ANNUAL REVIEW 2023

While the last year posed its challenges, it did not distract us from growing the business. We remain steadfast in our commitment to serving our shareholders, customers and communities and empowering our employees. David S. DeMarco President and CEO The information in this document may contain statements based on management’s beliefs, assumptions, expectations, estimates and projections about the future. Such "forward-looking statements," as defined in Section 21E of the Securities Exchange Act of 1934, as amended, involve a degree of uncertainty and attendant risk. Actual outcomes and results may differ, explicitly or by implication. We are not obliged to revise or update these statements to reflect unanticipated events. This document should be read in conjunction with Arrow’s Annual Report on Form 10-K for the year ended December 31, 2023 and other filings with the Securities and Exchange Commission.

2 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW Arrow Stakeholders: As we reflect on the past year, I am pleased to share our accomplishments and milestones. While the last year posed its challenges, it did not distract us from growing the business. We remain steadfast in our commitment to serving our shareholders, customers and communities and empowering our employees. One of the highlights of 2023 was our robust loan growth. This growth was coupled with record-high loan balances, a testament to our ability to meet the diverse financial needs of our customers while maintaining strong credit, capital and liquidity positions. We issued a cash dividend to our shareholders for the 43rd consecutive quarter, expanded our existing stock repurchase program by $5 million, reinstated our dividend reinvestment program and issued an annual stock dividend for the 15th consecutive year. Both Glens Falls National Bank and Trust Company and Saratoga National Bank and Trust Company maintained their Bauer Financial 5-Star "Exceptional Performance" ratings for the 16th and 14th consecutive years, respectively. Furthermore, we completed a multi-year renovation project on our downtown Glens Falls headquarters, providing a modern and welcoming space for both employees and customers alike. The Main Office branch of Glens Falls National Bank also reopened right in the center of downtown Glens Falls, serving as a centerpiece of what community banking means to us—accessible, long-lasting and friendly. This investment in our infrastructure underscores our dedication to providing the best possible customer experience and reinforces our commitment to the community. You can read more about the headquarters renovation on page 4. In line with our commitment to innovation, we continued to advance our technology, enhancing our capabilities and delivering a superior customer experience. Additionally, we invested in our people through expanded learning and development programs designed to support our culture of collaboration and continuous improvement. At the heart of everything we do is our mission to strengthen financial lives and make a positive impact in the communities we serve. As noted at the end of this review, we continued to demonstrate an impressive commitment to our communities by donating $781,000 and more than 11,000 volunteer hours in 2023. We are incredibly proud of the dollars we donate, the thousands of hours our team gives back and the impact we make on our communities by doing so. Finally, I would like to take this opportunity to recognize our exceptional team for their hard work and dedication throughout the year. Our success is directly tied to their unwavering commitment to our values and vision. As we look ahead, we remain focused on building upon our achievements and continuing to deliver value to our shareholders, customers and communities. Thank you for your commitment to the Arrow Family of Companies. For those of you who are shareholders, thank you for your investment in Arrow Financial Corporation. Your support is appreciated as we continue to work to maintain your trust in us and create increased value for your investment. David S. DeMarco President and CEO

3 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW Our team continued to advance our strategic goals while serving the needs of our customers, communities and shareholders. Find more details below, followed by our financial highlights. SOLID RESULTS In 2023, Arrow Financial Corporation saw robust loan growth and retail deposit balances of $3.5 billion, slightly ahead of year-end 2022. Arrow finished the year with solid earnings, again thanks to the hard work and dedication of our exceptional team. In a challenging rate environment, we looked to draw in new customers with competitive rates on deposit products while continuing to deepen existing customer relationships. We maintained asset quality with total assets reaching $4.17 billion at year-end. Throughout the year, we focused on enhancing customer relationships, expanding our presence in newer markets and maintaining asset quality and other performance metrics. 2023 IN REVIEW

