false000071439500007143952025-11-052025-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

______________________

Date of Report (Date of earliest event reported): November 5, 2025

GERMAN AMERICAN BANCORP, INC.

(Exact name of registrant as specified in its charter)

Indiana

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

|

| 001-15877 |

35-1547518 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| 711 Main Street |

|

| Jasper, |

Indiana |

47546 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (812) 482-1314

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, no par value |

|

GABC |

|

Nasdaq Global Select Market |

Item 7.01. Regulation FD Disclosure.

D. Neil Dauby, Chairman and Chief Executive Officer, and Bradley M. Rust, President and Chief Financial Officer, of German American Bancorp, Inc. will participate in the 2025 Hovde Group Financial Services Conference by hosting a series of meetings with investors on November 6, 2025.

Attached as Exhibit 99.1 is the information that will be provided to meeting participants. Such information is incorporated herein by reference.

The information in this Item 7.01, including the information incorporated herein from Exhibit 99.1, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

| (d) |

Exhibits |

|

|

|

|

|

|

|

Exhibit No. |

|

Description |

|

|

|

|

|

|

|

German American Bancorp, Inc. Presentation dated November 6, 2025. |

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* * * * * * Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SIGNATURE

|

|

|

|

|

|

|

|

|

|

GERMAN AMERICAN BANCORP, INC. |

Date: November 5, 2025 |

By: |

/s/ D. Neil Dauby |

|

|

D. Neil Dauby, Chairman and Chief Executive Officer |

EX-99.1

2

hovde112025.htm

EX-99.1

hovde112025

Symbol: GABC November 6, 2025 Hovde Financial Services Conference German American 1 Scan for electronic presentation

Presented By D. Neil Dauby, Chairman and Chief Executive Officer (812) 482-0707 neil.dauby@germanamerican.com Bradley M. Rust, President and CFO (812) 482-0718 brad.rust@germanamerican.com 2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2024 as updated and supplemented by our other SEC reports filed from time to time. 3

Indiana, Kentucky & Ohio Community-focused Financial Services Organization Who We Are 4 $8.4 Billion Total Banking Assets $4.0 Billion Investment & Trust Assets Under Management ~1050 Team Members 94 Banking Offices in Indiana, Kentucky & Ohio

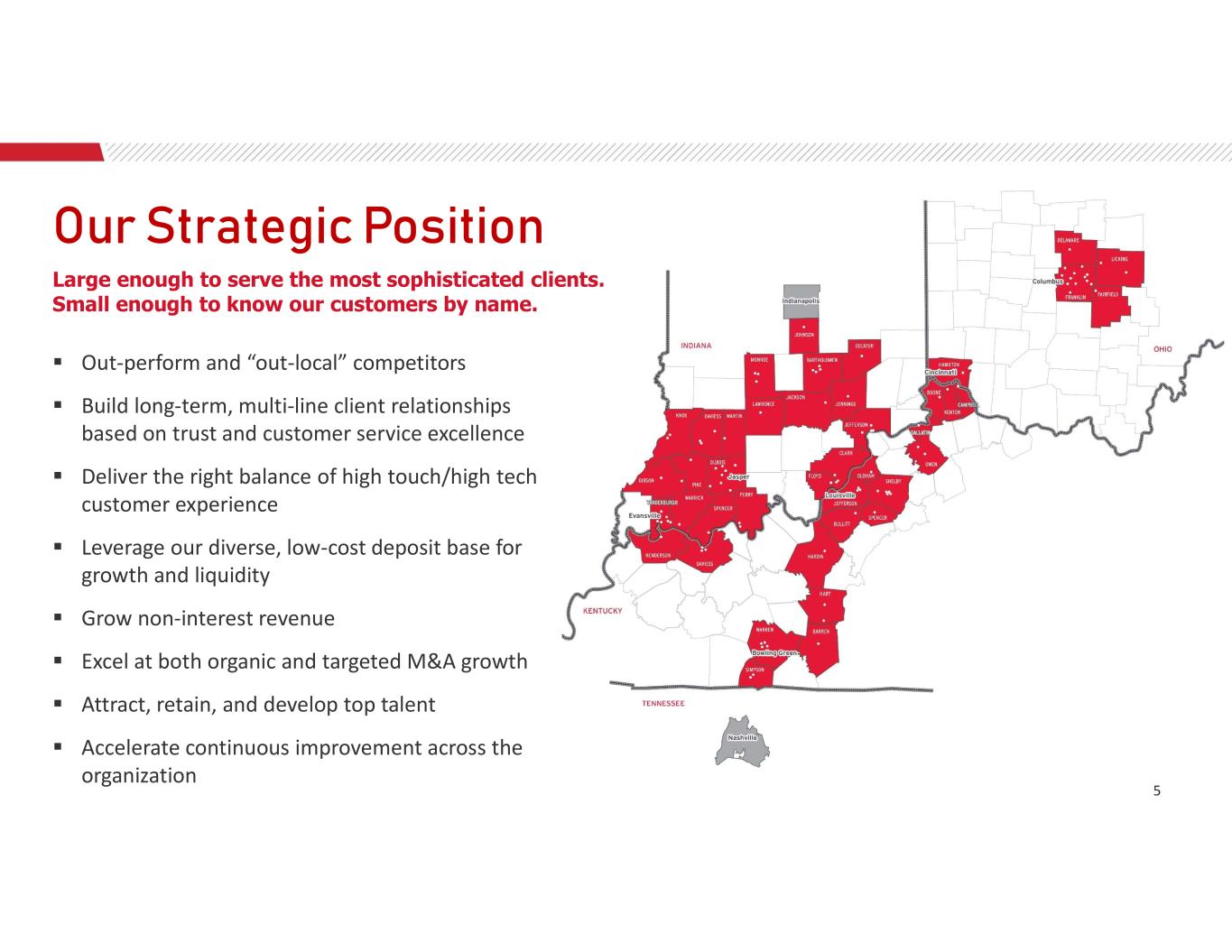

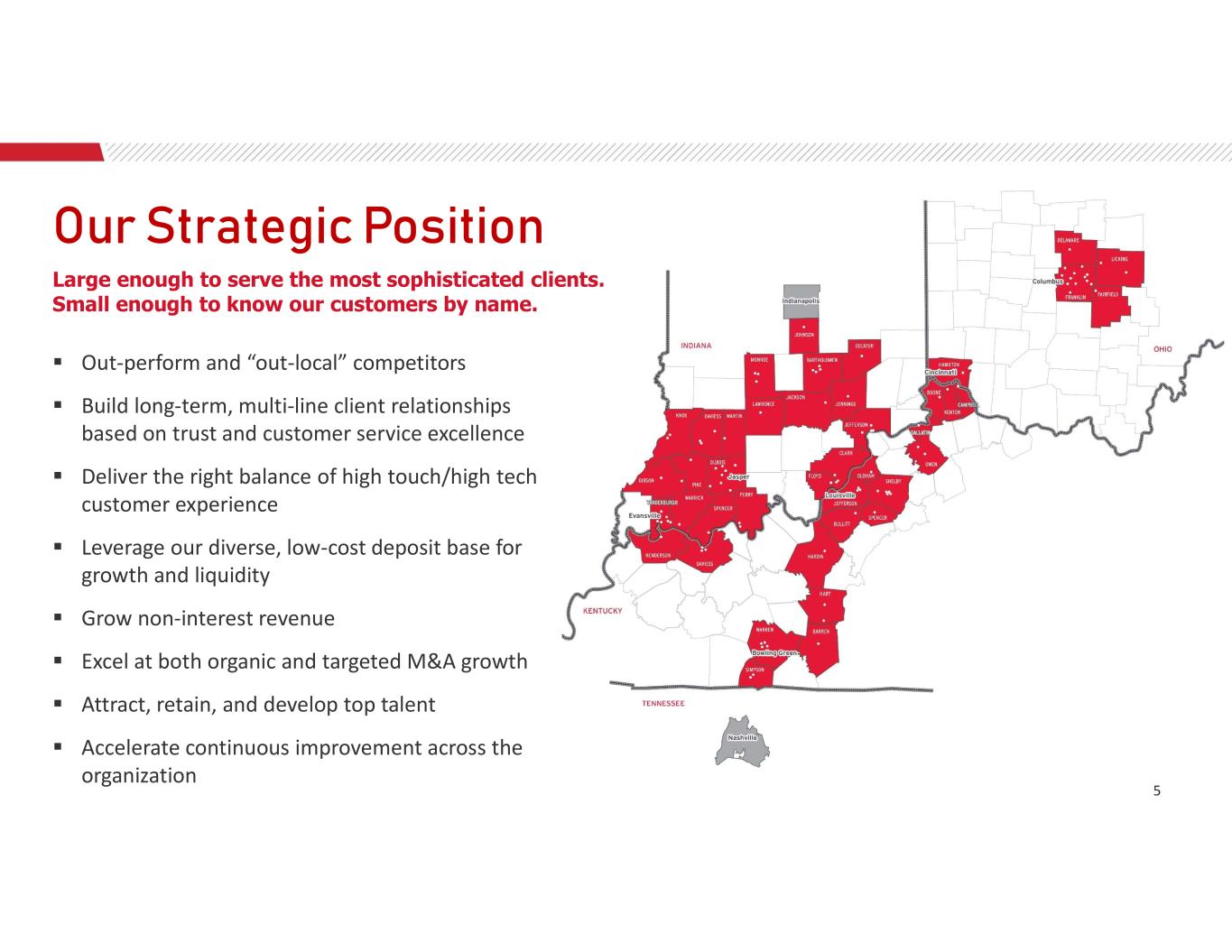

Out-perform and “out-local” competitors Build long-term, multi-line client relationships based on trust and customer service excellence Deliver the right balance of high touch/high tech customer experience Leverage our diverse, low-cost deposit base for growth and liquidity Grow non-interest revenue Excel at both organic and targeted M&A growth Attract, retain, and develop top talent Accelerate continuous improvement across the organization Our Strategic Position 5 Large enough to serve the most sophisticated clients. Small enough to know our customers by name.

