Symbol: GABC September 3, 2025 Raymond James Conference German American 1 Scan for electronic presentation

Presented By D. Neil Dauby, Chairman and Chief Executive Officer (812) 482-0707 neil.dauby@germanamerican.com Bradley M. Rust, President and CFO (812) 482-0718 brad.rust@germanamerican.com 2

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS When used in this presentation and our oral statements, the words or phrases “believe,” “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation, and we do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur in the future. By their nature, these statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated in the statements. Factors that could cause actual results and performance to vary materially from those expressed or implied by any forward-looking statement include those that are discussed in Item 1, “Business – Forward Looking Statements and Associated Risk,” and Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for 2024 as updated and supplemented by our other SEC reports filed from time to time. 3

Indiana, Kentucky & Ohio Community-focused Financial Services Organization Who We Are 4 $8.3 Billion Total Banking Assets $3.8 Billion Investment & Trust Assets Under Management ~1050 Team Members 94 Banking Offices in Indiana, Kentucky & Ohio

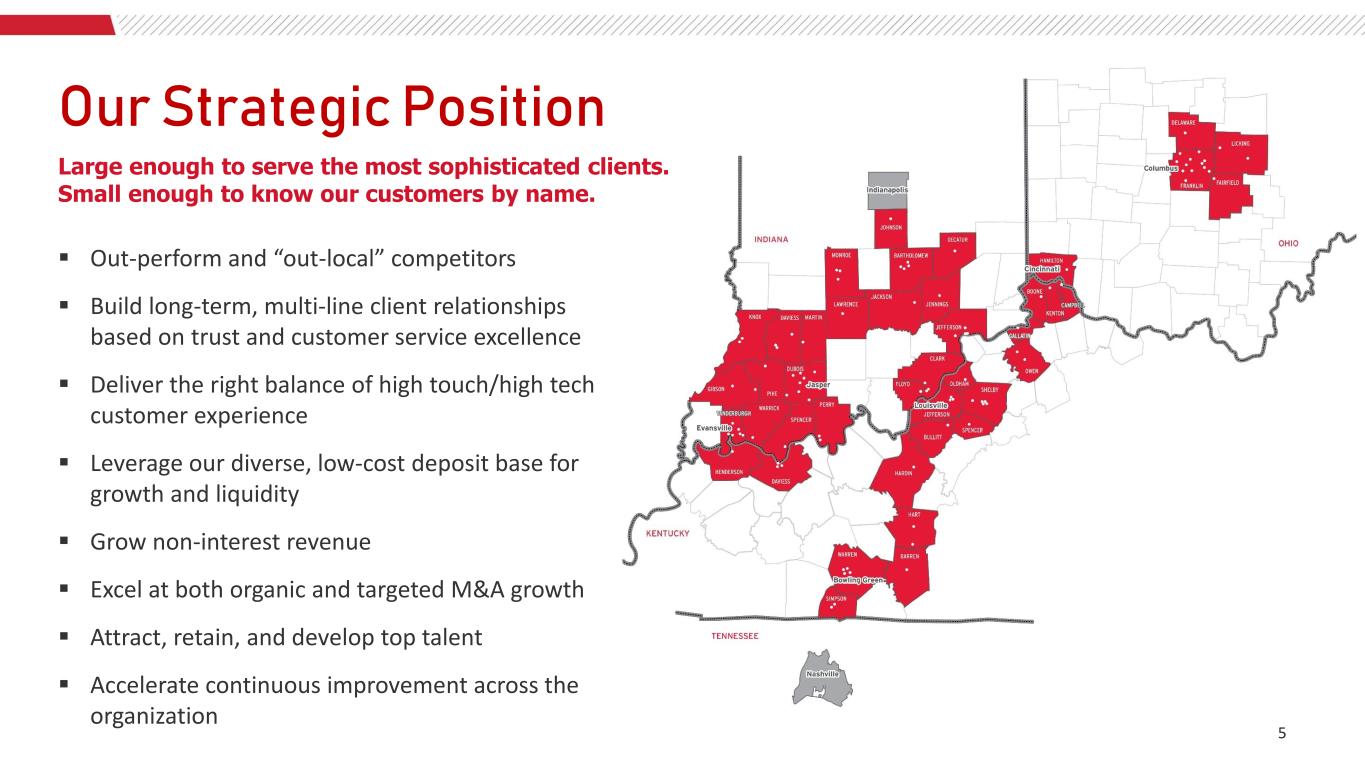

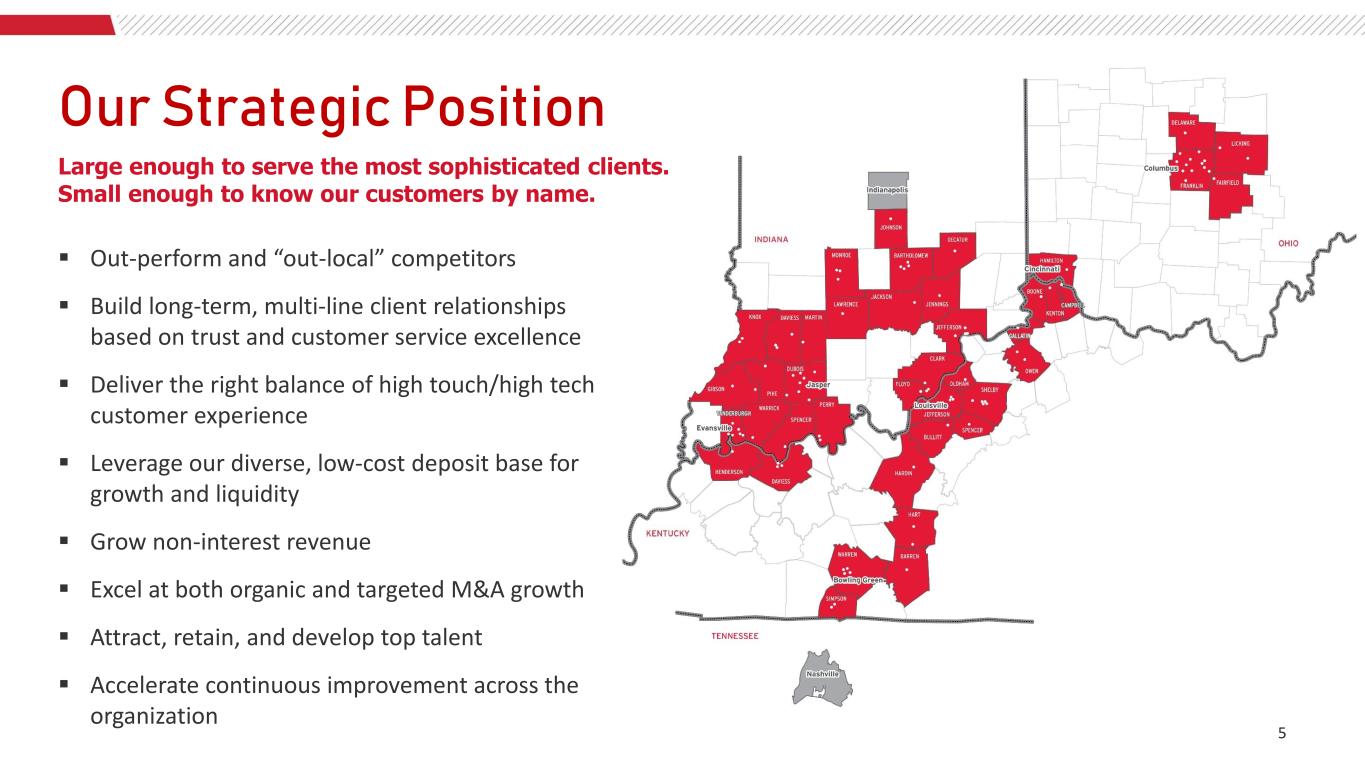

▪ Out-perform and “out-local” competitors ▪ Build long-term, multi-line client relationships based on trust and customer service excellence ▪ Deliver the right balance of high touch/high tech customer experience ▪ Leverage our diverse, low-cost deposit base for growth and liquidity ▪ Grow non-interest revenue ▪ Excel at both organic and targeted M&A growth ▪ Attract, retain, and develop top talent ▪ Accelerate continuous improvement across the organization Our Strategic Position 5 Large enough to serve the most sophisticated clients. Small enough to know our customers by name.

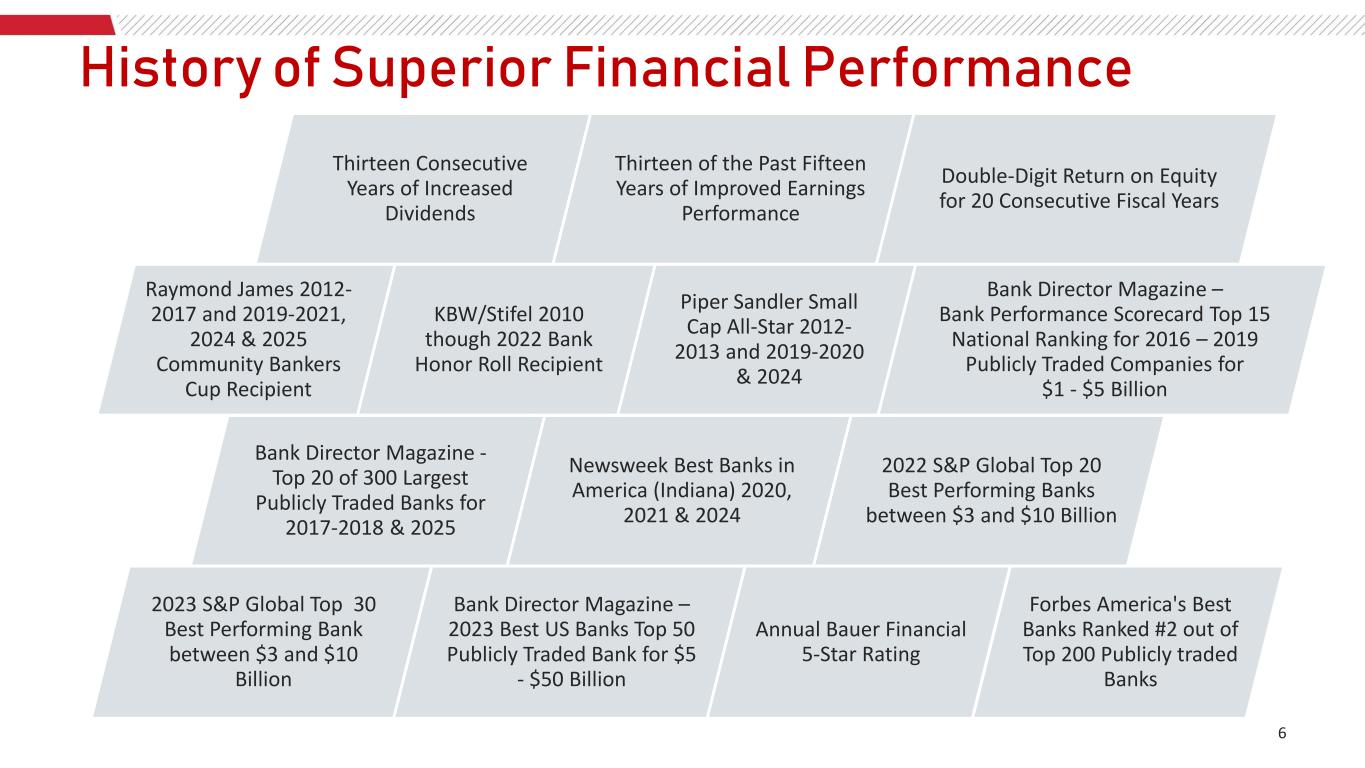

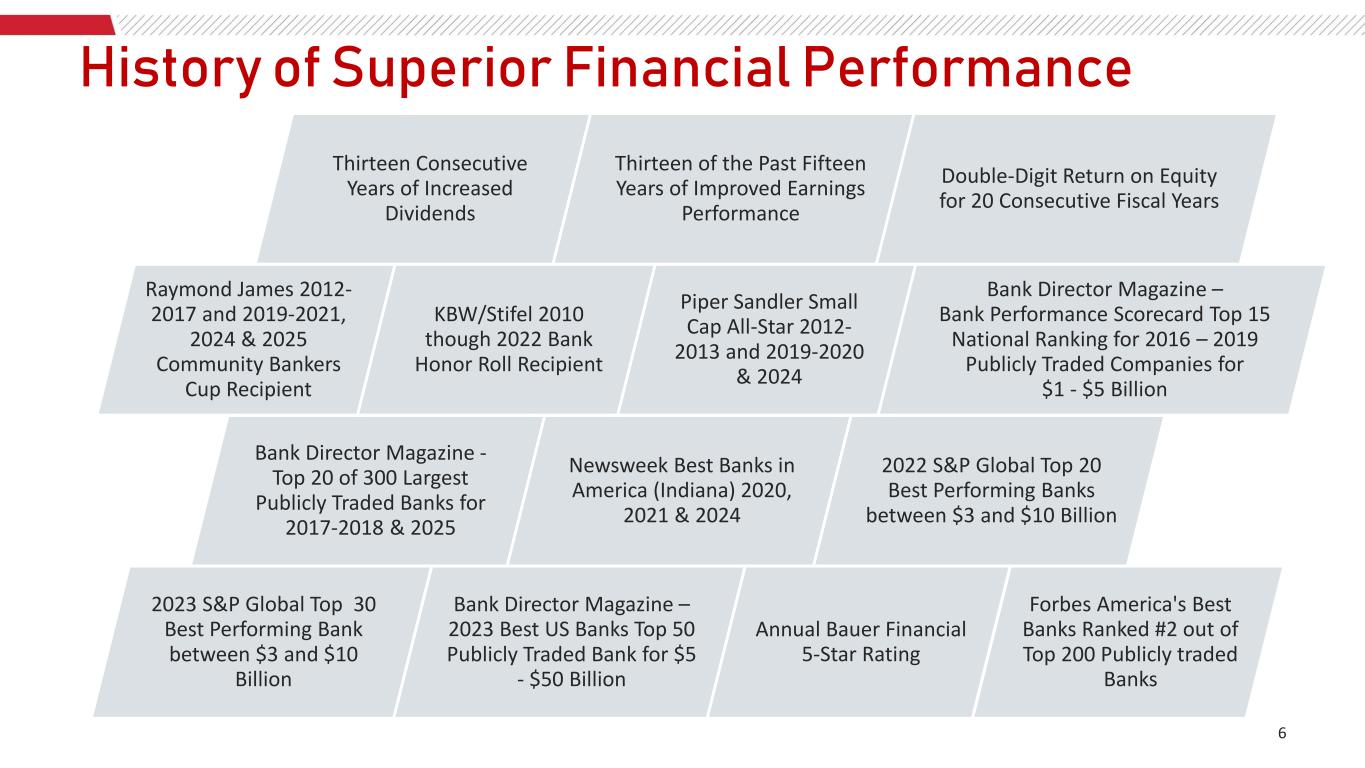

History of Superior Financial Performance 6 Bank Director Magazine - Top 20 of 300 Largest Publicly Traded Banks for 2017-2018 & 2025 Newsweek Best Banks in America (Indiana) 2020, 2021 & 2024 2022 S&P Global Top 20 Best Performing Banks between $3 and $10 Billion 2023 S&P Global Top 30 Best Performing Bank between $3 and $10 Billion Bank Director Magazine – 2023 Best US Banks Top 50 Publicly Traded Bank for $5 - $50 Billion Annual Bauer Financial 5-Star Rating Forbes America's Best Banks Ranked #2 out of Top 200 Publicly traded Banks Thirteen Consecutive Years of Increased Dividends Thirteen of the Past Fifteen Years of Improved Earnings Performance Double-Digit Return on Equity for 20 Consecutive Fiscal Years Raymond James 2012- 2017 and 2019-2021, 2024 & 2025 Community Bankers Cup Recipient KBW/Stifel 2010 though 2022 Bank Honor Roll Recipient Piper Sandler Small Cap All-Star 2012- 2013 and 2019-2020 & 2024 Bank Director Magazine – Bank Performance Scorecard Top 15 National Ranking for 2016 – 2019 Publicly Traded Companies for $1 - $5 Billion

