1

Forward-Looking Statements and Non-GAAP Financial Measures This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including certain plans, expectations, goals, projections, and other statements, which are subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures; inflation; impacts of political events, including government shutdowns, ongoing competition in labor markets and employee turnover; deterioration in the value of Camden National's investment securities; changes in consumer spending and savings habits; changes in the interest rate environment; changes in general economic conditions; operational risks including, but not limited to, cybersecurity, fraud, pandemics and natural disasters; legislative and regulatory changes that adversely affect the business in which Camden National is engaged; turmoil and volatility in the financial services industry, including failures or rumors of failures of other depository institutions which could affect Camden National's ability to attract and retain depositors, and could affect the ability of financial services providers, including the Company, to borrow or raise capital; actions taken by governmental agencies to stabilize the financial system and the effectiveness of such actions; changes to regulatory capital requirements in response to recent developments affecting the banking sector; changes in the securities markets and other risks and uncertainties disclosed from time to time in Camden National’s Annual Report on Form 10-K for the year ended December 31, 2023, as updated by other filings with the Securities and Exchange Commission ("SEC"). Further, statements regarding the potential effects of notable and global current events on the Company's business, financial condition, liquidity and results of operations may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possible materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond the Company's control. This release may also contain forward-looking statements relating to the Company's acquisition of Northway. Factors that could cause actual results to differ materially include the following: the reaction to the transaction of the companies' customers, employees and counterparties; customer disintermediation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; credit and interest rate risks associated with Camden's and Northway's respective businesses, customers, borrowings, repayment, investment and deposit practices; and other risks. Camden National does not have any obligation to update forward-looking statements. Use of Non-GAAP Measures In addition to evaluating the Company's results of operations in accordance with generally accepted accounting principles in the United States ("GAAP"), management supplements this evaluation with certain non-GAAP financial measures such as: adjusted net income; adjusted diluted earnings per share; adjusted return on average assets; adjusted return on average equity; pre-tax, pre-provision income; adjusted pre-tax, pre-provision income; core operating expenses, core adjusted return on average tangible equity; core net interest margin; and adjusted return on average tangible equity; the efficiency and tangible common equity ratios; tangible book value per share; core deposits; adjusted total deposits and average core deposits. Management uses these non- GAAP financial measures to assess our performance relative to our peer group and other financial institutions, and to analyze our internal performance. We also believe these non-GAAP financial measures help investors better understand the Company's operating performance and trends, and allow for more meaningful comparisons with other financial institutions. In addition, these non-GAAP financial measures remove the impact of unusual items that may obscure trends in the Company's underlying performance. These disclosures should not be viewed as a substitute for GAAP operating results, nor are they necessarily comparable to non-GAAP performance measures that other financial institutions may present. Reconciliations to the comparable GAAP financial measures can be found by referring to the Company’s financial information filed with the SEC for the respective period. 12

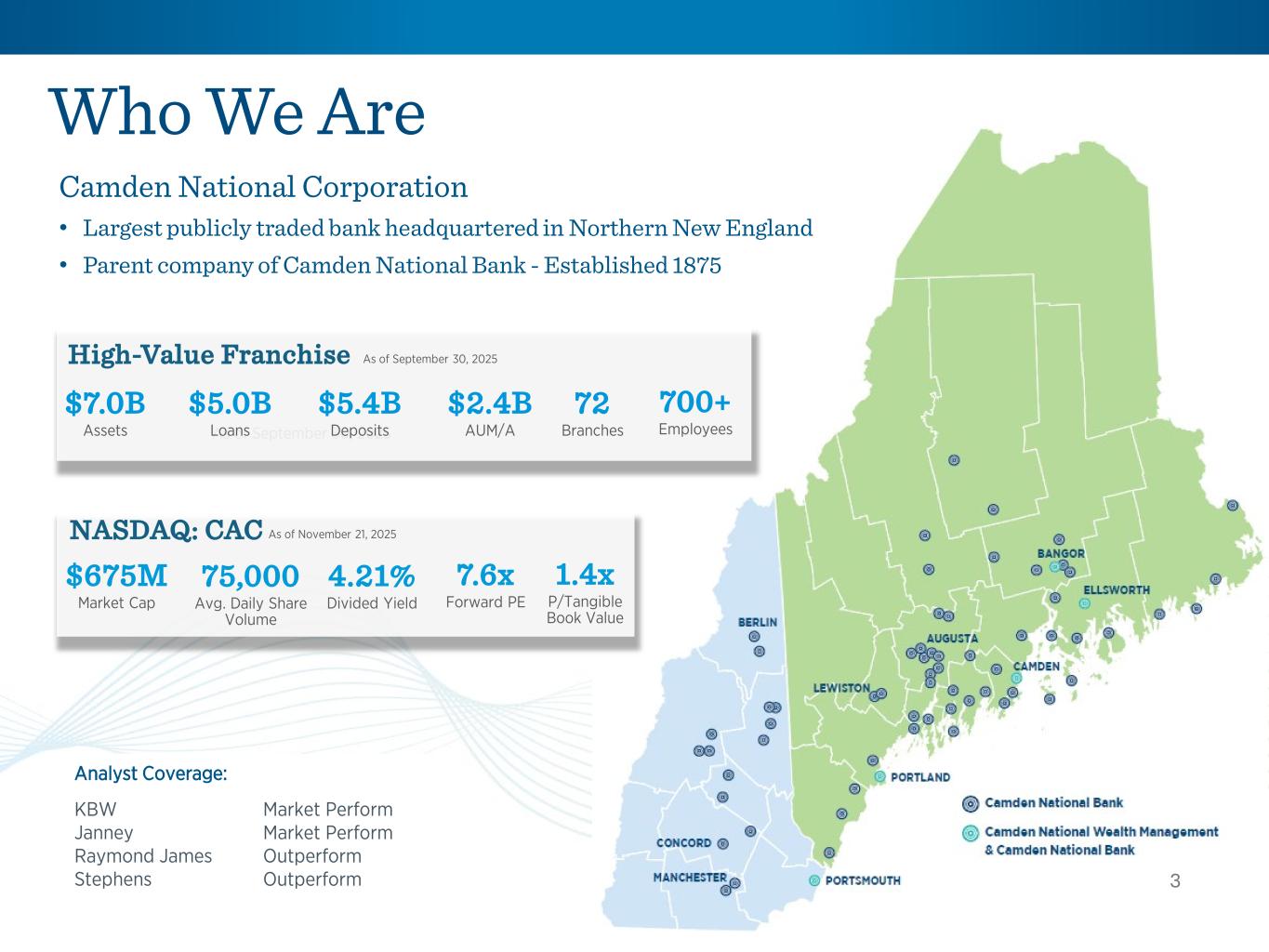

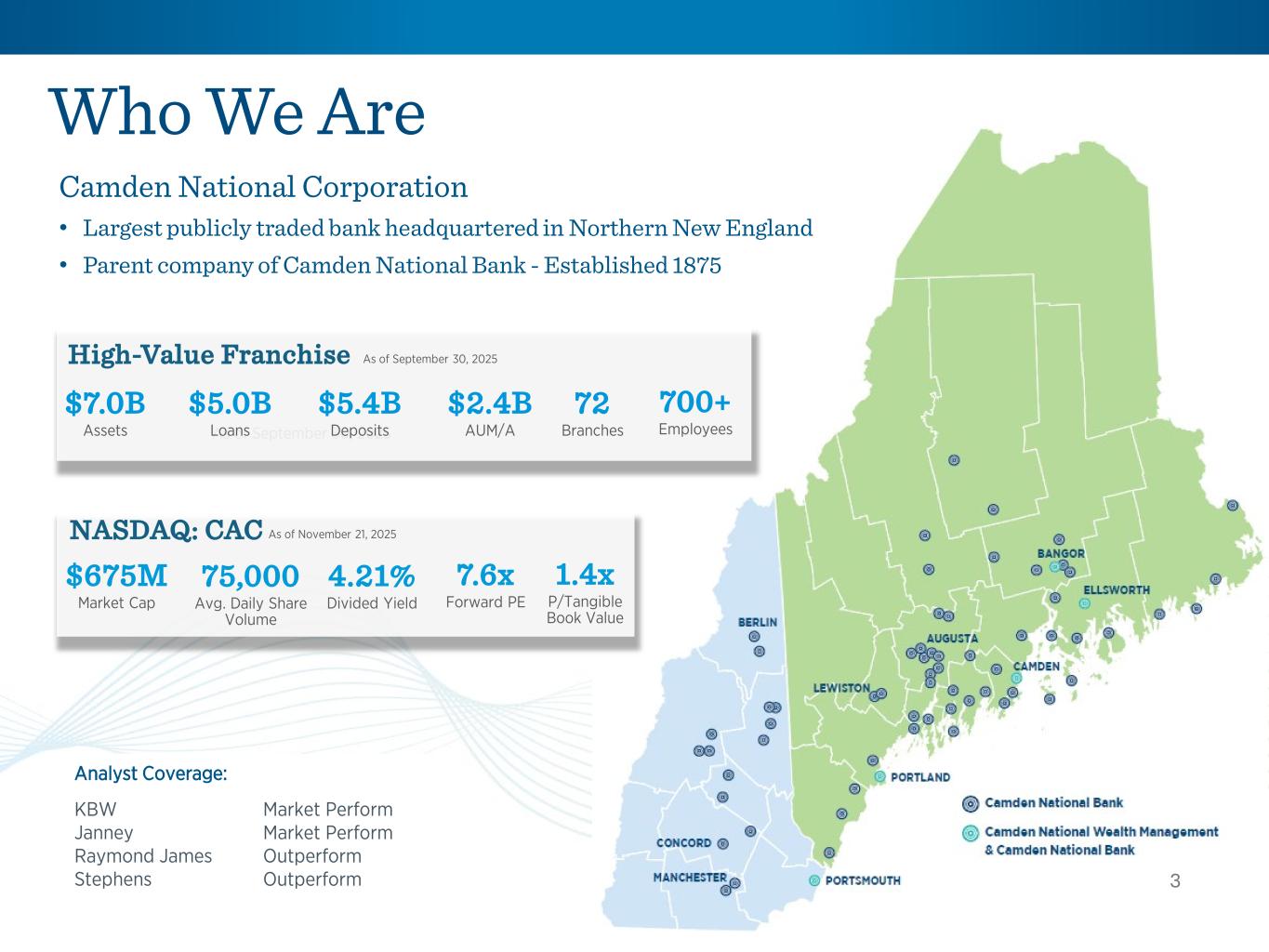

As of September 30, 2025 2 Camden National Corporation • Largest publicly traded bank headquartered in Northern New England • Parent company of Camden National Bank - Established 1875 Who We Are 3 High-Value Franchise $7.0B Assets $5.0B Loans $5.4B Deposits 700+ Employees 72 Branches $2.4B AUM/A As of September 30, 2025 NASDAQ: CAC $675M Market Cap 75,000 Avg. Daily Share Volume 4.21% Divided Yield 7.6x Forward PE As of November 21, 2025 Analyst Coverage: KBW Janney Raymond James Stephens Market Perform Market Perform Outperform Outperform 1.4x P/Tangible Book Value

