Pennsylvania |

0-12508 |

25-1434426 |

||||||||||||

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

||||||||||||

800 Philadelphia Street |

Indiana | PA | 15701 |

|||||||||||

(Address of Principal Executive Offices) |

(Zip Code) |

|||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, $2.50 par value | STBA | NASDAQ Global Select Market | ||||||

| Exhibit No. | Description of Exhibit | |||||||

| Press Release | ||||||||

| Supplemental Information | ||||||||

| 104 | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) | |||||||

S&T Bancorp, Inc. |

|||||

| /s/ Mark Kochvar | |||||

| July 18, 2024 | Mark Kochvar Senior Executive Vice President, Chief Financial Officer |

||||

|

INVESTOR CONTACT:

Mark Kochvar

S&T Bancorp, Inc.

Chief Financial Officer

724.465.4826

mark.kochvar@stbank.com

|

|

|||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 5 |

||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars in thousands, except per share data) | Quarter | Quarter | Quarter | |||||||||||||||||

| INTEREST AND DIVIDEND INCOME | ||||||||||||||||||||

| Loans, including fees | $119,564 | $118,577 | $108,699 | |||||||||||||||||

| Investment Securities: | ||||||||||||||||||||

| Taxable | 8,761 | 8,595 | 7,806 | |||||||||||||||||

| Tax-exempt | 168 | 193 | 215 | |||||||||||||||||

| Dividends | 272 | 389 | 613 | |||||||||||||||||

| Total Interest and Dividend Income | 128,765 | 127,754 | 117,333 | |||||||||||||||||

| INTEREST EXPENSE | ||||||||||||||||||||

| Deposits | 39,629 | 36,662 | 20,102 | |||||||||||||||||

| Borrowings, junior subordinated debt securities and other | 5,542 | 7,615 | 9,108 | |||||||||||||||||

| Total Interest Expense | 45,171 | 44,277 | 29,210 | |||||||||||||||||

| NET INTEREST INCOME | 83,594 | 83,477 | 88,123 | |||||||||||||||||

| Provision for credit losses | 422 | 2,627 | 10,529 | |||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 83,172 | 80,850 | 77,594 | |||||||||||||||||

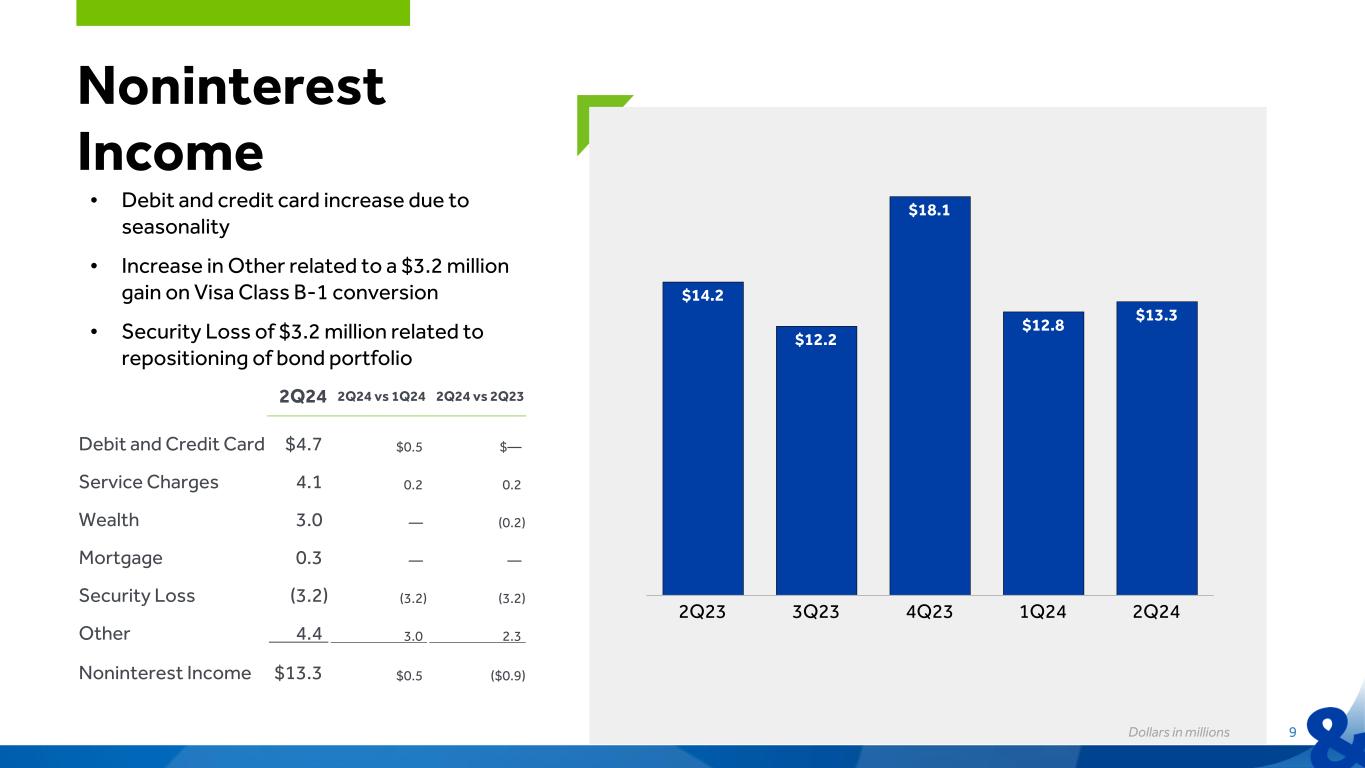

| NONINTEREST INCOME | ||||||||||||||||||||

| Net (loss) gain on sale of securities | (3,150) | 3 | — | |||||||||||||||||

| Debit and credit card | 4,713 | 4,235 | 4,645 | |||||||||||||||||

| Service charges on deposit accounts | 4,089 | 3,828 | 3,928 | |||||||||||||||||

| Wealth management | 2,995 | 3,042 | 3,185 | |||||||||||||||||

| Mortgage banking | 254 | 277 | 289 | |||||||||||||||||

| Other | 4,404 | 1,445 | 2,144 | |||||||||||||||||

| Total Noninterest Income | 13,305 | 12,830 | 14,191 | |||||||||||||||||

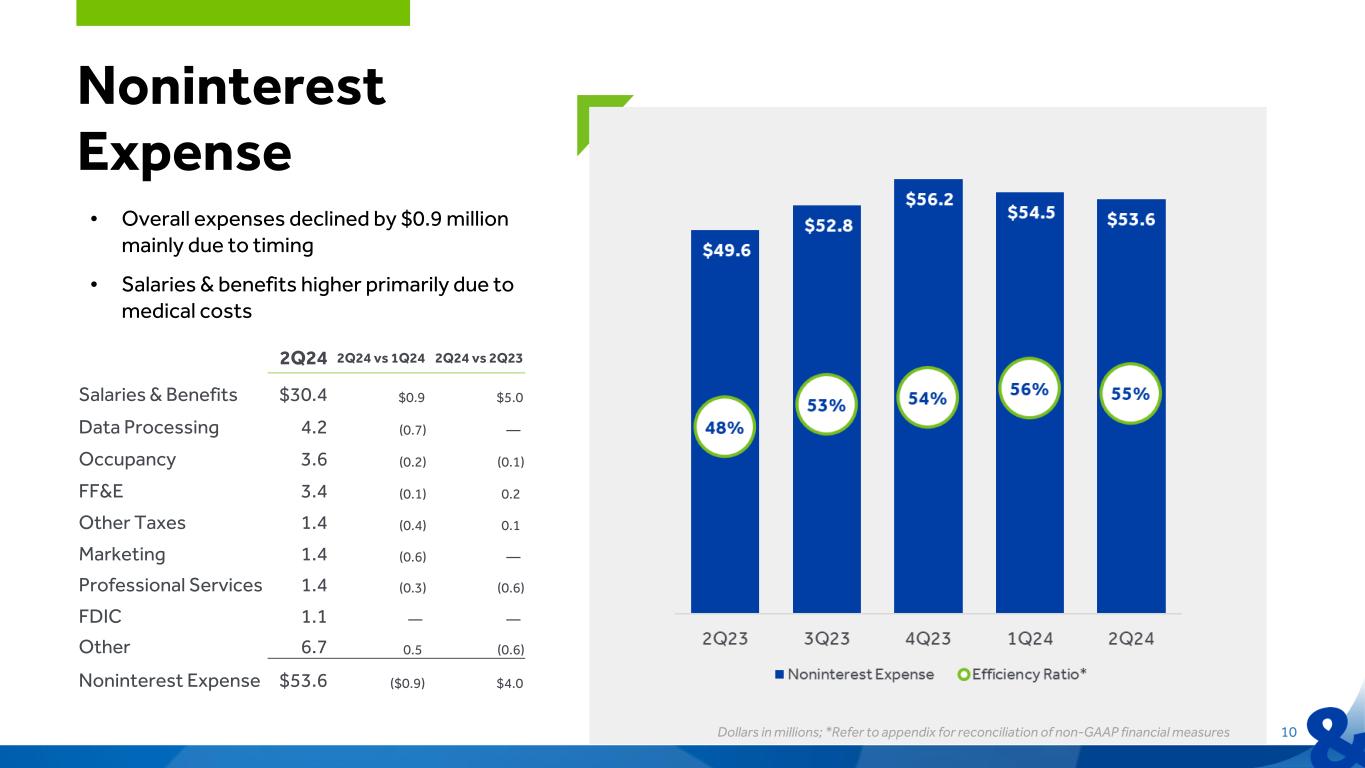

| NONINTEREST EXPENSE | ||||||||||||||||||||

| Salaries and employee benefits | 30,388 | 29,512 | 25,391 | |||||||||||||||||

| Data processing and information technology | 4,215 | 4,954 | 4,177 | |||||||||||||||||

