INVESTOR PRESENTATION AUGUST 2025 2025

2AUGUST 2025 INVESTOR PRESENTATION Cautionary Notice Regarding Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired, or expects to acquire, as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements. Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast Banking Corporation of Florida (“Seacoast” or the “Company”) or its wholly-owned banking subsidiary, Seacoast National Bank (“Seacoast Bank”), to be materially different from results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements. All statements other than statements of historical fact could be forward-looking statements. You can identify these forward- looking statements through the use of words such as "may", "will", "anticipate", "assume", "should", "support", "indicate", "would", "believe", "contemplate", "expect", "estimate", "continue", "further", "plan", "point to", "project", "could", "intend", "target" or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the impact of current and future economic and market conditions generally (including seasonality) and in the financial services industry, nationally and within Seacoast’s primary market areas, including the effects of inflationary pressures, changes in interest rates, tariffs or trade wars (including reduced consumer spending), slowdowns in economic growth, and the potential for high unemployment rates, as well as the financial stress on borrowers and changes to customer and client behavior and credit risk as a result of the foregoing; potential impacts of adverse developments in the banking industry, including those highlighted by high-profile bank failures, and including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto (including increases in the cost of our deposit insurance assessments), the Company's ability to effectively manage its liquidity risk and any growth plans, and the availability of capital and funding; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as well as legislative, tax and regulatory changes including overdraft and late fee caps (if implemented), including those that impact the money supply and inflation; the risks of changes in interest rates on the level and composition of deposits (as well as the cost of, and competition for, deposits), loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks (including the impacts of interest rates on macroeconomic conditions, customer and client behavior, and on our net interest income), sensitivities and the shape of the yield curve; changes in accounting policies, rules and practices; changes in retail distribution strategies, customer preferences and behavior generally and as a result of economic factors, including heightened or persistent inflation; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate, especially as they relate to the value of collateral supporting the Company’s loans; the Company’s concentration in commercial real estate loans and in real estate collateral in Florida; Seacoast’s ability to comply with any regulatory requirements; and the risk that the regulatory environment may not be conducive to or may prohibit or delay the consummation of future mergers and/or business combinations, may increase the length of time and amount of resources required to consummate such transactions, and may reduce the anticipated benefit; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of Seacoast’s investments due to market volatility or counterparty payment risk, as well as the effect of a decline in stock market prices on our fee income from our wealth management business; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including Seacoast’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions and realize expected revenues and revenue synergies; changes in technology or products that may be more difficult, costly, or less effective than anticipated; the Company’s ability to identify and address increased cybersecurity risks, including those impacting vendors and other third parties which may be exacerbated by developments in generative artificial intelligence; fraud or misconduct by internal or external parties, which Seacoast may not be able to prevent, detect or mitigate; inability of Seacoast’s risk management framework to manage risks associated with the Company’s business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms; reduction in or the termination of Seacoast’s ability to use the online- or mobile-based platform that is critical to the Company’s business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, including hurricanes in the Company’s footprint, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions and/or increase costs, including, but not limited to, property and casualty and other insurance costs; Seacoast’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company’s operations and tax planning strategies are less than currently estimated, the results of tax audit findings, challenges to our tax positions, or adverse changes or interpretations of tax laws; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non-bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions; the failure of assumptions underlying the establishment of reserves for expected credit losses; risks related to, and the costs associated with, environmental, social and governance matters, including the scope and pace of related rulemaking activity and disclosure requirements; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding the federal budget and economic policy, including the impact of tariffs and trade policies; the risk that balance sheet, revenue growth, and loan growth expectations may differ from actual results; and other factors and risks described herein and under “Risk Factors” in any of the Company's subsequent reports filed with the SEC and available on its website at www.sec.gov. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10-K for the year ended December 31, 2024 and in other periodic reports that the Company files with the SEC. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at www.sec.gov.

3AUGUST 2025 INVESTOR PRESENTATION Important Information for Investors and Shareholders Seacoast has filed with the SEC a registration statement on Form S-4 containing a proxy statement of Villages Bancorporation, Inc. and a prospectus of Seacoast, and Seacoast will file other documents with respect to the proposed transaction. A definitive proxy statement/prospectus will be mailed to shareholders of Villages Bancorporation, Inc. Investors and shareholders of Seacoast and Villages Bancorporation, Inc. are urged to read the entire proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and shareholders will be able to obtain free copies of the registration statement and proxy statement/prospectus (when available) and other documents filed with the SEC by Seacoast through the website maintained by the SEC at https://www.sec.gov. Copies of the documents filed with the SEC by Seacoast will be available free of charge on Seacoast’s internet website or by contacting Seacoast. Villages Bancorporation, Inc. and its directors and executive officers and other members of management and employees may be considered participants in the solicitation of proxies in connection with the proposed merger. Information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

01 ABOUT SEACOAST BANK 02 STRATEGIC PRIORITIES 03 COMPANY PERFORMANCE 04 APPENDIX

AGENDA ABOUT SEACOAST BANK

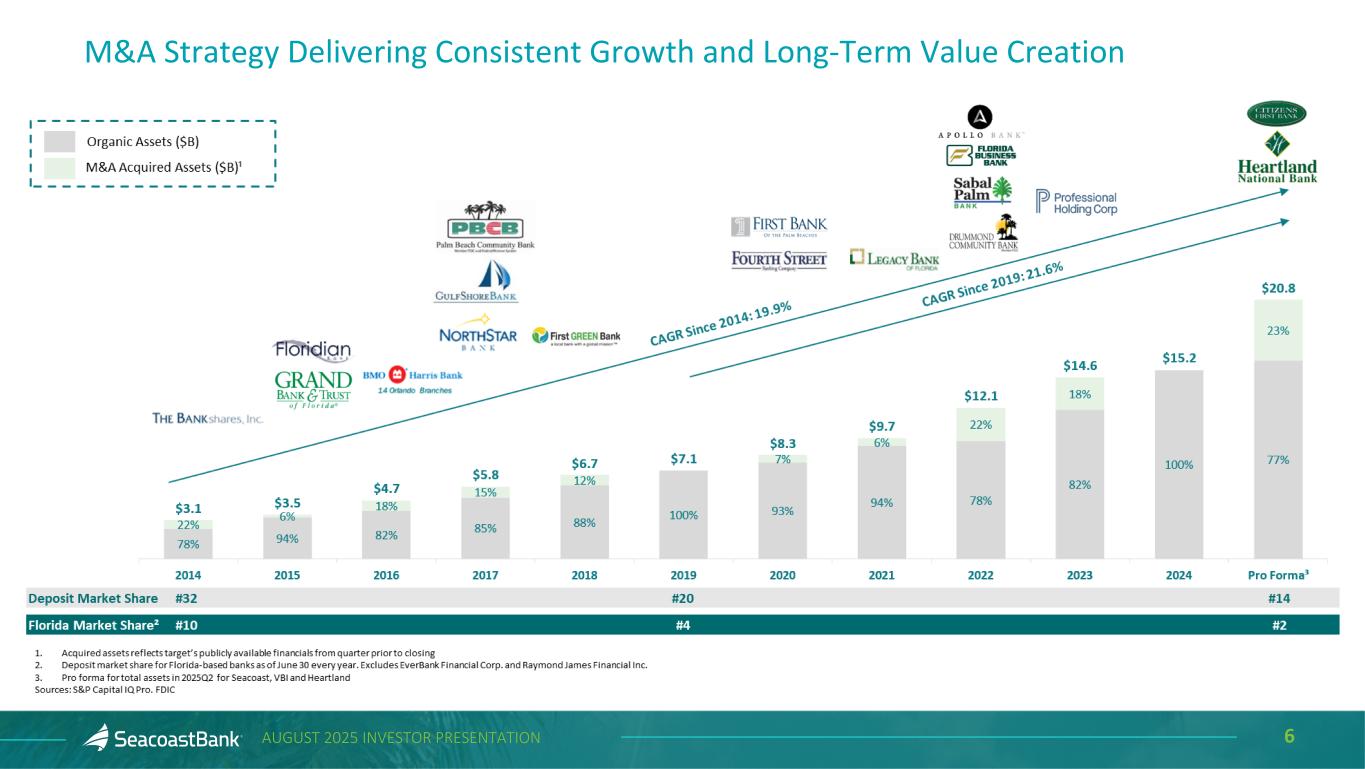

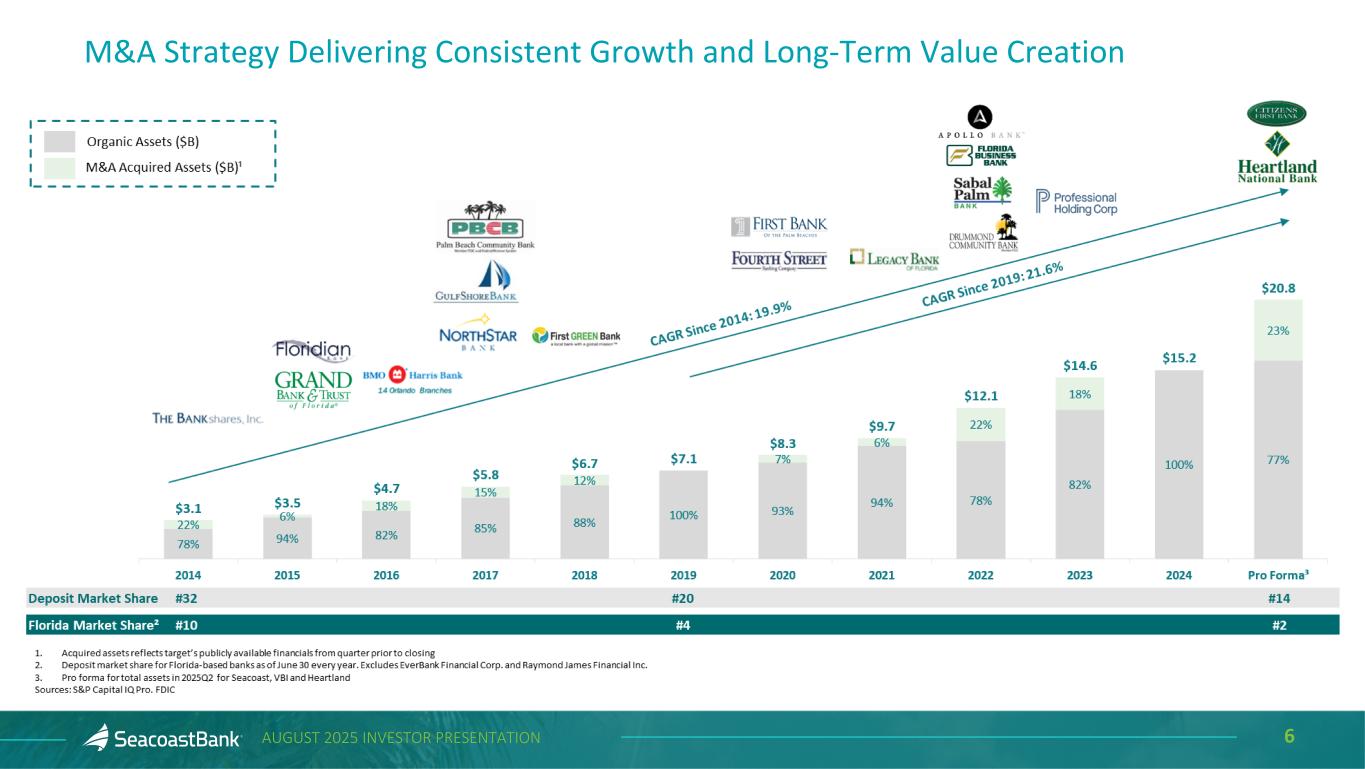

6AUGUST 2025 INVESTOR PRESENTATION M&A Strategy Delivering Consistent Growth and Long-Term Value Creation

7AUGUST 2025 INVESTOR PRESENTATION Seacoast Continues to Build its Story as the #1 Pure Play Florida Public Bank¹ 1. Deposit data as of June 30, 2024. Excludes Raymond James Financial, Inc. 2. For illustrative purposes, assumes transaction closes December 31, 2025, cost savings are 100% phased-in and excludes one-time transaction related costs 3. Deposit data as of June 30, 2024. Reflects deposits domiciled in Florida. Excludes Raymond James Financial, Inc. 4. As of March 31, 2025, excluding transaction-related adjustments Sources: S&P Capital IQ Pro. FDIC Attractive Pro Forma Metrics Further Demonstrate Seacoast’s Commitment to Maximizing Shareholder Value Total Assets $21B Gross Loans $12B Total Deposits $17B 2026E EPS Accretion² ~24% TBV Per Share Earnback Period 2.8yrs Internal Rate of Return >25% Top Publicly-Traded Florida Banks by Florida Deposits³ Orlando Pr o Fo rm a 3rd 2ndPure Play Florida Banks Regulatory CRE Concentration Ratio4 191% Loan / Deposit Ratio4 71%

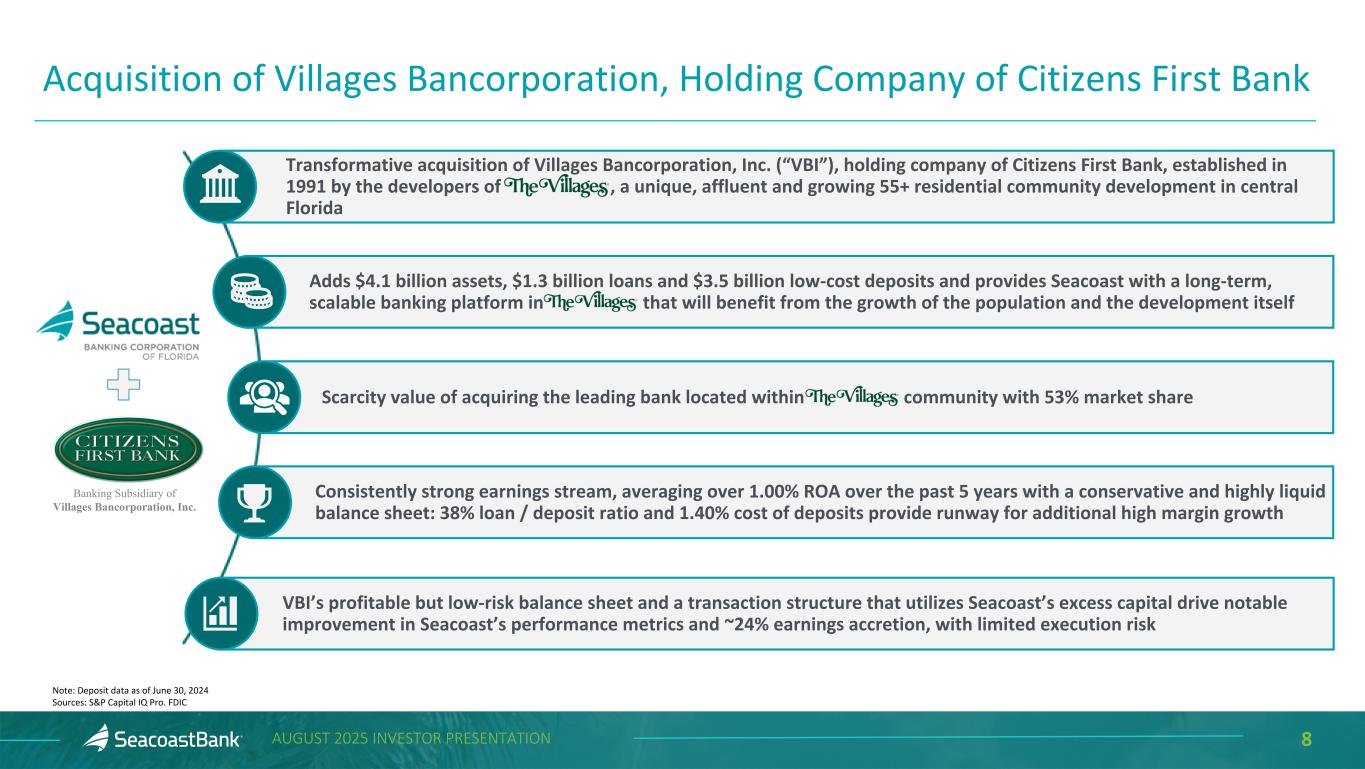

8AUGUST 2025 INVESTOR PRESENTATION Acquisition of Villages Bancorporation, Holding Company of Citizens First Bank Note: Deposit data as of June 30, 2024 Sources: S&P Capital IQ Pro. FDIC Transformative acquisition of Villages Bancorporation, Inc. (“VBI”), holding company of Citizens First Bank, established in 1991 by the developers of , a unique, affluent and growing 55+ residential community development in central Florida Adds $4.1 billion assets, $1.3 billion loans and $3.5 billion low-cost deposits and provides Seacoast with a long-term, scalable banking platform in that will benefit from the growth of the population and the development itself Scarcity value of acquiring the leading bank located within community with 53% market share VBI’s profitable but low-risk balance sheet and a transaction structure that utilizes Seacoast’s excess capital drive notable improvement in Seacoast’s performance metrics and ~24% earnings accretion, with limited execution risk Consistently strong earnings stream, averaging over 1.00% ROA over the past 5 years with a conservative and highly liquid balance sheet: 38% loan / deposit ratio and 1.40% cost of deposits provide runway for additional high margin growth Banking Subsidiary of Villages Bancorporation, Inc.

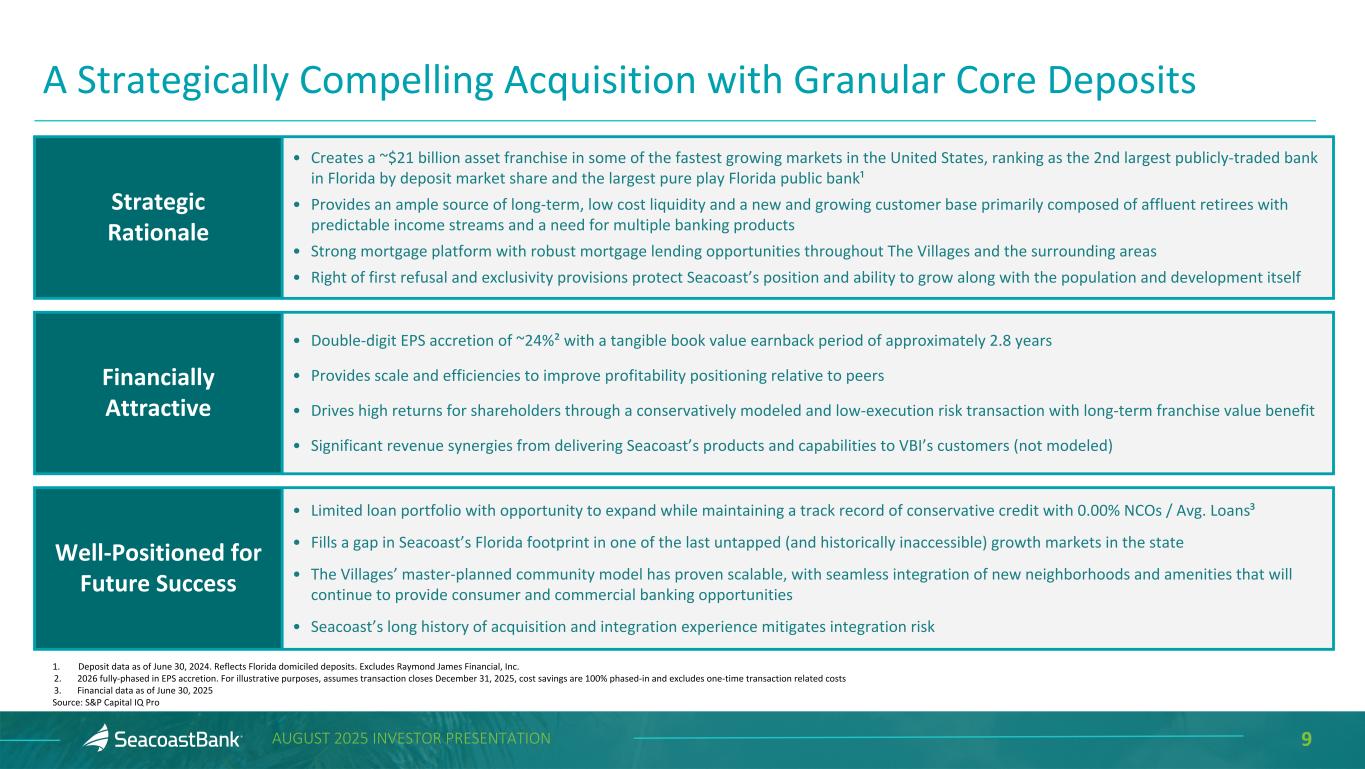

9AUGUST 2025 INVESTOR PRESENTATION A Strategically Compelling Acquisition with Granular Core Deposits 1. Deposit data as of June 30, 2024. Reflects Florida domiciled deposits. Excludes Raymond James Financial, Inc. 2. 2026 fully-phased in EPS accretion. For illustrative purposes, assumes transaction closes December 31, 2025, cost savings are 100% phased-in and excludes one-time transaction related costs 3. Financial data as of June 30, 2025 Source: S&P Capital IQ Pro • Double-digit EPS accretion of ~24%² with a tangible book value earnback period of approximately 2.8 years • Provides scale and efficiencies to improve profitability positioning relative to peers • Drives high returns for shareholders through a conservatively modeled and low-execution risk transaction with long-term franchise value benefit • Significant revenue synergies from delivering Seacoast’s products and capabilities to VBI’s customers (not modeled) Financially Attractive • Limited loan portfolio with opportunity to expand while maintaining a track record of conservative credit with 0.00% NCOs / Avg. Loans³ • Fills a gap in Seacoast’s Florida footprint in one of the last untapped (and historically inaccessible) growth markets in the state • The Villages’ master-planned community model has proven scalable, with seamless integration of new neighborhoods and amenities that will continue to provide consumer and commercial banking opportunities • Seacoast’s long history of acquisition and integration experience mitigates integration risk Well-Positioned for Future Success • Creates a ~$21 billion asset franchise in some of the fastest growing markets in the United States, ranking as the 2nd largest publicly-traded bank in Florida by deposit market share and the largest pure play Florida public bank¹ • Provides an ample source of long-term, low cost liquidity and a new and growing customer base primarily composed of affluent retirees with predictable income streams and a need for multiple banking products • Strong mortgage platform with robust mortgage lending opportunities throughout The Villages and the surrounding areas • Right of first refusal and exclusivity provisions protect Seacoast’s position and ability to grow along with the population and development itself Strategic Rationale

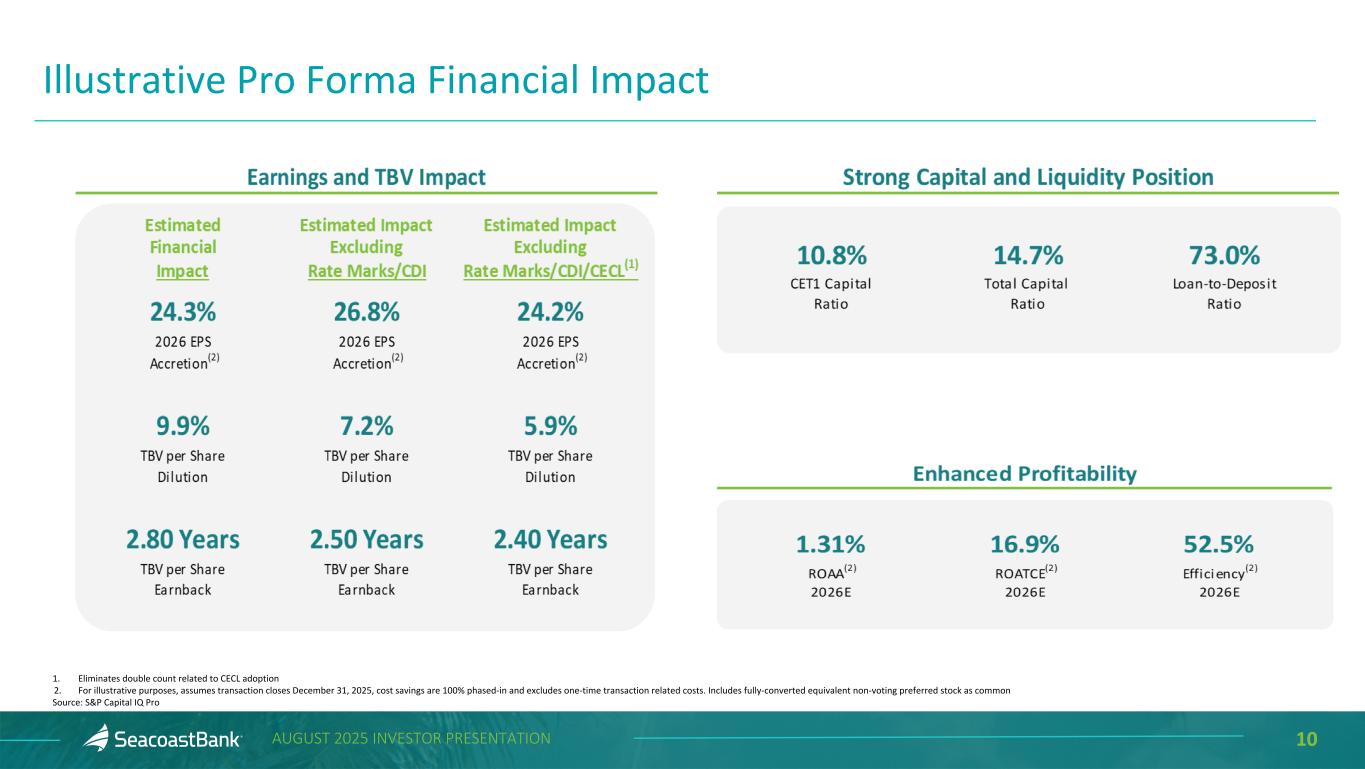

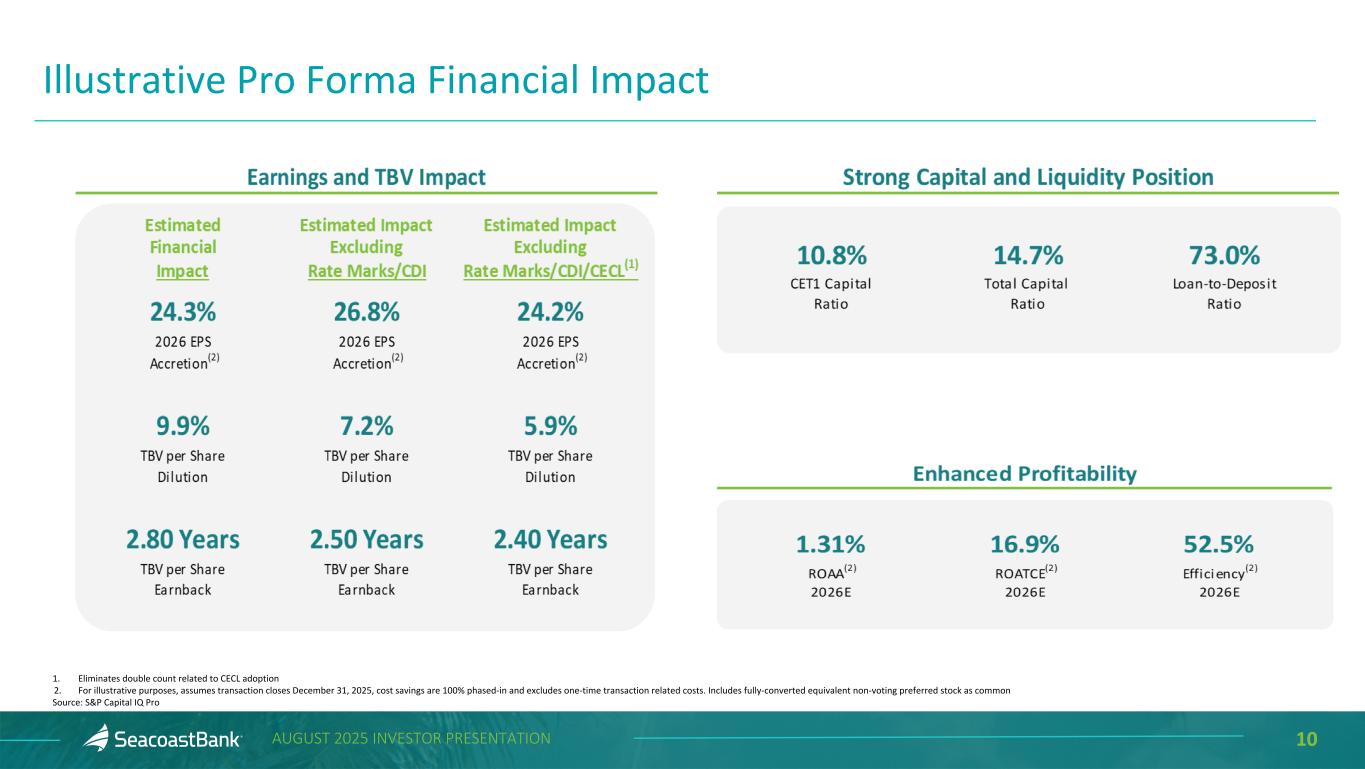

10AUGUST 2025 INVESTOR PRESENTATION Illustrative Pro Forma Financial Impact 1. Eliminates double count related to CECL adoption 2. For illustrative purposes, assumes transaction closes December 31, 2025, cost savings are 100% phased-in and excludes one-time transaction related costs. Includes fully-converted equivalent non-voting preferred stock as common Source: S&P Capital IQ Pro

