New Jersey |

1-11277 |

22-2477875 |

||||||||||||

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number) |

(I.R.S. Employer

Identification Number)

|

||||||||||||

One Penn Plaza, |

New York, |

New York |

10119 |

|||||||||||

(Address of Principal Executive Offices) |

(Zip Code) |

|||||||||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading Symbols | Name of exchange on which registered | ||||||

| Common Stock, no par value | VLY | The Nasdaq Stock Market LLC | ||||||

| Non-Cumulative Perpetual Preferred Stock, Series A, no par value | VLYPP | The Nasdaq Stock Market LLC | ||||||

| Non-Cumulative Perpetual Preferred Stock, Series B, no par value | VLYPO | The Nasdaq Stock Market LLC | ||||||

| Item 2.02 | Results of Operations and Financial Condition. | ||||

| Item 7.01 | Regulation FD Disclosure. |

||||

| Item 9.01 | Financial Statements and Exhibits. | ||||

| Exhibit No. | Description | ||||

| (d) | Exhibits. | ||||

| 99.1 | |||||

The Press Release disclosed in this Item 9.01 as Exhibit 99.1 shall be considered “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended. |

|||||

| 99.2 | |||||

The presentation materials disclosed in this Item 9.01 as Exhibit 99.2 shall be considered “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended. |

|||||

Dated: January 26, 2023 |

VALLEY NATIONAL BANCORP |

||||||||||

By: |

/s/ Michael D. Hagedorn |

||||||||||

Michael D. Hagedorn |

|||||||||||

Senior Executive Vice President and |

|||||||||||

|

Chief Financial Officer

(Principal Financial Officer)

|

|||||||||||

|

News Release

|

|||||||

| FOR IMMEDIATE RELEASE | Contact: | Michael D. Hagedorn | |||||||||

| Senior Executive Vice President and | |||||||||||

| Chief Financial Officer | |||||||||||

| 973-872-4885 | |||||||||||

| December 31, 2022 | September 30, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||||

| Allocation | Allocation | Allocation | ||||||||||||||||||||||||||||||||||||

| as a % of | as a % of | as a % of | ||||||||||||||||||||||||||||||||||||

| Allowance | Loan | Allowance | Loan | Allowance | Loan | |||||||||||||||||||||||||||||||||

| Allocation | Category | Allocation | Category | Allocation | Category | |||||||||||||||||||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||||||||||||||||

| Loan Category: | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial loans | $ | 139,941 | 1.59 | % | $ | 154,051 | 1.77 | % | $ | 103,090 | 1.76 | % | ||||||||||||||||||||||||||

| Commercial real estate loans: | ||||||||||||||||||||||||||||||||||||||

| Commercial real estate | 200,421 | 0.78 | 217,124 | 0.89 | 193,258 | 1.02 | ||||||||||||||||||||||||||||||||

| Construction | 58,987 | 1.59 | 50,656 | 1.42 | 24,232 | 1.31 | ||||||||||||||||||||||||||||||||

| Total commercial real estate loans | 259,408 | 0.88 | 267,780 | 0.95 | 217,490 | 1.05 | ||||||||||||||||||||||||||||||||

| Residential mortgage loans | 39,020 | 0.73 | 36,157 | 0.70 | 25,120 | 0.55 | ||||||||||||||||||||||||||||||||

| Consumer loans: | ||||||||||||||||||||||||||||||||||||||

| Home equity | 4,333 | 0.86 | 4,083 | 0.87 | 3,889 | 0.97 | ||||||||||||||||||||||||||||||||

| Auto and other consumer | 15,953 | 0.57 | 13,673 | 0.49 | 9,613 | 0.37 | ||||||||||||||||||||||||||||||||

| Total consumer loans | 20,286 | 0.61 | 17,756 | 0.55 | 13,502 | 0.45 | ||||||||||||||||||||||||||||||||

| Allowance for loan losses | 458,655 | 0.98 | 475,744 | 1.05 | 359,202 | 1.05 | ||||||||||||||||||||||||||||||||

| Allowance for unfunded credit commitments | 24,600 | 22,664 | 16,500 | |||||||||||||||||||||||||||||||||||

| Total allowance for credit losses for loans | $ | 483,255 | $ | 498,408 | $ | 375,702 | ||||||||||||||||||||||||||||||||

| Allowance for credit losses for | ||||||||||||||||||||||||||||||||||||||

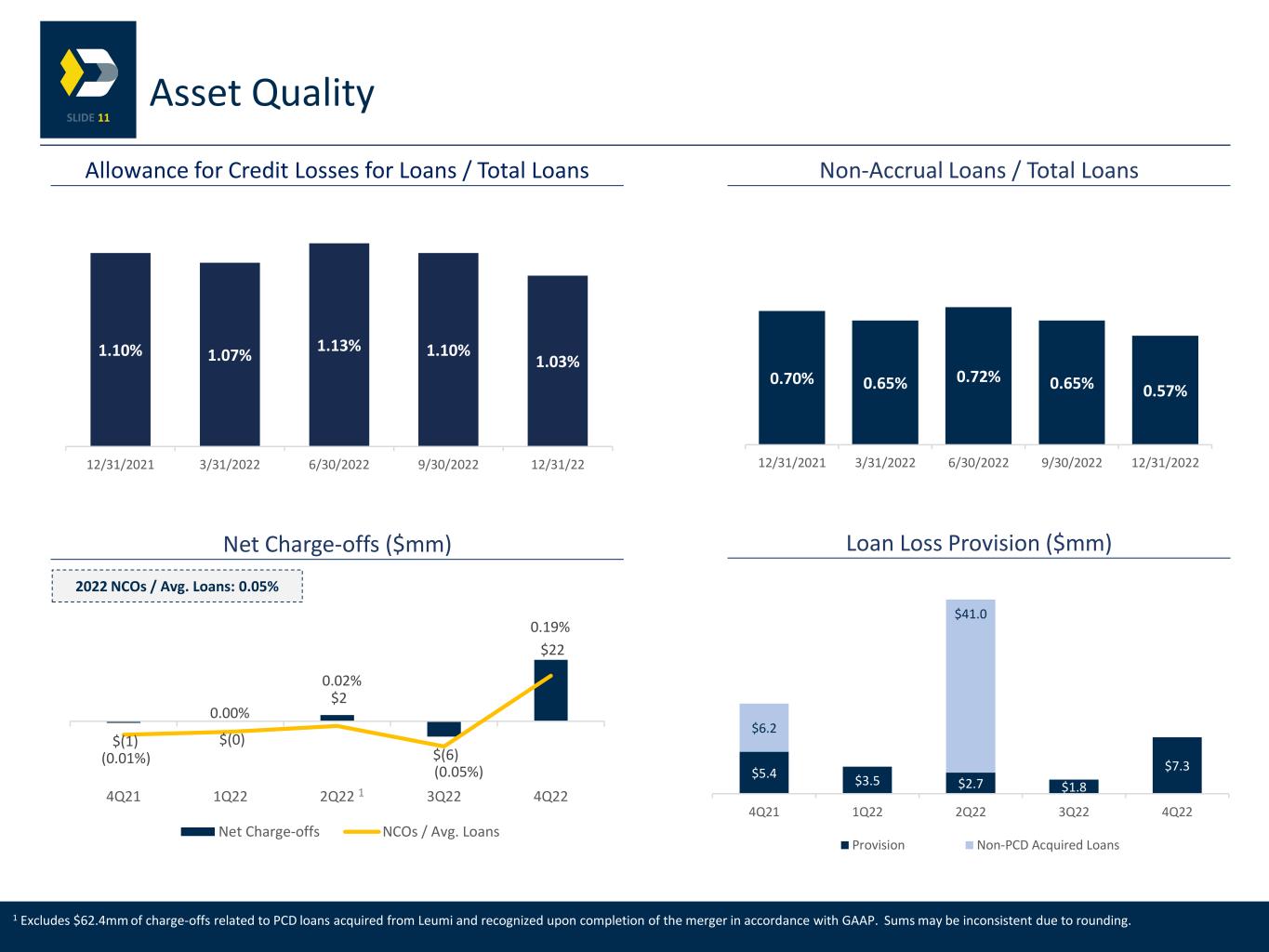

| loans as a % loans | 1.03 | % | 1.10 | % | 1.10 | % | ||||||||||||||||||||||||||||||||

| Three Months Ended | Years Ended | ||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | ||||||||||||||||||||||||||

| ($ in thousands, except for share data) | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||

| FINANCIAL DATA: | |||||||||||||||||||||||||||||

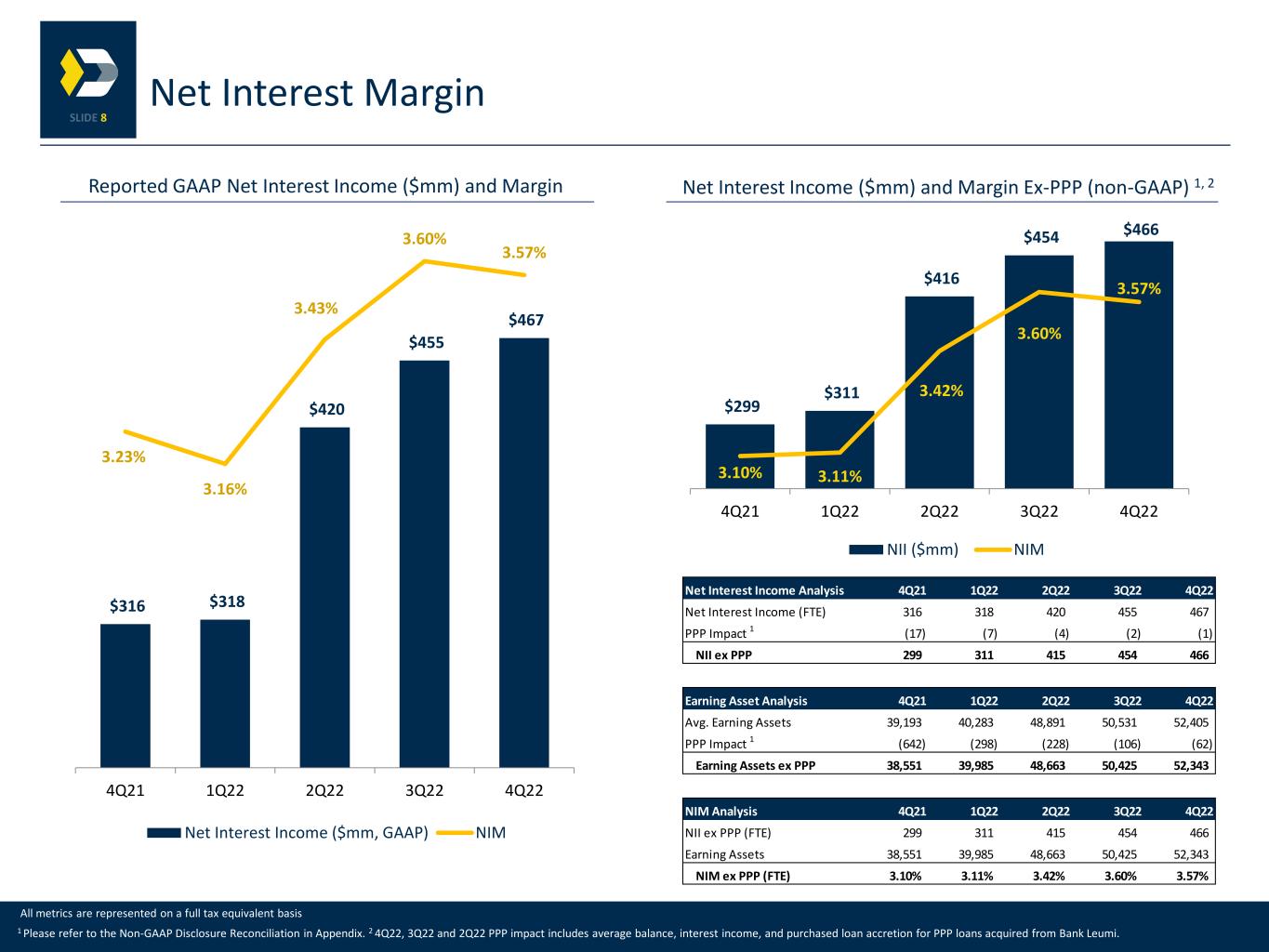

Net interest income - FTE (1) |

$ | 467,233 | $ | 455,308 | $ | 316,000 | $ | 1,660,468 | $ | 1,213,115 | |||||||||||||||||||

| Net interest income | 465,819 | 453,992 | 315,301 | 1,655,640 | 1,209,901 | ||||||||||||||||||||||||

