Document

|

|

|

| Contact: Peter G. Wiese, EVP & CFO, (530) 898-0300 |

| For Immediate Release |

TRICO BANCSHARES ANNOUNCES THIRD QUARTER 2023 RESULTS

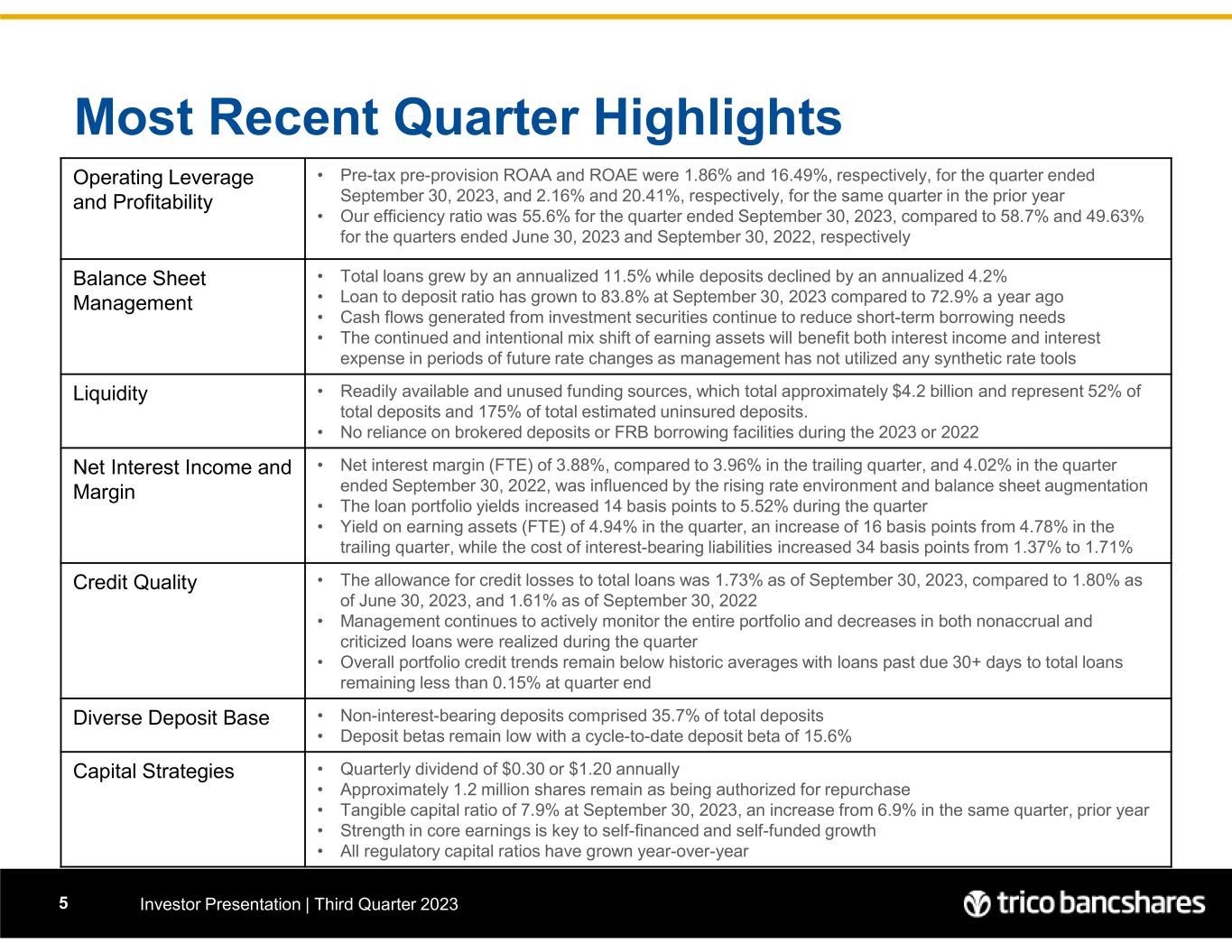

Notable Items for Third Quarter 2023

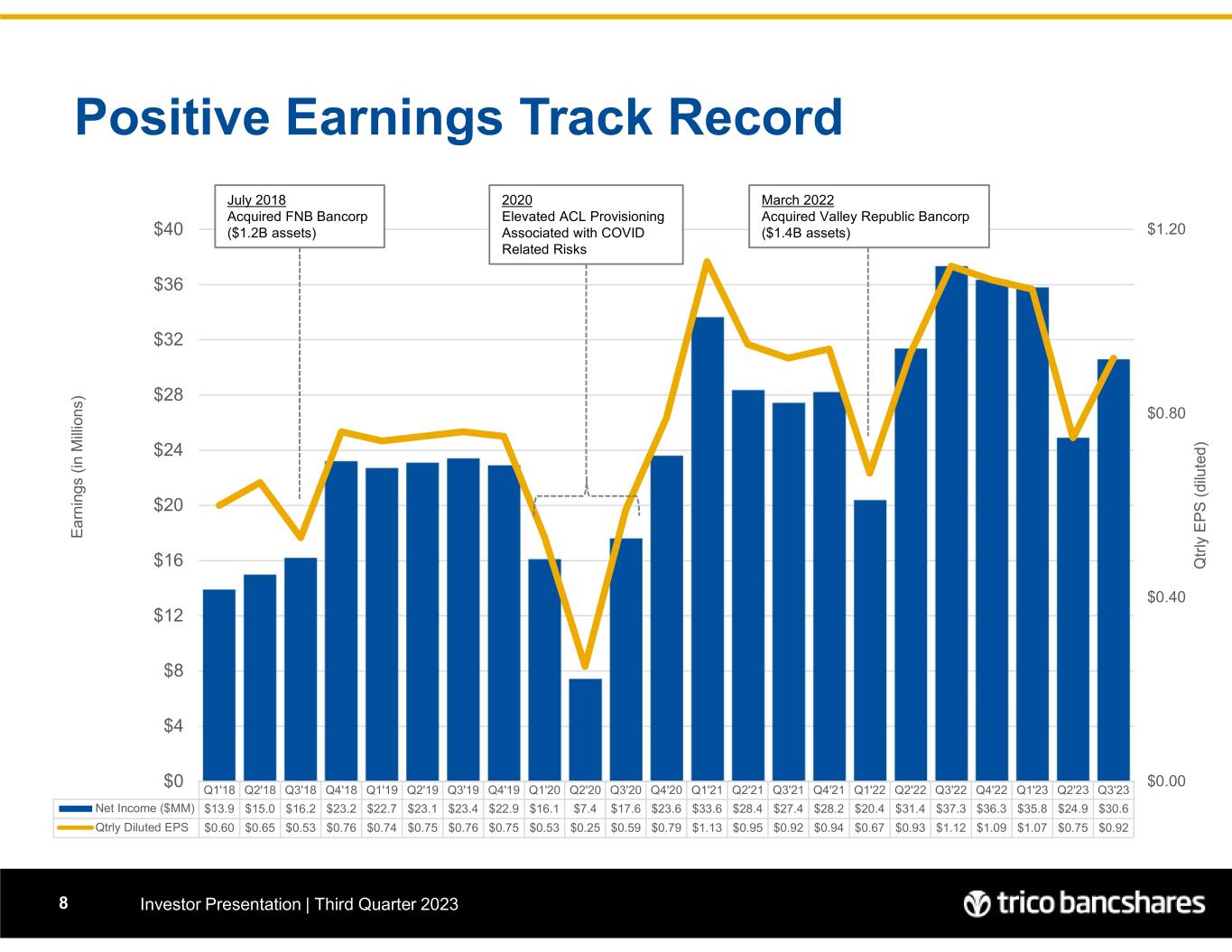

•Net income was $30.6 million compared to $24.9 million in the trailing quarter, and compared to $37.3 million in the same quarter of the prior year; Pre-tax pre-provision net revenue was $46.2 million compared to $43.1 million in the trailing quarter, and compared to $55.3 million in the same quarter of the prior year

•Return on average assets was 1.23% for the current quarter as compared to 1.01% in the trailing quarter and 1.46% in the same quarter of the prior year

•The Bank continues to operate a balance sheet without the utilization of brokered deposits or FRB borrowings

•Loan balances increased $187.9 million or 2.9% while deposit balances declined $85.7 million or 1.1% from the trailing quarter

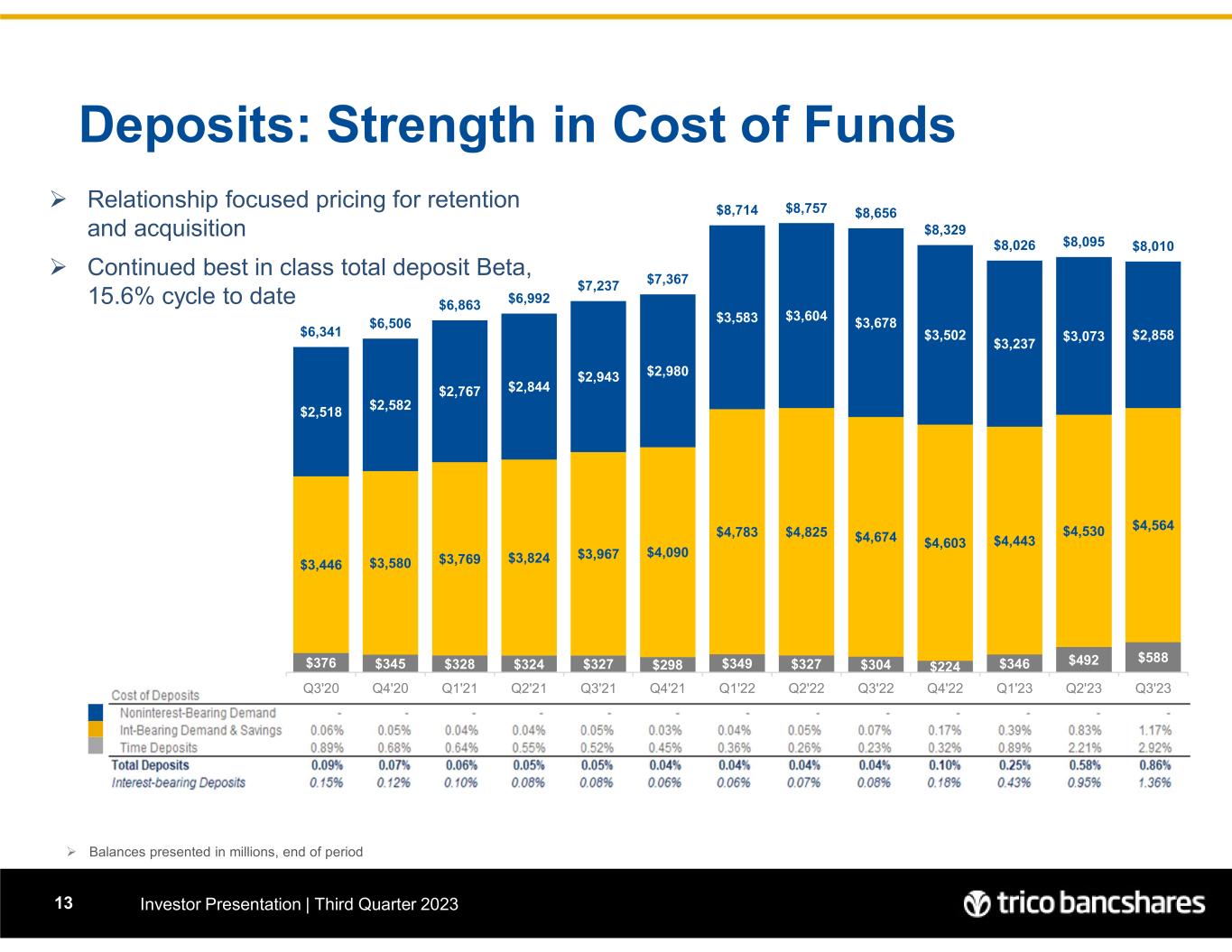

•The average cost of total deposits was 0.86% for the quarter as compared to 0.58% in the trailing quarter and 0.04% in the same quarter of the prior year and, as a result, the Company's total cost of deposits have increased 82 basis points since FOMC rate actions began in March 2022, which translates to a cycle-to-date deposit beta of 15.6%

•Balance sheet flexibility remains anchored in readily accessible sources of liquidity including undrawn borrowing capacities, on-balance sheet cash and unpledged investment securities totaling in excess of $4.1 billion

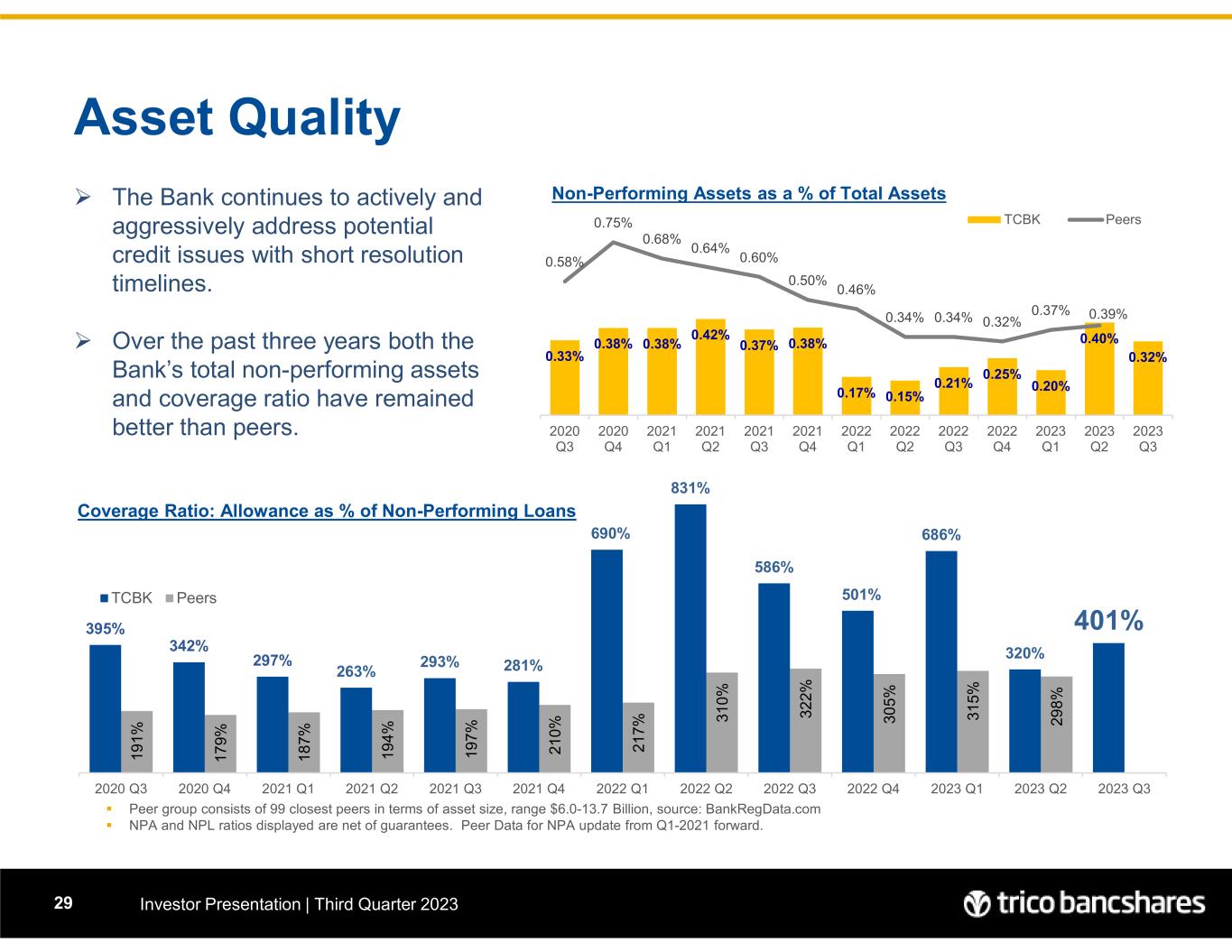

•Overall credit quality remains within historical norms as non-performing assets represent approximately 0.33% of total assets and the ratio of classified loans to total loans remains low and manageable.

