INVESTOR PRESENTATION I 2nd QUARTER W O R K IN G T O G E T H E R . B U IL D IN G S U C C ES S. ®

WORKING TOGETHER BUILDING SUCCESS2 TABLE OF CONTENTS Statements in this presentation which are not historical are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may include discussions of the strategic plans and objectives or anticipated future performance and events of Peoples Bancorp Inc. (“Peoples”). The information contained in this presentation should be read in conjunction with Peoples’ Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “2024 Form 10-K”), and the earnings release for the second quarter ended June 30, 2025 (the “Second Quarter Earnings Release”) included in Peoples’ current report on Form 8-K furnished to the Securities and Exchange Commission (“SEC”) on July 22, 2025, each of which is available on the SEC’s website (sec.gov) or at Peoples’ website (peoplesbancorp.com). Peoples expects to file its quarterly report on Form 10-Q for the quarter ended June 30, 2025 (the “Second Quarter Form 10-Q”) with the SEC on or about July 31, 2025. Investors are cautioned that forward-looking statements, which are not historical fact, involve risks and uncertainties, including those detailed in the 2024 Form 10-K under the section, “Risk Factors” in Part I, Item 1A. As such, actual results could differ materially from those contemplated by forward-looking statements made in this presentation. Management believes that the expectations in these forward-looking statements are based upon reasonable assumptions within the bounds of management’s knowledge of Peoples’ business and operations. Peoples disclaims any responsibility to update these forward-looking statements to reflect events or circumstances after the date of this presentation.

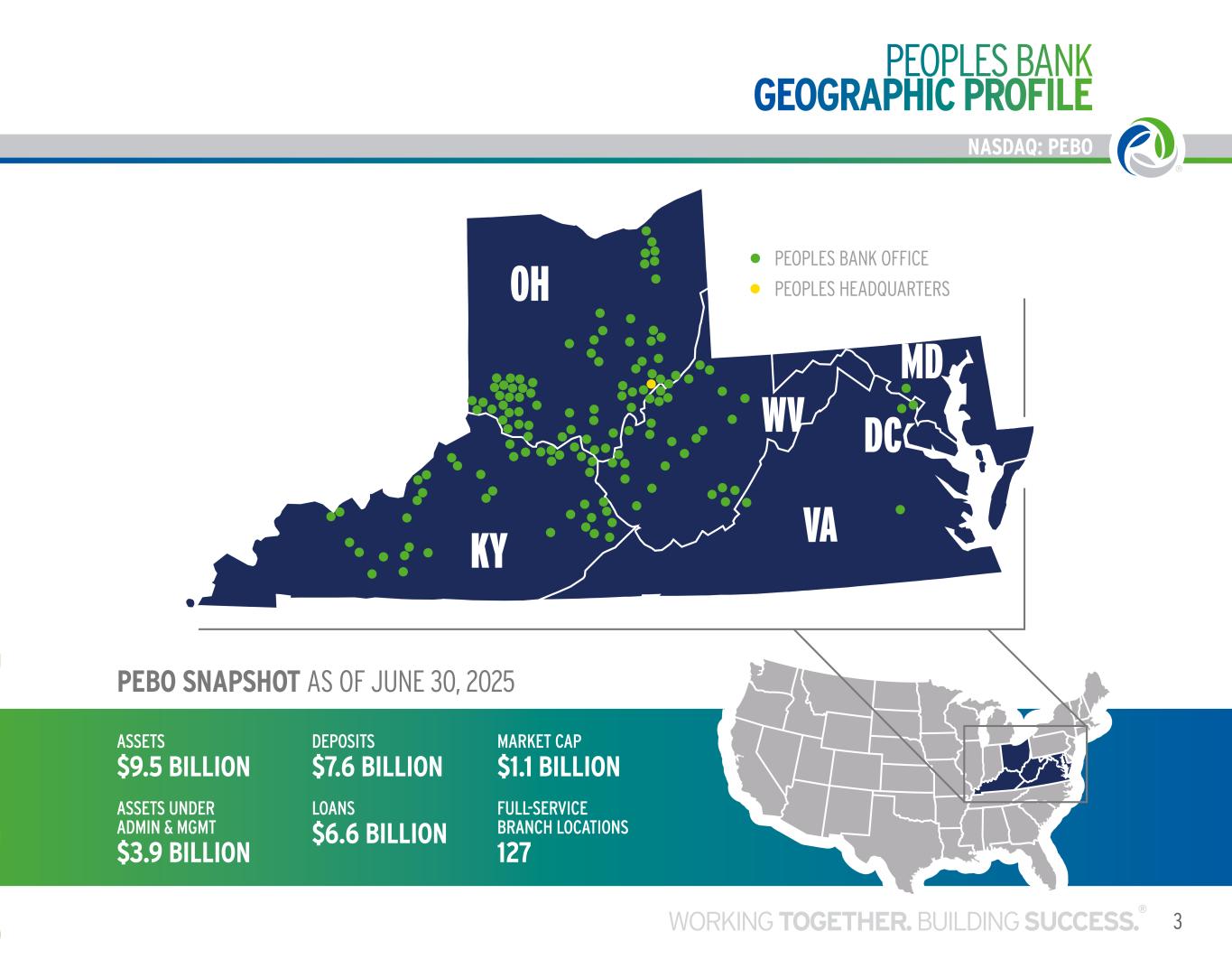

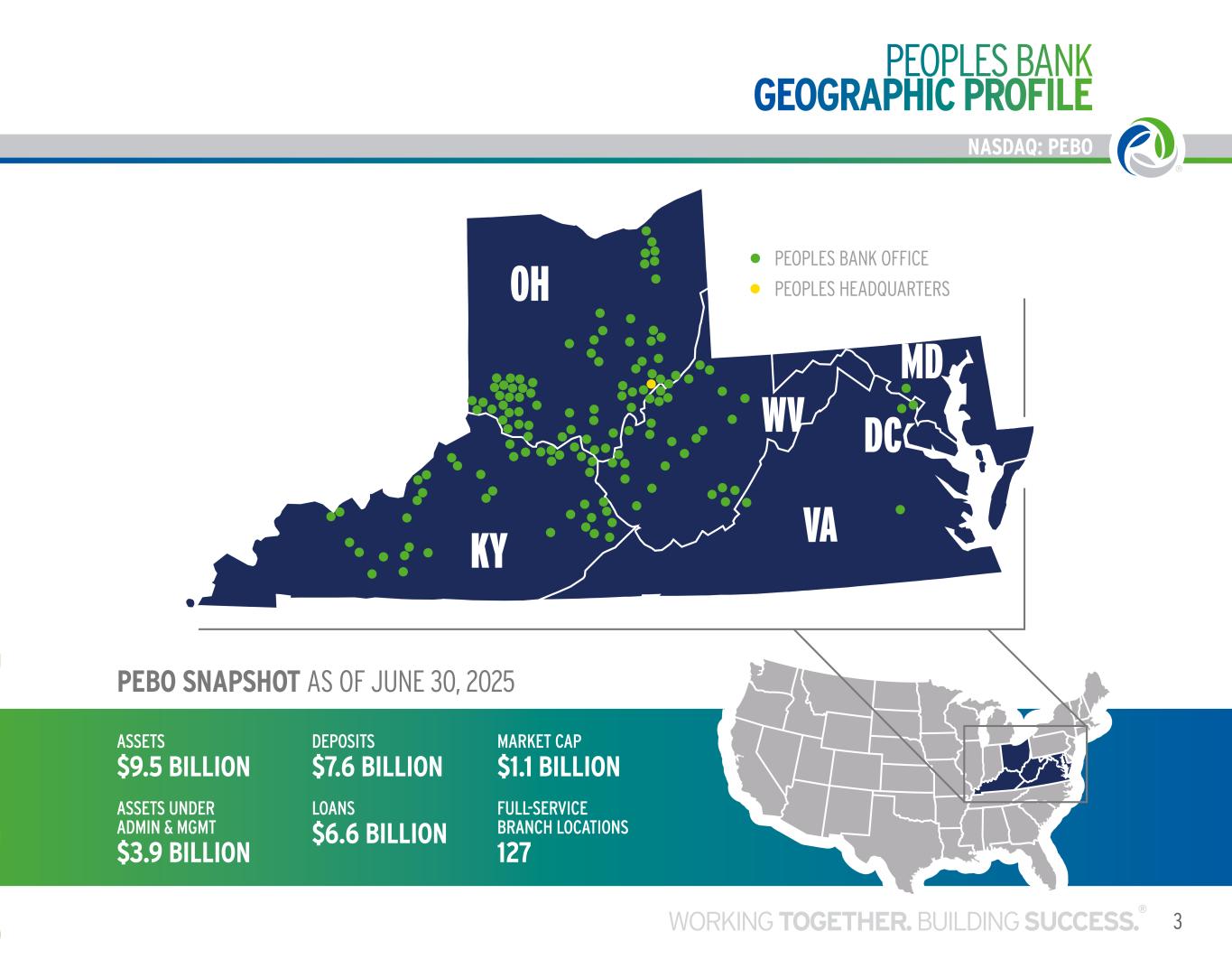

WV VAKY OH MD DC WORKING TOGETHER BUILDING SUCCESS NASDAQ: PEBO PEOPLES BANK GEOGRAPHIC PROFILE 3WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO PEBO SNAPSHOT AS OF JUNE 30, 2025 ASSETS $9.5 BILLION ASSETS UNDER ADMIN & MGMT $3.9 BILLION LOANS $6.6 BILLION DEPOSITS $7.6 BILLION FULL-SERVICE BRANCH LOCATIONS 127 MARKET CAP $1.1 BILLION PEOPLES BANK OFFICE PEOPLES HEADQUARTERS

4 CORPORATE CULTURE NASDAQ: PEBO Our vision is to be the BEST COMMUNITY BANK IN AMERICA for our employees, clients, shareholders, and local communities. Our actions are guided by our core values represented by the PEBO Promise Circle, which embodies how we do business and our never ending pursuit of creating value for our associates, our communities, our clients, and our shareholders. Being true to these core values in the decisions we make and in our business practices is essential to driving sustainable long-term growth. OUR VISION OUR CORE VALUES CLIENTS FIRST INTEGRITY ALWAYS RESPECT FOR ALL COMMITMENT TO COMMUNITY LEAD THE WAY EXCELLENCE IN EVERYTHING

NASDAQ: PEBO STRATEGIC ROAD MAP 5WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO • Everyone is a Risk Manager • Know the Risks: Strategic, Reputation, Credit, Market, Liquidity, Operational, Compliance • Disciplined Credit Culture • Do Things Right the First Time • Raise Your Hand • Discover the Root Cause • Manage Change Effectively • Keep Information Secure • Treat The Client Like Family • Delight The Client • Ensure A Consistent Client Experience Across All Channels • Learn Client’s Goals and Fears • Deliver Expert Advice and Solutions • Evolve the Digital Experience • DWYSYWD (Do What You Say You Will Do) • Acquire, Grow and Retain Clients • Earn Client Referrals • Go Wide • Price for the Value We Provide • Operate Efficiently • Have Appetite For Winning • Execute Thoughtful Mergers and Acquisitions • Hire for Values • Competition Is Across the Street • Promote a Culture of Learning • Coach In Every Direction • Put Right People In Right Job • Be Accountable, No Excuses • Recognize and Reward Performance • Balance Work And Life • Cultivate Diversity • Spread Goodness / No Jerks RESPONSIBLE RISK MANAGEMENT EXTRAORDINARY CLIENT EXPERIENCE PROFITABLE REVENUE GROWTH FIRST CLASS WORKPLACE • Commitment to Superior Shareholder Returns • Clients’ First Choice for Financial Services • Great Place to Work • Meaningful Impact on Our Communities BEST COMMUNITY BANK IN AMERICA

NASDAQ: PEBO 6 INVESTMENT RATIONALE • Top 10 bank-owned insurance agency with expertise in commercial, personal, life & health • Wealth management – $3.9 billion in assets under administration and management, including brokerage, trust and retirement planning as of June 30, 2025 • Top 100 U.S. equipment leasing company (North Star Leasing and Vantage Financial, LLC combined) STRONG, DIVERSE SOURCES OF FEE INCOME • Strong capital, earnings growth and operating performance to support M&A strategy • Proven acquisition and integration capabilities and scalable infrastructure CAPACITY TO GROW OUR FRANCHISE *Non-US GAAP financial measure. See Appendix. • Strongest deposit market share positions in rural markets where we can affect pricing. Top 3 market share in 36 counties across three states. • Presence near larger cities puts us in a position to capture lending opportunities in urban markets (e.g. Cincinnati, Cleveland, Columbus, Lexington, Louisville, Richmond, Washington D.C.) • Greater revenue diversity than average $1 -$10 billion bank, with a fee income ratio of 24%* • Strong reputation with very active community involvement and award-winning brand name • Nationwide insurance premium financing and equipment leasing businesses UNIQUE COMMUNITY BANKING MODEL

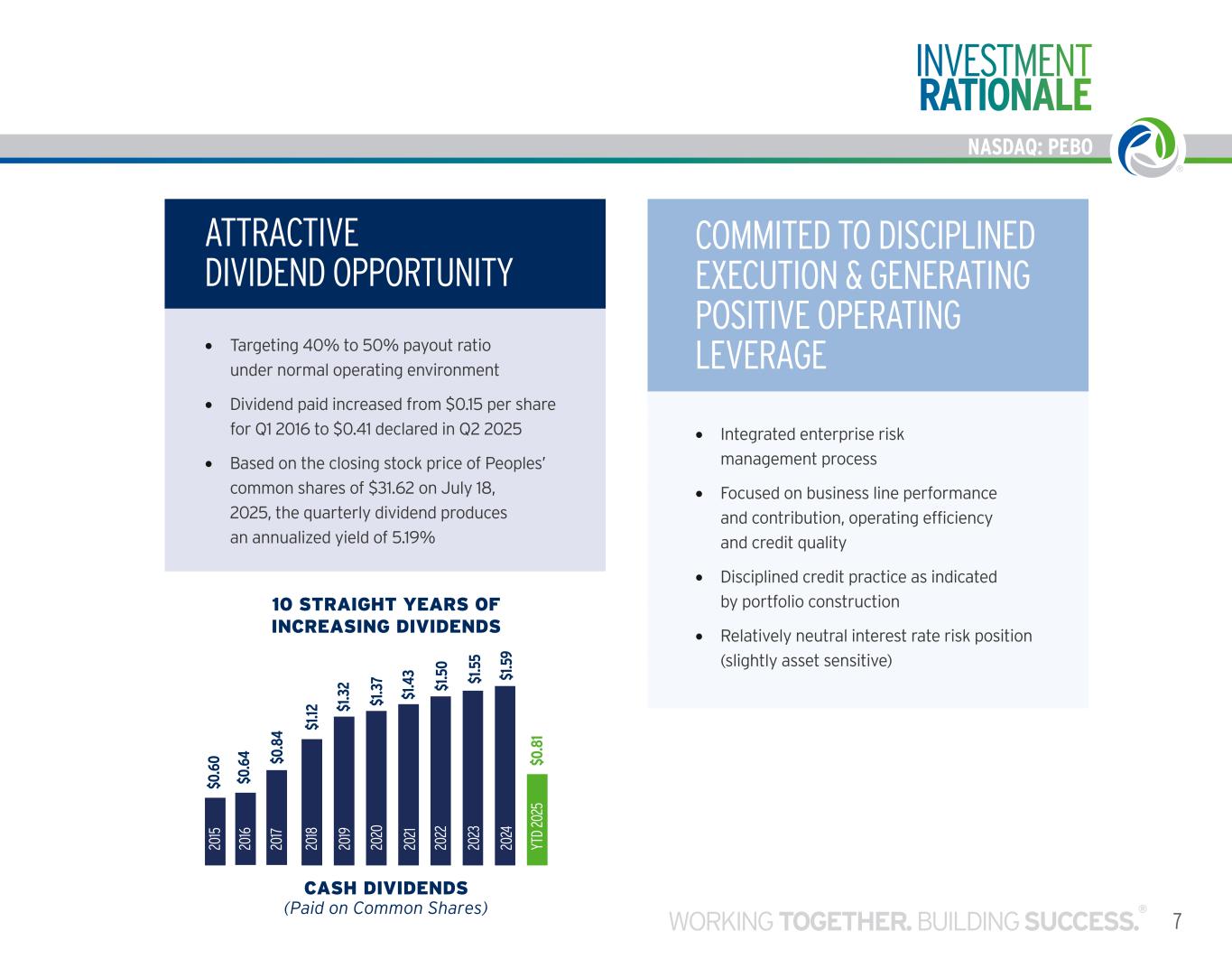

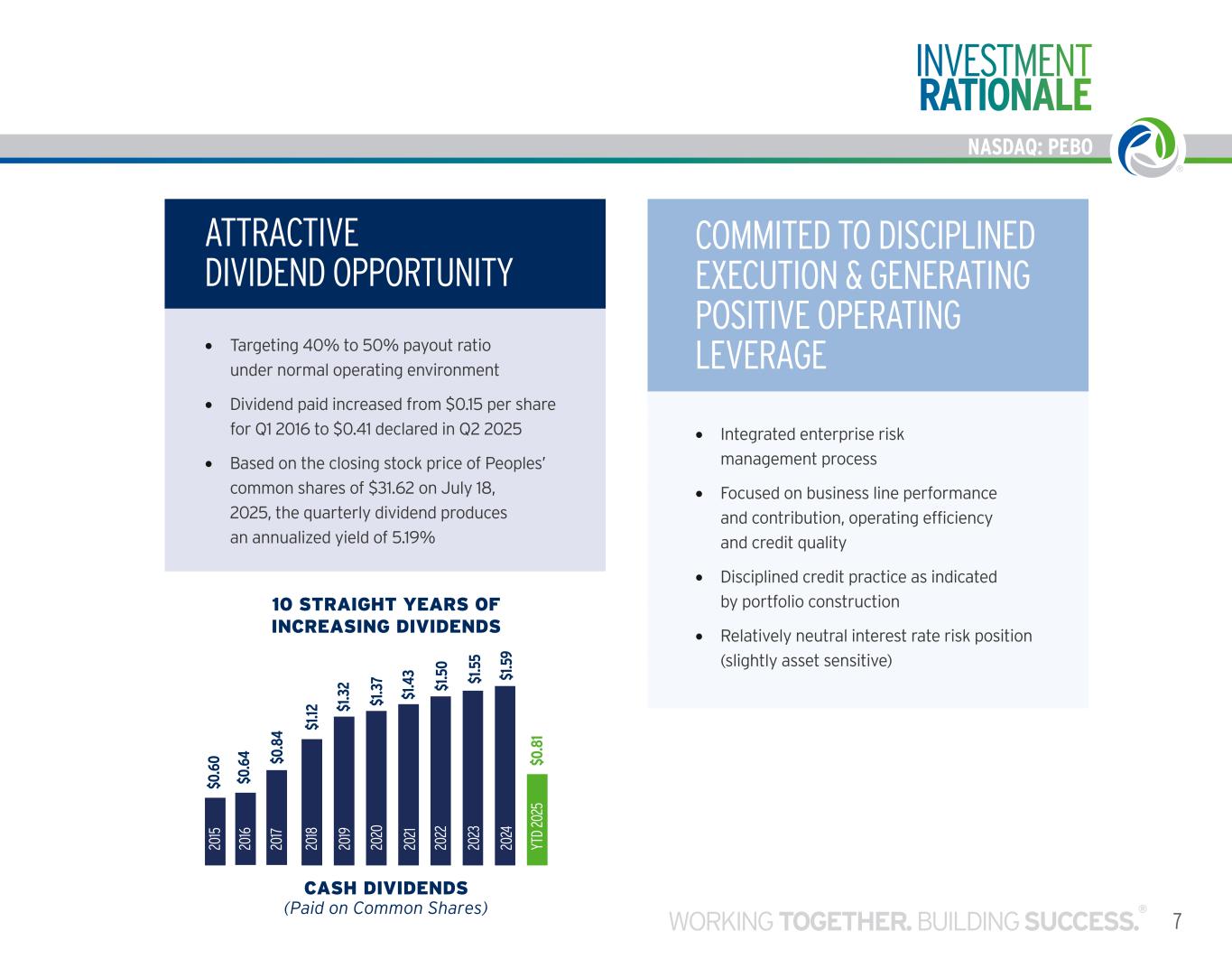

NASDAQ: PEBO 7WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO INVESTMENT RATIONALE • Integrated enterprise risk management process • Focused on business line performance and contribution, operating efficiency and credit quality • Disciplined credit practice as indicated by portfolio construction • Relatively neutral interest rate risk position (slightly asset sensitive) COMMITED TO DISCIPLINED EXECUTION & GENERATING POSITIVE OPERATING LEVERAGE CASH DIVIDENDS (Paid on Common Shares) 10 STRAIGHT YEARS OF INCREASING DIVIDENDS • Targeting 40% to 50% payout ratio under normal operating environment • Dividend paid increased from $0.15 per share for Q1 2016 to $0.41 declared in Q2 2025 • Based on the closing stock price of Peoples’ common shares of $31.62 on July 18, 2025, the quarterly dividend produces an annualized yield of 5.19% ATTRACTIVE DIVIDEND OPPORTUNITY 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 23 20 24 YT D 20 25 $0 .6 0 $0 .6 4 $0 .8 4 $1 .12 $1 .3 2 $1 .3 7 $1 .4 3 $1 .5 0 $1 .5 5 $1 .5 9 $0 .8 1

8 NASDAQ: PEBO INVESTMENT RATIONALE CREDIT • NPAs of 0.49% as a percentage of total assets • 99.1% of loan portfolio “current” at quarter-end • Total outstanding balance of commercial office space was $182 million or 2.8% of total loans • 0.43% net charge-offs to average loans as of Q2 2025 • CRE is 190% of risk based capital as of 6/30/2025 CAPITAL • Continue to exceed the capital required by FRB to be deemed well capitalized • Tier 1 capital ratio was 12.39% • Tangible book value per share was $21.18 • Over $42.0 million in share buybacks since 2020, including $0.5 million in 2025 DEPOSITS • 78% of our deposits are retail deposits (consumer and small businesses) • Average retail customer deposit relationship: $23,000 • Median retail customer deposit relationship: $2,300 • 26% of our deposit balances exceeded FDIC1 insurance limits (18% if you exclude collateralized governmental deposits) LIQUIDITY • Loan-to-deposit ratio of 86% • $878.5 million in liquefiable assets • $3.7 billion of contingent liquidity sources (nearly $607.5 million of the available funding is from lines available from the FHLB2 and the FRB3) STRENGTH IN THE CURRENT ENVIRONMENT (AS OF JUNE 30, 2025) 1 Federal Deposit Insurance Corporation 2 Federal Home Loan Bank 3 Federal Reserve Bank

NASDAQ: PEBO 9WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO EXTERNAL RECOGNITION & COMMUNITY INVOLVEMENT $700,000+ AMOUNT RAISED IN ASSOCIATE DONATIONS TO LOCAL FOOD BANKS & PANTRIES SINCE APRIL 2020 $8 MILLION PEOPLES BANK FOUNDATION GRANTS AND SCHOLARSHIPS AWARDED SINCE ITS INCEPTION IN 2003 5,000+ HOURS IN COMMUNITY REINVESTMENT VOLUNTEER ACTIVITIES FROM 2023-2024 FOUR YEARS IN A ROW FOUR YEARS IN A ROW TWO YEARS IN A ROW TWO YEARS IN A ROW TWO YEARS IN A ROW

