Investor Presentation September 2024

2Central Pacific Financial Corp. Forward-Looking Statements This document and any accompanying oral presentation may contain forward-looking statements (“FLS”) concerning: projections of revenues, expenses, income or loss, earnings or loss per share, capital expenditures, payment or nonpayment of dividends, capital position, credit losses, net interest margin or other financial items; statements of plans, objectives and expectations of Central Pacific Financial Corp. (the "Company") or its management or Board of Directors, including those relating to business plans, use of capital resources, products or services and regulatory developments and regulatory actions; statements of future economic performance including anticipated performance results from our business initiatives; or any statements of the assumptions underlying or relating to any of the foregoing. Words such as "believe," "plan," "anticipate," "seek," "expect," "intend," "forecast," "hope," "target," "continue," "remain," "estimate," "will," "should," "may" and other similar expressions are intended to identify FLS but are not the exclusive means of identifying such statements. While we believe that our FLS and the assumptions underlying them are reasonably based, such statements and assumptions are by their nature subject to risks and uncertainties, and thus could later prove to be inaccurate or incorrect. Accordingly, actual results could differ materially from those statements or projections for a variety of reasons, including, but not limited to: the effects of inflation and interest rate fluctuations; the adverse effects of recent bank failures and the potential impact of such developments on customer confidence, deposit behavior, liquidity and regulatory responses thereto; the adverse effects of the COVID-19 pandemic virus (and its variants) and other pandemic viruses on local, national and international economies, including, but not limited to, the adverse impact on tourism and construction in the State of Hawaii, our borrowers, customers, third-party contractors, vendors and employees, as well as the effects of government programs and initiatives in response thereto; supply chain disruptions; the increase in inventory or adverse conditions in the real estate market and deterioration in the construction industry; adverse changes in the financial performance and/or condition of our borrowers and, as a result, increased loan delinquency rates, deterioration in asset quality, and losses in our loan portfolio; the impact of local, national, and international economies and events (including natural disasters such as wildfires, volcanic eruptions, hurricanes, tsunamis, storms, and earthquakes) on the Company's business and operations and on tourism, the military, and other major industries operating within the Hawaii market and any other markets in which the Company does business; deterioration or malaise in domestic economic conditions, including any destabilization in the financial industry and deterioration of the real estate market, as well as the impact of declining levels of consumer and business confidence in the state of the economy in general and in financial institutions in particular; changes in estimates of future reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements; the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, changes in capital standards, other regulatory reform and federal and state legislation, including but not limited to regulations promulgated by the Consumer Financial Protection Bureau, government-sponsored enterprise reform, and any related rules and regulations which affect our business operations and competitiveness; the costs and effects of legal and regulatory developments, including legal proceedings and lawsuits we are or may become subject to, or regulatory or other governmental inquiries and proceedings and the resolution thereof; the results of regulatory examinations or reviews and the effect of, and our ability to comply with, any regulations or regulatory orders or actions we are or may become subject to, and the effect of any recurring or special FDIC assessments; the effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters and the cost and resources required to implement such changes; the effects of and changes in trade, monetary and fiscal policies and laws, including the interest rate policies of the Board of Governors of the Federal Reserve System; securities market and monetary fluctuations, including the impact resulting from the elimination of the London Interbank Offered Rate Index; negative trends in our market capitalization and adverse changes in the price of the Company's common stock; the effects of any acquisitions or dispositions we may make; political instability; acts of war or terrorism; changes in consumer spending, borrowings and savings habits; technological changes and developments; cybersecurity and data privacy breaches and the consequence therefrom; failure to maintain effective internal control over financial reporting or disclosure controls and procedures; our ability to address deficiencies in our internal controls over financial reporting or disclosure controls and procedures; changes in the competitive environment among financial holding companies and other financial service providers; our ability to successfully implement our initiatives to lower our efficiency ratio; our ability to attract and retain key personnel; changes in our personnel, organization, compensation and benefit plans; our ability to successfully implement and achieve the objectives of our Banking-as-a-Service initiatives, including adoption of the initiatives by customers and risks faced by any of our bank collaborations including reputational and regulatory risk; and our success at managing the risks involved in the foregoing items. For further information with respect to factors that could cause actual results to materially differ from the expectations or projections stated in the FLS, please see the Company's publicly available Securities and Exchange Commission filings, including the Company's Form 10-K for the last fiscal year and, in particular, the discussion of "Risk Factors" set forth therein. We urge investors to consider all of these factors carefully in evaluating the FLS contained in this document. FLS speak only as of the date on which such statements are made. We undertake no obligation to update any FLS to reflect events or circumstances after the date on which such statements are made, or to reflect the occurrence of unanticipated events except as required by law.

3Central Pacific Financial Corp. celebrating legacy MARKET INFORMATION NYSE TICKER CPF SUBSIDIARY CPB TOTAL ASSETS $7.4 BILLION MARKET CAP $749 MILLION SHARE PRICE $27.66 DIVIDEND YIELD 3.8% Central Pacific Financial Corp. (CPF) is a Hawaii-based bank holding company. Central Pacific Bank (CPB) was founded in 1954 by Japanese-American veterans of World War II to serve the needs of families and small businesses that did not have access to financial services. Today CPB is the 4th largest financial institution in Hawaii with 27 branches across the State. CPB is a market leader in residential mortgage, small business banking and digital banking. In 2024, CPB celebrated 70 years of providing financial solutions in the State of Hawaii. Note: Total assets as of June 30, 2024. Other Market Information above as of August 26, 2024. Central Pacific Financial - Corporate Profile 70-year

