Document

EXHIBIT 99.1

For More Information:

Investor contact: Ann Thornton 414-438-6887

Media contact: Kate Venne 414-358-5176

Brady Corporation Reports Record EPS in its Fiscal 2024 Fourth Quarter, Expands its Share Buyback Program and Announces its Fiscal 2025 EPS Guidance

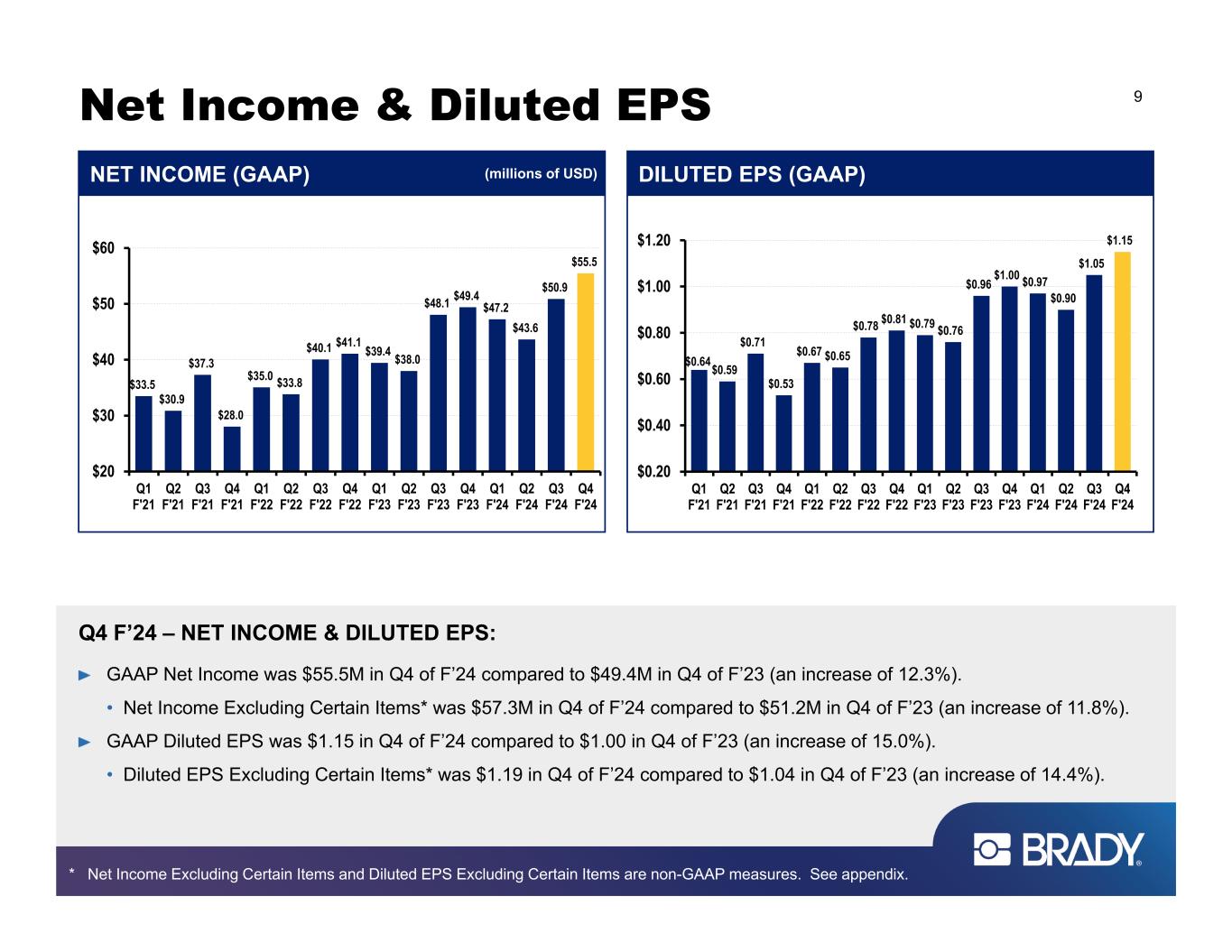

•Diluted EPS increased 15.0 percent to a record high of $1.15 in the fourth quarter of fiscal 2024 compared to $1.00 in the same quarter of the prior year. Diluted EPS Excluding Certain Items* increased 14.4 percent to a record high of $1.19 in the fourth quarter of fiscal 2024 compared to $1.04 in the same quarter of the prior year.

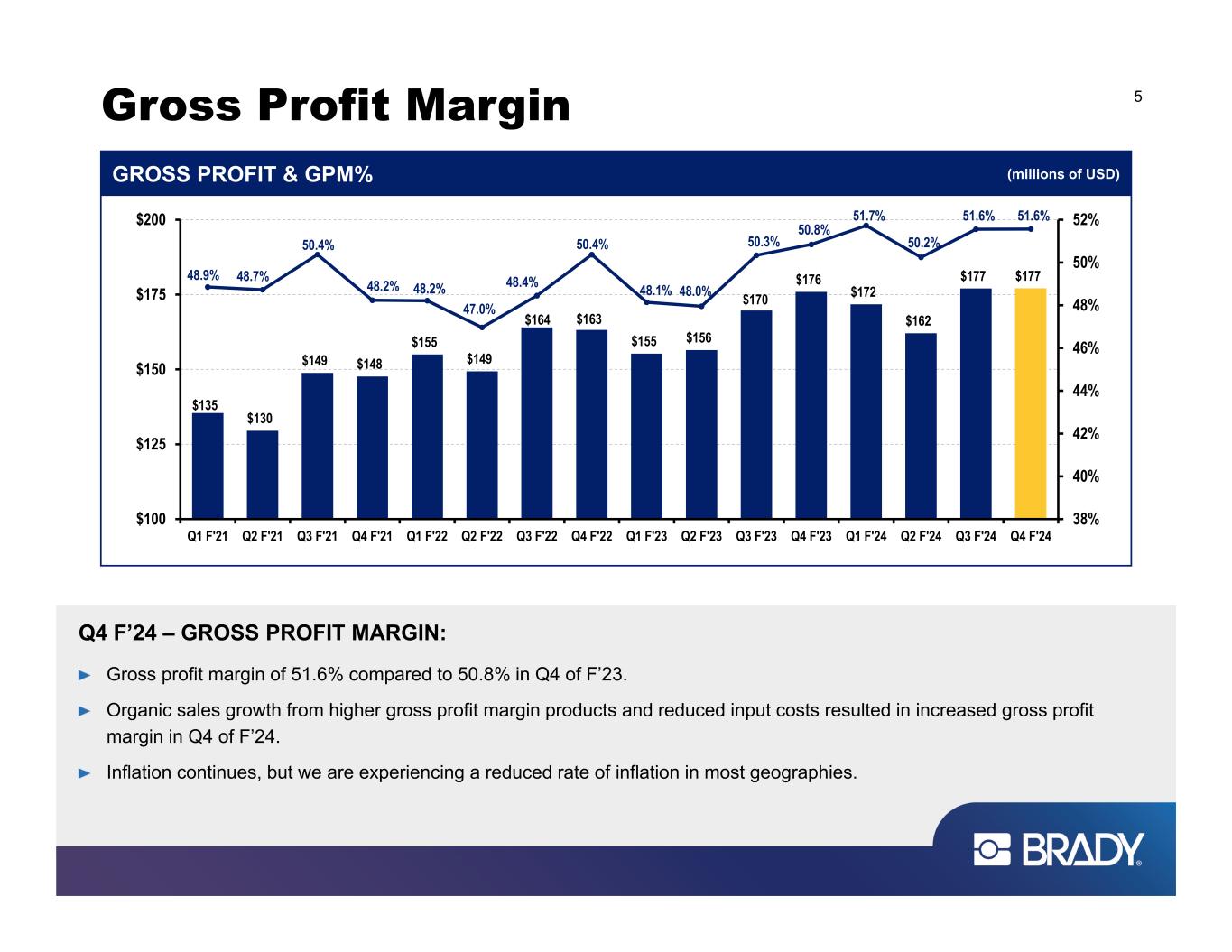

•Gross profit margin increased to 51.6 percent in the fourth quarter of fiscal 2024 compared to 50.8 percent in the same quarter of the prior year.

