Delaware |

1-09720 |

16-1434688 |

||||||

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock | PAR | New York Stock Exchange | ||||||

| Exhibit No. | Exhibit Description | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

PAR TECHNOLOGY CORPORATION |

||||||||

(Registrant) |

||||||||

| Date: | August 8, 2024 | /s/ Bryan A. Menar |

||||||

Bryan A. Menar |

||||||||

Chief Financial Officer |

||||||||

(Principal Financial Officer) |

||||||||

|

FOR RELEASE:

CONTACT:

|

New Hartford, NY, August 8, 2024

Christopher R. Byrnes (315) 743-8376

cbyrnes@partech.com, www.partech.com

|

||||

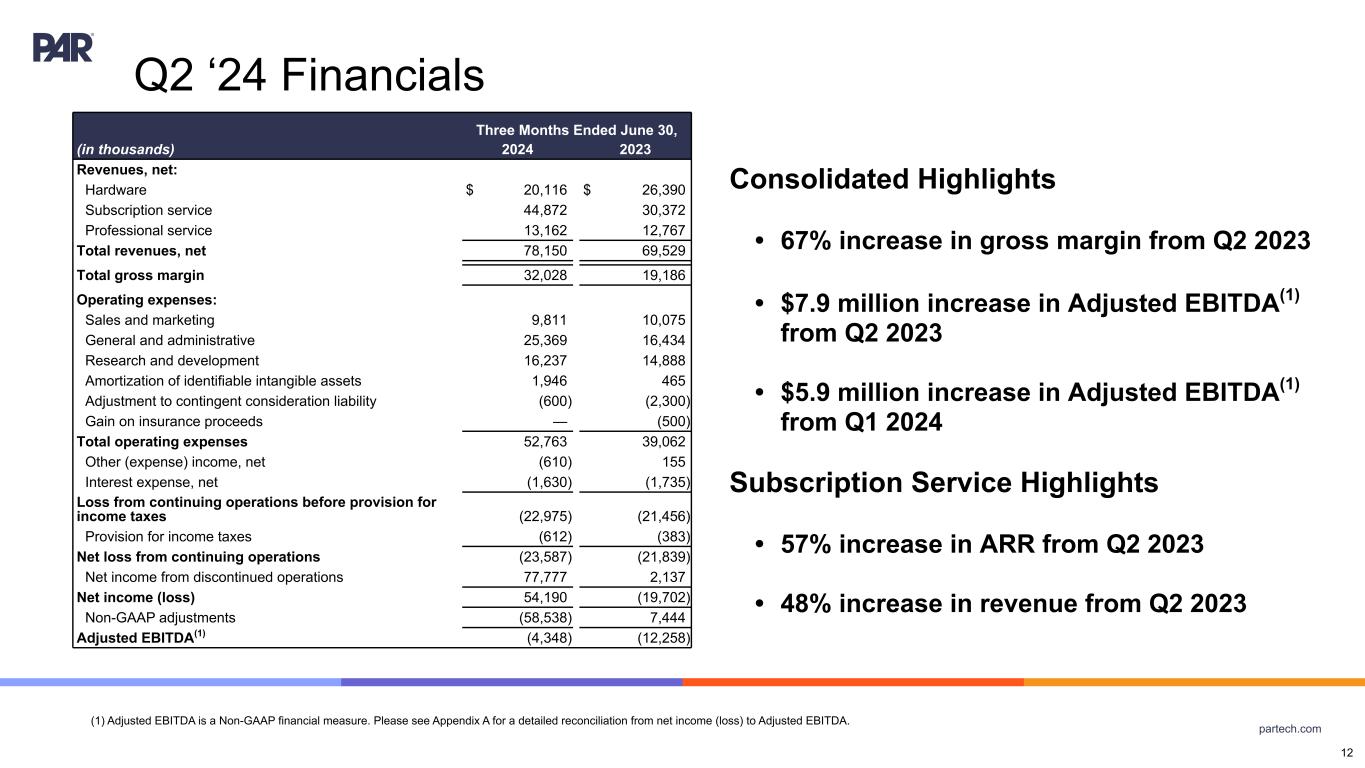

| Q2 2024 Financial Highlights | |||||||||||||||||||||||

| (in millions, except % and per share amounts) | GAAP | Non-GAAP(1) |

|||||||||||||||||||||

| Q2 2024 | Q2 2023 | vs. Q2 2023 | Q2 2024 | Q2 2023 | vs. Q2 2023 | ||||||||||||||||||

| Revenue | $78.2 | $69.5 | better 12.4% |

||||||||||||||||||||

| Net Loss from Continuing Operations/Adjusted EBITDA | $(23.6) | $(21.8) | worse $1.7 million |

