0000350894FALSE00003508942025-07-172025-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

July 17, 2025

Date of report (Date of earliest event reported)

________________________________________

________________________________________

SEI INVESTMENTS COMPANY

(Exact name of registrant as specified in charter)

________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pennsylvania |

|

0-10200 |

|

23-1707341 |

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

1 Freedom Valley Drive

Oaks, Pennsylvania 19456

(Address of Principal Executive Offices and Zip Code)

(610) 676-1000

(Registrants’ Telephone Number, Including Area Code)

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

SEIC |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Information.

On Friday, July 18, 2025, SEI Investments Company ("SEI" or the "Company") announced a strategic investment in Stratos Wealth Holdings ("Stratos"), a family of companies focused on supporting the success of financial advisors across business models and affiliation structures. As part of the transaction, a newly formed entity will purchase the operating entities composing the current Stratos business. The Company will pay a total cash consideration of approximately $527.0 million for 57.5% of the equity of this entity. Certain legacy Stratos equity holders will continue to own 42.5%, which is subject to three equal put/call options at 36, 54 and 72 months post closing that, if fully exercised, will result in the Company owning 100.0% of the entity. Subject to applicable regulatory approval and other customary closing conditions, the transaction is expected to close in two stages: The U.S.-based Stratos business, representing approximately 80.0% of the transaction value, is expected to close in the second half of 2025, and the Mexico-based NSC business is expected to close in the first half of 2026.

The strategic investment in Stratos is not a significant acquisition of assets or otherwise material to the operations or financial results of the Company. A copy of the press release and investor presentation is furnished as Exhibit 99.1 and 99.2, respectively, and incorporated into this Item 7.01 by reference.

As provided in General Instruction B.2 to Form 8-K, the information furnished pursuant to Item 7.01, Exhibit 99.1, and Exhibit 99.2 hereof shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing with the Securities and Exchange Commission, except as shall be expressly provided by specific reference in such filing.

This Current Report on Form 8-K, Exhibit 99.1, and Exhibit 99.2 hereto contains forward-looking statements within the meaning or the rules and regulations of the Securities and Exchange Commission. In some cases you can identify forward-looking statements by terminology, such as "may," "will," "expect," "believe" and "continue" or "appear." SEI's forward-looking statements include its current expectations as to:

•our ability to realize the various aspects of our strategic rationale for the Stratos partnership;

•the capital we will allocate to the partnership acquisition strategy;

•the factors driving fee-based wealth management and the sustainability of these factors;

•the size of the total addressable market for RIA acquisitions over the next decade;

•the value creation opportunities in the partnership;

•the scalability of the Stratos growth engine;

•when, if at all, the partnership will be accretive to our earnings per share;

•the operational model of Stratos going-forward;

•the benefits to each of SEI and Stratos, and their respective stakeholders, of the transaction;

•the effect of the partnership on our capacity to return capital; and

•the timing of the closing of the investment, if any.

You should not place undue reliance on any forward-looking statements, as they are based on the current beliefs and expectations of management and subject to significant risks and uncertainties, many of which are beyond management’s control or are subject to change. Although management believes the assumptions upon which the forward-looking statements are based are reasonable, they could be inaccurate. Some of the risks and important factors that could cause actual results to differ from those described in SEI’s forward-looking statements can be found in the "Risk Factors" section of SEI’s Annual Report on Form 10-K for the year ended December 31, 2024 filed with the Securities and Exchange Commission.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