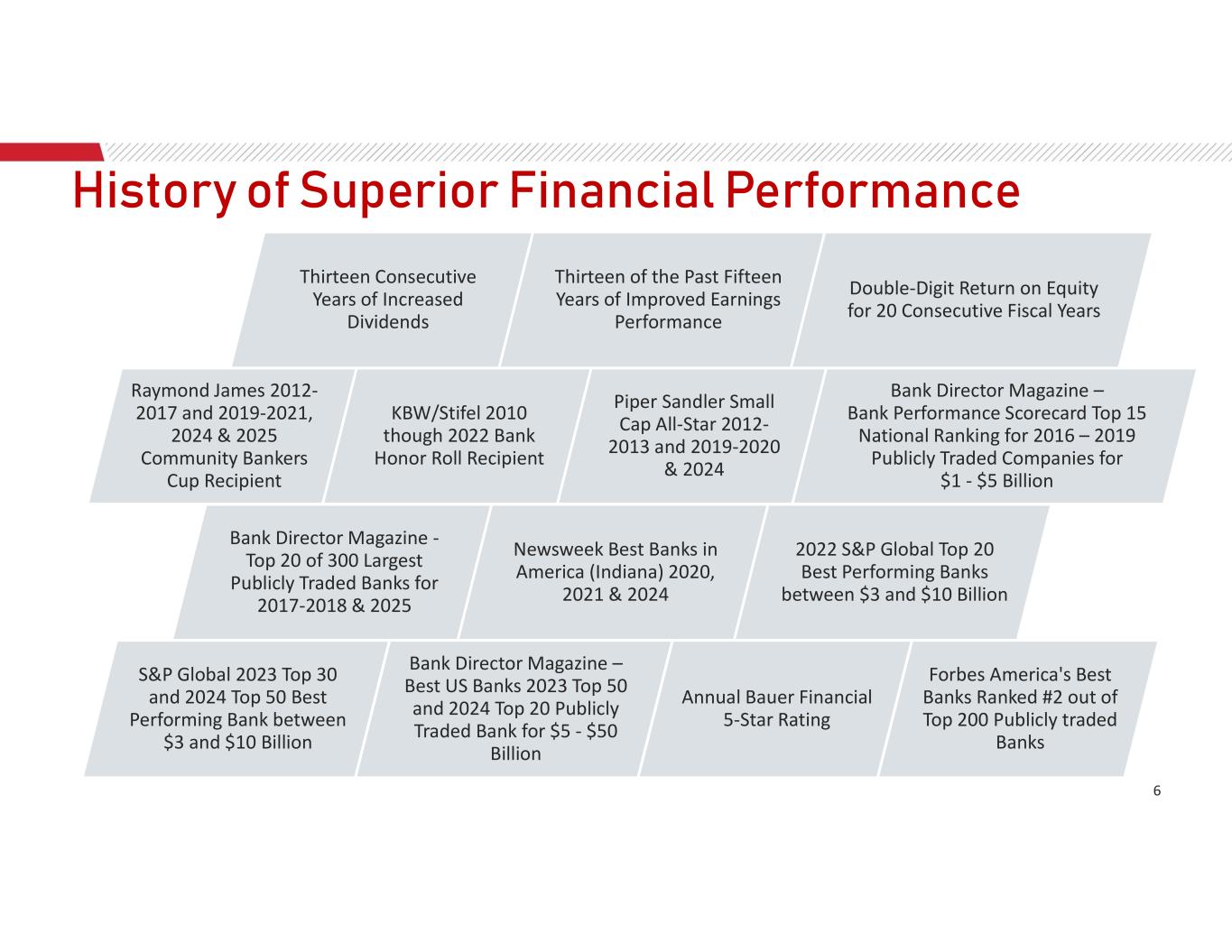

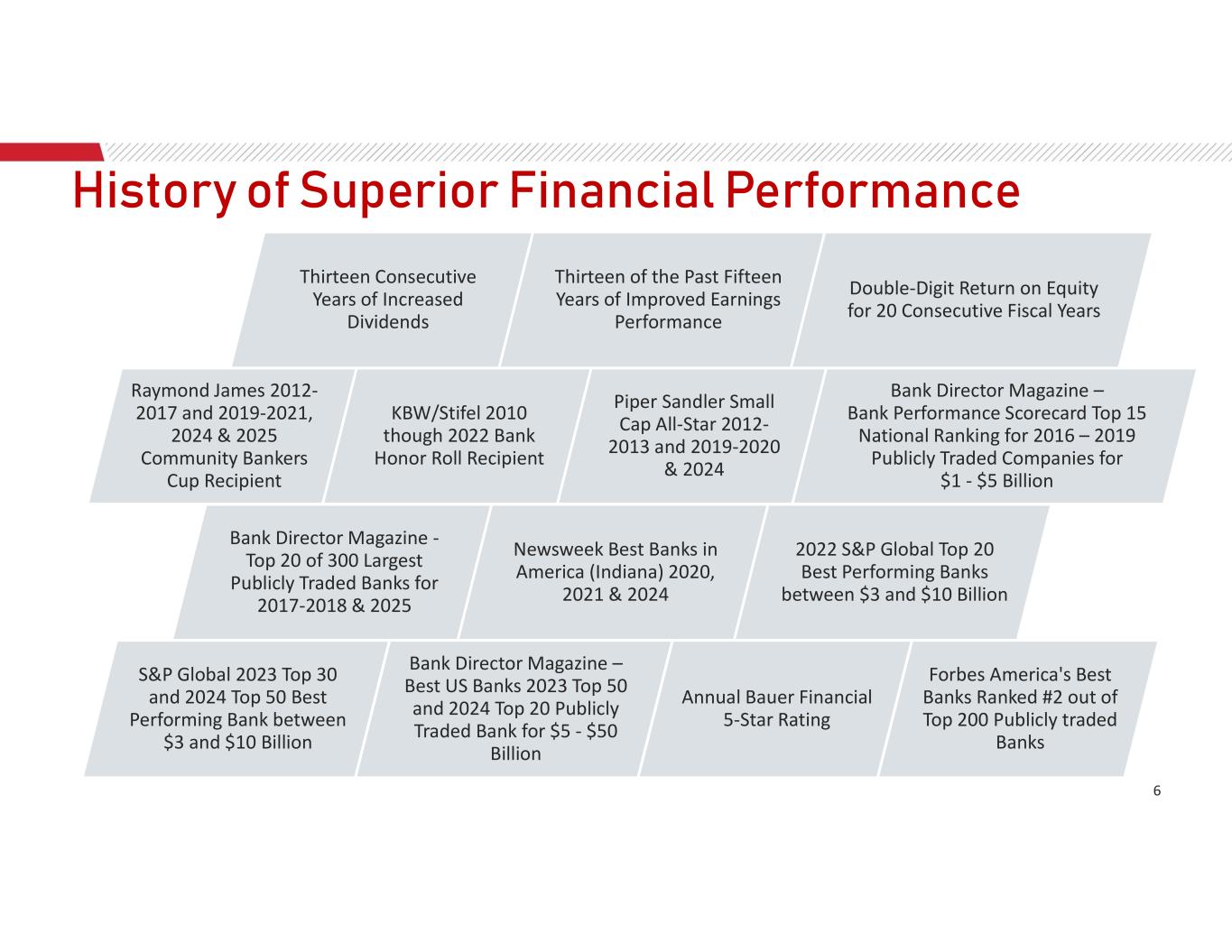

History of Superior Financial Performance 6 Bank Director Magazine - Top 20 of 300 Largest Publicly Traded Banks for 2017-2018 & 2025 Newsweek Best Banks in America (Indiana) 2020, 2021 & 2024 2022 S&P Global Top 20 Best Performing Banks between $3 and $10 Billion S&P Global 2023 Top 30 and 2024 Top 50 Best Performing Bank between $3 and $10 Billion Bank Director Magazine – Best US Banks 2023 Top 50 and 2024 Top 20 Publicly Traded Bank for $5 - $50 Billion Annual Bauer Financial 5-Star Rating Forbes America's Best Banks Ranked #2 out of Top 200 Publicly traded Banks Thirteen Consecutive Years of Increased Dividends Thirteen of the Past Fifteen Years of Improved Earnings Performance Double-Digit Return on Equity for 20 Consecutive Fiscal Years Raymond James 2012- 2017 and 2019-2021, 2024 & 2025 Community Bankers Cup Recipient KBW/Stifel 2010 though 2022 Bank Honor Roll Recipient Piper Sandler Small Cap All-Star 2012- 2013 and 2019-2020 & 2024 Bank Director Magazine – Bank Performance Scorecard Top 15 National Ranking for 2016 – 2019 Publicly Traded Companies for $1 - $5 Billion

