Document

Exhibit 99.1

REALTY INCOME ANNOUNCES OPERATING RESULTS FOR

THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

SAN DIEGO, CALIFORNIA, November 4, 2024....Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced operating results for the three and nine months ended September 30, 2024. All per share amounts presented in this press release are on a diluted per common share basis unless stated otherwise.

COMPANY HIGHLIGHTS:

For the three months ended September 30, 2024:

•Net income available to common stockholders was $261.8 million, or $0.30 per share

•AFFO available to common shareholders was $915.6 million, or $1.05 per share

•Invested $740.1 million at an initial weighted average cash yield of 7.4%

•Net Debt to Annualized Pro Forma Adjusted EBITDAre was 5.4x

•Raised $271.0 million from the sale of common stock, primarily through our At-The-Market (ATM) program, at a weighted average price of $62.25

•ATM forward agreements for a total of 17.0 million shares remain unsettled with total expected net proceeds of approximately $968.7 million, of which 0.2 million shares were executed in October 2024

•Issued $500.0 million of 5.375% senior unsecured notes due 2054, £350.0 million of 5.000% senior unsecured notes due 2029, and £350.0 million of 5.250% senior unsecured notes due 2041

•Achieved a rent recapture rate of 105.0% on properties re-leased

•Celebrated our 30-year anniversary as a New York Stock Exchange ("NYSE") listed company

CEO Comments

“Our third quarter results reflect disciplined execution of our strategy and the inherent benefits of our global platform,” said Sumit Roy, Realty Income's President and Chief Executive Officer. “Supported by improvements in the investment environment and solid operating results, we see a robust pipeline of opportunities. As a result, we’re pleased to increase our 2024 investment volume guidance to approximately $3.5 billion and raise the low-end of our AFFO per share guidance to a range of $4.17 to $4.21 per share, reflecting a 4.8% growth at the mid-point of the range. Looking ahead, Realty Income is pursuing a wide range of growth opportunities, including capital diversification initiatives to further enhance the reach and scale of our proven platform.”

Select Financial Results

The following summarizes our select financial results (dollars in millions, except per share data).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

Nine months ended

September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Total revenue |

|

$ |

1,330.9 |

|

$ |

1,039.1 |

|

$ |

3,930.8 |

|

$ |

3,002.7 |

Net income available to common stockholders (1) (2) |

|

$ |

261.8 |

|

$ |

233.5 |

|

$ |

648.3 |

|

$ |

653.9 |

Net income per share |

|

$ |

0.30 |

|

$ |

0.33 |

|

$ |

0.75 |

|

$ |

0.96 |

Funds from operations available to common stockholders (FFO) (3) |

|

$ |

854.9 |

|

$ |

736.1 |

|

$ |

2,569.7 |

|

$ |

2,108.4 |

FFO per share |

|

$ |

0.98 |

|

$ |

1.04 |

|

$ |

2.99 |

|

$ |

3.09 |

Normalized funds from operations available to common stockholders (Normalized FFO) (3) |

|

$ |

863.5 |

|

$ |

739.0 |

|

$ |

2,675.2 |

|

$ |

2,113.0 |

Normalized FFO per share |

|

$ |

0.99 |

|

$ |

1.04 |

|

$ |

3.11 |

|

$ |

3.10 |

Adjusted funds from operations available to common stockholders (AFFO) (3) |

|

$ |

915.6 |

|

$ |

721.4 |

|

$ |

2,699.5 |

|

$ |

2,043.8 |

AFFO per share |

|

$ |

1.05 |

|

$ |

1.02 |

|

$ |

3.14 |

|

$ |

2.99 |

(1) The calculation to determine net income attributable to common stockholders includes provisions for impairment, gain on sales of real estate, and foreign currency gain and loss. These items can vary from quarter to quarter and can significantly impact net income available to common stockholders and period to period comparisons.

(2) Our financial results during the three and nine months ended September 30, 2024 were impacted by the following: (i) merger, transaction, and other costs of $8.6 million and $105.5 million, respectively, and (ii) provisions for impairment of $96.9 million and $282.9 million, respectively.

(3) FFO, Normalized FFO, and AFFO are non-GAAP financial measures. Normalized FFO is based on FFO and adjusted to exclude merger, transaction, and other costs and AFFO further adjusts Normalized FFO for unique revenue and expense items. Please see the Glossary for our definitions and explanations of how we utilize these metrics. Please see pages 10 and 11 herein for reconciliations to the most directly comparable GAAP measure.

Dividend Increases

In September 2024, we announced the 108th consecutive quarterly dividend increase, which is the 127th increase since our listing on the NYSE in 1994. The annualized dividend amount as of September 30, 2024 was $3.162 per share. The amount of monthly dividends paid per share increased 2.9% to $0.789 during the three months ended September 30, 2024, as compared to $0.767 for the same period in 2023, representing 75.1% of our diluted AFFO per share of $1.05 during the three months ended September 30, 2024.

