| California | 0-10661 | 94-2792841 | ||||||

| (State or other jurisdiction of incorporation or organization) |

(Commission File No.) | (I.R.S. Employer Identification No.) |

||||||

63 Constitution Drive |

Chico, | California | 95973 | ||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

||||||||||||

| Common Stock, no par value | TCBK | Nasdaq | ||||||||||||

| TRICO BANCSHARES | |||||

Date: October 23, 2025 |

/s/ Peter G. Wiese | ||||

| Peter G. Wiese, Executive Vice President and Chief Financial Officer | |||||

| (Principal Financial and Accounting Officer) | |||||

For Immediate Release | October 23, 2025 | Chico, California | ||

| ||

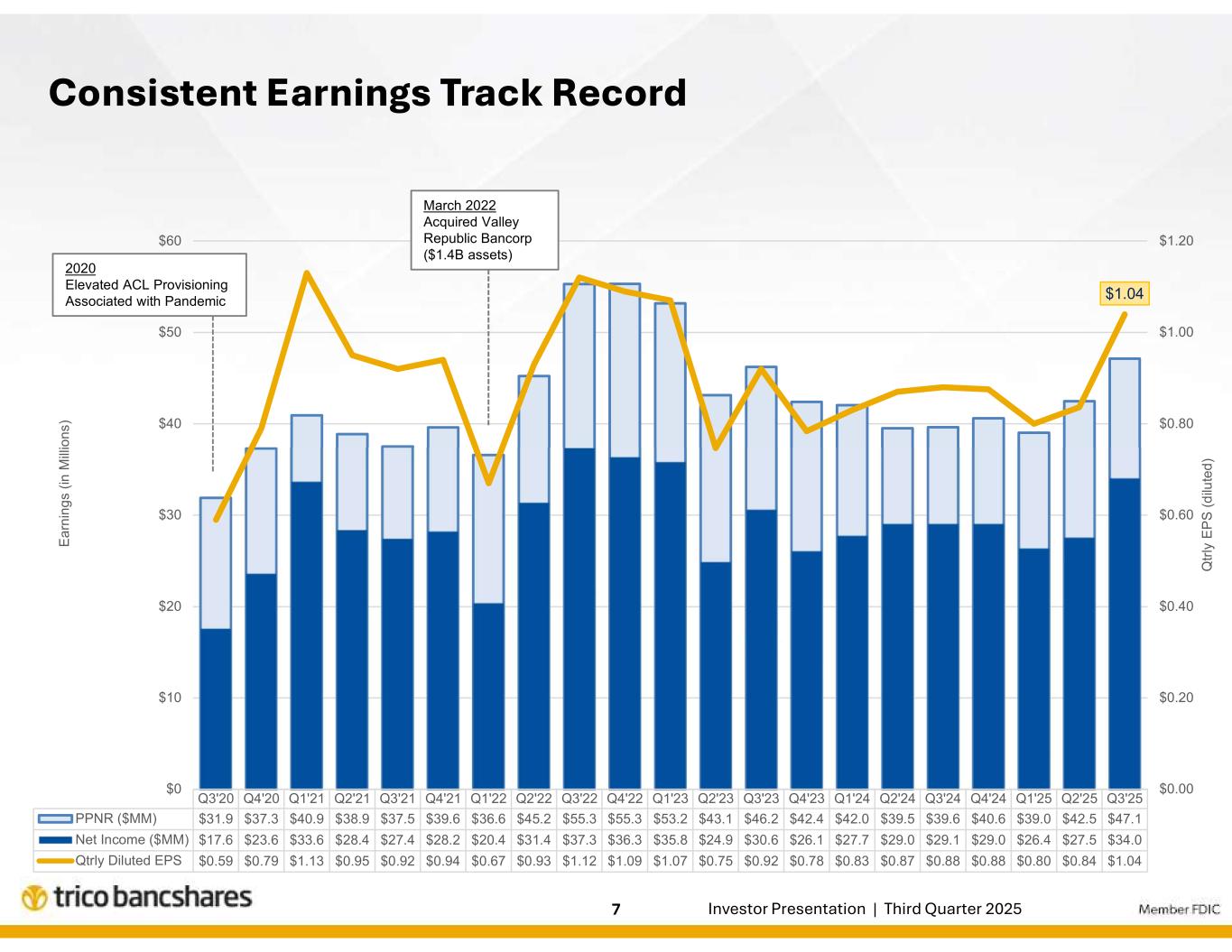

TriCo Bancshares reports third quarter 2025 net income of $34.0 million, diluted EPS of $1.04 | ||

3Q25 Financial Highlights | ||

|

Executive Commentary:

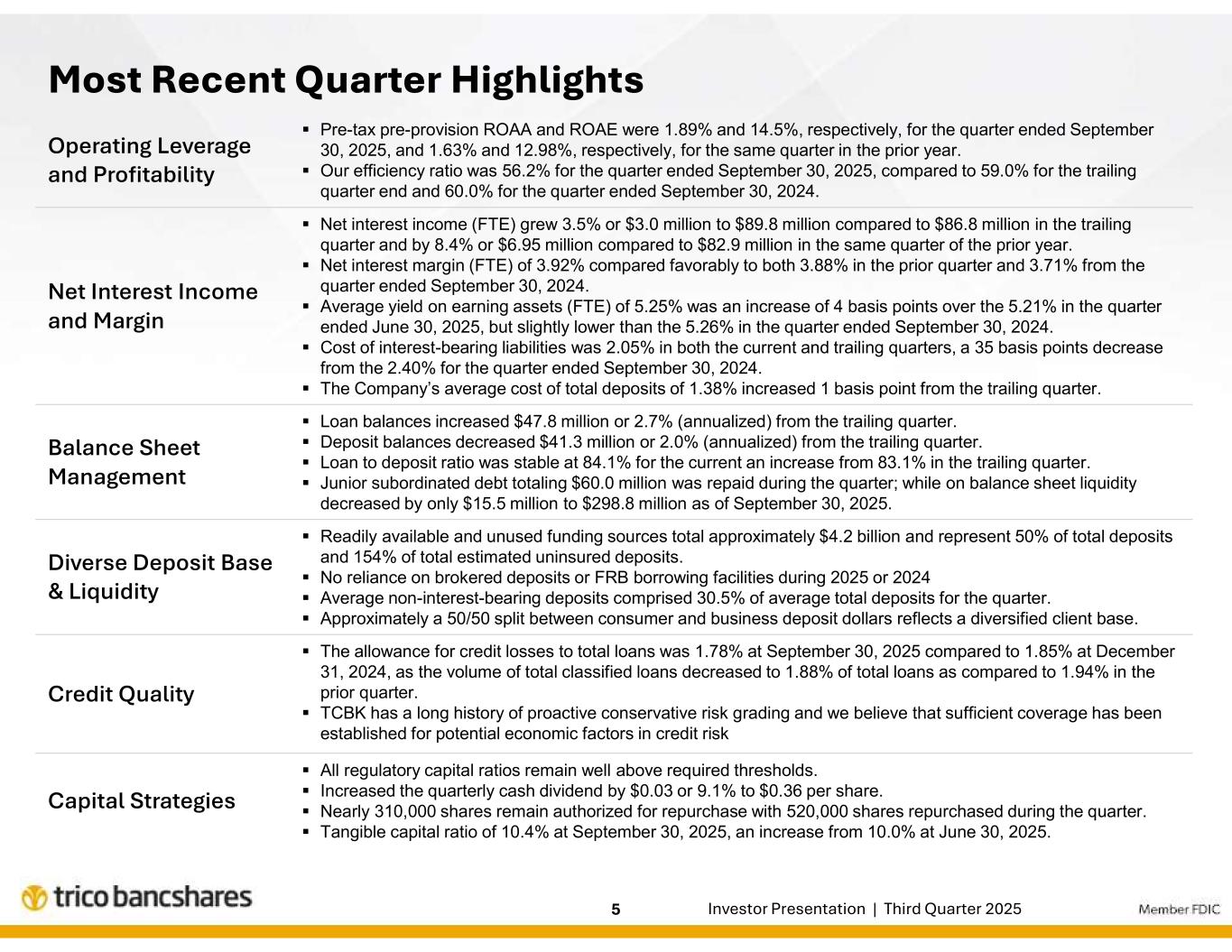

“We continue to see positive trends in a number of measures that will benefit the Company in future periods, which, as demonstrated in the current quarter, led to both positive operating leverage and growth in return on equity. While we anticipate crossing the $10 billion threshold in 2026, our ability to execute on our long-term strategies remain our primary focus,” said Rick Smith, Chairman and CEO.