$(4.3) | $(12.3) | better $7.9 million |

|||||||||||||||||

| Diluted Net Loss Per Share from Continuing Operations | $(0.69) | $(0.80) | better $0.11 |

$(0.23) | $(0.60) | better $0.37 |

|||||||||||||||||

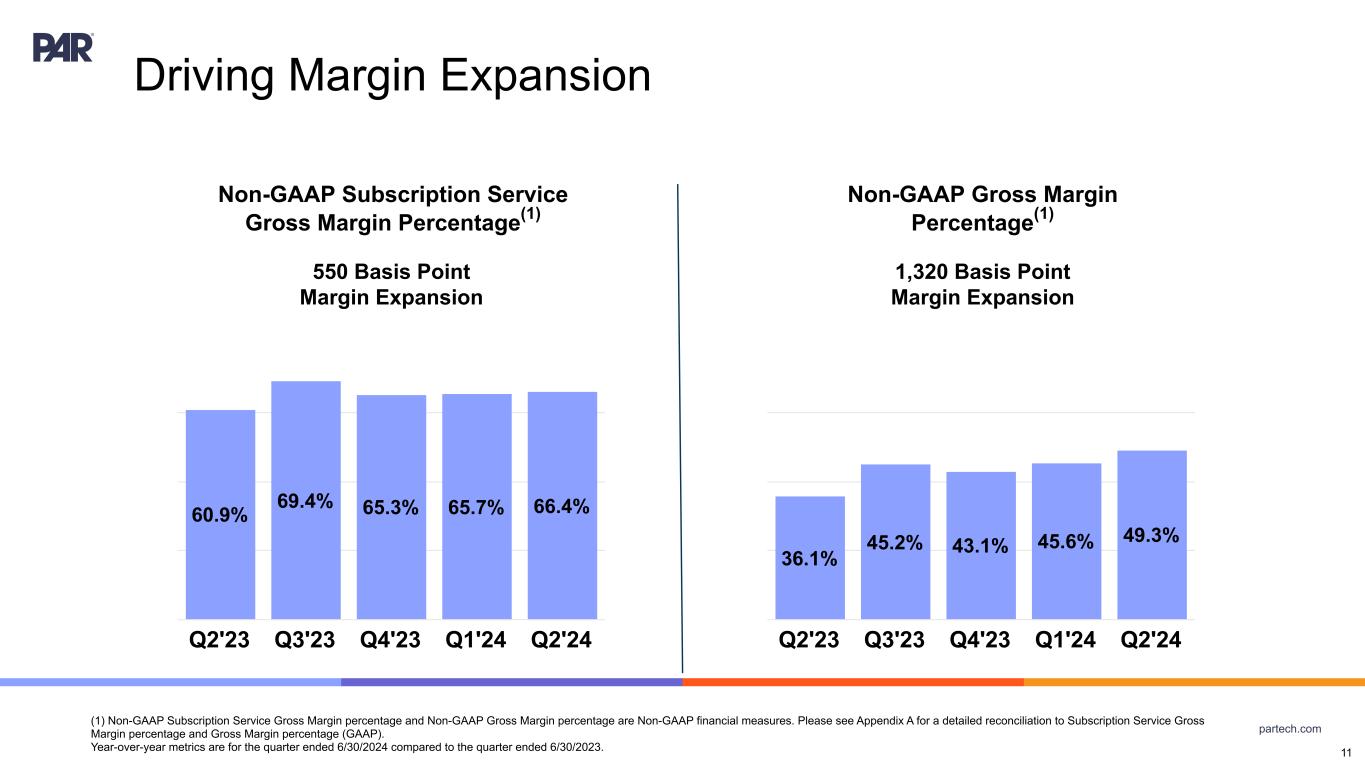

| Subscription Service Gross Margin Percentage | 53.1% | 43.3% | better 9.8% |

66.4% | 60.9% | better 5.5% |

|||||||||||||||||

| Year-to-Date 2024 Financial Highlights | |||||||||||||||||||||||

| (in millions, except % and per share amounts) | GAAP | Non-GAAP(1) |

|||||||||||||||||||||

| Q2 2024 | Q2 2023 | vs. Q2 2023 | Q2 2024 | Q2 2023 | vs. Q2 2023 | ||||||||||||||||||

| Revenue | $148.2 | $138.1 | better 7.3% |

||||||||||||||||||||

| Net Loss from Continuing Operations/Adjusted EBITDA | $(44.0) | $(40.9) | worse $3.1 million |

$(14.5) | $(24.5) | better $9.9 million |

|||||||||||||||||

| Diluted Net Loss Per Share from Continuing Operations | $(1.33) | $(1.49) | better $0.16 |