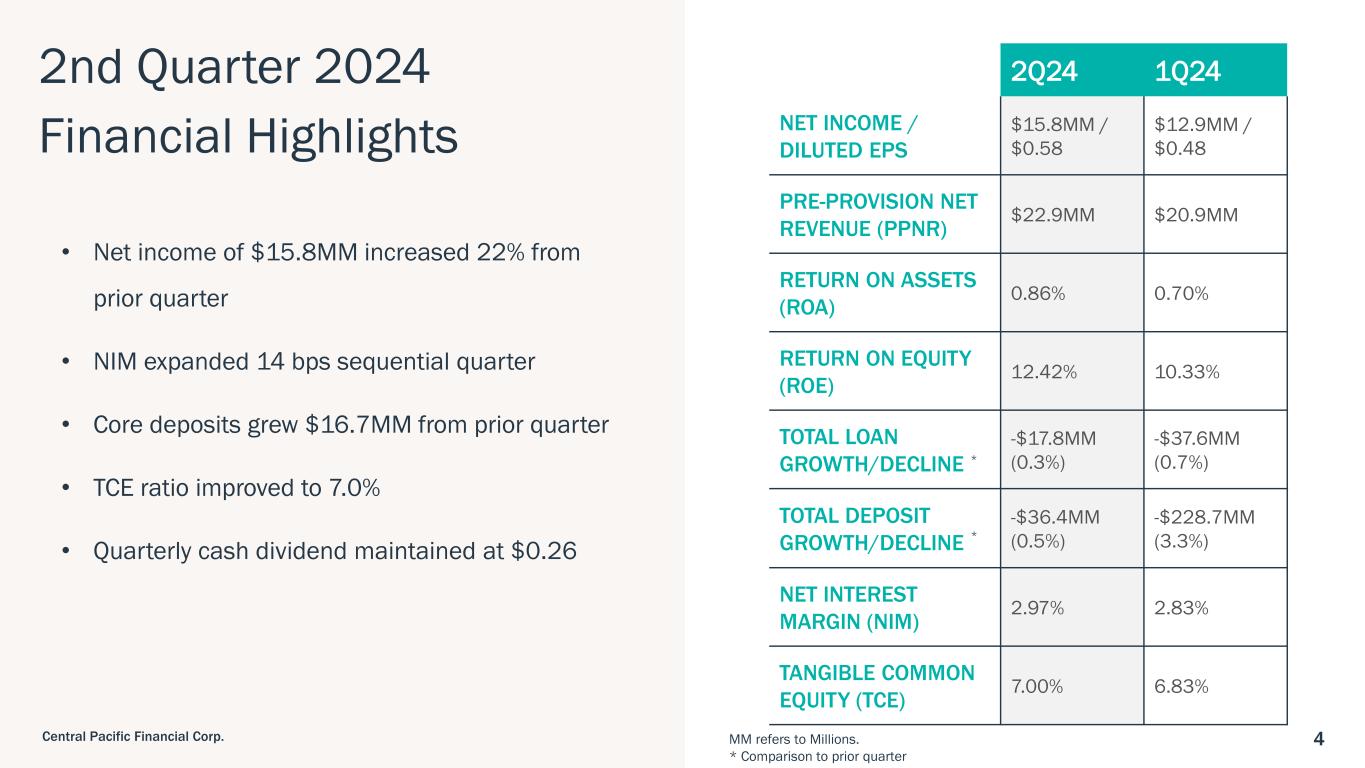

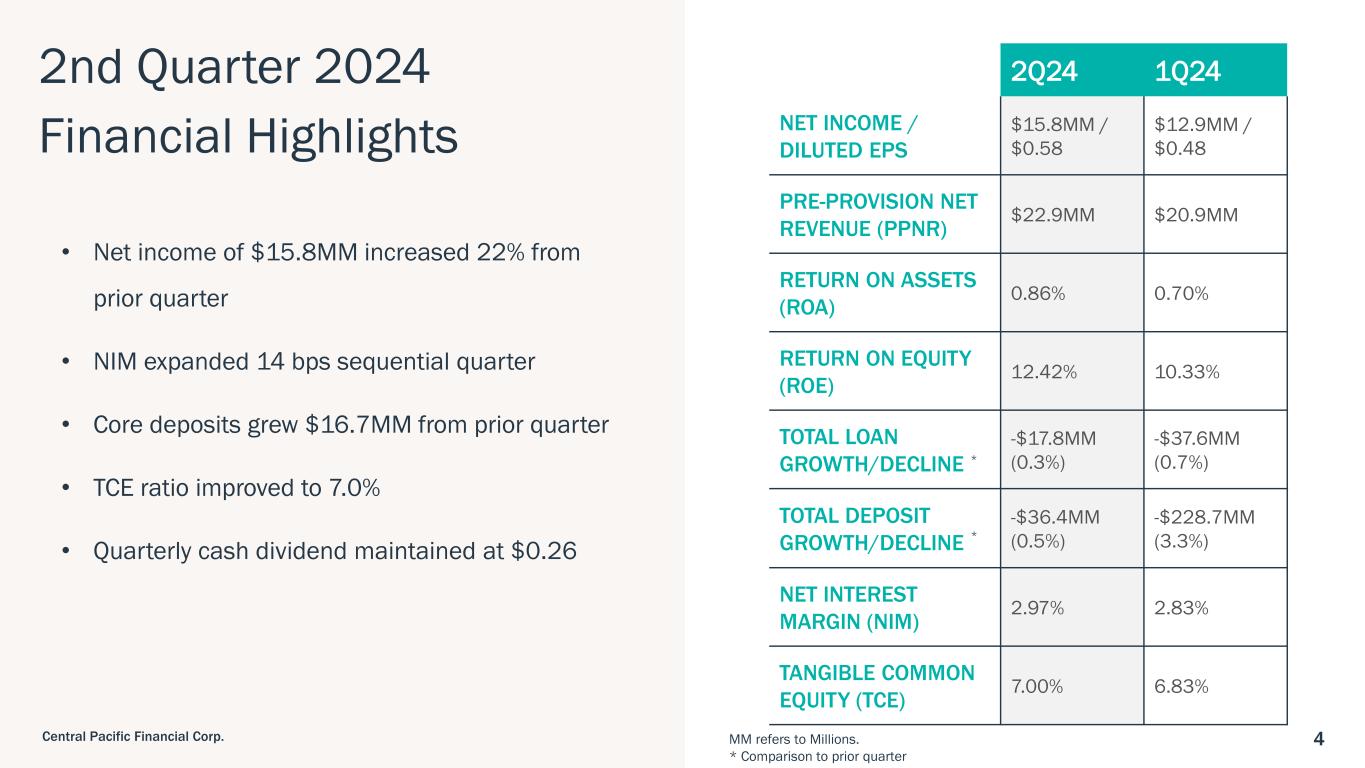

4Central Pacific Financial Corp. 2nd Quarter 2024 Financial Highlights • Net income of $15.8MM increased 22% from prior quarter • NIM expanded 14 bps sequential quarter • Core deposits grew $16.7MM from prior quarter • TCE ratio improved to 7.0% • Quarterly cash dividend maintained at $0.26 2Q24 1Q24 NET INCOME / DILUTED EPS $15.8MM / $0.58 $12.9MM / $0.48 PRE-PROVISION NET REVENUE (PPNR) $22.9MM $20.9MM RETURN ON ASSETS (ROA) 0.86% 0.70% RETURN ON EQUITY (ROE) 12.42% 10.33% TOTAL LOAN GROWTH/DECLINE -$17.8MM (0.3%) -$37.6MM (0.7%) TOTAL DEPOSIT GROWTH/DECLINE -$36.4MM (0.5%) -$228.7MM (3.3%) NET INTEREST MARGIN (NIM) 2.97% 2.83% TANGIBLE COMMON EQUITY (TCE) 7.00% 6.83% MM refers to Millions. * Comparison to prior quarter * *

