Document

Management's discussion and analysis

Table of contents

Management’s discussion and analysis

In this management’s discussion and analysis (MD&A), we, us, our, BCE and the company mean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.

All amounts in this MD&A are in millions of Canadian dollars, except where noted. Please refer to section 8, Non-GAAP financial measures, other financial measures and key performance indicators (KPIs) for a list of defined non-GAAP financial measures, other financial measures and KPIs.

Please refer to BCE’s unaudited consolidated financial statements for the third quarter of 2025 (Q3 2025 Financial Statements) when reading this MD&A. We also encourage you to read BCE’s MD&A for the year ended December 31, 2024 dated March 6, 2025 (BCE 2024 Annual MD&A) as updated in BCE's MD&A for the first quarter of 2025 dated May 7, 2025 (BCE 2025 First Quarter MD&A), BCE's MD&A for the second quarter of 2025 dated August 6, 2025 (BCE 2025 Second Quarter MD&A) and BCE’s news release dated August 7, 2025, which contains an update to our 2025 financial guidance targets originally provided on February 6, 2025 to incorporate the impact of the acquisition of Northwest Fiber Holdco, LLC (doing business as Ziply Fiber (Ziply Fiber)) (BCE 2025 Second Quarter News Release). In preparing this MD&A, we have taken into account information available to us up to November 5, 2025, the date of this MD&A, unless otherwise stated.

You will find additional information relating to BCE, including BCE’s annual information form for the year ended December 31, 2024 dated March 6, 2025 (BCE 2024 AIF) and recent financial reports, including the BCE 2024 Annual MD&A, the BCE 2025 First Quarter MD&A, the BCE 2025 Second Quarter MD&A and the BCE 2025 Second Quarter News Release on BCE’s website at BCE.ca, on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov.

Documents and other information contained in BCE’s website including, without limitation, the BCE 2025 Third Quarter News Release, or in any other site referred to in BCE’s website or in this MD&A are not part of this MD&A and are not incorporated by reference herein unless explicitly stated.

This MD&A comments on our business operations, performance, financial position and other matters for the three months (Q3) and nine months (YTD) ended September 30, 2025 and 2024.

Caution regarding forward-looking statements

This MD&A and, in particular, but without limitation, section 1.2, Key corporate and business developments, section 3.1, Bell CTS, the section and sub-sections entitled Assumptions and section 4.7, Liquidity, contain forward-looking statements. These forward-looking statements include, without limitation, statements relating to: BCE’s three-year strategic plan to deliver sustainable free cash flow growth and long-term shareholder value; potential future purchases by BCE of its preferred shares pursuant to a normal course issuer bid (NCIB); the proposed disposition of Northwestel Inc. (Northwestel); Bell Canada’s plan to deploy low Earth orbit direct-to-cell services in 2026 and the benefits expected to result therefrom; the sources of liquidity we expect to use to meet our 2025 cash requirements; BCE's annualized common share dividend; BCE's common share dividend payout policy target; and BCE’s business outlook, objectives, plans and strategic priorities, and other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, project, strategy, target, commitment and other similar expressions or future or conditional verbs such as aim, anticipate, believe, could, expect, intend, may, plan, seek, should, strive and will. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the United States (U.S.) Private Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in this MD&A describe our expectations as at November 5, 2025 and, accordingly, are subject to change after that date. Except as may be required by applicable securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. These statements are not guarantees of future performance or events, and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in this MD&A for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

We have made certain economic, market, operational and other assumptions in preparing the forward-looking statements contained in this MD&A and, in particular, but without limitation, the forward-looking statements contained in the previously mentioned sections of this MD&A. These assumptions include, without limitation, the assumptions described in the section and sub-sections of this MD&A entitled Assumptions, which section and sub-sections are incorporated by reference in this

4 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT

cautionary statement. Subject to various factors, we believe that our assumptions were reasonable at November 5, 2025. If our assumptions turn out to be inaccurate, our actual results could be materially different from what we expect.

Important risk factors that could cause actual results or events to differ materially from those expressed in, or implied by, the previously-mentioned forward-looking statements and other forward-looking statements contained in this MD&A, include, but are not limited to: the negative effect of adverse economic conditions, including from trade tariffs and other protective government measures, including the imposition of U.S. tariffs on imports from Canada and retaliatory tariffs by the Canadian government on goods coming from the U.S., recessions, inflation, reductions in immigration levels, high housing support costs relative to income, and financial and capital market volatility, and the resulting negative impact on customer spending and the demand for our products and services, higher costs and supply chain disruptions; the negative effect of adverse conditions associated with geopolitical events; the intensity of competitive activity and the failure to effectively respond to evolving competitive dynamics; the level of technological substitution and the presence of alternative service providers contributing to disruptions and disintermediation in each of our business segments; changing customer behaviour and the expansion of cloud-based, over-the-top (OTT) and other alternative solutions; advertising market pressures from economic conditions, fragmentation and non-traditional/global digital services; rising content costs and challenges in our ability to acquire or develop key content; high Canadian Internet and smartphone penetration; regulatory initiatives, proceedings and decisions, government consultations and government positions that negatively affect us and influence our business including, without limitation, concerning mandatory access to networks, spectrum auctions, the imposition of consumer-related codes of conduct, approval of acquisitions, broadcast and spectrum licensing, foreign ownership requirements, privacy and cybersecurity obligations and control of copyright piracy; the inability to implement enhanced compliance frameworks and to comply with legal and regulatory obligations; unfavourable resolution of legal proceedings; the failure to evolve and transform our networks, systems and operations using next-generation technologies while lowering our cost structure, including the failure to meet customer expectations of product and service experience; the inability to drive a positive customer experience; the inability to protect our physical and non-physical assets from events such as information security attacks, unauthorized access or entry, fire and natural disasters; the failure to implement an effective security and data governance framework; the risk that we may need to incur significant capital expenditures to provide additional capacity and reduce network congestion; service interruptions or outages due to network failures or slowdowns; events affecting the functionality of, and our ability to protect, test, maintain, replace and upgrade, our networks, information technology (IT) systems, equipment and other facilities; the failure by other telecommunications carriers on which we rely to provide services to complete planned and sufficient testing, maintenance, replacement or upgrade of their networks, equipment and other facilities, which could disrupt our operations including through network or other infrastructure failures; the complexity of our operations and IT systems and the failure to implement, maintain or manage highly effective processes and IT systems; in-orbit and other operational risks to which the satellites used to provide our satellite television (TV) services are subject; the failure to attract, develop and retain a talented team capable of furthering our strategic imperatives and operational transformation; the potential deterioration in employee morale and engagement resulting from staff reductions, cost reductions or reorganizations and the de-prioritization of transformation initiatives due to staff reductions, cost reductions or reorganizations; the failure to adequately manage health and safety concerns; labour disruptions and shortages; the inability to access adequate sources of capital and generate sufficient cash flows from operating activities to meet our cash requirements, fund capital expenditures and provide for planned growth; uncertainty as to whether our dividend payout policy will be maintained or achieved, or that the dividend on common shares will be maintained or dividends on any of BCE’s outstanding shares will be declared by BCE’s board of directors (the Board); the failure to reduce costs and adequately assess investment priorities, as well as unexpected increases in costs; the inability to manage various credit, liquidity and market risks; the failure to evolve practices to effectively monitor and control fraudulent activities; new or higher taxes due to new tax laws or changes thereto or in the interpretation thereof, and the inability to predict the outcome of government audits; the impact on our financial statements and estimates from a number of factors; pension obligation volatility and increased contributions to post-employment benefit plans; the expected timing and completion of the proposed disposition of Northwestel are subject to closing conditions, termination rights and other risks and uncertainties, including, without limitation, the purchaser securing financing, which may affect its completion, terms or timing and, as such, there can be no assurance that the proposed disposition will occur, or that it will occur on the terms and conditions, or at the time, currently contemplated, or that the potential benefits expected to result from the proposed disposition will be realized; there can be no assurance that the potential benefits expected to result from the formation of Network FiberCo will be realized; reputational risks and the inability to meaningfully integrate environmental, social and governance (ESG) considerations into our business strategy, operations and governance; the adverse impact of various internal and external factors on our ability to achieve our ESG targets including, without limitation, those related to greenhouse gas (GHG) reduction and supplier engagement; the failure to take appropriate actions to adapt to current and emerging environmental impacts, including climate change; the failure to develop and implement sufficient corporate governance practices; the inability to adequately manage social issues; health risks, including pandemics, epidemics and other health concerns, such as radio frequency emissions from wireless communications devices and equipment; our dependence on third-party suppliers, outsourcers and consultants to provide an uninterrupted supply of the products and services we need; the failure of our vendor selection, governance and oversight processes, including our management of supplier risk in the areas of security, data governance and responsible procurement; the quality of our products and services and the extent to which they may be subject to defects or fail to comply with applicable government regulations and standards; the failure to successfully expand Ziply Fiber’s fibre network and optimize its existing copper network; the inability of Ziply Fiber’s current and future initiatives or programs to generate the level of returns, or to occur on the timeline, we anticipate; the intensity of competitive activity in Ziply Fiber’s services market in the U.S., and the failure to effectively respond to fragmented and rapidly evolving competitive dynamics; the failure to successfully integrate Ziply Fiber as a subsidiary of BCE, and to generate the anticipated benefits from the acquisition of Ziply Fiber; the failure to accurately anticipate fluctuations in the exchange rate between the Canadian dollar and U.S. dollar and our inability to successfully implement currency hedging strategies; Ziply Fiber is subject to significant regulation in the U.S. which may reduce the amount of subsidies or revenues it receives, increase its compliance burdens or constrain its ability to compete; the failure to comply with the non-U.S. ownership rules and our regulatory obligations imposed by the Federal Communications Commission (FCC); changes to tax legislation in the U.S., Canada, or other relevant jurisdictions, or to its interpretation or enforcement, may affect Ziply Fiber’s income tax position, as well as our effective tax rate and the after-tax returns we derive from Ziply Fiber’s U.S. operations.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also materially adversely affect us. Please see section 9, Business risks of the BCE 2024 Annual MD&A for a more complete description of the above-mentioned and other risks, which section, and the other sections of the BCE 2024 Annual MD&A referred to therein, are incorporated by reference in this cautionary statement. Please also see section 6, Regulatory environment in the BCE 2025 First Quarter MD&A, in the BCE 2025 Second Quarter MD&A and in this MD&A for an update to the regulatory initiatives and proceedings described in the BCE 2024 Annual MD&A, which sections 6 are incorporated by reference in this cautionary statement. Please also see section 7, Business risks in the BCE 2025 Second Quarter MD&A for a description of the risk factors relating to Ziply Fiber, which section 7 is incorporated by reference in this cautionary statement. Any of those risks could cause actual results or events to differ materially from our expectations expressed in, or implied by, the forward-looking statements set out in this MD&A. Except for the updates set out in section 6, Regulatory environment in the BCE 2025 First Quarter MD&A, in the BCE 2025 Second Quarter MD&A and in this MD&A, as well as in section 7, Business risks in the BCE 2025 Second Quarter MD&A, the risks described in the BCE 2024 Annual MD&A remain substantially unchanged.

Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition, liquidity, financial results or reputation. We regularly consider potential acquisitions, dispositions, mergers, business combinations, investments, monetizations, joint ventures and other transactions, some of which may be significant. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any such transactions or of special items that may be announced or that may occur after November 5, 2025. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way, or in the same way we present known risks affecting our business.

6 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT

1 Overview

BCE Q3 2025 selected quarterly information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating revenues |

Net earnings (loss) |

Adjusted EBITDA(1) |

|

| $6,049 |

$4,555 |

$2,762 |

|

| million |

million |

million |

|

+1.3% vs. Q3 2024 |

vs. ($1,191) million in Q3 2024 |

+1.5% vs. Q3 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) attributable to common shareholders |

Adjusted net earnings(1) |

Cash flows from operating activities |

Free cash flow(1) |

|

| $4,502 |

$733 |

$1,914 |

$1,003 |

|

| million |

million |

million |

million |

|

vs. ($1,237) million in Q3 2024 |

+6.5% vs. Q3 2024 |

+3.9% vs. Q3 2024 |

+20.6% vs. Q3 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total mobile phones(2)(5)(6) |

Bell CTS retail high-speed Internet(3)(4)(6) |

Bell CTS retail Internet protocol television (IPTV)(3)(4)(7) |

Bell CTS retail residential network access services (NAS) lines(3)(4) |

| +0.4% |

+9.7% |

(2.0%) |

(5.9%) |

|

10.4 million subscribers

at September 30, 2025

|

4.9 million subscribers

at September 30, 2025

|

2.1 million subscribers

at September 30, 2025

|

1.8 million subscribers

at September 30, 2025

|

(1)Adjusted EBITDA is a total of segments measure, and adjusted net earnings and free cash flow are non-GAAP financial measures. See section 8.3, Total of segments measures and section 8.1, Non-GAAP financial measures in this MD&A for more information on these measures.

(2)In Q3 2025, Bell Communication and Technology Services (Bell CTS) Canada reduced its postpaid mobile phone and connected device subscriber bases by 51,541 and 7,867, respectively, following a review of a public sector customer account to eliminate subscribers with no usage.

(3)In Q3 2025, as a result of the acquisition of Ziply Fiber on August 1, 2025, Bell CTS U.S. retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases increased by 442,225, 6,089 and 84,440 subscribers, respectively.

(4)In Q1 2025, we reduced our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases by 80,666, 441 and 14,150 subscribers, respectively, in Bell CTS Canada, as at March 31, 2025, as we stopped selling new plans for these services under the Distributel, Acanac, Oricom and B2B2C brands. Additionally, at the beginning of Q1 2025, we reduced our retail high-speed Internet subscriber base by 2,783 subscribers in Bell CTS Canada to adjust for prior year customer deactivations following a review of customer accounts.

(5)In Q4 2024, we removed 124,216 Bell prepaid mobile phone subscribers from our prepaid mobile phone subscriber base in Bell CTS Canada as at December 31, 2024, as we stopped selling new plans for this service as of that date.

(6)In Q3 2024, we removed 77,971 Virgin Plus prepaid mobile phone subscribers from our prepaid mobile phone subscriber base in Bell CTS Canada as at September 30, 2024, as we stopped selling new plans for this service as of that date. Additionally, as a result of a recent Canadian Radio-television and Telecommunications Commission (CRTC) decision on wholesale high-speed Internet access services, we are no longer able to resell cable Internet services to new customers in our wireline footprint as of September 12, 2024, and consequently, in Bell CTS Canada, we removed all of the existing 106,259 cable subscribers in our wireline footprint from our retail high-speed Internet subscriber base as of that date.

(7)In Q2 2024, we increased our retail IPTV subscriber base by 40,997 in Bell CTS Canada to align the deactivation policy for our Fibe TV streaming services to our traditional Fibe TV service.

BCE income statements - selected information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Operating revenues |

|

|

|

|

|

|

|

|

| Service |

5,329 |

5,286 |

43 |

|

0.8 |

% |

15,768 |

15,786 |

(18) |

|

(0.1 |

%) |

| Product |

720 |

685 |

35 |

|

5.1 |

% |

2,296 |

2,201 |

95 |

|

4.3 |

% |

| Total operating revenues |

6,049 |

5,971 |

78 |

|

1.3 |

% |

18,064 |

17,987 |

77 |

|

0.4 |

% |

| Operating costs |

(3,287) |

(3,249) |

(38) |

|

(1.2 |

%) |

(10,070) |

(10,003) |

(67) |

|

(0.7 |

%) |

| Adjusted EBITDA |

2,762 |

2,722 |

40 |

|

1.5 |

% |

7,994 |

7,984 |

10 |

|

0.1 |

% |

Adjusted EBITDA margin(1) |

45.7 |

% |

45.6 |

% |

|

0.1 pts |

44.3 |

% |

44.4 |

% |

|

(0.1) pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) attributable to: |

|

|

|

|

|

|

|

|

| Common shareholders |

4,502 |

(1,237) |

5,739 |

|

n.m. |

5,711 |

(298) |

6,009 |

|

n.m. |

| Preferred shareholders |

38 |

45 |

(7) |

|

(15.6 |

%) |

119 |

138 |

(19) |

|

(13.8 |

%) |

| Non-controlling interest (NCI) |

15 |

1 |

14 |

|

n.m. |

52 |

30 |

22 |

|

73.3 |

% |

| Net earnings (loss) |

4,555 |

(1,191) |

5,746 |

|

n.m. |

5,882 |

(130) |

6,012 |

|

n.m. |

| Adjusted net earnings |

733 |

688 |

45 |

|

6.5 |

% |

1,958 |

2,054 |

(96) |

|

(4.7 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) per common share (EPS) |

4.84 |

(1.36) |

6.20 |

|

n.m. |

6.15 |

(0.33) |

6.48 |

|

n.m. |

Adjusted EPS(2) |

0.79 |

0.75 |

0.04 |

|

5.3 |

% |

2.11 |

2.25 |

(0.14) |

|

(6.2 |

%) |

n.m.: not meaningful

(1)Adjusted EBITDA margin is defined as adjusted EBITDA divided by operating revenues. Refer to section 8.6, KPIs in this MD&A for more information on this measure.

(2)Adjusted EPS is a non-GAAP ratio. Refer to section 8.2, Non-GAAP ratios in this MD&A for more information on this measure.

BCE statements of cash flows – selected information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Cash flows from operating activities |

1,914 |

|

1,842 |

|

72 |

|

3.9 |

% |

5,432 |

|

5,111 |

|

321 |

|

6.3 |

% |

| Capital expenditures |

(891) |

|

(954) |

|

63 |

|

6.6 |

% |

(2,383) |

|

(2,934) |

|

551 |

|

18.8 |

% |

| Free cash flow |

1,003 |

|

832 |

|

171 |

|

20.6 |

% |

2,953 |

|

2,014 |

|

939 |

|

46.6 |

% |

Q3 2025 financial highlights

BCE operating revenues grew by 1.3% in Q3 2025, compared to the same period last year, driven by higher service and product revenues of 0.8% and 5.1%, respectively. The increase in service revenues was driven by our new segment, Bell CTS U.S., due to the contribution from the acquisition of Ziply Fiber on August 1, 2025, higher wireless and retail Internet average subscriber bases coupled with the flow-through of rate increases, greater Bell Media direct-to-consumer (DTC) streaming subscriber revenues, and higher revenues from our artificial intelligence (AI)-powered solutions business. This growth was moderated by ongoing erosion in legacy voice and data revenues, greater acquisition, retention and bundle discounts on wireline residential services, lower TV revenues, continued decreased demand for traditional advertising, ongoing but abating wireless competitive pricing pressures and lower Bell Media subscriber revenues due to the benefit in Q3 2024 from retroactive adjustments related to contracts with Canadian TV distributors. The increase in product revenues was mainly driven by higher wireless device sales, moderated by lower consumer electronics sales from The Source (Bell) Electronics Inc. (The Source) due to permanent store closures and conversions of locations to Best Buy Express as part of our distribution partnership with Best Buy Canada.