$(0.66) | $(1.18) | better $0.52 |

|||||||||||||||||

| Subscription Service Gross Margin Percentage | 52.4% | 46.6% | better 5.8% |

66.1% | 65.6% | better 0.5% |

|||||||||||||||||

| Assets | June 30, 2024 | December 31, 2023 | |||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 114,928 | $ | 37,183 | |||||||

| Cash held on behalf of customers | 12,804 | 10,170 | |||||||||

| Short-term investments | 27,527 | 37,194 | |||||||||

| Accounts receivable – net | 50,203 | 42,679 | |||||||||

| Inventories | 25,526 | 23,560 | |||||||||

| Other current assets | 9,427 | 8,123 | |||||||||

| Current assets of discontinued operations | 6,382 | 21,690 | |||||||||

| Total current assets | 246,797 | 180,599 | |||||||||

| Property, plant and equipment – net | 14,452 | 15,524 | |||||||||

| Goodwill | 623,875 | 488,918 | |||||||||

| Intangible assets – net | 148,292 | 93,969 | |||||||||

| Lease right-of-use assets | 4,740 | 3,169 | |||||||||

| Other assets | 17,689 | 17,642 | |||||||||

| Noncurrent assets of discontinued operations | 839 | 2,785 | |||||||||

| Total Assets | $ | 1,056,684 | $ | 802,606 | |||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 30,682 | $ | 25,599 | |||||||

| Accrued salaries and benefits | 13,954 | 14,128 | |||||||||

| Accrued expenses | 4,047 | 3,533 | |||||||||

| Customers payable | 12,804 | 10,170 | |||||||||

| Lease liabilities – current portion | 1,288 | 1,120 | |||||||||

| Customer deposits and deferred service revenue | 14,294 | 9,304 | |||||||||

| Current liabilities of discontinued operations | 2,033 | 16,378 | |||||||||

| Total current liabilities | 79,102 | 80,232 | |||||||||

| Lease liabilities – net of current portion | 3,540 | 2,145 | |||||||||

| Long-term debt | 378,672 | 377,647 | |||||||||

| Deferred service revenue – noncurrent | 2,876 | 4,204 | |||||||||

| Other long-term liabilities | 4,173 | 3,603 | |||||||||

| Noncurrent liabilities of discontinued operations | — | 1,710 | |||||||||

| Total liabilities | 468,363 | 469,541 | |||||||||

| Shareholders’ equity: | |||||||||||

| Preferred stock, $0.02 par value, 1,000,000 shares authorized, none outstanding | — | — | |||||||||

| Common stock, $0.02 par value, 116,000,000 shares authorized, 35,574,128 and 29,386,234 shares issued, 34,104,235 and 28,029,915 outstanding at June 30, 2024 and December 31, 2023, respectively | 705 | 584 | |||||||||

| Additional paid in capital | 852,406 | 625,154 | |||||||||

| Accumulated deficit | (239,054) | (274,956) | |||||||||

| Accumulated other comprehensive loss | (3,908) | (939) | |||||||||

| Treasury stock, at cost, 1,469,893 shares and 1,356,319 shares at June 30, 2024 and December 31, 2023, respectively | (21,828) | (16,778) | |||||||||

| Total shareholders’ equity | 588,321 | 333,065 | |||||||||

| Total Liabilities and Shareholders’ Equity | $ | 1,056,684 | $ | 802,606 | |||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenues, net: | |||||||||||||||||||||||

