00007021652023FYFALSEseven dayshttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#UnusualOrInfrequentItemLossGross00007021652023-01-012023-12-3100007021652023-06-30iso4217:USD00007021652024-01-31xbrli:shares00007021652022-01-012022-12-3100007021652021-01-012021-12-31iso4217:USDxbrli:shares00007021652023-12-3100007021652022-12-3100007021652021-12-3100007021652020-12-310000702165us-gaap:CommonStockMember2020-12-310000702165us-gaap:AdditionalPaidInCapitalMember2020-12-310000702165us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000702165us-gaap:RetainedEarningsMember2020-12-310000702165us-gaap:RetainedEarningsMember2021-01-012021-12-310000702165us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000702165us-gaap:CommonStockMember2021-01-012021-12-310000702165us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000702165us-gaap:CommonStockMember2021-12-310000702165us-gaap:AdditionalPaidInCapitalMember2021-12-310000702165us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000702165us-gaap:RetainedEarningsMember2021-12-310000702165us-gaap:RetainedEarningsMember2022-01-012022-12-310000702165us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000702165us-gaap:CommonStockMember2022-01-012022-12-310000702165us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000702165us-gaap:CommonStockMember2022-12-310000702165us-gaap:AdditionalPaidInCapitalMember2022-12-310000702165us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000702165us-gaap:RetainedEarningsMember2022-12-310000702165us-gaap:RetainedEarningsMember2023-01-012023-12-310000702165us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000702165us-gaap:CommonStockMember2023-01-012023-12-310000702165us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000702165us-gaap:CommonStockMember2023-12-310000702165us-gaap:AdditionalPaidInCapitalMember2023-12-310000702165us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000702165us-gaap:RetainedEarningsMember2023-12-31utr:mi0000702165nsc:IntermodalMember2023-01-012023-12-31xbrli:pure0000702165nsc:AgricultureForestAndConsumerProductsMember2023-01-012023-12-310000702165nsc:ChemicalsMember2023-01-012023-12-310000702165nsc:CoalMember2023-01-012023-12-310000702165nsc:MetalsAndConstructionMember2023-01-012023-12-310000702165nsc:AutomotiveMember2023-01-012023-12-31nsc:depreciable_asset_class0000702165us-gaap:EquipmentMember2023-01-012023-12-310000702165nsc:RoadwayMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:AgriculturalForestAndConsumerMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:AgriculturalForestAndConsumerMember2022-01-012022-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:AgriculturalForestAndConsumerMember2021-01-012021-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:ChemicalsMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:ChemicalsMember2022-01-012022-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:ChemicalsMember2021-01-012021-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:MetalsAndConstructionMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:MetalsAndConstructionMember2022-01-012022-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:MetalsAndConstructionMember2021-01-012021-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:AutomotiveMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:AutomotiveMember2022-01-012022-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMembernsc:AutomotiveMember2021-01-012021-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMember2022-01-012022-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupMerchandiseMember2021-01-012021-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupIntermodalMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupIntermodalMember2022-01-012022-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupIntermodalMember2021-01-012021-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupCoalMember2023-01-012023-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupCoalMember2022-01-012022-12-310000702165nsc:RailwayOperatingRevenuesMarketGroupCoalMember2021-01-012021-12-310000702165nsc:AncillaryServicesMember2023-01-012023-12-310000702165nsc:AncillaryServicesMember2022-01-012022-12-310000702165nsc:AncillaryServicesMember2021-01-012021-12-310000702165us-gaap:TradeAccountsReceivableMember2023-12-310000702165us-gaap:TradeAccountsReceivableMember2022-12-310000702165nsc:OtherReceivablesMember2023-12-310000702165nsc:OtherReceivablesMember2022-12-310000702165us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165nsc:ConrailIncMember2023-12-310000702165nsc:ConrailIncMember2022-12-310000702165nsc:TTXCompanyMember2023-12-310000702165nsc:TTXCompanyMember2022-12-310000702165us-gaap:OtherLongTermInvestmentsMember2023-12-310000702165us-gaap:OtherLongTermInvestmentsMember2022-12-310000702165nsc:ConrailEconomicMember2022-12-310000702165nsc:ConrailEconomicMember2023-12-310000702165nsc:ConrailVotingMember2022-12-310000702165nsc:ConrailVotingMember2023-12-310000702165nsc:ConrailIncMember2023-12-310000702165nsc:ConrailIncMember2023-01-012023-12-310000702165nsc:ConrailIncMember2022-01-012022-12-310000702165nsc:ConrailIncMember2021-01-012021-12-310000702165nsc:ConrailIncMember2022-12-31nsc:railroad0000702165nsc:TTXCompanyMember2023-12-310000702165nsc:TTXCompanyMember2023-01-012023-12-310000702165nsc:TTXCompanyMember2022-01-012022-12-310000702165nsc:TTXCompanyMember2021-01-012021-12-310000702165us-gaap:LandMember2023-12-310000702165us-gaap:LandMember2023-01-012023-12-310000702165us-gaap:RailroadTransportationEquipmentMember2023-12-310000702165us-gaap:RailroadTransportationEquipmentMember2023-01-012023-12-310000702165nsc:TiesMember2023-12-310000702165nsc:TiesMember2023-01-012023-12-310000702165nsc:BallastMember2023-12-310000702165nsc:BallastMember2023-01-012023-12-310000702165nsc:ConstructionInProcessRoadwayMember2023-12-310000702165nsc:ConstructionInProcessRoadwayMember2023-01-012023-12-310000702165nsc:OtherRoadwayMember2023-12-310000702165nsc:OtherRoadwayMember2023-01-012023-12-310000702165nsc:TotalRoadwayMember2023-12-310000702165nsc:LocomotivesMember2023-12-310000702165nsc:LocomotivesMember2023-01-012023-12-310000702165nsc:FreightCarsMember2023-12-310000702165nsc:FreightCarsMember2023-01-012023-12-310000702165us-gaap:TechnologyEquipmentMember2023-12-310000702165us-gaap:TechnologyEquipmentMember2023-01-012023-12-310000702165nsc:ConstructionInProcessEquipmentMember2023-12-310000702165nsc:ConstructionInProcessEquipmentMember2023-01-012023-12-310000702165us-gaap:OtherMachineryAndEquipmentMember2023-12-310000702165us-gaap:OtherMachineryAndEquipmentMember2023-01-012023-12-310000702165us-gaap:EquipmentMember2023-12-310000702165srt:OtherPropertyMember2023-12-310000702165srt:OtherPropertyMember2023-01-012023-12-310000702165us-gaap:LandMember2022-12-310000702165us-gaap:LandMember2022-01-012022-12-310000702165us-gaap:RailroadTransportationEquipmentMember2022-12-310000702165us-gaap:RailroadTransportationEquipmentMember2022-01-012022-12-310000702165nsc:TiesMember2022-12-310000702165nsc:TiesMember2022-01-012022-12-310000702165nsc:BallastMember2022-12-310000702165nsc:BallastMember2022-01-012022-12-310000702165nsc:ConstructionInProcessRoadwayMember2022-12-310000702165nsc:ConstructionInProcessRoadwayMember2022-01-012022-12-310000702165nsc:OtherRoadwayMember2022-12-310000702165nsc:OtherRoadwayMember2022-01-012022-12-310000702165nsc:TotalRoadwayMember2022-12-310000702165nsc:LocomotivesMember2022-12-310000702165nsc:LocomotivesMember2022-01-012022-12-310000702165nsc:FreightCarsMember2022-12-310000702165nsc:FreightCarsMember2022-01-012022-12-310000702165us-gaap:TechnologyEquipmentMember2022-12-310000702165us-gaap:TechnologyEquipmentMember2022-01-012022-12-310000702165nsc:ConstructionInProcessEquipmentMember2022-12-310000702165nsc:ConstructionInProcessEquipmentMember2022-01-012022-12-310000702165us-gaap:OtherMachineryAndEquipmentMember2022-12-310000702165us-gaap:OtherMachineryAndEquipmentMember2022-01-012022-12-310000702165us-gaap:EquipmentMember2022-12-310000702165srt:OtherPropertyMember2022-12-310000702165srt:OtherPropertyMember2022-01-012022-12-310000702165nsc:A420MaturingTo2028Member2023-12-310000702165nsc:A420MaturingTo2028Member2022-12-310000702165nsc:A430Maturing2029To2033Member2023-12-310000702165nsc:A430Maturing2029To2033Member2022-12-310000702165nsc:A432Maturing2034To2064Member2023-12-310000702165nsc:A432Maturing2034To2064Member2022-12-310000702165nsc:A522Maturing2097To2121Member2023-12-310000702165nsc:A522Maturing2097To2121Member2022-12-310000702165nsc:A555SeniorNotesDue2034Memberus-gaap:SeniorNotesMember2023-11-300000702165nsc:A595SeniorNotesDue2064Memberus-gaap:SeniorNotesMember2023-11-300000702165nsc:A505SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2023-08-310000702165us-gaap:SeniorNotesMembernsc:A535SeniorNotesDue2054Member2023-08-310000702165us-gaap:SeniorNotesMembernsc:A445SeniorNotesDue2033Member2023-02-280000702165nsc:SecuritizationBorrowingsMember2023-05-310000702165nsc:SecuritizationBorrowingsMember2022-12-310000702165nsc:SecuritizationBorrowingsMember2023-12-310000702165nsc:A800MillionCreditAgreementExpiringInMarch2025Member2023-12-310000702165nsc:A800MillionCreditAgreementExpiringInMarch2025Member2022-12-310000702165us-gaap:SubsequentEventMembernsc:A800MillionCreditAgreementExpiringInJanuary2029Member2024-01-310000702165us-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMembernsc:DelayedDrawTermLoanFacilityMember2024-01-012024-01-310000702165us-gaap:UnsecuredDebtMemberus-gaap:SubsequentEventMembernsc:DelayedDrawTermLoanFacilityMember2024-01-310000702165srt:MinimumMemberus-gaap:EquipmentMember2023-12-310000702165srt:MaximumMemberus-gaap:EquipmentMember2023-12-310000702165srt:MinimumMembernsc:RoadwayAndPropertyMember2023-12-310000702165srt:MaximumMembernsc:RoadwayAndPropertyMember2023-12-310000702165us-gaap:BuildingMember2023-12-310000702165nsc:November2022RailwayPurchaseMember2022-11-012022-11-300000702165nsc:November2022RailwayPurchaseMember2023-06-012023-06-300000702165us-gaap:PensionPlansDefinedBenefitMember2023-12-310000702165us-gaap:PensionPlansDefinedBenefitMember2022-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000702165us-gaap:PensionPlansDefinedBenefitMember2021-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310000702165us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000702165us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000702165us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310000702165us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000702165us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000702165us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310000702165us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000702165us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000702165us-gaap:FundedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FundedPlanMember2023-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FundedPlanMember2022-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:FundedPlanMember2021-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2023-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2022-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2021-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2023-01-012023-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2022-01-012022-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2021-01-012021-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2023-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2022-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2021-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2023-01-012023-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2022-01-012022-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:UnfundedPlanMember2021-01-012021-12-31nsc:investment_firm0000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2022-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000702165us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMember2023-12-310000702165us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMember2022-12-310000702165srt:MinimumMember2023-12-310000702165srt:MaximumMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2023-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2023-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000702165us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembernsc:CommingledFundsMember2023-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembernsc:CommingledFundsMember2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMembernsc:CommingledFundsMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310000702165us-gaap:FairValueMeasurementsRecurringMember2023-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2022-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMember2022-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:DefinedBenefitPlanDebtSecurityMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2022-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2022-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2022-12-310000702165us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:AssetBackedSecuritiesMember2022-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembernsc:CommingledFundsMember2022-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembernsc:CommingledFundsMember2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMembernsc:CommingledFundsMember2022-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310000702165us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310000702165us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310000702165us-gaap:FairValueMeasurementsRecurringMember2022-12-310000702165us-gaap:FairValueInputsLevel2Member2023-12-310000702165us-gaap:FairValueInputsLevel2Member2022-12-310000702165nsc:ThoroughbredStockOptionPlanTSOPMember2023-12-310000702165us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000702165us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000702165us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000702165us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000702165us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000702165us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000702165us-gaap:PerformanceSharesMember2023-01-012023-12-310000702165us-gaap:PerformanceSharesMember2022-01-012022-12-310000702165us-gaap:PerformanceSharesMember2021-01-012021-12-310000702165us-gaap:EmployeeStockOptionMembersrt:MinimumMember2023-01-012023-12-310000702165us-gaap:EmployeeStockOptionMembersrt:MaximumMember2023-01-012023-12-310000702165us-gaap:EmployeeStockOptionMembernsc:LTIPMember2023-01-012023-12-310000702165us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembernsc:LTIPMember2023-01-012023-12-310000702165us-gaap:EmployeeStockOptionMembernsc:LTIPMember2022-01-012022-12-310000702165us-gaap:EmployeeStockOptionMembernsc:LTIPMember2021-01-012021-12-310000702165us-gaap:EmployeeStockOptionMember2023-12-310000702165us-gaap:RestrictedStockUnitsRSUMember2022-12-310000702165us-gaap:RestrictedStockUnitsRSUMember2023-12-310000702165us-gaap:PerformanceSharesMember2022-12-310000702165us-gaap:PerformanceSharesMember2023-12-310000702165nsc:LTIPMember2023-12-310000702165nsc:LTIPMember2022-12-310000702165nsc:LTIPMember2021-12-310000702165nsc:ThoroughbredStockOptionPlanTSOPMember2022-12-310000702165nsc:ThoroughbredStockOptionPlanTSOPMember2021-12-310000702165nsc:LTIPMember2023-01-012023-12-310000702165nsc:LTIPMember2022-01-012022-12-310000702165nsc:LTIPMember2021-01-012021-12-310000702165nsc:ThoroughbredStockOptionPlanTSOPMember2023-01-012023-12-310000702165nsc:ThoroughbredStockOptionPlanTSOPMember2022-01-012022-12-310000702165nsc:ThoroughbredStockOptionPlanTSOPMember2021-01-012021-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000702165nsc:AccumulatedOtherComprehensiveIncomeEquityInvesteesMember2022-12-310000702165nsc:AccumulatedOtherComprehensiveIncomeEquityInvesteesMember2023-01-012023-12-310000702165nsc:AccumulatedOtherComprehensiveIncomeEquityInvesteesMember2023-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000702165nsc:AccumulatedOtherComprehensiveIncomeEquityInvesteesMember2021-12-310000702165nsc:AccumulatedOtherComprehensiveIncomeEquityInvesteesMember2022-01-012022-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-012022-12-310000702165us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-01-012021-12-310000702165nsc:AccumulatedOtherComprehensiveIncomeEquityInvesteesMember2021-01-012021-12-3100007021652022-03-290000702165nsc:EasternOhioIncidentMember2023-02-03nsc:railcar0000702165nsc:EasternOhioIncidentMember2023-01-012023-12-310000702165nsc:EasternOhioIncidentMember2023-12-310000702165nsc:EasternOhioIncidentMember2023-01-012023-12-310000702165nsc:EasternOhioIncidentMember2023-08-22nsc:school_District0000702165nsc:EasternOhioIncidentMember2023-08-222023-08-220000702165nsc:OtherEnvironmentalClaimsMember2023-12-310000702165nsc:OtherEnvironmentalClaimsMember2022-12-31nsc:location0000702165nsc:OtherEnvironmentalClaimsMember2023-01-012023-12-3100007021652023-10-012023-12-310000702165nsc:AccountsPayableCasualtyAndOtherClaimsCurrentMember2022-12-310000702165nsc:AccountsPayableCasualtyAndOtherClaimsCurrentMember2023-01-012023-12-310000702165nsc:AccountsPayableCasualtyAndOtherClaimsCurrentMember2023-12-310000702165nsc:OtherLiabilitiesCasualtyAndOtherClaimsMember2022-12-310000702165nsc:OtherLiabilitiesCasualtyAndOtherClaimsMember2023-01-012023-12-310000702165nsc:OtherLiabilitiesCasualtyAndOtherClaimsMember2023-12-310000702165nsc:AccountsPayableCasualtyAndOtherClaimsCurrentMember2021-12-310000702165nsc:AccountsPayableCasualtyAndOtherClaimsCurrentMember2022-01-012022-12-310000702165nsc:OtherLiabilitiesCasualtyAndOtherClaimsMember2021-12-310000702165nsc:OtherLiabilitiesCasualtyAndOtherClaimsMember2022-01-012022-12-310000702165nsc:AccountsPayableCasualtyAndOtherClaimsCurrentMember2020-12-310000702165nsc:AccountsPayableCasualtyAndOtherClaimsCurrentMember2021-01-012021-12-310000702165nsc:OtherLiabilitiesCasualtyAndOtherClaimsMember2020-12-310000702165nsc:OtherLiabilitiesCasualtyAndOtherClaimsMember2021-01-012021-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

