UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Act of 1934

Date of Report (Date of earliest event reported): February 18, 2025

FONAR CORPORATION

______________________________________________________

(Exact name of registrant as specified in its charter)

| Delaware | 0-10248 | 11-2464137 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

| 110

Marcus Drive,

Melville,

New

York 11747

(631) 694-2929 |

||||

| (Address, including zip code, and telephone number of registrant's principal executive office) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act 17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $.0001 par value | FONR | Nasdaq Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 2.02(a) Results of Operations and Financial Condition.

We reported the results of operations and financial condition of the Company for the second Fiscal quarter of 2025 which ended December 31, 2024 in a press release dated February 18, 2025.

Exhibits:

99.1 Press Release dated February 18, 2025.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FONAR CORPORATION

(Registrant)

-------------------------------------------

By /s/ Timothy R. Damadian

Timothy R. Damadian

President and CEO

Dated: February 19, 2025

| NEWS | Fonar Corporation | |

| For Immediate Release | The Inventor of MR Scanning™ | |

| Contact: Daniel Culver | An ISO 13485 Company | |

| Director of Communications | Melville, New York 11747 | |

| E-mail: investor@fonar.com | Phone: (631) 694-2929 | |

| www.fonar.com | Fax: (631) 390-1772 |

FONAR ANNOUNCES SIX MONTH AND 2ND QUARTER

FINANCIAL RESULTS FOR FISCAL 2025

| * | MRI scan volume at HMCA managed sites increased 7% to 79,207 scans during the six-month period ended December 31, 2024, versus 73,776 scans for the six-month period ended December 31, 2023. MRI scan volume at HMCA owned sites decreased 4% to 26,961 scans during the six-month period ended December 31, 2024, versus 28,214 scans for the six-month period ended December 31, 2023. |

| * | Cash and Cash Equivalents and Short-term Investments decreased 5% to $53.7 million at December 31, 2024, versus the fiscal year ended June 30, 2024. |

| * | Total Revenues-Net for the six-month period ended December 31, 2024, decreased by 3% to $49.9 million, and for the quarter ended December 31, 2024, decreased by 2% to $25.0 million, versus the corresponding periods one year earlier. |

| * | Income from Operations for the six-month period ended December 31, 2024, decreased 38% to $7.2 million, and for the quarter ended December 31, 2024, decreased 48% to $2.6 million, versus the corresponding periods one year earlier. |

| * | Net Income for the six-month period ended December 31, 2024, decreased 36% to $6.4 million, and for the quarter ended December 31, 2024, decreased 48% to $2.4 million, versus the corresponding period one year earlier. |

| * | Diluted Net Income per Common Share for the six-month period ended December 31, 2024, decreased 33% to $0.75 and for the quarter ended December 31, 2024, decreased 44% to $0.30, versus the corresponding periods one year earlier. |

| * | Net Book Value Per Common Share increased to $25.66 per share at December 31, 2024. |

MELVILLE, NEW YORK, February 18, 2025 - FONAR Corporation (NASDAQ-FONR), The Inventor of MR Scanning™, reported today its financial results for the six-month period and 2nd quarter of fiscal 2025 which ended December 31, 2024. FONAR’s primary source of income is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company of America (HMCA). In 2009, HMCA managed 9 MRI scanners. Currently, HMCA manages 43 MRI scanners in New York (25) and in Florida (18).

| Page |

Financial Results

Income Statement Items

Total Revenues-Net for the quarter ended December 31, 2024, decreased 2% to $25.0 million, as compared to $25.4 million for the corresponding quarter ended December 31, 2023. Total Revenues-Net for the six-month period ended December 31, 2024, decreased 3% to $49.9 million, as compared to $51.2 million for the corresponding six-month period ended December 31, 2023.

