false2024Q2000071140410/31http://fasb.org/us-gaap/2024#DebtCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purecoo:installmentcoo:interest_rate_swap_contract00007114042023-11-012024-04-3000007114042024-05-2400007114042024-02-012024-04-3000007114042023-02-012023-04-3000007114042022-11-012023-04-3000007114042024-02-162024-02-1600007114042024-04-3000007114042023-10-310000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2022-10-310000711404us-gaap:TreasuryStockCommonMember2022-10-310000711404coo:TreasuryStockParNetValueMember2022-10-310000711404us-gaap:AdditionalPaidInCapitalMember2022-10-310000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310000711404us-gaap:RetainedEarningsMember2022-10-310000711404us-gaap:NoncontrollingInterestMember2022-10-3100007114042022-10-310000711404us-gaap:RetainedEarningsMember2022-11-012023-01-3100007114042022-11-012023-01-310000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-11-012023-01-310000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2022-11-012023-01-310000711404us-gaap:AdditionalPaidInCapitalMember2022-11-012023-01-310000711404us-gaap:TreasuryStockCommonMember2022-11-012023-01-310000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2023-01-310000711404us-gaap:TreasuryStockCommonMember2023-01-310000711404coo:TreasuryStockParNetValueMember2023-01-310000711404us-gaap:AdditionalPaidInCapitalMember2023-01-310000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-310000711404us-gaap:RetainedEarningsMember2023-01-310000711404us-gaap:NoncontrollingInterestMember2023-01-3100007114042023-01-310000711404us-gaap:RetainedEarningsMember2023-02-012023-04-300000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-02-012023-04-300000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2023-02-012023-04-300000711404us-gaap:AdditionalPaidInCapitalMember2023-02-012023-04-300000711404us-gaap:TreasuryStockCommonMember2023-02-012023-04-300000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2023-04-300000711404us-gaap:TreasuryStockCommonMember2023-04-300000711404coo:TreasuryStockParNetValueMember2023-04-300000711404us-gaap:AdditionalPaidInCapitalMember2023-04-300000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-300000711404us-gaap:RetainedEarningsMember2023-04-300000711404us-gaap:NoncontrollingInterestMember2023-04-3000007114042023-04-300000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2023-10-310000711404us-gaap:TreasuryStockCommonMember2023-10-310000711404coo:TreasuryStockParNetValueMember2023-10-310000711404us-gaap:AdditionalPaidInCapitalMember2023-10-310000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-310000711404us-gaap:RetainedEarningsMember2023-10-310000711404us-gaap:NoncontrollingInterestMember2023-10-310000711404us-gaap:RetainedEarningsMember2023-11-012024-01-3100007114042023-11-012024-01-310000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-012024-01-310000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2023-11-012024-01-310000711404us-gaap:AdditionalPaidInCapitalMember2023-11-012024-01-310000711404us-gaap:TreasuryStockCommonMember2023-11-012024-01-310000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2024-01-310000711404us-gaap:TreasuryStockCommonMember2024-01-310000711404coo:TreasuryStockParNetValueMember2024-01-310000711404us-gaap:AdditionalPaidInCapitalMember2024-01-310000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-310000711404us-gaap:RetainedEarningsMember2024-01-310000711404us-gaap:NoncontrollingInterestMember2024-01-3100007114042024-01-310000711404us-gaap:RetainedEarningsMember2024-02-012024-04-300000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-012024-04-300000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2024-02-012024-04-300000711404us-gaap:AdditionalPaidInCapitalMember2024-02-012024-04-300000711404us-gaap:TreasuryStockCommonMember2024-02-012024-04-300000711404coo:CommonStockExcludingTreasuryStockParNetValueMember2024-04-300000711404us-gaap:TreasuryStockCommonMember2024-04-300000711404coo:TreasuryStockParNetValueMember2024-04-300000711404us-gaap:AdditionalPaidInCapitalMember2024-04-300000711404us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-300000711404us-gaap:RetainedEarningsMember2024-04-300000711404us-gaap:NoncontrollingInterestMember2024-04-3000007114042024-02-160000711404coo:CookMedicalMember2023-11-012023-11-010000711404coo:CookMedicalMembercoo:PayablesFirstInstallmentMember2023-11-012023-11-010000711404coo:CookMedicalMembercoo:PayablesSecondInstallmentMember2023-11-012023-11-010000711404coo:CookMedicalMember2023-11-022024-04-300000711404coo:CookMedicalMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-11-010000711404us-gaap:CustomerRelationshipsMembercoo:CookMedicalMember2023-11-010000711404coo:CookMedicalMember2023-11-0100007114042022-03-012022-03-310000711404coo:SightGlassVisionIncMember2022-03-310000711404coo:EssilorInternationalSASMember2022-03-012022-03-310000711404coo:SightGlassVisionIncMember2022-02-280000711404us-gaap:CustomerRelationshipsMember2024-04-300000711404us-gaap:CustomerRelationshipsMember2023-10-310000711404coo:CompositeMember2024-04-300000711404coo:CompositeMember2023-10-310000711404us-gaap:TechnologyBasedIntangibleAssetsMember2024-04-300000711404us-gaap:TechnologyBasedIntangibleAssetsMember2023-10-310000711404us-gaap:TrademarksMember2024-04-300000711404us-gaap:TrademarksMember2023-10-310000711404coo:LicenseAndDistributionRightsAndOtherMember2024-04-300000711404coo:LicenseAndDistributionRightsAndOtherMember2023-10-310000711404us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2024-04-300000711404us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-10-310000711404us-gaap:MediumTermNotesMember2024-04-300000711404us-gaap:MediumTermNotesMember2023-10-310000711404coo:OtherDebtMember2024-04-300000711404coo:OtherDebtMember2023-10-310000711404us-gaap:LineOfCreditMembercoo:TermLoanFacility2021Member2021-12-170000711404us-gaap:LineOfCreditMembercoo:TermLoanFacility2021Member2024-04-300000711404us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembercoo:CreditAgreement2020Member2020-04-010000711404coo:TermLoanFacility2020Memberus-gaap:LineOfCreditMembercoo:CreditAgreement2020Member2020-04-010000711404us-gaap:LineOfCreditMembercoo:RevolvingCreditFacilityAndTermLoanFacility2020Membercoo:CreditAgreement2020Member2020-04-010000711404coo:TermLoanFacility2020Memberus-gaap:LineOfCreditMembercoo:CreditAgreement2020Member2024-04-300000711404us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembercoo:CreditAgreement2020Member2024-04-300000711404us-gaap:LineOfCreditMembercoo:RevolvingCreditFacilityAndTermLoanFacility2020Membercoo:CreditAgreement2020Member2024-04-300000711404coo:CreditAgreement2024Memberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMember2024-05-010000711404coo:CreditAgreement2024Memberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SubsequentEventMember2024-05-012024-05-010000711404us-gaap:EmployeeStockOptionMember2024-02-012024-04-300000711404us-gaap:EmployeeStockOptionMember2023-02-012023-04-300000711404us-gaap:EmployeeStockOptionMember2023-11-012024-04-300000711404us-gaap:EmployeeStockOptionMember2022-11-012023-04-300000711404us-gaap:RestrictedStockUnitsRSUMember2024-02-012024-04-300000711404us-gaap:RestrictedStockUnitsRSUMember2023-02-012023-04-300000711404us-gaap:RestrictedStockUnitsRSUMember2023-11-012024-04-300000711404us-gaap:RestrictedStockUnitsRSUMember2022-11-012023-04-300000711404us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-02-012024-04-300000711404us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-02-012023-04-300000711404us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-11-012024-04-300000711404us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-11-012023-04-300000711404us-gaap:CostOfSalesMember2024-02-012024-04-300000711404us-gaap:CostOfSalesMember2023-02-012023-04-300000711404us-gaap:CostOfSalesMember2023-11-012024-04-300000711404us-gaap:CostOfSalesMember2022-11-012023-04-300000711404us-gaap:ResearchAndDevelopmentExpenseMember2024-02-012024-04-300000711404us-gaap:ResearchAndDevelopmentExpenseMember2023-02-012023-04-300000711404us-gaap:ResearchAndDevelopmentExpenseMember2023-11-012024-04-300000711404us-gaap:ResearchAndDevelopmentExpenseMember2022-11-012023-04-300000711404us-gaap:AccumulatedTranslationAdjustmentMember2022-10-310000711404us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-10-310000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-310000711404us-gaap:AccumulatedTranslationAdjustmentMember2022-11-012023-04-300000711404us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-11-012023-04-300000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-11-012023-04-300000711404us-gaap:AccumulatedTranslationAdjustmentMember2023-04-300000711404us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-04-300000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-04-300000711404us-gaap:AccumulatedTranslationAdjustmentMember2023-10-310000711404us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-10-310000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-10-310000711404us-gaap:AccumulatedTranslationAdjustmentMember2023-11-012024-04-300000711404us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-11-012024-04-300000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-11-012024-04-300000711404us-gaap:AccumulatedTranslationAdjustmentMember2024-04-300000711404us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-04-300000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-04-3000007114042017-03-3100007114042023-02-102023-02-100000711404coo:ToricAndMultifocalMemberus-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2024-02-012024-04-300000711404coo:ToricAndMultifocalMemberus-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2023-02-012023-04-300000711404coo:ToricAndMultifocalMemberus-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2023-11-012024-04-300000711404coo:ToricAndMultifocalMemberus-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2022-11-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMembercoo:SphereOtherMember2024-02-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMembercoo:SphereOtherMember2023-02-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMembercoo:SphereOtherMember2023-11-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMembercoo:SphereOtherMember2022-11-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2024-02-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2023-02-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2023-11-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2022-11-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:OfficeAndSurgicalMembercoo:CoopersurgicalSegmentMember2024-02-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:OfficeAndSurgicalMembercoo:CoopersurgicalSegmentMember2023-02-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:OfficeAndSurgicalMembercoo:CoopersurgicalSegmentMember2023-11-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:OfficeAndSurgicalMembercoo:CoopersurgicalSegmentMember2022-11-012023-04-300000711404coo:FertilityMemberus-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2024-02-012024-04-300000711404coo:FertilityMemberus-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2023-02-012023-04-300000711404coo:FertilityMemberus-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2023-11-012024-04-300000711404coo:FertilityMemberus-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2022-11-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2024-02-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2023-02-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2023-11-012024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2022-11-012023-04-300000711404us-gaap:CorporateNonSegmentMember2024-02-012024-04-300000711404us-gaap:CorporateNonSegmentMember2023-02-012023-04-300000711404us-gaap:CorporateNonSegmentMember2023-11-012024-04-300000711404us-gaap:CorporateNonSegmentMember2022-11-012023-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopervisionSegmentMember2023-10-310000711404us-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2024-04-300000711404us-gaap:OperatingSegmentsMembercoo:CoopersurgicalSegmentMember2023-10-310000711404us-gaap:CorporateNonSegmentMember2024-04-300000711404us-gaap:CorporateNonSegmentMember2023-10-310000711404country:US2024-02-012024-04-300000711404country:US2023-02-012023-04-300000711404country:US2023-11-012024-04-300000711404country:US2022-11-012023-04-300000711404srt:EuropeMember2024-02-012024-04-300000711404srt:EuropeMember2023-02-012023-04-300000711404srt:EuropeMember2023-11-012024-04-300000711404srt:EuropeMember2022-11-012023-04-300000711404coo:RestOfWorldExcludingUnitedStatesAndEuropeMember2024-02-012024-04-300000711404coo:RestOfWorldExcludingUnitedStatesAndEuropeMember2023-02-012023-04-300000711404coo:RestOfWorldExcludingUnitedStatesAndEuropeMember2023-11-012024-04-300000711404coo:RestOfWorldExcludingUnitedStatesAndEuropeMember2022-11-012023-04-300000711404country:US2024-04-300000711404country:US2023-10-310000711404srt:EuropeMember2024-04-300000711404srt:EuropeMember2023-10-310000711404coo:RestOfWorldExcludingUnitedStatesAndEuropeMember2024-04-300000711404coo:RestOfWorldExcludingUnitedStatesAndEuropeMember2023-10-310000711404us-gaap:ForeignExchangeForwardMember2024-04-300000711404us-gaap:InterestRateSwapMember2024-04-300000711404us-gaap:InterestRateSwapMember2023-11-012024-04-300000711404us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2024-02-012024-04-300000711404us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2023-02-012023-04-300000711404us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2023-11-012024-04-300000711404us-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2022-11-012023-04-300000711404coo:AccumulatedGainLossNetCashFlowHedgeBeforeTaxParentMember2024-01-310000711404coo:AccumulatedGainLossNetCashFlowHedgeBeforeTaxParentMember2023-01-310000711404coo:AccumulatedGainLossNetCashFlowHedgeBeforeTaxParentMember2023-10-310000711404coo:AccumulatedGainLossNetCashFlowHedgeBeforeTaxParentMember2022-10-310000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-02-012024-04-300000711404us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-02-012023-04-300000711404coo:AccumulatedGainLossNetCashFlowHedgeBeforeTaxParentMember2024-04-300000711404coo:AccumulatedGainLossNetCashFlowHedgeBeforeTaxParentMember2023-04-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