| Occupancy | 3,649 | 3,870 | 3,710 | |||||||||||||||||

| Furniture, equipment and software | 3,382 | 3,472 | 3,192 | |||||||||||||||||

| Marketing | 1,404 | 1,943 | 1,459 | |||||||||||||||||

| Other taxes | 1,433 | 1,871 | 1,322 | |||||||||||||||||

| Professional services and legal | 1,403 | 1,720 | 2,069 | |||||||||||||||||

| FDIC insurance | 1,053 | 1,049 | 1,032 | |||||||||||||||||

| Other noninterest expense | 6,681 | 6,129 | 7,281 | |||||||||||||||||

| Total Noninterest Expense | 53,608 | 54,520 | 49,633 | |||||||||||||||||

| Income Before Taxes | 42,869 | 39,160 | 42,152 | |||||||||||||||||

| Income tax expense | 8,498 | 7,921 | 7,685 | |||||||||||||||||

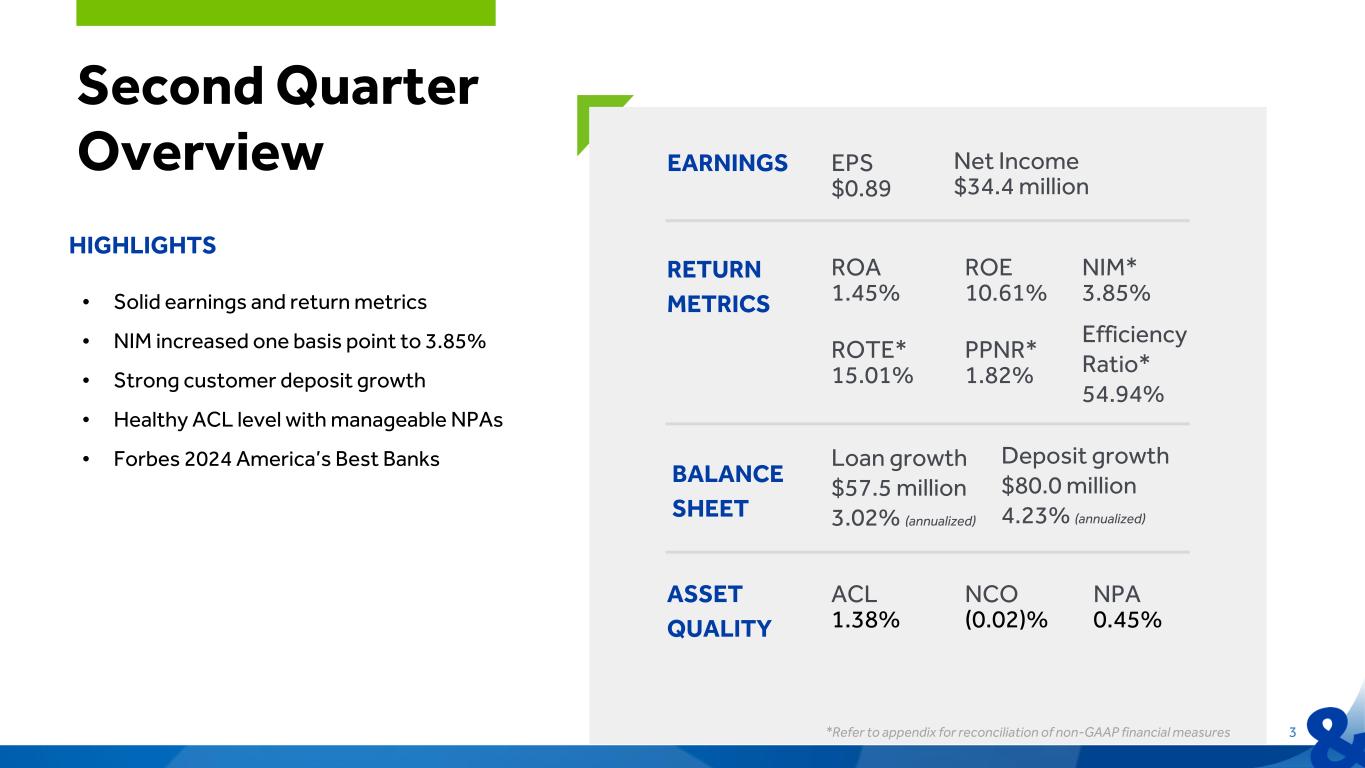

| Net Income | $34,371 | $31,239 | $34,467 | |||||||||||||||||

| Per Share Data | ||||||||||||||||||||

| Shares outstanding at end of period | 38,256,204 | 38,233,280 | 38,241,918 | |||||||||||||||||

| Average shares outstanding - diluted | 38,531,692 | 38,418,085 | 38,614,022 | |||||||||||||||||

| Diluted earnings per share | $0.89 | $0.81 | $0.89 | |||||||||||||||||

| Dividends declared per share | $0.33 | $0.33 | $0.32 | |||||||||||||||||

| Dividend yield (annualized) | 3.95 | % | 4.11 | % | 4.71 | % | ||||||||||||||

| Dividends paid to net income | 36.97 | % | 40.39 | % | 35.98 | % | ||||||||||||||

| Book value | $34.54 | $33.87 | $31.72 | |||||||||||||||||

Tangible book value (1) |

$24.71 | $24.03 | $21.85 | |||||||||||||||||

| Market value | $33.39 | $32.08 | $27.19 | |||||||||||||||||

| Profitability Ratios (Annualized) | ||||||||||||||||||||

| Return on average assets | 1.45 | % | 1.32 | % | 1.51 | % | ||||||||||||||

| Return on average shareholders' equity | 10.61 | % | 9.74 | % | 11.23 | % | ||||||||||||||

Return on average tangible shareholders' equity(2) |

15.01 | % | 13.85 | % | 16.32 | % | ||||||||||||||

Pre-provision net revenue / average assets(3) |

1.82 | % | 1.76 | % | 2.30 | % | ||||||||||||||

Efficiency ratio (FTE)(4) |

54.94 | % | 56.21 | % | 48.21 | % | ||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 6 |

||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||

| (dollars in thousands, except per share data) | 2024 | 2023 | ||||||||||||||||||

| INTEREST AND DIVIDEND INCOME | ||||||||||||||||||||

| Loans, including fees | $238,141 | $211,423 | ||||||||||||||||||

| Investment Securities: | ||||||||||||||||||||

| Taxable | 17,356 | 15,263 | ||||||||||||||||||

| Tax-exempt | 361 | 429 | ||||||||||||||||||

| Dividends | 661 | 1,121 | ||||||||||||||||||

| Total Interest and Dividend Income | 256,519 | 228,236 | ||||||||||||||||||

| INTEREST EXPENSE | ||||||||||||||||||||

| Deposits | 76,291 | 35,005 | ||||||||||||||||||

| Borrowings, junior subordinated debt securities and other | 13,157 | 16,317 | ||||||||||||||||||

| Total Interest Expense | 89,448 | 51,322 | ||||||||||||||||||

| NET INTEREST INCOME | 167,071 | 176,914 | ||||||||||||||||||

| Provision for credit losses | 3,049 | 11,451 | ||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 164,022 | 165,463 | ||||||||||||||||||

| NONINTEREST INCOME | ||||||||||||||||||||

| Net (loss) gain on sale of securities | (3,147) | — | ||||||||||||||||||

| Debit and credit card | 8,948 | 9,018 | ||||||||||||||||||

| Service charges on deposit accounts | 7,917 | 8,004 | ||||||||||||||||||

| Wealth management | 6,037 | 6,133 | ||||||||||||||||||

| Mortgage banking | 531 | 590 | ||||||||||||||||||

| Other | 5,849 | 3,636 | ||||||||||||||||||

| Total Noninterest Income | 26,135 | 27,381 | ||||||||||||||||||

| NONINTEREST EXPENSE | ||||||||||||||||||||

| Salaries and employee benefits | 59,900 | 52,992 | ||||||||||||||||||

| Data processing and information technology | 9,169 | 8,435 | ||||||||||||||||||

| Occupancy | 7,519 | 7,545 | ||||||||||||||||||

| Furniture, equipment and software | 6,854 | 6,053 | ||||||||||||||||||

| Professional services and legal | 3,123 | 3,890 | ||||||||||||||||||

| Other taxes | 3,304 | 3,112 | ||||||||||||||||||

| Marketing | 3,347 | 3,312 | ||||||||||||||||||

| FDIC insurance | 2,102 | 2,044 | ||||||||||||||||||

| Other noninterest expense | 12,810 | 13,949 | ||||||||||||||||||

| Total Noninterest Expense | 108,128 | 101,332 | ||||||||||||||||||

| Income Before Taxes | 82,029 | 91,512 | ||||||||||||||||||

| Income tax expense | 16,419 | 17,246 | ||||||||||||||||||

| Net Income | $65,610 | $74,266 | ||||||||||||||||||

| Per Share Data | ||||||||||||||||||||

| Average shares outstanding - diluted | 38,495,622 | 38,821,886 | ||||||||||||||||||

| Diluted earnings per share | $1.70 | $1.91 | ||||||||||||||||||

| Dividends declared per share | $0.66 | $0.64 | ||||||||||||||||||

| Dividends paid to net income | 38.60 | % | 33.48 | % | ||||||||||||||||

| Profitability Ratios (annualized) | ||||||||||||||||||||

| Return on average assets | 1.38 | % | 1.64 | % | ||||||||||||||||

| Return on average shareholders' equity | 10.17 | % | 12.29 | % | ||||||||||||||||

