Document

FOR IMMEDIATE RELEASE

|

|

|

|

|

|

|

Media Contact:

Christine Needles

Global Corporate Communications

Christine.Needles@interface.com

+1 404-491-4660

|

Investor Contact:

Bruce Hausmann

Chief Financial Officer

Bruce.Hausmann@interface.com

+1 770-437-6802

|

Interface Reports First Quarter 2025 Results

Delivered strong quarter; One Interface strategy continues to drive results

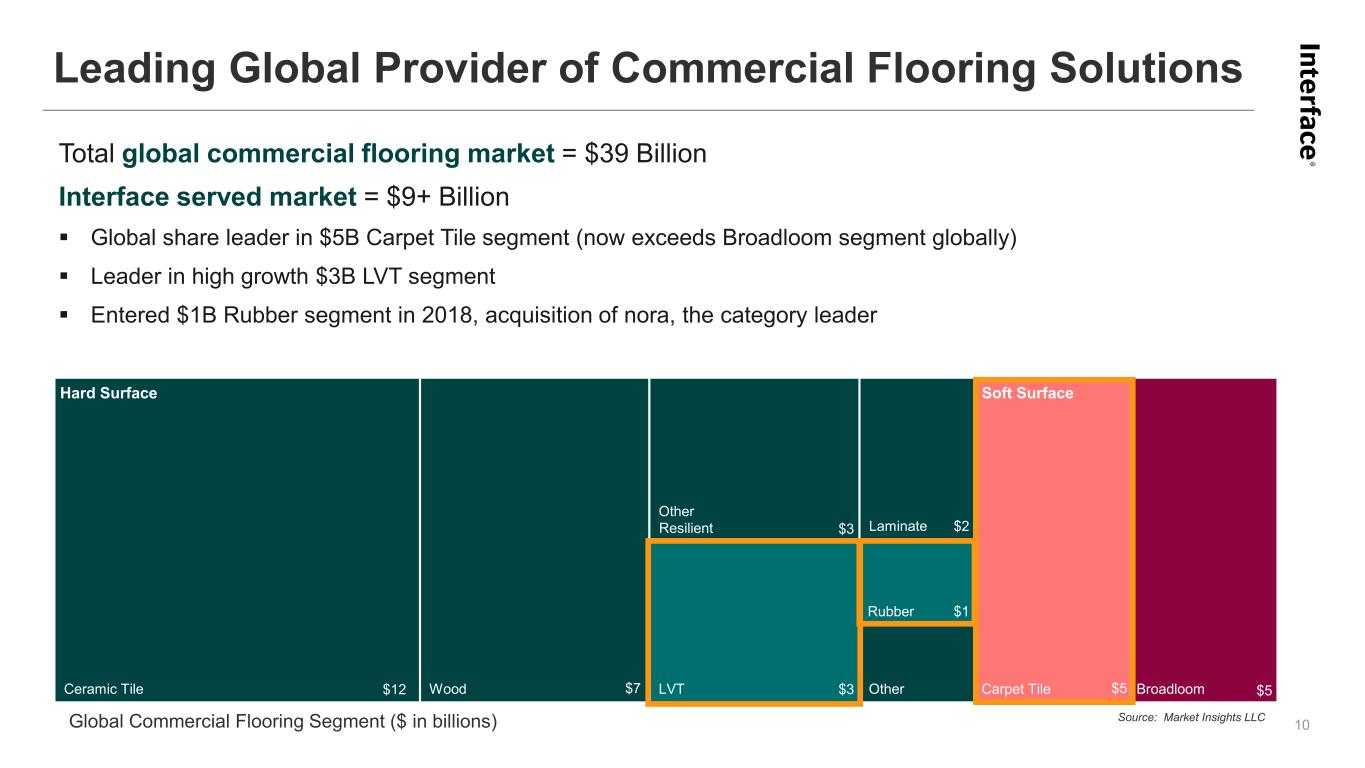

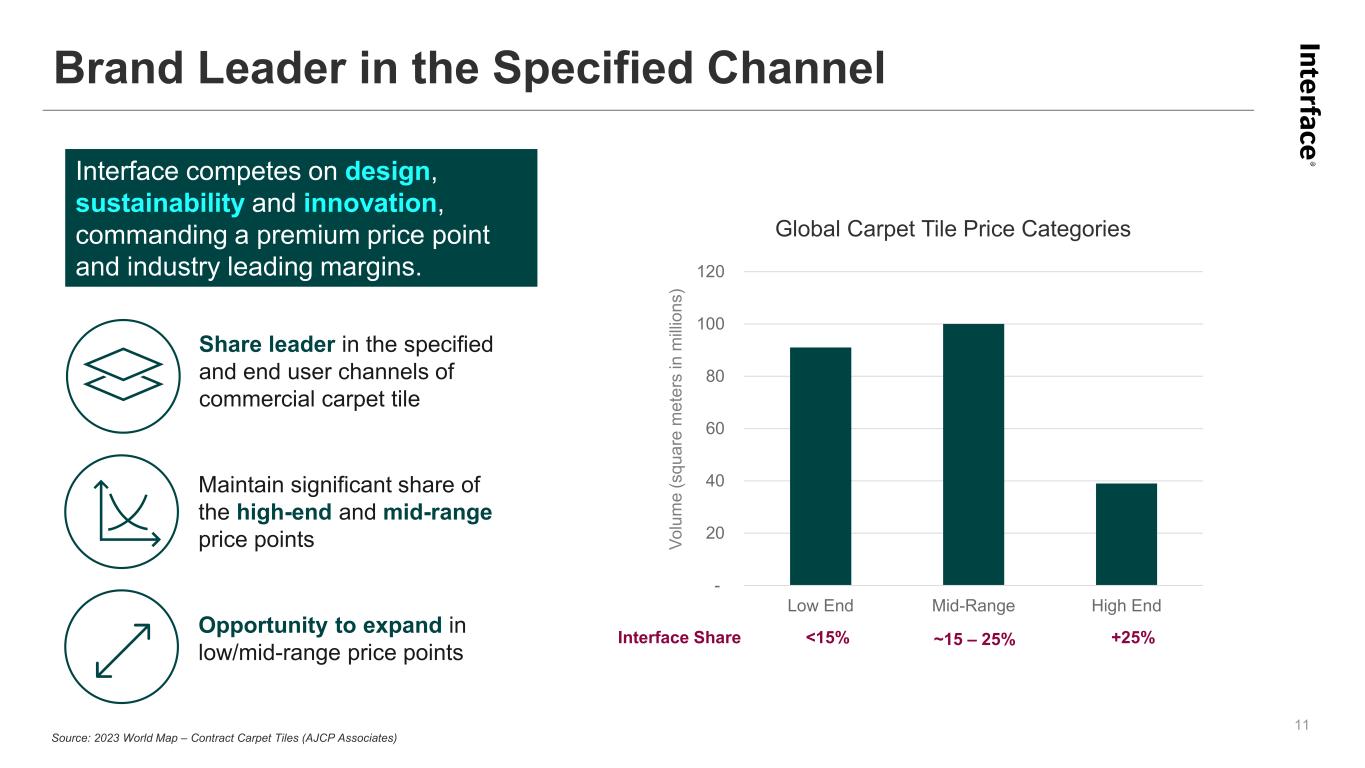

ATLANTA – May 2, 2025 – Interface, Inc. (Nasdaq: TILE), a worldwide commercial flooring company and global leader in sustainability, today announced results for the first quarter ended March 30, 2025.

First quarter highlights:

•Net sales totaled $297 million, up 2.6% year-over-year and up 4.1% currency-neutral.

•GAAP earnings per diluted share of $0.22; Adjusted earnings per diluted share of $0.25.

•Momentum continues with One Interface strategy.