FORM 10-Q

_____________________________________________________________

|

|

|

|

|

|

| ☒ |

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended April 30, 2024

|

|

|

|

|

|

| ☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 1-8597

_____________________________________________________________

The Cooper Companies, Inc.

(Exact name of registrant as specified in its charter)

_____________________________________________________________

|

|

|

|

|

|

| Delaware |

94-2657368 |

(State or other jurisdiction of

incorporation or organization) |

(I.R.S. Employer

Identification No.) |

6101 Bollinger Canyon Road, Suite 500,

San Ramon, California 94583

(Address of principal executive offices) (Zip Code)

(925) 460-3600

(Registrant’s telephone number, including area code)

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.10 par value |

|

COO |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

| Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.): Yes ☐ No ☒

On May 24, 2024, 199,119,880 shares of Common Stock, $0.10 par value, were outstanding.

INDEX

|

|

|

|

|

|

|

|

|

| |

|

Page No. |

| PART I. |

|

|

|

|

|

| Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 2. |

|

|

|

|

|

| Item 3. |

|

|

|

|

|

| Item 4. |

|

|

|

|

|

| PART II. |

|

|

|

|

|

| Item 1. |

|

|

|

|

|

| Item 1A. |

|

|

|

|

|

| Item 2. |

|

|

|

|

|

| Item 3. |

|

|

|

|

|

| Item 4. |

|

|

|

|

|

| Item 5. |

|

|

|

|

|

| Item 6. |

|

|

|

|

|

|

PART I. FINANCIAL INFORMATION

Item 1. Unaudited Financial Statements

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Income and Comprehensive Income