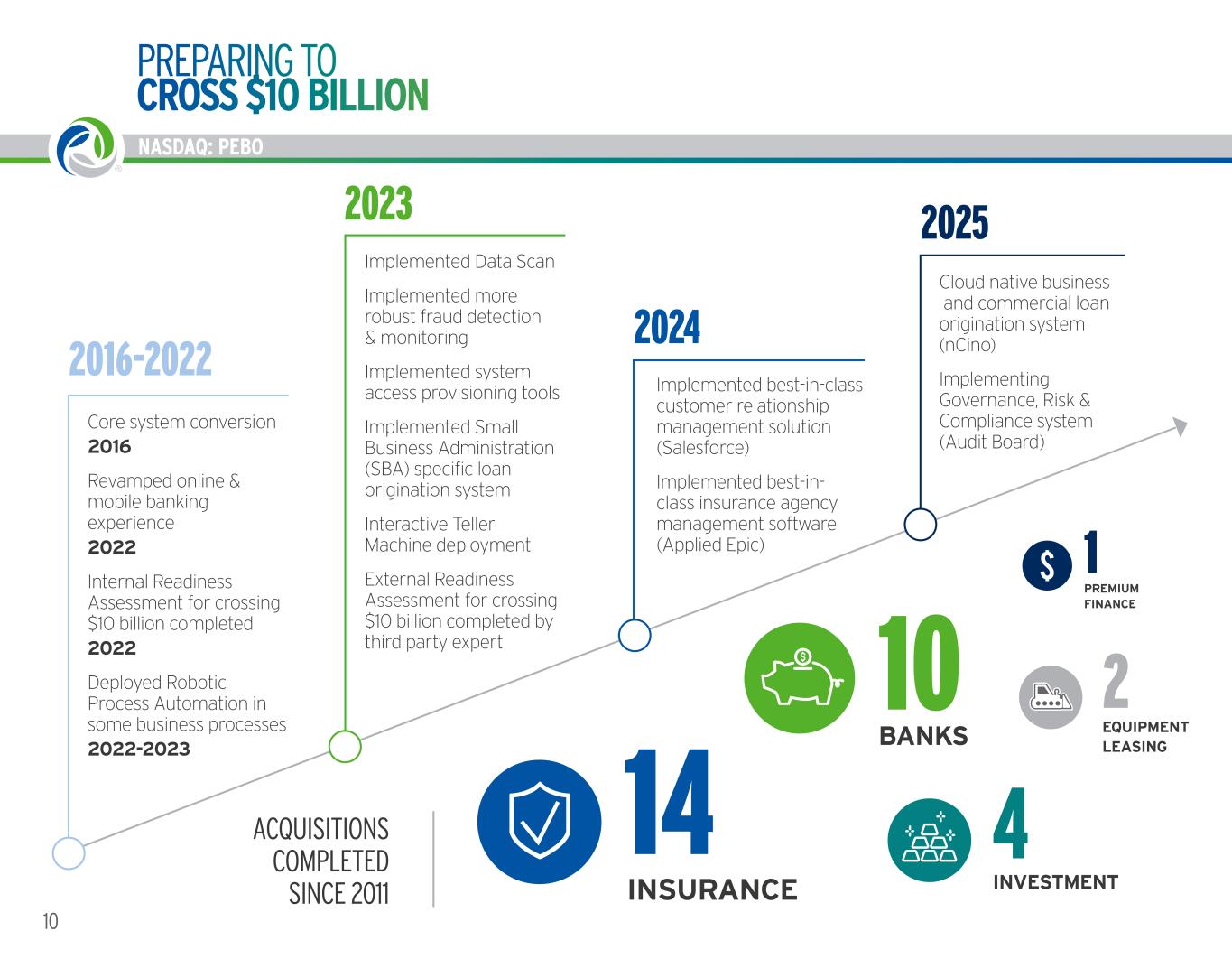

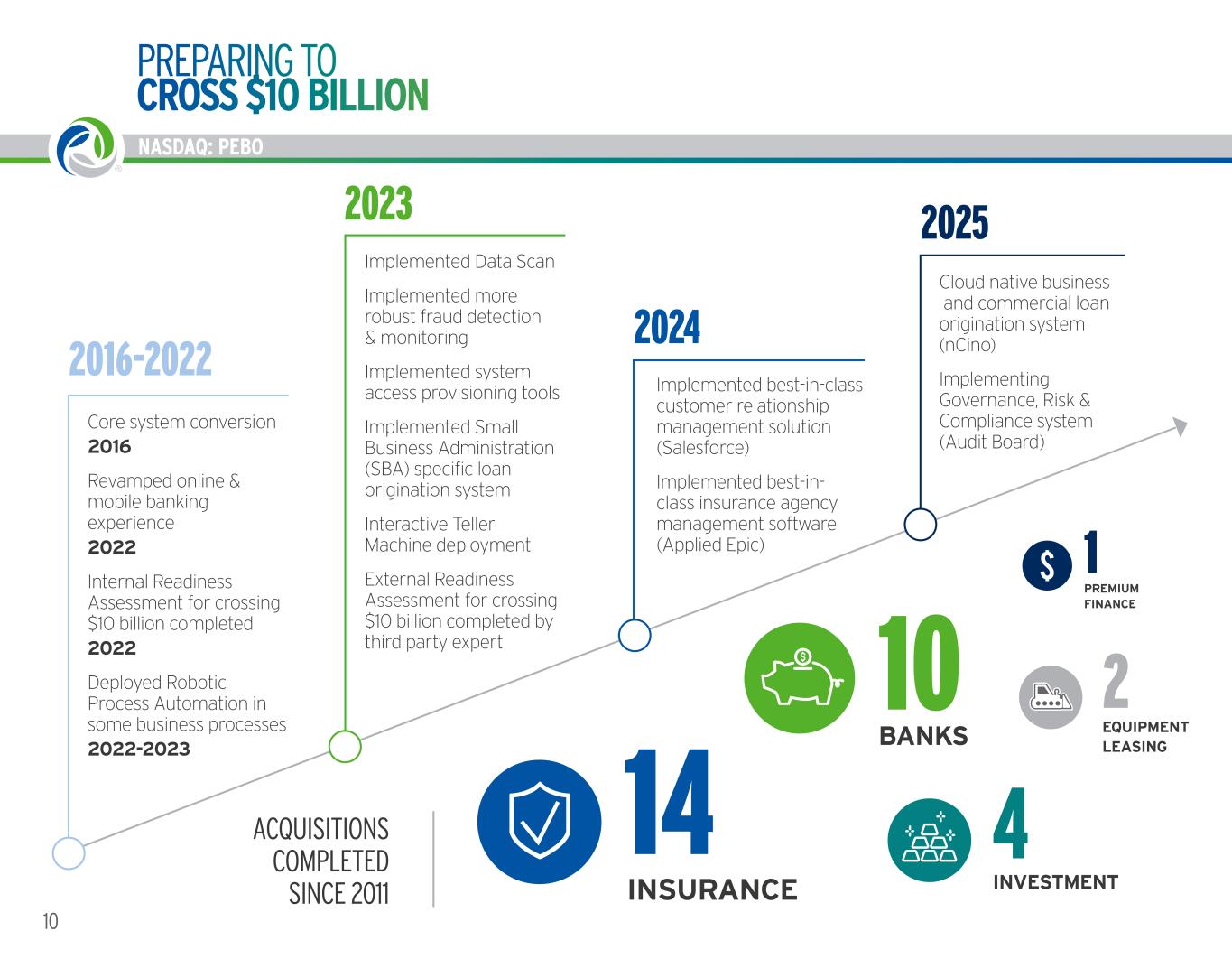

PREPARING TO CROSS $10 BILLION 10 NASDAQ: PEBO 2016-2022 2023 2025 2024 Core system conversion 2016 Revamped online & mobile banking experience 2022 Internal Readiness Assessment for crossing $10 billion completed 2022 Deployed Robotic Process Automation in some business processes 2022-2023 Implemented Data Scan Implemented more robust fraud detection & monitoring Implemented system access provisioning tools Implemented Small Business Administration (SBA) specific loan origination system Interactive Teller Machine deployment External Readiness Assessment for crossing $10 billion completed by third party expert Implemented best-in-class customer relationship management solution (Salesforce) Implemented best-in- class insurance agency management software (Applied Epic) Cloud native business and commercial loan origination system (nCino) Implementing Governance, Risk & Compliance system (Audit Board) ACQUISITIONS COMPLETED SINCE 2011 BANKS 10 EQUIPMENT LEASING 2 PREMIUM FINANCE 1 INSURANCE 14 INVESTMENT 4

NASDAQ: PEBO 11WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO COMPETITIVE PRODUCTS, TECHNOLOGY AND CAPABILITIES CREDIT CARD SOLUTIONS Purchasing card, ghost card, virtual card, credit cards for consumers and small business COMMERCIAL CAPABILITIES Remote deposit capture, sweep accounts, escrow management and more FRAUD PREVENTION TOOLS Positive pay, reverse positive pay, debit card on/off switch, 24/7 fraud monitoring and more SPECIALTY FINANCE Online applications and servicing for leasing and premium finance BANKING MOBILE APP Mobile check deposit, Zelle, Apple Pay, ACH approval and more Apple App Store Rating: 4.6 Stars Google Play Store Rating: 4.5 Stars INVESTMENT and INSURANCE APPS App Store Ratings as of June 1, 2025

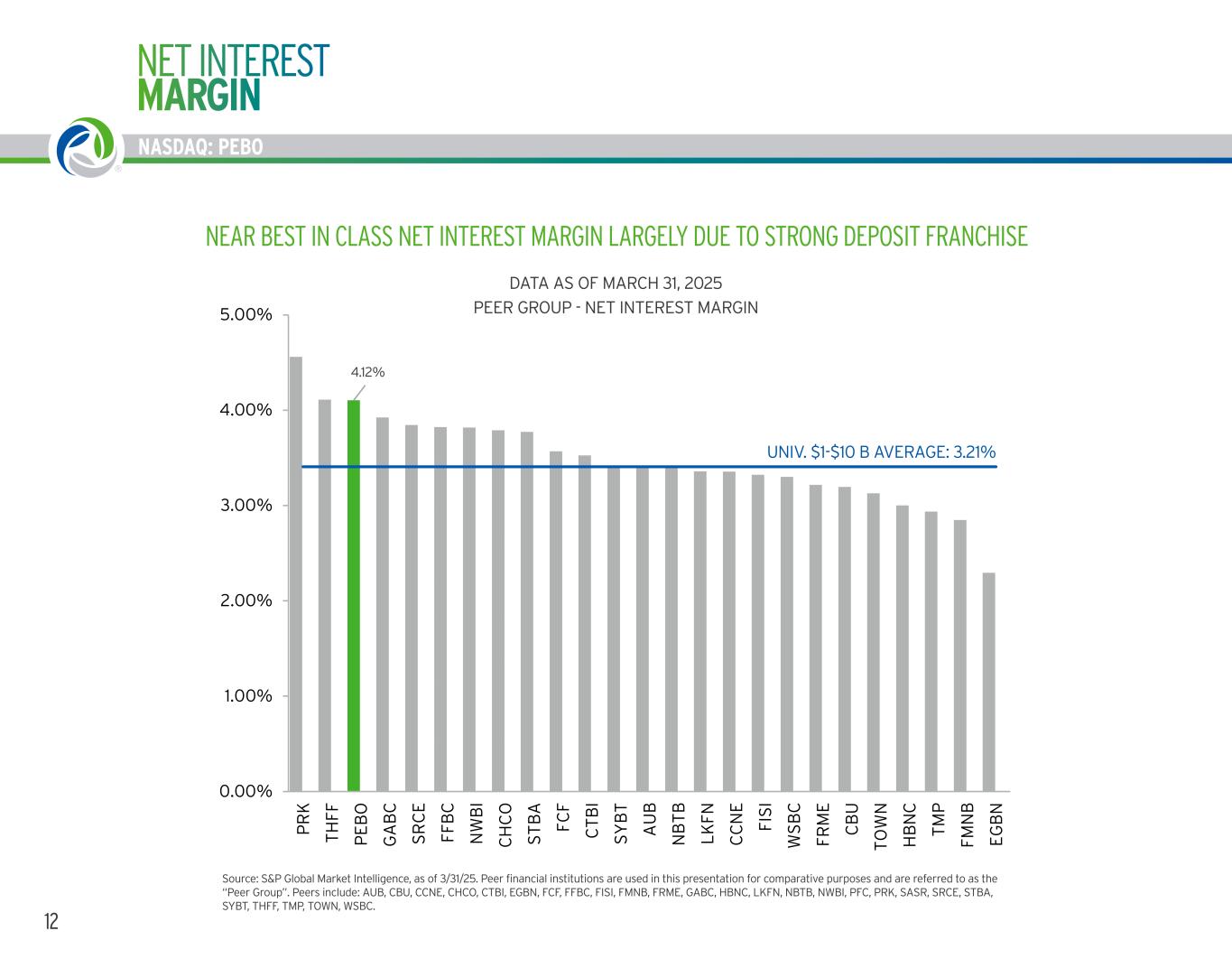

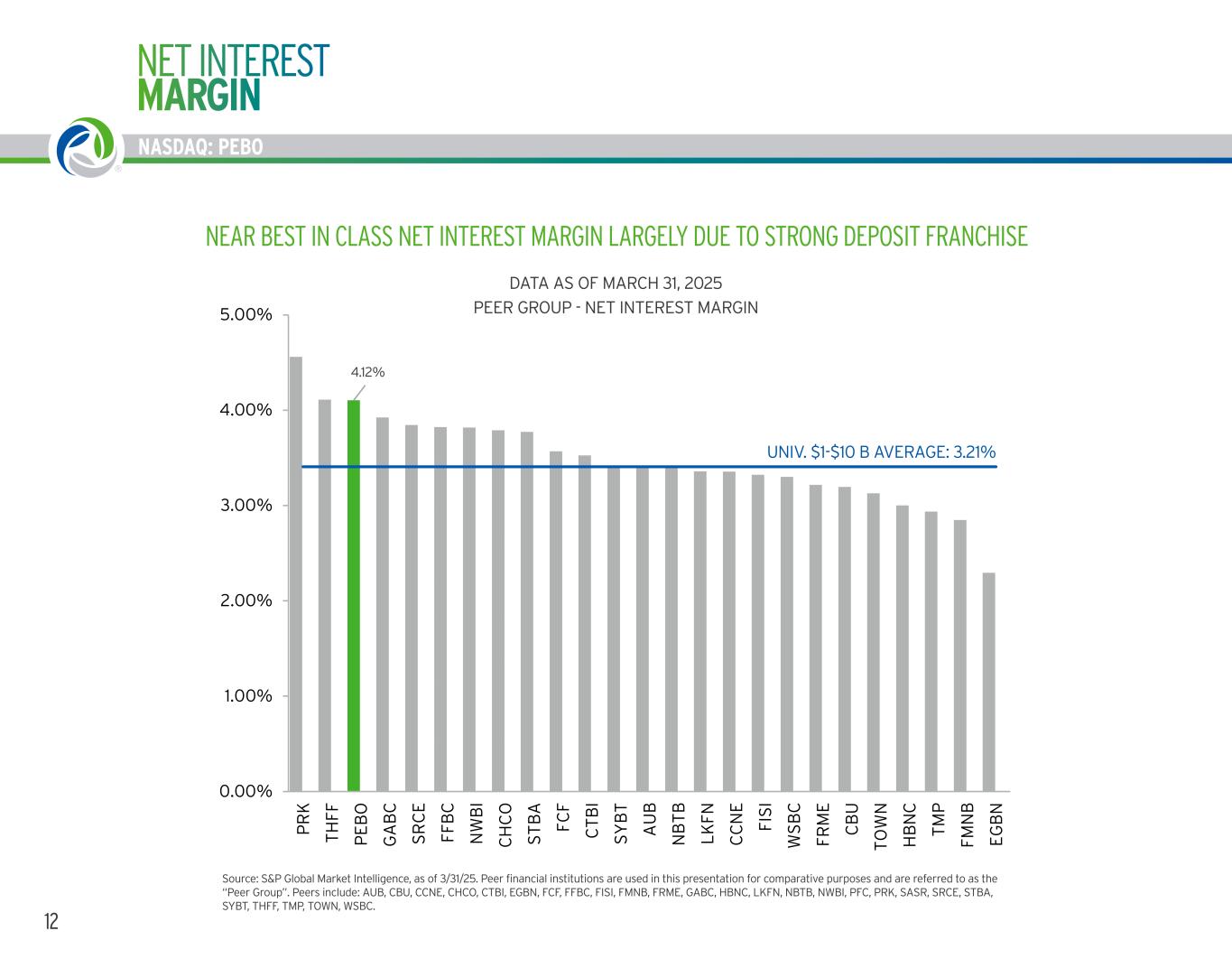

12 NASDAQ: PEBO 4.10% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% P R K T H FF P E B O G A B C S R C E FF B C N W B I C H C O S T B A FC F C T B I S Y B T A U B N B T B L K FN C C N E FI S I W S B C FR M E C B U T O W N H B N C T M P FM N B E G B N NEAR BEST IN CLASS NET INTEREST MARGIN LARGELY DUE TO STRONG DEPOSIT FRANCHISE PEER GROUP - NET INTEREST MARGIN Source: S&P Global Market Intelligence, as of 3/31/25. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. DATA AS OF MARCH 31, 2025 UNIV. $1-$10 B AVERAGE: 3.21% NET INTEREST MARGIN 4.12

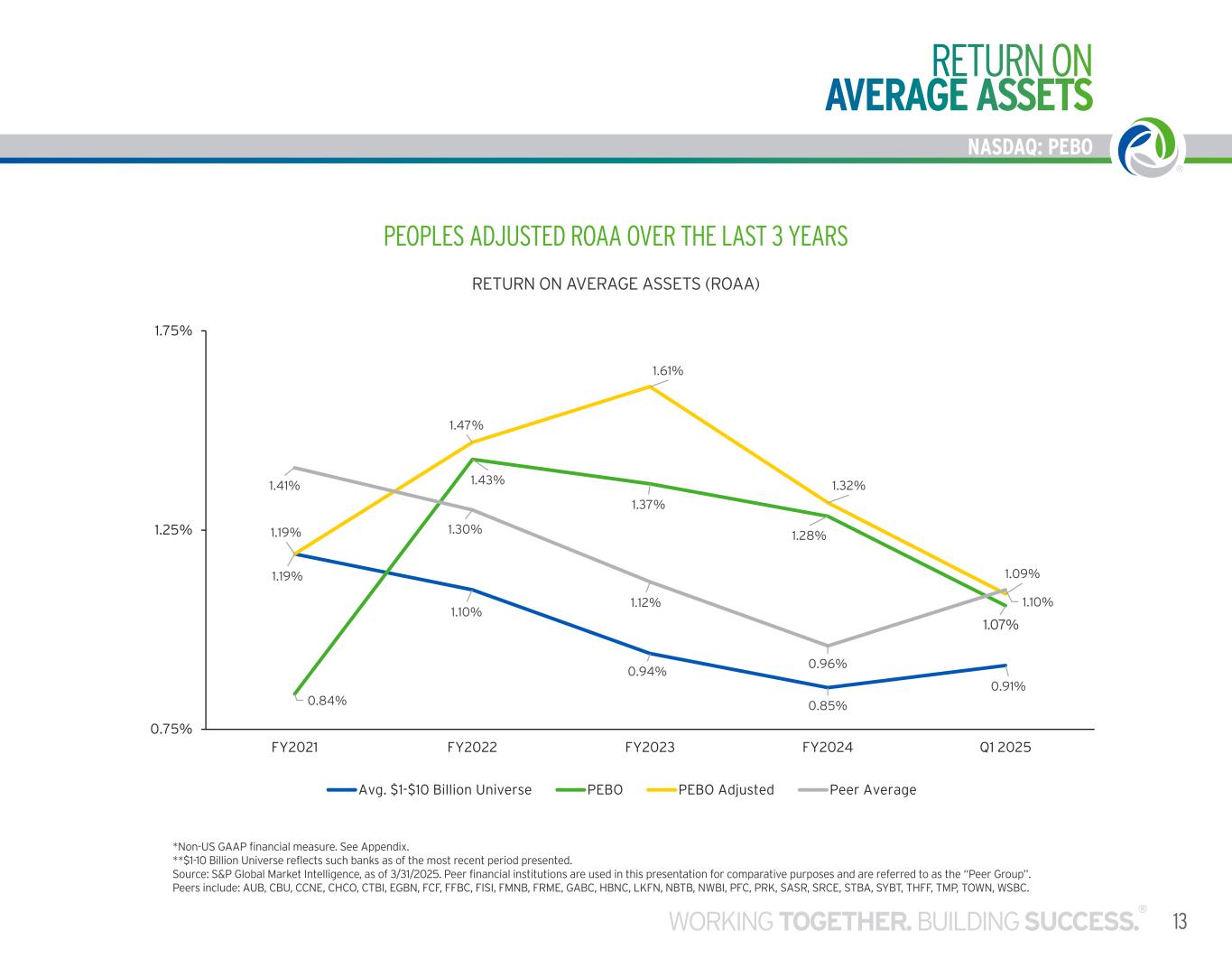

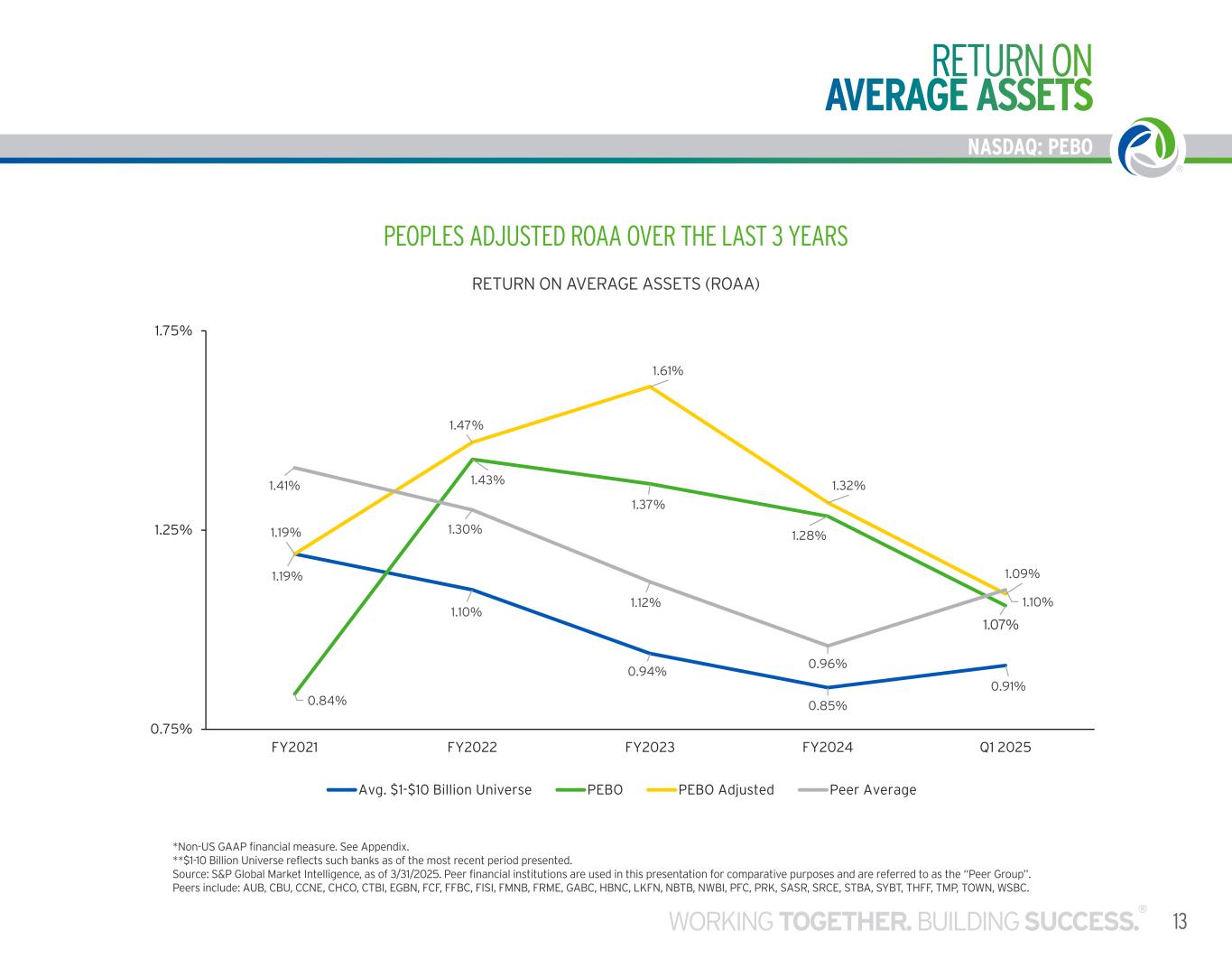

NASDAQ: PEBO 13WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 1.19% 1.10% 0.94% 0.85% 0.91% 0.84% 1.43% 1.37% 1.28% 1.06% 1.19% 1.47% 1.61% 1.32% 1.09% 1.41% 1.30% 1.12% 0.96% 1.10% 0.75% 1.25% 1.75% FY2021 FY2022 FY2023 FY2024 Q1 2025 Avg. $1-$10 Billion Universe PEBO PEBO Adjusted Peer Average RETURN ON AVERAGE ASSETS NEAR BEST IN CLASS NET INTEREST MARGIN LARGELY DUE TO STRONG DEPOSIT FRANCHISE PEER GROUP - NET INTEREST MARGIN PEOPLES ADJUSTED ROAA OVER THE LAST 3 YEARS *Non-US GAAP financial measure. See Appendix. **$1-10 Billion Universe reflects such banks as of the most recent period presented. Source: S&P Global Market Intelligence, as of 3/31/2025. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. RETURN ON AVERAGE ASSETS (ROAA) 7

