Document

CONTACT:

Michael Archer

Executive Vice President

Chief Financial Officer

Camden National Corporation

(800) 860-8821

marcher@camdennational.bank

FOR IMMEDIATE RELEASE

CAMDEN NATIONAL CORPORATION REPORTS

FIRST QUARTER 2023 FINANCIAL RESULTS

Capital, Liquidity and Asset Quality Remain Strong

CAMDEN, Maine, April 25, 2023/PRNewswire/--Camden National Corporation (NASDAQ: CAC; “Camden National” or the “Company”), a $5.7 billion bank holding company headquartered in Camden, Maine, reported net income of $12.7 million and diluted earnings per share of ("EPS") of $0.87 for the first quarter of 2023, each a decrease of 17% compared to the fourth quarter of 2022, while earnings before income tax expense and provision (non-GAAP) decreased 9% on a linked quarter-basis. This quarter's performance was primarily the result of continued interest rate volatility, normal seasonal deposit outflows along with increasing deposit competition, as well as a $1.8 million loss on an investment security. The Company's return on average equity was 11.16% and return on average tangible equity (non-GAAP) was 14.21% for the first quarter of 2023, compared to 14.03% and 18.18%, respectively, for the fourth quarter of 2022.

“The industry and economic events of the last quarter reinforce our commitment to the long-term stability of our organization and customers,” said Gregory A. Dufour, President and Chief Executive Officer. “Our strategies are focused on optimizing our funding costs through our diversified deposit base, maintaining our strong asset quality and capital levels, exercising disciplined expense management, and, of course, growing our relationships with our customers.”

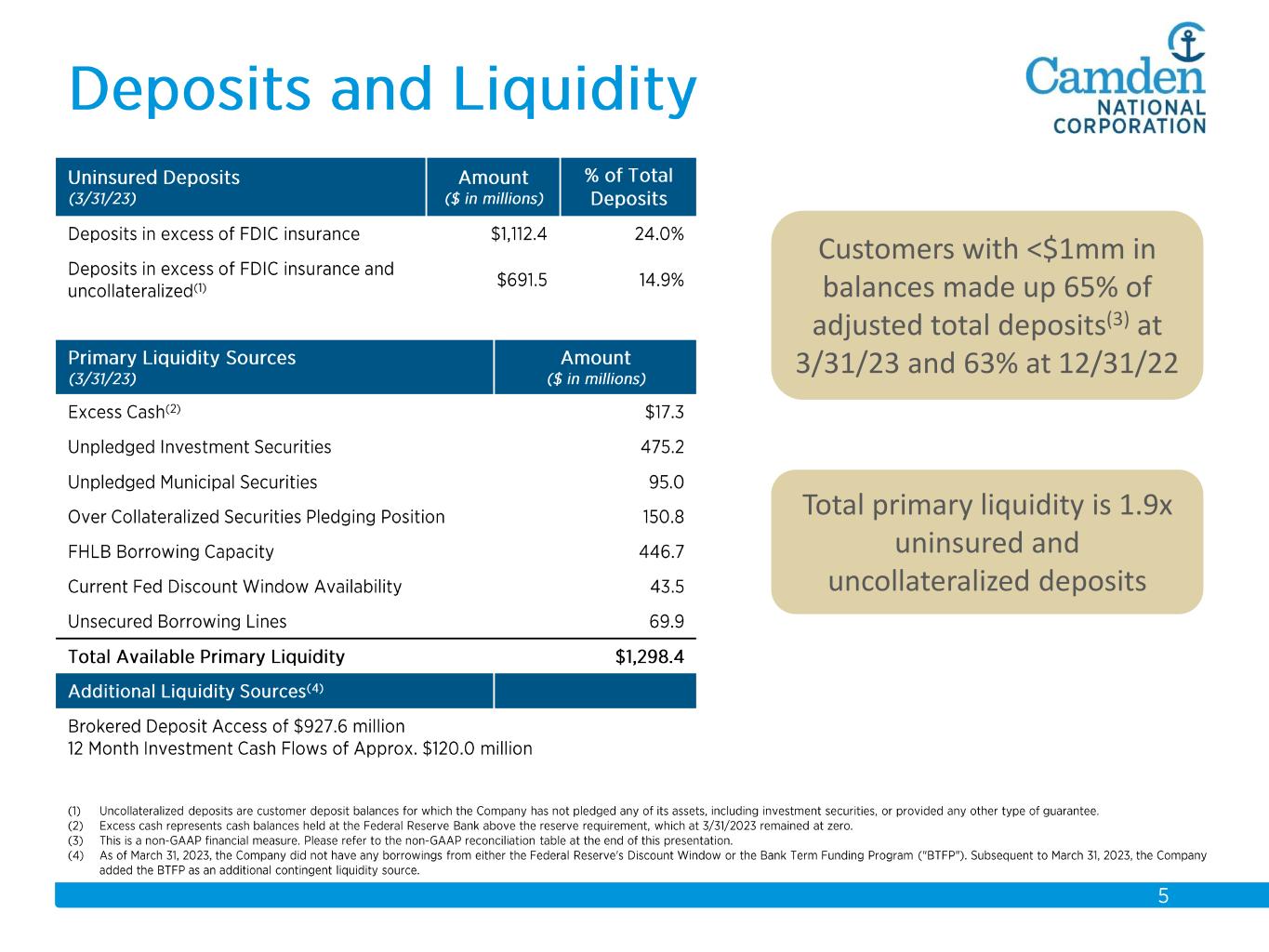

The Company believes it is well positioned to manage through recent market disruptions and volatility through the strength of our balance sheet, which includes strong capital, liquidity, and asset quality. At March 31, 2023, the Company's regulatory capital ratios were well in excess of regulatory requirements; total uninsured FDIC and uncollateralized deposits1 were $691.5 million, or 15% of total deposits, compared to $1.3 billion of available liquidity (not including access to brokered markets); and nonperforming assets were 0.09% of total assets and loans 30-89 days past due were 0.05% of total loans.

In March, the Company announced a cash dividend of $0.42 per share, payable on April 28, 2023, to shareholders of record on April 14, 2023, representing an annualized dividend yield of 4.64%, based on the Company's closing share price of $36.19, as reported by NASDAQ on March 31, 2023.

1 Uncollateralized deposits are customer deposits for which the Company has not pledged any of its assets, including investment securities, or provided any other type of guarantee.

FIRST QUARTER 2023 HIGHLIGHTS

•Uninsured FDIC and uncollateralized deposits were 15% of total deposits at March 31, 2023, compared to 16% at December 31, 2022.

•Available liquidity sources totaled $1.3 billion, or 28% of total deposits, at March 31, 2023, compared to $1.5 billion, or 31% of total deposits, at December 31, 2022 (not including brokered market availability).

•Loan-to-deposit ratio was 88% at March 31, 2023, compared to 83% at December 31, 2022.

•Asset quality remained strong, with non-performing assets totaling 0.09% of total assets and 0.13% of total loans, and loans 30-89 days delinquent were 0.05% to total loans, and, as a result, the allowance for credit losses ("ACL") on loans to total loans ratio remained stable at 0.91% of total loans, a decrease of 1 basis point from December 31, 2022.

•Net income decreased by $2.6 million, or 17%, compared to the fourth quarter, and earnings before income taxes and provision (non-GAAP) decreased $1.8 million, or 9% between periods.

•Net interest margin decreased 22 basis points to 2.54%, compared to the fourth quarter of 2022, as funding costs increased 49 basis points while interest-earning asset yields increased 25 basis points.

•Wrote-off a $1.8 million Signature Bank bond in the first quarter of 2023.

FINANCIAL CONDITION

As of March 31, 2023, total assets were $5.7 billion, an increase of $44.8 million, or 1%, since December 31, 2022.

Loans

Loans at March 31, 2023, totaled $4.1 billion, an increase of 2% since December 31, 2022.

