Document

Management's discussion and analysis

Table of contents

Management’s discussion and analysis

In this management’s discussion and analysis (MD&A), we, us, our, BCE and the company mean, as the context may require, either BCE Inc. or, collectively, BCE Inc., Bell Canada, their subsidiaries, joint arrangements and associates. Bell means, as the context may require, either Bell Canada or, collectively, Bell Canada, its subsidiaries, joint arrangements and associates.

All amounts in this MD&A are in millions of Canadian dollars, except where noted. Please refer to section 9, Non-GAAP financial measures, other financial measures and key performance indicators (KPIs) for a list of defined non-GAAP financial measures, other financial measures and KPIs.

Please refer to BCE’s unaudited consolidated financial statements for the second quarter of 2025 (Q2 2025 Financial Statements) when reading this MD&A as well as BCE’s news release to be dated August 7, 2025 announcing BCE’s financial results for the three months and six months ended June 30, 2025 and 2024 (BCE 2025 Second Quarter News Release). We also encourage you to read BCE’s MD&A for the year ended December 31, 2024 dated March 6, 2025 (BCE 2024 Annual MD&A) as updated in BCE's MD&A for the first quarter of 2025 dated May 7, 2025 (BCE 2025 First Quarter MD&A). In preparing this MD&A, we have taken into account information available to us up to August 6, 2025, the date of this MD&A, unless otherwise stated.

You will find additional information relating to BCE, including BCE’s annual information form for the year ended December 31, 2024 dated March 6, 2025 (BCE 2024 AIF) and recent financial reports, including the BCE 2024 Annual MD&A, the BCE 2025 First Quarter MD&A, and the BCE 2025 Second Quarter News Release on BCE’s website at BCE.ca, on SEDAR+ at sedarplus.ca and on EDGAR at sec.gov.

Documents and other information contained in BCE’s website including, without limitation, the BCE 2025 Second Quarter News Release, or in any other site referred to in BCE’s website or in this MD&A are not part of this MD&A and are not incorporated by reference herein.

This MD&A comments on our business operations, performance, financial position and other matters for the three months (Q2) and six months (YTD) ended June 30, 2025 and 2024.

Caution regarding forward-looking statements

This MD&A and, in particular, but without limitation, section 1.2, Key corporate and business developments, section 3.1, Bell CTS, section 3.2, Bell Media, the section and sub-sections entitled Assumptions and section 4.7, Liquidity, contain forward-looking statements. These forward-looking statements include, without limitation, statements relating to: the acquisition by Bell Canada of Northwest Fiber Holdco, LLC (doing business as Ziply Fiber (Ziply Fiber)), certain potential benefits expected to result from this acquisition and Bell Canada’s growth prospects and strategic priorities; the proposed disposition of substantially all of BCE’s home security and monitored alarm assets to a.p.i. ALARM Inc., the expected timing and completion thereof and the expected amount of proceeds to result from this proposed disposition; Bell Canada’s launch of Bell AI Fabric intended to create a national initiative to support Canada's artificial intelligence (AI) ecosystem, the benefits expected to result from the launch of Bell AI Fabric, the expected number of AI data centres to be launched by the end of 2026 and Bell Canada’s long-term objective to drive AI innovation and economic growth in Canada; the sources of liquidity we expect to use to meet our 2025 cash requirements, BCE's annualized common share dividend and BCE's common share dividend payout policy target; BCE’s business outlook, objectives, plans and strategic priorities, and other statements that do not refer to historical facts. A statement we make is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements are typically identified by the words assumption, goal, guidance, objective, outlook, project, strategy, target, commitment and other similar expressions or future or conditional verbs such as aim, anticipate, believe, could, expect, intend, may, plan, seek, should, strive and will. All such forward-looking statements are made pursuant to the safe harbour provisions of applicable Canadian securities laws and of the United States (U.S.) Private Securities Litigation Reform Act of 1995.

Unless otherwise indicated by us, forward-looking statements in this MD&A describe our expectations as at August 6, 2025 and, accordingly, are subject to change after that date. Except as may be required by applicable securities laws, we do not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements, by their very nature, are subject to inherent risks and uncertainties and are based on several assumptions, both general and specific, which give rise to the possibility that actual results or events could differ materially from our expectations expressed in, or implied by, such forward-looking statements and that our business outlook, objectives, plans and strategic priorities may not be achieved. These statements are not guarantees of future performance or events, and we caution you against relying on any of these forward-looking statements. Forward-looking statements are presented in this MD&A for the purpose of assisting investors and others in understanding our objectives, strategic priorities and business outlook as well as our anticipated operating environment. Readers are cautioned, however, that such information may not be appropriate for other purposes.

We have made certain economic, market, operational and other assumptions in preparing the forward-looking statements contained in this MD&A and, in particular, but without limitation, the forward-looking statements contained in the previously

4 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

mentioned sections of this MD&A. These assumptions include, without limitation, the assumptions described in the section and sub-sections of this MD&A entitled Assumptions, which section and sub-sections are incorporated by reference in this cautionary statement. Subject to various factors, we believe that our assumptions were reasonable at August 6, 2025. If our assumptions turn out to be inaccurate, our actual results could be materially different from what we expect.

