0000717538FALSE00007175382025-06-172025-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: June 17, 2025

(Date of earliest event reported)

ARROW FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| New York |

0-12507 |

22-2448962 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 250 Glen Street |

Glens Falls |

New York |

12801 |

| (Address of principal executive offices) |

(Zip Code) |

|

|

|

|

|

| Registrant’s telephone number, including area code: |

518 |

|

745-1000 |

(Former name or former address, if changed since last report)

|

|

|

|

|

|

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of Each Class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, Par Value $1.00 per share |

AROW |

NASDAQ Global Select Market |

|

|

|

|

|

|

|

|

|

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

|

| Emerging growth company |

☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act |

☐ |

Item 7.01. Regulation FD Disclosure

On June 17 and 18, 2025, Arrow Financial Corporation (“Arrow”) will participate in virtual investor meetings. In addition to the First Quarter 2025 Investor Presentation previously furnished on the Form 8-K filed May 1, 2025, Arrow has prepared a Mid-2Q Update for use during the virtual meetings with certain current and potential investors (the “Meeting Presentation”). A copy of the Meeting Presentation is attached hereto as Exhibit 99.1 and incorporated herein.

The information contained in this Item 7.01 and in Exhibit 99.1 attached to this Report is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. Furthermore, such information shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

| Exhibit No |

|

Description |

|

|

|

| Exhibit 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ARROW FINANCIAL CORPORATION |

|

|

|

|

|

|

| Date: |

June 17, 2025 |

/s/ Penko Ivanov |

|

|

Penko Ivanov

Chief Financial Officer |

EX-99.1

2

midq2investorupdate.htm

EX-99.1

midq2investorupdate

Mid-2Q Update Virtual Investor Meetings June 17, 2025

2 Forward-Looking Statements This presentation may contain certain forward-looking statements about Arrow Financial Corporation (“Arrow” or the “Company”). Forward-looking statements, as defined in Section 21E of the Securities Exchange Act of 1934, as amended, include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the banking industry or securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged. We are not obligated to revise or update these statements to reflect unanticipated events. This document should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 (the “2024 10-K”), the Company’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025, and the first quarter 2025 earnings release (the “1Q Earnings Release”) and the related Investor Presentation, both issued on May 1, 2025.

3 Net Interest Margin – QTD May 2025 1 1Yield includes the impact of deferred fees and amortization of loan origination costs 2FTE has historically been 1-2 bps higher than NIM reported under GAAP 2.98% 2.63% 2.55%2.55% 2.62% 2.69% 2.79% 2.85% 3.08% 3.12% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 All NIM 2024 and beyond presented on a fully taxable equivalent basis (FTE2) 2.62% 2.69% 2.79% 2.85% 3.08% 3.12% 5.01% 5.17% 5.27% 5.30% 5.30% 5.34% 2.06% 2.12% 2.12% 2.15% 1.96% 1.96% 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 NIM Average Loan Yield for the Period Shown Cost of Deposits Strong NIM expansion through May 2025 – further expansion expected… but moderating absent additional rate cuts