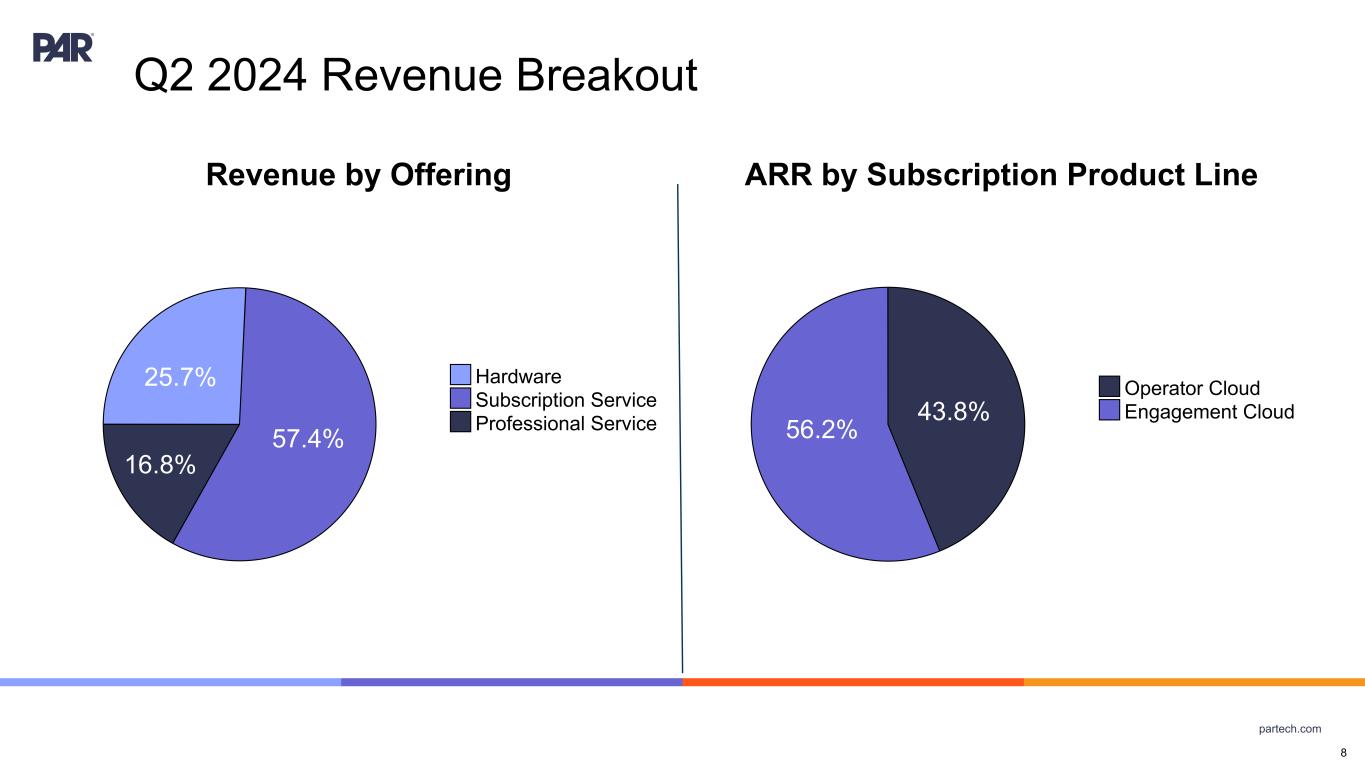

| Hardware | $ | 20,116 | $ | 26,390 | $ | 38,342 | $ | 53,167 | |||||||||||||||

| Subscription service | 44,872 | 30,372 | 83,251 | 58,337 | |||||||||||||||||||

| Professional service | 13,162 | 12,767 | 26,630 | 26,609 | |||||||||||||||||||

| Total revenues, net | 78,150 | 69,529 | 148,223 | 138,113 | |||||||||||||||||||

| Cost of sales: | |||||||||||||||||||||||

| Hardware | 15,539 | 21,326 | 29,709 | 43,707 | |||||||||||||||||||

| Subscription service | 21,041 | 17,233 | 39,635 | 31,158 | |||||||||||||||||||

| Professional service | 9,542 | 11,784 | 20,793 | 23,150 | |||||||||||||||||||

| Total cost of sales | 46,122 | 50,343 | 90,137 | 98,015 | |||||||||||||||||||

| Gross margin | 32,028 | 19,186 | 58,086 | 40,098 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Sales and marketing | 9,811 | 10,075 | 20,737 | 19,473 | |||||||||||||||||||

| General and administrative | 25,369 | 16,434 | 50,544 | 35,401 | |||||||||||||||||||

| Research and development | 16,237 | 14,888 | 32,005 | 29,203 | |||||||||||||||||||

| Amortization of identifiable intangible assets | 1,946 | 465 | 2,878 | 929 | |||||||||||||||||||

| Adjustment to contingent consideration liability | (600) | (2,300) | (600) | (7,500) | |||||||||||||||||||

| Gain on insurance proceeds | — | (500) | — | (500) | |||||||||||||||||||

| Total operating expenses | 52,763 | 39,062 | 105,564 | 77,006 | |||||||||||||||||||

| Operating loss | (20,735) | (19,876) | (47,478) | (36,908) | |||||||||||||||||||

| Other (expense) income, net | (610) | 155 | (310) | 146 | |||||||||||||||||||

| Interest expense, net | (1,630) | (1,735) | (3,338) | (3,402) | |||||||||||||||||||

| Loss from continuing operations before (provision for) benefit from income taxes | (22,975) | (21,456) | (51,126) | (40,164) | |||||||||||||||||||

| (Provision for) benefit from income taxes | (612) | (383) | 7,173 | (698) | |||||||||||||||||||

| Net loss from continuing operations | (23,587) | (21,839) | (43,953) | (40,862) | |||||||||||||||||||

| Net income from discontinued operations | 77,777 | 2,137 | 79,855 | 5,255 | |||||||||||||||||||