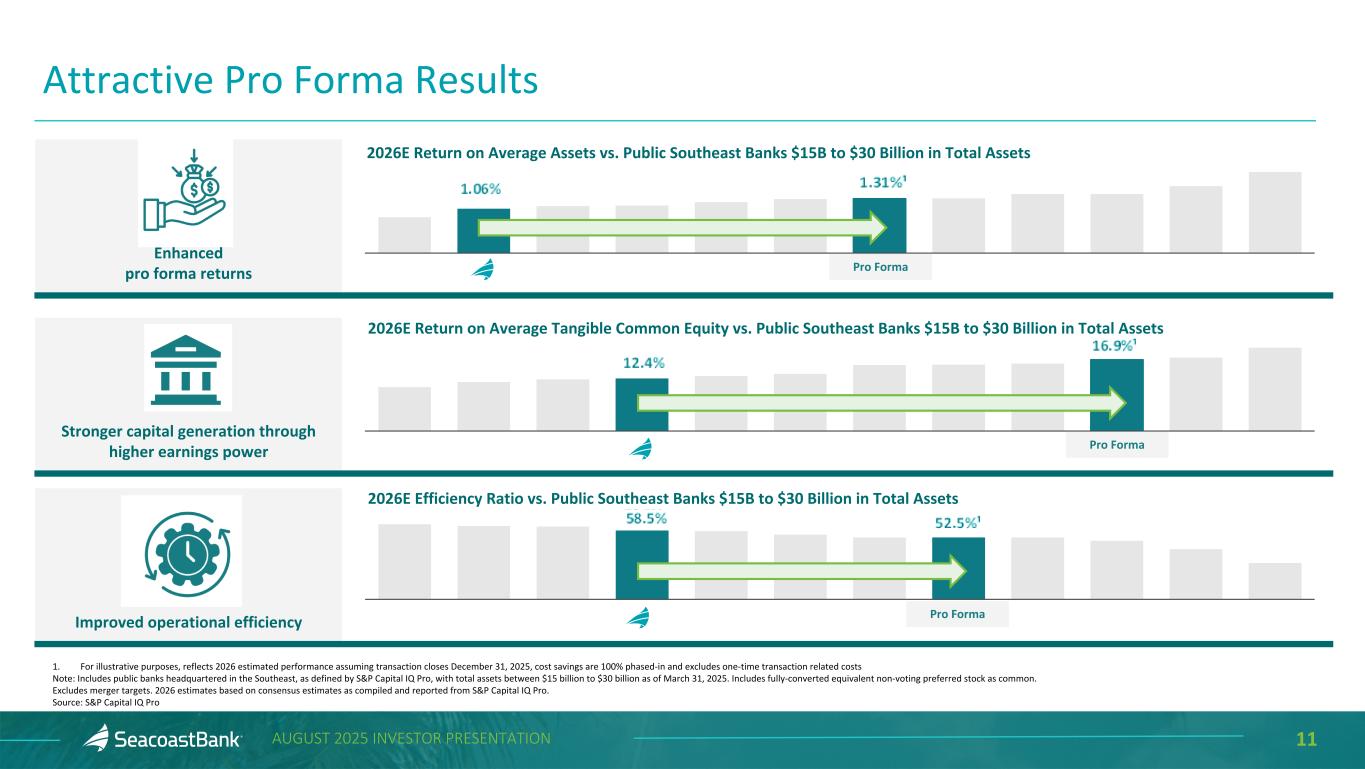

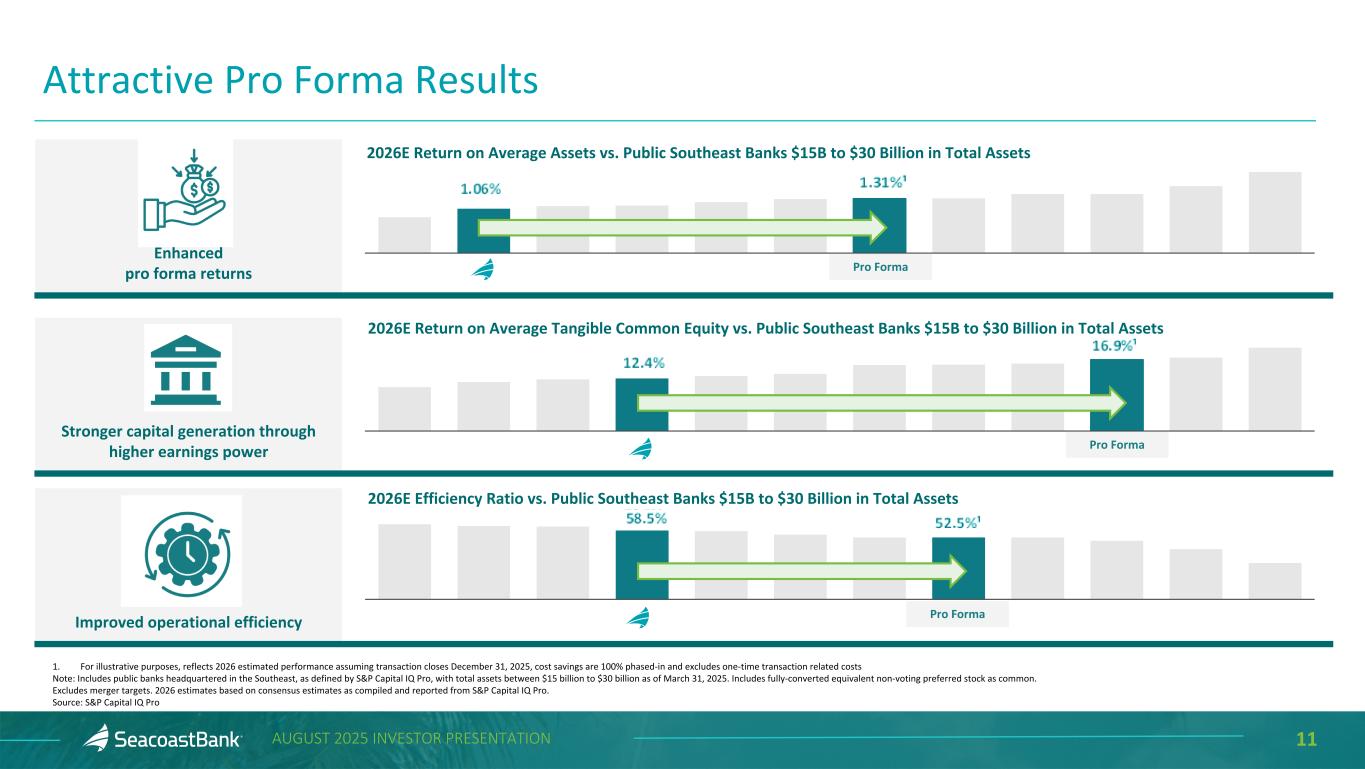

11AUGUST 2025 INVESTOR PRESENTATION Attractive Pro Forma Results 1. For illustrative purposes, reflects 2026 estimated performance assuming transaction closes December 31, 2025, cost savings are 100% phased-in and excludes one-time transaction related costs Note: Includes public banks headquartered in the Southeast, as defined by S&P Capital IQ Pro, with total assets between $15 billion to $30 billion as of March 31, 2025. Includes fully-converted equivalent non-voting preferred stock as common. Excludes merger targets. 2026 estimates based on consensus estimates as compiled and reported from S&P Capital IQ Pro. Source: S&P Capital IQ Pro Pro Forma Enhanced pro forma returns 2026E Return on Average Assets vs. Public Southeast Banks $15B to $30 Billion in Total Assets Stronger capital generation through higher earnings power 2026E Return on Average Tangible Common Equity vs. Public Southeast Banks $15B to $30 Billion in Total Assets Improved operational efficiency 2026E Efficiency Ratio vs. Public Southeast Banks $15B to $30 Billion in Total Assets Pro Forma Pro Forma

AGENDA STRATEGIC PRIORITIES

13AUGUST 2025 INVESTOR PRESENTATION Executing Our Balanced Growth Strategy Relationship Oriented Value Proposition High Performance Culture Attractive Markets Opportunistic Acquisitions Fortress Balance Sheet Resonates with both clients and bankers. Treasury management product expansion and wealth management services support revenue growth. Attracts the best banking talent from larger regionals. Investments in talent are driving disciplined loan growth and strong deposit gathering. State-wide Florida presence with continuing strong macroeconomic trends. Strategic investments will continue to build market share and scarcity value. Leveraging our proven M&A capabilities, improving profitability through growth in low- cost deposit base and strategic deployment of liquidity. Industry-leading capital, robust liquidity, credit diversity and granularity provide flexibility to seize growth opportunities as they arise, and provide long-term support to customers and shareholders. Our advantage is rooted in a top-tier banker force, compelling brand and footprint, and strong capital and liquidity supporting further organic growth and opportunistic acquisitions. Our laser focus is on leveraging these strengths to compete and take share from vulnerable competitors.

AGENDA COMPANY PERFORMANCE

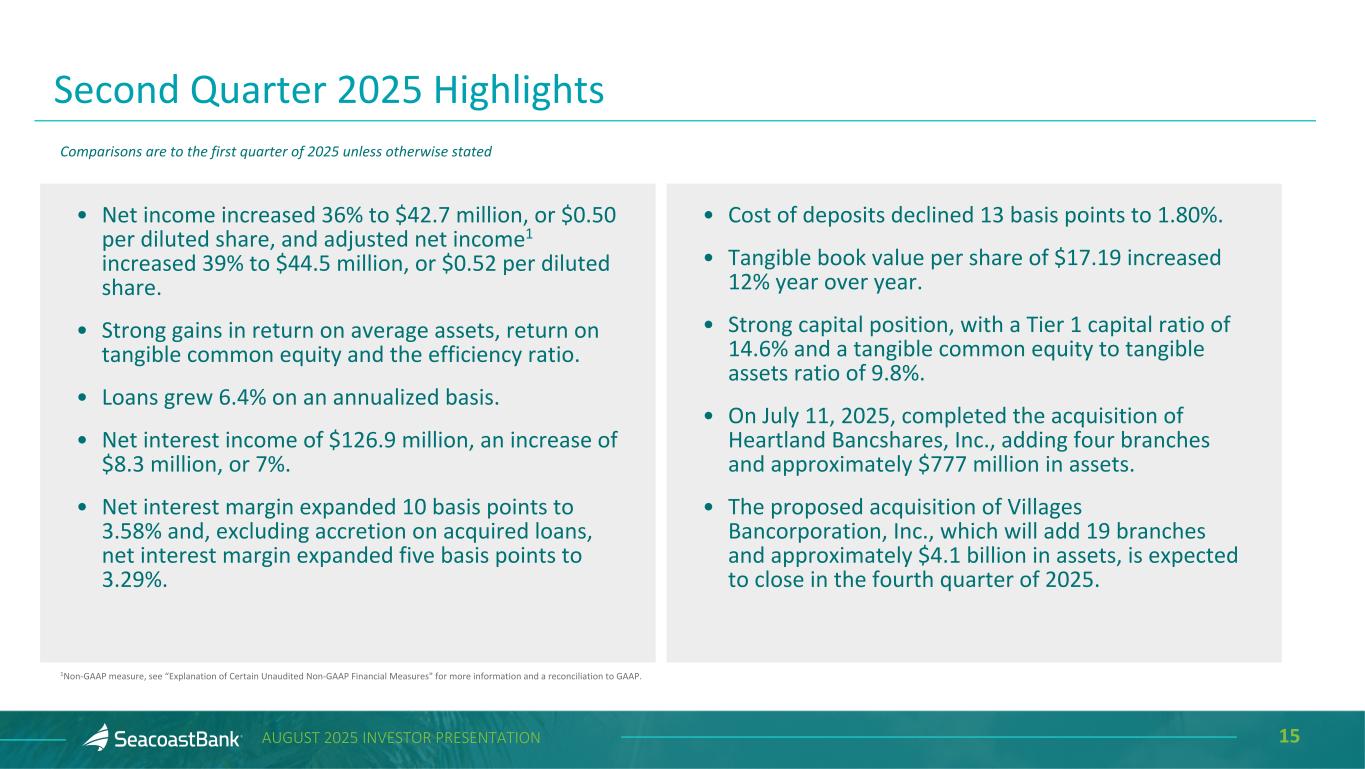

15AUGUST 2025 INVESTOR PRESENTATION • Net income increased 36% to $42.7 million, or $0.50 per diluted share, and adjusted net income1 increased 39% to $44.5 million, or $0.52 per diluted share. • Strong gains in return on average assets, return on tangible common equity and the efficiency ratio. • Loans grew 6.4% on an annualized basis. • Net interest income of $126.9 million, an increase of $8.3 million, or 7%. • Net interest margin expanded 10 basis points to 3.58% and, excluding accretion on acquired loans, net interest margin expanded five basis points to 3.29%. Second Quarter 2025 Highlights Comparisons are to the first quarter of 2025 unless otherwise stated • Cost of deposits declined 13 basis points to 1.80%. • Tangible book value per share of $17.19 increased 12% year over year. • Strong capital position, with a Tier 1 capital ratio of 14.6% and a tangible common equity to tangible assets ratio of 9.8%. • On July 11, 2025, completed the acquisition of Heartland Bancshares, Inc., adding four branches and approximately $777 million in assets. • The proposed acquisition of Villages Bancorporation, Inc., which will add 19 branches and approximately $4.1 billion in assets, is expected to close in the fourth quarter of 2025. 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP.

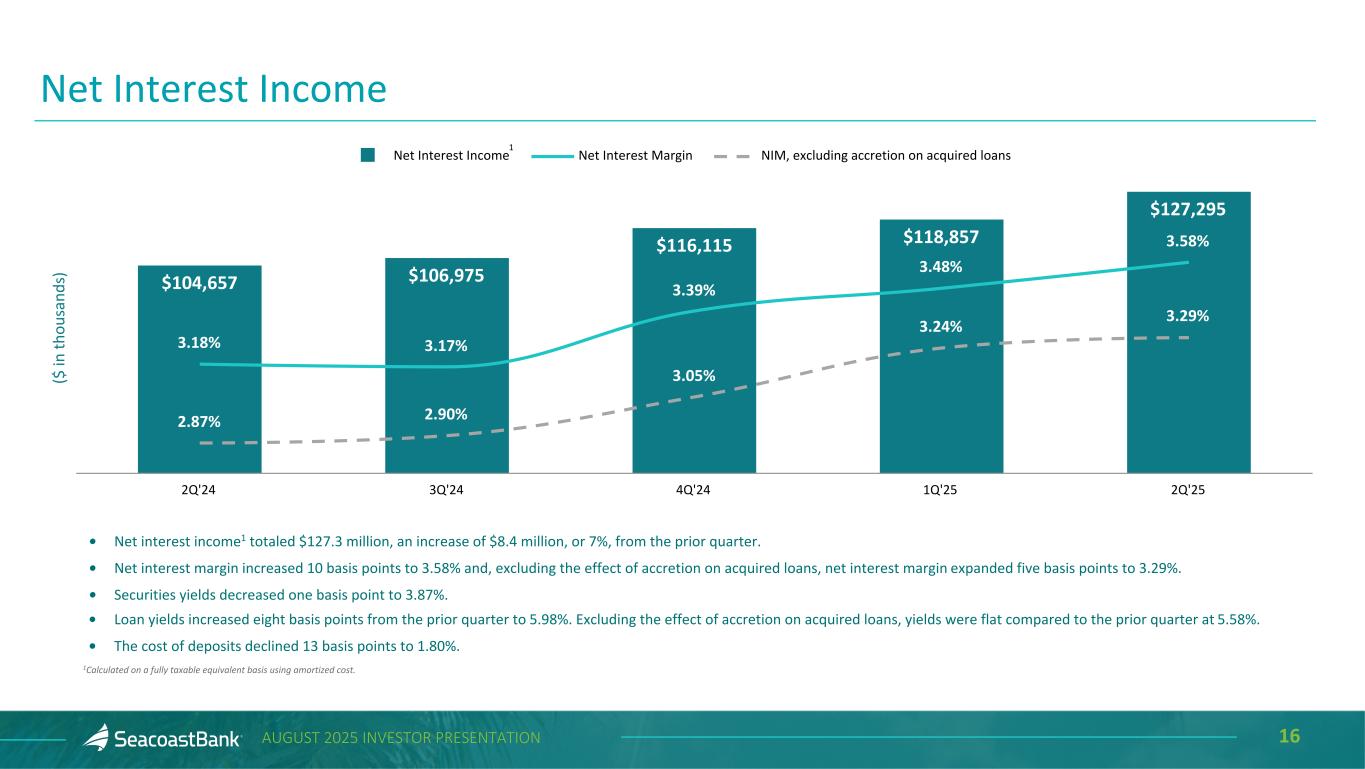

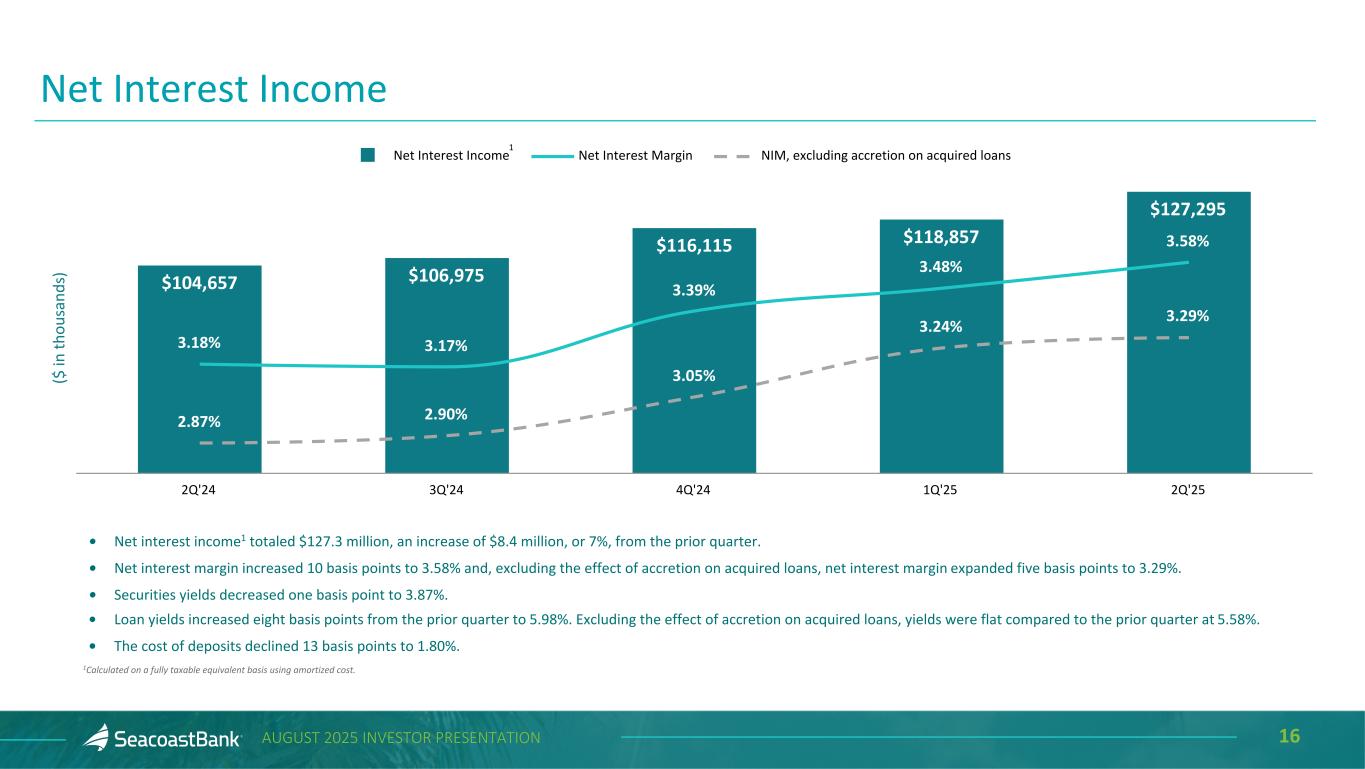

16AUGUST 2025 INVESTOR PRESENTATION Net Interest Income ($ in th ou sa nd s) $104,657 $106,975 $116,115 $118,857 $127,295 3.18% 3.17% 3.39% 3.48% 3.58% 2.87% 2.90% 3.05% 3.24% 3.29% Net Interest Income Net Interest Margin NIM, excluding accretion on acquired loans 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 • Net interest income1 totaled $127.3 million, an increase of $8.4 million, or 7%, from the prior quarter. • Net interest margin increased 10 basis points to 3.58% and, excluding the effect of accretion on acquired loans, net interest margin expanded five basis points to 3.29%. • Securities yields decreased one basis point to 3.87%. • Loan yields increased eight basis points from the prior quarter to 5.98%. Excluding the effect of accretion on acquired loans, yields were flat compared to the prior quarter at 5.58%. • The cost of deposits declined 13 basis points to 1.80%. 1Calculated on a fully taxable equivalent basis using amortized cost. 1

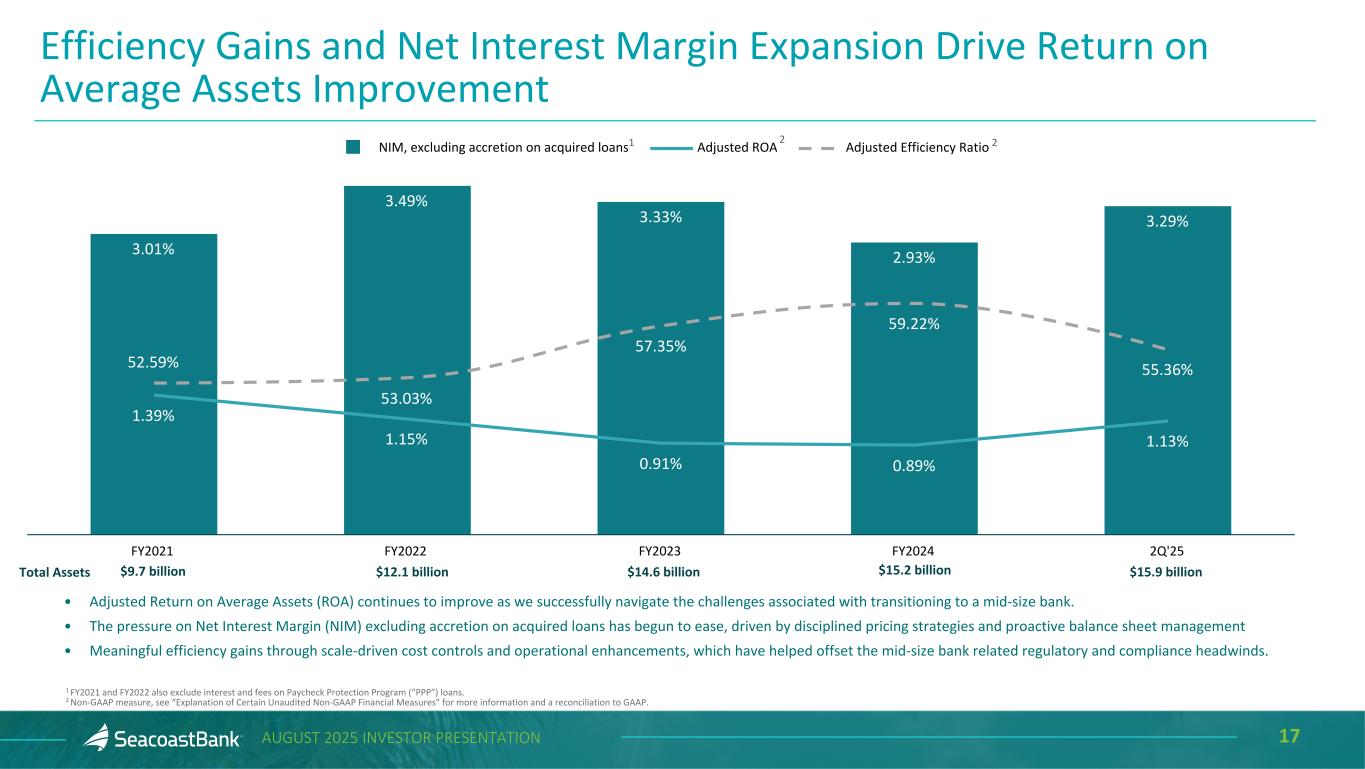

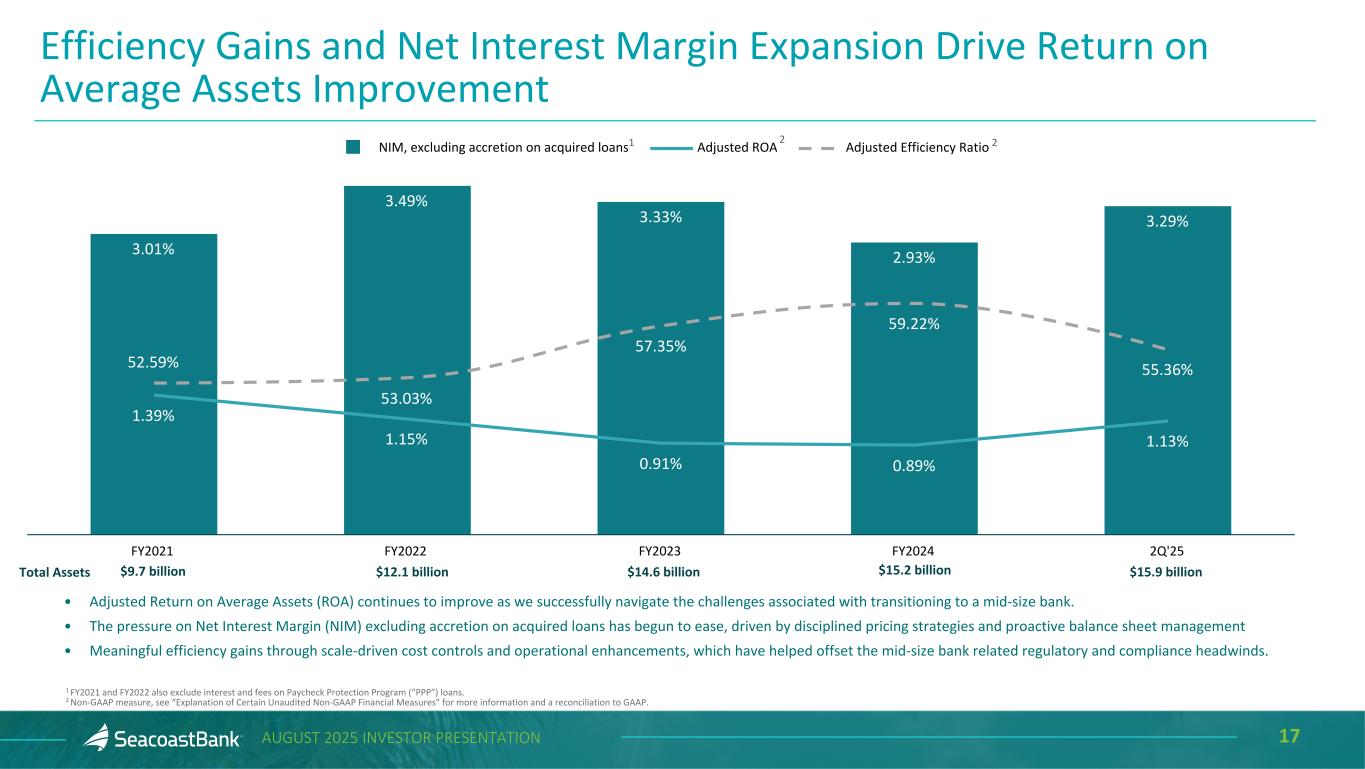

17AUGUST 2025 INVESTOR PRESENTATION Efficiency Gains and Net Interest Margin Expansion Drive Return on Average Assets Improvement 3.01% 3.49% 3.33% 2.93% 3.29% 1.39% 1.15% 0.91% 0.89% 1.13% 52.59% 53.03% 57.35% 59.22% 55.36% NIM, excluding accretion on acquired loans Adjusted ROA Adjusted Efficiency Ratio FY2021 FY2022 FY2023 FY2024 2Q'25 $15.9 billion$12.1 billion$9.7 billion $14.6 billion $15.2 billion 2 1 FY2021 and FY2022 also exclude interest and fees on Paycheck Protection Program (“PPP”) loans. 2 Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. 2 Total Assets • Adjusted Return on Average Assets (ROA) continues to improve as we successfully navigate the challenges associated with transitioning to a mid-size bank. • The pressure on Net Interest Margin (NIM) excluding accretion on acquired loans has begun to ease, driven by disciplined pricing strategies and proactive balance sheet management • Meaningful efficiency gains through scale-driven cost controls and operational enhancements, which have helped offset the mid-size bank related regulatory and compliance headwinds. 1

