7031768.v6 AMENDMENT NO. 5 TO CREDIT AGREEMENT This Amendment No. 5 to Credit Agreement dated to be effective as of September 3, 2025 (the “Amendment”), is entered into by and among Air’Zona Aircraft Services, Inc., an Arizona corporation, CSA Air, Inc., a North Carolina corporation, Global Ground Support, LLC, a North Carolina limited liability company, Jet Yard, LLC, an Arizona limited liability company, Jet Yard Solutions, LLC, an Arizona limited liability company, Mountain Air Cargo, Inc., a North Carolina corporation, Worldwide Aircraft Services, Inc., a Kansas corporation, Royal Aircraft Services, LLC, a Maryland limited liability company, and Worthington Aviation, LLC, a North Carolina limited liability company (such entities being sometimes collectively referred to herein as the “Borrowers” and individually as a “Borrower”), Air T, Inc., a Delaware corporation (“Air T”), in its separate capacities as “Loan Party Agent” and “Guarantor” (as defined in the Original Agreement, hereinafter defined), and Alerus Financial, National Association (the “Lender”). RECITALS: A. The Borrowers, the Loan Party Agent and the Lender are parties to that certain Credit Agreement dated as of August 29, 2024, as amended by that certain Amendment No. 1 to Credit Agreement and Other Loan Documents dated as of January 21, 2025, by that certain Amendment No. 2 to Credit Agreement and Consent dated as of February 21, 2025, by that certain Amendment No. 3 to Credit Agreement dated as of March 31, 2025, and by that certain Amendment No. 4 to Credit Agreement and Consent dated as of May 15, 2025 (as so amended, the “Original Agreement”), pursuant to which Lender has agreed to extend credit to the Borrowers under the terms and conditions set forth therein. B. The Borrowers have requested that the Lender amend certain provisions of the Original Agreement. C. Subject to the terms and conditions of this Amendment, the Lender will agree to the foregoing requests of the Borrowers. NOW, THEREFORE, the parties agree as follows: 1. Defined Terms. All capitalized terms used in this Amendment shall, except where the context otherwise requires, have the meanings set forth in the Original Agreement as amended hereby. 2. Amendments. (a) The definition of the terms “Borrower(s)”, “Maturity Date”, “Measurement Date”, “Measurement Period”, “Revolving Credit Commitment”, “Revolving Credit Termination Date” and “Total Usage” appearing in Section 1.01 of the Original Agreement are hereby amended in their respective entireties to read as follows: “ ‘Borrower(s)’.shall mean, individually or collectively, as the context requires, Air’Zona Aircraft Services, Inc., an Arizona corporation, CSA Air, Inc.,

2 a North Carolina corporation, Global Ground Support, LLC, a North Carolina limited liability company, Jet Yard, LLC, an Arizona limited liability company, Jet Yard Solutions, LLC, an Arizona limited liability company, Mountain Air Cargo, Inc., a North Carolina corporation, Worldwide Aircraft Services, Inc., a Kansas corporation, Royal Aircraft Services, LLC, a Maryland limited liability company, and Worthington Aviation, LLC, a North Carolina limited liability company. ‘Maturity Date’ means, the earlier of: (a) the date on which the Loans become due and payable under Section 8.02 upon the occurrence of an Event of Default; or (b) (i) the Revolving Credit Termination Date for the Revolving Credit Loans; (ii) August 15, 2029 for Term Loan A; or (iii) May 15, 2030 for Term Loan C. ‘Measurement Date’ shall mean December 31 and March 31 of each year. The first Measurement Date will be December 31, 2025. ‘Measurement Period’ shall mean the period of four consecutive fiscal quarters ending on a Measurement Date. ‘Revolving Credit Commitment’ shall mean the obligation of the Lender to make Revolving Credit Loans to the Borrowers and to issue Letters of Credit for the account of the Borrowers, in an aggregate principal amount not to exceed $20,000,000, as the same may be changed from time to time pursuant to the terms hereof. “Revolving Credit Termination Date” means the earliest to occur of (a) August 28, 2027, and (b) the termination of the Revolving Credit Commitment pursuant to Section 8.02 or Section 2.04 ‘Total Usage” means, at any date of determination, the sum of: (a) the aggregate outstanding principal balance of the Revolving Credit Loans; plus (b) the Letter of Credit Obligations. (b) Section 1.01 of the Original Agreement is hereby further amended by deleting the definitions of the following terms “Overline Commitment”, “Overline Commitment Period”, “Overline Loans”, “Overline Termination Date”, “Quarterly Measurement Date” and “Semi-Annual Measurement Date” and by inserting the following new definitions of the term “Hedge Agreement(s)” in the appropriate alphabetical order: ‘ ‘Hedge Agreement(s)” means any or all Swap Transaction Documents.” (c) Section 2.02A of the Original Agreement which had provided for an “Overline Commitment” is hereby amended in its entirety to read as follows:

3 “Section 2.02A Intentionally Deleted.” (d) Section 2.03A of the Original Agreement which had provided the procedure for Overline borrowing is hereby amended in its entirety to read as follows: “Section 2.03A Intentionally Deleted.” (e) Section 2.05(c) of the Original Agreement regarding the Overline Note is hereby amended in its entirety to read as follows: (f) “Section 2.05(c) Intentionally Deleted.” (g) Section 2.07(a) of the Original Agreement is hereby amended in its entirety to read as follows: “ (a) if, at any time, the Total Usage would exceed the lesser of (A) the Revolving Credit Commitment or (B) the Borrowing Base, then the Borrowers shall immediately prepay the amount of such excess together with interest on the amount prepaid; any prepayment shall be applied first to prepay the Revolving Credit Loans and then to cash collateralize the Letter of Credit Obligations on terms acceptable to the Lender.” (h) Section 6.01(c) of the Original Agreement is hereby amended in its entirety to read as follows: “ (c) as soon as available, but in any event not later than 45 days after the end of each fiscal quarter occurring during each fiscal year of Air T, the unaudited combined and combining balance sheets of the Borrowers as at the end of such fiscal quarter and the related unaudited combined and combining statements of income and of cash flows for such fiscal quarter and the portion of the fiscal year through the end of such fiscal quarter, setting forth in each case in comparative form the figures for the previous year, certified by a Responsible Officer of the Loan Party Agent as being fairly stated in all material respects (subject to normal year-end audit adjustments).” (i) Section 6.02(b) of the Original Agreement is hereby amended in its entirety to read as follows: “ On the same dates as delivery of the financial statements in Error! Reference source not found. above for the fiscal quarters ending December 31 and March 31 of each year, a compliance certificate in the form of Exhibit A from a Responsible Officer of the Loan Party Agent (i) containing all information and calculations necessary for determining compliance by the Borrowers with the provisions of this Agreement as of the last day of such fiscal quarter of the Borrowers, as the case may be and (ii) stating that to the best of such Responsible Officer's knowledge, each