FINANCIAL TRENDS 7

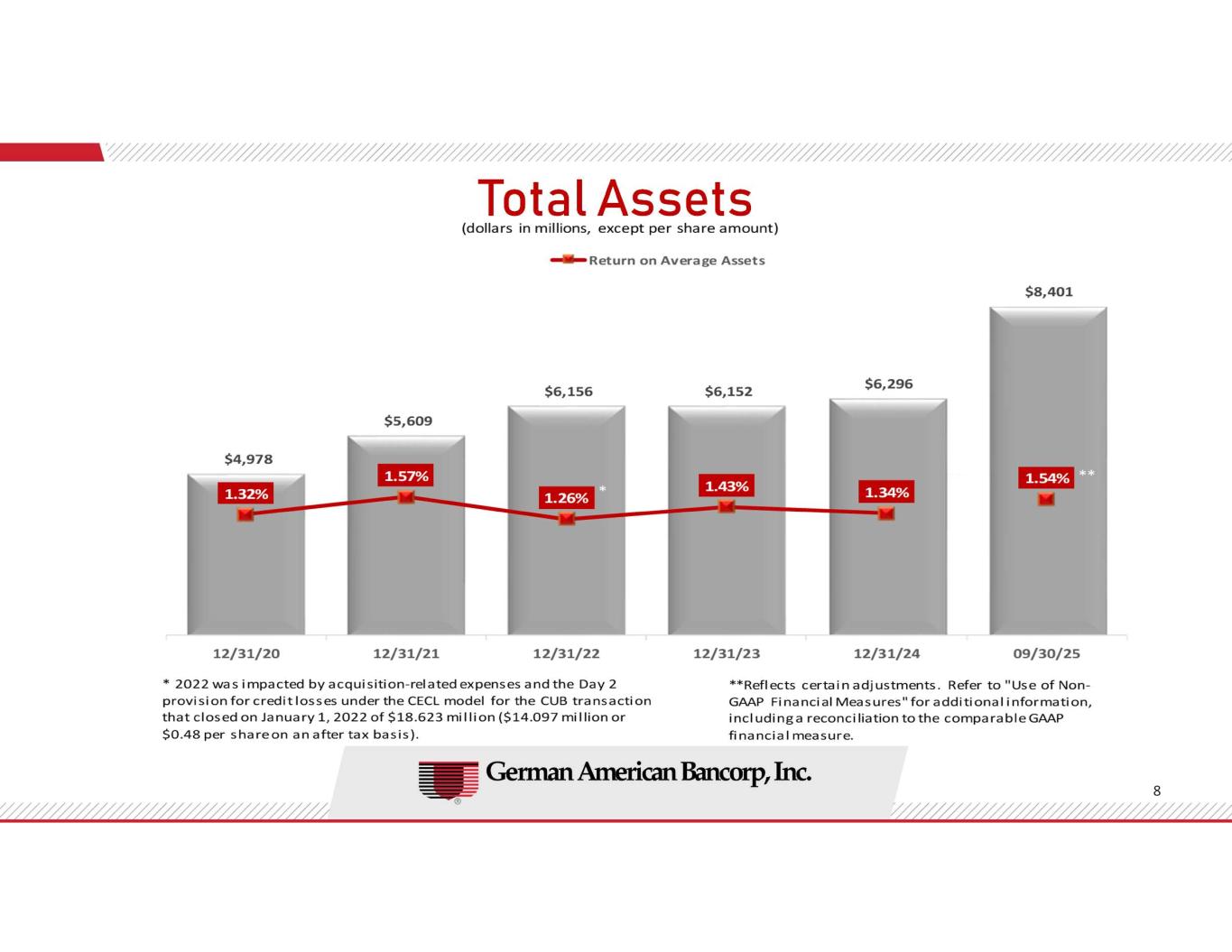

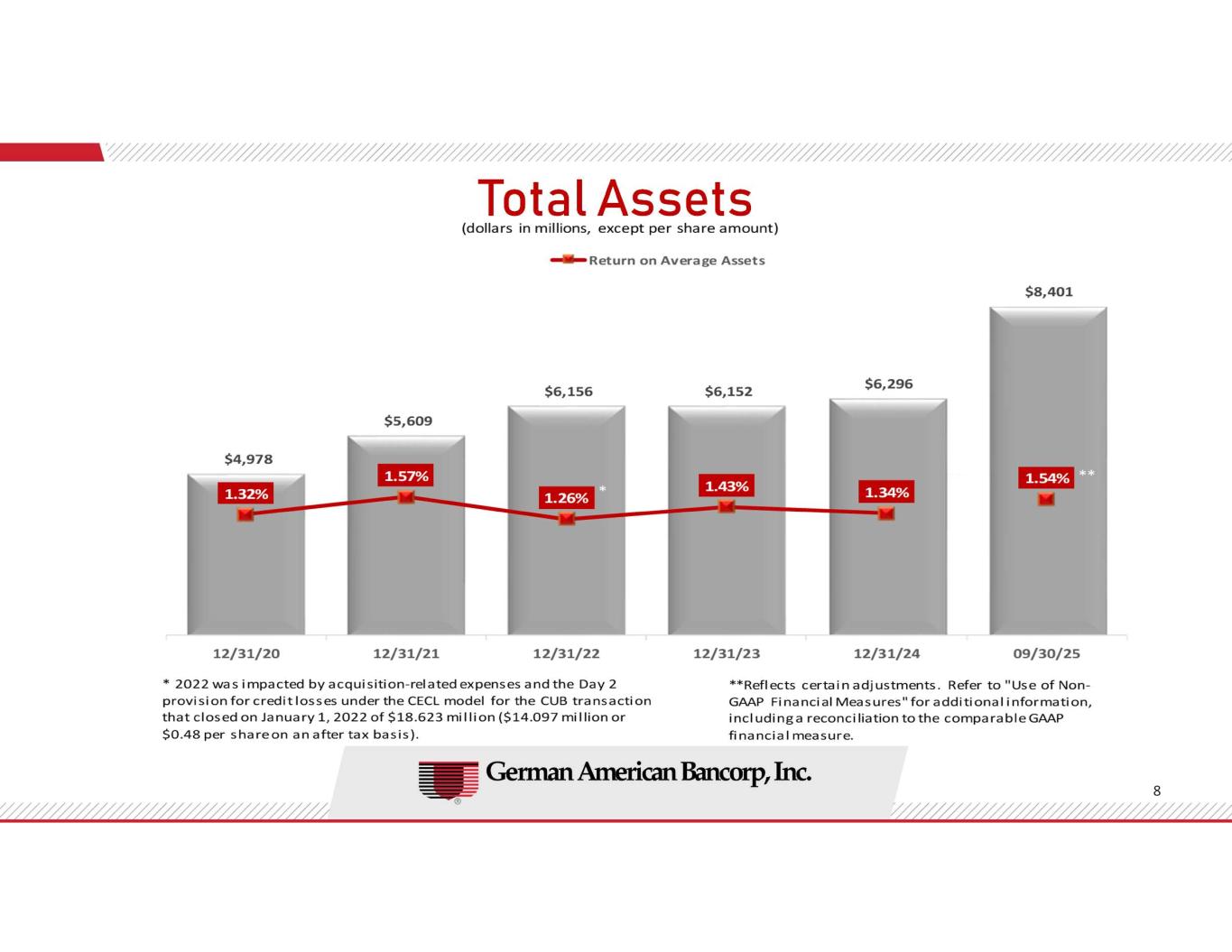

Total Assets 8

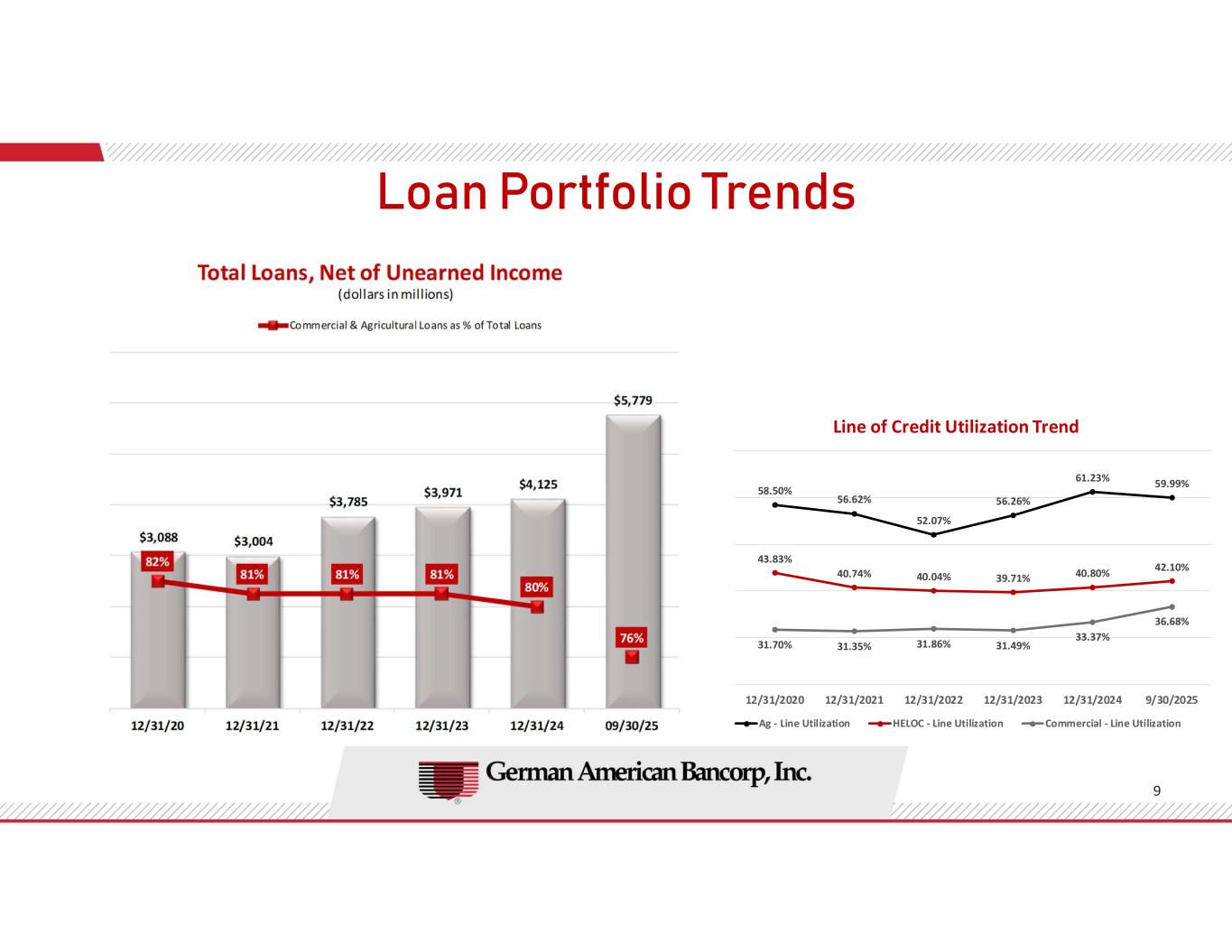

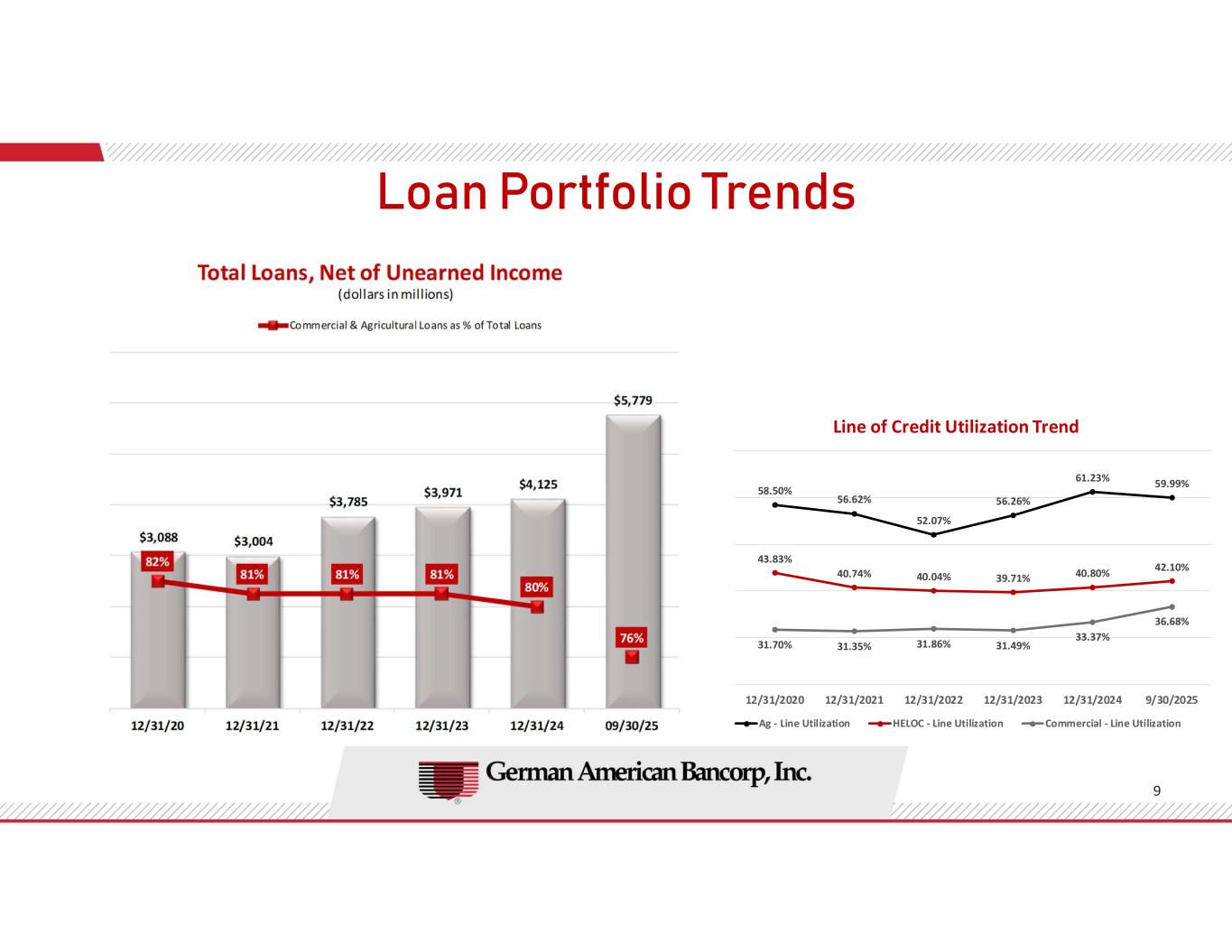

Loan Portfolio Trends 9 58.50% 56.62% 52.07% 56.26% 61.23% 59.99% 43.83% 40.74% 40.04% 39.71% 40.80% 42.10% 31.70% 31.35% 31.86% 31.49% 33.37% 36.68% 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 9/30/2025 Line of Credit Utilization Trend Ag - Line Utilization HELOC - Line Utilization Commercial - Line Utilization