Income from Operations for the quarter ended December 31, 2024, decreased 48% to $2.6 million as compared to $4.9 million for the corresponding quarter ended December 31, 2023. Income from Operations for the six-month period ended December 31, 2024, decreased 38% to $7.2 million as compared to $11.5 million for the corresponding six-month period ended December 31, 2023.

Net Income for the quarter ended December 31, 2024, decreased 48% to $2.4 million as compared to $4.6 million for the corresponding quarter ended December 31, 2023. Net Income for the six-month period ended December 31, 2024, decreased 36% to $6.4 million as compared to $10.0 million for the corresponding six-month period ended December 31, 2023.

Diluted Net Income per Common Share Available to Common Stockholders for the quarter ended December 31, 2024, decreased 44% to $0.30 as compared to $0.54 for the corresponding quarter ended December 31, 2023.

Diluted Net Income per Common Share Available to Common Stockholders for the six-month period ended December 31, 2024, decreased 33% to $0.75 as compared to $1.12 for the corresponding six-month period ended December 31, 2023.

Selling, general & administrative expenses (SG&A) for the quarter ended December 31, 2024, increased 24% to $6.9 million, as compared to $5.6 million for the corresponding quarter ended December 31, 2023. SG&A for the six-month period ended December 31, 2024, increased 16% to $12.1 million as compared to $10.5 million for the corresponding six-month period ended December 31, 2023. Included in the SG&A is a significant reserve against accounts receivables attributable to American Transit Insurance Company, a New York based motor vehicle insurer, who has recently indicated that they are approaching insolvency. In addition, there was a new outside billing contract that increased the SG&A.

Cash Flow Statement Item

Operating Cash Flow for the six-month period ended December 31, 2024, decreased 42% to $3.9 million, compared to $6.7 million for the six-month period ended December 31, 2023.

| Page |

Balance Sheet Items

Cash and cash equivalents and short-term investments were $53.7 million at December 31, 2024, as compared to $56.5 million at June 30, 2024.

Total Current Assets at December 31, 2024, were $137.7 million as compared to $140.3 million at June 30, 2024.

Total Assets were $209.1 million at December 31, 2024, as compared to $214.2 million at June 30, 2024.

Total Current Liabilities were $12.2 million at December 31, 2024, as compared to $17.9 million at June 30, 2024.

Total Liabilities at December 31, 2024, were $50.0 million, as compared to $57.5 million at June 30, 2024.

Total Stockholders’ Equity at December 31, 2024, was $159.2 million, as compared to $156.8 million at June 30, 2024.

Financial Ratios

The ratio of Total Assets / Total Liabilities at December 31, 2024, was 4.2 as compared to 3.7 at June 30, 2024.

Working Capital increased 2% to $125.4 million at December 31, 2024, as compared to $122.5 million at June 30, 2024.

Net Book Value Per Common Share increased 4% to $25.66 per share at December 31, 2024, as compared to $24.70 at December 31, 2023.

Management Discussion

Timothy Damadian, president and CEO of FONAR, said, “The total second-quarter scan volume in Fiscal 2025 at HMCA-managed MRI centers was 53,114, slightly more (0.11%) than that of the previous quarter (53,054), and 1,868 more (3.65%) than that of the second-quarter of 2024 (51,246). The first-half scan volume in Fiscal 2025 was 106,168, or 4.1% higher than that of the first-half of Fiscal 2024 (101,990).”

“Scan volume for the balance of Fiscal 2025 looks promising. A major reason is the highly anticipated addition of high-field MRIs at two existing HMCA-managed scanning centers in Nassau County, New York. Once installed, these facilities will be offering physicians and patients both a STAND-UP® MRI and a high-field MRI. These scanners complement one another perfectly and, between the two of them, will readily accommodate an exceptionally broad range of MRI needs and eliminate excessive appointment backlogs.”