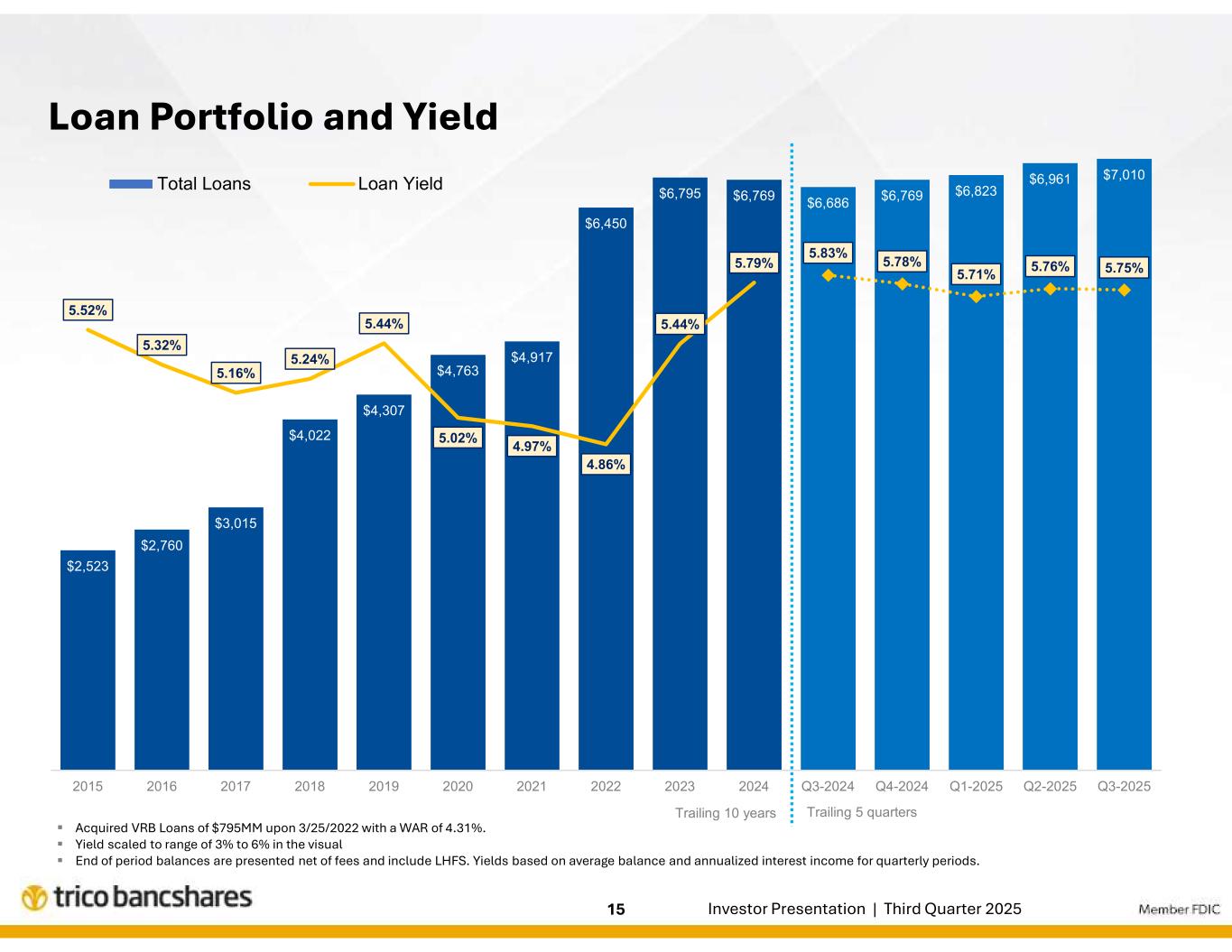

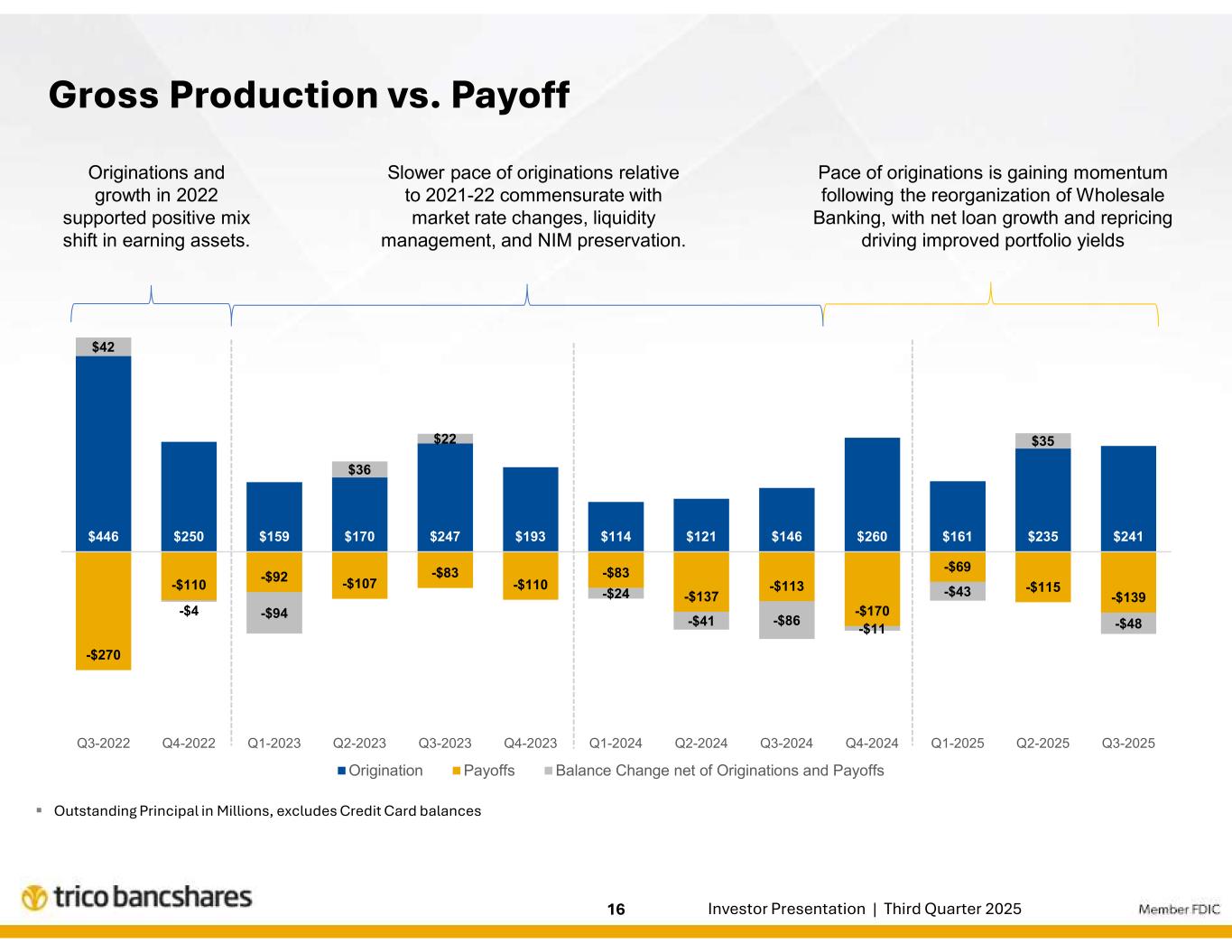

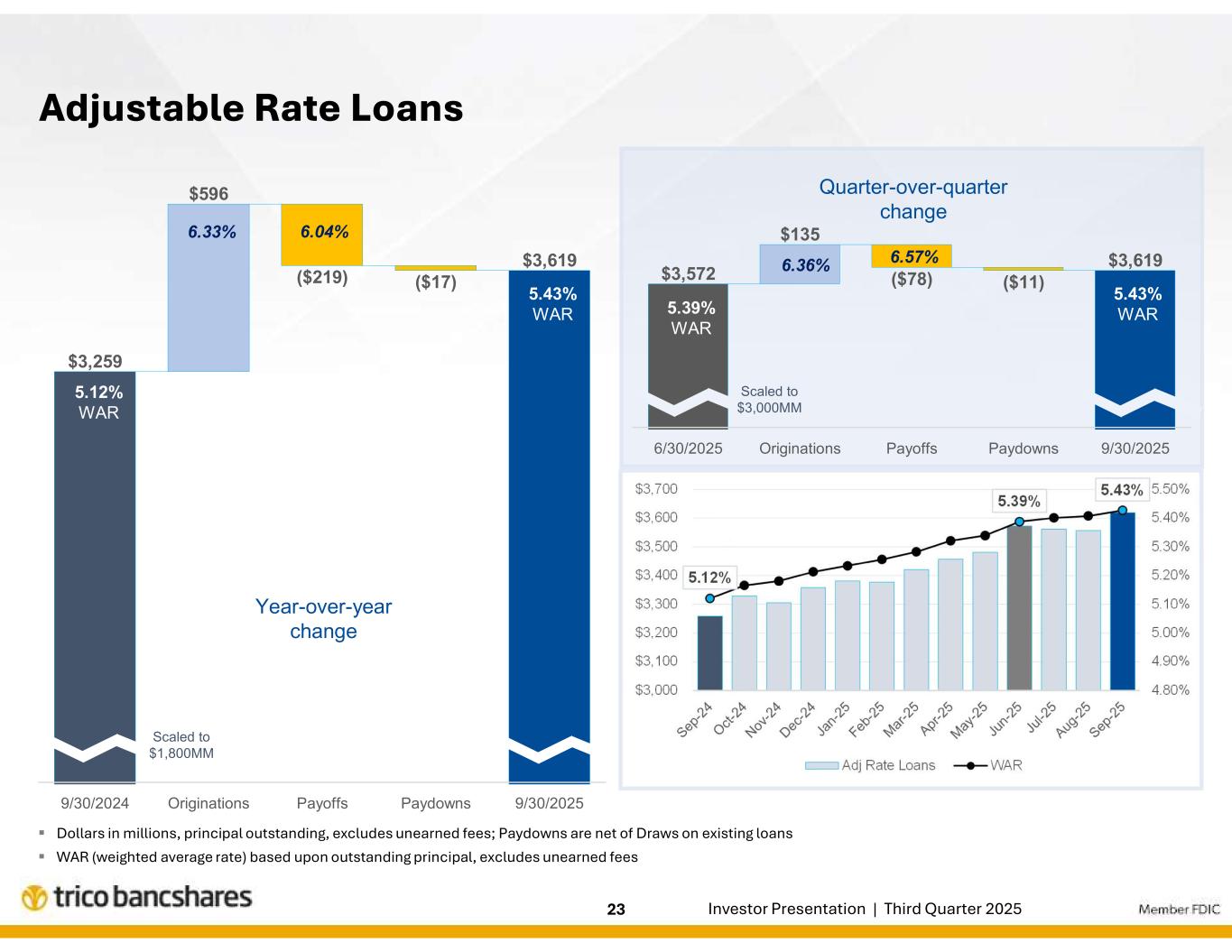

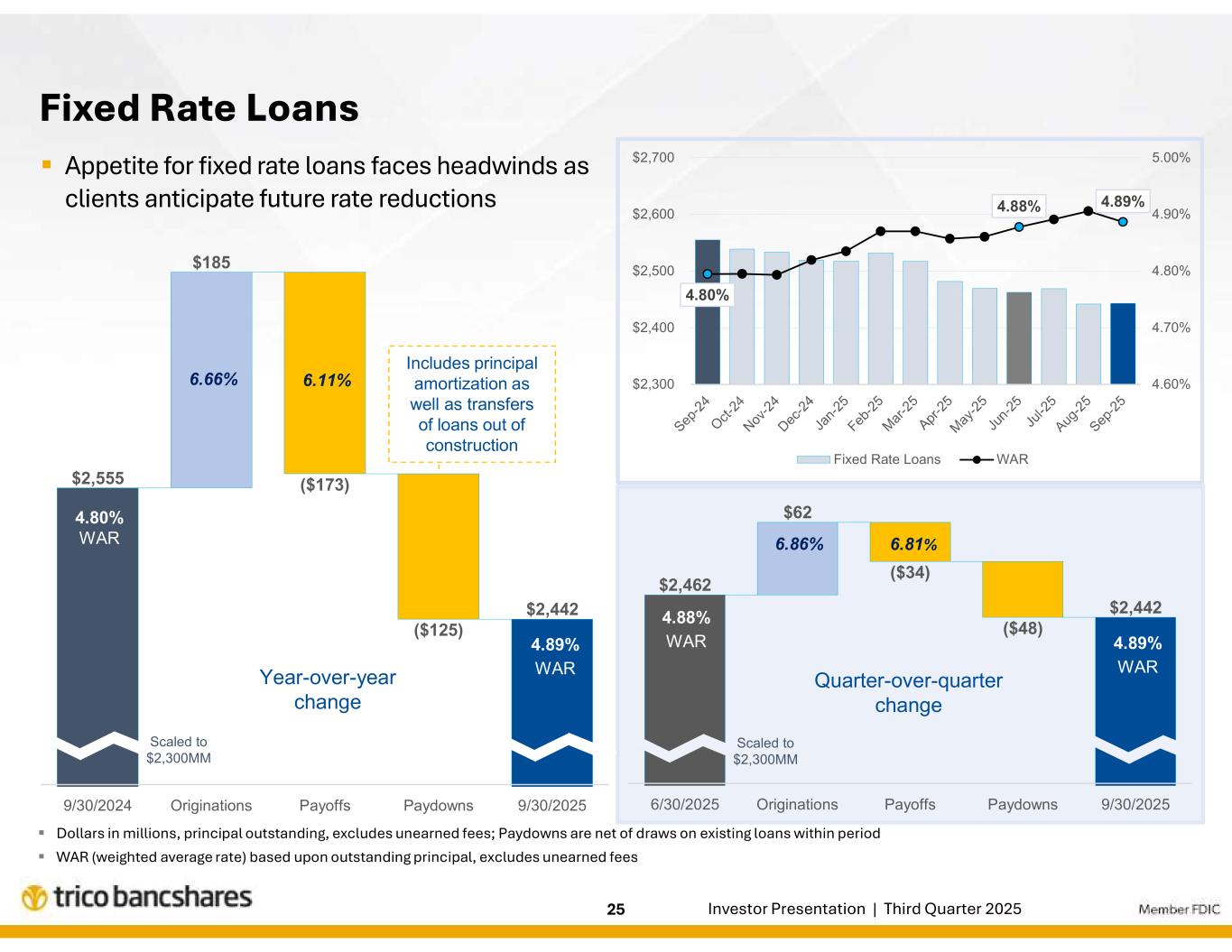

Peter Wiese, EVP and CFO added, “Loan production and origination activities continue to increase while balance sheet repricing remains ahead of expectations. The migration towards a steepening yield curve will likely contribute positively to net interest income expansion while management remains diligent about controlling expenses despite the persistence of an inflationary environment.”

| ||

| Selected Financial Highlights | |||||

| Operating Results and Performance Ratios | ||||||||||||||

| Three months ended | |||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

||||||||||||||||||||||

| (dollars and shares in thousands, except per share data) | $ Change | % Change | |||||||||||||||||||||

| Net interest income | $ | 89,555 | $ | 86,519 | $ | 3,036 | 3.5 | % | |||||||||||||||

| Provision for credit losses | (670) | (4,665) | 3,995 | (85.6) | % | ||||||||||||||||||

| Noninterest income | 18,007 | 17,090 | 917 | 5.4 | % | ||||||||||||||||||

| Noninterest expense | (60,424) | (61,131) | 707 | (1.2) | % | ||||||||||||||||||

| Provision for income taxes | (12,449) | (10,271) | (2,178) | 21.2 | % | ||||||||||||||||||

| Net income | $ | 34,019 | $ | 27,542 | $ | 6,477 | 23.5 | % | |||||||||||||||

| Diluted earnings per share | $ | 1.04 | $ | 0.84 | $ | 0.20 | 23.8 | % | |||||||||||||||

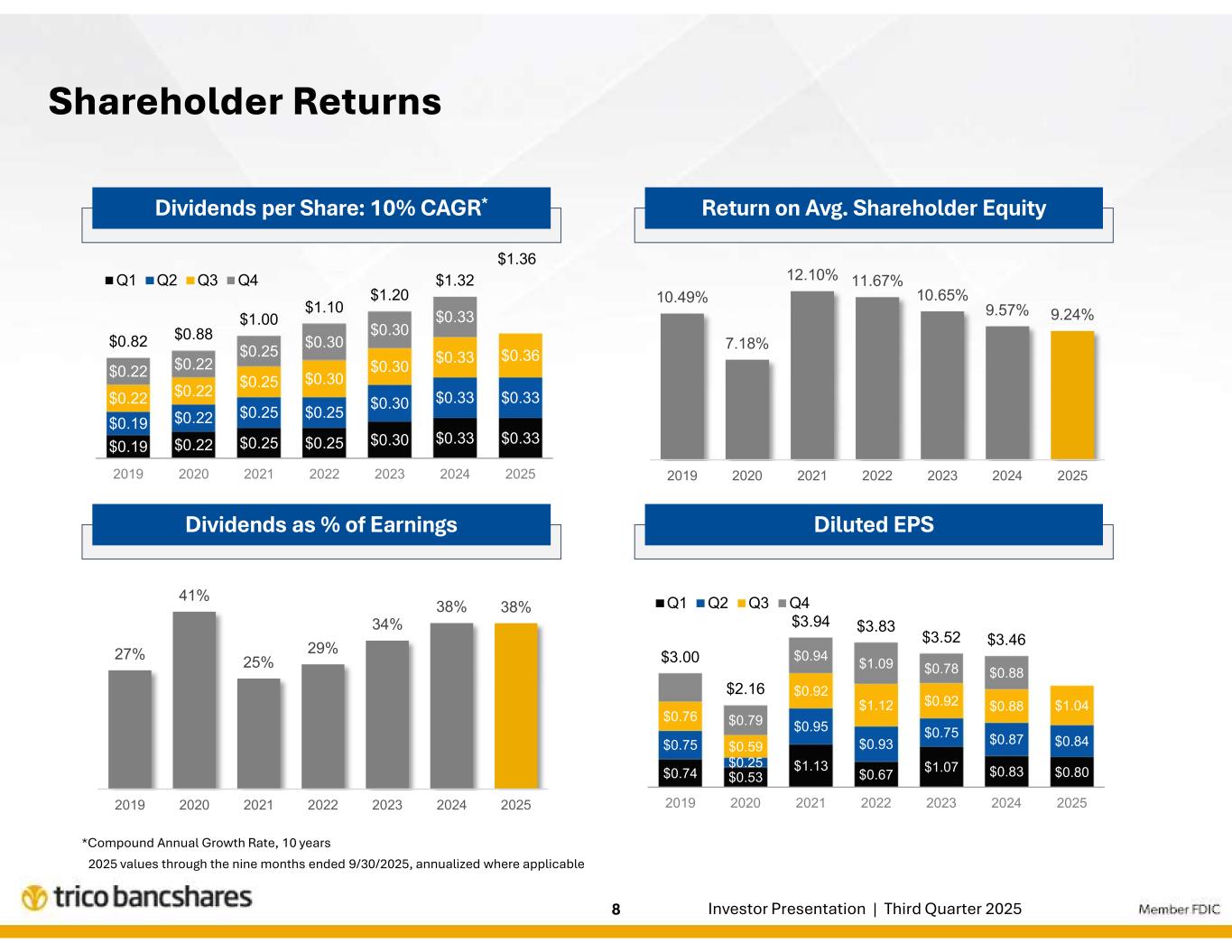

| Dividends per share | $ | 0.36 | $ | 0.33 | $ | 0.03 | 9.1 | % | |||||||||||||||