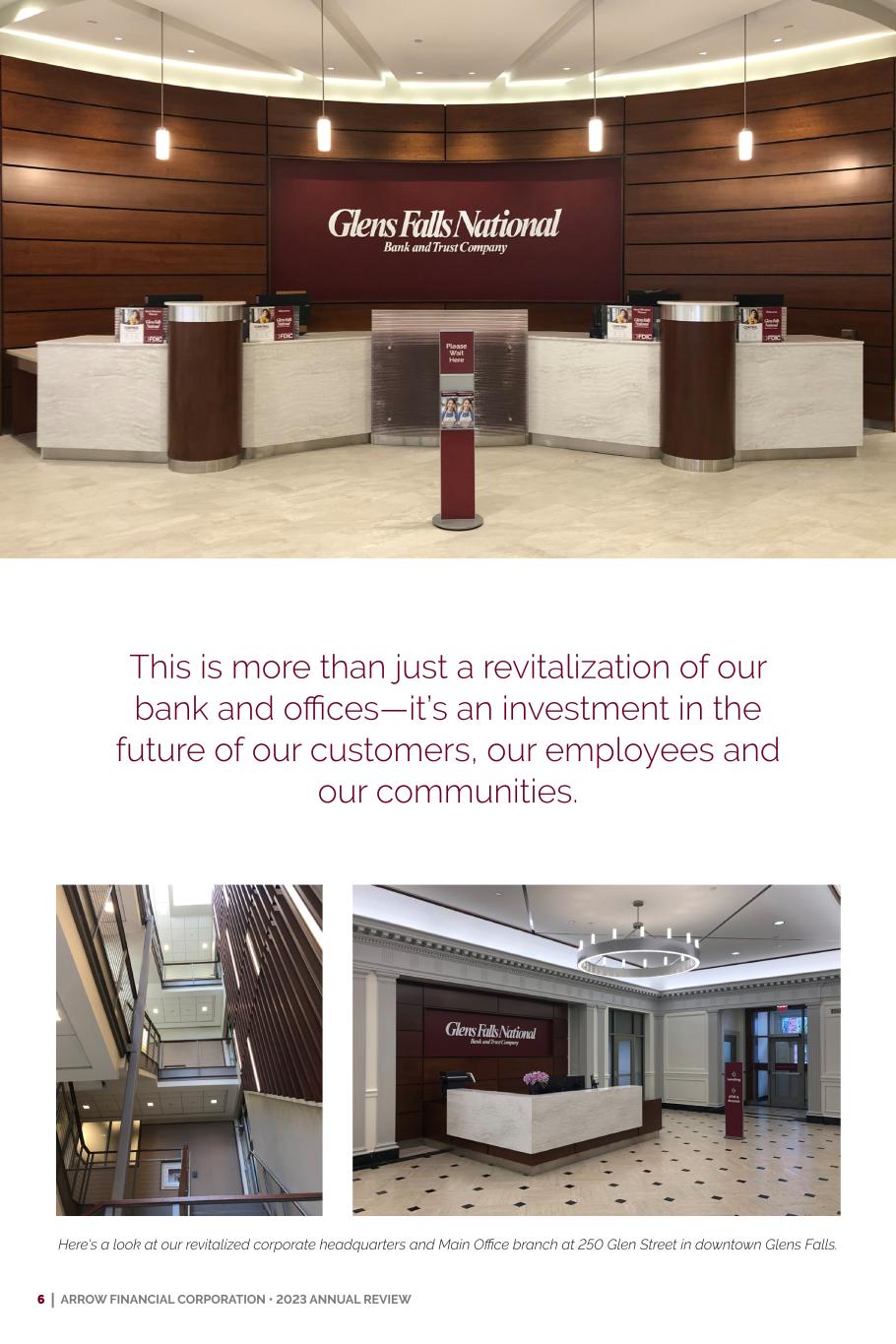

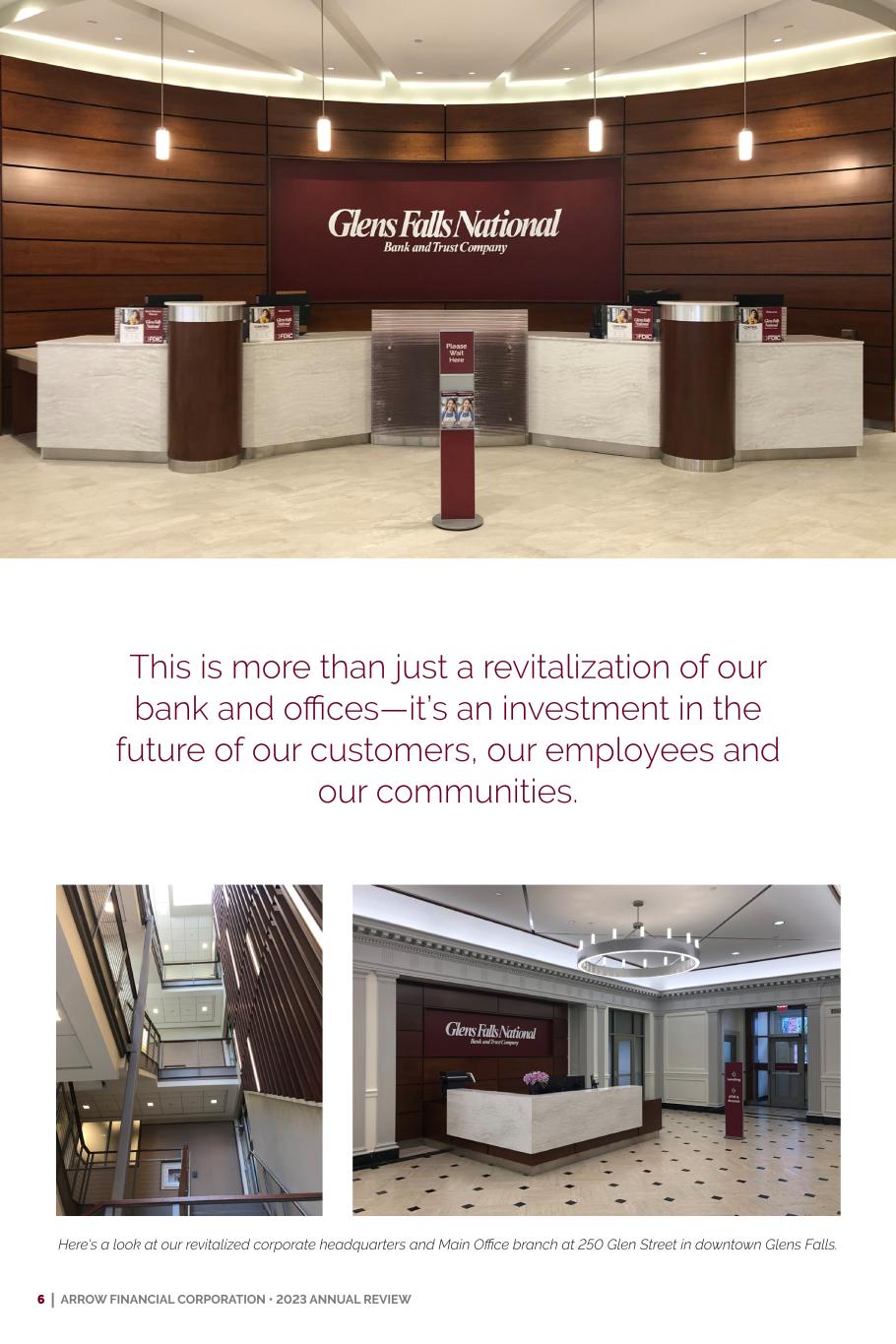

4 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW HEADQUARTERS RENOVATION After a multi-year investment, we reopened our completely renovated corporate headquarters in downtown Glens Falls and welcomed back our team and our customers. These renovations and updates, which include our Main Office branch and lending areas, provide our team with an efficient and flexible workspace, an enhanced experience for our customers and will help reduce our environmental impact. Project updates included: • A fully renovated lobby and lending center for the main branch of Glens Falls National Bank • The replacement of aging infrastructure and equipment including a full overhaul of electrical and HVAC, a rooftop green space, solar panels, energy-saving lighting and water-conserving plumbing • Flexible and functional workspaces for our teams • Increased physical security • Energy-saving interior and exterior improvements The completion of our corporate headquarters renovation project is more than just a revitalization of our bank and offices—it's an investment in the future of our customers, our employees and our communities. See images on page 6. ADVANCING TECHNOLOGY As a company, we are continually making enhancements to our customer-facing platforms. Upgrades focused on improving the user experience with efficient tools and mobile capabilities. In addition, we continue to introduce easy- to-use fraud prevention digital services for businesses to monitor and approve activity on their accounts. As always, our goal is to improve operational efficiency and internal reporting to make data-driven decisions. SAFER BANKING, TOGETHER Fraud attempts are widespread, targeting both individuals and businesses. We are dedicated to educating and empowering our customers to prevent, detect and report fraud on their accounts. We also urge our customers and communities to be cautious with their financial and personal information. Behind the scenes, we work to maintain robust and ever-evolving fraud prevention measures to protect customer data. SOCIALLY CONSCIOUS PERFORMANCE At Arrow, we are committed to operating in a socially conscious manner that demonstrates positive environmental, social and governance contributions. Below are some examples of our commitment to conserving natural resources, supporting our employees, customers and communities, demonstrating that we value differences, particularly in the areas of diversity, equity, inclusion and belonging (“DEIB”) and adhering to strong corporate governance. • Digital banking options and paperless statements are provided and encouraged • Facility renovations, including our corporate headquarters, incorporate energy-saving features • Emissions reduction through remote work and video conferencing

5 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW • Long-standing dedication to diversity on Arrow’s Board of Directors, exceeding Nasdaq requirements • Professional development, wellness and mental health employee services are available to our team • Annual engagements with a third party to assess diversity within our employee base and support for the setting and tracking of goals to encourage the advancement of minorities, women, veterans and persons with disabilities • Incorporation of inclusion and belonging into our HR policies, practices and programs • Products to facilitate first-time home ownership • Bank On certification for Smart Steps checking to serve the underbanked • Annually, time, dollars and expertise are donated to community organizations with an emphasis on affordable homeownership, economic empowerment, health and human services and social progress (find more about our 2023 support on page 12) • Comprehensive governance program, as described in further detail in our annual Proxy Statement • Expanding our philanthropic support of environmental sustainability in our community, including organizations that impact soil, water and land conservation, sustainable farming, mountain and lake protection and stewardship, and parks and recreation • Developed sustainability investment models for our socially conscious clients • Strong cybersecurity protections and training Find additional details in our shareholder communications and filings with the Securities and Exchange Commission. GREAT TEAM, GREAT RESULTS What we achieve, we achieve together. It is through our team’s hard work and dedication that we continue to deliver on our mission of strengthening financial lives. Beyond our mission, we have a company culture of continuous improvement. That means we are constantly growing, learning and evolving. We have internal programs in place to support our emerging talent and our seasoned managers. As our business environment changes more rapidly, we want to meet the evolving needs of our customers, and that starts with a culture of learning and collaboration. Together, the Arrow Team will continue to deliver the results that our customers, communities and shareholders expect. IN MEMORY OF THOMAS L. HOY Finally, we would like to acknowledge and remember Tom Hoy, former President and CEO, and Chairman of Arrow Financial Corporation. In his nearly five-decade career with the Arrow Family of Companies, Tom’s dedica- tion was unwavering. He held various roles before becoming company President and CEO from 1997 until his retirement in 2012. He remained Chair of the Board until early 2023, when he stepped back due to health reasons. During his time as CEO, Tom expanded our company’s footprint and set forth a strategic vision that we still follow today. As Chair, his steadiness and integrity helped us navigate significant growth and continuous improvement. We are grateful to have known Tom, and his professional legacy lives on in the company culture he helped shape.

6 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW This is more than just a revitalization of our bank and offices—it’s an investment in the future of our customers, our employees and our communities. Here's a look at our revitalized corporate headquarters and Main Office branch at 250 Glen Street in downtown Glens Falls.

