| Georgia | 001-42397 | 58-1492391 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) | ||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | |||||||

| Title of each Class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common stock, par value $1.00 per share | CBAN | The New York Stock Exchange | ||||||

| Exhibit Number | Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

|||||||

| COLONY BANKCORP, INC. | ||||||||

Date: April 23, 2025 |

By: | /s/ Derek Shelnutt | ||||||

| Derek Shelnutt | ||||||||

| Executive Vice President and Chief Financial Officer | ||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Measures | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

(dollars in thousands, except per share data) |

First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Operating noninterest income reconciliation | ||||||||||||||||||||||||||||||||

| Noninterest income (GAAP) | $ | 9,044 | $ | 10,309 | $ | 10,082 | $ | 9,497 | $ | 9,487 | ||||||||||||||||||||||

| Writedown of bank premises | — | — | — | 197 | — | |||||||||||||||||||||||||||

| Loss on sales of securities | — | 401 | 454 | 425 | 555 | |||||||||||||||||||||||||||

| Operating noninterest income | $ | 9,044 | $ | 10,710 | $ | 10,536 | $ | 10,119 | $ | 10,042 | ||||||||||||||||||||||

| Operating noninterest expense reconciliation | ||||||||||||||||||||||||||||||||

| Noninterest expense (GAAP) | $ | 20,221 | $ | 21,272 | $ | 20,835 | $ | 20,330 | $ | 20,397 | ||||||||||||||||||||||

| Severance costs | — | — | (265) | — | (23) | |||||||||||||||||||||||||||

| Operating noninterest expense | $ | 20,221 | $ | 21,272 | $ | 20,570 | $ | 20,330 | $ | 20,374 | ||||||||||||||||||||||

| Operating net income reconciliation | ||||||||||||||||||||||||||||||||

| Net income (GAAP) | $ | 6,613 | $ | 7,432 | $ | 5,629 | $ | 5,474 | $ | 5,333 | ||||||||||||||||||||||

| Severance costs | — | — | 265 | — | 23 | |||||||||||||||||||||||||||

| Writedown of bank premises | — | — | — | 197 | — | |||||||||||||||||||||||||||

| Loss on sales of securities | — | 401 | 454 | 425 | 555 | |||||||||||||||||||||||||||

| Income tax benefit | — | (77) | (143) | (129) | (121) | |||||||||||||||||||||||||||

| Operating net income | $ | 6,613 | $ | 7,756 | $ | 6,205 | $ | 5,967 | $ | 5,790 | ||||||||||||||||||||||

| Weighted average diluted shares | 17,509,059 | 17,531,808 | 17,587,902 | 17,551,007 | 17,560,210 | |||||||||||||||||||||||||||

| Adjusted earnings per diluted share | $ | 0.38 | $ | 0.44 | $ | 0.35 | $ | 0.34 | $ | 0.33 | ||||||||||||||||||||||

| Operating return on average assets reconciliation | ||||||||||||||||||||||||||||||||

| Return on average assets (GAAP) | 0.85 | % | 0.95 | % | 0.74 | % | 0.73 | % | 0.71 | % | ||||||||||||||||||||||

| Severance costs | — | — | 0.03 | — | — | |||||||||||||||||||||||||||

| Writedown of bank premises | — | — | — | 0.03 | — | |||||||||||||||||||||||||||

| Loss on sales of securities | — | 0.05 | 0.06 | 0.06 | 0.07 | |||||||||||||||||||||||||||

| Tax effect of adjustment items | — | (0.01) | (0.02) | (0.02) | (0.02) | |||||||||||||||||||||||||||

| Operating return on average assets | 0.85 | % | 0.99 | % | 0.81 | % | 0.80 | % | 0.76 | % | ||||||||||||||||||||||

| Operating return on average equity reconciliation | ||||||||||||||||||||||||||||||||

| Return on average equity (GAAP) | 9.63 | % | 10.71 | % | 8.33 | % | 8.46 | % | 8.38 | % | ||||||||||||||||||||||

| Severance costs | — | — | 0.39 | — | 0.04 | |||||||||||||||||||||||||||

| Writedown of bank premises | — | — | — | 0.30 | — | |||||||||||||||||||||||||||

| Loss on sales of securities | — | 0.58 | 0.67 | 0.66 | 0.87 | |||||||||||||||||||||||||||

| Tax effect of adjustment items | — | (0.11) | (0.21) | (0.20) | (0.19) | |||||||||||||||||||||||||||

| Operating return on average equity | 9.63 | % | 11.18 | % | 9.18 | % | 9.22 | % | 9.10 | % | ||||||||||||||||||||||

| Tangible book value per common share reconciliation | ||||||||||||||||||||||||||||||||

| Book value per common share (GAAP) | $ | 16.41 | $ | 15.91 | $ | 15.73 | $ | 15.09 | $ | 14.80 | ||||||||||||||||||||||

| Effect of goodwill and other intangibles | (2.95) | (2.96) | (2.97) | (2.99) | (3.01) | |||||||||||||||||||||||||||

Tangible book value per common share |

$ | 13.46 | $ | 12.95 | $ | 12.76 | $ | 12.10 | $ | 11.79 | ||||||||||||||||||||||

| Tangible equity to tangible assets reconciliation | ||||||||||||||||||||||||||||||||

| Equity to assets (GAAP) | 9.05 | % | 8.96 | % | 9.01 | % | 8.80 | % | 8.62 | % | ||||||||||||||||||||||

| Effect of goodwill and other intangibles | (1.51) | (1.54) | (1.58) | (1.62) | (1.63) | |||||||||||||||||||||||||||

Tangible equity to tangible assets |

7.54 | % | 7.42 | % | 7.43 | % | 7.18 | % | 6.99 | % | ||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Reconciliation of Non-GAAP Measures | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

(dollars in thousands, except per share data) |

First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Operating efficiency ratio calculation | ||||||||||||||||||||||||||||||||

| Efficiency ratio (GAAP) | 67.41 | % | 69.11 | % | 72.79 | % | 72.85 | % | 72.48 | % | ||||||||||||||||||||||

| Severance costs | — | — | (0.93) | — | (0.08) | |||||||||||||||||||||||||||

| Writedown of bank premises | — | — | — | (0.71) | — | |||||||||||||||||||||||||||

| Loss on sales of securities | — | (1.31) | (1.59) | (1.52) | (1.97) | |||||||||||||||||||||||||||

| Operating efficiency ratio | 67.41 | % | 67.80 | % | 70.27 | % | 70.62 | % | 70.43 | % | ||||||||||||||||||||||