for the transition period from ___________ to___________

Commission File Number 1-8339

NORFOLK SOUTHERN CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Virginia |

52-1188014 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S Employer Identification No.) |

| 650 West Peachtree Street NW |

30308-1925 |

| Atlanta, |

Georgia |

| (Address of principal executive offices) |

(Zip Code) |

| (855) |

667-3655 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Norfolk Southern Corporation Common Stock (Par Value $1.00) |

NSC |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting common equity held by non-affiliates at June 30, 2023 was $51,455,298,277 (based on the closing price as quoted on the New York Stock Exchange on June 30, 2023).

The number of shares outstanding of each of the registrant’s classes of common stock, at January 31, 2024: 225,881,508 (excluding 20,320,777 shares held by the registrant’s consolidated subsidiaries).

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Registrant’s definitive proxy statement to be filed electronically pursuant to Regulation 14A not later than 120 days after the end of the fiscal year, are incorporated herein by reference in Part III.

TABLE OF CONTENTS

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

PART I

NORFOLK SOUTHERN CORPORATION AND SUBSIDIARIES

Item 1. Business and Item 2. Properties

GENERAL – Norfolk Southern Corporation (Norfolk Southern) is an Atlanta, Georgia-based company that owns a major freight railroad, Norfolk Southern Railway Company (NSR). We were incorporated on July 23, 1980, under the laws of the Commonwealth of Virginia. Our common stock (Common Stock) is listed on the New York Stock Exchange (NYSE) under the symbol “NSC.”

Unless indicated otherwise, Norfolk Southern Corporation and its subsidiaries, including NSR, are referred to collectively as NS, we, us, and our.