FINANCIAL TRENDS 7

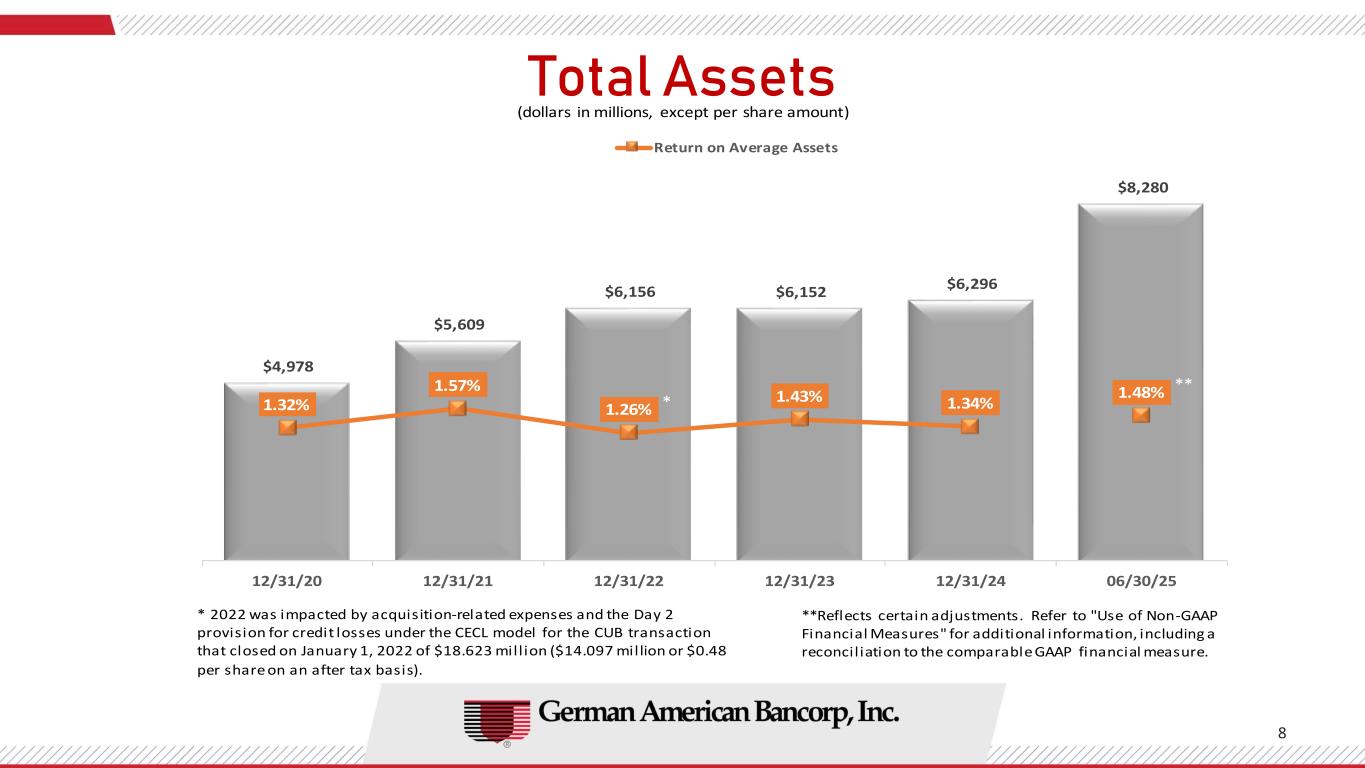

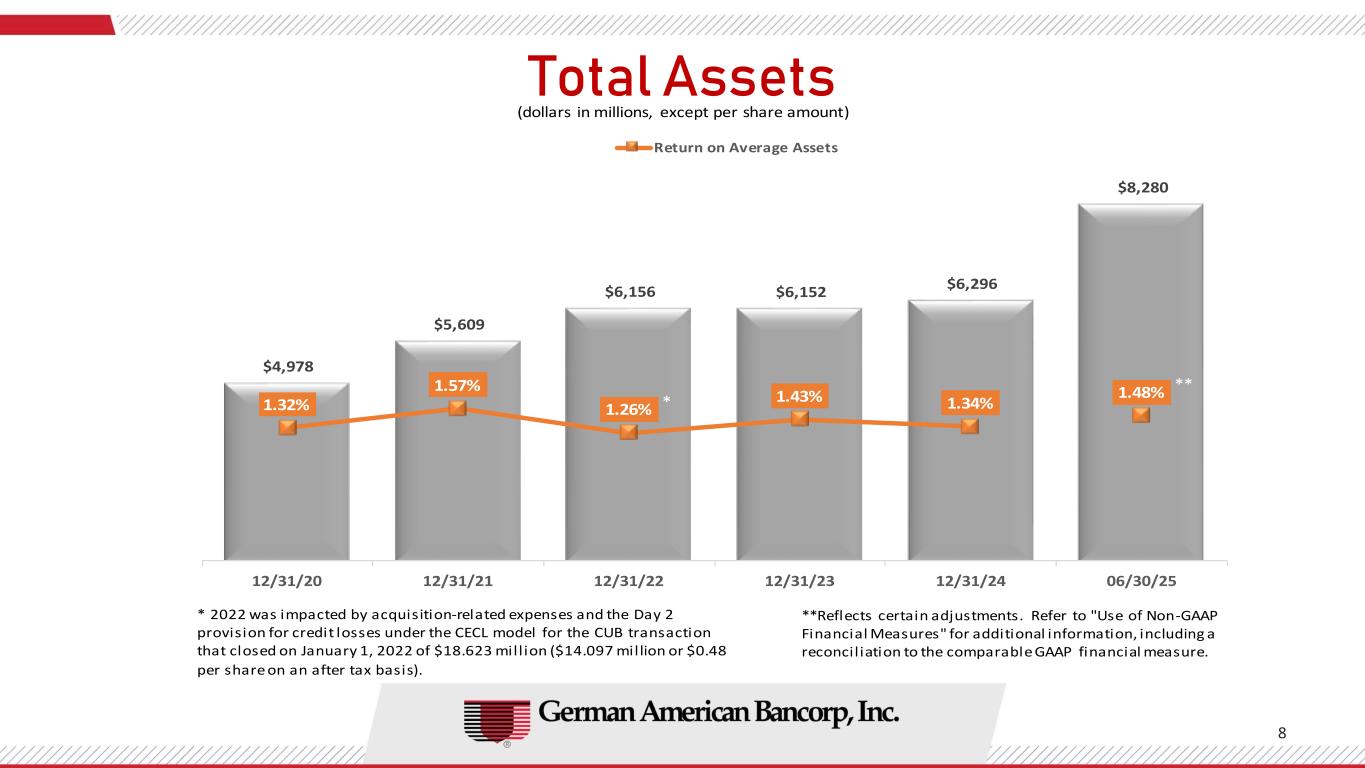

Total Assets 8 $4,978 $5,609 $6,156 $6,152 $6,296 $8,280 1.32% 1.57% 1.26% 1.43% 1.34% 1.48% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 (dollars in millions, except per share amount) Return on Average Assets * ** **Reflects certain adjustments. Refer to "Use of Non-GAAP Financial Measures" for additional information, including a reconciliation to the comparable GAAP financial measure. ** * 2022 was impacted by acquisition-related expenses and the Day 2 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18.623 mill ion ($14.097 million or $0.48 per share on an after tax basis).