Return on average tangible shareholders' equity(5) |

14.44 | % | 17.93 | % | ||||||||||||||||

Pre-provision net revenue / average assets(6) |

1.79 | % | 2.27 | % | ||||||||||||||||

Efficiency ratio (FTE)(7) |

55.57 | % | 49.31 | % | ||||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 7 |

||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars in thousands) | Quarter | Quarter | Quarter | |||||||||||||||||

| ASSETS | ||||||||||||||||||||

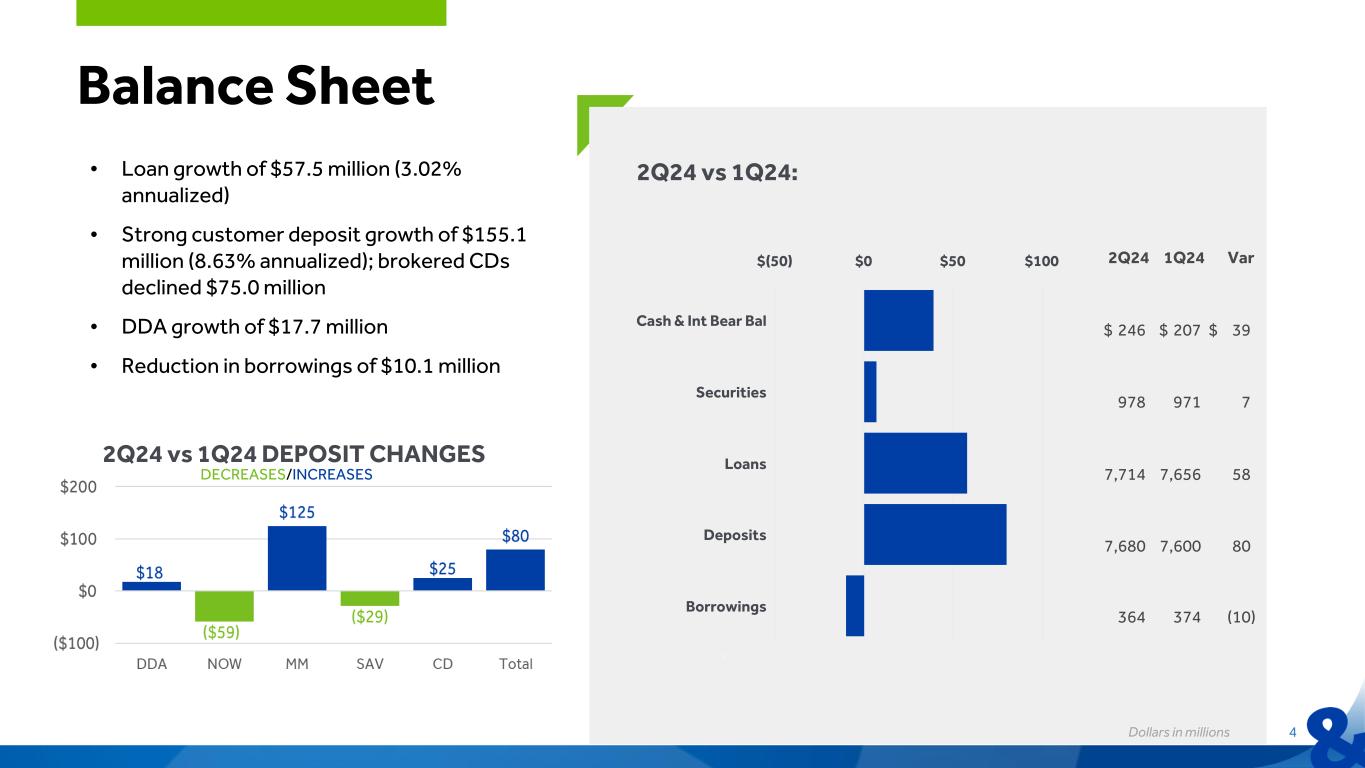

| Cash and due from banks | $246,310 | $207,462 | $227,867 | |||||||||||||||||

| Securities available for sale, at fair value | 977,958 | 970,728 | 970,372 | |||||||||||||||||

| Loans held for sale | 188 | — | 541 | |||||||||||||||||

| Commercial loans: | ||||||||||||||||||||

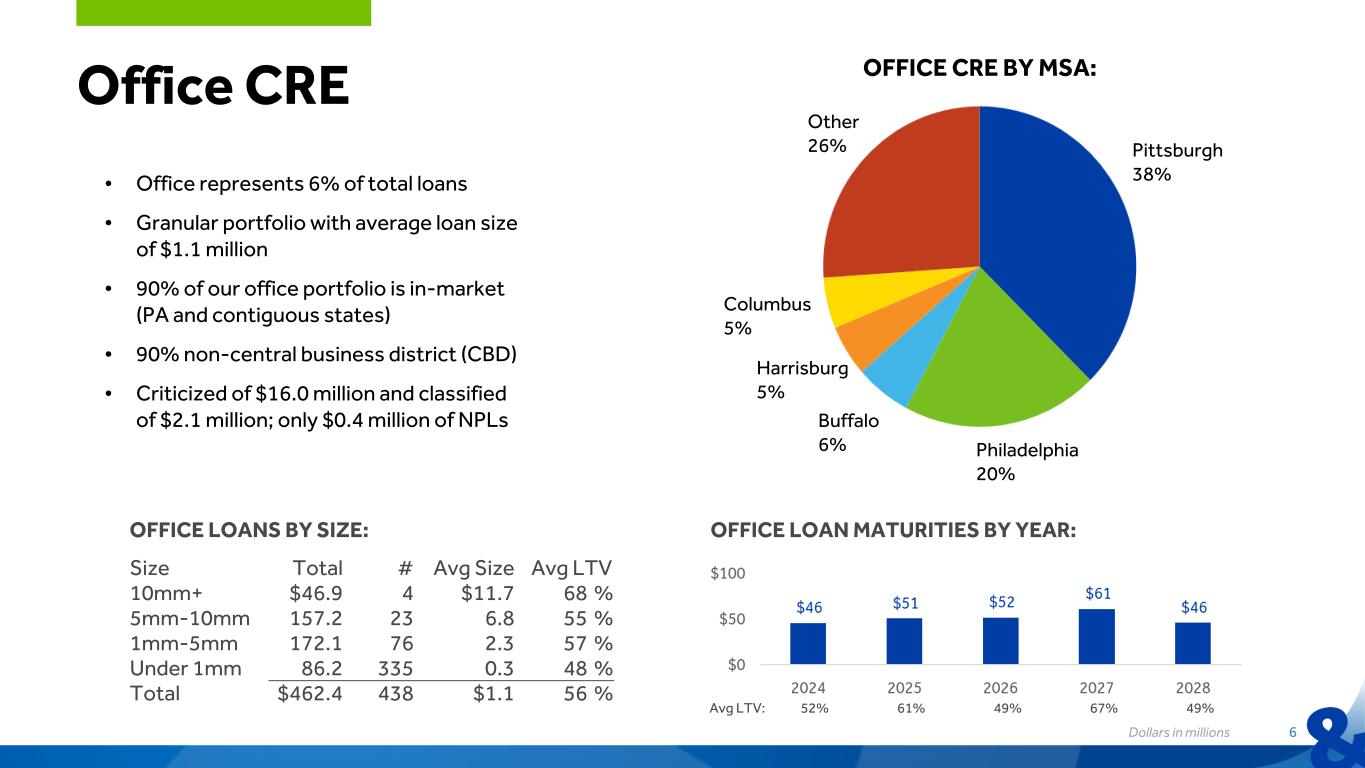

| Commercial real estate | 3,347,699 | 3,367,722 | 3,224,180 | |||||||||||||||||

| Commercial and industrial | 1,611,183 | 1,597,119 | 1,639,332 | |||||||||||||||||

| Commercial construction | 380,128 | 360,086 | 363,100 | |||||||||||||||||

| Total Commercial Loans | 5,339,010 | 5,324,927 | 5,226,612 | |||||||||||||||||

| Consumer loans: | ||||||||||||||||||||

| Residential mortgage | 1,562,026 | 1,500,499 | 1,286,771 | |||||||||||||||||

| Home equity | 642,225 | 645,780 | 645,897 | |||||||||||||||||

| Installment and other consumer | 102,660 | 108,232 | 115,634 | |||||||||||||||||