| Exhibit No. |

Description |

|

|

| 99.1 |

|

|

|

| 99.2 |

|

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SEI INVESTMENTS COMPANY |

|

|

| Date: |

July 18, 2025 |

By: |

/s/ Sean J. Denham |

|

|

Sean J. Denham

Chief Financial and Chief Operating Officer |

EX-99.1

2

exh991corpeclipserls7172.htm

PRESS RELEASE

exh991corpeclipserls7172

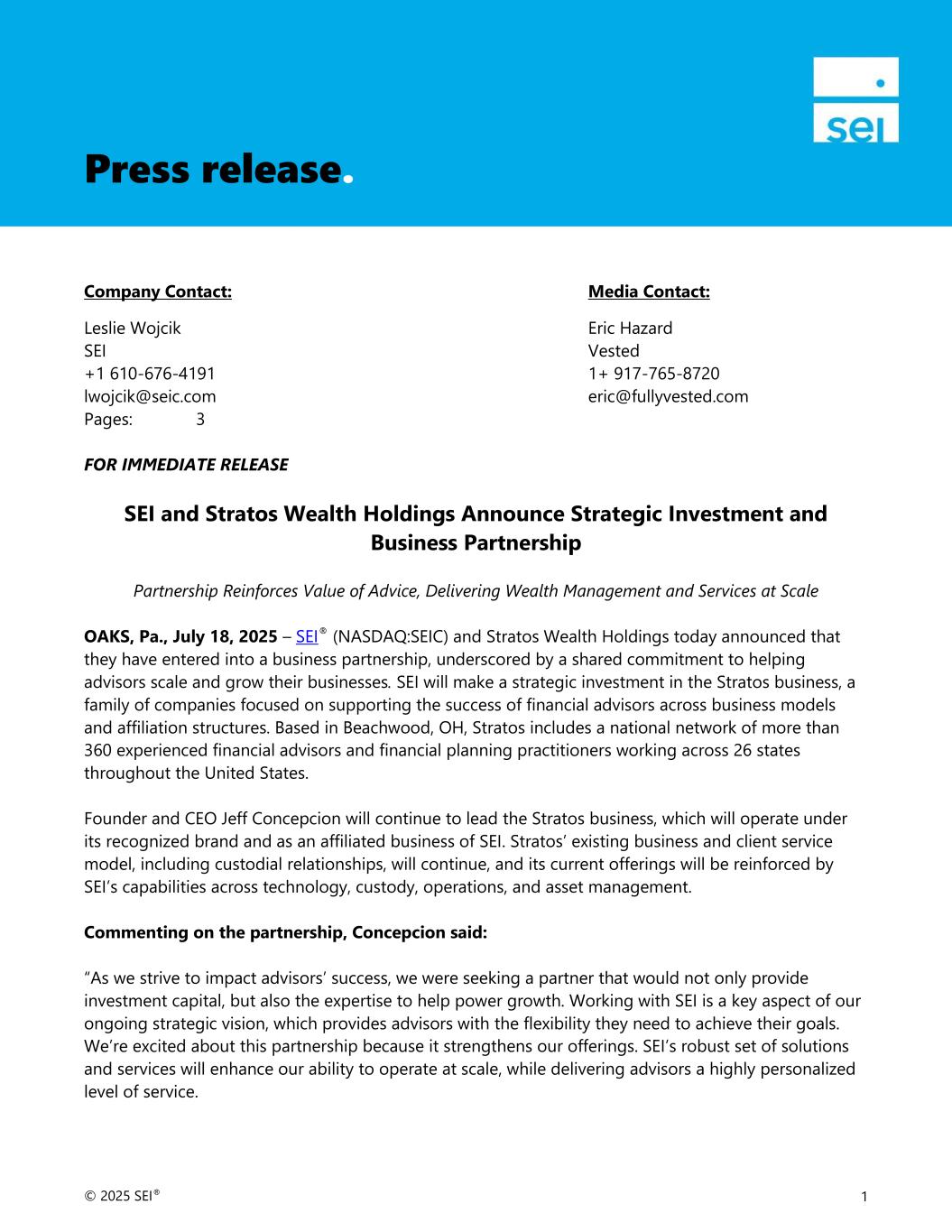

© 2025 SEI® 1 Company Contact: Media Contact: Leslie Wojcik Eric Hazard SEI Vested +1 610-676-4191 1+ 917-765-8720 lwojcik@seic.com eric@fullyvested.com Pages: 3 FOR IMMEDIATE RELEASE SEI and Stratos Wealth Holdings Announce Strategic Investment and Business Partnership Partnership Reinforces Value of Advice, Delivering Wealth Management and Services at Scale OAKS, Pa., July 18, 2025 – SEI® (NASDAQ:SEIC) and Stratos Wealth Holdings today announced that they have entered into a business partnership, underscored by a shared commitment to helping advisors scale and grow their businesses. SEI will make a strategic investment in the Stratos business, a family of companies focused on supporting the success of financial advisors across business models and affiliation structures. Based in Beachwood, OH, Stratos includes a national network of more than 360 experienced financial advisors and financial planning practitioners working across 26 states throughout the United States. Founder and CEO Jeff Concepcion will continue to lead the Stratos business, which will operate under its recognized brand and as an affiliated business of SEI. Stratos’ existing business and client service model, including custodial relationships, will continue, and its current offerings will be reinforced by SEI’s capabilities across technology, custody, operations, and asset management. Commenting on the partnership, Concepcion said: “As we strive to impact advisors’ success, we were seeking a partner that would not only provide investment capital, but also the expertise to help power growth. Working with SEI is a key aspect of our ongoing strategic vision, which provides advisors with the flexibility they need to achieve their goals. We’re excited about this partnership because it strengthens our offerings. SEI’s robust set of solutions and services will enhance our ability to operate at scale, while delivering advisors a highly personalized level of service. Press release.

© 2025 SEI 2 “We have worked closely with SEI for 15 years, and we appreciate their shared commitment to consistently delivering value to our advisors. We are closely aligned with their leadership on how to foster independence—a key for advisors in helping clients meet their financial goals. SEI’s breadth of capabilities and its connections across the industry can significantly enhance and advance the services we deliver to make doing business and serving clients more seamless for advisors.” Ryan Hicke, CEO of SEI, added: “We’re making a strategic investment that reinforces our unwavering belief in financial advisors and their delivery of advice, and Stratos brings an intimate understanding of what adds value to an advisor’s business. Their approach to coaching, building sustainable value, and focusing on client acquisition and service can help advisors scale their businesses, drive more organic growth, and address the industry’s most prevalent challenges. “Partnering with Stratos allows us to build upon our world-class investment management, processing, and operations capabilities with deeper insight into the demands and needs of the end client, so we can continue to enhance the solutions and services we provide across all intermediaries. As we look to the future of wealth management, this partnership enables us to help accelerate growth for advisors and wealth managers, solve succession and business transition challenges, and develop the next generation of professionals delivering advice. We share Stratos’ deep respect for independence and look ahead with excitement as we build a long-standing partnership that can simplify the complex and amplify the value of advice.” A newly formed entity will purchase the operating entities comprising the current Stratos business. SEI will pay a total cash consideration of approximately $527 million for 57.5% of the equity of this entity. Certain legacy Stratos equity holders will continue to own 42.5%, which is subject to put/call rights that, if fully exercised, will result in SEI owning 100% of the entity. As part of the transaction, Emigrant Partners will exit their investment in Stratos at closing. Subject to applicable regulatory approval and other customary closing conditions, the transaction is expected to close in two stages: The U.S.-based Stratos business, representing approximately 80% of the transaction value, is expected to close in the second half of 2025, and the Mexico-based NSC business is expected to close in the first half of 2026. Goldman Sachs & Co. LLC served as financial advisor to Stratos, and Alston & Bird LLP served as legal counsel to Stratos. Wells Fargo served as financial advisor to SEI, and Holland & Knight served as legal counsel to SEI. About SEI® SEI (NASDAQ: SEIC) is a leading global provider of financial technology, operations, and asset management services within the financial services industry. SEI tailors its solutions and services to help clients more effectively deploy their capital—whether that’s money, time, or talent—so they can better serve their clients and achieve their growth objectives. As of March 31, 2025, SEI manages, advises, or administers approximately $1.6 trillion in assets. For more information, visit seic.com. About Stratos Wealth Holdings

