0000721371--06-302024Q3falsehttp://fasb.org/us-gaap/2024#GainLossOnSalesOfAssetsAndAssetImpairmentCharges00007213712023-07-012024-03-3100007213712024-04-26xbrli:shares00007213712024-01-012024-03-31iso4217:USD00007213712023-01-012023-03-3100007213712022-07-012023-03-31iso4217:USDxbrli:shares00007213712024-03-3100007213712023-06-300000721371us-gaap:CommonStockMember2023-12-310000721371us-gaap:RetainedEarningsMember2023-12-310000721371us-gaap:TreasuryStockCommonMember2023-12-310000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000721371us-gaap:NoncontrollingInterestMember2023-12-3100007213712023-12-310000721371us-gaap:NoncontrollingInterestMember2024-01-012024-03-310000721371us-gaap:CommonStockMember2024-01-012024-03-310000721371us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000721371us-gaap:RetainedEarningsMember2024-01-012024-03-310000721371us-gaap:CommonStockMember2024-03-310000721371us-gaap:RetainedEarningsMember2024-03-310000721371us-gaap:TreasuryStockCommonMember2024-03-310000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000721371us-gaap:NoncontrollingInterestMember2024-03-310000721371us-gaap:CommonStockMember2022-12-310000721371us-gaap:RetainedEarningsMember2022-12-310000721371us-gaap:TreasuryStockCommonMember2022-12-310000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000721371us-gaap:NoncontrollingInterestMember2022-12-3100007213712022-12-310000721371us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000721371us-gaap:CommonStockMember2023-01-012023-03-310000721371us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000721371us-gaap:RetainedEarningsMember2023-01-012023-03-310000721371us-gaap:CommonStockMember2023-03-310000721371us-gaap:RetainedEarningsMember2023-03-310000721371us-gaap:TreasuryStockCommonMember2023-03-310000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000721371us-gaap:NoncontrollingInterestMember2023-03-3100007213712023-03-310000721371us-gaap:CommonStockMember2023-06-300000721371us-gaap:RetainedEarningsMember2023-06-300000721371us-gaap:TreasuryStockCommonMember2023-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000721371us-gaap:NoncontrollingInterestMember2023-06-300000721371us-gaap:NoncontrollingInterestMember2023-07-012024-03-310000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012024-03-310000721371us-gaap:CommonStockMember2023-07-012024-03-310000721371us-gaap:TreasuryStockCommonMember2023-07-012024-03-310000721371us-gaap:RetainedEarningsMember2023-07-012024-03-310000721371us-gaap:CommonStockMember2022-06-300000721371us-gaap:RetainedEarningsMember2022-06-300000721371us-gaap:TreasuryStockCommonMember2022-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000721371us-gaap:NoncontrollingInterestMember2022-06-3000007213712022-06-300000721371us-gaap:NoncontrollingInterestMember2022-07-012023-03-310000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012023-03-310000721371us-gaap:CommonStockMember2022-07-012023-03-310000721371us-gaap:TreasuryStockCommonMember2022-07-012023-03-310000721371us-gaap:RetainedEarningsMember2022-07-012023-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:OptumRxMember2022-07-012023-06-30xbrli:pure0000721371cah:SpecialtyNetworksMember2024-01-012024-03-310000721371cah:SpecialtyNetworksMemberus-gaap:CustomerRelationshipsMember2024-03-180000721371cah:SpecialtyNetworksMembercah:TrademarksAndPatentsMember2024-03-180000721371cah:SpecialtyNetworksMemberus-gaap:DevelopedTechnologyRightsMember2024-03-180000721371cah:SpecialtyNetworksMember2024-03-180000721371cah:TransactionDataSystemInvestmentMember2024-03-310000721371cah:OutcomesDivestitureMember2023-07-012024-03-310000721371us-gaap:FairValueInputsLevel3Membercah:TransactionDataSystemInvestmentMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-07-100000721371us-gaap:EmployeeSeveranceMember2023-06-300000721371us-gaap:FacilityClosingMember2023-06-300000721371us-gaap:EmployeeSeveranceMember2023-07-012024-03-310000721371us-gaap:FacilityClosingMember2023-07-012024-03-310000721371us-gaap:EmployeeSeveranceMember2024-03-310000721371us-gaap:FacilityClosingMember2024-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMember2023-06-300000721371cah:GMPDMember2023-06-300000721371us-gaap:AllOtherSegmentsMember2023-06-300000721371cah:PharmaceuticalAndSpecialtySolutionsMember2023-07-012024-03-310000721371cah:GMPDMember2023-07-012024-03-310000721371us-gaap:AllOtherSegmentsMember2023-07-012024-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMember2024-03-310000721371cah:GMPDMember2024-03-310000721371us-gaap:AllOtherSegmentsMember2024-03-310000721371cah:OptiFreightLogisticsMember2024-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMember2022-07-012023-06-300000721371us-gaap:AllOtherSegmentsMember2022-07-012023-06-300000721371cah:GMPDMember2024-01-010000721371cah:OptiFreightLogisticsMemberus-gaap:AllOtherSegmentsMember2024-03-310000721371cah:GMPDMember2024-01-012024-03-310000721371cah:GMPDMember2024-03-31utr:Rate0000721371cah:GMPDMember2023-07-012023-09-300000721371cah:GMPDMember2022-10-012022-12-310000721371cah:GMPDMember2022-07-012022-09-300000721371cah:GMPDMember2023-03-310000721371cah:IPRDTrademarksandOtherMember2024-03-310000721371us-gaap:CustomerRelationshipsMember2024-03-310000721371cah:TrademarksAndPatentsMember2024-03-310000721371us-gaap:DevelopedTechnologyRightsMember2024-03-310000721371cah:IPRDTrademarksandOtherMember2023-06-300000721371us-gaap:CustomerRelationshipsMember2023-06-300000721371cah:TrademarksAndPatentsMember2023-06-300000721371us-gaap:DevelopedTechnologyRightsMember2023-06-300000721371cah:A3.079Notesdue2024Member2024-03-310000721371cah:A3.079Notesdue2024Member2023-06-300000721371cah:A3.5NotesDue2024Member2024-03-310000721371cah:A3.5NotesDue2024Member2023-06-300000721371cah:A3.75NotesDue2025Member2024-03-310000721371cah:A3.75NotesDue2025Member2023-06-300000721371cah:A3.41Notesdue2027Member2024-03-310000721371cah:A3.41Notesdue2027Member2023-06-300000721371cah:A5.125NotesDue2029Member2024-03-310000721371cah:A5.125NotesDue2029Member2023-06-300000721371cah:A5.45NotesDue2034Member2024-03-310000721371cah:A5.45NotesDue2034Member2023-06-300000721371cah:A4.6Notesdue2043Member2024-03-310000721371cah:A4.6Notesdue2043Member2023-06-300000721371cah:A4.5Notesdue2044Member2024-03-310000721371cah:A4.5Notesdue2044Member2023-06-300000721371cah:A4.9Notesdue2045Member2024-03-310000721371cah:A4.9Notesdue2045Member2023-06-300000721371cah:A4.368Notesdue2047Member2024-03-310000721371cah:A4.368Notesdue2047Member2023-06-300000721371cah:A7.0Debenturesduefiscal2027Member2024-03-310000721371cah:A7.0Debenturesduefiscal2027Member2023-06-300000721371cah:A5.125NotesDue2029Member2023-07-012024-03-310000721371cah:A5.45NotesDue2034Member2023-07-012024-03-310000721371cah:RemainingCashFromDebtProceedsMember2024-03-310000721371us-gaap:CommercialPaperMember2024-03-310000721371us-gaap:RevolvingCreditFacilityMember2024-03-310000721371cah:ShortTermCreditFacilitiesMembercah:CommittedReceivablesSalesFacilityProgramMember2024-03-310000721371cah:CommittedReceivablesSalesFacilityProgramMember2023-07-012024-03-310000721371cah:ShortTermCreditFacilitiesMember2024-03-310000721371cah:CVSHealthMember2014-07-312014-07-310000721371cah:NewYorkOpioidStewardshipActMember2018-04-300000721371cah:NewYorkOpioidStewardshipActMember2022-07-012023-06-300000721371cah:NewYorkOpioidStewardshipActMember2023-06-300000721371cah:TotalOpioidLitigationMember2024-03-310000721371cah:TotalOpioidLitigationMember2024-01-012024-03-310000721371cah:OpioidLawsuitsMember2024-03-31cah:statescah:numberOfUSTerritories0000721371stpr:ALcah:OpioidLawsuitsMember2023-11-300000721371stpr:ALcah:OpioidLawsuitsMember2023-07-012024-03-310000721371us-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2021-07-012024-04-300000721371us-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2024-05-012038-12-310000721371stpr:WVcah:OpioidLawsuitsMember2022-07-310000721371cah:NativeAmericanTribesMembercah:OpioidLawsuitsMember2022-10-310000721371cah:OpioidLawsuitsMember2024-01-012024-03-310000721371cah:PrivatePartiesMemberus-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2024-04-26cah:lawsuit0000721371cah:PrivatePartiesMembercah:ClassActionLawsuitsMemberus-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2024-04-260000721371cah:PrivatePartiesMembercah:ClassActionLawsuitsMembercah:OpioidLawsuitsMember2024-03-310000721371cah:PrivatePartiesMemberstpr:GAcah:OpioidLawsuitsMember2023-01-012023-03-31cah:plaintiff0000721371stpr:ALcah:PrivatePartiesMemberus-gaap:SubsequentEventMembercah:OpioidLawsuitsMember2024-07-012024-07-010000721371cah:OpioidLawsuitsMember2022-07-012023-06-300000721371us-gaap:SubsequentEventMembercah:ProductLiabilityLawsuitsMember2024-04-260000721371cah:AlamedaCountyMemberus-gaap:SubsequentEventMembercah:ProductLiabilityLawsuitsMember2024-04-262024-04-260000721371cah:ProductLiabilityLawsuitsMembercah:IVCApril2023AgreementMember2023-04-302023-04-300000721371cah:ProductLiabilityLawsuitsMembercah:IVCApril2023AgreementMember2023-04-300000721371cah:ProductLiabilityLawsuitsMembercah:IVCApril2023AgreementMember2023-05-012023-09-300000721371cah:ProductLiabilityLawsuitsMembercah:OtherAgreementsMemberus-gaap:SubsequentEventMember2021-07-012024-04-260000721371cah:ProductLiabilityLawsuitsMember2022-07-012023-06-300000721371cah:ProductLiabilityLawsuitsMembersrt:MinimumMember2024-03-310000721371srt:ScenarioForecastMembercah:GMPDMember2023-07-012024-06-300000721371cah:GMPDMemberus-gaap:SubsequentEventMember2024-04-012024-06-300000721371srt:MinimumMember2024-03-310000721371srt:MaximumMember2024-03-310000721371cah:CareFusionMember2024-03-310000721371cah:CareFusionMember2023-06-300000721371us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000721371us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000721371us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310000721371us-gaap:FairValueMeasurementsRecurringMember2024-03-310000721371us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