Important risk factors that could cause actual results or events to differ materially from those expressed in, or implied by, the previously-mentioned forward-looking statements and other forward-looking statements contained in this MD&A, include, but are not limited to: the negative effect of adverse economic conditions, including from trade tariffs and other protective government measures, including the imposition of U.S. tariffs on imports from Canada and retaliatory tariffs by the Canadian government on goods coming from the U.S., recessions, inflation, reductions in immigration levels, high housing support costs relative to income, and financial and capital market volatility, and the resulting negative impact on customer spending and the demand for our products and services, higher costs and supply chain disruptions; the negative effect of adverse conditions associated with geopolitical events; the intensity of competitive activity and the failure to effectively respond to evolving competitive dynamics; the level of technological substitution and the presence of alternative service providers contributing to disruptions and disintermediation in each of our business segments; changing customer behaviour and the expansion of cloud-based, over-the-top (OTT) and other alternative solutions; advertising market pressures from economic conditions, fragmentation and non-traditional/global digital services; rising content costs and challenges in our ability to acquire or develop key content; high Canadian Internet and smartphone penetration; regulatory initiatives, proceedings and decisions, government consultations and government positions that negatively affect us and influence our business including, without limitation, concerning mandatory access to networks, spectrum auctions, the imposition of consumer-related codes of conduct, approval of acquisitions, broadcast and spectrum licensing, foreign ownership requirements, privacy and cybersecurity obligations and control of copyright piracy; the inability to implement enhanced compliance frameworks and to comply with legal and regulatory obligations; unfavourable resolution of legal proceedings; the failure to evolve and transform our networks, systems and operations using next-generation technologies while lowering our cost structure, including the failure to meet customer expectations of product and service experience; the inability to drive a positive customer experience; the inability to protect our physical and non-physical assets from events such as information security attacks, unauthorized access or entry, fire and natural disasters; the failure to implement an effective security and data governance framework; the risk that we may need to incur significant capital expenditures to provide additional capacity and reduce network congestion; service interruptions or outages due to network failures or slowdowns; events affecting the functionality of, and our ability to protect, test, maintain, replace and upgrade, our networks, information technology (IT) systems, equipment and other facilities; the failure by other telecommunications carriers on which we rely to provide services to complete planned and sufficient testing, maintenance, replacement or upgrade of their networks, equipment and other facilities, which could disrupt our operations including through network or other infrastructure failures; the complexity of our operations and IT systems and the failure to implement, maintain or manage highly effective processes and IT systems; in-orbit and other operational risks to which the satellites used to provide our satellite television (TV) services are subject; the failure to attract, develop and retain a talented team capable of furthering our strategic imperatives and operational transformation; the potential deterioration in employee morale and engagement resulting from staff reductions, cost reductions or reorganizations and the de-prioritization of transformation initiatives due to staff reductions, cost reductions or reorganizations; the failure to adequately manage health and safety concerns; labour disruptions and shortages; the inability to access adequate sources of capital and generate sufficient cash flows from operating activities to meet our cash requirements, fund capital expenditures and provide for planned growth; uncertainty as to whether our dividend payout policy will be maintained or achieved, or that the dividend on common shares will be maintained or dividends on any of BCE’s outstanding shares will be declared by BCE’s board of directors (the Board); the failure to reduce costs and adequately assess investment priorities, as well as unexpected increases in costs; the inability to manage various credit, liquidity and market risks; the failure to evolve practices to effectively monitor and control fraudulent activities; new or higher taxes due to new tax laws or changes thereto or in the interpretation thereof, and the inability to predict the outcome of government audits; the impact on our financial statements and estimates from a number of factors; pension obligation volatility and increased contributions to post-employment benefit plans; the expected timing and completion of the proposed disposition of Northwestel Inc. (Northwestel) are subject to closing conditions, termination rights and other risks and uncertainties, including, without limitation, the purchaser securing financing and the completion of confirmatory due diligence, which may affect its completion, terms or timing and, as such, there can be no assurance that the proposed disposition will occur, or that it will occur on the terms and conditions, or at the time, currently contemplated, or that the potential benefits expected to result from the proposed disposition will be realized; the expected timing and completion of the transaction relating to the formation of Network FiberCo, a long-term strategic partnership to accelerate the development of fibre infrastructure through Ziply Fiber in underserved markets in the U.S., are subject to customary closing conditions and other risks and uncertainties, which may affect its completion, terms or timing and, as such, there can be no assurance that the transaction relating to the formation of Network FiberCo will occur, or that it will occur on the terms and conditions, or at the time, currently contemplated, or that the potential benefits expected to result therefrom will be realized; reputational risks and the inability to meaningfully integrate environmental, social and governance (ESG) considerations into our business strategy, operations and governance; the adverse impact of various internal and external factors on our ability to achieve our ESG targets including, without limitation, those related to greenhouse gas (GHG) reduction and supplier engagement; the failure to take appropriate actions to adapt to current and emerging environmental impacts, including climate change; the failure to develop and implement sufficient corporate governance practices; the inability to adequately manage social issues; health risks, including pandemics, epidemics and other health concerns, such as radio frequency emissions from wireless communications devices and equipment; our dependence on third-party suppliers, outsourcers and consultants to provide an uninterrupted supply of the products and services we need; the failure of our vendor selection, governance and oversight processes, including our management of supplier risk in the areas of security, data governance and responsible procurement; the quality of our products and services and the extent to which they may be subject to defects or fail to comply with applicable government regulations and standards; the failure to successfully expand Ziply Fiber’s fibre network and optimize its existing copper network; the inability of Ziply Fiber’s current and future initiatives or programs to generate the level of returns, or to occur on the timeline, we anticipate; the intensity of competitive activity in Ziply Fiber’s services market in the U.S., and the failure to effectively respond to fragmented and rapidly evolving competitive dynamics; the failure to successfully integrate Ziply Fiber as a subsidiary of BCE, and to generate the anticipated benefits from the acquisition of Ziply Fiber; the failure to accurately anticipate fluctuations in the exchange rate between the Canadian dollar and U.S. dollar and our inability to successfully implement currency hedging strategies; Ziply Fiber is subject to significant regulation in the U.S. which may reduce the amount of subsidies or revenues it receives, increase its compliance burdens or constrain its ability to compete; the failure to comply with the non-U.S. ownership rules and our regulatory obligations imposed by the Federal Communications Commission (FCC); changes to tax legislation in the U.S., Canada, or other relevant jurisdictions, or to its interpretation or enforcement, may affect Ziply Fiber’s income tax position, as well as our effective tax rate and the after-tax returns we derive from Ziply Fiber’s U.S. operations.

We caution that the foregoing list of risk factors is not exhaustive and other factors could also materially adversely affect us. Please see section 9, Business risks of the BCE 2024 Annual MD&A for a more complete description of the above-mentioned and other risks, which section, and the other sections of the BCE 2024 Annual MD&A referred to therein, are incorporated by reference in this cautionary statement. Please also see section 6, Regulatory environment in the BCE 2025 First Quarter MD&A and in this MD&A for an update to the regulatory initiatives and proceedings described in the BCE 2024 Annual MD&A, which sections 6 are incorporated by reference in this cautionary statement. Please also see section 7, Business risks in this MD&A for a description of the risk factors relating to Ziply Fiber, which section 7 is incorporated by reference in this cautionary statement. Any of those risks could cause actual results or events to differ materially from our expectations expressed in, or implied by, the forward-looking statements set out in this MD&A. Except for the updates set out in section 6, Regulatory environment in the BCE 2025 First Quarter MD&A and in this MD&A, as well as in section 7, Business risks in this MD&A, the risks described in the BCE 2024 Annual MD&A remain substantially unchanged.

Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also have a material adverse effect on our business, financial condition, liquidity, financial results or reputation. We regularly consider potential acquisitions, dispositions, mergers, business combinations, investments, monetizations, joint ventures and other transactions, some of which may be significant. Except as otherwise indicated by us, forward-looking statements do not reflect the potential impact of any such transactions or of special items that may be announced or that may occur after August 6, 2025. The financial impact of these transactions and special items can be complex and depends on facts particular to each of them. We therefore cannot describe the expected impact in a meaningful way, or in the same way we present known risks affecting our business.

6 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

1 Overview

BCE Q2 2025 selected quarterly information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating revenues |

Net earnings |

Adjusted EBITDA(1) |

|

| $6,085 |

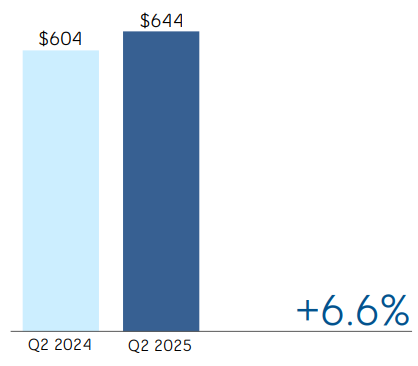

$644 |

$2,674 |

|

| million |

million |

million |

|

+1.3% vs. Q2 2024 |

+6.6% vs. Q2 2024 |

(0.9%) vs. Q2 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings attributable to common shareholders |

Adjusted net earnings(1) |

Cash flows from operating activities |

Free cash flow(1) |

|

| $579 |

$592 |

$1,947 |

$1,152 |

|

| million |

million |

million |

million |

|

+7.8% vs. Q2 2024 |

(16.9%) vs. Q2 2024 |

(8.9%) vs. Q2 2024 |

+5.0% vs. Q2 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total mobile phones(3)(4) |

Retail high-speed Internet(2)(4) |

Retail internet protocol television (IPTV)(2)(5) |

Retail residential network access services (NAS) lines(2) |

| +0.4% |

(2.2%) |

(1.1%) |

(10.2%) |

|

10.4 million subscribers

at June 30, 2025

|

4.4 million subscribers

at June 30, 2025

|

2.1 million subscribers

at June 30, 2025

|

1.7 million subscribers

at June 30, 2025

|

(1)Adjusted EBITDA is a total of segments measure, and adjusted net earnings and free cash flow are non-GAAP financial measures. See section 9.3, Total of segments measures and section 9.1, Non-GAAP financial measures in this MD&A for more information on these measures.

(2)In Q1 2025, we reduced our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases by 80,666, 441 and 14,150 subscribers, respectively, as at March 31, 2025, as we stopped selling new plans for these services under the Distributel, Acanac, Oricom and B2B2C brands. Additionally, at the beginning of Q1 2025, we reduced our retail high-speed Internet subscriber base by 2,783 subscribers to adjust for prior year customer deactivations following a review of customer accounts.

(3)In Q4 2024, we removed 124,216 Bell prepaid mobile phone subscribers from our prepaid mobile phone subscriber base as at December 31, 2024, as we stopped selling new plans for this service as of that date.

(4)In Q3 2024, we removed 77,971 Virgin Plus prepaid mobile phone subscribers from our prepaid mobile phone subscriber base as at September 30, 2024, as we stopped selling new plans for this service as of that date. Additionally, as a result of a recent Canadian Radio-television and Telecommunications Commission (CRTC) decision on wholesale high-speed Internet access services, we are no longer able to resell cable Internet services to new customers in our wireline footprint as of September 12, 2024, and consequently we removed all of the existing 106,259 cable subscribers in our wireline footprint from our retail high-speed Internet subscriber base as of that date.

