false2024FY0000723612P2Yhttp://fasb.org/us-gaap/2024#AssetImpairmentChargeshttp://fasb.org/us-gaap/2024#AssetImpairmentChargeshttp://fasb.org/us-gaap/2024#Revenueshttp://fasb.org/us-gaap/2024#Revenueshttp://fasb.org/us-gaap/2024#Revenueshttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccountsPayableAndAccruedLiabilitiesCurrenthttp://www.avis.com/20241231#VehiclesNethttp://www.avis.com/20241231#VehiclesNethttp://fasb.org/us-gaap/2024#FinanceLeaseLiabilityhttp://fasb.org/us-gaap/2024#FinanceLeaseLiabilityhttp://fasb.org/us-gaap/2024#OperatingLeaseRightOfUseAssethttp://fasb.org/us-gaap/2024#OperatingLeaseRightOfUseAssethttp://fasb.org/us-gaap/2024#OperatingLeaseRightOfUseAssethttp://fasb.org/us-gaap/2024#OperatingLeaseRightOfUseAssethttp://fasb.org/us-gaap/2024#SecuredOvernightFinancingRateSofrMemberhttp://fasb.org/us-gaap/2024#SecuredOvernightFinancingRateSofrMember0.3334http://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpenseiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureiso4217:EURcar:classActioncar:defendantcar:employeecar:vehicle00007236122024-01-012024-12-3100007236122024-06-3000007236122025-02-0700007236122024-10-012024-12-3100007236122023-01-012023-12-3100007236122022-01-012022-12-310000723612us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-12-310000723612us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-12-310000723612us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-01-012022-12-3100007236122024-12-3100007236122023-12-3100007236122022-12-3100007236122021-12-310000723612us-gaap:CommonStockMember2021-12-310000723612us-gaap:AdditionalPaidInCapitalMember2021-12-310000723612us-gaap:RetainedEarningsMember2021-12-310000723612us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-12-310000723612us-gaap:TreasuryStockCommonMember2021-12-310000723612us-gaap:ParentMember2021-12-310000723612us-gaap:NoncontrollingInterestMember2021-12-310000723612us-gaap:RetainedEarningsMember2022-01-012022-12-310000723612us-gaap:ParentMember2022-01-012022-12-310000723612us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000723612us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000723612us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000723612us-gaap:CommonStockMember2022-12-310000723612us-gaap:AdditionalPaidInCapitalMember2022-12-310000723612us-gaap:RetainedEarningsMember2022-12-310000723612us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310000723612us-gaap:TreasuryStockCommonMember2022-12-310000723612us-gaap:ParentMember2022-12-310000723612us-gaap:NoncontrollingInterestMember2022-12-310000723612us-gaap:RetainedEarningsMember2023-01-012023-12-310000723612us-gaap:ParentMember2023-01-012023-12-310000723612us-gaap:NoncontrollingInterestMember2023-01-012023-12-310000723612us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000723612us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000723612us-gaap:CommonStockMember2023-12-310000723612us-gaap:AdditionalPaidInCapitalMember2023-12-310000723612us-gaap:RetainedEarningsMember2023-12-310000723612us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310000723612us-gaap:TreasuryStockCommonMember2023-12-310000723612us-gaap:ParentMember2023-12-310000723612us-gaap:NoncontrollingInterestMember2023-12-310000723612us-gaap:RetainedEarningsMember2024-01-012024-12-310000723612us-gaap:ParentMember2024-01-012024-12-310000723612us-gaap:NoncontrollingInterestMember2024-01-012024-12-310000723612us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000723612us-gaap:TreasuryStockCommonMember2024-01-012024-12-310000723612us-gaap:CommonStockMember2024-12-310000723612us-gaap:AdditionalPaidInCapitalMember2024-12-310000723612us-gaap:RetainedEarningsMember2024-12-310000723612us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-12-310000723612us-gaap:TreasuryStockCommonMember2024-12-310000723612us-gaap:ParentMember2024-12-310000723612us-gaap:NoncontrollingInterestMember2024-12-310000723612us-gaap:RoyaltyMember2024-01-012024-12-310000723612us-gaap:RoyaltyMember2023-01-012023-12-310000723612us-gaap:RoyaltyMember2022-01-012022-12-310000723612srt:AmericasMember2024-01-012024-12-310000723612srt:AmericasMember2023-01-012023-12-310000723612srt:AmericasMember2022-01-012022-12-310000723612us-gaap:EMEAMember2024-01-012024-12-310000723612us-gaap:EMEAMember2023-01-012023-12-310000723612us-gaap:EMEAMember2022-01-012022-12-310000723612car:AsiaandAustralasiaMember2024-01-012024-12-310000723612car:AsiaandAustralasiaMember2023-01-012023-12-310000723612car:AsiaandAustralasiaMember2022-01-012022-12-310000723612car:AvisMember2024-01-012024-12-310000723612car:AvisMember2023-01-012023-12-310000723612car:AvisMember2022-01-012022-12-310000723612car:BudgetMember2024-01-012024-12-310000723612car:BudgetMember2023-01-012023-12-310000723612car:BudgetMember2022-01-012022-12-310000723612car:OtherBrandsMember2024-01-012024-12-310000723612car:OtherBrandsMember2023-01-012023-12-310000723612car:OtherBrandsMember2022-01-012022-12-310000723612car:CustomerLoyaltyMembersrt:MaximumMember2024-01-012024-12-310000723612car:CustomerLoyaltyMembersrt:MinimumMember2024-01-012024-12-310000723612car:CustomerLoyaltyMember2023-12-310000723612car:CustomerLoyaltyMember2022-12-310000723612car:CustomerLoyaltyMember2024-01-012024-12-310000723612car:CustomerLoyaltyMember2023-01-012023-12-310000723612car:CustomerLoyaltyMember2024-12-3100007236122025-01-01srt:MinimumMember2024-12-3100007236122025-01-01srt:MaximumMember2024-12-310000723612us-gaap:BuildingMember2024-12-310000723612srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-12-310000723612srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2024-12-310000723612srt:MinimumMemberus-gaap:ComputerSoftwareIntangibleAssetMember2024-12-310000723612srt:MaximumMemberus-gaap:ComputerSoftwareIntangibleAssetMember2024-12-310000723612srt:MinimumMemberus-gaap:VehiclesMember2024-12-310000723612srt:MaximumMemberus-gaap:VehiclesMember2024-12-310000723612us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-02-280000723612us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-310000723612us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-03-012022-03-310000723612car:PropertyMember2024-01-012024-12-310000723612car:PropertyMember2023-01-012023-12-310000723612car:PropertyMember2022-01-012022-12-310000723612us-gaap:VehiclesMember2024-01-012024-12-310000723612us-gaap:VehiclesMember2023-01-012023-12-310000723612us-gaap:VehiclesMember2022-01-012022-12-310000723612car:PropertyMember2024-12-310000723612car:PropertyMember2023-12-310000723612us-gaap:VehiclesMember2024-12-310000723612us-gaap:VehiclesMember2023-12-310000723612us-gaap:RestrictedStockMember2024-01-012024-12-310000723612us-gaap:RestrictedStockMember2023-01-012023-12-310000723612us-gaap:RestrictedStockMember2022-01-012022-12-310000723612car:GlobalRightsizingMember2024-12-310000723612us-gaap:EmployeeSeveranceMember2021-12-310000723612us-gaap:FacilityClosingMember2021-12-310000723612us-gaap:OtherRestructuringMember2021-12-310000723612us-gaap:EmployeeSeveranceMembercar:CostOptimizationMember2022-01-012022-12-310000723612us-gaap:FacilityClosingMembercar:CostOptimizationMember2022-01-012022-12-310000723612us-gaap:OtherRestructuringMembercar:CostOptimizationMember2022-01-012022-12-310000723612car:CostOptimizationMember2022-01-012022-12-310000723612us-gaap:EmployeeSeveranceMembercar:T21RestructuringPlanMember2022-01-012022-12-310000723612us-gaap:FacilityClosingMembercar:T21RestructuringPlanMember2022-01-012022-12-310000723612us-gaap:OtherRestructuringMembercar:T21RestructuringPlanMember2022-01-012022-12-310000723612car:T21RestructuringPlanMember2022-01-012022-12-310000723612us-gaap:EmployeeSeveranceMembercar:BrazilRestructuringMember2022-01-012022-12-310000723612us-gaap:FacilityClosingMembercar:BrazilRestructuringMember2022-01-012022-12-310000723612us-gaap:OtherRestructuringMembercar:BrazilRestructuringMember2022-01-012022-12-310000723612car:BrazilRestructuringMember2022-01-012022-12-310000723612us-gaap:EmployeeSeveranceMembercar:A2020OptimizationMember2022-01-012022-12-310000723612us-gaap:FacilityClosingMembercar:A2020