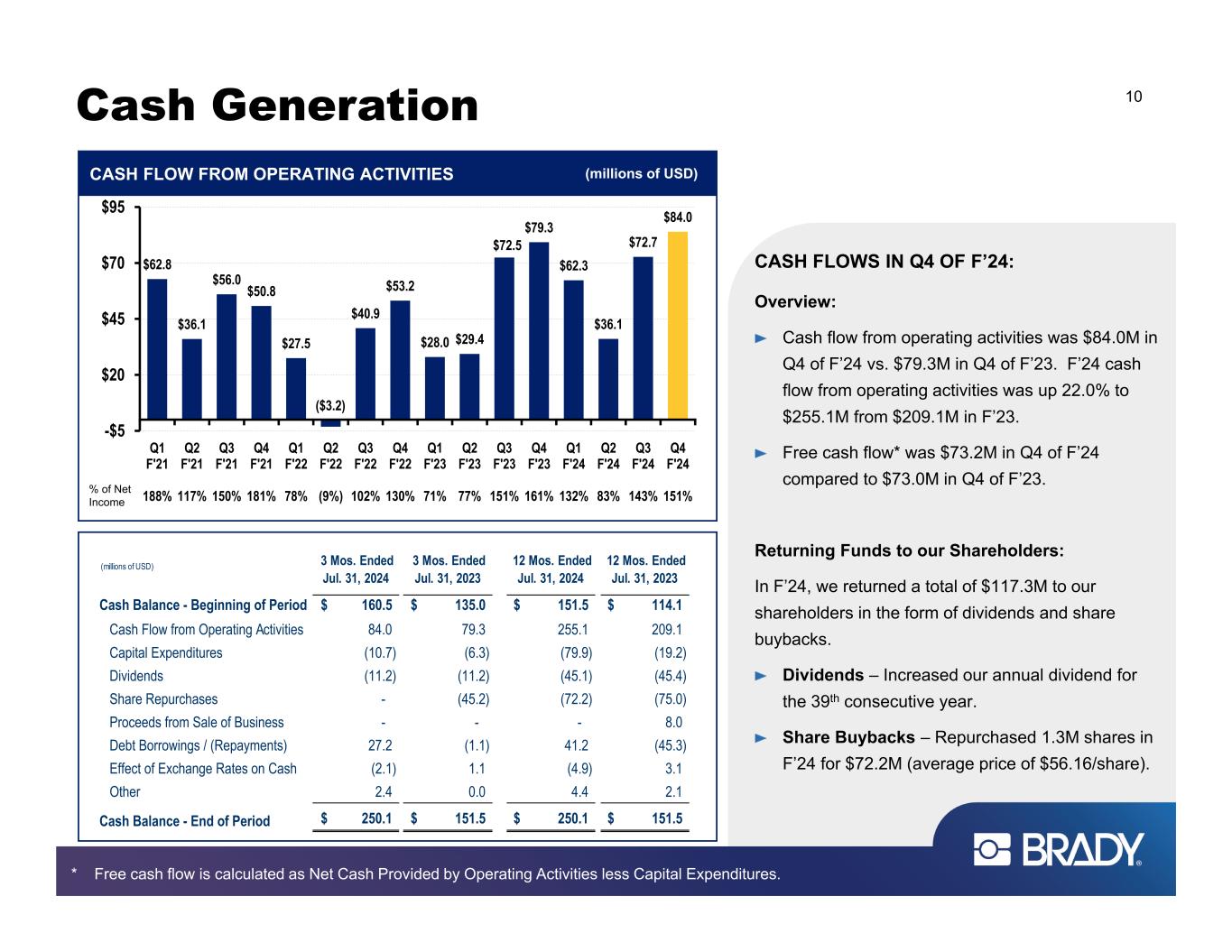

•Net cash provided by operating activities increased to a record high of $255.1 million in fiscal 2024 compared to $209.1 million in fiscal 2023.

•On September 4, 2024, Brady’s Board of Directors authorized an additional $100 million of shares for repurchase, which based on current share prices equates to approximately 1.5 million shares and approximately 3.0 percent of total outstanding shares.

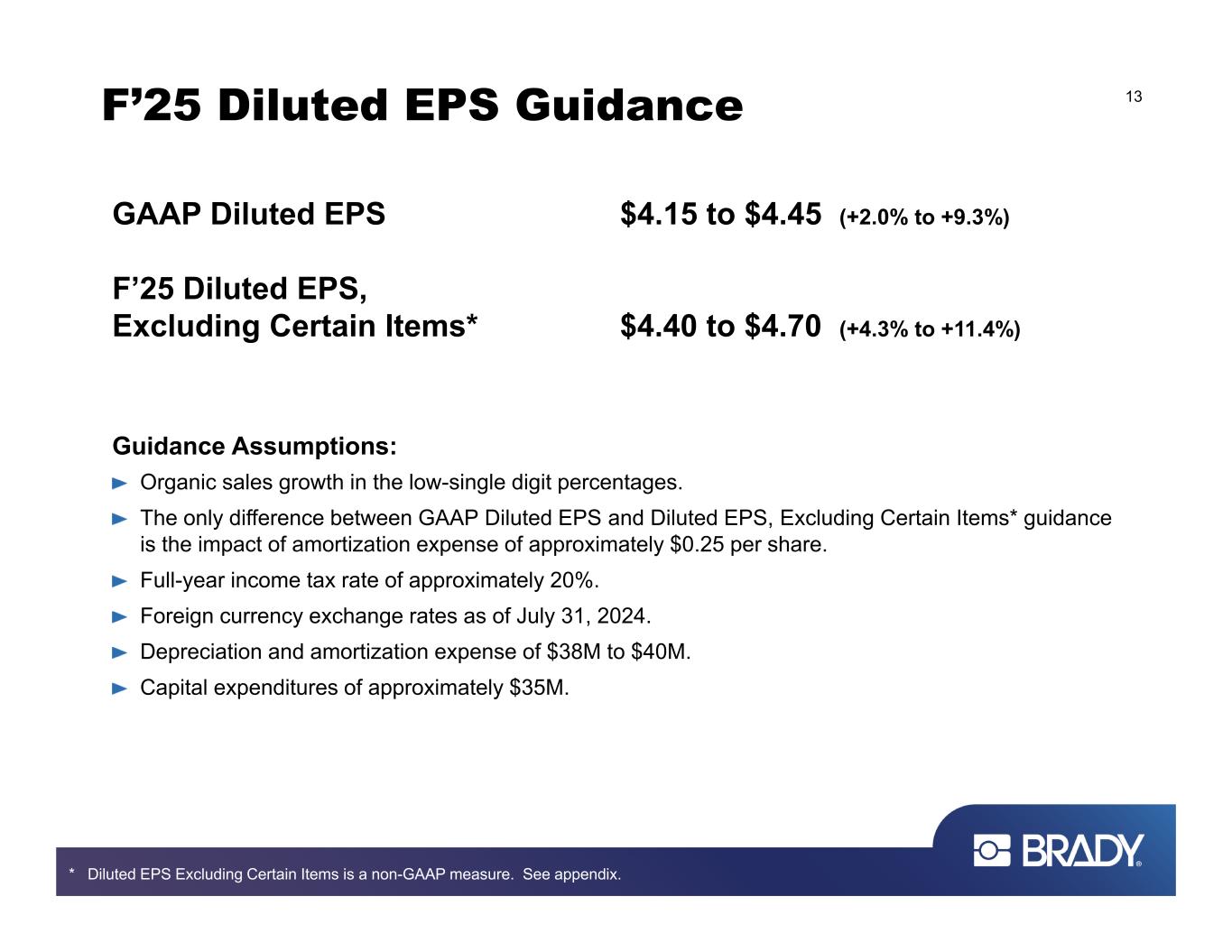

•Diluted EPS guidance for the year ending July 31, 2025 was announced at a range of $4.15 to $4.45 on a GAAP basis, and a range of $4.40 to $4.70 on a non-GAAP basis.

MILWAUKEE (September 6, 2024) -- Brady Corporation (NYSE: BRC) (“Brady” or “Company”), a world leader in identification solutions, today reported its financial results for its fiscal 2024 fourth quarter ended July 31, 2024.

Quarter Ended July 31, 2024 Financial Results:

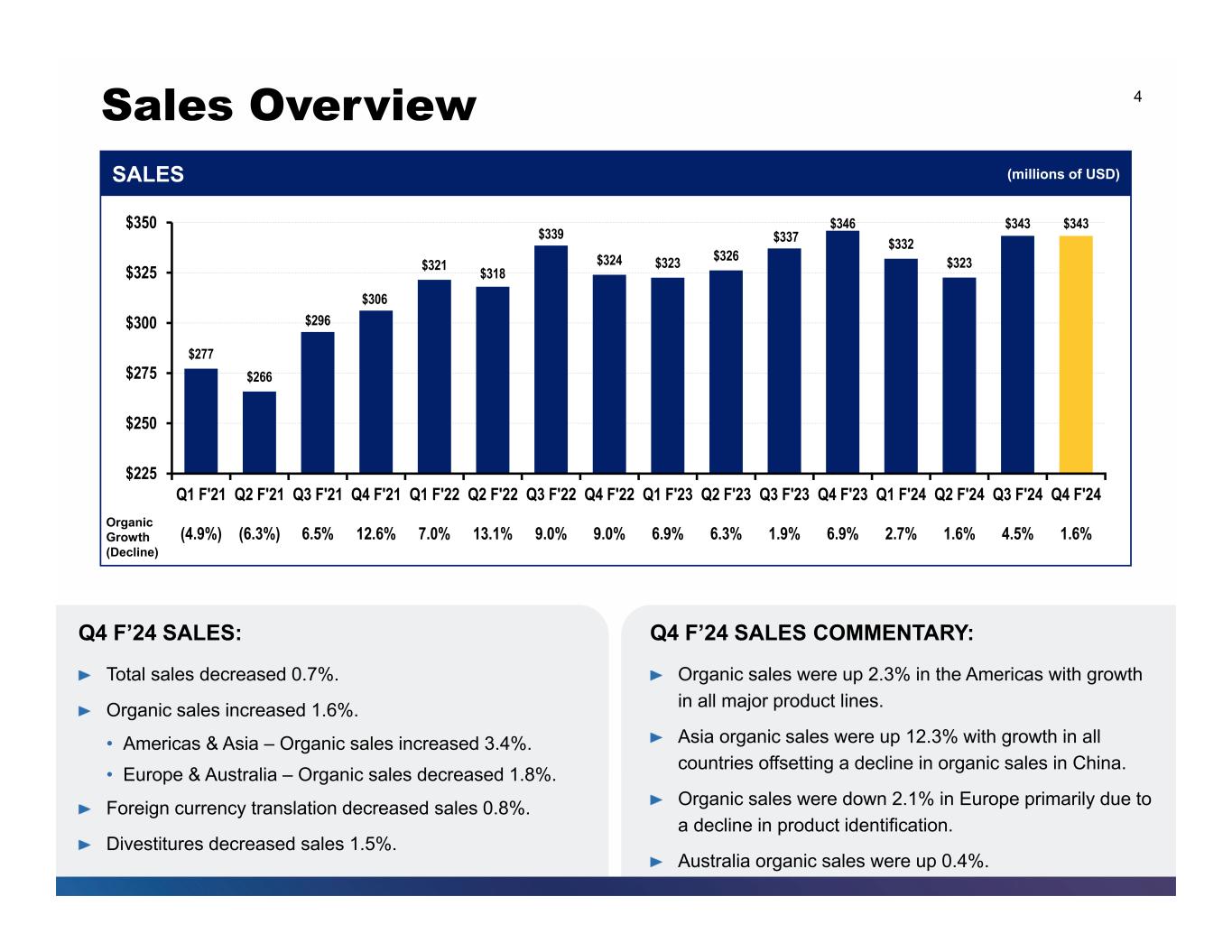

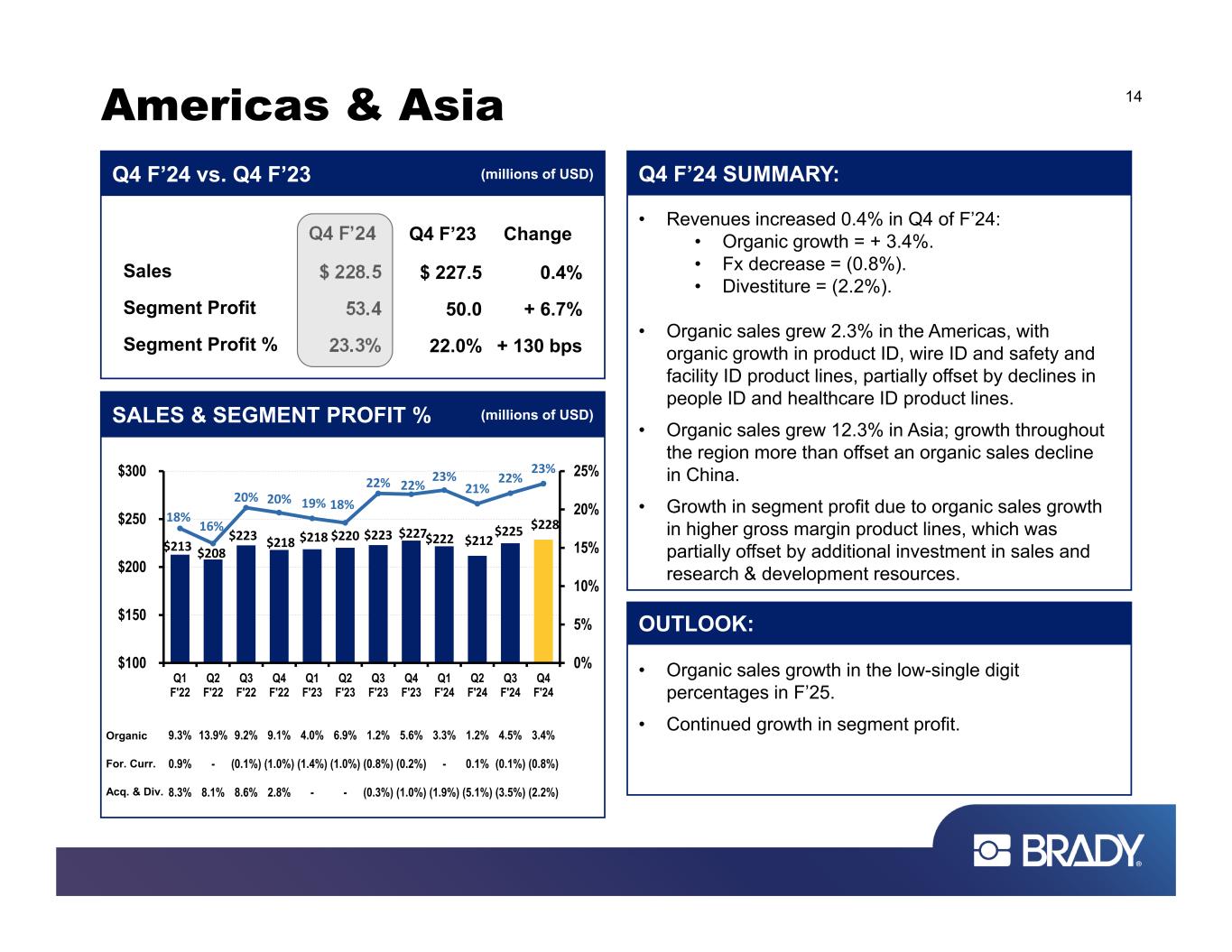

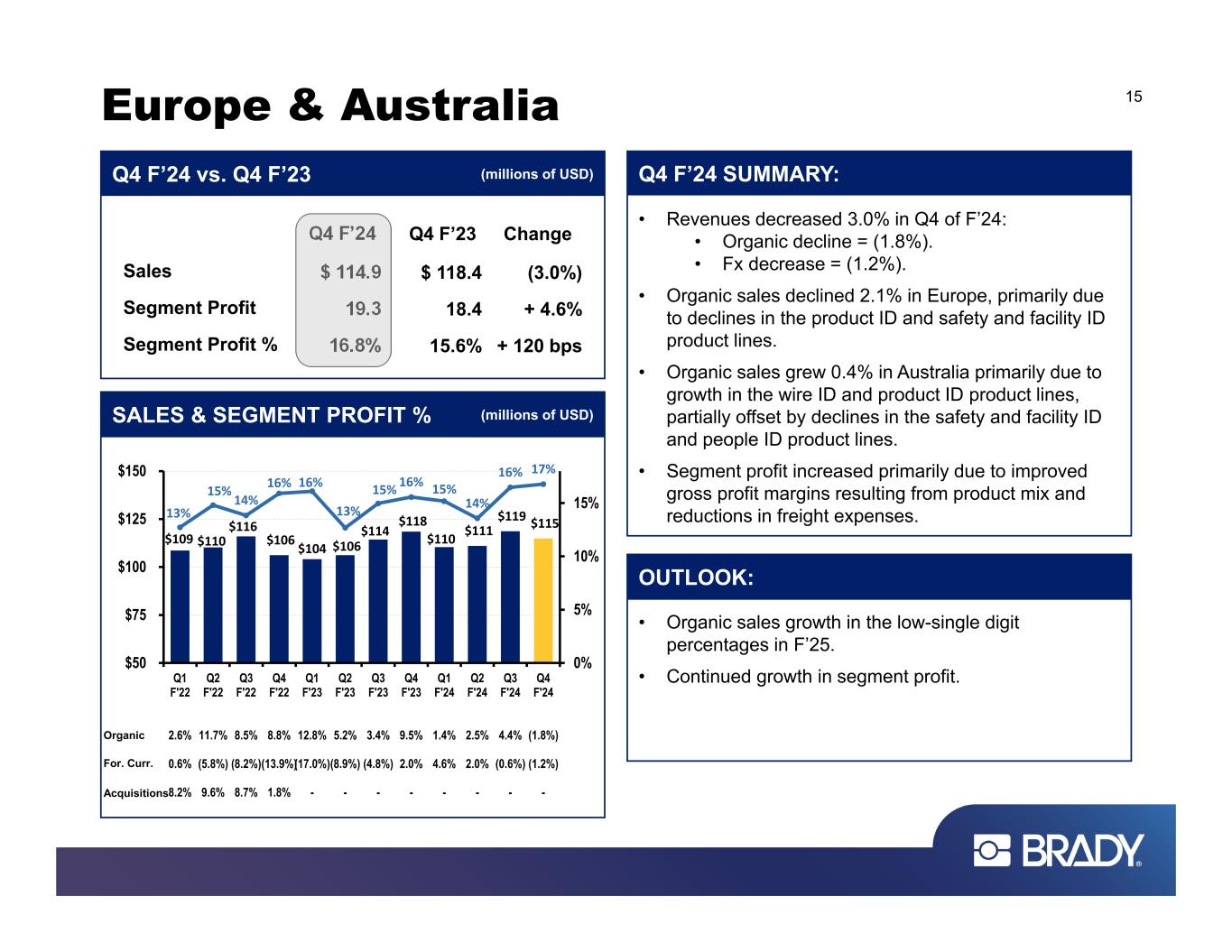

Sales for the quarter ended July 31, 2024 decreased 0.7 percent, which consisted of organic sales growth of 1.6 percent, a decrease of 0.8 percent from foreign currency translation and a decrease of 1.5 percent from divestitures. Sales for the quarter ended July 31, 2024 were $343.4 million compared to $345.9 million in the same quarter last year. By region, sales increased 0.4 percent in the Americas & Asia and decreased 3.0 percent in Europe & Australia, which consisted of organic sales growth of 3.4 percent in the Americas & Asia and an organic sales decline of 1.8 percent in Europe & Australia.