© 2025 SEI 3 Stratos is a family of companies including affiliated registered investment advisors. Stratos supports a network of independent financial advisors by providing flexible affiliation models, including a hybrid option, and practice management consulting, operations, IT, and compliance services. Financial advisors associated through the Stratos network of registered investment advisors advise and service more than $37 billion in client assets. Forward-looking statements This communication contains forward-looking statements within the meaning or the rules and regulations of the Securities and Exchange Commission. In some cases you can identify forward- looking statements by terminology, such as "may," "will," "expect," "believe," ”remain” and "continue" or "appear." SEI’s forward-looking statements include its current expectations as to: • the benefits that SEI’s clients may derive from its capabilities; • the going-forward operating model for Stratos; • SEI’s ability to realize the various aspects of its strategic rationale for the Stratos partnership; • the benefits that Stratos may derive from SEI’s investment and capabilities; and • the degree to which the put/call features of the transaction will be exercised. You should not place undue reliance on any forward-looking statements, as they are based on the current beliefs and expectations of management and subject to significant risks and uncertainties, many of which are beyond management’s control or are subject to change. Although management believes the assumptions upon which the forward-looking statements are based are reasonable, they could be inaccurate. Some of the risks and important factors that could cause actual results to differ from those described in SEI’s forward-looking statements can be found in the "Risk Factors" section of SEI’s Annual Report on Form 10-K for the year ended Dec. 31, 2024, filed with the Securities and Exchange Commission. ###

EX-99.2

3

exh992corpeclipsestrateg.htm

INVESTOR PRESENTATION

exh992corpeclipsestrateg

July 18, 2025 Enhancing SEI’s wealth management ecosystem. SEI partnership with Stratos Wealth Holdings 1

2 Safe Harbor Statement This presentation contains forward-looking statements within the meaning or the rules and regulations of the Securities and Exchange Commission. In some cases you can identify forward-looking statements by terminology, such as "may," "will," "expect," "believe," ”remain” and "continue" or "appear." Our forward-looking statements include our current expectations as to: You should not place undue reliance on our forward-looking statements, as they are based on the current beliefs and expectations of our management and subject to significant risks and uncertainties, many of which are beyond our control or are subject to change. Although we believe the assumptions upon which we base our forward- looking statements are reasonable, they could be inaccurate. Some of the risks and important factors that could cause actual results to differ from those described in our forward-looking statements can be found in the "Risk Factors" section of our Annual Report on Form 10-K for the year ended Dec. 31, 2024, filed with the Securities and Exchange Commission. Past performance does not guarantee future results. • our ability to realize the various aspects of our strategic rationale for the Stratos partnership; • the capital we will allocate to the partnership acquisition strategy; • the factors driving fee-based wealth management and the sustainability of these factors; • the size of the total addressable market for RIA acquisitions over the next decade; • the value creation opportunities in the partnership; • the scalability of the Stratos growth engine; • when, if at all, the partnership will be accretive to our earnings per share; • the operational model of Stratos going-forward; • the benefits to each of SEI and Stratos, and their respective stakeholders, of the transaction; • the effect of the partnership on our capacity to return capital; and • the timing of the closing of the investment, if any.

3 Strategic rationale. Belief in the value of delivering scalable advice and wealth services, capitalizing on robust long-term outlook and stable fee structures. Enhances SEI’s capital allocation strategy with opportunities to deploy incremental capital at high ROICs, supported by Stratos’ experienced team. Stratos is the right partner; successful track record of organic growth, advisor recruitment, and M&A. Existing infrastructure is highly scalable. It will continue to operate under the Stratos brand. Expands opportunities to enhance offerings for SEI advisors and wealth managers, to grow and scale their businesses, or implement business transition plans—delivering greater value and flexibility. Unlocks operational and revenue synergies, creating opportunities to optimize technology infrastructure and processes and enhance offerings for advisors. 1 2 3 SEI to capitalize on consolidating wealth management industry—empowering clients and investors 4 5 Custody Advice Asset management Investment processing Technology Adds key capabilities in wealth management ecosystem. Professional services

