Florida |

1-9109 |

59-1517485 |

||||||||||||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

880 Carillon Parkway |

St. Petersburg |

Florida |

33716 |

|||||||||||

(Address of principal executive offices) |

(Zip Code) |

|||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $.01 par value | RJF | New York Stock Exchange | ||||||

RAYMOND JAMES FINANCIAL, INC. |

||||||||

Date: January 28, 2026 |

By: |

/s/ Jonathan W. Oorlog, Jr. |

||||||

| Jonathan W. Oorlog, Jr. | ||||||||

| Chief Financial Officer | ||||||||

| January 28, 2026 | FOR IMMEDIATE RELEASE | |||||||

| Media Contact: Steve Hollister, 727.567.2824 | ||||||||

| Investor Contact: Kristina Waugh, 727.567.7654 | ||||||||

| raymondjames.com/news-and-media/press-releases | ||||||||

|

RAYMOND JAMES FINANCIAL, INC.

Fiscal First Quarter of 2026

|

Selected Financial Highlights (Unaudited) |

||||

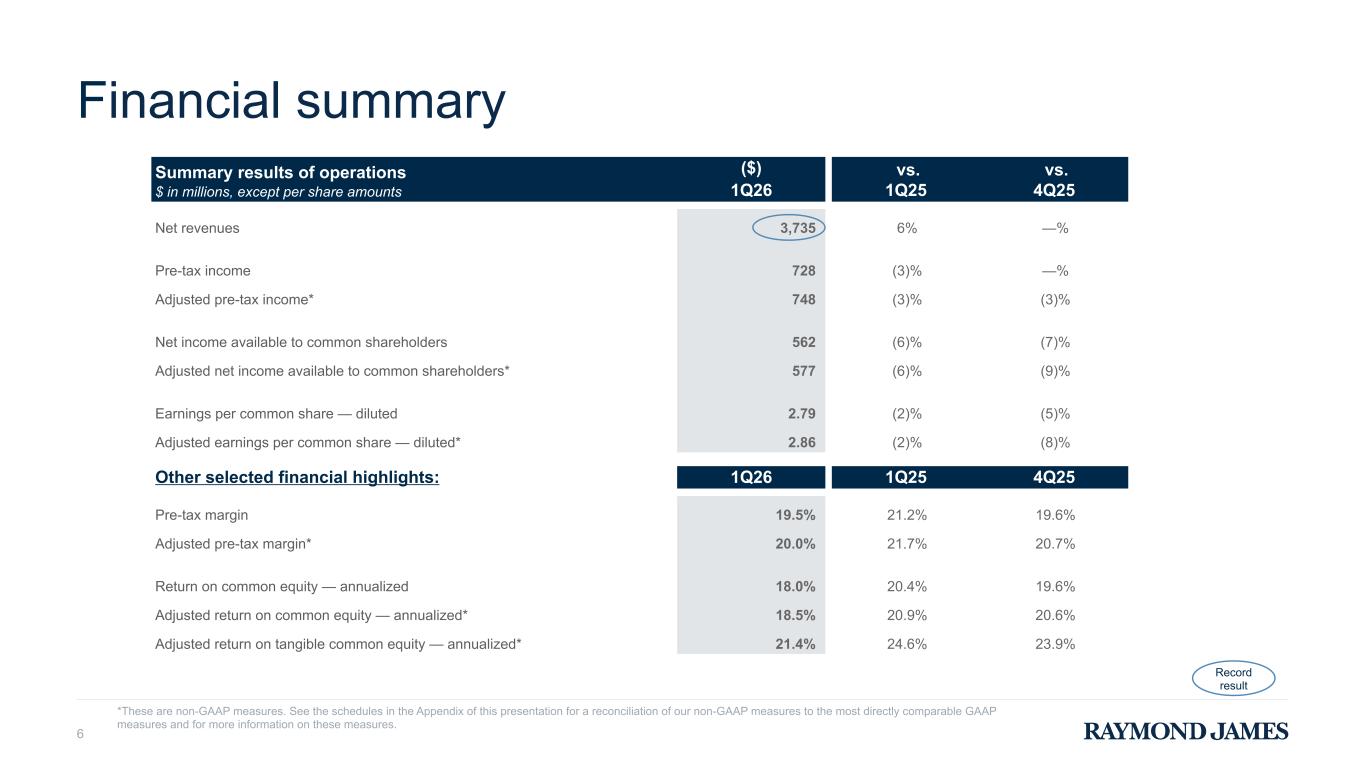

| Three months ended | % change from | |||||||||||||||||||||||||||||||

|

$ in millions, except per share amounts

|

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

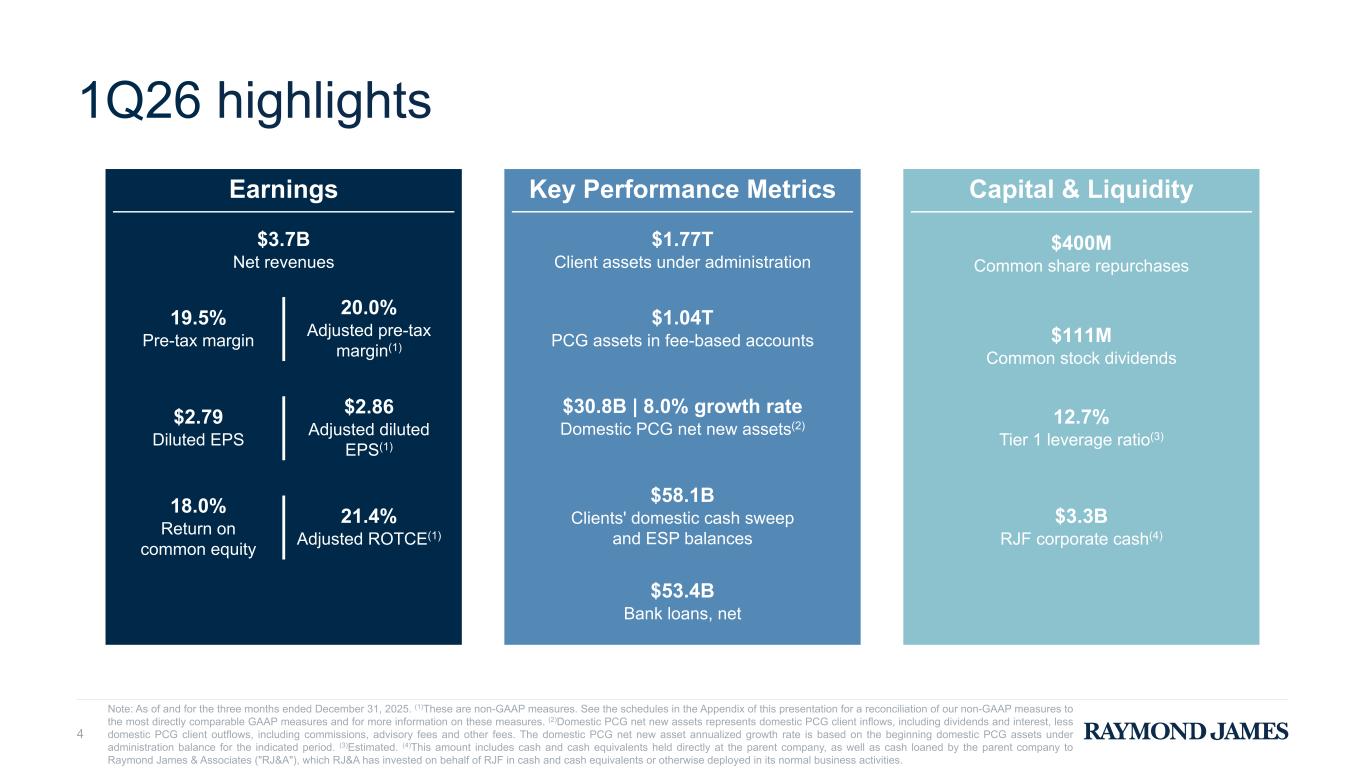

| Net revenues | $ | 3,735 | $ | 3,537 | $ | 3,727 | 6% | —% | ||||||||||||||||||||||||

| Pre-tax income | $ | 728 | $ | 749 | $ | 731 | (3)% | —% | ||||||||||||||||||||||||

| Net income available to common shareholders | $ | 562 | $ | 599 | $ | 603 | (6)% | (7)% | ||||||||||||||||||||||||

Earnings per common share: (4) |

||||||||||||||||||||||||||||||||

| Basic | $ | 2.85 | $ | 2.94 | $ | 3.03 | (3)% | (6)% | ||||||||||||||||||||||||

| Diluted | $ | 2.79 | $ | 2.86 | $ | 2.95 | (2)% | (5)% | ||||||||||||||||||||||||

Non-GAAP measures: (1) |

||||||||||||||||||||||||||||||||

Adjusted pre-tax income |

$ | 748 | $ | 769 | $ | 770 | (3)% | (3)% | ||||||||||||||||||||||||

| Adjusted net income available to common shareholders | $ | 577 | $ | 614 | $ | 635 | (6)% | (9)% | ||||||||||||||||||||||||

Adjusted earnings per common share – basic (4) |

$ | 2.92 | $ | 3.01 | $ | 3.19 | (3)% | (8)% | ||||||||||||||||||||||||

Adjusted earnings per common share – diluted (4) |

$ | 2.86 | $ | 2.93 | $ | 3.11 | (2)% | (8)% | ||||||||||||||||||||||||

| Three months ended | ||||||||||||||||||||

| Other selected financial highlights | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

Return on common equity (5) |

18.0 | % | 20.4 | % | 19.6 | % | ||||||||||||||

Adjusted return on common equity (1) (5) |

18.5 | % | 20.9 | % | 20.6 | % | ||||||||||||||

Adjusted return on tangible common equity (1) (5) |

21.4 | % | 24.6 | % | 23.9 | % | ||||||||||||||

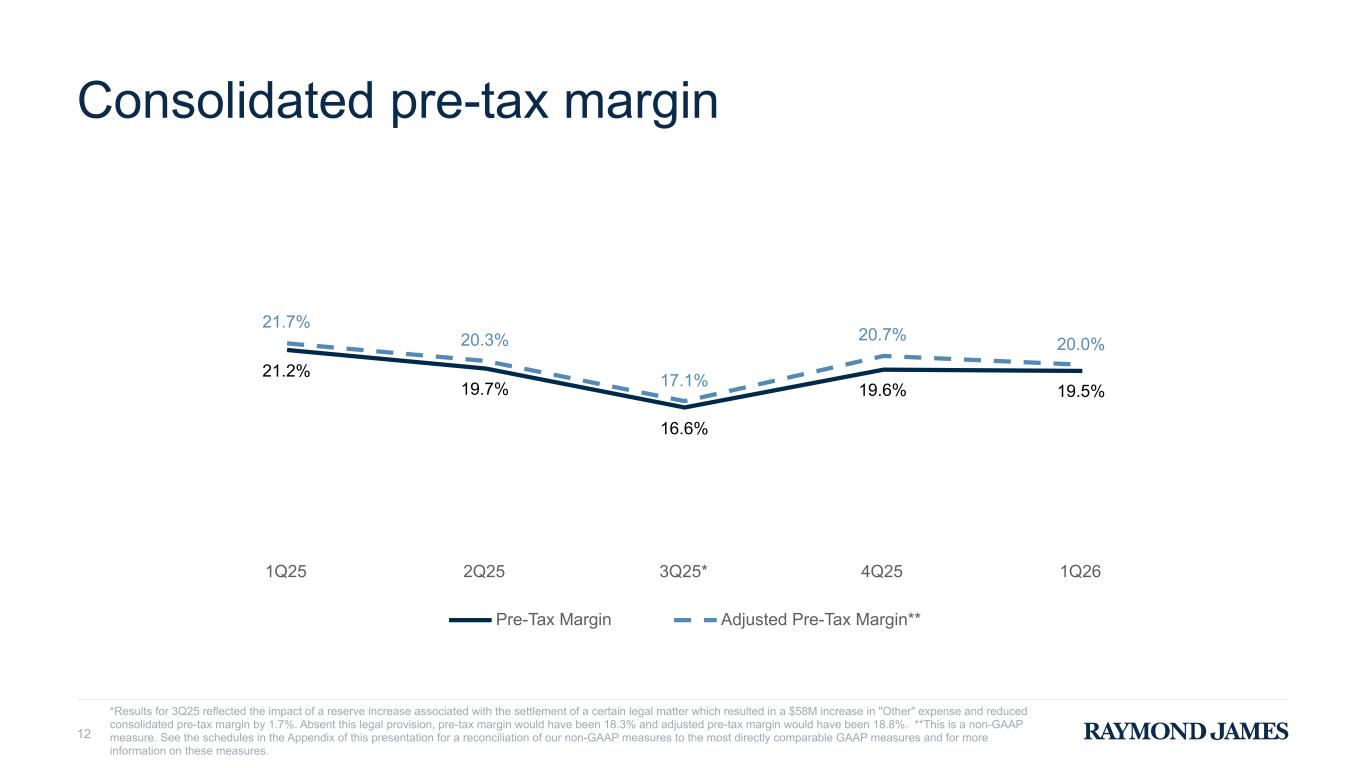

Pre-tax margin (6) |

19.5 | % | 21.2 | % | 19.6 | % | ||||||||||||||

Adjusted pre-tax margin (1) (6) |

20.0 | % | 21.7 | % | 20.7 | % | ||||||||||||||

Total compensation ratio (7) |

65.6 | % | 64.2 | % | 64.2 | % | ||||||||||||||

Adjusted total compensation ratio (1) (7) |

65.4 | % | 64.0 | % | 64.0 | % | ||||||||||||||

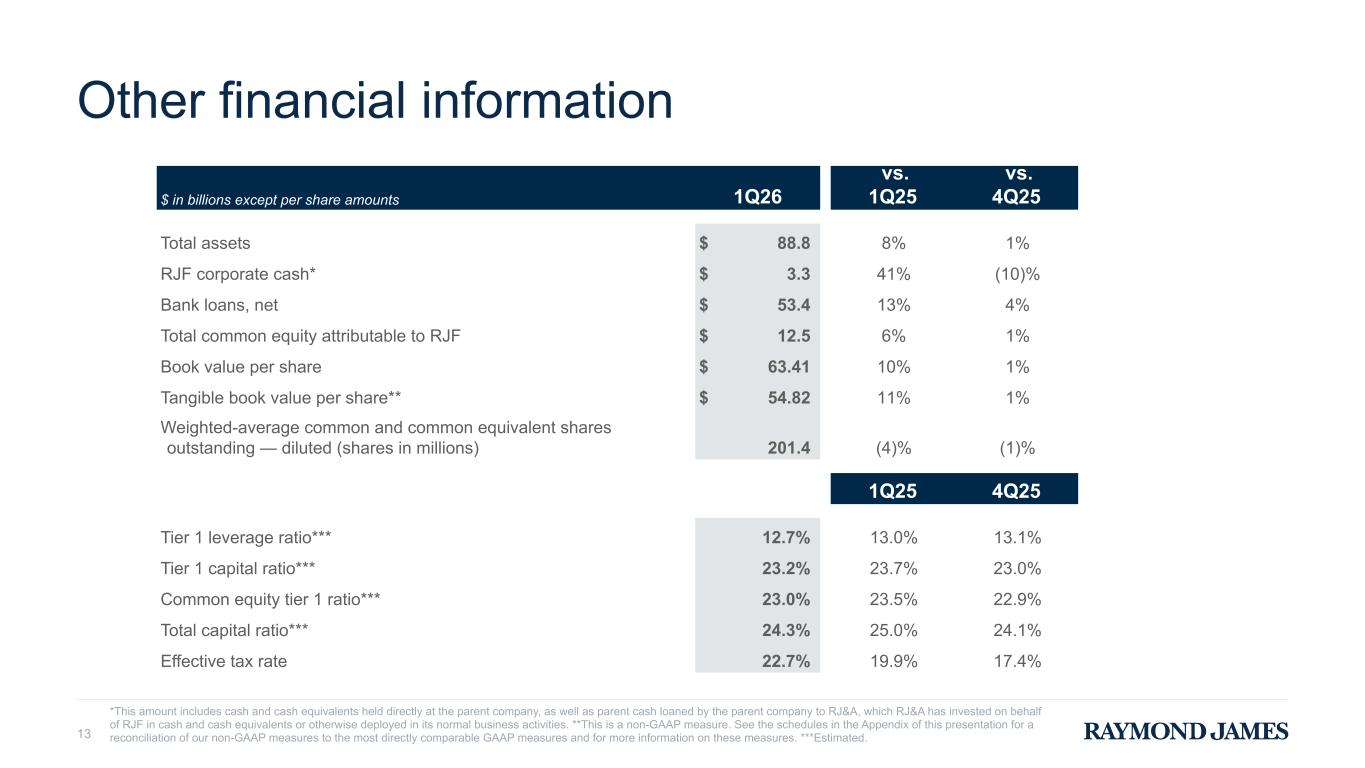

| Effective tax rate | 22.7 | % | 19.9 | % | 17.4 | % | ||||||||||||||

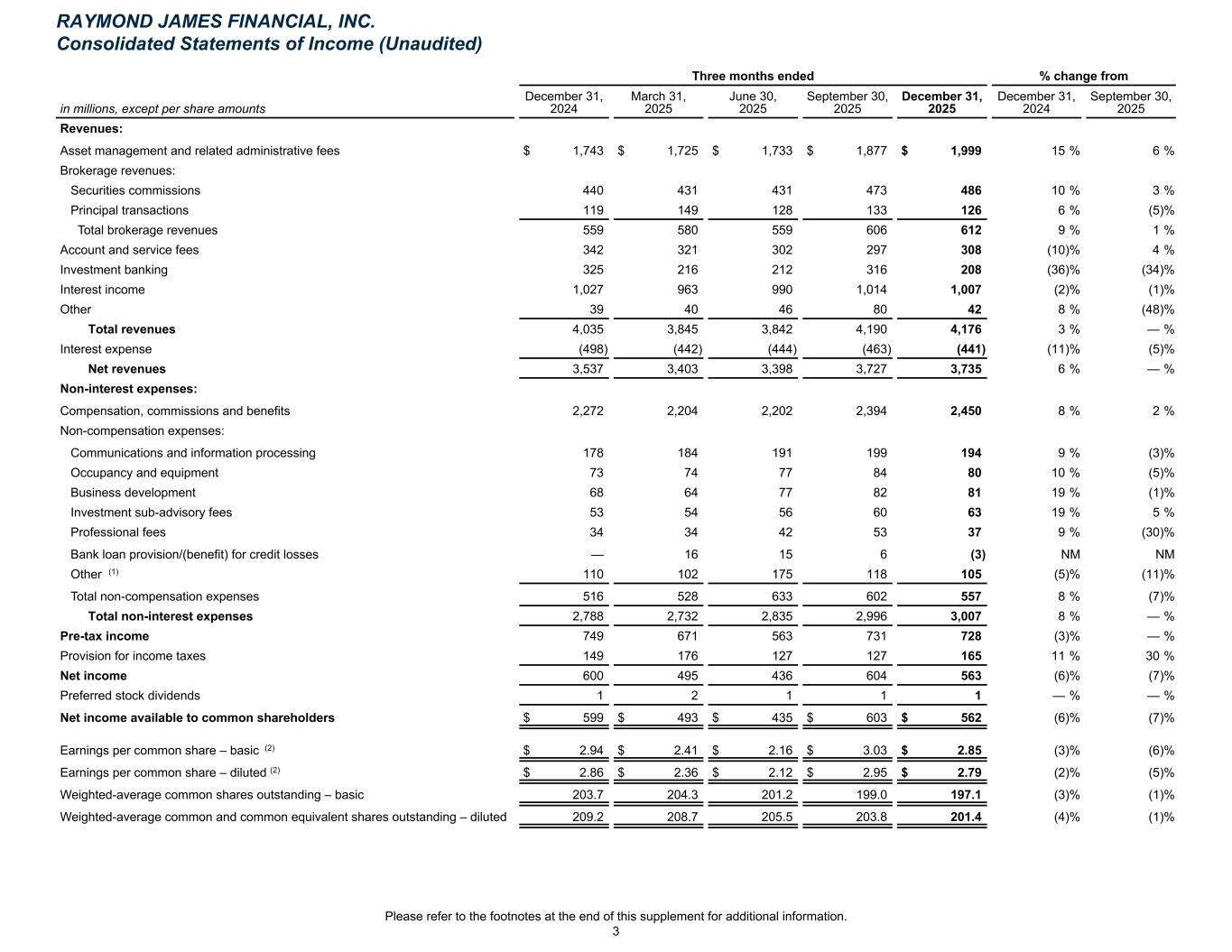

| Consolidated Statements of Income (Unaudited) | ||||||||||||||||||||||||||||||||

| Three months ended | % change from | |||||||||||||||||||||||||||||||

| in millions, except per share amounts | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

