Third Quarter 2025 Investor Presentation

This presentation may contain various statements about Renasant Corporation (“Renasant,” “we,” “our,” or “us”) that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “focus,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward-looking in nature and not historical facts. Forward-looking statements include information about our future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management. We believe these forward-looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions about future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements; such differences may be material. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investors should not place undue reliance on these forward- looking statements, which speak only as of the date they are made. Important factors currently known to management that could cause our actual results to differ materially from those in forward-looking statements include the following: (i) Renasant’s ability to efficiently integrate acquisitions (including its merger with The First Bancshares, Inc. (“The First”)) into its operations, retain the customers of these businesses, grow the acquired operations and realize the cost savings expected from an acquisition to the extent and in the timeframe anticipated by management (including the possibility that such cost savings will not be realized when expected, or at all, as a result of the impact of, or challenges arising from, the integration of the acquired assets and assumed liabilities into Renasant, potential adverse reactions or changes to business or employee relationships, or as a result of other unexpected factors or events); (ii) potential exposure to unknown or contingent risks and liabilities we have acquired, or may acquire, or target for acquisition, including in connection with our merger with The First; (iii) the effect of economic conditions and interest rates on a national, regional or international basis; (iv) timing and success of the implementation of changes in operations to achieve enhanced earnings or effect cost savings; (v) competitive pressures in the consumer finance, commercial finance, financial services, asset management, retail banking, factoring and mortgage lending and auto lending industries; (vi) the financial resources of, and products available from, competitors; (vii) changes in laws and regulations as well as changes in accounting standards; (viii) changes in governmental and regulatory policy, whether applicable specifically to financial institutions or impacting the United States generally (such as, for example, changes in trade policy); (ix) increased scrutiny by, and/or additional regulatory requirements of, regulatory agencies as a result of our merger with The First; (x) changes in the securities and foreign exchange markets; (xi) Renasant’s potential growth, including its entrance or expansion into new markets, and the need for sufficient capital to support that growth; (xii) changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers or issuers of investment securities, or the impact of interest rates on the value of our investment securities portfolio; (xiii) an insufficient allowance for credit losses as a result of inaccurate assumptions; (xiv) changes in the sources and costs of the capital we use to make loans and otherwise fund our operations, due to deposit outflows, changes in the mix of deposits and the cost and availability of borrowings; (xv) general economic, market or business conditions, including the impact of inflation; (xvi) changes in demand for loan and deposit products and other financial services; (xvii) concentrations of credit or deposit exposure; (xviii) changes or the lack of changes in interest rates, yield curves and interest rate spread relationships; (xix) increased cybersecurity risk, including potential network breaches, business disruptions or financial losses; (xx) civil unrest, natural disasters, epidemics and other catastrophic events in our geographic area; (xxi) geopolitical conditions, including acts or threats of terrorism, and actions taken by the United States or other governments in response to acts or threats of terrorism and/or military conflicts, which could impact business and economic conditions in the United States and abroad; (xxii) the impact, extent and timing of technological changes; and (xxiii) other circumstances, many of which are beyond management’s control. Management believes that the assumptions underlying our forward-looking statements are reasonable, but any of the assumptions could prove to be inaccurate. Investors are urged to carefully consider the risks described in Renasant’s filings with the Securities and Exchange Commission (“SEC”) from time to time, including its most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are available at www.renasant.com and the SEC’s website at www.sec.gov. We undertake no obligation, and specifically disclaim any obligation, to update or revise our forward- looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws. Forward-Looking Statements 2

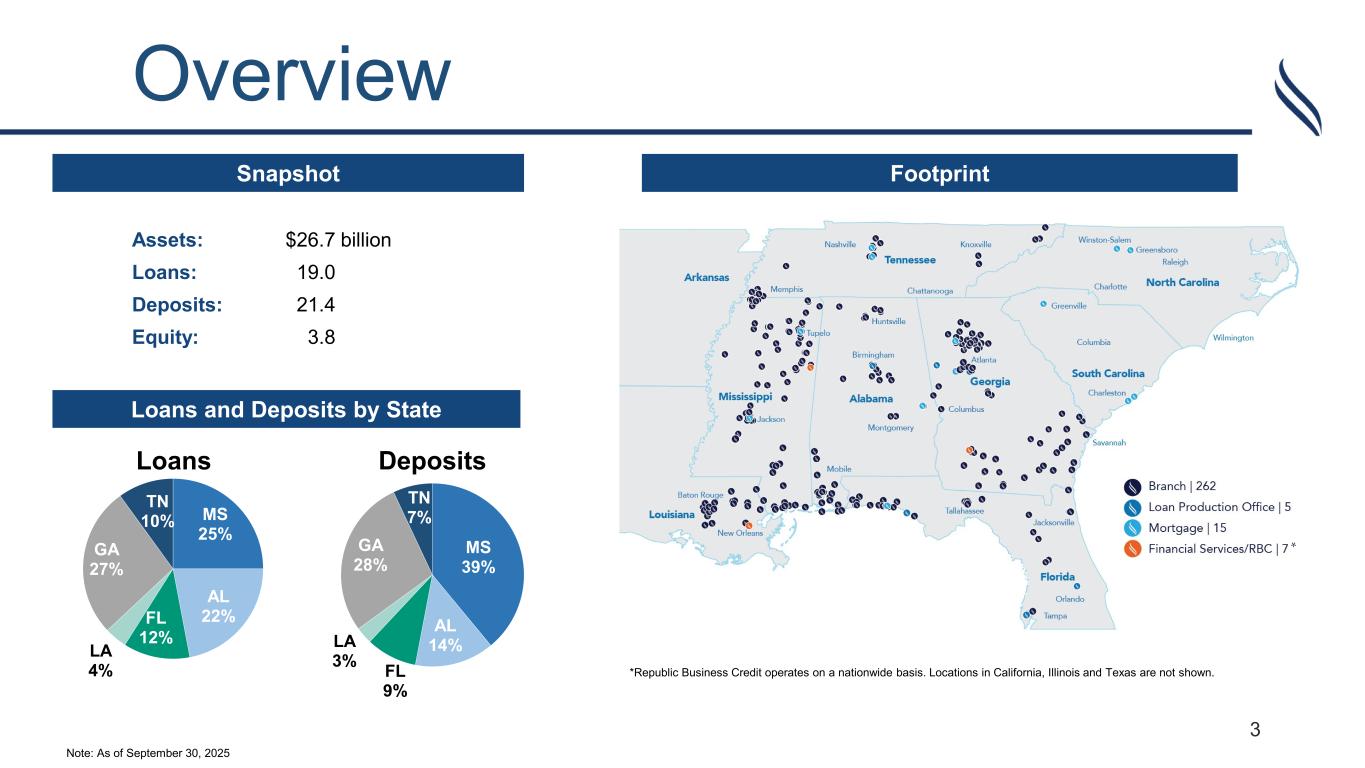

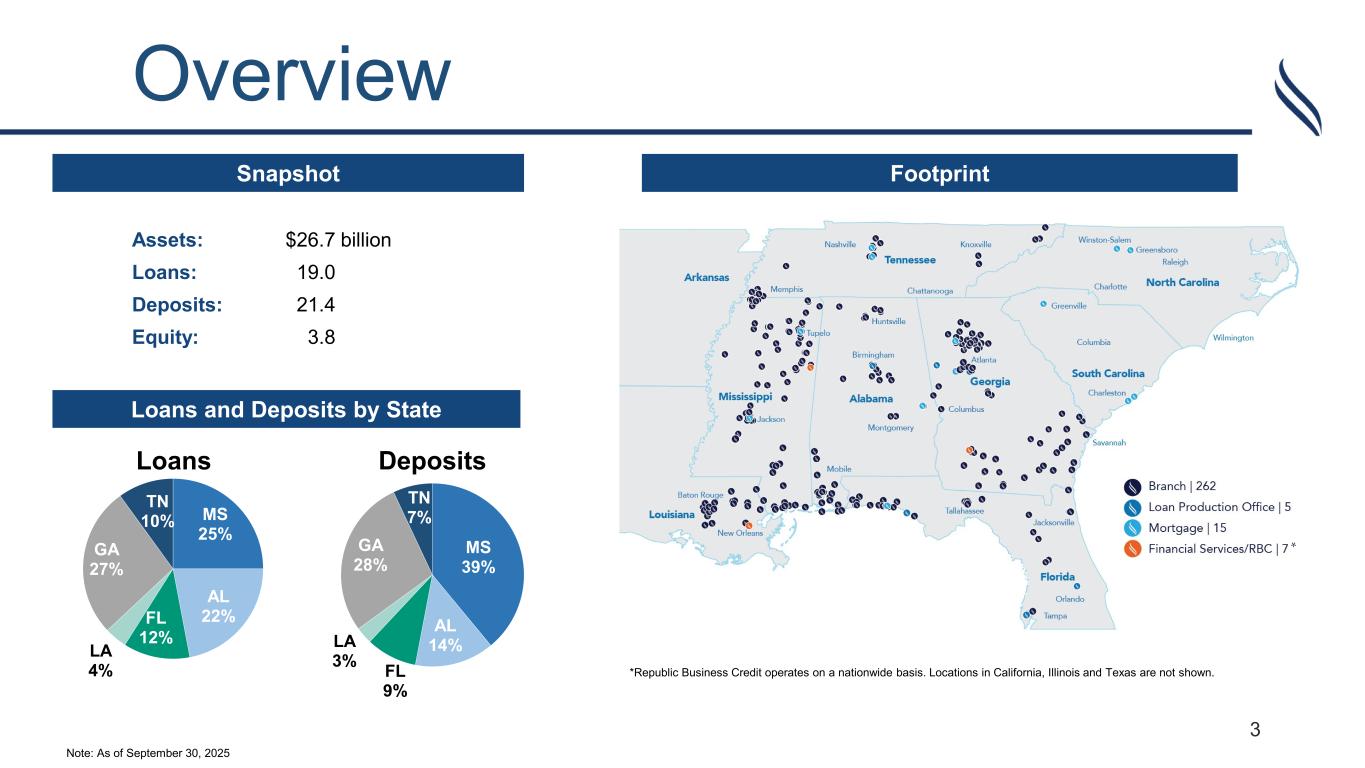

Snapshot Assets: $26.7 billion Loans: 19.0 Deposits: 21.4 Equity: 3.8 Loans and Deposits by State MS 25% AL 22%FL 12% LA 4% GA 27% TN 10% Loans MS 39% AL 14% FL 9% LA 3% GA 28% TN 7% Deposits Footprint *Republic Business Credit operates on a nationwide basis. Locations in California, Illinois and Texas are not shown. Overview 3 Note: As of September 30, 2025 *

