4Q2024 Earnings Release

SEACOAST REPORTS FOURTH QUARTER AND FULL YEAR 2024 RESULTS

Fourth Quarter 2024 Net Interest Margin Expands 22 Basis Points to 3.39%

Well-Positioned Balance Sheet with Strong Capital and Liquidity

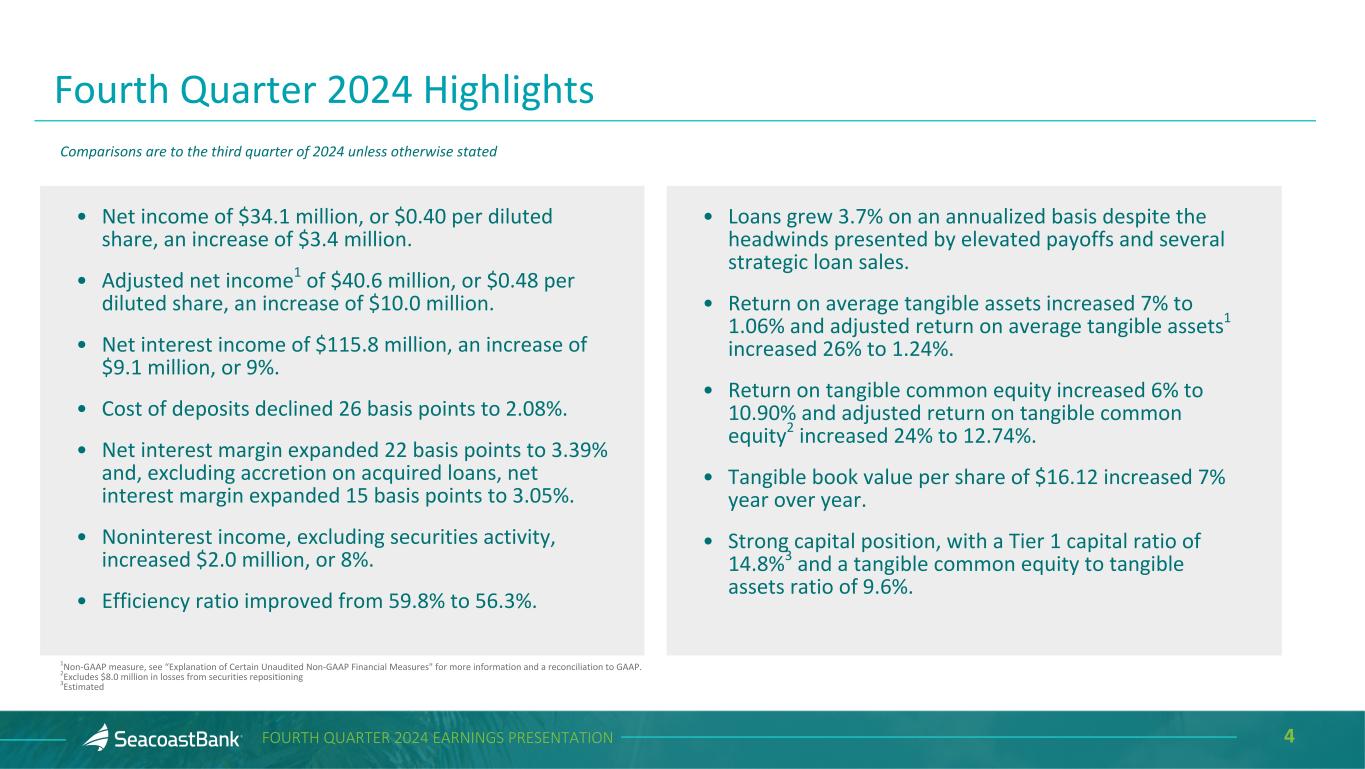

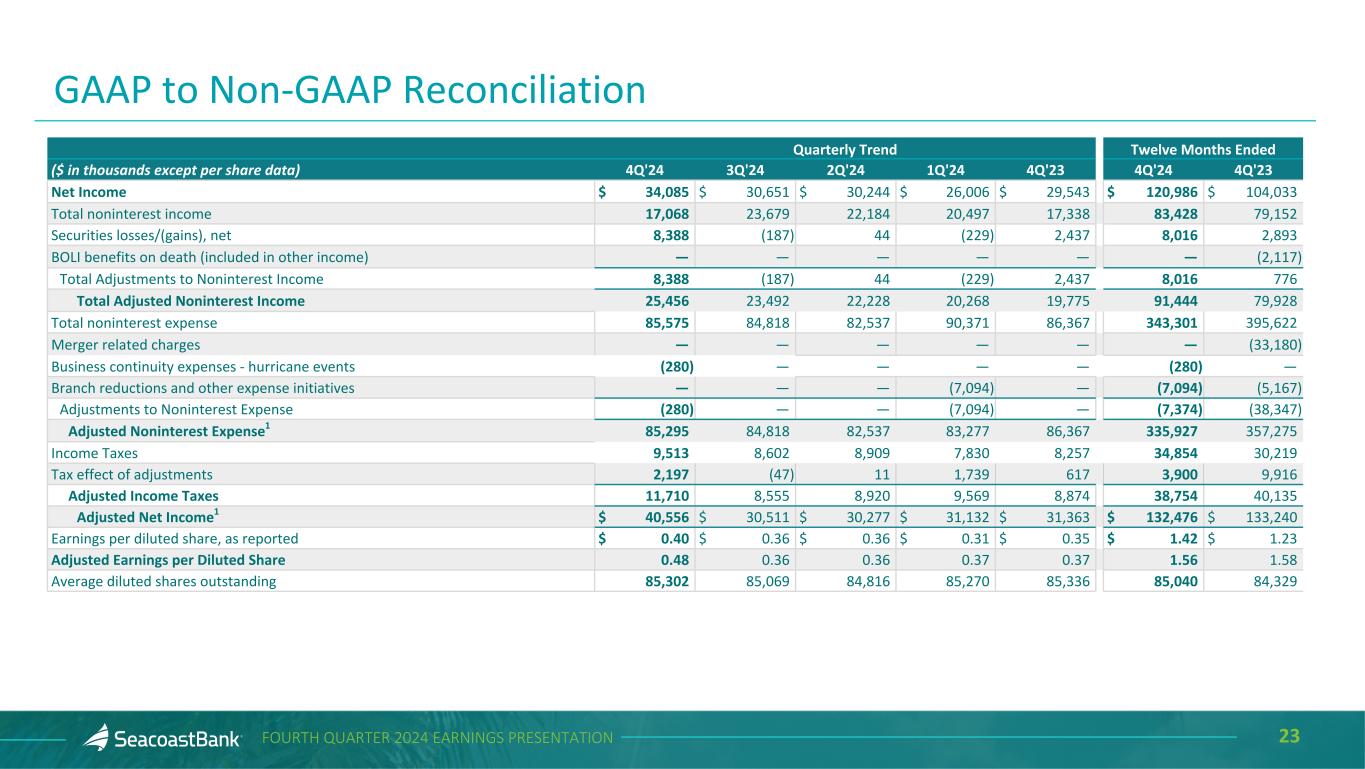

STUART, Fla., January 27, 2025 /BUSINESS WIRE/ -- Seacoast Banking Corporation of Florida ("Seacoast" or the "Company") (NASDAQ: SBCF) today reported net income in the fourth quarter of 2024 of $34.1 million, or $0.40 per diluted share, compared to $30.7 million, or $0.36 per diluted share in the third quarter of 2024 and $29.5 million, or $0.35 per diluted share in the fourth quarter of 2023. For the year ended December 31, 2024, net income was $121.0 million, or $1.42 per diluted share, compared to $104.0 million, or $1.23 per diluted share, for the year ended December 31, 2023.

Adjusted net income1 for the fourth quarter of 2024 was $40.6 million, or $0.48 per diluted share, compared to $30.5 million, or $0.36 per diluted share in the third quarter of 2024 and $31.4 million, or $0.37 per diluted share in the fourth quarter of 2023. Adjusted net income1 for the year ended December 31, 2024 was $132.5 million, or $1.56 per diluted share, compared to $133.2 million, or $1.58 per diluted share, for the year ended December 31, 2023.

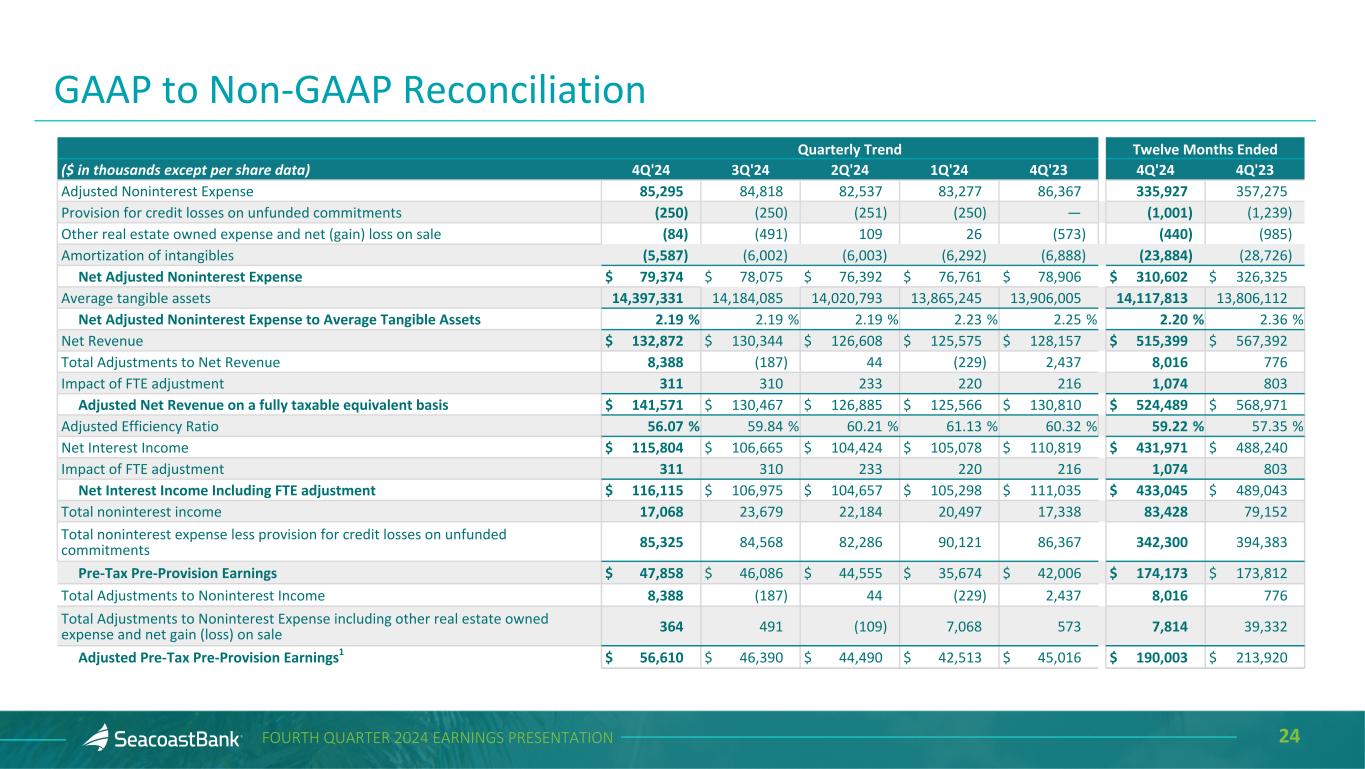

Pre-tax pre-provision earnings1 were $47.9 million in the fourth quarter of 2024, an increase of $1.8 million, or 4%, compared to the third quarter of 2024 and an increase of $5.9 million, or 14%, compared to the fourth quarter of 2023. Pre-tax pre-provision earnings1 for the year ended December 31, 2024 were $174.2 million, an increase of $0.4 million, or 0.2%, when compared to the year ended December 31, 2023. Adjusted pre-tax pre-provision earnings1 were $56.6 million in the fourth quarter of 2024, an increase of $10.2 million, or 22%, compared to the third quarter of 2024 and an increase of $11.6 million, or 26%, compared to the fourth quarter of 2023. Adjusted pre-tax pre-provision earnings1 for the year ended December 31, 2024 were $190.0 million, a decrease of $23.9 million, or 11%, when compared to the year ended December 31, 2023.