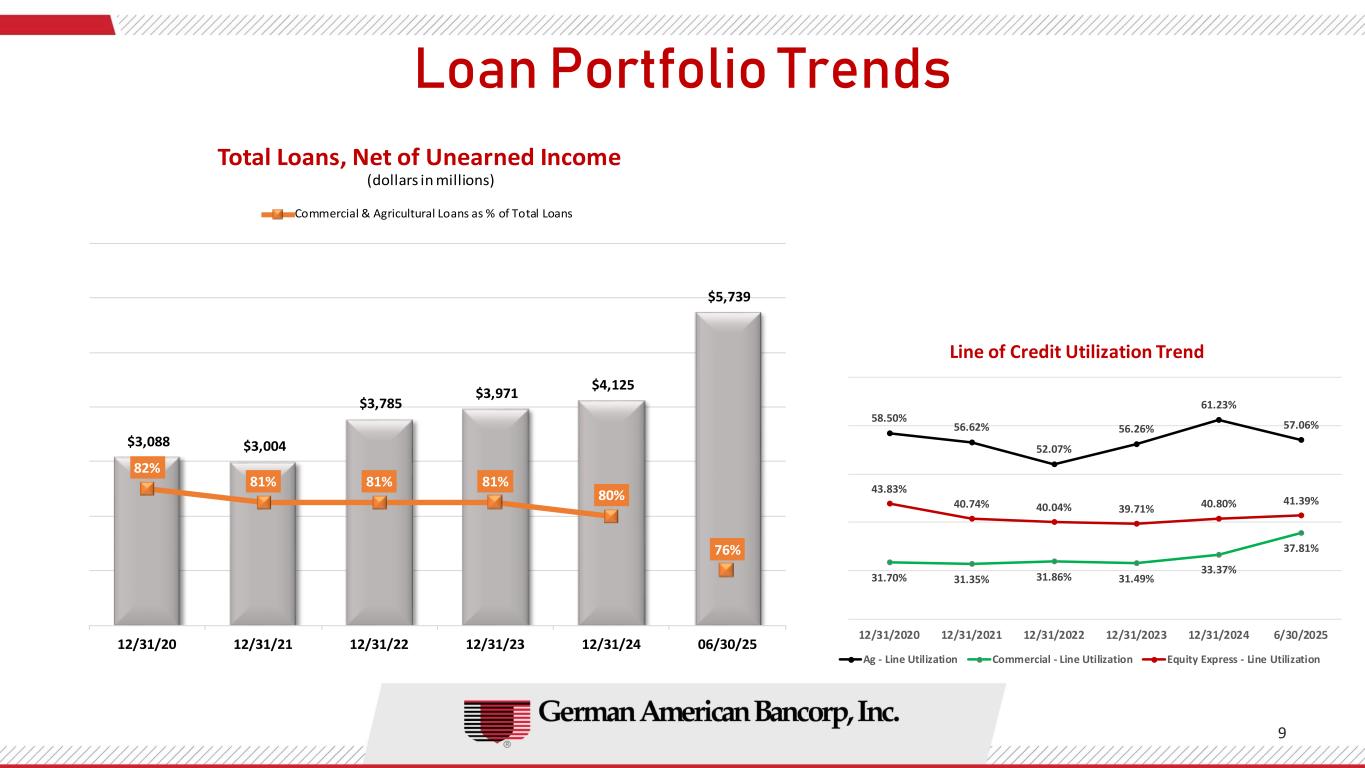

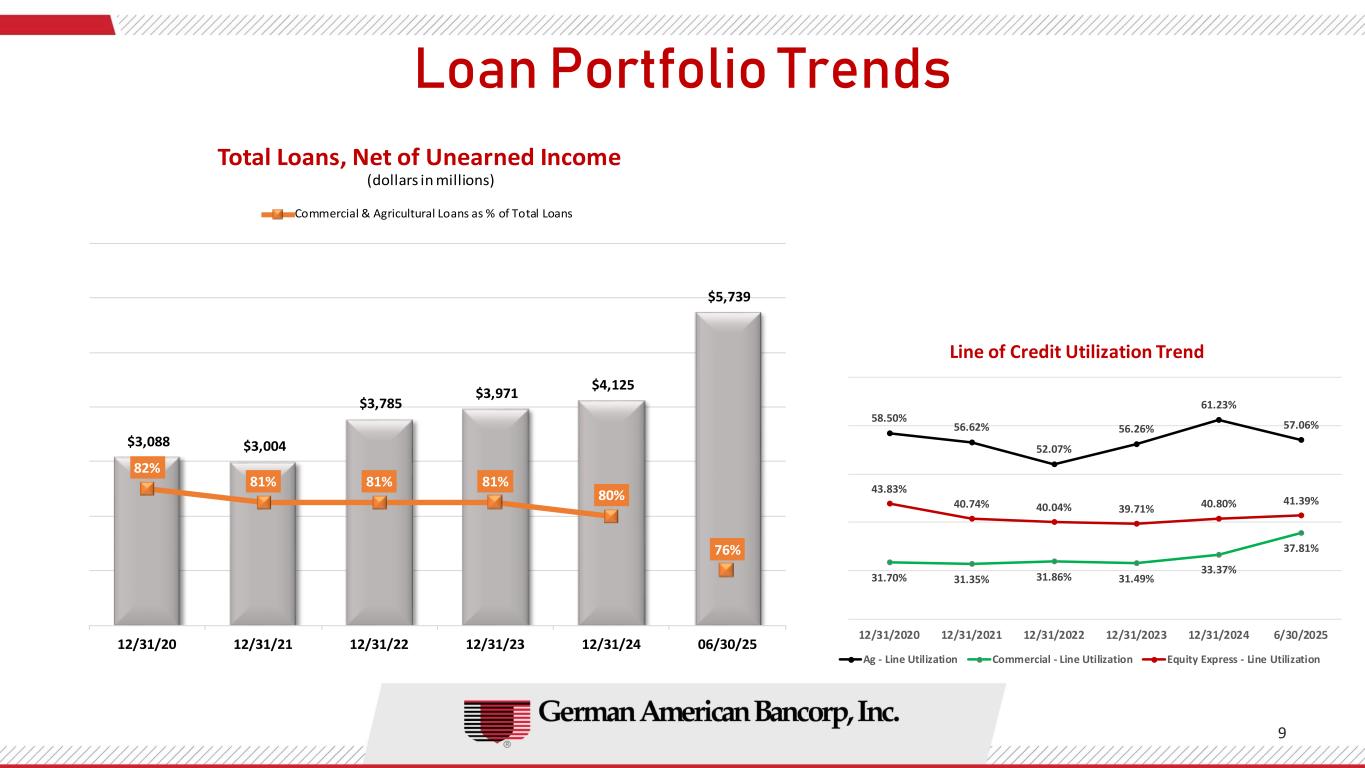

Loan Portfolio Trends 9 58.50% 56.62% 52.07% 56.26% 61.23% 57.06% 31.70% 31.35% 31.86% 31.49% 33.37% 37.81% 43.83% 40.74% 40.04% 39.71% 40.80% 41.39% 12/31/2020 12/31/2021 12/31/2022 12/31/2023 12/31/2024 6/30/2025 Line of Credit Utilization Trend Ag - Line Utilization Commercial - Line Utilization Equity Express - Line Utilization $3,088 $3,004 $3,785 $3,971 $4,125 $5,739 82% 81% 81% 81% 80% 76% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 Total Loans, Net of Unearned Income Commercial & Agricultural Loans as % of Total Loans (dollars in millions)

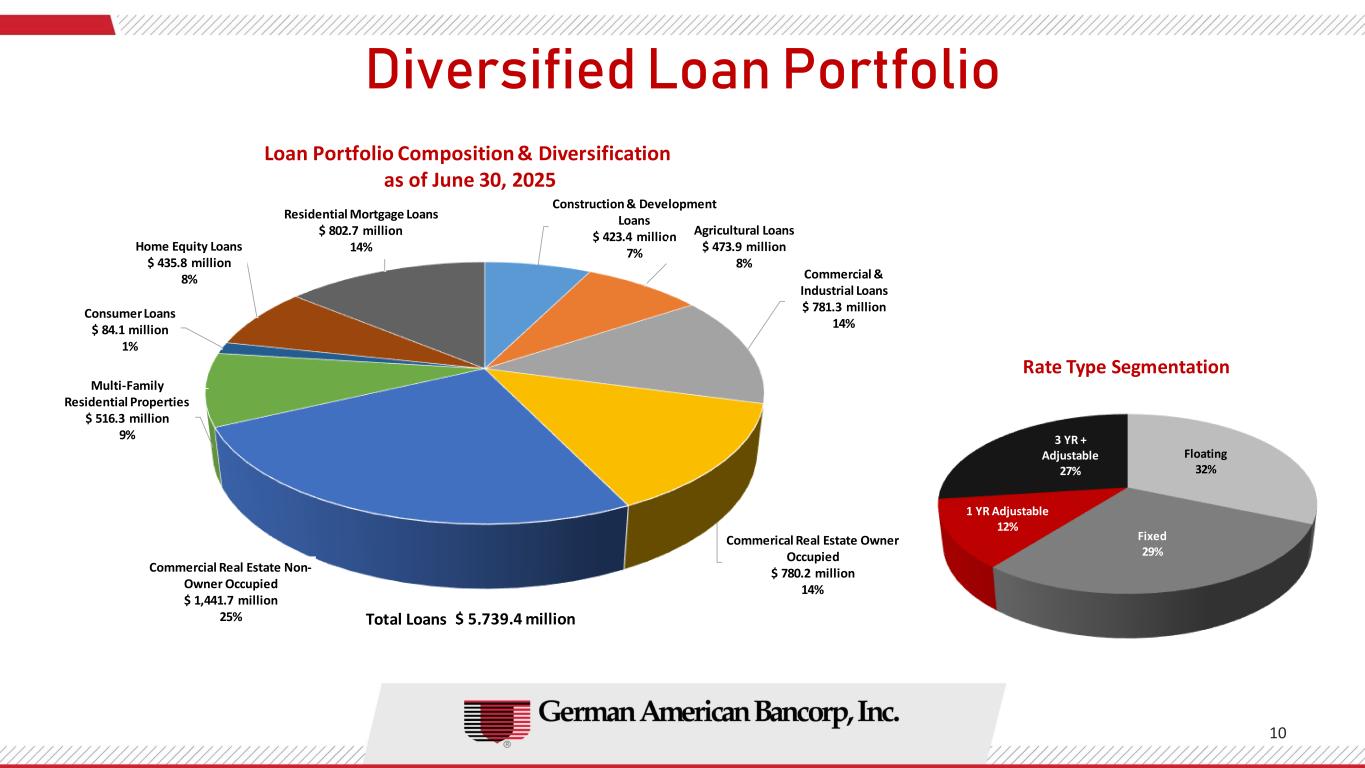

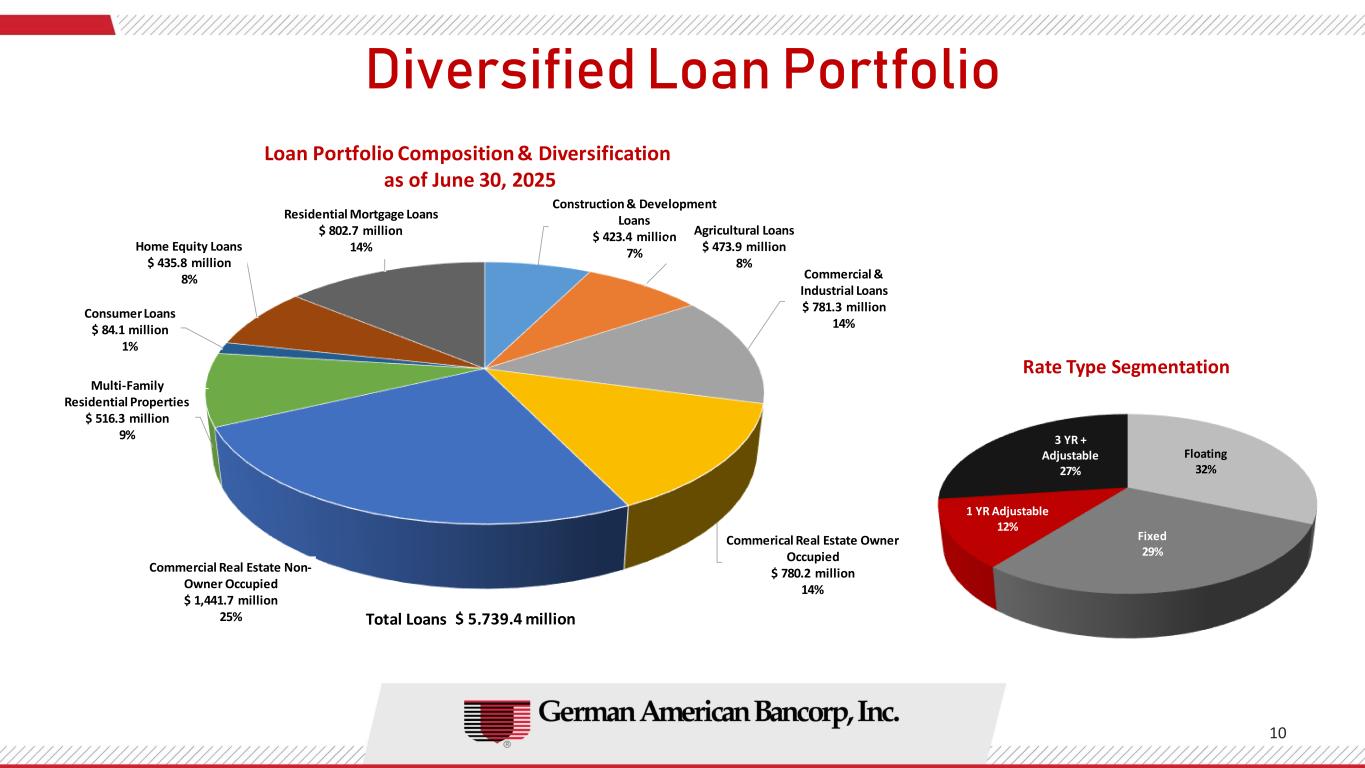

Floating 32% Fixed 29% 1 YR Adjustable 12% 3 YR + Adjustable 27% Rate Type Segmentation Diversified Loan Portfolio 10 Construction & Development Loans $ 423.4 million 7% Agricultural Loans $ 473.9 million 8% Commercial & Industrial Loans $ 781.3 million 14% Commerical Real Estate Owner Occupied $ 780.2 million 14% Commercial Real Estate Non- Owner Occupied $ 1,441.7 million 25% Multi-Family Residential Properties $ 516.3 million 9% Consumer Loans $ 84.1 million 1% Home Equity Loans $ 435.8 million 8% Residential Mortgage Loans $ 802.7 million 14% Loan Portfolio Composition & Diversification as of June 30, 2025 Total Loans $ 5,739.4 million

Non-Performing Assets to Total Assets 11 0.44% 0.26% 0.23% 0.15% 0.18% 0.30% 0.52% 0.34% 0.29% 0.37% 0.49% 0.49% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 GABC Peer Group * * Peer Group (St. Louis Federal Reserve District BHC with Total Assets between $3 and $10 billion) Data. ** As of 3/31/2025 * *

