| Georgia | 001-33994 | 58-1451243 | ||||||||||||

| (State or other Jurisdiction of Incorporation or Organization) | (Commission File Number) |

(IRS Employer Identification No.) |

||||||||||||

| 1280 West Peachtree Street NW | Atlanta | Georgia | 30309 | ||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

| Common Stock, $0.10 Par Value Per Share | TILE | Nasdaq Global Select Market | ||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Exhibit No. | Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

| INTERFACE, INC. | |||||

| By: | /s/ Bruce A. Hausmann |

||||

| Bruce A. Hausmann | |||||

| Chief Financial Officer | |||||

| Date: August 1, 2025 | |||||

|

Media Contact:

Christine Needles

Global Corporate Communications

Christine.Needles@interface.com

+1 404-491-4660

|

Investor Contact:

Bruce Hausmann

Chief Financial Officer

Bruce.Hausmann@interface.com

+1 770-437-6802

|

||||

| Consolidated Results Summary (Unaudited) | Three Months Ended | Six Months Ended | |||||||||||||||||||||

| (in millions, except percentages and per share data) | 6/29/2025 | 6/30/2024 | Change | 6/29/2025 | 6/30/2024 | Change | |||||||||||||||||

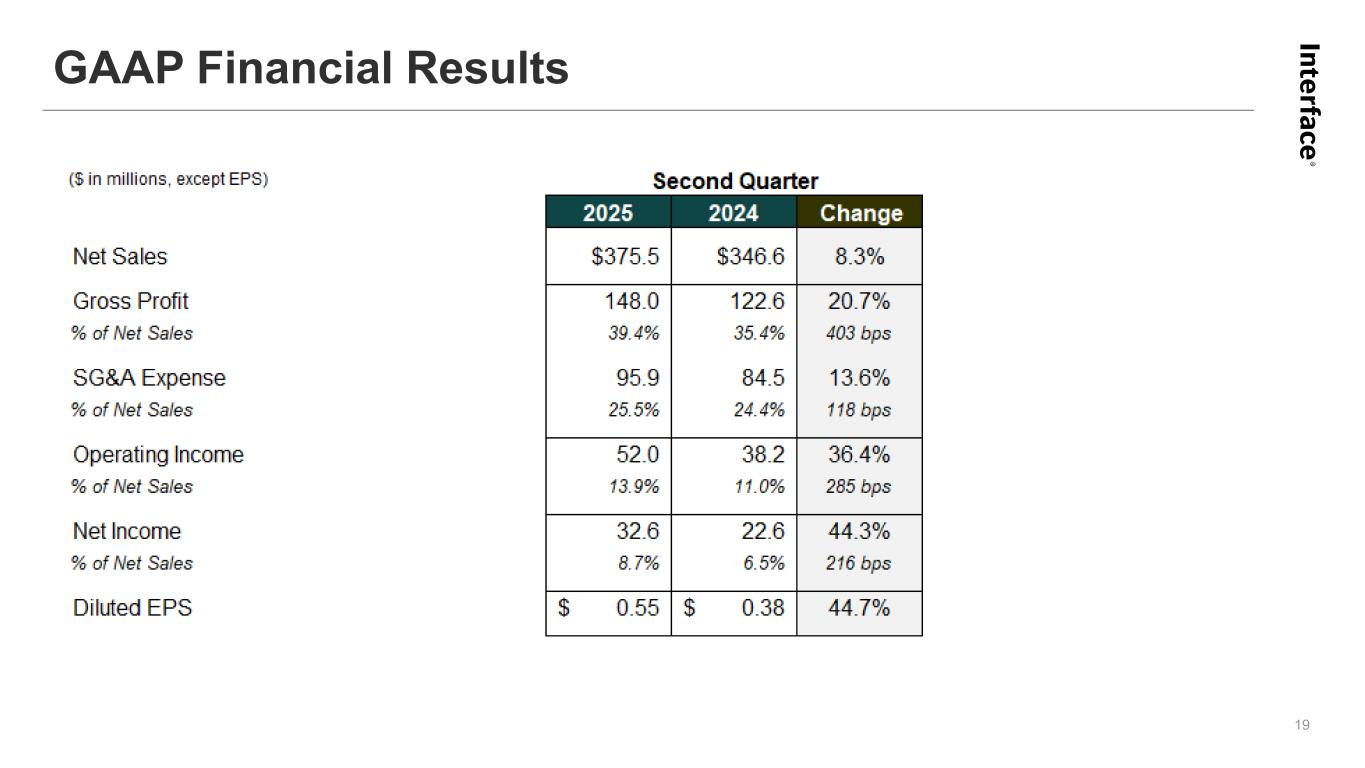

| GAAP | |||||||||||||||||||||||

| Net Sales | $ | 375.5 | $ | 346.6 | 8.3 | % | $ | 672.9 | $ | 636.4 | 5.7 | % | |||||||||||

