Document

Exhibit 99.1

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

FOR IMMEDIATE RELEASE |

| |

|

|

|

| Investor Contact: |

Ian Tanaka |

Media Contact: |

Tim Sakahara |

| |

SVP, Treasury Manager |

|

AVP, Corporate Communications Manager |

| |

(808) 544-3646 |

|

(808) 544-5125 |

| |

ian.tanaka@cpb.bank |

|

tim.sakahara@cpb.bank |

CENTRAL PACIFIC FINANCIAL REPORTS FOURTH QUARTER AND FULL YEAR 2024 EARNINGS

Highlights include:

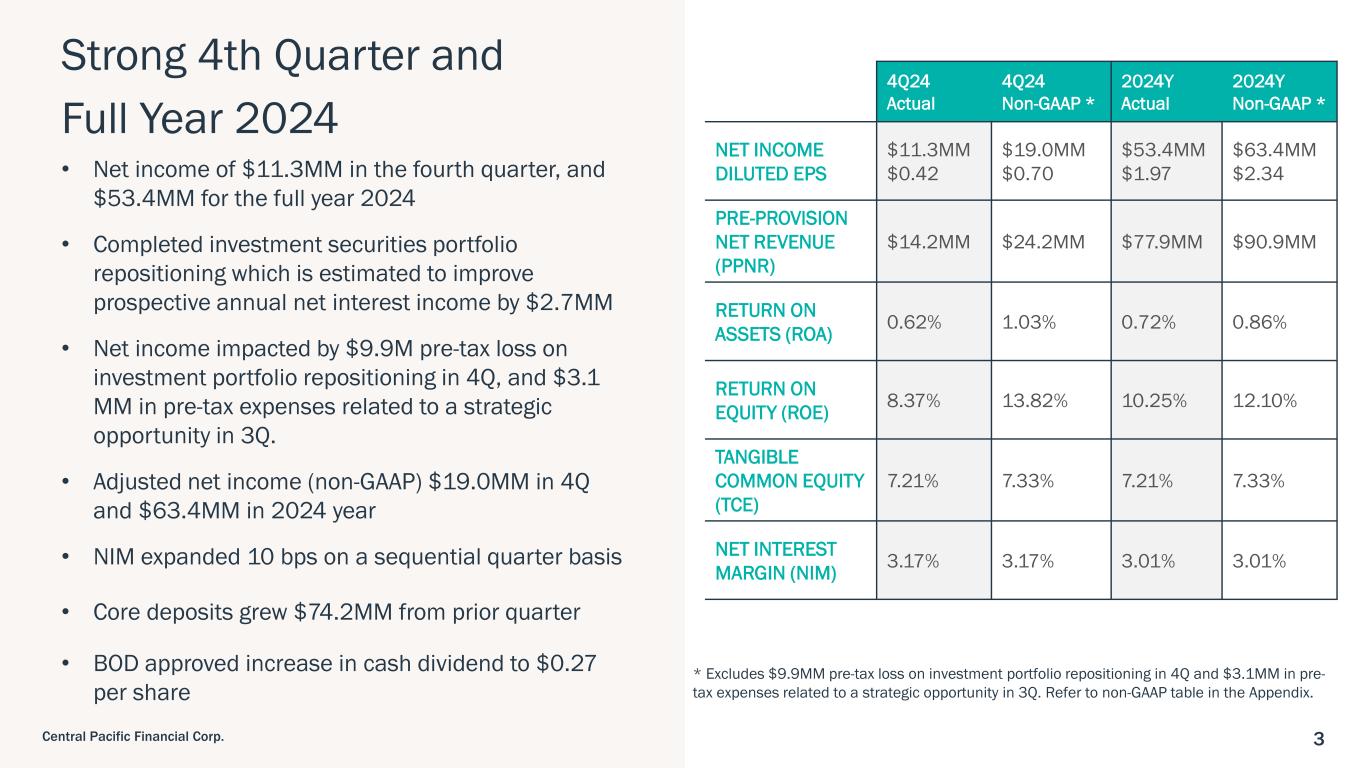

•Net income of $11.3 million, or $0.42 per diluted share for the fourth quarter of 2024 and $53.4 million, or $1.97 per diluted share for the full year 2024

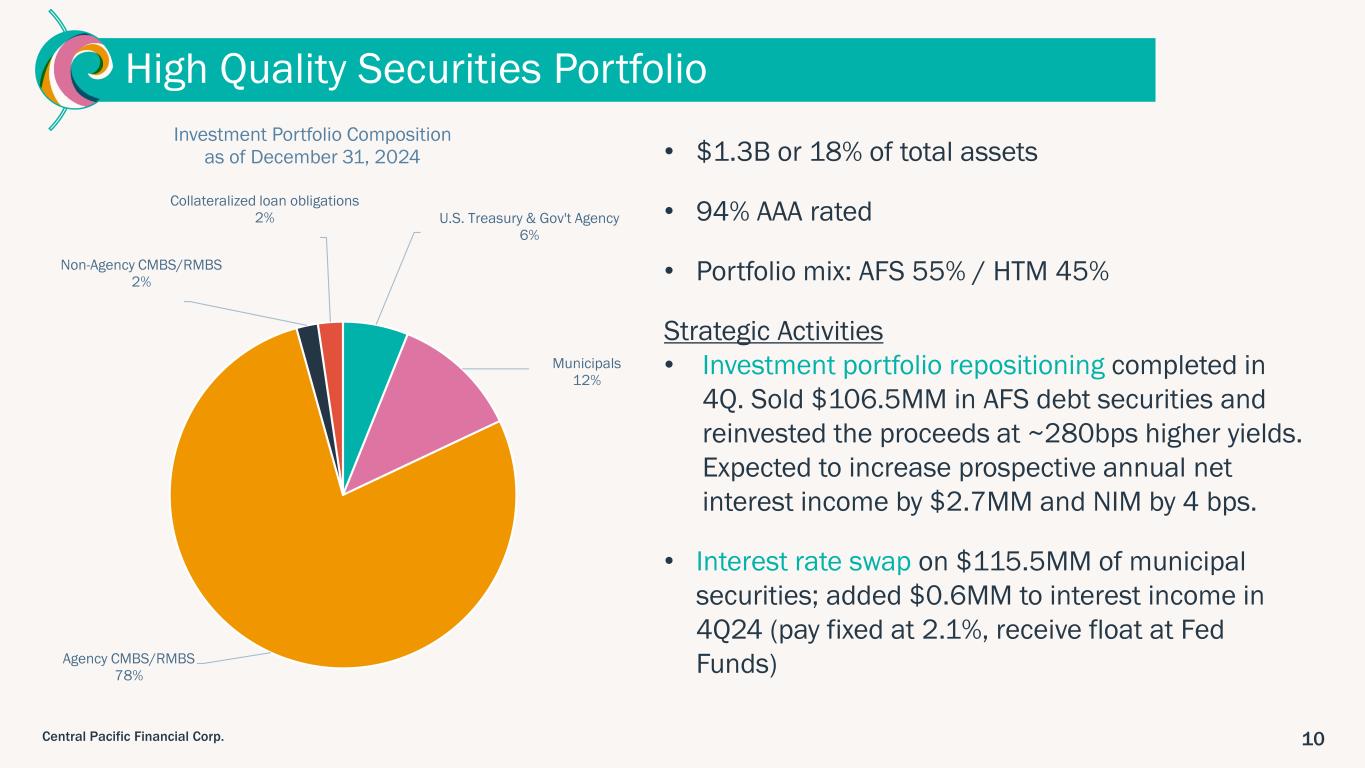

•Completed investment securities portfolio repositioning which resulted in a pre-tax loss of $9.9 million in the fourth quarter of 2024, and is estimated to improve annual net interest income by $2.7 million beginning in 2025

•Adjusted net income (non-GAAP) of $19.0 million, or $0.70 per diluted share for the fourth quarter of 2024 and $63.4 million and $2.34 per diluted share for the full year 2024, which excludes pre-tax items totaling $9.9 million and $13.0 million in the fourth quarter and full year 2024, respectively

•Net interest margin of 3.17% increased by 10 bps from 3.07% in the previous quarter

•Total risk-based capital and common equity tier 1 ratios of 15.4% and 12.3%, respectively

•CPF Board of Directors approved an increase in the quarterly cash dividend by 3.8% to $0.27 per share and authorized a new share repurchase program of up to $30.0 million for 2025