(5)In Q2 2024, we increased our retail IPTV subscriber base by 40,997 to align the deactivation policy for our Fibe TV streaming services to our traditional Fibe TV service.

BCE income statements - selected information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Operating revenues |

|

|

|

|

|

|

|

|

| Service |

5,267 |

5,308 |

(41) |

|

(0.8 |

%) |

10,439 |

10,500 |

(61) |

|

(0.6 |

%) |

| Product |

818 |

697 |

121 |

|

17.4 |

% |

1,576 |

1,516 |

60 |

|

4.0 |

% |

| Total operating revenues |

6,085 |

6,005 |

80 |

|

1.3 |

% |

12,015 |

12,016 |

(1) |

|

— |

|

| Operating costs |

(3,411) |

(3,308) |

(103) |

|

(3.1 |

%) |

(6,783) |

(6,754) |

(29) |

|

(0.4 |

%) |

| Adjusted EBITDA |

2,674 |

2,697 |

(23) |

|

(0.9 |

%) |

5,232 |

5,262 |

(30) |

|

(0.6 |

%) |

Adjusted EBITDA margin(1) |

43.9 |

% |

44.9 |

% |

|

(1.0) pts |

43.5 |

% |

43.8 |

% |

|

(0.3) pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings attributable to: |

|

|

|

|

|

|

|

|

| Common shareholders |

579 |

537 |

42 |

|

7.8 |

% |

1,209 |

939 |

270 |

|

28.8 |

% |

| Preferred shareholders |

40 |

46 |

(6) |

|

(13.0 |

%) |

81 |

93 |

(12) |

|

(12.9 |

%) |

| Non-controlling interest (NCI) |

25 |

21 |

4 |

|

19.0 |

% |

37 |

29 |

8 |

|

27.6 |

% |

| Net earnings |

644 |

604 |

40 |

|

6.6 |

% |

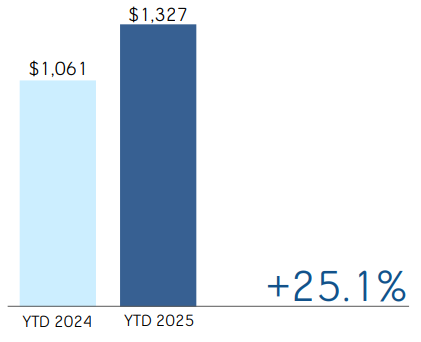

1,327 |

1,061 |

266 |

|

25.1 |

% |

| Adjusted net earnings |

592 |

712 |

(120) |

|

(16.9 |

%) |

1,225 |

1,366 |

(141) |

|

(10.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings per common share (EPS) |

0.63 |

0.59 |

0.04 |

|

6.8 |

% |

1.31 |

1.03 |

0.28 |

|

27.2 |

% |

Adjusted EPS(2) |

0.63 |

0.78 |

(0.15) |

|

(19.2 |

%) |

1.32 |

1.50 |

(0.18) |

|

(12.0 |

%) |

(1)Adjusted EBITDA margin is defined as adjusted EBITDA divided by operating revenues. Refer to section 9.6, KPIs in this MD&A for more information on this measure.

(2)Adjusted EPS is a non-GAAP ratio. Refer to section 9.2, Non-GAAP ratios in this MD&A for more information on this measure.

BCE statements of cash flows – selected information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Cash flows from operating activities |

1,947 |

|

2,137 |

|

(190) |

|

(8.9 |

%) |

3,518 |

|

3,269 |

|

249 |

|

7.6 |

% |

| Capital expenditures |

(763) |

|

(978) |

|

215 |

|

22.0 |

% |

(1,492) |

|

(1,980) |

|

488 |

|

24.6 |

% |

| Free cash flow |

1,152 |

|

1,097 |

|

55 |

|

5.0 |

% |

1,950 |

|

1,182 |

|

768 |

|

65.0 |

% |

Q2 2025 financial highlights

BCE operating revenues grew by 1.3% in Q2 2025, compared to the same period last year, driven by greater product revenues of 17.4%, moderated by lower service revenues of 0.8%. The increase in product revenues was attributable to Bell AI Fabric, our full-stack sovereign artificial intelligence (AI) platform that combines scalable infrastructure with managed services, resulting from the delivery of our first AI facility in Kamloops, British Columbia (B.C.), along with higher wireless device sales, partly offset by reduced consumer electronics sales at The Source (Bell) Electronics Inc. (The Source) due to permanent store closures and conversion to Best Buy Express as part of our distribution partnership with Best Buy Canada. The decrease in service revenues reflected ongoing erosion in legacy voice, and satellite TV revenues, greater acquisition, retention and bundle discounts on wireline residential services, ongoing elevated wireless competitive pricing pressures and continued lower demand for traditional broadcast TV advertising. This decline in service revenues was moderated by higher wireless and retail Internet average subscriber bases coupled with the flow-through of rate increases, the contribution from various acquisitions, wireless revenues related to the 2025 G7 Leader's Summit, higher Bell Media subscriber revenues, and greater revenues from the Formula 1 (F1) Canadian Grand Prix 2025.

Net earnings of $644 million and net earnings attributable to common shareholders of $579 million in the second quarter of 2025 increased by $40 million and $42 million, respectively, compared to the same period last year, mainly due to lower other expense and lower impairment of assets, partly offset by lower adjusted EBITDA, higher severance, acquisition and other costs, higher depreciation and amortization and higher interest expense.

BCE adjusted EBITDA decreased by 0.9% in Q2 2025, compared to the same period last year, due to a decline in our Bell Communication and Technology Services (Bell CTS) segment, partly offset by growth in our Bell Media segment. This decrease was driven by higher operating costs, partly offset by greater operating revenues. This drove an adjusted EBITDA margin of 43.9% in Q2 2025, down 1.0 pts year over year, attributable to reduced service revenue flow-through, coupled with a higher proportion of lower margin product sales in our total revenue base, moderated by cost reduction initiatives driven by workforce reductions, cost containment, as well as technology and automation-enabled operating efficiencies across the organization.

BCE’s EPS of $0.63 in Q2 2025 increased by $0.04 compared to the same period last year.

In the second quarter of 2025, adjusted net earnings, which excludes the impact of severance, acquisition and other costs, net mark-to-market gains (losses) on derivatives used to economically hedge equity settled share-based compensation

8 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

plans, net equity gains (losses) on investments in associates and joint ventures, net gains (losses) on investments, early debt redemption gains (costs) and impairment of assets, net of tax and NCI, was $592 million, or $0.63 per common share, compared to $712 million, or $0.78 per common share, for the same period last year.

Cash flows from operating activities in the second quarter of 2025 decreased by $190 million, compared to the same period last year, mainly due to higher severance and other costs paid and lower cash from working capital, partly offset by lower income taxes paid and lower interest paid.

Free cash flow in the second quarter of 2025 increased by $55 million compared to the same period last year, mainly due to lower capital expenditures and lower cash dividends paid by subsidiaries to NCI, partly offset by lower cash flows from operating activities, excluding cash from acquisition and other costs paid.

1.2 Key corporate and business developments

This section contains forward-looking statements, including relating to the acquisition by Bell Canada of Ziply Fiber, certain potential benefits expected to result from this acquisition, Bell Canada’s growth prospects and strategic priorities, the proposed disposition of substantially all of BCE’s home security and monitored alarm assets to a.p.i. ALARM Inc., the expected timing and completion thereof and the expected amount of proceeds to result from this proposed disposition. Refer to the section Caution regarding forward-looking statements at the beginning of this MD&A.

Completion of Ziply Fiber acquisition

Subsequent to quarter end, on August 1, 2025, Bell Canada completed its previously announced acquisition of Ziply Fiber, the leading fibre internet provider in the Pacific Northwest of the U.S., for cash consideration of $3.65 billion in U.S. dollars ($5.04 billion in Canadian dollars) and the assumption of outstanding net debt(1) of $1.92 billion in U.S. dollars ($2.65 billion in Canadian dollars), following all regulatory approvals. The acquisition expands Bell’s fibre footprint into the U.S. by 1.4 million locations, cementing its position as the third-largest fibre Internet provider in North America.

The acquisition financing was supported by the proceeds of the sale of BCE’s minority stake in Maple Leaf Sports and Entertainment Ltd. (MLSE) on July 1, 2025. This transaction marked the conversion of BCE’s passive interest in MLSE into a core business growth driver.