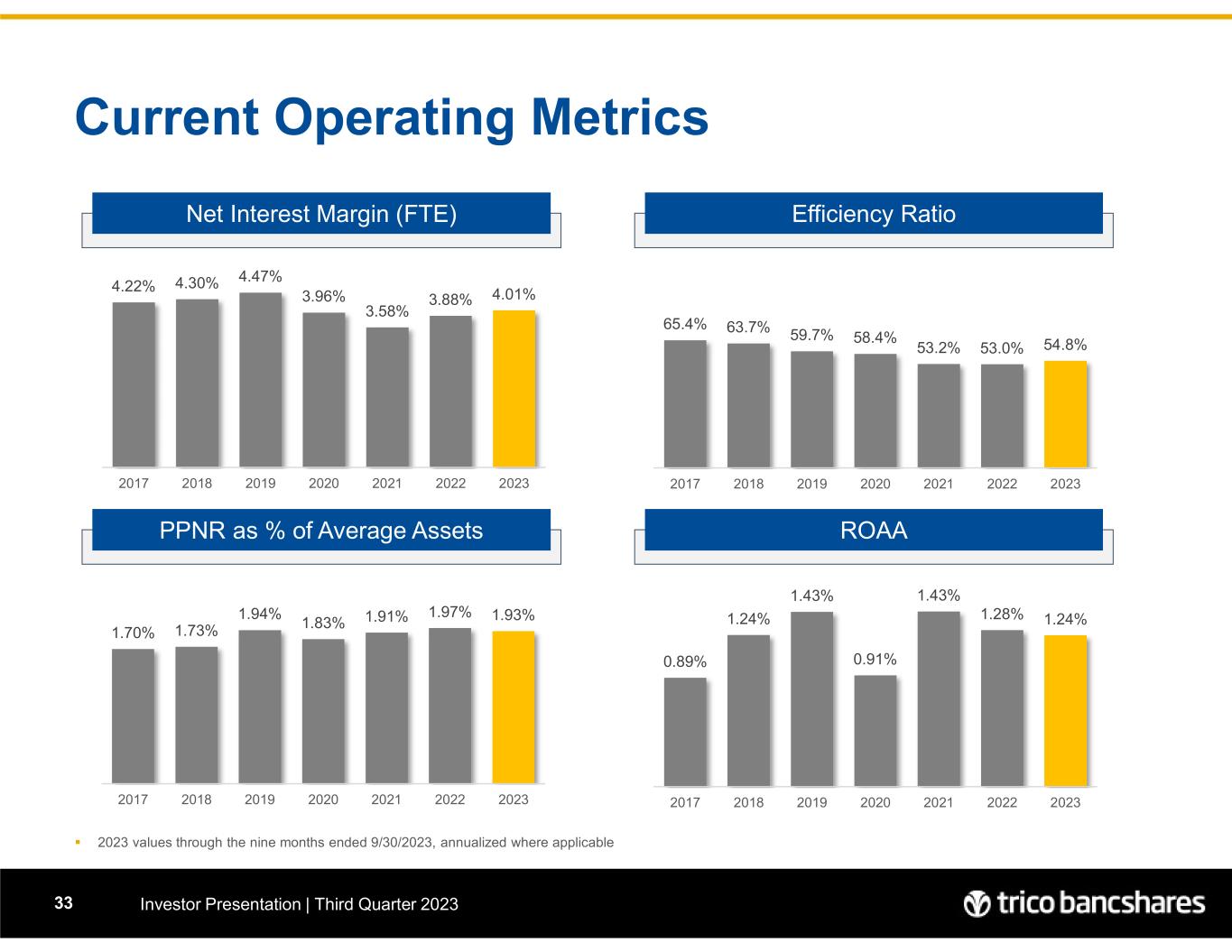

•Average yield on earning assets was 4.94%, an increase of 16 basis points over the 4.78% in the trailing quarter; net interest margin was 3.88% in the recent quarter, narrowing only 8 basis points from 3.96% in the trailing quarter

"Led by both margin and non-interest expenses, operating results for the quarter were improved over both the immediately preceding quarter and general market expectations," explained Rick Smith, President and Chief Executive Officer. Peter Wiese, EVP and Chief Financial Officer added, "We continue to be mindful about the unique economic circumstances in which we are operating and the need for long-term strategic perseverance consistent with the characteristic strengths for which we are known including consistency in shareholder returns, a conservative credit culture, expense control and depth and strength of our TriCo Team."

CHICO, CA – (October 25, 2023) – TriCo Bancshares (NASDAQ: TCBK) (the “Company”), parent company of Tri Counties Bank, today announced net income of $30.6 million for the quarter ended September 30, 2023, compared to $24.9 million during the trailing quarter ended June 30, 2023, and $37.3 million during the quarter ended September 30, 2022. Diluted earnings per share were $0.92 for the third quarter of 2023, compared to $0.75 for the second quarter of 2023 and $1.12 during the third quarter of 2022.

Financial Highlights

Performance highlights for the Company as of or for the three and nine months ended September 30, 2023, included the following:

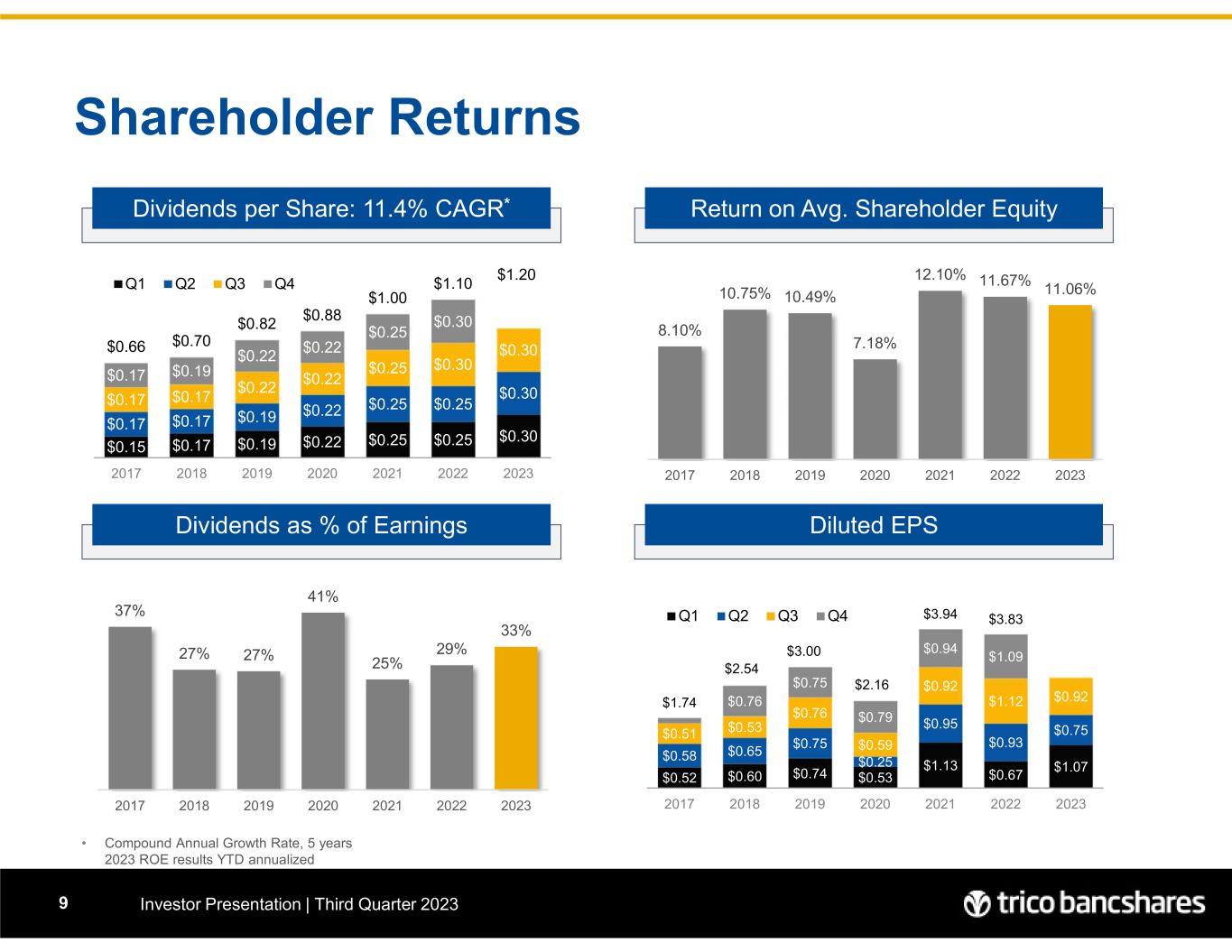

•For the quarter ended September 30, 2023, the Company’s return on average assets was 1.23%, while the return on average equity was 10.91%.

•The loan to deposit ratio increased to 83.8% as of September 30, 2023, as compared to 80.6% as of the trailing quarter.

•The efficiency ratio was 54.8% and 53.4% for the nine months ended September 30, 2023 and 2022, respectively.

•The provision for credit losses was approximately $4.2 million during the quarter ended September 30, 2023, as compared to a provision for credit losses of $9.7 million during the trailing quarter ended June 30, 2023, and a provision for credit losses of $3.8 million for the three-month period ended September 30, 2022.

•The allowance for credit losses to total loans was 1.73% as of September 30, 2023, compared to 1.80% as of the trailing quarter end, and 1.61% as of September 30, 2022. Non-performing assets to total assets were 0.33% on September 30, 2023, as compared to 0.41% as of June 30, 2023, and 0.21% at September 30, 2022.

•While total classified loans increased to 1.2% of total loans, criticized loans as a percentage of total loans decreased by 0.8% ($44.6 million) to 2.6% as a result of loan repayments and improved borrower performance, including a negligible level of past due loans.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Financial results reported in this document are preliminary and unaudited. Final financial results and other disclosures will be reported in our Quarterly Report on Form 10-Q for the period ended September 30, 2023, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information.

Summary Results

The following is a summary of the components of the Company’s operating results and performance ratios for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