•Central Pacific Bank became a member of the Federal Reserve System

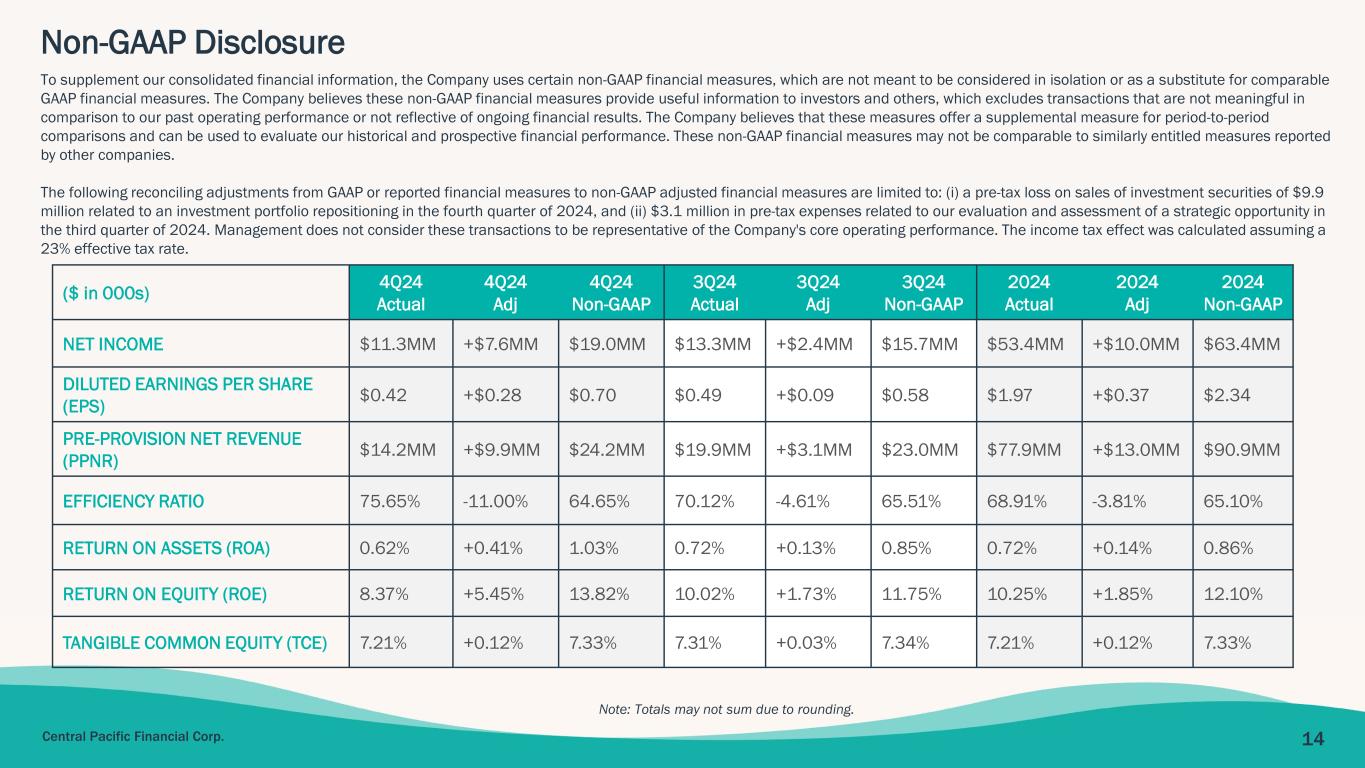

HONOLULU, HI, January 29, 2025 – Central Pacific Financial Corp. (NYSE: CPF) (the "Company"), parent company of Central Pacific Bank (the "Bank" or "CPB"), today reported net income of $11.3 million, or fully diluted earnings per share ("EPS") of $0.42 for the fourth quarter of 2024, compared to net income of $13.3 million, or EPS of $0.49 in the previous quarter and net income of $14.9 million, or EPS of $0.55 in the year-ago quarter. For the 2024 year, net income and EPS was $53.4 million and $1.97, respectively, compared to net income and EPS of $58.7 million and $2.17, respectively, in the 2023 year.

Results for the fourth quarter of 2024 were impacted by a pre-tax loss related to an investment portfolio repositioning of $9.9 million. Results for the third quarter of 2024 were impacted by $3.1 million in pre-tax expenses related to our evaluation and assessment of a strategic opportunity, as previously reported. Excluding the aforementioned pre-tax items of $3.1 million and $9.9 million in the third and fourth quarters of 2024, respectively, adjusted net income and EPS (non-GAAP) for the third quarter was approximately $15.7 million and $0.58, respectively, compared to adjusted net income and EPS (non-GAAP) of $19.0 million and $0.70, respectively, in the fourth quarter of 2024. Excluding the aforementioned pre-tax items in the third and fourth quarters of 2024 totaling $13.0 million, adjusted net income and EPS (non-GAAP) for the 2024 year was $63.4 million and $2.34, respectively.

"2024 was a solid year for Central Pacific Bank and we would like to send a sincere thank you to our valued customers and all the communities we serve. Key contributors to our success in 2024 included strong NIM expansion and core deposit growth, along with very healthy levels of liquidity, asset quality and capital," said Arnold Martines, Chairman, President and Chief Executive Officer.

Central Pacific Financial Reports Fourth Quarter and Full Year 2024 Earnings

Page 2

"We are proud to be recognized once again as one of America’s Best Regional Banks by Newsweek, one of the Best in State Banks by Forbes, and the Best Bank in Hawaii by readers of the Honolulu Star Advertiser. It is a testament to the hard work and exceptional customer service all of our employees consistently demonstrate. In 2025, we will continue to execute upon our strategies and build upon the success we've had in 2024."

Earnings Highlights

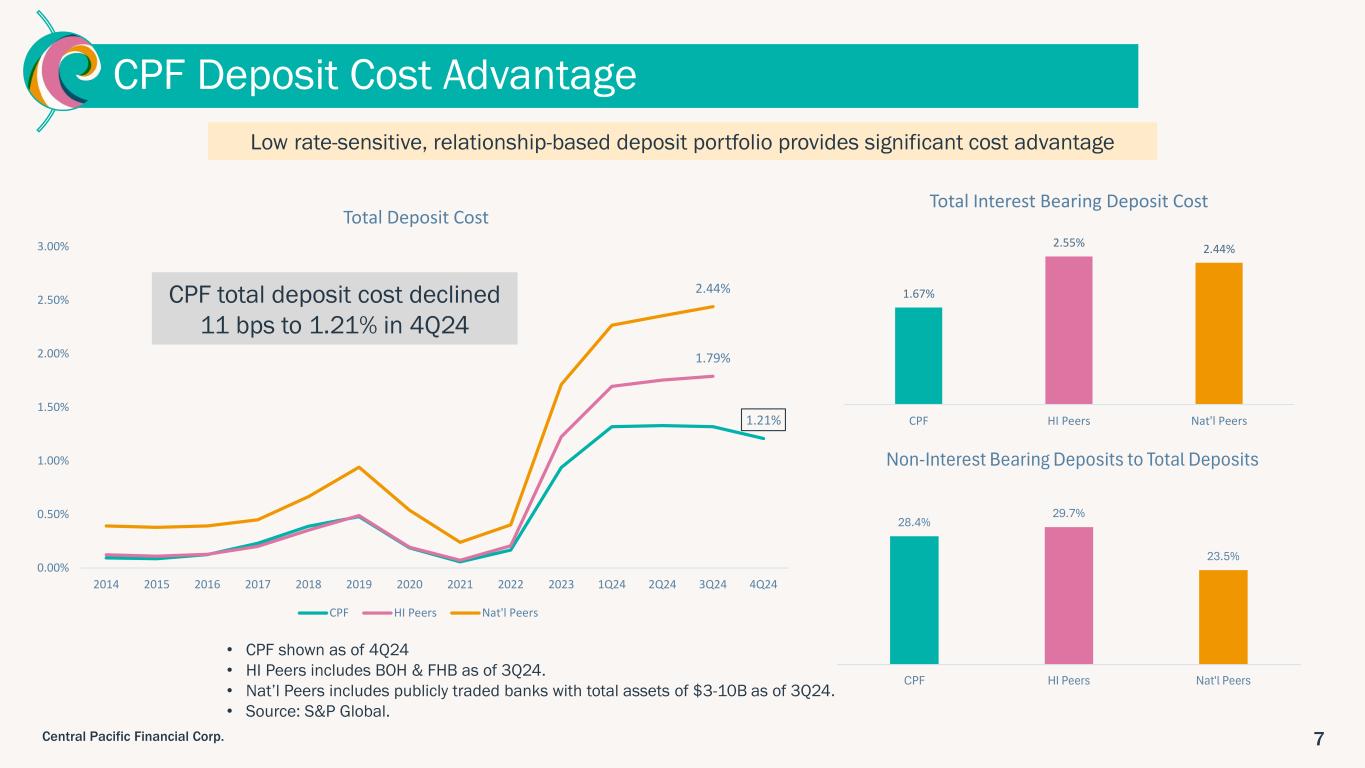

Net interest income was $55.8 million for the fourth quarter of 2024, which increased by $1.9 million, or 3.6% from the previous quarter, and increased by $4.6 million, or 9.1% from the year-ago quarter. Net interest margin ("NIM") was 3.17% for the fourth quarter of 2024, an increase of 10 basis points ("bp" or "bps") from the previous quarter and an increase of 33 bps from the year-ago quarter. The sequential quarter increase in net interest income and NIM was primarily due to a 15 bps decline in average rates paid on interest-bearing deposits, combined with a higher average yield earned on loans of 2 bps.

During the fourth quarter of 2024, the Company completed an investment portfolio repositioning related to its available-for-sale investment securities portfolio. The Company sold lower-yielding available-for-sale debt securities with a book value of $106.5 million and received proceeds of $96.6 million, which resulted in a pre-tax loss of $9.9 million. Proceeds from the sale were reinvested in $101.6 million of higher-yielding debt securities. The Company estimates the transaction will result in a prospective annual increase to net interest income of $2.7 million and net interest margin of 4 bps. The earn-back period is estimated to be approximately 3.5 years. The securities sold had a weighted average yield of 2.1% and a weighted average duration of 3.6 years, and the securities purchased had a weighted average yield of 4.9% and a weighted average duration of 4.1 years.