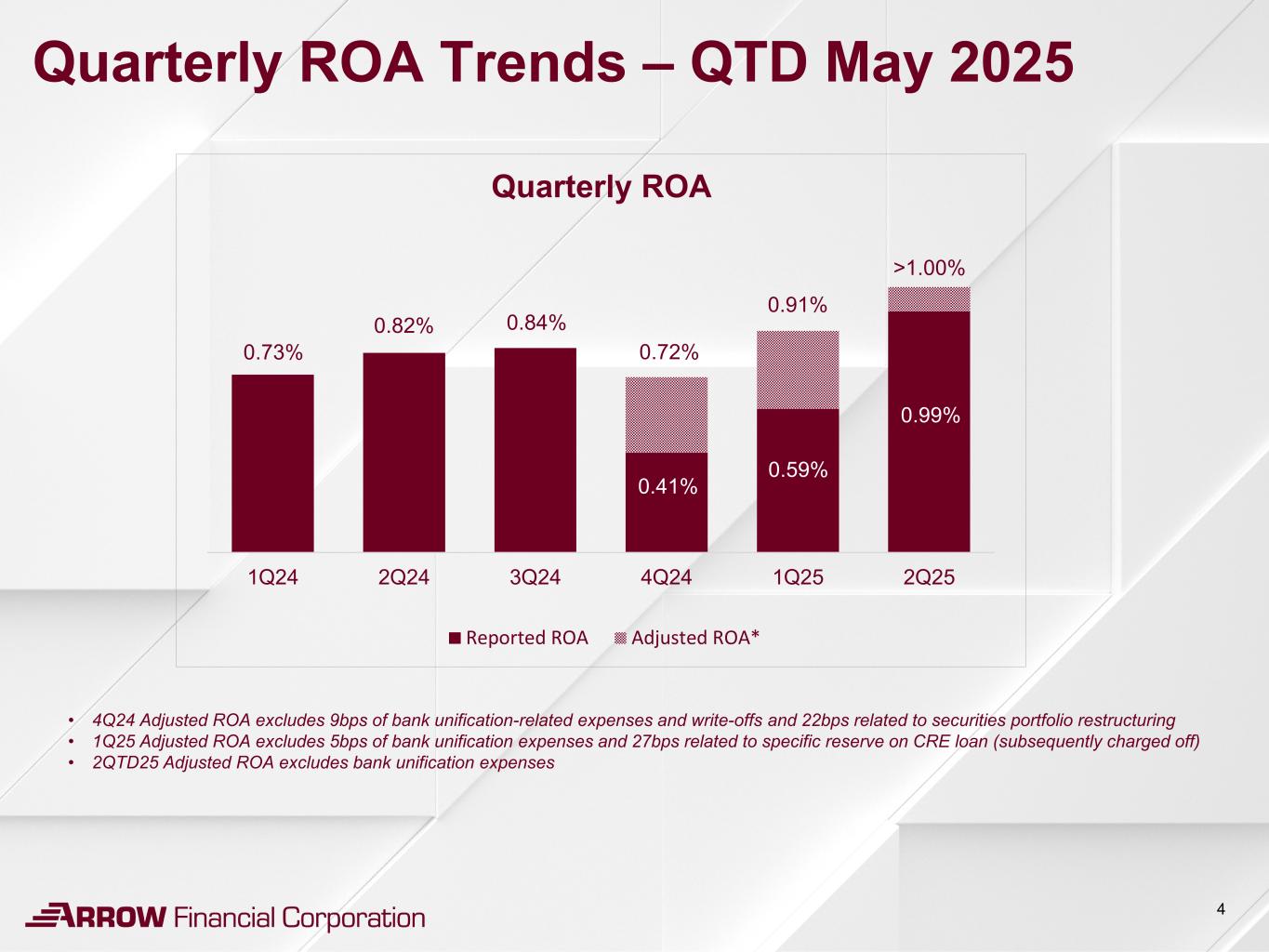

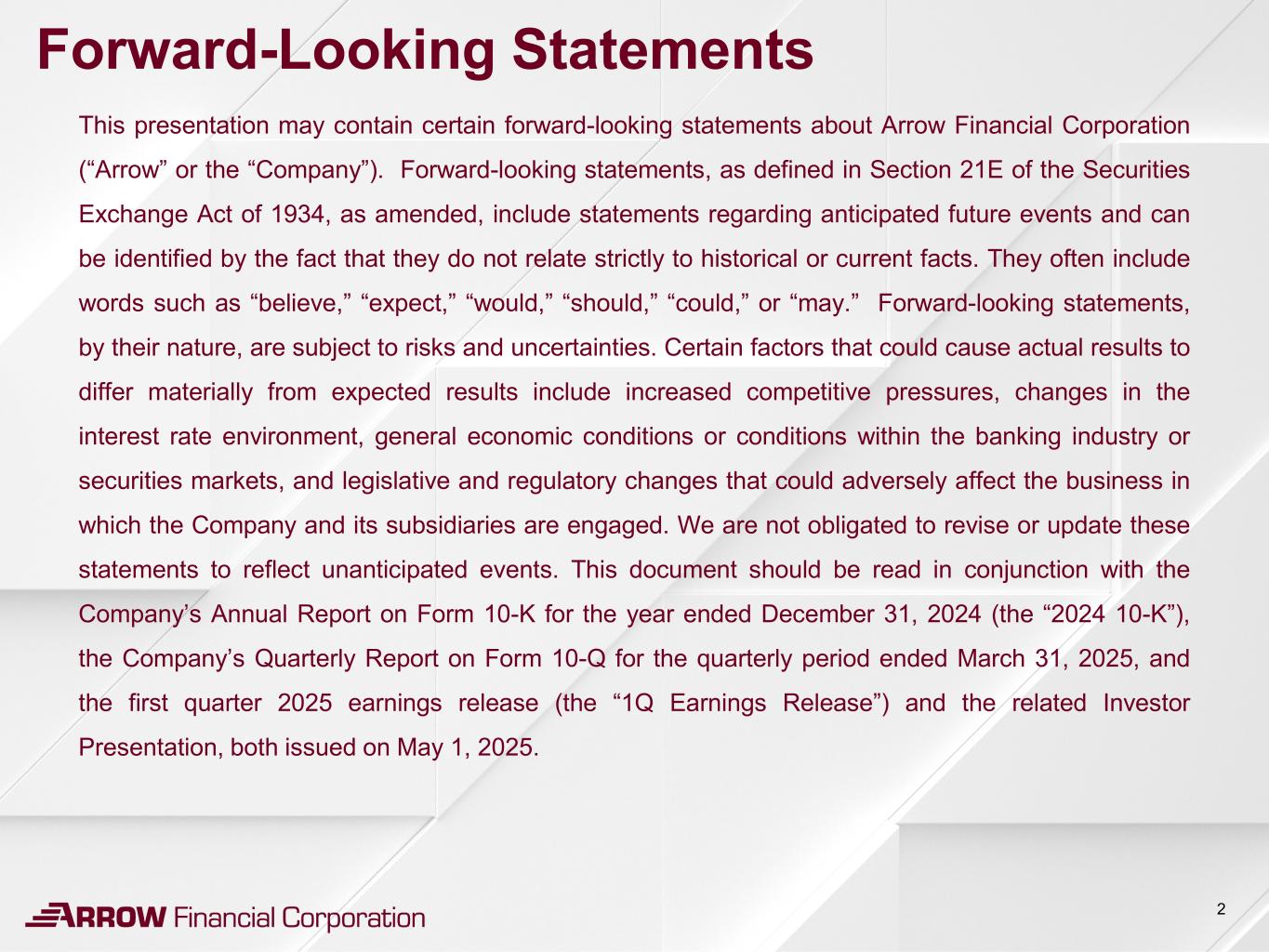

4 Quarterly ROA Trends – QTD May 2025 0.73% 0.82% 0.84% 0.72% 0.91% 0.99% 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 Quarterly ROA Reported ROA Adjusted ROA* 0.41% 0.59% • 4Q24 Adjusted ROA excludes 9bps of bank unification-related expenses and write-offs and 22bps related to securities portfolio restructuring • 1Q25 Adjusted ROA excludes 5bps of bank unification expenses and 27bps related to specific reserve on CRE loan (subsequently charged off) • 2QTD25 Adjusted ROA excludes bank unification expenses >1.00%