| Consumer construction | 67,649 | 76,596 | 44,697 | |||||||||||||||||

| Total Consumer Loans | 2,374,560 | 2,331,107 | 2,092,999 | |||||||||||||||||

| Total Portfolio Loans | 7,713,570 | 7,656,034 | 7,319,611 | |||||||||||||||||

| Allowance for credit losses | (106,150) | (104,802) | (105,757) | |||||||||||||||||

| Total Portfolio Loans, Net | 7,607,420 | 7,551,232 | 7,213,854 | |||||||||||||||||

| Federal Home Loan Bank and other restricted stock, at cost | 12,056 | 13,703 | 31,271 | |||||||||||||||||

| Goodwill | 373,424 | 373,424 | 373,424 | |||||||||||||||||

| Other assets | 418,106 | 422,554 | 435,593 | |||||||||||||||||

| Total Assets | $9,635,462 | $9,539,103 | $9,252,922 | |||||||||||||||||

| LIABILITIES | ||||||||||||||||||||

| Deposits: | ||||||||||||||||||||

| Noninterest-bearing demand | $2,206,589 | $2,188,927 | $2,330,237 | |||||||||||||||||

| Interest-bearing demand | 789,317 | 848,729 | 875,174 | |||||||||||||||||

| Money market | 2,008,486 | 1,882,157 | 1,583,717 | |||||||||||||||||

| Savings | 906,794 | 936,056 | 1,018,936 | |||||||||||||||||

| Certificates of deposit | 1,769,150 | 1,744,478 | 1,333,146 | |||||||||||||||||

| Total Deposits | 7,680,336 | 7,600,347 | 7,141,210 | |||||||||||||||||

| Borrowings: | ||||||||||||||||||||

| Short-term borrowings | 275,000 | 285,000 | 530,000 | |||||||||||||||||

| Long-term borrowings | 39,034 | 39,156 | 39,513 | |||||||||||||||||

| Junior subordinated debt securities | 49,388 | 49,373 | 54,483 | |||||||||||||||||

| Total Borrowings | 363,422 | 373,529 | 623,996 | |||||||||||||||||

| Other liabilities | 270,261 | 270,153 | 274,863 | |||||||||||||||||

| Total Liabilities | 8,314,019 | 8,244,029 | 8,040,069 | |||||||||||||||||

| SHAREHOLDERS’ EQUITY | ||||||||||||||||||||

| Total Shareholders’ Equity | 1,321,443 | 1,295,074 | 1,212,853 | |||||||||||||||||

| Total Liabilities and Shareholders’ Equity | $9,635,462 | $9,539,103 | $9,252,922 | |||||||||||||||||

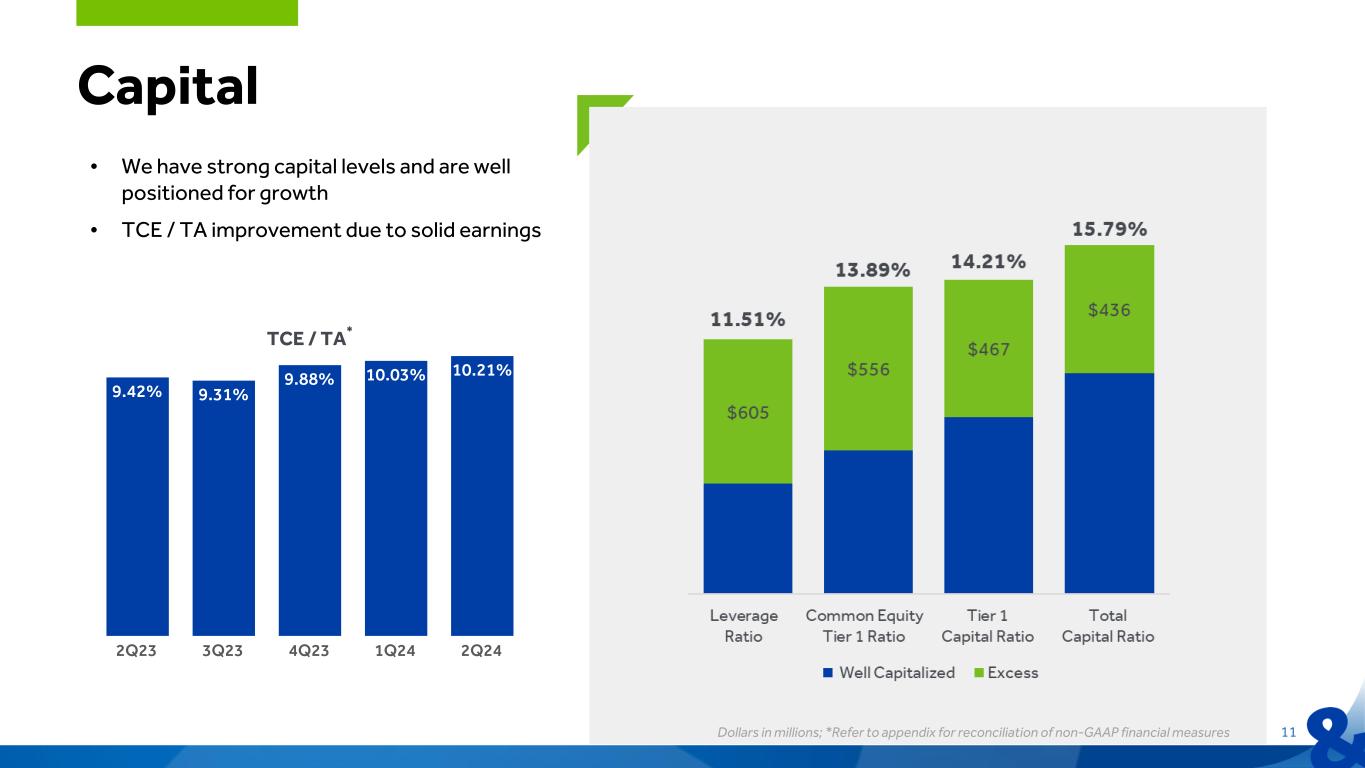

| Capitalization Ratios | ||||||||||||||||||||

| Shareholders' equity / assets | 13.71 | % | 13.58 | % | 13.11 | % | ||||||||||||||

Tangible common equity / tangible assets(9) |

10.21 | % | 10.03 | % | 9.42 | % | ||||||||||||||

| Tier 1 leverage ratio | 11.51 | % | 11.30 | % | 11.12 | % | ||||||||||||||

| Common equity tier 1 capital | 13.89 | % | 13.59 | % | 13.07 | % | ||||||||||||||

| Risk-based capital - tier 1 | 14.21 | % | 13.91 | % | 13.47 | % | ||||||||||||||

| Risk-based capital - total | 15.79 | % | 15.49 | % | 15.06 | % | ||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 8 |

||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars in thousands) | Quarter | Quarter | Quarter | |||||||||||||||||

| Net Interest Margin (FTE) (QTD Averages) | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Interest-bearing deposits with banks | $143,521 | 5.47% | $144,637 | 5.75% | $132,900 | 5.61% | ||||||||||||||

| Securities, at fair value | 961,552 | 2.93% | 966,703 | 2.81% | 983,349 | 2.54% | ||||||||||||||

| Loans held for sale | 27 | 7.37% | 176 | 7.12% | 92 | 6.87% | ||||||||||||||

| Commercial real estate | 3,346,725 | 5.97% | 3,365,142 | 5.92% | 3,176,154 | 5.62% | ||||||||||||||

| Commercial and industrial | 1,606,173 | 7.38% | 1,626,633 | 7.36% | 1,684,944 | 7.13% | ||||||||||||||

| Commercial construction | 374,856 | 7.82% | 365,088 | 7.70% | 384,329 | 7.63% | ||||||||||||||

| Total Commercial Loans | 5,327,754 | 6.52% | 5,356,863 | 6.48% | 5,245,427 | 6.25% | ||||||||||||||

| Residential mortgage | 1,528,200 | 5.00% | 1,478,609 | 4.93% | 1,229,129 | 4.52% | ||||||||||||||

| Home equity | 644,545 | 7.01% | 648,265 | 6.99% | 647,070 | 6.59% | ||||||||||||||

| Installment and other consumer | 105,313 | 8.63% | 110,899 | 8.64% | 118,641 | 8.28% | ||||||||||||||

| Consumer construction | 72,899 | 5.97% | 69,676 | 5.60% | 42,879 | 4.26% | ||||||||||||||

| Total Consumer Loans | 2,350,957 | 5.75% | 2,307,449 | 5.71% | 2,037,719 | 5.39% | ||||||||||||||

| Total Portfolio Loans | 7,678,711 | 6.29% | 7,664,312 | 6.25% | 7,283,146 | 6.01% | ||||||||||||||

| Total Loans | 7,678,738 | 6.29% | 7,664,488 | 6.25% | 7,283,238 | 6.01% | ||||||||||||||

| Total other earning assets | 20,087 | 7.04% | 25,335 | 7.12% | 37,003 | 7.26% | ||||||||||||||