Operating net noninterest expense(1) to average assets calculation |

||||||||||||||||||||||||||||||||

| Net noninterest expense to average assets | 1.44 | % | 1.40 | % | 1.41 | % | 1.45 | % | 1.45 | % | ||||||||||||||||||||||

| Severance costs | — | — | (0.03) | — | — | |||||||||||||||||||||||||||

| Writedown of bank premises | — | — | — | (0.03) | — | |||||||||||||||||||||||||||

| Loss on sales of securities | — | (0.05) | (0.06) | (0.06) | (0.07) | |||||||||||||||||||||||||||

| Operating net noninterest expense to average assets | 1.44 | % | 1.35 | % | 1.32 | % | 1.36 | % | 1.38 | % | ||||||||||||||||||||||

| Pre-provision net revenue | ||||||||||||||||||||||||||||||||

| Net interest income before provision for credit losses | $ | 20,952 | $ | 20,472 | $ | 18,541 | $ | 18,409 | $ | 18,654 | ||||||||||||||||||||||

| Noninterest income | 9,044 | 10,309 | 10,082 | 9,497 | 9,487 | |||||||||||||||||||||||||||

| Total income | 29,996 | 30,781 | 28,623 | 27,906 | 28,141 | |||||||||||||||||||||||||||

| Noninterest expense | 20,221 | 21,272 | 20,835 | 20,330 | 20,397 | |||||||||||||||||||||||||||

| Pre-provision net revenue | $ | 9,775 | $ | 9,509 | $ | 7,788 | $ | 7,576 | $ | 7,744 | ||||||||||||||||||||||

(1) Net noninterest expense is defined as noninterest expense less noninterest income. |

||||||||||||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Selected Financial Information | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| EARNINGS SUMMARY | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 20,952 | $ | 20,472 | $ | 18,541 | $ | 18,409 | $ | 18,654 | ||||||||||||||||||||||

| Provision for credit losses | 1,500 | 650 | 750 | 650 | 1,000 | |||||||||||||||||||||||||||

| Noninterest income | 9,044 | 10,309 | 10,082 | 9,497 | 9,487 | |||||||||||||||||||||||||||

| Noninterest expense | 20,221 | 21,272 | 20,835 | 20,330 | 20,397 | |||||||||||||||||||||||||||

| Income taxes | 1,662 | 1,427 | 1,409 | 1,452 | 1,411 | |||||||||||||||||||||||||||

| Net income | $ | 6,613 | $ | 7,432 | $ | 5,629 | $ | 5,474 | $ | 5,333 | ||||||||||||||||||||||

| PERFORMANCE MEASURES | ||||||||||||||||||||||||||||||||

| Per common share: | ||||||||||||||||||||||||||||||||

| Common shares outstanding | 17,481,709 | 17,519,884 | 17,554,884 | 17,538,611 | 17,558,611 | |||||||||||||||||||||||||||

| Weighted average basic shares | 17,509,059 | 17,531,808 | 17,587,902 | 17,551,007 | 17,560,210 | |||||||||||||||||||||||||||

| Weighted average diluted shares | 17,509,059 | 17,531,808 | 17,587,902 | 17,551,007 | 17,560,210 | |||||||||||||||||||||||||||

| Earnings per basic share | $ | 0.38 | $ | 0.42 | $ | 0.32 | $ | 0.31 | $ | 0.30 | ||||||||||||||||||||||

| Earnings per diluted share | 0.38 | 0.42 | 0.32 | 0.31 | 0.30 | |||||||||||||||||||||||||||