Ziply Fiber will operate as a separate business unit and will continue to be headquartered in Kirkland, Washington, with its existing management team and highly skilled workforce in alignment with Bell’s strategic priority of building the best fibre Internet networks. Together, Bell Canada and Ziply Fiber will offer enhanced value for existing and new customers in both Canada and the U.S. as demand for faster, more reliable Internet continues to grow. The results of Ziply Fiber will be included in Bell CTS. A news release to be dated August 7, 2025 contains an update to our 2025 financial guidance targets originally provided on February 6, 2025 to incorporate the impact of the acquisition of Ziply Fiber. This news release can be found on SEDAR+ at sedarplus.ca.

Disposition of minority stake in MLSE

On July 1, 2025, BCE completed the previously announced sale of its 37.5% ownership stake in MLSE for $4.7 billion to Rogers Communications Inc. (Rogers). BCE directed the net proceeds of this disposition towards its acquisition of Ziply Fiber. As part of the MLSE transaction, Bell Media has secured access to content rights for the Toronto Maple Leafs and Toronto Raptors on TSN through the 2043/2044 season via a long-term agreement with Rogers.

Disposition of home security and monitored alarm assets

In Q2 2025, BCE entered into an agreement to sell substantially all of its home security and monitored alarm assets to a.p.i. ALARM Inc. as part of its ongoing strategy to focus on its core telecommunications, enterprise solutions and media businesses. Completion of the sale is expected in the second half of 2025, subject to customary closing conditions. Proceeds are expected to be $90 million with additional proceeds of up to $80 million to be received contingent on the achievement of certain performance obligations.

Tender offers for debt securities

On June 12, 2025, Bell Canada repurchased, pursuant to tender offers, for an aggregate cash purchase price of $602 million, an aggregate principal amount of $700 million representing part of the outstanding principal amount of four of its series of medium-term notes (MTN) debentures. In aggregate, these tender offers reduced our net debt by $98 million. Refer to section 4.1, Net debt, of this MD&A for more details.

(1)Net debt is a non-GAAP financial measure. See section 9.1, Non-GAAP financial measures in this MD&A for more information on this measure.

BCE executive team update

On May 20, 2025, Mark McDonald was promoted to the role of Executive Vice President (EVP) and Chief Technology Officer. In his new role, Mark is responsible for Bell’s network strategy and infrastructure, as well as maximizing the potential of key technologies like Fifth Generation (5G) and fibre. Mark has over ten years of experience within Bell’s wireless network team, most recently holding the role of Senior Vice President, Networks.

Also on May 20, 2025, Hadeer Hassaan assumed an expanded role as EVP and Chief Information and Customer Experience Officer. In this role, Hadeer will ensure Bell’s customer-first approach is supported by the right data and information, leveraging technology to create a seamless and positive experience for Bell's customers. She will also lead Bell’s cloud services strategy.

As at the date of this MD&A, our forward-looking statements set out in the BCE 2024 Annual MD&A, as updated or supplemented in the BCE 2025 First Quarter MD&A and in this MD&A, are based on certain assumptions including, without limitation, the following assumptions, as well as the various assumptions referred to under the sub-sections entitled Assumptions set out in section 3, Business segment analysis of this MD&A.

Assumptions about the Canadian economy

Our forward-looking statements are based on certain assumptions concerning the Canadian economy. Given ongoing uncertainty around U.S. trade policy, the economic outlook remains clouded. While the risk of a severe and escalating global trade conflict has diminished and there is some clarity around what tariffs will look like, how U.S. trade policy will unfold remains highly uncertain. It is still too early to confidently project the effects of tariffs on economic growth and inflation. We have assumed current trade policies remain in place. In particular, we have assumed:

•Slowing economic growth, given the Bank of Canada’s most recent estimated growth in Canadian gross domestic product of 1.3% in 2025 under the current tariff scenario, representing a decrease from the earlier estimate of 1.8%

•Slower population growth because of government policies designed to slow immigration

•Slowdown in consumer spending reflecting ongoing trade policy uncertainty

•Slowing business investment, particularly by businesses in sectors most reliant on U.S. markets

•Stable consumer price index (CPI) inflation

•Ongoing labour market softness

•Interest rates expected to remain at or near current levels

•Canadian dollar expected to remain near current levels. Further movements may be impacted by the degree of strength of the U.S. dollar, interest rates and changes in commodity prices

Assumptions about the U.S. economy

In the context of our acquisition of Ziply Fiber, we have made certain assumptions concerning the U.S. economy. In particular, we have assumed:

•Stable consumer spending, but emerging concerns about upward pricing pressure stemming from evolving trade policies

•Slowing business investment due to trade policy uncertainty

•Stable CPI inflation

•Slower population growth than recent historical trends

Canadian market assumptions

•A higher level of wireline and wireless competition in consumer, business and wholesale markets

•Higher, but slowing, wireless industry penetration

•A shrinking data and voice connectivity market as business customers migrate to lower-priced telecommunications solutions or alternative OTT competitors

•The Canadian traditional TV and radio advertising markets are expected to be impacted by audience declines as the advertising market growth continues to shift towards digital

•Declines in broadcasting distribution undertaking (BDU) subscribers driven by increasing competition from the continued rollout of subscription video on demand (SVOD) streaming services together with further scaling of OTT aggregators

U.S. market assumptions

In the context of our acquisition of Ziply Fiber, we have made certain assumptions concerning the U.S. market for our products and services. In particular, we have assumed:

•A higher level of wireline pricing competition in consumer, business and wholesale markets

•Increased demand for colocation and data centre connectivity services

•A shrinking traditional voice services market as customers migrate to wireless or Voice over IP (VoIP) offerings

10 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

Assumptions underlying expected continuing contribution holiday in 2025 in the majority of our pension plans

•At the relevant time, our defined benefit (DB) pension plans will remain in funded positions with going concern surpluses and maintain solvency ratios that exceed the minimum legal requirements for a contribution holiday to be taken for applicable DB and defined contribution (DC) components

•No significant declines in our DB pension plans’ financial position due to declines in investment returns or interest rates

•No material experience losses from other events such as through litigation or changes in laws, regulations or actuarial standards

2 Consolidated financial analysis

This section provides detailed information and analysis about BCE’s performance in Q2 and YTD 2025 compared with Q2 and YTD 2024. It focuses on BCE’s consolidated operating results and provides financial information for our Bell CTS and Bell Media business segments. For further discussion and analysis of our business segments, refer to section 3, Business segment analysis.