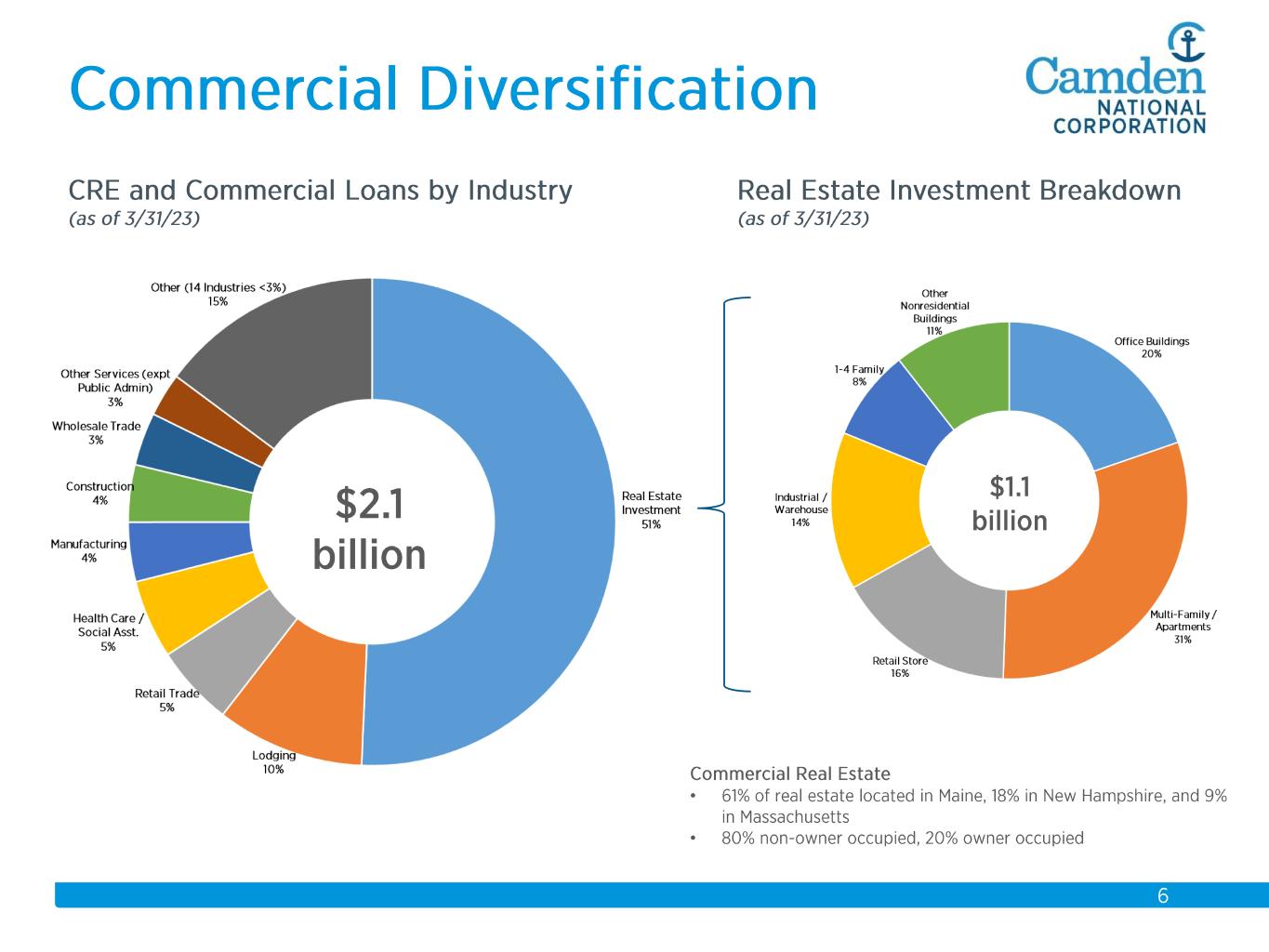

•Commercial real estate loans grew 3% and residential real estate loans grew 2% in the first quarter of 2023.

•Residential real estate production for the first quarter of 2023 decreased 35% in comparison to the fourth quarter as a result of local market seasonality and a deliberate shift in our loan pricing strategy to slow on-books loan production in light of the current interest rate environment.

•The Company sold 40% of its residential mortgage production for the first quarter of 2023, compared to 16% for the fourth quarter 2022.

•At March 31, 2023, the committed retail and commercial loan portfolio pipelines totaled $45.5 million and $43.6 million, respectively.

Investments

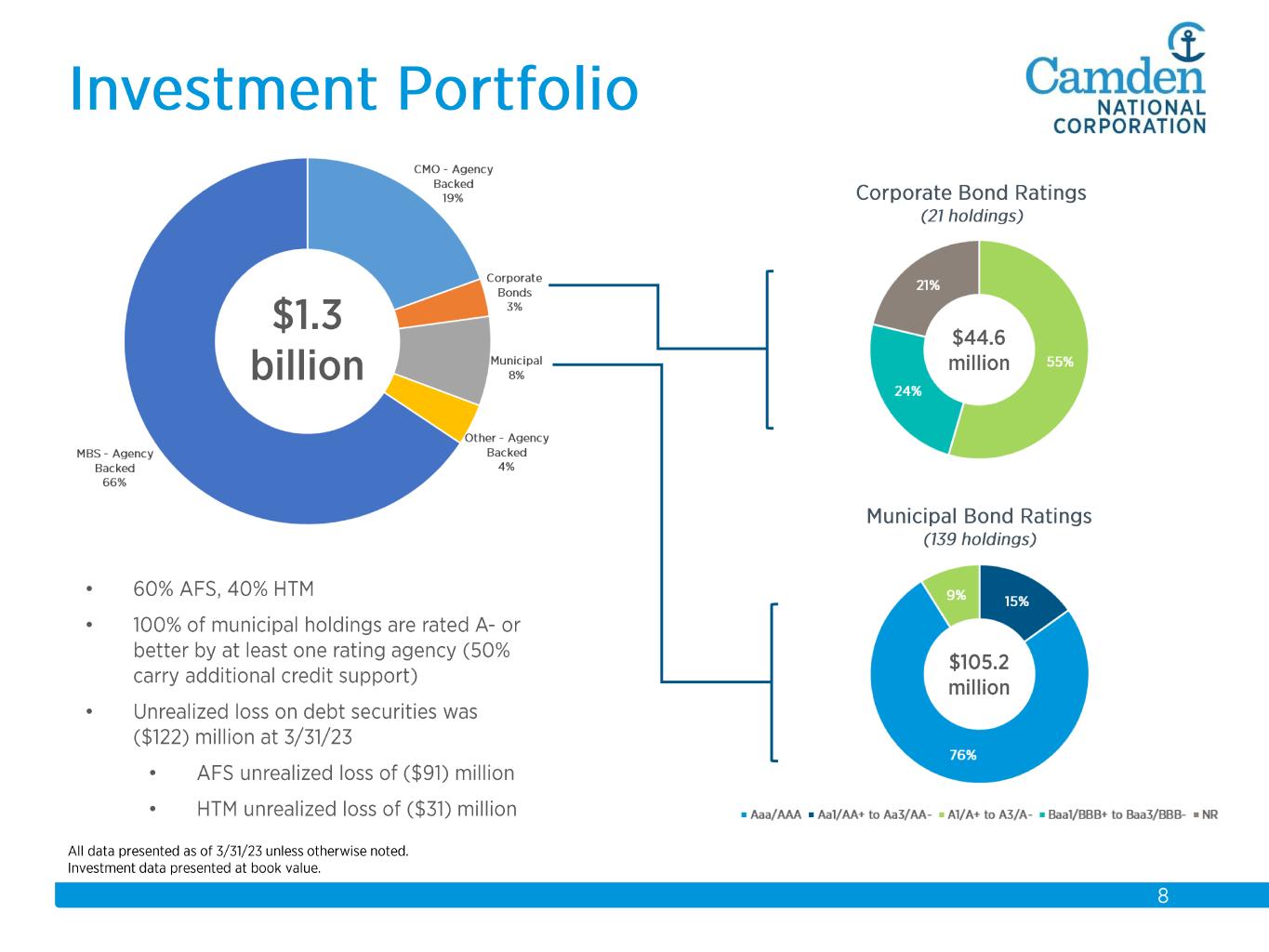

Investments totaled $1.2 billion as of March 31, 2023, a decrease of 1% since December 31, 2022.

•At March 31, 2023, the Company wrote-off a $1.8 million Signature Bank bond due to Signature Bank's failure during the first quarter of 2023.

•As of March 31, 2023, the Company's debt securities designated as available-for-sale ("AFS") and held-to-maturity ("HTM") were in a net unrealized loss position of $122.0 million, compared to $141.5 million as of December 31, 2022. The decrease in the net change in unrealized loss during the first quarter reflects the change in interest rates between periods.

•As of March 31, 2023, the weighted-average life and duration of the Company's debt securities investments was 8.1 years and 5.7 years, respectively, compared to 7.8 years and 5.8 years at December 31, 2022.

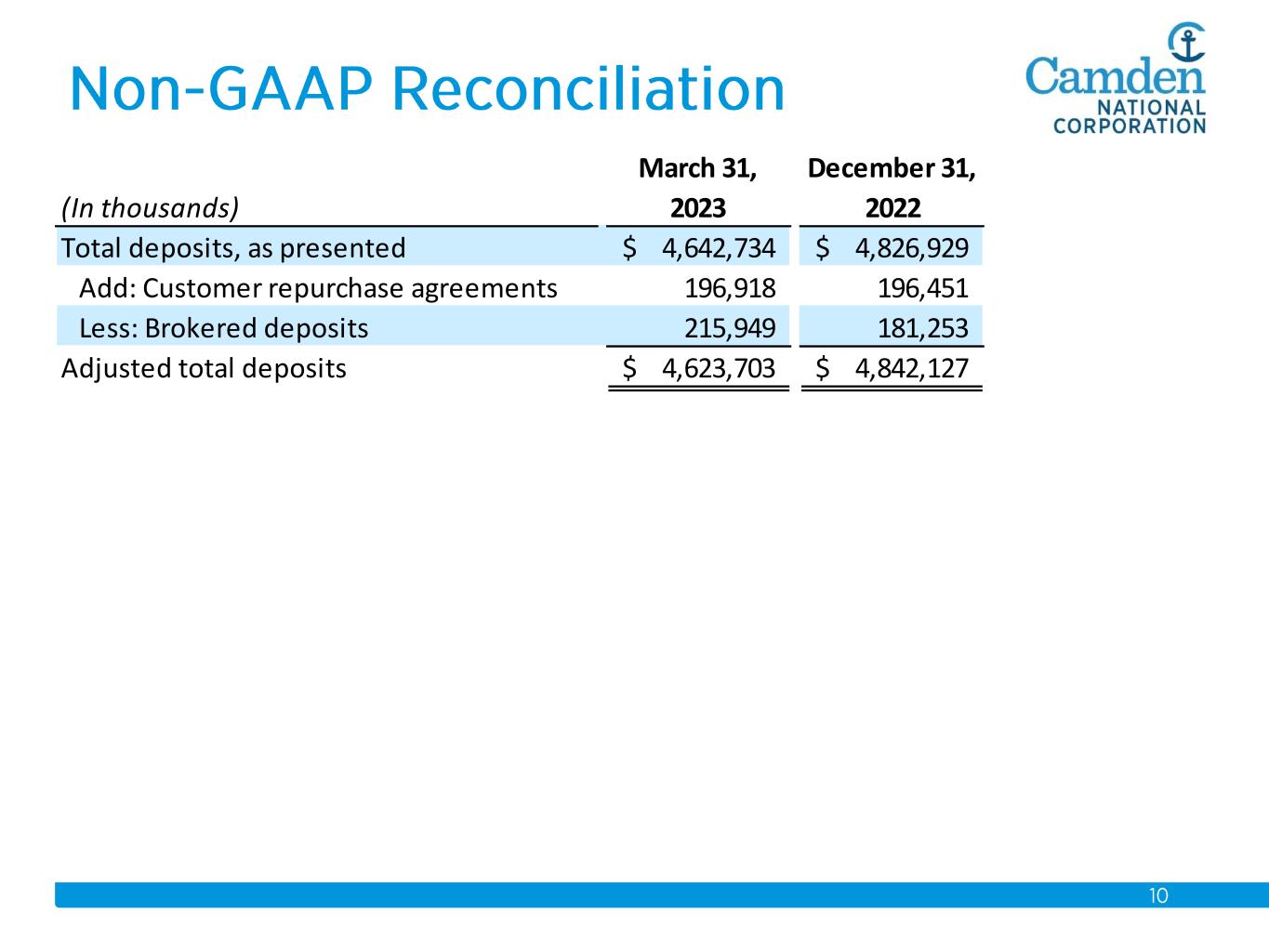

Deposits

As of March 31, 2023, deposits totaled $4.6 billion, a decrease of $184.2 million, or 4%, since December 31, 2022, which was primarily the result of one large municipal deposit relationship decreasing its interest checking balance by $122.4 million during the first quarter of 2023. The Company has the ability to move funds in and out of this deposit relationship when it is cost advantageous compared to other alternative funding sources, such as FHLB borrowings. Excluding the impact of this one large municipal deposit relationship, the Company's total deposits decreased $61.8 million, or 1%, during the first quarter of 2023.

•Core deposits (non-GAAP) decreased $278.5 million, or 6%, during the first quarter of 2023, as checking deposit balances decreased 9% and savings and money market balances decreased 2%. However, excluding the impact of the one large municipal deposit relationship discussed above, core deposits decreased $156.1 million, or 4%, during the first quarter of 2023. The decrease in core deposits was primarily the result of normal seasonal outflows combined with pricing pressures as depositors look for alternative products with higher interest rates in the current environment, such as certificates of deposit ("CD"), which increased $59.7 million, or 20%, during the first quarter of 2023.

•Brokered deposits increased $34.7 million, or 19%, during the first quarter of 2023 in connection with the Company's laddered brokered CD strategy that it implemented during the fourth quarter of 2022 and again utilized in the first quarter of 2023, to protect a portion of its funding from the risk of further rising interest rates, as well as to supplement overnight borrowings when cost advantageous.

•As of March 31, 2023, uninsured FDIC and uncollateralized deposits totaled 15% of total deposits, compared to 16% as of December 31, 2022.

•As of March 31, 2023 the Company had $1.3 billion in available liquidity from different sources, or 28% of total deposits (not including brokered market availability).

•The loan-to-deposit ratio was 88% at March 31, 2023, compared to 83% at December 31, 2022.

Borrowings

As of March 31, 2023, borrowings totaled $530.6 million, an increase of $221.1 million, or 71%, since December 31, 2022.

•Federal Home Loan Bank ("FHLB") borrowings have been used to supplement funding needs to support asset growth as well as net deposit outflows during the first quarter of 2023. The Company has continued to keep its FHLB borrowing position short. At March 31, 2023, FHLB borrowings totaled $289.4 million, compared to $68.7 million as of December 31, 2022.

•As of March 31, 2023, the Company did not have any borrowings from either the Federal Reserve's Discount Window or the Bank Term Funding Program ("BTFP"). Subsequent to March 31, 2023, the Company added the BTFP as an additional contingent liquidity source.

Derivatives

The Company executed four fixed-for-floating interest rate swaps for a total of $300.0 million of notional in the first quarter of 2023. These derivatives contributed $479,000 of interest income in the first quarter of 2023, and were executed to promote short-term asset sensitivity.

Capital

As of March 31, 2023, the Company's regulatory capital ratios were each well in excess of regulatory capital requirements. The Company announced a cash dividend of $0.42 per share, payable on April 28, 2023, to shareholders of record on April 14, 2023, representing an annualized dividend yield of 4.64%, based on the Company's closing share price of $36.19, as reported by NASDAQ on March 31, 2023.

•As of March 31, 2023, the Company's common equity ratio was 8.13%, and its tangible common equity ratio (non-GAAP) was 6.56%, compared to 7.96% and 6.37% as of December 31, 2022, respectively.

•As of March 31, 2023, the Company's book value per share was $31.87, and its tangible book value per share (non-GAAP) was $25.28, compared to $30.98 and $24.37 as of December 31, 2022, respectively.

ASSET QUALITY

The Company's credit quality within its loan portfolio remained very strong throughout the first quarter of 2023. The Company continues to actively monitor its loan portfolio for signs of credit stress and, as of March 31, 2023, there have been no materials trends or concerns identified.

•Annualized net charge-offs to average loans decreased 1 basis point on a linked quarter-basis to 0.02% for the first quarter of 2023.

•Non-performing loans were 0.13% of total loans at March 31, 2023 and December 31, 2022.

•Loans 30-89 days past due decreased 1 basis point during the first quarter of 2023 to 0.05% of total loans at March 31, 2023.

Each quarter the Company evaluates its investment portfolio for potential credit risk, and, in the first quarter of 2023, the Company fully wrote-off one $1.8 million Signature Bank corporate bond. Through our evaluation of our holdings there were no other credit concerns identified within our investment portfolio as of March 31, 2023.

•At March 31, 2023, the book value of the Company's corporate bonds totaled $44.6 million, of which 79% carry an investment-grade credit rating and the remaining are non-rated community banks within our markets.

•At March 31, 2023, the book value of the Company's municipal bonds totaled $105.2 million and all carry an investment-grade credit rating.

FINANCIAL OPERATING RESULTS (Q1 2023 vs. Q4 2022)

Net income for the first quarter of 2023 was $12.7 million, a decrease of $2.6 million, or 17%, compared to the fourth quarter of 2022. Excluding income taxes and provision for credit losses, adjusted earnings (non-GAAP) for the first quarter of 2023 were $18.0 million, a decrease of $1.8 million, or 9%, compared to last quarter.