2024-03-310000721371us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:FairValueHedgingMemberus-gaap:InterestRateSwapMember2023-03-310000721371us-gaap:CashFlowHedgingMember2024-01-012024-03-310000721371us-gaap:CashFlowHedgingMember2023-01-012023-03-310000721371us-gaap:CashFlowHedgingMember2023-07-012024-03-310000721371us-gaap:CashFlowHedgingMember2022-07-012023-03-310000721371us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2024-01-012024-03-310000721371us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2023-01-012023-03-310000721371us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2023-07-012024-03-310000721371us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2022-07-012023-03-310000721371srt:ScenarioForecastMemberus-gaap:CashFlowHedgingMemberus-gaap:SubsequentEventMemberus-gaap:ForeignExchangeContractMember2024-04-012025-03-310000721371cah:September2025Memberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2024-03-31iso4217:JPY0000721371us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembercah:June2027Member2024-03-310000721371us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembercah:January2023Member2024-03-310000721371cah:January2023Member2023-07-012024-03-310000721371cah:September2025Memberus-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMember2023-03-310000721371us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembercah:June2027Member2023-03-310000721371us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembercah:March2025Member2023-03-31iso4217:EUR0000721371us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembercah:March2026Member2023-03-310000721371us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembercah:March2022Member2023-03-310000721371us-gaap:CurrencySwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:NetInvestmentHedgingMembercah:September2018Member2023-03-310000721371cah:March2022Member2023-01-012023-03-310000721371cah:September2018Member2023-01-012023-03-310000721371us-gaap:ForeignExchangeContractMember2024-01-012024-03-310000721371us-gaap:ForeignExchangeContractMember2023-07-012024-03-310000721371us-gaap:ForeignExchangeContractMember2022-07-012023-03-310000721371us-gaap:ForeignExchangeContractMember2023-01-012023-03-310000721371us-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMemberus-gaap:ForeignExchangeContractMember2022-07-012023-03-310000721371us-gaap:FairValueInputsLevel2Member2024-03-310000721371us-gaap:FairValueInputsLevel2Member2023-06-300000721371cah:A250MillionShareRepurchaseProgramMember2023-10-012023-12-310000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-10-012023-12-310000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-11-022023-11-020000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-12-132023-12-130000721371cah:A500MillionShareRepurchaseProgramMember2023-07-012023-09-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-07-012023-09-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-07-012023-12-310000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-10-312023-10-310000721371cah:A500MillionShareRepurchaseProgramMember2023-04-012023-06-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-04-012023-06-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-04-012023-09-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-08-162023-08-160000721371cah:A250MillionShareRepurchaseProgramMember2023-01-012023-03-310000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-01-012023-03-310000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-01-012023-02-280000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-02-282023-02-280000721371cah:A300MillionShareRepurchaseProgramMember2022-10-012022-12-310000721371us-gaap:TreasuryStockCommonMembercah:A300MillionShareRepurchaseProgramMember2022-10-012022-12-310000721371us-gaap:TreasuryStockCommonMembercah:A300MillionShareRepurchaseProgramMember2022-10-012023-03-310000721371us-gaap:TreasuryStockCommonMembercah:A300MillionShareRepurchaseProgramMember2023-01-132023-01-130000721371cah:A500MillionShareRepurchaseProgramMember2022-07-012022-09-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2022-07-012022-09-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2022-07-012022-12-230000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2022-12-232022-12-230000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012024-03-310000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012024-03-310000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012024-03-310000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-03-310000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2024-03-310000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-03-310000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2022-06-300000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-07-012023-03-310000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2022-07-012023-03-310000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-07-012023-03-310000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-03-310000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2023-03-310000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-03-31cah:segmentcah:Segments0000721371cah:PharmaceuticalAndSpecialtySolutionsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000721371cah:GMPDMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000721371cah:GMPDMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:NuclearPrecisionHealthSolutionsMember2024-01-012024-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:NuclearPrecisionHealthSolutionsMember2023-01-012023-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:AtHomeSolutionsMember2024-01-012024-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:AtHomeSolutionsMember2023-01-012023-03-310000721371cah:OptiFreightLogisticsMemberus-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000721371cah:OptiFreightLogisticsMemberus-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310000721371us-gaap:OperatingSegmentsMember2024-01-012024-03-310000721371us-gaap:OperatingSegmentsMember2023-01-012023-03-310000721371us-gaap:CorporateNonSegmentMember2024-01-012024-03-310000721371us-gaap:CorporateNonSegmentMember2023-01-012023-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMemberus-gaap:OperatingSegmentsMember2023-07-012024-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMemberus-gaap:OperatingSegmentsMember2022-07-012023-03-310000721371cah:GMPDMemberus-gaap:OperatingSegmentsMember2023-07-012024-03-310000721371cah:GMPDMemberus-gaap:OperatingSegmentsMember2022-07-012023-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:NuclearPrecisionHealthSolutionsMember2023-07-012024-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:NuclearPrecisionHealthSolutionsMember2022-07-012023-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:AtHomeSolutionsMember2023-07-012024-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMembercah:AtHomeSolutionsMember2022-07-012023-03-310000721371cah:OptiFreightLogisticsMemberus-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-07-012024-03-310000721371cah:OptiFreightLogisticsMemberus-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-07-012023-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-07-012024-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-07-012023-03-310000721371us-gaap:OperatingSegmentsMember2023-07-012024-03-310000721371us-gaap:OperatingSegmentsMember2022-07-012023-03-310000721371us-gaap:CorporateNonSegmentMember2023-07-012024-03-310000721371us-gaap:CorporateNonSegmentMember2022-07-012023-03-310000721371country:US2024-01-012024-03-310000721371country:US2023-01-012023-03-310000721371us-gaap:NonUsMember2024-01-012024-03-310000721371us-gaap:NonUsMember2023-01-012023-03-310000721371country:US2023-07-012024-03-310000721371country:US2022-07-012023-03-310000721371us-gaap:NonUsMember2023-07-012024-03-310000721371us-gaap:NonUsMember2022-07-012023-03-310000721371cah:GMPDMember2022-07-012023-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMemberus-gaap:OperatingSegmentsMember2024-03-310000721371cah:PharmaceuticalAndSpecialtySolutionsMemberus-gaap:OperatingSegmentsMember2023-06-300000721371cah:GMPDMemberus-gaap:OperatingSegmentsMember2024-03-310000721371cah:GMPDMemberus-gaap:OperatingSegmentsMember2023-06-300000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2024-03-310000721371us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-06-300000721371us-gaap:CorporateNonSegmentMember2024-03-310000721371us-gaap:CorporateNonSegmentMember2023-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310000721371us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310000721371us-gaap:PerformanceSharesMember2024-01-012024-03-310000721371us-gaap:PerformanceSharesMember2023-01-012023-03-310000721371us-gaap:RestrictedStockUnitsRSUMember2023-07-012024-03-310000721371us-gaap:RestrictedStockUnitsRSUMember2022-07-012023-03-310000721371us-gaap:PerformanceSharesMember2023-07-012024-03-310000721371us-gaap:PerformanceSharesMember2022-07-012023-03-310000721371us-gaap:RestrictedStockUnitsRSUMember2023-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2024-03-310000721371cah:Fiscal2023Membersrt:MinimumMemberus-gaap:PerformanceSharesMember2023-07-012024-03-310000721371cah:Fiscal2022Membersrt:MinimumMemberus-gaap:PerformanceSharesMember2023-07-012024-03-310000721371srt:MaximumMembercah:Fiscal2023Memberus-gaap:PerformanceSharesMember2023-07-012024-03-310000721371cah:Fiscal2022Membersrt:MaximumMemberus-gaap:PerformanceSharesMember2023-07-012024-03-310000721371srt:MinimumMembercah:Fiscal2024Memberus-gaap:PerformanceSharesMember2023-07-012024-03-310000721371srt:MaximumMembercah:Fiscal2024Memberus-gaap:PerformanceSharesMember2023-07-012024-03-310000721371us-gaap:PerformanceSharesMember2023-06-300000721371us-gaap:PerformanceSharesMember2024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