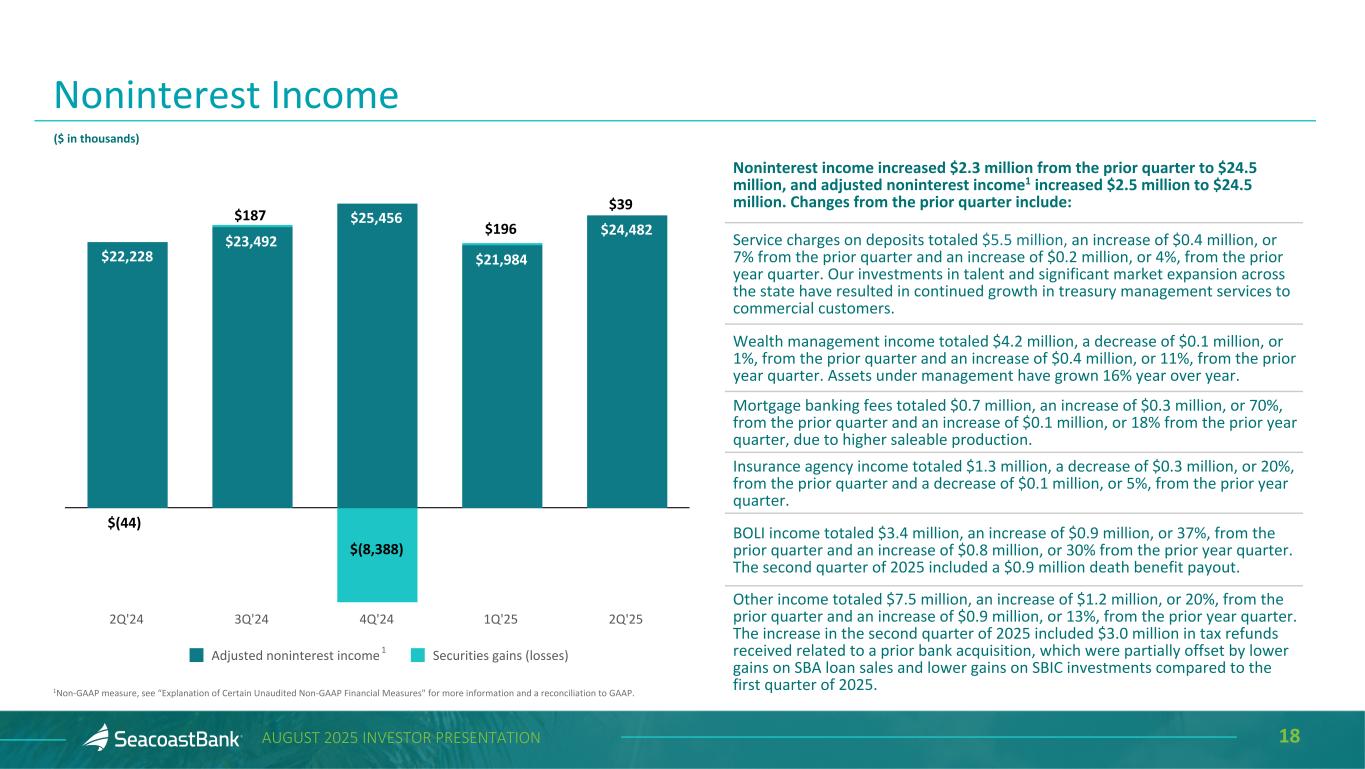

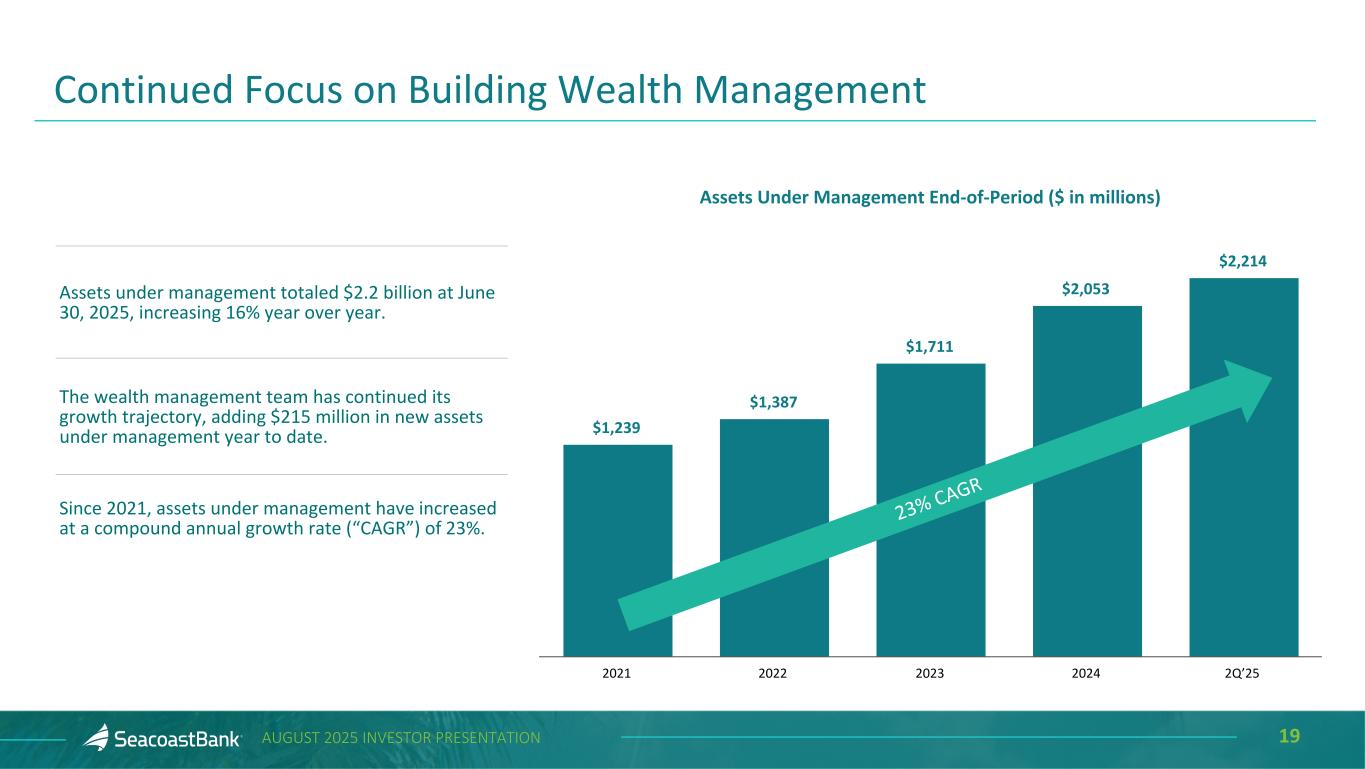

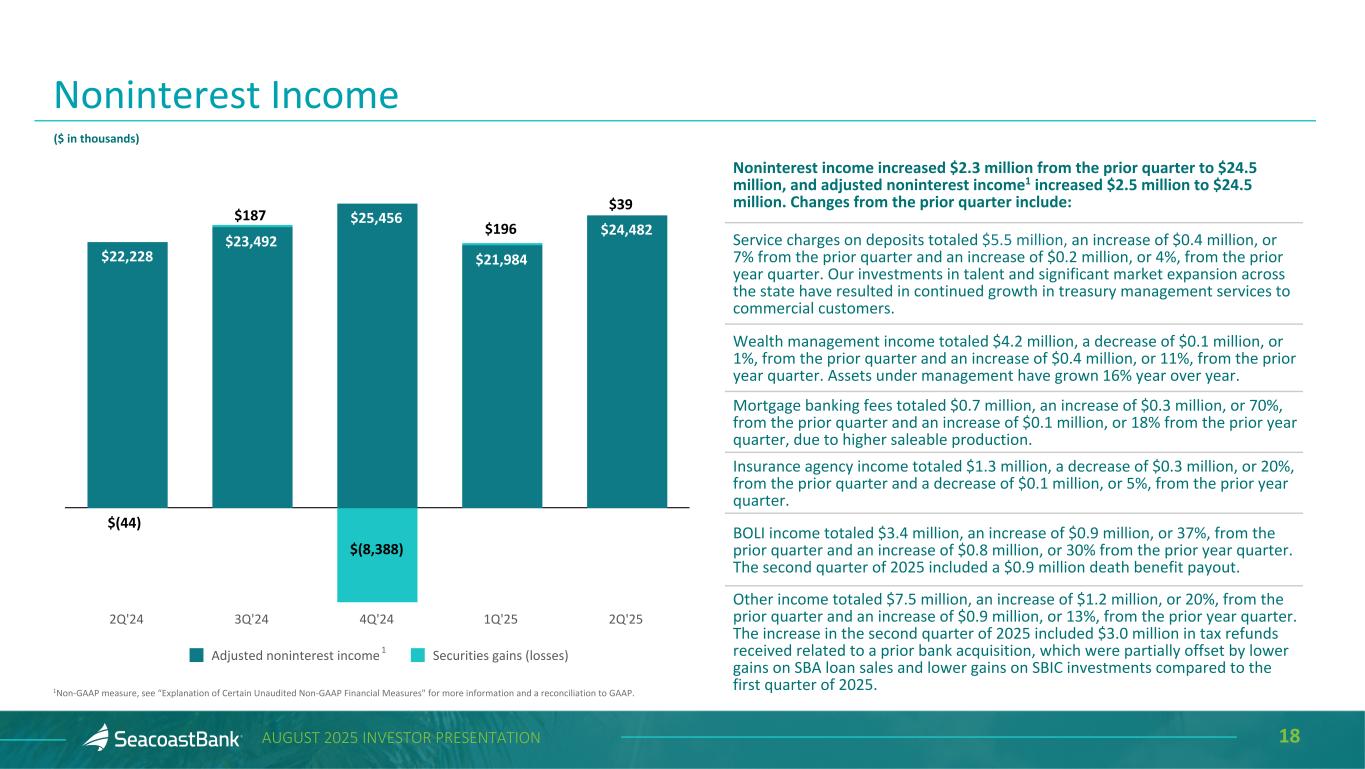

18AUGUST 2025 INVESTOR PRESENTATION Noninterest income increased $2.3 million from the prior quarter to $24.5 million, and adjusted noninterest income1 increased $2.5 million to $24.5 million. Changes from the prior quarter include: Service charges on deposits totaled $5.5 million, an increase of $0.4 million, or 7% from the prior quarter and an increase of $0.2 million, or 4%, from the prior year quarter. Our investments in talent and significant market expansion across the state have resulted in continued growth in treasury management services to commercial customers. Wealth management income totaled $4.2 million, a decrease of $0.1 million, or 1%, from the prior quarter and an increase of $0.4 million, or 11%, from the prior year quarter. Assets under management have grown 16% year over year. Mortgage banking fees totaled $0.7 million, an increase of $0.3 million, or 70%, from the prior quarter and an increase of $0.1 million, or 18% from the prior year quarter, due to higher saleable production. Insurance agency income totaled $1.3 million, a decrease of $0.3 million, or 20%, from the prior quarter and a decrease of $0.1 million, or 5%, from the prior year quarter. BOLI income totaled $3.4 million, an increase of $0.9 million, or 37%, from the prior quarter and an increase of $0.8 million, or 30% from the prior year quarter. The second quarter of 2025 included a $0.9 million death benefit payout. Other income totaled $7.5 million, an increase of $1.2 million, or 20%, from the prior quarter and an increase of $0.9 million, or 13%, from the prior year quarter. The increase in the second quarter of 2025 included $3.0 million in tax refunds received related to a prior bank acquisition, which were partially offset by lower gains on SBA loan sales and lower gains on SBIC investments compared to the first quarter of 2025.1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. Noninterest Income $22,228 $23,492 $25,456 $21,984 $24,482 Adjusted noninterest income Securities gains (losses) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 ($ in thousands) $(44) $196 1 $187 $(8,388) $39

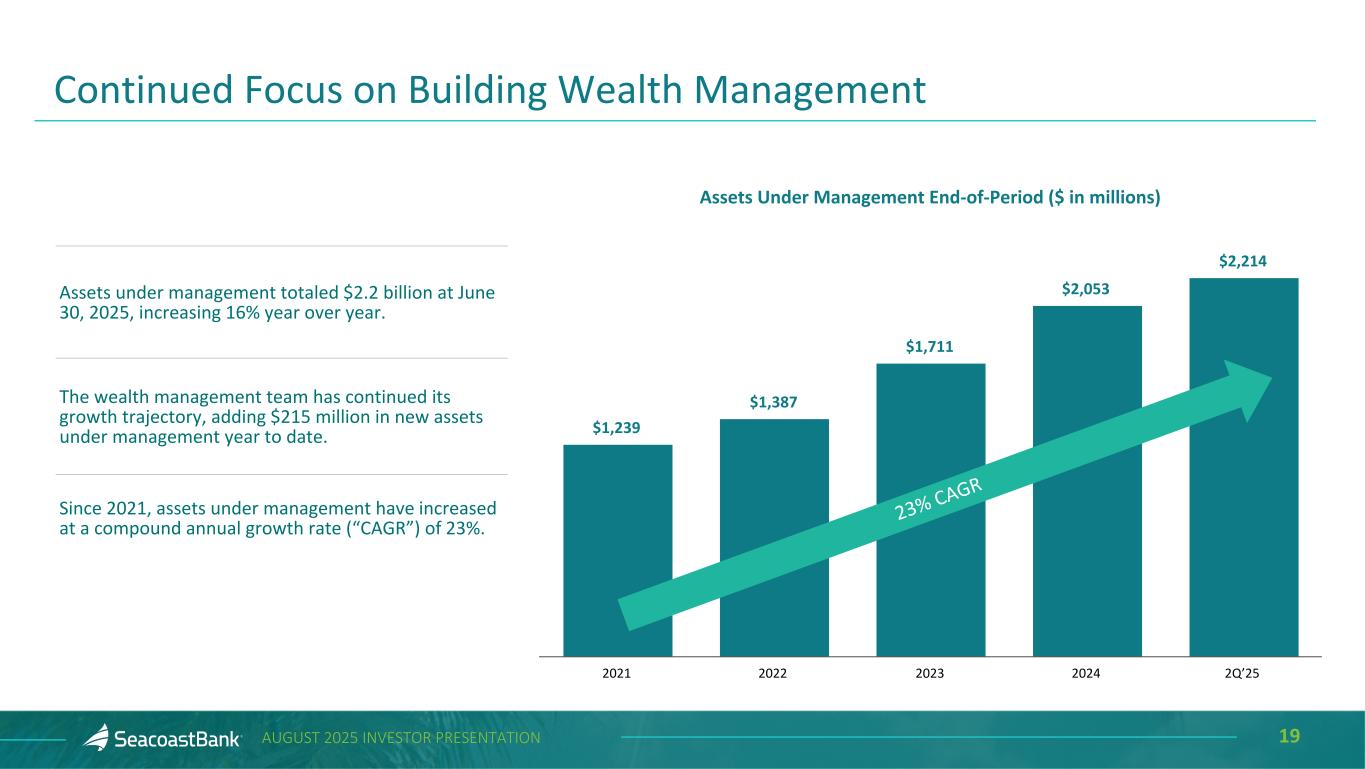

19AUGUST 2025 INVESTOR PRESENTATION Assets Under Management End-of-Period ($ in millions) $1,239 $1,387 $1,711 $2,053 $2,214 2021 2022 2023 2024 2Q’25 Continued Focus on Building Wealth Management Assets under management totaled $2.2 billion at June 30, 2025, increasing 16% year over year. The wealth management team has continued its growth trajectory, adding $215 million in new assets under management year to date. Since 2021, assets under management have increased at a compound annual growth rate (“CAGR”) of 23%. 23% CAG R

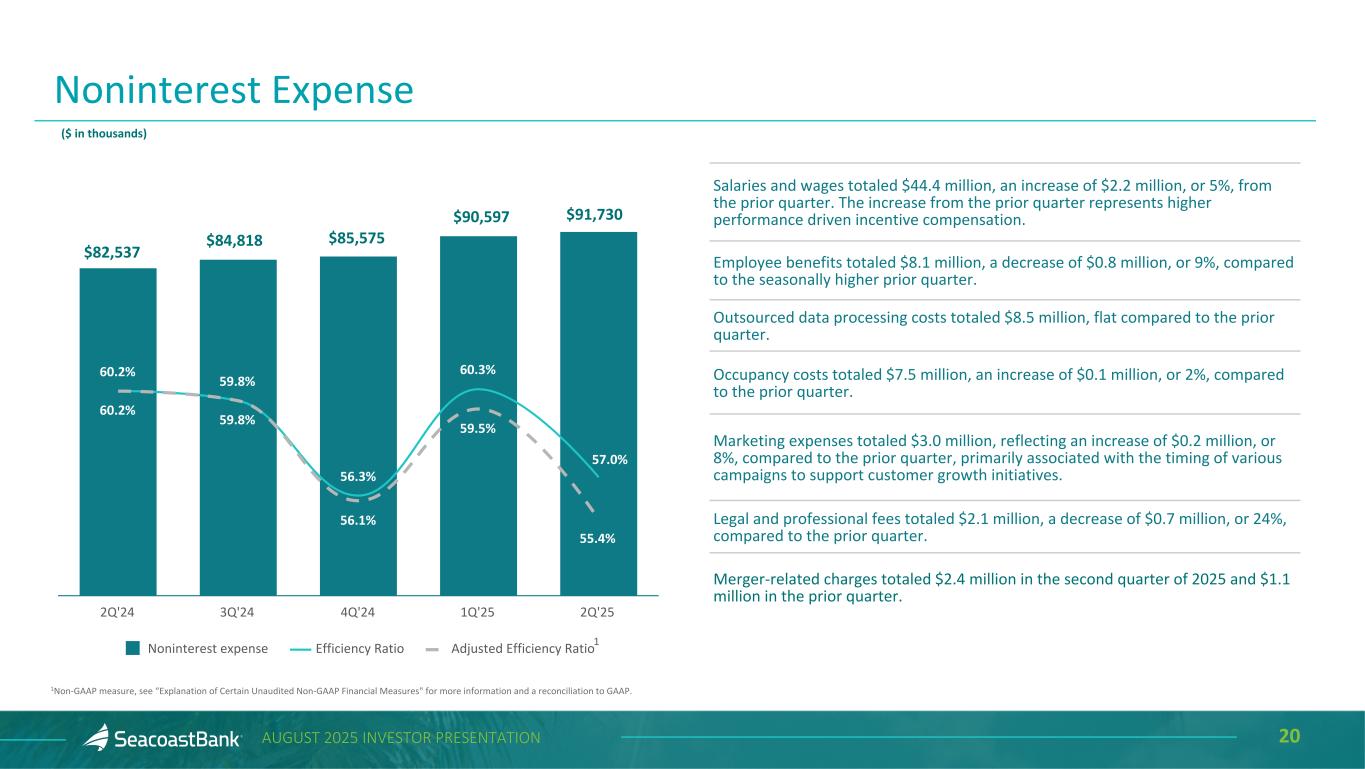

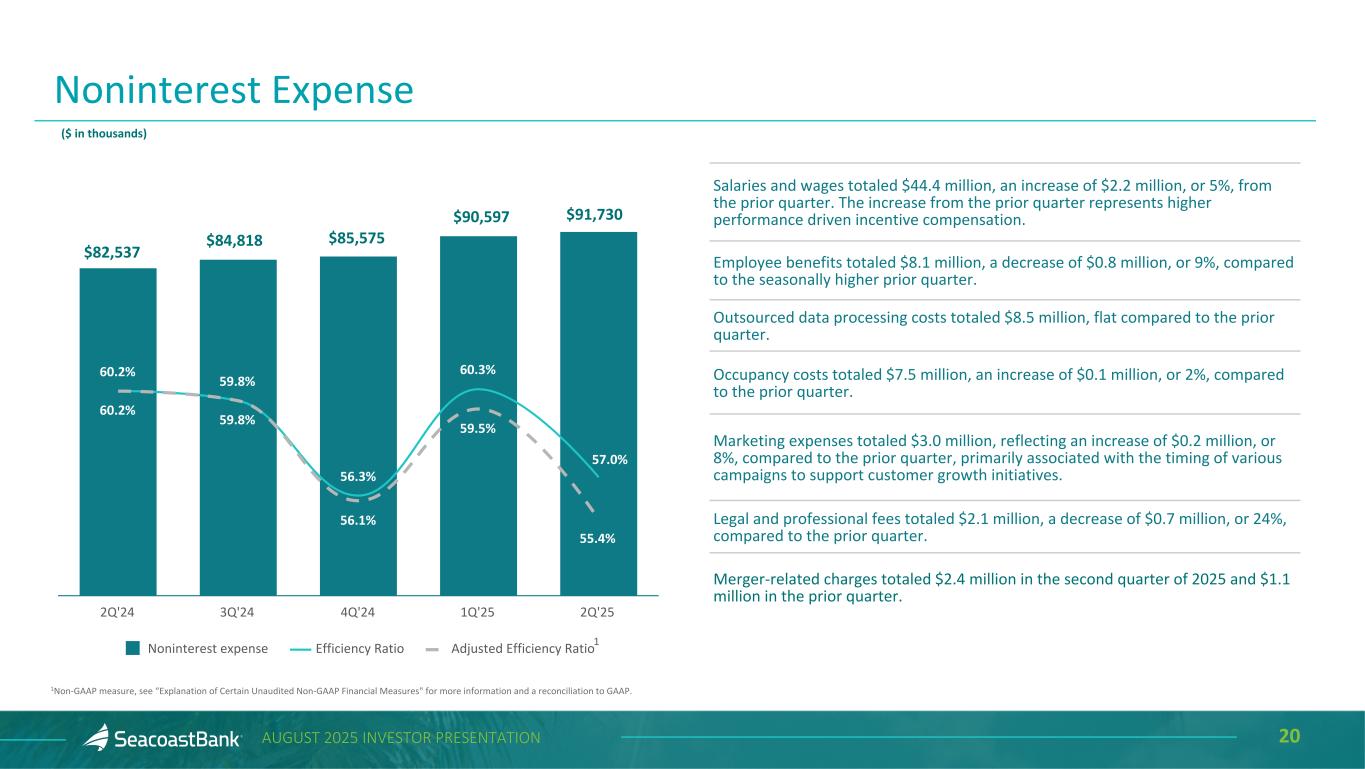

20AUGUST 2025 INVESTOR PRESENTATION Noninterest Expense Salaries and wages totaled $44.4 million, an increase of $2.2 million, or 5%, from the prior quarter. The increase from the prior quarter represents higher performance driven incentive compensation. Employee benefits totaled $8.1 million, a decrease of $0.8 million, or 9%, compared to the seasonally higher prior quarter. Outsourced data processing costs totaled $8.5 million, flat compared to the prior quarter. Occupancy costs totaled $7.5 million, an increase of $0.1 million, or 2%, compared to the prior quarter. Marketing expenses totaled $3.0 million, reflecting an increase of $0.2 million, or 8%, compared to the prior quarter, primarily associated with the timing of various campaigns to support customer growth initiatives. Legal and professional fees totaled $2.1 million, a decrease of $0.7 million, or 24%, compared to the prior quarter. Merger-related charges totaled $2.4 million in the second quarter of 2025 and $1.1 million in the prior quarter. ($ in thousands) 60.2% 59.8% 56.3% 60.3% 60.2% 59.8% 56.1% 59.5% 55.4% Noninterest expense Efficiency Ratio Adjusted Efficiency Ratio 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 1 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. $91,730$90,597 $85,575$84,818 $82,537 57.0%