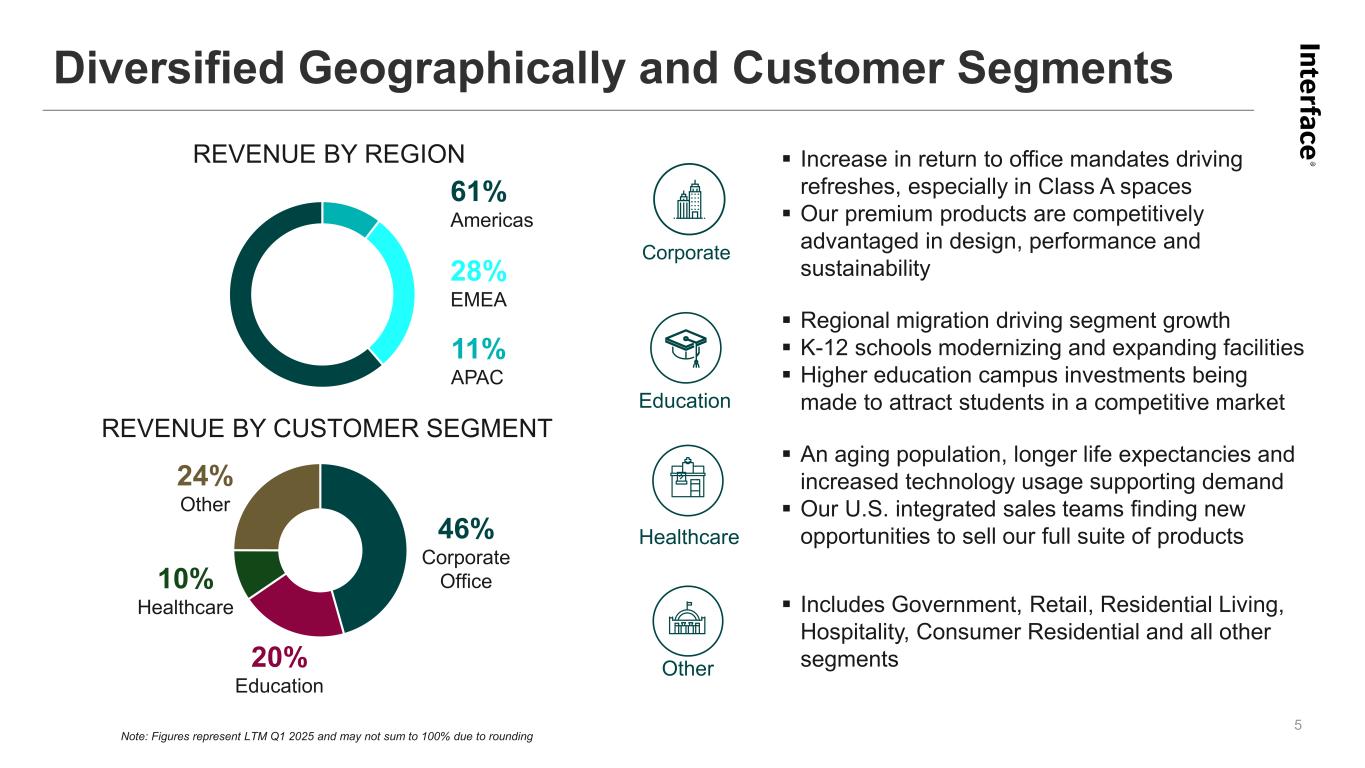

“We delivered a solid start to the year, with currency-neutral net sales growth of 4% year-over-year. Strong momentum continued in the Americas, where net sales grew 6% and currency-neutral orders were up 10%, partially offset by a softer macro environment in EAAA. Global billings in both Healthcare and Education grew double digits demonstrating the power of our strategy that continues to diversify and strengthen our business,” commented Laurel Hurd, CEO of Interface.

“Our first quarter performance highlights the ongoing success of our One Interface strategy, which aims to accelerate growth, expand margins, and lead in design, performance, and sustainability. To further these goals, we recently named our first Vice President of Global Product Category Management to accelerate and optimize our product innovation pipeline, ensuring we continue to deliver world-class products that meet the evolving needs of the market while embodying the essence of Interface,” continued Hurd.

“First quarter results exceeded our expectations, reflecting our team’s disciplined execution amid a dynamic macroeconomic backdrop. We are navigating the current environment from a position of strength, as our One Interface strategy continues to yield tangible results, and our strong balance sheet provides optionality and flexibility. We remain focused on delivering long-term value for our shareholders,” added Bruce Hausmann, CFO of Interface.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Results Summary (Unaudited) |

Three Months Ended |

|

| (in millions, except percentages and per share data) |

3/30/2025 |

3/31/2024 |

Change |

|

|

|

|

|

|

| GAAP |

|

|

|

|

| Net Sales |

$ |

297.4 |

|

$ |

289.7 |

|

2.6 |

% |

|

| Gross Profit Margin % of Net Sales |

37.3 |

% |

38.1 |

% |

(80) bps |

|

| SG&A Expenses |

$ |

87.7 |

|

$ |

86.0 |

|

2.1 |

% |

|

| SG&A Expenses % of Net Sales |

29.5 |

% |

29.7 |

% |

(17) bps |

|

| Operating Income |

$ |

23.2 |

|

$ |

24.4 |

|

(5.0) |

% |

|

| Net Income |

$ |

13.0 |

|

$ |

14.2 |

|

(8.3) |

% |

|

| Earnings per Diluted Share |

$ |

0.22 |

|

$ |

0.24 |

|

(8.3) |

% |

|

|

|

|

|

|

| Non-GAAP |

|

|

|

|

| Currency-Neutral Net Sales |

$ |

301.7 |

|

$ |

289.7 |

|

4.1 |

% |

|

| Adjusted Gross Profit Margin % of Net Sales |

37.7 |

% |

38.6 |

% |

(82) bps |

|

| Adjusted SG&A Expenses |

$ |

86.8 |

|

$ |

86.2 |

|

0.7 |

% |

|

| Adjusted SG&A Expenses % of Net Sales |

29.2 |

% |

29.7 |

% |

(57) bps |

|

| Adjusted Operating Income |

$ |

25.5 |

|

$ |

25.5 |

|

(0.3) |

% |

|

| Adjusted Net Income |

$ |

14.6 |

|

$ |

14.2 |

|

3.0 |

% |

|

| Adjusted Earnings per Diluted Share |

$ |

0.25 |

|

$ |

0.24 |

|

4.2 |

% |

|

| Adjusted EBITDA |

$ |

37.0 |

|

$ |

38.8 |

|

(4.5) |

% |

|

| Currency-Neutral Orders Increase Year-Over-Year |

3.3 |

% |

|

|

|

|

|

|

|

|

•First quarter 2025 adjusted gross profit margin declined 82 basis points year-over-year, as expected, due to higher manufacturing costs in EAAA and higher freight costs partially offset by higher pricing. |

|

|

|

|

|

| Additional Metrics |

3/30/2025 |

12/29/2024 |

Change |

|

| Cash |

$ |

97.8 |

|

$ |

99.2 |

|

(1.5) |

% |

|

| Total Debt |

$ |

302.9 |

|

$ |

302.8 |

|

0.0 |

% |

|

| Total Debt Minus Cash ("Net Debt") |

$ |

205.1 |

|

$ |

203.5 |

|

0.8 |

% |

|

| Last 12-Months Adjusted EBITDA |

$ |

187.2 |

|

|

|

|

| Total Debt divided by Last 12-Months Net Income |

3.5x |

|

|

|

| Net Debt divided by Last 12-Months Adjusted EBITDA ("Net Leverage Ratio") |

1.1x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment Results Summary (Unaudited) |