Adjusted earnings per diluted share(b) |

0.38 | 0.44 | 0.35 | 0.34 | 0.33 | |||||||||||||||||||||||||||

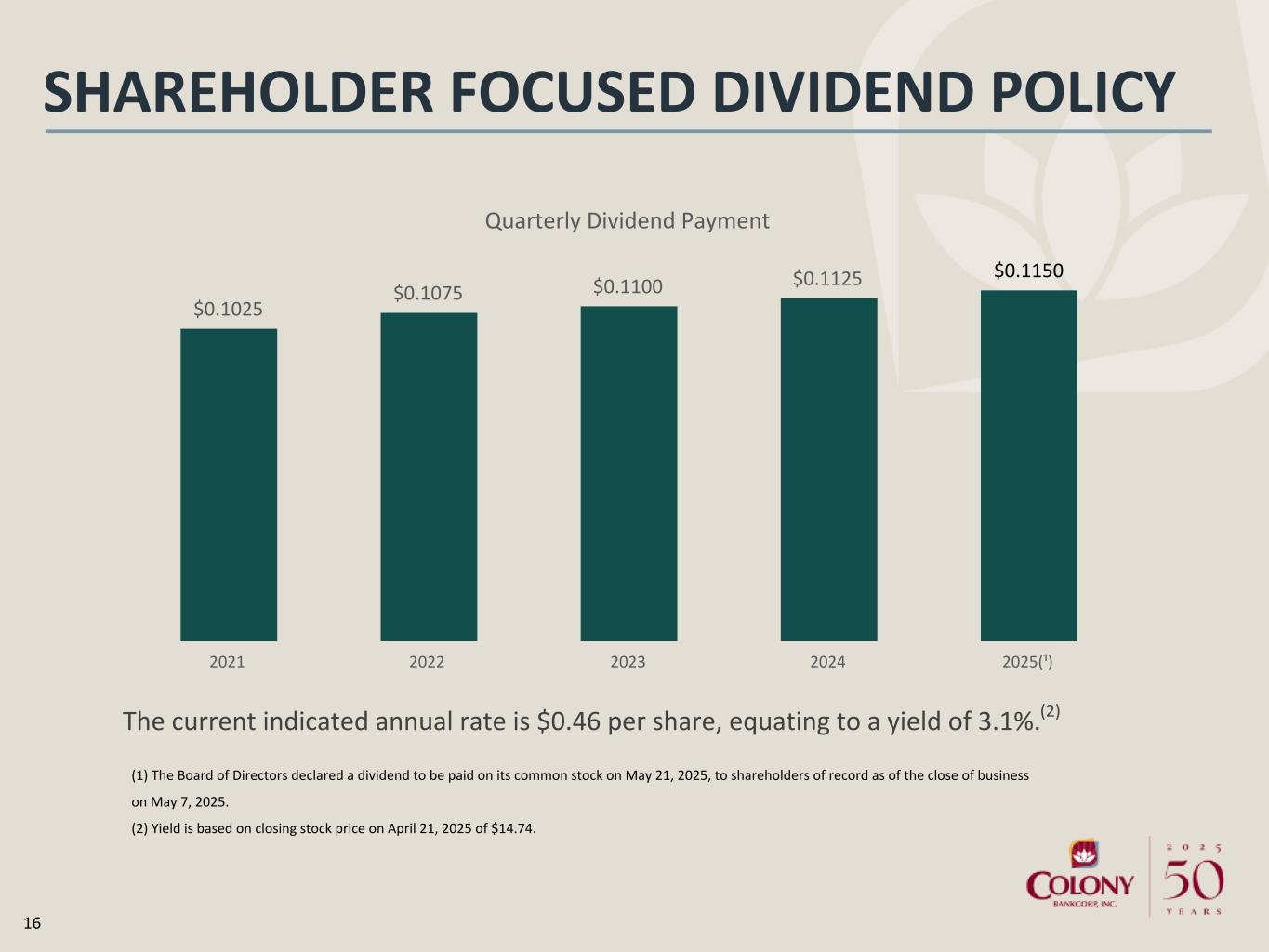

| Cash dividends declared per share | 0.1150 | 0.1125 | 0.1125 | 0.1125 | 0.1125 | |||||||||||||||||||||||||||

| Common book value per share | 16.41 | 15.91 | 15.73 | 15.09 | 14.80 | |||||||||||||||||||||||||||

Tangible book value per common share(b) |

13.46 | 12.95 | 12.76 | 12.10 | 11.79 | |||||||||||||||||||||||||||

Pre-provision net revenue(b) |

$ | 9,775 | $ | 9,509 | $ | 7,788 | $ | 7,576 | $ | 7,744 | ||||||||||||||||||||||

| Performance ratios: | ||||||||||||||||||||||||||||||||

Net interest margin (a) |

2.93 | % | 2.84 | % | 2.64 | % | 2.68 | % | 2.69 | % | ||||||||||||||||||||||

| Return on average assets | 0.85 | 0.95 | 0.74 | 0.73 | 0.71 | |||||||||||||||||||||||||||

Operating return on average assets (b) |

0.85 | 0.99 | 0.81 | 0.80 | 0.76 | |||||||||||||||||||||||||||

| Return on average total equity | 9.63 | 10.71 | 8.33 | 8.46 | 8.38 | |||||||||||||||||||||||||||

Operating return on average total equity (b) |

9.63 | 11.18 | 9.18 | 9.22 | 9.10 | |||||||||||||||||||||||||||

| Total equity to total assets | 9.05 | 8.96 | 9.01 | 8.80 | 8.62 | |||||||||||||||||||||||||||

Tangible equity to tangible assets (b) |

7.54 | 7.42 | 7.43 | 7.18 | 6.99 | |||||||||||||||||||||||||||

Efficiency ratio |

67.41 | 69.11 | 72.79 | 72.85 | 72.48 | |||||||||||||||||||||||||||

Operating efficiency ratio (b) |

67.41 | 67.80 | 70.27 | 70.62 | 70.43 | |||||||||||||||||||||||||||

| Net noninterest expense to average assets | 1.44 | 1.40 | 1.41 | 1.45 | 1.45 | |||||||||||||||||||||||||||

Operating net noninterest expense to average assets(b) |

1.44 | 1.35 | 1.32 | 1.36 | 1.38 | |||||||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Selected Financial Information | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in thousands, except per share data) | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| ASSET QUALITY | ||||||||||||||||||||||||||||||||

| Nonperforming portfolio loans | $ | 7,538 | $ | 5,024 | $ | 6,273 | $ | 3,653 | $ | 3,674 | ||||||||||||||||||||||

| Nonperforming SBA government loans-guaranteed portion | 3,647 | 4,293 | 4,514 | 2,309 | 2,148 | |||||||||||||||||||||||||||

| Nonperforming SBA government loans-unguaranteed portion | 1,271 | 1,343 | 1,428 | 707 | 609 | |||||||||||||||||||||||||||

| Loans 90 days past due and still accruing | 22 | 152 | 44 | 41 | — | |||||||||||||||||||||||||||

| Total nonperforming loans (NPLs) | 12,478 | 10,812 | 12,259 | 6,710 | 6,431 | |||||||||||||||||||||||||||

| Other real estate owned | 522 | 202 | 227 | 582 | 562 | |||||||||||||||||||||||||||

| Repossessed assets | 6 | 328 | 9 | 13 | — | |||||||||||||||||||||||||||

| Total nonperforming assets (NPAs) | 13,006 | 11,342 | 12,495 | 7,305 | 6,993 | |||||||||||||||||||||||||||

| Classified loans | 26,453 | 20,103 | 20,918 | 22,355 | 25,965 | |||||||||||||||||||||||||||

| Criticized loans | 55,823 | 49,387 | 52,062 | 44,850 | 55,065 | |||||||||||||||||||||||||||

| Net loan charge-offs (recoveries) | 606 | 1,534 | 139 | 667 | 664 | |||||||||||||||||||||||||||

| Allowance for credit losses to total loans | 1.04 | % | 1.03 | % | 1.04 | % | 1.01 | % | 1.00 | % | ||||||||||||||||||||||

| Allowance for credit losses to total NPLs | 160.26 | 175.55 | 160.40 | 280.27 | 290.11 | |||||||||||||||||||||||||||

| Allowance for credit losses to total NPAs | 153.75 | 167.34 | 157.37 | 257.44 | 266.80 | |||||||||||||||||||||||||||

| Net charge-offs (recoveries) to average loans, net | 0.13 | 0.33 | 0.03 | 0.14 | 0.14 | |||||||||||||||||||||||||||