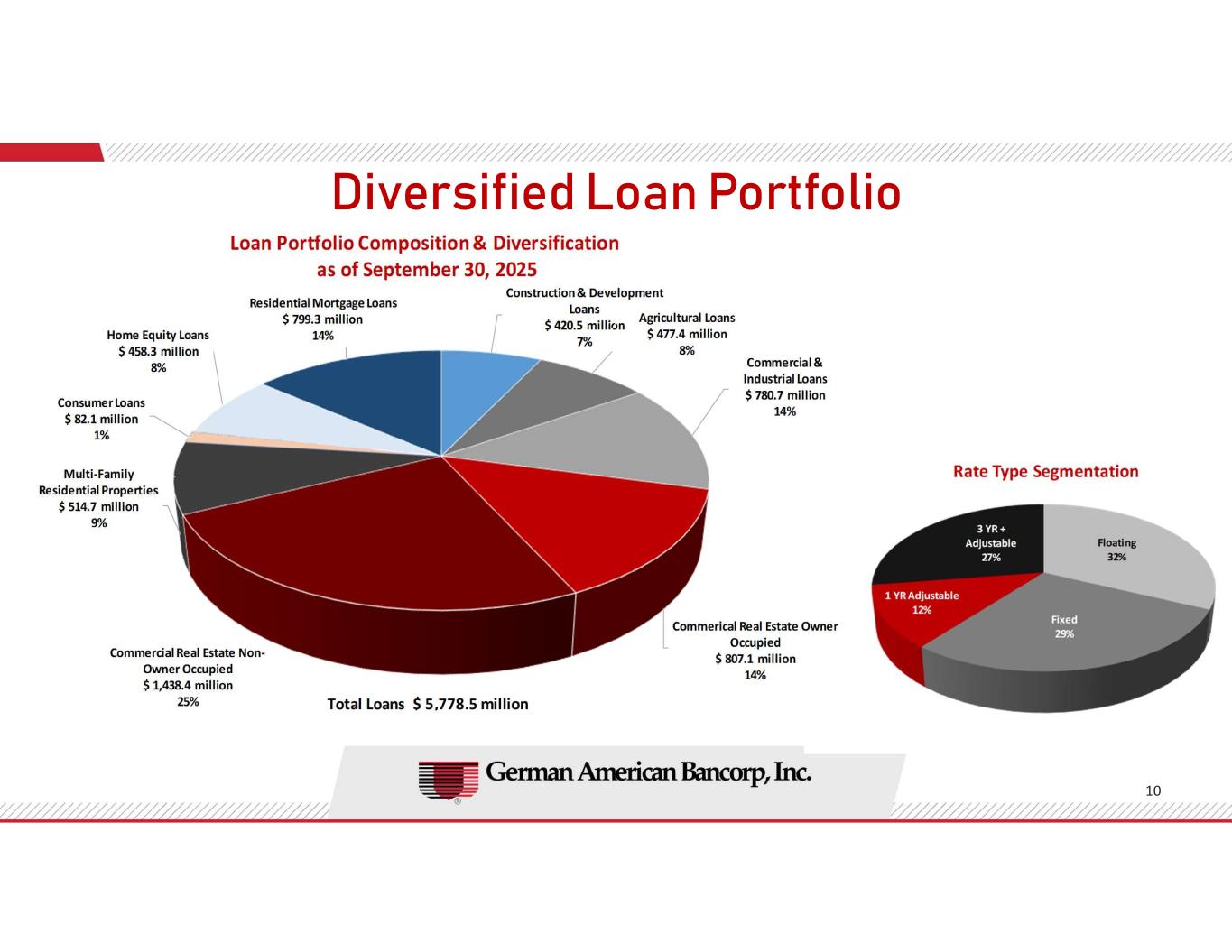

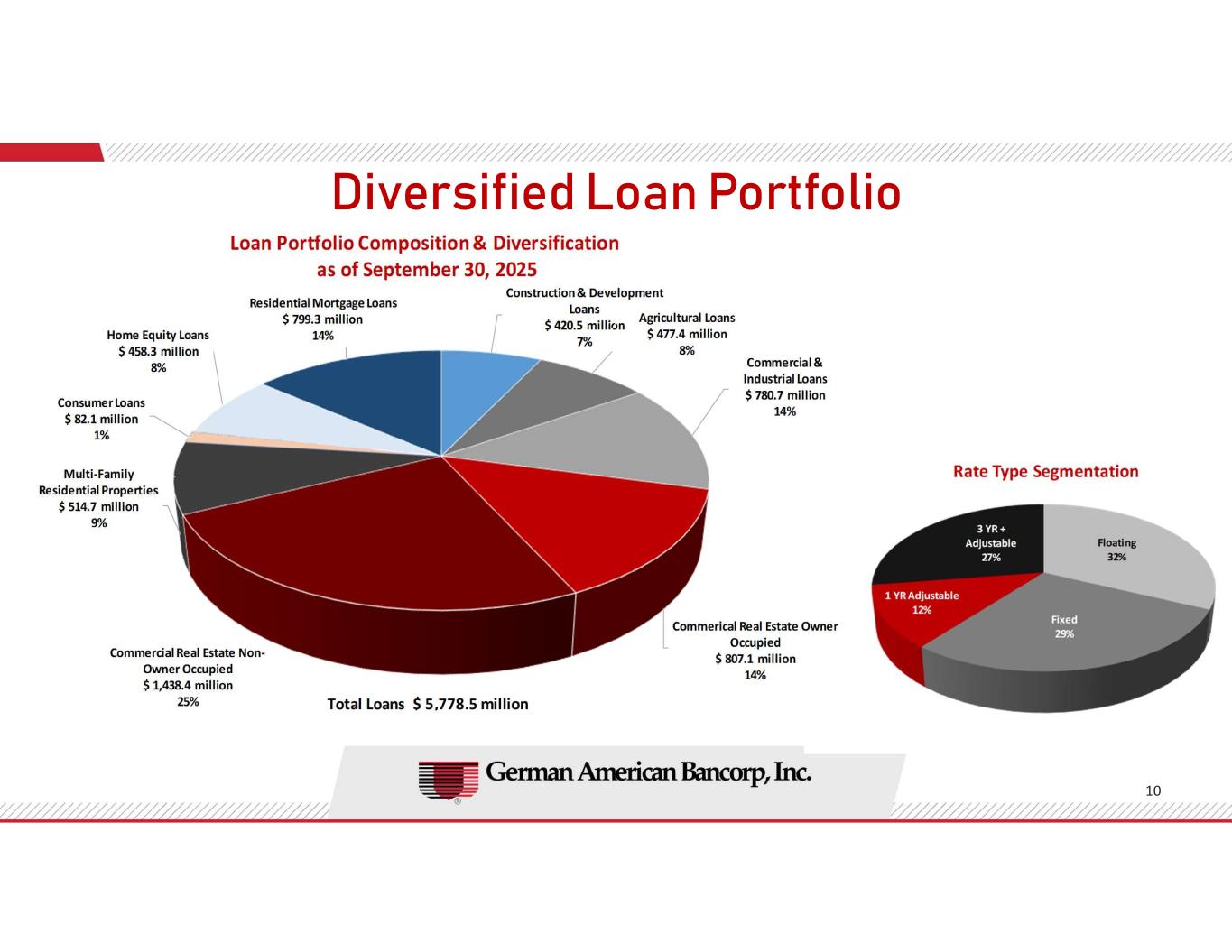

Diversified Loan Portfolio 10

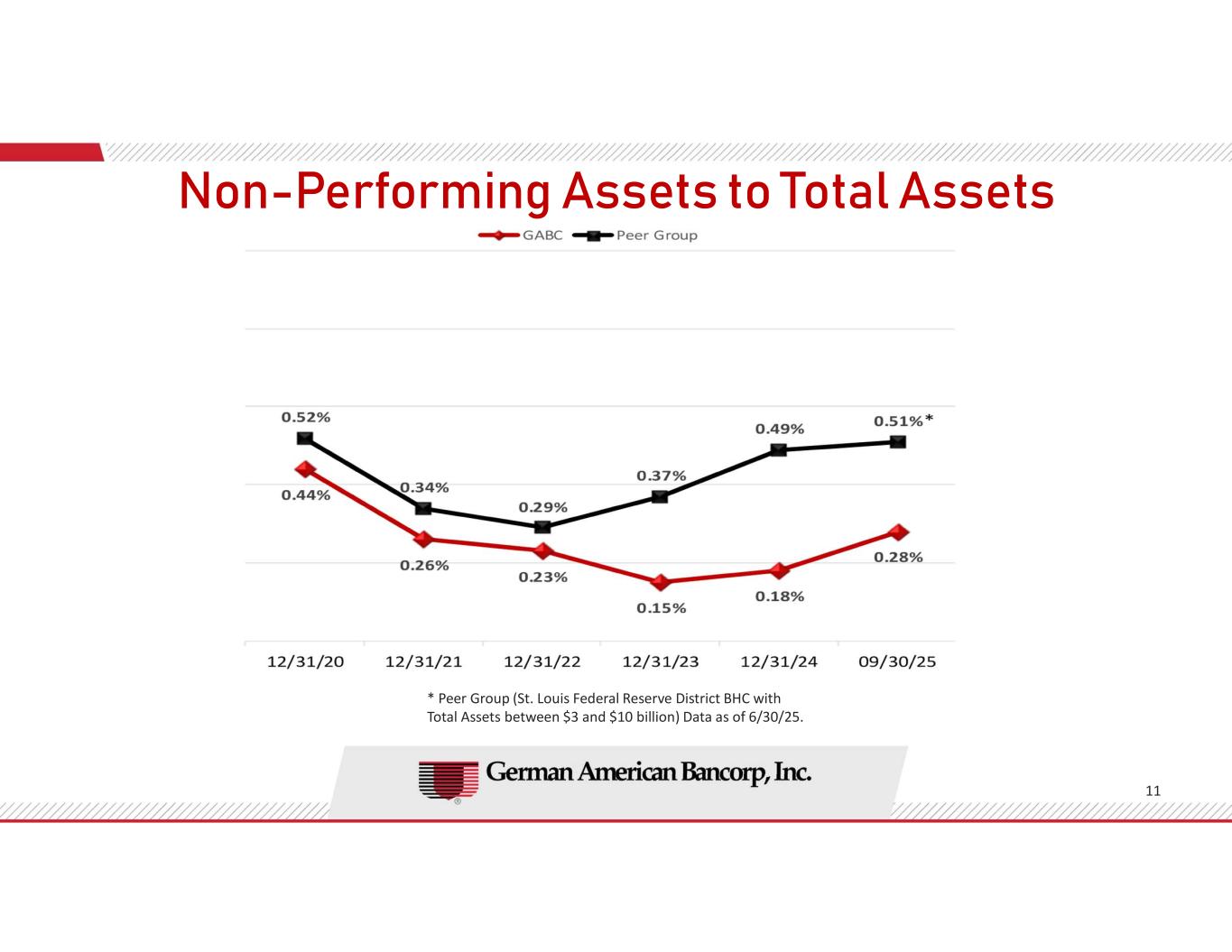

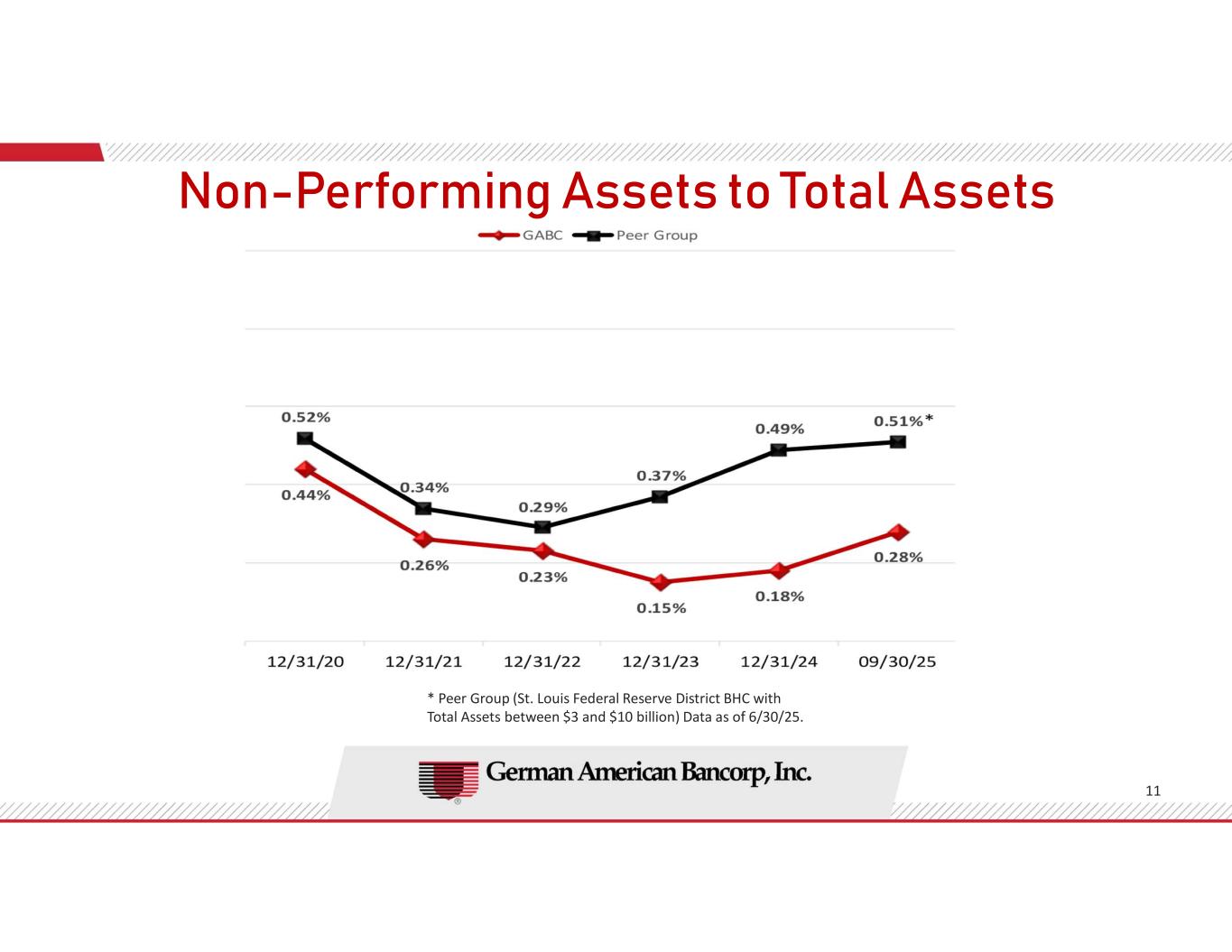

Non-Performing Assets to Total Assets 11 * Peer Group (St. Louis Federal Reserve District BHC with Total Assets between $3 and $10 billion) Data as of 6/30/25.

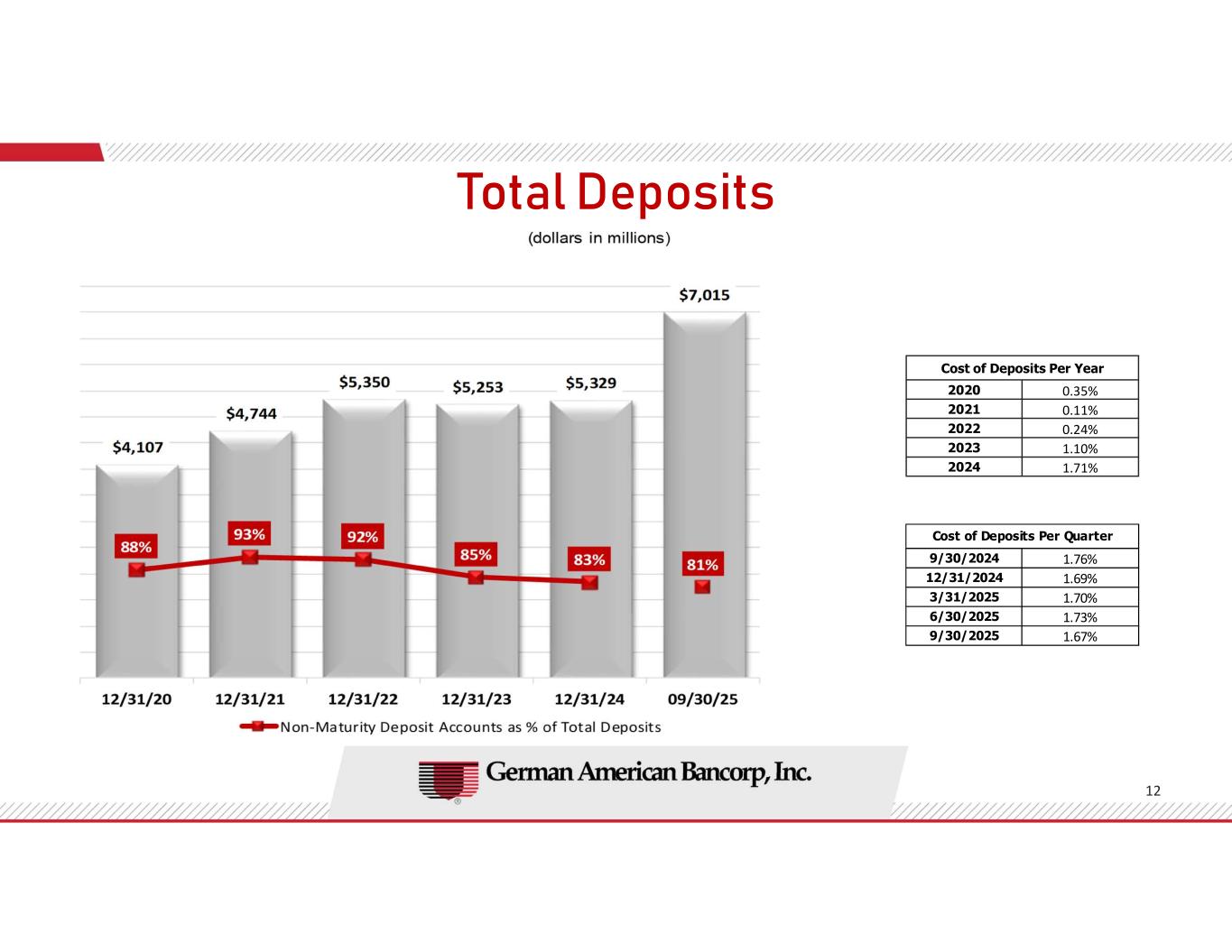

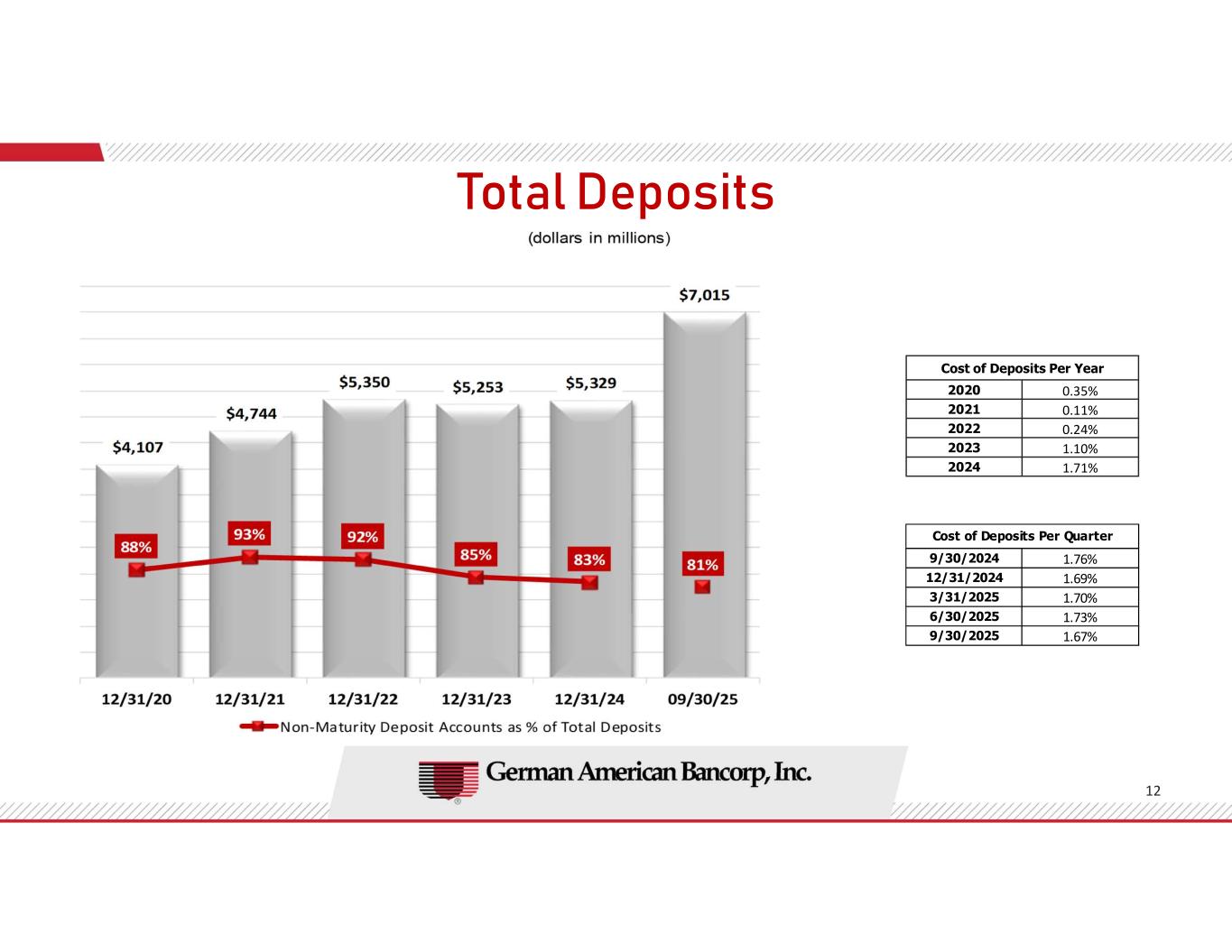

Total Deposits 12 Cost of Deposits Per Year 0.35%2020 0.11%2021 0.24%2022 1.10%2023 1.71%2024 9/30/2024 1.76% 12/31/2024 1.69% 3/31/2025 1.70% 6/30/2025 1.73% 9/30/2025 1.67% Cost of Deposits Per Quarter