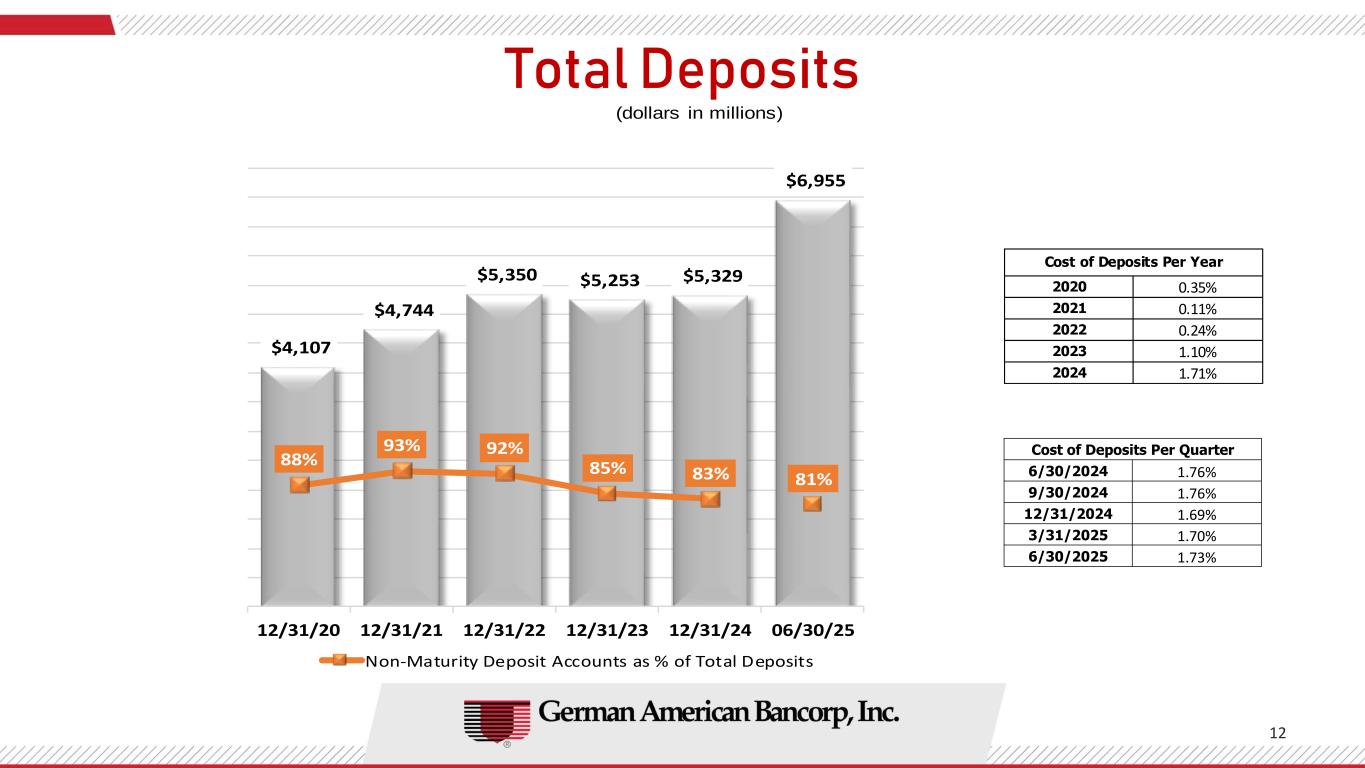

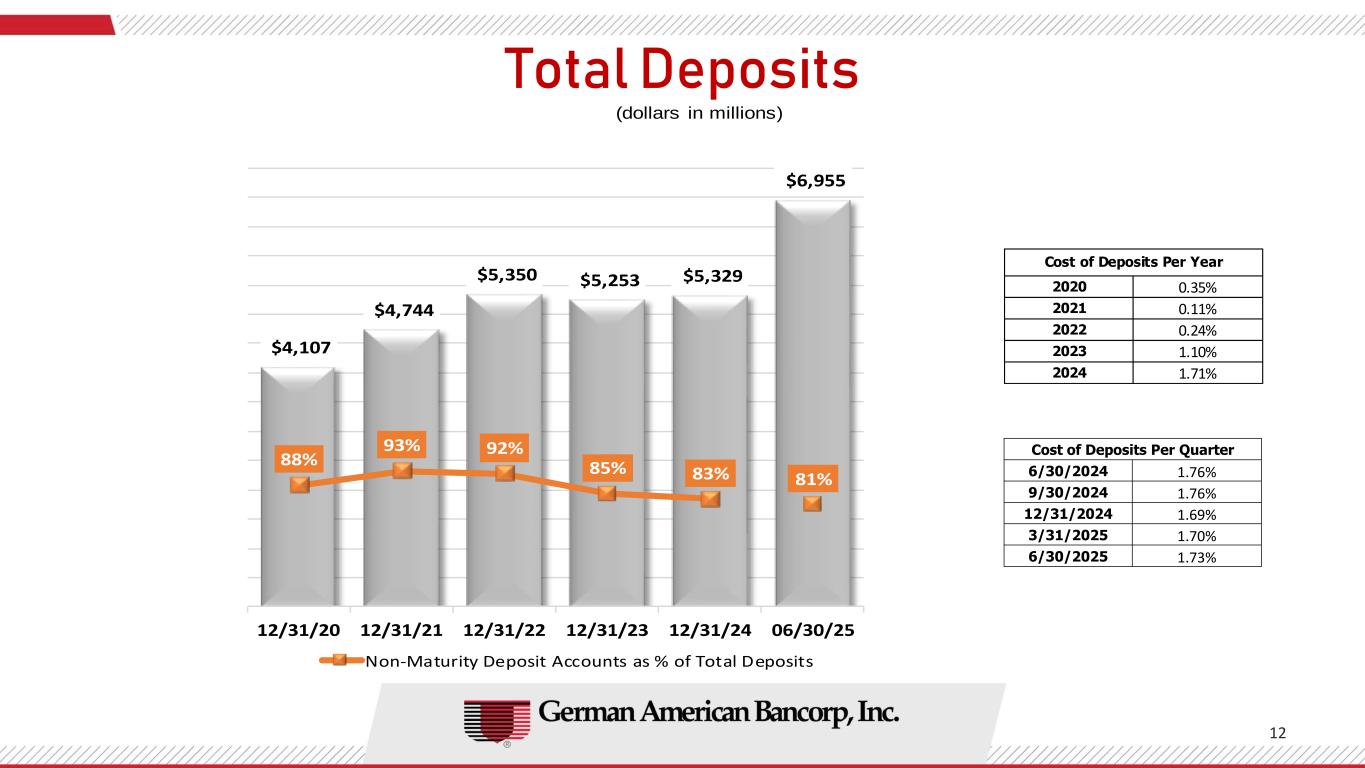

Total Deposits 12 $4,107 $4,744 $5,350 $5,253 $5,329 $6,955 88% 93% 92% 85% 83% 81% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 Non-Maturity Deposit Accounts as % of Total Deposits (dollars in millions) 2020 0.35% 2021 0.11% 2022 0.24% 2023 1.10% 2024 1.71% Cost of Deposits Per Year Cost of Deposits Per Quarter 6/30/2024 1.76% 9/30/2024 1.76% 12/31/2024 1.69% 3/31/2025 1.70% 6/30/2025 1.73%

Commercial $2,382 million 34% Public Fund $1,321 million 19% Retail $3,252 million 47% 13 Total Deposit Composition as of 06/30/2025 Total Deposits $6,955 million24% of Total Deposits are Uninsured and Uncollateralized as of 6/30/2025. Average Deposit Account Size equals $27,665. Non-Interest Bearing Demand $1,897 million 27% Interest Bearing Demand, Savings & Money Market $3,728 million 54% Time Deposits > $100,000 $808 million 12% Time Deposits < $100,000 $522 million 7%

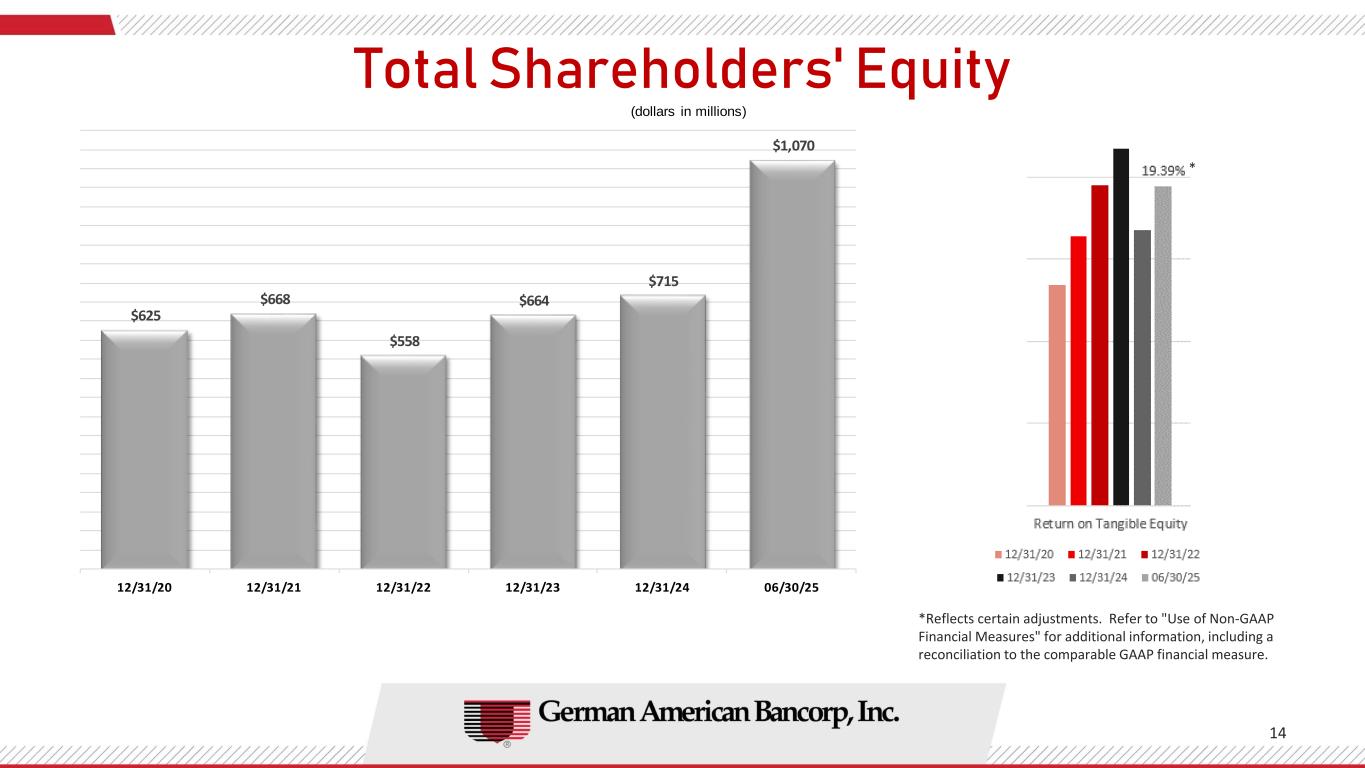

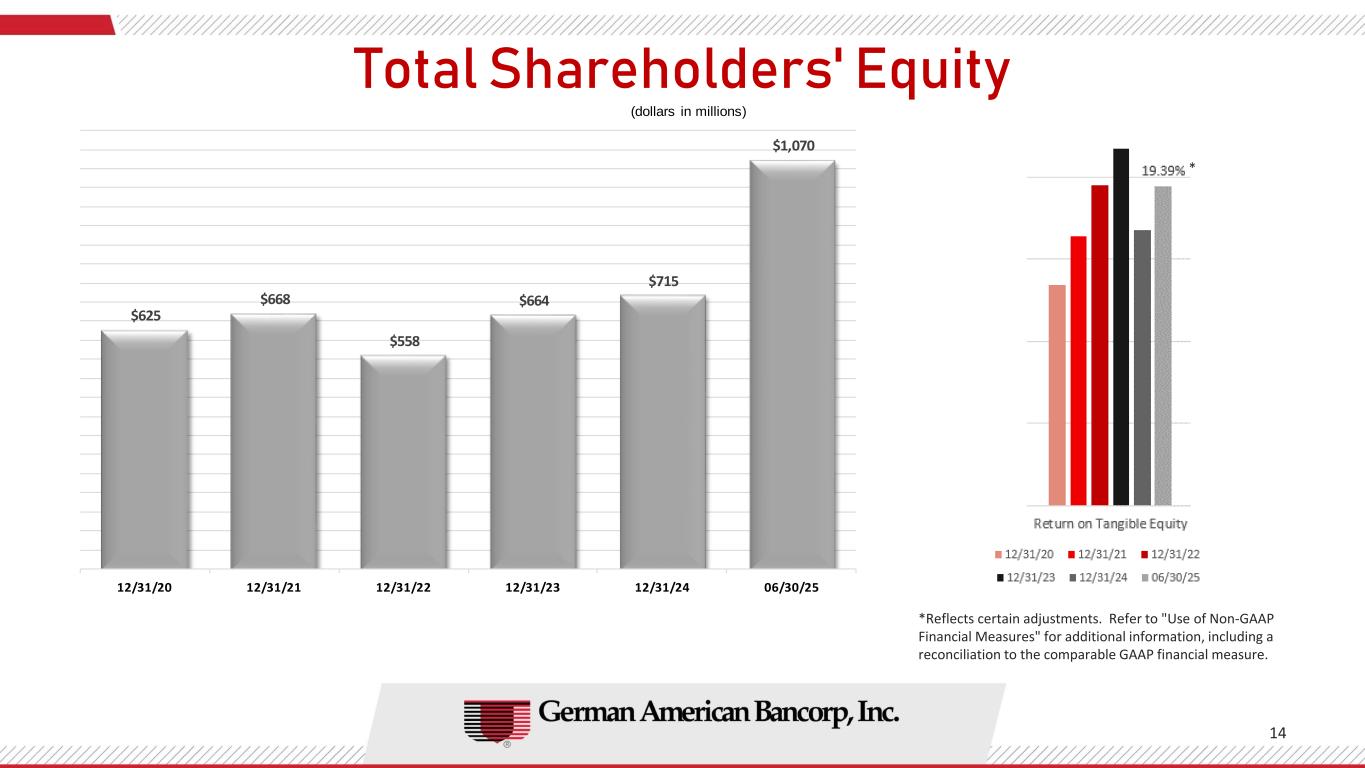

Total Shareholders' Equity 14 $625 $668 $558 $664 $715 $1,070 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25 (dollars in millions) * *Reflects certain adjustments. Refer to "Use of Non-GAAP Financial Measures" for additional information, including a reconciliation to the comparable GAAP financial measure.