Three Months Ended |

|

| (in millions, except percentages) |

3/30/2025 |

3/31/2024 |

Change |

|

|

|

|

|

|

| AMS |

|

|

|

|

| Net Sales |

$ |

179.9 |

|

$ |

169.9 |

|

5.9 |

% |

|

| Currency-Neutral Net Sales |

$ |

180.7 |

|

$ |

169.9 |

|

6.3 |

% |

|

| Operating Income |

$ |

19.1 |

|

$ |

18.2 |

|

5.2 |

% |

|

| Adjusted Operating Income |

$ |

19.9 |

|

$ |

18.1 |

|

9.9 |

% |

|

| Currency-Neutral Orders Increase Year-Over-Year |

9.8 |

% |

|

|

|

|

|

|

|

|

| EAAA |

|

|

|

|

| Net Sales |

$ |

117.5 |

|

$ |

119.8 |

|

(2.0) |

% |

|

| Currency-Neutral Net Sales |

$ |

121.1 |

|

$ |

119.8 |

|

1.0 |

% |

|

| Operating Income |

$ |

4.1 |

|

$ |

6.3 |

|

(34.6) |

% |

|

| Adjusted Operating Income |

$ |

5.6 |

|

$ |

7.4 |

|

(24.9) |

% |

|

| Currency-Neutral Orders (Decrease) Year-Over-Year |

(5.7) |

% |

|

|

|

Outlook

Interface is forecasting a strong second quarter and remains focused on delivering a strong year amid a dynamic macro environment and increased global macro uncertainty. Order momentum and a healthy backlog support the Company's expectations for a strong second quarter. With that backdrop in mind, Interface anticipates the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q2 Fiscal Year 2025 Outlook |

|

|

| Net sales |

|

$355 million to $365 million |

|

|

| Adjusted gross profit margin |

|

37.2% of net sales |

|

|

| Adjusted SG&A expenses |

|

$90 million |

|

|

| Adjusted interest & other expenses |

|

$6 million |

|

|

| Adjusted effective income tax rate |

|

27.5% |

|

|

| Fully diluted weighted average share count |

|

59.3 million shares |

|

|

| Note: All figures are approximate |

|

|

|

|

|

|

|

|

|

|

|

Full Fiscal Year 2025 Outlook |

|

Previous Full Fiscal Year 2025 Outlook |

| Net sales |

|

$1.340 billion to $1.365 billion |

|

$1.315 billion to $1.365 billion |

| Adjusted gross profit margin |

|

37.2% to 37.4% of net sales |

|

37.2% to 37.4% of net sales |

| Adjusted SG&A expenses |

|

26% of net sales |

|

26% of net sales |

| Adjusted interest & other expenses |

|

$24 million |

|

$24 million |

| Adjusted effective income tax rate |

|

27.0% |

|

28.0% |

| Capital expenditures |

|

$45 million |

|

$45 million |

| Note: All figures are approximate |

|

|

|

|

Webcast and Conference Call Information

Interface will host a conference call on May 2, 2025, at 8:00 a.m. Eastern Time, to discuss its first quarter 2025 results. The conference call will be simultaneously broadcast live over the Internet.

Listeners may access the conference call live over the Internet at:

https://events.q4inc.com/attendee/711411681, or through the Company's website at: https://investors.interface.com.

The archived version of the webcast will be available at these sites for one year beginning approximately one hour after the call ends.

Non-GAAP Financial Measures

Interface provides adjusted earnings per share, adjusted net income, adjusted operating income ("AOI"), adjusted gross profit, adjusted gross profit margin, adjusted SG&A expenses, currency- neutral sales and currency-neutral sales growth, net debt, and adjusted EBITDA as additional information regarding its operating results in this press release. These non-GAAP measures are not in accordance with – or alternatives to – GAAP measures, and may be different from non-GAAP measures used by other companies. Adjusted EPS, adjusted net income, and AOI exclude nora purchase accounting amortization, restructuring, asset impairment, severance, and other, net, and the cyber event impact. Adjusted EPS and adjusted net income also exclude the property casualty loss impact. Adjusted gross profit and adjusted gross profit margin exclude the nora purchase accounting amortization. Adjusted SG&A expenses exclude restructuring, asset impairment, severance, and other, net and the cyber event impact. Currency-neutral sales and currency-neutral sales growth exclude the impact of foreign currency fluctuations.

Net debt is total debt less cash on hand. Adjusted EBITDA is GAAP net income excluding interest expense, income tax expense, depreciation and amortization, share-based compensation expense, cyber event impact, property casualty loss impact, restructuring, asset impairment, severance, and other, net, the nora purchase accounting amortization, and the loss on foreign subsidiary liquidation. This news release should be read in conjunction with the Company's Current Report on Form 8-K furnished today to the U.S. Securities & Exchange Commission, which explains why Interface believes presentation of these non-GAAP measures provides useful information to investors, as well as any additional material purposes for which Interface uses these non-GAAP measures.