5Central Pacific Financial Corp. CPF Value Drivers Resilient Hawaii Economy Diversified Loan Portfolio Valuable Deposit Franchise Focus on Driving Efficiency Solid Credit & Capital Profile Digital Leader in Hawaii 1 2 3 4 5 6

6Central Pacific Financial Corp. Tourism Visitor arrivals compared to pre-pandemic 93% 1 Employment Unemployment Rate July 2024 2.9% 1 FACTORS FOR A FAVORABLE HAWAII OUTLOOK • Maui tourism recovery from Maui wildfires in August 2023 continues with visitor arrivals at 80% of the previous year in July 2024 • Japanese visitor return slowly improving, with counts up 32% from a year ago, yet still at ~50% of pre-pandemic levels • Low unemployment and strong real estate market • Substantial Federal government contracts and military investments. $1.32 billion and $1.20 billion budgeted for the Navy Dry Dock 3 replacement at Joint Base Pearl Harbor-Hickam for federal fiscal years 2024 and 2025, respectively. • Increase in public and private investments to address housing shortage 1 Source: Hawaii Department of Business, Economic Development & Tourism. Tourism represents total visitor in July 2024 compared to July 2019. 2 Source: Honolulu Board of Realtors. Resilient Hawaii Economy Housing Oahu Median Single- Family Home Price July 2024 $1.1MM 2 1

