SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________

FORM 10-Q

(Mark One)

|

|

þ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended: June 30, 2025

OR

|

|

¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 1-8625

READING INTERNATIONAL, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

Nevada State or other jurisdiction of incorporation or organization) |

95-3885184 (IRS Employer Identification Number) |

|

189 Second Avenue, Suite 2S New York, New York (Address of principal executive offices) |

10003 (Zip Code) |

Registrant’s telephone number, including area code: (213) 235-2240

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Class A Nonvoting Common Stock, $0.01 par value |

|

RDI |

|

The Nasdaq Stock Market LLC |

Class B Voting Common Stock, $0.01 par value |

|

RDIB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ¨ Accelerated Filer ¨ Non-Accelerated Filer þ Smaller Reporting Company þ Emerging Growth Company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. As of August 13, 2025, there were 21,036,670 shares of Class A Nonvoting Common Stock, $0.01 par value per share, and 1,680,590 shares of Class B Voting Common Stock, $0.01 par value per share, outstanding. READING INTERNATIONAL, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

|

|

Page |

3 |

|

3 |

|

3 |

|

4 |

|

5 |

|

6 |

|

7 |

|

Item 2 – Management’s Discussion and Analysis of Financial Condition and Results of Operations |

28 |

Item 3 – Quantitative and Qualitative Disclosure about Market Risk |

48 |

50 |

|

51 |

|

51 |

|

51 |

|

Item 2 – Unregistered Sales of Equity Securities and Use of Proceeds |

51 |

51 |

|

51 |

|

51 |

|

52 |

|

53 |

|

|

PART 1 – FINANCIAL INFORMATION

Item 1 - Financial Statements

READING INTERNATIONAL, INC.

CONSOLIDATED BALANCE SHEETS

(U.S. dollars in thousands, except share information)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

||

|

|

2025 |

|

2024 |

||

ASSETS |

|

(Unaudited) |

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,073 |

|

$ |

12,347 |

Restricted cash |

|

|

2,882 |

|

|

2,735 |

Receivables |

|

|

3,371 |

|

|

5,276 |

Inventories |

|

|

1,522 |

|

|

1,685 |

Prepaid and other current assets |

|

|

3,963 |

|

|

2,668 |

Land and property held for sale |

|

|

460 |

|

|

32,331 |

Total current assets |

|

|

21,271 |

|

|

57,042 |

Operating property, net |

|

|

213,340 |

|

|

214,694 |

Operating lease right-of-use assets |

|

|

160,562 |

|

|

160,873 |

Investment in unconsolidated joint ventures |

|

|

3,306 |

|

|

3,138 |

Goodwill |

|

|

24,868 |

|

|

23,712 |

Intangible assets, net |

|

|

1,744 |

|

|

1,800 |

Deferred tax asset, net |

|

|

1,284 |

|

|

953 |

Other assets |

|

|

11,700 |

|

|

8,799 |

Total assets |

|

$ |

438,075 |

|

$ |

471,011 |

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

51,347 |

|

$ |

48,651 |

Film rent payable |

|

|

4,371 |

|

|

5,820 |

Debt - current portion |

|

|

38,229 |

|

|

69,193 |

Taxes payable - current |

|

|

615 |

|

|

891 |

Deferred revenue |

|

|

9,077 |

|

|

9,731 |

Operating lease liabilities - current portion |

|

|

20,183 |

|

|

20,747 |

Other current liabilities |

|

|

6,629 |

|

|

6,593 |

Total current liabilities |

|

|

130,451 |

|

|

161,626 |

Debt - long-term portion |

|

|

106,449 |

|

|

105,239 |

Derivative financial instruments - non-current portion |

|

|

235 |

|

|

137 |

Subordinated debt, net |

|

|

27,506 |

|

|

27,394 |

Noncurrent tax liabilities |

|

|

6,622 |

|

|

6,041 |

Operating lease liabilities - non-current portion |

|

|

161,386 |

|

|

161,702 |

Other liabilities |

|

|

13,854 |

|

|

13,662 |

Total liabilities |

|

$ |

446,503 |

|

$ |

475,801 |

Commitments and contingencies (Note 16) |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Class A non-voting common shares, par value $0.01, 100,000,000 shares authorized, |

|

|

|

|

|

|

33,972,781 issued and 21,036,670 outstanding at June 30, 2025 and |

|

|

|

|

|

|

33,681,705 issued and 20,745,594 outstanding at December 31, 2024 |

|

|

241 |

|

|

238 |

Class B voting common shares, par value $0.01, 20,000,000 shares authorized and |

|

|

|

|

|

|

1,680,590 issued and outstanding at June 30, 2025 and December 31, 2024 |

|

|

17 |

|

|

17 |

Nonvoting preferred shares, par value $0.01, 12,000 shares authorized and no issued |

|

|

|

|

|

|

or outstanding shares at June 30, 2025 and December 31, 2024 |

|

|

— |

|

|

— |

Additional paid-in capital |

|

|

158,696 |

|

|

157,751 |

Retained earnings/(deficits) |

|

|

(122,213) |

|

|

(114,790) |

Treasury shares |

|

|

(40,407) |

|

|

(40,407) |

Accumulated other comprehensive income |

|

|

(4,017) |

|

|

(7,173) |

Total Reading International, Inc. stockholders’ equity |

|

|

(7,683) |

|

|

(4,364) |

Noncontrolling interests |

|

|

(745) |

|

|

(426) |

Total stockholders’ equity |

|

|

(8,428) |

|

|

(4,790) |

Total liabilities and stockholders’ equity |

|

$ |

438,075 |

|

$ |

471,011 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited; U.S. dollars in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Six Months Ended |

||||||||

|

|

June 30, |

|

June 30, |

||||||||

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

$ |

56,782 |

|

$ |

42,942 |

|

$ |

93,186 |

|

$ |

84,213 |

Real estate |

|

|

3,596 |

|

|

3,867 |

|

|

7,361 |

|

|

7,648 |

Total revenue |

|

|

60,378 |

|

|

46,809 |

|

|

100,547 |

|

|

91,861 |

Costs and expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Cinema |

|

|

(46,883) |

|

|

(42,758) |

|

|

(83,460) |

|

|

(83,478) |

Real estate |

|

|

(1,840) |

|

|

(2,461) |

|

|

(3,795) |

|

|

(4,696) |

Depreciation and amortization |

|

|

(3,380) |

|

|

(4,011) |

|

|

(6,756) |

|

|

(8,216) |

General and administrative |

|

|

(5,384) |

|

|

(5,271) |

|

|

(10,537) |

|

|

(10,693) |

Total costs and expenses |

|

|

(57,487) |

|

|

(54,501) |

|

|

(104,548) |

|

|

(107,083) |

Operating income (loss) |

|

|

2,891 |

|

|

(7,692) |

|

|

(4,001) |

|

|

(15,222) |

Interest expense, net |

|

|

(4,354) |

|

|

(5,377) |

|

|

(9,096) |

|

|

(10,662) |

Gain (loss) on sale of assets |

|

|

1,872 |

|

|

9 |

|

|

8,398 |

|

|

(1,116) |

Other income (expense) |

|

|

(2,273) |

|

|

(216) |

|

|

(2,607) |

|

|

123 |

Income (loss) before income tax expense and equity earnings of unconsolidated joint ventures |