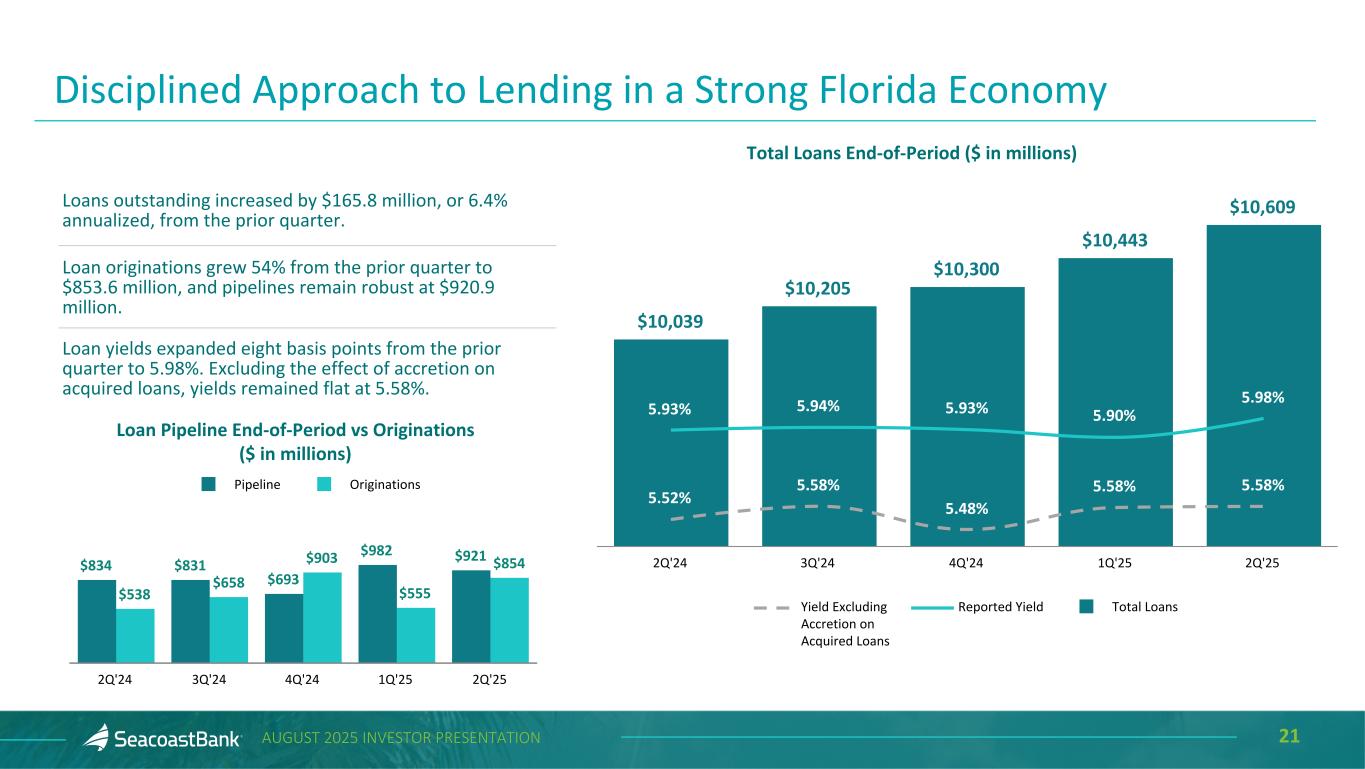

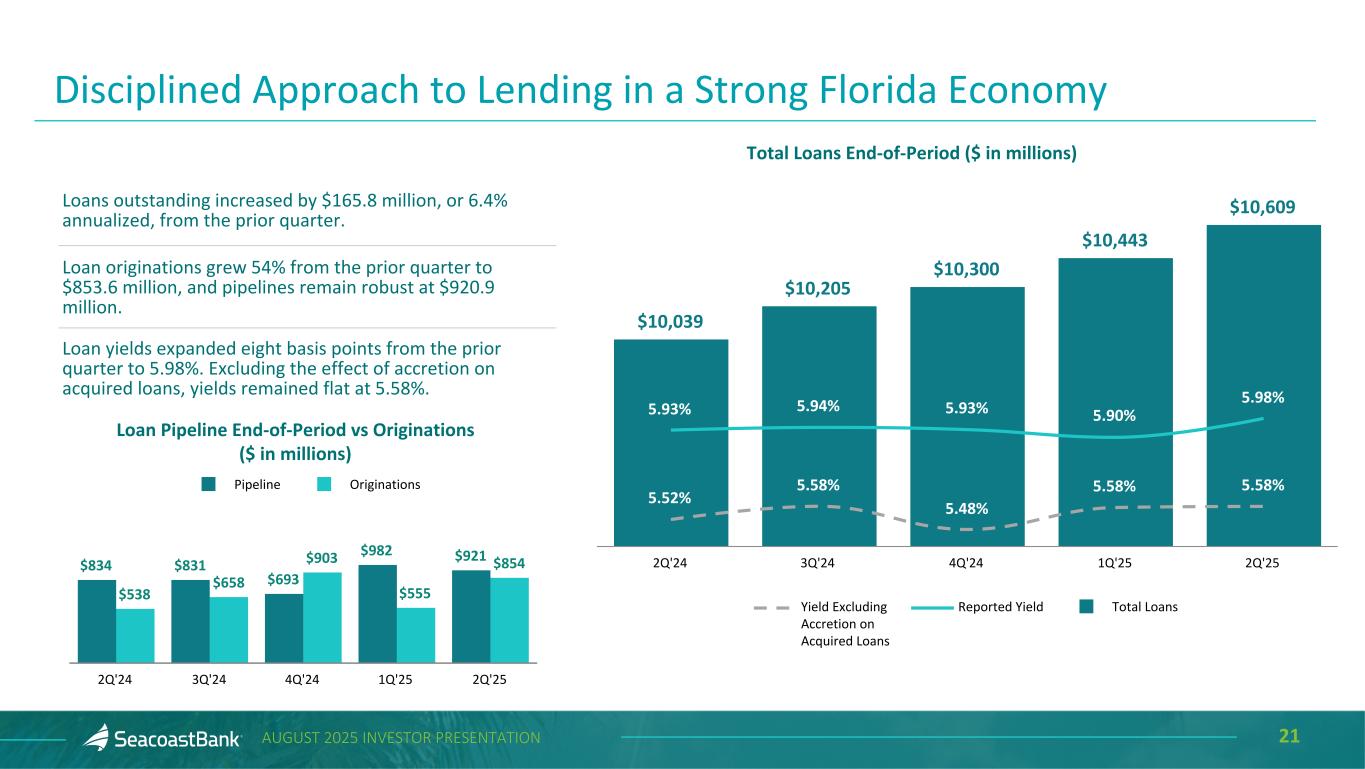

21AUGUST 2025 INVESTOR PRESENTATION $834 $831 $693 $982 $921 $538 $658 $903 $555 $854 Pipeline Originations 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Loan Pipeline End-of-Period vs Originations ($ in millions) $10,039 $10,205 $10,300 $10,443 $10,609 5.93% 5.94% 5.93% 5.90% 5.98% 5.52% 5.58% 5.48% 5.58% 5.58% Yield Excluding Accretion on Acquired Loans Reported Yield Total Loans 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Total Loans End-of-Period ($ in millions) Disciplined Approach to Lending in a Strong Florida Economy Loans outstanding increased by $165.8 million, or 6.4% annualized, from the prior quarter. Loan originations grew 54% from the prior quarter to $853.6 million, and pipelines remain robust at $920.9 million. Loan yields expanded eight basis points from the prior quarter to 5.98%. Excluding the effect of accretion on acquired loans, yields remained flat at 5.58%.

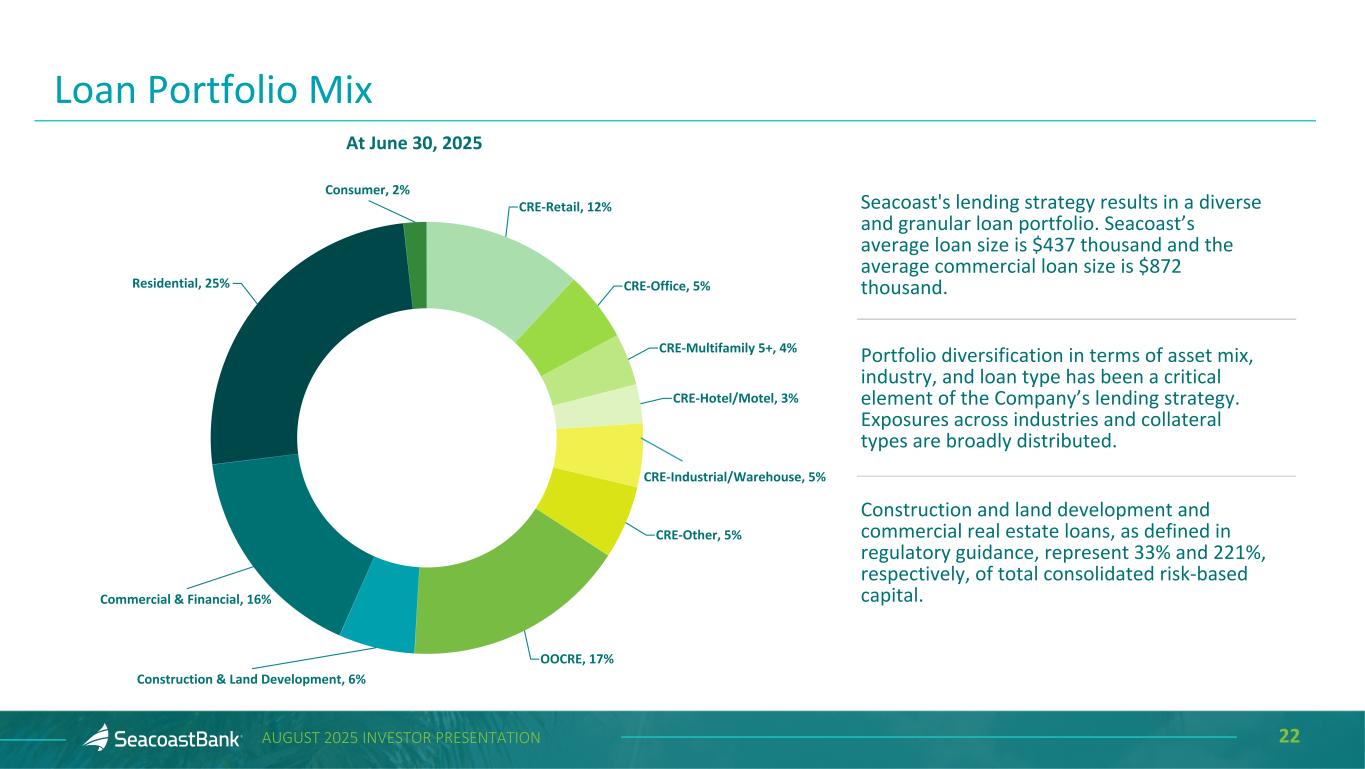

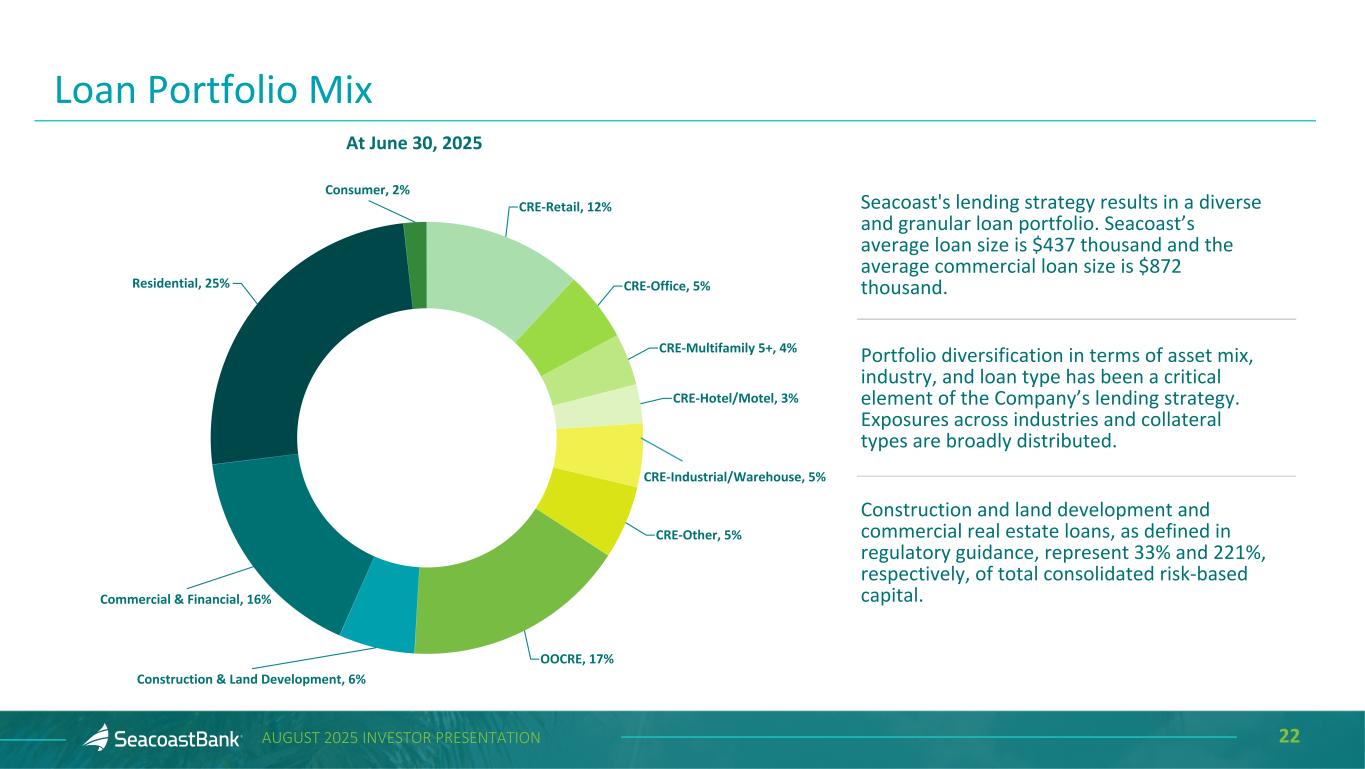

22AUGUST 2025 INVESTOR PRESENTATION At June 30, 2025 Loan Portfolio Mix Seacoast's lending strategy results in a diverse and granular loan portfolio. Seacoast’s average loan size is $437 thousand and the average commercial loan size is $872 thousand. Portfolio diversification in terms of asset mix, industry, and loan type has been a critical element of the Company’s lending strategy. Exposures across industries and collateral types are broadly distributed. Construction and land development and commercial real estate loans, as defined in regulatory guidance, represent 33% and 221%, respectively, of total consolidated risk-based capital. CRE-Retail, 12% CRE-Office, 5% CRE-Multifamily 5+, 4% CRE-Hotel/Motel, 3% CRE-Industrial/Warehouse, 5% CRE-Other, 5% OOCRE, 17% Construction & Land Development, 6% Commercial & Financial, 16% Residential, 25% Consumer, 2%

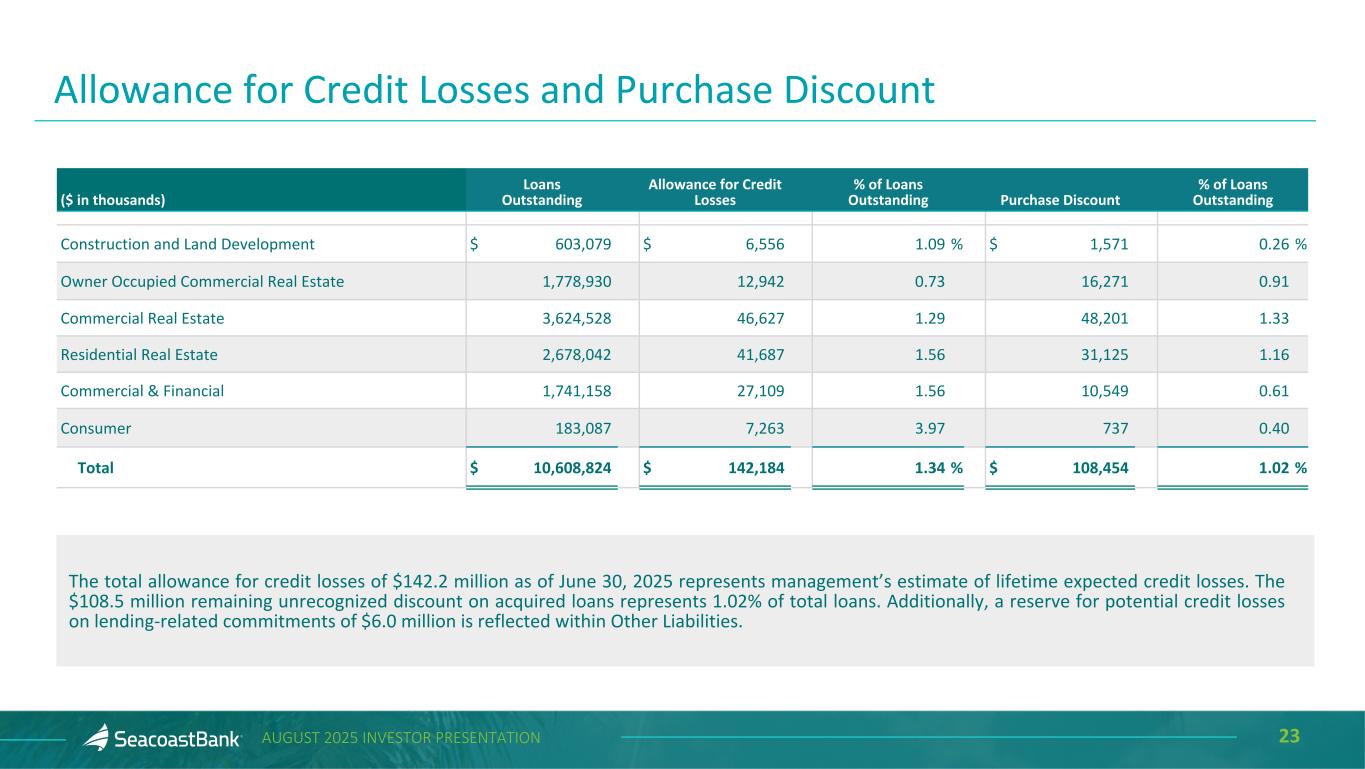

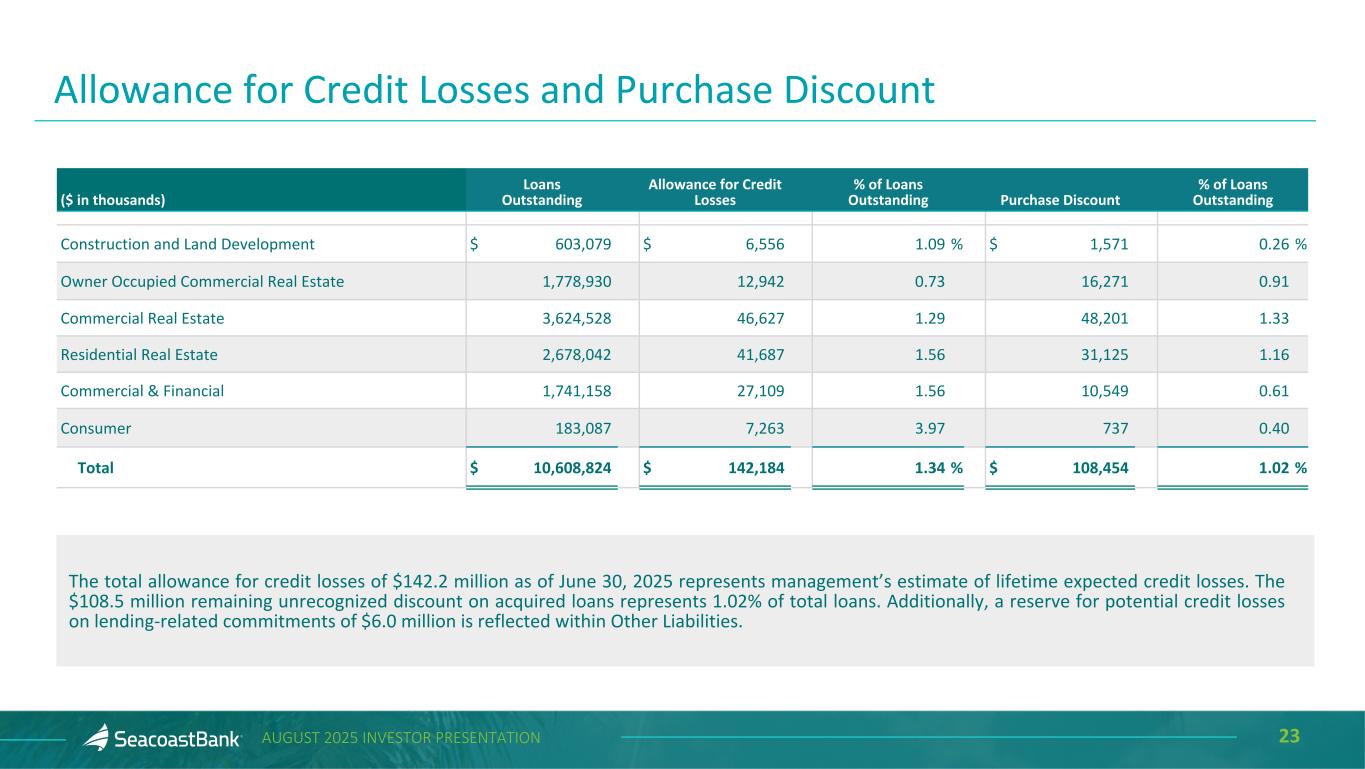

23AUGUST 2025 INVESTOR PRESENTATION Allowance for Credit Losses and Purchase Discount ($ in thousands) Loans Outstanding Allowance for Credit Losses % of Loans Outstanding Purchase Discount % of Loans Outstanding Construction and Land Development $ 603,079 $ 6,556 1.09 % $ 1,571 0.26 % Owner Occupied Commercial Real Estate 1,778,930 12,942 0.73 16,271 0.91 Commercial Real Estate 3,624,528 46,627 1.29 48,201 1.33 Residential Real Estate 2,678,042 41,687 1.56 31,125 1.16 Commercial & Financial 1,741,158 27,109 1.56 10,549 0.61 Consumer 183,087 7,263 3.97 737 0.40 Total $ 10,608,824 $ 142,184 1.34 % $ 108,454 1.02 % The total allowance for credit losses of $142.2 million as of June 30, 2025 represents management’s estimate of lifetime expected credit losses. The $108.5 million remaining unrecognized discount on acquired loans represents 1.02% of total loans. Additionally, a reserve for potential credit losses on lending-related commitments of $6.0 million is reflected within Other Liabilities.

24AUGUST 2025 INVESTOR PRESENTATION Net Charge-Offs $7,445 $6,113 $7,038 $2,462 0.40% 0.29% 0.24% 0.27% 0.09% NCO NCO/Average Loans 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 ($ in thousands) Allowance for Credit Losses $141,641 $140,469 $138,055 $140,267 $142,184 1.41% 1.38% 1.34% 1.34% 1.34% ACL ACL/Total Loans 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Continued Strong Asset Quality Trends Nonperforming Loans $59,927 $80,857 $92,446 $71,018 $64,198 0.60% 0.79% 0.90% 0.68% 0.61% 0.39% 0.50% 0.15% 0.16% 0.13% NPL NPL/Total Loans Accruing Past Due / Total Loans 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Criticized and Classified Loans $260,040 $264,140 $223,859 $251,428 $253,693 2.59% 2.59% 2.17% 2.41% 2.39% Criticized and Classified Loans Criticized and Classified Loans / Total Loans 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 $9,946

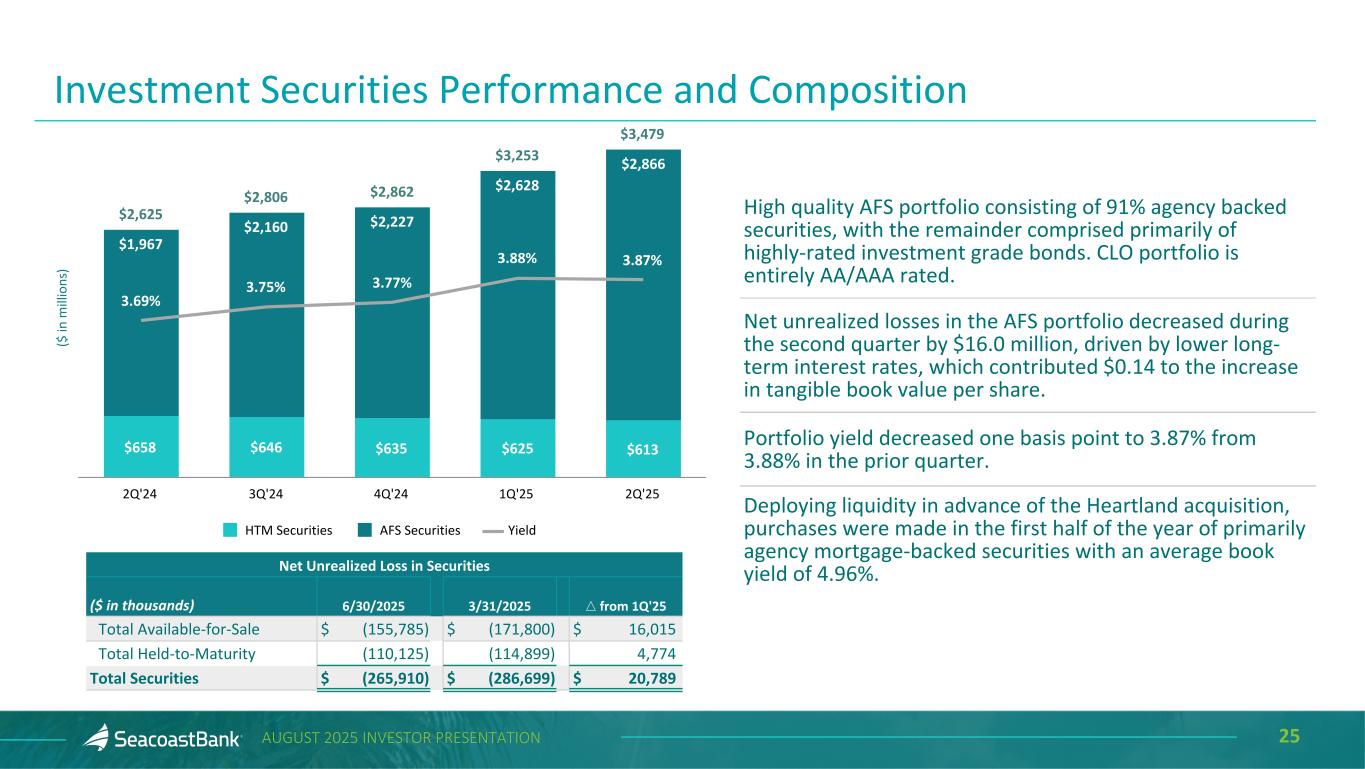

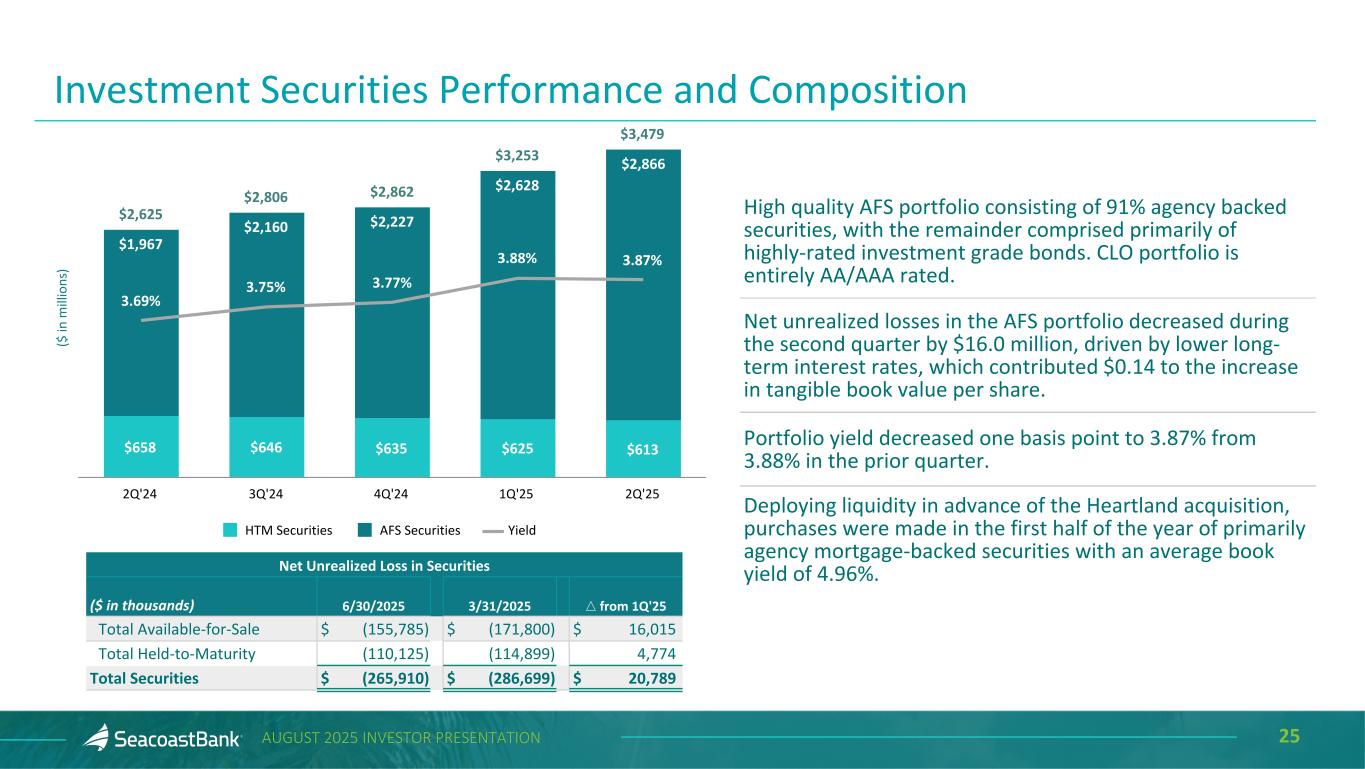

25AUGUST 2025 INVESTOR PRESENTATION Investment Securities Performance and Composition High quality AFS portfolio consisting of 91% agency backed securities, with the remainder comprised primarily of highly-rated investment grade bonds. CLO portfolio is entirely AA/AAA rated. Net unrealized losses in the AFS portfolio decreased during the second quarter by $16.0 million, driven by lower long- term interest rates, which contributed $0.14 to the increase in tangible book value per share. Portfolio yield decreased one basis point to 3.87% from 3.88% in the prior quarter. Deploying liquidity in advance of the Heartland acquisition, purchases were made in the first half of the year of primarily agency mortgage-backed securities with an average book yield of 4.96%. Net Unrealized Loss in Securities ($ in thousands) 6/30/2025 3/31/2025 △ from 1Q'25 Total Available-for-Sale $ (155,785) $ (171,800) $ 16,015 Total Held-to-Maturity (110,125) (114,899) 4,774 Total Securities $ (265,910) $ (286,699) $ 20,789 ($ in m ill io ns ) $2,625 $2,806 $2,862 $3,253 $3,479 $658 $646 $635 $625 $613 $1,967 $2,160 $2,227 $2,628 $2,866 3.69% 3.75% 3.77% 3.88% 3.87% HTM Securities AFS Securities Yield 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25