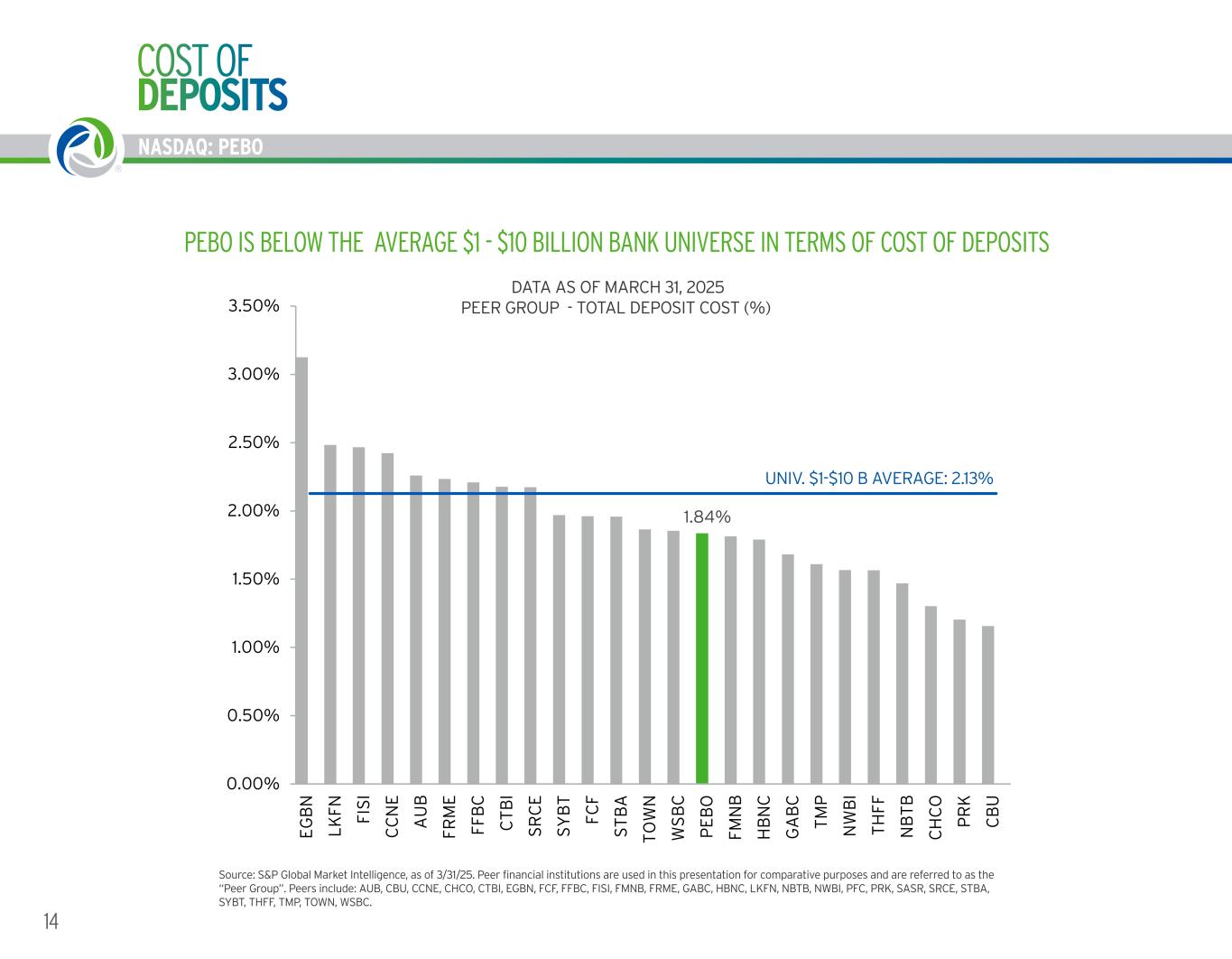

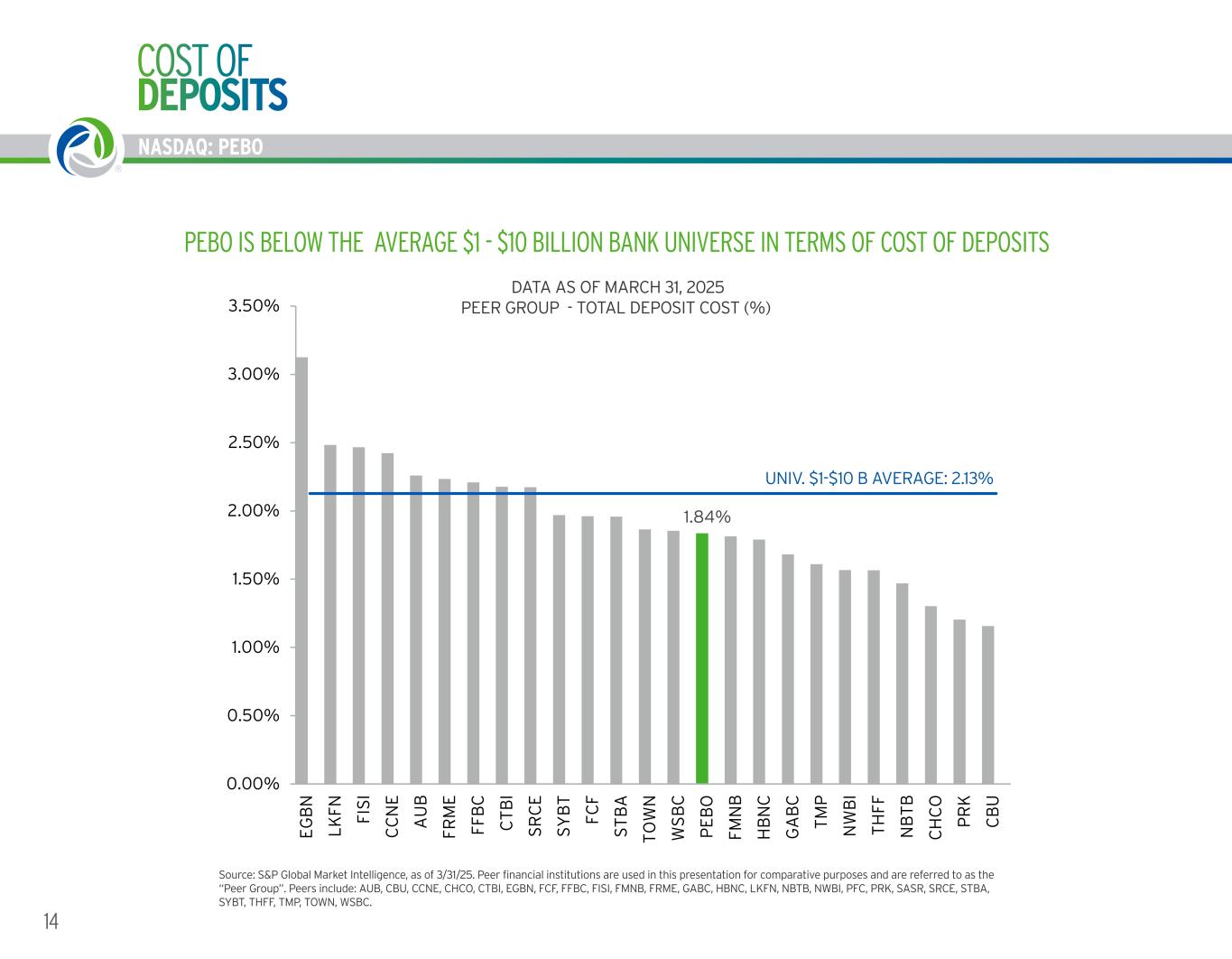

14 NASDAQ: PEBO 1.84% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% E G B N L K FN FI S I C C N E A U B FR M E FF B C C T B I S R C E S Y B T FC F S T B A T O W N W S B C P E B O FM N B H B N C G A B C T M P N W B I T H FF N B T B C H C O P R K C B U COST OF DEPOSITS Source: S&P Global Market Intelligence, as of 3/31/25. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. UNIV. $1-$10 B AVERAGE: 2.13% PEBO IS BELOW THE AVERAGE $1 - $10 BILLION BANK UNIVERSE IN TERMS OF COST OF DEPOSITS PEER GROUP - TOTAL DEPOSIT COST (%) DATA AS OF MARCH 31, 2025

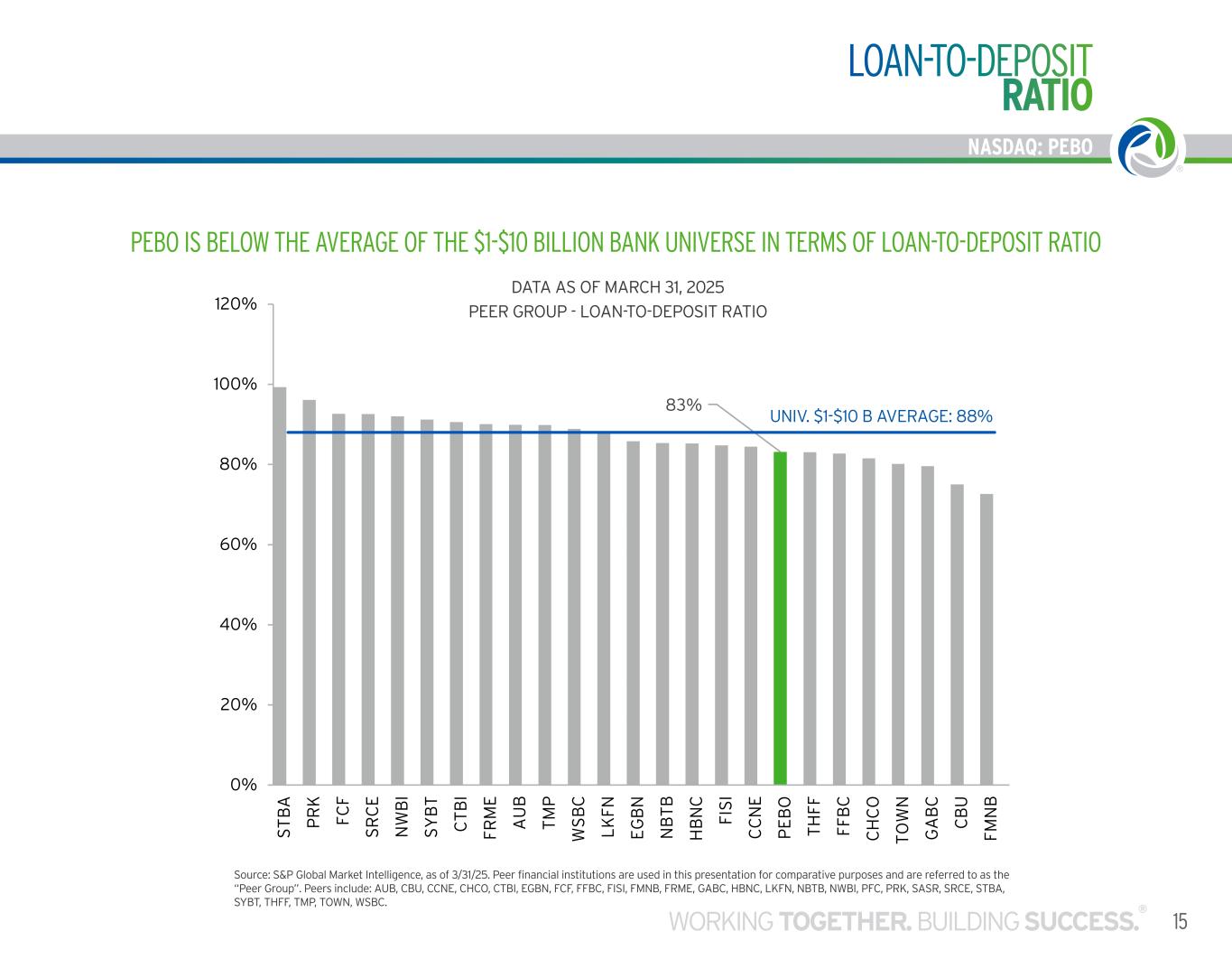

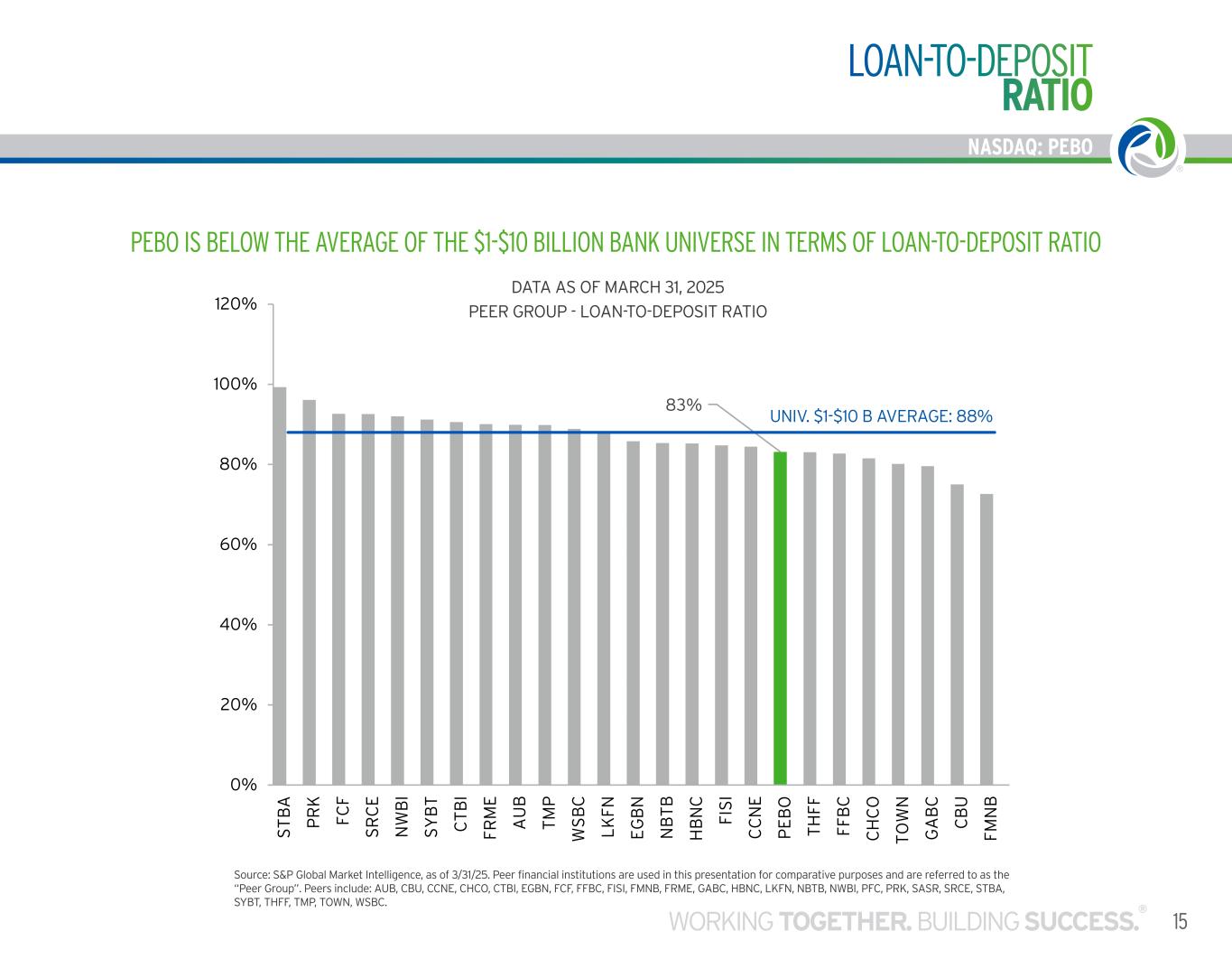

NASDAQ: PEBO 15WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 83% 0% 20% 40% 60% 80% 100% 120% S T B A P R K FC F S R C E N W B I S Y B T C T B I FR M E A U B T M P W S B C L K FN E G B N N B T B H B N C FI S I C C N E P E B O T H FF FF B C C H C O T O W N G A B C C B U FM N B LOAN-TO-DEPOSIT RATIO Source: S&P Global Market Intelligence, as of 3/31/25. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. PEBO IS BELOW THE AVERAGE OF THE $1-$10 BILLION BANK UNIVERSE IN TERMS OF LOAN-TO-DEPOSIT RATIO PEER GROUP - LOAN-TO-DEPOSIT RATIO DATA AS OF MARCH 31, 2025 UNIV. $1-$10 B AVERAGE: 88% DATA AS OF MARCH 31, 2025

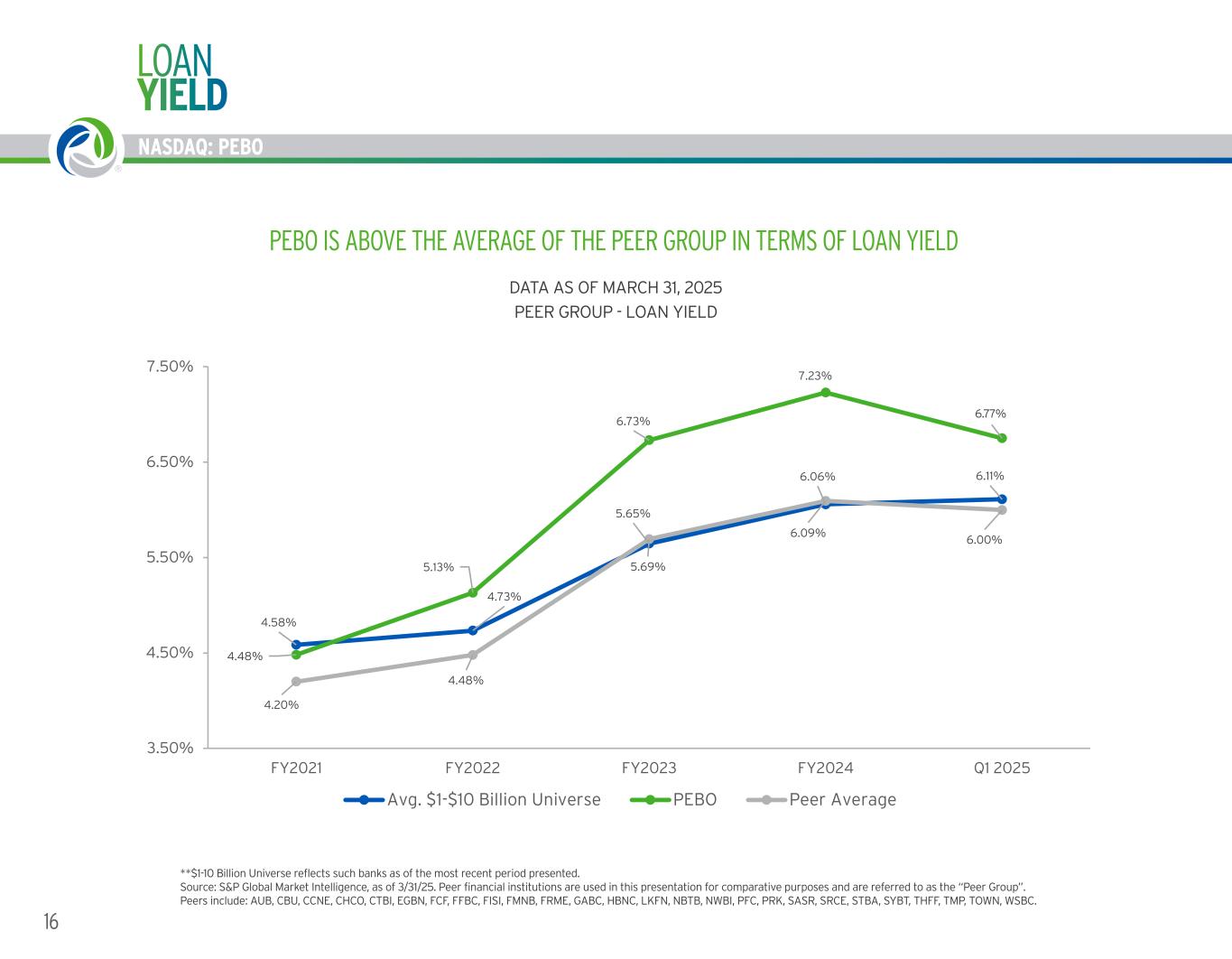

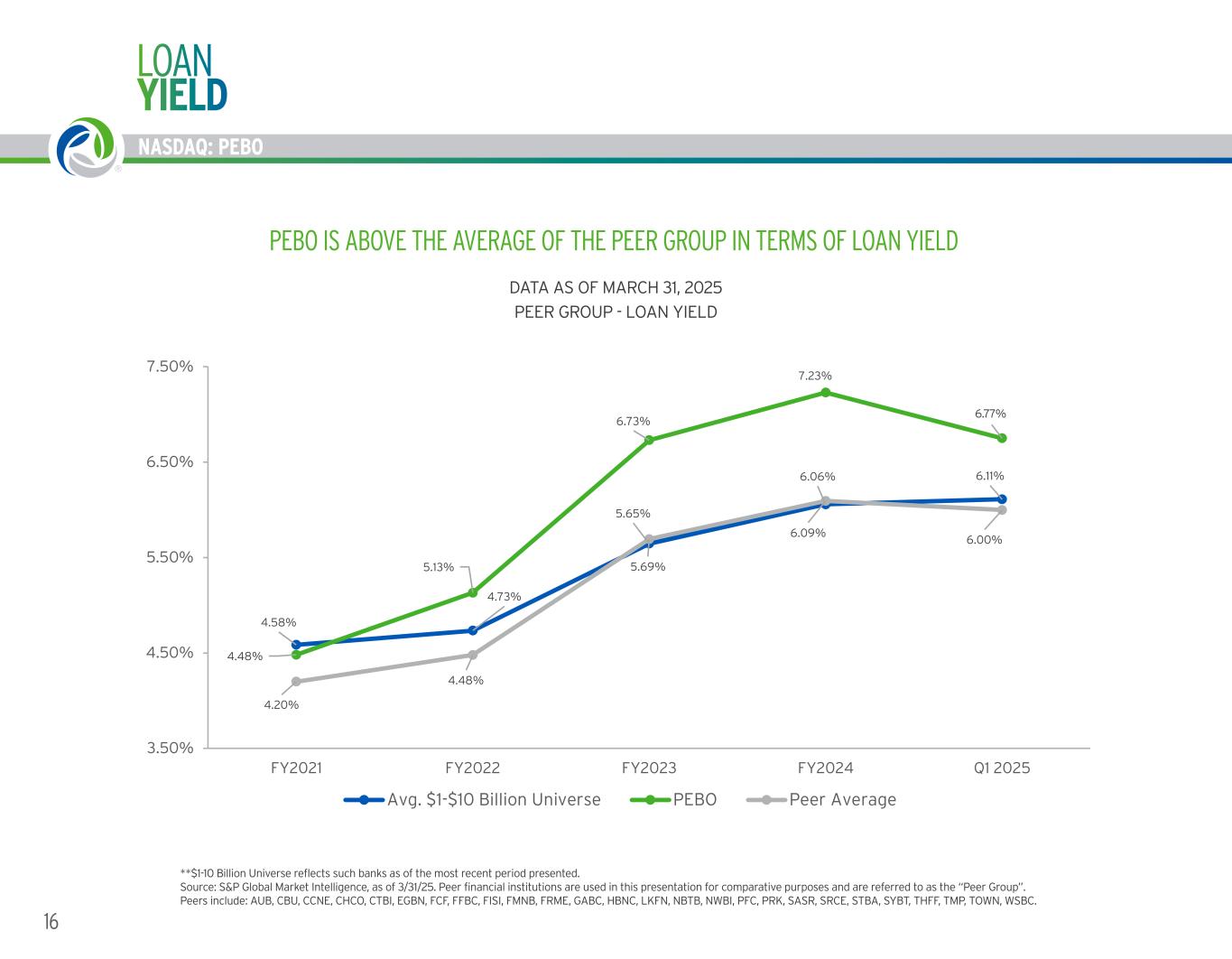

16 NASDAQ: PEBO 4.58% 4.73% 5.65% 6.06% 6.11% 4.48% 5.13% 6.73% 7.23% 6.75% 4.20% 4.48% 5.69% 6.09% 6.00% 3.50% 4.50% 5.50% 6.50% 7.50% FY2021 FY2022 FY2023 FY2024 Q1 2025 Avg. $1-$10 Billion Universe PEBO Peer Average LOAN YIELD PEBO IS ABOVE THE AVERAGE OF THE PEER GROUP IN TERMS OF LOAN YIELD PEER GROUP - LOAN YIELD DATA AS OF MARCH 31, 2025 **$1-10 Billion Universe reflects such banks as of the most recent period presented. Source: S&P Global Market Intelligence, as of 3/31/25. Peer financial institutions are used in this presentation for comparative purposes and are referred to as the “Peer Group”. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. . 7

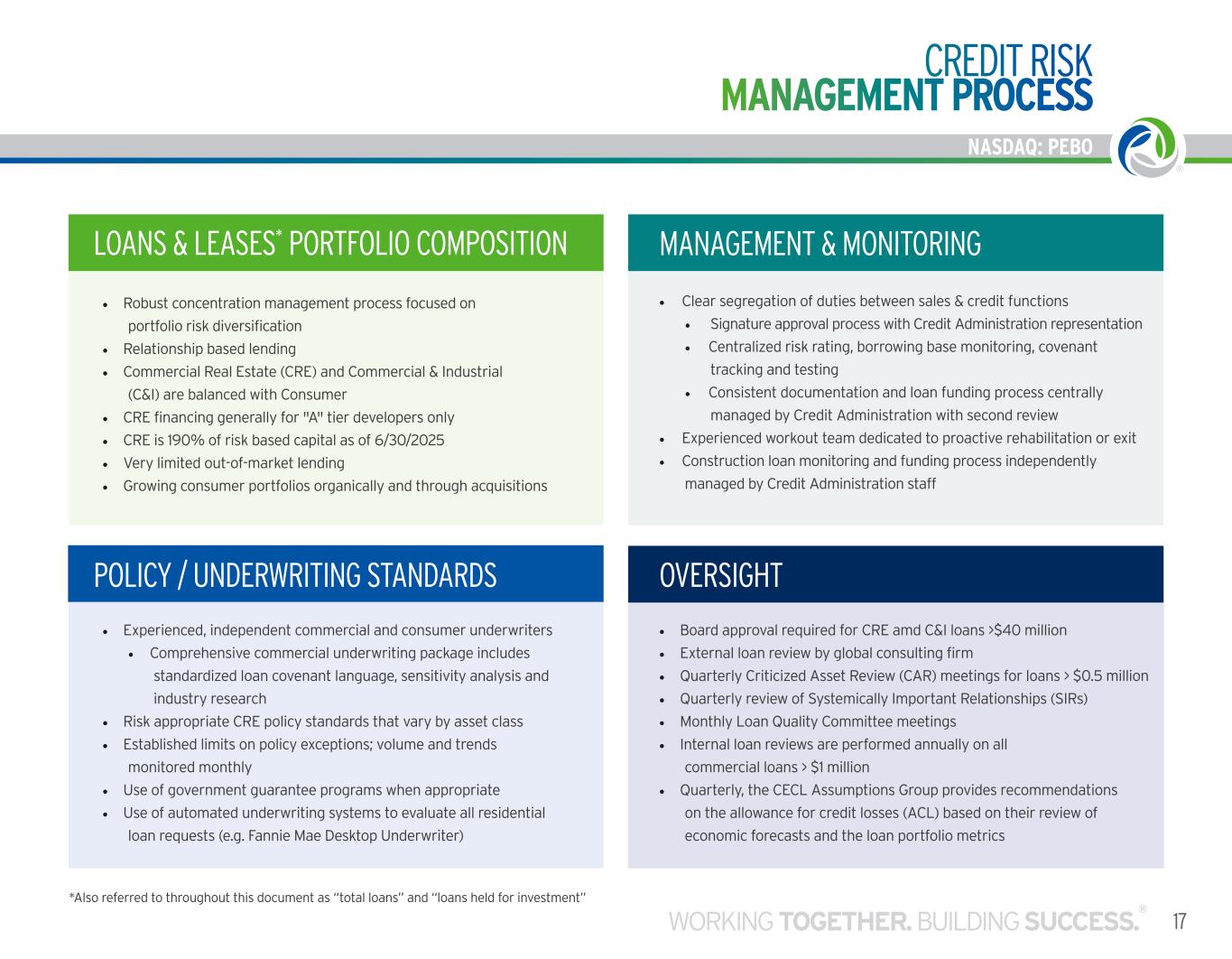

NASDAQ: PEBO 17WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO *Also referred to throughout this document as “total loans” and “loans held for investment” CREDIT RISK MANAGEMENT PROCESS POLICY / UNDERWRITING STANDARDS • Robust concentration management process focused on portfolio risk diversification • Relationship based lending • Commercial Real Estate (CRE) and Commercial & Industrial (C&I) are balanced with Consumer • CRE financing generally for "A" tier developers only • CRE is 190% of risk based capital as of 6/30/2025 • Very limited out-of-market lending • Growing consumer portfolios organically and through acquisitions • Experienced, independent commercial and consumer underwriters • Comprehensive commercial underwriting package includes standardized loan covenant language, sensitivity analysis and industry research • Risk appropriate CRE policy standards that vary by asset class • Established limits on policy exceptions; volume and trends monitored monthly • Use of government guarantee programs when appropriate • Use of automated underwriting systems to evaluate all residential loan requests (e.g. Fannie Mae Desktop Underwriter) • Board approval required for CRE amd C&I loans >$40 million • External loan review by global consulting firm • Quarterly Criticized Asset Review (CAR) meetings for loans > $0.5 million • Quarterly review of Systemically Important Relationships (SIRs) • Monthly Loan Quality Committee meetings • Internal loan reviews are performed annually on all commercial loans > $1 million • Quarterly, the CECL Assumptions Group provides recommendations on the allowance for credit losses (ACL) based on their review of economic forecasts and the loan portfolio metrics • Clear segregation of duties between sales & credit functions • Signature approval process with Credit Administration representation • Centralized risk rating, borrowing base monitoring, covenant tracking and testing • Consistent documentation and loan funding process centrally managed by Credit Administration with second review • Experienced workout team dedicated to proactive rehabilitation or exit • Construction loan monitoring and funding process independently managed by Credit Administration staff LOANS & LEASES* PORTFOLIO COMPOSITION MANAGEMENT & MONITORING OVERSIGHT