|

|

(1,864) |

|

|

(13,276) |

|

|

(7,306) |

|

|

(26,877) |

Equity earnings of unconsolidated joint ventures |

|

|

285 |

|

|

119 |

|

|

308 |

|

|

94 |

Income (loss) before income taxes |

|

|

(1,579) |

|

|

(13,157) |

|

|

(6,998) |

|

|

(26,783) |

Income tax benefit (expense) |

|

|

(1,225) |

|

|

156 |

|

|

(753) |

|

|

379 |

Net income (loss) |

|

$ |

(2,804) |

|

$ |

(13,001) |

|

$ |

(7,751) |

|

$ |

(26,404) |

Less: net income (loss) attributable to noncontrolling interests |

|

|

(137) |

|

|

(195) |

|

|

(328) |

|

|

(370) |

Net income (loss) attributable to Reading International, Inc. |

|

$ |

(2,667) |

|

$ |

(12,806) |

|

$ |

(7,423) |

|

$ |

(26,034) |

Basic earnings (loss) per share |

|

$ |

(0.12) |

|

$ |

(0.57) |

|

$ |

(0.33) |

|

$ |

(1.16) |

Diluted earnings (loss) per share |

|

$ |

(0.12) |

|

$ |

(0.57) |

|

$ |

(0.33) |

|

$ |

(1.16) |

Weighted average number of shares outstanding–basic |

|

|

22,708,206 |

|

|

22,413,617 |

|

|

22,586,019 |

|

|

22,379,881 |

Weighted average number of shares outstanding–diluted |

|

|

22,708,206 |

|

|

22,413,617 |

|

|

22,586,019 |

|

|

22,379,881 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited; U.S. dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Six Months Ended |

||||||||

|

|

June 30, |

|

June 30, |

||||||||

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||

Net income (loss) |

|

$ |

(2,804) |

|

$ |

(13,001) |

|

$ |

(7,751) |

|

$ |

(26,404) |

Foreign currency translation gain (loss) |

|

|

2,741 |

|

|

932 |

|

|

3,154 |

|

|

(1,659) |

Gain (loss) on cash flow hedges |

|

|

(87) |

|

|

(98) |

|

|

(98) |

|

|

(98) |

Other |

|

|

58 |

|

|

52 |

|

|

109 |

|

|

102 |

Comprehensive income (loss) |

|

|

(92) |

|

|

(12,115) |

|

|

(4,586) |

|

|

(28,059) |

Less: net income (loss) attributable to noncontrolling interests |

|

|

(137) |

|

|

(195) |

|

|

(328) |

|

|

(370) |

Less: comprehensive income (loss) attributable to noncontrolling interests |

|

|

8 |

|

|

— |

|

|

9 |

|

|

(1) |

Comprehensive income (loss) |

|

$ |

37 |

|

|

(11,920) |

|

$ |

(4,267) |

|

$ |

(27,688) |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; U.S. dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

||||

|

|

June 30, |

||||

|

|

2025 |

|

2024 |

||

Operating Activities |

|

|

|

|

|

|

Net income (loss) |

|

$ |

(7,751) |

|

$ |

(26,404) |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: |

|

|

|

|

|

|

Equity earnings of unconsolidated joint ventures |

|

|

(308) |

|

|

(94) |

Distributions of earnings from unconsolidated joint ventures |

|

|

333 |

|

|

329 |

(Gain) loss recognized on foreign currency transactions |

|

|

2,652 |

|

|

(66) |

(Gain) loss on sale of assets |

|

|

(8,398) |

|

|

1,116 |

Amortization of operating leases |

|

|

12,155 |

|

|

9,089 |

Amortization of finance leases |

|

|

21 |

|

|

21 |

Change in operating lease liabilities |

|

|

(10,975) |

|

|

(9,903) |

Change in net deferred tax assets |

|

|

(238) |

|

|

(1,824) |

Depreciation and amortization |

|

|

6,756 |

|

|

8,216 |

Other amortization |

|

|

584 |

|

|

829 |

Stock based compensation expense |

|

|

1,130 |

|

|

1,134 |

Net changes in operating assets and liabilities: |

|

|

|

|

|

|

Receivables |

|

|

2 |

|

|

(151) |

Prepaid and other assets |

|

|

(4,141) |

|

|

414 |

Payments for accrued pension |

|

|

(342) |

|

|

(342) |

Accounts payable and accrued expenses |

|

|

4,802 |

|

|

5,383 |

Film rent payable |

|

|

(1,558) |

|

|

(1,069) |

Taxes payable |

|

|

(306) |

|

|

758 |

Deferred revenue and other liabilities |

|

|

(569) |

|

|

(593) |

Net cash provided by (used in) operating activities |

|

|

(6,151) |

|

|

(13,157) |

Investing Activities |

|

|

|

|

|

|

Purchases of and additions to operating and investment properties |

|

|

(635) |

|

|

(2,175) |

Contributions to unconsolidated joint ventures |

|

|

— |

|

|

(30) |

Proceeds from sale of assets |

|

|

38,441 |

|

|

9,603 |

Net cash provided by (used in) investing activities |

|

|

37,806 |

|

|

7,398 |

Financing Activities |

|

|

|

|

|

|

Repayment of borrowings |

|

|

(33,843) |

|

|

(11,391) |

Repayment of finance lease principal |

|

|

(21) |

|

|

(20) |

Proceeds from borrowings |

|

|

— |

|

|

12,980 |

Capitalized borrowing costs |

|

|

(837) |

|

|

(438) |

(Cash paid) proceeds from the settlement of employee share transactions |

|

|

(182) |

|

|

(6) |

Net cash provided by (used in) financing activities |

|

|

(34,883) |

|

|

1,125 |

Effect of exchange rate on cash and restricted cash |

|

|

101 |

|

|

(80) |

Net increase (decrease) in cash and cash equivalents and restricted cash |

|

|

(3,127) |

|

|

(4,714) |

Cash and cash equivalents and restricted cash at the beginning of the period |

|

|

15,082 |

|

|

15,441 |

Cash and cash equivalents and restricted cash at the end of the period |

|

$ |

11,955 |

|

$ |

10,727 |

|

|

|

|

|

|

|

Cash and cash equivalents and restricted cash consists of: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,073 |