Net Interest Income and Net Interest Margin

Net interest income for the first quarter of 2023 was $34.3 million, a decrease of $2.7 million, or 7%, compared to the fourth quarter of 2022. The decrease reflects the speed in which funding costs have risen in the current interest rate environment, as well as the level of deposit competition across our markets, which has resulted in higher deposit and funding betas for the first quarter of 2023. As a result, our net interest margin for the first quarter of 2023 decreased 22 basis points on a linked quarter-basis to 2.54% for the first quarter of 2023.

•Funding costs rose 49 basis points during the first quarter of 2023 to 1.45%. The rise in funding costs during the quarter reflects the impact of two increases in the Federal Funds Interest Rate in the fourth quarter of 2022 and two increases in the first quarter of 2023, resulting in a total increase of 175 basis points over the last two quarters. Cost of deposits for the first quarter of 2023 were 1.22%, an increase of 38 basis points over the previous quarter, and costs of borrowings were 3.13%, an increase of 99 basis points over the previous quarter.

•Yield on average interest-earning assets during the first quarter of 2023 rose 25 basis points to 3.92% driven by a rise in our loan yield of 29 basis points over this same period. The increase in interest-earning asset yields reflects the continued increase in interest rates through the first quarter of 2023, continued redeployment of lower yielding cash and investments to help fund the average loan growth during the quarter, as well as higher loan pricing on new originations.

Provision for Credit Losses

Asset quality remained very strong in the first quarter of 2023, although the risk of a macroeconomic slow-down in future periods remains, consistent with the previous quarter's forecast. At March 31, 2023, the ACL on loans was 0.91% of total loans and was 7.3 times total non-performing loans, compared to 0.92% and 7.2 times, respectively, at December 31, 2022.

The change in provision for credit losses between periods is highlighted in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in thousands) |

|

Q1 2023 |

|

Q4 2022 |

|

Increase /

(Decrease) |

| Provision for credit losses - loans |

|

$ |

439 |

|

|

$ |

642 |

|

|

$ |

(203) |

|

| Credit for credit losses - off-balance sheet credit exposures |

|

(275) |

|

|

(176) |

|

|

(99) |

|

| Provision for credit losses - HTM debt securities |

|

1,838 |

|

|

— |

|

|

1,838 |

|

| Provision for credit losses |

|

$ |

2,002 |

|

|

$ |

466 |

|

|

$ |

1,536 |

|

The provision for credit losses on HTM debt securities was driven by the full write-off of one corporate bond related to a bank failure in March 2023.

Non-Interest Income

Non-interest income for the first quarter of 2023 was $9.9 million, an increase of $84,000, or 1%, over the fourth quarter of 2022.

•In the fourth quarter of 2022, the Company executed an investment restructure trade and recorded a $903,000 loss on the sale of securities, with no corresponding loss in the first quarter of 2023.

•Generated additional fee income of $288,000 upon execution of back-to-back customer loan swaps in the first quarter of 2023.

•Lower debit card income of $1.0 million on a linked quarter-basis primarily because of the timing of recognition of our annual debit card volume-based incentive of $806,000 in the fourth quarter of 2022.

•Lower mortgage banking income of $319,000 primarily driven by the change in fair value on the residential mortgage loan pipeline on a linked-quarter basis. The Company sold 40% of its residential mortgage originations in the first quarter of 2023, compared to 16% in the fourth quarter of 2022, which resulted in higher sold production of $14.1 million on a linked quarter-basis. The Company anticipates over the next several quarters it will continue to sell more residential mortgage production as a percent of total production in comparison to more recent periods as it manages its on-books production in the current interest rate environment.

Non-Interest Expense

Non-interest expense for the first quarter of 2023 was $26.2 million, a decrease of $828,000, or 3%, compared to the fourth quarter of 2022. The Company's GAAP efficiency ratio and non-GAAP efficiency ratio for the first quarter of 2023 was 59.27% and 58.96%, respectively, compared to 57.72% and 56.35% for the fourth quarter of 2022. The increase in the GAAP and non-GAAP efficiency ratio on a linked quarter-basis reflects the decrease in revenues from net interest income. The Company's overhead ratio, which compares annualized non-interest expense for the quarter to average assets, for the first quarter of 2023 was 1.84%, compared to 1.93% for the fourth quarter of 2022.

•Salaries and employees benefits costs were $689,000 lower on a linked quarter-basis, primarily the result of lower incentive accruals.

•Other expenses were $496,000 lower on a linked quarter-basis, primarily due to lower losses on customer fraud claims and other seasonal costs.

Q1 2023 CONFERENCE CALL

Camden National will host a conference call and webcast at 3:00 p.m., Eastern Time, on Tuesday, April 25, 2023 to discuss its first quarter 2023 financial results and outlook. Participants should dial into the call 10 - 15 minutes before it begins. Information about the conference call is as follows:

Live dial-in (Domestic): (833) 470-1428

Live dial-in (All other locations): (929) 526-1599

Participant access code: 523637

Live webcast: https://events.q4inc.com/attendee/122489444

A link to the live webcast will be available on Camden National's website under "About — Investor Relations" at CamdenNational.bank prior to the meeting, and a replay of the webcast will be available on Camden National's website following the conference call. The transcript of the conference call will also be available on Camden National's website approximately two days after the conference call.

2023 ANNUAL MEETING OF SHAREHOLDERS

Camden National has scheduled its annual meeting of shareholders ("Annual Meeting") for Tuesday, May 23, 2023, at 9:00 a.m., Eastern Daylight Time. The Annual Meeting will be held virtually via a live audio webcast at www.virtualshareholdermeeting.com/CAC2023 and in person at Camden National's Hanley Center, Fox Ridge Office Park, 245 Commercial Street, Rockport, Maine 04856. We encourage all shareholders as of the March 27, 2023 record date to attend the Annual Meeting.

ABOUT CAMDEN NATIONAL CORPORATION

Camden National Corporation (NASDAQ: CAC) is the largest publicly traded bank holding company in Northern New England with $5.7 billion in assets, and was proudly listed as one of the Best Places to Work in Maine in 2021 and 2022. Founded in 1875, Camden National Bank is a full-service community bank dedicated to customers at every stage of their financial journey. With 24/7 live phone support, 58 banking centers, and additional lending offices in New Hampshire and Massachusetts, Camden National Bank offers the latest in digital banking, complemented by award-winning, personalized service. To learn more, visit CamdenNational.bank. Member FDIC. Equal Housing Lender.

Comprehensive wealth management, investment and financial planning services are delivered by Camden National Wealth Management.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including certain plans, expectations, goals, projections and other statements, which are subject to numerous risks, assumptions and uncertainties. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures; inflation; ongoing competition in labor markets and employee turnover; deterioration in the value of Camden National's investment securities; changes in consumer spending and savings habits; changes in the interest rate environment; changes in general economic conditions; operational risks including, but not limited to, cybersecurity, fraud and natural disasters; legislative and regulatory changes that adversely affect the business in which Camden National is engaged; turmoil and volatility in the financial services industry, including failures or rumors of failures of other depository institutions, including the Company, to attract and retain depositors, and could affect the ability of financial services providers, including the Company, to borrow or raise capital; actions taken by governmental agencies to stabilize the financial system and the effectiveness of such actions; changes to regulatory capital requirements in response to recent developments affecting the banking sector; changes in the securities markets and other risks and uncertainties disclosed from time to time in Camden National’s Annual Report on Form 10-K for the year ended December 31, 2022, as updated by other filings with the Securities and Exchange Commission ("SEC"). Further, statements regarding the potential effects of the war in Ukraine, the COVID-19 pandemic and other notable and global current events on the Company's business, financial condition, liquidity and results of operations may constitute forward-looking statements and are subject to the risk that the actual effects may differ, possible materially, from what is reflected in those forward-looking statements due to factors and future developments that are uncertain, unpredictable and in many cases beyond the Company's control. Camden National does not have any obligation to update forward-looking statements.