4 Loan Party during such period has observed and performed in all material respects all of the covenants and other agreements, and satisfied every condition contained in this Agreement and the other Loan Documents to which it is a party to be observed, performed, or satisfied by it, and that such officer has not obtained any knowledge of any Default or Event of Default except as specified in such certificate;” (j) Section 7.12 of the Original Agreement is hereby amended in its entirety to read as follows: “Section 7.12. Financial Covenants. (a) Permit the Debt Service Coverage Ratio to be less than 1.25 to 1.00 at any Measurement Date; or (b) Permit the Leverage Ratio to be greater than 3.00 to 1.00 at any Annual Measurement Date.” (k) The form of Compliance Certificate attached as Exhibit A to the Original Agreement is hereby amended in its entirety to conform with the form of Compliance Certificate (Amended 8/2025) attached as Exhibit A to this Amendment. (l) The form of Borrowing Base Certificate attached as Exhibit B to the Original Agreement is hereby amended in its entirety to conform with the form of Borrowing Base Certificate (Amended 8/2025) attached as Exhibit B to this Amendment. 3. Termination of Overline Commitment. The “Overline Commitment” under the Original Agreement is hereby terminated. On and after the Effective Date of this Amendent, the Lender will be under no obligation to make Overline Loans to the Borrowers and any outstanding Overline Lines will be deemed to be outstanding Revolving Credit Loans. 4. Conditions to Effectiveness. This Amendment shall become effective as of the date first set forth above (the “Effective Date”) when, and only when, the Lender shall have received: (a) this Amendment, duly executed by a Responsible Officer of each Loan Party; (b) an Amended and Restated Revolving Credit Note (the “A&R Revolving Credit Note”), in the form provided by the Lender, duly executed by a Responsible Officer of each Borrower; (c) an Amended and Restated Term Note A (the “A&R Term Note A”), in the form provided by the Lender, duly executed by a Responsible Officer of each Borrower; (d) a certificate of the secretary of each Borrower in the form provided by the Lender, appropriately completed and duly executed by such Borrower’s secretary;

5 (e) an Acknowledgment and Agreement, in the form provided by the Lender, duly executed by a Responsible Officer of Air T in its capacity as Guarantor; (f) an ISDA Master Agreement, in the form provided by the Lender, duly executed by a Responsible Officer of each Borrower; (g) a Schedule to ISDA Master Agreement, in the form provided by the Lender, duly executed by a Responsible Officer of each Borrower; (h) an Unlimited Continuing Guaranty (Swap Transactions), in the form provided by the Lender, duly executed by a Responsible Officer of Air T; (i) a Swap Customer Agreement, in the form provided by Lender, duly completed and executed by a Responsible Officer of each Loan Party; (j) an amendment fee in the amount of $100,000, payable in immediately available funds; (k) certificates of good standing for each Loan Party issued by the state of its formation; (l) results of lien searches acceptable to Lender; and (m) such other documents, instruments and certificates as the Lender may reasonably request. 5. Representations and Warranties. To induce the Lender to enter into this Amendment, the Loan Parties jointly and severally represent and warrant to the Lender as follows: (a) The execution, delivery and performance by the Borrowers, the Borrowers’ Agent and the Guarantor of this Amendment and each other Loan Document have been duly authorized by all necessary corporate, or as the case may be, limited liability company, action, do not require any approval or consent of, or any registration, qualification or filing with, any government agency or authority or any approval or consent of any other person (including, without limitation, any shareholder), do not and will not conflict with, result in any violation of or constitute any default under, any provision of any such Person’s formation or governance documents, any agreement binding on or applicable to any such Person or any such Person’s property, or any law or governmental regulation or court decree or order, binding upon or applicable to any such Person or of any such Person’s property and will not result in the creation or imposition of any security interest or other lien or encumbrance in or on any of its property pursuant to the provisions of any agreement applicable to any such Person or any such Person’s property; (b) The representations and warranties contained in the Original Agreement are true and correct as of the date hereof as though made on that date except: (i) to the extent that such representations and warranties relate solely to an earlier date; and (ii) that the representations and warranties set forth in Section 5.04 of the Original Agreement to the

6 audited annual financial statements and internally-prepared interim financial statements of Loan Parties shall be deemed to be a reference to the audited financial statements and interim financial statements, as the case may be, most recently delivered to the Lender pursuant to Section 6.01(a), 6.01(b) or 6.01(c) of the Original Agreement; (c) No events have taken place and no circumstances exist at the date hereof which would give any Loan Party the right to assert a defense, offset or counterclaim to any claim by the Lender for payment of the Obligations; (d) The Original Agreement, as amended by this Amendment, and each other Loan Document to which any Loan Party is a party are the legal, valid and binding obligations of such Loan Party and are enforceable in accordance with their respective terms, subject only to bankruptcy, insolvency, reorganization, moratorium or similar laws, rulings or decisions at the time in effect affecting the enforceability of rights of creditors generally and to general equitable principles which may limit the right to obtain equitable remedies; and (e) Before and after giving effect to this Amendment, there does not exist any Default or Event of Default. 6. Release. The Borrowers, the Borrowers’ Agent and the Guarantor jointly and severally release and forever discharge the Lender and its successors, assigns, directors, officers, agents, employees and participants from any and all actions, causes of action, suits, proceedings, debts, sums of money, covenants, contracts, controversies, claims and demands, at law or in equity, which any of the Borrowers, the Borrowers’ Agent or the Guarantor ever had or now has against the Lender or its successors, assigns, directors, officers, agents, employees or participants by virtue of the Lender’s relationship to the Loan Parties in connection with the Loan Documents and the transactions related thereto 7. Reference to and Effect on the Loan Documents. (a) From and after the date of this Amendment, each reference in: (i) the Original Agreement to “this Agreement”, “hereunder”, “hereof”, “herein” or words of like import referring to the Original Agreement, and each reference to the “Credit Agreement”, the “Credit Agreement”, “thereunder”, “thereof”, “therein” or words of like import referring to the Original Agreement in any other Loan Document shall mean and be a reference to the Original Agreement as amended hereby; (ii) any Loan Document to “the Revolving Credit Note,” “thereunder,” “thereof,” “therein” or words of like import referring to the Revolving Credit Note shall include a reference to the A&R Revolving Credit Note executed and delivered by the Borrowers pursuant to this letter amendment; and (iii) any Loan Document to “the Term Note A,” “thereunder,” “thereof,”