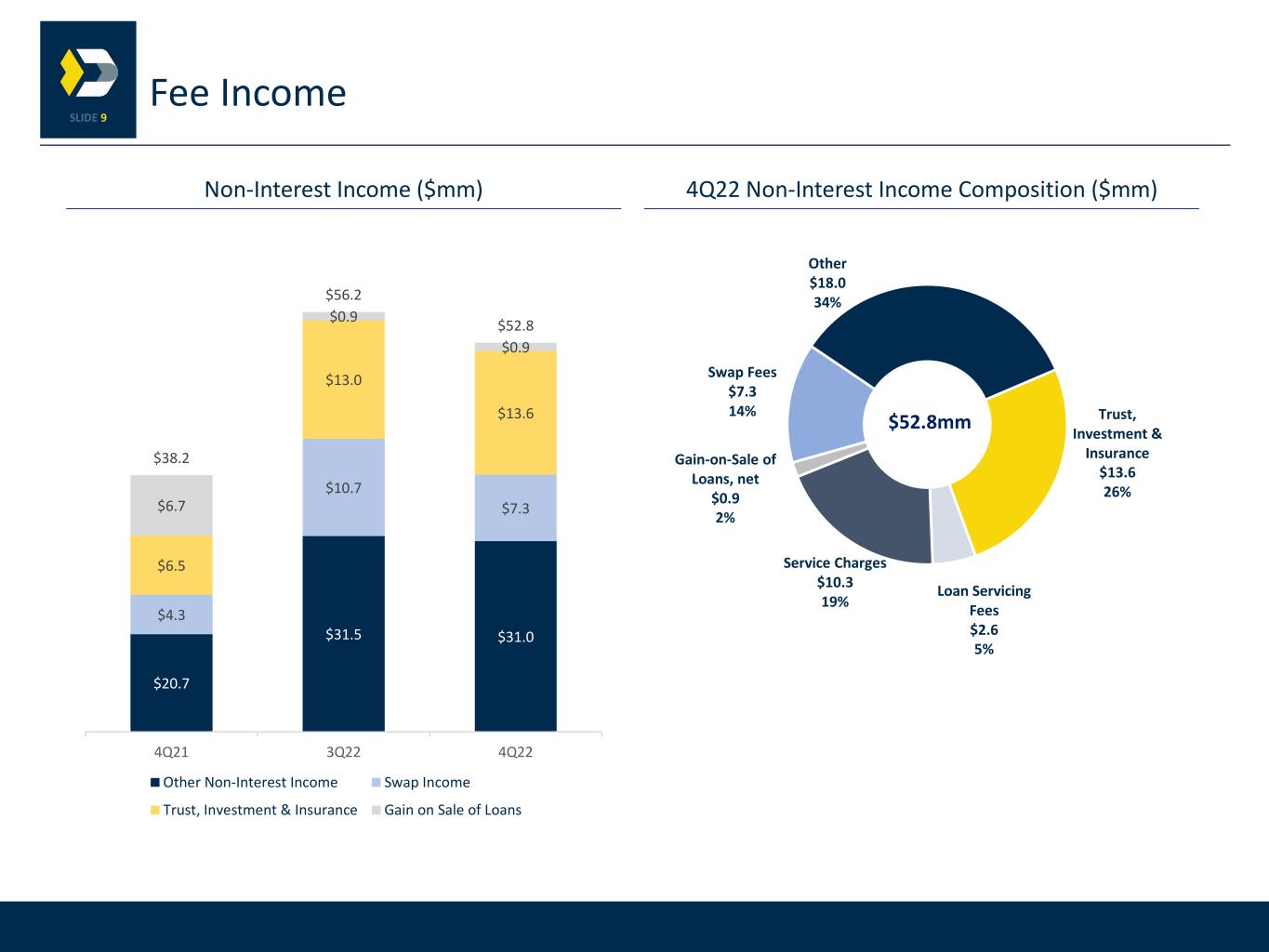

| Non-interest income | 52,796 | 56,194 | 38,223 | 206,793 | 155,013 | ||||||||||||||||||||||||

| Total revenue | 518,615 | 510,186 | 353,524 | 1,862,433 | 1,364,914 | ||||||||||||||||||||||||

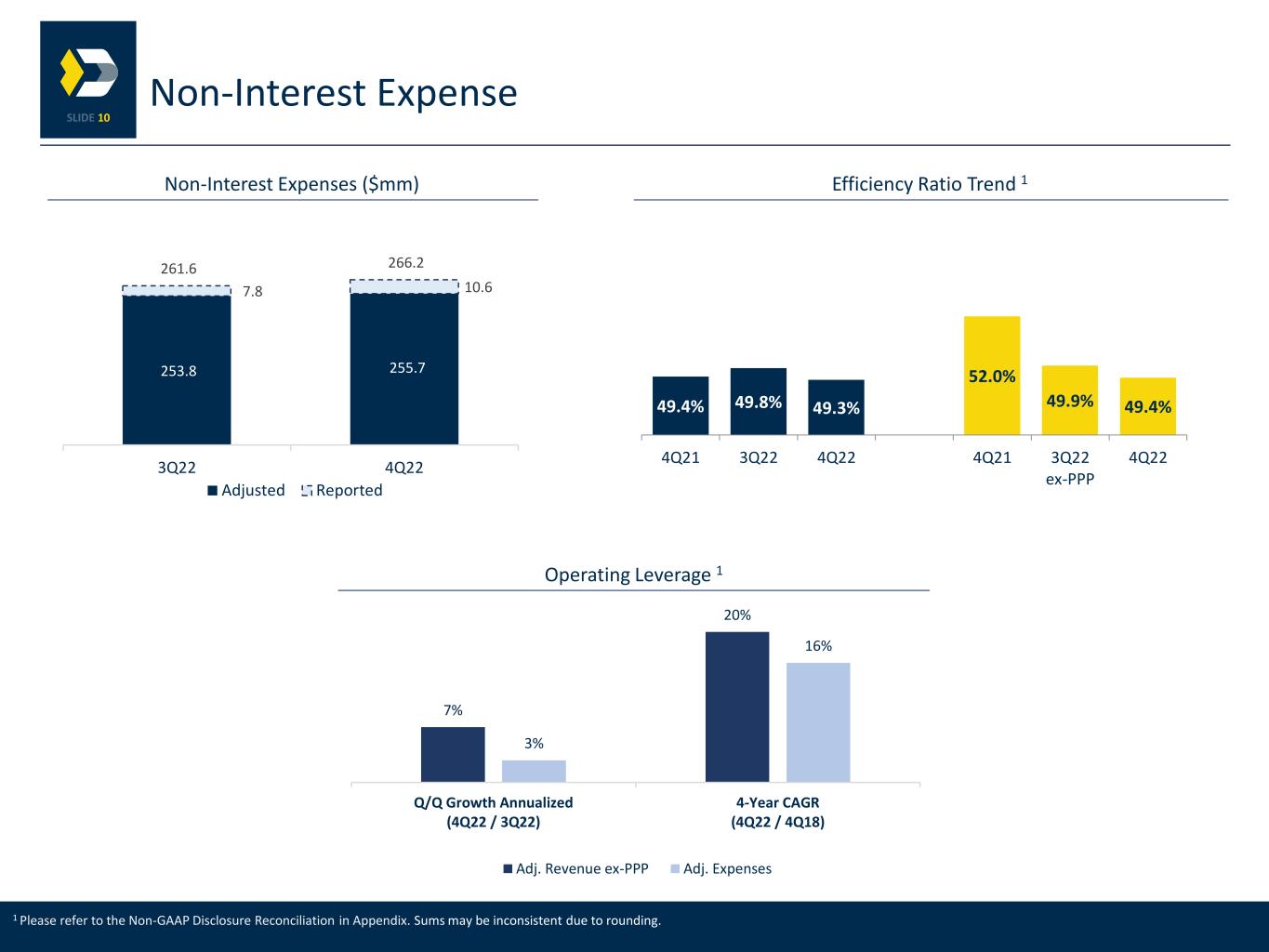

| Non-interest expense | 266,240 | 261,639 | 184,514 | 1,024,949 | 691,542 | ||||||||||||||||||||||||

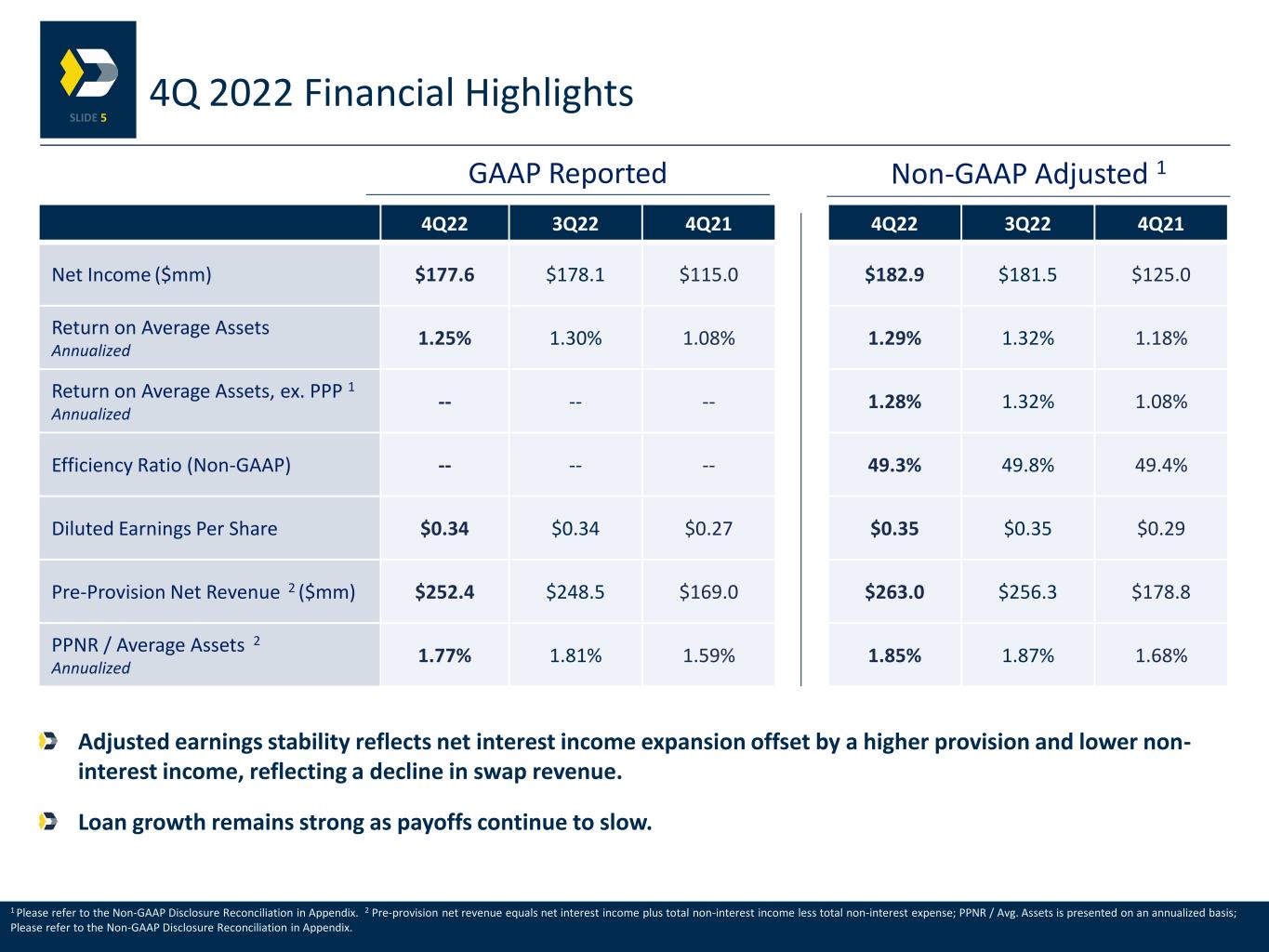

| Pre-provision net revenue | 252,375 | 248,547 | 169,010 | 837,484 | 673,372 | ||||||||||||||||||||||||

| Provision for credit losses | 7,239 | 2,023 | 11,699 | 56,817 | 32,633 | ||||||||||||||||||||||||

| Income tax expense | 67,545 | 68,405 | 42,273 | 211,816 | 166,899 | ||||||||||||||||||||||||

| Net income | 177,591 | 178,119 | 115,038 | 568,851 | 473,840 | ||||||||||||||||||||||||

| Dividends on preferred stock | 3,630 | 3,172 | 3,172 | 13,146 | 12,688 | ||||||||||||||||||||||||

| Net income available to common stockholders | $ | 173,961 | $ | 174,947 | $ | 111,866 | $ | 555,705 | $ | 461,152 | |||||||||||||||||||

| Weighted average number of common shares outstanding: | |||||||||||||||||||||||||||||

| Basic | 506,359,704 | 506,342,200 | 411,775,590 | 485,434,918 | 407,445,379 | ||||||||||||||||||||||||

| Diluted | 509,301,813 | 508,690,997 | 414,472,820 | 487,817,710 | 410,018,328 | ||||||||||||||||||||||||

