NASDAQ: AIRT FY26 Q1 Update A PORTFOLIO OF POWERFUL COMPANIES As of June 30, 2025

Statements in this document, which contain more than historical information, may be considered forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995), which are subject to risks and uncertainties. Actual results may differ materially from those expressed in the forward-looking statements because of important potential risks and uncertainties, including, but not limited to, economic and industry conditions in the Company’s markets, the risk that contracts with FedEx could be terminated or adversely modified, the risk that the number of aircraft operated for FedEx will be reduced, the risk that GGS customers will defer or reduce significant orders for deicing equipment, the impact of any terrorist activities on United States soil or abroad; the Company’s ability to manage its cost structure for operating expenses, or unanticipated capital requirements, and match them to shifting customer service requirements and production volume levels, the Company's ability to meet debt service covenants and to refinance existing debt obligations, the risk of injury or other damage arising from accidents involving the Company’s overnight air cargo operations, equipment or parts sold and/or services provided, market acceptance of the Company’s commercial and military equipment and services, competition from other providers of similar equipment and services, changes in government regulation and technology, changes in the value of marketable securities held as investments, mild winter weather conditions reducing the demand for deicing equipment, and market acceptance and operational success of the Company’s relatively new aircraft asset management business and related aircraft capital joint venture. A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. The Company is under no obligation, and it expressly disclaims any obligation, to update or alter any forward-looking statements, whether as a result of new information, future events or otherwise. Potential investors should review the Company’s risk factors contained in its reports filed with the Securities and Exchange Commission, as well as the summary Risk Factors contained herein, prior to investing. 2 SAFE HARBOR

3 ■ AIR T, INC. (NASDAQ: AIRT) is an industrious American company focusing on growing intrinsic value per share at a high rate. ■ Founded in 1980, our businesses have a history of growth and cash flow generation. ■ Current management has been in place since 2013. ■ The two largest shareholders own, in the aggregate, approximately 67% of the outstanding common stock and have seats on the Board of Directors. WHO WE ARE OPERATING HIGHLIGHTS EXECUTIVE SUMMARY ■ AIR T, INC. operates 16 companies with 600+ employees. ■ For the fiscal year ended 3/31/2025, Revenues were $291.9 million, and Adjusted EBITDA was $7.4 million. ■ Since 9/30/13, shares outstanding have declined from 3.7m* to 2.7m or 23.2%. *Adjusted for 3/2 stock split

1. About AIR T, INC. 2. Performance 3. Our Growth Strategies 4. Appendix - Risk Factors 4 CONTENTS

5 ABOUT AIR T, INC.

We are an industrious American company established 40+ years and growing. 6 ■ Our businesses have a history of growth and cash flow generation. ■ We seek to identify and empower individuals and teams who will operate businesses well, increasing value over time. ■ We work to activate growth and overcome challenges, ultimately building businesses that flourish over the long term. ■ Management has repurchased AIRT common stock in the open market, demonstrating real alignment with all common shareholders. As of 06/30/25, our treasury stock was $6.4M. ■ AIRT’s management team has a track record of successfully allocating capital.

“Investor-Operator Partnership” is designed to drive short and long-term value creation. 7 “We want our businesses to be managed by dynamic individuals within high-performance teams. We are set up to make space for dynamos and support their enterprises. The holding company team seeks to focus resources, activate growth and deliver long-term value for everyone associated with AIR T, INC.” - Nick Swenson

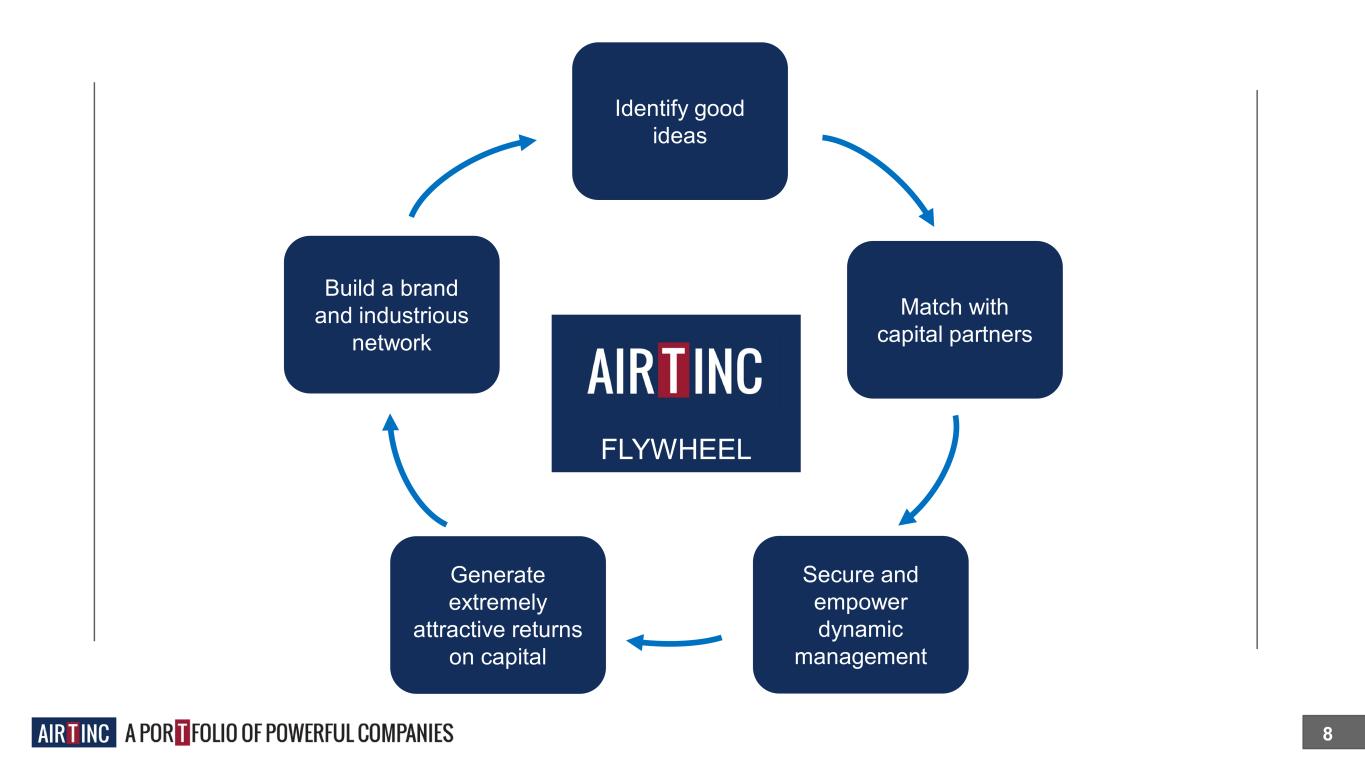

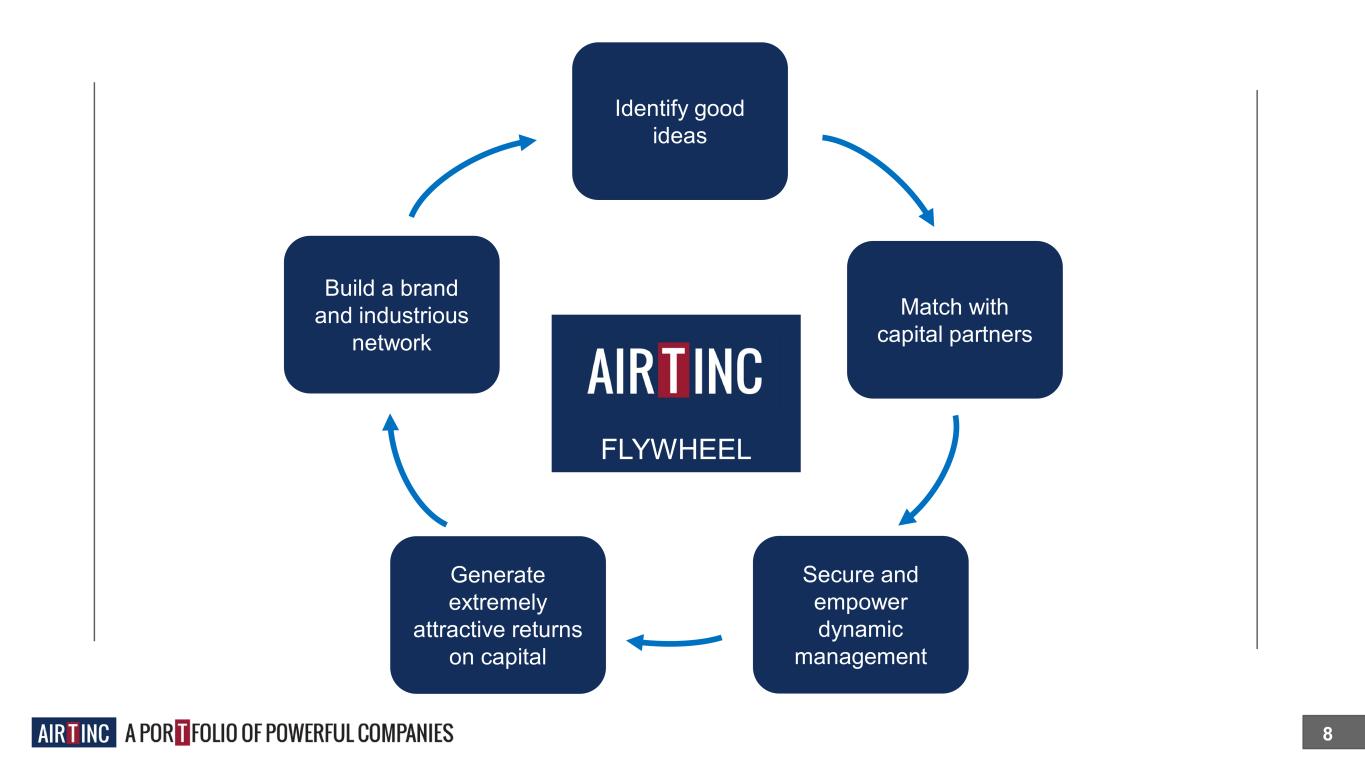

8 Build a brand and industrious network FLYWHEEL Generate extremely attractive returns on capital Secure and empower dynamic management Match with capital partners Identify good ideas 8

$292M 9 FY25 Revenue $7.4M FY25 Adj. EBITDA* 4 CORE SEGMENTS 16 COMPANIES 646 EMPLOYEES OVERNIGHT AIR CARGO COMMERCIAL AIRCRAFT ENGINES AND PARTS GROUND SUPPORT EQUIPMENT *See Adjusted EBITDA reconciliation on slide 38 DIGITAL SOLUTIONS

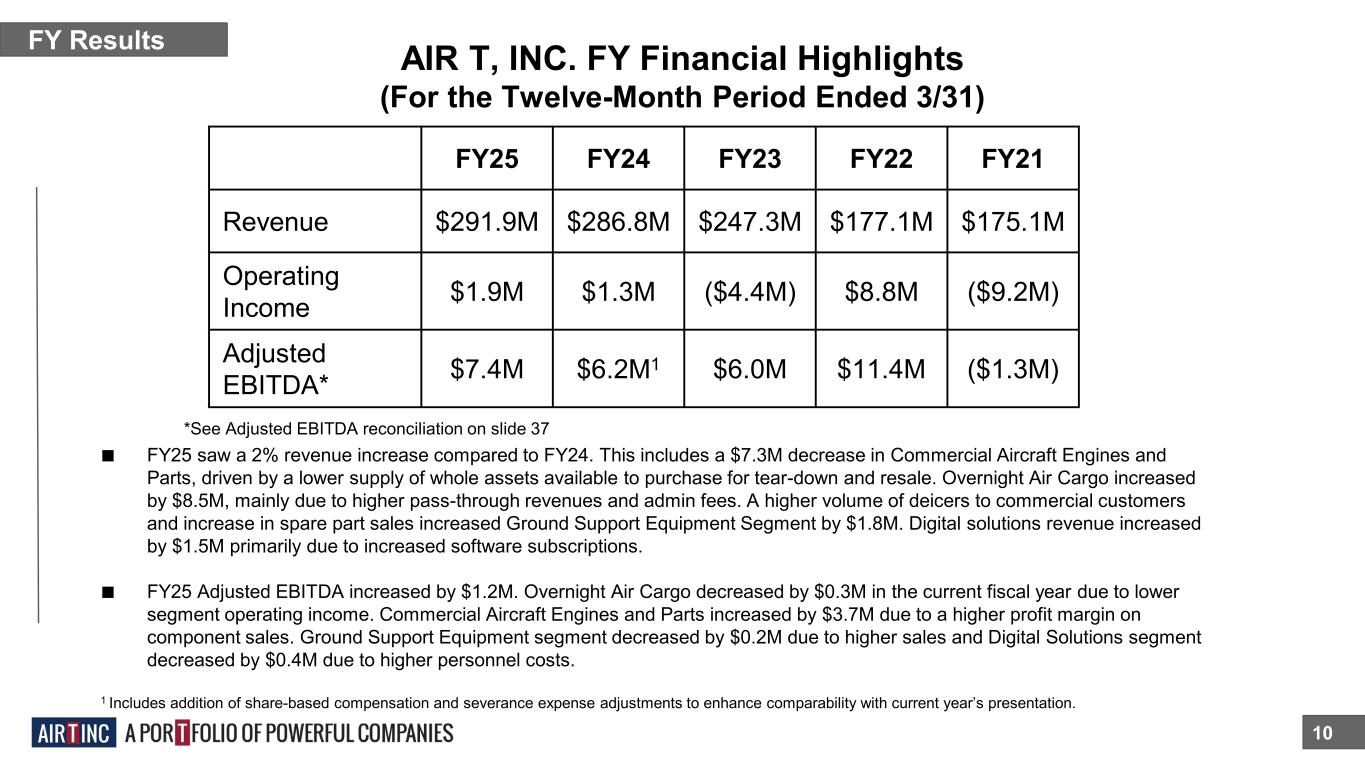

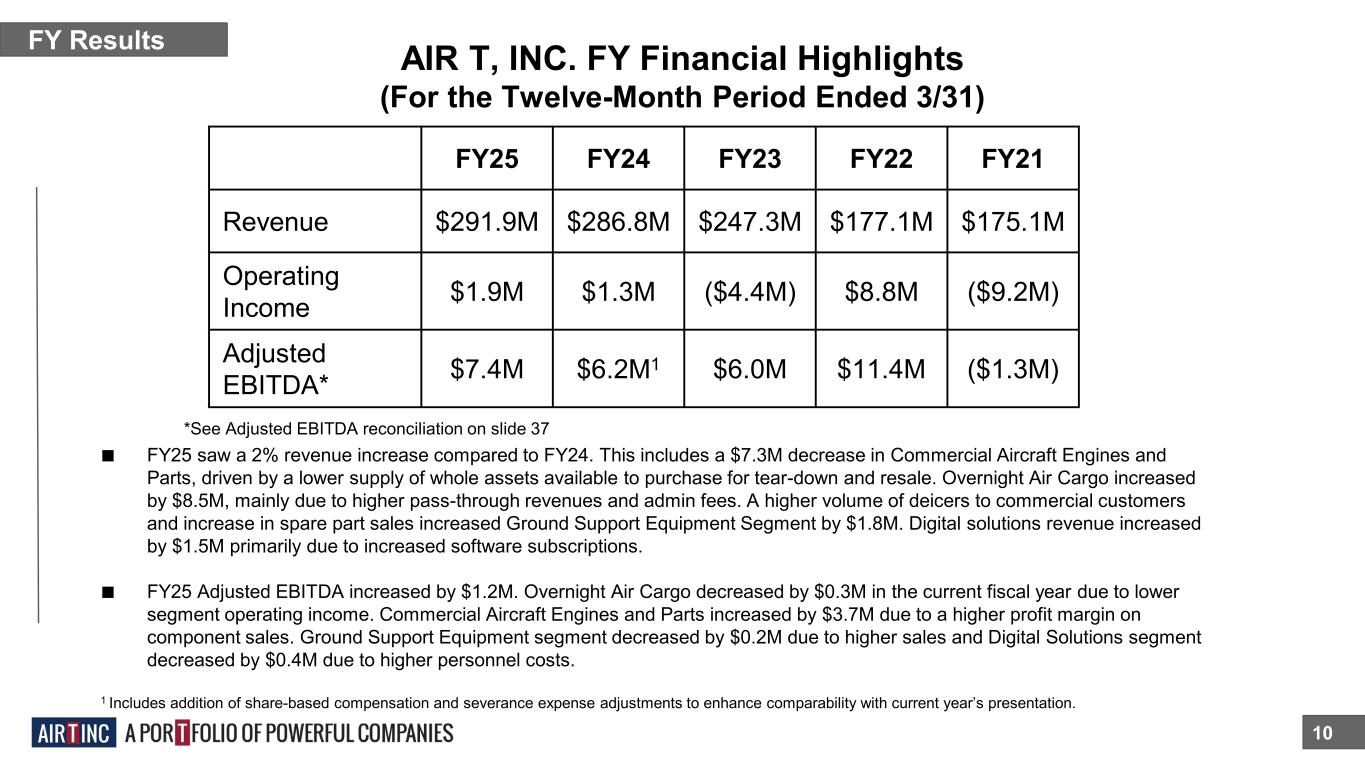

AIR T, INC. FY Financial Highlights (For the Twelve-Month Period Ended 3/31) 10 FY Results ■ FY25 saw a 2% revenue increase compared to FY24. This includes a $7.3M decrease in Commercial Aircraft Engines and Parts, driven by a lower supply of whole assets available to purchase for tear-down and resale. Overnight Air Cargo increased by $8.5M, mainly due to higher pass-through revenues and admin fees. A higher volume of deicers to commercial customers and increase in spare part sales increased Ground Support Equipment Segment by $1.8M. Digital solutions revenue increased by $1.5M primarily due to increased software subscriptions. ■ FY25 Adjusted EBITDA increased by $1.2M. Overnight Air Cargo decreased by $0.3M in the current fiscal year due to lower segment operating income. Commercial Aircraft Engines and Parts increased by $3.7M due to a higher profit margin on component sales. Ground Support Equipment segment decreased by $0.2M due to higher sales and Digital Solutions segment decreased by $0.4M due to higher personnel costs. 1 Includes addition of share-based compensation and severance expense adjustments to enhance comparability with current year’s presentation. FY25 FY24 FY23 FY22 FY21 Revenue $291.9M $286.8M $247.3M $177.1M $175.1M Operating Income $1.9M $1.3M ($4.4M) $8.8M ($9.2M) Adjusted EBITDA* $7.4M $6.2M1 $6.0M $11.4M ($1.3M) *See Adjusted EBITDA reconciliation on slide 37