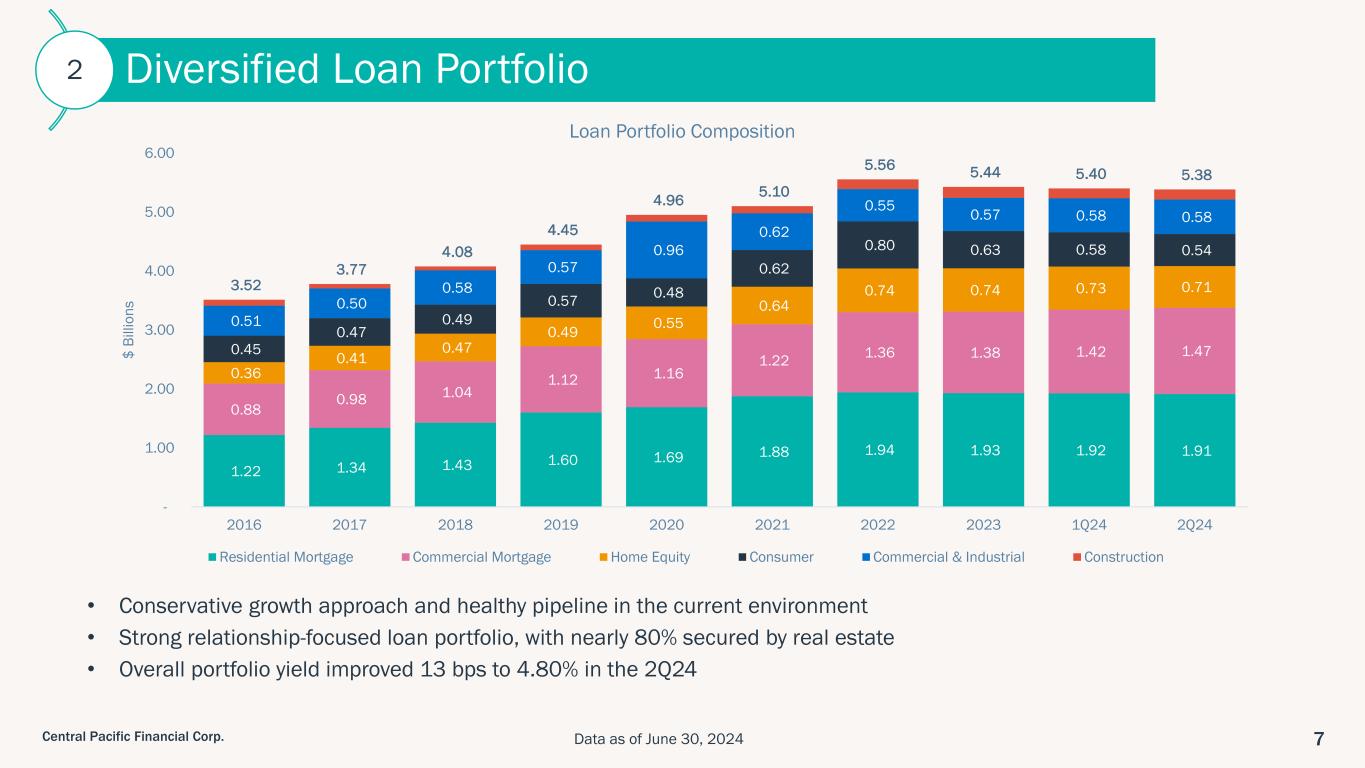

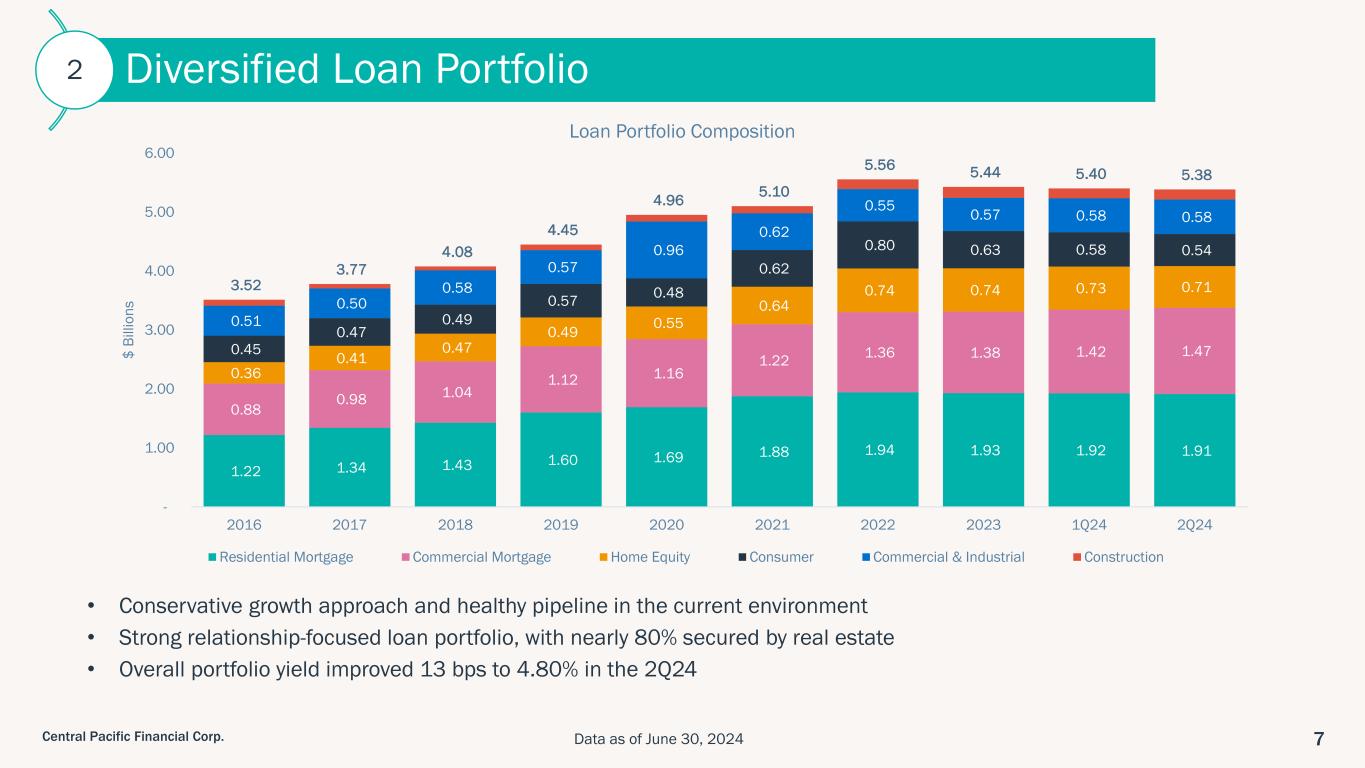

7Central Pacific Financial Corp. • Conservative growth approach and healthy pipeline in the current environment • Strong relationship-focused loan portfolio, with nearly 80% secured by real estate • Overall portfolio yield improved 13 bps to 4.80% in the 2Q24 Diversified Loan Portfolio2 1.22 1.34 1.43 1.60 1.69 1.88 1.94 1.93 1.92 1.91 0.88 0.98 1.04 1.12 1.16 1.22 1.36 1.38 1.42 1.47 0.36 0.41 0.47 0.49 0.55 0.64 0.74 0.74 0.73 0.71 0.45 0.47 0.49 0.57 0.48 0.62 0.80 0.63 0.58 0.54 0.51 0.50 0.58 0.57 0.96 0.62 0.55 0.57 0.58 0.58 3.52 3.77 4.08 4.45 4.96 5.10 5.56 5.44 5.40 5.38 - 1.00 2.00 3.00 4.00 5.00 6.00 2016 2017 2018 2019 2020 2021 2022 2023 1Q24 2Q24 $ Bi lli on s Loan Portfolio Composition Residential Mortgage Commercial Mortgage Home Equity Consumer Commercial & Industrial Construction Data as of June 30, 2024

8Central Pacific Financial Corp. HAWAII RESIDENTIAL MARKET • Housing prices continue to be strong with median single-family home price of $1.1MM 1 • Affordability and lack of inventory present ongoing challenges CPB GO-TO HOUSING PARTNER • Every step from housing construction development to individual homebuyer residential mortgage financing Market leader making a difference to support affordable housing in the State of Hawaii Affordable housing advocate and educator Multi-family Construction funding and LIHTC investments Joint ventures with residential real estate companies Lead lender on take out mortgages Driving Hawaii Homeownership Solutions 1 Source: Honolulu Board of Realtors as of July 2024. Most recently a LIHTC debt and equity investment to support housing for Native Hawaiian households at 60% or less of area median income CPB is one of the lead lenders for take- out financing on two residential condominiums (affordable and luxury) closing in 2024 in Honolulu

9Central Pacific Financial Corp. Innovative & Proven Programs • Business Exceptional – Successful 2023 campaign provided a cash bonus for small businesses to open a checking account, which resulted in over $50MM in deposit growth and 85 new small business relationships • Non-Profit Plus – Ongoing program provides exclusive benefits tailored to non-profit organizations 2023 SBA Hawaii Lender of the Year For 7(a) Category II, 504 Category II, and Veteran Loans Niche Markets • CPB has strong market share in the Dental and Physician niche as the primary bank to nearly half of the dentists and a quarter of the physicians in the State of Hawaii • Women Entrepreneurs – CPB sponsors an annual conference and has led 4 cohorts in a women entrepreneurs program to support and grow their businesses CPB – The Bank for Small Businesses in Hawaii Currently CPB banks around 26,000 small businesses in Hawaii with over 280 net new small business relationships to-date in 2024 Small Business Leader