“The STAND-UP® MRI, in addition to being the most “Non-Claustrophobic MRI,” offers unique diagnostic advances. It’s the only MRI that can scan patients in weight-bearing positions, including sitting and standing. It’s also the only MRI that can scan the cervical and lumbar spines in flexion and extension. These unique features can reveal pathology that would be underestimated or missed entirely on any other type of MRI scanner. In addition, the high-field MRIs provide high-resolution imaging, speed, and advanced diagnostic protocols. HMCA currently manages ten facilities that have both the STAND-UP® MRI and a high-field MRI, providing patients and physicians with the best of MRI worlds.”

“As always, we continue to seek to establish new locations or to acquire centers that will enhance our existing networks and increase their profitability. Currently, we manage 43 MRI scanners, 25 in New York and 18 in Florida.”

| Page |

“I would also like to report that pursuant to our September 13, 2022 announcement of a FONAR stock repurchase plan of up to $9 million, the Company has, as of December 31, 2024, repurchased 343,485 shares at a cost of $5,607,486. FONAR is limited by the manner, timing, price, and volume restrictions of its share repurchases as prescribed in the safe harbor provisions of Rule 10b-18.”

Mr. Damadian concluded, “I remain grateful for our management team and all the FONAR and HMCA employees whose hard work and commitment continue to make the Company successful.”

