnings presentation, can be accessed on the Company's website, www.investors.lci1.com.

A replay of the conference call will be available for two weeks by dialing (929) 458-6194 for participants in the U.S. and (226) 828-7578 for those in Canada or (204) 525-0658 for participants outside the U.S./Canada and referencing access code 829204. A replay of the webcast will be available on the Company’s website immediately following the conclusion of the call.

About LCI Industries

LCI Industries, through its wholly-owned subsidiary, Lippert, supplies, domestically and internationally, a broad array of highly engineered components for the leading OEMs in the recreation and transportation product markets, consisting primarily of recreational vehicles and adjacent industries, including buses; trailers used to haul boats, livestock, equipment, and other cargo; trucks; boats; trains; manufactured homes; and modular housing. The Company also supplies engineered components to the related aftermarkets of these industries, primarily by selling to retail dealers, wholesale distributors, and service centers, as well as direct to retail customers via the Internet. Lippert's products include steel chassis and related components; axles and suspension solutions; slide-out mechanisms and solutions; thermoformed bath, kitchen, and other products; vinyl, aluminum, and frameless windows; manual, electric, and hydraulic stabilizer and leveling systems; entry, luggage, patio, and ramp doors; furniture and mattresses; electric and manual entry steps; awnings and awning accessories; towing products; truck accessories; electronic components; appliances; air conditioners; televisions and sound systems; tankless water heaters; and other accessories.

Additional information about Lippert and its products can be found at www.lippert.com.

Forward-Looking Statements

This press release contains certain "forward-looking statements" with respect to our financial condition, results of operations, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company's common stock, the impact of legal proceedings, and other matters. Statements in this press release that are not historical facts are "forward-looking statements" for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties.

Forward-looking statements, including, without limitation, those relating to our future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, and industry trends, whenever they occur in this press release are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this press release, the impacts of COVID-19, or other future pandemics, the Russia-Ukraine war, and heightened tensions between China and Taiwan on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices, and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2021, and in the Company's subsequent filings with the Securities and Exchange Commission. Readers of this press release are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

###

LCI INDUSTRIES

OPERATING RESULTS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

|

|

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

| (In thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

894,346 |

|

|

$ |

1,213,410 |

|

|

$ |

5,207,143 |

|

|

$ |

4,472,697 |

|

|

|

| Cost of sales |

747,439 |

|

|

921,344 |

|

|

3,933,854 |

|

|

3,429,662 |

|

|

|

| Gross profit |

146,907 |

|

|

292,066 |

|

|

1,273,289 |

|

|

1,043,035 |

|

|

|

| Selling, general and administrative expenses |

169,944 |

|

|

178,093 |

|

|

720,261 |

|

|

644,625 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (loss) profit |

(23,037) |

|

|

113,973 |

|

|

553,028 |

|

|

398,410 |

|

|

|

| Interest expense, net |

8,220 |

|

|

5,522 |

|

|

27,573 |

|

|

16,366 |

|

|

|

| (Loss) income before income taxes |

(31,257) |

|

|

108,451 |

|

|

525,455 |

|

|

382,044 |

|

|

|

| (Benefit) provision for income taxes |

(14,128) |

|

|

26,122 |

|

|

130,481 |

|

|

94,305 |

|

|

|

| Net (loss) income |

$ |

(17,129) |

|

|

$ |

82,329 |

|

|

$ |

394,974 |

|

|

$ |

287,739 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income per common share: |