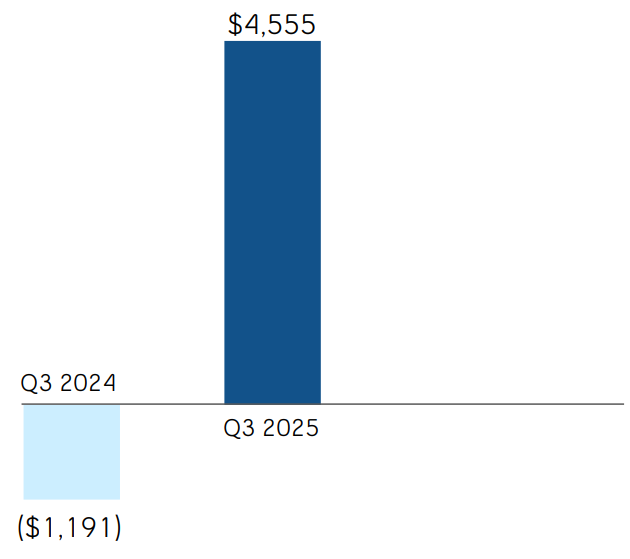

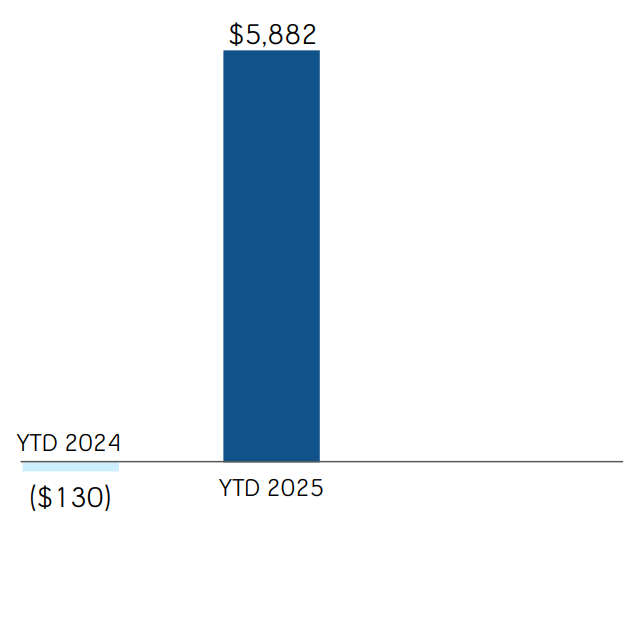

Net earnings of $4,555 million and net earnings attributable to common shareholders of $4,502 million in the third quarter of 2025 increased by $5,746 million and $5,739 million, respectively, compared to the same period last year, mainly due to higher gains on investments resulting from the sale of our minority stake in Maple Leaf Sports and Entertainment Ltd. (MLSE) and lower impairment of assets, primarily in our Bell Media segment, partly offset by higher income taxes.

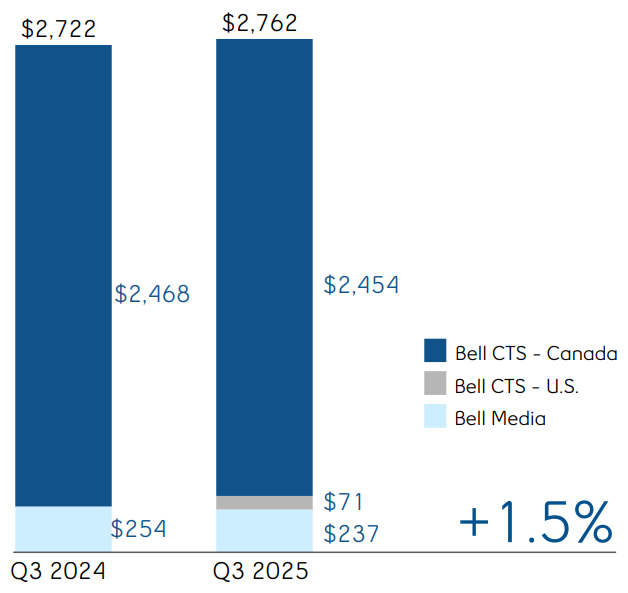

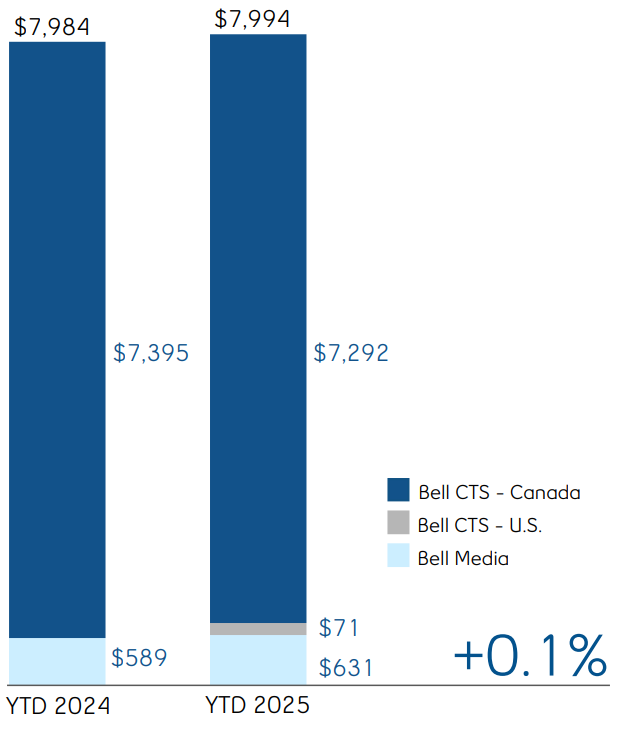

BCE adjusted EBITDA increased by 1.5% in Q3 2025, compared to the same period last year, driven by the contribution from our Bell CTS U.S. segment due to the acquisition of Ziply Fiber, partly offset by declines in our Bell CTS Canada and Bell Media segments. The year-over-year growth in adjusted EBITDA was driven by higher operating revenues, partly offset by greater operating expenses mainly resulting from the acquisition of Ziply Fiber, moderated by cost reduction initiatives driven by workforce reductions, cost containment, as well as technology and automation-enabled operating efficiencies across the organization. This drove an adjusted EBITDA margin of 45.7% in Q3 2025, which was essentially stable year over year, up 0.1 pts over Q3 2024.

BCE’s EPS of $4.84 in Q3 2025 increased by $6.20 compared to the same period last year.

8 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT

In the third quarter of 2025, adjusted net earnings, which excludes the impact of severance, acquisition and other costs, net mark-to-market gains (losses) on derivatives used to economically hedge equity settled share-based compensation plans, net equity gains (losses) on investments in associates and joint ventures, net gains (losses) on investments, early debt redemption gains (costs) and impairment of assets, net of tax and NCI, was $733 million, or $0.79 per common share, compared to $688 million, or $0.75 per common share, for the same period last year.

Cash flows from operating activities in the third quarter of 2025 increased by $72 million, compared to the same period last year, mainly due to higher cash from working capital and lower severance and other costs paid, partly offset by higher interest paid and higher income taxes paid.

Free cash flow in the third quarter of 2025 increased by $171 million compared to the same period last year, mainly due to higher cash flows from operating activities, excluding cash from acquisition and other costs paid, and lower capital expenditures and lower cash dividends paid on preferred shares.

1.2 Key corporate and business developments

This section contains forward-looking statements, including relating to BCE’s three-year strategic plan to deliver sustainable free cash flow growth and long-term shareholder value; BCE's strategic priorities; potential future purchases by BCE of its preferred shares pursuant to an NCIB; and the proposed disposition of Northwestel. Refer to the section Caution regarding forward-looking statements at the beginning of this MD&A.

Strategic plan to drive sustainable growth and long-term shareholder value

On October 14, 2025, ahead of its Investor Day, BCE unveiled its three-year strategic plan to deliver sustainable free cash flow growth and long-term shareholder value, supported by a disciplined capital allocation strategy tailored to a reshaped operating environment. The plan is anchored by four strategic priorities: put the customer first, deliver the best fibre and wireless networks, lead in enterprise with AI-powered solutions, and build a digital media and content powerhouse.

Refreshed brand platform

On October 14, 2025, Bell introduced its refreshed brand platform, “Connection is everything”, alongside a modernized visual identity. The initiative emphasizes a more human, relevant and connected future. The platform underscores Bell's fundamental role in facilitating essential human connections, reaffirming its dedication to helping individuals and businesses forge meaningful relationships with each other, their communities and the wider world.

Extension of partnership with Canadian Olympic Committee

On October 2, 2025, Bell announced the renewal of its long-standing partnership with the Canadian Olympic Committee, extending through the 2032 Olympic Games. This renewal continues Bell’s nearly 30-year commitment to supporting Canadian athletes through the Bell Athletes Connect program, including free phones and mobile plans to Team Canada. With this renewal, Bell remains the Official Telecommunications Partner of Team Canada for the 2026, 2028, 2030 and 2032 Olympic Games.

Public debt offering

On August 14, 2025, Bell Canada completed a public offering in Canada of $2.0 billion aggregate principal amount of medium-term note (MTN) debentures in four series pursuant to its MTN program.

The $400 million Series M-64 MTN debentures will mature on August 14, 2029 carry an annual interest rate of 3.65%. The $500 million Series M-65 MTN debentures will mature on March 14, 2033 and carry an annual interest rate of 4.30%. The $600 million Series M-66 MTN debentures will mature on March 14, 2036 and carry an annual interest rate of 4.70%. The $500 million Series M-67 MTN debentures will mature on August 14, 2055 and carry an annual interest rate of 5.25%. The MTN debentures are fully and unconditionally guaranteed by BCE. The net proceeds of the offering were used to redeem, prior to maturity, outstanding debt securities issued by Ziply Fiber and for general corporate purposes.

Early redemption of Ziply Fiber debt

On August 28, 2025, Bell Canada completed the redemption, prior to maturity, of all of Ziply Fiber’s outstanding debt securities having an aggregate principal amount of $1,961 million in U.S. dollars ($2,701 million in Canadian dollars). Ziply Fiber's outstanding debt securities consisted of $1,594 million in U.S. dollars ($2,192 million in Canadian dollars) principal amount of Secured Fiber Network Revenue Term Notes (Term Notes), which were redeemed on August 28, 2025, and $367 million in U.S. dollars ($509 million in Canadian dollars) in Secured Fiber Network Revenue Funding Notes (Funding Notes), which were redeemed on August 20, 2025. The redemption of Ziply Fiber’s debt was partially funded by Bell’s $2.0 billion offering of MTN debentures which was completed on August 14, 2025.