7 “therein” or words of like import referring to the Term Note A shall include a reference to the A&R Term Note A executed and delivered by the Borrowers pursuant to this letter amendment. (b) The execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of the Lender under the Original Agreement or any other Loan Document, nor constitute a waiver of any provision of the Agreement or any such other Loan Document. 8. Costs, Expenses and Taxes. The Borrowers jointly and severally agree to pay on demand all costs and expenses of the Lender in connection with the preparation, reproduction, execution and delivery of this Amendment and the other documents to be delivered hereunder or thereunder, including their reasonable attorneys’ fees and legal expenses. In addition, the Borrowers shall pay any and all stamp and other taxes and fees payable or determined to be payable in connection with the execution and delivery, filing or recording of this Amendment and the other instruments and documents to be delivered hereunder and agrees to save the Lender harmless from and against any and all liabilities with respect to, or resulting from, any delay in the Borrowers’ paying or omission to pay, such taxes or fees. 9. Governing Law. THE VALIDITY, CONSTRUCTION AND ENFORCEABILITY OF THIS AMENDMENT SHALL BE GOVERNED BY THE INTERNAL LAWS OF THE STATE OF MINNESOTA, WITHOUT GIVING EFFECT TO CONFLICT OF LAWS PRINCIPLES THEREOF, BUT GIVING EFFECT TO FEDERAL LAWS OF THE UNITED STATES APPLICABLE TO NATIONAL BANKS. 10. Headings. Section headings in this Amendment are included herein for convenience of reference only and shall not constitute a part of this Amendment for any other purpose. 11. Counterparts. This Amendment may be executed in counterparts and by separate parties in separate counterparts, each of which shall be an original and all of which taken together shall constitute one and the same document. Receipt by telecopy, pdf file or other electronic means of any executed signature page to this Amendment shall constitute effective delivery of such signature page; provided, that each of the undersigned agree to promptly deliver to Lender original signed counterparts of this Amendment upon request by Lender. 12. Recitals. The Recitals hereto are incorporated herein by reference and constitute a part of this Amendment. [SIGNATURE PAGES FOLLOW]

EXHIBIT A FORM OF COMPLIANCE CERTIFICATE (Amended 8/2025) Alerus Financial, National Association 2805 Dodd Rd., Suite 160 Eagan, MN 55121 Attention: Mr. Eric P. Gundersen, Senior Vice President The undersigned is the Loan Party Agent under that certain Credit Agreement, dated as of August 29, 2024 (as amended to date and as the same may be further amended, modified or supplemented from time to time, herein called the “Agreement;” capitalized terms not otherwise defined herein being used as therein defined) by and among Air’Zona Aircraft Services, Inc., an Arizona corporation, CSA Air, Inc., a North Carolina corporation, Global Ground Support, LLC, a North Carolina limited liability company, Jet Yard, LLC, an Arizona limited liability company, Jet Yard Solutions, LLC, an Arizona limited liability company, Mountain Air Cargo, Inc., a North Carolina corporation, Worldwide Aircraft Services, Inc., a Kansas corporation, Royal Aircraft Services, LLC, a Maryland limited liability company, and Worthington Aviation, LLC, a North Carolina limited liability company (such entities being sometimes collectively referred to herein as the “Borrowers” and individually as a “Borrower”), the undersigned, in its capacity as Loan Party Agent, and Alerus Financial, National Association (the “Lender”). Pursuant to Section 6.02(a) of the Agreement, the undersigned certifies to the Lender as follows: (a) The financial statements of the Borrowers attached hereto for the period ending ______________, 202__ (the “Financial Statements”) have been prepared in accordance with GAAP (except, in the case of the interim financial statements, for the absence of footnotes and subject to customary year-end adjustments). (b) The representations and warranties contained in Article V of the Credit Agreement are true and correct as of the date hereof as though made on that date except to the extent that such representations and warranties expressly relate to an earlier date and except that the representations and warranties set forth in Section 5.04 of the Credit Agreement shall be deemed to refer to the financial statements then most recently delivered to the Lender pursuant to Section 6.01(a) or (b) of the Credit Agreement, as the case may be. (c) As of _________, 202__ (the “Measurement Date”), no Default or Event of Default has occurred and is continuing [except (describe here any Default or Event of Default and the action which the undersigned proposes to take with respect thereto.)].

(d) Section 7.12(a). As of the Measurement Date, the minimum permitted Debt Service Coverage Ratio was 1.25 to 1.00 and the actual Debt Service Coverage Ratio was ___ to 1.00, as calculated in accordance with the Credit Agreement as set forth on the spreadsheet attached hereto as Schedule I and incorporated herein by reference. (e) Section 7.12(b). As of the Measurement Date, the maximum permitted Leverage Ratio was 3.00 to 1.00 and the actual Leverage Ratio was ___ to 1.00, as calculated in accordance with the Credit Agreement as set forth on the spreadsheet attached hereto as Schedule I and incorporated herein by reference. AIR T, INC., as Loan Party Agent, on behalf of the Borrowers By Title: Date:

Schedule I to Compliance Certificate Covenant Calculations [see attached]

