00007088212024FYFALSEhttp://fasb.org/us-gaap/2024#AccountingStandardsUpdate202006MemberP3YP3Yhttp://fasb.org/us-gaap/2024#ResearchAndDevelopmentExpensehttp://fasb.org/us-gaap/2024#ResearchAndDevelopmentExpenseP7YP1YP3YP3YP3Y0.02327220.012987P1YP1YP1Yhttp://fasb.org/us-gaap/2024#BusinessCombinationContingentConsiderationArrangementsChangeInAmountOfContingentConsiderationLiability1.0103089358iso4217:USDxbrli:sharesiso4217:USDxbrli:sharespar:reporting_unitxbrli:purepar:intangibleAsset00007088212024-01-012024-12-3100007088212024-06-2800007088212025-02-2400007088212024-12-3100007088212023-12-310000708821par:SubscriptionServiceMember2024-01-012024-12-310000708821par:SubscriptionServiceMember2023-01-012023-12-310000708821par:SubscriptionServiceMember2022-01-012022-12-310000708821par:HardwareMember2024-01-012024-12-310000708821par:HardwareMember2023-01-012023-12-310000708821par:HardwareMember2022-01-012022-12-310000708821par:ProfessionalServiceMember2024-01-012024-12-310000708821par:ProfessionalServiceMember2023-01-012023-12-310000708821par:ProfessionalServiceMember2022-01-012022-12-3100007088212023-01-012023-12-3100007088212022-01-012022-12-310000708821us-gaap:CommonStockMember2021-12-310000708821us-gaap:AdditionalPaidInCapitalMember2021-12-310000708821par:EquityConsiderationPayableMember2021-12-310000708821us-gaap:RetainedEarningsMember2021-12-310000708821us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000708821us-gaap:TreasuryStockCommonMember2021-12-3100007088212021-12-3100007088212021-01-012021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:CommonStockMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AdditionalPaidInCapitalMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberpar:EquityConsiderationPayableMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:RetainedEarningsMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMemberus-gaap:TreasuryStockCommonMember2021-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2021-12-310000708821us-gaap:CommonStockMember2022-01-012022-12-310000708821us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000708821us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000708821us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000708821us-gaap:RetainedEarningsMember2022-01-012022-12-310000708821us-gaap:CommonStockMember2022-12-310000708821us-gaap:AdditionalPaidInCapitalMember2022-12-310000708821par:EquityConsiderationPayableMember2022-12-310000708821us-gaap:RetainedEarningsMember2022-12-310000708821us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000708821us-gaap:TreasuryStockCommonMember2022-12-3100007088212022-12-310000708821us-gaap:CommonStockMember2023-01-012023-12-310000708821us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000708821us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000708821us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000708821us-gaap:RetainedEarningsMember2023-01-012023-12-310000708821us-gaap:CommonStockMember2023-12-310000708821us-gaap:AdditionalPaidInCapitalMember2023-12-310000708821par:EquityConsiderationPayableMember2023-12-310000708821us-gaap:RetainedEarningsMember2023-12-310000708821us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000708821us-gaap:TreasuryStockCommonMember2023-12-310000708821us-gaap:CommonStockMember2024-01-012024-12-310000708821us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310000708821par:EquityConsiderationPayableMember2024-01-012024-12-310000708821us-gaap:TreasuryStockCommonMember2024-01-012024-12-310000708821us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000708821us-gaap:RetainedEarningsMember2024-01-012024-12-310000708821us-gaap:CommonStockMember2024-12-310000708821us-gaap:AdditionalPaidInCapitalMember2024-12-310000708821par:EquityConsiderationPayableMember2024-12-310000708821us-gaap:RetainedEarningsMember2024-12-310000708821us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000708821us-gaap:TreasuryStockCommonMember2024-12-310000708821par:USTreasuryBillAndBondSecuritiesMember2024-12-310000708821par:USTreasuryBillAndBondSecuritiesMember2023-12-310000708821par:ShortTermDepositsMember2024-12-310000708821par:ShortTermDepositsMember2023-12-310000708821srt:MinimumMember2024-12-310000708821srt:MaximumMember2024-12-310000708821srt:DirectorMemberus-gaap:DevelopedTechnologyRightsMember2023-12-310000708821srt:DirectorMemberus-gaap:DevelopedTechnologyRightsMember2024-12-310000708821srt:DirectorMemberpar:MasterDevelopmentAgreementMember2024-01-012024-12-310000708821srt:DirectorMemberpar:MasterDevelopmentAgreementMember2023-01-012023-12-310000708821srt:DirectorMemberpar:MasterDevelopmentAgreementMember2022-01-012022-12-310000708821srt:DirectorMemberpar:HoudenSuperannuationMember2024-10-012024-12-310000708821srt:DirectorMemberpar:HoudenSuperannuationMember2024-12-310000708821srt:MinimumMemberpar:RestaurantAndRetailMember2024-01-012024-12-310000708821srt:MaximumMemberpar:RestaurantAndRetailMember2024-01-012024-12-310000708821us-gaap:SubscriptionAndCirculationMembersrt:MinimumMember2024-01-012024-12-310000708821us-gaap:SubscriptionAndCirculationMembersrt:MaximumMember2024-01-012024-12-310000708821par:MENUTechnologiesAGMember2022-07-310000708821par:MENUTechnologiesAGMember2022-01-012022-12-310000708821par:MENUTechnologiesAGMember2022-12-310000708821par:MENUTechnologiesAGMember2023-01-012023-12-310000708821par:MENUTechnologiesAGMember2023-12-310000708821par:MENUTechnologiesAGMember2024-12-310000708821us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000708821us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000708821us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000708821us-gaap:RestrictedStockMember2024-01-012024-12-310000708821us-gaap:RestrictedStockMember2023-01-012023-12-310000708821us-gaap:RestrictedStockMember2022-01-012022-12-3100007088212024-11-202024-11-200000708821par:ConvertibleSeniorNotesDue2026Membersrt:MaximumMember2024-11-200000708821par:ConvertibleSeniorNotesDue2027Membersrt:MaximumMember2024-11-200000708821par:ConvertibleSeniorNotesDue2026Membersrt:MaximumMember2024-11-202024-11-200000708821par:ConvertibleSeniorNotesDue2027Membersrt:MaximumMember2024-11-202024-11-200000708821par:DelagetMember2024-12-310000708821par:DelagetMember2024-12-312024-12-310000708821par:DelagetMemberus-gaap:DevelopedTechnologyRightsMember2024-12-310000708821par:DelagetMemberus-gaap:CustomerRelationshipsMember2024-12-310000708821par:DelagetMemberus-gaap:NoncompeteAgreementsMember2024-12-310000708821par:DelagetMemberus-gaap:DevelopedTechnologyRightsMemberpar:MeasurementInputRoyaltyRateMember2024-12-310000708821par:DelagetMemberus-gaap:DevelopedTechnologyRightsMemberus-gaap:MeasurementInputDiscountRateMember2024-12-310000708821par:DelagetMemberus-gaap:CustomerRelationshipsMemberpar:MeasurementInputAnnualAttritionRateMember2024-12-310000708821par:DelagetMemberus-gaap:CustomerRelationshipsMemberus-gaap:MeasurementInputDiscountRateMember2024-12-310000708821par:DelagetMemberus-gaap:DevelopedTechnologyRightsMember2024-12-312024-12-310000708821par:DelagetMemberus-gaap:CustomerRelationshipsMember2024-12-312024-12-310000708821par:DelagetMemberus-gaap:NoncompeteAgreementsMember2024-12-312024-12-310000708821par:DelagetMember2024-01-012024-12-310000708821par:TASKGroupHoldingsLimitedMember2024-07-182024-07-180000708821par:TASKGroupHoldingsLimitedMember2024-07-180000708821par:TASKGroupHoldingsLimitedMember2024-12-310000708821par:TASKGroupHoldingsLimitedMemberus-gaap:DevelopedTechnologyRightsMember2024-12-310000708821par:TASKGroupHoldingsLimitedMemberus-gaap:DevelopedTechnologyRightsMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:CustomerRelationshipsMember2024-12-310000708821par:TASKGroupHoldingsLimitedMemberus-gaap:CustomerRelationshipsMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:TrademarksMember2024-12-310000708821par:TASKGroupHoldingsLimitedMemberus-gaap:TrademarksMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:DevelopedTechnologyRightsMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:DevelopedTechnologyRightsMemberpar:MeasurementInputRoyaltyRateMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:DevelopedTechnologyRightsMemberus-gaap:MeasurementInputDiscountRateMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:DevelopedTechnologyRightsMemberpar:MeasurementInputRoyaltyRateMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:DevelopedTechnologyRightsMemberus-gaap:MeasurementInputDiscountRateMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:CustomerRelationshipsMemberpar:MeasurementInputAnnualAttritionRateMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:CustomerRelationshipsMemberus-gaap:MeasurementInputDiscountRateMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:CustomerRelationshipsMemberpar:MeasurementInputProbabilityOfRenewalFactorMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:CustomerRelationshipsMemberus-gaap:MeasurementInputDiscountRateMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:TradeNamesMemberpar:MeasurementInputReliefFromRoyaltyRateMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:TradeNamesMemberus-gaap:MeasurementInputDiscountRateMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:TradeNamesMemberpar:MeasurementInputRoyaltyRateMember2024-07-180000708821par:PlexureGroupHoldingsMemberus-gaap:TradeNamesMemberus-gaap:MeasurementInputDiscountRateMember2024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