|

$ |

9,242 |

Restricted cash |

|

|

2,882 |

|

|

1,485 |

|

|

$ |

11,955 |

|

$ |

10,727 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosures |

|

|

|

|

|

|

Interest paid |

|

$ |

8,130 |

|

$ |

9,608 |

Income taxes (refunded) paid |

|

|

2,002 |

|

|

1,029 |

Non-Cash Transactions |

|

|

|

|

|

|

Additions to operating and investing properties through accrued expenses |

|

|

420 |

|

|

2,736 |

See accompanying Notes to the Unaudited Consolidated Financial Statements.

READING INTERNATIONAL, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

As of and for the six Months Ended June 30, 2025

NOTE 1 – DESCRIPTION OF BUSINESS AND SEGMENT REPORTING

Our Company

Reading International, Inc., a Nevada corporation (“RDI” and collectively with our consolidated subsidiaries and corporate predecessors, the “Company,” “Reading,” and “we,” “us,” or “our”) was incorporated in 1999. Our businesses consist primarily of:

the development, ownership, and operation of cinemas in the United States, Australia, and New Zealand; and

the development, ownership, operation and/or rental of retail, commercial and live venue real estate assets in Australia, New Zealand, and the United States.

NOTE 2 – LIQUIDITY AND IMPAIRMENT ASSESSMENT

Going Concern

We continue to evaluate the going concern assertion required by ASC 205-40 Going Concern as it relates to our Company. The evaluation of the going concern assertion involves considering whether it is probable that our Company has sufficient resources, as at the issue date of the financial statements, to meet its obligations as they fall due for twelve months following the issue date. Should it be probable that there are not sufficient resources, we must develop plans to overcome that shortfall. We must then determine whether it is probable that our plans will be effectively implemented and will mitigate the consequential going concern substantial doubt.

We have $38.2 million of debt due in twelve months, cash of $12.0 million and negative working capital of $109.2 million. As a result, we have developed a plan to address and overcome the going concern uncertainty. Our plan is informed by current liquidity positions, debt obligations, our beliefs about the marketability of certain real estate properties, our beliefs about the recovery of the global cinema industry, cash flow estimates, known capital and other expenditure requirements and commitments and our current business plan and strategies. Our Company’s business plan - two businesses (real estate and cinema) in three countries (Australia, New Zealand and the U.S.) - has served us well historically and is key to management’s overall evaluation of ASC 205-40 Going Concern.

While we believe that, with an increase in the quantity and quality of films being released to cinemas compared to pre-pandemic levels, patronage and operating revenue levels will improve, we have no control over attendance levels and no assurances can be given as to the nature of the reception of future movies by the movie-going public.

We have begun the process of refinancing and/or extending certain loans, as further discussed in Note 13 - Borrowings. On January 31, 2025, we repaid our $10.7 million Westpac loan. On February 5, 2025, we repaid $6.1 million of our Bank of America facility, taking the balance to $8.7 million. On July 3, 2025, we extended the maturity date of this loan to May 18, 2026. On February 26, 2025, we exercised our option to extend our Valley National debt to October 1, 2025. On May 2, 2025, we extended our Emerald Creek Capital loan to November 6, 2026. On May 21, 2025, we sold our Cannon Park property for $20.7 million, and repaid our $12.9 million NAB bridging facility and $970,000 on our Core Facility. On July 18, 2025, we extended the maturity date of our Santander loan to June 1, 2026.

Moreover, we intend to raise the liquidity necessary for the next twelve months from refinancings and real estate asset monetization. Management has been authorized to pursue such actions where necessary. We believe we have more than sufficient marketable real estate assets that can be monetized on a timely basis and at the values required to meet our funding needs over the next twelve months. After having sold nine property assets with combined proceeds of $201.5 million since 2021, we have demonstrated our ability to complete real estate asset monetizations.

In conclusion, as of the date of issuance of these financial statements, based on our evaluation of ASC 205-40 Going Concern and the current conditions and events, considered in the aggregate, and our various plans for enhancing liquidity and the extent to which those plans are progressing, we conclude that our plan to raise sufficient liquidity primarily through certain real estate asset monetizations to the extent needed is probable of being implemented to the extent required such that this alleviates the substantial doubt about our Company’s ability to continue as a going concern.

Impairment Considerations

Our Company considers that the events and factors described above constitute impairment indicators under ASC 360 Property, Plant and Equipment. At December 31, 2024, our Company performed a quantitative recoverability test of the carrying values of all its asset groups. Our Company estimated the undiscounted future cash flows expected to result from the use of these asset groups and found that no impairment charge was necessary.

Our first six months of 2025 produced higher revenues and operating income compared to the same period in 2024, and we believe that this improved performance at an asset group level will continue throughout the remainder of 2025. As a result, we recorded no impairment charges for the first six months of 2025. Actual performance against our forecasts is dependent on several variables and conditions, many of which are subject to the uncertainties associated with among other things, the factors presented above, and as a result, actual results may materially differ from management’s estimates.

Our Company also considers that the events and factors described above continue to constitute impairment indicators under ASC 350 Intangibles – Goodwill and Other. Our Company performed a quantitative goodwill impairment test and determined that our goodwill was not impaired as of December 31, 2024. The test was performed at a reporting unit level by comparing each reporting unit’s carrying value, including goodwill, to its fair value. The fair value of each reporting unit was assessed using a discounted cash flow model based on the budgetary revisions performed by management in response to COVID-19 and the developing market conditions. No impairment charges were recorded in the first six months of 2025. Actual performance against our forecasts is dependent on several variables and conditions, including among other things, the factors presented above, and as a result, actual results may materially differ from management’s estimates.

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Consolidation

The accompanying consolidated financial statements include the accounts of our Company’s wholly-owned subsidiaries as well as majority-owned subsidiaries that our Company controls and should be read in conjunction with our Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2024 (“2024 Form 10-K”). All significant intercompany balances and transactions have been eliminated on consolidation. These consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim reporting with the instructions for Form 10-Q and Rule 10-01 of Regulation S-X of the Securities and Exchange Commission (“SEC”). As such, they do not include all information and footnotes required by U.S. GAAP for complete financial statements. We believe that we have included all normal and recurring adjustments necessary for a fair presentation of the results for the interim period.