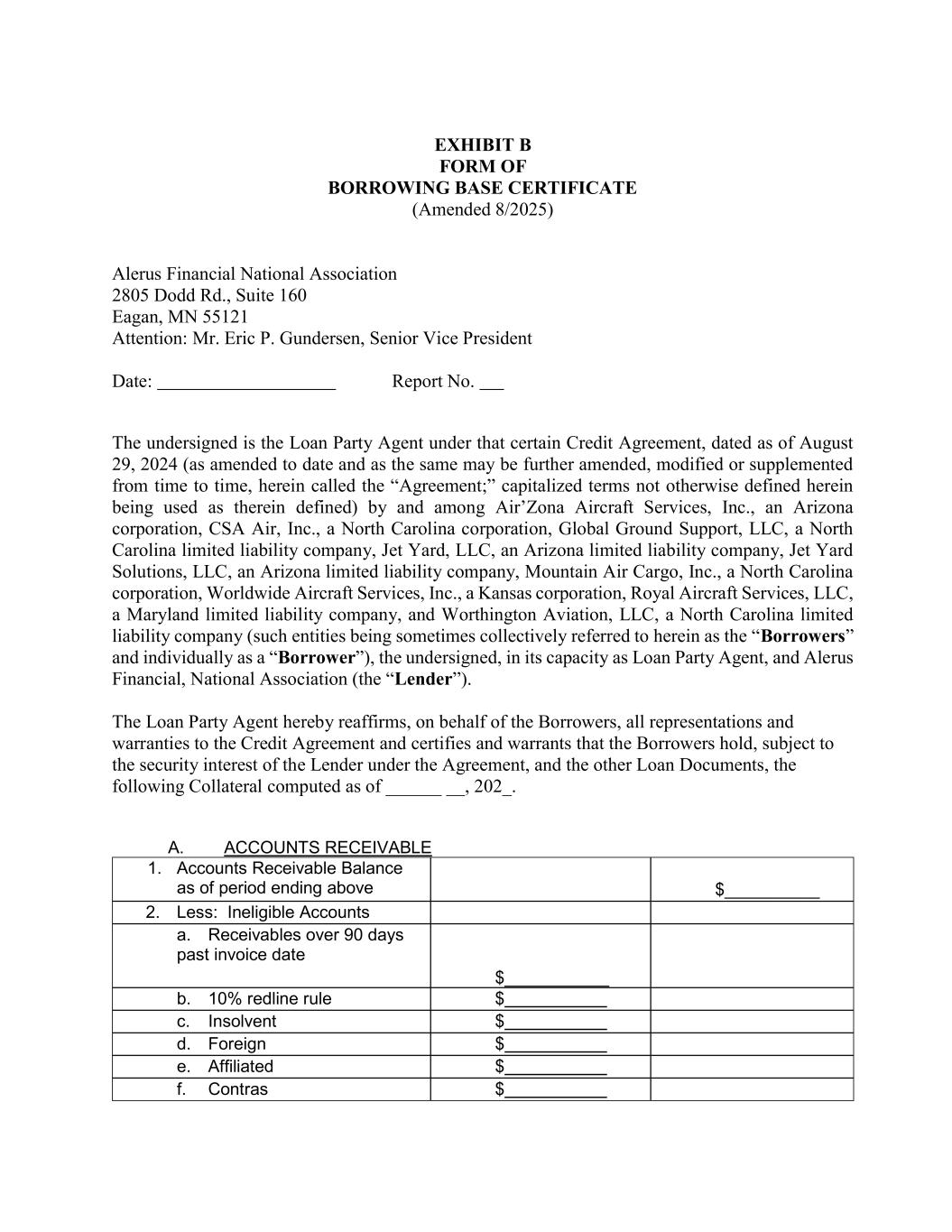

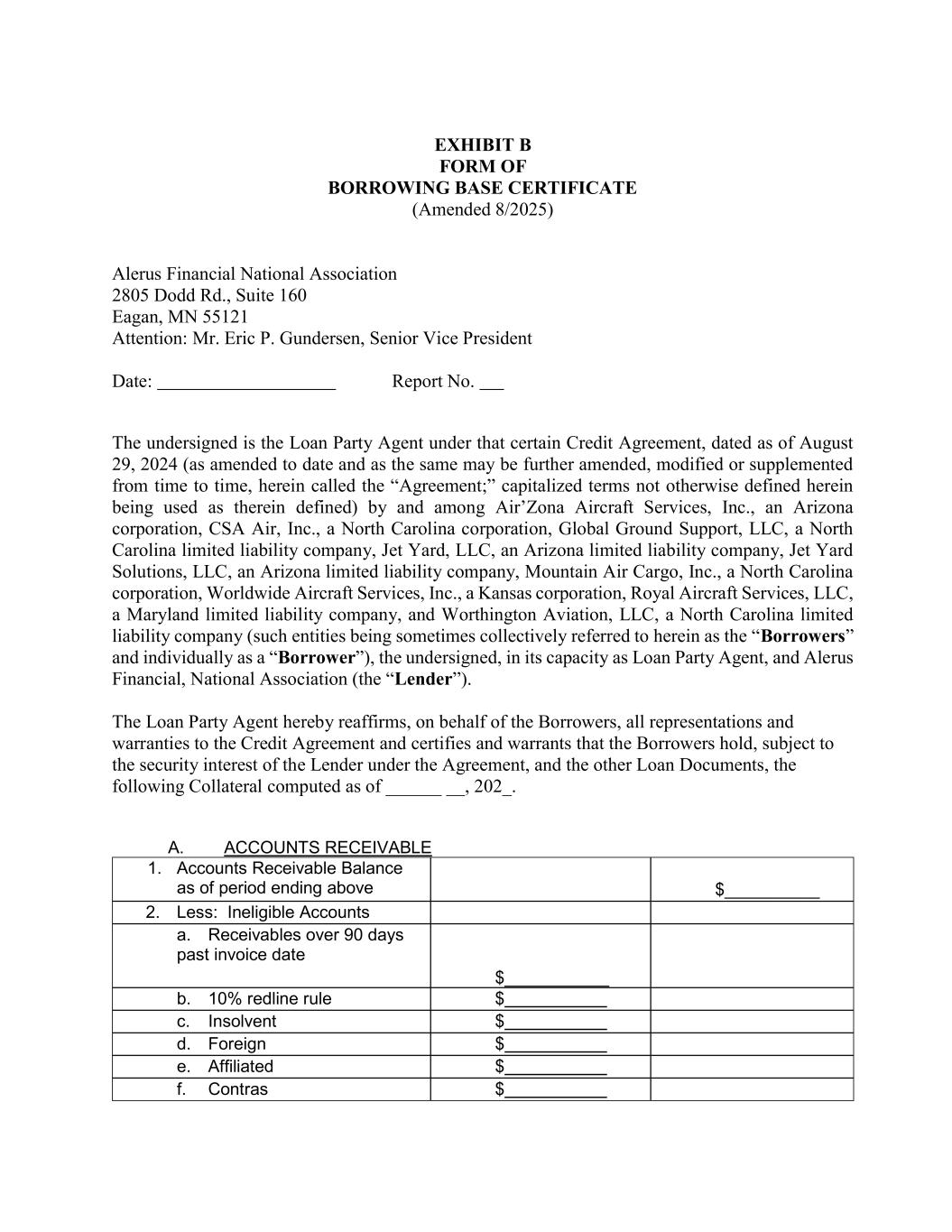

EXHIBIT B FORM OF BORROWING BASE CERTIFICATE (Amended 8/2025) Alerus Financial National Association 2805 Dodd Rd., Suite 160 Eagan, MN 55121 Attention: Mr. Eric P. Gundersen, Senior Vice President Date: Report No. The undersigned is the Loan Party Agent under that certain Credit Agreement, dated as of August 29, 2024 (as amended to date and as the same may be further amended, modified or supplemented from time to time, herein called the “Agreement;” capitalized terms not otherwise defined herein being used as therein defined) by and among Air’Zona Aircraft Services, Inc., an Arizona corporation, CSA Air, Inc., a North Carolina corporation, Global Ground Support, LLC, a North Carolina limited liability company, Jet Yard, LLC, an Arizona limited liability company, Jet Yard Solutions, LLC, an Arizona limited liability company, Mountain Air Cargo, Inc., a North Carolina corporation, Worldwide Aircraft Services, Inc., a Kansas corporation, Royal Aircraft Services, LLC, a Maryland limited liability company, and Worthington Aviation, LLC, a North Carolina limited liability company (such entities being sometimes collectively referred to herein as the “Borrowers” and individually as a “Borrower”), the undersigned, in its capacity as Loan Party Agent, and Alerus Financial, National Association (the “Lender”). The Loan Party Agent hereby reaffirms, on behalf of the Borrowers, all representations and warranties to the Credit Agreement and certifies and warrants that the Borrowers hold, subject to the security interest of the Lender under the Agreement, and the other Loan Documents, the following Collateral computed as of ______ __, 202_. A. ACCOUNTS RECEIVABLE 1. Accounts Receivable Balance as of period ending above $__________ 2. Less: Ineligible Accounts a. Receivables over 90 days past invoice date $___________ b. 10% redline rule $ c. Insolvent $ d. Foreign $ e. Affiliated $ f. Contras $