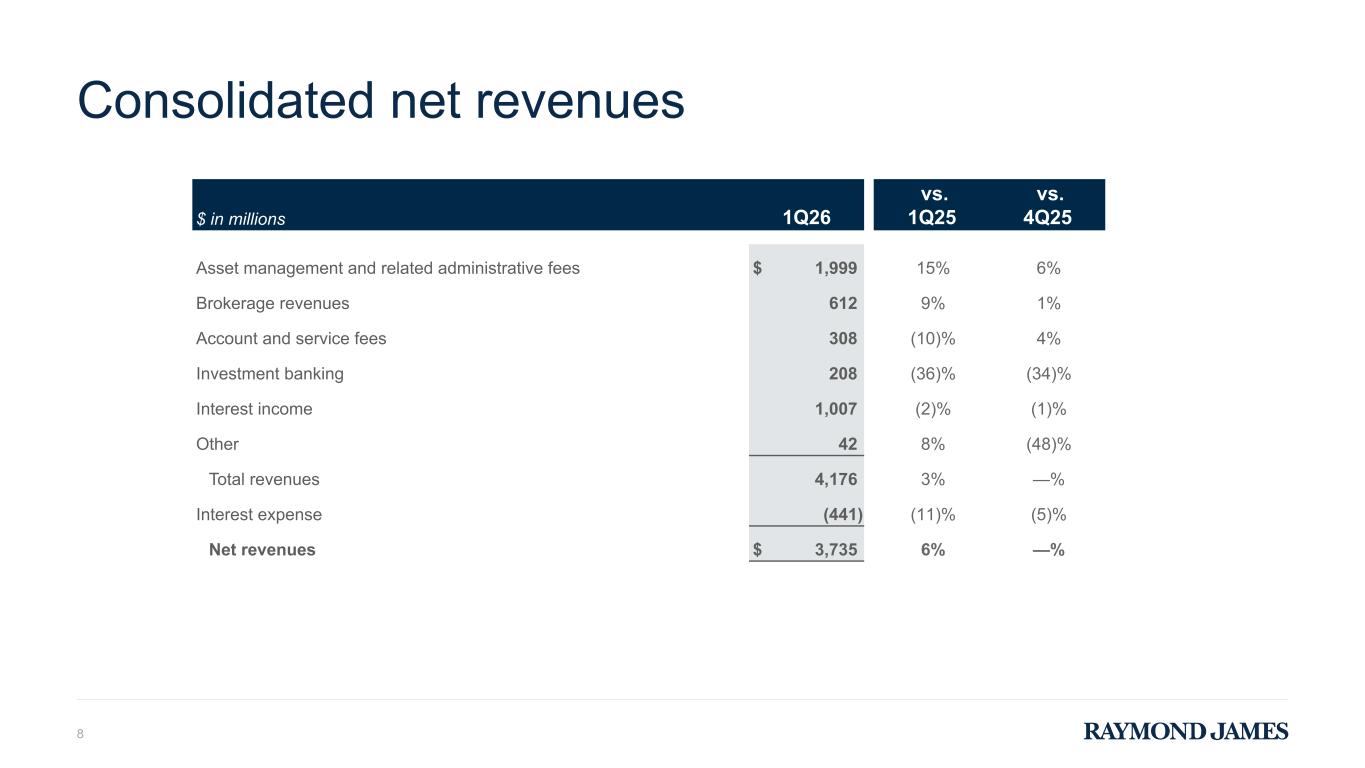

| Revenues: | ||||||||||||||||||||||||||||||||

| Asset management and related administrative fees | $ | 1,999 | $ | 1,743 | $ | 1,877 | 15% | 6% | ||||||||||||||||||||||||

| Brokerage revenues: | ||||||||||||||||||||||||||||||||

| Securities commissions | 486 | 440 | 473 | 10% | 3% | |||||||||||||||||||||||||||

| Principal transactions | 126 | 119 | 133 | 6% | (5)% | |||||||||||||||||||||||||||

| Total brokerage revenues | 612 | 559 | 606 | 9% | 1% | |||||||||||||||||||||||||||

| Account and service fees | 308 | 342 | 297 | (10)% | 4% | |||||||||||||||||||||||||||

| Investment banking | 208 | 325 | 316 | (36)% | (34)% | |||||||||||||||||||||||||||

| Interest income | 1,007 | 1,027 | 1,014 | (2)% | (1)% | |||||||||||||||||||||||||||

| Other | 42 | 39 | 80 | 8% | (48)% | |||||||||||||||||||||||||||

| Total revenues | 4,176 | 4,035 | 4,190 | 3% | —% | |||||||||||||||||||||||||||

| Interest expense | (441) | (498) | (463) | (11)% | (5)% | |||||||||||||||||||||||||||

| Net revenues | 3,735 | 3,537 | 3,727 | 6% | —% | |||||||||||||||||||||||||||

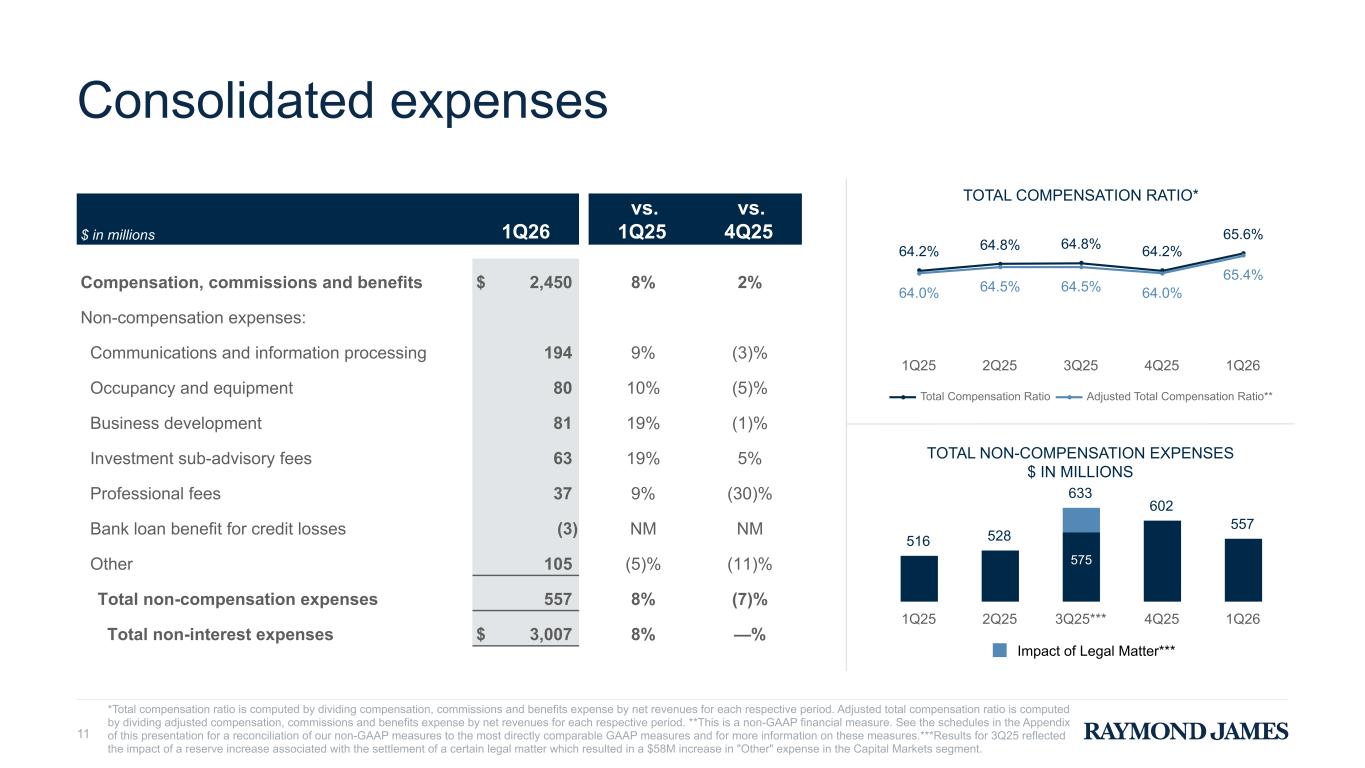

| Non-interest expenses: | ||||||||||||||||||||||||||||||||

Compensation, commissions and benefits |

2,450 | 2,272 | 2,394 | 8% | 2% | |||||||||||||||||||||||||||

| Non-compensation expenses: | ||||||||||||||||||||||||||||||||

| Communications and information processing | 194 | 178 | 199 | 9% | (3)% | |||||||||||||||||||||||||||

| Occupancy and equipment | 80 | 73 | 84 | 10% | (5)% | |||||||||||||||||||||||||||

| Business development | 81 | 68 | 82 | 19% | (1)% | |||||||||||||||||||||||||||

| Investment sub-advisory fees | 63 | 53 | 60 | 19% | 5% | |||||||||||||||||||||||||||

| Professional fees | 37 | 34 | 53 | 9% | (30)% | |||||||||||||||||||||||||||

| Bank loan provision/(benefit) for credit losses | (3) | — | 6 | NM | NM | |||||||||||||||||||||||||||

| Other | 105 | 110 | 118 | (5)% | (11)% | |||||||||||||||||||||||||||

| Total non-compensation expenses | 557 | 516 | 602 | 8% | (7)% | |||||||||||||||||||||||||||

| Total non-interest expenses | 3,007 | 2,788 | 2,996 | 8% | —% | |||||||||||||||||||||||||||

Pre-tax income |

728 | 749 | 731 | (3)% | —% | |||||||||||||||||||||||||||

| Provision for income taxes | 165 | 149 | 127 | 11% | 30% | |||||||||||||||||||||||||||

| Net income | 563 | 600 | 604 | (6)% | (7)% | |||||||||||||||||||||||||||

| Preferred stock dividends | 1 | 1 | 1 | —% | —% | |||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 562 | $ | 599 | $ | 603 | (6)% | (7)% | ||||||||||||||||||||||||

Earnings per common share – basic (4) |

$ | 2.85 | $ | 2.94 | $ | 3.03 | (3)% | (6)% | ||||||||||||||||||||||||

Earnings per common share – diluted (4) |

$ | 2.79 | $ | 2.86 | $ | 2.95 | (2)% | (5)% | ||||||||||||||||||||||||

| Weighted-average common shares outstanding – basic | 197.1 | 203.7 | 199.0 | (3)% | (1)% | |||||||||||||||||||||||||||

| Weighted-average common and common equivalent shares outstanding – diluted | 201.4 | 209.2 | 203.8 | (4)% | (1)% | |||||||||||||||||||||||||||

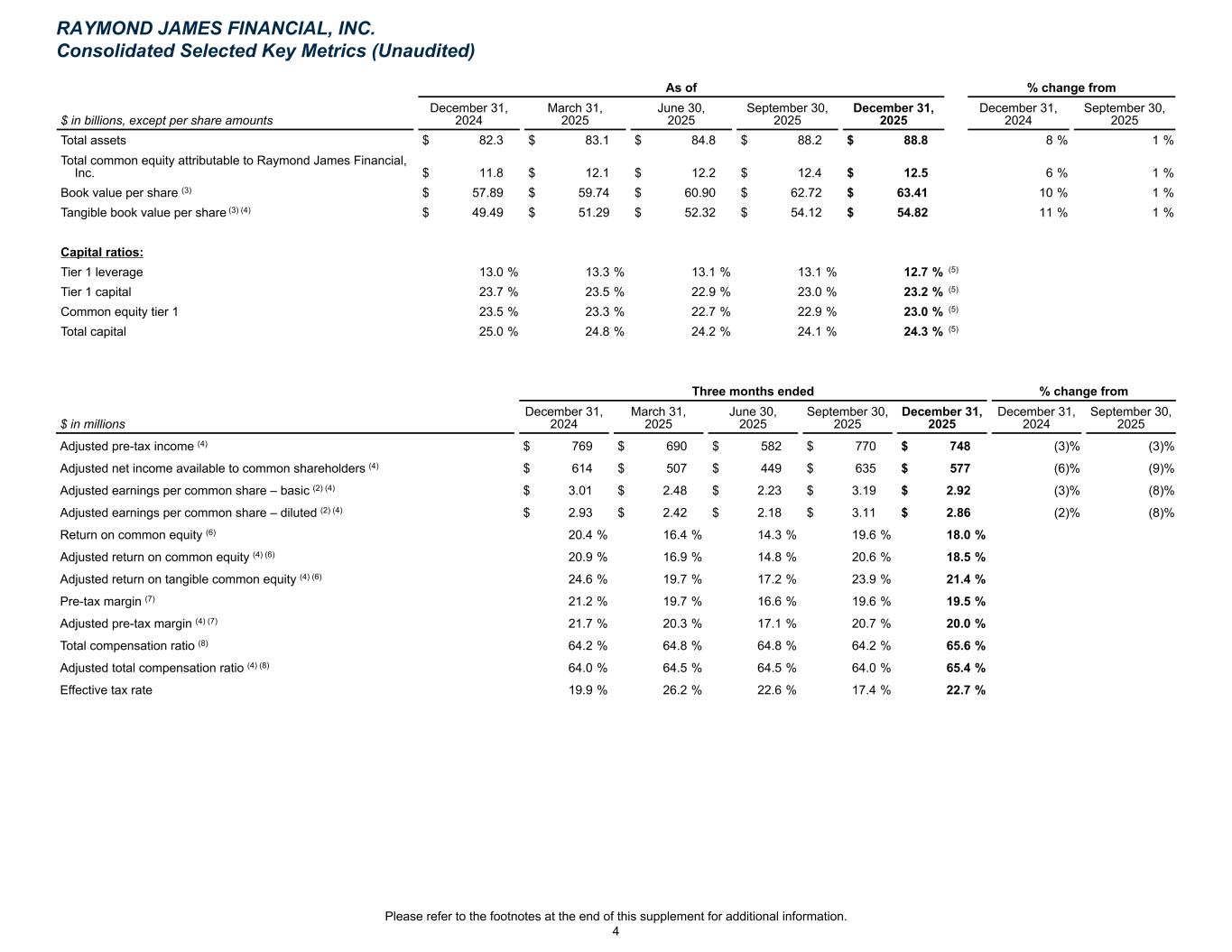

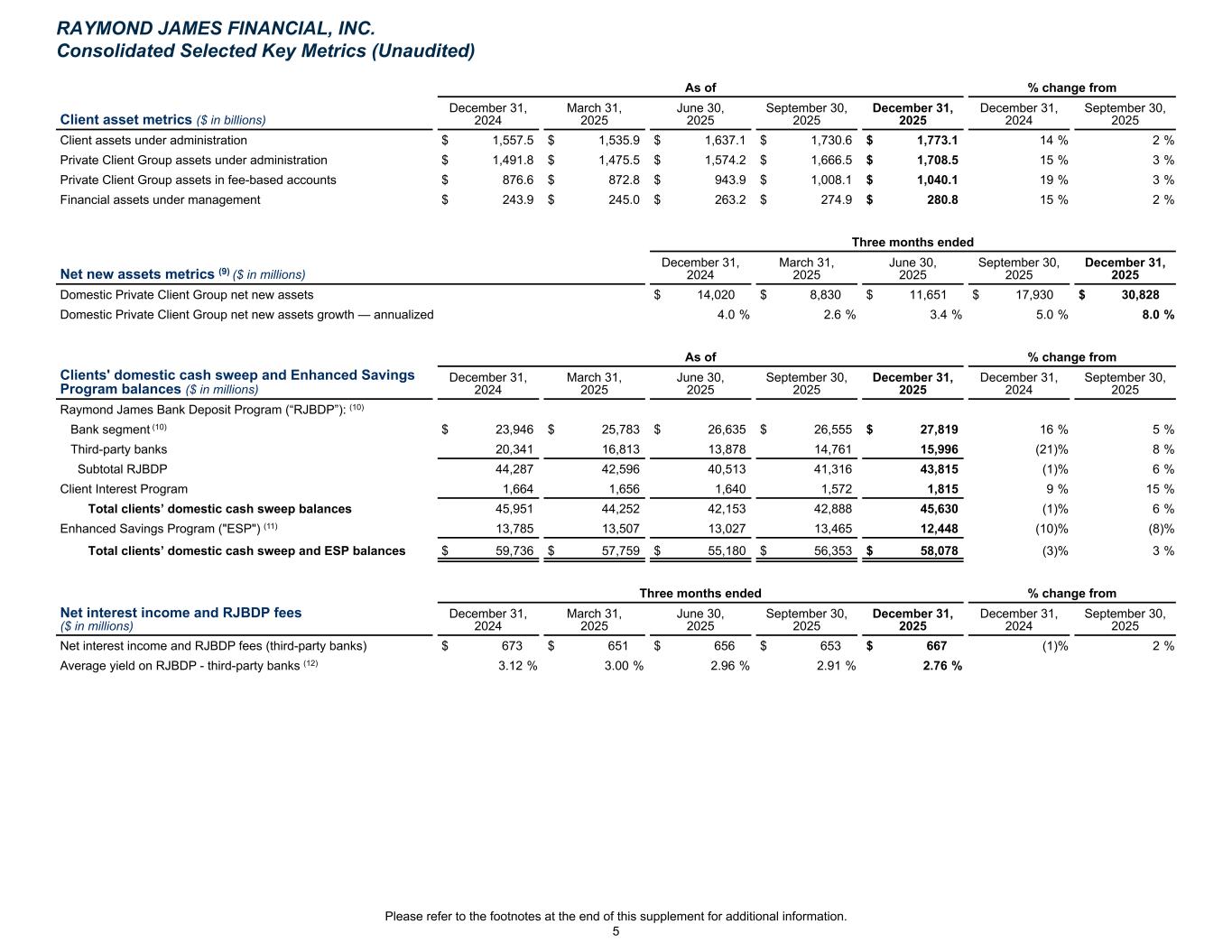

| RAYMOND JAMES FINANCIAL, INC. | Consolidated Selected Key Metrics | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| As of | % change from | |||||||||||||||||||||||||||||||

$ in billions, except per share amounts |

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Total assets | $ | 88.8 | $ | 82.3 | $ | 88.2 | 8% | 1% | ||||||||||||||||||||||||

| Total common equity attributable to Raymond James Financial, Inc. | $ | 12.5 | $ | 11.8 | $ | 12.4 | 6% | 1% | ||||||||||||||||||||||||