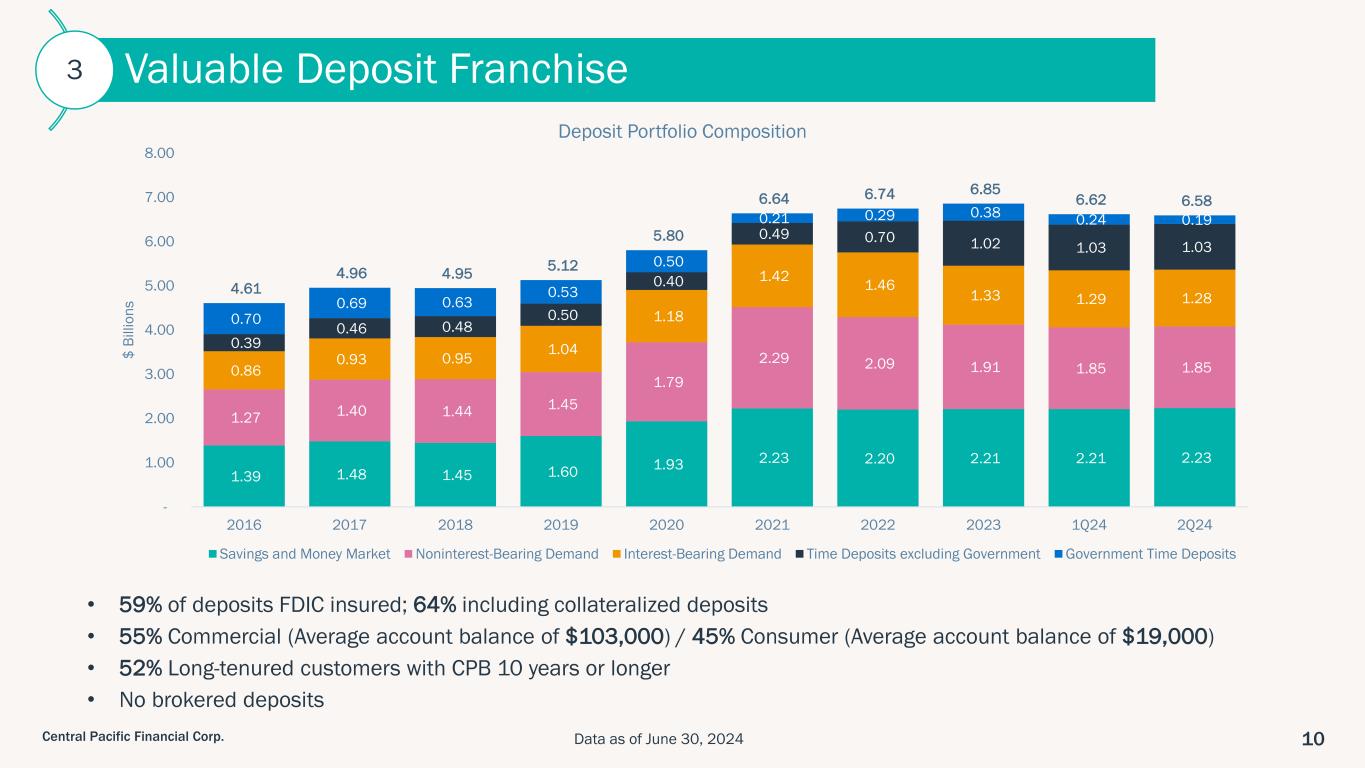

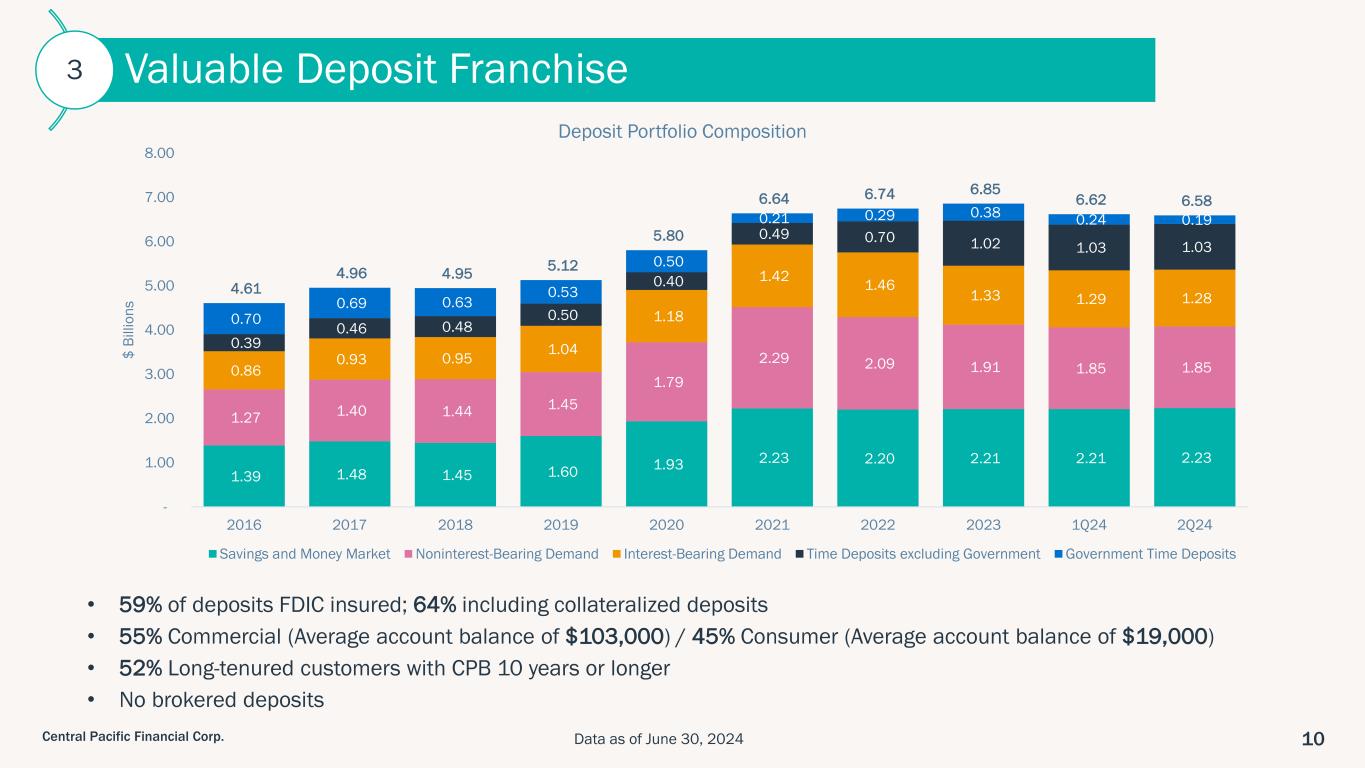

10Central Pacific Financial Corp. Valuable Deposit Franchise • 59% of deposits FDIC insured; 64% including collateralized deposits • 55% Commercial (Average account balance of $103,000) / 45% Consumer (Average account balance of $19,000) • 52% Long-tenured customers with CPB 10 years or longer • No brokered deposits 1.39 1.48 1.45 1.60 1.93 2.23 2.20 2.21 2.21 2.23 1.27 1.40 1.44 1.45 1.79 2.29 2.09 1.91 1.85 1.85 0.86 0.93 0.95 1.04 1.18 1.42 1.46 1.33 1.29 1.28 0.39 0.46 0.48 0.50 0.40 0.49 0.70 1.02 1.03 1.03 0.70 0.69 0.63 0.53 0.50 0.21 0.29 0.38 0.24 0.19 4.61 4.96 4.95 5.12 5.80 6.64 6.74 6.85 6.62 6.58 - 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 2016 2017 2018 2019 2020 2021 2022 2023 1Q24 2Q24 $ Bi lli on s Deposit Portfolio Composition Savings and Money Market Noninterest-Bearing Demand Interest-Bearing Demand Time Deposits excluding Government Government Time Deposits 3 Data as of June 30, 2024