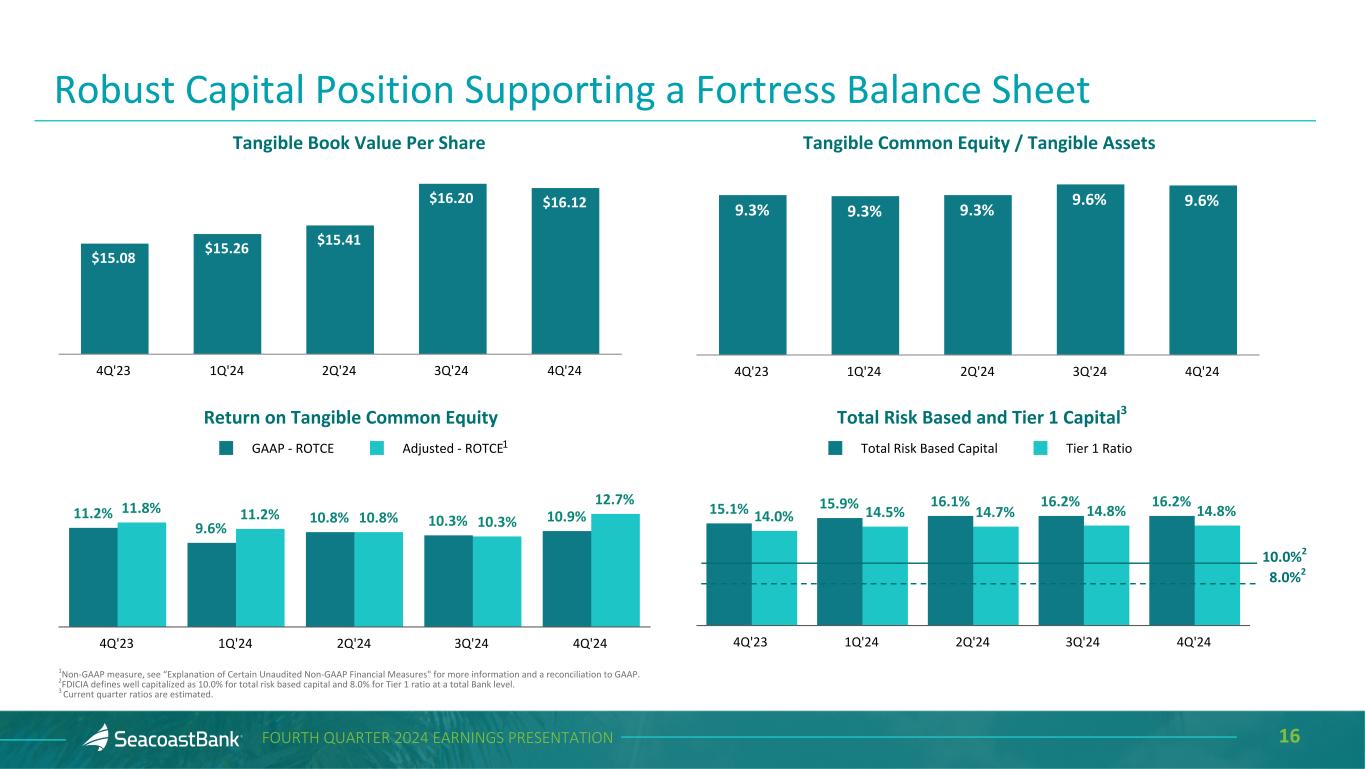

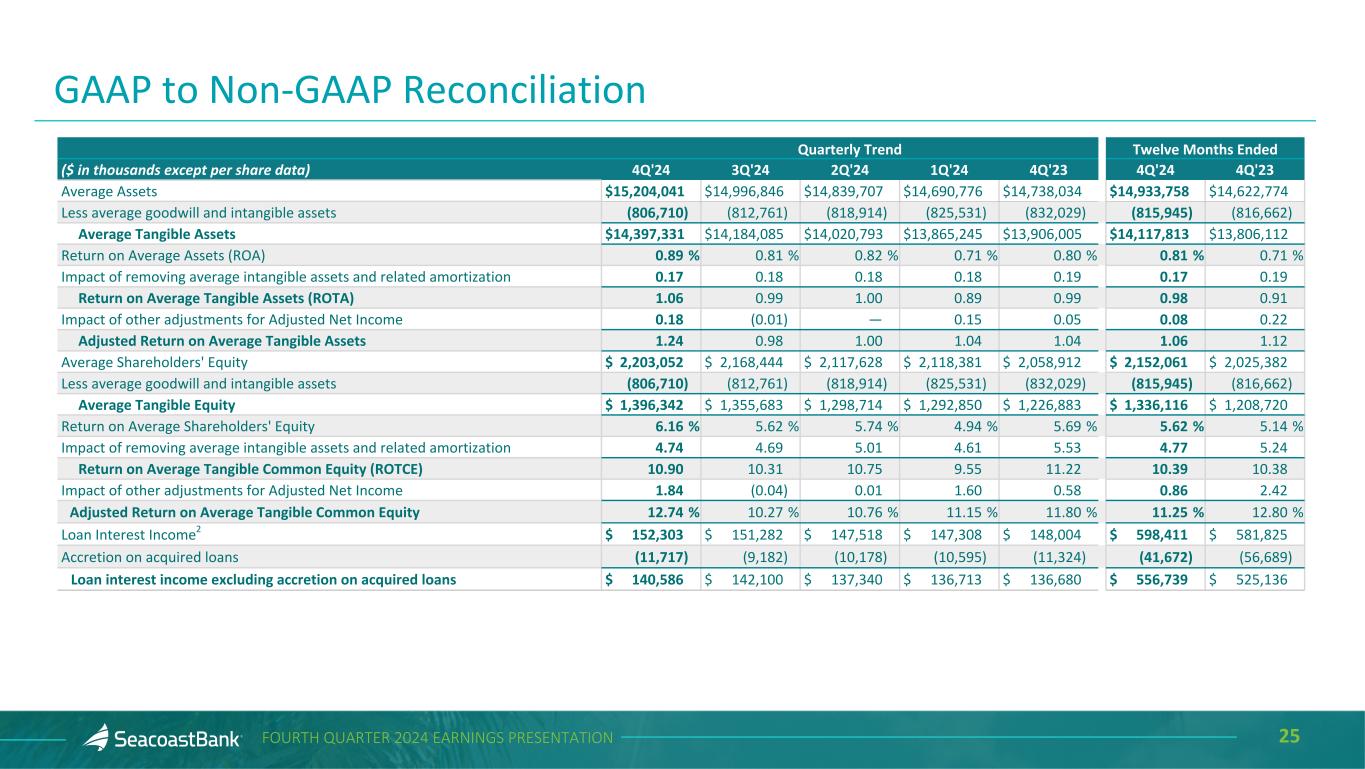

For the fourth quarter of 2024, return on average tangible assets was 1.06% and return on average tangible shareholders' equity was 10.90%, compared to 0.99% and 10.31%, respectively, in the prior quarter, and 0.99% and 11.22%, respectively, in the prior year quarter. Adjusted return on average tangible assets1 in the fourth quarter of 2024 was 1.24% and adjusted return on average tangible shareholders' equity1 was 12.74%, compared to 0.98% and 10.27%, respectively, in the prior quarter, and 1.04% and 11.80%, respectively, in the prior year quarter. For the year ended December 31, 2024, return on average tangible assets was 0.98%, and return on average tangible shareholders' equity was 10.39%, compared to 0.91% and 10.38%, respectively, for the year ended December 31, 2023. For the year ended December 31, 2024, adjusted return on average tangible assets1 was 1.06%, and adjusted return on average tangible shareholders' equity1 was 11.25%, compared to 1.12% and 12.80%, respectively, for the year ended December 31, 2023.

Charles M. Shaffer, Seacoast's Chairman and CEO, said, "Our Seacoast associates weathered the impacts of two successive hurricanes to deliver remarkable revenue growth, record loan production, and a 33% increase in adjusted net income. The strong net interest margin expansion in the fourth quarter evidenced the solid, granular core deposit franchise that we have built over many decades through our relationship-focused banking model. With accelerating business momentum and tailwinds from fixed rate asset repricing, we remain focused on profitability improvement and growth in the year ahead."

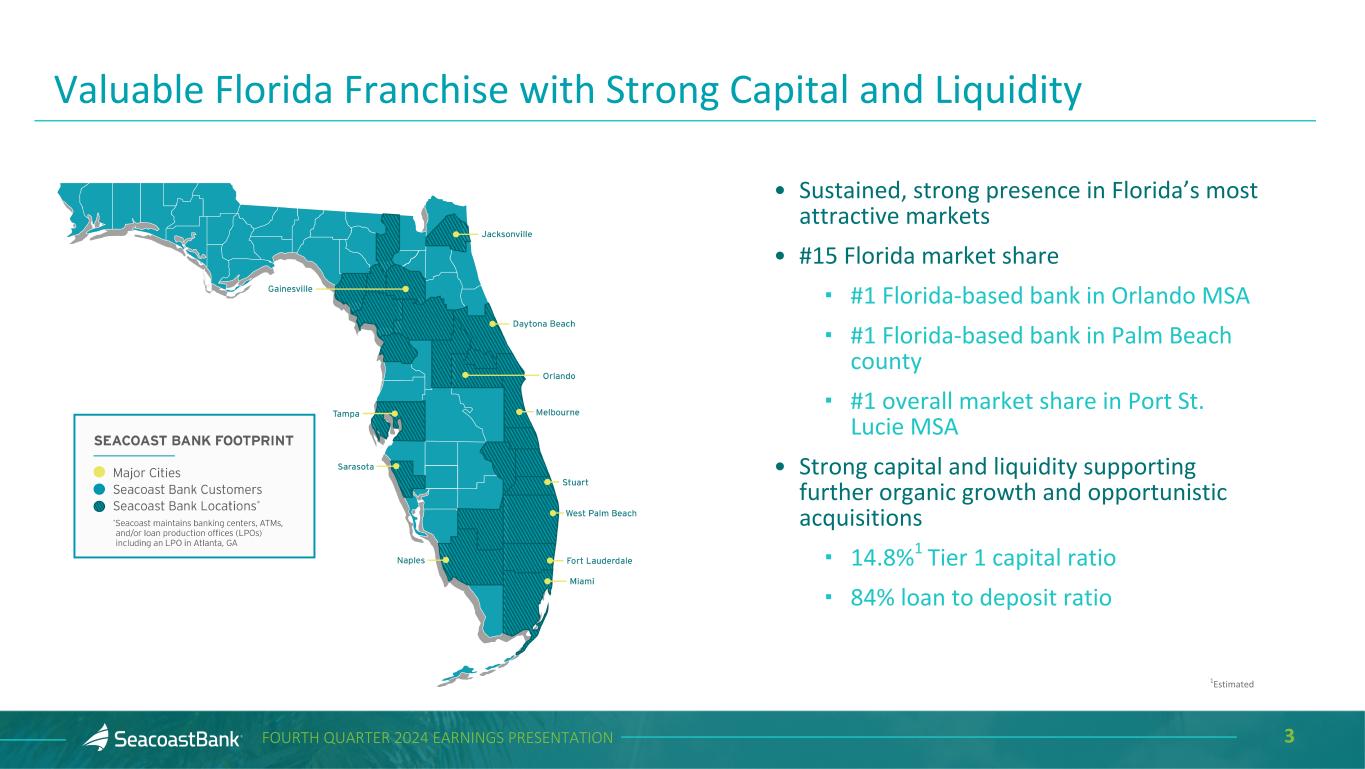

Shaffer added, "We advanced several key initiatives this year including the expansion of our commercial lending team and treasury deposit products that will support the next phase of growth for Seacoast. With a tangible common equity ratio of 9.6% and a loan to deposit ratio of 84%, we have a tremendous opportunity ahead to serve clients in our economically vibrant footprint."

Shaffer concluded, "The Seacoast team remains unwavering to our core tenets of maintaining a fortress balance sheet and building one of the best, granular customer deposit franchises in the country."

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

Financial Results

Income Statement

•Net income in the fourth quarter of 2024 was $34.1 million, or $0.40 per diluted share, compared to $30.7 million, or $0.36 per diluted share in the prior quarter and $29.5 million, or $0.35 per diluted share in the prior year quarter. For the year ended December 31, 2024, net income was $121.0 million, or $1.42 per diluted share, compared to $104.0 million, or $1.23 per diluted share, for the year ended December 31, 2023. Adjusted net income1 for the fourth quarter of 2024 was $40.6 million, or $0.48 per diluted share, compared to $30.5 million, or $0.36 per diluted share, for the prior quarter, and $31.4 million, or $0.37 per diluted share, for the prior year quarter. For the year ended December 31, 2024, adjusted net income1 was $132.5 million, or $1.56 per diluted share, compared to $133.2 million, or $1.58 per diluted share, for the year ended December 31, 2023.

•Net revenues were $132.9 million in the fourth quarter of 2024, an increase of $2.5 million, or 2%, compared to the prior quarter, and an increase of $4.7 million, or 4%, compared to the prior year quarter. For the year ended December 31, 2024, net revenues were $515.4 million, a decrease of $52.0 million, or 9%, compared to the year ended December 31, 2023. Adjusted net revenues1 were $141.6 million in the fourth quarter of 2024, an increase of $11.1 million, or 9%, compared to the prior quarter, and an increase of $10.8 million, or 8%, compared to the prior year quarter. For the year ended December 31, 2024, adjusted net revenues1 were $524.5 million, a decrease of $44.5 million, or 8%, compared to the year ended December 31, 2023.

•Pre-tax pre-provision earnings1 were $47.9 million in the fourth quarter of 2024, an increase of $1.8 million, or 4%, compared to the third quarter of 2024 and an increase of $5.9 million, or 14%, compared to the fourth quarter of 2023. For the year ended December 31, 2024, pre-tax pre-provision earnings1 were $174.2 million, an increase of $0.4 million, or 0.2%, compared to the year ended December 31, 2023. Adjusted pre-tax pre-provision earnings1 were $56.6 million in the fourth quarter of 2024, an increase of $10.2 million, or 22%, compared to the third quarter of 2024 and an increase of $11.6 million, or 26%, compared to the fourth quarter of 2023. For the year ended December 31, 2024, adjusted pre-tax pre-provision earnings1 were $190.0 million, a decrease of $23.9 million, or 11%, compared to the year ended December 31, 2023.