| NPLs to total loans | 0.65 | 0.59 | 0.65 | 0.36 | 0.35 | |||||||||||||||||||||||||||

| NPAs to total assets | 0.41 | 0.36 | 0.41 | 0.24 | 0.23 | |||||||||||||||||||||||||||

| NPAs to total loans and foreclosed assets | 0.68 | 0.62 | 0.66 | 0.39 | 0.38 | |||||||||||||||||||||||||||

| ACTUAL BALANCES | ||||||||||||||||||||||||||||||||

| Total assets | $ | 3,171,825 | $ | 3,109,782 | $ | 3,065,103 | $ | 3,007,907 | $ | 3,015,509 | ||||||||||||||||||||||

| Loans held for sale | 24,844 | 39,786 | 27,760 | 40,132 | 31,102 | |||||||||||||||||||||||||||

| Loans, net of unearned income | 1,921,263 | 1,842,980 | 1,886,037 | 1,865,574 | 1,859,018 | |||||||||||||||||||||||||||

| Deposits | 2,622,531 | 2,567,943 | 2,524,970 | 2,460,225 | 2,522,748 | |||||||||||||||||||||||||||

| Total stockholders’ equity | 286,925 | 278,675 | 276,052 | 264,743 | 259,914 | |||||||||||||||||||||||||||

| AVERAGE BALANCES | ||||||||||||||||||||||||||||||||

| Total assets | $ | 3,149,321 | $ | 3,108,762 | $ | 3,038,947 | $ | 3,010,486 | $ | 3,036,093 | ||||||||||||||||||||||

| Loans held for sale | 23,253 | 35,299 | 34,533 | 33,024 | 24,612 | |||||||||||||||||||||||||||

| Loans, net of unearned income | 1,869,476 | 1,851,628 | 1,881,842 | 1,869,178 | 1,871,402 | |||||||||||||||||||||||||||

| Deposits | 2,606,706 | 2,568,824 | 2,504,101 | 2,492,479 | 2,543,259 | |||||||||||||||||||||||||||

| Total stockholders’ equity | 278,551 | 276,082 | 268,769 | 260,162 | 255,927 | |||||||||||||||||||||||||||

| (a) Computed using fully taxable-equivalent net income. | ||||||||||||||||||||||||||||||||

| (b) Non-GAAP measure - see “Explanation of Certain Unaudited Non-GAAP Financial Measures” for more information and reconciliation to GAAP. | ||||||||||||||||||||||||||||||||

| Colony Bankcorp, Inc. | |||||||||||||||||||||||||||||||||||

| Average Balance Sheet and Net Interest Analysis | |||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||||||||||||||||||||

| 2025 | 2024 | ||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balances |

Income/ Expense |

Yields/ Rates |

Average Balances |

Income/ Expense |

Yields/ Rates |

|||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||

| Loans held for sale | $ | 23,253 | $ | 328 | 5.73 | % | $ | 24,612 | $ | 434 | 7.09 | % | |||||||||||||||||||||||

| Loans, net of unearned income 1 | 1,869,476 | 27,716 | 6.01 | % | 1,871,402 | 26,711 | 5.74 | % | |||||||||||||||||||||||||||

| Investment securities, taxable | 710,293 | 4,837 | 2.76 | % | 737,257 | 5,042 | 2.75 | % | |||||||||||||||||||||||||||

| Investment securities, tax-exempt 2 | 94,379 | 494 | 2.12 | % | 106,819 | 605 | 2.28 | % | |||||||||||||||||||||||||||

| Deposits in banks and short term investments | 229,016 | 2,322 | 4.11 | % | 71,431 | 693 | 3.90 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | 2,926,417 | 35,697 | 4.95 | % | 2,811,521 | 33,485 | 4.79 | % | |||||||||||||||||||||||||||

| Noninterest-earning assets | 222,904 | 224,572 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 3,149,321 | $ | 3,036,093 | |||||||||||||||||||||||||||||||

| Liabilities and stockholders' equity | |||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand and savings | $ | 1,549,509 | $ | 6,468 | 1.69 | % | $ | 1,451,490 | $ | 6,408 | 1.78 | % | |||||||||||||||||||||||

| Other time | 601,920 | 5,305 | 3.57 | % | 612,241 | 5,683 | 3.73 | % | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 2,151,429 | 11,773 | 2.22 | % | 2,063,731 | 12,091 | 2.36 | % | |||||||||||||||||||||||||||

| Federal funds purchased | — | — | — | % | 13 | — | — | % | |||||||||||||||||||||||||||

| Federal Home Loan Bank advances | 185,000 | 1,873 | 4.10 | % | 156,978 | 1,572 | 4.03 | % | |||||||||||||||||||||||||||

| Other borrowings | 63,048 | 927 | 5.97 | % | 63,086 | 993 | 6.33 | % | |||||||||||||||||||||||||||

| Total other interest-bearing liabilities | 248,048 | 2,800 | 4.58 | % | 220,077 | 2,565 | 4.69 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 2,399,477 | 14,573 | 2.46 | % | 2,283,808 | 14,656 | 2.58 | % | |||||||||||||||||||||||||||

| Noninterest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

| Demand deposits | 455,277 | $ | 479,528 | ||||||||||||||||||||||||||||||||

| Other liabilities | 16,016 | 16,830 | |||||||||||||||||||||||||||||||||

| Stockholders' equity | 278,551 | 255,927 | |||||||||||||||||||||||||||||||||

| Total noninterest-bearing liabilities and stockholders' equity | 749,844 | 752,285 | |||||||||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 3,149,321 | $ | 3,036,093 | |||||||||||||||||||||||||||||||

| Interest rate spread | 2.49 | % | 2.21 | % | |||||||||||||||||||||||||||||||

| Net interest income | $ | 21,124 | $ | 18,829 | |||||||||||||||||||||||||||||||

| Net interest margin | 2.93 | % | 2.69 | % | |||||||||||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Segment Reporting | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