| Net income (loss) | $ | 54,190 | $ | (19,702) | $ | 35,902 | $ | (35,607) | |||||||||||||||

| Net income (loss) per share (basic and diluted): | |||||||||||||||||||||||

| Continuing operations | $ | (0.69) | $ | (0.80) | $ | (1.33) | $ | (1.49) | |||||||||||||||

| Discontinued operations | 2.29 | 0.08 | 2.42 | 0.19 | |||||||||||||||||||

| Total | $ | 1.60 | $ | (0.72) | $ | 1.09 | $ | (1.30) | |||||||||||||||

| Weighted average shares outstanding (basic and diluted) | 34,015 | 27,357 | 32,935 | 27,381 | |||||||||||||||||||

| Non-GAAP Measure | Definition | Usefulness to management and investors | ||||||

| Non-GAAP subscription service gross margin percentage | Non-GAAP subscription service gross margin percentage represents subscription service gross margin percentage adjusted to exclude amortization from acquired and internally developed software, stock-based compensation, and severance. |

We believe that non-GAAP subscription service gross margin percentage and adjusted EBITDA provide useful perspectives with respect to the Company's core operating performance and ongoing cash earnings by adjusting for certain non-cash and non-recurring charges that may not be indicative of our financial performance. | ||||||

| Adjusted EBITDA | Adjusted EBITDA represents net income (loss) before income taxes, interest expense and depreciation and amortization adjusted to exclude certain non-cash and non-recurring charges that may not be indicative of our financial performance. |

|||||||

| Non-GAAP diluted net loss per share | Non-GAAP diluted net loss per share represents net loss per share excluding amortization of acquired intangible assets and certain non-cash and non-recurring charges that may not be indicative of our financial performance. |

We believe that adjusting our non-GAAP diluted net loss per share to remove non-cash and non-recurring charges provides a useful perspective with respect to the Company's operating performance as well as comparisons to past and competitor operating results. |

||||||

| Non-GAAP Adjustment | Definition | Usefulness to management and investors | ||||||

| Stock-based compensation | Stock-based compensation consists of charges related to our employee equity incentive plans. | We exclude stock-based compensation because these non-cash charges are not viewed by management as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. | ||||||

| Contingent consideration | Adjustment reflects a non-cash reduction to the fair market value of the contingent consideration liability related to our acquisition of MENU Technologies AG. | We exclude changes to the fair market value of our contingent consideration liability because management does not view these non-cash, non-recurring charges as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. | ||||||

| Transaction costs | Adjustment reflects non-recurring professional fees incurred in transaction due diligence, including costs incurred in the acquisitions of Stuzo Blocker, Inc., Stuzo Holdings, LLC and their subsidiaries (the "Stuzo Acquisition") and TASK. | We exclude professional fees incurred in corporate development because management does not view these non-recurring charges, which are inconsistent in size and are significantly impacted by the timing and valuation of our transactions, as part of our core operating performance. This adjustment facilitates a useful evaluation of our current operating performance, comparisons to past and competitor operating results, and additional means to evaluate expense trends. | ||||||

| Gain on insurance proceeds | Adjustment reflects the gain on insurance proceeds due to the settlement of a legacy claim. | We exclude these non-recurring adjustments because these costs do not reflect our core operating performance. These adjustments facilitate a useful evaluation of our current operating performance as well as comparisons to past and competitor operating results. | ||||||

| Severance | Adjustment reflects the severance included in cost of sales, sales and marketing expense, general and administrative expense, and research and development expense. | |||||||

| Discontinued operations | Adjustment reflects income from discontinued operations related to the disposition of our Government segment. | |||||||

| Other expense (income), net | Adjustment reflects foreign currency transaction gains and losses, rental income and losses, and other non-recurring expenses recorded in other expense (income), net, in the accompanying statements of operations. | |||||||

| (Provision for) benefit from income taxes | Adjustment reflects a partial release of our deferred tax asset valuation allowance resulting from the Stuzo Acquisition. | We exclude these non-cash and non-recurring adjustments for purposes of calculating non-GAAP diluted net loss per share because these costs do not reflect our core operating performance. These adjustments facilitate a useful evaluation of our current operating performance, comparisons to past and competitor operating results, and additional means to evaluate expense trends. | ||||||

| Non-cash interest | Adjustment reflects non-cash amortization of issuance costs related to the Company's long-term debt. | |||||||

| Acquired intangible assets amortization | Adjustment reflects amortization expense of acquired developed technology included within cost of sales and amortization expense of acquired intangible assets. | |||||||