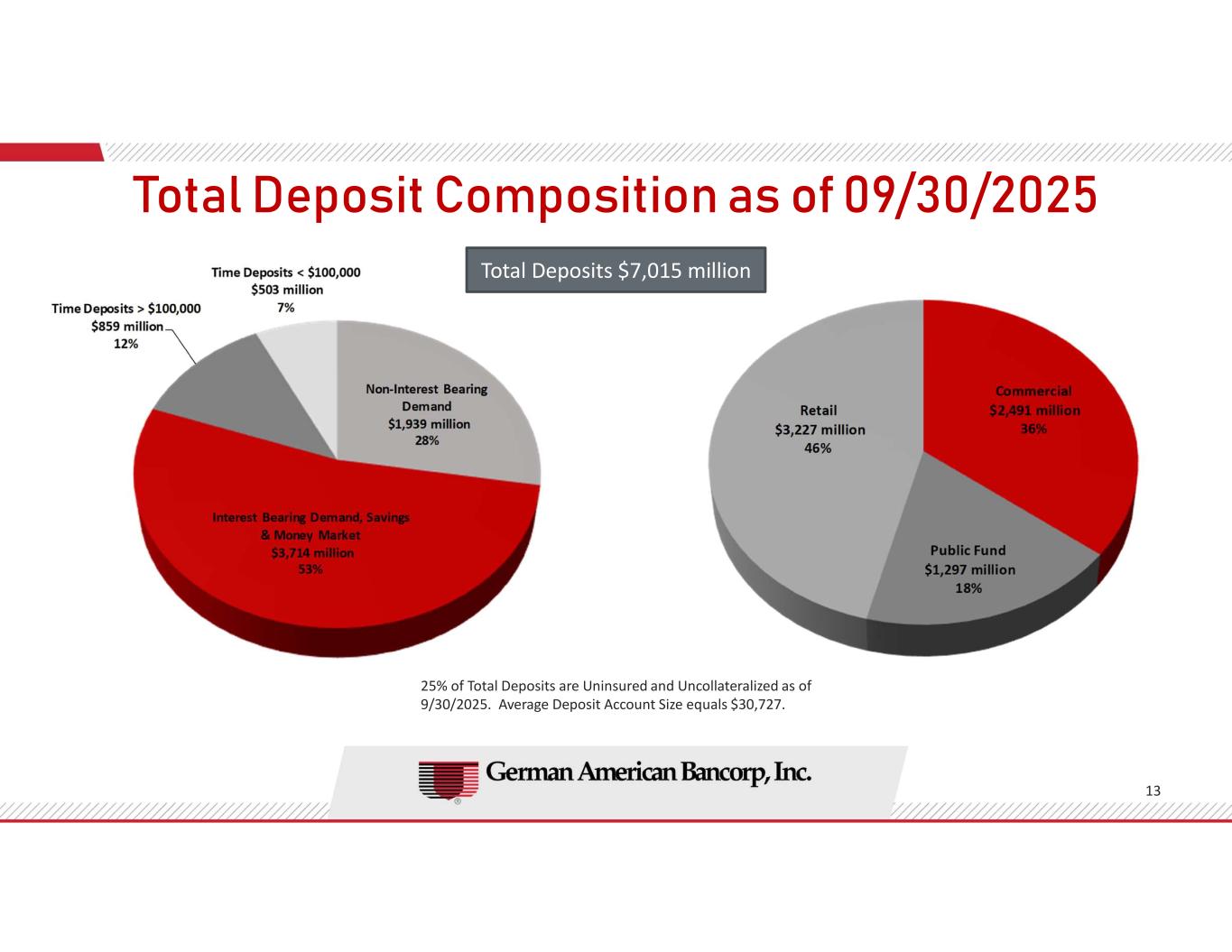

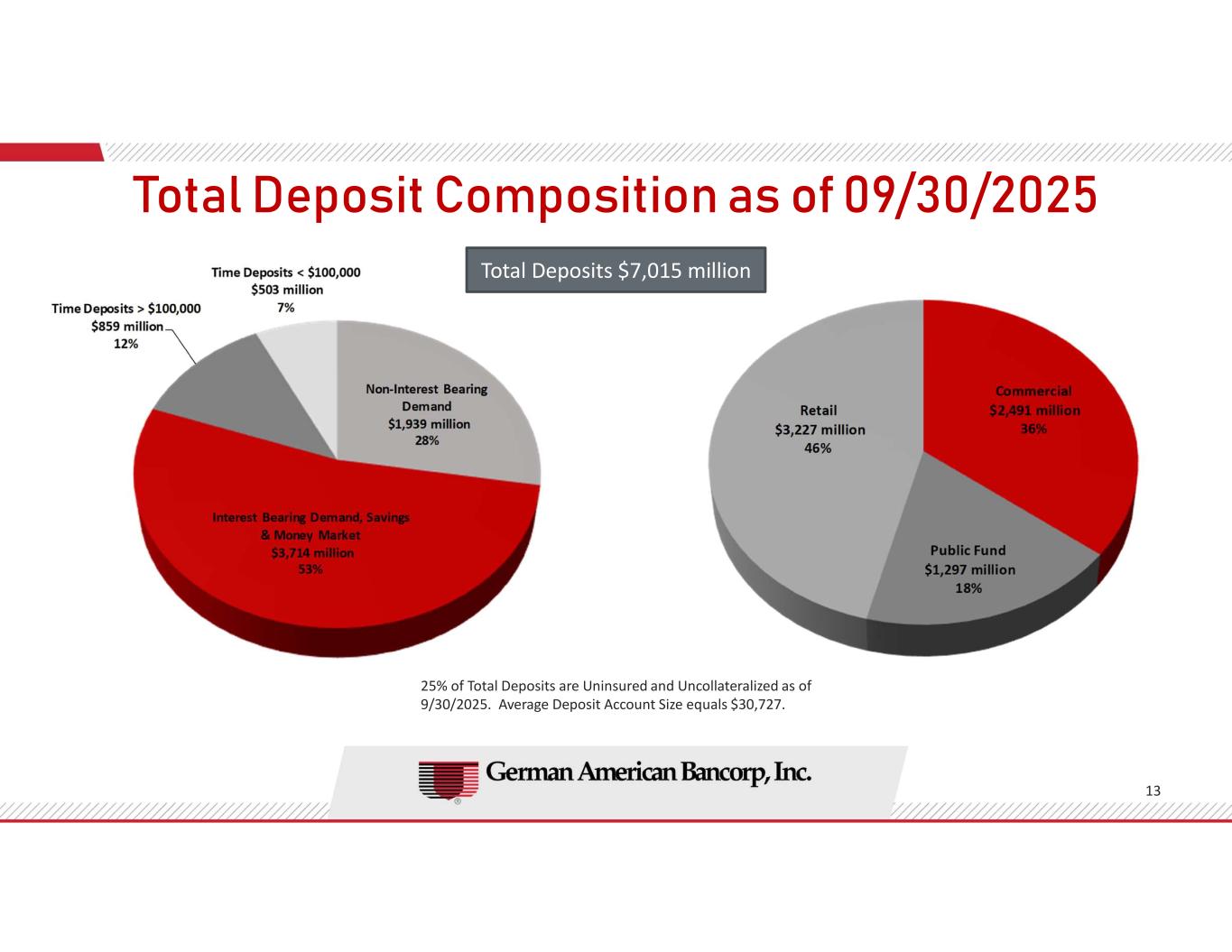

13 Total Deposit Composition as of 09/30/2025 Total Deposits $7,015 million 25% of Total Deposits are Uninsured and Uncollateralized as of 9/30/2025. Average Deposit Account Size equals $30,727.

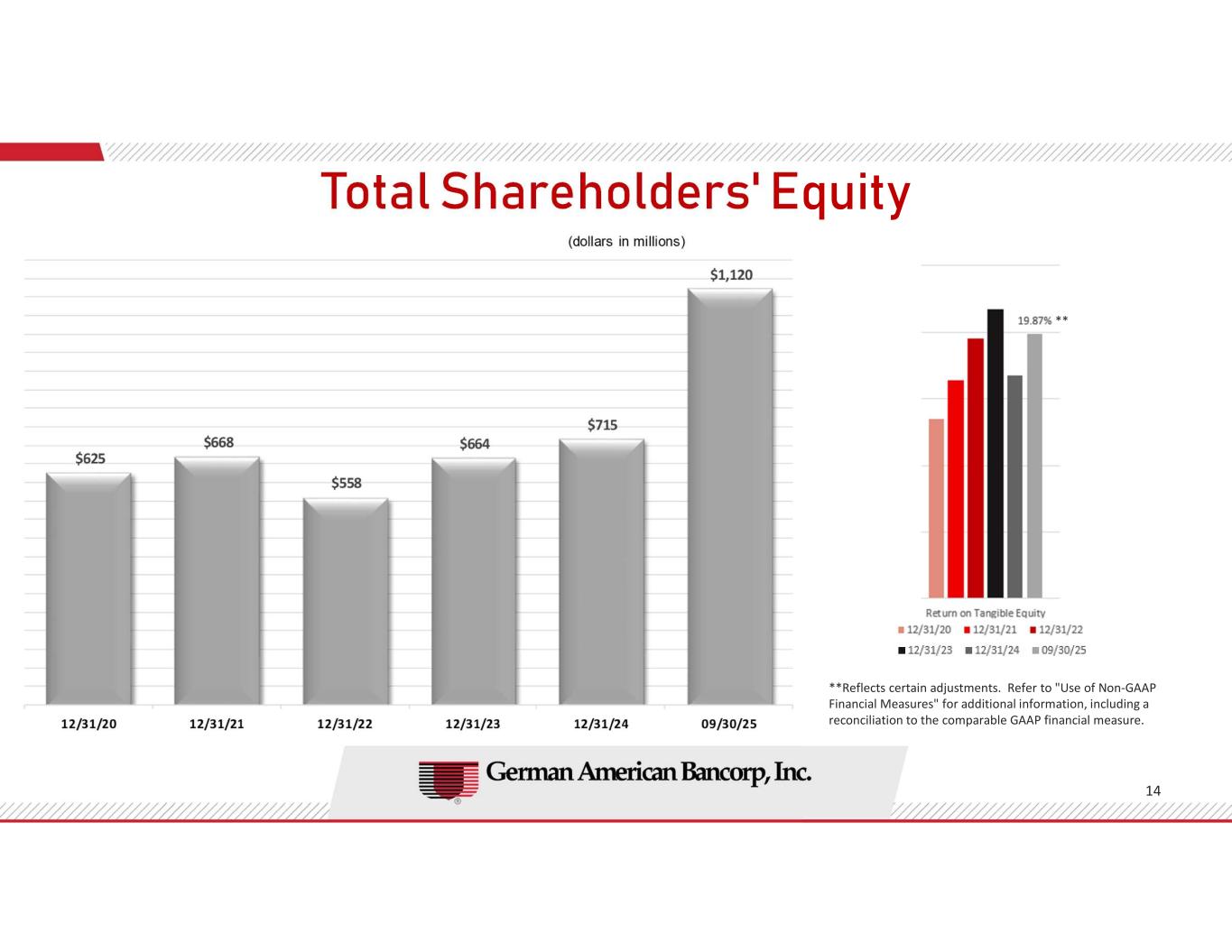

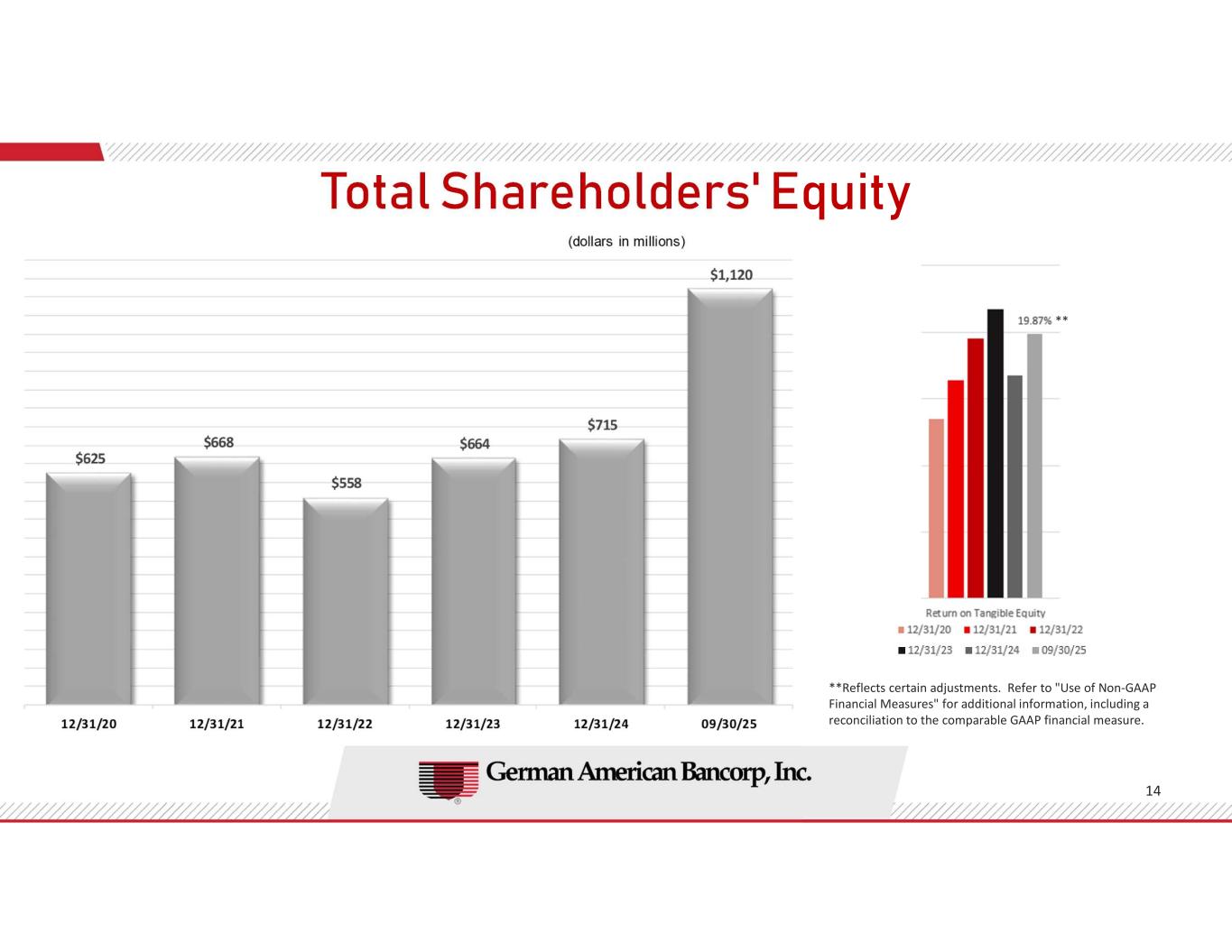

Total Shareholders' Equity 14 ** **Reflects certain adjustments. Refer to "Use of Non-GAAP Financial Measures" for additional information, including a reconciliation to the comparable GAAP financial measure.

