UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Act of 1934

Date of Report (Date of earliest event reported): March 31, 2024

FONAR CORPORATION

______________________________________________________

(Exact name of registrant as specified in its charter)

| Delaware | 0-10248 | 11-2464137 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||

| 110

Marcus Drive,

Melville,

New

York 11747

(631) 694-2929 |

||||

| (Address, including zip code, and telephone number of registrant's principal executive office) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act 17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Securities registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $.0001 par value | FONR | Nasdaq Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 2.02(a) Results of Operations and Financial Condition.

We reported the results of operations and financial condition of the Company for the 3rd Quarter of Fiscal 2024 which ended March 31, 2024 in a press release dated May 15, 2024.

Exhibits:

99.1 Press Release dated May 15, 2024.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FONAR CORPORATION

(Registrant)

-------------------------------------------

By /s/ Timothy R. Damadian

Timothy R. Damadian

President and CEO

Dated: May 16, 2024

| NEWS |

|

Fonar Corporation |

| For Immediate Release | The Inventor of MR Scanning™ | |

| Contact: Daniel Culver | An ISO 9001 Company | |

| Director of Communications | Melville, New York 11747 | |

| E-mail: investor@fonar.com | Phone: (631) 694-2929 | |

| www.fonar.com | Fax: (631) 390-1772 |

FONAR ANNOUNCES FISCAL 2024 FINANCIAL RESULTS FOR

3RD QUARTER AND NINE-MONTH PERIOD

| · | Total MRI scan volume at the HMCA-managed sites increased 11% to 154,790 scans for the nine-month period ended March 31, 2024 as compared to the nine-month period ended March 31, 2023. |

| · | Net Income increased 25% to $12.5 million for the nine-month period ended March 31, 2024 as compared to the nine-month period ended March 31, 2023. |

| · | Income from Operations for the nine-month period ended March 31, 2024 increased 24% to $15.2 million as compared to the nine-month period ended March 31, 2023. |

| · | Diluted Net Income Per Common Share Available to Common Stockholders increased 21% to $1.40 for the nine-month period ended March 31, 2024 as compared to the nine-month period ended March 31, 2023. |

| · | Total Revenues-Net increased 6% to $76.9 million for the nine-month period ended March 31, 2024 as compared to the nine-month period ended March 31, 2023. |

| · | Total Cash, Cash Equivalents and Short-Term Investments increased 5% to $54.1 million at March 31, 2024 as compared to June 30, 2023. |

| · | Net Book Value per Common Share increased 8% to $24.82 at March 31, 2024 as compared to the same period one year earlier. |

MELVILLE, NEW YORK, May 15, 2024 - FONAR Corporation (NASDAQ-FONR), The Inventor of MR Scanning™ reported today its financial results for the 3rd fiscal 2024 quarter and nine-month period ended March 31, 2024. FONAR’s primary source of income and growth is attributable to its diagnostic imaging management subsidiary, Health Management Company of America (HMCA). In 2009, HMCA managed 9 MRI scanners. Currently, HMCA manages 42 MRI scanners.

Operating Results

Total Revenues-Net for the nine-month period ended March 31, 2024 increased 6% to $76.9 million as compared to $72.9 million for the nine-month period ended March 31, 2023. Total Revenues-Net for the quarter ended March 31, 2024 increased 1% to $25.7 million as compared to $25.4 million for the quarter ended March 31, 2023.

Income From Operations for the nine-month period ended March 31, 2024 increased 24% to $15.2 million as compared to $12.3 million for the nine-month period ended March 31, 2023. Income From Operations for the quarter ended March 31, 2024 decreased 10% to $3.7 million as compared to $4.2 million for the quarter ended March 31, 2023.

Income before provision for income taxes and noncontrolling interests for the nine-month period ended March 31, 2024 increased 35% to $17.3 million as compared to $12.8 million for the nine-month period ended March 31, 2023. Income before provision for income taxes and noncontrolling interests for the quarter ended March 31, 2024 decreased 4% to $4.3 million as compared to $4.5 million for the quarter ended March 31, 2023.

Net Income for the nine-month period ended March 31, 2024 increased 25% to $12.5 million as compared to $9.9 million for the nine-month period ended March 31, 2023. Net Income for the quarter ended March 31, 2024 decreased 45% to $2.5 million as compared to $4.5 million for the quarter ended March 31, 2023.

