Delaware |

1-09720 |

16-1434688 |

||||||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock | PAR | New York Stock Exchange | ||||||

| Exhibit No. | Exhibit Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

PAR TECHNOLOGY CORPORATION |

||||||||

(Registrant) |

||||||||

| Date: | November 8, 2024 | /s/ Bryan A. Menar |

||||||

Bryan A. Menar |

||||||||

Chief Financial Officer |

||||||||

(Principal Financial Officer) |

||||||||

|

FOR RELEASE:

CONTACT:

|

New Hartford, NY, November 8, 2024

Christopher R. Byrnes (315) 743-8376

cbyrnes@partech.com, www.partech.com

|

||||

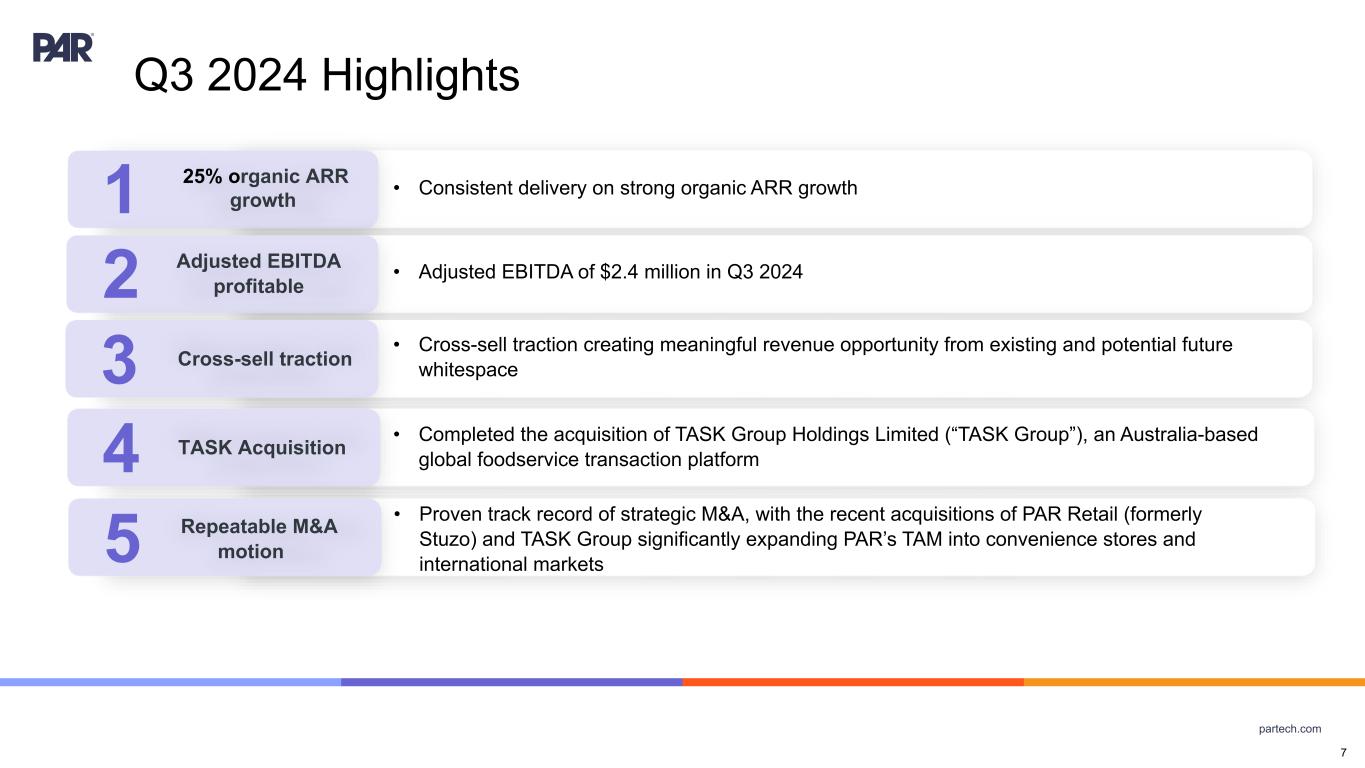

Q3 2024 Financial Highlights(2) |

|||||||||||||||||||||||

| (in millions, except % and per share amounts) | GAAP | Non-GAAP(1) |

|||||||||||||||||||||

| Q3 2024 | Q3 2023 | vs. Q3 2023 | Q3 2024 | Q3 2023 | vs. Q3 2023 | ||||||||||||||||||

| Revenue | $96.8 | $68.7 | better 40.8% |

||||||||||||||||||||

| Net Loss from Continuing Operations/Adjusted EBITDA | $(20.7) | $(19.2) | worse $1.4 million |