| Average common shares | 32,542 | 32,757 | (215) | (0.7) | % | ||||||||||||||||||

| Average diluted common shares | 32,723 | 32,936 | (213) | (0.6) | % | ||||||||||||||||||

| Return on average total assets | 1.36 | % | 1.13 | % | |||||||||||||||||||

| Return on average equity | 10.47 | % | 8.68 | % | |||||||||||||||||||

| Efficiency ratio | 56.18 | % | 59.00 | % | |||||||||||||||||||

| Three months ended September 30, |

|||||||||||||||||||||||

| (dollars and shares in thousands, except per share data) | 2025 | 2024 | $ Change | % Change | |||||||||||||||||||

| Net interest income | $ | 89,555 | $ | 82,611 | $ | 6,944 | 8.4 | % | |||||||||||||||

| Provision for credit losses | (670) | (220) | (450) | 204.5 | % | ||||||||||||||||||

| Noninterest income | 18,007 | 16,495 | 1,512 | 9.2 | % | ||||||||||||||||||

| Noninterest expense | (60,424) | (59,487) | (937) | 1.6 | % | ||||||||||||||||||

| Provision for income taxes | (12,449) | (10,348) | (2,101) | 20.3 | % | ||||||||||||||||||

| Net income | $ | 34,019 | $ | 29,051 | $ | 4,968 | 17.1 | % | |||||||||||||||

| Diluted earnings per share | $ | 1.04 | $ | 0.88 | $ | 0.16 | 18.2 | % | |||||||||||||||

| Dividends per share | $ | 0.36 | $ | 0.33 | $ | 0.03 | 9.1 | % | |||||||||||||||

| Average common shares | 32,542 | 32,993 | (451) | (1.4) | % | ||||||||||||||||||

| Average diluted common shares | 32,723 | 33,137 | (414) | (1.2) | % | ||||||||||||||||||

| Return on average total assets | 1.36 | % | 1.20 | % | |||||||||||||||||||

| Return on average equity | 10.47 | % | 9.52 | % | |||||||||||||||||||

| Efficiency ratio | 56.18 | % | 60.02 | % | |||||||||||||||||||

| Nine months ended September 30, |

|||||||||||||||||||||||

| (dollars and shares in thousands) | 2025 | 2024 | $ Change | % Change | |||||||||||||||||||

| Net interest income | $ | 258,616 | $ | 247,344 | $ | 11,272 | 4.6 | % | |||||||||||||||

| Provision for credit losses | (9,063) | (4,930) | (4,133) | 83.8 | % | ||||||||||||||||||

| Noninterest income | 51,170 | 48,132 | 3,038 | 6.3 | % | ||||||||||||||||||

| Noninterest expense | (181,140) | (174,330) | (6,810) | 3.9 | % | ||||||||||||||||||

| Provision for income taxes | (31,659) | (30,382) | (1,277) | 4.2 | % | ||||||||||||||||||

| Net income | $ | 87,924 | $ | 85,834 | $ | 2,090 | 2.4 | % | |||||||||||||||

| Diluted earnings per share | $ | 2.67 | $ | 2.58 | $ | 0.09 | 3.5 | % | |||||||||||||||

| Dividends per share | $ | 1.02 | $ | 0.99 | $ | 0.03 | 3.0 | % | |||||||||||||||

| Average common shares | 32,749 | 33,119 | (370) | (1.1) | % | ||||||||||||||||||

| Average diluted common shares | 32,929 | 33,251 | (322) | (1.0) | % | ||||||||||||||||||

| Return on average total assets | 1.20 | % | 1.17 | % | |||||||||||||||||||

| Return on average equity | 9.24 | % | 9.67 | % | |||||||||||||||||||

| Efficiency ratio | 58.47 | % | 59.00 | % | |||||||||||||||||||

| Balance Sheet Data | ||||||||||||||

| Trailing Quarter Balance Sheet Change | |||||||||||||||||||||||

| Ending balances | September 30, 2025 |

June 30, 2025 |

Annualized % Change |

||||||||||||||||||||

| (dollars in thousands) | $ Change | ||||||||||||||||||||||

| Total assets | $ | 9,878,836 | $ | 9,923,983 | $ | (45,147) | (1.8) | % | |||||||||||||||

| Total loans | 7,006,824 | 6,958,993 | 47,831 | 2.7 | |||||||||||||||||||

| Total investments | 1,856,133 | 1,936,954 | (80,821) | (16.7) | |||||||||||||||||||

| Total deposits | 8,334,461 | 8,375,809 | (41,348) | (2.0) | |||||||||||||||||||

| Total other borrowings | 17,039 | 17,788 | (749) | (16.8) | |||||||||||||||||||

| Average Trailing Quarter Balance Sheet Change | |||||||||||||||||||||||

| Quarterly average balances for the period ended | September 30, 2025 |

June 30, 2025 |

Annualized % Change |

||||||||||||||||||||

| (dollars in thousands) | $ Change | ||||||||||||||||||||||

| Total assets | $ | 9,900,675 | $ | 9,778,834 | $ | 121,841 | 5.0 | % | |||||||||||||||

| Total loans | 6,971,860 | 6,878,186 | 93,674 | 5.4 | |||||||||||||||||||

| Total investments | 1,869,394 | 1,951,390 | (81,996) | (16.8) | |||||||||||||||||||

| Total deposits | 8,361,600 | 8,222,982 | 138,618 | 6.7 | |||||||||||||||||||

| Total other borrowings | 17,495 | 22,707 | (5,212) | (91.8) | |||||||||||||||||||

| Year Over Year Balance Sheet Change | |||||||||||||||||||||||

| Ending balances | As of September 30, | % Change | |||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | $ Change | ||||||||||||||||||||

| Total assets | $ | 9,878,836 | $ | 9,823,890 | $ | 54,946 | 0.6 | % | |||||||||||||||

| Total loans | 7,006,824 | 6,683,891 | 322,933 | 4.8 | |||||||||||||||||||

| Total investments | 1,856,133 | 2,116,469 | (260,336) | (12.3) | |||||||||||||||||||

| Total deposits | 8,334,461 | 8,037,091 | 297,370 | 3.7 | |||||||||||||||||||

| Total other borrowings | 17,039 | 266,767 | (249,728) | (93.6) | |||||||||||||||||||

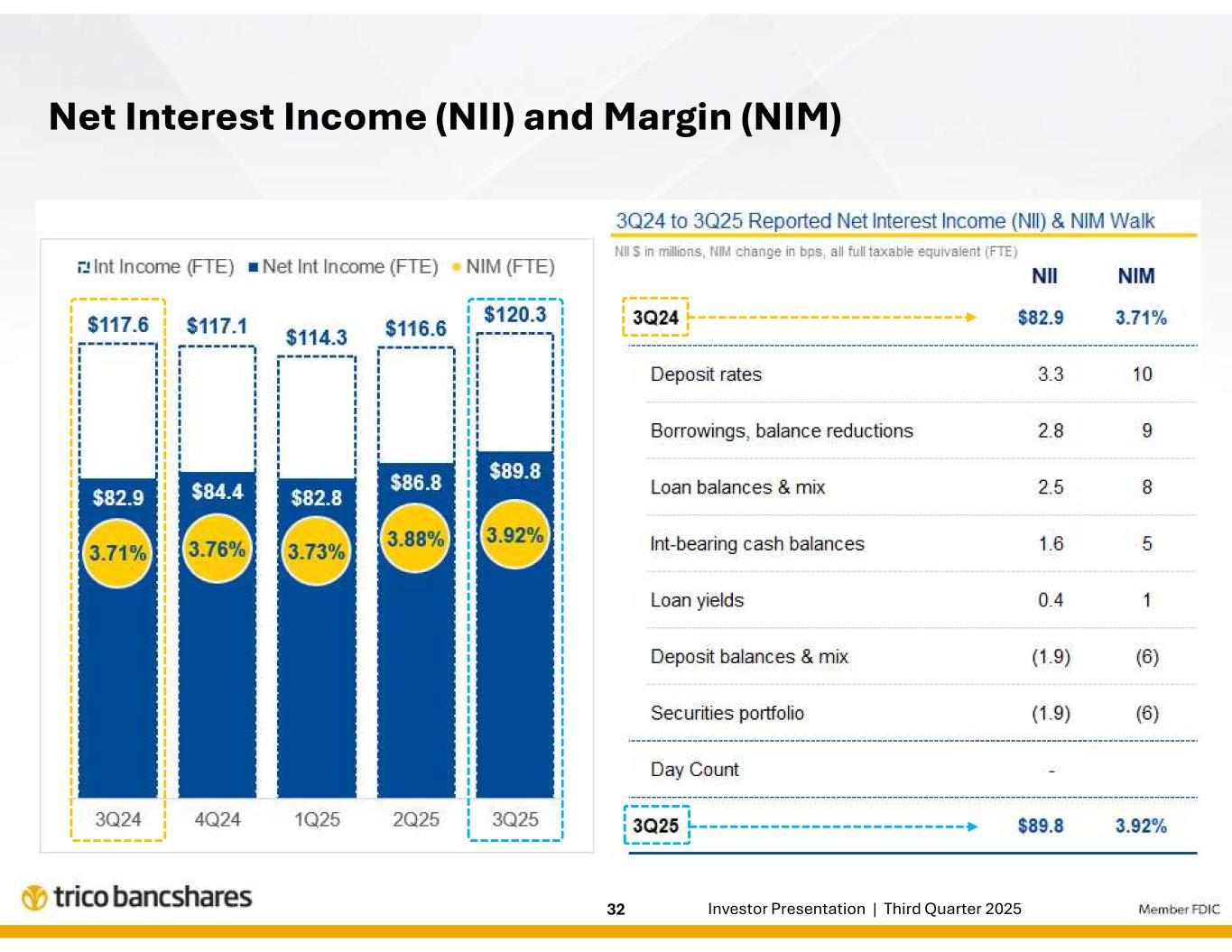

Net Interest Income and Net Interest Margin |

||||||||||||||

| Three months ended | |||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

||||||||||||||||||||||

| (dollars in thousands) | Change | % Change | |||||||||||||||||||||

| Interest income | $ | 119,987 | $ | 116,361 | $ | 3,626 | 3.1 | % | |||||||||||||||

| Interest expense | (30,432) | (29,842) | (590) | 2.0 | % | ||||||||||||||||||

Fully tax-equivalent adjustment (FTE) (1) |

262 | 264 | (2) | (0.8) | % | ||||||||||||||||||

| Net interest income (FTE) | $ | 89,817 | $ | 86,783 | $ | 3,034 | 3.5 | % | |||||||||||||||

| Net interest margin (FTE) | 3.92 | % | 3.88 | % | |||||||||||||||||||

| Acquired loans discount accretion, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 996 | $ | 1,247 | $ | (251) | (20.1) | % | |||||||||||||||

Net interest margin less effect of acquired loan discount accretion(1) |

3.88 | % | 3.82 | % | 0.06 | % | |||||||||||||||||

| Three months ended September 30, |

|||||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | Change | % Change | |||||||||||||||||||

| Interest income | $ | 119,987 | $ | 117,347 | $ | 2,640 | 2.2 | % | |||||||||||||||

| Interest expense | (30,432) | (34,736) | 4,304 | (12.4) | % | ||||||||||||||||||

Fully tax-equivalent adjustment (FTE) (1) |

262 | 269 | (7) | (2.6) | % | ||||||||||||||||||

| Net interest income (FTE) | $ | 89,817 | $ | 82,880 | $ | 6,937 | 8.4 | % | |||||||||||||||

| Net interest margin (FTE) | 3.92 | % | 3.71 | % | |||||||||||||||||||

| Acquired loans discount accretion, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 996 | $ | 1,018 | $ | (22) | (2.2) | % | |||||||||||||||