OptimizationMember2022-01-012022-12-310000723612us-gaap:OtherRestructuringMembercar:A2020OptimizationMember2022-01-012022-12-310000723612car:A2020OptimizationMember2022-01-012022-12-310000723612us-gaap:EmployeeSeveranceMembercar:T19RestructuringPlanMember2022-01-012022-12-310000723612us-gaap:FacilityClosingMembercar:T19RestructuringPlanMember2022-01-012022-12-310000723612us-gaap:OtherRestructuringMembercar:T19RestructuringPlanMember2022-01-012022-12-310000723612car:T19RestructuringPlanMember2022-01-012022-12-310000723612us-gaap:EmployeeSeveranceMember2022-12-310000723612us-gaap:FacilityClosingMember2022-12-310000723612us-gaap:OtherRestructuringMember2022-12-310000723612us-gaap:EmployeeSeveranceMembercar:CostOptimizationMember2023-01-012023-12-310000723612us-gaap:FacilityClosingMembercar:CostOptimizationMember2023-01-012023-12-310000723612us-gaap:OtherRestructuringMembercar:CostOptimizationMember2023-01-012023-12-310000723612car:CostOptimizationMember2023-01-012023-12-310000723612us-gaap:EmployeeSeveranceMembercar:BrazilRestructuringMember2023-01-012023-12-310000723612us-gaap:FacilityClosingMembercar:BrazilRestructuringMember2023-01-012023-12-310000723612us-gaap:OtherRestructuringMembercar:BrazilRestructuringMember2023-01-012023-12-310000723612car:BrazilRestructuringMember2023-01-012023-12-310000723612us-gaap:EmployeeSeveranceMember2023-12-310000723612us-gaap:FacilityClosingMember2023-12-310000723612us-gaap:OtherRestructuringMember2023-12-310000723612us-gaap:EmployeeSeveranceMembercar:GlobalRightsizingMember2024-01-012024-12-310000723612us-gaap:FacilityClosingMembercar:GlobalRightsizingMember2024-01-012024-12-310000723612us-gaap:OtherRestructuringMembercar:GlobalRightsizingMember2024-01-012024-12-310000723612car:GlobalRightsizingMember2024-01-012024-12-310000723612us-gaap:EmployeeSeveranceMembercar:CostOptimizationMember2024-01-012024-12-310000723612us-gaap:FacilityClosingMembercar:CostOptimizationMember2024-01-012024-12-310000723612us-gaap:OtherRestructuringMembercar:CostOptimizationMember2024-01-012024-12-310000723612car:CostOptimizationMember2024-01-012024-12-310000723612us-gaap:EmployeeSeveranceMember2024-12-310000723612us-gaap:FacilityClosingMember2024-12-310000723612us-gaap:OtherRestructuringMember2024-12-310000723612srt:AmericasMember2021-12-310000723612car:InternationalMember2021-12-310000723612srt:AmericasMembercar:CostOptimizationMember2022-01-012022-12-310000723612car:InternationalMembercar:CostOptimizationMember2022-01-012022-12-310000723612srt:AmericasMembercar:T21RestructuringPlanMember2022-01-012022-12-310000723612car:InternationalMembercar:T21RestructuringPlanMember2022-01-012022-12-310000723612srt:AmericasMembercar:BrazilRestructuringMember2022-01-012022-12-310000723612car:InternationalMembercar:BrazilRestructuringMember2022-01-012022-12-310000723612srt:AmericasMembercar:A2020OptimizationMember2022-01-012022-12-310000723612car:InternationalMembercar:A2020OptimizationMember2022-01-012022-12-310000723612srt:AmericasMembercar:T19RestructuringPlanMember2022-01-012022-12-310000723612car:InternationalMembercar:T19RestructuringPlanMember2022-01-012022-12-310000723612srt:AmericasMember2022-12-310000723612car:InternationalMember2022-12-310000723612srt:AmericasMembercar:CostOptimizationMember2023-01-012023-12-310000723612car:InternationalMembercar:CostOptimizationMember2023-01-012023-12-310000723612srt:AmericasMembercar:BrazilRestructuringMember2023-01-012023-12-310000723612car:InternationalMembercar:BrazilRestructuringMember2023-01-012023-12-310000723612srt:AmericasMember2023-12-310000723612car:InternationalMember2023-12-310000723612srt:AmericasMembercar:GlobalRightsizingMember2024-01-012024-12-310000723612car:InternationalMembercar:GlobalRightsizingMember2024-01-012024-12-310000723612srt:AmericasMembercar:CostOptimizationMember2024-01-012024-12-310000723612car:InternationalMembercar:CostOptimizationMember2024-01-012024-12-310000723612srt:AmericasMember2024-12-310000723612car:InternationalMember2024-12-310000723612srt:ExecutiveVicePresidentMember2022-01-012022-12-310000723612car:McNicollVehicleHireMember2023-09-012023-09-300000723612car:McNicollVehicleHireMember2023-09-300000723612car:McNicollVehicleHireMemberus-gaap:TradeNamesMember2023-09-012023-09-300000723612car:McNicollVehicleHireMemberus-gaap:CustomerRelationshipsMember2023-09-012023-09-300000723612car:McNicollVehicleHireMember2024-12-3100007236122023-06-012023-06-300000723612us-gaap:VehiclesMember2023-06-012023-06-3000007236122023-10-012023-10-310000723612us-gaap:VehiclesMember2023-10-012023-10-310000723612us-gaap:FranchiseRightsMember2023-06-012023-06-300000723612us-gaap:LicensingAgreementsMember2023-10-012023-10-310000723612us-gaap:LicensingAgreementsMember2024-12-310000723612us-gaap:LicensingAgreementsMember2023-12-310000723612us-gaap:CustomerRelationshipsMember2024-12-310000723612us-gaap:CustomerRelationshipsMember2023-12-310000723612us-gaap:OtherIntangibleAssetsMember2024-12-310000723612us-gaap:OtherIntangibleAssetsMember2023-12-310000723612us-gaap:TrademarksMember2024-12-310000723612us-gaap:TrademarksMember2023-12-310000723612us-gaap:LicensingAgreementsMembersrt:MinimumMember2024-12-310000723612us-gaap:LicensingAgreementsMembersrt:MaximumMember2024-12-310000723612us-gaap:LicensingAgreementsMembersrt:WeightedAverageMember2024-12-310000723612us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-12-310000723612us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-12-310000723612us-gaap:CustomerRelationshipsMembersrt:WeightedAverageMember2024-12-310000723612us-gaap:OtherIntangibleAssetsMembersrt:MinimumMember2024-12-310000723612us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2024-12-310000723612us-gaap:OtherIntangibleAssetsMembersrt:WeightedAverageMember2024-12-310000723612us-gaap:LicensingAgreementsMember2024-01-012024-12-310000723612us-gaap:LicensingAgreementsMember2023-01-012023-12-310000723612us-gaap:LicensingAgreementsMember2022-01-012022-12-310000723612us-gaap:CustomerRelationshipsMember2024-01-012024-12-310000723612us-gaap:CustomerRelationshipsMember2023-01-012023-12-310000723612us-gaap:CustomerRelationshipsMember2022-01-012022-12-310000723612us-gaap:OtherIntangibleAssetsMember2024-01-012024-12-310000723612us-gaap:OtherIntangibleAssetsMember2023-01-012023-12-310000723612us-gaap:OtherIntangibleAssetsMember2022-01-012022-12-310000723612car:InternationalMember2023-01-012023-12-310000723612car:InternationalMember2024-01-012024-12-310000723612car:VehicleProgramsMember2024-12-310000723612car:VehicleProgramsMember2023-12-310000723612us-gaap:OtherAssetsMember2024-12-310000723612us-gaap:OtherAssetsMember2023-12-310000723612us-gaap:AssetsMember2024-12-310000723612us-gaap:AssetsMember2023-12-310000723612us-gaap:OtherLiabilitiesMember2024-12-310000723612us-gaap:OtherLiabilitiesMember2023-12-310000723612us-gaap:LiabilityMember2024-12-310000723612us-gaap:LiabilityMember2023-12-310000723612car:VehicleProgramsNetMember2024-12-310000723612car:VehicleProgramsNetMember2023-12-310000723612us-gaap:InternalRevenueServiceIRSMember2024-12-310000723612car:CurrentIncomeTaxesPayableMember2024-12-310000723612car:CurrentIncomeTaxesPayableMember2023-12-310000723612car:NoncurrentIncomeTaxesPayableMember2024-12-310000723612car:NoncurrentIncomeTaxesPayableMember2023-12-310000723612us-gaap:LandMember2024-12-310000723612us-gaap:LandMember2023-12-310000723612us-gaap:BuildingAndBuildingImprovementsMember2024-12-310000723612us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000723612us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000723612us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310000723612us-gaap:FurnitureAndFixturesMember2024-12-310000723612us-gaap:FurnitureAndFixturesMember2023-12-310000723612us-gaap:ConstructionInProgressMember2024-12-310000723612us-gaap:ConstructionInProgressMember2023-12-310000723612car:FourPointSevenFivePercentEuroDenominatedSeniorNotesDue2026Memberus-gaap:SeniorNotesMember2024-12-310000723612car:FourPointSevenFivePercentEuroDenominatedSeniorNotesDue2026Memberus-gaap:SeniorNotesMember2023-12-310000723612car:FivePointSevenFivePercentSeniorNotesDue2027Memberus-gaap:SeniorNotesMember2024-12-310000723612car:FivePointSevenFivePercentSeniorNotesDue2027Memberus-gaap:SeniorNotesMember2023-12-310000723612car:FourPointSevenFivePercentSeniorNotesDue2028Memberus-gaap:SeniorNotesMember2024-12-310000723612car:FourPointSevenFivePercentSeniorNotesDue2028Memberus-gaap:SeniorNotesMember2023-12-310000723612car:SevenPointZeroPercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000723612car:SevenPointZeroPercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000723612car:FivePointThreeSevenFivePercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2024-12-310000723612car:FivePointThreeSevenFivePercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2023-12-310000723612car:EightPointTwoFivePercentSeniorNotesDue2030Memberus-gaap:SeniorNotesMember2024-12-310000723612car:EightPointTwoFivePercentSeniorNotesDue2030Memberus-gaap:SeniorNotesMember2023-12-310000723612car:SevenPointTwoFivePercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2024-12-310000723612car:SevenPointTwoFivePercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310000723612car:EightPointZeroPercentSeniorNotesDue2031Memberus-gaap:SeniorNotesMember2024-12-310000723612car:EightPointZeroPercentSeniorNotesDue2031Memberus-gaap:SeniorNotesMember2023-12-310000723612car:FloatingRateTermLoanDueAugustTwoThousandTwentySevenMemberus-gaap:LoansPayableMember2024-12-310000723612car:FloatingRateTermLoanDueAugustTwoThousandTwentySevenMemberus-gaap:LoansPayableMember2023-12-310000723612car:FloatingRateTermLoanDueMarchTwoThousandTwentyNineMemberus-gaap:LoansPayableMember2024-12-310000723612car:FloatingRateTermLoanDueMarchTwoThousandTwentyNineMemberus-gaap:LoansPayableMember2023-12-310000723612car:FloatingRateTermLoanDueAugustTwoThousandTwentySevenMemberus-gaap:LoansPayableMember2024-01-012024-12-310000723612car:FloatingRateTermLoanDueAugustTwoThousandTwentySevenMemberus-gaap:InterestRateSwapMemberus-gaap:LoansPayableMember2024-12-310000723612car:FloatingRateTermLoanDueMarchTwoThousandTwentyNineMemberus-gaap:LoansPayableMember2022-03-310000723612car:EightPointZeroPercentSeniorNotesDue2031Memberus-gaap:LoansPayableMember2023-12-310000723612car:EightPointZeroPercentSeniorNotesDue2031Memberus-gaap:LoansPayableMember2023-11-300000723612car:EightPointTwoFivePercentSeniorNotesDue2030Memberus-gaap:SeniorNotesMember2024-10-310000723612car:FourPointSevenFivePercentEuroDenominatedSeniorNotesDue2026Memberus-gaap:SeniorNotesMember2018-10-310000723612car:FivePointOneTwoFivePercentSeniorNotesDue2022Memberus-gaap:SeniorNotesMember2018-10-310000723612car:SevenPointZeroPercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2024-04-300000723612car:FivePointSevenFivePercentSeniorNotesDue2027Memberus-gaap:SeniorNotesMember2019-07-310000723612car:FivePointFivePercentSeniorNotesDue2023Memberus-gaap:SeniorNotesMember2019-07-310000723612car:FivePointSevenFivePercentSeniorNotesDue2027Memberus-gaap:SeniorNotesMember2020-08-310000723612car:FivePointSevenFivePercentSeniorNotesDue2027Memberus-gaap:SeniorNotesMember2020-08-012020-08-310000723612car:FivePointFivePercentSeniorNotesDue2023Memberus-gaap:SeniorNotesMember2020-08-310000723612car:FourPointSevenFivePercentSeniorNotesDue2028Memberus-gaap:SeniorNotesMember2021-03-310000723612car:SixPointThreeSevenFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2021-03-310000723612car:SixPointThreeSevenFivePercentSeniorNotesMemberus-gaap:SeniorNotesMember2021-03-012021-03-310000723612car:FivePointTwoFivePercentSeniorNotesDue2025Memberus-gaap:SeniorNotesMember2021-03-310000723612car:FivePointTwoFivePercentSeniorNotesDue2025Memberus-gaap:SeniorNotesMember2021-03-012021-03-310000723612car:FivePointThreeSevenFivePercentSeniorNotesDue2029Memberus-gaap:SeniorNotesMember2021-03-310000723612car:TenPointFivePercentSeniorSecuredNotesDue2025Memberus-gaap:SeniorNotesMember2021-03-310000723612car:TenPointFivePercentSeniorSecuredNotesDue2025Memberus-gaap:SeniorNotesMember2021-03-012021-03-310000723612car:SevenPointTwoFivePercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2023-07-310000723612car:FourPointOneTwoFivePercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2023-07-310000723612car:SevenPointTwoFivePercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2024-05-310000723612car:SevenPointTwoFivePercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2024-05-012024-05-310000723612car:EightPointZeroPercentSeniorNotesDue2031Memberus-gaap:SeniorNotesMember2023-11-300000723612car:NinetyNinePointThreeSeniorNotesDue2031Memberus-gaap:SeniorNotesMember2023-11-012023-11-300000723612car:FourPointFivePercentEuroDenominatedSeniorNotesDue2025Memberus-gaap:SeniorNotesMember2017-03-310000723612car:SevenPointZeroPercentEuroDenominatedSeniorNotesMemberus-gaap:SeniorNotesMember2024-02-290000723612car:FourPointSevenFivePercentEuroDenominatedSeniorNotesDue2026Memberus-gaap:SeniorNotesMember2024-02-290000723612car:EightPointTwoFivePercentSeniorNotesDue2030Memberus-gaap:SeniorNotesMember2024-09-300000723612car:FourPointSevenFivePercentSeniorNotesDue2028Memberus-gaap:SeniorNotesMember2022-03-310000723612car:DebtInsturmentsMember2024-12-310000723612srt:MaximumMember2024-12-310000723612srt:MinimumMember2024-12-310000723612us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310000723612us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-12-310000723612car:SBLCFacilityMemberus-gaap:LineOfCreditMember2024-12-310000723612car:DebtDueToRentalCarFundingMember2024-12-310000723612car:DebtDueToRentalCarFundingMember2023-12-310000723612car:AmericasDebtBorrowingsMember2024-12-310000723612car:AmericasDebtBorrowingsMember2023-12-310000723612car:InternationalDebtBorrowingsMember2024-12-310000723612car:InternationalDebtBorrowingsMember2023-12-310000723612car:InternationalCapitalLeasesMember2024-12-310000723612car:InternationalCapitalLeasesMember2023-12-310000723612car:OtherDebtUnderVehicleProgramMember2024-12-310000723612car:OtherDebtUnderVehicleProgramMember2023-12-310000723612car:VehicleProgramsMember2024-12-310000723612car:VehicleProgramsMember2023-12-310000723612car:DebtDueToRentalCarFundingClassRNotesMember2024-12-310000723612car:DebtDueToRentalCarFundingClassRNotesMember2023-12-310000723612car:VehicleProgramsMembercar:AvisBudgetRentalCarFundingMember2024-12-310000723612car:VehicleProgramsMembercar:AvisBudgetRentalCarFundingMember2023-12-310000723612car:AvisBudgetRentalCarFundingProgramJune2029Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramApril2026Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramApril2028Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramOctober2026Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramOctober2027Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramDecember2029Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramFebruary2026Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramApril2026IssuedDecember2024Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramOctober2026IssuedDecember2024Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramFebruary2027Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramApril2027Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramOctober2027IssuedDecember2024Member2024-12-310000723612car:AvisBudgetRentalCarFundingProgramApril2028Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramOctober2026Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramFebruary2027Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramJune2028Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramApril2027Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramDecember2028Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramAugust2027Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramFebruary2029Member2023-12-310000723612car:AvisBudgetRentalCarFundingProgramMember2024-12-310000723612car:AvisBudgetRentalCarFundingProgramMember2023-12-310000723612car:AmericasDebtBorrowingsMember2024-12-310000723612car:AmericasDebtBorrowingsMember2023-12-310000723612car:RepurchaseFacilityMember2024-01-012024-12-310000723612car:RepurchaseFacilityMember