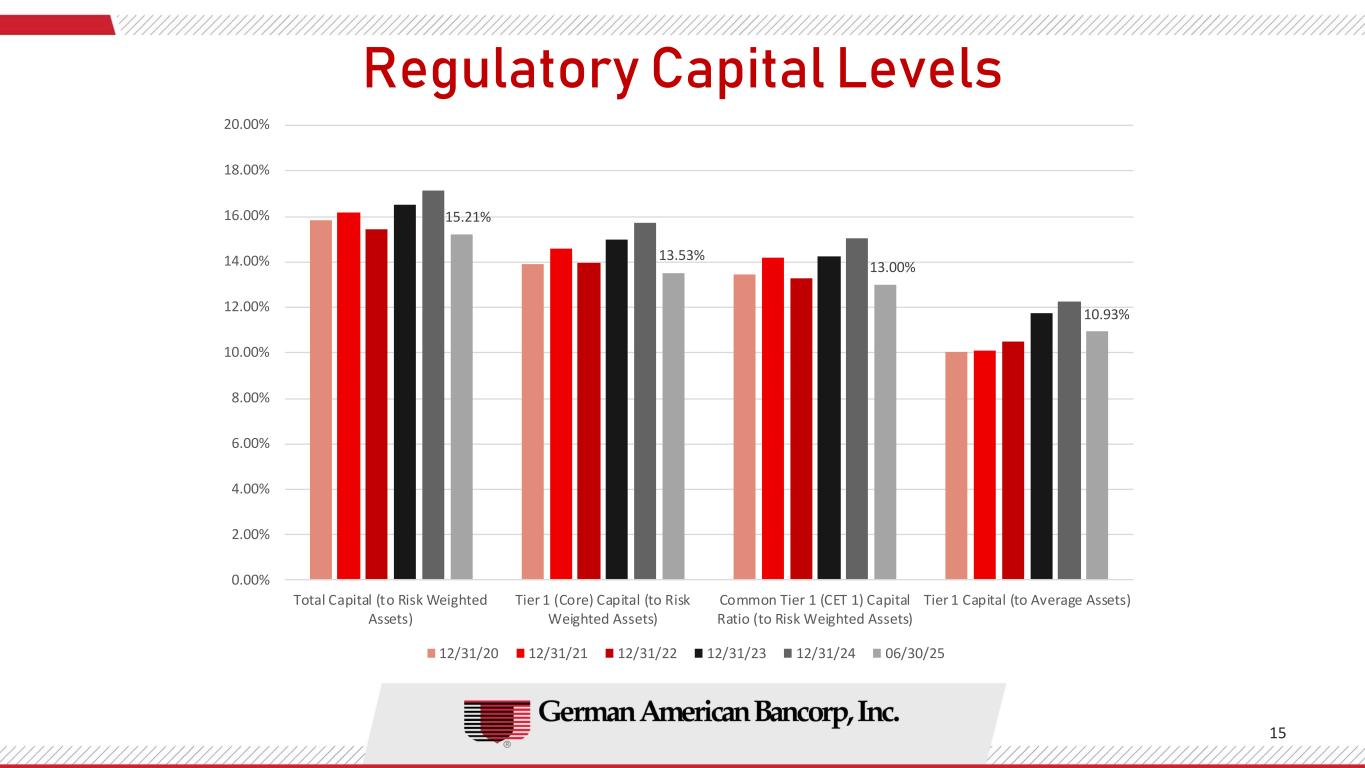

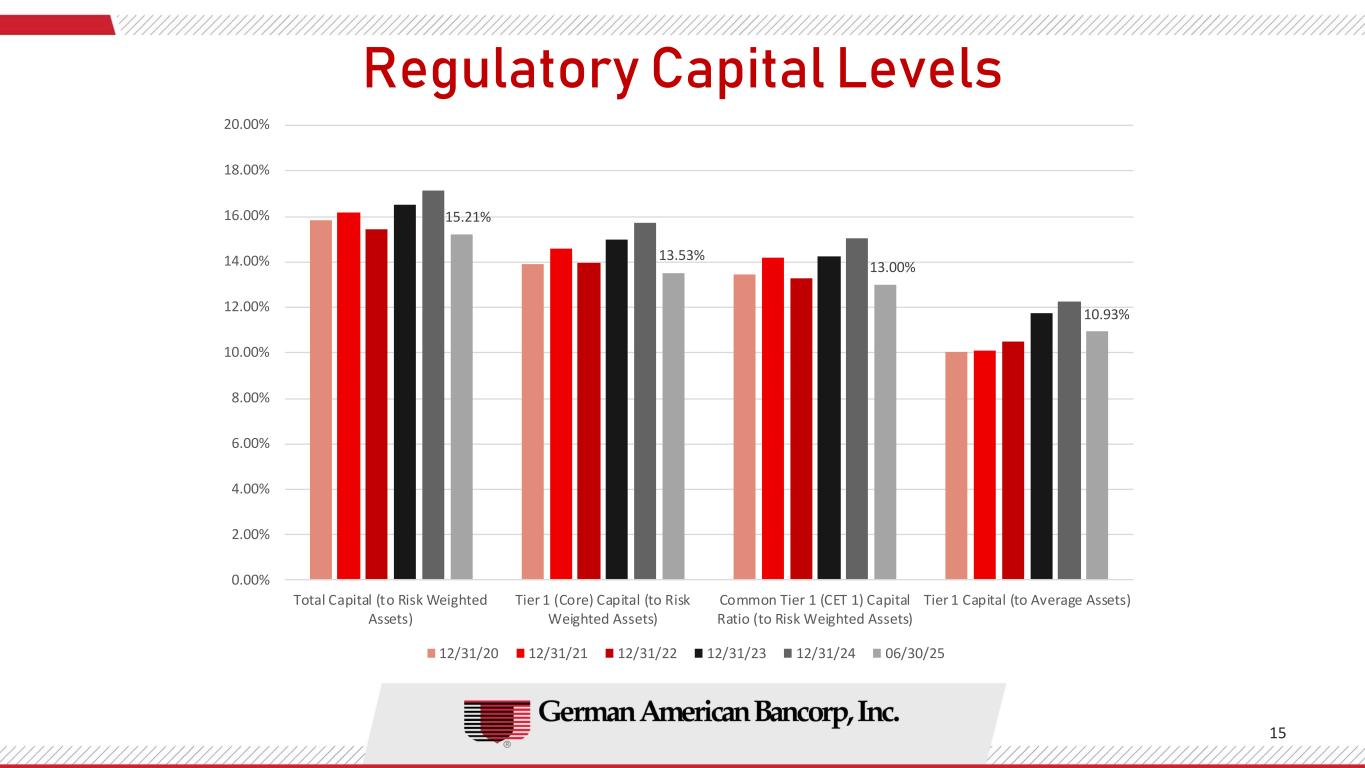

Regulatory Capital Levels 15 15.21% 13.53% 13.00% 10.93% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% Total Capital (to Risk Weighted Assets) Tier 1 (Core) Capital (to Risk Weighted Assets) Common Tier 1 (CET 1) Capital Ratio (to Risk Weighted Assets) Tier 1 Capital (to Average Assets) 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/25

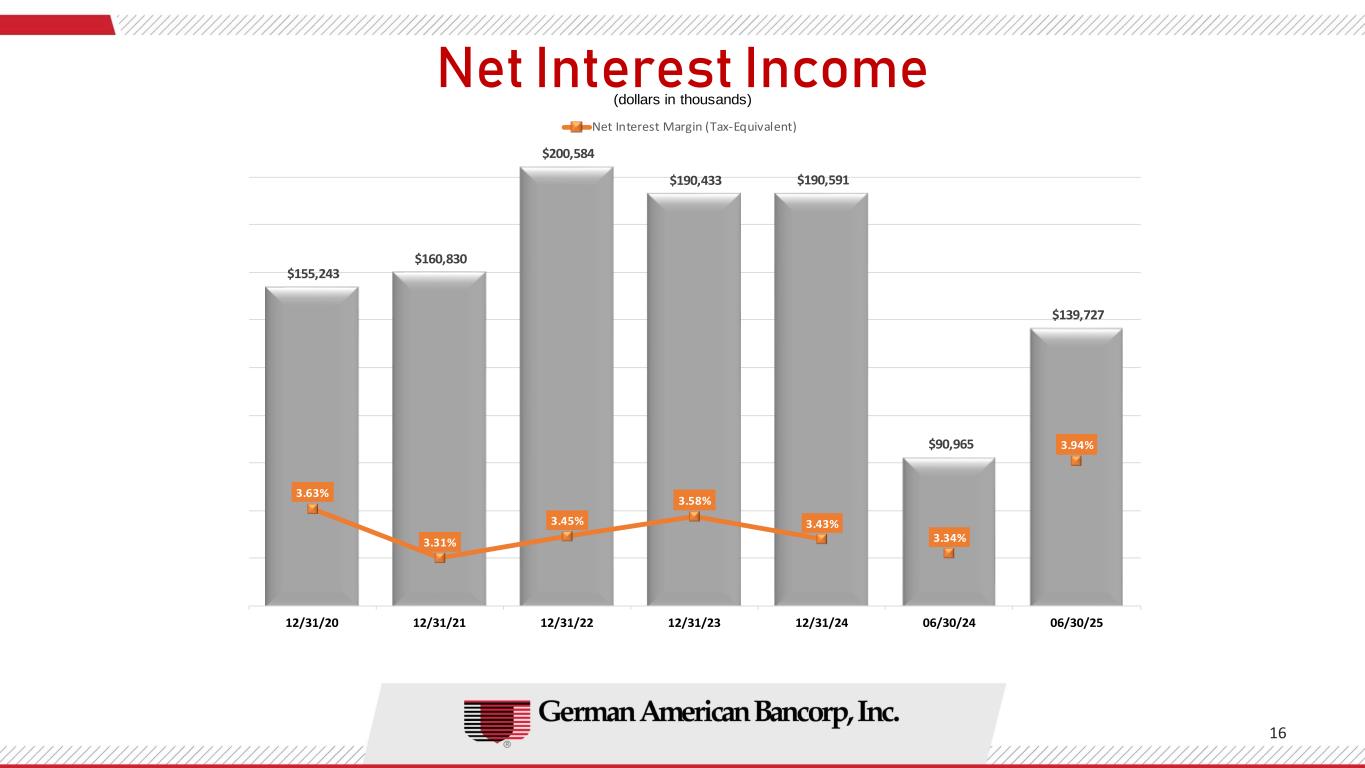

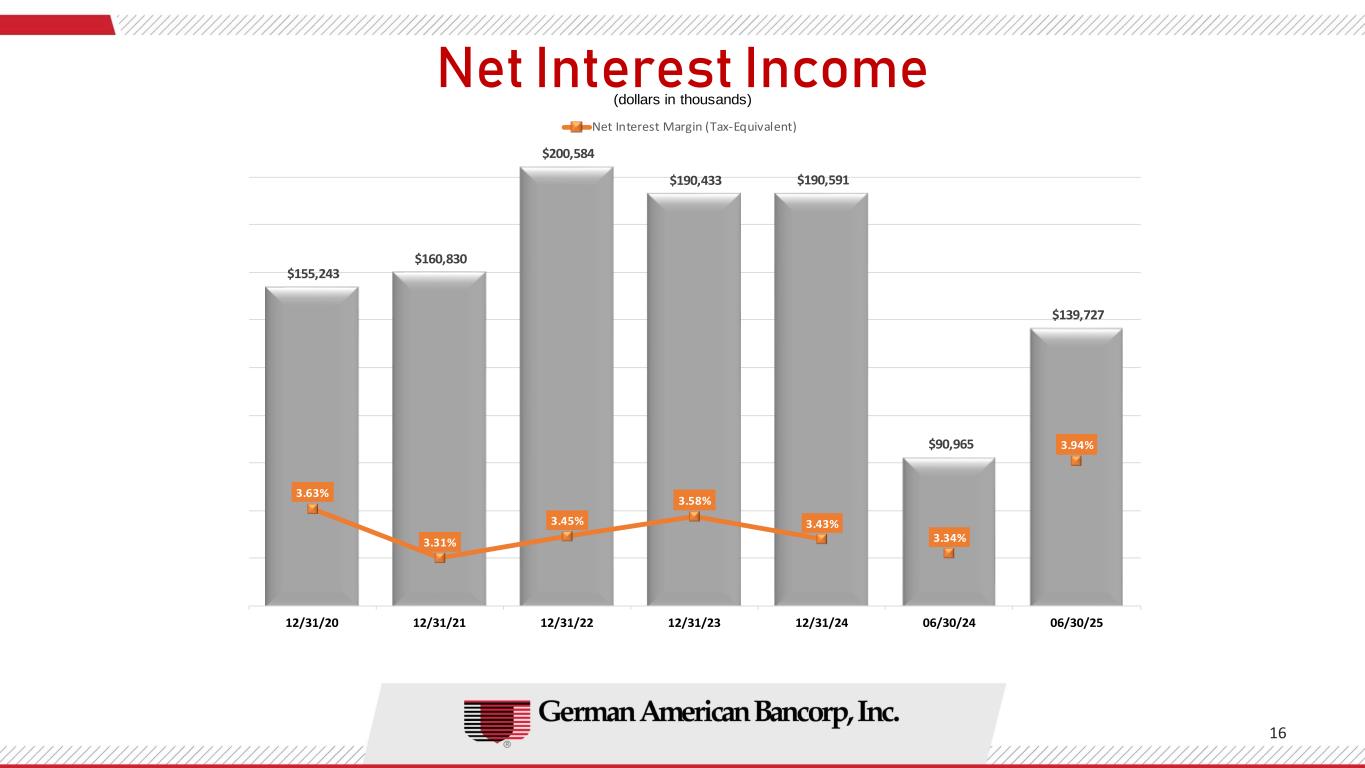

Net Interest Income 16 $155,243 $160,830 $200,584 $190,433 $190,591 $90,965 $139,727 3.63% 3.31% 3.45% 3.58% 3.43% 3.34% 3.94% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/24 06/30/25 Net Interest Margin (Tax-Equivalent) (dollars in thousands)