Resilient and Forward-Looking Franchise 5 • Strong balance sheet, with prudent interest rate and liquidity risk management • Disciplined credit culture with a history of delivering top-quartile asset quality • Diversified, low-cost deposit base, grounded in primary relationships • Strong foundation with an established risk framework • Disciplined capital strategy with a history of driving dividends and opportunistic share repurchases 4 • History of delivering strong earnings across all cycles • Lean cost structure designed for scalable operating leverage • Experienced acquirer delivering value and financial returns • Proven track record of organic capital generation supporting sustainable growth • Diversified revenue base • Deeply engaged, management team High-Performing PlatformProven Strength

Strategic Objectives Fueling Accelerated Growth 55 Proven acquiror Positioned for commercial banking expansion through deep local expertise and market presence Bolstering wealth management with an exceptional service model reaching mass affluent and affluent customers Attracting and retaining top talent to fuel long-term success Our strategy delivers measurable results through disciplined execution

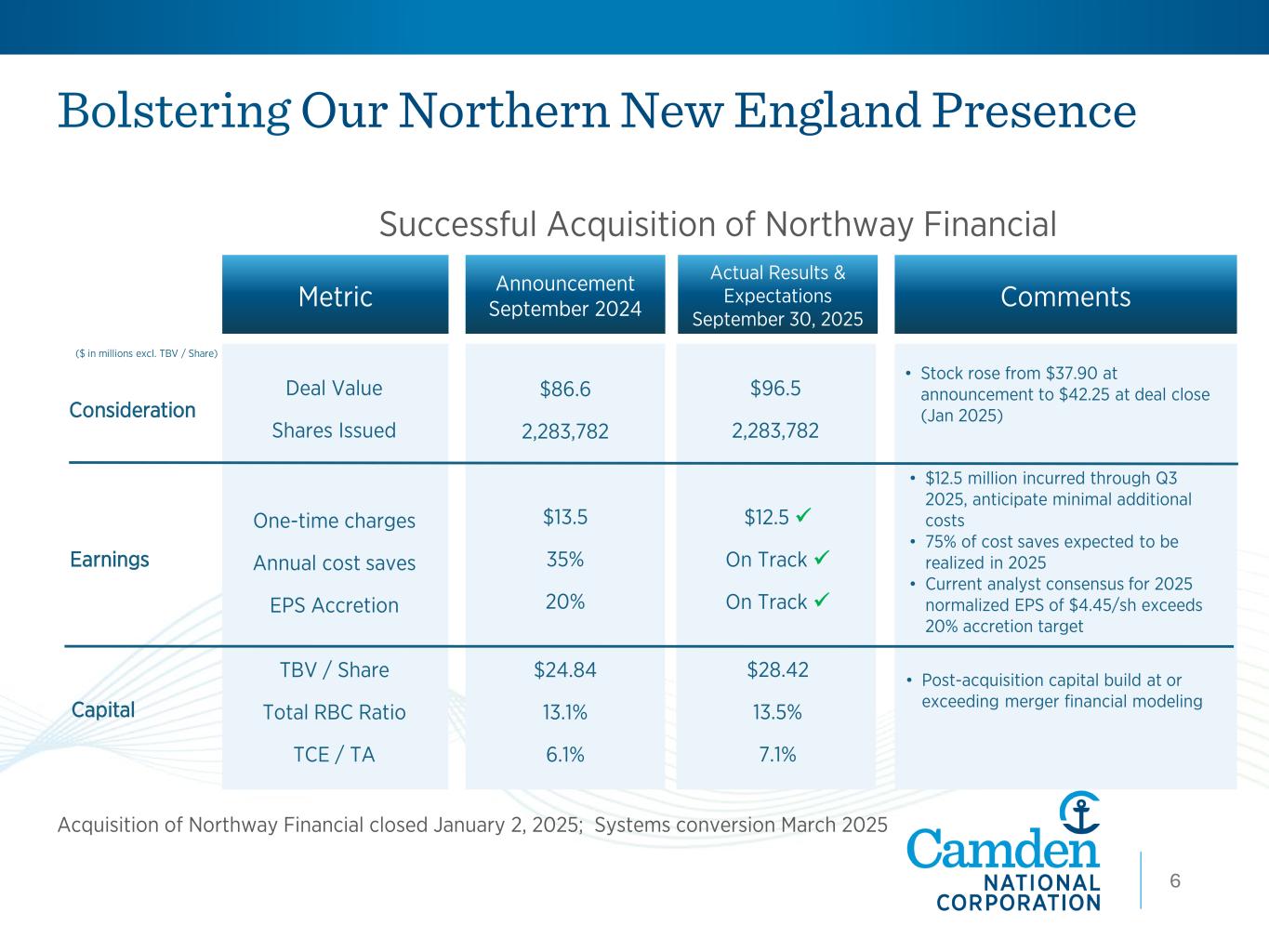

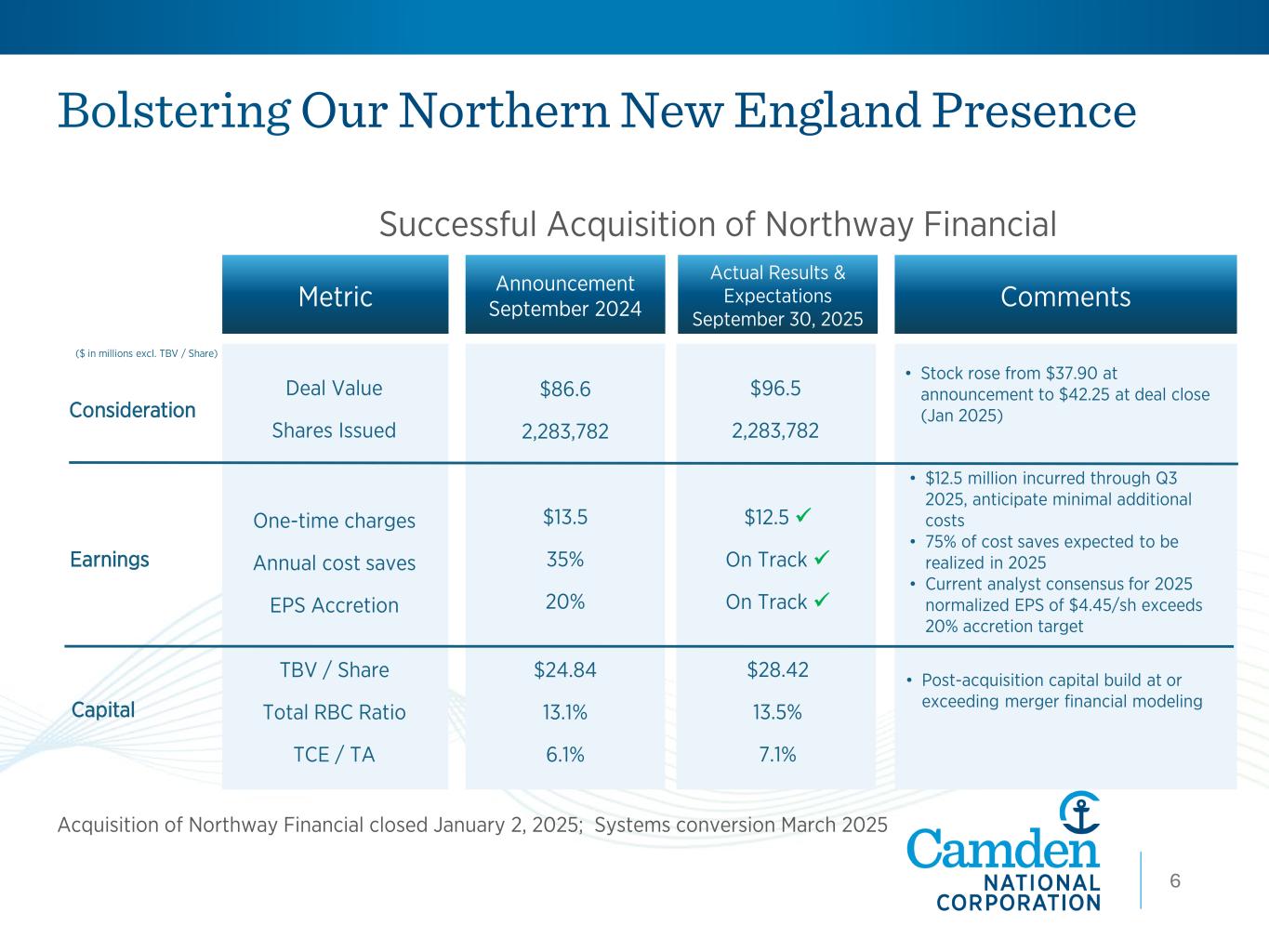

Bolstering Our Northern New England Presence Successful Acquisition of Northway Financial 5 Metric Announcement September 2024 Consideration Earnings Deal Value Shares Issued $86.6 2,283,782 One-time charges Annual cost saves EPS Accretion $13.5 35% 20% Actual Results & Expectations September 30, 2025 Comments $96.5 2,283,782 • Stock rose from $37.90 at announcement to $42.25 at deal close (Jan 2025) $12.5 On Track On Track • $12.5 million incurred through Q3 2025, anticipate minimal additional costs • 75% of cost saves expected to be realized in 2025 • Current analyst consensus for 2025 normalized EPS of $4.45/sh exceeds 20% accretion target Capital TBV / Share Total RBC Ratio TCE / TA $24.84 13.1% 6.1% $28.42 13.5% 7.1% • Post-acquisition capital build at or exceeding merger financial modeling ($ in millions excl. TBV / Share) 6 Acquisition of Northway Financial closed January 2, 2025; Systems conversion March 2025

$5.9B $5.5B $3.9B $3.4B $3.2B $2.7B $2.3B $2.3B $2.3B $1.6B $1.6B $1.6B $1.4B $1.4B $1.4B $1.1B $1.0B $0.9B $0.8B $0.7B Bangor Savings Camden Bar Harbor Northeast Bank NH Mutual First National Machias Savings Bank of New Hampshire Maine Community Kennebunk Norway Savings Mascoma Androscoggin Savings Kennebec Savings Bank of New England Bath Savings Saco & Biddeford Savings Katahdin SIS Franklin Savings Positioned for Growth in Neighboring Attractive Markets 1 Community banks defined as banks with total assets less than $50B; deposit data as of June 30, 2025, based on combined deposits in Maine and New Hampshire and pro forma for pending or recently completed mergers Community Bank Deposits in Maine and New Hampshire1 as of June 30, 2025 Source: S&P Global Market Intelligence, US Bureau of Economic Analysis, NAICS Association // Household income (“HHI”) shown on a median basis Maine New Hampshire Population GDP # of Businesses Population density Household Income 1,411K $75.2K 1,414K $96.8K $99B $119B 73,337 90,058 46/sq. mi 158/sq. mi 6 Deposit Market Share 7.9% 1.9% 7 #2 Community bank in ME & NH #5 All Banks & Credit Unions in ME & NH