$2.4 | $(6.6) | better $9.0 million |

|||||||||||||||||

| Diluted Net Loss Per Share from Continuing Operations | $(0.58) | $(0.70) | better $0.12 |

$(0.09) | $(0.35) | better $0.26 |

|||||||||||||||||

| Subscription Service Gross Margin Percentage | 55.3% | 50.6% | better 4.7% |

66.8% | 69.4% | worse 2.6% |

|||||||||||||||||

Year-to-Date 2024 Financial Highlights(2) |

|||||||||||||||||||||||

| (in millions, except % and per share amounts) | GAAP | Non-GAAP(1) |

|||||||||||||||||||||

| Q3 2024 | Q3 2023 | vs. Q3 2023 | Q3 2024 | Q3 2023 | vs. Q3 2023 | ||||||||||||||||||

| Revenue | $245.0 | $206.8 | better 18.5% |

||||||||||||||||||||

| Net Loss from Continuing Operations/Adjusted EBITDA | $(64.6) | $(60.1) | worse $4.5 million |

$(12.1) | $(31.0) | better $18.9 million |

|||||||||||||||||

| Diluted Net Loss Per Share from Continuing Operations | $(1.90) | $(2.19) | better $0.29 |

$(0.74) | $(1.53) | better $0.79 |

|||||||||||||||||

| Subscription Service Gross Margin Percentage | 53.6% | 48.0% | better 5.6% |

66.4% | 67.0% | worse 0.6% |

|||||||||||||||||

| Assets | September 30, 2024 | December 31, 2023 | |||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 105,804 | $ | 37,183 | |||||||

| Cash held on behalf of customers | 15,266 | 10,170 | |||||||||

| Short-term investments | 12,578 | 37,194 | |||||||||

| Accounts receivable – net | 60,298 | 42,679 | |||||||||

| Inventories | 23,915 | 23,560 | |||||||||

| Other current assets | 14,743 | 8,123 | |||||||||

| Current assets of discontinued operations | — | 21,690 | |||||||||

| Total current assets | 232,604 | 180,599 | |||||||||

| Property, plant and equipment – net | 14,865 | 15,524 | |||||||||

| Goodwill | 803,084 | 488,918 | |||||||||

| Intangible assets – net | 226,051 | 93,969 | |||||||||

| Lease right-of-use assets | 7,651 | 3,169 | |||||||||

| Other assets | 15,019 | 17,642 | |||||||||

| Noncurrent assets of discontinued operations | — | 2,785 | |||||||||

| Total Assets | $ | 1,299,274 | $ | 802,606 | |||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 35,186 | $ | 25,599 | |||||||

| Accrued salaries and benefits | 17,959 | 14,128 | |||||||||

| Accrued expenses | 8,309 | 3,533 | |||||||||

| Customers payable | 15,266 | 10,170 | |||||||||

| Lease liabilities – current portion | 2,178 | 1,120 | |||||||||

| Customer deposits and deferred service revenue | 30,444 | 9,304 | |||||||||

| Current liabilities of discontinued operations | — | 16,378 | |||||||||

| Total current liabilities | 109,342 | 80,232 | |||||||||

| Lease liabilities – net of current portion | 5,559 | 2,145 | |||||||||

| Long-term debt | 466,735 | 377,647 | |||||||||

| Deferred service revenue – noncurrent | 1,733 | 4,204 | |||||||||

| Other long-term liabilities | 23,198 | 3,603 | |||||||||

| Noncurrent liabilities of discontinued operations | — | 1,710 | |||||||||

| Total liabilities | 606,567 | 469,541 | |||||||||

| Shareholders’ equity: | |||||||||||

| Preferred stock, $0.02 par value, 1,000,000 shares authorized, none outstanding | — | — | |||||||||