Diluted Net Income Per Common Share Available to Common Stockholders for the nine-month period ended March 31, 2024 increased 21% to $1.40 as compared to $1.16 for the nine-month period ended March 31, 2023. Diluted Net Income per Common Share Available to Common Stockholders decreased 51% to $0.27 for the quarter ended March 31, 2024 as compared to $0.55 for the quarter ended March 31, 2023.

Total Costs and Expenses for the nine-month period ended March 31, 2024 were $61.7 million and for the nine-month period ended March 31, 2023 were $60.6 million. Total Costs and Expenses were $21.9 million for the quarter ended March 31, 2024 and $21.3 million for the quarter ended March 31, 2023.

Selling, general & administrative costs (SG&A) decreased 10% to $18.0 million for the nine-month period ended March 31, 2024 as compared to $20.1 million for the nine-month period ended March 31, 2023. SG&A increased 6% to $7.6 million for the quarter ended March 31, 2024 as compared to $7.1 million for the quarter ended March 31, 2023.

Balance Sheet Items

Total Cash and Cash Equivalents and Short-Term Investments at March 31, 2024 were $54.1 million as compared to the $51.3 million at June 30, 2023.

Total Assets at March 31, 2024 were $209.6 million as compared to $200.1 million at June 30, 2023.

Total Liabilities at March 31, 2024 were $52.6 million as compared to $49.8 million at June 30, 2023.

The ratio of Total Assets / Total Liabilities was 4.0 at March 31, 2024 and June 30, 2023.

| Page |

Total Current Assets at March 31, 2024 were $135.8 million as compared to $125.7 million at June 30, 2023.

Total Current Liabilities at March 31, 2024 were $14.5 million as compared to $15.6 million at June 30, 2023.

Total Stockholders Equity at March 31, 2024 was $157.0 million as compared to $150.8 million at June 30, 2023.

The Current Ratio (Current Assets / Current Liabilities) increased 16% to 9.37 as compared to 8.04 at June 30, 2023.

Working Capital increased 10% to $121.3 million at March 31, 2024 as compared to $110.0 million at June 30, 2023.

Net Book Value per Common Share increased 8% to $24.82 at March 31, 2024 as compared to $23.04 at March 31, 2023, one year ago.

Cash Flow Statement Item

Net Cash Provided by Operating Activities was $9.5 million for the nine-month period ended March 31, 2024 as compared to $10.1 million at March 31, 2023.

Management Discussion

Timothy Damadian, president and CEO of FONAR, said, “Last quarter, I reported that the total scan volume at HMCA-managed MRI centers was 51,246, a new record for the Company. Today I am pleased to report that the scan volume in the third quarter of Fiscal 2024 was 52,800, setting yet another quarterly record. This new record is 3.0% higher than that of the previous quarter, and 6.8% higher than the scan volume in the corresponding quarter of Fiscal 2023 (49,452).”

“I’m very pleased with back-to-back record quarterly scan volumes at the HMCA-managed sites. Now that the prolonged periods of reduced business hours as the result of COVID-related staffing shortages, particularly among MRI technologists, are largely behind us, I believe the Company has once again hit its stride. Fiscal 2024 continues to be very promising for the Company. The total scan volume in the first nine months was a record 154,790, 11.1% higher than that of the corresponding nine months of Fiscal 2023. The opening of a new Stand-Up MRI center in Casselberry, Florida and another in the Bronx, New York account for 19% of the total increase in scan volume.”

“One major reason for the increase in scan volume at HMCA-managed sites is the employment of SwiftMR™, a product of AIRS Medical that enhances the quality of MRI images and enables shorter exam times. SwiftMR™ is basically a software product that de-noises and sharpens already completed MRI images. The results are very impressive.”

“Patients naturally prefer shorter scan times, which can be significantly reduced, thanks to SwiftMR™. While it may seem counter-intuitive, reducing the time of an MRI scan, in and of itself, actually improves image quality.” Mr. Damadian explained, “Patient motion is a major problem for any MRI scanner, because it causes artifacts, such as blurring, in the images. And, of course, the longer the patient is in the MRI scanner, the more the motion. So, shorter exam times mean less patient motion, thereby improving image quality.’

| Page |

“Radiologists and referring physicians are very pleased with the improvements in image quality, and the owners of the HMCA-managed centers are benefiting from both the increase in patient referrals and the ability to scan more patients per hour. SwiftMR™ is an across-the-board win for the Company.”