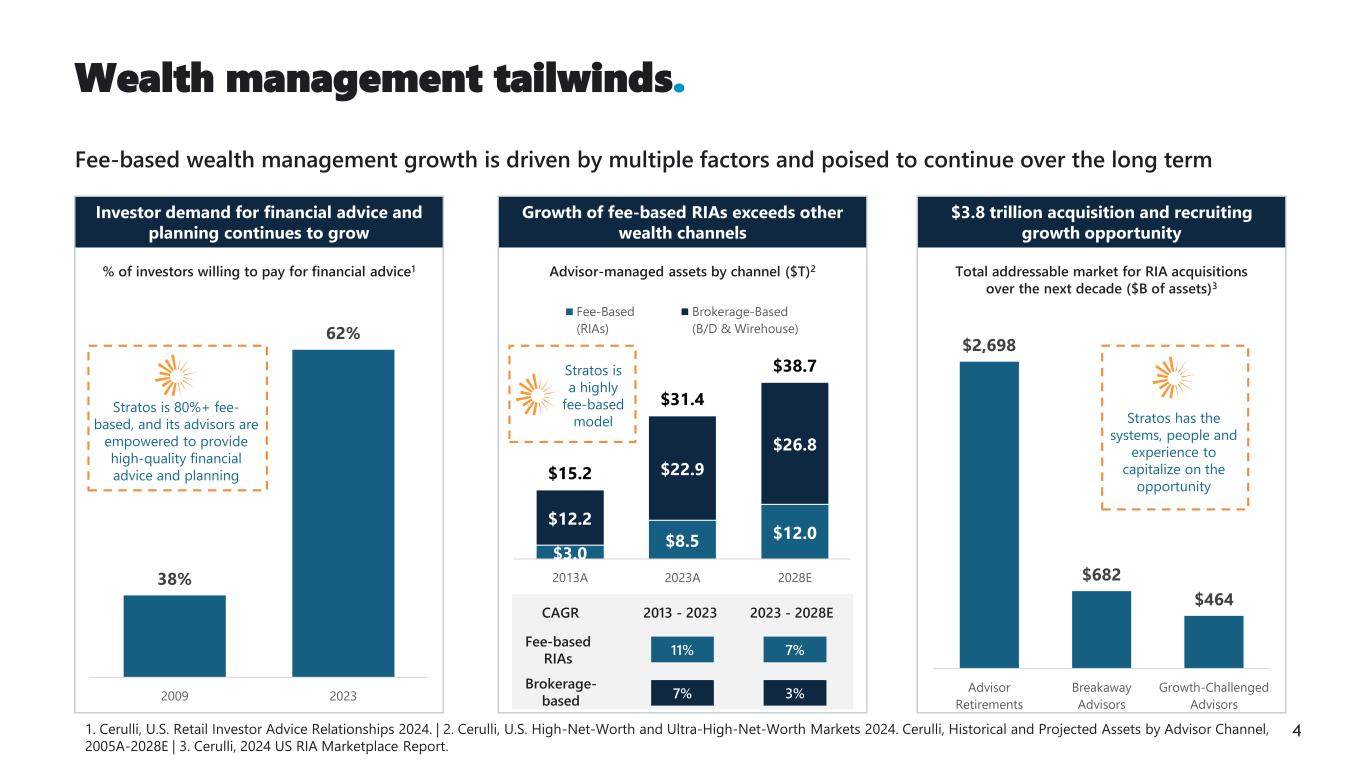

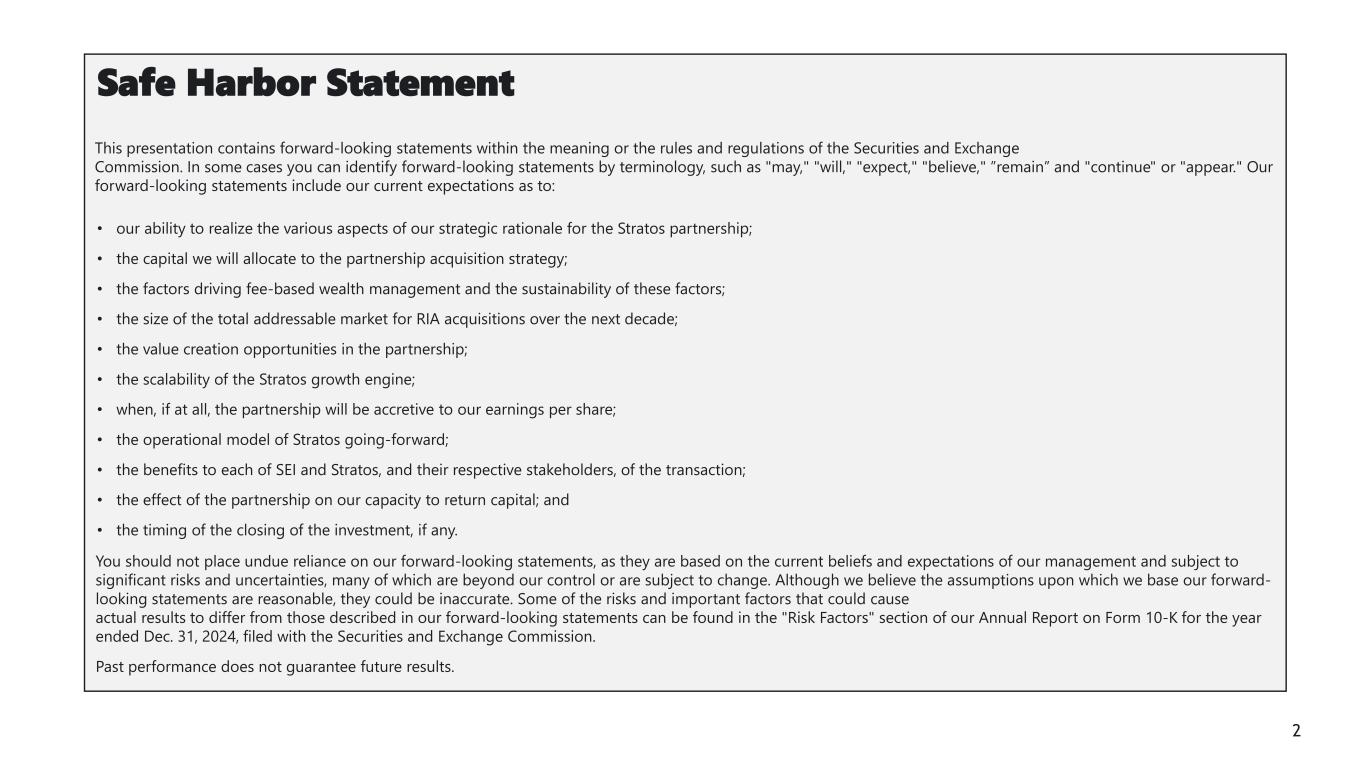

4 Wealth management tailwinds. 1. Cerulli, U.S. Retail Investor Advice Relationships 2024. | 2. Cerulli, U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2024. Cerulli, Historical and Projected Assets by Advisor Channel, 2005A-2028E | 3. Cerulli, 2024 US RIA Marketplace Report. Fee-based wealth management growth is driven by multiple factors and poised to continue over the long term Investor demand for financial advice and planning continues to grow Growth of fee-based RIAs exceeds other wealth channels $3.8 trillion acquisition and recruiting growth opportunity 38% 62% 2009 2023 % of investors willing to pay for financial advice1 $2,698 $682 $464 Advisor Retirements Breakaway Advisors Growth-Challenged Advisors Total addressable market for RIA acquisitions over the next decade ($B of assets)3 Advisor-managed assets by channel ($T)2 Stratos is 80%+ fee- based, and its advisors are empowered to provide high-quality financial advice and planning Stratos has the systems, people and experience to capitalize on the opportunity $3.0 $8.5 $12.0 $12.2 $22.9 $26.8 $15.2 $31.4 $38.7 2013A 2023A 2028E Fee-Based (RIAs) Brokerage-Based (B/D & Wirehouse) CAGR 11% 7% 7% 3% Fee-based RIAs Brokerage- based 2013 - 2023 2023 - 2028E Stratos is a highly fee-based model

5 Stratos enhances SEI’s ecosystem. Revenue synergies via SEI platform and products Optionality for SEI advisor base via new advisor acquisition capabilities Stratos to leverage SEI technology and operational expertise Key capabilities ✓ Fully integrated wealth management solutions ✓ Diversified investment management and model portfolios ✓ Custody services and operations ✓ Model management and trading ✓ Advisor technology and services ✓ Infrastructure, regulatory & compliance ✓ Cybersecurity, SEI Data Cloud, and system integration Key capabilities ✓ Advisor acquisition and integration ✓ Advisor recruiting and onboarding ✓ Advisor support, practice management, and technology ✓ Multiple affiliation model (Employee advisors / Independent advisors) ✓ Advisory and brokerage Multi-custodian ✓ Succession planning Value creation opportunity Enhanced client lifecycle management via advisor feedback loop