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.68) |

|

|

$ |

3.26 |

|

|

$ |

15.57 |

|

|

$ |

11.39 |

|

|

|

| Diluted |

$ |

(0.68) |

|

|

$ |

3.22 |

|

|

$ |

15.48 |

|

|

$ |

11.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

| Basic |

25,327 |

|

|

25,289 |

|

|

25,372 |

|

|

25,257 |

|

|

|

| Diluted |

25,327 |

|

|

25,598 |

|

|

25,514 |

|

|

25,427 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

$ |

18,886 |

|

|

$ |

17,707 |

|

|

$ |

72,839 |

|

|

$ |

64,755 |

|

|

|

| Amortization |

$ |

14,360 |

|

|

$ |

14,401 |

|

|

$ |

56,373 |

|

|

$ |

47,565 |

|

|

|

| Capital expenditures |

$ |

26,893 |

|

|

$ |

24,662 |

|

|

$ |

130,641 |

|

|

$ |

98,534 |

|

|

|

LCI INDUSTRIES

SEGMENT RESULTS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

December 31, |

|

Twelve Months Ended

December 31, |

|

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

| (In thousands) |

|

|

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

|

| OEM Segment: |

|

|

|

|

|

|

|

|

|

| RV OEMs: |

|

|

|

|

|

|

|

|

|

| Travel trailers and fifth-wheels |

$ |

356,335 |

|

|

$ |

662,553 |

|

|

$ |

2,617,585 |

|

|

$ |

2,295,612 |

|

|

|

| Motorhomes |

77,441 |

|

|

65,890 |

|

|

339,097 |

|

|

258,995 |

|

|

|

| Adjacent Industries OEMs |

296,814 |

|

|

287,984 |

|

|

1,359,188 |

|

|

1,089,005 |

|

|

|

| Total OEM Segment net sales |

730,590 |

|

|

1,016,427 |

|

|

4,315,870 |

|

|

3,643,612 |

|

|

|

| Aftermarket Segment: |

|

|

|

|

|

|

|

|

|

| Total Aftermarket Segment net sales |

163,756 |

|

|

196,983 |

|

|

891,273 |

|

|

829,085 |

|

|

|

| Total net sales |

$ |

894,346 |

|

|

$ |

1,213,410 |

|

|

$ |

5,207,143 |

|

|

$ |

4,472,697 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating (loss) profit: |

|

|

|

|

|

|

|

|

|

| OEM Segment |

$ |

(21,987) |

|

|

$ |

97,919 |

|

|

$ |

479,150 |

|

|

$ |

304,676 |

|

|

|

| Aftermarket Segment |

(1,050) |

|

|

16,054 |

|

|

73,878 |

|

|

93,734 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating (loss) profit |

$ |

(23,037) |

|

|

$ |

113,973 |

|

|

$ |

553,028 |

|

|

$ |

398,410 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization: |

|

|

|

|

|

|

|

|

|

| OEM Segment depreciation |

$ |

15,075 |

|

|

$ |

13,789 |

|

|

$ |

58,166 |

|

|

$ |

50,843 |

|

|

|

| Aftermarket Segment depreciation |

3,811 |

|

|

3,918 |

|

|

14,673 |

|

|

13,912 |

|

|

|

| Total depreciation |

$ |

18,886 |

|

|

$ |

17,707 |

|

|

$ |

72,839 |

|

|

$ |

64,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OEM Segment amortization |