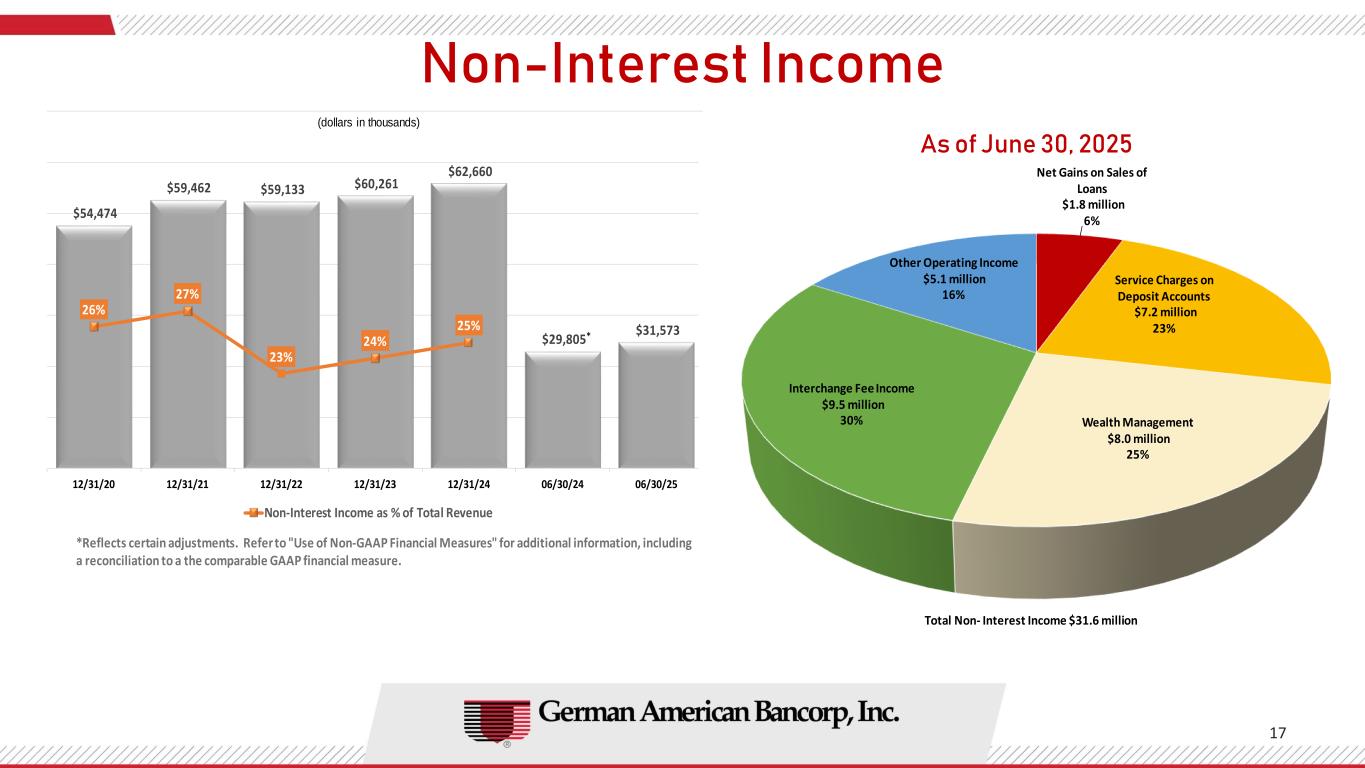

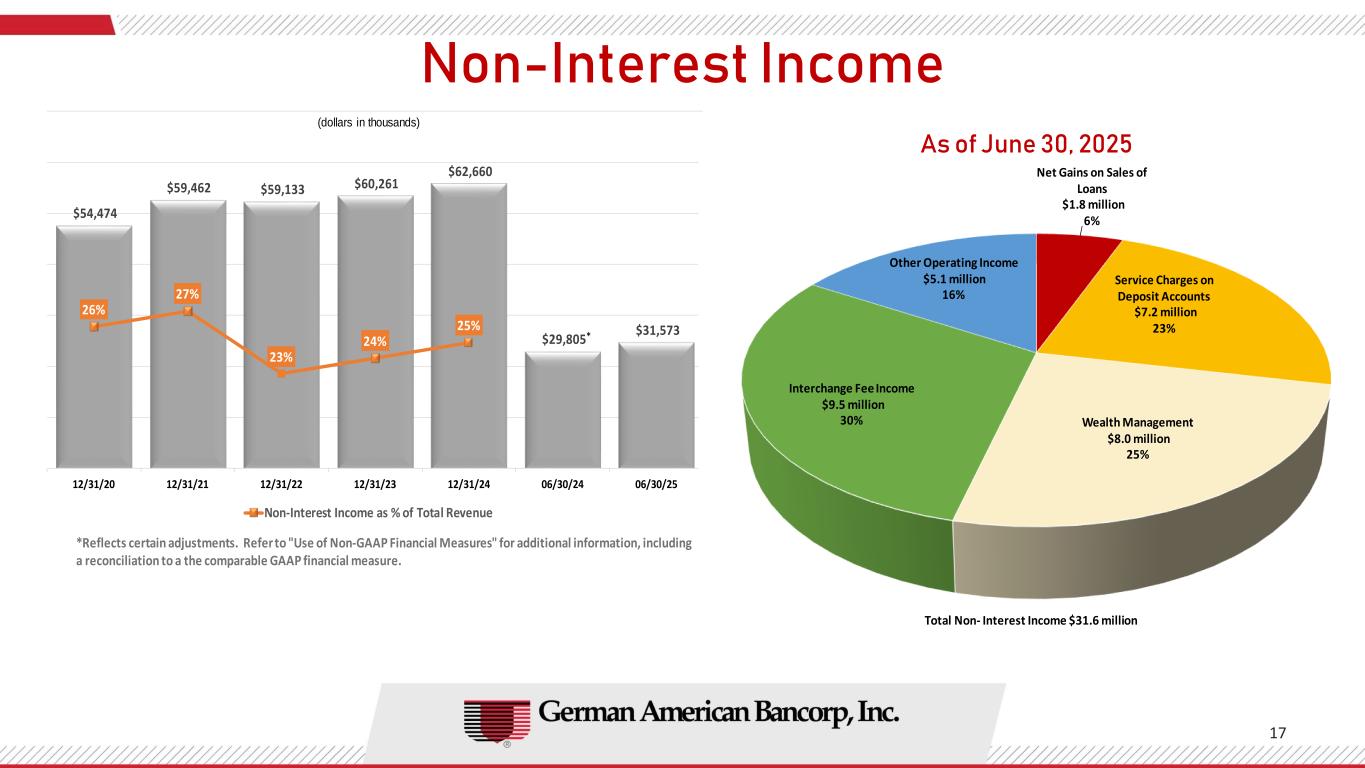

Non-Interest Income 17 As of June 30, 2025 $54,474 $59,462 $59,133 $60,261 $62,660 $29,805 $31,573 26% 27% 23% 24% 25% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/24 06/30/25 Non-Interest Income as % of Total Revenue (dollars in thousands) * *Reflects certain adjustments. Refer to "Use of Non-GAAP Financial Measures" for additional information, including a reconciliation to a the comparable GAAP financial measure. Net Gains on Sales of Loans $1.8 million 6% Service Charges on Deposit Accounts $7.2 million 23% Wealth Management $8.0 million 25% Interchange Fee Income $9.5 million 30% Other Operating Income $5.1 million 16% Total Non- Interest Income $31.6 million

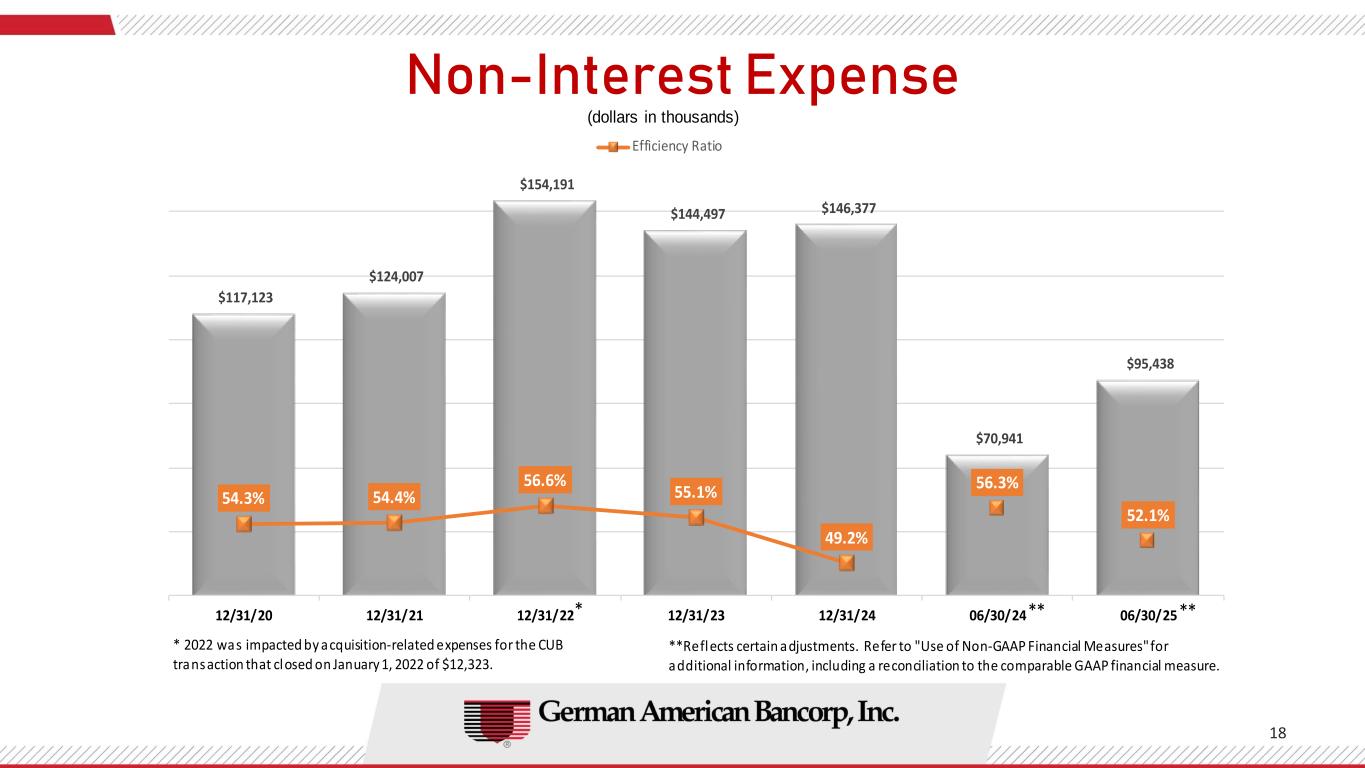

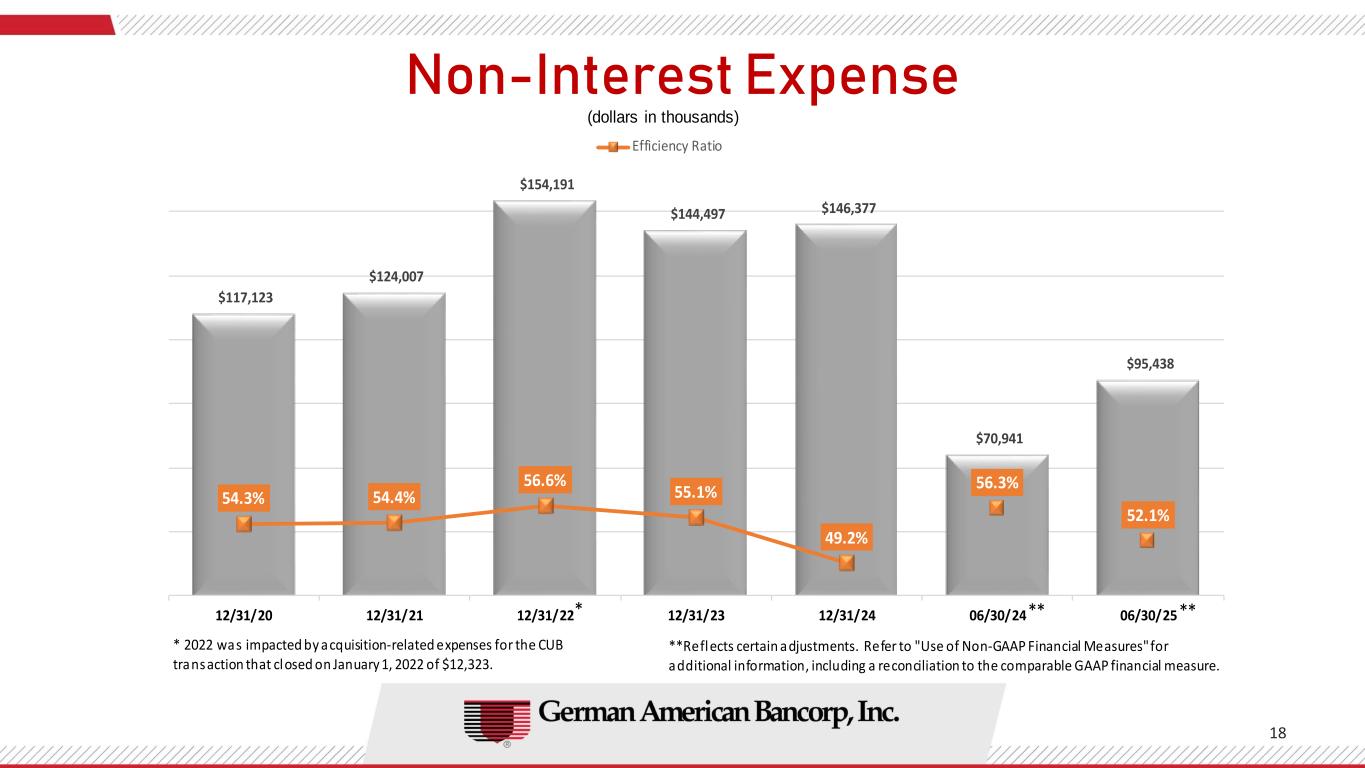

Non-Interest Expense 18 $117,123 $124,007 $154,191 $144,497 $146,377 $70,941 $95,438 54.3% 54.4% 56.6% 55.1% 49.2% 56.3% 52.1% 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/24 06/30/25 Efficiency Ratio * 2022 was impacted by acquisition-related expenses for the CUB transaction that closed on January 1, 2022 of $12,323. * (dollars in thousands) **Reflects certain adjustments. Refer to "Use of Non-GAAP Financial Measures" for additional information, including a reconciliation to the comparable GAAP financial measure. ****