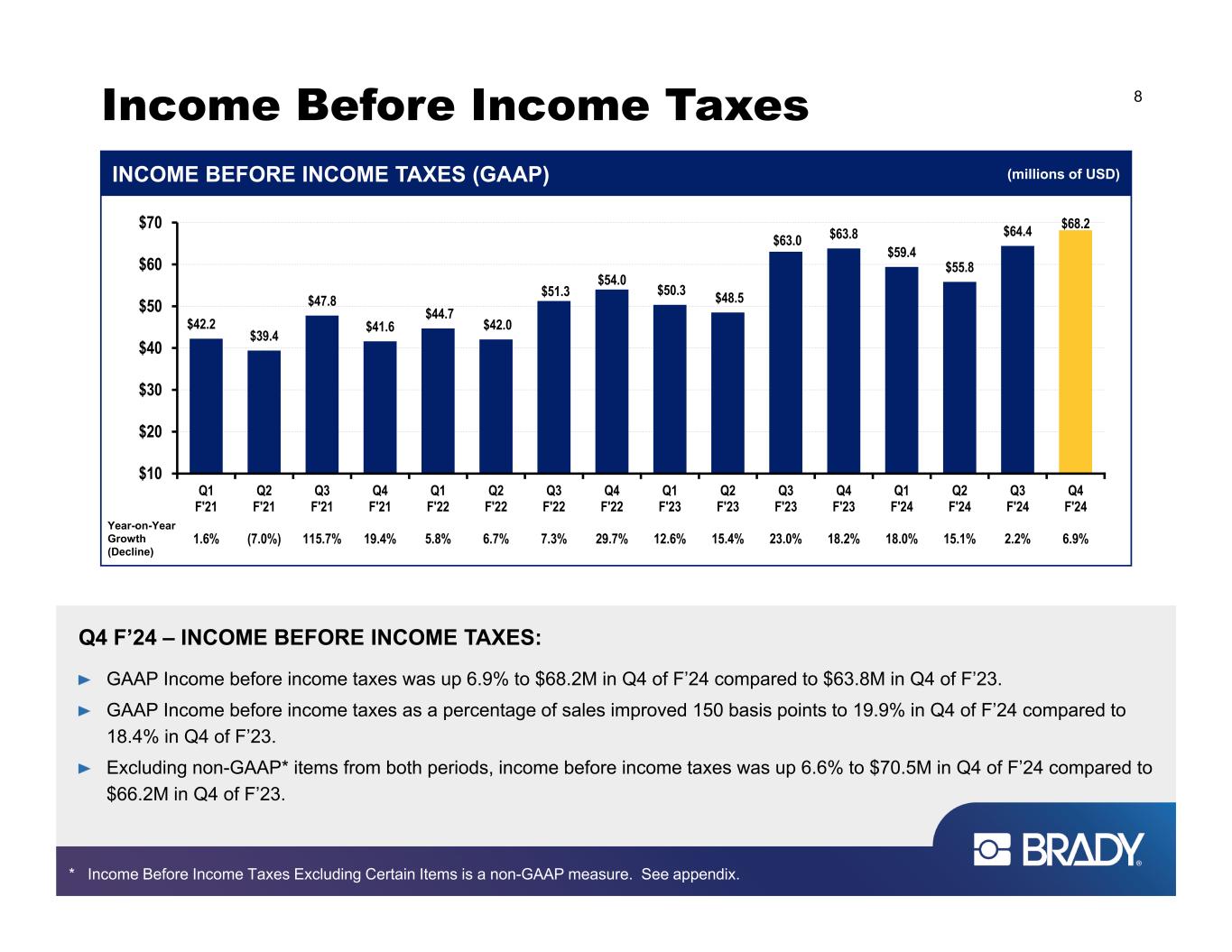

Income before income taxes increased 6.9 percent to $68.2 million for the quarter ended July 31, 2024, compared to $63.8 million in the same quarter last year. Income Before Income Taxes Excluding Certain Items* for the quarter ended July 31, 2024, which was adjusted for amortization expense of $2.3 million, was $70.5 million, an increase of 6.6 percent.

Net income for the quarter ended July 31, 2024 was $55.5 million compared to $49.4 million in the same quarter last year. Earnings per diluted Class A Nonvoting Common Share were $1.15 in the fourth quarter of fiscal 2024, compared to $1.00 in the same quarter last year. Net Income Excluding Certain Items* for the quarter ended July 31, 2024 was $57.3 million and Diluted EPS Excluding Certain Items* for the quarter ended July 31, 2024 was $1.19.

Net Income Excluding Certain Items* for the quarter ended July 31, 2023 was $51.2 million and Diluted EPS Excluding Certain Items* for the quarter ended July 31, 2023 was $1.04.

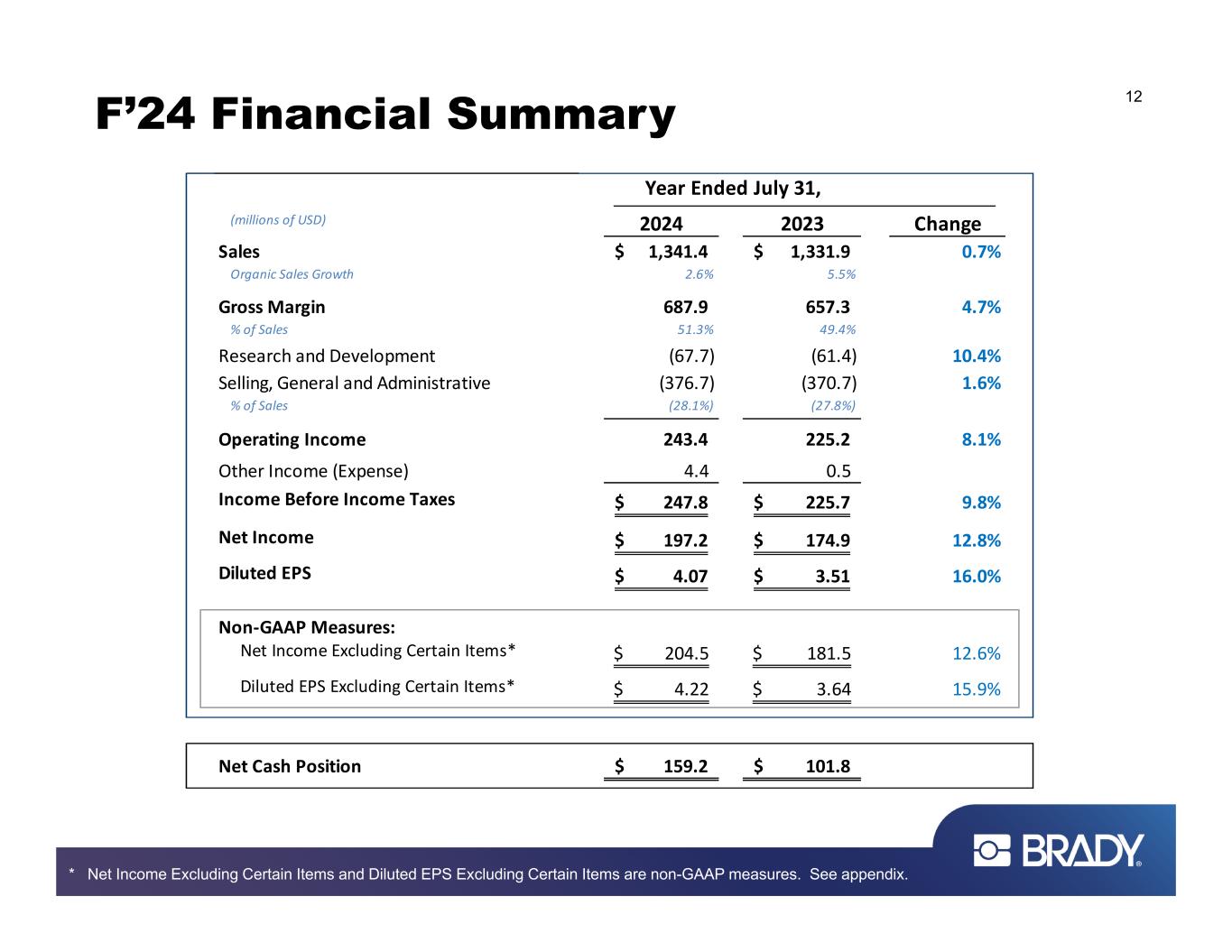

Year Ended July 31, 2024 Financial Results:

Sales for the year ended July 31, 2024 increased 0.7 percent, which consisted of organic sales growth of 2.6 percent, an increase of 0.2 percent from foreign currency translation and a decrease of 2.1 percent from divestitures. Sales for the year ended July 31, 2024 were $1.34 billion compared to $1.33 billion in the prior year. By region, sales decreased 0.3 percent in the Americas & Asia and increased 2.7 percent in Europe & Australia, which consisted of organic sales growth of 3.1 percent in the Americas & Asia and organic sales growth of 1.6 percent in Europe & Australia.

Income before income taxes increased 9.8 percent to $247.8 million for the year ended July 31, 2024, compared to $225.7 million for the year ended July 31, 2023. Income Before Income Taxes Excluding Certain Items* for the year ended July 31, 2024, which was adjusted for amortization expense of $9.4 million, was $257.3 million, an increase of 10.1 percent compared to the year ended July 31, 2023.

Net income for the year ended July 31, 2024 was $197.2 million compared to $174.9 million for the year ended July 31, 2023. Earnings per diluted Class A Nonvoting Common Share were $4.07 for the year ended July 31, 2024 compared to $3.51 in the same period last year. Net Income Excluding Certain Items* for the year ended July 31, 2024 was $204.5 million and Diluted EPS Excluding Certain Items* for the year ended July 31, 2024 was $4.22. Net Income Excluding Certain Items* for the year ended July 31, 2023 was $181.5 million, and Diluted EPS Excluding Certain Items* for the year ended July 31, 2023 was $3.64.

Commentary:

“This quarter, we once again reported record-high EPS, marking Brady’s best earnings year ever. For the full year ended July 31, 2024, our GAAP EPS was $4.07, representing a 16.0 percent increase over the previous year’s record,” said Brady’s President and CEO, Russell R. Shaller. “Both regions continue to perform well, with growth in organic sales and operating income. I’m excited about the innovative new products we have slated for launch in fiscal 2025. We also look forward to expanding our product offerings with the addition of direct part marking and laser engraving solutions, following our acquisition of Gravotech, which closed on August 1, 2024.”