Book value per share (9) |

$ | 63.41 | $ | 57.89 | $ | 62.72 | 10% | 1% | ||||||||||||||||||||||||

Tangible book value per share (1) (9) |

$ | 54.82 | $ | 49.49 | $ | 54.12 | 11% | 1% | ||||||||||||||||||||||||

Capital ratios: |

||||||||||||||||||||||||||||||||

| Tier 1 leverage | 12.7 | % | (3) |

13.0 | % | 13.1 | % | |||||||||||||||||||||||||

| Tier 1 capital | 23.2 | % | (3) |

23.7 | % | 23.0 | % | |||||||||||||||||||||||||

| Common equity tier 1 | 23.0 | % | (3) |

23.5 | % | 22.9 | % | |||||||||||||||||||||||||

| Total capital | 24.3 | % | (3) |

25.0 | % | 24.1 | % | |||||||||||||||||||||||||

| As of | % change from | |||||||||||||||||||||||||||||||

Client asset metrics ($ in billions) |

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Client assets under administration | $ | 1,773.1 | $ | 1,557.5 | $ | 1,730.6 | 14% | 2% | ||||||||||||||||||||||||

| Private Client Group assets under administration | $ | 1,708.5 | $ | 1,491.8 | $ | 1,666.5 | 15% | 3% | ||||||||||||||||||||||||

| Private Client Group assets in fee-based accounts | $ | 1,040.1 | $ | 876.6 | $ | 1,008.1 | 19% | 3% | ||||||||||||||||||||||||

| Financial assets under management | $ | 280.8 | $ | 243.9 | $ | 274.9 | 15% | 2% | ||||||||||||||||||||||||

| Three months ended | ||||||||||||||||||||

Net new assets metrics ($ in millions) |

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

Domestic Private Client Group net new assets (2) |

$ | 30,828 | $ | 14,020 | $ | 17,930 | ||||||||||||||

Domestic Private Client Group net new assets growth — annualized (2) |

8.0 | % | 4.0 | % | 5.0 | % | ||||||||||||||

| As of | % change from | |||||||||||||||||||||||||||||||

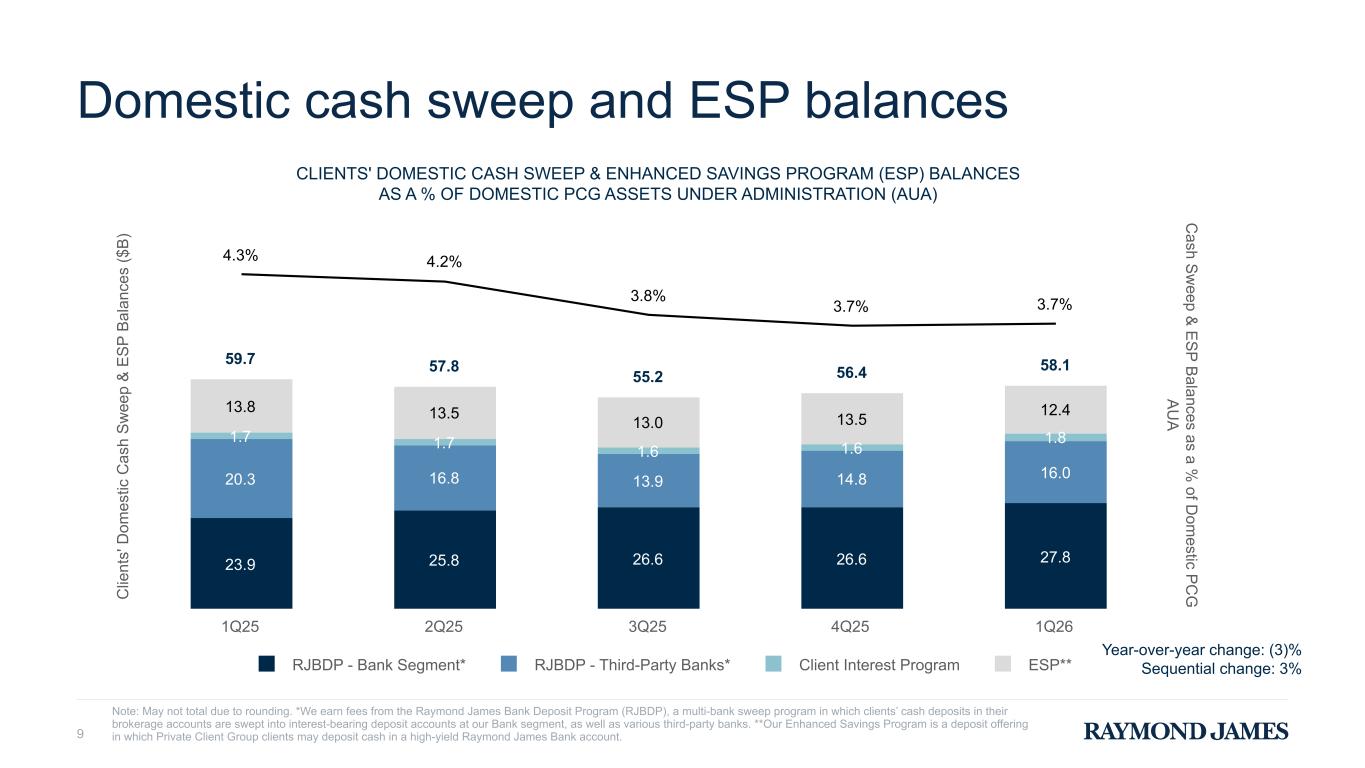

Clients’ domestic cash sweep and Enhanced Savings Program balances ($ in millions) |

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

Raymond James Bank Deposit Program (“RJBDP”): (10) |

||||||||||||||||||||||||||||||||

| Bank segment | $ | 27,819 | $ | 23,946 | $ | 26,555 | 16% | 5% | ||||||||||||||||||||||||

| Third-party banks | 15,996 | 20,341 | 14,761 | (21)% | 8% | |||||||||||||||||||||||||||

| Subtotal RJBDP | 43,815 | 44,287 | 41,316 | (1)% | 6% | |||||||||||||||||||||||||||

| Client Interest Program | 1,815 | 1,664 | 1,572 | 9% | 15% | |||||||||||||||||||||||||||

Total clients’ domestic cash sweep balances |

45,630 | 45,951 | 42,888 | (1)% | 6% | |||||||||||||||||||||||||||

Enhanced Savings Program (“ESP”) (11) |

12,448 | 13,785 | 13,465 | (10)% | (8)% | |||||||||||||||||||||||||||

| Total clients’ domestic cash sweep and ESP balances | $ | 58,078 | $ | 59,736 | $ | 56,353 | (3)% | 3% | ||||||||||||||||||||||||

|

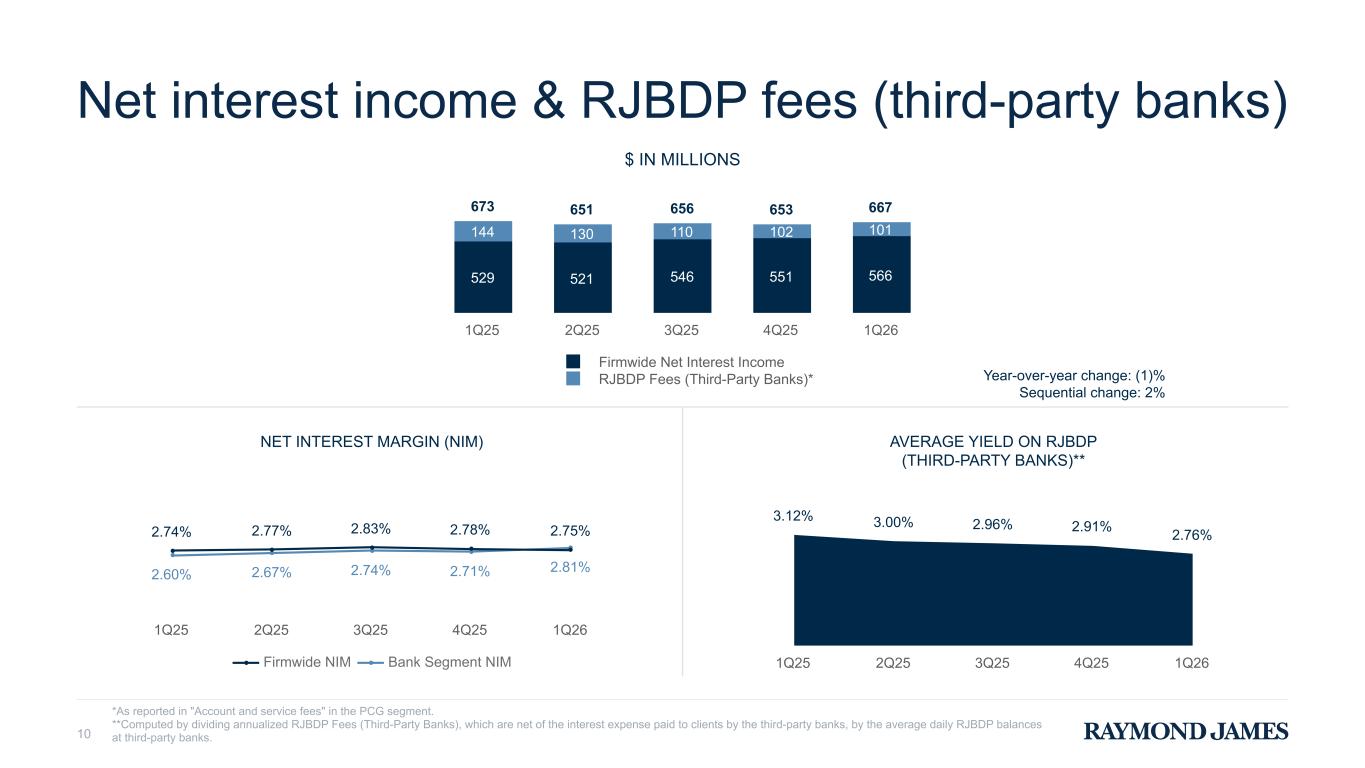

Net interest income and RJBDP fees

($ in millions)

|

Three months ended | % change from | ||||||||||||||||||||||||||||||

| December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

||||||||||||||||||||||||||||

| Net interest income and RJBDP fees (third-party banks) | $ | 667 | $ | 673 | $ | 653 | (1)% | 2% | ||||||||||||||||||||||||

Average yield on RJBDP - third-party banks (12) |

2.76 | % | 3.12 | % | 2.91 | % | ||||||||||||||||||||||||||

| RAYMOND JAMES FINANCIAL, INC. | Consolidated Net Interest | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| Three months ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2025 | December 31, 2024 | September 30, 2025 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ in millions | Average balance |

Interest | Annualized average rate |

Average balance |

Interest | Annualized average rate |

Average balance |

Interest | Annualized average rate |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| INTEREST-EARNING ASSETS | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank segment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 5,321 | $ | 52 | 3.85 | % | $ | 6,453 | $ | 76 | 4.65 | % | $ | 5,564 | $ | 60 | 4.30 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Available-for-sale securities | 7,276 | 42 | 2.29 | % | 8,753 | 49 | 2.26 | % | 7,611 | 43 | 2.28 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Loans held for sale and investment: (13) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for investment: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Securities-based loans (14) |

20,626 | 296 | 5.62 | % | 16,485 | 270 | 6.40 | % | 18,961 | 289 | 5.96 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial and industrial loans | 10,701 | 168 | 6.16 | % | 10,128 | 178 | 6.88 | % | 10,614 | 174 | 6.40 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial real estate loans | 7,718 | 121 | 6.13 | % | 7,641 | 135 | 6.92 | % | 7,709 | 127 | 6.44 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Real estate investment trust loans | 1,718 | 29 | 6.59 | % | 1,653 | 31 | 7.35 | % | 1,662 | 31 | 7.06 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage loans | 10,467 | 107 | 4.10 | % | 9,536 | 91 | 3.82 | % | 10,154 | 103 | 4.05 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Tax-exempt loans (15) |

1,148 | 8 | 3.41 | % | 1,305 | 9 | 3.36 | % | 1,257 | 9 | 3.47 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 304 | 5 | 6.69 | % | 212 | 4 | 7.22 | % | 232 | 4 | 7.00 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total loans held for sale and investment | 52,682 | 734 | 5.49 | % | 46,960 | 718 | 6.02 | % | 50,589 | 737 | 5.72 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| All other interest-earning assets | 241 | 3 | 4.85 | % | 243 | 4 | 5.81 | % | 239 | 3 | 5.06 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets — Bank segment | $ | 65,520 | $ | 831 | 5.00 | % | $ | 62,409 | $ | 847 | 5.35 | % | $ | 64,003 | $ | 843 | 5.19 | % | ||||||||||||||||||||||||||||||||||||||||||||

| All other segments | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | 5,109 | $ | 49 | 3.81 | % | $ | 4,056 | $ | 48 | 4.72 | % | $ | 4,444 | $ | 48 | 4.23 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Assets segregated for regulatory purposes and restricted cash | 3,897 | 35 | 3.56 | % | 3,648 | 42 | 4.55 | % | 3,634 | 35 | 3.91 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading assets — debt securities | 1,570 | 22 | 5.47 | % | 1,395 | 19 | 5.41 | % | 1,409 | 18 | 5.23 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Brokerage client receivables | 2,617 | 43 | 6.56 | % | 2,407 | 45 | 7.35 | % | 2,448 | 43 | 6.94 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| All other interest-earning assets | 2,928 | 27 | 3.53 | % | 2,579 | 26 | 3.93 | % | 2,755 | 27 | 3.83 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets — all other segments | $ | 16,121 | $ | 176 | 4.31 | % | $ | 14,085 | $ | 180 | 5.05 | % | $ | 14,690 | $ | 171 | 4.62 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | $ | 81,641 | $ | 1,007 | 4.86 | % | $ | 76,494 | $ | 1,027 | 5.29 | % | $ | 78,693 | $ | 1,014 | 5.08 | % | ||||||||||||||||||||||||||||||||||||||||||||

| INTEREST-BEARING LIABILITIES | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank Segment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank deposits: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Money market and savings accounts (10) |

$ | 35,027 | $ | 131 | 1.49 | % | $ | 32,548 | $ | 168 | 2.05 | % | $ | 33,517 | $ | 143 | 1.69 | % | ||||||||||||||||||||||||||||||||||||||||||||

Interest-bearing demand deposits (11) |

22,144 | 204 | 3.66 | % | 20,921 | 229 | 4.34 | % | 22,262 | 227 | 4.03 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Certificates of deposit | 1,961 | 20 | 4.13 | % | 2,452 | 28 | 4.59 | % | 1,855 | 20 | 4.27 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

Total bank deposits (16) |

59,132 | 355 | 2.39 | % | 55,921 | 425 | 3.02 | % | 57,634 | 390 | 2.68 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Federal Home Loan Bank advances and all other interest-bearing liabilities | 751 | 6 | 2.85 | % | 1,091 | 8 | 2.69 | % | 818 | 11 | 2.02 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities — Bank segment | $ | 59,883 | $ | 361 | 2.40 | % | $ | 57,012 | $ | 433 | 3.01 | % | $ | 58,452 | $ | 401 | 2.71 | % | ||||||||||||||||||||||||||||||||||||||||||||

| All other segments | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Trading liabilities — debt securities | $ | 932 | $ | 12 | 5.25 | % | $ | 859 | $ | 11 | 5.07 | % | $ | 883 | $ | 12 | 5.39 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Brokerage client payables | 5,042 | 14 | 1.09 | % | 4,771 | 20 | 1.65 | % | 4,882 | 14 | 1.20 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Senior notes payable | 3,521 | 43 | 4.91 | % | 2,040 | 23 | 4.50 | % | 2,362 | 27 | 4.65 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

All other interest-bearing liabilities (16) |

1,272 | 11 | 3.19 | % | 1,132 | 11 | 3.78 | % | 1,277 | 9 | 2.79 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities — all other segments | $ | 10,767 | $ | 80 | 2.95 | % | $ | 8,802 | $ | 65 | 2.92 | % | $ | 9,404 | $ | 62 | 2.68 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | $ | 70,650 | $ | 441 | 2.48 | % | $ | 65,814 | $ | 498 | 3.00 | % | $ | 67,856 | $ | 463 | 2.71 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Firmwide net interest income | $ | 566 | $ | 529 | $ | 551 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin (net yield on interest-earning assets) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bank segment | 2.81 | % | 2.60 | % | 2.71 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Firmwide | 2.75 | % | 2.74 | % | 2.78 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RAYMOND JAMES FINANCIAL, INC. | Segment Results | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

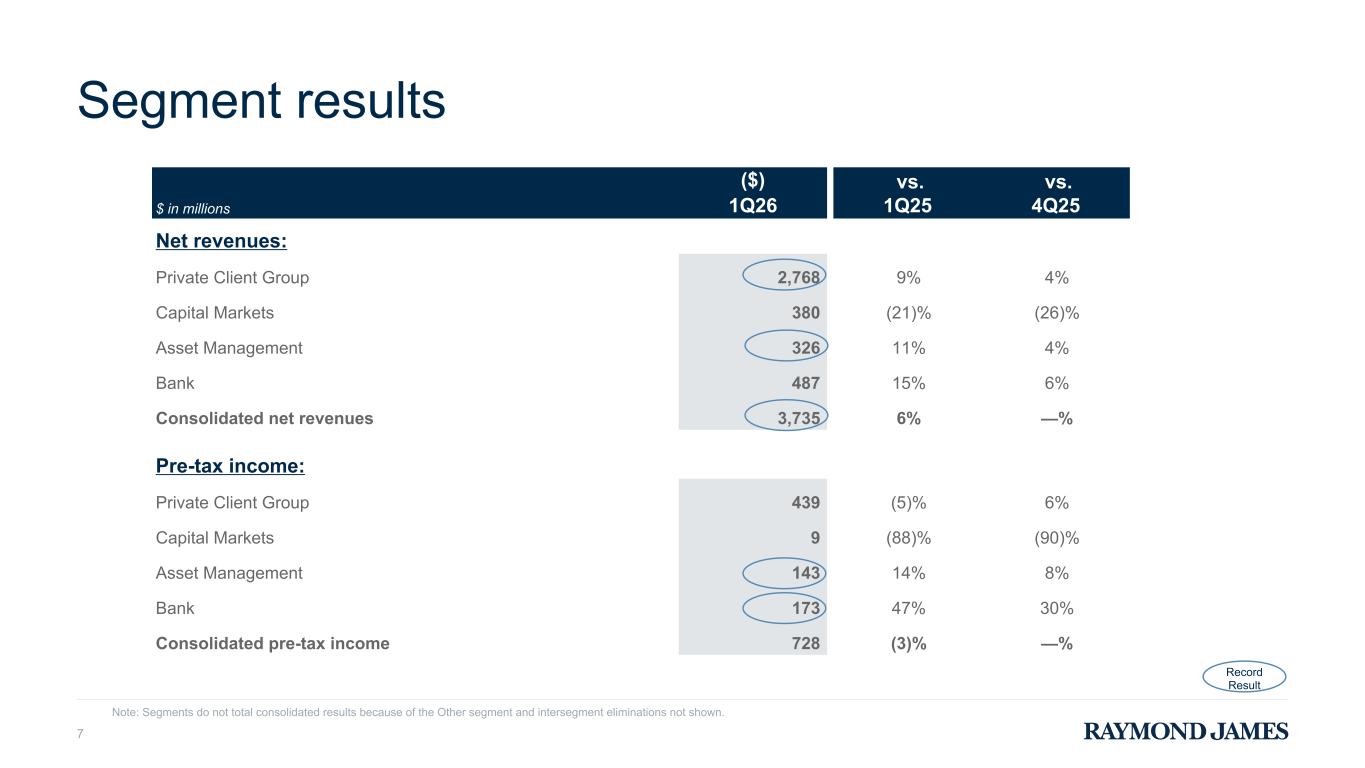

| Three months ended | % change from | |||||||||||||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Net revenues/(losses): | ||||||||||||||||||||||||||||||||

| Private Client Group | $ | 2,768 | $ | 2,548 | $ | 2,660 | 9% | 4% | ||||||||||||||||||||||||

| Capital Markets | 380 | 480 | 513 | (21)% | (26)% | |||||||||||||||||||||||||||

| Asset Management | 326 | 294 | 314 | 11% | 4% | |||||||||||||||||||||||||||

| Bank | 487 | 425 | 459 | 15% | 6% | |||||||||||||||||||||||||||

Other (17) |

(1) | 12 | 12 | NM | NM | |||||||||||||||||||||||||||

| Intersegment eliminations | (225) | (222) | (231) | 1% | (3)% | |||||||||||||||||||||||||||