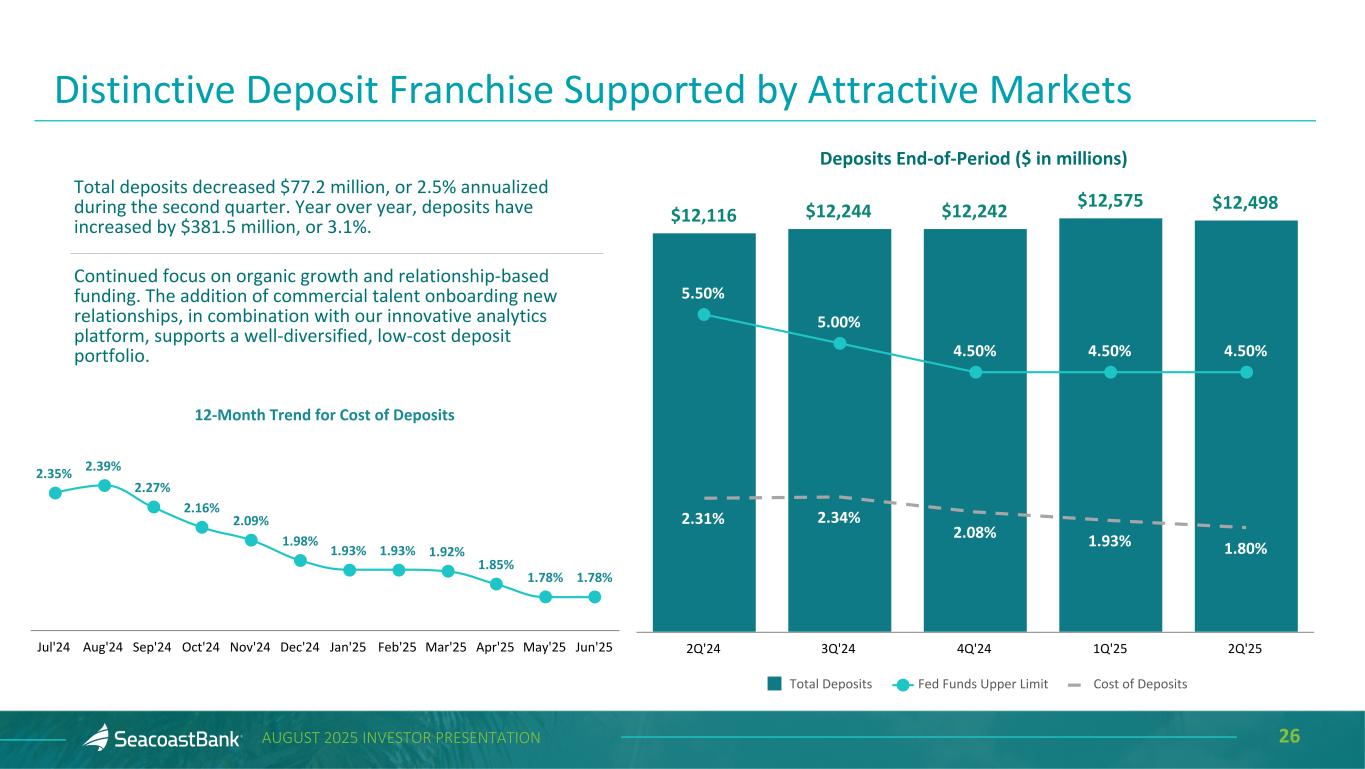

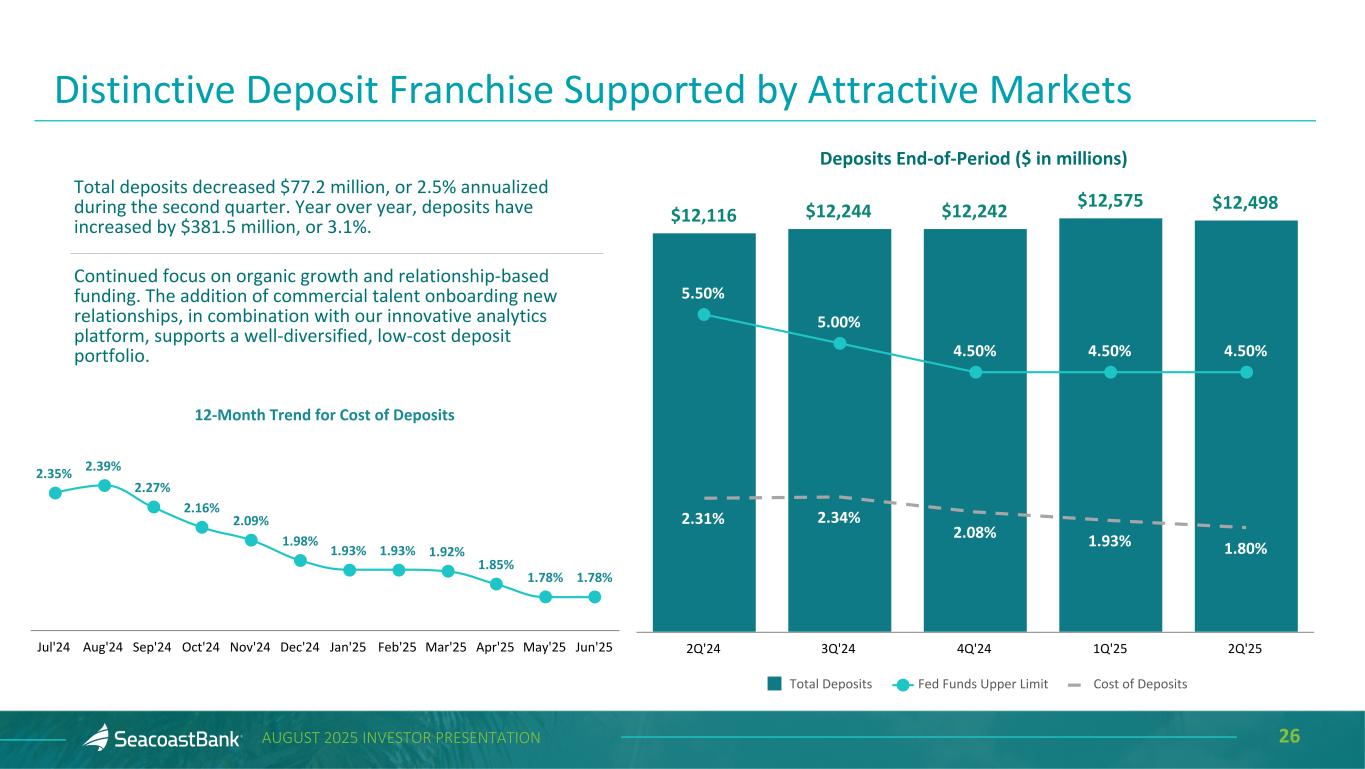

26AUGUST 2025 INVESTOR PRESENTATION Deposits End-of-Period ($ in millions) $12,116 $12,244 $12,242 $12,575 $12,498 5.50% 5.00% 4.50% 4.50% 4.50% 2.31% 2.34% 2.08% 1.93% 1.80% Total Deposits Fed Funds Upper Limit Cost of Deposits 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Distinctive Deposit Franchise Supported by Attractive Markets Total deposits decreased $77.2 million, or 2.5% annualized during the second quarter. Year over year, deposits have increased by $381.5 million, or 3.1%. Continued focus on organic growth and relationship-based funding. The addition of commercial talent onboarding new relationships, in combination with our innovative analytics platform, supports a well-diversified, low-cost deposit portfolio. 12-Month Trend for Cost of Deposits 2.35% 2.39% 2.27% 2.16% 2.09% 1.98% 1.93% 1.93% 1.92% 1.85% 1.78% 1.78% Jul'24 Aug'24 Sep'24 Oct'24 Nov'24 Dec'24 Jan'25 Feb'25 Mar'25 Apr'25 May'25 Jun'25

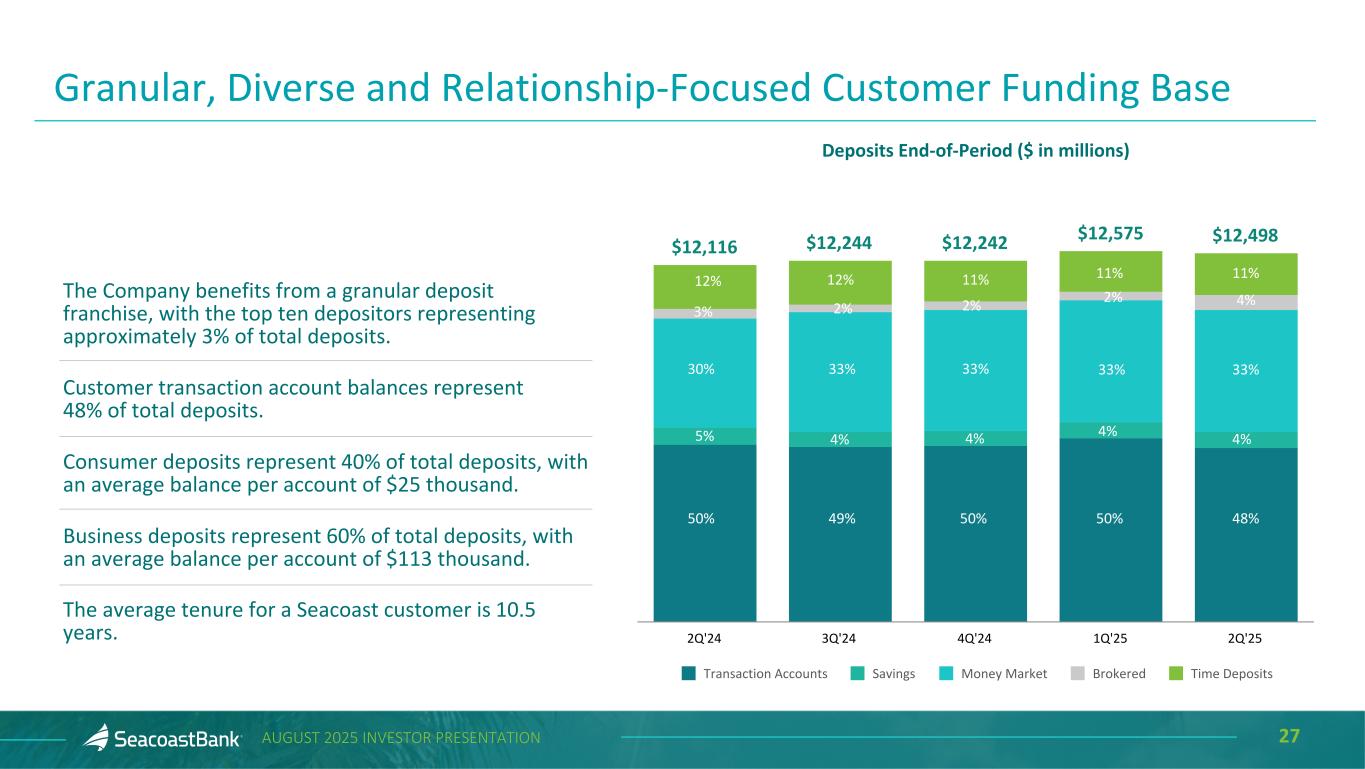

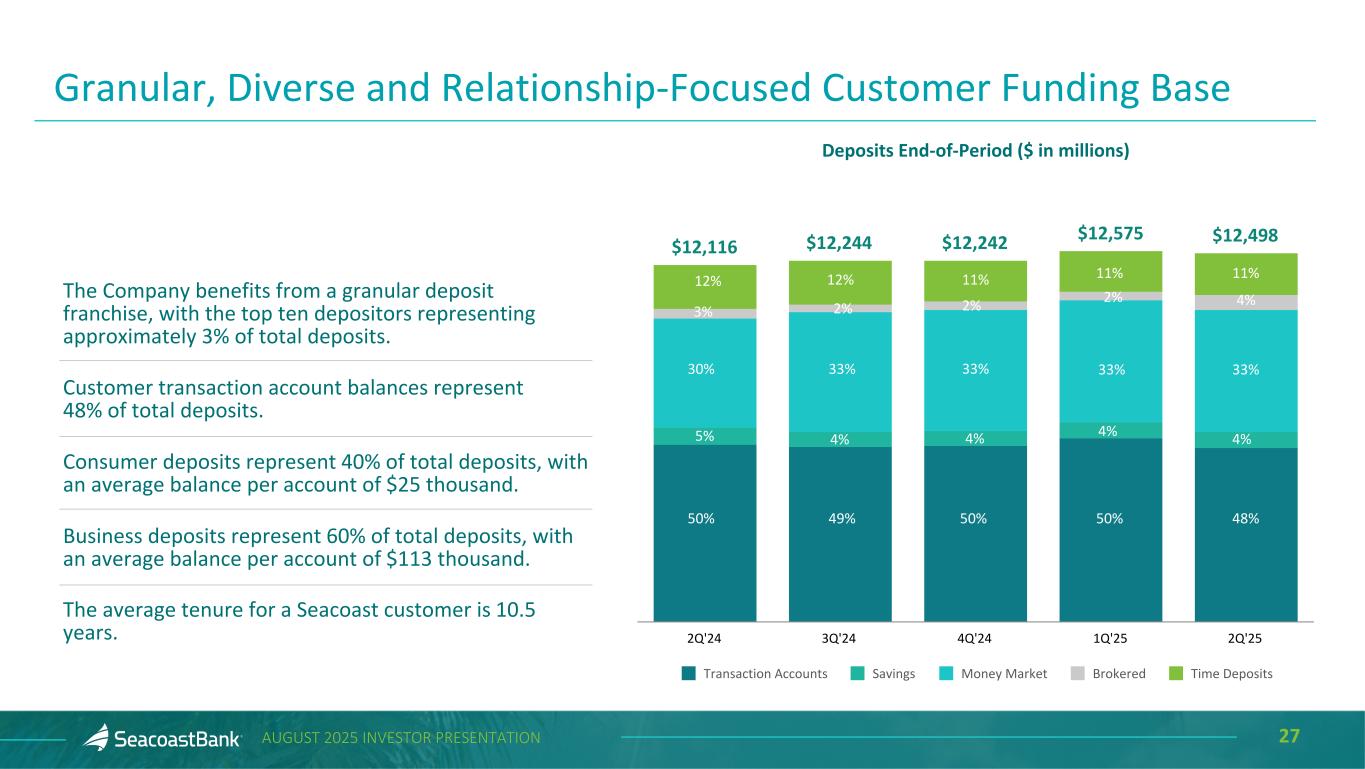

27AUGUST 2025 INVESTOR PRESENTATION Deposits End-of-Period ($ in millions) $12,116 $12,244 $12,242 $12,575 $12,498 Transaction Accounts Savings Money Market Brokered Time Deposits 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Granular, Diverse and Relationship-Focused Customer Funding Base The Company benefits from a granular deposit franchise, with the top ten depositors representing approximately 3% of total deposits. Customer transaction account balances represent 48% of total deposits. Consumer deposits represent 40% of total deposits, with an average balance per account of $25 thousand. Business deposits represent 60% of total deposits, with an average balance per account of $113 thousand. The average tenure for a Seacoast customer is 10.5 years. 48%50%50%49%50% 4%4%4%4%5% 30% 33% 33% 33% 33% 3% 2% 2% 2% 4% 12% 12% 11% 11% 11%

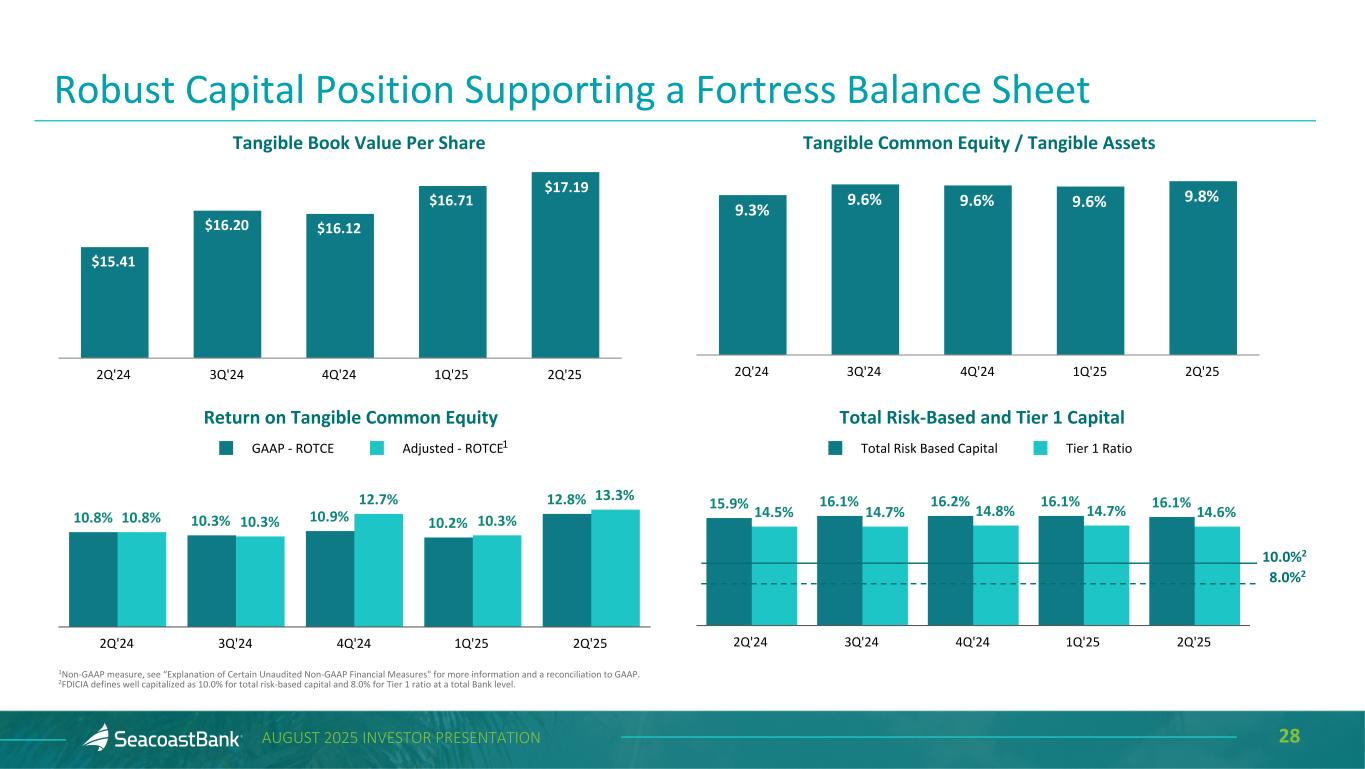

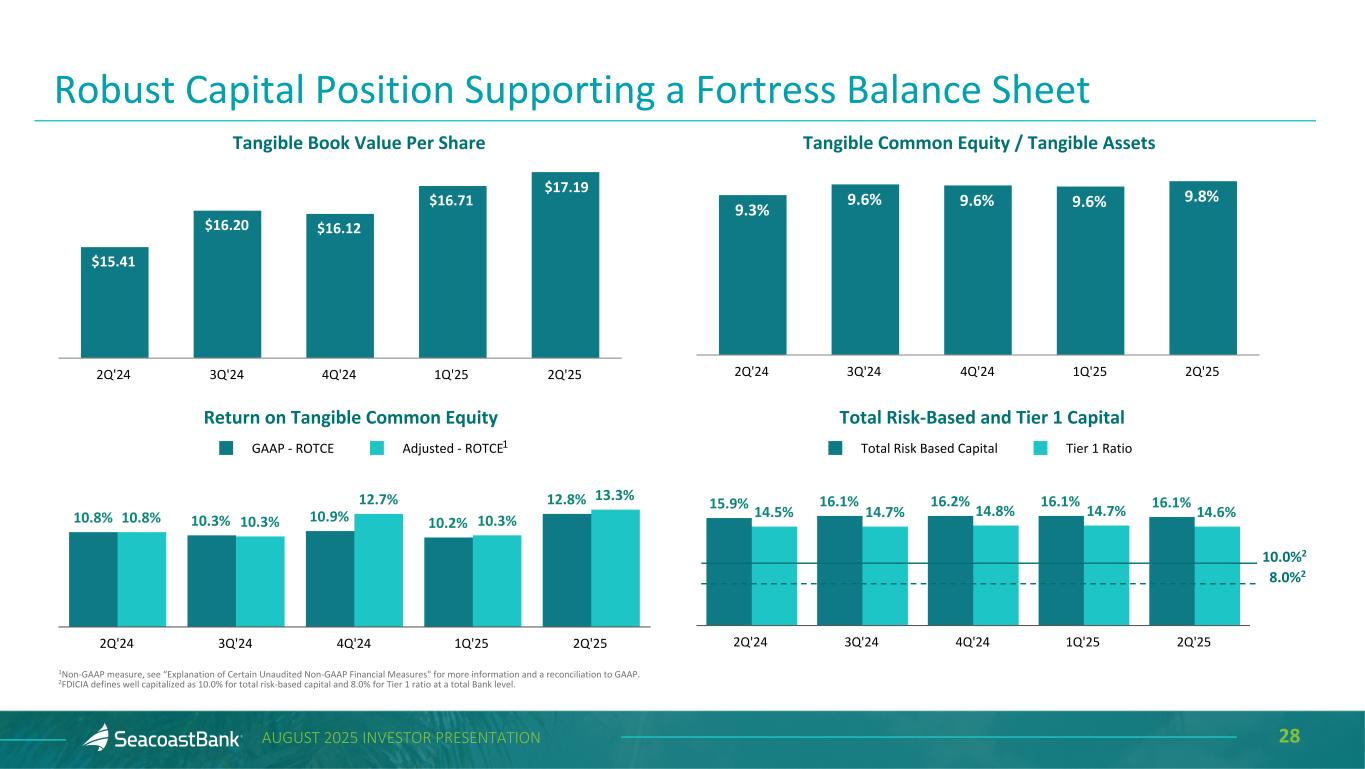

28AUGUST 2025 INVESTOR PRESENTATION $15.41 $16.20 $16.12 $16.71 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 9.3% 9.6% 9.6% 9.6% 9.8% 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 15.9% 16.1% 16.2% 16.1% 16.1% 14.5% 14.7% 14.8% 14.7% 14.6% Total Risk Based Capital Tier 1 Ratio 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 10.8% 10.3% 10.9% 10.2% 12.8% 10.8% 10.3% 12.7% 10.3% 13.3% GAAP - ROTCE Adjusted - ROTCE 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. 2FDICIA defines well capitalized as 10.0% for total risk-based capital and 8.0% for Tier 1 ratio at a total Bank level. Tangible Book Value Per Share Tangible Common Equity / Tangible Assets Total Risk-Based and Tier 1 CapitalReturn on Tangible Common Equity 1 10.0%2 8.0%2 Robust Capital Position Supporting a Fortress Balance Sheet $17.19

Michael Young EVP, Treasurer & Director of Corporate Development & Investor Relations Michael.Young@SeacoastBank.com (772) 403-0451 INVESTOR RELATIONS NASDAQ: SBCF