September 30, |

|

June 30, |

|

|

|

|

| (dollars and shares in thousands, except per share data) |

2023 |

|

2023 |

|

$ Change |

|

% Change |

| Net interest income |

$ |

88,123 |

|

|

$ |

88,601 |

|

|

$ |

(478) |

|

|

(0.5) |

% |

| Provision for credit losses |

(4,155) |

|

|

(9,650) |

|

|

5,495 |

|

|

(56.9) |

% |

| Noninterest income |

15,984 |

|

|

15,741 |

|

|

243 |

|

|

1.5 |

% |

| Noninterest expense |

(57,878) |

|

|

(61,243) |

|

|

3,365 |

|

|

(5.5) |

% |

| Provision for income taxes |

(11,484) |

|

|

(8,557) |

|

|

(2,927) |

|

|

34.2 |

% |

| Net income |

$ |

30,590 |

|

|

$ |

24,892 |

|

|

$ |

5,698 |

|

|

22.9 |

% |

| Diluted earnings per share |

$ |

0.92 |

|

|

$ |

0.75 |

|

|

$ |

0.17 |

|

|

22.7 |

% |

| Dividends per share |

$ |

0.30 |

|

|

$ |

0.30 |

|

|

$ |

— |

|

|

— |

% |

| Average common shares |

33,263 |

|

|

33,219 |

|

|

44 |

|

|

0.1 |

% |

| Average diluted common shares |

33,319 |

|

|

33,302 |

|

|

17 |

|

|

0.1 |

% |

| Return on average total assets |

1.23 |

% |

|

1.01 |

% |

|

|

|

|

| Return on average equity |

10.91 |

% |

|

8.98 |

% |

|

|

|

|

| Efficiency ratio |

55.59 |

% |

|

58.69 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

|

|

|

| (dollars and shares in thousands, except per share data) |

2023 |

|

2022 |

|

$ Change |

|

% Change |

| Net interest income |

$ |

88,123 |

|

|

$ |

94,106 |

|

|

$ |

(5,983) |

|

|

(6.4) |

% |

| Provision for credit losses |

(4,155) |

|

|

(3,795) |

|

|

(360) |

|

|

9.5 |

% |

| Noninterest income |

15,984 |

|

|

15,640 |

|

|

344 |

|

|

2.2 |

% |

| Noninterest expense |

(57,878) |

|

|

(54,465) |

|

|

(3,413) |

|

|

6.3 |

% |

| Provision for income taxes |

(11,484) |

|

|

(14,148) |

|

|

2,664 |

|

|

(18.8) |

% |

| Net income |

$ |

30,590 |

|

|

$ |

37,338 |

|

|

$ |

(6,748) |

|

|

(18.1) |

% |

| Diluted earnings per share |

$ |

0.92 |

|

|

$ |

1.12 |

|

|

$ |

(0.20) |

|

|

(17.9) |

% |

| Dividends per share |

$ |

0.30 |

|

|

$ |

0.30 |

|

|

$ |

— |

|

|

— |

% |

| Average common shares |

33,263 |

|

|

33,348 |

|

|

(85) |

|

|

(0.3) |

% |

| Average diluted common shares |

33,319 |

|

|

33,463 |

|

|

(144) |

|

|

(0.4) |

% |

| Return on average total assets |

1.23 |

% |

|

1.46 |

% |

|

|

|

|

| Return on average equity |

10.91 |

% |

|

13.78 |

% |

|

|

|

|

| Efficiency ratio |

55.59 |

% |

|

49.63 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended

September 30, |

|

|

| (dollars and shares in thousands) |

2023 |

|

2022 |

|

$ Change |

|

% Change |

| Net interest income |

$ |

270,060 |

|

|

$ |

247,076 |

|

|

$ |

22,984 |

|

|

9.3 |

% |

| Provision for credit losses |

(18,000) |

|

|

(14,225) |

|

|

(3,775) |

|

|

26.5 |

% |

| Noninterest income |

45,360 |

|

|

47,166 |

|

|

(1,806) |

|

|

(3.8) |

% |

| Noninterest expense |

(172,915) |

|

|

(157,176) |

|

|

(15,739) |

|

|

10.0 |

% |

| Provision for income taxes |

(33,190) |

|

|

(33,765) |

|

|

575 |

|

|

(1.7) |

% |

| Net income |

$ |

91,315 |

|

|

$ |

89,076 |

|

|

$ |

2,239 |

|

|

2.5 |

% |

| Diluted earnings per share |

$ |

2.75 |

|

|

$ |

2.74 |

|

|

$ |

0.01 |

|

|

0.4 |

% |

| Dividends per share |

$ |

0.90 |

|

|

$ |

0.80 |

|

|

$ |

0.10 |

|

|

12.5 |

% |

| Average common shares |

33,259 |

|

|

32,332 |

|

|

927 |

|

|

2.9 |

% |

| Average diluted common shares |

33,356 |

|

|

32,469 |

|

|

887 |

|

|

2.7 |

% |

| Return on average total assets |

1.24 |

% |

|

1.23 |

% |

|

|

|

|

| Return on average equity |

11.06 |

% |

|

11.25 |

% |

|

|

|

|

| Efficiency ratio |

54.82 |

% |

|

53.42 |

% |

|

|

|

|

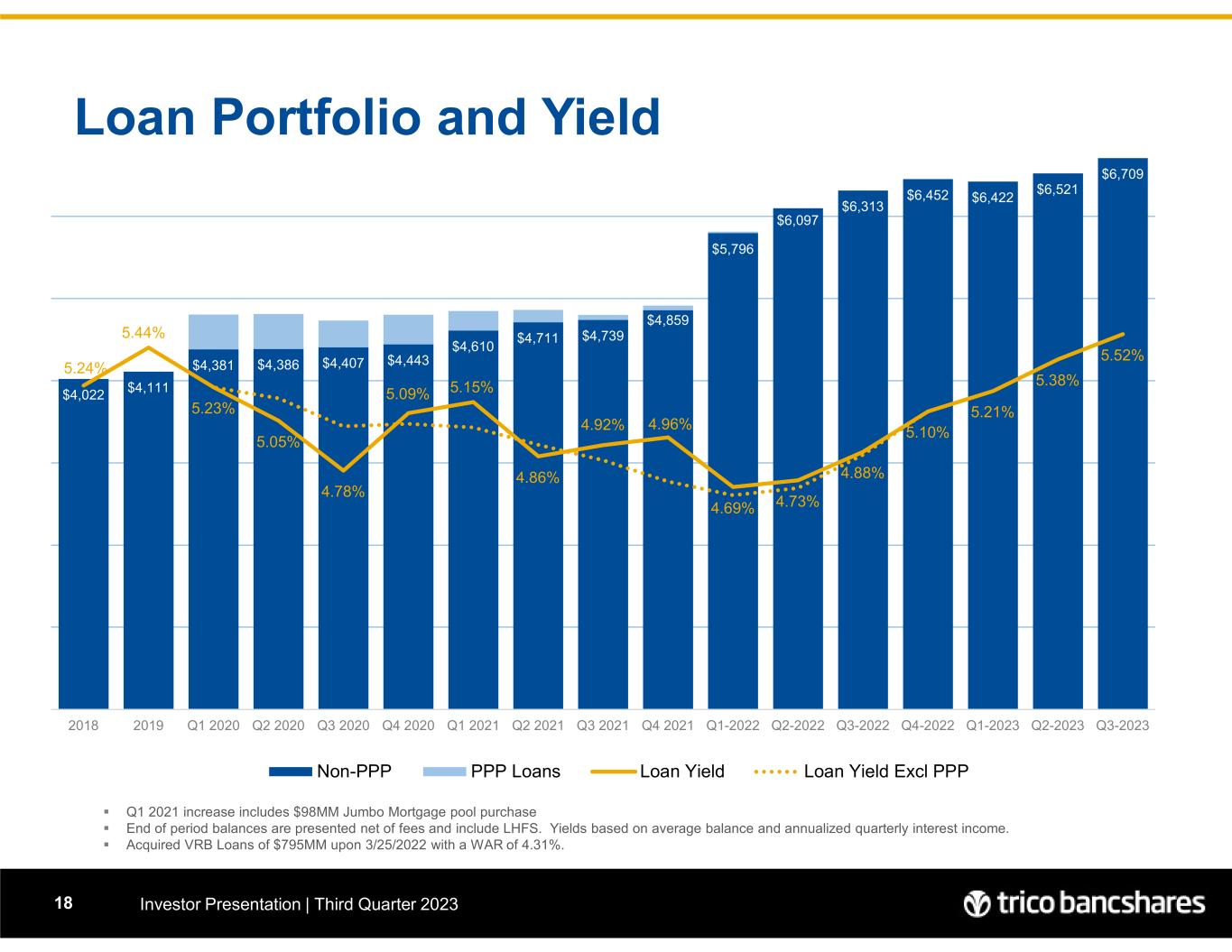

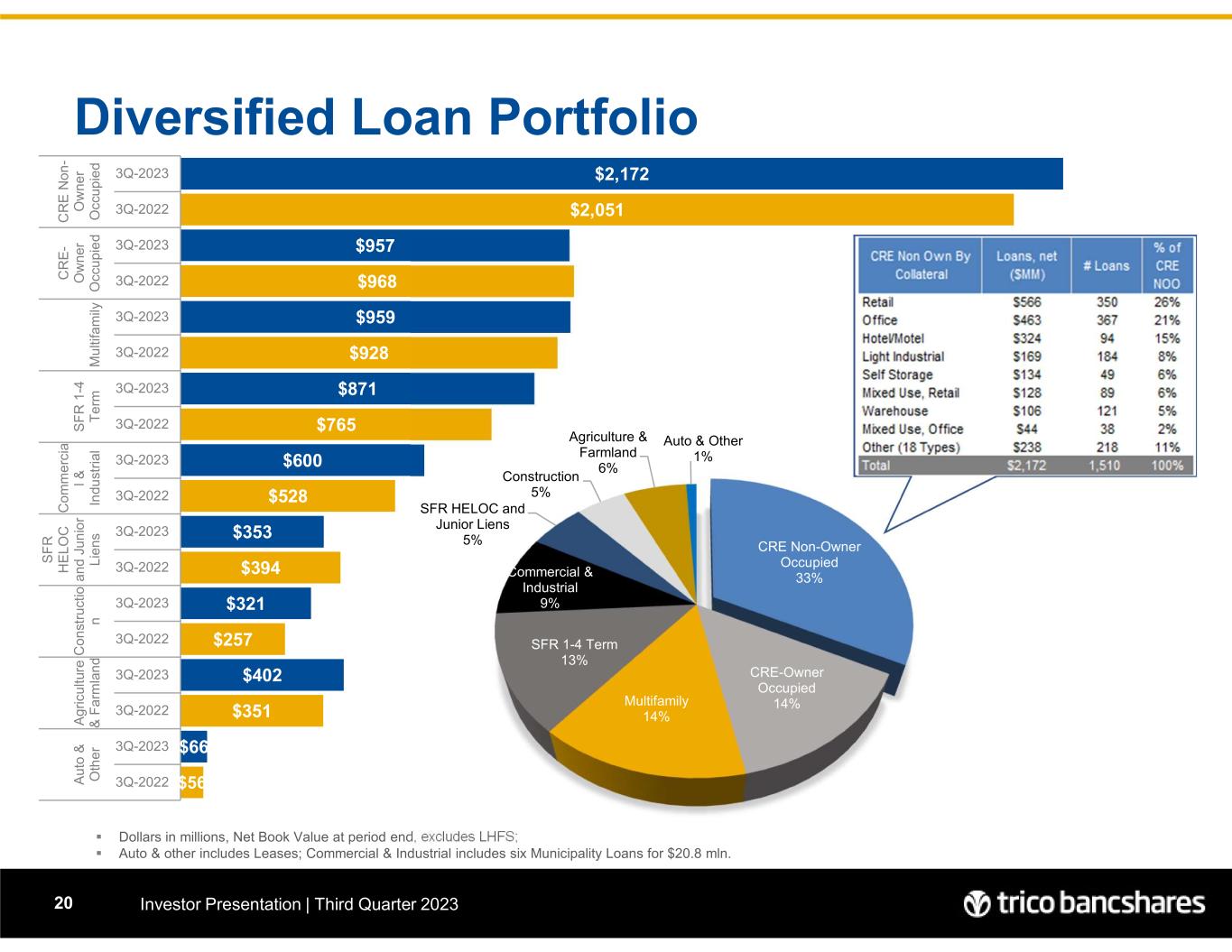

Balance Sheet

Total loans outstanding grew to $6.7 billion as of September 30, 2023, an organic based increase of 6.2% over the prior twelve months. As compared to June 30, 2023, total loans outstanding increased by $187.9 million or 11.5% annualized. Investments decreased to $2.33 billion as of September 30, 2023, an annualized decrease of 12.6% over the prior year quarter end. Quarterly average earning assets to quarterly total average assets were 91.7% on September 30, 2023, as compared to 91.6% and 92.0% at December 31, 2022, and September 30, 2022, respectively. The loan-to-deposit ratio was 83.8% on September 30, 2023, as compared to 80.6% and 73.0% at December 31, 2022, and September 30, 2022, respectively. During the current year to date period, and throughout the 2022 fiscal year, the Company held no brokered deposits and relied solely on short-term borrowings to fund cash flow timing differences.

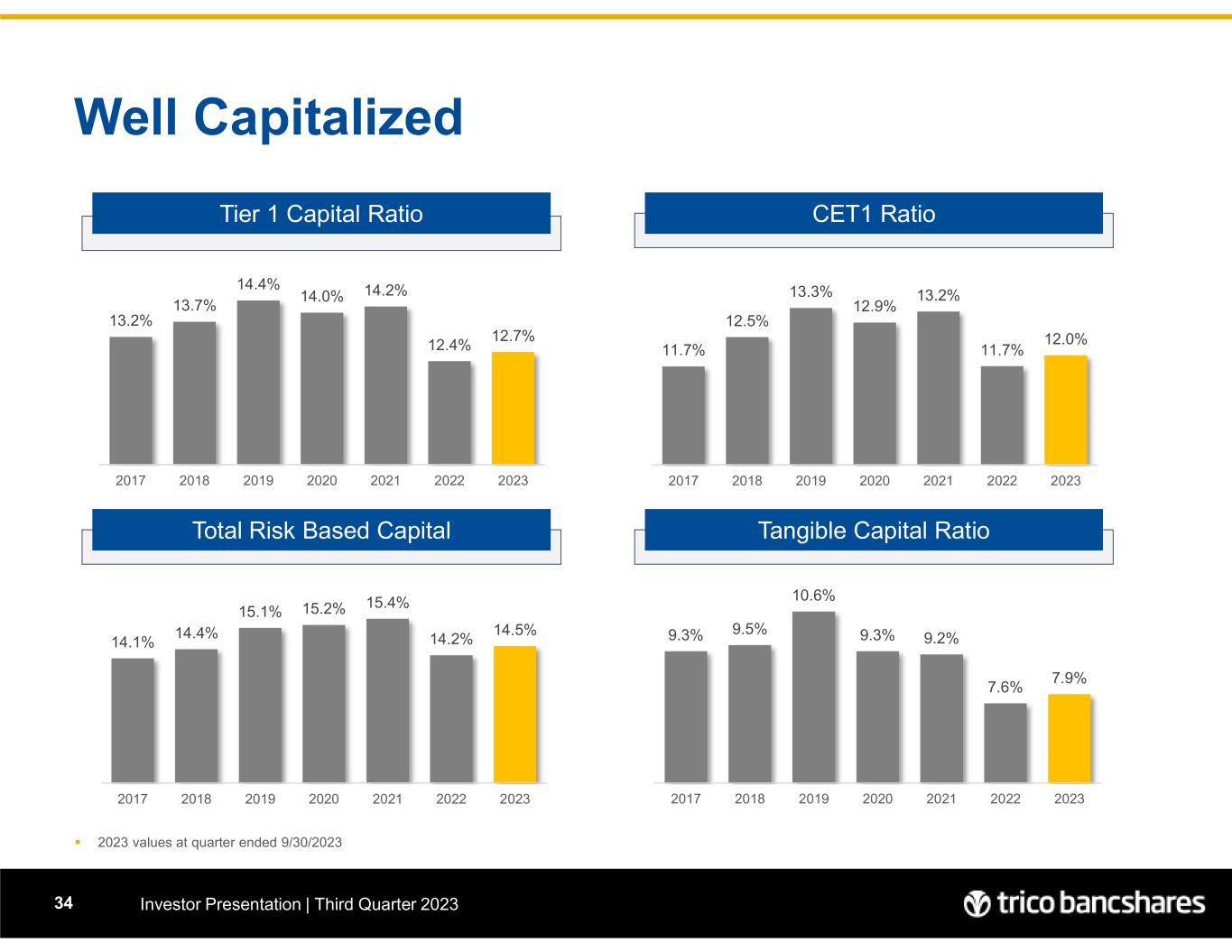

Total shareholders' equity decreased by $22.4 million during the quarter ended September 30, 2023, as a result of accumulated other comprehensive losses increasing by $44.0 million and cash dividend payments on common stock of approximately $10.0 million, offset by net income of $30.6 million. As a result, the Company’s book value was $32.18 per share at September 30, 2023, as compared to $32.86 and $29.71 at December 31, 2022 and September 30, 2022, respectively. The Company’s tangible book value per share, a non-GAAP measure, calculated by subtracting goodwill and other intangible assets from total shareholders’ equity and dividing that sum by total shares outstanding, was $22.67 per share at September 30, 2023, as compared to $23.30 and $19.92 at December 31, 2022, and September 30, 2022, respectively. As noted above, despite the consistent retention of earnings in each quarter of the Company's history, recent changes in the balance of unrealized losses on available-for-sale investment securities, net of deferred taxes, has been the primary driver of decreases in tangible book value per share.