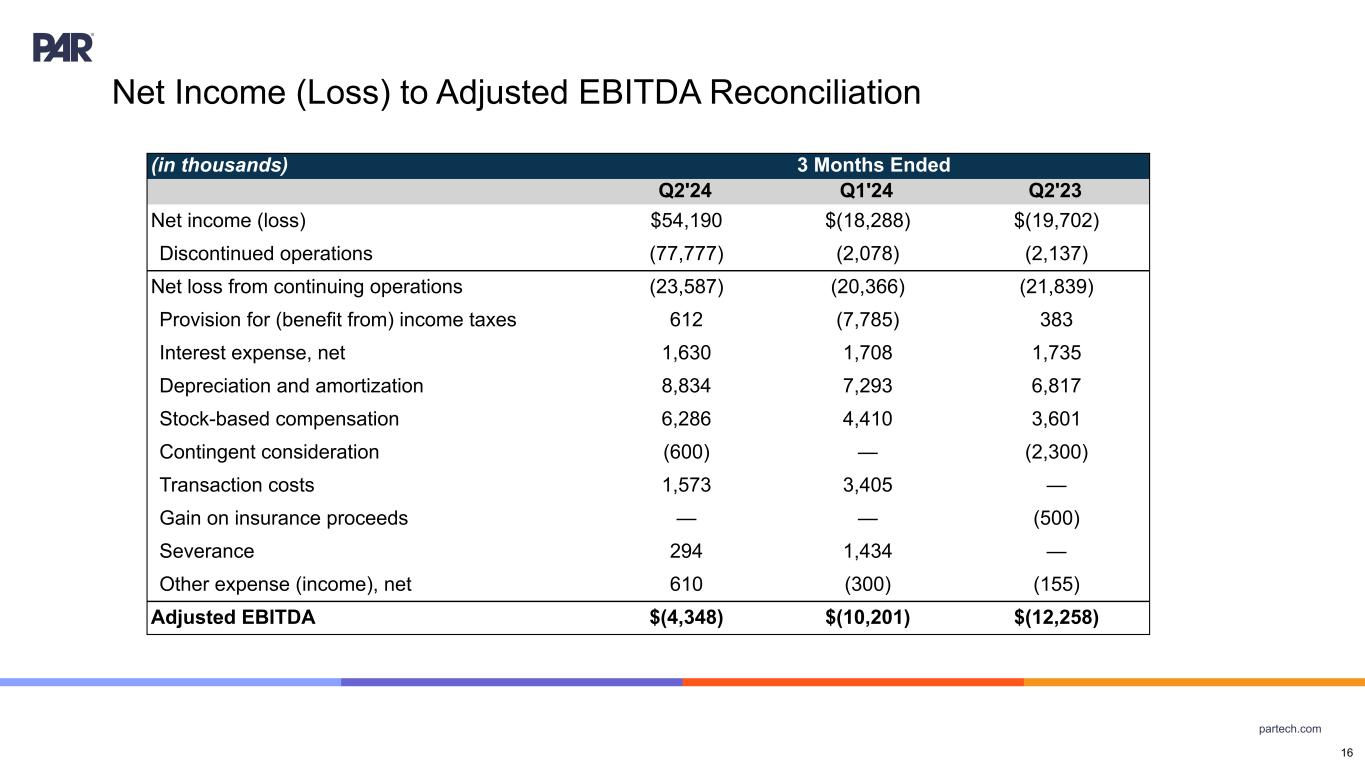

| (in thousands) | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||

| Reconciliation of Net Income (Loss) to Adjusted EBITDA | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net income (loss) | $ | 54,190 | $ | (19,702) | $ | 35,902 | $ | (35,607) | |||||||||||||||

| Discontinued operations | (77,777) | (2,137) | (79,855) | (5,255) | |||||||||||||||||||

| Net loss from continuing operations | (23,587) | (21,839) | (43,953) | (40,862) | |||||||||||||||||||

| Provision for (benefit from) income taxes | 612 | 383 | (7,173) | 698 | |||||||||||||||||||

| Interest expense, net | 1,630 | 1,735 | 3,338 | 3,402 | |||||||||||||||||||

| Depreciation and amortization | 8,834 | 6,817 | 16,127 | 13,584 | |||||||||||||||||||

| Stock-based compensation | 6,286 | 3,601 | 10,696 | 6,609 | |||||||||||||||||||

| Contingent consideration | (600) | (2,300) | (600) | (7,500) | |||||||||||||||||||

| Transaction costs | 1,573 | — | 4,978 | — | |||||||||||||||||||

| Gain on insurance proceeds | — | (500) | — | (500) | |||||||||||||||||||

| Severance | 294 | — | 1,728 | 253 | |||||||||||||||||||

| Other expense (income), net | 610 | (155) | 310 | (146) | |||||||||||||||||||

| Adjusted EBITDA | $ | (4,348) | $ | (12,258) | $ | (14,549) | $ | (24,462) | |||||||||||||||