30AUGUST 2025 INVESTOR PRESENTATION Appendix

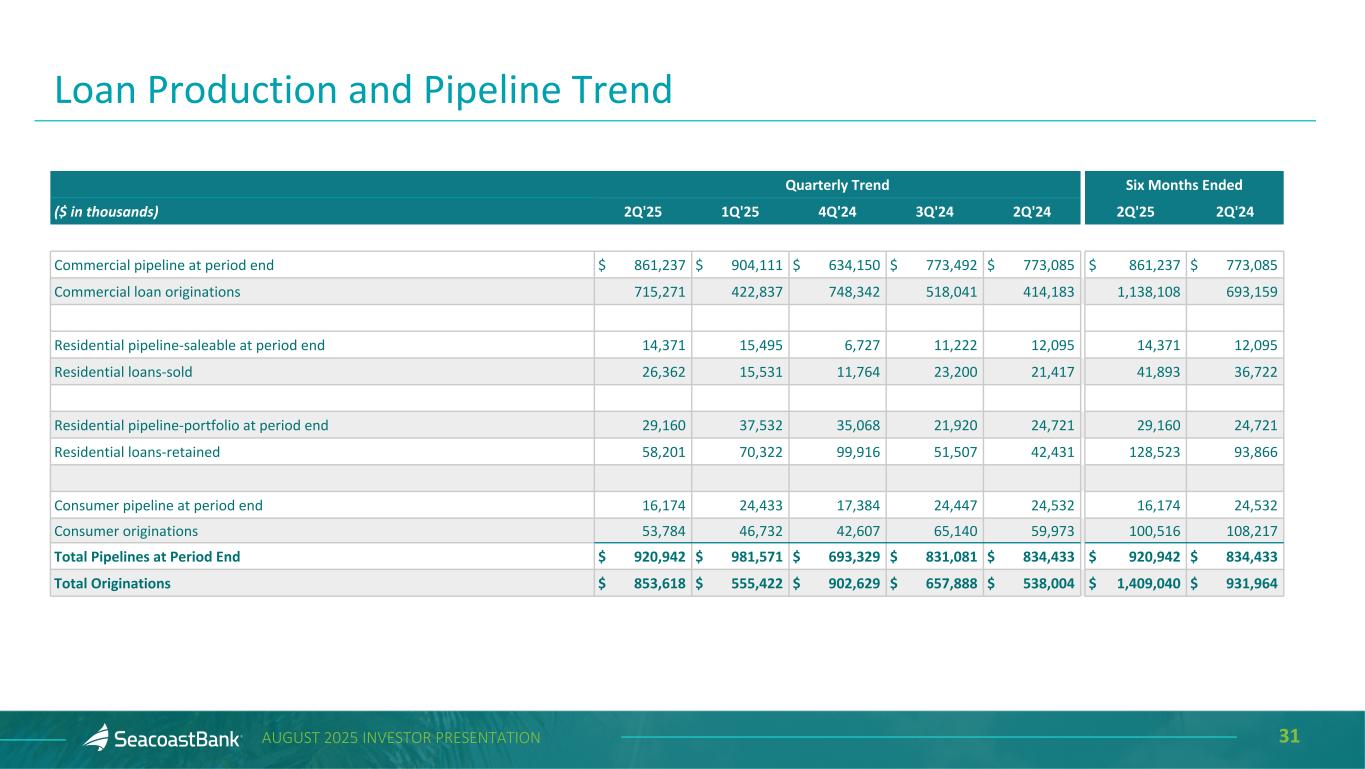

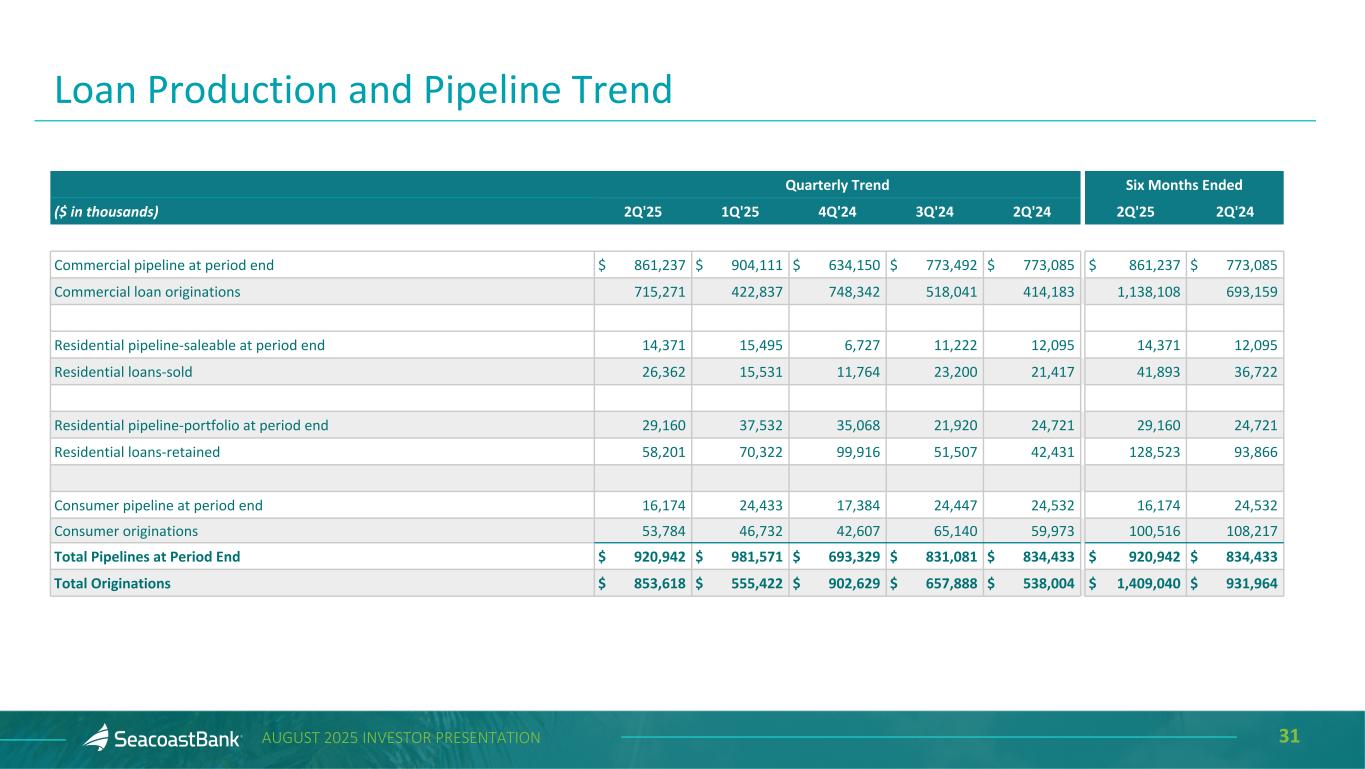

31AUGUST 2025 INVESTOR PRESENTATION Quarterly Trend Six Months Ended ($ in thousands) 2Q'25 1Q'25 4Q'24 3Q'24 2Q'24 2Q'25 2Q'24 Commercial pipeline at period end $ 861,237 $ 904,111 $ 634,150 $ 773,492 $ 773,085 $ 861,237 $ 773,085 Commercial loan originations 715,271 422,837 748,342 518,041 414,183 1,138,108 693,159 Residential pipeline-saleable at period end 14,371 15,495 6,727 11,222 12,095 14,371 12,095 Residential loans-sold 26,362 15,531 11,764 23,200 21,417 41,893 36,722 Residential pipeline-portfolio at period end 29,160 37,532 35,068 21,920 24,721 29,160 24,721 Residential loans-retained 58,201 70,322 99,916 51,507 42,431 128,523 93,866 Consumer pipeline at period end 16,174 24,433 17,384 24,447 24,532 16,174 24,532 Consumer originations 53,784 46,732 42,607 65,140 59,973 100,516 108,217 Total Pipelines at Period End $ 920,942 $ 981,571 $ 693,329 $ 831,081 $ 834,433 $ 920,942 $ 834,433 Total Originations $ 853,618 $ 555,422 $ 902,629 $ 657,888 $ 538,004 $ 1,409,040 $ 931,964 Loan Production and Pipeline Trend

32AUGUST 2025 INVESTOR PRESENTATION 7.95 7.86 7.30 7.02 7.02 3.26 3.25 2.88 2.63 2.49 4.65 4.73 4.77 4.80 4.91 2.31 2.34 2.08 1.93 1.80 3.69 3.75 3.77 3.88 3.87 Variable Rate Loans Interest-Bearing Deposit Costs Fixed/Adjustable Rate Loans Total Deposit Costs Securities 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 Quarterly Average Yields/Rates (%) Net Interest Margin (Right Axis) Rate on Total Interest Bearing Liabilities (Left Axis) Yield on Total Earning Assets (Left Axis) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 — 1.00 2.00 3.00 4.00 5.00 6.00 3.10 3.20 3.30 3.40 3.50 3.60 3.70 Asset & Liability Yield/Rate Trends (%) Average Yield Trends Only 22% of Total Interest Earning Assets Earning asset yields expanded four basis points in 2Q’25 while the rate on interest-bearing liabilities declined eight basis points.

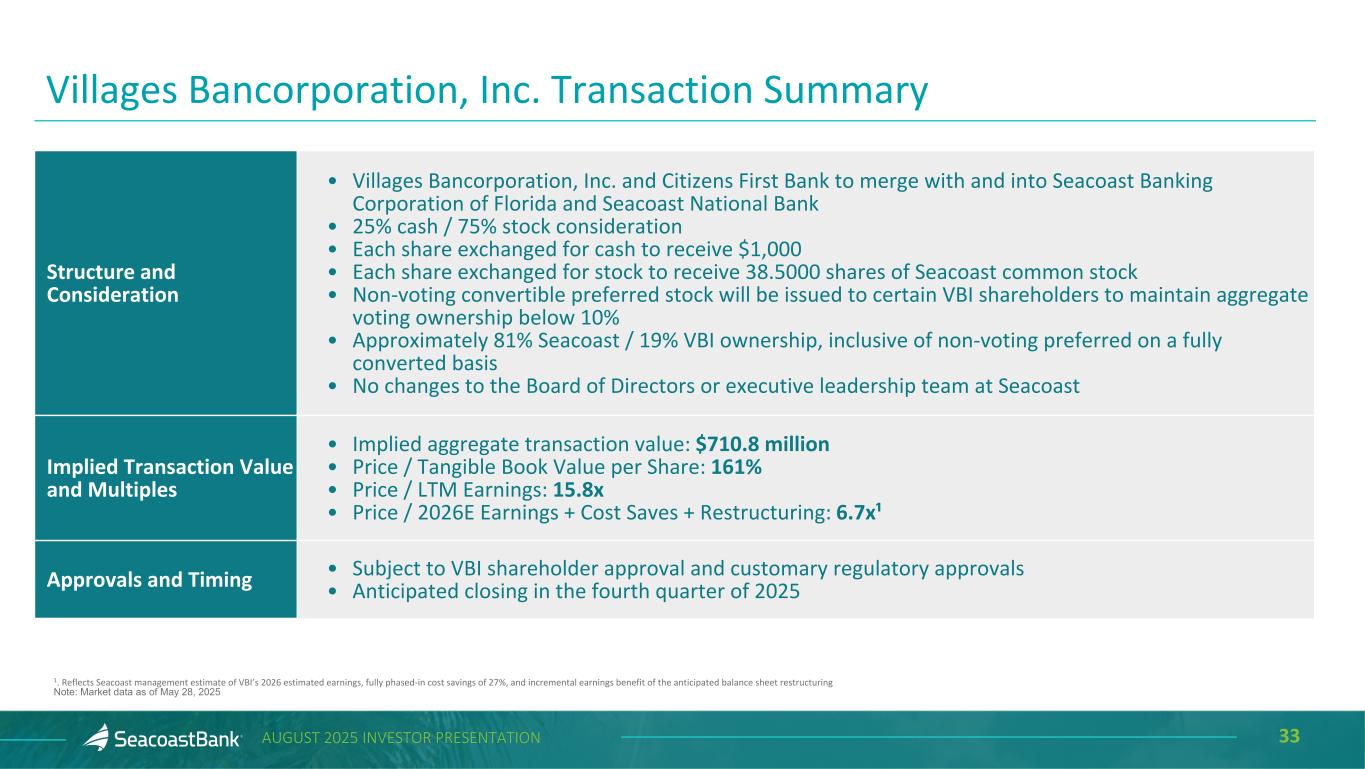

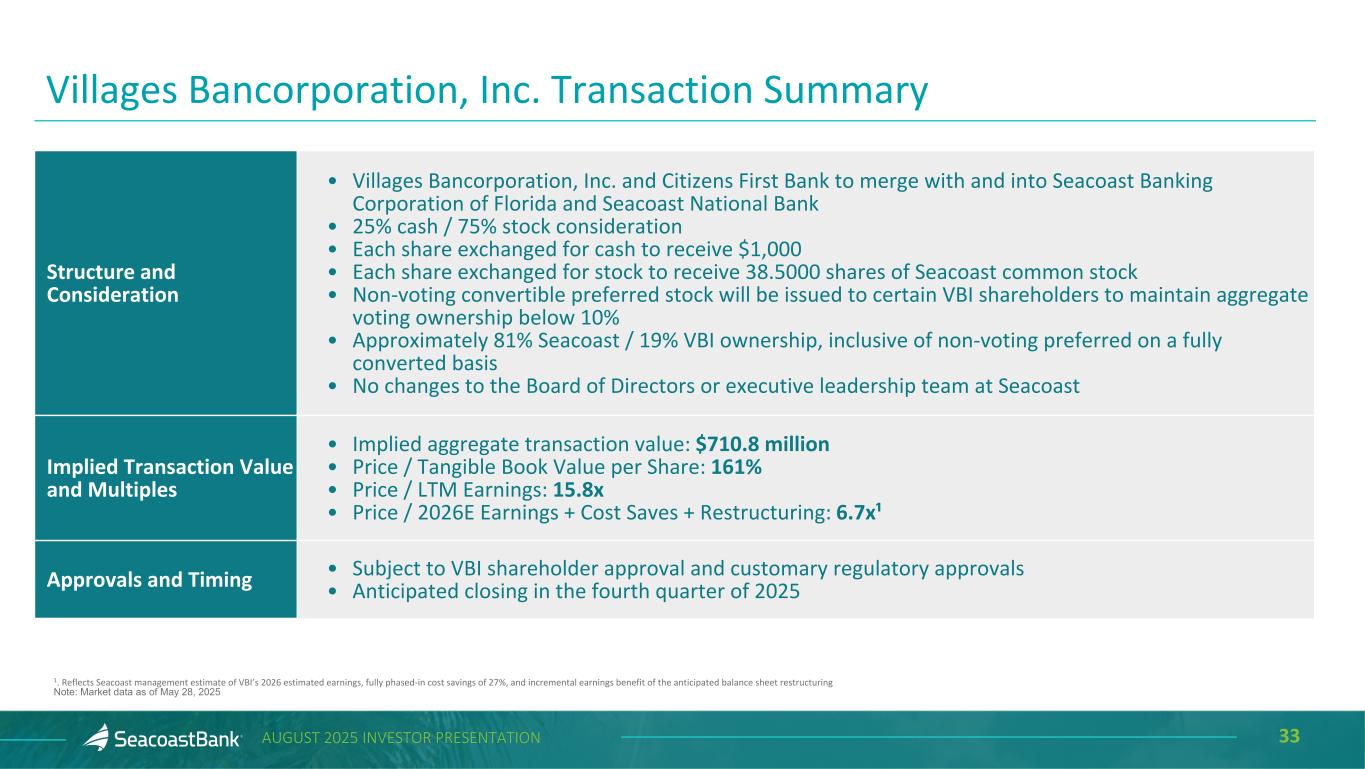

33AUGUST 2025 INVESTOR PRESENTATION Villages Bancorporation, Inc. Transaction Summary Structure and Consideration • Villages Bancorporation, Inc. and Citizens First Bank to merge with and into Seacoast Banking Corporation of Florida and Seacoast National Bank • 25% cash / 75% stock consideration • Each share exchanged for cash to receive $1,000 • Each share exchanged for stock to receive 38.5000 shares of Seacoast common stock • Non-voting convertible preferred stock will be issued to certain VBI shareholders to maintain aggregate voting ownership below 10% • Approximately 81% Seacoast / 19% VBI ownership, inclusive of non-voting preferred on a fully converted basis • No changes to the Board of Directors or executive leadership team at Seacoast Implied Transaction Value and Multiples • Implied aggregate transaction value: $710.8 million • Price / Tangible Book Value per Share: 161% • Price / LTM Earnings: 15.8x • Price / 2026E Earnings + Cost Saves + Restructuring: 6.7x¹ Approvals and Timing • Subject to VBI shareholder approval and customary regulatory approvals • Anticipated closing in the fourth quarter of 2025 1. Reflects Seacoast management estimate of VBI’s 2026 estimated earnings, fully phased-in cost savings of 27%, and incremental earnings benefit of the anticipated balance sheet restructuring Note: Market data as of May 28, 2025

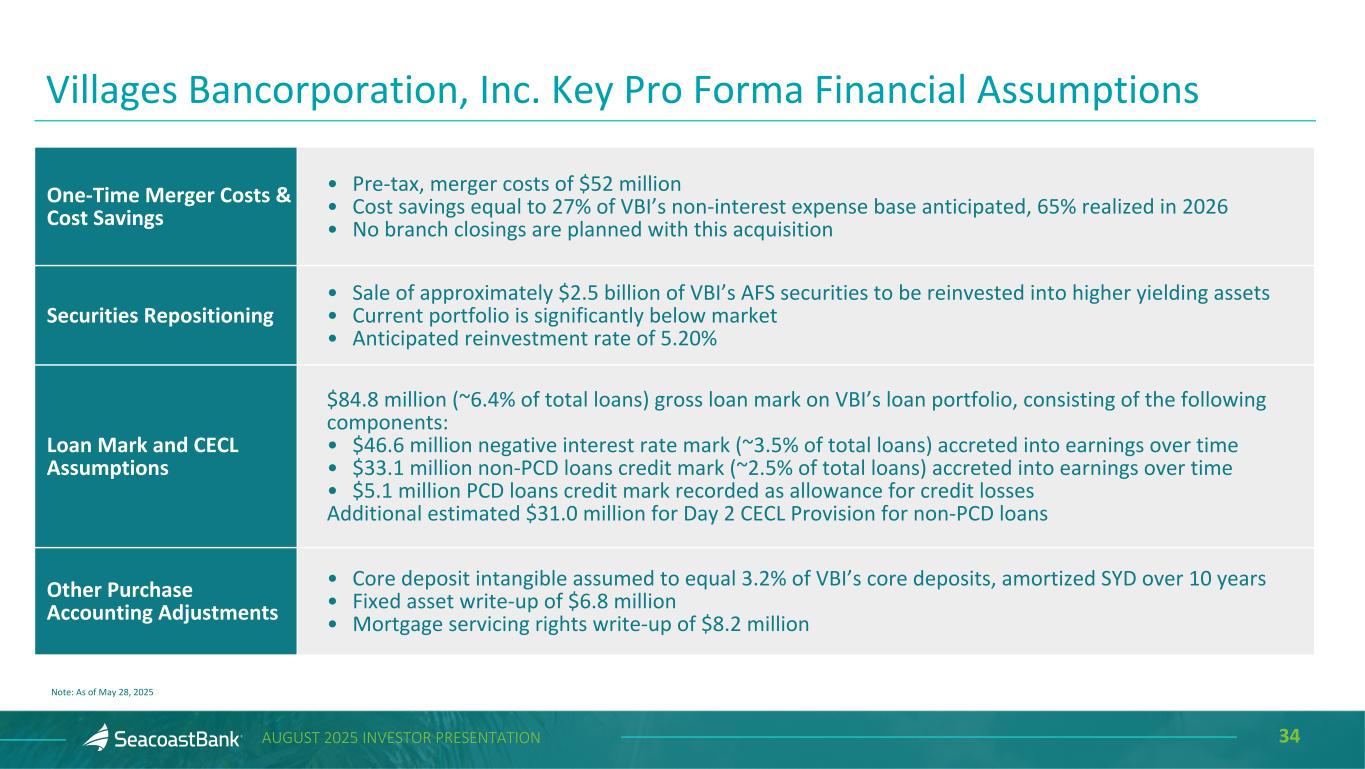

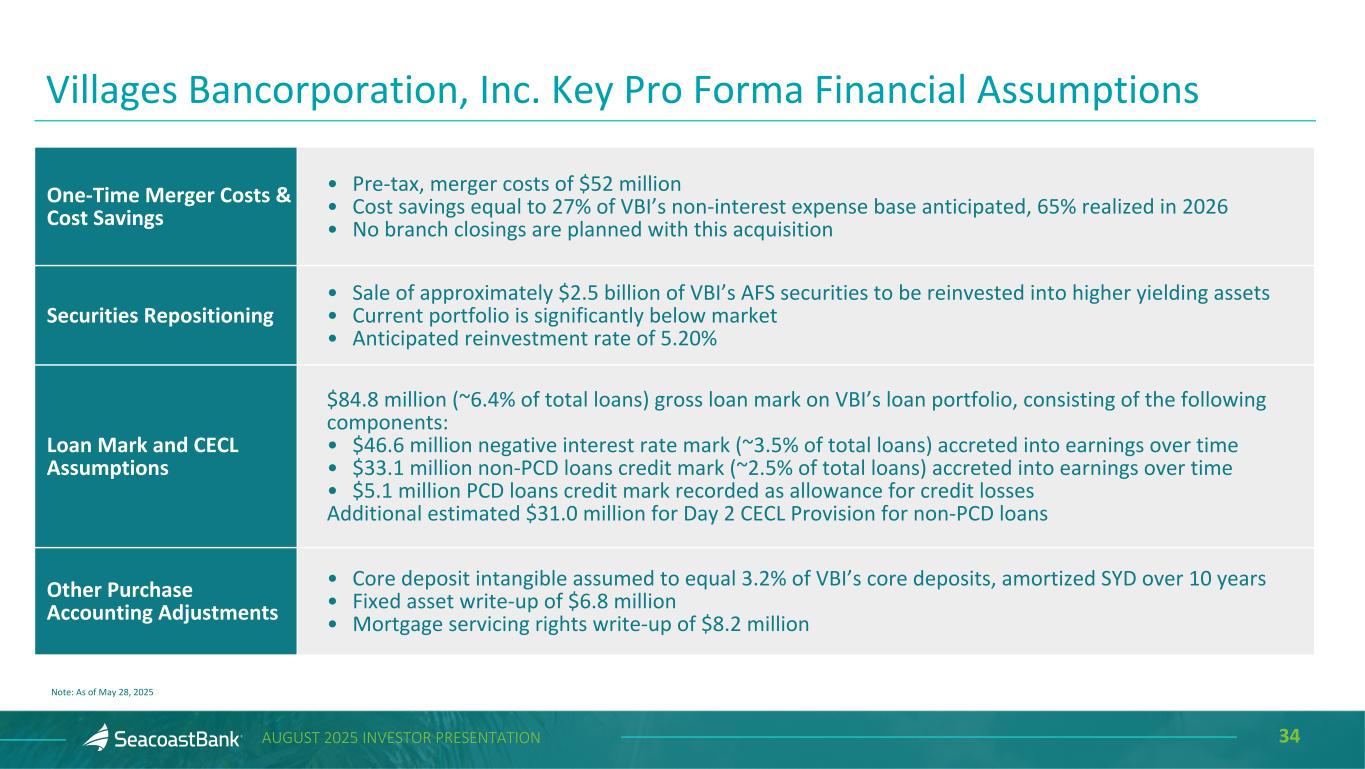

34AUGUST 2025 INVESTOR PRESENTATION Villages Bancorporation, Inc. Key Pro Forma Financial Assumptions One-Time Merger Costs & Cost Savings • Pre-tax, merger costs of $52 million • Cost savings equal to 27% of VBI’s non-interest expense base anticipated, 65% realized in 2026 • No branch closings are planned with this acquisition Securities Repositioning • Sale of approximately $2.5 billion of VBI’s AFS securities to be reinvested into higher yielding assets • Current portfolio is significantly below market • Anticipated reinvestment rate of 5.20% Loan Mark and CECL Assumptions $84.8 million (~6.4% of total loans) gross loan mark on VBI’s loan portfolio, consisting of the following components: • $46.6 million negative interest rate mark (~3.5% of total loans) accreted into earnings over time • $33.1 million non-PCD loans credit mark (~2.5% of total loans) accreted into earnings over time • $5.1 million PCD loans credit mark recorded as allowance for credit losses Additional estimated $31.0 million for Day 2 CECL Provision for non-PCD loans Other Purchase Accounting Adjustments • Core deposit intangible assumed to equal 3.2% of VBI’s core deposits, amortized SYD over 10 years • Fixed asset write-up of $6.8 million • Mortgage servicing rights write-up of $8.2 million Note: As of May 28, 2025

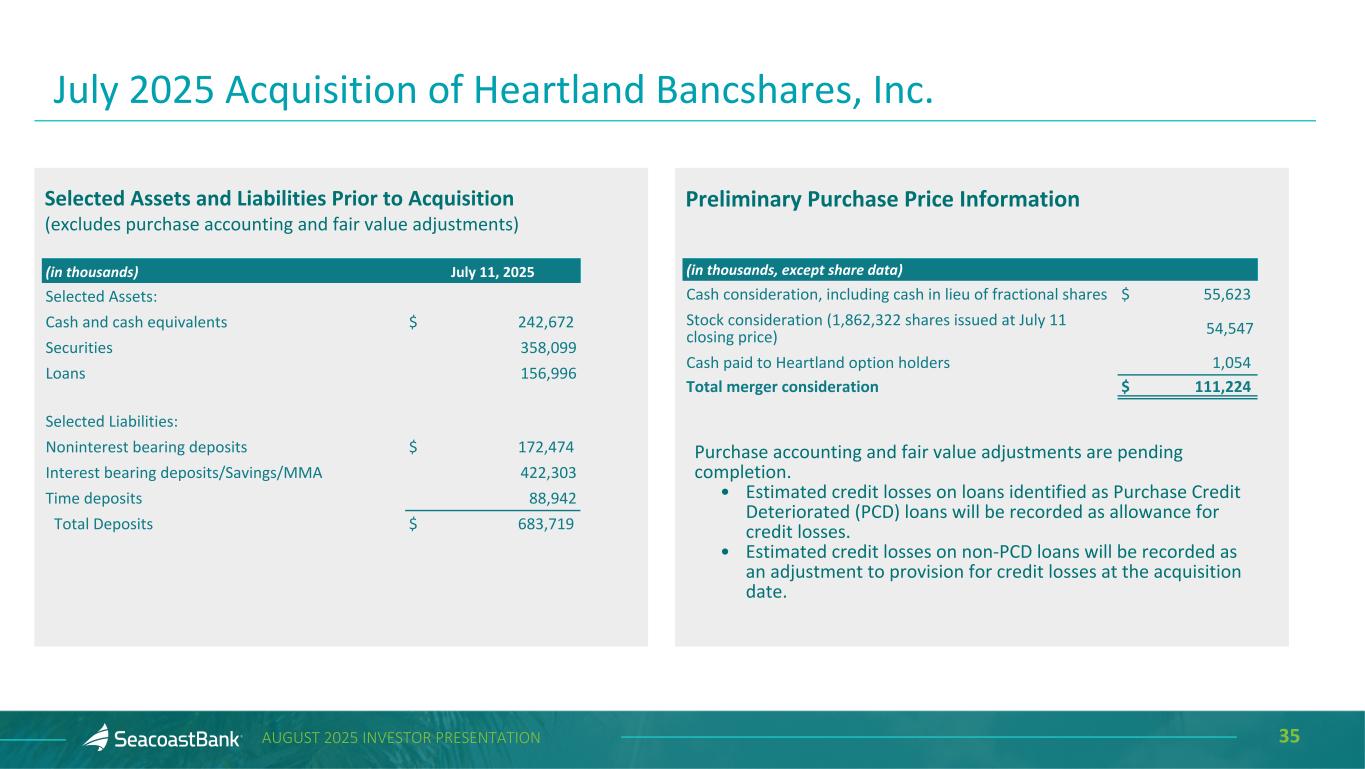

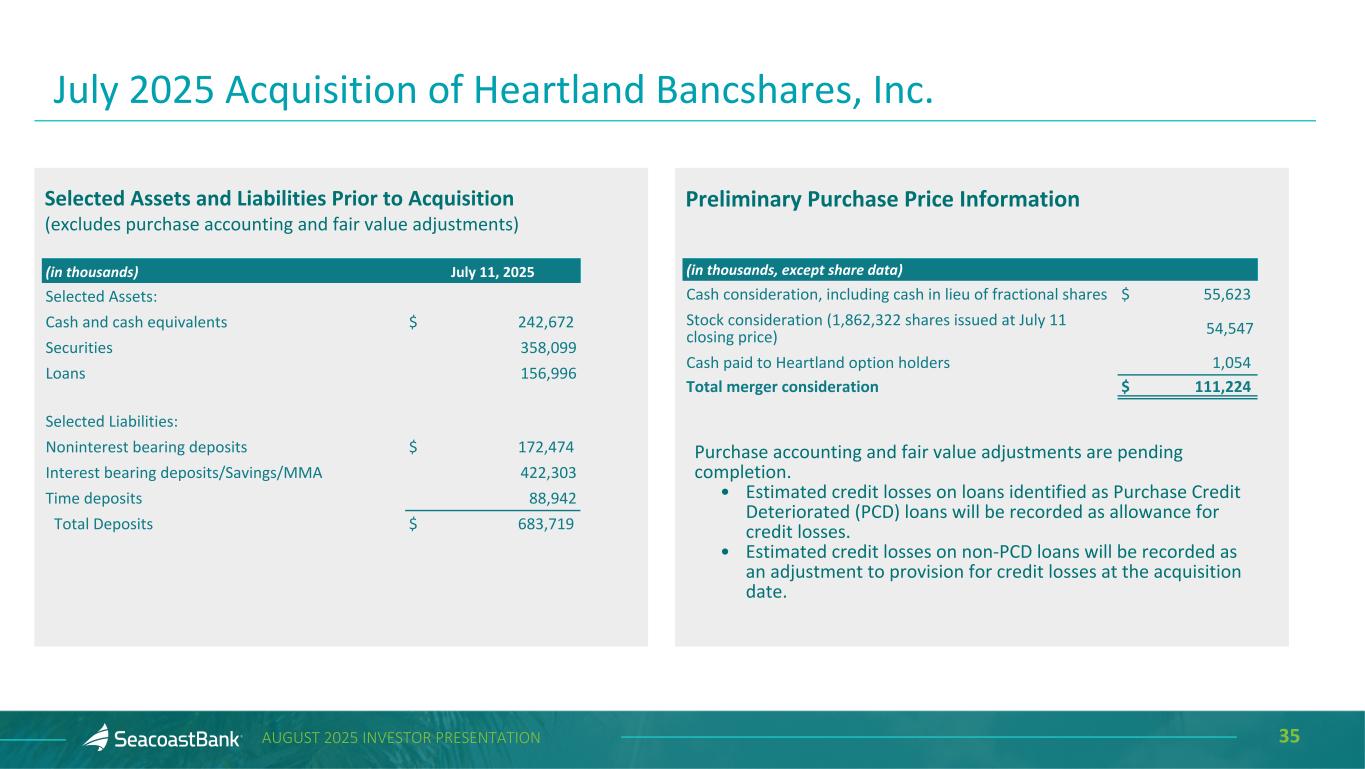

35AUGUST 2025 INVESTOR PRESENTATION Selected Assets and Liabilities Prior to Acquisition (excludes purchase accounting and fair value adjustments) July 2025 Acquisition of Heartland Bancshares, Inc. (in thousands) July 11, 2025 Selected Assets: Cash and cash equivalents $ 242,672 Securities 358,099 Loans 156,996 Selected Liabilities: Noninterest bearing deposits $ 172,474 Interest bearing deposits/Savings/MMA 422,303 Time deposits 88,942 Total Deposits $ 683,719 Preliminary Purchase Price Information (in thousands, except share data) Cash consideration, including cash in lieu of fractional shares $ 55,623 Stock consideration (1,862,322 shares issued at July 11 closing price) 54,547 Cash paid to Heartland option holders 1,054 Total merger consideration $ 111,224 Purchase accounting and fair value adjustments are pending completion. • Estimated credit losses on loans identified as Purchase Credit Deteriorated (PCD) loans will be recorded as allowance for credit losses. • Estimated credit losses on non-PCD loans will be recorded as an adjustment to provision for credit losses at the acquisition date.