| Gross Profit Margin % of Net Sales | 39.4 | % | 35.4 | % | 403 bps | 38.5 | % | 36.6 | % | 186 bps | |||||||||||||

| SG&A Expenses | $ | 95.9 | $ | 84.5 | 13.6 | % | $ | 183.7 | $ | 170.4 | 7.8 | % | |||||||||||

| SG&A Expenses % of Net Sales | 25.5 | % | 24.4 | % | 118 bps | 27.3 | % | 26.8 | % | 51 bps | |||||||||||||

| Operating Income | $ | 52.0 | $ | 38.2 | 36.4 | % | $ | 75.3 | $ | 62.6 | 20.3 | % | |||||||||||

| Net Income | $ | 32.6 | $ | 22.6 | 44.3 | % | $ | 45.6 | $ | 36.7 | 24.0 | % | |||||||||||

| Earnings per Diluted Share | $ | 0.55 | $ | 0.38 | 44.7 | % | $ | 0.77 | $ | 0.63 | 22.2 | % | |||||||||||

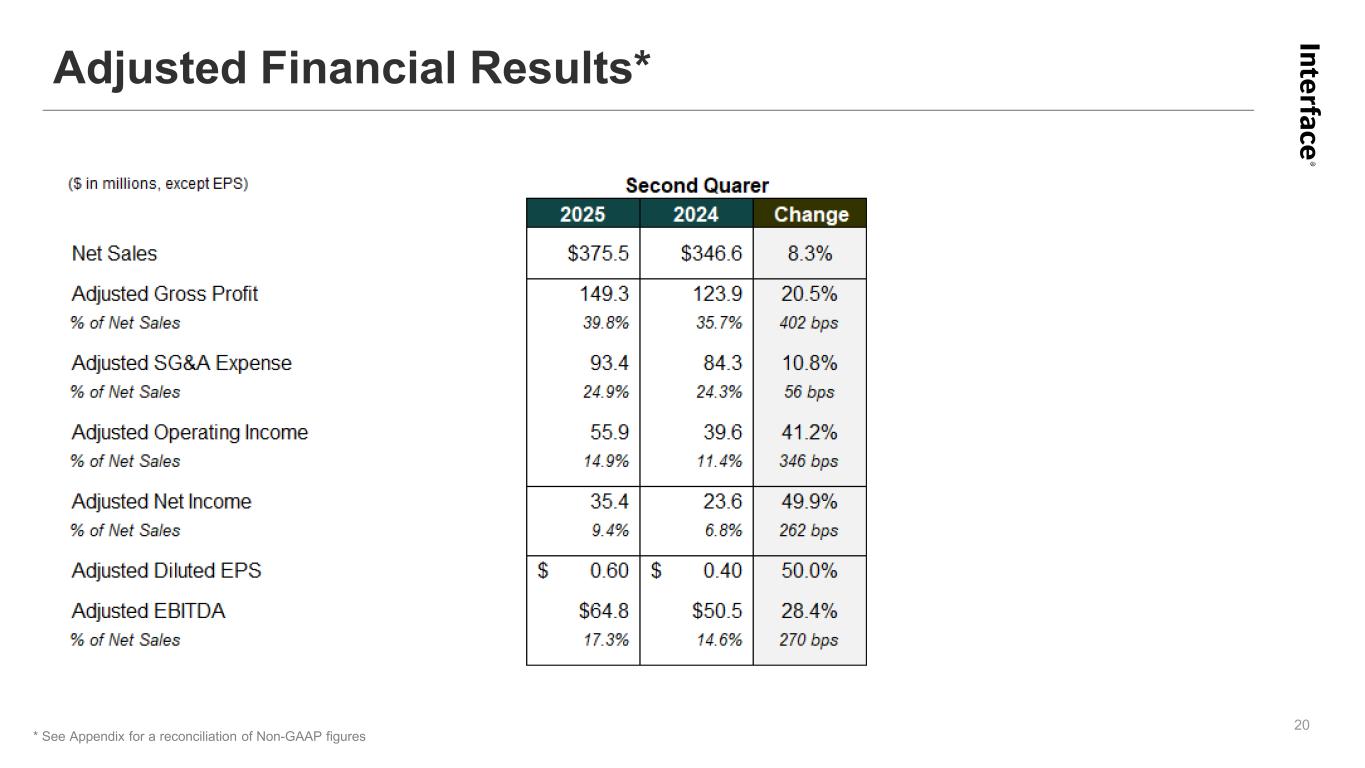

| Non-GAAP | |||||||||||||||||||||||

| Currency-Neutral Net Sales | $ | 371.1 | $ | 346.6 | 7.1 | % | $ | 672.9 | $ | 636.4 | 5.7 | % | |||||||||||