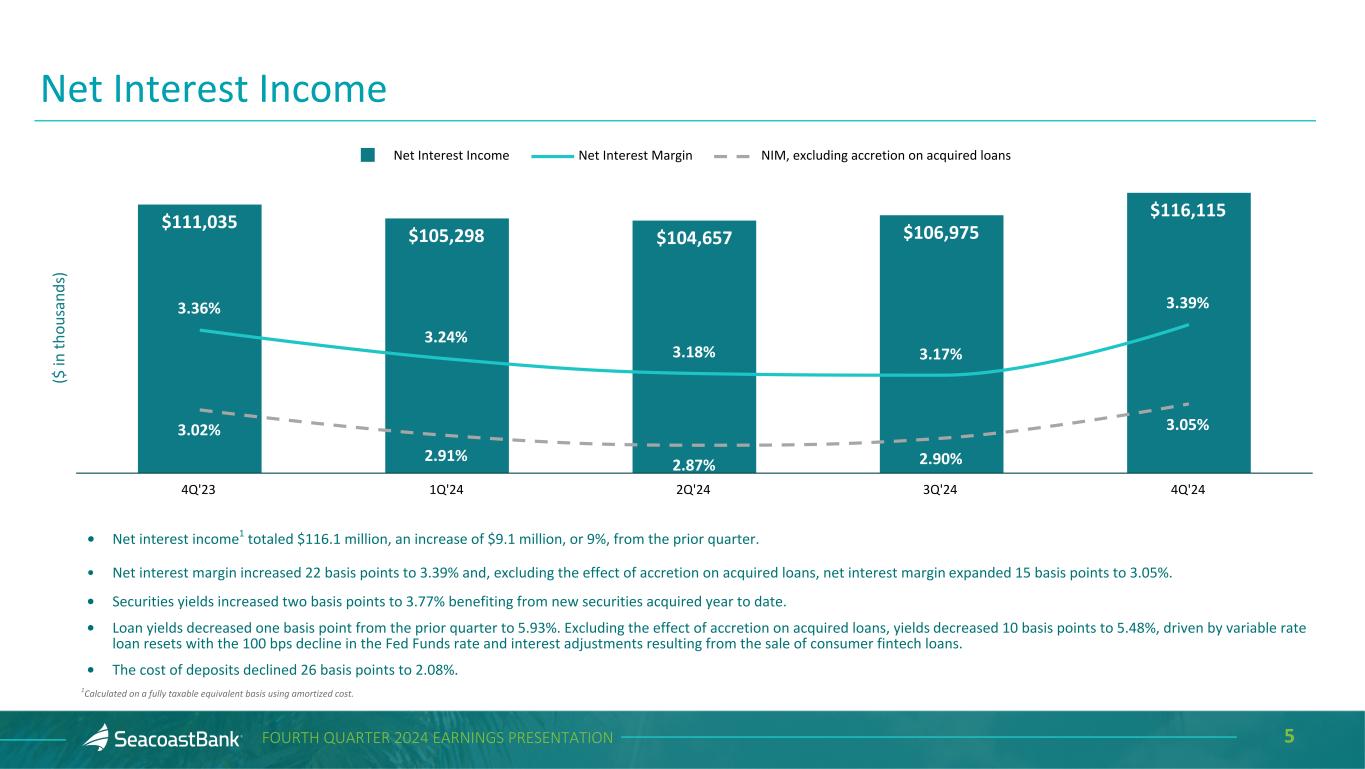

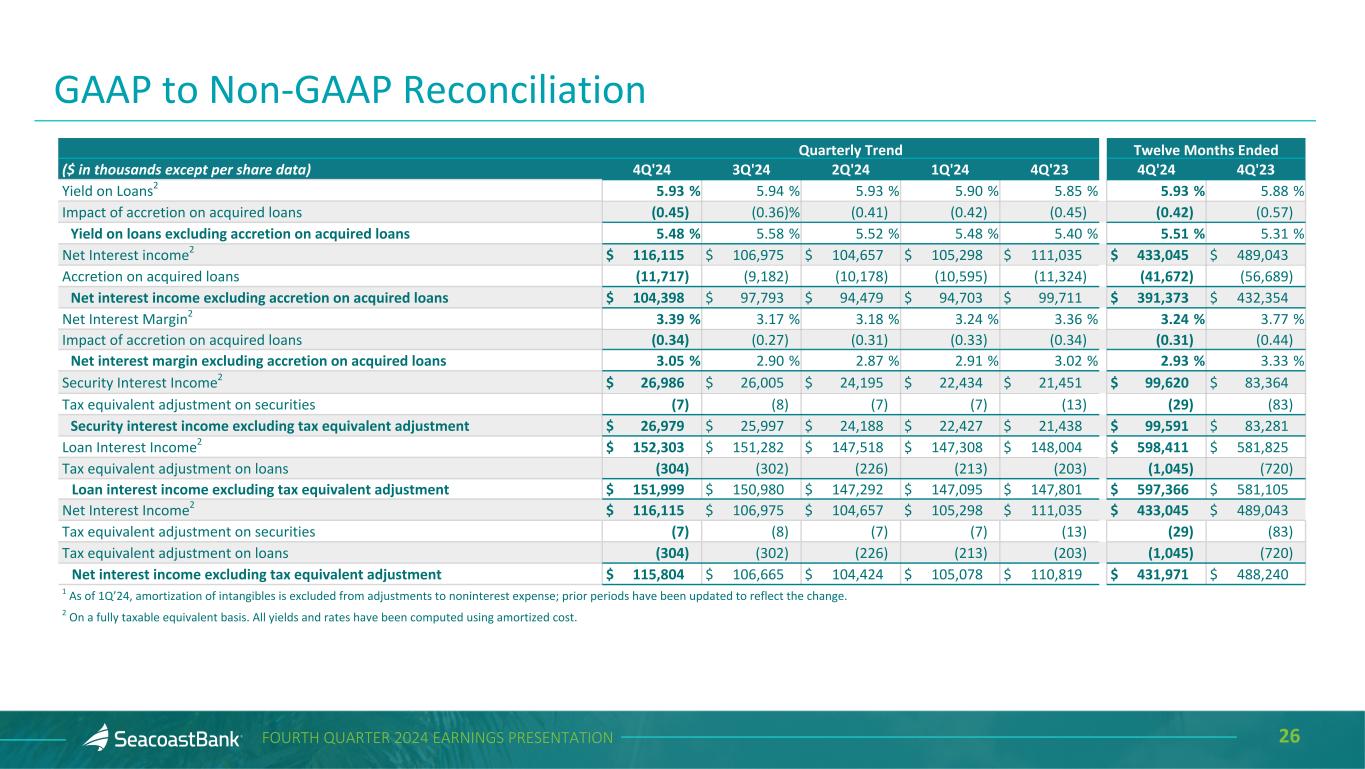

•Net interest income totaled $115.8 million in the fourth quarter of 2024, an increase of $9.1 million, or 9%, compared to the prior quarter, and an increase of $5.0 million, or 4%, compared to the prior year quarter. For the year ended December 31, 2024, net interest income was $432.0 million, a decrease of $56.3 million, or 12%, compared to the year ended December 31, 2023. The increase in the fourth quarter of 2024 was largely driven by a 26 basis point decline in the cost of deposits. Included in loan interest income was accretion on acquired loans of $11.7 million in the fourth quarter of 2024, $9.2 million in the third quarter of 2024, and $11.3 million in the fourth quarter of 2023. For the year ended December 31, 2024, accretion on acquired loans totaled $41.7 million, compared to $56.7 million for the year ended December 31, 2023.

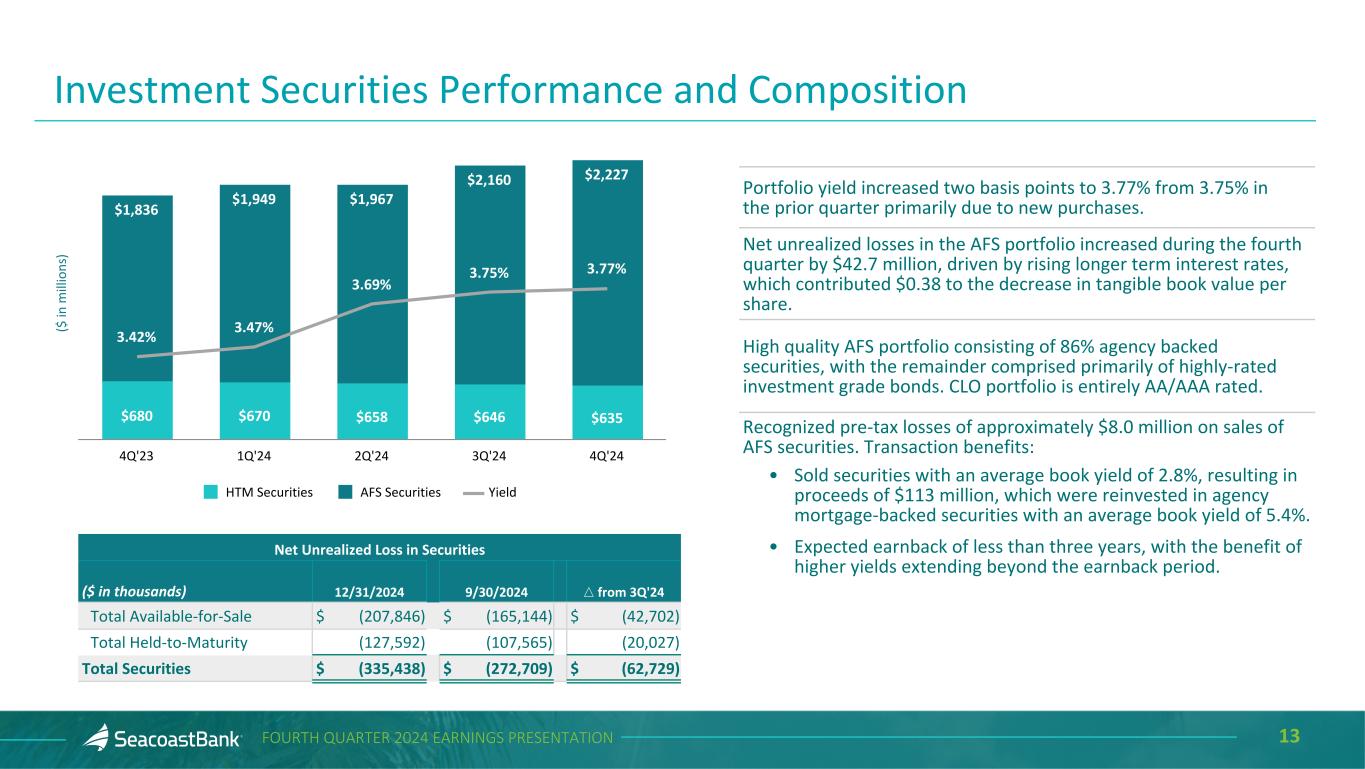

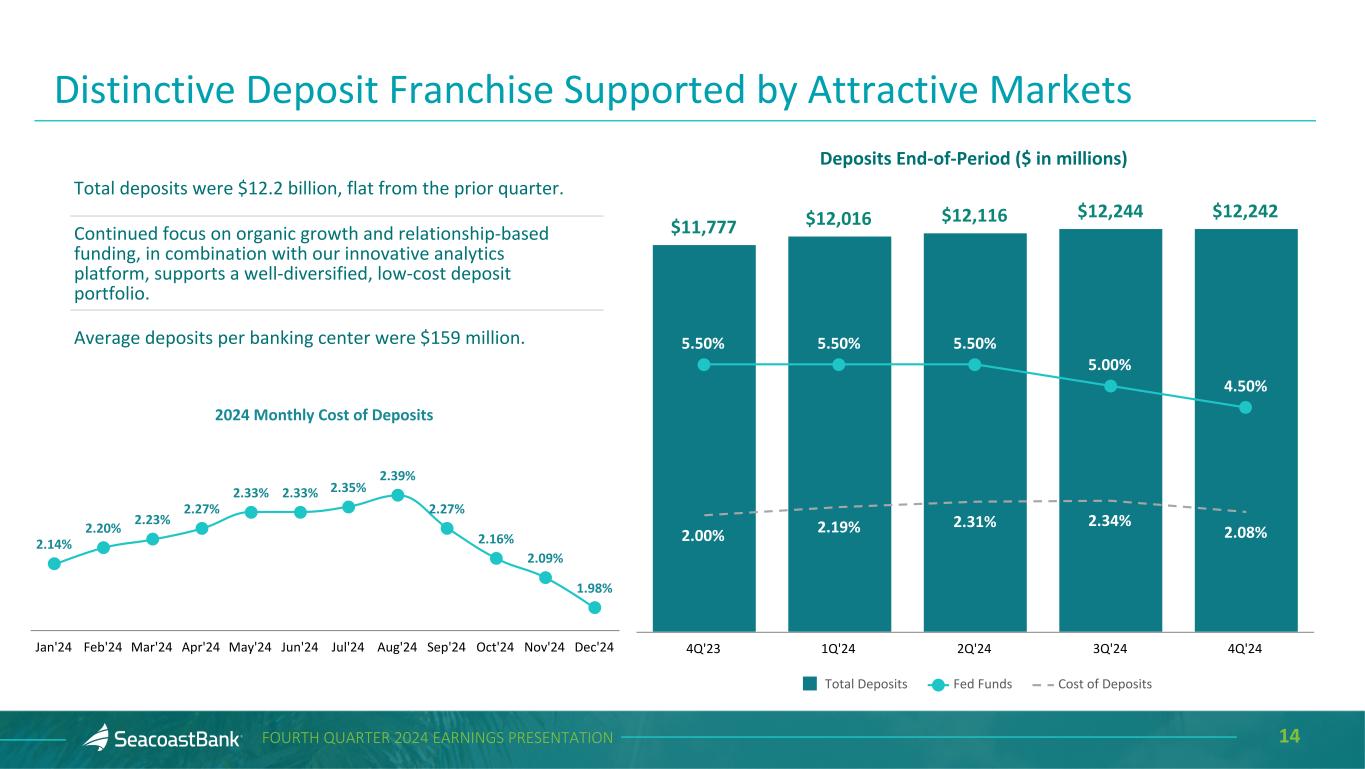

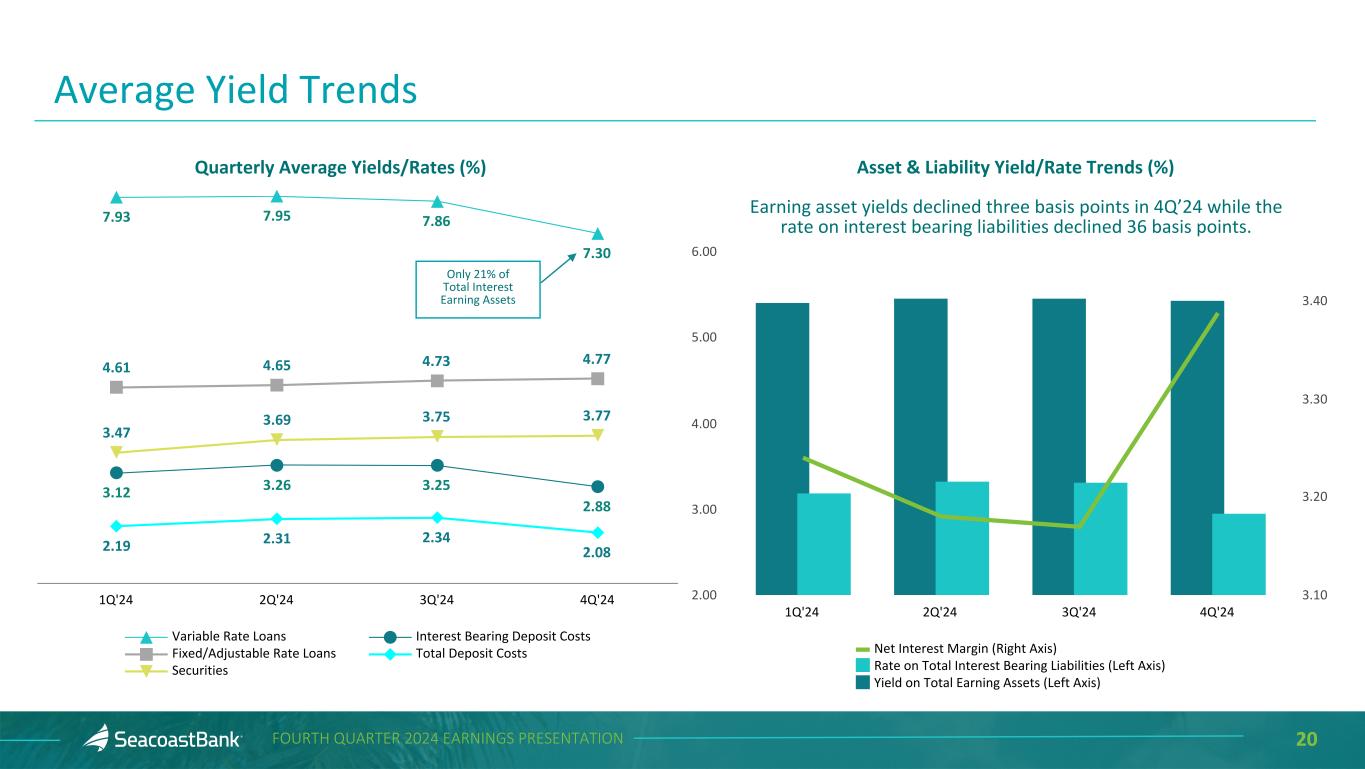

•Net interest margin increased 22 basis points to 3.39% in the fourth quarter of 2024 compared to 3.17% in the third quarter of 2024. Excluding the effects of accretion on acquired loans, net interest margin expanded 15 basis points to 3.05% in the fourth quarter of 2024 compared to 2.90% in the third quarter of 2024. Loan yields were 5.93%, a decrease of one basis point from the prior quarter. Securities yields increased two basis points to 3.77%, compared to 3.75% in the prior quarter. The cost of deposits declined 26 basis points from 2.34% in the prior quarter, to 2.08% in the fourth quarter of 2024. Lower interest expense on deposits reflects the impact of recent cuts to the Federal Funds rate.