36AUGUST 2025 INVESTOR PRESENTATION Recognition 2nd consecutive year 4th consecutive year 1st time winner 5th consecutive year 1st time winner 1st time winner 2nd consecutive year 2nd consecutive year

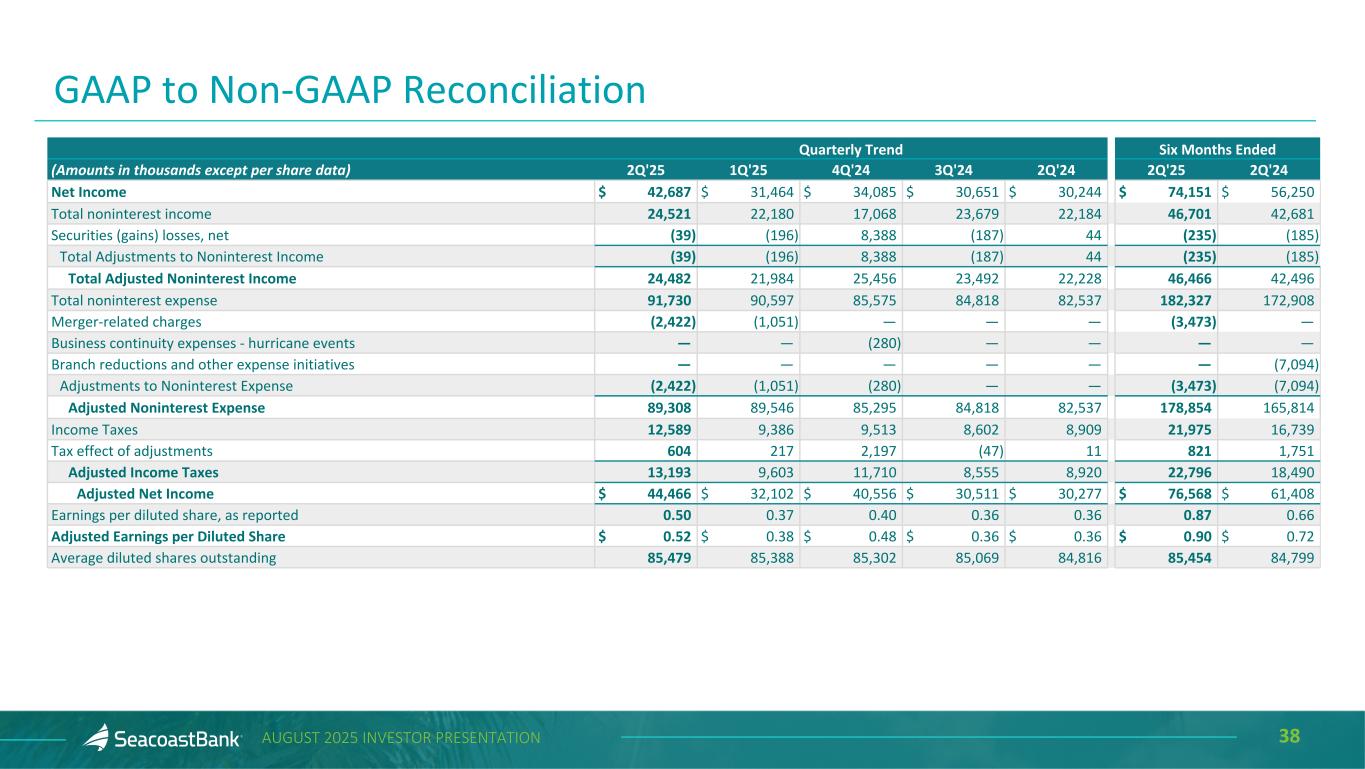

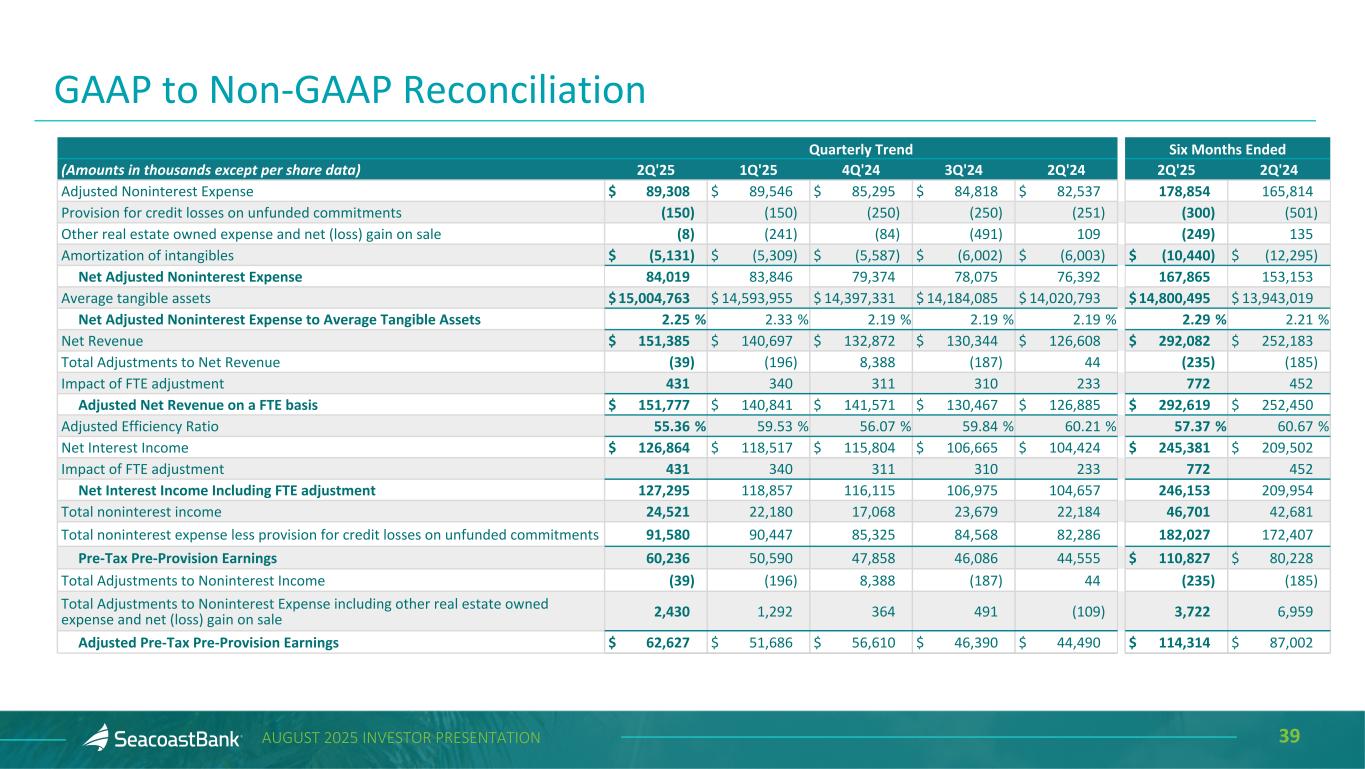

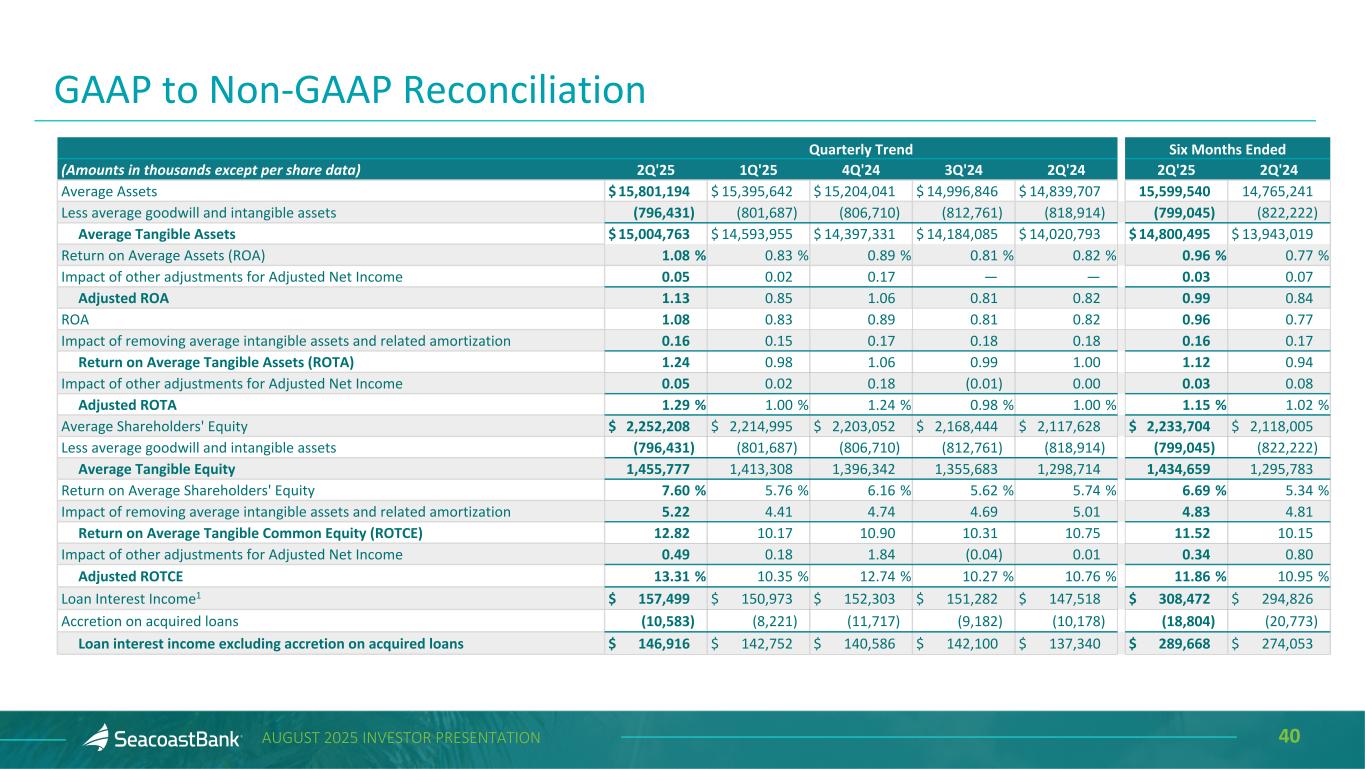

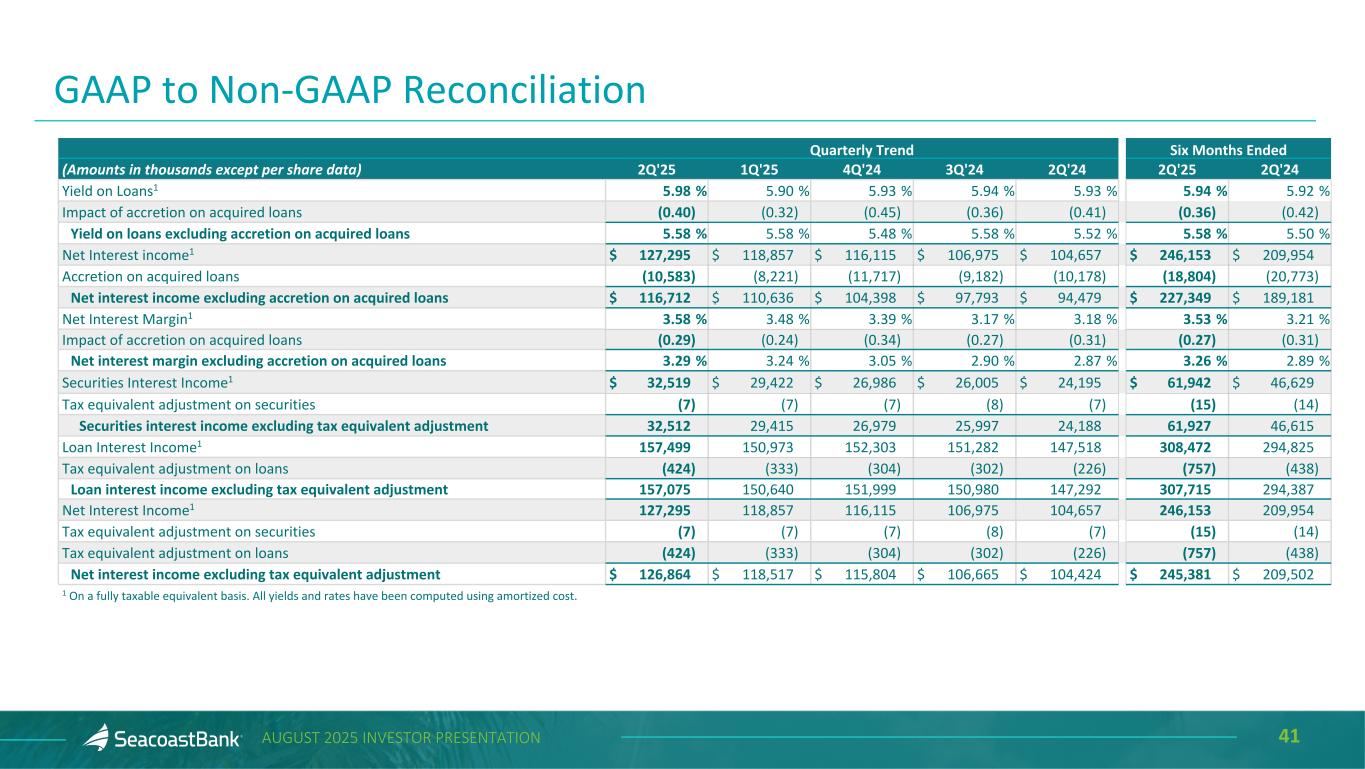

37AUGUST 2025 INVESTOR PRESENTATION This presentation contains financial information determined by methods other than Generally Accepted Accounting Principles (“GAAP”). The financial highlights provide reconciliations between GAAP and adjusted financial measures including net income, noninterest income, noninterest expense, tax adjustments and other financial ratios. Management uses these non-GAAP financial measures in its analysis of the Company’s performance and believes these presentations provide useful supplemental information, and a clearer understanding of the Company’s performance. The Company believes the non-GAAP measures enhance investors’ understanding of the Company’s business and performance and if not provided would be requested by the investor community. These measures are also useful in understanding performance trends and facilitate comparisons with the performance of other financial institutions. The limitations associated with operating measures are the risk that persons might disagree as to the appropriateness of items comprising these measures and that different companies might define or calculate these measures differently. The Company provides reconciliations between GAAP and these non-GAAP measures. These disclosures should not be considered an alternative to GAAP. Explanation of Certain Unaudited Non-GAAP Financial Measures

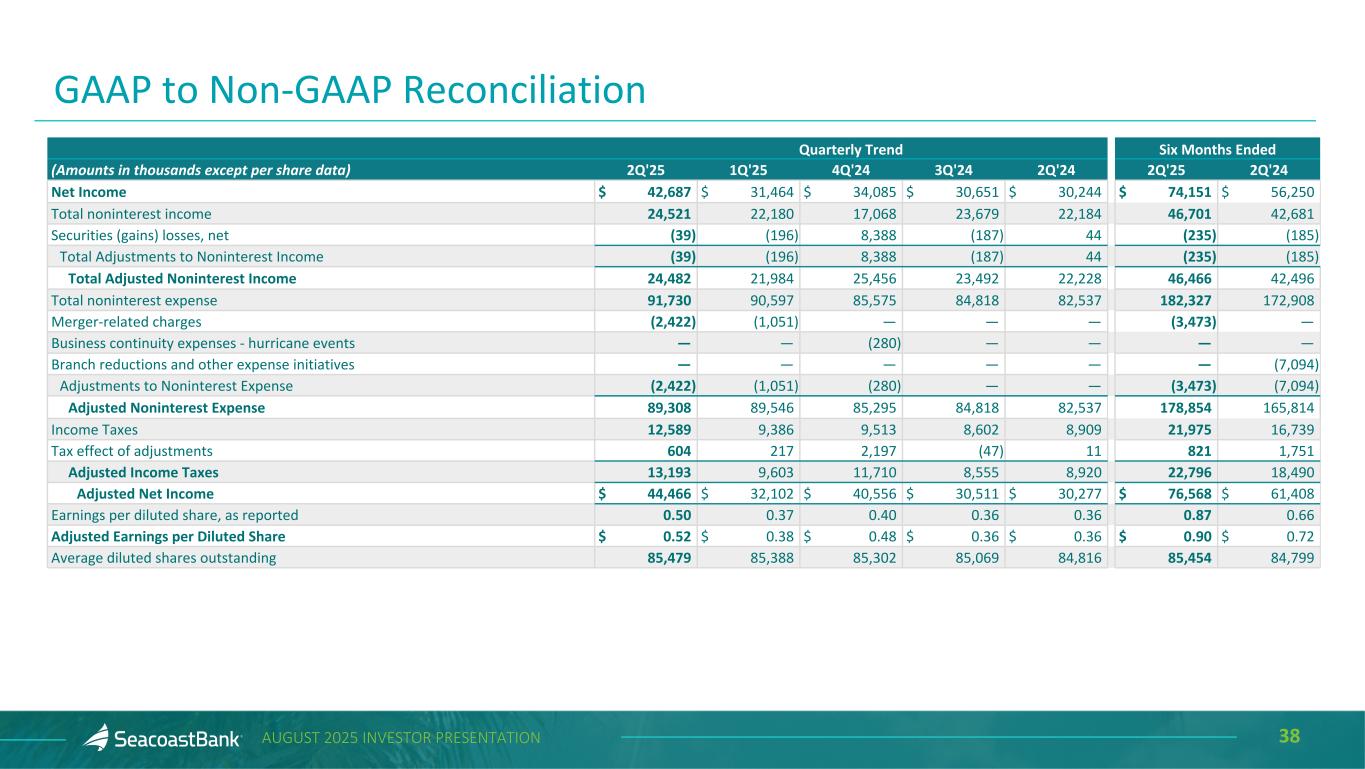

38AUGUST 2025 INVESTOR PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'25 1Q'25 4Q'24 3Q'24 2Q'24 2Q'25 2Q'24 Net Income $ 42,687 $ 31,464 $ 34,085 $ 30,651 $ 30,244 $ 74,151 $ 56,250 Total noninterest income 24,521 22,180 17,068 23,679 22,184 46,701 42,681 Securities (gains) losses, net (39) (196) 8,388 (187) 44 (235) (185) Total Adjustments to Noninterest Income (39) (196) 8,388 (187) 44 (235) (185) Total Adjusted Noninterest Income 24,482 21,984 25,456 23,492 22,228 46,466 42,496 Total noninterest expense 91,730 90,597 85,575 84,818 82,537 182,327 172,908 Merger-related charges (2,422) (1,051) — — — (3,473) — Business continuity expenses - hurricane events — — (280) — — — — Branch reductions and other expense initiatives — — — — — — (7,094) Adjustments to Noninterest Expense (2,422) (1,051) (280) — — (3,473) (7,094) Adjusted Noninterest Expense 89,308 89,546 85,295 84,818 82,537 178,854 165,814 Income Taxes 12,589 9,386 9,513 8,602 8,909 21,975 16,739 Tax effect of adjustments 604 217 2,197 (47) 11 821 1,751 Adjusted Income Taxes 13,193 9,603 11,710 8,555 8,920 22,796 18,490 Adjusted Net Income $ 44,466 $ 32,102 $ 40,556 $ 30,511 $ 30,277 $ 76,568 $ 61,408 Earnings per diluted share, as reported 0.50 0.37 0.40 0.36 0.36 0.87 0.66 Adjusted Earnings per Diluted Share $ 0.52 $ 0.38 $ 0.48 $ 0.36 $ 0.36 $ 0.90 $ 0.72 Average diluted shares outstanding 85,479 85,388 85,302 85,069 84,816 85,454 84,799 GAAP to Non-GAAP Reconciliation

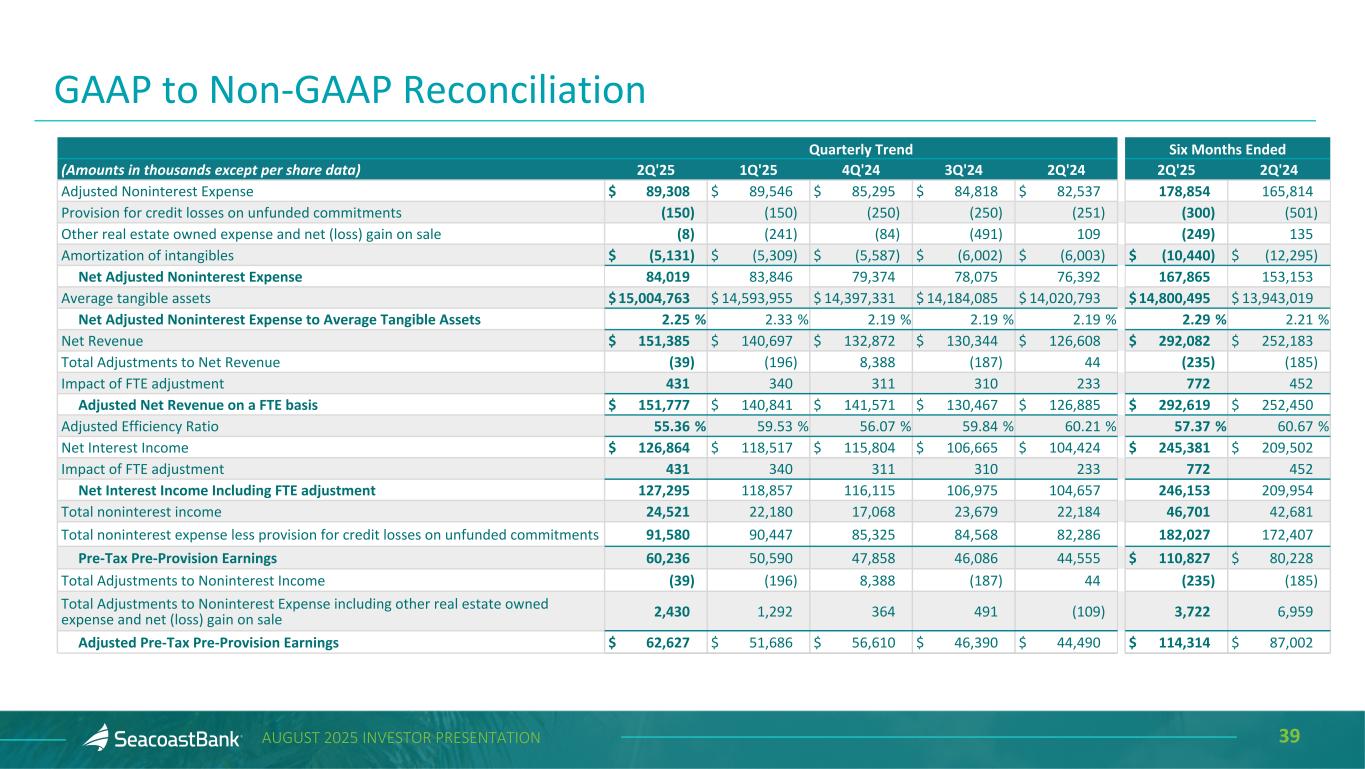

39AUGUST 2025 INVESTOR PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'25 1Q'25 4Q'24 3Q'24 2Q'24 2Q'25 2Q'24 Adjusted Noninterest Expense $ 89,308 $ 89,546 $ 85,295 $ 84,818 $ 82,537 178,854 165,814 Provision for credit losses on unfunded commitments (150) (150) (250) (250) (251) (300) (501) Other real estate owned expense and net (loss) gain on sale (8) (241) (84) (491) 109 (249) 135 Amortization of intangibles $ (5,131) $ (5,309) $ (5,587) $ (6,002) $ (6,003) $ (10,440) $ (12,295) Net Adjusted Noninterest Expense 84,019 83,846 79,374 78,075 76,392 167,865 153,153 Average tangible assets $ 15,004,763 $ 14,593,955 $ 14,397,331 $ 14,184,085 $ 14,020,793 $ 14,800,495 $ 13,943,019 Net Adjusted Noninterest Expense to Average Tangible Assets 2.25 % 2.33 % 2.19 % 2.19 % 2.19 % 2.29 % 2.21 % Net Revenue $ 151,385 $ 140,697 $ 132,872 $ 130,344 $ 126,608 $ 292,082 $ 252,183 Total Adjustments to Net Revenue (39) (196) 8,388 (187) 44 (235) (185) Impact of FTE adjustment 431 340 311 310 233 772 452 Adjusted Net Revenue on a FTE basis $ 151,777 $ 140,841 $ 141,571 $ 130,467 $ 126,885 $ 292,619 $ 252,450 Adjusted Efficiency Ratio 55.36 % 59.53 % 56.07 % 59.84 % 60.21 % 57.37 % 60.67 % Net Interest Income $ 126,864 $ 118,517 $ 115,804 $ 106,665 $ 104,424 $ 245,381 $ 209,502 Impact of FTE adjustment 431 340 311 310 233 772 452 Net Interest Income Including FTE adjustment 127,295 118,857 116,115 106,975 104,657 246,153 209,954 Total noninterest income 24,521 22,180 17,068 23,679 22,184 46,701 42,681 Total noninterest expense less provision for credit losses on unfunded commitments 91,580 90,447 85,325 84,568 82,286 182,027 172,407 Pre-Tax Pre-Provision Earnings 60,236 50,590 47,858 46,086 44,555 $ 110,827 $ 80,228 Total Adjustments to Noninterest Income (39) (196) 8,388 (187) 44 (235) (185) Total Adjustments to Noninterest Expense including other real estate owned expense and net (loss) gain on sale 2,430 1,292 364 491 (109) 3,722 6,959 Adjusted Pre-Tax Pre-Provision Earnings $ 62,627 $ 51,686 $ 56,610 $ 46,390 $ 44,490 $ 114,314 $ 87,002 GAAP to Non-GAAP Reconciliation