Fonar Legacy

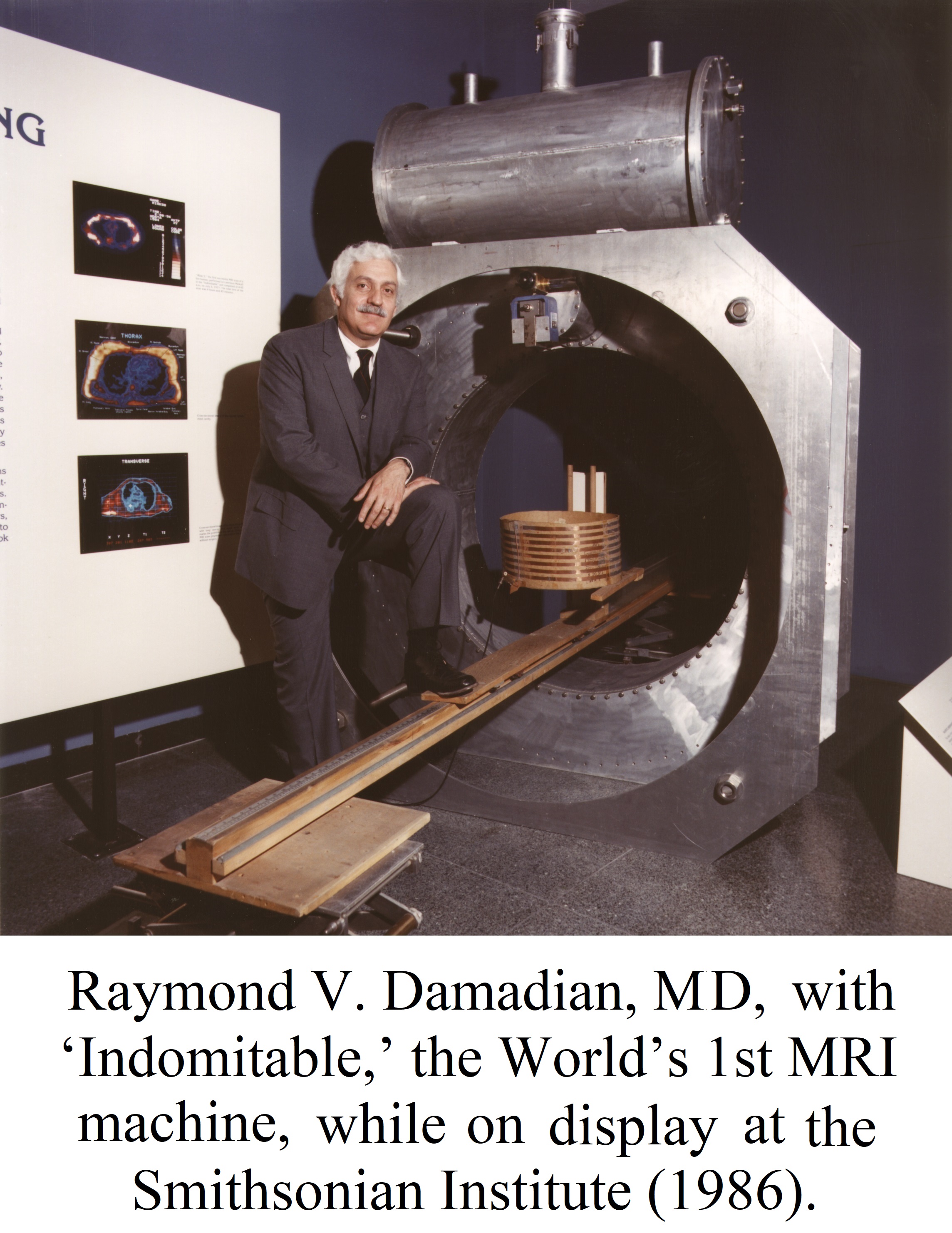

On April 25, 2001, Raymond V. Damadian, M.D., was awarded one of America’s highest honors – the Lemelson–MIT Lifetime Achievement Award – for his important contributions to the field of magnetic resonance imaging for medical diagnostics.

The Lemelson-MIT Lifetime Achievement Award is conferred annually by the Lemelson-MIT Program. Dr. Damadian was formally presented with a trophy for the Lemelson-MIT Lifetime Achievement Award on Wednesday, April 25, 2001, at a special ceremony at the Smithsonian Institute, Washington, D.C. The award is currently on display at the Raymond V. Damadian Museum, at FONAR Headquarters, Melville, NY. Visitors are welcome to visit the museum at FONAR headquarters by appointment.

In acknowledging his myriad of achievements, the event’s program stated, “Through his tenacity and willingness to defy conventional thought, Raymond Damadian changed the face of diagnostic medicine through his revolutionary application of nuclear magnetic resonance. This independent inventor designed and built the first full-body human magnetic resonance scanner, which he would later name ‘Indomitable’ in tribute to the seven arduous years in which he and his assistants toiled to invent the device.”

It went on to say, “Dr. Damadian’s original patent, granted in 1974, which led to the creation of ‘Indomitable’ and, later, all commercial MRI scanners, was given “pioneer patent” status. This status is given only to groundbreaking innovations that are separately recognized by U.S. courts because they set the foundation for new industries to occur.”

| Page |

The text from the original press release issued by MIT may be found at www.fonar.com/awards.html.

About the Lemelson-MIT Lifetime Achievement Award

The Lifetime Achievement Award is a prestigious recognition given to individuals who have made significant contributions to the field of invention and innovation throughout their careers. It is considered to be one of the top accolades for lifetime achievements in invention. The award is through a joint initiative between the Lemelson Foundation and the Massachusetts Institute of Technology (MIT). The Lemelson Foundation was founded by Jerome and Dorothy Lemelson in 1992.

About FONAR

FONAR, The Inventor of MR Scanning™, located in Melville, NY, was incorporated in 1978, and is the first, oldest and most experienced MRI Company in the industry. FONAR went public in 1981 (Nasdaq:FONR). FONAR sold the world’s first commercial MRI to Ronald J. Ross, MD, Cleveland, Ohio. It was installed in 1980. Dr. Ross and his team began the world’s first clinical MRI trials in January 1981. The results were reported in the June 1981 edition of Radiology/Nuclear Medicine Magazine. The technique used for obtaining T1 and T2 values was the FONAR technique (Field fOcused Nuclear mAgnetic Resonance), not the back projection technique. www.fonar.com/innovations-timeline.html.