(dollars in thousands) |

First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Banking Division | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 19,989 | $ | 19,191 | $ | 17,152 | $ | 17,217 | $ | 17,552 | ||||||||||||||||||||||

| Provision for credit losses | 1,221 | 309 | 698 | 96 | 455 | |||||||||||||||||||||||||||

| Noninterest income | 5,774 | 5,452 | 5,494 | 5,086 | 5,680 | |||||||||||||||||||||||||||

| Noninterest expenses | 16,790 | 17,616 | 17,075 | 17,135 | 17,129 | |||||||||||||||||||||||||||

| Income taxes | 1,551 | 927 | 1,017 | 1,060 | 1,166 | |||||||||||||||||||||||||||

| Segment income | $ | 6,201 | $ | 5,791 | $ | 3,856 | $ | 4,012 | $ | 4,482 | ||||||||||||||||||||||

Total segment assets |

$ | 3,065,385 | $ | 2,985,856 | $ | 2,955,145 | $ | 2,889,013 | $ | 2,910,102 | ||||||||||||||||||||||

Full time employees |

366 | 376 | 375 | 385 | 377 | |||||||||||||||||||||||||||

| Mortgage Banking Division | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 53 | $ | 53 | $ | 67 | $ | 50 | $ | 40 | ||||||||||||||||||||||

| Provision for credit losses | — | — | — | — | — | |||||||||||||||||||||||||||

| Noninterest income | 1,579 | 1,545 | 1,812 | 1,456 | 1,165 | |||||||||||||||||||||||||||

| Noninterest expenses | 1,601 | 1,699 | 1,533 | 1,326 | 1,218 | |||||||||||||||||||||||||||

| Income taxes | 10 | (12) | 71 | 42 | 1 | |||||||||||||||||||||||||||

| Segment income | $ | 21 | $ | (89) | $ | 275 | $ | 138 | $ | (14) | ||||||||||||||||||||||

Total segment assets |

$ | 16,041 | $ | 17,970 | $ | 9,300 | $ | 19,004 | $ | 8,011 | ||||||||||||||||||||||

Variable noninterest expense(1) |

$ | 880 | $ | 764 | $ | 1,005 | $ | 807 | $ | 603 | ||||||||||||||||||||||

| Fixed noninterest expense | 721 | 935 | 528 | 519 | 615 | |||||||||||||||||||||||||||

| Full time employees | 42 | 45 | 44 | 42 | 43 | |||||||||||||||||||||||||||

| Small Business Specialty Lending Division | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 910 | $ | 1,228 | $ | 1,322 | $ | 1,142 | $ | 1,062 | ||||||||||||||||||||||

| Provision for credit losses | 279 | 341 | 52 | 554 | 545 | |||||||||||||||||||||||||||

| Noninterest income | 1,691 | 3,312 | 2,776 | 2,955 | 2,642 | |||||||||||||||||||||||||||

| Noninterest expenses | 1,830 | 1,957 | 2,227 | 1,869 | 2,050 | |||||||||||||||||||||||||||

| Income taxes | 101 | 512 | 321 | 350 | 244 | |||||||||||||||||||||||||||

| Segment income | $ | 391 | $ | 1,730 | $ | 1,498 | $ | 1,324 | $ | 865 | ||||||||||||||||||||||

Total segment assets |

$ | 90,399 | $ | 105,956 | $ | 100,658 | $ | 99,890 | $ | 97,396 | ||||||||||||||||||||||

| Full time employees | 35 | 34 | 33 | 33 | 31 | |||||||||||||||||||||||||||

| Total Consolidated | ||||||||||||||||||||||||||||||||

| Net interest income | $ | 20,952 | $ | 20,472 | $ | 18,541 | $ | 18,409 | $ | 18,654 | ||||||||||||||||||||||

| Provision for credit losses | 1,500 | 650 | 750 | 650 | 1,000 | |||||||||||||||||||||||||||

| Noninterest income | 9,044 | 10,309 | 10,082 | 9,497 | 9,487 | |||||||||||||||||||||||||||

| Noninterest expenses | 20,221 | 21,272 | 20,835 | 20,330 | 20,397 | |||||||||||||||||||||||||||

| Income taxes | 1,662 | 1,427 | 1,409 | 1,452 | 1,411 | |||||||||||||||||||||||||||

| Segment income | $ | 6,613 | $ | 7,432 | $ | 5,629 | $ | 5,474 | $ | 5,333 | ||||||||||||||||||||||

Total segment assets |

$ | 3,171,825 | $ | 3,109,782 | $ | 3,065,103 | $ | 3,007,907 | $ | 3,015,509 | ||||||||||||||||||||||

| Full time employees | 443 | 455 | 452 | 460 | 451 | |||||||||||||||||||||||||||

(1) Variable noninterest expense includes commission based salary expenses and volume based loan related fees. | ||||||||||||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||

| Consolidated Balance Sheets | ||||||||||||||

| March 31, 2025 | December 31, 2024 | |||||||||||||

(dollars in thousands) |

(unaudited) | (audited) | ||||||||||||

| ASSETS | ||||||||||||||

| Cash and due from banks | $ | 26,093 | $ | 26,045 | ||||||||||

| Interest-bearing deposits in banks and federal funds sold | 195,112 | 204,989 | ||||||||||||

| Cash and cash equivalents | 221,205 | 231,034 | ||||||||||||

| Investment securities available for sale, at fair value | 380,705 | 366,049 | ||||||||||||

| Investment securities held to maturity, at amortized cost | 421,894 | 430,077 | ||||||||||||

| Other investments | 17,822 | 17,694 | ||||||||||||

| Loans held for sale | 24,844 | 39,786 | ||||||||||||

| Loans, net of unearned income | 1,921,263 | 1,842,980 | ||||||||||||

| Allowance for credit losses | (19,997) | (18,980) | ||||||||||||

| Loans, net | 1,901,266 | 1,824,000 | ||||||||||||

| Premises and equipment | 36,433 | 37,831 | ||||||||||||

| Other real estate | 522 | 202 | ||||||||||||

| Goodwill | 48,923 | 48,923 | ||||||||||||

| Other intangible assets | 2,702 | 2,975 | ||||||||||||

| Bank owned life insurance | 58,382 | 57,970 | ||||||||||||

| Deferred income taxes, net | 20,404 | 21,891 | ||||||||||||

| Other assets | 36,723 | 31,350 | ||||||||||||

| Total assets | $ | 3,171,825 | $ | 3,109,782 | ||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||