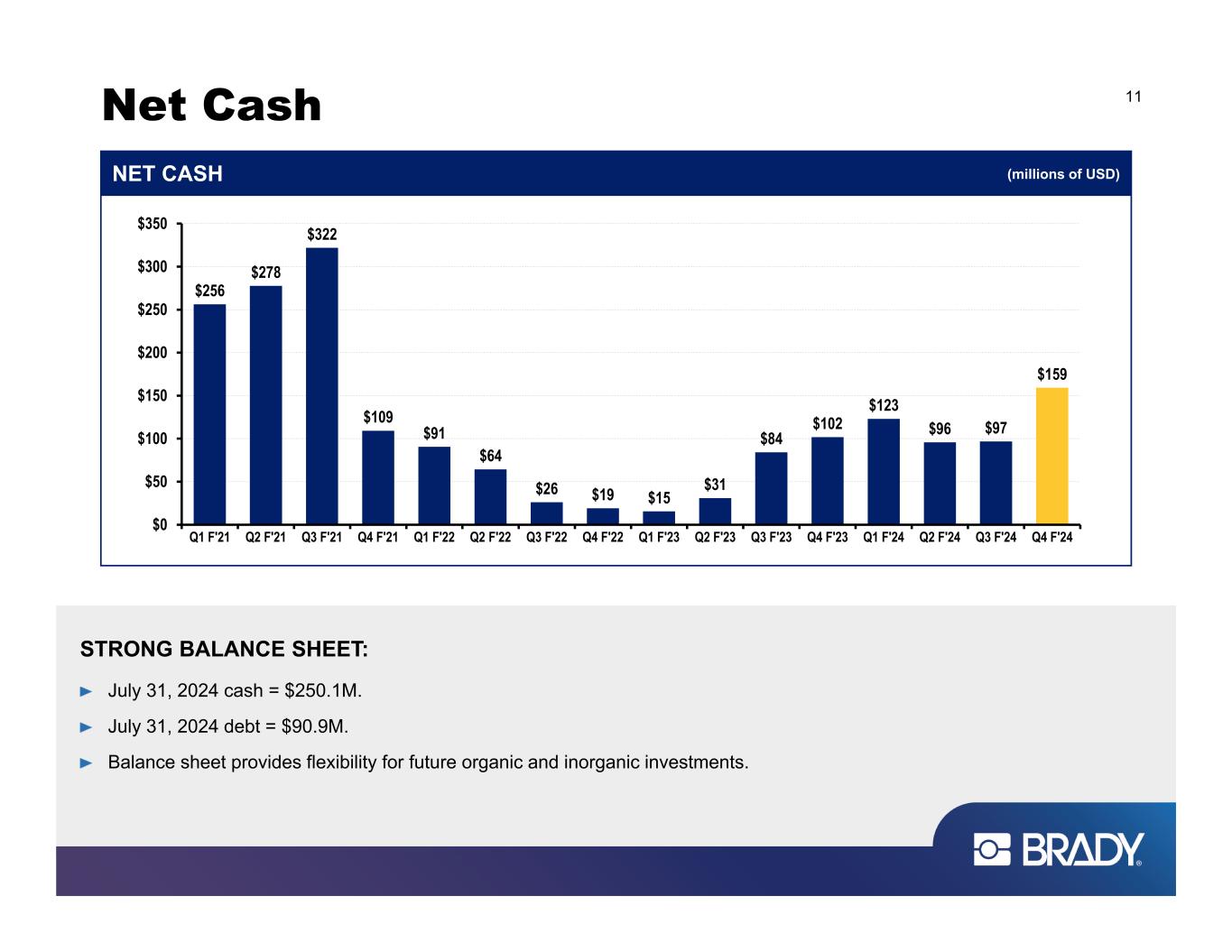

“In addition to our record EPS this quarter and this fiscal year, we also used our strong balance sheet and cash generation to return funds to our shareholders through share buybacks and increased dividends. This year, we repurchased a total of 1.3 million shares for $72.2 million, and returned another $45.1 million to our shareholders in the form of dividends,” said Brady’s Chief Financial Officer, Ann Thornton. “Our strong balance sheet provides us with opportunities to continue to invest in both organic growth and strategic acquisitions to increase shareholder value.”

Share Buyback Program:

On September 4, 2024, Brady’s Board of Directors authorized an additional $100 million of Class A Nonvoting Common Stock for repurchase under the Company’s share buyback program. The share buyback program may be implemented from time to time in the open market or in privately negotiated transactions and has no expiration date.

Fiscal 2025 Guidance:

The Company expects GAAP earnings per diluted Class A Nonvoting Common Share to range from $4.15 to $4.45, which would be an increase of 2.0 percent to 9.3 percent over GAAP earnings per diluted Class A Nonvoting Common Share of $4.07 for the year ended July 31, 2024.

The Company also expects Diluted EPS Excluding Certain Items* to range from $4.40 to $4.70 for the year ending July 31, 2024, which would be an increase of 4.3 percent to 11.4 percent over Diluted EPS Excluding Certain Items* of $4.22 for the year ended July 31, 2024. Adjusted from this Diluted EPS Excluding Certain Items* guidance is amortization expense estimated at $0.25 per share for the year ending July 31, 2025.

Included in fiscal 2025 guidance are a full-year income tax rate of approximately 20 percent and depreciation and amortization expense ranging from $38 million to $40 million. Capital expenditures are expected to approximate $35 million. Fiscal 2025 guidance is based upon foreign currency exchange rates as of July 31, 2024 and assumes continued economic growth.

A webcast regarding Brady’s fiscal 2024 fourth quarter financial results will be available at www.bradycorp.com/investors beginning at 9:30 a.m. central time today.

Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect people, products and places. Brady’s products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software. Founded in 1914, the Company has a diverse customer base in electronics, telecommunications, manufacturing, electrical, construction, medical, aerospace and a variety of other industries. Brady is headquartered in Milwaukee, Wisconsin and as of July 31, 2024, employed approximately 5,700 people in its worldwide businesses. Brady’s fiscal 2024 sales were approximately $1.34 billion. Brady stock trades on the New York Stock Exchange under the symbol BRC. More information is available on the Internet at www.bradyid.com.

* Income Before Income Taxes Excluding Certain Items, Net Income Excluding Certain Items, and Diluted EPS Excluding Certain Items are non-GAAP measures. See appendix for more information on these measures, including reconciliations to the most directly comparable GAAP measures.

###

In this news release, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations.

The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project,” “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady’s control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: increased cost of raw materials and labor as well as material shortages and supply chain disruptions; decreased demand for our products; our ability to compete effectively or to successfully execute our strategy; our ability to develop technologically advanced products that meet customer demands; Brady’s ability to identify, integrate and grow acquired companies, and to manage contingent liabilities from divested businesses; difficulties in protecting our websites, networks, and systems against security breaches; risks associated with the loss of key employees; extensive regulations by U.S. and non-U.S.

governmental and self-regulatory entities; global climate change and environmental regulations; litigation, including product liability claims; foreign currency fluctuations; changes in tax legislation and tax rates; potential write-offs of goodwill and other intangible assets; differing interests of voting and non-voting shareholders and changes in the regulatory and business environment around dual-class voting structures; numerous other matters of national, regional and global scale, including major public health crises and government responses thereto and those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady’s U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2024.

These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited; Dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, |