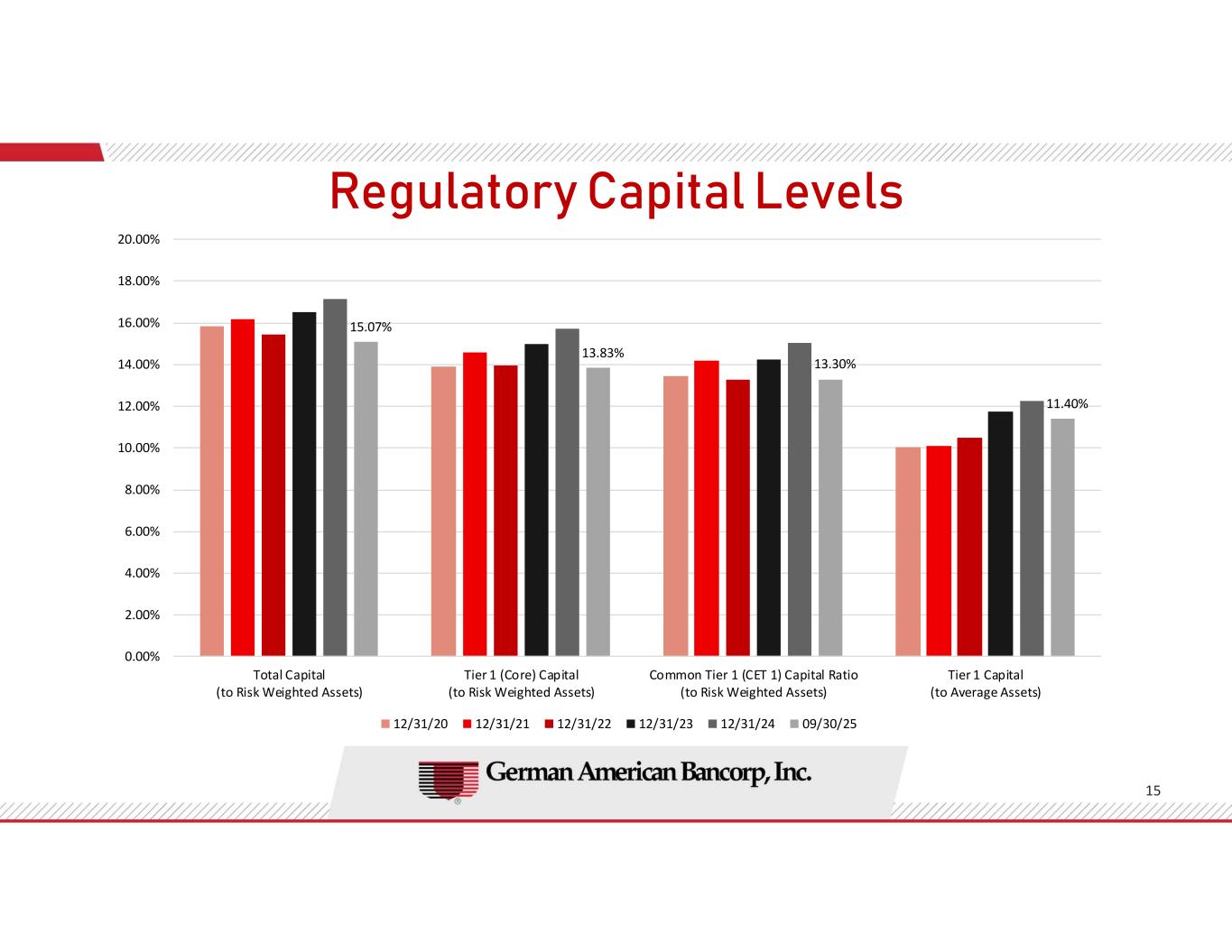

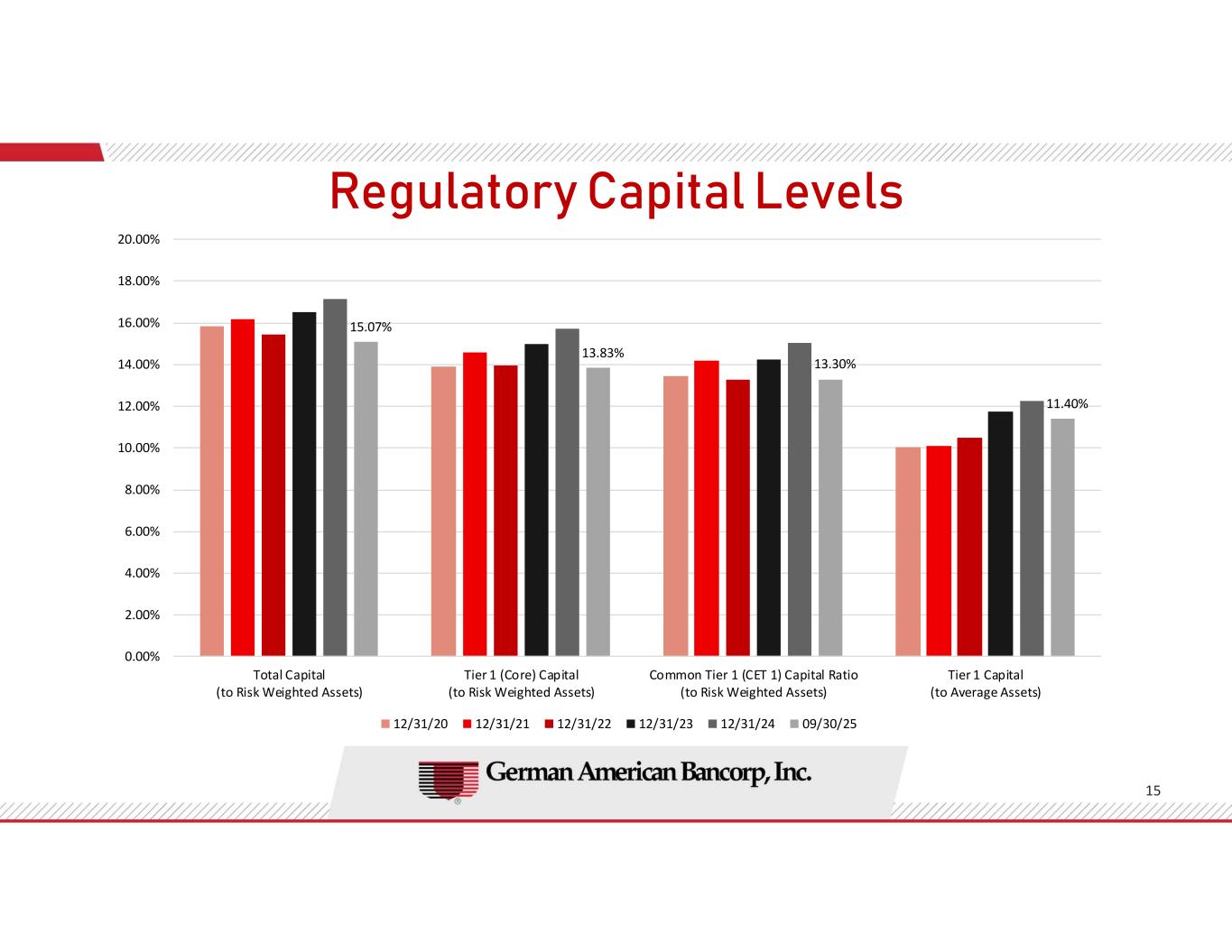

Regulatory Capital Levels 15 15.07% 13.83% 13.30% 11.40% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% Total Capital (to Risk Weighted Assets) Tier 1 (Core) Capital (to Risk Weighted Assets) Common Tier 1 (CET 1) Capital Ratio (to Risk Weighted Assets) Tier 1 Capital (to Average Assets) 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 09/30/25