Growing relationships via seamless digital and self-service solutions • 131% increase in consumer accounts originated digitally YoY • 6% increase in mobile users YoY • 11% increase in digital engagement among customers under 45 YoY Driving Innovation Across our Business 7 Scaling enterprise for operational excellence and superior service • Over 143 Bots in production, processing 5 million items, saving over 74,000+ hours • “Cam” our AI phone banking assistant, resolves over 60% of customer inquiries, delivering convenience and efficiency • Introducing “PrepWise”: AI-Powered insights, developed in-house, to streamline customer prep time by delivering essential insights: o customer relationship overviews o product recommendations o AI-generated talking points All in one place to empower bankers to build stronger relationships and drive more meaningful conversations. • Strengthening customer connections with personalized, advice-driven engagement • Delivering seamless human and digital interactions that set us apart • Leveraging data and technology for speed, value, and efficiency • Embracing intelligent automation to meet evolving business needs faster Innovation Fuels Customer-Centric Growth 8

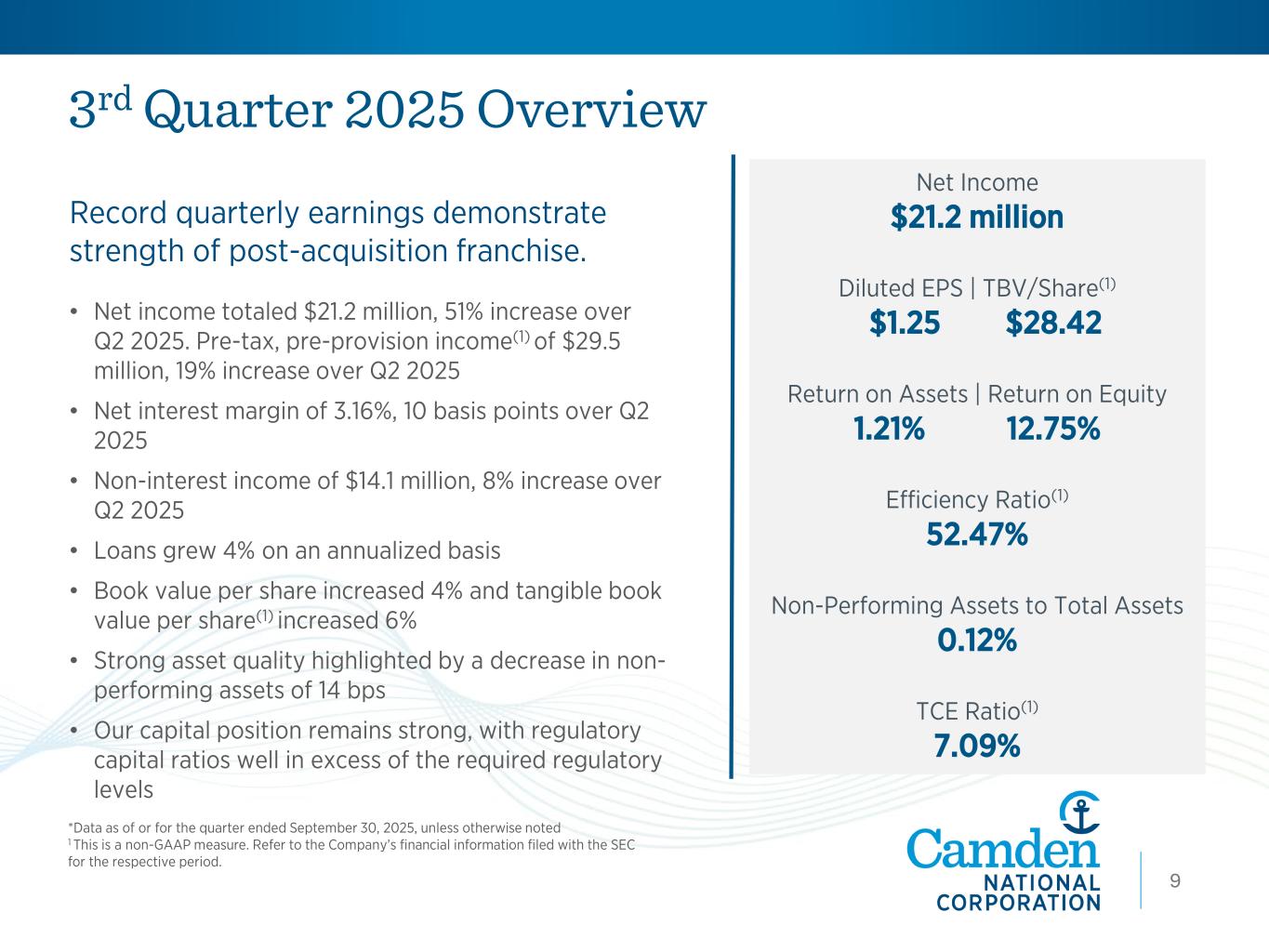

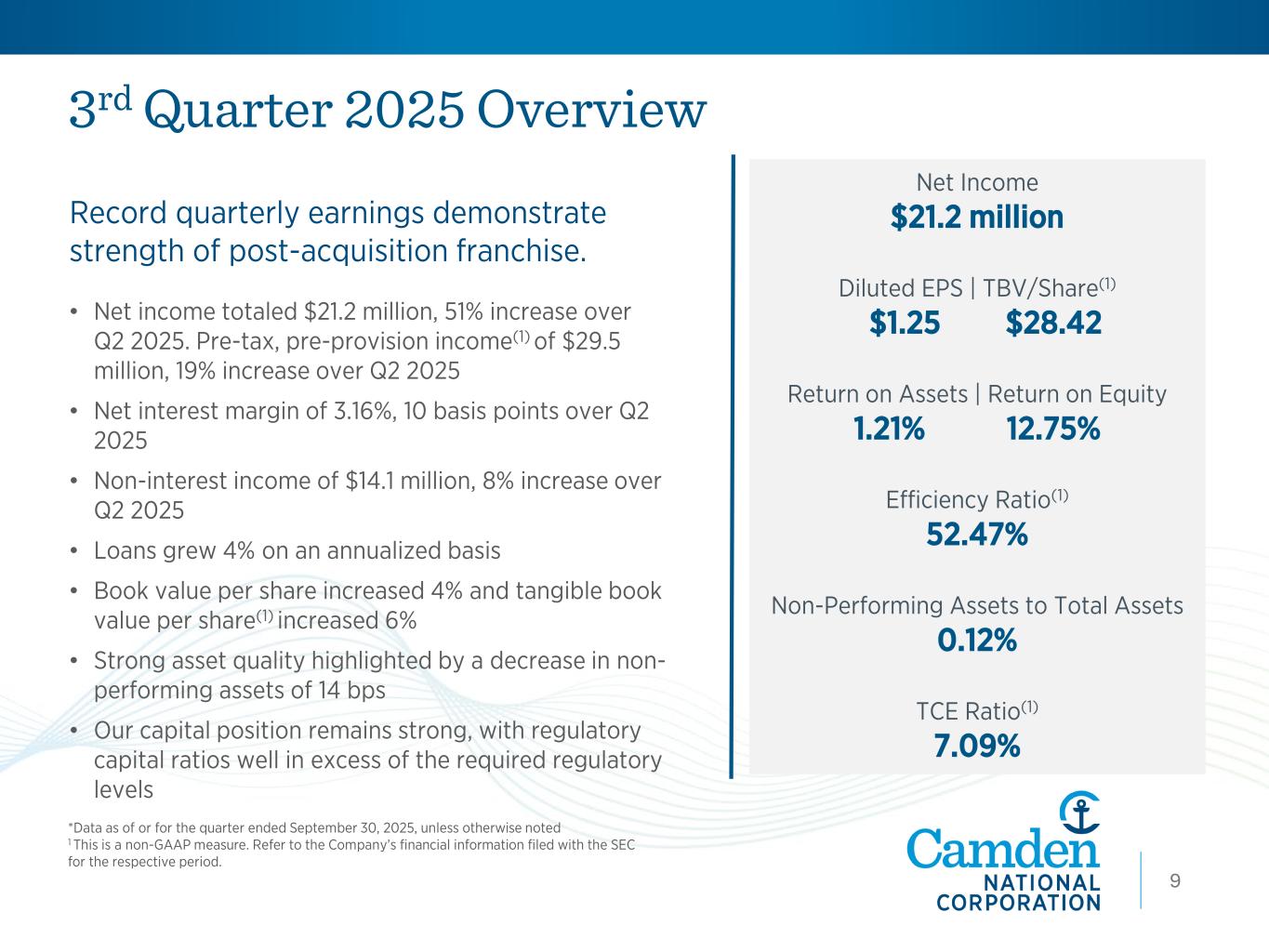

3rd Quarter 2025 Overview • Net income totaled $21.2 million, 51% increase over Q2 2025. Pre-tax, pre-provision income(1) of $29.5 million, 19% increase over Q2 2025 • Net interest margin of 3.16%, 10 basis points over Q2 2025 • Non-interest income of $14.1 million, 8% increase over Q2 2025 • Loans grew 4% on an annualized basis • Book value per share increased 4% and tangible book value per share(1) increased 6% • Strong asset quality highlighted by a decrease in non- performing assets of 14 bps • Our capital position remains strong, with regulatory capital ratios well in excess of the required regulatory levels Net Income $21.2 million Diluted EPS | TBV/Share(1) $1.25 $28.42 Return on Assets | Return on Equity 1.21% 12.75% Efficiency Ratio(1) 52.47% Non-Performing Assets to Total Assets 0.12% TCE Ratio(1) 7.09% *Data as of or for the quarter ended September 30, 2025, unless otherwise noted 1 This is a non-GAAP measure. Refer to the Company’s financial information filed with the SEC for the respective period. Record quarterly earnings demonstrate strength of post-acquisition franchise. 179