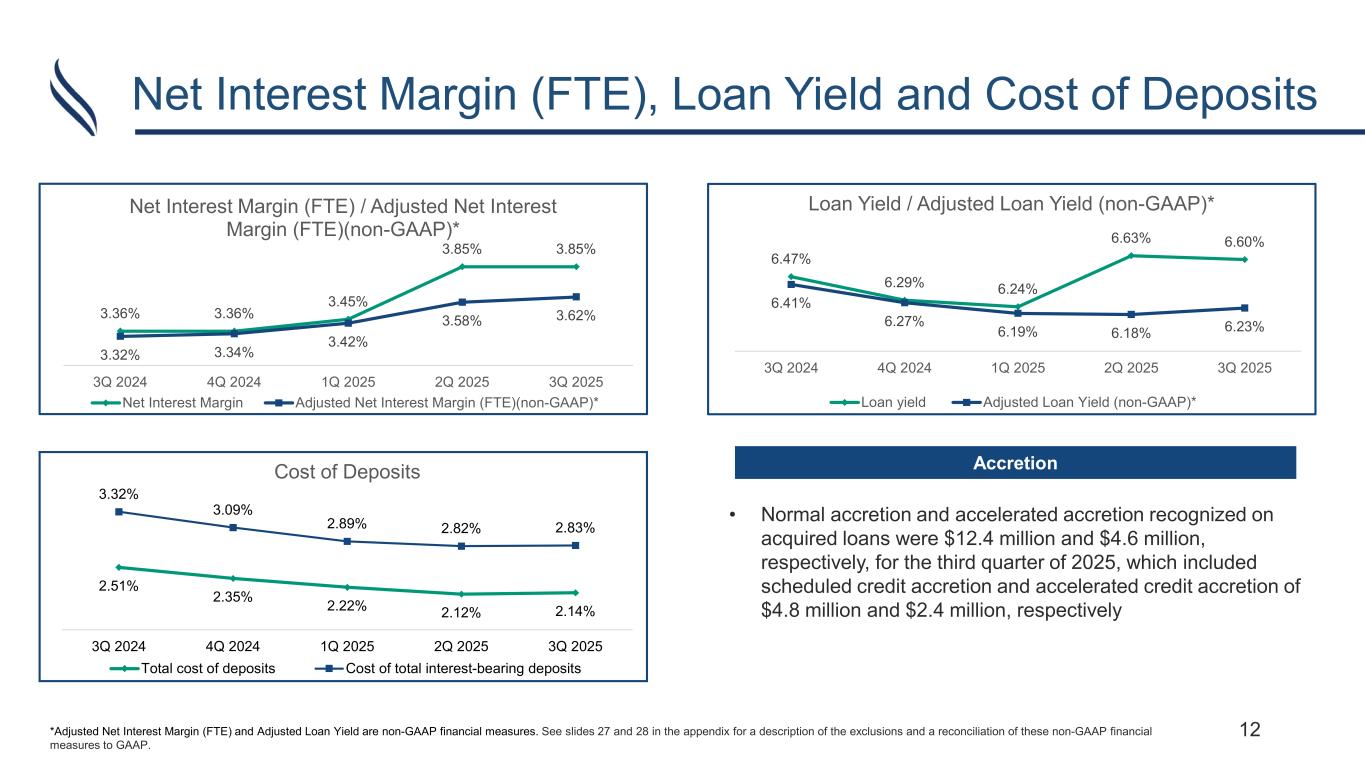

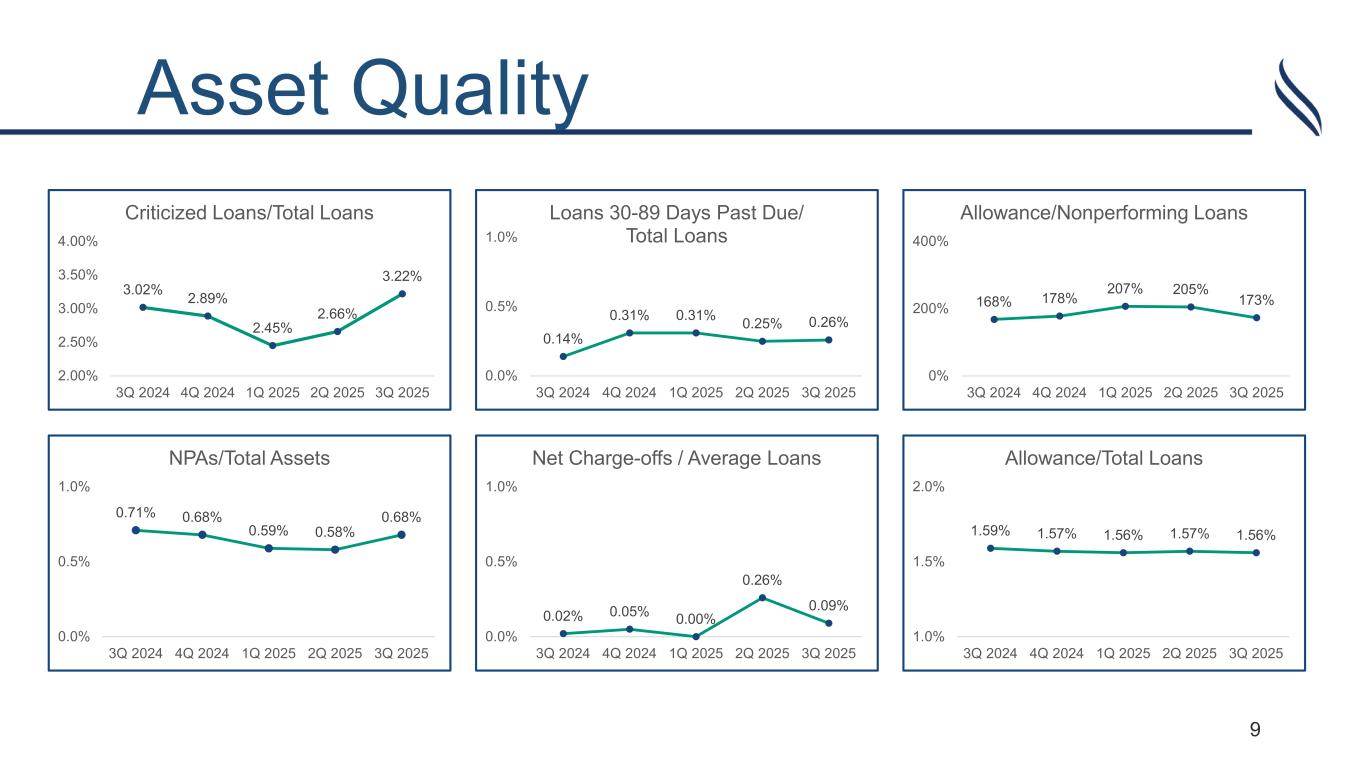

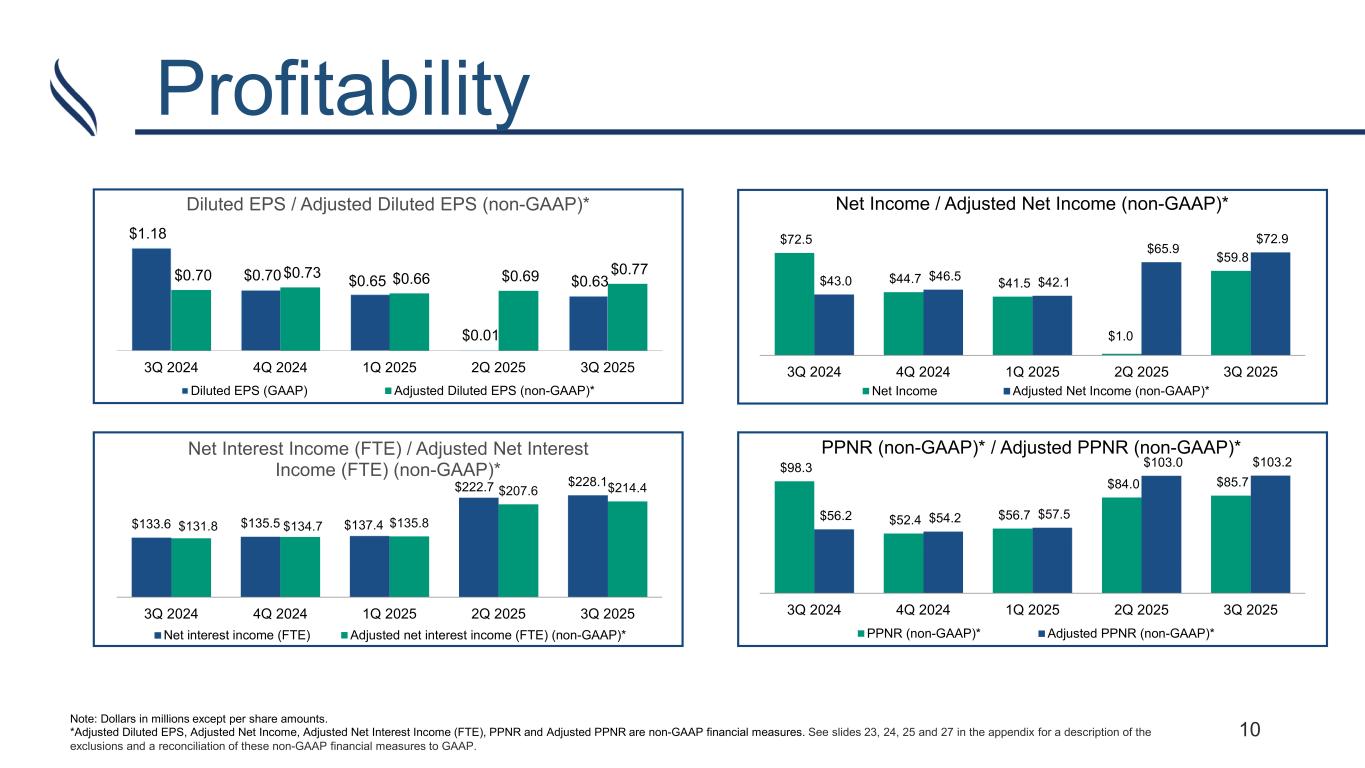

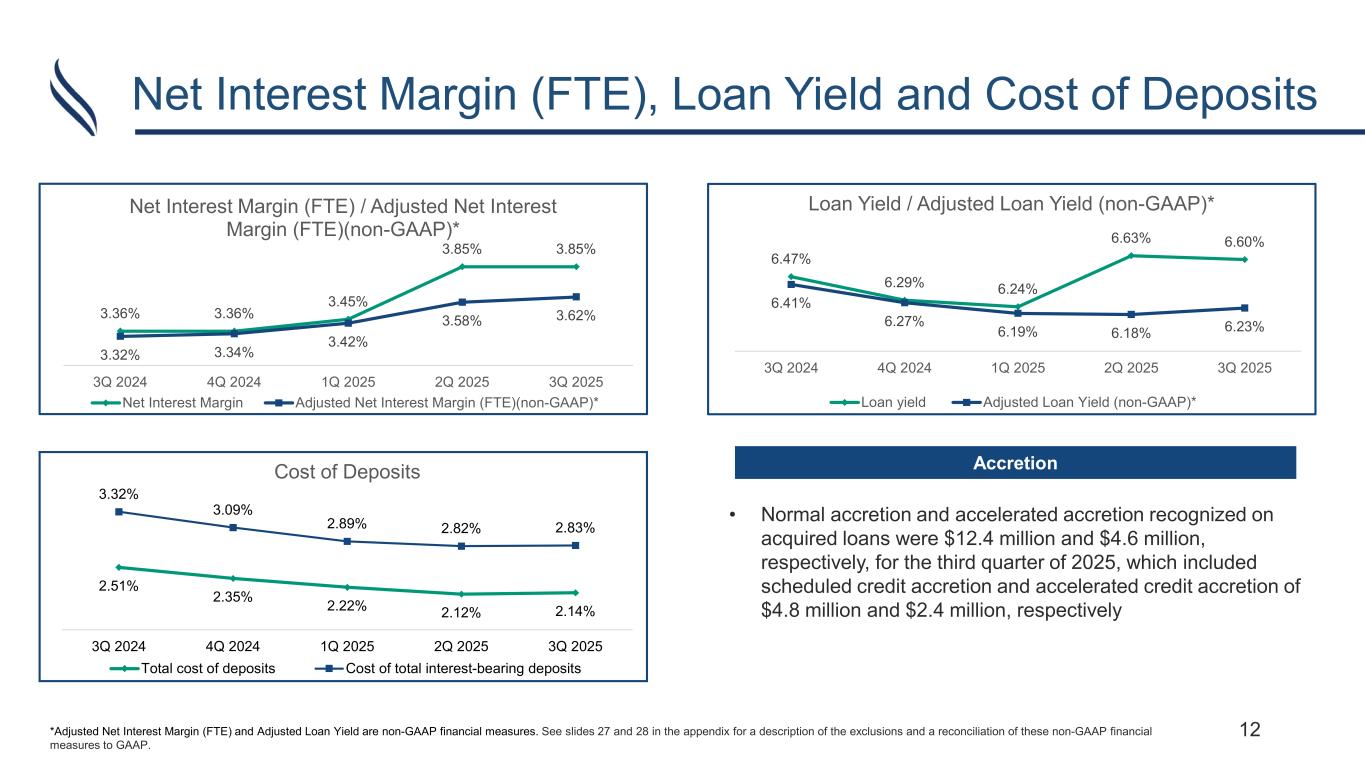

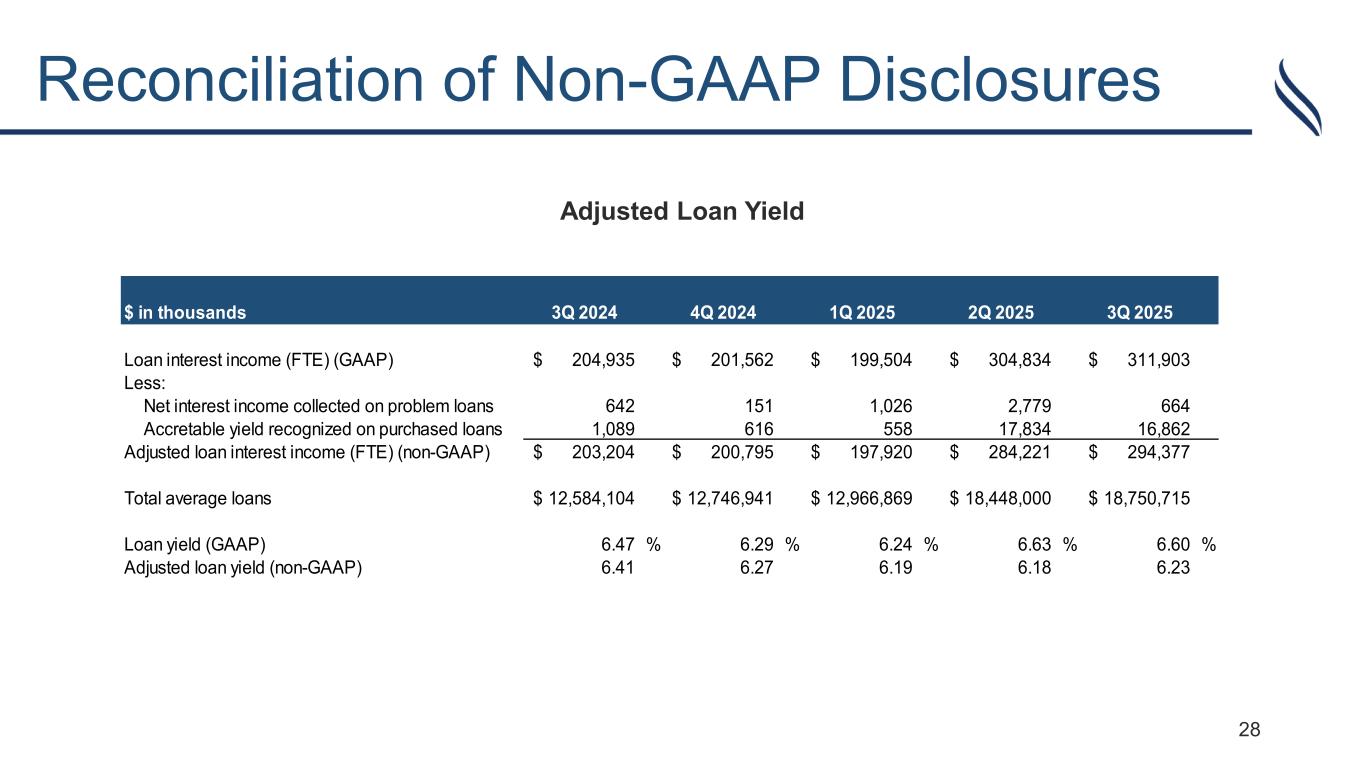

• Net income of $59.8 million with diluted EPS of $0.63 and adjusted diluted EPS (non-GAAP)(1) of $0.77 • Net interest margin was unchanged linked quarter at 3.85%; adjusted net interest margin (non-GAAP)(1) was 3.62%, up 4 basis points linked quarter • Loans increased $462.1 million, or 9.9% annualized • Deposits decreased $158.1 million linked quarter. Public fund seasonality was the primary driver with a decrease of $169.6 million linked quarter. Noninterest bearing deposits decreasing $117.7 million linked quarter; noninterest-bearing deposits represented 24.5% of total deposits • Reported loan yield decreased 3 basis points; adjusted loan yield (non-GAAP)(1) increased 5 basis points • Cost of total deposits increased 2 basis points to 2.14% • The ratio of allowance for credit losses on loans to total loans decreased 1 basis point to 1.56% linked quarter • Nonperforming loans represented 0.90% of total loans, an increase of 14 basis points linked quarter • Redeemed $60.0 million subordinated notes acquired from The First Bancshares, Inc. (“The First”) on October 1, 2025 Third Quarter Highlights 4(1) Adjusted diluted EPS, Adjusted net interest margin and Adjusted loan yield are non-GAAP financial measures. See slide 25, 27 and 28 in the appendix for a description of exclusions and a reconciliation of these non-GAAP financial measures to GAAP.

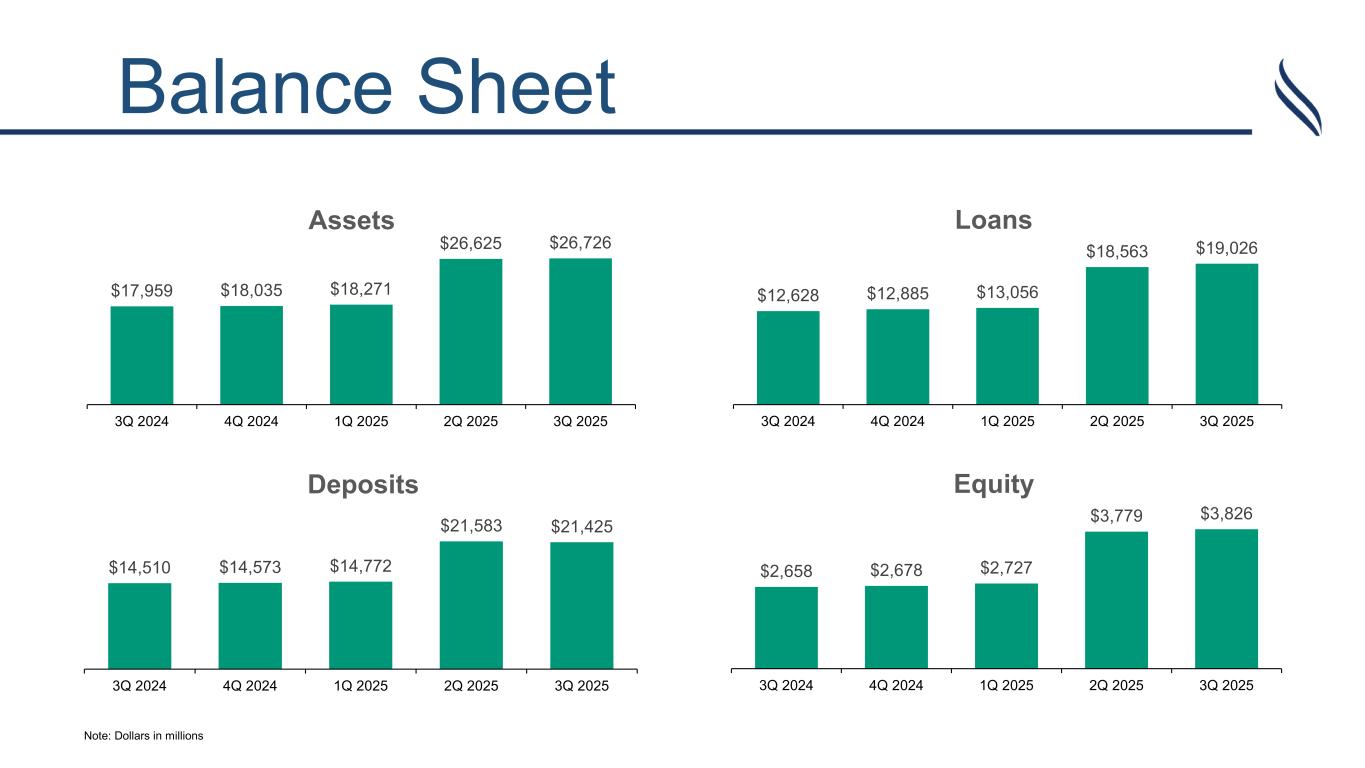

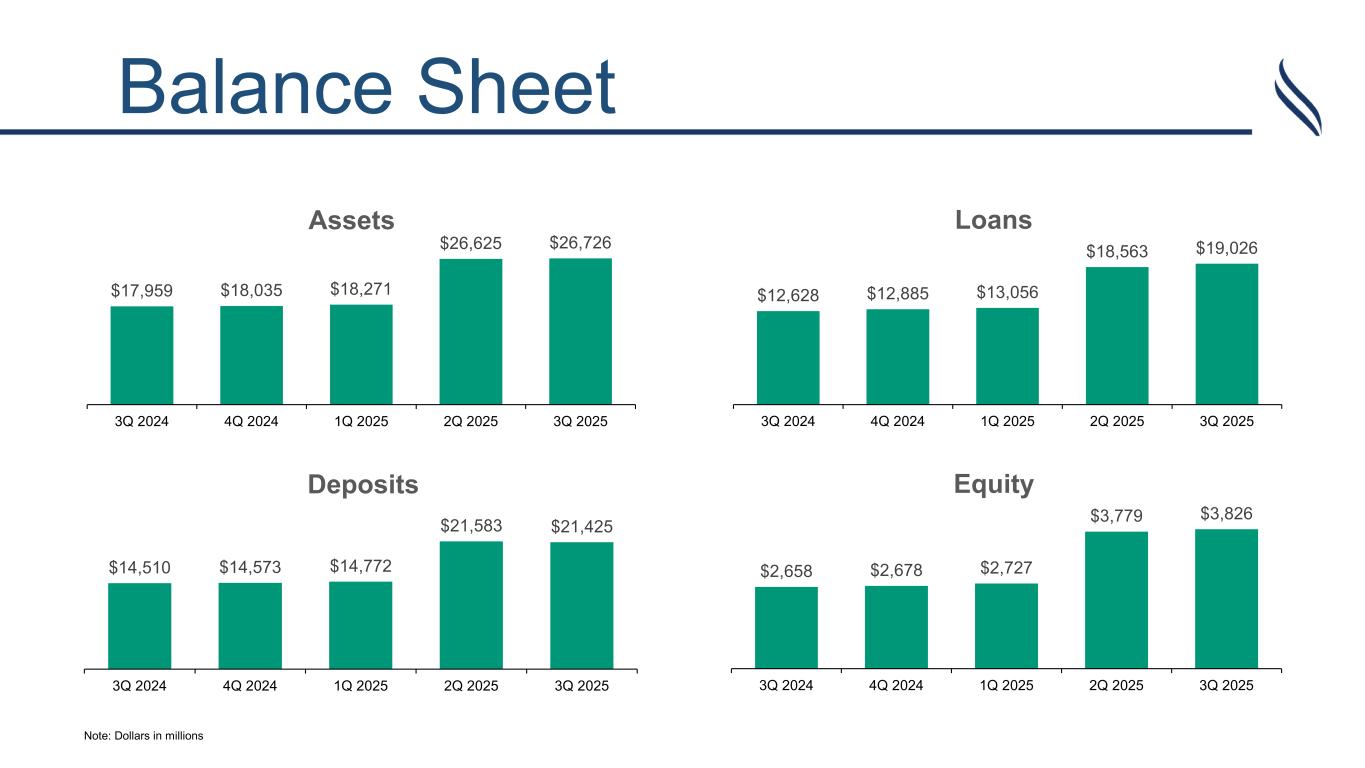

Balance Sheet $14,510 $14,573 $14,772 $21,583 $21,425 $0 $5,000 $10 ,000 $15 ,000 $20 ,000 $25 ,000 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Deposits $12,628 $12,885 $13,056 $18,563 $19,026 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Loans $2,658 $2,678 $2,727 $3,779 $3,826 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Equity Note: Dollars in millions Note: In millions $17,959 $18,035 $18,271 $26,625 $26,726 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Assets

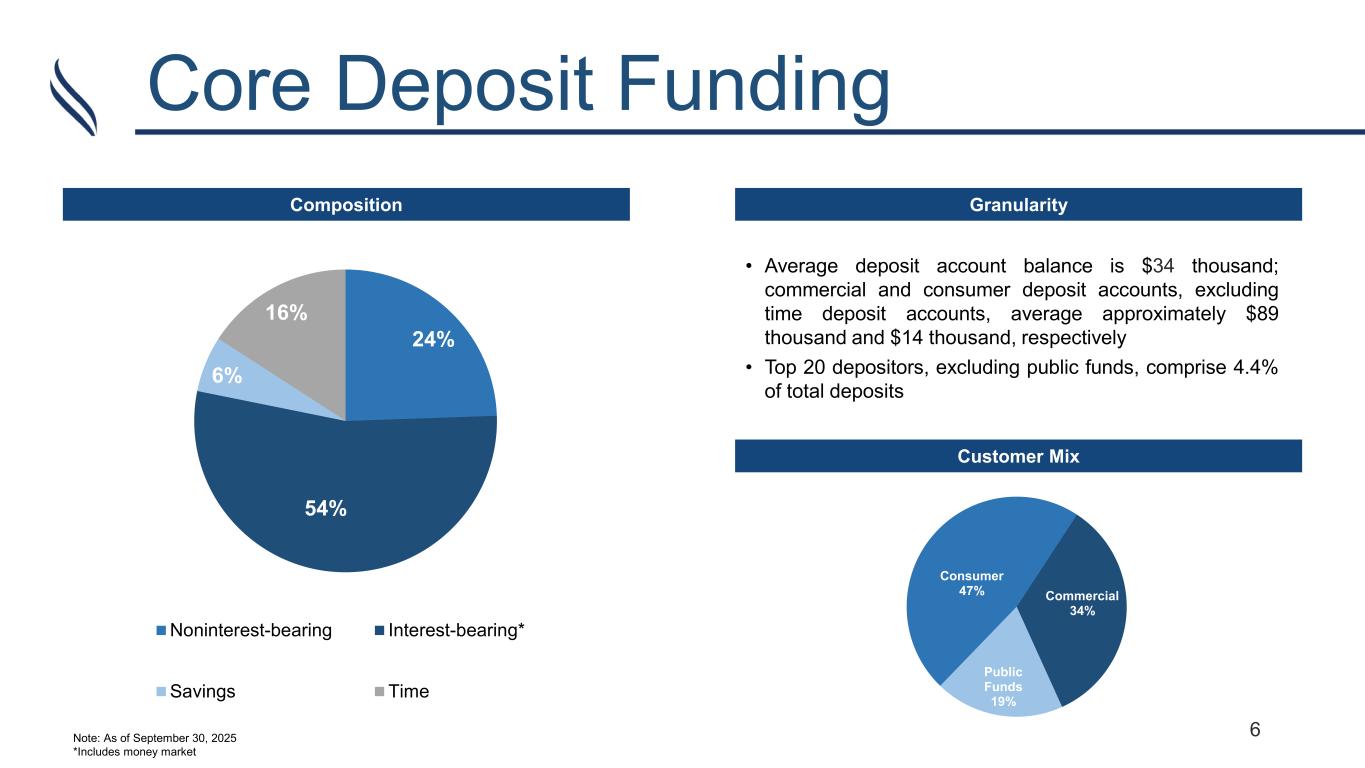

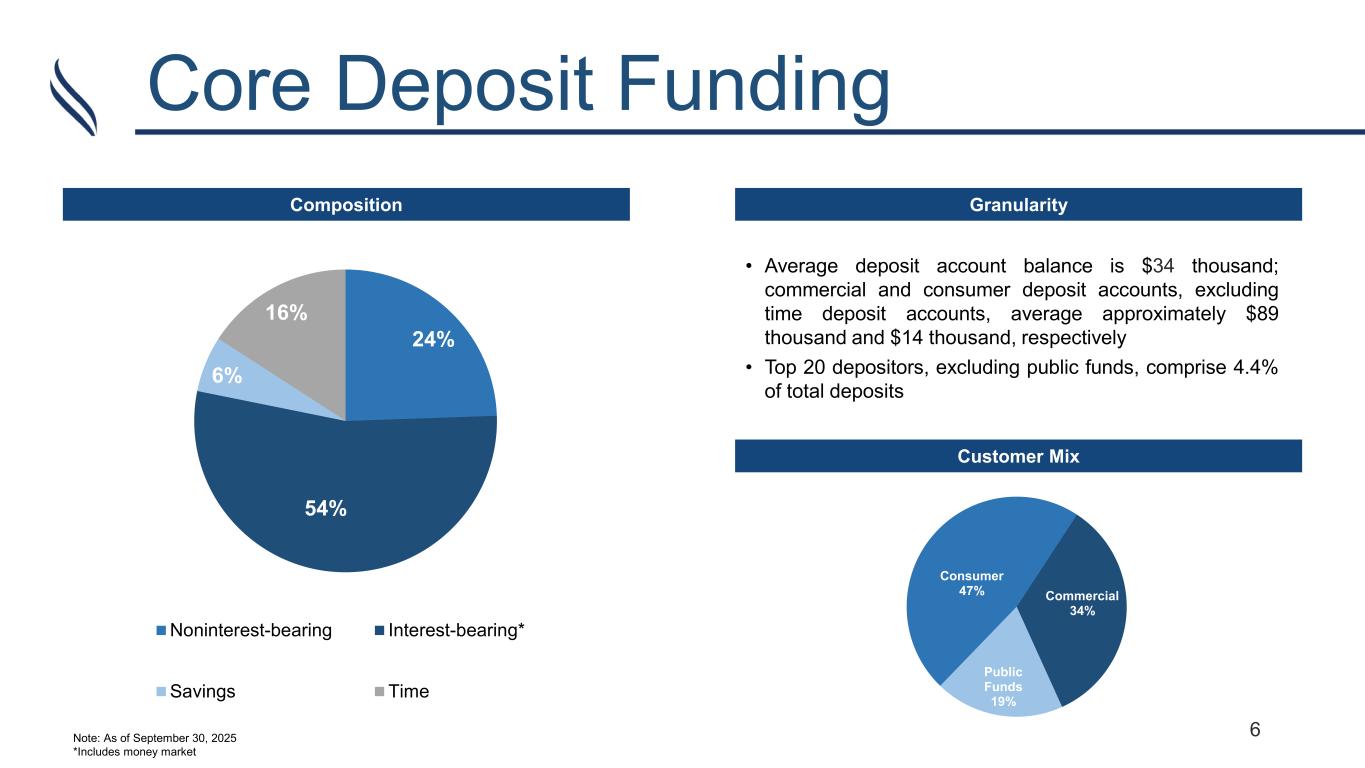

6 Core Deposit Funding Composition Granularity • Average deposit account balance is $34 thousand; commercial and consumer deposit accounts, excluding time deposit accounts, average approximately $89 thousand and $14 thousand, respectively • Top 20 depositors, excluding public funds, comprise 4.4% of total deposits Customer Mix Consumer 47% Commercial 34% Public Funds 19% Note: As of September 30, 2025 *Includes money market 24% 54% 6% 16% Noninterest-bearing Interest-bearing* Savings Time

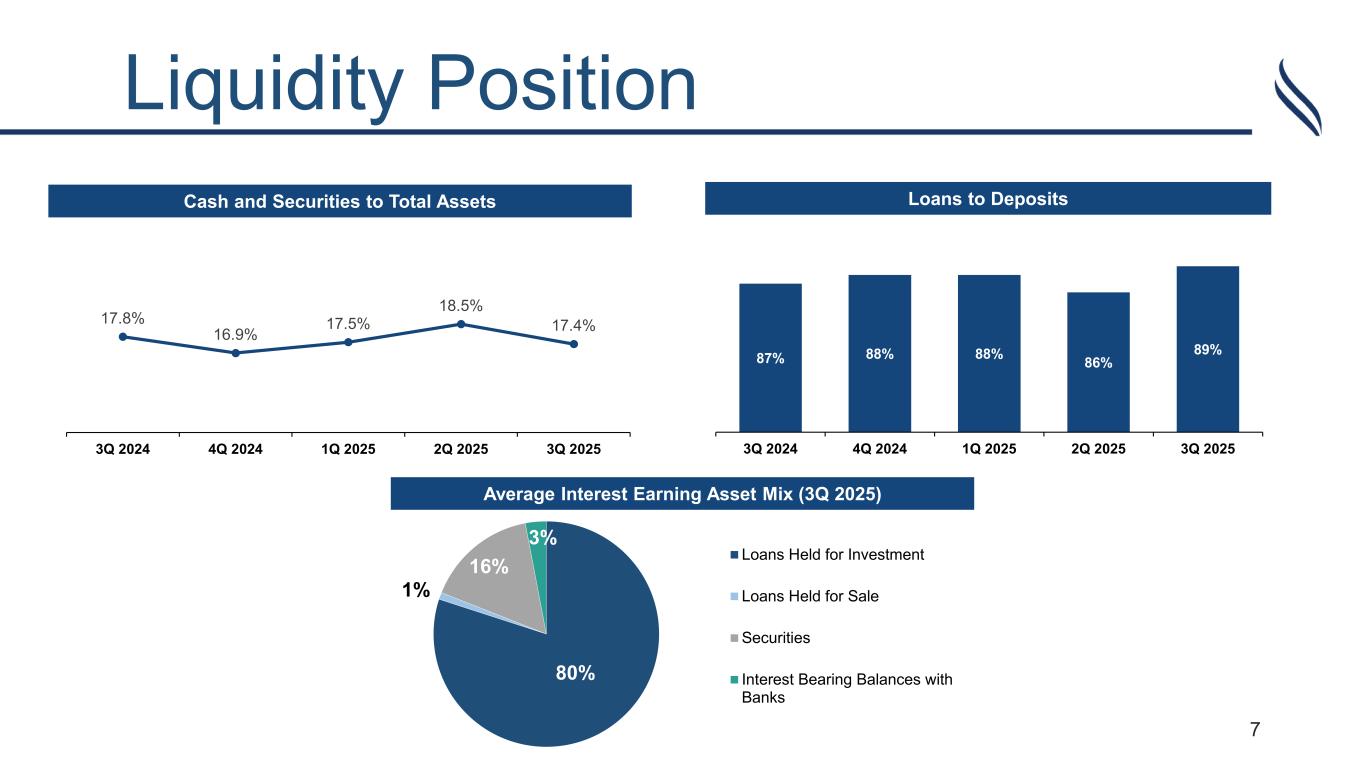

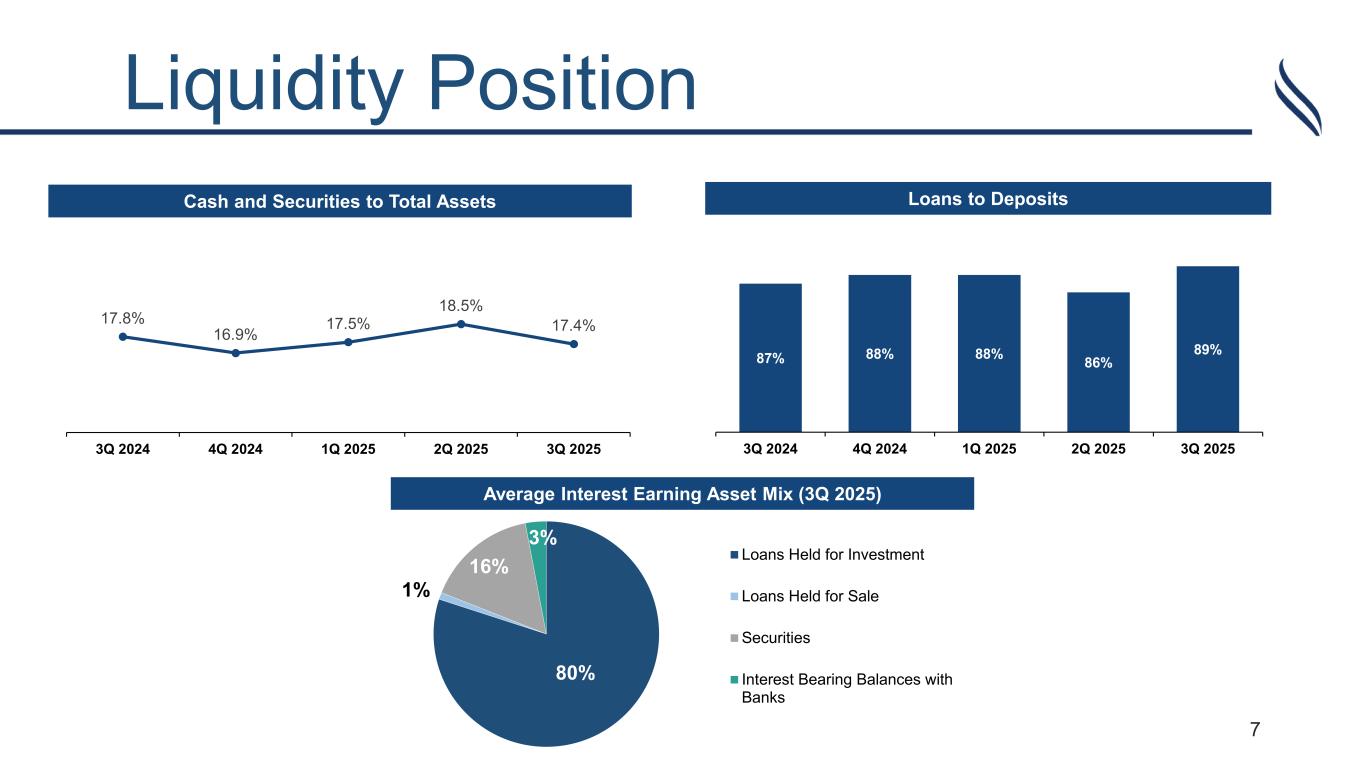

7 Liquidity Position Cash and Securities to Total Assets 17.8% 16.9% 17.5% 18.5% 17.4% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Loans to Deposits 87% 88% 88% 86% 89% $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 $1 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Average Interest Earning Asset Mix (3Q 2025) 80% 1% 16% 3% Loans Held for Investment Loans Held for Sale Securities Interest Bearing Balances with Banks