Net interest margin less effect of acquired loan discount accretion(1) |

3.88 | % | 3.66 | % | 0.22 | % | |||||||||||||||||

| Nine months ended September 30, |

|||||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | Change | % Change | |||||||||||||||||||

| Interest income | $ | 350,425 | $ | 349,796 | $ | 629 | 0.2 | % | |||||||||||||||

| Interest expense | (91,809) | (102,452) | 10,643 | (10.4) | % | ||||||||||||||||||

Fully tax-equivalent adjustment (FTE) (1) |

791 | 819 | (28) | (3.4) | % | ||||||||||||||||||

| Net interest income (FTE) | $ | 259,407 | $ | 248,163 | $ | 11,244 | 4.5 | % | |||||||||||||||

| Net interest margin (FTE) | 3.84 | % | 3.69 | % | |||||||||||||||||||

| Acquired loans discount accretion, net: | |||||||||||||||||||||||

| Amount (included in interest income) | $ | 4,238 | $ | 3,200 | $ | 1,038 | 32.4 | % | |||||||||||||||

Net interest margin less effect of acquired loan discount accretion(1) |

3.78 | % | 3.64 | % | 0.14 | % | |||||||||||||||||

Analysis Of Change in Net Interest Margin on Earning Assets | ||

| Three months ended | Three months ended | Three months ended | |||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2025 | June 30, 2025 | September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loans | $ | 6,971,860 | $ | 101,004 | 5.75 | % | $ | 6,878,186 | $ | 98,695 | 5.76 | % | $ | 6,690,326 | $ | 98,085 | 5.83 | % | |||||||||||||||||||||||||||||||||||

| Investments-taxable | 1,737,273 | 15,321 | 3.50 | % | 1,818,814 | 14,921 | 3.29 | % | 1,972,859 | 17,188 | 3.47 | % | |||||||||||||||||||||||||||||||||||||||||

Investments-nontaxable (1) |

132,121 | 1,134 | 3.41 | % | 132,576 | 1,143 | 3.46 | % | 135,500 | 1,166 | 3.42 | % | |||||||||||||||||||||||||||||||||||||||||

| Total investments | 1,869,394 | 16,455 | 3.49 | % | 1,951,390 | 16,064 | 3.30 | % | 2,108,359 | 18,354 | 3.46 | % | |||||||||||||||||||||||||||||||||||||||||

| Cash at Fed Reserve and other banks | 249,646 | 2,790 | 4.43 | % | 144,383 | 1,866 | 5.18 | % | 93,538 | 1,177 | 5.01 | % | |||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 9,090,900 | 120,249 | 5.25 | % | 8,973,959 | 116,625 | 5.21 | % | 8,892,223 | 117,616 | 5.26 | % | |||||||||||||||||||||||||||||||||||||||||

| Other assets, net | 809,775 | 804,875 | 774,756 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 9,900,675 | $ | 9,778,834 | $ | 9,666,979 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and shareholders’ equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 1,850,733 | $ | 6,649 | 1.43 | % | $ | 1,804,856 | $ | 6,076 | 1.35 | % | $ | 1,736,442 | $ | 6,132 | 1.40 | % | |||||||||||||||||||||||||||||||||||

| Savings deposits | 2,855,750 | 12,965 | 1.80 | % | 2,799,470 | 12,246 | 1.75 | % | 2,686,303 | 13,202 | 1.96 | % | |||||||||||||||||||||||||||||||||||||||||

| Time deposits | 1,107,646 | 9,587 | 3.43 | % | 1,102,025 | 9,716 | 3.54 | % | 1,055,612 | 11,354 | 4.28 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 5,814,129 | 29,201 | 1.99 | % | 5,706,351 | 28,038 | 1.97 | % | 5,478,357 | 30,688 | 2.23 | % | |||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 17,495 | 3 | 0.07 | % | 22,707 | 92 | 1.63 | % | 175,268 | 2,144 | 4.87 | % | |||||||||||||||||||||||||||||||||||||||||

| Junior subordinated debt | 71,477 | 1,228 | 6.82 | % | 101,236 | 1,712 | 6.78 | % | 101,150 | 1,904 | 7.49 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 5,903,101 | 30,432 | 2.05 | % | 5,830,294 | 29,842 | 2.05 | % | 5,754,775 | 34,736 | 2.40 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing deposits | 2,547,471 | 2,516,631 | 2,542,579 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 160,568 | 158,817 | 155,115 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,289,535 | 1,273,092 | 1,214,510 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 9,900,675 | $ | 9,778,834 | $ | 9,666,979 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest rate spread (1) (2) |

3.20 | % | 3.16 | % | 2.86 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income and margin (1) (3) |

$ | 89,817 | 3.92 | % | $ | 86,783 | 3.88 | % | $ | 82,880 | 3.71 | % | |||||||||||||||||||||||||||||||||||||||||

| Nine months ended September 30, 2025 | Nine months ended September 30, 2024 | ||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

|||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Loans | $ | 6,876,128 | $ | 295,077 | 5.74 | % | $ | 6,755,916 | $ | 292,799 | 5.79 | % | |||||||||||||||||||||||

| Investments-taxable | 1,812,965 | 45,994 | 3.39 | % | 2,034,336 | 52,021 | 3.42 | % | |||||||||||||||||||||||||||

Investments-nontaxable (1) |

132,690 | 3,426 | 3.45 | % | 137,515 | 3,548 | 3.45 | % | |||||||||||||||||||||||||||

| Total investments | 1,945,655 | 49,420 | 3.40 | % | 2,171,851 | 55,569 | 3.42 | % | |||||||||||||||||||||||||||

| Cash at Fed Reserve and other banks | 200,364 | 6,719 | 4.48 | % | 58,792 | 2,247 | 5.11 | % | |||||||||||||||||||||||||||

| Total earning assets | 9,022,147 | 351,216 | 5.20 | % | 8,986,559 | 350,615 | 5.21 | % | |||||||||||||||||||||||||||

| Other assets, net | 807,433 | 781,406 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 9,829,580 | $ | 9,767,965 | |||||||||||||||||||||||||||||||

| Liabilities and shareholders’ equity | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 1,828,709 | $ | 18,946 | 1.39 | % | $ | 1,738,876 | $ | 17,294 | 1.33 | % | |||||||||||||||||||||||

| Savings deposits | 2,795,620 | 37,409 | 1.79 | % | 2,670,555 | 36,362 | 1.82 | % | |||||||||||||||||||||||||||

| Time deposits | 1,110,123 | 29,749 | 3.58 | % | 961,577 | 29,582 | 4.11 | % | |||||||||||||||||||||||||||

| Total interest-bearing deposits | 5,734,452 | 86,104 | 2.01 | % | 5,371,008 | 83,238 | 2.07 | % | |||||||||||||||||||||||||||

| Other borrowings | 42,959 | 1,064 | 3.31 | % | 361,175 | 13,640 | 5.04 | % | |||||||||||||||||||||||||||

| Junior subordinated debt | 91,196 | 4,641 | 6.80 | % | 101,128 | 5,574 | 7.36 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 5,868,607 | 91,809 | 2.09 | % | 5,833,311 | 102,452 | 2.35 | % | |||||||||||||||||||||||||||

| Noninterest-bearing deposits | 2,526,280 | 2,584,705 | |||||||||||||||||||||||||||||||||

| Other liabilities | 163,015 | 163,704 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,271,678 | 1,186,245 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 9,829,580 | $ | 9,767,965 | |||||||||||||||||||||||||||||||

Net interest rate spread (1) (2) |

3.11 | % | 2.86 | % | |||||||||||||||||||||||||||||||

Net interest income and margin (1) (3) |

$ | 259,407 | 3.84 | % | $ | 248,163 | 3.69 | % | |||||||||||||||||||||||||||

Interest Rates and Earning Asset Composition | ||

|

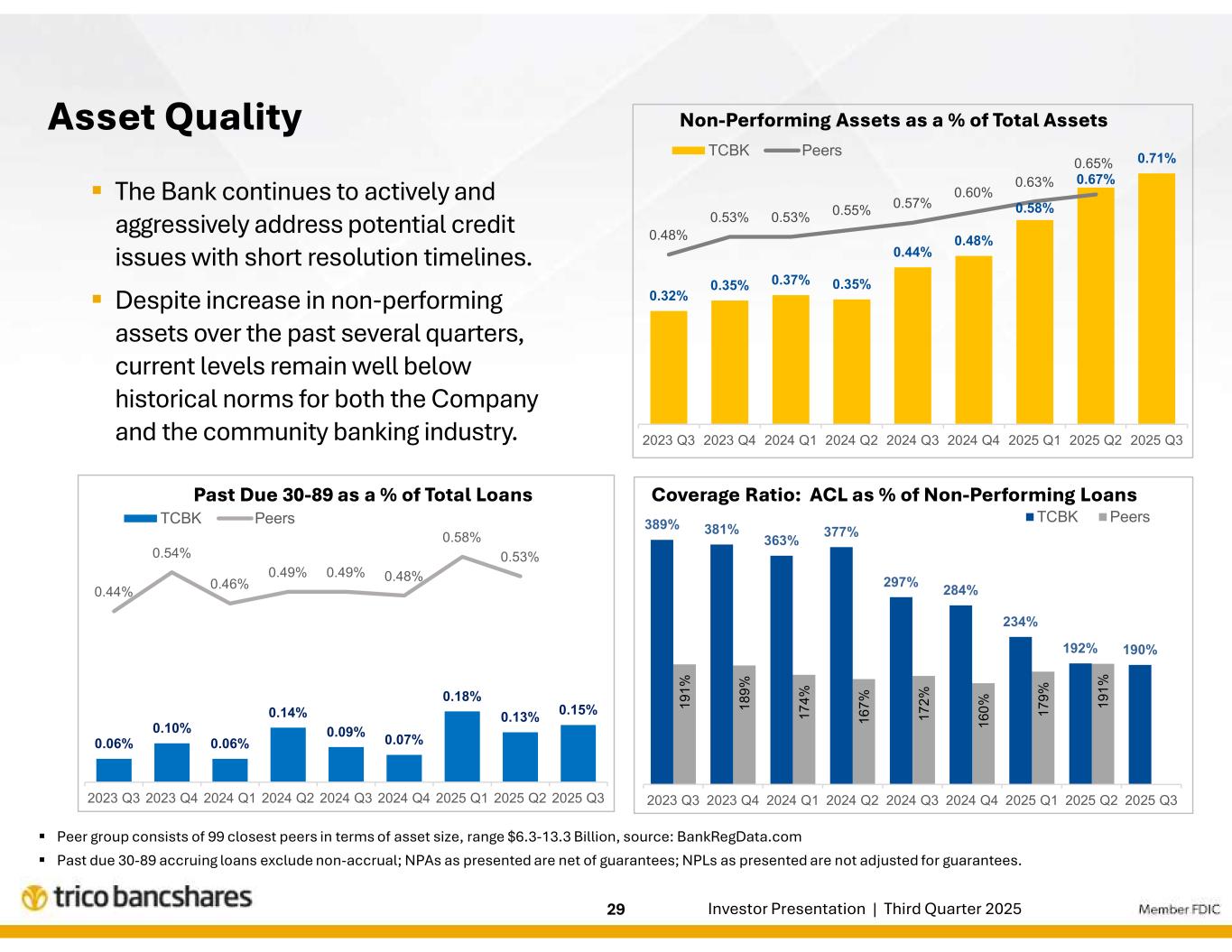

Asset Quality and Credit Loss Provisioning

| ||

| Three months ended | Nine months ended | ||||||||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 |

June 30, 2025 |

September 30, 2024 |

September 30, 2025 |

September 30, 2024 |

||||||||||||||||||||||||

| Addition to allowance for credit losses | $ | 730 | $ | 4,525 | $ | 320 | $ | 7,918 | $ | 4,670 | |||||||||||||||||||