| Adjusted Gross Profit Margin % of Net Sales | 39.8 | % | 35.7 | % | 402 bps | 38.9 | % | 37.0 | % | 184 bps | |||||||||||||

| Adjusted SG&A Expenses | $ | 93.4 | $ | 84.3 | 10.8 | % | $ | 180.2 | $ | 170.5 | 5.7 | % | |||||||||||

| Adjusted SG&A Expenses % of Net Sales | 24.9 | % | 24.3 | % | 56 bps | 26.8 | % | 26.8 | % | (1) bps | |||||||||||||

| Adjusted Operating Income | $ | 55.9 | $ | 39.6 | 41.2 | % | $ | 81.4 | $ | 65.1 | 24.9 | % | |||||||||||

| Adjusted Net Income | $ | 35.4 | $ | 23.6 | 49.9 | % | $ | 50.0 | $ | 37.8 | 32.3 | % | |||||||||||

| Adjusted Earnings per Diluted Share | $ | 0.60 | $ | 0.40 | 50.0 | % | $ | 0.85 | $ | 0.64 | 32.8 | % | |||||||||||

| Adjusted EBITDA | $ | 64.8 | $ | 50.5 | 28.4 | % | $ | 101.8 | $ | 89.2 | 14.1 | % | |||||||||||

| Currency-Neutral Orders Increase Year-Over-Year | 2.9 | % | |||||||||||||||||||||

•Second quarter 2025 adjusted gross profit margin increased 402 basis points year-over-year, due to higher pricing, favorable product mix, and lower manufacturing costs per unit on higher volume; partially offset by higher raw material costs. | |||||||||||||||||||||||

•Second quarter 2025 adjusted SG&A expenses increased $9.1 million year-over-year due to higher sales commissions and variable compensation on increased sales and profits, higher healthcare costs, inflation, and foreign currency exchange variances. | |||||||||||||||||||||||

| Additional Metrics | 6/29/2025 | 12/29/2024 | Change | ||||||||||||||||||||

| Cash | $ | 121.7 | $ | 99.2 | 22.6 | % | |||||||||||||||||

| Total Debt | $ | 304.4 | $ | 302.8 | 0.6 | % | |||||||||||||||||

| Total Debt Minus Cash ("Net Debt") | $ | 182.7 | $ | 203.5 | (10.2) | % | |||||||||||||||||

| Last 12-Months Adjusted EBITDA | $ | 201.6 | |||||||||||||||||||||

| Total Debt divided by Last 12-Months Net Income | 3.2x | ||||||||||||||||||||||

| Net Debt divided by Last 12-Months Adjusted EBITDA ("Net Leverage Ratio") | 0.9x | ||||||||||||||||||||||

| Segment Results Summary (Unaudited) | Three Months Ended | Six Months Ended | ||||||||||||||||||||||||

| (in millions, except percentages) | 6/29/2025 | 6/30/2024 | Change | 6/29/2025 | 6/30/2024 | Change | ||||||||||||||||||||

| AMS | ||||||||||||||||||||||||||

| Net Sales | $ | 239.4 | $ | 215.0 | 11.4 | % | $ | 419.4 | $ | 384.9 | 9.0 | % | ||||||||||||||

| Currency-Neutral Net Sales | $ | 239.6 | $ | 215.0 | 11.5 | % | $ | 420.3 | $ | 384.9 | 9.2 | % | ||||||||||||||

| Operating Income | $ | 48.8 | $ | 26.8 | 82.2 | % | $ | 68.0 | $ | 45.0 | 51.1 | % | ||||||||||||||

| Adjusted Operating Income | $ | 48.8 | $ | 26.9 | 81.3 | % | $ | 68.7 | $ | 45.0 | 52.6 | % | ||||||||||||||

| Currency-Neutral Orders Increase Year-Over-Year | 2.1 | % | ||||||||||||||||||||||||

| EAAA | ||||||||||||||||||||||||||

| Net Sales | $ | 136.1 | $ | 131.6 | 3.4 | % | $ | 253.6 | $ | 251.5 | 0.8 | % | ||||||||||||||

| Currency-Neutral Net Sales | $ | 131.5 | $ | 131.6 | (0.1) | % | $ | 252.6 | $ | 251.5 | 0.4 | % | ||||||||||||||

| Operating Income | $ | 3.2 | $ | 11.3 | (71.8) | % | $ | 7.3 | $ | 17.6 | (58.5) | % | ||||||||||||||

| Adjusted Operating Income | $ | 7.1 | $ | 12.7 | (44.2) | % | $ | 12.7 | $ | 20.1 | (37.0) | % | ||||||||||||||

| Currency-Neutral Orders (Decrease) Year-Over-Year | 4.3 | % | ||||||||||||||||||||||||