Mr. Damadian continued, “Our ongoing growth strategy is to install second or even third MRI scanners in facilities when the demand for MRIs approaches their scanning capacities, or where the introduction of high-field MRI technology is expected to increase referrals from their existing referral bases and also from physicians outside their referral bases who will embrace the new technology. We also seek to establish new locations or to acquire existing centers that will enhance our existing networks and increase their profitability. Currently, we manage 42 MRI scanners, 25 in New York and 17 in Florida.”

“I would also like to report that pursuant to our September 13, 2022 announcement of a FONAR stock repurchase plan of up to $9 million, the Company has, as of March 31, 2024, repurchased 218,656 shares at a cost of $3,644,101. FONAR is limited by the manner, timing, price, and volume restrictions of its share repurchases as prescribed in the safe harbor provisions of Rule 10b-18.”

Mr. Damadian concluded, “I remain grateful for our management team and all the HCMA employees whose hard work and commitment have made the Company successful.”

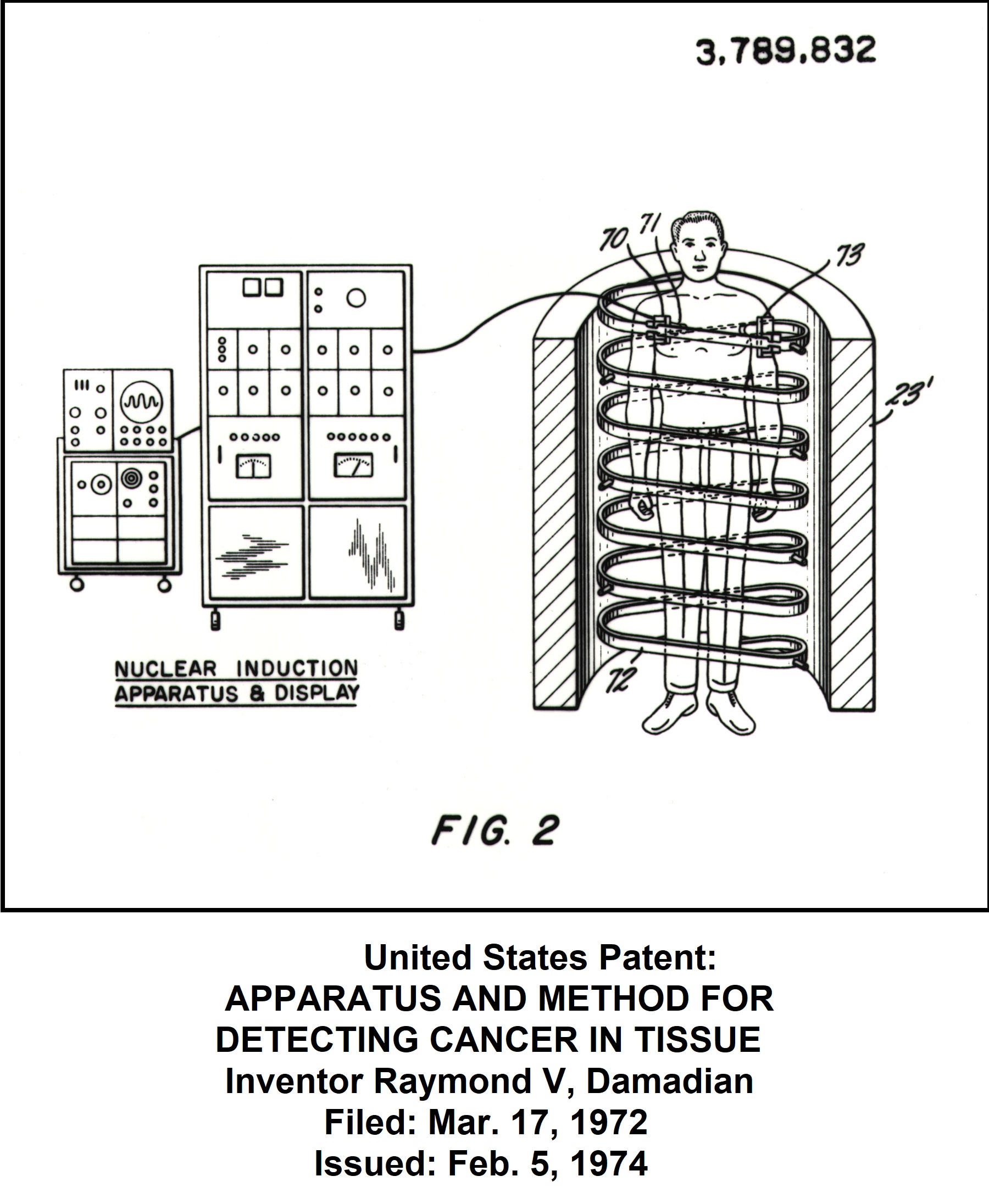

FONAR Historic Legacy

On February 5, 1974, Raymond V. Damadian, M.D., was awarded the patent titled “APPARATUS AND METHOD FOR DETECTING CANCER IN TISSUE,” USPTO# 3,789,832. Often referred to as ‘The Cancer Detection Patent,’ it was the first MRI patent, one that birthed an industry that has benefitted millions of people around the world. Today there are several thousands of patents in MRI. This year is the 50th Anniversary for that patent.