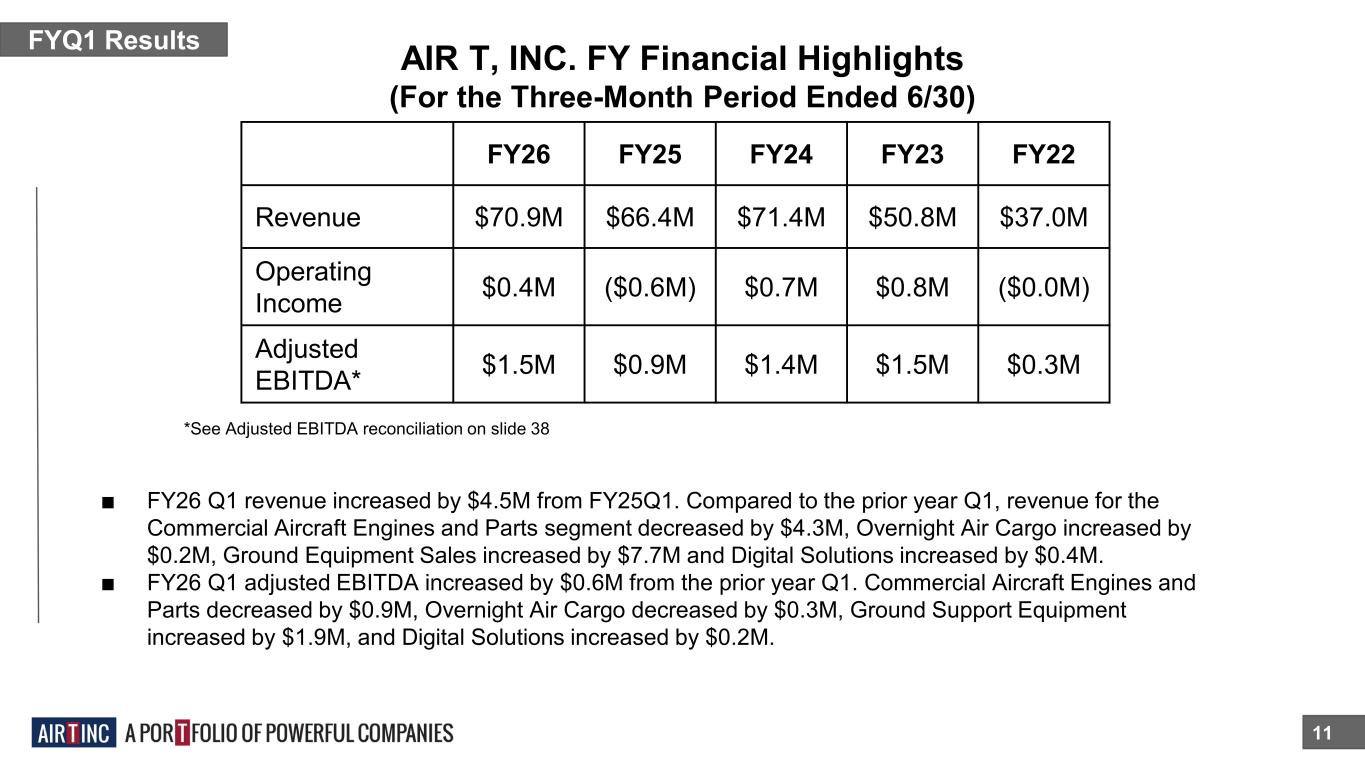

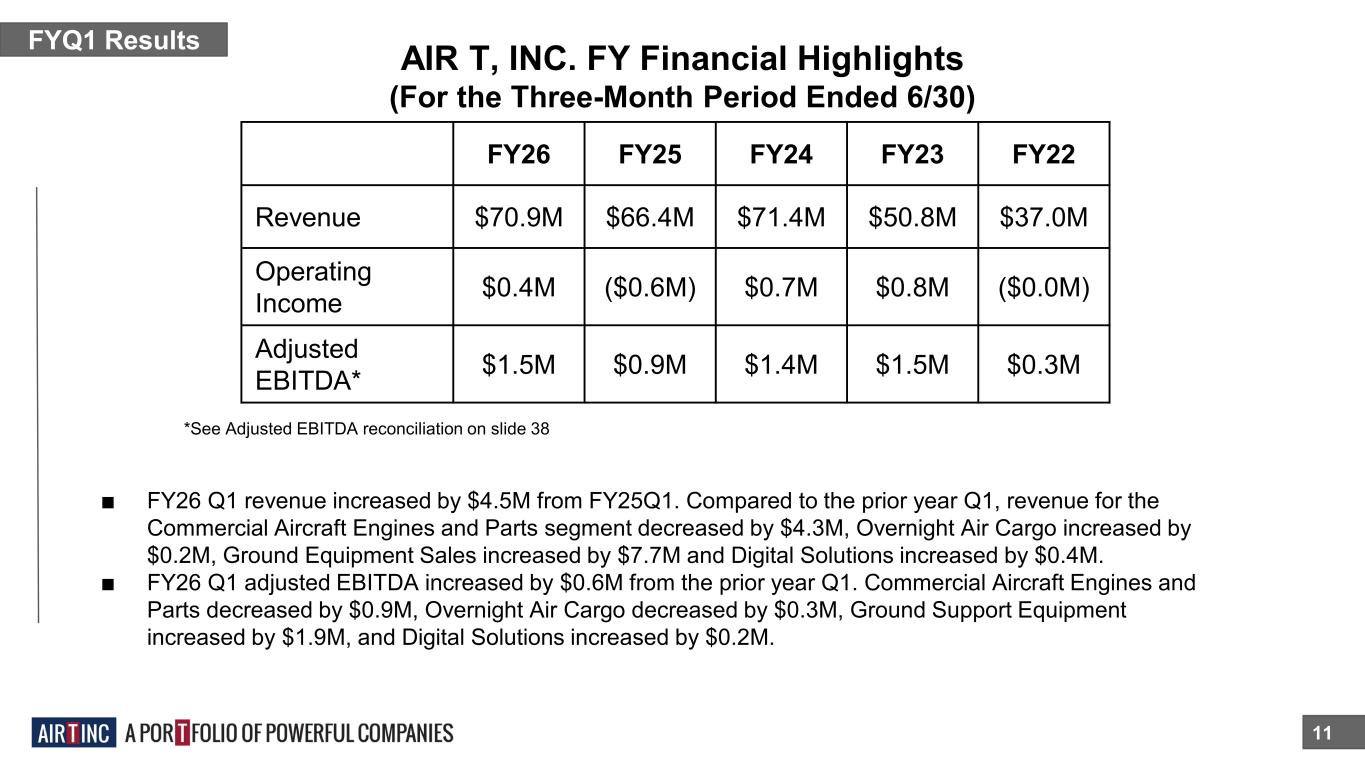

AIR T, INC. FY Financial Highlights (For the Three-Month Period Ended 6/30) 11 FYQ1 Results ■ FY26 Q1 revenue increased by $4.5M from FY25Q1. Compared to the prior year Q1, revenue for the Commercial Aircraft Engines and Parts segment decreased by $4.3M, Overnight Air Cargo increased by $0.2M, Ground Equipment Sales increased by $7.7M and Digital Solutions increased by $0.4M. ■ FY26 Q1 adjusted EBITDA increased by $0.6M from the prior year Q1. Commercial Aircraft Engines and Parts decreased by $0.9M, Overnight Air Cargo decreased by $0.3M, Ground Support Equipment increased by $1.9M, and Digital Solutions increased by $0.2M. FY26 FY25 FY24 FY23 FY22 Revenue $70.9M $66.4M $71.4M $50.8M $37.0M Operating Income $0.4M ($0.6M) $0.7M $0.8M ($0.0M) Adjusted EBITDA* $1.5M $0.9M $1.4M $1.5M $0.3M *See Adjusted EBITDA reconciliation on slide 38

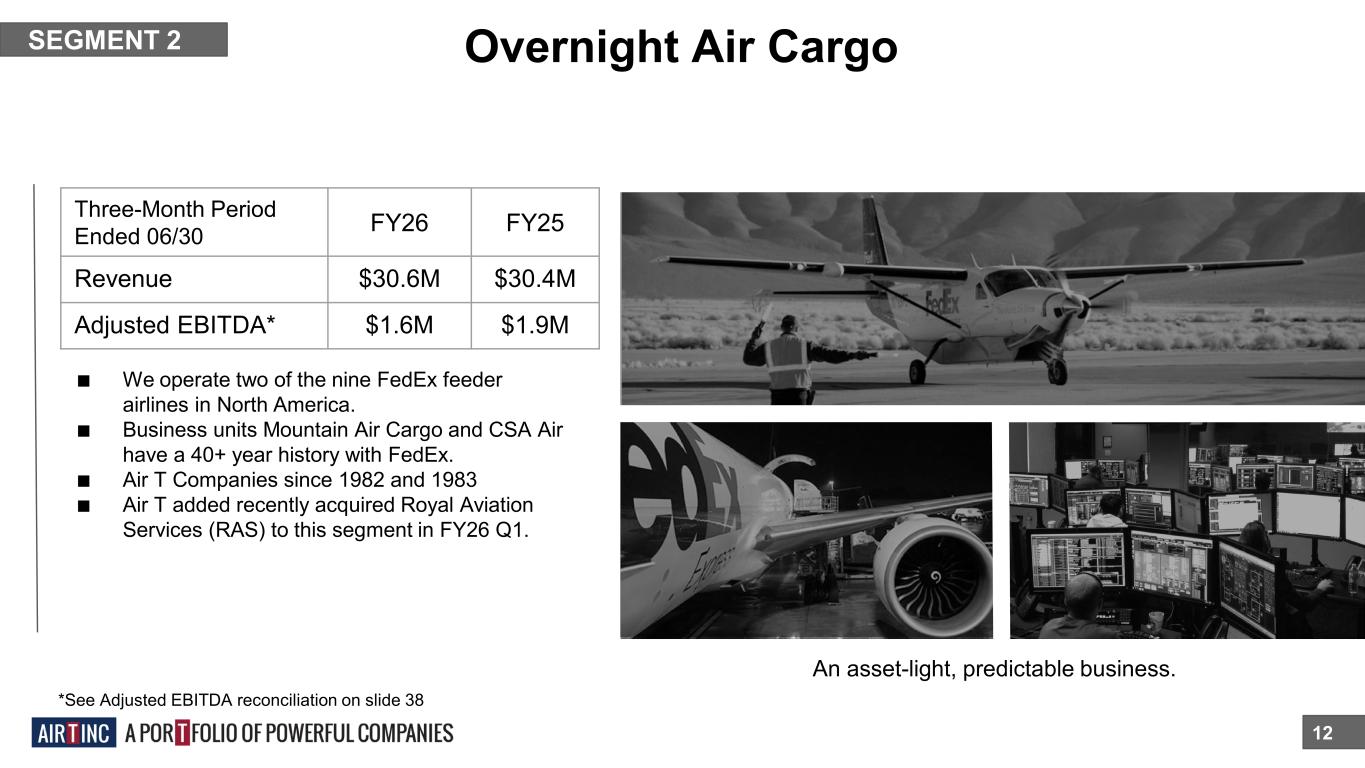

Overnight Air Cargo 12 SEGMENT 2 ■ We operate two of the nine FedEx feeder airlines in North America. ■ Business units Mountain Air Cargo and CSA Air have a 40+ year history with FedEx. ■ Air T Companies since 1982 and 1983 ■ Air T added recently acquired Royal Aviation Services (RAS) to this segment in FY26 Q1. An asset-light, predictable business. Three-Month Period Ended 06/30 FY26 FY25 Revenue $30.6M $30.4M Adjusted EBITDA* $1.6M $1.9M *See Adjusted EBITDA reconciliation on slide 38

Ground Support Equipment 13 SEGMENT 3 ■ We manufacture deicing equipment, scissor lift trucks, and other ground support equipment. ■ Sole-source deicer supplier to the US Air Force for 20+ years. ■ Highly efficient light manufacturing facility. ■ The segment is comprised of Global Ground Support LLC. ■ Air T Company since 1998. ■ The $7.7M revenue increase YoY is primarily attributed to higher number of deicing trucks sold. Segment’s order backlog was $7.2 million as of 06/30/25 compared to $9.9 million as of 06/30/24 Three-Month Period Ended 06/30 FY26 FY25 Revenue $15.1M $7.4M Adjusted EBITDA* $1.4M ($0.5M) *See Adjusted EBITDA reconciliation on slide 38

Commercial Aircraft Engines and Parts 14 SEGMENT 1 ■ We buy aircraft and engines, then either lease, trade, or send them to part out. ■ We supply parts to maintenance, repair, and overhaul facilities (MRO). ■ Companies in this segment include Contrail, AirCo, AirCo Services, Worthington, Jet Yard, Air’Zona, and LGSS. ■ The YoY decrease in Q1 revenue is primarily attributed to lower component sales. A niche between aircraft owners and MRO shops, this segment will seek to grow by coordinating activities. Three-Month Period Ended 06/30 FY26 FY25 Revenue $22.0M $26.3M Adjusted EBITDA* $0.8M $1.7M *See Adjusted EBITDA reconciliation on slide 39

Digital Solutions 15 SEGMENT 4 ■ Digital solutions develops and provides digital aviation and other business services to customers within the aviation industry to generate recurring subscription revenues. Digital solutions has historically been reported as part of the central corporate function referred to as Corporate and Other. Three-Month Period Ended 06/30 FY26 FY25 Revenue $2.1M $1.7M Adjusted EBITDA* ($0.1M) ($0.3M) *See Adjusted EBITDA reconciliation on slide 38