Operating results for the quarter and six months ended June 30, 2025 are not necessarily indicative of the results that may be expected for the year ending December 31, 2025.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and footnotes thereto. Significant estimates include (i) projections we make regarding the recoverability and impairment of our assets (including goodwill and intangibles), (ii) valuations of our derivative instruments, (iii) recoverability of our deferred tax assets, (iv) estimation of breakage and redemption experience rates, which drive how we recognize breakage on our gift card and gift certificates, and revenue from our customer loyalty program, and (v) estimation of our Incremental Borrowing Rate (“IBR”) as relates to the valuation of our right-of-use assets and lease liabilities. Actual results may differ from those estimates.

NOTE 4 – SEGMENT REPORTING

We report information about operating segments in accordance with ASC 280-10 Segment Reporting, which requires financial information to be reported based on the way management organizes segments with a company for making operating decisions and evaluating performance. We have organized our business into two reportable segments, being cinema exhibition and real estate.

Our cinema exhibition segment aggregates all our cinemas, both leased and owned, across the United States, Australia and New Zealand. Each of our cinemas earns revenue through the sale of movie tickets, food and beverage, screen advertising, theater rentals, merchandise, gift card and loyalty membership, and other ancillary sales. The segment also earns revenue through service fees related to online ticket sales. Expenses are incurred through film rent, wages and salaries, food and beverage costs, occupancy costs, utilities, and other ancillary costs. We further organize this segment by geography, as while all our cinemas are engaged in substantially the same business activities, each geography is subject to its own unique regulatory and business conditions.

Our real estate segment aggregates all our retail, commercial and live theater real estate assets across Australia, New Zealand, and the United States. Our retail and commercial real estate assets earn revenue through the leasing or licensing of space to third party tenants.

Our live theater assets in the United States earn revenue through leasing or licensing space to third party production companies, an activity we consider sufficiently similar to our broader real estate base to support inclusion in our real estate segment. Our live theatre operations also earn revenue by providing front of house and box office services and through concession sale of food and beverage. All of our real estate assets incur expenses from property maintenance, utilities, taxes, and other costs of maintaining real estate and in some cases third party property management. Most of our real estate is currently self-managed.

Each of these segments has discrete and separate financial information and for which operating results are evaluated regularly by our President, Chief Executive Officer and Vice Chair of Board and Director, the chief operating decision-maker (“CODM”) of the Company. The CODM is responsible for the allocation of resources to, and the assessment of the performance of, our operating segments. The CODM determines, among other things:

-the execution, renewal or termination of cinema leases

-the execution, renewal or termination of third-party tenant leases

-significant capital expenditures

-internal resource allocation

-operational budgets.

Segment operating income is a key measure of profit or loss used by the CODM to assess segment performance and allocate resources. Segment operating income includes certain amounts charged by our real estate segment to our cinema exhibition segment where a cinema exhibition is a tenant of the real estate segment. These charges are eliminated for consolidated financial statement purposes in the consolidated income statement, but are presented gross to the CODM. We do not report asset information by segment because that information is not used to evaluate the performance or allocate resources between segments.

The tables below summarize the results of operations for each of our business segments, presenting a reconciliation of segment revenue to operating segment income, and the impact of inter-segment transactions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Quarter Ended |

|

Six Months Ended |

|

Six Months Ended |

||||||||||||||||||||||||||||

|

June 30, 2025 |

|

June 30, 2024 |

|

June 30, 2025 |

|

June 30, 2024 |

||||||||||||||||||||||||||||

(Dollars in thousands) |

Cinema |

|

Real |

|

Total |

|

Cinema |

|

Real |

|

Total |

|

Cinema |

|

Real |

|

Total |

|

Cinema |

|

Real |

|

Total |

||||||||||||

Revenue - third party |

$ |

56,782 |

|

$ |

3,596 |

|

$ |

60,378 |

|

$ |

42,941 |

|

$ |

3,867 |

|

$ |

46,808 |

|

$ |

93,186 |

|

$ |

7,361 |

|

$ |

100,547 |

|

$ |

84,213 |

|

$ |

7,648 |

|

$ |

91,861 |

Inter-segment revenue (1) |

|

— |

|

|

1,057 |

|

|

1,057 |

|

|

— |

|

|

1,146 |

|

|

1,146 |

|

|

— |

|

|

2,137 |

|

|

2,137 |

|

|

— |

|

|

2,298 |

|

|

2,298 |

Total segment revenue |

|

56,782 |

|

|

4,653 |

|

|

61,435 |

|

|

42,941 |

|

|

5,013 |

|

|

47,954 |

|

|

93,186 |

|

|

9,498 |

|

|

102,684 |

|

|

84,213 |

|

|

9,946 |

|

|

94,159 |

Operating expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expense - Third Party |

|

(46,883) |

|

|

(1,840) |

|

|

(48,723) |

|

|

(42,757) |

|

|

(2,461) |

|

|

(45,218) |

|

|

(83,460) |

|

|

(3,795) |

|

|

(87,255) |

|

|

(83,477) |

|

|

(4,696) |

|

|

(88,173) |

Inter-Segment Operating Expenses (1) |

|

(1,057) |

|

|

— |

|

|

(1,057) |

|

|

(1,146) |

|

|

— |

|

|

(1,146) |

|

|

(2,137) |

|

|

— |

|

|

(2,137) |

|

|

(2,298) |

|

|

— |

|

|

(2,298) |

Total of services and products (excluding depreciation and amortization) |

|

(47,940) |

|

|

(1,840) |

|

|

(49,780) |

|

|

(43,903) |

|

|

(2,461) |

|

|

(46,364) |

|

|

(85,597) |

|

|

(3,795) |

|

|

(89,392) |

|

|

(85,775) |

|

|

(4,696) |

|

|

(90,471) |

Depreciation and amortization |

|

(2,172) |

|

|

(1,125) |

|

|

(3,297) |

|

|

(2,554) |

|

|

(1,358) |

|

|

(3,912) |

|

|

(4,312) |

|

|

(2,226) |

|

|

(6,538) |

|

|

(5,141) |

|

|

(2,874) |

|

|

(8,015) |

General and administrative expense |

|

(1,217) |

|

|

(209) |

|

|

(1,426) |

|

|

(1,093) |

|

|

(248) |

|

|

(1,341) |

|

|

(2,298) |

|

|

(403) |

|

|

(2,701) |

|

|

(2,072) |

|

|

(539) |

|

|

(2,611) |

Total operating expense |

|

(51,329) |

|

|

(3,174) |

|

|

(54,503) |

|

|

(47,550) |

|

|

(4,067) |

|

|

(51,617) |

|

|

(92,207) |

|

|

(6,424) |

|

|

(98,631) |

|

|

(92,988) |

|

|

(8,109) |

|

|

(101,097) |

Segment operating income (loss) |

$ |

5,453 |

|

$ |

1,479 |

|

$ |

6,932 |

|

$ |

(4,609) |

|

$ |

946 |

|

$ |

(3,663) |

|

$ |

979 |

|

$ |

3,074 |

|

$ |

4,053 |

|

$ |

(8,775) |

|

$ |

1,837 |

|

$ |

(6,938) |

(1)Inter-segment Revenues and Operating Expense relates to the internal charge between the two segments where the cinema operates within real estate owned within the group.