Renewal of NCIB for BCE First Preferred Shares

On November 5, 2025, the Board authorized the company to renew its NCIB to purchase for cancellation up to 10% of the public float of each series of BCE’s outstanding First Preferred Shares (Preferred Shares) that are listed on the Toronto Stock Exchange (TSX). The NCIB will extend from November 11, 2025 to November 10, 2026, or an earlier date should BCE complete its purchases under the NCIB. Under the NCIB, BCE is authorized to repurchase up to 711,590 Series R Preferred Shares, 188,207 Series S Preferred Shares, 506,243 Series T Preferred Shares, 540,688 Series Y Preferred Shares, 239,924 Series Z Preferred Shares, 1,031,507 Series AA Preferred Shares, 607,333 Series AB Preferred Shares, 620,567 Series AC Preferred Shares, 1,100,123 Series AD Preferred Shares, 323,372 Series AE Preferred Shares, 1,057,613 Series AF Preferred Shares, 813,483 Series AG Preferred Shares, 420,261 Series AH Preferred Shares, 875,404 Series AI Preferred Shares, 378,276 Series AJ Preferred Shares, 1,939,114 Series AK Preferred Shares, 165,538 Series AL Preferred Shares, 898,765 Series AM Preferred Shares, 95,442 Series AN Preferred Shares and 774,390 Series AQ Preferred Shares, representing approximately 10% of the public float in respect of each series of Preferred Shares. The actual number of Preferred Shares to be repurchased under the NCIB and the timing of such repurchases will be at BCE’s discretion and shall be subject to the limitations set out by the TSX. BCE is making this NCIB because it believes that, from time to time, the Preferred Shares may trade in price ranges that do not fully reflect their value. BCE believes that, in such circumstances, the repurchase of its Preferred Shares represents an appropriate use of its available funds. Since the beginning of BCE’s previous NCIB for Preferred Shares on November 11, 2024 until October 31, 2025, BCE repurchased and cancelled 9,770,589 Preferred Shares with a stated capital of $243 million for a total of cost of $176 million. A copy of BCE’s Notice of Intention to Make a Normal Course Issuer Bid through the facilities of the TSX may be obtained, without charge, by contacting BCE’s Investor Relations department at investor.relations@bce.ca or by phone at 1-800-339-6353.

Disposition of Northwestel

In June 2024, Bell Canada entered into an agreement for the disposition of Northwestel to Sixty North Unity, a consortium of Indigenous communities from the Yukon, the Northwest Territories and Nunavut, for up to $1 billion, subject to adjustments. We previously expected this transaction to close in 2025 but that is no longer our expectation and we continue to work with Sixty North Unity to close the transaction in 2026. The transaction remains subject to certain closing conditions, including securing financing by Sixty North Unity and, as such, there can be no assurance that the transaction will ultimately be consummated. The results of Northwestel are included in our Bell CTS Canada segment.

Home security and monitored alarm assets

In Q2 2025, BCE entered into an agreement to sell substantially all of its home security and monitored alarm assets to a.p.i. ALARM Inc. Subsequent to quarter end, on October 1, 2025, BCE completed the previously announced sale of substantially all of its home security and monitored alarm assets to a.p.i. ALARM Inc. for $170 million.

Appointment to BCE's and Bell Canada's boards of directors; Gordon Nixon to retire as Chair, Board to nominate Louis Vachon

On November 5, 2025, Steve Weed was appointed to the BCE and Bell Canada boards of directors. Mr. Weed is the former Executive Chairman of Ziply Fiber and is Chief Executive Officer of WaveDivision Capital, a broadband investment firm which has invested in over a dozen broadband companies with the goal of bringing better broadband to more homes and businesses across the U.S. and Canada. Mr. Weed was also the founder and Chief Executive Officer of Wave Broadband, which he led from 2002 through its sale in 2018. Mr. Weed serves as an advisory board member of Consolidated Communications and as a board member of Greenlight Networks.

As previously announced, Gordon Nixon, who will reach the end of his 12-year term in 2026, will step down as Chair and will not seek re-election as a director at the BCE Annual General Shareholder Meeting on May 7, 2026. Mr. Nixon joined the Board in 2014 and served as Chair for 10 years. As part of the Board's renewal and succession plan, the Board plans to nominate BCE director Louis Vachon C.M., O.Q., as Chair of the Board, contingent upon his re-election as a director by BCE shareholders on May 7, 2026. Mr. Vachon joined the Board in 2022 and is a member of the Management Resources and Compensation Committee and Risk and Pension Fund Committee.

10 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT

As at the date of this MD&A, our forward-looking statements set out in the BCE 2024 Annual MD&A, as updated or supplemented in the BCE 2025 First Quarter MD&A, in the BCE 2025 Second Quarter MD&A and in this MD&A, are based on certain assumptions including, without limitation, the following assumptions, as well as the various assumptions referred to under the sub-sections entitled Assumptions set out in section 3, Business segment analysis of this MD&A.

Assumptions about the Canadian economy

Considerable uncertainty remains around U.S. tariffs and how changes to global trade relationships will affect economic growth and consumer prices in Canada. In particular, we have assumed:

•Slowing economic growth, given the Bank of Canada’s most recent estimated growth in Canadian gross domestic product of 1.2% in 2025, representing a decrease from the earlier estimate of 1.8%

•Low population growth driven by government policies designed to reduce the inflow of newcomers

•Modest growth in consumer spending supported by lower interest rates

•Slowing business investment, particularly by businesses in sectors most reliant on U.S. markets

•Easing consumer price index (CPI) inflation

•Ongoing labour market softness

•Interest rates expected to remain at or near current levels

•Canadian dollar expected to remain near current levels. Further movements may be impacted by the degree of strength of the U.S. dollar, interest rates and changes in commodity prices.

Assumptions about the U.S. economy

•Slowdown in consumer spending, offset by business investment

•Ongoing uncertainty surrounding trade policy

•Stable CPI inflation

•Near-term resolution to the U.S. government shutdown

Canadian market assumptions

•A higher level of wireline and wireless competition in consumer, business and wholesale markets

•Higher, but slowing, wireless industry penetration

•A shrinking data and voice connectivity market as business customers migrate to lower-priced telecommunications solutions or alternative OTT competitors

•The Canadian traditional TV and radio advertising markets are expected to be impacted by audience declines as the advertising market growth continues to shift towards digital

•Declines in broadcasting distribution undertaking (BDU) subscribers driven by increasing competition from the continued rollout of subscription video on demand (SVOD) streaming services together with further scaling of OTT aggregators

U.S. market assumptions

•A higher level of wireline pricing competition in consumer, business and wholesale markets

•Increased demand for colocation and data centre connectivity services

•A shrinking traditional voice services market as customers migrate to wireless or voice over Internet protocol (VoIP) offerings

Assumptions underlying expected continuing contribution holiday in 2025 in the majority of our pension plans

•At the relevant time, our defined benefit (DB) pension plans will remain in funded positions with going concern surpluses and maintain solvency ratios that exceed the minimum legal requirements for a contribution holiday to be taken for applicable DB and defined contribution (DC) components

•No significant declines in our DB pension plans’ financial position due to declines in investment returns or interest rates

•No material experience losses from other events such as through litigation or changes in laws, regulations or actuarial standards

2 Consolidated financial analysis

On August 1, 2025, BCE acquired Ziply Fiber, the leading fibre Internet provider in the Pacific Northwest of the U.S. providing wireline, Internet and TV services to residential, business and wholesale customers in this region. The results from the acquired Ziply Fiber operations are included in a new segment, Bell CTS U.S., from the date of acquisition.

Our results are subsequently reported in three segments: Bell CTS Canada, Bell CTS U.S. and Bell Media. Our segments reflect how we manage our business and how we classify our operations for planning and measuring performance.

This section provides detailed information and analysis about BCE’s performance in Q3 and YTD 2025 compared with Q3 and YTD 2024. It focuses on BCE’s consolidated operating results and provides financial information for our Bell CTS Canada, Bell CTS U.S. and Bell Media business segments. For further discussion and analysis of our business segments, refer to section 3, Business segment analysis.