|

Year ended July 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net sales |

$ |

343,402 |

|

|

$ |

345,929 |

|

|

$ |

1,341,393 |

|

|

$ |

1,331,863 |

|

| Cost of goods sold |

166,347 |

|

|

170,049 |

|

|

653,509 |

|

|

674,588 |

|

| Gross margin |

177,055 |

|

|

175,880 |

|

|

687,884 |

|

|

657,275 |

|

| Operating expenses: |

|

|

|

|

|

|

|

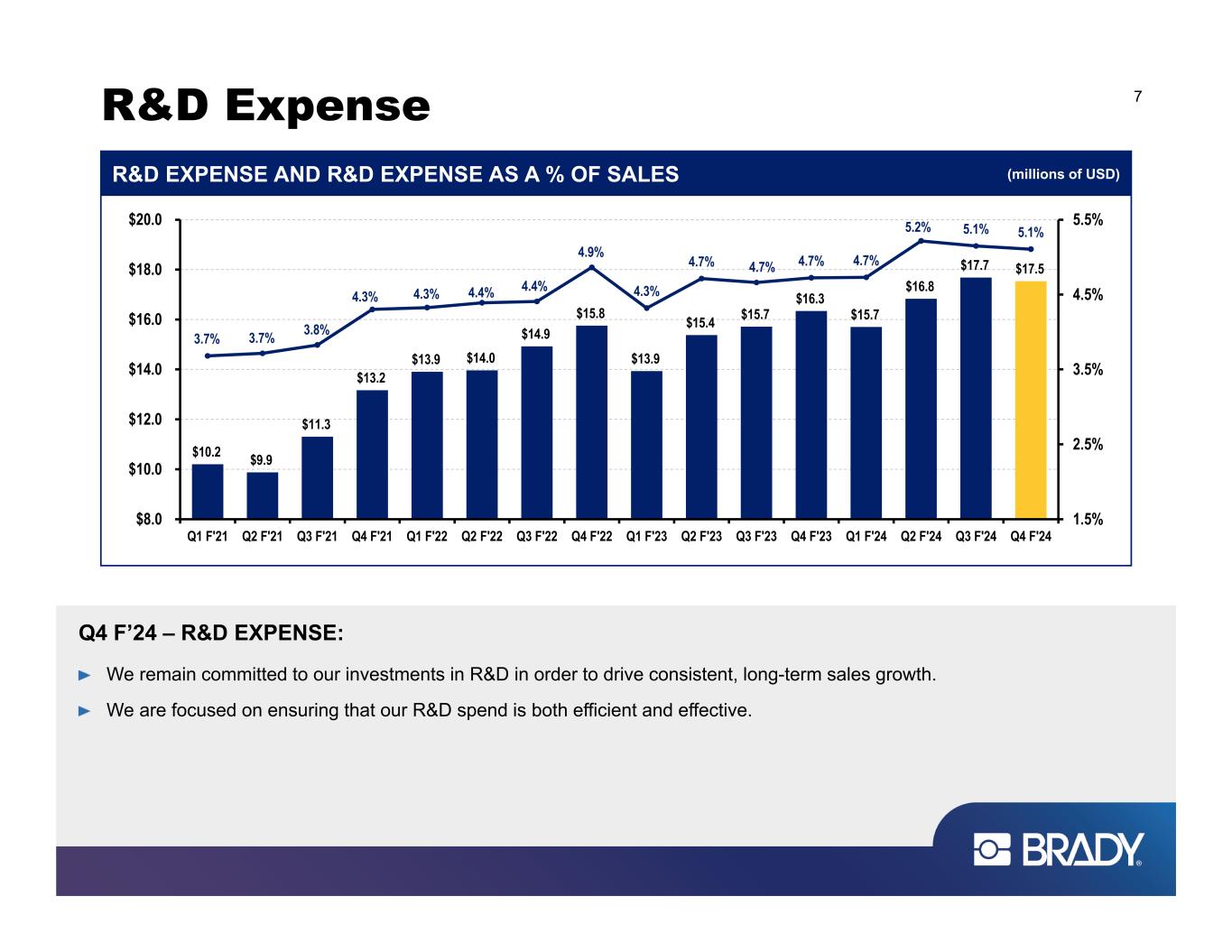

| Research and development |

17,533 |

|

|

16,340 |

|

|

67,748 |

|

|

61,365 |

|

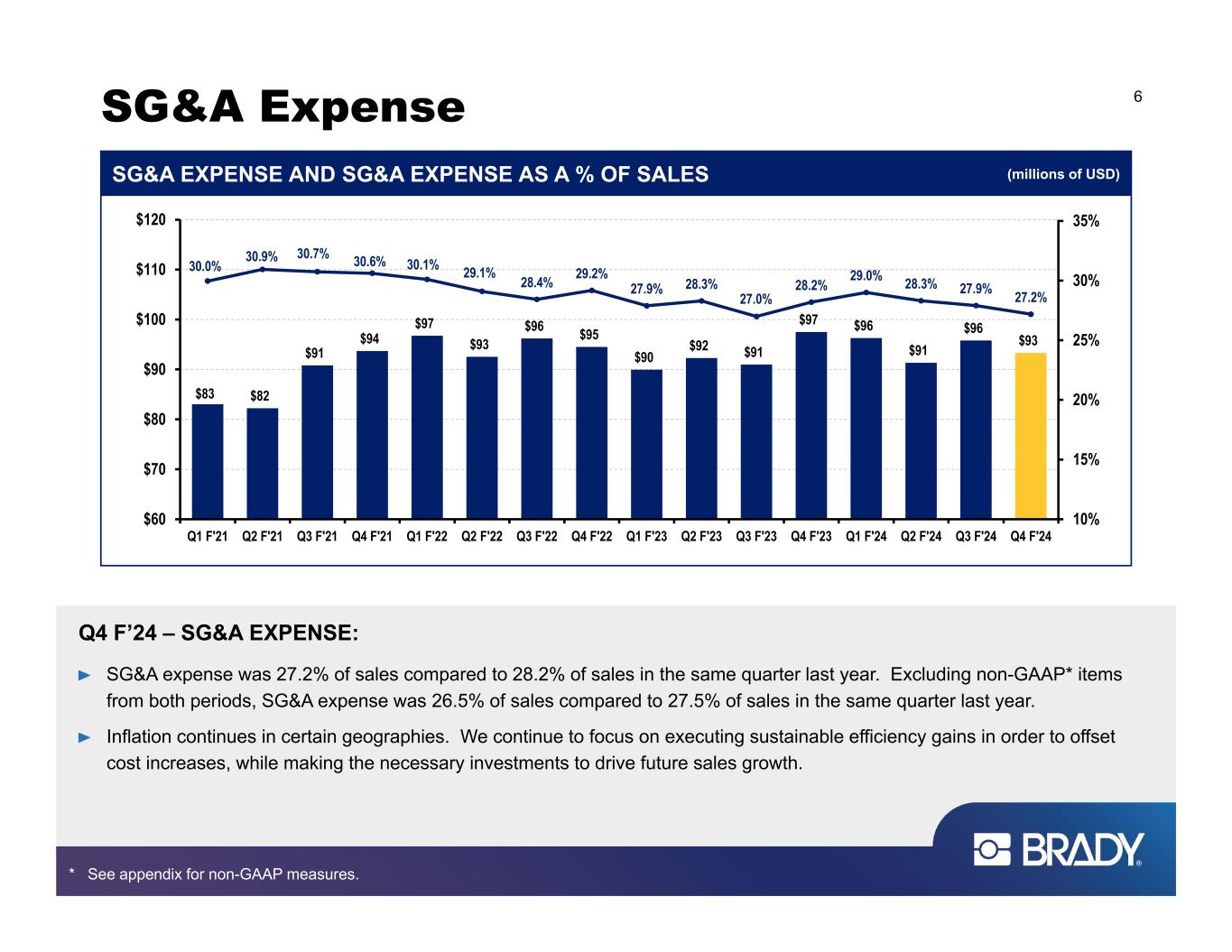

| Selling, general and administrative |

93,307 |

|

|

97,495 |

|

|

376,722 |

|

|

370,697 |

|

| Total operating expenses |

110,840 |

|

|

113,835 |

|

|

444,470 |

|

|

432,062 |

|

|

|

|

|

|

|

|

|

| Operating income |

66,215 |

|

|

62,045 |

|

|

243,414 |

|

|

225,213 |

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

| Investment and other income |

2,835 |

|

|

2,426 |

|

|

7,553 |

|

|

4,022 |

|

| Interest expense |

(842) |

|

|

(653) |

|

|

(3,126) |

|

|

(3,539) |

|

|

|

|

|

|

|

|

|

| Income before income taxes |

68,208 |

|

|

63,818 |

|

|

247,841 |

|

|

225,696 |

|

|

|

|

|

|

|

|

|

| Income tax expense |

12,752 |

|

|

14,440 |

|

|

50,626 |

|

|

50,839 |

|

|

|

|

|

|

|

|

|

| Net income |

$ |

55,456 |

|

|

$ |

49,378 |

|

|

$ |

197,215 |

|

|

$ |

174,857 |

|

|

|

|

|

|

|

|

|

| Net income per Class A Nonvoting Common Share: |

|

|

|

|

|

|

|

| Basic |

$ |

1.17 |

|

|

$ |

1.01 |

|

|

$ |

4.10 |

|

|

$ |

3.53 |

|

| Diluted |

$ |

1.15 |

|

|

$ |

1.00 |

|

|

$ |

4.07 |

|

|

$ |

3.51 |

|

|

|

|

|

|

|

|

|

| Net income per Class B Voting Common Share: |

|

|

|

|

|

|

|

| Basic |

$ |

1.17 |

|

|

$ |

1.01 |

|

|

$ |

4.08 |

|

|

$ |

3.51 |

|

| Diluted |

$ |

1.15 |

|

|

$ |

1.00 |

|

|

$ |

4.05 |

|

|

$ |

3.49 |

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

47,595 |

|

|

49,099 |

|

|

48,119 |

|

|

49,591 |

|

| Diluted |

48,063 |

|

|

49,377 |

|

|

48,496 |

|

|

49,869 |

|

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited; Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

July 31, 2024 |

|

July 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

250,118 |

|

|

$ |

151,532 |

|

| Accounts receivable, net of allowance for credit losses of $6,749 and $8,467, respectively |

185,486 |

|

|

184,420 |

|

| Inventories |

152,729 |

|

|

177,078 |

|

| Prepaid expenses and other current assets |

11,382 |

|

|

11,790 |

|

| Total current assets |

599,715 |

|

|

524,820 |

|

| Property, plant and equipment—net |

195,758 |

|

|

142,149 |

|

| Goodwill |

589,611 |

|

|

592,646 |

|

| Other intangible assets |

51,839 |

|

|

62,096 |

|

| Deferred income taxes |

15,596 |

|

|

15,716 |

|

| Operating lease assets |

38,504 |

|

|

29,688 |

|

| Other assets |

24,546 |

|

|

22,142 |

|

| Total |

$ |

1,515,569 |

|

|

$ |

1,389,257 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

84,691 |

|

|

$ |

79,855 |

|

| Accrued compensation and benefits |

77,954 |

|

|

71,470 |

|

| Taxes, other than income taxes |

14,061 |

|

|

13,575 |

|

| Accrued income taxes |

7,424 |

|

|

12,582 |

|

| Current operating lease liabilities |

13,382 |

|

|

14,726 |

|

| Other current liabilities |

67,170 |

|

|

65,828 |

|

| Total current liabilities |

264,682 |

|

|

258,036 |

|

| Long-term debt |

90,935 |

|

|

49,716 |

|

| Long-term operating lease liabilities |

25,342 |

|

|

16,217 |

|

| Other liabilities |

67,952 |

|

|

74,369 |

|

| Total liabilities |

448,911 |

|

|

398,338 |

|

| Stockholders’ equity: |

|

|

|

| Common stock: |

|

|

|

| Class A nonvoting common stock—Issued 51,261,487 shares, and outstanding 44,042,462 and 45,008,724 shares, respectively (aggregate liquidation preference of $42,716) |