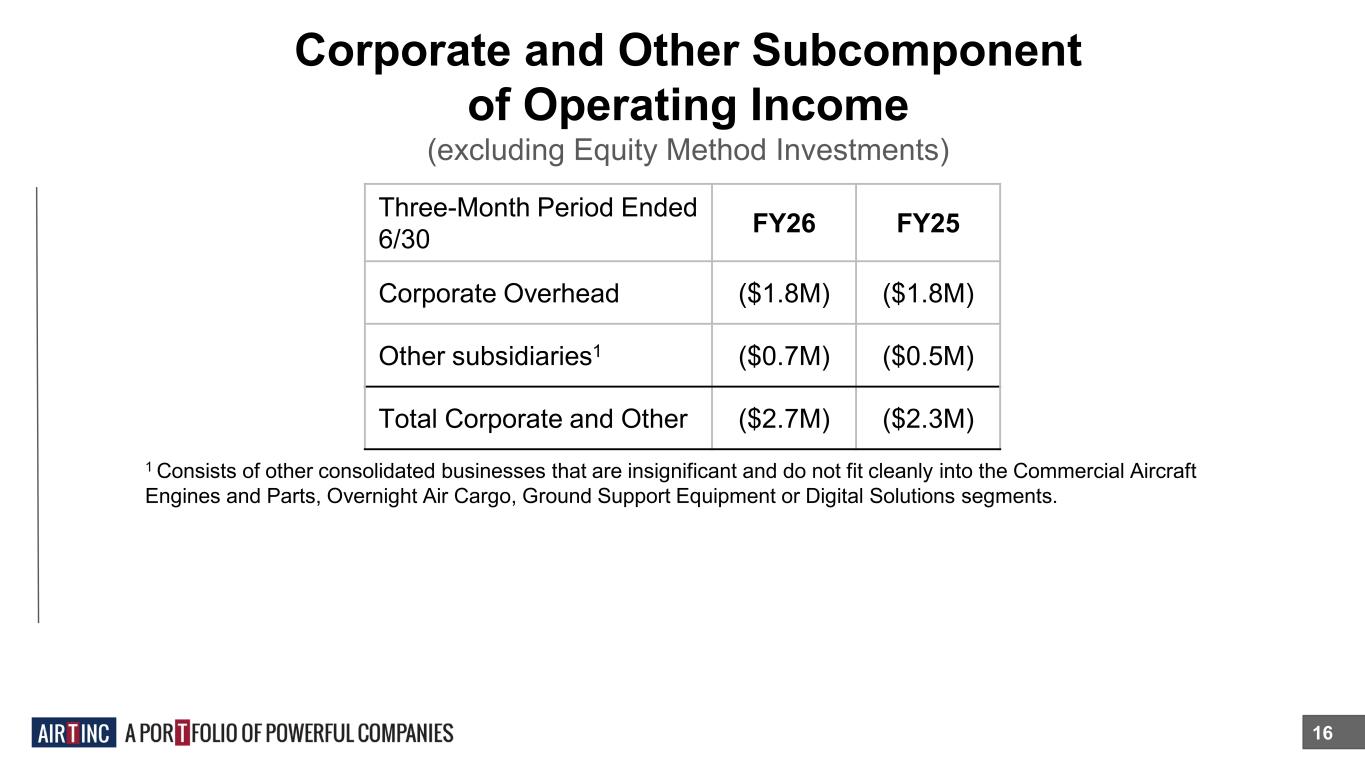

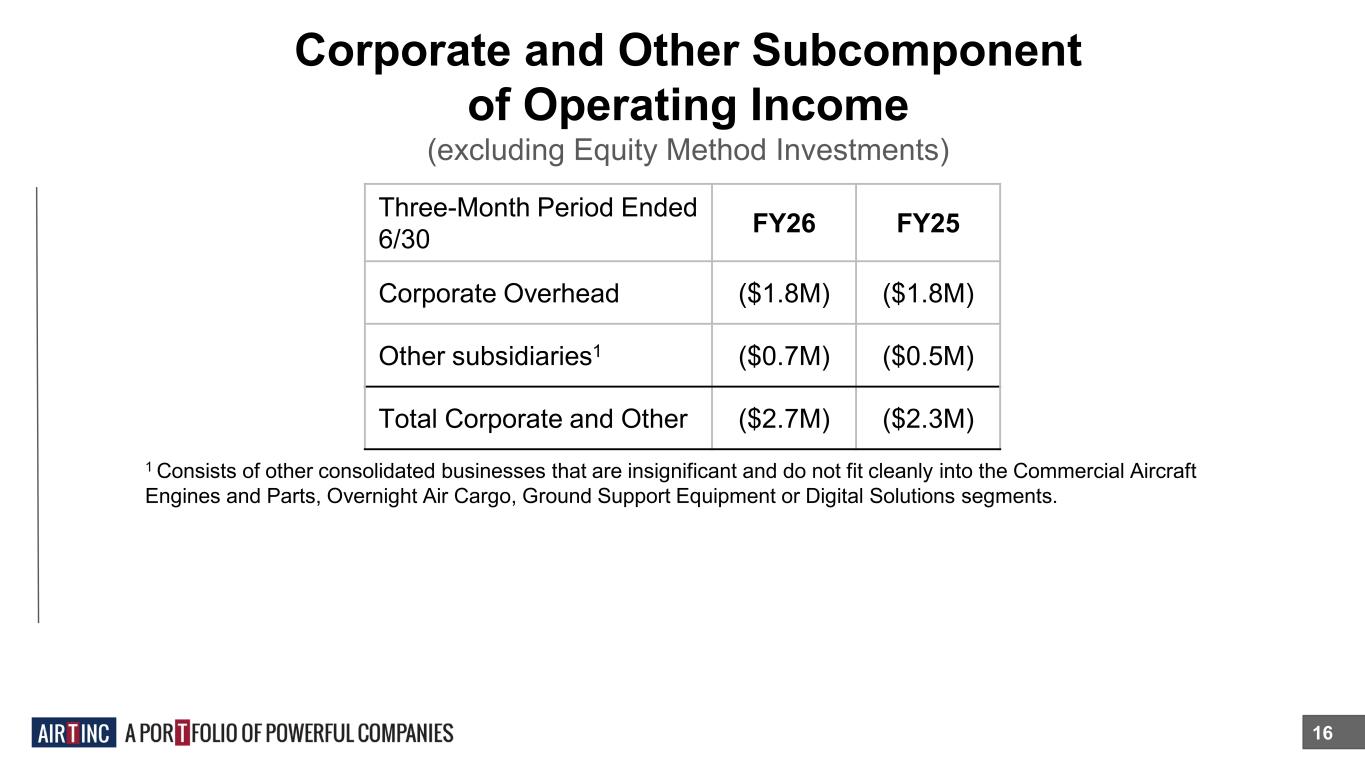

16 Three-Month Period Ended 6/30 FY26 FY25 Corporate Overhead ($1.8M) ($1.8M) Other subsidiaries1 ($0.7M) ($0.5M) Total Corporate and Other ($2.7M) ($2.3M) 1 Consists of other consolidated businesses that are insignificant and do not fit cleanly into the Commercial Aircraft Engines and Parts, Overnight Air Cargo, Ground Support Equipment or Digital Solutions segments. Corporate and Other Subcomponent of Operating Income (excluding Equity Method Investments)

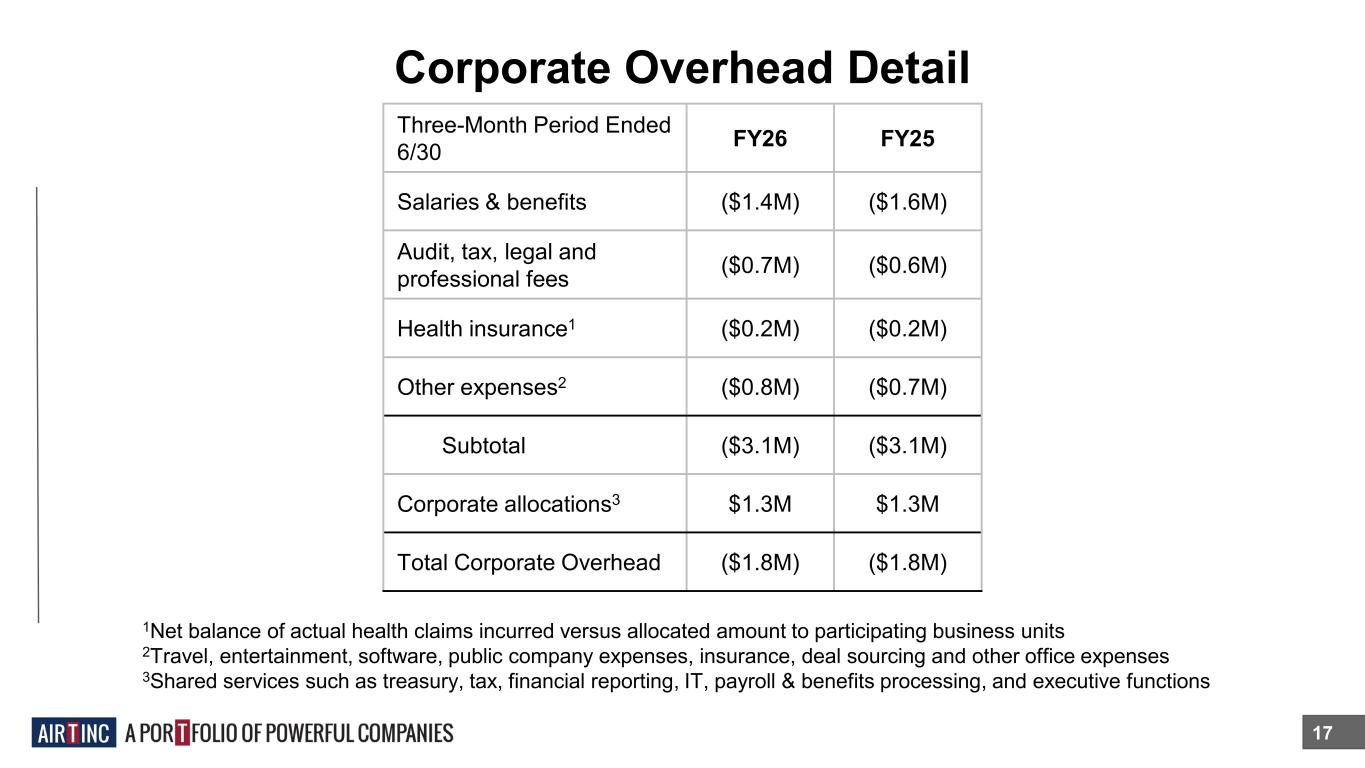

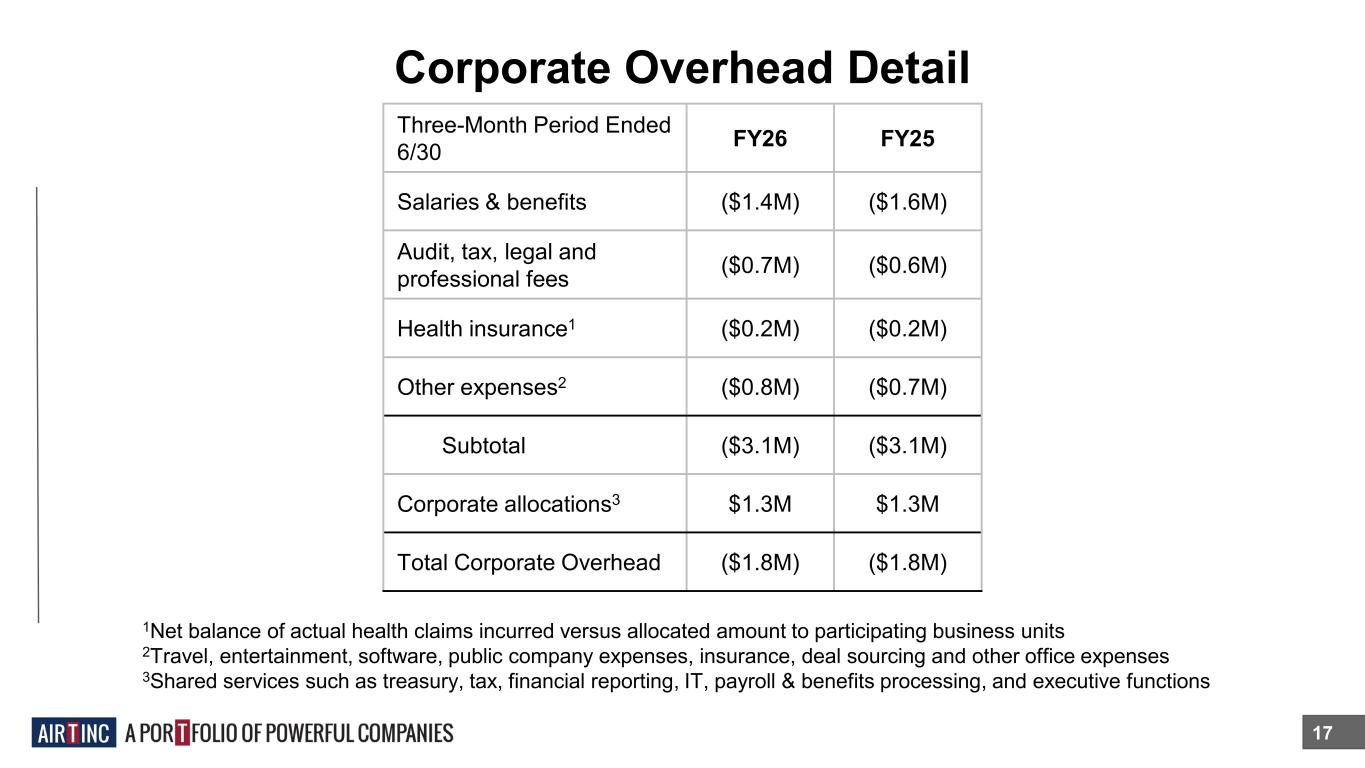

17 Three-Month Period Ended 6/30 FY26 FY25 Salaries & benefits ($1.4M) ($1.6M) Audit, tax, legal and professional fees ($0.7M) ($0.6M) Health insurance1 ($0.2M) ($0.2M) Other expenses2 ($0.8M) ($0.7M) Subtotal ($3.1M) ($3.1M) Corporate allocations3 $1.3M $1.3M Total Corporate Overhead ($1.8M) ($1.8M) Corporate Overhead Detail 1Net balance of actual health claims incurred versus allocated amount to participating business units 2Travel, entertainment, software, public company expenses, insurance, deal sourcing and other office expenses 3Shared services such as treasury, tax, financial reporting, IT, payroll & benefits processing, and executive functions

18 Investment manager focused on unearthing fundamentally attractive small and mid-cap opportunities. Allows us to further expand upon our idea generation capabilities to identify, analyze, develop and execute innovative investment strategies that are aimed at building better financial futures for all our stakeholders. Air T company since 2017.1 Digital inkjet press designer and manufacturer, delivering color presses that produce high-quality output without compromising efficiency or budgets. Air T company since 2017.1 Investing For Growth 1Included in the central corporate function referred to as Corporate and Other

