000070134712/312025Q2FALSEhttp://fasb.org/us-gaap/2024#InterestReceivablehttp://fasb.org/us-gaap/2024#InterestReceivablehttp://fasb.org/us-gaap/2024#InterestReceivablehttp://www.cpb.bank/20250630#MortgageBankinghttp://www.cpb.bank/20250630#OtherNoninterestIncomehttp://www.cpb.bank/20250630#MortgageBankinghttp://www.cpb.bank/20250630#OtherNoninterestIncomehttp://www.cpb.bank/20250630#MortgageBankinghttp://www.cpb.bank/20250630#OtherNoninterestIncomehttp://www.cpb.bank/20250630#OtherServiceChargesAndFeeshttp://www.cpb.bank/20250630#MortgageBankinghttp://www.cpb.bank/20250630#OtherNoninterestIncomehttp://www.cpb.bank/20250630#OtherServiceChargesAndFeeshttp://fasb.org/us-gaap/2024#InterestAndDividendIncomeOperatinghttp://fasb.org/us-gaap/2024#InterestAndDividendIncomeOperatinghttp://fasb.org/us-gaap/2024#InterestIncomeExpenseNethttp://fasb.org/us-gaap/2024#InterestIncomeExpenseNethttp://fasb.org/us-gaap/2024#DebtSecuritiesAvailableForSaleExcludingAccruedInterestP2YP3Yhttp://fasb.org/us-gaap/2024#OccupancyNethttp://fasb.org/us-gaap/2024#OccupancyNethttp://fasb.org/us-gaap/2024#OccupancyNethttp://fasb.org/us-gaap/2024#OccupancyNetxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:purecpf:securitycpf:loancpf:propertycpf:period00007013472025-01-012025-06-3000007013472025-07-3100007013472025-06-3000007013472024-12-3100007013472025-04-012025-06-3000007013472024-04-012024-06-3000007013472024-01-012024-06-300000701347cpf:CommonSharesOutstandingMember2024-12-310000701347us-gaap:CommonStockMember2024-12-310000701347us-gaap:AdditionalPaidInCapitalMember2024-12-310000701347us-gaap:RetainedEarningsMember2024-12-310000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000701347us-gaap:RetainedEarningsMember2025-01-012025-03-3100007013472025-01-012025-03-310000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310000701347cpf:CommonSharesOutstandingMember2025-01-012025-03-310000701347us-gaap:CommonStockMember2025-01-012025-03-310000701347us-gaap:AdditionalPaidInCapitalMember2025-01-012025-03-310000701347cpf:CommonSharesOutstandingMember2025-03-310000701347us-gaap:CommonStockMember2025-03-310000701347us-gaap:AdditionalPaidInCapitalMember2025-03-310000701347us-gaap:RetainedEarningsMember2025-03-310000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-3100007013472025-03-310000701347us-gaap:RetainedEarningsMember2025-04-012025-06-300000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-04-012025-06-300000701347cpf:CommonSharesOutstandingMember2025-04-012025-06-300000701347us-gaap:CommonStockMember2025-04-012025-06-300000701347us-gaap:AdditionalPaidInCapitalMember2025-04-012025-06-300000701347cpf:CommonSharesOutstandingMember2025-06-300000701347us-gaap:CommonStockMember2025-06-300000701347us-gaap:AdditionalPaidInCapitalMember2025-06-300000701347us-gaap:RetainedEarningsMember2025-06-300000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-06-300000701347cpf:CommonSharesOutstandingMember2023-12-310000701347us-gaap:CommonStockMember2023-12-310000701347us-gaap:AdditionalPaidInCapitalMember2023-12-310000701347us-gaap:RetainedEarningsMember2023-12-310000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-3100007013472023-12-310000701347us-gaap:RetainedEarningsMember2024-01-012024-03-3100007013472024-01-012024-03-310000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000701347cpf:CommonSharesOutstandingMember2024-01-012024-03-310000701347us-gaap:CommonStockMember2024-01-012024-03-310000701347us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000701347cpf:CommonSharesOutstandingMember2024-03-310000701347us-gaap:CommonStockMember2024-03-310000701347us-gaap:AdditionalPaidInCapitalMember2024-03-310000701347us-gaap:RetainedEarningsMember2024-03-310000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100007013472024-03-310000701347us-gaap:RetainedEarningsMember2024-04-012024-06-300000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000701347cpf:CommonSharesOutstandingMember2024-04-012024-06-300000701347us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-300000701347cpf:CommonSharesOutstandingMember2024-06-300000701347us-gaap:CommonStockMember2024-06-300000701347us-gaap:AdditionalPaidInCapitalMember2024-06-300000701347us-gaap:RetainedEarningsMember2024-06-300000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-3000007013472024-06-300000701347us-gaap:RetainedEarningsMember2025-01-012025-06-300000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-06-300000701347cpf:CommonSharesOutstandingMember2025-01-012025-06-300000701347us-gaap:CommonStockMember2025-01-012025-06-300000701347us-gaap:AdditionalPaidInCapitalMember2025-01-012025-06-300000701347us-gaap:RetainedEarningsMember2024-01-012024-06-300000701347us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300000701347cpf:CommonSharesOutstandingMember2024-01-012024-06-300000701347us-gaap:CommonStockMember2024-01-012024-06-300000701347us-gaap:AdditionalPaidInCapitalMember2024-01-012024-06-300000701347us-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000701347us-gaap:USTreasurySecuritiesMember2025-06-300000701347us-gaap:CollateralizedLoanObligationsMember2025-06-300000701347cpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2025-06-300000701347cpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2025-06-300000701347cpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000701347us-gaap:USTreasurySecuritiesMember2024-12-310000701347us-gaap:CollateralizedLoanObligationsMember2024-12-310000701347cpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2024-12-310000701347cpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2024-12-310000701347cpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:AccumulatedNetInvestmentGainLossAttributableToNoncontrollingInterestMember2025-04-012025-06-300000701347us-gaap:AccumulatedNetInvestmentGainLossAttributableToNoncontrollingInterestMember2025-01-012025-06-300000701347us-gaap:AccumulatedNetInvestmentGainLossAttributableToNoncontrollingInterestMember2024-04-012024-06-300000701347us-gaap:AccumulatedNetInvestmentGainLossAttributableToNoncontrollingInterestMember2024-01-012024-06-300000701347us-gaap:AssetPledgedAsCollateralWithoutRightMemberus-gaap:MortgageBackedSecuritiesMember2025-06-300000701347us-gaap:AssetPledgedAsCollateralWithoutRightMemberus-gaap:MortgageBackedSecuritiesMember2024-12-310000701347us-gaap:ResidentialMortgageBackedSecuritiesMember2025-06-300000701347cpf:MortgagebackedSecuritiesIssuedbyPrivateEnterprisesResidentialMember2025-06-300000701347us-gaap:CommercialMortgageBackedSecuritiesMember2025-06-300000701347us-gaap:ResidentialMortgageBackedSecuritiesMember2024-12-310000701347cpf:MortgagebackedSecuritiesIssuedbyPrivateEnterprisesResidentialMember2024-12-310000701347us-gaap:CommercialMortgageBackedSecuritiesMember2024-12-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2025-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2024-12-310000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2025-06-300000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2024-12-310000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-06-300000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-12-310000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2025-06-300