USE OF NON-GAAP MEASURES

In addition to evaluating the Company's results of operations in accordance with generally accepted accounting principles in the United States ("GAAP"), management supplements this evaluation with certain non-GAAP financial measures, such as earnings before income taxes and provision and earnings before income taxes, provision and SBA PPP loan income; return on average tangible equity; the efficiency and tangible common equity ratios; tangible book value per share; core deposits and average core deposits; and total loans, excluding SBA PPP loans. Management utilizes these non-GAAP financial measures for purposes of measuring our performance against our peer group and other financial institutions and analyzing our internal performance. We also believe these non-GAAP financial measures help investors better understand the Company's operating performance and trends and allow for better performance comparisons to other financial institutions. In addition, these non-GAAP financial measures remove the impact of unusual items that may obscure trends in the Company's underlying performance. These disclosures should not be viewed as a substitute for GAAP operating results, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other financial institutions. Reconciliations to the comparable GAAP financial measures can be found in this document.

ANNUALIZED DATA

Certain returns, yields and performance ratios are presented on an “annualized” basis. This is done for analytical and decision-making purposes to better discern underlying performance trends when compared to full-year or year-over-year amounts. Annualized data may not be indicative of any four-quarter period, and is presented for illustrative purposes only.

Selected Financial Data

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For The

Three Months Ended |

|

|

(In thousands, except number of shares and per share data) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

|

|

| Financial Condition Data |

|

|

|

|

|

|

|

|

|

|

| Investments |

|

$ |

1,249,882 |

|

|

$ |

1,259,161 |

|

|

$ |

1,437,410 |

|

|

|

|

|

| Loans and loans held for sale |

|

$ |

4,077,670 |

|

|

$ |

4,015,550 |

|

|

$ |

3,540,923 |

|

|

|

|

|

| Allowance for credit losses on loans |

|

$ |

37,134 |

|

|

$ |

36,922 |

|

|

$ |

31,770 |

|

|

|

|

|

| Total assets |

|

$ |

5,716,605 |

|

|

$ |

5,671,850 |

|

|

$ |

5,420,415 |

|

|

|

|

|

| Deposits |

|

$ |

4,642,734 |

|

|

$ |

4,826,929 |

|

|

$ |

4,576,664 |

|

|

|

|

|

| Borrowings |

|

$ |

530,649 |

|

|

$ |

309,507 |

|

|

$ |

281,999 |

|

|

|

|

|

| Shareholders' equity |

|

$ |

464,874 |

|

|

$ |

451,278 |

|

|

$ |

482,446 |

|

|

|

|

|

| Operating Data |

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

$ |

34,280 |

|

|

$ |

36,982 |

|

|

$ |

36,365 |

|

|

|

|

|

| Provision (credit) for credit losses |

|

2,002 |

|

|

466 |

|

|

(1,075) |

|

|

|

|

|

| Non-interest income |

|

9,866 |

|

|

9,782 |

|

|

9,825 |

|

|

|

|

|

| Non-interest expense |

|

26,165 |

|

|

26,993 |

|

|

26,209 |

|

|

|

|

|

| Income before income tax expense |

|

15,979 |

|

|

19,305 |

|

|

21,056 |

|

|

|

|

|

| Income tax expense |

|

3,252 |

|

|

3,954 |

|

|

4,261 |

|

|

|

|

|

| Net income |

|

$ |

12,727 |

|

|

$ |

15,351 |

|

|

$ |

16,795 |

|

|

|

|

|

| Key Ratios |

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

0.91 |

% |

|

1.09 |

% |

|

1.26 |

% |

|

|

|

|

| Return on average equity |

|

11.16 |

% |

|

14.03 |

% |

|

12.96 |

% |

|

|

|

|

| GAAP efficiency ratio |

|

59.27 |

% |

|

57.72 |

% |

|

56.74 |

% |

|

|

|

|

| Net interest margin (fully-taxable equivalent) |

|

2.54 |

% |

|

2.76 |

% |

|

2.87 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-performing assets to total assets |

|

0.09 |

% |

|

0.09 |

% |

|

0.12 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common equity ratio |

|

8.13 |

% |

|

7.96 |

% |

|

8.90 |

% |

|

|

|

|

| Tier 1 leverage capital ratio |

|

9.24 |

% |

|

9.22 |

% |

|

9.30 |

% |

|

|

|

|

| Common equity tier 1 risk-based capital ratio |

|

11.90 |

% |

|

11.74 |

% |

|

12.38 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total risk-based capital ratio |

|

13.95 |

% |

|

13.80 |

% |

|

14.51 |

% |

|

|

|

|

| Per Share Data |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.87 |

|

|

$ |

1.05 |

|

|

$ |

1.14 |

|

|

|

|

|

| Diluted earnings per share |

|

$ |

0.87 |

|

|

$ |

1.05 |

|

|

$ |

1.13 |

|

|

|

|

|

| Cash dividends declared per share |

|

$ |

0.42 |

|

|

$ |

0.42 |

|

|

$ |

0.40 |

|

|

|

|

|

| Book value per share |

|

$ |

31.87 |

|

|

$ |

30.98 |

|

|

$ |

32.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Measures(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes and provision for credit losses |

|

$ |

17,981 |

|

|

$ |

19,771 |

|

|

$ |

19,981 |

|

|

|

|

|

| Earnings before income taxes, and provision (credit) for credit losses and SBA PPP loan income |

|

$ |

17,977 |

|

|

$ |

19,765 |

|

|

$ |

18,948 |

|

|

|

|

|

| Tangible book value per share |

|

$ |

25.28 |

|

|

$ |

24.37 |

|

|

$ |

26.16 |

|

|

|

|

|

| Tangible common equity ratio |

|

6.56 |

% |

|

6.37 |

% |

|

7.25 |

% |

|

|

|

|

| Return on average tangible equity |

|

14.21 |

% |

|

18.18 |

% |

|

16.01 |

% |

|

|

|

|

| Efficiency ratio |

|

58.96 |

% |

|

56.35 |

% |

|

56.47 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Please see "Reconciliation of non-GAAP to GAAP Financial Measures (unaudited)."

Consolidated Statements of Condition Data

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

| ASSETS |

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash |

|

$ |

75,741 |

|

|

$ |

75,427 |

|

|

$ |

139,383 |

|

| Investments: |

|

|

|

|

|

|

| Trading securities |

|

3,971 |

|

|

3,990 |

|

|

4,124 |

|

| Available-for-sale securities, at fair value (amortized cost of $777,621, $796,960, and $1,516,057 respectively) |

|

686,423 |

|

|

695,875 |

|

|

1,421,809 |

|

| Held-to-maturity securities, at amortized cost (fair value of $509,250, $506,193 and $1,300 respectively) |

|

540,074 |

|

|

546,583 |

|

|

1,290 |

|

| Other investments |

|

19,414 |

|

|

12,713 |

|

|

10,187 |

|

| Total investments |

|

1,249,882 |

|

|

1,259,161 |

|

|

1,437,410 |

|

| Loans held for sale, at fair value (book value of $4,539, $5,259, and 6,818 respectively) |

|

4,562 |

|

|

5,197 |

|

|

6,705 |

|

| Loans: |

|

|

|

|

|

|

| Commercial real estate |

|

1,666,617 |

|

|

1,624,937 |

|

|

1,503,890 |

|

| Commercial |

|

420,530 |

|

|

429,499 |

|

|

403,352 |

|

| SBA PPP |

|

569 |

|

|

632 |

|

|

6,311 |

|

| Residential real estate |

|

1,733,147 |

|

|

1,700,266 |

|

|

1,392,199 |

|

| Consumer and home equity |

|

252,245 |

|

|

255,019 |

|

|

228,466 |

|

| Total loans |

|

4,073,108 |

|

|

4,010,353 |

|

|

3,534,218 |

|

| Less: allowance for credit losses on loans |

|

(37,134) |

|

|

(36,922) |

|

|

(31,770) |

|

| Net loans |

|

4,035,974 |

|

|

3,973,431 |

|

|

3,502,448 |

|

| Goodwill and core deposit intangible assets |

|

96,112 |

|

|

96,260 |

|

|

96,729 |

|

| Other assets |

|

254,334 |

|

|

262,374 |

|

|

237,740 |

|

| Total assets |

|

$ |

5,716,605 |

|

|

$ |

5,671,850 |

|

|

$ |

5,420,415 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

| Non-interest checking |

|

$ |

1,047,491 |

|

|

$ |

1,141,753 |

|

|

$ |

1,200,807 |

|

| Interest checking |

|

1,609,330 |

|

|

1,763,850 |

|

|

1,440,390 |

|

| Savings and money market |

|

1,409,861 |

|

|

1,439,622 |

|

|

1,474,300 |

|

| Certificates of deposit |

|

360,103 |

|

|

300,451 |

|

|

299,865 |

|

| Brokered deposits |

|

215,949 |

|

|

181,253 |

|

|

161,302 |

|

| Total deposits |

|

4,642,734 |

|

|

4,826,929 |

|

|

4,576,664 |

|

| Short-term borrowings |

|

486,318 |

|

|

265,176 |

|

|

237,668 |

|

|

|

|

|

|

|

|

| Junior subordinated debentures |

|

44,331 |

|

|

44,331 |

|

|

44,331 |

|

| Accrued interest and other liabilities |

|

78,348 |

|

|

84,136 |

|

|

79,306 |

|

| Total liabilities |

|

5,251,731 |

|

|

5,220,572 |

|

|

4,937,969 |

|

| Commitments and Contingencies |

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

|

Common stock, no par value: authorized 40,000,000 shares, issued and outstanding 14,587,906, 14,567,325 and 14,746,410 shares on March 31, 2023, December 31, 2022 and March 31, 2022, respectively |