$ |

10,585 |

|

|

$ |

10,003 |

|

|

$ |

41,253 |

|

|

$ |

32,880 |

|

|

|

| Aftermarket Segment amortization |

3,775 |

|

|

4,398 |

|

|

15,120 |

|

|

14,685 |

|

|

|

| Total amortization |

$ |

14,360 |

|

|

$ |

14,401 |

|

|

$ |

56,373 |

|

|

$ |

47,565 |

|

|

|

LCI INDUSTRIES

BALANCE SHEET INFORMATION

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

December 31, |

| |

2022 |

|

|

|

2021 |

| (In thousands) |

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

| Current assets |

|

|

|

|

|

| Cash and cash equivalents |

$ |

47,499 |

|

|

|

|

$ |

62,896 |

|

|

|

|

|

|

|

| Accounts receivable, net |

214,262 |

|

|

|

|

319,782 |

|

| Inventories, net |

1,029,705 |

|

|

|

|

1,095,907 |

|

| Prepaid expenses and other current assets |

99,310 |

|

|

|

|

88,300 |

|

| Total current assets |

1,390,776 |

|

|

|

|

1,566,885 |

|

| Fixed assets, net |

482,185 |

|

|

|

|

426,455 |

|

| Goodwill |

567,063 |

|

|

|

|

543,180 |

|

| Other intangible assets, net |

503,320 |

|

|

|

|

519,957 |

|

| Operating lease right-of-use assets |

247,007 |

|

|

|

|

164,618 |

|

|

|

|

|

|

|

| Other long-term assets |

56,561 |

|

|

|

|

66,999 |

|

| Total assets |

$ |

3,246,912 |

|

|

|

|

$ |

3,288,094 |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

| Current maturities of long-term indebtedness |

$ |

23,086 |

|

|

|

|

$ |

71,003 |

|

| Accounts payable, trade |

143,529 |

|

|

|

|

282,183 |

|

|

|

|

|

|

|

| Current portion of operating lease obligations |

35,447 |

|

|

|

|

30,592 |

|

| Accrued expenses and other current liabilities |

219,238 |

|

|

|

|

243,438 |

|

| Total current liabilities |

421,300 |

|

|

|

|

627,216 |

|

| Long-term indebtedness |

1,095,888 |

|

|

|

|

1,231,959 |

|

| Operating lease obligations |

222,478 |

|

|

|

|

143,436 |

|

| Deferred taxes |

30,580 |

|

|

|

|

43,184 |

|

| Other long-term liabilities |

95,658 |

|

|

|

|

149,424 |

|

| Total liabilities |

1,865,904 |

|

|

|

|

2,195,219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders' equity |

1,381,008 |

|

|

|

|

1,092,875 |

|

| Total liabilities and stockholders' equity |

$ |

3,246,912 |

|

|

|

|

$ |

3,288,094 |

|

LCI INDUSTRIES

SUMMARY OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Twelve Months Ended

December 31, |

| |

2022 |

|

2021 |

| (In thousands) |

|

|

|

| Cash flows from operating activities: |

|

|

|

| Net income |

$ |

394,974 |

|

|

$ |

287,739 |

|

| Adjustments to reconcile net income to cash flows provided by (used in) operating activities: |