Periods Ended April 30,

(In millions, except for earnings per share)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months |

|

Six Months |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net sales |

$ |

942.6 |

|

|

$ |

877.4 |

|

|

$ |

1,874.2 |

|

|

$ |

1,735.9 |

|

| Cost of sales |

311.4 |

|

|

294.5 |

|

|

619.2 |

|

|

594.5 |

|

| Gross profit |

631.2 |

|

|

582.9 |

|

|

1,255.0 |

|

|

1,141.4 |

|

| Selling, general and administrative expense |

380.3 |

|

|

407.5 |

|

|

761.2 |

|

|

738.4 |

|

| Research and development expense |

38.9 |

|

|

32.6 |

|

|

78.4 |

|

|

64.2 |

|

| Amortization of intangibles |

50.3 |

|

|

46.5 |

|

|

100.6 |

|

|

93.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

161.7 |

|

|

96.3 |

|

|

314.8 |

|

|

245.8 |

|

| Interest expense |

28.9 |

|

|

26.1 |

|

|

58.8 |

|

|

52.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other expense, net |

2.8 |

|

|

4.6 |

|

|

6.0 |

|

|

5.9 |

|

| Income before income taxes |

130.0 |

|

|

65.6 |

|

|

250.0 |

|

|

187.7 |

|

Provision for income taxes (Note 6) |

41.1 |

|

|

25.8 |

|

|

79.9 |

|

|

63.3 |

|

| Net income |

$ |

88.9 |

|

|

$ |

39.8 |

|

|

$ |

170.1 |

|

|

$ |

124.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share (Note 7)*: |

|

|

|

|

|

|

|

| Basic |

$ |

0.45 |

|

|

$ |

0.20 |

|

|

$ |

0.86 |

|

|

$ |

0.63 |

|

| Diluted |

$ |

0.44 |

|

|

$ |

0.20 |

|

|

$ |

0.85 |

|

|

$ |

0.63 |

|

Number of shares used to compute earnings per share*: |

|

|

|

|

|

|

|

| Basic |

198.9 |

|

|

197.9 |

|

|

198.6 |

|

|

197.7 |

|

| Diluted |

200.5 |

|

|

199.2 |

|

|

200.2 |

|

|

198.9 |

|

| Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

| Cash flow hedges |

$ |

21.4 |

|

|

$ |

(5.5) |

|

|

$ |

(6.6) |

|

|

$ |

(26.5) |

|

| Foreign currency translation adjustment |

(22.0) |

|

|

(14.5) |

|

|

37.8 |

|

|

69.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income |

$ |

88.3 |

|

|

$ |

19.8 |

|

|

$ |

201.3 |

|

|

$ |

167.4 |

|

*All periods presented have been adjusted to reflect the four-for-one stock split effected on February 16, 2024. Refer to Note 1. General for further information.

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Balance Sheets

(In millions, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

April 30, 2024 |

|

October 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

112.4 |

|

|

$ |

120.8 |

|

Trade accounts receivable, net of allowance for credit losses of $39.9 at April 30, 2024, and $31.3 at October 31, 2023 |

688.7 |

|

|

609.7 |

|

Inventories (Note 3) |

775.4 |

|

|

735.6 |

|

| Prepaid expense and other current assets |

282.5 |

|

|

238.8 |

|

|

|

|

|

| Total current assets |

1,859.0 |

|

|

1,704.9 |

|

| Property, plant and equipment, net |

1,709.3 |

|

|

1,632.6 |

|

| Goodwill |

3,761.3 |

|

|

3,624.5 |

|

Other intangibles, net (Note 4) |

1,796.9 |

|

|

1,710.3 |

|

| Deferred tax assets |

2,283.7 |

|

|

2,349.5 |

|

| Other assets |

637.2 |

|

|

637.1 |

|

| Total assets |

$ |

12,047.4 |

|

|

$ |

11,658.9 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

Short-term debt (Note 5) |

$ |

41.7 |

|

|

$ |

45.4 |

|

| Accounts payable |

230.7 |

|

|

261.9 |

|

| Employee compensation and benefits |

144.7 |

|

|

174.8 |

|

| Deferred revenue |

121.7 |

|

|

123.6 |

|

| Other current liabilities |

413.7 |

|

|

363.3 |

|

|

|

|

|

| Total current liabilities |

952.5 |

|

|

969.0 |

|

Long-term debt (Note 5) |

2,671.3 |

|

|

2,523.8 |

|

| Deferred tax liabilities |

94.2 |

|

|

101.5 |

|

| Long-term tax payable |

59.0 |

|

|

90.2 |

|

| Deferred revenue |

188.6 |

|

|

184.2 |

|

Other liabilities |

277.9 |

|

|

239.2 |

|

| Total liabilities |

$ |

4,243.5 |

|

|

$ |

4,107.9 |

|

Contingencies (Note 10) |

|

|

|

Stockholders’ equity*: |

|

|

|

Preferred stock, $0.10 par value, 1.0 shares authorized, zero shares issued or outstanding |

— |

|

|

— |

|

Common stock, $0.10 par value, 480.0 shares authorized, 216.8 issued and 199.1 outstanding at April 30, 2024, and 215.8 issued and 198.1 outstanding at October 31, 2023 |

21.7 |

|

|

21.6 |

|

| Additional paid-in capital |

1,866.7 |

|

|

1,817.2 |

|

| Accumulated other comprehensive loss |

(422.6) |

|

|

(453.8) |

|

| Retained earnings |

7,046.2 |

|

|

6,876.1 |

|

Treasury stock at cost: 17.7 shares at April 30, 2024, and 17.7 shares at October 31, 2023 |

(708.3) |

|

|

(710.3) |

|

| Total Cooper stockholders’ equity |

7,803.7 |

|

|

7,550.8 |

|

| Noncontrolling interests |

0.2 |

|

|

0.2 |

|

Stockholders’ equity (Note 9) |

7,803.9 |

|

|

7,551.0 |

|

| Total liabilities and stockholders’ equity |

$ |

12,047.4 |

|

|

$ |

11,658.9 |

|

|

|

|

|

*All periods presented have been adjusted to reflect the four-for-one stock split effected on February 16, 2024. Refer to Note 1. General for further information.

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Stockholders' Equity

(In millions, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Common Shares |

|

Treasury Stock |

|

Additional Paid-In Capital |

|

Accumulated

Other

Comprehensive

Loss |

|

Retained Earnings |

|

Treasury Stock |

|

Noncontrolling Interests |

|

Total

Stockholders'

Equity |

|

Shares |

|

Amount |

Shares |

|

Amount |

| Balance at November 1, 2022* |

197.4 |

|

|

$ |

19.7 |

|

|

17.8 |

|

|

$ |

1.8 |

|

|

$ |

1,749.4 |

|

|

$ |

(466.8) |

|

|

$ |

6,584.9 |

|

|

$ |

(714.5) |

|

|

$ |

0.2 |

|

|

$ |

7,174.7 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

84.6 |

|

|

— |

|

|

— |

|

|

84.6 |

|

| Other comprehensive income, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

63.0 |

|

|

— |

|

|

— |

|

|

— |

|

|

63.0 |

|

| Issuance of common stock for stock plans, net and employee stock purchase plan |

0.4 |

|

|

— |

|

|

— |

|

|

— |

|

|

(2.5) |

|

|

— |

|

|

— |

|

|

1.2 |

|

|

— |

|

|

(1.3) |

|

Dividends on common stock ($0.03 per share) |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1.5) |

|

|

— |

|

|

— |

|

|

(1.5) |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

16.2 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

16.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 31, 2023* |

197.8 |

|

|

$ |

19.7 |

|

|

17.8 |

|

|

$ |

1.8 |

|

|

$ |

1,763.1 |

|

|

$ |

(403.8) |

|

|

$ |

6,668.0 |

|

|

$ |

(713.3) |

|

|

$ |

0.2 |

|

|

$ |

7,335.7 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

39.8 |

|

|

— |

|

|

— |

|

|

39.8 |

|

| Other comprehensive income (loss), net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(20.0) |

|

|

— |

|

|

— |

|

|

— |

|

|

(20.0) |

|

| Issuance of common stock for stock plans, net and employee stock purchase plan |

0.2 |

|

|

0.1 |

|

|

— |

|

|

— |

|

|

6.7 |

|

|

— |

|

|

— |

|

|

1.0 |

|

|

— |

|

|

7.8 |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

14.7 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

14.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at April 30, 2023* |

198.0 |

|

|

$ |

19.8 |

|

|

17.8 |

|

|

$ |

1.8 |

|

|

$ |

1,784.5 |

|

|

$ |

(423.8) |

|

|

$ |

6,707.8 |

|

|

$ |

(712.3) |

|

|

$ |

0.2 |

|

|

$ |

7,378.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*All periods presented have been adjusted to reflect the four-for-one stock split effected on February 16, 2024. Refer to Note 1. General for further information.