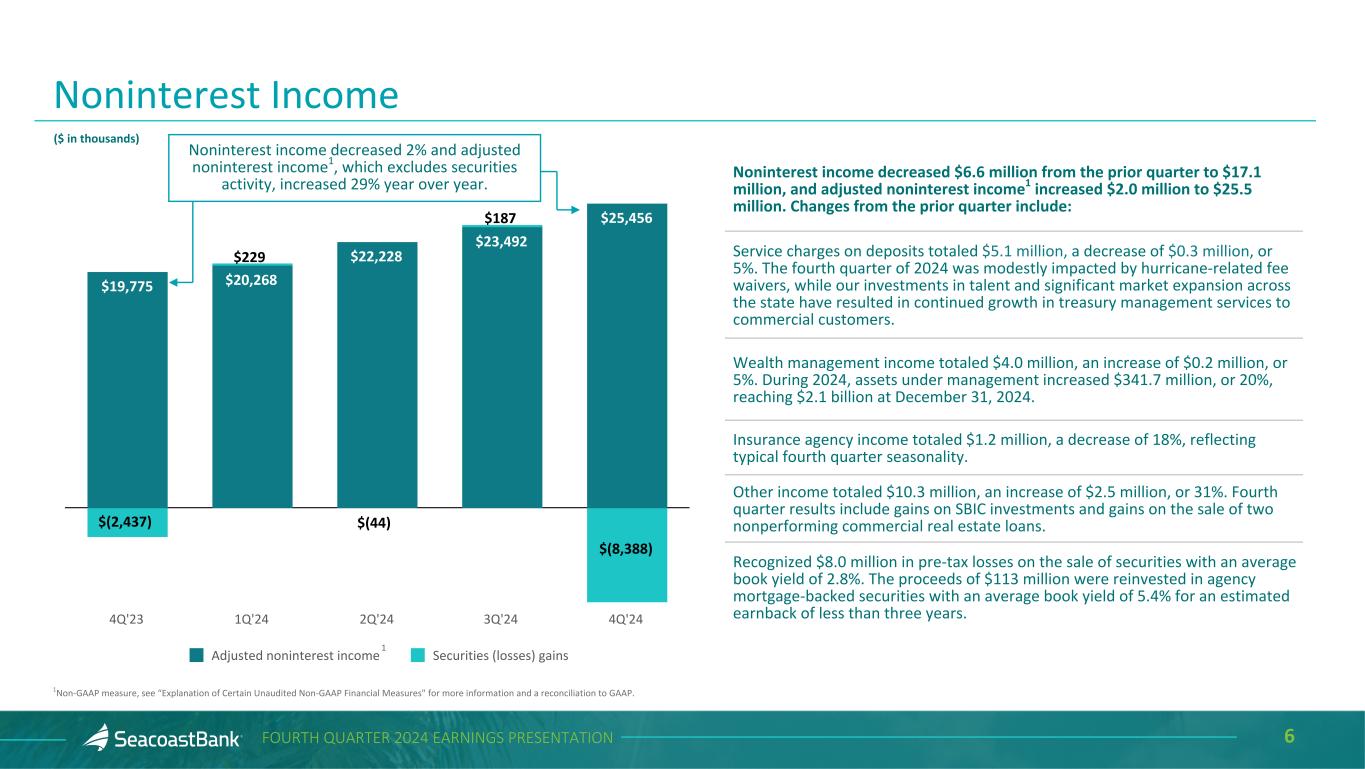

•Noninterest income totaled $17.1 million in the fourth quarter of 2024, a decrease of $6.6 million, or 28%, compared to the prior quarter, and a decrease of $0.3 million, or 2%, compared to the prior year quarter. For the year ended December 31, 2024, noninterest income totaled $83.4 million, an increase of $4.3 million, or 5%, compared to the year ended December 31, 2023. Results for the fourth quarter of 2024 included an $8.0 million loss on the repositioning of a portion of the available-for-sale securities portfolio. Securities with an average book yield of 2.8% were sold, and the proceeds of approximately $113 million were reinvested in agency mortgage-backed securities with an average book yield of 5.4%, for an estimated earnback of less than three years. Other changes compared to the third quarter of 2024 included the following:

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

•Service charges on deposits totaled $5.1 million, a decrease of $0.3 million, or 5%, from the prior quarter and an increase of $0.3 million, or 6%, from the prior year quarter. The fourth quarter of 2024 was modestly impacted by hurricane-related fee waivers, while our investments in talent and significant market expansion across the state have resulted in continued growth in treasury management services to commercial customers compared to the prior year.

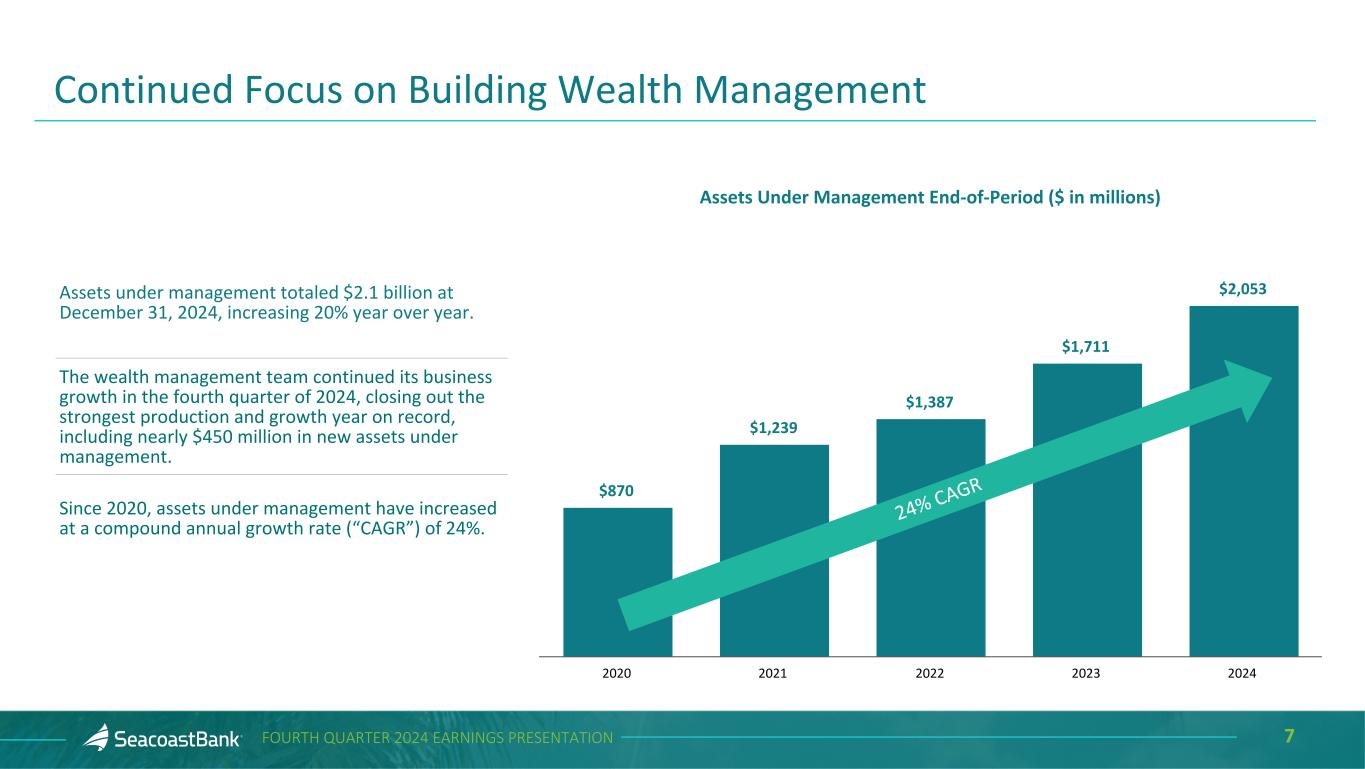

•Wealth management income totaled $4.0 million, an increase of $0.2 million, or 5%, from the prior quarter and an increase of $0.8 million, or 23%, from the prior year quarter. During 2024, assets under management increased $341.7 million, or 20%, reaching $2.1 billion at December 31, 2024.

•Insurance agency income totaled $1.2 million, a decrease of 18% from the prior quarter, reflecting typical fourth quarter seasonality, and an increase of 8% from the prior year quarter. For the full year 2024, insurance agency income totaled $5.2 million, an increase of $0.7 million, or 15%, from the prior year.

•Other income totaled $10.3 million, an increase of $2.5 million, or 31%, from the prior quarter and an increase of $4.7 million, or 85% from the prior year quarter. Fourth quarter 2024 results include gains on SBIC investments and gains on the sale of two nonperforming commercial real estate loans.

•The provision for credit losses was $3.7 million in the fourth quarter of 2024, compared to $6.3 million in the third quarter of 2024 and $4.0 million in the fourth quarter of 2023. In the fourth quarter of 2024, no hurricane-related adjustment to the allowance for credit losses was determined to be necessary.

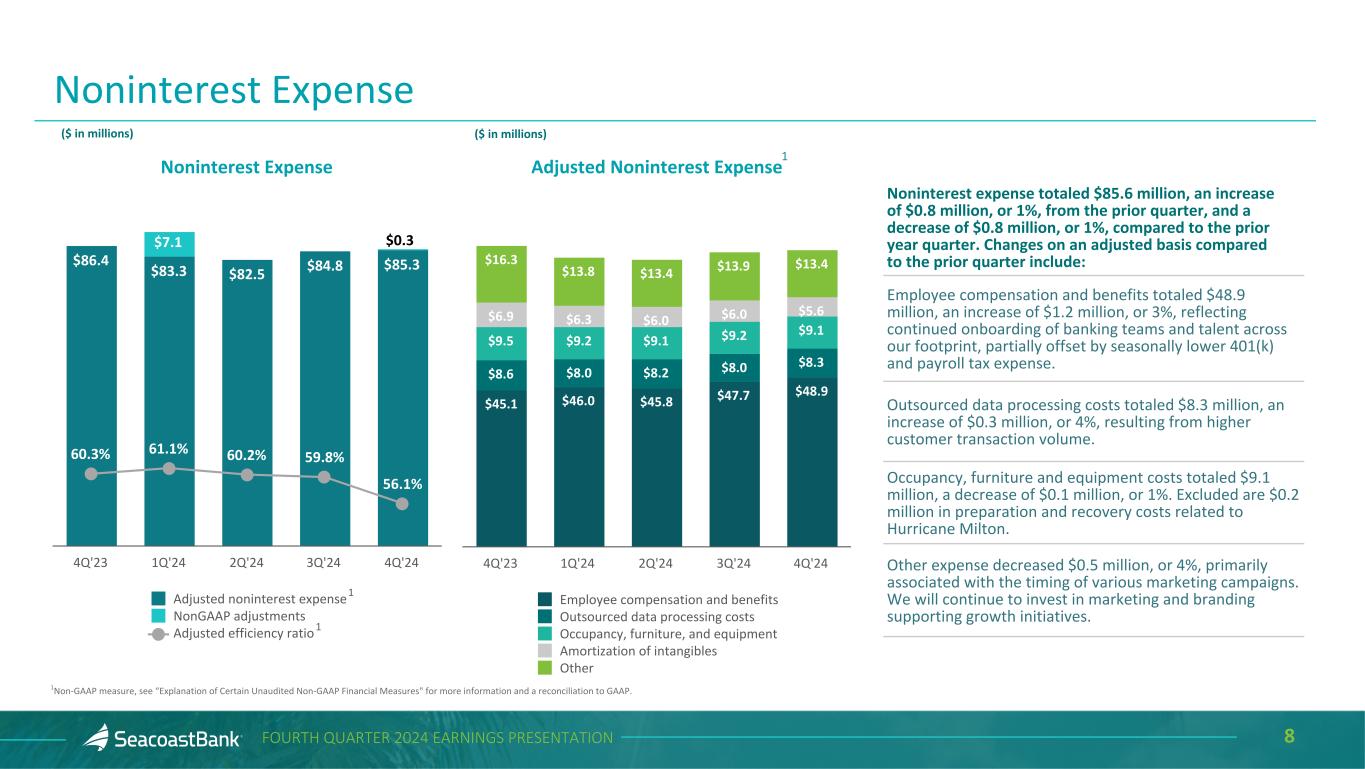

•Noninterest expense was $85.6 million in the fourth quarter of 2024, an increase of $0.8 million, or 1%, compared to the prior quarter, and a decrease of $0.8 million, or 1%, compared to the prior year quarter. Noninterest expense for the year ended December 31, 2024, totaled $343.3 million, a decrease of $52.3 million, or 13%, compared to the year ended December 31, 2023. Seacoast has prudently managed expenses while strategically investing to support continued growth. Results in the fourth quarter of 2024 included:

•Salaries and wages totaled $42.4 million, an increase of $1.7 million, or 4%, compared to the prior quarter and an increase of $3.9 million, or 10%, from the prior year quarter, reflecting continued onboarding of banking teams and talent across our footprint.

•Employee benefits totaled $6.5 million, a decrease of $0.4 million, or 6%, compared to the prior quarter and a decrease of $0.1 million, or 2%, from the prior year quarter. The decrease from the prior quarter is due to seasonally lower 401(k) and payroll tax expense.

•Outsourced data processing costs totaled $8.3 million, an increase of $0.3 million, or 4%, compared to the prior quarter and a decrease of $0.3 million, or 4%, from the prior year quarter. Higher customer transaction volume contributed to the increase over the prior quarter.

•Occupancy costs totaled $7.2 million, an increase of $0.1 million, or 2%, compared to the prior quarter and a decrease of $0.3 million, or 4%, from the prior year quarter. The fourth quarter of 2024 included $0.2 million in preparation and recovery costs related to Hurricane Milton.

•Marketing expenses totaled $2.1 million, reflecting a decrease of $0.6 million, or 22%, compared to the prior quarter and a decrease of $0.9 million, or 29%, from the prior year quarter, primarily associated with the timing of various campaigns. We will continue to invest in marketing and branding supporting customer growth initiatives.

•Legal and professional fees totaled $2.8 million, an increase of $0.1 million, or 4%, compared to the prior quarter and a decrease of $0.5 million, or 15%, from the prior year quarter.

•Seacoast recorded $9.5 million of income tax expense in the fourth quarter of 2024, compared to $8.6 million in the third quarter of 2024, and $8.3 million in the fourth quarter of 2023. Tax expense related to stock-based compensation totaled $0.2 million in the fourth quarter of 2024, compared to tax benefit of $0.1 million in the third quarter of 2024 and a tax benefit of $0.6 million in the fourth quarter of 2023.

•The efficiency ratio was 56.26% in the fourth quarter of 2024, benefiting from lower deposit costs and higher revenues, compared to 59.84% in the third quarter of 2024 and 60.32% in the prior year quarter. The adjusted

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

efficiency ratio1 was 56.07% in the fourth quarter of 2024, compared to 59.84% in the third quarter of 2024 and 60.32% in the prior year quarter. The efficiency ratio for the year ended December 31, 2024 was 60.63% compared to 63.86% for the year ended December 31, 2023. The adjusted efficiency ratio1 for the year ended December 31, 2024 was 59.22% compared to 57.35% for the year ended December 31, 2023. The Company continues to remain keenly focused on disciplined expense control, while making investments for growth.

Balance Sheet

•At December 31, 2024, the Company had total assets of $15.2 billion and total shareholders' equity of $2.2 billion. Book value per share was $25.51 as of December 31, 2024, compared to $25.68 as of September 30, 2024, and $24.84 as of December 31, 2023. Tangible book value per share was $16.12 as of December 31, 2024, compared to $16.20 as of September 30, 2024, and $15.08 as of December 31, 2023. The decline in the value of the available-for-sale securities portfolio driven by rising longer term interest rates negatively impacted tangible book value per share by $0.38 during the fourth quarter of 2024.

•Debt securities totaled $2.9 billion as of December 31, 2024, an increase of $55.6 million compared to September 30, 2024. Debt securities include approximately $2.2 billion in securities classified as available-for-sale and recorded at fair value. The unrealized loss on these securities is fully reflected in the value presented on the balance sheet. The portfolio also includes $635.2 million in securities classified as held-to-maturity with a fair value of $507.6 million. Held-to-maturity securities consist solely of mortgage-backed securities and collateralized mortgage obligations guaranteed by U.S. government agencies, each of which is expected to recover any price depreciation over its holding period as the debt securities move to maturity. The Company has significant liquidity and available borrowing capacity and has the intent and ability to hold these investments to maturity.