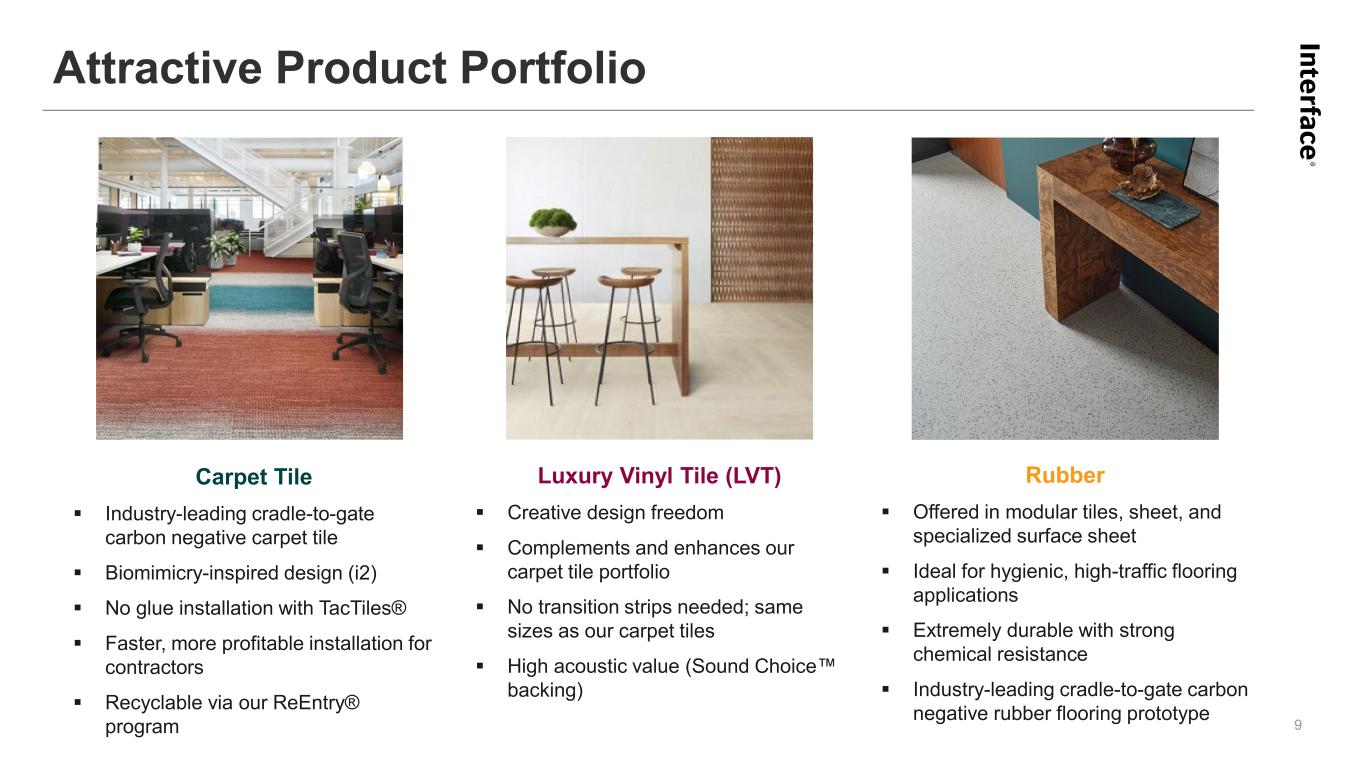

About Interface

Interface, Inc. (NASDAQ: TILE) is a global flooring solutions company and sustainability leader, offering an integrated portfolio of carpet tile and resilient flooring products that includes Interface® carpet tile and LVT, nora® rubber flooring, and FLOR® premium area rugs for commercial and residential spaces. Made with purpose and without compromise, Interface flooring brings more sophisticated design, more performance, more innovation, and more climate progress to interior spaces.

A decades-long pioneer in sustainability, Interface remains “all in” on becoming a restorative business. Today, the company is focusing on carbon reductions, not offsets, as it works toward achieving its verified science-based targets by 2030 and its goal to become a carbon negative enterprise by 2040.

Learn more about Interface at interface.com and blog.interface.com, nora by Interface at nora.com, FLOR at FLOR.com, and our sustainability journey at interface.com/sustainability.

Follow us on Facebook, Instagram, LinkedIn, X, and Pinterest.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995:

Except for historical information contained herein, the other matters set forth in this news release are forward-looking statements. Forward-looking statements may be identified by words such as “may,” “expect,” “forecast,” “anticipate,” “intend,” “plan,” “believe,” “could,” “should,” “goal,” “aim," “objective,” “seek,” “project,” “estimate,” “target,” “will” and similar expressions. Forward-looking statements in this press release include, without limitation, any projections we make regarding the Company’s 2025 second quarter and full year 2025 under “Outlook” above. The forward-looking statements set forth above involve a number of risks and uncertainties that could cause actual results to differ materially from any such statement, including but not limited to the risks under the following subheadings in “Risk Factors” in the Company's Annual Report on Form 10-K for the fiscal year ended December 29, 2024: "We compete with a large number of manufacturers in the highly competitive floorcovering products market, and some of these competitors have greater financial resources than we do. We may face challenges competing on price, making investments in our business, or competing on product design or sustainability", "Our earnings could be adversely affected by non-cash adjustments to goodwill, when a test of goodwill assets indicates a material impairment of those assets", "Our success depends significantly upon the efforts, abilities and continued service of our senior management executives, our principal design consultant and other key personnel (including experienced sales and manufacturing personnel), and our loss of any of them could affect us adversely", "Large increases in the cost of our raw materials, shipping costs, duties or tariffs could adversely affect us if we are unable to pass these cost increases through to our customers", "Unanticipated termination