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Stockholders' Equity

(In millions, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Shares |

|

Treasury Stock |

|

Additional Paid-In Capital |

|

Accumulated

Other

Comprehensive

Loss |

|

Retained Earnings |

|

Treasury Stock |

|

Noncontrolling Interests |

|

Total

Stockholders'

Equity |

|

Shares |

|

Amount |

Shares |

|

Amount |

| Balance at November 1, 2023* |

198.1 |

|

|

$ |

19.8 |

|

|

17.7 |

|

|

$ |

1.8 |

|

|

$ |

1,817.2 |

|

|

$ |

(453.8) |

|

|

$ |

6,876.1 |

|

|

$ |

(710.3) |

|

|

$ |

0.2 |

|

|

$ |

7,551.0 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

81.2 |

|

|

— |

|

|

— |

|

|

81.2 |

|

| Other comprehensive income, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

31.8 |

|

|

— |

|

|

— |

|

|

— |

|

|

31.8 |

|

| Issuance of common stock for stock plans, net and employee stock purchase plan |

0.6 |

|

|

— |

|

|

— |

|

|

— |

|

|

6.6 |

|

|

|

|

— |

|

|

1.1 |

|

|

— |

|

|

7.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

23.6 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

23.6 |

|

| Balance at January 31, 2024* |

198.7 |

|

|

$ |

19.8 |

|

|

17.7 |

|

|

$ |

1.8 |

|

|

$ |

1,847.4 |

|

|

$ |

(422.0) |

|

|

$ |

6,957.3 |

|

|

$ |

(709.2) |

|

|

$ |

0.2 |

|

|

$ |

7,695.3 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

88.9 |

|

|

— |

|

|

— |

|

|

88.9 |

|

| Other comprehensive income (loss), net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.6) |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.6) |

|

| Issuance of common stock for stock plans, net and employee stock purchase plan |

0.4 |

|

|

0.1 |

|

|

— |

|

|

— |

|

|

2.5 |

|

|

— |

|

|

— |

|

|

0.9 |

|

|

— |

|

|

3.5 |

|

| Share-based compensation expense |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

16.8 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

16.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at April 30, 2024* |

199.1 |

|

|

$ |

19.9 |

|

|

17.7 |

|

|

$ |

1.8 |

|

|

$ |

1,866.7 |

|

|

$ |

(422.6) |

|

|

$ |

7,046.2 |

|

|

$ |

(708.3) |

|

|

$ |

0.2 |

|

|

$ |

7,803.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*All periods presented have been adjusted to reflect the four-for-one stock split effected on February 16, 2024. Refer to Note 1. General for further information.

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Consolidated Condensed Statements of Cash Flows

Six Months Ended April 30,

(In millions, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

2023 |

| Cash flows from operating activities: |

|

|

|

| Net income |

$ |

170.1 |

|

|

$ |

124.4 |

|

| Depreciation and amortization |

195.1 |

|

|

180.5 |

|

|

|

|

|

| Change in fair value of contingent consideration |

— |

|

|

(31.8) |

|

| Accrual for acquisition termination fee |

— |

|

|

45.0 |

|

| Net changes in operating capital |

(252.7) |

|

|

(103.0) |

|

|

|

|

|

| Other non-cash items |

121.2 |

|

|

75.7 |

|

| Net cash provided by operating activities |

233.7 |

|

|

290.8 |

|

| Cash flows from investing activities: |

|

|

|

| Purchases of property, plant and equipment |

(192.2) |

|

|

(156.6) |

|

| Acquisitions of businesses and assets, net of cash acquired, and other |

(206.7) |

|

|

(38.7) |

|

|

|

|

|

| Net cash used in investing activities |

(398.9) |

|

|

(195.3) |

|

| Cash flows from financing activities: |

|

|

|

| Proceeds from long-term debt, net of issuance costs |

1,403.1 |

|

|

1,199.3 |

|

| Repayments of long-term debt |

(1,256.4) |

|

|

(985.5) |

|

Net repayments of short-term debt |

(2.0) |

|

|

(342.5) |

|

Net proceeds related to share-based compensation awards |

6.8 |

|

|

2.1 |

|

| Dividends on common stock |

— |

|

|

(1.5) |

|

|

|

|

|

| Issuance of common stock for employee stock purchase plan |

3.7 |

|

|

3.7 |

|

|

|

|

|

Net cash provided by (used in) financing activities |

155.2 |

|

|

(124.4) |

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

1.7 |

|

|

2.4 |

|

Net decrease in cash, cash equivalents, and restricted cash |

(8.3) |

|

|

(26.5) |

|

| Cash, cash equivalents, and restricted cash at beginning of period |

120.9 |

|

|

138.6 |

|

| Cash, cash equivalents, and restricted cash at end of period |

$ |

112.6 |

|

|

$ |

112.1 |

|

| Reconciliation of cash flow information: |

|

|

|

| Cash and cash equivalents |

$ |

112.4 |

|

|

$ |

111.9 |

|

| Restricted cash included in other current assets |

0.2 |

|

|

0.2 |

|

|

|

|

|

| Total cash, cash equivalents, and restricted cash |

$ |

112.6 |

|

|

$ |

112.1 |

|

The accompanying notes are an integral part of these Consolidated Condensed Financial Statements.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Note 1. General

The accompanying Consolidated Condensed Financial Statements of The Cooper Companies, Inc. and its subsidiaries have been prepared in accordance with generally accepted accounting principles in the United States (GAAP) for interim financial information and with the requirements of Regulation S-X, Rule 10-01 for financial statements required to be filed as a part of this Quarterly Report on Form 10-Q. Unless the context requires otherwise, terms "the Company", "we", "us", and "our" are used to refer collectively to The Cooper Companies, Inc. and its subsidiaries.

The accompanying Consolidated Condensed Financial Statements and related notes are unaudited and should be read in conjunction with the audited Consolidated Financial Statements of the Company and related notes as contained in the Company’s Annual Report on Form 10-K for the fiscal year ended October 31, 2023. The Consolidated Condensed Financial Statements include all adjustments (consisting only of normal recurring adjustments) and accruals necessary in the judgment of management for a fair presentation of the results for the interim periods presented.

Accounting Policies

There have been no material changes to our significant accounting policies1 described in our Annual Report on Form 10-K for the fiscal year ended October 31, 2023.

Estimates

The preparation of Consolidated Condensed Financial Statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of net sales and expenses during the reporting period. Actual results could differ from those estimates. The Company continually monitors and evaluates the estimates used as additional information becomes available. Adjustments will be made to these provisions periodically to reflect new facts and circumstances that may indicate that historical experience may not be indicative of current and/or future results.

Stock Split

On February 16, 2024, the Company effected a four-for-one stock split of its outstanding shares of common stock. The par value of the common stock remains at $0.10 per share. Accordingly, an amount equal to the par value of the increased shares resulting from the stock split was reclassified from "Additional paid-in capital" to "Common stock". All share and per share information has been retroactively adjusted to reflect the stock split for all periods presented.

Accounting Pronouncements Issued But Not Yet Adopted

In December 2023, the Financial Accounting Standards Board (FASB) issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. This ASU requires public entities to disclose specific categories in the effective tax rate reconciliation and additional information for reconciling items that exceed a quantitative threshold. The guidance also requires all disaggregated information pertaining to taxes paid, net of refunds received, for federal, state and foreign income taxes. The new guidance is effective for fiscal years beginning after December 15, 2024, with the option to apply prospectively or retrospectively. Early adoption is permitted. We are currently evaluating the impact that the adoption of this guidance will have on our consolidated financial statements and disclosures.

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which enhances the disclosures required for operating segments in our annual and interim consolidated financial statements. The ASU is effective for us beginning on November 1, 2024, and will be applied retrospectively. Early adoption is permitted. We are currently evaluating the impact of adopting this ASU on our consolidated financial statements and disclosures.

Note 2. Acquisitions and Joint Venture

All acquisitions were funded by cash generated from operations or facility borrowings.