Trailing Quarter Balance Sheet Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending balances |

September 30, |

|

June 30, |

|

|

|

|

|

|

|

Annualized

% Change |

| (dollars in thousands) |

2023 |

|

2023 |

|

$ Change |

|

|

| Total assets |

$ |

9,897,006 |

|

|

$ |

9,853,421 |

|

|

$ |

43,585 |

|

|

|

|

|

|

1.8 |

% |

| Total loans |

6,708,666 |

|

|

6,520,740 |

|

|

187,926 |

|

|

|

|

|

|

11.5 |

|

| Total investments |

2,333,162 |

|

|

2,485,378 |

|

|

(152,216) |

|

|

|

|

|

|

(24.5) |

|

| Total deposits |

8,009,643 |

|

|

8,095,365 |

|

|

(85,722) |

|

|

|

|

|

|

(4.2) |

|

| Total other borrowings |

$ |

537,975 |

|

|

$ |

392,714 |

|

|

$ |

145,261 |

|

|

|

|

|

|

148.0 |

% |

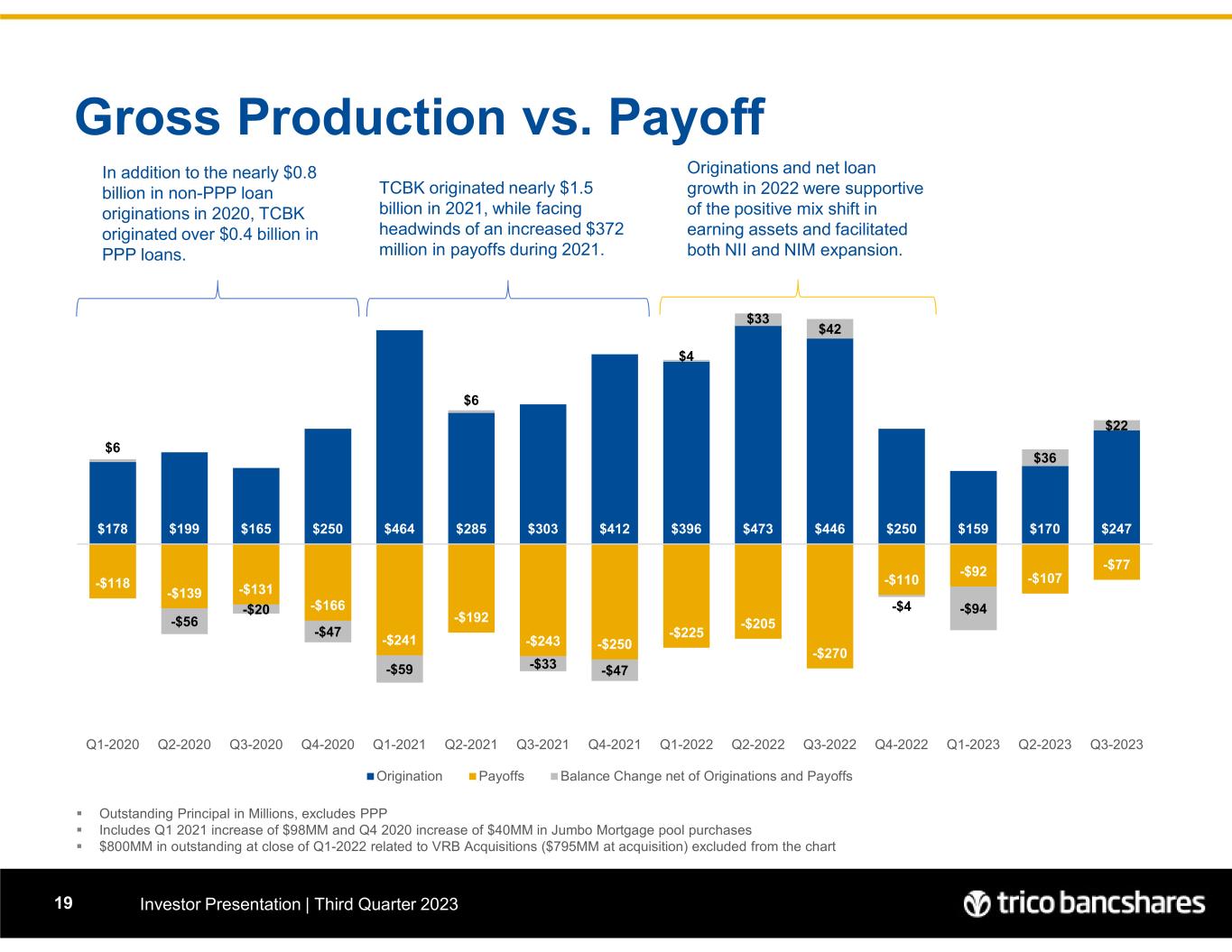

Loans outstanding increased by $187.9 million or 11.5% on an annualized basis during the quarter ended September 30, 2023. During the quarter, loan originations/draws totaled approximately $495.0 million while payoffs/repayments of loans totaled $308.0 million, which compares to originations/draws and payoffs/repayments during the trailing quarter ended of $456.0 million and $356.0 million, respectively. While origination volume increased from the previous quarter, activity levels continue to be lower relative to the comparative period in 2022 due in part to disciplined pricing and underwriting, as well as decreased borrower appetite at currently offered lending rates. Investment security balances decreased $152.2 million or 24.5% on an annualized basis as the result of net prepayments, maturities, and purchases totaling approximating $89.7 million and net decreases in the market value of securities of $62.5 million. Management seeks to utilize excess cash flows from the investment security portfolio to support loan growth or reduce borrowings thus resulting in an improved mix of earning assets. Deposit balances decreased by $85.7 million or 4.2% annualized during the period. Funding for the net cash outflows of loans, investment securities and deposits during the quarter were supported by a net increase of $145.3 million in short-term borrowings, which totaled $538.0 million at September 30, 2023.

Average Trailing Quarter Balance Sheet Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Quarterly average balances for the period ended |

September 30, |

|

June 30, |

|

|

|

|

|

|

|

Annualized

% Change |

|

|

|

|

|

|

| (dollars in thousands) |

2023 |

|

2023 |

|

$ Change |

|

|

|

|

|

| Total assets |

$ |

9,874,240 |

|

|

$ |

9,848,191 |

|

|

$ |

26,049 |

|

|

|

|

|

|

1.1 |

% |

|

|

|

|

|

|

| Total loans |

6,597,400 |

|

|

6,467,381 |

|

|

130,019 |

|

|

|

|

|

|

8.0 |

|

|

|

|

|

|

|

| Total investments |

2,429,335 |

|

|

2,525,334 |

|

|

(95,999) |

|

|

|

|

|

|

(15.2) |

|

|

|

|

|

|

|

| Total deposits |

8,043,101 |

|

|

7,981,515 |

|

|

61,586 |

|

|

|

|

|

|

3.1 |

|

|

|

|

|

|

|

| Total other borrowings |

$ |

449,274 |

|

|

$ |

477,256 |

|

|

$ |

(27,982) |

|

|

|

|

|

|

(23.5) |

% |

|

|

|

|

|

|

Year Over Year Balance Sheet Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Ending balances |

As of September 30, |

|

|

|

|

|

|

|

% Change |

| (dollars in thousands) |

2023 |

|

2022 |

|

$ Change |

|

|

| Total assets |

$ |

9,897,006 |

|

|

$ |

9,976,879 |

|

|

$ |

(79,873) |

|

|

|

|

|

|

(0.8) |

% |

| Total loans |

6,708,666 |

|

|

6,314,290 |

|

|

394,376 |

|

|

|

|

|

|

6.2 |

|

| Total loans, excluding PPP |

6,707,530 |

|

|

6,312,348 |

|

|

395,182 |

|

|

|

|

|

|

6.3 |

|

| Total investments |

2,333,162 |

|

|

2,668,145 |

|

|

(334,983) |

|

|

|

|

|

|

(12.6) |

|

| Total deposits |

8,009,643 |

|

|

8,655,769 |

|

|

(646,126) |

|

|

|

|

|

|

(7.5) |

|

| Total other borrowings |

$ |

537,975 |

|

|

$ |

47,068 |

|

|

$ |

490,907 |

|

|

|

|

|

|

1,043.0 |

% |

Non-PPP loan balances increased as a result of organic activities by approximately $395.2 million or 6.3% during the twelve-month period ending September 30, 2023. Over the same period deposit balances have declined by $646.1 million or 7.5%. The Company has offset these declines through the deployment of excess cash balances, runoff of investment security balances, and proceeds from short-term FHLB borrowings. As of September 30, 2023 and June 30, 2023, short-term borrowings from the FHLB totaled $500.0 and $394.1 million and had a weighted average interest rate of 5.14 and 5.11%, respectively.

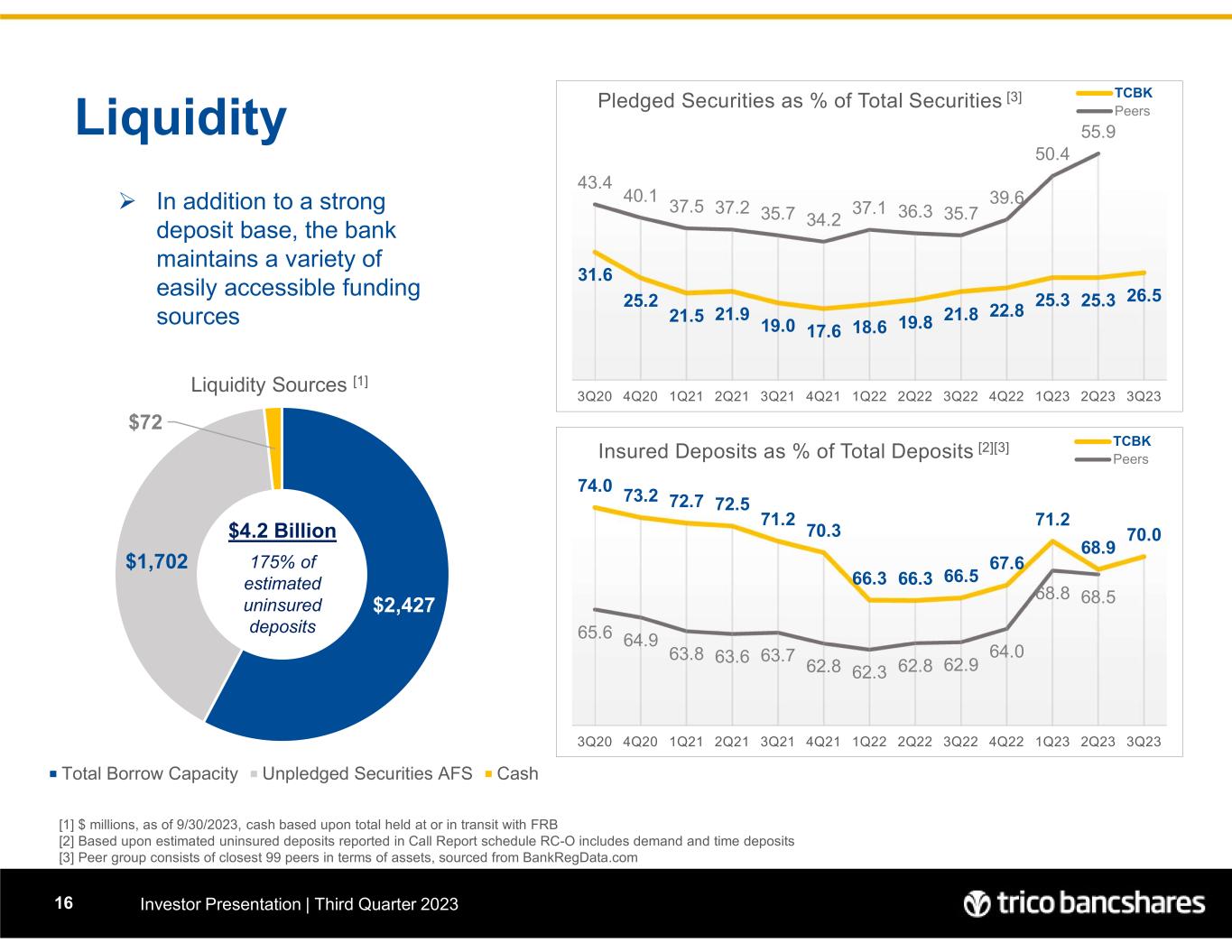

Liquidity

The Company's primary sources of liquidity include the following for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

| Borrowing capacity at correspondent banks and FRB |

$ |

2,927,065 |

|

|

$ |

2,847,052 |

|

|

$ |

2,720,468 |

|

| Less: borrowings outstanding |

(500,000) |

|

|

(350,000) |

|

|

— |

|

Unpledged available-for-sale (AFS) investment securities |

1,702,265 |

|

|

1,813,894 |

|

|

2,040,802 |

|

Cash held or in transit with FRB |

72,049 |

|

|

79,530 |

|

|

199,994 |

|

| Total primary liquidity |

$ |

4,201,379 |

|

|

$ |

4,390,476 |

|

|

$ |

4,961,264 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Estimated uninsured deposit balances |

$ |

2,406,552 |

|

|

$ |

2,522,718 |

|

|

$ |

2,898,347 |

|

At September 30, 2023, the Company's primary sources of liquidity represented 52.5% of total deposits and 175% of estimated total uninsured (excluding collateralized municipal deposits and intercompany balances) deposits, respectively. As secondary sources of liquidity, the Company's held-to-maturity investment securities had a fair value of $124.0 million, including approximately $15.0 million in net unrealized losses. The Company did not utilize any brokered deposits during 2023 or 2022.