2.1 BCE consolidated income statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Operating revenues |

|

|

|

|

|

|

|

|

| Service |

5,329 |

5,286 |

43 |

|

0.8 |

% |

15,768 |

15,786 |

(18) |

|

(0.1 |

%) |

| Product |

720 |

685 |

35 |

|

5.1 |

% |

2,296 |

2,201 |

95 |

|

4.3 |

% |

| Total operating revenues |

6,049 |

5,971 |

78 |

|

1.3 |

% |

18,064 |

17,987 |

77 |

|

0.4 |

% |

| Operating costs |

(3,287) |

(3,249) |

(38) |

|

(1.2 |

%) |

(10,070) |

(10,003) |

(67) |

|

(0.7 |

%) |

| Adjusted EBITDA |

2,762 |

2,722 |

40 |

|

1.5 |

% |

7,994 |

7,984 |

10 |

|

0.1 |

% |

| Adjusted EBITDA margin |

45.7 |

% |

45.6 |

% |

|

0.1 pts |

44.3 |

% |

44.4 |

% |

|

(0.1) pts |

| Severance, acquisition and other costs |

(82) |

(49) |

(33) |

|

(67.3 |

%) |

(370) |

(300) |

(70) |

|

(23.3 |

%) |

| Depreciation |

(969) |

(934) |

(35) |

|

(3.7 |

%) |

(2,859) |

(2,825) |

(34) |

|

(1.2 |

%) |

| Amortization |

(340) |

(325) |

(15) |

|

(4.6 |

%) |

(1,009) |

(966) |

(43) |

|

(4.5 |

%) |

| Finance costs |

|

|

|

|

|

|

|

|

| Interest expense |

(457) |

(440) |

(17) |

|

(3.9 |

%) |

(1,322) |

(1,282) |

(40) |

|

(3.1 |

%) |

| Net return on post-employment benefit plans |

26 |

16 |

10 |

|

62.5 |

% |

77 |

49 |

28 |

|

57.1 |

% |

| Impairment of assets |

(970) |

(2,113) |

1,143 |

|

54.1 |

% |

(987) |

(2,186) |

1,199 |

|

54.8 |

% |

| Gains on investments |

5,175 |

66 |

5,109 |

|

n.m. |

5,165 |

58 |

5,107 |

|

n.m. |

| Other (expense) income |

(95) |

(129) |

34 |

|

26.4 |

% |

185 |

(260) |

445 |

|

n.m. |

| Income taxes |

(495) |

(5) |

(490) |

|

n.m. |

(992) |

(402) |

(590) |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) |

4,555 |

(1,191) |

5,746 |

|

n.m. |

5,882 |

(130) |

6,012 |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) attributable to: |

|

|

|

|

|

|

|

|

| Common shareholders |

4,502 |

(1,237) |

5,739 |

|

n.m. |

5,711 |

(298) |

6,009 |

|

n.m. |

| Preferred shareholders |

38 |

45 |

(7) |

|

(15.6 |

%) |

119 |

138 |

(19) |

|

(13.8 |

%) |

| NCI |

15 |

1 |

14 |

|

n.m. |

52 |

30 |

22 |

|

73.3 |

% |

| Net earnings (loss) |

4,555 |

(1,191) |

5,746 |

|

n.m. |

5,882 |

(130) |

6,012 |

|

n.m. |

| Adjusted net earnings |

733 |

688 |

45 |

|

6.5 |

% |

1,958 |

2,054 |

(96) |

|

(4.7 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPS |

4.84 |

(1.36) |

6.20 |

|

n.m. |

6.15 |

(0.33) |

6.48 |

|

n.m. |

| Adjusted EPS |

0.79 |

0.75 |

0.04 |

|

5.3 |

% |

2.11 |

2.25 |

(0.14) |

|

(6.2 |

%) |

n.m.: not meaningful

12 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT

2.2 Customer connections

Total BCE net activations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

% change |

YTD 2025 |

YTD 2024 |

% change |

| Mobile phone net subscriber activations |

68,018 |

|

102,196 |

|

(33.4 |

%) |

161,901 |

|

258,447 |

|

(37.4 |

%) |

| Postpaid |

11,511 |

|

33,111 |

|

(65.2 |

%) |

46,460 |

|

156,858 |

|

(70.4 |

%) |

| Prepaid |

56,507 |

|

69,085 |

|

(18.2 |

%) |

115,441 |

|

101,589 |

|

13.6 |

% |

| Mobile connected device net subscriber activations |

83,505 |

|

56,216 |

|

48.5 |

% |

216,991 |

|

210,539 |

|

3.1 |

% |

| Bell CTS retail high-speed Internet net subscriber activations |

26,111 |

|

42,415 |

|

(38.4 |

%) |

40,625 |

|

97,334 |

|

(58.3 |

%) |

|

|

|

|

|

|

|

| Bell CTS - Canada |

21,426 |

|

42,415 |

|

(49.5 |

%) |

35,940 |

|

97,334 |

|

(63.1 |

%) |

| Bell CTS - U.S. |

4,685 |

|

— |

|

n.m. |

4,685 |

|

— |

|

n.m. |

| Bell CTS retail IPTV net subscriber (losses) activations |

(16,218) |

|

9,197 |

|

n.m. |

(48,040) |

|

22,058 |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bell CTS - Canada |

(16,161) |

|

9,197 |

|

n.m. |

(47,983) |

|

22,058 |

|

n.m. |

| Bell CTS - U.S. |

(57) |

|

— |

|

n.m. |

(57) |

|

— |

|

n.m. |

| Bell CTS retail residential NAS lines net losses |

(45,990) |

|

(47,674) |

|

3.5 |

% |

(138,120) |

|

(144,835) |

|

4.6 |

% |

| Bell CTS - Canada |

(42,866) |

|

(47,674) |

|

10.1 |

% |

(134,996) |

|

(144,835) |

|

6.8 |

% |

| Bell CTS - U.S. |

(3,124) |

|

— |

|

n.m. |

(3,124) |

|

— |

|

n.m. |

|

|

|

|

|

|

|

| Total services net activations |

115,426 |

|

162,350 |

|

(28.9 |

%) |

233,357 |

|

443,543 |

|

(47.4 |

%) |

n.m.: not meaningful

Total BCE customer connections

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

% change |

|

|

|

Mobile phone subscribers(1)(4)(5) |

10,398,934 |

|

10,361,720 |

|

0.4 |

% |

|

|

|

Postpaid(1) |

9,525,355 |

|

9,473,886 |

|

0.5 |

% |

|

|

|

Prepaid(4)(5) |

873,579 |

|

887,834 |

|

(1.6 |

%) |

|

|

|

Mobile connected device subscribers(1) |

3,252,554 |

|

2,943,087 |

|

10.5 |

% |

|

|

|

Bell CTS retail high-speed Internet subscribers(2)(3)(5) |

4,890,297 |

|

4,456,709 |

|

9.7 |

% |

|

|

|

|

|

|

|

|

|

|

Bell CTS - Canada(3)(5) |

4,443,387 |

|

4,456,709 |

|

(0.3 |

%) |

|

|

|

Bell CTS - U.S.(2) |

446,910 |

|

— |

|

n.m. |

|

|

|

Bell CTS retail IPTV subscribers(2)(3)(6) |

2,090,561 |

|

2,133,397 |

|

(2.0 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bell CTS - Canada(3)(6) |

2,084,529 |

|

2,133,397 |

|

(2.3 |

%) |

|

|

|

Bell CTS - U.S.(2) |

6,032 |

|

— |

|

n.m. |

|

|

|

Bell CTS retail residential NAS lines(2)(3) |

1,766,361 |

|

1,876,782 |

|

(5.9 |

%) |

|

|

|

Bell CTS - Canada(3) |

1,685,045 |

|

1,876,782 |

|

(10.2 |

%) |

|

|

|

Bell CTS - U.S.(2) |

81,316 |

|

— |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

| Total services subscribers |

22,398,707 |

|

21,771,695 |

|

2.9 |

% |

|

|

|

n.m.: not meaningful

(1)In Q3 2025, Bell CTS Canada reduced its postpaid mobile phone and connected device subscriber bases by 51,541 and 7,867, respectively, following a review of a public sector customer account to eliminate subscribers with no usage.

(2)In Q3 2025, as a result of the acquisition of Ziply Fiber on August 1, 2025, Bell CTS U.S. retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases increased by 442,225, 6,089 and 84,440 subscribers, respectively.

(3)In Q1 2025, we reduced our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases by 80,666, 441 and 14,150 subscribers, respectively, in Bell CTS Canada as at March 31, 2025, as we stopped selling new plans for these services under the Distributel, Acanac, Oricom and B2B2C brands. Additionally, at the beginning of Q1 2025, we reduced our retail high-speed Internet subscriber base by 2,783 subscribers in Bell CTS Canada to adjust for prior year customer deactivations following a review of customer accounts.

(4)In Q4 2024, we removed 124,216 Bell prepaid mobile phone subscribers from our prepaid mobile phone subscriber base in Bell CTS Canada as at December 31, 2024, as we stopped selling new plans for this service as of that date.

(5)In Q3 2024, we removed 77,971 Virgin Plus prepaid mobile phone subscribers from our prepaid mobile phone subscriber base in Bell CTS Canada as at September 30, 2024, as we stopped selling new plans for this service as of that date. Additionally, as a result of a recent CRTC decision on wholesale high-speed Internet access services, we are no longer able to resell cable Internet services to new customers in our wireline footprint as of September 12, 2024, and consequently, in Bell CTS Canada, we removed all of the existing 106,259 cable subscribers in our wireline footprint from our retail high-speed Internet subscriber base as of that date.

(6)In Q2 2024, we increased our retail IPTV subscriber base by 40,997 in Bell CTS Canada to align the deactivation policy for our Fibe TV streaming services to our traditional Fibe TV service.

BCE total services net subscriber activations were 115,426 in Q3 2025, down 28.9% compared to Q3 2024. The total services net subscriber activations in Q3 2025 consisted of:

•68,018 mobile phone and 83,505 mobile connected device net subscriber activations

•26,111 Bell CTS retail high-speed Internet net subscriber activations, composed of:

•Bell CTS Canada net subscriber activations of 21,426

•Bell CTS U.S. net subscriber activations of 4,685

•16,218 Bell CTS retail IPTV net subscriber losses, composed of:

•Bell CTS Canada net subscriber losses of 16,161

•Bell CTS U.S. net subscriber losses of 57

•45,990 Bell CTS retail residential NAS lines net losses, composed of:

•Bell CTS Canada net losses of 42,866

•Bell CTS U.S. net losses of 3,124

In the first nine months of the year, BCE added 233,357 total services net subscriber activations, down 47.4% compared to the same period in 2024. The total services net subscriber activations in the first nine months of 2025 consisted of:

•161,901 mobile phone and 216,991 mobile connected device net subscriber activations

•40,625 Bell CTS retail high-speed Internet net subscriber activations, composed of:

•Bell CTS Canada net subscriber activations of 35,940

•Bell CTS U.S. net subscriber activations of 4,685

•48,040 Bell CTS retail IPTV net subscriber losses, composed of:

•Bell CTS Canada net subscriber losses of 47,983

•Bell CTS U.S. net subscriber losses of 57

•138,120 Bell CTS retail residential NAS lines net losses, composed of:

•Bell CTS Canada net losses of 134,996

•Bell CTS U.S. net losses of 3,124

At September 30, 2025, BCE's customer connections totalled 22,398,707, up 2.9% year over year, and consisted of:

•10,398,934 mobile phone subscribers, up 0.4% year over year, and 3,252,554 mobile connected device subscribers, up 10.5% year over year