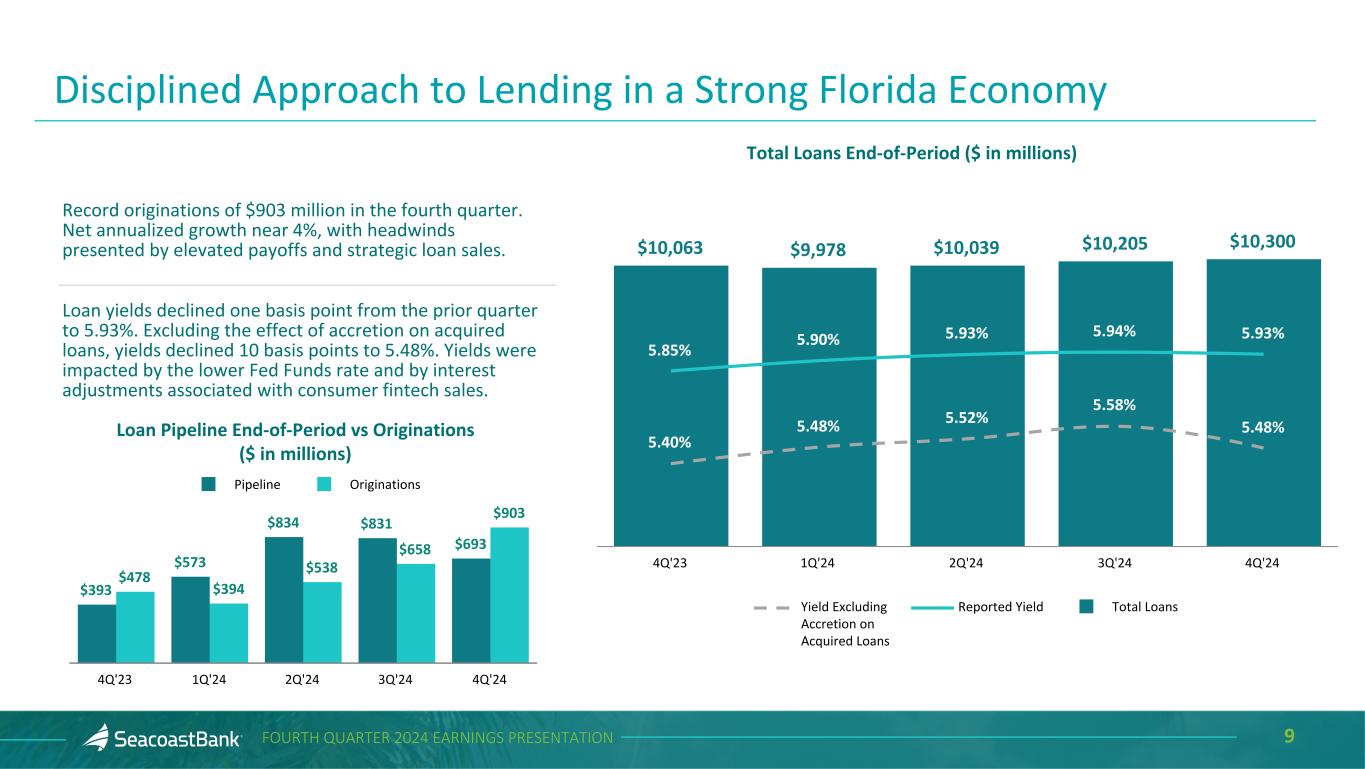

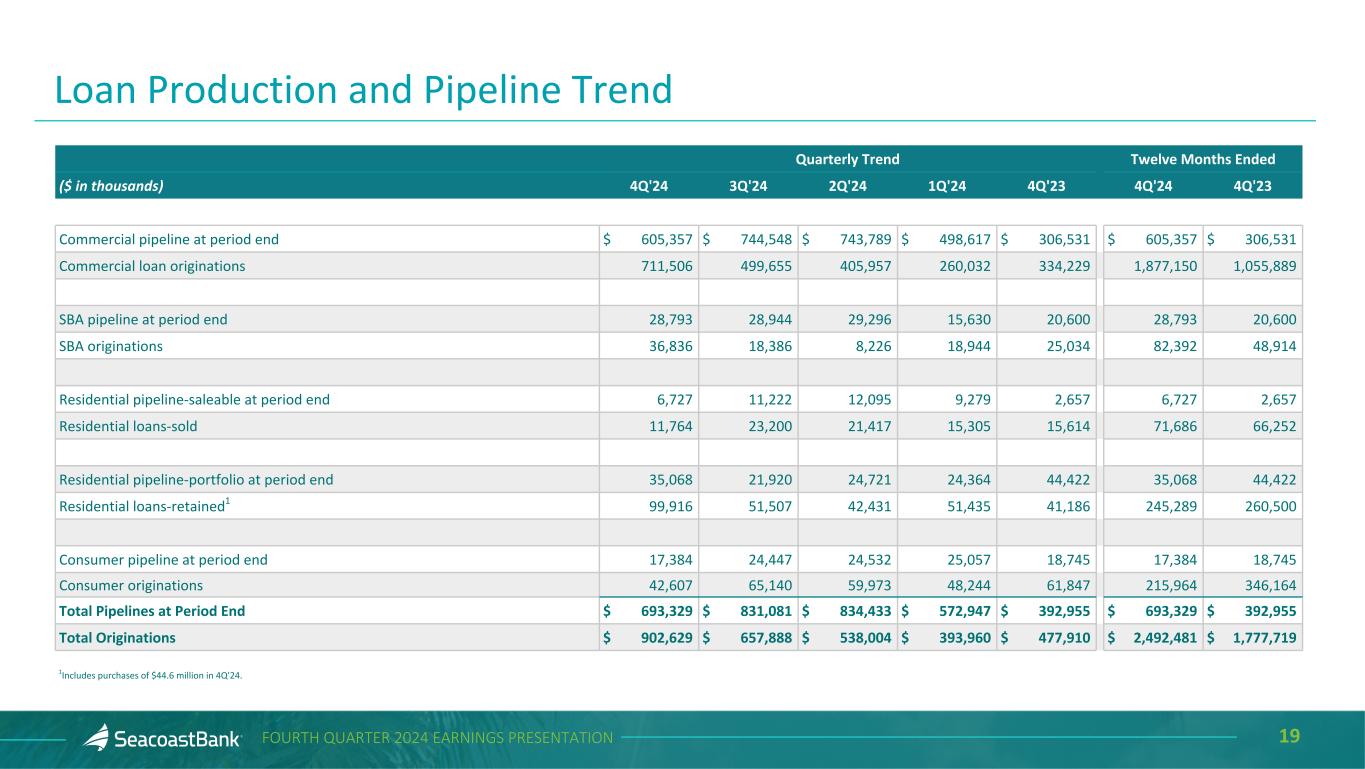

•Loans increased $94.7 million, or 3.7% annualized, totaling $10.3 billion as of December 31, 2024. Loan originations increased 37% to $902.6 million in the fourth quarter of 2024, compared to $657.9 million in the third quarter of 2024. Gross production during the fourth quarter of 2024 was offset by elevated payoffs, the sale of two nonperforming commercial real estate loans totaling $19.0 million in aggregate, and the transfer to held-for-sale of $20.0 million in consumer loans previously acquired through bank acquisitions (the “consumer fintech loans”). The Company continues to exercise a disciplined approach to lending and is benefiting from the investments made in recent years to attract talent from large regional banks across its markets. This talent is onboarding significant new relationships, resulting in increased loan production.

•Loan pipelines (loans in underwriting and approval or approved and not yet closed) totaled $693.3 million as of December 31, 2024, compared to $831.1 million at September 30, 2024 and $393.0 million at December 31, 2023.

•Commercial pipelines were $605.4 million as of December 31, 2024, compared to $744.5 million at September 30, 2024, and $306.5 million at December 31, 2023.

•SBA pipelines were $28.8 million as of December 31, 2024, compared to $28.9 million at September 30, 2024, and $20.6 million at December 31, 2023.

•Residential saleable pipelines were $6.7 million as of December 31, 2024, compared to $11.2 million at September 30, 2024, and $2.7 million at December 31, 2023. Retained residential pipelines were $35.1 million as of December 31, 2024, compared to $21.9 million at September 30, 2024, and $44.4 million at December 31, 2023.

•Consumer pipelines were $17.4 million as of December 31, 2024, compared to $24.4 million at September 30, 2024 and $18.7 million at December 31, 2023.

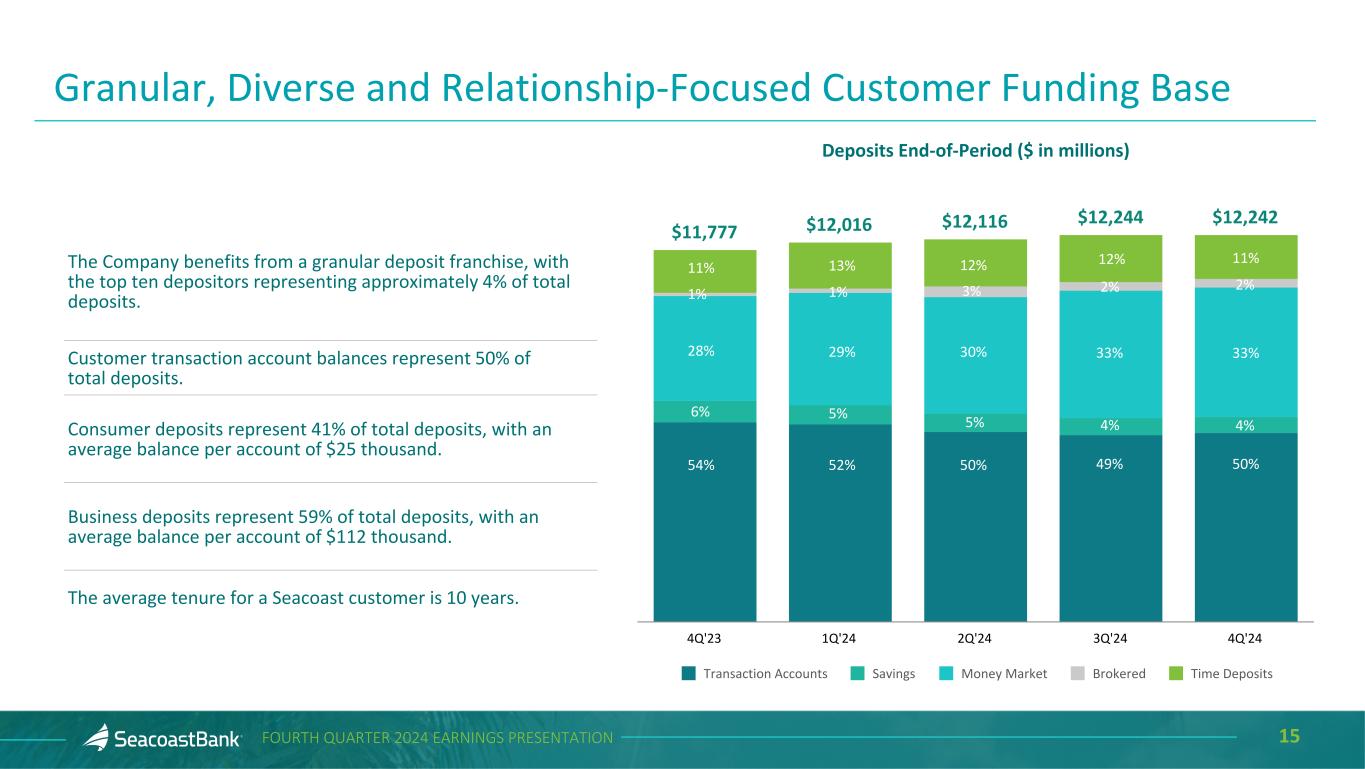

•Total deposits were $12.2 billion as of December 31, 2024, near flat when compared to September 30, 2024.

•At December 31, 2024, customer transaction account balances represented 50% of total deposits.

•The Company benefits from a granular deposit franchise, with the top ten depositors representing approximately 4% of total deposits.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

•Average deposits per banking center were $159 million at December 31, 2024, compared to $153 million at December 31, 2023.

•Uninsured deposits represented only 36% of overall deposit accounts as of December 31, 2024. This includes public funds under the Florida Qualified Public Depository program, which provides loss protection to depositors beyond FDIC insurance limits. Excluding such balances, the uninsured and uncollateralized deposits were 30% of total deposits. The Company has liquidity sources including cash and lines of credit with the Federal Reserve and Federal Home Loan Bank that represent 138% of uninsured deposits, and 167% of uninsured and uncollateralized deposits.

•Consumer deposits represent 41% of overall deposit funding with an average consumer customer balance of $25 thousand. Commercial deposits represent 59% of overall deposit funding with an average business customer balance of $112 thousand.

•Federal Home Loan Bank advances totaled $245.0 million at December 31, 2024 with a weighted average interest rate of 4.19%.

Asset Quality

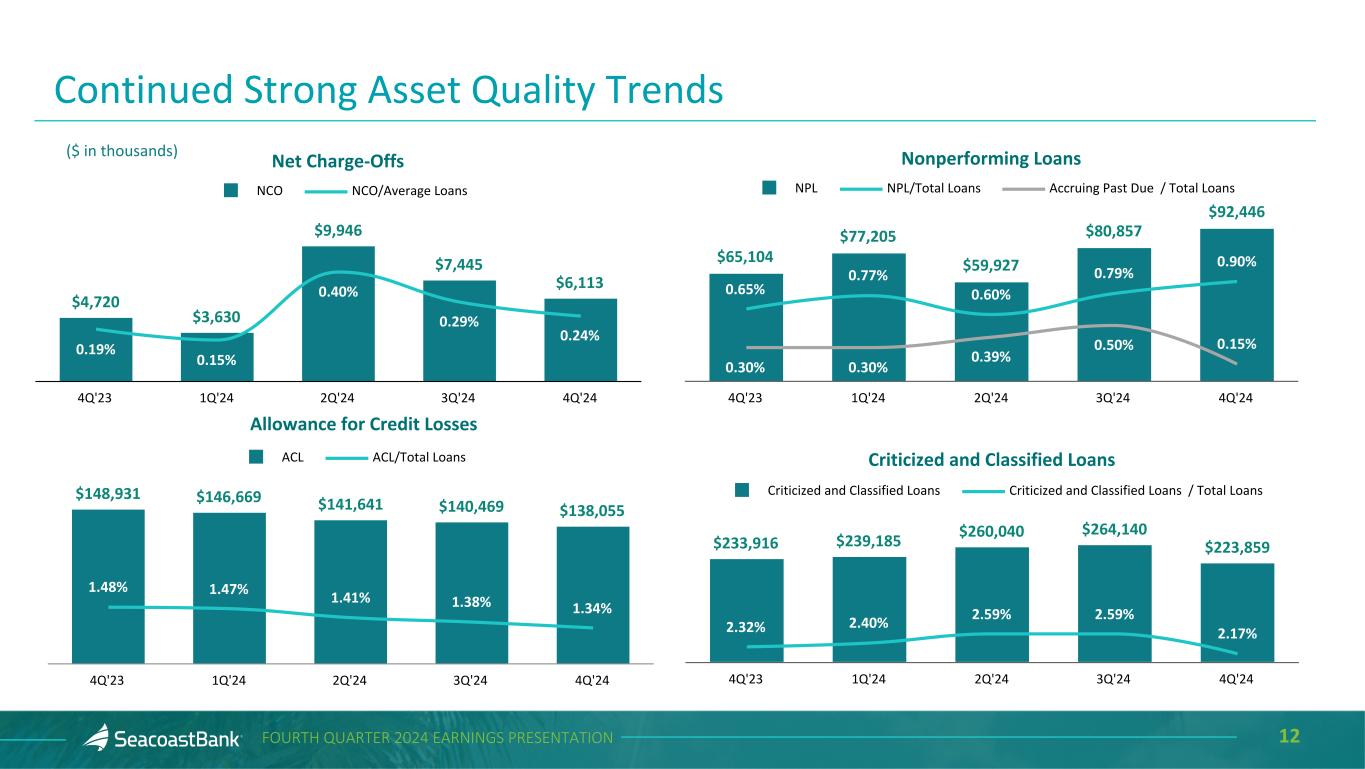

•The ratio of criticized and classified loans to total loans decreased to 2.17% at December 31, 2024 from 2.59% at September 30, 2024 and from 2.32% at December 31, 2023, benefiting from the strategic sale of two nonperforming commercial real estate loans.