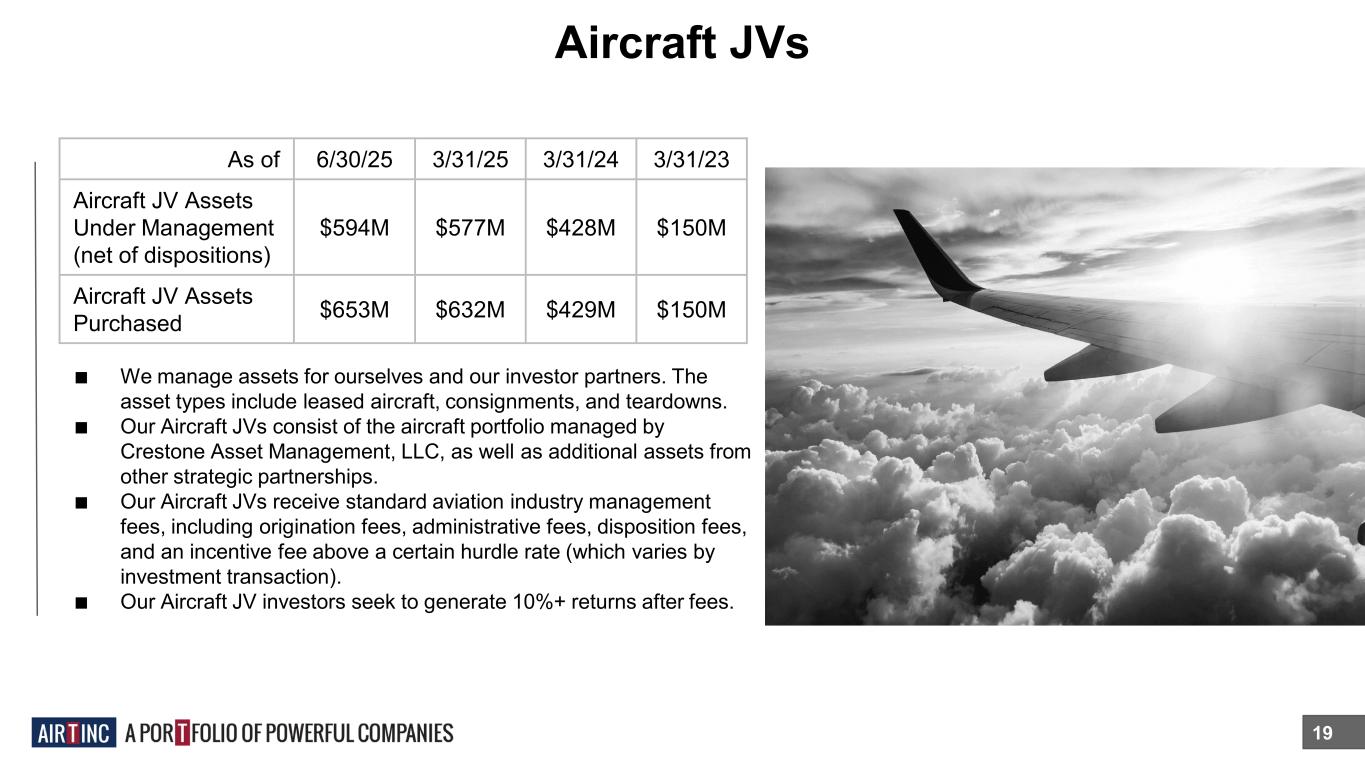

Aircraft JVs 19 ■ We manage assets for ourselves and our investor partners. The asset types include leased aircraft, consignments, and teardowns. ■ Our Aircraft JVs consist of the aircraft portfolio managed by Crestone Asset Management, LLC, as well as additional assets from other strategic partnerships. ■ Our Aircraft JVs receive standard aviation industry management fees, including origination fees, administrative fees, disposition fees, and an incentive fee above a certain hurdle rate (which varies by investment transaction). ■ Our Aircraft JV investors seek to generate 10%+ returns after fees. As of 6/30/25 3/31/25 3/31/24 3/31/23 Aircraft JV Assets Under Management (net of dispositions) $594M $577M $428M $150M Aircraft JV Assets Purchased $653M $632M $429M $150M

BCCM Advisors 20 ■ Air T‘s wholly-owned management company, BCCM Advisors, is the manager of a fund focused on growth “at-a- reasonable-price” US Equities, BCCM also conducts ongoing research into new fund approaches. ■ Through 06/30/25, BCCM has not generated cumulative positive cash flows since inception. As of 6/30/25 3/31/25 3/31/24 3/31/23 BCCM Assets Under Management $33M $26M $37M $33M

21 NEWS Royal Aircraft Services ■ On May 15, 2025, Mountain Air Cargo, Inc. (“MAC”), a wholly-owned subsidiary of Air T, Inc., completed the acquisition of Royal Aircraft Services ("Royal"), a privately held aircraft maintenance and repair company based in Hagerstown, Maryland. The assets and liabilities of Royal were recorded at their estimated fair values at the date of acquisition and were not material, individually or in the aggregate, to the unaudited Condensed Consolidated Financial Statement. The acquired business is included in Overnight Air Cargo segment. Alerus Credit Agreement ■ In connection with the acquisition of Royal on May 15, 2025, Air'Zona, CSA, GGS, MAC, WASI, Worthington, Jet Yard, and Jet Yard Solutions ("the Alerus Loan Parties") under the Revolving Credit Agreement with Alerus entered into Amendment No. 4 to Credit Agreement and Consent and Term Loan C with Alerus in the amount of $1.1 million. The purpose of the Amendment and Term Note was to provide a term loan to finance the full purchase price of the acquisition, to add Royal as a part of the Alerus Loan Parties to the Alerus credit agreement, as amended and to memorialize Alerus’ consent to the Royal acquisition. The new term loan matures May 15, 2030 and bears interest at the greater of 5.00% or the CME one-month term SOFR rate plus 2.25%. Monthly payments on Term Note C commenced June 15, 2025 and are equal to $12,500 plus accrued interest. The term loan is secured by the terms of Security Agreement dated as of August 29, 2024.

22 NEWS AAM 24-1 ■ On May 30, 2025, the Company, along with AAM 24-1 (the "Issuer"), entered into new transaction documents with the Institutional Investors that replaced the Second Note Purchase Agreement transaction documents. Pursuant to the Third NPA with the Institutional Investors, the Issuer agreed to issue and sell a Multiple Advance Senior Secured Note in an aggregate principal amount of up to $100.0 million (the “Multiple Advance Note”). For purposes of clarity and the avoidance of doubt, as of the closing date, the Institutional Investors advanced an additional $10.0 million to the Issuer and have collectively advanced under the Multiple Advance Note to the Issuer the aggregate amount of $40.0 million. Provided no default or event of default of the Issuer exists, and subject to satisfaction of all requirements for any closing as set forth in the Third Note Purchase Agreement, the Investors are obligated to advance to the Issuer an additional aggregate $60.0 million in $10.0 million increments. The Multiple Advance Note bears annual interest at a rate of 8.5% which is computed on the basis of a 30/360-day year and actual days elapsed and is payable semi-annually in arrears, pursuant to the terms of the Multiple Advance Note. The maturity date of the Multiple Advance Note is May 31, 2035. The Multiple Advance Note contains standard and customary events of default including, but not limited to, failure to make payments when due under the Multiple Advance Note, failure to comply with certain covenants contained in the Multiple Advance Note, or bankruptcy or insolvency of, or certain monetary judgments against the Issuer or the Company. The prior notes were cancelled and replaced by the Multiple Advance Note. Funds advanced under the Multiple Advance Note may be reinvested for a period of six years from the date of closing.

23 NEWS CASP Airbus Sale ■ On July 15, 2025, CASP, a 95% owned subsidiary of Contrail, completed the sale of two Airbus aircraft, including associated engines, for over $18.0 million. The purchaser was FTAI Aircraft Leasing Ireland (2025) DAC. Concurrently, CASP entered into assignment, assumption, and amendment agreements under the existing leases, effectively transferring the lessor’s rights and obligations to FTAI Aircraft Leasing Ireland (2025) DAC.

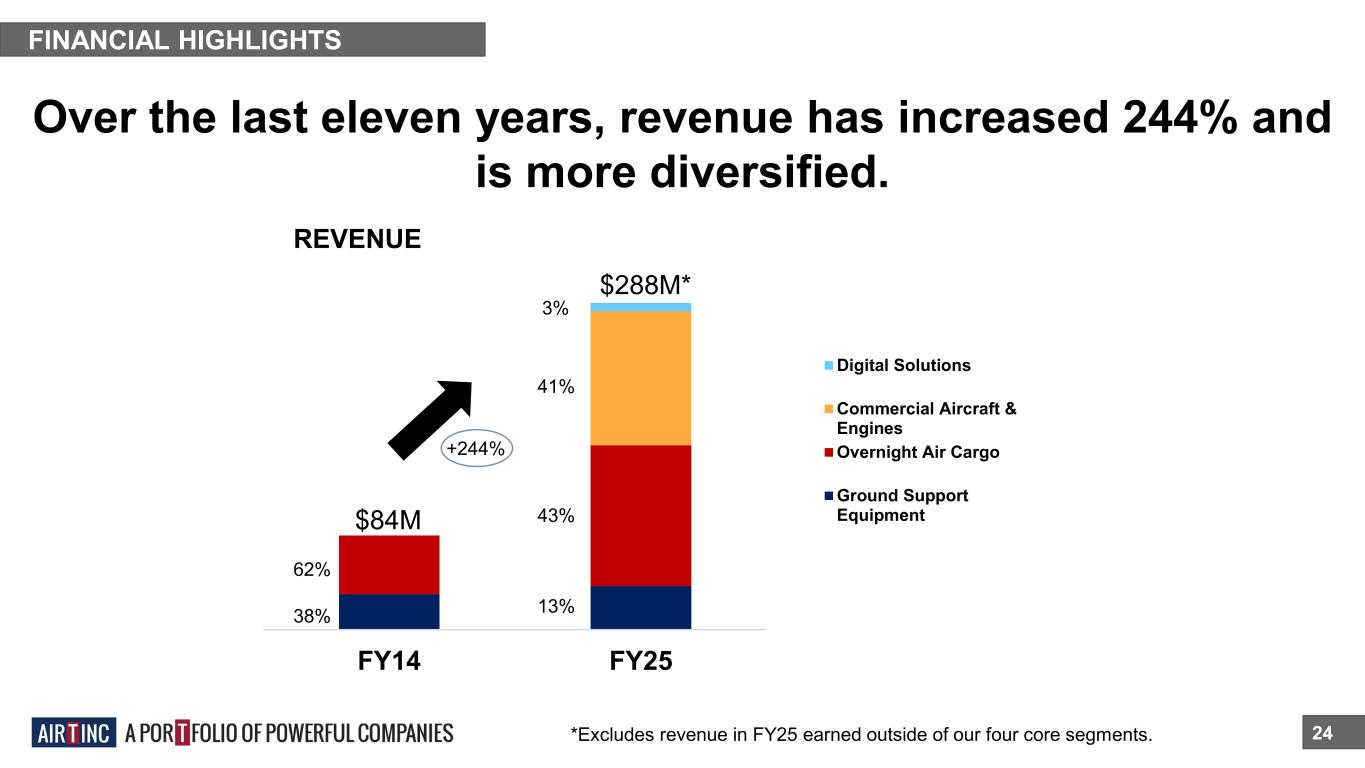

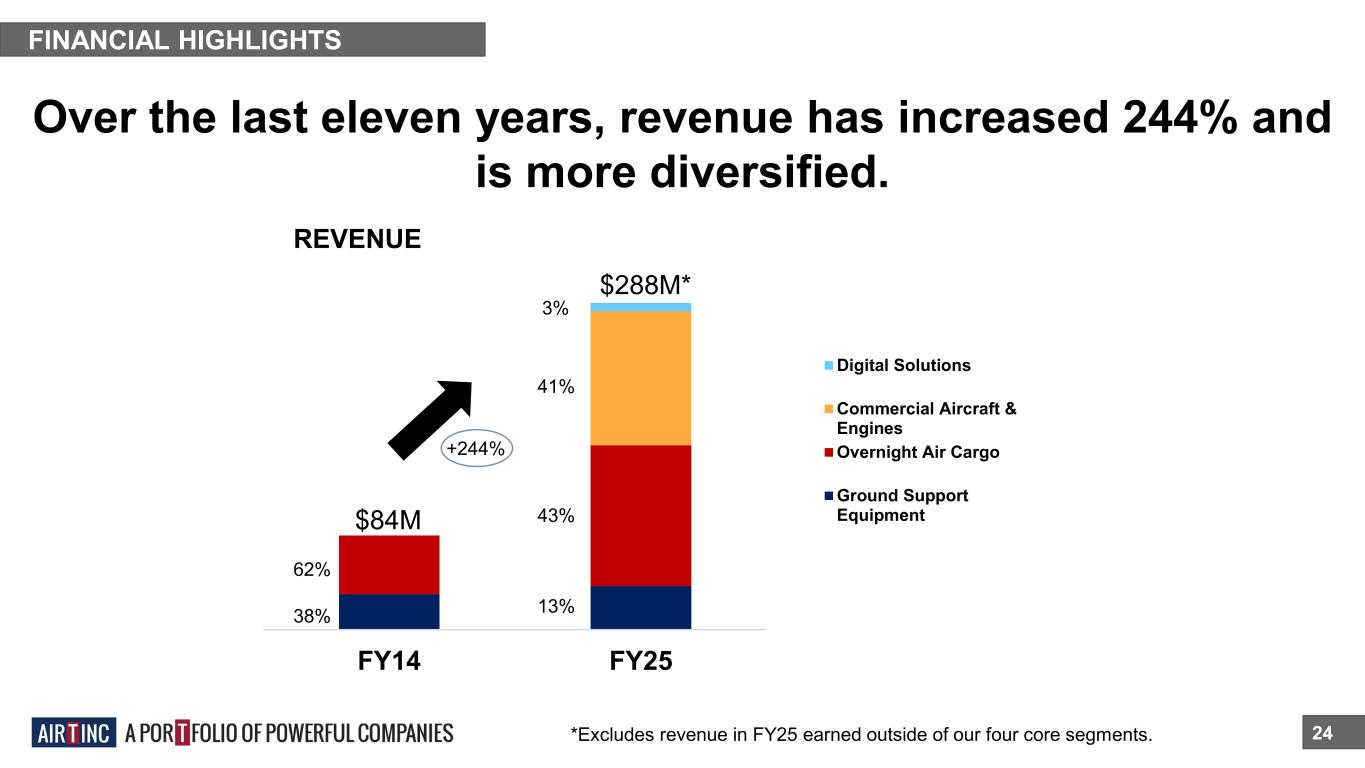

FINANCIAL HIGHLIGHTS Over the last eleven years, revenue has increased 244% and is more diversified. 24*Excludes revenue in FY25 earned outside of our four core segments. FY14 FY25 Digital Solutions Commercial Aircraft & Engines Overnight Air Cargo Ground Support Equipment 62% 38% 13% 43% 41% 3% +244% REVENUE $84M $288M*