| Q3 Fiscal Year 2025 Outlook | ||||||||||||||

| Net sales | $350 million to $360 million | |||||||||||||

| Adjusted gross profit margin | 38.0% of net sales | |||||||||||||

| Adjusted SG&A expenses | $92 million | |||||||||||||

| Adjusted interest & other expenses | $6 million | |||||||||||||

| Adjusted effective income tax rate | 27.0% | |||||||||||||

| Fully diluted weighted average share count | 59.1 million shares | |||||||||||||

| Note: All figures are approximate | ||||||||||||||

| Full Fiscal Year 2025 Outlook | Previous Full Fiscal Year 2025 Outlook | |||||||||||||

| Net sales | $1.370 billion to $1.390 billion | $1.340 billion to $1.365 billion | ||||||||||||

| Adjusted gross profit margin | 37.7% of net sales | 37.2% to 37.4% of net sales | ||||||||||||

| Adjusted SG&A expenses | $362 million | 26% of net sales | ||||||||||||

| Adjusted interest & other expenses | $25 million | $24 million | ||||||||||||

| Adjusted effective income tax rate | 26.0% | 27.0% | ||||||||||||

| Capital expenditures | $45 million | $45 million | ||||||||||||

| Note: All figures are approximate | ||||||||||||||

| Consolidated Statements of Operations (Unaudited) | Three Months Ended | Six Months Ended | ||||||||||||||||||||||||

| (In thousands, except per share data) | 6/29/2025 | 6/30/2024 | 6/29/2025 | 6/30/2024 | ||||||||||||||||||||||

| Net Sales | $ | 375,522 | $ | 346,635 | $ | 672,935 | $ | 636,378 | ||||||||||||||||||

| Cost of Sales | 227,545 | 224,022 | 413,995 | 403,360 | ||||||||||||||||||||||

| Gross Profit | 147,977 | 122,613 | 258,940 | 233,018 | ||||||||||||||||||||||

| Selling, General & Administrative Expenses | 95,930 | 84,462 | 183,666 | 170,421 | ||||||||||||||||||||||

| Operating Income | 52,047 | 38,151 | 75,274 | 62,597 | ||||||||||||||||||||||

| Interest Expense | 4,443 | 6,173 | 8,858 | 12,596 | ||||||||||||||||||||||

| Other Expense (Income), net | 3,411 | 832 | 5,114 | (144) | ||||||||||||||||||||||

| Income Before Income Tax Expense | 44,193 | 31,146 | 61,302 | 50,145 | ||||||||||||||||||||||

| Income Tax Expense | 11,632 | 8,588 | 15,739 | 13,408 | ||||||||||||||||||||||

| Net Income | $ | 32,561 | $ | 22,558 | $ | 45,563 | $ | 36,737 | ||||||||||||||||||

| Earnings Per Share – Basic | $ | 0.56 | $ | 0.39 | $ | 0.78 | $ | 0.63 | ||||||||||||||||||

| Earnings Per Share – Diluted | $ | 0.55 | $ | 0.38 | $ | 0.77 | $ | 0.63 | ||||||||||||||||||

Common Shares Outstanding – Basic |

58,555 | 58,281 | 58,495 | 58,260 | ||||||||||||||||||||||

Common Shares Outstanding – Diluted |

59,073 | 58,692 | 59,123 | 58,703 | ||||||||||||||||||||||

| Consolidated Balance Sheets (Unaudited) | |||||||||||

| (In thousands) | 6/29/2025 | 12/29/2024 | |||||||||

| Assets | |||||||||||

| Cash and Cash Equivalents | $ | 121,701 | $ | 99,226 | |||||||

| Accounts Receivable, net | 194,251 | 171,135 | |||||||||

| Inventories, net | 288,165 | 260,581 | |||||||||

Other Current Assets |

38,969 | 33,355 | |||||||||

Total Current Assets |

643,086 | 564,297 | |||||||||

| Property, Plant and Equipment, net | 291,839 | 282,374 | |||||||||

| Operating Lease Right-of-Use Assets | 80,619 | 76,815 | |||||||||

| Goodwill and intangibles assets, net | 162,770 | 148,160 | |||||||||

Other Assets |

99,908 | 99,170 | |||||||||

Total Assets |

$ | 1,278,222 | $ | 1,170,816 | |||||||

| Liabilities | |||||||||||

Accounts Payable |

$ | 86,621 | $ | 68,943 | |||||||

| Accrued Expenses | 122,850 | 134,996 | |||||||||

Current Portion of Operating Lease Liabilities |

13,571 | 12,296 | |||||||||

Current Portion of Long-Term Debt |

506 | 482 | |||||||||

Total Current Liabilities |

223,548 | 216,717 | |||||||||

Long-Term Debt |

303,943 | 302,275 | |||||||||

Operating Lease Liabilities |

71,541 | 68,092 | |||||||||

Other Long-Term Liabilities |

104,165 | 94,584 | |||||||||

Total Liabilities |

703,197 | 681,668 | |||||||||

Shareholders’ Equity |

575,025 | 489,148 | |||||||||

Total Liabilities and Shareholders’ Equity |

$ | 1,278,222 | $ | 1,170,816 | |||||||

| Consolidated Statements of Cash Flows (Unaudited) | Three Months Ended | Six Months Ended | |||||||||||||||||||||||||||