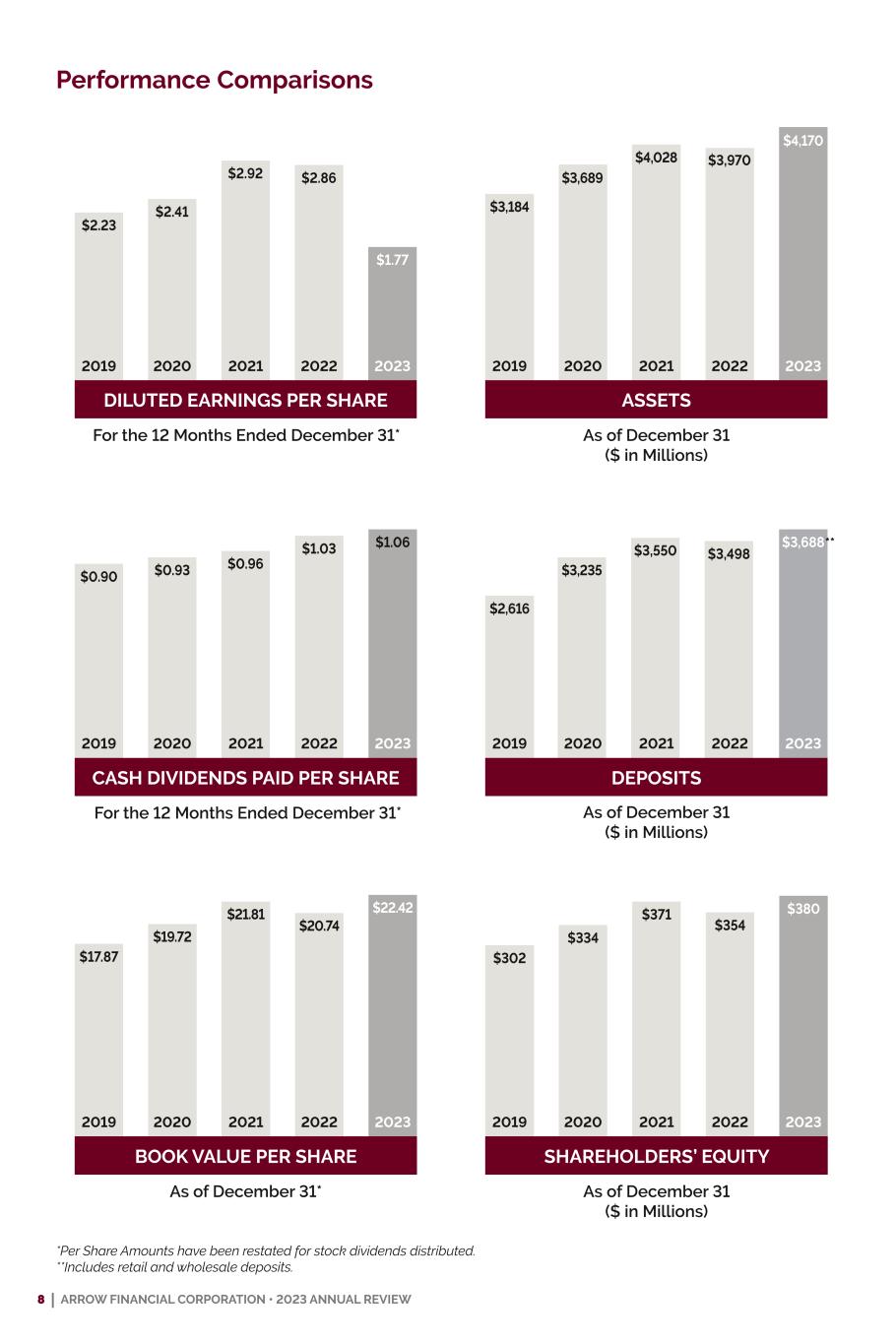

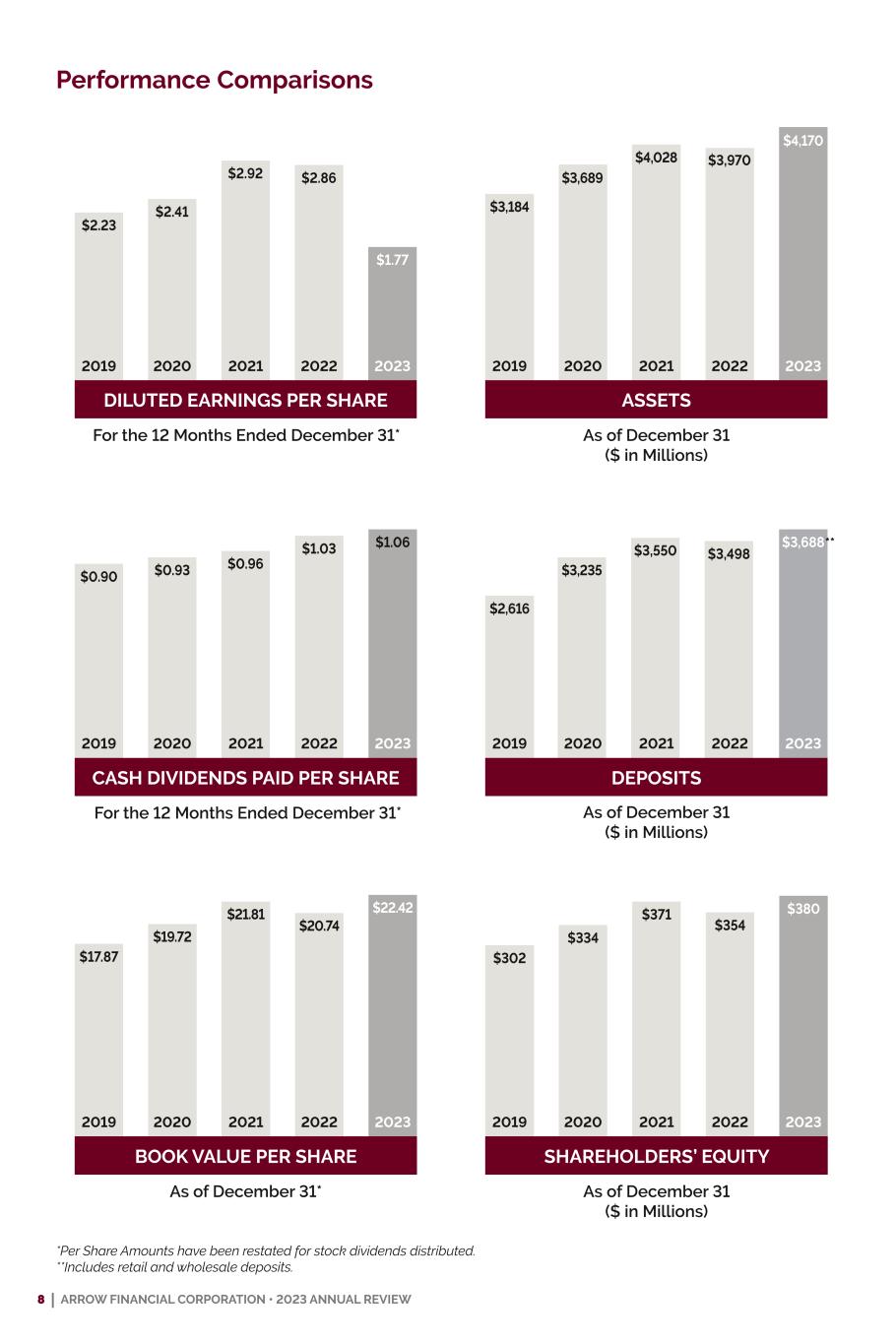

7 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW 2023 Financial Highlights Arrow finished the year with robust loan growth, posting record high loan balances while maintaining strong credit, capital and liquidity positions. Net Income: $30.08 million Total Loans: $3.18 billion, up 7.7% Total Retail Deposits: $3.51 billion, up 0.4% Total Assets: $4.17 billion, up 5.0% Total Shareholders' Equity: $379.77 million, up 7.4% Return on Average Equity: 8.29% Return on Average Assets: 0.74% Stock Dividend: 3% distributed in September 2023 Current Quarterly $0.27 Cash Dividend: Book Value Per Share: $22.42 Diluted Earnings per Share: $1.77

8 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW $380$22.42 $3,688$1.06 $1.77 $4,170 $302 $334 $371 Performance Comparisons As of December 31 ($ in Millions) *Per Share Amounts have been restated for stock dividends distributed. **Includes retail and wholesale deposits. $2.86 $2.23 $2.41 $2.92 For the 12 Months Ended December 31* DILUTED EARNINGS PER SHARE 2019 2020 2021 2022 2023 As of December 31 ($ in Millions) $3,184 $3,689 $4,028 ASSETS 2019 2020 2021 2022 2023 $3,970 $0.90 $0.93 $0.96 $1.03 For the 12 Months Ended December 31* CASH DIVIDENDS PAID PER SHARE 2019 2020 2021 2022 2023 $2,616 $3,235 $3,550 As of December 31 ($ in Millions) DEPOSITS 2019 2020 2021 2022 2023 $3,498 $17.87 $19.72 $21.81 As of December 31* BOOK VALUE PER SHARE 2019 2020 2021 2022 2023 $20.74 $354 2019 2020 2021 2022 2023 SHAREHOLDERS’ EQUITY **