| (in thousands, except per share amounts) | Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||

| Reconciliation between GAAP and Non-GAAP Diluted Net Income (Loss) per share |

2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Diluted net income (loss) per share | $ | 1.60 | $ | (0.72) | $ | 1.09 | $ | (1.30) | |||||||||||||||

| Discontinued operations | (2.29) | (0.08) | (2.42) | (0.19) | |||||||||||||||||||

| Diluted net loss per share from continuing operations | (0.69) | (0.80) | (1.33) | (1.49) | |||||||||||||||||||

| Provision for (benefit from) income taxes | 0.01 | — | (0.23) | — | |||||||||||||||||||

| Non-cash interest | 0.02 | 0.02 | 0.03 | 0.04 | |||||||||||||||||||

| Acquired intangible assets amortization | 0.20 | 0.16 | 0.36 | 0.32 | |||||||||||||||||||

| Stock-based compensation | 0.18 | 0.13 | 0.32 | 0.24 | |||||||||||||||||||

| Contingent consideration | (0.02) | (0.08) | (0.02) | (0.27) | |||||||||||||||||||

| Transaction costs | 0.05 | — | 0.15 | — | |||||||||||||||||||

| Gain on insurance proceeds | — | (0.02) | — | (0.02) | |||||||||||||||||||

| Severance | 0.01 | — | 0.05 | 0.01 | |||||||||||||||||||

| Other expense (income), net | 0.02 | (0.01) | 0.01 | (0.01) | |||||||||||||||||||

| Non-GAAP diluted net loss per share | $ | (0.23) | $ | (0.60) | $ | (0.66) | $ | (1.18) | |||||||||||||||

| Diluted weighted average shares outstanding | 34,015 | 27,357 | 32,935 | 27,381 | |||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