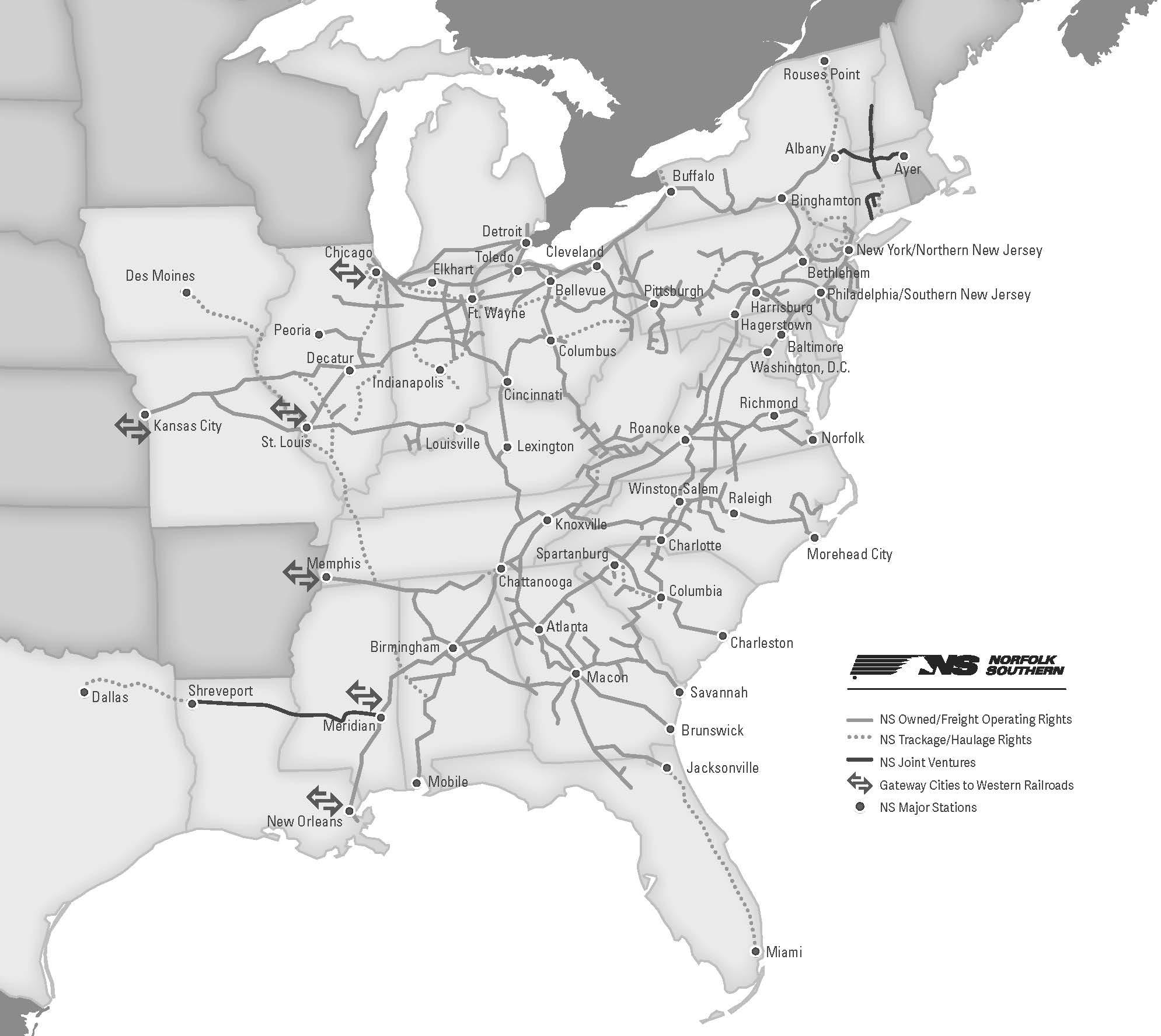

We are primarily engaged in the rail transportation of raw materials, intermediate products, and finished goods primarily in the Southeast, East, and Midwest and, via interchange with rail carriers, to and from the rest of the United States (U.S.). We also transport overseas freight through several Atlantic and Gulf Coast ports. We offer the most extensive intermodal network in the eastern half of the U.S.

We make available free of charge through our website, www.norfolksouthern.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the U.S. Securities and Exchange Commission (SEC). In addition, the following documents are available on our website and in print to any shareholder who requests them:

•Norfolk Southern Corporation Bylaws

•Charters of the Committees of the Board of Directors

•Corporate Governance Guidelines

•Categorical Independence Standards

•The Thoroughbred Code of Ethics

•Code of Ethical Conduct for Senior Financial Officers

RAILROAD OPERATIONS – At December 31, 2023, we operated approximately 19,100 route miles in 22 states and the District of Columbia.

Our system reaches many manufacturing plants, electric generating facilities, mines, distribution centers, transload facilities, and other businesses located in our service area.

Corridors with heaviest freight volume:

•New York City area to Chicago (via Allentown and Pittsburgh)

•Chicago to Macon (via Cincinnati, Chattanooga, and Atlanta)

•Central Ohio to Norfolk (via Columbus and Roanoke)

•Cleveland to Kansas City

•Birmingham to Meridian

•Memphis to Chattanooga

The miles operated, which include major leased lines between Cincinnati and Chattanooga, and an exclusive operating agreement for trackage rights over property owned by North Carolina Railroad Company, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Mileage Operated at December 31, 2023 |

|

Route Miles |

|

Second

and

Other

Main

Track |

|

Passing

Track,

Crossovers

and

Turnouts |

|

Way and

Yard

Switching

|

|

Total |

|

|

|

|

|

|

|

|

|

|

| Owned |

14,312 |

|

|

2,676 |

|

|

1,953 |

|

|

8,142 |

|

|

27,083 |

|

| Operated under lease, contract or trackage |

|

|

|

|

|

|

|

|

|

| rights |

4,825 |

|

|

1,889 |

|

|

406 |

|

|

841 |

|

|

7,961 |

|

|

|

|

|

|

|

|

|

|

|

| Total |

19,137 |

|

|

4,565 |

|

|

2,359 |

|

|

8,983 |

|

|

35,044 |

|

In 2022, we entered into an asset purchase and sale agreement with the Board of Trustees of the Cincinnati Southern Railway (CSR) to purchase 337 miles of railway line that extends from Cincinnati, Ohio to Chattanooga, Tennessee that we currently operate under a lease. The transaction is scheduled to close on March 15, 2024. See further discussion in Item 7 “Management's Discussion and Analysis of Financial Condition and Results of Operations” and Item 8 “Notes to Consolidated Financial Statements.”

We operate freight service over lines with significant ongoing Amtrak and commuter passenger operations and conduct freight operations over trackage owned or leased by Amtrak, New Jersey Transit, Southeastern Pennsylvania Transportation Authority, Metro-North Commuter Railroad Company, and Michigan Department of Transportation.

The following table sets forth certain statistics relating to our operations for the past five years:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Years ended December 31, |

|

| |

2023 |

|

2022 |

|

2021 |

|

2020 |

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue ton miles (billions) |

176 |

|

|

179 |

|

|

178 |

|

|

164 |

|

|

194 |

|

|

| Revenue per thousand revenue ton miles |

$ |

69.05 |

|

|

$ |

71.35 |

|

|

$ |

62.56 |

|

|

$ |

59.67 |

|

|

$ |

58.21 |

|

|

| Revenue ton miles (thousands) per railroad employee |

8,719 |

|

|

9,513 |

|

|

9,694 |

|

|

8,191 |

|

|

7,939 |

|

|

| Ratio of railway operating expenses to railway |

|

|

|

|

|

|

|

|

|

|

| operating revenues (railway operating ratio) |

76.5% |

|

62.3% |

|

60.1% |

|

69.3% |

|

64.7% |

|

RAILWAY OPERATING REVENUES – Total railway operating revenues were $12.2 billion in 2023. Following is an overview of our three commodity groups. See the discussion of merchandise revenues by major commodity group, intermodal revenues, and coal revenues and tonnage in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

MERCHANDISE – Our merchandise commodity group is composed of four groupings:

•Agriculture, forest and consumer products includes soybeans, wheat, corn, fertilizer, livestock and poultry feed, food products, food oils, flour, sweeteners, ethanol, lumber and wood products, pulp board and paper products, wood fibers, wood pulp, beverages, and canned goods.

•Chemicals includes sulfur and related chemicals, petroleum products (including crude oil), chlorine and bleaching compounds, plastics, rubber, industrial chemicals, chemical wastes, sand, and natural gas liquids.