| Total Interest-earning Assets | 8,803,898 | 5.91% | 8,801,163 | 5.86% | 8,436,490 | 5.61% | ||||||||||||||

| Noninterest-earning assets | 756,552 | 737,742 | 740,299 | |||||||||||||||||

| Total Assets | $9,560,450 | $9,538,905 | $9,176,789 | |||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||||||||||

| Interest-bearing demand | $822,671 | 1.13% | $829,095 | 1.12% | $847,776 | 0.58% | ||||||||||||||

| Money market | 1,938,963 | 3.25% | 1,920,009 | 3.15% | 1,599,051 | 2.13% | ||||||||||||||

| Savings | 915,768 | 0.70% | 939,467 | 0.63% | 1,037,924 | 0.38% | ||||||||||||||

| Certificates of deposit | 1,774,037 | 4.55% | 1,639,059 | 4.37% | 1,235,496 | 3.06% | ||||||||||||||

| Total Interest-bearing Deposits | 5,451,439 | 2.92% | 5,327,630 | 2.77% | 4,720,247 | 1.71% | ||||||||||||||

| Short-term borrowings | 261,923 | 5.09% | 408,351 | 5.37% | 529,013 | 5.39% | ||||||||||||||

| Long-term borrowings | 39,099 | 4.53% | 39,221 | 4.53% | 32,980 | 4.14% | ||||||||||||||

| Junior subordinated debt securities | 49,379 | 8.18% | 49,364 | 8.23% | 54,474 | 7.62% | ||||||||||||||

| Total Borrowings | 350,401 | 5.46% | 496,936 | 5.59% | 616,467 | 5.52% | ||||||||||||||

| Total Other Interest-bearing Liabilities | 57,734 | 5.42% | 52,239 | 5.42% | 49,572 | 5.06% | ||||||||||||||

| Total Interest-bearing Liabilities | 5,859,574 | 3.10% | 5,876,805 | 3.03% | 5,386,286 | 2.18% | ||||||||||||||

| Noninterest-bearing liabilities | 2,397,606 | 2,371,586 | 2,559,888 | |||||||||||||||||

| Shareholders' equity | 1,303,270 | 1,290,514 | 1,230,615 | |||||||||||||||||

| Total Liabilities and Shareholders' Equity | $9,560,450 | $9,538,905 | $9,176,789 | |||||||||||||||||

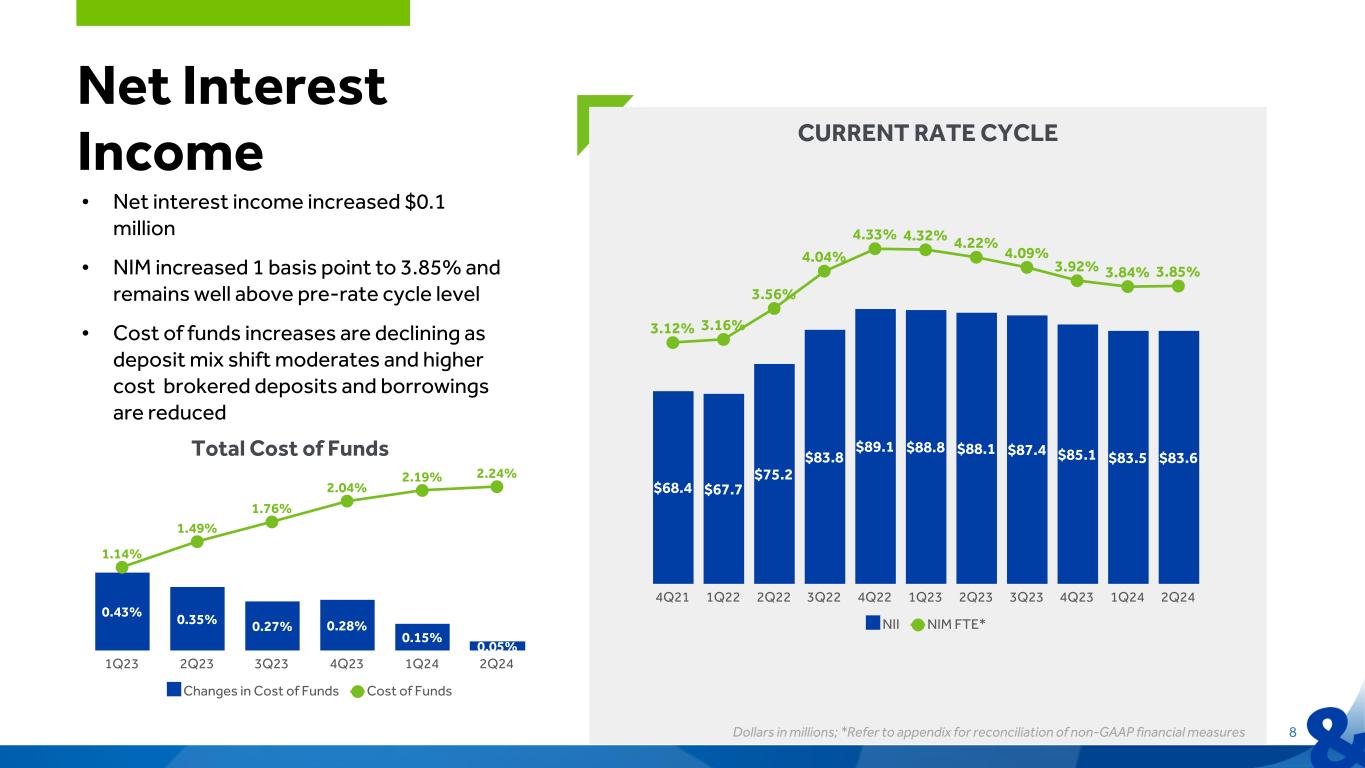

Net Interest Margin(10) |

3.85% | 3.84% | 4.22% | |||||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 9 |

||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||

| (dollars in thousands) | 2024 | 2023 | ||||||||||||||||||

| Net Interest Margin (FTE) (YTD Averages) | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Interest-bearing deposits with banks | $144,079 | 5.61% | $136,679 | 4.90% | ||||||||||||||||

| Securities, at fair value | 964,128 | 2.87% | 991,931 | 2.52% | ||||||||||||||||

| Loans held for sale | 101 | 7.16% | 108 | 6.60% | ||||||||||||||||

| Commercial real estate | 3,355,933 | 5.95% | 3,154,390 | 5.54% | ||||||||||||||||

| Commercial and industrial | 1,616,403 | 7.37% | 1,697,956 | 6.94% | ||||||||||||||||

| Commercial construction | 369,972 | 7.76% | 386,549 | 7.43% | ||||||||||||||||

| Total Commercial Loans | 5,342,308 | 6.50% | 5,238,895 | 6.13% | ||||||||||||||||

| Residential mortgage | 1,503,405 | 4.97% | 1,187,208 | 4.48% | ||||||||||||||||

| Home equity | 646,405 | 7.00% | 648,718 | 6.44% | ||||||||||||||||

| Installment and other consumer | 108,106 | 8.64% | 120,746 | 8.04% | ||||||||||||||||

| Consumer construction | 71,288 | 5.79% | 44,366 | 4.47% | ||||||||||||||||

| Total Consumer Loans | 2,329,204 | 5.73% | 2,001,038 | 5.33% | ||||||||||||||||

| Total Portfolio Loans | 7,671,512 | 6.27% | 7,239,933 | 5.91% | ||||||||||||||||

| Total Loans | 7,671,613 | 6.27% | 7,240,041 | 5.91% | ||||||||||||||||

| Total other earning assets | 22,711 | 7.08% | 35,868 | 6.99% | ||||||||||||||||

| Total Interest-earning Assets | 8,802,531 | 5.89% | 8,404,519 | 5.50% | ||||||||||||||||

| Noninterest-earning assets | 747,147 | 747,464 | ||||||||||||||||||

| Total Assets | $9,549,678 | $9,151,983 | ||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||||||||||||||||

| Interest-bearing demand | $825,883 | 1.13% | $836,263 | 0.46% | ||||||||||||||||

| Money market | 1,929,486 | 3.20% | 1,634,820 | 2.00% | ||||||||||||||||

| Savings | 927,618 | 0.66% | 1,063,887 | 0.34% | ||||||||||||||||

| Certificates of deposit | 1,706,548 | 4.46% | 1,144,484 | 2.66% | ||||||||||||||||

| Total Interest-bearing deposits | 5,389,535 | 2.85% | 4,679,454 | 1.51% | ||||||||||||||||

| Short-term borrowings | 335,137 | 5.26% | 490,554 | 5.18% | ||||||||||||||||

| Long-term borrowings | 39,160 | 4.53% | 23,885 | 3.71% | ||||||||||||||||

| Junior subordinated debt securities | 49,372 | 8.20% | 54,466 | 7.56% | ||||||||||||||||

| Total Borrowings | 423,669 | 5.54% | 568,905 | 5.34% | ||||||||||||||||

| Total Other Interest-bearing Liabilities | 54,986 | 5.42% | 52,107 | 4.81% | ||||||||||||||||

| Total Interest-bearing Liabilities | 5,868,190 | 3.06% | 5,300,466 | 1.95% | ||||||||||||||||

| Noninterest-bearing liabilities | 2,384,596 | 2,632,964 | ||||||||||||||||||

| Shareholders' equity | 1,296,892 | 1,218,553 | ||||||||||||||||||

| Total Liabilities and Shareholders' Equity | $9,549,678 | $9,151,983 | ||||||||||||||||||