The patent, issued on February 5, 1974, was based on Dr. Damadian’s 1970 discovery that there are dramatic differences in the characteristic nuclear magnetic resonance (NMR) parameters known as T1 and T2 between healthy and cancerous tissues, as well as between one type of healthy tissue and another. It is precisely these differences that provide the extraordinary tissue contrast and anatomical detail in today's MRI images. Dr. Damadian had reported his discovery in the March 1971 peer-reviewed Journal “Science.”

| Page |

The patent abstract says: “An apparatus and method in which a tissue sample positioned in a nuclear induction apparatus (magnet) whereby selected nuclei are energized from their equilibrium states to higher energy states through nuclear magnetic resonance (NMR). By measuring the spin-lattice relaxation time (T1) and the spin-spin relaxation time (T2) as the energized nuclei return to their equilibrium states, and then comparing these relaxation times with their respective values for known normal and malignant tissue, an indication of the presence and degree of malignancy of cancerous tissue can be obtained.”

After Dr. Damadian and his colleagues built the world’s first whole-body MRI scanner, which produced the world’s first MRI scan in July 1977, his next step was to commercialize his discovery by starting a company. He spearheaded an effort that raised $2.5 million by 1980, putting the company on a path to its success. Key to persuading those early investors, who wished to prosper from the success of their investment, was that this new company owned ‘The Cancer Detection Patent.’

The company, eventually named FONAR, sold and installed the first-ever commercial MRI in 1980. Soon thereafter other companies began to sell and install their own MRI scanners. Just as FONAR MRI scanners rested entirely on ‘The Cancer Detection Patent,’ so did theirs, triggering FONAR’s seventeen-year battle to protect it.

| Page |

On October 7, 1982, the company and Dr. Damadian commenced legal action against Johnson & Johnson, Inc. and a subsidiary before the U.S. District Court for the District of Massachusetts, alleging their infringement upon the ‘The Cancer Detection Patent.’ A trial began in October 1985 and concluded in November 1985. The jury found the defendants guilty of infringement.

However, on January 31, 1986, the trial judge found that the defendants had not infringed upon the patent because their scanners plotted various T1 and T2 signals to make an MR (Magnetic Resonance) image as opposed to the method in the patent that indicated identifying “standard” T1 and T2 signals which would be used to ‘spot’ cancer. After an appeal, the U.S. Court of Appeals for the Federal Circuit agreed with the trial judge, dashing Dr. Damadian’s right to protect his intellectual property.

Nevertheless, many held Dr. Damadian’s accomplishments and ‘The Cancer Detection Patent’ in high regard. On February 12, 1989, Dr. Damadian was inducted into the National Inventors Hall of Fame “for his independent contributions in conceiving and developing the application of magnetic resonance technology to medical uses including whole body scanning and diagnostic imaging.” Among those offering congratulations was President George Bush. Other members of the National Inventors Hall of Fame include Thomas Edison, Nicolai Tesla, Henry Ford and Cyrus McCormick.

On September 2, 1992, Fonar Corporation initiated legal action to enforce its patent rights, filing suit against General Electric and Hitachi for their impingement of ‘The Cancer Detection Patent’ and three other MRI patents. The MRI was no longer in its infancy and much research had been done. A 1987 peer-reviewed journal article by General Electric scientists provided new data to support how T1 and T2 MR Images supported the ‘The Cancer Detection Patent’ claims that there are standards that the MRI scanners used, providing hope that this time Dr. Damadian’s patent would be successful.

The trial began in February 1995 and on May 19, 1995, a jury rendered a verdict in FONAR’s favor for two of the patents, including ‘The Cancer Detection Patent.’ A week later the jury awarded the Company $110.6 million for damages for the infringement of the two MRI patents.