•Metals and construction includes steel, aluminum products, machinery, scrap metals, cement, aggregates, minerals, clay, transportation equipment, and items for the U.S. military.

•Automotive includes finished motor vehicles and automotive parts.

In 2023, we handled 2.2 million merchandise carloads, which accounted for 61% of our total railway operating revenues.

INTERMODAL – Our intermodal commodity group consists of shipments moving in domestic and international containers and trailers. These shipments are handled on behalf of intermodal marketing companies, international steamship lines, premium customers and asset-owning companies. In 2023, we handled 3.8 million intermodal units, which accounted for 25% of our total railway operating revenues.

COAL – Coal revenues accounted for 14% of our total railway operating revenues in 2023. We handled 76 million tons, or 0.7 million carloads, most of which originated on our lines from major eastern coal basins, with the balance from major western coal basins received via the Memphis and Chicago gateways. Our coal franchise supports the electric generation market, directly serving approximately 30 coal-fired power plants, as well as the export, domestic metallurgical and industrial markets, primarily through direct rail and river, lake, and coastal facilities, including various terminals on the Ohio River, at Lamberts Point in Norfolk, Virginia, at the Port of Baltimore, and on Lake Erie.

FREIGHT RATES – Our predominant pricing mechanisms, private contracts and exempt price quotes, are not subject to regulation. In general, market forces are the primary determinant of rail service prices.

RAILWAY PROPERTY

Our railroad infrastructure makes us capital intensive with net properties of approximately $33 billion on a historical cost basis.

Property Additions – Property additions for the past five years were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2023 |

|

2022 |

|

2021 |

|

2020 |

|

2019 |

| |

($ in millions) |

|

|

|

|

|

|

|

|

|

|

| Road and other property |

$ |

1,547 |

|

|

$ |

1,345 |

|

|

$ |

1,041 |

|

|

$ |

1,046 |

|

|

$ |

1,371 |

|

| Equipment |

802 |

|

|

603 |

|

|

429 |

|

|

448 |

|

|

648 |

|

|

|

|

|

|

|

|

|

|

|

| Total |

$ |

2,349 |

|

|

$ |

1,948 |

|

|

$ |

1,470 |

|

|

$ |

1,494 |

|

|

$ |

2,019 |

|

Our capital spending and replacement programs are and have been designed to support our ability to provide safe, efficient, and reliable rail transportation services.

Equipment – Our equipment includes owned and leased locomotives and railcars; maintenance of way equipment and machinery; other equipment and tools used in our shops, offices and facilities; and vehicles and other equipment used for maintenance, transportation, and other activities. Our equipment includes both owned equipment acquired by us, and equipment held under lease arrangements. At December 31, 2023, we owned or leased the following revenue generating equipment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owned |

|

Leased |

|

Total |

|

Capacity of

Equipment |

| Locomotives: |

|

|

|

|

|

|

(Horsepower) |

| Multiple purpose |

3,162 |

|

|

30 |

|

|

3,192 |

|

|

12,471,795 |

|

| Auxiliary units |

140 |

|

|

— |

|

|

140 |

|

|

— |

|

| Switching |

4 |

|

|

— |

|

|

4 |

|

|

4,400 |

|

|

|

|

|

|

|

|

|

| Total locomotives |

3,306 |

|

|

30 |

|

|

3,336 |

|

|

12,476,195 |

|

|

|

|

|

|

|

|

|

| Freight cars: |

|

|

|

|

|

|

(Tons) |

| Gondola |

18,011 |

|

|

3,741 |

|

|

21,752 |

|

|

2,443,624 |

|

| Hopper |

7,672 |

|

|

— |

|

|

7,672 |

|

|

876,433 |

|

| Covered hopper |

5,384 |

|

|

— |

|

|

5,384 |

|

|

598,451 |

|

| Box |

2,189 |

|

|

610 |

|

|

2,799 |

|

|

257,694 |

|

| Flat |

1,213 |

|

|

676 |

|

|

1,889 |

|

|

135,106 |

|

| Other |

1,086 |

|

|

— |

|

|

1,086 |

|

|

46,815 |

|

|

|

|

|

|

|

|

|

| Total freight cars |

35,555 |

|

|

5,027 |

|

|

40,582 |

|

|

4,358,123 |

|

|

|

|

|

|

|

|

|

| Intermodal equipment: |

|

|

|

|

|

|

|

| Chassis |

38,397 |

|

|

1,063 |

|

|

39,460 |

|

|

|

| Containers |

17,662 |

|

|

— |

|

|

17,662 |

|

|

|

| Roadrailers |

1,110 |

|

|

— |

|

|

1,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total intermodal equipment |

57,169 |

|

|

1,063 |

|

|

58,232 |

|

|

|

The following table indicates the number and year built for locomotives and freight cars owned at December 31, 2023:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

2021 |

|

2020 |

|

2019 |

|

2014-

2018 |

|

2009-

2013 |

|

2008 &

Before |

|

Total |

| Locomotives: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| No. of units |

— |

|

— |

|

1 |

|

10 |

|

36 |

|

225 |

|

242 |

|

2,792 |

|

3,306 |

| % of fleet |

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

1 |

% |

|

7 |

% |

|

7 |

% |

|

85 |

% |

|

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Freight cars: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| No. of units |

1,043 |

|

236 |

|

— |

|

— |

|

198 |

|

4,195 |

|

6,401 |

|

23,482 |

|

35,555 |

| % of fleet |

3 |

% |

|

1 |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

12 |

% |

|

18 |

% |

|

66 |

% |

|

100 |

% |

The following table shows the average age of our owned locomotive and freight car fleets at December 31, 2023 and information regarding 2023 retirements:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Locomotives |

|

Freight Cars |

| Average age – in service |

28.5 |

years |

|

25.4 |

years |

| Retirements |

2 |

units |

|

1,744 |

|

units |

| Average age – retired |

23.0 |

years |

|

40.8 |

years |

Track Maintenance – Of the 35,000 total miles of track on which we operate, we are responsible for maintaining 28,400 miles, with the remainder being operated under trackage rights from other parties responsible for maintenance.

Over 85% of the main line trackage (including first, second, third, and branch main tracks, all excluding rail operated pursuant to trackage rights) has rail ranging from 131 to 155 pounds per yard with the standard installation currently at 136 pounds per yard. Approximately 39% of our lines, excluding rail operated pursuant to trackage rights, carried 20 million or more gross tons per track mile during 2023.