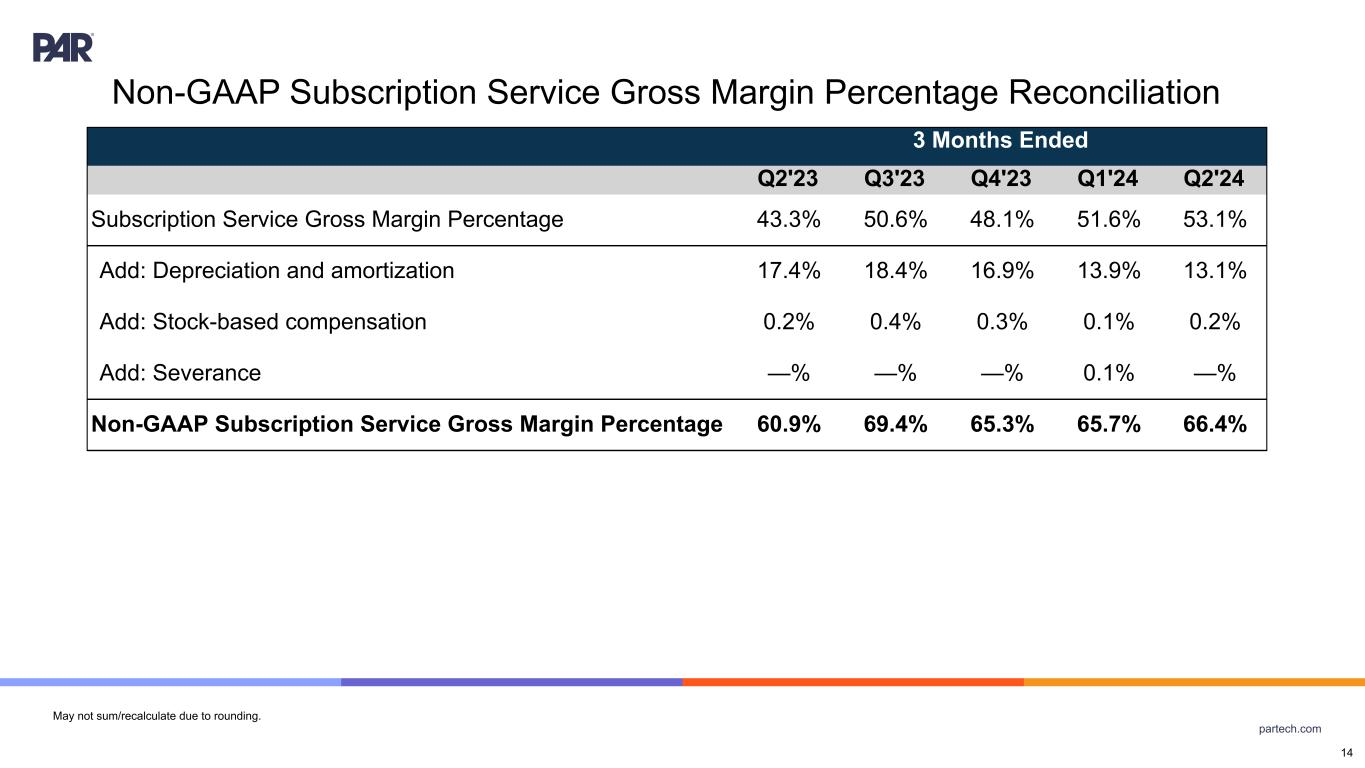

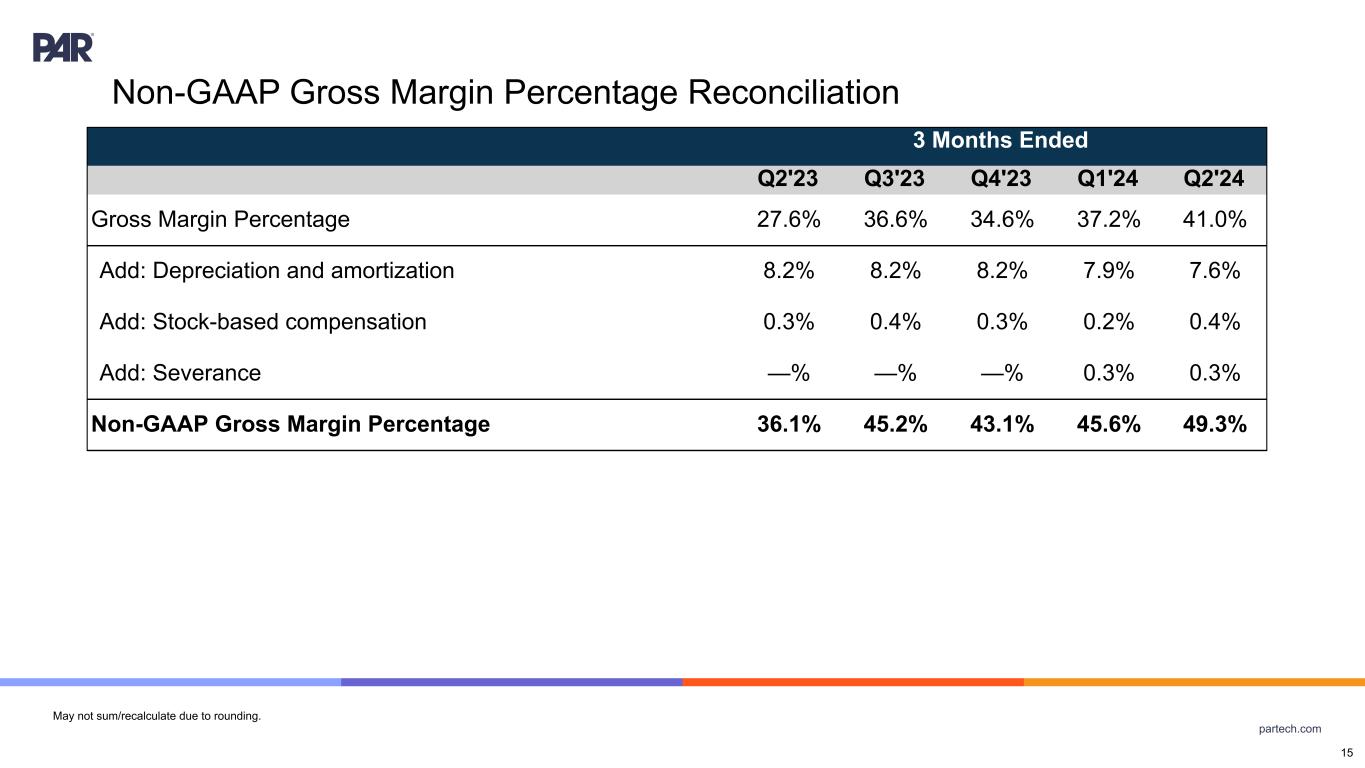

| Reconciliation between GAAP and Non-GAAP Subscription Service Gross Margin Percentage |

2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Subscription Service Gross Margin Percentage | 53.1 | % | 43.3 | % | 52.4 | % | 46.6 | % | |||||||||||||||

| Depreciation and amortization | 13.1 | % | 17.4 | % | 13.4 | % | 18.8 | % | |||||||||||||||

| Stock-based compensation | 0.2 | % | 0.2 | % | 0.2 | % | 0.2 | % | |||||||||||||||

| Severance | — | % | — | % | 0.1 | % | — | % | |||||||||||||||

| Non-GAAP Subscription Service Gross Margin Percentage | 66.4 | % | 60.9 | % | 66.1 | % | 65.6 | % | |||||||||||||||