|

115,590 |

|

|

115,069 |

|

|

123,012 |

|

| Retained earnings |

|

468,755 |

|

|

462,164 |

|

|

435,347 |

|

| Accumulated other comprehensive loss: |

|

|

|

|

|

|

| Net unrealized loss on debt securities, net of tax |

|

(122,445) |

|

|

(131,539) |

|

|

(73,984) |

|

| Net unrealized gain on cash flow hedging derivative instruments, net of tax |

|

3,286 |

|

|

5,891 |

|

|

1,166 |

|

| Net unrecognized loss on postretirement plans, net of tax |

|

(312) |

|

|

(307) |

|

|

(3,095) |

|

| Total accumulated other comprehensive loss |

|

(119,471) |

|

|

(125,955) |

|

|

(75,913) |

|

| Total shareholders’ equity |

|

464,874 |

|

|

451,278 |

|

|

482,446 |

|

| Total liabilities and shareholders’ equity |

|

$ |

5,716,605 |

|

|

$ |

5,671,850 |

|

|

$ |

5,420,415 |

|

Consolidated Statements of Income Data

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For The

Three Months Ended |

|

|

| (In thousands, except per share data) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

|

|

| Interest Income |

|

|

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

45,332 |

|

|

$ |

41,985 |

|

|

$ |

32,035 |

|

|

|

|

|

| Taxable interest on investments |

|

5,963 |

|

|

5,944 |

|

|

5,789 |

|

|

|

|

|

| Nontaxable interest on investments |

|

763 |

|

|

772 |

|

|

764 |

|

|

|

|

|

| Dividend income |

|

219 |

|

|

182 |

|

|

106 |

|

|

|

|

|

| Other interest income |

|

448 |

|

|

436 |

|

|

164 |

|

|

|

|

|

| Total interest income |

|

52,725 |

|

|

49,319 |

|

|

38,858 |

|

|

|

|

|

| Interest Expense |

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

|

15,832 |

|

|

10,520 |

|

|

1,833 |

|

|

|

|

|

| Interest on borrowings |

|

2,085 |

|

|

1,277 |

|

|

131 |

|

|

|

|

|

| Interest on junior subordinated debentures |

|

528 |

|

|

540 |

|

|

529 |

|

|

|

|

|

| Total interest expense |

|

18,445 |

|

|

12,337 |

|

|

2,493 |

|

|

|

|

|

| Net interest income |

|

34,280 |

|

|

36,982 |

|

|

36,365 |

|

|

|

|

|

| Provision (credit) for credit losses |

|

2,002 |

|

|

466 |

|

|

(1,075) |

|

|

|

|

|

| Net interest income after provision (credit) for credit losses |

|

32,278 |

|

|

36,516 |

|

|

37,440 |

|

|

|

|

|

| Non-Interest Income |

|

|

|

|

|

|

|

|

|

|

| Debit card income |

|

2,938 |

|

|

3,969 |

|

|

2,924 |

|

|

|

|

|

| Service charges on deposit accounts |

|

1,762 |

|

|

1,882 |

|

|

1,833 |

|

|

|

|

|

| Income from fiduciary services |

|

1,600 |

|

|

1,560 |

|

|

1,631 |

|

|

|

|

|

| Brokerage and insurance commissions |

|

1,093 |

|

|

878 |

|

|

994 |

|

|

|

|

|

| Mortgage banking income, net |

|

716 |

|

|

1,035 |

|

|

1,034 |

|

|

|

|

|

| Bank-owned life insurance |

|

592 |

|

|

382 |

|

|

576 |

|

|

|

|

|

| Net loss on sale of securities |

|

— |

|

|

(903) |

|

|

— |

|

|

|

|

|

| Other income |

|

1,165 |

|

|

979 |

|

|

833 |

|

|

|

|

|

| Total non-interest income |

|

9,866 |

|

|

9,782 |

|

|

9,825 |

|

|

|

|

|

| Non-Interest Expense |

|

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

14,573 |

|

|

15,262 |

|

|

15,506 |

|

|

|

|

|

| Furniture, equipment and data processing |

|

3,211 |

|

|

3,404 |

|

|

3,132 |

|

|

|

|

|

| Net occupancy costs |

|

2,079 |

|

|

1,863 |

|

|

2,144 |

|

|

|

|

|

| Debit card expense |

|

1,201 |

|

|

1,192 |

|

|

1,066 |

|

|

|

|

|

| Consulting and professional fees |

|

1,055 |

|

|

959 |

|

|

1,007 |

|

|

|

|

|

| Regulatory assessments |

|

845 |

|

|

593 |

|

|

655 |

|

|

|

|

|

| Amortization of core deposit intangible assets |

|

148 |

|

|

156 |

|

|

156 |

|

|

|

|

|

| Other real estate owned and collection costs (recoveries), net |

|

5 |

|

|

20 |

|

|

(85) |

|

|

|

|

|

| Other expenses |

|

3,048 |

|

|

3,544 |

|

|

2,628 |

|

|

|

|

|

| Total non-interest expense |

|

26,165 |

|

|

26,993 |

|

|

26,209 |

|

|

|

|

|

| Income before income tax expense |

|

15,979 |

|

|

19,305 |

|

|

21,056 |

|

|

|

|

|

| Income Tax Expense |

|

3,252 |

|

|

3,954 |

|

|

4,261 |

|

|

|

|

|

| Net Income |

|

$ |

12,727 |

|

|

$ |

15,351 |

|

|

$ |

16,795 |

|

|

|

|

|

| Per Share Data |

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.87 |

|

|

$ |

1.05 |

|

|

$ |

1.14 |

|

|

|

|

|

| Diluted earnings per share |

|

$ |

0.87 |

|

|

$ |

1.05 |

|

|

$ |

1.13 |

|

|

|

|

|

Quarterly Average Balance and Yield/Rate Analysis

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Balance |

|

|

Yield/Rate |

|

|

For The Three Months Ended |

|

|

For The Three Months Ended |

| (Dollars in thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

March 31,

2023 |

|

December 31,

2022 |

|

|

March 31,

2022 |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits in other banks and other interest-earning assets |

|

$ |

26,018 |

|

|

$ |

28,219 |

|

|

$ |

100,002 |

|

|

|

3.89 |

% |

|

3.52 |

% |

|

|

0.13 |

% |

| Investments - taxable |

|

1,237,351 |

|

|

1,256,135 |

|

|

1,409,567 |

|

|

|

2.06 |

% |

|

2.01 |

% |

|

|

1.71 |

% |

Investments - nontaxable(1) |

|

105,502 |

|

|

106,921 |

|

|

115,021 |

|

|

|

3.66 |

% |

|

3.65 |

% |

|

|

3.36 |

% |

Loans(2): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial real estate |

|

1,646,005 |

|

|

1,591,392 |

|

|

1,489,304 |

|

|

|

5.49 |

% |

|

4.37 |

% |

|

|

3.64 |

% |

Commercial(1) |

|

409,112 |

|

|

409,233 |

|

|

372,910 |

|

|

|

5.49 |

% |

|

4.91 |

% |

|

|

3.54 |

% |

| SBA PPP |

|

594 |

|

|

652 |

|

|

21,687 |

|

|

|

2.55 |

% |

|

3.50 |

% |

|

|

19.05 |

% |

Municipal(1) |

|

15,997 |

|

|

20,693 |

|

|

15,221 |

|

|

|

3.56 |

% |

|

3.28 |

% |

|

|

3.46 |

% |

| Residential real estate |

|

1,715,192 |

|

|

1,667,256 |

|

|

1,347,427 |

|

|

|

3.78 |

% |

|

3.58 |

% |

|

|

3.46 |

% |

| Consumer and home equity |

|

253,760 |

|

|

255,355 |

|

|

226,731 |

|

|

|

7.10 |

% |

|

6.24 |

% |

|

|

4.26 |

% |

| Total loans |

|

4,040,660 |

|

|

3,944,581 |

|

|

3,473,280 |

|

|

|

4.50 |

% |

|

4.21 |

% |

|

|

3.70 |

% |

| Total interest-earning assets |

|

5,409,531 |

|

|

5,335,856 |

|

|

5,097,870 |

|

|

|

3.92 |

% |

|

3.67 |

% |

|

|

3.07 |

% |

| Other assets |

|

278,136 |

|

|

267,215 |

|

|

323,233 |

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

5,687,667 |

|

|

$ |

5,603,071 |

|

|

$ |

5,421,103 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities & Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest checking |