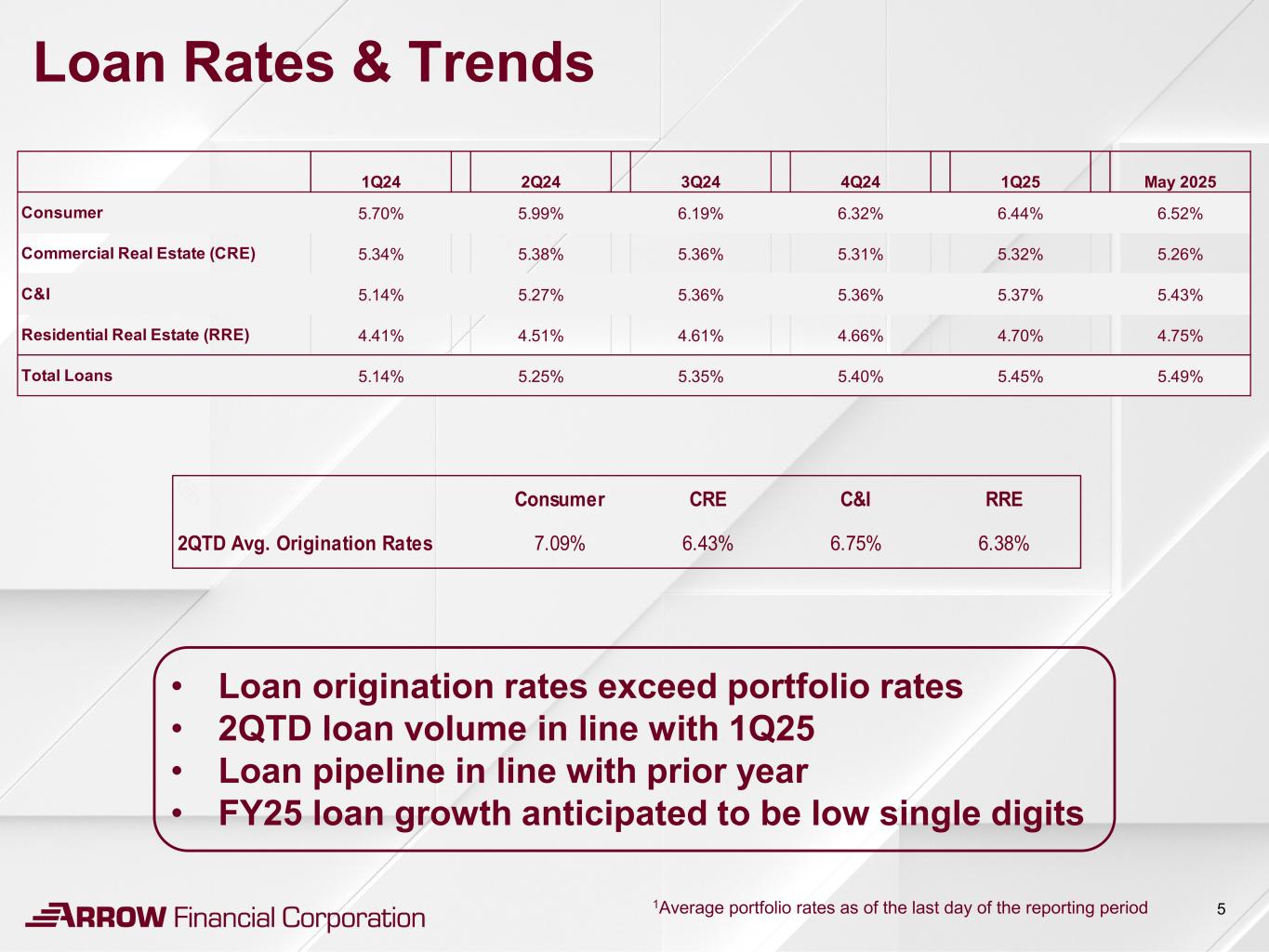

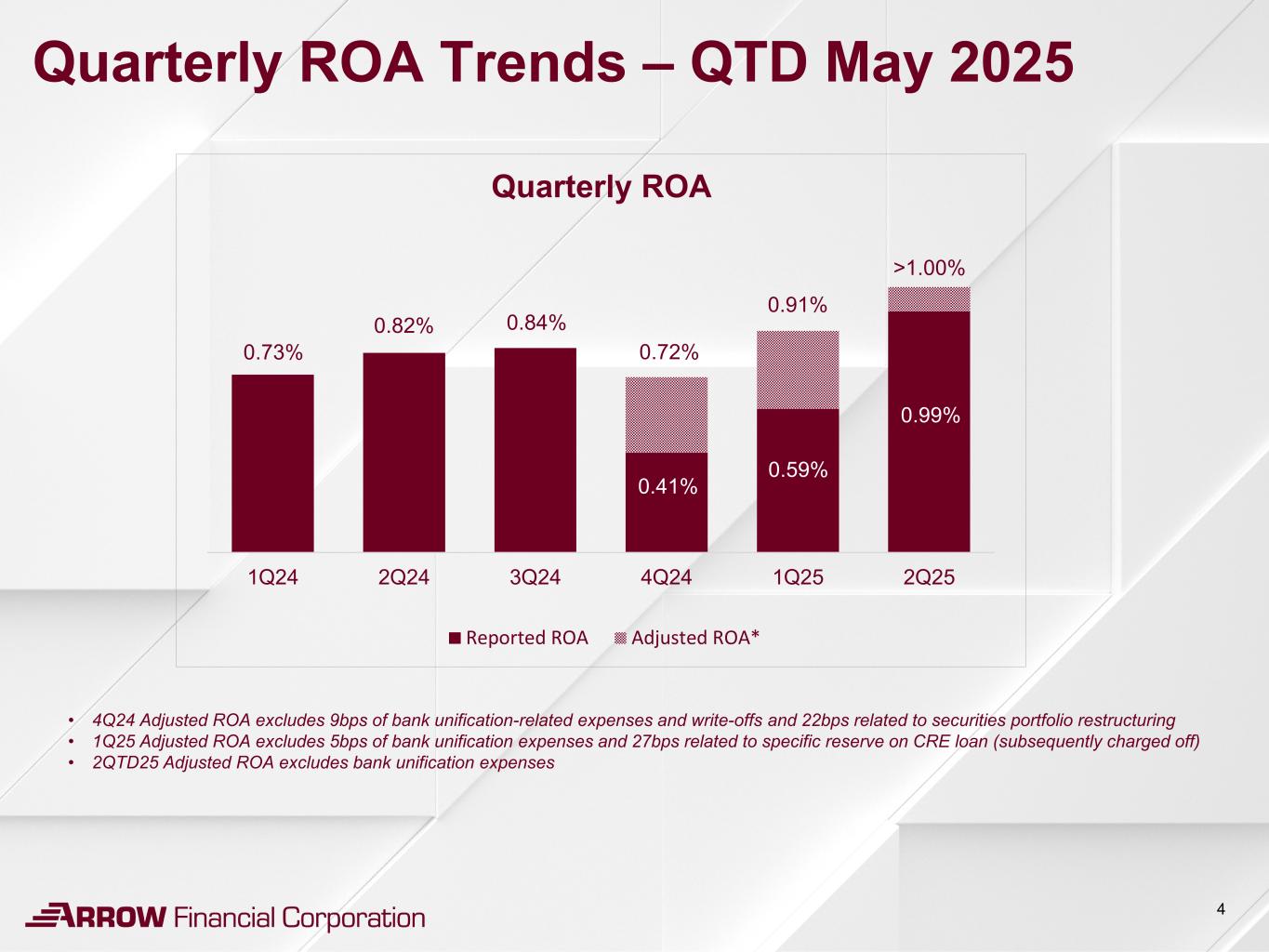

5 Loan Rates & Trends • Loan origination rates exceed portfolio rates • 2QTD loan volume in line with 1Q25 • Loan pipeline in line with prior year • FY25 loan growth anticipated to be low single digits 1Average portfolio rates as of the last day of the reporting period Consumer CRE C&I RRE 2QTD Avg. Origination Rates 7.09% 6.43% 6.75% 6.38% 1Q24 2Q24 3Q24 4Q24 1Q25 May 2025 Consumer 5.70% 5.99% 6.19% 6.32% 6.44% 6.52% Commercial Real Estate (CRE) 5.34% 5.38% 5.36% 5.31% 5.32% 5.26% C&I 5.14% 5.27% 5.36% 5.36% 5.37% 5.43% Residential Real Estate (RRE) 4.41% 4.51% 4.61% 4.66% 4.70% 4.75% Total Loans 5.14% 5.25% 5.35% 5.40% 5.45% 5.49%

6 Deposit Rates & Trends Exit Rate1 Exit Rate1 Exit Rate1 Demand (Non-Interest Bearing) 0.00% 0.00% 0.00% Interest Bearing Checking 1.12% 1.02% 1.03% Savings and Money Market 2.65% 2.53% 2.51% Time Deposits 3.60% 3.44% 3.42% Total 1.92% 1.80% 1.79% 4Q 2024 1Q 2025 May 2025 • Disciplined pricing continues to favorably impact core deposit rates Deposit cost reduction moderating absent additional Fed rate cuts Deposit market remains very competitive • ~$50M of CDs set to reprice lower by the end of 2Q25 1Average rates as of the last day of the reporting period