(Reduction) addition to reserve for unfunded loan commitments |

(60) | 140 | (100) | 1,145 | 260 | ||||||||||||||||||||||||

| Total provision for credit losses | $ | 670 | $ | 4,665 | $ | 220 | $ | 9,063 | $ | 4,930 | |||||||||||||||||||

| Three Months Ended September 30, | Nine months ended September 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | 2025 | 2024 | |||||||||||||||||||

| Balance, beginning of period | $ | 124,455 | $ | 123,517 | $ | 125,366 | $ | 121,522 | |||||||||||||||

| Provision for credit losses | 730 | 320 | 7,918 | 4,670 | |||||||||||||||||||

| Loans charged-off | (737) | (444) | (9,706) | (3,329) | |||||||||||||||||||

| Recoveries of previously charged-off loans | 123 | 367 | 993 | 897 | |||||||||||||||||||

| Balance, end of period | $ | 124,571 | $ | 123,760 | $ | 124,571 | $ | 123,760 | |||||||||||||||

| (dollars in thousands) | As of September 30, 2025 | % of Loans Outstanding | As of June 30, 2025 | % of Loans Outstanding | As of September 30, 2024 | % of Loans Outstanding | ||||||||||||||||||||

| Risk Rating: | ||||||||||||||||||||||||||

| Pass | $ | 6,785,679 | 96.8 | % | $ | 6,751,005 | 97.0 | % | $ | 6,461,451 | 96.6 | % | ||||||||||||||

| Special Mention | 89,352 | 1.3 | % | 73,215 | 1.1 | % | 104,759 | 1.6 | % | |||||||||||||||||

| Substandard | 131,793 | 1.9 | % | 134,773 | 1.9 | % | 117,681 | 1.8 | % | |||||||||||||||||

| Total | $ | 7,006,824 | 100.0 | % | $ | 6,958,993 | 100.0 | % | $ | 6,683,891 | 100.0 | % | ||||||||||||||

| Classified loans to total loans | 1.88 | % | 1.94 | % | 1.76 | % | ||||||||||||||||||||

| Loans past due 30+ days to total loans | 0.65 | % | 0.62 | % | 0.57 | % | ||||||||||||||||||||

| ACL to non-performing loans | 189.76 | % | 192.11 | % | 297.24 | % | ||||||||||||||||||||

| As of September 30, 2025 | As of June 30, 2025 | As of September 30, 2024 | |||||||||||||||||||||||||||||||||

| (dollars in thousands) | Amount | % of Loans Outstanding | Amount | % of Loans Outstanding | Amount | % of Loans Outstanding | |||||||||||||||||||||||||||||

| Commercial real estate: | |||||||||||||||||||||||||||||||||||

| CRE - Non-Owner Occupied | $ | 41,180 | 1.68 | % | $ | 40,921 | 1.68 | % | $ | 36,206 | 1.61 | % | |||||||||||||||||||||||

| CRE - Owner Occupied | 11,929 | 1.15 | % | 11,578 | 1.16 | % | 15,382 | 1.62 | % | ||||||||||||||||||||||||||

| Multifamily | 15,706 | 1.50 | % | 15,097 | 1.47 | % | 15,735 | 1.54 | % | ||||||||||||||||||||||||||

| Farmland | 6,202 | 2.40 | % | 6,888 | 2.60 | % | 4,016 | 1.50 | % | ||||||||||||||||||||||||||

| Total commercial real estate loans | 75,017 | 1.57 | % | 74,484 | 1.57 | % | 71,339 | 1.59 | % | ||||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||||||||

| SFR 1-4 1st Liens | 11,022 | 1.30 | % | 11,135 | 1.31 | % | 14,366 | 1.66 | % | ||||||||||||||||||||||||||

| SFR HELOCs and Junior Liens | 12,362 | 3.07 | % | 12,021 | 3.08 | % | 10,185 | 2.87 | % | ||||||||||||||||||||||||||

| Other | 2,364 | 5.48 | % | 2,162 | 4.49 | % | 2,953 | 4.70 | % | ||||||||||||||||||||||||||

| Total consumer loans | 25,748 | 1.99 | % | 25,318 | 1.96 | % | 27,504 | 2.14 | % | ||||||||||||||||||||||||||

| Commercial and Industrial | 9,090 | 2.01 | % | 10,024 | 2.14 | % | 14,453 | 2.98 | % | ||||||||||||||||||||||||||

| Construction | 10,792 | 3.61 | % | 10,995 | 3.61 | % | 7,119 | 2.58 | % | ||||||||||||||||||||||||||

| Agricultural Production | 3,901 | 2.40 | % | 3,609 | 2.24 | % | 3,312 | 2.30 | % | ||||||||||||||||||||||||||

| Leases | 23 | 0.44 | % | 25 | 0.44 | % | 33 | 0.44 | % | ||||||||||||||||||||||||||

| Allowance for credit losses | 124,571 | 1.78 | % | 124,455 | 1.79 | % | 123,760 | 1.85 | % | ||||||||||||||||||||||||||

| Reserve for unfunded loan commitments | 7,145 | 7,205 | 6,110 | ||||||||||||||||||||||||||||||||

| Total allowance for credit losses | $ | 131,716 | 1.88 | % | $ | 131,660 | 1.89 | % | $ | 129,870 | 1.92 | % | |||||||||||||||||||||||

|

Non-interest Income

| ||

| Three months ended | |||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 | June 30, 2025 | Change | % Change | |||||||||||||||||||

| ATM and interchange fees | $ | 6,493 | $ | 6,590 | $ | (97) | (1.5) | % | |||||||||||||||

| Service charges on deposit accounts | 5,448 | 5,189 | 259 | 5.0 | % | ||||||||||||||||||

| Other service fees | 1,485 | 1,485 | — | — | % | ||||||||||||||||||

| Mortgage banking service fees | 430 | 438 | (8) | (1.8) | % | ||||||||||||||||||

| Change in value of mortgage servicing rights | (105) | (52) | (53) | (101.9) | % | ||||||||||||||||||

| Total service charges and fees | 13,751 | 13,650 | 101 | 0.7 | % | ||||||||||||||||||

| Increase in cash value of life insurance | 871 | 842 | 29 | 3.4 | % | ||||||||||||||||||

| Asset management and commission income | 1,932 | 1,635 | 297 | 18.2 | % | ||||||||||||||||||

| Gain on sale of loans | 327 | 503 | (176) | (35.0) | % | ||||||||||||||||||

| Lease brokerage income | 82 | 50 | 32 | 64.0 | % | ||||||||||||||||||

| Sale of customer checks | 311 | 318 | (7) | (2.2) | % | ||||||||||||||||||

| (Loss) gain on sale of investment securities | (2,124) | 4 | (2,128) | (53,200.0) | % | ||||||||||||||||||

| (Loss) gain on marketable equity securities | 26 | 8 | 18 | 225.0 | % | ||||||||||||||||||

| Other income | 2,831 | 80 | 2,751 | 3,438.8 | % | ||||||||||||||||||

| Total other non-interest income | 4,256 | 3,440 | 816 | 23.7 | % | ||||||||||||||||||

| Total non-interest income | $ | 18,007 | $ | 17,090 | $ | 917 | 5.4 | % | |||||||||||||||

| Three months ended September 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | Change | % Change | |||||||||||||||||||

| ATM and interchange fees | $ | 6,493 | $ | 6,472 | $ | 21 | 0.3 | % | |||||||||||||||

| Service charges on deposit accounts | 5,448 | 4,979 | 469 | 9.4 | % | ||||||||||||||||||

| Other service fees | 1,485 | 1,224 | 261 | 21.3 | % | ||||||||||||||||||

| Mortgage banking service fees | 430 | 439 | (9) | (2.1) | % | ||||||||||||||||||

| Change in value of mortgage servicing rights | (105) | (332) | 227 | 68.4 | % | ||||||||||||||||||

| Total service charges and fees | 13,751 | 12,782 | 969 | 7.6 | % | ||||||||||||||||||

| Increase in cash value of life insurance | 871 | 786 | 85 | 10.8 | % | ||||||||||||||||||

| Asset management and commission income | 1,932 | 1,502 | 430 | 28.6 | % | ||||||||||||||||||

| Gain on sale of loans | 327 | 549 | (222) | (40.4) | % | ||||||||||||||||||

| Lease brokerage income | 82 | 62 | 20 | 32.3 | % | ||||||||||||||||||

| Sale of customer checks | 311 | 303 | 8 | 2.6 | % | ||||||||||||||||||

| (Loss) gain on sale or exchange of investment securities | (2,124) | 2 | (2,126) | (106,300.0) | % | ||||||||||||||||||

| (Loss) gain on marketable equity securities | 26 | 356 | (330) | (92.7) | % | ||||||||||||||||||

| Other income | 2,831 | 153 | 2,678 | 1,750.3 | % | ||||||||||||||||||

| Total other non-interest income | 4,256 | 3,713 | 543 | 14.6 | % | ||||||||||||||||||

| Total non-interest income | $ | 18,007 | $ | 16,495 | $ | 1,512 | 9.2 | % | |||||||||||||||

| Nine months ended September 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | Change | % Change | |||||||||||||||||||

| ATM and interchange fees | $ | 19,189 | $ | 19,013 | $ | 176 | 0.9 | % | |||||||||||||||

| Service charges on deposit accounts | 15,551 | 14,489 | 1,062 | 7.3 | % | ||||||||||||||||||

| Other service fees | 4,329 | 3,876 | 453 | 11.7 | % | ||||||||||||||||||

| Mortgage banking service fees | 1,307 | 1,305 | 2 | 0.2 | % | ||||||||||||||||||

| Change in value of mortgage servicing rights | (297) | (468) | 171 | 36.5 | % | ||||||||||||||||||

| Total service charges and fees | 40,079 | 38,215 | 1,864 | 4.9 | % | ||||||||||||||||||

| Increase in cash value of life insurance | 2,533 | 2,420 | 113 | 4.7 | % | ||||||||||||||||||

| Asset management and commission income | 5,055 | 3,989 | 1,066 | 26.7 | % | ||||||||||||||||||

| Gain on sale of loans | 1,174 | 1,198 | (24) | (2.0) | % | ||||||||||||||||||

| Lease brokerage income | 198 | 377 | (179) | (47.5) | % | ||||||||||||||||||

| Sale of customer checks | 974 | 916 | 58 | 6.3 | % | ||||||||||||||||||

| (Loss) gain on sale or exchange of investment securities | (3,266) | (43) | (3,223) | (7,495.3) | % | ||||||||||||||||||

| (Loss) gain on marketable equity securities | 73 | 207 | (134) | (64.7) | % | ||||||||||||||||||

| Other income | 4,350 | 853 | 3,497 | 410.0 | % | ||||||||||||||||||

| Total other non-interest income | 11,091 | 9,917 | 1,174 | 11.8 | % | ||||||||||||||||||

| Total non-interest income | $ | 51,170 | $ | 48,132 | $ | 3,038 | 6.3 | % | |||||||||||||||

|

Non-interest Expense

| ||

| Three months ended | |||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 | June 30, 2025 | Change | % Change | |||||||||||||||||||

| Base salaries, net of deferred loan origination costs | $ | 25,340 | $ | 25,757 | $ | (417) | (1.6) | % | |||||||||||||||

| Incentive compensation | 5,351 | 5,223 | 128 | 2.5 | % | ||||||||||||||||||

| Benefits and other compensation costs | 7,038 | 7,306 | (268) | (3.7) | % | ||||||||||||||||||

| Total salaries and benefits expense | 37,729 | 38,286 | (557) | (1.5) | % | ||||||||||||||||||

| Occupancy | 4,388 | 4,200 | 188 | 4.5 | % | ||||||||||||||||||

| Data processing and software | 4,838 | 4,959 | (121) | (2.4) | % | ||||||||||||||||||

| Equipment | 1,269 | 1,189 | 80 | 6.7 | % | ||||||||||||||||||

| Intangible amortization | 482 | 483 | (1) | (0.2) | % | ||||||||||||||||||

| Advertising | 647 | 808 | (161) | (19.9) | % | ||||||||||||||||||

| ATM and POS network charges | 1,911 | 1,843 | 68 | 3.7 | % | ||||||||||||||||||

| Professional fees | 1,842 | 1,667 | 175 | 10.5 | % | ||||||||||||||||||

| Telecommunications | 503 | 513 | (10) | (1.9) | % | ||||||||||||||||||

| Regulatory assessments and insurance | 1,282 | 1,297 | (15) | (1.2) | % | ||||||||||||||||||

| Postage | 353 | 385 | (32) | (8.3) | % | ||||||||||||||||||

| Operational loss | 544 | 270 | 274 | 101.5 | % | ||||||||||||||||||

| Courier service | 577 | 544 | 33 | 6.1 | % | ||||||||||||||||||

| (Gain) loss on sale or acquisition of foreclosed assets | — | — | — | — | % | ||||||||||||||||||

| (Gain) loss on disposal of fixed assets | 21 | 5 | 16 | 320.0 | % | ||||||||||||||||||

| Other miscellaneous expense | 4,038 | 4,682 | (644) | (13.8) | % | ||||||||||||||||||

| Total other non-interest expense | 22,695 | 22,845 | (150) | (0.7) | % | ||||||||||||||||||

| Total non-interest expense | $ | 60,424 | $ | 61,131 | $ | (707) | (1.2) | % | |||||||||||||||

| Average full-time equivalent staff | 1,154 | 1,171 | (17) | (1.5) | % | ||||||||||||||||||

| Three months ended September 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | Change | % Change | |||||||||||||||||||

| Base salaries, net of deferred loan origination costs | $ | 25,340 | $ | 24,407 | $ | 933 | 3.8 | % | |||||||||||||||

| Incentive compensation | 5,351 | 4,361 | 990 | 22.7 | % | ||||||||||||||||||

| Benefits and other compensation costs | 7,038 | 6,782 | 256 | 3.8 | % | ||||||||||||||||||

| Total salaries and benefits expense | 37,729 | 35,550 | 2,179 | 6.1 | % | ||||||||||||||||||

| Occupancy | 4,388 | 4,191 | 197 | 4.7 | % | ||||||||||||||||||

| Data processing and software | 4,838 | 5,258 | (420) | (8.0) | % | ||||||||||||||||||

| Equipment | 1,269 | 1,374 | (105) | (7.6) | % | ||||||||||||||||||

| Intangible amortization | 482 | 1,030 | (548) | (53.2) | % | ||||||||||||||||||

| Advertising | 647 | 1,152 | (505) | (43.8) | % | ||||||||||||||||||

| ATM and POS network charges | 1,911 | 1,712 | 199 | 11.6 | % | ||||||||||||||||||

| Professional fees | 1,842 | 1,893 | (51) | (2.7) | % | ||||||||||||||||||

| Telecommunications | 503 | 507 | (4) | (0.8) | % | ||||||||||||||||||

| Regulatory assessments and insurance | 1,282 | 1,256 | 26 | 2.1 | % | ||||||||||||||||||