2024-12-310000723612car:EuropeanRentalFleetSecuritizationMember2024-01-312024-01-310000723612car:EuropeanRentalFleetSecuritizationMember2024-02-012024-02-290000723612car:EuropeanRentalFleetSecuritizationMember2024-03-012024-12-310000723612car:InternationalDebtBorrowingsMember2024-12-310000723612car:InternationalDebtBorrowingsMember2023-12-310000723612car:VehicleProgramsMembercar:BankAndBankSponsoredFacilitiesMember2024-12-310000723612car:DebtDueToRentalCarFundingMembersrt:AffiliatedEntityMember2024-12-310000723612car:DebtDueToRentalCarFundingMemberus-gaap:SecuredDebtMembersrt:AffiliatedEntityMember2024-12-310000723612car:AmericasDebtBorrowingsMemberus-gaap:SecuredDebtMember2024-12-310000723612car:InternationalDebtBorrowingsMemberus-gaap:SecuredDebtMember2024-12-310000723612car:InternationalCapitalLeasesMemberus-gaap:SecuredDebtMember2024-12-310000723612car:RealEstateIncMembercar:TaxLiabilityMember2023-03-310000723612car:WyndhamHotelsAndResortsIncAndTravelLeisureCoMembercar:TaxLiabilityMember2023-03-310000723612car:CauseNo.CC2303188EMemberus-gaap:PendingLitigationMember2023-06-012023-06-3000007236122023-06-300000723612car:CauseNo.CC2303188EMemberus-gaap:PendingLitigationMember2024-06-300000723612car:RealogyCorporationMember2024-12-310000723612car:WyndhamWorldwideCorporationMember2024-12-3100007236122022-01-012024-12-310000723612us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310000723612us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310000723612us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000723612us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000723612us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310000723612us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310000723612us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000723612us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000723612us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310000723612us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000723612us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000723612us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310000723612us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310000723612us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000723612us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000723612us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310000723612us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000723612us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000723612us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-12-310000723612us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-12-310000723612us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-12-310000723612us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310000723612us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310000723612us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310000723612us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000723612car:SubsidiaryEquityMembercar:SRSMobilityVenturesLLCMember2021-01-012021-12-310000723612car:SubsidiaryEquityMembercar:CompanySubsidiaryMembercar:SRSMobilityVenturesLLCMembersrt:MaximumMember2022-09-010000723612car:SubsidiaryEquityMembercar:SRSMobilityVenturesLLCMember2022-09-010000723612car:SubsidiaryEquityMember2024-12-310000723612car:SubsidiaryEquityMembercar:SubsidiaryEquityMembercar:SRSMobilityVenturesLLCMembersrt:MaximumMember2023-08-310000723612car:SubsidiaryEquityMembercar:SubsidiaryEquityMembercar:SRSMobilityVenturesLLCMembersrt:MaximumMember2023-10-310000723612car:SubsidiaryEquityMembercar:SRSMobilityVenturesLLCMember2024-06-012024-06-300000723612car:SubsidiaryEquityMembercar:CompanySubsidiaryMembercar:SRSMobilityVenturesLLCMembersrt:MaximumMember2024-06-300000723612us-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:ReceivablesFromRelatedPartyMember2024-12-310000723612us-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:ReceivablesFromRelatedPartyMember2023-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMember2024-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMember2023-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:AdministrativeServicesMember2024-01-012024-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:AdministrativeServicesMember2023-01-012023-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:AdministrativeServicesMember2022-01-012022-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:EquipmentInvestmentMember2024-01-012024-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:EquipmentInvestmentMember2023-01-012023-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMembercar:EquipmentInvestmentMember2022-01-012022-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMember2024-01-012024-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMember2023-01-012023-12-310000723612car:AvisMobilityVenturesLLCAMVMemberus-gaap:RelatedPartyMembercar:AvisMobilityVenturesLLCAMVMember2022-01-012022-12-310000723612car:SubsidiaryEquityMembercar:CompanySubsidiaryMembercar:SRSMobilityVenturesLLCMember2021-12-310000723612us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310000723612us-gaap:PerformanceSharesMember2024-01-012024-12-310000723612us-gaap:RestrictedStockUnitsRSUMember2023-12-310000723612us-gaap:RestrictedStockUnitsRSUMember2024-12-310000723612us-gaap:PerformanceSharesMember2023-12-310000723612us-gaap:PerformanceSharesMember2024-12-310000723612us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000723612us-gaap:PerformanceSharesMember2023-01-012023-12-310000723612us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000723612us-gaap:PerformanceSharesMember2022-01-012022-12-310000723612us-gaap:OperatingExpenseMember2024-01-012024-12-310000723612us-gaap:OperatingExpenseMember2023-01-012023-12-310000723612us-gaap:OperatingExpenseMember2022-01-012022-12-310000723612us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000723612country:US2024-01-012024-12-310000723612country:US2023-01-012023-12-310000723612country:US2022-01-012022-12-310000723612country:US2024-12-310000723612country:US2023-12-310000723612country:US2022-12-310000723612us-gaap:ForeignPlanMember2024-01-012024-12-310000723612us-gaap:ForeignPlanMember2023-01-012023-12-310000723612us-gaap:ForeignPlanMember2022-01-012022-12-310000723612us-gaap:ForeignPlanMember2024-12-310000723612us-gaap:ForeignPlanMember2023-12-310000723612us-gaap:ForeignPlanMember2022-12-310000723612srt:MinimumMemberus-gaap:EquitySecuritiesMember2024-12-310000723612srt:MaximumMemberus-gaap:EquitySecuritiesMember2024-12-310000723612srt:MinimumMemberus-gaap:DebtSecuritiesMember2024-12-310000723612srt:MaximumMemberus-gaap:DebtSecuritiesMember2024-12-310000723612srt:MinimumMembercar:AlternativeInvestmentMember2024-12-310000723612srt:MaximumMembercar:AlternativeInvestmentMember2024-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2024-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2024-12-310000723612us-gaap:CashAndCashEquivalentsMember2024-12-310000723612us-gaap:FairValueInputsLevel1Membercar:DomesticStockMember2024-12-310000723612us-gaap:FairValueInputsLevel2Membercar:DomesticStockMember2024-12-310000723612us-gaap:FairValueInputsLevel3Membercar:DomesticStockMember2024-12-310000723612car:DomesticStockMember2024-12-310000723612us-gaap:FairValueInputsLevel1Membercar:InternationalStockMember2024-12-310000723612us-gaap:FairValueInputsLevel2Membercar:InternationalStockMember2024-12-310000723612us-gaap:FairValueInputsLevel3Membercar:InternationalStockMember2024-12-310000723612car:InternationalStockMember2024-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310000723612us-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2024-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2024-12-310000723612us-gaap:CorporateDebtSecuritiesMember2024-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:OtherAssetsMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2024-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMember2024-12-310000723612us-gaap:OtherAssetsMember2024-12-310000723612us-gaap:FairValueInputsLevel1Member2024-12-310000723612us-gaap:FairValueInputsLevel2Member2024-12-310000723612us-gaap:FairValueInputsLevel3Member2024-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2023-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2023-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2023-12-310000723612us-gaap:CashAndCashEquivalentsMember2023-12-310000723612us-gaap:FairValueInputsLevel1Membercar:DomesticStockMember2023-12-310000723612us-gaap:FairValueInputsLevel2Membercar:DomesticStockMember2023-12-310000723612us-gaap:FairValueInputsLevel3Membercar:DomesticStockMember2023-12-310000723612car:DomesticStockMember2023-12-310000723612us-gaap:FairValueInputsLevel1Membercar:InternationalStockMember2023-12-310000723612us-gaap:FairValueInputsLevel2Membercar:InternationalStockMember2023-12-310000723612us-gaap:FairValueInputsLevel3Membercar:InternationalStockMember2023-12-310000723612car:InternationalStockMember2023-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310000723612us-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310000723612us-gaap:CorporateDebtSecuritiesMember2023-12-310000723612us-gaap:FairValueInputsLevel1Memberus-gaap:OtherAssetsMember2023-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2023-12-310000723612us-gaap:FairValueInputsLevel3Memberus-gaap:OtherAssetsMember2023-12-310000723612us-gaap:OtherAssetsMember2023-12-310000723612us-gaap:FairValueInputsLevel1Member2023-12-310000723612us-gaap:FairValueInputsLevel2Member2023-12-310000723612us-gaap:FairValueInputsLevel3Member2023-12-310000723612us-gaap:FairValueInputsLevel3Member2024-01-012024-12-310000723612us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310000723612us-gaap:CurrencySwapMember2024-12-310000723612us-gaap:CurrencySwapMember2023-12-310000723612us-gaap:InterestRateCapMember2024-12-310000723612us-gaap:InterestRateCapMember2023-12-310000723612us-gaap:InterestRateSwapMember2024-12-310000723612us-gaap:InterestRateSwapMember2023-12-310000723612car:SoldMember2024-12-310000723612car:PurchaseMember2024-12-310000723612car:SoldMember2023-12-310000723612car:PurchaseMember2023-12-310000723612us-gaap:InterestRateCapMembersrt:SubsidiariesMember2024-12-310000723612us-gaap:InterestRateCapMembersrt:SubsidiariesMember2023-12-310000723612us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000723612us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310000723612us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-12-310000723612us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-12-310000723612us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2024-12-310000723612us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2023-12-310000723612us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-12-310000723612us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000723612us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000723612car:EuroDenominatedNotesMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-12-310000723612car:EuroDenominatedNotesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000723612car:EuroDenominatedNotesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-01-012024-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-01-012023-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2022-01-012022-12-310000723612us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2024-01-012024-12-310000723612us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2023-01-012023-12-310000723612us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2022-01-012022-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:InterestExpenseMember2024-01-012024-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:InterestExpenseMember2023-01-012023-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OperatingExpenseMember2023-01-012023-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:InterestExpenseMember2022-01-012022-12-310000723612us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMemberus-gaap:OperatingExpenseMember2022-01-012022-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMembercar:AvisBudgetRentalCarFundingMember2024-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMembercar:AvisBudgetRentalCarFundingMember2024-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMembercar:AvisBudgetRentalCarFundingMember2023-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMembercar:AvisBudgetRentalCarFundingMember2023-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000723612us-gaap:FairValueInputsLevel2Membercar:VehicleBackedDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000723612us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000723612us-gaap:OperatingSegmentsMembercar:AmericasSegmentMember2024-01-012024-12-310000723612us-gaap:OperatingSegmentsMembercar:InternationalMember2024-01-012024-12-310000723612us-gaap:OperatingSegmentsMember2024-01-012024-12-310000723612us-gaap:CorporateNonSegmentMember2024-01-012024-12-310000723612us-gaap:OperatingSegmentsMembercar:AmericasSegmentMember2023-01-012023-12-310000723612us-gaap:OperatingSegmentsMembercar:InternationalMember2023-01-012023-12-310000723612us-gaap:OperatingSegmentsMember2023-01-012023-12-310000723612us-gaap:CorporateNonSegmentMember2023-01-012023-12-310000723612car:AmericasSegmentMember2022-01-012022-12-310000723612car:InternationalMember2022-01-012022-12-310000723612us-gaap:OperatingSegmentsMembercar:AmericasSegmentMember2022-01-012022-12-310000723612us-gaap:OperatingSegmentsMembercar:InternationalMember2022-01-012022-12-310000723612us-gaap:OperatingSegmentsMember2022-01-012022-12-310000723612us-gaap:CorporateNonSegmentMember2022-01-012022-12-310000723612car:AmericasSegmentMember2024-01-012024-12-310000723612car:InternationalMember2024-01-012024-12-310000723612car:UnallocatedAssetsSegmentMember2024-01-012024-12-310000723612car:AmericasSegmentMember2024-12-310000723612car:InternationalMember2024-12-310000723612car:UnallocatedAssetsSegmentMember2024-12-310000723612car:AmericasSegmentMember2023-01-012023-12-310000723612car:InternationalMember2023-01-012023-12-310000723612car:UnallocatedAssetsSegmentMember2023-01-012023-12-310000723612car:AmericasSegmentMember2023-12-310000723612car:InternationalMember2023-12-310000723612car:UnallocatedAssetsSegmentMember2023-12-310000723612car:UnallocatedAssetsSegmentMember2022-01-012022-12-310000723612car:AmericasSegmentMember2022-12-310000723612car:InternationalMember2022-12-310000723612car:UnallocatedAssetsSegmentMember2022-12-310000723612country:US2024-01-012024-12-310000723612car:AllOtherCountriesMember2024-01-012024-12-310000723612country:US2024-12-310000723612car:AllOtherCountriesMember2024-12-310000723612country:US2023-01-012023-12-310000723612car:AllOtherCountriesMember2023-01-012023-12-310000723612country:US2023-12-310000723612car:AllOtherCountriesMember2023-12-310000723612country:US2022-01-012022-12-310000723612car:AllOtherCountriesMember2022-01-012022-12-310000723612country:US2022-12-310000723612car:AllOtherCountriesMember2022-12-310000723612us-gaap:SubsequentEventMember2025-01-310000723612car:FloatingRateTermLoanDueDecemberTwoThousandTwentyFiveMemberus-gaap:LoansPayableMemberus-gaap:SubsequentEventMember2025-02-120000723612us-gaap:AllowanceForCreditLossMember2023-12-310000723612us-gaap:AllowanceForCreditLossMember2024-01-012024-12-310000723612us-gaap:AllowanceForCreditLossMember2024-12-310000723612us-gaap:AllowanceForCreditLossMember2022-12-310000723612us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310000723612us-gaap:AllowanceForCreditLossMember2021-12-310000723612us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310000723612car:ValuationAllowanceOfTaxAssetsMember2023-12-310000723612car:ValuationAllowanceOfTaxAssetsMember2024-01-012024-12-310000723612car:ValuationAllowanceOfTaxAssetsMember2024-12-310000723612car:ValuationAllowanceOfTaxAssetsMember2022-12-310000723612car:ValuationAllowanceOfTaxAssetsMember2023-01-012023-12-310000723612car:ValuationAllowanceOfTaxAssetsMember2021-12-310000723612car:ValuationAllowanceOfTaxAssetsMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