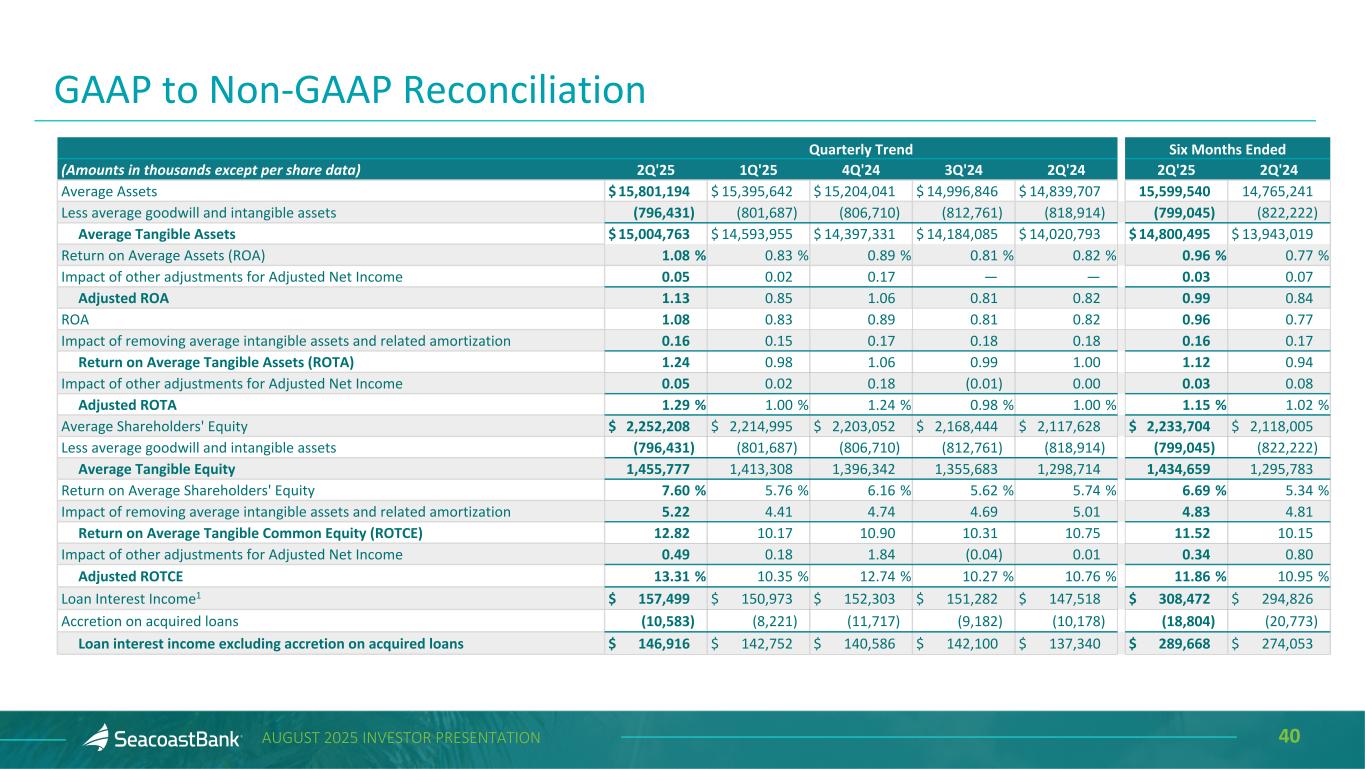

40AUGUST 2025 INVESTOR PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'25 1Q'25 4Q'24 3Q'24 2Q'24 2Q'25 2Q'24 Average Assets $ 15,801,194 $ 15,395,642 $ 15,204,041 $ 14,996,846 $ 14,839,707 15,599,540 14,765,241 Less average goodwill and intangible assets (796,431) (801,687) (806,710) (812,761) (818,914) (799,045) (822,222) Average Tangible Assets $ 15,004,763 $ 14,593,955 $ 14,397,331 $ 14,184,085 $ 14,020,793 $ 14,800,495 $ 13,943,019 Return on Average Assets (ROA) 1.08 % 0.83 % 0.89 % 0.81 % 0.82 % 0.96 % 0.77 % Impact of other adjustments for Adjusted Net Income 0.05 0.02 0.17 — — 0.03 0.07 Adjusted ROA 1.13 0.85 1.06 0.81 0.82 0.99 0.84 ROA 1.08 0.83 0.89 0.81 0.82 0.96 0.77 Impact of removing average intangible assets and related amortization 0.16 0.15 0.17 0.18 0.18 0.16 0.17 Return on Average Tangible Assets (ROTA) 1.24 0.98 1.06 0.99 1.00 1.12 0.94 Impact of other adjustments for Adjusted Net Income 0.05 0.02 0.18 (0.01) 0.00 0.03 0.08 Adjusted ROTA 1.29 % 1.00 % 1.24 % 0.98 % 1.00 % 1.15 % 1.02 % Average Shareholders' Equity $ 2,252,208 $ 2,214,995 $ 2,203,052 $ 2,168,444 $ 2,117,628 $ 2,233,704 $ 2,118,005 Less average goodwill and intangible assets (796,431) (801,687) (806,710) (812,761) (818,914) (799,045) (822,222) Average Tangible Equity 1,455,777 1,413,308 1,396,342 1,355,683 1,298,714 1,434,659 1,295,783 Return on Average Shareholders' Equity 7.60 % 5.76 % 6.16 % 5.62 % 5.74 % 6.69 % 5.34 % Impact of removing average intangible assets and related amortization 5.22 4.41 4.74 4.69 5.01 4.83 4.81 Return on Average Tangible Common Equity (ROTCE) 12.82 10.17 10.90 10.31 10.75 11.52 10.15 Impact of other adjustments for Adjusted Net Income 0.49 0.18 1.84 (0.04) 0.01 0.34 0.80 Adjusted ROTCE 13.31 % 10.35 % 12.74 % 10.27 % 10.76 % 11.86 % 10.95 % Loan Interest Income1 $ 157,499 $ 150,973 $ 152,303 $ 151,282 $ 147,518 $ 308,472 $ 294,826 Accretion on acquired loans (10,583) (8,221) (11,717) (9,182) (10,178) (18,804) (20,773) Loan interest income excluding accretion on acquired loans $ 146,916 $ 142,752 $ 140,586 $ 142,100 $ 137,340 $ 289,668 $ 274,053 GAAP to Non-GAAP Reconciliation

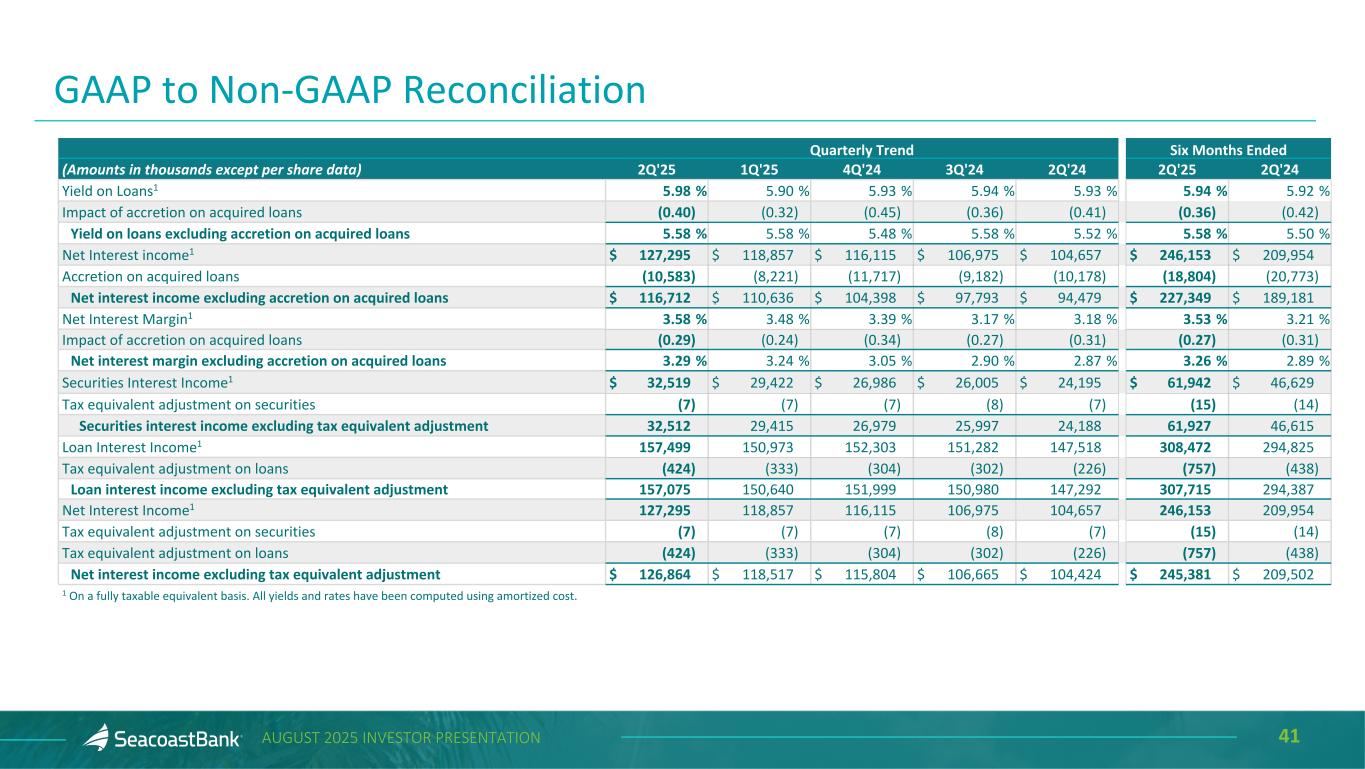

41AUGUST 2025 INVESTOR PRESENTATION Quarterly Trend Six Months Ended (Amounts in thousands except per share data) 2Q'25 1Q'25 4Q'24 3Q'24 2Q'24 2Q'25 2Q'24 Yield on Loans1 5.98 % 5.90 % 5.93 % 5.94 % 5.93 % 5.94 % 5.92 % Impact of accretion on acquired loans (0.40) (0.32) (0.45) (0.36) (0.41) (0.36) (0.42) Yield on loans excluding accretion on acquired loans 5.58 % 5.58 % 5.48 % 5.58 % 5.52 % 5.58 % 5.50 % Net Interest income1 $ 127,295 $ 118,857 $ 116,115 $ 106,975 $ 104,657 $ 246,153 $ 209,954 Accretion on acquired loans (10,583) (8,221) (11,717) (9,182) (10,178) (18,804) (20,773) Net interest income excluding accretion on acquired loans $ 116,712 $ 110,636 $ 104,398 $ 97,793 $ 94,479 $ 227,349 $ 189,181 Net Interest Margin1 3.58 % 3.48 % 3.39 % 3.17 % 3.18 % 3.53 % 3.21 % Impact of accretion on acquired loans (0.29) (0.24) (0.34) (0.27) (0.31) (0.27) (0.31) Net interest margin excluding accretion on acquired loans 3.29 % 3.24 % 3.05 % 2.90 % 2.87 % 3.26 % 2.89 % Securities Interest Income1 $ 32,519 $ 29,422 $ 26,986 $ 26,005 $ 24,195 $ 61,942 $ 46,629 Tax equivalent adjustment on securities (7) (7) (7) (8) (7) (15) (14) Securities interest income excluding tax equivalent adjustment 32,512 29,415 26,979 25,997 24,188 61,927 46,615 Loan Interest Income1 157,499 150,973 152,303 151,282 147,518 308,472 294,825 Tax equivalent adjustment on loans (424) (333) (304) (302) (226) (757) (438) Loan interest income excluding tax equivalent adjustment 157,075 150,640 151,999 150,980 147,292 307,715 294,387 Net Interest Income1 127,295 118,857 116,115 106,975 104,657 246,153 209,954 Tax equivalent adjustment on securities (7) (7) (7) (8) (7) (15) (14) Tax equivalent adjustment on loans (424) (333) (304) (302) (226) (757) (438) Net interest income excluding tax equivalent adjustment $ 126,864 $ 118,517 $ 115,804 $ 106,665 $ 104,424 $ 245,381 $ 209,502 1 On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. GAAP to Non-GAAP Reconciliation

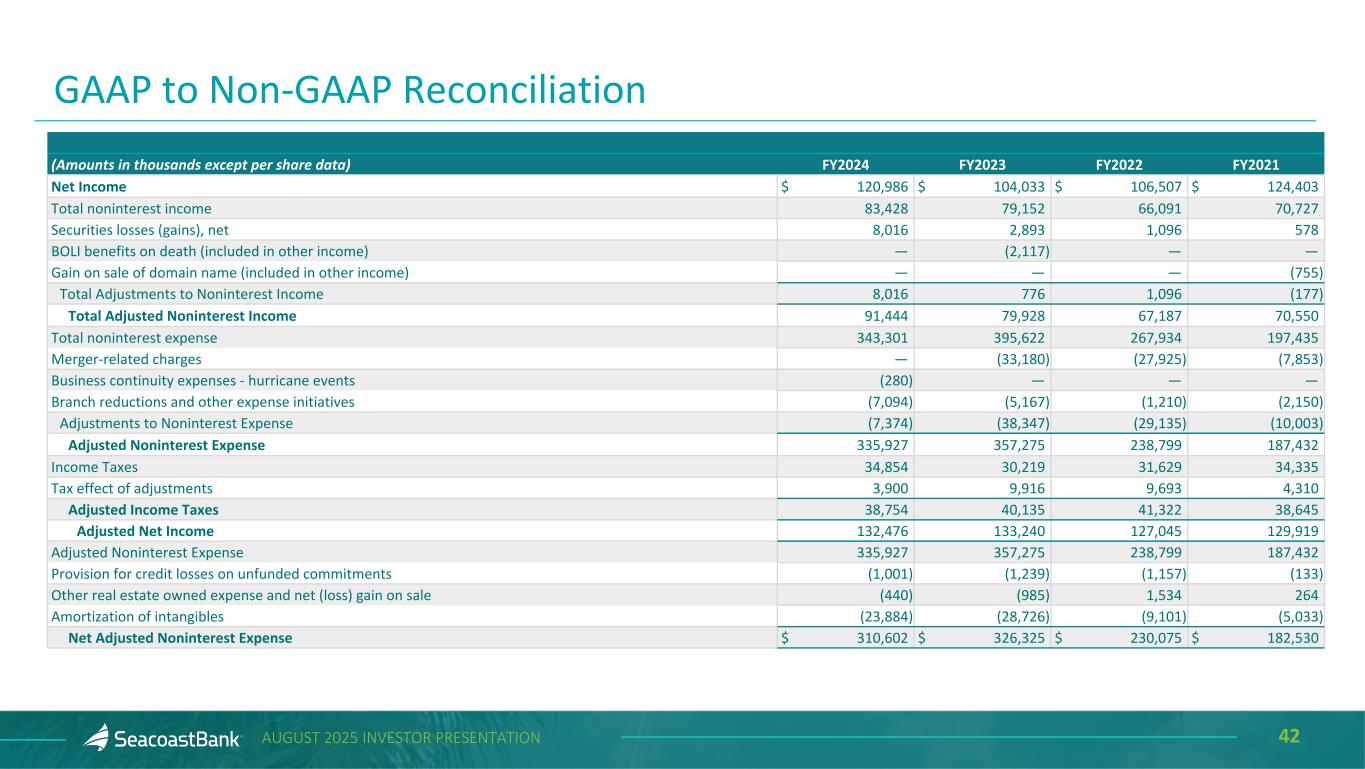

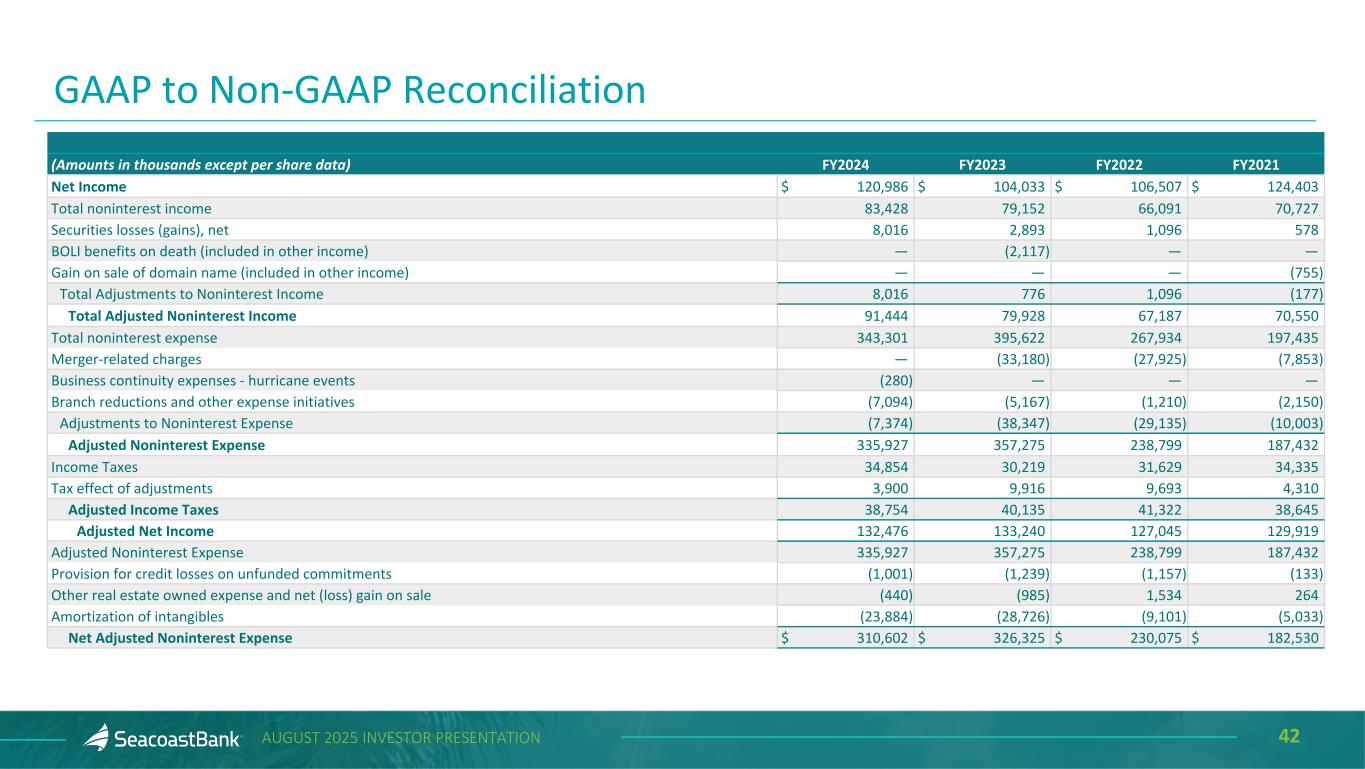

42AUGUST 2025 INVESTOR PRESENTATION (Amounts in thousands except per share data) FY2024 FY2023 FY2022 FY2021 Net Income $ 120,986 $ 104,033 $ 106,507 $ 124,403 Total noninterest income 83,428 79,152 66,091 70,727 Securities losses (gains), net 8,016 2,893 1,096 578 BOLI benefits on death (included in other income) — (2,117) — — Gain on sale of domain name (included in other income) — — — (755) Total Adjustments to Noninterest Income 8,016 776 1,096 (177) Total Adjusted Noninterest Income 91,444 79,928 67,187 70,550 Total noninterest expense 343,301 395,622 267,934 197,435 Merger-related charges — (33,180) (27,925) (7,853) Business continuity expenses - hurricane events (280) — — — Branch reductions and other expense initiatives (7,094) (5,167) (1,210) (2,150) Adjustments to Noninterest Expense (7,374) (38,347) (29,135) (10,003) Adjusted Noninterest Expense 335,927 357,275 238,799 187,432 Income Taxes 34,854 30,219 31,629 34,335 Tax effect of adjustments 3,900 9,916 9,693 4,310 Adjusted Income Taxes 38,754 40,135 41,322 38,645 Adjusted Net Income 132,476 133,240 127,045 129,919 Adjusted Noninterest Expense 335,927 357,275 238,799 187,432 Provision for credit losses on unfunded commitments (1,001) (1,239) (1,157) (133) Other real estate owned expense and net (loss) gain on sale (440) (985) 1,534 264 Amortization of intangibles (23,884) (28,726) (9,101) (5,033) Net Adjusted Noninterest Expense $ 310,602 $ 326,325 $ 230,075 $ 182,530 GAAP to Non-GAAP Reconciliation

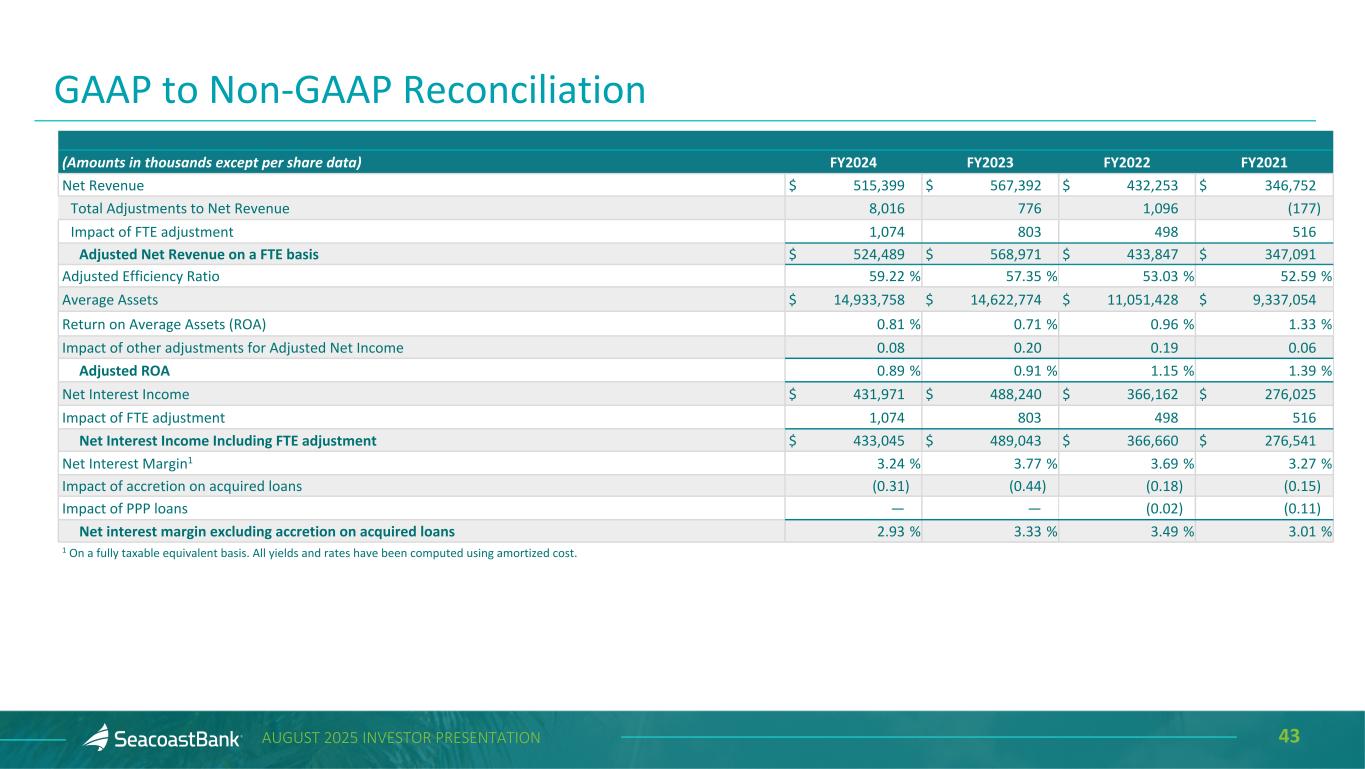

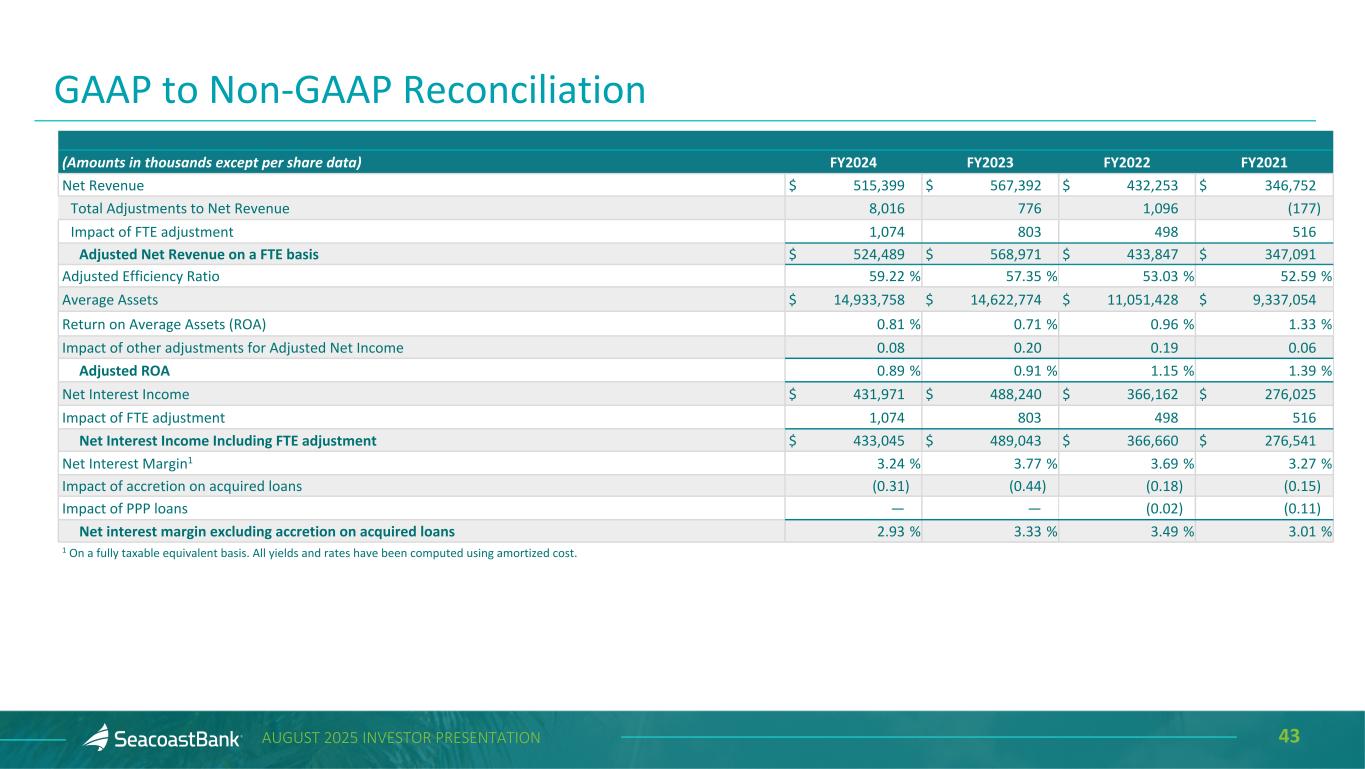

43AUGUST 2025 INVESTOR PRESENTATION (Amounts in thousands except per share data) FY2024 FY2023 FY2022 FY2021 Net Revenue $ 515,399 $ 567,392 $ 432,253 $ 346,752 Total Adjustments to Net Revenue 8,016 776 1,096 (177) Impact of FTE adjustment 1,074 803 498 516 Adjusted Net Revenue on a FTE basis $ 524,489 $ 568,971 $ 433,847 $ 347,091 Adjusted Efficiency Ratio 59.22 % 57.35 % 53.03 % 52.59 % Average Assets $ 14,933,758 $ 14,622,774 $ 11,051,428 $ 9,337,054 Return on Average Assets (ROA) 0.81 % 0.71 % 0.96 % 1.33 % Impact of other adjustments for Adjusted Net Income 0.08 0.20 0.19 0.06 Adjusted ROA 0.89 % 0.91 % 1.15 % 1.39 % Net Interest Income $ 431,971 $ 488,240 $ 366,162 $ 276,025 Impact of FTE adjustment 1,074 803 498 516 Net Interest Income Including FTE adjustment $ 433,045 $ 489,043 $ 366,660 $ 276,541 Net Interest Margin1 3.24 % 3.77 % 3.69 % 3.27 % Impact of accretion on acquired loans (0.31) (0.44) (0.18) (0.15) Impact of PPP loans — — (0.02) (0.11) Net interest margin excluding accretion on acquired loans 2.93 % 3.33 % 3.49 % 3.01 % 1 On a fully taxable equivalent basis. All yields and rates have been computed using amortized cost. GAAP to Non-GAAP Reconciliation