| Postage | 353 | 335 | 18 | 5.4 | % | ||||||||||||||||||

| Operational loss | 544 | 603 | (59) | (9.8) | % | ||||||||||||||||||

| Courier service | 577 | 542 | 35 | 6.5 | % | ||||||||||||||||||

| (Gain) loss on sale or acquisition of foreclosed assets | — | 26 | (26) | nm | |||||||||||||||||||

| (Gain) loss on disposal of fixed assets | 21 | 6 | 15 | 250.0 | % | ||||||||||||||||||

| Other miscellaneous expense | 4,038 | 4,052 | (14) | (0.3) | % | ||||||||||||||||||

| Total other non-interest expense | 22,695 | 23,937 | (1,242) | (5.2) | % | ||||||||||||||||||

| Total non-interest expense | $ | 60,424 | $ | 59,487 | $ | 937 | 1.6 | % | |||||||||||||||

| Average full-time equivalent staff | 1,154 | 1,161 | (7) | (0.6) | % | ||||||||||||||||||

| Nine months ended September 30, | |||||||||||||||||||||||

| (dollars in thousands) | 2025 | 2024 | Change | % Change | |||||||||||||||||||

| Base salaries, net of deferred loan origination costs | $ | 76,498 | $ | 72,279 | $ | 4,219 | 5.8 | % | |||||||||||||||

| Incentive compensation | 14,612 | 12,329 | 2,283 | 18.5 | % | ||||||||||||||||||

| Benefits and other compensation costs | 21,760 | 20,647 | 1,113 | 5.4 | % | ||||||||||||||||||

| Total salaries and benefits expense | 112,870 | 105,255 | 7,615 | 7.2 | % | ||||||||||||||||||

| Occupancy | 12,665 | 12,205 | 460 | 3.8 | % | ||||||||||||||||||

| Data processing and software | 14,855 | 15,459 | (604) | (3.9) | % | ||||||||||||||||||

| Equipment | 3,742 | 4,060 | (318) | (7.8) | % | ||||||||||||||||||

| Intangible amortization | 1,479 | 3,090 | (1,611) | (52.1) | % | ||||||||||||||||||

| Advertising | 2,659 | 2,733 | (74) | (2.7) | % | ||||||||||||||||||

| ATM and POS network charges | 5,605 | 5,360 | 245 | 4.6 | % | ||||||||||||||||||

| Professional fees | 5,027 | 5,047 | (20) | (0.4) | % | ||||||||||||||||||

| Telecommunications | 1,504 | 1,576 | (72) | (4.6) | % | ||||||||||||||||||

| Regulatory assessments and insurance | 3,862 | 3,651 | 211 | 5.8 | % | ||||||||||||||||||

| Postage | 1,058 | 983 | 75 | 7.6 | % | ||||||||||||||||||

| Operational loss | 1,238 | 1,199 | 39 | 3.3 | % | ||||||||||||||||||

| Courier service | 1,609 | 1,581 | 28 | 1.8 | % | ||||||||||||||||||

| (Gain) loss on sale or acquisition of foreclosed assets | (3) | (12) | 9 | (75.0) | % | ||||||||||||||||||

| (Gain) loss on disposal of fixed assets | 111 | 12 | 99 | 825.0 | % | ||||||||||||||||||

| Other miscellaneous expense | 12,859 | 12,131 | 728 | 6.0 | % | ||||||||||||||||||

| Total other non-interest expense | 68,270 | 69,075 | (805) | (1.2) | % | ||||||||||||||||||

| Total non-interest expense | $ | 181,140 | $ | 174,330 | $ | 6,810 | 3.9 | % | |||||||||||||||

| Average full-time equivalent staff | 1,173 | 1,170 | 3 | 0.3 | % | ||||||||||||||||||

|

Provision for Income Taxes

| ||

Investor Contact | ||

About TriCo Bancshares | ||

Forward-Looking Statements | ||

TriCo Bancshares—Condensed Consolidated Financial Data (unaudited) | ||

| (dollars in thousands, except per share data) | Three months ended | ||||||||||||||||||||||||||||

| September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

|||||||||||||||||||||||||

| Revenue and Expense Data | |||||||||||||||||||||||||||||

| Interest income | $ | 119,987 | $ | 116,361 | $ | 114,077 | $ | 116,842 | $ | 117,347 | |||||||||||||||||||

| Interest expense | 30,432 | 29,842 | 31,535 | 32,752 | 34,736 | ||||||||||||||||||||||||

| Net interest income | 89,555 | 86,519 | 82,542 | 84,090 | 82,611 | ||||||||||||||||||||||||

| Provision for credit losses | 670 | 4,665 | 3,728 | 1,702 | 220 | ||||||||||||||||||||||||

| Noninterest income: | |||||||||||||||||||||||||||||

| Service charges and fees | 13,751 | 13,650 | 12,678 | 13,115 | 12,782 | ||||||||||||||||||||||||

| (Loss) gain on sale or exchange of investment securities | (2,124) | 4 | (1,146) | — | 2 | ||||||||||||||||||||||||

| Other income | 6,380 | 3,436 | 4,541 | 3,160 | 3,711 | ||||||||||||||||||||||||

| Total noninterest income | 18,007 | 17,090 | 16,073 | 16,275 | 16,495 | ||||||||||||||||||||||||

| Noninterest expense: | |||||||||||||||||||||||||||||

| Salaries and benefits | 37,729 | 38,286 | 36,855 | 35,326 | 35,550 | ||||||||||||||||||||||||

| Occupancy and equipment | 5,657 | 5,389 | 5,361 | 5,570 | 5,565 | ||||||||||||||||||||||||

| Data processing and network | 6,749 | 6,802 | 6,909 | 7,284 | 6,970 | ||||||||||||||||||||||||

| Other noninterest expense | 10,289 | 10,654 | 10,460 | 11,595 | 11,402 | ||||||||||||||||||||||||

| Total noninterest expense | 60,424 | 61,131 | 59,585 | 59,775 | 59,487 | ||||||||||||||||||||||||

| Total income before taxes | 46,468 | 37,813 | 35,302 | 38,888 | 39,399 | ||||||||||||||||||||||||

| Provision for income taxes | 12,449 | 10,271 | 8,939 | 9,854 | 10,348 | ||||||||||||||||||||||||

| Net income | $ | 34,019 | $ | 27,542 | $ | 26,363 | $ | 29,034 | $ | 29,051 | |||||||||||||||||||

| Share Data | |||||||||||||||||||||||||||||

| Basic earnings per share | $ | 1.04 | $ | 0.84 | $ | 0.80 | $ | 0.88 | $ | 0.88 | |||||||||||||||||||

| Diluted earnings per share | $ | 1.04 | $ | 0.84 | $ | 0.80 | $ | 0.88 | $ | 0.88 | |||||||||||||||||||

| Dividends per share | $ | 0.36 | $ | 0.33 | $ | 0.33 | $ | 0.33 | $ | 0.33 | |||||||||||||||||||

| Book value per common share | $ | 40.12 | $ | 38.92 | $ | 38.17 | $ | 37.03 | $ | 37.55 | |||||||||||||||||||

| Tangible book value per common share (1) | $ | 30.61 | $ | 29.40 | $ | 28.73 | $ | 27.60 | $ | 28.09 | |||||||||||||||||||

| Shares outstanding | 32,506,880 | 32,550,264 | 32,892,488 | 32,970,425 | 33,000,508 | ||||||||||||||||||||||||

| Weighted average shares | 32,542,401 | 32,757,378 | 32,952,541 | 32,993,975 | 32,992,855 | ||||||||||||||||||||||||

| Weighted average diluted shares | 32,723,358 | 32,935,750 | 33,129,161 | 33,161,715 | 33,136,858 | ||||||||||||||||||||||||

| Credit Quality | |||||||||||||||||||||||||||||

| Allowance for credit losses to gross loans | 1.78 | % | 1.79 | % | 1.88 | % | 1.85 | % | 1.85 | % | |||||||||||||||||||

| Loans past due 30 days or more | $ | 45,712 | $ | 42,965 | $ | 44,753 | $ | 32,711 | $ | 37,888 | |||||||||||||||||||

| Total nonperforming loans | $ | 65,647 | $ | 64,783 | $ | 54,854 | $ | 44,096 | $ | 41,636 | |||||||||||||||||||

| Total nonperforming assets | $ | 71,077 | $ | 67,466 | $ | 57,539 | $ | 46,882 | $ | 44,400 | |||||||||||||||||||

| Loans charged-off | $ | 737 | $ | 8,595 | $ | 374 | $ | 722 | $ | 444 | |||||||||||||||||||

| Loans recovered | $ | 123 | $ | 102 | $ | 768 | $ | 516 | $ | 367 | |||||||||||||||||||

| Selected Financial Ratios | |||||||||||||||||||||||||||||

| Return on average total assets | 1.36 | % | 1.13 | % | 1.09 | % | 1.19 | % | 1.20 | % | |||||||||||||||||||

| Return on average equity | 10.47 | % | 8.68 | % | 8.54 | % | 9.30 | % | 9.52 | % | |||||||||||||||||||

| Average yield on loans | 5.75 | % | 5.76 | % | 5.71 | % | 5.78 | % | 5.83 | % | |||||||||||||||||||

| Average yield on interest-earning assets | 5.25 | % | 5.21 | % | 5.15 | % | 5.22 | % | 5.26 | % | |||||||||||||||||||

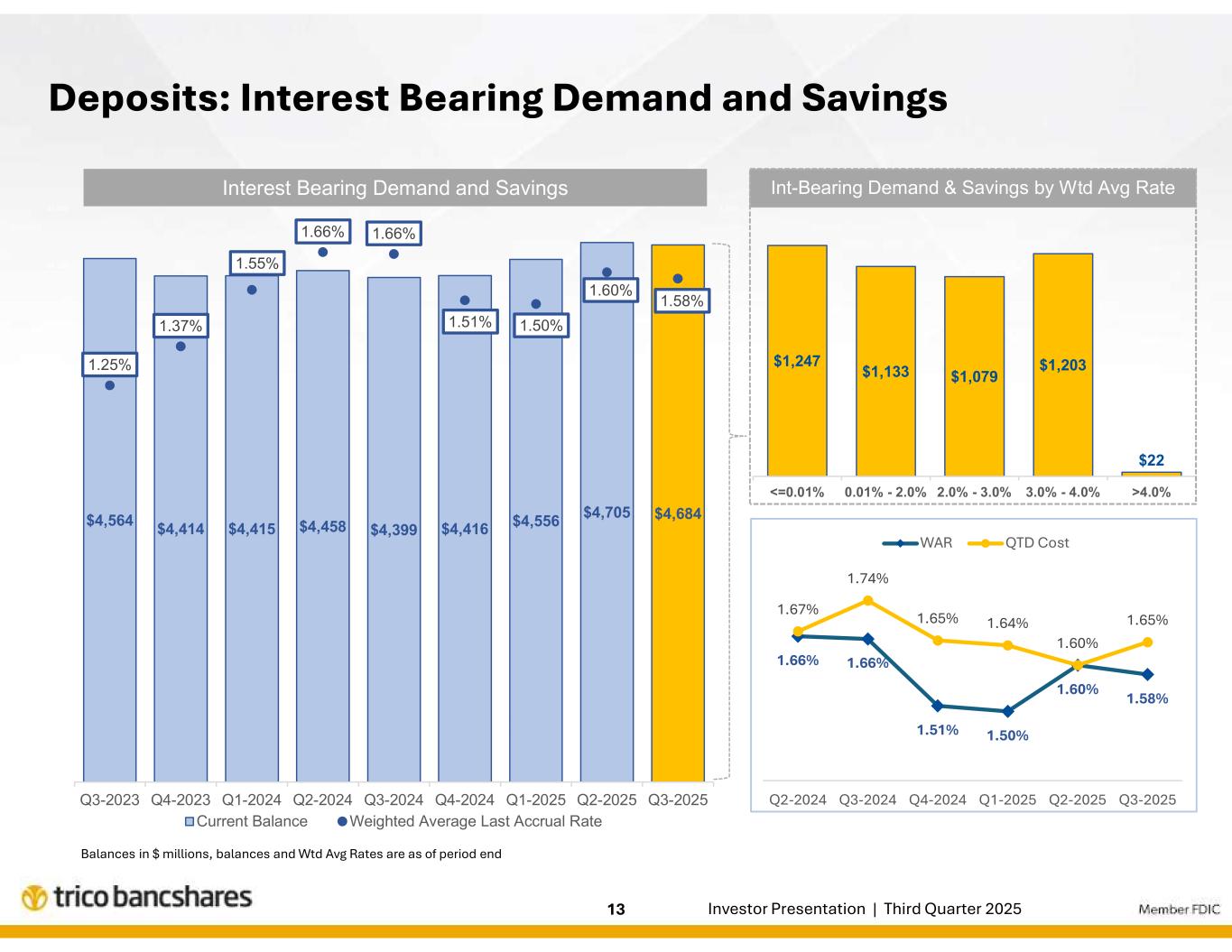

| Average rate on interest-bearing deposits | 1.99 | % | 1.97 | % | 2.06 | % | 2.15 | % | 2.23 | % | |||||||||||||||||||