|

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

|

|

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-10308

AVIS BUDGET GROUP, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

06-0918165 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

| 379 Interpace Parkway |

|

|

Parsippany, NJ |

|

07054 |

| (Address of principal executive offices) |

|

(Zip Code) |

|

(973) 496-4700 |

|

|

(Registrant’s telephone number, including area code) |

|

Securities registered pursuant to section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| TITLE OF EACH CLASS |

TRADING SYMBOL(S) |

NAME OF EACH EXCHANGE ON WHICH REGISTERED |

| Common Stock, Par Value $.01 |

CAR |

The Nasdaq Global Select Market |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

| Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. þ

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

As of June 30, 2024, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $1,797,778,805 based on the closing price of its common stock on the Nasdaq Global Select Market.

As of February 7, 2025, the number of shares outstanding of the registrant’s common stock was 35,110,440.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be mailed to stockholders in connection with the registrant’s 2025 annual meeting of stockholders (the “Annual Proxy Statement”) are incorporated by reference into Part III hereof.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

| Item |

Description |

Page |

|

|

|

|

PART I |

|

| 1 |

|

|

| 1A |

|

|

| 1B |

|

|

| 1C |

|

|

| 2 |

|

|

| 3 |

|

|

| 4 |

|

|

|

|

|

|

PART II |

|

| 5 |

|

|

| 6 |

|

|

| 7 |

|

|

| 7A |

|

|

| 8 |

|

|

| 9 |

|

|

| 9A |

|

|

| 9B |

|

|

| 9C |

|

|

|

|

|

|

PART III |

|

| 10 |

|

|

| 11 |

|

|

| 12 |

|

|

| 13 |

|

|

| 14 |

|

|

|

|

|

|

PART IV |

|

| 15 |

|

|

| 16 |

|

|

|

|

|

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K may be considered “forward-looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained herein are subject to known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by any such forward-looking statements. Forward-looking statements include information concerning our future financial performance, business strategy, projected plans and objectives. These statements may be identified by the fact that they do not relate to historical or current facts and may use words such as “believes,” “expects,” “anticipates,” “will,” “should,” “could,” “may,” “would,” “intends,” “projects,” “estimates,” “plans,” “forecasts,” “guidance,” and similar words, expressions or phrases. The following important factors and assumptions could affect our future results and could cause actual results to differ materially from those expressed in such forward-looking statements. These factors include, but are not limited to:

•the high level of competition in the mobility industry, including from new companies or technology, and the impact such competition may have on pricing and rental volume;

•a change in our fleet costs, including as a result of a change in the cost of new vehicles, resulting from inflation, tariffs or otherwise, manufacturer recalls, disruption in the supply of new vehicles, including due to labor actions, tariffs or otherwise, shortages in semiconductors used in new vehicle production, and/or a change in the price at which we dispose of used vehicles either in the used vehicle market or under repurchase or guaranteed depreciation programs;

•the results of operations or financial condition of the manufacturers of our vehicles, which could impact their ability to perform their payment obligations under our agreements with them, including repurchase and/or guaranteed depreciation arrangements, and/or their willingness or ability to make vehicles available to us or the mobility industry as a whole on commercially reasonable terms or at all;

•levels of and volatility in travel demand, including future volatility in airline passenger traffic;

•a deterioration in economic conditions, resulting in a recession or otherwise, particularly during our peak season or in key market segments;

•an occurrence or threat of terrorism, pandemics, severe weather events or natural disasters, military conflicts, including the ongoing military conflict in Eastern Europe, or civil unrest in the locations in which we operate, and the potential effects of sanctions on the world economy and markets and/or international trade;

•any substantial changes in the cost or supply of fuel, vehicle parts, energy, labor or other resources on which we depend to operate our business, including as a result of pandemics, inflation, tariffs, the ongoing military conflict in Eastern Europe, and any embargoes on oil sales imposed on or by the Russian government;

•our ability to successfully implement or achieve our business plans and strategies, achieve and maintain cost savings and adapt our business to changes in mobility;

•political, economic, or commercial instability and/or political, regulatory, or legal changes in the countries in which we operate, and our ability to conform to multiple and conflicting laws or regulations in those countries;

•the performance of the used vehicle market from time to time, including our ability to dispose of vehicles in the used vehicle market on attractive terms;

•our dependence on third-party distribution channels, third-party suppliers of other services and co-marketing arrangements with third parties;

•risks related to completed or future acquisitions or investments that we may pursue, including the incurrence of incremental indebtedness to help fund such transactions and our ability to promptly and effectively integrate any acquired businesses or capitalize on joint ventures, partnerships and other investments;

•our ability to utilize derivative instruments, and the impact of derivative instruments we utilize, which can be affected by fluctuations in interest rates, fuel prices and exchange rates, changes in government regulations and other factors;

•our exposure to uninsured or unpaid claims in excess of historical levels or changes in the number of incidents or cost per incident, and our ability to obtain insurance at desired levels and the cost of that insurance;

•risks associated with litigation or governmental or regulatory inquiries, or any failure or inability to comply with laws, regulations or contractual obligations or any changes in laws, regulations or contractual obligations, including with respect to personally identifiable information and consumer privacy, labor and employment, and tax;

•risks related to protecting the integrity of, and preventing unauthorized access to, our information technology systems or those of our third-party vendors, licensees, dealers, independent operators and independent contractors, and protecting the confidential information of our employees and customers against security breaches, including physical or cybersecurity breaches, attacks, or other disruptions, compliance with privacy and data protection regulation, and the effects of any potential increase in cyberattacks on the world economy and markets and/or international trade;

•any impact on us from the actions of our third-party vendors, licensees, dealers, independent operators and independent contractors and/or disputes that may arise out of our agreements with such parties;

•any major disruptions in our communication networks or information systems;

•risks related to tax obligations and the effect of future changes in tax laws and accounting standards;

•risks related to our indebtedness, including our substantial outstanding debt obligations, recent and future interest rate increases, which increase our financing costs, downgrades by rating agencies and our ability to incur substantially more debt;

•our ability to obtain financing for our global operations, including the funding of our vehicle fleet through the issuance of asset-backed securities and use of the global lending markets;

•our ability to meet the financial and other covenants contained in the agreements governing our indebtedness, or to obtain a waiver or amendment of such covenants should we be unable to meet such covenants;

•significant changes in the timing of our fleet rotation, carrying value of goodwill, or long-lived assets, including when there are events or changes in circumstances that indicate the carrying value may exceed the current fair value, which could result in a significant impairment charge; and

•other business, economic, competitive, governmental, regulatory, political or technological factors affecting our operations, pricing or services.

We operate in a continuously changing business environment and new risk factors emerge from time to time. New risk factors, factors beyond our control, or changes in the impact of identified risk factors may cause actual results to differ materially from those set forth in any forward-looking statements. Accordingly, forward-looking statements should not be relied upon as a prediction of actual results. Moreover, we do not assume responsibility if future results are materially different from those forecasted or anticipated. Other factors and assumptions not identified above, including those discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in Part II, Item 7, in “Risk Factors” set forth in Part I, Item 1A and in other portions of this Annual Report on Form 10-K, may contain forward-looking statements and involve uncertainties that could cause actual results to differ materially from those projected in any forward-looking statements.