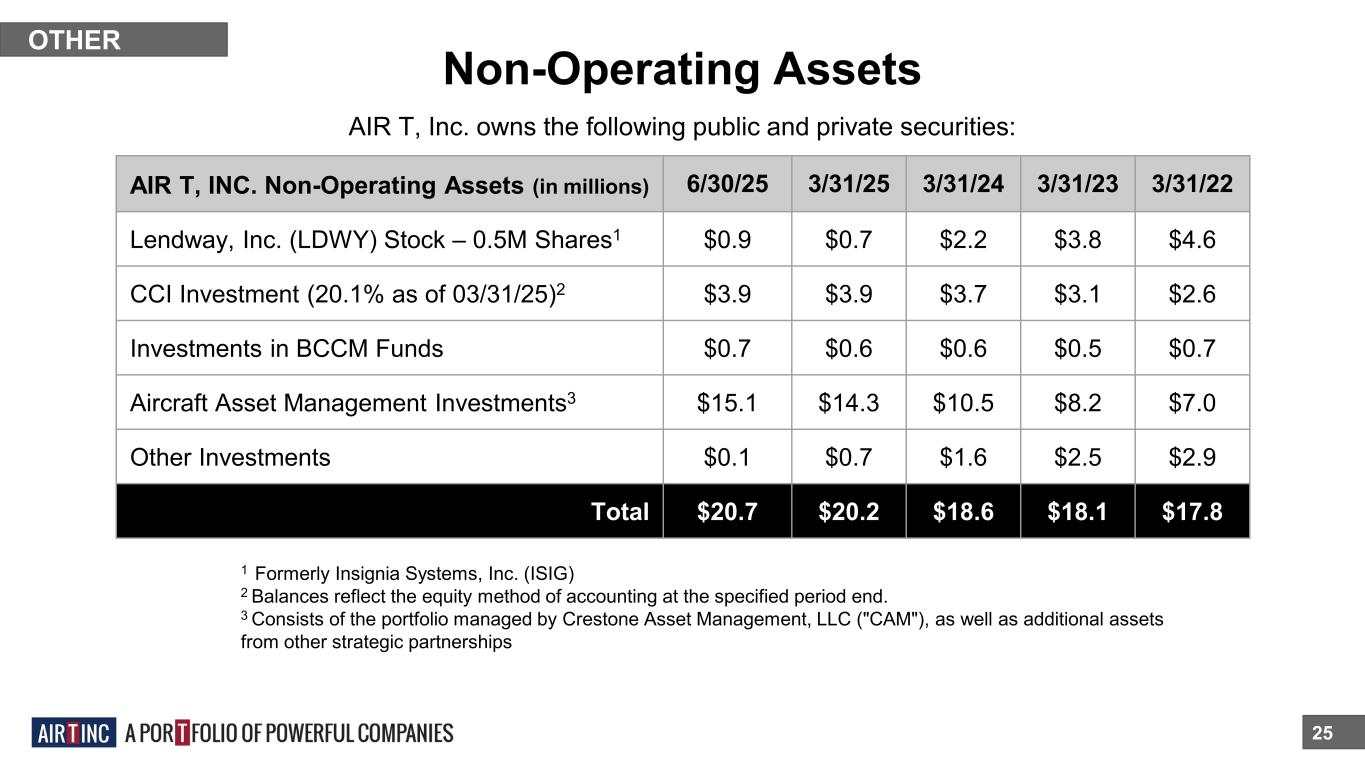

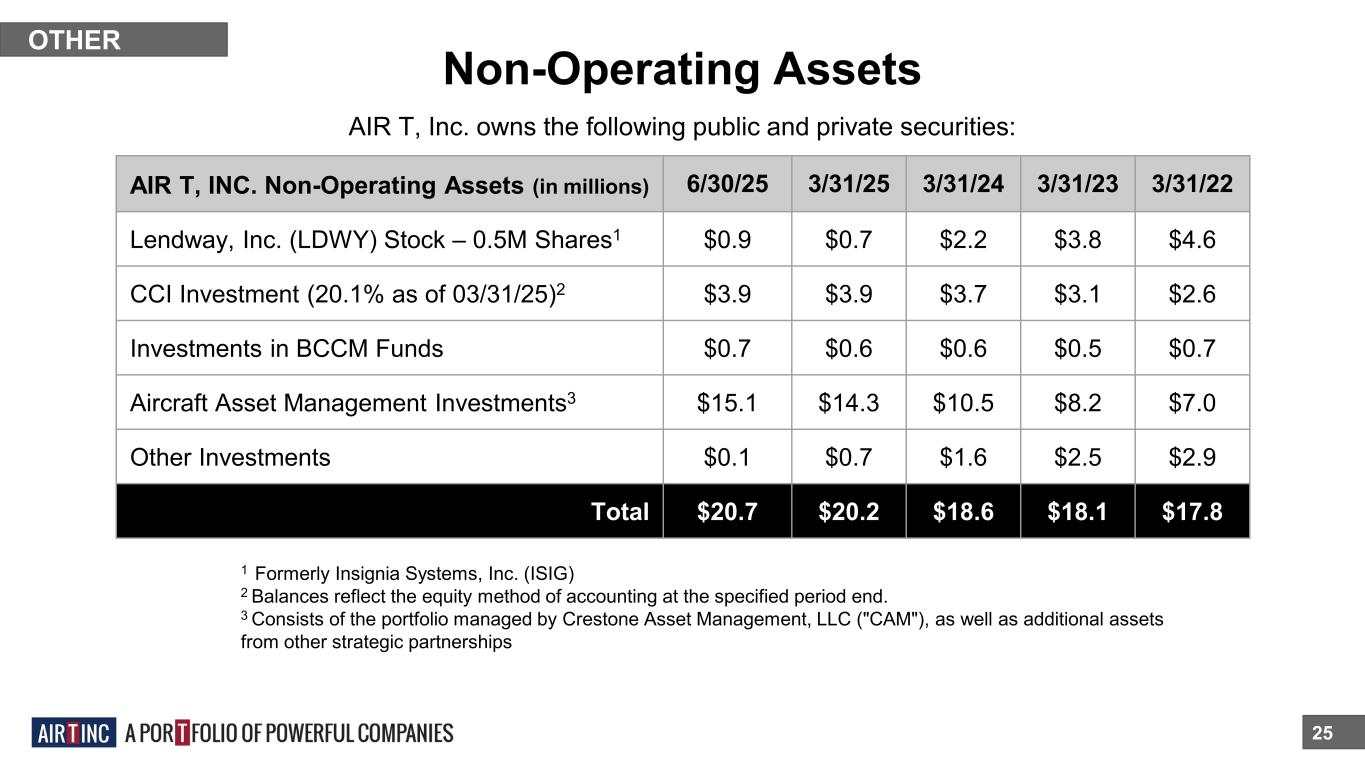

Non-Operating Assets 25 AIR T, Inc. owns the following public and private securities: OTHER AIR T, INC. Non-Operating Assets (in millions) 6/30/25 3/31/25 3/31/24 3/31/23 3/31/22 Lendway, Inc. (LDWY) Stock – 0.5M Shares1 $0.9 $0.7 $2.2 $3.8 $4.6 CCI Investment (20.1% as of 03/31/25)2 $3.9 $3.9 $3.7 $3.1 $2.6 Investments in BCCM Funds $0.7 $0.6 $0.6 $0.5 $0.7 Aircraft Asset Management Investments3 $15.1 $14.3 $10.5 $8.2 $7.0 Other Investments $0.1 $0.7 $1.6 $2.5 $2.9 Total $20.7 $20.2 $18.6 $18.1 $17.8 1 Formerly Insignia Systems, Inc. (ISIG) 2 Balances reflect the equity method of accounting at the specified period end. 3 Consists of the portfolio managed by Crestone Asset Management, LLC ("CAM"), as well as additional assets from other strategic partnerships

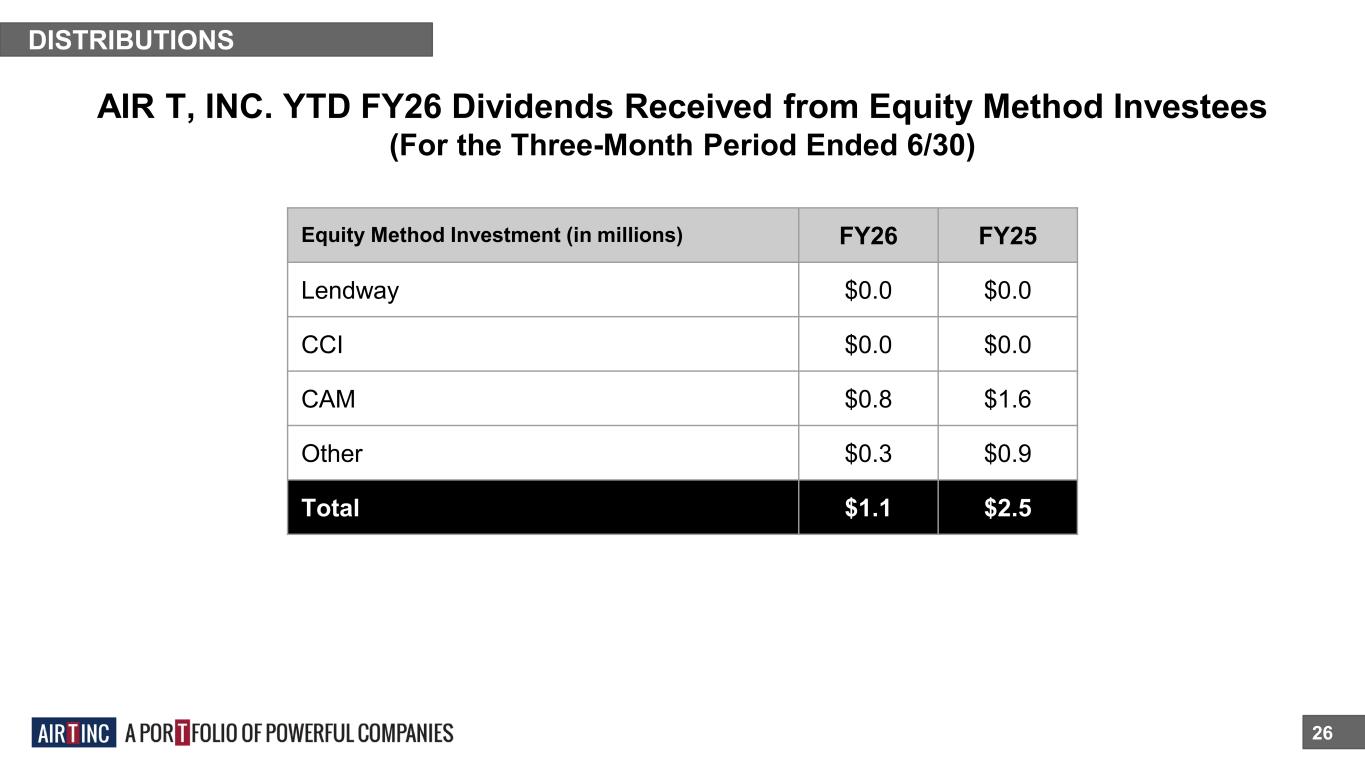

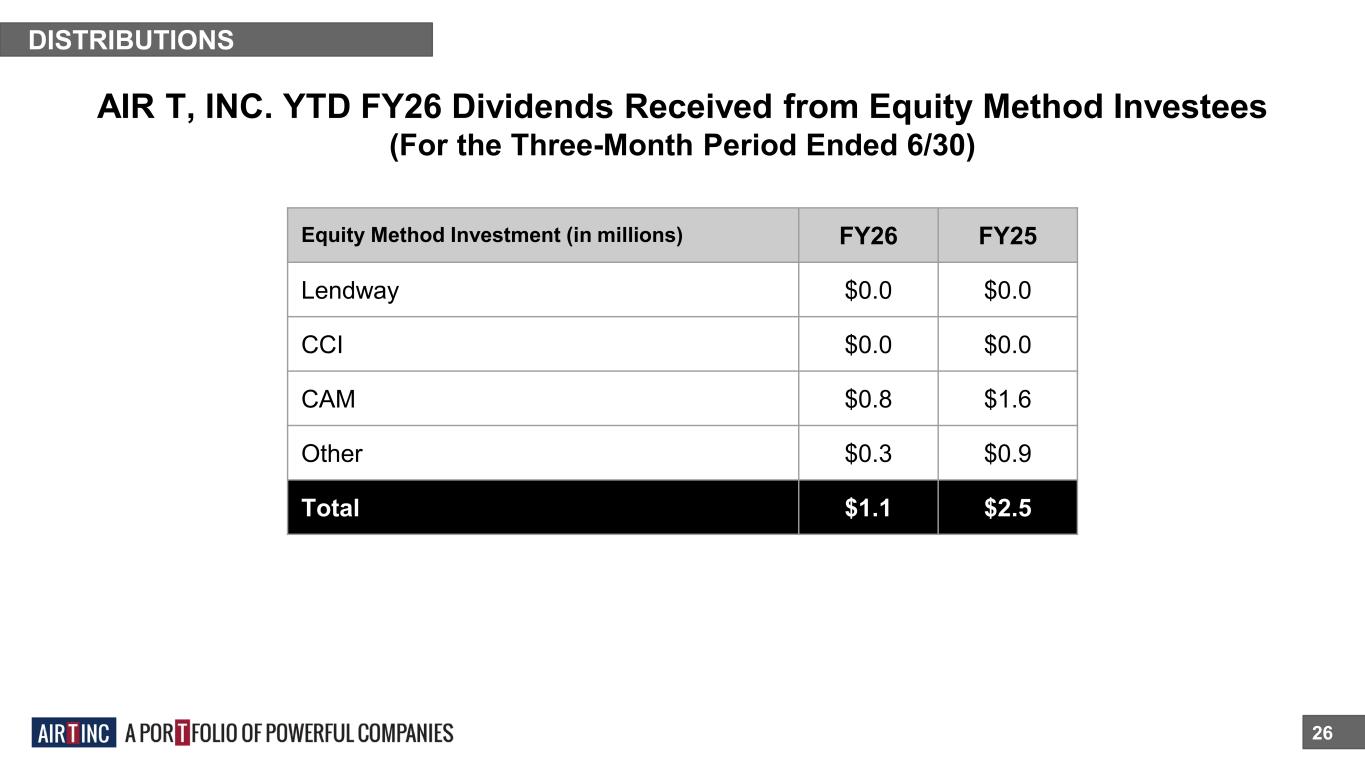

26 DISTRIBUTIONS Equity Method Investment (in millions) FY26 FY25 Lendway $0.0 $0.0 CCI $0.0 $0.0 CAM $0.8 $1.6 Other $0.3 $0.9 Total $1.1 $2.5 AIR T, INC. YTD FY26 Dividends Received from Equity Method Investees (For the Three-Month Period Ended 6/30)