Total net revenues |

$ | 3,735 | $ | 3,537 | $ | 3,727 | 6% | —% | ||||||||||||||||||||||||

Pre-tax income/(loss): |

||||||||||||||||||||||||||||||||

| Private Client Group | $ | 439 | $ | 462 | $ | 416 | (5)% | 6% | ||||||||||||||||||||||||

| Capital Markets | 9 | 74 | 90 | (88)% | (90)% | |||||||||||||||||||||||||||

| Asset Management | 143 | 125 | 132 | 14% | 8% | |||||||||||||||||||||||||||

| Bank | 173 | 118 | 133 | 47% | 30% | |||||||||||||||||||||||||||

Other (17) |

(36) | (30) | (40) | (20)% | 10% | |||||||||||||||||||||||||||

Pre-tax income |

$ | 728 | $ | 749 | $ | 731 | (3)% | —% | ||||||||||||||||||||||||

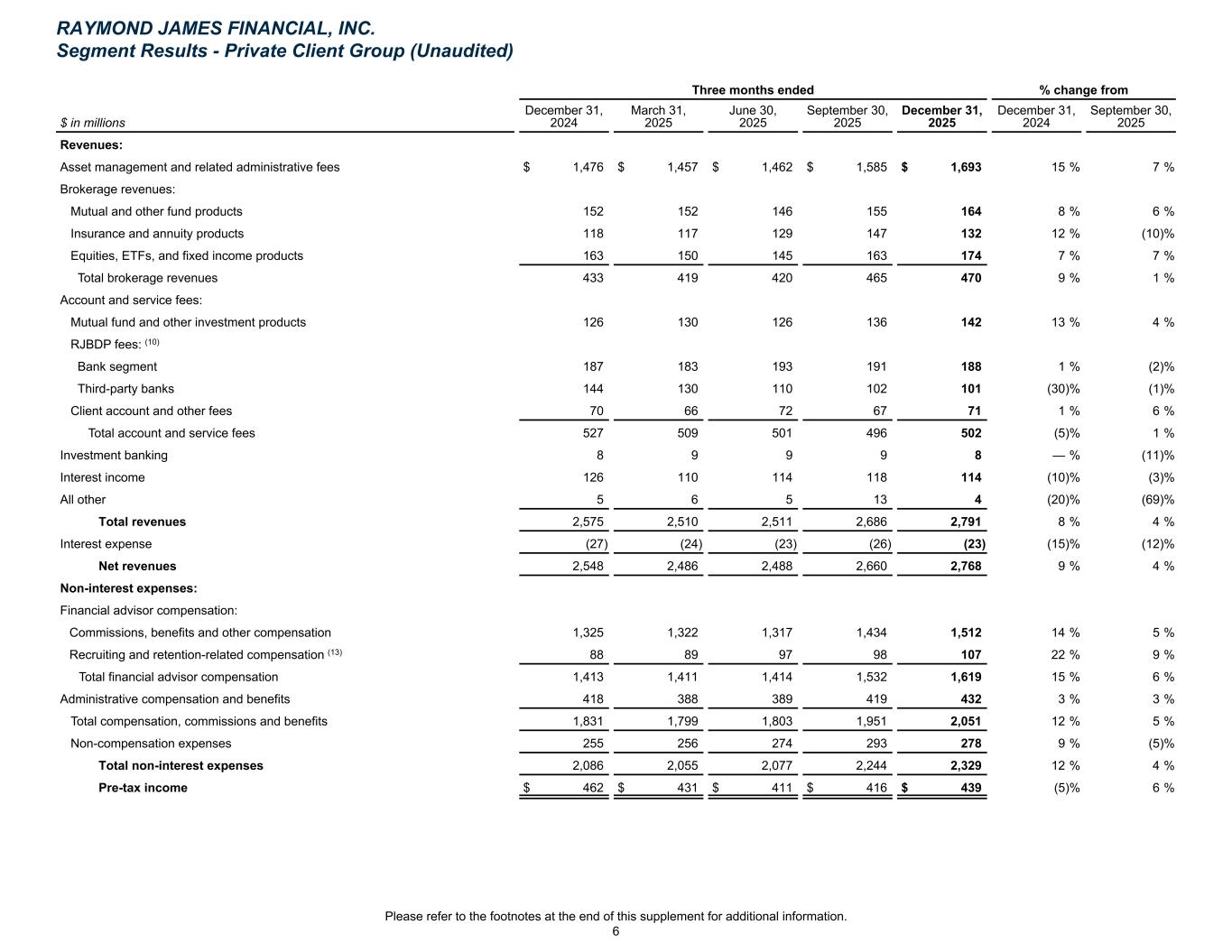

| RAYMOND JAMES FINANCIAL, INC. | Segment Results | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| Private Client Group | ||||||||||||||||||||||||||||||||

| Three months ended | % change from | |||||||||||||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Asset management and related administrative fees | $ | 1,693 | $ | 1,476 | $ | 1,585 | 15% | 7% | ||||||||||||||||||||||||

| Brokerage revenues: | ||||||||||||||||||||||||||||||||

| Mutual and other fund products | 164 | 152 | 155 | 8% | 6% | |||||||||||||||||||||||||||

| Insurance and annuity products | 132 | 118 | 147 | 12% | (10)% | |||||||||||||||||||||||||||

| Equities, exchange-traded funds (“ETFs”) and fixed income products | 174 | 163 | 163 | 7% | 7% | |||||||||||||||||||||||||||

| Total brokerage revenues | 470 | 433 | 465 | 9% | 1% | |||||||||||||||||||||||||||

| Account and service fees: | ||||||||||||||||||||||||||||||||

| Mutual fund and other investment products | 142 | 126 | 136 | 13% | 4% | |||||||||||||||||||||||||||

RJBDP fees: (10) |

||||||||||||||||||||||||||||||||

| Bank segment | 188 | 187 | 191 | 1% | (2)% | |||||||||||||||||||||||||||

| Third-party banks | 101 | 144 | 102 | (30)% | (1)% | |||||||||||||||||||||||||||

| Client account and other fees | 71 | 70 | 67 | 1% | 6% | |||||||||||||||||||||||||||

| Total account and service fees | 502 | 527 | 496 | (5)% | 1% | |||||||||||||||||||||||||||

| Investment banking | 8 | 8 | 9 | —% | (11)% | |||||||||||||||||||||||||||

| Interest income | 114 | 126 | 118 | (10)% | (3)% | |||||||||||||||||||||||||||

| All other | 4 | 5 | 13 | (20)% | (69)% | |||||||||||||||||||||||||||

| Total revenues | 2,791 | 2,575 | 2,686 | 8% | 4% | |||||||||||||||||||||||||||

| Interest expense | (23) | (27) | (26) | (15)% | (12)% | |||||||||||||||||||||||||||

| Net revenues | 2,768 | 2,548 | 2,660 | 9% | 4% | |||||||||||||||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||||||||||||||

| Financial advisor compensation: | ||||||||||||||||||||||||||||||||

| Commissions, benefits and other compensation | 1,512 | 1,325 | 1,434 | 14% | 5% | |||||||||||||||||||||||||||

Recruiting and retention-related compensation (8) |

107 | 88 | 98 | 22% | 9% | |||||||||||||||||||||||||||

| Total financial advisor compensation | 1,619 | 1,413 | 1,532 | 15% | 6% | |||||||||||||||||||||||||||

| Administrative compensation and benefits | 432 | 418 | 419 | 3% | 3% | |||||||||||||||||||||||||||

| Total compensation, commissions and benefits | 2,051 | 1,831 | 1,951 | 12% | 5% | |||||||||||||||||||||||||||

| Non-compensation expenses | 278 | 255 | 293 | 9% | (5)% | |||||||||||||||||||||||||||

| Total non-interest expenses | 2,329 | 2,086 | 2,244 | 12% | 4% | |||||||||||||||||||||||||||

| Pre-tax income | $ | 439 | $ | 462 | $ | 416 | (5)% | 6% | ||||||||||||||||||||||||

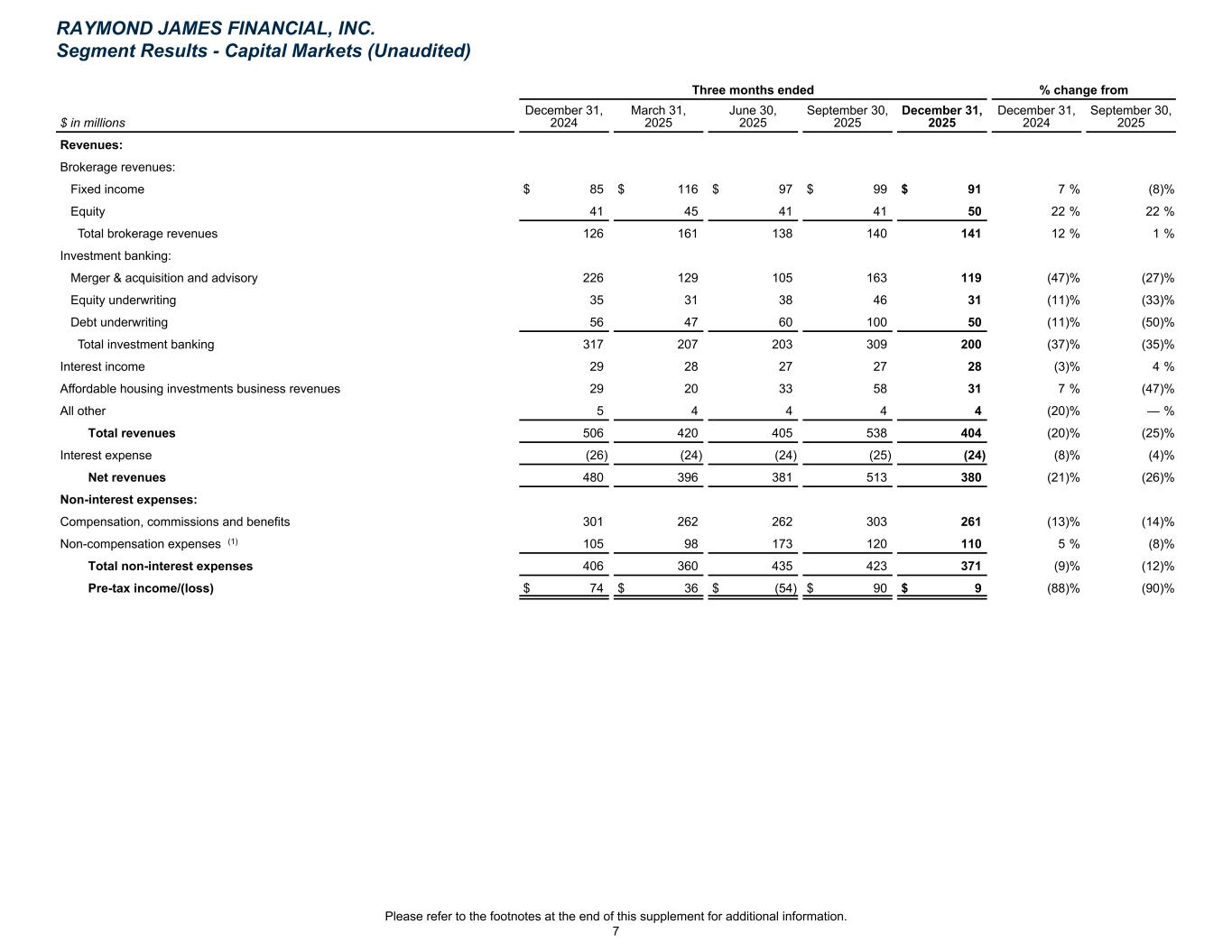

| RAYMOND JAMES FINANCIAL, INC. | Segment Results | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| Capital Markets | ||||||||||||||||||||||||||||||||

| Three months ended | % change from | |||||||||||||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Brokerage revenues: | ||||||||||||||||||||||||||||||||

| Fixed income | $ | 91 | $ | 85 | $ | 99 | 7% | (8)% | ||||||||||||||||||||||||

| Equity | 50 | 41 | 41 | 22% | 22% | |||||||||||||||||||||||||||

| Total brokerage revenues | 141 | 126 | 140 | 12% | 1% | |||||||||||||||||||||||||||

| Investment banking: | ||||||||||||||||||||||||||||||||

| Merger & acquisition and advisory | 119 | 226 | 163 | (47)% | (27)% | |||||||||||||||||||||||||||

| Equity underwriting | 31 | 35 | 46 | (11)% | (33)% | |||||||||||||||||||||||||||

| Debt underwriting | 50 | 56 | 100 | (11)% | (50)% | |||||||||||||||||||||||||||

| Total investment banking | 200 | 317 | 309 | (37)% | (35)% | |||||||||||||||||||||||||||

| Interest income | 28 | 29 | 27 | (3)% | 4% | |||||||||||||||||||||||||||

| Affordable housing investments business revenues | 31 | 29 | 58 | 7% | (47)% | |||||||||||||||||||||||||||

| All other | 4 | 5 | 4 | (20)% | —% | |||||||||||||||||||||||||||

| Total revenues | 404 | 506 | 538 | (20)% | (25)% | |||||||||||||||||||||||||||

| Interest expense | (24) | (26) | (25) | (8)% | (4)% | |||||||||||||||||||||||||||

| Net revenues | 380 | 480 | 513 | (21)% | (26)% | |||||||||||||||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||||||||||||||

Compensation, commissions and benefits |

261 | 301 | 303 | (13)% | (14)% | |||||||||||||||||||||||||||

| Non-compensation expenses | 110 | 105 | 120 | 5% | (8)% | |||||||||||||||||||||||||||

| Total non-interest expenses | 371 | 406 | 423 | (9)% | (12)% | |||||||||||||||||||||||||||

| Pre-tax income | $ | 9 | $ | 74 | $ | 90 | (88)% | (90)% | ||||||||||||||||||||||||

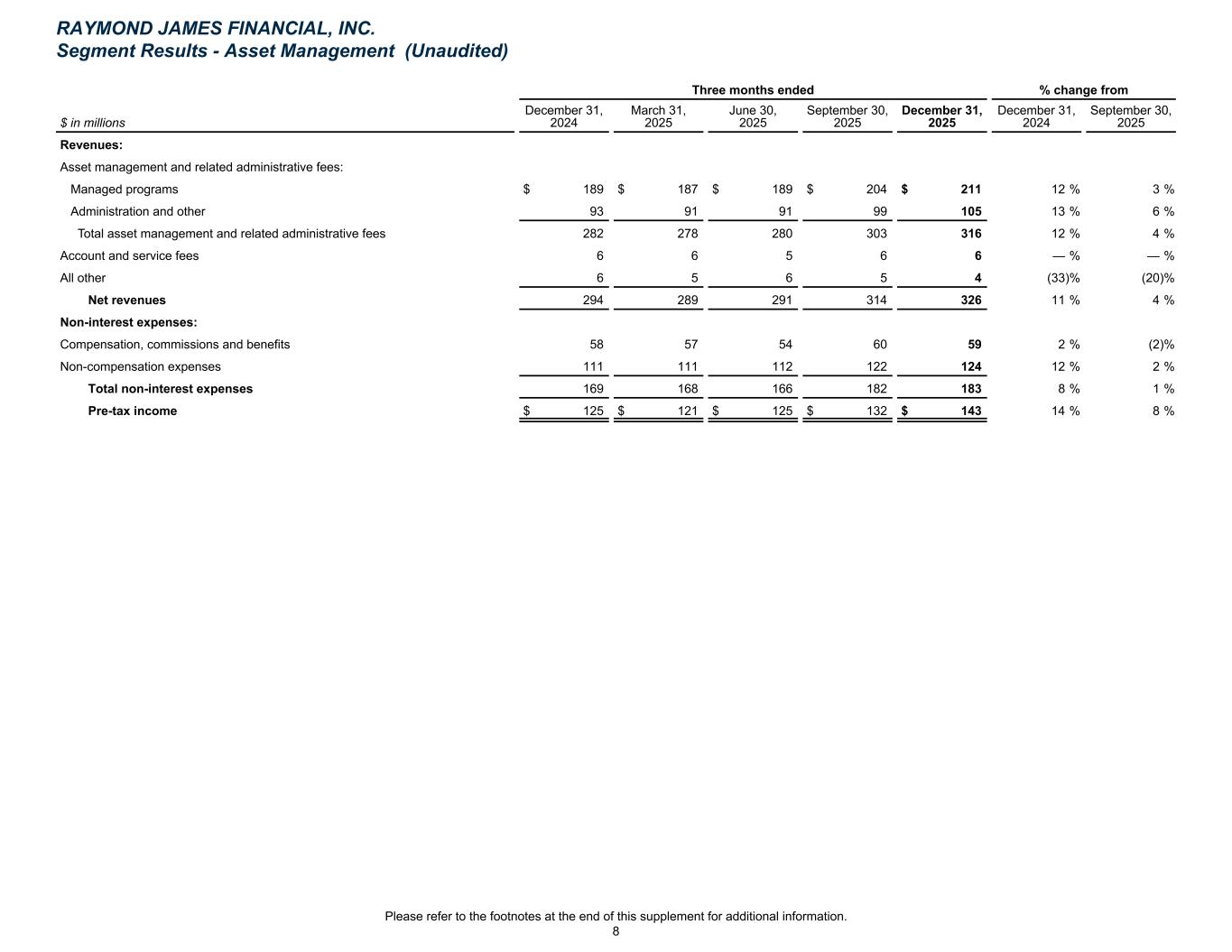

| Asset Management | ||||||||||||||||||||||||||||||||

| Three months ended | % change from | |||||||||||||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

Asset management and related administrative fees: |

||||||||||||||||||||||||||||||||

| Managed programs | $ | 211 | $ | 189 | $ | 204 | 12% | 3% | ||||||||||||||||||||||||

| Administration and other | 105 | 93 | 99 | 13% | 6% | |||||||||||||||||||||||||||

Total asset management and related administrative fees |

316 | 282 | 303 | 12% | 4% | |||||||||||||||||||||||||||

| Account and service fees | 6 | 6 | 6 | —% | —% | |||||||||||||||||||||||||||

| All other | 4 | 6 | 5 | (33)% | (20)% | |||||||||||||||||||||||||||

| Net revenues | 326 | 294 | 314 | 11% | 4% | |||||||||||||||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||||||||||||||

Compensation, commissions and benefits |

59 | 58 | 60 | 2% | (2)% | |||||||||||||||||||||||||||

| Non-compensation expenses | 124 | 111 | 122 | 12% | 2% | |||||||||||||||||||||||||||

| Total non-interest expenses | 183 | 169 | 182 | 8% | 1% | |||||||||||||||||||||||||||

Pre-tax income |

$ | 143 | $ | 125 | $ | 132 | 14% | 8% | ||||||||||||||||||||||||

| RAYMOND JAMES FINANCIAL, INC. | Segment Results | |||||||

Fiscal First Quarter of 2026 |

(Unaudited) | |||||||

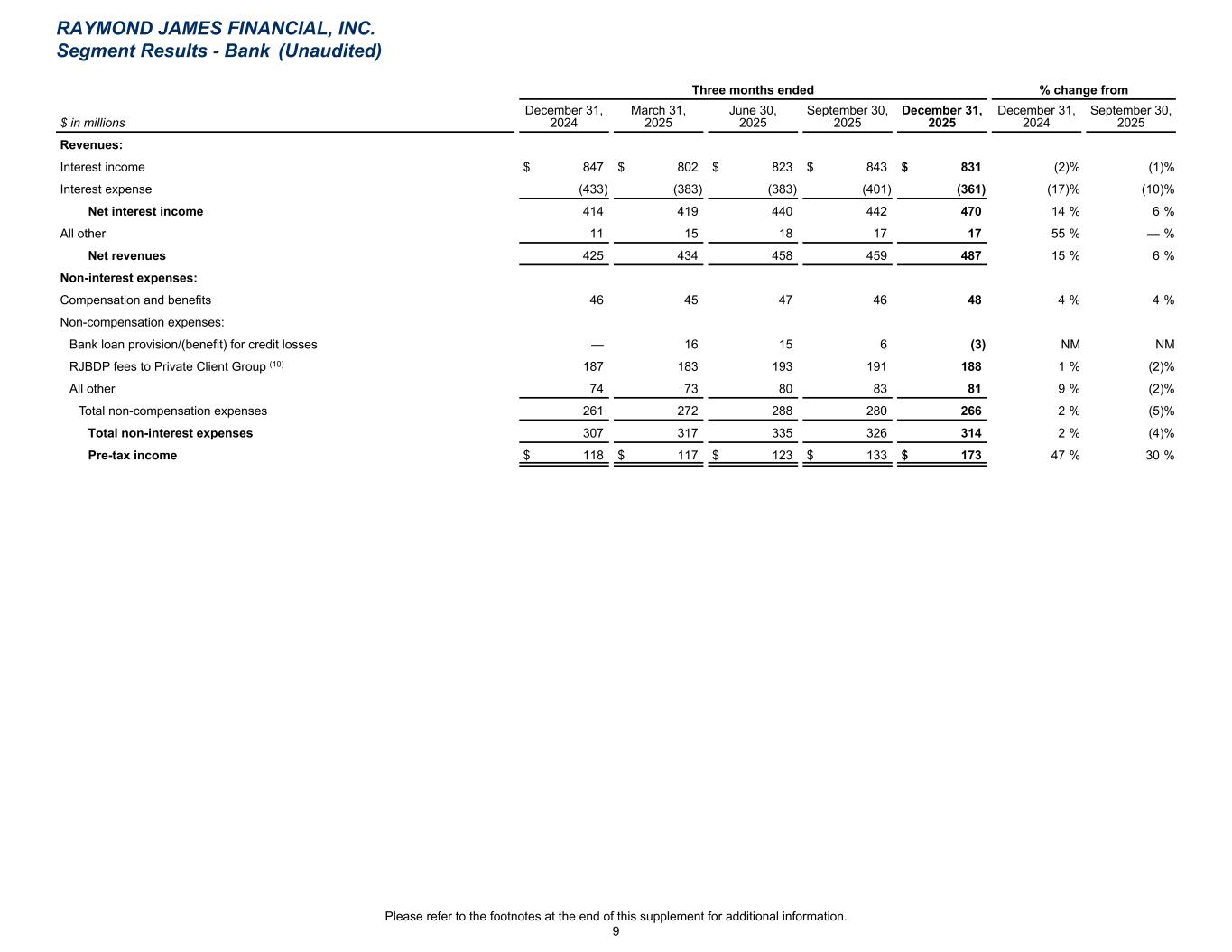

| Bank | ||||||||||||||||||||||||||||||||

| Three months ended | % change from | |||||||||||||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Interest income | $ | 831 | $ | 847 | $ | 843 | (2)% | (1)% | ||||||||||||||||||||||||

| Interest expense | (361) | (433) | (401) | (17)% | (10)% | |||||||||||||||||||||||||||

| Net interest income | 470 | 414 | 442 | 14% | 6% | |||||||||||||||||||||||||||

| All other | 17 | 11 | 17 | 55% | —% | |||||||||||||||||||||||||||

| Net revenues | 487 | 425 | 459 | 15% | 6% | |||||||||||||||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||||||||||||||

| Compensation and benefits | 48 | 46 | 46 | 4% | 4% | |||||||||||||||||||||||||||

| Non-compensation expenses: | ||||||||||||||||||||||||||||||||

| Bank loan provision/(benefit) for credit losses | (3) | — | 6 | NM | NM | |||||||||||||||||||||||||||