Common stock, $0.02 par value, 116,000,000 shares authorized, 37,773,764 and 29,386,234 shares issued, 36,303,459 and 28,029,915 outstanding at September 30, 2024 and December 31, 2023, respectively |

749 | 584 | |||||||||

| Additional paid in capital | 972,811 | 625,154 | |||||||||

| Accumulated deficit | (258,886) | (274,956) | |||||||||

| Accumulated other comprehensive loss | (118) | (939) | |||||||||

| Treasury stock, at cost, 1,470,305 shares and 1,356,319 shares at September 30, 2024 and December 31, 2023, respectively | (21,849) | (16,778) | |||||||||

| Total shareholders’ equity | 692,707 | 333,065 | |||||||||

| Total Liabilities and Shareholders’ Equity | $ | 1,299,274 | $ | 802,606 | |||||||

| Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenues, net: | |||||||||||||||||||||||

| Subscription service | $ | 59,909 | $ | 31,363 | $ | 143,160 | $ | 89,700 | |||||||||||||||

| Hardware | 22,650 | 25,824 | 60,992 | 78,991 | |||||||||||||||||||

| Professional service | 14,195 | 11,514 | 40,825 | 38,123 | |||||||||||||||||||

| Total revenues, net | 96,754 | 68,701 | 244,977 | 206,814 | |||||||||||||||||||

| Cost of sales: | |||||||||||||||||||||||

| Subscription service | 26,789 | 15,497 | 66,424 | 46,655 | |||||||||||||||||||

| Hardware | 16,878 | 19,295 | 46,587 | 63,002 | |||||||||||||||||||

| Professional service | 10,056 | 8,775 | 30,849 | 31,925 | |||||||||||||||||||

| Total cost of sales | 53,723 | 43,567 | 143,860 | 141,582 | |||||||||||||||||||

| Gross margin | 43,031 | 25,134 | 101,117 | 65,232 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Sales and marketing | 10,500 | 9,532 | 31,237 | 29,005 | |||||||||||||||||||

| General and administrative | 27,352 | 17,525 | 77,896 | 52,926 | |||||||||||||||||||

| Research and development | 17,821 | 14,660 | 49,826 | 43,863 | |||||||||||||||||||

| Amortization of identifiable intangible assets | 2,699 | 464 | 5,577 | 1,393 | |||||||||||||||||||

| Adjustment to contingent consideration liability | — | — | (600) | (7,500) | |||||||||||||||||||

| Gain on insurance proceeds | (147) | — | (147) | (500) | |||||||||||||||||||

| Total operating expenses | 58,225 | 42,181 | 163,789 | 119,187 | |||||||||||||||||||

| Operating loss | (15,194) | (17,047) | (62,672) | (53,955) | |||||||||||||||||||

| Other expense, net | (1,400) | (262) | (1,710) | (116) | |||||||||||||||||||

| Interest expense, net | (3,417) | (1,750) | (6,755) | (5,152) | |||||||||||||||||||

| Loss from continuing operations before (provision for) benefit from income taxes | (20,011) | (19,059) | (71,137) | (59,223) | |||||||||||||||||||

| (Provision for) benefit from income taxes | (653) | (175) | 6,520 | (873) | |||||||||||||||||||

| Net loss from continuing operations | (20,664) | (19,234) | (64,617) | (60,096) | |||||||||||||||||||

| Net income from discontinued operations | 832 | 3,718 | 80,687 | 8,973 | |||||||||||||||||||

| Net income (loss) | $ | (19,832) | $ | (15,516) | $ | 16,070 | $ | (51,123) | |||||||||||||||

| Net income (loss) per share (basic and diluted): | |||||||||||||||||||||||

| Continuing operations | $ | (0.58) | $ | (0.70) | $ | (1.90) | $ | (2.19) | |||||||||||||||

| Discontinued operations | 0.02 | 0.14 | 2.38 | 0.33 | |||||||||||||||||||

| Total | $ | (0.56) | $ | (0.56) | $ | 0.48 | $ | (1.86) | |||||||||||||||

| Weighted average shares outstanding (basic and diluted) | 35,865 | 27,472 | 33,931 | 27,412 | |||||||||||||||||||

| Non-GAAP Measure or Adjustment | Definition | Usefulness to management and investors | ||||||

| Non-GAAP subscription service gross margin percentage | Represents subscription service gross margin percentage adjusted to exclude amortization from acquired and internally developed software, stock-based compensation, and severance. |