000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2024-12-310000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-06-300000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-12-310000701347us-gaap:ConsumerPortfolioSegmentMember2025-06-300000701347us-gaap:ConsumerPortfolioSegmentMember2024-12-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2025-01-012025-03-310000701347cpf:ConsumerAutomobileLoanMemberus-gaap:ConsumerPortfolioSegmentMember2025-04-012025-06-300000701347cpf:ConsumerAutomobileLoanMemberus-gaap:ConsumerPortfolioSegmentMember2024-04-012024-06-300000701347cpf:ConsumerAutomobileLoanMemberus-gaap:ConsumerPortfolioSegmentMember2025-01-012025-06-300000701347cpf:ConsumerAutomobileLoanMemberus-gaap:ConsumerPortfolioSegmentMember2024-01-012024-06-300000701347cpf:RealEstatePortfolioSegmentMembercpf:ResidentialRealEstateLoanMembercpf:A14FamilyResidentialPropertiesMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMembercpf:A14FamilyResidentialPropertiesMember2025-06-300000701347cpf:A14FamilyResidentialPropertiesMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMembercpf:ResidentialRealEstateLoanMembercpf:A14FamilyResidentialPropertiesMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMembercpf:A14FamilyResidentialPropertiesMember2024-12-310000701347cpf:A14FamilyResidentialPropertiesMember2024-12-310000701347us-gaap:FinancingReceivables30To59DaysPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2025-06-300000701347us-gaap:FinancingReceivables60To89DaysPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2025-06-300000701347us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2025-06-300000701347us-gaap:FinancialAssetNotPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancialAssetNotPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2025-06-300000701347us-gaap:ResidentialMortgageMembercpf:RealEstatePortfolioSegmentMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancialAssetNotPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancialAssetNotPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2025-06-300000701347us-gaap:CommercialRealEstateMembercpf:RealEstatePortfolioSegmentMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancialAssetNotPastDueMember2025-06-300000701347us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2025-06-300000701347us-gaap:FinancingReceivables60To89DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2025-06-300000701347us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2025-06-300000701347us-gaap:FinancialAssetNotPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2025-06-300000701347us-gaap:FinancingReceivables30To59DaysPastDueMember2025-06-300000701347us-gaap:FinancingReceivables60To89DaysPastDueMember2025-06-300000701347us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2025-06-300000701347us-gaap:FinancialAssetNotPastDueMember2025-06-300000701347us-gaap:FinancingReceivables30To59DaysPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2024-12-310000701347us-gaap:FinancingReceivables60To89DaysPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2024-12-310000701347us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2024-12-310000701347us-gaap:FinancialAssetNotPastDueMembercpf:CommercialAndIndustrialPortfolioSegmentMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ConstructionLoansMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310000701347us-gaap:ResidentialMortgageMembercpf:RealEstatePortfolioSegmentMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:ResidentialMortgageMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:HomeEquityLoanMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancingReceivables30To59DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancingReceivables60To89DaysPastDueMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310000701347us-gaap:CommercialRealEstateMembercpf:RealEstatePortfolioSegmentMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:CommercialRealEstateMemberus-gaap:FinancialAssetNotPastDueMember2024-12-310000701347us-gaap:FinancingReceivables30To59DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2024-12-310000701347us-gaap:FinancingReceivables60To89DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2024-12-310000701347us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2024-12-310000701347us-gaap:FinancialAssetNotPastDueMemberus-gaap:ConsumerPortfolioSegmentMember2024-12-310000701347us-gaap:FinancingReceivables30To59DaysPastDueMember2024-12-310000701347us-gaap:FinancingReceivables60To89DaysPastDueMember2024-12-310000701347us-gaap:FinancingReceivablesEqualToGreaterThan90DaysPastDueMember2024-12-310000701347us-gaap:FinancialAssetNotPastDueMember2024-12-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMemberus-gaap:PassMember2025-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMemberus-gaap:SpecialMentionMember2025-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMemberus-gaap:SubstandardMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMemberus-gaap:ConstructionLoansMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMembercpf:ResidentialRealEstateLoanMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SubstandardMembercpf:ResidentialRealEstateLoanMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMemberus-gaap:HomeEquityLoanMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SubstandardMemberus-gaap:HomeEquityLoanMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMembercpf:CommercialRealEstateLoanMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SpecialMentionMembercpf:CommercialRealEstateLoanMember2025-06-300000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SubstandardMembercpf:CommercialRealEstateLoanMember2025-06-300000701347us-gaap:ConsumerPortfolioSegmentMemberus-gaap:PassMember2025-06-300000701347us-gaap:ConsumerPortfolioSegmentMemberus-gaap:SubstandardMember2025-06-300000701347us-gaap:ConsumerPortfolioSegmentMemberus-gaap:UnlikelyToBeCollectedFinancingReceivableMember2025-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2025-01-012025-06-300000701347us-gaap:ConsumerPortfolioSegmentMember2025-01-012025-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMemberus-gaap:PassMember2024-12-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMemberus-gaap:SpecialMentionMember2024-12-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMemberus-gaap:SubstandardMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMemberus-gaap:ConstructionLoansMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMembercpf:ResidentialRealEstateLoanMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SubstandardMembercpf:ResidentialRealEstateLoanMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMemberus-gaap:HomeEquityLoanMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SubstandardMemberus-gaap:HomeEquityLoanMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:PassMembercpf:CommercialRealEstateLoanMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SpecialMentionMembercpf:CommercialRealEstateLoanMember2024-12-310000701347cpf:RealEstatePortfolioSegmentMemberus-gaap:SubstandardMembercpf:CommercialRealEstateLoanMember2024-12-310000701347us-gaap:ConsumerPortfolioSegmentMemberus-gaap:PassMember2024-12-310000701347us-gaap:ConsumerPortfolioSegmentMemberus-gaap:SubstandardMember2024-12-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2024-01-012024-06-300000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-01-012024-06-300000701347us-gaap:ConsumerPortfolioSegmentMember2024-01-012024-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2025-03-310000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2025-03-310000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-03-310000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2025-03-310000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-03-310000701347us-gaap:ConsumerPortfolioSegmentMember2025-03-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2025-04-012025-06-300000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2025-04-012025-06-300000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-04-012025-06-300000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2025-04-012025-06-300000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-04-012025-06-300000701347us-gaap:ConsumerPortfolioSegmentMember2025-04-012025-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2024-03-310000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2024-03-310000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-03-310000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2024-03-310000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-03-310000701347us-gaap:ConsumerPortfolioSegmentMember2024-03-310000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2024-04-012024-06-300000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2024-04-012024-06-300000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-04-012024-06-300000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2024-04-012024-06-300000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-04-012024-06-300000701347us-gaap:ConsumerPortfolioSegmentMember2024-04-012024-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2024-06-300000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2024-06-300000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-06-300000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2024-06-300000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-06-300000701347us-gaap:ConsumerPortfolioSegmentMember2024-06-300000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2025-01-012025-06-300000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-01-012025-06-300000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2025-01-012025-06-300000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2025-01-012025-06-300000701347cpf:CommercialAndIndustrialPortfolioSegmentMember2023-12-310000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2023-12-310000701347cpf:ResidentialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2023-12-310000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2023-12-310000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2023-12-310000701347us-gaap:ConsumerPortfolioSegmentMember2023-12-310000701347us-gaap:ConstructionLoansMembercpf:RealEstatePortfolioSegmentMember2024-01-012024-06-300000701347us-gaap:HomeEquityLoanMembercpf:RealEstatePortfolioSegmentMember2024-01-012024-06-300000701347cpf:CommercialRealEstateLoanMembercpf:RealEstatePortfolioSegmentMember2024-01-012024-06-300000701347srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2025-04-012025-06-300000701347srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2024-04-012024-06-300000701347srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2025-01-012025-06-300000701347srt:CumulativeEffectPeriodOfAdoptionAdjustedBalanceMember2024-01-012024-06-300000701347cpf:FundCommitmentsMember2025-06-300000701347cpf:FundCommitmentsMember2024-12-310000701347cpf:LowIncomeHousingTaxCreditMember2025-06-300000701347cpf:LowIncomeHousingTaxCreditMember2024-12-310000701347cpf:OtherPartnershipsMember2025-06-300000701347cpf:JAMFINTOPBanktechFundLPMember2022-12-310000701347cpf:OtherPartnershipsMember2024-12-310000701347us-gaap:FederalNationalMortgageAssociationCertificatesAndObligationsFNMAMember2025-06-300000701347us-gaap:FederalNationalMortgageAssociationCertificatesAndObligationsFNMAMember2024-12-310000701347us-gaap:FederalHomeLoanMortgageCorporationCertificatesAndObligationsFHLMCMember2025-06-300000701347us-gaap:FederalHomeLoanMortgageCorporationCertificatesAndObligationsFHLMCMember2024-12-310000701347us-gaap:FederalHomeLoanBankCertificatesAndObligationsFHLBMember2025-06-300000701347us-gaap:FederalHomeLoanBankCertificatesAndObligationsFHLBMember2024-12-310000701347cpf:MortgageServicingRightsMember2025-03-310000701347cpf:MortgageServicingRightsMember2025-04-012025-06-300000701347cpf:MortgageServicingRightsMember2025-06-300000701347cpf:MortgageServicingRightsMember2024-03-310000701347cpf:MortgageServicingRightsMember2024-04-012024-06-300000701347cpf:MortgageServicingRightsMember2024-06-300000701347cpf:MortgageServicingRightsMember2024-12-310000701347cpf:MortgageServicingRightsMember2025-01-012025-06-300000701347cpf:MortgageServicingRightsMember2023-12-310000701347cpf:MortgageServicingRightsMember2024-01-012024-06-300000701347cpf:MortgageServicingRightsMemberus-gaap:MeasurementInputDiscountRateMember2025-06-300000701347cpf:MortgageServicingRightsMemberus-gaap:MeasurementInputDiscountRateMember2024-12-310000701347cpf:MortgageServicingRightsMemberus-gaap:MeasurementInputConstantPrepaymentRateMember2025-06-300000701347cpf:MortgageServicingRightsMemberus-gaap:MeasurementInputConstantPrepaymentRateMember2024-12-310000701347us-gaap:InterestRateLockCommitmentsMemberus-gaap:NondesignatedMember2024-12-310000701347us-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2024-12-310000701347cpf:RiskParticipationAgreementsMemberus-gaap:NondesignatedMember2025-06-300000701347cpf:RiskParticipationAgreementsMemberus-gaap:NondesignatedMember2024-12-310000701347cpf:BackToBackSwapAgreementsMemberus-gaap:NondesignatedMember2025-06-300000701347cpf:BackToBackSwapAgreementsMemberus-gaap:NondesignatedMember2024-12-310000701347us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-03-310000701347us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-06-300000701347us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-04-012025-06-300000701347us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-04-012025-06-300000701347us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-012024-06-300000701347us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-01-012025-06-300000701347us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-01-012024-06-300000701347us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2025-06-300000701347us-gaap:InterestRateContractMemberus-gaap:NondesignatedMember2024-12-310000701347us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-12-310000701347cpf:InterestRateLockandForwardSaleCommitmentMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2025-04-012025-06-300000701347cpf:LoansHeldforsaleMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2025-04-012025-06-300000701347cpf:InterestRateLockandForwardSaleCommitmentMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2024-04-012024-06-300000701347cpf:LoansHeldforsaleMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2024-04-012024-06-300000701347cpf:InterestRateLockandForwardSaleCommitmentMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2025-01-012025-06-300000701347cpf:LoansHeldforsaleMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2025-01-012025-06-300000701347cpf:BackToBackSwapAgreementsMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2025-01-012025-06-300000701347cpf:InterestRateLockandForwardSaleCommitmentMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2024-01-012024-06-300000701347cpf:LoansHeldforsaleMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2024-01-012024-06-300000701347cpf:BackToBackSwapAgreementsMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2024-01-012024-06-300000701347us-gaap:FederalHomeLoanBankAdvancesMember2025-06-300000701347us-gaap:FederalHomeLoanBankAdvancesMember2024-12-310000701347us-gaap:SubordinatedDebtMember2025-06-300000701347us-gaap:SubordinatedDebtMember2024-12-310000701347us-gaap:SeniorSubordinatedNotesMember2025-06-300000701347us-gaap:SeniorSubordinatedNotesMember2024-12-310000701347us-gaap:FederalHomeLoanBankBorrowingsMember2025-06-300000701347us-gaap:FederalHomeLoanBankBorrowingsMember2024-12-310000701347us-gaap:FederalHomeLoanBankBorrowingsMembersrt:MinimumMember2024-12-310000701347us-gaap:FederalHomeLoanBankBorrowingsMembersrt:MinimumMember2025-06-300000701347us-gaap:FederalHomeLoanBankBorrowingsMembersrt:MaximumMember2025-06-300000701347us-gaap:FederalHomeLoanBankBorrowingsMembersrt:MaximumMember2024-12-310000701347us-gaap:AssetPledgedAsCollateralMemberus-gaap:FederalHomeLoanBankBorrowingsMember2025-06-300000701347us-gaap:AssetPledgedAsCollateralMemberus-gaap:FederalHomeLoanBankBorrowingsMember2024-12-310000701347us-gaap:FederalReserveBankAdvancesMember2025-06-300000701347us-gaap:FederalReserveBankAdvancesMember2024-12-310000701347us-gaap:AssetPledgedAsCollateralMemberus-gaap:FederalReserveBankAdvancesMember2025-06-300000701347us-gaap:AssetPledgedAsCollateralMemberus-gaap:FederalReserveBankAdvancesMember2024-12-310000701347cpf:PacificCoastBankersBankPCBBMember2025-06-300000701347cpf:PacificCoastBankersBankPCBBMember2024-12-310000701347cpf:TrustIVMemberus-gaap:JuniorSubordinatedDebtMember2025-06-300000701347cpf:TrustIVMemberus-gaap:JuniorSubordinatedDebtMember2024-12-310000701347cpf:TrustIVMemberus-gaap:JuniorSubordinatedDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2025-01-012025-03-310000701347cpf:TrustIVMemberus-gaap:JuniorSubordinatedDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2025-01-012025-06-300000701347cpf:TrustIVMemberus-gaap:JuniorSubordinatedDebtMembercpf:TenorSpreadAdjustmentMember2025-01-012025-03-310000701347cpf:TrustIVMemberus-gaap:JuniorSubordinatedDebtMembercpf:TenorSpreadAdjustmentMember2025-01-012025-06-300000701347cpf:TrustVMemberus-gaap:JuniorSubordinatedDebtMember2025-06-300000701347cpf:TrustVMemberus-gaap:JuniorSubordinatedDebtMember2024-12-310000701347cpf:TrustVMemberus-gaap:JuniorSubordinatedDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2025-01-012025-06-300000701347cpf:TrustVMemberus-gaap:JuniorSubordinatedDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2025-01-012025-03-310000701347cpf:TrustVMemberus-gaap:JuniorSubordinatedDebtMembercpf:TenorSpreadAdjustmentMember2025-01-012025-06-300000701347cpf:TrustVMemberus-gaap:JuniorSubordinatedDebtMembercpf:TenorSpreadAdjustmentMember2025-01-012025-03-310000701347us-gaap:JuniorSubordinatedDebtMember2025-06-300000701347us-gaap:JuniorSubordinatedDebtMember2024-12-310000701347cpf:CPBCapitalTrustIVMember2004-09-012004-09-300000701347cpf:TrustIVMemberus-gaap:JuniorSubordinatedDebtMember2004-09-012004-09-300000701347cpf:CPBCapitalTrustIVMemberus-gaap:SubordinatedDebtMember2025-06-300000701347cpf:CPBCapitalTrustVMember2004-12-012004-12-310000701347cpf:TrustVMemberus-gaap:JuniorSubordinatedDebtMember2004-12-012004-12-310000701347cpf:CPBCapitalTrustVMemberus-gaap:SubordinatedDebtMember2025-06-300000701347srt:MaximumMemberus-gaap:SubordinatedDebtMember2025-01-012025-06-300000701347us-gaap:SubordinatedDebtMember2025-01-012025-06-300000701347cpf:SubordinatedNotesDue2030Memberus-gaap:SeniorSubordinatedNotesMember2025-06-300000701347cpf:SubordinatedNotesDue2030Memberus-gaap:SeniorSubordinatedNotesMember2024-12-310000701347cpf:SubordinatedNotesDue2030Memberus-gaap:SeniorSubordinatedNotesMember2025-01-012025-06-300000701347cpf:SubordinatedNotesDue2030Memberus-gaap:SeniorSubordinatedNotesMember2025-01-012025-03-310000701347cpf:SubordinatedNotesDue2030Memberus-gaap:SeniorSubordinatedNotesMember2020-10-200000701347cpf:SubordinatedNotesDue2030Memberus-gaap:SeniorSubordinatedNotesMember2020-10-202020-10-200000701347cpf:MortgageBankingIncomeMember2025-04-012025-06-300000701347cpf:MortgageBankingIncomeMember2024-04-012024-06-300000701347cpf:ServiceChargesonDepositAccountsMember2025-04-012025-06-300000701347cpf:ServiceChargesonDepositAccountsMember2024-04-012024-06-300000701347cpf:OtherServiceChargesandFeesMember2025-04-012025-06-300000701347cpf:OtherServiceChargesandFeesMember2024-04-012024-06-300000701347cpf:IncomefromFiduciaryActivitiesMember2025-04-012025-06-300000701347cpf:IncomefromFiduciaryActivitiesMember2024-04-012024-06-300000701347cpf:IncomefromBankownedLifeInsuranceMember2025-04-012025-06-300000701347cpf:IncomefromBankownedLifeInsuranceMember2024-04-012024-06-300000701347cpf:OtherMember2025-04-012025-06-300000701347cpf:OtherMember2024-04-012024-06-300000701347cpf:MortgageBankingIncomeMember2025-01-012025-06-300000701347cpf:MortgageBankingIncomeMember2024-01-012024-06-300000701347cpf:ServiceChargesonDepositAccountsMember2025-01-012025-06-300000701347cpf:ServiceChargesonDepositAccountsMember2024-01-012024-06-300000701347cpf:OtherServiceChargesandFeesMember2025-01-012025-06-300000701347cpf:OtherServiceChargesandFeesMember2024-01-012024-06-300000701347cpf:IncomefromFiduciaryActivitiesMember2025-01-012025-06-300000701347cpf:IncomefromFiduciaryActivitiesMember2024-01-012024-06-300000701347cpf:IncomefromBankownedLifeInsuranceMember2025-01-012025-06-300000701347cpf:IncomefromBankownedLifeInsuranceMember2024-01-012024-06-300000701347cpf:OtherMember2025-01-012025-06-300000701347cpf:OtherMember2024-01-012024-06-300000701347cpf:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2025-01-012025-06-300000701347cpf:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2025-01-012025-06-300000701347cpf:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2025-01-012025-06-300000701347cpf:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMember2024-12-310000701347cpf:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMember2025-01-012025-06-300000701347cpf:RestrictedStockUnitsRSUsAndPerformanceStockUnitsPSUsMember2025-06-300000701347us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2025-06-300000701347us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-12-310000701347us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2025-04-012025-06-300000701347us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-04-012024-06-300000701347us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2025-01-012025-06-300000701347us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