| Liabilities: | ||||||||||||||

| Deposits: | ||||||||||||||

| Noninterest-bearing | $ | 449,818 | $ | 462,283 | ||||||||||

| Interest-bearing | 2,172,713 | 2,105,660 | ||||||||||||

Total deposits |

2,622,531 | 2,567,943 | ||||||||||||

| Federal Home Loan Bank advances | 185,000 | 185,000 | ||||||||||||

| Other borrowed money | 63,062 | 63,039 | ||||||||||||

| Accrued expenses and other liabilities | 14,307 | 15,125 | ||||||||||||

| Total liabilities | 2,884,900 | 2,831,107 | ||||||||||||

| Stockholders’ equity | ||||||||||||||

| Common stock, $1 par value; 50,000,000 shares authorized, 17,481,709 and 17,519,884 issued and outstanding, respectively | 17,482 | 17,520 | ||||||||||||

| Paid in capital | 167,876 | 168,353 | ||||||||||||

| Retained earnings | 144,967 | 140,369 | ||||||||||||

| Accumulated other comprehensive loss, net of tax | (43,400) | (47,567) | ||||||||||||

| Total stockholders’ equity | 286,925 | 278,675 | ||||||||||||

| Total liabilities and stockholders’ equity | $ | 3,171,825 | $ | 3,109,782 | ||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||

Consolidated Statements of Income (unaudited) |

||||||||||||||

| Three months ended March 31, | ||||||||||||||

| 2025 | 2024 | |||||||||||||

(dollars in thousands, except per share data) |

||||||||||||||

| Interest income: | ||||||||||||||

| Loans, including fees | $ | 27,976 | $ | 27,097 | ||||||||||

| Investment securities | 5,227 | 5,520 | ||||||||||||

| Deposits in banks and short term investments | 2,322 | 693 | ||||||||||||

| Total interest income | 35,525 | 33,310 | ||||||||||||

| Interest expense: | ||||||||||||||

| Deposits | 11,773 | 12,091 | ||||||||||||

| Federal funds purchased | — | — | ||||||||||||

| Federal Home Loan Bank advances | 1,873 | 1,572 | ||||||||||||

| Other borrowings | 927 | 993 | ||||||||||||

| Total interest expense | 14,573 | 14,656 | ||||||||||||

Net interest income |

20,952 | 18,654 | ||||||||||||

| Provision for credit losses | 1,500 | 1,000 | ||||||||||||

| Net interest income after provision for credit losses | 19,452 | 17,654 | ||||||||||||

| Noninterest income: | ||||||||||||||

| Service charges on deposits | 2,172 | 2,373 | ||||||||||||

| Mortgage fee income | 1,579 | 1,249 | ||||||||||||

| Gain on sales of SBA loans | 1,035 | 2,046 | ||||||||||||

| Loss on sales of securities | — | (555) | ||||||||||||

| Interchange fees | 1,938 | 2,028 | ||||||||||||

| BOLI income | 396 | 533 | ||||||||||||

| Insurance commissions | 469 | 465 | ||||||||||||

| Other | 1,455 | 1,348 | ||||||||||||

Total noninterest income |

9,044 | 9,487 | ||||||||||||

| Noninterest expense: | ||||||||||||||

| Salaries and employee benefits | 11,905 | 12,018 | ||||||||||||

| Occupancy and equipment | 1,580 | 1,507 | ||||||||||||

| Information technology expenses | 2,477 | 2,110 | ||||||||||||

| Professional fees | 748 | 834 | ||||||||||||

| Advertising and public relations | 805 | 960 | ||||||||||||

| Communications | 205 | 226 | ||||||||||||

| Other | 2,501 | 2,742 | ||||||||||||

Total noninterest expense |

20,221 | 20,397 | ||||||||||||

| Income before income taxes | 8,275 | 6,744 | ||||||||||||

| Income taxes | 1,662 | 1,411 | ||||||||||||

| Net income | $ | 6,613 | $ | 5,333 | ||||||||||

| Earnings per common share: | ||||||||||||||

| Basic | $ | 0.38 | $ | 0.30 | ||||||||||

| Diluted | 0.38 | 0.30 | ||||||||||||

| Dividends declared per share | 0.1150 | 0.1125 | ||||||||||||

| Weighted average common shares outstanding: | ||||||||||||||

| Basic | 17,509,059 | 17,560,210 | ||||||||||||

| Diluted | 17,509,059 | 17,560,210 | ||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Quarterly Consolidated Statements of Income | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | ||||||||||||||||||||||||||||

(dollars in thousands, except per share data) |

(unaudited) | (unaudited) | (unaudited) | (unaudited) | (unaudited) | |||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 27,976 | $ | 28,473 | $ | 28,501 | $ | 27,604 | $ | 27,097 | ||||||||||||||||||||||

| Investment securities | 5,227 | 5,158 | 5,248 | 5,048 | 5,520 | |||||||||||||||||||||||||||

| Deposits in banks and short term investments | 2,322 | 2,360 | 855 | 684 | 693 | |||||||||||||||||||||||||||

| Total interest income | 35,525 | 35,991 | 34,604 | 33,336 | 33,310 | |||||||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||

| Deposits | 11,773 | 12,656 | 13,154 | 12,106 | 12,091 | |||||||||||||||||||||||||||

| Federal funds purchased | — | — | — | — | — | |||||||||||||||||||||||||||

| Federal Home Loan Bank advances | 1,873 | 1,905 | 1,913 | 1,821 | 1,572 | |||||||||||||||||||||||||||

| Other borrowings | 927 | 958 | 996 | 1,000 | 993 | |||||||||||||||||||||||||||

| Total interest expense | 14,573 | 15,519 | 16,063 | 14,927 | 14,656 | |||||||||||||||||||||||||||

Net interest income |

20,952 | 20,472 | 18,541 | 18,409 | 18,654 | |||||||||||||||||||||||||||

| Provision for credit losses | 1,500 | 650 | 750 | 650 | 1,000 | |||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 19,452 | 19,822 | 17,791 | 17,759 | 17,654 | |||||||||||||||||||||||||||

| Noninterest income: | ||||||||||||||||||||||||||||||||

| Service charges on deposits | 2,172 | 2,302 | 2,401 | 2,288 | 2,373 | |||||||||||||||||||||||||||

| Mortgage fee income | 1,579 | 1,545 | 1,812 | 1,442 | 1,249 | |||||||||||||||||||||||||||

| Gain on sales of SBA loans | 1,035 | 2,622 | 2,227 | 2,347 | 2,046 | |||||||||||||||||||||||||||

| Loss on sales of securities | — | (401) | (454) | (425) | (555) | |||||||||||||||||||||||||||

| Interchange fees | 1,938 | 2,030 | 2,163 | 2,078 | 2,028 | |||||||||||||||||||||||||||

| BOLI income | 396 | 412 | 383 | 398 | 533 | |||||||||||||||||||||||||||

| Insurance commissions | 469 | 471 | 433 | 420 | 465 | |||||||||||||||||||||||||||

| Other | 1,455 | 1,328 | 1,117 | 949 | 1,348 | |||||||||||||||||||||||||||

Total noninterest income |

9,044 | 10,309 | 10,082 | 9,497 | 9,487 | |||||||||||||||||||||||||||

| Noninterest expense: | ||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 11,905 | 12,877 | 12,594 | 12,277 | 12,018 | |||||||||||||||||||||||||||

| Occupancy and equipment | 1,580 | 1,645 | 1,523 | 1,475 | 1,507 | |||||||||||||||||||||||||||

| Information technology expenses | 2,477 | 2,491 | 2,150 | 2,227 | 2,110 | |||||||||||||||||||||||||||

| Professional fees | 748 | 539 | 748 | 704 | 834 | |||||||||||||||||||||||||||

| Advertising and public relations | 805 | 1,118 | 965 | 967 | 960 | |||||||||||||||||||||||||||

| Communications | 205 | 213 | 210 | 216 | 226 | |||||||||||||||||||||||||||

| Other | 2,501 | 2,389 | 2,645 | 2,464 | 2,742 | |||||||||||||||||||||||||||

Total noninterest expense |

20,221 | 21,272 | 20,835 | 20,330 | 20,397 | |||||||||||||||||||||||||||

| Income before income taxes | 8,275 | 8,859 | 7,038 | 6,926 | 6,744 | |||||||||||||||||||||||||||

| Income taxes | 1,662 | 1,427 | 1,409 | 1,452 | 1,411 | |||||||||||||||||||||||||||

| Net income | $ | 6,613 | $ | 7,432 | $ | 5,629 | $ | 5,474 | $ | 5,333 | ||||||||||||||||||||||

| Earnings per common share: | ||||||||||||||||||||||||||||||||

| Basic | $ | 0.38 | $ | 0.42 | $ | 0.32 | $ | 0.31 | $ | 0.30 | ||||||||||||||||||||||

| Diluted | 0.38 | 0.42 | 0.32 | 0.31 | 0.30 | |||||||||||||||||||||||||||

| Dividends declared per share | 0.1150 | 0.1125 | 0.1125 | 0.1125 | 0.1125 | |||||||||||||||||||||||||||

| Weighted average common shares outstanding: | ||||||||||||||||||||||||||||||||

| Basic | 17,509,059 | 17,531,808 | 17,587,902 | 17,551,007 | 17,560,210 | |||||||||||||||||||||||||||

| Diluted | 17,509,059 | 17,531,808 | 17,587,902 | 17,551,007 | 17,560,210 | |||||||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Quarterly Deposits Composition Comparison | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in thousands) | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Noninterest-bearing demand | $ | 449,818 | $ | 462,283 | $ | 439,892 | $ | 437,623 | $ | 476,413 | ||||||||||||||||||||||

| Interest-bearing demand | 873,156 | 813,783 | 769,123 | 788,674 | 802,596 | |||||||||||||||||||||||||||

| Savings | 689,446 | 687,603 | 684,371 | 670,848 | 650,188 | |||||||||||||||||||||||||||

| Time over $250,000 | 189,466 | 185,176 | 198,942 | 168,856 | 173,386 | |||||||||||||||||||||||||||

| Other time | 420,645 | 419,098 | 432,642 | 394,224 | 420,165 | |||||||||||||||||||||||||||

| Total | $ | 2,622,531 | $ | 2,567,943 | $ | 2,524,970 | $ | 2,460,225 | $ | 2,522,748 | ||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Quarterly Deposits by Location Comparison | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in thousands) | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Coastal Georgia | $ | 142,230 | $ | 145,828 | $ | 142,580 | $ | 144,021 | $ | 138,103 | ||||||||||||||||||||||

| Middle Georgia | 283,149 | 279,360 | 269,144 | 275,758 | 286,697 | |||||||||||||||||||||||||||

| Atlanta and North Georgia | 333,845 | 318,927 | 321,808 | 336,338 | 333,856 | |||||||||||||||||||||||||||

| South Georgia | 1,249,192 | 1,217,433 | 1,165,529 | 1,110,049 | 1,132,701 | |||||||||||||||||||||||||||

| West Georgia | 335,438 | 337,818 | 357,450 | 365,380 | 378,764 | |||||||||||||||||||||||||||

| Brokered deposits | 59,499 | 59,499 | 70,999 | 39,240 | 59,019 | |||||||||||||||||||||||||||

| Reciprocal deposits | 219,178 | 209,078 | 197,460 | 189,439 | 193,608 | |||||||||||||||||||||||||||

| Total | $ | 2,622,531 | $ | 2,567,943 | $ | 2,524,970 | $ | 2,460,225 | $ | 2,522,748 | ||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Quarterly Loan Comparison | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in thousands) | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Core | $ | 1,808,879 | $ | 1,720,444 | $ | 1,759,600 | $ | 1,732,843 | $ | 1,718,284 | ||||||||||||||||||||||

| Purchased | 112,384 | 122,536 | 126,437 | 132,731 | 140,734 | |||||||||||||||||||||||||||

| Loans, net of unearned income | $ | 1,921,263 | $ | 1,842,980 | $ | 1,886,037 | $ | 1,865,574 | $ | 1,859,018 | ||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Quarterly Loans by Composition Comparison | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in thousands) | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Construction, land & land development | $ | 208,872 | $ | 205,046 | $ | 196,390 | $ | 199,916 | $ | 234,000 | ||||||||||||||||||||||