•4,890,297 Bell CTS retail high-speed Internet subscribers, up 9.7% year over year, composed of:

•Bell CTS Canada subscribers of 4,443,387, down 0.3% year over year

•Bell CTS U.S. subscribers of 446,910, compared to nil last year, as a result of the acquisition of Ziply Fiber on August 1, 2025

•2,090,561 Bell CTS retail IPTV subscribers, down 2.0% year over year, composed of:

•Bell CTS Canada subscribers of 2,084,529, down 2.3% year over year

•Bell CTS U.S. subscribers of 6,032, compared to nil last year, as a result of the acquisition of Ziply Fiber

•1,766,361 Bell CTS retail residential NAS lines, down 5.9% year over year, composed of:

•Bell CTS Canada lines of 1,685,045, down 10.2% year over year

•Bell CTS U.S. lines of 81,316, compared to nil in last year, as a result of the acquisition of Ziply Fiber

14 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT

2.3 Operating revenues

|

|

|

|

|

|

|

|

|

| BCE |

|

BCE |

| Revenues |

|

Revenues |

| (in $ millions) |

|

(in $ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

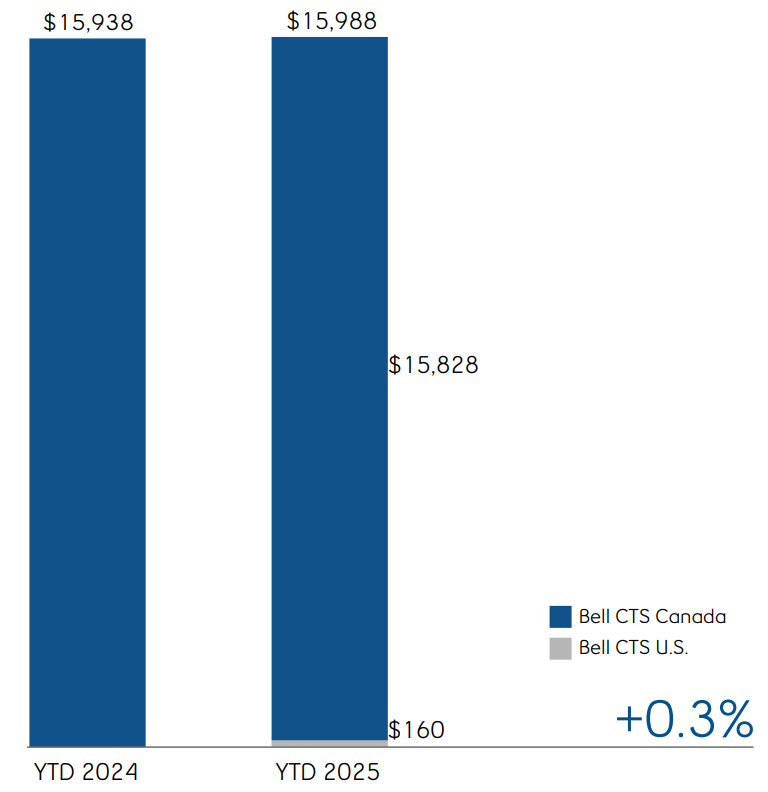

| Bell CTS |

5,408 |

|

5,280 |

|

128 |

|

2.4 |

% |

15,988 |

|

15,938 |

|

50 |

|

0.3 |

% |

| Bell CTS - Canada |

5,248 |

|

5,280 |

|

(32) |

|

(0.6 |

%) |

15,828 |

|

15,938 |

|

(110) |

|

(0.7 |

%) |

| Bell CTS - U.S. |

160 |

|

— |

|

160 |

|

n.m. |

160 |

|

— |

|

160 |

|

n.m. |

|

|

|

|

|

|

|

|

|

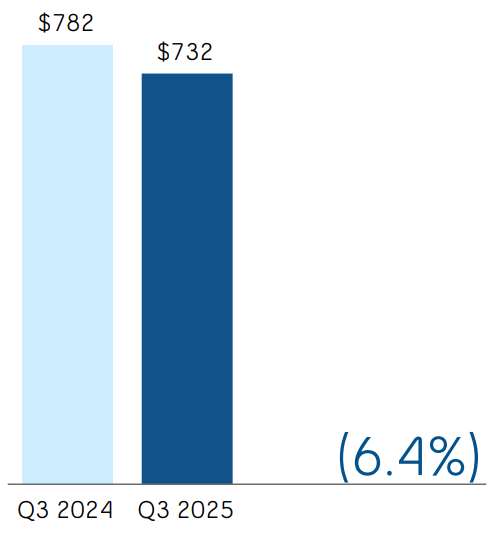

| Bell Media |

732 |

|

782 |

|

(50) |

|

(6.4 |

%) |

2,350 |

|

2,319 |

|

31 |

|

1.3 |

% |

| Inter-segment eliminations |

(91) |

|

(91) |

|

— |

|

— |

|

(274) |

|

(270) |

|

(4) |

|

(1.5 |

%) |

| Total BCE operating revenues |

6,049 |

|

5,971 |

|

78 |

|

1.3 |

% |

18,064 |

|

17,987 |

|

77 |

|

0.4 |

% |

n.m.: not meaningful

BCE

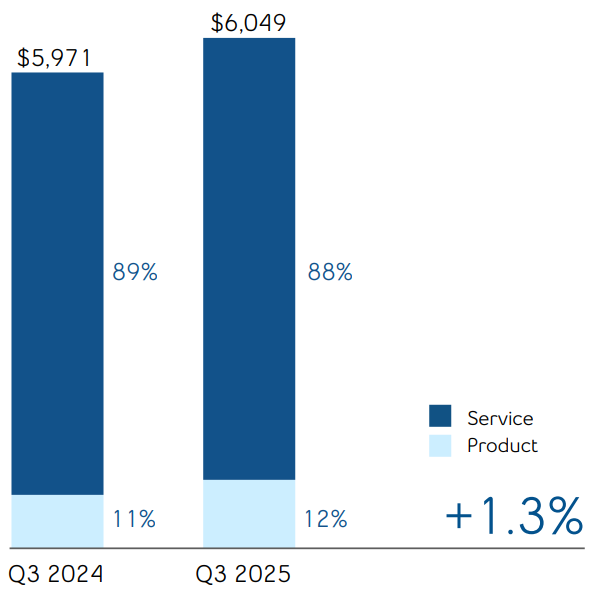

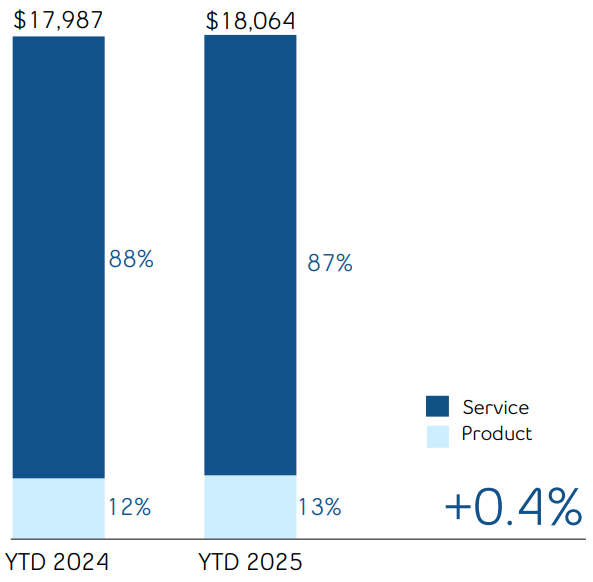

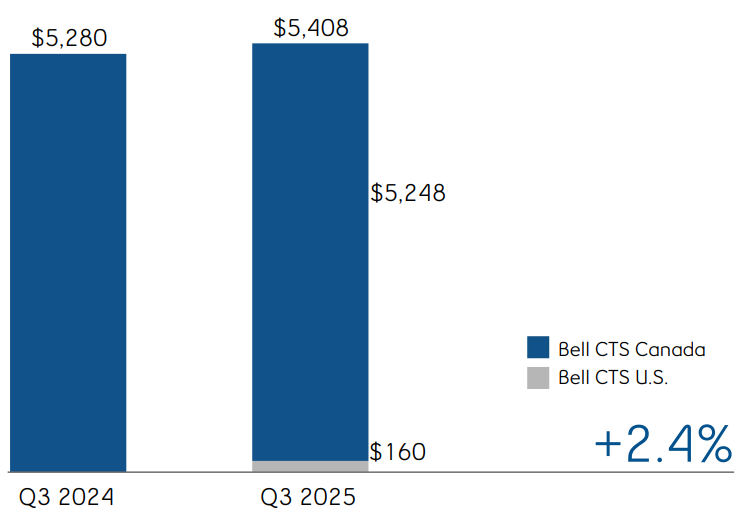

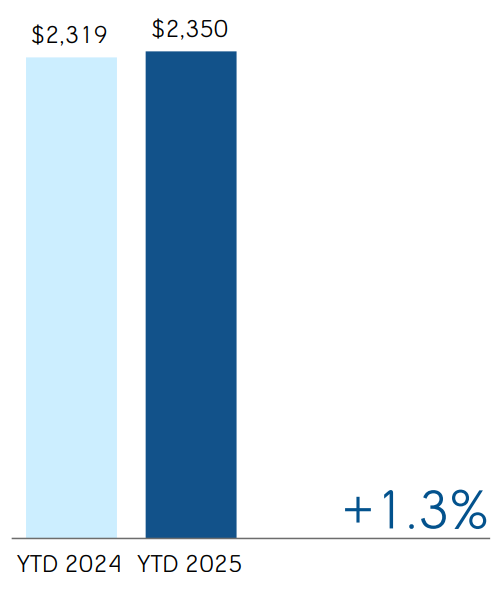

BCE operating revenues increased by 1.3% in Q3 2025, compared to the same period last year, driven by both higher service and product revenues. During the first nine months of 2025, BCE operating revenues grew by 0.4% year over year, from higher product revenues, moderated by lower service revenues. Service revenues of $5,329 million in Q3 2025 increased by 0.8% compared to Q3 2024, while service revenues of $15,768 million year to date, declined by 0.1% year over year. Product revenues of $720 million in Q3 2025 and $2,296 million year to date, increased by 5.1% and 4.3%, respectively, over the same periods in 2024.