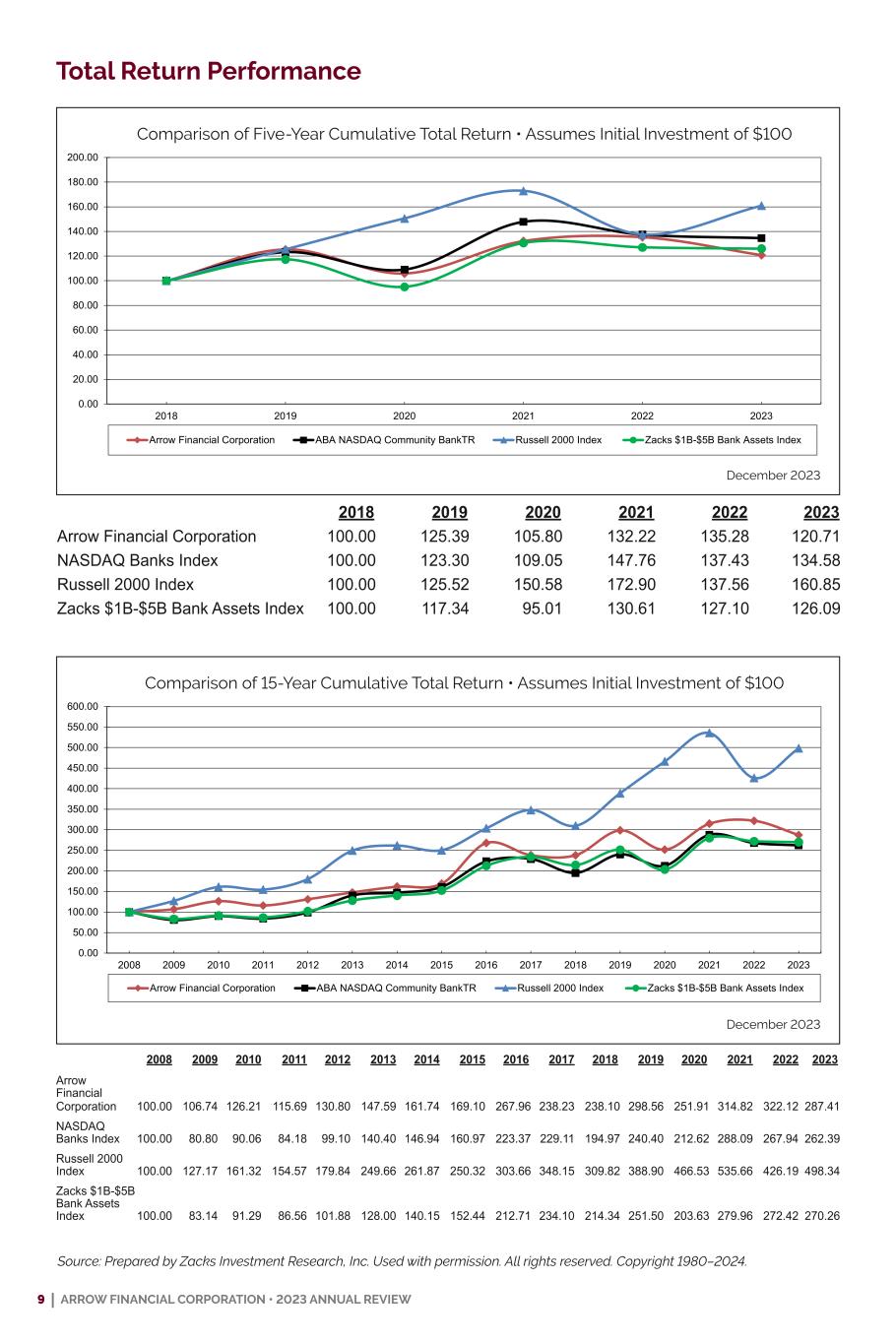

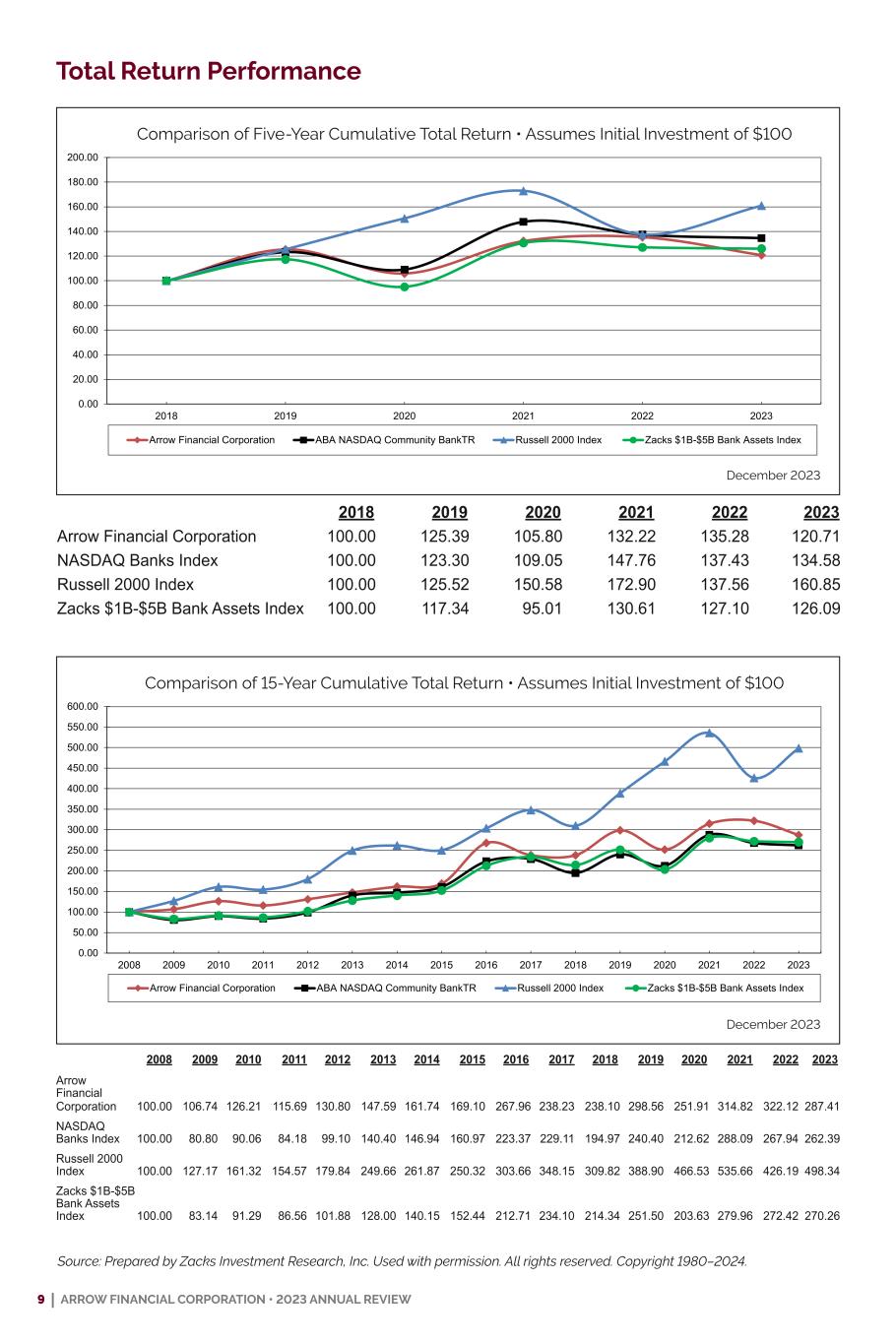

9 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW Source: Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980–2024. Total Return Performance 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Arrow Financial Corporation 100.00 106.74 126.21 115.69 130.80 147.59 161.74 169.10 267.96 238.23 238.10 298.56 251.91 314.82 322.12 287.41 NASDAQ Banks Index 100.00 80.80 90.06 84.18 99.10 140.40 146.94 160.97 223.37 229.11 194.97 240.40 212.62 288.09 267.94 262.39 Russell 2000 Index 100.00 127.17 161.32 154.57 179.84 249.66 261.87 250.32 303.66 348.15 309.82 388.90 466.53 535.66 426.19 498.34 Zacks $1B-$5B Bank Assets Index 100.00 83.14 91.29 86.56 101.88 128.00 140.15 152.44 212.71 234.10 214.34 251.50 203.63 279.96 272.42 270.26 0.00 20.00 40.00 60.00 80.00 100.00 120.00 140.00 160.00 180.00 200.00 2018 2019 2020 2021 2022 2023 Comparison of 5 Year Cumulative Total Return Assumes Initial Investment of $100 December 2023 Arrow Financial Corporation ABA NASDAQ Community BankTR Russell 2000 Index Zacks $1B-$5B Bank Assets Index 0.00 50.00 100.00 150.00 200.00 250.00 300.00 350.00 400.00 450.00 500.00 550.00 600.00 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Comparison of 15 Year Cumulative Total Return Assumes Initial Investment of $100 December 2023 Arrow Financial Corporation ABA NASDAQ Community BankTR Russell 2000 Index Zacks $1B-$5B Bank Assets Index 2018 2019 2020 2021 2022 2023 Arrow Financial Corporation 100.00 125.39 105.80 132.22 135.28 120.71 NASDAQ Banks Index 100.00 123.30 109.05 147.76 137.43 134.58 Russell 2000 Index 100.00 125.52 150.58 172.90 137.56 160.85 Zacks $1B-$5B Bank Assets Index 100.00 117.34 95.01 130.61 127.10 126.09 Comparison of Five-Year Cumulative Total Return • Assumes Initial Investment of $100 Comparison of 15-Year Cumulative Total Return • Assumes Initial Investment of $100 December 2023 December 2023