Net Interest Margin(8) |

3.84% | 4.27% | ||||||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 10 |

||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars in thousands) | Quarter | Quarter | Quarter | |||||||||||||||||

| Nonaccrual Loans | ||||||||||||||||||||

| Commercial loans: | % Loans | % Loans | % Loans | |||||||||||||||||

| Commercial real estate | $15,090 | 0.45% | $18,082 | 0.54% | $1,859 | 0.06% | ||||||||||||||

| Commercial and industrial | 7,075 | 0.44% | 3,092 | 0.19% | 4,842 | 0.30% | ||||||||||||||

| Commercial construction | 4,960 | 1.30% | 4,960 | 1.38% | 384 | 0.11% | ||||||||||||||

| Total Nonaccrual Commercial Loans | 27,125 | 0.51% | 26,134 | 0.49% | 7,085 | 0.14% | ||||||||||||||

| Consumer loans: | ||||||||||||||||||||

| Residential mortgage | 4,698 | 0.30% | 4,160 | 0.28% | 4,167 | 0.32% | ||||||||||||||

| Home equity | 2,804 | 0.44% | 2,709 | 0.42% | 2,700 | 0.42% | ||||||||||||||

| Installment and other consumer | 230 | 0.22% | 206 | 0.19% | 367 | 0.32% | ||||||||||||||

| Total Nonaccrual Consumer Loans | 7,732 | 0.33% | 7,075 | 0.30% | 7,234 | 0.35% | ||||||||||||||

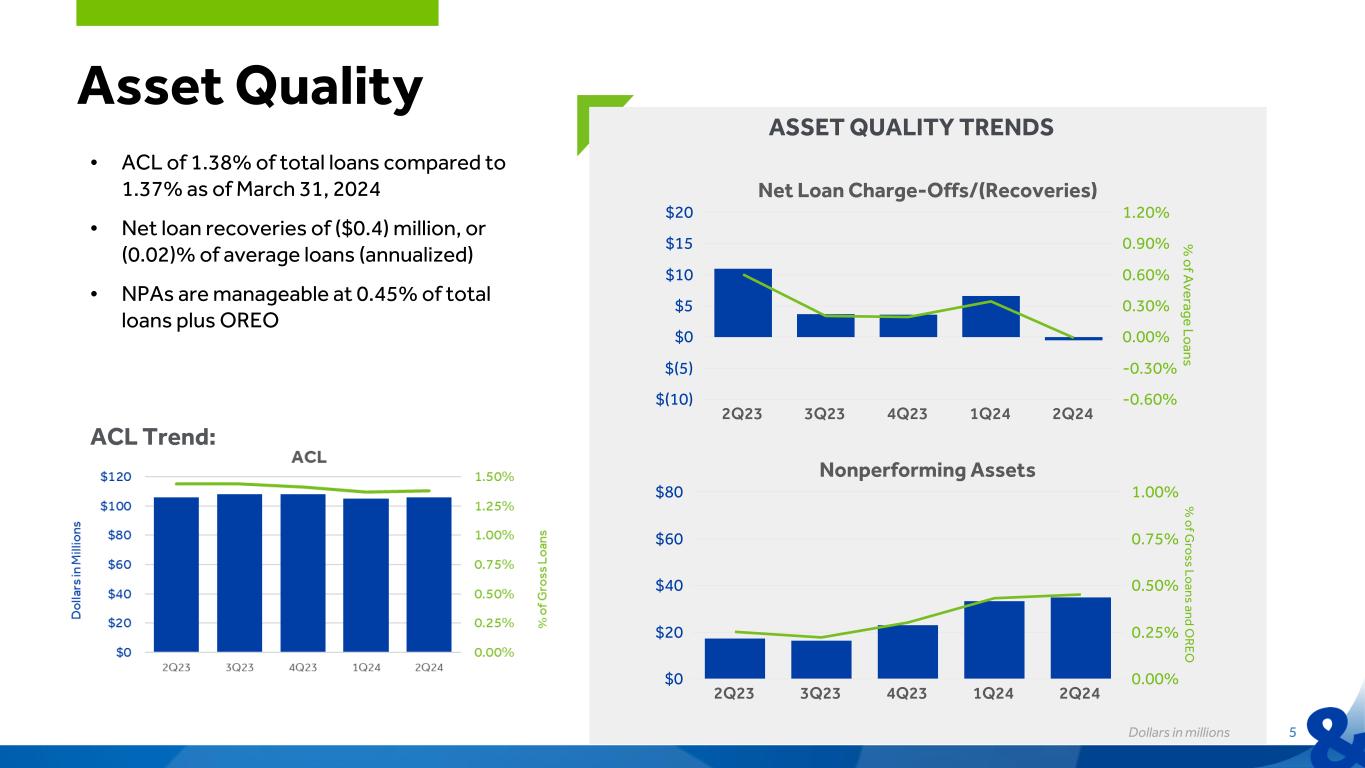

| Total Nonaccrual Loans | $34,857 | 0.45% | $33,209 | 0.43% | $14,319 | 0.20% | ||||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars in thousands) | Quarter | Quarter | Quarter | |||||||||||||||||

| Loan (Recoveries) Charge-offs | ||||||||||||||||||||

| Charge-offs | $845 | $6,939 | $12,222 | |||||||||||||||||

| Recoveries | (1,233) | (350) | (1,255) | |||||||||||||||||

| Net Loan (Recoveries) Charge-offs | ($388) | $6,589 | $10,967 | |||||||||||||||||

| Net Loan (Recoveries) Charge-offs | ||||||||||||||||||||

| Commercial loans: | ||||||||||||||||||||

| Commercial real estate | ($379) | $5,238 | ($1,030) | |||||||||||||||||

| Commercial and industrial | (658) | 950 | 11,296 | |||||||||||||||||

| Commercial construction | — | — | — | |||||||||||||||||

| Total Commercial Loan (Recoveries) Charge-offs | (1,037) | 6,188 | 10,266 | |||||||||||||||||

| Consumer loans: | ||||||||||||||||||||

| Residential mortgage | 33 | 7 | (1) | |||||||||||||||||

| Home equity | 274 | 105 | (12) | |||||||||||||||||

| Installment and other consumer | 342 | 289 | 714 | |||||||||||||||||

| Total Consumer Loan Charge-offs | 649 | 401 | 701 | |||||||||||||||||

| Total Net Loan (Recoveries) Charge-offs | ($388) | $6,589 | $10,967 | |||||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 11 |

||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||

| (dollars in thousands) | 2024 | 2023 | ||||||||||||||||||

| Loan Charge-offs (Recoveries) | ||||||||||||||||||||

| Charge-offs | $7,784 | $16,681 | ||||||||||||||||||

| Recoveries | (1,583) | (10,829) | ||||||||||||||||||

| Net Loan Charge-offs | $6,201 | $5,852 | ||||||||||||||||||

| Net Loan Charge-offs (Recoveries) | ||||||||||||||||||||

| Commercial loans: | ||||||||||||||||||||

| Customer fraud | $— | ($9,329) | ||||||||||||||||||

| Commercial real estate | 4,859 | (1,055) | ||||||||||||||||||

| Commercial and industrial | 292 | 15,244 | ||||||||||||||||||

| Commercial construction | — | (2) | ||||||||||||||||||

| Total Commercial Loan Charge-offs | 5,151 | 4,858 | ||||||||||||||||||

| Consumer loans: | ||||||||||||||||||||

| Residential mortgage | 40 | 8 | ||||||||||||||||||

| Home equity | 379 | 19 | ||||||||||||||||||

| Installment and other consumer | 631 | 967 | ||||||||||||||||||

| Total Consumer Loan Charge-offs | 1,050 | 994 | ||||||||||||||||||

| Total Net Loan Charge-offs | $6,201 | $5,852 | ||||||||||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars in thousands) | Quarter | Quarter | Quarter | |||||||||||||||||

| Asset Quality Data | ||||||||||||||||||||

| Nonaccrual loans | $34,857 | $33,209 | $14,319 | |||||||||||||||||

| OREO | 95 | 140 | 3,666 | |||||||||||||||||

| Total nonperforming assets | 34,952 | 33,349 | 17,985 | |||||||||||||||||

| Nonaccrual loans / total loans | 0.45 | % | 0.43 | % | 0.20 | % | ||||||||||||||

| Nonperforming assets / total loans plus OREO | 0.45 | % | 0.44 | % | 0.25 | % | ||||||||||||||

| Allowance for credit losses / total portfolio loans | 1.38 | % | 1.37 | % | 1.44 | % | ||||||||||||||

| Allowance for credit losses / nonaccrual loans | 305 | % | 316 | % | 739 | % | ||||||||||||||

| Net loan (recoveries) charge-offs | ($388) | $6,589 | $10,967 | |||||||||||||||||

| Net loan (recoveries) charge-offs (annualized) / average loans | (0.02 | %) | 0.35 | % | 0.60 | % | ||||||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||

| (dollars in thousands) | 2024 | 2023 | ||||||||||||||||||

| Asset Quality Data | ||||||||||||||||||||

| Net loan charge-offs | $6,201 | $5,852 | ||||||||||||||||||

| Net loan charge-offs / average loans | 0.16 | % | 0.16 | % | ||||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 12 |

||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars and shares in thousands) | Quarter | Quarter | Quarter | |||||||||||||||||