A reconciliation of cinema exhibition segment revenue to segment operating income for the quarter and six months ended June 30, 2025 and June 30, 2024, is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Six Months Ended |

||||||||

(Dollars in thousands) |

June 30, 2025 |

|

June 30, 2024 |

|

June 30, 2025 |

|

June 30, 2024 |

||||||

REVENUE |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

Admissions revenue |

$ |

16,099 |

|

$ |

11,681 |

|

$ |

26,344 |

|

$ |

23,922 |

|

|

Concessions revenue |

|

11,274 |

|

|

7,452 |

|

|

17,382 |

|

|

14,413 |

|

|

Advertising and other revenue |

|

2,885 |

|

|

2,347 |

|

|

4,827 |

|

|

4,450 |

|

|

|

$ |

30,258 |

|

$ |

21,480 |

|

$ |

48,553 |

|

$ |

42,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

Admissions revenue |

$ |

14,275 |

|

$ |

10,851 |

|

$ |

23,905 |

|

$ |

21,113 |

|

|

Concessions revenue |

|

7,213 |

|

|

6,348 |

|

|

12,069 |

|

|

12,114 |

|

|

Advertising and other revenue |

|

1,421 |

|

|

1,344 |

|

|

2,617 |

|

|

2,640 |

|

|

|

$ |

22,909 |

|

$ |

18,543 |

|

$ |

38,591 |

|

$ |

35,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Zealand |

Admissions revenue |

$ |

2,338 |

|

$ |

1,744 |

|

$ |

3,884 |

|

$ |

3,344 |

|

|

Concessions revenue |

|

1,135 |

|

|

1,013 |

|

|

1,901 |

|

|

1,923 |

|

|

Advertising and other revenue |

|

142 |

|

|

161 |

|

|

257 |

|

|

294 |

|

|

|

$ |

3,615 |

|

$ |

2,918 |

|

$ |

6,042 |

|

$ |

5,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

$ |

56,782 |

|

$ |

42,941 |

|

$ |

93,186 |

|

$ |

84,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

Film rent and advertising cost |

$ |

(9,108) |

|

$ |

(6,272) |

|

$ |

(14,166) |

|

$ |

(12,411) |

|

|

Food & beverage cost |

|

(2,931) |

|

|

(2,012) |

|

|

(4,514) |

|

|

(3,919) |

|

|

Occupancy expense |

|

(4,420) |

|

|

(6,545) |

|

|

(8,387) |

|

|

(12,332) |

|

|

Labor cost |

|

(4,212) |

|

|

(4,002) |

|

|

(8,293) |

|

|

(8,150) |

|

|

Utilities |

|

(1,332) |

|

|

(1,337) |

|

|

(2,551) |

|

|

(2,645) |

|

|

Cleaning and maintenance |

|

(1,754) |

|

|

(1,656) |

|

|

(3,295) |

|

|

(3,083) |

|

|

Other operating expenses |

|

(2,321) |

|

|

(2,094) |

|

|

(4,468) |

|

|

(4,219) |

|

|

|

$ |

(26,078) |

|

$ |

(23,918) |

|

$ |

(45,674) |

|

$ |

(46,759) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

Film rent and advertising cost |

$ |

(6,586) |

|

$ |

(4,947) |

|

$ |

(10,542) |

|

$ |

(9,395) |

|

|

Food & beverage cost |

|

(1,531) |

|

|

(1,435) |

|

|

(2,606) |

|

|

(2,709) |

|

|

Occupancy expense |

|

(4,511) |

|

|

(4,538) |

|

|

(8,805) |

|

|

(8,940) |

|

|

Labor cost |

|

(3,425) |

|

|

(3,442) |

|

|

(6,732) |

|

|

(6,715) |

|

|

Utilities |

|

(651) |

|

|

(640) |

|

|

(1,493) |

|

|

(1,452) |

|

|

Cleaning and maintenance |

|

(1,154) |

|

|

(1,173) |

|

|

(2,304) |

|

|

(2,377) |

|

|

Other operating expenses |

|

(799) |

|

|

(908) |

|

|

(1,574) |

|

|

(1,780) |

|

|

|

$ |

(18,657) |

|

$ |

(17,083) |

|

$ |

(34,056) |

|

$ |

(33,368) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Zealand |

Film rent and advertising cost |

$ |

(1,141) |

|

$ |

(752) |

|

$ |

(1,789) |

|

$ |

(1,434) |

|

|

Food & beverage cost |

|

(269) |

|

|

(225) |

|

|

(416) |

|

|

(430) |

|

|

Occupancy expense |

|

(737) |

|

|

(783) |

|

|

(1,471) |

|

|

(1,543) |

|

|

Labor cost |

|

(579) |

|

|

(593) |

|

|

(1,113) |

|

|

(1,155) |

|

|

Utilities |

|

(136) |

|

|

(101) |

|

|

(234) |

|

|

(198) |

|

|

Cleaning and maintenance |

|

(196) |

|

|

(189) |

|

|

(390) |

|

|

(393) |

|

|

Other operating expenses |

|

(147) |

|

|

(259) |

|

|

(454) |

|

|

(495) |

|

|

|

$ |

(3,205) |

|

$ |

(2,902) |

|

$ |

(5,867) |

|

$ |

(5,648) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expense |

$ |

(47,940) |

|

$ |

(43,903) |

|

$ |

(85,597) |

|

$ |

(85,775) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPRECIATION, AMORTIZATION, GENERAL AND ADMINISTRATIVE EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