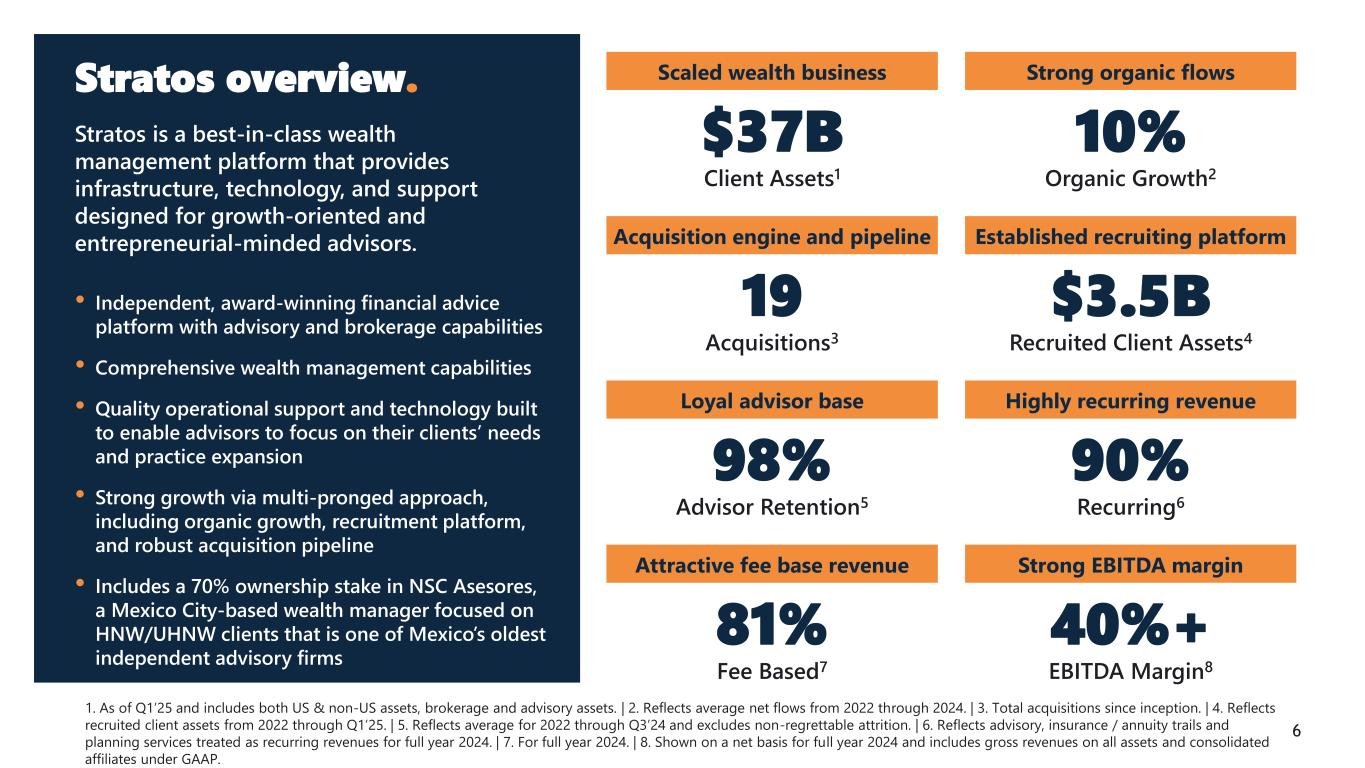

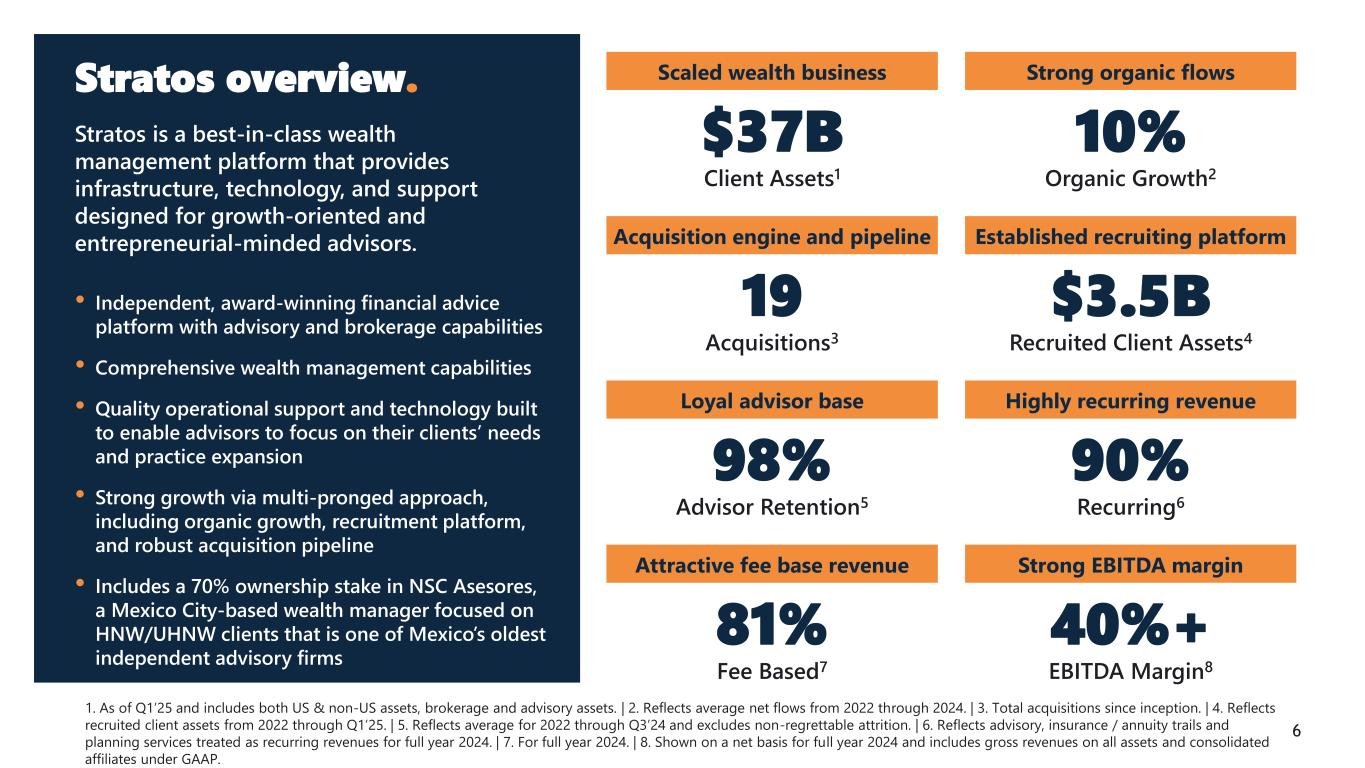

6 Stratos overview. 1. As of Q1’25 and includes both US & non-US assets, brokerage and advisory assets. | 2. Reflects average net flows from 2022 through 2024. | 3. Total acquisitions since inception. | 4. Reflects recruited client assets from 2022 through Q1’25. | 5. Reflects average for 2022 through Q3’24 and excludes non-regrettable attrition. | 6. Reflects advisory, insurance / annuity trails and planning services treated as recurring revenues for full year 2024. | 7. For full year 2024. | 8. Shown on a net basis for full year 2024 and includes gross revenues on all assets and consolidated affiliates under GAAP. Stratos is a best-in-class wealth management platform that provides infrastructure, technology, and support designed for growth-oriented and entrepreneurial-minded advisors. • Independent, award-winning financial advice platform with advisory and brokerage capabilities • Comprehensive wealth management capabilities • Quality operational support and technology built to enable advisors to focus on their clients’ needs and practice expansion • Strong growth via multi-pronged approach, including organic growth, recruitment platform, and robust acquisition pipeline • Includes a 70% ownership stake in NSC Asesores, a Mexico City-based wealth manager focused on HNW/UHNW clients that is one of Mexico’s oldest independent advisory firms Scaled wealth business $37B Client Assets1 Acquisition engine and pipeline 19 Acquisitions3 Loyal advisor base 98% Advisor Retention5 Attractive fee base revenue 81% Fee Based7 Strong organic flows 10% Organic Growth2 Established recruiting platform $3.5B Recruited Client Assets4 Highly recurring revenue 90% Recurring6 Strong EBITDA margin 40%+ EBITDA Margin8