(1) Tangible Book Value (non-GAAP) |

||||||||||||||||||||

| Total shareholders' equity | $1,321,443 | $1,295,074 | $1,212,853 | |||||||||||||||||

| Less: goodwill and other intangible assets, net of deferred tax liability | (376,154) | (376,396) | (377,144) | |||||||||||||||||

| Tangible common equity (non-GAAP) | $945,289 | $918,678 | $835,709 | |||||||||||||||||

| Common shares outstanding | 38,256 | 38,233 | 38,242 | |||||||||||||||||

| Tangible book value (non-GAAP) | $24.71 | $24.03 | $21.85 | |||||||||||||||||

| Tangible book value is a preferred industry metric used to measure our company's value and commonly used by investors and analysts. | ||||||||||||||||||||

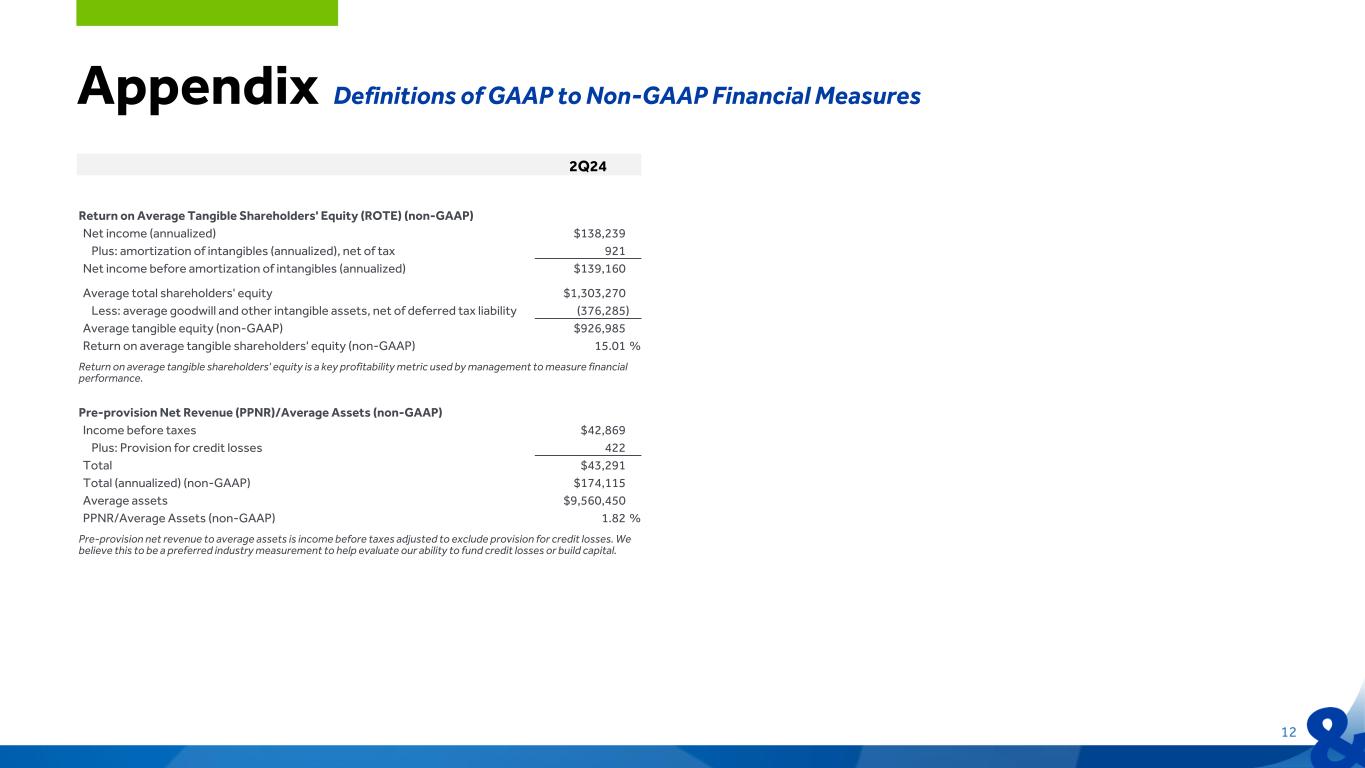

(2) Return on Average Tangible Shareholders' Equity (non-GAAP) |

||||||||||||||||||||

| Net income (annualized) | $138,239 | $125,643 | $138,248 | |||||||||||||||||

| Plus: amortization of intangibles (annualized), net of tax | 921 | 944 | 1,046 | |||||||||||||||||

| Net income before amortization of intangibles (annualized) | $139,160 | $126,587 | $139,294 | |||||||||||||||||

| Average total shareholders' equity | $1,303,270 | $1,290,514 | $1,230,615 | |||||||||||||||||

| Less: average goodwill and other intangible assets, net of deferred tax liability | (376,285) | (376,518) | (377,280) | |||||||||||||||||

| Average tangible equity (non-GAAP) | $926,985 | $913,996 | $853,335 | |||||||||||||||||

| Return on average tangible shareholders' equity (non-GAAP) | 15.01 | % | 13.85 | % | 16.32 | % | ||||||||||||||

| Return on average tangible shareholders' equity is a key profitability metric used by management to measure financial performance. | ||||||||||||||||||||

(3) Pre-provision Net Revenue / Average Assets (non-GAAP) |

||||||||||||||||||||

| Income before taxes | $42,869 | $39,160 | $42,152 | |||||||||||||||||

| Plus: Provision for credit losses | 422 | 2,627 | 10,529 | |||||||||||||||||

| Total | $43,291 | $41,787 | $52,681 | |||||||||||||||||

| Total (annualized) (non-GAAP) | $174,115 | $168,066 | $211,302 | |||||||||||||||||

| Average assets | $9,560,450 | $9,538,905 | $9,176,789 | |||||||||||||||||

| Pre-provision Net Revenue / Average Assets (non-GAAP) | 1.82 | % | 1.76 | % | 2.30 | % | ||||||||||||||

| Pre-provision net revenue to average assets is income before taxes adjusted to exclude provision for credit losses. We believe this to be a preferred industry measurement to help evaluate our ability to fund credit losses or build capital. | ||||||||||||||||||||

(4) Efficiency Ratio (non-GAAP) |

||||||||||||||||||||

| Noninterest expense | $53,608 | $54,520 | $49,633 | |||||||||||||||||

| Net interest income per consolidated statements of net income | $83,594 | $83,477 | $88,123 | |||||||||||||||||

| Plus: taxable equivalent adjustment | 682 | 692 | 639 | |||||||||||||||||

| Net interest income (FTE) (non-GAAP) | 84,276 | 84,169 | 88,762 | |||||||||||||||||

| Noninterest income | 13,305 | 12,830 | 14,191 | |||||||||||||||||

| Less: net gains on sale of securities | 3,150 | (3) | — | |||||||||||||||||

| Less: Visa Class B-1 exchange | (3,156) | — | — | |||||||||||||||||

| Net interest income (FTE) (non-GAAP) plus noninterest income | $97,575 | $96,996 | $102,953 | |||||||||||||||||

| Efficiency ratio (non-GAAP) | 54.94 | % | 56.21 | % | 48.21 | % | ||||||||||||||

| The efficiency ratio is noninterest expense divided by noninterest income plus net interest income, on an FTE basis (non-GAAP), which ensures comparability of net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. | ||||||||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 13 |

||||||||||

| Six Months Ended June 30, | ||||||||||||||||||||

| (dollars in thousands) | 2024 | 2023 | ||||||||||||||||||

(5) Return on Average Tangible Shareholders' Equity (non-GAAP) |

||||||||||||||||||||

| Net income (annualized) | $131,941 | $149,763 | ||||||||||||||||||

| Plus: amortization of intangibles (annualized), net of tax | 932 | 1,066 | ||||||||||||||||||

| Net income before amortization of intangibles (annualized) | $132,873 | $150,829 | ||||||||||||||||||

| Average total shareholders' equity | $1,296,892 | $1,218,553 | ||||||||||||||||||

| Less: average goodwill and other intangible assets, net of deferred tax liability | (376,402) | (377,427) | ||||||||||||||||||

| Average tangible equity (non-GAAP) | $920,490 | $841,126 | ||||||||||||||||||

| Return on average tangible shareholders' equity (non-GAAP) | 14.44 | % | 17.93 | % | ||||||||||||||||

| Return on average tangible shareholders' equity is a key profitability metric used by management to measure financial performance. | ||||||||||||||||||||