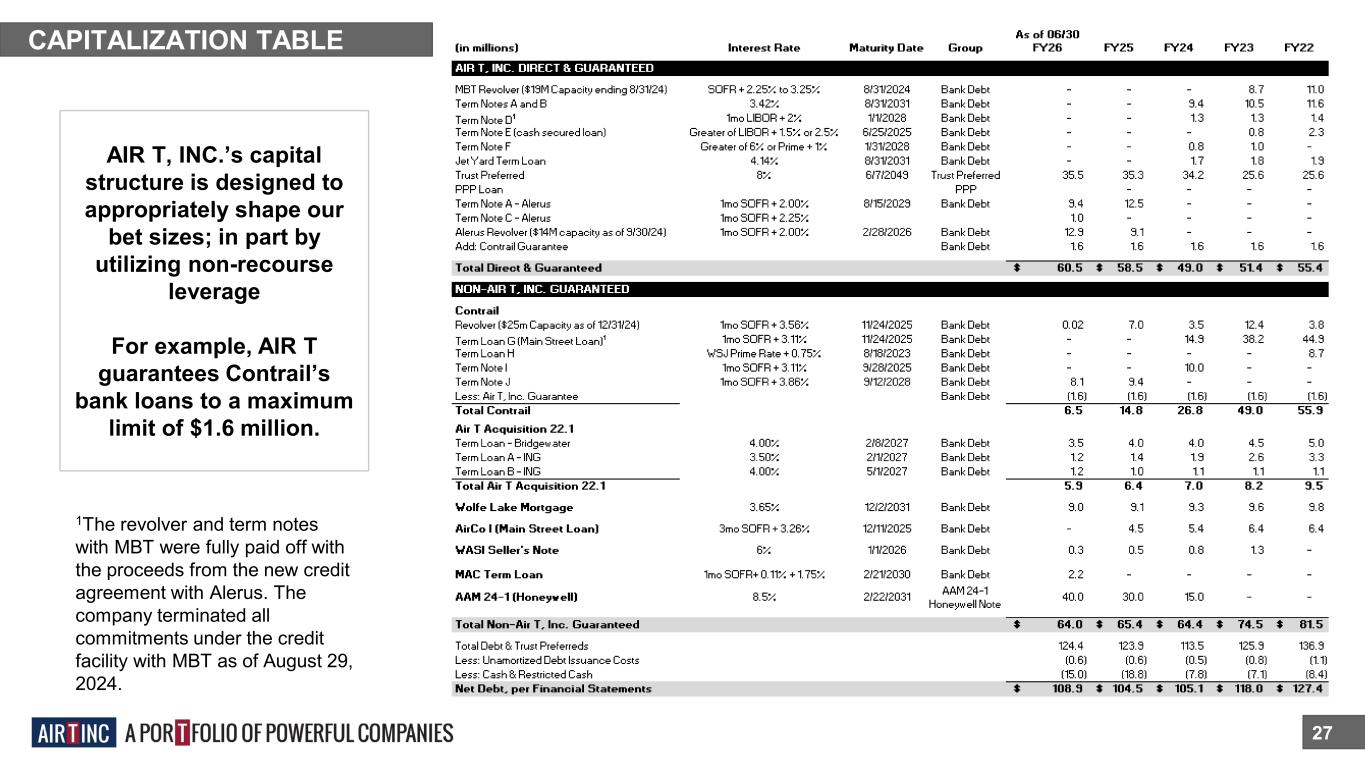

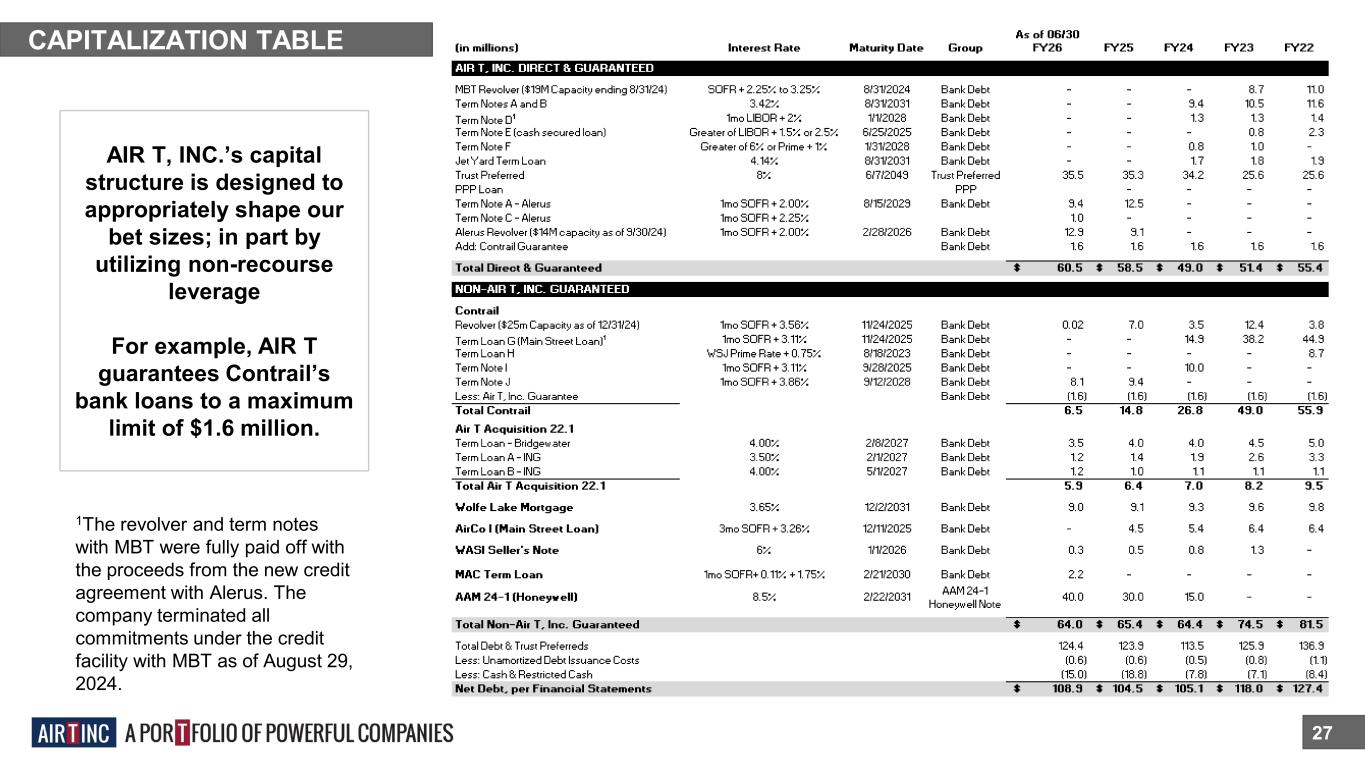

27 CAPITALIZATION TABLE AIR T, INC.’s capital structure is designed to appropriately shape our bet sizes; in part by utilizing non-recourse leverage For example, AIR T guarantees Contrail’s bank loans to a maximum limit of $1.6 million. 1The revolver and term notes with MBT were fully paid off with the proceeds from the new credit agreement with Alerus. The company terminated all commitments under the credit facility with MBT as of August 29, 2024.

Calibrated Investments & Capitalization Structure 28 Risk Management: Downside Protection • Anti-fragile company • Islands of segregated assets and businesses • Market-driven and savvy risk management program that oversees all of the company STRUCTURE Tailored, Limited, Convex Exposures • Convexity-promoting organizational design • Kelly-calibrated investments: sized to edge & bankroll • Limit downside: tailored exposures

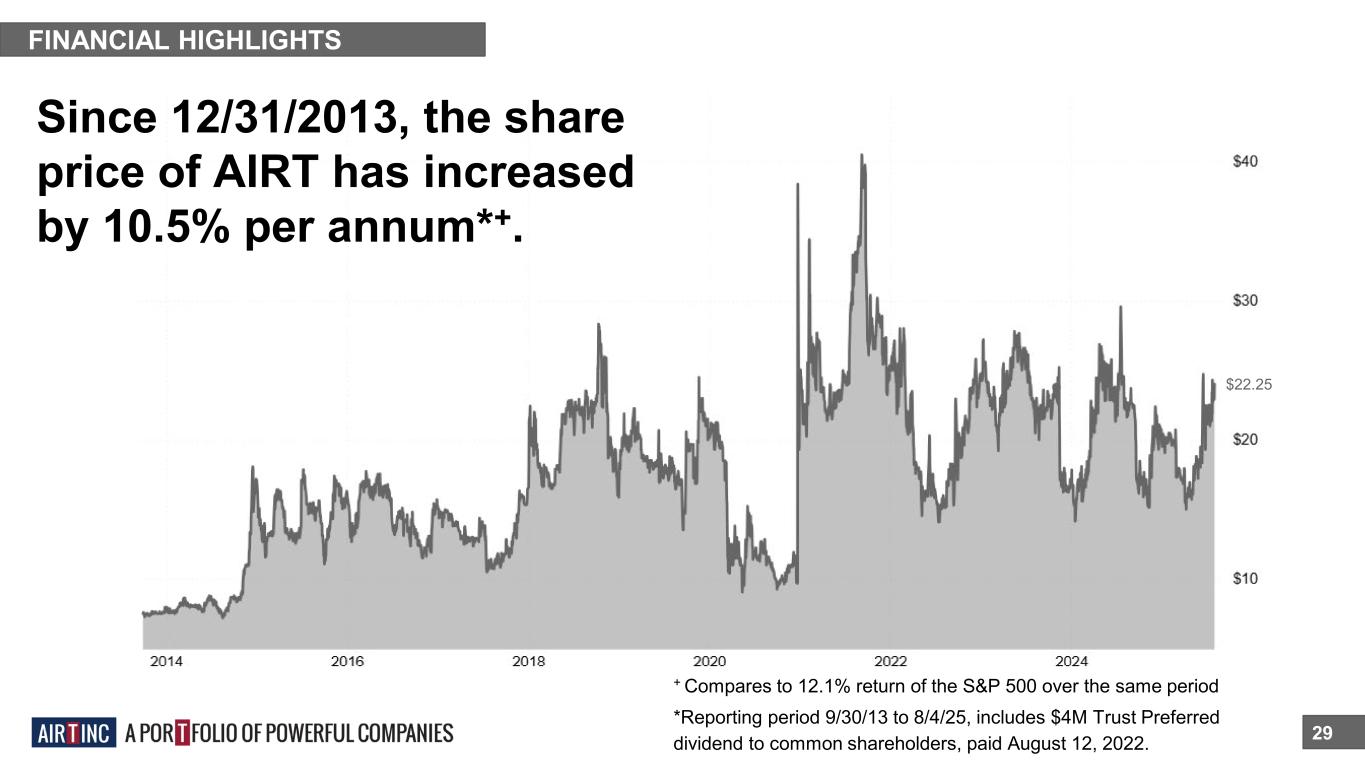

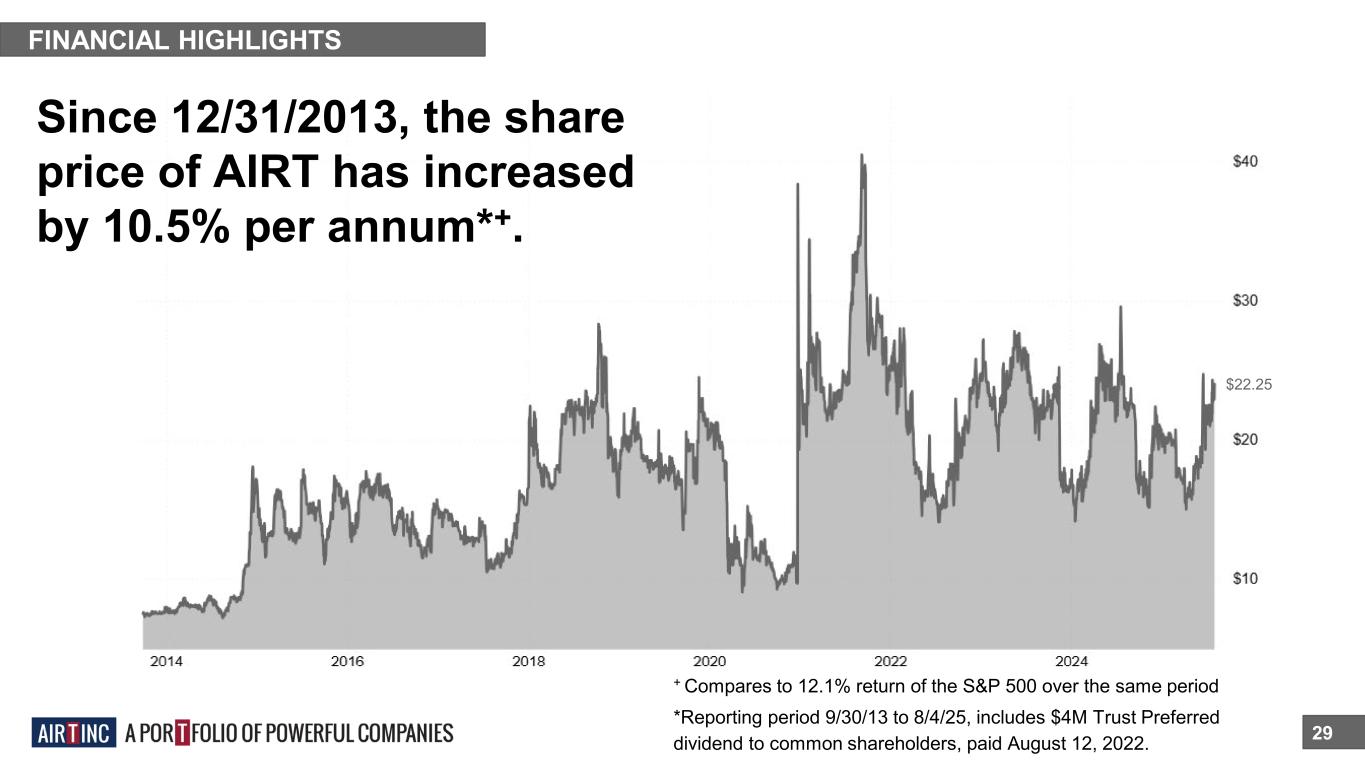

FINANCIAL HIGHLIGHTS 29 *Reporting period 9/30/13 to 8/4/25, includes $4M Trust Preferred dividend to common shareholders, paid August 12, 2022. + Compares to 12.1% return of the S&P 500 over the same period Since 12/31/2013, the share price of AIRT has increased by 10.5% per annum*+. $22.25

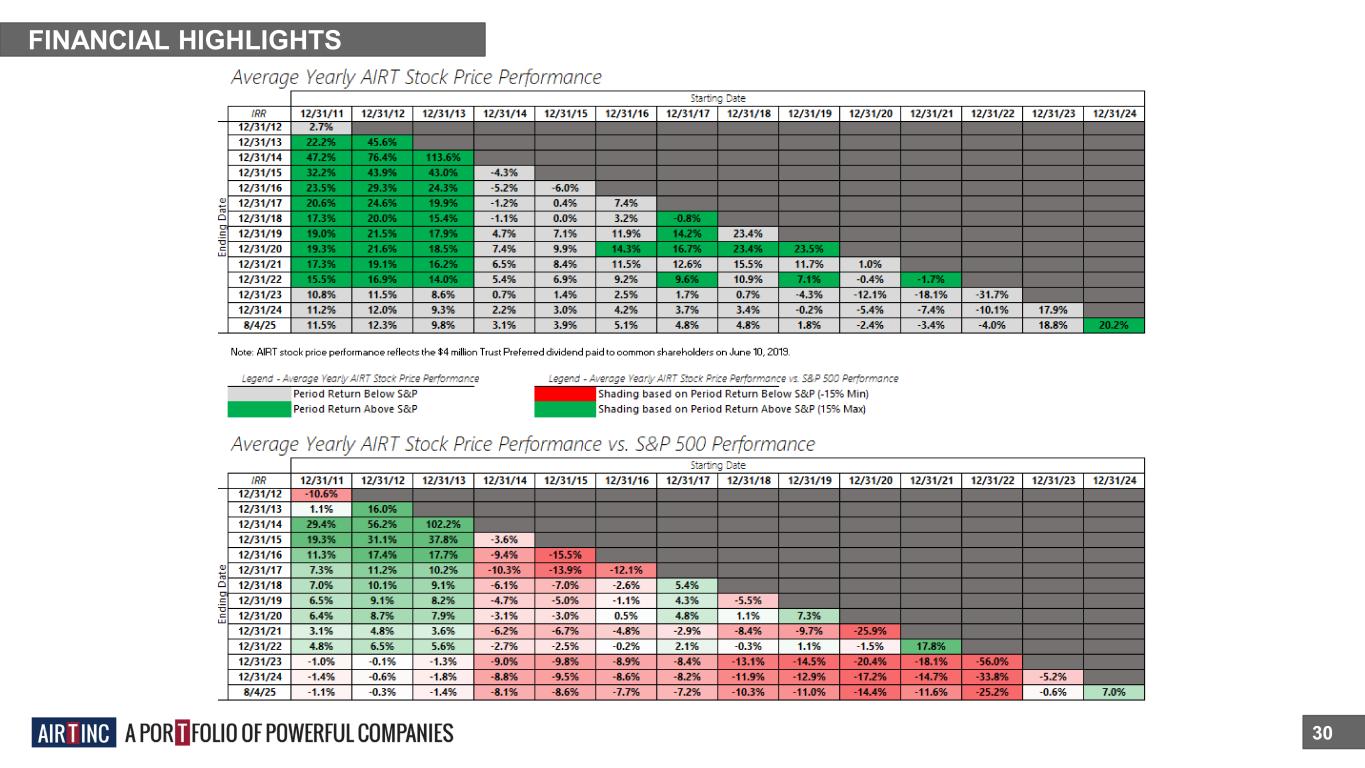

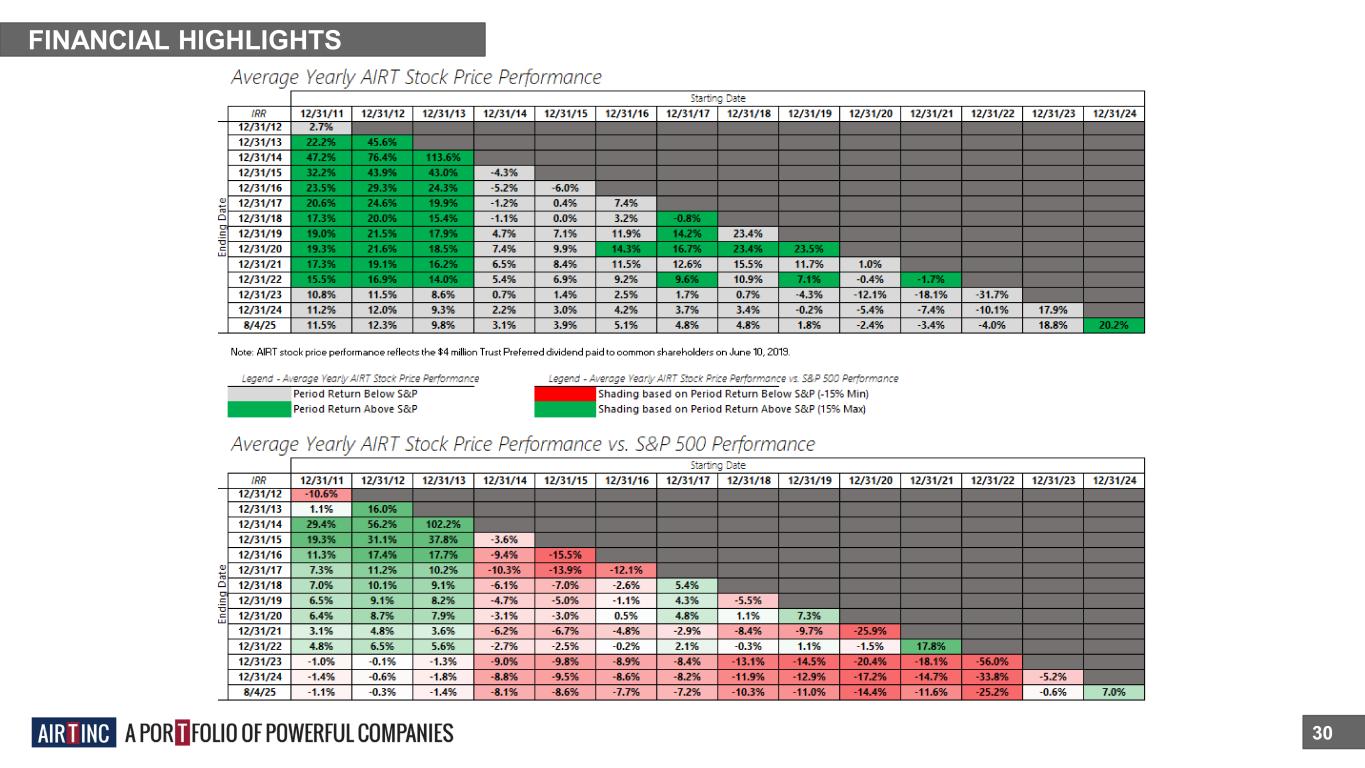

FINANCIAL HIGHLIGHTS 30

31 GROWTH STRATEGIES

GROWTH STRATEGIES Our four growth strategies are... 32 ■ Invest to build our current high-performing businesses. ■ Seek to acquire new cash-flow generating businesses. ■ Identify great marketable securities or alternative assets. ■ Create unique investment products and fund alongside third- party capital partnerships.