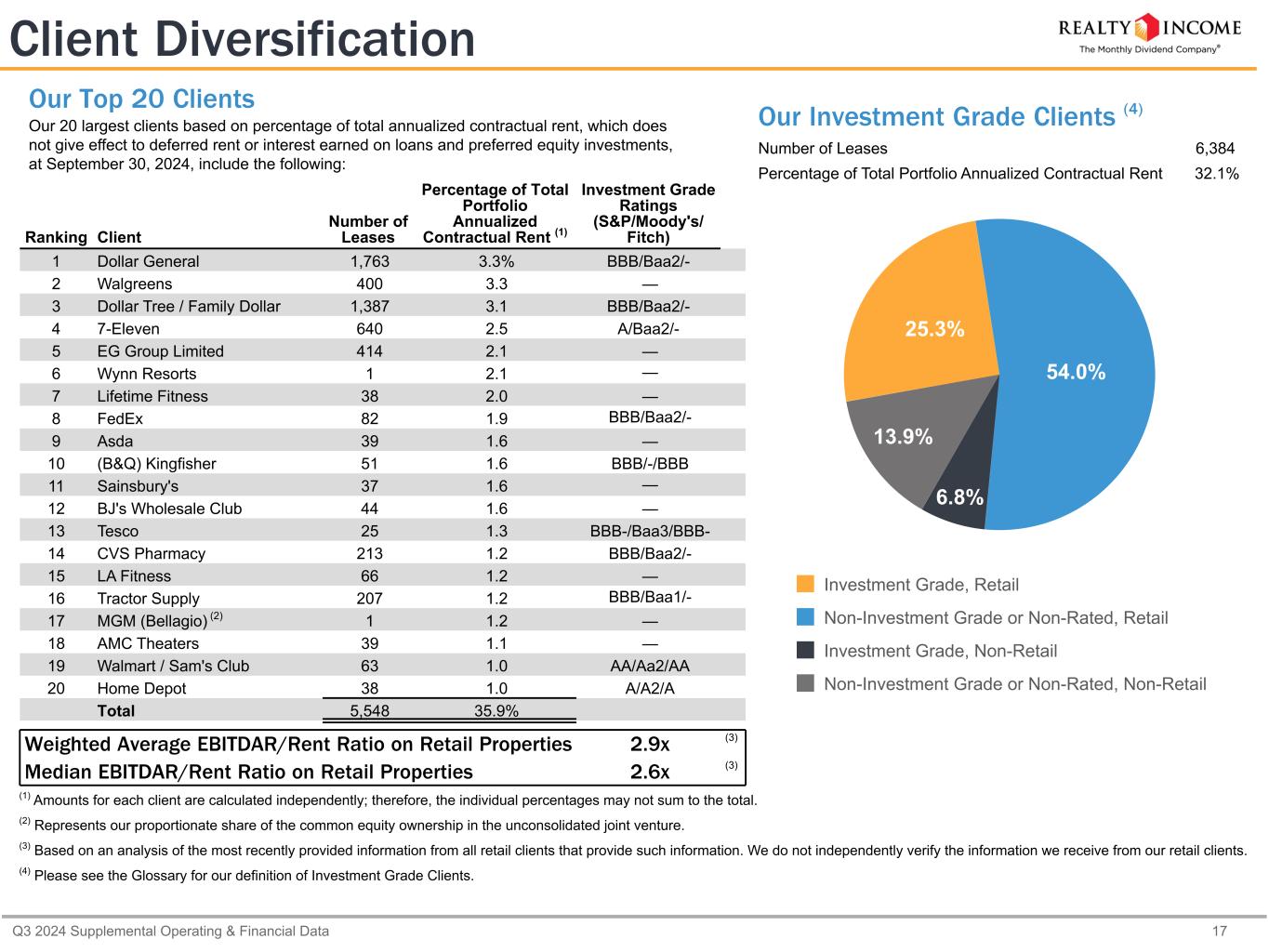

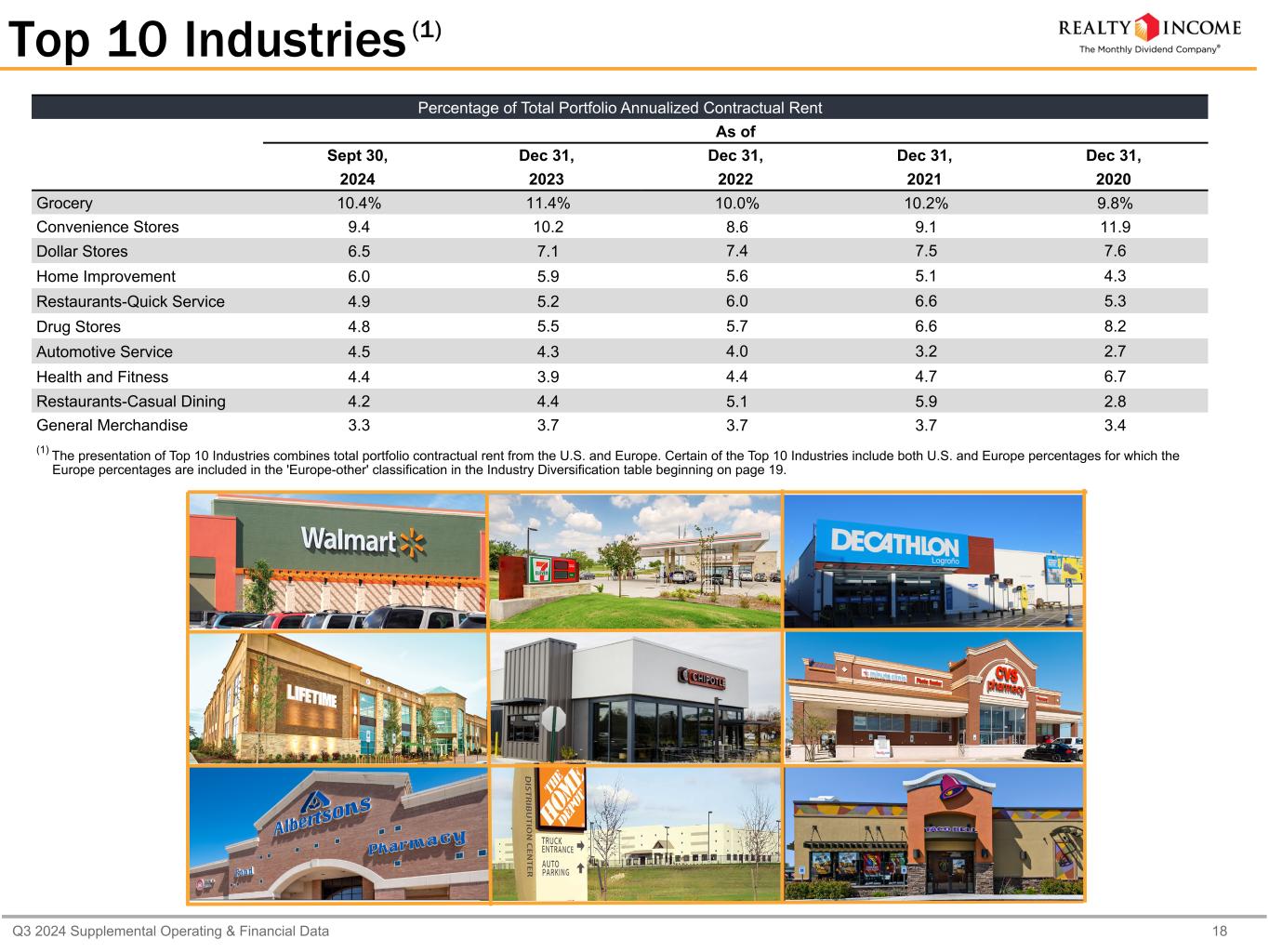

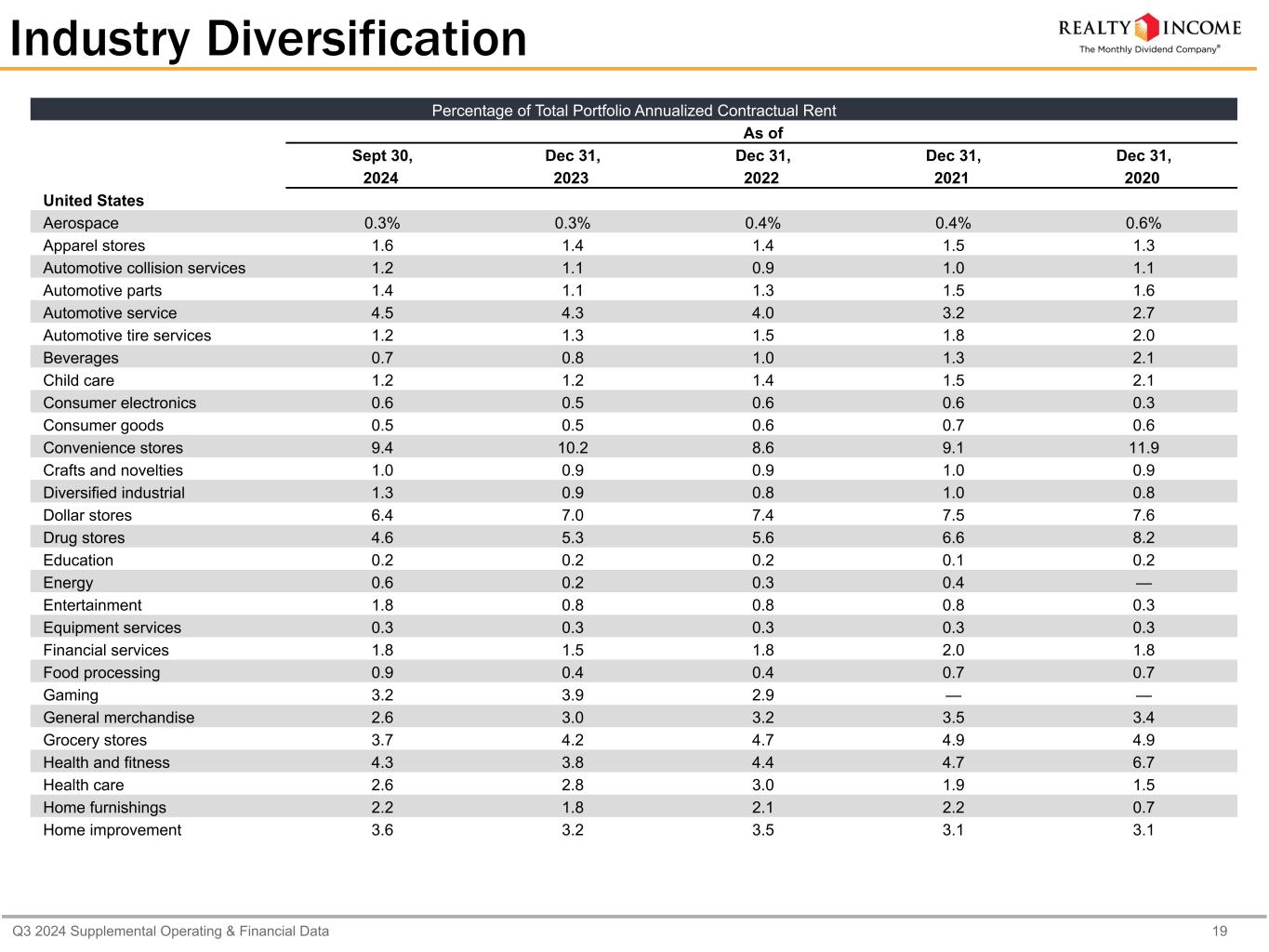

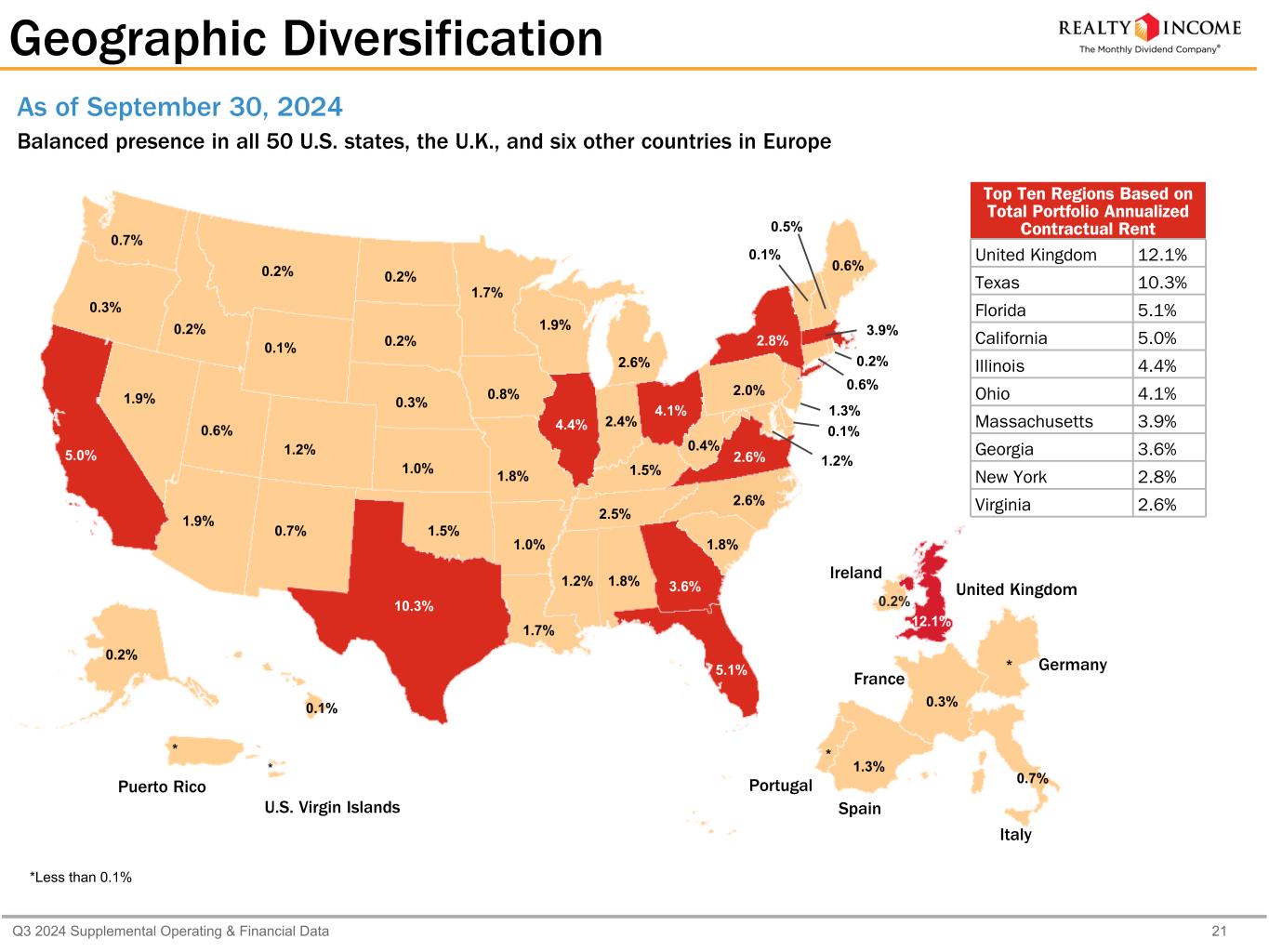

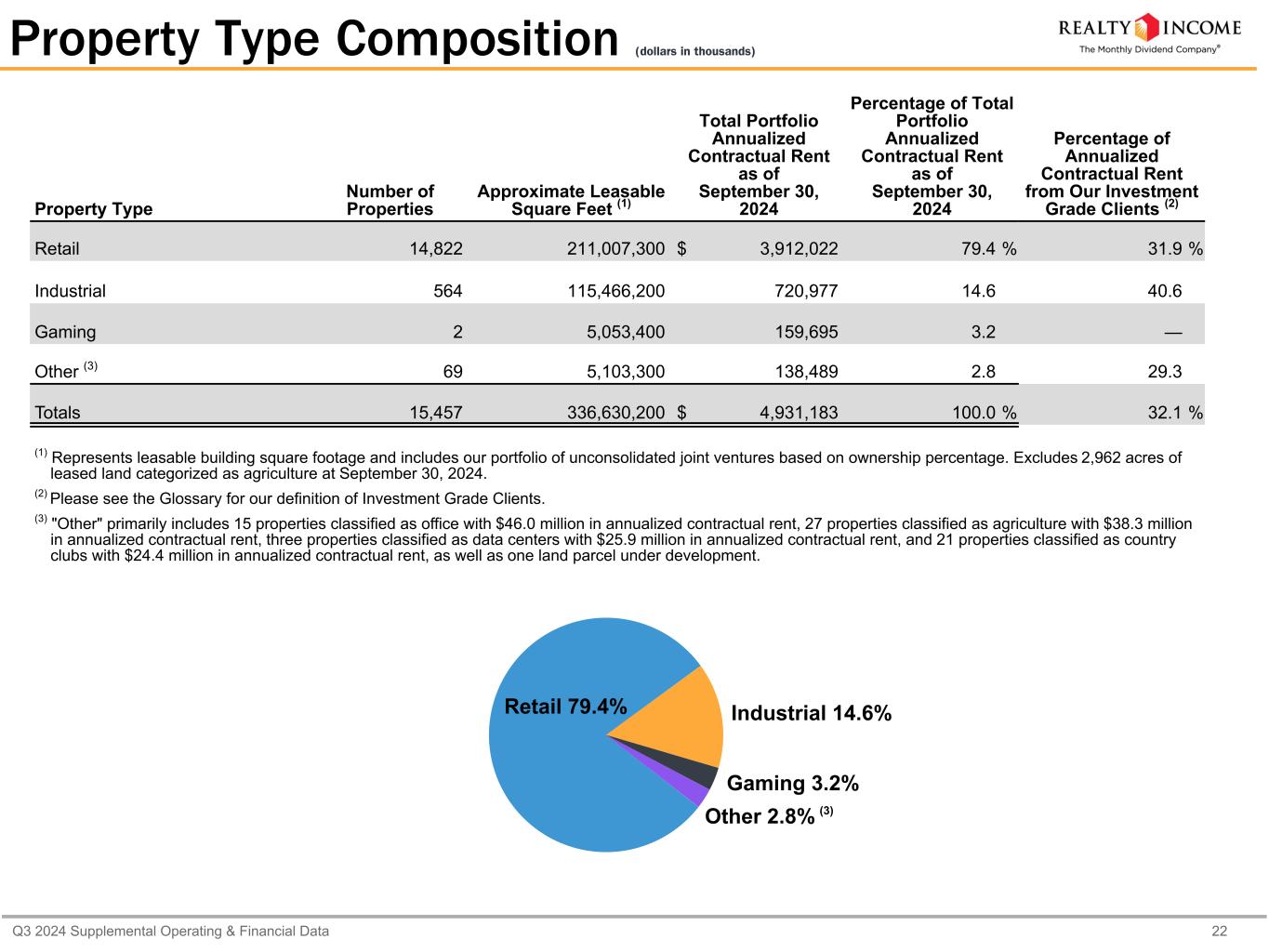

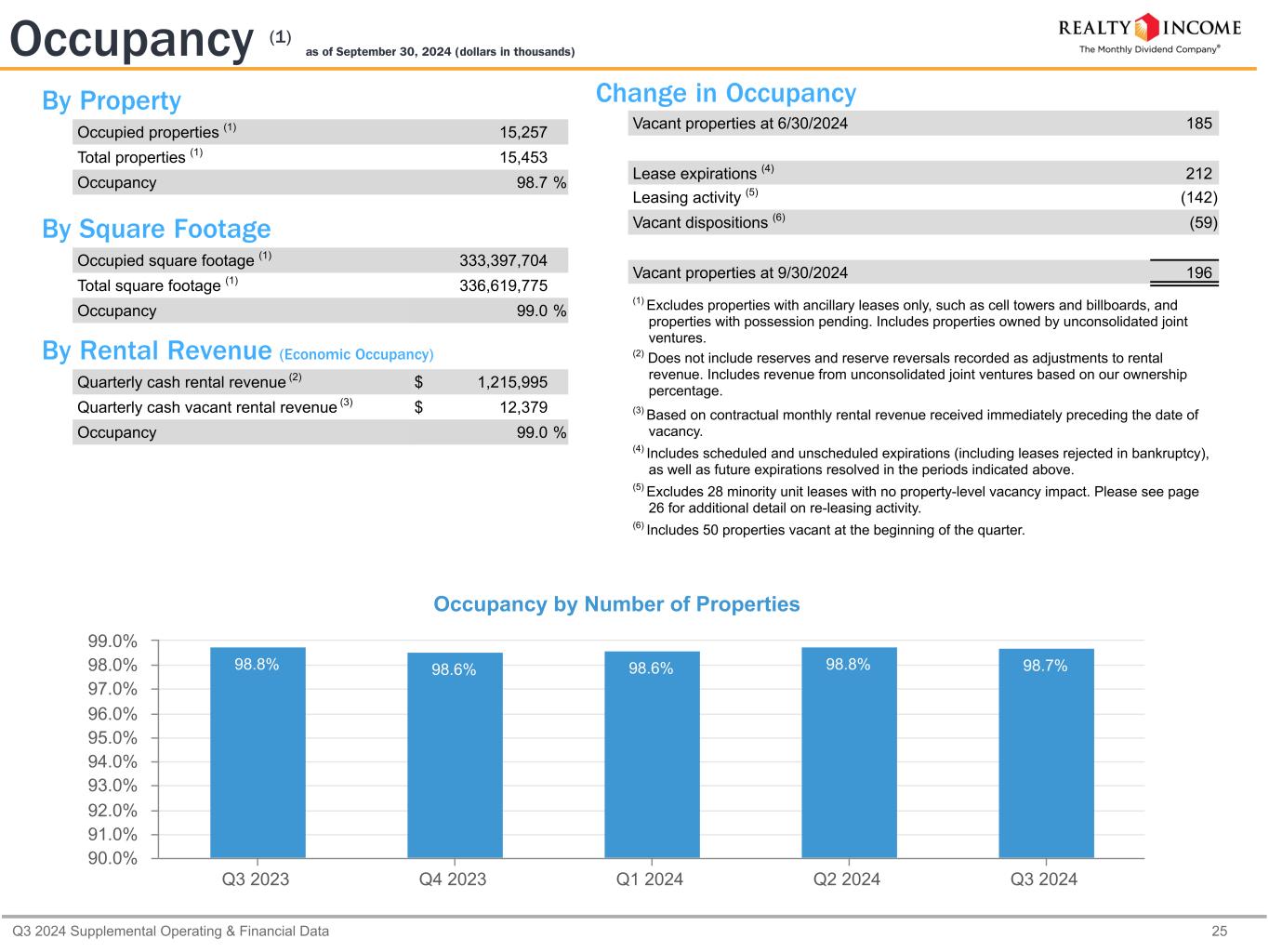

Real Estate Portfolio Update

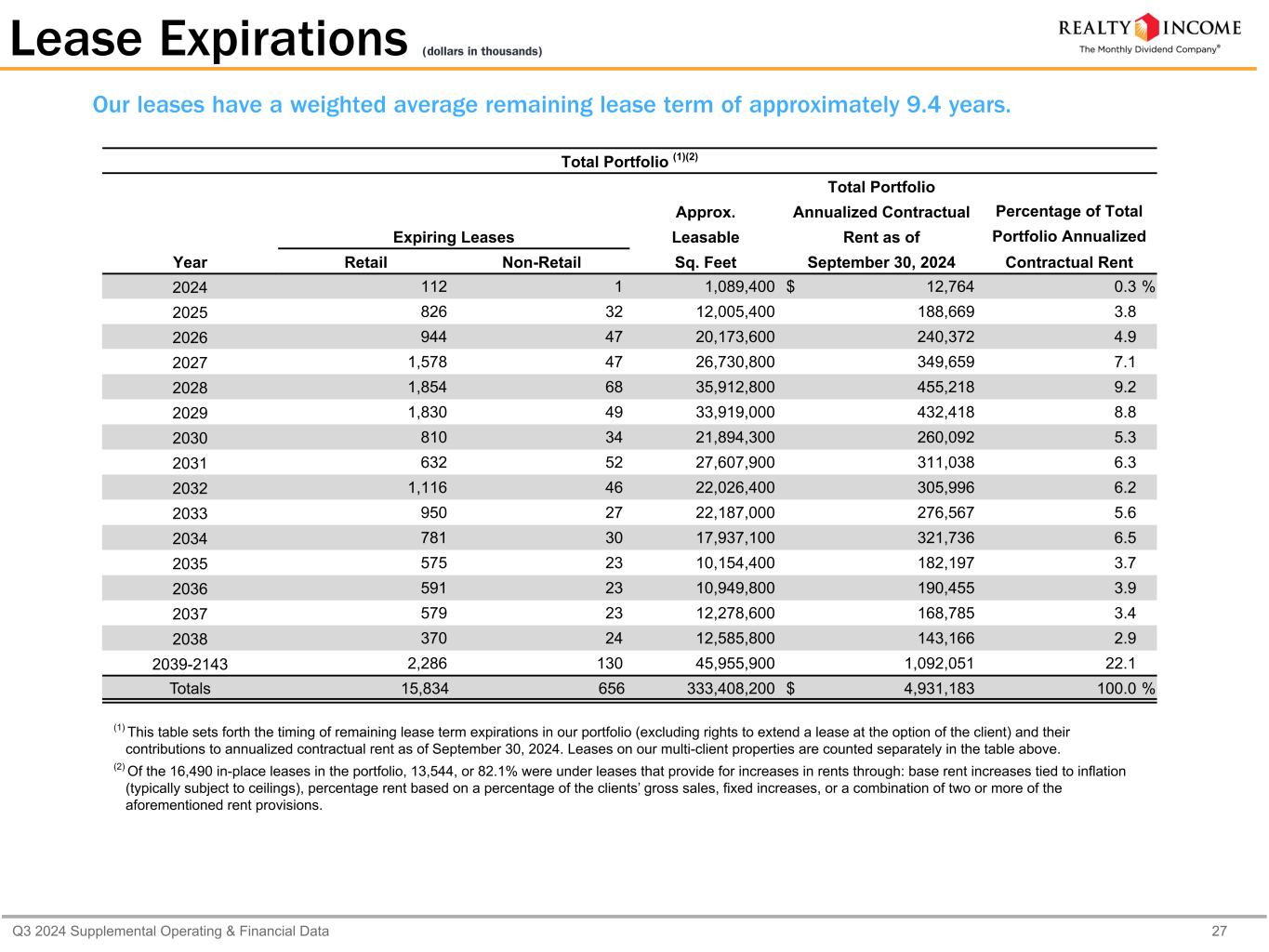

As of September 30, 2024, we owned or held interests in 15,457 properties, which were leased to 1,552 clients doing business in 90 industries. Our diversified portfolio of commercial properties under long-term, net lease agreements is actively managed with a weighted average remaining lease term of approximately 9.4 years. Our portfolio of commercial real estate has historically provided dependable rental revenue supporting the payment of monthly dividends. As of September 30, 2024, portfolio occupancy was 98.7% with 196 properties available for lease or sale, as compared to 98.8% for both periods as of June 30, 2024 and September 30, 2023, respectively. Our property-level occupancy rates exclude properties with ancillary leases only, such as cell towers and billboards, and properties with possession pending and include properties owned by unconsolidated joint ventures. Below is a summary of our portfolio activity for the periods indicated below:

Changes in Occupancy

|

|

|

|

|

|

Three months ended September 30, 2024 |

|

Properties available for lease at June 30, 2024 |

185 |

|

Lease expirations (1) |

212 |

|

| Re-leases to same client |

(131) |

|

| Re-leases to new client |

(11) |

|

| Vacant dispositions |

(59) |

|

Properties available for lease at September 30, 2024 |

196 |

|

|

|

| Nine months ended September 30, 2024 |

|

Properties available for lease at December 31, 2023 |

193 |

|

Lease expirations (1) |

642 |

|

| Re-leases to same client |

(441) |

|

| Re-leases to new client |

(32) |

|

| Vacant dispositions |

(166) |

|

Properties available for lease at September 30, 2024 |

196 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Includes scheduled and unscheduled expirations (including leases rejected in bankruptcy), as well as future expirations resolved in the periods indicated above.