The following table summarizes several measurements regarding our track roadway additions and replacements during the past five years:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2023 |

|

2022 |

|

2021 |

|

2020 |

|

2019 |

| Track miles of rail installed |

584 |

|

|

541 |

|

|

458 |

|

|

418 |

|

|

449 |

|

| Miles of track surfaced |

4,013 |

|

|

4,155 |

|

|

4,225 |

|

|

4,785 |

|

|

5,012 |

|

| Crossties installed (millions) |

2.1 |

|

|

2.2 |

|

|

2.0 |

|

|

1.8 |

|

|

2.4 |

|

Traffic Control – Of the 16,200 route miles we dispatch, 11,300 miles incorporate signalization. This includes 8,500 miles governed by centralized traffic control (CTC) and 2,800 miles utilizing automatic block signals. Within the 8,500 miles of CTC, 7,600 miles are controlled by data radio systems originating from 355 base station radio sites.

ENVIRONMENTAL MATTERS – Compliance with federal, state, and local laws and regulations relating to the protection of the environment is one of our principal goals. With the exception of our response to the Eastern Ohio Incident (the “Incident” as defined in Note 17) such compliance has not had a material effect on our financial position, results of operations, liquidity, or competitive position. For further information on the Incident and environmental matters, see Note 17 in Item 8 “Notes to Consolidated Financial Statements.”

HUMAN CAPITAL MANAGEMENT

Workforce – We employed an average of 20,300 employees during 2023, and 20,700 employees at the end of 2023. Approximately 80% of our railroad employees are covered by collective bargaining agreements with various labor unions, and referred to as “craft” employees. See the discussion of “Labor Agreements” in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The remainder of our workforce is composed of management employees.

Craft Workforce Levels and Productivity – Maintaining appropriate headcount levels for our craft-employee workforce is critical to our on-time and consistent delivery of customers’ goods and operational efficiency goals. We manage this human capital metric through forecasting tools designed to ensure the optimal level of staffing to meet business demands. We measure and monitor employee productivity based on various factors, including gross ton miles per train and engine employee.

Safety – We are dedicated to providing employees with a safe workplace and the knowledge and tools they need to work safely and return home safely every day. Our commitment to an injury-free workplace is outlined in our Foundation of Safety policy which focuses on rules compliance, responsibility, relationships, and responsiveness.

Our safety programs, practices, and messaging further reinforce the importance of working safely. We measure employee safety performance through internal metrics such as accidents, injuries, and serious injuries per 200,000 employee-hours. We also use metrics established by the Federal Railroad Administration (FRA) to measure FRA-reportable accidents per million train miles and injuries per 200,000 employee-hours. Given that safety continues to be a top priority, and the importance of safety among our workforce and to our business, our Board of Directors (Board) has a standing Safety Committee that, among other duties, reviews, monitors, and evaluates our compliance with our safety programs and practices.

Attracting and Retaining Management Employees – Our talent strategy for management employees is essential to attracting strong candidates in a competitive talent environment. We evaluate the effectiveness of that strategy by studying market trends, benchmarking the attractiveness of our employee value proposition, maintaining a competitive compensation package, and analyzing retention data.

We also focus on driving employee engagement, which is key to increasing employee productivity, retention, and safety. We take a data-centric approach, including the use of periodic surveys among employees, to identify new initiatives that will help boost engagement and drive business results.

Employee Development and Training – We provide a range of developmental programs, opportunities, skills, and resources for our employees to be successful in their careers. We provide classroom instruction, hands-on training and simulation-based training designed to improve on-the-job effectiveness and safety outcomes.

We also use modern learning and performance technologies to offer robust professional growth opportunities. Through on-demand digital course offerings, custom-built learning paths, and in-person facilitated content, our programs provide a holistic and inclusive approach to professional development throughout an employee's career.

Diversity, Equity, and Inclusion – As a leading transportation service company, we recognize that success in the global marketplace relies on the recruitment and retention of top-tier talent, as well as leveraging the expertise and experiences of individuals from all backgrounds.

In pursuit of this goal, we are dedicated to establishing a workplace that is diverse, equitable, and inclusive, where a broad spectrum of identities, perspectives, and experiences is not only represented but also valued and empowered to thrive.

Our Inclusion Leadership Council, comprised of senior leaders from all departments, our seven employee resource groups, and the Diversity, Equity, and Inclusion strategy team, collaborate closely to implement the plan, articulate measurable goals, and hold ourselves accountable.

GOVERNMENT REGULATION – In addition to environmental, safety, securities, and other regulations generally applicable to all business, our railroads are subject to regulation by the U.S. Surface Transportation Board (STB). The STB has jurisdiction to varying extents over rates, routes, customer access provisions, fuel surcharges, conditions of service, and the extension or abandonment of rail lines. The STB has jurisdiction to determine whether we are “revenue adequate” on an annual basis based on the results of the prior year. A railroad is “revenue adequate” on an annual basis under the applicable law when its return on net investment exceeds the rail industry’s composite cost of capital. This determination is made pursuant to a statutory requirement. The STB also has jurisdiction over the consolidation, merger, or acquisition of control of and by rail common carriers.

The relaxation of economic regulation of railroads, following the Staggers Rail Act of 1980, included exemption from STB regulation of the rates and most service terms for intermodal business (trailer-on-flat-car, container-on-flat-car), rail boxcar shipments, lumber, manufactured steel, automobiles, and certain bulk commodities such as sand, gravel, pulpwood, and wood chips for paper manufacturing. Further, all shipments that we have under contract are effectively removed from commercial regulation for the duration of the contract. Approximately 90% of our revenues comes from either exempt shipments or shipments moving under transportation contracts; the remainder comes from shipments moving under public tariff rates.

Efforts have been made over the past several years to increase federal economic regulation of the rail industry, and such efforts are expected to continue in 2024. The Staggers Rail Act of 1980 substantially balanced the interests of shippers and rail carriers, and encouraged and enabled rail carriers to innovate, invest in their infrastructure, and compete for business, thereby contributing to the economic health of the nation and to the revitalization of the industry. Accordingly, we will continue to oppose efforts to reimpose increased economic regulation.

Railroads are also subject to the enactment of laws by Congress and regulation by the U.S. Department of Transportation (DOT) (including the FRA) and the U.S. Department of Homeland Security (DHS) (including the Transportation Security Administration (TSA)), which regulate most aspects of our operations related to safety, security and cybersecurity.

Government regulations are further discussed within Item 1A “Risk Factors” and the safety and security of our railroads are discussed within the “Security of Operations” section contained herein.

COMPETITION – There is continuing strong competition among rail, water, and highway carriers. Price is usually only one factor of importance as shippers and receivers choose a transport mode and specific hauling company. Inventory carrying costs, service reliability, ease of handling, and the desire to avoid loss and damage during transit are also important considerations, especially for higher-valued finished goods, machinery, and consumer products. Even for raw materials, semi-finished goods, and work-in-progress, users are increasingly sensitive to transport arrangements that minimize problems at successive production stages.

Our primary rail competitor is CSX Corporation (CSX); both we and CSX operate throughout much of the same territory. Other railroads also operate in parts of the territory. We also compete with motor carriers, water carriers, and with shippers who have the additional options of handling their own goods in private carriage, sourcing products from different geographic areas, and using substitute products.