On September 30, 1995, Judge Leonard D. Wexler, U.S. District Court for the Eastern District of New York, ruled on the two patents. He agreed with the jury’s findings that one patent was valid and infringed. He set aside ‘The Cancer Detection Patent’ for the same reason as had the previous trial judge. Both sides appealed to the U.S. Court of Appeals.

| Page |

On February 25, 1997, FONAR received the news from the U.S. Court of Appeals. ‘The Cancer Detection Patent’ was reinstated and the other patent confirmed. On May 8, 1997, the Court of Appeals denied GE’s petition for a rehearing and an in banc hearing. On May 27, Chief Justice William Rehnquist denied GE’s motion to stay the judgment to FONAR pending appeal to the Supreme Court, in effect saying to GE: “Pay FONAR and pay them now.” On July 2, 1987, General Electric wired FONAR $128.7 million. On October 6, 1997, the Supreme Court announced its decision to deny GE a certiorari petition in this case.

With this mammoth case over, where roughly 1 million pages of documents were involved, this was one of the nation’s largest penalties for a patent infringement case. It was also a victory that went far in acknowledging the credit for the MRI due Dr. Damadian, who could now savor the victory with the knowledge that his pioneering patent based on his 1970 discovery and 1971 peer-reviewed Journal article in “Science” was successful.

About FONAR

FONAR, The Inventor of MR Scanning™, located in Melville, NY, was incorporated in 1978, and is the first, oldest and most experienced MRI Company in the industry. FONAR went public in 1981 (Nasdaq:FONR). FONAR sold the world’s first commercial MRI to Ronald J. Ross, MD, Cleveland, Ohio. It was installed in 1980. Dr. Ross and his team began the world’s first clinical MRI trials in January 1981. The results were reported in the June 1981 edition of Radiology/Nuclear Medicine Magazine and the April 1982 peer-reviewed article in the Journal Radiology. The technique used for obtaining T1 and T2 values was the FONAR technique (Field fOcusing Nuclear mAgnetic Resonance), not the back projection technique. www.fonar.com/innovations-timeline.html.

FONAR’s signature product is the FONAR UPRIGHT® Multi-Position™ MRI (also known as the STAND-UP® MRI), the only whole-body MRI that performs Position™ Imaging (pMRI™) and scans patients in numerous weight-bearing positions, i.e. standing, sitting, in flexion and extension, as well as the conventional lie-down position. The FONAR UPRIGHT® Multi-Position™ MRI often detects patient problems that other MRI scanners cannot because they are lie-down, “weightless-only” scanners. The patient-friendly UPRIGHT® MRI has a near-zero patient claustrophobic rejection rate. As a FONAR customer states, “If the patient is claustrophobic in this scanner, they’ll be claustrophobic in my parking lot.” Approximately 85% of patients are scanned sitting while watching TV.

FONAR has new works-in-progress technology for visualizing and quantifying the cerebral hydraulics of the central nervous system, the flow of cerebrospinal fluid (CSF), which circulates throughout the brain and vertebral column at the rate of 32 quarts per day. This imaging and quantifying of the dynamics of this vital life-sustaining physiology of the body’s neurologic system has been made possible first by FONAR’s introduction of the MRI and now by this latest works-in-progress method for quantifying CSF in all the normal positions of the body, particularly in its upright flow against gravity. Patients with whiplash or other neck injuries are among those who will benefit from this new understanding.

| Page |

FONAR’s primary source of income and growth is attributable to its wholly-owned diagnostic imaging management subsidiary, Health Management Company of America (HMCA) www.hmca.com.

FONAR’s substantial list of patents includes recent patents for its technology enabling full weight-bearing MRI imaging of all the gravity sensitive regions of the human anatomy, especially the brain, extremities and spine. It includes its newest technology for measuring the Upright cerebral hydraulics of the cerebrospinal fluid (CSF) of the central nervous system. FONAR’s UPRIGHT® Multi-Position™ MRI is the only scanner licensed under these patents.

#

UPRIGHT®, and STAND-UP® are registered trademarks. The Inventor of MR Scanning™, CSP™, MultiPosition™, UPRIGHT RADIOLOGY™, pMRI™, CFS Videography™, Dynamic™ and The Proof is in the Picture™, are trademarks of FONAR Corporation.

This release may include forward-looking statements from the company that may or may not materialize. Additional information on factors that could potentially affect the company's financial results may be found in the company's filings with the Securities and Exchange Commission.