•Nonperforming loans were $92.4 million at December 31, 2024, compared to $80.9 million at September 30, 2024, and $65.1 million at December 31, 2023. New nonperforming loans in the fourth quarter of 2024 have collateral values well in excess of balances outstanding, and therefore, no loss is expected. Nonperforming loans to total loans outstanding were 0.90% at December 31, 2024, 0.79% at September 30, 2024, and 0.65% at December 31, 2023.

•Accruing past due loans were $15.6 million, or 0.15% of total loans, at December 31, 2024, compared to $50.7 million, or 0.50% of total loans, at September 30, 2024, and $30.5 million, or 0.30% of total loans, at December 31, 2023.

•Nonperforming assets to total assets were 0.65% at December 31, 2024, compared to 0.58% at September 30, 2024, and 0.50% at December 31, 2023.

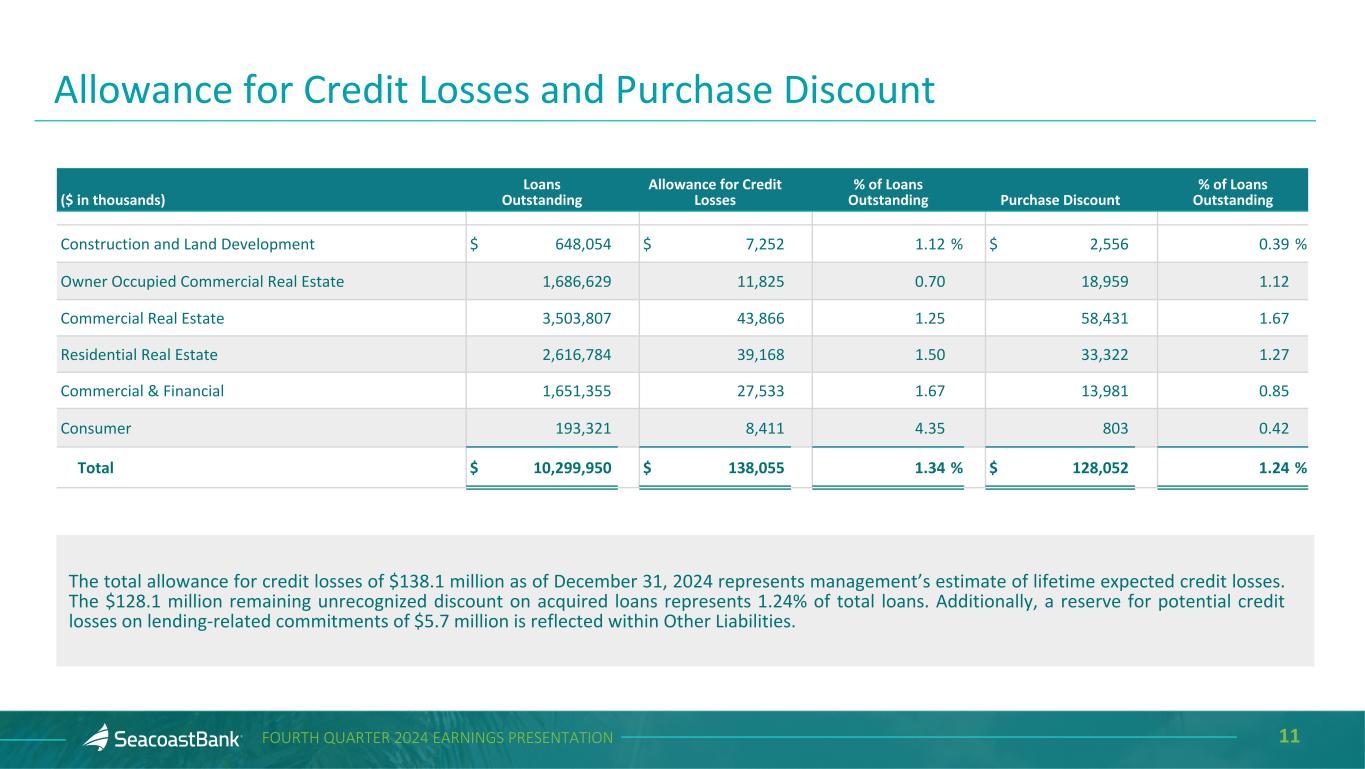

•The ratio of allowance for credit losses to total loans was 1.34% at December 31, 2024, 1.38% at September 30, 2024, and 1.48% at December 31, 2023.

•Net charge-offs were $6.1 million in the fourth quarter of 2024, compared to $7.4 million in the third quarter of 2024 and $4.7 million in the fourth quarter of 2023. During the fourth quarter of 2024, the Company entered into arrangements to sell approximately $20.0 million in consumer fintech loans and, as a result, charged down these loans by $3.0 million.

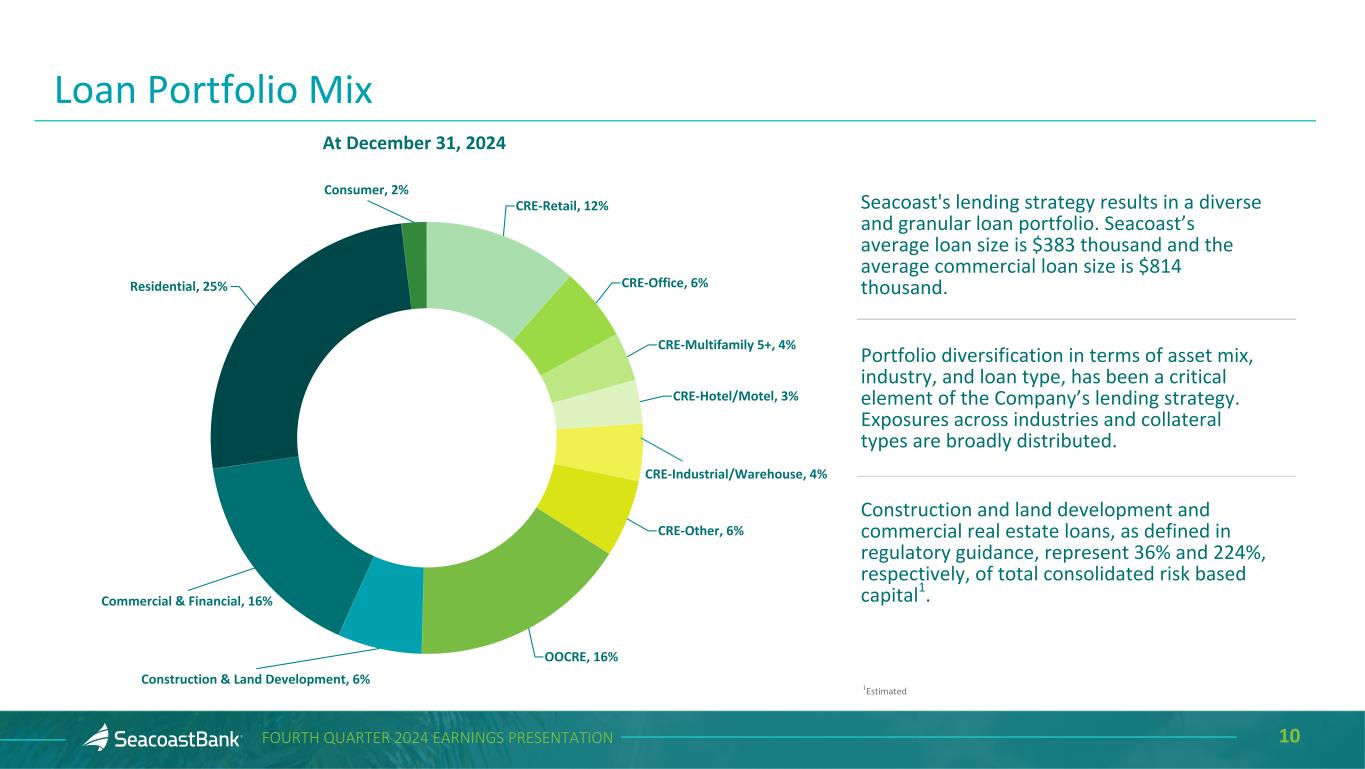

•Portfolio diversification, in terms of asset mix, industry, and loan type, has been a critical element of the Company's lending strategy. Exposure across industries and collateral types is broadly distributed. Seacoast's average loan size is $383 thousand, and the average commercial loan size is $814 thousand, reflecting an ability to maintain granularity within the overall loan portfolio.

•Construction and land development and commercial real estate loans remain well below regulatory guidance as of December 31, 2024 at 38% and 237% of total bank-level risk-based capital2, respectively, compared to 36% and 241%, respectively, at September 30, 2024. On a consolidated basis and as of December 31, 2024, construction and land development and commercial real estate loans represent 36% and 224%, respectively, of total consolidated risk-based capital2.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

2 Estimated.

Capital and Liquidity

•The Company continues to operate with a fortress balance sheet, with a Tier 1 capital ratio at December 31, 2024 of 14.8%2 compared to 14.8% at September 30, 2024, and 14.0% at December 31, 2023. The Total capital ratio was 16.2%2, the Common Equity Tier 1 capital ratio was 14.2%2, and the Tier 1 leverage ratio was 11.2%2 at December 31, 2024. The Company is considered “well capitalized” based on applicable U.S. regulatory capital ratio requirements.

•Cash and cash equivalents at December 31, 2024 totaled $476.6 million.

•The Company’s loan to deposit ratio was 84.27% at December 31, 2024, which should continue to provide liquidity and flexibility moving forward.

•Tangible common equity to tangible assets was 9.60% at December 31, 2024, compared to 9.64% at September 30, 2024, and 9.31% at December 31, 2023. If all held-to-maturity securities were adjusted to fair value, the tangible common equity ratio would have been 8.96% at December 31, 2024.

•At December 31, 2024, in addition to $476.6 million in cash, the Company had $5.6 billion in available borrowing capacity, including $4.0 billion in available collateralized lines of credit, $1.3 billion of unpledged debt securities available as collateral for potential additional borrowings, and available unsecured lines of credit of $0.3 billion. These liquidity sources as of December 31, 2024, represented 167% of uninsured and uncollateralized deposits.

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and for a reconciliation to GAAP.

2Estimated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL HIGHLIGHTS |

|

|

|

|

|

|

|

|

|

| (Amounts in thousands except per share data) |

|

(Unaudited) |

|

|

|

Quarterly Trends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4Q'24 |

|

3Q'24 |

|

2Q'24 |

|

1Q'24 |

|

4Q'23 |

|

| Selected balance sheet data: |

|

|

|

|

|

|

|

|

|

|

|

| Gross loans |

|

$ |

10,299,950 |

|

|

$ |

10,205,281 |

|

|

$ |

10,038,508 |

|

|

$ |

9,978,052 |

|

|

$ |

10,062,940 |

|

|

| Total deposits |

|

12,242,427 |

|

|

12,243,585 |

|

|

12,116,118 |

|

|

12,015,840 |

|

|

11,776,935 |

|

|

| Total assets |

|

15,176,308 |

|

|

15,168,371 |

|

|

14,952,613 |

|

|

14,830,015 |

|

|

14,580,249 |

|

|

| Performance measures: |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

34,085 |

|

|

$ |

30,651 |

|

|

$ |

30,244 |

|

|

$ |

26,006 |

|

|

$ |

29,543 |

|

|

| Net interest margin |

|

3.39 |

% |

|

3.17 |

% |

|

3.18 |

% |

|

3.24 |

% |

|

3.36 |

% |

|

Pre-tax pre-provision earnings1 |

|

$ |

47,858 |

|

|

$ |

46,086 |

|

|

$ |

44,555 |

|

|

$ |

35,674 |

|

|

$ |

42,006 |

|

|

| Average diluted shares outstanding |

|

85,302 |

|

|

85,069 |

|

|

84,816 |

|

|

85,270 |

|

|

85,336 |

|

|

| Diluted earnings per share (EPS) |

|

0.40 |

|

|

0.36 |

|

|

0.36 |

|

|

0.31 |

|

|

0.35 |

|

|

| Return on (annualized): |

|

|

|

|

|

|

|

|

|

|

|

| Average assets (ROA) |

|

0.89 |

% |

|

0.81 |

% |

|

0.82 |

% |

|

0.71 |

% |

|

0.80 |

% |

|

Average tangible assets (ROTA)2 |

|

1.06 |

|

|

0.99 |

|

|

1.00 |

|

|

0.89 |

|

|

0.99 |

|

|

Average tangible common equity (ROTCE)2 |

|

10.90 |

|

|

10.31 |

|

|

10.75 |

|

|

9.55 |

|

|

11.22 |

|

|

Tangible common equity to tangible assets2 |

|

9.60 |

|

|

9.64 |

|

|

9.30 |

|

|

9.25 |

|

|

9.31 |

|

|

Tangible book value per share2 |

|

$ |

16.12 |

|

|

$ |

16.20 |

|

|

$ |

15.41 |

|

|

$ |

15.26 |

|

|

$ |

15.08 |

|

|

| Efficiency ratio |

|

56.26 |

% |

|

59.84 |

% |

|

60.21 |

% |

|

66.78 |

% |

|

60.32 |

% |

|

Adjusted operating measures1: |

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income4 |

|

$ |

40,556 |

|

|

$ |

30,511 |

|

|

$ |

30,277 |

|

|

$ |

31,132 |

|

|

$ |

31,363 |

|

|

Adjusted pre-tax pre-provision earnings4 |

|

56,610 |

|

|

46,390 |

|

|

44,490 |

|

|

42,513 |

|

|

45,016 |

|

|

Adjusted diluted EPS4 |

|

0.48 |

|

|

0.36 |

|

|

0.36 |

|

|

0.37 |

|

|

0.37 |

|

|

Adjusted ROTA2 |

|

1.24 |

% |

|

0.98 |

% |

|

1.00 |

% |

|

1.04 |

% |

|

1.04 |

% |

|

Adjusted ROTCE2 |

|

12.74 |

|

|

10.27 |

|

|

10.76 |

|

|

11.15 |

|

|

11.80 |

|

|

| Adjusted efficiency ratio |

|

56.07 |

|

|

59.84 |

|

|

60.21 |

|

|

61.13 |

|

|

60.32 |

|

|

|

Net adjusted noninterest expense as a

percent of average tangible assets2

|

|

2.19 |

% |

|

2.19 |

% |

|

2.19 |

% |

|

2.23 |

% |

|

2.25 |

% |

|

| Other data: |

|

|

|

|

|

|

|

|

|

|

|

Market capitalization3 |

|

$ |

2,355,679 |

|

$ |

2,277,003 |

|

$ |

2,016,472 |

|

$ |

2,156,529 |

|

$ |

2,415,158 |

|

| Full-time equivalent employees |

|

1,504 |

|

|

1,493 |

|

|

1,449 |

|

|

1,445 |

|

|

1,541 |

|

|

| Number of ATMs |

|

96 |

|

|

96 |

|

|

95 |

|

|

95 |

|

|

96 |

|

|

| Full-service banking offices |

|

77 |

|

|

77 |

|

|

77 |

|

|

77 |

|

|

77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Non-GAAP measure, see “Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. |

2The Company defines tangible assets as total assets less intangible assets, and tangible common equity as total shareholders' equity less intangible assets. |

3Common shares outstanding multiplied by closing bid price on last day of each period. |

4As of 1Q’24, amortization of intangibles is excluded from adjustments to noninterest expense; prior periods have been updated to reflect the change. |

|

OTHER INFORMATION

Conference Call Information

Seacoast will host a conference call January 28, 2025, at 10:00 a.m. (Eastern Time) to discuss the fourth quarter of 2024 earnings results and business trends. Investors may call in (toll-free) by dialing (800) 715-9871 (Conference ID: 8804483). Charts will be used during the conference call and may be accessed at Seacoast’s website at www.SeacoastBanking.com by selecting “Presentations” under the heading “News/Events.” Additionally, a recording of the call will be made available to individuals shortly after the conference call and can be accessed via a link at www.SeacoastBanking.com under the heading “Corporate Information.” The recording will be available for one year.