On November 1, 2023, CooperSurgical completed the acquisition of select Cook Medical assets focused primarily on the obstetrics, doppler monitoring, and gynecology surgery markets. The purchase price of the acquisition was $300.0 million, with $200.0 million paid at closing and two cash payments of $50.0 million each to be paid on November 1, 2024, and November 1, 2025. The present value of the acquisition purchase price was $291.6 million, which is included in the Company's balance sheet.

1 To further clarify the policy detailed in our Annual Report on Form 10-K for the fiscal year ended October 31, 2023, the current portion of the deferred revenue balances at the beginning of each period presented were generally fully recognized in a ratable manner in the subsequent 12-month period. We recognized revenue of approximately $31.0 million and $62.0 million for the three and six months ended April 30, 2024, respectively, that was included in the deferred revenue balance at January 31, 2024, and October 31, 2023. We recognized revenue of approximately $27.0 million and $50.0 million for the three and six months ended April 30, 2023, respectively, that was included in the deferred revenue balance at January 31, 2023, and October 31, 2022.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Assets acquired primarily comprised of $157.9 million of technologies, $26.6 million of customer relationship related intangibles, and $107.2 million of goodwill. The goodwill is deductible for tax purposes.

Joint Venture

CooperVision and Essilor International SAS (Essilor) executed a Contribution Agreement and a Stock Purchase Agreement (the “Agreements”) in March 2022 to form a joint venture in SightGlass Vision, Inc. (SGV), which is a medical device company developing spectacle lenses for myopia management. Essilor paid CooperVision $52.1 million in exchange for a 50% interest in SGV and their proportionate share of the revenue payments. As part of the Agreements, each party contributed their interest in SGV and $10 million in cash. Prior to March 2022, CooperVision owned 100% of SGV.

Further information regarding the joint venture is included in the notes to our consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended October 31, 2023.

Note 3. Inventories

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions) |

April 30, 2024 |

|

October 31, 2023 |

| Raw materials |

$ |

212.8 |

|

|

$ |

207.3 |

|

| Work-in-process |

23.1 |

|

|

19.0 |

|

| Finished goods |

539.5 |

|

|

509.3 |

|

| Total inventories |

$ |

775.4 |

|

|

$ |

735.6 |

|

Note 4. Intangible Assets

Intangible assets consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

April 30, 2024 |

|

October 31, 2023 |

|

|

| (In millions) |

Gross

Carrying

Amount |

|

Accumulated

Amortization |

|

Gross

Carrying

Amount |

|

Accumulated

Amortization |

|

Weighted-Average Amortization Period

(in years)

|

|

|

|

|

|

|

|

|

|

|

| Intangible assets with definite lives: |

|

|

|

|

|

|

|

|

|

| Customer relationships |

$ |

1,122.8 |

|

|

$ |

372.2 |

|

|

$ |

1,099.2 |

|

|

$ |

345.8 |

|

|

19 |

| Composite intangible asset |

1,061.9 |

|

|

460.2 |

|

|

1,061.9 |

|

|

424.8 |

|

|

15 |

| Technology |

653.2 |

|

|

361.1 |

|

|

494.5 |

|

|

335.4 |

|

|

12 |

| Trademarks |

204.2 |

|

|

83.3 |

|

|

208.9 |

|

|

81.1 |

|

|

15 |

| License and distribution rights and other |

47.7 |

|

|

25.4 |

|

|

51.6 |

|

|

28.0 |

|

|

11 |

|

3,089.8 |

|

|

$ |

1,302.2 |

|

|

2,916.1 |

|

|

$ |

1,215.1 |

|

|

16 |

| Less: accumulated amortization and translation |

1,302.2 |

|

|

|

|

1,215.1 |

|

|

|

|

|

| Intangible assets with definite lives, net |

1,787.6 |

|

|

|

|

1,701.0 |

|

|

|

|

|

Intangible assets with indefinite lives, net (1) |

9.3 |

|

|

|

|

9.3 |

|

|

|

|

|

| Total other intangibles, net |

$ |

1,796.9 |

|

|

|

|

$ |

1,710.3 |

|

|

|

|

|

(1) Intangible assets with indefinite lives include technology and trademarks.

Balances include foreign currency translation adjustments.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

As of April 30, 2024, the estimate of future amortization expenses for intangible assets with definite lives is as follows:

|

|

|

|

|

|

| Fiscal Years: |

(In millions) |

| Remainder of 2024 |

$ |

97.3 |

|

| 2025 |

187.7 |

|

| 2026 |

180.1 |

|

| 2027 |

165.8 |

|

| 2028 |

161.2 |

|

| Thereafter |

995.5 |

|

| Total remaining amortization for intangible assets with definite lives |

$ |

1,787.6 |

|

There was no impairment of goodwill or intangible assets recorded in the six months ended April 30, 2024.

Note 5. Financing Arrangements

The Company had outstanding debt as follows:

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions) |

April 30, 2024 |

|

October 31, 2023 |

| Short-term debt, excluding financing leases |

$ |

40.7 |

|

|

$ |

44.4 |

|

| Financing lease liabilities |

1.0 |

|

|

1.0 |

|

| Short-term debt |

$ |

41.7 |

|

|

$ |

45.4 |

|

|

|

|

|

| Revolving credit |

$ |

320.0 |

|

|

$ |

172.6 |

|

| Term loans |

2,350.0 |

|

|

2,350.0 |

|

| Other |

0.2 |

|

|

0.2 |

|

| Less: unamortized debt issuance cost |

(1.9) |

|

|

(2.4) |

|

| Long-term debt, excluding financing leases |

2,668.3 |

|

|

2,520.4 |

|

| Financing lease liabilities |

3.0 |

|

|

3.4 |

|

| Long-term debt |

$ |

2,671.3 |

|

|

$ |

2,523.8 |

|

| Total debt |

$ |

2,713.0 |

|

|

$ |

2,569.2 |

|

Additional information regarding our indebtedness is included in our notes to our consolidated financial statements in our Annual Report on Form 10-K for the fiscal year ended October 31, 2023. The carrying value of the Company's revolving credit facility and term loans approximates fair value based on current market rates (Level 2). As of April 30, 2024, the Company was in compliance with all debt covenants.

Term Loan Agreement on December 17, 2021

On December 17, 2021, the Company entered into a Term Loan Agreement (the 2021 Credit Agreement) by and among the Company, the lenders from time to time party thereto, and PNC Bank, National Association, as administrative agent. The 2021 Credit Agreement provides for a term loan facility (the 2021 Term Loan Facility) in an aggregate principal amount of $1.5 billion, which, unless terminated earlier, matures on December 17, 2026.

On April 30, 2024, the Company had $1.5 billion outstanding under the 2021 Term Loan Facility and the interest rate was 6.43%.

Revolving Credit and Term Loan Agreement on April 1, 2020

On April 1, 2020, the Company entered into a Revolving Credit and Term Loan Agreement (the 2020 Credit Agreement), among the Company, CooperVision International Holding Company, LP, CooperSurgical Netherlands B.V., CooperVision Holding Kft, the lenders from time to time party thereto, and KeyBank National Association, as administrative agent. The 2020 Credit Agreement provides for (a) a multicurrency revolving credit facility (the 2020 Revolving Credit Facility) in an aggregate principal amount of $1.29 billion and (b) a term loan facility (the 2020 Term Loan Facility) in an aggregate principal amount of $850.0 million, each of which, unless terminated earlier, mature on April 1, 2025. The Company has an uncommitted option to increase the revolving credit facility or establish a new term loan in an aggregate amount up to $1.605 billion.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

On April 30, 2024, the Company had $850.0 million outstanding under the 2020 Term Loan Facility and $320.0 million outstanding under the 2020 Revolving Credit Facility. The interest rate on the 2020 Term Loan Facility and the 2020 Revolving Credit Facility was 6.42% at April 30, 2024.