513 |

|

|

513 |

|

| Class B voting common stock—Issued and outstanding, 3,538,628 shares |

35 |

|

|

35 |

|

| Additional paid-in capital |

353,654 |

|

|

351,771 |

|

| Retained earnings |

1,174,025 |

|

|

1,021,870 |

|

| Treasury stock—7,219,025 and 6,252,763 shares, respectively of Class A nonvoting common stock, at cost |

(351,947) |

|

|

(290,209) |

|

| Accumulated other comprehensive loss |

(109,622) |

|

|

(93,061) |

|

| Total stockholders’ equity |

1,066,658 |

|

|

990,919 |

|

| Total |

$ |

1,515,569 |

|

|

$ |

1,389,257 |

|

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended July 31, |

| |

2024 |

|

2023 |

| Operating activities: |

|

|

|

| Net income |

$ |

197,215 |

|

|

$ |

174,857 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

29,873 |

|

|

32,370 |

|

| Stock-based compensation expense |

7,361 |

|

|

7,508 |

|

| Gain on sale of business |

— |

|

|

(3,770) |

|

| Deferred income taxes |

(9,399) |

|

|

(12,472) |

|

| Other |

1,401 |

|

|

(308) |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable |

(6,581) |

|

|

2,380 |

|

| Inventories |

21,697 |

|

|

14,972 |

|

| Prepaid expenses and other assets |

(743) |

|

|

(1,023) |

|

| Accounts payable and accrued liabilities |

19,198 |

|

|

(9,459) |

|

| Income taxes |

(4,948) |

|

|

4,094 |

|

| Net cash provided by operating activities |

255,074 |

|

|

209,149 |

|

|

|

|

|

| Investing activities: |

|

|

|

| Purchases of property, plant and equipment |

(79,892) |

|

|

(19,226) |

|

| Sale of business |

— |

|

|

8,000 |

|

| Other |

(1,155) |

|

|

12 |

|

| Net cash used in investing activities |

(81,047) |

|

|

(11,214) |

|

|

|

|

|

| Financing activities: |

|

|

|

| Payment of dividends |

(45,060) |

|

|

(45,404) |

|

| Proceeds from exercise of stock options |

8,186 |

|

|

4,091 |

|

| Payments for employee taxes withheld from stock-based awards |

(2,797) |

|

|

(2,041) |

|

| Purchase of treasury stock |

(72,225) |

|

|

(74,996) |

|

| Proceeds from borrowing on credit facilities |

175,103 |

|

|

127,660 |

|

| Repayment of borrowing on credit facilities |

(133,884) |

|

|

(172,944) |

|

| Other |

149 |

|

|

66 |

|

| Net cash used in financing activities |

(70,528) |

|

|

(163,568) |

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

(4,913) |

|

|

3,096 |

|

|

|

|

|

| Net increase in cash and cash equivalents |

98,586 |

|

|

37,463 |

|

| Cash and cash equivalents, beginning of period |

151,532 |

|

|

114,069 |

|

|

|

|

|

| Cash and cash equivalents, end of period |

$ |

250,118 |

|

|

$ |

151,532 |

|

|

|

|

|

| Supplemental disclosures: |

|

|

|

| Cash paid during the period for: |

|

|

|

| Interest |

$ |

2,930 |

|

|

$ |

3,408 |

|

| Income taxes |

62,073 |

|

|

58,829 |

|

BRADY CORPORATION AND SUBSIDIARIES

SEGMENT INFORMATION

(Unaudited; Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, |

|

Year ended July 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| NET SALES |

|

|

|

|

|

|

|

| Americas & Asia |

$ |

228,493 |

|

|

$ |

227,482 |

|

|

$ |

886,528 |

|

|

$ |

888,857 |

|

| Europe & Australia |

114,909 |

|

|

118,447 |

|

|

454,865 |

|

|

443,006 |

|

| Total |

$ |

343,402 |

|

|

$ |

345,929 |

|

|

$ |

1,341,393 |

|

|

$ |

1,331,863 |

|

|

|

|

|

|

|

|

|

| SALES INFORMATION |

|

|

|

|

|

|

|

| Americas & Asia |

|

|

|

|

|

|

|

| Organic |

3.4 |

% |

|

5.6 |

% |

|

3.1 |

% |

|

4.4 |

% |

| Currency |

(0.8) |

% |

|

(0.2) |

% |

|

(0.2) |

% |

|

(0.9) |

% |

| Divestiture |

(2.2) |

% |

|

(1.0) |

% |

|

(3.2) |

% |

|

(0.3) |

% |

| Total |

0.4 |

% |

|

4.4 |

% |

|

(0.3) |

% |

|

3.2 |

% |

| Europe & Australia |

|

|

|

|

|

|

|

| Organic |

(1.8) |

% |

|

9.5 |

% |

|

1.6 |

% |

|

7.6 |

% |

| Currency |

(1.2) |

% |

|

2.0 |

% |

|

1.1 |

% |

|

(7.1) |

% |

| Total |

(3.0) |

% |

|

11.5 |

% |

|

2.7 |

% |

|

0.5 |

% |

| Total Company |

|

|

|

|

|

|

|

| Organic |

1.6 |

% |

|

6.9 |

% |

|

2.6 |

% |

|

5.5 |

% |

| Currency |

(0.8) |

% |

|

0.6 |

% |

|

0.2 |

% |

|

(3.0) |

% |

| Divestiture |

(1.5) |

% |

|

(0.7) |

% |

|

(2.1) |

% |

|

(0.2) |

% |

| Total |

(0.7) |

% |

|

6.8 |

% |

|

0.7 |

% |

|

2.3 |

% |

|

|

|

|

|

|

|

|

| SEGMENT PROFIT |

|

|

|

|

|

|

|

| Americas & Asia |

$ |

53,353 |

|

|

$ |

49,992 |

|

|

$ |

196,842 |

|

|

$ |

180,503 |

|

| Europe & Australia |

19,277 |

|

|

18,426 |

|

|

70,612 |

|

|

65,742 |

|

| Total |

$ |

72,630 |

|

|

$ |

68,418 |

|

|

$ |

267,454 |

|

|

$ |

246,245 |

|

| SEGMENT PROFIT AS A PERCENT OF NET SALES |

|

|

|

|

|

|

|

| Americas & Asia |

23.3 |

% |

|

22.0 |

% |

|

22.2 |

% |

|

20.3 |

% |

| Europe & Australia |

16.8 |

% |

|

15.6 |

% |

|

15.5 |

% |

|

14.8 |

% |

| Total |

21.2 |

% |

|

19.8 |

% |

|

19.9 |

% |

|

18.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, |

|

Year ended July 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Total segment profit |