| Per common share data: | |||||||||||||||||||||||||||||

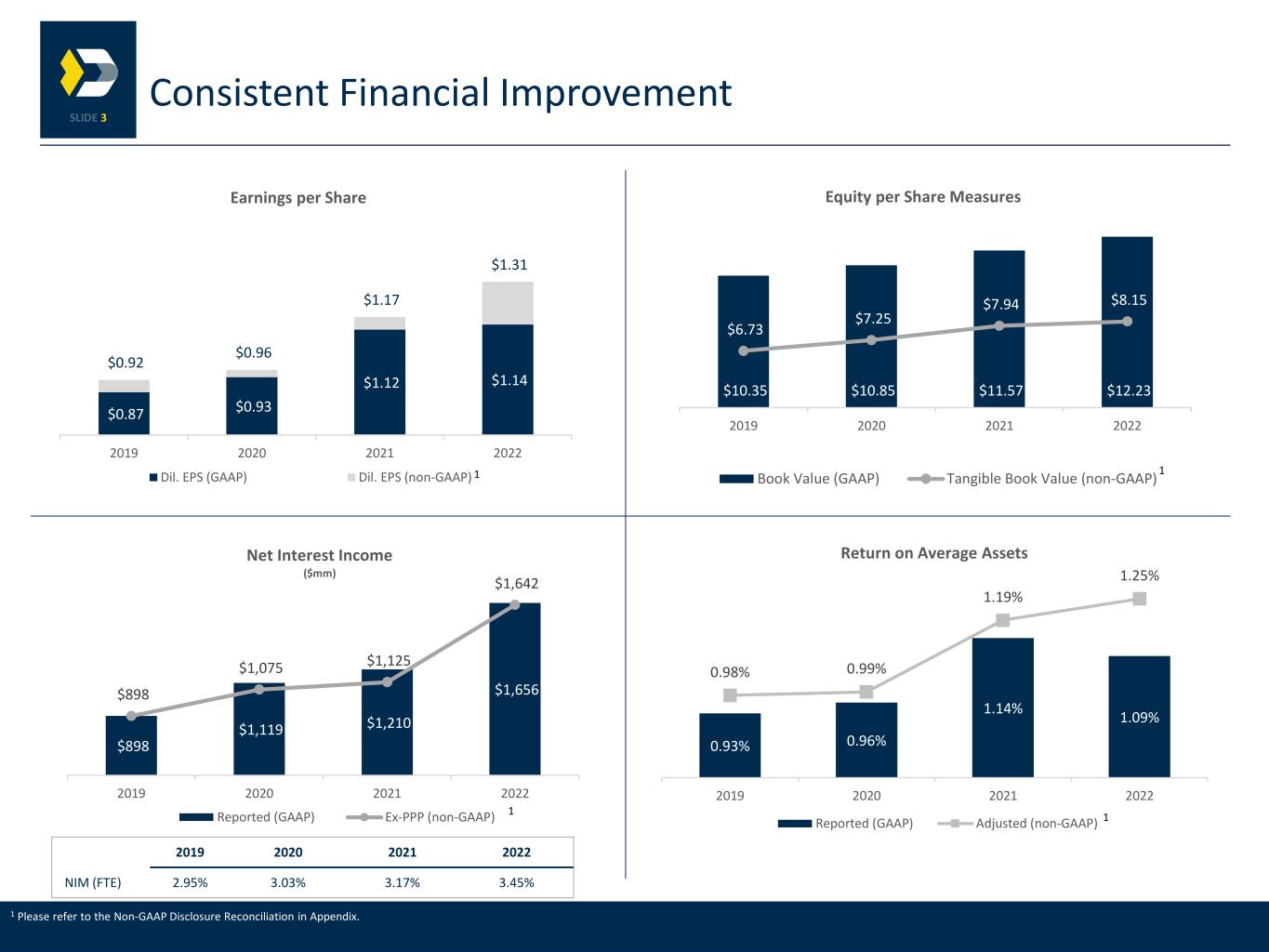

| Basic earnings | $ | 0.34 | $ | 0.35 | $ | 0.27 | $ | 1.14 | $ | 1.13 | |||||||||||||||||||

| Diluted earnings | 0.34 | 0.34 | 0.27 | 1.14 | 1.12 | ||||||||||||||||||||||||

| Cash dividends declared | 0.11 | 0.11 | 0.11 | 0.44 | 0.44 | ||||||||||||||||||||||||

| Closing stock price - high | 12.92 | 12.95 | 14.82 | 15.02 | 14.82 | ||||||||||||||||||||||||

| Closing stock price - low | 10.96 | 10.14 | 13.04 | 10.14 | 9.74 | ||||||||||||||||||||||||

| FINANCIAL RATIOS: | |||||||||||||||||||||||||||||

| Net interest margin | 3.56 | % | 3.59 | % | 3.22 | % | 3.44 | % | 3.16 | % | |||||||||||||||||||

Net interest margin - FTE (1) |

3.57 | 3.60 | 3.23 | 3.45 | 3.17 | ||||||||||||||||||||||||

| Annualized return on average assets | 1.25 | 1.30 | 1.08 | 1.09 | 1.14 | ||||||||||||||||||||||||

| Annualized return on avg. shareholders' equity | 11.23 | 11.39 | 9.38 | 9.50 | 9.98 | ||||||||||||||||||||||||

NON-GAAP FINANCIAL DATA AND RATIOS: (3) | |||||||||||||||||||||||||||||

| Basic earnings per share, as adjusted | $ | 0.35 | $ | 0.35 | $ | 0.30 | $ | 1.31 | $ | 1.18 | |||||||||||||||||||

| Diluted earnings per share, as adjusted | 0.35 | 0.35 | 0.29 | 1.31 | 1.17 | ||||||||||||||||||||||||

| Annualized return on average assets, as adjusted | 1.29 | % | 1.32 | % | 1.18 | % | 1.25 | % | 1.19 | % | |||||||||||||||||||

| Annualized return on average shareholders' equity, as adjusted | 11.56 | 11.60 | 10.19 | 10.87 | 10.37 | ||||||||||||||||||||||||

| Annualized return on avg. tangible shareholders' equity | 16.70 | % | 17.21 | % | 13.44 | % | 14.08 | % | 14.40 | % | |||||||||||||||||||

| Annualized return on average tangible shareholders' equity, as adjusted | 17.20 | 17.54 | 14.61 | 16.10 | 14.96 | ||||||||||||||||||||||||

| Efficiency ratio | 49.30 | 49.76 | 49.44 | 50.55 | 48.46 | ||||||||||||||||||||||||

| AVERAGE BALANCE SHEET ITEMS: | |||||||||||||||||||||||||||||

| Assets | $ | 56,913,215 | $ | 54,858,306 | $ | 42,473,828 | $ | 52,182,310 | $ | 41,475,682 | |||||||||||||||||||

| Interest earning assets | 52,405,601 | 50,531,242 | 39,193,014 | 48,067,381 | 38,227,815 | ||||||||||||||||||||||||

| Loans | 46,086,363 | 44,341,894 | 33,338,128 | 41,930,353 | 32,816,985 | ||||||||||||||||||||||||

| Interest bearing liabilities | 33,596,874 | 31,228,739 | 25,582,956 | 30,190,267 | 25,586,867 | ||||||||||||||||||||||||

| Deposits | 46,234,857 | 44,770,368 | 34,746,786 | 42,451,465 | 33,239,432 | ||||||||||||||||||||||||

| Shareholders' equity | 6,327,970 | 6,256,767 | 4,905,343 | 5,985,236 | 4,747,745 | ||||||||||||||||||||||||

| As of | |||||||||||||||||||||||||||||

| BALANCE SHEET ITEMS: | December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||

| (In thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | ||||||||||||||||||||||||

| Assets | $ | 57,462,749 | $ | 55,927,501 | $ | 54,438,807 | $ | 43,551,457 | $ | 43,446,443 | |||||||||||||||||||

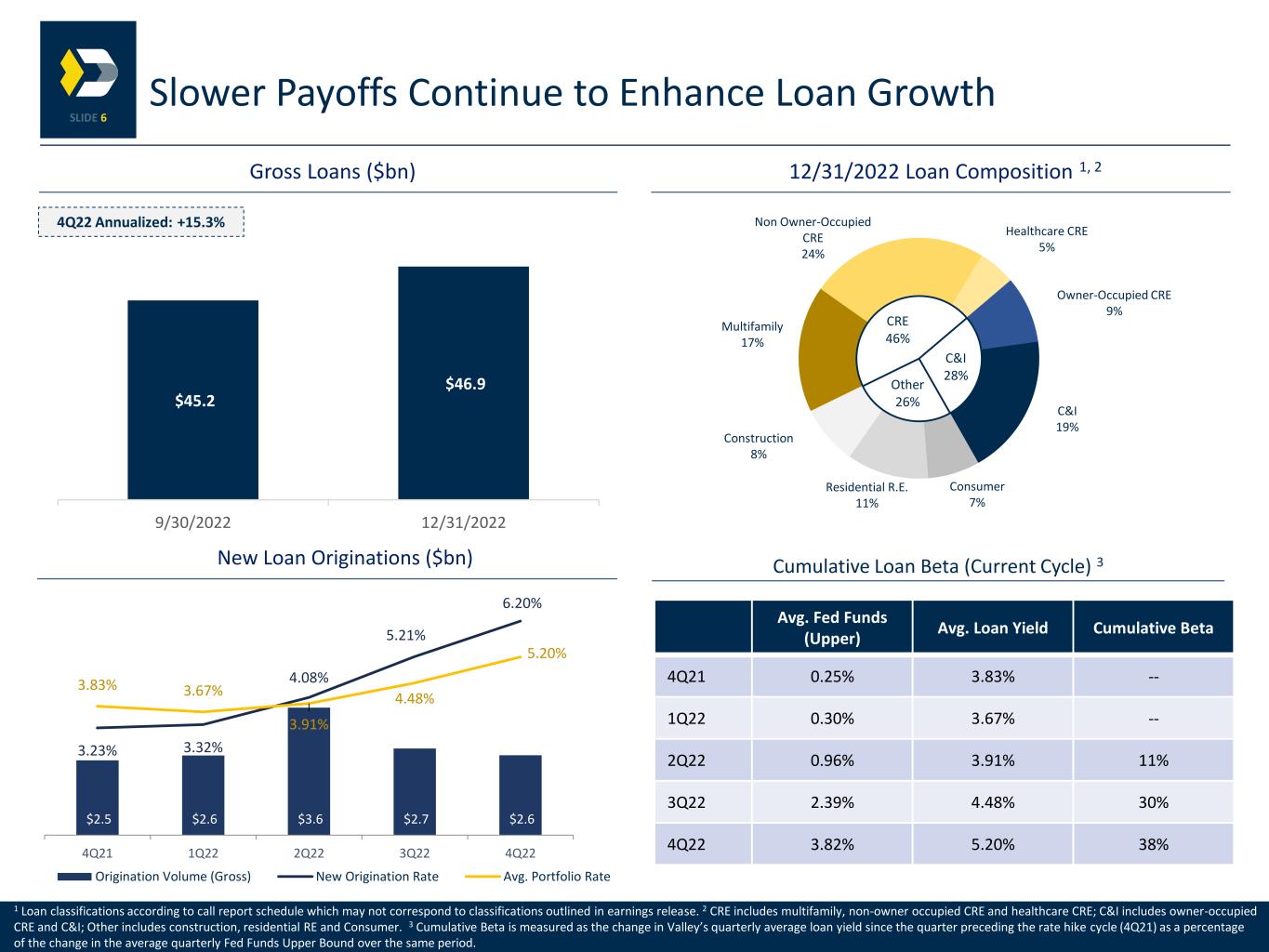

| Total loans | 46,917,200 | 45,185,764 | 43,560,777 | 35,364,405 | 34,153,657 | ||||||||||||||||||||||||

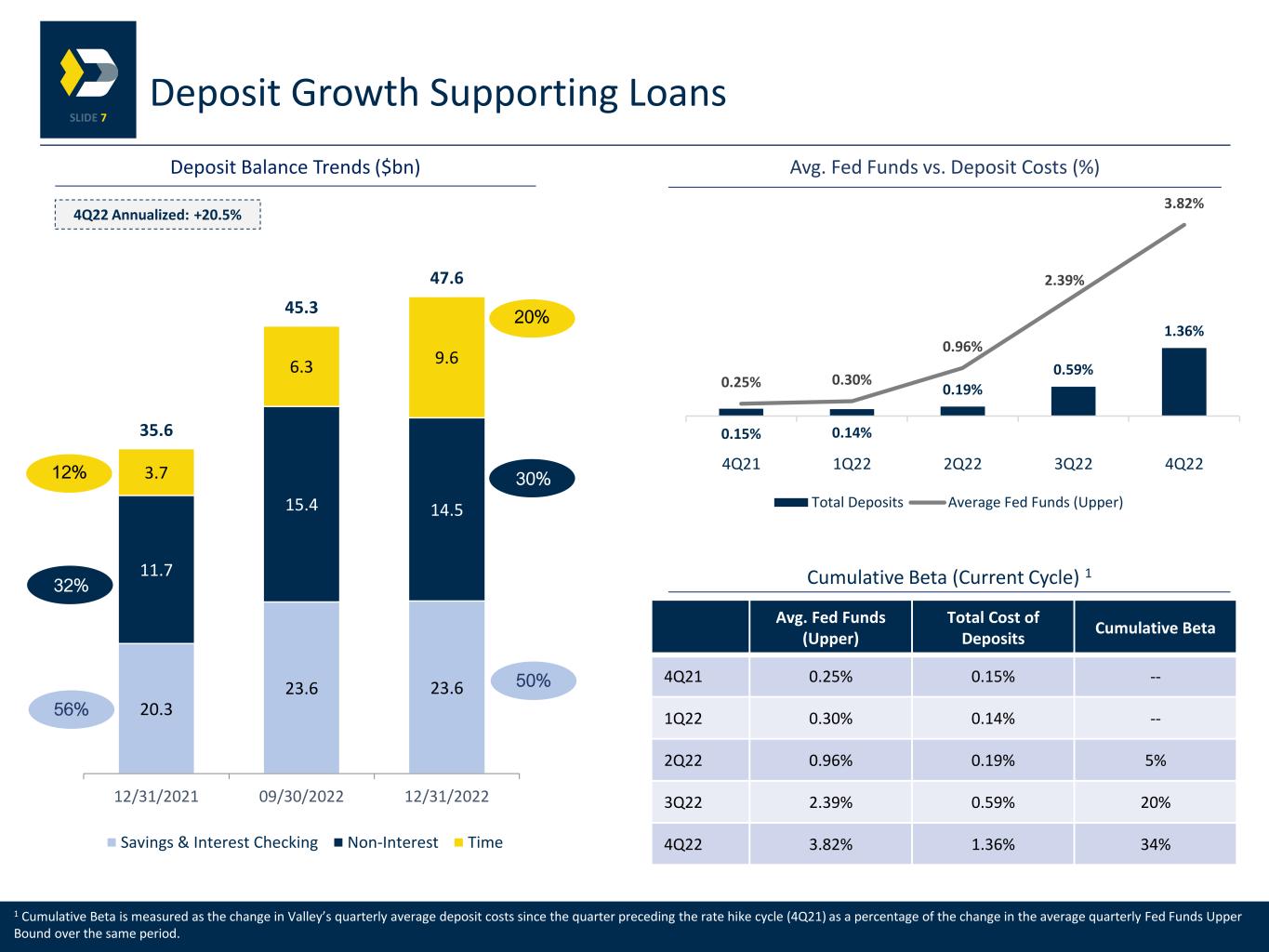

| Deposits | 47,636,914 | 45,308,843 | 43,881,051 | 35,647,336 | 35,632,412 | ||||||||||||||||||||||||