FONAR’s signature product is the FONAR UPRIGHT® Multi-Position™ MRI (also known as the STAND-UP® MRI), the only whole-body MRI that performs Position™ Imaging (pMRI™) and scans patients in numerous weight-bearing positions, i.e., standing, sitting, in flexion and extension, as well as the conventional lie-down position. The FONAR UPRIGHT® MRI often detects patient problems that other MRI scanners cannot because they are lie-down, “weightless-only” scanners. The patient-friendly UPRIGHT® MRI has a near-zero patient claustrophobic rejection rate. As a FONAR customer states, “If the patient is claustrophobic in this scanner, they’ll be claustrophobic in my parking lot.” Approximately 85% of patients are scanned sitting while watching TV.

FONAR has new works-in-progress technology for visualizing and quantifying the cerebral hydraulics of the central nervous system, the flow of cerebrospinal fluid (CSF), which circulates throughout the brain and vertebral column at the rate of 32 quarts per day. This imaging and quantifying of the dynamics of this vital life-sustaining physiology of the body’s neurologic system has been made possible first by FONAR’s introduction of the MRI and now by this latest works-in-progress method for quantifying CSF in all the normal positions of the body, particularly in its upright flow against gravity. Patients with whiplash or other neck injuries are among those who will benefit from this new understanding.

FONAR’s primary source of income and growth is attributable to its wholly owned diagnostic imaging management subsidiary, Health Management Company of America (HMCA) www.hmca.com.

FONAR’s substantial list of patents includes recent patents for its technology enabling full weight-bearing MRI imaging of all the gravity sensitive regions of the human anatomy, especially the brain, extremities and spine. It includes its newest technology for measuring the Upright cerebral hydraulics of CSF in the central nervous system. FONAR’s UPRIGHT® Multi-Position™ MRI is the only scanner licensed under these patents.

UPRIGHT®, and STAND-UP® are registered trademarks. The Inventor of MR Scanning™, CSP™, MultiPosition™, UPRIGHT RADIOLOGY™, pMRI™, CFS Videography™, Dynamic™ and The Proof is in the Picture™, are trademarks of Fonar Corporation.

This release may include forward-looking statements from the company that may or may not materialize. Additional information on factors that could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission.

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

ASSETS

|

December 31, 2024 |

June 30, 2024 |

|||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 53,583 | $ | 56,341 | ||||

| Short-term investments | 121 | 136 | ||||||

| Accounts receivable – net | 3,390 | 4,035 | ||||||

| Accounts receivable - related party | 60 | — | ||||||

| Medical receivable – net | 23,496 | 23,992 | ||||||

| Management and other fees receivable – net | 42,485 | 41,954 | ||||||

| Management and other fees receivable – related medical practices – net | 9,677 | 9,865 | ||||||

| Inventories | 2,858 | 2,715 | ||||||

| Prepaid expenses and other current assets | 1,962 | 1,286 | ||||||

| Total Current Assets | 137,632 | 140,324 | ||||||

| Accounts receivable – long term | 724 | 830 | ||||||

| Deferred income tax asset | 6,113 | 7,223 | ||||||

| Property and equipment – net | 19,270 | 18,709 | ||||||

| Note receivable – related party | 607 | 581 | ||||||

| Right-of-use-asset – operating leases | 34,946 | 38,428 | ||||||

| Right-of-use-asset – financing lease | 496 | 531 | ||||||

| Goodwill | 4,269 | 4,269 | ||||||

| Other intangible assets – net | 3,407 | 2,870 | ||||||

| Other assets | 493 | 481 | ||||||

| Total Assets | $ | 207,957 | $ | 214,246 | ||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