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

ASSETS

| March

31, 2024 |

June

30, 2023 |

|||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 53,982 | $ | 51,280 | ||||

| Short-term investments | 134 | 33 | ||||||

| Accounts receivable – net | 3,309 | 3,861 | ||||||

| Accounts receivable - related party | 30 | — | ||||||

| Medical receivable – net | 23,583 | 21,259 | ||||||

| Management and other fees receivable – net | 40,954 | 35,888 | ||||||

| Management and other fees receivable – related medical practices – net | 9,590 | 9,162 | ||||||

| Inventories | 2,935 | 2,570 | ||||||

| Prepaid expenses and other current assets | 1,310 | 1,608 | ||||||

|

Total Current Assets |

135,827 | 125,661 | ||||||

| Accounts receivable – long term | 576 | 710 | ||||||

| Note receivable – related party | 590 | — | ||||||

| Deferred income tax asset | 7,039 | 10,042 | ||||||

| Property and equipment – net | 19,253 | 22,146 | ||||||

| Right-of-use Asset – operating lease | 37,779 | 33,069 | ||||||

| Right-of-use Asset – financing lease | 580 | 729 | ||||||

| Goodwill | 4,269 | 4,269 | ||||||

| Other intangible assets – net | 3,179 | 3,432 | ||||||

| Other assets | 539 | 524 | ||||||

|

Total Assets |

$ | 209,631 | $ | 200,582 | ||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

LIABILITIES AND STOCKHOLDERS’ EQUITY

| March

31, 2024 |

June

30, 2023 |

|||||||

| Current Liabilities: | ||||||||

| Current portion of long-term debt | $ | 46 | $ | 44 | ||||

| Accounts payable | 1,676 | 1,579 | ||||||

| Other current liabilities | 4,897 | 5,444 | ||||||

| Unearned revenue on service contracts | 3,444 | 3,832 | ||||||

| Unearned revenue on service contracts – related party | 28 | — | ||||||

| Operating lease liability - current portion | 3,635 | 3,905 | ||||||

| Financing lease liability - current portion | 224 | 218 | ||||||

| Customer deposits | 553 | 602 | ||||||

| Total Current Liabilities | 14,503 | 15,624 | ||||||

| Long-Term Liabilities: | ||||||||

| Unearned revenue on service contracts | 572 | 760 | ||||||

| Deferred income tax liability | 395 | 395 | ||||||

| Due to related medical practices | 93 | 93 | ||||||

| Operating lease liability – net of current portion | 36,466 | 32,105 | ||||||

| Financing lease liability – net of current portion | 452 | 620 | ||||||

| Long-term debt, less current portion | 80 | 115 | ||||||

| Other liabilities | 40 | 42 | ||||||

| Total Long-Term Liabilities | 38,098 | 34,130 | ||||||

|

Total Liabilities |

52,601 | 49,754 | ||||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

LIABILITIES AND STOCKHOLDERS’ EQUITY (Continued)

| STOCKHOLDERS' EQUITY: |

March 31, 2024 |

June

30, 2023 |

||||||

| Class A non-voting preferred stock $.0001 par value; 453 shares authorized at March 31, 2024 and June 30, 2023, 313 issued and outstanding at March 31, 2024 and June 30, 2023 | $ | — | $ | — | ||||

| Preferred stock $.001 par value; 567 shares authorized at March 31, 2024 and June 30, 2023, issued and outstanding – none | — | — | ||||||

| Common Stock $.0001 par value; 8,500 shares authorized at March 31, 2024 and June 30, 2023, 6,332 and 6,462 issued at March 31, 2024 and June 30, 2023, respectively 6,328 and 6,451 outstanding at March 31, 2024 and June 30, 2023 respectively | 1 | 1 | ||||||

| Class B Common Stock (10 votes per share) $.0001 par value; 227 shares authorized at March 31, 2024 and June 30, 2023; .146 issued and outstanding at March 31, 2024 and June 30, 2023 | — | — | ||||||

| Class C Common Stock (25 votes per share) $.0001 par value; 567 shares authorized at March 31, 2024 and June 30, 2023, 383 issued and outstanding at March 31, 2024 and June 30, 2023 | — | — | ||||||

| Paid-in capital in excess of par value | 180,607 | 182,613 | ||||||

| Accumulated deficit | (14,454 | ) | (24,191 | ) | ||||

| Treasury stock, at cost - 4 shares of common stock at March 31, 2024 and 11 shares of common stock at June 30, 2023 | (395 | ) | (516 | ) | ||||