RJBDP fees to Private Client Group (10) |

188 | 187 | 191 | 1% | (2)% | |||||||||||||||||||||||||||

| All other | 81 | 74 | 83 | 9% | (2)% | |||||||||||||||||||||||||||

| Total non-compensation expenses | 266 | 261 | 280 | 2% | (5)% | |||||||||||||||||||||||||||

| Total non-interest expenses | 314 | 307 | 326 | 2% | (4)% | |||||||||||||||||||||||||||

| Pre-tax income | $ | 173 | $ | 118 | $ | 133 | 47% | 30% | ||||||||||||||||||||||||

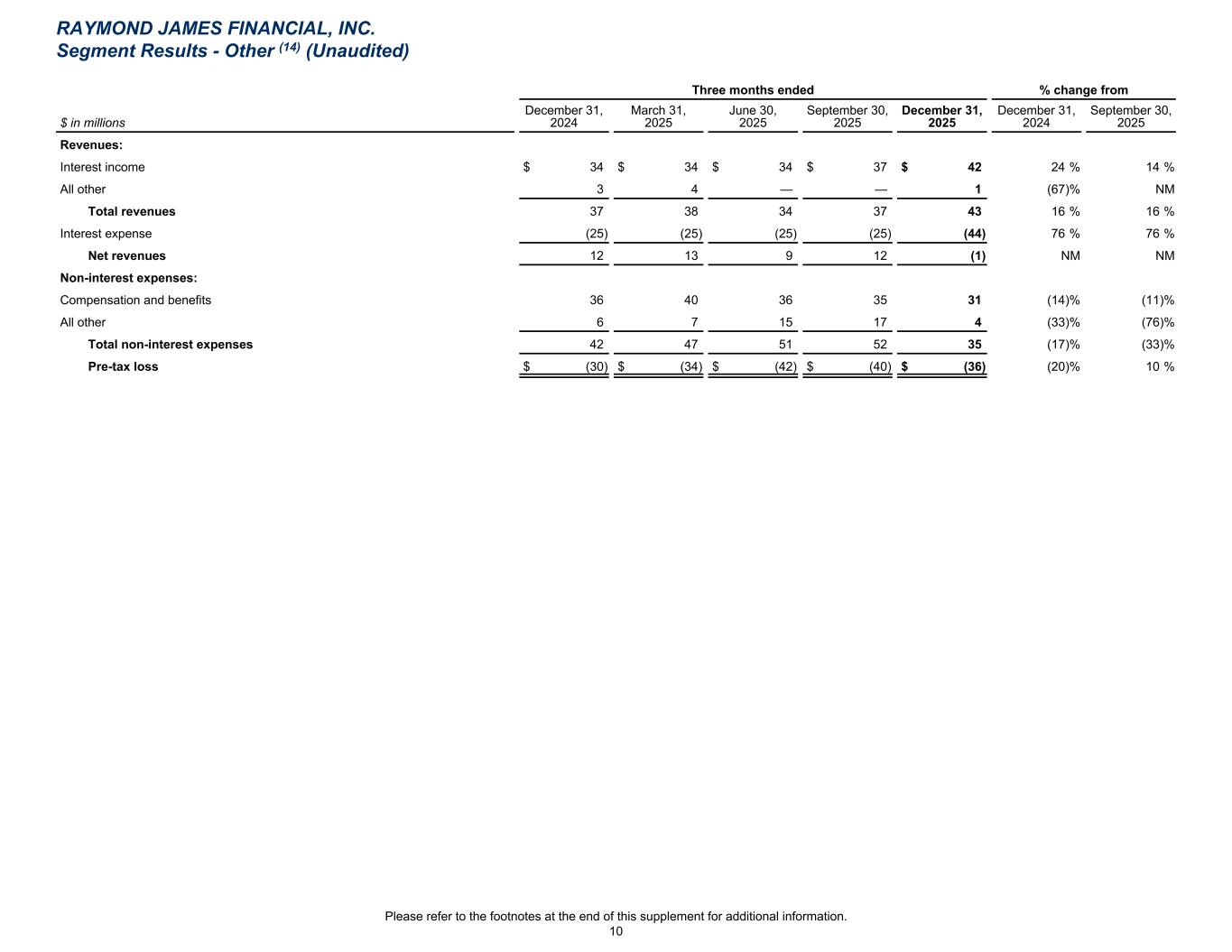

Other (17) | ||||||||||||||||||||||||||||||||

| Three months ended | % change from | |||||||||||||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||

| Interest income | $ | 42 | $ | 34 | $ | 37 | 24% | 14% | ||||||||||||||||||||||||

| All other | 1 | 3 | — | (67)% | NM | |||||||||||||||||||||||||||

| Total revenues | 43 | 37 | 37 | 16% | 16% | |||||||||||||||||||||||||||

| Interest expense | (44) | (25) | (25) | 76% | 76% | |||||||||||||||||||||||||||

| Net revenues/(losses) | (1) | 12 | 12 | NM | NM | |||||||||||||||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||||||||||||||

| Compensation and benefits | 31 | 36 | 35 | (14)% | (11)% | |||||||||||||||||||||||||||

| All other | 4 | 6 | 17 | (33)% | (76)% | |||||||||||||||||||||||||||

| Total non-interest expenses | 35 | 42 | 52 | (17)% | (33)% | |||||||||||||||||||||||||||

Pre-tax loss |

$ | (36) | $ | (30) | $ | (40) | (20)% | 10% | ||||||||||||||||||||||||

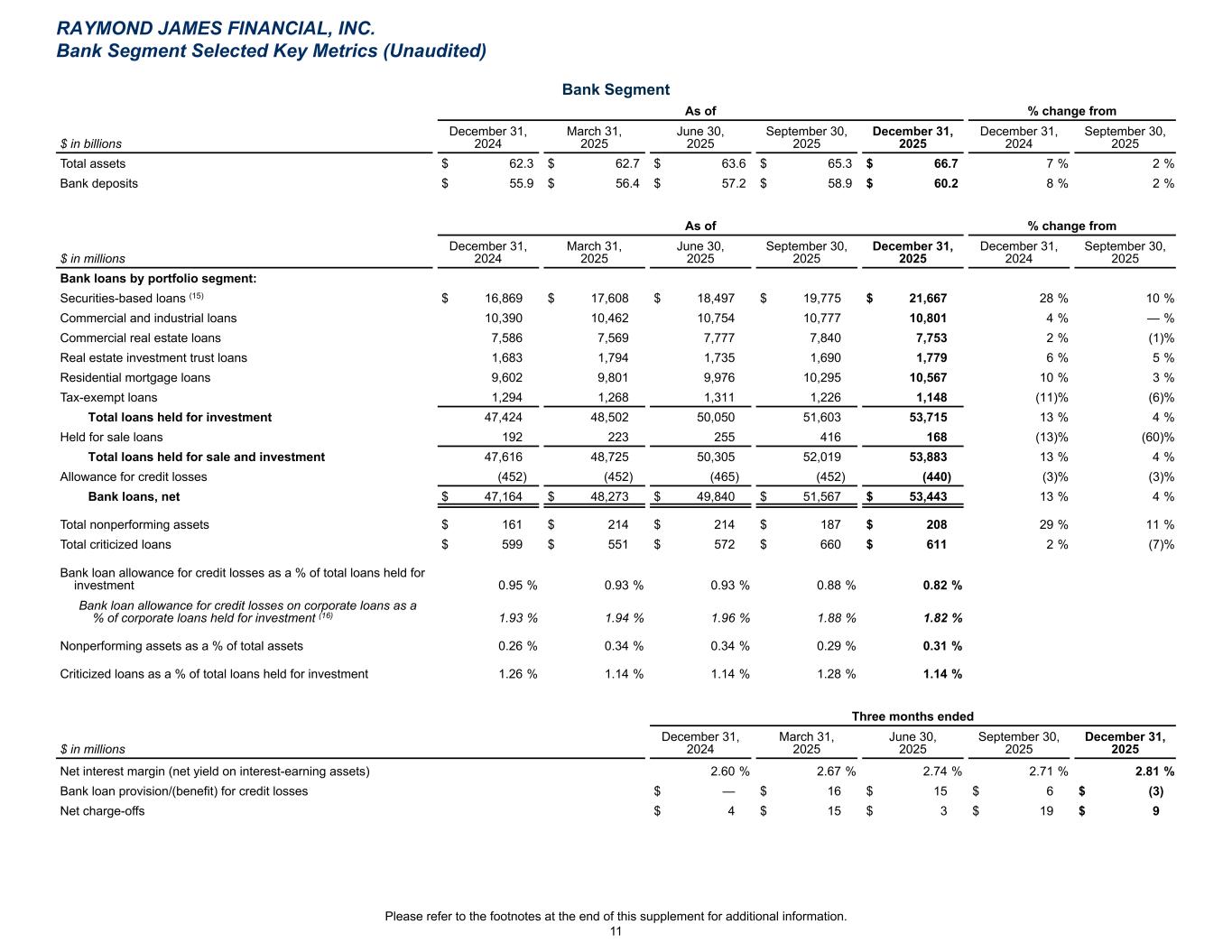

| RAYMOND JAMES FINANCIAL, INC. | Bank Segment Selected Key Metrics | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| As of | % change from | |||||||||||||||||||||||||||||||

$ in billions |

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Total assets | $ | 66.7 | $ | 62.3 | $ | 65.3 | 7% | 2% | ||||||||||||||||||||||||

| Bank loans, net | $ | 53.4 | $ | 47.2 | $ | 51.6 | 13% | 4% | ||||||||||||||||||||||||

| Bank deposits | $ | 60.2 | $ | 55.9 | $ | 58.9 | 8% | 2% | ||||||||||||||||||||||||

| As of | % change from | |||||||||||||||||||||||||||||||

$ in millions |

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||||||||||||

| Bank loan allowance for credit losses | $ | 440 | $ | 452 | $ | 452 | (3)% | (3)% | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 208 | $ | 161 | $ | 187 | 29% | 11% | ||||||||||||||||||||||||

| Total criticized loans | $ | 611 | $ | 599 | $ | 660 | 2% | (7)% | ||||||||||||||||||||||||

| Bank loan allowance for credit losses as a % of total loans held for investment | 0.82 | % | 0.95 | % | 0.88 | % | ||||||||||||||||||||||||||

Bank loan allowance for credit losses on corporate loans as a % of corporate loans held for investment (18) |

1.82 | % | 1.93 | % | 1.88 | % | ||||||||||||||||||||||||||

| Nonperforming assets as a % of total assets | 0.31 | % | 0.26 | % | 0.29 | % | ||||||||||||||||||||||||||

| Criticized loans as a % of total loans held for investment | 1.14 | % | 1.26 | % | 1.28 | % | ||||||||||||||||||||||||||

| Three months ended | ||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

| Net interest margin (net yield on interest-earning assets) | 2.81 | % | 2.60 | % | 2.71 | % | ||||||||||||||

| Bank loan provision/(benefit) for credit losses | $ | (3) | $ | — | $ | 6 | ||||||||||||||

| Net charge-offs | $ | 9 | $ | 4 | $ | 19 | ||||||||||||||

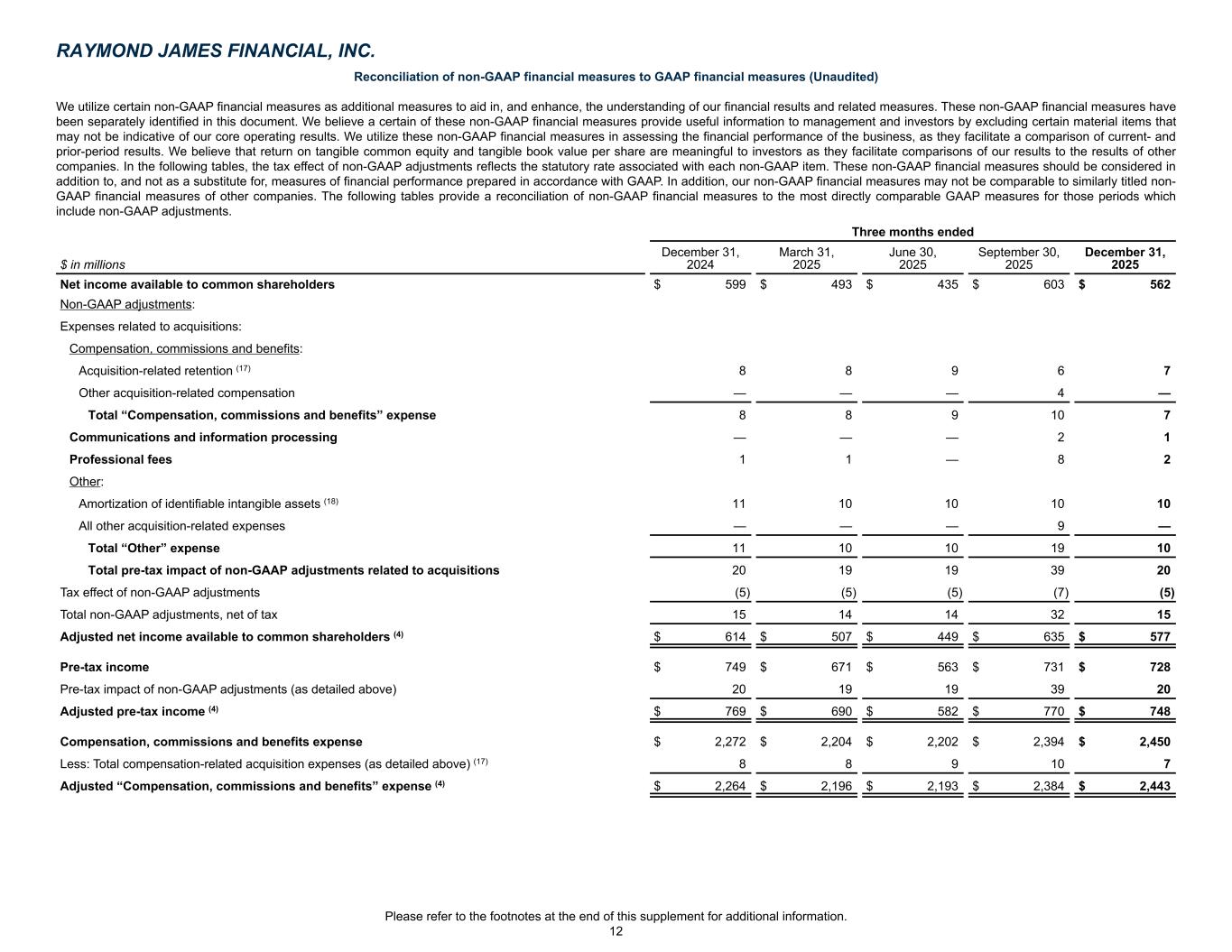

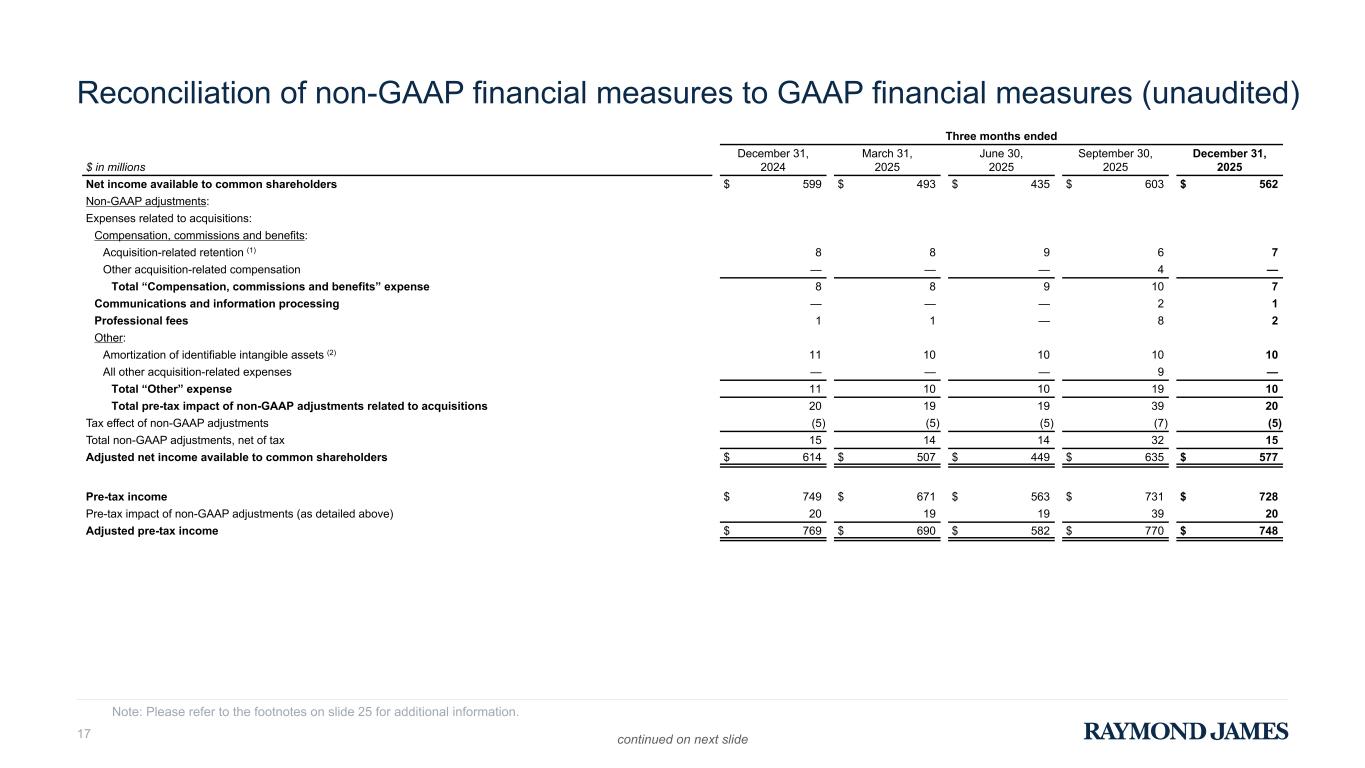

| RAYMOND JAMES FINANCIAL, INC. | Non-GAAP Financial Measures | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| Three months ended | ||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

| Net income available to common shareholders | $ | 562 | $ | 599 | $ | 603 | ||||||||||||||

Non-GAAP adjustments: |

||||||||||||||||||||

| Expenses related to acquisitions: | ||||||||||||||||||||

Compensation, commissions and benefits: |

||||||||||||||||||||

Acquisition-related retention (19) |

7 | 8 | 6 | |||||||||||||||||

| Other acquisition-related compensation | — | — | 4 | |||||||||||||||||

| Total “Compensation, commissions and benefits” expense | 7 | 8 | 10 | |||||||||||||||||

| Communications and information processing | 1 | — | 2 | |||||||||||||||||

| Professional fees | 2 | 1 | 8 | |||||||||||||||||

Other: |

||||||||||||||||||||

Amortization of identifiable intangible assets (20) |

10 | 11 | 10 | |||||||||||||||||

| All other acquisition-related expenses | — | — | 9 | |||||||||||||||||

| Total “Other” expense | 10 | 11 | 19 | |||||||||||||||||

| Total pre-tax impact of non-GAAP adjustments related to acquisitions | 20 | 20 | 39 | |||||||||||||||||