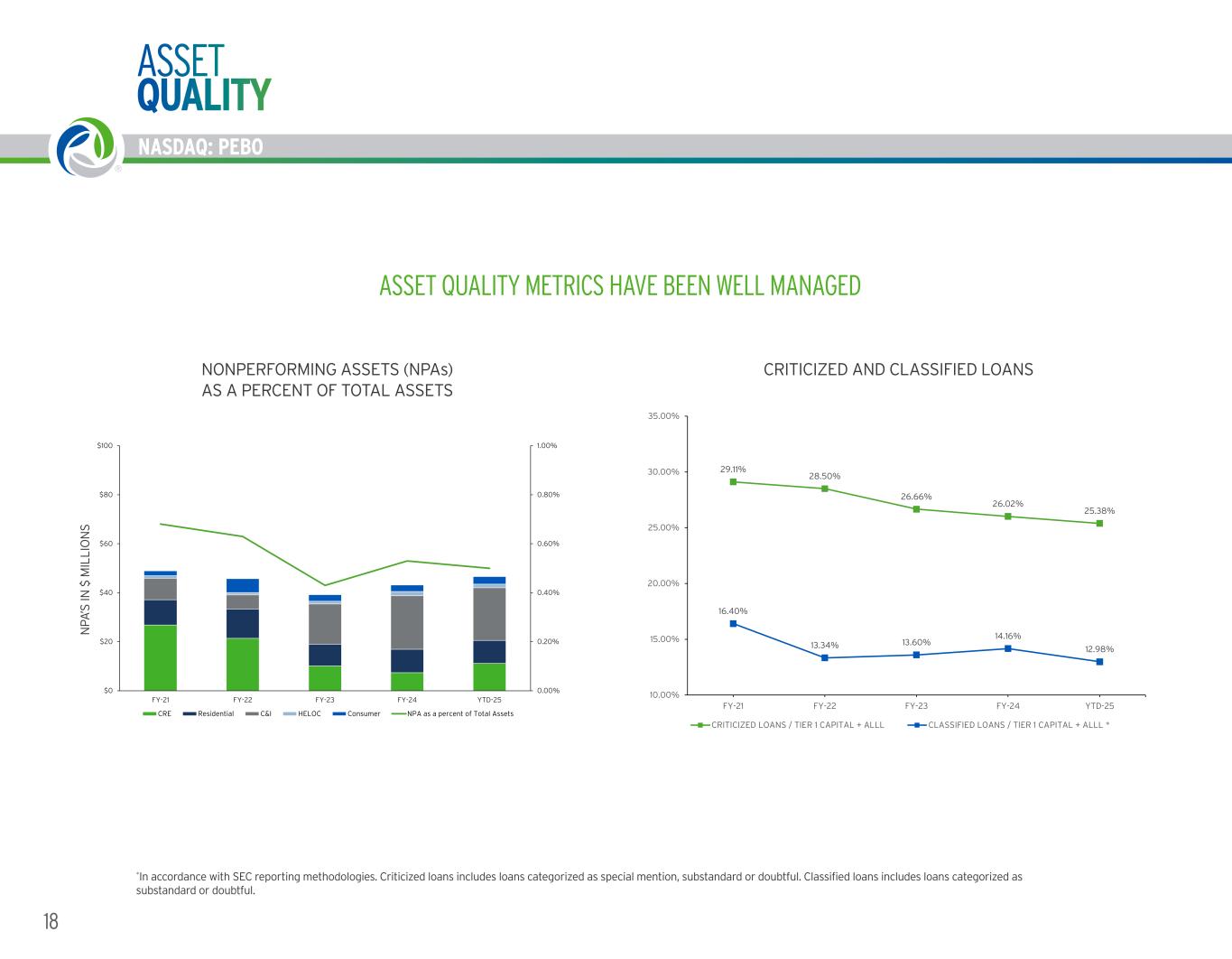

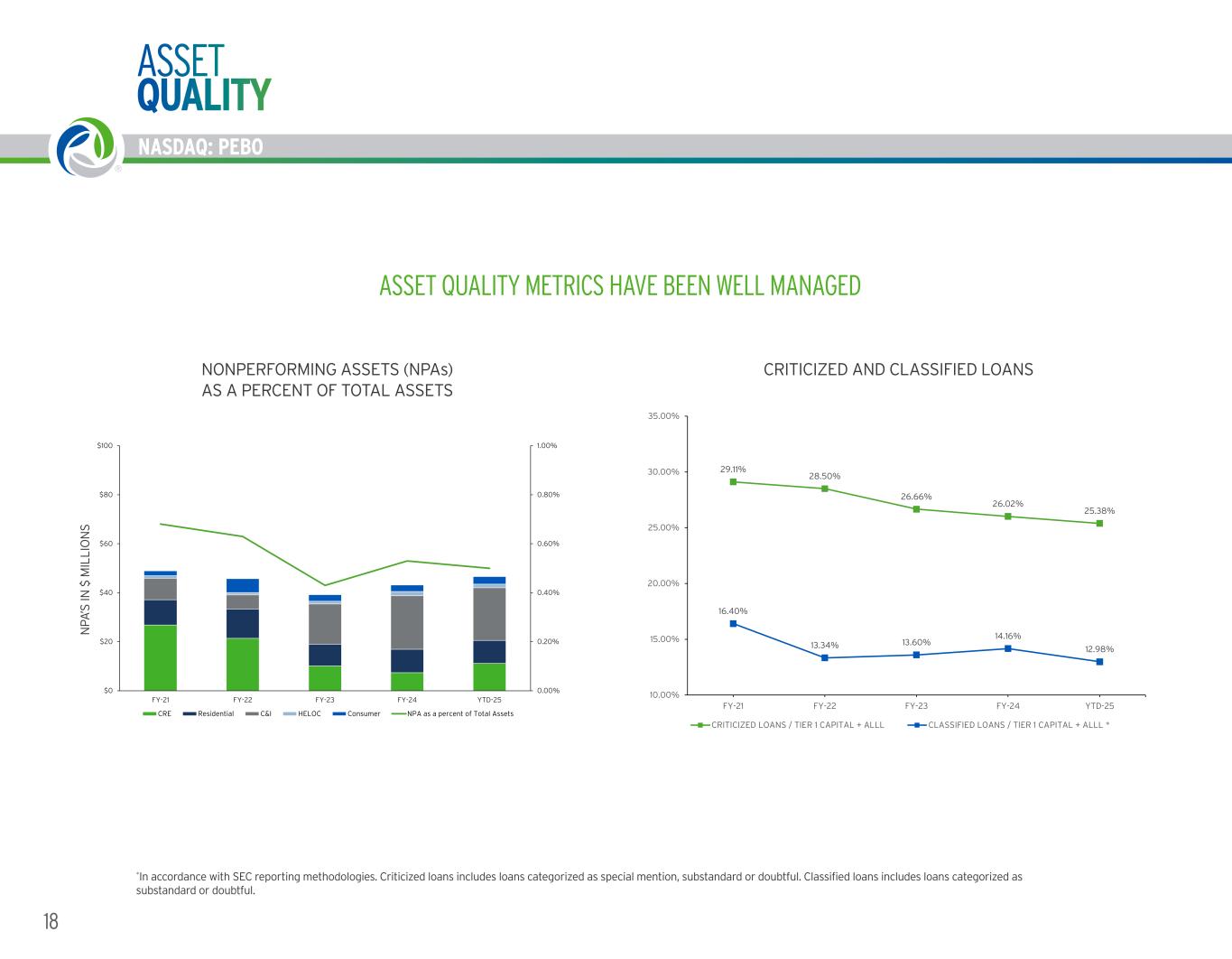

18 NASDAQ: PEBO 29.11% 28.50% 26.66% 26.02% 25.38% 16.40% 13.34% 13.60% 14.16% 12.98% 10.00% 15.00% 20.00% 25.00% 30.00% 35.00% FY-21 FY-22 FY-23 FY-24 YTD-25 CRITICIZED AND CLASSIFIED LOANS CRITICIZED LOANS / TIER 1 CAPITAL + ALLL CLASSIFIED LOANS / TIER 1 CAPITAL + ALLL * 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% $0 $20 $40 $60 $80 $100 FY-21 FY-22 FY-23 FY-24 YTD-25 NONPERFORMING ASSETS (NPAs) AND NPA PERCENT OF TOTAL ASSETS CRE Residential C&I HELOC Consumer NPA as a percent of Total Assets *In accordance with SEC reporting methodologies. Criticized loans includes loans categorized as special mention, substandard or doubtful. Classified loans includes loans categorized as substandard or doubtful. ASSET QUALITY METRICS HAVE BEEN WELL MANAGED CRITICIZED AND CLASSIFIED LOANS N PA ’S IN $ M IL LI O N S NONPERFORMING ASSETS (NPAs) AS A PERCENT OF TOTAL ASSETS ASSET QUALITY

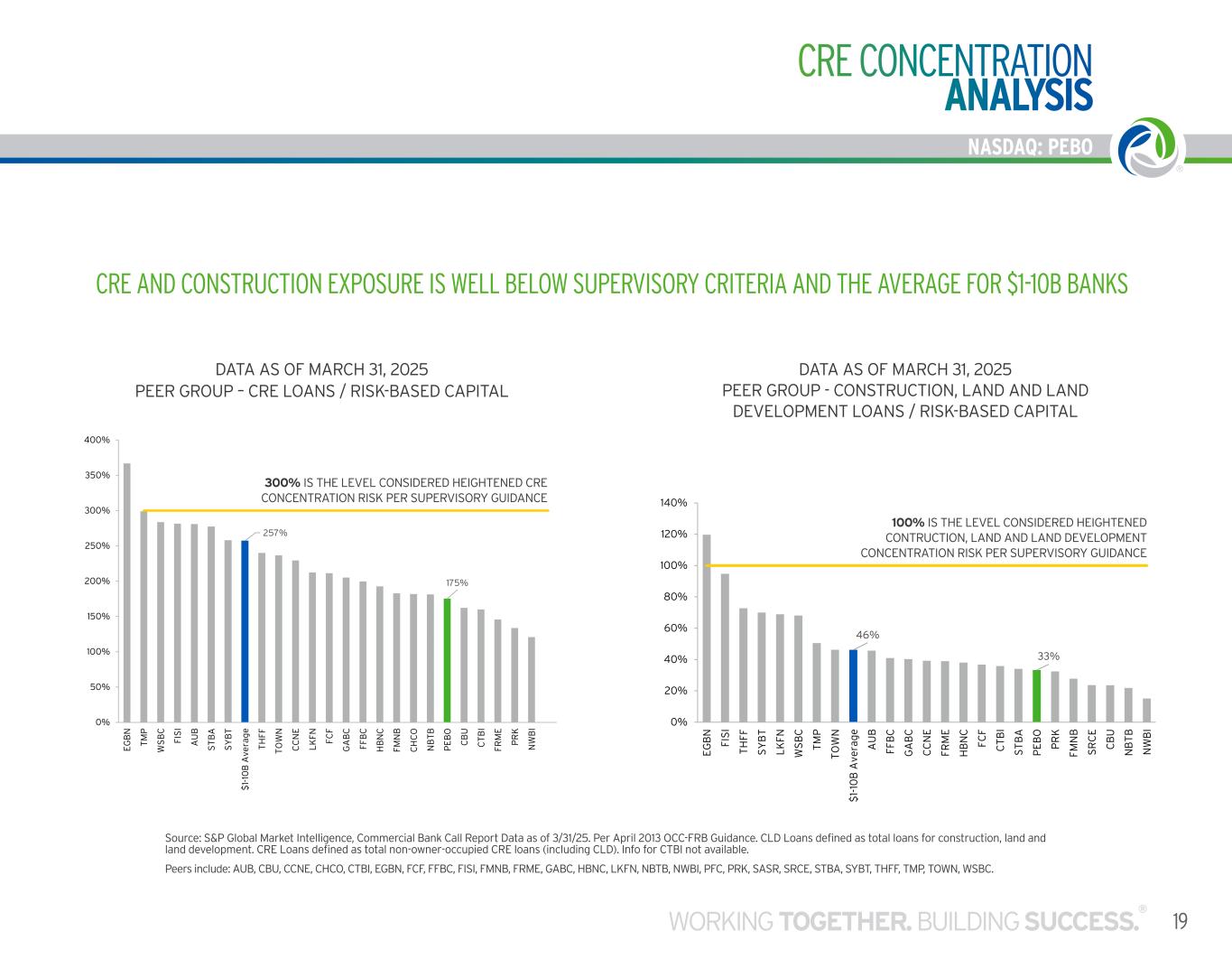

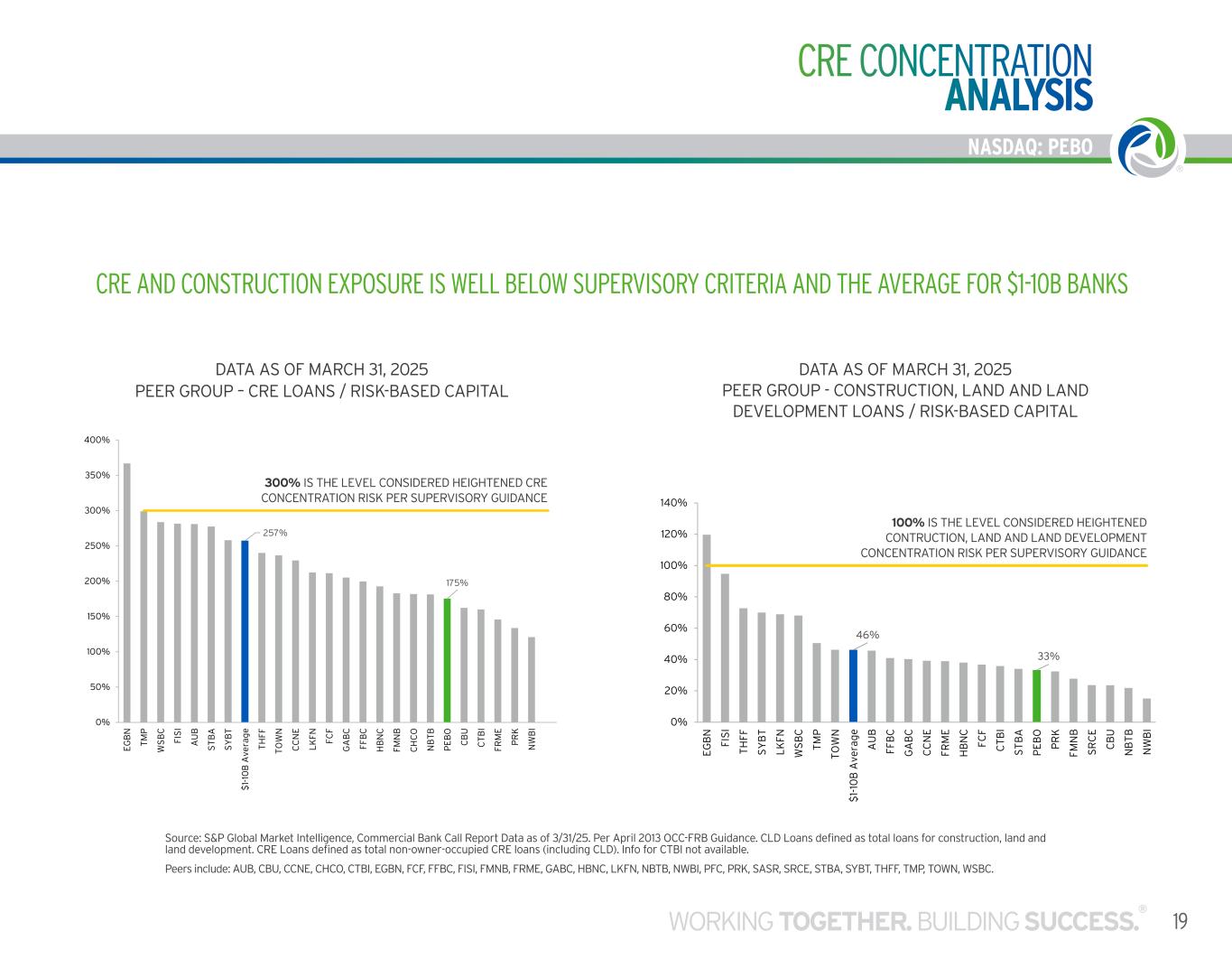

NASDAQ: PEBO 19WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 257% 175% 0% 50% 100% 150% 200% 250% 300% 350% 400% E G B N T M P W S B C FI S I A U B S T B A S Y B T $ 1- 10 B A ve ra g e T H FF T O W N C C N E L K FN FC F G A B C FF B C H B N C FM N B C H C O N B T B P E B O C B U C T B I FR M E P R K N W B I 46% 33% 0% 20% 40% 60% 80% 100% 120% 140% E G B N FI S I T H FF S Y B T L K FN W S B C T M P T O W N $ 1- 10 B A ve ra g e A U B FF B C G A B C C C N E FR M E H B N C FC F C T B I S T B A P E B O P R K FM N B S R C E C B U N B T B N W B I DATA AS OF MARCH 31, 2025 PEER GROUP - CONSTRUCTION, LAND AND LAND DEVELOPMENT LOANS / RISK-BASED CAPITAL CRE AND CONSTRUCTION EXPOSURE IS WELL BELOW SUPERVISORY CRITERIA AND THE AVERAGE FOR $1-10B BANKS CRE CONCENTRATION ANALYSIS PEER GROUP – CRE LOANS / RISK-BASED CAPITAL DATA AS OF MARCH 31, 2025 Source: S&P Global Market Intelligence, Commercial Bank Call Report Data as of 3/31/25. Per April 2013 OCC-FRB Guidance. CLD Loans defined as total loans for construction, land and land development. CRE Loans defined as total non-owner-occupied CRE loans (including CLD). Info for CTBI not available. Peers include: AUB, CBU, CCNE, CHCO, CTBI, EGBN, FCF, FFBC, FISI, FMNB, FRME, GABC, HBNC, LKFN, NBTB, NWBI, PFC, PRK, SASR, SRCE, STBA, SYBT, THFF, TMP, TOWN, WSBC. 100% IS THE LEVEL CONSIDERED HEIGHTENED CONTRUCTION, LAND AND LAND DEVELOPMENT CONCENTRATION RISK PER SUPERVISORY GUIDANCE 300% IS THE LEVEL CONSIDERED HEIGHTENED CRE CONCENTRATION RISK PER SUPERVISORY GUIDANCE