Subsequent Event

On May 1, 2024, the Company entered into a Revolving Credit Agreement (the 2024 Credit Agreement), among the Company, CooperVision International Limited, the lenders from time to time party thereto, and PNC Bank, National Association, as administrative agent. The 2024 Credit Agreement provides for a multicurrency revolving credit facility (the 2024 Revolving Credit Facility) in an aggregate principal amount of $2.3 billion which, unless terminated earlier, matures on May 1, 2029. On May 1, 2024, the Company used $1.170 billion under the 2024 Revolving Credit Facility to fully repay all borrowings outstanding under the 2020 Term Loan Facility and the 2020 Revolving Credit Facility, and terminated the 2020 Credit Agreement.

On May 1, 2024, in connection with the Company's entry into the 2024 Credit Agreement, the Company also entered into Amendment No. 2 to the 2021 Credit Agreement, modifying the 2021 Credit Agreement by, among other things, conforming certain provisions therein to those contained in the 2024 Credit Agreement.

Note 6. Income Taxes

The effective tax rates for the three months ended April 30, 2024, and 2023, were 31.6% and 39.3%, respectively. The effective tax rates for the six months ended April 30, 2024, and 2023, were 32.0% and 33.7%, respectively. The decreases were primarily due to changes in the geographic composition of pre-tax earnings, partially offset by an increase in the UK statutory tax rate from 19% to 25%.

Note 7. Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Periods Ended April 30, |

Three Months |

|

Six Months |

| (In millions, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net income |

$ |

88.9 |

|

|

$ |

39.8 |

|

|

$ |

170.1 |

|

|

$ |

124.4 |

|

| Basic: |

|

|

|

|

|

|

|

| Weighted-average common shares |

198.9 |

|

|

197.9 |

|

|

198.6 |

|

|

197.7 |

|

| Basic earnings per share |

$ |

0.45 |

|

|

$ |

0.20 |

|

|

$ |

0.86 |

|

|

$ |

0.63 |

|

| Diluted: |

|

|

|

|

|

|

|

| Weighted-average common shares |

198.9 |

|

|

197.9 |

|

|

198.6 |

|

|

197.7 |

|

| Effect of dilutive stock plans |

1.6 |

|

|

1.3 |

|

|

1.6 |

|

|

1.2 |

|

Diluted weighted-average common shares |

200.5 |

|

|

199.2 |

|

|

200.2 |

|

|

198.9 |

|

| Diluted earnings per share |

$ |

0.44 |

|

|

$ |

0.20 |

|

|

$ |

0.85 |

|

|

$ |

0.63 |

|

The following table sets forth stock options to purchase our common stock and restricted stock units that were not included in the diluted earnings per share calculation because their effect would have been antidilutive for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Periods Ended April 30, |

Three Months |

|

Six Months |

| (In thousands, except exercise prices) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Stock option shares excluded |

833 |

|

|

1,252 |

|

|

833 |

|

|

1,252 |

|

| Exercise prices |

$82.46 - $101.54 |

|

$75.03 - $101.54 |

|

$82.46 - $101.54 |

|

$75.03 - $101.54 |

| Restricted stock units excluded |

3 |

|

|

248 |

|

|

22 |

|

|

268 |

|

Note 8. Share-Based Compensation

The Company has several stock plans that are described in the Company’s Annual Report on Form 10‑K for the fiscal year ended October 31, 2023. The compensation expense and related income tax benefit recognized in our Consolidated Condensed Statements of Income and Comprehensive Income for share-based awards, including the Employee Stock Purchase Plan, were as follows:

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Periods Ended April 30, |

Three Months |

|

Six Months |

| (In millions) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Selling, general and administrative expense |

$ |

15.4 |

|

|

$ |

13.4 |

|

|

$ |

37.2 |

|

|

$ |

27.8 |

|

| Cost of sales |

1.1 |

|

|

0.9 |

|

|

2.3 |

|

|

2.0 |

|

| Research and development expense |

0.7 |

|

|

0.8 |

|

|

1.6 |

|

|

1.6 |

|

| Total share-based compensation expense |

$ |

17.2 |

|

|

$ |

15.1 |

|

|

$ |

41.1 |

|

|

$ |

31.4 |

|

| Related income tax benefit |

$ |

1.5 |

|

|

$ |

1.6 |

|

|

$ |

4.8 |

|

|

$ |

3.3 |

|

|

|

|

|

|

|

|

|

Note 9. Stockholders' Equity

Analysis of Changes in Accumulated Other Comprehensive Loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions) |

Foreign Currency Translation Adjustment |

|

Minimum Pension Liability |

|

Derivative Instruments |

|

Total |

| Balance at October 31, 2022 |

$ |

(555.0) |

|

|

$ |

(6.2) |

|

|

$ |

94.4 |

|

|

$ |

(466.8) |

|

| Gross change in value |

69.5 |

|

|

— |

|

|

(35.0) |

|

|

34.5 |

|

| Tax effect |

— |

|

|

— |

|

|

8.5 |

|

|

8.5 |

|

| Balance at April 30, 2023 |

$ |

(485.5) |

|

|

$ |

(6.2) |

|

|

$ |

67.9 |

|

|

$ |

(423.8) |

|

|

|

|

|

|

|

|

|

| Balance at October 31, 2023 |

$ |

(538.0) |

|

|

$ |

(3.2) |

|

|

$ |

87.4 |

|

|

$ |

(453.8) |

|

| Gross change in value |

37.8 |

|

|

— |

|

|

(8.7) |

|

|

29.1 |

|

| Tax effect |

— |

|

|

— |

|

|

2.1 |

|

|

2.1 |

|

| Balance at April 30, 2024 |

$ |

(500.2) |

|

|

$ |

(3.2) |

|

|

$ |

80.8 |

|

|

$ |

(422.6) |

|

Share Repurchases

In March 2017, the authorization under the 2012 Share Repurchase Program was increased to $1.0 billion by the Company's Board of Directors. As of April 30, 2024, $256.4 million remains authorized for repurchase.

During the three and six months ended April 30, 2024, and 2023, there were no share repurchases.

Dividends

In December 2023, the Company's Board of Directors decided to end the declaration of the semiannual dividend.

The Company paid a semiannual dividend of approximately $1.5 million or 3 cents per share, on February 10, 2023, to stockholders of record on January 23, 2023.

Note 10. Contingencies and Commitments

The Company is involved in various lawsuits, claims and other legal matters from time to time that arise in the ordinary course of conducting business, including matters involving our products, intellectual property, supplier relationships, distributors, competitor relationships, employees and other matters. The Company does not believe that the ultimate resolution of these proceedings or claims pending against it could have a material adverse effect on its financial condition or results of operations. At each reporting period, the Company evaluates whether or not a potential loss amount or a potential range of loss is probable and reasonably estimable under ASC 450, Contingencies. Legal fees are expensed as incurred.

As of April 30, 2024, the Company entered into an additional lease that has not yet commenced in order to expand capacity. The undiscounted lease payments are estimated at $73.0 million for a lease that will commence beginning in fiscal 2025 for a term of 25 years.