|

|

|

|

|

| ☑ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number: 1-11373

Cardinal Health, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ohio |

|

31-0958666 |

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

| 7000 Cardinal Place |

, |

Dublin |

, |

Ohio |

|

43017 |

| (Address of principal executive offices) |

|

(Zip Code) |

(614) 757-5000

(Registrant’s telephone number, including area code)

|

|

|

|

|

|

|

|

|

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common shares (without par value) |

CAH |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☑ |

|

Accelerated filer |

☐ |

|

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The number of the registrant’s common shares, without par value, outstanding as of April 26, 2024, was the following: 243,566,952.

|

|

|

|

Cardinal Health

Q3 Fiscal 2024 Form 10-Q

|

Table of Contents

About Cardinal Health

Cardinal Health, Inc., an Ohio corporation formed in 1979, is a global healthcare services and products company providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices and patients in the home. We provide pharmaceuticals and medical products and cost-effective solutions that enhance supply chain efficiency. We connect patients, providers, payers, pharmacists and manufacturers for integrated care coordination. Effective January 1, 2024, we began operating under an updated organizational structure and re-aligned our financial reporting structure under two reportable segments: Pharmaceutical and Specialty Solutions ("PSS") segment and Global Medical Products and Distribution ("GMPD") segment. All remaining operating segments that are not significant enough to require separate reportable segment disclosures are included in Other, which is comprised of Nuclear and Precision Health Solutions, at-Home Solutions and OptiFreight® Logistics. As used in this report, “we,” “our,” “us,” and similar pronouns refer to Cardinal Health, Inc. and its majority-owned and consolidated subsidiaries, unless the context requires otherwise. Our fiscal year ends on June 30. References to fiscal 2024 and fiscal 2023 and to FY24 and FY23 are to the fiscal years ending or ended June 30, 2024 and June 30, 2023, respectively.

Forward-Looking Statements

This Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 (this "Form 10-Q") (including information incorporated by reference) includes "forward-looking statements" addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. Many forward-looking statements appear in Management’s Discussion and Analysis of Financial Condition and Results of Operations ("MD&A"), but there are others in this Form 10-Q, which may be identified by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue,” “likely,” and similar expressions, and include statements reflecting future results or guidance, statements of outlook and expense accruals. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those made, projected or implied. The most significant of these risks and uncertainties are described in this Form 10-Q, including Exhibit 99.1, and in "Risk Factors" in our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (our “2023 Form 10-K”), our Forms 10-Q for the quarters ending September 30, 2023 and December 31, 2023, and other SEC filings made since June 30, 2023. Forward-looking statements in this Form 10-Q speak only as of the date of this document. Except to the extent required by applicable law, we undertake no obligation to update or revise any forward-looking statement.