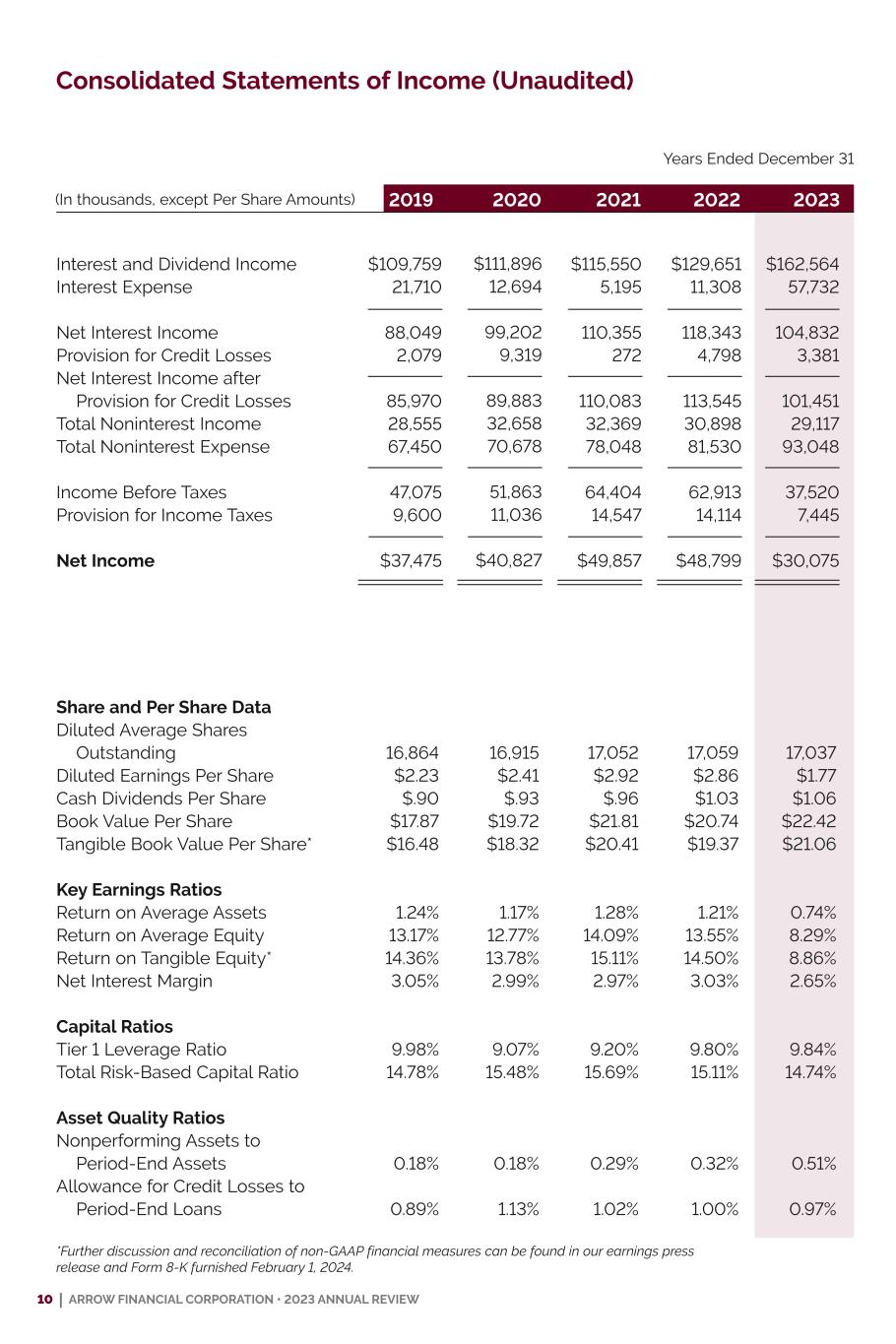

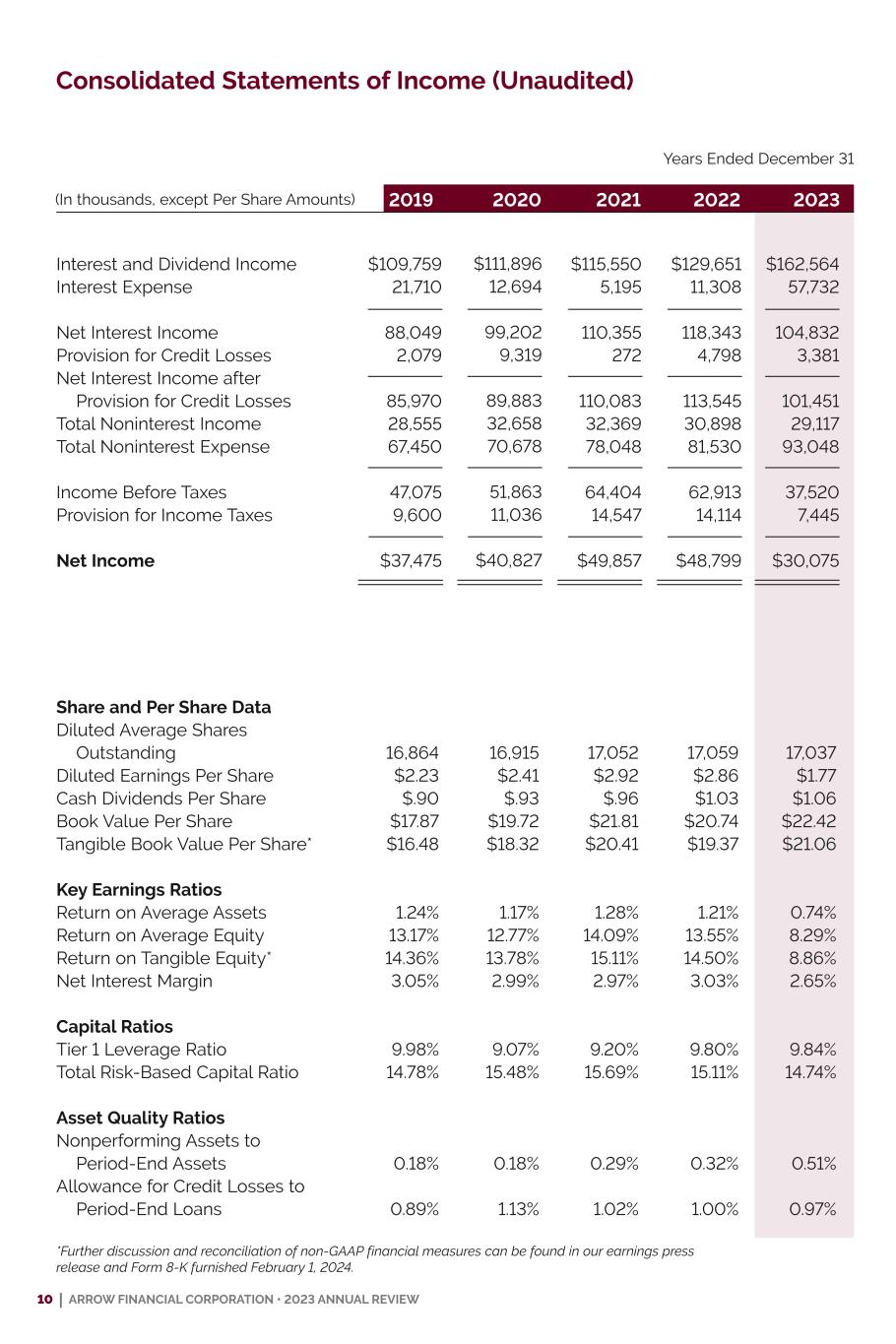

10 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW $111,896 12,694 99,202 9,319 89,883 32,658 70,678 51,863 11,036 $40,827 Consolidated Statements of Income (Unaudited) (In thousands, except Per Share Amounts) Years Ended December 31 2019 2020 2021 2022 2023 Interest and Dividend Income Interest Expense Net Interest Income Provision for Credit Losses Net Interest Income after Provision for Credit Losses Total Noninterest Income Total Noninterest Expense Income Before Taxes Provision for Income Taxes Net Income Share and Per Share Data Diluted Average Shares Outstanding Diluted Earnings Per Share Cash Dividends Per Share Book Value Per Share Tangible Book Value Per Share* Key Earnings Ratios Return on Average Assets Return on Average Equity Return on Tangible Equity* Net Interest Margin Capital Ratios Tier 1 Leverage Ratio Total Risk-Based Capital Ratio Asset Quality Ratios Nonperforming Assets to Period-End Assets Allowance for Credit Losses to Period-End Loans 17,052 $2.92 $.96 $21.81 $20.41 1.28% 14.09% 15.11% 2.97% 9.20% 15.69% 0.29% 1.02% 16,864 $2.23 $.90 $17.87 $16.48 1.24% 13.17% 14.36% 3.05% 9.98% 14.78% 0.18% 0.89% $109,759 21,710 88,049 2,079 85,970 28,555 67,450 47,075 9,600 $37,475 $115,550 5,195 110,355 272 110,083 32,369 78,048 64,404 14,547 $49,857 16,915 $2.41 $.93 $19.72 $18.32 1.17% 12.77% 13.78% 2.99% 9.07% 15.48% 0.18% 1.13% 17,059 $2.86 $1.03 $20.74 $19.37 1.21% 13.55% 14.50% 3.03% 9.80% 15.11% 0.32% 1.00% 17,037 $1.77 $1.06 $22.42 $21.06 0.74% 8.29% 8.86% 2.65% 9.84% 14.74% 0.51% 0.97% $129,651 11,308 118,343 4,798 113,545 30,898 81,530 62,913 14,114 $48,799 $162,564 57,732 104,832 3,381 101,451 29,117 93,048 37,520 7,445 $30,075 *Further discussion and reconciliation of non-GAAP financial measures can be found in our earnings press release and Form 8-K furnished February 1, 2024.