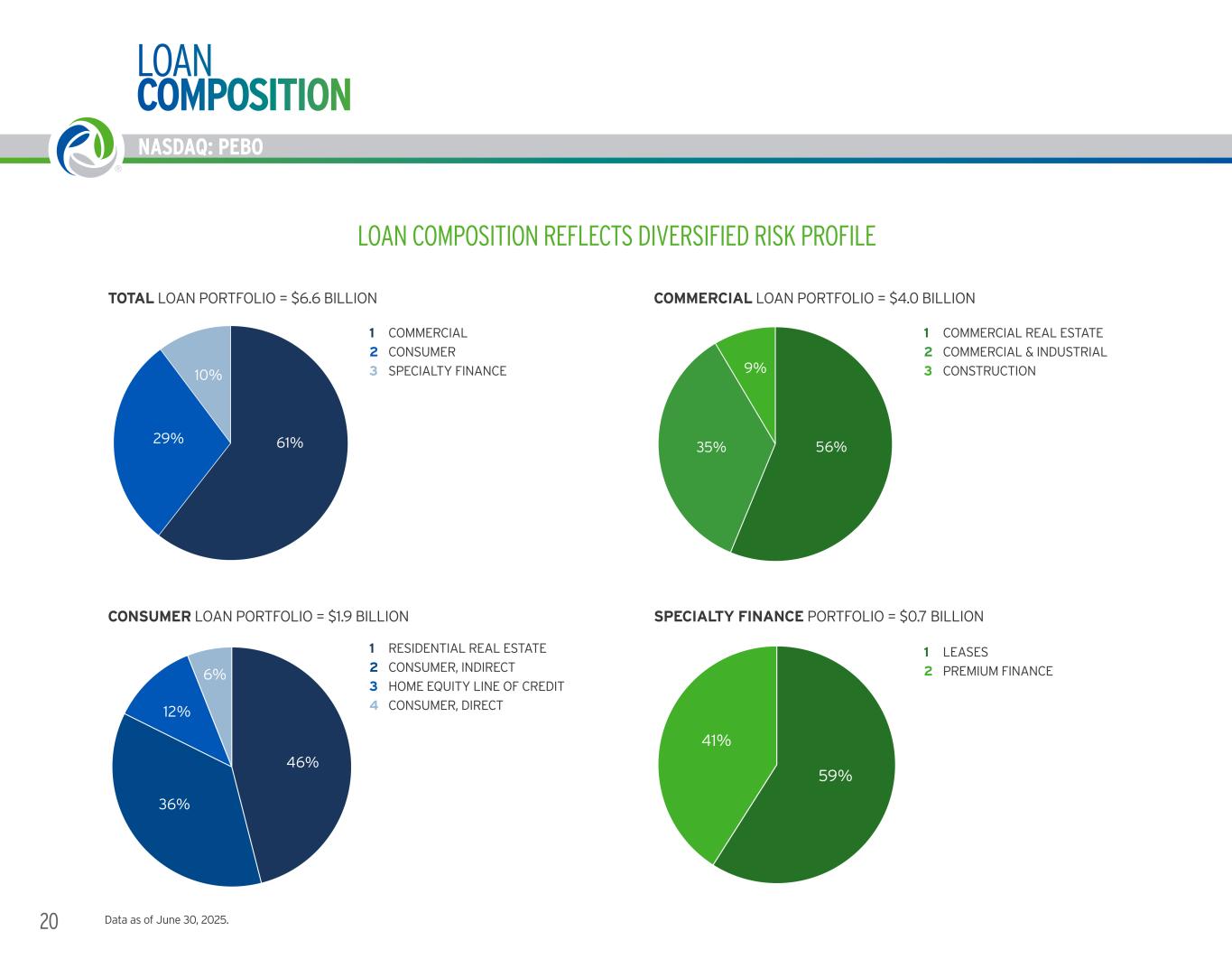

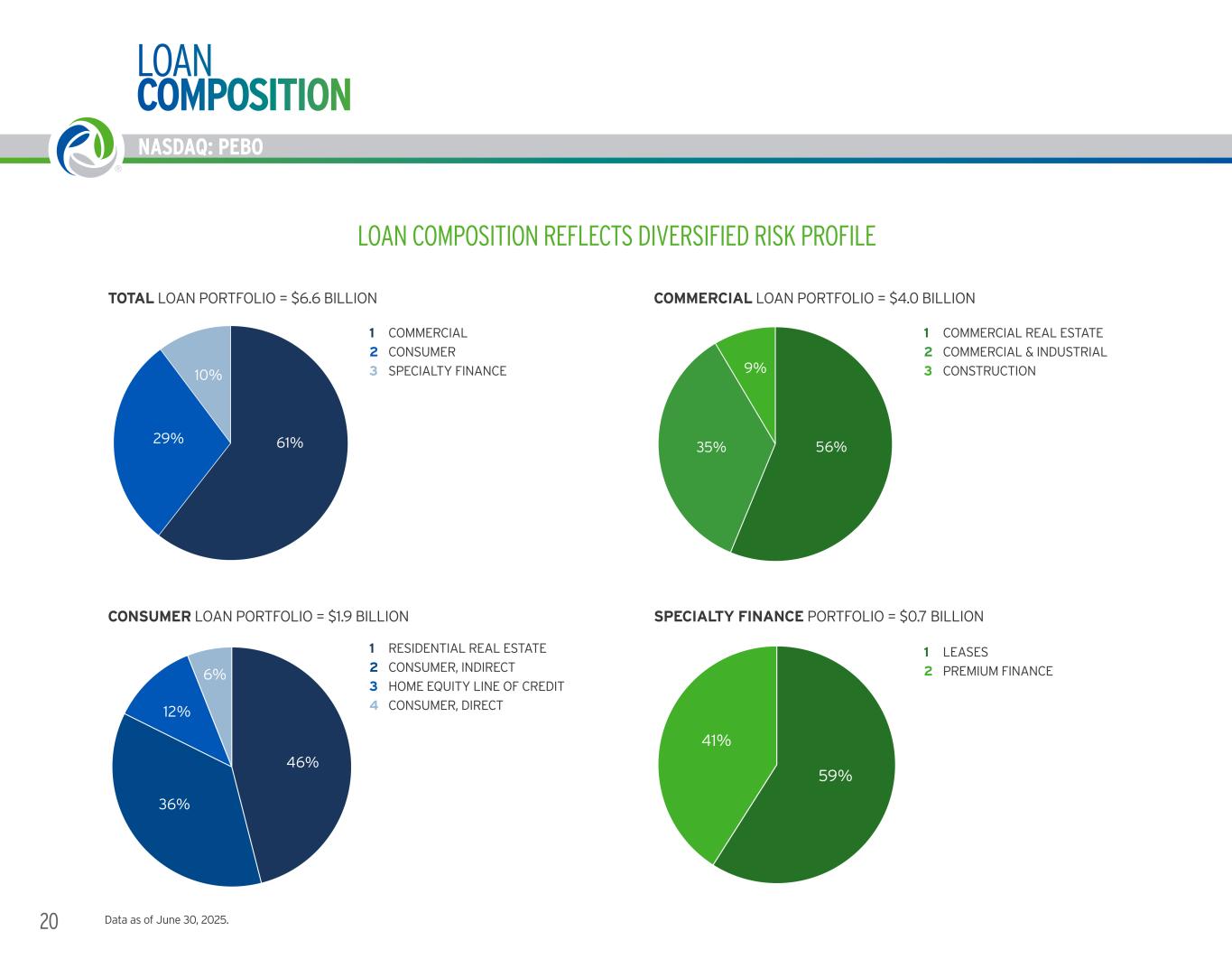

20 NASDAQ: PEBO 56%35% 9% COMMERICAL LOAN PORTFOLIO COMMERICAL REAL ESTATE COMMERCIAL & INDUSTRIAL CONSTRUCTION Data as of June 30, 2025. LOAN COMPOSITION REFLECTS DIVERSIFIED RISK PROFILE LOAN COMPOSITION TOTAL LOAN PORTFOLIO = $6.6 BILLION COMMERCIAL CONSUMER SPECIALTY FINANCE 1 2 3 CONSUMER LOAN PORTFOLIO = $1.9 BILLION RESIDENTIAL REAL ESTATE CONSUMER, INDIRECT HOME EQUITY LINE OF CREDIT CONSUMER, DIRECT 1 2 3 4 COMMERCIAL LOAN PORTFOLIO = $4.0 BILLION COMMERCIAL REAL ESTATE COMMERCIAL & INDUSTRIAL CONSTRUCTION 1 2 3 SPECIALTY FINANCE PORTFOLIO = $0.7 BILLION LEASES PREMIUM FINANCE 1 2 61%29% 10% TOTAL LOAN PORTFOLIO COMMERICAL CONSUMER 46% 36% 12% 6% CONSUMER LOAN PORTFOLIO RESIDENTIAL REAL ESTATE COSUMER, INDIRECT HOME EQUITY LINE OF CREDIT CONSUMER, DIRECT 59% 41% SPECIALITY FINANCE PORTFOLIO LEASES PREIMUM FINANCE

NASDAQ: PEBO 21WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 28% 14% 4% 4%4%3% 3% 3% 2% 2% 33% TOTAL C&I PORTFOLIO= $1.4 BILLION FOOD SERVICES RETAIL TRADE REAL ESTATE CONTRACTORS MERCHANT WHOLESALERS WOOD PRODUCT MANUFACTURING AMBULATORY HEALTH CARE SERVICES PROFESSIONAL, SCIENTIFIC, AND TECHNICAL SERVICES HEAVY AND CIVIL ENGINEERING CONSTRUCTION EDUCATIONAL SERVICES OTHER 50% 21% 18% 4% 3% 1% 1% 2% GEOGRAPHIC DISPERSION OF TOTAL LOAN EXPOSURE (COMMITMENTS)^ OHIO KENTUCKY WEST VIRGINIA VIRGINIA MARYLAND WASHINGTON DC PENNSLYVANIA OTHER STATES 18% 11% 11% 8%9% 5% 4% 4% 3% 3% 24% TOTAL CRE LOAN PORTFOLIO* = $2.2 BILLION APARTMENT RETAIL INDUSTRIAL OFFICE BUILDING LODGING ASSISTED LIVING WAREHOUSE RESTAURANT MIXED USE HEALTHCARE LOAN COMPOSITION REFLECTS DIVERSIFIED RISK PROFILE LOAN COMPOSITION Data as of June 30, 2025. *Total includes commercial real estate and construction loans, and exposure includes commitments. **Top ten categories in terms of loan size are shown (remaining categories in other) ^ EXCLUDES PREMIUM FINANCE, NORTH STAR LEASING AND VANTAGE LEASING TOTAL C&I PORTFOLIO* = $1.4 BILLION TOTAL CRE PORTFOLIO* = $2.2 BILLION 9 8 NORTH STAR LEASING BY SEGMENTGEOGRAPHIC D SPERSION F TOTAL LOAN EXPOSURE (COMMITMENTS)^ OHIO — 50% KEN CKY — 21% WEST VIRGINIA — 18% VIRGINIA — 4% MA YLAND — 3% WASHINGTON DC — 1% PENNSYLVANIA — 1% OTHER STATES — 2% 1 2 3 4 5 6 7 8 FOOD SERVICES — 28% RETAIL TRADE — 14% CONTRACTORS — 4% MANUFACTURING — 4% REAL ESTATE — 4% AMBULATORY SERVICES — 3% WHOLESALE TRADE — 3% PROFESSIONAL, SCIENTIFIC, — 3% AND TECHNICAL SERVICES TRANSPORTA ON — 2% MACHINERY MANUFACTURING — 2% OTHER — 33% 1 2 3 4 5 6 7 8 9 10 11 APARTMENT — 18% RETAIL — 11% INDUSTRIAL — 11% LODGING — 9% OFFICE BUILDING — 8% ASSISTED LIVING — 5% WAREHOUSE — 4% RESTAURANT — 4% MIXED USE — 3% HEALTHCARE — 3% OTHER — 24% 1 2 3 4 5 6 7 8 9 10 11 21% 13% 10% 9% 8% 6% 33% NORTH STAR LEASING BY SEGMENT Restaurant Titled - Vocational Titled - Trucking/Trailer/Flee t Brewery/Distillery Heavy Equipment Manufacturing - Production Other RESTAURANT — 21% TITLED - VOCATIONAL — 13% TRUCKING/TRAILER/FLEET — 10% BREWERY/DISTILLERY — 9% HEAVY EQUIPMENT — 8% MANUFACTURING — 6% OTHER — 33% 1 2 3 4 5 6 7

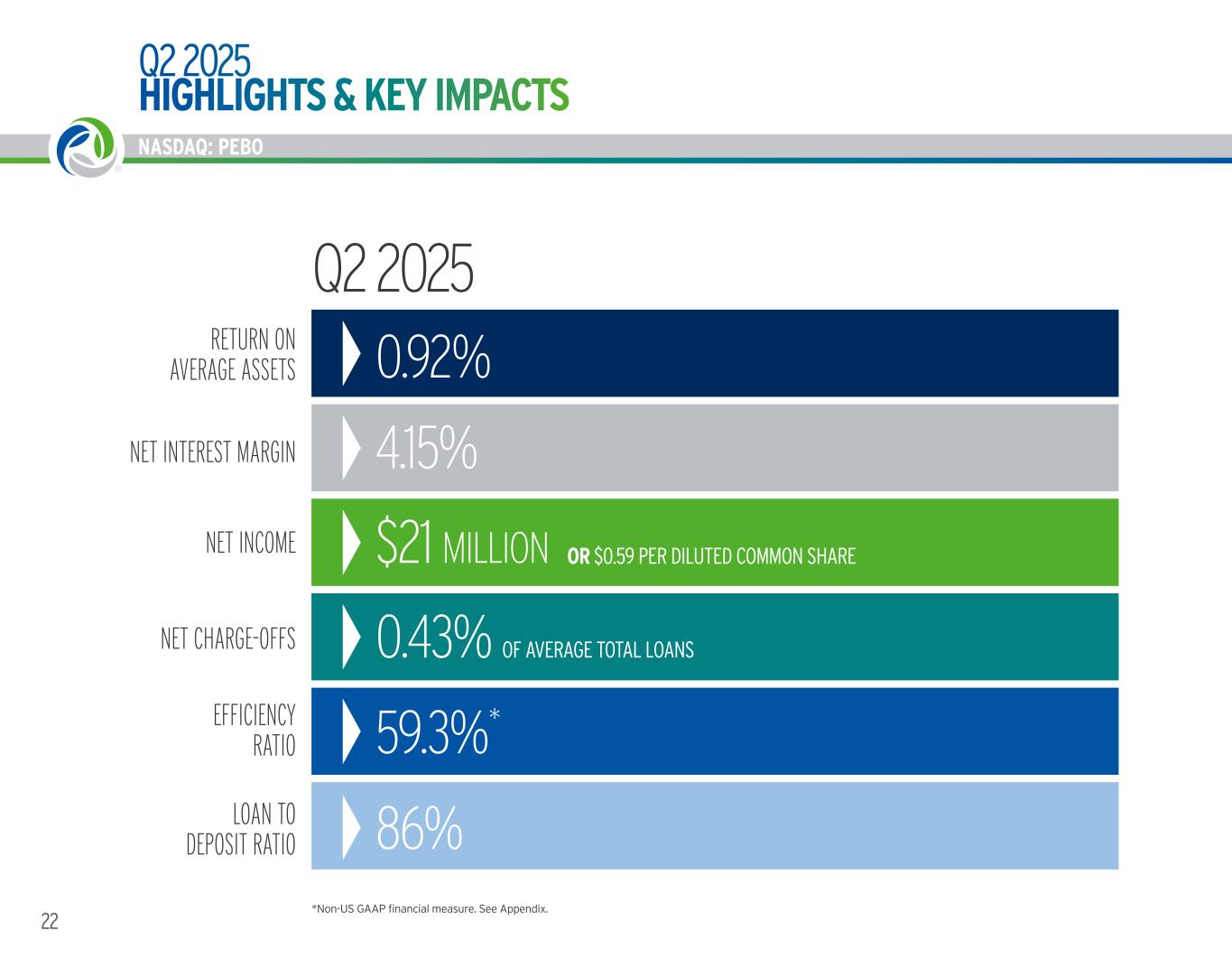

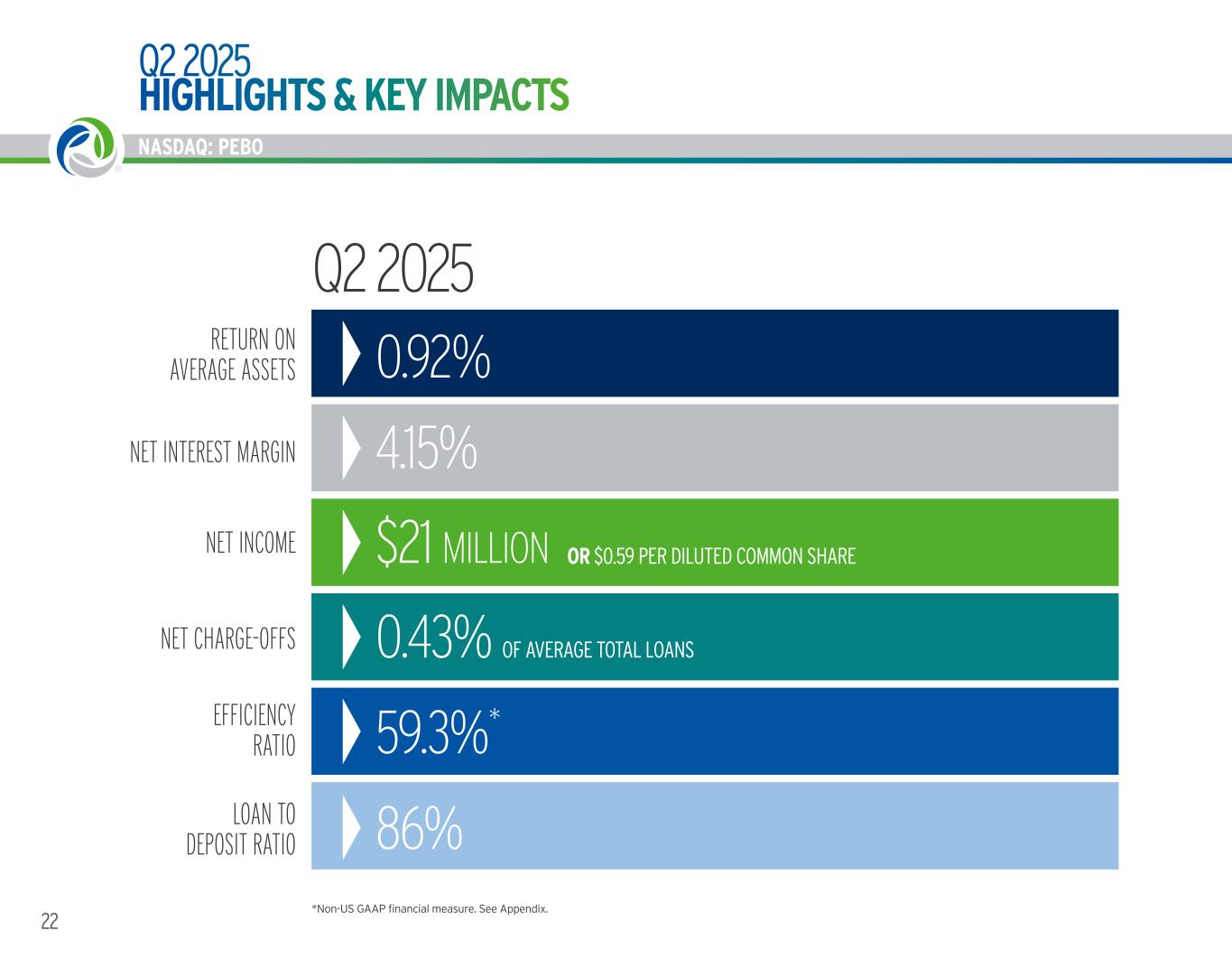

22 NASDAQ: PEBO Q2 2025 HIGHLIGHTS & KEY IMPACTS LOAN TO DEPOSIT RATIO 86% NET INCOME $21 MILLION OR $0.59 PER DILUTED COMMON SHARE NET CHARGE-OFFS 0.43% OF AVERAGE TOTAL LOANS EFFICIENCY RATIO 59.3%* RETURN ON AVERAGE ASSETS 0.92% NET INTEREST MARGIN 4.15% Q2 2025 *Non-US GAAP financial measure. See Appendix.

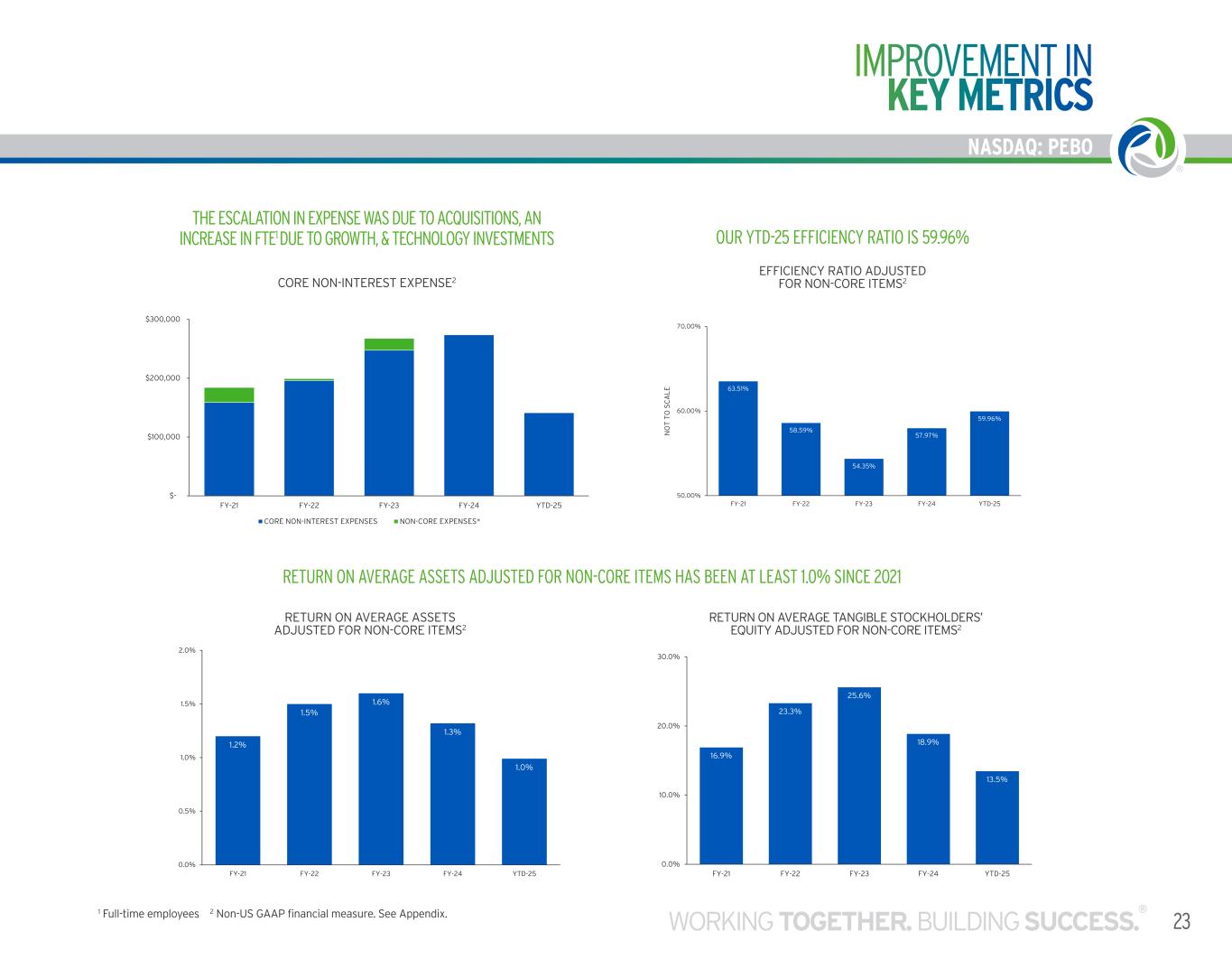

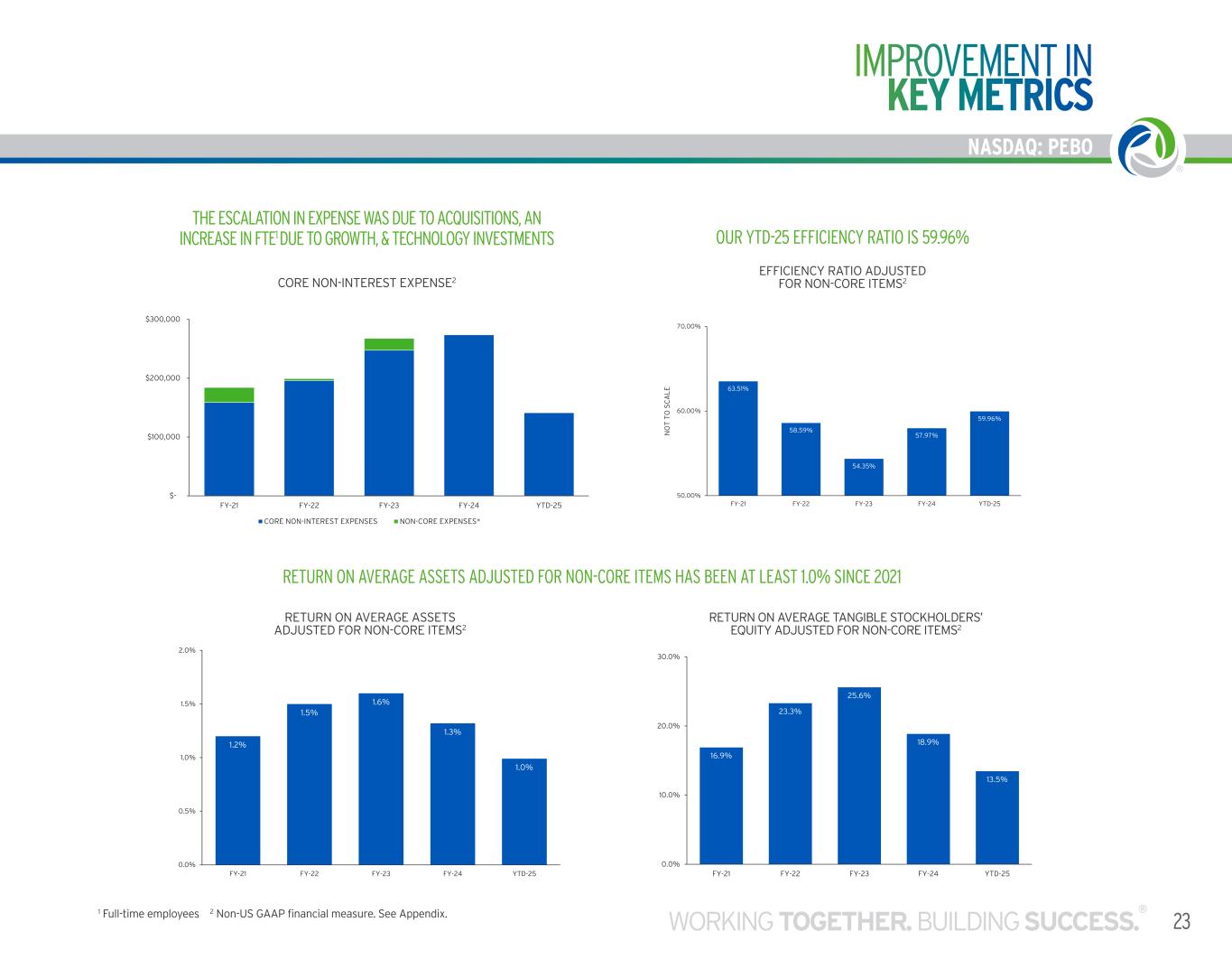

NASDAQ: PEBO 23WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO $- $100,000 $200,000 $300,000 FY-21 FY-22 FY-23 FY-24 YTD-25 CORE NON-INTEREST EXPENSE* CORE NON-INTEREST EXPENSES NON-CORE EXPENSES* 16.9% 23.3% 25.6% 18.9% 13.5% 0.0% 10.0% 20.0% 30.0% FY-21 FY-22 FY-23 FY-24 YTD-25 RETURN ON AVERAGE TANGIBLE STOCKHOLDERS EQUITY ADJUSTED FOR NON-CORE ITEMS 1.2% 1.5% 1.6% 1.3% 1.0% 0.0% 0.5% 1.0% 1.5% 2.0% FY-21 FY-22 FY-23 FY-24 YTD-25 RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS THE ESCALATION IN EXPENSE WAS DUE TO ACQUISITIONS, AN INCREASE IN FTE1 DUE TO GROWTH, & TECHNOLOGY INVESTMENTS CORE NON-INTEREST EXPENSE2 OUR YTD-25 EFFICIENCY RATIO IS 59.96% EFFICIENCY RATIO ADJUSTED FOR NON-CORE ITEMS2 RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS HAS BEEN AT LEAST 1.0% SINCE 2021 RETURN ON AVERAGE TANGIBLE STOCKHOLDERS’ EQUITY ADJUSTED FOR NON-CORE ITEMS2 RETURN ON AVERAGE ASSETS ADJUSTED FOR NON-CORE ITEMS2 IMPROVEMENT IN KEY METRICS 1 Full-time employees 2 Non-US GAAP financial measure. See Appendix. 63.51% 58.59% 54.35% 57.97% 59.96% 50.00% 60.00% 70.00% FY-21 FY-22 FY-23 FY-24 YTD-25 N O T T O S C A L E EFFICENCY RATIO ADJUSTED FOR NON-CORE ITEMS