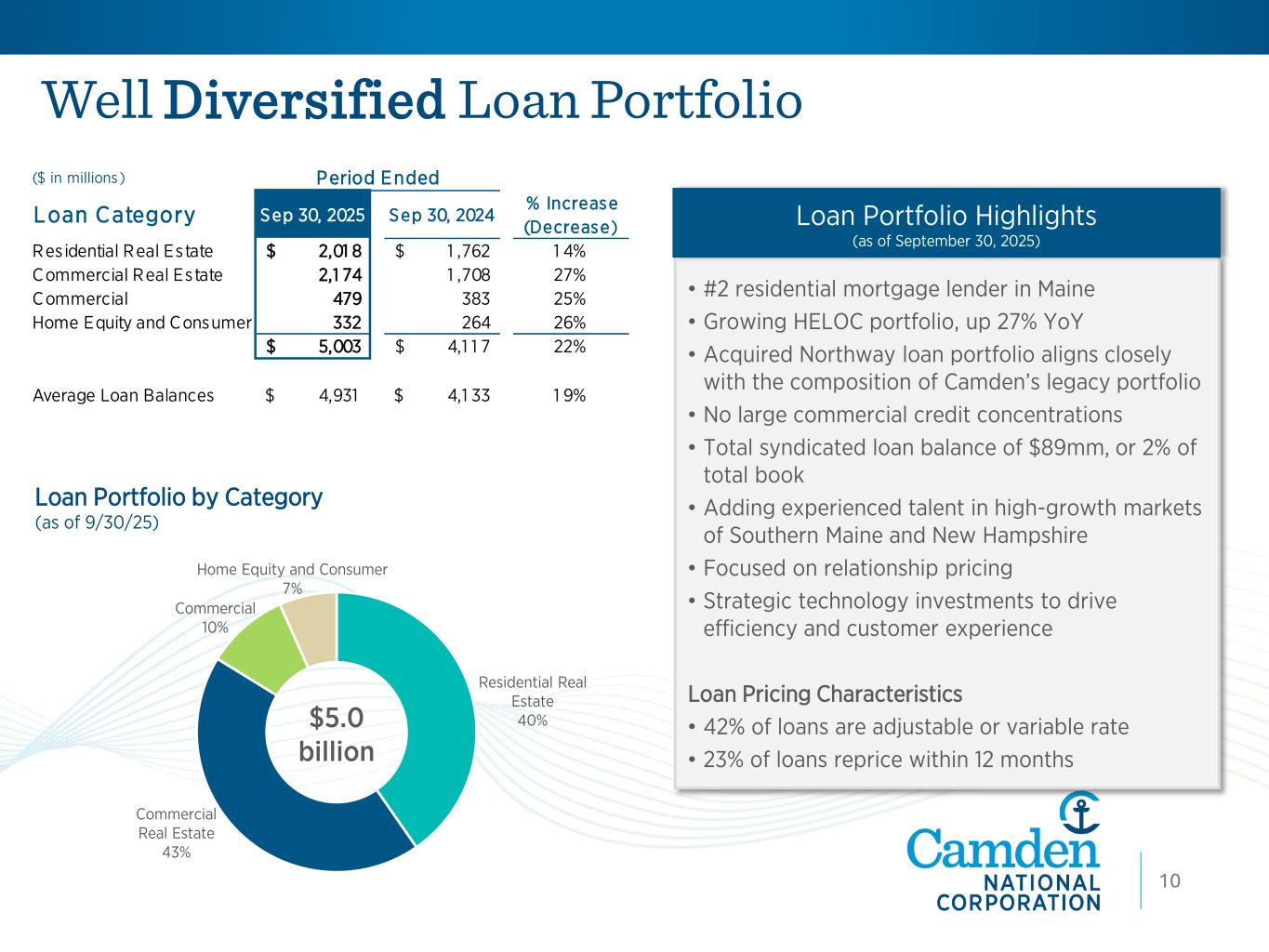

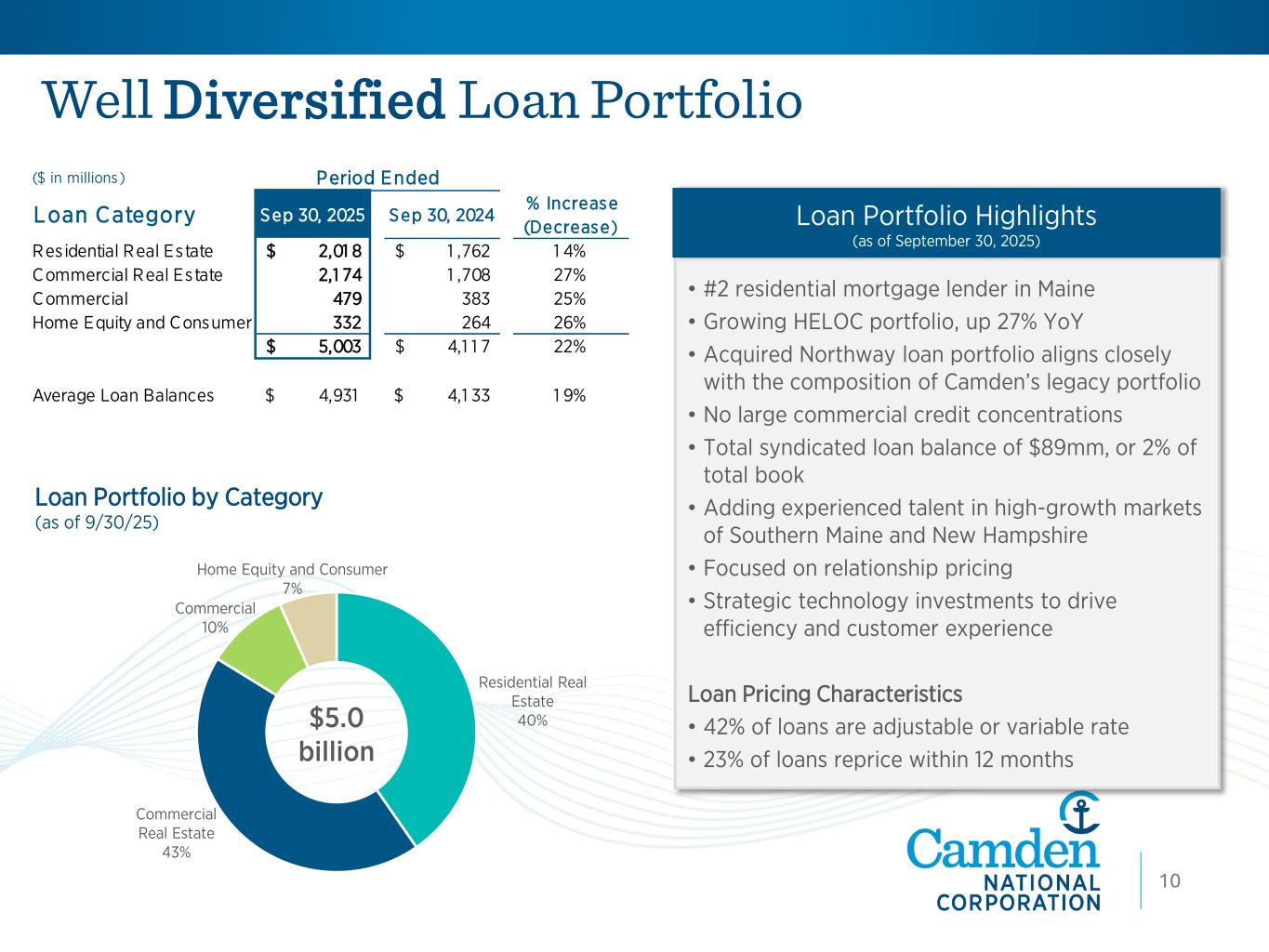

Residential Real Estate 40% Commercial Real Estate 43% Commercial 10% Home Equity and Consumer 7% Well Diversified Loan Portfolio • #2 residential mortgage lender in Maine • Growing HELOC portfolio, up 27% YoY • Acquired Northway loan portfolio aligns closely with the composition of Camden’s legacy portfolio • No large commercial credit concentrations • Total syndicated loan balance of $89mm, or 2% of total book • Adding experienced talent in high-growth markets of Southern Maine and New Hampshire • Focused on relationship pricing • Strategic technology investments to drive efficiency and customer experience Loan Pricing Characteristics • 42% of loans are adjustable or variable rate • 23% of loans reprice within 12 months Loan Portfolio Highlights (as of September 30, 2025) $5.0 billion 8 Loan Portfolio by Category (as of 9/30/25) ($ in millions) Loan Category Sep 30, 2025 Sep 30, 2024 % Increase (Decrease) Res idential Real Estate 2,01 8$ 1 ,762$ 1 4% Commercial Real Estate 2,1 74 1 ,708 27% Commercial 479 383 25% Home Equity and Consumer 332 264 26% 5,003$ 4,1 1 7$ 22% Average Loan Balances 4,931$ 4,1 33$ 1 9% Period Ended 10