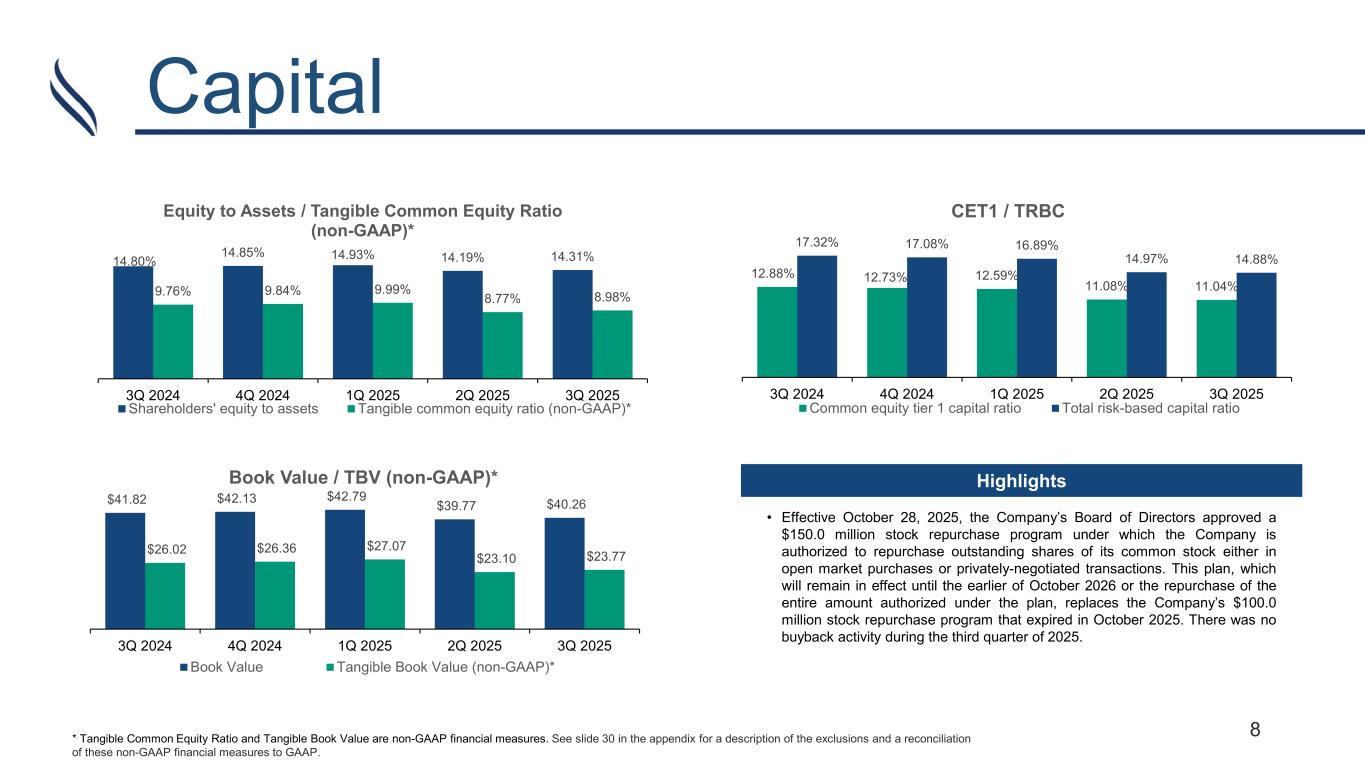

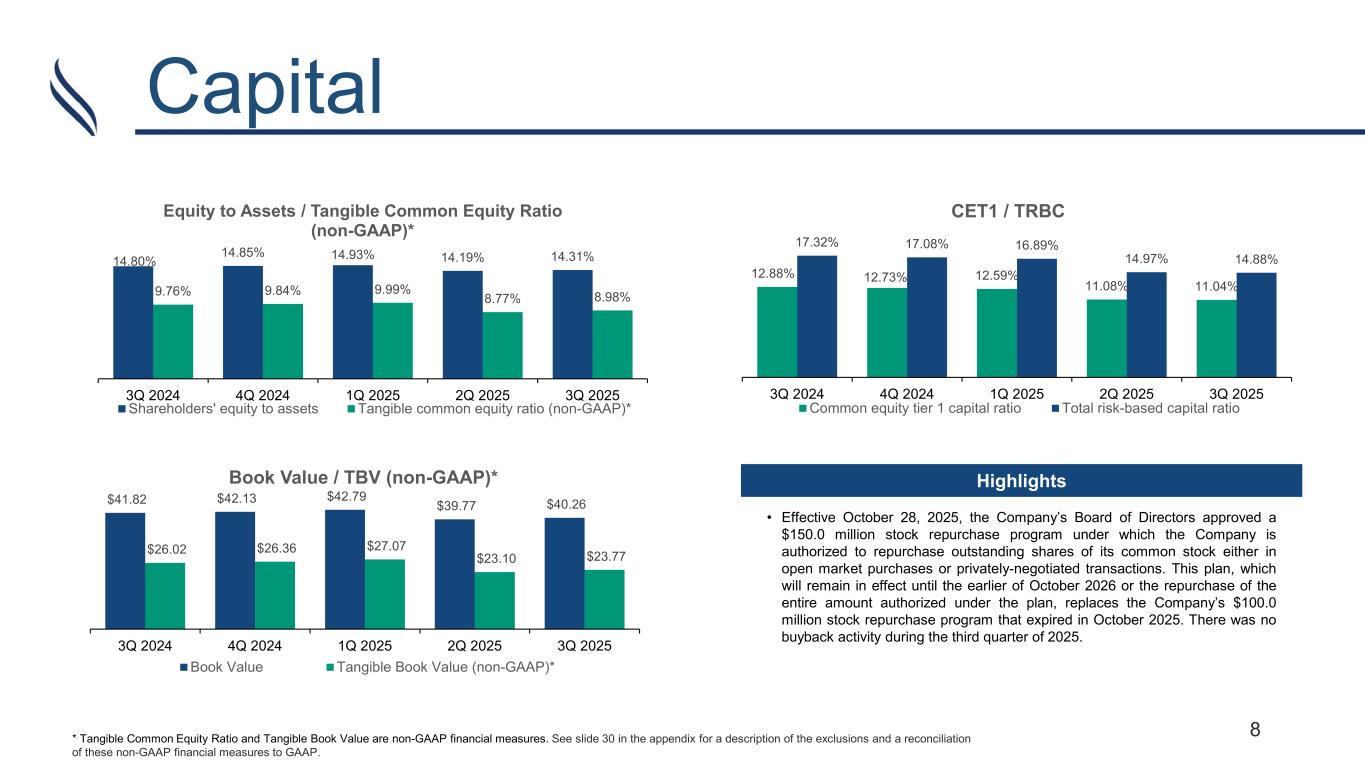

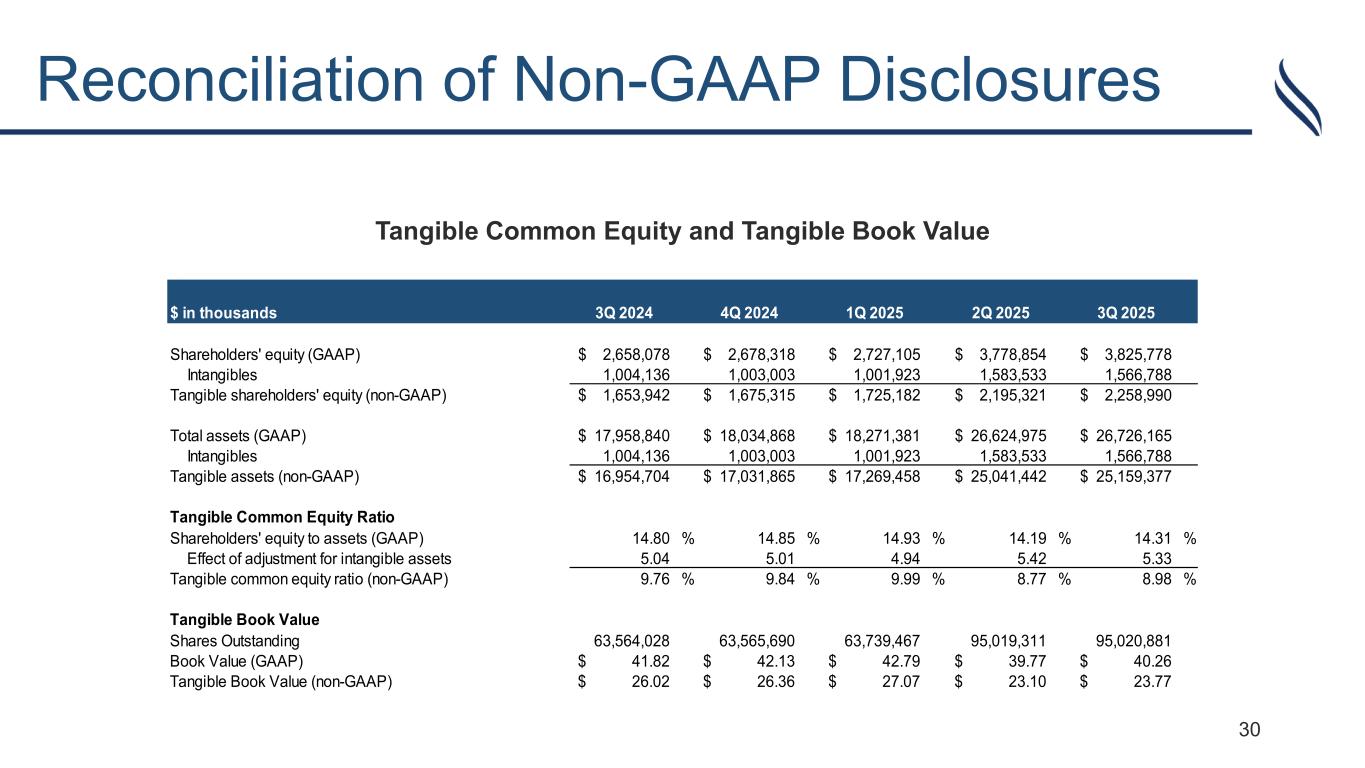

8 Capital 14.80% 14.85% 14.93% 14.19% 14.31% 9.76% 9.84% 9.99% 8.77% 8.98% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Equity to Assets / Tangible Common Equity Ratio (non-GAAP)* Shareholders' equity to assets Tangible common equity ratio (non-GAAP)* $41.82 $42.13 $42.79 $39.77 $40.26 $26.02 $26.36 $27.07 $23.10 $23.77 $5 $10 $15 $20 $25 $30 $35 $40 $45 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Book Value / TBV (non-GAAP)* Book Value Tangible Book Value (non-GAAP)* * Tangible Common Equity Ratio and Tangible Book Value are non-GAAP financial measures. See slide 30 in the appendix for a description of the exclusions and a reconciliation of these non-GAAP financial measures to GAAP. 12.88% 12.73% 12.59% 11.08% 11.04% 17.32% 17.08% 16.89% 14.97% 14.88% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 CET1 / TRBC Common equity tier 1 capital ratio Total risk-based capital ratio Highlights • Effective October 28, 2025, the Company’s Board of Directors approved a $150.0 million stock repurchase program under which the Company is authorized to repurchase outstanding shares of its common stock either in open market purchases or privately-negotiated transactions. This plan, which will remain in effect until the earlier of October 2026 or the repurchase of the entire amount authorized under the plan, replaces the Company’s $100.0 million stock repurchase program that expired in October 2025. There was no buyback activity during the third quarter of 2025.

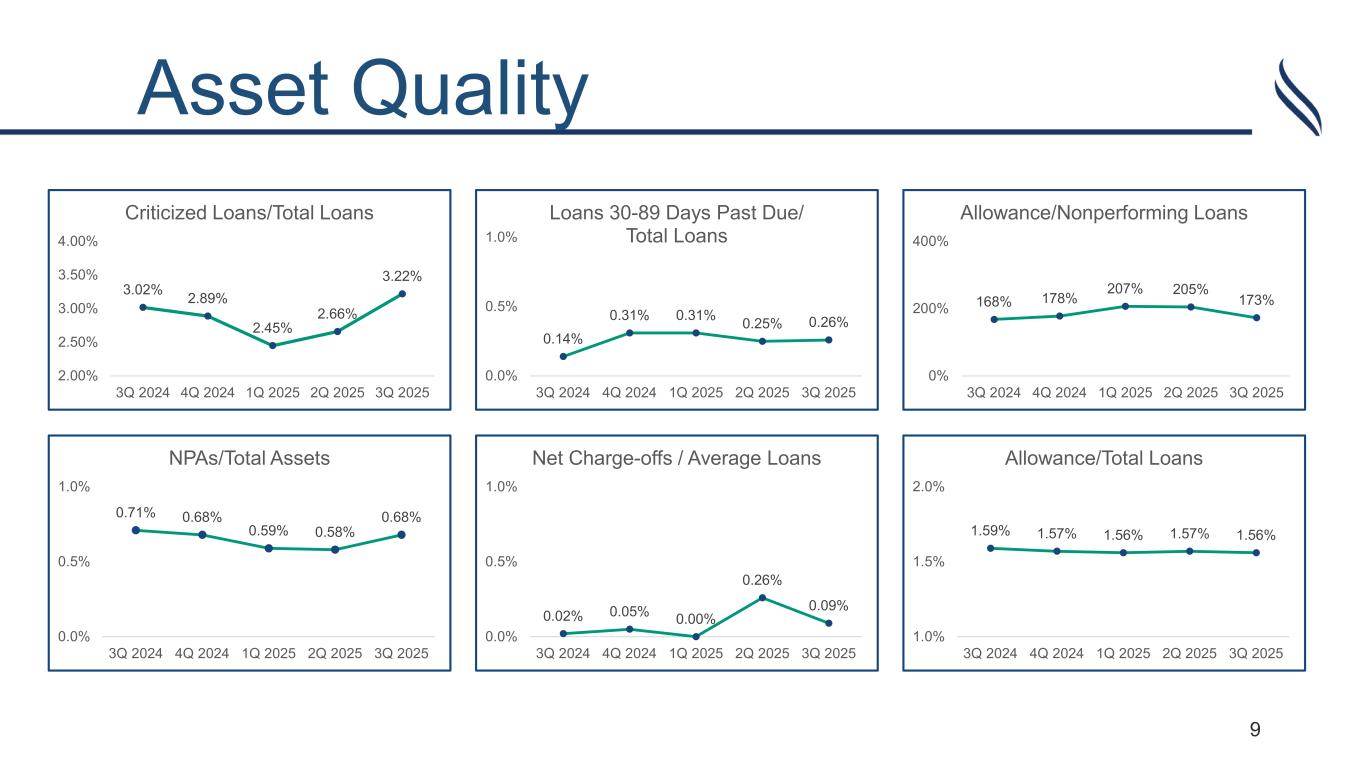

9 Asset Quality 3.02% 2.89% 2.45% 2.66% 3.22% 2.00% 2.50% 3.00% 3.50% 4.00% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Criticized Loans/Total Loans 0.14% 0.31% 0.31% 0.25% 0.26% 0.0% 0.5% 1.0% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Loans 30-89 Days Past Due/ Total Loans 0.02% 0.05% 0.00% 0.26% 0.09% 0.0% 0.5% 1.0% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net Charge-offs / Average Loans 1.59% 1.57% 1.56% 1.57% 1.56% 1.0% 1.5% 2.0% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Allowance/Total Loans 168% 178% 207% 205% 173% 0% 200% 400% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Allowance/Nonperforming Loans 0.71% 0.68% 0.59% 0.58% 0.68% 0.0% 0.5% 1.0% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 NPAs/Total Assets

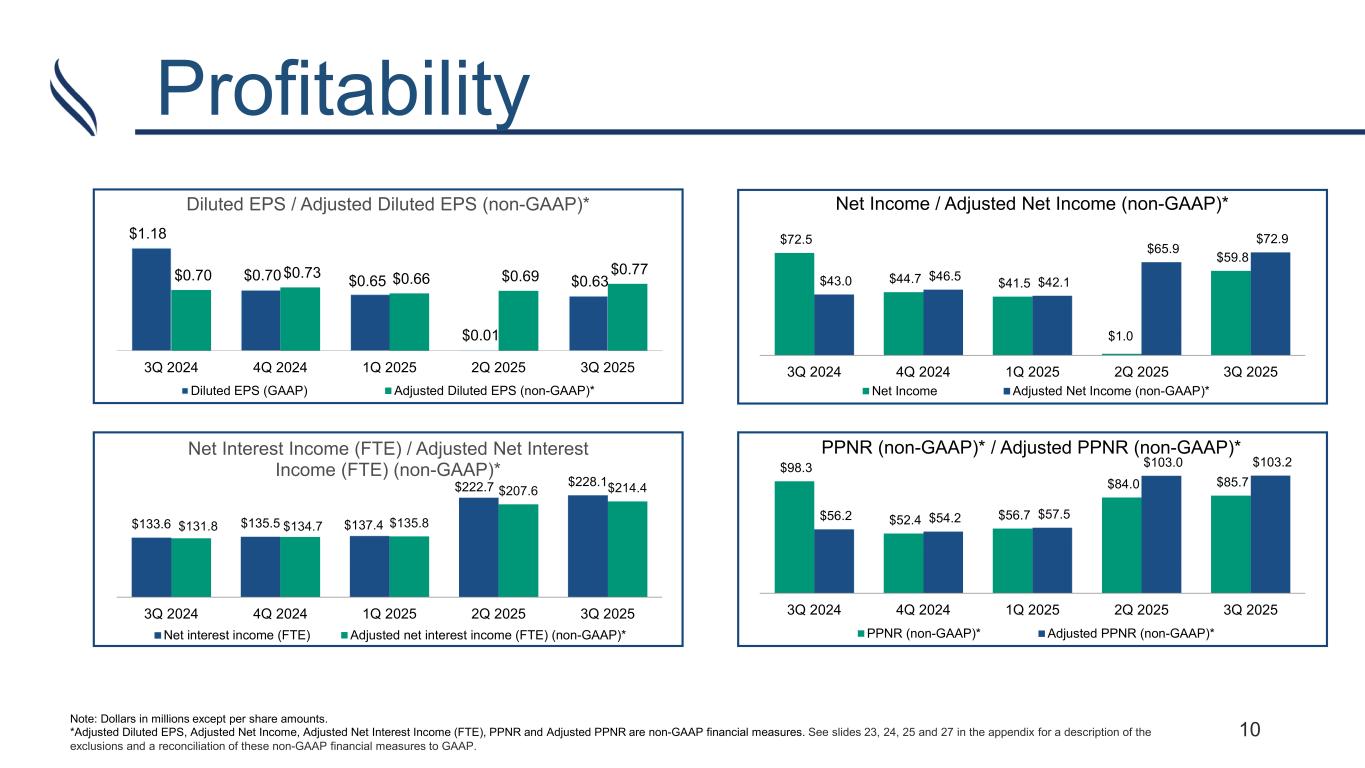

10 Profitability Note: Dollars in millions except per share amounts. *Adjusted Diluted EPS, Adjusted Net Income, Adjusted Net Interest Income (FTE), PPNR and Adjusted PPNR are non-GAAP financial measures. See slides 23, 24, 25 and 27 in the appendix for a description of the exclusions and a reconciliation of these non-GAAP financial measures to GAAP. $133.6 $135.5 $137.4 $222.7 $228.1 $131.8 $134.7 $135.8 $207.6 $214.4 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net Interest Income (FTE) / Adjusted Net Interest Income (FTE) (non-GAAP)* Net interest income (FTE) Adjusted net interest income (FTE) (non-GAAP)* $98.3 $52.4 $56.7 $84.0 $85.7 $56.2 $54.2 $57.5 $103.0 $103.2 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 PPNR (non-GAAP)* / Adjusted PPNR (non-GAAP)* PPNR (non-GAAP)* Adjusted PPNR (non-GAAP)* $72.5 $44.7 $41.5 $1.0 $59.8 $43.0 $46.5 $42.1 $65.9 $72.9 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net Income / Adjusted Net Income (non-GAAP)* Net Income Adjusted Net Income (non-GAAP)* $1.18 $0.70 $0.65 $0.01 $0.63 $0.70 $0.73 $0.66 $0.69 $0.77 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Diluted EPS / Adjusted Diluted EPS (non-GAAP)* Diluted EPS (GAAP) Adjusted Diluted EPS (non-GAAP)*