GROWTH STRATEGY 1 We plan to reinvest in projects at our high-performing businesses by... 33 ■ Purchasing commercial aircraft for trading, leasing and part-out. ■ Purchasing engine parts inventory. ■ Funding deicer builds for Global Ground Support.

GROWTH STRATEGY 2 We seek to acquire new cash-flow generating businesses by... 34 ■ Identifying and acquiring high- performing businesses, which either complement our current portfolio or diversify into industries beyond aviation.

GROWTH STRATEGY 3 We plan to identify great marketable securities or alternative assets by... 35 ■ Searching for another committed activist opportunity. ■ Investing in distressed and high yield securities. ■ Investing in small cap securities. ■ Further investing in our current securities portfolio.

GROWTH STRATEGY 4 We plan to create unique investment products with outside capital partners by... 36 ■ Offering thoughtful and sustainable products with attractive return profiles ■ Attracting and retaining sophisticated investment professionals and creating space for talented asset managers.

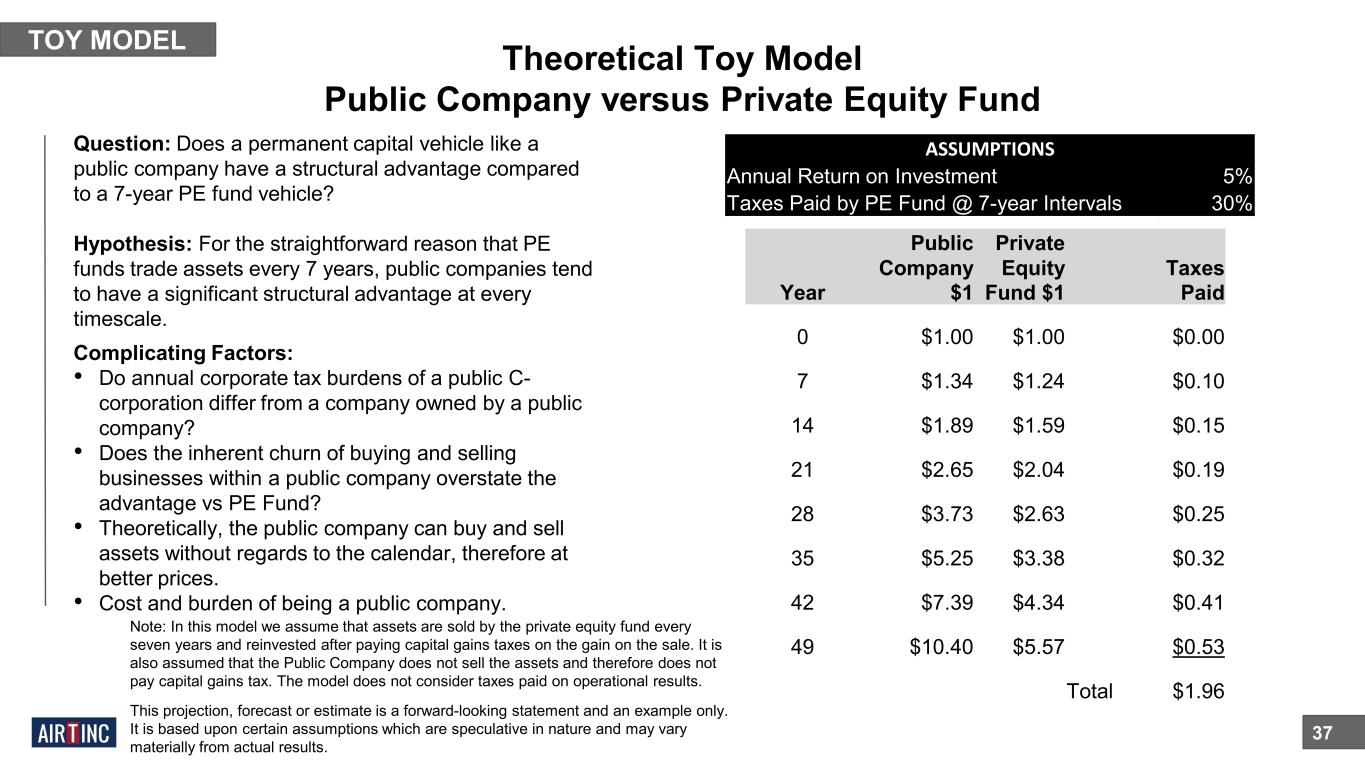

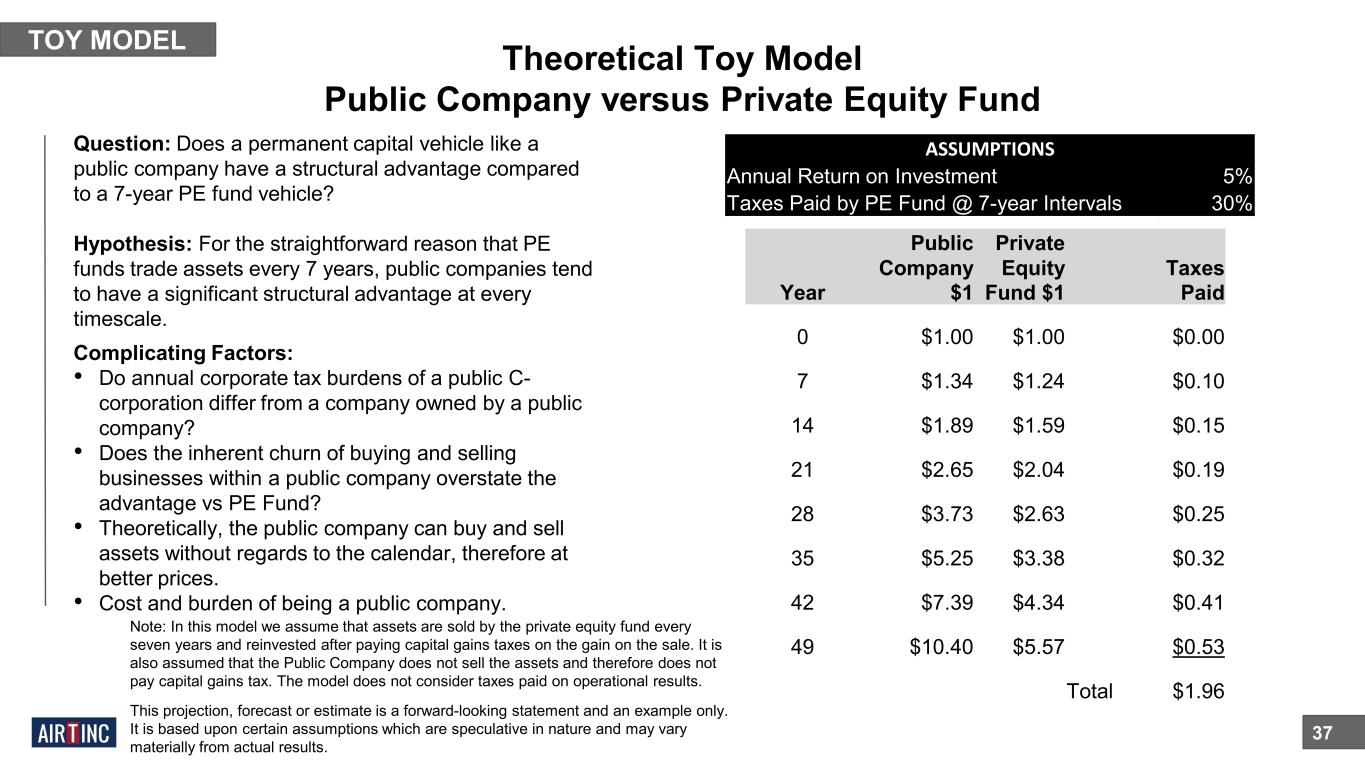

Theoretical Toy Model Public Company versus Private Equity Fund 37 TOY MODEL ASSUMPTIONS Annual Return on Investment 5% Taxes Paid by PE Fund @ 7-year Intervals 30% Year Public Company $1 Private Equity Fund $1 Taxes Paid 0 $1.00 $1.00 $0.00 7 $1.34 $1.24 $0.10 14 $1.89 $1.59 $0.15 21 $2.65 $2.04 $0.19 28 $3.73 $2.63 $0.25 35 $5.25 $3.38 $0.32 42 $7.39 $4.34 $0.41 49 $10.40 $5.57 $0.53 Total $1.96 Question: Does a permanent capital vehicle like a public company have a structural advantage compared to a 7-year PE fund vehicle? Hypothesis: For the straightforward reason that PE funds trade assets every 7 years, public companies tend to have a significant structural advantage at every timescale. Complicating Factors: • Do annual corporate tax burdens of a public C- corporation differ from a company owned by a public company? • Does the inherent churn of buying and selling businesses within a public company overstate the advantage vs PE Fund? • Theoretically, the public company can buy and sell assets without regards to the calendar, therefore at better prices. • Cost and burden of being a public company. Note: In this model we assume that assets are sold by the private equity fund every seven years and reinvested after paying capital gains taxes on the gain on the sale. It is also assumed that the Public Company does not sell the assets and therefore does not pay capital gains tax. The model does not consider taxes paid on operational results. This projection, forecast or estimate is a forward-looking statement and an example only. It is based upon certain assumptions which are speculative in nature and may vary materially from actual results.

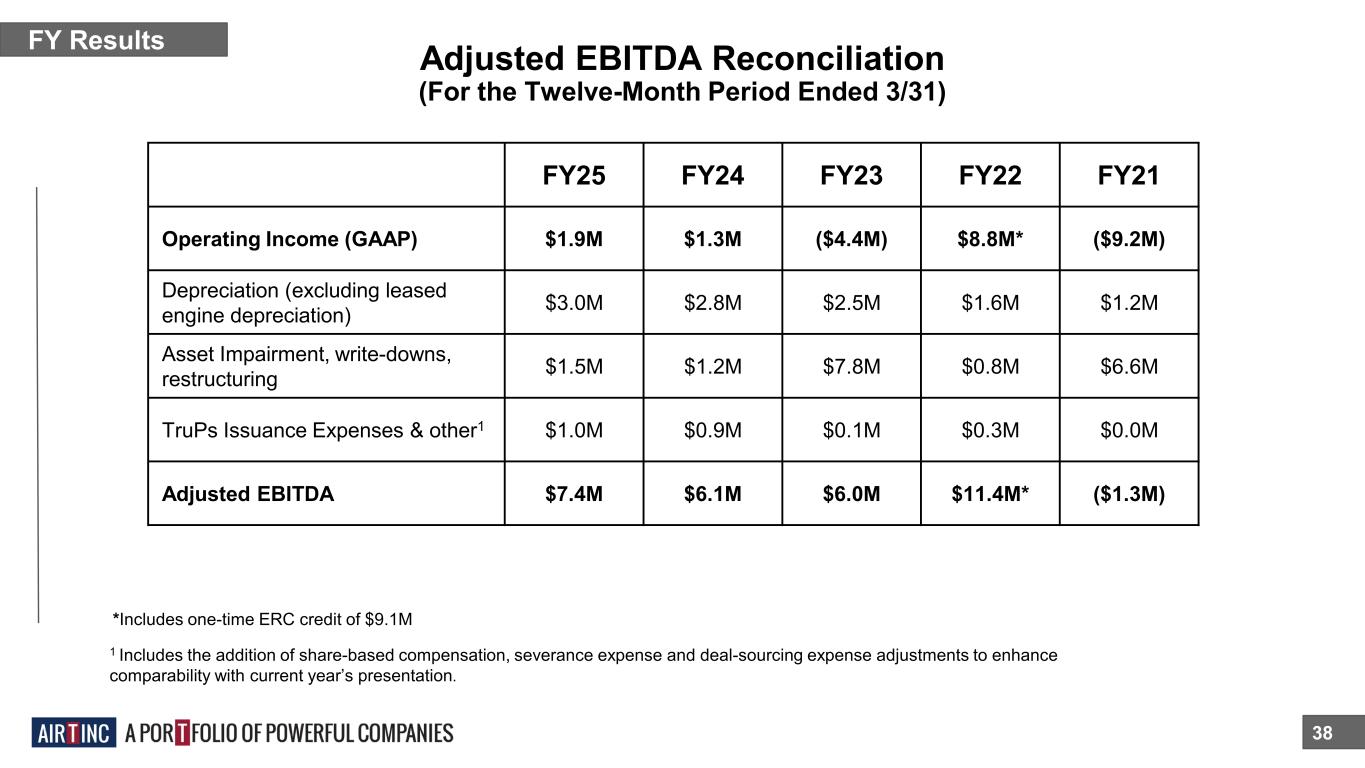

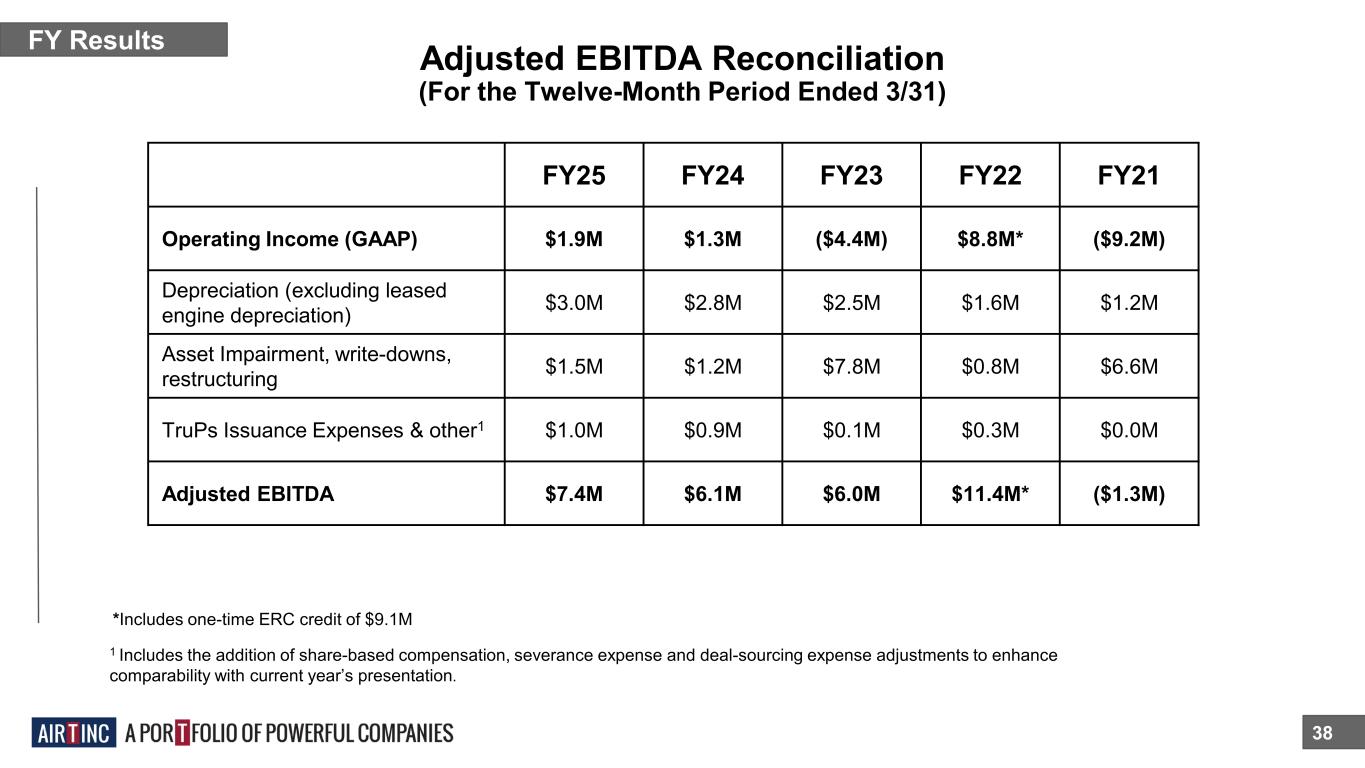

Adjusted EBITDA Reconciliation 38 FY Results *Includes one-time ERC credit of $9.1M (For the Twelve-Month Period Ended 3/31) FY25 FY24 FY23 FY22 FY21 Operating Income (GAAP) $1.9M $1.3M ($4.4M) $8.8M* ($9.2M) Depreciation (excluding leased engine depreciation) $3.0M $2.8M $2.5M $1.6M $1.2M Asset Impairment, write-downs, restructuring $1.5M $1.2M $7.8M $0.8M $6.6M TruPs Issuance Expenses & other1 $1.0M $0.9M $0.1M $0.3M $0.0M Adjusted EBITDA $7.4M $6.1M $6.0M $11.4M* ($1.3M) 1 Includes the addition of share-based compensation, severance expense and deal-sourcing expense adjustments to enhance comparability with current year’s presentation.