2024-01-012024-06-300000701347cpf:GainLossOnUnrealizedLossesOnDerivativeInstrumentsMember2025-04-012025-06-300000701347cpf:GainLossOnUnrealizedLossesOnDerivativeInstrumentsMember2024-04-012024-06-300000701347cpf:GainLossOnUnrealizedLossesOnDerivativeInstrumentsMember2025-01-012025-06-300000701347cpf:GainLossOnUnrealizedLossesOnDerivativeInstrumentsMember2024-01-012024-06-300000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-03-310000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2025-03-310000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-03-310000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-04-012025-06-300000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2025-04-012025-06-300000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-04-012025-06-300000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-06-300000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2025-06-300000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-06-300000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-03-310000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2024-03-310000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-04-012024-06-300000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2024-04-012024-06-300000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-04-012024-06-300000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-06-300000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2024-06-300000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-06-300000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-12-310000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2024-12-310000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2025-01-012025-06-300000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2025-01-012025-06-300000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-01-012025-06-300000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2023-12-310000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000701347us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2024-01-012024-06-300000701347cpf:DebtSecuritiesDerivativesFairValueHedgeHeldToMaturityMember2024-01-012024-06-300000701347us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-06-300000701347cpf:AccumulatedNetUnrealizedLossOnHeldToMaturitySecuritiesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2025-04-012025-06-300000701347cpf:AccumulatedNetUnrealizedLossOnHeldToMaturitySecuritiesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000701347us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2025-04-012025-06-300000701347us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000701347cpf:AccumulatedNetUnrealizedLossOnHeldToMaturitySecuritiesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2025-01-012025-06-300000701347cpf:AccumulatedNetUnrealizedLossOnHeldToMaturitySecuritiesMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300000701347us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2025-01-012025-06-300000701347us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-06-300000701347us-gaap:EmployeeStockOptionMember2025-04-012025-06-300000701347us-gaap:EmployeeStockOptionMember2024-04-012024-06-300000701347us-gaap:EmployeeStockOptionMember2025-01-012025-06-300000701347us-gaap:EmployeeStockOptionMember2024-01-012024-06-300000701347us-gaap:CarryingReportedAmountFairValueDisclosureMember2025-06-300000701347us-gaap:EstimateOfFairValueFairValueDisclosureMember2025-06-300000701347us-gaap:FairValueInputsLevel1Member2025-06-300000701347us-gaap:FairValueInputsLevel2Member2025-06-300000701347us-gaap:FairValueInputsLevel3Member2025-06-300000701347us-gaap:CommitmentsToExtendCreditMember2025-06-300000701347us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CommitmentsToExtendCreditMember2025-06-300000701347us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CommitmentsToExtendCreditMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:CommitmentsToExtendCreditMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:CommitmentsToExtendCreditMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:CommitmentsToExtendCreditMember2025-06-300000701347cpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2025-06-300000701347us-gaap:CarryingReportedAmountFairValueDisclosureMembercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2025-06-300000701347us-gaap:EstimateOfFairValueFairValueDisclosureMembercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2025-06-300000701347us-gaap:FairValueInputsLevel1Membercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2025-06-300000701347us-gaap:FairValueInputsLevel2Membercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2025-06-300000701347us-gaap:FairValueInputsLevel3Membercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2025-06-300000701347cpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2025-06-300000701347us-gaap:CarryingReportedAmountFairValueDisclosureMembercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2025-06-300000701347us-gaap:EstimateOfFairValueFairValueDisclosureMembercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2025-06-300000701347us-gaap:FairValueInputsLevel1Membercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2025-06-300000701347us-gaap:FairValueInputsLevel2Membercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2025-06-300000701347us-gaap:FairValueInputsLevel3Membercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2025-06-300000701347cpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2025-06-300000701347us-gaap:FairValueInputsLevel1Membercpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2025-06-300000701347us-gaap:FairValueInputsLevel2Membercpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2025-06-300000701347us-gaap:FairValueInputsLevel3Membercpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2025-06-300000701347cpf:RiskParticipationAgreementMember2025-06-300000701347us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMembercpf:RiskParticipationAgreementMember2025-06-300000701347us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMembercpf:RiskParticipationAgreementMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:RiskParticipationAgreementMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:RiskParticipationAgreementMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:RiskParticipationAgreementMember2025-06-300000701347us-gaap:InterestRateSwapMember2025-06-300000701347us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:InterestRateSwapMember2025-06-300000701347us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:InterestRateSwapMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2025-06-300000701347us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000701347us-gaap:FairValueInputsLevel1Member2024-12-310000701347us-gaap:FairValueInputsLevel2Member2024-12-310000701347us-gaap:FairValueInputsLevel3Member2024-12-310000701347us-gaap:CommitmentsToExtendCreditMember2024-12-310000701347us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CommitmentsToExtendCreditMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:CommitmentsToExtendCreditMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:CommitmentsToExtendCreditMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:CommitmentsToExtendCreditMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:CommitmentsToExtendCreditMember2024-12-310000701347cpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2024-12-310000701347us-gaap:CarryingReportedAmountFairValueDisclosureMembercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMembercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2024-12-310000701347us-gaap:FairValueInputsLevel1Membercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2024-12-310000701347us-gaap:FairValueInputsLevel2Membercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2024-12-310000701347us-gaap:FairValueInputsLevel3Membercpf:StandbyLettersOfCreditAndFinancialGuaranteesMember2024-12-310000701347cpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2024-12-310000701347us-gaap:CarryingReportedAmountFairValueDisclosureMembercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMembercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2024-12-310000701347us-gaap:FairValueInputsLevel1Membercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2024-12-310000701347us-gaap:FairValueInputsLevel2Membercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2024-12-310000701347us-gaap:FairValueInputsLevel3Membercpf:BackToBackSwapAgreementsReceiveFixedPayVariableMember2024-12-310000701347cpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2024-12-310000701347us-gaap:FairValueInputsLevel1Membercpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2024-12-310000701347us-gaap:FairValueInputsLevel2Membercpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2024-12-310000701347us-gaap:FairValueInputsLevel3Membercpf:BackToBackSwapAgreementsPayVariableReceiveFixedMember2024-12-310000701347us-gaap:InterestRateLockCommitmentsMember2024-12-310000701347us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:InterestRateLockCommitmentsMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:InterestRateLockCommitmentsMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateLockCommitmentsMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateLockCommitmentsMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateLockCommitmentsMember2024-12-310000701347cpf:InterestRateForwardsMember2024-12-310000701347us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMembercpf:InterestRateForwardsMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMembercpf:InterestRateForwardsMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:InterestRateForwardsMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:InterestRateForwardsMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:InterestRateForwardsMember2024-12-310000701347cpf:RiskParticipationAgreementMember2024-12-310000701347us-gaap:CarryingReportedAmountFairValueDisclosureMembercpf:RiskParticipationAgreementMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMembercpf:RiskParticipationAgreementMember2024-12-310000701347us-gaap:FairValueInputsLevel1Membercpf:RiskParticipationAgreementMember2024-12-310000701347us-gaap:FairValueInputsLevel2Membercpf:RiskParticipationAgreementMember2024-12-310000701347us-gaap:FairValueInputsLevel3Membercpf:RiskParticipationAgreementMember2024-12-310000701347us-gaap:InterestRateSwapMember2024-12-310000701347us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:InterestRateSwapMember2024-12-310000701347us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:InterestRateSwapMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2025-06-300000701347us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2025-06-300000701347us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2025-06-300000701347us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2025-06-300000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USTreasurySecuritiesMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CollateralizedLoanObligationsMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialUSGovernmentSponsoredEntitiesMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMembercpf:MortgageBackedSecuritiesCommercialNonGovernmentAgenciesMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateLockCommitmentsMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateLockCommitmentsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMembercpf:InterestRateForwardsMember2024-12-310000701347us-gaap:FairValueInputsLevel1Membercpf:InterestRateForwardsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel2Membercpf:InterestRateForwardsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel3Membercpf:InterestRateForwardsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2024-12-310000701347us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310000701347cpf:MortgageRevenueBondsMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-12-310000701347cpf:MortgageRevenueBondsMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-12-310000701347cpf:MortgageRevenueBondsMemberus-gaap:InterestRateSwapMember2024-12-310000701347cpf:MortgageRevenueBondsMember2024-12-310000701347cpf:MortgageRevenueBondsMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2025-01-012025-06-300000701347cpf:MortgageRevenueBondsMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2025-01-012025-06-300000701347cpf:MortgageRevenueBondsMemberus-gaap:InterestRateSwapMember2025-01-012025-06-300000701347cpf:MortgageRevenueBondsMember2025-01-012025-06-300000701347cpf:MortgageRevenueBondsMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2025-06-300000701347cpf:MortgageRevenueBondsMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2025-06-300000701347cpf:MortgageRevenueBondsMemberus-gaap:InterestRateSwapMember2025-06-300000701347cpf:MortgageRevenueBondsMember2025-06-300000701347cpf:MortgageRevenueBondsMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2023-12-310000701347cpf:MortgageRevenueBondsMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2023-12-310000701347cpf:MortgageRevenueBondsMemberus-gaap:InterestRateSwapMember2023-12-310000701347cpf:MortgageRevenueBondsMember2023-12-310000701347cpf:MortgageRevenueBondsMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-01-012024-06-300000701347cpf:MortgageRevenueBondsMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-01-012024-06-300000701347cpf:MortgageRevenueBondsMemberus-gaap:InterestRateSwapMember2024-01-012024-06-300000701347cpf:MortgageRevenueBondsMember2024-01-012024-06-300000701347cpf:MortgageRevenueBondsMemberus-gaap:USStatesAndPoliticalSubdivisionsMember2024-06-300000701347cpf:MortgageRevenueBondsMembercpf:MortgageBackedSecuritiesResidentialNonGovernmentAgenciesMember2024-06-300000701347cpf:MortgageRevenueBondsMemberus-gaap:InterestRateSwapMember2024-06-300000701347cpf:MortgageRevenueBondsMember2024-06-300000701347us-gaap:MeasurementInputDiscountRateMembersrt:WeightedAverageMembercpf:MortgageRevenueBondsMember2025-06-300000701347us-gaap:MeasurementInputDiscountRateMembersrt:WeightedAverageMembercpf:MortgageRevenueBondsMember2024-12-310000701347us-gaap:MeasurementInputDiscountRateMembersrt:WeightedAverageMembercpf:MortgageRevenueBondsMember2024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2025