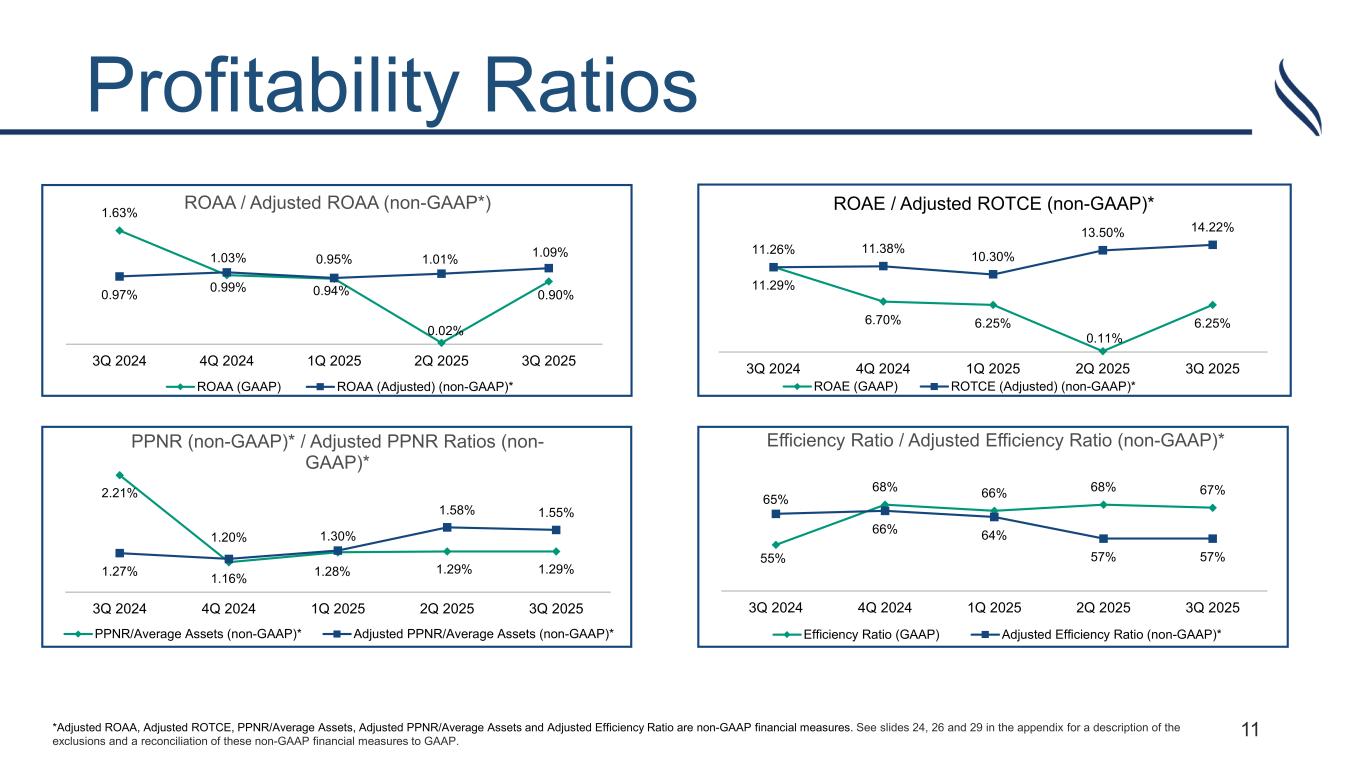

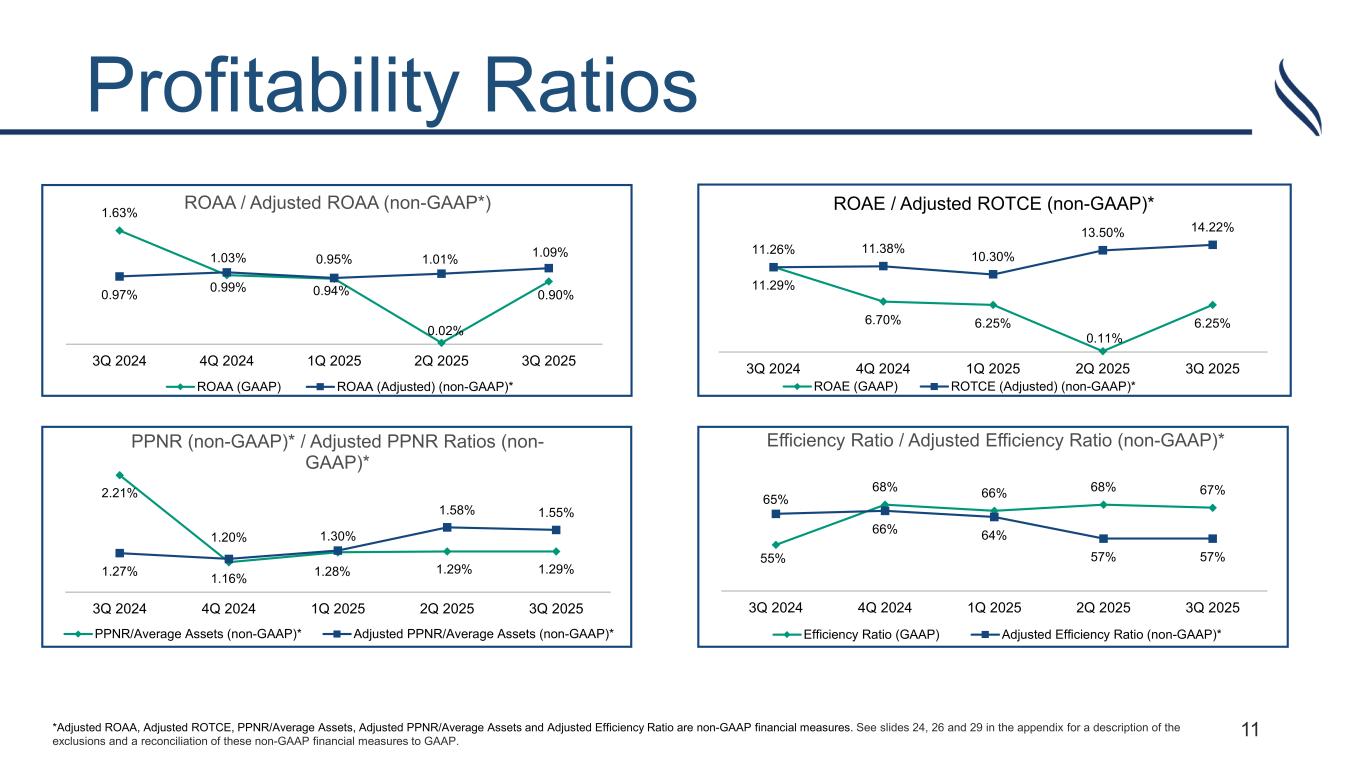

11 Profitability Ratios *Adjusted ROAA, Adjusted ROTCE, PPNR/Average Assets, Adjusted PPNR/Average Assets and Adjusted Efficiency Ratio are non-GAAP financial measures. See slides 24, 26 and 29 in the appendix for a description of the exclusions and a reconciliation of these non-GAAP financial measures to GAAP. 11.29% 6.70% 6.25% 0.11% 6.25% 11.26% 11.38% 10.30% 13.50% 14.22% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 ROAE / Adjusted ROTCE (non-GAAP)* ROAE (GAAP) ROTCE (Adjusted) (non-GAAP)* 1.63% 0.99% 0.94% 0.02% 0.90%0.97% 1.03% 0.95% 1.01% 1.09% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 ROAA / Adjusted ROAA (non-GAAP*) ROAA (GAAP) ROAA (Adjusted) (non-GAAP)* 55% 68% 66% 68% 67% 65% 66% 64% 57% 57% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Efficiency Ratio / Adjusted Efficiency Ratio (non-GAAP)* Efficiency Ratio (GAAP) Adjusted Efficiency Ratio (non-GAAP)* 2.21% 1.16% 1.28% 1.29% 1.29%1.27% 1.20% 1.30% 1.58% 1.55% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 PPNR (non-GAAP)* / Adjusted PPNR Ratios (non- GAAP)* PPNR/Average Assets (non-GAAP)* Adjusted PPNR/Average Assets (non-GAAP)*

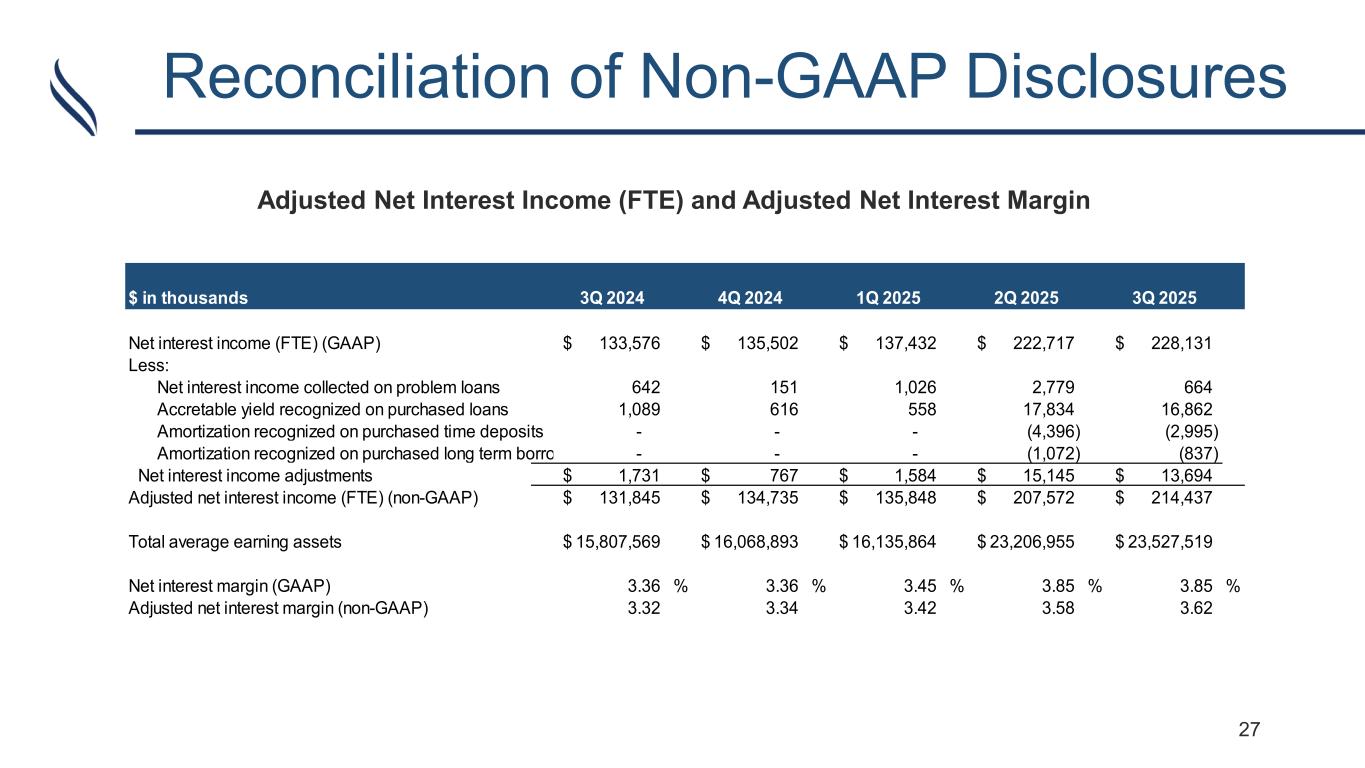

12 Net Interest Margin (FTE), Loan Yield and Cost of Deposits *Adjusted Net Interest Margin (FTE) and Adjusted Loan Yield are non-GAAP financial measures. See slides 27 and 28 in the appendix for a description of the exclusions and a reconciliation of these non-GAAP financial measures to GAAP. 3.36% 3.36% 3.45% 3.85% 3.85% 3.32% 3.34% 3.42% 3.58% 3.62% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net Interest Margin (FTE) / Adjusted Net Interest Margin (FTE)(non-GAAP)* Net Interest Margin Adjusted Net Interest Margin (FTE)(non-GAAP)* 6.47% 6.29% 6.24% 6.63% 6.60% 6.41% 6.27% 6.19% 6.18% 6.23% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Loan Yield / Adjusted Loan Yield (non-GAAP)* Loan yield Adjusted Loan Yield (non-GAAP)* 2.51% 2.35% 2.22% 2.12% 2.14% 3.32% 3.09% 2.89% 2.82% 2.83% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Cost of Deposits Total cost of deposits Cost of total interest-bearing deposits • Normal accretion and accelerated accretion recognized on acquired loans were $12.4 million and $4.6 million, respectively, for the third quarter of 2025, which included scheduled credit accretion and accelerated credit accretion of $4.8 million and $2.4 million, respectively Accretion

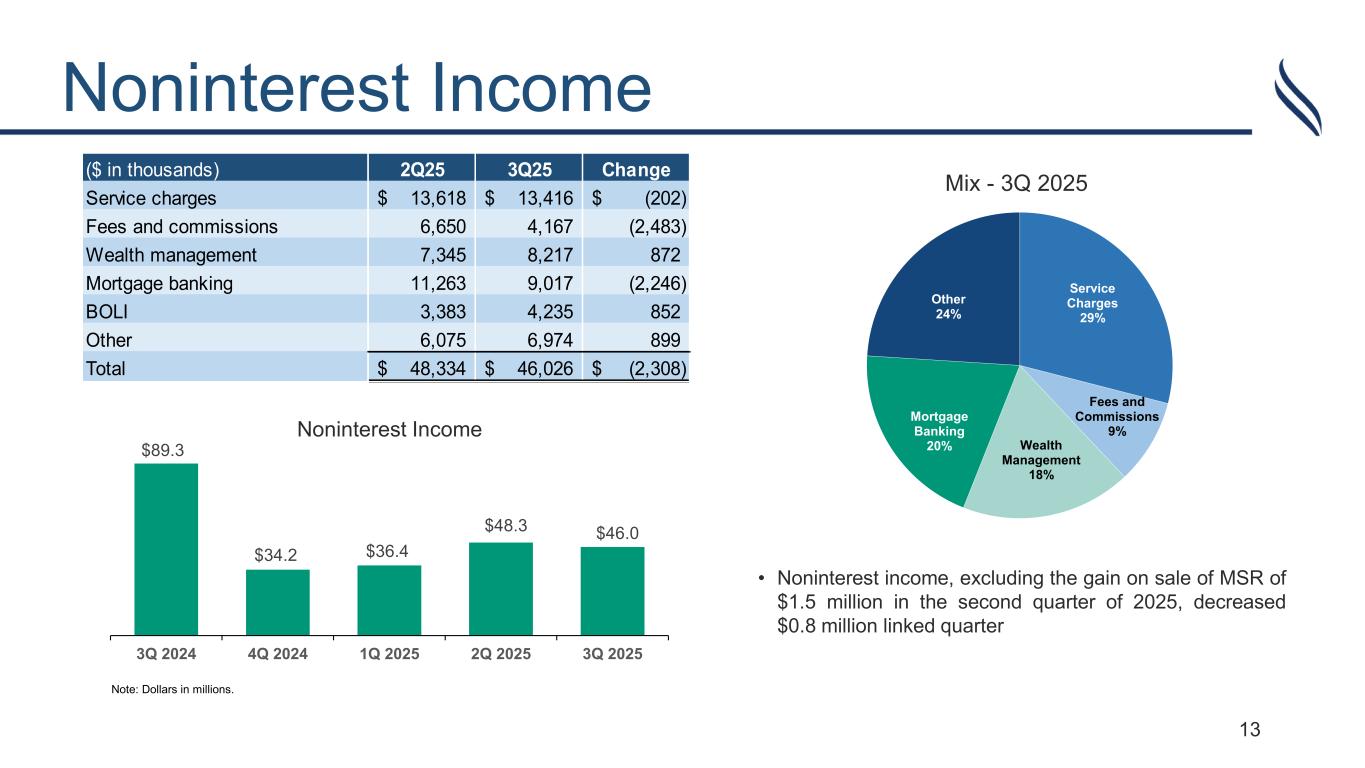

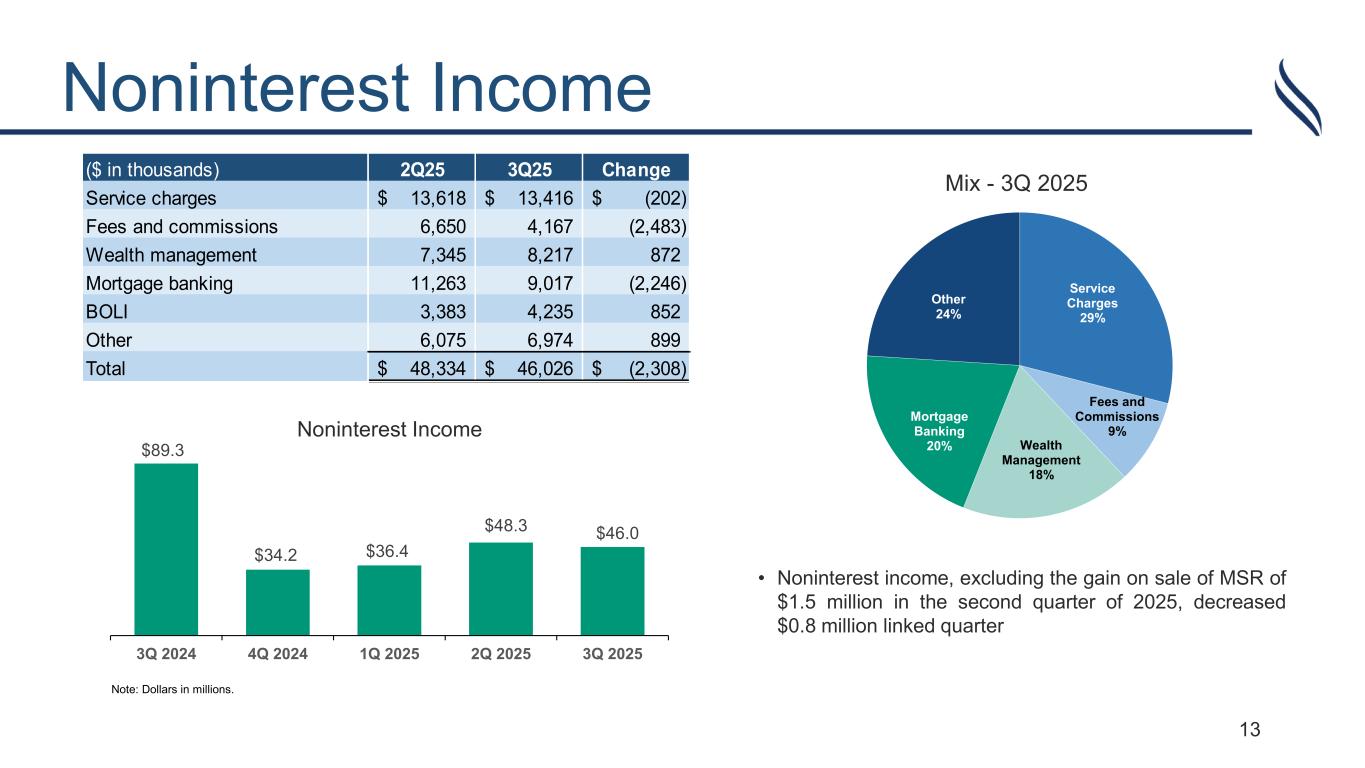

Noninterest Income $89.3 $34.2 $36.4 $48.3 $46.0 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Noninterest Income • Noninterest income, excluding the gain on sale of MSR of $1.5 million in the second quarter of 2025, decreased $0.8 million linked quarter Note: Dollars in millions. 13 Service Charges 29% Fees and Commissions 9% Wealth Management 18% Mortgage Banking 20% Other 24% Mix - 3Q 2025($ in thousands) 2Q25 3Q25 Change Service charges 13,618$ 13,416$ (202)$ Fees and commissions 6,650 4,167 (2,483) Wealth management 7,345 8,217 872 Mortgage banking 11,263 9,017 (2,246) BOLI 3,383 4,235 852 Other 6,075 6,974 899 Total 48,334$ 46,026$ (2,308)$

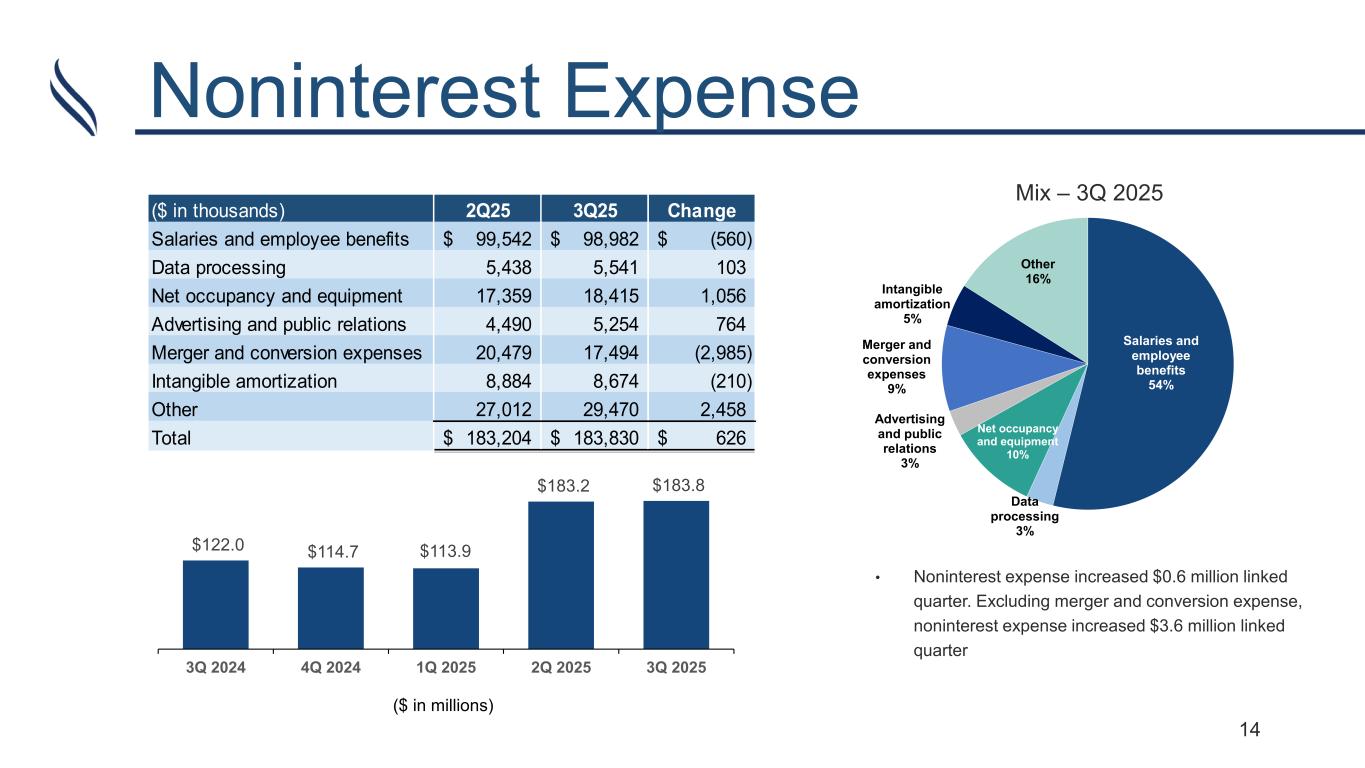

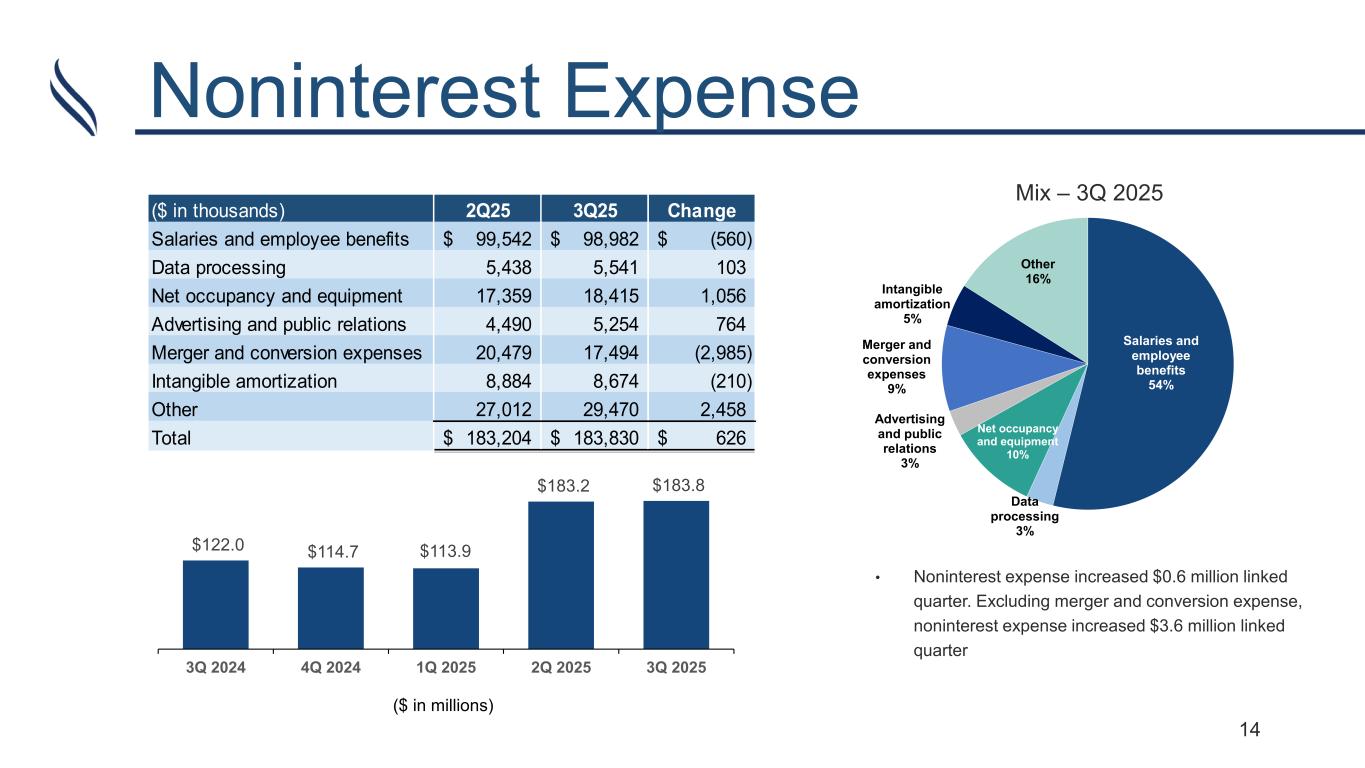

14 Noninterest Expense ($ in thousands) 2Q25 3Q25 Change Salaries and employee benefits 99,542$ 98,982$ (560)$ Data processing 5,438 5,541 103 Net occupancy and equipment 17,359 18,415 1,056 Advertising and public relations 4,490 5,254 764 Merger and conversion expenses 20,479 17,494 (2,985) Intangible amortization 8,884 8,674 (210) Other 27,012 29,470 2,458 Total 183,204$ 183,830$ 626$ $122.0 $114.7 $113.9 $183.2 $183.8 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Salaries and employee benefits 54% Data processing 3% Net occupancy and equipment 10% Advertising and public relations 3% Merger and conversion expenses 9% Intangible amortization 5% Other 16% Mix – 3Q 2025 • Noninterest expense increased $0.6 million linked quarter. Excluding merger and conversion expense, noninterest expense increased $3.6 million linked quarter ($ in millions)