Depreciation and amortization |

$ |

(1,157) |

|

$ |

(1,250) |

|

$ |

(2,278) |

|

$ |

(2,521) |

|

|

General and administrative expense |

|

(731) |

|

|

(738) |

|

|

(1,456) |

|

|

(1,373) |

|

|

|

$ |

(1,888) |

|

$ |

(1,988) |

|

$ |

(3,734) |

|

$ |

(3,894) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

Depreciation and amortization |

$ |

(905) |

|

$ |

(1,192) |

|

$ |

(1,819) |

|

$ |

(2,382) |

|

|

General and administrative expense |

|

(427) |

|

|

(355) |

|

|

(772) |

|

|

(699) |

|

|

|

$ |

(1,332) |

|

$ |

(1,547) |

|

$ |

(2,591) |

|

$ |

(3,081) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Zealand |

Depreciation and amortization |

$ |

(111) |

|

$ |

(112) |

|

$ |

(214) |

|

$ |

(238) |

|

|

General and administrative expense |

|

(58) |

|

|

— |

|

|

(71) |

|

|

— |

|

|

|

$ |

(169) |

|

$ |

(112) |

|

$ |

(285) |

|

$ |

(238) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total depreciation, amortization, general and administrative expense |

$ |

(3,389) |

|

$ |

(3,647) |

|

$ |

(6,610) |

|

$ |

(7,213) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING INCOME (LOSS) - CINEMA |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

$ |

2,292 |

|

$ |

(4,426) |

|

$ |

(855) |

|

$ |

(7,868) |

|

|

Australia |

|

2,920 |

|

|

(87) |

|

|

1,944 |

|

|

(582) |

|

|

New Zealand |

|

241 |

|

|

(96) |

|

|

(110) |

|

|

(325) |

|

|

Total Cinema operating income (loss) |

$ |

5,453 |

|

$ |

(4,609) |

|

$ |

979 |

|

$ |

(8,775) |

|

A reconciliation of real estate segment revenue to segment operating income for the quarter and six months ended June 30, 2025 and June 30, 2024, is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Six Months Ended |

||||||||

(Dollars in thousands) |

June 30, 2025 |

|

June 30, 2024 |

|

June 30, 2025 |

|

June 30, 2024 |

||||||

REVENUE |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

Live theater rental and ancillary income |

$ |

630 |

|

$ |

416 |

|

$ |

1,173 |

|

$ |

828 |

|

|

Property rental income |

|

1,070 |

|

|

1,067 |

|

|

2,114 |

|

|

2,139 |

|

|

|

|

1,700 |

|

|

1,483 |

|

|

3,287 |

|

|

2,967 |

|

Australia |

Property rental income |

|

2,741 |

|

|

3,177 |

|

|

5,756 |

|

|

6,261 |

|

New Zealand |

Property rental income |

|

212 |

|

|

353 |

|

|

455 |

|

|

718 |

|

Total revenue |

$ |

4,653 |

|

$ |

5,013 |

|

$ |

9,498 |

|

$ |

9,946 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

Live theater cost |

$ |

(255) |

|

$ |

(279) |

|

$ |

(492) |

|

$ |

(512) |

|

|

Occupancy expense |

|

(174) |

|

|

(160) |

|

|

(352) |

|

|

(354) |

|

|

Labor cost |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

Utilities |

|

16 |

|

|

(49) |

|

|

(28) |

|

|

(79) |

|

|

Cleaning and maintenance |

|

(75) |

|

|

(31) |

|

|

(106) |

|

|

(78) |

|

|

Other operating expenses |

|

(264) |

|

|

(279) |

|

|

(430) |

|

|

(621) |

|

|

|

$ |

(752) |

|

$ |

(798) |

|

$ |

(1,408) |

|

$ |

(1,644) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

Occupancy expense |

$ |

(479) |

|

$ |

(478) |

|

$ |

(967) |

|

$ |

(968) |

|

|

Labor cost |

|

(76) |

|

|

(55) |

|

|

(119) |

|

|

(113) |

|

|

Utilities |

|

(20) |

|

|

(19) |

|

|

(34) |

|

|

(33) |

|

|

Cleaning and maintenance |

|

(215) |

|

|

(278) |

|

|

(435) |

|

|

(494) |

|

|

Other operating expenses |

|

(198) |

|

|

(299) |

|

|

(456) |

|

|

(531) |

|

|

|

$ |

(988) |

|

$ |

(1,129) |

|

$ |

(2,011) |

|

$ |

(2,139) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Zealand |

Occupancy expense |

$ |

(31) |

|

$ |

(110) |

|

$ |

(89) |

|

$ |

(221) |

|

|

Labor cost |

|

— |

|

|

(6) |

|

|

(2) |

|

|

(11) |

|

|

Utilities |

|

— |

|

|

(16) |

|

|

(5) |

|

|

(36) |

|

|

Cleaning and maintenance |

|

— |

|

|

(7) |

|

|

(4) |

|

|

(17) |

|

|

Other operating expenses |

|

(69) |

|

|

(395) |

|

|

(276) |

|

|

(628) |

|

|

|

$ |

(100) |

|

$ |

(534) |

|

$ |

(376) |

|

$ |

(913) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expense |

$ |

(1,840) |

|

$ |

(2,461) |

|

$ |

(3,795) |

|

$ |

(4,696) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEPRECIATION, AMORTIZATION, GENERAL AND ADMINISTRATIVE EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

Depreciation and amortization |

$ |

(674) |

|

$ |

(677) |

|

$ |

(1,333) |

|

$ |

(1,416) |

|

|

General and administrative expense |

|

(185) |

|

|

(212) |

|

|

(315) |

|

|

(480) |

|

|

|

|

(859) |

|

|

(889) |

|

|

(1,648) |

|

|

(1,896) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia |

Depreciation and amortization |

$ |

(391) |

|

$ |

(551) |

|

$ |

(776) |

|

$ |

(1,142) |

|

|

General and administrative expense |

|

(24) |

|

|

(36) |

|

|

(87) |

|

|

(59) |

|

|

|

|

(415) |

|

|

(587) |

|

|

(863) |

|

|

(1,201) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Zealand |

Depreciation and amortization |

|

(60) |

|

|

(130) |

|

|

(117) |

|

|

(316) |

|

|

General and administrative expense |

|

— |

|

|

— |

|

|

(1) |

|

|

— |

|

|

|

|

(60) |

|

|

(130) |

|

|

(118) |

|

|

(316) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total depreciation, amortization, general and administrative expense |