December 31, 2024 |

June 30, 2024 |

|||||||

| Current Liabilities: | ||||||||

| Current portion of long-term debt | $ | 49 | $ | 47 | ||||

| Accounts payable | 953 | 1,856 | ||||||

| Other current liabilities | 3,912 | 7,941 | ||||||

| Unearned revenue on service contracts | 3,413 | 3,870 | ||||||

| Unearned revenue on service contracts – related party | 55 | — | ||||||

| Operating lease liabilities - current portion | 3,259 | 3,474 | ||||||

| Financing lease liability - current portion | 244 | 226 | ||||||

| Customer deposits | 357 | 443 | ||||||

| Total Current Liabilities | 12,242 | 17,857 | ||||||

| Long-Term Liabilities: | ||||||||

| Unearned revenue on service contracts | 1,050 | 1,175 | ||||||

| Deferred income tax liability | 371 | 371 | ||||||

| Due to related party medical practices | 93 | 93 | ||||||

| Operating lease liabilities – net of current portion | 34,927 | 37,468 | ||||||

| Financing lease liability – net of current portion | 290 | 395 | ||||||

| Long-term debt, less current portion | 7 | 67 | ||||||

| Other liabilities | 26 | 32 | ||||||

| Total Long-Term Liabilities | 36,764 | 39,601 | ||||||

| Total Liabilities | 49,006 | 57,458 | ||||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

LIABILITIES AND STOCKHOLDERS’ EQUITY (Continued)

| STOCKHOLDERS' EQUITY: |

December 31, 2024 |

June 30, 2024 |

||||||

| Class A non-voting preferred stock $.0001 par value; 453 shares authorized at December 31, 2024 and June 30, 2024, 313 issued and outstanding at December 31, 2024 and June 30, 2024 | $ | — | $ | — | ||||

| Preferred stock $.001 par value; 567 shares authorized at December 31, 2024 and June 30, 2024, issued and outstanding – none | — | — | ||||||

| Common Stock $.0001 par value; 8,500 shares authorized at December 31, 2024 and June 30, 2024, 6,207 and 6,373 issued at December 31, 2024 and June 30, 2024, respectively, 6,203 and 6,328 outstanding at December 31, 2024 and June 30, 2024 respectively | 1 | 1 | ||||||

| Class B Common Stock (10 votes per share) $.0001 par value; 227 shares authorized at December 31, 2024 and June 30, 2024; .146 issued and outstanding at December 31, 2024 and June 30, 2024 | — | — | ||||||

| Class C Common Stock (25 votes per share) $.0001 par value; 567 shares authorized at December 31, 2024 and June 30, 2024, 383 issued and outstanding at December 31, 2024 and June 30, 2024 | — | — | ||||||

| Paid-in capital in excess of par value | 178,758 | 180,608 | ||||||

| Accumulated deficit | (8,525 | ) | (13,624 | ) | ||||

| Treasury stock, at cost – 4 shares of common stock at December 31, 2024 and 45 shares of common stock at June 30, 2024 | (395 | ) | (1,017 | ) | ||||

| Total Fonar Corporation’s Stockholders’ Equity | 169,839 | 165,968 | ||||||

| Noncontrolling interests | (10,888 | ) | (9,180 | ) | ||||

| Total Stockholders' Equity | 158,951 | 156,788 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 207,957 | $ | 214,246 | ||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

| FOR THE THREE MONTHS ENDED DECEMBER 31, | ||||||||

| REVENUES | 2024 | 2023 | ||||||

| Patient fee revenue – net of contractual allowances and discounts | $ | 7,944 | $ | 8,221 | ||||

| Product sales | 25 | 55 | ||||||

| Service and repair fees | 1,759 | 1,778 | ||||||

| Service and repair fees - related parties | 45 | 28 | ||||||

| Management and other fees | 12,189 | 12,316 | ||||||

| Management and other fees - related medical practices | 2,988 | 2,988 | ||||||

| Total Revenues – Net | 24,950 | 25,386 | ||||||

| COSTS AND EXPENSES | ||||||||

| Costs related to patient fee revenue | 4,623 | 4,602 | ||||||

| Costs related to product sales | 221 | 302 | ||||||

| Costs related to service and repair fees | 938 | 784 | ||||||

| Costs related to service and repair fees - related parties | 28 | 12 | ||||||

| Costs related to management and other fees | 7,801 | 7,208 | ||||||

| Costs related to management and other fees – related medical practices | 1,601 | 1,590 | ||||||