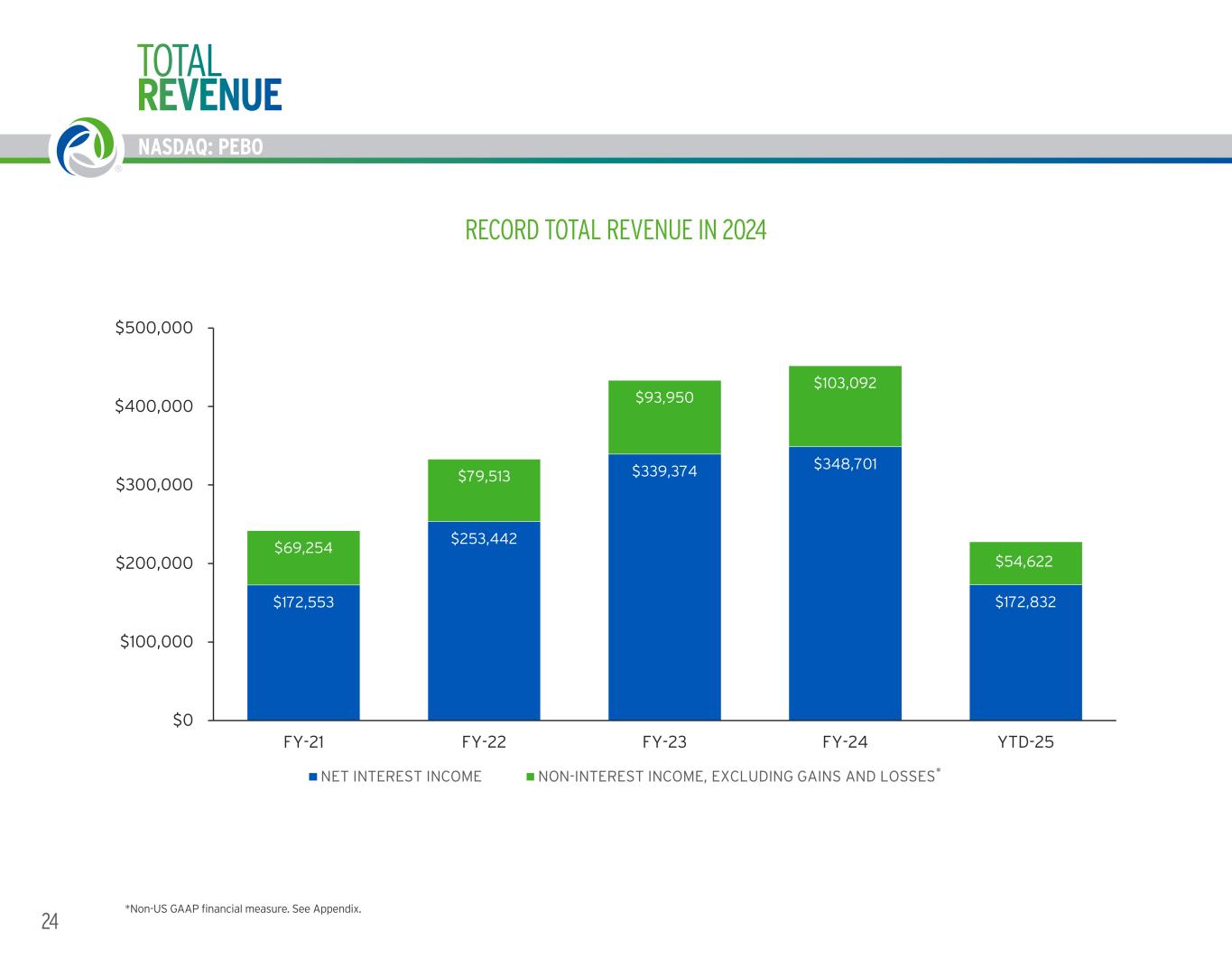

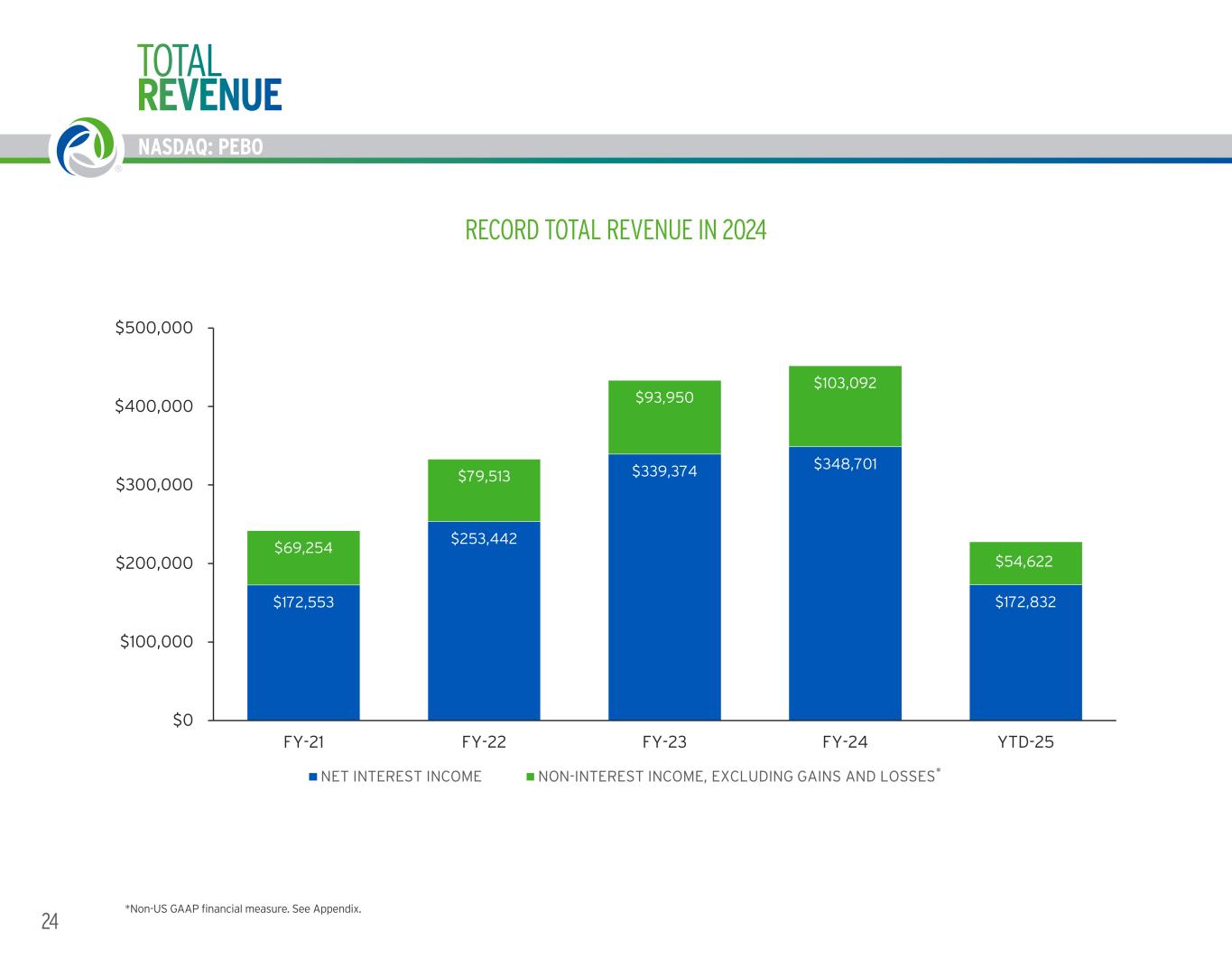

24 TOTAL REVENUE NASDAQ: PEBO RECORD TOTAL REVENUE IN 2024 SOURCES OF FEE BASED INCOME NON-INTEREST INCOME YTD 2025 $172,553 $253,442 $339,374 $348,701 $172,832 $69,254 $79,513 $93,950 $103,092 $54,622 $0 $100,000 $200,000 $300,000 $400,000 $500,000 FY-21 FY-22 FY-23 FY-24 YTD-25 RECORD TOTAL REVENUE IN 2024 NET INTEREST INCOME NON-INTEREST INCOME, EXCLUDING GAINS AND LOSSES *Non-US GAAP financial measure. See Appendix. *

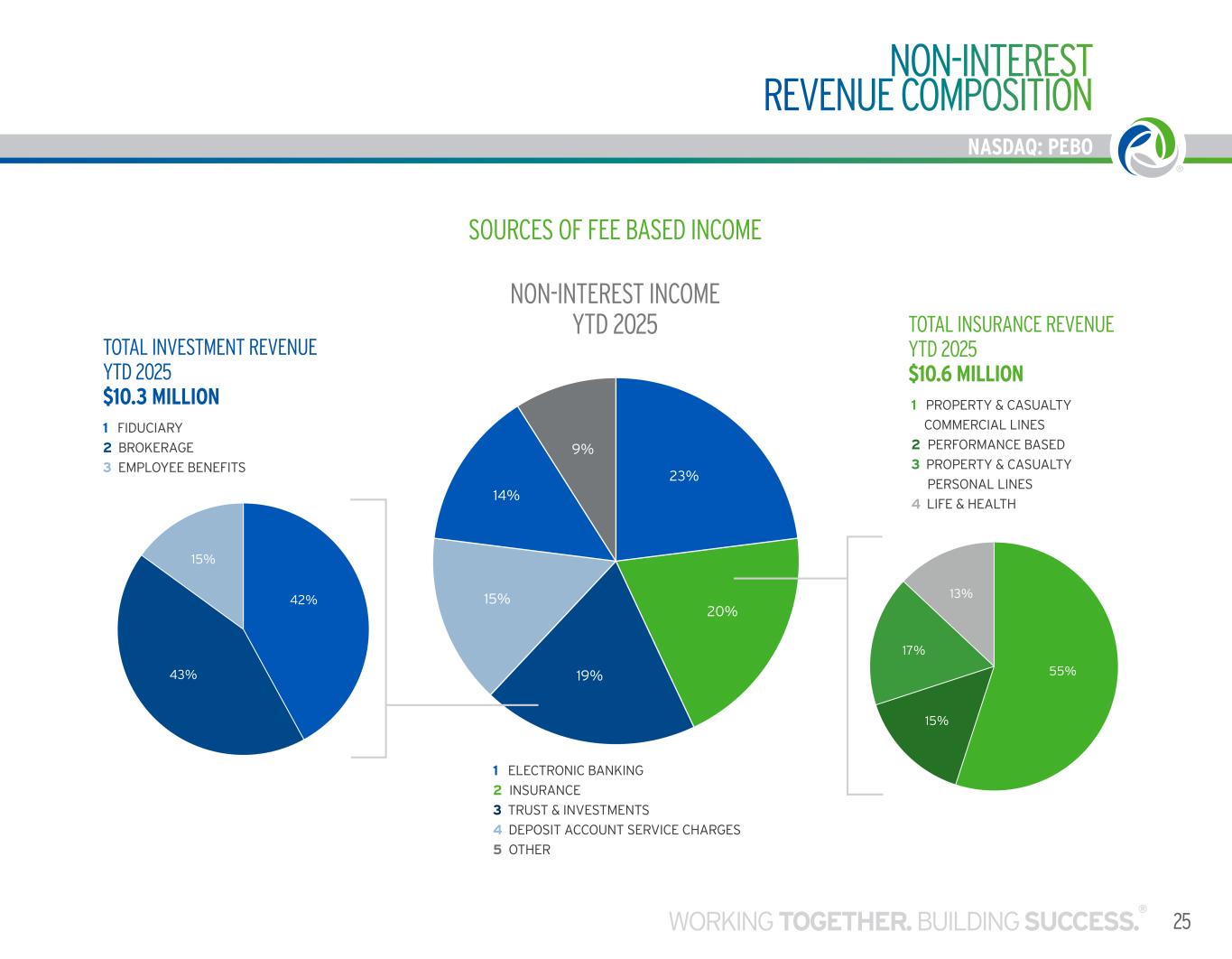

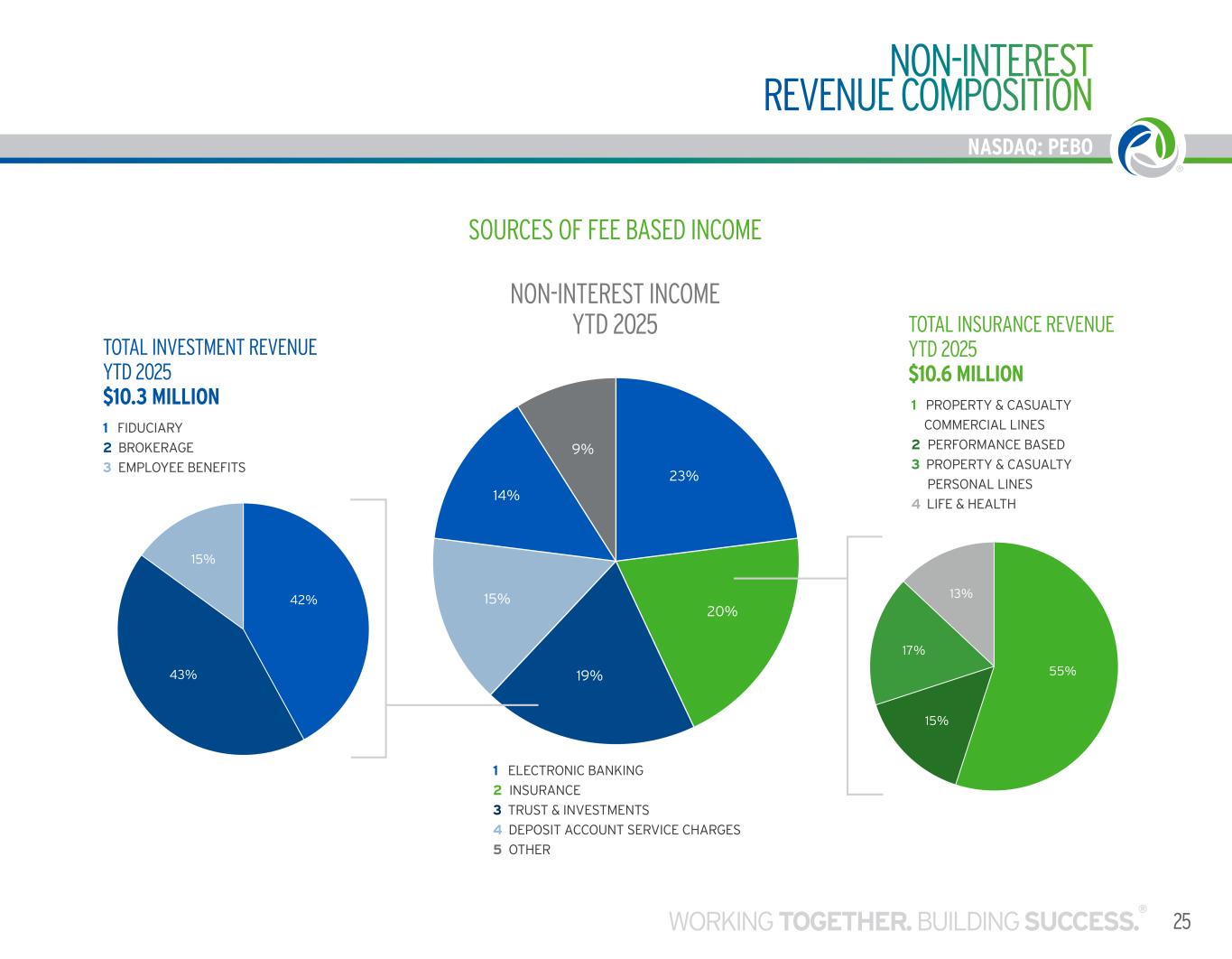

23% 20% 19% 15% 14% 9% NON-INTEREST INCOME YTD 2025 $54 MILLION ELECTRONIC BANKING INSURANCE TRUST & INVESTMENTS DEPOSIT ACCOUNT SERVICE CHARGES LEASE INCOME OTHER 55% 15% 17% 13% TOTAL INSURANCE REVENUE YTD 2025 $10 MILLION PROPERTY & CASUALTY COMMERICAL LINES PERFORMANCE BASED PROPERTY & CASUALTY PERSONAL LINES LIFE & HEALTH 42% 43% 15% TOTAL INVESTMENT REVENUE YTD 2025 $10 MILLION FIDUCIARY BROKERAGE EMPLOYEE BENEFITS NASDAQ: PEBO NON-INTEREST REVENUE COMPOSITION 25WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO 3 4 SOURCES OF FEE BASED INCOME TOTAL INVESTMENT REVENUE YTD 2025 $10.3 MILLION 1 FIDUCIARY 2 BROKERAGE 3 EMPLOYEE BENEFITS 1 PROPERTY & CASUALTY C MMERCIAL LINES 2 PERFORMANCE BASED 3 PROPERTY & CASUALTY PERSONAL LINES 4 LIFE & HEALTH TOTAL INSURANCE REVENUE YTD 2025 $10.6 MILLION 1 ELECTRONIC BANKING 2 INSURANCE 3 TRUST & INVESTMENTS 4 DEPOSIT ACCOUNT SERVICE CHARGES 5 OTHER NO -INTEREST INCOME YTD 2025

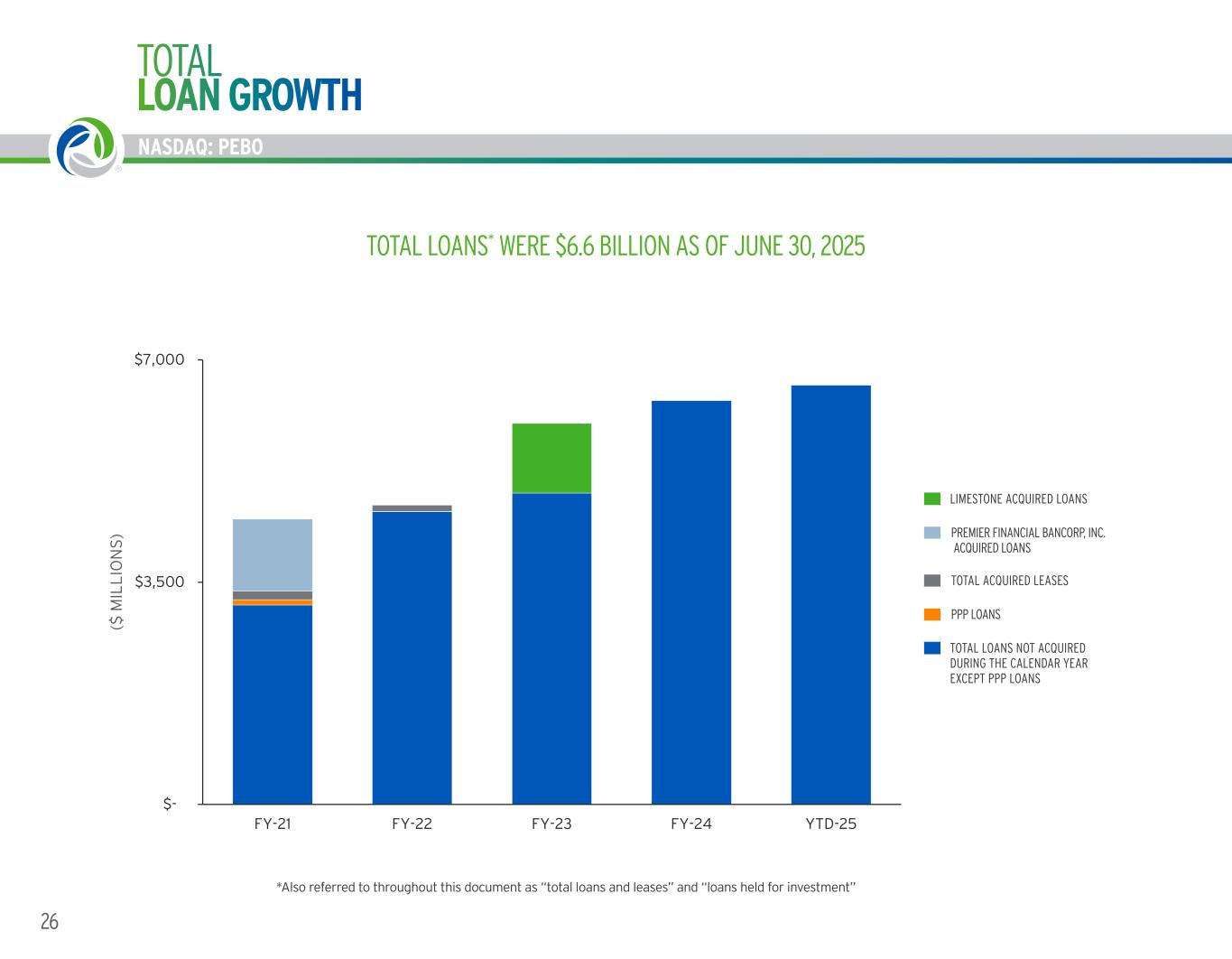

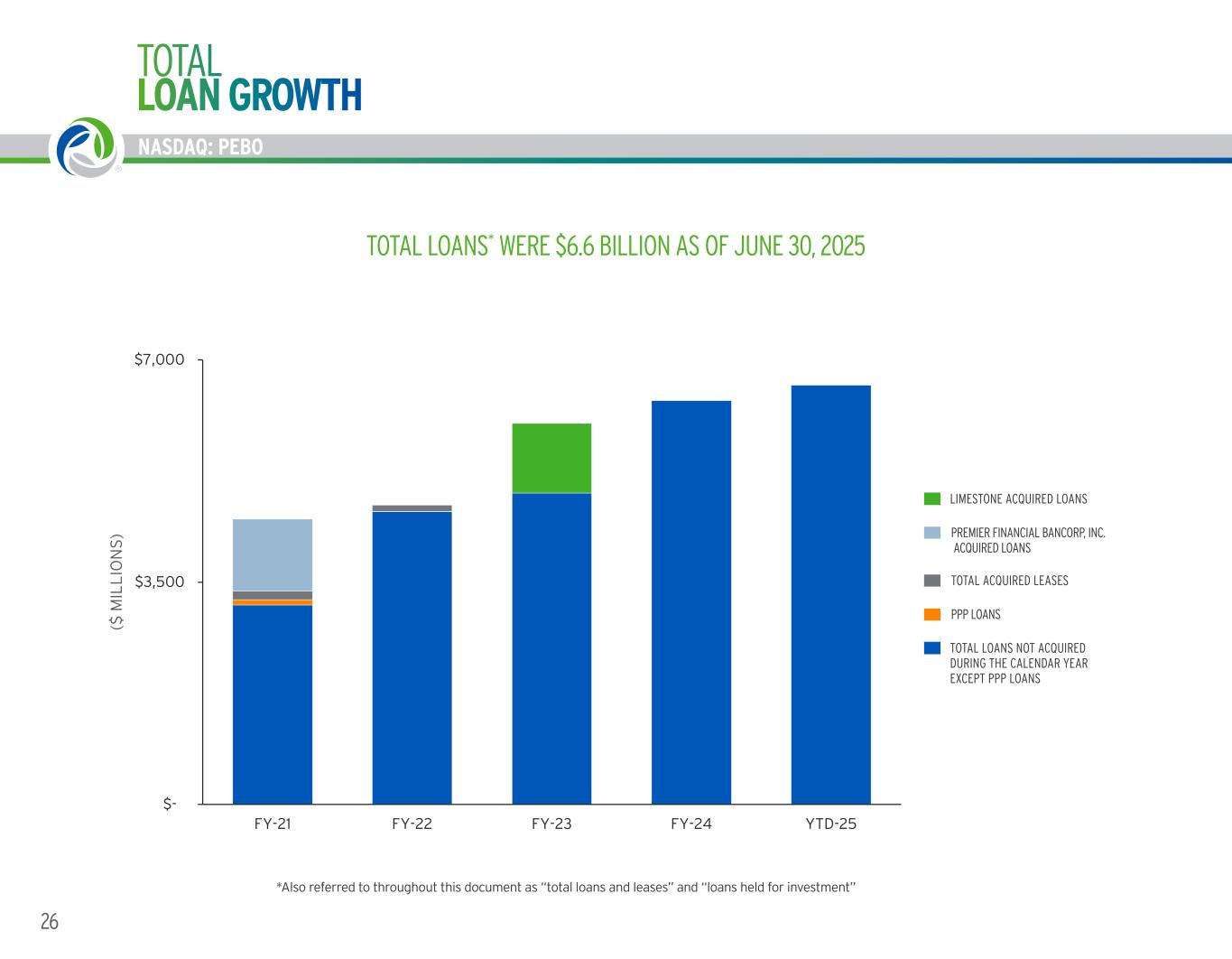

26 TOTAL LOAN GROWTH TOTAL LOANS* WERE $6.6 BILLION AS OF JUNE 30, 2025 *Also referred to throughout this document as “total loans and leases” and “loans held for investment” NASDAQ: PEBO TOTAL LOANS NOT ACQUIRED DURING THE CALENDAR YEAR EXCEPT PPP LOANS LIMESTONE ACQUIRED LOANS PPP LOANS TOTAL ACQUIRED LEASES PREMIER FINANCIAL BANCORP, INC. ACQUIRED LOANS GRAPH LABELS ARE MIXED UP $- $3,500 $7,000 FY-21 FY-22 FY-23 FY-24 YTD-25 ($ M IL L IO N S ) TOTAL LOANS* AS OF MARCH 31, 2025 LIMESTONE ACQUIRED LOANS PREMIER FINANCIAL BANCORP, INC, ACQUIRED LOANS TOTAL ACQUIRED LEASES PPP LOANS TOTAL LOANS NOT ACQUIRED