| (In thousands) | 6/29/2025 | 6/30/2024 | 6/29/2025 | 6/30/2024 | |||||||||||||||||||||||||

| OPERATING ACTIVITIES | |||||||||||||||||||||||||||||

| Net Income | $ | 32,561 | $ | 22,558 | $ | 45,563 | $ | 36,737 | |||||||||||||||||||||

| Adjustments to Reconcile Net Income to Cash Provided by Operating Activities: | |||||||||||||||||||||||||||||

| Depreciation and Amortization | 9,829 | 9,728 | 19,230 | 19,344 | |||||||||||||||||||||||||

| Share-Based Compensation Expense | 2,771 | 2,616 | 6,917 | 6,531 | |||||||||||||||||||||||||

| Deferred Taxes | 1,091 | (361) | 254 | (1,039) | |||||||||||||||||||||||||

| Other | (1,959) | (58) | 1,111 | (3,766) | |||||||||||||||||||||||||

| Amortization of Acquired Intangible Assets | 1,352 | 1,287 | 2,606 | 2,584 | |||||||||||||||||||||||||

| Change in Working Capital | |||||||||||||||||||||||||||||

| Accounts Receivable | (25,414) | (32,744) | (14,739) | (18,907) | |||||||||||||||||||||||||

| Inventories | 4,238 | 14,816 | (12,101) | (5,661) | |||||||||||||||||||||||||

| Prepaid Expenses and Other Current Assets | (970) | (4,139) | (4,408) | (6,332) | |||||||||||||||||||||||||

| Accounts Payable and Accrued Expenses | 6,629 | 7,836 | (2,566) | 4,667 | |||||||||||||||||||||||||

| Cash Provided by Operating Activities | 30,128 | 21,539 | 41,867 | 34,158 | |||||||||||||||||||||||||

| INVESTING ACTIVITIES | |||||||||||||||||||||||||||||

| Capital Expenditures | (7,354) | (9,574) | (14,821) | (13,607) | |||||||||||||||||||||||||

| Proceeds from Sale of Property, Plant and Equipment | — | — | — | 1,040 | |||||||||||||||||||||||||

| Insurance Proceeds from Property Casualty Loss | — | — | — | 1,000 | |||||||||||||||||||||||||

| Cash Used in Investing Activities | (7,354) | (9,574) | (14,821) | (11,567) | |||||||||||||||||||||||||

| FINANCING ACTIVITIES | |||||||||||||||||||||||||||||

| Repayments of Long-term Debt | (131) | (12,147) | (253) | (46,930) | |||||||||||||||||||||||||

| Borrowing of Long-term Debt | 1,306 | 7,334 | 1,306 | 17,334 | |||||||||||||||||||||||||

| Repurchase of Common Stock | (4,286) | — | (4,286) | — | |||||||||||||||||||||||||

| Tax Withholding Payments for Share-Based Compensation | (6) | (483) | (7,736) | (4,754) | |||||||||||||||||||||||||

| Dividends Paid | (1,173) | (1,167) | (1,227) | (1,173) | |||||||||||||||||||||||||

| Finance Lease Payments | (782) | (721) | (1,544) | (1,437) | |||||||||||||||||||||||||

| Cash Used in Financing Activities | (5,072) | (7,184) | (13,740) | (36,960) | |||||||||||||||||||||||||

| Net Cash Provided by (Used in) Operating, Investing and Financing Activities | 17,702 | 4,781 | 13,306 | (14,369) | |||||||||||||||||||||||||

| Effect of Exchange Rate Changes on Cash | 6,242 | (368) | 9,169 | (1,942) | |||||||||||||||||||||||||

| CASH AND CASH EQUIVALENTS | |||||||||||||||||||||||||||||

| Net Change During the Period | 23,944 | 4,413 | 22,475 | (16,311) | |||||||||||||||||||||||||

| Balance at Beginning of Period | 97,757 | 89,774 | 99,226 | 110,498 | |||||||||||||||||||||||||

| Balance at End of Period | $ | 121,701 | $ | 94,187 | $ | 121,701 | $ | 94,187 | |||||||||||||||||||||

| Second Quarter 2025 | Second Quarter 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjustments | Adjustments | ||||||||||||||||||||||||||||||||||||||||||||||

| Gross Profit | SG&A Expenses | Operating Income (Loss) | Pre-tax | Tax Effect | Net Income (Loss) | Diluted EPS | Gross Profit | SG&A Expenses | Operating Income (Loss) | Pre-tax | Tax Effect | Net Income (Loss) | Diluted EPS | ||||||||||||||||||||||||||||||||||