11Central Pacific Financial Corp. CPF Deposit Cost Advantage 1 HI Peers includes BOH & FHB 2 Nat’l Peers includes publicly traded banks with total assets of $3-10B Source: S&P Global. Data as of June 30, 2024. Low rate sensitive, relationship-based deposit portfolio provides significant cost advantage 1.33% 1.76% 2.35% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 1Q24 2Q24 Total Deposit Cost CPF HI Peers Nat'l Peers Implied Repricing Beta in Current Cycle: CPF 24% HI Peers 32% Nat’l Peers 40% 1.83% 2.52% 3.03% CPF HI Peers Nat'l Peers Total Interest Bearing Deposit Cost 2Q24 28.1% 30.0% 23.5% CPF HI Peers Nat'l Peers Non-Interest Bearing Deposits to Total Deposits 2Q24 1 1 1 2 2 2

12Central Pacific Financial Corp. Leadership Connections Strategic Alliances Best Service Level Captive Insurance Deposits CPB Foundation with Mana Up Hawaii sponsored the first Aloha Market at Tokyo Haneda Airport in November 2023 showcasing 40 Hawai’i brands CPB and Tokyo Star Bank alliance announced in August 2023 for business and investment opportunities in Japan and Hawaii Favorable Hawaii State laws for Japanese captive insurance CPB is a member of the Hawaii Captive Insurance Council Japan Competitive Advantage Convenient, customized services and online banking experience tailored to Japanese customers

13Central Pacific Financial Corp. Focus on Driving Efficiency4 27 branches down 8 (-23%) since 2020 Branch Consolidation 726 FTE down 84 (-10%) since 2020 FTE Initiatives 50+ processes being standardized and automated Process Automation $1.3MM 2024 savings + additional in progress Vendor Contract Savings Data as of June 30, 2024 1.50% 1.70% 1.90% 2.10% 2.30% 2.50% 2.70% 2.90% 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Non-Interest Expense to Total Assets (Annualized) Maintained relatively flat non-interest expense to total assets despite an inflationary environment

14Central Pacific Financial Corp. 0.11% 0.12% 0.13% 0.19% 0.19% 0.09% 0.20% 2Q23 3Q23 4Q23 1Q24 2Q24 NPAs/Total Loans 5 * NPA increase relates to 2 Hawaii construction loans to a single borrower that subsequently paid off in full in mid-July 2023. 2Q23 NPAs/Total Loans ratio is 0.11% excluding the 2 Hawaii construction loans mentioned above. Strong credit risk management continues to drive low levels of problem assets * Solid Credit Profile 1.34% 1.09% 0.92% 0.56% 0.66% 2Q23 3Q23 4Q23 1Q24 2Q24 Criticized/Total Loans 0.04% 0.05% 0.07% 0.10% 0.08% 0.20% 0.23% 0.34% 0.24% 0.20% 0.24% 0.28% 0.41% 0.34% 0.28% 2Q23 3Q23 4Q23 1Q24 2Q24 Annualized NCO/Avg Loans All Other NCO/Avg Loans Mainland Consumer NCO/Avg Loans 0.06% 0.05% 0.02% 0.05% 0.04% 2Q23 3Q23 4Q23 1Q24 2Q24 Delinquencies 90+Days/Total Loans