During the three months ended September 30, 2024, the new annualized contractual rent on re-leases was $38.41 million, as compared to the previous annual rent of $36.57 million on the same units, representing a rent recapture rate of 105.0% on the units re-leased. We re-leased two units to new clients without a period of vacancy, and 14 units to new clients after a period of vacancy. Please see the Glossary for our definition of annualized contractual rent.

During the nine months ended September 30, 2024, the new annualized contractual rent on re-leases was $131.50 million, as compared to the previous annual rent of $125.39 million on the same units, representing a rent recapture rate of 104.9% on the units re-leased. We re-leased 16 units to new clients without a period of vacancy, and 29 units to new clients after a period of vacancy.

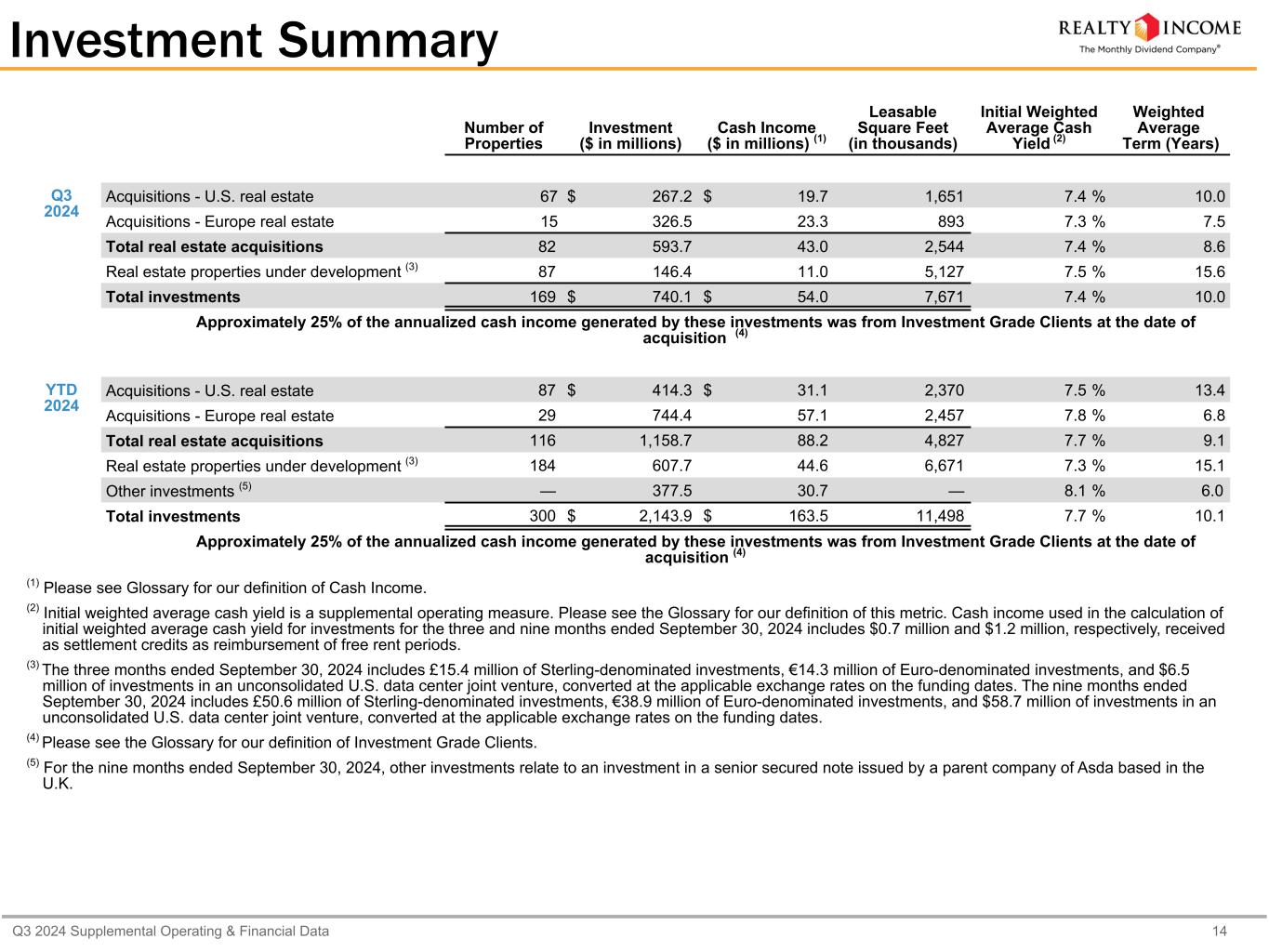

Investment Summary

The following table summarizes our investments in the U.S. and Europe for the periods indicated below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

Properties |

|

Investment

($ in millions) |

|

Leasable

Square Feet

(in thousands) |

|

Initial Weighted Average

Cash Yield (1)

|

|

Weighted

Average Term

(Years) |

Three months ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

| Acquisitions - U.S. real estate |

67 |

|

|

$ |

267.2 |

|

|

1,651 |

|

|

7.4 |

% |

|

10.0 |

|

Acquisitions - Europe real estate |

15 |

|

|

326.5 |

|

|

893 |

|

|

7.3 |

% |

|

7.5 |

|

| Total real estate acquisitions |

82 |

|

|

$ |

593.7 |

|

|

2,544 |

|

|

7.4 |

% |

|

8.6 |

|

Real estate properties under development (2) |

87 |

|

|

146.4 |

|

|

5,127 |

|

|

7.5 |

% |

|

15.6 |

|

|

|

|

|

|

|

|

|

|

|

Total investments (3) |

169 |

|

|

$ |

740.1 |

|

|

7,671 |

|

|

7.4 |

% |

|

10.0 |

|

|

|

|

|

|

|

|

|

|

|

| Nine months ended September 30, 2024 |

|

|

|

|

|

|

|

|

|

| Acquisitions - U.S. real estate |

87 |

|

|

$ |

414.3 |

|

|

2,370 |

|

|

7.5 |

% |

|

13.4 |

|

Acquisitions - Europe real estate |

29 |

|

|

744.4 |

|

|

2,457 |

|

|

7.8 |

% |

|

6.8 |

|

| Total real estate acquisitions |

116 |

|

|

$ |

1,158.7 |

|

|

4,827 |

|

|

7.7 |

% |

|

9.1 |

|

Real estate properties under development (2) |

184 |

|

|

607.7 |

|

|

6,671 |

|

|

7.3 |

% |

|

15.1 |

|

Other investments (4) |

— |

|

|

377.5 |

|

|

— |

|

|

8.1 |

% |

|

6.0 |

|

Total investments (5) |

300 |

|

|

$ |

2,143.9 |

|

|

11,498 |

|

|

7.7 |

% |

|

10.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)Initial weighted average cash yield is a supplemental operating measure. Cash income used in the calculation of initial weighted average cash yield for investments for the three and nine months ended September 30, 2024 includes $0.7 million and $1.2 million, respectively, received as settlement credits as reimbursement of free rent periods. Please see the Glossary for our definitions of Initial Weighted Average Cash Yield and Cash Income.

(2) The three months ended September 30, 2024 includes £15.4 million of Sterling-denominated investments, €14.3 million of Euro-denominated investments, and $6.5 million of investments in an unconsolidated U.S. data center joint venture, converted at the applicable exchange rates on the funding dates. The nine months ended September 30, 2024 includes £50.6 million of Sterling-denominated investments, €38.9 million of Euro-denominated investments, and $58.7 million of investments in an unconsolidated U.S. data center joint venture, converted at the applicable exchange rates on the funding dates.

(3) Clients we have invested in are 82.3% retail, 16.8% industrial, and 0.9% other based on cash income. Approximately 25% of the annualized cash income generated from acquisitions was from investment grade rated clients, their subsidiaries or affiliated companies at the date of acquisition. Please see the Glossary for our definition of Investment Grade Clients and Cash Income.

(4) For the nine months ended September 30, 2024, other investments relate to an investment in a senior secured note issued by a parent company of Asda based in the U.K.

(5) Clients we have invested in are 85.6% retail, 11.9% industrial, and 2.5% other based on cash income. Approximately 25% of the annualized cash income generated from acquisitions was from investment grade rated clients, their subsidiaries or affiliated companies at the date of acquisition.

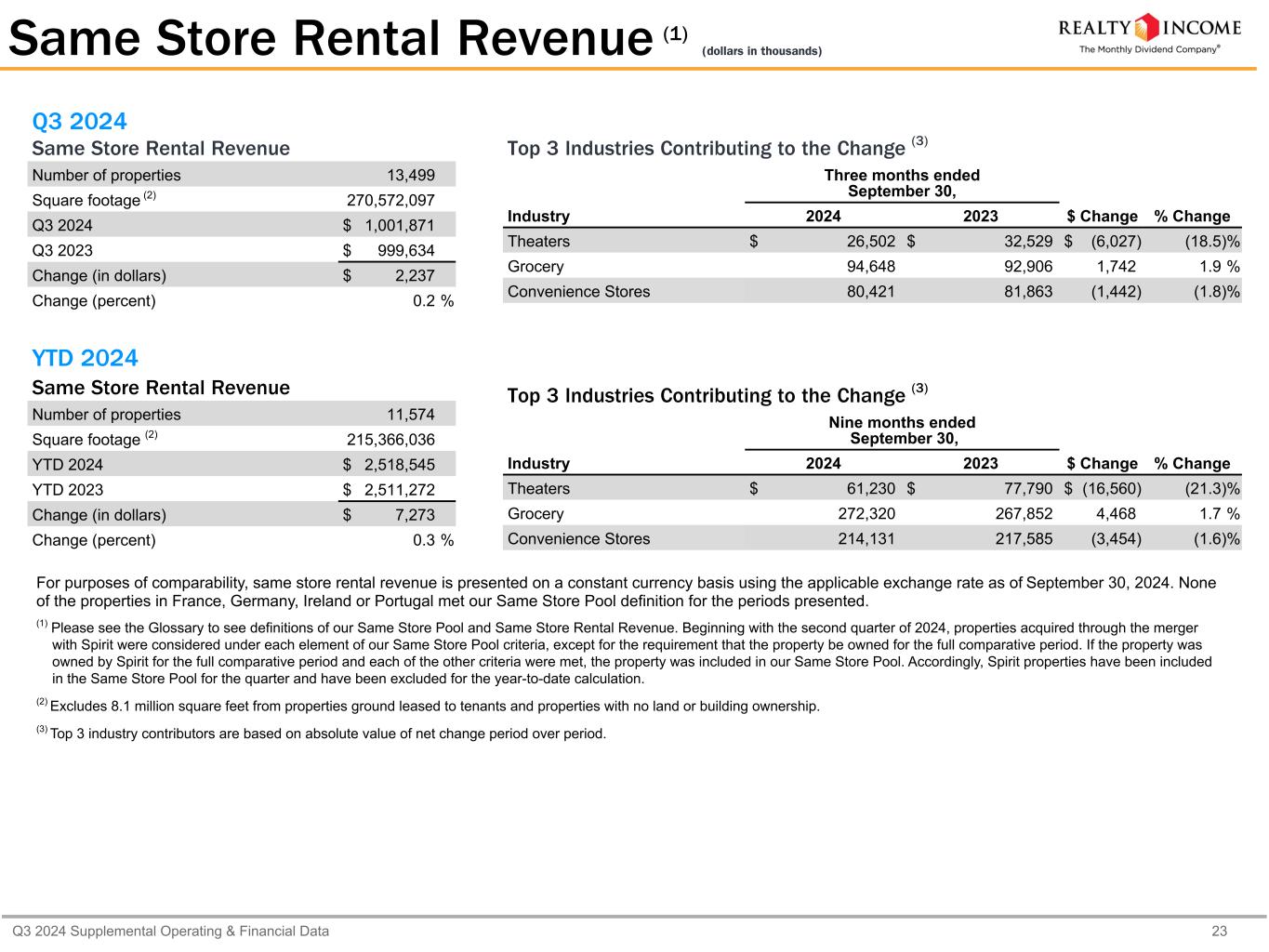

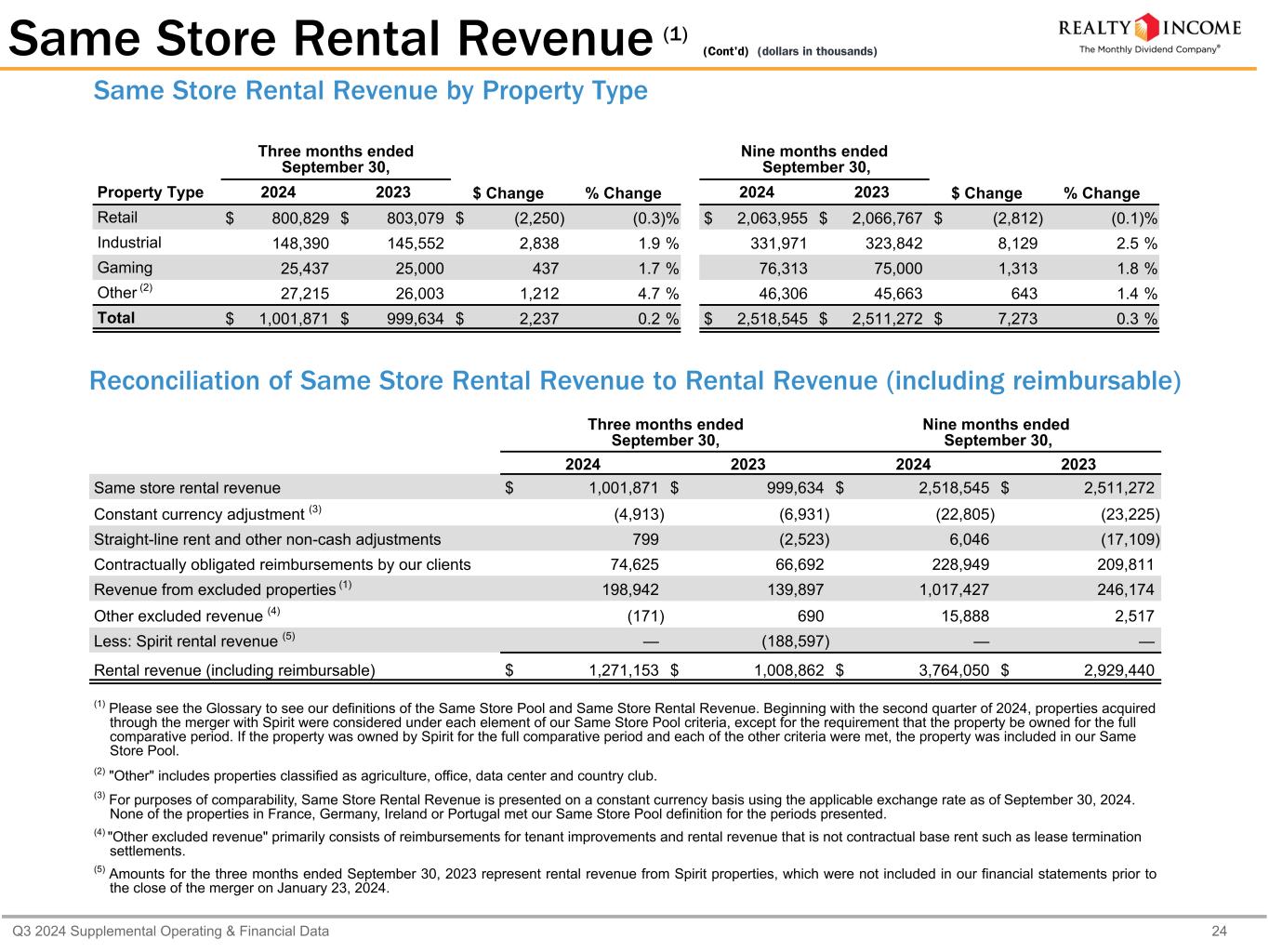

Same Store Rental Revenue

The following summarizes our same store rental revenue for 13,499 and 11,574 properties under lease for the three and nine months ended September 30, 2024, respectively (dollars in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