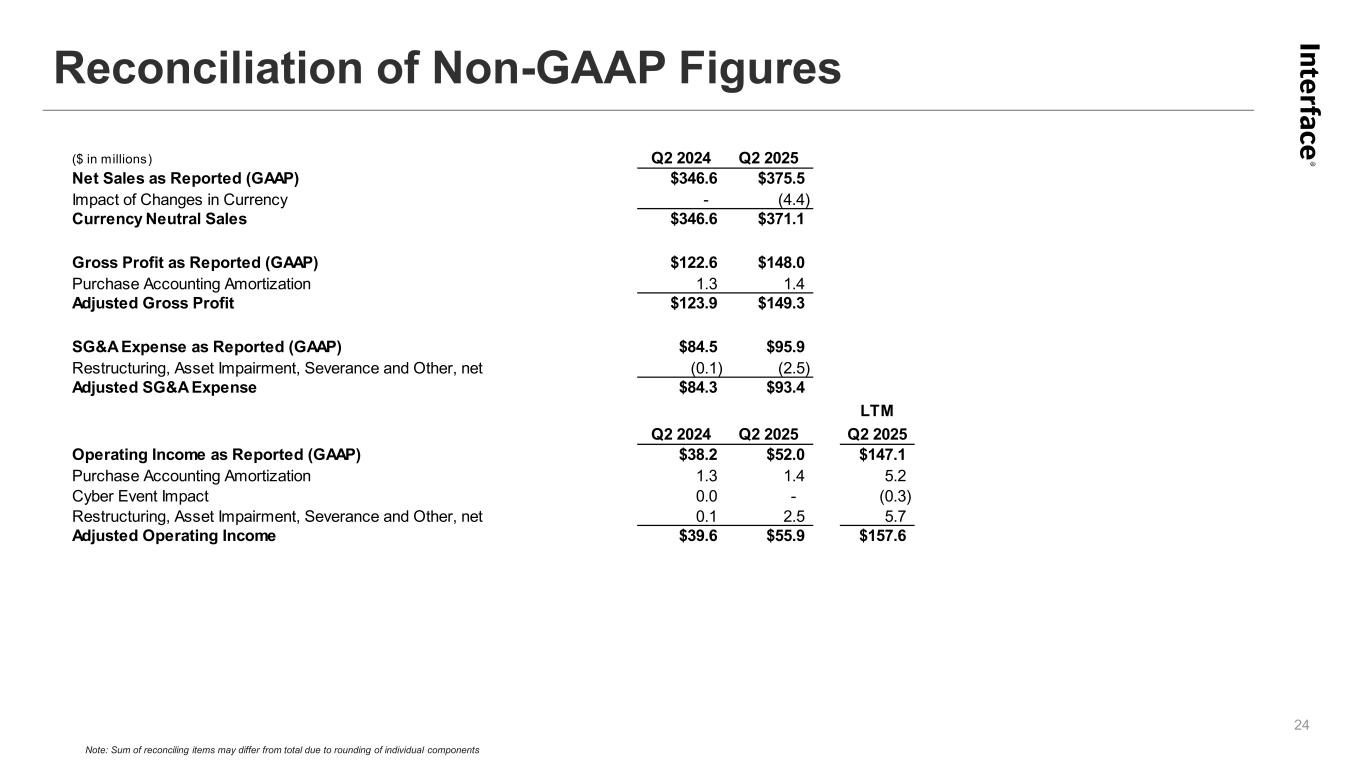

| GAAP As Reported | $ | 148.0 | $ | 95.9 | $ | 52.0 | $ | 32.6 | $ | 0.55 | $ | 122.6 | $ | 84.5 | $ | 38.2 | $ | 22.6 | $ | 0.38 | |||||||||||||||||||||||||||

| Non-GAAP Adjustments: | |||||||||||||||||||||||||||||||||||||||||||||||

| Purchase Accounting Amortization | 1.4 | — | 1.4 | 1.4 | (0.4) | 1.0 | 0.02 | 1.3 | — | 1.3 | 1.3 | (0.4) | 0.9 | 0.02 | |||||||||||||||||||||||||||||||||

| Restructuring, Asset Impairment, Severance, and Other, net | — | (2.5) | 2.5 | 2.5 | (0.6) | 1.9 | 0.03 | — | (0.1) | 0.1 | 0.1 | 0.0 | 0.1 | — | |||||||||||||||||||||||||||||||||

| Adjustments Subtotal * | 1.4 | (2.5) | 3.9 | 3.9 | (1.0) | 2.8 | 0.05 | 1.3 | (0.2) | 1.5 | 1.5 | (0.4) | 1.0 | 0.02 | |||||||||||||||||||||||||||||||||

| Adjusted (non-GAAP) * | $ | 149.3 | $ | 93.4 | $ | 55.9 | $ | 35.4 | $ | 0.60 | $ | 123.9 | $ | 84.3 | $ | 39.6 | $ | 23.6 | $ | 0.40 | |||||||||||||||||||||||||||