Appendix

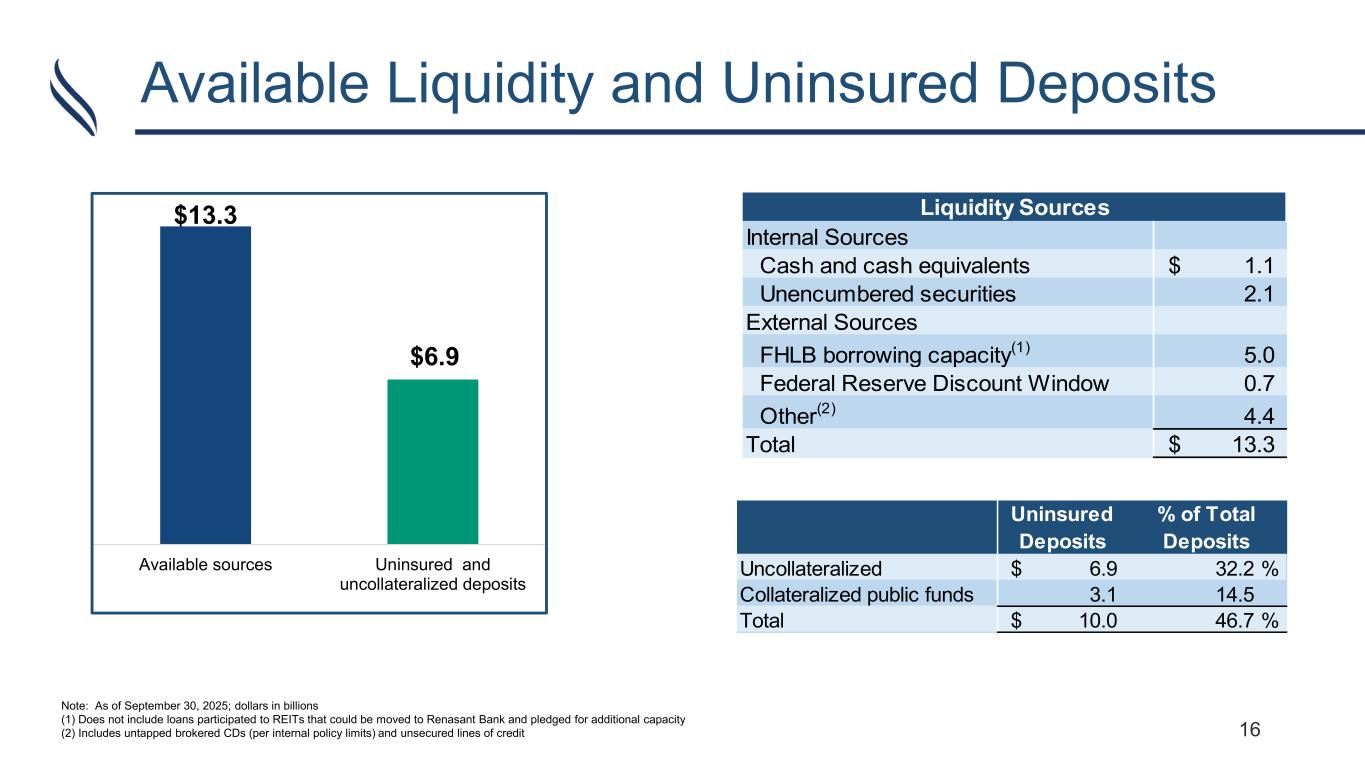

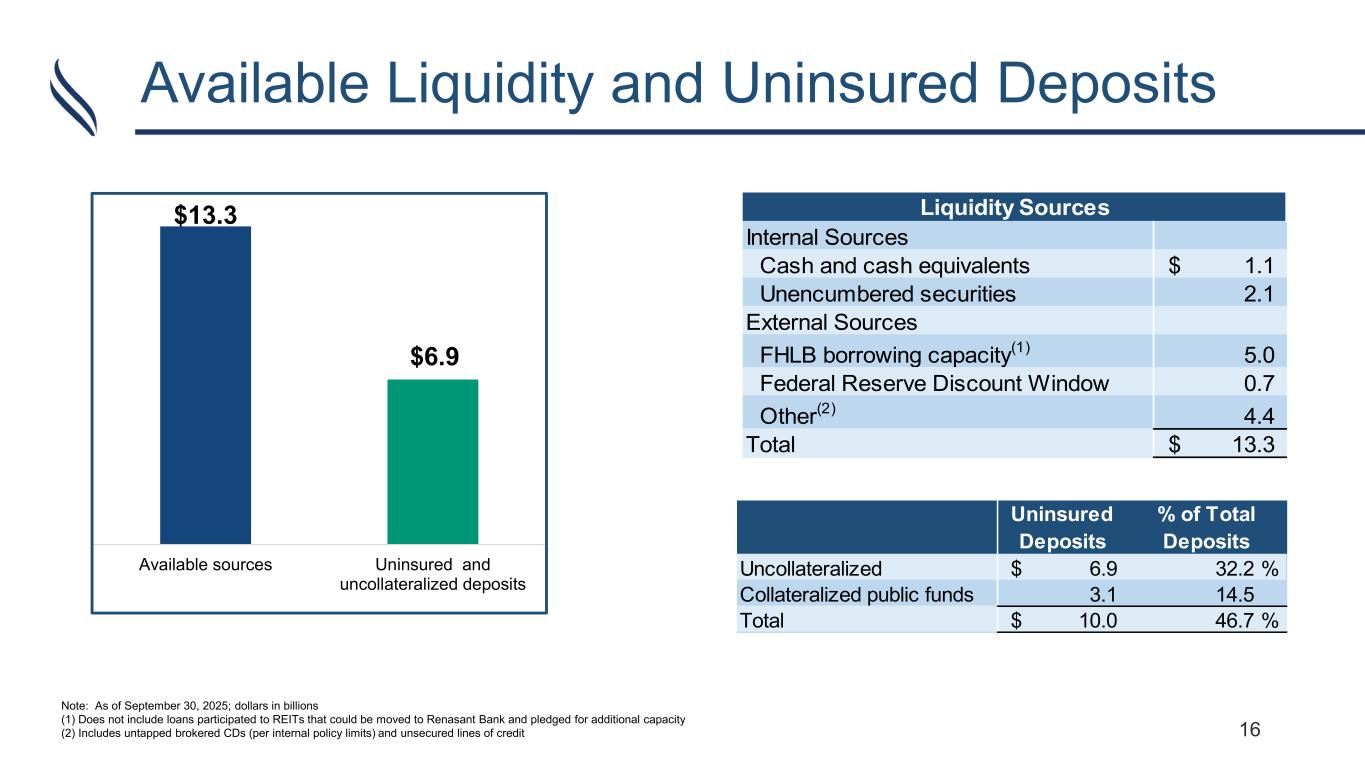

16 Available Liquidity and Uninsured Deposits $13.3 $6.9 Available sources Uninsured and uncollateralized deposits Uninsured Deposits Uncollateralized 6.9$ 32.2 % Collateralized public funds 3.1 14.5 Total 10.0$ 46.7 % % of Total Deposits Internal Sources Cash and cash equivalents 1.1$ Unencumbered securities 2.1 External Sources FHLB borrowing capacity(1) 5.0 Federal Reserve Discount Window 0.7 Other(2) 4.4 Total 13.3$ Liquidity Sources Note: As of September 30, 2025; dollars in billions (1) Does not include loans participated to REITs that could be moved to Renasant Bank and pledged for additional capacity (2) Includes untapped brokered CDs (per internal policy limits) and unsecured lines of credit

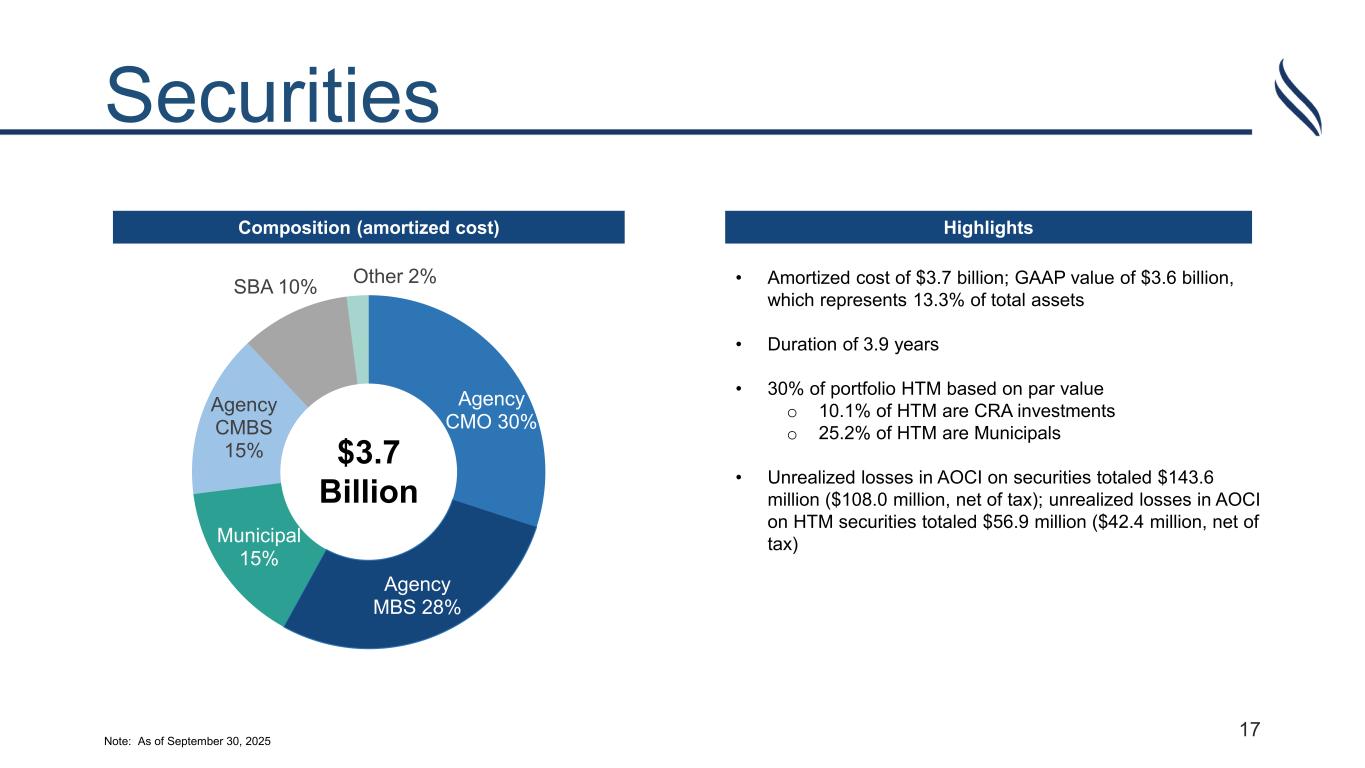

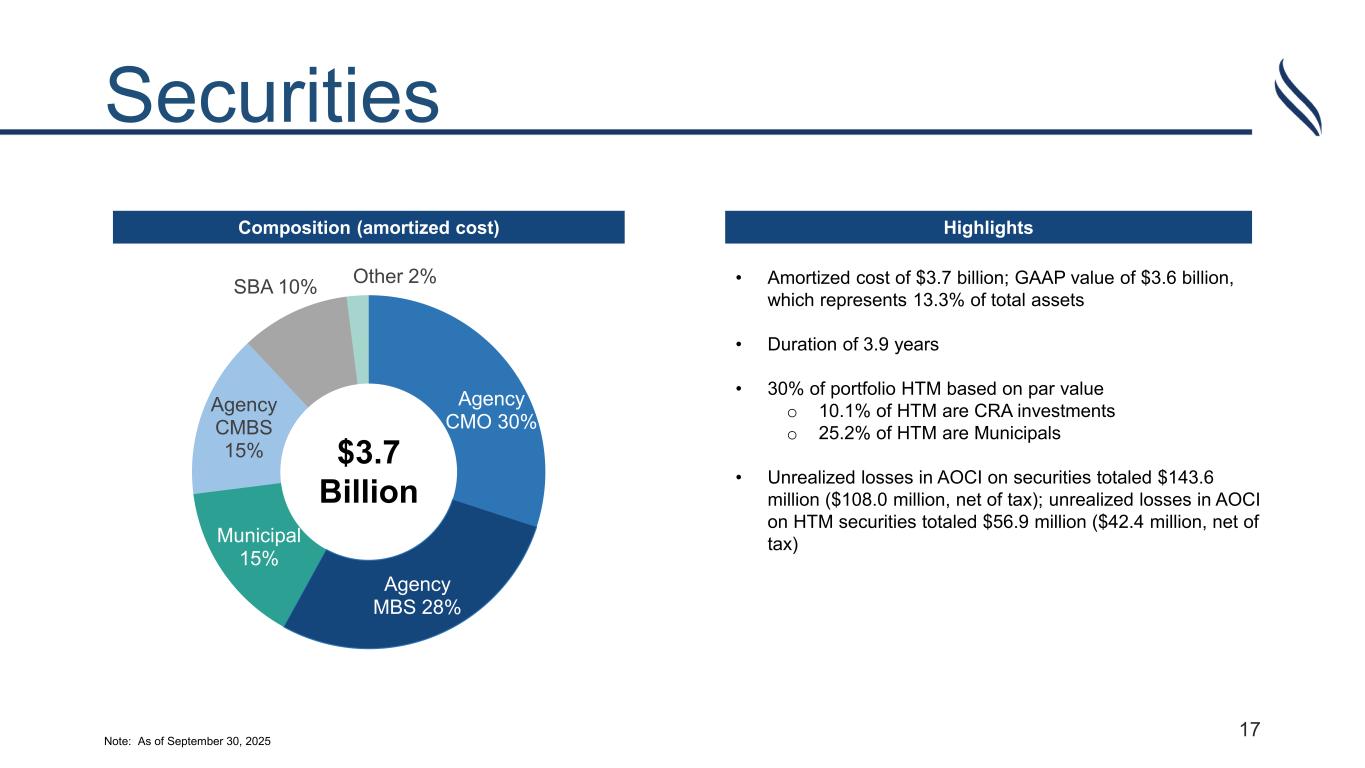

17 Securities Composition (amortized cost) Highlights • Amortized cost of $3.7 billion; GAAP value of $3.6 billion, which represents 13.3% of total assets • Duration of 3.9 years • 30% of portfolio HTM based on par value o 10.1% of HTM are CRA investments o 25.2% of HTM are Municipals • Unrealized losses in AOCI on securities totaled $143.6 million ($108.0 million, net of tax); unrealized losses in AOCI on HTM securities totaled $56.9 million ($42.4 million, net of tax) Note: As of September 30, 2025 Agency CMO 30% Agency MBS 28% Municipal 15% Agency CMBS 15% SBA 10% Other 2% $3.7 Billion

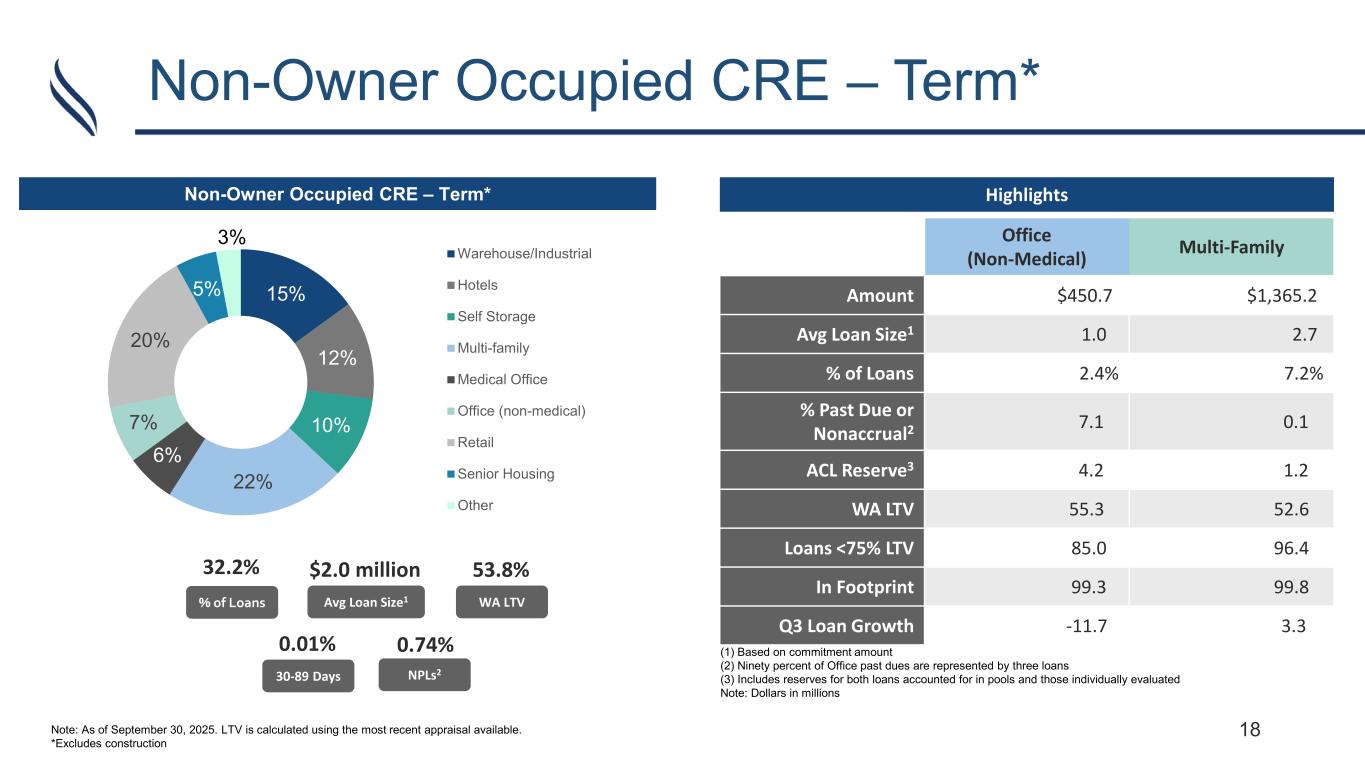

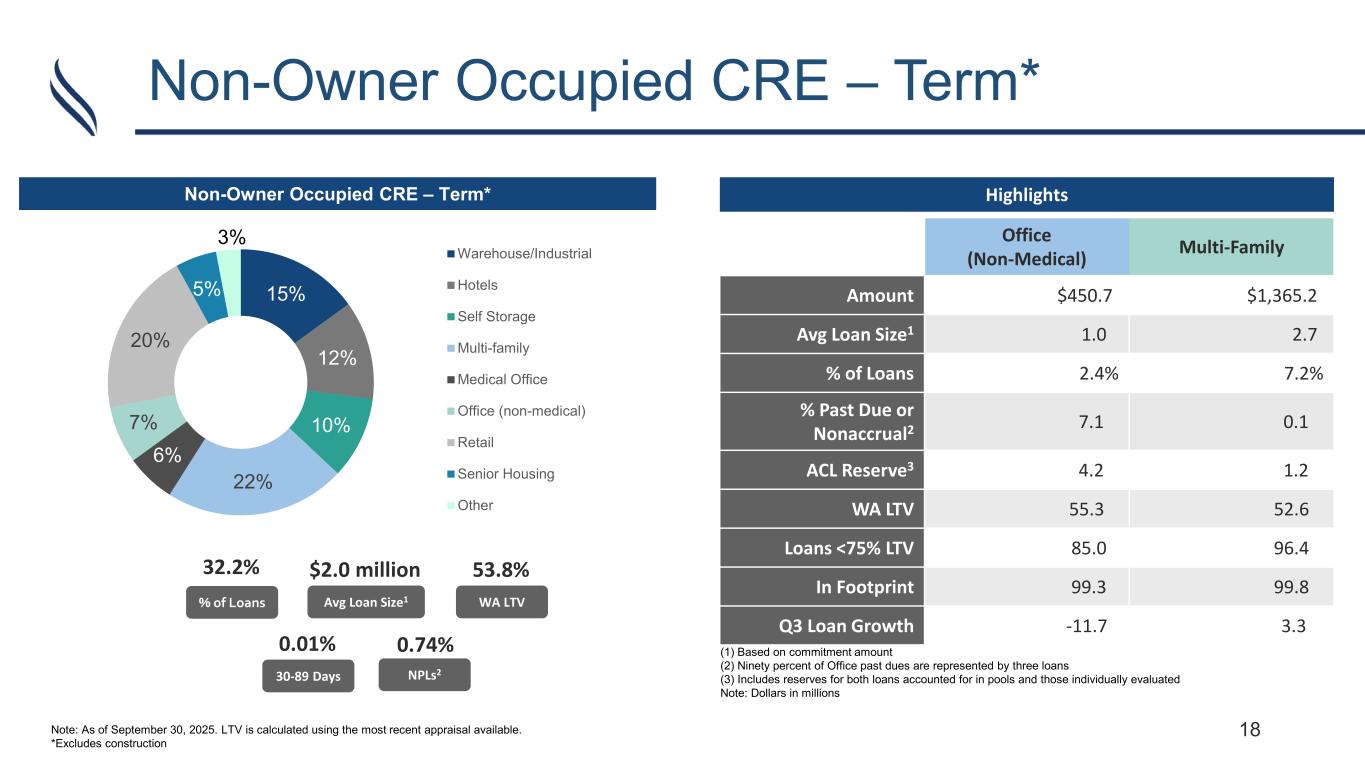

18 Non-Owner Occupied CRE – Term* Non-Owner Occupied CRE – Term* Note: As of September 30, 2025. LTV is calculated using the most recent appraisal available. *Excludes construction 15% 12% 10% 22% 6% 7% 20% 5% 3% Warehouse/Industrial Hotels Self Storage Multi-family Medical Office Office (non-medical) Retail Senior Housing Other % of Loans 32.2% Avg Loan Size1 $2.0 million WA LTV 0.01% 0.74% 53.8% 30-89 Days NPLs2 Highlights Office (Non-Medical) Multi-Family Amount $450.7- $1,365.2- Avg Loan Size1 1.0-- 2.7- % of Loans 2.4% 7.2% % Past Due or Nonaccrual2 7.1 0.1 ACL Reserve3 4.2 1.2 WA LTV 55.3 52.6 Loans <75% LTV 85.0 96.4 In Footprint 99.3 99.8 Q3 Loan Growth -11.7 3.3 (1) Based on commitment amount (2) Ninety percent of Office past dues are represented by three loans (3) Includes reserves for both loans accounted for in pools and those individually evaluated Note: Dollars in millions