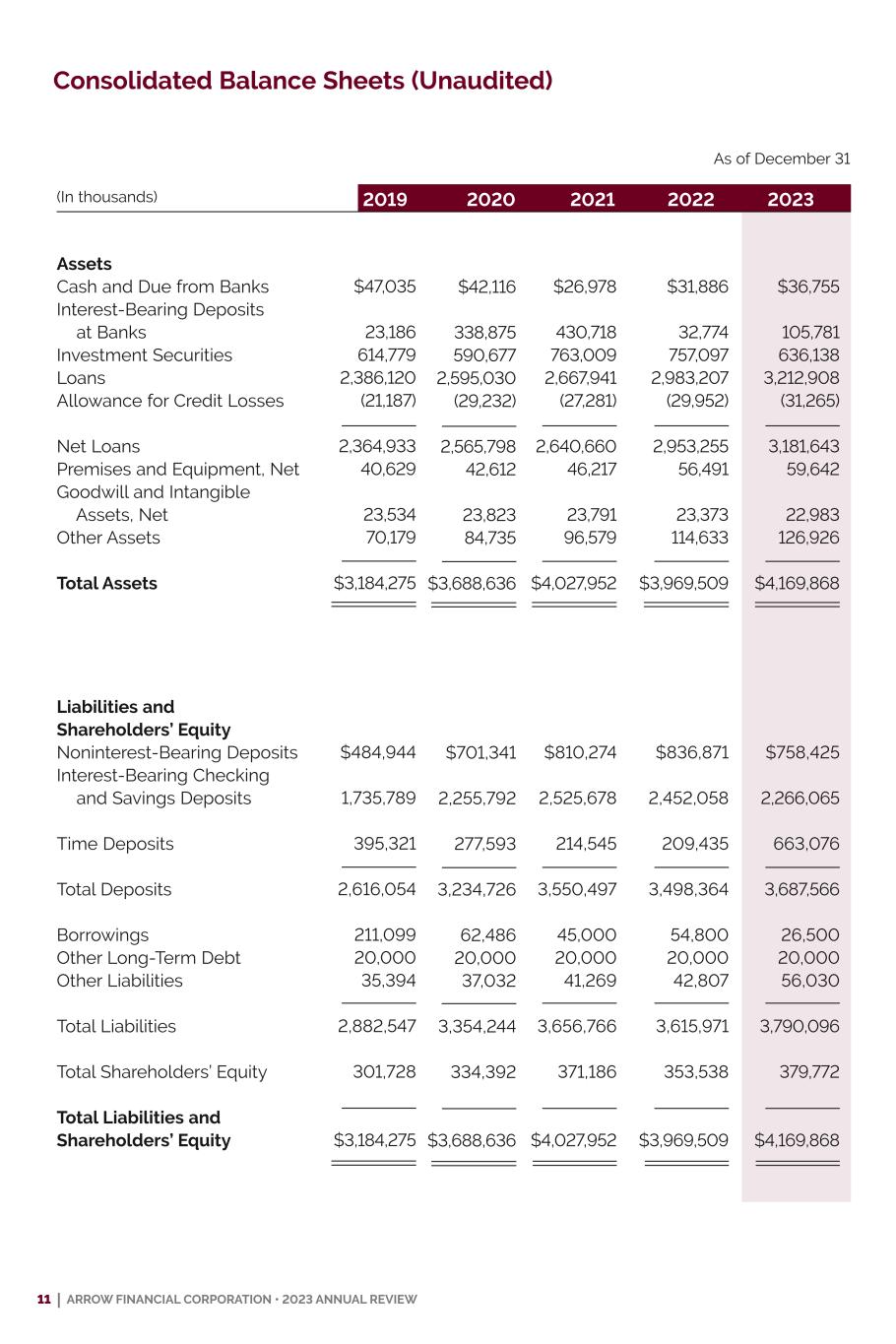

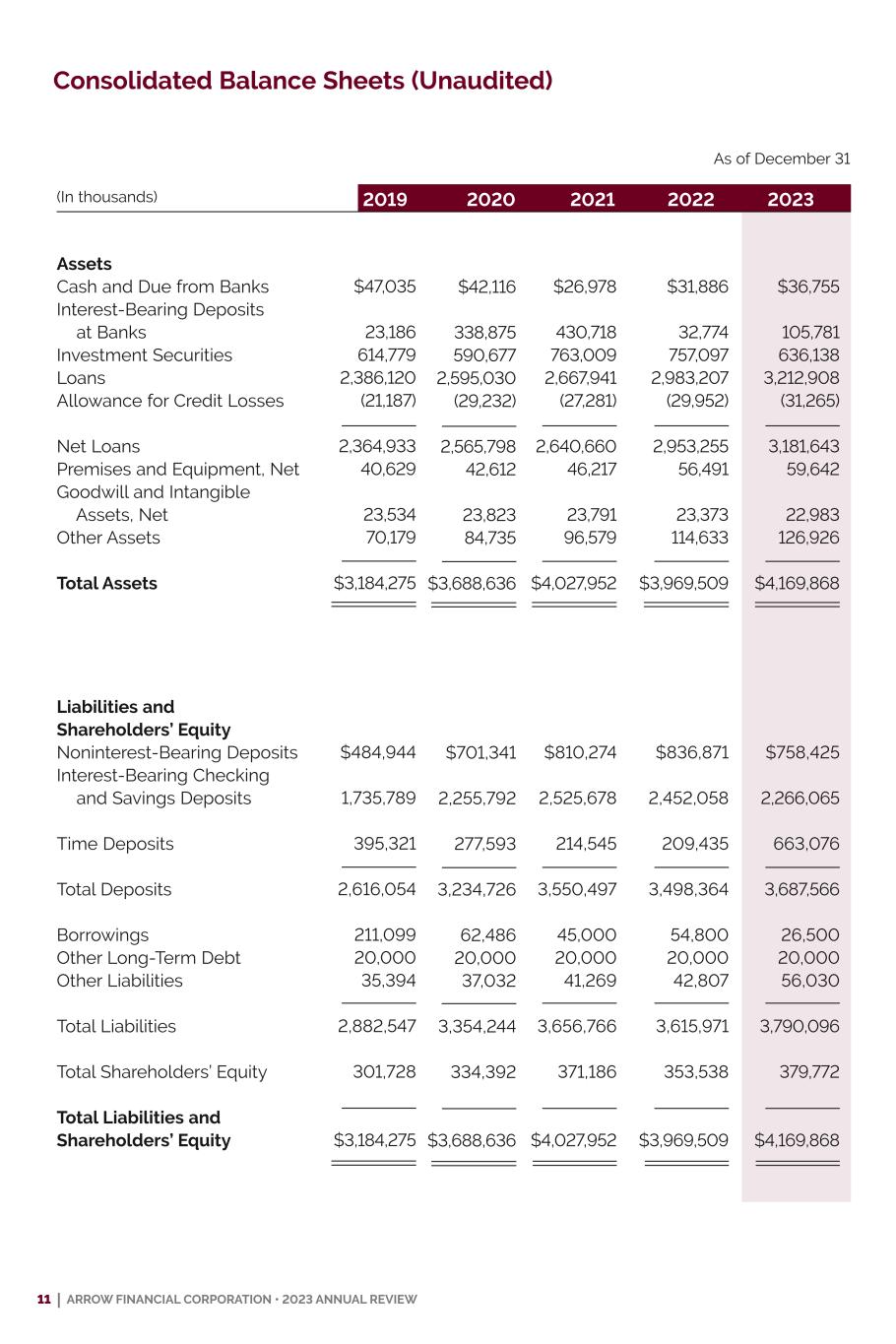

11 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW 2019 2020 2021 2022 2023 Consolidated Balance Sheets (Unaudited) (In thousands) As of December 31 Assets Cash and Due from Banks Interest-Bearing Deposits at Banks Investment Securities Loans Allowance for Credit Losses Net Loans Premises and Equipment, Net Goodwill and Intangible Assets, Net Other Assets Total Assets Liabilities and Shareholders’ Equity Noninterest-Bearing Deposits Interest-Bearing Checking and Savings Deposits Time Deposits Total Deposits Borrowings Other Long-Term Debt Other Liabilities Total Liabilities Total Shareholders’ Equity Total Liabilities and Shareholders’ Equity $47,035 23,186 614,779 2,386,120 (21,187) 2,364,933 40,629 23,534 70,179 $3,184,275 $484,944 1,735,789 395,321 2,616,054 211,099 20,000 35,394 2,882,547 301,728 $3,184,275 $26,978 430,718 763,009 2,667,941 (27,281) 2,640,660 46,217 23,791 96,579 $4,027,952 $810,274 2,525,678 214,545 3,550,497 45,000 20,000 41,269 3,656,766 371,186 $4,027,952 $42,116 338,875 590,677 2,595,030 (29,232) 2,565,798 42,612 23,823 84,735 $3,688,636 $701,341 2,255,792 277,593 3,234,726 62,486 20,000 37,032 3,354,244 334,392 $3,688,636 $31,886 32,774 757,097 2,983,207 (29,952) 2,953,255 56,491 23,373 114,633 $3,969,509 $836,871 2,452,058 209,435 3,498,364 54,800 20,000 42,807 3,615,971 353,538 $3,969,509 $36,755 105,781 636,138 3,212,908 (31,265) 3,181,643 59,642 22,983 126,926 $4,169,868 $758,425 2,266,065 663,076 3,687,566 26,500 20,000 56,030 3,790,096 379,772 $4,169,868

12 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW Community Contributions OUR 2023 GIVING IN ACTION $781,000 11,193 HOURS LOGGED DONATED TO OUR COMMUNITIES INCLUDING $103,076 from employee contributions 252 EMPLOYEE VOLUNTEERS UP 21% 561 UP 19% UP 19% NON-PROFITS SUPPORTED across our 8 county footprint Nearly $3 million donated in the last five years. FROM 2022 FROM 2022 FROM 2022

13 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW Beyond our mission, we have a company culture of continuous improvement. That means we are constantly growing, learning and evolving.

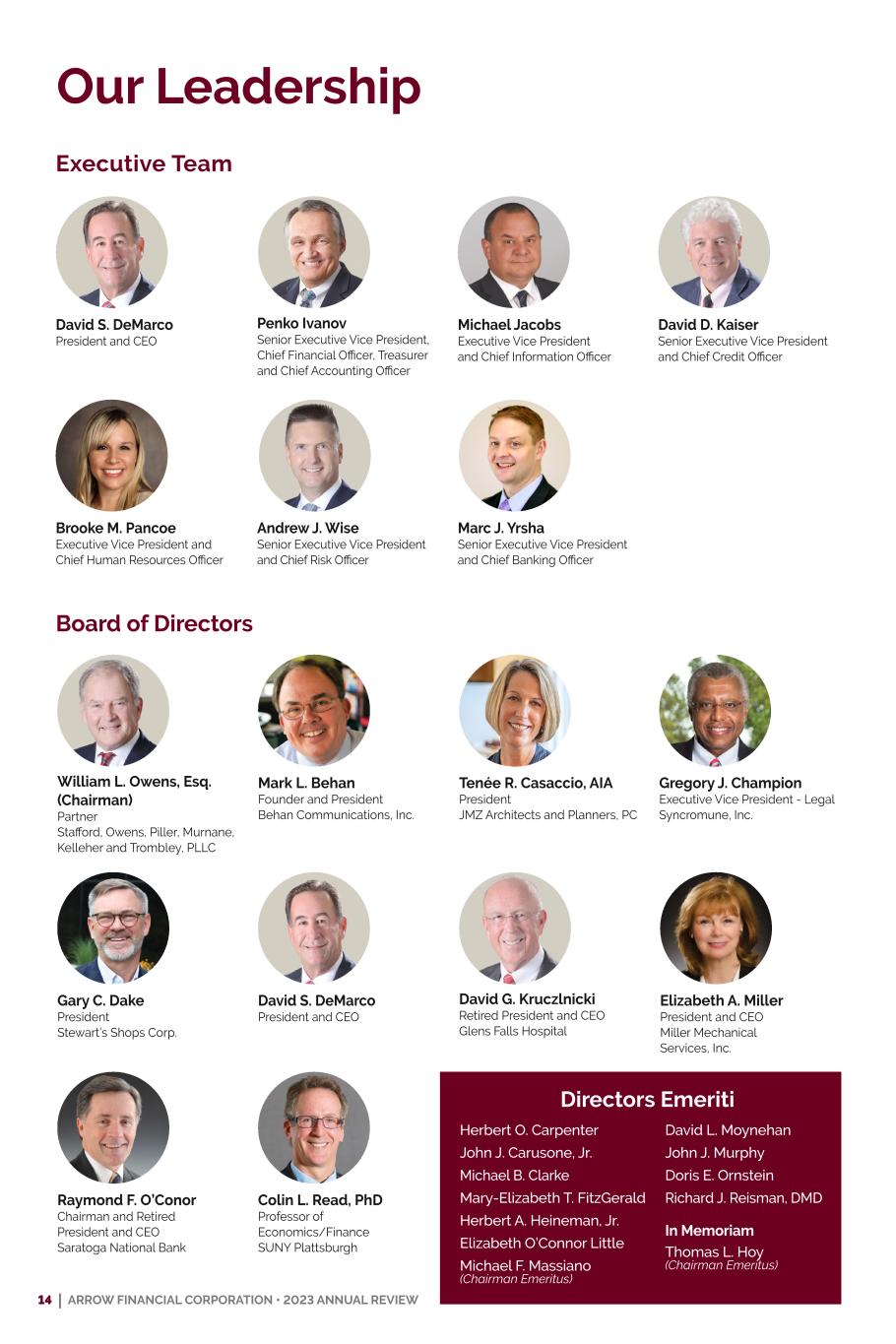