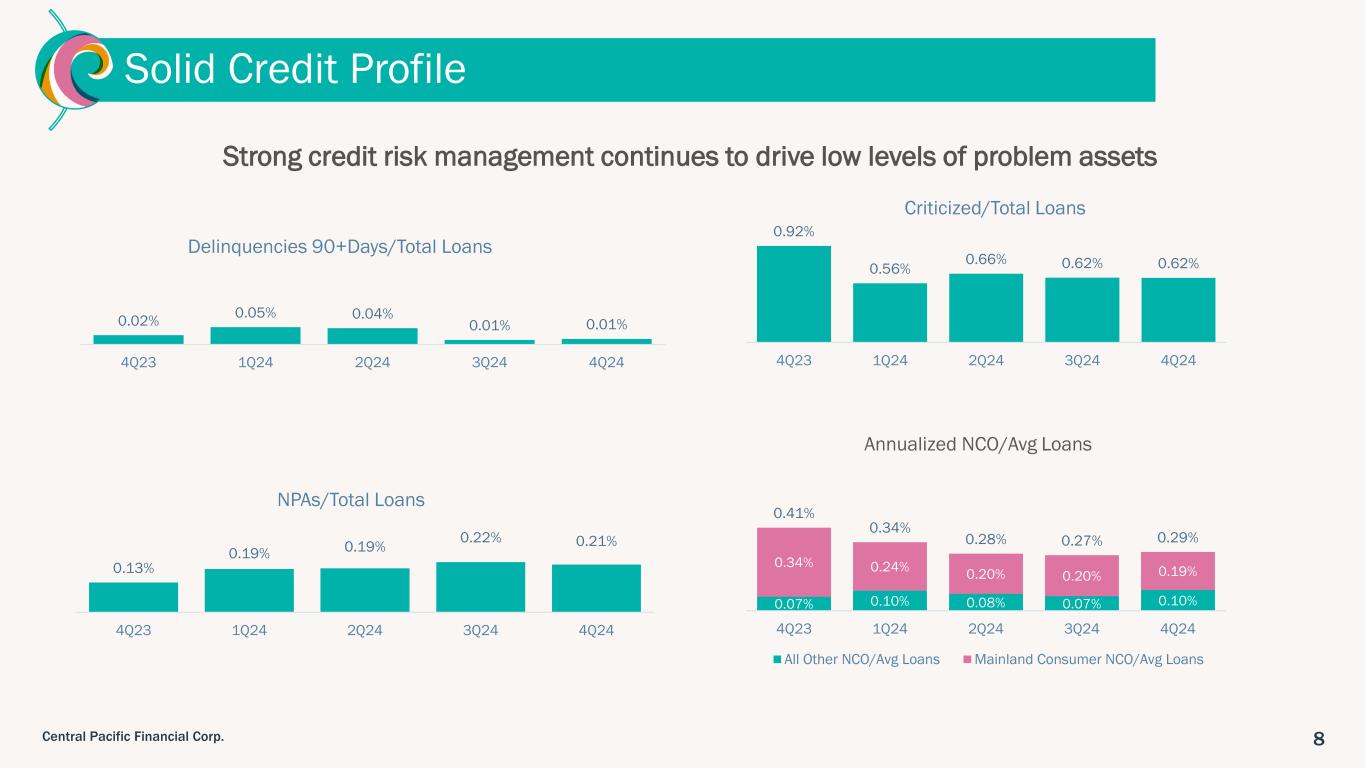

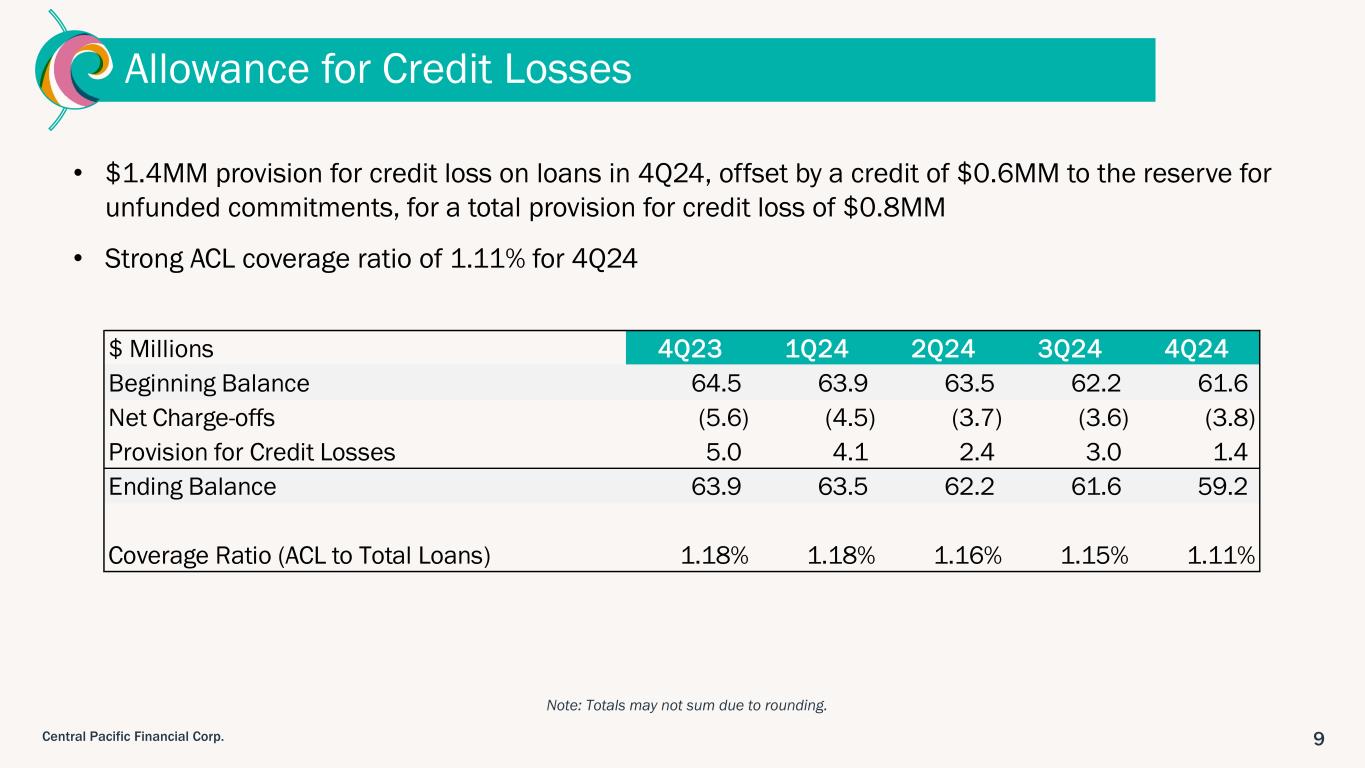

The Company recorded a provision for credit losses of $0.8 million in the fourth quarter of 2024, compared to a provision of $2.8 million in the previous quarter and a provision of $4.7 million in the year-ago quarter. The provision in the current quarter consisted of a provision for credit losses on loans of $1.4 million, offset by a credit to the provision for off-balance sheet exposures of $0.6 million. The lower provision for credit losses was primarily due to improvements in the economic forecast and movements in loan balances by segment, combined with an overall loan balance decline during the quarter.

Other operating income totaled $2.6 million for the fourth quarter of 2024, compared to $12.7 million in the previous quarter and $15.2 million in the year-ago quarter. The lower other operating income was primarily due to the aforementioned pre-tax loss on sales of investment securities related to an investment portfolio repositioning of $9.9 million.

Other operating expense totaled $44.2 million for the fourth quarter of 2024, compared to $46.7 million in the previous quarter and $42.5 million in the year-ago quarter. The sequential quarter reduction in other operating expense was primarily due to the aforementioned $3.1 million in expenses related to a strategic opportunity (included in other) in the third quarter of 2024. In addition, the Company recorded lower directors' deferred compensation plan expenses of $1.2 million (included in other). These decreases were partially offset by an impairment charge on intangible assets of $1.4 million (included in other) during the fourth quarter of 2024.

The efficiency ratio was 75.65% for the fourth quarter of 2024, compared to 70.12% in the previous quarter and 64.12% in the year-ago quarter. Excluding the aforementioned pre-tax items, the adjusted efficiency ratio (non-GAAP) was 64.65% for the fourth quarter of 2024, compared to an adjusted efficiency ratio (non-GAAP) of 65.51% for the third quarter of 2024.

The effective tax rate was 15.4% for the fourth quarter of 2024, compared to 22.0% in the previous quarter and 22.3% in the year-ago quarter. The decrease in the effective tax rate was primarily due to additional tax credits recognized and tax return to provision adjustments.

Balance Sheet Highlights

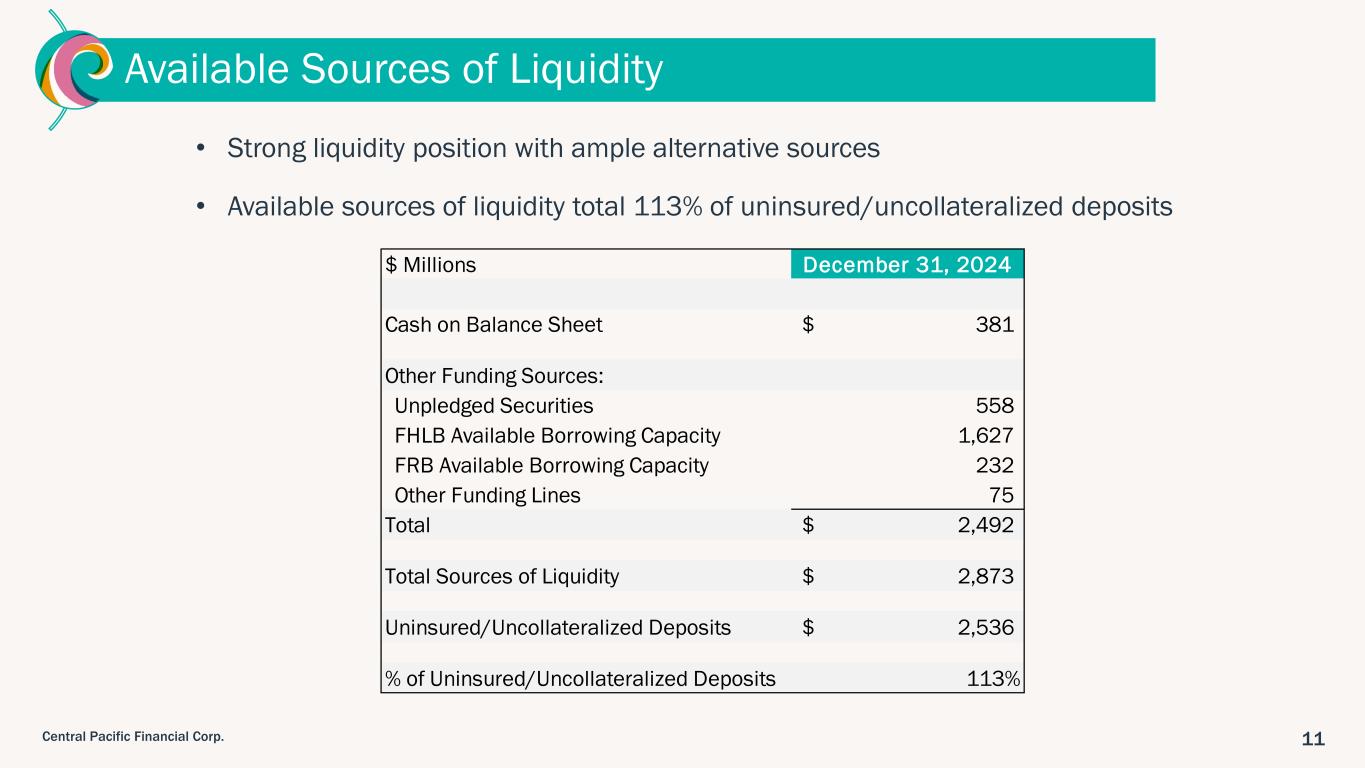

Total assets of $7.47 billion at December 31, 2024 increased by $56.7 million, or 0.8% from $7.42 billion at September 30, 2024, and decreased by $170.7 million, or 2.2% from $7.64 billion at December 31, 2023. The Company had $380.9 million in cash on its balance sheet and $2.49 billion in total other liquidity sources, including available borrowing capacity and unpledged investment securities at December 31, 2024.