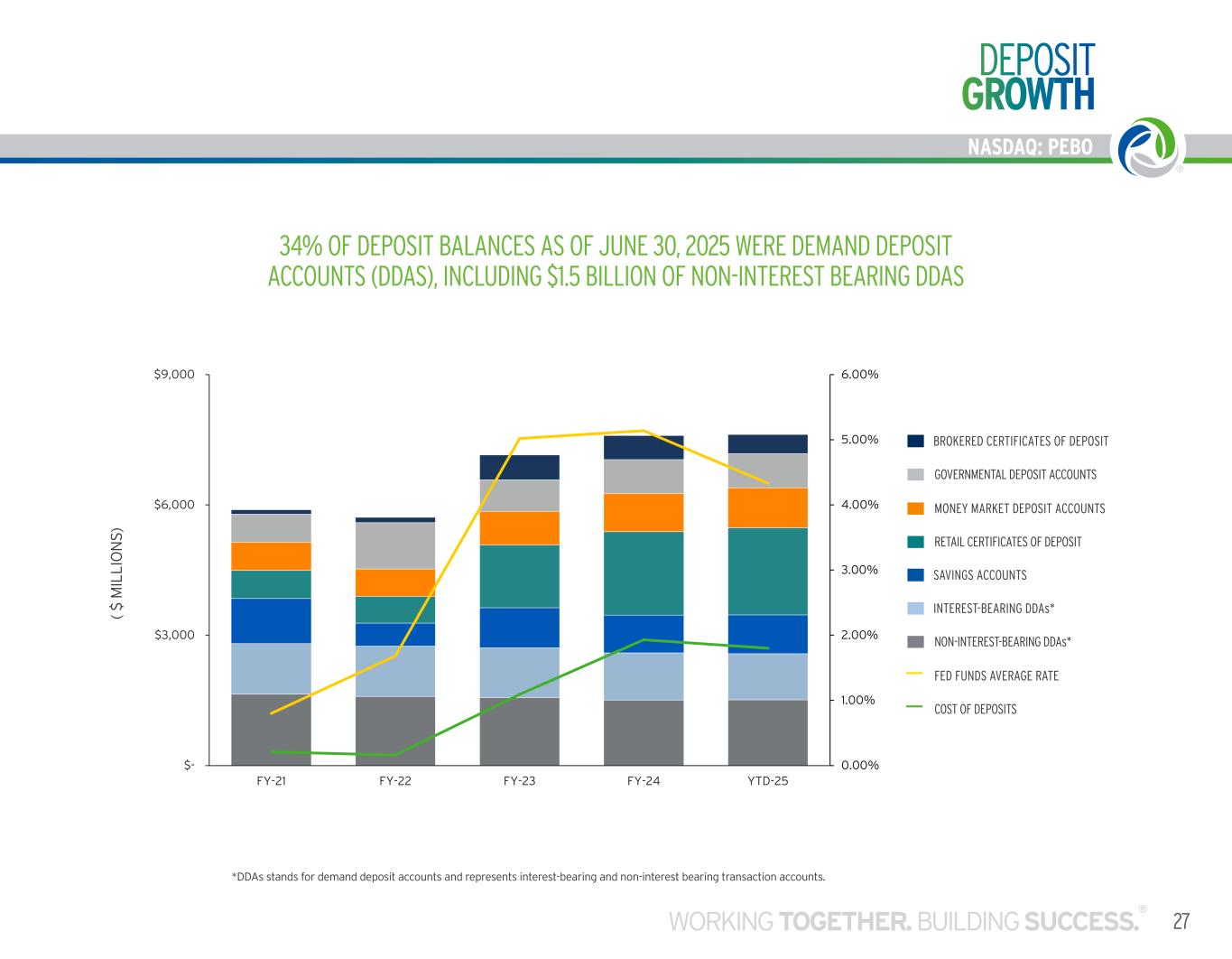

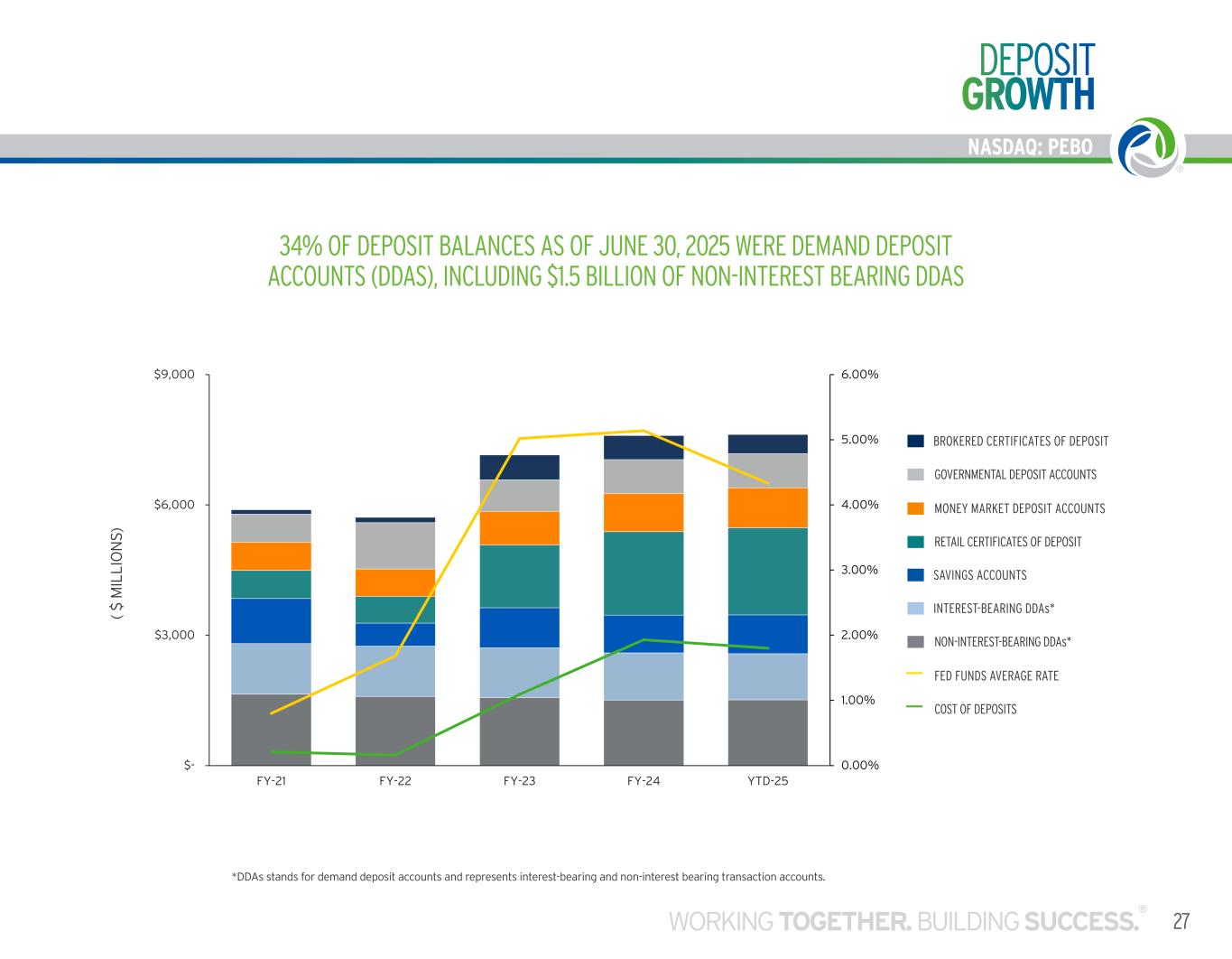

34% OF DEPOSIT BALANCES AS OF JUNE 30, 2025 WERE DEMAND DEPOSIT ACCOUNTS (DDAS), INCLUDING $1.5 BILLION OF NON-INTEREST BEARING DDAS *DDAs stands for demand deposit accounts and represents interest-bearing and non-interest bearing transaction accounts. DEPOSIT GROWTH NASDAQ: PEBO 27WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO SAVINGS ACCOUNTS BROKERED CERTIFICATES OF DEPOSIT INTEREST-BEARING DDAs* RETAIL CERTIFICATES OF DEPOSIT COST OF DEPOSITS MONEY MARKET DEPOSIT ACCOUNTS FED FUNDS AVERAGE RATE GOVERNMENTAL DEPOSIT ACCOUNTS NON-INTEREST-BEARING DDAs* ( $ M IL LI O N S) 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% $- $3,000 $6,000 $9,000 FY-21 FY-22 FY-23 FY-24 YTD-25 BROKERED CERTIFICATES OF DEPOSIT GOVERNMENTAL DEPOSIT ACCOUNTS MONEY MARKET DEPOSIT ACCOUNTS RETAIL CERTIFICATES OF DEPOSIT SAVINGS ACCOUNTS INTEREST-BEARING DDs* NON-INTEREST-BEARING DDs* PEBO COST OF DEPOSITS FED FUNDS RATE

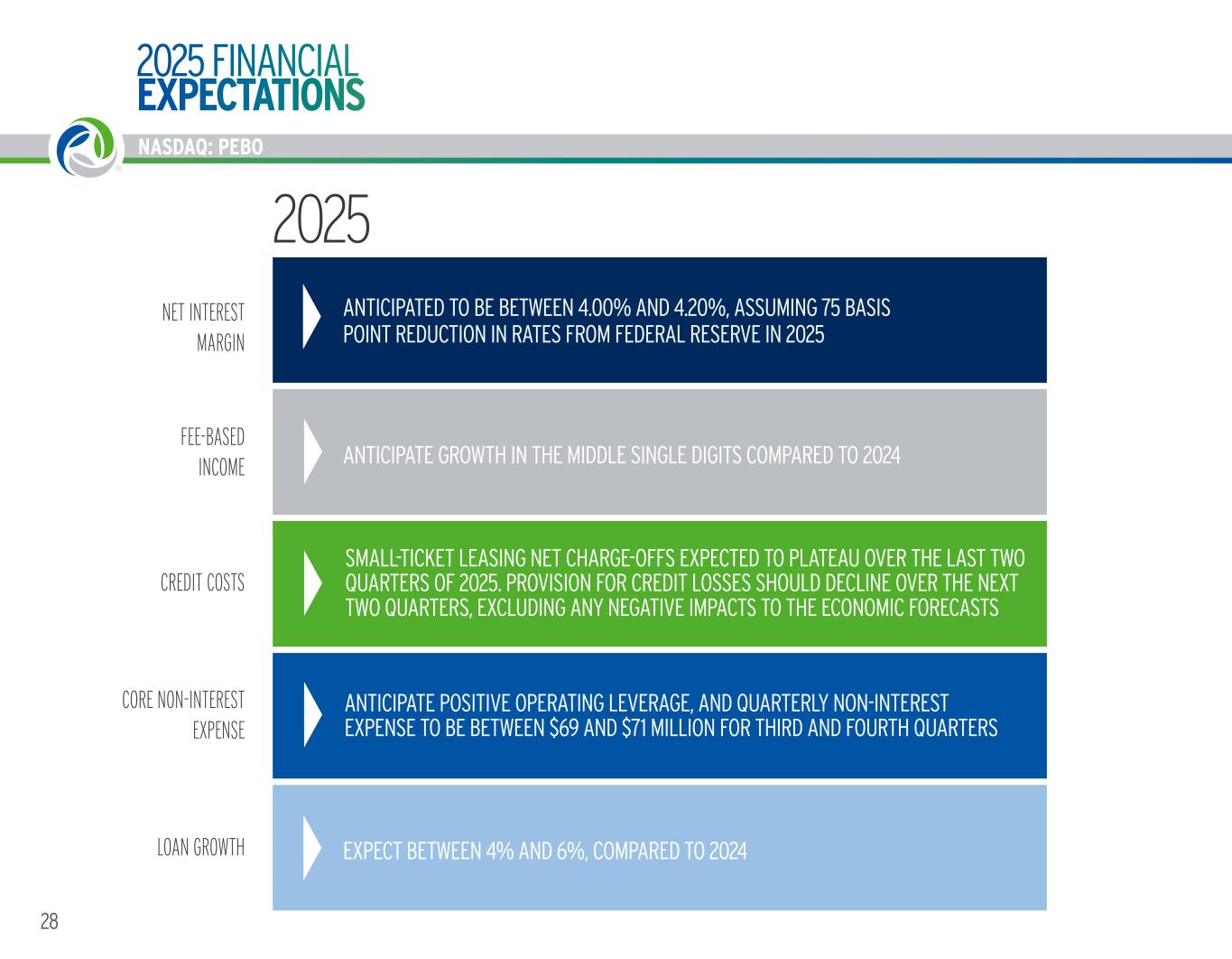

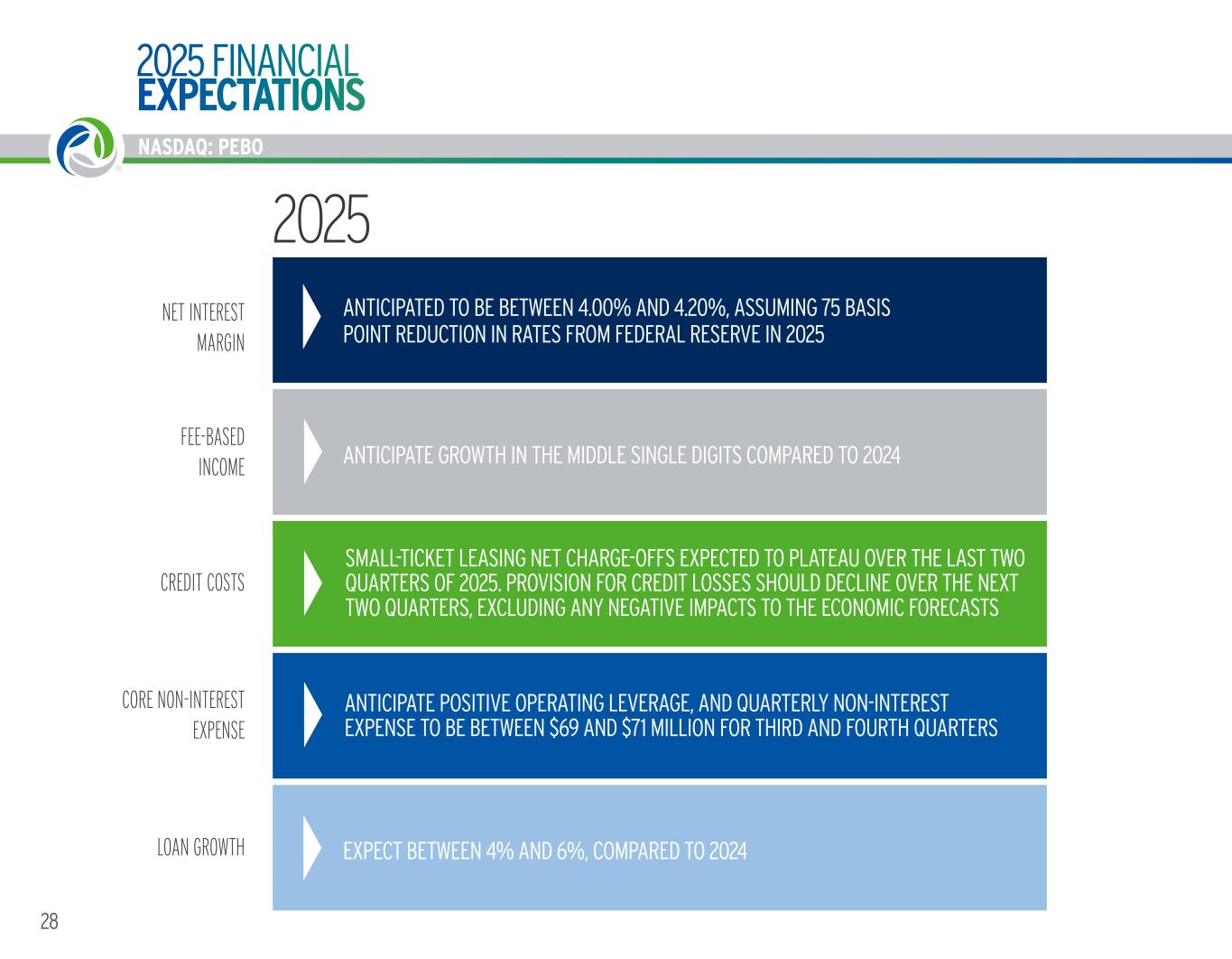

28 2025 LOAN GROWTH EXPECT BETWEEN 4% AND 6%, COMPARED TO 2024 FEE-BASED INCOME ANTICIPATE GROWTH IN THE MIDDLE SINGLE DIGITS COMPARED TO 2024 CREDIT COSTS SMALL-TICKET LEASING NET CHARGE-OFFS EXPECTED TO PLATEAU OVER THE LAST TWO QUARTERS OF 2025. PROVISION FOR CREDIT LOSSES SHOULD DECLINE OVER THE NEXT TWO QUARTERS, EXCLUDING ANY NEGATIVE IMPACTS TO THE ECONOMIC FORECASTS CORE NON-INTEREST EXPENSE ANTICIPATE POSITIVE OPERATING LEVERAGE, AND QUARTERLY NON-INTEREST EXPENSE TO BE BETWEEN $69 AND $71 MILLION FOR THIRD AND FOURTH QUARTERS NET INTEREST MARGIN ANTICIPATED TO BE BETWEEN 4.00% AND 4.20%, ASSUMING 75 BASIS POINT REDUCTION IN RATES FROM FEDERAL RESERVE IN 2025 2025 FINANCIAL EXPECTATIONS NASDAQ: PEBO

NASDAQ: PEBO 29WORKING TOGETHER. BUILDING SUCCESS. ® NASDAQ: PEBO Q2 2025 APPENDIX

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 30 CORE NON-INTEREST INCOME CORE NON-INTEREST EXPENSE ($ in Thousands) FY-21 FY-22 FY-23 FY-24 YTD-25 Total non-interest income $ 68,885 $ 78,836 $ 87,413 $ 99,366 $ 53,979 Less: net gain (loss) on investment securities (862) (61) (3,700) (416) (2) Less: net (loss) gain on asset disposals and other transactions 493 (616) (2,837) (3,310) (641) Core non-interest income excluding gains and losses $ 69,254 $ 79,513 $ 93,950 $ 103,092 $ 54,622 ($ in Thousands) FY-21 FY-22 FY-23 FY-24 YTD-25 Total non-interest expense $ 183,737 $ 207,147 $ 266,487 $ 273,816 $ 141,149 Less: acquisition-related expenses 21,423 3,016 16,970 169 — Less: pension settlement charges 143 185 2,424 — — Less: COVID-19 related expenses 1,248 134 — — — Add: COVID -19 Employee Retention Credit — — 548 — — Less: contract negotiation expenses 1,248 — — — — Less: other non-core charges 579 — — — — Core non-interest expense $ 159,096 $ 203,812 $ 247,641 $ 273,647 $ 141,149 Core non-interest income is a financial measure use by Peoples’ recurring non-interest revenue stream. This measure is non-US GAAP since it excludes the impact of all gains and/or losses. Core non-interest expense is a financial measure used to evaluate Peoples’ recurring expense stream. This measure is non-US GAAP since it excludes the impact of acquisition-related expenses, COVID-19-related expenses, COVID-19 employee retention credit, contract negotiation expenses, pension settlement charges, and other non-recurring expenses.

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 31 EFFICIENCY RATIO AND ADJUSTED FOR NON-CORE ITEMS ($ in Thousands) FY-21 FY-22 FY-23 FY-24 Q2 2025 YTD-25 Total non-interest expense $ 183,737 $ 207,147 $ 266,847 $ 273,816 $ 70,362 $ 141,149 Less: amortization on other intangible assets 4,775 7,763 11,222 11,161 2,211 4,424 Adjusted total non-interest expense $ 178,962 $ 199,384 $ 255,625 $ 262,655 $ 68,151 $ 136,725 Total non-interest income excluding net gains and losses $ 69,254 $ 79,513 $ 93,950 $ 103,092 $ 27,160 $ 54,622 Net interest income $ 172,553 $ 253,442 $ 339,374 $ 348,701 $ 87,577 $ 172,832 Add: fully taxable equivalent adjustment 1,349 1,644 1,703 1,308 280 563 Net interest income on a fully taxable equivalent basis $ 173,902 $ 255,086 $ 341,077 $ 350,009 $ 87,857 $ 173,395 Adjusted revenue $ 243,156 $ 334,599 $ 435,027 $ 453,101 $ 115,017 $ 228,017 Efficiency ratio 73.60% 59.59% 58.68% 57.97% 59.25% 59.96% Core non-interest expense $ 159,096 $ 203,812 $ 247,641 $ 273,647 $ 70,362 $ 141,149 Less: amortization on other intangible assets 4,775 7,763 11,222 11,161 2,211 4,424 Adjusted core non-interest expense $ 154,321 $ 196,049 $ 236,419 $ 262,486 $ 68,151 $ 136,725 Core non-interest income excluding gains and losses $ 69,254 $ 79,513 $ 93,950 $ 103,092 $ 115,017 $ 54,622 Net interest income on a fully taxable equivalent basis 173,902 255,086 341,077 350,009 87,857 173,395 Adjusted core revenue $ 243,156 $ 334,599 $ 435,027 $ 453,101 $ 115,017 $ 228,017 Efficiency ratio adjusted for non-core items 63.47% 58.59% 54.35% 57.93% 59.25% 59.96% The efficiency ratio is a key financial measure used to monitor performance. The efficiency ratio is calculated as total non-interest expense (less amortization of other intangible assets) as a percentage of fully tax-equivalent net interest income plus total non-interest income excluding all gains and losses. This measure in non-US GAAP since it excludes amortization of other intangible assets, and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. The efficiency ratio adjusted for non-core items is non-US GAAP since it excludes amortization of other intangible assets, non-core expenses and all gains and/or losses included in earnings, and uses fully tax-equivalent net interest income. CORE NON-INTEREST EXPENSE