14 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW Board of Directors Our Leadership Executive Team Mark L. Behan Founder and President Behan Communications, Inc. Tenée R. Casaccio, AIA President JMZ Architects and Planners, PC Gary C. Dake President Stewart’s Shops Corp. David G. Kruczlnicki Retired President and CEO Glens Falls Hospital Elizabeth A. Miller President and CEO Miller Mechanical Services, Inc. David S. DeMarco President and CEO Raymond F. O’Conor Chairman and Retired President and CEO Saratoga National Bank William L. Owens, Esq. (Chairman) Partner Stafford, Owens, Piller, Murnane, Kelleher and Trombley, PLLC Colin L. Read, PhD Professor of Economics/Finance SUNY Plattsburgh Marc J. Yrsha Senior Executive Vice President and Chief Banking Officer Andrew J. Wise Senior Executive Vice President and Chief Risk Officer Brooke M. Pancoe Executive Vice President and Chief Human Resources Officer Michael Jacobs Executive Vice President and Chief Information Officer David D. Kaiser Senior Executive Vice President and Chief Credit Officer David S. DeMarco President and CEO Gregory J. Champion Executive Vice President - Legal Syncromune, Inc. Penko Ivanov Senior Executive Vice President, Chief Financial Officer, Treasurer and Chief Accounting Officer Herbert O. Carpenter John J. Carusone, Jr. Michael B. Clarke Mary-Elizabeth T. FitzGerald Herbert A. Heineman, Jr. Elizabeth O’Connor Little Michael F. Massiano (Chairman Emeritus) Directors Emeriti David L. Moynehan John J. Murphy Doris E. Ornstein Richard J. Reisman, DMD In Memoriam Thomas L. Hoy (Chairman Emeritus)

Glens Falls National Bank and Trust Company is a community bank headquartered in Glens Falls, New York, that serves Warren, Washington, Essex, Clinton and northern Saratoga counties in Upstate New York. It operates 26 banking offices and provides a wide range of financial products and services to individuals and businesses, including banking, investments and insurance. Saratoga National Bank and Trust Company is a community bank headquartered in Saratoga Springs, New York. It serves Saratoga, Albany, Rensselaer and Schenectady counties through 11 banking offices and provides a wide range of financial products to individuals and businesses, including banking, investments and insurance. Other Arrow Financial Corporation subsidiaries include: Upstate Agency, LLC, an insurance agency that specializes in personal and business insurance, as well as group health and employee benefits. North Country Investment Advisers, Inc., an investment advisory firm that provides portfolio management of proprietary accounts for our banks. Arrow Financial Corporation is the parent company of Glens Falls National Bank and Trust Company and Saratoga National Bank and Trust Company. Other subsidiaries include Upstate Agency, LLC and North Country Investment Advisers, Inc. Our Family of Companies 15 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW

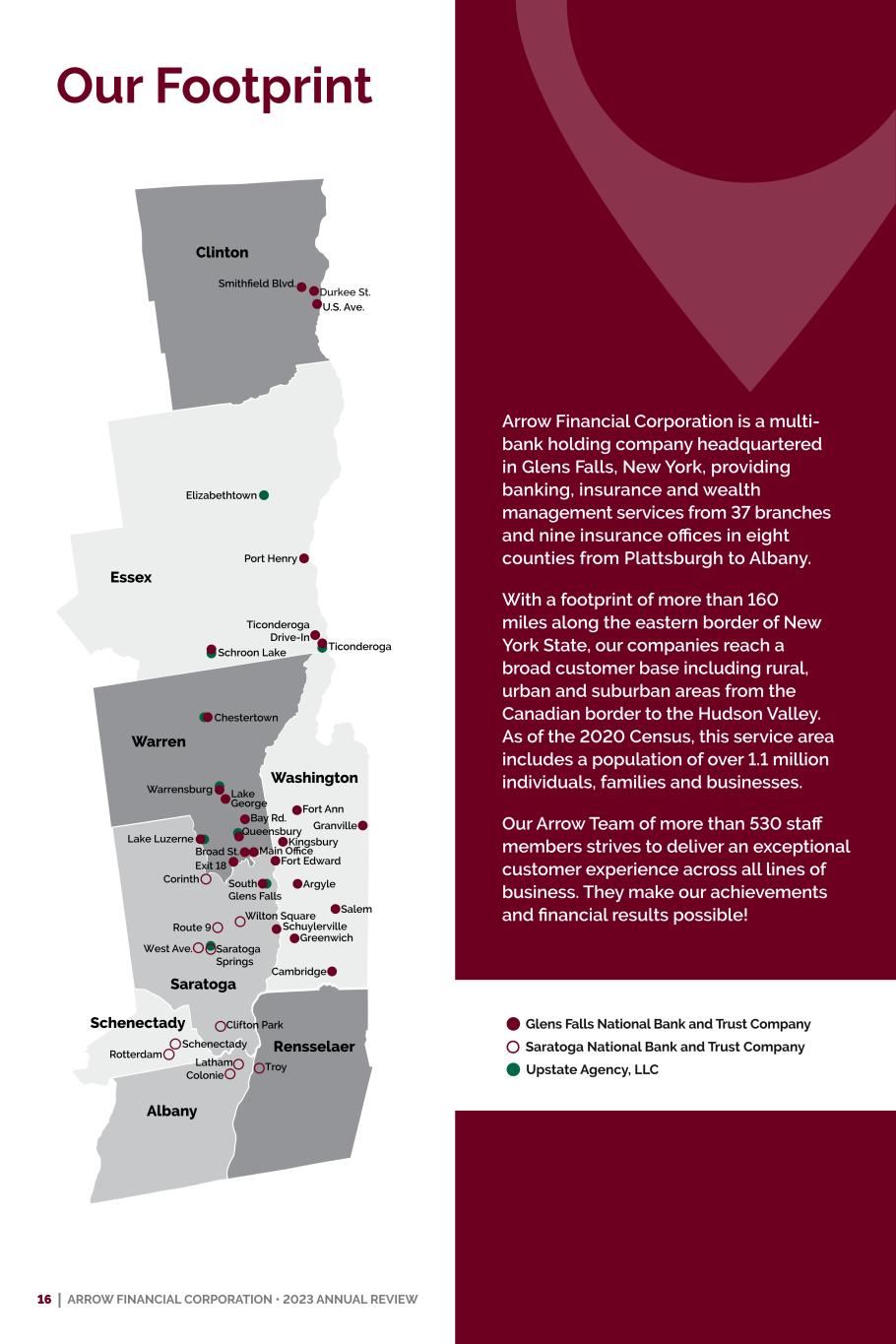

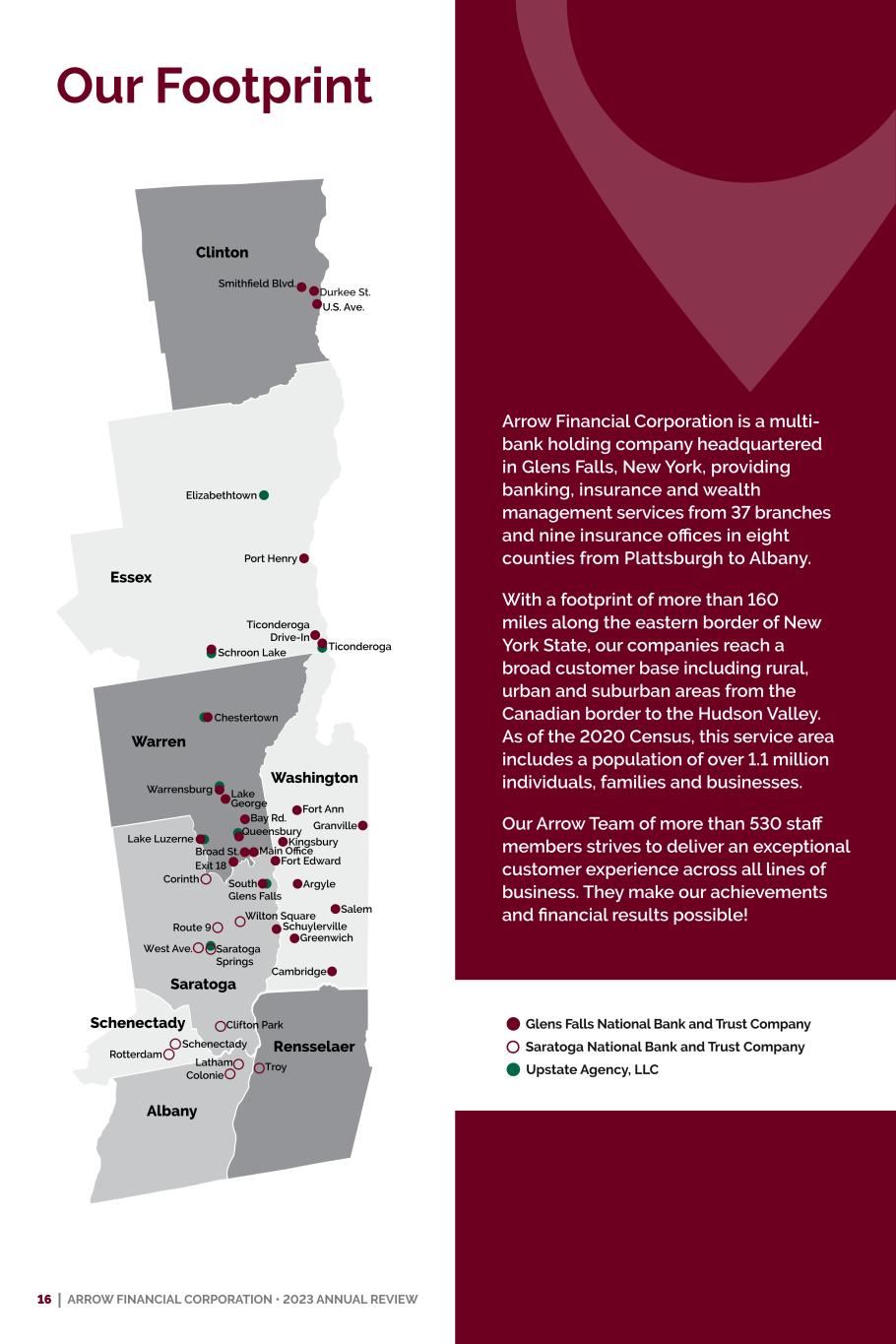

16 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW Our Footprint Glens Falls National Bank and Trust Company Saratoga National Bank and Trust Company Upstate Agency, LLC Arrow Financial Corporation is a multi- bank holding company headquartered in Glens Falls, New York, providing banking, insurance and wealth management services from 37 branches and nine insurance offices in eight counties from Plattsburgh to Albany. With a footprint of more than 160 miles along the eastern border of New York State, our companies reach a broad customer base including rural, urban and suburban areas from the Canadian border to the Hudson Valley. As of the 2020 Census, this service area includes a population of over 1.1 million individuals, families and businesses. Our Arrow Team of more than 530 staff members strives to deliver an exceptional customer experience across all lines of business. They make our achievements and financial results possible! Elizabethtown Warrensburg Chestertown Ticonderoga Schroon Lake Durkee St. Ticonderoga Drive-In Port Henry U.S. Ave. Schuylerville Cambridge Salem Argyle Kingsbury Fort Ann Fort Edward Greenwich Granville Main Office Queensbury Lake George South Glens Falls Lake Luzerne Broad St. Bay Rd. Exit 18 Corinth Wilton Square Route 9 West Ave. Clifton Park TroyLatham Colonie Saratoga Springs Schenectady Rotterdam Saratoga Albany Rensselaer Schenectady Washington Warren Clinton Essex

17 | ARROW FINANCIAL CORPORATION • 2023 ANNUAL REVIEW 250 Glen Street, PO Box 307, Glens Falls, NY 12801 (518) 415-4307 | arrowfinancial.com