or interruption of any of our arrangements with our primary third-party suppliers of synthetic fiber or our primary third-party supplier for luxury vinyl tile (“LVT”) or other key raw materials could have a material adverse effect on us", "Changes to our facilities, manufacturing processes, product construction, and product composition could disrupt our operations, increase our manufacturing costs, increase customer complaints, increase warranty claims, negatively affect our reputation, and have a material adverse effect on our financial condition and results of operations", "Our business operations could suffer significant losses from natural disasters, acts of war, terrorism, catastrophes, fire, adverse weather conditions, pandemics, endemics, unstable geopolitical situations or other unexpected events", "The market price of our common stock has been volatile and the value of your investment may decline", "Sales of our principal products have been and may continue to be affected by adverse economic cycles, and effects in the new construction market and renovation market", "Disruptions to or failures of information technology systems we use could adversely affect our business", "The impact of potential changes to environmental laws and regulations and industry standards regarding climate change and other sustainability matters could lead to unforeseen disruptions to our business operations", "Health crisis events, such as epidemics or pandemics, have adversely impacted, and may continue to impact, the economy and disrupt our operations and supply chains, which may have an adverse effect on our results of operations", Our substantial international operations are subject to various political, economic and other uncertainties that could adversely affect our business results, including foreign currency fluctuations, restrictive taxation, custom duties, tariffs, border closings or other adverse government regulations", "The conflicts between Russia and Ukraine and in the Middle East could adversely affect our business, results of operations and financial position", "Fluctuations in foreign currency exchange rates have had, and could continue to have, an adverse impact on our financial condition and results of operations", "The uncertainty surrounding the ongoing implementation and effect of the U.K.’s exit from the European Union, and related negative developments in the European Union, could adversely affect our business, results of operations or financial condition", "We have a substantial amount of debt, which could adversely affect our business, financial condition and results of operations and our ability to meet our payment obligations under our debt", "Servicing our debt requires a significant amount of cash, and we may not have sufficient cash flow from our operations to pay our indebtedness", "We may incur substantial additional indebtedness, which could further exacerbate the risks associated with our substantial indebtedness", and "We face risks associated with litigation and claims".