|

|

|

| Depreciation and amortization |

129,212 |

|

|

112,320 |

|

| Stock-based compensation expense |

23,695 |

|

|

27,161 |

|

| Deferred taxes |

(9,277) |

|

|

(3,279) |

|

| Other non-cash items |

3,496 |

|

|

7,456 |

|

| Changes in assets and liabilities, net of acquisitions of businesses: |

|

|

|

| Accounts receivable, net |

115,706 |

|

|

(58,843) |

|

| Inventories, net |

117,419 |

|

|

(516,692) |

|

| Prepaid expenses and other assets |

14,990 |

|

|

(13,306) |

|

| Accounts payable, trade |

(161,121) |

|

|

68,879 |

|

| Accrued expenses and other liabilities |

(26,580) |

|

|

(23,008) |

|

| Net cash flows provided by (used in) operating activities |

602,514 |

|

|

(111,573) |

|

| Cash flows from investing activities: |

|

|

|

| Capital expenditures |

(130,641) |

|

|

(98,534) |

|

| Acquisitions of businesses |

(108,470) |

|

|

(194,107) |

|

|

|

|

|

|

|

|

|

| Other investing activities |

(2,679) |

|

|

11,423 |

|

| Net cash flows used in investing activities |

(241,790) |

|

|

(281,218) |

|

| Cash flows from financing activities: |

|

|

|

| Vesting of stock-based awards, net of shares tendered for payment of taxes |

(10,961) |

|

|

(8,324) |

|

| Proceeds from revolving credit facility |

1,128,400 |

|

|

1,303,193 |

|

| Repayments under revolving credit facility |

(1,233,740) |

|

|

(1,281,147) |

|

| Proceeds from term loan borrowings |

— |

|

|

124,199 |

|

| Repayments under shelf loan, term loan, and other borrowings |

(73,031) |

|

|

(21,457) |

|

| Proceeds from issuance of convertible notes |

— |

|

|

460,000 |

|

| Purchases of convertible note hedge contracts |

— |

|

|

(100,142) |

|

| Proceeds from issuance of warrants concurrent with note hedge contracts |

— |

|

|

48,484 |

|

| Payment of debt issuance costs |

— |

|

|

(12,214) |

|

| Payment of dividends |

(102,726) |

|

|

(87,171) |

|

| Payment of contingent consideration and holdbacks related to acquisitions |

(60,228) |

|

|

(22,830) |

|

| Repurchases of common stock |

(24,054) |

|

|

— |

|

| Other financing activities |

1,469 |

|

|

1,972 |

|

| Net cash flows (used in) provided by financing activities |

(374,871) |

|

|

404,563 |

|

| Effect of exchange rate changes on cash and cash equivalents |

(1,250) |

|

|

(697) |

|

| Net (decrease) increase in cash and cash equivalents |

(15,397) |

|

|

11,075 |

|

| Cash and cash equivalents at beginning of period |

62,896 |

|

|

51,821 |

|

| Cash and cash equivalents cash at end of period |

$ |

47,499 |

|

|

$ |

62,896 |

|

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

Industry Data(1) (in thousands of units): |

|

|

|

|

|

|

|

|

|

|

| Industry Wholesale Production: |

|

|

|

|

|

|

|

|

|

|

| Travel trailer and fifth-wheel RVs |

62.4 |

|

|

130.4 |

|

|

421.7 |

|

|

531.4 |

|

|

|

|

| Motorhome RVs |

12.6 |

|

|

13.8 |

|

|

58.4 |

|

|

56.2 |

|

|

|

|

| Industry Retail Sales: |

|

|

|

|

|

|

|

|

|

|

| Travel trailer and fifth-wheel RVs |

58.4 |

|

|

76.7 |

|

|

387.2 |

|

|

502.7 |

|

|

|

|

| Impact on dealer inventories |

4.0 |

|

|

53.7 |

|

|

34.5 |

|

|

28.7 |

|

|

|

|

| Motorhome RVs |

8.9 |

|

|

11.0 |

|

|

48.1 |

|

|

55.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended |

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

|

|

|

2022 |

|

2021 |

|

|

|

| Lippert Content Per Industry Unit Produced: |

|

|

|

|

|

|

|

| Travel trailer and fifth-wheel RV |

|

|

|

|

$ |

6,090 |

|

|

$ |

4,197 |

|

|

|

|

| Motorhome RV |

|

|

|

|

$ |

4,099 |

|

|

$ |

2,857 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

|

|

|

|

|

2022 |

|

2021 |

|

|

|

Balance Sheet Data (debt availability in millions): |

|

|

|

|

|

|

|

Remaining availability under the revolving credit facility (2) |

|

$ |

306.5 |

|

|

$ |

168.3 |

|

|

|

|

| Days sales in accounts receivable, based on last twelve months |

|

27.5 |

|

|

30.6 |

|

|

|

|

| Inventory turns, based on last twelve months |

|

3.5 |

|

|

5.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

| Estimated Full Year Data: |

|

|

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

|

|

$80 - $100 million |

|

|

|

| Depreciation and amortization |

|

|

|

|

$130 - $140 million |

|

|

|

| Stock-based compensation expense |

|

|

|

|

$25 - $30 million |

|

|

|

Annual tax rate |

|

|

|

|

24% - 26% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Industry wholesale production data for travel trailer and fifth-wheel RVs and motorhome RVs provided by the Recreation Vehicle Industry Association. Industry retail sales data provided by Statistical Surveys, Inc.

(2) Remaining availability under the revolving credit facility is subject to covenant restrictions.

LCI INDUSTRIES

SUPPLEMENTARY INFORMATION

RECONCILIATION OF NON-GAAP MEASURES

(unaudited)