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-31567

CENTRAL PACIFIC FINANCIAL CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Hawaii |

|

99-0212597 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

220 South King Street, Honolulu, Hawaii 96813

(Address of principal executive offices) (Zip code)

(808) 544-0500

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, No Par Value |

|

CPF |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of "large accelerated filer", "accelerated filer", "smaller reporting company", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large Accelerated Filer |

☐ |

Accelerated filer |

☒ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

| Emerging growth company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Securities Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of registrant's common stock, no par value, on July 31, 2025 was 26,981,436 shares.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

Form 10-Q

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

| (dollars in thousands) |

|

June 30,

2025 |

|

December 31,

2024 |

| Assets |

|

|

|

|

| Cash and due from financial institutions |

|

$ |

110,935 |

|

|

$ |

77,774 |

|

| Interest-bearing deposits in other financial institutions |

|

206,035 |

|

|

303,167 |

|

| Investment securities: |

|

|

|

|

| Debt securities available-for-sale, at fair value |

|

765,213 |

|

|

737,658 |

|

Debt securities held-to-maturity, at amortized cost; fair value of: $499,833 as of June 30, 2025 and $506,681 as of December 31, 2024 |

|

580,476 |

|

|

596,930 |

|

|

|

|

|

|

| Total investment securities |

|

1,345,689 |

|

|

1,334,588 |

|

| Loans held for sale |

|

— |

|

|

5,662 |

|

| Loans |

|

5,289,809 |

|

|

5,332,852 |

|

| Less: allowance for credit losses |

|

(59,611) |

|

|

(59,182) |

|

| Loans, net of allowance for credit losses |

|

5,230,198 |

|

|

5,273,670 |

|

| Premises and equipment, net |

|

103,657 |

|

|

104,342 |

|

| Accrued interest receivable |

|

23,518 |

|

|

23,378 |

|

| Investment in unconsolidated entities |

|

49,370 |

|

|

52,417 |

|

|

|

|

|

|

| Mortgage servicing rights, net |

|

8,436 |

|

|

8,473 |

|

|

|

|

|

|

| Bank-owned life insurance |

|

177,639 |

|

|

176,216 |

|

| Federal Home Loan Bank of Des Moines ("FHLB") and Federal Reserve Bank ("FRB") stock |

|

24,816 |

|

|

6,929 |

|

| Right-of-use lease assets |

|

30,693 |

|

|

30,824 |

|

| Other assets |

|

58,581 |

|

|

74,656 |

|

| Total assets |

|

$ |

7,369,567 |

|

|

$ |

7,472,096 |

|

| Liabilities and Equity |

|

|

|

|

| Deposits: |

|

|

|

|

| Noninterest-bearing demand |

|

$ |

1,938,226 |

|

|

$ |

1,888,937 |

|

| Interest-bearing demand |

|

1,336,620 |

|

|

1,338,719 |

|

| Savings and money market |

|

2,242,122 |

|

|

2,329,170 |

|

| Time |

|

1,028,021 |

|

|

1,087,185 |

|

| Total deposits |

|

6,544,989 |

|

|

6,644,011 |

|

|

|

|

|

|

| Long-term debt, net of unamortized debt issuance costs |

|

131,466 |

|

|

156,345 |

|

| Lease liabilities |

|

31,981 |

|

|

32,025 |

|

|

|

|

|

|

| Accrued interest payable |

|

8,755 |

|

|

10,051 |

|

| Other liabilities |

|

83,502 |

|

|

91,279 |

|

| Total liabilities |

|

6,800,693 |

|

|

6,933,711 |

|

| Contingent liabilities and other commitments (see Note 17) |

|

|

|

|

| Equity: |

|

|

|

|

|

|

|

|

|

|

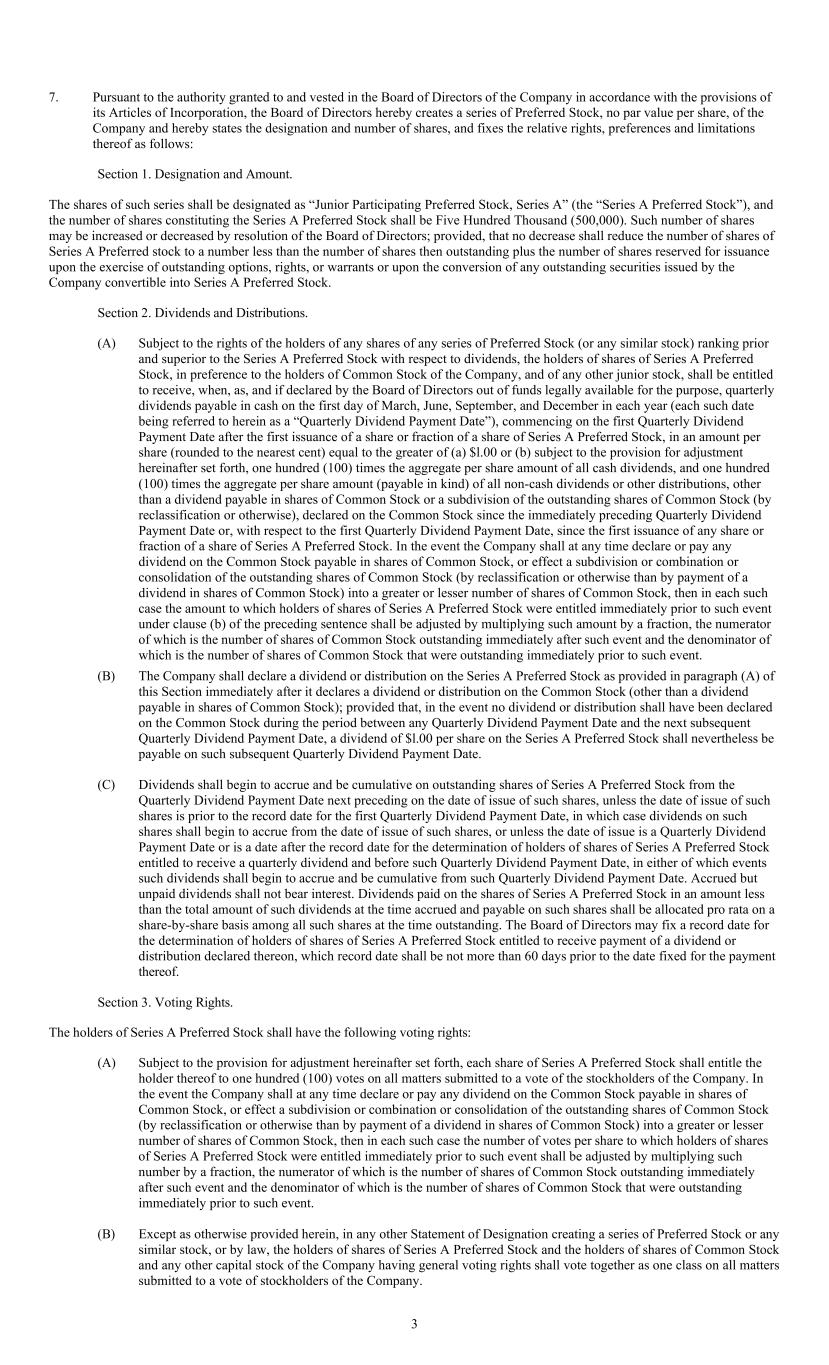

Preferred stock, no par value, authorized 1,000,000 shares;

issued and outstanding: none as of June 30, 2025 and December 31, 2024

|

|

— |

|

|

— |

|

|

Common stock, no par value, authorized 185,000,000 shares;

issued and outstanding: 26,981,436 as of June 30, 2025 and 27,065,570 as of December 31, 2024

|

|

399,823 |

|

|

404,494 |

|

| Additional paid-in capital |

|

106,033 |

|

|

105,054 |

|

| Retained earnings |

|

164,676 |

|

|

143,259 |

|

| Accumulated other comprehensive loss |

|

(101,658) |

|

|

(114,422) |

|

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

568,874 |

|

|

538,385 |

|

| Total liabilities and equity |

|

$ |

7,369,567 |

|

|

$ |

7,472,096 |

|

See accompanying notes to consolidated financial statements.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (dollars in thousands, except per share data) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Interest income: |