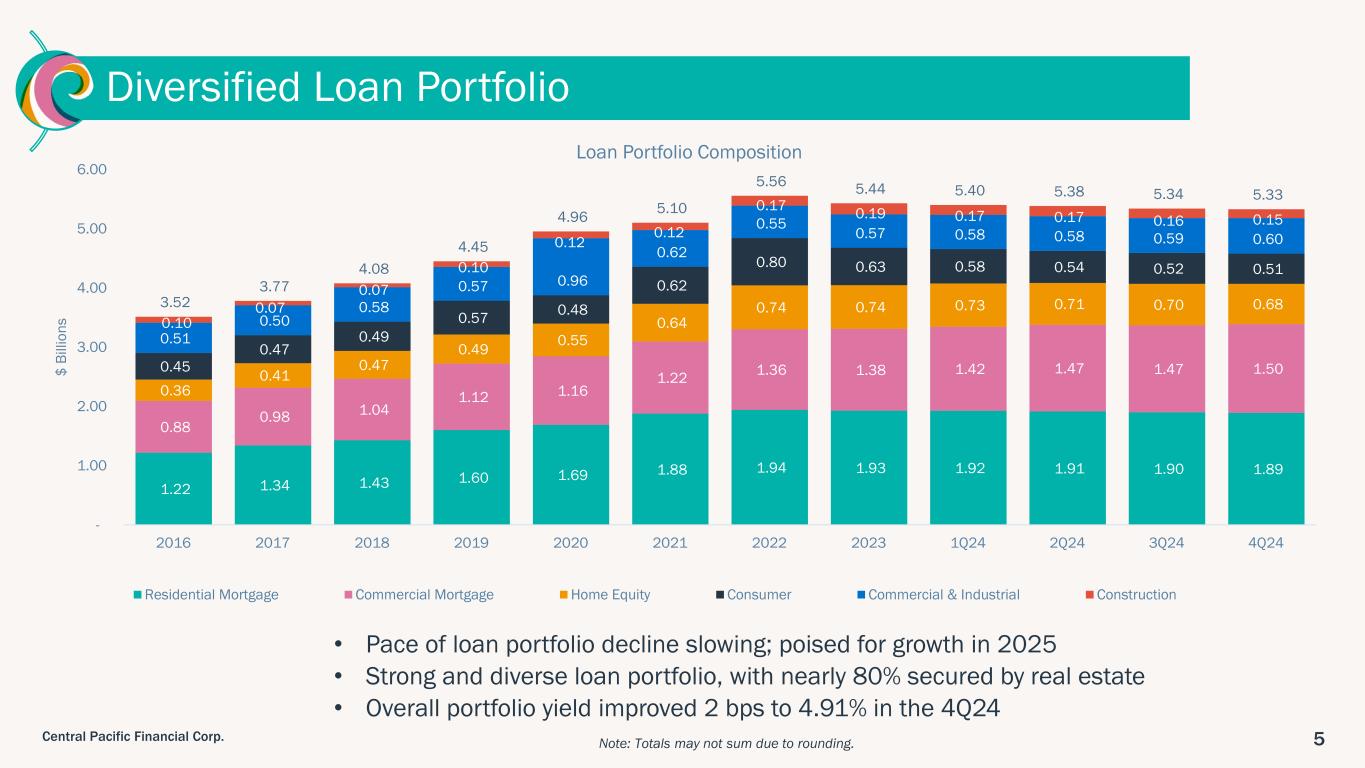

Total loans, net of deferred fees and costs, of $5.33 billion at December 31, 2024 decreased by $9.8 million, or 0.2% from $5.34 billion at September 30, 2024, and decreased by $106.1 million, or 2.0% from $5.44 billion at December 31, 2023. Average yields earned on loans during the fourth quarter of 2024 was 4.91%, compared to 4.89% in the previous quarter and 4.55% in the year-ago quarter.

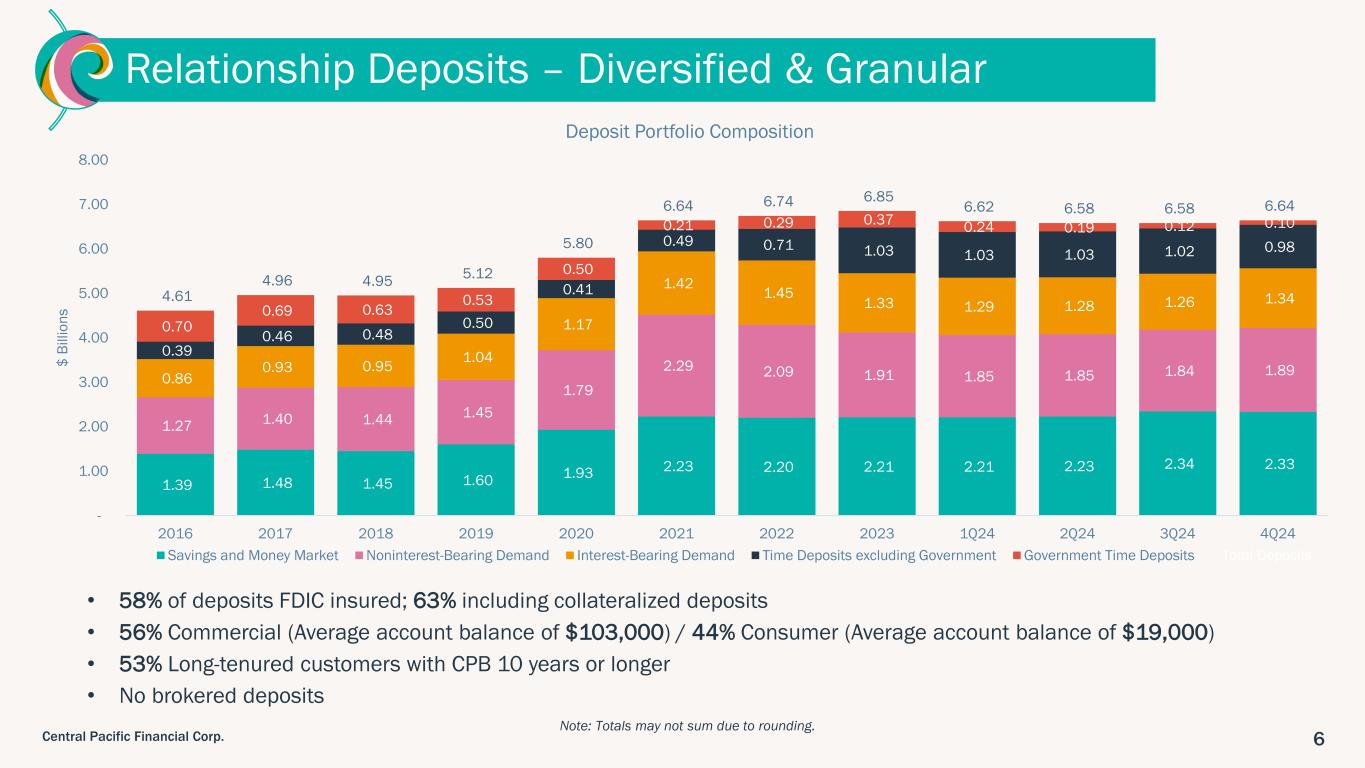

Total deposits of $6.64 billion at December 31, 2024 increased by $61.0 million or 0.93% from $6.58 billion at September 30, 2024, and decreased by $203.6 million, or 3.0% from $6.85 billion at December 31, 2023. Core deposits, which include demand deposits, savings and money market deposits and time deposits up to $250,000, totaled $6.04 billion at December 31, 2024, and increased by $74.2 million, or 1.2% from $5.97 billion at September 30, 2024.

Central Pacific Financial Reports Fourth Quarter and Full Year 2024 Earnings

Page 3

Average rates paid on total deposits during the fourth quarter of 2024 was 1.21%, compared to 1.32% in the previous quarter and 1.22% in the year-ago quarter.

Asset Quality

Nonperforming assets totaled $11.0 million, or 0.15% of total assets at December 31, 2024, compared to $11.6 million, or 0.16% of total assets at September 30, 2024 and $7.0 million, or 0.09% of total assets at December 31, 2023.

Net charge-offs totaled $3.8 million in the fourth quarter of 2024, compared to net charge-offs of $3.6 million in the previous quarter, and net charge-offs of $5.5 million in the year-ago quarter. Annualized net charge-offs as a percentage of average loans was 0.29%, 0.27% and 0.41% during the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively.

The allowance for credit losses, as a percentage of total loans was 1.11% at December 31, 2024, compared to 1.15% at September 30, 2024, and 1.18% at December 31, 2023.

Capital

Total shareholders' equity was $538.4 million at December 31, 2024, compared to $543.7 million and $503.8 million at September 30, 2024 and December 31, 2023, respectively.

The Company's leverage, common equity tier 1, tier 1 risk-based capital, and total risk-based capital ratios were 9.3%, 12.3%, 13.2%, and 15.4%, respectively, at December 31, 2024, compared to 9.5%, 12.1%, 13.1%, and 15.3%, respectively, at September 30, 2024.

On January 28, 2025, the Company's Board of Directors declared a quarterly cash dividend of $0.27 per share on its outstanding common shares. The dividend represents an increase of 3.8% from the $0.26 per share in the fourth quarter of 2024 and will be payable on March 17, 2025 to shareholders of record at the close of business on February 28, 2025.

On January 28, 2025, the Company's Board of Directors also authorized the repurchase of up to $30 million of its common stock from time to time in the open market or in privately negotiated transactions, pursuant to a newly authorized share repurchase program (the "Repurchase Plan"). The Repurchase Plan replaces and supersedes in its entirety the share repurchase program previously approved by the Company's Board of Directors. During the year ended December 31, 2024, the Company repurchased 49,960 shares of common stock, at a total cost of $0.9 million, or an average cost per share of $18.92. During the year ended December 31, 2024, the Company returned $29.1 million in capital to its shareholders through cash dividends and share repurchases.