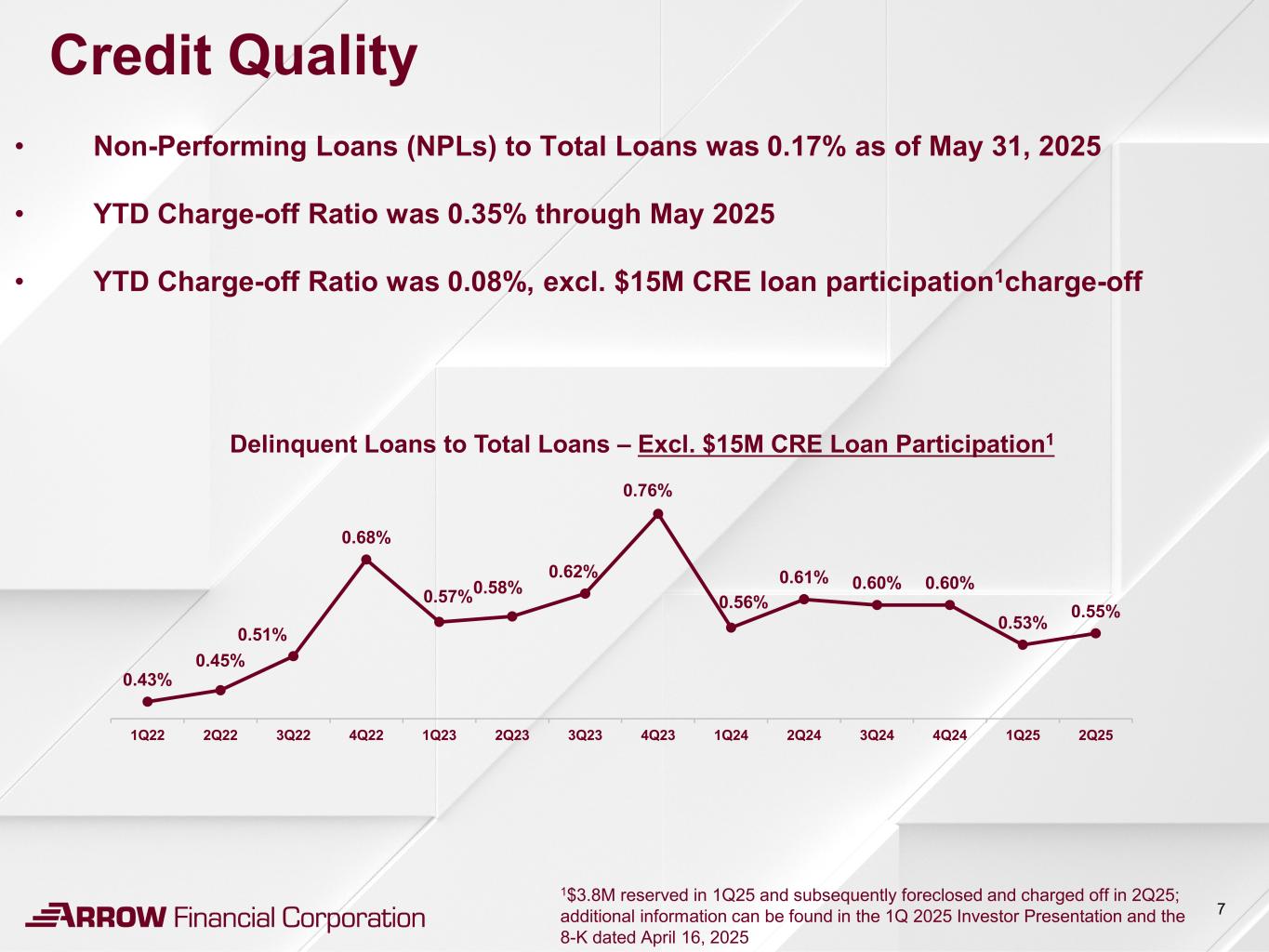

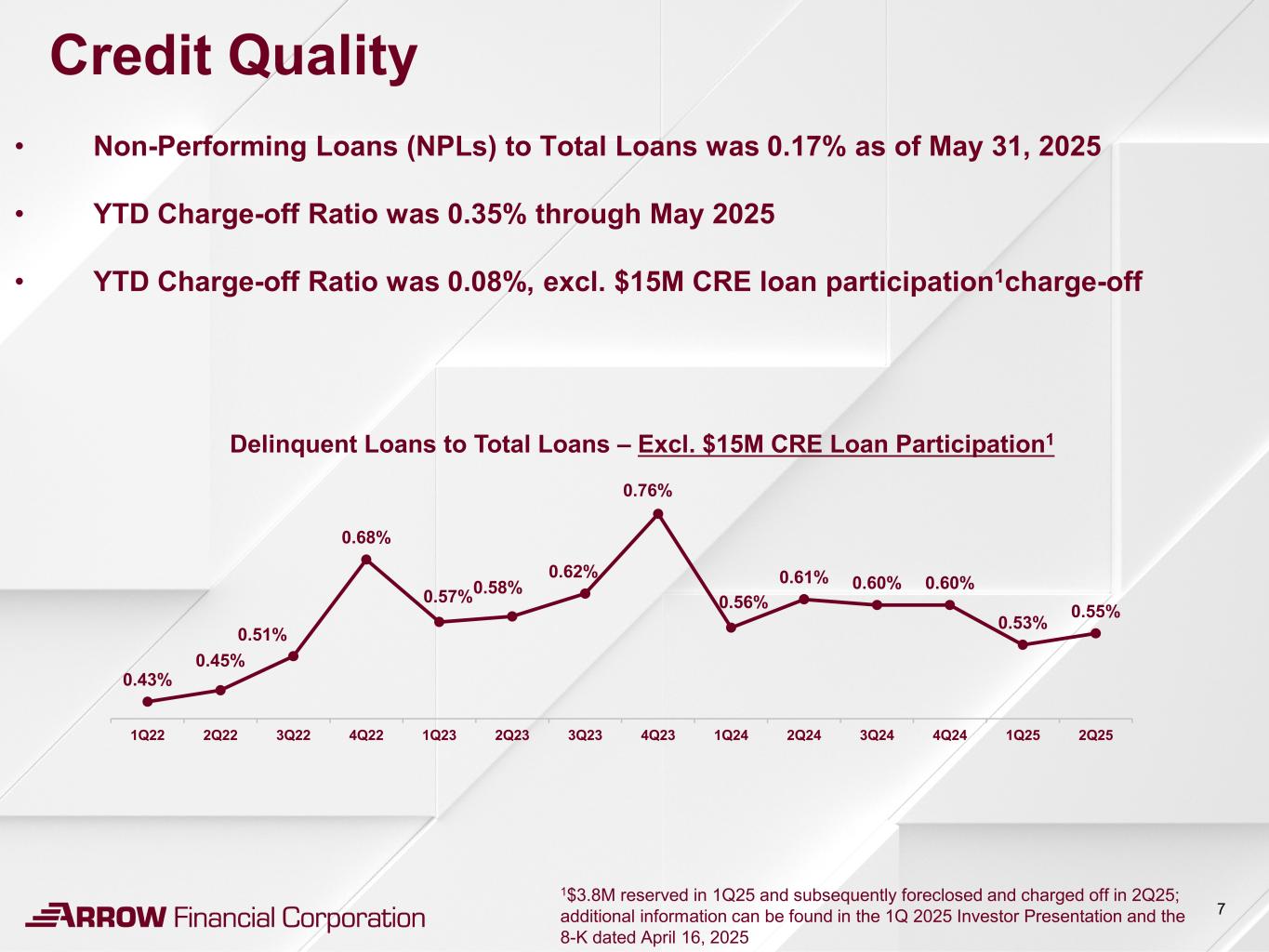

7 Credit Quality • Non-Performing Loans (NPLs) to Total Loans was 0.17% as of May 31, 2025 • YTD Charge-off Ratio was 0.35% through May 2025 • YTD Charge-off Ratio was 0.08%, excl. $15M CRE loan participation1charge-off 0.43% 0.45% 0.51% 0.68% 0.57%0.58% 0.62% 0.76% 0.56% 0.61% 0.60% 0.60% 0.53% 0.55% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 Delinquent Loans to Total Loans – Excl. $15M CRE Loan Participation1 1$3.8M reserved in 1Q25 and subsequently foreclosed and charged off in 2Q25; additional information can be found in the 1Q 2025 Investor Presentation and the 8-K dated April 16, 2025