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | |||||||||||||||||||||||||||||||||||||||||||||||

| First Six Months 2025 | First Six Months 2024 | ||||||||||||||||||||||||||||||||||||||||||||||

| Adjustments | Adjustments | ||||||||||||||||||||||||||||||||||||||||||||||

| Gross Profit | SG&A Expenses | Operating Income (Loss) | Pre-tax | Tax Effect | Net Income (Loss) | Diluted EPS | Gross Profit | SG&A Expenses | Operating Income (Loss) | Pre-tax | Tax Effect | Net Income (Loss) | Diluted EPS | ||||||||||||||||||||||||||||||||||

| GAAP As Reported | $ | 258.9 | $ | 183.7 | $ | 75.3 | $ | 45.6 | $ | 0.77 | $ | 233.0 | $ | 170.4 | $ | 62.6 | $ | 36.7 | $ | 0.63 | |||||||||||||||||||||||||||

| Non-GAAP Adjustments: | |||||||||||||||||||||||||||||||||||||||||||||||

| Purchase Accounting Amortization | 2.6 | — | 2.6 | 2.6 | (0.8) | 1.8 | 0.03 | 2.6 | — | 2.6 | 2.6 | (0.8) | 1.8 | 0.03 | |||||||||||||||||||||||||||||||||

| Restructuring, Asset Impairment, Severance, and Other, net | — | (3.5) | 3.5 | 3.5 | (0.9) | 2.6 | 0.04 | — | (0.3) | 0.3 | 0.3 | (0.1) | 0.3 | — | |||||||||||||||||||||||||||||||||

| Cyber Event Impact | — | — | — | — | — | — | — | — | 0.4 | (0.4) | (0.4) | 0.1 | (0.3) | (0.01) | |||||||||||||||||||||||||||||||||

Property Casualty Loss (1) |

— | — | — | — | — | — | — | — | — | — | (1.0) | 0.2 | (0.7) | (0.01) | |||||||||||||||||||||||||||||||||

| Adjustments Subtotal * | 2.6 | (3.5) | 6.1 | 6.1 | (1.6) | 4.5 | 0.08 | 2.6 | 0.1 | 2.5 | 1.6 | (0.5) | 1.1 | 0.02 | |||||||||||||||||||||||||||||||||

| Adjusted (non-GAAP) * | $ | 261.5 | $ | 180.2 | $ | 81.4 | $ | 50.0 | $ | 0.85 | $ | 235.6 | $ | 170.5 | $ | 65.1 | $ | 37.8 | $ | 0.64 | |||||||||||||||||||||||||||

| (1) Represents property insurance (recovery) / loss | |||||||||||||||||||||||||||||||||||||||||||||||

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | |||||||||||||||||||||||||||||||||||||||||||||||

| Second Quarter 2025 | Second Quarter 2024 | ||||||||||||||||||||||

| AMS Segment | EAAA Segment | Consolidated * | AMS Segment | EAAA Segment | Consolidated * | ||||||||||||||||||

| Net Sales as Reported (GAAP) | $ | 239.4 | $ | 136.1 | $ | 375.5 | $ | 215.0 | $ | 131.6 | $ | 346.6 | |||||||||||

| Impact of Changes in Currency | 0.2 | (4.6) | (4.4) | — | — | — | |||||||||||||||||

| Currency-Neutral Net Sales * | $ | 239.6 | $ | 131.5 | $ | 371.1 | $ | 215.0 | $ | 131.6 | $ | 346.6 | |||||||||||

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | |||||||||||||||||||||||

| First Six Months 2025 | First Six Months 2024 | ||||||||||||||||||||||

| AMS Segment | EAAA Segment | Consolidated * | AMS Segment | EAAA Segment | Consolidated * | ||||||||||||||||||

| Net Sales as Reported (GAAP) | $ | 419.4 | $ | 253.6 | $ | 672.9 | $ | 384.9 | $ | 251.5 | $ | 636.4 | |||||||||||

| Impact of Changes in Currency | 0.9 | (1.0) | (0.1) | — | — | — | |||||||||||||||||

| Currency-Neutral Net Sales * | $ | 420.3 | $ | 252.6 | $ | 672.9 | $ | 384.9 | $ | 251.5 | $ | 636.4 | |||||||||||