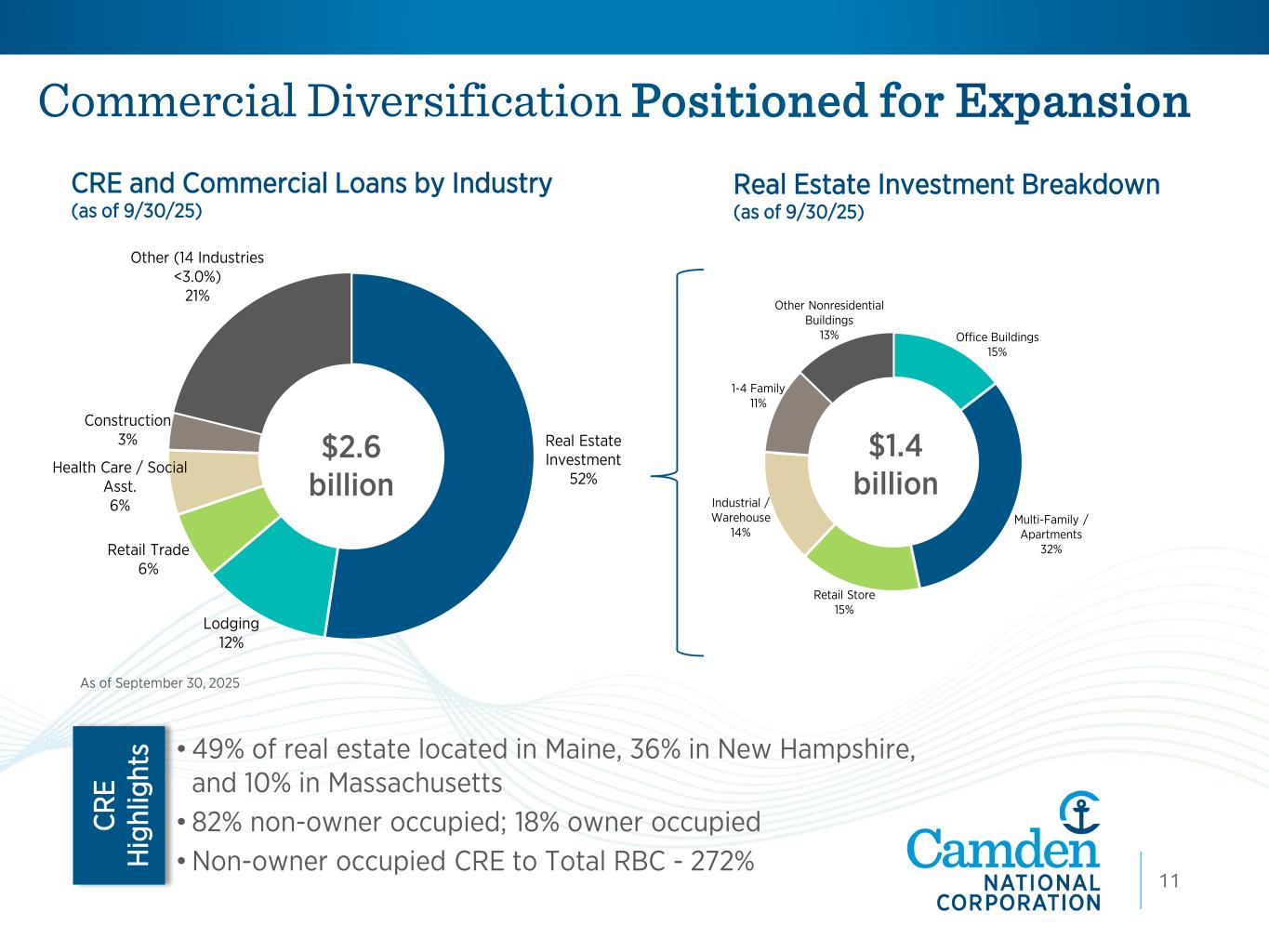

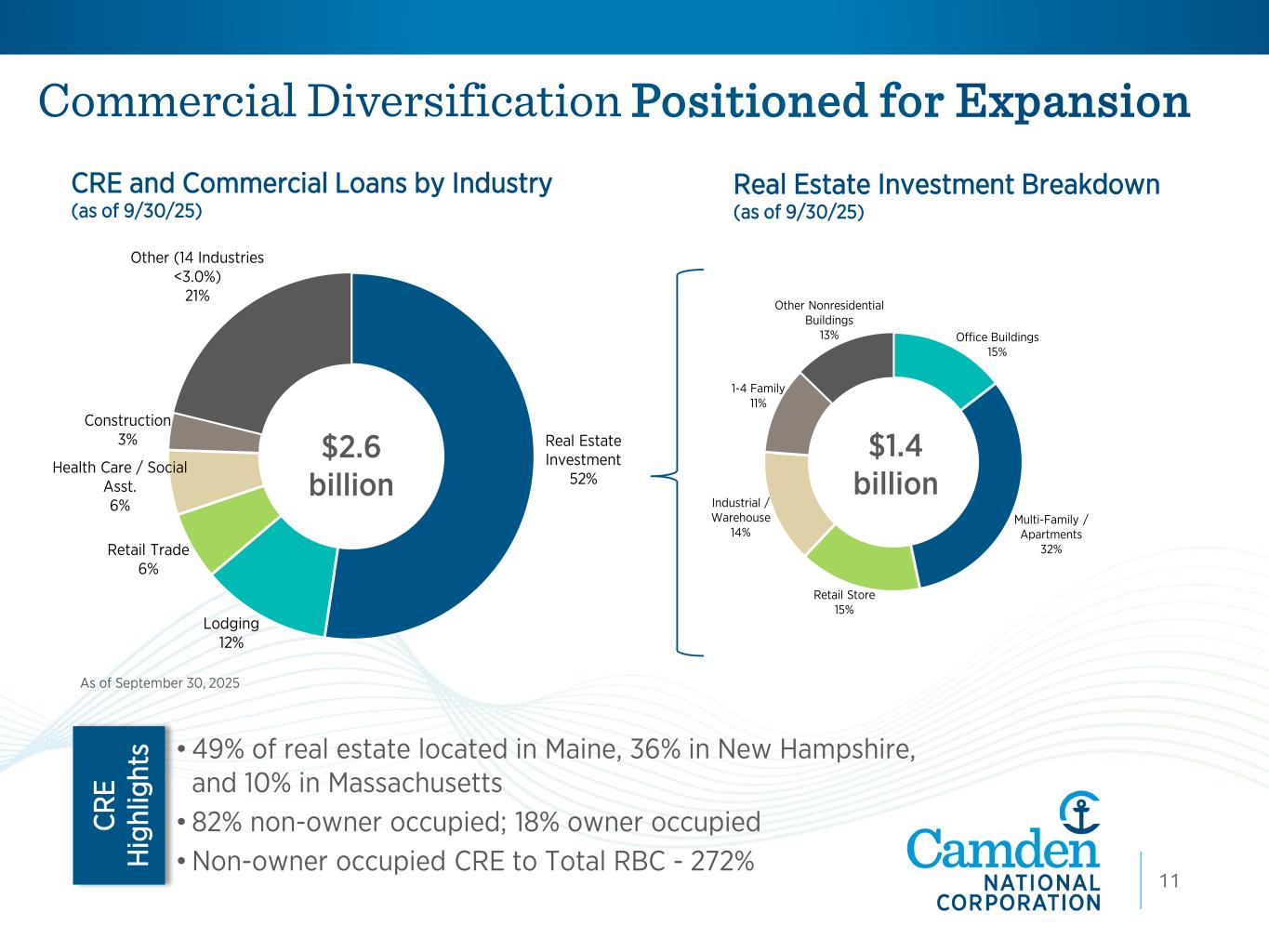

Commercial Diversification Positioned for Expansion 9 Real Estate Investment Breakdown (as of 9/30/25) CRE and Commercial Loans by Industry (as of 9/30/25) C R E H ig hl ig ht s • 49% of real estate located in Maine, 36% in New Hampshire, and 10% in Massachusetts • 82% non-owner occupied; 18% owner occupied • Non-owner occupied CRE to Total RBC - 272% As of September 30, 2025 Real Estate Investment 52% Lodging 12% Retail Trade 6% Health Care / Social Asst. 6% Construction 3% Other (14 Industries <3.0%) 21% Office Buildings 15% Multi-Family / Apartments 32% Retail Store 15% Industrial / Warehouse 14% 1-4 Family 11% Other Nonresidential Buildings 13% $2.6 billion $1.4 billion 11