$ |

72,630 |

|

|

$ |

68,418 |

|

|

$ |

267,454 |

|

|

$ |

246,245 |

|

| Unallocated amounts: |

|

|

|

|

|

|

|

| Administrative costs |

(6,415) |

|

|

(6,373) |

|

|

(24,040) |

|

|

(24,802) |

|

| Gain on sale of business |

— |

|

|

— |

|

|

— |

|

|

3,770 |

|

| Investment and other income |

2,835 |

|

|

2,426 |

|

|

7,553 |

|

|

4,022 |

|

| Interest expense |

(842) |

|

|

(653) |

|

|

(3,126) |

|

|

(3,539) |

|

| Income before income taxes |

$ |

68,208 |

|

|

$ |

63,818 |

|

|

$ |

247,841 |

|

|

$ |

225,696 |

|

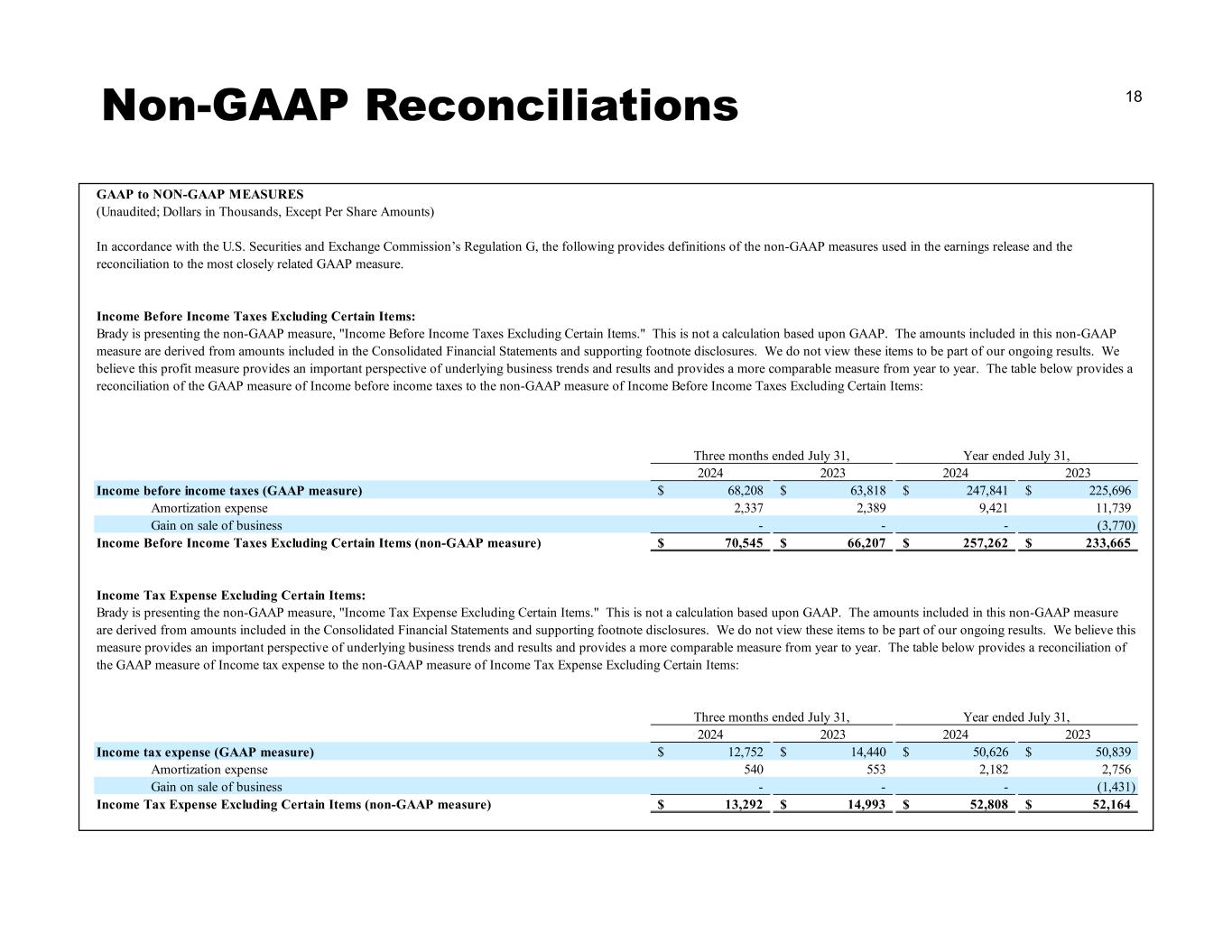

GAAP to NON-GAAP MEASURES

(Unaudited; Dollars in Thousands, Except Per Share Amounts)

In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure.

Income Before Income Taxes Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Income Before Income Taxes Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this profit measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income before income taxes and losses of unconsolidated affiliate to the non-GAAP measure of Income Before Income Taxes Excluding Certain Items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, |

|

Year ended July 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Income before income taxes (GAAP measure) |

$ |

68,208 |

|

|

$ |

63,818 |

|

|

$ |

247,841 |

|

|

$ |

225,696 |

|

| Amortization expense |

2,337 |

|

|

2,389 |

|

|

9,421 |

|

|

11,739 |

|

| Gain on sale of business |

— |

|

|

— |

|

|

— |

|

|

(3,770) |

|

| Income Before Income Taxes Excluding Certain Items (non-GAAP measure) |

$ |

70,545 |

|

|

$ |

66,207 |

|

|

$ |

257,262 |

|

|

$ |

233,665 |

|

Income Tax Expense Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Income Tax Expense Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Income tax expense to the non-GAAP measure of Income Tax Expense Excluding Certain Items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, |

|

Year ended July 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Income tax expense (GAAP measure) |

$ |

12,752 |

|

|

$ |

14,440 |

|

|

$ |

50,626 |

|

|

$ |

50,839 |

|

| Amortization expense |

540 |

|

|

553 |

|

|

2,182 |

|

|

2,756 |

|

| Gain on sale of business |

— |

|

|

— |

|

|

— |

|

|

(1,431) |

|

| Income Tax Expense Excluding Certain Items (non-GAAP measure) |

$ |

13,292 |

|

|

$ |

14,993 |

|

|

$ |

52,808 |

|

|

$ |

52,164 |

|

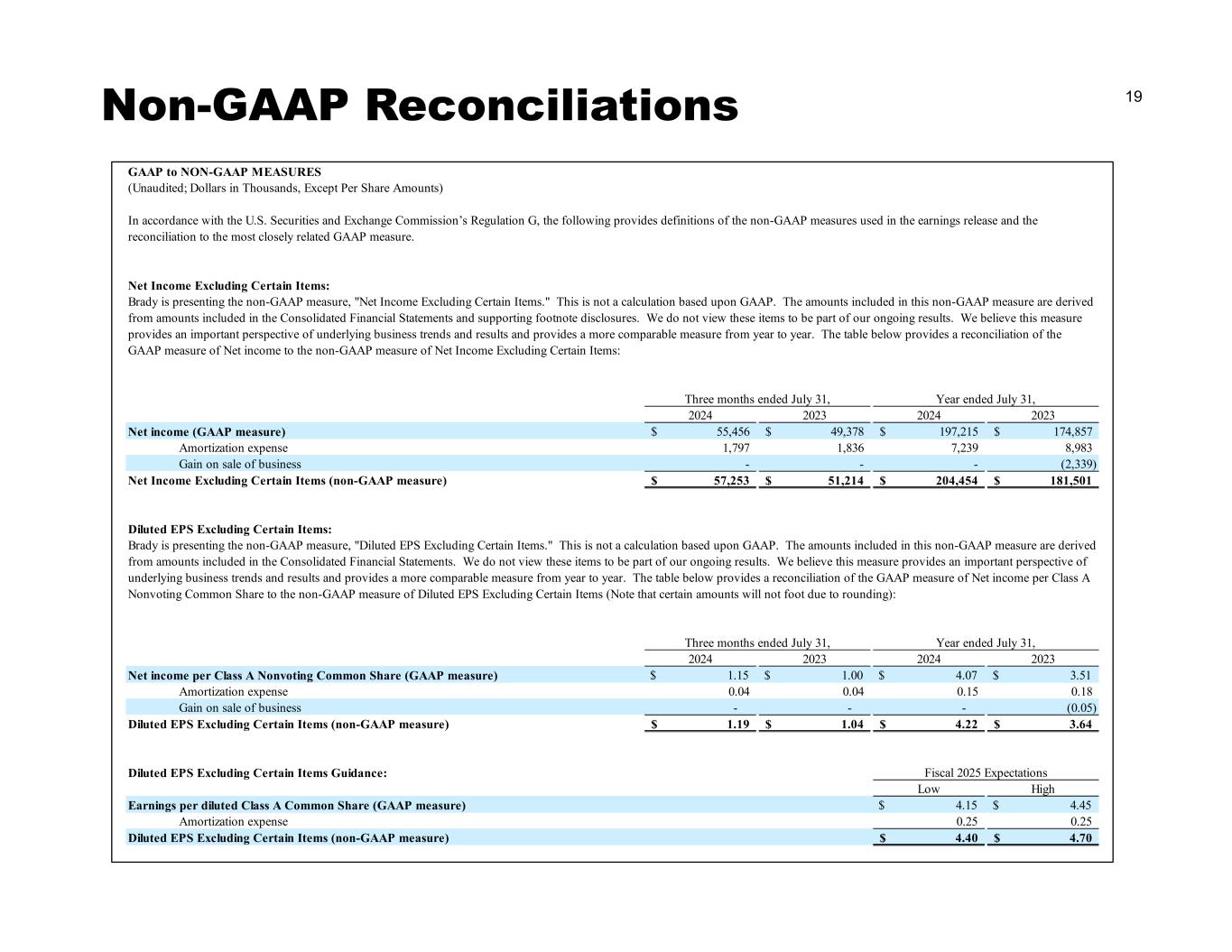

Net Income Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Net Income Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income to the non-GAAP measure of Net Income Excluding Certain Items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, |

|

Year ended July 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net income (GAAP measure) |

$ |

55,456 |

|

|

$ |

49,378 |

|

|

$ |

197,215 |

|

|

$ |

174,857 |

|

| Amortization expense |

1,797 |

|

|

1,836 |

|

|

7,239 |

|

|

8,983 |

|

| Gain on sale of business |

— |

|

|

— |

|

|

— |

|

|

(2,339) |

|

| Net Income Excluding Certain Items (non-GAAP measure) |

$ |

57,253 |

|

|

$ |

51,214 |

|

|

$ |

204,454 |

|

|

$ |

181,501 |

|

Diluted EPS Excluding Certain Items:

Brady is presenting the non-GAAP measure, "Diluted EPS Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this non-GAAP measure are derived from amounts included in the Consolidated Financial Statements. We do not view these items to be part of our ongoing results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of the GAAP measure of Net income per Class A Nonvoting Common Share to the non-GAAP measure of Diluted EPS Excluding Certain Items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended July 31, |

|

Year ended July 31, |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net income per Class A Nonvoting Common Share (GAAP measure) |

$ |

1.15 |

|

|

$ |

1.00 |

|

|

$ |

4.07 |

|

|

$ |

3.51 |

|

| Amortization expense |

0.04 |

|

|

0.04 |

|

|

0.15 |

|

|

0.18 |

|

| Gain on sale of business |

— |

|

|

— |

|

|

— |

|

|

(0.05) |

|

| Diluted EPS Excluding Certain Items (non-GAAP measure) |

$ |

1.19 |

|

|

$ |

1.04 |

|

|

$ |

4.22 |

|

|

$ |

3.64 |

|

Diluted EPS Excluding Certain Items Guidance:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal 2025 Expectations |

|

|

|

|

|

Low |

|

High |

| Earnings per Class A Nonvoting Common Share (GAAP measure) |

|

|

|

|

$ |

4.15 |

|

|

$ |

4.45 |

|

| Amortization expense |

|

|

|

|

0.25 |

|

|

0.25 |

|

| Diluted EPS Excluding Certain Items (non-GAAP measure) |

|

|

|

|

$ |

4.40 |

|

|

$ |

4.70 |

|