2.1 BCE consolidated income statements

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Operating revenues |

|

|

|

|

|

|

|

|

| Service |

5,267 |

5,308 |

(41) |

|

(0.8 |

%) |

10,439 |

10,500 |

(61) |

|

(0.6 |

%) |

| Product |

818 |

697 |

121 |

|

17.4 |

% |

1,576 |

1,516 |

60 |

|

4.0 |

% |

| Total operating revenues |

6,085 |

6,005 |

80 |

|

1.3 |

% |

12,015 |

12,016 |

(1) |

|

— |

|

| Operating costs |

(3,411) |

(3,308) |

(103) |

|

(3.1 |

%) |

(6,783) |

(6,754) |

(29) |

|

(0.4 |

%) |

| Adjusted EBITDA |

2,674 |

2,697 |

(23) |

|

(0.9 |

%) |

5,232 |

5,262 |

(30) |

|

(0.6 |

%) |

| Adjusted EBITDA margin |

43.9 |

% |

44.9 |

% |

|

(1.0) pts |

43.5 |

% |

43.8 |

% |

|

(0.3) pts |

| Severance, acquisition and other costs |

(41) |

(22) |

(19) |

|

(86.4 |

%) |

(288) |

(251) |

(37) |

|

(14.7 |

%) |

| Depreciation |

(949) |

(945) |

(4) |

|

(0.4 |

%) |

(1,890) |

(1,891) |

1 |

|

0.1 |

% |

| Amortization |

(338) |

(325) |

(13) |

|

(4.0 |

%) |

(669) |

(641) |

(28) |

|

(4.4 |

%) |

| Finance costs |

|

|

|

|

|

|

|

|

| Interest expense |

(442) |

(426) |

(16) |

|

(3.8 |

%) |

(865) |

(842) |

(23) |

|

(2.7 |

%) |

| Net return on post-employment benefit plans |

26 |

17 |

9 |

|

52.9 |

% |

51 |

33 |

18 |

|

54.5 |

% |

| Impairment of assets |

(8) |

(60) |

52 |

|

86.7 |

% |

(17) |

(73) |

56 |

|

76.7 |

% |

| Other (expense) income |

(38) |

(101) |

63 |

|

62.4 |

% |

270 |

(139) |

409 |

|

n.m. |

| Income taxes |

(240) |

(231) |

(9) |

|

(3.9 |

%) |

(497) |

(397) |

(100) |

|

(25.2 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

644 |

604 |

40 |

|

6.6 |

% |

1,327 |

1,061 |

266 |

|

25.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings attributable to: |

|

|

|

|

|

|

|

|

| Common shareholders |

579 |

537 |

42 |

|

7.8 |

% |

1,209 |

939 |

270 |

|

28.8 |

% |

| Preferred shareholders |

40 |

46 |

(6) |

|

(13.0 |

%) |

81 |

93 |

(12) |

|

(12.9 |

%) |

| NCI |

25 |

21 |

4 |

|

19.0 |

% |

37 |

29 |

8 |

|

27.6 |

% |

| Net earnings |

644 |

604 |

40 |

|

6.6 |

% |

1,327 |

1,061 |

266 |

|

25.1 |

% |

| Adjusted net earnings |

592 |

712 |

(120) |

|

(16.9 |

%) |

1,225 |

1,366 |

(141) |

|

(10.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPS |

0.63 |

0.59 |

0.04 |

|

6.8 |

% |

1.31 |

1.03 |

0.28 |

|

27.2 |

% |

| Adjusted EPS |

0.63 |

0.78 |

(0.15) |

|

(19.2 |

%) |

1.32 |

1.50 |

(0.18) |

|

(12.0 |

%) |

n.m.: not meaningful

12 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

2.2 Customer connections

BCE net activations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

% change |

YTD 2025 |

YTD 2024 |

% change |

| Mobile phone net subscriber activations |

94,479 |

|

131,043 |

|

(27.9 |

%) |

93,883 |

|

156,251 |

|

(39.9 |

%) |

| Postpaid |

44,547 |

|

78,500 |

|

(43.3 |

%) |

34,949 |

|

123,747 |

|

(71.8 |

%) |

| Prepaid |

49,932 |

|

52,543 |

|

(5.0 |

%) |

58,934 |

|

32,504 |

|

81.3 |

% |

| Mobile connected device net subscriber activations |

97,502 |

|

87,917 |

|

10.9 |

% |

133,486 |

|

154,323 |

|

(13.5 |

%) |

| Retail high-speed Internet net subscriber activations |

4,999 |

|

23,841 |

|

(79.0 |

%) |

14,514 |

|

54,919 |

|

(73.6 |

%) |

|

|

|

|

|

|

|

| Retail IPTV net subscriber (losses) activations |

(15,851) |

|

(1,313) |

|

n.m. |

(31,822) |

|

12,861 |

|

n.m. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Retail residential NAS lines net losses |

(44,700) |

|

(53,250) |

|

16.1 |

% |

(92,130) |

|

(97,161) |

|

5.2 |

% |

|

|

|

|

|

|

|

| Total services net activations |

136,429 |

|

188,238 |

|

(27.5 |

%) |

117,931 |

|

281,193 |

|

(58.1 |

%) |

n.m.: not meaningful

Total BCE customer connections

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

% change |

|

|

|

Mobile phone subscribers(2)(3) |

10,382,457 |

|

10,337,495 |

|

0.4 |

% |

|

|

|

| Postpaid |

9,565,385 |

|

9,440,775 |

|

1.3 |

% |

|

|

|

Prepaid(2)(3) |

817,072 |

|

896,720 |

|

(8.9 |

%) |

|

|

|

| Mobile connected device subscribers |

3,176,916 |

|

2,886,871 |

|

10.0 |

% |

|

|

|

Retail high-speed Internet subscribers(1)(3) |

4,421,961 |

|

4,520,553 |

|

(2.2 |

%) |

|

|

|

|

|

|

|

|

|

|

Retail IPTV subscribers(1)(4) |

2,100,690 |

|

2,124,200 |

|

(1.1 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail residential NAS lines(1) |

1,727,911 |

|

1,924,456 |

|

(10.2 |

%) |

|

|

|

|

|

|

|

|

|

|

| Total services subscribers |

21,809,935 |

|

21,793,575 |

|

0.1 |

% |

|

|

|

(1)In Q1 2025, we reduced our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases by 80,666, 441 and 14,150 subscribers, respectively, as at March 31, 2025, as we stopped selling new plans for these services under the Distributel, Acanac, Oricom and B2B2C brands. Additionally, at the beginning of Q1 2025, we reduced our retail high-speed Internet subscriber base by 2,783 subscribers to adjust for prior year customer deactivations following a review of customer accounts.

(2)In Q4 2024, we removed 124,216 Bell prepaid mobile phone subscribers from our prepaid mobile phone subscriber base as at December 31, 2024, as we stopped selling new plans for this service as of that date.

(3)In Q3 2024, we removed 77,971 Virgin Plus prepaid mobile phone subscribers from our prepaid mobile phone subscriber base as at September 30, 2024, as we stopped selling new plans for this service as of that date. Additionally, as a result of a recent CRTC decision on wholesale high-speed Internet access services, we are no longer able to resell cable Internet services to new customers in our wireline footprint as of September 12, 2024, and consequently we removed all of the existing 106,259 cable subscribers in our wireline footprint from our retail high-speed Internet subscriber base as of that date.

(4)In Q2 2024, we increased our retail IPTV subscriber base by 40,997 to align the deactivation policy for our Fibe TV streaming services to our traditional Fibe TV service.

BCE total services net subscriber activations were 136,429 in Q2 2025, down 27.5% compared to the same period in 2024. The total services net subscriber activations in Q2 2025 consisted of:

•94,479 mobile phone net subscriber activations and 97,502 mobile connected device net subscriber activations

•4,999 retail high-speed Internet net subscriber activations

•15,851 retail IPTV net subscriber losses

•44,700 retail residential NAS lines net losses

In the first half of the year, BCE added 117,931 total services net subscriber activations, down 58.1% compared to the same period in 2024. The total services net subscriber activations in the first half of 2025 consisted of:

•93,883 mobile phone net subscriber activations and 133,486 mobile connected device net subscriber activations

•14,514 retail high-speed Internet net subscriber activations

•31,822 retail IPTV net subscriber losses

•92,130 retail residential NAS lines net losses

At June 30, 2025, BCE's customer connections totalled 21,809,935, up 0.1% year over year, and consisted of:

•10,382,457 mobile phone subscribers, up 0.4% year over year, and 3,176,916 mobile connected device subscribers, up 10.0% year over year