About Seacoast Banking Corporation of Florida (NASDAQ: SBCF)

Seacoast Banking Corporation of Florida (NASDAQ: SBCF) is one of the largest community banks headquartered in Florida with approximately $15.2 billion in assets and $12.2 billion in deposits as of December 31, 2024. Seacoast provides integrated financial services including commercial and consumer banking, wealth management, and mortgage services to customers at 77 full-service branches across Florida, and through advanced mobile and online banking solutions. Seacoast National Bank is the wholly-owned subsidiary bank of Seacoast Banking Corporation of Florida. For more information about Seacoast, visit www.SeacoastBanking.com.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning, and protections, of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements about future financial and operating results, cost savings, enhanced revenues, economic and seasonal conditions in the Company’s markets, and improvements to reported earnings that may be realized from cost controls, tax law changes, new initiatives and for integration of banks that the Company has acquired, or expects to acquire, as well as statements with respect to Seacoast's objectives, strategic plans, expectations and intentions and other statements that are not historical facts. Actual results may differ from those set forth in the forward-looking statements.

Forward-looking statements include statements with respect to the Company’s beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates and intentions about future performance and involve known and unknown risks, uncertainties and other factors, which may be beyond the Company’s control, and which may cause the actual results, performance or achievements of Seacoast Banking Corporation of Florida (“Seacoast” or the “Company”) or its wholly-owned banking subsidiary, Seacoast National Bank (“Seacoast Bank”), to be materially different from results, performance or achievements expressed or implied by such forward-looking statements. You should not expect the Company to update any forward-looking statements.

All statements other than statements of historical fact could be forward-looking statements. You can identify these forward-looking statements through the use of words such as "may", "will", "anticipate", "assume", "should", "support", "indicate", "would", "believe", "contemplate", "expect", "estimate", "continue", "further", "plan", "point to", "project", "could", "intend", "target" or other similar words and expressions of the future. These forward-looking statements may not be realized due to a variety of factors, including, without limitation: the impact of current and future economic and market conditions generally (including seasonality) and in the financial services industry, nationally and within Seacoast’s primary market areas, including the effects of inflationary pressures, changes in interest rates, slowdowns in economic growth, and the potential for high unemployment rates, as well as the financial stress on borrowers and changes to customer and client behavior and credit risk as a result of the foregoing; potential impacts of adverse developments in the banking industry, including those highlighted by high-profile bank failures, and including impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto (including increases in the cost of our deposit insurance assessments), the Company's ability to effectively manage its liquidity risk and any growth plans, and the availability of capital and funding; governmental monetary and fiscal policies, including interest rate policies of the Board of Governors of the Federal Reserve, as

well as legislative, tax and regulatory changes including overdraft and late fee caps (if implemented), including those that impact the money supply and inflation; the risks of changes in interest rates on the level and composition of deposits (as well as the cost of, and competition for, deposits), loan demand, liquidity and the values of loan collateral, securities, and interest rate sensitive assets and liabilities; interest rate risks (including the impacts of interest rates on macroeconomic conditions, customer and client behavior, and on our net interest income), sensitivities and the shape of the yield curve; changes in accounting policies, rules and practices; changes in retail distribution strategies, customer preferences and behavior generally and as a result of economic factors, including heightened or persistent inflation; changes in the availability and cost of credit and capital in the financial markets; changes in the prices, values and sales volumes of residential and commercial real estate, especially as they relate to the value of collateral supporting the Company’s loans; the Company’s concentration in commercial real estate loans and in real estate collateral in Florida; Seacoast’s ability to comply with any regulatory requirements and the risk that the regulatory environment may not be conducive to or may prohibit or delay the consummation of future mergers and/or business combinations, may increase the length of time and amount of resources required to consummate such transactions, and may reduce the anticipated benefit; inaccuracies or other failures from the use of models, including the failure of assumptions and estimates, as well as differences in, and changes to, economic, market and credit conditions; the impact on the valuation of Seacoast’s investments due to market volatility or counterparty payment risk, as well as the effect of a decline in stock market prices on our fee income from our wealth management business; statutory and regulatory dividend restrictions; increases in regulatory capital requirements for banking organizations generally; the risks of mergers, acquisitions and divestitures, including Seacoast’s ability to continue to identify acquisition targets, successfully acquire and integrate desirable financial institutions and realize expected revenues and revenue synergies; changes in technology or products that may be more difficult, costly, or less effective than anticipated; the Company’s ability to identify and address increased cybersecurity risks, including those impacting vendors and other third parties which may be exacerbated by developments in generative artificial intelligence; fraud or misconduct by internal or external parties, which Seacoast may not be able to prevent, detect or mitigate; inability of Seacoast’s risk management framework to manage risks associated with the Company’s business; dependence on key suppliers or vendors to obtain equipment or services for the business on acceptable terms; reduction in or the termination of Seacoast’s ability to use the online- or mobile-based platform that is critical to the Company’s business growth strategy; the effects of war or other conflicts, acts of terrorism, natural disasters, including hurricanes in the Company’s footprint, health emergencies, epidemics or pandemics, or other catastrophic events that may affect general economic conditions and/or increase costs, including, but not limited to, property and casualty and other insurance costs; Seacoast’s ability to maintain adequate internal controls over financial reporting; potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions; the risks that deferred tax assets could be reduced if estimates of future taxable income from the Company’s operations and tax planning strategies are less than currently estimated, the results of tax audit findings, challenges to our tax positions, or adverse changes or interpretations of tax laws; the effects of competition from other commercial banks, thrifts, mortgage banking firms, consumer finance companies, credit unions, non-bank financial technology providers, securities brokerage firms, insurance companies, money market and other mutual funds and other financial institutions; the failure of assumptions underlying the establishment of reserves for expected credit losses; risks related to, and the costs associated with, environmental, social and governance matters, including the scope and pace of related rulemaking activity and disclosure requirements; a deterioration of the credit rating for U.S. long-term sovereign debt, actions that the U.S. government may take to avoid exceeding the debt ceiling, and uncertainties surrounding the federal budget and economic policy, including the impact of tariffs and trade policies; the risk that balance sheet, revenue growth, and loan growth expectations may differ from actual results; and other factors and risks desc ribed herein and under “Risk Factors” in any of the Company's subsequent reports filed with the SEC and available on its website at www.sec.gov.

All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including, without limitation, those risks and uncertainties described in the Company’s annual report on Form 10-K for the year ended December 31, 2023 and in other periodic reports that the Company files with the SEC. Such reports are available upon request from the Company, or from the Securities and Exchange Commission, including through the SEC's Internet website at www.sec.gov.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FINANCIAL HIGHLIGHTS |

(Unaudited) |

|

|

|

|

|

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

|

|

|

|

|

|

|

|

|

Quarterly Trends |

|

Twelve months ended |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands, except ratios and per share data) |

4Q'24 |

|

3Q'24 |

|

2Q'24 |

|

1Q'24 |

|

4Q'23 |

|

4Q'24 |

|

4Q'23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary of Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

34,085 |

|

|

$ |

30,651 |

|

|

$ |

30,244 |

|

|

$ |

26,006 |

|

|

$ |

29,543 |

|

|

$ |

120,986 |

|

|

$ |

104,033 |

|

Adjusted net income1,6 |

40,556 |

|

|

30,511 |

|

|

30,277 |

|

|

31,132 |

|

|

31,363 |

|

|

132,476 |

|

|

133,240 |

|

Net interest income2 |

116,115 |

|

|

106,975 |

|

|

104,657 |

|

|

105,298 |

|

|

111,035 |

|

|

433,045 |

|

|

489,043 |

|

Net interest margin2,3 |

3.39 |

% |

|

3.17 |

% |

|

3.18 |

% |

|

3.24 |

% |

|

3.36 |

% |

|

3.24 |

% |

|

3.77 |

% |

Pre-tax pre-provision earnings1 |

47,858 |

|

|

46,086 |

|

|

44,555 |

|

|

35,674 |

|

|

42,006 |

|

|

174,173 |

|

|

173,812 |

|

Adjusted pre-tax pre-provision earnings1,6 |

56,610 |

|

|

46,390 |

|

|

44,490 |

|

|

42,513 |

|

|

45,016 |

|

|

190,003 |

|

|

213,920 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets-GAAP basis3 |

0.89 |

% |

|

0.81 |

% |

|

0.82 |

% |

|

0.71 |

% |

|

0.80 |

% |

|

0.81 |

% |

|

0.71 |

% |

Return on average tangible assets-GAAP basis3,4 |

1.06 |

|

|

0.99 |

|

|

1.00 |

|

|

0.89 |

|

|

0.99 |

|

|

0.98 |

|

|

0.91 |

|

Adjusted return on average tangible assets1,3,4 |

1.24 |

|

|

0.98 |

|

|

1.00 |

|

|

1.04 |

|

|

1.04 |

|

|

1.06 |

|

|

1.12 |

|

Net adjusted noninterest expense to average tangible assets1,3,4 |

2.19 |

|

|

2.19 |

|

|

2.19 |

|

|

2.23 |

|

|

2.25 |

|

|

2.20 |

|

|

2.36 |

|

Return on average shareholders' equity-GAAP basis3 |

6.16 |

|

|

5.62 |

|

|

5.74 |

|

|

4.94 |

|

|

5.69 |

|

|

5.62 |

|

|

5.14 |

|

Return on average tangible common equity-GAAP basis3,4 |

10.90 |

|

|

10.31 |

|

|

10.75 |

|

|

9.55 |

|

|

11.22 |

|

|

10.39 |

|

|

10.38 |

|

Adjusted return on average tangible common equity1,3,4 |

12.74 |

|

|

10.27 |

|

|

10.76 |

|

|

11.15 |

|

|

11.80 |

|

|

11.25 |

|

|

12.80 |

|

Efficiency ratio5 |

56.26 |

|

|

59.84 |

|

|

60.21 |

|

|

66.78 |

|

|

60.32 |

|

|

60.63 |

|

|

63.86 |

|

Adjusted efficiency ratio1 |

56.07 |

|

|

59.84 |

|

|

60.21 |

|

|

61.13 |

|

|

60.32 |

|

|

59.22 |

|

|

57.35 |

|

| Noninterest income to total revenue (excluding securities gains/losses) |

18.02 |

|

|

18.05 |

|

|

17.55 |

|

|

16.17 |

|

|

15.14 |

|

|

17.47 |

|

|

14.39 |

|

Tangible common equity to tangible assets4 |

9.60 |

|

|

9.64 |

|

|

9.30 |

|

|

9.25 |

|

|

9.31 |

|

|

9.60 |

|

|

9.31 |

|

| Average loan-to-deposit ratio |

83.14 |

|

|

83.79 |

|

|

83.11 |

|

|

84.50 |

|

|

83.38 |

|

|

83.63 |

|

|

82.99 |

|

| End of period loan-to-deposit ratio |

84.27 |

|

|

83.44 |

|

|

82.90 |

|

|

83.12 |

|

|

85.48 |

|

|

84.27 |

|

|

85.48 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income diluted-GAAP basis |

$ |

0.40 |

|

|

$ |

0.36 |

|

|

$ |

0.36 |

|

|

$ |

0.31 |

|

|

$ |

0.35 |

|

|

$ |

1.42 |

|

|

$ |

1.23 |

|

| Net income basic-GAAP basis |

0.40 |

|

|

0.36 |

|

|

0.36 |

|

|

0.31 |

|

|

0.35 |

|

|

1.43 |

|

|

1.24 |

|

Adjusted earnings1,6 |

0.48 |

|

|

0.36 |

|

|

0.36 |

|

|

0.37 |

|

|

0.37 |

|

|

1.56 |

|

|

1.58 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Book value per share common |

25.51 |

|

|

25.68 |

|

|

24.98 |

|

|

24.93 |

|

|

24.84 |

|

|

25.51 |

|

|

24.84 |

|

| Tangible book value per share |

16.12 |

|

|

16.20 |

|

|

15.41 |

|

|

15.26 |

|

|

15.08 |

|

|

16.12 |

|

|

15.08 |

|

| Cash dividends declared |

0.18 |

|

|

0.18 |

|

|

0.18 |

|

|

0.18 |

|

|

0.18 |

|

|

0.72 |

|

|

0.71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Non-GAAP measure - see "Explanation of Certain Unaudited Non-GAAP Financial Measures" for more information and a reconciliation to GAAP. |

|

|

2Calculated on a fully taxable equivalent basis using amortized cost. |

|

|

3These ratios are stated on an annualized basis and are not necessarily indicative of future periods. |

|

|

4The Company defines tangible assets as total assets less intangible assets, and tangible common equity as total shareholders' equity less intangible assets. |

|

|

5Defined as noninterest expense less amortization of intangibles and gains, losses, and expenses on foreclosed properties divided by net operating revenue (net interest income on a fully taxable equivalent basis plus noninterest income excluding securities gains and losses). |

6As of 1Q’24, amortization of intangibles is excluded from adjustments to noninterest expense; prior periods have been updated to reflect the change. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED STATEMENTS OF INCOME |

(Unaudited) |

|

|

|

|

|

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

|

|

|

|

|

|

|

|

|

Quarterly Trends |

|

Twelve months ended |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands, except per share data) |

|

4Q'24 |

|

3Q'24 |

|

2Q'24 |

|

1Q'24 |

|

4Q'23 |

|

4Q'24 |

|

4Q'23 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and dividends on securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