Regulatory

On January 10, 2025, the Bank received final approval from the Federal Reserve to become a member of the Federal Reserve System (the “Fed Membership”). Accordingly, upon the effective date, the Bank’s primary federal supervisor will be the Board of Governors of the Federal Reserve System, acting through authority delegated to the Federal Reserve Bank of San Francisco. The Fed Membership became effective on January 24, 2025.

As a bank holding company, the Company is already supervised by the Federal Reserve Bank of San Francisco, and the Company believes that the Bank’s Fed Membership will streamline the Company’s regulatory oversight structure by having a single federal supervisor for both the Company and the Bank. Both the Company and the Bank will continue to be regulated by the Hawaii Division of Financial Institutions. The Bank’s deposits will continue to be insured by the Federal Deposit Insurance Corporation, in accordance with applicable limits.

Conference Call

The Company's management will host a conference call today at 1:00 p.m. Eastern Time (8:00 a.m. Hawaii Time) to discuss the quarterly results. Individuals are encouraged to listen to the live webcast of the presentation by visiting the investor relations page of the Company's website at http://ir.cpb.bank. Alternatively, investors may participate in the live call by dialing 1-800-715-9871 (conference ID: 6299769). A playback of the call will be available through February 28, 2025 by dialing 1-800-770-2030 (playback ID: 6299769) and on the Company's website. Information which may be discussed in the conference call is provided in an earnings supplement presentation on the Company's website at http://ir.cpb.bank.

Central Pacific Financial Reports Fourth Quarter and Full Year 2024 Earnings

Page 4

About Central Pacific Financial Corp.

Central Pacific Financial Corp. is a Hawaii-based bank holding company with approximately $7.47 billion in assets as of December 31, 2024. Central Pacific Bank, its primary subsidiary, operates 27 branches and 55 ATMs in the State of Hawaii. Central Pacific Financial Corp. is traded on the New York Stock Exchange (NYSE) under the symbol "CPF." For additional information, please visit: cpb.bank

**********

Central Pacific Financial Reports Fourth Quarter and Full Year 2024 Earnings

Page 5

Forward-Looking Statements

This document may contain forward-looking statements ("FLS") concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, payment or nonpayment of dividends, net interest income, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. (the "Company") or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believe," "plan," "anticipate," "seek," "expect," "intend," "forecast," "hope," "target," "continue," "remain," "estimate," "will," "should," "may" and other similar expressions are intended to identify FLS but are not the exclusive means of identifying such statements.

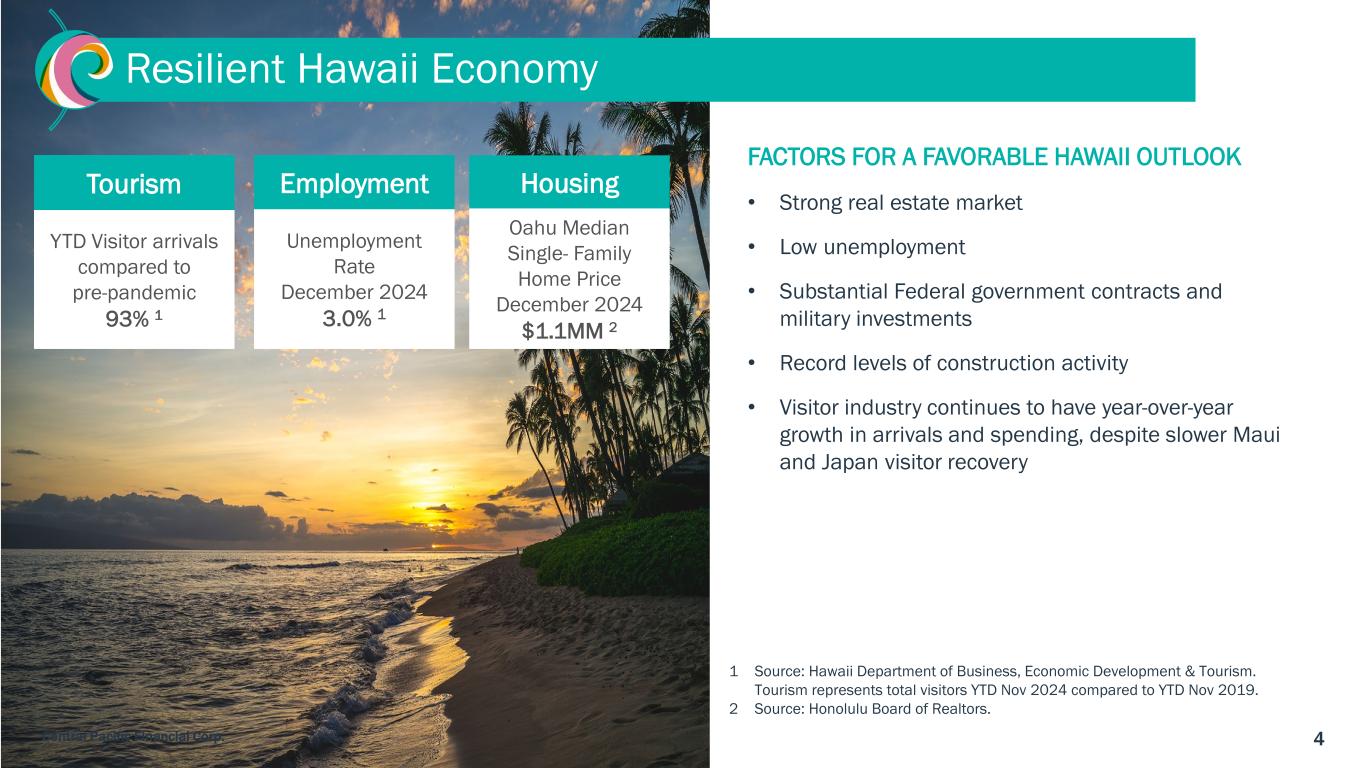

While we believe that our FLS and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the effects of inflation and interest rate fluctuations; the adverse effects of bank failures and the potential impact of such developments on customer confidence, deposit behavior, liquidity and regulatory responses thereto; the adverse effects of the COVID-19 pandemic virus (and its variants) and other pandemic viruses on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees, as well as the effects of government programs and initiatives in response thereto; supply chain disruptions; labor contract disputes and potential strikes; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, and earthquakes) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau, government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings and lawsuits we are or may become subject to, or regulatory or other governmental inquiries and proceedings and the resolution thereof; the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to, and the effect of any recurring or special FDIC assessments; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the PCAOB, the FASB and other accounting standard setters and the cost and resources required to implement such changes; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System; securities market and monetary fluctuations, including the impact resulting from the elimination of the LIBOR Index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; the effects of any potential or actual acquisitions or dispositions we may make or evaluate, and the related costs; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; technological changes and developments; cybersecurity and data privacy breaches and the consequence therefrom; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; our ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; changes in the competitive environment among financial holding companies and other financial service providers; our ability to successfully implement our initiatives to lower our efficiency ratio; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; our ability to successfully implement and achieve the objectives of our BaaS initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; and our success at managing the risks involved in the foregoing items.

For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the FLS, please see the Company's publicly available SEC filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the FLS contained in this document. FLS speak only as of the date on which such statements are made. We undertake no obligation to update any FLS to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

|

|

|

|

|

|

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES |

|

| Financial Highlights |

|

| (Unaudited) |

TABLE 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| (Dollars in thousands, |

|

Dec 31, |

|

Sep 30, |

|

Jun 30, |

|

Mar 31, |

|

Dec 31, |

|

Dec 31, |

| except for per share amounts) |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| CONDENSED INCOME STATEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

$ |

55,774 |

|

|

$ |

53,851 |

|

|

$ |

51,921 |

|

|

$ |

50,187 |

|

|

$ |

51,142 |

|

|

$ |

211,733 |

|

|

$ |

210,000 |

|

| Provision for credit losses |

|

818 |

|

|

2,833 |

|

|

2,239 |

|

|

3,936 |

|

|

4,653 |

|

|

9,826 |

|

|

15,698 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other operating income |

|

2,624 |

|

|

12,734 |

|

|

12,121 |

|

|

11,244 |

|

|

15,172 |

|

|

38,723 |

|

|

46,663 |

|

| Total other operating expense |

|

44,177 |

|

|

46,687 |

|

|

41,151 |

|

|

40,576 |

|

|

42,522 |

|

|

172,591 |

|

|

164,143 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

2,058 |

|

|

3,760 |

|

|

4,835 |

|

|

3,974 |

|

|

4,273 |

|

|

14,627 |

|

|

18,153 |

|

| Net income |

|

11,345 |

|

|

13,305 |

|

|

15,817 |

|

|

12,945 |

|

|

14,866 |

|

|

53,412 |

|

|

58,669 |

|

| Basic earnings per share |

|

$ |

0.42 |

|

|

$ |

0.49 |

|

|

$ |

0.58 |

|

|

$ |

0.48 |

|

|

$ |

0.55 |

|

|

$ |

1.97 |

|

|

$ |

2.17 |

|

| Diluted earnings per share |

|

0.42 |

|

|

0.49 |

|

|

0.58 |

|

|

0.48 |

|

|

0.55 |

|

|

1.97 |

|

|

2.17 |

|

| Dividends declared per share |

|

0.26 |

|

|

0.26 |

|

|

0.26 |

|

|

0.26 |

|

|

0.26 |

|

|

1.04 |

|

|

1.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets (ROA) [1] |

|

0.62 |

% |

|

0.72 |

% |

|

0.86 |

% |

|

0.70 |

% |

|

0.79 |

% |

|

0.72 |

% |

|

0.78 |

% |

| Return on average shareholders’ equity (ROE) [1] |

|

8.37 |

|

|

10.02 |

|

|

12.42 |

|

|

10.33 |

|

|

12.55 |

|

|

10.25 |

|

|

12.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average shareholders’ equity to average assets |