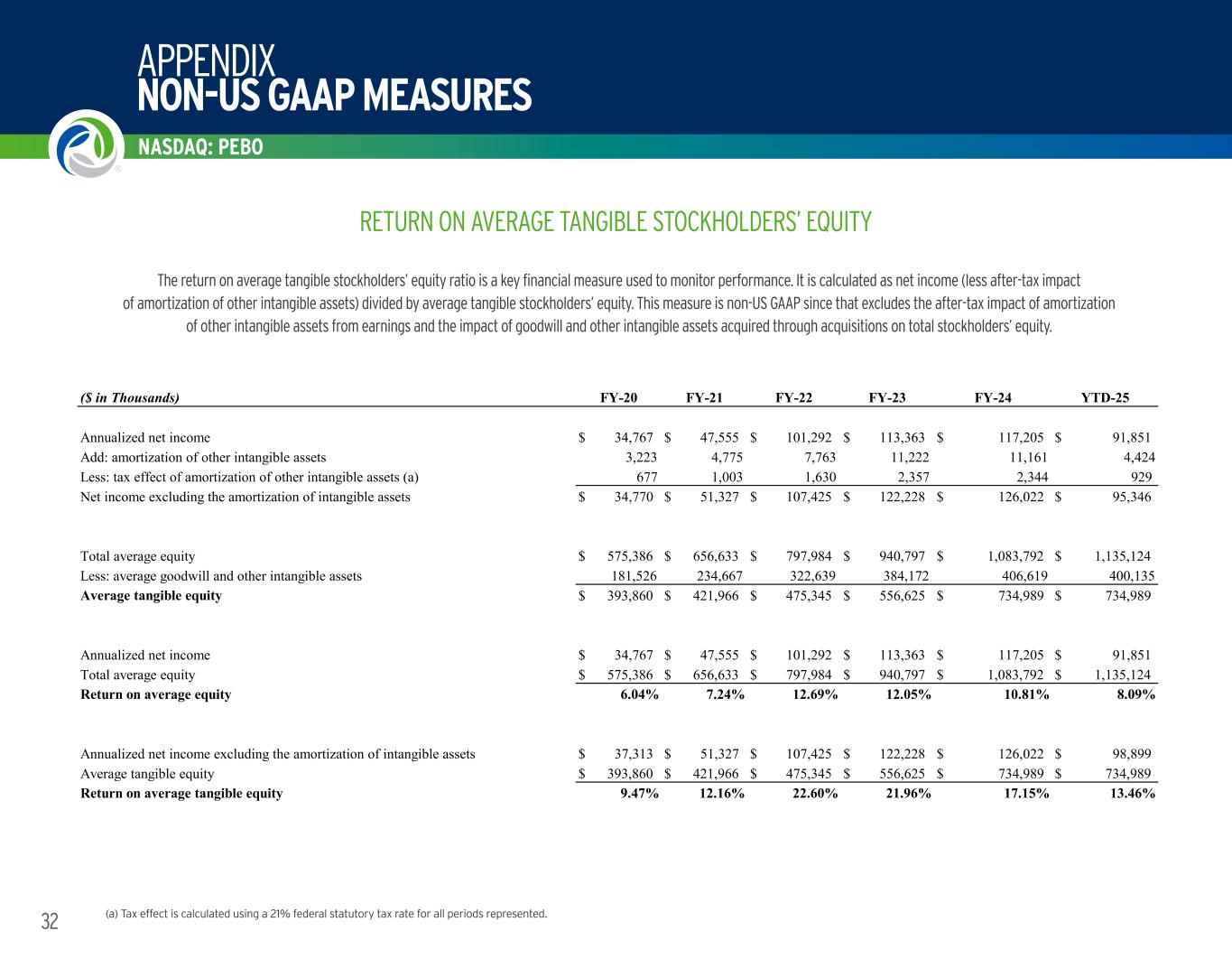

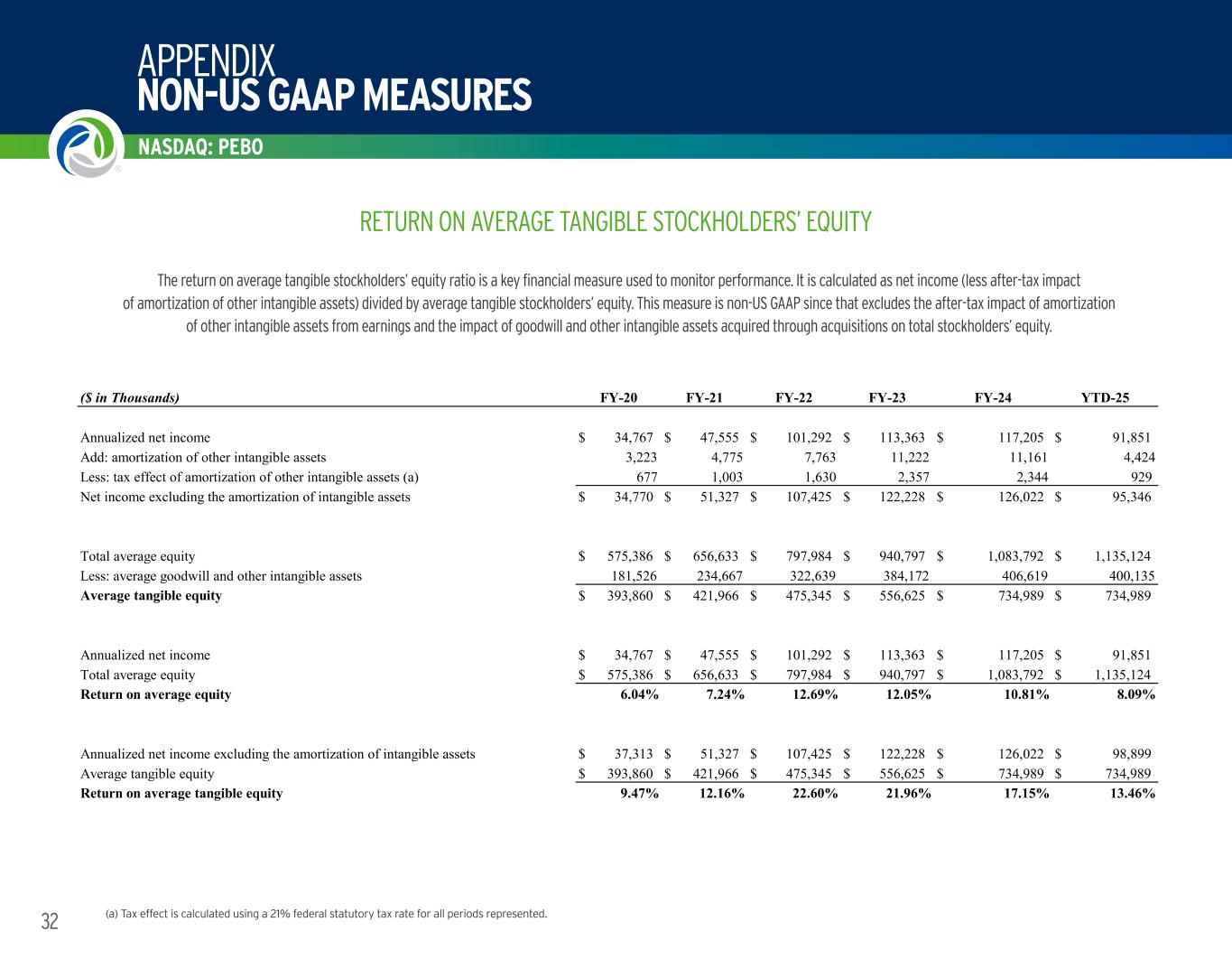

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 32 (a) Tax effect is calculated using a 21% federal statutory tax rate for all periods represented. RETURN ON AVERAGE TANGIBLE STOCKHOLDERS’ EQUITY The return on average tangible stockholders’ equity ratio is a key financial measure used to monitor performance. It is calculated as net income (less after-tax impact of amortization of other intangible assets) divided by average tangible stockholders’ equity. This measure is non-US GAAP since that excludes the after-tax impact of amortization of other intangible assets from earnings and the impact of goodwill and other intangible assets acquired through acquisitions on total stockholders’ equity. ($ in Thousands) FY-20 FY-21 FY-22 FY-23 FY-24 YTD-25 Annualized net income $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 117,205 $ 91,851 Add: amortization of other intangible assets 3,223 4,775 7,763 11,222 11,161 4,424 Less: tax effect of amortization of other intangible assets (a) 677 1,003 1,630 2,357 2,344 929 Net income excluding the amortization of intangible assets $ 34,770 $ 51,327 $ 107,425 $ 122,228 $ 126,022 $ 95,346 Total average equity $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,083,792 $ 1,135,124 Less: average goodwill and other intangible assets 181,526 234,667 322,639 384,172 406,619 400,135 Average tangible equity $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 734,989 $ 734,989 Annualized net income $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 117,205 $ 91,851 Total average equity $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,083,792 $ 1,135,124 Return on average equity 6.04% 7.24% 12.69% 12.05% 10.81% 8.09% Annualized net income excluding the amortization of intangible assets $ 37,313 $ 51,327 $ 107,425 $ 122,228 $ 126,022 $ 98,899 Average tangible equity $ 393,860 $ 421,966 $ 475,345 $ 556,625 $ 734,989 $ 734,989 Return on average tangible equity 9.47% 12.16% 22.60% 21.96% 17.15% 13.46%

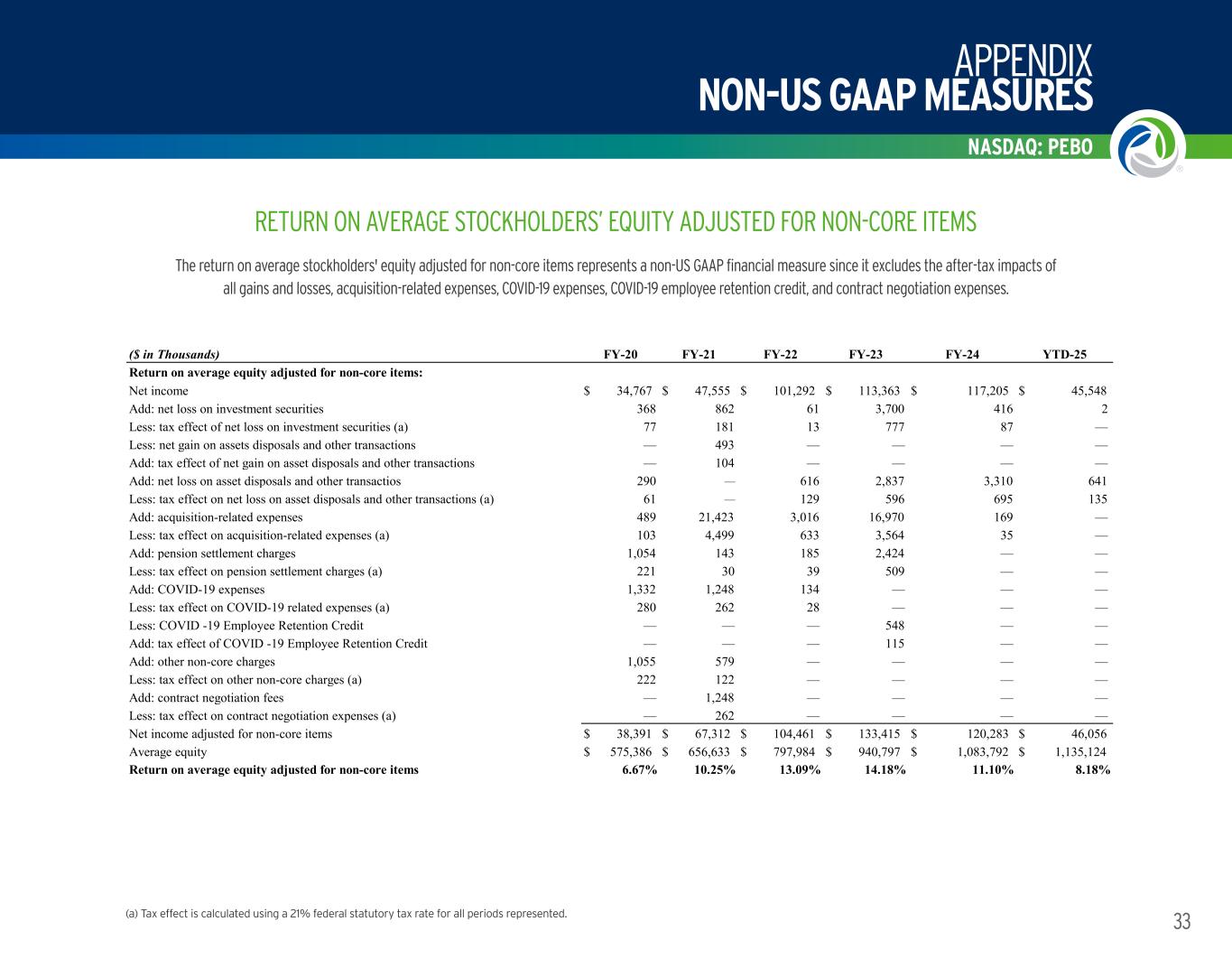

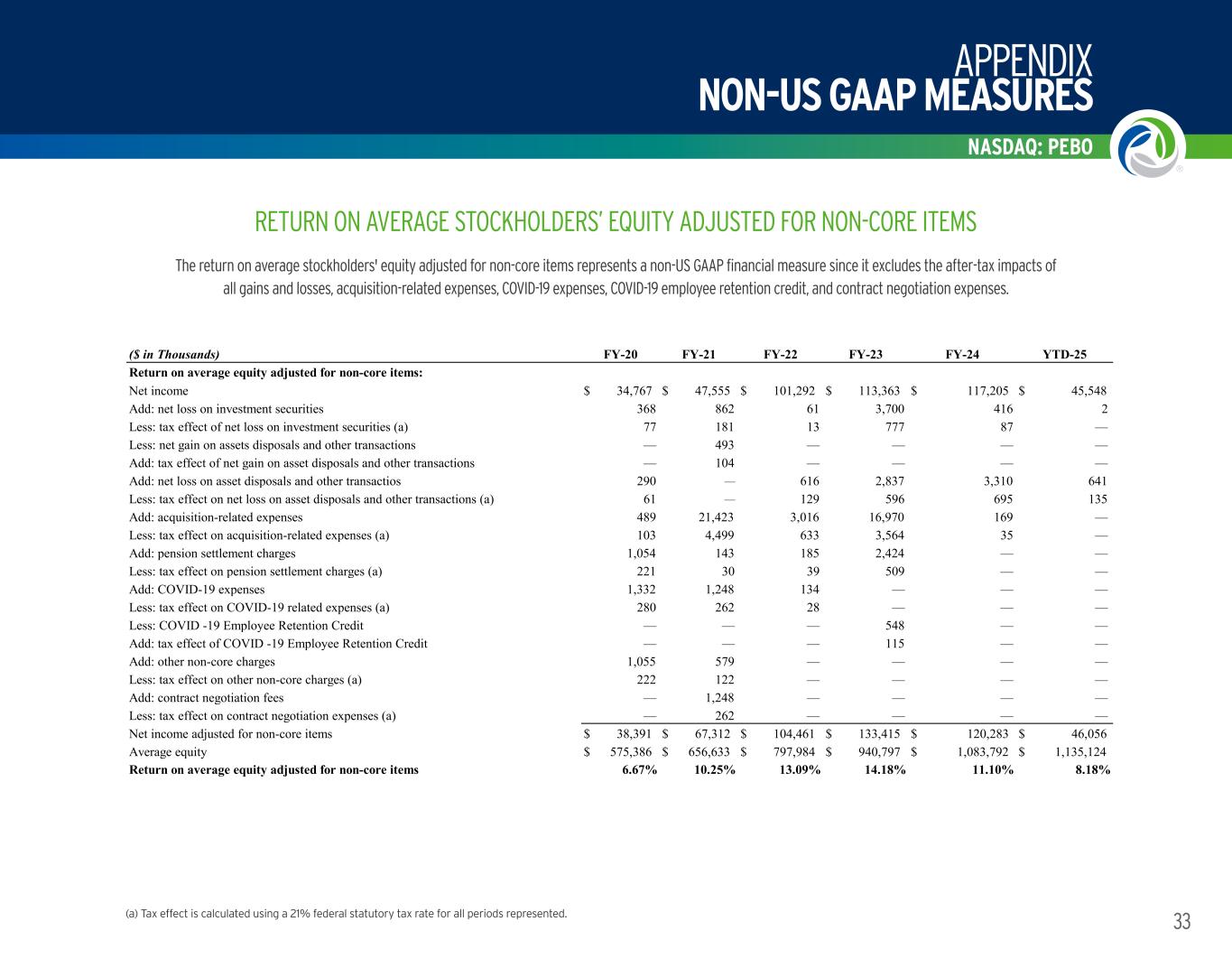

APPENDIX NON-US GAAP MEASURES NASDAQ: PEBO 33 RETURN ON AVERAGE STOCKHOLDERS’ EQUITY ADJUSTED FOR NON-CORE ITEMS (a) Tax effect is calculated using a 21% federal statutory tax rate for all periods represented. The return on average stockholders' equity adjusted for non-core items represents a non-US GAAP financial measure since it excludes the after-tax impacts of all gains and losses, acquisition-related expenses, COVID-19 expenses, COVID-19 employee retention credit, and contract negotiation expenses. ($ in Thousands) FY-20 FY-21 FY-22 FY-23 FY-24 YTD-25 Return on average equity adjusted for non-core items: Net income $ 34,767 $ 47,555 $ 101,292 $ 113,363 $ 117,205 $ 45,548 Add: net loss on investment securities 368 862 61 3,700 416 2 Less: tax effect of net loss on investment securities (a) 77 181 13 777 87 — Less: net gain on assets disposals and other transactions — 493 — — — — Add: tax effect of net gain on asset disposals and other transactions — 104 — — — — Add: net loss on asset disposals and other transactios 290 — 616 2,837 3,310 641 Less: tax effect on net loss on asset disposals and other transactions (a) 61 — 129 596 695 135 Add: acquisition-related expenses 489 21,423 3,016 16,970 169 — Less: tax effect on acquisition-related expenses (a) 103 4,499 633 3,564 35 — Add: pension settlement charges 1,054 143 185 2,424 — — Less: tax effect on pension settlement charges (a) 221 30 39 509 — — Add: COVID-19 expenses 1,332 1,248 134 — — — Less: tax effect on COVID-19 related expenses (a) 280 262 28 — — — Less: COVID -19 Employee Retention Credit — — — 548 — — Add: tax effect of COVID -19 Employee Retention Credit — — — 115 — — Add: other non-core charges 1,055 579 — — — — Less: tax effect on other non-core charges (a) 222 122 — — — — Add: contract negotiation fees — 1,248 — — — — Less: tax effect on contract negotiation expenses (a) — 262 — — — — Net income adjusted for non-core items $ 38,391 $ 67,312 $ 104,461 $ 133,415 $ 120,283 $ 46,056 Average equity $ 575,386 $ 656,633 $ 797,984 $ 940,797 $ 1,083,792 $ 1,135,124 Return on average equity adjusted for non-core items 6.67% 10.25% 13.09% 14.18% 11.10% 8.18%

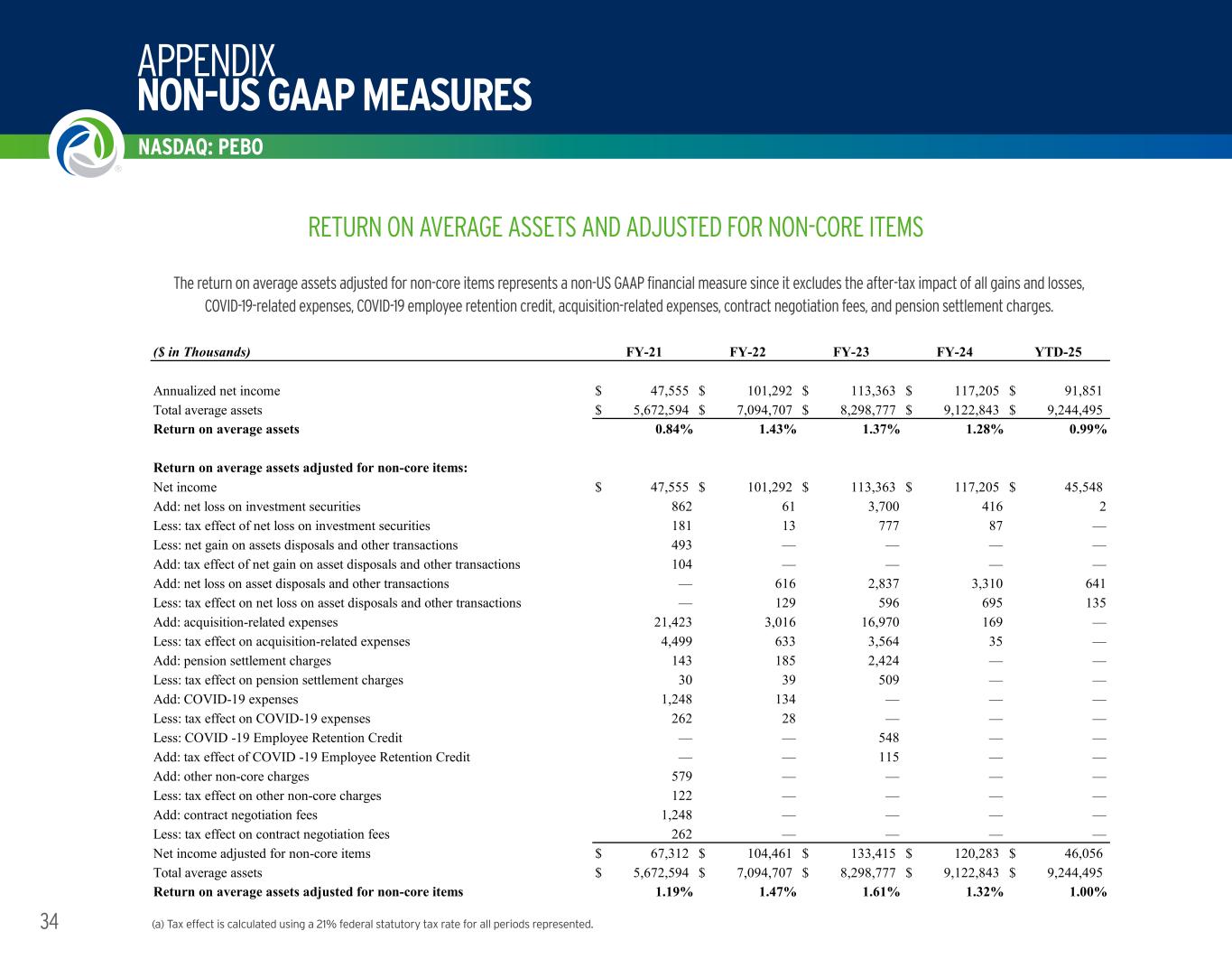

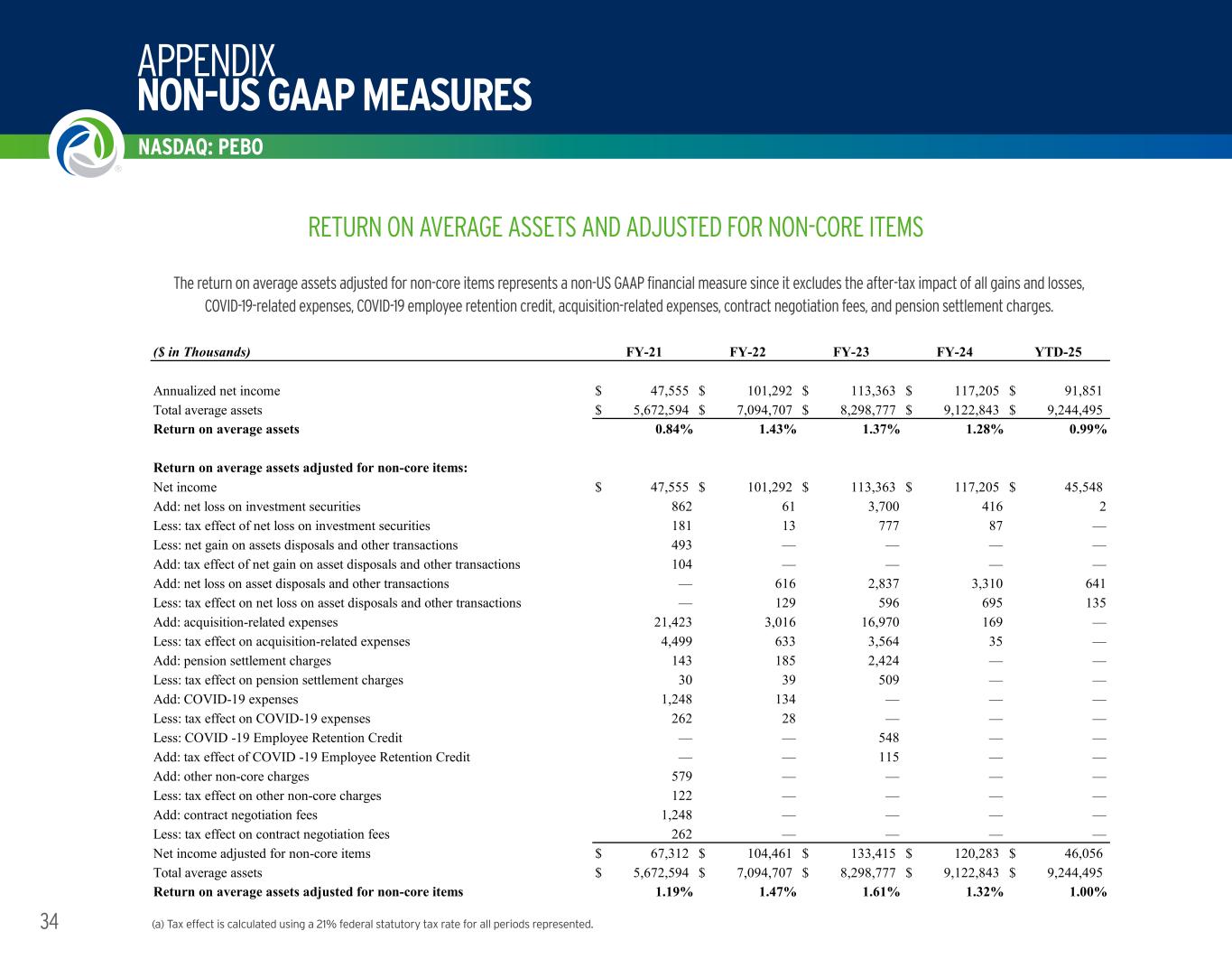

NASDAQ: PEBO APPENDIX NON-US GAAP MEASURES 34 RETURN ON AVERAGE ASSETS AND ADJUSTED FOR NON-CORE ITEMS (a) Tax effect is calculated using a 21% federal statutory tax rate for all periods represented. The return on average assets adjusted for non-core items represents a non-US GAAP financial measure since it excludes the after-tax impact of all gains and losses, COVID-19-related expenses, COVID-19 employee retention credit, acquisition-related expenses, contract negotiation fees, and pension settlement charges. ($ in Thousands) FY-21 FY-22 FY-23 FY-24 YTD-25 Annualized net income $ 47,555 $ 101,292 $ 113,363 $ 117,205 $ 91,851 Total average assets $ 5,672,594 $ 7,094,707 $ 8,298,777 $ 9,122,843 $ 9,244,495 Return on average assets 0.84% 1.43% 1.37% 1.28% 0.99% Return on average assets adjusted for non-core items: Net income $ 47,555 $ 101,292 $ 113,363 $ 117,205 $ 45,548 Add: net loss on investment securities 862 61 3,700 416 2 Less: tax effect of net loss on investment securities 181 13 777 87 — Less: net gain on assets disposals and other transactions 493 — — — — Add: tax effect of net gain on asset disposals and other transactions 104 — — — — Add: net loss on asset disposals and other transactions — 616 2,837 3,310 641 Less: tax effect on net loss on asset disposals and other transactions — 129 596 695 135 Add: acquisition-related expenses 21,423 3,016 16,970 169 — Less: tax effect on acquisition-related expenses 4,499 633 3,564 35 — Add: pension settlement charges 143 185 2,424 — — Less: tax effect on pension settlement charges 30 39 509 — — Add: COVID-19 expenses 1,248 134 — — — Less: tax effect on COVID-19 expenses 262 28 — — — Less: COVID -19 Employee Retention Credit — — 548 — — Add: tax effect of COVID -19 Employee Retention Credit — — 115 — — Add: other non-core charges 579 — — — — Less: tax effect on other non-core charges 122 — — — — Add: contract negotiation fees 1,248 — — — — Less: tax effect on contract negotiation fees 262 — — — — Net income adjusted for non-core items $ 67,312 $ 104,461 $ 133,415 $ 120,283 $ 46,056 Total average assets $ 5,672,594 $ 7,094,707 $ 8,298,777 $ 9,122,843 $ 9,244,495 Return on average assets adjusted for non-core items 1.19% 1.47% 1.61% 1.32% 1.00%

MORE THAN JUST A BANK NASDAQ: PEBO 35 LOCATIONS IN OHIO, WEST VIRGINIA, KENTUCKY, VIRGINIA, WASHINGTON D.C. AND MARYLAND NATIONWIDE SPECIALTY FINANCE DIVISIONS PROXY PEER GROUP DEFINITIONS AUB: Atlantic Union Bank CBU: Community Bank CCNE: CNB Bank CHCO: City National Bank CTBI: Community Trust Bank EGBN: Eagle Bank FCF: First Commonwealth Bank FFBC: First Financial Bancorp FISI: Five Star Bank FMNB: Farmers National Bank FRME: First Merchants Bank GABC: German American Bank HBNC: Horizon Bank LKFN: Lake City Bank NBTB: NBT Bancorp NWBI: Northwest Bank PRK: Park National Bank SRCE: 1st Source Bank STBA: S&T Bank SYBT: Stock Yards Bank THFF: First Financial Bank TMP: Tompkins Bank TOWN: Towne Bank WSBC: Wesbanco

peoplesbancorp.com Peoples Bancorp® is a federally registered service mark of Peoples Bancorp Inc. The three arched ribbons logo is a federally registered service mark of Peoples Bank. Peoples Bank (w/logo)® is a federally registered service mark of Peoples Bank. Working Together. Building Success.® is a federally registered service mark of Peoples Bank. TYLER WILCOX President and Chief Executive Officer 740.373.7737 Tyler.Wilcox@pebo.com KATIE BAILEY Executive Vice President Chief Financial Officer and Treasurer 740.376.7138 Kathryn.Bailey@pebo.com