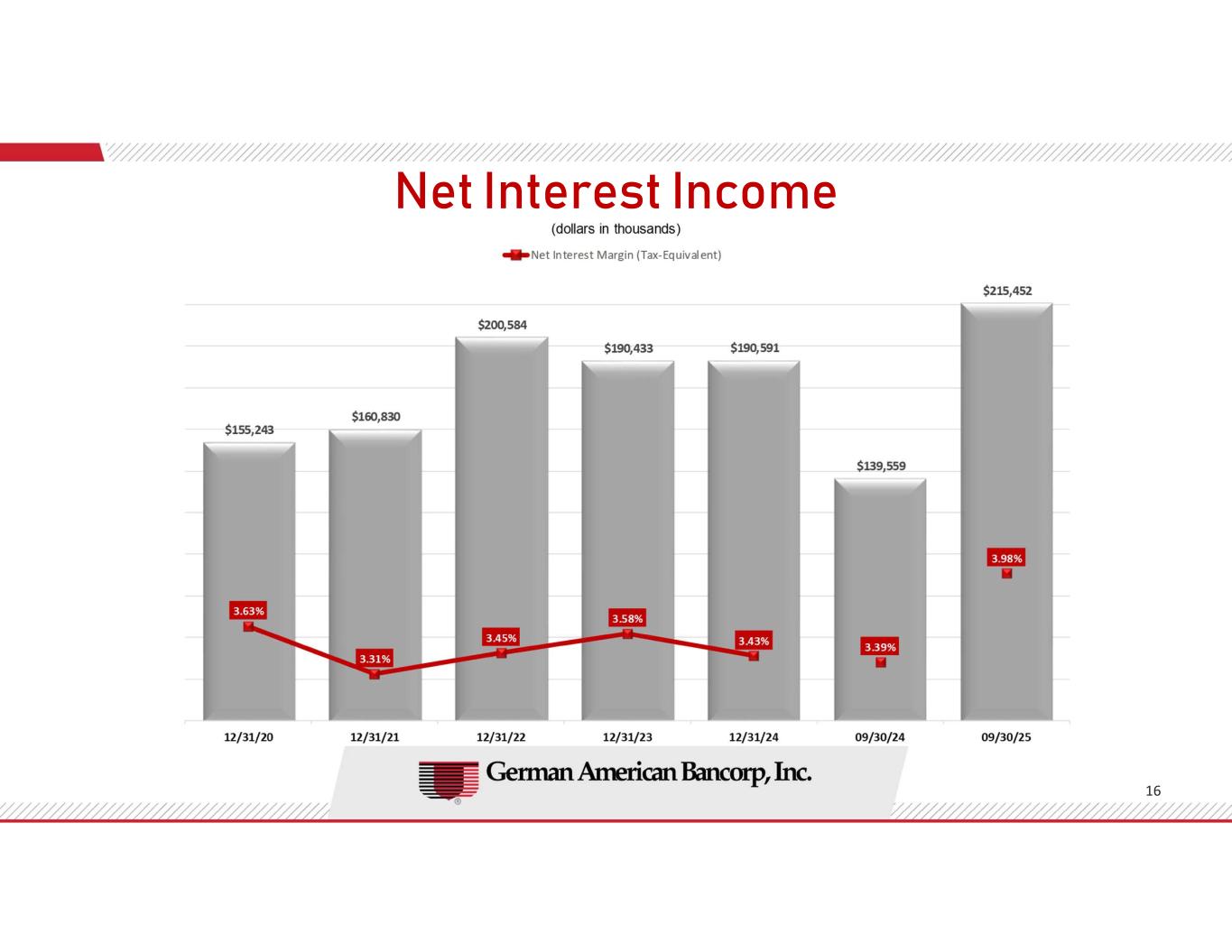

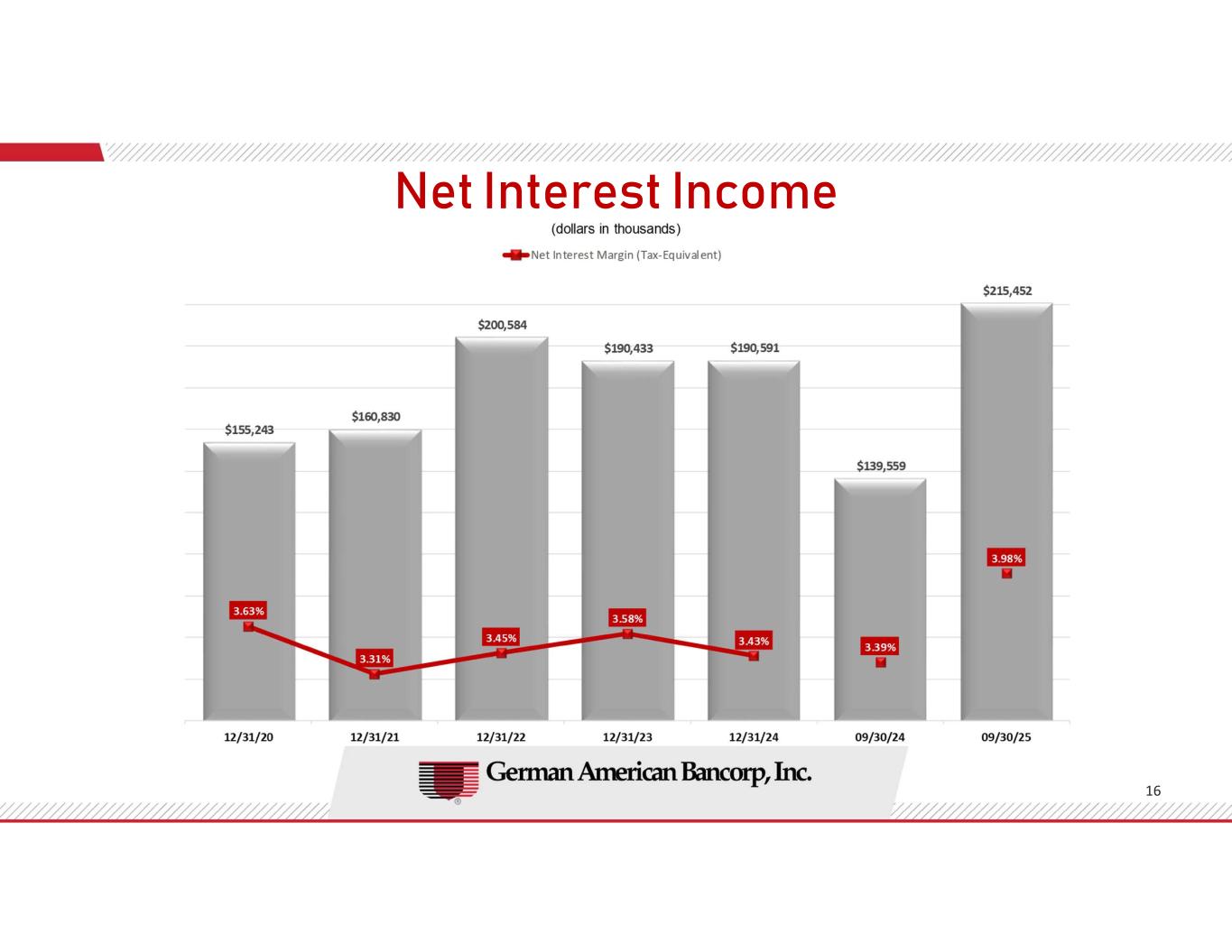

Net Interest Income 16

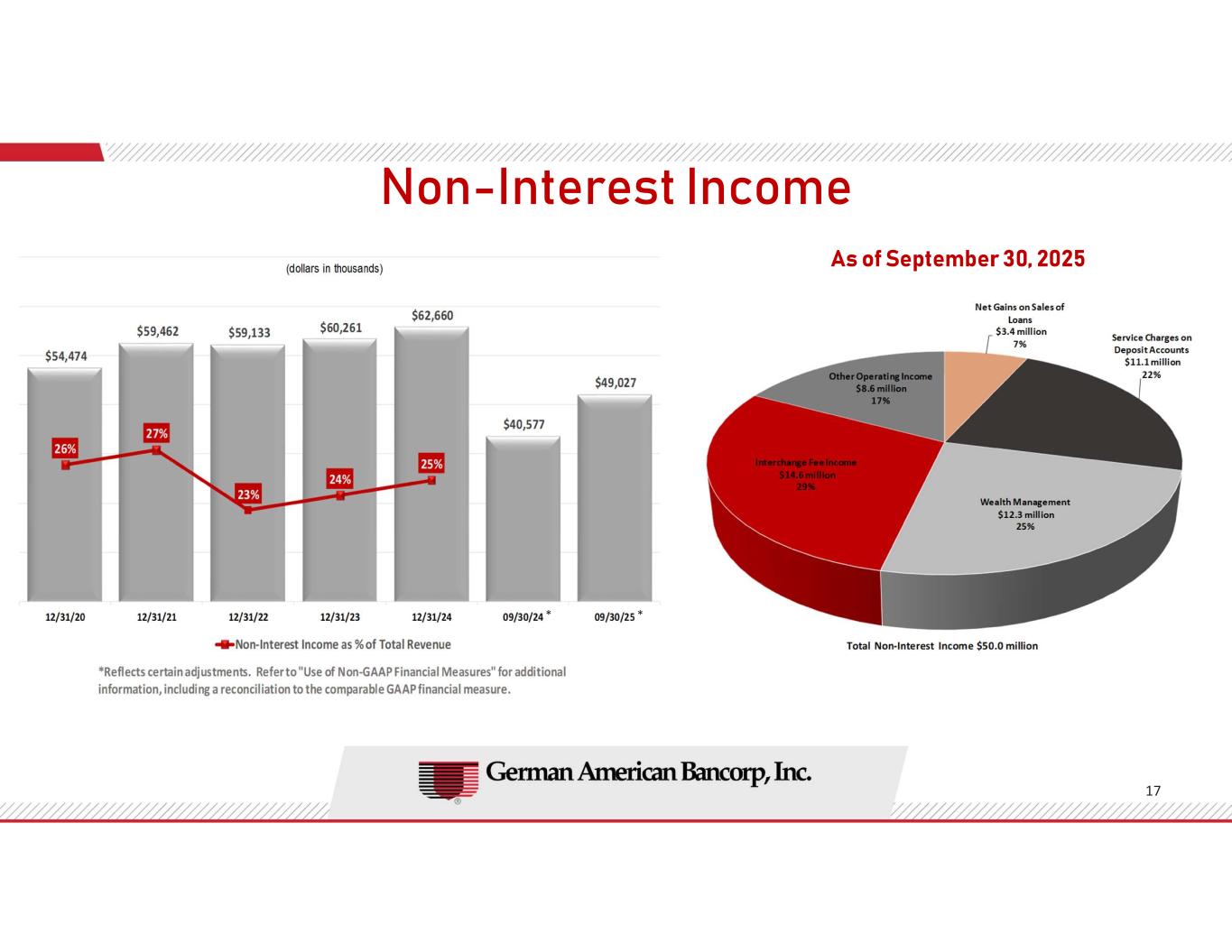

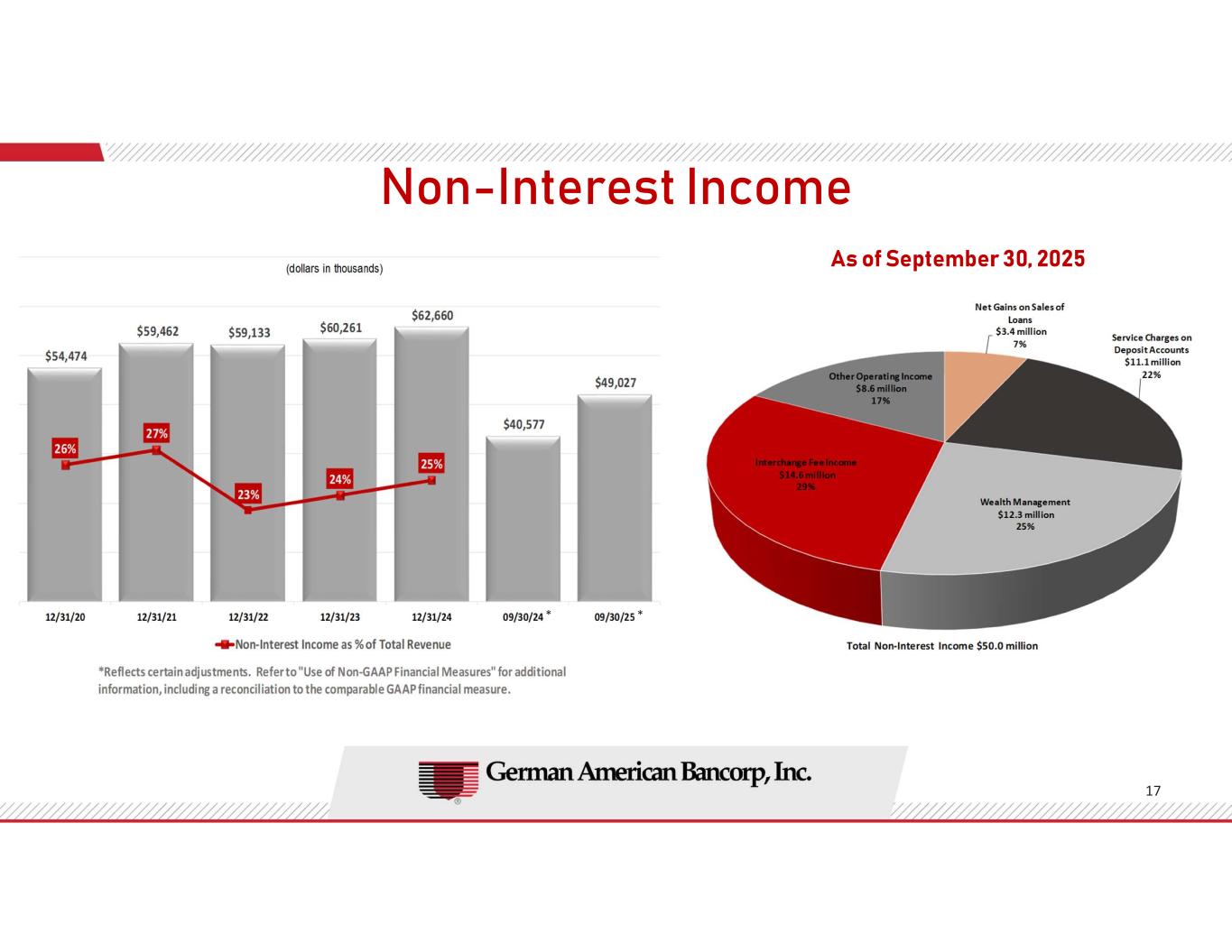

Non-Interest Income 17 As of September 30, 2025 **

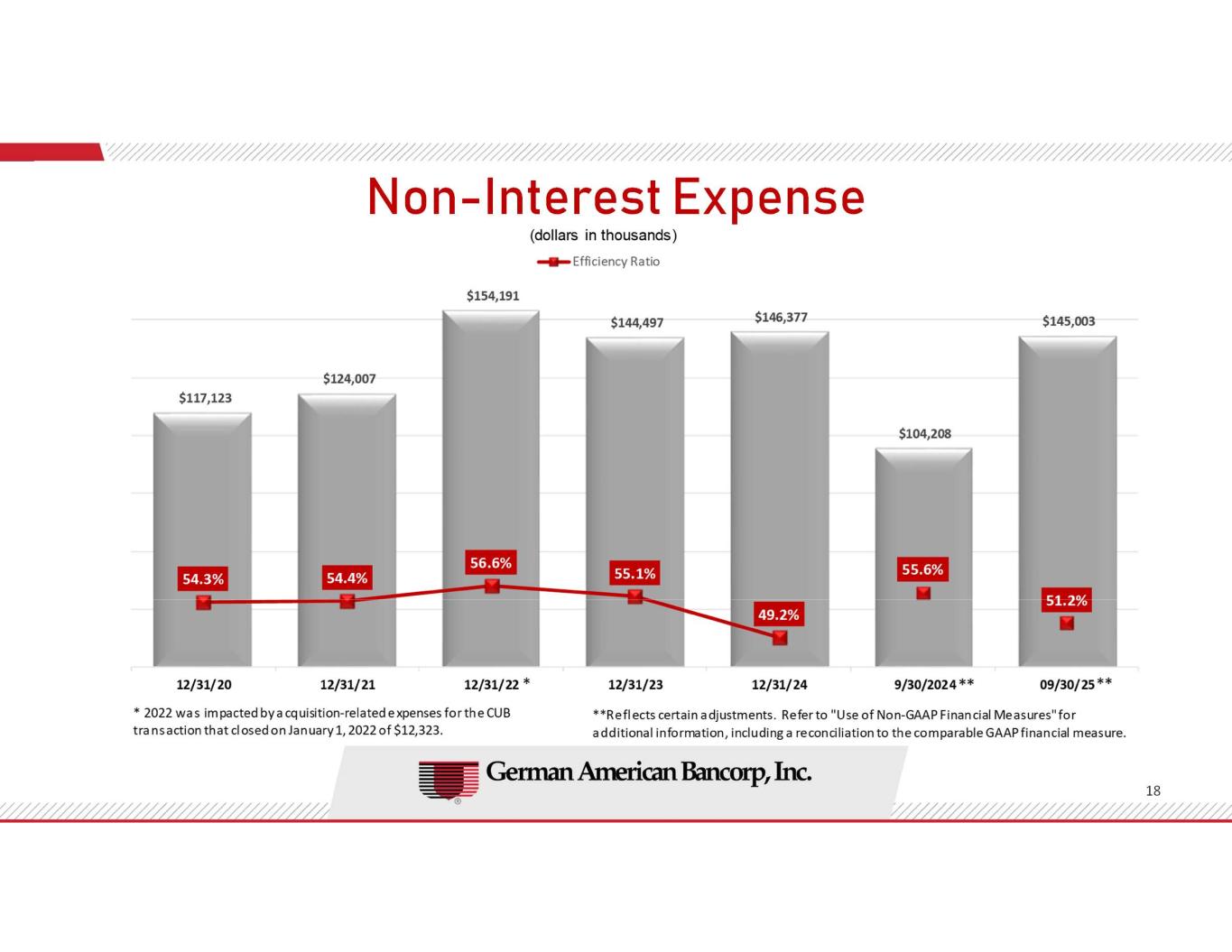

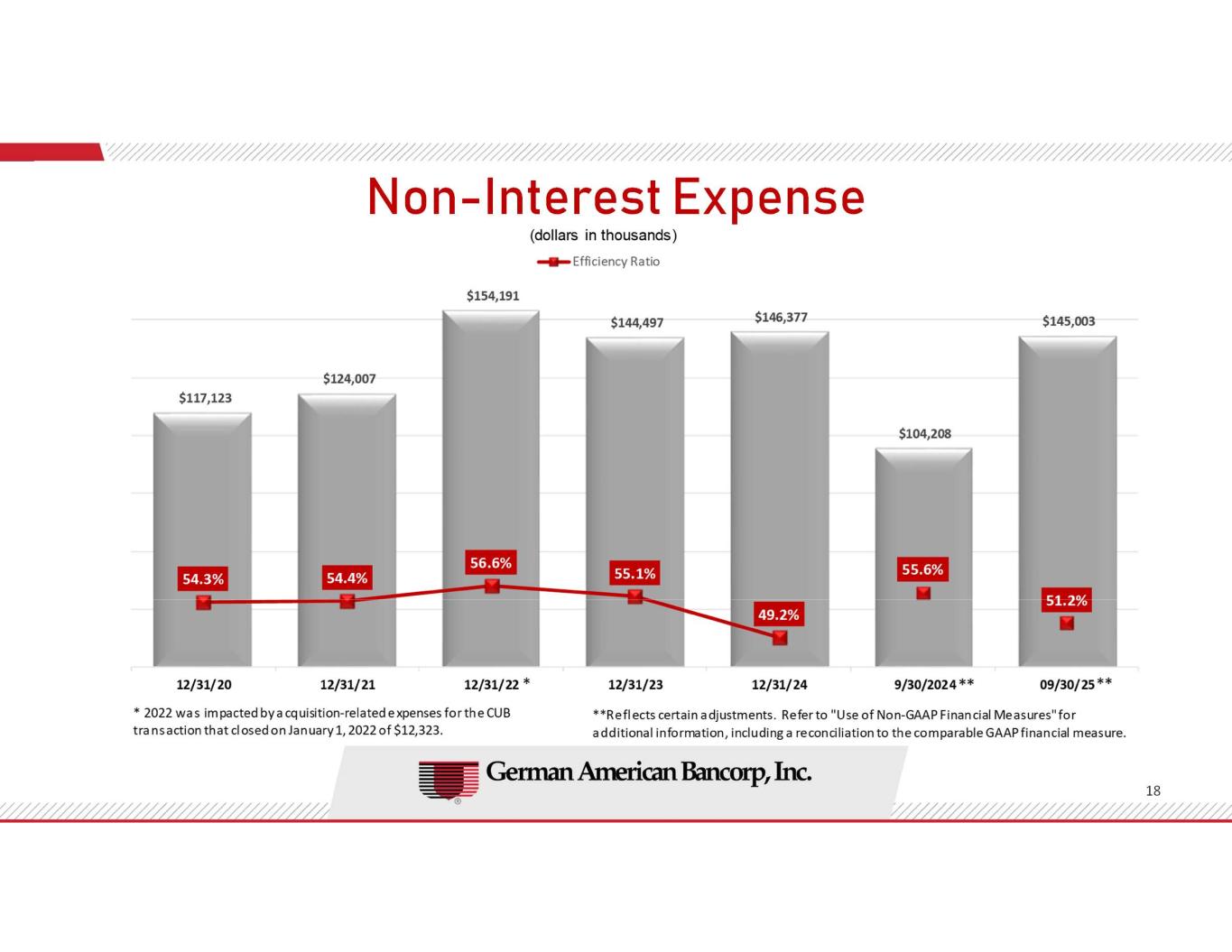

Non-Interest Expense 18

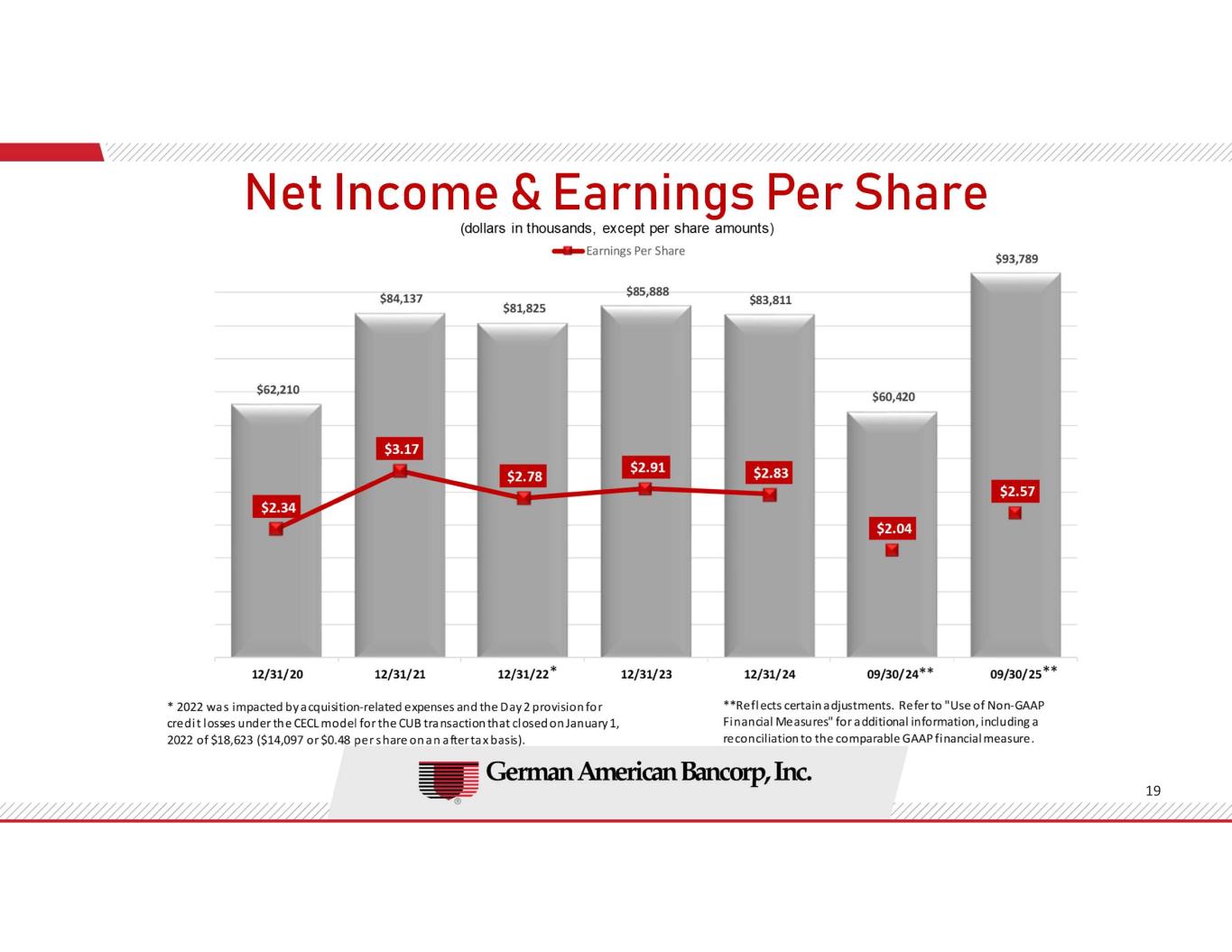

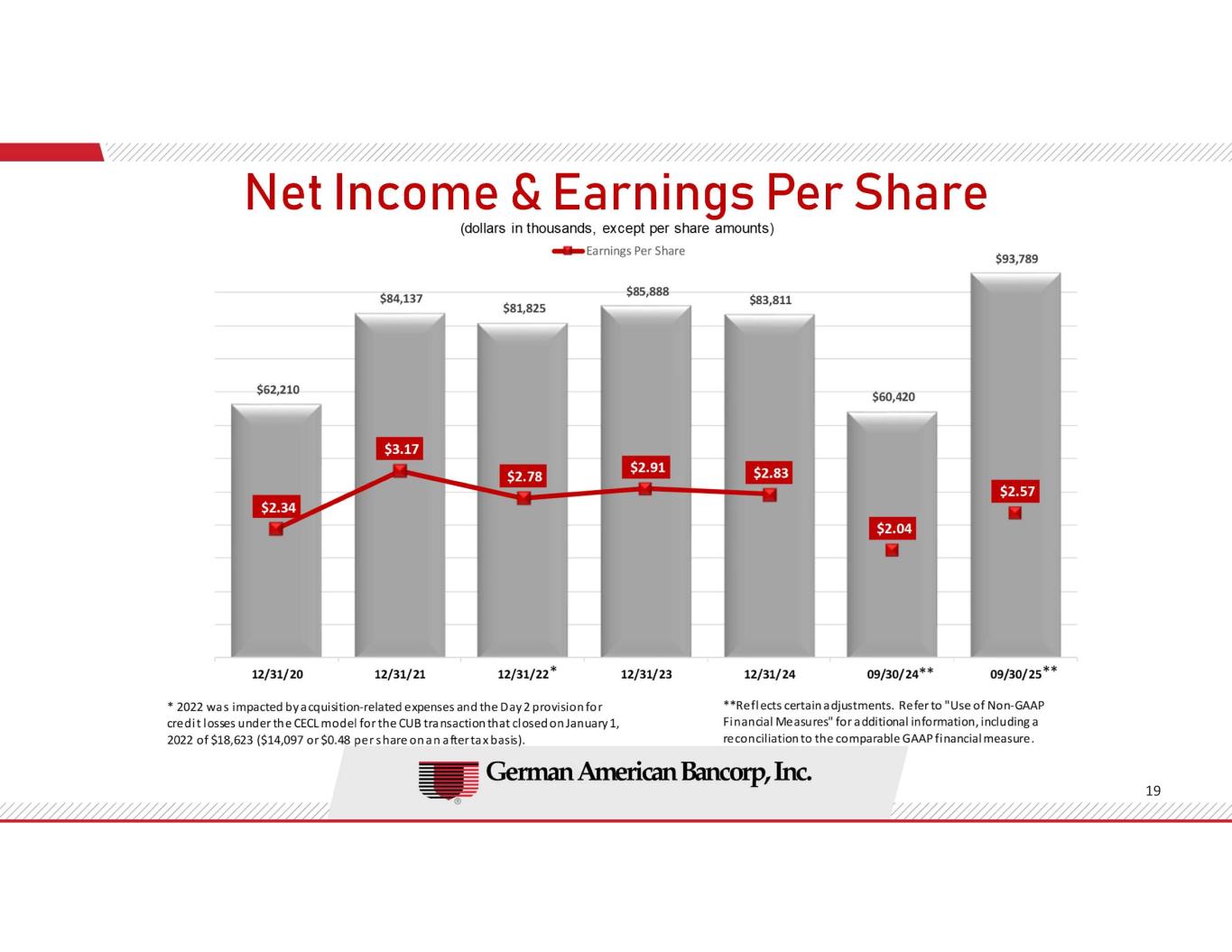

Net Income & Earnings Per Share 19

Why Invest in GABC? 20

Why Invest in GABC? 21

Why Invest in GABC? 22 Diversified Footprint of Rural, Suburban, and Urban Markets Providing a Strong Deposit Franchise Base Along with Significant Organic Growth Opportunities Existing Platform for Continuous Improvement and Operating Efficiency Infrastructure in Place for Perpetuating Ongoing EPS Growth Consistent Strong Dividend Yield and Dividend Pay-out Capacity Long Term Focus and Investment in Digital Optimization and Delivery Proven Executive Management Team Track Record of Consistent Top Quartile Financial Performance Experienced in Operating Plan Execution and M & A Transitions

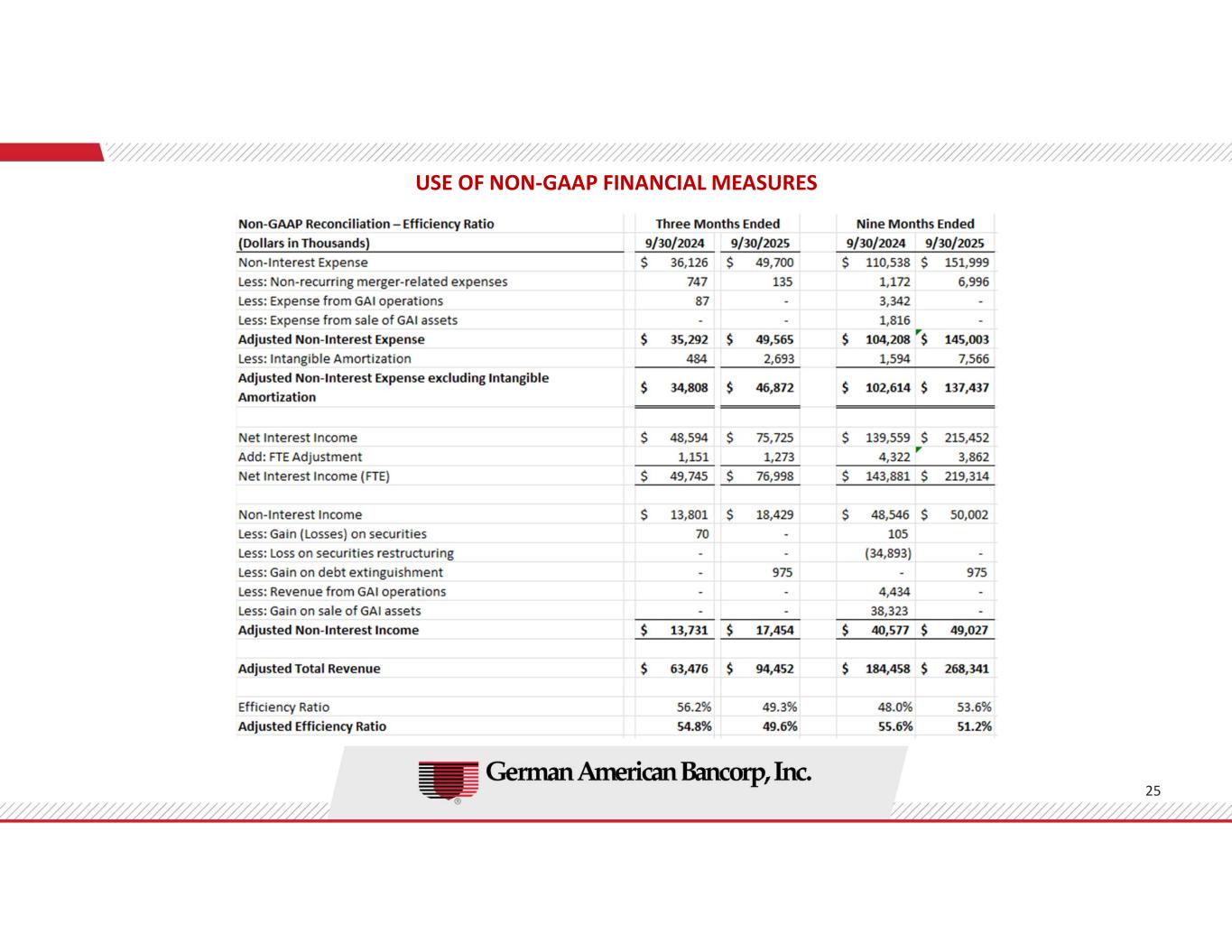

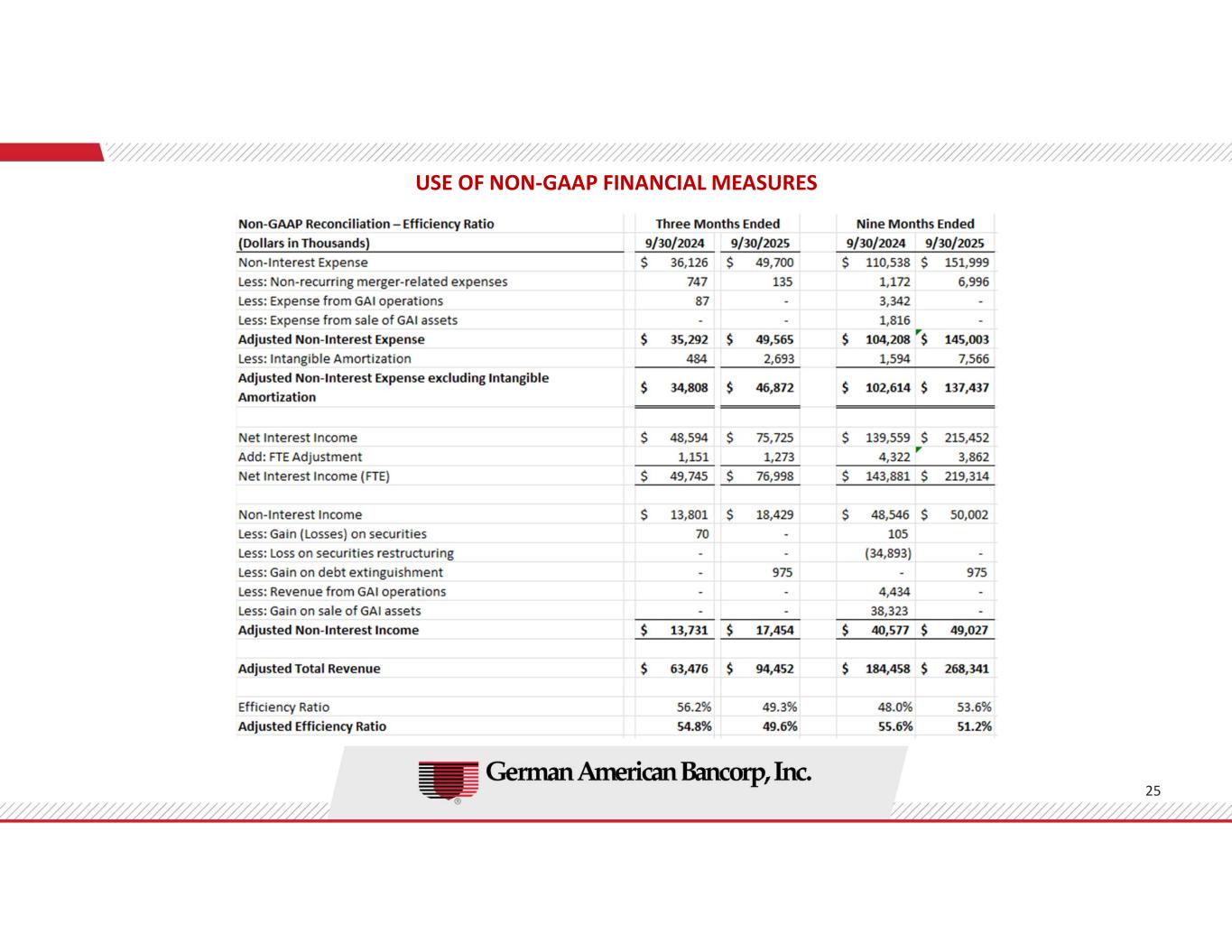

USE OF NON-GAAP FINANCIAL MEASURES The accounting and reporting policies of German American Bancorp, Inc. (the “Company”) conform to U.S. generally accepted accounting principles (“GAAP”) and general practices within the banking industry. As a supplement to GAAP, the Company has provided certain, non-GAAP financial measures, which it believes are useful because they assist investors in assessing the Company’s operating performance. Specifically, the Company has presented its net income, earnings per share, provision for credit losses, non-interest expense, non-interest income, efficiency ratio, and net interest margin on an as adjusted basis for the periods set forth below to reflect the exclusion of the following items: (1) the Current Expected Credit Losses (“CECL”) “Day 2” provision expense for acquired loans that have only insignificant credit deterioration (i.e., non-PCD loans) related to the Heartland merger; (2) non-recurring expenses related to the Heartland merger; (3) the gain on the extinguishment of debt resulting from the redemption of certain subordinated notes on September 15, 2025; (4) the operating results for German American Insurance, Inc. (“GAI”), whose assets were sold effective June 1, 2024; (5) the gain on the sale of GAI assets; and (6) the loss related to the securities portfolio restructuring transaction that occurred in the second quarter of 2024. Management believes excluding such items from