|

7.35 |

|

|

7.23 |

|

|

6.94 |

|

|

6.73 |

|

|

6.32 |

|

|

7.06 |

|

|

6.34 |

|

| Efficiency ratio [2] |

|

75.65 |

|

|

70.12 |

|

|

64.26 |

|

|

66.05 |

|

|

64.12 |

|

|

68.91 |

|

|

63.95 |

|

| Net interest margin (NIM) [1] |

|

3.17 |

|

|

3.07 |

|

|

2.97 |

|

|

2.83 |

|

|

2.84 |

|

|

3.01 |

|

|

2.94 |

|

| Dividend payout ratio [3] |

|

61.90 |

|

|

53.06 |

|

|

44.83 |

|

|

54.17 |

|

|

47.27 |

|

|

52.79 |

|

|

47.93 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELECTED AVERAGE BALANCES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average loans, including loans held for sale |

|

$ |

5,315,802 |

|

|

$ |

5,330,810 |

|

|

$ |

5,385,829 |

|

|

$ |

5,400,558 |

|

|

$ |

5,458,245 |

|

|

$ |

5,358,059 |

|

|

$ |

5,508,530 |

|

| Average interest-earning assets |

|

7,052,296 |

|

|

7,022,910 |

|

|

7,032,515 |

|

|

7,140,264 |

|

|

7,208,613 |

|

|

7,061,864 |

|

|

7,169,463 |

|

| Average assets |

|

7,377,398 |

|

|

7,347,403 |

|

|

7,338,714 |

|

|

7,449,661 |

|

|

7,498,097 |

|

|

7,378,207 |

|

|

7,479,243 |

|

| Average deposits |

|

6,546,616 |

|

|

6,535,422 |

|

|

6,542,767 |

|

|

6,659,812 |

|

|

6,730,883 |

|

|

6,570,990 |

|

|

6,700,127 |

|

| Average interest-bearing liabilities |

|

4,906,623 |

|

|

4,904,460 |

|

|

4,910,998 |

|

|

5,009,542 |

|

|

5,023,321 |

|

|

4,932,757 |

|

|

4,938,705 |

|

| Average shareholders’ equity |

|

542,135 |

|

|

530,928 |

|

|

509,507 |

|

|

501,120 |

|

|

473,708 |

|

|

521,008 |

|

|

473,819 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] ROA and ROE are annualized based on a 30/360 day convention. Annualized net interest income and expense in the NIM calculation are based on the day count interest payment conventions at the interest-earning asset or interest-bearing liability level (i.e. 30/360, actual/actual). |

| [2] Efficiency ratio is defined as total other operating expense divided by total revenue (net interest income and total other operating income). |

| [3] Dividend payout ratio is defined as dividends declared per share divided by diluted earnings per share. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES |

|

| Financial Highlights |

|

| (Unaudited) |

TABLE 1 (CONTINUED) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Dec 31, |

|

Sep 30, |

|

Jun 30, |

|

Mar 31, |

|

Dec 31, |

|

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REGULATORY CAPITAL RATIOS |

|

|

|

|

|

|

|

|

|

|

| Central Pacific Financial Corp. |

|

|

|

|

|

|

|

|

|

|

| Leverage ratio |

|

9.3 |

% |

|

9.5 |

% |

|

9.3 |

% |

|

9.0 |

% |

|

8.8 |

% |

| Common equity tier 1 capital ratio |

|

12.3 |

|

|

12.1 |

|

|

11.9 |

|

|

11.6 |

|

|

11.4 |

|

| Tier 1 risk-based capital ratio |

|

13.2 |

|

|

13.1 |

|

|

12.8 |

|

|

12.6 |

|

|

12.4 |

|

| Total risk-based capital ratio |

|

15.4 |

|

|

15.3 |

|

|

15.1 |

|

|

14.8 |

|

|

14.6 |

|

|

|

|

|

|

|

|

|

|

|

|

| Central Pacific Bank |

|

|

|

|

|

|

|

|

|

|

| Leverage ratio |

|

9.7 |

|

|

9.8 |

|

|

9.6 |

|

|

9.4 |

|

|

9.2 |

|

| Common equity tier 1 capital ratio |

|

13.8 |

|

|

13.6 |

|

|

13.3 |

|

|

13.1 |

|

|

12.9 |

|

| Tier 1 risk-based capital ratio |

|

13.8 |

|

|

13.6 |

|

|

13.3 |

|

|

13.1 |

|

|

12.9 |

|

| Total risk-based capital ratio |

|

14.9 |

|

|

14.8 |

|

|

14.5 |

|

|

14.3 |

|

|

14.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec 31, |

|

Sep 30, |

|

Jun 30, |

|

Mar 31, |

|

Dec 31, |

| (dollars in thousands, except for per share amounts) |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

| BALANCE SHEET |

|

|

|

|

|

|

|

|

|

|

| Total loans, net of deferred fees and costs |

|

$ |

5,332,852 |

|

|

$ |

5,342,609 |

|

|

$ |

5,383,644 |

|

|

$ |

5,401,417 |

|

|

$ |

5,438,982 |

|

| Total assets |

|

7,472,096 |

|

|

7,415,430 |

|

|

7,386,952 |

|

|

7,409,999 |

|

|

7,642,796 |

|

| Total deposits |

|

6,644,011 |

|

|

6,583,013 |

|

|

6,582,455 |

|

|

6,618,854 |

|

|

6,847,592 |

|

| Long-term debt |

|

156,345 |

|

|

156,284 |

|

|

156,223 |

|

|

156,163 |

|

|

156,102 |

|

| Total shareholders’ equity |

|

538,385 |

|

|

543,725 |

|

|

518,647 |

|

|

507,203 |

|

|

503,815 |

|

| Total shareholders’ equity to total assets |

|

7.21 |

% |

|

7.33 |

% |

|

7.02 |

% |

|

6.84 |

% |

|

6.59 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSET QUALITY |

|

|

|

|

|

|

|

|

|

|

| Allowance for credit losses (ACL) |

|

$ |

59,182 |

|

|

$ |

61,647 |

|

|

$ |

62,225 |

|

|

$ |

63,532 |

|

|

$ |

63,934 |

|

| Nonaccrual loans |

|

11,018 |

|

|

11,597 |

|

|

10,257 |

|

|

10,132 |

|

|

7,008 |

|

| Non-performing assets (NPA) |

|

11,018 |

|

|

11,597 |

|

|

10,257 |

|

|

10,132 |

|

|

7,008 |

|

| Ratio of ACL to total loans |

|

1.11 |

% |

|

1.15 |

% |

|

1.16 |

% |

|

1.18 |

% |

|

1.18 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ratio of NPA to total assets |

|

0.15 |

% |

|

0.16 |

% |

|

0.14 |

% |

|

0.14 |

% |

|

0.09 |

% |

|

|

|

|

|

|

|

|

|

|

|

| PER SHARE OF COMMON STOCK OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

| Book value per common share |

|

$ |

19.89 |

|

|

$ |

20.09 |

|

|

$ |

19.16 |

|

|

$ |

18.76 |

|

|

$ |

18.63 |

|

|

|

|

|

|

|

|

|

|

|

|

| Closing market price per common share |

|

29.05 |

|

|

29.51 |

|

|

21.20 |

|

|

19.75 |

|

|

19.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES |

|

| Consolidated Balance Sheets |

|

| (Unaudited) |

TABLE 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Dec 31, |

|

Sep 30, |

|

Jun 30, |

|

Mar 31, |

|

Dec 31, |

| (Dollars in thousands, except share data) |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

| ASSETS |

|

|

|

|

|

|

|

|

|

|

| Cash and due from financial institutions |

|

$ |

77,774 |

|

|

$ |

100,064 |

|

|

$ |

103,829 |

|

|

$ |

98,410 |

|

|

$ |

116,181 |

|

| Interest-bearing deposits in other financial institutions |

|

303,167 |

|

|

226,505 |

|

|

195,062 |

|

|

214,472 |

|

|

406,256 |

|

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

| Available-for-sale debt securities, at fair value |

|

737,658 |

|

|

723,453 |

|

|

676,719 |

|

|

660,833 |

|

|

647,210 |

|

| Held-to-maturity debt securities, at amortized cost; fair value of: $506,681 at December 31, 2024, $546,990 at September 30, 2024, $528,088 at June 30, 2024, $541,685 at March 31, 2024, and $565,178 at December 31, 2023 |

|

596,930 |

|

|

606,117 |

|

|

615,867 |

|

|

624,948 |

|

|

632,338 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total investment securities |

|

1,334,588 |

|

|

1,329,570 |

|

|

1,292,586 |

|

|

1,285,781 |

|

|

1,279,548 |

|

| Loans held for sale |

|

5,662 |

|

|

1,609 |

|

|

3,950 |

|

|

755 |

|

|

1,778 |

|

| Loans, net of deferred fees and costs |

|

5,332,852 |

|

|

5,342,609 |

|

|

5,383,644 |

|

|

5,401,417 |

|

|

5,438,982 |

|

| Less: allowance for credit losses |

|

(59,182) |

|

|

(61,647) |

|

|

(62,225) |

|

|

(63,532) |

|

|

(63,934) |

|

| Loans, net of allowance for credit losses |

|

5,273,670 |

|

|

5,280,962 |

|

|

5,321,419 |

|

|

5,337,885 |

|

|

5,375,048 |

|

| Premises and equipment, net |

|

104,342 |

|

|

104,575 |

|

|

100,646 |

|

|

97,688 |

|

|

96,184 |

|

| Accrued interest receivable |

|

23,378 |

|

|

23,942 |

|

|

23,184 |

|

|

21,957 |

|

|

21,511 |

|

| Investment in unconsolidated entities |

|

52,417 |

|

|

54,836 |

|

|

40,155 |

|

|

40,780 |

|

|

41,546 |

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage servicing rights |

|

8,473 |

|

|

8,513 |

|

|

8,636 |

|

|

8,599 |

|

|

8,696 |

|

|

|

|

|

|

|

|

|

|

|

|

| Bank-owned life insurance |

|

176,216 |

|

|

175,914 |

|

|

173,716 |

|

|

172,228 |

|

|

170,706 |

|

| Federal Home Loan Bank of Des Moines ("FHLB") stock |

|

6,929 |

|

|

6,929 |

|

|

6,925 |

|

|

6,921 |

|

|

6,793 |

|

| Right-of-use lease assets |

|

30,824 |

|

|

32,192 |

|

|

32,081 |

|

|

32,079 |

|

|

29,720 |

|

| Other assets |

|

74,656 |

|

|

69,819 |

|

|

84,763 |

|

|

92,444 |

|

|

88,829 |

|

| Total assets |

|

$ |

7,472,096 |

|

|

$ |

7,415,430 |

|

|

$ |

7,386,952 |

|

|

$ |

7,409,999 |

|

|

$ |

7,642,796 |

|

| LIABILITIES |

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing demand |

|

$ |

1,888,937 |

|

|

$ |

1,838,009 |

|

|

$ |

1,847,173 |

|

|

$ |

1,848,554 |

|

|

$ |

1,913,379 |

|

| Interest-bearing demand |

|

1,338,719 |

|

|

1,255,382 |

|

|

1,283,669 |

|

|

1,290,321 |

|

|

1,329,189 |

|

| Savings and money market |

|

2,329,170 |

|

|

2,336,323 |

|

|

2,234,111 |

|

|

2,211,966 |

|

|

2,209,733 |

|

| Time |

|

1,087,185 |

|

|

1,153,299 |

|

|

1,217,502 |

|

|

1,268,013 |

|

|

1,395,291 |

|

| Total deposits |

|

6,644,011 |

|

|

6,583,013 |

|

|

6,582,455 |

|

|

6,618,854 |

|

|

6,847,592 |

|

|

|

|

|

|

|

|

|

|

|

|

| Long-term debt, net of unamortized debt issuance costs of: $202 at December 31, 2024, $263 at September 30, 2024, $324 at June 30, 2024, $384 at March 31, 2024, and $445 at December 31, 2023 |