Non-GAAP Financial Measures

In the "Overview of Consolidated Results" section of MD&A, we use financial measures that are derived from our consolidated financial data but are not presented in our condensed consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). These measures are considered "non-GAAP financial measures" under the United States Securities and Exchange Commission ("SEC") rules. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the “Explanation and Reconciliation of Non-GAAP Financial Measures” section following MD&A in this Form 10-Q.

|

|

|

|

|

|

|

|

|

|

|

|

1 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

The discussion and analysis presented below is concerned with material changes in financial condition and results of operations, including amounts and certainty of cash flows from operations and from outside sources, between the periods specified in our condensed consolidated balance sheets at March 31, 2024 and June 30, 2023, and in our condensed consolidated statements of earnings for the three and nine months ended March 31, 2024 and 2023. All comparisons presented are with respect to the prior-year period, unless stated otherwise. Our previously reported segment results have been recast to conform to our new reporting structure and reflect changes in the elimination of inter-segment revenue and allocated corporate technology and shared function expenses, which are driven by the reporting structure change. The discussion and analysis in this Form 10-Q should be read in conjunction with the MD&A included in our 2023 Form 10-K.

|

|

|

|

|

|

|

|

|

|

|

|

2 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

Overview of Consolidated Results

Revenue

During the three and nine months ended March 31, 2024, revenue increased 9 percent and 10 percent to $54.9 billion and $167.1 billion, respectively, primarily due to branded and specialty pharmaceutical sales growth from existing customers.

GAAP and Non-GAAP Operating Earnings

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| (in millions) |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

GAAP operating earnings |

$ |

367 |

|

|

$ |

572 |

|

|

(36) |

% |

|

$ |

835 |

|

|

$ |

590 |

|

|

42 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| State opioid assessment related to prior fiscal years |

— |

|

|

— |

|

|

|

|

— |

|

|

(6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder cooperation agreement costs |

1 |

|

|

— |

|

|

|

|

1 |

|

|

8 |

|

|

|

| Restructuring and employee severance |

53 |

|

|

16 |

|

|

|

|

106 |

|

|

62 |

|

|

|

| Amortization and other acquisition-related costs |

80 |

|

|

74 |

|

|

|

|

207 |

|

|

216 |

|

|

|

| Impairments and (gain)/loss on disposal of assets, net |

84 |

|

|

20 |

|

|

|

|

622 |

|

|

883 |

|

|

|

| Litigation (recoveries)/charges, net |

81 |

|

|

(76) |

|

|

|

|

29 |

|

|

(256) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP operating earnings |

$ |

666 |

|

|

$ |

606 |

|

|

10 |

% |

|

$ |

1,799 |

|

|

$ |

1,497 |

|

|

20 |

% |

The sum of the components and certain computations may reflect rounding adjustments.

We had GAAP operating earnings of $367 million and $572 million during the three months ended March 31, 2024 and 2023, respectively, and $835 million and $590 million during the nine months ended March 31, 2024 and 2023, respectively. GAAP operating earnings during the three and nine months ended March 31, 2024 were favorably impacted by GMPD and Pharmaceutical and Specialty Solutions segment profit. GAAP operating earnings also reflects the pre-tax non-cash goodwill impairment charges related to the GMPD segment of $90 million during the three months ended March 31, 2024 and the $671 million and $863 million during the nine months ended March 31, 2024 and 2023, respectively. See "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and

Note 5 of the "Notes to Condensed Consolidated Financial Statements" for additional information.

GAAP operating earnings during the three months ended March 31, 2024 reflects $193 million of litigation charges recognized in connection with opioid-related matters, which were partially offset by a benefit of $105 million related to opioid-related prepayments. GAAP operating earnings during the three and nine months ended March 31, 2023 were favorably impacted by litigation recoveries and a reduction in litigation reserves. See "Results of Operations" section of this MD&A and

Note 7 of the "Notes to Condensed Consolidated Financial Statements" for additional information.

Non-GAAP operating earnings during the three and nine months ended March 31, 2024 increased 10 percent and 20 percent, respectively, due to increases in GMPD and Pharmaceutical and Specialty Solutions segment profit.

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

GAAP and Non-GAAP Diluted EPS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| ($ per share) |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

GAAP diluted EPS (1) |

$ |

1.05 |

|

|

$ |

1.34 |

|

|

(22) |

% |

|

$ |

2.49 |

|

|

$ |

1.23 |

|

|

N.M. |

|

|

|

|

|

|

|

|

|

|

|

|

| State opioid assessment related to prior fiscal years |

— |

|

|

— |

|

|

|

|

— |

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholder cooperation agreement costs |

— |

|

|

— |

|

|

|

|

— |

|

|

(0.02) |

|

|

|

| Restructuring and employee severance |

0.16 |

|

|

0.05 |

|

|

|

|

0.32 |

|

|

0.18 |

|

|

|

| Amortization and other acquisition-related costs |

0.24 |

|

|

0.21 |

|

|

|

|

0.62 |

|

|

0.61 |

|

|

|

Impairments and (gain)/loss on disposal of assets, net (2) |

0.44 |

|

|

0.35 |

|

|

|

|

2.14 |

|

|

2.82 |

|

|

|

| Litigation (recoveries)/charges, net |

0.19 |

|

|

(0.21) |

|

|

|

|

0.05 |

|

|

(0.60) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP diluted EPS (1) |

$ |

2.08 |

|

|

$ |

1.74 |

|

|

20 |

% |

|

$ |

5.62 |

|

|

$ |

4.24 |

|

|

33 |

% |

The sum of the components and certain computations may reflect rounding adjustments.

The reconciling items are presented within this table net of tax. See quantification of tax effect of each reconciling item in our GAAP to Non-GAAP Reconciliations in the "Explanation and Reconciliation of Non-GAAP Financial Measures."

(1)Diluted earnings per share attributable to Cardinal Health, Inc. ("diluted EPS").

(2)For the three and nine months ended March 31, 2024, impairments and (gain)/loss on disposal of assets, net includes pre-tax goodwill impairment charges of $90 million and $671 million, respectively, related to the GMPD segment. For fiscal 2024, the estimated net tax benefit related to the impairments is $56 million and is included in the annual effective tax rate. The incremental interim tax benefit recognized during the nine months ended March 31, 2024 is $36 million and will reverse in the fourth quarter of the fiscal year.

For the nine months ended March 31, 2023, impairments and (gain)/loss on disposal of assets, net included cumulative pre-tax goodwill impairment charges of $863 million related to the former Medical segment. For fiscal 2023, the net tax benefit related to the impairment was $68 million and was included in the annual effective tax rate. The incremental interim tax benefit recognized during the nine months ended March 31, 2023 was $66 million and reversed in the fourth quarter of fiscal 2023.

The changes in GAAP diluted EPS during the three and nine months ended March 31, 2024 were primarily due to the factors impacting GAAP operating earnings. GAAP diluted EPS was adversely impacted by goodwill impairment charges related to the GMPD segment, which had a $(0.29) per share after tax impact during the three months ended March 31, 2024, and a $(2.35) and $(2.76) per share after tax impact during the nine months ended March 31, 2024 and 2023, respectively. See "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A, and

Note 5 and

Note 8 of the "Notes to Condensed Consolidated Financial Statements" for additional details.

During the three and nine months ended March 31, 2024, non-GAAP diluted EPS increased 20 percent and 33 percent to $2.08 and $5.62 per share, respectively, due to higher non-GAAP operating earnings and a lower share count.