You should consider any additional or updated information we include under the heading “Risk Factors” in our subsequent quarterly and annual reports.

Any forward-looking statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and, as such, speak only as of the date made. The Company assumes no responsibility to update or revise forward-looking statements made in this press release and cautions readers not to place undue reliance on any such forward-looking statements.

- TABLES FOLLOW -

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Statements of Operations (Unaudited) |

Three Months Ended |

|

|

| (In thousands, except per share data) |

3/30/2025 |

|

3/31/2024 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net Sales |

$ |

297,413 |

|

|

$ |

289,743 |

|

|

|

|

|

| Cost of Sales |

186,450 |

|

|

179,338 |

|

|

|

|

|

| Gross Profit |

110,963 |

|

|

110,405 |

|

|

|

|

|

| Selling, General & Administrative Expenses |

87,736 |

|

|

85,959 |

|

|

|

|

|

| Operating Income |

23,227 |

|

|

24,446 |

|

|

|

|

|

| Interest Expense |

4,415 |

|

|

6,423 |

|

|

|

|

|

| Other Expense (Income), net |

1,703 |

|

|

(976) |

|

|

|

|

|

| Income Before Income Tax Expense |

17,109 |

|

|

18,999 |

|

|

|

|

|

| Income Tax Expense |

4,107 |

|

|

4,820 |

|

|

|

|

|

| Net Income |

$ |

13,002 |

|

|

$ |

14,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share – Basic |

$ |

0.22 |

|

|

$ |

0.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share – Diluted |

$ |

0.22 |

|

|

$ |

0.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares Outstanding – Basic |

58,434 |

|

|

58,238 |

|

|

|

|

|

Common Shares Outstanding – Diluted |

59,173 |

|

|

58,714 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Balance Sheets (Unaudited) |

|

|

|

| (In thousands) |

3/30/2025 |

|

12/29/2024 |

| Assets |

|

|

|

| Cash and Cash Equivalents |

$ |

97,757 |

|

|

$ |

99,226 |

|

| Accounts Receivable, net |

162,754 |

|

|

171,135 |

|

| Inventories, net |

281,741 |

|

|

260,581 |

|

Other Current Assets |

37,185 |

|

|

33,355 |

|

Total Current Assets |

579,437 |

|

|

564,297 |

|

| Property, Plant and Equipment, net |

283,783 |

|

|

282,374 |

|

| Operating Lease Right-of-Use Assets |

77,845 |

|

|

76,815 |

|

| Goodwill and intangibles assets, net |

152,282 |

|

|

148,160 |

|

Other Assets |

98,451 |

|

|

99,170 |

|

Total Assets |

$ |

1,191,798 |

|

|

$ |

1,170,816 |

|

|

|

|

|

| Liabilities |

|

|

|

Accounts Payable |

$ |

82,958 |

|

|

$ |

68,943 |

|

| Accrued Expenses |

114,009 |

|

|

134,996 |

|

Current Portion of Operating Lease Liabilities |

12,718 |

|

|

12,296 |

|

Current Portion of Long-Term Debt |

487 |

|

|

482 |

|

Total Current Liabilities |

210,172 |

|

|

216,717 |

|

Long-Term Debt |

302,390 |

|

|

302,275 |

|

Operating Lease Liabilities |

69,160 |

|

|

68,092 |

|

Other Long-Term Liabilities |

97,009 |

|

|

94,584 |

|

Total Liabilities |

678,731 |

|

|

681,668 |

|

Shareholders’ Equity |

513,067 |

|

|

489,148 |

|

Total Liabilities and Shareholders’ Equity |

$ |

1,191,798 |

|

|

$ |

1,170,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Statements of Cash Flows (Unaudited) |

|

Three Months Ended |

| (In thousands) |

|

3/30/2025 |

|

3/31/2024 |

| OPERATING ACTIVITIES |

|

|

|

|

| Net Income |

|

$ |

13,002 |

|

|

$ |

14,179 |

|

| Adjustments to Reconcile Net Income to Cash Provided by Operating Activities: |