| Shareholders' equity | 6,400,802 | 6,273,829 | 6,204,913 | 5,096,384 | 5,084,066 | ||||||||||||||||||||||||

| LOANS: | |||||||||||||||||||||||||||||

| (In thousands) | |||||||||||||||||||||||||||||

| Commercial and industrial loans: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 8,771,250 | $ | 8,615,557 | $ | 8,378,454 | $ | 5,587,781 | $ | 5,411,601 | |||||||||||||||||||

| Commercial and industrial PPP loans | 33,580 | 85,820 | 136,004 | 203,609 | 435,950 | ||||||||||||||||||||||||

| Total commercial and industrial | 8,804,830 | 8,701,377 | 8,514,458 | 5,791,390 | 5,847,551 | ||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||

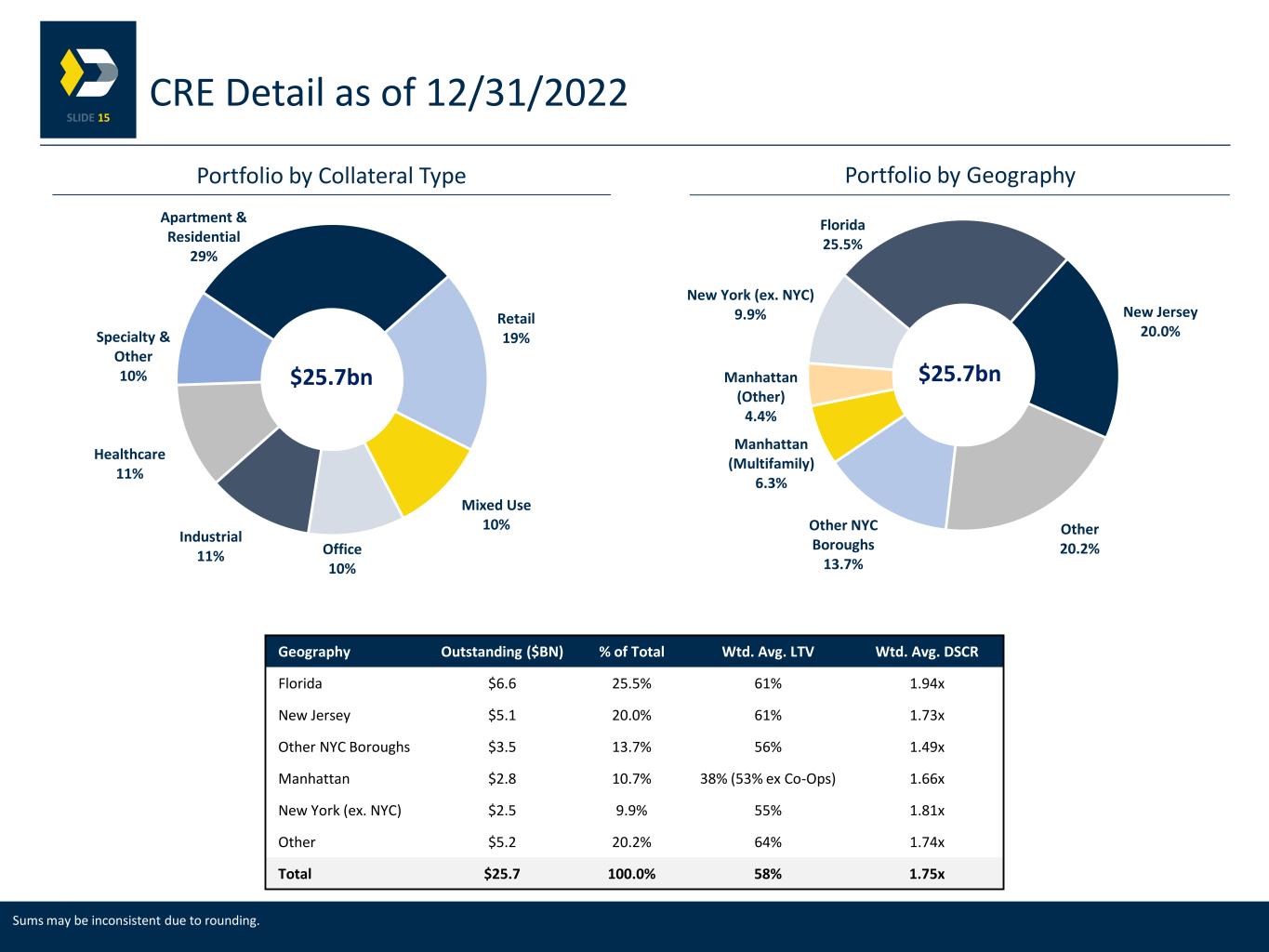

| Commercial real estate | 25,732,033 | 24,493,445 | 23,535,086 | 19,763,202 | 18,935,486 | ||||||||||||||||||||||||

| Construction | 3,700,835 | 3,571,818 | 3,374,373 | 2,174,542 | 1,854,580 | ||||||||||||||||||||||||

| Total commercial real estate | 29,432,868 | 28,065,263 | 26,909,459 | 21,937,744 | 20,790,066 | ||||||||||||||||||||||||

| Residential mortgage | 5,364,550 | 5,177,128 | 5,005,069 | 4,691,935 | 4,545,064 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Home equity | 503,884 | 467,135 | 431,455 | 393,538 | 400,779 | ||||||||||||||||||||||||

| Automobile | 1,746,225 | 1,711,086 | 1,673,482 | 1,552,928 | 1,570,036 | ||||||||||||||||||||||||

| Other consumer | 1,064,843 | 1,063,775 | 1,026,854 | 996,870 | 1,000,161 | ||||||||||||||||||||||||

| Total consumer loans | 3,314,952 | 3,241,996 | 3,131,791 | 2,943,336 | 2,970,976 | ||||||||||||||||||||||||

| Total loans | $ | 46,917,200 | $ | 45,185,764 | $ | 43,560,777 | $ | 35,364,405 | $ | 34,153,657 | |||||||||||||||||||

| CAPITAL RATIOS: | |||||||||||||||||||||||||||||

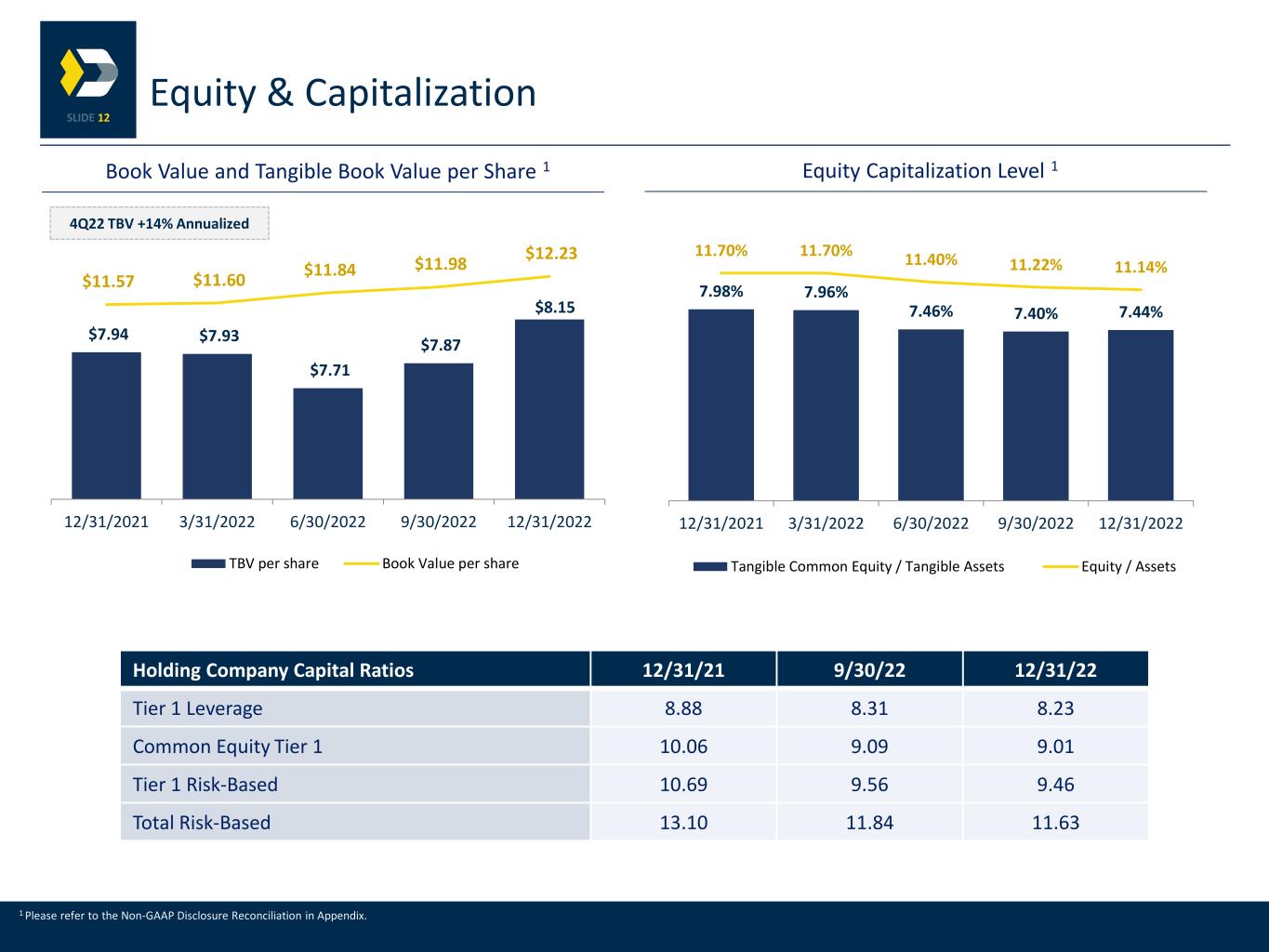

| Book value per common share | $ | 12.23 | $ | 11.98 | $ | 11.84 | $ | 11.60 | $ | 11.57 | |||||||||||||||||||

Tangible book value per common share (3) |

8.15 | 7.87 | 7.71 | 7.93 | 7.94 | ||||||||||||||||||||||||

Tangible common equity to tangible assets (3) |

7.45 | % | 7.40 | % | 7.46 | % | 7.96 | % | 7.98 | % | |||||||||||||||||||

| Tier 1 leverage capital | 8.23 | 8.31 | 8.33 | 8.70 | 8.88 | ||||||||||||||||||||||||

| Common equity tier 1 capital | 9.01 | 9.09 | 9.06 | 9.67 | 10.06 | ||||||||||||||||||||||||

| Tier 1 risk-based capital | 9.46 | 9.56 | 9.54 | 10.27 | 10.69 | ||||||||||||||||||||||||

| Total risk-based capital | 11.63 | 11.84 | 11.53 | 12.65 | 13.10 | ||||||||||||||||||||||||

| Three Months Ended | Years Ended | ||||||||||||||||||||||||||||

| ALLOWANCE FOR CREDIT LOSSES: | December 31, | September 30, | December 31, | December 31, | |||||||||||||||||||||||||

| ($ in thousands) | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||

| Allowance for credit losses for loans | |||||||||||||||||||||||||||||

| Beginning balance | $ | 498,408 | $ | 490,963 | $ | 356,927 | $ | 375,702 | $ | 351,354 | |||||||||||||||||||