Nine months ended

September 30, |

|

% Increase |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Three Months |

|

Nine Months |

Same store rental revenue |

$ |

1,001.9 |

|

|

$ |

999.6 |

|

|

$ |

2,518.5 |

|

|

$ |

2,511.3 |

|

|

0.2 |

% |

|

0.3 |

% |

For purposes of comparability, same store rental revenue is presented on a constant currency basis using the applicable exchange rate as of September 30, 2024. None of the properties in France, Germany, Ireland or Portugal met our Same Store Pool definition for the periods presented. Beginning with the second quarter of 2024, properties acquired through the merger with Spirit Realty Capital, Inc. ("Spirit") were considered under each element of our Same Store Pool criteria, except for the requirement that the property be owned for the full comparative period. If the property was owned by Spirit for the full comparative period and each of the other criteria were met, the property was included in our Same Store Pool. Accordingly, Spirit properties have been included in the Same Store Pool for the quarter and have been excluded for the year-to-date calculation. Please see the Glossary to see definitions of our Same Store Pool and Same Store Rental Revenue.

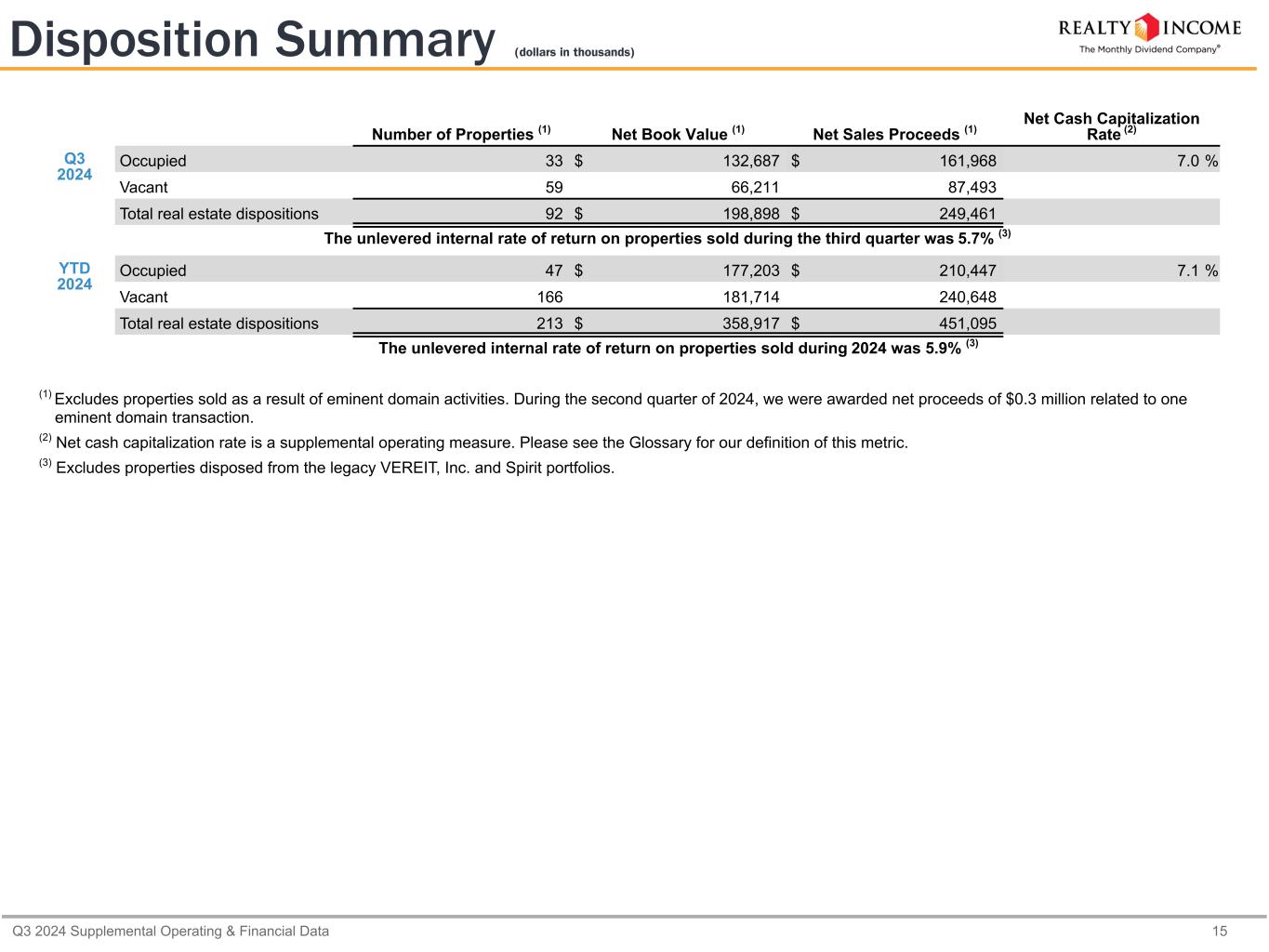

Property Dispositions

The following summarizes our property dispositions (dollars in millions):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, 2024 |

|

Nine months ended September 30, 2024 |

|

|

| Properties sold |

92 |

|

|

214 |

|

|

|

| Net sales proceeds |

$ |

249.5 |

|

|

$ |

451.4 |

|

|

|

| Gain on sale of real estate |

$ |

50.6 |

|

|

$ |

92.3 |

|

|

|

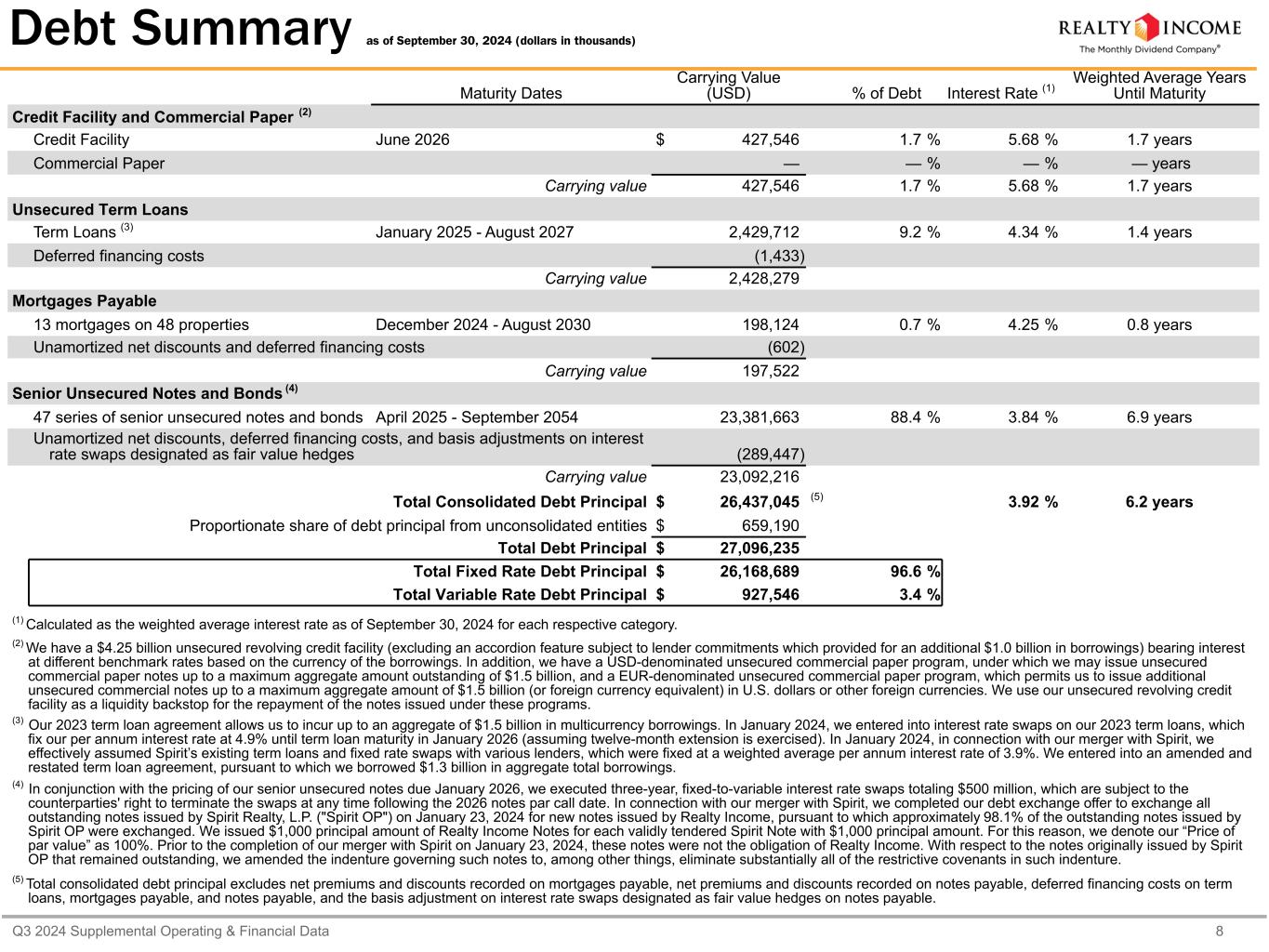

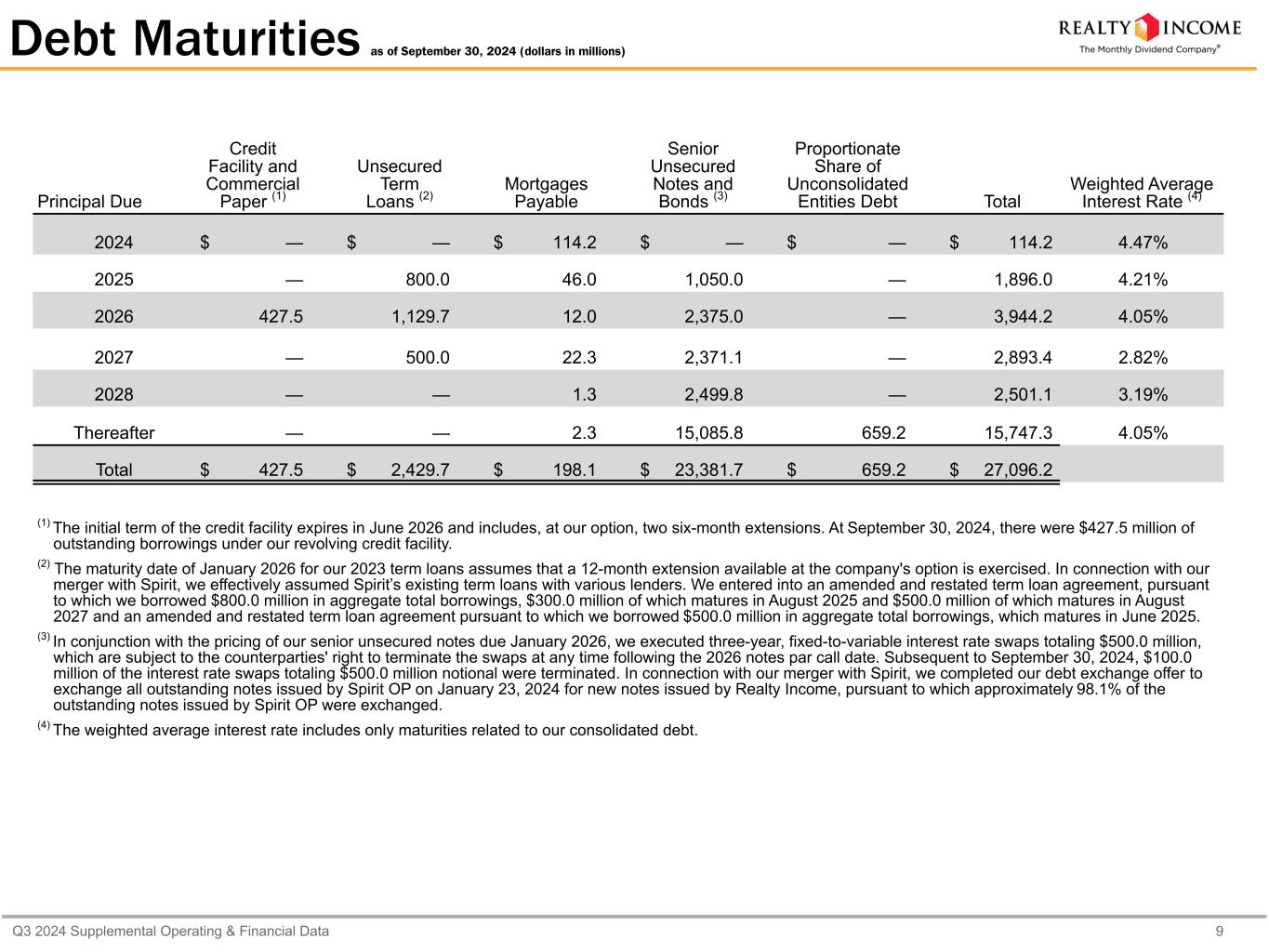

Liquidity and Capital Markets

Capital Raising

During the three months ended September 30, 2024, we raised $271.0 million of proceeds from the sale of common stock at a weighted average price of $62.25 per share, primarily through the sale of approximately 4.3 million shares of common stock pursuant to forward sale agreements through our ATM program. As of September 30, 2024, there were approximately 16.8 million shares of unsettled common stock subject to forward sale agreements through our ATM program, representing approximately $958.1 million in expected net proceeds and a weighted average initial gross price of $57.58 per share. ATM net sale proceed amounts assume full physical settlement of all outstanding shares of common stock, subject to such forward sale agreements and certain assumptions made with respect to settlement dates. As of November 4, 2024, ATM forward agreements for a total of 17.0 million shares remain unsettled with total expected net proceeds of approximately $968.7 million, of which 0.2 million shares were executed in October 2024.