(6) Pre-provision Net Revenue / Average Assets (non-GAAP) |

||||||||||||||||||||

| Income before taxes | $82,029 | $91,512 | ||||||||||||||||||

| Plus: Provision for credit losses | 3,049 | 11,451 | ||||||||||||||||||

| Total | $85,078 | $102,963 | ||||||||||||||||||

| Total (annualized) (non-GAAP) | $171,091 | $207,632 | ||||||||||||||||||

| Average assets | $9,549,678 | $9,151,983 | ||||||||||||||||||

| Pre-provision Net Revenue / Average Assets (non-GAAP) | 1.79 | % | 2.27 | % | ||||||||||||||||

| Pre-provision net revenue to average assets is income before taxes adjusted to exclude provision for credit losses. We believe this to be a preferred industry measurement to help evaluate our ability to fund credit losses or build capital. | ||||||||||||||||||||

(7) Efficiency Ratio (non-GAAP) |

||||||||||||||||||||

| Noninterest expense | $108,128 | $101,332 | ||||||||||||||||||

| Net interest income per consolidated statements of net income | $167,071 | $176,914 | ||||||||||||||||||

| Plus: taxable equivalent adjustment | 1,375 | 1,194 | ||||||||||||||||||

| Net interest income (FTE) (non-GAAP) | 168,446 | 178,108 | ||||||||||||||||||

| Noninterest income | 26,135 | 27,381 | ||||||||||||||||||

| Less: net gains on sale of securities | 3,147 | — | ||||||||||||||||||

| Less: Visa Class B-1 exchange | (3,156) | — | ||||||||||||||||||

| Net interest income (FTE) (non-GAAP) plus noninterest income | $194,572 | $205,489 | ||||||||||||||||||

| Efficiency ratio (non-GAAP) | 55.57 | % | 49.31 | % | ||||||||||||||||

| The efficiency ratio is noninterest expense divided by noninterest income plus net interest income, on an FTE basis (non-GAAP), which ensures comparability of net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. | ||||||||||||||||||||

(8) Net Interest Margin Rate (FTE) (non-GAAP) |

||||||||||||||||||||

| Interest income and dividend income | $256,519 | $228,236 | ||||||||||||||||||

| Less: interest expense | (89,448) | (51,322) | ||||||||||||||||||

| Net interest income per consolidated statements of net income | 167,071 | 176,914 | ||||||||||||||||||

| Plus: taxable equivalent adjustment | 1,375 | 1,194 | ||||||||||||||||||

| Net interest income (FTE) (non-GAAP) | $168,446 | $178,108 | ||||||||||||||||||

| Net interest income (FTE) (annualized) | $338,743 | $359,166 | ||||||||||||||||||

| Average interest-earning assets | $8,802,531 | $8,404,519 | ||||||||||||||||||

| Net interest margin - (FTE) (non-GAAP) | 3.84 | % | 4.27 | % | ||||||||||||||||

| The interest income on interest-earning assets, net interest income and net interest margin are presented on an FTE basis (non-GAAP). The FTE basis (non-GAAP) adjusts for the tax benefit of income on certain tax-exempt loans and securities and the dividend-received deduction for equity securities using the federal statutory tax rate of 21 percent for each period. We believe this to be the preferred industry measurement of net interest income that provides a relevant comparison between taxable and non-taxable sources of interest income. | ||||||||||||||||||||

| S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited |

S&T Earnings Release - 14 |

||||||||||

| 2024 | 2024 | 2023 | ||||||||||||||||||

| Second | First | Second | ||||||||||||||||||

| (dollars in thousands) | Quarter | Quarter | Quarter | |||||||||||||||||

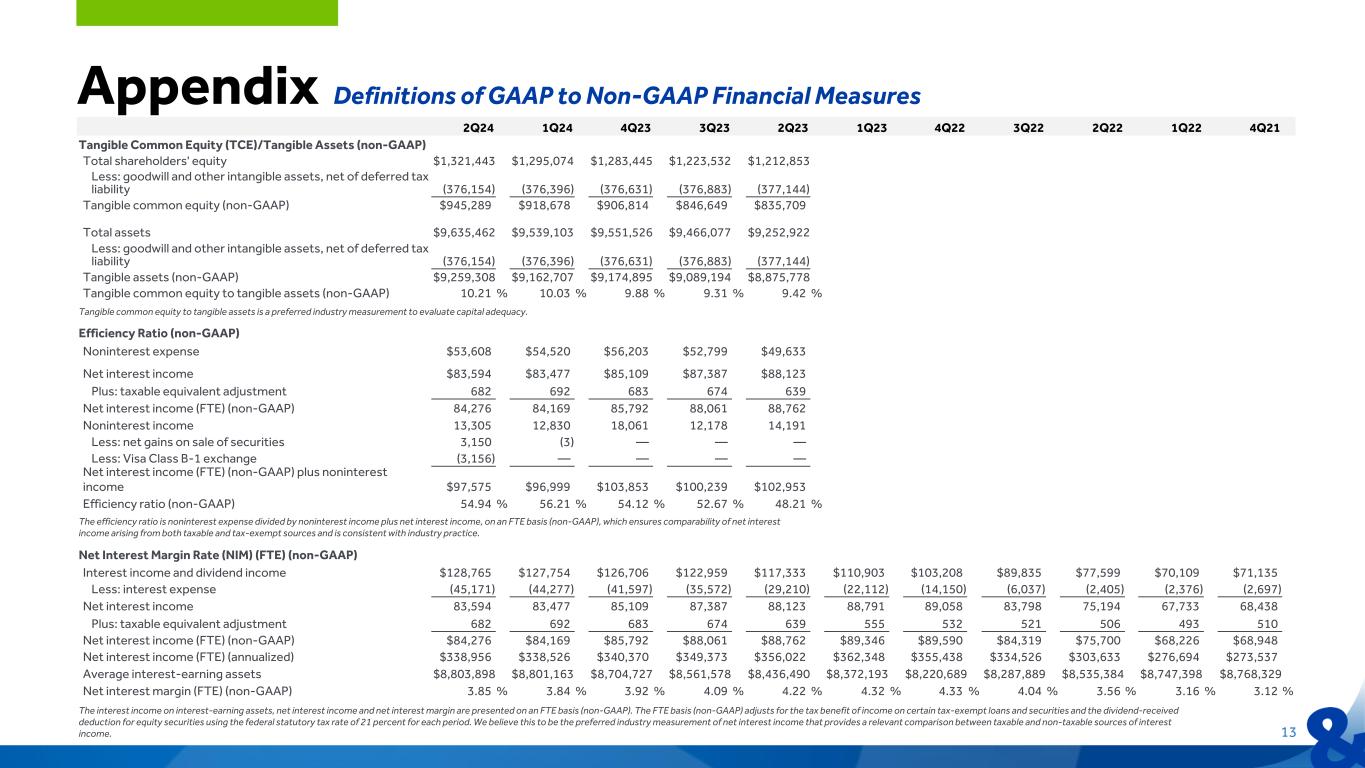

(9) Tangible Common Equity / Tangible Assets (non-GAAP) |

||||||||||||||||||||

| Total shareholders' equity | $1,321,443 | $1,295,074 | $1,212,853 | |||||||||||||||||

| Less: goodwill and other intangible assets, net of deferred tax liability | (376,154) | (376,396) | (377,144) | |||||||||||||||||

| Tangible common equity (non-GAAP) | $945,289 | $918,678 | $835,709 | |||||||||||||||||

| Total assets | $9,635,462 | $9,539,103 | $9,252,922 | |||||||||||||||||

| Less: goodwill and other intangible assets, net of deferred tax liability | (376,154) | (376,396) | (377,144) | |||||||||||||||||

| Tangible assets (non-GAAP) | $9,259,308 | $9,162,707 | $8,875,778 | |||||||||||||||||

| Tangible common equity to tangible assets (non-GAAP) | 10.21 | % | 10.03 | % | 9.42 | % | ||||||||||||||

| Tangible common equity to tangible assets is a preferred industry measurement to evaluate capital adequacy. | ||||||||||||||||||||

(10) Net Interest Margin Rate (FTE) (non-GAAP) |

||||||||||||||||||||

| Interest income and dividend income | $128,765 | $127,754 | $117,333 | |||||||||||||||||

| Less: interest expense | (45,171) | (44,277) | (29,210) | |||||||||||||||||

| Net interest income per consolidated statements of net income | 83,594 | 83,477 | 88,123 | |||||||||||||||||

| Plus: taxable equivalent adjustment | 682 | 692 | 639 | |||||||||||||||||

| Net interest income (FTE) (non-GAAP) | $84,276 | $84,169 | $88,762 | |||||||||||||||||

| Net interest income (FTE) (annualized) | $338,956 | $338,526 | $356,022 | |||||||||||||||||

| Average interest-earning assets | $8,803,898 | $8,801,163 | $8,436,490 | |||||||||||||||||

| Net interest margin (FTE) (non-GAAP) | 3.85 | % | 3.84 | % | 4.22 | % | ||||||||||||||

| The interest income on interest-earning assets, net interest income and net interest margin are presented on an FTE basis (non-GAAP). The FTE basis (non-GAAP) adjusts for the tax benefit of income on certain tax-exempt loans and securities and the dividend-received deduction for equity securities using the federal statutory tax rate of 21 percent for each period. We believe this to be the preferred industry measurement of net interest income that provides a relevant comparison between taxable and non-taxable sources of interest income. | ||||||||||||||||||||