Allowance for purchased credit deteriorated (PCD) loans, net (2) |

— | — | 6,542 | 70,319 | 6,542 | ||||||||||||||||||||||||

| Beginning balance, adjusted | 498,408 | 490,963 | 363,469 | 446,021 | 357,896 | ||||||||||||||||||||||||

| Loans charged-off: | |||||||||||||||||||||||||||||

| Commercial and industrial | (22,106) | (5,033) | (2,224) | (33,250) | (21,507) | ||||||||||||||||||||||||

| Commercial real estate | (388) | (4,000) | — | (4,561) | (382) | ||||||||||||||||||||||||

| Residential mortgage | (1) | — | (1) | (28) | (140) | ||||||||||||||||||||||||

| Total consumer | (1,544) | (962) | (914) | (4,057) | (4,303) | ||||||||||||||||||||||||

| Total loans charged-off | (24,039) | (9,995) | (3,139) | (41,896) | (26,332) | ||||||||||||||||||||||||

| Charged-off loans recovered: | |||||||||||||||||||||||||||||

| Commercial and industrial | 1,069 | 13,236 | 1,153 | 17,081 | 3,934 | ||||||||||||||||||||||||

| Commercial real estate | 13 | 1,729 | 1,794 | 2,073 | 2,553 | ||||||||||||||||||||||||

| Construction | — | — | — | — | 4 | ||||||||||||||||||||||||

| Residential mortgage | 17 | 163 | 100 | 711 | 676 | ||||||||||||||||||||||||

| Total consumer | 498 | 477 | 716 | 2,929 | 4,075 | ||||||||||||||||||||||||

| Total loans recovered | 1,597 | 15,605 | 3,763 | 22,794 | 11,242 | ||||||||||||||||||||||||

| Net (charge-offs) recoveries | (22,442) | 5,610 | 624 | (19,102) | (15,090) | ||||||||||||||||||||||||

| Provision for credit losses for loans | 7,289 | 1,835 | 11,609 | 56,336 | 32,896 | ||||||||||||||||||||||||

| Ending balance | $ | 483,255 | $ | 498,408 | $ | 375,702 | $ | 483,255 | $ | 375,702 | |||||||||||||||||||

| Components of allowance for credit losses for loans: | |||||||||||||||||||||||||||||

| Allowance for loan losses | $ | 458,655 | $ | 475,744 | $ | 359,202 | $ | 458,655 | $ | 359,202 | |||||||||||||||||||

| Allowance for unfunded credit commitments | 24,600 | 22,664 | 16,500 | 24,600 | 16,500 | ||||||||||||||||||||||||

| Allowance for credit losses for loans | $ | 483,255 | $ | 498,408 | $ | 375,702 | $ | 483,255 | $ | 375,702 | |||||||||||||||||||

| Components of provision for credit losses for loans: | |||||||||||||||||||||||||||||

| Provision for credit losses for loans | $ | 5,353 | $ | 1,315 | $ | 9,509 | $ | 48,236 | $ | 27,507 | |||||||||||||||||||

| Provision for unfunded credit commitments | 1,936 | 520 | 2,100 | 8,100 | 5,389 | ||||||||||||||||||||||||

| Total provision for credit losses for loans | $ | 7,289 | $ | 1,835 | $ | 11,609 | $ | 56,336 | $ | 32,896 | |||||||||||||||||||

| Annualized ratio of total net charge-offs (recoveries) to average loans | 0.19 | % | (0.05) | % | (0.01) | % | 0.05 | % | 0.05 | % | |||||||||||||||||||

| Allowance for credit losses as a % of total loans | 1.03 | % | 1.10 | % | 1.10 | % | 1.03 | % | 1.10 | % | |||||||||||||||||||

| As of | |||||||||||||||||||||||||||||

| ASSET QUALITY: | December 31, | September 30, | June 30, | March 31, | December 31, | ||||||||||||||||||||||||

| ($ in thousands) | 2022 | 2022 | 2022 | 2022 | 2021 | ||||||||||||||||||||||||

| Accruing past due loans: | |||||||||||||||||||||||||||||

| 30 to 59 days past due: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 11,664 | $ | 19,526 | $ | 7,143 | $ | 6,723 | $ | 6,717 | |||||||||||||||||||

| Commercial real estate | 6,638 | 6,196 | 10,516 | 30,807 | 14,421 | ||||||||||||||||||||||||

| Construction | — | — | 9,108 | 1,708 | 1,941 | ||||||||||||||||||||||||

| Residential mortgage | 16,146 | 13,045 | 12,326 | 9,266 | 10,999 | ||||||||||||||||||||||||

| Total consumer | 9,087 | 6,196 | 6,009 | 5,862 | 6,811 | ||||||||||||||||||||||||

| Total 30 to 59 days past due | 43,535 | 44,963 | 45,102 | 54,366 | 40,889 | ||||||||||||||||||||||||

| 60 to 89 days past due: | |||||||||||||||||||||||||||||

| Commercial and industrial | 12,705 | 2,188 | 3,870 | 14,461 | 7,870 | ||||||||||||||||||||||||

| Commercial real estate | 3,167 | 383 | 630 | 6,314 | — | ||||||||||||||||||||||||

| Construction | — | 12,969 | 3,862 | 3,125 | — | ||||||||||||||||||||||||

| Residential mortgage | 3,315 | 5,947 | 2,410 | 2,560 | 3,314 | ||||||||||||||||||||||||

| Total consumer | 1,579 | 1,174 | 702 | 554 | 1,020 | ||||||||||||||||||||||||

| Total 60 to 89 days past due | 20,766 | 22,661 | 11,474 | 27,014 | 12,204 | ||||||||||||||||||||||||

| 90 or more days past due: | |||||||||||||||||||||||||||||

| Commercial and industrial | 18,392 | 15,072 | 15,470 | 9,261 | 1,273 | ||||||||||||||||||||||||

| Commercial real estate | 2,292 | 15,082 | — | — | 32 | ||||||||||||||||||||||||

| Construction | 3,990 | — | — | — | — | ||||||||||||||||||||||||

| Residential mortgage | 1,866 | 550 | 1,188 | 1,746 | 677 | ||||||||||||||||||||||||

| Total consumer | 47 | 421 | 267 | 400 | 789 | ||||||||||||||||||||||||

| Total 90 or more days past due | 26,587 | 31,125 | 16,925 | 11,407 | 2,771 | ||||||||||||||||||||||||

| Total accruing past due loans | $ | 90,888 | $ | 98,749 | $ | 73,501 | $ | 92,787 | $ | 55,864 | |||||||||||||||||||

| Non-accrual loans: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 98,881 | $ | 135,187 | $ | 148,404 | $ | 96,631 | $ | 99,918 | |||||||||||||||||||

| Commercial real estate | 68,316 | 67,319 | 85,807 | 79,180 | 83,592 | ||||||||||||||||||||||||

| Construction | 74,230 | 61,098 | 49,780 | 17,618 | 17,641 | ||||||||||||||||||||||||

| Residential mortgage | 25,160 | 26,564 | 25,847 | 33,275 | 35,207 | ||||||||||||||||||||||||

| Total consumer | 3,174 | 3,227 | 3,279 | 3,754 | 3,858 | ||||||||||||||||||||||||

| Total non-accrual loans | 269,761 | 293,395 | 313,117 | 230,458 | 240,216 | ||||||||||||||||||||||||

| Other real estate owned (OREO) | 286 | 286 | 422 | 1,024 | 2,259 | ||||||||||||||||||||||||

| Other repossessed assets | 1,937 | 1,122 | 1,200 | 1,176 | 2,931 | ||||||||||||||||||||||||

| Total non-performing assets | $ | 271,984 | $ | 294,803 | $ | 314,739 | $ | 232,658 | $ | 245,406 | |||||||||||||||||||

| Performing troubled debt restructured loans | $ | 77,530 | $ | 69,748 | $ | 67,274 | $ | 56,538 | $ | 71,330 | |||||||||||||||||||

| Total non-accrual loans as a % of loans | 0.57 | % | 0.65 | % | 0.72 | % | 0.65 | % | 0.70 | % | |||||||||||||||||||

Total accruing past due and non-accrual loans as a % of loans |

0.77 | % | 0.87 | % | 0.89 | % | 0.91 | % | 0.87 | % | |||||||||||||||||||

| Allowance for losses on loans as a % of non-accrual loans | 170.02 | % | 162.15 | % | 149.73 | % | 157.30 | % | 149.53 | % | |||||||||||||||||||

| (1) | Net interest income and net interest margin are presented on a tax equivalent basis using a 21 percent federal tax rate. Valley believes that this presentation provides comparability of net interest income and net interest margin arising from both taxable and tax-exempt sources and is consistent with industry practice and SEC rules. | ||||

| (2) | Represents the allowance for acquired PCD loans, net of PCD loan charge-offs totaling $62.4 million in the second quarter 2022. | ||||

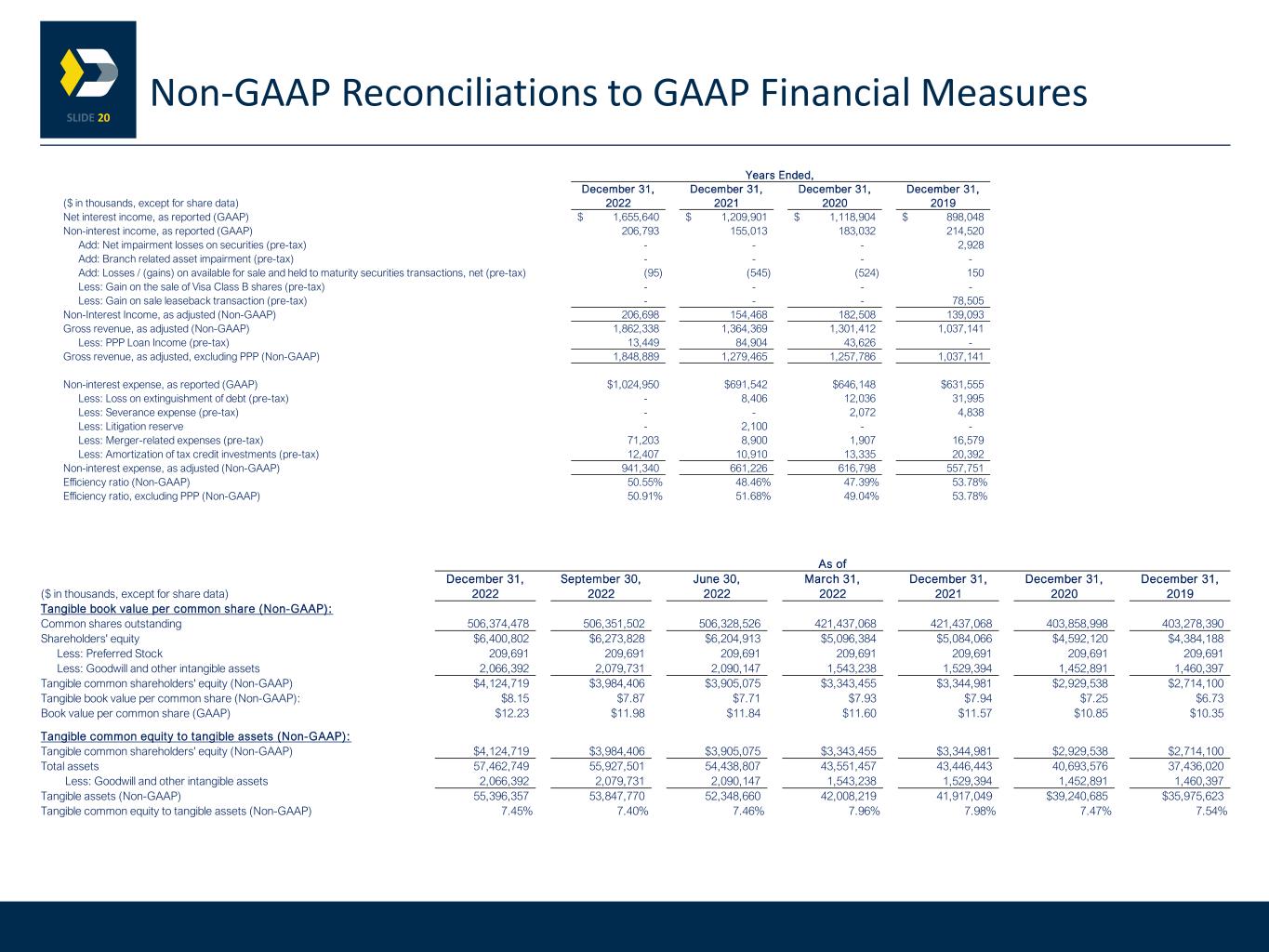

| (3) | Non-GAAP Reconciliations. This press release contains certain supplemental financial information, described in the Notes below, which has been determined by methods other than U.S. Generally Accepted Accounting Principles ("GAAP") that management uses in its analysis of Valley's performance. The Company believes that the non-GAAP financial measures provide useful supplemental information to both management and investors in understanding Valley’s underlying operational performance, business and performance trends, and may facilitate comparisons of our current and prior performance with the performance of others in the financial services industry. Management utilizes these measures for internal planning, forecasting and analysis purposes. Management believes that Valley’s presentation and discussion of this supplemental information, together with the accompanying reconciliations to the GAAP financial measures, also allows investors to view performance in a manner similar to management. These non-GAAP financial measures should not be considered in isolation or as a substitute for or superior to financial measures calculated in accordance with U.S. GAAP. These non-GAAP financial measures may also be calculated differently from similar measures disclosed by other companies. |

||||

| Three Months Ended | Years Ended | ||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | ||||||||||||||||||||||||||

| ($ in thousands, except for share data) | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||