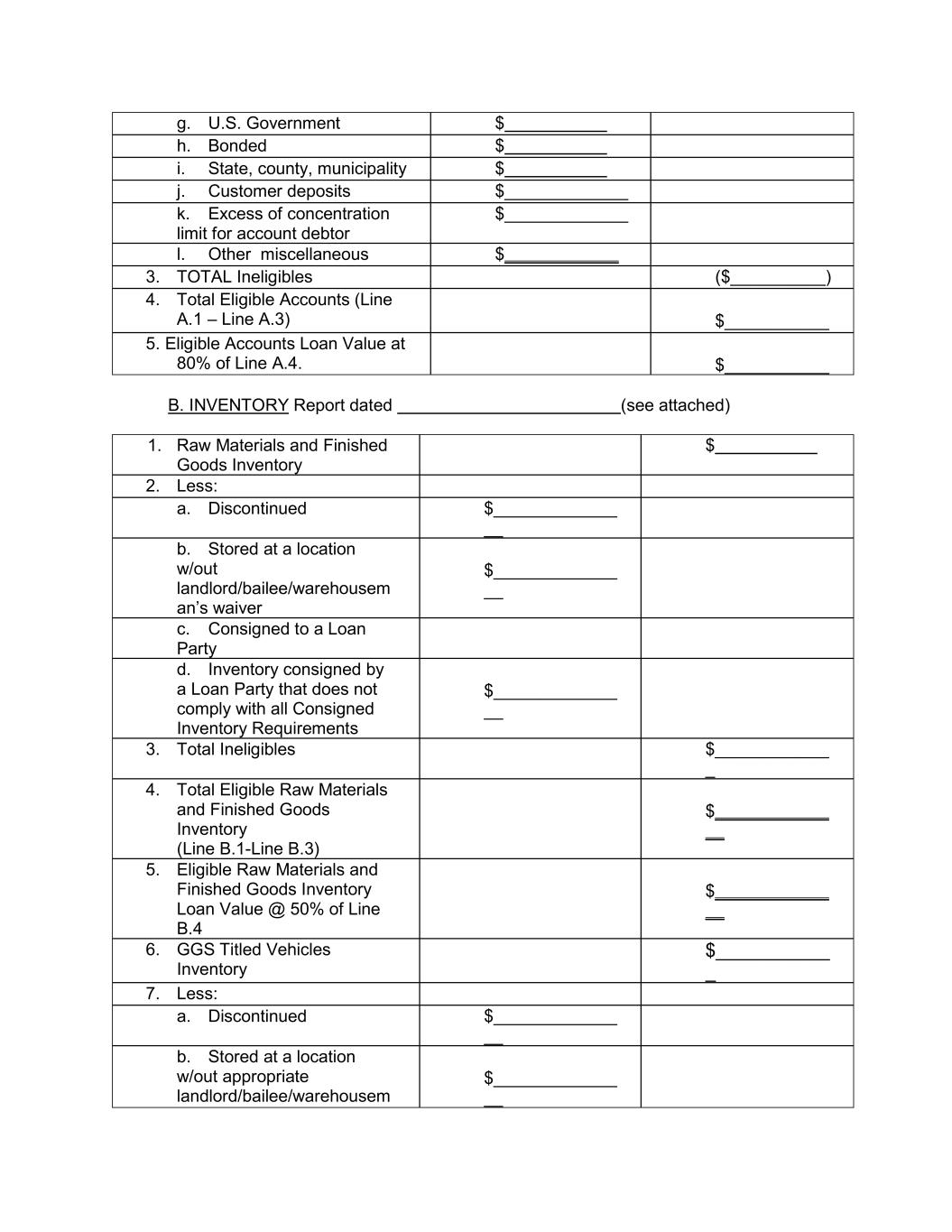

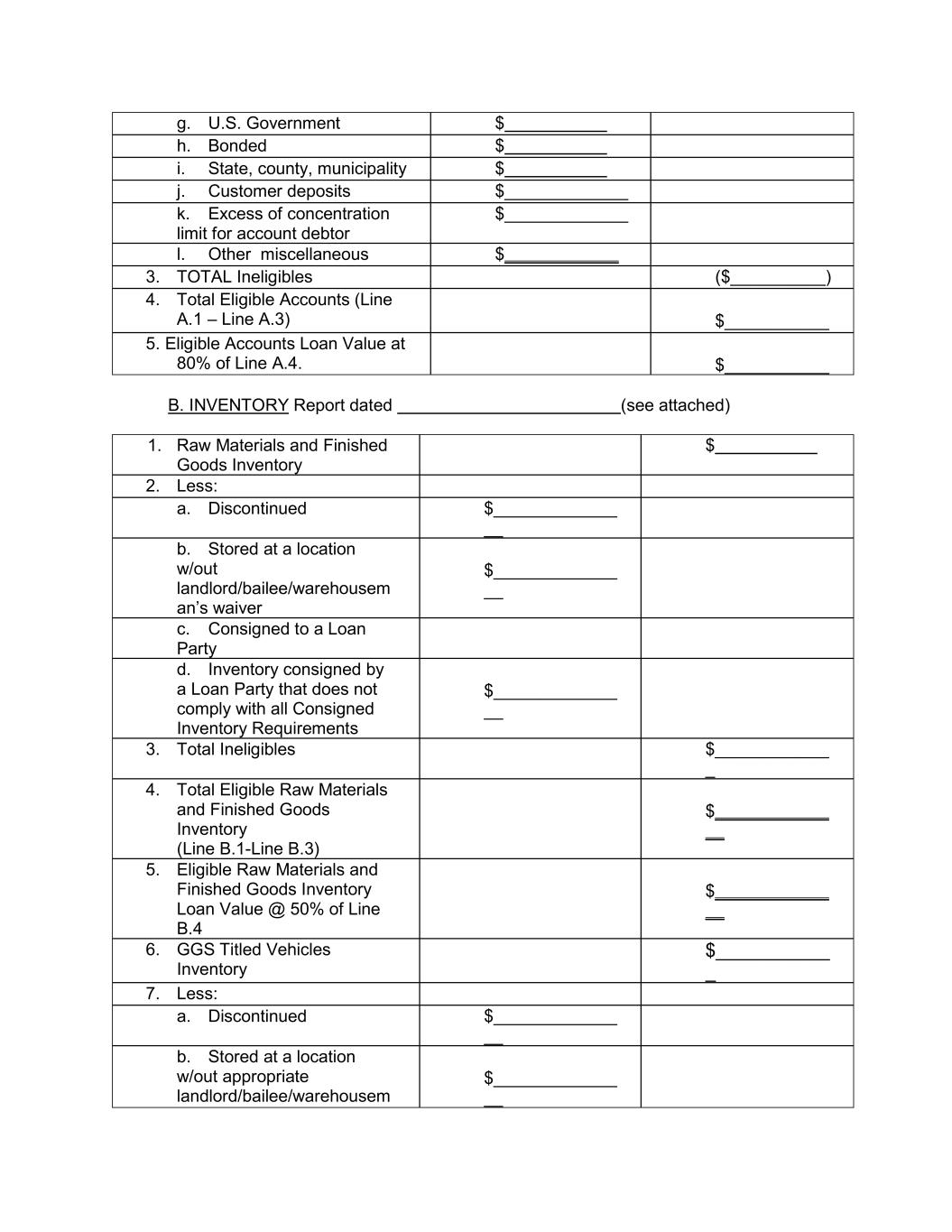

g. U.S. Government $ h. Bonded $ i. State, county, municipality $ j. Customer deposits $_____________ k. Excess of concentration limit for account debtor $_____________ l. Other miscellaneous $____________ 3. TOTAL Ineligibles ($__________) 4. Total Eligible Accounts (Line A.1 – Line A.3) $___________ 5. Eligible Accounts Loan Value at 80% of Line A.4. $___________ B. INVENTORY Report dated (see attached) 1. Raw Materials and Finished Goods Inventory $ 2. Less: a. Discontinued $_____________ __ b. Stored at a location w/out landlord/bailee/warehousem an’s waiver $_____________ __ c. Consigned to a Loan Party d. Inventory consigned by a Loan Party that does not comply with all Consigned Inventory Requirements $_____________ __ 3. Total Ineligibles $____________ _ 4. Total Eligible Raw Materials and Finished Goods Inventory (Line B.1-Line B.3) $____________ __ 5. Eligible Raw Materials and Finished Goods Inventory Loan Value @ 50% of Line B.4 $____________ __ 6. GGS Titled Vehicles Inventory $___________ _ 7. Less: a. Discontinued $_____________ __ b. Stored at a location w/out appropriate landlord/bailee/warehousem $_____________ __