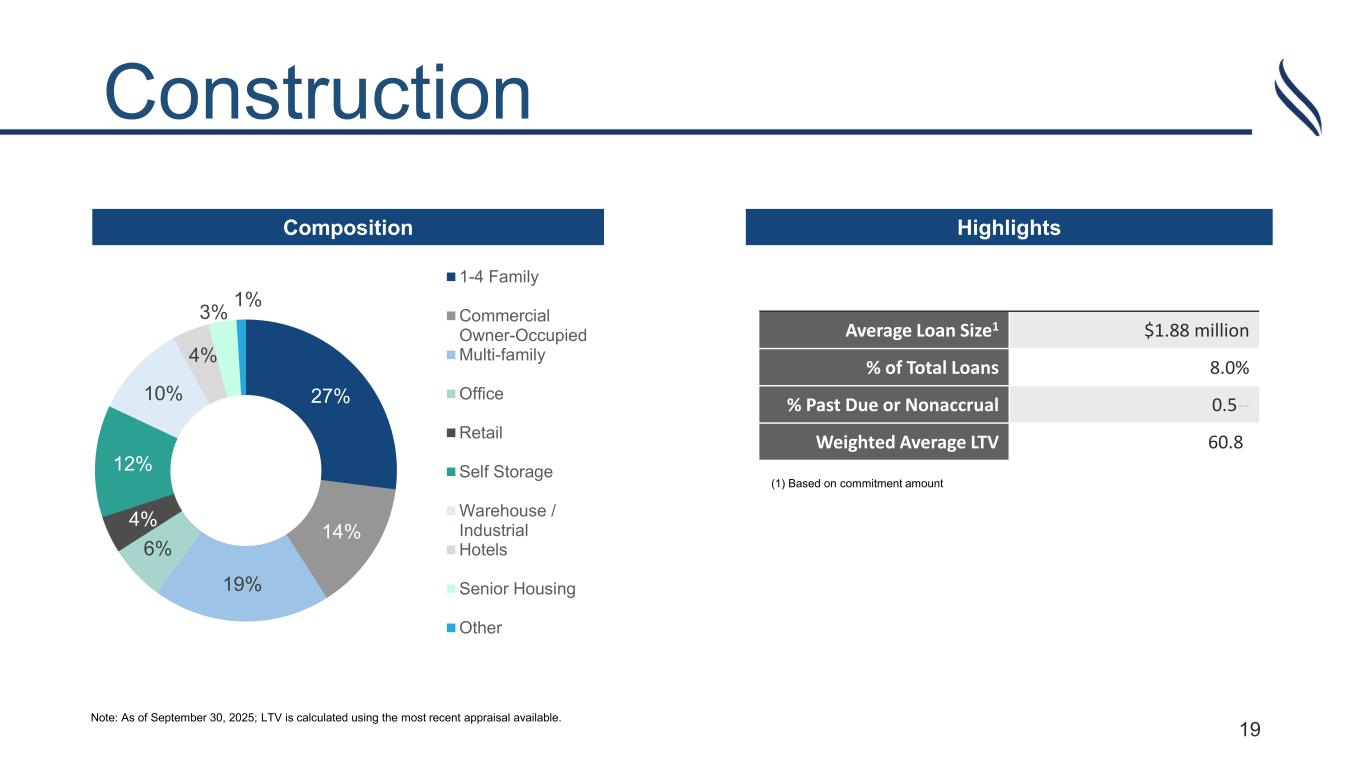

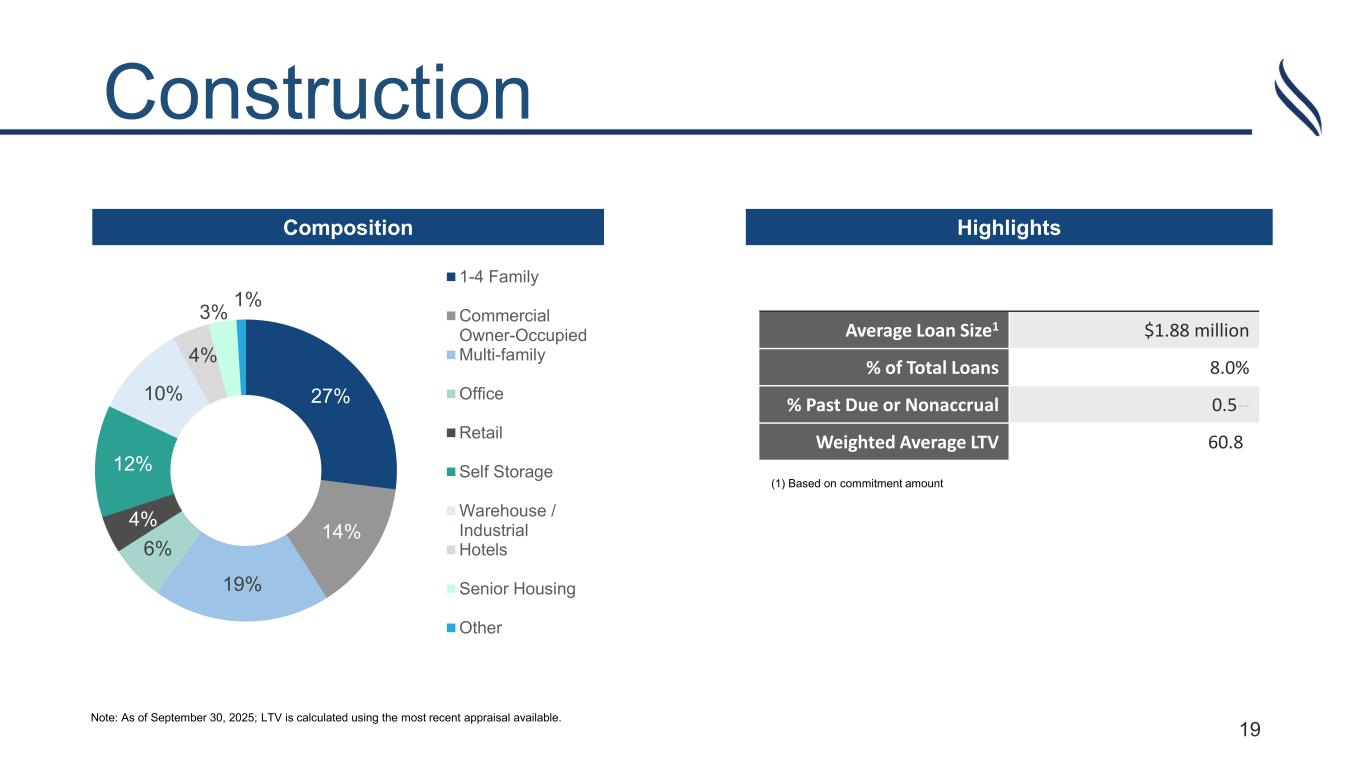

19 Construction Composition Note: As of September 30, 2025; LTV is calculated using the most recent appraisal available. Highlights 27% 14% 19% 6% 4% 12% 10% 4% 3% 1% 1-4 Family Commercial Owner-Occupied Multi-family Office Retail Self Storage Warehouse / Industrial Hotels Senior Housing Other Average Loan Size1 $1.88 million % of Total Loans 8.0% % Past Due or Nonaccrual 0.5-- Weighted Average LTV 60.8- (1) Based on commitment amount

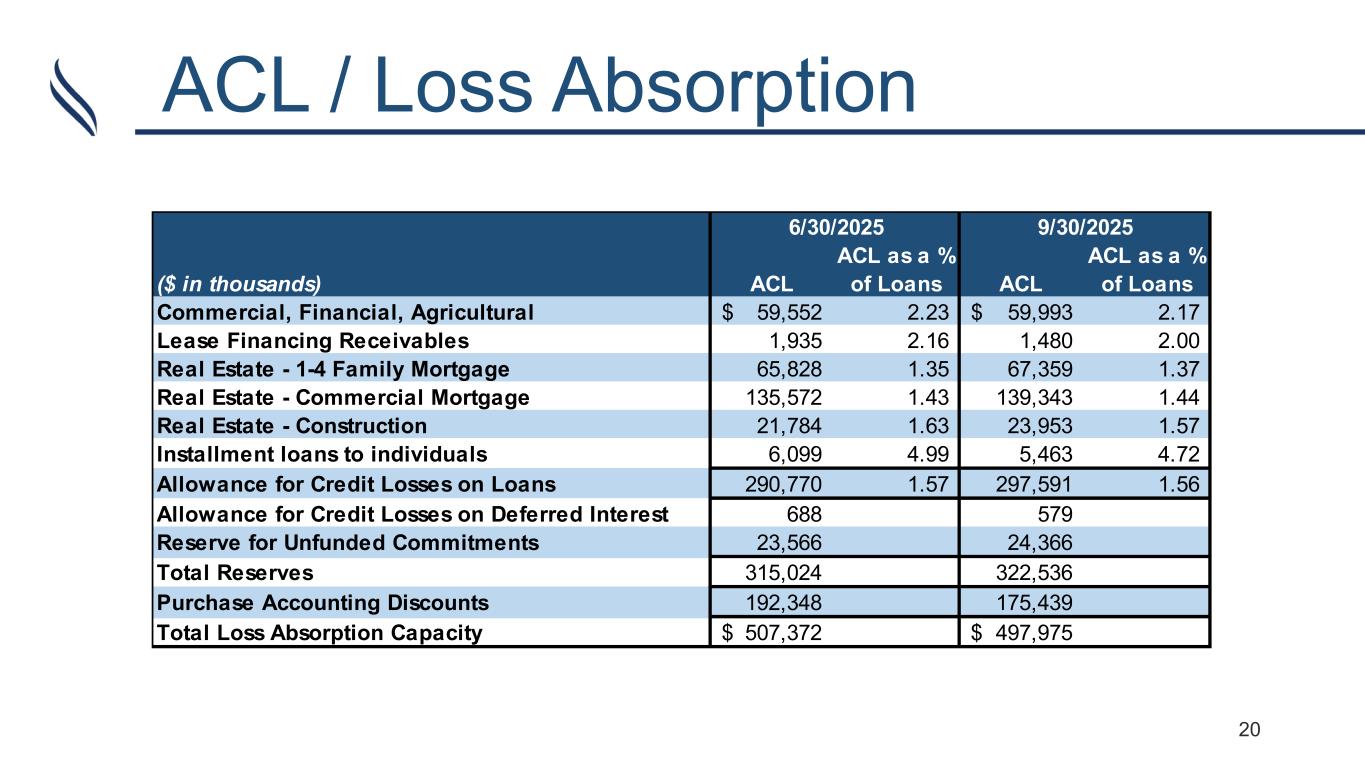

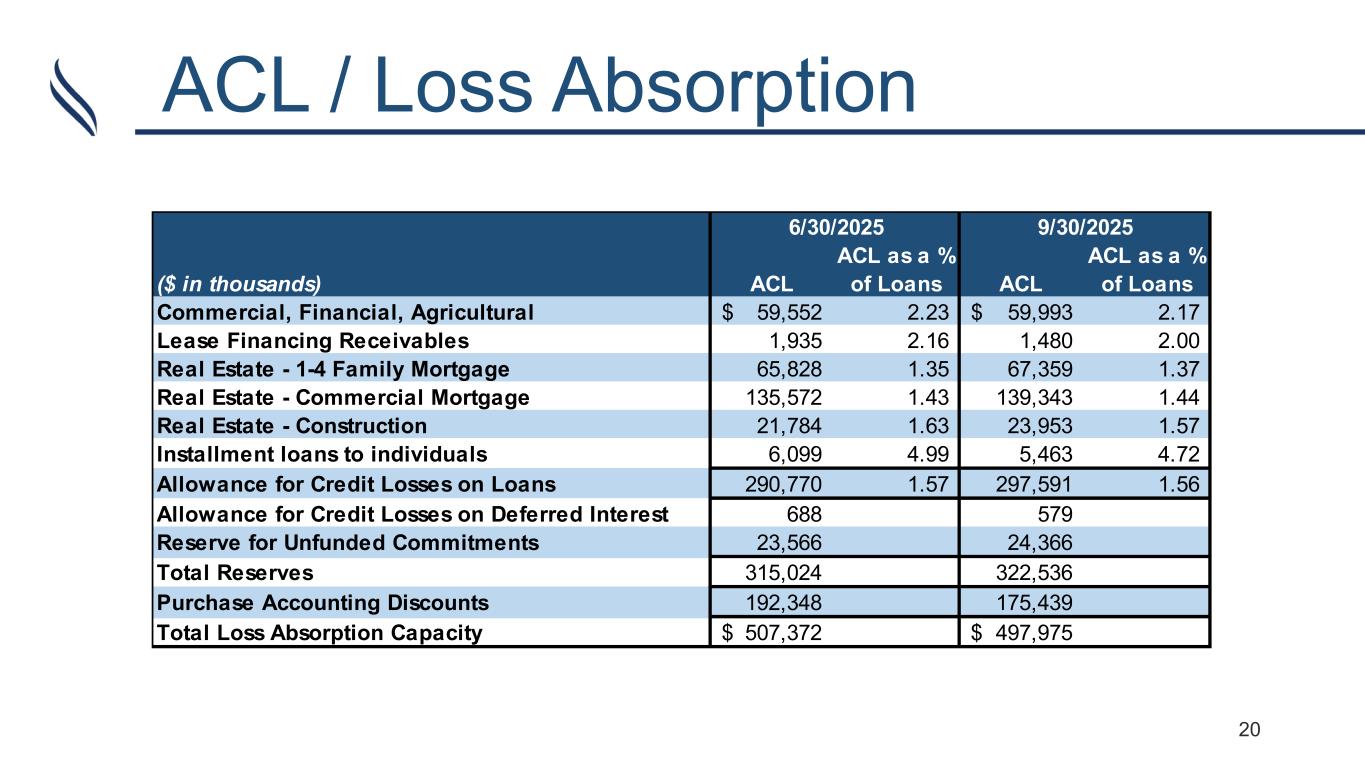

Forward-Looking Statements 20 ACL / Loss Absorption ($ in thousands) ACL ACL as a % of Loans ACL ACL as a % of Loans Commercial, Financial, Agricultural 59,552$ 2.23 59,993$ 2.17 Lease Financing Receivables 1,935 2.16 1,480 2.00 Real Estate - 1-4 Family Mortgage 65,828 1.35 67,359 1.37 Real Estate - Commercial Mortgage 135,572 1.43 139,343 1.44 Real Estate - Construction 21,784 1.63 23,953 1.57 Installment loans to individuals 6,099 4.99 5,463 4.72 Allowance for Credit Losses on Loans 290,770 1.57 297,591 1.56 Allowance for Credit Losses on Deferred Interest 688 579 Reserve for Unfunded Commitments 23,566 24,366 Total Reserves 315,024 322,536 Purchase Accounting Discounts 192,348 175,439 Total Loss Absorption Capacity 507,372$ 497,975$ 9/30/20256/30/2025

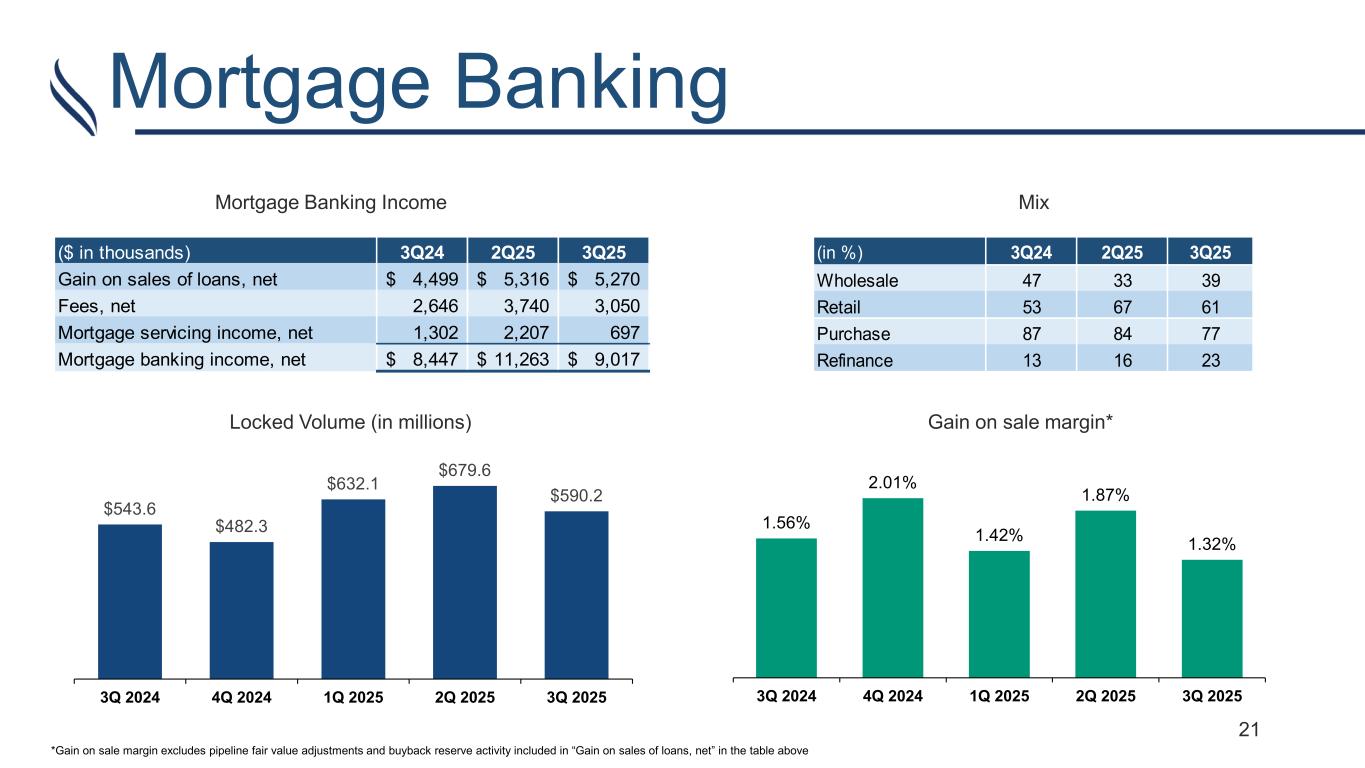

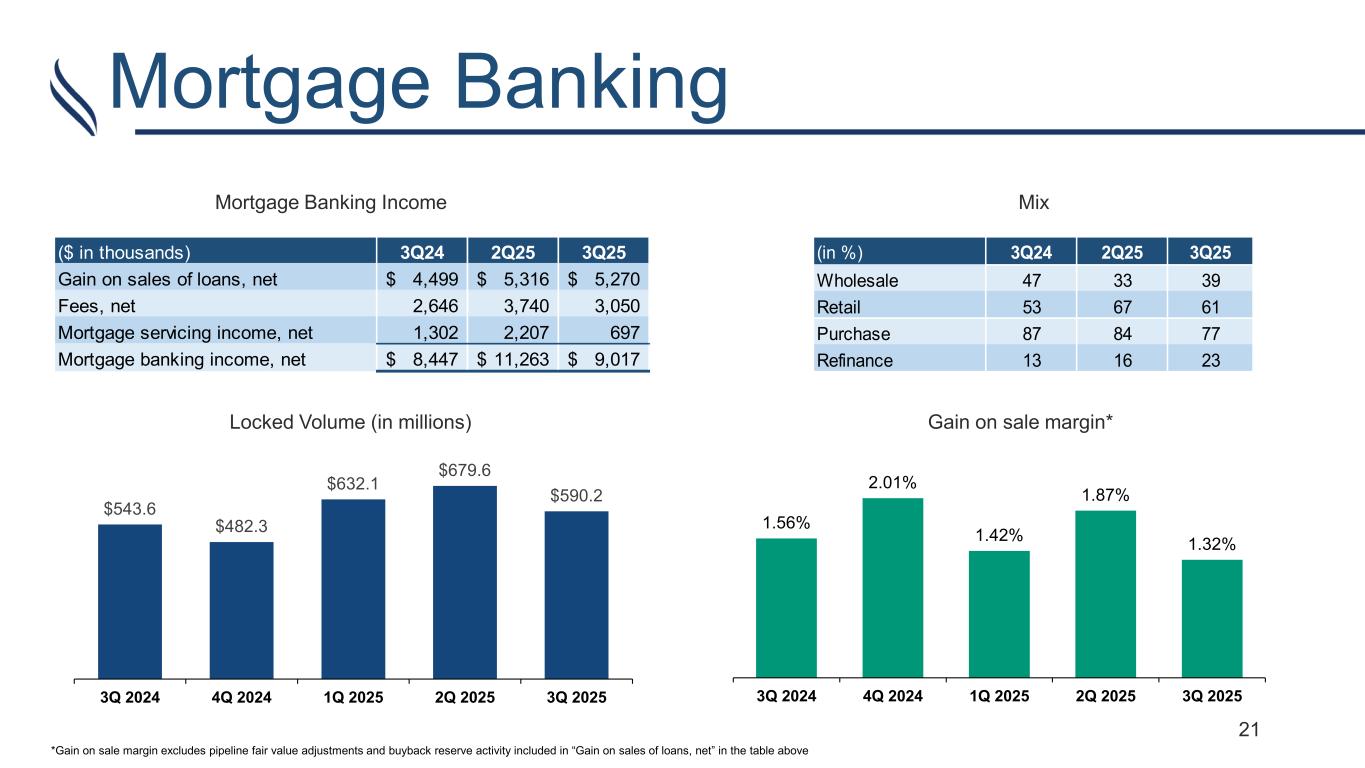

21 Mortgage Banking Mortgage Banking Income $543.6 $482.3 $632.1 $679.6 $590.2 $- $100 $200 $300 $400 $500 $600 $700 $800 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Locked Volume (in millions) Mix Gain on sale margin* 1.56% 2.01% 1.42% 1.87% 1.32% 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 *Gain on sale margin excludes pipeline fair value adjustments and buyback reserve activity included in “Gain on sales of loans, net” in the table above ($ in thousands) 3Q24 2Q25 3Q25 Gain on sales of loans, net 4,499$ 5,316$ 5,270$ Fees, net 2,646 3,740 3,050 Mortgage servicing income, net 1,302 2,207 697 Mortgage banking income, net 8,447$ 11,263$ 9,017$ (in %) 3Q24 2Q25 3Q25 Wholesale 47 33 39 Retail 53 67 61 Purchase 87 84 77 Refinance 13 16 23