In September 2024, we completed the acquisition of 42 properties by paying cash and by issuing 0.7 million common partnership units in Realty Income, LP, and recorded $46.5 million of contributions to non-controlling interests.

In August 2024, we issued $500.0 million of 5.375% senior unsecured notes due 2054 (the "2054 Notes"). The public offering price for the 2054 Notes was 98.374% of the principal amount for an effective semi-annual yield to maturity of 5.486%.

In September 2024, we issued £350.0 million of 5.000% senior unsecured notes due 2029 (the "2029 Notes") and £350.0 million of 5.250% senior unsecured notes due 2041 (the "2041 Notes"). The public offering price for the 2029 Notes was 99.139% of the principal amount for an effective annual yield to maturity of 5.199% and the public offering price for the 2041 Notes was 96.211% of the principal amount for an effective annual yield to maturity of 5.601%. Combined, the notes have a weighted average tenor of approximately 11.1 years, a weighted average effective annual yield to maturity of 5.400%, and a weighted average coupon rate of 5.125%.

Redemption of Preferred Stock

In September 2024, we redeemed all 6.9 million shares outstanding of our 6.000% Series A Cumulative Redeemable Preferred Stock at a redemption price of $25.00 per share, plus accrued and unpaid dividends. The excess of the $25.00 liquidation price per share over the carrying value of the preferred stock redeemed resulted in a loss on redemption of $5.1 million for the three months ended September 30, 2024.

Liquidity

As of September 30, 2024, we had $5.2 billion of liquidity, which consists of cash and cash equivalents of $397.0 million, unsettled ATM forward equity of $958.1 million, and $3.8 billion of availability under our $4.25 billion unsecured revolving credit facility, net of $427.5 million of borrowing on the revolving credit facility. We use our unsecured revolving credit facility as a liquidity backstop for the repayment of the notes issued under our commercial paper programs.

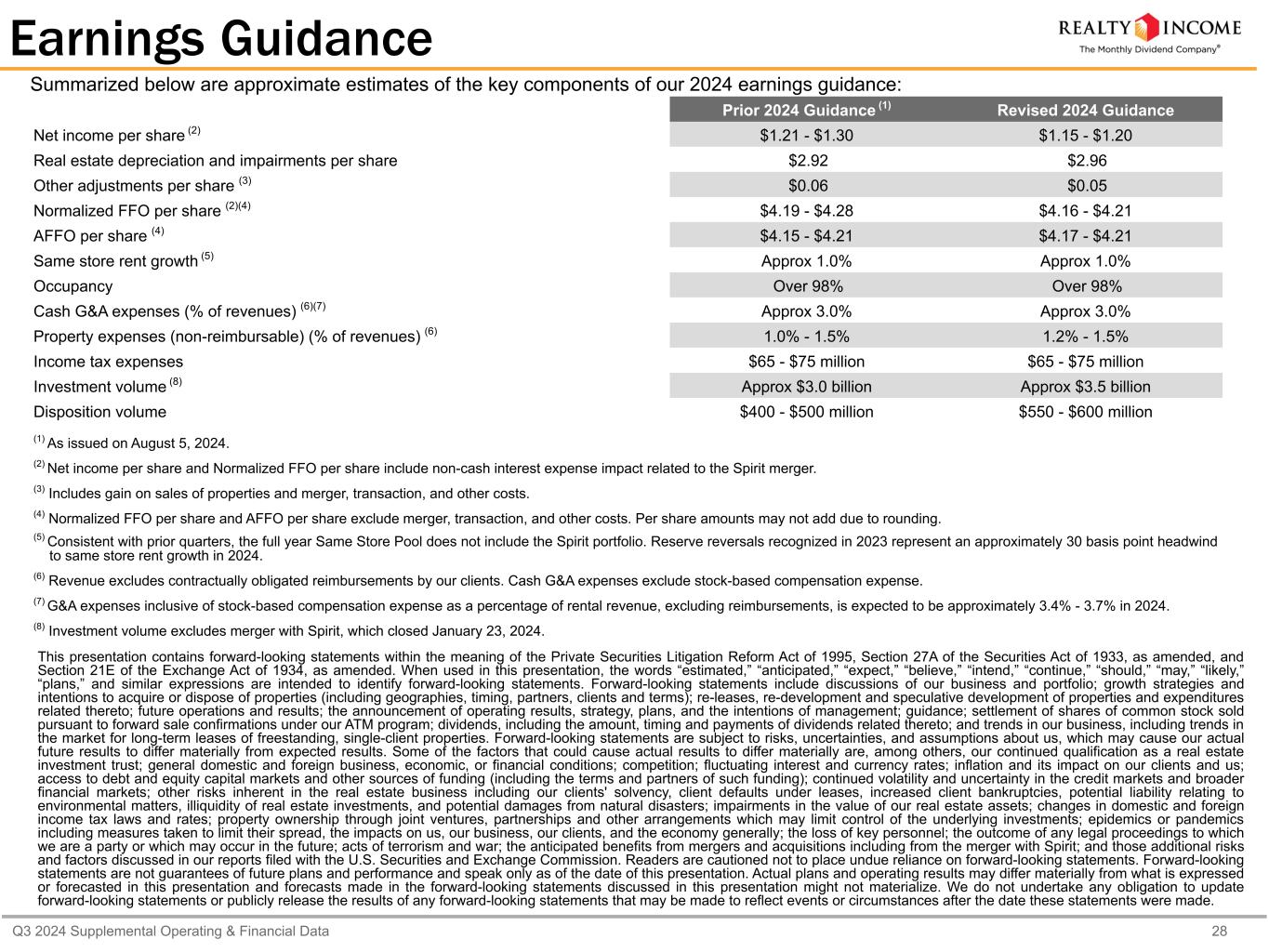

Earnings Guidance

Summarized below are approximate estimates of the key components of our 2024 earnings guidance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior 2024 Guidance (1) |

|

Revised 2024 Guidance |

Net income per share (2) |

|

$1.21 - $1.30 |

|

$1.15 - $1.20 |

| Real estate depreciation and impairments per share |

|

$2.92 |

|

$2.96 |

Other adjustments per share (3) |

|

$0.06 |

|

$0.05 |

Normalized FFO per share (2)(4) |

|

$4.19 - $4.28 |

|

$4.16 - $4.21 |

AFFO per share (4) |

|

$4.15 - $4.21 |

|

$4.17 - $4.21 |

Same store rent growth (5) |

|

Approx 1.0% |

|

Approx 1.0% |

| Occupancy |

|

Over 98% |

|

Over 98% |

Cash G&A expenses (% of revenues) (6)(7) |

|

Approx 3.0% |

|

Approx 3.0% |

Property expenses (non-reimbursable) (% of revenues) (6) |

|

1.0% - 1.5% |

|

1.2% - 1.5% |

| Income tax expenses |

|

$65 - $75 million |

|

$65 - $75 million |

Investment volume (8) |

|

Approx $3.0 billion |

|

Approx $3.5 billion |

| Disposition volume |

|

$400 - $500 million |

|

$550 - $600 million |

|

|

|

|

|

(1) As issued on August 5, 2024. |

(2) Net income per share and Normalized FFO per share include non-cash interest expense impact related to the Spirit merger. |

(3) Includes gain on sales of properties and merger, transaction, and other costs. |

(4) Normalized FFO per share and AFFO per share exclude merger, transaction, and other costs. Per share amounts may not add due to rounding. |

(5) Consistent with prior quarters, the full year Same Store Pool does not include the Spirit portfolio. Reserve reversals recognized in 2023 represent an approximately 30 basis point headwind to same store rent growth in 2024. |

(6) Revenue excludes contractually obligated reimbursements by our clients. Cash G&A expenses exclude stock-based compensation expense. |

(7) G&A expenses inclusive of stock-based compensation expense as a percentage of rental revenue, excluding reimbursements, is expected to be approximately 3.4% - 3.7% in 2024. |

(8) Investment volume excludes merger with Spirit, which closed January 23, 2024. |

Conference Call Information

In conjunction with the release of our operating results, we will host a conference call on November 5, 2024 at 11:00 a.m. PDT to discuss the operating results. To access the conference call, dial (833) 816-1264 (United States) or (412) 317-5632 (International). When prompted, please ask for the Realty Income conference call.

A telephone replay of the conference call can also be accessed by calling (877) 344-7529 (United States) or (412) 317-0088 (International) and entering the conference ID 6281798. The telephone replay will be available through November 12, 2024.

A live webcast will be available in listen-only mode by clicking on the webcast link on the company’s home page at www.realtyincome.com. A replay of the conference call webcast will be available approximately one hour after the conclusion of the live broadcast. No access code is required for this replay.

Supplemental Materials and Sustainability Report

Supplemental Operating and Financial Data for the three and nine months ended September 30, 2024 is available on our corporate website at www.realtyincome.com/investors/quarterly-and-annual-results.

The Sustainability Report for the year ended December 31, 2023 is available on our corporate website at https://esg.realtyincome.com/sustainability/esg-reporting. Our Green Financing Framework is also available on our corporate website at esg.realtyincome.com/indicators/green_financing.

About Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies. Founded in 1969, we invest in diversified commercial real estate and have a portfolio of over 15,450 properties in all 50 U.S. states, the U.K., and six other countries in Europe. We are known as “The Monthly Dividend Company®,” and have a mission to invest in people and places to deliver dependable monthly dividends that increase over time. Since our founding, we have declared 652 consecutive monthly dividends and are a member of the S&P 500 Dividend Aristocrats® index for having increased our dividend for the last 30 consecutive years. Additional information about the company can be found at www.realtyincome.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the words “estimated,” “anticipated,” “expect,” “believe,” “intend,” “continue,” “should,” “may,” “likely,” “plans,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions of our business and portfolio; growth strategies and intentions to acquire or dispose of properties (including geographies, timing, partners, clients and terms); re-leases, re-development and speculative development of properties and expenditures related thereto; future operations and results; the announcement of operating results, strategy, plans, and the intentions of management; guidance; settlement of shares of common stock sold pursuant to forward sale confirmations under our ATM program; dividends, including the amount, timing and payments of dividends related thereto; and trends in our business, including trends in the market for long-term leases of freestanding, single-client properties. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment trust; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding (including the terms and partners of such funding); continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients' solvency, client defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in domestic and foreign income tax laws and rates; property ownership through joint ventures, partnerships and other arrangements which may limit control of the underlying investments; epidemics or pandemics including measures taken to limit their spread, the impacts on us, our business, our clients, and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the anticipated benefits from mergers and acquisitions including from the merger with Spirit; and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this press release.

Actual plans and operating results may differ materially from what is expressed or forecasted in this press release and forecasts made in the forward-looking statements discussed in this press release might not materialize. We do not undertake any obligation to update forward-looking statements or publicly release the results of any forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

Investor Relations:

Steve Bakke

Senior Vice President, Corporate Finance

+1 858 284 5425

sbakke@realtyincome.com

Kelsey Mueller

Vice President, Investor Relations

+1 858 284 5023

kmueller@realtyincome.com

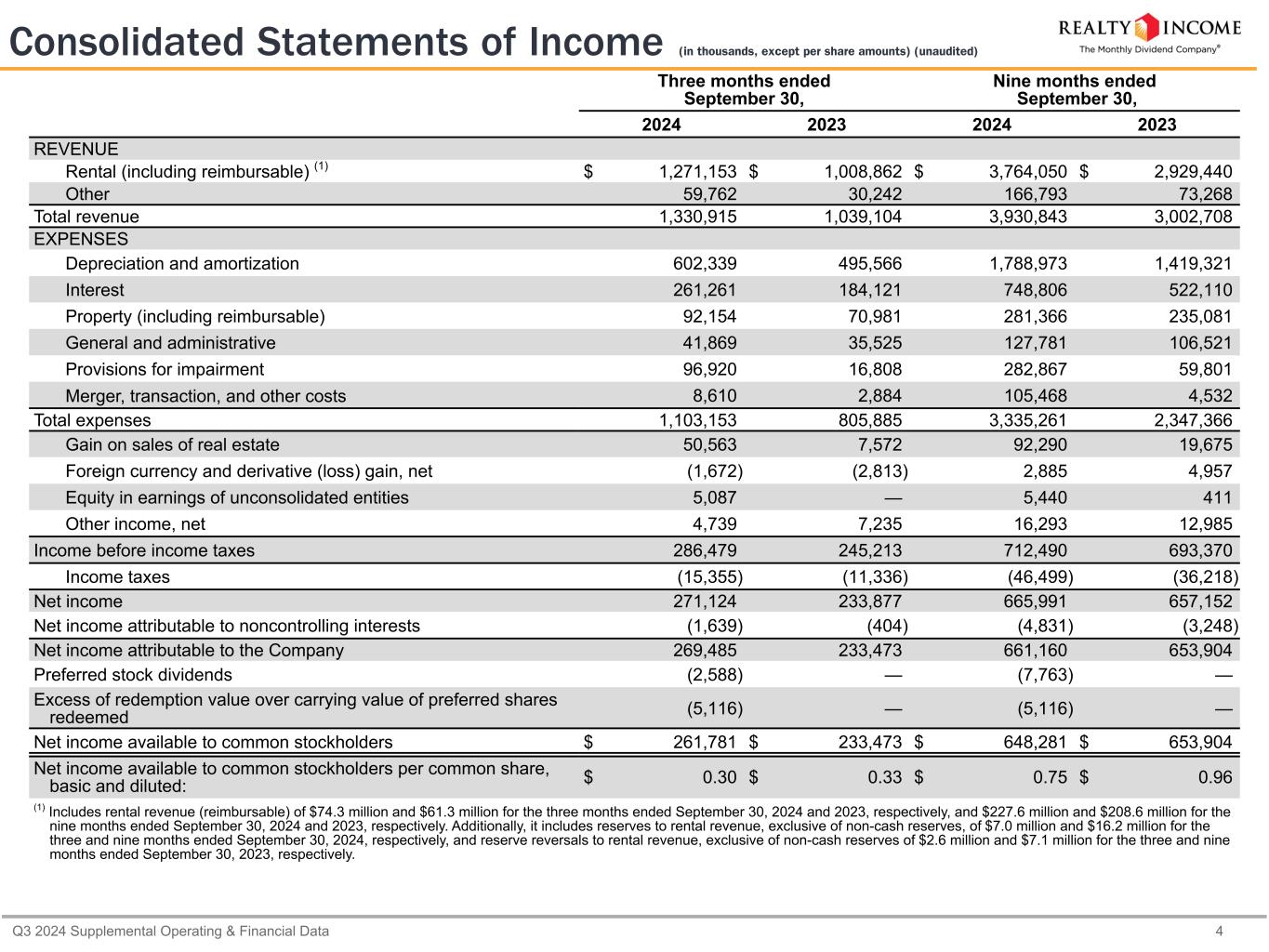

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30,

|

|

Nine months ended September 30,

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| REVENUE |

|

|

|

|

|

|

|

|

Rental (including reimbursable) (1) |

|

$ |

1,271,153 |

|

|

$ |

1,008,862 |

|

|

$ |

3,764,050 |

|

|

$ |

2,929,440 |

|

Other |

|

59,762 |

|

|

30,242 |

|

|

166,793 |

|

|

73,268 |

|

| Total revenue |

|

1,330,915 |

|

|

1,039,104 |

|

|

3,930,843 |

|

|

3,002,708 |

|

| EXPENSES |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

602,339 |

|

|

495,566 |

|

|

1,788,973 |

|

|

1,419,321 |

|

| Interest |

|

261,261 |

|

|

184,121 |

|

|

748,806 |

|

|

522,110 |

|

| Property (including reimbursable) |

|

92,154 |

|

|

70,981 |

|

|

281,366 |

|

|

235,081 |

|

| General and administrative |

|

41,869 |

|

|

35,525 |

|

|

127,781 |

|

|

106,521 |

|

| Provisions for impairment |

|

96,920 |

|

|

16,808 |

|

|

282,867 |

|

|

59,801 |

|

| Merger, transaction, and other costs |

|

8,610 |

|

|

2,884 |

|

|

105,468 |

|

|

4,532 |

|

|

|

|

|

|

|

|

|

|

| Total expenses |

|

1,103,153 |

|

|

805,885 |

|

|

3,335,261 |

|

|

2,347,366 |

|

| Gain on sales of real estate |

|

50,563 |

|

|

7,572 |

|

|

92,290 |

|

|

19,675 |

|

| Foreign currency and derivative (loss) gain, net |

|

(1,672) |

|

|

(2,813) |

|

|

2,885 |

|

|

4,957 |

|

|

|

|

|

|

|

|

|

|

| Equity in earnings of unconsolidated entities |

|

5,087 |

|

|

— |

|

|

5,440 |

|

|

411 |

|

Other income, net |

|

4,739 |

|

|

7,235 |

|

|

16,293 |

|

|

12,985 |

|

| Income before income taxes |

|

286,479 |

|

|

245,213 |

|

|

712,490 |

|

|

693,370 |

|

| Income taxes |

|

(15,355) |

|

|

(11,336) |

|

|

(46,499) |

|

|

(36,218) |

|

| Net income |

|

271,124 |

|

|

233,877 |

|

|

665,991 |

|

|

657,152 |

|

| Net income attributable to noncontrolling interests |

|

(1,639) |

|

|

(404) |

|

|

(4,831) |

|

|

(3,248) |

|

| Net income attributable to the Company |

|

269,485 |

|

|

233,473 |

|

|

661,160 |

|

|

653,904 |

|

| Preferred stock dividends |

|

(2,588) |

|

|

— |

|

|

(7,763) |

|

|

— |

|

| Excess of redemption value over carrying value of preferred shares redeemed |

|

(5,116) |

|

|

— |

|

|

(5,116) |

|

|

— |

|

| Net income available to common stockholders |

|

$ |

261,781 |

|

|

$ |

233,473 |

|

|

$ |

648,281 |

|

|

$ |

653,904 |

|

| Funds from operations available to common stockholders (FFO) |

|

$ |

854,926 |

|

|

$ |

736,146 |

|

|

$ |

2,569,742 |

|

|

$ |

2,108,422 |

|

| Normalized funds from operations available to common stockholders (Normalized FFO) |

|

$ |

863,536 |

|

|

$ |

739,030 |

|

|

$ |

2,675,210 |

|

|

$ |

2,112,954 |

|

| Adjusted funds from operations available to common stockholders (AFFO) |

|

$ |

915,572 |

|

|

$ |

721,370 |

|

|

$ |

2,699,517 |

|

|

$ |

2,043,836 |

|

| Per share information for common stockholders: |

|

|

|

|

|

|

|

|

| Net income available to common stockholders per common share, basic and diluted: |

|

$ |

0.30 |

|

|

$ |

0.33 |

|

|

$ |

0.75 |

|

|

$ |

0.96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FFO per common share, basic and diluted: |

|

$ |

0.98 |

|

|

$ |

1.04 |

|

|

$ |

2.99 |

|

|

$ |

3.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Normalized FFO per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.99 |

|

|

$ |

1.04 |

|

|

$ |

3.12 |

|

|

$ |

3.10 |

|

| Diluted |

|

$ |

0.99 |

|

|

$ |

1.04 |

|

|

$ |

3.11 |

|

|

$ |

3.10 |

|

| AFFO per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.05 |

|

|

$ |

1.02 |

|

|

$ |

3.14 |

|

|

$ |

3.00 |

|

| Diluted |

|

$ |

1.05 |

|

|

$ |

1.02 |

|

|

$ |

3.14 |

|

|

$ |

2.99 |

|

| Cash dividends paid per common share |

|

$ |

0.7890 |

|

|

$ |

0.7665 |

|

|

$ |

2.3350 |

|

|

$ |

2.2830 |

|

|

|

|

|

|

|

|

|

|

(1) Includes rental revenue (reimbursable) of $74.3 million and $61.3 million for the three months ended September 30, 2024 and 2023, respectively, and $227.6 million and $208.6 million for the nine months ended September 30, 2024 and 2023, respectively. Additionally, it includes reserves to rental revenue, exclusive of non-cash reserves, of $7.0 million and $16.2 million for the three and nine months ended September 30, 2024, respectively, and reserve reversals to rental revenue, exclusive of non-cash reserves of $2.6 million and $7.1 million for the three and nine months ended September 30, 2023, respectively.

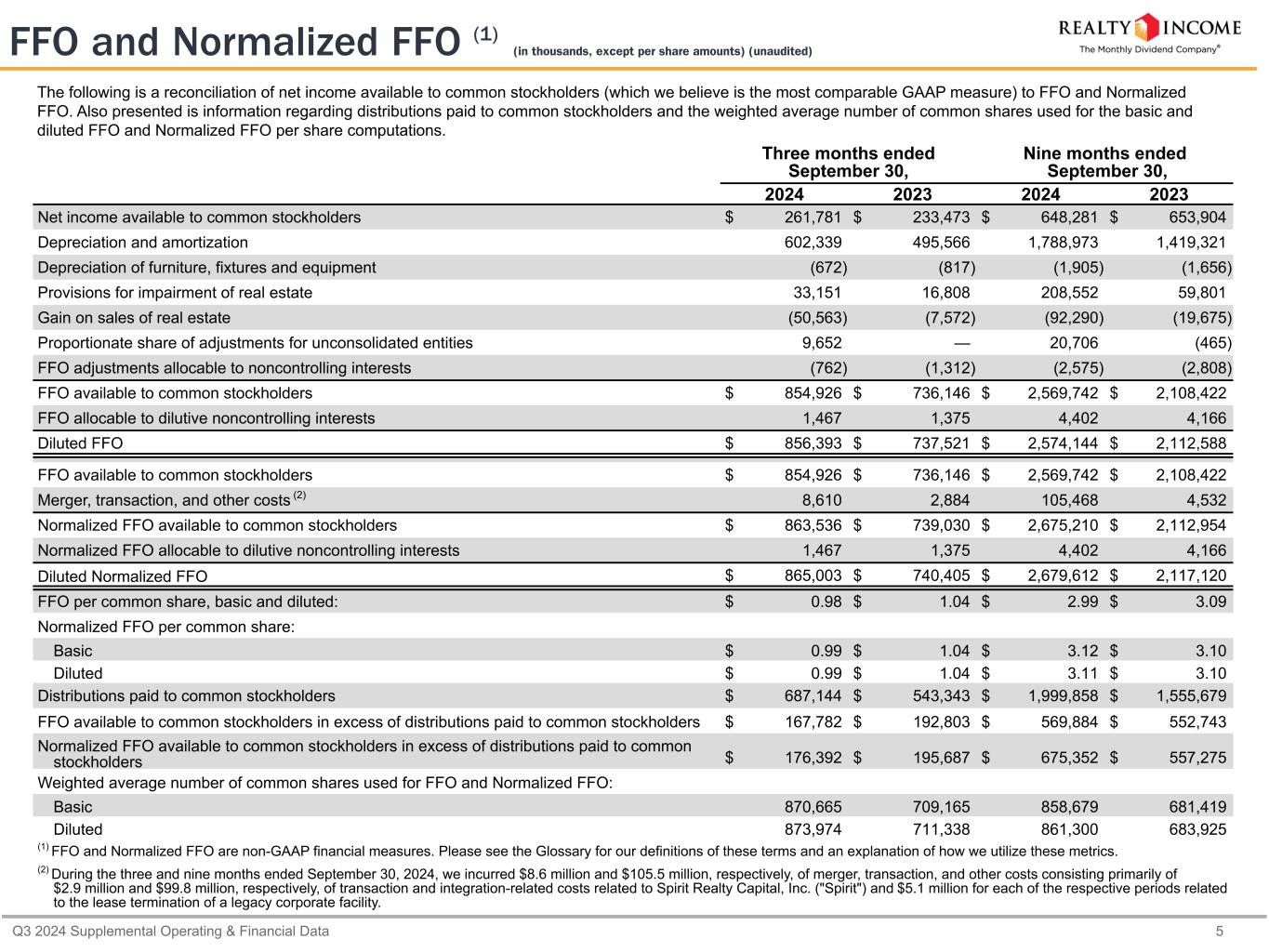

FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FUNDS FROM OPERATIONS (Normalized FFO)

(in thousands, except per share amounts) (unaudited)

FFO and Normalized FFO are non-GAAP financial measures. Please see the Glossary for our definitions and explanations of how we utilize these metrics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

Nine months ended

September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

Net income available to common stockholders |

|

$ |

261,781 |

|

|

$ |

233,473 |

|

|

$ |

648,281 |

|

|

$ |

653,904 |

|

Depreciation and amortization |

|

602,339 |

|

|

495,566 |

|

|

1,788,973 |

|

|

1,419,321 |

|

Depreciation of furniture, fixtures and equipment |

|

(672) |

|

|

(817) |

|

|

(1,905) |

|

|

(1,656) |

|

| Provisions for impairment of real estate |

|

33,151 |

|

|

16,808 |

|

|

208,552 |

|

|

59,801 |

|

Gain on sales of real estate |

|

(50,563) |

|

|

(7,572) |

|

|

(92,290) |

|

|

(19,675) |

|

Proportionate share of adjustments for unconsolidated entities |

|

9,652 |

|

|

— |

|

|

20,706 |

|

|

(465) |

|

FFO adjustments allocable to noncontrolling interests |

|

(762) |

|

|

(1,312) |

|

|

(2,575) |

|

|

(2,808) |

|

FFO available to common stockholders |

|

$ |

854,926 |

|

|

$ |

736,146 |

|

|

$ |

2,569,742 |

|

|

$ |

2,108,422 |

|

FFO allocable to dilutive noncontrolling interests |

|

1,467 |

|

|

1,375 |

|

|

4,402 |

|

|

4,166 |

|

Diluted FFO |

|

$ |

856,393 |

|

|

$ |

737,521 |

|

|

$ |

2,574,144 |

|

|

$ |

2,112,588 |

|

|

|

|

|

|

|

|

|

|

FFO available to common stockholders |

|

$ |

854,926 |

|

|

$ |

736,146 |

|

|

$ |

2,569,742 |

|

|

$ |

2,108,422 |

|

Merger, transaction, and other costs (1) |

|

8,610 |

|

|

2,884 |

|

|

105,468 |

|

|

4,532 |

|

Normalized FFO available to common stockholders |

|

$ |

863,536 |

|

|

$ |

739,030 |

|

|

$ |

2,675,210 |

|

|

$ |

2,112,954 |

|

Normalized FFO allocable to dilutive noncontrolling interests |

|

1,467 |

|

|

1,375 |

|

|

4,402 |

|

|

4,166 |

|

Diluted Normalized FFO |

|

$ |

865,003 |

|

|

$ |

740,405 |

|

|

$ |

2,679,612 |

|

|

$ |

2,117,120 |

|

|

|

|

|

|

|

|

|

|

| FFO per common share, basic and diluted: |

|

$ |

0.98 |

|

|

$ |

1.04 |

|

|

$ |

2.99 |

|

|

$ |

3.09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Normalized FFO per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.99 |

|

|

$ |

1.04 |

|

|

$ |

3.12 |

|

|

$ |

3.10 |

|

| Diluted |

|

$ |

0.99 |

|

|

$ |

1.04 |

|

|

$ |

3.11 |

|

|

$ |

3.10 |

|

Distributions paid to common stockholders |

|

$ |

687,144 |

|

|

$ |

543,343 |

|

|

$ |

1,999,858 |

|

|

$ |

1,555,679 |

|

FFO available to common stockholders in excess of distributions paid to common stockholders |

|

$ |

167,782 |

|

|

$ |

192,803 |

|

|

$ |

569,884 |

|

|

$ |

552,743 |

|

Normalized FFO available to common stockholders in excess of distributions paid to common stockholders |

|

$ |

176,392 |

|

|

$ |

195,687 |

|

|

$ |

675,352 |

|

|

$ |

557,275 |

|

Weighted average number of common shares used for FFO and Normalized FFO: |

|

|

|

|

|

|

|

|

| Basic |

|

870,665 |

|

|

709,165 |

|

|

858,679 |

|

|

681,419 |

|

| Diluted |

|

873,974 |

|

|

711,338 |

|

|

861,300 |

|

|

683,925 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)During the three and nine months ended September 30, 2024, we incurred $8.6 million and $105.5 million, respectively, of merger, transaction, and other costs consisting primarily of $2.9 million and $99.8 million, respectively, of transaction and integration-related costs related to Spirit and $5.1 million for each of the respective periods related to the lease termination of a legacy corporate facility.

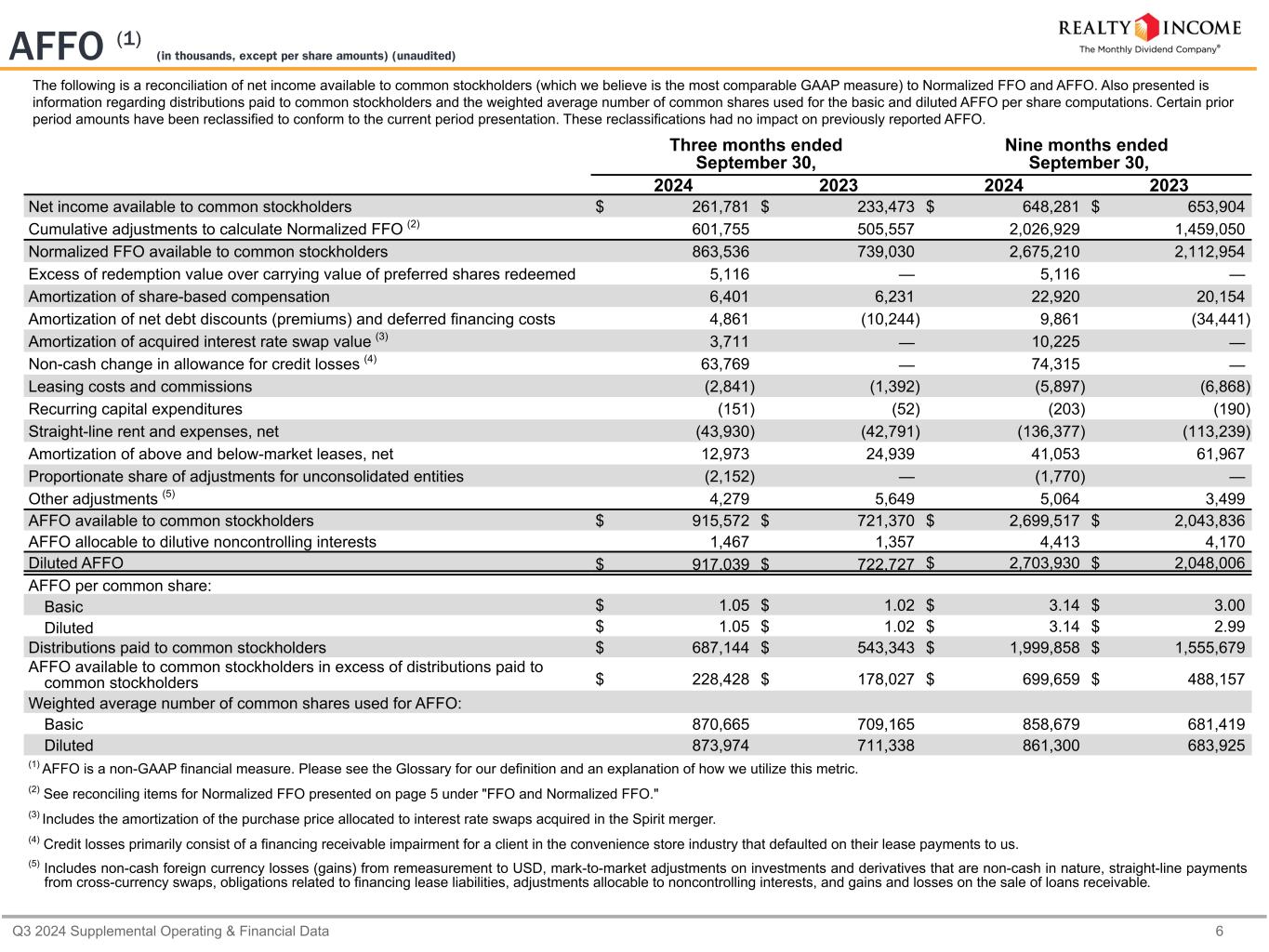

ADJUSTED FUNDS FROM OPERATIONS (AFFO)