|

|

|

|

| Depreciation and Amortization |

|

9,401 |

|

|

9,616 |

|

| Share-Based Compensation Expense |

|

4,145 |

|

|

3,915 |

|

| Amortization of Acquired Intangible Assets |

|

1,255 |

|

|

1,297 |

|

| Deferred Taxes |

|

(837) |

|

|

(678) |

|

| Other |

|

3,070 |

|

|

(3,708) |

|

| Change in Working Capital |

|

|

|

|

| Accounts Receivable |

|

10,675 |

|

|

13,837 |

|

| Inventories |

|

(16,339) |

|

|

(20,477) |

|

| Prepaid Expenses and Other Current Assets |

|

(3,438) |

|

|

(2,193) |

|

| Accounts Payable and Accrued Expenses |

|

(9,195) |

|

|

(3,169) |

|

| Cash Provided by Operating Activities |

|

11,739 |

|

|

12,619 |

|

| INVESTING ACTIVITIES |

|

|

|

|

| Capital Expenditures |

|

(7,467) |

|

|

(4,033) |

|

| Proceeds from Sale of Property, Plant and Equipment |

|

— |

|

|

1,040 |

|

| Insurance Proceeds from Property Casualty Loss |

|

— |

|

|

1,000 |

|

| Cash Used in Investing Activities |

|

(7,467) |

|

|

(1,993) |

|

| FINANCING ACTIVITIES |

|

|

|

|

| Repayments of Long-term Debt |

|

(122) |

|

|

(34,783) |

|

| Borrowing of Long-term Debt |

|

— |

|

|

10,000 |

|

| Tax Withholding Payments for Share-Based Compensation |

|

(7,730) |

|

|

(4,271) |

|

| Dividends Paid |

|

(54) |

|

|

(6) |

|

| Finance Lease Payments |

|

(762) |

|

|

(716) |

|

| Cash Used in Financing Activities |

|

(8,668) |

|

|

(29,776) |

|

| Net Cash Used in Operating, Investing and Financing Activities |

|

(4,396) |

|

|

(19,150) |

|

| Effect of Exchange Rate Changes on Cash |

|

2,927 |

|

|

(1,574) |

|

| CASH AND CASH EQUIVALENTS |

|

|

|

|

| Net Change During the Period |

|

(1,469) |

|

|

(20,724) |

|

| Balance at Beginning of Period |

|

99,226 |

|

|

110,498 |

|

| Balance at End of Period |

|

$ |

97,757 |

|

|

$ |

89,774 |

|

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures (Unaudited)

(In millions, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter 2025 |

|

First Quarter 2024 |

|

|

|

|

Adjustments |

|

|

|

|

|

|

Adjustments |

|

|

|

Gross Profit |

SG&A Expenses |

Operating Income (Loss) |

Pre-tax |

Tax Effect |

Net Income (Loss) |

Diluted EPS |

|

Gross Profit |

SG&A Expenses |

Operating Income (Loss) |

Pre-tax |

Tax Effect |

Net Income (Loss) |

Diluted EPS |

| GAAP As Reported |

$ |

111.0 |

|

$ |

87.7 |

|

$ |

23.2 |

|

|

|

$ |

13.0 |

|

$ |

0.22 |

|

|

$ |

110.4 |

|

$ |

86.0 |

|

$ |

24.4 |

|

|

|

$ |

14.2 |

|

$ |

0.24 |

|

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchase Accounting Amortization |

1.3 |

|

— |

|

1.3 |

|

1.3 |

|

(0.4) |

|

0.9 |

|

0.02 |

|

|

1.3 |

|

— |

|

1.3 |

|

1.3 |

|

(0.4) |

|

0.9 |

|

0.02 |

|

| Restructuring, Asset Impairment, Severance, and Other, net |

— |

|

(1.0) |

|

1.0 |

|

1.0 |

|

(0.2) |

|

0.7 |

|

0.01 |

|

|

— |

|

(0.2) |

|

0.2 |

|

0.2 |

|

0.0 |

0.2 |

|

— |

|

| Cyber Event Impact |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

0.4 |

|

(0.4) |

|

(0.4) |

|

0.1 |

|

(0.3) |

|

(0.01) |

|

Property Casualty Loss (1) |

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

— |

|

— |

|

— |

|

(1.0) |

|

0.2 |

|

(0.7) |

|

(0.01) |

|

| Adjustments Subtotal * |

1.3 |

|

(1.0) |

|

2.2 |

|

2.2 |

|

(0.6) |

|

1.6 |

|

0.03 |

|

|

1.3 |

|

0.2 |

|

1.1 |

|

0.1 |

|

(0.1) |

|

— |

|

— |

|

| Adjusted (non-GAAP) * |

$ |

112.2 |

|

$ |

86.8 |

|

$ |

25.5 |

|

|

|

$ |

14.6 |

|

$ |

0.25 |

|

|

$ |

111.7 |

|

$ |

86.2 |

|

$ |

25.5 |

|

|

|

$ |

14.2 |

|

$ |

0.24 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Represents property insurance (recovery) / loss |

|

|

|

|

|

|

|

|

|

|

|

|

| * Note: Sum of reconciling items may differ from total due to rounding of individual components |

|

|

|

|

|

|

|

|

Reconciliation of Segment GAAP Financial Measures to Non-GAAP Financial Measures ("Currency-Neutral Net Sales", and "AOI")