Reconciliation of Non- GAAP Disclosures

Forward-Looking Statements 23 Reconciliation of Non-GAAP Disclosures Pre-Provision Net Revenue and Adjusted Pre-Provision Net Revenue $ in thousands 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net income (GAAP) 72,455$ 44,747$ 41,518$ 1,018$ 59,788$ Income taxes 24,924 5,006 10,448 1,649 15,478 Provision for credit losses (including unfunded commitments) 935 2,600 4,750 81,322 10,450 Pre-provision net revenue (non-GAAP) 98,314$ 52,353$ 56,716$ 83,989$ 85,716$ Merger and conversion expense 11,273 2,076 791 20,479 17,494 Gain on sale of MSR - (252) - (1,467) - Gain on sale of insurance agency (53,349) - - - - Adjusted pre-provision net revenue (non-GAAP) 56,238$ 54,177$ 57,507$ 103,001$ 103,210$

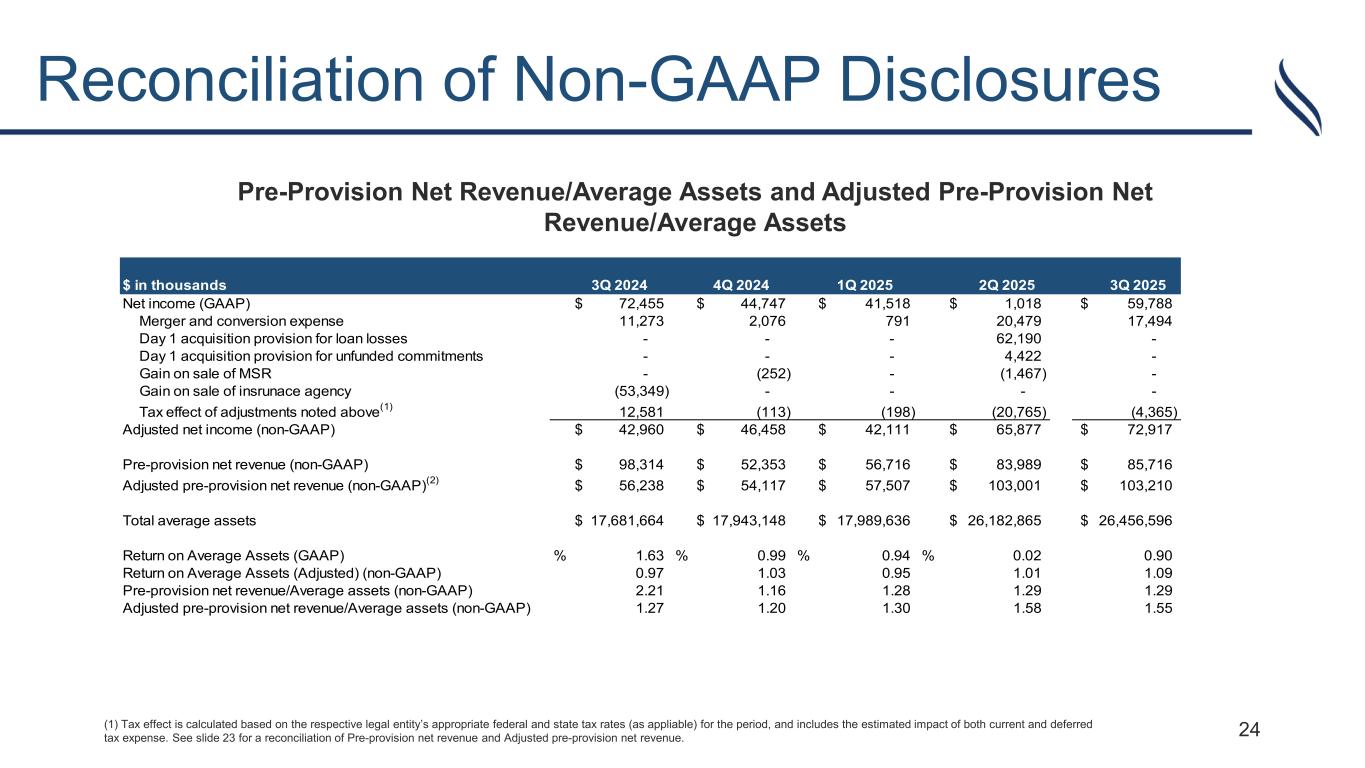

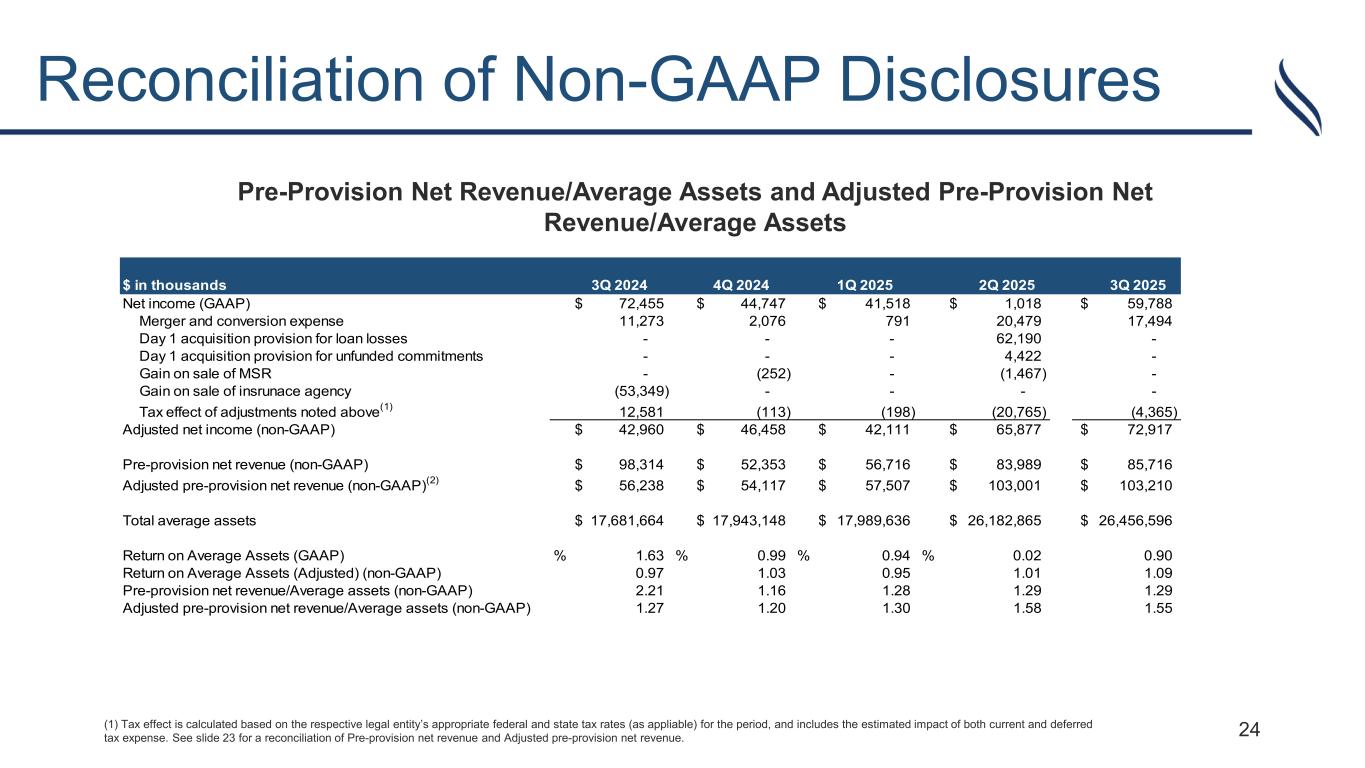

24 Reconciliation of Non-GAAP Disclosures Pre-Provision Net Revenue/Average Assets and Adjusted Pre-Provision Net Revenue/Average Assets $ in thousands 3Q 2024 4Q 2024 1Q 2025 Net income (GAAP) 72,455$ 44,747$ 41,518$ 1,018$ 59,788$ Merger and conversion expense 11,273 2,076 791 20,479 17,494 Day 1 acquisition provision for loan losses - - - 62,190 - Day 1 acquisition provision for unfunded commitments - - - 4,422 - Gain on sale of MSR - (252) - (1,467) - Gain on sale of insrunace agency (53,349) - - - - Tax effect of adjustments noted above(1) 12,581 (113) (198) (20,765) (4,365) Adjusted net income (non-GAAP) 42,960$ 46,458$ 42,111$ 65,877$ 72,917$ Pre-provision net revenue (non-GAAP) 98,314$ 52,353$ 56,716$ 83,989$ 85,716$ Adjusted pre-provision net revenue (non-GAAP)(2) 56,238$ 54,117$ 57,507$ 103,001$ 103,210$ Total average assets 17,681,664$ 17,943,148$ 17,989,636$ 26,182,865$ 26,456,596$ Return on Average Assets (GAAP) % 1.63 % 0.99 % 0.94 % 0.02 0.90 Return on Average Assets (Adjusted) (non-GAAP) 0.97 1.03 0.95 1.01 1.09 Pre-provision net revenue/Average assets (non-GAAP) 2.21 1.16 1.28 1.29 1.29 Adjusted pre-provision net revenue/Average assets (non-GAAP) 1.27 1.20 1.30 1.58 1.55 2Q 2025 3Q 2025 (1) Tax effect is calculated based on the respective legal entity’s appropriate federal and state tax rates (as appliable) for the period, and includes the estimated impact of both current and deferred tax expense. See slide 23 for a reconciliation of Pre-provision net revenue and Adjusted pre-provision net revenue.

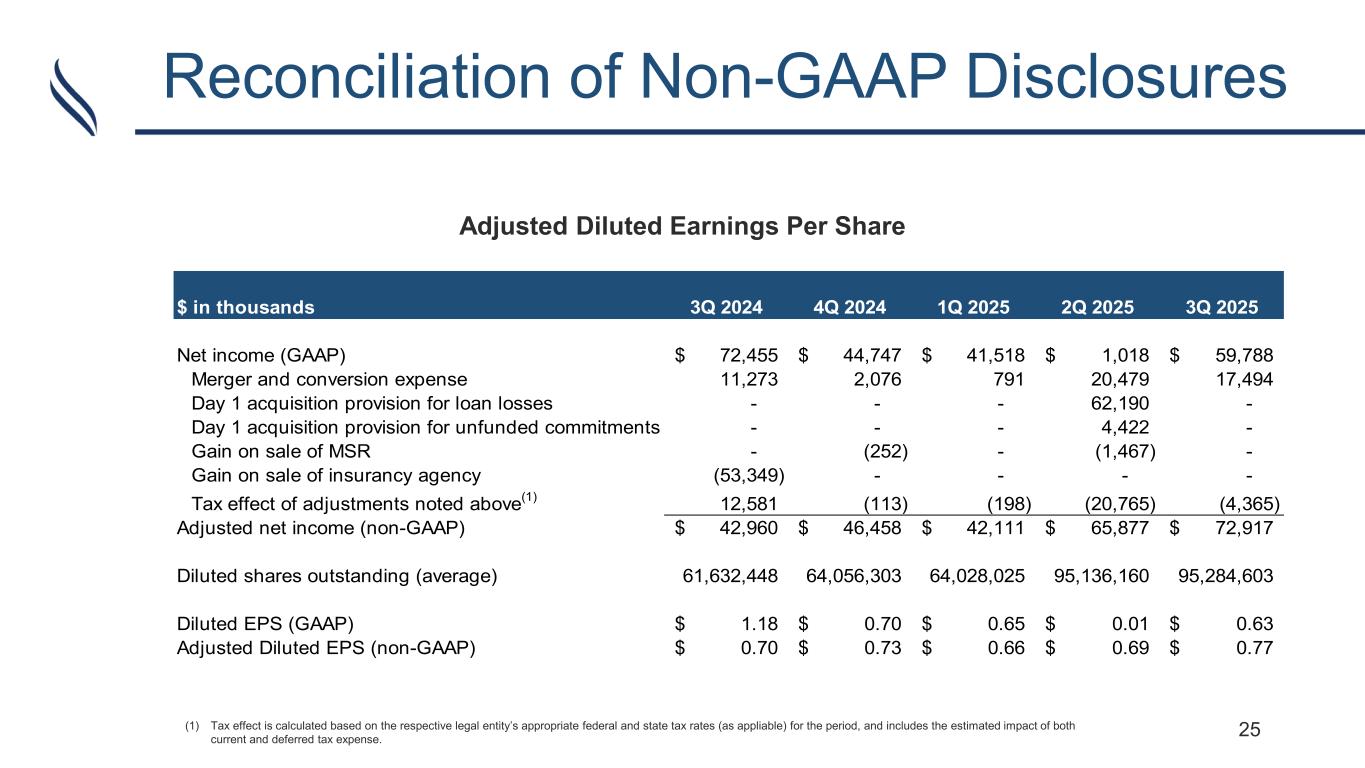

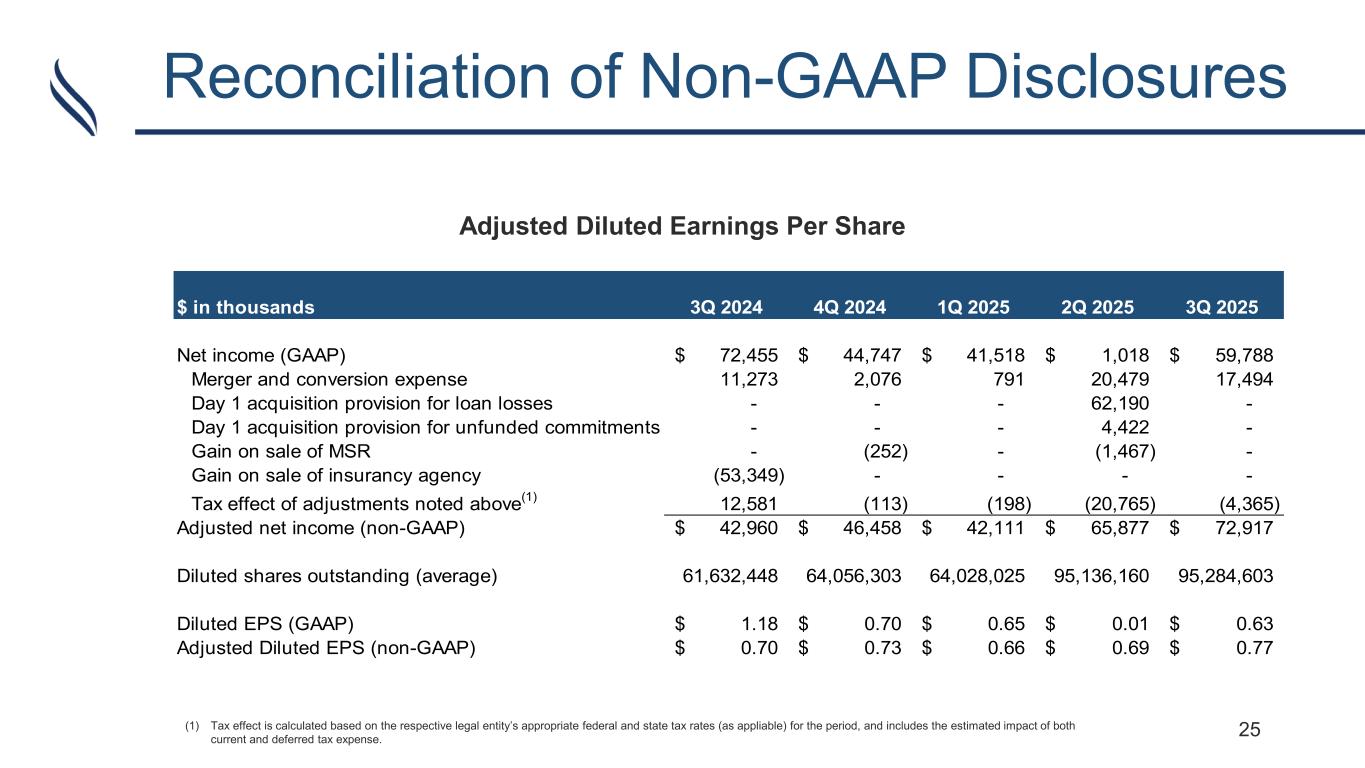

Forward-Looking Statements 25 Reconciliation of Non-GAAP Disclosures Adjusted Diluted Earnings Per Share $ in thousands 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net income (GAAP) 72,455$ 44,747$ 41,518$ 1,018$ 59,788$ Merger and conversion expense 11,273 2,076 791 20,479 17,494 Day 1 acquisition provision for loan losses - - - 62,190 - Day 1 acquisition provision for unfunded commitments - - - 4,422 - Gain on sale of MSR - (252) - (1,467) - Gain on sale of insurancy agency (53,349) - - - - Tax effect of adjustments noted above(1) 12,581 (113) (198) (20,765) (4,365) Adjusted net income (non-GAAP) 42,960$ 46,458$ 42,111$ 65,877$ 72,917$ Diluted shares outstanding (average) 61,632,448 64,056,303 64,028,025 95,136,160 95,284,603 Diluted EPS (GAAP) 1.18$ 0.70$ 0.65$ 0.01$ 0.63$ Adjusted Diluted EPS (non-GAAP) 0.70$ 0.73$ 0.66$ 0.69$ 0.77$ (1) Tax effect is calculated based on the respective legal entity’s appropriate federal and state tax rates (as appliable) for the period, and includes the estimated impact of both current and deferred tax expense.

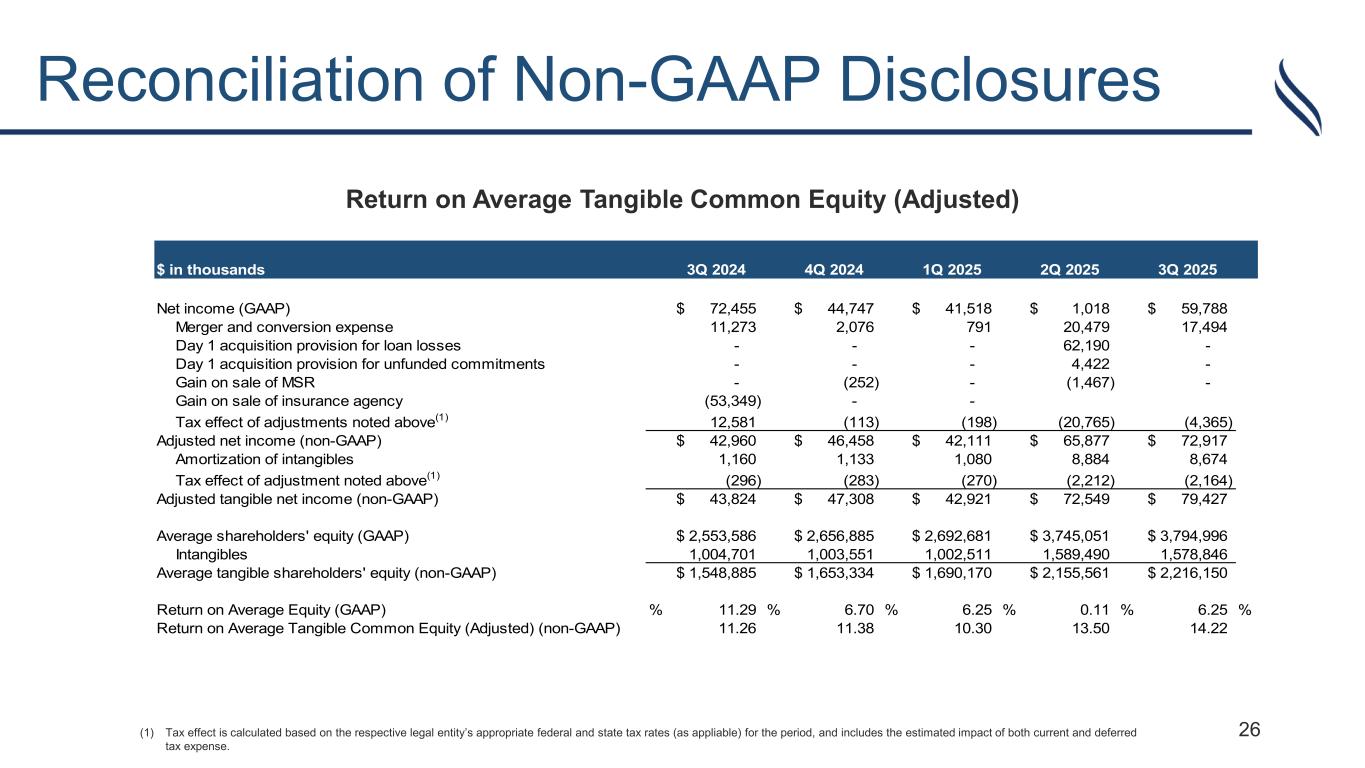

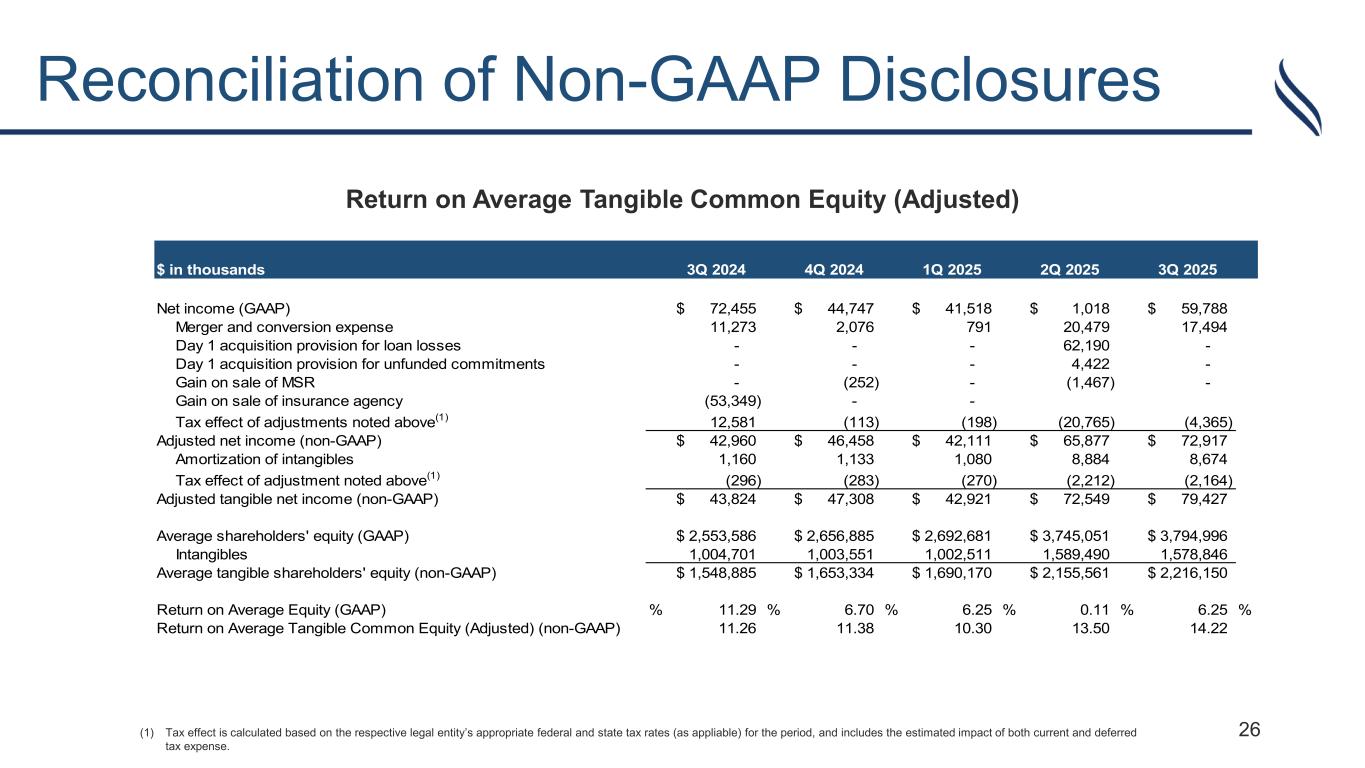

26 Reconciliation of Non-GAAP Disclosures Return on Average Tangible Common Equity (Adjusted) $ in thousands 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net income (GAAP) 72,455$ 44,747$ 41,518$ 1,018$ 59,788$ Merger and conversion expense 11,273 2,076 791 20,479 17,494 Day 1 acquisition provision for loan losses - - - 62,190 - Day 1 acquisition provision for unfunded commitments - - - 4,422 - Gain on sale of MSR - (252) - (1,467) - Gain on sale of insurance agency (53,349) - - Tax effect of adjustments noted above(1) 12,581 (113) (198) (20,765) (4,365) Adjusted net income (non-GAAP) 42,960$ 46,458$ 42,111$ 65,877$ 72,917$ Amortization of intangibles 1,160 1,133 1,080 8,884 8,674 Tax effect of adjustment noted above(1) (296) (283) (270) (2,212) (2,164) Adjusted tangible net income (non-GAAP) 43,824$ 47,308$ 42,921$ 72,549$ 79,427$ Average shareholders' equity (GAAP) 2,553,586$ 2,656,885$ 2,692,681$ 3,745,051$ 3,794,996$ Intangibles 1,004,701 1,003,551 1,002,511 1,589,490 1,578,846 Average tangible shareholders' equity (non-GAAP) 1,548,885$ 1,653,334$ 1,690,170$ 2,155,561$ 2,216,150$ Return on Average Equity (GAAP) % 11.29 % 6.70 % 6.25 % 0.11 % 6.25 % Return on Average Tangible Common Equity (Adjusted) (non-GAAP) 11.26 11.38 10.30 13.50 14.22 (1) Tax effect is calculated based on the respective legal entity’s appropriate federal and state tax rates (as appliable) for the period, and includes the estimated impact of both current and deferred tax expense.