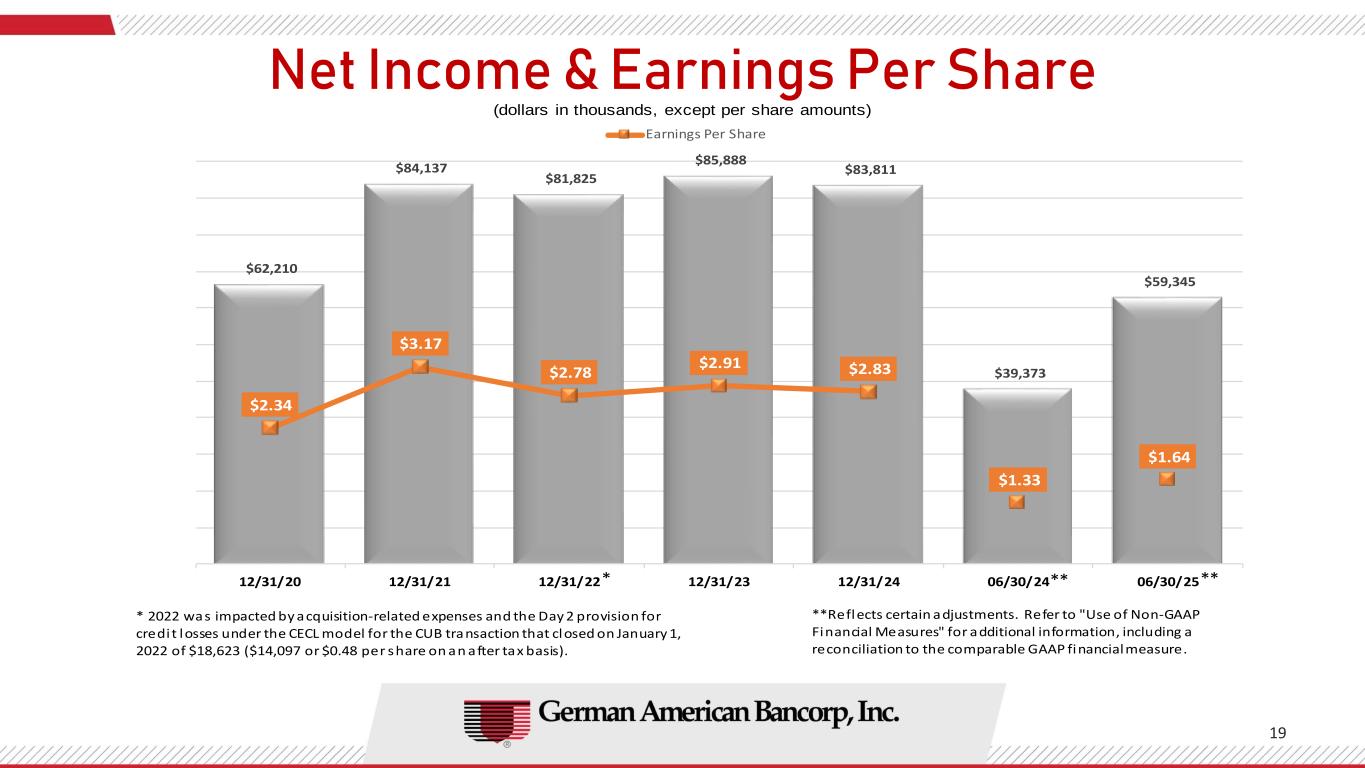

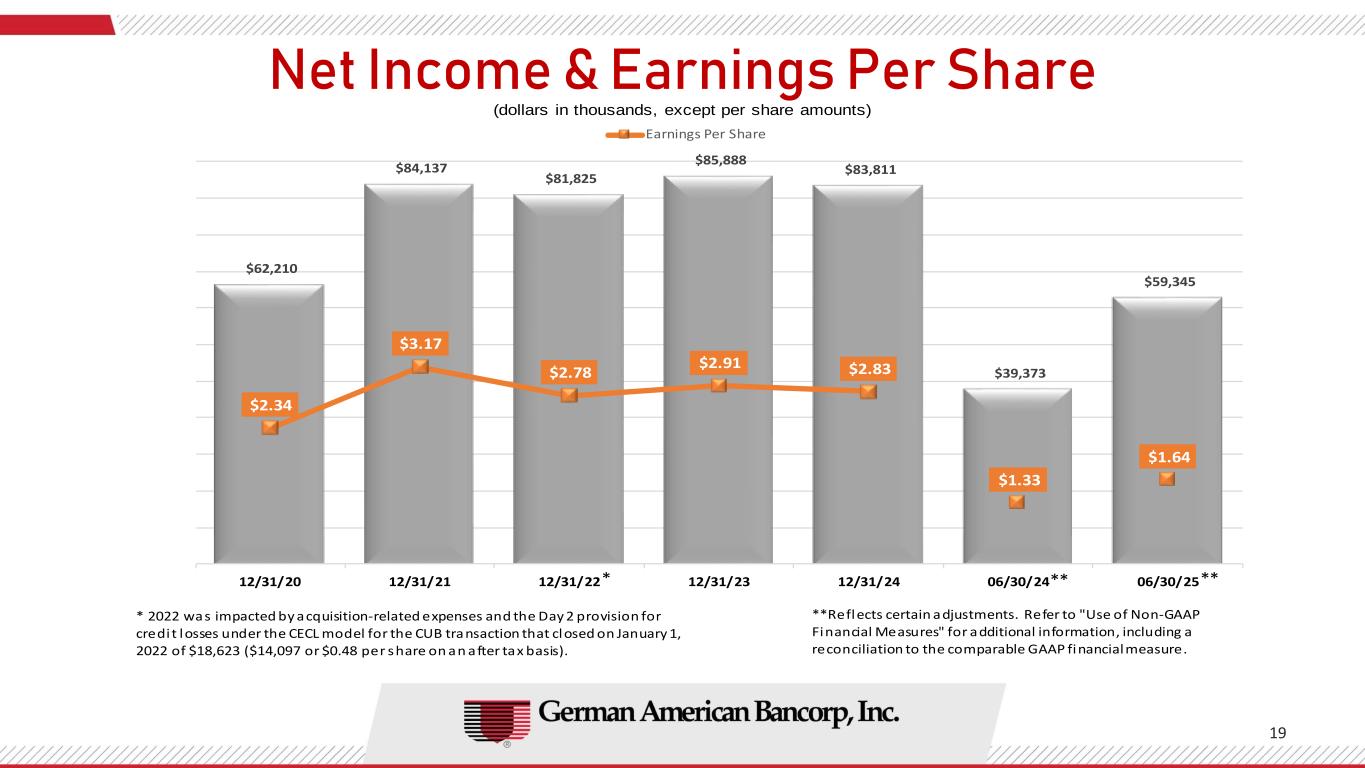

Net Income & Earnings Per Share 19 $62,210 $84,137 $81,825 $85,888 $83,811 $39,373 $59,345 $2.34 $3.17 $2.78 $2.91 $2.83 $1.33 $1.64 12/31/20 12/31/21 12/31/22 12/31/23 12/31/24 06/30/24 06/30/25 Earnings Per Share * 2022 was impacted by acquisition-related expenses and the Day 2 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18,623 ($14,097 or $0.48 per share on an after tax basis). * (dollars in thousands, except per share amounts) ** **Reflects certain adjustments. Refer to "Use of Non-GAAP Financial Measures" for additional information, including a reconciliation to the comparable GAAP financial measure. **

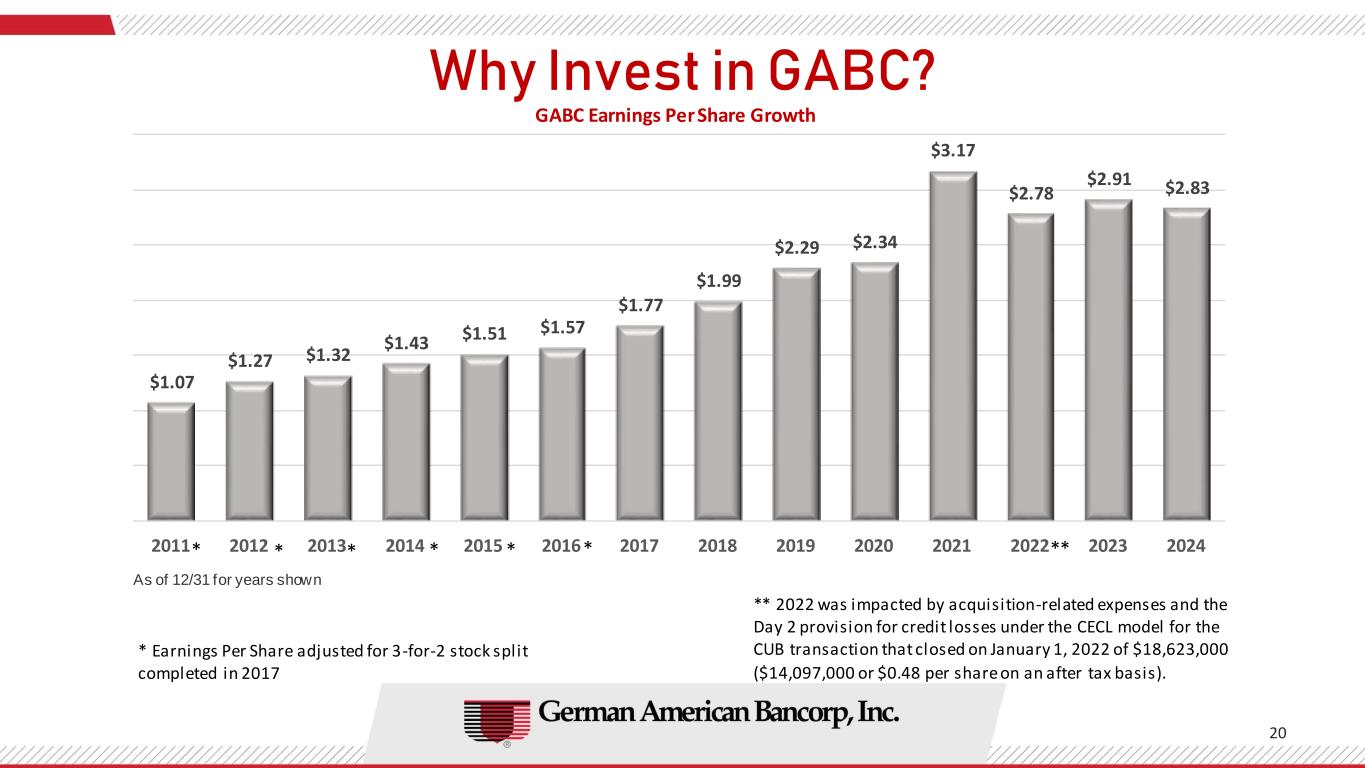

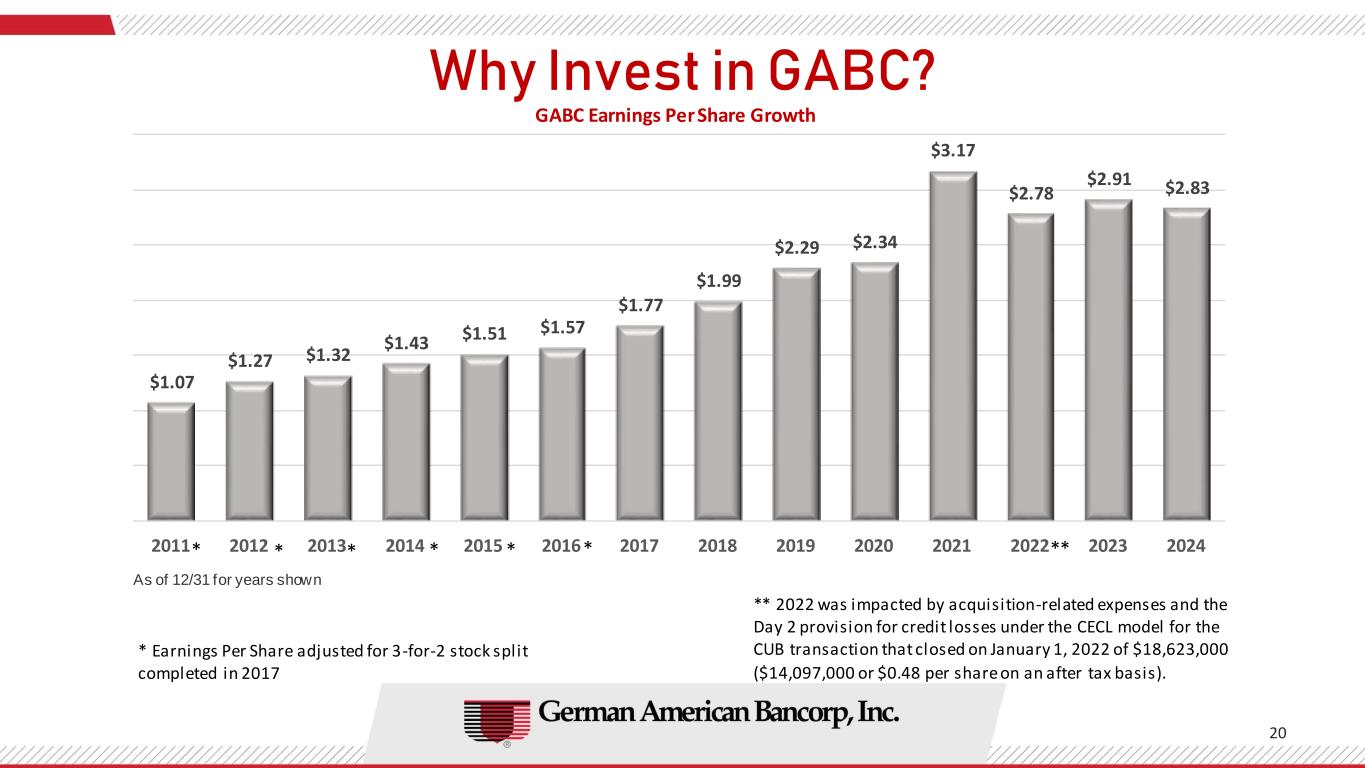

Why Invest in GABC? 20 $1.07 $1.27 $1.32 $1.43 $1.51 $1.57 $1.77 $1.99 $2.29 $2.34 $3.17 $2.78 $2.91 $2.83 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 As of 12/31 for years shown * Earnings Per Share adjusted for 3-for-2 stock split completed in 2017 ***** *** GABC Earnings Per Share Growth ** 2022 was impacted by acquisition-related expenses and the Day 2 provision for credit losses under the CECL model for the CUB transaction that closed on January 1, 2022 of $18,623,000 ($14,097,000 or $0.48 per share on an after tax basis).

Why Invest in GABC? 21 $0.40 $0.43 $0.45 $0.48 $0.52 $0.60 $0.68 $0.76 $0.84 $0.92 $1.00 $1.08 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 *Dividends per share adjusted for 3-for-2 stock split completed in 2017 As of 12/31 for years shown * * * * Cash Dividend Growth

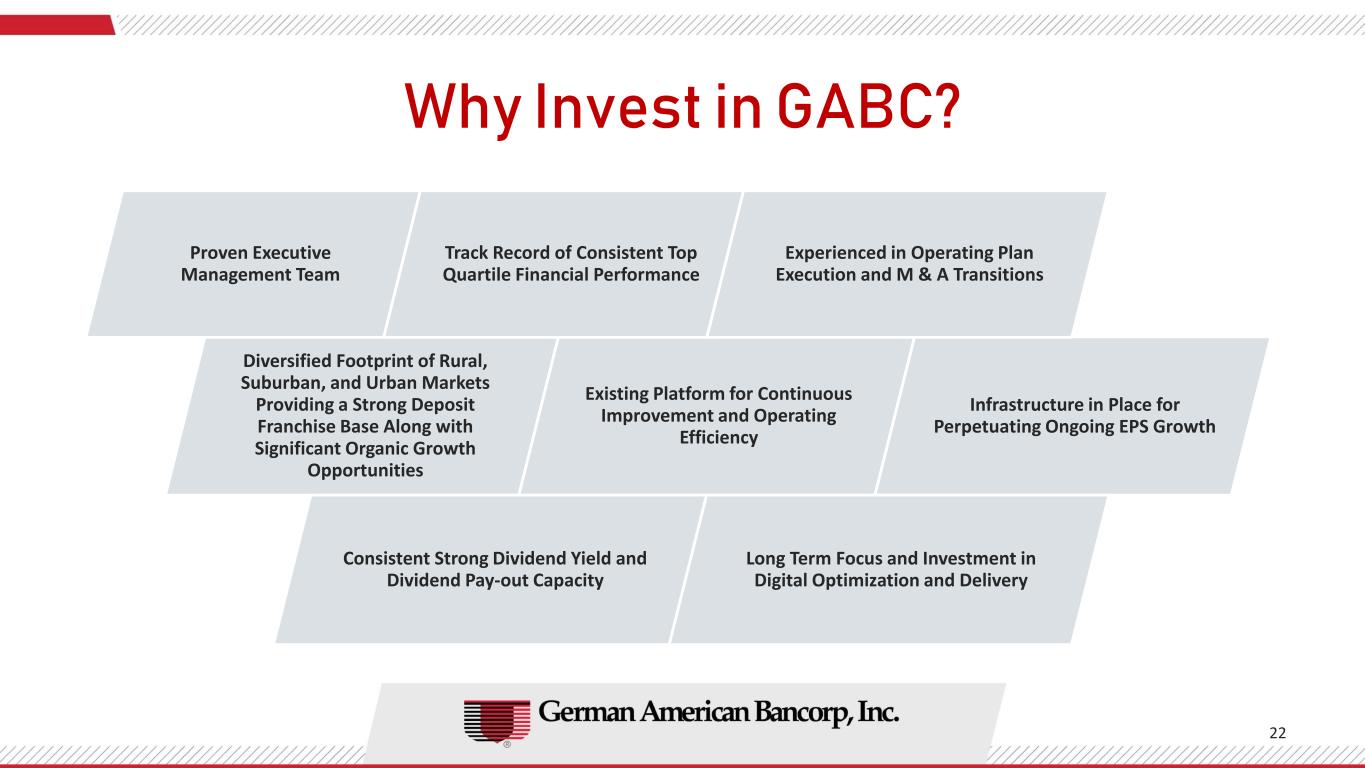

Why Invest in GABC? 22 Diversified Footprint of Rural, Suburban, and Urban Markets Providing a Strong Deposit Franchise Base Along with Significant Organic Growth Opportunities Existing Platform for Continuous Improvement and Operating Efficiency Infrastructure in Place for Perpetuating Ongoing EPS Growth Consistent Strong Dividend Yield and Dividend Pay-out Capacity Long Term Focus and Investment in Digital Optimization and Delivery Proven Executive Management Team Track Record of Consistent Top Quartile Financial Performance Experienced in Operating Plan Execution and M & A Transitions