these financial measures may be useful in assessing the Company’s underlying operational performance since the applicable transactions do not pertain to its core business operations and exclusion may facilitate better comparability between periods. In addition, management believes that by excluding such items the measures are useful to the Company, as well as analysts and investors, in assessing operating performance. Management also believes excluding these items may enhance comparability for peer comparison purposes. Management believes that it is standard practice in the banking industry to present the efficiency ratio and net interest margin on a fully tax- equivalent basis and that, by doing so, it may enhance comparability for peer comparison purposes. The tax-equivalent adjustment to net interest income (for purposes of the efficiency ratio) and net interest margin recognizes the income tax savings when comparing taxable and tax-exempt assets. Interest income and yields on tax-exempt securities and loans are presented using the current federal income tax rate of 21%. Although intended to enhance investors’ understanding of the Company’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. 23

USE OF NON-GAAP FINANCIAL MEASURES 24 Non-GAAP Reconciliation – Return on Average Assets (Dollars in Thousands) 9/30/2024 9/30/2025 9/30/2024 9/30/2025 Net Income, as reported $ 21,048 $ 35,074 $ 60,600 $ 76,952 Adjustments: Plus: CECL Day 2 non-PCD provision - - - 12,150 Plus: Non-recurring merger-related expenses 609 101 928 5,418 Less: Gain on debt extinguishment - 731 - 731 Less: Loss on securities restructuring - - (27,189) - Less: Income from GAI operations (65) - 821 - Less: Gain on sale of GAI assets - - 27,476 - Adjusted Net Income $ 21,722 $ 34,444 $ 60,420 $ 93,789 Average Assets $ 6,216,284 $ 8,350,565 $ 6,183,231 $ 8,137,211 Return on Average Assets, as reported 1.35% 1.68% 1.31% 1.26% Return on Average Assets, as adjusted 1.40% 1.65% 1.30% 1.54% Non-GAAP Reconciliation – Return on Tangible Equity (Dollars in Thousands) 9/30/2024 9/30/2025 9/30/2024 9/30/2025 Adjusted Net Income $ 21,722 $ 34,444 $ 60,420 $ 93,789 Average Equity, as reported $ 703,377 $ 1,079,359 $ 670,136 $ 1,020,200 Average Intangibles, as reported 183,805 415,666 185,130 390,701 Average Tangible Equity $ 519,572 $ 663,693 $ 485,006 $ 629,499 Return on Tangible Equity, as reported 16.20% 21.14% 16.66% 16.30% Return on Tangible Equity, as adjusted 16.72% 20.76% 16.61% 19.87% Nine Months Ended Nine Months Ended Three Months Ended Three Months Ended

USE OF NON-GAAP FINANCIAL MEASURES 25

USE OF NON-GAAP FINANCIAL MEASURES 26

27