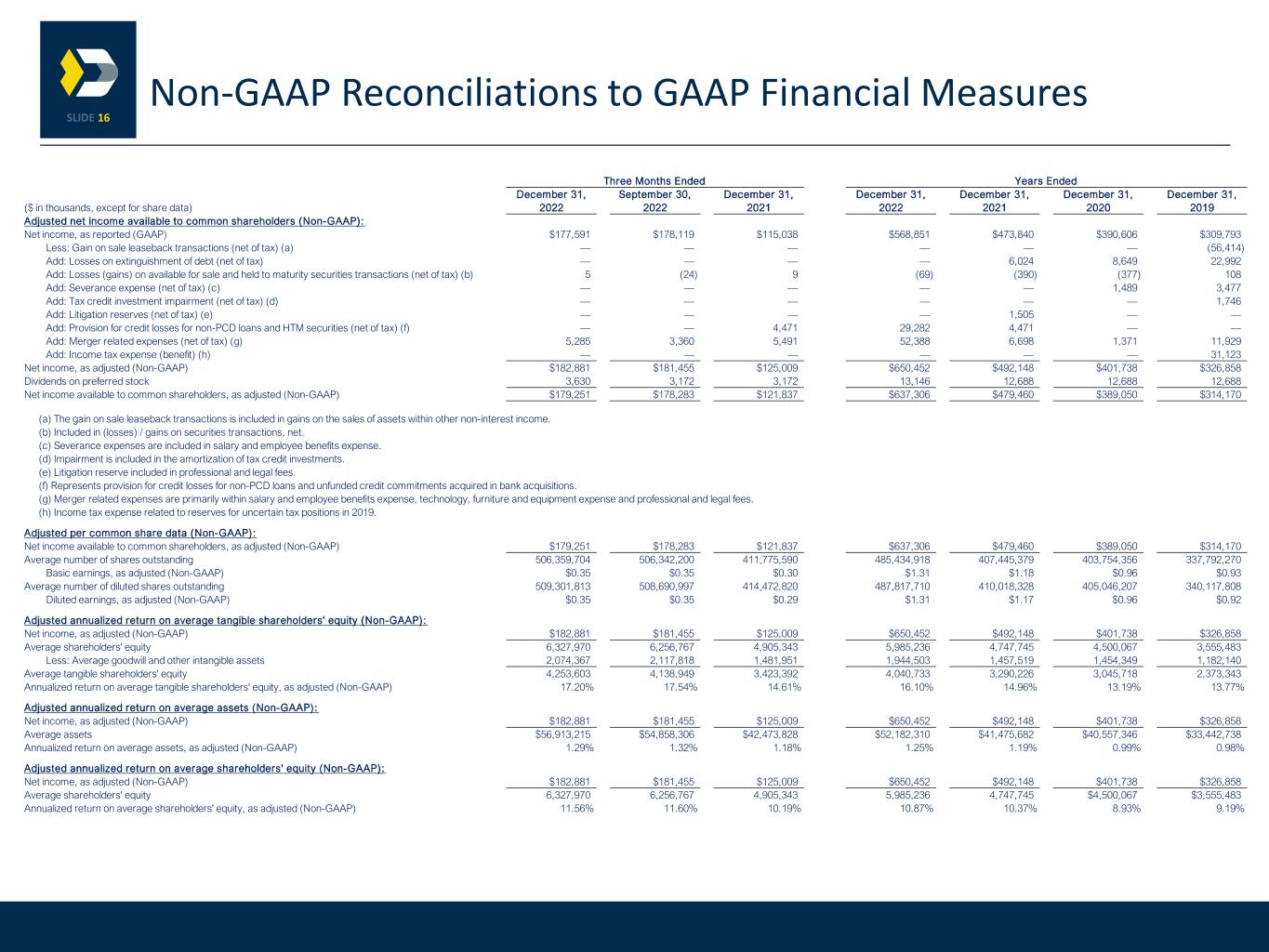

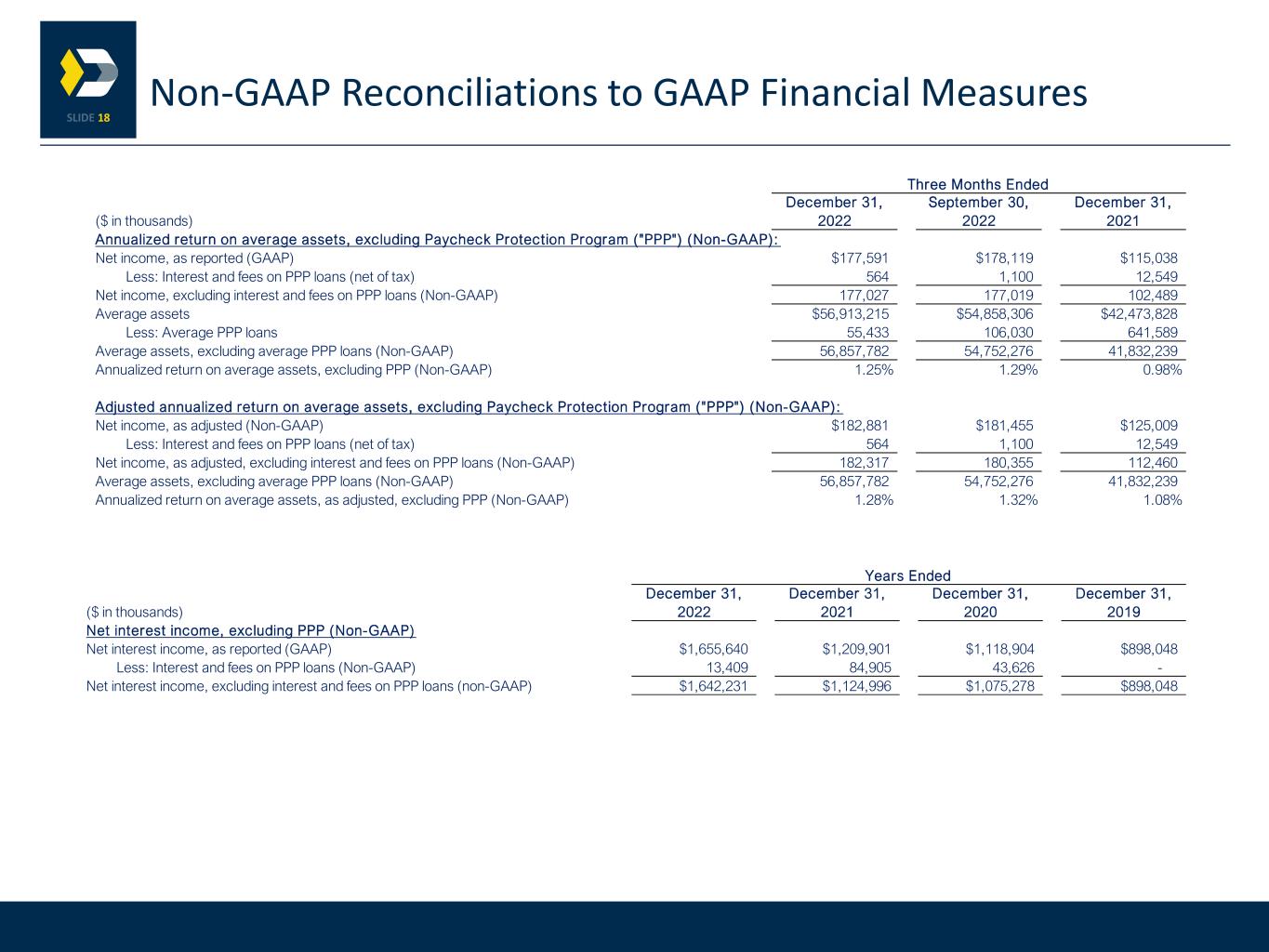

| Adjusted net income available to common shareholders (non-GAAP): | |||||||||||||||||||||||||||||

| Net income, as reported (GAAP) | $ | 177,591 | $ | 178,119 | $ | 115,038 | $ | 568,851 | $ | 473,840 | |||||||||||||||||||

Add: Losses on extinguishment of debt (net of tax) |

— | — | — | — | 6,024 | ||||||||||||||||||||||||

Add: Losses (gains) on available for sale and held to maturity securities transactions (net of tax)(a) |

5 | (24) | 9 | (69) | (390) | ||||||||||||||||||||||||

Add: Provision for credit losses (net of tax)(b) |

— | — | 4,471 | 29,282 | 4,471 | ||||||||||||||||||||||||

Add: Merger related expenses (net of tax)(c) |

5,285 | 3,360 | 5,491 | 52,388 | 6,698 | ||||||||||||||||||||||||

Add: Litigation reserve (net of tax)(d) |

— | — | — | — | 1,505 | ||||||||||||||||||||||||

| Net income, as adjusted (non-GAAP) | $ | 182,881 | $ | 181,455 | $ | 125,009 | $ | 650,452 | $ | 492,148 | |||||||||||||||||||

| Dividends on preferred stock | 3,630 | 3,172 | 3,172 | 13,146 | 12,688 | ||||||||||||||||||||||||

| Net income available to common shareholders, as adjusted (non-GAAP) | $ | 179,251 | $ | 178,283 | $ | 121,837 | $ | 637,306 | $ | 479,460 | |||||||||||||||||||

| _____________ | |||||||||||||||||||||||||||||

| (a) Included in (losses) gains on securities transactions, net. | |||||||||||||||||||||||||||||

| (b) Primarily represents provision for credit losses for non-PCD loans and unfunded credit commitments acquired in bank acquisitions. | |||||||||||||||||||||||||||||

(c) Merger related expenses are primarily within salary and employee benefits expense, technology, furniture and equipment expense and professional and legal fees for the year ended December 31, 2022. | |||||||||||||||||||||||||||||

(d) Included in professional and legal fees. | |||||||||||||||||||||||||||||

| Adjusted per common share data (non-GAAP): | |||||||||||||||||||||||||||||

| Net income available to common shareholders, as adjusted (non-GAAP) | $ | 179,251 | $ | 178,283 | $ | 121,837 | $ | 637,306 | $ | 479,460 | |||||||||||||||||||

| Average number of shares outstanding | 506,359,704 | 506,342,200 | 411,775,590 | 485,434,918 | 407,445,379 | ||||||||||||||||||||||||

| Basic earnings, as adjusted (non-GAAP) | $ | 0.35 | $ | 0.35 | $ | 0.30 | $ | 1.31 | $ | 1.18 | |||||||||||||||||||

| Average number of diluted shares outstanding | 509,301,813 | 508,690,997 | 414,472,820 | 487,817,710 | 410,018,328 | ||||||||||||||||||||||||

| Diluted earnings, as adjusted (non-GAAP) | $ | 0.35 | $ | 0.35 | $ | 0.29 | $ | 1.31 | $ | 1.17 | |||||||||||||||||||

| Adjusted annualized return on average tangible shareholders' equity (non-GAAP): | |||||||||||||||||||||||||||||

| Net income, as adjusted (non-GAAP) | $ | 182,881 | $ | 181,455 | $ | 125,009 | $ | 650,452 | $ | 492,148 | |||||||||||||||||||

| Average shareholders' equity | 6,327,970 | 6,256,767 | 4,905,343 | 5,985,236 | 4,747,745 | ||||||||||||||||||||||||

| Less: Average goodwill and other intangible assets | 2,074,367 | 2,117,818 | 1,481,951 | 1,944,503 | 1,457,519 | ||||||||||||||||||||||||

| Average tangible shareholders' equity | $ | 4,253,603 | $ | 4,138,949 | $ | 3,423,392 | $ | 4,040,733 | $ | 3,290,226 | |||||||||||||||||||

| Annualized return on average tangible shareholders' equity, as adjusted (non-GAAP) | 17.20 | % | 17.54 | % | 14.61 | % | 16.10 | % | 14.96 | % | |||||||||||||||||||

| Adjusted annualized return on average assets (non-GAAP): | |||||||||||||||||||||||||||||

| Net income, as adjusted (non-GAAP) | $ | 182,881 | $ | 181,455 | $ | 125,009 | $ | 650,452 | $ | 492,148 | |||||||||||||||||||

| Average assets | $ | 56,913,215 | $ | 54,858,306 | $ | 42,473,828 | $ | 52,182,310 | $ | 41,475,682 | |||||||||||||||||||

| Annualized return on average assets, as adjusted (non-GAAP) | 1.29 | % | 1.32 | % | 1.18 | % | 1.25 | % | 1.19 | % | |||||||||||||||||||

| Three Months Ended | Years Ended | ||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | ||||||||||||||||||||||||||

| ($ in thousands) | 2022 | 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||