$ |

(1,334) |

|

$ |

(1,606) |

|

$ |

(2,629) |

|

$ |

(3,413) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING INCOME (LOSS) - REAL ESTATE |

|

|

|

|

|

|

|

|

|

|

|

||

|

United States |

$ |

89 |

|

$ |

(204) |

|

$ |

231 |

|

$ |

(573) |

|

|

Australia |

|

1,338 |

|

|

1,461 |

|

|

2,882 |

|

|

2,921 |

|

|

New Zealand |

|

52 |

|

|

(311) |

|

|

(39) |

|

|

(511) |

|

|

Total real estate operating income (loss) |

$ |

1,479 |

|

$ |

946 |

|

$ |

3,074 |

|

$ |

1,837 |

|

A reconciliation of segment operating income to income before income taxes is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Six Months Ended |

||||||||

(Dollars in thousands) |

June 30, 2025 |

|

June 30, 2024 |

|

June 30, 2025 |

|

June 30, 2024 |

||||

Segment operating income (loss) |

$ |

6,932 |

|

$ |

(3,663) |

|

$ |

4,053 |

|

$ |

(6,938) |

Unallocated corporate expense: |

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

(84) |

|

|

(100) |

|

|

(219) |

|

|

(201) |

General and administrative expense |

|

(3,957) |

|

|

(3,929) |

|

|

(7,835) |

|

|

(8,083) |

Interest expense, net |

|

(4,354) |

|

|

(5,377) |

|

|

(9,096) |

|

|

(10,662) |

Equity earnings (loss) of unconsolidated joint ventures |

|

285 |

|

|

119 |

|

|

308 |

|

|

94 |

Gain (loss) on sale of assets |

|

1,872 |

|

|

9 |

|

|

8,398 |

|

|

(1,116) |

Other (expense) income |

|

(2,273) |

|

|

(216) |

|

|

(2,607) |

|

|

123 |

Income (loss) before income taxes |

$ |

(1,579) |

|

$ |

(13,157) |

|

$ |

(6,998) |

|

$ |

(26,783) |

Assuming cash and cash equivalents are accounted for as corporate assets, total assets by business segment and by country are presented as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

||

(Dollars in thousands) |

|

2025 |

|

2024 |

||

By segment: |

|

|

|

|

|

|

Cinema |

|

$ |

186,901 |

|

$ |

191,008 |

Real estate |

|

|

177,511 |

|

|

207,044 |

Corporate (1) |

|

|

73,663 |

|

|

72,959 |

Total assets |

|

$ |

438,075 |

|

$ |

471,011 |

By country: |

|

|

|

|

|

|

United States |

|

$ |

252,309 |

|

$ |

264,284 |

Australia |

|

|

159,856 |

|

|

167,667 |

New Zealand |

|

|

25,910 |

|

|

39,060 |

Total assets |

|

$ |

438,075 |

|

$ |

471,011 |

(1) Corporate Assets includes cash and cash equivalents of $12.0 million and $7.0 million as of June 30, 2025 and December 31, 2024, respectively.

The following table sets forth our operating properties by country:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

||

(Dollars in thousands) |

|

2025 |

|

2024 |

||

United States |

|

$ |

143,337 |

|

$ |

146,531 |

Australia |

|

|

60,470 |

|

|

59,081 |

New Zealand |

|

|

9,533 |

|

|

9,082 |

Total operating property |

|

$ |

213,340 |

|

$ |

214,694 |

The table below summarizes capital expenditures for the six months ended June 30, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

||||

(Dollars in thousands) |

|

|

|

|

|

|

June 30, 2025 |

|

June 30, 2024 |

||

Segment capital expenditures |

|

|

|

|

|

|

$ |

804 |

|

$ |

2,028 |

Corporate capital expenditures |

|

|

|

|

|

|

|

— |

|

|

— |

Total capital expenditures |

|

|

|

|

|

|

$ |

804 |

|

$ |

2,028 |

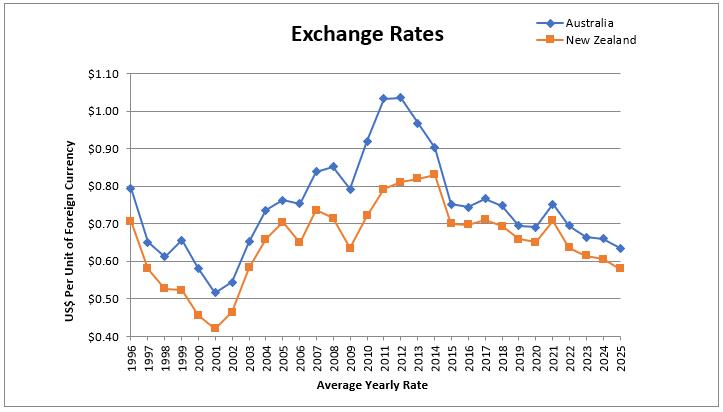

NOTE 5 – OPERATIONS IN FOREIGN CURRENCY

We have significant assets in Australia and New Zealand. Historically, we have conducted our Australian and New Zealand operations (collectively “foreign operations”) on a self-funding basis, where we use cash flows generated by our foreign operations to pay for the expenses of those foreign operations. However, in recent periods, cash flows from our overseas operations have been used to cover our domestic general and administrative costs, interest expense, and losses from our domestic cinema operations. Our Australian and New Zealand assets and liabilities are translated from their functional currencies of Australian dollar (“AU$”) and New Zealand dollar (“NZ$”), respectively, to the U.S. dollar based on the exchange rate as of June 30, 2025. The carrying value of the assets and liabilities of our foreign operations fluctuates as a result of changes in the exchange rates between the functional currencies of the foreign operations and the U.S. dollar. The translation adjustments are accumulated in the Accumulated Other Comprehensive Income in the Consolidated Balance Sheets.

We take a global view of our financial resources and are flexible in making use of resources from one jurisdiction in other jurisdictions.

Presented in the table below are the currency exchange rates for Australia and New Zealand:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Currency / USD |

|||||

|

As of and |

|

As of and |

|

As of and |

|

|

June 30, 2025 |

December 31, 2024 |

|

June 30, 2024 |

||

Spot Rate |

|

|

|

|

|

|

Australian Dollar |

0.6573 |

0.6185 |

|

0.6677 |

||

New Zealand Dollar |

0.6092 |

0.5596 |

|

0.6096 |

||

Average Rate |

|

|

|

|

|

|

Australian Dollar |

0.6412 |

|

0.6596 |

|

0.6591 |

|

New Zealand Dollar |

0.5936 |

|

0.6051 |

|

0.6054 |

|

NOTE 6 – EARNINGS PER SHARE

Basic earnings per share (“EPS”) is calculated by dividing the net income attributable to our Company by the weighted average number of common shares outstanding during the period. Diluted EPS is calculated by dividing the net income attributable to our Company by the weighted average number of common and common equivalent shares outstanding during the period and is calculated using the treasury stock method for equity-based compensation awards.