:DevelopedTechnologyRightsMember2024-07-182024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:CustomerRelationshipsMember2024-07-182024-07-180000708821par:TASKGroupHoldingsLimitedMemberus-gaap:TradeNamesMember2024-07-182024-07-180000708821par:StuzoAcquistionMember2024-03-080000708821par:StuzoAcquistionMember2024-03-082024-03-080000708821par:StuzoAcquistionMember2024-12-310000708821par:StuzoAcquistionMemberus-gaap:DevelopedTechnologyRightsMember2024-12-310000708821par:StuzoAcquistionMemberus-gaap:DevelopedTechnologyRightsMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:CustomerRelationshipsMember2024-12-310000708821par:StuzoAcquistionMemberus-gaap:CustomerRelationshipsMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:TrademarksMember2024-12-310000708821par:StuzoAcquistionMemberus-gaap:TrademarksMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:NoncompeteAgreementsMember2024-12-310000708821par:StuzoAcquistionMemberus-gaap:NoncompeteAgreementsMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:DevelopedTechnologyRightsMemberpar:MeasurementInputRoyaltyRateMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:DevelopedTechnologyRightsMemberus-gaap:MeasurementInputDiscountRateMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:CustomerRelationshipsMemberpar:MeasurementInputAnnualAttritionRateMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:CustomerRelationshipsMemberus-gaap:MeasurementInputDiscountRateMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:TrademarksMemberpar:MeasurementInputReliefFromRoyaltyRateMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:TrademarksMemberus-gaap:MeasurementInputDiscountRateMember2024-03-080000708821par:StuzoAcquistionMemberus-gaap:DevelopedTechnologyRightsMember2024-03-082024-03-080000708821par:StuzoAcquistionMemberpar:CustomerRelationshipsRelatedToSAASPlatformMember2024-03-082024-03-080000708821par:StuzoAcquistionMemberpar:CustomerRelationshipsRelatedToManagedPlatformDevelopmentServicesMember2024-03-082024-03-080000708821par:StuzoAcquistionMemberus-gaap:NoncompeteAgreementsMember2024-03-082024-03-080000708821par:StuzoAcquistionMember2024-01-012024-12-310000708821par:TASKGroupHoldingsLimitedMember2024-01-012024-12-310000708821par:StuzoDelagetAndTASKGroupHoldingsLimitedAcquisitionsMember2024-01-012024-12-310000708821par:StuzoDelagetAndTASKGroupHoldingsLimitedAcquisitionsMember2023-01-012023-12-310000708821us-gaap:AcquisitionRelatedCostsMember2024-01-012024-03-310000708821us-gaap:CustomerRelationshipsMember2023-10-012023-12-310000708821us-gaap:ShortTermContractWithCustomerMember2024-12-310000708821us-gaap:ShortTermContractWithCustomerMember2023-12-310000708821us-gaap:LongTermContractWithCustomerMember2024-12-310000708821us-gaap:LongTermContractWithCustomerMember2023-12-310000708821us-gaap:LongTermContractWithCustomerMember2025-01-012024-12-3100007088212025-01-012024-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:SubscriptionServiceMember2024-01-012024-12-310000708821us-gaap:TransferredOverTimeMemberpar:SubscriptionServiceMember2024-01-012024-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:HardwareMember2024-01-012024-12-310000708821us-gaap:TransferredOverTimeMemberpar:HardwareMember2024-01-012024-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:ProfessionalServiceMember2024-01-012024-12-310000708821us-gaap:TransferredOverTimeMemberpar:ProfessionalServiceMember2024-01-012024-12-310000708821us-gaap:TransferredAtPointInTimeMember2024-01-012024-12-310000708821us-gaap:TransferredOverTimeMember2024-01-012024-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:SubscriptionServiceMember2023-01-012023-12-310000708821us-gaap:TransferredOverTimeMemberpar:SubscriptionServiceMember2023-01-012023-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:HardwareMember2023-01-012023-12-310000708821us-gaap:TransferredOverTimeMemberpar:HardwareMember2023-01-012023-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:ProfessionalServiceMember2023-01-012023-12-310000708821us-gaap:TransferredOverTimeMemberpar:ProfessionalServiceMember2023-01-012023-12-310000708821us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000708821us-gaap:TransferredOverTimeMember2023-01-012023-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:SubscriptionServiceMember2022-01-012022-12-310000708821us-gaap:TransferredOverTimeMemberpar:SubscriptionServiceMember2022-01-012022-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:HardwareMember2022-01-012022-12-310000708821us-gaap:TransferredOverTimeMemberpar:HardwareMember2022-01-012022-12-310000708821us-gaap:TransferredAtPointInTimeMemberpar:ProfessionalServiceMember2022-01-012022-12-310000708821us-gaap:TransferredOverTimeMemberpar:ProfessionalServiceMember2022-01-012022-12-310000708821us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000708821us-gaap:TransferredOverTimeMember2022-01-012022-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCMember2024-06-070000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:RRCMember2024-07-010000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCMember2024-07-010000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCMember2024-01-012024-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCMember2024-07-072024-07-070000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCMember2024-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCMember2024-10-012024-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:RRCMember2024-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:RRCMember2024-01-012024-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCMember2023-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCMember2023-01-012023-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCMember2022-01-012022-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCIncludingAdjustmentsMember2024-01-012024-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCIncludingAdjustmentsMember2023-01-012023-12-310000708821us-gaap:DiscontinuedOperationsDisposedOfBySaleMemberpar:PGSCAndRRCIncludingAdjustmentsMember2022-01-012022-12-310000708821us-gaap:LandMember2024-12-310000708821us-gaap:LandMember2023-12-310000708821us-gaap:BuildingAndBuildingImprovementsMember2024-12-310000708821us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000708821us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000708821us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310000708821par:FurnitureAndEquipmentMember2024-12-310000708821par:FurnitureAndEquipmentMember2023-12-310000708821us-gaap:ConstructionInProgressMember2024-12-310000708821us-gaap:ConstructionInProgressMember2023-12-310000708821srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310000708821srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310000708821srt:MinimumMemberpar:FurnitureAndEquipmentMember2024-12-310000708821srt:MaximumMemberpar:FurnitureAndEquipmentMember2024-12-310000708821srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2024-12-310000708821srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2024-12-310000708821us-gaap:TechnologyBasedIntangibleAssetsMember2024-12-310000708821us-gaap:TechnologyBasedIntangibleAssetsMember2023-12-310000708821us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MinimumMember2024-12-310000708821us-gaap:TechnologyBasedIntangibleAssetsMembersrt:MaximumMember2024-12-310000708821us-gaap:SoftwareDevelopmentMember2024-12-310000708821us-gaap:SoftwareDevelopmentMember2023-12-310000708821us-gaap:CustomerRelationshipsMember2024-12-310000708821us-gaap:CustomerRelationshipsMember2023-12-310000708821us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-12-310000708821us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-12-310000708821us-gaap:TradeNamesMember2024-12-310000708821us-gaap:TradeNamesMember2023-12-310000708821us-gaap:TradeNamesMembersrt:MinimumMember2024-12-310000708821us-gaap:TradeNamesMembersrt:MaximumMember2024-12-310000708821us-gaap:NoncompeteAgreementsMember2024-12-310000708821us-gaap:NoncompeteAgreementsMember2023-12-310000708821us-gaap:NoncompeteAgreementsMembersrt:MinimumMember2024-12-310000708821us-gaap:NoncompeteAgreementsMembersrt:MaximumMember2024-12-310000708821us-gaap:InProcessResearchAndDevelopmentMember2024-12-310000708821us-gaap:InProcessResearchAndDevelopmentMember2023-12-310000708821us-gaap:TrademarksAndTradeNamesMember2024-12-310000708821us-gaap:TrademarksAndTradeNamesMember2023-12-310000708821us-gaap:TechnologyBasedIntangibleAssetsMember2024-01-012024-12-310000708821us-gaap:TechnologyBasedIntangibleAssetsMember2023-01-012023-12-310000708821us-gaap:TechnologyBasedIntangibleAssetsMember2022-01-012022-12-310000708821us-gaap:SoftwareDevelopmentMember2024-01-012024-12-310000708821us-gaap:SoftwareDevelopmentMember2023-01-012023-12-310000708821us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310000708821us-gaap:CostOfSalesMember2024-01-012024-12-310000708821us-gaap:CostOfSalesMember2023-01-012023-12-310000708821us-gaap:CostOfSalesMember2022-01-012022-12-310000708821par:AmortizationExpenseMember2024-01-012024-12-310000708821par:AmortizationExpenseMember2023-01-012023-12-310000708821par:AmortizationExpenseMember2022-01-012022-12-310000708821par:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2024-12-310000708821par:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2024-12-310000708821us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310000708821par:