Tax effect of non-GAAP adjustments |

(5) | (5) | (7) | |||||||||||||||||

Total non-GAAP adjustments, net of tax |

15 | 15 | 32 | |||||||||||||||||

Adjusted net income available to common shareholders (1) |

$ | 577 | $ | 614 | $ | 635 | ||||||||||||||

Pre-tax income |

$ | 728 | $ | 749 | $ | 731 | ||||||||||||||

Pre-tax impact of non-GAAP adjustments (as detailed above) |

20 | 20 | 39 | |||||||||||||||||

Adjusted pre-tax income (1) |

$ | 748 | $ | 769 | $ | 770 | ||||||||||||||

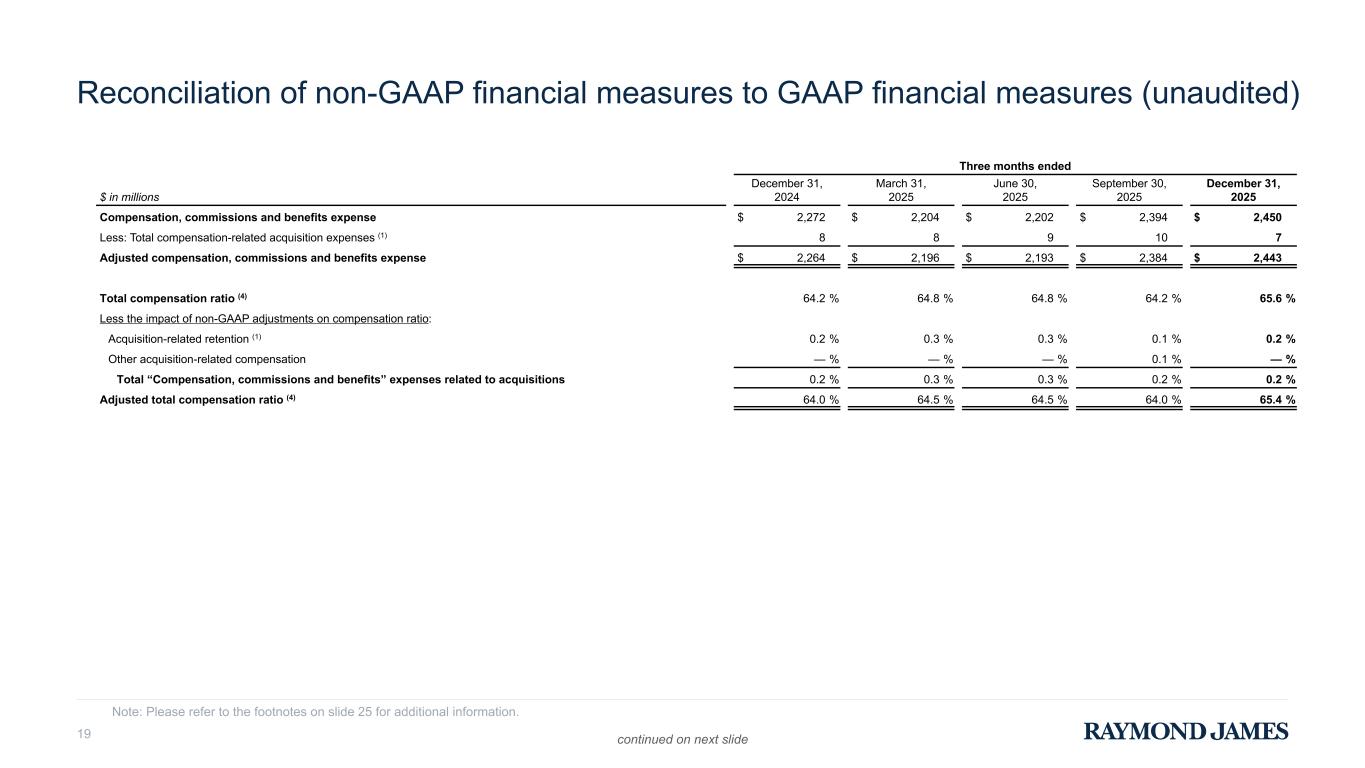

| Compensation, commissions and benefits expense | $ | 2,450 | $ | 2,272 | $ | 2,394 | ||||||||||||||

| Less: Total compensation-related acquisition expenses (as detailed above) | 7 | 8 | 10 | |||||||||||||||||

Adjusted “Compensation, commissions and benefits” expense (1) |

$ | 2,443 | $ | 2,264 | $ | 2,384 | ||||||||||||||

| RAYMOND JAMES FINANCIAL, INC. | Non-GAAP Financial Measures | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

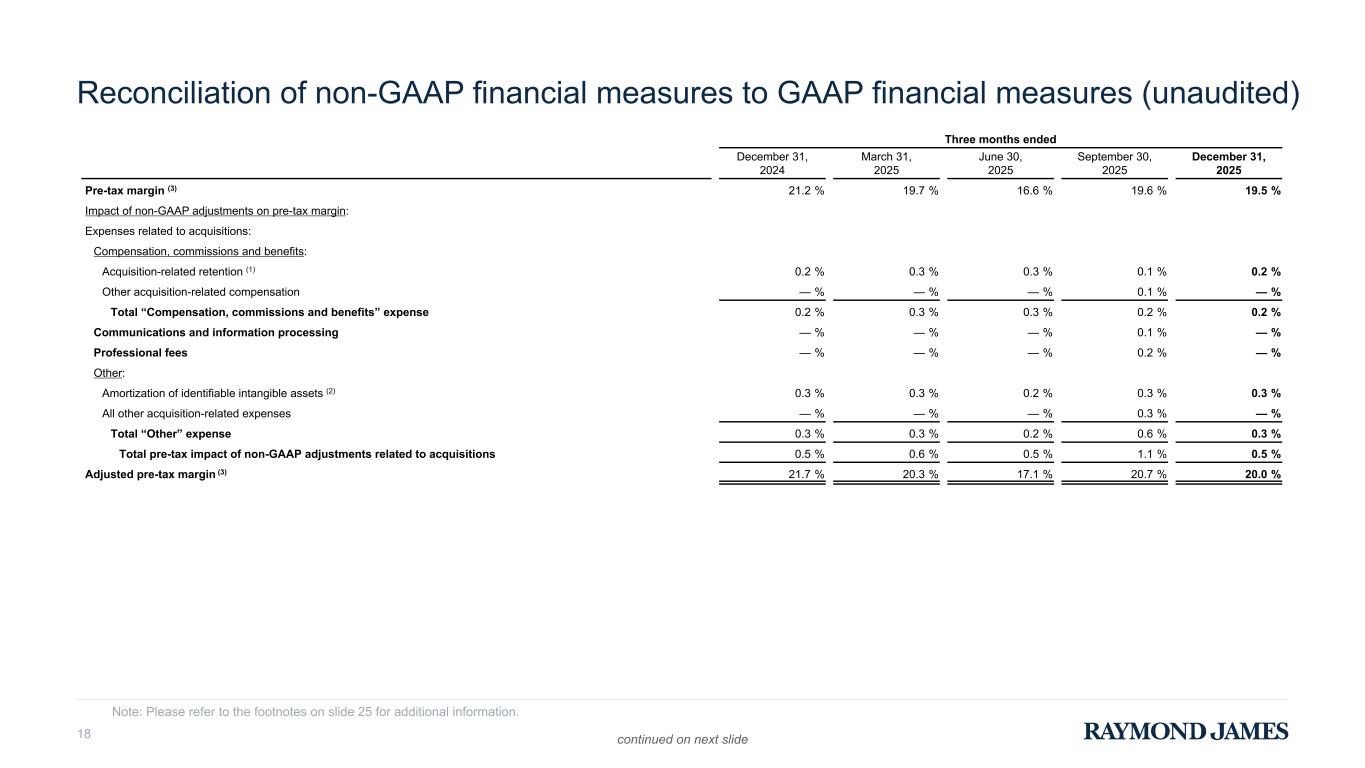

| Reconciliation of non-GAAP financial measures to GAAP financial measures | ||||||||||||||||||||

| (Continued from previous page) | ||||||||||||||||||||

| Three months ended | ||||||||||||||||||||

| December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

||||||||||||||||||

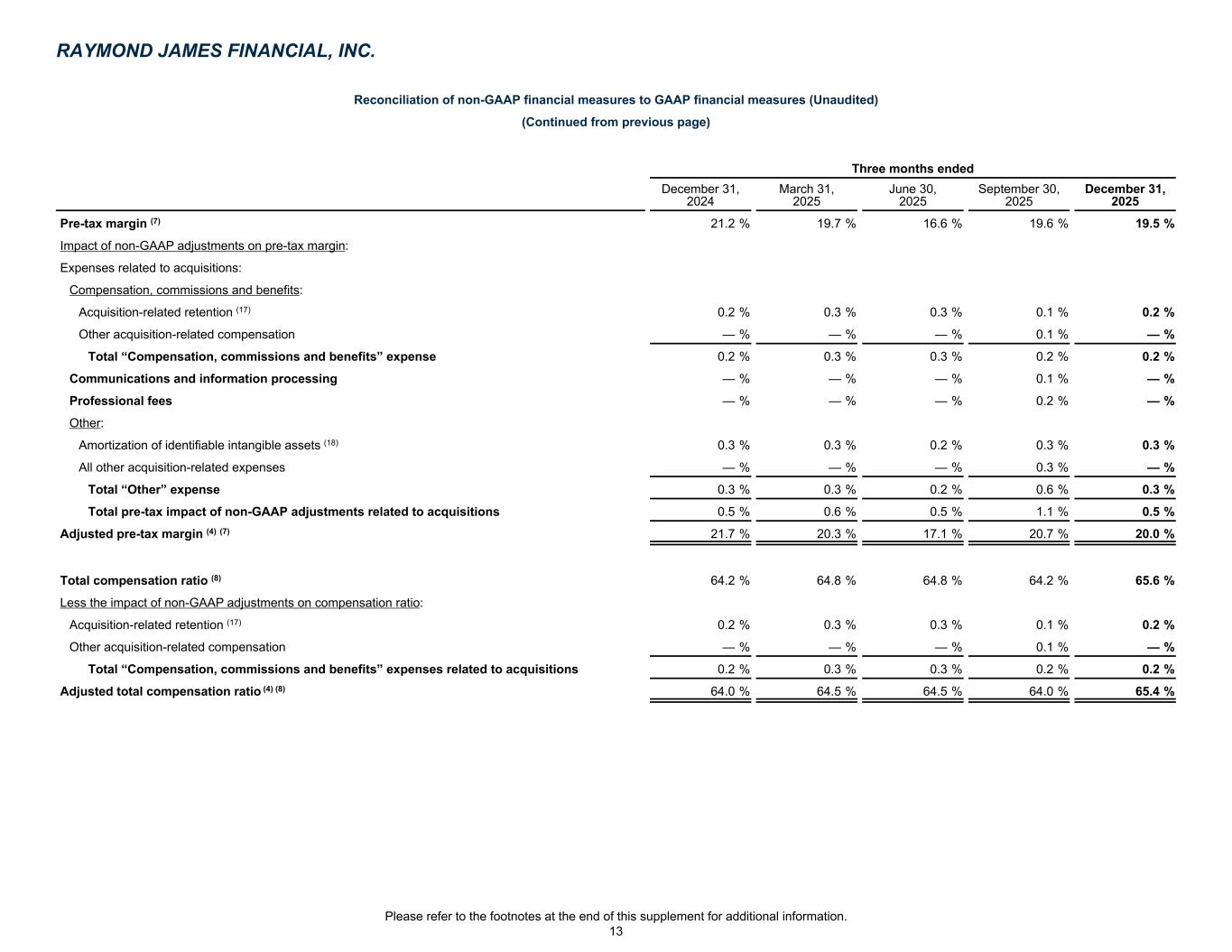

Pre-tax margin (6) |

19.5 | % | 21.2 | % | 19.6 | % | ||||||||||||||

Impact of non-GAAP adjustments on pre-tax margin: |

||||||||||||||||||||

| Expenses related to acquisitions: | ||||||||||||||||||||

Compensation, commissions and benefits: |

||||||||||||||||||||

Acquisition-related retention (19) |

0.2 | % | 0.2 | % | 0.1 | % | ||||||||||||||

| Other acquisition-related compensation | — | % | — | % | 0.1 | % | ||||||||||||||

| Total “Compensation, commissions and benefits” expense | 0.2 | % | 0.2 | % | 0.2 | % | ||||||||||||||

| Communications and information processing | — | % | — | % | 0.1 | % | ||||||||||||||

| Professional fees | — | % | — | % | 0.2 | % | ||||||||||||||

Other: |

||||||||||||||||||||

Amortization of identifiable intangible assets (20) |

0.3 | % | 0.3 | % | 0.3 | % | ||||||||||||||

| All other acquisition-related expenses | — | % | — | % | 0.3 | % | ||||||||||||||

| Total “Other” expense | 0.3 | % | 0.3 | % | 0.6 | % | ||||||||||||||

| Total pre-tax impact of non-GAAP adjustments related to acquisitions | 0.5 | % | 0.5 | % | 1.1 | % | ||||||||||||||

Adjusted pre-tax margin (1) (6) |

20.0 | % | 21.7 | % | 20.7 | % | ||||||||||||||

Total compensation ratio (7) |

65.6 | % | 64.2 | % | 64.2 | % | ||||||||||||||

Less the impact of non-GAAP adjustments on compensation ratio: |

||||||||||||||||||||

Acquisition-related retention (19) |

0.2 | % | 0.2 | % | 0.1 | % | ||||||||||||||

| Other acquisition-related compensation | — | % | — | % | 0.1 | % | ||||||||||||||

| Total “Compensation, commissions and benefits” expenses related to acquisitions | 0.2 | % | 0.2 | % | 0.2 | % | ||||||||||||||

Adjusted total compensation ratio (1) (7) |

65.4 | % | 64.0 | % | 64.0 | % | ||||||||||||||

| RAYMOND JAMES FINANCIAL, INC. | Non-GAAP Financial Measures | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| Reconciliation of non-GAAP financial measures to GAAP financial measures | ||||||||||||||||||||

| (Continued from previous page) | ||||||||||||||||||||

| Three months ended | ||||||||||||||||||||

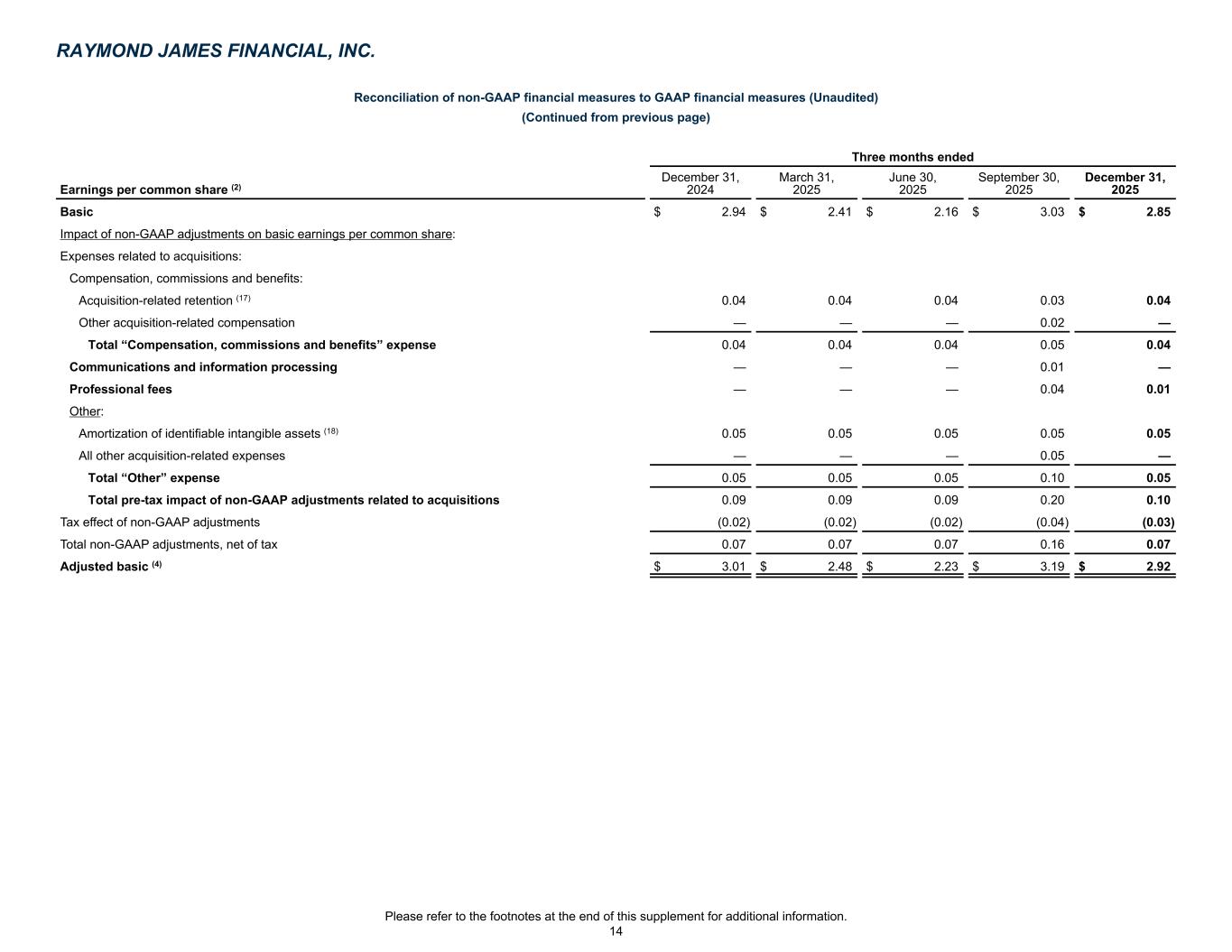

Earnings per common share (4) |

December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

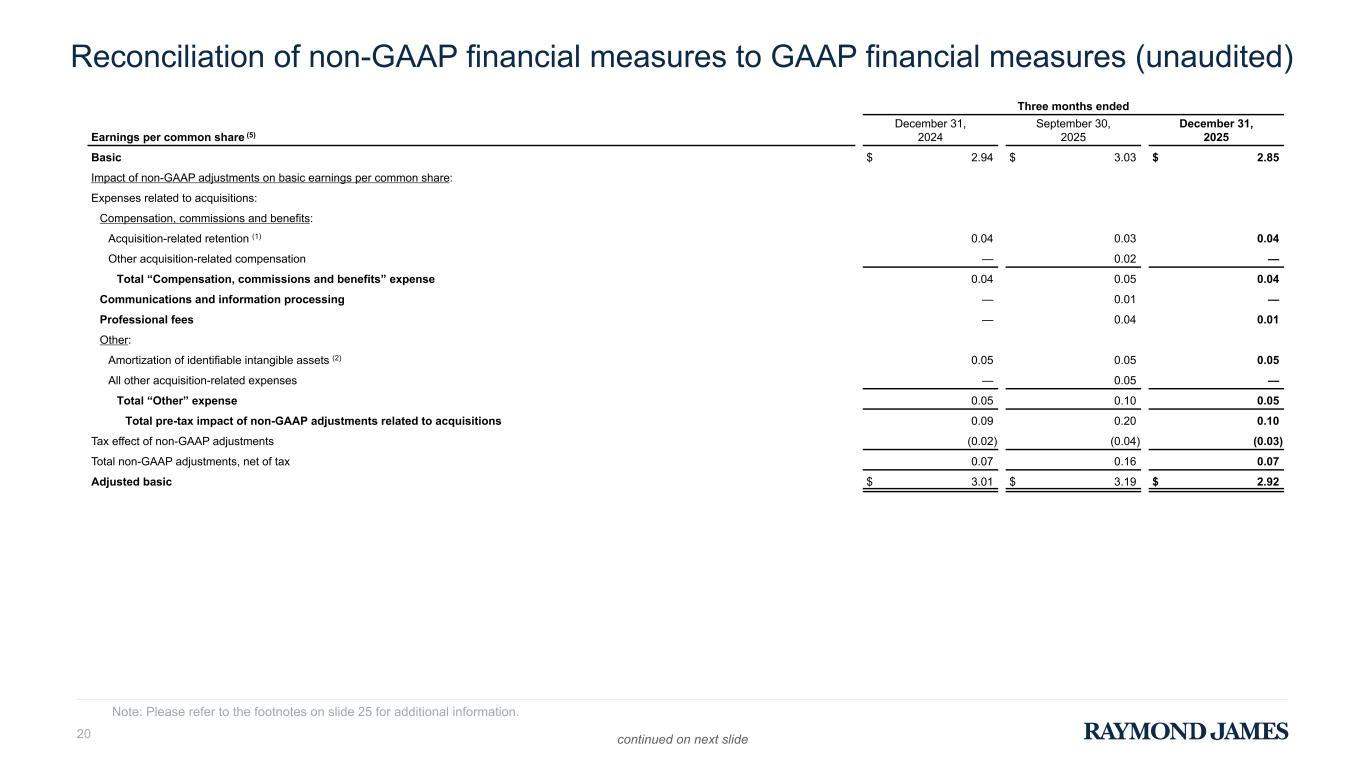

| Basic | $ | 2.85 | $ | 2.94 | $ | 3.03 | ||||||||||||||

Impact of non-GAAP adjustments on basic earnings per common share: |

||||||||||||||||||||

| Expenses related to acquisitions: | ||||||||||||||||||||

Compensation, commissions and benefits: |

||||||||||||||||||||

Acquisition-related retention (19) |

0.04 | 0.04 | 0.03 | |||||||||||||||||

| Other acquisition-related compensation | — | — | 0.02 | |||||||||||||||||

| Total “Compensation, commissions and benefits” expense | 0.04 | 0.04 | 0.05 | |||||||||||||||||

| Communications and information processing | — | — | 0.01 | |||||||||||||||||

| Professional fees | 0.01 | — | 0.04 | |||||||||||||||||

Other: |

||||||||||||||||||||

Amortization of identifiable intangible assets (20) |

0.05 | 0.05 | 0.05 | |||||||||||||||||

| All other acquisition-related expenses | — | — | 0.05 | |||||||||||||||||

| Total “Other” expense | 0.05 | 0.05 | 0.10 | |||||||||||||||||

| Total pre-tax impact of non-GAAP adjustments related to acquisitions | 0.10 | 0.09 | 0.20 | |||||||||||||||||