•4,421,961 retail high-speed Internet subscribers, down 2.2% year over year

•2,100,690 retail IPTV subscribers, down 1.1% year over year

•1,727,911 retail residential NAS lines, down 10.2% year over year

2.3 Operating revenues

|

|

|

|

|

|

|

|

|

| BCE |

|

BCE |

| Revenues |

|

Revenues |

| (in $ millions) |

|

(in $ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

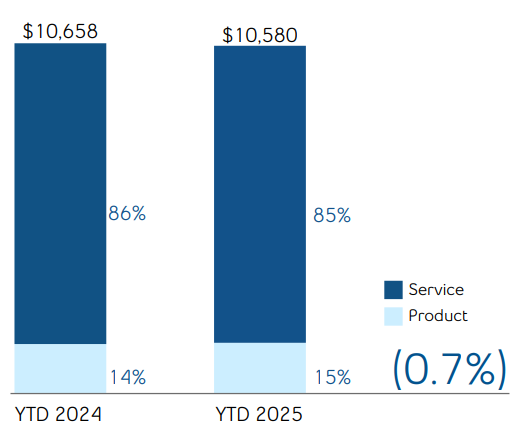

| Bell CTS |

5,334 |

|

5,283 |

|

51 |

|

1.0 |

% |

10,580 |

|

10,658 |

|

(78) |

|

(0.7 |

%) |

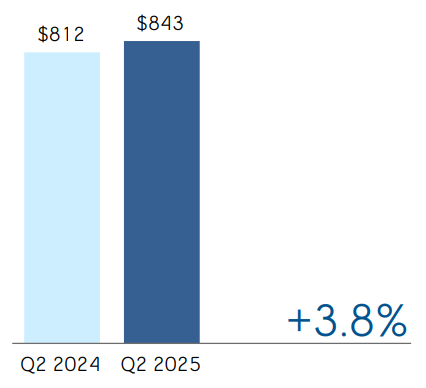

| Bell Media |

843 |

|

812 |

|

31 |

|

3.8 |

% |

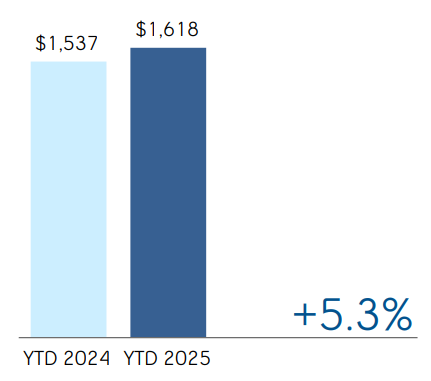

1,618 |

|

1,537 |

|

81 |

|

5.3 |

% |

| Inter-segment eliminations |

(92) |

|

(90) |

|

(2) |

|

(2.2 |

%) |

(183) |

|

(179) |

|

(4) |

|

(2.2 |

%) |

| Total BCE operating revenues |

6,085 |

|

6,005 |

|

80 |

|

1.3 |

% |

12,015 |

|

12,016 |

|

(1) |

|

— |

|

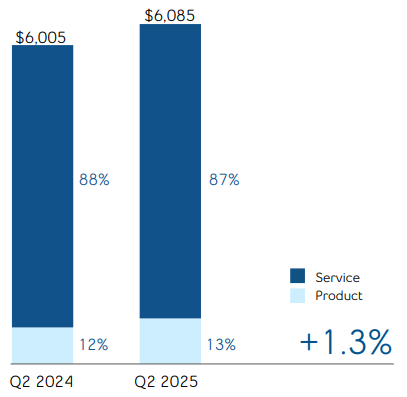

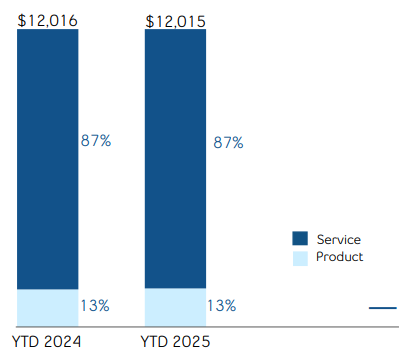

BCE

BCE operating revenues increased by 1.3% in Q2 2025, compared to Q2 2024, resulting from greater product revenues, partly offset by lower service revenues. During the first six months of the year, BCE operating revenues were stable year over year, as higher product revenues were offset by lower service revenues. Service revenues of $5,267 million in Q2 2025 and of $10,439 million year to date, declined by 0.8% and 0.6%, respectively, year over year. Product revenues of $818 million in Q2 2025 and $1,576 million year to date, increased by 17.4% and 4.0%, respectively, over the same periods last year.

The year-over-year growth in Q2 2025 operating revenues was driven by an increase from both our Bell CTS and Bell Media segments. Year-to-date revenues were stable year over year, as higher revenues from our Bell Media segment were essentially offset by a decrease in our Bell CTS segment. Bell CTS operating revenues in the quarter grew by 1.0% year over year, due to higher product revenues of 17.4%, moderated by decreased service revenues of 1.5%, from ongoing erosion in wireline voice revenues, along with lower wireline data and wireless revenues. The year-to-date decline in Bell CTS operating revenues of 0.7%, was driven by lower service revenues of 1.5% from reduced wireline voice, wireless and wireline data revenues, moderated by greater product revenues of 4.0%. Bell Media operating revenues increased by 3.8% in Q2 2025, compared to last year, from higher subscriber and F1 Canadian Grand Prix 2025 revenues, partly offset by lower advertising revenues. Bell Media operating revenues during the first half of the year, increased by 5.3% year over year, due to higher subscriber, F1 Canadian Grand Prix 2025 and advertising revenues.

14 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

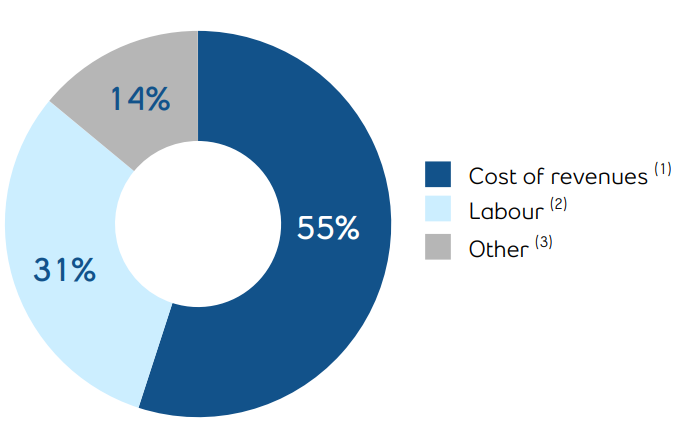

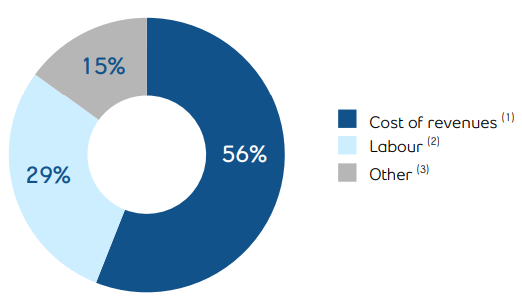

2.4 Operating costs

|

|

|

|

|

|

| BCE |

BCE |

| Operating cost profile |

Operating cost profile |

| Q2 2024 |

Q2 2025 |

|

|

| BCE |

BCE |

| Operating cost profile |

Operating cost profile |

| YTD 2024 |

YTD 2025 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Bell CTS |

(2,895) |

|

(2,804) |

|

(91) |

|

(3.2 |

%) |

(5,742) |

|

(5,731) |

|

(11) |

|

(0.2 |

%) |

| Bell Media |

(608) |

|

(594) |

|

(14) |

|

(2.4 |

%) |

(1,224) |

|

(1,202) |

|

(22) |

|

(1.8 |

%) |

| Inter-segment eliminations |

92 |

|

90 |

|

2 |

|

2.2 |

% |

183 |

|

179 |

|

4 |

|

2.2 |

% |

| Total BCE operating costs |

(3,411) |

|

(3,308) |

|

(103) |

|

(3.1 |

%) |

(6,783) |

|

(6,754) |

|

(29) |

|

(0.4 |

%) |

(1)Cost of revenues includes costs of wireless devices and other equipment sold, network and content costs, and payments to other carriers.

(2)Labour costs (net of capitalized costs) include wages, salaries and related taxes and benefits, post-employment benefit plans service cost, and other labour costs, including contractor and outsourcing costs.

(3)Other operating costs include marketing, advertising and sales commission costs, bad debt expense, taxes other than income taxes, IT costs, professional service fees and rent.

BCE

BCE operating costs increased by 3.1% in Q2 2025, and by 0.4% in the first half of the year, compared to the same periods in 2024, driven by higher expenses in Bell CTS of 3.2% and 0.2%, respectively, and in Bell Media of 2.4% and 1.8%, respectively.

2.5 Net earnings

|

|

|

|

|

|

|

|

|

| BCE |

|

BCE |

| Net earnings |

|

Net earnings |

| (in $ millions) |

|

(in $ millions) |

|

|

|

Net earnings in the second quarter of 2025 increased by $40 million, compared to the same period last year, mainly due to lower other expense and lower impairment of assets, partly offset by lower adjusted EBITDA, higher severance, acquisition and other costs, higher depreciation and amortization and higher interest expense.

Net earnings on a year-to-date basis in 2025 increased by $266 million, compared to the same period last year, mainly due to higher other income primarily resulting from early debt redemption gains and lower impairment of assets, partly offset by higher income taxes, higher severance, acquisition and other costs, lower adjusted EBITDA, higher amortization and higher interest expense.