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter 2025 |

|

First Quarter 2024 |

|

AMS Segment |

EAAA Segment |

Consolidated * |

|

AMS Segment |

EAAA Segment |

Consolidated * |

| Net Sales as Reported (GAAP) |

$ |

179.9 |

|

$ |

117.5 |

|

$ |

297.4 |

|

|

$ |

169.9 |

|

$ |

119.8 |

|

$ |

289.7 |

|

| Impact of Changes in Currency |

0.7 |

|

3.6 |

|

4.3 |

|

|

— |

|

— |

|

— |

|

| Currency-Neutral Net Sales * |

$ |

180.7 |

|

$ |

121.1 |

|

$ |

301.7 |

|

|

$ |

169.9 |

|

$ |

119.8 |

|

$ |

289.7 |

|

|

|

|

|

|

|

|

|

| * Note: Sum of reconciling items may differ from total due to rounding of individual components |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter 2025 |

|

First Quarter 2024 |

|

|

|

AMS Segment |

EAAA Segment |

Consolidated * |

|

AMS Segment |

EAAA Segment |

Consolidated * |

|

|

|

|

| GAAP Operating Income (Loss) |

$ |

19.1 |

|

$ |

4.1 |

|

$ |

23.2 |

|

|

$ |

18.2 |

|

$ |

6.3 |

|

$ |

24.4 |

|

|

|

|

|

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

| Purchase Accounting Amortization |

— |

|

1.3 |

|

1.3 |

|

|

— |

|

1.3 |

|

1.3 |

|

|

|

|

|

| Cyber Event Impact |

— |

|

— |

|

— |

|

|

(0.2) |

|

(0.2) |

|

(0.4) |

|

|

|

|

|

| Restructuring, Asset Impairment, Severance, and Other, net |

0.7 |

|

0.2 |

|

1.0 |

|

|

0.1 |

|

0.1 |

|

0.2 |

|

|

|

|

|

| Adjustments Subtotal * |

0.7 |

|

1.5 |

|

2.2 |

|

|

(0.1) |

|

1.2 |

|

1.1 |

|

|

|

|

|

| AOI * |

$ |

19.9 |

|

$ |

5.6 |

|

$ |

25.5 |

|

|

$ |

18.1 |

|

$ |

7.4 |

|

$ |

25.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Note: Sum of reconciling items may differ from total due to rounding of individual components |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

First Quarter 2025 |

|

First Quarter 2024 |

|

Last Twelve Months (LTM) Ended 3/30/2025 |

|

|

|

Fiscal Year 2024 |

|

|

| Net Income as Reported (GAAP) |

$ |

13.0 |

|

|

$ |

14.2 |

|

|

$ |

85.8 |

|

|

|

|

$ |

86.9 |

|

|

|

| Income Tax Expense |

4.1 |

|

|

4.8 |

|

|

25.9 |

|

|

|

|

26.6 |

|

|

|

Interest Expense (including debt issuance cost amortization) |

4.4 |

|

|

6.4 |

|

|

21.2 |

|

|

|

|

23.2 |

|

|

|

Depreciation and Amortization (excluding debt issuance cost amortization) |

9.1 |

|

|

9.3 |

|

|

37.2 |

|

|

|

|

37.3 |

|

|

|

| Share-based Compensation Expense |

4.1 |

|

|

3.9 |

|

|

13.1 |

|

|

|

|

12.9 |

|

|

|

| Purchase Accounting Amortization |

1.3 |

|

|

1.3 |

|

|

5.1 |

|

|

|

|

5.2 |

|

|

|

| Restructuring, Asset Impairment, Severance, and Other, net |

1.0 |

|

|

0.2 |

|

|

3.3 |

|

|

|

|

2.5 |

|

|

|

| Cyber Event Impact |

— |

|

|

(0.4) |

|

|

(5.1) |

|

|

|

|

(5.5) |

|

|

|

Property Casualty Loss(1) |

— |

|

|

(1.0) |

|

|

(1.4) |

|

|

|

|

(2.3) |

|

|

|

Loss on Foreign Subsidiary Liquidation (2) |

— |

|

|

— |

|

|

2.2 |

|

|

|

|

2.2 |

|

|

|

| Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (AEBITDA)* |

$ |

37.0 |

|

|

$ |

38.8 |

|

|

$ |

187.2 |

|

|

|

|

$ |

189.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Represents insurance recovery. |

|

|

|

|

|

|

|

|

| (2) In 2024 our Thailand subsidiary was substantially liquidated and the related cumulative translation adjustment was recognized in other expense. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Note: Sum of reconciling items may differ from total due to rounding of individual components |

|

|

|

|

|

|

|

|

|

The impacts of changes in foreign currency presented in the tables are calculated based on applying the prior year period's average foreign currency exchange rates to the current year period.

The Company believes that the above non-GAAP performance measures, which management uses in managing and evaluating the Company’s business, may provide users of the Company’s financial information with additional meaningful basis for comparing the Company’s current results and results in a prior period, as these measures reflect factors that are unique to one period relative to the comparable period. However, these non‑GAAP performance measures should be viewed in addition to, and not as an alternative for, the Company’s reported results under accounting principles generally accepted in the United States. Tax effects identified above (when applicable) are calculated using the statutory tax rate for the jurisdictions in which the charge or income occurred.

# # #