Tax effect of non-GAAP adjustments |

(0.03) | (0.02) | (0.04) | |||||||||||||||||

| Total non-GAAP adjustments, net of tax | 0.07 | 0.07 | 0.16 | |||||||||||||||||

Adjusted basic (1) |

$ | 2.92 | $ | 3.01 | $ | 3.19 | ||||||||||||||

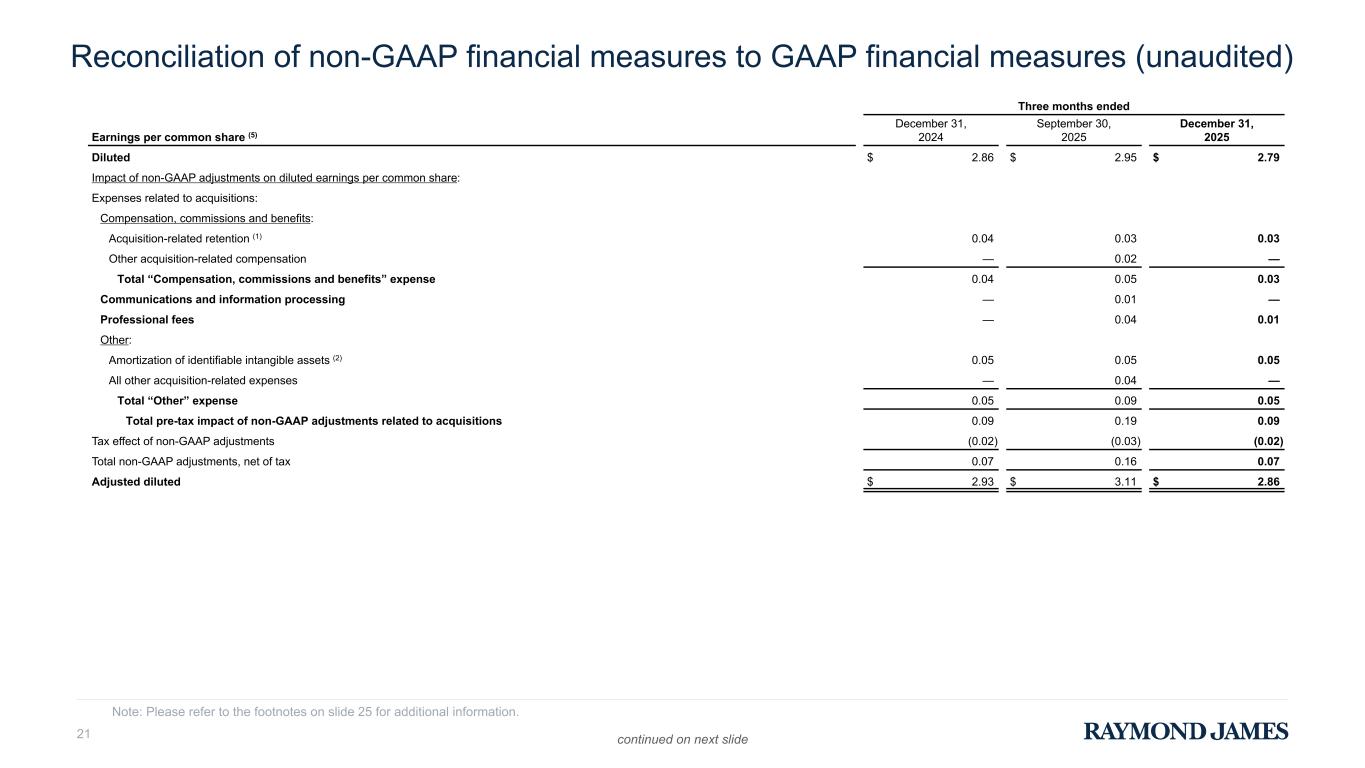

| Diluted | $ | 2.79 | $ | 2.86 | $ | 2.95 | ||||||||||||||

Impact of non-GAAP adjustments on diluted earnings per common share: |

||||||||||||||||||||

| Expenses related to acquisitions: | ||||||||||||||||||||

Compensation, commissions and benefits: |

||||||||||||||||||||

Acquisition-related retention (19) |

0.03 | 0.04 | 0.03 | |||||||||||||||||

| Other acquisition-related compensation | — | — | 0.02 | |||||||||||||||||

| Total “Compensation, commissions and benefits” expense | 0.03 | 0.04 | 0.05 | |||||||||||||||||

| Communications and information processing | — | — | 0.01 | |||||||||||||||||

| Professional fees | 0.01 | — | 0.04 | |||||||||||||||||

Other: |

||||||||||||||||||||

Amortization of identifiable intangible assets (20) |

0.05 | 0.05 | 0.05 | |||||||||||||||||

| All other acquisition-related expenses | — | — | 0.04 | |||||||||||||||||

| Total “Other” expense | 0.05 | 0.05 | 0.09 | |||||||||||||||||

| Total pre-tax impact of non-GAAP adjustments related to acquisitions | 0.09 | 0.09 | 0.19 | |||||||||||||||||

Tax effect of non-GAAP adjustments |

(0.02) | (0.02) | (0.03) | |||||||||||||||||

| Total non-GAAP adjustments, net of tax | 0.07 | 0.07 | 0.16 | |||||||||||||||||

Adjusted diluted (1) |

$ | 2.86 | $ | 2.93 | $ | 3.11 | ||||||||||||||

| RAYMOND JAMES FINANCIAL, INC. | Non-GAAP Financial Measures | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

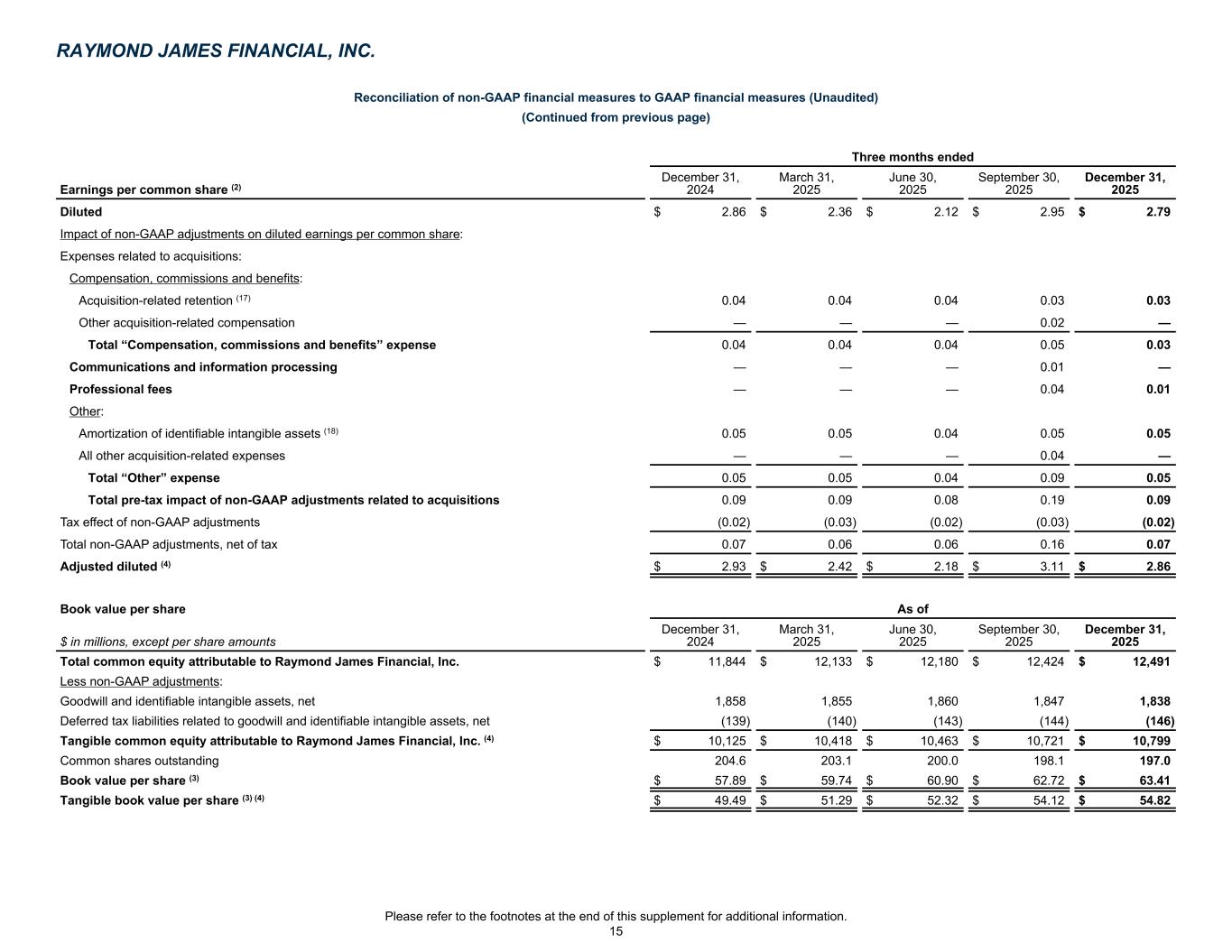

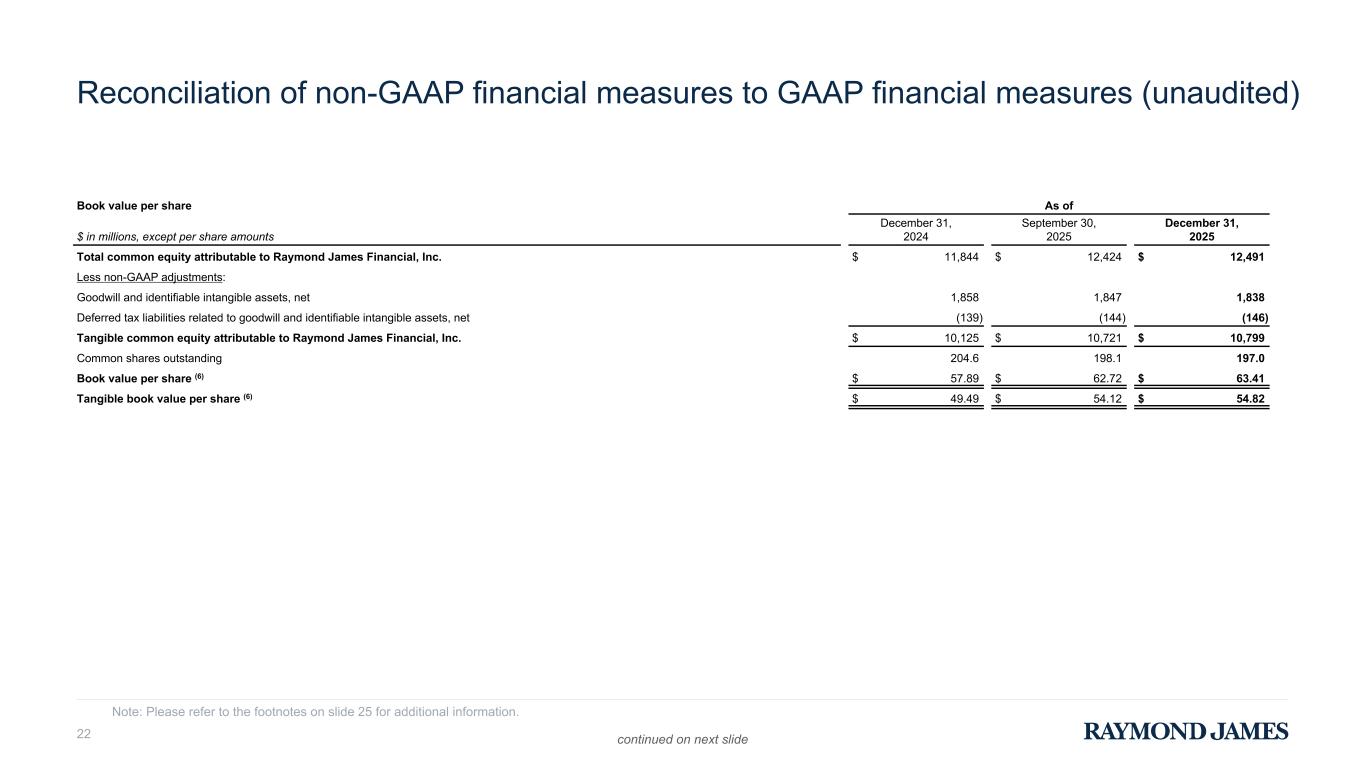

| Book value per share | As of | |||||||||||||||||||

| $ in millions, except per share amounts | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

| Total common equity attributable to Raymond James Financial, Inc. | $ | 12,491 | $ | 11,844 | $ | 12,424 | ||||||||||||||

Less non-GAAP adjustments: |

||||||||||||||||||||

Goodwill and identifiable intangible assets, net |

1,838 | 1,858 | 1,847 | |||||||||||||||||

| Deferred tax liabilities related to goodwill and identifiable intangible assets, net | (146) | (139) | (144) | |||||||||||||||||

Tangible common equity attributable to Raymond James Financial, Inc. (1) |

$ | 10,799 | $ | 10,125 | $ | 10,721 | ||||||||||||||

| Common shares outstanding | 197.0 | 204.6 | 198.1 | |||||||||||||||||

Book value per share (9) |

$ | 63.41 | $ | 57.89 | $ | 62.72 | ||||||||||||||

Tangible book value per share (1) (9) |

$ | 54.82 | $ | 49.49 | $ | 54.12 | ||||||||||||||

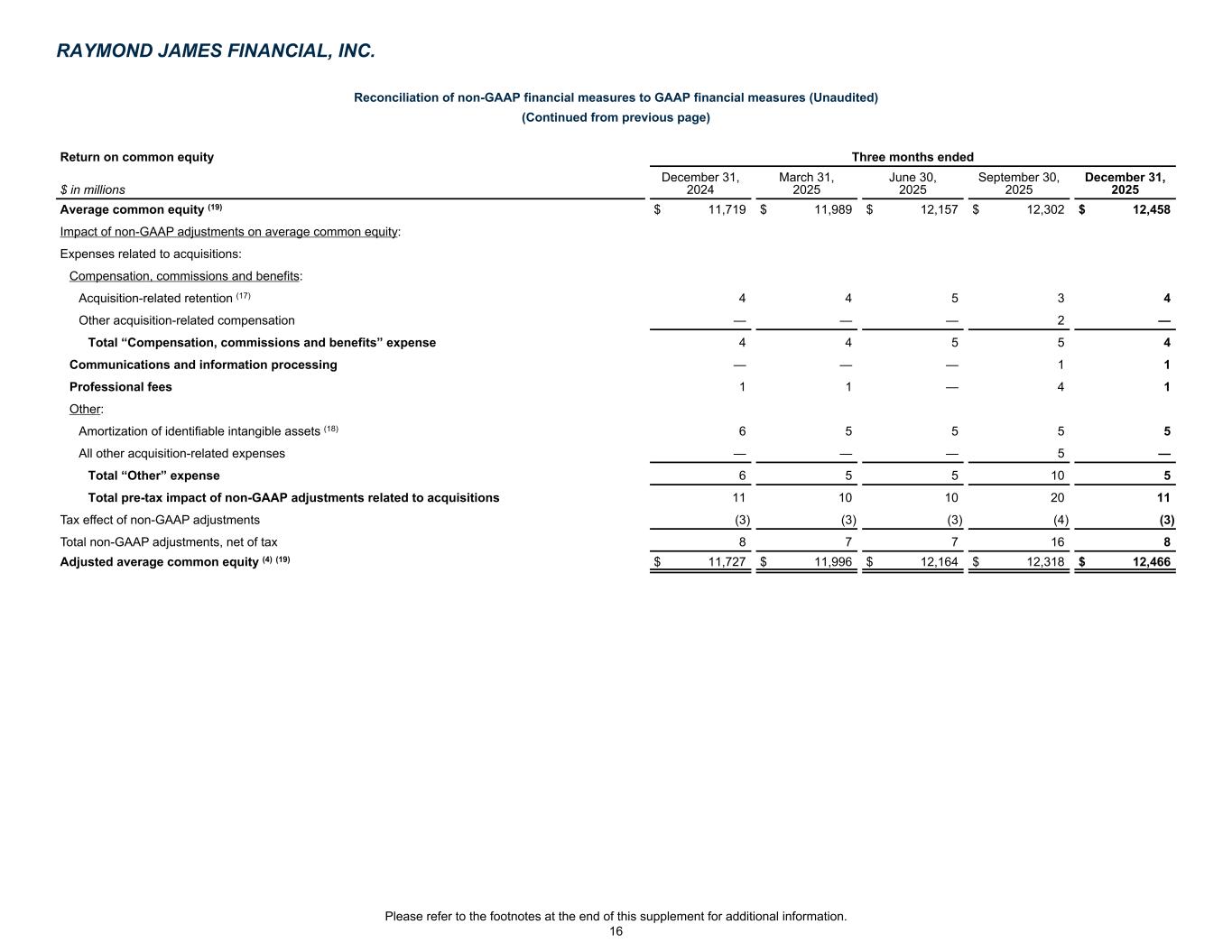

| Return on common equity | Three months ended | |||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

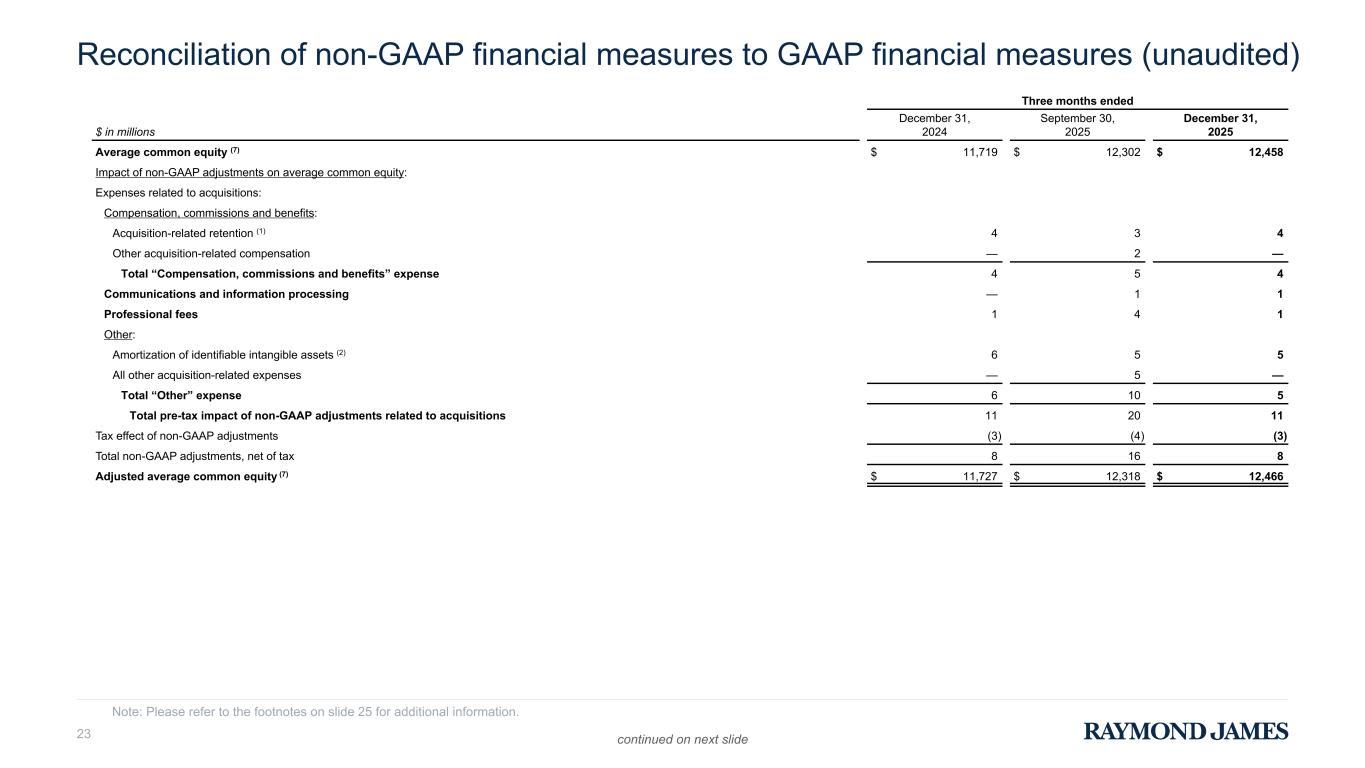

Average common equity (21) |

$ | 12,458 | $ | 11,719 | $ | 12,302 | ||||||||||||||

Impact of non-GAAP adjustments on average common equity: |

||||||||||||||||||||

| Expenses related to acquisitions: | ||||||||||||||||||||

Compensation, commissions and benefits: |

||||||||||||||||||||

Acquisition-related retention (19) |

4 | 4 | 3 | |||||||||||||||||

| Other acquisition-related compensation | — | — | 2 | |||||||||||||||||

| Total “Compensation, commissions and benefits” expense | 4 | 4 | 5 | |||||||||||||||||

| Communications and information processing | 1 | — | 1 | |||||||||||||||||

| Professional fees | 1 | 1 | 4 | |||||||||||||||||

Other: |

||||||||||||||||||||

Amortization of identifiable intangible assets (20) |

5 | 6 | 5 | |||||||||||||||||

| All other acquisition-related expenses | — | — | 5 | |||||||||||||||||

| Total “Other” expense | 5 | 6 | 10 | |||||||||||||||||

| Total pre-tax impact of non-GAAP adjustments related to acquisitions | 11 | 11 | 20 | |||||||||||||||||