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2023-12-310000708821par:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2023-12-310000708821us-gaap:ConvertibleDebtMember2023-12-310000708821par:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2020-02-100000708821par:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2021-09-170000708821par:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2021-09-170000708821par:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2024-11-202024-11-200000708821par:ConvertibleSeniorNotesDue2026Member2024-11-202024-11-200000708821par:ConvertibleSeniorNotesDue2026Member2024-11-200000708821us-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2024-07-050000708821us-gaap:SecuredDebtMemberus-gaap:BaseRateMemberpar:VariableRateComponentOneMember2024-07-052024-07-050000708821us-gaap:SecuredDebtMemberus-gaap:BaseRateMemberpar:VariableRateComponentTwoMember2024-07-052024-07-050000708821us-gaap:SecuredDebtMemberus-gaap:BaseRateMemberpar:VariableRateComponentThreeMember2024-07-052024-07-050000708821us-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrMemberpar:VariableRateComponentOneMember2024-07-052024-07-050000708821us-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrMemberpar:VariableRateComponentTwoMember2024-07-052024-07-050000708821us-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrMemberpar:VariableRateComponentThreeMember2024-07-052024-07-050000708821us-gaap:SecuredDebtMember2024-07-050000708821srt:MaximumMemberus-gaap:SecuredDebtMember2024-07-052024-07-050000708821par:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2024-11-202024-11-200000708821us-gaap:PrivatePlacementMember2024-03-072024-03-070000708821us-gaap:PrivatePlacementMemberpar:PARCommonStockMember2024-03-072024-03-070000708821us-gaap:PrivatePlacementMemberpar:PARCommonStockMember2024-03-070000708821us-gaap:WarrantMember2024-01-020000708821us-gaap:PrivatePlacementMember2021-04-082021-04-080000708821us-gaap:PrivatePlacementMember2024-01-022024-01-020000708821us-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:PrivatePlacementMember2021-04-080000708821us-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:PrivatePlacementMember2024-01-020000708821us-gaap:MeasurementInputOptionVolatilityMemberus-gaap:PrivatePlacementMember2021-04-080000708821us-gaap:MeasurementInputOptionVolatilityMemberus-gaap:PrivatePlacementMember2024-01-020000708821us-gaap:MeasurementInputSharePriceMemberus-gaap:PrivatePlacementMember2021-04-080000708821us-gaap:MeasurementInputSharePriceMemberus-gaap:PrivatePlacementMember2024-01-020000708821us-gaap:PrivatePlacementMember2024-03-0700007088212024-03-070000708821par:EquityIncentivePlan2015Member2024-12-310000708821par:EquityIncentivePlan2015Memberus-gaap:EmployeeStockOptionMembersrt:MinimumMember2024-01-012024-12-310000708821par:EquityIncentivePlan2015Memberus-gaap:EmployeeStockOptionMembersrt:MaximumMember2024-01-012024-12-310000708821us-gaap:EmployeeStockOptionMemberpar:EquityIncentivePlan2015Member2024-01-012024-12-310000708821us-gaap:RestrictedStockMembersrt:MinimumMember2024-01-012024-12-310000708821us-gaap:RestrictedStockMembersrt:MaximumMember2024-01-012024-12-310000708821par:RestrictedStockAndRestrictedStockUnitsMembersrt:MinimumMember2024-01-012024-12-310000708821par:RestrictedStockAndRestrictedStockUnitsMembersrt:MaximumMember2024-01-012024-12-310000708821us-gaap:EmployeeStockOptionMember2024-01-012024-12-310000708821us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000708821us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000708821us-gaap:RestrictedStockUnitsRSUMember2023-12-310000708821us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310000708821us-gaap:RestrictedStockUnitsRSUMember2024-12-310000708821par:ServiceBasedRSUMember2024-01-012024-12-310000708821par:ServiceBasedRSUMember2023-01-012023-12-310000708821par:ServiceBasedRSUMember2022-01-012022-12-310000708821par:PerformanceBasedRSUMember2024-01-012024-12-310000708821par:PerformanceBasedRSUMember2023-01-012023-12-310000708821par:PerformanceBasedRSUMember2022-01-012022-12-310000708821us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000708821us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000708821par:TwoThousandTwentyOneEmployeeStockPurchasePlanMember2024-12-310000708821par:TwoThousandTwentyOneEmployeeStockPurchasePlanMember2024-01-012024-12-310000708821us-gaap:DomesticCountryMember2024-12-310000708821us-gaap:StateAndLocalJurisdictionMember2024-12-310000708821us-gaap:ForeignCountryMember2024-12-310000708821par:InterestTaxCarryforwardMember2024-12-310000708821srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-01-012022-12-310000708821par:CapitalizedResearchAndDevelopmentMember2022-01-012022-12-310000708821par:ForeignNetOperatingLossCarryforwardMember2022-01-012022-12-310000708821par:ReportableSegmentMember2024-01-012024-12-310000708821par:ReportableSegmentMember2023-01-012023-12-310000708821par:ReportableSegmentMember2022-01-012022-12-310000708821par:SubscriptionServiceMemberpar:ReportableSegmentMember2024-01-012024-12-310000708821par:SubscriptionServiceMemberpar:ReportableSegmentMember2023-01-012023-12-310000708821par:SubscriptionServiceMemberpar:ReportableSegmentMember2022-01-012022-12-310000708821par:HardwareMemberpar:ReportableSegmentMember2024-01-012024-12-310000708821par:HardwareMemberpar:ReportableSegmentMember2023-01-012023-12-310000708821par:HardwareMemberpar:ReportableSegmentMember2022-01-012022-12-310000708821par:ProfessionalServiceMemberpar:ReportableSegmentMember2024-01-012024-12-310000708821par:ProfessionalServiceMemberpar:ReportableSegmentMember2023-01-012023-12-310000708821par:ProfessionalServiceMemberpar:ReportableSegmentMember2022-01-012022-12-310000708821country:US2024-01-012024-12-310000708821country:US2023-01-012023-12-310000708821country:US2022-01-012022-12-310000708821us-gaap:NonUsMember2024-01-012024-12-310000708821us-gaap:NonUsMember2023-01-012023-12-310000708821us-gaap:NonUsMember2022-01-012022-12-310000708821country:US2024-12-310000708821country:US2023-12-310000708821us-gaap:NonUsMember2024-12-310000708821us-gaap:NonUsMember2023-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:McdonaldsCorporationMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:McdonaldsCorporationMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:McdonaldsCorporationMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:YumBrandsIncMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:YumBrandsIncMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:YumBrandsIncMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:DairyQueenMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:DairyQueenMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310000708821us-gaap:CustomerConcentrationRiskMemberpar:RestaurantAndRetailMemberpar:DairyQueenMemberus-gaap:OperatingSegmentsMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310000708821us-gaap:OtherCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:CorporateNonSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310000708821us-gaap:OtherCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:CorporateNonSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310000708821us-gaap:OtherCustomerMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:CorporateNonSegmentMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310000708821us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310000708821us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310000708821us-gaap:CustomerConcentrationRiskMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310000708821us-gaap:FairValueInputsLevel2Memberpar:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2024-12-310000708821us-gaap:FairValueInputsLevel2Memberpar:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2024-12-310000708821us-gaap:FairValueInputsLevel2Memberpar:CreditFacilityMemberus-gaap:ConvertibleDebtMember2024-12-310000708821us-gaap:FairValueInputsLevel2Memberpar:ConvertibleSeniorNotesDue2026Memberus-gaap:ConvertibleDebtMember2023-12-310000708821us-gaap:FairValueInputsLevel2Memberpar:ConvertibleSeniorNotesDue2027Memberus-gaap:ConvertibleDebtMember2023-12-310000708821us-gaap:ObligationsMember2021-12-310000708821us-gaap:ObligationsMember2022-01-012022-12-310000708821us-gaap:ObligationsMember2022-12-310000708821us-gaap:ObligationsMember2023-01-012023-12-310000708821us-gaap:ObligationsMember2024-01-012024-12-310000708821us-gaap:ObligationsMember2024-12-310000708821par:RevenueBasedPaymentsMember2023-12-310000708821par:RevenueBasedPaymentsMemberpar:MeasurementInputRevenueVolatilityMember2023-12-310000708821par:RevenueBasedPaymentsMemberus-gaap:MeasurementInputDiscountRateMember2023-12-310000708821par:DelagetMemberus-gaap:SubsequentEventMember2025-01-062025-01-060000708821par:ConvertibleSeniorNotesDue2030Memberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2025-01-240000708821par:AdditionalConvertibleSeniorNotesDue2030Memberus-gaap:SeniorNotesMemberus-gaap:SubsequentEventMember2025-01-240000708821us-gaap:SubsequentEventMemberus-gaap:LineOfCreditMember2025-01-302025-01-300000708821us-gaap:SubsequentEventMember2025-01-302025-01-300000708821par:BryanMenarMember2024-01-012024-12-310000708821par:BryanMenarMember2024-10-012024-12-310000708821par:BryanMenarMember2024-12-3100007088212024-10-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Transition Period From __________ to __________