16 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

|

|

|

|

|

|

|

|

|

| BCE |

|

BCE |

| Adjusted EBITDA |

|

Adjusted EBITDA |

| (in $ millions) |

|

(in $ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

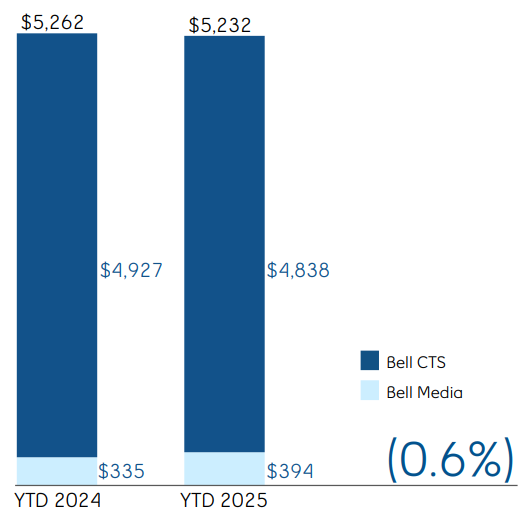

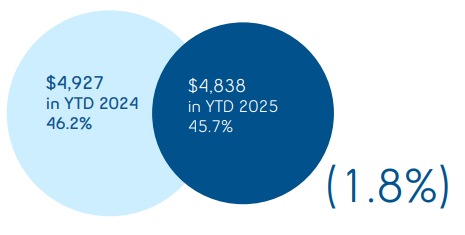

| Bell CTS |

2,439 |

|

2,479 |

|

(40) |

|

(1.6 |

%) |

4,838 |

|

4,927 |

|

(89) |

|

(1.8 |

%) |

| Adjusted EBITDA margin |

45.7 |

% |

46.9 |

% |

|

(1.2) pts |

45.7 |

% |

46.2 |

% |

|

(0.5) pts |

| Bell Media |

235 |

|

218 |

|

17 |

|

7.8 |

% |

394 |

|

335 |

|

59 |

|

17.6 |

% |

| Adjusted EBITDA margin |

27.9 |

% |

26.8 |

% |

|

1.1 pts |

24.4 |

% |

21.8 |

% |

|

2.6 pts |

| Total BCE adjusted EBITDA |

2,674 |

|

2,697 |

|

(23) |

|

(0.9 |

%) |

5,232 |

|

5,262 |

|

(30) |

|

(0.6 |

%) |

| Adjusted EBITDA margin |

43.9 |

% |

44.9 |

% |

|

(1.0) pts |

43.5 |

% |

43.8 |

% |

|

(0.3) pts |

BCE

BCE adjusted EBITDA decreased by 0.9% in Q2 2025, and by 0.6% in the first six months of the year, compared to the same periods last year, driven by a decline in our Bell CTS segment of 1.6% and 1.8%, respectively, moderated by growth in our Bell Media segment of 7.8% and 17.6%, respectively. This drove an adjusted EBITDA margin of 43.9% in Q2 2025, and 43.5% year to date, down 1.0 pts and 0.3 pts, respectively, over the same periods in 2024, resulting from reduced service revenues flow-through, along with a higher proportion of lower margin product sales in our total revenue base, mitigated in part by cost reduction initiatives and operating efficiencies.

2.7 Severance, acquisition and other costs

2025

Severance, acquisition and other costs of $41 million in the second quarter of 2025 and $288 million on a year-to-date basis included:

•Severance costs of $14 million in Q2 2025 and $245 million on a year-to-date basis related to involuntary and voluntary employee terminations

•Acquisition and other costs of $27 million in Q2 2025 and $43 million on a year-to-date basis

2024

Severance, acquisition and other costs of $22 million in the second quarter of 2024 and $251 million on a year-to-date basis included:

•Severance costs recovery of $4 million in Q2 2024

•Severance costs of $230 million on a year-to-date basis related to involuntary and voluntary employee terminations, including the estimated costs of the previously announced workforce reductions incurred up to June 30, 2024

•Acquisition and other costs of $26 million in Q2 2024 and $21 million on a year-to-date basis

2.8 Depreciation and amortization

Depreciation

Depreciation increased by $4 million in the second quarter of 2025 and decreased by $1 million on a year-to-date basis in 2025, compared to the same periods in 2024.

Amortization

Amortization in the second quarter and on a year-to-date basis in 2025 increased by $13 million and $28 million, respectively, compared to the same periods in 2024, mainly due to a higher asset base.

Interest expense

Interest expense in the second quarter and on a year-to-date basis in 2025 increased by $16 million and $23 million, respectively, compared to the same periods in 2024, mainly due to higher average debt balances.

Net return on post-employment benefit plans

Net return on our post-employment benefit plans is based on market conditions that existed at the beginning of the year as well as the net post-employment benefit plan asset (liability). On January 1, 2025, the discount rate was 4.7% compared to 4.6% on January 1, 2024.

In the second quarter and on a year-to-date basis in 2025, net return on post-employment benefit plans increased by $9 million and $18 million, respectively, compared to the same periods last year, as a result of a higher discount rate in 2025 and a higher net asset position.

The impacts of changes in market conditions during the year are recognized in Other comprehensive income (loss) (OCI).

2.10 Impairment of assets

Impairment charges for the second quarter and on a year-to-date basis in 2025 decreased by $52 million and $56 million, respectively, compared to the same periods last year, mainly due to charges in 2024 related to right-of-use assets for certain office spaces we ceased using as part of our real estate optimization strategy as a result of our hybrid work policy.

18 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

2.11 Other (expense) income

2025

Other expense of $38 million in the second quarter of 2025 included foreign exchange losses on derivatives used to economically hedge anticipated purchases and the acquisition of Ziply Fiber in foreign currencies and net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans, partly offset by early debt redemption gains due to the repurchase by Bell Canada, as a result of its cash tender offers, of a portion of its Series M-39, M-45, M-51 and M-55 MTN debentures.

Other income of $270 million on a year-to-date basis in 2025 included early debt redemption gains due to the repurchase by Bell Canada, as a result of its cash tender offers, of a portion of its Series M-39, M-45, M-51 and M-55 MTN debentures, and a portion of its Series US-2, US-4, US-5, US-6, and US-7 Notes and interest income, partly offset by foreign exchange losses on derivatives used to economically hedge anticipated purchases and the acquisition of Ziply Fiber in foreign currencies and net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans.

2024

Other expense of $101 million in the second quarter of 2024 included equity losses on our share of an obligation to repurchase at fair value the minority interest in MLSE, net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans and losses on retirements and disposals of property, plant and equipment and intangible assets, partly offset by interest income.

Other expense of $139 million on a year-to-date basis in 2024 included net mark-to-market losses on derivatives used to economically hedge equity settled share-based compensation plans, equity losses on our share of an obligation to repurchase at fair value the minority interest in MLSE and losses on retirements and disposals of property, plant and equipment and intangible assets, partly offset by interest income and income on operations from our equity investments.

Income taxes in the second quarter of 2025 increased by $9 million compared to the same period last year, mainly due to a higher value of favourable tax adjustments in 2024, partly offset by lower taxable income in 2025.

Income taxes on a year-to-date basis in 2025 increased by $100 million compared to the same period last year, mainly due to higher taxable income in 2025 and a higher value of favourable tax adjustments in 2024.

2.13 Net earnings attributable to common shareholders and EPS

Net earnings attributable to common shareholders in the second quarter of 2025 of $579 million, increased by $42 million, compared to the same period last year, mainly due to lower other expense and lower impairment of assets, partly offset by lower adjusted EBITDA, higher severance, acquisition and other costs, higher depreciation and amortization and higher interest expense.

Net earnings attributable to common shareholders on a year-to-date basis in 2025 of $1,209 million, increased by $270 million, compared to the same period last year, mainly due to higher other income primarily resulting from early debt redemption gains and lower impairment of assets, partly offset by higher income taxes, higher severance, acquisition and other costs, lower adjusted EBITDA, higher amortization and higher interest expense.

BCE’s EPS of $0.63 in Q2 2025 increased by $0.04 compared to the same period last year. BCE's EPS of $1.31 on a year-to-date basis in 2025 increased by $0.28 compared to the same period last year.