| Total Fonar Corporation’s Stockholders’ Equity | 165,759 | 157,907 | ||||||

| Noncontrolling interests | (8,729 | ) | (7,079 | ) | ||||

| Total Stockholders' Equity | 157,030 | 150,828 | ||||||

| Total Liabilities and Stockholders' Equity | $ | 209,631 | $ | 200,582 | ||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

| FOR THE THREE MONTHS ENDED MARCH 31, | ||||||||

| REVENUES | 2024 | 2023 | ||||||

| Patient fee revenue – net of contractual allowances and discounts | $ | 8,614 | $ | 8,188 | ||||

| Product sales – net | 110 | 25 | ||||||

| Service and repair fees – net | 1,818 | 1,831 | ||||||

| Service and repair fees - related parties – net | 39 | 28 | ||||||

| Management and other fees – net | 12,149 | 12,375 | ||||||

| Management and other fees - related medical practices – net | 2,988 | 2,975 | ||||||

| Total Revenues – Net | 25,718 | 25,422 | ||||||

| COSTS AND EXPENSES | ||||||||

| Costs related to patient fee revenue | 4,437 | 4,056 | ||||||

| Costs related to product sales | 153 | 196 | ||||||

| Costs related to service and repair fees | 900 | 801 | ||||||

| Costs related to service and repair fees - related parties | 82 | 12 | ||||||

| Costs related to management and other fees | 6,864 | 7,157 | ||||||

| Costs related to management and other fees – related medical practices | 1,529 | 1,455 | ||||||

| Research and development | 414 | 435 | ||||||

| Selling, general and administrative | 7,593 | 7,143 | ||||||

| Total Costs and Expenses | 21,972 | 21,255 | ||||||

| Income From Operations | 3,746 | 4,167 | ||||||

| Other Income (Expense) | 45 | (6 | ) | |||||

| Interest Expense | (9 | ) | (15 | ) | ||||

| Investment Income – related party | 13 | — | ||||||

| Investment Income | 536 | 356 | ||||||

| Income Before Provision for Income Taxes and Non controlling Interests | 4,331 | 4,502 | ||||||

| Provision for Income Taxes | (1,848 | ) | (17 | ) | ||||

| Net Income | 2,483 | 4,485 | ||||||

| Net Income – Non controlling Interests | (611 | ) | (625 | ) | ||||

| Net Income – Attributable to FONAR | $ | 1,872 | $ | 3,860 | ||||

| Net Income Available to Common Stockholders | $ | 1,755 | $ | 3,627 | ||||

| Net Income Available to Class A Non-Voting Preferred Stockholders | $ | 87 | $ | 174 | ||||

| Net Income Available to Class C Common Stockholders | $ | 30 | $ | 59 | ||||

| Basic Net Income Per Common Share Available to Common Stockholders | $ | 0.28 | $ | 0.56 | ||||

| Diluted Net Income Per Common Share Available to Common Stockholders | $ | 0.27 | $ | 0.55 | ||||

| Basic and Diluted Income Per Share – Class C Common | $ | 0.08 | $ | 0.16 | ||||

| Weighted Average Basic Shares Outstanding – Common Stockholders | 6,335 | 6,481 | ||||||

| Weighted Average Diluted Shares Outstanding - Common Stockholders | 6,463 | 6,609 | ||||||

| Weighted Average Basic and Diluted Shares Outstanding – Class C Common | 383 | 383 | ||||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts and shares in thousands, except per share amounts)

(UNAUDITED)

| FOR THE NINE MONTHS ENDED MARCH 31, | ||||||||

| REVENUES | 2024 | 2023 | ||||||

| Patient fee revenue – net of contractual allowances and discounts | $ | 25,511 | $ | 21,393 | ||||

| Product sales – net | 329 | 225 | ||||||

| Service and repair fees – net | 5,460 | 5,489 | ||||||

| Service and repair fees - related parties – net | 94 | 83 | ||||||

| Management and other fees – net | 36,585 | 36,717 | ||||||

| Management and other fees - related medical practices – net | 8,962 | 8,962 | ||||||

| Total Revenues – Net | 76,941 | 72,869 | ||||||

| COSTS AND EXPENSES | ||||||||

| Costs related to patient fee revenue | 13,466 | 11,879 | ||||||

| Costs related to product sales | 558 | 580 | ||||||

| Costs related to service and repair fees | 2,533 | 2,241 | ||||||

| Costs related to service and repair fees - related parties | 106 | 34 | ||||||

| Costs related to management and other fees | 21,095 | 20,281 | ||||||

| Costs related to management and other fees – related medical practices | 4,638 | 4,345 | ||||||