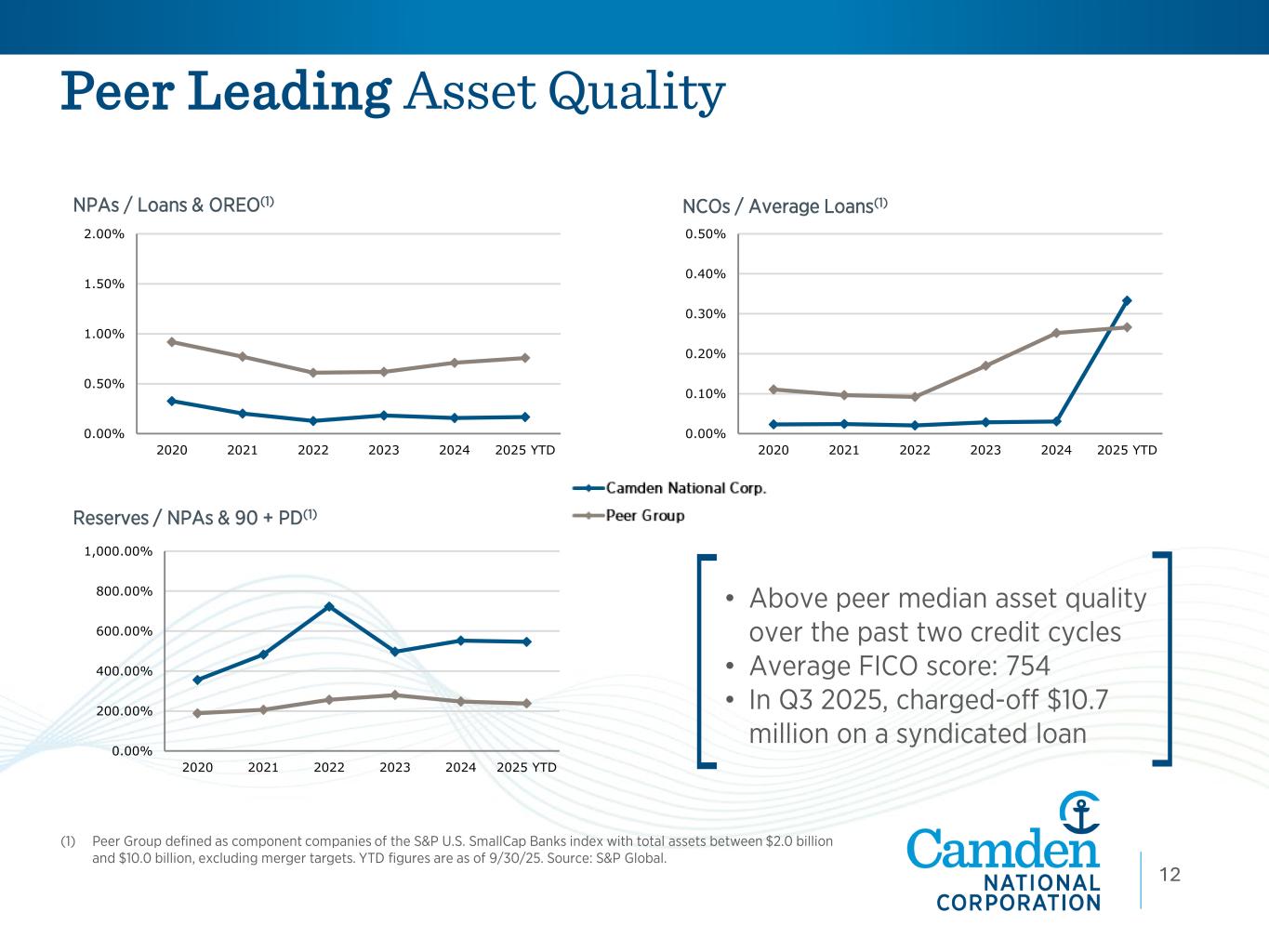

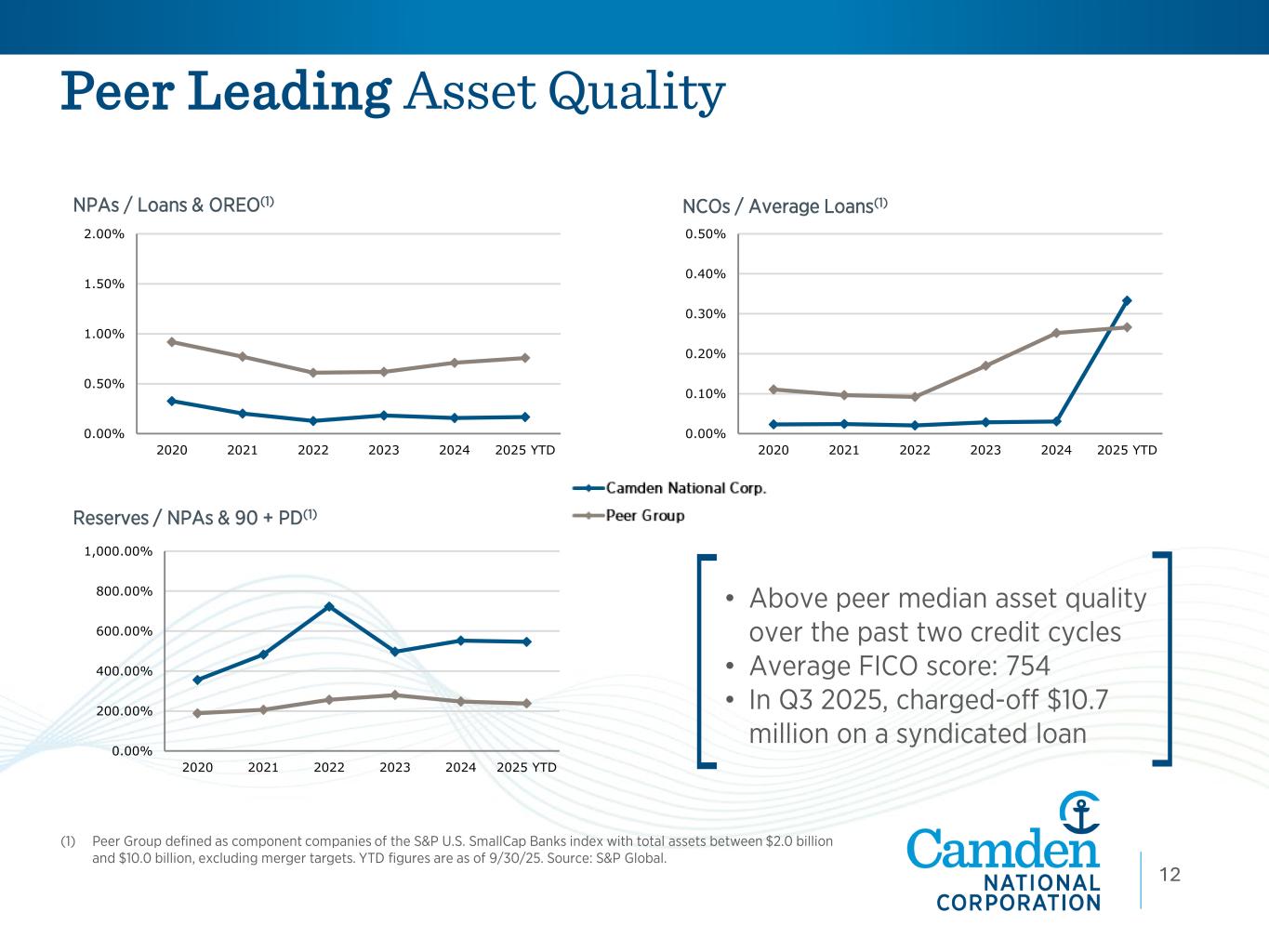

Peer Leading Asset Quality • Above peer median asset quality over the past two credit cycles • Average FICO score: 754 • In Q3 2025, charged-off $10.7 million on a syndicated loan (1) Peer Group defined as component companies of the S&P U.S. SmallCap Banks index with total assets between $2.0 billion and $10.0 billion, excluding merger targets. YTD figures are as of 9/30/25. Source: S&P Global. NPAs / Loans & OREO(1) NCOs / Average Loans(1) Reserves / NPAs & 90 + PD(1) 1012 0.00% 0.50% 1.00% 1.50% 2.00% 2020 2021 2022 2023 2024 2025 YTD 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 2020 2021 2022 2023 2024 2025 YTD 0.00% 200.00% 400.00% 600.00% 800.00% 1,000.00% 2020 2021 2022 2023 2024 2025 YTD

Diversified Low-Cost Deposit Base (1) This is a non-GAAP financial measure. Refer to the non-GAAP reconciliation table in the appendix. • Total deposits up 22%, YoY • Acquired $972mm in total deposits from Northway acquisition • Customers with <$1mm in balances made up 70% of adjusted total deposits(1) • Uninsured and uncollateralized deposits of 15% of total deposits, supported by 2.0x available sources of liquidity Deposit Portfolio Highlights (as of September 30, 2025) Loan to Deposit Ratio 11 ($ in millions) Depos it Category Sep 30, 2025 Sep 30, 2024 % Increase (Decrease) Noninterest checking 1 ,1 62$ 941$ 24% Interest checking 1 ,535 1 ,446 6% Savings and money market 1 ,880 1 ,467 28% Certificates of deposit 701 553 27% Brokered deposits 1 24 1 69 (26%) 5,403$ 4,575$ 1 8% Average Deposit Balances 5,307$ 4,367$ 22% Period Ended 13 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% 2020 2021 2022 2023 2024 2025 YTD