The year-over-year growth in Q3 2025 operating revenues was driven by an increase from Bell CTS of 2.4% as a result of the contribution from our Bell CTS U.S. segment, due to the acquisition of Ziply Fiber on August 1, 2025, moderated by a decline in our Bell CTS Canada segment of 0.6%, as well as reflecting a decline in our Bell Media segment of 6.4%. Year-to-date revenues grew by 0.4% year over year, due to an increase in Bell CTS of 0.3% from the contribution of Bell CTS U.S, moderated by a decrease in Bell CTS Canada of 0.7%, along with an increase in Bell Media of 1.3%.

2.4 Operating costs

|

|

|

|

|

|

| BCE |

BCE |

| Operating cost profile |

Operating cost profile |

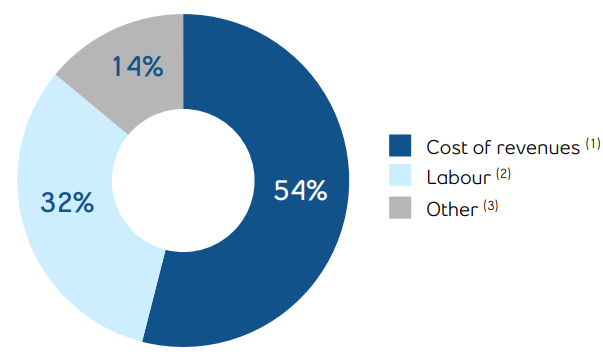

| Q3 2024 |

Q3 2025 |

|

|

| BCE |

BCE |

| Operating cost profile |

Operating cost profile |

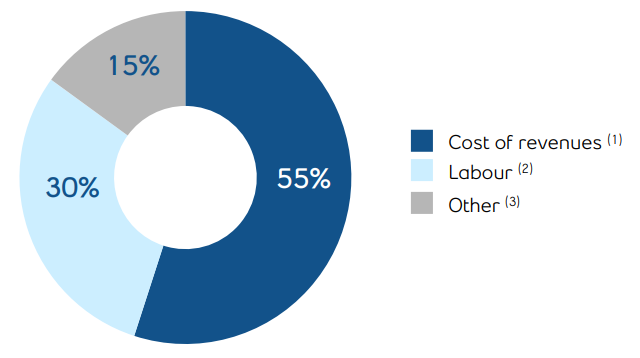

| YTD 2024 |

YTD 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Bell CTS |

(2,883) |

|

(2,812) |

|

(71) |

|

(2.5 |

%) |

(8,625) |

|

(8,543) |

|

(82) |

|

(1.0 |

%) |

| Bell CTS - Canada |

(2,794) |

|

(2,812) |

|

18 |

|

0.6 |

% |

(8,536) |

|

(8,543) |

|

7 |

|

0.1 |

% |

| Bell CTS - U.S. |

(89) |

|

— |

|

(89) |

|

n.m. |

(89) |

|

— |

|

(89) |

|

n.m. |

|

|

|

|

|

|

|

|

|

| Bell Media |

(495) |

|

(528) |

|

33 |

|

6.3 |

% |

(1,719) |

|

(1,730) |

|

11 |

|

0.6 |

% |

| Inter-segment eliminations |

91 |

|

91 |

|

— |

|

— |

|

274 |

|

270 |

|

4 |

|

1.5 |

% |

| Total BCE operating costs |

(3,287) |

|

(3,249) |

|

(38) |

|

(1.2 |

%) |

(10,070) |

|

(10,003) |

|

(67) |

|

(0.7 |

%) |

n.m.: not meaningful

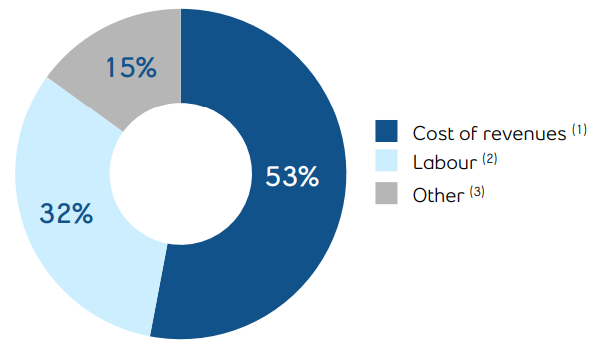

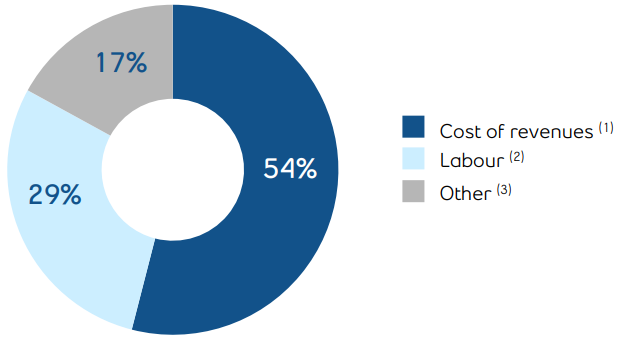

(1)Cost of revenues includes costs of wireless devices and other equipment sold, network and content costs, and payments to other carriers.

(2)Labour costs (net of capitalized costs) include wages, salaries and related taxes and benefits, post-employment benefit plans service cost, and other labour costs, including contractor and outsourcing costs.

(3)Other operating costs include marketing, advertising and sales commission costs, bad debt expense, taxes other than income taxes, IT costs, professional service fees and rent.

BCE

BCE operating costs increased by 1.2% in Q3 2025, and by 0.7% in the first nine months of the year, compared to the same periods in 2024, driven by higher expenses in Bell CTS of 2.5% and 1.0%, respectively, due to increased costs from Bell CTS U.S. of $89 million in both the quarter and year to date reflecting the operating costs of Ziply Fiber as a result of the acquisition on August 1, 2025, partly offset by reductions in Bell CTS Canada of 0.6% in Q3 2025 and 0.1% year to date, as well as reflecting lower costs in Bell Media of 6.3% and 0.6%, respectively.

16 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT

2.5 Net earnings (loss)

|

|

|

|

|

|

|

|

|

| BCE |

|

BCE |

| Net earnings (loss) |

|

Net earnings (loss) |

| (in $ millions) |

|

(in $ millions) |

|

|

|

Net earnings in the third quarter of 2025 increased by $5,746 million, compared to the same period last year, mainly due to higher gains on investments resulting from the sale of our minority stake in MLSE and lower impairment of assets primarily in our Bell Media segment, partly offset by higher income taxes.

Net earnings on a year-to-date basis in 2025 increased by $6,012 million, compared to the same period last year, mainly due to higher gains on investments resulting from the sale of our minority stake in MLSE, lower impairment of assets primarily in our Bell Media segment as well as higher other income from early debt redemption gains, partly offset by higher income taxes.