We believe that non-GAAP subscription service gross margin percentage and adjusted EBITDA provide useful perspectives with respect to the Company's core operating performance and ongoing cash earnings by adjusting for certain non-cash and non-recurring charges that may not be indicative of our financial performance. | ||||||

| Adjusted EBITDA | Represents net income (loss) before income taxes, interest expense and depreciation and amortization adjusted to exclude certain non-cash and non-recurring charges that may not be indicative of our financial performance. |

|||||||

| Non-GAAP diluted net loss per share | Represents net loss per share excluding amortization of acquired intangible assets and certain non-cash and non-recurring charges that may not be indicative of our financial performance. |

We believe that adjusting our non-GAAP diluted net loss per share to remove non-cash and non-recurring charges provides a useful perspective with respect to the Company's operating performance as well as comparisons to past and competitor operating results. |

||||||

| Stock-based compensation | Consists of charges related to our employee equity incentive plans. | We exclude stock-based compensation because management does not view these non-cash charges as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. | ||||||

| Non-GAAP Measure or Adjustment | Definition | Usefulness to management and investors | ||||||

| Contingent consideration | Adjustment reflects a non-cash reduction to the fair market value of the contingent consideration liability related to our acquisition of MENU Technologies AG. | We exclude changes to the fair market value of our contingent consideration liability because management does not view these non-cash, non-recurring charges as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. | ||||||

| Transaction costs | Adjustment reflects non-recurring professional fees incurred in transaction due diligence, including costs incurred in the acquisitions of Stuzo Blocker, Inc., Stuzo Holdings, LLC and their subsidiaries (the "Stuzo Acquisition") and TASK Group. | We exclude professional fees incurred in corporate development because management does not view these non-recurring charges, which are inconsistent in size and are significantly impacted by the timing and valuation of our transactions, as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance, comparisons to past and competitor operating results, and additional means to evaluate expense trends. | ||||||

| Gain on insurance proceeds | Adjustment reflects the gain on insurance proceeds due to the settlement of a legacy claim. | We exclude these non-recurring adjustments because management does not view these costs as part of our core operating performance. These adjustments facilitate a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. | ||||||

| Severance | Adjustment reflects severance tied to non-recurring restructuring events included in cost of sales, sales and marketing expense, general and administrative expense, and research and development expense. | |||||||

| Discontinued operations | Adjustment reflects income from discontinued operations related to the disposition of our Government segment. | |||||||

| Impairment loss | Adjustment reflects impairment loss included in general and administrative expense related to the discontinuance of the Brink POS trade name. | |||||||

| Other expense, net | Adjustment reflects foreign currency transaction gains and losses, rental income and losses, and other non-recurring expenses recorded in other expense, net in the accompanying statements of operations. | |||||||

| Non-recurring income taxes | Adjustment reflects a partial release of our deferred tax asset valuation allowance resulting from the Stuzo Acquisition. | We exclude these non-cash and non-recurring adjustments for purposes of calculating non-GAAP diluted net loss per share because management does not view these costs as part of our core operating performance. These adjustments facilitate a useful evaluation of our current operating performance, comparisons to past and competitor operating results, and additional means to evaluate expense trends. | ||||||

| Non-cash interest | Adjustment reflects non-cash amortization of issuance costs and discount related to the Company's long-term debt. | |||||||

| Acquired intangible assets amortization | Adjustment reflects amortization expense of acquired developed technology included within cost of sales and amortization expense of acquired intangible assets. | |||||||