| Research and development | 376 | 416 | ||||||

| Selling, general and administrative expenses | 6,927 | 5,587 | ||||||

| Total Costs and Expenses | 22,515 | 20,501 | ||||||

| INCOME FROM OPERATIONS | 2,435 | 4,885 | ||||||

| Other Income and (Expenses) | ||||||||

| Interest Expense | (6 | ) | (10 | ) | ||||

| Investment income – related party | 13 | — | ||||||

| Investment Income | 524 | 534 | ||||||

| Other income – Related party | — | 577 | ||||||

| Other income | 1 | — | ||||||

| Income Before Provision for Income Taxes and Noncontrolling Interests | 2,967 | 5,986 | ||||||

| Provision for Income Taxes | (762 | ) | (1,366 | ) | ||||

| Net Income | 2,205 | 4,620 | ||||||

| Net Income - Noncontrolling Interests | (241 | ) | (861 | ) | ||||

| Net Income – Attributable to FONAR | $ | 1,964 | $ | 3,759 | ||||

| Net Income Available to Common Stockholders | $ | 1,840 | $ | 3,525 | ||||

| Net Income Available to Class A Non-Voting Preferred Stockholders | $ | 93 | $ | 175 | ||||

| Net Income Available to Class C Common Stockholders | $ | 31 | $ | 59 | ||||

| Basic Net Income Per Common Share Available to Common Stockholders | $ | 0.29 | $ | 0.55 | ||||

| Diluted Net Income Per Common Share Available to Common Stockholders | $ | 0.29 | $ | 0.54 | ||||

| Basic and Diluted Income Per Share – Class C Common | $ | 0.08 | $ | 0.16 | ||||

| Weighted Average Basic Shares Outstanding – Common Stockholders | 6,303 | 6,437 | ||||||

| Weighted Average Diluted Shares Outstanding - Common Stockholders | 6,431 | 6,565 | ||||||

| Weighted Average Basic and Diluted Shares Outstanding - Class C Common | 383 | 383 | ||||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

| FOR THE SIX MONTHS ENDED DECEMBER 31, | ||||||||

| REVENUES | 2024 | 2023 | ||||||

| Patient fee revenue – net of contractual allowances and discounts | $ | 15,431 | $ | 16,896 | ||||

| Product sales | 145 | 219 | ||||||

| Service and repair fees | 3,751 | 3,643 | ||||||

| Service and repair fees - related parties | 90 | 55 | ||||||

| Management and other fees | 24,518 | 24,436 | ||||||

| Management and other fees - related medical practices | 5,975 | 5,975 | ||||||

| Total Revenues – Net | 49,910 | 51,224 | ||||||

| COSTS AND EXPENSES | ||||||||

| Costs related to patient fee revenue | 9,269 | 9,029 | ||||||

| Costs related to product sales | 442 | 405 | ||||||

| Costs related to service and repair fees | 2,029 | 1,633 | ||||||

| Costs related to service and repair fees - related parties | 96 | 25 | ||||||

| Costs related to management and other fees | 15,111 | 14,231 | ||||||

| Costs related to management and other fees – related medical practices | 3,174 | 3,109 | ||||||

| Research and development | 683 | 883 | ||||||

| Selling, general and administrative expenses | 12,065 | 10,453 | ||||||

| Total Costs and Expenses | 42,869 | 39,768 | ||||||

| INCOME FROM OPERATIONS | 7,041 | 11,456 | ||||||

| Other Income and (Expenses) | ||||||||

| Interest Expense | (14 | ) | (58 | ) | ||||

| Investment income – related party | 26 | — | ||||||

| Investment Income | 1,163 | 1,040 | ||||||

| Other income – Related party | — | 577 | ||||||

| Other income | — | 1 | ||||||

| Income Before Provision for Income Taxes and Noncontrolling Interests | 8,216 | 13,016 | ||||||