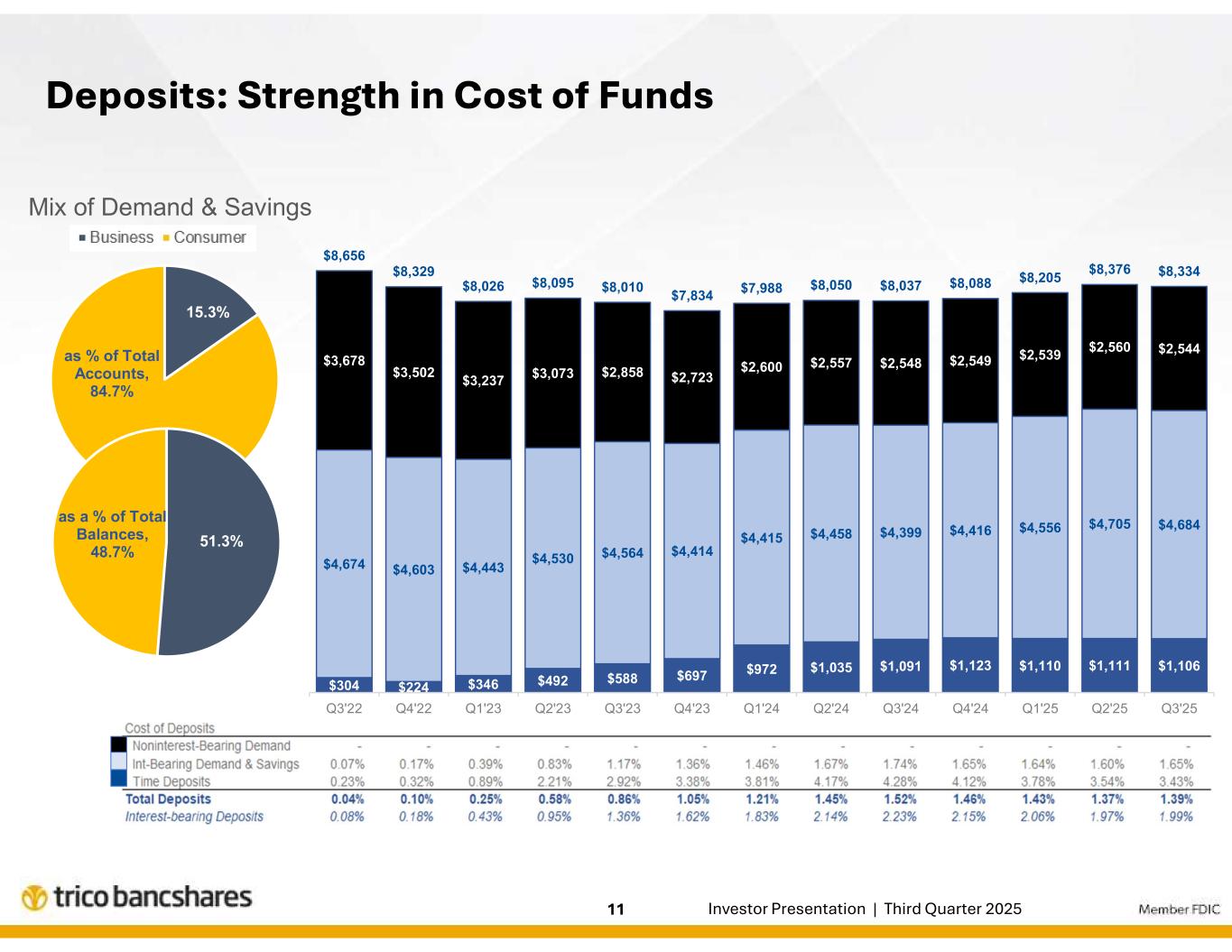

| Average cost of total deposits | 1.39 | % | 1.37 | % | 1.43 | % | 1.46 | % | 1.52 | % | |||||||||||||||||||

| Average cost of total deposits and other borrowings | 1.38 | % | 1.37 | % | 1.46 | % | 1.50 | % | 1.59 | % | |||||||||||||||||||

| Average rate on borrowings & subordinated debt | 5.49 | % | 5.84 | % | 5.68 | % | 5.80 | % | 5.83 | % | |||||||||||||||||||

| Average rate on interest-bearing liabilities | 2.05 | % | 2.05 | % | 2.18 | % | 2.27 | % | 2.40 | % | |||||||||||||||||||

| Net interest margin (fully tax-equivalent) (1) | 3.92 | % | 3.88 | % | 3.73 | % | 3.76 | % | 3.71 | % | |||||||||||||||||||

| Loans to deposits | 84.07 | % | 83.08 | % | 83.13 | % | 83.69 | % | 83.16 | % | |||||||||||||||||||

| Efficiency ratio | 56.18 | % | 59.00 | % | 60.42 | % | 59.56 | % | 60.02 | % | |||||||||||||||||||

| Supplemental Loan Interest Income Data | |||||||||||||||||||||||||||||

| Discount accretion on acquired loans | $ | 996 | $ | 1,247 | $ | 1,995 | $ | 1,129 | $ | 1,018 | |||||||||||||||||||

| All other loan interest income (1) | $ | 100,008 | $ | 97,448 | $ | 93,383 | $ | 96,563 | $ | 97,067 | |||||||||||||||||||

| Total loan interest income (1) | $ | 101,004 | $ | 98,695 | $ | 95,378 | $ | 97,692 | $ | 98,085 | |||||||||||||||||||

TriCo Bancshares—Condensed Consolidated Financial Data (unaudited) | ||

| (dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

| Balance Sheet Data | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||

| Cash and due from banks | $ | 298,820 | $ | 314,268 | $ | 308,250 | $ | 144,956 | $ | 320,114 | |||||||||||||||||||

| Securities, available for sale, net | 1,743,437 | 1,818,032 | 1,854,998 | 1,907,494 | 1,981,960 | ||||||||||||||||||||||||

| Securities, held to maturity, net | 95,446 | 101,672 | 106,868 | 111,866 | 117,259 | ||||||||||||||||||||||||

| Restricted equity securities | 17,250 | 17,250 | 17,250 | 17,250 | 17,250 | ||||||||||||||||||||||||

| Loans held for sale | 2,785 | 1,577 | 2,028 | 709 | 1,995 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Commercial real estate | 4,793,394 | 4,730,732 | 4,634,446 | 4,577,632 | 4,487,524 | ||||||||||||||||||||||||

| Consumer | 1,293,909 | 1,288,691 | 1,279,878 | 1,281,059 | 1,283,963 | ||||||||||||||||||||||||

| Commercial and industrial | 453,221 | 467,564 | 457,189 | 471,271 | 484,763 | ||||||||||||||||||||||||

| Construction | 298,774 | 304,920 | 298,319 | 279,933 | 276,095 | ||||||||||||||||||||||||

| Agriculture production | 162,338 | 161,457 | 144,588 | 151,822 | 144,123 | ||||||||||||||||||||||||

| Leases | 5,188 | 5,629 | 6,354 | 6,806 | 7,423 | ||||||||||||||||||||||||

| Total loans, gross | 7,006,824 | 6,958,993 | 6,820,774 | 6,768,523 | 6,683,891 | ||||||||||||||||||||||||

| Allowance for credit losses | (124,571) | (124,455) | (128,423) | (125,366) | (123,760) | ||||||||||||||||||||||||

| Total loans, net | 6,882,253 | 6,834,538 | 6,692,351 | 6,643,157 | 6,560,131 | ||||||||||||||||||||||||

| Premises and equipment | 70,509 | 70,092 | 70,475 | 70,287 | 70,423 | ||||||||||||||||||||||||

| Cash value of life insurance | 136,391 | 135,520 | 134,678 | 140,149 | 139,312 | ||||||||||||||||||||||||

| Accrued interest receivable | 32,126 | 32,534 | 32,536 | 34,810 | 33,061 | ||||||||||||||||||||||||

| Goodwill | 304,442 | 304,442 | 304,442 | 304,442 | 304,442 | ||||||||||||||||||||||||

| Other intangible assets | 4,953 | 5,435 | 5,918 | 6,432 | 7,462 | ||||||||||||||||||||||||

| Operating leases, right-of-use | 25,917 | 22,158 | 22,806 | 23,529 | 24,716 | ||||||||||||||||||||||||

| Other assets | 264,507 | 266,465 | 266,999 | 268,647 | 245,765 | ||||||||||||||||||||||||

| Total assets | $ | 9,878,836 | $ | 9,923,983 | $ | 9,819,599 | $ | 9,673,728 | $ | 9,823,890 | |||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | $ | 2,544,306 | $ | 2,559,788 | $ | 2,539,109 | $ | 2,548,613 | $ | 2,547,736 | |||||||||||||||||||

| Interest-bearing demand deposits | 1,836,550 | 1,826,041 | 1,778,615 | 1,758,629 | 1,708,726 | ||||||||||||||||||||||||

| Savings deposits | 2,847,168 | 2,879,212 | 2,777,840 | 2,657,849 | 2,690,045 | ||||||||||||||||||||||||

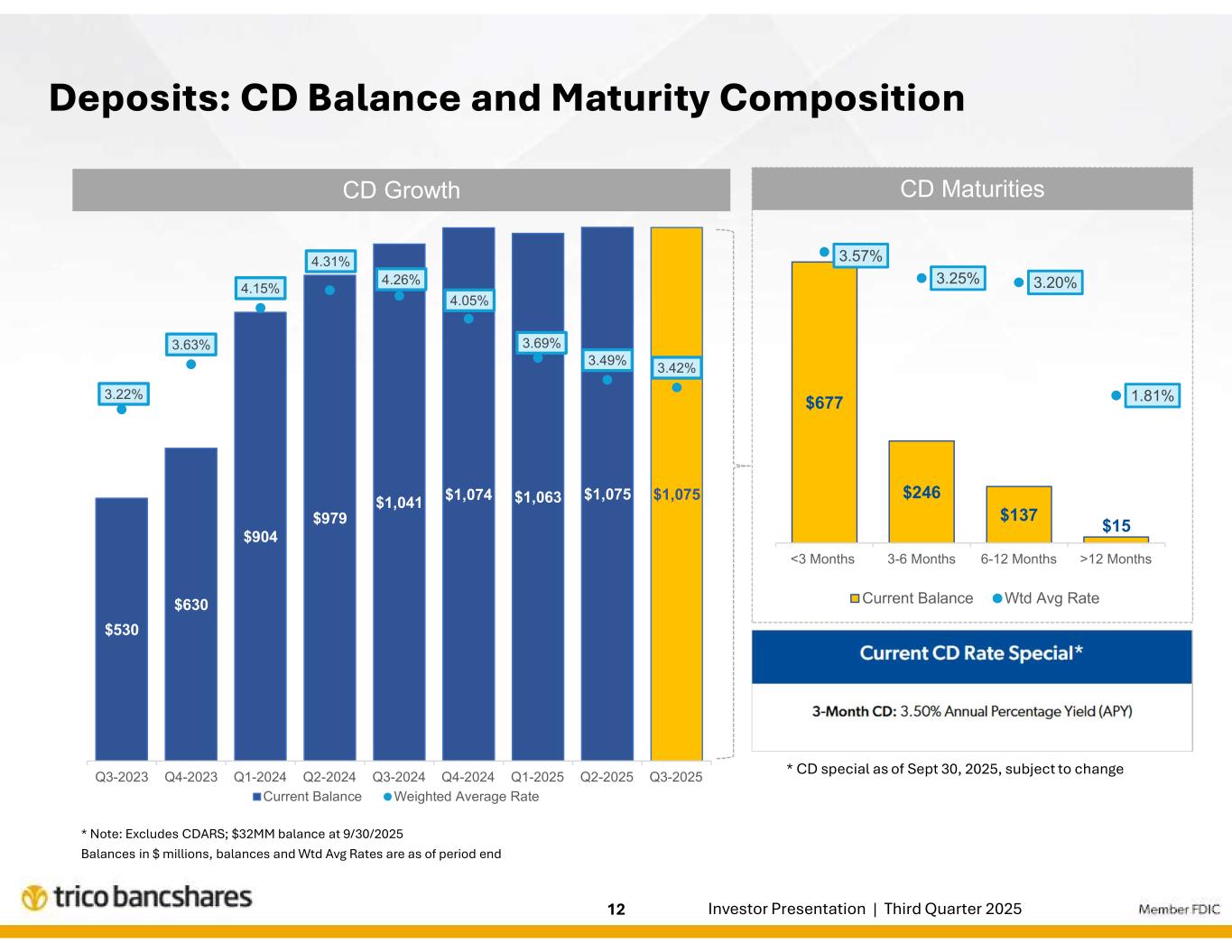

| Time certificates | 1,106,437 | 1,110,768 | 1,109,768 | 1,122,485 | 1,090,584 | ||||||||||||||||||||||||

| Total deposits | 8,334,461 | 8,375,809 | 8,205,332 | 8,087,576 | 8,037,091 | ||||||||||||||||||||||||

| Accrued interest payable | 8,241 | 10,172 | 9,685 | 11,501 | 11,664 | ||||||||||||||||||||||||

| Operating lease liability | 27,683 | 23,965 | 24,657 | 25,437 | 26,668 | ||||||||||||||||||||||||

| Other liabilities | 145,869 | 128,162 | 131,478 | 137,506 | 141,521 | ||||||||||||||||||||||||

| Other borrowings | 17,039 | 17,788 | 91,706 | 89,610 | 266,767 | ||||||||||||||||||||||||

| Junior subordinated debt | 41,238 | 101,264 | 101,222 | 101,191 | 101,164 | ||||||||||||||||||||||||

| Total liabilities | 8,574,531 | 8,657,160 | 8,564,080 | 8,452,821 | 8,584,875 | ||||||||||||||||||||||||

| Common stock | 685,594 | 685,489 | 692,500 | 693,462 | 693,176 | ||||||||||||||||||||||||

| Retained earnings | 723,668 | 702,690 | 693,383 | 679,907 | 662,816 | ||||||||||||||||||||||||

| Accumulated other comprehensive loss, net of tax | (104,957) | (121,356) | (130,364) | (152,462) | (116,977) | ||||||||||||||||||||||||

| Total shareholders’ equity | $ | 1,304,305 | $ | 1,266,823 | $ | 1,255,519 | $ | 1,220,907 | $ | 1,239,015 | |||||||||||||||||||

| Quarterly Average Balance Data | |||||||||||||||||||||||||||||

| Average loans | $ | 6,971,860 | $ | 6,878,186 | $ | 6,776,188 | $ | 6,720,732 | $ | 6,690,326 | |||||||||||||||||||

| Average interest-earning assets | $ | 9,090,900 | $ | 8,973,959 | $ | 9,007,447 | $ | 8,932,077 | $ | 8,892,223 | |||||||||||||||||||

| Average total assets | $ | 9,900,675 | $ | 9,778,834 | $ | 9,808,216 | $ | 9,725,643 | $ | 9,666,979 | |||||||||||||||||||

| Average deposits | $ | 8,361,600 | $ | 8,222,982 | $ | 8,195,793 | $ | 8,118,663 | $ | 8,020,936 | |||||||||||||||||||

| Average borrowings and subordinated debt | $ | 88,972 | $ | 123,943 | $ | 190,666 | $ | 196,375 | $ | 276,418 | |||||||||||||||||||

| Average total equity | $ | 1,289,535 | $ | 1,273,092 | $ | 1,251,994 | $ | 1,241,522 | $ | 1,214,510 | |||||||||||||||||||