|

156,345 |

|

|

156,284 |

|

|

156,223 |

|

|

156,163 |

|

|

156,102 |

|

| Lease liabilities |

|

32,025 |

|

|

33,807 |

|

|

33,422 |

|

|

33,169 |

|

|

30,634 |

|

|

|

|

|

|

|

|

|

|

|

|

| Accrued interest payable |

|

10,051 |

|

|

12,980 |

|

|

14,998 |

|

|

16,654 |

|

|

18,948 |

|

| Other liabilities |

|

91,279 |

|

|

85,621 |

|

|

81,207 |

|

|

77,956 |

|

|

85,705 |

|

| Total liabilities |

|

6,933,711 |

|

|

6,871,705 |

|

|

6,868,305 |

|

|

6,902,796 |

|

|

7,138,981 |

|

| SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

| Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

| Preferred stock, no par value, authorized 1,000,000 shares; issued and outstanding: none at December 31, 2024, September 30, 2024, June 30, 2024, March 31, 2024, and December 31, 2023 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Common stock, no par value, authorized 185,000,000 shares; issued and outstanding: 27,065,570 at December 31, 2024, 27,064,501 at September 30, 2024, 27,063,644 at June 30, 2024, 27,042,326 at March 31, 2024, and 27,045,033 at December 31, 2023 |

|

404,494 |

|

|

404,494 |

|

|

404,494 |

|

|

404,494 |

|

|

405,439 |

|

| Additional paid-in capital |

|

105,054 |

|

|

104,794 |

|

|

104,161 |

|

|

103,130 |

|

|

102,982 |

|

| Retained earnings |

|

143,259 |

|

|

138,951 |

|

|

132,683 |

|

|

123,902 |

|

|

117,990 |

|

| Accumulated other comprehensive loss |

|

(114,422) |

|

|

(104,514) |

|

|

(122,691) |

|

|

(124,323) |

|

|

(122,596) |

|

| Total shareholders' equity |

|

538,385 |

|

|

543,725 |

|

|

518,647 |

|

|

507,203 |

|

|

503,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and shareholders' equity |

|

$ |

7,472,096 |

|

|

$ |

7,415,430 |

|

|

$ |

7,386,952 |

|

|

$ |

7,409,999 |

|

|

$ |

7,642,796 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES |

|

| Consolidated Statements of Income |

|

| (Unaudited) |

TABLE 3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

Dec 31, |

|

Sep 30, |

|

Jun 30, |

|

Mar 31, |

|

Dec 31, |

|

Dec 31, |

| (Dollars in thousands, except per share data) |

|

2024 |

|

2024 |

|

2024 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and fees on loans |

|

$ |

65,482 |

|

|

$ |

65,469 |

|

|

$ |

64,422 |

|

|

$ |

62,819 |

|

|

$ |

62,429 |

|

|

$ |

258,192 |

|

|

$ |

243,315 |

|

| Interest and dividends on investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable investment securities |

|

8,626 |

|

|

8,975 |

|

|

8,466 |

|

|

7,211 |

|

|

7,292 |

|

|

33,278 |

|

|

28,789 |

|

| Tax-exempt investment securities |

|

723 |

|

|

551 |

|

|

598 |

|

|

655 |

|

|

686 |

|

|

2,527 |

|

|

2,912 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits in other financial institutions |

|

3,004 |

|

|

2,775 |

|

|

2,203 |

|

|

3,611 |

|

|

3,597 |

|

|

11,593 |

|

|

7,163 |

|

| Dividend income on FHLB stock |

|

125 |

|

|

127 |

|

|

151 |

|

|

106 |

|

|

109 |

|

|

509 |

|

|

478 |

|

| Total interest income |

|

77,960 |

|

|

77,897 |

|

|

75,840 |

|

|

74,402 |

|

|

74,113 |

|

|

306,099 |

|

|

282,657 |

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest on deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand |

|

686 |

|

|

484 |

|

|

490 |

|

|

499 |

|

|

467 |

|

|

2,159 |

|

|

1,701 |

|

| Savings and money market |

|

9,388 |

|

|

10,235 |

|

|

8,977 |

|

|

8,443 |

|

|

7,459 |

|

|

37,043 |

|

|

21,979 |

|

| Time |

|

9,881 |

|

|

11,040 |

|

|

12,173 |

|

|

12,990 |

|

|

12,741 |

|

|

46,084 |

|

|

39,205 |

|

| Interest on short-term borrowings |

|

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

— |

|

|

1 |

|

|

1,139 |

|

| Interest on long-term debt |

|

2,231 |

|

|

2,287 |

|

|

2,278 |

|

|

2,283 |

|

|

2,304 |

|

|

9,079 |

|

|

8,633 |

|

| Total interest expense |

|

22,186 |

|

|

24,046 |

|

|

23,919 |

|

|

24,215 |

|

|

22,971 |

|

|

94,366 |

|

|

72,657 |

|

| Net interest income |

|

55,774 |

|

|

53,851 |

|

|

51,921 |

|

|

50,187 |

|

|

51,142 |

|

|

211,733 |

|

|

210,000 |

|

| Provision for credit losses |

|

818 |

|

|

2,833 |

|

|

2,239 |

|

|

3,936 |

|

|

4,653 |

|

|

9,826 |

|

|

15,698 |

|

| Net interest income after provision for credit losses |

|

54,956 |

|

|

51,018 |

|

|

49,682 |

|

|

46,251 |

|

|

46,489 |

|

|

201,907 |

|

|

194,302 |

|

| Other operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage banking income |

|

913 |

|

|

822 |

|

|

1,040 |

|

|

613 |

|

|

611 |

|

|

3,388 |

|

|

2,592 |

|

| Service charges on deposit accounts |

|

2,251 |

|

|

2,167 |

|

|

2,135 |

|

|

2,103 |

|

|

2,312 |

|

|

8,656 |

|

|

8,753 |

|

| Other service charges and fees |

|

5,476 |

|

|

5,947 |

|

|

5,869 |

|

|

5,261 |

|

|

5,349 |

|

|

22,553 |

|

|

20,531 |

|

| Income from fiduciary activities |

|

1,430 |

|

|

1,447 |

|

|

1,449 |

|

|

1,435 |

|

|

1,272 |

|

|

5,761 |

|

|

4,895 |

|

| Income from bank-owned life insurance |

|

1,966 |

|

|

1,897 |

|

|

1,234 |

|

|

1,522 |

|

|

2,015 |

|

|

6,619 |

|

|

4,870 |

|

| Net loss on sales of investment securities |

|

(9,934) |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,939) |

|

|

(9,934) |

|

|

(2,074) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

522 |

|

|

454 |

|

|

394 |

|

|

310 |

|

|

5,552 |

|

|

1,680 |

|

|

7,096 |

|

| Total other operating income |

|

2,624 |

|

|

12,734 |

|

|

12,121 |

|

|

11,244 |

|

|

15,172 |

|

|

38,723 |

|

|

46,663 |

|

| Other operating expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Salaries and employee benefits |