(in thousands, except per share amounts) (unaudited)

AFFO is a non-GAAP financial measure. Please see the Glossary for our definition and an explanation of how we utilize this metric. Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications had no impact on previously reported AFFO.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

Nine months ended

September 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

Net income available to common stockholders |

|

$ |

261,781 |

|

|

$ |

233,473 |

|

|

$ |

648,281 |

|

|

$ |

653,904 |

|

Cumulative adjustments to calculate Normalized FFO (1) |

|

601,755 |

|

|

505,557 |

|

|

2,026,929 |

|

|

1,459,050 |

|

Normalized FFO available to common stockholders |

|

863,536 |

|

|

739,030 |

|

|

2,675,210 |

|

|

2,112,954 |

|

|

|

|

|

|

|

|

|

|

Excess of redemption value over carrying value of preferred shares redeemed |

|

5,116 |

|

|

— |

|

|

5,116 |

|

|

— |

|

Amortization of share-based compensation |

|

6,401 |

|

|

6,231 |

|

|

22,920 |

|

|

20,154 |

|

Amortization of net debt discounts (premiums) and deferred financing costs |

|

4,861 |

|

|

(10,244) |

|

|

9,861 |

|

|

(34,441) |

|

|

|

|

|

|

|

|

|

|

Amortization of acquired interest rate swap value (2) |

|

3,711 |

|

|

— |

|

|

10,225 |

|

|

— |

|

Non-cash change in allowance for credit losses (3) |

|

63,769 |

|

|

— |

|

|

74,315 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

Leasing costs and commissions |

|

(2,841) |

|

|

(1,392) |

|

|

(5,897) |

|

|

(6,868) |

|

|

|

|

|

|

|

|

|

|

Recurring capital expenditures |

|

(151) |

|

|

(52) |

|

|

(203) |

|

|

(190) |

|

| Straight-line rent and expenses, net |

|

(43,930) |

|

|

(42,791) |

|

|

(136,377) |

|

|

(113,239) |

|

Amortization of above and below-market leases, net |

|

12,973 |

|

|

24,939 |

|

|

41,053 |

|

|

61,967 |

|

| Proportionate share of adjustments for unconsolidated entities |

|

(2,152) |

|

|

— |

|

|

(1,770) |

|

|

— |

|

Other adjustments (4) |

|

4,279 |

|

|

5,649 |

|

|

5,064 |

|

|

3,499 |

|

AFFO available to common stockholders |

|

$ |

915,572 |

|

|

$ |

721,370 |

|

|

$ |

2,699,517 |

|

|

$ |

2,043,836 |

|

AFFO allocable to dilutive noncontrolling interests |

|

1,467 |

|

|

1,357 |

|

|

4,413 |

|

|

4,170 |

|

Diluted AFFO |

|

$ |

917,039 |

|

|

$ |

722,727 |

|

|

$ |

2,703,930 |

|

|

$ |

2,048,006 |

|

|

|

|

|

|

|

|

|

|

| AFFO per common share: |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.05 |

|

|

$ |

1.02 |

|

|

$ |

3.14 |

|

|

$ |

3.00 |

|

| Diluted |

|

$ |

1.05 |

|

|

$ |

1.02 |

|

|

$ |

3.14 |

|

|

$ |

2.99 |

|

|

|

|

|

|

|

|

|

|

Distributions paid to common stockholders |

|

$ |

687,144 |

|

|

$ |

543,343 |

|

|

$ |

1,999,858 |

|

|

$ |

1,555,679 |

|

AFFO available to common stockholders in excess of distributions paid to common stockholders |

|

$ |

228,428 |

|

|

$ |

178,027 |

|

|

$ |

699,659 |

|

|

$ |

488,157 |

|

Weighted average number of common shares used for AFFO: |

|

|

|

|

|

|

|

|

| Basic |

|

870,665 |

|

|

709,165 |

|

|

858,679 |

|

|

681,419 |

|

| Diluted |

|

873,974 |

|

|

711,338 |

|

|

861,300 |

|

|

683,925 |

|

(1)See Normalized FFO calculations on page 10 for reconciling items.

(2)Includes the amortization of the purchase price allocated to interest rate swaps acquired in the Spirit merger.

(3)Credit losses primarily consist of a financing receivable impairment for a client in the convenience store industry that defaulted on their lease payments to us.

(4)Includes non-cash foreign currency losses (gains) from remeasurement to USD, mark-to-market adjustments on investments and derivatives that are non-cash in nature, straight-line payments from cross-currency swaps, obligations related to financing lease liabilities, adjustments allocable to noncontrolling interests, and gains and losses on the sale of loans receivable.

HISTORICAL FFO AND AFFO

(in thousands, except per share amounts) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended September 30, |

|

2024 |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

Net income available to common stockholders |

|

$ |

261,781 |

|

|

$ |

233,473 |

|

|

$ |

219,567 |

|

|

$ |

134,996 |

|

|

$ |

22,904 |

|

Depreciation and amortization, net of furniture, fixtures and equipment |

|

601,667 |

|

|

494,749 |

|

|

418,505 |

|

|

198,602 |

|

|

168,927 |

|

Provisions for impairment of real estate |

|

33,151 |

|

|

16,808 |

|

|

1,650 |

|

|

11,011 |

|

|

105,095 |

|

Gain on sales of real estate |

|

(50,563) |

|

|

(7,572) |

|

|

(42,883) |

|

|

(12,094) |

|

|

(13,736) |

|

Proportionate share of adjustments for unconsolidated entities |

|

9,652 |

|

|

— |

|

|

717 |

|

|

— |

|

|

— |

|

FFO adjustments allocable to noncontrolling interests |

|

(762) |

|

|

(1,312) |

|

|

(402) |

|

|

(180) |

|

|

(212) |

|

| FFO available to common stockholders |

|

$ |

854,926 |

|

|

$ |

736,146 |

|

|

$ |

597,154 |

|

|

$ |

332,335 |

|

|

$ |

282,978 |

|

| Merger, transaction, and other costs |

|

8,610 |

|

|

2,884 |

|

|

3,746 |

|

|

16,783 |

|

|

— |

|

| Normalized FFO available to common stockholders |

|

$ |

863,536 |

|

|

$ |

739,030 |

|

|

$ |

600,900 |

|

|

$ |

349,118 |

|

|

$ |

282,978 |

|

| FFO per diluted share |

|

$ |

0.98 |

|

|

$ |

1.04 |

|

|

$ |

0.97 |

|

|

$ |

0.85 |

|

|

$ |

0.82 |

|

| Normalized FFO per diluted share |

|

$ |

0.99 |

|

|

$ |

1.04 |

|

|

$ |

0.97 |

|

|

$ |

0.89 |

|

|

$ |

0.82 |

|

| AFFO available to common stockholders |

|

$ |

915,572 |

|

|

$ |

721,370 |

|

|

$ |

603,566 |

|

|

$ |

356,837 |

|

|

$ |

282,509 |

|

| AFFO per diluted share |

|

$ |

1.05 |

|

|

$ |

1.02 |

|

|

$ |

0.98 |

|

|

$ |

0.91 |

|

|

$ |

0.81 |

|

| Common stock dividends paid |

|

$ |

0.7890 |

|

|

$ |

0.7665 |

|

|

$ |

0.7425 |

|

|

$ |

0.7065 |

|

|

$ |

0.7005 |

|

| Weighted average diluted shares outstanding - FFO, Normalized FFO and AFFO |

|

873,974 |

|

|

711,338 |

|

|

619,201 |

|

|

392,514 |

|

|

347,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the nine months ended September 30, |

|

2024 |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

Net income available to common stockholders |

|

$ |

648,281 |

|

|

$ |

653,904 |

|

|

$ |

642,143 |

|

|

$ |

355,415 |

|

|

$ |

277,555 |

|

Depreciation and amortization, net of furniture, fixtures and equipment |

|

1,787,068 |

|

|

1,417,665 |

|

|

1,230,737 |

|

|

563,932 |

|

|

501,562 |

|

Provisions for impairment of real estate |

|

208,552 |

|

|

59,801 |

|

|

16,379 |

|

|

30,977 |

|

|

123,442 |

|

Gain on sales of real estate |

|

(92,290) |

|

|

(19,675) |

|

|

(93,611) |

|

|

(35,396) |

|

|

(53,565) |

|

Proportionate share of adjustments for unconsolidated entities |

|

20,706 |

|

|

(465) |

|

|

12,812 |

|

|

— |

|

|

— |

|

FFO adjustments allocable to noncontrolling interests |

|

(2,575) |

|

|

(2,808) |

|

|

(1,075) |

|

|

(511) |

|

|

(575) |

|

| FFO available to common stockholders |

|

$ |

2,569,742 |

|

|

$ |

2,108,422 |

|

|

$ |

1,807,385 |

|

|

$ |

914,417 |

|

|

$ |

848,419 |

|

| Merger, transaction, and other costs |

|

105,468 |

|

|

4,532 |

|

|

12,994 |

|

|

30,081 |

|

|

— |

|

| Normalized FFO available to common stockholders |

|

$ |

2,675,210 |

|

|

$ |

2,112,954 |

|

|

$ |

1,820,379 |

|

|

$ |

944,498 |

|

|

$ |

848,419 |

|

| FFO per diluted share |

|

$ |

2.99 |

|

|

$ |

3.09 |

|

|

$ |

2.99 |

|

|

$ |

2.41 |

|

|

$ |

2.48 |

|

| Normalized FFO per diluted share |

|

$ |

3.11 |

|

|

$ |

3.10 |

|

|

$ |

3.01 |

|

|

$ |

2.49 |

|

|

$ |

2.48 |

|

| AFFO available to common stockholders |

|

$ |

2,699,517 |

|

|

$ |

2,043,836 |

|

|

$ |

1,767,392 |

|

|

$ |

1,002,706 |

|

|

$ |

874,972 |

|

| AFFO per diluted share |

|

$ |

3.14 |

|

|

$ |

2.99 |

|

|

$ |

2.92 |

|

|

$ |

2.64 |

|

|

$ |

2.55 |

|

| Common stock dividends paid |

|

$ |

2.3350 |

|

|

$ |

2.2830 |

|

|

$ |

2.2230 |

|

|

$ |

2.1150 |

|

|

$ |

2.0920 |

|

| Weighted average diluted shares outstanding - FFO, Normalized FFO and AFFO |

|

861,300 |

|

|

683,925 |

|

|

605,958 |

|

|

379,873 |

|

|

342,946 |

|

|

|

|

|

|

|

|

|

|

|

|

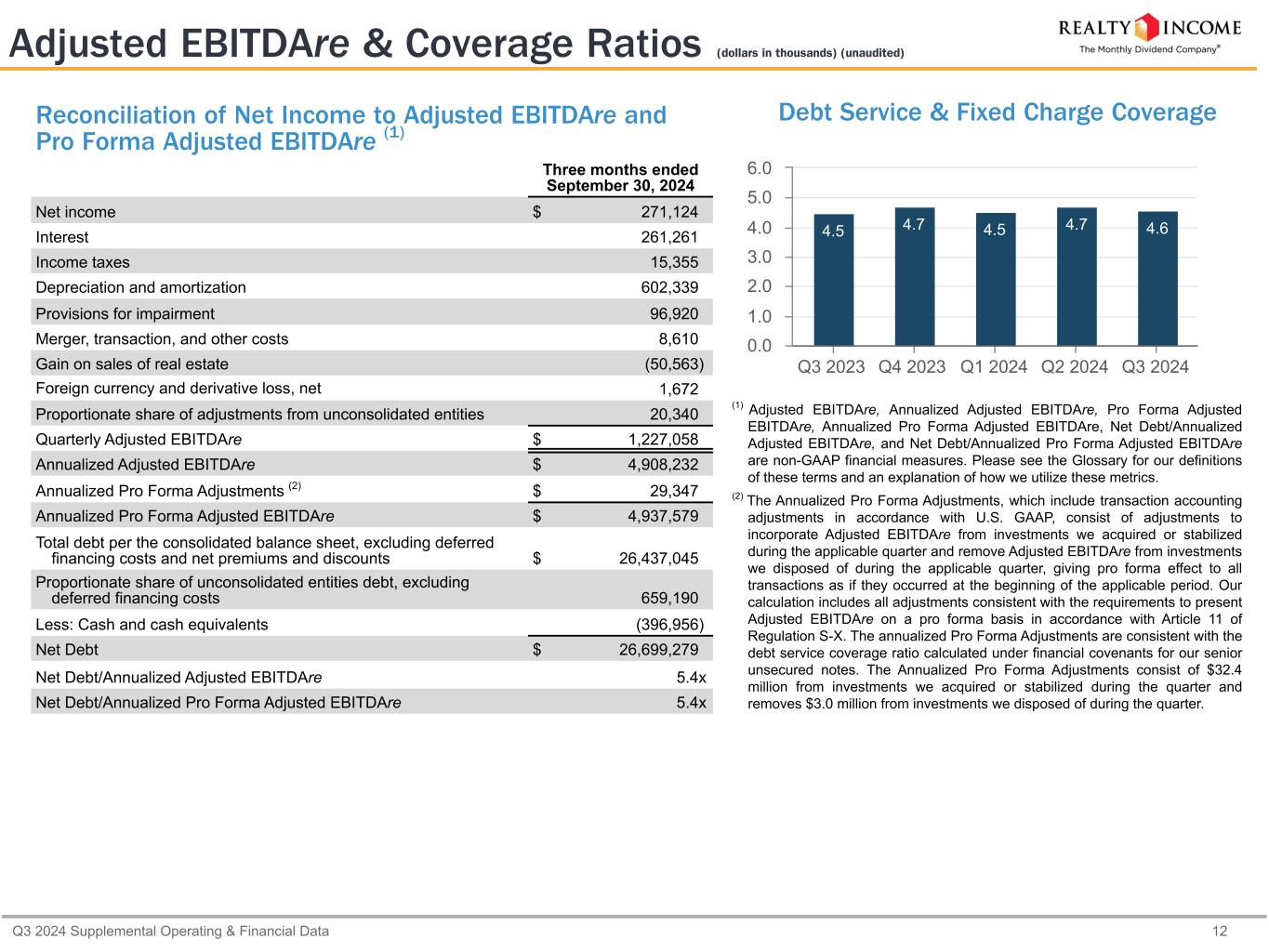

ADJUSTED EBITDAre

(dollars in thousands) (unaudited)

Adjusted EBITDAre, Annualized Adjusted EBITDAre, Pro Forma Adjusted EBITDAre, Annualized Pro Forma Adjusted EBITDAre, Net Debt/Annualized Adjusted EBITDAre, and Net Debt/Annualized Pro Forma Adjusted EBITDAre are non-GAAP financial measures. Please see the Glossary for our definition and an explanation of how we utilize these metrics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

|

2024 |

|

2023 |

| Net income |

|

$ |

271,124 |

|

|

$ |

233,877 |

|

| Interest |

|

261,261 |

|

|

184,121 |

|

|

|

|

|

|

| Income taxes |

|

15,355 |

|

|

11,336 |

|

| Depreciation and amortization |

|

602,339 |

|

|

495,566 |

|

| Provisions for impairment |

|

96,920 |

|

|

16,808 |

|

| Merger, transaction, and other costs |

|

8,610 |

|

|

2,884 |

|

| Gain on sales of real estate |

|

(50,563) |

|

|

(7,572) |

|

| Foreign currency and derivative loss, net |

|

1,672 |

|

|

2,813 |

|

|

|

|

|

|

| Proportionate share of adjustments from unconsolidated entities |

|

20,340 |

|

|

— |

|

Quarterly Adjusted EBITDAre |

|

$ |

1,227,058 |

|

|

$ |

939,833 |

|

Annualized Adjusted EBITDAre (1) |

|

$ |

4,908,232 |

|

|

$ |

3,759,332 |

|

| Annualized Pro Forma Adjustments |

|

$ |

29,347 |

|

|

$ |

74,503 |

|

Annualized Pro Forma Adjusted EBITDAre |

|

$ |

4,937,579 |

|

|

$ |

3,833,835 |

|

| Total debt per the consolidated balance sheet, excluding deferred financing costs and net premiums and discounts |

|

$ |

26,437,045 |

|

|

$ |

20,388,406 |

|

| Proportionate share of unconsolidated entities debt, excluding deferred financing costs |

|

659,190 |

|

|

— |

|

| Less: Cash and cash equivalents |

|

(396,956) |

|

|

(344,129) |

|

Net Debt (2) |

|

$ |

26,699,279 |

|

|

$ |

20,044,277 |

|

|

|

|

|

|

|

|

|

|

|

Net Debt/Annualized Adjusted EBITDAre |

|

5.4 |

x |

|

5.3 |

x |

Net Debt/Annualized Pro Forma Adjusted EBITDAre |

|

5.4 |

x |

|

5.2 |

x |

|

|

|

|

|

|

|

|

|

|

(1) We calculate Annualized Adjusted EBITDAre by multiplying the Quarterly Adjusted EBITDAre by four.