|

$ |

1,076,469 |

|

|

$ |

1,182,999 |

|

|

$ |

1,199,456 |

|

|

|

— |

% |

|

— |

% |

|

|

— |

% |

| Interest checking |

|

1,689,862 |

|

|

1,665,360 |

|

|

1,414,704 |

|

|

|

2.00 |

% |

|

1.56 |

% |

|

|

0.19 |

% |

| Savings |

|

734,804 |

|

|

763,858 |

|

|

750,899 |

|

|

|

0.08 |

% |

|

0.05 |

% |

|

|

0.04 |

% |

| Money market |

|

699,080 |

|

|

689,738 |

|

|

710,256 |

|

|

|

2.20 |

% |

|

1.46 |

% |

|

|

0.30 |

% |

| Certificates of deposit |

|

320,209 |

|

|

289,476 |

|

|

304,720 |

|

|

|

1.73 |

% |

|

0.68 |

% |

|

|

0.45 |

% |

| Total deposits |

|

4,520,424 |

|

|

4,591,431 |

|

|

4,380,035 |

|

|

|

1.22 |

% |

|

0.84 |

% |

|

|

0.15 |

% |

| Borrowings: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Brokered deposits |

|

220,559 |

|

|

120,150 |

|

|

176,399 |

|

|

|

4.05 |

% |

|

2.75 |

% |

|

|

0.55 |

% |

Customer repurchase agreements |

|

182,754 |

|

|

203,105 |

|

|

208,147 |

|

|

|

1.07 |

% |

|

0.82 |

% |

|

|

0.25 |

% |

| Subordinated debentures |

|

44,331 |

|

|

44,331 |

|

|

44,331 |

|

|

|

4.83 |

% |

|

4.83 |

% |

|

|

4.84 |

% |

| Other borrowings |

|

175,223 |

|

|

123,142 |

|

|

1,613 |

|

|

|

3.71 |

% |

|

2.76 |

% |

|

|

0.39 |

% |

| Total borrowings |

|

622,867 |

|

|

490,728 |

|

|

430,490 |

|

|

|

3.13 |

% |

|

2.14 |

% |

|

|

0.85 |

% |

| Total funding liabilities |

|

5,143,291 |

|

|

5,082,159 |

|

|

4,810,525 |

|

|

|

1.45 |

% |

|

0.96 |

% |

|

|

0.21 |

% |

| Other liabilities |

|

81,725 |

|

|

86,827 |

|

|

85,140 |

|

|

|

|

|

|

|

|

|

| Shareholders' equity |

|

462,651 |

|

|

434,085 |

|

|

525,438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities & shareholders' equity |

|

$ |

5,687,667 |

|

|

$ |

5,603,071 |

|

|

$ |

5,421,103 |

|

|

|

|

|

|

|

|

|

| Net interest rate spread (fully-taxable equivalent) |

|

2.47 |

% |

|

2.71 |

% |

|

|

2.86 |

% |

| Net interest margin (fully-taxable equivalent) |

|

2.54 |

% |

|

2.76 |

% |

|

|

2.87 |

% |

(1) Reported on a tax-equivalent basis calculated using the federal corporate income tax rate of 21%, including certain commercial loans.

(2) Non-accrual loans and loans held for sale are included in total average loans.

Asset Quality Data

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In thousands) |

|

At or For The

Three Months Ended

March 31, 2023 |

|

At or For The

Year Ended

December 31, 2022 |

|

At or For The

Nine Months Ended

September 30, 2022 |

|

At or For The

Six Months Ended

June 30, 2022 |

|

At or For The

Three Months Ended

March 31, 2022 |

| Non-accrual loans: |

|

|

|

|

|

|

|

|

|

|

| Residential real estate |

|

$ |

1,713 |

|

|

$ |

1,733 |

|

|

$ |

1,562 |

|

|

$ |

1,831 |

|

|

$ |

2,052 |

|

| Commercial real estate |

|

56 |

|

|

57 |

|

|

73 |

|

|

182 |

|

|

183 |

|

| Commercial |

|

748 |

|

|

715 |

|

|

541 |

|

|

723 |

|

|

1,045 |

|

| Consumer and home equity |

|

441 |

|

|

486 |

|

|

589 |

|

|

769 |

|

|

1,172 |

|

| Total non-accrual loans |

|

2,958 |

|

|

2,991 |

|

|

2,765 |

|

|

3,505 |

|

|

4,452 |

|

|

|

|

|

|

|

|

|

|

|

|

| Accruing troubled-debt restructured loans not included above |

|

2,154 |

|

|

2,114 |

|

|

2,285 |

|

|

2,316 |

|

|

2,303 |

|

| Total non-performing loans |

|

5,112 |

|

|

5,105 |

|

|

5,050 |

|

|

5,821 |

|

|

6,755 |

|

| Other real estate owned |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total non-performing assets |

|

$ |

5,112 |

|

|

$ |

5,105 |

|

|

$ |

5,050 |

|

|

$ |

5,821 |

|

|

$ |

6,755 |

|

| Loans 30-89 days past due: |

|

|

|

|

|

|

|

|

|

|

| Residential real estate |

|

$ |

313 |

|

|

$ |

1,038 |

|

|

$ |

2,326 |

|

|

$ |

918 |

|

|

$ |

575 |

|

| Commercial real estate |

|

111 |

|

|

323 |

|

|

195 |

|

|

258 |

|

|

91 |

|

| Commercial |

|

1,030 |

|

|

802 |

|

|

1,344 |

|

|

422 |

|

|

169 |

|

| Consumer and home equity |

|

684 |

|

|

391 |

|

|

843 |

|

|

577 |

|

|

466 |

|

Total loans 30-89 days past due |

|

$ |

2,138 |

|

|

$ |

2,554 |

|

|

$ |

4,708 |

|

|

$ |

2,175 |

|

|

$ |

1,301 |

|

| ACL on loans at the beginning of the period |

|

$ |

36,922 |

|

|

$ |

33,256 |

|

|

$ |

33,256 |

|

|

$ |

33,256 |

|

|

$ |

33,256 |

|

| Provision (credit) for loan losses |

|

439 |

|

|

4,430 |

|

|

3,788 |

|

|

1,275 |

|

|

(1,236) |

|

| Charge-offs: |

|

|

|

|

|

|

|

|

|

|

| Residential real estate |

|

18 |

|

|

66 |

|

|

65 |

|

|

16 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial |

|

312 |

|

|

1,042 |

|

|

744 |

|

|

561 |

|

|

245 |

|

| Consumer and home equity |

|

4 |

|

|

134 |

|

|

130 |

|

|

84 |

|

|

67 |

|

| Total charge-offs |

|

334 |

|

|

1,242 |

|

|

939 |

|

|

661 |

|

|

312 |

|

| Total recoveries |

|

(107) |

|

|

(478) |

|

|

(437) |

|

|

(374) |

|

|

(62) |

|

| Net charge-offs |

|

227 |

|

|

764 |

|

|

502 |

|

|

287 |

|

|

250 |

|

| ACL on loans at the end of the period |

|

$ |

37,134 |

|

|

$ |

36,922 |

|

|

$ |

36,542 |

|

|

$ |

34,244 |

|

|

$ |

31,770 |

|

| Components of ACL: |

|

|

|

|

|

|

|

|

|

|

| ACL on loans |

|

$ |

37,134 |

|

|

$ |

36,922 |

|

|

$ |

36,542 |

|

|

$ |

34,244 |

|

|

$ |

31,770 |

|

ACL on off-balance sheet credit exposures(1) |

|

2,990 |

|

|

3,265 |

|

|

3,441 |

|

|

3,190 |

|

|

3,356 |

|

| ACL, end of period |

|

$ |

40,124 |

|

|

$ |

40,187 |

|

|

$ |

39,983 |

|

|

$ |

37,434 |

|

|

$ |

35,126 |

|

| Ratios: |

|

|

|

|

|

|

|

|

|

|

| Non-performing loans to total loans |

|

0.13 |

% |

|

0.13 |

% |

|

0.13 |

% |

|

0.16 |

% |

|

0.19 |

% |

| Non-performing assets to total assets |

|

0.09 |

% |

|

0.09 |

% |

|

0.09 |

% |

|

0.11 |

% |

|

0.12 |

% |

| ACL on loans to total loans |

|

0.91 |

% |

|

0.92 |

% |

|

0.95 |

% |

|

0.92 |

% |

|

0.90 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Net charge-offs to average loans (annualized): |