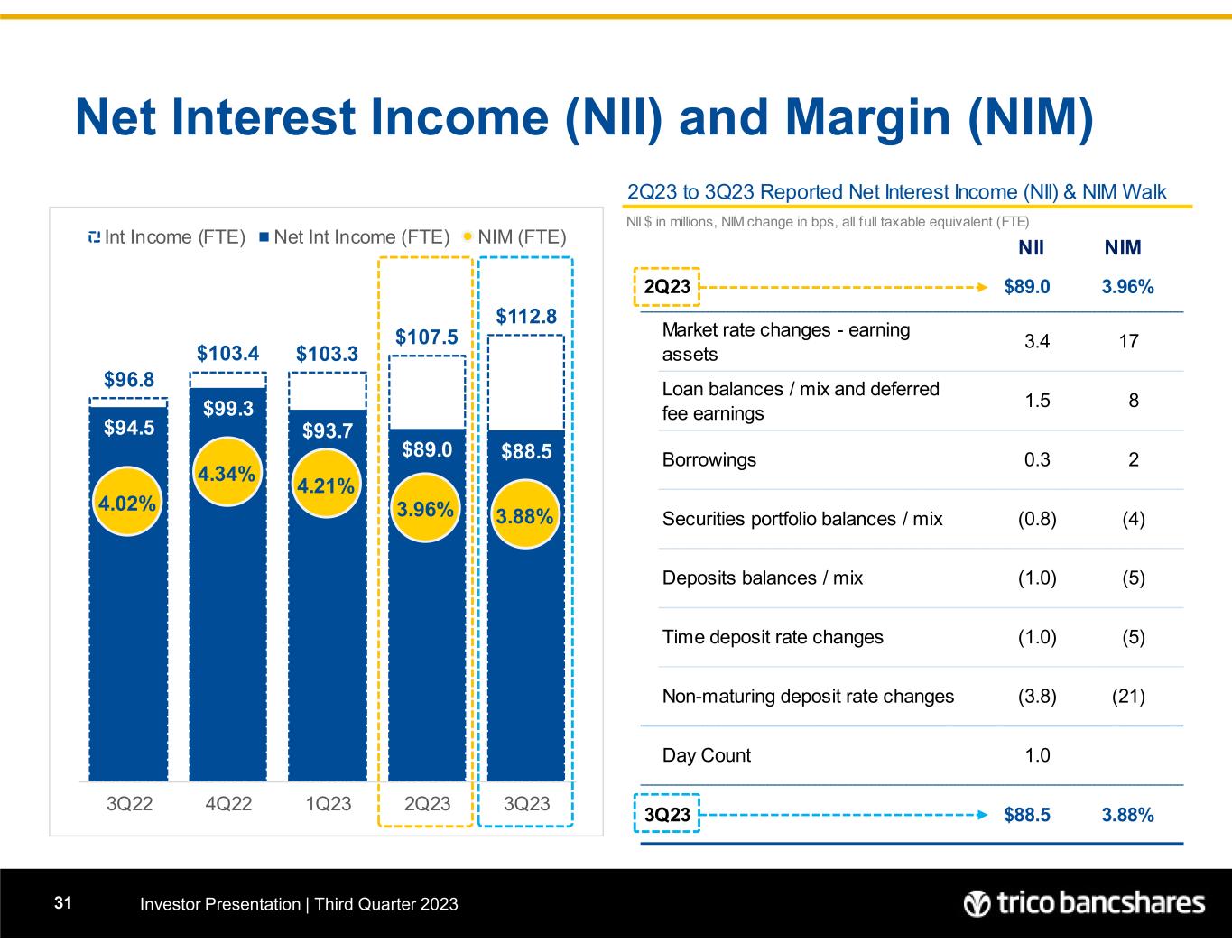

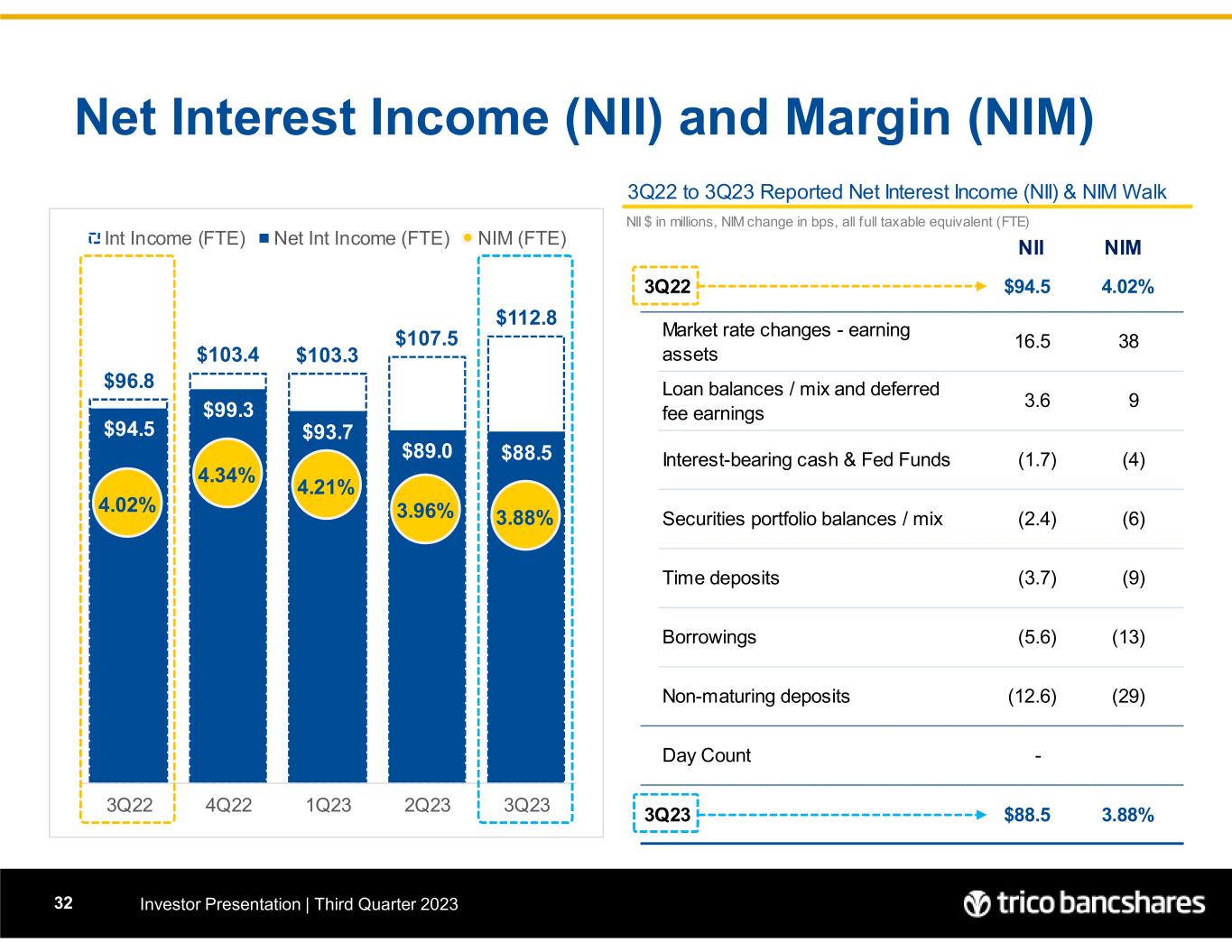

Net Interest Income and Net Interest Margin

During the twelve-month period ended September 30, 2023, the Federal Open Market Committee's (FOMC) actions have resulted in an increase in the Fed Funds Rate by approximately 225 basis points. During the same period the Company's yield on total loans (excluding PPP) increased 65 basis points to 5.52% for the three months ended September 30, 2023, from 4.87% for the three months ended September 30, 2022. Moreover, the tax equivalent yield on the Company's investment security portfolio was 3.39%, an increase of 70 basis points from the 2.69% for the three months ended September 30, 2022. The cost of total interest-bearing deposits and total interest-bearing liabilities increased by 128 basis points and 154 basis points, respectively, between the three month periods ended September 30, 2023 and 2022. Since FOMC rate actions began in March 2022, the Company's cost of total deposits has increased 82 basis points which translates to a cycle to date deposit beta of 15.6%.

The Company continues to manage its cost of deposits through the use of various pricing and product mix strategies. As of September 30, 2023, June 30, 2023, and December 31, 2022, deposits priced utilizing these strategies totaled $1,232.4 million, $1,070.7 million and $579.1 million, respectively, and carried weighted average rates of 3.53%, 3.38%, and 1.64%, respectively.

The following is a summary of the components of net interest income for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

|

September 30, |

|

June 30, |

|

|

|

|

| (dollars in thousands) |

2023 |

|

2023 |

|

Change |

|

% Change |

| Interest income |

$ |

112,380 |

|

|

$ |

107,158 |

|

|

$ |

5,222 |

|

|

4.9 |

% |

| Interest expense |

(24,257) |

|

|

(18,557) |

|

|

(5,700) |

|

|

30.7 |

% |

Fully tax-equivalent adjustment (FTE) (1) |

405 |

|

|

379 |

|

|

26 |

|

|

6.9 |

% |

| Net interest income (FTE) |

$ |

88,528 |

|

|

$ |

88,980 |

|

|

$ |

(452) |

|

|

(0.5) |

% |

| Net interest margin (FTE) |

3.88 |

% |

|

3.96 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquired loans discount accretion, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

1,324 |

|

|

$ |

1,471 |

|

|

$ |

(147) |

|

|

(10.0) |

% |

Net interest margin less effect of acquired loan discount accretion(1) |

3.82 |

% |

|

3.89 |

% |

|

(0.07) |

% |

|

|

|

|

|

|

|

|

|

|

| PPP loans yield, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

2 |

|

|

$ |

4 |

|

|

$ |

(2) |

|

|

(50.0) |

% |

Net interest margin less effect of PPP loan yield (1) |

3.88 |

% |

|

3.96 |

% |

|

(0.08) |

% |

|

|

|

|

|

|

|

|

|

|

Acquired loans discount accretion and PPP loan yield, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

1,326 |

|

|

$ |

1,475 |

|

|

$ |

(149) |

|

|

(10.1) |

% |

Net interest margin less effect of acquired loan discount accretion and PPP loan yield (1) |

3.82 |

% |

|

3.89 |

% |

|

(0.07) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended

September 30, |

|

|

|

|

| (dollars in thousands) |

2023 |

|

2022 |

|

Change |

|

% Change |

| Interest income |

$ |

112,380 |

|

|

$ |

96,366 |

|

|

$ |

16,014 |

|

|

16.6 |

% |

| Interest expense |

(24,257) |

|

|

(2,260) |

|

|

(21,997) |

|

|

973.3 |

% |

Fully tax-equivalent adjustment (FTE) (1) |

405 |

|

|

440 |

|

|

(35) |

|

|

(8.0) |

% |

| Net interest income (FTE) |

$ |

88,528 |

|

|

$ |

94,546 |

|

|

$ |

(6,018) |

|

|

(6.4) |

% |

| Net interest margin (FTE) |

3.88 |

% |

|

4.02 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquired loans discount accretion, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

1,324 |

|

|

$ |

714 |

|

|

$ |

610 |

|

|

85.4 |

% |

Net interest margin less effect of acquired loan discount accretion(1) |

3.82 |

% |

|

3.99 |

% |

|

(0.17) |

% |

|

|

| PPP loans yield, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

2 |

|

|

$ |

313 |

|

|

$ |

(311) |

|

|

(99.4) |

% |

Net interest margin less effect of PPP loan yield (1) |

3.88 |

% |

|

4.02 |

% |

|

(0.14) |

% |

|

|

Acquired loans discount accretion and PPP loan yield, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

1,326 |

|

|

$ |

1,027 |

|

|

$ |

299 |

|

|

29.1 |

% |

Net interest margin less effect of acquired loan discount accretion and PPP loan yield (1) |

3.82 |

% |

|

3.98 |

% |

|

(0.16) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended

September 30, |

|

|

|

|

| (dollars in thousands) |

2023 |

|

2022 |

|

Change |

|

% Change |

| Interest income |

$ |

322,445 |

|

|

$ |

252,516 |

|

|

$ |

69,929 |

|

|

27.7 |

% |

| Interest expense |

(52,385) |

|

|

(5,440) |

|

|

(46,945) |

|

|

863.0 |

% |

Fully tax-equivalent adjustment (FTE) (1) |

1,176 |

|

|

1,120 |

|

|

56 |

|

|

5.0 |

% |

| Net interest income (FTE) |

$ |

271,236 |

|

|

$ |

248,196 |

|

|

$ |

23,040 |

|

|

9.3 |

% |

| Net interest margin (FTE) |

4.01 |

% |

|

3.71 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Acquired loans discount accretion, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

4,192 |

|

|

$ |

3,714 |

|

|

$ |

478 |

|

|

12.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin less effect of acquired loan discount accretion(1) |

3.95 |

% |

|

3.65 |

% |

|

0.30 |

% |

|

|

|

|

|

|

|

|

|

|

| PPP loans yield, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

11 |

|

|

$ |

2,374 |

|

|

$ |

(2,363) |

|

|

(99.5) |

% |

|

|

|

|

|

|

|

|

Net interest margin less effect of PPP loan yield (1) |

4.01 |

% |

|

3.69 |

% |

|

0.32 |

% |

|

|

Acquired loans discount accretion and PPP loan yield, net: |

|

|

|

|

|

|

|

| Amount (included in interest income) |

$ |

4,203 |

|

|

$ |

6,088 |

|

|

$ |

(1,885) |

|

|

(31.0) |

% |

Net interest margin less effect of acquired loans discount and PPP loan yield (1) |

3.95 |

% |

|

3.63 |

% |

|

0.32 |

% |

|

|

(1)Certain information included herein is presented on a fully tax-equivalent (FTE) basis and / or to present additional financial details which may be desired by users of this financial information. The Company believes the use of these non-generally accepted accounting principles (non-GAAP) measures provide additional clarity in assessing its results, and the presentation of these measures are common practice within the banking industry. See additional information related to non-GAAP measures at the back of this document.

Loans may be acquired at a premium or discount to par value, in which case, the premium is amortized (subtracted from) or the discount is accreted (added to) interest income over the remaining life of the loan. The dollar impact of loan discount accretion and loan premium amortization decrease as the purchased loans mature or pay off early. Upon the early pay off of a loan, any remaining unaccreted discount or unamortized premium is immediately taken into interest income; and as loan payoffs may vary significantly from quarter to quarter, so may the impact of discount accretion and premium amortization on interest income. As a result of the increase in interest rates, the prepayment rate of portfolio loans, inclusive of those acquired at a premium or discount, declined during 2023 as compared to 2022. During the three months ended September 30, 2023, June 30, 2023, and September 30, 2022, purchased loan discount accretion was $1.3 million, $1.5 million, and $0.7 million, respectively.