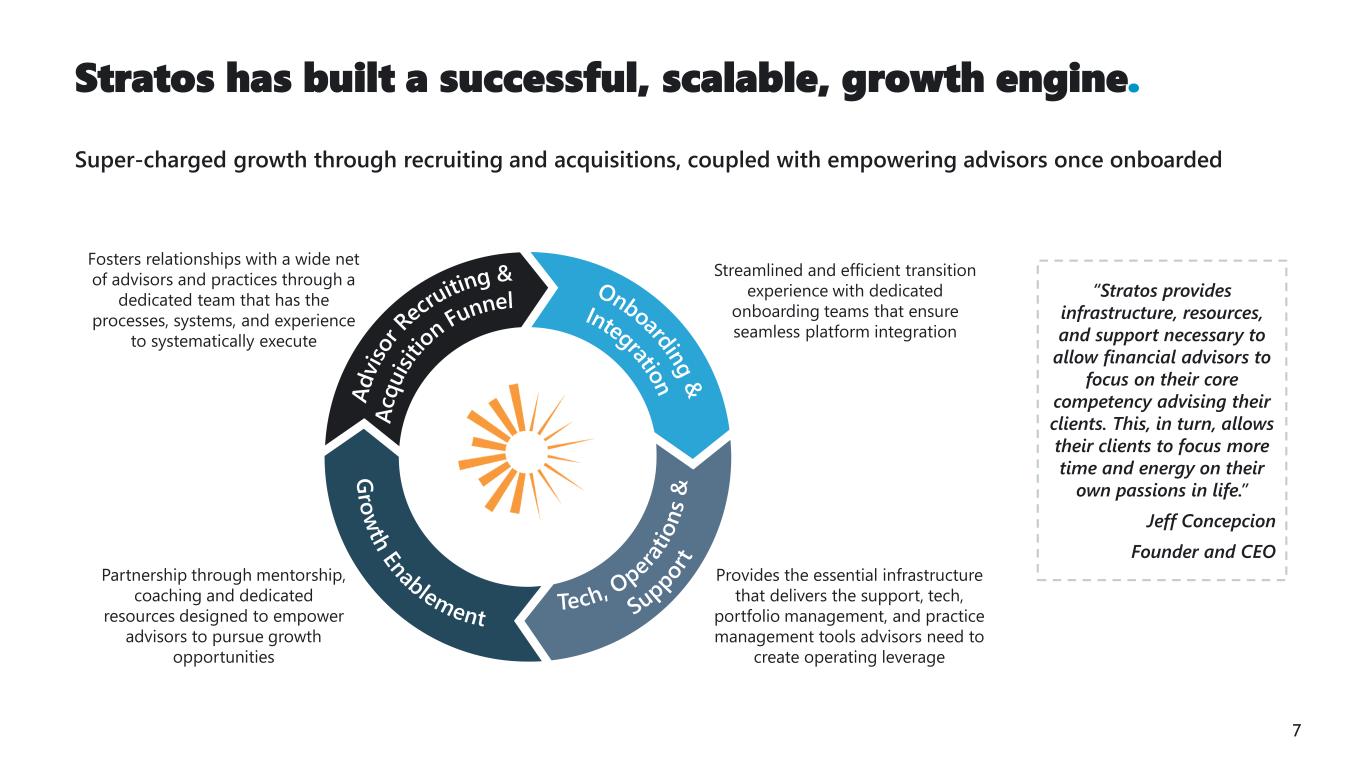

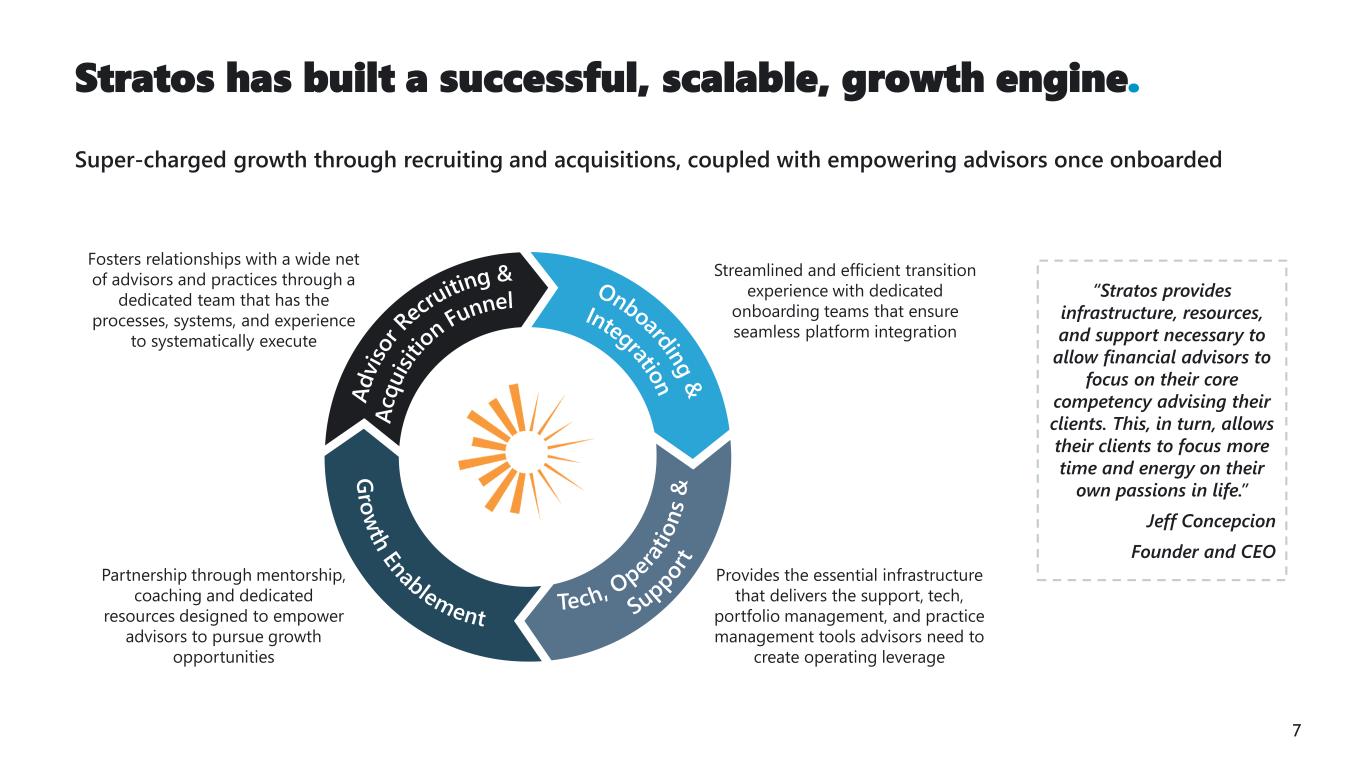

7 Stratos has built a successful, scalable, growth engine. Super-charged growth through recruiting and acquisitions, coupled with empowering advisors once onboarded G ro w th Enablement Onboardin g & Integratio n A d vi so r Rec ru itin g & A cq u is it io n Funnel Tech, Oper at io n s & Suppo rt Fosters relationships with a wide net of advisors and practices through a dedicated team that has the processes, systems, and experience to systematically execute Partnership through mentorship, coaching and dedicated resources designed to empower advisors to pursue growth opportunities “Stratos provides infrastructure, resources, and support necessary to allow financial advisors to focus on their core competency advising their clients. This, in turn, allows their clients to focus more time and energy on their own passions in life.” Jeff Concepcion Founder and CEO Streamlined and efficient transition experience with dedicated onboarding teams that ensure seamless platform integration Provides the essential infrastructure that delivers the support, tech, portfolio management, and practice management tools advisors need to create operating leverage

8 Transaction summary. Purchase price Timing and approvals • SEI to pay approximately $527M in cash for its 57.5%, subject to certain purchase price adjustments between signing and closing • SEI will finance predominantly with available corporate cash, in addition to SEI’s existing credit facility, as needed • High-teens estimated run-rate EBITDA multiple, with future option rights priced at similar valuations • Expected to be EPS accretive based on current Stratos run-rate earnings1 • Acquisition is not expected to constrain SEI’s capital return capacity • Transaction is expected to close in two stages; the US-based Stratos business, representing ~80% of the transaction value, is expected to close in 2H 2025 and the NSC business is expected to close in 1H 2026 • Subject to customary closing and applicable regulatory approvals for both US and Mexico based entities Shareholder value creation 1Excludes impact of transaction-related amortization and one-time charges Transaction structure • Stratos and SEI will form a new entity to hold current Stratos operating entities; SEI will own 57.5% • Certain legacy Stratos equity holders will own 42.5%, subject to three equal put/call options at 36, 54 and 72 months post close that, if fully exercised, will result in SEI owning 100% of Stratos • SEI plans to operate Stratos as a separate entity which will be consolidated on SEI’s financial statements