Although we believe that our assumptions are reasonable, any or all of our forward-looking statements may prove to be inaccurate and we can make no guarantees about our future performance. Should unknown risks or uncertainties materialize or underlying assumptions prove inaccurate, actual results could differ materially from past results and/or those anticipated, estimated or projected. We undertake no obligation to release any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. For any forward-looking statements contained in any document, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

PART I

Except as expressly indicated or unless the context otherwise requires, the “Company,” “Avis Budget,” “we,” “our” or “us” means Avis Budget Group, Inc. and its subsidiaries. Unless the context requires otherwise, these references and references to our brands do not include the operations of our licensees, as further discussed below.

We are a leading global provider of mobility solutions through our three most recognized brands, Avis, Budget and Zipcar, as well as several other brands, well recognized in their respective markets. Our brands offer a range of options, from car and truck rental to car sharing. We license the use of the Avis, Budget, Zipcar and other brands’ trademarks to licensees in areas in which we do not operate directly. We and our licensees operate our brands in approximately 180 countries throughout the world. We generally maintain a leading share of airport car rental revenues in North America, Europe and Australasia, and we operate a leading car sharing network and one of the leading commercial truck rental businesses in the United States. We believe the range of options from our diversified brands enjoy complementary demand patterns with mid-week commercial demand balanced by weekend leisure demand.

On average, our global rental fleet totaled approximately 695,000 vehicles in 2024. We completed over 38 million vehicle rental transactions worldwide and generated total revenues of approximately $11.8 billion during 2024. Our brands and mobility solutions have an extended global reach with approximately 10,250 rental locations throughout the world, including approximately 3,800 locations operated by our licensees.

We categorize our operations into two reportable business segments:

•Americas - consisting primarily of (i) vehicle rental operations in North America, South America, Central America and the Caribbean, (ii) car sharing operations in certain of these markets, and (iii) licensees in certain areas in which we do not operate directly.

•International - consisting primarily of (i) vehicle rental operations in Europe, the Middle East, Africa, Asia and Australasia, (ii) car sharing operations in certain of these markets, and (iii) licensees in certain areas in which we do not operate directly.

Additional discussion of our reportable segments is included in Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in Note 21 – Segment Information to the Consolidated Financial Statements included in this Annual Report on Form 10-K.

For 2025, we expect our strategy to focus on transforming key parts of our business through technology, system enhancements and data, particularly with respect to customer experience, revenue generation and costs. We believe this strategy, together with a change in fourth quarter 2024 in our fleet strategy to accelerate certain fleet rotations (as discussed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in Part II, Item 7), will continue to strengthen our Company, maximize profitability, and deliver stakeholder value. With respect to customer experience, our aim will continue to be to deliver a superior customer journey. For revenue, we will focus on optimizing mix and marketing, and for costs, we plan to implement centers of excellence and develop new tools and capabilities to increase margin.

|

|

|

| OUR BRANDS AND OPERATIONS |

OUR BRANDS

Our Avis, Budget and Zipcar brands are three of the most recognized brands in our industry. We believe that each of our brands is positioned to be embraced by different target customers, and we see benefits and savings from our brands sharing some of the same facilities, systems, and administrative infrastructure. In addition, we are able to recognize benefits as a result of complementary demand patterns with commercial rentals occurring primarily on business days and leisure rentals occurring primarily on holidays and weekends. We also operate the Payless and Apex brands in the value segment of the car rental industry. In addition, we further extend our offerings through our AmicoBlu, Maggiore, and Morini Rent brands in Italy; FranceCars brand in France, ACL Hire and McNicoll Hire brands in the UK; and Turiscar and Turisprime brands in Portugal.

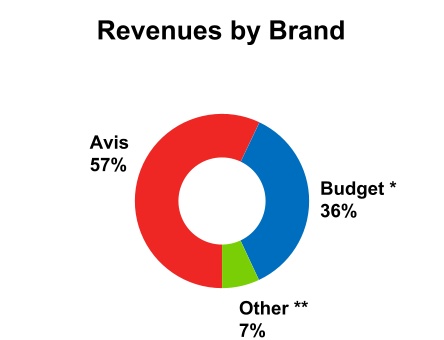

The following graphs present the approximate composition of our revenues in 2024.

* Includes Budget Truck.

** Includes Zipcar and other operating brands.

The Avis brand provides high-quality vehicle rental and other mobility solutions at price points generally above non-branded and value-branded vehicle rental companies and serves the premium commercial and leisure segments of the travel industry.

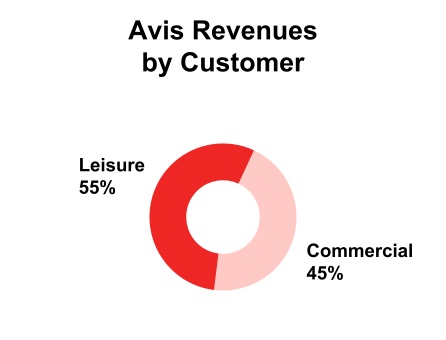

In 2024, our Company-operated Avis locations generated total revenues of approximately $6.8 billion. The following graphs present the approximate composition of our Avis revenues in 2024.

We also license the Avis brand to independent commercial owners who operate approximately half of our locations worldwide and generally pay royalty fees to us based on a percentage of applicable revenues. In 2024, these royalty fees totaled approximately 1% of our Avis revenues.

We operate or license Avis vehicle rental locations at virtually all of the largest commercial airports and cities in the world. The table below presents the approximate number of Avis locations as of December 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Avis Locations* |

|

Americas |

|

International |

|

Total |

| Company-operated locations |

2,075 |

|

|

970 |

|

|

3,045 |

|

| Licensee locations |

430 |

|

|

1,635 |

|

|

2,065 |

|

| Total Avis Locations |

2,505 |

|

|

2,605 |

|

|

5,110 |

|

* Certain locations support multiple brands.

We offer Avis customers a variety of premium services, including:

•the Avis mobile application, which allows customers a unique and innovative way to control many elements of their rental experience via their mobile devices without the need to visit the rental counter. In many United States locations, the application also allows customers to choose, exchange or upgrade their vehicles upon arrival and utilize a unique code to exit via our automated Express Exit for a completely contactless rental experience. The application also allows customers to track Avis shuttle buses to rental locations, find their vehicle, and locate nearby gas stations and parking facilities;

•Avis Preferred, our frequent renter rewards program that offers counter bypass at major airport locations, as well as additional benefits at different customer status levels, such as vehicle upgrades;

•availability of a selection of luxury vehicles through our Avis Signature Series, as well as premium, sport, performance and electrified vehicles;

•access to satellite radio service, mobile WiFi devices, and GPS navigation;

•Avis rental services such as roadside assistance, fuel service options, e-receipts, electronic toll collection services that allow customers to pay highway tolls without waiting in toll booth lines, and amenities such as Avis Cares, a full range of special products and services for drivers and passengers with disabilities;

•for our corporate customers, Avis Budget Group Business Intelligence, a proprietary reporting solution that provides a centralized reporting tool and customer reporting portal for corporate clients in North America and Europe, enabling them to easily view and analyze their rental activity, allowing them to better manage their travel budgets and monitor employee compliance with applicable travel policies.

The Budget brand is a leading supplier of vehicle rental and other mobility solutions focused primarily on more value-conscious customers.

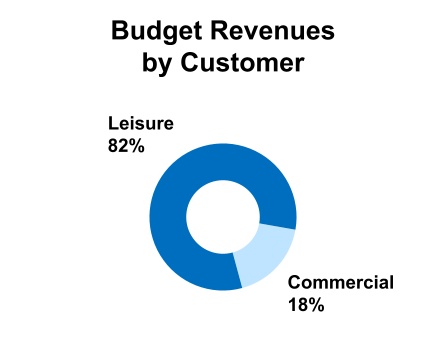

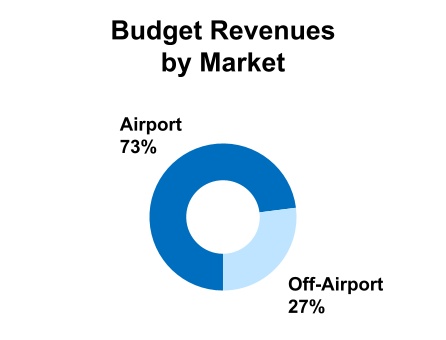

In 2024, our Company-operated Budget vehicle rental operations generated total revenues of approximately $4.3 billion. The following graphs present the approximate composition of our Budget revenues in 2024.