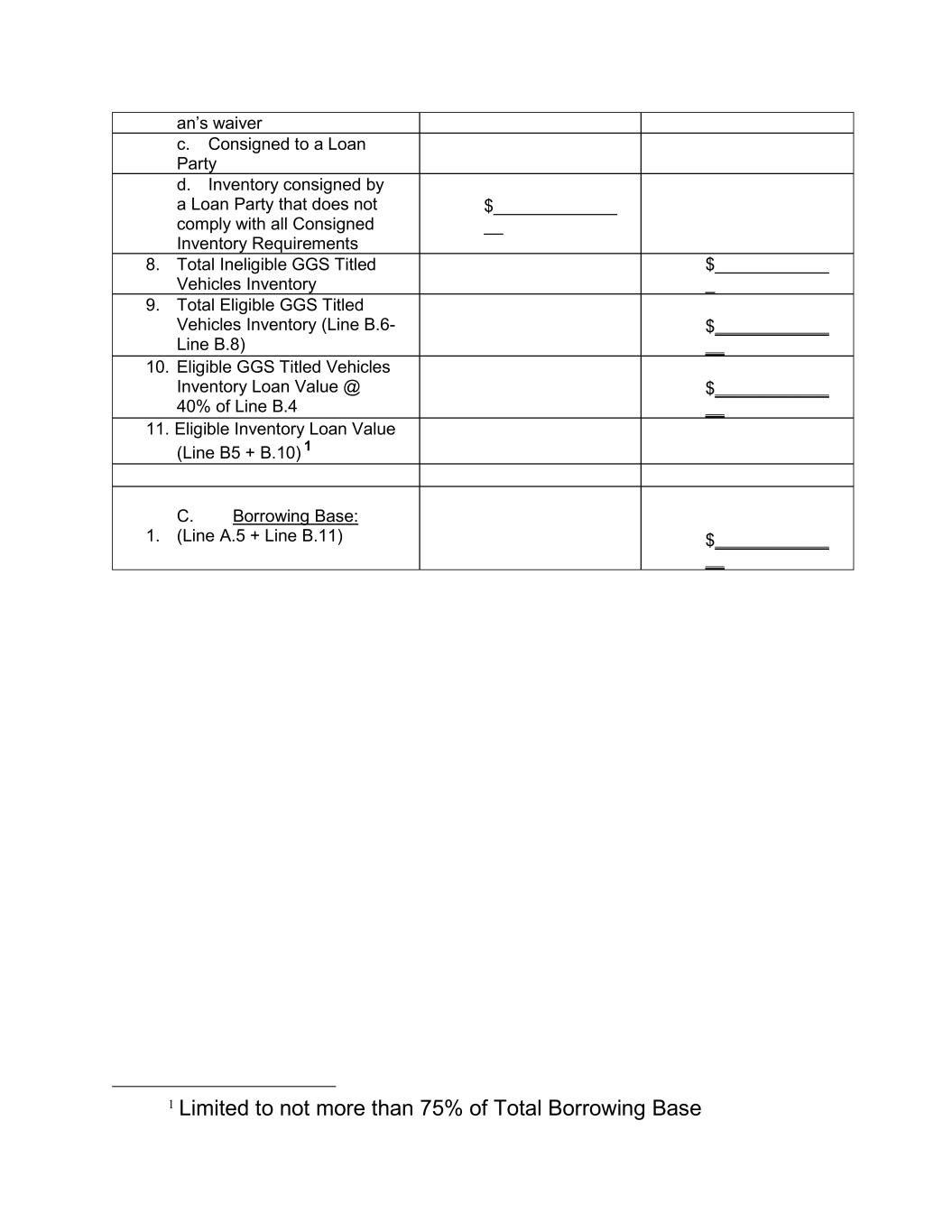

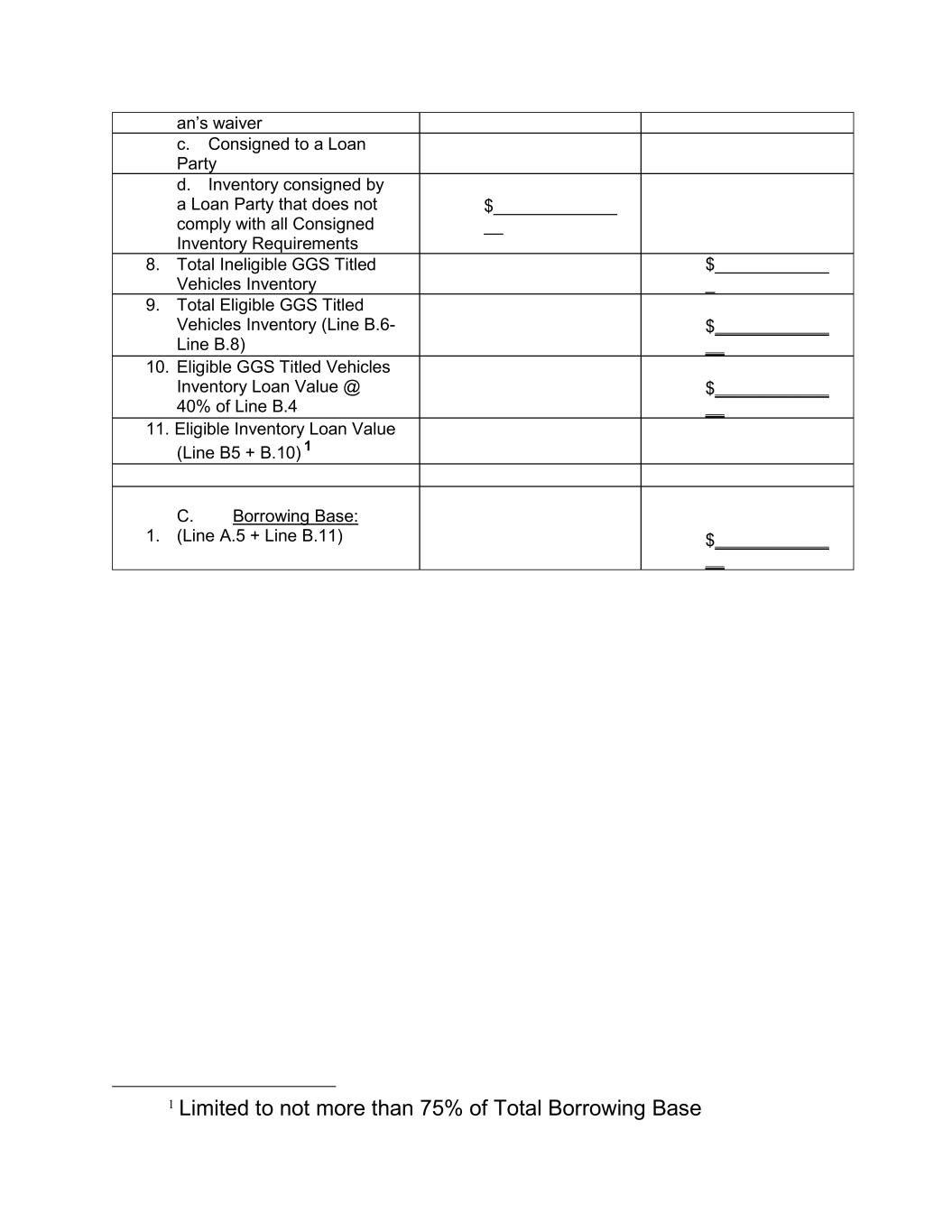

an’s waiver c. Consigned to a Loan Party d. Inventory consigned by a Loan Party that does not comply with all Consigned Inventory Requirements $_____________ __ 8. Total Ineligible GGS Titled Vehicles Inventory $____________ _ 9. Total Eligible GGS Titled Vehicles Inventory (Line B.6- Line B.8) $____________ __ 10. Eligible GGS Titled Vehicles Inventory Loan Value @ 40% of Line B.4 $____________ __ 11. Eligible Inventory Loan Value (Line B5 + B.10) 1 C. Borrowing Base: 1. (Line A.5 + Line B.11) $____________ __ 1 Limited to not more than 75% of Total Borrowing Base