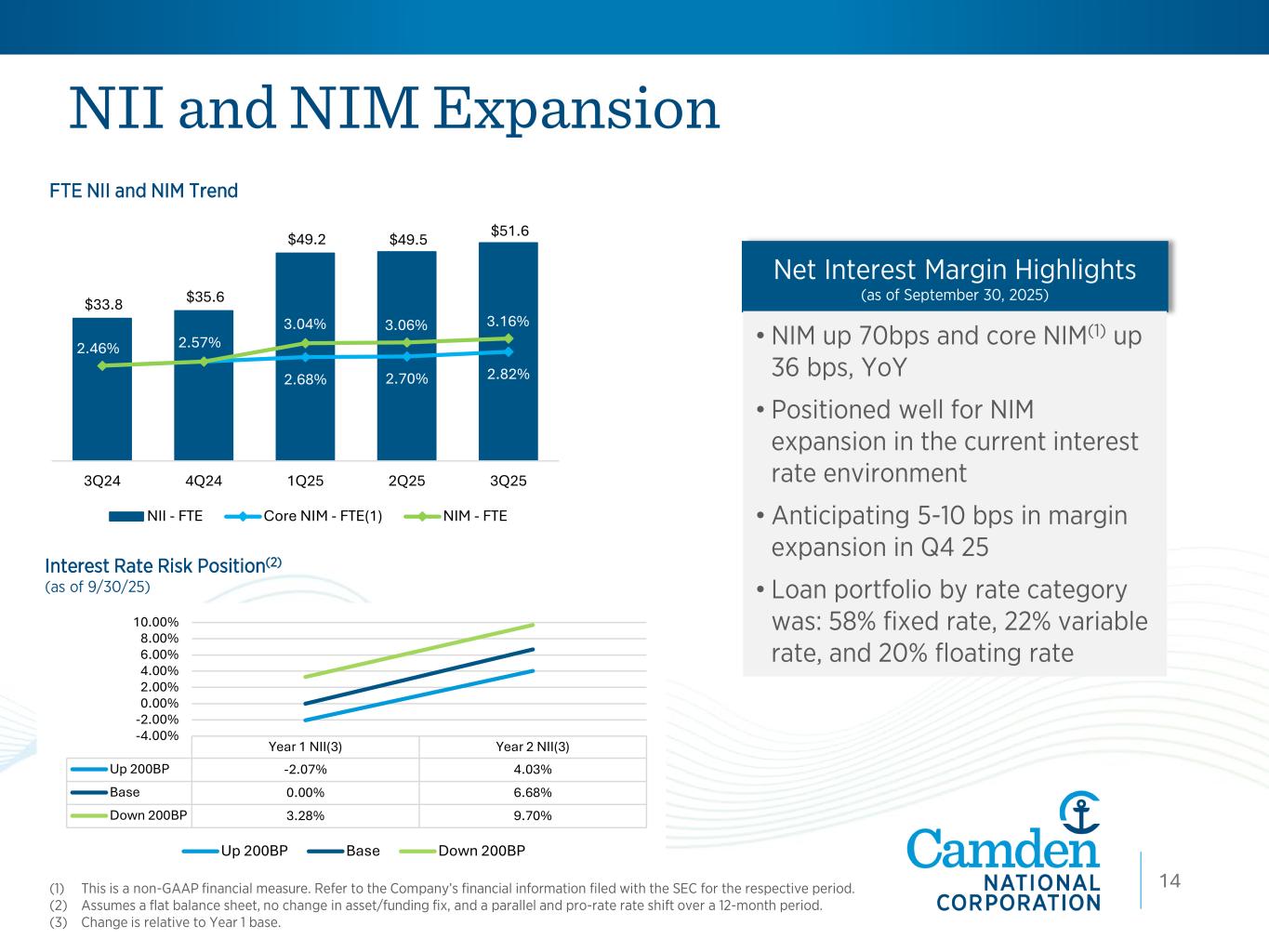

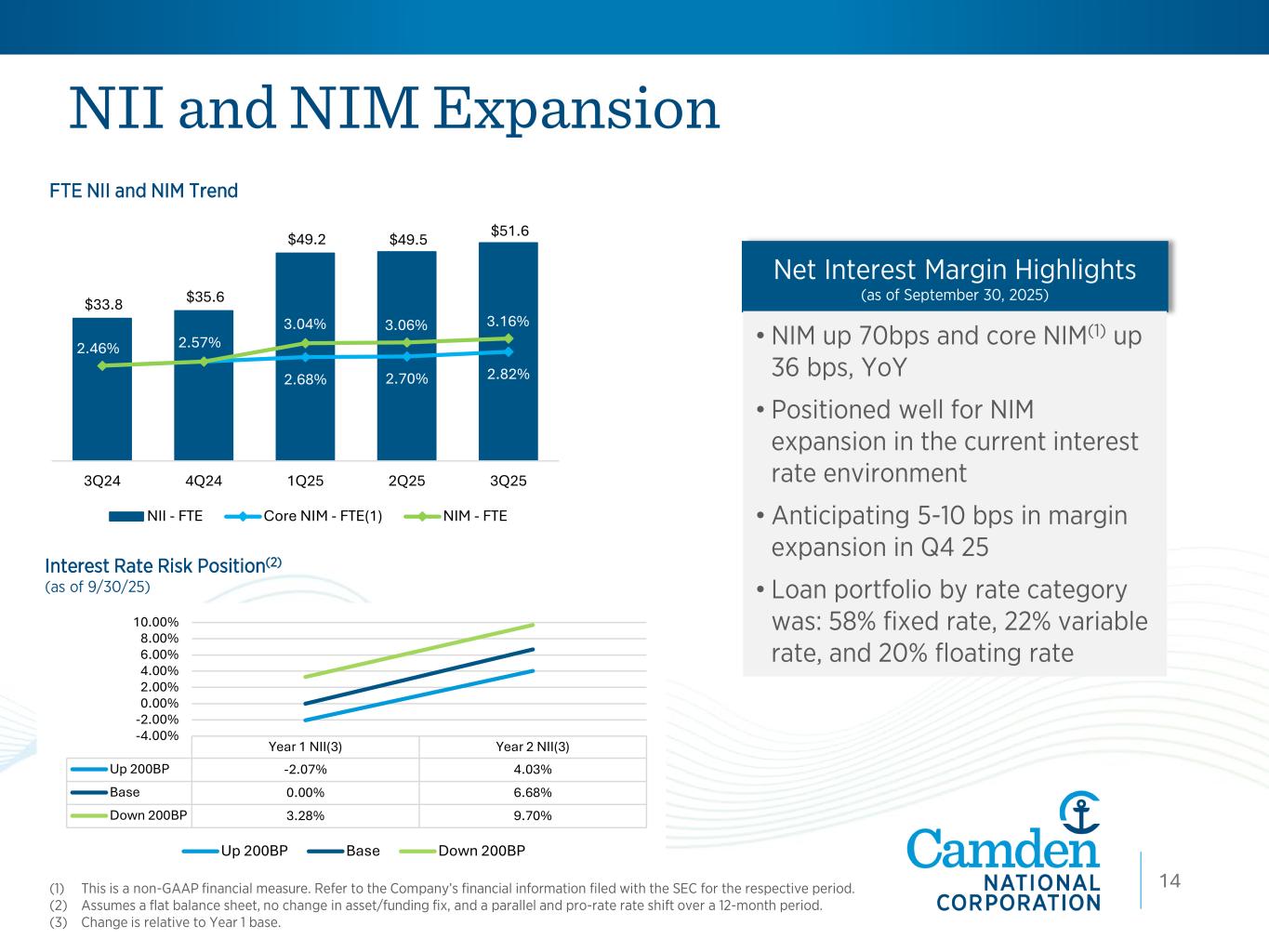

NII and NIM Expansion 14 Net Interest Margin Highlights (as of September 30, 2025) • NIM up 70bps and core NIM(1) up 36 bps, YoY • Positioned well for NIM expansion in the current interest rate environment • Anticipating 5-10 bps in margin expansion in Q4 25 • Loan portfolio by rate category was: 58% fixed rate, 22% variable rate, and 20% floating rate Interest Rate Risk Position(2) (as of 9/30/25) (1) This is a non-GAAP financial measure. Refer to the Company’s financial information filed with the SEC for the respective period. (2) Assumes a flat balance sheet, no change in asset/funding fix, and a parallel and pro-rate rate shift over a 12-month period. (3) Change is relative to Year 1 base. FTE NII and NIM Trend $33.8 $35.6 $49.2 $49.5 $51.6 2.68% 2.70% 2.82% 2.46% 2.57% 3.04% 3.06% 3.16% 3Q24 4Q24 1Q25 2Q25 3Q25 NII - FTE Core NIM - FTE(1) NIM - FTE Year 1 NII(3) Year 2 NII(3) Up 200BP -2.07% 4.03% Base 0.00% 6.68% Down 200BP 3.28% 9.70% -4.00% -2.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% Up 200BP Base Down 200BP

Growing Non-Interest Income H ig hl ig ht s 12 • 11% AUM YoY organic growth driving fee income momentum • Non-interest income represents 22% of total revenue • Residential mortgage sales: 52% of originated sold in first nine months vs. 57% in 2024 As of September 30, 2025 ($ in thousands) YTD Income % of Total YTD Income % of Total Debit Card Income 1 0,583$ 27% 9,1 04$ 28% 1 6% Fiduciary and Brokerage Income 1 1 ,044 29% 9,530 29% 1 6% Service Charges on Deposit Accounts 7,293 1 9% 6,308 20% 1 6% Mortgage Banking Income 2,660 7% 2,297 7% 1 6% BOLI 2,620 7% 2,086 7% 26% Other Income 4,1 88 1 1 % 3,048 9% 37% 38,388$ 1 00% 32,373$ 1 00% 1 9% % Increase (Decrease) Sep 30, 2025 Sep 30, 2024 YTD Period Ended Fee Income Category 15

Driving Operating Efficiency and Scale ($ in millions) Efficiency Ratio(1) 62% 58% 59% 55% 52% Non-Interest Expense Highlights (as of September 30, 2025) 13 (1)This is a non-GAAP measure. Refer to the non-GAAP reconciliation table in the appendix. Overhead Expense Ratio = Annualized Non-interest Expense / Average Assets. Peer Group is defined as component companies of the S&P U.S. SmallCap Banks index with total assets between $2.0 billion and $10.0 billion, excluding merger targets. • Balanced approach to investing while maintaining efficiency • Advancing efficiency and scale with technology, digital channels, and automation 16 $28.2 $27.9 $36.9 $36.2 $35.6 $28.9 $28.4 $44.5 $37.6 $35.9 2.01% 1.95% 2.56% 2.17% 2.06% 2.45% 2.47% 2.47% 2.61% 2.52% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $- $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 $45.0 $50.0 3Q24 4Q24 1Q25 2Q25 3Q25 Core Operating Expense(1) Merger and Acquisition Costs Overhead Ratio (CAC) Overhead Ratio (Peers)