(2) Net Debt is total debt per our consolidated balance sheets, excluding deferred financing costs and net premiums and discounts, but including our proportionate share of debt from unconsolidated entities, less cash and cash equivalents.

The Annualized Pro Forma Adjustments, which include transaction accounting adjustments in accordance with U.S GAAP, consist of adjustments to incorporate Adjusted EBITDAre from investments we acquired or stabilized during the applicable quarter and remove Adjusted EBITDAre from investments we disposed of during the applicable quarter, giving pro forma effect to all transactions as if they occurred at the beginning of the applicable period. Our calculation includes all adjustments consistent with the requirements to present Adjusted EBITDAre on a pro forma basis in accordance with Article 11 of Regulation S-X. The Annualized Pro Forma Adjustments are consistent with the debt service coverage ratio calculated under financial covenants for our senior unsecured notes. The following table summarizes our Annualized Pro Forma Adjustments related to our Annualized Pro Forma Adjusted EBITDAre calculation for the periods indicated below (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

|

|

|

2024 |

|

2023 |

|

|

| Annualized pro forma adjustments from investments acquired or stabilized |

|

$ |

32,378 |

|

|

$ |

79,141 |

|

|

|

| Annualized pro forma adjustments from investments disposed |

|

(3,031) |

|

|

(4,638) |

|

|

|

| Annualized Pro Forma Adjustments |

|

$ |

29,347 |

|

|

$ |

74,503 |

|

|

|

Adjusted Free Cash Flow

(in thousands) (unaudited)

Adjusted Free Cash Flow and Annualized Adjusted Free Cash Flow are non-GAAP financial measures. Please see the Glossary for our definition and an explanation of how we utilize these metrics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended

September 30, |

|

|

|

|

2024 |

|

2023 |

|

|

| Net cash provided by operating activities |

|

$ |

2,601,313 |

|

|

$ |

2,198,111 |

|

|

|

| Non-recurring capital expenditures |

|

(79,952) |

|

|

(37,541) |

|

|

|

| Distributions paid to common stockholders |

|

(1,999,858) |

|

|

(1,555,679) |

|

|

|

| Distributions paid to preferred stockholders |

|

(7,763) |

|

|

— |

|

|

|

Merger, transaction, and other costs (1) |

|

80,717 |

|

|

4,532 |

|

|

|

| Increase in net working capital |

|

(3,867) |

|

|

(143,989) |

|

|

|

| Lease termination fees |

|

(17,048) |

|

|

(4,178) |

|

|

|

| Adjusted Free Cash Flow |

|

$ |

573,542 |

|

|

$ |

461,256 |

|

|

|

| Annualized Adjusted Free Cash Flow |

|

$ |

764,723 |

|

|

$ |

615,008 |

|

|

|

|

|

|

|

|

|

|

(1) Excludes share-based compensation costs recognized in merger, transaction, and other costs.

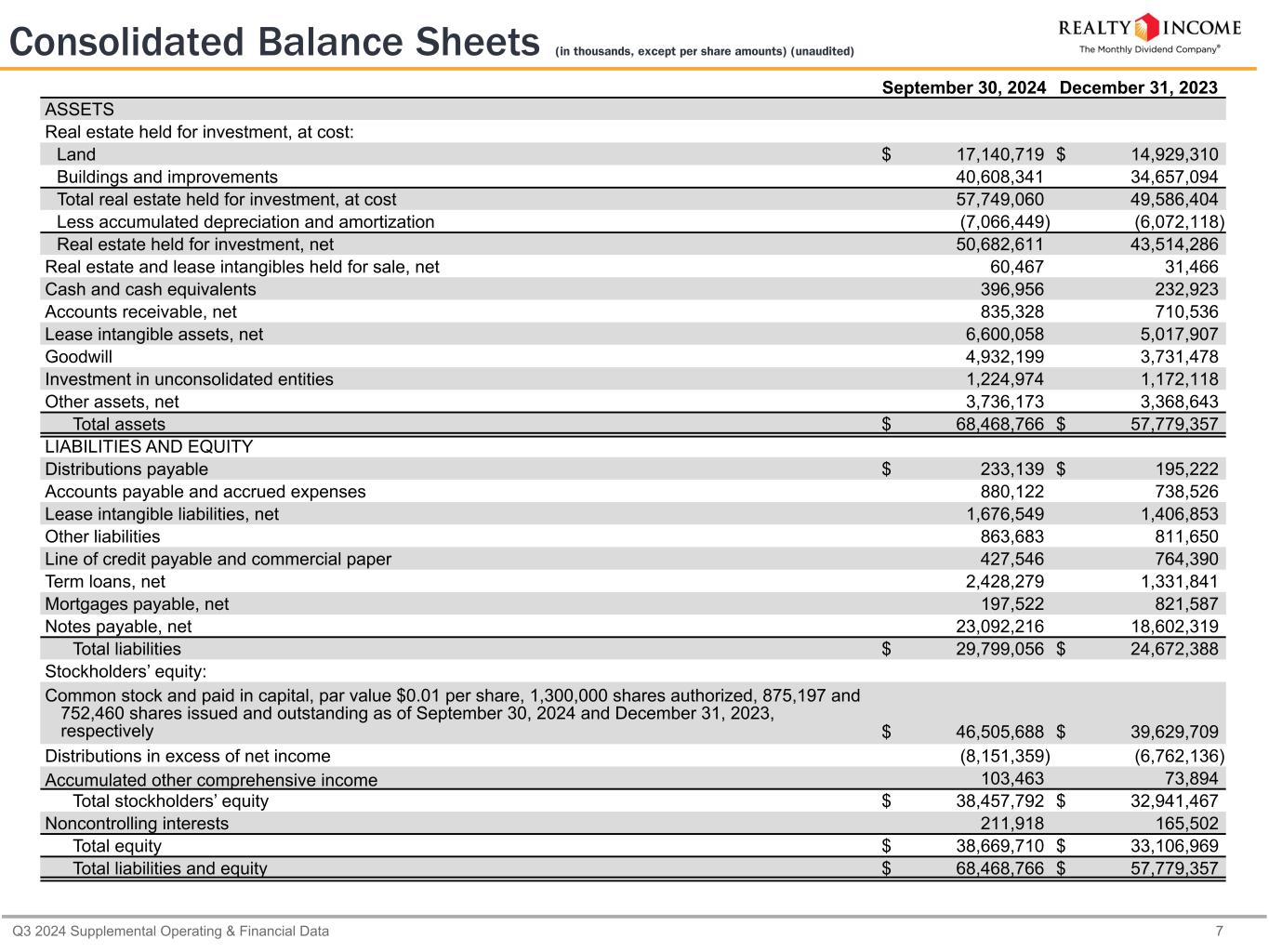

CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts) (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

December 31, 2023 |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

Real estate held for investment, at cost: |

|

|

|

|

|

|

|

|

Land |

|

$ |

17,140,719 |

|

|

$ |

14,929,310 |

|

|

|

|

|

Buildings and improvements |

|

40,608,341 |

|

|

34,657,094 |

|

|

|

|

|

Total real estate held for investment, at cost |

|

57,749,060 |

|

|

49,586,404 |

|

|

|

|

|

Less accumulated depreciation and amortization |

|

(7,066,449) |

|

|

(6,072,118) |

|

|

|

|

|

Real estate held for investment, net |

|

50,682,611 |

|

|

43,514,286 |

|

|

|

|

|

Real estate and lease intangibles held for sale, net |

|

60,467 |

|

|

31,466 |

|

|

|

|

|

Cash and cash equivalents |

|

396,956 |

|

|

232,923 |

|

|

|

|

|

| Accounts receivable, net |

|

835,328 |

|

|

710,536 |

|

|

|

|

|

| Lease intangible assets, net |

|

6,600,058 |

|

|

5,017,907 |

|

|

|

|

|

| Goodwill |

|

4,932,199 |

|

|

3,731,478 |

|

|

|

|

|

| Investment in unconsolidated entities |

|

1,224,974 |

|

|

1,172,118 |

|

|

|

|

|

Other assets, net |

|

3,736,173 |

|

|

3,368,643 |

|

|

|

|

|

Total assets |

|

$ |

68,468,766 |

|

|

$ |

57,779,357 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

Distributions payable |

|

$ |

233,139 |

|

|

$ |

195,222 |

|

|

|

|

|

Accounts payable and accrued expenses |

|

880,122 |

|

|

738,526 |

|

|

|

|

|

Lease intangible liabilities, net |

|

1,676,549 |

|

|

1,406,853 |

|

|

|

|

|

Other liabilities |

|

863,683 |

|

|

811,650 |

|

|

|

|

|

Line of credit payable and commercial paper |

|

427,546 |

|

|

764,390 |

|

|

|

|

|

| Term loans, net |

|

2,428,279 |

|

|

1,331,841 |

|

|

|

|

|

Mortgages payable, net |

|

197,522 |

|

|

821,587 |

|

|

|

|

|

Notes payable, net |

|

23,092,216 |

|

|

18,602,319 |

|

|

|

|

|

Total liabilities |

|

$ |

29,799,056 |

|

|

$ |

24,672,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

Common stock and paid in capital, par value $0.01 per share, 1,300,000 shares authorized, 875,197 and 752,460 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively |

|

$ |

46,505,688 |

|

|

$ |

39,629,709 |

|

|

|

|

|

Distributions in excess of net income |

|

(8,151,359) |

|

|

(6,762,136) |

|

|

|

|

|

| Accumulated other comprehensive income |

|

103,463 |

|

|

73,894 |

|

|

|

|

|

Total stockholders’ equity |

|

$ |

38,457,792 |

|

|

$ |

32,941,467 |

|

|

|

|

|

Noncontrolling interests |

|

211,918 |

|

|

165,502 |

|

|

|

|

|

Total equity |

|

$ |

38,669,710 |

|

|

$ |

33,106,969 |

|

|

|

|

|

Total liabilities and equity |

|

$ |

68,468,766 |

|

|

$ |

57,779,357 |

|

|

|

|

|

GLOSSARY

Adjusted EBITDAre, The National Association of Real Estate Investment Trusts (Nareit) established an EBITDA metric for real estate companies (i.e., EBITDA for real estate, or EBITDAre) it believed would provide investors with a consistent measure to help make investment decisions among certain REITs. Our definition of “Adjusted EBITDAre” is generally consistent with the Nareit definition, other than our adjustment to remove foreign currency and derivative gain and loss and merger, transaction, and other costs. We define Adjusted EBITDAre, a non-GAAP financial measure, for the most recent quarter as earnings (net income) before (i) interest expense, (ii) income taxes, (iii) depreciation and amortization, (iv) provisions for impairment, (v) merger, transaction, and other costs, (vi) gain on sales of real estate, (vii) foreign currency and derivative gain and loss, net, and (viii) our proportionate share of adjustments from unconsolidated entities. Our Adjusted EBITDAre may not be comparable to Adjusted EBITDAre reported by other companies or as defined by Nareit, and other companies may interpret or define Adjusted EBITDAre differently than we do. Management believes Adjusted EBITDAre to be a meaningful measure of a REIT’s performance because it provides a view of our operating performance, analyzes our ability to meet interest payment obligations before the effects of income tax, depreciation and amortization expense, provisions for impairment, gain on sales of real estate and other items, as defined above, that affect comparability, including the removal of non-recurring and non-cash items that industry observers believe are less relevant to evaluating the operating performance of a company. In addition, EBITDAre is widely followed by industry analysts, lenders, investors, rating agencies, and others as a means of evaluating the operational cash generating capacity of a company prior to servicing debt obligations. Management also believes the use of an annualized quarterly Adjusted EBITDAre metric is meaningful because it represents our current earnings run rate for the period presented. The ratio of our total debt to our annualized quarterly Adjusted EBITDAre is also used to determine vesting of performance share awards granted to our executive officers. Adjusted EBITDAre should be considered along with, but not as an alternative to, net income as a measure of our operating performance.

Adjusted Free Cash Flow, a non-GAAP financial measure, is defined as net cash provided by operating activities, excluding merger, transaction, and other costs, changes in net working capital and lease termination fees, less non-recurring capital expenditures and dividends paid. We believe adjusted free cash flow to be a useful liquidity measure for us and our investors by helping to evaluate our ability to generate cash beyond what is needed to fund capital expenditures, debt service and other obligations. Notwithstanding cash on hand and incremental borrowing capacity, adjusted free cash flow reflects our ability to grow our business through investments and acquisitions, as well as our ability to return cash to shareholders through dividends. Adjusted free cash flow is not considered under generally accepted accounting principles to be a primary measure of an entity’s residual cash flow available for discretionary spending, and accordingly should not be considered an alternative to operating income, net income, or amounts shown in our consolidated statements of cash flows.

Adjusted Funds From Operations (AFFO), a non-GAAP financial measure, is defined as FFO adjusted for unique revenue and expense items, which we believe are not as pertinent to the measurement of our ongoing operating performance. Most companies in our industry use a similar measurement to AFFO, but they may use the term "CAD" (for Cash Available for Distribution) or "FAD" (for Funds Available for Distribution). We believe AFFO provides useful information to investors because it is a widely accepted industry measure of the operating performance of real estate companies used by the investment community. In particular, AFFO provides an additional measure to compare the operating performance of different REITs without having to account for differing depreciation assumptions and other unique revenue and expense items which are not pertinent to measuring a particular company’s ongoing operating performance. Therefore, we believe that AFFO is an appropriate supplemental performance metric, and that the most appropriate GAAP performance metric to which AFFO should be reconciled is net income available to common stockholders.

Annualized Adjusted EBITDAre, a non-GAAP financial measure, is calculated by annualizing Adjusted EBITDAre.