| Other commercial real estate | 1,052,967 | 990,648 | 1,012,466 | 985,102 | 971,205 | |||||||||||||||||||||||||||

| Total commercial real estate | 1,261,839 | 1,195,694 | 1,208,856 | 1,185,018 | 1,205,205 | |||||||||||||||||||||||||||

| Residential real estate | 345,521 | 344,167 | 349,777 | 360,847 | 347,277 | |||||||||||||||||||||||||||

| Commercial, financial & agricultural | 213,355 | 213,910 | 242,389 | 242,205 | 239,837 | |||||||||||||||||||||||||||

| Consumer and other | 100,548 | 89,209 | 85,015 | 77,504 | 66,699 | |||||||||||||||||||||||||||

| Loans, net of unearned income | $ | 1,921,263 | $ | 1,842,980 | $ | 1,886,037 | $ | 1,865,574 | $ | 1,859,018 | ||||||||||||||||||||||

| Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||

| Quarterly Loans by Location Comparison | ||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||

| (dollars in thousands) | First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||

| Alabama | $ | 52,183 | $ | 45,365 | $ | 46,630 | $ | 44,575 | $ | 44,806 | ||||||||||||||||||||||

| Florida | 19,490 | 13,135 | 12,280 | 2,753 | 1,579 | |||||||||||||||||||||||||||

| Augusta | 91,758 | 76,492 | 59,557 | 64,465 | 71,483 | |||||||||||||||||||||||||||

| Coastal Georgia | 230,242 | 224,609 | 220,452 | 228,844 | 232,557 | |||||||||||||||||||||||||||

| Middle Georgia | 130,302 | 121,059 | 120,843 | 124,268 | 121,131 | |||||||||||||||||||||||||||

| Atlanta and North Georgia | 441,323 | 427,046 | 432,377 | 427,568 | 425,753 | |||||||||||||||||||||||||||

| South Georgia | 398,295 | 384,907 | 427,887 | 413,098 | 409,681 | |||||||||||||||||||||||||||

| West Georgia | 168,851 | 169,699 | 184,634 | 184,365 | 183,679 | |||||||||||||||||||||||||||

| Small Business Specialty Lending | 79,517 | 81,636 | 79,967 | 75,182 | 71,196 | |||||||||||||||||||||||||||

| Consumer Portfolio Mortgages | 251,816 | 250,555 | 253,481 | 257,772 | 261,204 | |||||||||||||||||||||||||||

| Marine/RV Lending | 55,033 | 46,941 | 45,785 | 41,922 | 35,017 | |||||||||||||||||||||||||||

| Other | 2,453 | 1,536 | 2,144 | 762 | 932 | |||||||||||||||||||||||||||

| Loans, net of unearned income | $ | 1,921,263 | $ | 1,842,980 | $ | 1,886,037 | $ | 1,865,574 | $ | 1,859,018 | ||||||||||||||||||||||

Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||||||||

| Classified Loans | ||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||||||||

(dollars in thousands) |

First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||||||||

| $ | # | $ | # | $ | # | $ | # | $ | # | |||||||||||||||||||||||||||||

| Construction, land & land development | $ | 126 | 4 | $ | — | — | $ | — | — | $ | 54 | 3 | $ | 572 | 11 | |||||||||||||||||||||||

| Other commercial real estate | 18,578 | 51 | 13,367 | 38 | 13,338 | 36 | 13,990 | 34 | 13,918 | 46 | ||||||||||||||||||||||||||||

| Residential real estate | 1,670 | 76 | 1,265 | 83 | 1,554 | 85 | 2,168 | 104 | 5,896 | 183 | ||||||||||||||||||||||||||||

| Commercial, financial & agricultural | 6,077 | 58 | 5,407 | 70 | 6,005 | 61 | 6,075 | 54 | 5,487 | 70 | ||||||||||||||||||||||||||||

| Consumer and other | 2 | 25 | 64 | 22 | 21 | 23 | 68 | 24 | 92 | 67 | ||||||||||||||||||||||||||||

| TOTAL | $ | 26,453 | 214 | $ | 20,103 | 213 | $ | 20,918 | 205 | $ | 22,355 | 219 | $ | 25,965 | 377 | |||||||||||||||||||||||

| Classified loans to total loans | 1.38 | % | 1.09 | % | 1.11 | % | 1.20 | % | 1.40 | % | ||||||||||||||||||||||||||||

Colony Bankcorp, Inc. | ||||||||||||||||||||||||||||||||||||||

| Criticized Loans | ||||||||||||||||||||||||||||||||||||||

| 2025 | 2024 | |||||||||||||||||||||||||||||||||||||

(dollars in thousands) |

First Quarter | Fourth Quarter | Third Quarter | Second Quarter | First Quarter | |||||||||||||||||||||||||||||||||

| $ | # | $ | # | $ | # | $ | # | $ | # | |||||||||||||||||||||||||||||

| Construction, land & land development | $ | 4,028 | 11 | $ | 2,865 | 9 | $ | 4,418 | 9 | $ | 626 | 6 | $ | 1,543 | 18 | |||||||||||||||||||||||

| Other commercial real estate | 28,869 | 70 | 32,077 | 65 | 32,790 | 64 | 31,544 | 59 | 31,498 | 46 | ||||||||||||||||||||||||||||

| Residential real estate | 8,289 | 83 | 5,504 | 89 | 5,389 | 90 | 5,431 | 107 | 13,050 | 249 | ||||||||||||||||||||||||||||

| Commercial, financial & agricultural | 14,501 | 82 | 8,877 | 76 | 9,444 | 68 | 7,181 | 59 | 8,609 | 114 | ||||||||||||||||||||||||||||

| Consumer and other | 136 | 26 | 64 | 22 | 21 | 23 | 68 | 24 | 365 | 85 | ||||||||||||||||||||||||||||

| TOTAL | $ | 55,823 | 272 | $ | 49,387 | 261 | $ | 52,062 | 254 | $ | 44,850 | 255 | $ | 55,065 | 512 | |||||||||||||||||||||||

| Criticized loans to total loans | 2.91 | % | 2.68 | % | 2.76 | % | 2.40 | % | 2.96 | % | ||||||||||||||||||||||||||||