Commission File Number 1-09720

PAR TECHNOLOGY CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

| Delaware |

16-1434688 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

|

PAR Technology Park, 8383 Seneca Turnpike, New Hartford, New York 13413-4991 |

| (Address of principal executive offices, including zip code) |

(315) 738-0600

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading symbol |

Name of each exchange on which registered |

| Common Stock, $0.02 par value |

PAR |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of the Chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer ☑ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

Emerging growth company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant’s voting common stock held by non-affiliates (computed by reference to the price at which the common stock was last sold) was $1,586,321,913 on June 28, 2024.

There were 40,213,079 shares of common stock outstanding as of February 24, 2025.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2025 annual meeting of shareholders are incorporated by reference into Items 10, 11, 12, 13 and 14 of Part III of this Annual Report.

PAR TECHNOLOGY CORPORATION

Form 10-K

For the Fiscal Year Ended December 31, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

Item

Number |

Description |

Page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unless the context indicates otherwise, references in this Annual Report to "we," "us," "our," the "Company," and "PAR" mean PAR Technology Corporation and its consolidated subsidiaries.

“PAR®,” “PAR POS®” (formerly “Brink POS®”), “Punchh®,” “PAR OrderingTM” (formerly “MENUTM”), "PAR OPSTM," “Data Central®," “DelagetTM,” "PAR RetailTM", "PAR® Pay”, “PAR® Payment Services”, and other trademarks identifying our products and services appearing in this Annual Report belong to us. This Annual Report may also contain trade names and trademarks of other companies. Our use of such other companies’ trade names or trademarks is not intended to imply any endorsement or sponsorship by these companies of us or our products or services.

FORWARD-LOOKING STATEMENTS

This Annual Report contains “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not historical in nature, but rather are predictive of PAR's future operations, financial condition, financial results, business strategies and prospects. Forward-looking statements are generally identified by words such as “believe,” “could”, "would," "should," "will," “continue,” "anticipate," “expect,” "plan," "intend," “estimate,” “future,” “may,” “potential,” and similar expressions.

Forward-looking statements are based on management's current expectations and assumptions and are inherently uncertain. Actual results and outcomes could differ materially from those expressed in or implied by forward-looking statements, including forward-looking statements relating to and our expectations regarding:

•our plans, strategies and objectives for future operations and the growth of our business, including our service and product offerings, our go-to-market strategies and the expected development, demand, performance, market share, and competitive performance of our products and services;

•our ability to achieve and sustain profitability;

•our future revenues, gross margins, expenses, cash flows, and other financial measures;

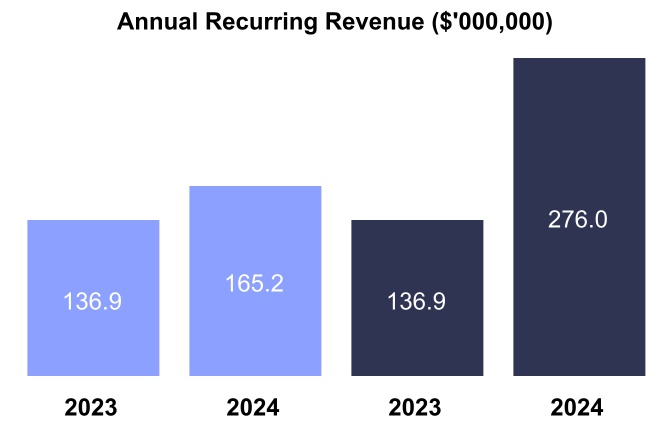

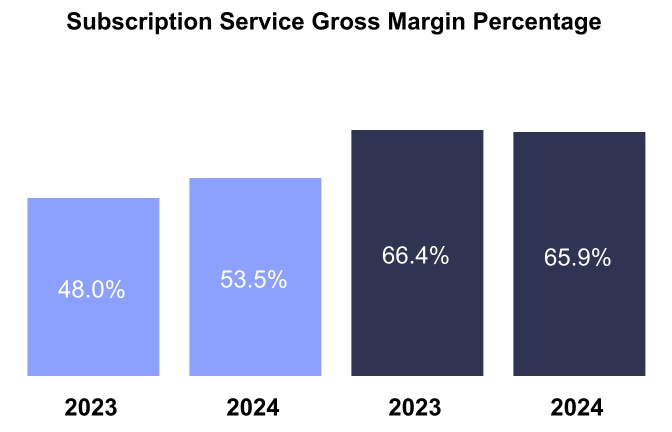

•annual recurring revenue (ARR), active sites, subscription service gross margins, net loss, net loss per share, and other key performance indicators and non-GAAP financial measures;

•the availability and terms of product and component supplies for our hardware products;

•the timing and expected benefits of acquisitions, divestitures, and capital markets transactions;

•our human capital strategies and engagement;

•macroeconomic trends or geopolitical events and the expected impact of those trends and events on our business, financial condition, results of operations, and cash flows;

•claims, disputes, or other litigation matters; and

•assumptions underlying any of the foregoing.