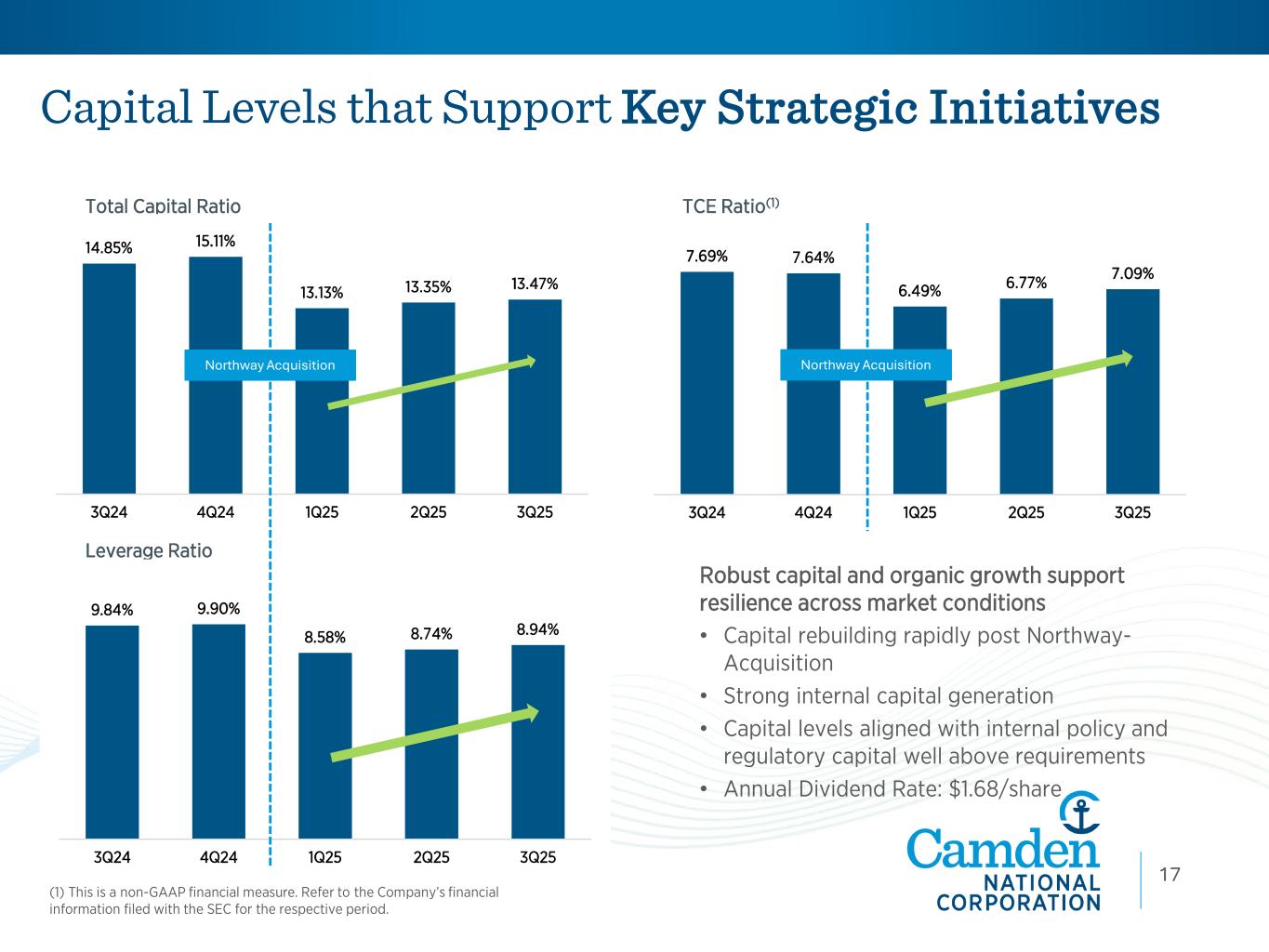

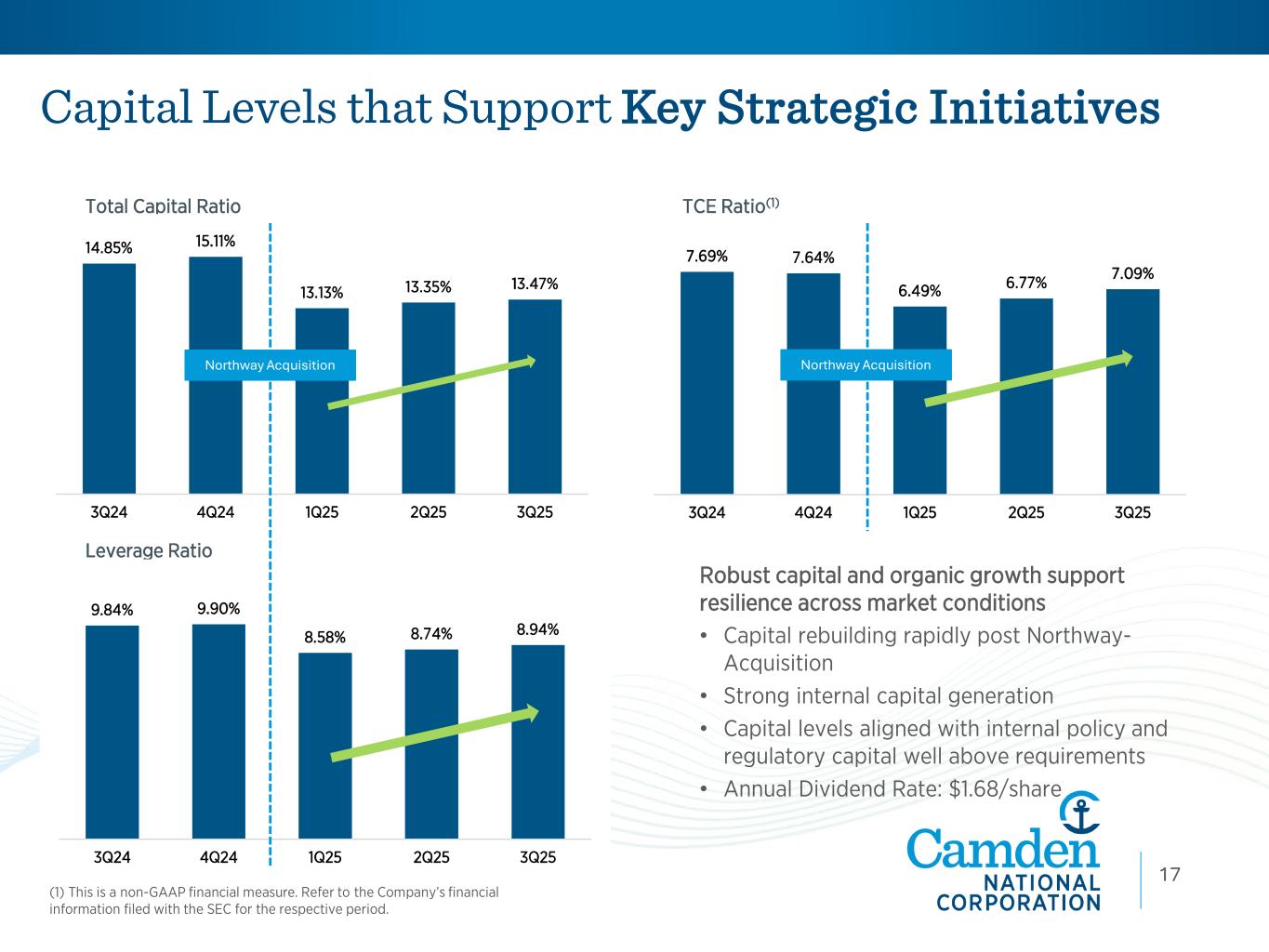

Total Capital Ratio TCE Ratio(1) Leverage Ratio Capital Levels that Support Key Strategic Initiatives (1) This is a non-GAAP financial measure. Refer to the Company’s financial information filed with the SEC for the respective period. 14.85% 15.11% 13.13% 13.35% 13.47% 3Q24 4Q24 1Q25 2Q25 3Q25 9.84% 9.90% 8.58% 8.74% 8.94% 3Q24 4Q24 1Q25 2Q25 3Q25 7.69% 7.64% 6.49% 6.77% 7.09% 3Q24 4Q24 1Q25 2Q25 3Q25 Northway AcquisitionNorthway Acquisition Robust capital and organic growth support resilience across market conditions • Capital rebuilding rapidly post Northway- Acquisition • Strong internal capital generation • Capital levels aligned with internal policy and regulatory capital well above requirements • Annual Dividend Rate: $1.68/share 17

Built on Strength. Positioned for Growth. Focused on the Future. Investment Merits • Premier Franchise in Attractive Markets Expanding presence in high-growth regions with a strong competitive advantage • Low-Risk, High-Quality Balance Sheet Supported by a robust core deposit base and disciplined risk management • Strong Capital Foundation Well above regulatory requirements, enabling flexibility for strategic capital deployment • Earnings Momentum Ahead Expected improvement as fixed assets reprice to prevailing market rates • Innovation-Driven Culture Leading in technology to boost efficiency, growth, and customer experience • Focused on Sustainable Growth Committed to delivering consistent, long-term value for shareholders 18

APPENDIX 1619

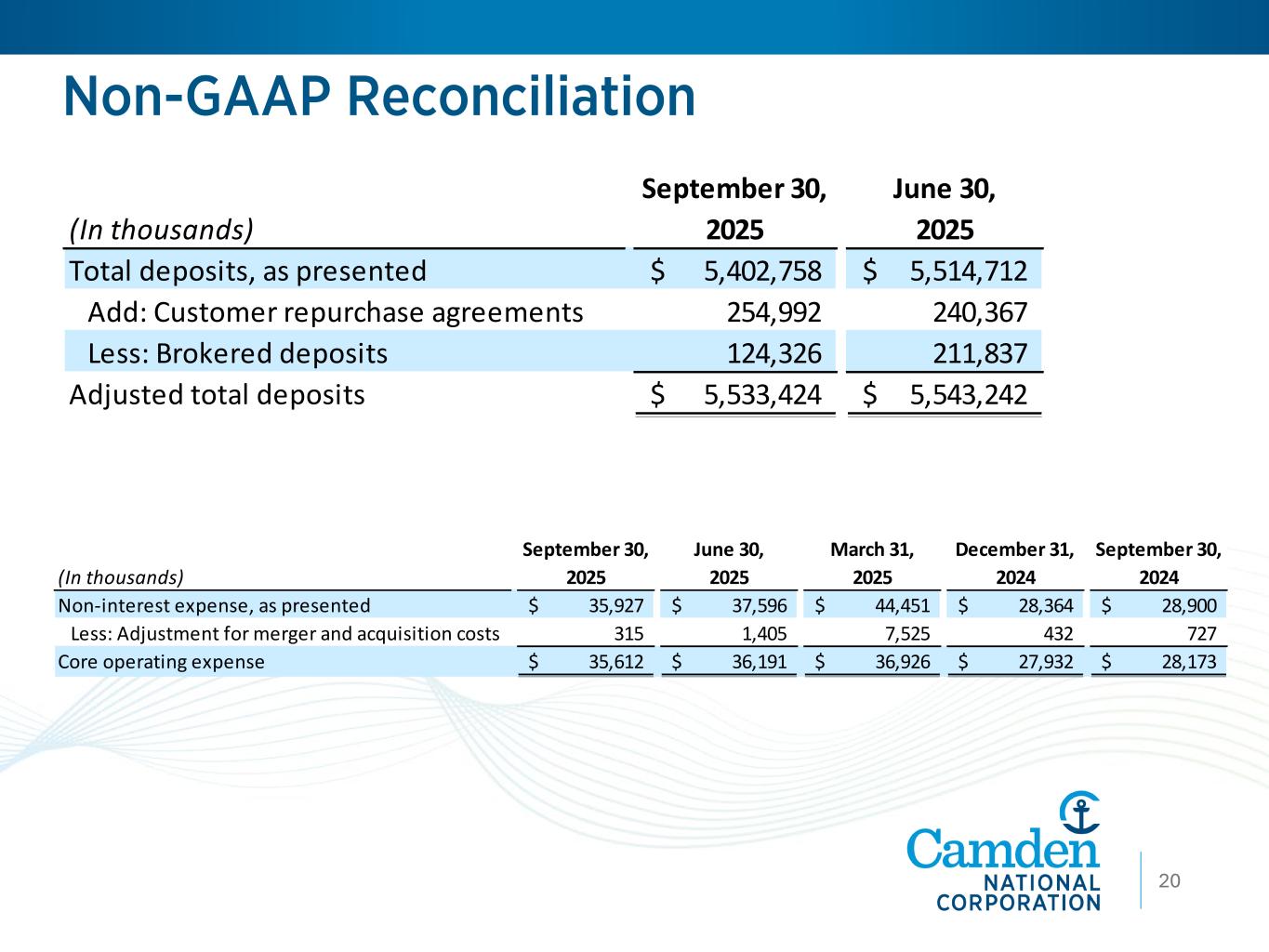

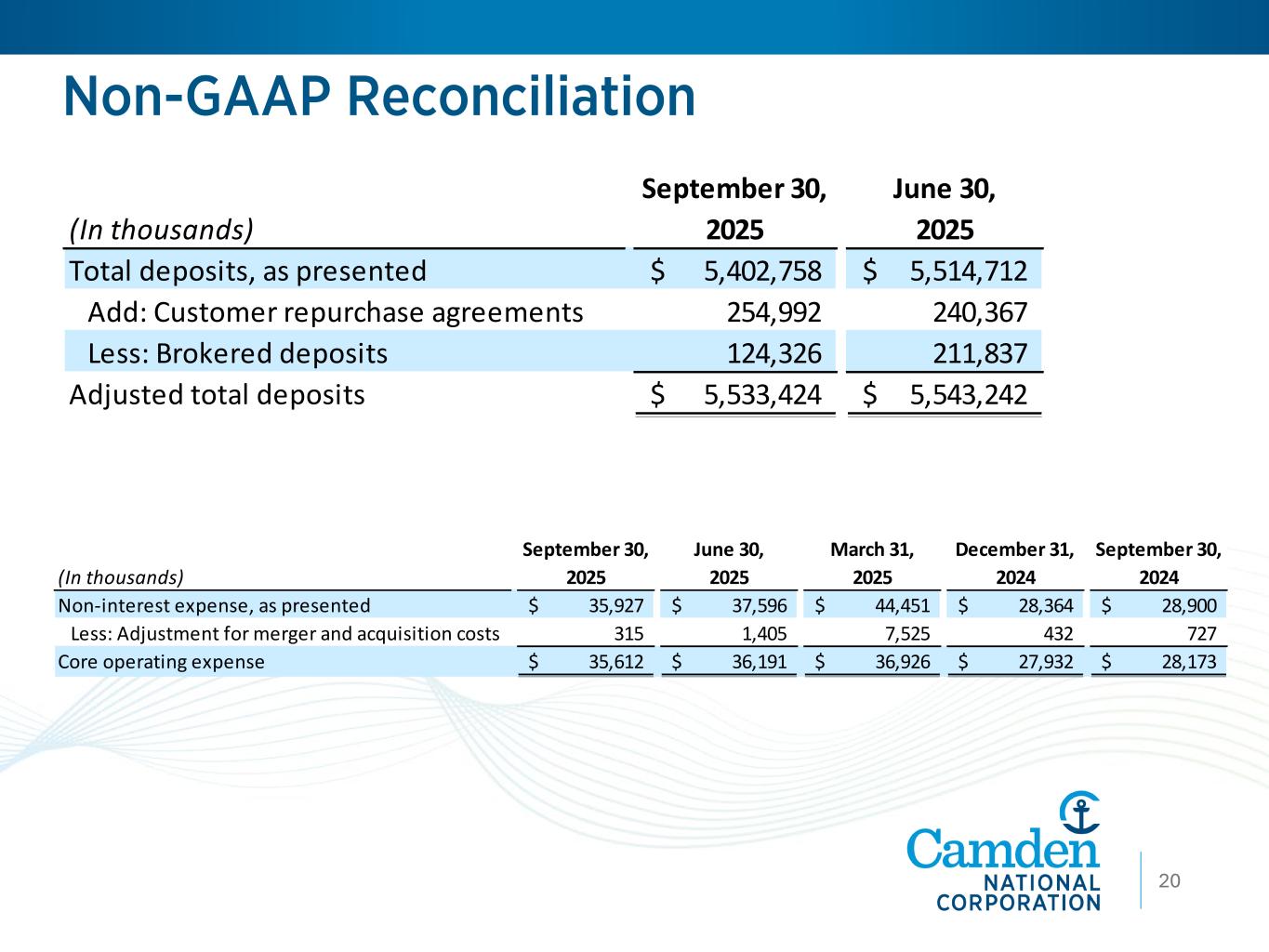

16 (In thousands) September 30, 2025 June 30, 2025 Total deposits, as presented 5,402,758$ 5,514,712$ Add: Customer repurchase agreements 254,992 240,367 Less: Brokered deposits 124,326 211,837 Adjusted total deposits 5,533,424$ 5,543,242$ Non-GAAP Reconciliation 20 (In thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Non-interest expense, as presented 35,927$ 37,596$ 44,451$ 28,364$ 28,900$ Less: Adjustment for merger and acquisition costs 315 1,405 7,525 432 727 Core operating expense 35,612$ 36,191$ 36,926$ 27,932$ 28,173$