Cash and Equivalents

Our cash and equivalents balance was $3.7 billion at March 31, 2024 compared to $4.0 billion at June 30, 2023. During the nine months ended March 31, 2024, net cash provided by operating activities was $1.7 billion, which includes the impact of our annual payment of $378 million and prepayments of $239 million primarily related to the agreement to settle the vast majority of the opioid lawsuits filed by states and local governmental entities (the "National Opioid Settlement Agreement"). During the three months ended March 31, 2024, we issued additional long-term debt and received net proceeds of $1.14 billion, of which $589 million were classified as cash and equivalents in our condensed consolidated balance sheets as of March 31, 2024. The remaining proceeds were invested in short-term time deposits with initial effective maturities of more than three months and classified as prepaid expenses and other. In addition, during the nine months ended March 31, 2024, we deployed $1.2 billion for the Specialty Networks acquisition, $750 million for share repurchases, $377 million for cash dividends and $318 million for capital expenditures.

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

Significant Developments in Fiscal 2024 and Trends

Operating and Segment Reporting Structure Changes

Effective January 1, 2024, we began operating under an updated organizational structure and re-aligned our financial reporting structure under two reportable segments: Pharmaceutical and Specialty Solutions segment and GMPD segment. All remaining operating segments that are not significant enough to require separate reportable segment disclosures are included in Other. The following indicates the changes from the second quarter of fiscal 2024 to the new reporting structure:

•Pharmaceutical and Specialty Solutions segment: This reportable segment is comprised of all businesses formerly within our Pharmaceutical segment except Nuclear and Precision Health Solutions.

•GMPD segment: This reportable segment is comprised of all businesses formerly within our Medical segment except at-Home Solutions and OptiFreight® Logistics.

•Other: This is comprised of the remaining operating segments, Nuclear and Precision Health Solutions, at-Home Solutions and OptiFreight® Logistics.

Our previously reported segment results have been recast to conform to our new reporting structure and reflect changes in the elimination of inter-segment revenue and allocated corporate technology and shared function expenses, which are driven by the reporting structure change.

Pharmaceutical and Specialty Solutions Segment

OptumRx Contracts

On April 22, 2024, we announced that our pharmaceutical distribution contracts with OptumRx, which expire at the end of June 2024, will not be renewed. Sales to OptumRx generated 16% of our consolidated revenue in fiscal 2023. Total sales to OptumRx generate a meaningfully lower operating margin than the overall Pharmaceutical and Specialty Solutions segment. We expect the nonrenewal of the OptumRx contracts to adversely impact our results of operations, including segment profit, financial condition and cash flows. In particular, we expect to generate lower than average operating cash flow in fiscal 2025 due to the unwinding of the negative net working capital associated with the contract.

Specialty Networks Acquisition

On March 18, 2024, we completed the acquisition of Specialty Networks for a purchase price of $1.2 billion in cash, subject to certain adjustments. Specialty Networks creates clinical and economic value for independent specialty providers and partners across multiple specialty group purchasing organizations ("GPOs"): UroGPO,Gastrologix and GastroGPO, and United Rheumatology. Specialty Networks’ PPS Analytics platform analyzes data from electronic medical records, practice management, imaging, and dispensing systems and transforms it into meaningful and actionable insights for providers and other stakeholders by using artificial intelligence and modern data analytics capabilities. The acquisition further expands our offerings in key therapeutic areas, accelerates our upstream data and research opportunities with biopharma manufacturers, and creates a platform for our expansion across therapeutic areas. We expect the Specialty Networks acquisition to positively impact Pharmaceutical and Specialty Solutions segment revenue and profit while increasing amortization and other acquisition-related costs during the remainder of fiscal 2024 and fiscal 2025.

COVID-19 Vaccine Distribution

Pharmaceutical and Specialty Solutions segment profit was favorably impacted during the nine months ended March 31, 2024 and on a year-over-year basis in part due to the company beginning to distribute the commercially available COVID-19 vaccines following U.S. Food and Drug Administration approval of updated vaccines in September 2023. The timing, magnitude and profit impact of vaccine distribution volume for the remainder of fiscal 2024 and beyond remains uncertain.

Generics Program

The performance of our Pharmaceutical and Specialty Solutions segment generics program positively impacted the year-over-year comparison of Pharmaceutical and Specialty Solutions segment profit during the three and nine months ended March 31, 2024. The Pharmaceutical and Specialty Solutions segment generics program includes, among other things, the impact of generic pharmaceutical product launches, customer volumes, pricing changes, the Red Oak Sourcing, LLC venture ("Red Oak Sourcing") with CVS Health Corporation ("CVS Health") and generic pharmaceutical contract manufacturing and sourcing costs.

|

|

|

|

|

|

|

|

|

|

|

|

5 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

The frequency, timing, magnitude and profit impact of generic pharmaceutical customer volumes, pricing changes, customer contract renewals, generic pharmaceutical manufacturer pricing changes and generic pharmaceutical contract manufacturing and sourcing costs all impact Pharmaceutical and Specialty Solutions segment profit and are subject to risks and uncertainties. These risks and uncertainties may impact Pharmaceutical and Specialty Solutions segment profit and consolidated operating earnings during the remainder of fiscal 2024.

Global Medical Products and Distribution Segment

Inflationary Impacts

Beginning in fiscal 2022, GMPD segment profit was negatively affected by incremental inflationary impacts, primarily related to transportation (including ocean and domestic freight), commodities and labor, and global supply chain constraints. Since that time, we have taken actions to partially mitigate these impacts, including implementing certain price increases and evolving our pricing and commercial contracting processes to provide us with greater pricing flexibility. In addition, decreases in some product-related costs have been recognized as the higher-cost inventory moved through our supply chain and was replaced by lower-cost inventory. These net inflationary impacts negatively affected the GMPD segment profit during fiscal 2023. The net inflationary impacts were less significant during the three and nine months ended March 31, 2024 and had a favorable impact on GMPD segment profit on a year-over-year basis.

We expect these net inflationary impacts to continue to affect GMPD segment profit during the remainder of fiscal 2024, but to a significantly lesser extent than in fiscal 2023 and prior periods due to our mitigation actions, together with continued decreases in certain product-related costs. However, these inflationary costs are difficult to predict and may be greater than we expect or continue longer than our current expectations. Our actions to increase prices and evolve our contracting strategies are subject to contingencies and uncertainties and it is possible that our results of operations will be adversely impacted to a greater extent than we currently anticipate or that we may not be able to mitigate the negative impact to the extent or on the timeline we anticipate.

Volumes

The GMPD segment profit was adversely impacted during fiscal 2023 in part due to lower volumes, which includes our Cardinal Health branded medical products. We have experienced Cardinal Health branded medical products sales growth during fiscal 2024 and expect further growth for the remainder of fiscal 2024 and beyond. The timing, magnitude and profit impact of this anticipated sales growth is subject to risks and uncertainties, which may impact GMPD segment profit.

Goodwill

The change in segment structure as discussed above resulted in changes to the composition of our reporting units. Accordingly, we are required to reallocate the goodwill in reporting units affected by the change using a relative fair value approach and assess goodwill for impairment both before and after the reallocation.

During the three months ended March 31, 2024, we allocated $90 million and $48 million of goodwill from the former Medical segment excluding our at-Home Solutions division (the "Medical Unit") to the GMPD reporting unit and the OptiFreight® Logistics reporting unit, respectively. We also assessed GMPD's goodwill for impairment and determined there was an impairment of GMPD’s remaining goodwill balance of $90 million. See "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and

Note 5 of the "Notes to Condensed Consolidated Financial Statements" for additional detail.