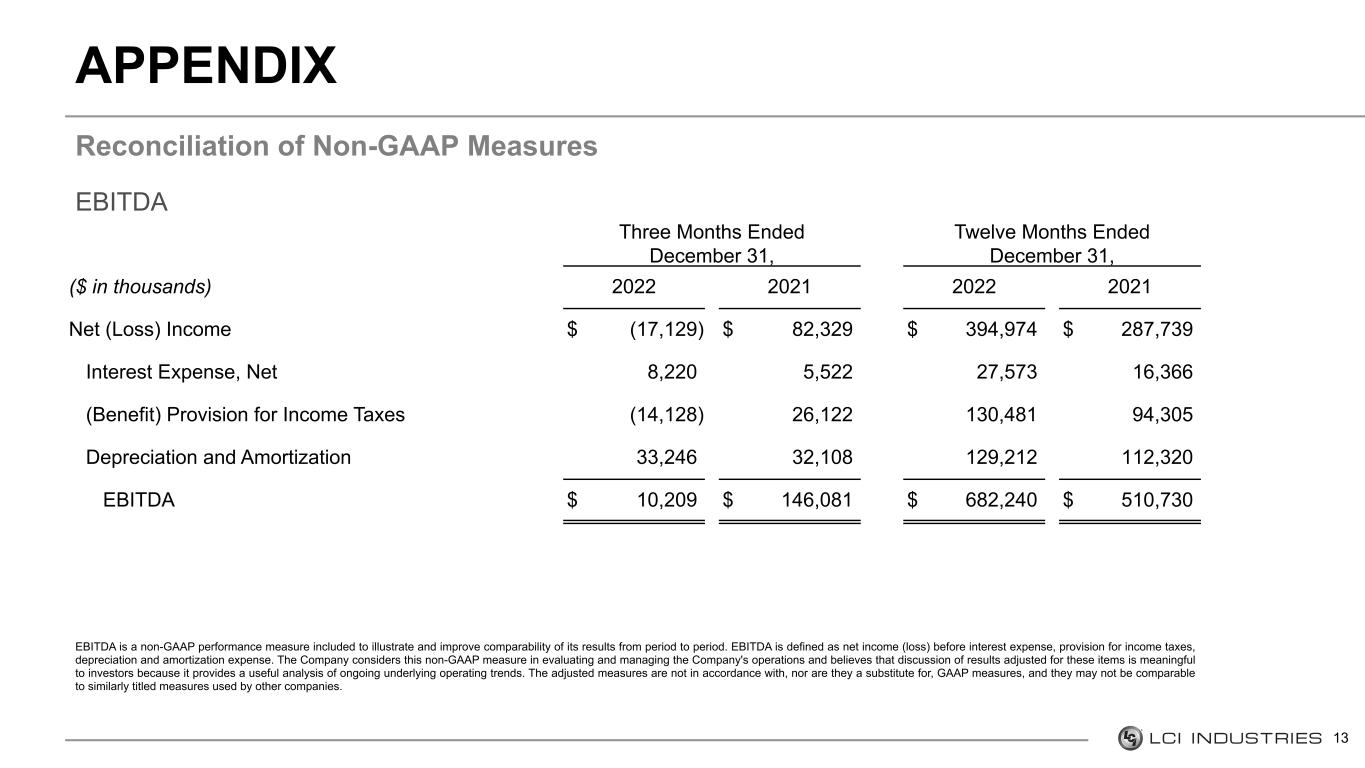

The following table reconciles net (loss) income to EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| (In thousands) |

|

|

|

|

|

|

|

| Net (loss) income |

$ |

(17,129) |

|

|

$ |

82,329 |

|

|

$ |

394,974 |

|

|

$ |

287,739 |

|

| Interest expense, net |

8,220 |

|

|

5,522 |

|

|

27,573 |

|

|

16,366 |

|

| (Benefit) provision for income taxes |

(14,128) |

|

|

26,122 |

|

|

130,481 |

|

|

94,305 |

|

| Depreciation expense |

18,886 |

|

|

17,707 |

|

|

72,839 |

|

|

64,755 |

|

| Amortization expense |

14,360 |

|

|

14,401 |

|

|

56,373 |

|

|

47,565 |

|

| EBITDA |

$ |

10,209 |

|

|

$ |

146,081 |

|

|

$ |

682,240 |

|

|

$ |

510,730 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In addition to reporting financial results in accordance with U.S. GAAP, the Company has provided the non-GAAP performance measure of EBITDA to illustrate and improve comparability of its results from period to period. EBITDA is defined as net income (loss) before interest expense, net, benefit/provision for income taxes, depreciation expense, and amortization expense during the three and twelve month periods ended December 31, 2022 and 2021. The Company considers this non-GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The measure is not in accordance with, nor is it a substitute for, GAAP measures, and it may not be comparable to similarly titled measures used by other companies.