| Research and development | 1,297 | 1,126 | ||||||

| Selling, general and administrative | 18,046 | 20,074 | ||||||

| Total Costs and Expenses | 61,739 | 60,560 | ||||||

| Income From Operations | 15,202 | 12,309 | ||||||

| Other Income (Expense) | 46 | (203 | ) | |||||

| Other Income – related party | 577 | — | ||||||

| Interest Expense | (67 | ) | (41 | ) | ||||

| Investment Income – related party | 13 | — | ||||||

| Investment Income | 1,576 | 770 | ||||||

| Income Before Provision for Income Taxes and Non controlling Interests | 17,347 | 12,835 | ||||||

| Provision for Income Taxes | (4,884 | ) | (2,889 | ) | ||||

| Net Income | 12,463 | 9,946 | ||||||

| Net Income – Non controlling Interests | (2,726 | ) | (1,807 | ) | ||||

| Net Income – Attributable to FONAR | $ | 9,737 | $ | 8,139 | ||||

| Net Income Available to Common Stockholders | $ | 9,130 | $ | 7,647 | ||||

| Net Income Available to Class A Non-Voting Preferred Stockholders | $ | 452 | $ | 367 | ||||

| Net Income Available to Class C Common Stockholders | $ | 155 | $ | 125 | ||||

| Basic Net Income Per Common Share Available to Common Stockholders | $ | 1.42 | $ | 1.18 | ||||

| Diluted Net Income Per Common Share Available to Common Stockholders | $ | 1.40 | $ | 1.16 | ||||

| Basic and Diluted Income Per Share – Class C Common | $ | 0.40 | $ | 0.33 | ||||

| Weighted Average Basic Shares Outstanding – Common Stockholders | 6,410 | 6,487 | ||||||

| Weighted Average Diluted Shares Outstanding - Common Stockholders | 6,538 | 6,615 | ||||||

| Weighted Average Basic and Diluted Shares Outstanding – Class C Common | 383 | 383 | ||||||

| Page |

FONAR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts and shares in thousands)

(UNAUDITED)

|

FOR THE NINE MONTHS ENDED MARCH 31, |

||||||||

| 2024 | 2023 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net income | $ | 12,463 | $ | 9,946 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | 3,546 | 3,357 | ||||||

| Amortization on right-of-use assets | 3,284 | 3,306 | ||||||

| Provision for bad debts | 1,674 | 4,441 | ||||||

| Deferred income tax – net | 3,003 | 1,931 | ||||||

| Gain on sale of equipment – related party | (577 | ) | — | |||||

| (Increase) decrease in operating assets, net: | ||||||||

| Accounts, medical and management fee receivable(s) | (8,835 | ) | (5,604 | ) | ||||

| Notes receivable | 55 | 11 | ||||||

| Inventories | (365 | ) | (301 | ) | ||||

| Prepaid expenses and other current assets | 243 | (73 | ) | |||||

| Other assets | (28 | ) | — | |||||

| Increase (decrease) in operating liabilities, net: | ||||||||

| Accounts payable | 97 | 168 | ||||||

| Other current liabilities | (1,095 | ) | (4,409 | ) | ||||

| Operating lease liabilities | (3,756 | ) | (2,865 | ) | ||||

| Financing lease liabilities | (163 | ) | (175 | ) | ||||

| Customer deposits | (49 | ) | 465 | |||||

| Other liabilities | (1 | ) | (49 | ) | ||||

| Net cash provided by operating activities | 9,496 | 10,149 | ||||||

| Cash Flows from Investing Activities: | ||||||||

| Purchases of property and equipment | (375 | ) | (3,553 | ) | ||||

| Purchase of short term investment | (102 | ) | — | |||||

| Cost of patents | (24 | ) | (87 | ) | ||||

| Net cash used in investing activities | (501 | ) | (3,640 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Repayment of borrowings and capital lease obligations | (32 | ) | (26 | ) | ||||

| Purchase of treasury stock | (1,885 | ) | (1,249 | ) | ||||

| Distributions to non controlling interests | (4,376 | ) | (4,317 | ) | ||||

| Net cash used in financing activities | (6,293 | ) | (5,592 | ) | ||||

| Net Increase in Cash and Cash Equivalents | 2,702 | 917 | ||||||

| Cash and Cash Equivalents - Beginning of Period | 51,280 | 48,723 | ||||||

| Cash and Cash Equivalents - End of Period | $ | 53,982 | $ | 49,640 | ||||

| Page |