Tax effect of non-GAAP adjustments |

(3) | (3) | (4) | |||||||||||||||||

| Total non-GAAP adjustments, net of tax | 8 | 8 | 16 | |||||||||||||||||

Adjusted average common equity (1) (21) |

$ | 12,466 | $ | 11,727 | $ | 12,318 | ||||||||||||||

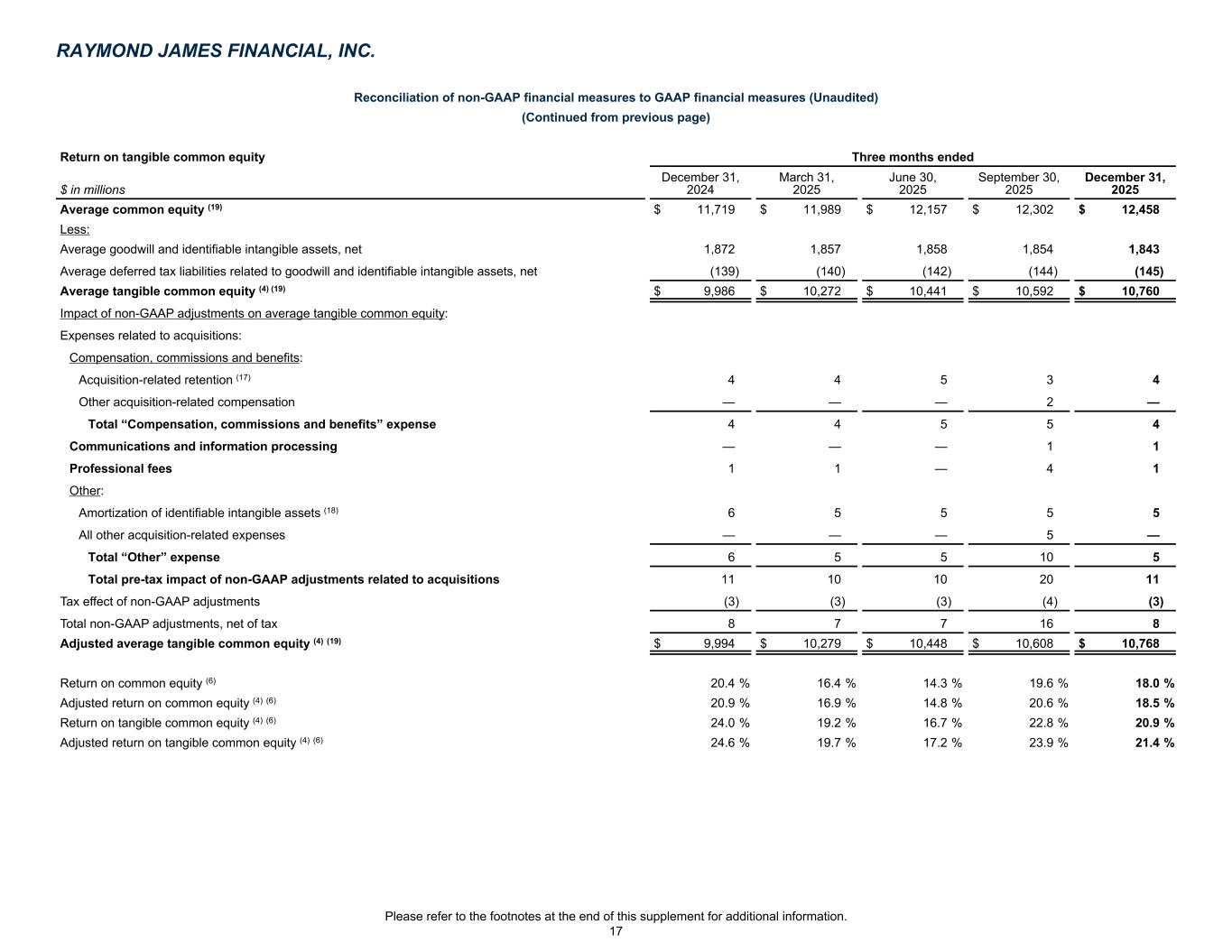

| RAYMOND JAMES FINANCIAL, INC. | Non-GAAP Financial Measures | ||||

Fiscal First Quarter of 2026 |

(Unaudited) | ||||

| Reconciliation of non-GAAP financial measures to GAAP financial measures | ||||||||||||||||||||

| (Continued from previous page) | ||||||||||||||||||||

| Three months ended | ||||||||||||||||||||

| $ in millions | December 31, 2025 |

December 31, 2024 |

September 30, 2025 |

|||||||||||||||||

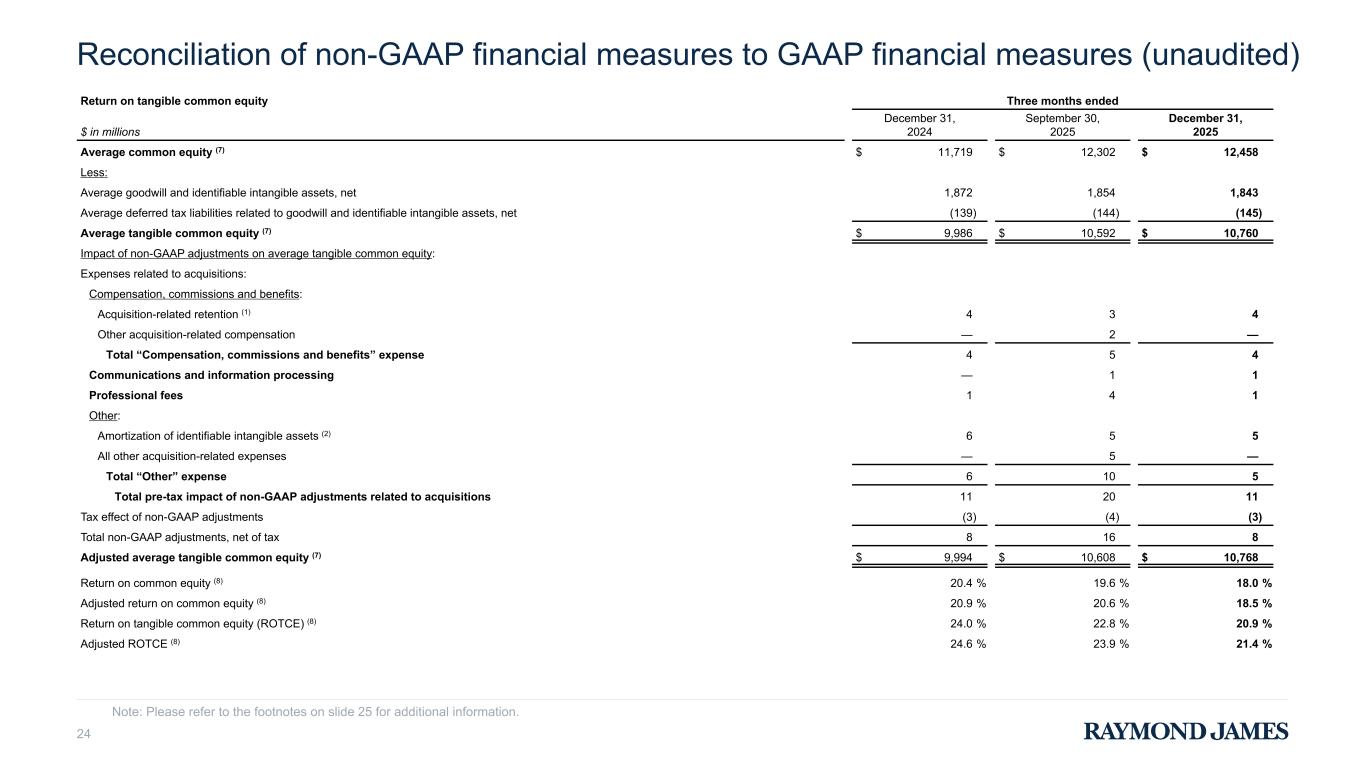

Average common equity (21) |

$ | 12,458 | $ | 11,719 | $ | 12,302 | ||||||||||||||

Less: |

||||||||||||||||||||

| Average goodwill and identifiable intangible assets, net | 1,843 | 1,872 | 1,854 | |||||||||||||||||

| Average deferred tax liabilities related to goodwill and identifiable intangible assets, net | (145) | (139) | (144) | |||||||||||||||||

Average tangible common equity (1) (21) |

$ | 10,760 | $ | 9,986 | $ | 10,592 | ||||||||||||||

Impact of non-GAAP adjustments on average tangible common equity: |

||||||||||||||||||||

| Expenses related to acquisitions: | ||||||||||||||||||||

Compensation, commissions and benefits: |

||||||||||||||||||||

Acquisition-related retention (19) |

4 | 4 | 3 | |||||||||||||||||

| Other acquisition-related compensation | — | — | 2 | |||||||||||||||||

| Total “Compensation, commissions and benefits” expense | 4 | 4 | 5 | |||||||||||||||||

| Communications and information processing | 1 | — | 1 | |||||||||||||||||

| Professional fees | 1 | 1 | 4 | |||||||||||||||||

Other: |

||||||||||||||||||||

Amortization of identifiable intangible assets (20) |

5 | 6 | 5 | |||||||||||||||||

| All other acquisition-related expenses | — | — | 5 | |||||||||||||||||

| Total “Other” expense | 5 | 6 | 10 | |||||||||||||||||

| Total pre-tax impact of non-GAAP adjustments related to acquisitions | 11 | 11 | 20 | |||||||||||||||||

Tax effect of non-GAAP adjustments |

(3) | (3) | (4) | |||||||||||||||||

| Total non-GAAP adjustments, net of tax | 8 | 8 | 16 | |||||||||||||||||

Adjusted average tangible common equity (1) (21) |

$ | 10,768 | $ | 9,994 | $ | 10,608 | ||||||||||||||

Return on common equity (5) |

18.0 | % | 20.4 | % | 19.6 | % | ||||||||||||||

Adjusted return on common equity (1) (5) |

18.5 | % | 20.9 | % | 20.6 | % | ||||||||||||||

Return on tangible common equity (1) (5) |

20.9 | % | 24.0 | % | 22.8 | % | ||||||||||||||

Adjusted return on tangible common equity (1) (5) |

21.4 | % | 24.6 | % | 23.9 | % | ||||||||||||||

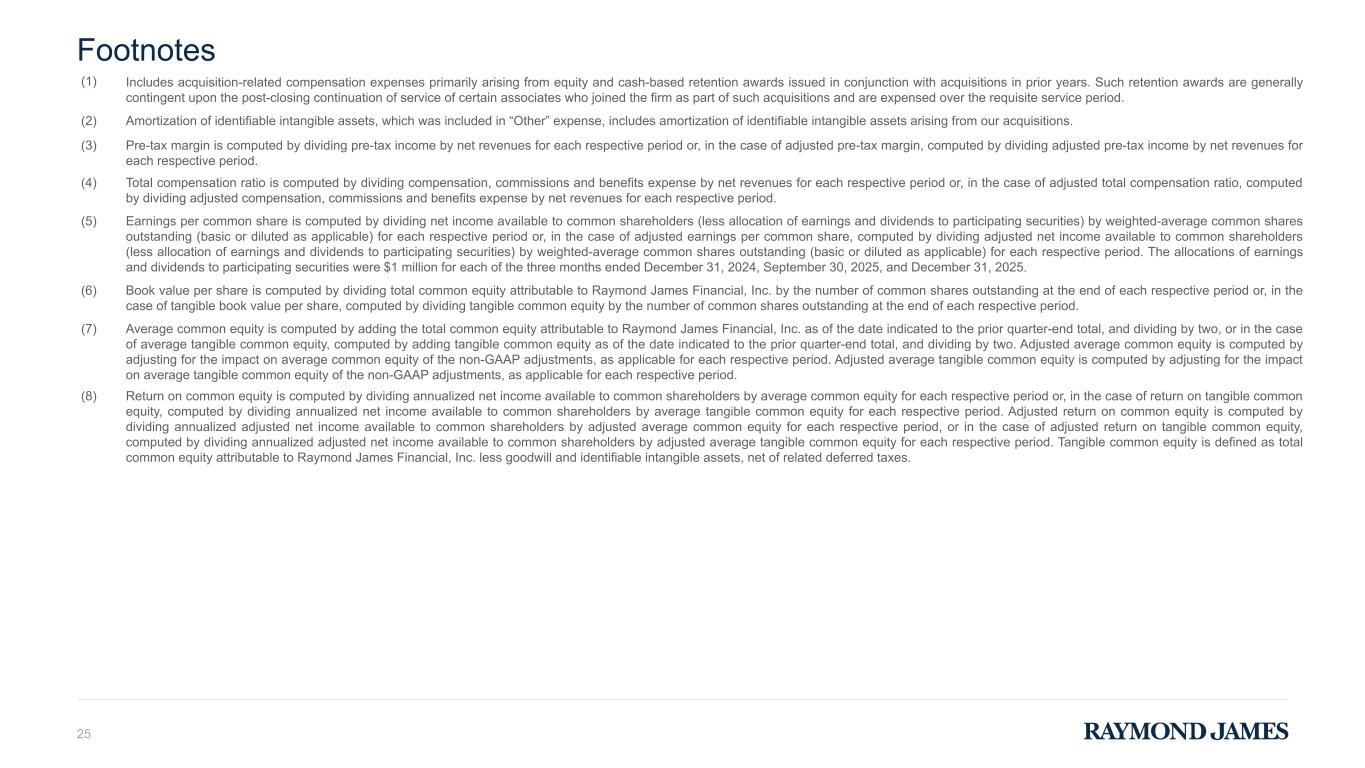

| (1) | These are non-GAAP financial measures. See the schedules on the previous pages for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP measures and for more information on these measures. | |||||||

| (2) | Domestic Private Client Group net new assets represents domestic Private Client Group client inflows, including dividends and interest, less domestic Private Client Group client outflows, including commissions, advisory fees, and other fees. The domestic Private Client Group net new asset growth — annualized percentage is based on the beginning domestic Private Client Group assets under administration balance for the indicated period. |

|||||||

| (3) | Estimated. | |||||||

| (4) | Earnings per common share is computed by dividing net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period or, in the case of adjusted earnings per common share, computed by dividing adjusted net income available to common shareholders (less allocation of earnings and dividends to participating securities) by weighted-average common shares outstanding (basic or diluted as applicable) for each respective period. The allocations of earnings and dividends to participating securities were $1 million for each of the three months ended December 31, 2025, September 30, 2025, and December 31, 2024. |

|||||||

| (5) | Return on common equity is computed by dividing annualized net income available to common shareholders by average common equity for each respective period or, in the case of return on tangible common equity, computed by dividing annualized net income available to common shareholders by average tangible common equity for each respective period. Adjusted return on common equity is computed by dividing annualized adjusted net income available to common shareholders by adjusted average common equity for each respective period, or in the case of adjusted return on tangible common equity, computed by dividing annualized adjusted net income available to common shareholders by adjusted average tangible common equity for each respective period. Tangible common equity is defined as total common equity attributable to Raymond James Financial, Inc. less goodwill and identifiable intangible assets, net of related deferred taxes. | |||||||

| (6) | Pre-tax margin is computed by dividing pre-tax income by net revenues for each respective period or, in the case of adjusted pre-tax margin, computed by dividing adjusted pre-tax income by net revenues for each respective period. | |||||||

| (7) | Total compensation ratio is computed by dividing compensation, commissions and benefits expense by net revenues for each respective period or, in the case of adjusted total compensation ratio, computed by dividing adjusted compensation, commissions and benefits expense by net revenues for each respective period. | |||||||

| (8) | PCG recruiting and retention-related compensation includes expenses related to cash and equity awards issued in conjunction with recruiting activities, as retention for existing advisors, or in conjunction with our acquisitions (as further described in footnote 19). Such awards are expensed over the requisite service period (typically between 5 and 10 years). |

|||||||

| (9) | Book value per share is computed by dividing total common equity attributable to Raymond James Financial, Inc. by the number of common shares outstanding at the end of each respective period or, in the case of tangible book value per share, computed by dividing tangible common equity by the number of common shares outstanding at the end of each respective period. | |||||||

| (10) | We earn fees from the RJBDP, a multi-bank sweep program in which clients’ cash deposits in their brokerage accounts are swept into interest-bearing deposit accounts at our Bank segment, as well as various third-party banks. RJBDP balances swept to our Bank segment are reflected in Bank deposits on our Consolidated Statement of Financial Condition and the vast majority are included in money market and other savings accounts in our net interest disclosures in this release. RJBDP balances swept to third-party banks are not included in our Bank deposits on our Consolidated Statement of Financial Condition given those deposits are held by third-party banks. Fees earned from the RJBDP are included in “Account and service fees” on our Consolidated Statements of Income, and those fees earned by the Private Client Group segment on deposits held by our Bank segment are eliminated in consolidation. |

|||||||

| (11) | Our Enhanced Savings Program is a deposit offering in which Private Client Group clients may deposit cash in a high-yield Raymond James Bank account. ESP balances held at Raymond James Bank as of the respective period end are reflected in Bank deposits on our Consolidated Statement of Financial Condition and the vast majority are included within interest-bearing demand deposits in our net interest disclosures in this release. |

|||||||

| (12) | Average yield on RJBDP - third-party banks is computed by dividing annualized RJBDP fees - third-party banks, which are net of the interest expense paid to clients by the third-party banks, by the average daily RJBDP balances at third-party banks. | |||||||

| (13) | Loans are presented net of unamortized purchase discounts or premiums, unearned income, deferred origination fees and costs, and charge-offs. | |||||||

| (14) | Securities-based loans included loans collateralized by the borrower’s marketable securities at advance rates consistent with industry standards and, to a lesser extent, the cash surrender value of life insurance policies. An insignificant portion of our securities-based loans portfolio is collateralized by private securities or other financial instruments with a limited trading market. | |||||||

| (15) | The average rate on tax-exempt loans is presented on a taxable-equivalent basis utilizing the applicable federal statutory rates for each respective period. | |||||||

| (16) | The average balance, interest expense, and average rate for “Total bank deposits” included amounts associated with affiliate deposits. Such amounts are eliminated in consolidation and are offset in “All other interest-bearing liabilities” under “All other segments.” |

|||||||

| (17) | The Other segment includes interest income on certain corporate cash balances, the results of our private equity investments, which predominantly consist of investments in third-party funds, certain other corporate investing activity, and certain corporate overhead costs of RJF that are not allocated to other segments including the interest costs on our public debt, certain provisions for legal and regulatory matters, and certain acquisition-related expenses. |

|||||||

| (18) | Corporate loans included commercial and industrial loans, commercial real estate loans, and real estate investment trust loans. | |||||||

| (19) | Includes acquisition-related compensation expenses primarily arising from equity and cash-based retention awards issued in conjunction with acquisitions in prior years. Such retention awards are generally contingent upon the post-closing continuation of service of certain associates who joined the firm as part of such acquisitions and are expensed over the requisite service period. |

|||||||

| (20) | Amortization of identifiable intangible assets, which was included in “Other” expense, includes amortization of identifiable intangible assets arising from our acquisitions. | |||||||

| (21) | Average common equity is computed by adding the total common equity attributable to Raymond James Financial, Inc. as of the date indicated to the prior quarter-end total, and dividing by two, or in the case of average tangible common equity, computed by adding tangible common equity as of the date indicated to the prior quarter-end total, and dividing by two. Adjusted average common equity is computed by adjusting for the impact on average common equity of the non-GAAP adjustments, as applicable for each respective period. Adjusted average tangible common equity is computed by adjusting for the impact on average tangible common equity of the non-GAAP adjustments, as applicable for each respective period. |

|||||||