|

|

|

|

|

|

|

|

|

| BCE |

|

BCE |

| Adjusted EBITDA |

|

Adjusted EBITDA |

| (in $ millions) |

|

(in $ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q3 2025 |

Q3 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

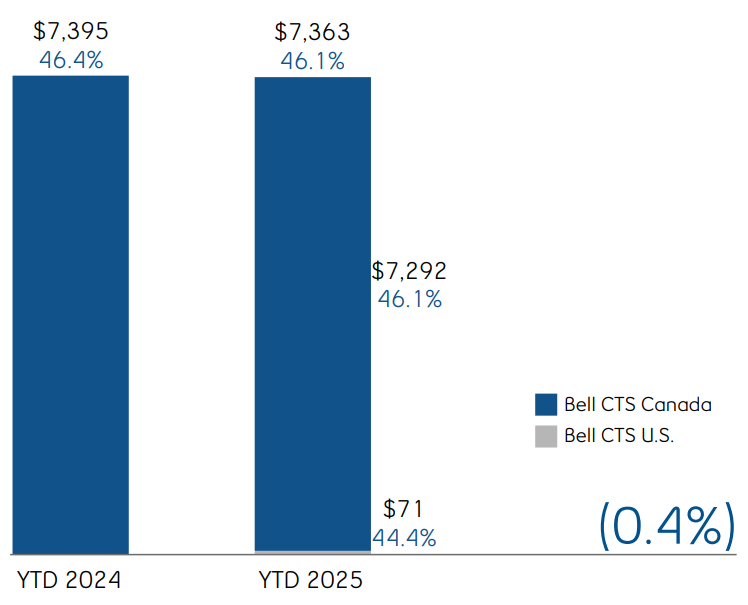

Bell CTS(1) |

2,525 |

|

2,468 |

|

57 |

|

2.3 |

% |

7,363 |

|

7,395 |

|

(32) |

|

(0.4 |

%) |

| Adjusted EBITDA margin |

46.7 |

% |

46.7 |

% |

|

— |

|

46.1 |

% |

46.4 |

% |

|

(0.3) pts |

| Bell CTS - Canada |

2,454 |

|

2,468 |

|

(14) |

|

(0.6 |

%) |

7,292 |

|

7,395 |

|

(103) |

|

(1.4 |

%) |

| Adjusted EBITDA margin |

46.8 |

% |

46.7 |

% |

|

0.1 pts |

46.1 |

% |

46.4 |

% |

|

(0.3) pts |

| Bell CTS - U.S. |

71 |

|

— |

|

71 |

|

n.m. |

71 |

|

— |

|

71 |

|

n.m. |

| Adjusted EBITDA margin |

44.4 |

% |

— |

|

|

44.4 pts |

44.4 |

% |

— |

|

|

44.4 pts |

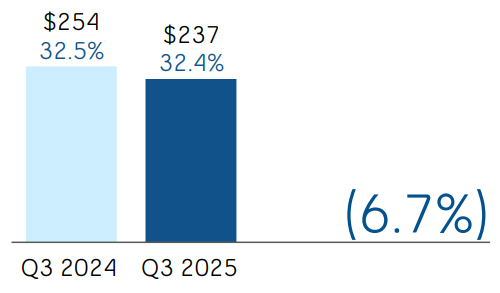

| Bell Media |

237 |

|

254 |

|

(17) |

|

(6.7 |

%) |

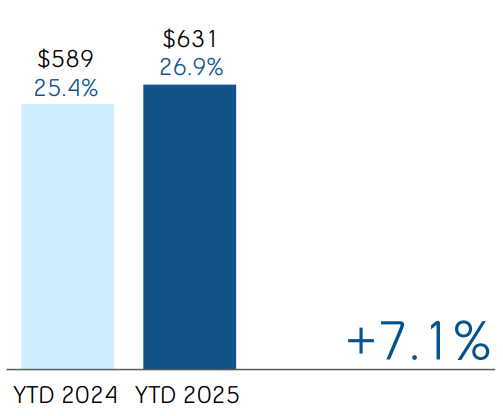

631 |

|

589 |

|

42 |

|

7.1 |

% |

| Adjusted EBITDA margin |

32.4 |

% |

32.5 |

% |

|

(0.1) pts |

26.9 |

% |

25.4 |

% |

|

1.5 pts |

| Total BCE adjusted EBITDA |

2,762 |

|

2,722 |

|

40 |

|

1.5 |

% |

7,994 |

|

7,984 |

|

10 |

|

0.1 |

% |

| Adjusted EBITDA margin |

45.7 |

% |

45.6 |

% |

|

0.1 pts |

44.3 |

% |

44.4 |

% |

|

(0.1) pts |

n.m.: not meaningful

(1)Bell CTS adjusted EBITDA is a total of segments measure. See section 8.3, Total of segments measures in this MD&A for more information on this measure.

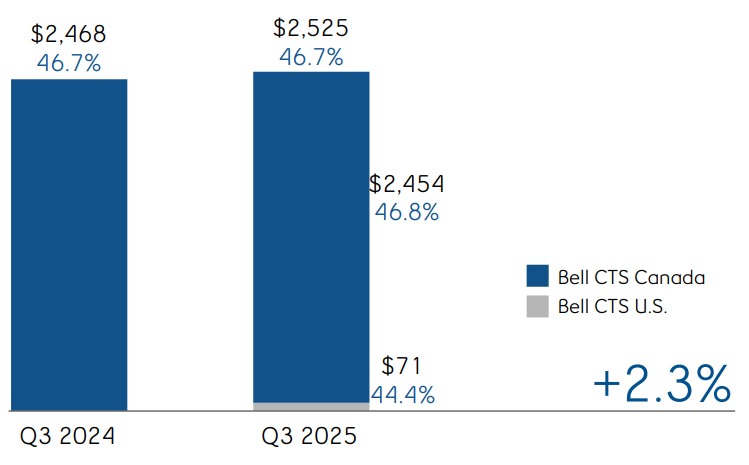

BCE

BCE adjusted EBITDA increased by 1.5% in Q3 2025, compared to the same period last year, driven by an increase in Bell CTS of 2.3% due to the contribution from our Bell CTS U.S. segment of $71 million resulting from the acquisition of Ziply Fiber on August 1, 2025, partly offset by a decline in our Bell CTS Canada segment of 0.6%, along with a decline in our Bell Media segment of 6.7%. During the first nine months of the year, BCE adjusted EBITDA grew by 0.1% year over year, from an increase in Bell Media of 7.1%, partly offset by a decline in Bell CTS of 0.4% from a decrease in Bell CTS Canada of 1.4%, partly offset by the contribution from Bell CTS U.S. of $71 million. This drove an adjusted EBITDA margin of 45.7% in Q3 2025 and 44.3% year to date, which was essentially stable year over year, up 0.1 pts in Q3 2025 and down 0.1 pts year to date.

18 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT Severance, acquisition and other costs of $82 million in the third quarter of 2025 and $370 million on a year-to-date basis included:

2.7 Severance, acquisition and other costs

2025

•Severance costs of $5 million in Q3 2025 and $250 million on a year-to-date basis related to involuntary and voluntary employee terminations

•Acquisition and other costs of $77 million in Q3 2025 and $120 million on a year-to-date basis

2024

Severance, acquisition and other costs of $49 million in the third quarter of 2024 and $300 million on a year-to-date basis included:

•Severance costs of $16 million in Q3 2024 and $246 million on a year-to-date basis related to involuntary and voluntary employee terminations

•Acquisition and other costs of $33 million in Q3 2024 and $54 million on a year-to-date basis

2.8 Depreciation and amortization

Depreciation

Depreciation in the third quarter and on a year-to-date basis in 2025 increased by $35 million and $34 million, respectively, compared to the same periods in 2024, mainly due to a higher asset base as a result of the acquisition of Ziply Fiber on August 1, 2025.

Amortization

Amortization in the third quarter and on a year-to-date basis in 2025 increased by $15 million and $43 million, respectively, compared to the same periods in 2024, mainly due to a higher asset base.

Interest expense

Interest expense in the third quarter of 2025 increased by $17 million compared to the same period last year, mainly due to higher average cost of debt and higher debt balances as a result of the acquisition of Ziply Fiber on August 1, 2025.

Interest expense in the first nine months of 2025 increased by $40 million compared to the same period last year, mainly due to higher debt balances as a result of the acquisition of Ziply Fiber on August 1, 2025 and higher average cost of debt.

Net return on post-employment benefit plans

Net return on our post-employment benefit plans is based on market conditions that existed at the beginning of the year as well as the net post-employment benefit plan asset (liability). On January 1, 2025, the discount rate was 4.7% compared to 4.6% on January 1, 2024.

In the third quarter and on a year-to-date basis in 2025, net return on post-employment benefit plans increased by $10 million and $28 million, respectively, compared to the same periods last year, as a result of a higher discount rate in 2025 and a higher net asset position.

The impacts of changes in market conditions during the year are recognized in Other comprehensive income (OCI).

2.10 Impairment of assets

2025

During the third quarter of 2025, we identified indicators of impairment for our Bell Media TV services, radio markets and out-of-home (OOH) advertising business, due to a decline in legacy advertising demand and spending in the linear advertising market as we transition to digital. Accordingly, impairment testing was required for certain groups of cash-generating units (CGUs) as well as for goodwill for the Bell Media group of CGUs.

We recognized $976 million of impairment charges for English and French TV services, radio markets and our OOH advertising business within our Bell Media segment. These charges included $554 million allocated to indefinite-life intangible assets for broadcast licences, spectrum and other licences and brands, $250 million allocated to program and feature film rights, $111 million allocated to property, plant and equipment for network, infrastructure and equipment and assets under construction, $39 million allocated to software, $18 million allocated to prepaid expenses and inventory, and $4 million allocated to finite-life intangible assets mainly for trademarks.

There was no impairment of Bell Media goodwill.

2024

During the third quarter of 2024, we identified indicators of impairment for our Bell Media TV services and radio markets, due to a further decline in advertising demand and spending in the linear advertising market. Accordingly, impairment testing was required for certain groups of CGUs as well as for goodwill for the Bell Media group of CGUs.

We recognized $958 million of impairment charges for English and French TV services and radio markets within our Bell Media segment. These charges included $627 million allocated to indefinite-life intangible assets for broadcast licences and brands, $144 million allocated to program and feature film rights, $85 million allocated to property, plant and equipment for network and infrastructure and equipment, $85 million allocated to software, $10 million allocated to finite-life intangible assets mainly for trademarks, and $7 million allocated to prepaid expenses.

We recorded $1,132 million of impairment charges for goodwill.

Additionally, for the three and nine months ended September 30, 2024, impairment charges of $23 million and $96 million, respectively, relate mainly to right-of-use assets for certain office spaces we ceased using as part of our real estate optimization strategy as a result of our hybrid work policy.

2.11 Gains on investments

2025

In the third quarter and on a year-to-date basis in 2025, gains on investments of $5,175 million and $5,165 million, respectively, included a $5.2 billion gain on sale of our minority stake in MLSE on July 1, 2025.

2024

In the third quarter and on a year-to-date basis in 2024, gains on investments of $66 million and $58 million, respectively, included a gain related to an obligation to repurchase at fair value the minority interest in one of our subsidiaries.

2.12 Other (expense) income

2025

Other expense of $95 million in the third quarter of 2025 included early debt redemption costs due to the redemption by Bell Canada of the outstanding principal amounts of Ziply Fiber's Term Notes and Funding Notes.

Other income of $185 million on a year-to-date basis in 2025 included early debt redemption gains due to the repurchase by Bell Canada, as a result of its cash tender offers, of a portion of its Series M-39, M-45, M-51 and M-55 MTN debentures, and a portion of its Series US-2, US-4, US-5, US-6, and US-7 Notes, and interest income, partly offset by early debt redemption costs due to the redemption by Bell Canada of the outstanding principal amounts of Ziply Fiber's Term Notes and Funding Notes, and foreign exchange losses on derivatives used to economically hedge anticipated purchases and the acquisition of Ziply Fiber in foreign currencies.

2024

Other expense of $129 million in the third quarter of 2024 included losses on our equity investments in associates and joint ventures, which included a loss on BCE's share of an obligation to repurchase at fair value the minority interest in MLSE, partly offset by net mark-to-market gains on derivatives used to economically hedge equity settled share-based compensation plans.

Other expense of $260 million on a year-to-date basis in 2024 included losses on our equity investments in associates and joint ventures, which included a loss on BCE's share of an obligation to repurchase at fair value the minority interest in MLSE, net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans and losses on retirements and disposals of property, plant and equipment and intangible assets, partly offset by interest income.

20 BCE Inc. 2025 THIRD QUARTER SHAREHOLDER REPORT