Certain marketing strategies to expand reach and shipping options among railroads and between railroads and motor carriers enable railroads to compete more effectively in specific markets.

SECURITY OF OPERATIONS – We continue to enhance the security of our rail system. Our comprehensive security plan is modeled on and was developed in conjunction with the security plan prepared by the Association of American Railroads (AAR) post September 11, 2001. The AAR Security Plan defines four Alert Levels and details the actions and countermeasures that are being applied across the railroad industry as the risk of terrorist, extremist or seriously disruptive cyber-attack increases or decreases. The Alert Level actions include countermeasures that will be applied in three general areas: (1) operations (including transportation, engineering, and mechanical); (2) information technology and communications; and, (3) railroad police. All of our Operations Division employees are advised by their supervisors or train dispatchers, as appropriate, of any change in Alert Level and any additional responsibilities they may incur due to such change.

Our security plan also complies with DOT security regulations pertaining to training and security plans with respect to the transportation of hazardous materials. As part of the plan, security awareness training is given to all railroad employees who directly affect hazardous material transportation safety, and is integrated into hazardous material training programs. Additionally, location-specific security plans are in place for rail corridors in certain metropolitan areas referred to as High Threat Urban Areas (HTUA). Particular attention is aimed at reducing risk in a HTUA by: (1) the establishment of secure storage areas for rail cars carrying toxic-by-inhalation (TIH) materials; (2) the expedited movement of trains transporting rail cars carrying TIH materials; (3) reducing the number of unattended loaded tank cars carrying TIH materials; and (4) cooperation with federal, state, local, and tribal governments to identify those locations where security risks are the highest.

We also operate four facilities that are under U.S. Coast Guard (USCG) Maritime Security Regulations. With respect to these facilities, each facility’s security plan has been approved by the applicable Captain of the Port and remains subject to inspection by the USCG.

Additionally, we continue to engage in close and regular coordination with numerous federal and state agencies, including the DHS, the TSA, the Federal Bureau of Investigation, the FRA, the USCG, U.S. Customs and Border Protection, the Department of Defense, and various state Homeland Security offices.

In 2023, through the Norfolk Southern Operation Awareness and Response Program as well as participation in the Transportation Community Awareness and Emergency Response Program, we provided rail accident response training to more than 5,000 emergency responders, such as local police and fire personnel, utilizing a combination of online training and face-to-face training sessions as well as the Norfolk Southern Safety Train. We also have ongoing programs to sponsor local emergency responders at the Security and Emergency Response Training Center.

We also continually evaluate ourselves for appropriate business continuity and disaster recovery planning, with test scenarios that include cybersecurity attacks. Our risk-based information security program helps ensure our defenses and resources are aligned to address the most likely and most damaging potential attacks, to provide support for our organizational mission and operational objectives, and to keep us in the best position to detect, mitigate, and recover from a wide variety of potential attacks in a timely fashion.

Item 1A. Risk Factors

The risks set forth in the following risk factors could have a material adverse effect on our financial position, results of operations, or liquidity in a particular year or quarter, and could cause those results to differ materially from those expressed or implied in our forward-looking statements. The information set forth in this Item 1A “Risk Factors” should be read in conjunction with the rest of the information included in this annual report, including

Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Item 8 “Financial Statements and Supplementary Data.” We have experienced a number of the risks described below over the past year in connection with the Incident and the Incident Proceedings (defined below). The risks described below should be read in conjunction with the information regarding the Incident and Incident Proceedings provided in Note 17 in Item 8 “Notes to Consolidated Financial Statements.”

INCIDENT RISKS

As defined and as further described in Note 17 in Item 8 “Notes to Consolidated Financial Statements”, there was an Incident that occurred in the first quarter that consisted of a February 3, 2023 train derailment in East Palestine, Ohio that included 11 non-Company-owned tank cars containing hazardous materials, fires associated with the derailment that threatened certain of the tank cars, and a controlled vent and burn procedure conducted on February 6, 2023 on five of the derailed tank cars, all of which contained vinyl chloride. As a result of the Incident, we have become subject to numerous legal, regulatory, legislative and other proceedings related thereto, including but not limited to, the National Transportation Safety Board (NTSB) Investigation, the FRA Incident Investigation, the FRA Safety Assessment, the U.S. Department of Justice (DOJ) Complaint, the Ohio Complaint, the Incident Lawsuits, the Shareholder Matters, and the Incident Inquiries and Investigations, (each as defined in Note 17 in Item 8 “Notes to Consolidated Financial Statements”), in addition to other proceedings, actions, or potential changes in response to the Incident, including but not limited to those related to, among other items, train size, train length, train composition, or crew size (collectively, the “Incident Proceedings”). Set forth below are additional risks pertaining to an investment in the Company that are related to the Incident and the Incident Proceedings.

The costs, liabilities, fines, penalties, and/or financial impact resulting from or related to the Incident or the Incident Proceedings have been significant to date, may exceed expected or accrued amounts, and have and can be expected to continue to negatively affect our financial results. We have incurred and will continue to remain subject to incurring significant costs, liabilities, fines, and penalties related to the Incident and the Incident Proceedings, including amounts that may have a material adverse effect on our financial position, results of operations, or liquidity.

In addition, while we have accrued estimates of probable and reasonably estimable liabilities with respect to the Incident and the Incident Proceedings (several of which are in early stages), we cannot predict the final outcome or estimate the reasonably possible range of loss with certainty and such estimates may change over time due to a variety of factors, including but not limited to those set forth in Note 17 in Item 8 “Notes to Consolidated Financial Statements” or other unfavorable or unexpected developments or outcomes which could result in our current estimates being insufficient. These estimated amounts also do not include any estimate of loss for specific items for which we believe a loss is either not probable or not reasonably estimable for the reasons set forth in Note 17 in Item 8 “Notes to Consolidated Financial Statements.” As a result, our currently accrued amounts of estimated liabilities may be insufficient, and any additional, new or updated accruals could have a material adverse effect on our results of operations or financial position.

New or additional governmental regulation and/or operational changes resulting from or related to the Incident or the Incident Proceedings may negatively impact us, our customers, the rail industry, or the markets we serve. The legislative, regulatory, operational or other actions taken, protocols adopted (including by us), or changes resulting from the Incident or any of the Incident Proceedings may, either individually or in the aggregate, have a material adverse effect on us, our customers, the rail industry, or the markets we serve. We also face risks from requirements that may be imposed by the government in resolution of government actions, including, for example, restrictions on our methods of operations. Our inability to comply with the requirements of any new or additional laws, regulations or operating protocols resulting from or related to the Incident or the Incident Proceedings may have a material adverse effect on our financial position, results of operations, liquidity, or operations.