| (in thousands) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||

| Reconciliation of Net Income (Loss) to Adjusted EBITDA | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net income (loss) | $ | (19,832) | $ | (15,516) | $ | 16,070 | $ | (51,123) | |||||||||||||||

| Discontinued operations | (832) | (3,718) | (80,687) | (8,973) | |||||||||||||||||||

| Net loss from continuing operations | (20,664) | (19,234) | (64,617) | (60,096) | |||||||||||||||||||

| Provision for (benefit from) income taxes | 653 | 175 | (6,520) | 873 | |||||||||||||||||||

| Interest expense, net | 3,417 | 1,750 | 6,755 | 5,152 | |||||||||||||||||||

| Depreciation and amortization | 10,575 | 6,549 | 26,702 | 20,133 | |||||||||||||||||||

| Stock-based compensation | 5,887 | 3,935 | 16,583 | 10,544 | |||||||||||||||||||

| Contingent consideration | — | — | (600) | (7,500) | |||||||||||||||||||

| Transaction costs | 1,125 | — | 6,103 | — | |||||||||||||||||||

| Gain on insurance proceeds | (147) | — | (147) | (500) | |||||||||||||||||||

| Severance | (48) | — | 1,680 | 253 | |||||||||||||||||||

| Impairment loss | 225 | — | 225 | — | |||||||||||||||||||

| Other expense, net | 1,400 | 262 | 1,710 | 116 | |||||||||||||||||||

| Adjusted EBITDA | $ | 2,423 | $ | (6,563) | $ | (12,126) | $ | (31,025) | |||||||||||||||

| (in thousands, except per share amounts) | Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||

| Reconciliation between GAAP and Non-GAAP Diluted Net Income (Loss) per share |

2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Diluted net income (loss) per share | $ | (0.56) | $ | (0.56) | $ | 0.48 | $ | (1.86) | |||||||||||||||

| Discontinued operations | (0.02) | (0.14) | (2.38) | (0.33) | |||||||||||||||||||

| Diluted net loss per share from continuing operations | (0.58) | (0.70) | (1.90) | (2.19) | |||||||||||||||||||

| Non-recurring income taxes | — | — | (0.23) | — | |||||||||||||||||||

| Non-cash interest | 0.02 | 0.02 | 0.05 | 0.06 | |||||||||||||||||||

| Acquired intangible assets amortization | 0.23 | 0.18 | 0.59 | 0.49 | |||||||||||||||||||

| Stock-based compensation | 0.16 | 0.14 | 0.49 | 0.38 | |||||||||||||||||||

| Contingent consideration | — | — | (0.02) | (0.27) | |||||||||||||||||||

| Transaction costs | 0.03 | — | 0.18 | — | |||||||||||||||||||

| Gain on insurance proceeds | — | — | — | (0.02) | |||||||||||||||||||

| Severance | — | — | 0.05 | 0.01 | |||||||||||||||||||

| Impairment loss | 0.01 | — | 0.01 | — | |||||||||||||||||||

| Other expense, net | 0.04 | 0.01 | 0.05 | — | |||||||||||||||||||

| Non-GAAP diluted net loss per share | $ | (0.09) | $ | (0.35) | $ | (0.74) | $ | (1.53) | |||||||||||||||

| Diluted weighted average shares outstanding | 35,865 | 27,472 | 33,931 | 27,412 | |||||||||||||||||||

| Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||||||||||

| Reconciliation between GAAP and Non-GAAP Subscription Service Gross Margin Percentage |

2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Subscription Service Gross Margin Percentage | 55.3 | % | 50.6 | % | 53.6 | % | 48.0 | % | |||||||||||||||

| Depreciation and amortization | 11.4 | % | 18.4 | % | 12.6 | % | 18.8 | % | |||||||||||||||

| Stock-based compensation | 0.1 | % | 0.4 | % | 0.1 | % | 0.2 | % | |||||||||||||||

| Severance | — | % | — | % | 0.1 | % | — | % | |||||||||||||||

| Non-GAAP Subscription Service Gross Margin Percentage | 66.8 | % | 69.4 | % | 66.4 | % | 67.0 | % | |||||||||||||||