The following table shows the components of net interest income and net interest margin on a fully tax-equivalent (FTE) basis for the quarterly periods indicated:

ANALYSIS OF CHANGE IN NET INTEREST MARGIN ON EARNING ASSETS

(unaudited, dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Three months ended |

|

Three months ended |

|

September 30, 2023 |

|

June 30, 2023 |

|

September 30, 2022 |

|

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

|

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

|

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans, excluding PPP |

$ |

6,596,116 |

|

|

$ |

91,705 |

|

|

5.52 |

% |

|

$ |

6,465,903 |

|

|

$ |

86,743 |

|

|

5.38 |

% |

|

$ |

6,162,267 |

|

|

$ |

75,643 |

|

|

4.87 |

% |

| PPP loans |

1,284 |

|

|

2 |

|

|

0.62 |

% |

|

1,478 |

|

|

4 |

|

|

1.09 |

% |

|

8,775 |

|

|

313 |

|

|

14.15 |

% |

| Investments-taxable |

2,246,569 |

|

|

18,990 |

|

|

3.35 |

% |

|

2,343,511 |

|

|

18,775 |

|

|

3.21 |

% |

|

2,591,513 |

|

|

17,122 |

|

|

2.62 |

% |

Investments-nontaxable (1) |

182,766 |

|

|

1,755 |

|

|

3.81 |

% |

|

181,823 |

|

|

1,641 |

|

|

3.62 |

% |

|

210,606 |

|

|

1,908 |

|

|

3.59 |

% |

| Total investments |

2,429,335 |

|

|

20,745 |

|

|

3.39 |

% |

|

2,525,334 |

|

|

20,416 |

|

|

3.24 |

% |

|

2,802,119 |

|

|

19,030 |

|

|

2.69 |

% |

| Cash at Federal Reserve and other banks |

26,654 |

|

|

333 |

|

|

4.96 |

% |

|

29,349 |

|

|

374 |

|

|

5.11 |

% |

|

346,991 |

|

|

1,820 |

|

|

2.08 |

% |

| Total earning assets |

9,053,389 |

|

|

112,785 |

|

|

4.94 |

% |

|

9,022,064 |

|

|

107,537 |

|

|

4.78 |

% |

|

9,320,152 |

|

|

96,806 |

|

|

4.12 |

% |

| Other assets, net |

820,851 |

|

|

|

|

|

|

826,127 |

|

|

|

|

|

|

810,966 |

|

|

|

|

|

| Total assets |

$ |

9,874,240 |

|

|

|

|

|

|

$ |

9,848,191 |

|

|

|

|

|

|

$ |

10,131,118 |

|

|

|

|

|

| Liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand deposits |

$ |

1,751,625 |

|

|

$ |

3,916 |

|

|

0.89 |

% |

|

$ |

1,657,714 |

|

|

$ |

2,173 |

|

|

0.53 |

% |

|

$ |

1,775,884 |

|

|

$ |

119 |

|

|

0.03 |

% |

| Savings deposits |

2,790,197 |

|

|

9,526 |

|

|

1.35 |

% |

|

2,768,981 |

|

|

6,936 |

|

|

1.00 |

% |

|

3,011,145 |

|

|

685 |

|

|

0.09 |

% |

| Time deposits |

535,715 |

|

|

3,937 |

|

|

2.92 |

% |

|

426,689 |

|

|

2,348 |

|

|

2.21 |

% |

|

321,100 |

|

|

188 |

|

|

0.23 |

% |

| Total interest-bearing deposits |

5,077,537 |

|

|

17,379 |

|

|

1.36 |

% |

|

4,853,384 |

|

|

11,457 |

|

|

0.95 |

% |

|

5,108,129 |

|

|

992 |

|

|

0.08 |

% |

| Other borrowings |

449,274 |

|

|

5,106 |

|

|

4.51 |

% |

|

477,256 |

|

|

5,404 |

|

|

4.54 |

% |

|

38,908 |

|

|

5 |

|

|

0.05 |

% |

| Junior subordinated debt |

101,070 |

|

|

1,772 |

|

|

6.96 |

% |

|

101,056 |

|

|

1,696 |

|

|

6.73 |

% |

|

101,011 |

|

|

1,263 |

|

|

4.96 |

% |

| Total interest-bearing liabilities |

5,627,881 |

|

|

24,257 |

|

|

1.71 |

% |

|

5,431,696 |

|

|

18,557 |

|

|

1.37 |

% |

|

5,248,048 |

|

|

2,260 |

|

|

0.17 |

% |

| Noninterest-bearing deposits |

2,965,564 |

|

|

|

|

|

|

3,128,131 |

|

|

|

|

|

|

3,644,086 |

|

|

|

|

|

| Other liabilities |

168,391 |

|

|

|

|

|

|

176,141 |

|

|

|

|

|

|

164,208 |

|

|

|

|

|

| Shareholders’ equity |

1,112,404 |

|

|

|

|

|

|

1,112,223 |

|

|

|

|

|

|

1,074,776 |

|

|

|

|

|

| Total liabilities and shareholders’ equity |

$ |

9,874,240 |

|

|

|

|

|

|

$ |

9,848,191 |

|

|

|

|

|

|

$ |

10,131,118 |

|

|

|

|

|

Net interest rate spread (1) (2) |

|

|

|

|

3.23 |

% |

|

|

|

|

|

3.41 |

% |

|

|

|

|

|

3.95 |

% |

Net interest income and margin (1) (3) |

|

|

$ |

88,528 |

|

|

3.88 |

% |

|

|

|

$ |

88,980 |

|

|

3.96 |

% |

|

|

|

$ |

94,546 |

|

|

4.02 |

% |

(1)Fully taxable equivalent (FTE). All yields and rates are calculated using specific day counts for the period and year as applicable.

(2)Net interest spread is the average yield earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(3)Net interest margin is computed by calculating the difference between interest income and interest expense, divided by the average balance of interest-earning assets.

Net interest income (FTE) during the three months ended September 30, 2023, decreased $0.5 million or 0.5% to $88.5 million compared to $89.0 million during the three months ended June 30, 2023. In addition, net interest margin declined 8 basis points to 3.88%, compared to the trailing quarter. The decrease in net interest income is primarily attributed to an additional $5.9 million or 24.3% in deposit interest expense due to increases in interest rates as compared to the trailing quarter. As a partial offset, total interest income also increased as compared to the trailing quarter, up $5.2 million or 4.6%.

As compared to the same quarter in the prior year, average loan yields, excluding PPP, increased 65 basis points from 4.87% during the three months ended September 30, 2022, to 5.52% during the three months ended September 30, 2023. The accretion of discounts from acquired loans added 8 and 5 basis points to loan yields during the quarters ended September 30, 2023 and September 30, 2022, respectively.

The rates paid on interest bearing deposits increased by 41 basis points during the quarter ended September 30, 2023, compared to the trailing quarter. The cost of interest-bearing deposits increased by 128 basis points between the quarter ended September 30, 2023, and the same quarter of the prior year. In addition, the average balance of noninterest-bearing deposits decreased by $162.6 million quarter over quarter and decreased by $678.5 million from three month average for the period ended September 30, 2022. As of September 30, 2023, the ratio of average total noninterest-bearing deposits to total average deposits was 36.9%, as compared to 39.2% and 41.6% at June 30, 2023 and September 30, 2022, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, 2023 |

|

Nine months ended September 30, 2022 |

|

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

|

Average

Balance |

|

Income/

Expense |

|

Yield/

Rate |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

| Loans, excluding PPP |

$ |

6,492,141 |

|

|

$ |

260,857 |

|

|

5.37 |

% |

|

$ |

5,668,055 |

|

|

$ |

201,245 |

|

|

4.75 |

% |

| PPP loans |

1,444 |

|

|

11 |

|

|

1.02 |

% |

|

32,287 |

|

|

2,374 |

|

|

9.83 |

% |

| Investments-taxable |

2,328,883 |

|

|

56,681 |

|

|

3.25 |

% |

|

2,487,111 |

|

|

41,695 |

|

|

2.24 |

% |

Investments-nontaxable (1) |

184,524 |

|

|

5,096 |

|

|

3.69 |

% |

|

183,772 |

|

|

4,853 |

|

|

3.53 |

% |

| Total investments |

2,513,407 |

|

|

61,777 |

|

|

3.29 |

% |

|

2,670,883 |

|

|

46,548 |

|

|

2.33 |

% |

| Cash at Federal Reserve and other banks |

27,606 |

|

|

976 |

|

|

4.73 |

% |

|

573,252 |

|

|

3,469 |

|

|

0.81 |

% |

| Total earning assets |

9,034,598 |

|

|

323,621 |

|

|

4.79 |

% |

|

8,944,477 |

|

|

253,636 |

|

|

3.79 |

% |

| Other assets, net |

832,501 |

|

|

|

|

|

|

737,721 |

|

|

|

|

|

| Total assets |

$ |

9,867,099 |

|

|

|

|

|

|

$ |

9,682,198 |

|

|

|

|

|

| Liabilities and shareholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

| Interest-bearing demand deposits |

$ |

1,694,438 |

|

|

$ |

6,476 |

|

|

0.51 |

% |

|

$ |

1,724,787 |

|

|

$ |

302 |

|

|

0.02 |

% |

| Savings deposits |

2,818,817 |

|

|

20,616 |

|

|

0.98 |

% |

|

2,863,447 |

|

|

1,541 |

|

|

0.07 |

% |

| Time deposits |

413,359 |

|

|

6,889 |

|

|

2.23 |

% |

|

319,940 |

|

|

676 |

|

|

0.28 |

% |

| Total interest-bearing deposits |

4,926,614 |

|

|

33,981 |

|

|

0.92 |

% |

|

4,908,174 |

|

|

2,519 |

|

|

0.07 |

% |

| Other borrowings |

402,016 |

|

|

13,318 |

|

|

4.43 |

% |

|

39,609 |

|

|

15 |

|

|

0.05 |

% |

| Junior subordinated debt |

101,057 |

|

|

5,086 |

|

|

6.73 |

% |

|

87,804 |

|

|

2,906 |

|

|

4.42 |

% |

| Total interest-bearing liabilities |

5,429,687 |

|

|

52,385 |

|

|

1.29 |

% |

|

5,035,587 |

|

|

5,440 |

|

|

0.14 |

% |

| Noninterest-bearing deposits |

3,153,807 |

|

|

|

|

|

|

3,435,487 |

|

|

|

|

|

| Other liabilities |

179,483 |

|

|

|

|

|

|

152,186 |

|

|

|

|

|

| Shareholders’ equity |

1,104,122 |

|

|

|

|

|

|

1,058,938 |

|

|

|

|

|

| Total liabilities and shareholders’ equity |

$ |

9,867,099 |

|

|

|

|

|

|

$ |

9,682,198 |

|

|

|

|

|

Net interest rate spread (1) (2) |

|

|

|

|

3.50 |

% |

|

|

|

|

|

3.65 |

% |

Net interest income and margin (1) (3) |

|

|

$ |

271,236 |

|

|

4.01 |

% |

|

|

|

$ |

248,196 |

|

|

3.71 |

% |

(1)Fully taxable equivalent (FTE). All yields and rates are calculated using specific day counts for the period and year as applicable.

(2)Net interest spread is the average yield earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(3)Net interest margin is computed by calculating the difference between interest income and interest expense, divided by the average balance of interest-earning assets.