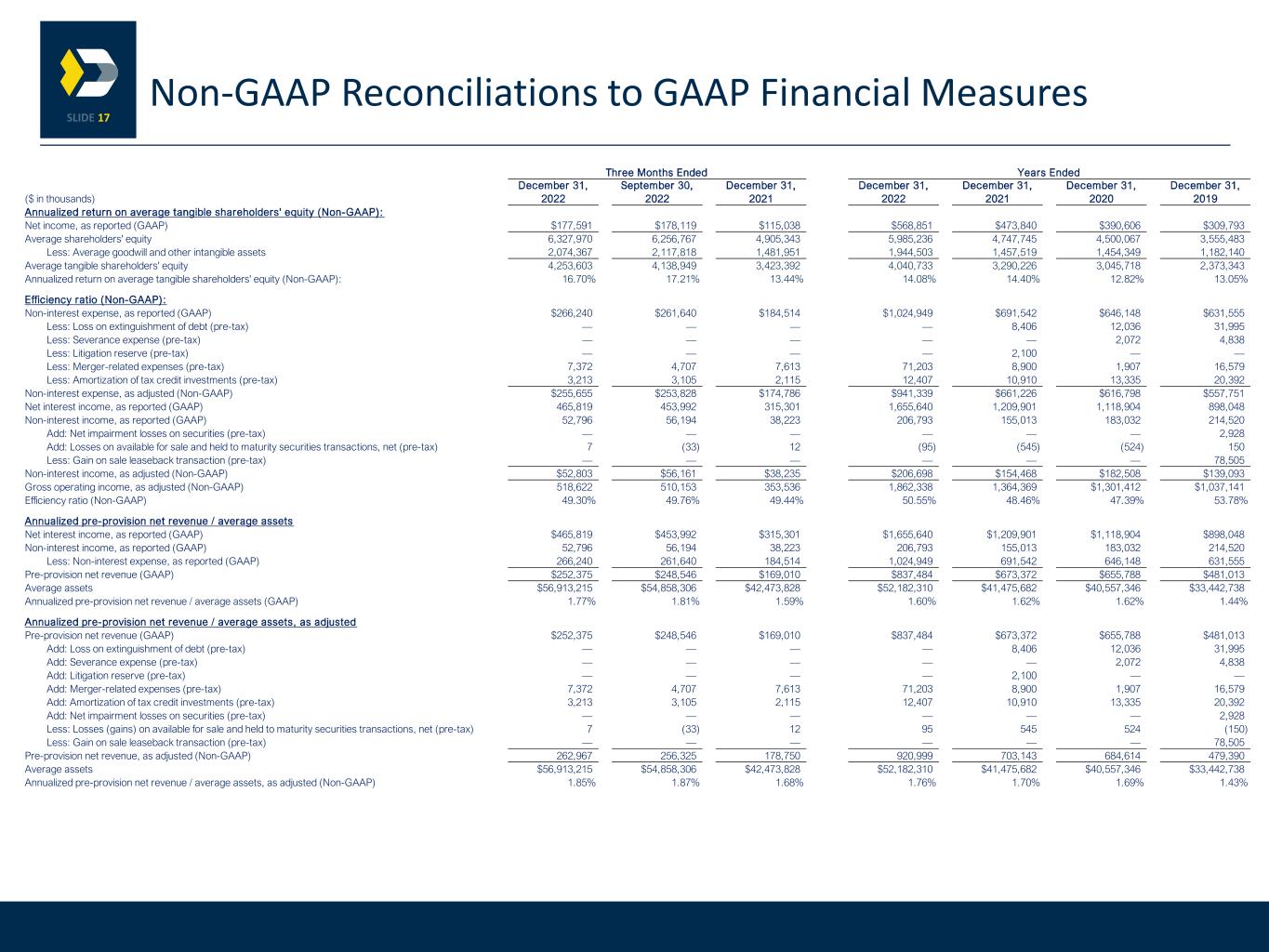

| Adjusted annualized return on average shareholders' equity (non-GAAP): | |||||||||||||||||||||||||||||

| Net income, as adjusted (non-GAAP) | $ | 182,881 | $ | 181,455 | $ | 125,009 | $ | 650,452 | $ | 492,148 | |||||||||||||||||||

| Average shareholders' equity | $ | 6,327,970 | $ | 6,256,767 | $ | 4,905,343 | $ | 5,985,236 | $ | 4,747,745 | |||||||||||||||||||

| Annualized return on average shareholders' equity, as adjusted (non-GAAP) | 11.56 | % | 11.60 | % | 10.19 | % | 10.87 | % | 10.37 | % | |||||||||||||||||||

| Annualized return on average tangible shareholders' equity (non-GAAP): | |||||||||||||||||||||||||||||

| Net income, as reported (GAAP) | $ | 177,591 | $ | 178,119 | $ | 115,038 | $ | 568,851 | $ | 473,840 | |||||||||||||||||||

| Average shareholders' equity | 6,327,970 | 6,256,767 | 4,905,343 | 5,985,236 | 4,747,745 | ||||||||||||||||||||||||

| Less: Average goodwill and other intangible assets | 2,074,367 | 2,117,818 | 1,481,951 | 1,944,503 | 1,457,519 | ||||||||||||||||||||||||

| Average tangible shareholders' equity | $ | 4,253,603 | $ | 4,138,949 | $ | 3,423,392 | $ | 4,040,733 | $ | 3,290,226 | |||||||||||||||||||

| Annualized return on average tangible shareholders' equity (non-GAAP) | 16.70 | % | 17.21 | % | 13.44 | % | 14.08 | % | 14.40 | % | |||||||||||||||||||

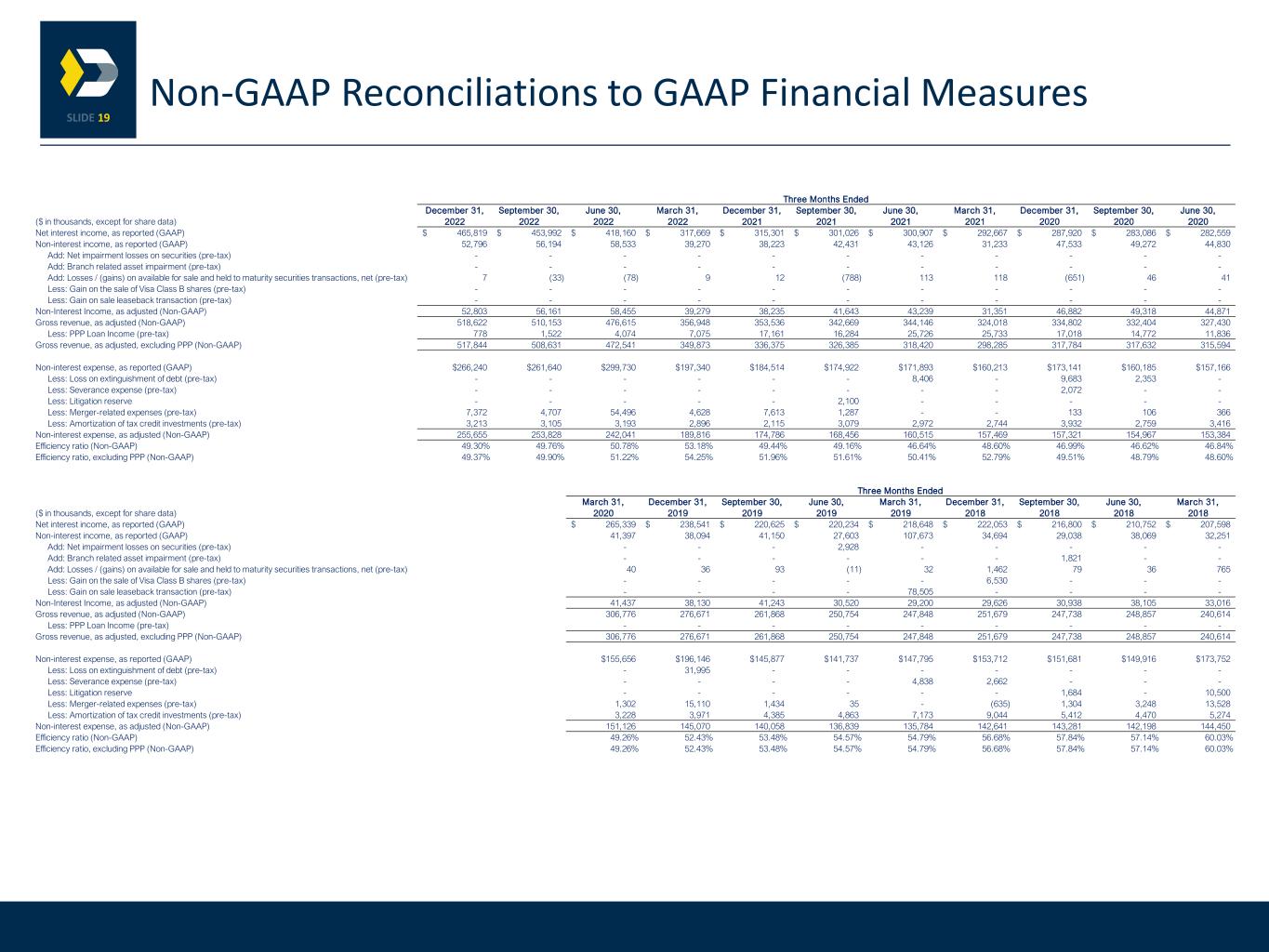

| Efficiency ratio (non-GAAP): | |||||||||||||||||||||||||||||

| Non-interest expense, as reported (GAAP) | $ | 266,240 | $ | 261,639 | $ | 184,514 | $ | 1,024,949 | $ | 691,542 | |||||||||||||||||||

| Less: Loss on extinguishment of debt (pre-tax) | — | — | — | — | 8,406 | ||||||||||||||||||||||||

| Less: Merger-related expenses (pre-tax) | 7,372 | 4,707 | 7,613 | 71,203 | 8,900 | ||||||||||||||||||||||||

Less: Amortization of tax credit investments (pre-tax) |

3,213 | 3,105 | 2,115 | 12,407 | 10,910 | ||||||||||||||||||||||||

| Less: Litigation reserve (pre-tax) | — | — | — | — | 2,100 | ||||||||||||||||||||||||

| Non-interest expense, as adjusted (non-GAAP) | 255,655 | 253,827 | 174,786 | 941,339 | 661,226 | ||||||||||||||||||||||||

| Net interest income, as reported (GAAP) | 465,819 | 453,992 | 315,301 | 1,655,640 | 1,209,901 | ||||||||||||||||||||||||

| Non-interest income, as reported (GAAP) | 52,796 | 56,194 | 38,223 | 206,793 | 155,013 | ||||||||||||||||||||||||

Add: Losses (gains) on available for sale and held to maturity securities transactions, net (pre-tax) |

7 | (33) | 12 | (95) | (545) | ||||||||||||||||||||||||

| Non-interest income, as adjusted (non-GAAP) | $ | 52,803 | $ | 56,161 | $ | 38,235 | $ | 206,698 | $ | 154,468 | |||||||||||||||||||

| Gross operating income, as adjusted (non-GAAP) | $ | 518,622 | $ | 510,153 | $ | 353,536 | $ | 1,862,338 | $ | 1,364,369 | |||||||||||||||||||

| Efficiency ratio (non-GAAP) | 49.30 | % | 49.76 | % | 49.44 | % | 50.55 | % | 48.46 | % | |||||||||||||||||||

| As Of | |||||||||||||||||||||||||||||

| December 31, | September 30, | June 30, | March 31, | December 31, | |||||||||||||||||||||||||

| ($ in thousands, except for share data) | 2022 | 2022 | 2022 | 2022 | 2021 | ||||||||||||||||||||||||

| Tangible book value per common share (non-GAAP): | |||||||||||||||||||||||||||||

| Common shares outstanding | 506,374,478 | 506,351,502 | 506,328,526 | 421,437,068 | 421,437,068 | ||||||||||||||||||||||||

| Shareholders' equity (GAAP) | $ | 6,400,802 | $ | 6,273,829 | $ | 6,204,913 | $ | 5,096,384 | $ | 5,084,066 | |||||||||||||||||||

| Less: Preferred stock | 209,691 | 209,691 | 209,691 | 209,691 | 209,691 | ||||||||||||||||||||||||

| Less: Goodwill and other intangible assets | 2,066,392 | 2,079,731 | 2,090,147 | 1,543,238 | 1,529,394 | ||||||||||||||||||||||||

| Tangible common shareholders' equity (non-GAAP) | $ | 4,124,719 | $ | 3,984,407 | $ | 3,905,075 | $ | 3,343,455 | $ | 3,344,981 | |||||||||||||||||||

| Tangible book value per common share (non-GAAP) | $ | 8.15 | $ | 7.87 | $ | 7.71 | $ | 7.93 | $ | 7.94 | |||||||||||||||||||

| Tangible common equity to tangible assets (non-GAAP): | |||||||||||||||||||||||||||||

| Tangible common shareholders' equity (non-GAAP) | $ | 4,124,719 | $ | 3,984,407 | $ | 3,905,075 | $ | 3,343,455 | $ | 3,344,981 | |||||||||||||||||||

| Total assets (GAAP) | $ | 57,462,749 | $ | 55,927,501 | $ | 54,438,807 | $ | 43,551,457 | $ | 43,446,443 | |||||||||||||||||||

| Less: Goodwill and other intangible assets | 2,066,392 | 2,079,731 | 2,090,147 | 1,543,238 | 1,529,394 | ||||||||||||||||||||||||

| Tangible assets (non-GAAP) | $ | 55,396,357 | $ | 53,847,770 | $ | 52,348,660 | $ | 42,008,219 | $ | 41,917,049 | |||||||||||||||||||

| Tangible common equity to tangible assets (non-GAAP) | 7.45 | % | 7.40 | % | 7.46 | % | 7.96 | % | 7.98 | % | |||||||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (Unaudited) | |||||||||||

| Assets | |||||||||||

| Cash and due from banks | $ | 444,325 | $ | 205,156 | |||||||

| Interest bearing deposits with banks | 503,622 | 1,844,764 | |||||||||

| Investment securities: | |||||||||||

| Equity securities | 48,731 | 36,473 | |||||||||

| Trading debt securities | 13,438 | 38,130 | |||||||||

| Available for sale debt securities | 1,261,397 | 1,128,809 | |||||||||

| Held to maturity debt securities (net of allowance for credit losses of $1,646 at December 31, 2022 and $1,165 at December 31, 2021) | 3,827,338 | 2,667,532 | |||||||||