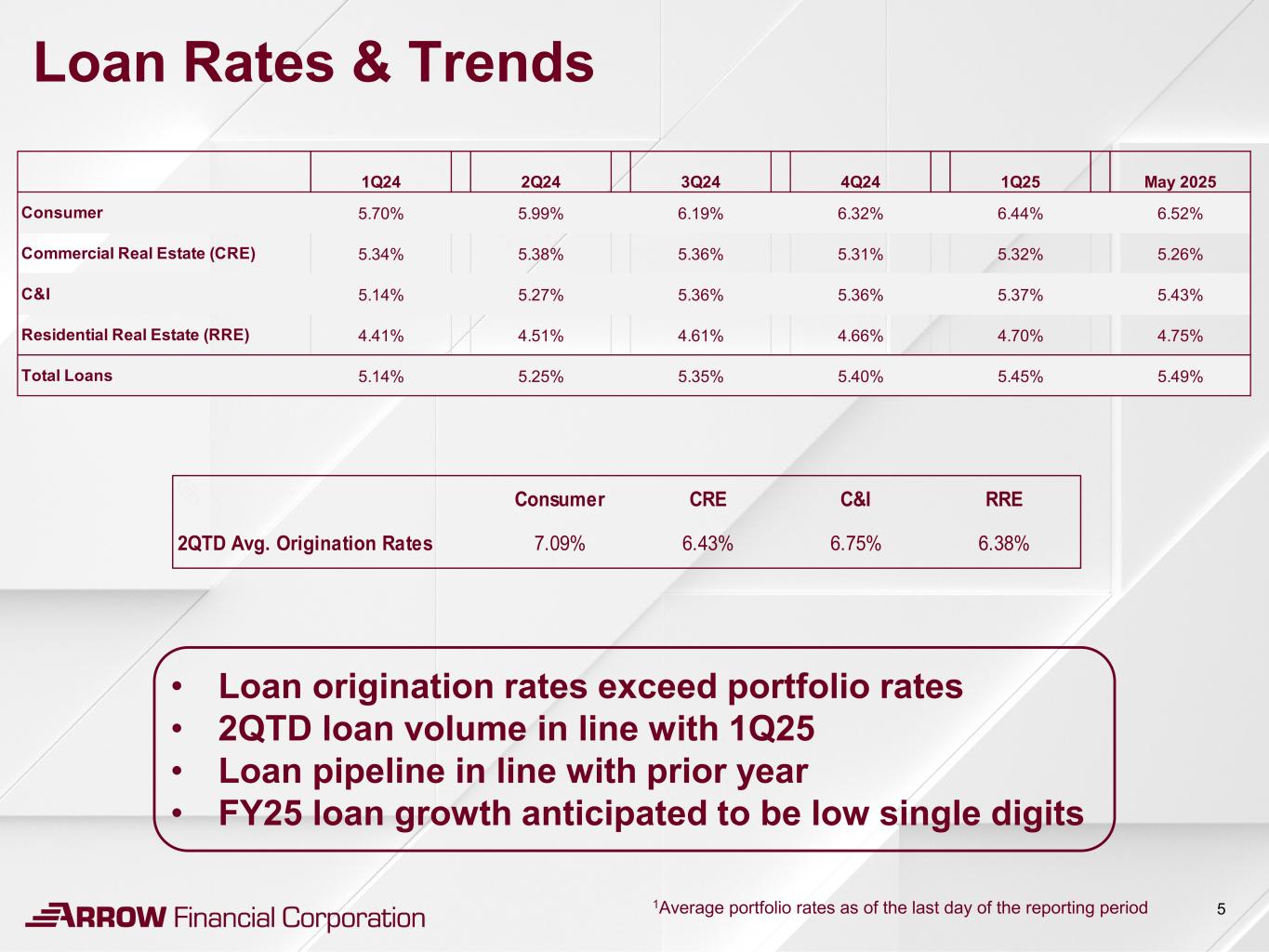

8 Capital & Ownership • TCE of 8.72% as of May 31, 2025, up from 8.56% at 1Q25 • YTD 2025 Share Repurchase Activity YTD through June 13, 2025, ~$8.5M of stock repurchases o ~324.5K shares at an average price of $26.23 2QTD, ~$5.1M of stock repurchases o ~196.5K shares at an average price of $26.06 • Stock Ownership as of June 13, 2025 Approximately 16.5M shares outstanding: Management – Approximately 1% Directors – Approximately 1% Employees – Approximately 5% a) Employee Stock Ownership Plan, b) Employee Stock Purchase Plan and c) equity incentives The above percentages do not include approximately 60K in unvested RSA shares

9 M&A • M&A Strategic Focus Branch(es) Bank(s) Geographic Target Area Wealth Management Insurance Current Branch Network

Thank You!