We also license the Budget brand to independent commercial owners who generally pay royalty fees to us based on a percentage of applicable revenues. In 2024, these royalty fees totaled approximately 1% of our Budget revenues.

Car Rental

We operate or license Budget car rental locations at airports and in cities worldwide. The table below presents the approximate number of Budget car rental locations as of December 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Budget Locations* |

|

Americas |

|

International |

|

Total |

| Company-operated locations |

1,425 |

|

|

785 |

|

|

2,210 |

|

| Licensee locations |

530 |

|

|

1,030 |

|

|

1,560 |

|

| Total Budget Locations |

1,955 |

|

|

1,815 |

|

|

3,770 |

|

* Certain locations support multiple brands.

Budget offers its customers several products and services similar to Avis, such as refueling options, roadside assistance, electronic toll collection, and other supplemental rental products, e-receipts and special rental rates for frequent renters. In addition, Budget’s Fastbreak service expedites rental service for frequent travelers and the mobile application allows customers to reserve, modify and cancel reservations on their mobile devices.

Budget Truck

Our Budget Truck rental business is one of the largest local and one-way truck and cargo van rental businesses in the United States. As of December 31, 2024, our Budget Truck fleet is comprised of approximately 22,000 vehicles that are rented through a network of approximately 400 Company-operated and 380 dealer-operated locations throughout the continental United States. These dealers are independently-owned businesses that generally operate other retail service businesses. In addition to their principal businesses, the dealers rent our light- and medium-duty trucks and commercial cargo vans to customers and are responsible for collecting payments on our behalf. The dealers receive a commission on all truck, van and ancillary equipment rentals. The Budget Truck rental business serves both the light commercial and consumer sectors. The light commercial sector consists of a wide range of businesses that rent light- to medium-duty trucks, which we define as trucks having a gross vehicle weight of less than 26,000 pounds, for a variety of commercial applications. The consumer sector consists primarily of individuals who rent trucks to move household goods on either a one-way or local basis.

Zipcar is a leading car sharing network, driven by a mission to enable simple and responsible urban living. With its wide variety of self-service vehicles available by the hour or day, Zipcar offers comprehensive, convenient and flexible car sharing options in urban areas and college campuses in hundreds of cities and towns. Zipcar provides its members on-demand, self-service vehicles in reserved parking spaces located in neighborhoods, business districts, office complexes and college campuses, as an alternative to car ownership. We continue to offer our Zipcar Flex product in London providing one-way rentals, including to and from Heathrow airport, which can be parked in public on-street parking spots in designated areas of the city.

Payless is a leading rental car supplier serving the deep-value segment of the industry, which we license or operate in approximately 285 locations worldwide, including more than 175 locations operated by licensees and approximately 110 Company-operated locations primarily located in North America, the majority of which are at or near major airports. Payless’ rental fees are often lower than those of larger, more established vehicle rental brands. The Payless business model allows us to extend the life-cycle of a portion of our rental fleet, as we “cascade” certain vehicles that exceed certain Avis and Budget age or mileage thresholds to be used by Payless.

RESERVATIONS, MARKETING AND SALES

Reservations

Our customers can make vehicle rental reservations through our brand-specific websites and toll-free reservation centers, through our brand-specific mobile applications, online travel agencies, travel agents or through selected partners, including many major airlines, associations and retailers. Travel agents can access our reservation systems through all major global distribution systems, which provide information with respect to rental locations, vehicle availability and applicable rate structures.

Our Zipcar members can reserve vehicles through Zipcar’s reservation system, which is accessible online or on a mobile device, by the hour or day, at rates that include fuel, secondary insurance and other costs typically associated with vehicle ownership.

Marketing and Sales

We support our brands through a range of marketing channels and campaigns, including traditional media as well as digital media, including internet and email marketing, social media, streaming services, and mobile device applications. Our Avis brand campaign Plan On Us highlights the trust our customers have in us. We also market through sponsorships of major sports entities and charitable organizations. We utilize a customer relationship management system that enables us to deliver more targeted and relevant offers to customers across online and offline channels, including an expedited and contactless rental process and loyalty programs that reward frequent renters with free rental days and car class upgrades.

We are able to reach and merchandise cars and rentals to a diverse demographic of consumers through our strategic partnerships with airlines, associations and hotel companies, and we maintain strong links to the travel industry. In addition, we have developed relationships that provide brand exposure and access to new customers, including deals to provide vehicles to ride-hail drivers in cities across North America.

In 2024, approximately 51% of vehicle rental transactions originating from Avis locations were generated by travelers who rented from Avis under contracts between Avis and their employers or through membership in an organization with which Avis has a contractual affiliation. We offer Avis Budget Group Business Intelligence, an online portal complete with rental summary dashboards, visualizations and detailed reports that provides our corporate customers with insight into their program’s performance, giving them direct access to more data in a customer-facing portal offering useful data insights, including options to customize and schedule reports. Avis also maintains marketing relationships with other travel partners through which we are able to offer their customers incentives to rent from Avis.

Additionally, we offer Unlimited Rewards, our loyalty incentive program for travel agents, and Avis and Budget programs for small businesses that offer discounted rates, central billing options and rental credits to members.

Our Zipcar brand utilizes a diverse set of marketing and sales strategies to acquire and engage members, including digital marketing, email and in-app messaging, and social media engagement. Zipcar maintains close relationships with universities that provide access to campuses and various marketing channels to attract students who, upon graduation, may continue their relationship with us. Through our Zipcar for Business program, we also offer direct-bill accounts and employee benefit programs to companies and governments that support the use of Zipcar vehicles.

LICENSING

We have licensees in approximately 175 countries throughout the world. Royalty fee revenues derived from our vehicle rental licensees in 2024 totaled $143 million, with $104 million in our International segment and $39 million in our Americas segment. Licensed locations are independently operated by our licensees and range from large operations at major airport locations and territories encompassing entire countries to relatively small operations in suburban or rural locations. Our licensees generally maintain separate independently owned and operated fleets. Royalties generated from licensing provide us with a source of high-margin revenue because there are relatively limited additional costs associated with fees paid by licensees to us. In some geographies we facilitate one-way vehicle rentals between Company-operated and licensed locations, which enables us to offer an integrated network of locations to our customers.

We generally enjoy good relationships with our licensees and meet regularly with them at regional, national and international meetings. Our relationships with our licensees are governed by license agreements that grant the licensee the right to operate independently operated vehicle rental businesses in certain territories. Our license agreements generally provide our licensees with the exclusive right to operate under one or more of our brands in their assigned territory. These agreements impose obligations on the licensee regarding its operations, and most agreements restrict the licensee’s ability to sell, transfer or assign its rights granted under the license agreement or to change the control of its ownership without our consent.

The terms of our license agreements, including duration, royalty fees and termination provisions, vary based upon brand, territory, and original signing date. Royalty fees are generally structured to be a percentage of the licensee’s gross rental income. We maintain the right to monitor the operations of licensees and, when applicable, can declare a licensee to be in default under its license agreement. We perform audits as part of our program to assure licensee compliance with brand quality standards and contract provisions. Generally, we can terminate license agreements for certain defaults, including failure to pay royalties or to adhere to our operational standards. Upon termination of a license agreement, the licensee is prohibited from using our brand names and related marks in any business. In the United States, these license relationships constitute “franchises” under most federal and state laws regulating the offer and sale of franchises and the relationship of the parties to a franchise agreement.

We continue to optimize the Avis, Budget and Payless brands by issuing new license agreements and periodically acquiring licensees to grow our revenues and expand our global presence. Discussion of our acquisitions is included in Note 6 – Acquisitions to the Consolidated Financial Statements included in this Annual Report on Form 10-K.

OTHER REVENUES