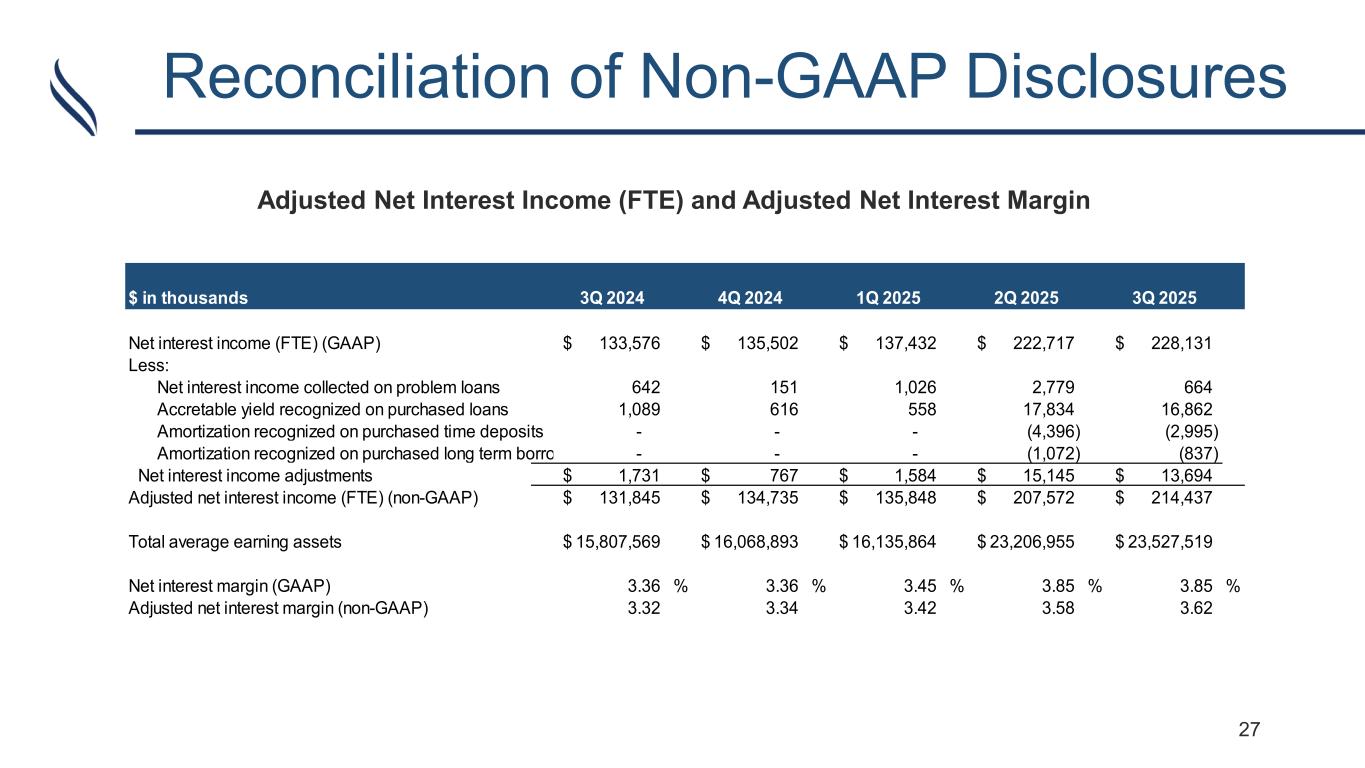

Forward-Looking Statements 27 Reconciliation of Non-GAAP Disclosures Adjusted Net Interest Income (FTE) and Adjusted Net Interest Margin $ in thousands 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net interest income (FTE) (GAAP) 133,576$ 135,502$ 137,432$ 222,717$ 228,131$ Less: Net interest income collected on problem loans 642 151 1,026 2,779 664 Accretable yield recognized on purchased loans 1,089 616 558 17,834 16,862 Amortization recognized on purchased time deposits - - - (4,396) (2,995) Amortization recognized on purchased long term borro - - - (1,072) (837) Net interest income adjustments 1,731$ 767$ 1,584$ 15,145$ 13,694$ Adjusted net interest income (FTE) (non-GAAP) 131,845$ 134,735$ 135,848$ 207,572$ 214,437$ Total average earning assets 15,807,569$ 16,068,893$ 16,135,864$ 23,206,955$ 23,527,519$ Net interest margin (GAAP) 3.36 % 3.36 % 3.45 % 3.85 % 3.85 % Adjusted net interest margin (non-GAAP) 3.32 3.34 3.42 3.58 3.62

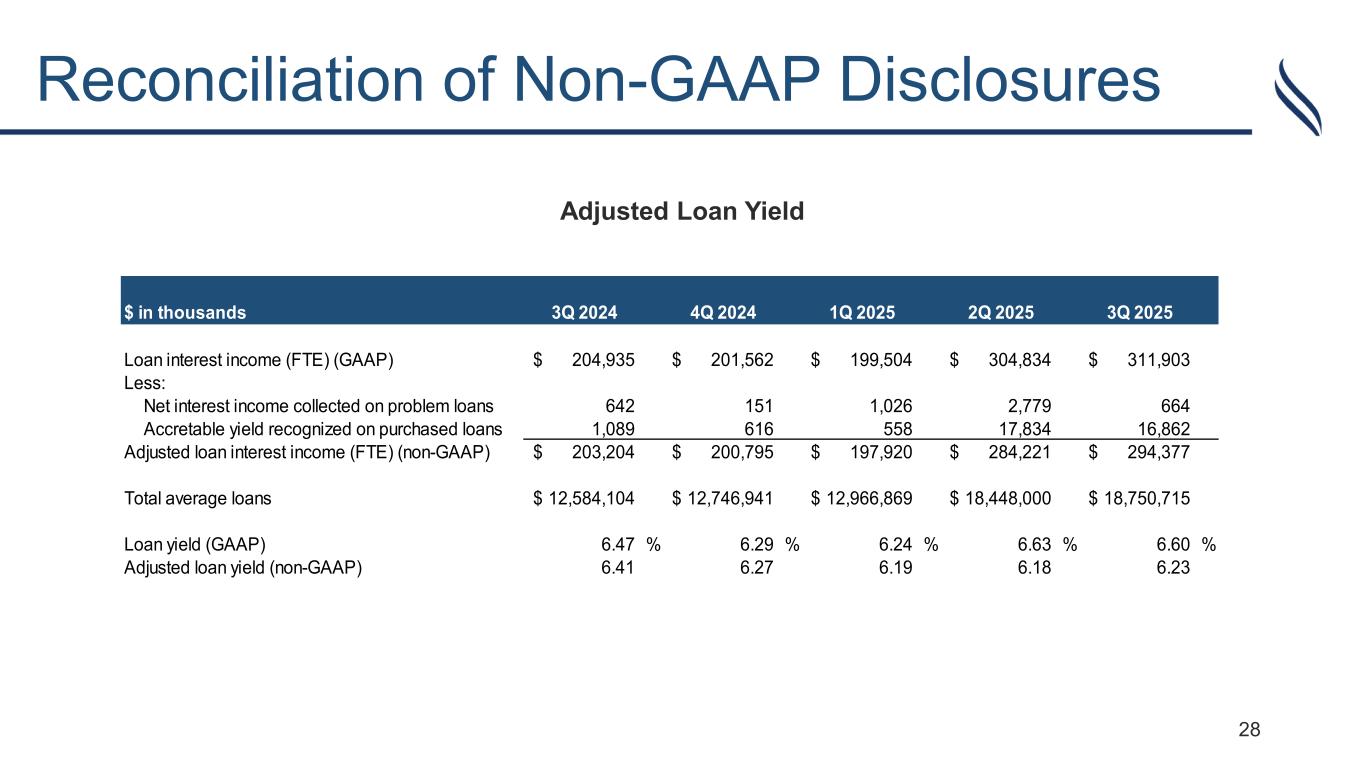

28 Reconciliation of Non-GAAP Disclosures Adjusted Loan Yield $ in thousands 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Loan interest income (FTE) (GAAP) 204,935$ 201,562$ 199,504$ 304,834$ 311,903$ Less: Net interest income collected on problem loans 642 151 1,026 2,779 664 Accretable yield recognized on purchased loans 1,089 616 558 17,834 16,862 Adjusted loan interest income (FTE) (non-GAAP) 203,204$ 200,795$ 197,920$ 284,221$ 294,377$ Total average loans 12,584,104$ 12,746,941$ 12,966,869$ 18,448,000$ 18,750,715$ Loan yield (GAAP) 6.47 % 6.29 % 6.24 % 6.63 % 6.60 % Adjusted loan yield (non-GAAP) 6.41 6.27 6.19 6.18 6.23

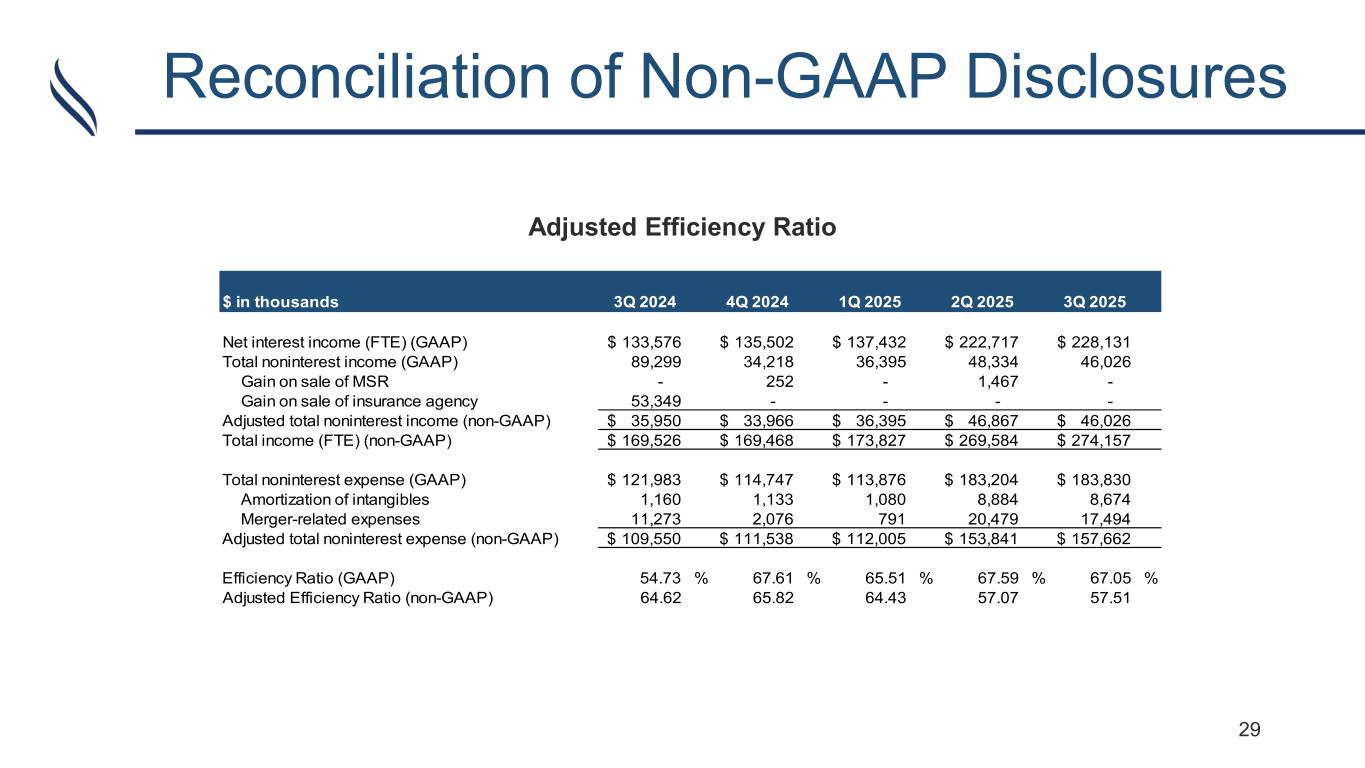

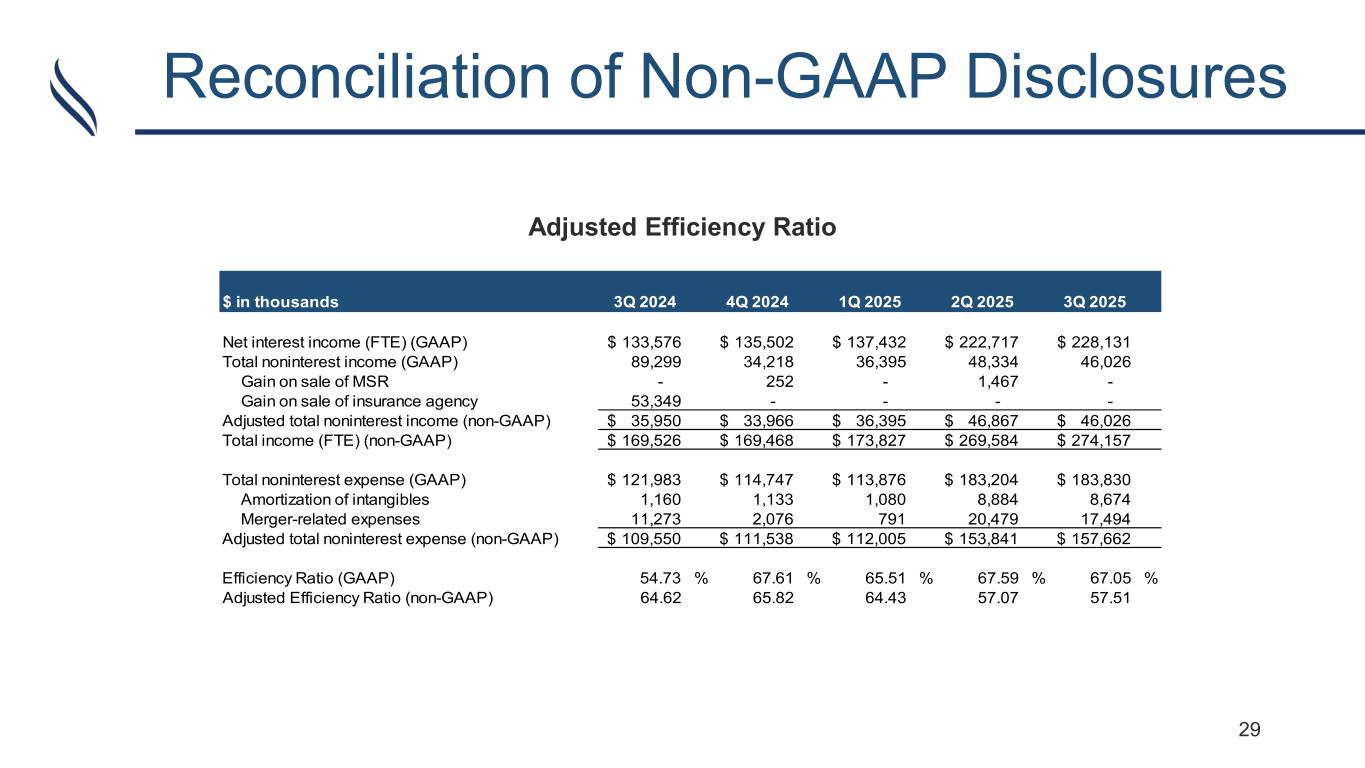

Forward-Looking Statements 29 Reconciliation of Non-GAAP Disclosures Adjusted Efficiency Ratio $ in thousands 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Net interest income (FTE) (GAAP) 133,576$ 135,502$ 137,432$ 222,717$ 228,131$ Total noninterest income (GAAP) 89,299 34,218 36,395 48,334 46,026 Gain on sale of MSR - 252 - 1,467 - Gain on sale of insurance agency 53,349 - - - - Adjusted total noninterest income (non-GAAP) 35,950$ 33,966$ 36,395$ 46,867$ 46,026$ Total income (FTE) (non-GAAP) 169,526$ 169,468$ 173,827$ 269,584$ 274,157$ Total noninterest expense (GAAP) 121,983$ 114,747$ 113,876$ 183,204$ 183,830$ Amortization of intangibles 1,160 1,133 1,080 8,884 8,674 Merger-related expenses 11,273 2,076 791 20,479 17,494 Adjusted total noninterest expense (non-GAAP) 109,550$ 111,538$ 112,005$ 153,841$ 157,662$ Efficiency Ratio (GAAP) 54.73 % 67.61 % 65.51 % 67.59 % 67.05 % Adjusted Efficiency Ratio (non-GAAP) 64.62 65.82 64.43 57.07 57.51

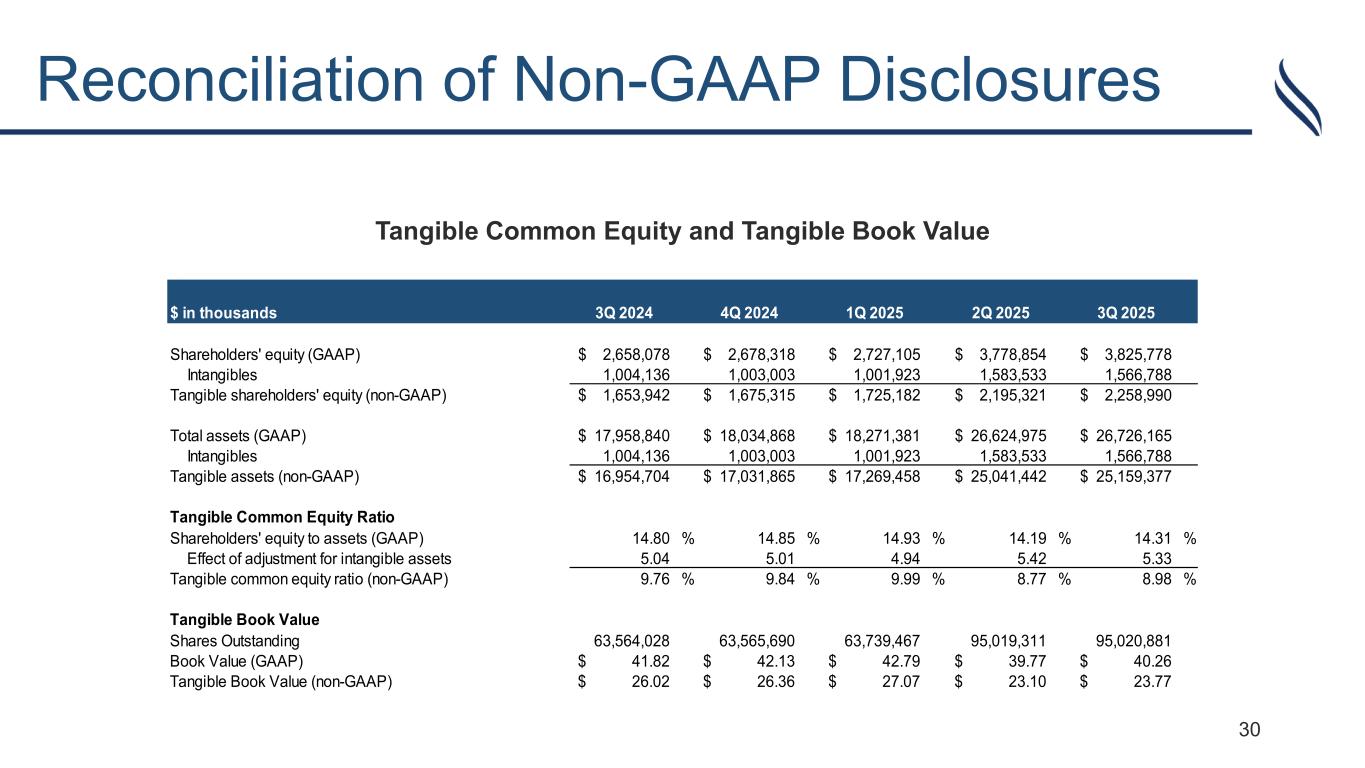

30 Reconciliation of Non-GAAP Disclosures Tangible Common Equity and Tangible Book Value $ in thousands 3Q 2024 4Q 2024 1Q 2025 2Q 2025 3Q 2025 Shareholders' equity (GAAP) 2,658,078$ 2,678,318$ 2,727,105$ 3,778,854$ 3,825,778$ Intangibles 1,004,136 1,003,003 1,001,923 1,583,533 1,566,788 Tangible shareholders' equity (non-GAAP) 1,653,942$ 1,675,315$ 1,725,182$ 2,195,321$ 2,258,990$ Total assets (GAAP) 17,958,840$ 18,034,868$ 18,271,381$ 26,624,975$ 26,726,165$ Intangibles 1,004,136 1,003,003 1,001,923 1,583,533 1,566,788 Tangible assets (non-GAAP) 16,954,704$ 17,031,865$ 17,269,458$ 25,041,442$ 25,159,377$ Tangible Common Equity Ratio Shareholders' equity to assets (GAAP) 14.80 % 14.85 % 14.93 % 14.19 % 14.31 % Effect of adjustment for intangible assets 5.04 5.01 4.94 5.42 5.33 Tangible common equity ratio (non-GAAP) 9.76 % 9.84 % 9.99 % 8.77 % 8.98 % Tangible Book Value Shares Outstanding 63,564,028 63,565,690 63,739,467 95,019,311 95,020,881 Book Value (GAAP) 41.82$ 42.13$ 42.79$ 39.77$ 40.26$ Tangible Book Value (non-GAAP) 26.02$ 26.36$ 27.07$ 23.10$ 23.77$