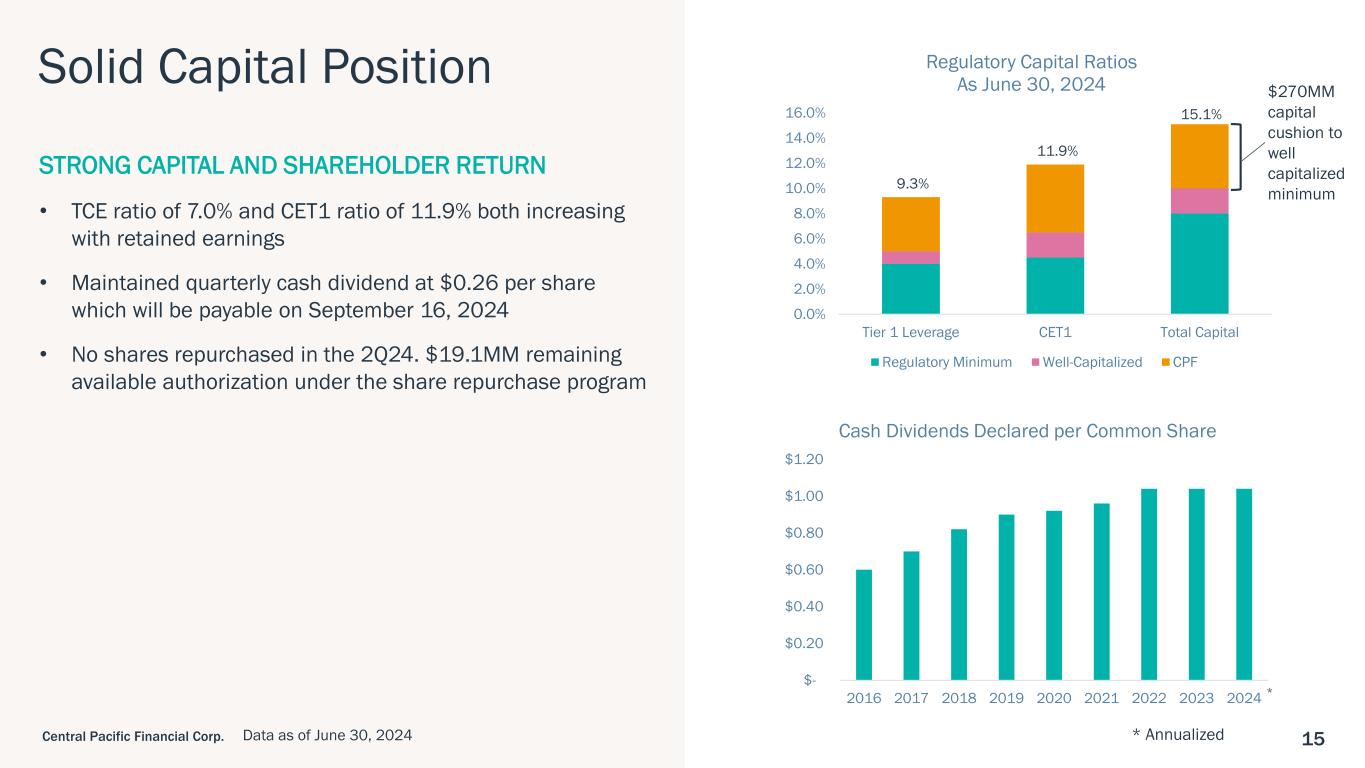

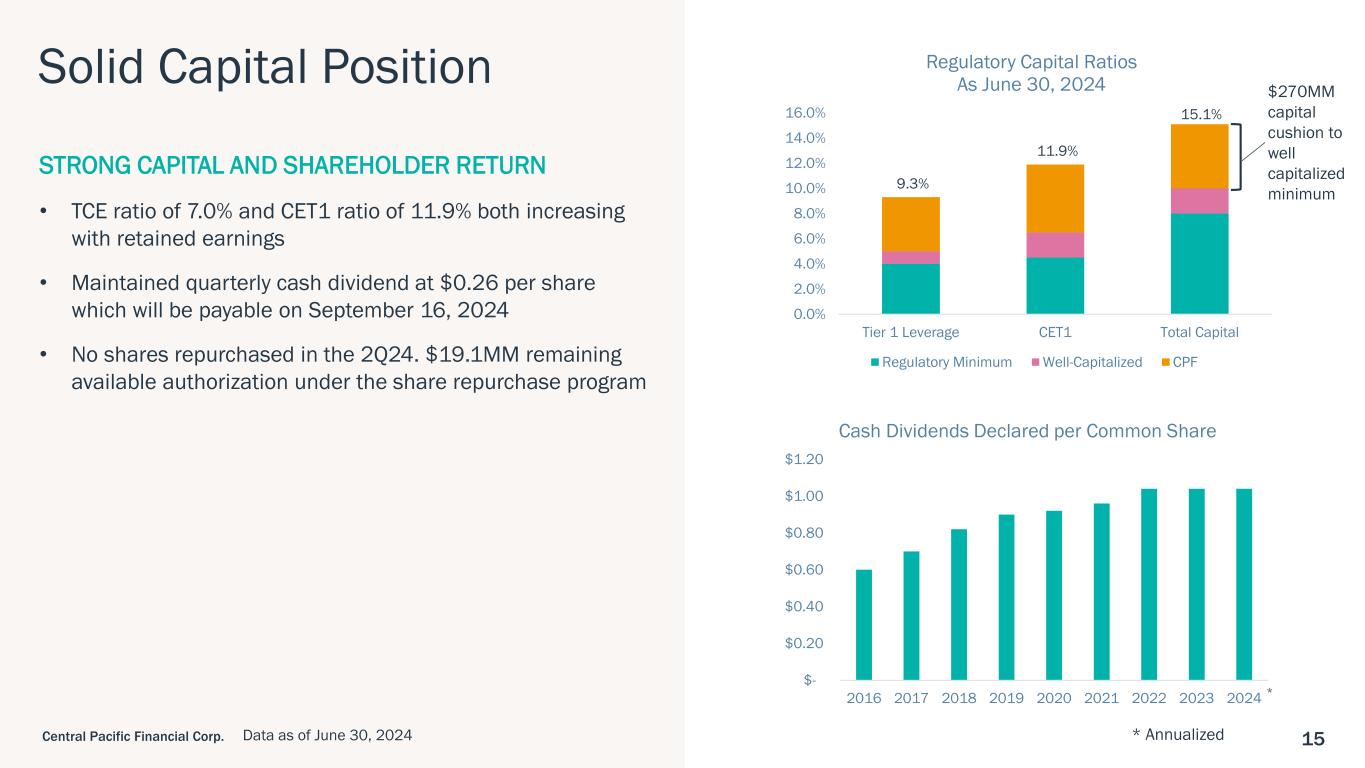

151Central Pacific Financial Corp. 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Tier 1 Leverage CET1 Total Capital Regulatory Capital Ratios As June 30, 2024 Regulatory Minimum Well-Capitalized CPF Solid Capital Position 9.3% $270MM capital cushion to well capitalized minimum 11.9% 15.1% STRONG CAPITAL AND SHAREHOLDER RETURN • TCE ratio of 7.0% and CET1 ratio of 11.9% both increasing with retained earnings • Maintained quarterly cash dividend at $0.26 per share which will be payable on September 16, 2024 • No shares repurchased in the 2Q24. $19.1MM remaining available authorization under the share repurchase program $- $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 2016 2017 2018 2019 2020 2021 2022 2023 2024 Cash Dividends Declared per Common Share * * AnnualizedData as of June 30, 2024

161Central Pacific Financial Corp. ACH, 75% ATM, 5% Mobile, 5% Branch, 15% 20,000 25,000 30,000 35,000 40,000 45,000 50,000 55,000 Retail Mobile Users 1 Digital Leader in Hawaii6 1 Excludes account clean-up that occurred in September 2023. 2 Defined as logging into online or mobile banking at least 1 time within the past 90 days as of July 2024. Customers engaged in digital banking 2 75% Customers enrolled in online banking at account opening in branch 75% CPB is the first bank in Hawaii to offer Filipino language and card tap feature on our ATMs 85% Consumer deposits processed digitally

17Central Pacific Financial Corp. Appendix

18Central Pacific Financial Corp. Commercial Real Estate Portfolio OFFICE RETAIL TOTAL BALANCE $174.2MM $296.0MM % OF TOTAL CRE 12% 20% % OF TOTAL LOANS 3% 6% WA LTV 55% 65% WA MONTHS TO MATURITY 69 65 INVESTOR / OWNER-OCCUPIED $129.1MM / $45.1MM $218.5MM / $77.5MM CRITICIZED / % OF LOAN CATEGORY $0.1MM / 0% $6.7MM / 2% • Hawaii 79% / Mainland 21% • Investor 76% / Owner-Occupied 24% Industrial/ Warehouse 27% Retail 20%Apartment 20% Office 12% Hotel 11% Other 5% Shopping Center 3% Storage 2% CRE Portfolio Composition as of June 30, 2024 Data as of June 30, 2024