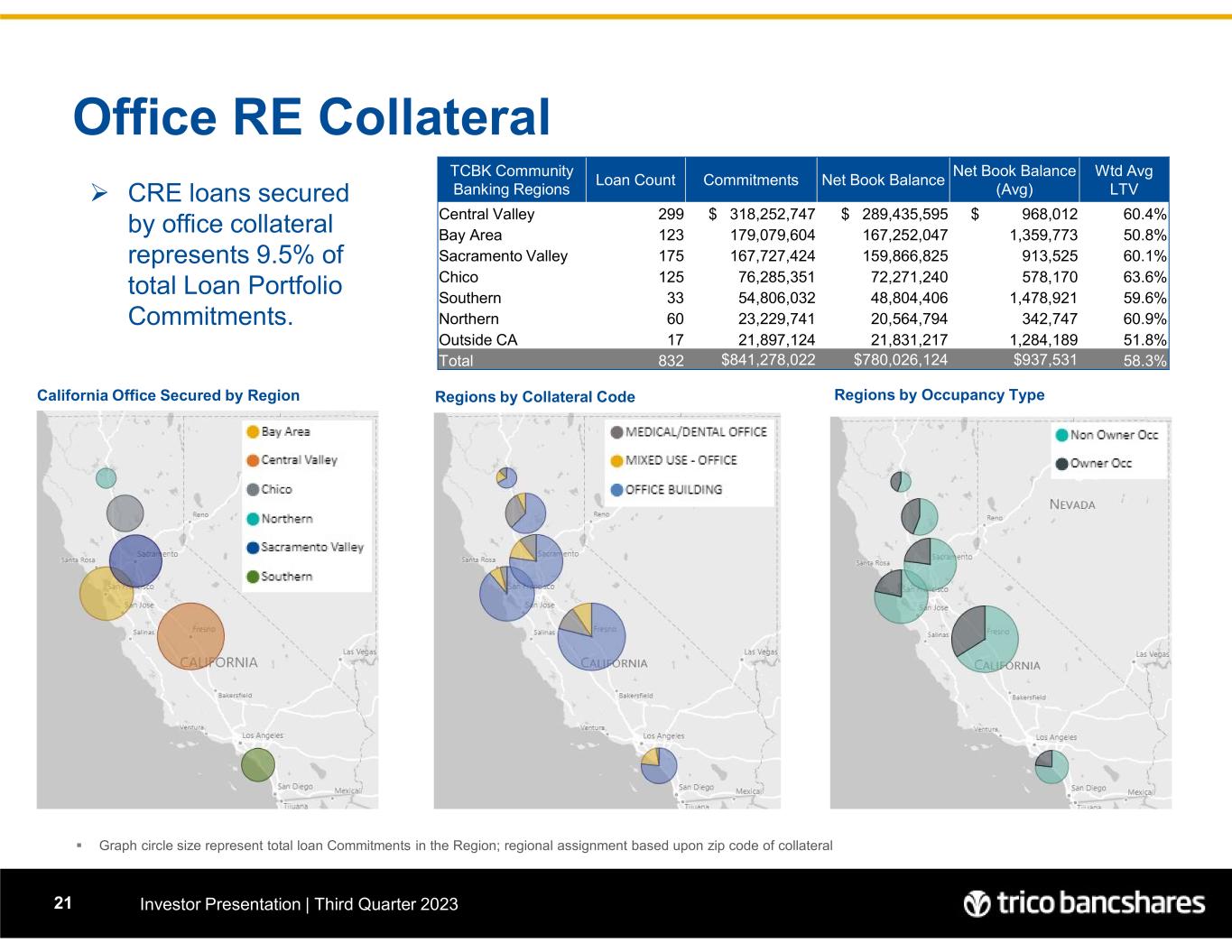

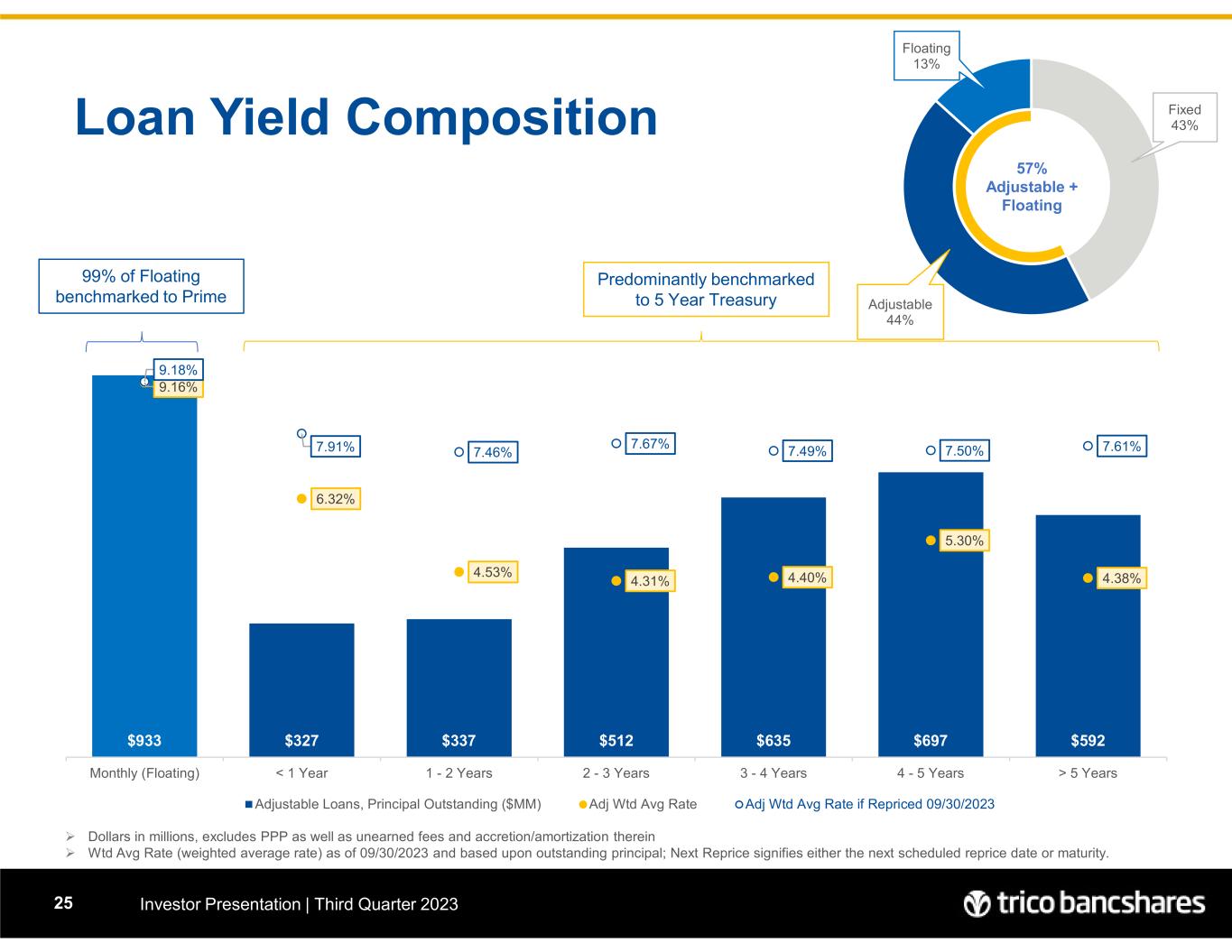

Interest Rates and Earning Asset Composition

Market interest rates, including many rates that serve as reference indices for variable rate loans and investment securities continued to increase. As noted above, these rate increases have continued to benefit growth in total interest income. As of September 30, 2023, the Company's loan portfolio consisted of approximately $6.7 billion in outstanding principal with a weighted average coupon rate of 5.33%. During the three-month periods ending September 30, 2023, June 30, 2023, and December 31, 2022, the weighted average coupon on loan production in the quarter was 7.31%, 6.85%, and 6.05%, respectively. Included in the September 30, 2023 loan total are adjustable rate loans totaling $3.5 billion, of which, $933.0 million are considered floating based on the Wall Street Prime index. In addition, the Company holds certain investment securities with fair values totaling $368.9 million which are subject to repricing on not less than a quarterly basis.

Asset Quality and Credit Loss Provisioning

During the three months ended September 30, 2023, the Company recorded a provision for credit losses of $4.2 million, as compared to $9.7 million during the trailing quarter, and $3.8 million during the third quarter of 2022.

The following table presents details of the provision for credit losses for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

|

|

|

|

|

|

|

|

| (dollars in thousands) |

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

|

|

|

|

|

|

|

|

| Addition to allowance for credit losses |

$ |

3,120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

3,500 |

|

|

$ |

16,415 |

|

|

$ |

13,645 |

|

|

|

|

|

|

|

|

|

Addition to reserve for unfunded loan commitments |

1,035 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

295 |

|

|

1,585 |

|

|

580 |

|

|

|

|

|

|

|

|

|

| Total provision for credit losses |

$ |

4,155 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

3,795 |

|

|

$ |

18,000 |

|

|

$ |

14,225 |

|

|

|

|

|

|

|

|

|

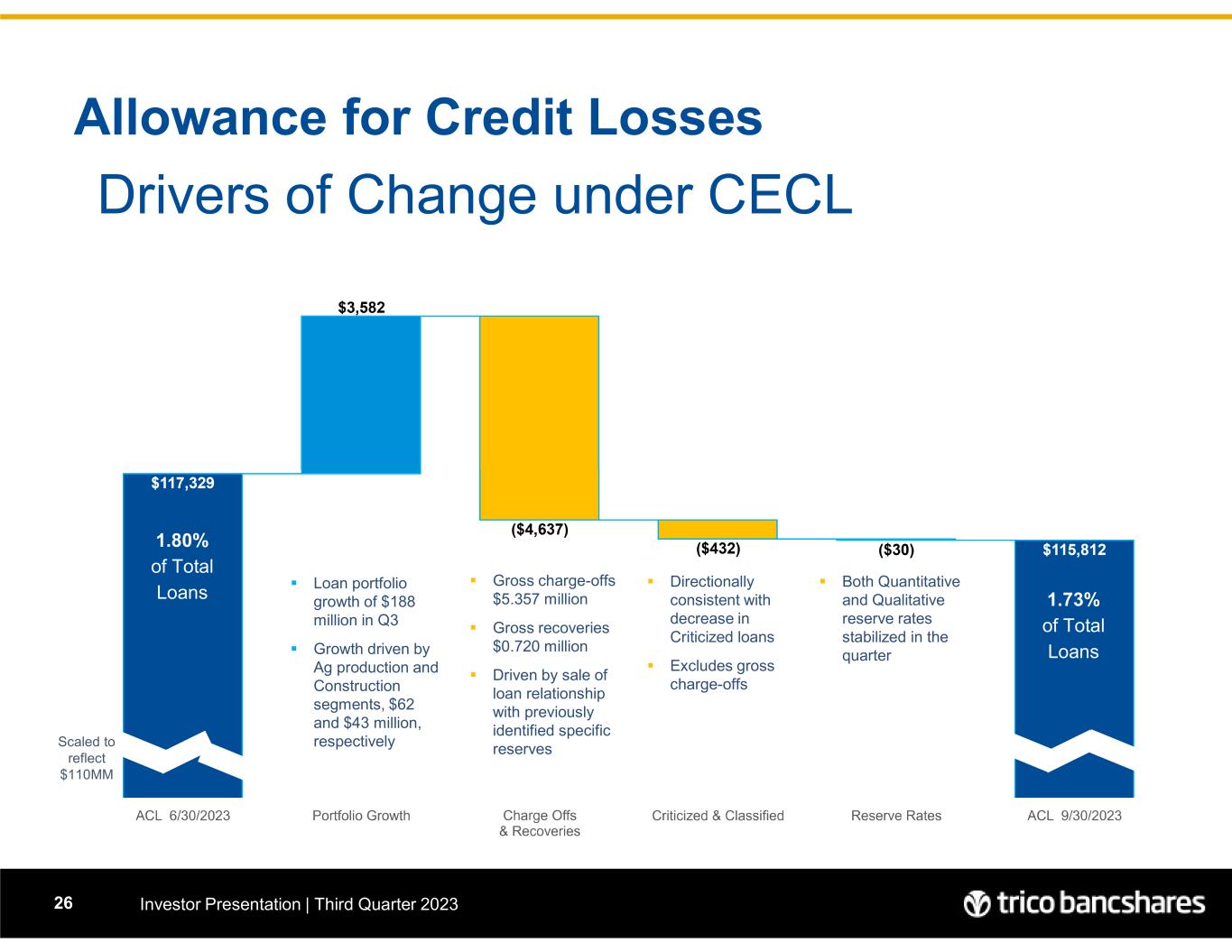

The following table presents the activity in the allowance for credit losses on loans for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Nine months ended |

| (dollars in thousands) |

September 30, 2023 |

|

|

|

September 30, 2022 |

|

September 30, 2023 |

|

September 30, 2022 |

| Balance, beginning of period |

$ |

117,329 |

|

|

|

|

$ |

97,944 |

|

|

$ |

105,680 |

|

|

$ |

85,376 |

|

| ACL at acquisition for PCD loans |

— |

|

|

|

|

— |

|

|

— |

|

|

2,037 |

|

| Provision for credit losses |

3,120 |

|

|

|

|

3,500 |

|

|

16,415 |

|

|

13,645 |

|

| Loans charged-off |

(5,357) |

|

|

|

|

(267) |

|

|

(7,392) |

|

|

(1,411) |

|

| Recoveries of previously charged-off loans |

720 |

|

|

|

|

311 |

|

|

1,109 |

|

|

1,841 |

|

| Balance, end of period |

$ |

115,812 |

|

|

|

|

$ |

101,488 |

|

|

$ |

115,812 |

|

|

$ |

101,488 |

|

The allowance for credit losses (ACL) was $115.8 million or 1.73% of total loans as of September 30, 2023. The provision for credit losses on loans of $3.1 million during the recent quarter was the net effect of charge-offs associated with the disposition of a previously reserved for and individually analyzed relationship of credits, partially offset by increases in reserves for qualitative factors and quantitative reserves under the cohort model from loan growth. On a comparative basis, the provision for credit losses of $3.5 million during the three months ended September 30, 2022, was largely the result of loan growth. For the current quarter, the qualitative components of the ACL resulted in a net increase in required reserves totaling approximately $2.5 million due primarily to softening of the California employment data. Meanwhile, the quantitative component of the ACL decreased reserve requirements by approximately $1.5 million over the trailing quarter primarily due to decreases in specific reserves, offset partially by increases attributed to loan growth.

The Company utilizes a forecast period of approximately eight quarters and obtains the forecast data from publicly available sources as of the balance sheet date. This forecast data continues to evolve and includes improving shifts in the magnitude of changes for both the unemployment and GDP factors leading up to the balance sheet date, particularly CA unemployment trends. Despite continued declines on a year over year comparative basis, core inflation remains elevated from wage pressures, and higher living costs such as housing, energy and food prices. Management notes the rapid intervals of rate increases by the Federal Reserve and flattening or inversion of the yield curve, have informed expectations of the US entering a recession within 12 months. As a result, management continues to believe that certain credit weaknesses are likely present in the overall economy and that it is appropriate to cautiously maintain a reserve level that incorporates such risk factors.

Loans past due 30 days or more decreased by $1.4 million during the quarter ended September 30, 2023, to $8.1 million, as compared to $9.5 million at June 30, 2023. Non-performing loans were $29.8 million at September 30, 2023, a decrease of $7.8 million from $37.6 million as of June 30, 2023, and an increase of $12.3 million from $17.5 million as of September 30, 2022. Of the $29.8 million loans designated as non-performing as of September 30, 2023, approximately $26.6 million are current with respect to payments required under their original loan agreements.

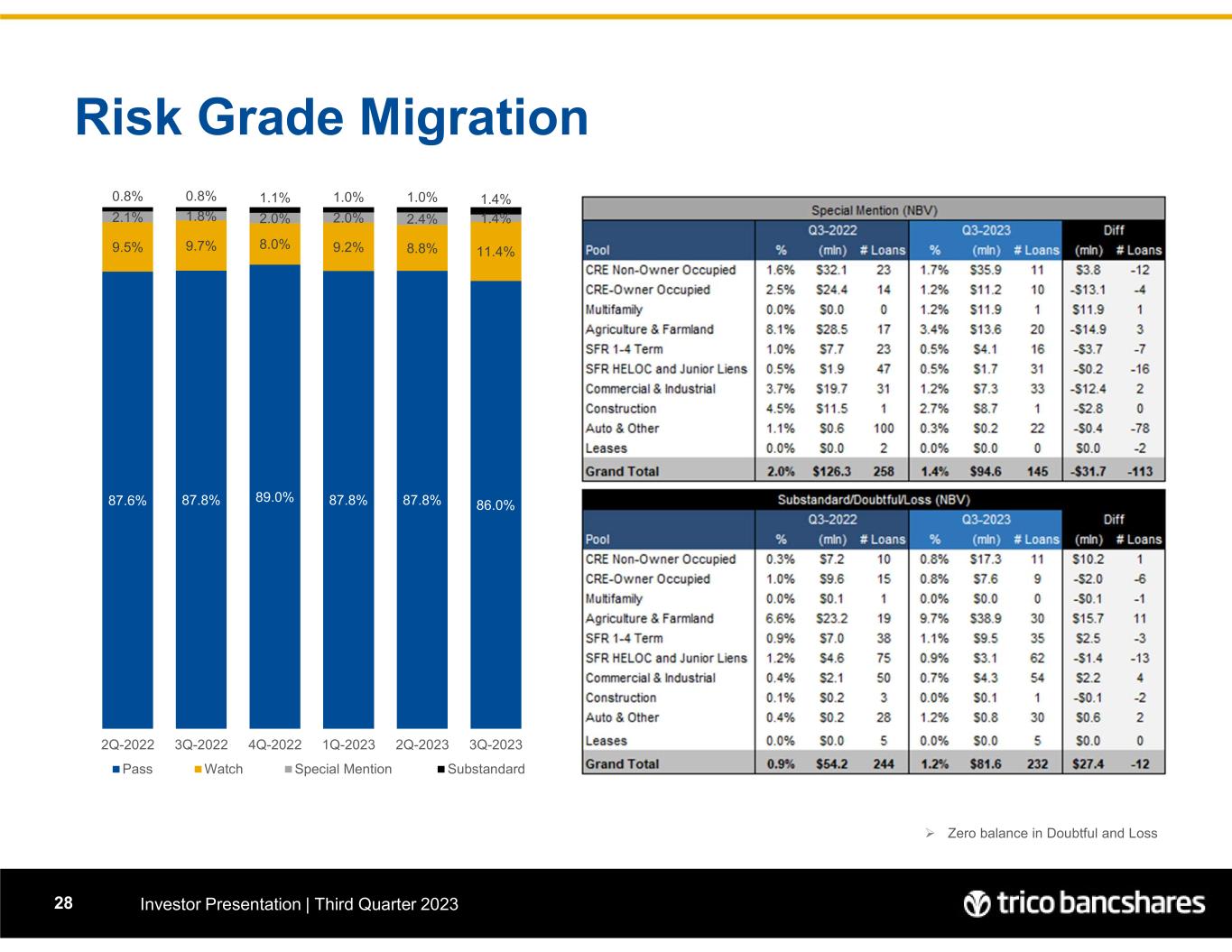

The following table illustrates the total loans by risk rating and their respective percentage of total loans for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

% of Loans Outstanding |

|

June 30, |

% of Loans Outstanding |

|

September 30, |

% of Loans Outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (dollars in thousands) |

2023 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

| Risk Rating: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pass |

$ |

6,532,424 |

|

97.4 |

% |

|

$ |

6,299,893 |

|

96.6 |

% |

|

$ |

6,133,805 |

|

97.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Special Mention |

94,614 |

|

1.4 |

% |

|

155,678 |

|

2.4 |

% |

|

126,273 |

|

2.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Substandard |

81,628 |

|

1.2 |

% |

|

65,169 |

|

1.0 |

% |

|

54,212 |

|

0.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

$ |

6,708,666 |

|

|

|

$ |

6,520,740 |

|

|

|

$ |

6,314,290 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Classified loans to total loans |

1.22 |

% |

|

|

1.00 |

% |

|

|

0.86 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loans past due 30+ days to total loans |

0.12 |

% |

|

|

0.15 |

% |

|

|

0.10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The ratio of classified loans of 1.22% as of September 30, 2023 increased 22 basis points from June 30, 2023 and increased 36 basis points from the comparative quarter ended 2022. The newly classified credits are spread amongst several CRE and agriculture relationships. As a percentage of total loans outstanding, classified assets are consistent with volumes experienced prior to the recent quantitative easing cycle spurred by the COVID pandemic, and reflects management's historically conservative approach to credit risk monitoring. The Company's combined criticized loan balances improved during the quarter by $44.6 million to $176.2 million as of September 30, 2023. This improvement was driven by upgrades in several CRE borrower relationships, as well as the disposition of a credit relationship referenced above.