Factors, risks, trends, and uncertainties that could cause our actual results to differ materially from those expressed in or implied by forward-looking statements include:

•our ability to successfully develop, acquire, and transition new products and services, while enhancing existing ones to meet evolving customer needs and emerging technological trends, including our effective use of artificial intelligence (AI) in product development and integration of AI tools into our product and service offerings;

•our ability to add and maintain active sites;

•our ability to retain and add integration partners;

•macroeconomic trends, such as the effects of inflation, recession, interest rate fluctuations, and changes in consumer confidence and discretionary spending; and geopolitical events affecting countries where we operate or our customers or suppliers operate;

•our ability to retain and manage suppliers, secure alternative suppliers, and manage inventory levels, navigate manufacturing disruptions or logistics challenges, shipping delays and shipping costs;

•the impact of changes in import/export regulations, including tariffs, and trade disputes between the United States and other countries where we operate or our customers or suppliers operate;

•the effects, costs and timing of acquisitions, divestitures, and capital markets transactions;

•our ability to integrate acquisitions into our operations and the timing, complexity and costs associated with integrations;

•our ability to attract, develop and retain qualified employees to develop and expand our business, execute product installations and respond to customer service level needs;

•the protection of our intellectual property;

•our ability to generate sufficient cash flow or access additional financing sources as needed to repay outstanding debts, including amounts owed under our outstanding convertible notes;

•legal, reputation and financial risks if we fail to protect customer and/or our data from security breaches and/or cyber attacks;

•the impact of future pandemics, epidemics or other outbreaks of disease;

•changes in estimates and assumptions we make in connection with the preparation of our financial statements, or in building our business and operations plan and in executing our strategies;

•our ability to maintain proper and effective internal control over financial reporting;

•our ability to execute our business, operations plan, and strategies and manage our business continuity risks, including disruptions or delays in product assembly and fulfillment;

•potential impacts, liabilities and costs from pending or potential investigations, claims and disputes; and

•other factors, risks, trends and uncertainties that could cause our actual results to differ materially from those expressed in or implied by forward-looking statements contained in this Annual Report, including but not limited to, those described under “Part I, Item 1. Business”, “Part I, Item 1A. Risk Factors,” “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report and in our other filings with the Securities and Exchange Commission (the “SEC”). We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

PART I

Item 1. BUSINESS

General

PAR is a global foodservice technology company providing leading omnichannel cloud-based software and hardware solutions to the restaurant industry in three major restaurant categories – quick service, fast casual, and table service –, and the retail industry, including convenience and fuel retailers (C-Stores). Our product and service offerings include point-of-sale, customer engagement and loyalty, digital ordering and delivery, operational intelligence, payment processing, hardware, and related technologies, solutions, and services. We provide enterprise restaurants, franchisees, and other foodservice outlets with operational efficiencies through a data-driven network with integration capabilities from front- and back-of-house to customer fulfillment.

Our omnichannel solutions are used in more than 140,000 active restaurants and retail locations in more than 110 countries.

2024 Business Highlights

•Stuzo Acquisition: In March 2024 we acquired Stuzo, LLC, a digital engagement software provider to C-Stores. With the acquisition of Stuzo, we expanded into an adjacent vertical and became a leader in technology for convenience and fuel retailers.

•Divestiture of Government Segment: In June 2024 we divested PAR Government Systems Corporation (“PGSC”) and in July 2024 we divested Rome Research Corporation (“RRC”) resulting in the divestiture of our Government segment; beginning with the quarter ended June 30, 2024, we operate in a single reportable segment.

•TASK Group Acquisition: In July 2024 we acquired TASK Group Holdings Limited ("TASK Group"), an Australia-based global foodservice transaction platform, offering international unified commerce solutions, including interactive customer engagement and seamless integration, tailored for major brands worldwide. The TASK Group’s transaction management platform, TASK, is used by some of the world’s largest foodservice brands including, Starbucks Corporation and Guzman y Gomez, and its loyalty customer engagement platform, Plexure, is used by McDonald’s Corporation in 63 markets. With the addition of TASK Group, we serve the top enterprise foodservice brands across the globe with a unified commerce approach from front-of-house to back-of-house.

•Delaget Acquisition: In December 2024 we acquired Delaget, LLC, a leading provider of restaurant analytics and business intelligence solutions. Delaget’s comprehensive platform delivers data analytics, loss prevention, and operational insights that help restaurant operators streamline operations and improve profitability.

Our mission is to enable personalized experiences that connect people to the brands, meals, and moments they love; and our strategy to achieve this mission is grounded in delivering a unified experience across our comprehensive suite of subscription services, hardware, and professional services that simplifies our customers' operations, elevates their customer engagement, and drives their continued success.

Our vision of unified experience is a single platform that provides seamless connections from our customers' backend systems through to their customer-facing channels enabling our customers to deliver innovation, differentiated experiences and competitive advantage. It's the setup enterprise restaurants and retailers require to support omnichannel journeys and create a unified view of customer interactions, products, and management systems. We continually strive to enhance and expand our omnichannel solutions to provide full integration of data points that drive guest satisfaction and operational efficiencies to our customers across our product and service offerings.

Our Products and Services

Subscription Services

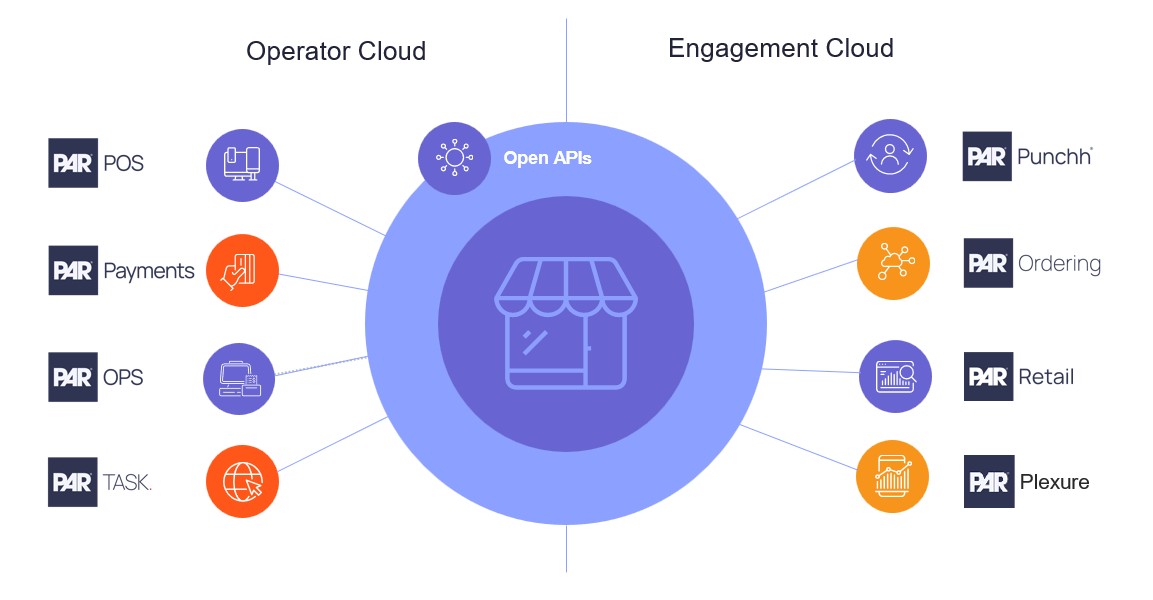

Our subscription services consist of software-as-a-service ("SaaS") solutions, related software support, managed platform development services, and transaction-based payment processing services, and are grouped into two product lines:

ENGAGEMENT CLOUD, offering customer facing solutions:

PUNCHH, an enterprise-grade customer loyalty and engagement solution that enables customers to deliver personalized promotions to their customers to increase customer lifetime value and same-store sales. Punchh seamlessly integrates with our customers’ existing systems, providing AI-powered tools to deliver omnichannel loyalty experiences and campaigns to engage their customers, create real-time 360-degree insights and drive repeat purchases and higher average spend.

PAR ORDERING, an eCommerce platform powering digital customer touchpoints from mobile, web, kiosk to delivery marketplaces. PAR Ordering provides customers with the tools they need to grow their digital business, manage orders from substantially all channels and order types, orchestrate their delivery operations, and fully control their digital experience to retain a direct customer relationship.

PAR RETAIL, a digital engagement software solution for convenience and fuel retailers (C-Stores) with an industry-leading guest engagement platform serving major brands in the space. PAR Retail enables retailers to deliver seamless, personalized experiences across mobile, web, and in-store channels. By leveraging data-driven insights, PAR Retail helps businesses increase customer engagement, drive loyalty program participation, and grow same-store sales with innovative, integrated technology solutions.

PLEXURE, an international customer engagement and loyalty platform that delivers hyper-personalized marketing campaigns and promotions in real-time. Leveraging advanced data analytics and machine learning, Plexure seamlessly integrates with existing systems to provide actionable insights and enhance the customer experience. By driving engagement across multiple channels, Plexure helps increase customer lifetime value, boost repeat transactions, and improve same-store sales performance through tailored, data-driven solutions.

OPERATOR CLOUD, offering front-of-house and back-of-house operator solutions:

PAR POS, an open cloud, point-of-sale solution that provides operators with tools to seamlessly integrate with multiple product offerings - including kiosks, kitchen video systems, and enterprise reporting - through PAR's ecosystem of integration partners.

PAR PAY, includes our PAR Payment Services merchant services business that enables electronic payment and processing services for businesses of all sizes to accept electronic payments online or in-person and PAR Pay Gateway, our front-end technology that reads payment cards and sends customer information to the merchant acquiring bank for processing.

Combined PAR Payment Services and PAR Pay Gateway offer a comprehensive payment processing solution that allows our customers to accept a variety of payments methods including debit and credit cards, near-field communication contactless, mobile devices, digital wallets and gift cards.

PAR OPS, includes Data Central and Delaget product offerings that leverage business intelligence, analytics, and automation technologies to streamline operations. Serving as the central hub of restaurant intelligence, PAR OPS aggregates data from point-of-sale, inventory, supply, payroll, and accounting systems to deliver actionable insights and a comprehensive view of operations. By simplifying complex data into intuitive dashboards and reports, PAR OPS equips customers with the tools to achieve peak operational and financial efficiency, driving better decision-making and performance across their business.

TASK, an enterprise-grade technology solution, delivers powerful solutions to streamline operations and drive efficiency for hospitality and retail businesses. Specializing in point-of-sale, kitchen management, and inventory systems, TASK offers a transaction management platform that integrates seamlessly with existing infrastructure. Designed for scalability and reliability, TASK empowers businesses to optimize workflows, enhance service delivery, and elevate the customer experience through innovative, data-driven solutions.

Our SaaS solutions are extensible and built on open application programming interfaces (“API”) enabling integration by more than 550 integration partners, including leading industry brands, to extend the reach and capabilities of our SaaS solutions and those of our integration partners.

Hardware

Our hardware offerings include point-of-sale terminals and tablets, wireless headsets, drive-thru systems, kitchen display systems, kiosks, printers, payment devices, and other in-store peripherals:

Point-of-Sale Hardware. Our POS hardware platforms are designed to reliably operate in harsh environments associated with food service. PAR terminals, including PAR WAVE and PAR PHASE, and our EverServ® POS tablets are durable and highly functioning, scalable, and easily integrated, offering customers competitive performance at a cost-conscious price. Our open architecture POS platforms are optimized to support our SaaS solutions, as well as many third-party POS software applications, support a distributed processing environment and are suitable for a broad range of use and functions within the markets served.

Wireless Communications, Drive-Thru Systems. Our wireless headsets for drive-thru order-taking provide our customers with another means to deliver their products and serve their customers. The PAR G5® and PAR Clear® headsets provide clear audio and an ergonomic fit. PAR's drive-thru timer systems provide crew and managers near-real-time feedback to improve speed of service and meet performance targets.

In-Store Peripherals. We partner with numerous vendors that offer in-store peripherals, including payment devices, cash drawers, and printers, allowing us to deliver a comprehensive, integrated hardware solution.

Professional Services

We provide a comprehensive portfolio of support services to our customers, including hardware repair, installation and implementation, training, and on-site and technical support.

Hardware repair. We offer depot repair, warranty, and overnight Advanced Exchange services from our offices in San Diego, California, Mississauga, Ontario, and our corporate headquarters in New Hartford, New York.

Installation and implementation. We offer hardware installation and software implementation services.

Training. We offer application training to customers’ in-store staff and provide technical training to our customers’ information systems personnel.

On-site and technical support. We offer on-site support in the continental U.S. through our field tech service network, and 24-hour help desk support from our diagnostic service centers located in New Hartford, New York and Tampa, Florida.

Outside the continental U.S. we provide our professional services either directly or through authorized providers.

Sales and Marketing

We sell our products and services to enterprise restaurants, franchisees, and other restaurant outlets and to C-Stores and other retail customers, including amusement parks, cinemas, cruise lines, spas, casinos, and other ticketing and entertainment venues. Our dedicated sales teams work closely with potential customers to understand their operational challenges and recommend the most effective solutions. Our sales teams are organized in two main areas: enterprise customer sales, focused on tier-one (brands operating 500 or more sites) and tier-two (brands operating 50-499 sites) customers; these customers are generally driven by requests for proposals and have longer sales cycles, where we aid our sales team with premier support and pre-sales engineers; and sales to customers with small to medium-size businesses, where we focus on providing simplified solutions and quicker implementation of our products. We also leverage a network of channel partners, including resellers, distributors, and integrators, as a cost effective means of extending our selling opportunities. Sales and marketing expenses were $41.7 million, $38.5 million, and $34.9 million, for the years ended December 31, 2024, 2023, and 2022, respectively.

We have longstanding relationships with several of the largest brands in the restaurant space, including as an approved provider of restaurant technology solutions and related support to McDonald's Corporation and its franchisees since 1980, to Yum! Brands since 1983, and to Dairy Queen since 2018. McDonald's Corporation represented 15% of our total revenue in 2024.

Competition

The markets for our products and services are highly competitive and rapidly evolving. We compete on the basis of features and functionality, user experience, integration capabilities, method of delivery (cloud versus traditional on-premise software applications), existing and planned product design, quality and reliability, product development capabilities, price, and customer service. Many of our larger customers have approved several suppliers of software and hardware similar to one or more of our products.