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

Note 11. Business Segment Information

The following tables present revenue and other financial information by reportable segment:

Segment information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Periods Ended April 30, |

Three Months |

|

Six Months |

| (In millions) |

2024 |

|

2023 |

|

2024 |

|

2023 |

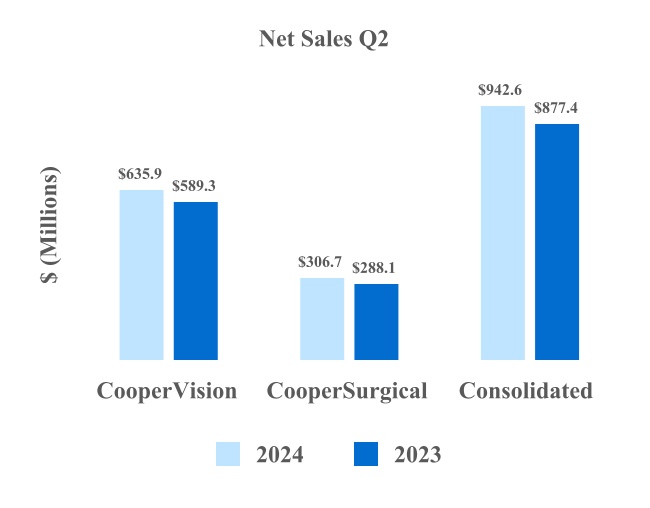

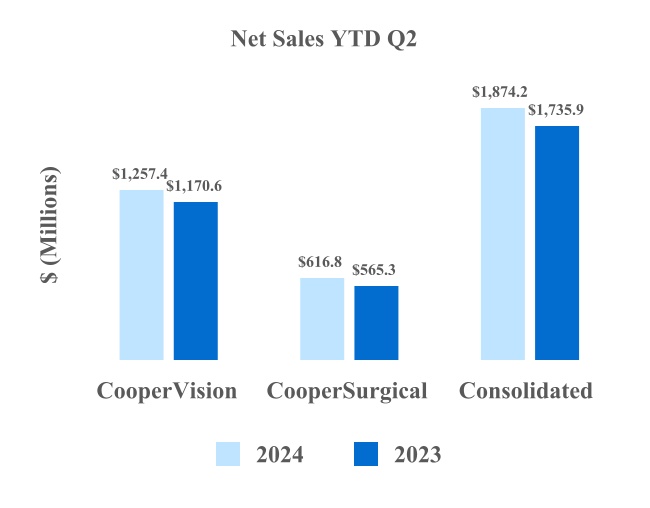

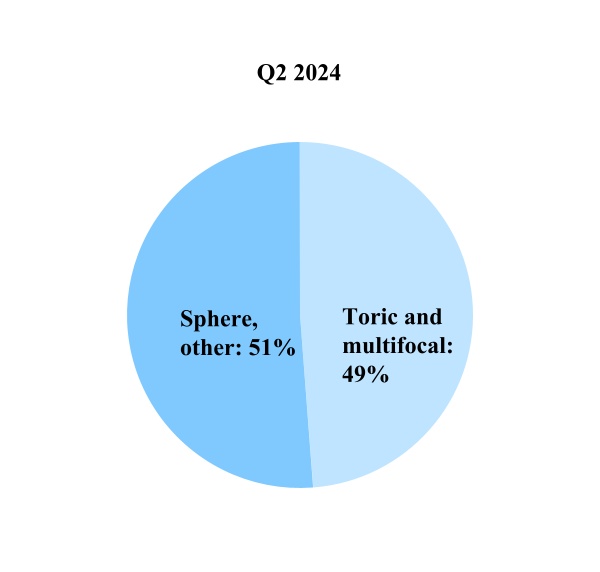

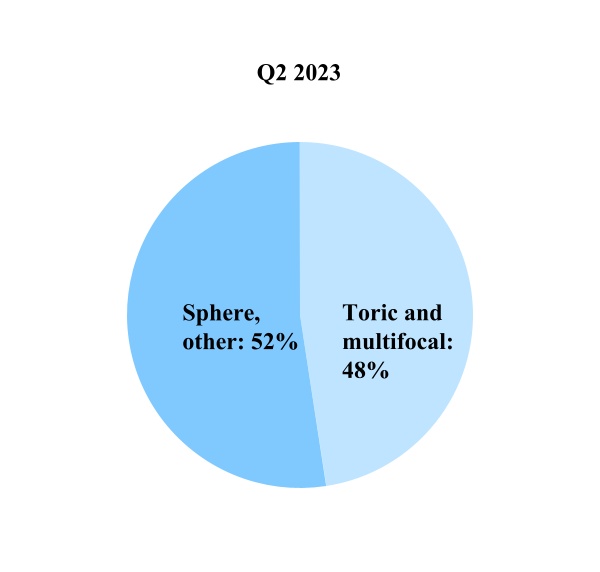

| CooperVision net sales by category: |

|

|

|

|

|

|

|

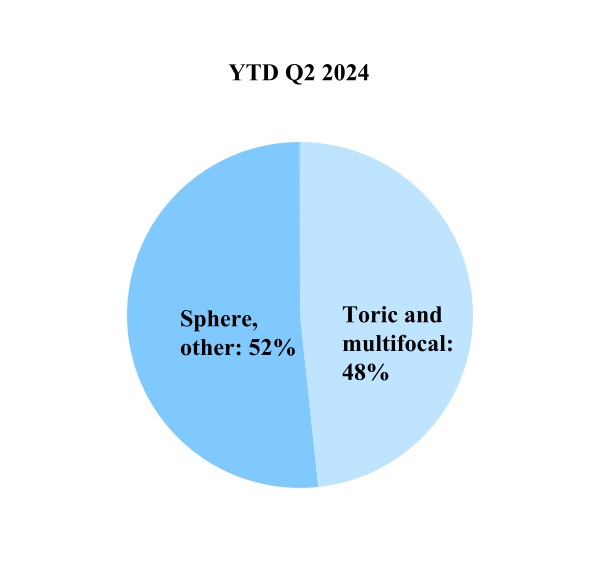

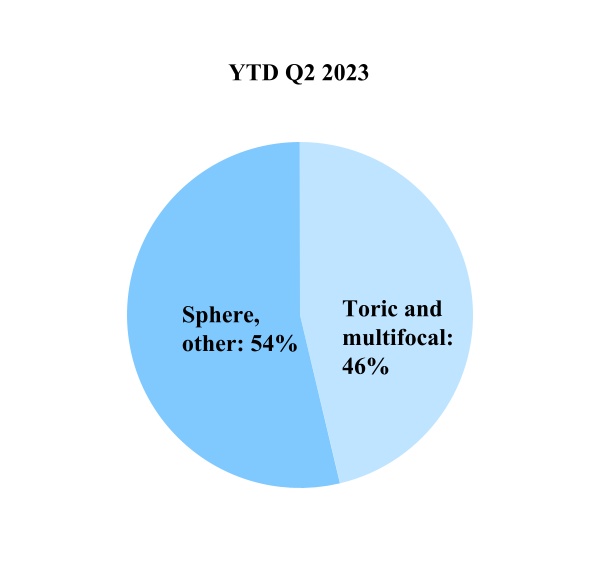

Toric and multifocal |

$ |

310.3 |

|

|

$ |

280.4 |

|

|

$ |

607.6 |

|

|

$ |

542.0 |

|

Sphere, other |

325.6 |

|

|

308.9 |

|

|

649.8 |

|

|

628.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total CooperVision net sales |