Shareholder Cooperation Agreement

In September 2022, we entered into a Cooperation Agreement (the "Cooperation Agreement") with Elliott Associates, L.P. and Elliott International, L.P. (together, "Elliott") under which our Board of Directors (the "Board"), among other things, (1) appointed four new independent directors, including a representative from Elliott, and (2) formed an advisory Business Review Committee of the Board, which is tasked with undertaking a comprehensive review of our strategy, portfolio, capital-allocation framework and operations. In May 2023, we extended the term of the Cooperation Agreement until the later of July 15, 2024 or until Elliott's representative ceases to serve on, or resigns from, the Board. In connection with this extension, the Board has extended the term of the Business Review Committee until July 15, 2024.

The evaluation and implementation of any actions recommended by the Business Review Committee and the Board have impacted and may continue to impact our business, financial position and results of operations during the remainder of fiscal 2024 and beyond. We have incurred, and may incur additional legal, consulting and other expenses related to the Cooperation Agreement and the activities of the Business Review Committee.

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

|

|

|

|

|

|

|

|

|

| MD&A |

Results of Operations |

|

Results of Operations

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| (in millions) |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

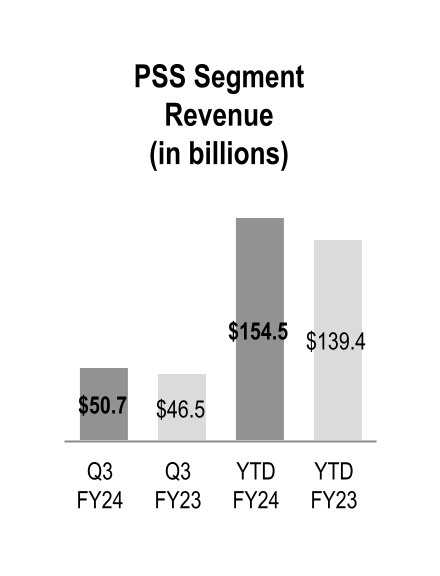

| Pharmaceutical and Specialty Solutions |

$ |

50,651 |

|

|

$ |

46,496 |

|

|

9 |

% |

|

$ |

154,524 |

|

|

$ |

139,441 |

|

|

11 |

% |

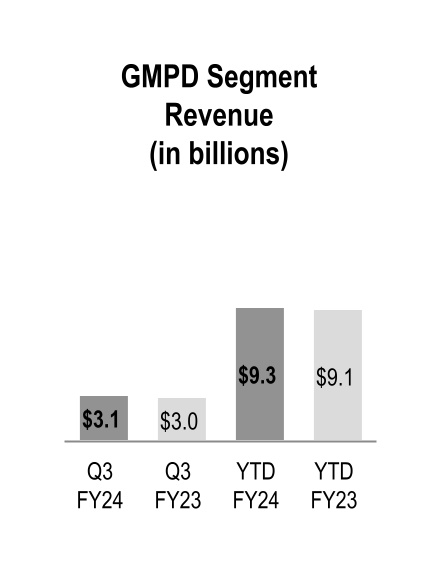

| Global Medical Products and Distribution |

3,113 |

|

|

2,989 |

|

|

4 |

% |

|

9,264 |

|

|

9,140 |

|

|

1 |

% |

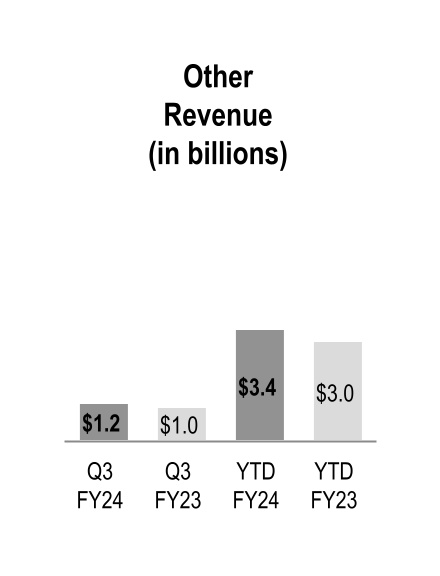

| Other |

1,167 |

|

|

1,025 |

|

|

14 |

% |

|

3,392 |

|

|

3,038 |

|

|

12 |

% |

| Total segment revenue |

54,931 |

|

|

50,510 |

|

|

9 |

% |

|

167,180 |

|

|

151,619 |

|

|

10 |

% |

| Corporate |

(20) |

|

|

(23) |

|

|

N.M. |

|

(61) |

|

|

(60) |

|

|

N.M. |

| Total revenue |

$ |

54,911 |

|

|

$ |

50,487 |

|

|

9 |

% |

|

$ |

167,119 |

|

|

$ |

151,559 |

|

|

10 |

% |

Pharmaceutical and Specialty Solutions

Pharmaceutical and Specialty Solutions segment revenue increased $4.2 billion and $15.1 billion during the three and nine months ended March 31, 2024, respectively, due to branded and specialty pharmaceutical sales growth from existing customers.

Global Medical Products and Distribution

GMPD segment revenue increased during the three and nine months ended March 31, 2024, driven by higher volumes from existing customers. Additionally, during the nine months ended March 31, 2024 GMPD segment revenue was adversely impacted by personal protective equipment ("PPE") volumes and pricing, partially offset by price increases to mitigate inflationary impacts.

Other

Other revenue increased during the three and nine months ended March 31, 2024 due to growth across the three operating segments: at-Home Solutions, Nuclear and Precision Health Solutions and OptiFreight® Logistics.

Cost of Products Sold

Cost of products sold for the three and nine months ended March 31, 2024 increased 9 percent and 10 percent to $53.0 billion and $161.6 billion, respectively, compared to the prior-year periods due to the factors affecting the changes in revenue and gross margin.

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

|

|

|

|

|

|

|

|

|

| MD&A |

Results of Operations |

|

Gross Margin

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| (in millions) |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

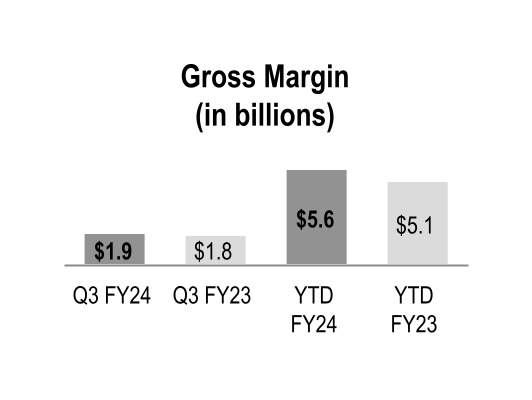

| Gross margin |

$ |

1,947 |

|

|

$ |

1,785 |

|

|

9 |

% |

|

$ |

5,561 |

|

|

$ |

5,062 |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin increased during the three and nine months ended March 31, 2024 primarily due to the beneficial comparison of the prior-year net inflationary impacts in the GMPD segment and the performance of our generics program in the Pharmaceutical and Specialty Solutions segment. Gross margin also increased during the nine months ended March 31, 2024 due to increased contribution from branded pharmaceutical and specialty pharmaceutical products in the Pharmaceutical and Specialty Solutions segment, which includes the favorable impact of COVID-19 vaccine distribution.