The following table sets forth the computation of basic and diluted EPS and a reconciliation of the weighted average number of common and common equivalent shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended |

|

Six Months Ended |

||||||||

|

|

June 30, |

|

June 30, |

||||||||

(Dollars in thousands, except share data) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Reading International, Inc. |

|

$ |

(2,667) |

|

$ |

(12,806) |

|

$ |

(7,423) |

|

$ |

(26,034) |

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common stock – basic |

|

|

22,708,206 |

|

|

22,413,617 |

|

|

22,586,019 |

|

|

22,379,881 |

Weighted average dilutive impact of awards |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

Weighted average number of common stock – diluted |

|

|

22,708,206 |

|

|

22,413,617 |

|

|

22,586,019 |

|

|

22,379,881 |

Basic earnings (loss) per share |

|

$ |

(0.12) |

|

$ |

(0.57) |

|

$ |

(0.33) |

|

$ |

(1.16) |

Diluted earnings (loss) per share |

|

$ |

(0.12) |

|

$ |

(0.57) |

|

$ |

(0.33) |

|

$ |

(1.16) |

Awards excluded from diluted earnings (loss) per share |

|

|

3,696,662 |

|

|

207,657 |

|

|

3,696,662 |

|

|

207,657 |

Our weighted average number of common stock - basic increased, primarily as a result of the vesting of restricted stock units. We did not repurchase any shares of Class A Common Stock during the first six months of 2025 or 2024.

Outstanding awards of 3,696,662 shares for the period ended June 30, 2025 and 207,657 shares for the period ended June 30, 2024 were excluded from the computation of dilutive shares, as they were anti-dilutive because of the net loss from continuing operations.

Note 7 – Property and Equipment

Operating Property, net

Property associated with our operating activities as at June 30, 2025 and December 31, 2024, is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

||

(Dollars in thousands) |

|

2025 |

|

2024 |

||

Land |

|

$ |

48,279 |

|

$ |

47,267 |

Building and improvements |

|

|

170,542 |

|

|

166,451 |

Leasehold improvements |

|

|

48,664 |

|

|

49,444 |

Fixtures and equipment |

|

|

149,152 |

|

|

143,773 |

Construction-in-progress |

|

|

2,054 |

|

|

1,987 |

Total cost |

|

|

418,691 |

|

|

408,922 |

Less: accumulated depreciation |

|

|

(205,351) |

|

|

(194,228) |

Operating property, net |

|

$ |

213,340 |

|

$ |

214,694 |

Depreciation expense for operating property was $3.4 million and $6.7 million for the quarter and six months ended June 30, 2025, as compared to $4.0 million and $8.1 million for the quarter and six months ended June 30, 2024.

Construction-in-Progress – Operating and Investment Properties

Construction-in-Progress balances are included in both our operating and development properties. The balances of our major projects along with the movements for the six months ended June 30, 2025, are shown below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in thousands) |

|

Balance, |

|

Additions during the period |

|

Completed |

|

Transferred to Held for Sale |

|

Foreign |

|

Balance, |

||||||

Cinema developments and improvements |

|

|

1,745 |

|

|

49 |

|

|

(38) |

|

|

— |

|

|

22 |

|

|

1,778 |

Other real estate projects |

|

|

242 |

|

|

165 |

|

|

(137) |

|

|

— |

|

|

6 |

|

|

276 |

Total |

|

$ |

1,987 |

|

$ |

214 |

|

$ |

(175) |

|

$ |

— |

|

$ |

28 |

|

$ |

2,054 |

2025 Real Estate Monetizations

In order to support our liquidity, we have monetized certain of our real estate holdings. During 2024 and the first six months of 2025 we sold three held for sale properties. In the first quarter of 2024, we monetized our office building in Culver City for $10.0 million. In the first quarter of 2025, we monetized our properties in Wellington, New Zealand for $21.5 million. In the second quarter of 2025, we monetized our Cannon Park properties, for $20.7 million. In the second quarter of 2023, we classified our Newberry Yard, Williamsport, Pennsylvania, property as held for sale.

A ‘disposal group’ represents assets to be disposed of in a single transaction. A disposal group may represent a single asset, or, multiple assets. Discussed below are those real estate transactions affecting the presentation in our consolidated balance sheet as of June 30, 2025 and December 31, 2024, and the profitability determination in our consolidated statements of income for the quarter and six months ended June 30, 2025, and 2024.

Cannon Park, Townsville, Queensland, Australia

In May 2024, we classified our Cannon Park ETC in Townsville, Queensland, Australia, as held for sale at the lower of cost and fair value less costs to sell. The disposal group consists of our Cannon Park City Center and Cannon Park Discount Center properties, comprising approximately 9.4-acres. The sale of the property was completed on May 21, 2025, at a gross sale price of $20.7 million. The proceeds were used principally to pay off our NAB bridging facility, and to reduce our Bank of America debt. We retained a lease over the cinema.

The gain on sale of this property is calculated as follows:

|

|

|

|

|

|

June 30 |

|

(Dollars in thousands) |

|

2025 |

|

Sales price |

|

$ |

20,698 |

Net book value |

|

|

(18,361) |

Gain on sale, gross of direct costs |

|

|

2,337 |

Direct sale costs incurred |

|

|

(518) |

Gain on sale, net of direct costs |

|

$ |

1,819 |

Courtenay Central, Wellington, New Zealand

In June 2024, we classified our property assets in Wellington, New Zealand including Courtenay Central, as held for sale at the lower of cost and fair value less costs to sell. The disposal group consisted of our Courtenay Central cinema and retail property, along with our Tory and Wakefield Street car parks. Our book value (as opposed to fair value) of the property was $14.7 million. No adjustments to the book value of the assets were required upon classification as held for sale. The sale was completed on January 31, 2025, at a gross sale price of $21.5 million. The proceeds were used to pay off the Westpac mortgage on the property, and to reduce our Bank of America debt. We have an Agreement to Lease the cinema portion from the Purchaser, which is expected to commence upon the completion of seismic upgrade work by the Landlord and cinema fit-out work by ourselves.

The gain on sale of this property is calculated as follows:

|

|

|

|

|

|

March 31 |

|

(Dollars in thousands) |

|

2025 |

|

Sales price |

|

$ |

21,538 |

Net book value |

|

|

(14,666) |

Gain on sale, gross of direct costs |

|

|