| Provision for Income Taxes | (2,011 | ) | (3,036 | ) | ||||

| Net Income | 6,205 | 9,980 | ||||||

| Net Income - Noncontrolling Interests | (1,106 | ) | (2,115 | ) | ||||

| Net Income – Attributable to FONAR | $ | 5,099 | $ | 7,865 | ||||

| Net Income Available to Common Stockholders | $ | 4,775 | $ | 7,375 | ||||

| Net Income Available to Class A Non-Voting Preferred Stockholders | $ | 241 | $ | 365 | ||||

| Net Income Available to Class C Common Stockholders | $ | 83 | $ | 125 | ||||

| Basic Net Income Per Common Share Available to Common Stockholders | $ | 0.76 | $ | 1.14 | ||||

| Diluted Net Income Per Common Share Available to Common Stockholders | $ | 0.74 | $ | 1.12 | ||||

| Basic and Diluted Income Per Share – Class C Common | $ | 0.22 | $ | 0.33 | ||||

| Weighted Average Basic Shares Outstanding – Common Stockholders | 6,313 | 6, 448 | ||||||

| Weighted Average Diluted Shares Outstanding - Common Stockholders | 6,441 | 6,576 | ||||||

| Weighted Average Basic and Diluted Shares Outstanding - Class C Common | 383 | 383 | ||||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

| FOR

THE SIX MONTHS ENDED DECEMBER 31, |

||||||||

| 2024 | 2023 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Consolidated Net income | $ | 6,205 | $ | 9,980 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 2,298 | 2,415 | ||||||

| Net Change in operating right of use assets and lease liabilities | (63 | ) | 119 | |||||

| Provision for credit losses | 1,279 | 355 | ||||||

| Deferred tax expense | 1,111 | 2,284 | ||||||

| Gain on sale of equipment – related party | — | (577 | ) | |||||

| Changes in operating assets and liabilities, net: | ||||||||

| Accounts, medical and management fee receivable(s) | (435 | ) | (4,958 | ) | ||||

| Notes receivable | — | 50 | ||||||

| Notes receivable – related party | (26 | ) | — | |||||

| Inventories | (143 | ) | (265 | ) | ||||

| Prepaid expenses and other current assets | (677 | ) | 217 | |||||

| Other assets | (11 | ) | 22 | |||||

| Accounts payable | (903 | ) | (244 | ) | ||||

| Other current liabilities | (4,556 | ) | (2,341 | ) | ||||

| Financing lease liabilities | (86 | ) | (108 | ) | ||||

| Customer deposits | (87 | ) | (3 | ) | ||||

| Other liabilities | (7 | ) | (19 | ) | ||||

| Net cash provided by operating activities | 3,899 | 6,689 | ||||||

| Cash Flows from Investing Activities: | ||||||||

| Purchases of property and equipment | (2,552 | ) | (192 | ) | ||||

| Proceeds from short term investments | 15 | — | ||||||

| Cost of patents | (20 | ) | (20 | ) | ||||

| Net cash used in investing activities | (2,557 | ) | (212 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Repayment of borrowings and capital lease obligations | (58 | ) | (21 | ) | ||||

| Sale of noncontrolling interest | 132 | — | ||||||

| Purchase of treasury stock | (1,341 | ) | (1,885 | ) | ||||

| Distributions to noncontrolling interests | (2,833 | ) | (2,626 | ) | ||||

| Net cash used in financing activities | (4,100 | ) | (4,532 | ) | ||||

| Net (Decrease) Increase in Cash and Cash Equivalents | (2,758 | ) | 1,945 | |||||

| Cash and Cash Equivalents - Beginning of Period | 56,341 | 51,280 | ||||||

| Cash and Cash Equivalents - End of Period | $ | 53,583 | $ | 53,225 | ||||

Page 11