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | |||||||||||||||||||||||

| Second Quarter 2025 | Second Quarter 2024 | ||||||||||||||||||||||||||||||||||

| AMS Segment | EAAA Segment | Consolidated * | AMS Segment | EAAA Segment | Consolidated * | ||||||||||||||||||||||||||||||

| GAAP Operating Income (Loss) | $ | 48.8 | $ | 3.2 | $ | 52.0 | $ | 26.8 | $ | 11.3 | $ | 38.2 | |||||||||||||||||||||||

| Non-GAAP Adjustments: | |||||||||||||||||||||||||||||||||||

| Purchase Accounting Amortization | — | 1.4 | 1.4 | — | 1.3 | 1.3 | |||||||||||||||||||||||||||||

| Restructuring, Asset Impairment, Severance, and Other, net | — | 2.5 | 2.5 | 0.1 | — | 0.1 | |||||||||||||||||||||||||||||

| Adjustments Subtotal * | — | 3.9 | 3.9 | 0.1 | 1.3 | 1.5 | |||||||||||||||||||||||||||||

| AOI * | $ | 48.8 | $ | 7.1 | $ | 55.9 | $ | 26.9 | $ | 12.7 | $ | 39.6 | |||||||||||||||||||||||

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | |||||||||||||||||||||||||||||||||||

| First Six Months 2025 | First Six Months 2024 | ||||||||||||||||||||||

| AMS Segment | EAAA Segment | Consolidated * | AMS Segment | EAAA Segment | Consolidated * | ||||||||||||||||||

| GAAP Operating Income (Loss) | $ | 68.0 | $ | 7.3 | $ | 75.3 | $ | 45.0 | $ | 17.6 | $ | 62.6 | |||||||||||

| Non-GAAP Adjustments: | |||||||||||||||||||||||

| Purchase Accounting Amortization | — | 2.6 | 2.6 | — | 2.6 | 2.6 | |||||||||||||||||

| Cyber Event Impact | — | — | — | (0.2) | (0.2) | (0.4) | |||||||||||||||||

| Restructuring, Asset Impairment, Severance, and Other, net | 0.7 | 2.8 | 3.5 | 0.3 | 0.1 | 0.3 | |||||||||||||||||

| Adjustments Subtotal * | 0.7 | 5.4 | 6.1 | — | 2.5 | 2.5 | |||||||||||||||||

| AOI * | $ | 68.7 | $ | 12.7 | $ | 81.4 | $ | 45.0 | $ | 20.1 | $ | 65.1 | |||||||||||

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | |||||||||||||||||||||||

| (in millions) | Second Quarter 2025 | Second Quarter 2024 | First Six Months 2025 | First Six Months 2024 | Last Twelve Months (LTM) Ended 6/29/2025 | Fiscal Year 2024 | |||||||||||||||||||||||||||||||||||

| Net Income as Reported (GAAP) | $ | 32.6 | $ | 22.6 | $ | 45.6 | $ | 36.7 | $ | 95.8 | $ | 86.9 | |||||||||||||||||||||||||||||

| Income Tax Expense | 11.6 | 8.6 | 15.7 | 13.4 | 28.9 | 26.6 | |||||||||||||||||||||||||||||||||||

Interest Expense (including debt issuance cost amortization) |

4.4 | 6.2 | 8.9 | 12.6 | 19.5 | 23.2 | |||||||||||||||||||||||||||||||||||

Depreciation and Amortization (excluding debt issuance cost amortization) |

9.6 | 9.1 | 18.7 | 18.4 | 37.6 | 37.3 | |||||||||||||||||||||||||||||||||||

| Share-based Compensation Expense | 2.8 | 2.6 | 6.9 | 6.5 | 13.3 | 12.9 | |||||||||||||||||||||||||||||||||||

| Purchase Accounting Amortization | 1.4 | 1.3 | 2.6 | 2.6 | 5.2 | 5.2 | |||||||||||||||||||||||||||||||||||

| Restructuring, Asset Impairment, Severance, and Other, net | 2.5 | 0.1 | 3.5 | 0.3 | 5.7 | 2.5 | |||||||||||||||||||||||||||||||||||

| Cyber Event Impact | — | — | — | (0.4) | (5.1) | (5.5) | |||||||||||||||||||||||||||||||||||

Property Casualty Loss(1) |

— | — | — | (1.0) | (1.4) | (2.3) | |||||||||||||||||||||||||||||||||||

Loss on Foreign Subsidiary Liquidation (2) |

— | — | — | — | 2.2 | 2.2 | |||||||||||||||||||||||||||||||||||

| Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (AEBITDA)* | $ | 64.8 | $ | 50.5 | $ | 101.8 | $ | 89.2 | $ | 201.6 | $ | 189.0 | |||||||||||||||||||||||||||||

| (1) Represents insurance recovery. | |||||||||||||||||||||||||||||||||||||||||

| (2) In 2024 our Thailand subsidiary was substantially liquidated and the related cumulative translation adjustment was recognized in other expense. | |||||||||||||||||||||||||||||||||||||||||

| * Note: Sum of reconciling items may differ from total due to rounding of individual components | |||||||||||||||||||||||||||||||||||||||||