|

21,661 |

|

|

22,299 |

|

|

21,246 |

|

|

20,735 |

|

|

20,164 |

|

|

85,941 |

|

|

82,050 |

|

| Net occupancy |

|

4,192 |

|

|

4,612 |

|

|

4,597 |

|

|

4,600 |

|

|

4,676 |

|

|

18,001 |

|

|

18,185 |

|

| Computer software |

|

4,757 |

|

|

4,590 |

|

|

4,381 |

|

|

4,287 |

|

|

4,026 |

|

|

18,015 |

|

|

17,726 |

|

| Legal and professional services |

|

2,504 |

|

|

2,460 |

|

|

2,506 |

|

|

2,320 |

|

|

2,245 |

|

|

9,790 |

|

|

9,959 |

|

| Equipment |

|

904 |

|

|

972 |

|

|

995 |

|

|

1,010 |

|

|

968 |

|

|

3,881 |

|

|

3,958 |

|

| Advertising |

|

911 |

|

|

889 |

|

|

901 |

|

|

914 |

|

|

1,045 |

|

|

3,615 |

|

|

3,888 |

|

| Communication |

|

943 |

|

|

740 |

|

|

657 |

|

|

837 |

|

|

632 |

|

|

3,177 |

|

|

3,010 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

|

8,305 |

|

|

10,125 |

|

|

5,868 |

|

|

5,873 |

|

|

8,766 |

|

|

30,171 |

|

|

25,367 |

|

| Total other operating expense |

|

44,177 |

|

|

46,687 |

|

|

41,151 |

|

|

40,576 |

|

|

42,522 |

|

|

172,591 |

|

|

164,143 |

|

| Income before income taxes |

|

13,403 |

|

|

17,065 |

|

|

20,652 |

|

|

16,919 |

|

|

19,139 |

|

|

68,039 |

|

|

76,822 |

|

| Income tax expense |

|

2,058 |

|

|

3,760 |

|

|

4,835 |

|

|

3,974 |

|

|

4,273 |

|

|

14,627 |

|

|

18,153 |

|

| Net income |

|

$ |

11,345 |

|

|

$ |

13,305 |

|

|

$ |

15,817 |

|

|

$ |

12,945 |

|

|

$ |

14,866 |

|

|

$ |

53,412 |

|

|

$ |

58,669 |

|

| Per common share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

|

$ |

0.42 |

|

|

$ |

0.49 |

|

|

$ |

0.58 |

|

|

$ |

0.48 |

|

|

$ |

0.55 |

|

|

$ |

1.97 |

|

|

$ |

2.17 |

|

| Diluted earnings per share |

|

0.42 |

|

|

0.49 |

|

|

0.58 |

|

|

0.48 |

|

|

0.55 |

|

|

1.97 |

|

|

2.17 |

|

| Cash dividends declared |

|

0.26 |

|

|

0.26 |

|

|

0.26 |

|

|

0.26 |

|

|

0.26 |

|

|

1.04 |

|

|

1.04 |

|

| Basic weighted average shares outstanding |

|

27,065,047 |

|

|

27,064,035 |

|

|

27,053,549 |

|

|

27,046,525 |

|

|

27,044,121 |

|

|

27,057,329 |

|

|

27,027,681 |

|

| Diluted weighted average shares outstanding |

|

27,221,121 |

|

|

27,194,625 |

|

|

27,116,349 |

|

|

27,099,101 |

|

|

27,097,285 |

|

|

27,157,120 |

|

|

27,080,518 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES |

|

| Average Balances, Interest Income & Expense, Yields and Rates (Taxable Equivalent) |

|

| (Unaudited) |

TABLE 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Three Months Ended |

|

Three Months Ended |

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| |

|

Average |

|

Average |

|

|

|

Average |

|

Average |

|

|

|

Average |

|

Average |

|

|

| (Dollars in thousands) |

|

Balance |

|

Yield/Rate |

|

Interest |

|

Balance |

|

Yield/Rate |

|

Interest |

|

Balance |

|

Yield/Rate |

|

Interest |

| ASSETS |

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits in other financial institutions |

|

$ |

250,493 |

|

|

4.77 |

% |

|

$ |

3,004 |

|

|

$ |

203,657 |

|

|

5.42 |

% |

|

$ |

2,775 |

|

|

$ |

261,594 |

|

|

5.45 |

% |

|

$ |

3,597 |

|

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

1,338,569 |

|

|

2.58 |

|

|

8,626 |

|

|

1,340,347 |

|

|

2.68 |

|

|

8,975 |

|

|

1,331,752 |

|

|

2.19 |

|

|

7,292 |

|

| Tax-exempt [1] |

|

140,503 |

|

|

2.60 |

|

|

915 |

|

|

141,168 |

|

|

1.98 |

|

|

697 |

|

|

146,803 |

|

|

2.36 |

|

|

868 |

|

| Total investment securities |

|

1,479,072 |

|

|

2.58 |

|

|

9,541 |

|

|

1,481,515 |

|

|

2.61 |

|

|

9,672 |

|

|

1,478,555 |

|

|

2.21 |

|

|

8,160 |

|

| Loans, including loans held for sale |

|

5,315,802 |

|

|

4.91 |

|

|

65,482 |

|

|

5,330,810 |

|

|

4.89 |

|

|

65,469 |

|

|

5,458,245 |

|

|

4.55 |

|

|

62,429 |

|

| FHLB stock |

|

6,929 |

|

|

7.23 |

|

|

125 |

|

|

6,928 |

|

|

7.31 |

|

|

127 |

|

|

10,219 |

|

|

4.30 |

|

|

109 |

|

| Total interest-earning assets |

|

7,052,296 |

|

|

4.42 |

|

|

78,152 |

|

|

7,022,910 |

|

|

4.43 |

|

|

78,043 |

|

|

7,208,613 |

|

|

4.10 |

|

|

74,295 |

|

| Noninterest-earning assets |

|

325,102 |

|

|

|

|

|

|

324,493 |

|

|

|

|

|

|

289,484 |

|

|

|

|

|

| Total assets |

|

$ |

7,377,398 |

|

|

|

|

|

|

$ |

7,347,403 |

|

|

|

|

|

|

$ |

7,498,097 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand deposits |

|

$ |

1,312,561 |

|

|

0.21 |

% |

|

$ |

686 |

|

|

$ |

1,267,135 |

|

|

0.15 |

% |

|

$ |

484 |

|

|

$ |

1,315,943 |

|

|

0.14 |

% |

|

$ |

467 |

|

| Savings and money market deposits |

|

2,313,293 |

|

|

1.61 |

|

|

9,388 |

|

|

2,298,853 |

|

|

1.77 |

|

|

10,235 |

|

|

2,217,065 |

|

|

1.33 |

|

|

7,459 |

|

| Time deposits up to $250,000 |

|

518,540 |

|

|

2.99 |

|

|

3,900 |

|

|

534,497 |

|

|

3.15 |

|

|

4,238 |

|

|

478,085 |

|

|

2.80 |

|

|

3,373 |

|

| Time deposits over $250,000 |

|

605,920 |

|

|

3.93 |

|

|

5,981 |

|

|

647,728 |

|

|

4.18 |

|

|

6,802 |

|

|

856,159 |

|

|

4.34 |

|

|

9,368 |

|

| Total interest-bearing deposits |

|

4,750,314 |

|

|

1.67 |

|

|

19,955 |

|

|

4,748,213 |

|

|

1.82 |

|

|

21,759 |

|

|

4,867,252 |

|

|

1.68 |

|

|

20,667 |

|

| Federal funds purchased and securities sold |

|

2 |

|

|

5.57 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| FHLB advances and other short-term borrowings |

|

2 |

|

|

5.04 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Long-term debt |

|

156,305 |

|

|

5.68 |

|

|

2,231 |

|

|

156,247 |

|

|

5.82 |

|

|

2,287 |

|

|

156,069 |

|

|

5.86 |

|

|

2,304 |

|

| Total interest-bearing liabilities |

|

4,906,623 |

|

|

1.80 |

|

|

22,186 |

|

|

4,904,460 |

|

|

1.95 |

|

|

24,046 |

|

|

5,023,321 |

|

|

1.81 |

|

|

22,971 |

|

| Noninterest-bearing deposits |

|

1,796,302 |

|

|

|

|

|

|

1,787,209 |

|

|

|

|

|

|

1,863,631 |

|

|

|

|

|

| Other liabilities |

|

132,338 |

|

|

|

|

|

|

124,806 |

|

|

|

|

|

|

137,437 |

|

|

|

|

|

| Total liabilities |

|

6,835,263 |

|

|

|

|

|

|

6,816,475 |

|

|

|

|

|

|

7,024,389 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total shareholders' equity |

|

542,135 |

|

|

|

|

|

|

530,928 |

|

|

|

|

|

|

473,708 |

|

|

|

|

|

| Total liabilities and shareholders' equity |

|

$ |

7,377,398 |

|

|

|

|

|

|

$ |

7,347,403 |

|

|

|

|

|

|

$ |

7,498,097 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

|

|

|

$ |

55,966 |

|

|

|

|

|

|

$ |

53,997 |

|

|

|

|

|

|

$ |

51,324 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest rate spread |

|

|

|

2.62 |

% |

|

|

|

|

|

2.48 |

% |

|

|

|

|

|

2.29 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest margin |

|

|

|

3.17 |

% |

|

|

|

|

|

3.07 |

% |

|

|

|

|

|

2.84 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| [1] Interest income and resultant yield information for tax-exempt investment securities is expressed on a taxable-equivalent basis using a federal statutory tax rate of 21%. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CENTRAL PACIFIC FINANCIAL CORP. AND SUBSIDIARIES |

|

| Average Balances, Interest Income & Expense, Yields and Rates (Taxable Equivalent) |

|

| (Unaudited) |

TABLE 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended |

|

Year Ended |

|

|

December 31, 2024 |

|

December 31, 2023 |

| |

|

Average |

|

Average |

|

|

|

Average |

|

Average |

|

|

| (Dollars in thousands) |

|

Balance |

|

Yield/Rate |

|

Interest |

|

Balance |

|

Yield/Rate |

|

Interest |

| ASSETS |

| Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing deposits in other financial institutions |

|

$ |

220,526 |

|

|

5.26 |

% |

|

$ |

11,593 |

|

|

$ |

134,150 |

|

|

5.34 |

% |

|

$ |

7,163 |

|

| Investment securities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Taxable |

|

1,334,695 |

|

|

2.49 |

|

|

33,278 |

|

|

1,365,067 |

|

|

2.11 |

|

|

28,789 |

|

| Tax-exempt [1] |

|

141,688 |

|

|

2.26 |

|

|

3,199 |

|

|

150,399 |

|

|

2.45 |

|

|

3,686 |

|

| Total investment securities |

|

1,476,383 |

|

|

2.47 |

|

|

36,477 |

|

|

1,515,466 |

|

|

2.14 |

|

|

32,475 |

|

| Loans, including loans held for sale |

|

5,358,059 |

|

|

4.82 |

|

|

258,192 |

|

|

5,508,530 |

|

|

4.42 |

|

|

243,315 |

|

| FHLB stock |

|

6,896 |

|

|

7.38 |

|

|

509 |

|

|

11,317 |

|

|

4.23 |

|

|

478 |

|

| Total interest-earning assets |

|

7,061,864 |

|

|

4.34 |

|

|

306,771 |

|

|

7,169,463 |

|

|

3.95 |

|

|

283,431 |

|

| Noninterest-earning assets |

|

316,343 |

|

|

|

|

|

|

309,780 |

|

|

|

|

|

| Total assets |

|

$ |

7,378,207 |

|

|

|

|

|

|

$ |

7,479,243 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

| Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand deposits |

|

$ |

1,287,628 |

|

|

0.17 |

% |

|

$ |

2,159 |

|

|

$ |

1,359,240 |

|

|

0.13 |

% |

|

$ |

1,701 |

|

| Savings and money market deposits |

|

2,263,273 |

|

|

1.64 |

|

|

37,043 |

|

|

2,195,763 |

|

|

1.00 |

|

|

21,979 |

|

| Time deposits up to $250,000 |

|