19Central Pacific Financial Corp. • Total Hawaii Consumer $287MM / Total Mainland Consumer $255MM • Weighted average origination FICO: • 744 for Hawaii Consumer • 737 for Mainland Consumer • Mainland Consumer net charge-offs peaked in 4Q23 and declined for 2 consecutive quarters in 2024 thus far • Mainland Unsecured: Highly granular with average loan amounts of $12,000 Consumer Loan Portfolio HI Auto $161 , 30% HI Other $126 , 23% Mainland Home Improvement $103 , 19% Mainland Unsecured $69 , 13% Mainland Auto $83 , 15% Consumer Portfolio Composition as of June 30, 2024 ($ Millions) Data as of June 30, 2024

20Central Pacific Financial Corp. • $2.4MM provision for credit loss on loans in 2Q24 driven by net charge-offs, offset by a credit of $0.2MM to the reserve for unfunded commitments, for a total provision for credit loss of $2.2MM • Strong ACL coverage ratio of 1.16% for 2Q24 Note: Totals may not sum due to rounding. Allowance for Credit Losses $ Millions 2Q23 3Q23 4Q23 1Q24 2Q24 Beginning Balance 63.1 63.8 64.5 63.9 63.5 Net Charge-offs (3.4) (3.9) (5.5) (4.5) (3.8) Provision for Credit Losses 4.1 4.5 5.0 4.1 2.4 Ending Balance 63.8 64.5 63.9 63.5 62.2 Coverage Ratio (ACL to Total Loans) 1.16% 1.17% 1.18% 1.18% 1.16%

21Central Pacific Financial Corp. High Quality Securities Portfolio • $1.3B or 17% of total assets • 92% AAA rated • Portfolio mix: AFS 52% / HTM 48% • $29.7MM in investment securities purchased in 2Q24 at weighted average yield of 4.73% • Interest rate swap on $115.5MM of municipal securities started on 3/31/24; added $0.9MM to interest income in 2Q24 (pay fixed at 2.1%, receive float at Fed Funds)U.S. Treasury & Gov't Agency 82% Municipals 12% Non-Agency CMBS/RMBS 2% Corporate 3% Other 1% Investment Portfolio Composition as of June 30, 2024 Data as of June 30, 2024

22Central Pacific Financial Corp. • Ample alternative sources of liquidity available • Available sources of liquidity total 121% of uninsured/uncollateralized deposits Available Sources of Liquidity $ Millions June 30, 2024 Cash on Balance Sheet 299 Other Funding Sources: Unpledged Securities 509 FHLB Available Borrowing Capacity 1,739 FRB Available Borrowing Capacity 238 Other Funding Lines 75 Total 2,561 Total Sources of Liquidity 2,860 Uninsured/Uncollateralized Deposits 2,367 % of Uninsured/Uncollateralized Deposits 121%

23Central Pacific Financial Corp. (*) Certain amounts in prior years were reclassified to conform to current year's presentation. These reclassifications had an immaterial impact to our previously reported efficiency ratios. Note: Totals may not sum due to rounding. Historical Financial Highlights ($ Millions) 2016 2017 2018 2019 2020 2021 2022 2023 1Q 2Q Balance Sheet (period end data) Loans and leases 3,524.9$ 3,770.6$ 4,078.4$ 4,449.5$ 4,964.1$ 5,101.6$ 5,555.5$ 5,439.0$ 5,401.4$ 5,383.6$ Total assets 5,384.2 5,623.7 5,807.0 6,012.7 6,594.6 7,419.1 7,432.8 7,642.8 7,410.0 7,387.0 Total deposits 4,608.2 4,956.4 4,946.5 5,120.0 5,796.1 6,639.2 6,736.2 6,847.6 6,618.9 6,582.5 Total shareholders' equity 504.7 500.0 491.7 528.5 546.7 558.3 452.9 503.8 507.2 518.6 Income Statement Net interest income 158.0 167.7 173.0 184.1 197.7 211.0 215.6 210.0 50.2 51.9 Provision (credit) for credit losses (5.4) (2.6) (1.5) 6.3 42.1 (14.6) (1.3) 15.7 3.9 2.2 Other operating income 42.3 36.5 38.8 41.8 45.2 43.1 47.9 46.7 11.2 12.1 Other operating expense 132.4 131.0 135.1 141.6 151.7 163.0 166.0 164.1 40.6 41.2 Income taxes 26.3 34.6 18.8 19.6 11.8 25.8 24.8 18.2 4.0 4.8 Net income 47.0 41.2 59.5 58.3 37.3 79.9 73.9 58.7 12.9 15.8 Prof itability Return on average assets 0.90% 0.75% 1.05% 0.99% 0.58% 1.13% 1.01% 0.78% 0.70% 0.86% Return on average shareholders' equity 9.16% 8.03% 12.22% 11.36% 6.85% 14.38% 15.47% 12.38% 10.33% 12.42% Efficiency ratio (*) 66.10% 64.14% 63.79% 62.69% 62.47% 64.16% 63.00% 63.95% 66.05% 64.26% Net interest margin 3.27% 3.28% 3.22% 3.35% 3.30% 3.18% 3.09% 2.94% 2.83% 2.97% Capital Adequacy (period end data) Leverage capital ratio 10.6% 10.4% 9.9% 9.5% 8.8% 8.5% 8.5% 8.8% 9.0% 9.3% Total risk-based capital ratio 15.5% 15.9% 14.7% 13.6% 15.2% 14.5% 13.5% 14.6% 14.8% 15.1% Asset Quality Net loan chargeoffs/average loans 0.03% 0.11% 0.02% 0.15% 0.15% 0.02% 0.09% 0.27% 0.34% 0.28% Nonaccrual loans/total loans (period end) 0.24% 0.07% 0.06% 0.03% 0.12% 0.12% 0.09% 0.13% 0.19% 0.19% Year Ended December 31, 2024

24Central Pacific Financial Corp. CPB Named Best Bank in Hawaii by Newsweek, Forbes, and Honolulu Star-Advertiser • Newsweek’s Best In State Bank 2024 • Forbes’ Best-In-State Banks 2024 • Forbes’ America’s Best Banks 2024 • Honolulu Star-Advertiser’s Best Bank in Hawaii 2024

25Central Pacific Financial Corp. Environmental, Social & Governance (ESG) Focus 2023 ESG Report available here: https://www.cpb.bank/esg

26Central Pacific Financial Corp. Mahalo