| Total investment securities | 5,150,904 | 3,870,944 | |||||||||

| Loans held for sale, at fair value | 18,118 | 139,516 | |||||||||

| Loans | 46,917,200 | 34,153,657 | |||||||||

| Less: Allowance for loan losses | (458,655) | (359,202) | |||||||||

| Net loans | 46,458,545 | 33,794,455 | |||||||||

| Premises and equipment, net | 358,556 | 326,306 | |||||||||

| Lease right of use assets | 306,352 | 259,117 | |||||||||

| Bank owned life insurance | 717,177 | 566,770 | |||||||||

| Accrued interest receivable | 196,606 | 96,882 | |||||||||

| Goodwill | 1,868,936 | 1,459,008 | |||||||||

| Other intangible assets, net | 197,456 | 70,386 | |||||||||

| Other assets | 1,242,152 | 813,139 | |||||||||

| Total Assets | $ | 57,462,749 | $ | 43,446,443 | |||||||

| Liabilities | |||||||||||

| Deposits: | |||||||||||

| Non-interest bearing | $ | 14,463,645 | $ | 11,675,748 | |||||||

| Interest bearing: | |||||||||||

| Savings, NOW and money market | 23,616,812 | 20,269,620 | |||||||||

| Time | 9,556,457 | 3,687,044 | |||||||||

| Total deposits | 47,636,914 | 35,632,412 | |||||||||

| Short-term borrowings | 138,729 | 655,726 | |||||||||

| Long-term borrowings | 1,543,058 | 1,423,676 | |||||||||

| Junior subordinated debentures issued to capital trusts | 56,760 | 56,413 | |||||||||

| Lease liabilities | 358,884 | 283,106 | |||||||||

| Accrued expenses and other liabilities | 1,327,602 | 311,044 | |||||||||

| Total Liabilities | 51,061,947 | 38,362,377 | |||||||||

| Shareholders’ Equity | |||||||||||

| Preferred stock, no par value; 50,000,000 shares authorized: | |||||||||||

| Series A (4,600,000 shares issued at December 31, 2022 and December 31, 2021) | 111,590 | 111,590 | |||||||||

| Series B (4,000,000 shares issued at December 31, 2022 and December 31, 2021) | 98,101 | 98,101 | |||||||||

| Common stock (no par value, authorized 650,000,000 shares; issued 507,896,910 shares at December 31, 2022 and 423,034,027 shares at December 31, 2021) | 178,185 | 148,482 | |||||||||

Surplus |

4,980,231 | 3,883,035 | |||||||||

| Retained earnings | 1,218,445 | 883,645 | |||||||||

| Accumulated other comprehensive loss | (164,002) | (17,932) | |||||||||

| Treasury stock, at cost (1,522,432 common shares at December 31, 2022 and 1,596,959 common shares at December 31, 2021) | (21,748) | (22,855) | |||||||||

| Total Shareholders’ Equity | 6,400,802 | 5,084,066 | |||||||||

| Total Liabilities and Shareholders’ Equity | $ | 57,462,749 | $ | 43,446,443 | |||||||

| Three Months Ended | Years Ended | ||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | ||||||||||||||||||||||||||

| 2022 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 599,015 | $ | 496,520 | $ | 319,141 | $ | 1,828,477 | $ | 1,257,389 | |||||||||||||||||||

| Interest and dividends on investment securities: | |||||||||||||||||||||||||||||

| Taxable | 31,300 | 28,264 | 15,852 | 105,716 | 56,026 | ||||||||||||||||||||||||

| Tax-exempt | 5,219 | 5,210 | 2,535 | 17,958 | 11,716 | ||||||||||||||||||||||||

| Dividends | 3,978 | 2,738 | 1,814 | 11,468 | 7,357 | ||||||||||||||||||||||||

| Interest on federal funds sold and other short-term investments | 7,038 | 3,996 | 637 | 13,064 | 1,738 | ||||||||||||||||||||||||

| Total interest income | 646,550 | 536,728 | 339,979 | 1,976,683 | 1,334,226 | ||||||||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||||||||

| Interest on deposits: | |||||||||||||||||||||||||||||

| Savings, NOW and money market | 109,286 | 50,674 | 9,983 | 186,709 | 42,879 | ||||||||||||||||||||||||

| Time | 48,417 | 15,174 | 3,328 | 69,691 | 25,094 | ||||||||||||||||||||||||

| Interest on short-term borrowings | 7,404 | 5,160 | 984 | 17,453 | 5,374 | ||||||||||||||||||||||||

| Interest on long-term borrowings and junior subordinated debentures | 15,624 | 11,728 | 10,383 | 47,190 | 50,978 | ||||||||||||||||||||||||

| Total interest expense | 180,731 | 82,736 | 24,678 | 321,043 | 124,325 | ||||||||||||||||||||||||

| Net Interest Income | 465,819 | 453,992 | 315,301 | 1,655,640 | 1,209,901 | ||||||||||||||||||||||||

| Provision (credit) for credit losses for held to maturity securities | (50) | 188 | 90 | 481 | (263) | ||||||||||||||||||||||||

| Provision for credit losses for loans | 7,289 | 1,835 | 11,609 | 56,336 | 32,896 | ||||||||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 458,580 | 451,969 | 303,602 | 1,598,823 | 1,177,268 | ||||||||||||||||||||||||

| Non-Interest Income | |||||||||||||||||||||||||||||

| Wealth management and trust fees | 10,720 | 9,281 | 4,499 | 34,709 | 14,910 | ||||||||||||||||||||||||

| Insurance commissions | 2,903 | 3,750 | 2,005 | 11,975 | 7,810 | ||||||||||||||||||||||||

| Service charges on deposit accounts | 10,313 | 10,338 | 5,810 | 36,930 | 21,424 | ||||||||||||||||||||||||

| (Losses) gains on securities transactions, net | (172) | 323 | 495 | (1,230) | 1,758 | ||||||||||||||||||||||||

| Fees from loan servicing | 2,637 | 3,138 | 2,671 | 11,273 | 11,651 | ||||||||||||||||||||||||

| Gains on sales of loans, net | 908 | 922 | 6,653 | 6,418 | 26,669 | ||||||||||||||||||||||||

| Bank owned life insurance | 2,200 | 1,681 | 1,993 | 8,040 | 8,817 | ||||||||||||||||||||||||

| Other | 23,287 | 26,761 | 14,097 | 98,678 | 61,974 | ||||||||||||||||||||||||

| Total non-interest income | 52,796 | 56,194 | 38,223 | 206,793 | 155,013 | ||||||||||||||||||||||||

| Non-Interest Expense | |||||||||||||||||||||||||||||

| Salary and employee benefits expense | 129,634 | 134,572 | 102,675 | 526,737 | 375,865 | ||||||||||||||||||||||||

| Net occupancy expense | 23,446 | 26,486 | 20,184 | 94,352 | 79,355 | ||||||||||||||||||||||||

| Technology, furniture and equipment expense | 46,507 | 39,365 | 24,265 | 161,752 | 89,221 | ||||||||||||||||||||||||

| FDIC insurance assessment | 6,827 | 6,500 | 3,889 | 22,836 | 14,183 | ||||||||||||||||||||||||

| Amortization of other intangible assets | 10,900 | 11,088 | 5,074 | 37,825 | 21,827 | ||||||||||||||||||||||||

| Professional and legal fees | 19,620 | 17,840 | 11,182 | 82,618 | 38,432 | ||||||||||||||||||||||||

| Loss on extinguishment of debt | — | — | — | — | 8,406 | ||||||||||||||||||||||||

| Amortization of tax credit investments | 3,213 | 3,105 | 2,115 | 12,407 | 10,910 | ||||||||||||||||||||||||

| Other | 26,093 | 22,683 | 15,130 | 86,422 | 53,343 | ||||||||||||||||||||||||

| Total non-interest expense | 266,240 | 261,639 | 184,514 | 1,024,949 | 691,542 | ||||||||||||||||||||||||

| Income Before Income Taxes | 245,136 | 246,524 | 157,311 | 780,667 | 640,739 | ||||||||||||||||||||||||

| Income tax expense | 67,545 | 68,405 | 42,273 | 211,816 | 166,899 | ||||||||||||||||||||||||

| Net Income | 177,591 | 178,119 | 115,038 | 568,851 | 473,840 | ||||||||||||||||||||||||

| Dividends on preferred stock | 3,630 | 3,172 | 3,172 | 13,146 | 12,688 | ||||||||||||||||||||||||

| Net Income Available to Common Shareholders | $ | 173,961 | $ | 174,947 | $ | 111,866 | $ | 555,705 | $ | 461,152 | |||||||||||||||||||

| Three Months Ended | Years Ended | ||||||||||||||||||||||||||||

| December 31, | September 30, | December 31, | December 31, | ||||||||||||||||||||||||||

| 2022 | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||||

| Earnings Per Common Share: | |||||||||||||||||||||||||||||

| Basic | $ | 0.34 | $ | 0.35 | $ | 0.27 | $ | 1.14 | $ | 1.13 | |||||||||||||||||||

| Diluted | 0.34 | 0.34 | 0.27 | 1.14 | 1.12 | ||||||||||||||||||||||||

| Cash Dividends Declared per Common Share | 0.11 | 0.11 | 0.11 | 0.44 | 0.44 | ||||||||||||||||||||||||

| Weighted Average Number of Common Shares Outstanding: | |||||||||||||||||||||||||||||

| Basic | 506,359,704 | 506,342,200 | 411,775,590 | 485,434,918 | 407,445,379 | ||||||||||||||||||||||||

| Diluted | 509,301,813 | 508,690,997 | 414,472,820 | 487,817,710 | 410,018,328 | ||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | September 30, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average | Avg. | Average | Avg. | Average | Avg. | ||||||||||||||||||||||||||||||||||||||||||||||||

| ($ in thousands) | Balance | Interest | Rate | Balance | Interest | Rate | Balance | Interest | Rate | ||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Loans (1)(2) |

$ | 46,086,363 | $ | 599,040 | 5.20 | % | $ | 44,341,894 | $ | 496,545 | 4.48 | % | $ | 33,338,128 | $ | 319,165 | 3.83 | % | |||||||||||||||||||||||||||||||||||

Taxable investments (3) |

4,934,084 | 35,278 | 2.86 | 4,815,181 | 31,002 | 2.58 | 3,563,329 | 17,667 | 1.98 | ||||||||||||||||||||||||||||||||||||||||||||

Tax-exempt investments (1)(3) |

623,322 | 6,608 | 4.24 | 635,795 | 6,501 | 4.09 | 418,049 | 3,209 | 3.07 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing deposits with banks | 761,832 | 7,038 | 3.70 | 738,372 | 3,996 | 2.16 | 1,873,508 | 636 | 0.14 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest earning assets | 52,405,601 | 647,964 | 4.95 | 50,531,242 | 538,044 | 4.26 | 39,193,014 | 340,677 | 3.48 | ||||||||||||||||||||||||||||||||||||||||||||

| Other assets | 4,507,614 | 4,327,064 | 3,280,814 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 56,913,215 | $ | 54,858,306 | $ | 42,473,828 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and shareholders' equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Savings, NOW and money market deposits |

$ | 23,476,111 | $ | 109,286 | 1.86 | % | $ | 23,541,694 | $ | 50,674 | 0.86 | % | $ | 19,685,730 | $ | 9,983 | 0.20 | % | |||||||||||||||||||||||||||||||||||

| Time deposits | 7,641,769 | 48,417 | 2.53 | 5,192,896 | 15,174 | 1.17 | 3,744,792 | 3,328 | 0.36 | ||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 880,615 | 7,404 | 3.36 | 1,016,240 | 5,160 | 2.03 | 670,433 | 983 | 0.59 | ||||||||||||||||||||||||||||||||||||||||||||

Long-term borrowings (4) |

1,598,379 | 15,624 | 3.91 | 1,477,909 | 11,728 | 3.17 | 1,482,001 | 10,383 | 2.80 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | 33,596,874 | 180,731 | 2.15 | 31,228,739 | 82,736 | 1.06 | 25,582,956 | 24,677 | 0.39 | ||||||||||||||||||||||||||||||||||||||||||||

| Non-interest bearing deposits | 15,116,977 | 16,035,778 | 11,316,264 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 1,871,394 | 1,337,022 | 669,265 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders' equity | 6,327,970 | 6,256,767 | 4,905,343 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 56,913,215 | $ | 54,858,306 | $ | 42,473,828 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income/interest rate spread (5) |

$ | 467,233 | 2.80 | % | $ | 455,308 | 3.20 | % | $ | 316,000 | 3.09 | % | |||||||||||||||||||||||||||||||||||||||||

| Tax equivalent adjustment | (1,414) | (1,316) | (699) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income, as reported | $ | 465,819 | $ | 453,992 | $ | 315,301 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin (6) |

3.56 | % | 3.59 | % | 3.22 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Tax equivalent effect | 0.01 | 0.01 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin on a fully tax equivalent basis (6) |

3.57 | % | 3.60 | % | 3.23 | % | |||||||||||||||||||||||||||||||||||||||||||||||

SHAREHOLDERS RELATIONS Requests for copies of reports and/or other inquiries should be directed to Tina Zarkadas, Assistant Vice President, Shareholder Relations Specialist, Valley National Bancorp, 1455 Valley Road, Wayne, New Jersey, 07470, by telephone at (973) 305-3380, by fax at (973) 305-1364 or by e-mail at tzarkadas@valley.com. | ||||||||||||||||||||||||||||||||