$ |

635.9 |

|

|

$ |

589.3 |

|

|

$ |

1,257.4 |

|

|

$ |

1,170.6 |

|

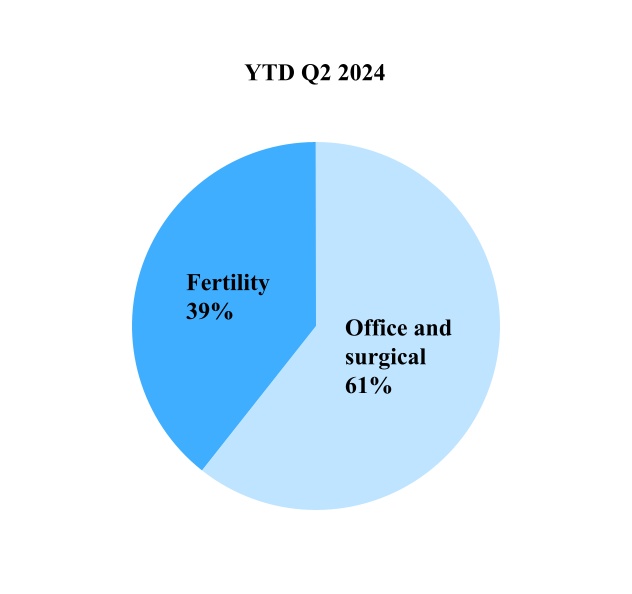

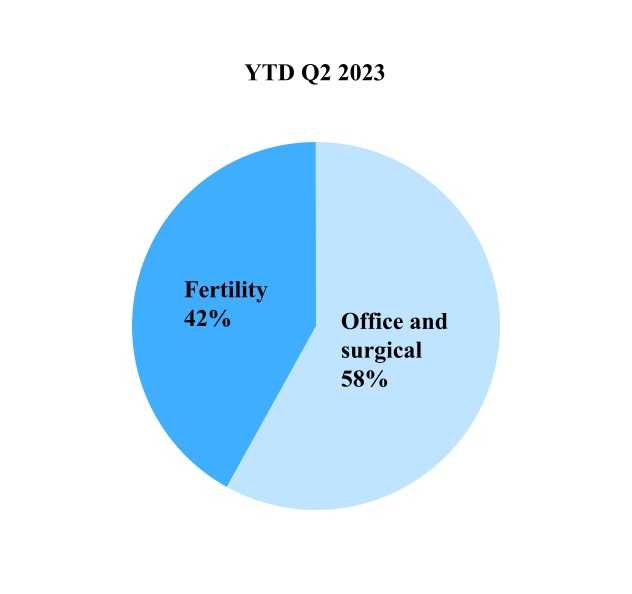

| CooperSurgical net sales by category: |

|

|

|

|

|

|

|

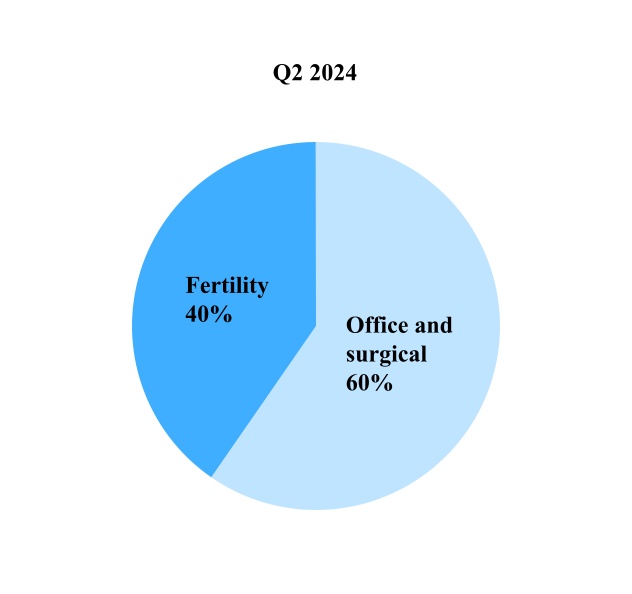

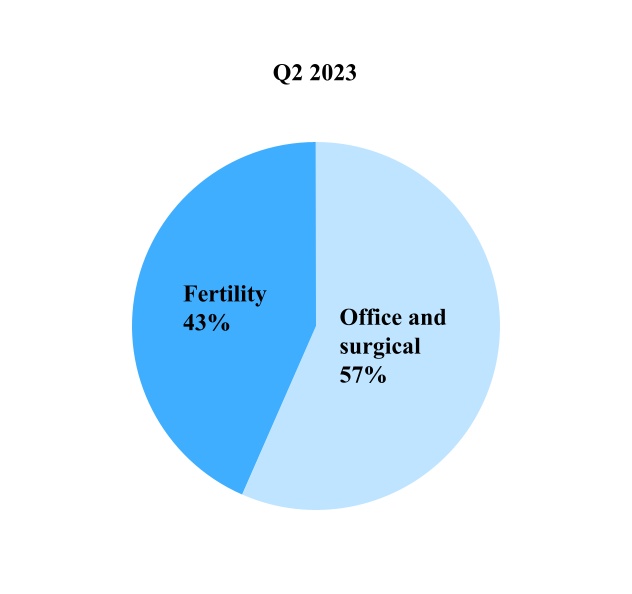

| Office and surgical |

$ |

182.9 |

|

|

$ |

163.0 |

|

|

$ |

374.0 |

|

|

$ |

328.2 |

|

| Fertility |

123.8 |

|

|

125.1 |

|

|

242.8 |

|

|

237.1 |

|

| CooperSurgical net sales |

306.7 |

|

|

288.1 |

|

|

616.8 |

|

|

565.3 |

|

| Total net sales |

$ |

942.6 |

|

|

$ |

877.4 |

|

|

$ |

1,874.2 |

|

|

$ |

1,735.9 |

|

| Operating income (loss): |

|

|

|

|

|

|

|

| CooperVision |

$ |

160.2 |

|

|

$ |

137.9 |

|

|

$ |

315.0 |

|

|

$ |

298.0 |

|

| CooperSurgical |

21.6 |

|

|

(24.3) |

|

|

45.6 |

|

|

(18.5) |

|

| Corporate |

(20.1) |

|

|

(17.3) |

|

|

(45.8) |

|

|

(33.7) |

|

| Total operating income |

161.7 |

|

|

96.3 |

|

|

314.8 |

|

|

245.8 |

|

| Interest expense |

28.9 |

|

|

26.1 |

|

|

58.8 |

|

|

52.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense, net |

2.8 |

|

|

4.6 |

|

|

6.0 |

|

|

5.9 |

|

| Income before income taxes |

$ |

130.0 |

|

|

$ |

65.6 |

|

|

$ |

250.0 |

|

|

$ |

187.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions) |

April 30, 2024 |

|

October 31, 2023 |

| Total identifiable assets: |

|

|

|

| CooperVision |

$ |

7,115.3 |

|

|

$ |

7,044.0 |

|

| CooperSurgical |

4,691.6 |

|

|

4,351.8 |

|

| Corporate |

240.5 |

|

|

263.1 |

|

| Total |

$ |

12,047.4 |

|

|

$ |

11,658.9 |

|

Geographic information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Periods Ended April 30, |

Three Months |

|

Six Months |

| (In millions) |

2024 |

|

2023 |

|

2024 |

|

2023 |

| Net sales to unaffiliated customers by country of domicile: |

|

|

|

|

|

|

|

| United States |

$ |

479.0 |

|

|

$ |

443.1 |

|

|

$ |

949.4 |

|

|

$ |

877.9 |

|

| Europe |

276.7 |

|

|

249.5 |

|

|

553.3 |

|

|

497.7 |

|

| Rest of world |

186.9 |

|

|

184.8 |

|

|

371.5 |

|

|

360.3 |

|

| Total |

$ |

942.6 |

|

|

$ |

877.4 |

|

|

$ |

1,874.2 |

|

|

$ |

1,735.9 |

|

THE COOPER COMPANIES, INC. AND SUBSIDIARIES

Notes to Consolidated Condensed Financial Statements

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| (In millions) |

April 30, 2024 |

|

October 31, 2023 |

| Net property, plant and equipment by country of domicile: |

|

|

|

| United States |

$ |

1,071.7 |

|

|

$ |

1,027.6 |

|

| Europe |

360.1 |

|

|

325.9 |

|

| Rest of world |

277.5 |

|

|

279.1 |

|

| Total |

$ |

1,709.3 |

|

|

$ |

1,632.6 |

|

Note 12. Financial Derivatives and Hedging

As of April 30, 2024, the notional amount of outstanding foreign currency forward contracts was $45.7 million. The resulting impact on our Consolidated Financial Statements from currency hedging activities was not significant for the three and six months ended April 30, 2024, and April 30, 2023.

As of April 30, 2024, the Company has 8 interest rate swap contracts that have a total notional amount of $1.6 billion and remaining maturities of less than four years.

The following table summarizes the amounts recognized with respect to our derivative instruments within the accompanying Consolidated Condensed Statements of Income and Comprehensive Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Periods Ended April 30, |

|

|

Three Months |

|

Six Months |

| (In millions) |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Derivatives designated as cash flow hedges |

|

Location of (Gain)/Loss Recognized on Derivatives |

|

|

|

|