Our open integration platform, enterprise-grade omnichannel cloud-based software and hardware solutions, combined with our development capabilities, extensive domain knowledge and expertise, excellent product reliability, direct sales teams, and responsive customer service and support, are some of our competitive advantages. We also believe our customer base is a competitive advantage; our customers are primarily enterprise and fast-growing brands and typically choose our products when opening new stores and locations. However, several factors can affect our ability to successfully compete, including rapid adoption of new technologies such as AI in product development and as a component of products and services, the constant introduction of new product and service offerings, and aggressive pricing strategies.

We face competition from companies both within our market segment and from those targeting lower market tiers. Some of these competitors have greater financial and technical resources, more relevant product and service offerings, and larger established customer bases. This competitive landscape can impact our market share and growth potential. As competition intensifies, both from existing competitors and new market entrants, we must continually innovate and adapt to maintain our competitive edge. Additionally, as we expand into new markets, we will encounter established competitors and new market entrants, further challenging our ability to compete effectively.

Supply

We have agreements for the supply of hardware products and components, including long-term or volume-based purchase agreements with some suppliers. We have alternative sources in the event one or more of our component suppliers are not able to perform or fully perform; and we hold safety stocks of single source hardware products in quantities that we believe are sufficient to protect against possible supply chain disruptions. To mitigate supply chain risks, we continue to expand our supplier network, including identifying and/or establishing alternative suppliers of our hardware products, increase our inventory levels of scarce components and adjust our pricing to reflect market conditions.

Research and Development

Product research, innovation, and product development are an integral part of our business. We continuously evaluate customer needs and new technologies to enable us to develop innovative and relevant products and product enhancements. We leverage AI to assist in the generation of code and other product-related artifacts which assists in driving efficiency and innovation in our development process. Research and development expenses were $67.3 million, $58.4 million, and $48.6 million, for the years ended December 31, 2024, 2023, and 2022, respectively.

Intellectual Property

We rely on various intellectual property laws, confidentiality procedures, and contractual provisions to establish, maintain, and protect our intellectual property. We have U.S. and foreign patents filed and issued to protect our discoveries and inventions, registered and common law trademarks to protect our brand, and copyrights that relate to software and various distinctive characteristics of our products. We also rely on a combination of confidentiality and assignment-of-invention agreements with our employees and consultants, and enter into confidentiality and licensing agreements with our customers and other third parties with whom we have strategic relationships. We believe our use and reliance on intellectual property laws and our agreements and licenses protect and maintain our rights in our intellectual property; however, there can be no assurance that our trademarks, copyrights, patents, and other intellectual property rights will not be challenged, invalidated, or circumvented; that others will not assert intellectual property rights in technologies that are relevant to our business; or that our intellectual property rights will give us a competitive advantage. For a discussion of risks associated with intellectual property, refer to the Risk Factor—"Assertions by third parties of infringement or other violations by us of their intellectual property rights could result in significant costs and materially and adversely harm our business, financial conditions, results of operations and cash flows" in "Part I, Item 1A. Risk Factors", which is incorporated herein by reference.

Government Regulation

We are subject to a variety of laws and regulations in the United States and other jurisdictions that involve matters central to our business, including privacy, data security and personal information, content, data retention and deletion as well as U.S. and foreign laws and regulations that impact the operations of our business, including employee matters, import/export controls, trade restrictions, including tariffs, anti-corruption and bribery. A failure, or alleged failure, by us to comply with any of these laws or regulations could have a material adverse effect on our business, financial condition, and results of operations. For additional information about government regulation and laws applicable to our business, refer to the risks described in "Part I, Item 1A. Risk Factors".

Human Capital

We prioritize finding, developing and rewarding extraordinary talent. Our employee-first strategy is designed to provide an inclusive and safe environment where our employees enjoy coming to work each day to support our customers and grow our business. As of December 31, 2024, we employed 1,585 people worldwide, 1,581 of whom were full-time.

We value urgency, ownership, delivering outcomes, never settling and winning together, which we consider to be the foundation for how we operate and make decisions.

Leadership's Role: Our senior management team is responsible for developing and executing our human capital strategy. We seek employees who share a passion for technology and its ability to improve our customers’ businesses. Our mission is to create an environment that reflects our values of urgency, ownership, delivering outcomes, never settling and winning together where our employees thrive. Our strategy is to seek to hire the best talent, give them the responsibility and authority they deserve, and let them make the decisions on how to best execute. We design our employee compensation and benefits programs to be competitive and consistent with our values, to incentivize and reward outstanding performance. Our Chief Executive Officer and Vice President, Commercial Finance regularly update the compensation committee of our board of directors on key areas of our human capital strategy, including the following:

Culture: Our commitment to culture is simple: it’s about community and belonging. We want to understand and integrate our employees’ unique perspectives and voices every day. Our employees should feel a sense of belonging and want to be part of the PAR team.

Employee Engagement and Talent Management/Development: Consistent with our employee-first strategy, we believe that our employees should have the opportunity to communicate their feedback, concerns and suggestions. We conduct annual employee engagement surveys, and quarterly “pulse” surveys. Understanding the “pulse” of our employees through these surveys is critical to inform our strategies around employee engagement, retention and total rewards. In 2024, we introduced quarterly “Living Our Values” awards. Employees submit examples where PAR values are demonstrated by a coworker, enabling them to be selected as a quarterly Living Our Values winner. Winning recipients are recognized in front of their peers for their efforts and accomplishments, in addition to custom swag and spot bonuses.

We offer a variety of programs to support employee growth and development at PAR. In 2024, we launched the PAR Career Framework which maps employees worldwide to a job-level structure. This career mapping drives consistency and intentional career discussions between managers and employees, enabling ongoing development of talent and internal mobility across the organization. Additionally, it provides an objective and equitable process for integrating incoming talent both organically via hiring and inorganically via M&A activity. In 2024 all people leaders were enrolled to attend PAR’s Leadership Academy, which is designed as an annual program for new and developing people leaders to gain the skills necessary for people management at PAR.

Our Annual Talent Roadmap includes a performance review, and 360 feedback annually for all employees, as well as a robust talent review of director level and above employees with our executive team. We offer a voluntary mentoring program and a women’s development program annually that employees can nominate themselves for. In 2025, we will continue to invest in training and development tools and additional resources such as tracking career development discussions between employees and managers, investing in individual career coaching, and continuing to create custom development content for specific teams and departments to meet employees where they are.

Our compensation philosophy aims to attract, retain and incentivize top performers in a highly competitive market for talent using short-term and long-term performance targets. To support our meritocratic, pay-for-performance strategy, we reward employees for achieving performance targets and contributing to our culture by living our values day in and day out. We have a robust CEO award program that gives leaders the opportunity to over index on rewarding top performers in their organizations during the annual performance review cycle.

Health and Safety: The health and safety of our employees in the workplace are of utmost importance to us. We regularly assess our facilities to ensure compliance with our health and safety guidelines and regulatory requirements. In December 2024, we launched our Headspace Employee Assistance Program (EAP) to our global team for confidential best-in-class meditation and mindfulness support as well as a full suite of work-life services available to PAR’s full-time employees and their families.

Talent Acquisition and Attrition: PAR works diligently to attract the best talent from a diverse range of sources to meet the current and future demands of our business. To proactively attract diverse talent and broaden our candidate pool, we engage with universities, professional associations, industry groups, and leverage PAR’s robust employee value proposition, which includes our location-flexible philosophy, a collaborative global work environment, and a shared sense of purpose. Our focus on retaining talent is rooted in our employee-first strategy and includes investments in employee engagement, diverse talent sourcing tools, talent management systems, and development. We continue to make appropriate adjustments to help ensure competitive compensation, including the implementation of a pay transparency initiative designed to ensure equity and fairness.