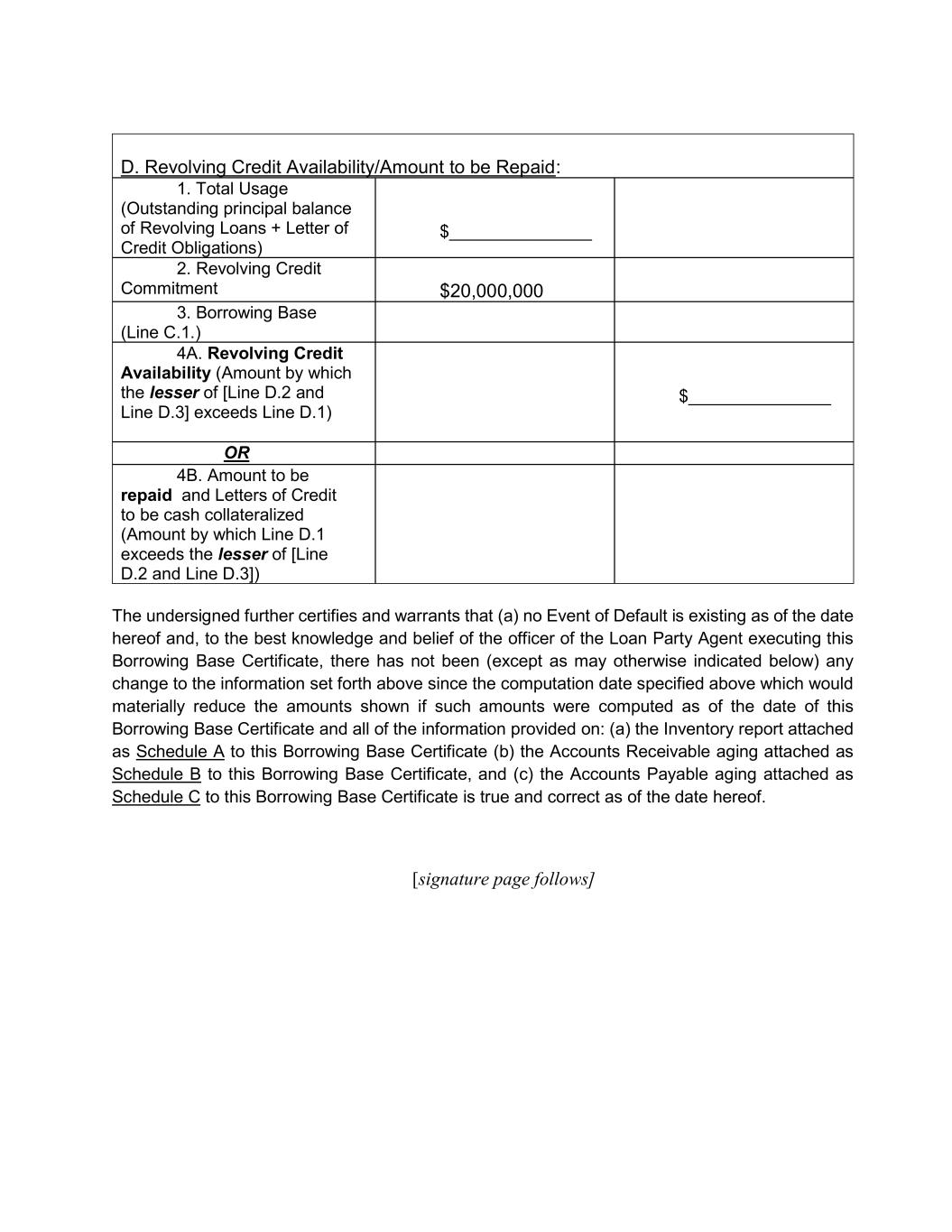

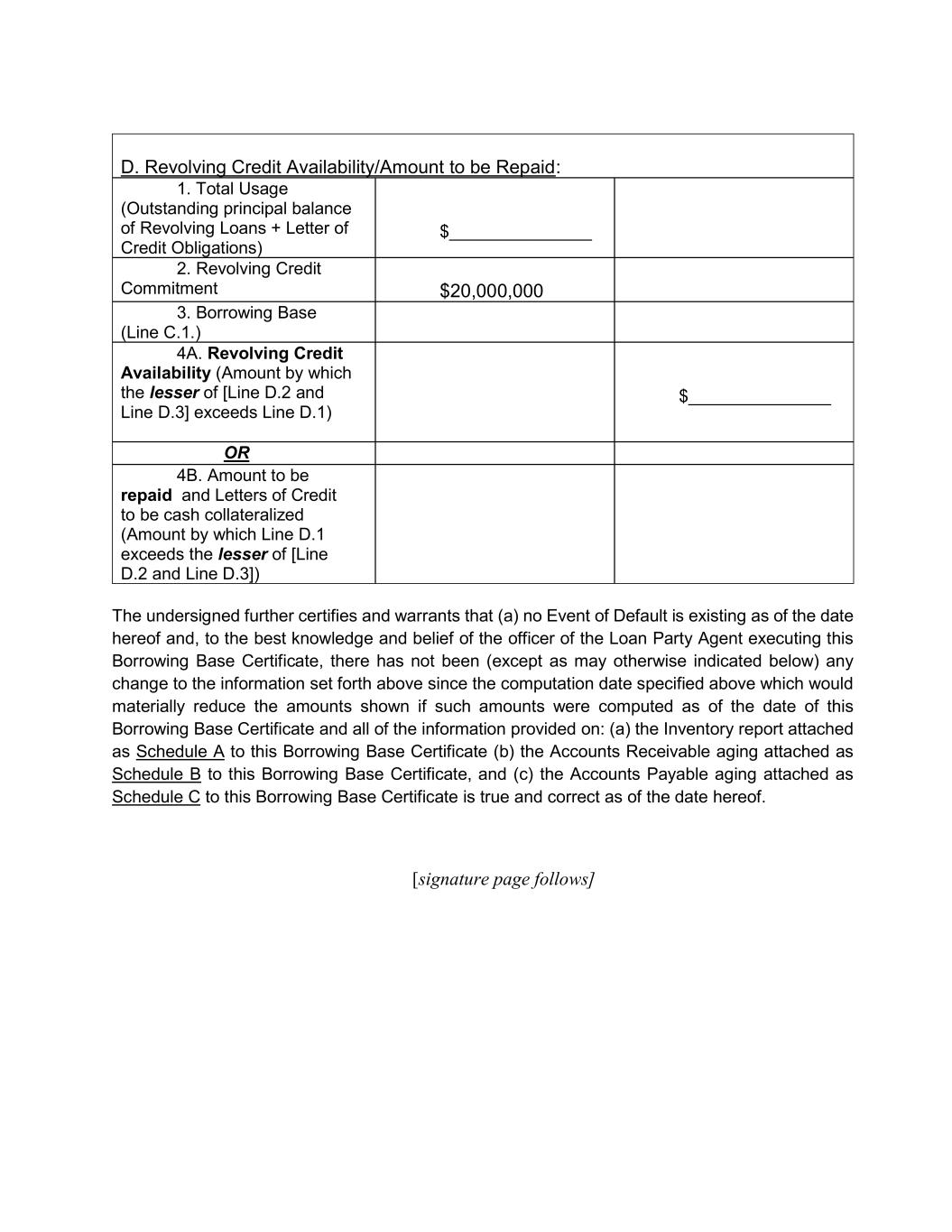

D. Revolving Credit Availability/Amount to be Repaid: 1. Total Usage (Outstanding principal balance of Revolving Loans + Letter of Credit Obligations) $_______________ 2. Revolving Credit Commitment $20,000,000 3. Borrowing Base (Line C.1.) 4A. Revolving Credit Availability (Amount by which the lesser of [Line D.2 and Line D.3] exceeds Line D.1) $_______________ OR 4B. Amount to be repaid and Letters of Credit to be cash collateralized (Amount by which Line D.1 exceeds the lesser of [Line D.2 and Line D.3]) The undersigned further certifies and warrants that (a) no Event of Default is existing as of the date hereof and, to the best knowledge and belief of the officer of the Loan Party Agent executing this Borrowing Base Certificate, there has not been (except as may otherwise indicated below) any change to the information set forth above since the computation date specified above which would materially reduce the amounts shown if such amounts were computed as of the date of this Borrowing Base Certificate and all of the information provided on: (a) the Inventory report attached as Schedule A to this Borrowing Base Certificate (b) the Accounts Receivable aging attached as Schedule B to this Borrowing Base Certificate, and (c) the Accounts Payable aging attached as Schedule C to this Borrowing Base Certificate is true and correct as of the date hereof. [signature page follows]

The Loan Party Agent further certifies and warrants, on behalf of itself and the Borrowers, that no Event of Default is existing as of the date hereof and, to the best knowledge and belief of the officer of the Loan Party Agent executing this Borrowing Base Certificate, there has not been (except as may otherwise indicated below) any change to the information set forth above since the date specified above which would materially reduce the amounts shown if such amounts were computed as of the date of this Borrowing Base Certificate. AIR T, INC., as Loan Party Agent By Title: Date:

SCHEDULE A TO BORROWING BASE CERTIFICATE INVENTORY REPORT [see attached]

SCHEDULE B TO BORROWING BASE CERTIFICATE ACCOUNTS RECEIVABLE AGING [SEE ATTACHED]

SCHEDULE C TO BORROWING BASE CERTIFICATE ACCOUNTS PAYABLE AGING [SEE ATTACHED]