REGULATORY AND LEGISLATIVE RISKS

Governmental legislation, regulation, and Executive Orders over commercial, operational, tax, safety, security, or cybersecurity matters could negatively affect us, our customers, the rail industry or the markets we serve. Congress can enact laws, agencies can promulgate regulations, and Executive Orders can be issued that increase or alter regulation in a way that negatively affects us, our customers, the rail industry or the markets we serve. Railroads presently are subject to commercial and operational regulation by the STB, which has jurisdiction to varying extents over rates, routes, customer access provisions, fuel surcharges, conditions of service, and the extension or abandonment of rail lines.

The STB also has jurisdiction over the consolidation, merger, or acquisition of control of and by rail common carriers. Additional or updated regulation of the rail industry by Congress or the STB, whether under new, existing or amended laws or regulations, could have a significant negative impact on our ability to negotiate prices for rail services, on our railway operating revenues, and on the efficiency, conduct, or complexity of our operations. Such additional or updated industry regulation, as well as enactment of any new or updated tax laws, could also negatively impact cash flows from our operating activities and, therefore, result in reduced capital spending on our rail network or abandonment of lines.

Railroads are also subject to the enactment of laws by Congress and regulation by the DOT (including the FRA) and the DHS (including the TSA), which regulate many aspects of our operations related to safety, security and cybersecurity. Additional or updated safety, security, or cybersecurity regulation by Congress, the DOT or DHS could have a negative impact on our business and the efficiency, conduct, or complexity of our operations including (but not limited to) increased operating costs, capital expenditures, claims and litigation.

Our inability to comply with the requirements of existing or updated laws, regulations, or Executive Orders that govern our operations or the rail industry, including but not limited to those pertaining to commercial, operational, tax, safety, security, or cybersecurity matters, could have a material adverse effect on our financial position, results of operations or liquidity.

We are addressing multiple governmental actions as a result of the Incident, as noted in “Incident Risks” above.

Federal and state environmental laws and regulations could negatively impact us and our operations. Our operations are subject to extensive federal and state environmental laws and regulations concerning, among other things: emissions to the air; discharges to waterways or groundwater supplies; handling, storage, transportation, and disposal of waste and other materials; and, the cleanup of hazardous material or petroleum releases. The risk of incurring environmental liability, for acts and omissions, past, present, and future, is inherent in the railroad business. This risk includes property owned by us, whether currently or in the past, that is or has been subject to a variety of uses, including our railroad operations and other industrial activity by past owners or our past and present tenants.

Environmental problems that are latent or undisclosed may exist on these properties, and we could incur environmental liabilities or costs, the amount and materiality of which cannot be estimated reliably at this time, with respect to one or more of these properties. Moreover, lawsuits and claims involving other unidentified environmental sites and matters are likely to arise from time to time.

Our inability to comply with the extensive federal and state environmental laws and regulations to which we are subject could result in significant liabilities or otherwise adversely impact our operations.

As noted in “Incident Risks” above, in connection with the Incident, we are experiencing negative impacts related to environmental matters, including extensive cleanup costs and litigation related to alleged environmental impacts of the Incident.

OPERATIONAL RISKS

A significant cybersecurity incident or other disruption to our technology infrastructure could disrupt our business operations. To conduct business, we extensively rely on information and operational technology systems, and improvements in those technologies, in all aspects of our business. The threat landscape is vast and includes hobbyists, cybercriminals, nation-states and state-sponsored activities. Attacks from these entities include, but is not limited to, denial of service, unauthorized access, theft of money, and data and extortion. System upgrades, redundancy and other continuity measures may be ineffective or inadequate, and our business continuity and disaster recovery planning may not be sufficient for all eventualities. Regardless of the cause, significant disruption or failure of one or more of information or operational technology systems operated by us or under control of third parties, including computer hardware, software, cloud services and communications equipment, can result in us experiencing a service interruption, data breach, or other operational difficulties. Such failures or disruptions can adversely impact our business by, among other things, preventing intercompany communications and disrupting operations that may result in direct or indirect monetary losses, damage to equipment or property, or loss of confidence in corporate competency. These events could have a materially adverse effect on our business, reputation, results of operations and financial condition. Although we maintain comprehensive security programs designed to protect our information technology systems, including our risk-based approach to cybersecurity, our reliance on the Framework for Improving Critical Infrastructure Cybersecurity drafted by the U.S Department of Commerce's National Institute of Standards and Technology (NIST CSF) and our layered defense system, we are continually targeted by threat actors attempting to access our networks and we may be unable to detect or prevent a breach of our systems or disruption to our service in the future. While we have previously experienced technology outages and cybersecurity events that have impacted our systems and service, future events may result in more significant impacts to our operations, reputation or financial results. These potentially impactful future events could include service disruptions, unauthorized access to our systems, viruses, ransomware, and/or compromise, acquisition, or destruction of our data. We also could be impacted by cybersecurity events targeting third parties that we rely on for business operations, including third party vendors that have access to our systems or data and third parties who provide services and are in our supply chain. Such a direct or indirect cybersecurity incident could interrupt our service, cause safety failures or operational difficulties, decrease revenues, increase operating costs, impact our efficiency, damage our corporate reputation, and/or expose us to litigation or government action or increased regulation, which could result in penalties, fines or judgments. In addition, our failure to comply with or adhere to privacy-related or data protection laws and regulations could result in government investigations and proceedings against us, or litigation, resulting in adverse reputational impacts, penalties, and legal liability.

Our business may be seriously harmed if we fail to develop, implement, maintain, upgrade, enhance, protect and integrate our information technology systems. If we fail to develop, acquire or implement new technology, or otherwise fail to maintain, protect or integrate our information technology systems, we may suffer a competitive disadvantage within the rail industry and with companies providing alternative modes of transportation service.

As a common carrier by rail, we must offer to transport hazardous materials, which exposes us to significant costs and claims. Transportation of certain hazardous materials or third party-owned equipment (typically used to transport such materials) creates risks of significant losses in terms of personal injury and property (including environmental) damage and compromise critical parts of our rail network. The costs of a catastrophic rail accident involving hazardous materials or third party-owned equipment could exceed our insurance coverage. We have obtained insurance for potential losses for third-party liability and first-party property damages (see Note 17 in Item 8 “Notes to Consolidated Financial Statements”); however, insurance is available from a limited number of insurers and may not continue to be available or, if available, may not be obtainable on terms acceptable to us. Any future legislation preventing the transportation of hazardous materials through specific cities could have negative impacts including increased network congestion and operating costs, reduced operating efficiency, and increased risk of an accident involving hazardous materials.

With regard to the risks arising from the transportation of hazardous materials, the Incident and the Incident Proceedings have given rise to significant costs to us and impacts on our rail network, as noted in “Incident Risks” above. With respect to third party-owned equipment, the primary risk arises from the potential for a latent defect we are unable to identify despite robust safety inspection protocols.