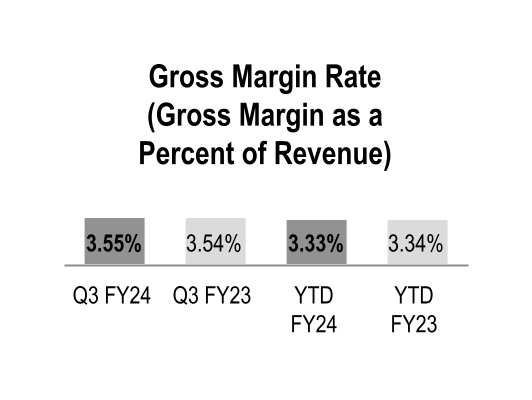

Gross margin rates were relatively flat during the three and nine months ended March 31, 2024 with the impact of the overall product mix mostly offset by the beneficial comparison to the prior-year net inflationary impacts in the GMPD segment. The changes in overall product mix were primarily driven by increased pharmaceutical distribution branded sales, which have a dilutive impact on our overall gross margin rate.

Distribution, Selling, General and Administrative ("SG&A") Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| (in millions) |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| SG&A expenses |

$ |

1,282 |

|

|

$ |

1,179 |

|

|

9 |

% |

|

$ |

3,762 |

|

|

$ |

3,567 |

|

|

5 |

% |

During the three and nine months ended March 31, 2024, SG&A expenses increased primarily due to investment projects, higher costs to support sales growth, and compensation-related costs.

|

|

|

|

|

|

|

|

|

|

|

|

8 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

|

|

|

|

|

|

|

|

|

| MD&A |

Results of Operations |

|

Segment Profit

We evaluate segment performance based on segment profit, among other measures. See

Note 13 of the "Notes to Condensed Consolidated Financial Statements" for additional information on segment profit.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| (in millions) |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Pharmaceutical and Specialty Solutions |

$ |

580 |

|

|

$ |

560 |

|

|

4 |

% |

|

$ |

1,541 |

|

|

$ |

1,394 |

|

|

11 |

% |

| Global Medical Products and Distribution |

20 |

|

|

(46) |

|

|

N.M. |

|

18 |

|

|

(175) |

|

|

N.M. |

| Other |

111 |

|

|

106 |

|

|

5 |

% |

|

319 |

|

|

305 |

|

|

5 |

% |

| Total segment profit |

711 |

|

|

620 |

|

|

15 |

% |

|

1,878 |

|

|

1,524 |

|

|

23 |

% |

| Corporate |

(344) |

|

|

(48) |

|

|

N.M. |

|

(1,043) |

|

|

(934) |

|

|

N.M. |

Total consolidated operating earnings |

$ |

367 |

|

|

$ |

572 |

|

|

(36) |

% |

|

$ |

835 |

|

|

$ |

590 |

|

|

(31) |

% |

Pharmaceutical and Specialty Solutions

Pharmaceutical and Specialty Solutions segment profit increased during the three and nine months ended March 31, 2024 primarily due to the performance of our generics program. During the nine months ended March 31, 2024, Pharmaceutical and Specialty Solutions segment profit also increased due to the increased contribution from branded pharmaceutical and specialty pharmaceutical products, which includes the favorable impact of COVID-19 vaccine distribution, partially offset by higher costs to support sales growth.

Global Medical Products and Distribution

Global Medical Product and Distribution segment profit increased during the three and nine months ended March 31, 2024 primarily due to beneficial comparison to the prior-year inflationary impacts, net of the effects of mitigation actions.

Other

Other segment profit increased during the three and nine months ended March 31, 2024 primarily due to the performance of OptiFreight® Logistics.

Corporate

The changes in Corporate during the three and nine months ended March 31, 2024 were due to the factors discussed in the "Other Components of Consolidated Operating Earnings" section that follows.

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

|

|

|

|

|

|

|

|

|

| MD&A |

Results of Operations |

|

Other Components of Consolidated Operating Earnings

In addition to revenue, gross margin and SG&A expenses discussed previously, consolidated operating earnings were impacted by the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| (in millions) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Restructuring and employee severance |

$ |

53 |

|

|

$ |

16 |

|

|

$ |

106 |

|

|

$ |

62 |

|

| Amortization and other acquisition-related costs |

80 |

|

|

74 |

|

|

207 |

|

|

216 |

|

| Impairments and (gain)/loss on disposal of assets, net |

84 |

|

|

20 |

|

|

622 |

|

|

883 |

|

| Litigation (recoveries)/charges, net |

81 |

|

|

(76) |

|

|

29 |

|

|

(256) |

|

Restructuring and Employee Severance

Restructuring and employee severance costs during the three and nine months ended March 31, 2024 and 2023 include costs related to the implementation of certain enterprise-wide cost-savings measures, which include certain initiatives to rationalize our manufacturing operations. The increase in restructuring costs during the three and nine months ended March 31, 2024 was primarily due to these initiatives and certain projects resulting from the review of our strategy portfolio, capital-allocation framework and operations. During the three and nine months ended March 31, 2023, restructuring and employee severance costs also included costs related to the divestiture of the Cordis business.

Amortization and Other Acquisition-Related Costs

Amortization of acquisition-related intangible assets was $64 million and $69 million for the three months ended March 31, 2024 and 2023, respectively, and $191 million and $211 million for the nine months ended March 31, 2024 and 2023, respectively.

Impairments and (Gain)/Loss on Disposal of Assets, Net

We recognized a $90 million pre-tax non-cash goodwill impairment charge related to the GMPD segment during the three months ended March 31, 2024 and charges of $671 million and $863 million during the nine months ended March 31, 2024 and 2023, respectively, as discussed further in the "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and

Note 5 of the "Notes to Condensed Consolidated Financial Statements."

Litigation (Recoveries)/Charges, Net

During the three months ended March 31, 2024, we recognized expense of $193 million in connection with opioid-related matters, which was offset by a benefit of $105 million related to prepayments at a prenegotiated discount of certain future payment amounts totaling $344 million. During the nine months ended March 31, 2024, we also recognized a $22 million charge related to an agreement in principle with the Alabama Attorney General. See

Note 7 of the "Notes to Condensed Consolidated Financial Statements" for additional information.

We recognized income for net recoveries in class action antitrust lawsuit in which we were a class member or plaintiff of $6 million and $77 million during the three and nine months ended March 31, 2024, respectively, and $66 million during the nine months ended March 31, 2023.

During the three and nine months ended March 31, 2023, we recognized income of $71 million and $95 million, respectively, primarily related to a reduction of the reserve for the estimated settlement and defense costs for the Cordis OptEase and TrapEase inferior vena cava ("IVC") product liability due to the execution of certain settlement agreements.

During the nine months ended March 31, 2023, we recognized income of $93 million due to net proceeds from the settlement of a shareholder derivative litigation matter.

Earnings Before Income Taxes

In addition to the items discussed above, earnings before income taxes were impacted by the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

Nine Months Ended March 31, |

| (in millions) |

2024 |

|

2023 |

|

Change |

|

2024 |

|

2023 |

|

Change |

| Other (income)/expense, net |

$ |

(7) |

|

|

$ |

— |

|

|

N.M. |

|

$ |

(25) |

|

|

$ |

(5) |

|

|

N.M. |

| Interest expense, net |

33 |

|

|

28 |

|

|

18 |

% |

|

55 |

|

|

78 |

|

|

(29) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

|

|

|

|

|

|

|

|

|

| MD&A |

Results of Operations |

|

Interest Expense, Net

During the nine months ended March 31, 2024, interest expense decreased by 29 percent primarily due to increased interest income from cash and equivalents.