Available Information

Our website is located at https://partech.com. Our Annual Reports on Form 10-K, Proxy Statements on Schedule 14A, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to such reports and statements filed or furnished by us pursuant to the Exchange Act are available, free of charge, on our website at https://partech.com/investor-relations/ as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Our Corporate Governance Guidelines, Board of Directors’ committee charters and Code of Conduct are also available, free of charge, at https://partech.com/investor-relations/. The information posted on or accessible through our website is not incorporated into this Annual Report or in any other report or document we file with the SEC. The SEC also maintains a website at http://www.sec.gov that contains reports, proxy statements and other information regarding SEC registrants, including PAR.

Item 1A. RISK FACTORS

Investing in our common stock involves a high degree of risk. The risks described below are not the only risks or uncertainties we face. The occurrence of any of the following risks or additional risks and uncertainties not presently known to us, or that we currently believe to be immaterial, could materially and adversely affect our business, results of operations, financial condition, cash flows, and stock price.

Risks Related to Our Business and Operations

We face extensive competition in our markets, and our failure to compete effectively could result in decreased demand for our products and services and/or price reductions, which could materially and adversely affect our ability to achieve and sustain profitability and harm our business, financial condition, and results of operations.

The markets for our products and services are characterized by rapid technological advances, intense competition among existing and emerging competitors, fluid and evolving industry practices, disruptive technology developments (including the use and integration of AI into products and service offerings), and frequent new product introductions; any one of these factors, could create downward pressure on pricing and gross margins and could adversely affect sales to our existing customers, as well as our ability to attract and sell to new customers. Our future success depends on our ability to anticipate and identify changes in customer needs and/or relevant technologies (including AI), quickly respond to customer requirements, and rapidly and effectively introduce new and innovative products, features, and functions, while maintaining the integrity, quality, and competitiveness of our existing products and services. If we fail in these efforts, our business, financial condition, and results of operations could suffer, and our ability to achieve and sustain profitability could be adversely impacted.

Our failure to meet service level commitments or milestones under customer contracts may result in our customer contracts being less profitable, and expose us to liability and reputational harm.

Our subscription services agreements typically include service level commitments or milestones. If we fail to meet these contractual commitments, we may be contractually obligated to pay penalties or provide service credits for a portion of the service fees paid by our customers. Customers also typically have the right to terminate their agreements and pursue damages claims for serious or repeated failures to meet service level commitments. These contractual commitments have, and may in the future, adversely impact our revenues, ARR, and gross margins earned on our subscription services. Moreover, our failure to meet our commitments could result in customer dissatisfaction, reputational harm, or the loss of customers, and adversely affect our business and results of operations.

We rely on third-party cloud and network infrastructure providers to deliver our subscription services, and any interruptions or delays in their services could harm our reputation and business.

Our ability to deliver our subscription services in a timely, secure, and reliable manner to our customers depends on the protection of the information we store with our third-party cloud providers, as well as the maintenance of third-party network infrastructures. Interruptions or delays in these services, including those which may be caused by natural disasters or malicious actors, have, and may in the future, result in service disruptions, resulting in our failure to meet service level commitments or milestones, exposing us to liability, reputational damage, and potential loss of customers. We may also incur significant costs to use alternative providers or equipment to deliver our subscription services or taking other actions to mitigate any prolonged service disruptions. Any such alternatives could be more difficult or costly to replace than what we currently license, and integration of alternatives into our information technology system could require significant work and resources and delays.

Our products might experience coding, configuration, or manufacturing errors, which could damage our reputation, deter current and potential customers from purchasing our products and materially and adversely affect our business, financial conditions, results of operations, and cash flows.

Our products or product updates may contain coding, configuration or manufacturing errors that can negatively impact their functionality, performance, operation, and integration capabilities, and expose us to product liability, performance issues, warranty claims, and harm to our reputation, which could adversely affect our business, financial condition, results of operations, and cash flows.

Macroeconomic conditions and geopolitical events could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

Economic instability or regulatory or political conditions in the United States and in other countries and regions in which we, our customers, suppliers, and our other third-party providers conduct business, and the impact of such conditions or insecurities, including inflated costs of goods and muted or decreased consumer confidence and discretionary spending, could materially and adversely impact the cost and demand for our products and services, our ability to perform our contractual obligations, and execute our operational and growth strategies.

•Cost of products and components. Certain areas of our business could experience supply chain challenges, including shortages, shipping delays, and increased costs due to price increases for hardware products and components and in shipping costs; changes in U.S. and foreign trade policies, including new or increased tariffs, potential sanctions and counter-sanctions, particularly with or involving China, South Korea, and Taiwan could result in increased costs; however, we have taken steps to minimize the impact of these factors. We have expanded the regions where we sell our hardware products, and we continue to build our supplier network, including identifying and/or establishing alternative suppliers of our hardware products, increase our inventory levels of scarce components and adjust our pricing to reflect market conditions.

•Cost of labor and labor shortages. High labor costs have a direct negative impact on our results of operations and could negatively influence our customers’ investment choices, including whether and when to invest in our products and services. Additionally, fewer participants in the labor market may dampen businesses’ and consumers’ ability and desire to invest and spend, which could also negatively influence our customers’ investment choices. Any of the forgoing events could adversely impact our business, including our costs of sales and operating results.

•Changes in consumer confidence. The restaurant/retail industries depend on consumer discretionary spending. Our customers are impacted by consumer confidence, which is influenced, in part, by general economic conditions, which may negatively affect consumer discretionary spending. A material decline in consumer confidence could result in consumers dining out less, spending less on meals, or altering the source or mix of their purchasing choices, which could negatively impact our customers’ sales and, in turn, result in reduced, delayed, or cancelled orders (bookings) or a decrease in active sites, revenue, or annual recurring revenue (ARR) from our subscription services, or an increase in customer churn; or reduced, delayed or cancelled hardware sales and installations.

Issues with product and component availability or supplier performance may affect our ability to assemble, repair, and deliver our hardware products and perform related services, which could have a material adverse effect on our business, financial condition, and results of operations.

We depend on third-party suppliers to deliver hardware products and components in sufficient quantities, at reasonable prices, and timely so that we can timely deliver and install our hardware products and perform our Advanced Exchange, depot repair and field services. We have agreements for the supply of hardware products and components, including long-term or volume-based purchase agreements with some suppliers. We have alternative sources in the event one or more of our component suppliers are not able to perform or fully perform; and we hold safety stocks of single source hardware products in quantities that we believe are sufficient to protect against possible supply chain disruptions; however, we cannot assure that hardware products and components will be available or available in needed quantities and quality or at favorable or competitive prices. If we experience a problem (availability, quantity, quality, or pricing) with one or more of our suppliers, and we are not able to cover or adequately cover from other sources, it could lead to a shortage of hardware products and components and extended lead times for the delivery and installation of our hardware products or adversely affect our performance of Advanced Exchange, depot repair and field services, which could negatively impact our ability to satisfactorily and timely meet our contractual and customer obligations. This could result in reduced sales, breach or termination of contracts, and damage to our reputation and relationships with our customers, which could have a material adverse effect on our business, financial condition, and results of operations.

Further, in some instances, we are dependent on single-source suppliers for our hardware products, which may subject us to other significant risks, including inadequate inventory, higher prices, and reduced control over delivery schedules.

Most of our suppliers of hardware products and components are located internationally, including in South Korea, China, and Taiwan, and are susceptible to hostilities in those regions and tariffs and other restrictions on trade between the United States and countries where our hardware products and components are sourced, which could increase the cost or restrict the availability of hardware products and components to us that we may not be able to offset or cover from another source. Furthermore, certain of our suppliers could decide to discontinue business with us or limit the allocation of hardware products and components to us, which could result in our inability to fill our supply needs, jeopardizing our ability to fulfill our contractual obligations, which could in turn, result in a decrease in sales and cash flows, contract penalties or terminations, and damage to customer relationships and our reputation.