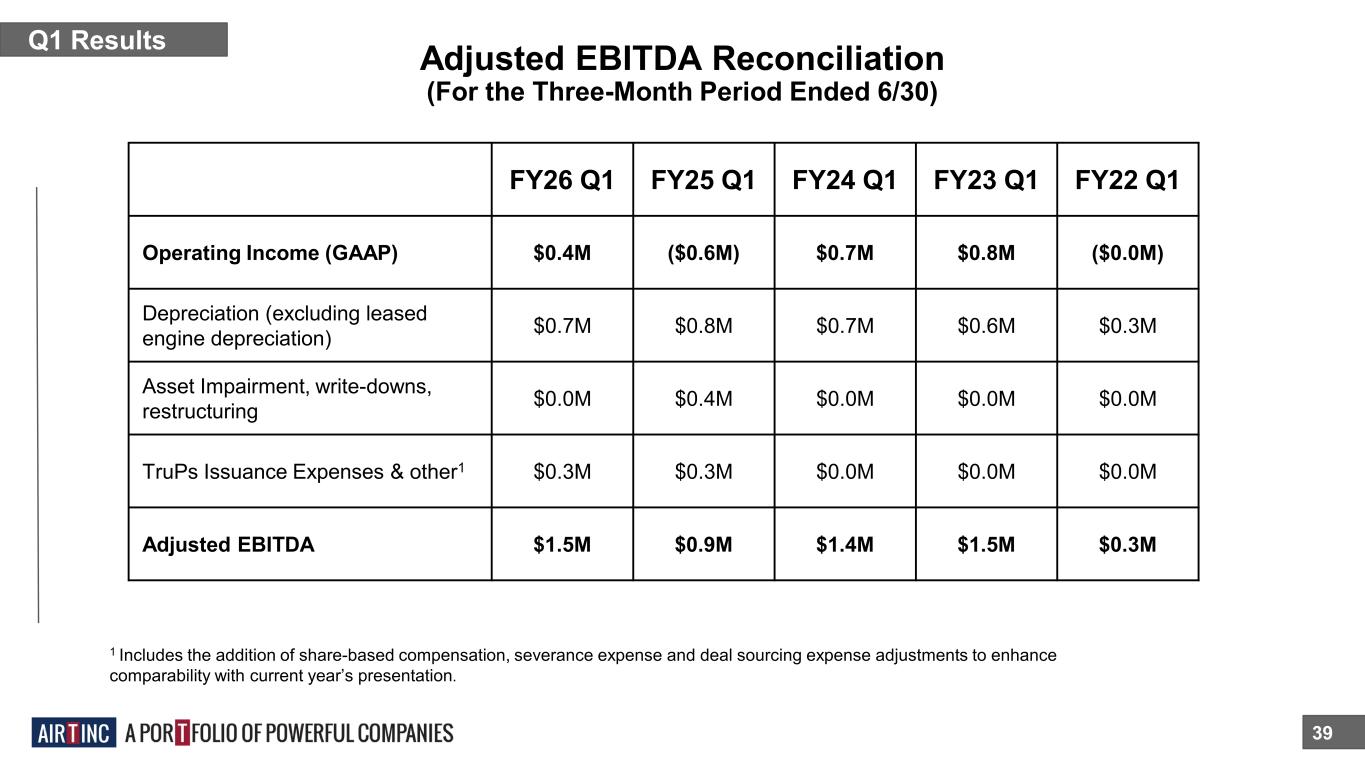

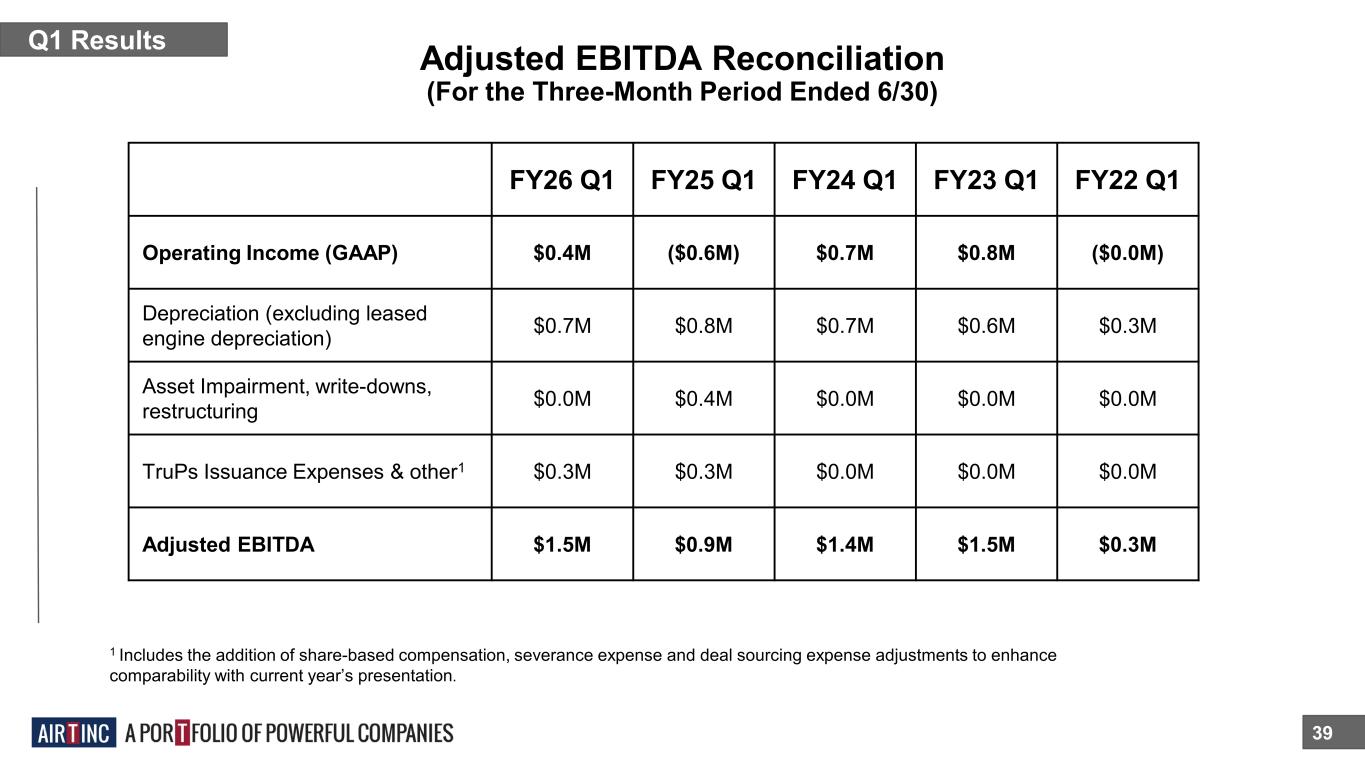

Adjusted EBITDA Reconciliation 39 Q1 Results (For the Three-Month Period Ended 6/30) FY26 Q1 FY25 Q1 FY24 Q1 FY23 Q1 FY22 Q1 Operating Income (GAAP) $0.4M ($0.6M) $0.7M $0.8M ($0.0M) Depreciation (excluding leased engine depreciation) $0.7M $0.8M $0.7M $0.6M $0.3M Asset Impairment, write-downs, restructuring $0.0M $0.4M $0.0M $0.0M $0.0M TruPs Issuance Expenses & other1 $0.3M $0.3M $0.0M $0.0M $0.0M Adjusted EBITDA $1.5M $0.9M $1.4M $1.5M $0.3M 1 Includes the addition of share-based compensation, severance expense and deal sourcing expense adjustments to enhance comparability with current year’s presentation.

40 Q&A WITH MANAGEMENT

Our interactive Q&A capability, through Slido.com, allows shareholders to ask questions of our management. Recently submitted questions have been answered below. To submit your own question, go to (https://app.sli.do/event/j8drfixw).1 41 How much is your quarterly interest payments? FY26 Q1 cash paid for interest expenses for the company and its subsidiaries were $2.3M, compared to $1.9M in FY25 Q1.

Our interactive Q&A capability, through Slido.com, allows shareholders to ask questions of our management. Recently submitted questions have been answered below. To submit your own question, go to (https://app.sli.do/event/j8drfixw).1 42 Do you have a positive shareholder equity, and if so, what is it? As of June 30, 2025, Air T does not have a positive shareholder equity.

43 Our interactive Q&A capability, through Slido.com, allows shareholders to ask questions of our management. Recently submitted questions have been answered below. To submit your own question, go to (https://app.sli.do/event/j8drfixw).1 Why did equity go from positive in FY24 to negative in FY25? The change was primarily driven by: • Net loss, excluding amount attributable to redeemable non-controlling interests: $6.1 million • Repurchase of common stock: $1.4 million • Reclassification of interest rate swaps into earnings: $1.4 million Please refer to the Consolidated Statements of Equity on our Form 10K as of March 31, 2025 for further details.

APPENDIX Risk Factors 44

SUMMARY RISK FACTORS 45 For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. The purchase of securities of Air T, Inc., the “Company,” is highly speculative and involves a very high degree of risk. An investment in the Company is suitable only for persons who can afford the loss of their entire investment. Accordingly, in making an investment decision with respect to the Company’s securities, investors should carefully consider all material risk factors, including the risks, uncertainties and additional information set forth below as well as set forth in our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Currents Reports on Form 8-K, and our definitive proxy statements, all which are filed with the SEC. Additional risks not presently known or are currently deemed immaterial could also materially and adversely affect our financial condition, results of operations, business and prospects. General Business Risks ● Market fluctuations may affect the Company’s operations. ● Rising inflation may result in increased costs of operations and negatively impact the credit and securities markets generally, which could have a material adverse effect on our results of operations and the market price of our Securities. ● We could experience significant increases in operating costs and reduced profitability due to competition for skilled management and staff employees in our operating businesses. ● Legacy technology systems require a unique technical skillset which is becoming scarcer. ● Security threats and other sophisticated computer intrusions could harm our information systems, which in turn could harm our business and financial results. ● We may not be able to insure certain risks adequately or economically. ● Legal liability may harm our business. ● Our business might suffer if we were to lose the services of certain key employees.

Risks Related to Our Segment Operations ● The operating results of our segments may fluctuate, particularly our commercial aircraft engine and parts segment. ● Our Overnight Air Cargo Segment is dependent on a significant customer. ● Our dry-lease agreements with FedEx subject us to operating risks. ● Because of our dependence on FedEx, we are subject to the risks that may affect FedEx’s operations. ● A material reduction in the aircraft we fly for FedEx could materially adversely affect our business and results of operations. ● Sales of deicing equipment can be affected by weather conditions. ● We are affected by the risks faced by commercial aircraft operators and MRO companies because they are our customers. ● Our engine values and lease rates, which are dependent on the status of the types of aircraft on which engines are installed, and other factors, could decline. ● Upon termination of a lease, we may be unable to enter into new leases or sell the airframe, engine or its parts on acceptable terms. ● Failures by lessees to meet their maintenance and recordkeeping obligations under our leases could adversely affect the value of our leased engines and aircraft which could affect our ability to re-lease the engines and aircraft in a timely manner following termination of the leases. ● We may experience losses and delays in connection with repossession of engines or aircraft when a lessee defaults. ● Our commercial aircraft engine and parts segment and its customers operate in a highly regulated industry and changes in laws or regulations may adversely affect our ability to lease or sell our engines or aircraft. ● Our aircraft, engines and parts could cause damage resulting in liability claims. ● We have risks in managing our portfolio of aircraft and engines to meet customer needs. ● Liens on our engines or aircraft could exceed the value of such assets, which could negatively affect our ability to repossess, lease or sell a particular engine or aircraft. ● In certain countries, an engine affixed to an aircraft may become an addition to the aircraft and we may not be able to exercise our ownership rights over the engine. ● Higher or volatile fuel prices could affect the profitability of the aviation industry and our lessees’ ability to meet their lease payment obligations to us. ● Interruptions in the capital markets could impair our lessees’ ability to finance their operations, which could prevent the lessees from complying with payment obligations to us. For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. SUMMARY RISK FACTORS 46

Risks Related to Our Segment Operations (continued) ● Our lessees may fail to adequately insure our aircraft or engines which could subject us to additional costs. ● If our lessees fail to cooperate in returning our aircraft or engines following lease terminations, we may encounter obstacles and are likely to incur significant costs and expenses conducting repossessions. ● If our lessees fail to discharge aircraft liens for which they are responsible, we may be obligated to pay to discharge the liens. ● If our lessees encounter financial difficulties and we restructure or terminate our leases, we are likely to obtain less favorable lease terms. ● Withdrawal, suspension or revocation of governmental authorizations or approvals could negatively affect our business. Risks Related to Our Structure and Financing/Liquidity Risks ● Our holding company structure may increase risks related to our operations. ● A small number of stockholders has the ability to control the Company. ● Although we do not expect to rely on the “controlled company” exemption, we may soon become a “controlled company” within the meaning of the Nasdaq listing standards, and we would qualify for exemptions from certain corporate governance requirements. ● An increase in interest rates or in our borrowing margin would increase the cost of servicing our debt and could reduce our cash flow and negatively affect the results of our business operations. ● Our inability to maintain sufficient liquidity could limit our operational flexibility and also impact our ability to make payments on our obligations as they come due. ● Future cash flows from operations or through financings may not be sufficient to enable the Company to meet its obligations. ● A large proportion of our capital is invested in physical assets and securities that can be hard to sell, especially if market conditions are poor. ● To service our debt and meet our other cash needs, we will require a significant amount of cash, which may not be available. ● If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to seek alternatives. ● Despite our substantial indebtedness, we may incur significantly more debt, and cash may not be available to meet our financial obligations when due or enable us to capitalize on investment opportunities when they arise. ● Our current financing arrangements require compliance with financial and other covenants and a failure to comply with such covenants could adversely affect our ability to operate. 47 For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. SUMMARY RISK FACTORS

Risks Related to Our Structure and Financing/Liquidity Risks (continued) ● Future acquisitions and dispositions of businesses and investments are possible, changing the components of our assets and liabilities, and if unsuccessful or unfavorable, could reduce the value of the Company and its securities. ● We face numerous risks and uncertainties as we expand our business. ● Our business strategy includes acquisitions, and acquisitions entail numerous risks, including the risk of management diversion and increased costs and expenses, all of which could negatively affect the Company’s ability to operate profitably. ● Strategic ventures may increase risks applicable to our operations. ● Rapid business expansions or new business initiatives may increase risk. ● Our policies and procedures may not be effective in ensuring compliance with applicable law. ● Compliance with the regulatory requirements imposed on us as a public company results in significant costs that may have an adverse effect on our results. ● Deficiencies in our public company financial reporting and disclosures could adversely impact our reputation. Risks Related to Air T Funding ● The ranking of the Company’s obligations under the Junior Subordinated Debentures and the Guarantee creates a risk that Air T Funding may not be able to pay amounts due to holders of the Capital Securities. ● The Company has the option to extend the Capital Securities interest payment period. ● Tax event or investment company act redemption of the Capital Securities. ● The Company may cause the Junior Subordinated Debentures to be distributed to the holders of the Capital Securities. ● There are limitations on direct actions against the Company and on rights under the guarantee. ● The covenants in the Indenture are limited. ● Holders of the Trust Preferred Securities have limited voting rights. 48 For more detail and explanation, please see the Company’s public filings including its Form S-3 and prospectus supplements filed with the SEC. SUMMARY RISK FACTORS