Provision for Income Taxes

The effective tax rate was 24.2 percent and 36.3 percent during the three months ended March 31, 2024 and 2023, respectively, and 23.2 percent and 36.7 percent during the nine months ended March 31, 2024 and 2023, respectively. These tax rates reflect the impact of the tax effects of goodwill impairment charges as well as certain other discrete items. See

Note 8 of the "Notes to Condensed Consolidated Financial Statements" for additional information, during the three and nine months ended March 31, 2024 and 2023.

Tax Effects of Goodwill Impairment Charges

During the nine months ended March 31, 2024, we recognized cumulative pre-tax goodwill impairment charges of $671 million related to the GMPD segment. The net tax benefit related to these charges is $56 million for fiscal 2024.

Unless an item is considered discrete because it is unusual or infrequent, the tax impact of the item is included in our estimated annual effective tax rate. When items are recognized through our estimated annual effective tax rate, we apply our estimated annual effective tax rate to the earnings before income taxes for the year-to-date period to compute our impact from income taxes for the current quarter and year-to-date period. The tax impacts of discrete items are recognized in their entirety in the period in which they occur.

The tax effect of the goodwill impairment charges recorded during the nine months ended March 31, 2024 was included in our estimated annual effective tax rate because it was not considered unusual or infrequent, given that we recorded goodwill impairments in prior fiscal years. The impact of the non-deductible goodwill increased the estimated annual effective tax rate for fiscal 2024. Applying the higher tax rate to the pre-tax income for the nine months ended March 31, 2024 resulted in recognizing an incremental interim tax benefit of approximately $36 million, which impacted the provision for income taxes in the condensed consolidated statements of earnings during the nine months ended March 31, 2024 and prepaid expenses and other assets in the condensed consolidated balance sheet at March 31, 2024. The incremental interim tax benefit will reverse in the fourth quarter of fiscal 2024.

|

|

|

|

|

|

|

|

|

|

|

|

11 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

|

|

|

|

|

|

|

|

|

| MD&A |

Liquidity and Capital Resources |

|

Liquidity and Capital Resources

We currently believe that, based on available capital resources and projected operating cash flow, we have adequate capital resources to fund our operations and expected future cash needs as described below. If we decide to engage in one or more acquisitions we may need to access capital markets for additional financing, depending on the size and timing of such transactions.

Cash and Equivalents

Our cash and equivalents balance was $3.7 billion at March 31, 2024 compared to $4.0 billion at June 30, 2023.

During the nine months ended March 31, 2024, net cash provided by operating activities was $1.7 billion, which includes the impact of our annual payment of $378 million and prepayments of $239 million primarily related to the National Opioid Settlement Agreement. During the three months ended March 31, 2024, we issued additional long-term debt and received net proceeds of $1.14 billion, of which $589 million were classified as cash and equivalents in our condensed consolidated balance sheets as of March 31, 2024. The remaining proceeds were invested in short-term time deposits with initial effective maturities of more than three months and classified as prepaid expenses and other. In addition, we deployed cash of $750 million for share repurchases, $377 million for cash dividends and $318 million for capital expenditures.

On March 18, 2024, we completed the acquisition of Specialty Networks for a purchase price of $1.2 billion in cash, subject to certain adjustments. See

Note 2 of the "Notes to Condensed Consolidated Financial Statements" for additional information.

At March 31, 2024, our cash and equivalents were held in cash depository accounts with major banks or invested in high quality, short-term liquid investments.

Changes in working capital, which impact operating cash flow, can vary significantly depending on factors such as the timing of customer payments, inventory purchases, payments to vendors and tax payments in the regular course of business, as well as fluctuating working capital needs driven by customer and product mix.

The cash and equivalents balance at March 31, 2024 includes $650 million of cash held by subsidiaries outside of the United States.

Other Financing Arrangements and Financial Instruments

Credit Facilities and Commercial Paper

In addition to cash and equivalents and operating cash flow, other sources of liquidity at March 31, 2024 include a $2.0 billion commercial paper program, backed by a $2.0 billion revolving credit facility. We also have a $1.0 billion committed receivables sales facility. At March 31, 2024, we had no amounts outstanding under our commercial paper program, revolving credit facility, or our committed receivables sales facility.

In February 2023, we extended our $2.0 billion revolving credit facility through February 25, 2028. In September 2022, we renewed our committed receivables sales facility program through Cardinal Health Funding, LLC ("CHF") through September 30, 2025. In September 2023, Cardinal Health 23 Funding, LLC was added as a seller under our committed receivables sales facility.

Our revolving credit and committed receivables sales facilities require us to maintain a consolidated net leverage ratio of no more than 3.75-to-1. As of March 31, 2024, we were in compliance with this financial covenant.

Long-Term Debt and Other Short-Term Borrowings

We had total long-term obligations, including the current portion and other short-term borrowings, of $5.9 billion and $4.7 billion at March 31, 2024 and June 30, 2023, respectively.

In February 2024, we issued additional debt with the aggregate principal amount of $1.15 billion to fund the repayment of all of the aggregate principal amount outstanding of our 3.5% Notes due 2024 and 3.079% Notes due 2024, at their respective maturities, and for general corporate purposes. The notes issued are $650 million aggregate principal amount of 5.125% Notes that mature on February 15, 2029 and $500 million aggregate principal amount of 5.45% Notes that mature on February 15, 2034. The proceeds of the notes issued, net of discounts, premiums, and debt issuance costs were $1.14 billion. A portion of the proceeds were invested in short-term time deposits of $550 million with initial effective maturities of more than three months and classified as prepaid expenses and other in our condensed consolidated balance sheets as of March 31, 2024. The remaining proceeds of $589 million were invested in short-term time deposits classified as cash and equivalents in our condensed consolidated balance sheets as of March 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

12 |

Cardinal Health | Q3 Fiscal 2024 Form 10-Q |

|

|

|

|

|

|

|

|

|

|

| MD&A |

Liquidity and Capital Resources |

|

Capital Deployment

Opioid Litigation Settlement Agreement

We had $5.3 billion accrued at March 31, 2024 related to certain opioid litigation, as further described within

Note 7 of the "Notes to Condensed Consolidated Financial Statements." We expect the majority of the remaining payment amounts to occur through 2038. During the nine months ended March 31, 2024, we made our third annual payment of $378 million under the National Opioid Settlement Agreement. The amounts of future annual payments may differ from the payments that we have already made.

In January 2024, we made additional payments of approximately $239 million to prepay at a prenegotiated discount of certain future payment amounts totaling approximately $344 million owed under each of the National Opioid Settlement Agreement, West Virginia Subdivisions Settlement Agreement and settlement agreements with Native American tribes and Cherokee Nation. The majority of the prepayment relates to the seventh annual payment due under the National Opioid Settlement Agreement. As a result of these prepayments, we recognized income of $105 million in litigation charges/(recoveries), net in our condensed consolidated statements of earnings during the nine months ended March 31, 2024.

Capital Expenditures

Capital expenditures during the nine months ended March 31, 2024 and 2023 were $318 million and $264 million, respectively.

Dividends

On each of May 11, 2023, August 9, 2023, November 14, 2023 and February 6, 2024, our Board of Directors approved a quarterly dividend of $0.5006 per share, or $2.00 per share on an annualized basis, which were paid on July 15, 2023, October 15, 2023, January 15, 2024 and April 15, 2024 to shareholders of record on July 3, 2023, October 3, 2023, January 2, 2024 and April 1, 2024, respectively.

Share Repurchases

During the nine months ended March 31, 2024, we deployed $750 million of our common shares, in the aggregate, under accelerated share repurchase ("ASR") programs. We funded the ASR programs with available cash. See