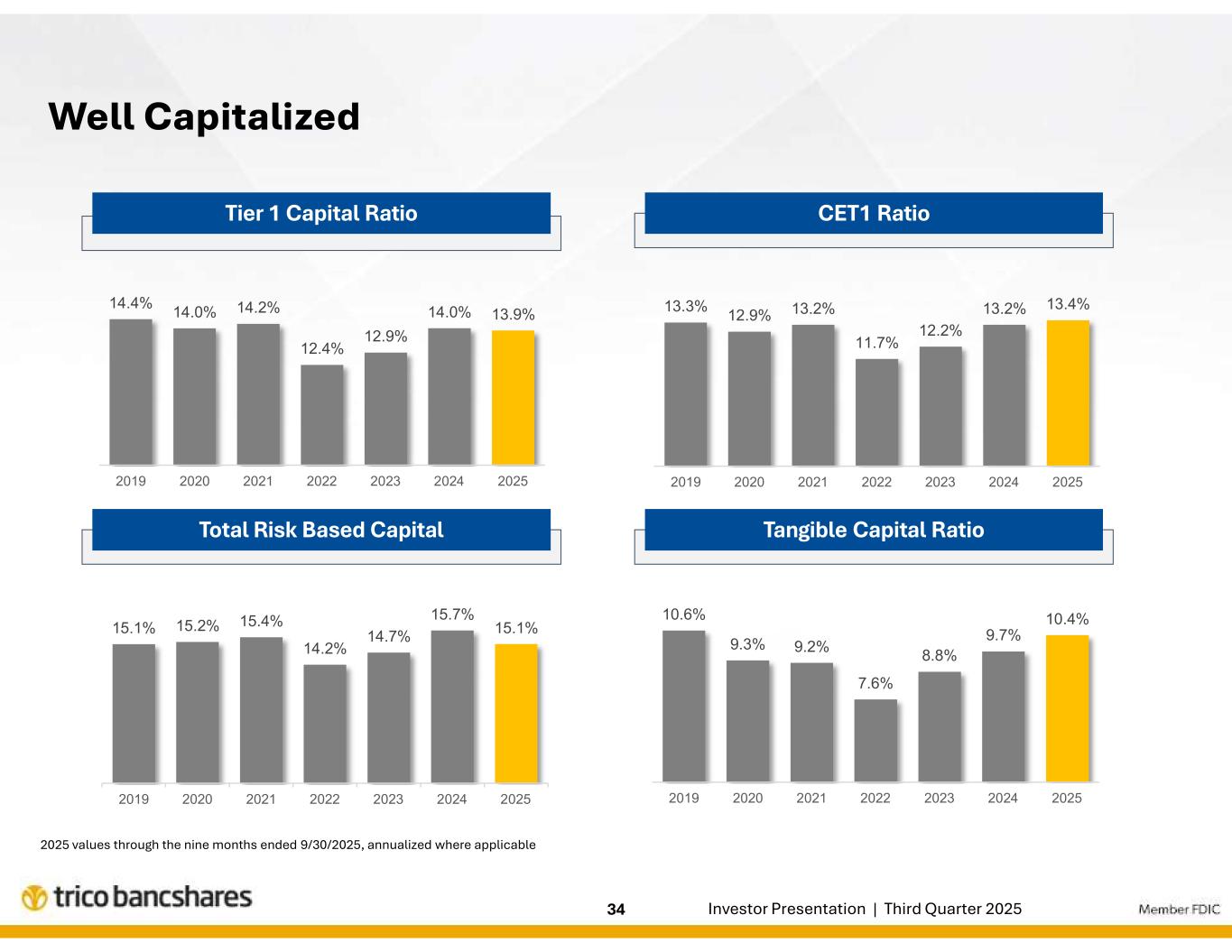

| Capital Ratio Data | |||||||||||||||||||||||||||||

| Total risk-based capital ratio | 15.1 | % | 15.6 | % | 15.8 | % | 15.7 | % | 15.6 | % | |||||||||||||||||||

| Tier 1 capital ratio | 13.9 | % | 13.9 | % | 14.1 | % | 14.0 | % | 13.8 | % | |||||||||||||||||||

| Tier 1 common equity ratio | 13.4 | % | 13.1 | % | 13.3 | % | 13.2 | % | 13.1 | % | |||||||||||||||||||

| Tier 1 leverage ratio | 11.7 | % | 11.8 | % | 11.7 | % | 11.7 | % | 11.6 | % | |||||||||||||||||||

| Tangible capital ratio (1) | 10.4 | % | 10.0 | % | 9.9 | % | 9.7 | % | 9.7 | % | |||||||||||||||||||

TriCo Bancshares—Non-GAAP Financial Measures (unaudited) | ||

| Three months ended | Nine months ended | ||||||||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 |

June 30, 2025 |

September 30, 2024 |

September 30, 2025 |

September 30, 2024 |

||||||||||||||||||||||||

| Net interest margin | |||||||||||||||||||||||||||||

| Acquired loans discount accretion, net: | |||||||||||||||||||||||||||||

| Amount (included in interest income) | $996 | $1,247 | $1,018 | $4,238 | $3,200 | ||||||||||||||||||||||||

| Effect on average loan yield | 0.06 | % | 0.08 | % | 0.06 | % | 0.08 | % | 0.06 | % | |||||||||||||||||||

| Effect on net interest margin (FTE) | 0.04 | % | 0.06 | % | 0.05 | % | 0.06 | % | 0.05 | % | |||||||||||||||||||

| Net interest margin (FTE) | 3.92 | % | 3.88 | % | 3.71 | % | 3.84 | % | 3.69 | % | |||||||||||||||||||

| Net interest margin less effect of acquired loan discount accretion (Non-GAAP) | 3.88 | % | 3.82 | % | 3.66 | % | 3.78 | % | 3.64 | % | |||||||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 |

June 30, 2025 |

September 30, 2024 |

September 30, 2025 |

September 30, 2024 |

||||||||||||||||||||||||

| Pre-tax pre-provision return on average assets or equity | |||||||||||||||||||||||||||||

| Net income (GAAP) | $34,019 | $27,542 | $29,051 | $87,924 | $85,834 | ||||||||||||||||||||||||

| Exclude provision for income taxes | 12,449 | 10,271 | 10,348 | 31,659 | 30,382 | ||||||||||||||||||||||||

| Exclude provision for credit losses | 670 | 4,665 | 220 | 9,063 | 4,930 | ||||||||||||||||||||||||

| Net income before provisions for income taxes and credit losses (Non-GAAP) | $47,138 | $42,478 | $39,619 | $128,646 | $121,146 | ||||||||||||||||||||||||

| Average assets (GAAP) | $9,900,675 | $9,778,834 | $9,666,979 | $9,829,580 | $9,767,965 | ||||||||||||||||||||||||

| Average equity (GAAP) | $1,289,535 | $1,273,092 | $1,214,510 | $1,271,678 | $1,186,245 | ||||||||||||||||||||||||

| Return on average assets (GAAP) (annualized) | 1.36 | % | 1.13 | % | 1.20 | % | 1.20 | % | 1.17 | % | |||||||||||||||||||

| Pre-tax pre-provision return on average assets (Non-GAAP) (annualized) | 1.89 | % | 1.74 | % | 1.63 | % | 1.75 | % | 1.66 | % | |||||||||||||||||||

| Return on average equity (GAAP) (annualized) | 10.47 | % | 8.68 | % | 9.52 | % | 9.24 | % | 9.67 | % | |||||||||||||||||||

| Pre-tax pre-provision return on average equity (Non-GAAP) (annualized) | 14.50 | % | 13.38 | % | 12.98 | % | 13.53 | % | 13.64 | % | |||||||||||||||||||

| Three months ended | Nine months ended | ||||||||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 |

June 30, 2025 |

September 30, 2024 |

September 30, 2025 |

September 30, 2024 |

||||||||||||||||||||||||

| Return on tangible common equity | |||||||||||||||||||||||||||||

| Average total shareholders' equity | $1,289,535 | $1,273,092 | $1,214,510 | $1,271,678 | $1,186,245 | ||||||||||||||||||||||||

| Exclude average goodwill | 304,442 | 304,442 | 304,442 | 304,442 | 304,442 | ||||||||||||||||||||||||

| Exclude average other intangibles | 5,259 | 5,743 | 8,093 | 5,741 | 9,098 | ||||||||||||||||||||||||

| Average tangible common equity (Non-GAAP) | $979,834 | $962,907 | $901,975 | $961,495 | $872,705 | ||||||||||||||||||||||||

| Net income (GAAP) | $34,019 | $27,542 | $29,051 | $87,924 | $85,834 | ||||||||||||||||||||||||

| Exclude amortization of intangible assets, net of tax effect | 339 | 340 | 725 | 1,041 | 2,175 | ||||||||||||||||||||||||

| Tangible net income available to common shareholders (Non-GAAP) | $34,358 | $27,882 | $29,776 | $88,965 | $88,009 | ||||||||||||||||||||||||

| Return on average equity (GAAP) (annualized) | 10.47 | % | 8.68 | % | 9.52 | % | 9.24 | % | 9.67 | % | |||||||||||||||||||

| Return on average tangible common equity (Non-GAAP) | 13.91 | % | 11.61 | % | 13.13 | % | 12.37 | % | 13.47 | % | |||||||||||||||||||

| Three months ended | |||||||||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||

| Tangible shareholders' equity to tangible assets | |||||||||||||||||||||||||||||

| Shareholders' equity (GAAP) | $1,304,305 | $1,266,823 | $1,255,519 | $1,220,907 | $1,239,015 | ||||||||||||||||||||||||

| Exclude goodwill and other intangible assets, net | 309,395 | 309,877 | 310,360 | 310,874 | 311,904 | ||||||||||||||||||||||||

| Tangible shareholders' equity (Non-GAAP) | $994,910 | $956,946 | $945,159 | $910,033 | $927,111 | ||||||||||||||||||||||||

| Total assets (GAAP) | $9,878,836 | $9,923,983 | $9,819,599 | $9,673,728 | $9,823,890 | ||||||||||||||||||||||||

| Exclude goodwill and other intangible assets, net | 309,395 | 309,877 | 310,360 | 310,874 | 311,904 | ||||||||||||||||||||||||

| Total tangible assets (Non-GAAP) | $9,569,441 | $9,614,106 | $9,509,239 | $9,362,854 | $9,511,986 | ||||||||||||||||||||||||

| Shareholders' equity to total assets (GAAP) | 13.20 | % | 12.77 | % | 12.79 | % | 12.62 | % | 12.61 | % | |||||||||||||||||||

| Tangible shareholders' equity to tangible assets (Non-GAAP) | 10.40 | % | 9.95 | % | 9.94 | % | 9.72 | % | 9.75 | % | |||||||||||||||||||

| Three months ended | |||||||||||||||||||||||||||||

| (dollars in thousands) | September 30, 2025 |

June 30, 2025 |

March 31, 2025 |

December 31, 2024 |

September 30, 2024 |

||||||||||||||||||||||||

| Tangible common shareholders' equity per share | |||||||||||||||||||||||||||||

| Tangible shareholders' equity (Non-GAAP) | $994,910 | $956,946 | $945,159 | $910,033 | $927,111 | ||||||||||||||||||||||||

| Common shares outstanding at end of period | 32,506,880 | 32,550,264 | 32,892,488 | 32,970,425 | 33,000,508 | ||||||||||||||||||||||||

| Common shareholders' equity (book value) per share (GAAP) | $40.12 | $38.92 | $38.17 | $37.03 | $37.55 | ||||||||||||||||||||||||

| Tangible common shareholders' equity (tangible book value) per share (Non-GAAP) | $30.61 | $29.40 | $28.73 | $27.60 | $28.09 | ||||||||||||||||||||||||