There was one property added and one disposed within Other Real Estate Owned during the third quarter of 2023. As of September 30, 2023, other real estate owned consisted of nine properties with a carrying value of approximately $2.9 million.

Non-performing assets of $32.7 million at September 30, 2023, represented 0.33% of total assets, a change from the $40.5 million or 0.41% and $20.9 million or 0.21% as of June 30, 2023 and September 30, 2022, respectively.

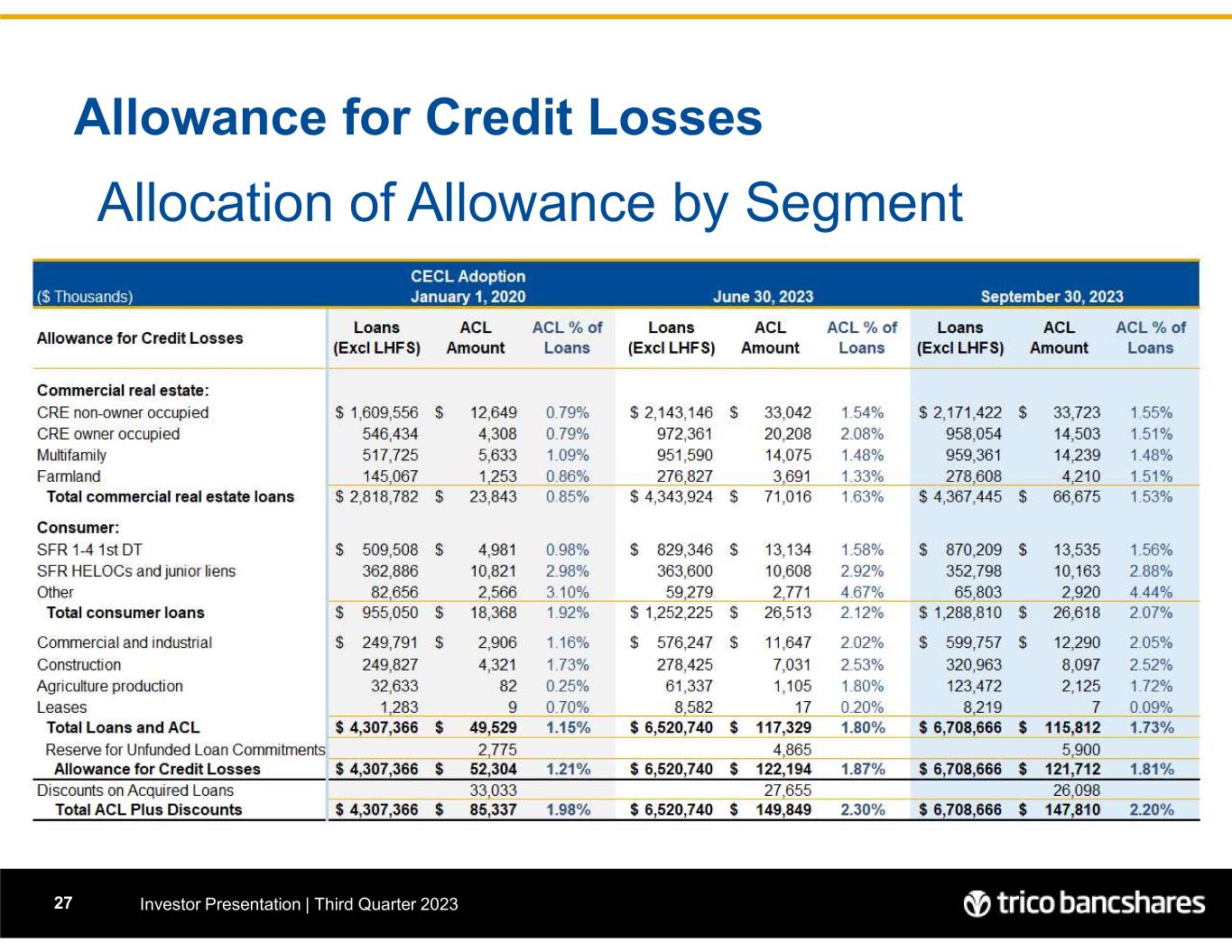

Allocation of Credit Loss Reserves by Loan Type

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2023 |

|

As of June 30, 2023 |

|

As of September 30, 2022 |

|

| (dollars in thousands) |

Amount |

|

% of Loans Outstanding |

|

Amount |

|

% of Loans Outstanding |

|

Amount |

|

% of Loans Outstanding |

|

| Commercial real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

| CRE - Non Owner Occupied |

$ |

33,723 |

|

|

1.55 |

% |

|

$ |

33,042 |

|

|

1.54 |

% |

|

$ |

29,244 |

|

|

1.42 |

% |

|

| CRE - Owner Occupied |

14,503 |

|

|

1.51 |

% |

|

20,208 |

|

2.08 |

% |

|

13,525 |

|

1.39 |

% |

|

| Multifamily |

14,239 |

|

1.48 |

% |

|

14,075 |

|

1.48 |

% |

|

12,749 |

|

1.36 |

% |

|

| Farmland |

4,210 |

|

1.51 |

% |

|

3,691 |

|

1.33 |

% |

|

3,122 |

|

1.12 |

% |

|

| Total commercial real estate loans |

66,675 |

|

1.53 |

% |

|

71,016 |

|

1.63 |

% |

|

58,640 |

|

1.38 |

% |

|

| Consumer: |

|

|

|

|

|

|

|

|

|

|

|

|

| SFR 1-4 1st Liens |

13,535 |

|

1.56 |

% |

|

13,134 |

|

1.58 |

% |

|

10,671 |

|

1.39 |

% |

|

| SFR HELOCs and Junior Liens |

10,163 |

|

2.88 |

% |

|

10,608 |

|

2.92 |

% |

|

11,383 |

|

2.89 |

% |

|

| Other |

2,920 |

|

4.44 |

% |

|

2,771 |

|

4.67 |

% |

|

1,878 |

|

3.23 |

% |

|

| Total consumer loans |

26,618 |

|

2.07 |

% |

|

26,513 |

|

2.12 |

% |

|

23,932 |

|

1.97 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial and Industrial |

12,290 |

|

2.05 |

% |

|

11,647 |

|

2.02 |

% |

|

10,400 |

|

1.94 |

% |

|

| Construction |

8,097 |

|

2.52 |

% |

|

7,031 |

|

2.53 |

% |

|

6,132 |

|

2.52 |

% |

|

| Agricultural Production |

2,125 |

|

1.72 |

% |

|

1,105 |

|

1.80 |

% |

|

2,368 |

|

3.31 |

% |

|

| Leases |

7 |

|

0.09 |

% |

|

17 |

|

0.20 |

% |

|

16 |

|

0.20 |

% |

|

| Allowance for credit losses |

115,812 |

|

1.73 |

% |

|

117,329 |

|

1.80 |

% |

|

101,488 |

|

1.61 |

% |

|

| Reserve for unfunded loan commitments |

5,900 |

|

|

|

|

4,865 |

|

|

|

|

4,370 |

|

|

|

|

| Total allowance for credit losses |

$ |

121,712 |

|

|

1.81 |

% |

|

$ |

122,194 |

|

|

1.87 |

% |

|

$ |

105,858 |

|

|

1.68 |

% |

|

In addition to the allowance for credit losses above, the Company has acquired various performing loans whose fair value as of the acquisition date was determined to be less than the principal balance owed on those loans. This difference represents the collective discount of credit, interest rate and liquidity measurements which is expected to be amortized over the life of the loans. As of September 30, 2023, the unamortized discount associated with acquired loans totaled $26.1 million.

Non-interest Income

The following table presents the key components of non-interest income for the current and trailing quarterly periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

|

|

|

| (dollars in thousands) |

September 30, 2023 |

|

June 30, 2023 |

|

Change |

|

% Change |

| ATM and interchange fees |

$ |

6,728 |

|

|

$ |

6,856 |

|

|

$ |

(128) |

|

|

(1.9) |

% |

| Service charges on deposit accounts |

4,851 |

|

|

4,581 |

|

|

270 |

|

|

5.9 |

% |

| Other service fees |

1,142 |

|

|

992 |

|

|

150 |

|

|

15.1 |

% |

| Mortgage banking service fees |

445 |

|

|

454 |

|

|

(9) |

|

|

(2.0) |

% |

| Change in value of mortgage servicing rights |

(91) |

|

|

85 |

|

|

(176) |

|

|

(207.1) |

% |

| Total service charges and fees |

13,075 |

|

|

12,968 |

|

|

107 |

|

|

0.8 |

% |

| Increase in cash value of life insurance |

684 |

|

|

788 |

|

|

(104) |

|

|

(13.2) |

% |

| Asset management and commission income |

1,141 |

|

|

1,158 |

|

|

(17) |

|

|

(1.5) |

% |

| Gain on sale of loans |

382 |

|

|

295 |

|

|

87 |

|

|

29.5 |

% |

| Lease brokerage income |

160 |

|

|

74 |

|

|

86 |

|

|

116.2 |

% |

| Sale of customer checks |

396 |

|

|

407 |

|

|

(11) |

|

|

(2.7) |

% |

| Loss on sale of investment securities |

— |

|

|

— |

|

|

— |

|

|

— |

% |

| (Loss) gain on marketable equity securities |

(81) |

|

|

(42) |

|

|

(39) |

|

|

92.9 |

% |

| Other income |

227 |

|

|

93 |

|

|

134 |

|

|

144.1 |

% |

| Total other non-interest income |

2,909 |

|

|

2,773 |

|

|

136 |

|

|

4.9 |

% |

| Total non-interest income |

$ |

15,984 |

|

|

$ |

15,741 |

|

|

$ |

243 |

|

|

1.5 |

% |

Non-interest income increased $0.2 million or 1.5% to $16.0 million during the three months ended September 30, 2023, compared to $15.7 million during the quarter ended June 30, 2023. Service charges on deposit accounts increased by $0.3 million or 5.9% resulting from improved profitability on commercial deposit account activity.

The following table presents the key components of non-interest income for the current and prior year periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30, |

|

|

|

|

| (dollars in thousands) |

2023 |

|

2022 |

|

Change |

|

% Change |

| ATM and interchange fees |

$ |

6,728 |

|

|

$ |

6,714 |

|

|

$ |

14 |

|

|

0.2 |

% |

| Service charges on deposit accounts |

4,851 |

|

|

4,436 |

|

|

415 |

|

|

9.4 |

% |

| Other service fees |

1,142 |

|

|

1,022 |

|

|

120 |

|

|

11.7 |

% |

| Mortgage banking service fees |

445 |

|

|

477 |

|

|

(32) |

|

|

(6.7) |

% |

| Change in value of mortgage servicing rights |

(91) |

|

|

33 |

|

|

(124) |

|

|

(375.8) |

% |

| Total service charges and fees |

13,075 |

|

|

12,682 |

|

|

393 |

|

|

3.1 |

% |

| Increase in cash value of life insurance |

684 |

|

|

659 |

|

|

25 |

|

|

3.8 |

% |

| Asset management and commission income |

1,141 |

|

|

1,020 |

|

|

121 |

|

|

11.9 |

% |

| Gain on sale of loans |

382 |

|

|

357 |

|

|

25 |

|

|

7.0 |

% |

| Lease brokerage income |

160 |

|

|

252 |

|

|

(92) |

|

|

(36.5) |

% |

| Sale of customer checks |

396 |

|

|

326 |

|

|

70 |

|

|

21.5 |

% |

| Loss on sale of investment securities |

— |

|

|

— |

|

|

— |

|

|

— |

% |

| Loss on marketable equity securities |

(81) |

|

|

(115) |

|

|

34 |

|

|

(29.6) |

% |

| Other income |

227 |

|

|

459 |

|

|

(232) |

|

|

(50.5) |

% |

| Total other non-interest income |

2,909 |

|

|

2,958 |

|

|

(49) |

|

|

(1.7) |

% |

| Total non-interest income |

$ |

15,984 |

|

|

$ |

15,640 |

|

|

$ |

344 |

|

|

2.2 |

% |

Non-interest income decreased $0.3 million or 2.2% to $16.0 million during the three months ended September 30, 2023, compared to $15.6 million during the quarter ended September 30, 2022. Service charges on deposit accounts increased by $0.4 million or 9.4% for the same reasons noted above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine months ended September 30, |

|

|

|

|

| (dollars in thousands) |

2023 |

|

2022 |

|

Change |

|

% Change |

| ATM and interchange fees |

$ |

19,928 |

|

|

$ |

19,941 |

|

|

$ |

(13) |

|

|

(0.1) |

% |

| Service charges on deposit accounts |

12,863 |

|

|

12,433 |

|

|

430 |

|

|

3.5 |

% |

| Other service fees |

3,300 |

|

|

3,183 |

|

|

117 |

|

|

3.7 |

% |

| Mortgage banking service fees |

1,364 |

|

|

1,422 |

|

|

(58) |

|

|

(4.1) |

% |

| Change in value of mortgage servicing rights |

(215) |

|

|

443 |

|

|

(658) |

|

|

(148.5) |

% |

| Total service charges and fees |

37,240 |

|

|

37,422 |

|

|

(182) |

|

|

(0.5) |

% |

| Increase in cash value of life insurance |

2,274 |

|

|

2,049 |

|

|

225 |

|

|

11.0 |

% |

| Asset management and commission income |

3,233 |

|

|

2,946 |

|

|

287 |

|

|

9.7 |

% |

| Gain on sale of loans |

883 |

|

|

2,145 |

|

|

(1,262) |

|

|

(58.8) |

% |

| Lease brokerage income |

332 |

|

|