|

|

|

|

|

|

|

|

|

|

Quarter-to-date |

|

0.02 |

% |

|

0.03 |

% |

|

0.02 |

% |

|

— |

% |

|

0.03 |

% |

Year-to-date |

|

0.02 |

% |

|

0.02 |

% |

|

0.02 |

% |

|

0.02 |

% |

|

0.03 |

% |

| ACL on loans to non-performing loans |

|

726.41 |

% |

|

723.25 |

% |

|

723.60 |

% |

|

588.28 |

% |

|

470.32 |

% |

Loans 30-89 days past due to total loans |

|

0.05 |

% |

|

0.06 |

% |

|

0.12 |

% |

|

0.06 |

% |

|

0.04 |

% |

(1) Presented within accrued interest and other liabilities on the consolidated statements of condition.

Reconciliation of non-GAAP to GAAP Financial Measures (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on Average Tangible Equity: |

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended |

|

|

| (Dollars in thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

|

|

| Net income, as presented |

|

$ |

12,727 |

|

|

$ |

15,351 |

|

|

$ |

16,795 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: amortization of core deposit intangible assets, net of tax(1) |

|

117 |

|

|

123 |

|

|

123 |

|

|

|

|

|

| Net income, adjusted for amortization of core deposit intangible assets |

|

$ |

12,844 |

|

|

$ |

15,474 |

|

|

$ |

16,918 |

|

|

|

|

|

| Average equity, as presented |

|

$ |

462,651 |

|

|

$ |

434,085 |

|

|

$ |

525,438 |

|

|

|

|

|

| Less: average goodwill and core deposit intangible assets |

|

(96,191) |

|

|

(96,336) |

|

|

(96,815) |

|

|

|

|

|

| Average tangible equity |

|

$ |

366,460 |

|

|

$ |

337,749 |

|

|

$ |

428,623 |

|

|

|

|

|

| Return on average equity |

|

11.16 |

% |

|

14.03 |

% |

|

12.96 |

% |

|

|

|

|

| Return on average tangible equity |

|

14.21 |

% |

|

18.18 |

% |

|

16.01 |

% |

|

|

|

|

(1) Assumed a 21% tax rate.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency Ratio: |

|

|

|

|

|

|

|

|

|

|

|

|

For the

Three Months Ended |

|

|

| (Dollars in thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

|

|

| Non-interest expense, as presented |

|

$ |

26,165 |

|

|

$ |

26,993 |

|

|

$ |

26,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income, as presented |

|

$ |

34,280 |

|

|

$ |

36,982 |

|

|

$ |

36,365 |

|

|

|

|

|

Add: effect of tax-exempt income(1) |

|

229 |

|

|

237 |

|

|

226 |

|

|

|

|

|

| Non-interest income, as presented |

|

9,866 |

|

|

9,782 |

|

|

9,825 |

|

|

|

|

|

| Add: net loss on sale of securities |

|

— |

|

|

903 |

|

|

— |

|

|

|

|

|

| Adjusted net interest income plus non-interest income |

|

$ |

44,375 |

|

|

$ |

47,904 |

|

|

$ |

46,416 |

|

|

|

|

|

| GAAP efficiency ratio |

|

59.27 |

% |

|

57.72 |

% |

|

56.74 |

% |

|

|

|

|

| Non-GAAP efficiency ratio |

|

58.96 |

% |

|

56.35 |

% |

|

56.47 |

% |

|

|

|

|

(1) Assumed a 21% tax rate.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before Income Taxes and Provision, and Earnings before Income Taxes, Provision and SBA PPP Loan Income: |

|

|

|

|

|

|

For the

Three Months Ended |

|

|

| (In thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

|

|

| Net income, as presented |

|

$ |

12,727 |

|

|

$ |

15,351 |

|

|

$ |

16,795 |

|

|

|

|

|

| Add: provision (credit) for credit losses |

|

2,002 |

|

|

466 |

|

|

(1,075) |

|

|

|

|

|

| Add: income tax expense |

|

3,252 |

|

|

3,954 |

|

|

4,261 |

|

|

|

|

|

| Earnings before income taxes and provision (credit) for credit losses |

|

17,981 |

|

|

19,771 |

|

|

19,981 |

|

|

|

|

|

| Less: SBA PPP loan income |

|

(4) |

|

|

(6) |

|

|

(1,033) |

|

|

|

|

|

| Earnings before income taxes and provision (credit) for credit losses and SBA PPP loan income |

|

$ |

17,977 |

|

|

$ |

19,765 |

|

|

$ |

18,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tangible Book Value Per Share and Tangible Common Equity Ratio: |

|

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

| (In thousands, except number of shares, per share data and ratios) |

|

| Tangible Book Value Per Share: |

|

|

|

|

|

|

| Shareholders' equity, as presented |

|

$ |

464,874 |

|

|

$ |

451,278 |

|

|

$ |

482,446 |

|

| Less: goodwill and core deposit intangible assets |

|

(96,112) |

|

|

(96,260) |

|

|

(96,729) |

|

| Tangible shareholders' equity |

|

$ |

368,762 |

|

|

$ |

355,018 |

|

|

$ |

385,717 |

|

| Shares outstanding at period end |

|

14,587,906 |

|

|

14,567,325 |

|

|

14,746,410 |

|

| Book value per share |

|

$ |

31.87 |

|

|

$ |

30.98 |

|

|

$ |

32.72 |

|

| Tangible book value per share |

|

$ |

25.28 |

|

|

$ |

24.37 |

|

|

$ |

26.16 |

|

| Tangible Common Equity Ratio: |

| Total assets |

|

$ |

5,716,605 |

|

|

$ |

5,671,850 |

|

|

$ |

5,420,415 |

|

| Less: goodwill and core deposit intangible assets |

|

(96,112) |

|

|

(96,260) |

|

|

(96,729) |

|

| Tangible assets |

|

$ |

5,620,493 |

|

|

$ |

5,575,590 |

|

|

$ |

5,323,686 |

|

| Common equity ratio |

|

8.13 |

% |

|

7.96 |

% |

|

8.90 |

% |

| Tangible common equity ratio |

|

6.56 |

% |

|

6.37 |

% |

|

7.25 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core Deposits: |

| (In thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

| Total deposits |

|

$ |

4,642,734 |

|

|

$ |

4,826,929 |

|

|

$ |

4,576,664 |

|

| Less: certificates of deposit |

|

(360,103) |

|

|

(300,451) |

|

|

(299,865) |

|

| Less: brokered deposits |

|

(215,949) |

|

|

(181,253) |

|

|

(161,302) |

|

| Core deposits |

|

$ |

4,066,682 |

|

|

$ |

4,345,225 |

|

|

$ |

4,115,497 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Core Deposits: |

|

|

|

|

|

|

For the

Three Months Ended |

|

|

| (In thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

|

|

Total average deposits, as presented(1) |

|

$ |

4,520,424 |

|

|

$ |

4,591,431 |

|

|

$ |

4,380,035 |

|

|

|

|

|

| Less: average certificates of deposit |

|

(320,209) |

|

|

(289,476) |

|

|

(304,720) |

|

|

|

|

|

| Average core deposits |

|

$ |

4,200,215 |

|

|

$ |

4,301,955 |

|

|

$ |

4,075,315 |

|

|

|

|

|

(1) Brokered deposits excluded from total average deposits, as presented on the Average Balance, Interest and Yield/Rate analysis table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total loans, excluding SBA PPP loans: |

|

|

|

|

|

|

| (In thousands) |

|

March 31,

2023 |

|

December 31,

2022 |

|

March 31,

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total loans, as presented |

|

$ |

4,073,108 |

|

|

$ |

4,010,353 |

|

|

$ |

3,534,218 |

|

| Less: SBA PPP loans |

|

(569) |

|

|

(632) |

|

|

(6,311) |

|

| Total loans, excluding SBA PPP loans |

|

$ |

4,072,539 |

|

|

$ |

4,009,721 |

|

|

$ |

3,527,907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|