USE OF NON-GAAP FINANCIAL MEASURES The accounting and reporting policies of German American Bancorp, Inc. (the “Company”) conform to U.S. generally accepted accounting principles (“GAAP”) and general practices within the banking industry. As a supplement to GAAP, the Company has provided certain, non-GAAP financial measures, which it believes are useful because they assist investors in assessing the Company’s operating performance. Specifically, the Company has presented its net income, earnings per share, provision for credit losses, non-interest expense, non-interest income, efficiency ratio, and net interest margin on an as adjusted basis for the periods set forth below to reflect the exclusion of the following items: (1) the Current Expected Credit Losses (“CECL”) “Day 2” provision expense for acquired loans that have only insignificant credit deterioration (i.e., non-PCD loans) related to the Company’s merger with Heartland BancCorp (“Heartland”); (2) non-recurring expenses related to the Heartland merger; (3) the operating results for German American Insurance, Inc. (“GAI”), whose assets were sold effective June 1, 2024; (4) the gain on the sale of GAI assets; and (5) the loss related to the securities portfolio restructuring transaction that occurred in the second quarter of 2024. Management believes excluding such items from these financial measures may be useful in assessing the Company’s underlying operational performance since the applicable transactions do not pertain to its core business operations and exclusion may facilitate better comparability between periods. In addition, management believes that by excluding such items the measures are useful to the Company, as well as analysts and investors, in assessing operating performance. Management also believes excluding these items may enhance comparability for peer comparison purposes. Management believes that it is standard practice in the banking industry to present the efficiency ratio and net interest margin on a fully tax- equivalent basis and that, by doing so, it may enhance comparability for peer comparison purposes. The tax-equivalent adjustment to net interest income (for purposes of the efficiency ratio) and net interest margin recognizes the income tax savings when comparing taxable and tax-exempt assets. Interest income and yields on tax-exempt securities and loans are presented using the current federal income tax rate of 21%. Although intended to enhance investors’ understanding of the Company’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP. 23

USE OF NON-GAAP FINANCIAL MEASURES 24 Non-GAAP Reconciliation – Return on Average Assets (Dollars in Thousands) 6/30/2024 6/30/2025 6/30/2024 6/30/2025 Net Income, as reported $ 20,530 $ 31,361 $ 39,552 $ 41,878 Adjustments: Plus: CECL Day 2 non-PCD provision - - - 12,150 Plus: Non-recurring merger-related expenses 318 697 318 5,317 Less: Loss on securities restructuring (27,189) - (27,189) - Less: Income from GAI operations 210 - 210 - Less: Gain on sale of GAI assets 27,476 - 27,476 - Adjusted Net Income $ 20,351 $ 32,058 $ 39,373 $ 59,345 Average Assets $ 6,230,676 $ 8,424,328 $ 6,166,523 $ 8,028,766 Return on Average Assets, as reported 1.49% 1.49% 1.04% 1.04% Return on Average Assets, as adjusted 1.31% 1.52% 1.28% 1.48% Non-GAAP Reconciliation – Return on Tangible Equity (Dollars in Thousands) 6/30/2024 6/30/2025 6/30/2024 6/30/2025 Adjusted Net Income $ 20,351 $ 32,058 $ 39,373 $ 59,345 Average Equity, as reported $ 649,886 $ 1,048,227 $ 653,334 $ 990,129 Average Intangibles, as reported 185,272 417,016 185,800 378,011 Average Tangible Equity $ 464,614 $ 631,211 $ 467,534 $ 612,118 Return on Tangible Equity, as reported 17.67% 19.87% 16.92% 13.68% Return on Tangible Equity, as adjusted 17.52% 20.32% 16.84% 19.39% Three Months Ended Six Months Ended Six Months EndedThree Months Ended

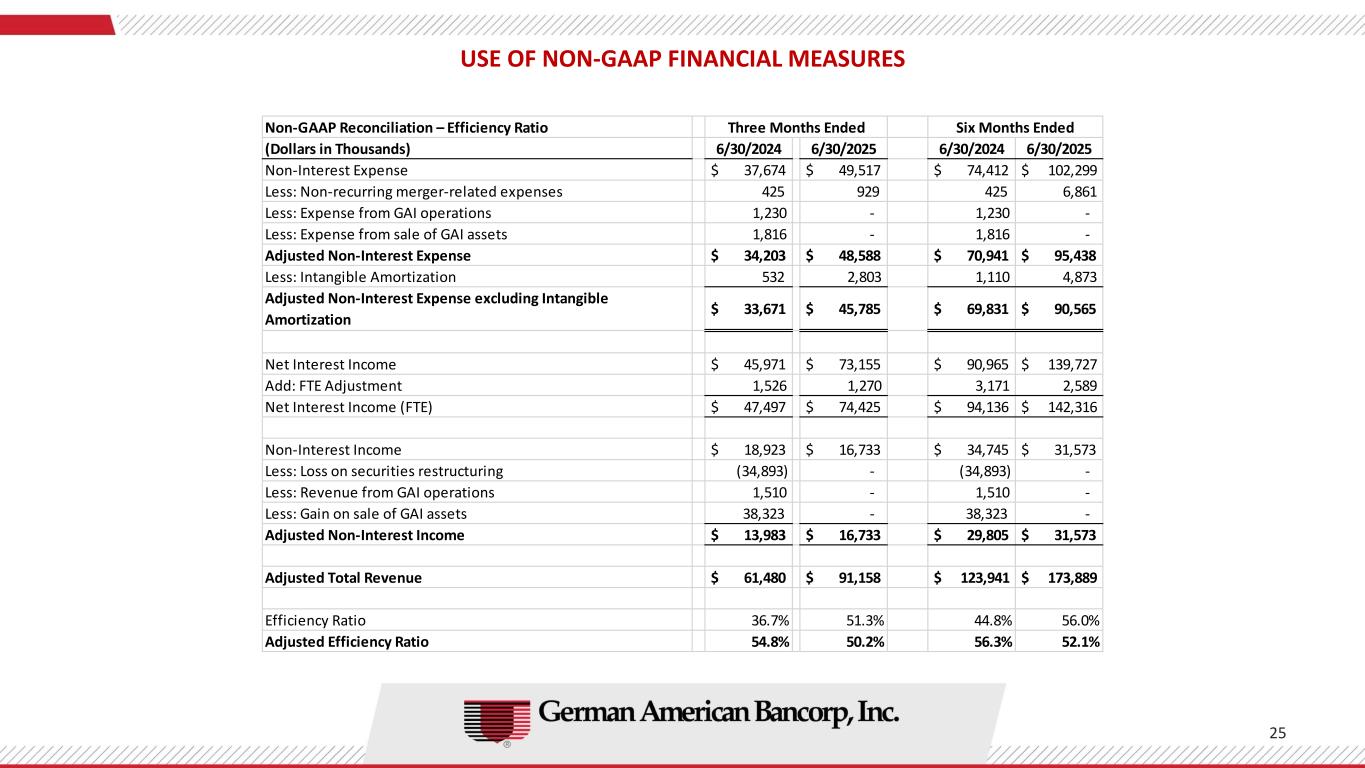

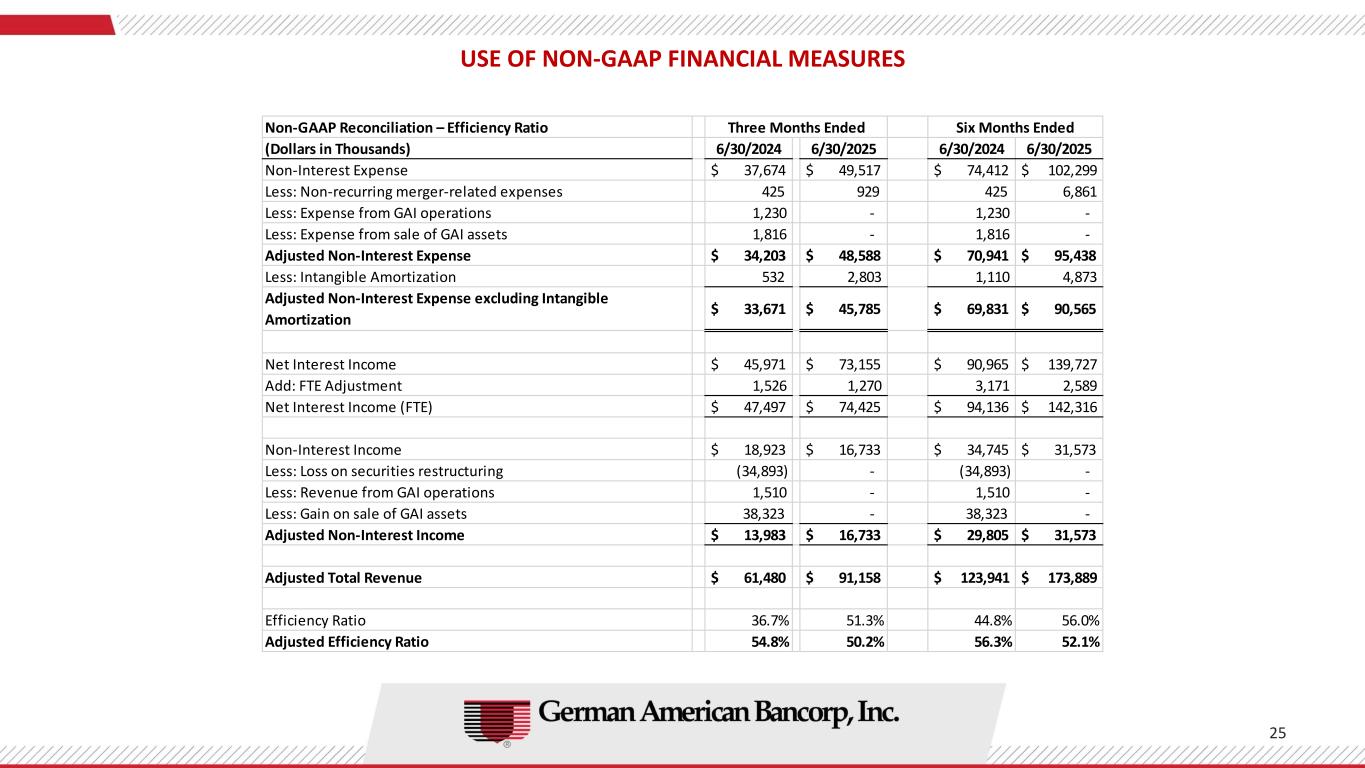

USE OF NON-GAAP FINANCIAL MEASURES 25 Non-GAAP Reconciliation – Efficiency Ratio (Dollars in Thousands) 6/30/2024 6/30/2025 6/30/2024 6/30/2025 Non-Interest Expense $ 37,674 $ 49,517 $ 74,412 $ 102,299 Less: Non-recurring merger-related expenses 425 929 425 6,861 Less: Expense from GAI operations 1,230 - 1,230 - Less: Expense from sale of GAI assets 1,816 - 1,816 - Adjusted Non-Interest Expense $ 34,203 $ 48,588 $ 70,941 $ 95,438 Less: Intangible Amortization 532 2,803 1,110 4,873 Adjusted Non-Interest Expense excluding Intangible Amortization $ 33,671 $ 45,785 $ 69,831 $ 90,565 Net Interest Income $ 45,971 $ 73,155 $ 90,965 $ 139,727 Add: FTE Adjustment 1,526 1,270 3,171 2,589 Net Interest Income (FTE) $ 47,497 $ 74,425 $ 94,136 $ 142,316 Non-Interest Income $ 18,923 $ 16,733 $ 34,745 $ 31,573 Less: Loss on securities restructuring (34,893) - (34,893) - Less: Revenue from GAI operations 1,510 - 1,510 - Less: Gain on sale of GAI assets 38,323 - 38,323 - Adjusted Non-Interest Income $ 13,983 $ 16,733 $ 29,805 $ 31,573 Adjusted Total Revenue $ 61,480 $ 91,158 $ 123,941 $ 173,889 Efficiency Ratio 36.7% 51.3% 44.8% 56.0% Adjusted Efficiency Ratio 54.8% 50.2% 56.3% 52.1% Six Months EndedThree Months Ended

USE OF NON-GAAP FINANCIAL MEASURES 26 Non-GAAP Reconciliation – Net Interest Margin (Dollars in Thousands) 6/30/2024 6/30/2025 6/30/2024 6/30/2025 Net Interest Income (FTE) from above $ 47,497 $ 74,425 $ 94,136 $ 142,316 Less: Accretion of Discount on Acquired Loans 293 3,483 653 7,675 Adjusted Net Interest Income (FTE) $ 47,204 $ 70,942 $ 93,483 $ 134,641 Average Earning Assets $ 5,709,014 $ 7,605,113 $ 5,649,925 $ 7,265,693 Net Interest Margin (FTE) 3.34% 3.92% 3.34% 3.94% Adjusted Net Interest Margin (FTE) 3.32% 3.74% 3.32% 3.73% Non-GAAP Reconciliation – Net Income and Earnings Per Share (Dollars in Thousands, except per share amounts) 6/30/2024 6/30/2025 6/30/2024 6/30/2025 Adjusted Net Income $ 20,351 $ 32,058 $ 39,373 $ 59,345 Weighted Average Shares Outstanding 29,667,770 37,479,342 29,633,631 36,087,762 Earnings Per Share, as reported $ 0.69 $ 0.84 $ 1.33 $ 1.16 Earnings Per Share, as adjusted $ 0.69 $ 0.86 $ 1.33 $ 1.64 Six Months Ended Six Months Ended Three Months Ended Three Months Ended

27