In the second quarter of 2025, adjusted net earnings, which excludes the impact of severance, acquisition and other costs, net mark-to-market gains (losses) on derivatives used to economically hedge equity settled share-based compensation plans, net equity gains (losses) on investments in associates and joint ventures, net gains (losses) on investments, early debt redemption gains (costs) and impairment of assets, net of tax and NCI, was $592 million, or $0.63 per common share, compared to $712 million, or $0.78 per common share, for the same period last year. Adjusted net earnings in the first half of 2025 was $1,225 million, or $1.32 per common share, compared to $1,366 million, or $1.50 per common share, for the first six months of 2024.

3 Business segment analysis

This section contains forward-looking statements, including relating to Bell Canada’s launch of Bell AI Fabric intended to create a national initiative to support Canada's AI ecosystem, the benefits expected to result from the launch of Bell AI Fabric, the expected number of AI data centres to be launched by the end of 2026, Bell Canada’s long-term objective to drive AI innovation and economic growth in Canada, BCE's plans and 2025 outlook. Refer to the section Caution regarding forward-looking statements at the beginning of this MD&A.

Key business developments

Launch of Bell AI Fabric

On May 28, 2025, Bell Canada announced Bell AI Fabric, a national initiative to support Canada's AI ecosystem. Bell AI Fabric will create a national network of purpose-built AI data centres starting with a data centre supercluster in B.C. that will aim to provide upwards of 500 Megawatts (MW) of hydroelectric-powered AI compute capacity across six facilities. The first facility came online in June 2025 in partnership with leading AI inference provider, Groq, Inc. (Groq), and the launch of its 7 MW AI inference facility in Kamloops, B.C. Additional data centres will come online by the end of 2026, including a 26 MW AI data centre being built in partnership with Thompson Rivers University, with additional facilities in advanced planning stages with stakeholders. Bell AI Fabric underscores Bell's capabilities as a leading full-stack AI Managed Service Provider that can support Canadian enterprises and governments across their full spectrum of AI needs, from strategy and applications development through infrastructure deployment. This initiative represents Bell's long-term objective to drive AI innovation and economic growth in Canada. With cutting-edge technology and ensuring data sovereignty, Bell is poised to lead the way in delivering secure, reliable, and transformative AI solutions for businesses and communities across the country.

Partnership with Zoom to offer workplace collaboration solutions for Canadian businesses

On May 20, 2025, Bell Canada and Zoom Communications, Inc. (Zoom), a global leader in workplace communications, announced a partnership to launch Workplace from Bell and Zoom, a collaboration tool available exclusively through Bell for Canadian enterprises. The open collaboration platform integrates advanced communication tools including video conferencing, messaging, file sharing, and external calling into a seamless experience across devices. With enterprise-grade security and AI-first capabilities included as a standard feature, Workplace from Bell and Zoom enhances productivity with AI-powered task automation. The partnership reinforces Bell’s commitment to deliver services and solutions that meet the productivity and collaboration needs of all Canadian businesses.

20 BCE Inc. 2025 SECOND QUARTER SHAREHOLDER REPORT

Financial performance analysis

Q2 2025 performance highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bell CTS |

Bell CTS |

| Revenues |

Adjusted EBITDA |

| (in $ millions) |

(in $ millions) |

|

|

|

|

(% adjusted EBITDA margin) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bell CTS |

Bell CTS |

| Revenues |

Adjusted EBITDA |

| (in $ millions) |

(in $ millions) |

|

|

|

|

(% adjusted EBITDA margin) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total mobile phone subscriber growth(2)(3) |

Mobile phone postpaid net subscriber activations in Q2 2025 |

Mobile phone prepaid net subscriber activations in

Q2 2025

|

Mobile phone postpaid churn in Q2 2025(5) |

Mobile phone blended average revenue per user (ARPU)(2)(3)(6) |

| per month |

|

| +0.4% |

44,547 |

49,932 |

1.06% |

(0.7%) |

|

Q2 2025 vs. Q2 2024 |

vs. net activations of 78,500 in Q2 2024 |

vs. net activations of 52,543 in Q2 2024 |

Decreased 0.12 pts vs. Q2 2024 |

Q2 2025:

Q2 2024:

|

$57.61

$58.04

|

|

Retail high-speed Internet subscriber decline(1)(3) |

Retail high-speed Internet net subscriber activations in Q2 2025 |

Retail IPTV subscriber decline(1)(4) |

| (2.2%) |

4,999 |

(1.1%) |

| Q2 2025 vs. Q2 2024 |

Decreased (79.0%) vs. Q2 2024 |

Q2 2025 vs. Q2 2024 |

Retail IPTV net subscriber losses in Q2 2025 |

Retail residential NAS lines subscriber decline(1) |

| (15,851) |

(10.2%) |

vs. net losses of (1,313) in Q2 2024 |

Q2 2025 vs. Q2 2024 |

(1)In Q1 2025, we reduced our retail high-speed Internet, retail IPTV and retail residential NAS lines subscriber bases by 80,666, 441 and 14,150 subscribers, respectively, as at March 31, 2025, as we stopped selling new plans for these services under the Distributel, Acanac, Oricom and B2B2C brands. Additionally, at the beginning of Q1 2025, we reduced our retail high-speed Internet subscriber base by 2,783 subscribers to adjust for prior year customer deactivations following a review of customer accounts.

(2)In Q4 2024, we removed 124,216 Bell prepaid mobile phone subscribers from our prepaid mobile phone subscriber base as at December 31, 2024, as we stopped selling new plans for this service as of that date.

(3)In Q3 2024, we removed 77,971 Virgin Plus prepaid mobile phone subscribers from our prepaid mobile phone subscriber base as at September 30, 2024, as we stopped selling new plans for this service as of that date. Additionally, as a result of a recent CRTC decision on wholesale high-speed Internet access services, we are no longer able to resell cable Internet services to new customers in our wireline footprint as of September 12, 2024, and consequently we removed all of the existing 106,259 cable subscribers in our wireline footprint from our retail high-speed Internet subscriber base as of that date.

(4)In Q2 2024, we increased our retail IPTV subscriber base by 40,997 to align the deactivation policy for our Fibe TV streaming services to our traditional Fibe TV service.

(5)Mobile phone churn is defined as the rate at which existing mobile phone subscribers cancel their services. Refer to section 9.6, KPIs in this MD&A for more information on this measure.

(6)Mobile phone blended ARPU is defined as Bell CTS wireless external services revenues divided by the average mobile phone subscriber base for the specified period, expressed as a dollar unit per month. Refer to section 9.6, KPIs in this MD&A for more information on this measure.

Bell CTS results

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Q2 2025 |

Q2 2024 |

$ change |

% change |

YTD 2025 |

YTD 2024 |

$ change |

% change |

| Wireless |

1,783 |

|

1,788 |

|

(5) |

|

(0.3 |

%) |

3,542 |

|

3,562 |

|

(20) |

|

(0.6 |

%) |

| Wireline data |

2,025 |

|

2,034 |

|

(9) |

|

(0.4 |

%) |

4,039 |

|

4,046 |

|

(7) |

|

(0.2 |

%) |

| Wireline voice |

624 |

|

677 |

|

(53) |

|

(7.8 |

%) |

1,253 |

|

1,360 |

|

(107) |

|

(7.9 |

%) |

| Other wireline services |

77 |

|

79 |

|

(2) |

|

(2.5 |

%) |

156 |

|

160 |

|

(4) |

|

(2.5 |

%) |

| External service revenues |

4,509 |

|

4,578 |

|

(69) |

|

(1.5 |

%) |

8,990 |

|

9,128 |

|

(138) |

|

(1.5 |

%) |

| Inter-segment service revenues |

7 |

|

8 |

|

(1) |

|

(12.5 |

%) |

14 |

|

14 |

|

— |

|

— |

|

| Operating service revenues |

4,516 |

|

4,586 |

|

(70) |

|

(1.5 |

%) |

9,004 |

|

9,142 |

|

(138) |

|

(1.5 |

%) |

| Wireless |

594 |

|

568 |

|

26 |

|

4.6 |

% |

1,218 |

|

1,252 |

|

(34) |

|

(2.7 |

%) |

| Wireline |

224 |

|

129 |

|

95 |

|

73.6 |

% |

358 |

|

264 |

|

94 |

|

35.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| External/Operating product revenues |

818 |

|

697 |

|

121 |

|

17.4 |

% |

1,576 |

|

1,516 |

|

60 |

|

4.0 |

% |