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

65,668 |

|

|

$ |

64,422 |

|

|

$ |

129,787 |

|

|

$ |

127,241 |

|

| Interest and dividends on investment securities: |

|

|

|

|

|

|

|

|

| Taxable investment securities |

|

9,871 |

|

|

8,466 |

|

|

19,672 |

|

|

15,677 |

|

| Tax-exempt investment securities |

|

709 |

|

|

598 |

|

|

1,417 |

|

|

1,253 |

|

|

|

|

|

|

|

|

|

|

| Interest on deposits in other financial institutions |

|

1,484 |

|

|

2,203 |

|

|

3,738 |

|

|

5,814 |

|

| Dividend income on FHLB and FRB stock |

|

388 |

|

|

151 |

|

|

712 |

|

|

257 |

|

| Total interest income |

|

78,120 |

|

|

75,840 |

|

|

155,326 |

|

|

150,242 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

| Interest on deposits: |

|

|

|

|

|

|

|

|

| Demand |

|

443 |

|

|

490 |

|

|

895 |

|

|

989 |

|

| Savings and money market |

|

8,414 |

|

|

8,977 |

|

|

17,276 |

|

|

17,420 |

|

| Time |

|

7,616 |

|

|

12,173 |

|

|

15,723 |

|

|

25,163 |

|

| Interest on short-term borrowings |

|

— |

|

|

1 |

|

|

— |

|

|

1 |

|

| Interest on long-term debt |

|

1,851 |

|

|

2,278 |

|

|

3,937 |

|

|

4,561 |

|

| Total interest expense |

|

18,324 |

|

|

23,919 |

|

|

37,831 |

|

|

48,134 |

|

| Net interest income |

|

59,796 |

|

|

51,921 |

|

|

117,495 |

|

|

102,108 |

|

| Provision for credit losses |

|

4,987 |

|

|

2,239 |

|

|

9,159 |

|

|

6,175 |

|

| Net interest income after provision for credit losses |

|

54,809 |

|

|

49,682 |

|

|

108,336 |

|

|

95,933 |

|

| Other operating income: |

|

|

|

|

|

|

|

|

| Mortgage banking income |

|

744 |

|

|

1,040 |

|

|

1,341 |

|

|

1,653 |

|

| Service charges on deposit accounts |

|

2,124 |

|

|

2,135 |

|

|

4,271 |

|

|

4,238 |

|

| Other service charges and fees |

|

5,957 |

|

|

5,869 |

|

|

11,723 |

|

|

11,130 |

|

| Income from fiduciary activities |

|

1,501 |

|

|

1,449 |

|

|

3,125 |

|

|

2,884 |

|

| Income from bank-owned life insurance |

|

2,260 |

|

|

1,234 |

|

|

2,757 |

|

|

2,756 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

427 |

|

|

394 |

|

|

892 |

|

|

704 |

|

| Total other operating income |

|

13,013 |

|

|

12,121 |

|

|

24,109 |

|

|

23,365 |

|

| Other operating expense: |

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

22,696 |

|

|

21,246 |

|

|

44,515 |

|

|

41,981 |

|

| Net occupancy |

|

4,253 |

|

|

4,597 |

|

|

8,645 |

|

|

9,197 |

|

| Computer software |

|

5,320 |

|

|

4,381 |

|

|

10,034 |

|

|

8,668 |

|

| Legal and professional services |

|

2,873 |

|

|

2,506 |

|

|

5,671 |

|

|

4,826 |

|

| Equipment |

|

950 |

|

|

995 |

|

|

2,032 |

|

|

2,005 |

|

| Advertising |

|

832 |

|

|

901 |

|

|

1,719 |

|

|

1,815 |

|

| Communication |

|

901 |

|

|

657 |

|

|

1,934 |

|

|

1,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

6,121 |

|

|

5,868 |

|

|

11,468 |

|

|

11,741 |

|

| Total other operating expense |

|

43,946 |

|

|

41,151 |

|

|

86,018 |

|

|

81,727 |

|

| Income before income taxes |

|

23,876 |

|

|

20,652 |

|

|

46,427 |

|

|

37,571 |

|

| Income tax expense |

|

5,605 |

|

|

4,835 |

|

|

10,396 |

|

|

8,809 |

|

| Net income |

|

$ |

18,271 |

|

|

$ |

15,817 |

|

|

$ |

36,031 |

|

|

$ |

28,762 |

|

| Per common share data: |

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.68 |

|

|

$ |

0.58 |

|

|

$ |

1.33 |

|

|

$ |

1.06 |

|

| Diluted earnings per share |

|

$ |

0.67 |

|

|

$ |

0.58 |

|

|

$ |

1.33 |

|

|

$ |

1.06 |

|

|

|

|

|

|

|

|

|

|

| Basic weighted average shares outstanding |

|

26,988,169 |

|

|

27,053,549 |

|

|

27,037,388 |

|

|

27,050,037 |

|

| Diluted weighted average shares outstanding |

|

27,069,677 |

|

|

27,116,349 |

|

|

27,139,969 |

|

|

27,106,267 |

|

See accompanying notes to consolidated financial statements.

CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| (dollars in thousands) |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income |

|

$ |

18,271 |

|

|

$ |

15,817 |

|

|

$ |

36,031 |

|

|

$ |

28,762 |

|

| Other comprehensive income, net of tax: |

|

|

|

|

|

|

|

|

| Net change in fair value of available-for-sale investment securities |

|

1,728 |

|

|

274 |

|

|

12,983 |

|

|

(4,906) |

|

| Amortization of unrealized losses on investment securities transferred to held-to-maturity |

|

1,305 |

|

|

1,374 |

|

|

2,448 |

|

|

2,580 |

|

| Net change in fair value of derivatives |

|

(1,126) |

|

|

(16) |

|

|

(2,667) |

|

|

2,231 |

|

|

|

|