$ |

26,945 |

|

|

$ |

25,963 |

|

|

$ |

24,155 |

|

|

$ |

22,393 |

|

|

$ |

21,383 |

|

|

$ |

99,456 |

|

|

$ |

82,926 |

|

| Nontaxable |

|

34 |

|

|

34 |

|

|

33 |

|

|

34 |

|

|

55 |

|

|

135 |

|

|

354 |

|

| Interest and fees on loans |

|

151,999 |

|

|

150,980 |

|

|

147,292 |

|

|

147,095 |

|

|

147,801 |

|

|

597,366 |

|

|

581,105 |

|

| Interest on interest bearing deposits and other investments |

|

6,952 |

|

|

7,138 |

|

|

8,328 |

|

|

6,184 |

|

|

7,616 |

|

|

28,602 |

|

|

24,590 |

|

| Total Interest Income |

|

185,930 |

|

|

184,115 |

|

|

179,808 |

|

|

175,706 |

|

|

176,855 |

|

|

725,559 |

|

|

688,975 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits |

|

47,394 |

|

|

51,963 |

|

|

51,319 |

|

|

47,534 |

|

|

44,923 |

|

|

198,210 |

|

|

126,535 |

|

| Interest on time certificates |

|

16,726 |

|

|

19,002 |

|

|

17,928 |

|

|

17,121 |

|

|

15,764 |

|

|

70,777 |

|

|

52,254 |

|

| Interest on borrowed money |

|

6,006 |

|

|

6,485 |

|

|

6,137 |

|

|

5,973 |

|

|

5,349 |

|

|

24,601 |

|

|

21,946 |

|

| Total Interest Expense |

|

70,126 |

|

|

77,450 |

|

|

75,384 |

|

|

70,628 |

|

|

66,036 |

|

|

293,588 |

|

|

200,735 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Interest Income |

|

115,804 |

|

|

106,665 |

|

|

104,424 |

|

|

105,078 |

|

|

110,819 |

|

|

431,971 |

|

|

488,240 |

|

| Provision for credit losses |

|

3,699 |

|

|

6,273 |

|

|

4,918 |

|

|

1,368 |

|

|

3,990 |

|

|

16,258 |

|

|

37,518 |

|

| Net Interest Income After Provision for Credit Losses |

|

112,105 |

|

|

100,392 |

|

|

99,506 |

|

|

103,710 |

|

|

106,829 |

|

|

415,713 |

|

|

450,722 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Service charges on deposit accounts |

|

5,138 |

|

|

5,412 |

|

|

5,342 |

|

|

4,960 |

|

|

4,828 |

|

|

20,852 |

|

|

18,278 |

|

| Interchange income |

|

1,860 |

|

|

1,911 |

|

|

1,940 |

|

|

1,888 |

|

|

2,433 |

|

|

7,599 |

|

|

13,877 |

|

| Wealth management income |

|

4,019 |

|

|

3,843 |

|

|

3,766 |

|

|

3,540 |

|

|

3,261 |

|

|

15,168 |

|

|

12,780 |

|

| Mortgage banking fees |

|

326 |

|

|

485 |

|

|

582 |

|

|

381 |

|

|

378 |

|

|

1,774 |

|

|

1,790 |

|

| Insurance agency income |

|

1,151 |

|

|

1,399 |

|

|

1,355 |

|

|

1,291 |

|

|

1,066 |

|

|

5,196 |

|

|

4,510 |

|

| BOLI income |

|

2,627 |

|

|

2,578 |

|

|

2,596 |

|

|

2,264 |

|

|

2,220 |

|

|

10,065 |

|

|

8,401 |

|

| Other |

|

10,335 |

|

|

7,864 |

|

|

6,647 |

|

|

5,944 |

|

|

5,589 |

|

|

30,790 |

|

|

22,409 |

|

|

|

25,456 |

|

|

23,492 |

|

|

22,228 |

|

|

20,268 |

|

|

19,775 |

|

|

91,444 |

|

|

82,045 |

|

| Securities (losses) gains, net |

|

(8,388) |

|

|

187 |

|

|

(44) |

|

|

229 |

|

|

(2,437) |

|

|

(8,016) |

|

|

(2,893) |

|

| Total Noninterest Income |

|

17,068 |

|

|

23,679 |

|

|

22,184 |

|

|

20,497 |

|

|

17,338 |

|

|

83,428 |

|

|

79,152 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and wages |

|

42,378 |

|

|

40,697 |

|

|

38,937 |

|

|

40,304 |

|

|

38,435 |

|

|

162,316 |

|

|

177,637 |

|

| Employee benefits |

|

6,548 |

|

|

6,955 |

|

|

6,861 |

|

|

7,889 |

|

|

6,678 |

|

|

28,253 |

|

|

29,918 |

|

| Outsourced data processing costs |

|

8,307 |

|

|

8,003 |

|

|

8,210 |

|

|

12,118 |

|

|

8,609 |

|

|

36,638 |

|

|

52,098 |

|

| Occupancy |

|

7,234 |

|

|

7,096 |

|

|

7,180 |

|

|

8,037 |

|

|

7,512 |

|

|

29,547 |

|

|

31,872 |

|

| Furniture and equipment |

|

2,004 |

|

|

2,060 |

|

|

1,956 |

|

|

2,011 |

|

|

2,028 |

|

|

8,031 |

|

|

8,692 |

|

| Marketing |

|

2,126 |

|

|

2,729 |

|

|

3,266 |

|

|

2,655 |

|

|

2,995 |

|

|

10,776 |

|

|

9,156 |

|

| Legal and professional fees |

|

2,807 |

|

|

2,708 |

|

|

1,982 |

|

|

2,151 |

|

|

3,294 |

|

|

9,648 |

|

|

17,514 |

|

| FDIC assessments |

|

2,274 |

|

|

1,882 |

|

|

2,131 |

|

|

2,158 |

|

|

2,813 |

|

|

8,445 |

|

|

8,630 |

|

| Amortization of intangibles |

|

5,587 |

|

|

6,002 |

|

|

6,003 |

|

|

6,292 |

|

|

6,888 |

|

|

23,884 |

|

|

28,726 |

|

| Other real estate owned expense and net loss (gain) on sale |

|

84 |

|

|

491 |

|

|

(109) |

|

|

(26) |

|

|

573 |

|

|

440 |

|

|

985 |

|

| Provision for credit losses on unfunded commitments |

|

250 |

|

|

250 |

|

|

251 |

|

|

250 |

|

|

— |

|

|

1,001 |

|

|

1,239 |

|

| Other |

|

5,976 |

|

|

5,945 |

|

|

5,869 |

|

|

6,532 |

|

|

6,542 |

|

|

24,322 |

|

|

29,155 |

|

| Total Noninterest Expense |

|

85,575 |

|

|

84,818 |

|

|

82,537 |

|

|

90,371 |

|

|

86,367 |

|

|

343,301 |

|

|

395,622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income Before Income Taxes |

|

43,598 |

|

|

39,253 |

|

|

39,153 |

|

|

33,836 |

|

|

37,800 |

|

|

155,840 |

|

|

134,252 |

|

| Provision for income taxes |

|

9,513 |

|

|

8,602 |

|

|

8,909 |

|

|

7,830 |

|

|

8,257 |

|

|

34,854 |

|

|

30,219 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income |

|

$ |

34,085 |

|

|

$ |

30,651 |

|

|

$ |

30,244 |

|

|

$ |

26,006 |

|

|

$ |

29,543 |

|

|

$ |

120,986 |

|

|

$ |

104,033 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share of common stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.40 |

|

|

$ |

0.36 |

|

|

$ |

0.36 |

|

|

$ |

0.31 |

|

|

$ |

0.35 |

|

|

$ |

1.42 |

|

|

$ |

1.23 |

|

| Basic |

|

0.40 |

|

|

0.36 |

|

|

0.36 |

|

|

0.31 |

|

|

0.35 |

|

|

1.43 |

|

|

1.24 |

|

| Cash dividends declared |

|

0.18 |

|

|

0.18 |

|

|

0.18 |

|

|

0.18 |

|

|

0.18 |

|

|

0.72 |

|

|

0.71 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

85,302 |

|

|

85,069 |

|

|

84,816 |

|

|

85,270 |

|

|

85,336 |

|

|

85,040 |

|

|

84,329 |

|

| Basic |

|

84,510 |

|

|

84,434 |

|

|

84,341 |

|

|

84,908 |

|

|

84,817 |

|

|

84,367 |

|

|

83,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED BALANCE SHEETS |

(Unaudited) |

|

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

|

|

|

|

|

|

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

| (Amounts in thousands) |

|

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

|

$ |

171,615 |

|

|

$ |

182,743 |

|

|

$ |

168,738 |

|

|

$ |

137,850 |

|

|

$ |

167,511 |

|

| Interest bearing deposits with other banks |

|

|

304,992 |

|

|

454,315 |

|

|

580,787 |

|

|

544,874 |

|

|

279,671 |

|

| Total cash and cash equivalents |

|

|

476,607 |

|

|

637,058 |

|

|

749,525 |

|

|

682,724 |

|

|

447,182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Time deposits with other banks |

|

|

3,215 |

|

|

5,207 |

|

|

7,856 |

|

|

7,856 |

|

|

5,857 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Debt Securities: |

|

|

|

|

|

|

|

|

|

|

|

| Securities available-for-sale (at fair value) |

|

|

2,226,543 |

|

|

2,160,055 |

|

|

1,967,204 |

|

|

1,949,463 |

|

|

1,836,020 |

|

| Securities held-to-maturity (at amortized cost) |

|

|

635,186 |

|

|

646,050 |

|

|

658,055 |

|

|

669,896 |

|

|

680,313 |

|

| Total debt securities |

|

|

2,861,729 |

|

|

2,806,105 |

|

|

2,625,259 |

|

|

2,619,359 |

|

|

2,516,333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans held for sale |

|

|

17,277 |

|

|

11,039 |

|

|

5,975 |

|

|

9,475 |

|

|

4,391 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans |

|

|

10,299,950 |

|

|

10,205,281 |

|

|

10,038,508 |

|

|

9,978,052 |

|

|

10,062,940 |

|

| Less: Allowance for credit losses |

|

|

(138,055) |

|

|

(140,469) |

|

|

(141,641) |

|

|

(146,669) |

|

|

(148,931) |

|

| Loans, net of allowance for credit losses |

|

|

10,161,895 |

|

|

10,064,812 |

|

|

9,896,867 |

|

|

9,831,383 |

|

|

9,914,009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bank premises and equipment, net |

|

|

107,555 |

|

|

108,776 |

|

|

109,945 |

|

|

110,787 |

|

|

113,304 |

|

| Other real estate owned |

|

|

6,421 |

|

|

6,421 |

|

|

6,877 |

|

|

7,315 |

|

|

7,560 |

|

| Goodwill |

|

|

732,417 |

|

|

732,417 |

|

|

732,417 |

|

|

732,417 |

|

|

732,417 |

|

| Other intangible assets, net |

|

|

71,723 |

|

|

77,431 |

|

|

83,445 |

|

|

89,377 |

|

|

95,645 |

|

| Bank owned life insurance |

|

|

308,995 |

|

|

306,379 |

|

|

303,816 |

|

|

301,229 |

|

|

298,974 |

|

| Net deferred tax assets |

|

|

102,989 |

|

|

94,820 |

|

|

108,852 |

|

|

111,539 |

|

|

113,232 |

|

| Other assets |

|

|

325,485 |

|

|

317,906 |

|

|

321,779 |

|

|

326,554 |

|

|

331,345 |

|

| Total Assets |

|

|

$ |

15,176,308 |

|

|

$ |

15,168,371 |

|

|

$ |

14,952,613 |

|

|

$ |

14,830,015 |

|

|

$ |

14,580,249 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

|

|

|

|

|

|

|

|

|

| Noninterest demand |

|

|

$ |

3,352,372 |

|

|

$ |

3,443,455 |

|

|

$ |

3,397,918 |

|

|

$ |

3,555,401 |

|

|

$ |

3,544,981 |

|

| Interest-bearing demand |

|

|

2,667,843 |

|

|

2,487,448 |

|

|

2,821,092 |

|

|

2,711,041 |

|

|

2,790,210 |

|

| Savings |

|

|

519,977 |

|

|

524,474 |

|

|

566,052 |

|

|

608,088 |

|

|

651,454 |

|

| Money market |

|

|

4,086,362 |

|

|

4,034,371 |

|

|

3,707,761 |

|

|

3,531,029 |

|

|

3,314,288 |

|

| Time deposits |

|

|

1,615,873 |

|

|

1,753,837 |

|

|

1,623,295 |

|

|

1,610,281 |

|

|

1,476,002 |

|

| Total Deposits |

|

|

12,242,427 |

|

|

12,243,585 |

|

|

12,116,118 |

|

|

12,015,840 |

|

|

11,776,935 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Securities sold under agreements to repurchase |

|

|

232,071 |

|

|

210,176 |

|

|

262,103 |

|

|

326,732 |

|

|

374,573 |

|

| Federal Home Loan Bank borrowings |

|

|

245,000 |

|

|

245,000 |

|

|

180,000 |

|

|

110,000 |

|

|

50,000 |

|

| Long-term debt, net |

|

|

106,966 |

|

|

106,800 |

|

|

106,634 |

|

|

106,468 |

|

|

106,302 |

|

| Other liabilities |

|

|

166,601 |

|

|

168,960 |

|

|

157,377 |

|

|

153,225 |

|

|

164,353 |

|

| Total Liabilities |

|

|

12,993,065 |

|

|

12,974,521 |

|

|

12,822,232 |

|

|

12,712,265 |

|

|

12,472,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

|

8,628 |

|

|

8,614 |

|

|

8,530 |

|

|

8,494 |

|

|

8,486 |

|

| Additional paid in capital |

|

|

1,824,935 |

|

|

1,821,050 |

|

|

1,815,800 |

|

|

1,811,941 |

|

|

1,808,883 |

|

| Retained earnings |

|

|

526,642 |

|

|

508,036 |

|

|

492,805 |

|

|

478,017 |

|

|

467,305 |

|

| Less: Treasury stock |

|

|

(19,095) |

|

|

(18,680) |

|

|

(18,744) |

|

|

(16,746) |

|

|

(16,710) |

|

|

|

|

2,341,110 |

|

|

2,319,020 |

|

|

2,298,391 |

|

|

2,281,706 |

|

|

2,267,964 |

|

| Accumulated other comprehensive loss, net |

|

|

(157,867) |

|

|

(125,170) |

|

|

(168,010) |

|

|

(163,956) |

|

|

(159,878) |

|

| Total Shareholders' Equity |

|

|

2,183,243 |

|

|

2,193,850 |

|

|

2,130,381 |

|

|

2,117,750 |

|

|

2,108,086 |

|

| Total Liabilities & Shareholders' Equity |

|

|

$ |

15,176,308 |

|

|

$ |

15,168,371 |

|

|

$ |

14,952,613 |

|

|

$ |

14,830,015 |

|

|

$ |

14,580,249 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common shares outstanding |

|

|

85,568 |

|

|

85,441 |

|

|

85,299 |

|

|

84,935 |

|

|

84,861 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CONSOLIDATED QUARTERLY FINANCIAL DATA |

(Unaudited) |

|

| SEACOAST BANKING CORPORATION OF FLORIDA AND SUBSIDIARIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Amounts in thousands) |

4Q'24 |

|

3Q'24 |

|

2Q'24 |

|

1Q'24 |

|

4Q'23 |

|

|

|

|

|

|

|

|

|

|

| Credit Analysis |

|

|

|

|

|

|

|

|

|

| Net charge-offs |

$ |

6,113 |

|

|

$ |

7,445 |

|

|

$ |

9,946 |

|

|

$ |

3,630 |

|

|

$ |

4,720 |

|

| Net charge-offs to average loans |

0.24 |

% |

|

0.29 |

% |

|

0.40 |

% |

|

0.15 |

% |

|

0.19 |

% |

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses |

$ |

138,055 |

|

|

$ |

140,469 |

|