false2024FY0000317540P5YP5Yhttp://fasb.org/us-gaap/2024#AccountsPayableTradeCurrenthttp://fasb.org/us-gaap/2024#AccountsPayableTradeCurrentP3Y0M0Diso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:purecoke:segmentcoke:reporting_unitcoke:benefitPlancoke:categorycoke:stockcoke:votecoke:financial_covenantcoke:casecoke:entitycoke:supplier00003175402024-01-012024-12-3100003175402024-06-280000317540coke:CommonClassUndefinedMember2025-01-240000317540us-gaap:CommonClassBMember2025-01-2400003175402023-01-012023-12-3100003175402022-01-012022-12-310000317540coke:CommonClassUndefinedMember2024-01-012024-12-310000317540coke:CommonClassUndefinedMember2023-01-012023-12-310000317540coke:CommonClassUndefinedMember2022-01-012022-12-310000317540us-gaap:CommonClassBMember2024-01-012024-12-310000317540us-gaap:CommonClassBMember2023-01-012023-12-310000317540us-gaap:CommonClassBMember2022-01-012022-12-3100003175402024-12-3100003175402023-12-310000317540us-gaap:NonrelatedPartyMember2024-12-310000317540us-gaap:NonrelatedPartyMember2023-12-310000317540us-gaap:RelatedPartyMember2024-12-310000317540us-gaap:RelatedPartyMember2023-12-310000317540us-gaap:DistributionRightsMember2024-12-310000317540us-gaap:DistributionRightsMember2023-12-310000317540us-gaap:CustomerListsMember2024-12-310000317540us-gaap:CustomerListsMember2023-12-310000317540us-gaap:ConvertiblePreferredStockMember2023-12-310000317540us-gaap:ConvertiblePreferredStockMember2024-12-310000317540coke:NonconvertiblePreferredStockMember2024-12-310000317540coke:NonconvertiblePreferredStockMember2023-12-310000317540coke:PreferredClassUndefinedMember2024-12-310000317540coke:PreferredClassUndefinedMember2023-12-310000317540coke:CommonClassUndefinedMember2023-12-310000317540coke:CommonClassUndefinedMember2024-12-310000317540us-gaap:CommonClassBMember2024-12-310000317540us-gaap:CommonClassBMember2023-12-310000317540us-gaap:CommonClassCMember2024-12-310000317540us-gaap:CommonClassCMember2023-12-3100003175402022-12-3100003175402021-12-310000317540us-gaap:CommonStockMembercoke:CommonClassUndefinedMember2021-12-310000317540us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310000317540us-gaap:AdditionalPaidInCapitalMember2021-12-310000317540us-gaap:RetainedEarningsMember2021-12-310000317540us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000317540us-gaap:TreasuryStockCommonMembercoke:CommonClassUndefinedMember2021-12-310000317540us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassBMember2021-12-310000317540us-gaap:RetainedEarningsMember2022-01-012022-12-310000317540us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000317540us-gaap:RetainedEarningsMembercoke:CommonClassUndefinedMember2022-01-012022-12-310000317540us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2022-01-012022-12-310000317540us-gaap:CommonStockMembercoke:CommonClassUndefinedMember2022-01-012022-12-310000317540us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-01-012022-12-310000317540us-gaap:CommonStockMembercoke:CommonClassUndefinedMember2022-12-310000317540us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310000317540us-gaap:AdditionalPaidInCapitalMember2022-12-310000317540us-gaap:RetainedEarningsMember2022-12-310000317540us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000317540us-gaap:TreasuryStockCommonMembercoke:CommonClassUndefinedMember2022-12-310000317540us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassBMember2022-12-310000317540us-gaap:RetainedEarningsMember2023-01-012023-12-310000317540us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000317540us-gaap:RetainedEarningsMembercoke:CommonClassUndefinedMember2023-01-012023-12-310000317540us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2023-01-012023-12-310000317540us-gaap:CommonStockMembercoke:CommonClassUndefinedMember2023-12-310000317540us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310000317540us-gaap:AdditionalPaidInCapitalMember2023-12-310000317540us-gaap:RetainedEarningsMember2023-12-310000317540us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000317540us-gaap:TreasuryStockCommonMembercoke:CommonClassUndefinedMember2023-12-310000317540us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassBMember2023-12-310000317540us-gaap:RetainedEarningsMember2024-01-012024-12-310000317540us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310000317540us-gaap:RetainedEarningsMembercoke:CommonClassUndefinedMember2024-01-012024-12-310000317540us-gaap:RetainedEarningsMemberus-gaap:CommonClassBMember2024-01-012024-12-310000317540us-gaap:CommonStockMembercoke:CommonClassUndefinedMember2024-01-012024-12-310000317540us-gaap:TreasuryStockCommonMembercoke:CommonClassUndefinedMember2024-01-012024-12-310000317540us-gaap:CommonStockMembercoke:CommonClassUndefinedMember2024-12-310000317540us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-12-310000317540us-gaap:AdditionalPaidInCapitalMember2024-12-310000317540us-gaap:RetainedEarningsMember2024-12-310000317540us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000317540us-gaap:TreasuryStockCommonMembercoke:CommonClassUndefinedMember2024-12-310000317540us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassBMember2024-12-310000317540coke:CokeBottleCanSalesVolumeProductMember2024-01-012024-12-310000317540coke:BottleOrCanSalesMember2024-01-012024-12-310000317540coke:OtherProductsSalesPostMixAndOtherMember2024-01-012024-12-310000317540us-gaap:DistributionRightsMembersrt:MinimumMember2024-12-310000317540us-gaap:DistributionRightsMembersrt:MaximumMember2024-12-310000317540us-gaap:CustomerListsMembersrt:MinimumMember2024-12-310000317540us-gaap:CustomerListsMembersrt:MaximumMember2024-12-310000317540us-gaap:PensionPlansDefinedBenefitMember2024-12-310000317540coke:RepairServiceMembersrt:MinimumMember2024-01-012024-12-310000317540coke:RepairServiceMembersrt:MaximumMember2024-01-012024-12-310000317540coke:JFrankHarrisonIIIMemberus-gaap:CommonClassBMember2024-12-310000317540coke:JFrankHarrisonIIIMember2024-12-310000317540us-gaap:InvestorMember2024-12-310000317540coke:TenderOfferAndPurchaseAgreementMember2024-05-060000317540coke:TenderOfferMember2024-05-060000317540coke:TenderOfferMembersrt:MinimumMember2024-05-200000317540coke:TenderOfferMembersrt:MaximumMember2024-05-200000317540coke:TenderOfferMember2024-05-200000317540coke:TenderOfferMember2024-06-182024-06-180000317540coke:TenderOfferMember2024-06-180000317540coke:TheCocaColaCompanyMember2024-07-050000317540coke:PurchaseAgreementMembercoke:CarolinaCocaColaBottlingInvestmentsMember2024-07-052024-07-050000317540coke:PurchaseAgreementMember2024-05-200000317540us-gaap:InvestorMember2024-01-012024-12-310000317540us-gaap:InvestorMember2023-01-012023-12-310000317540us-gaap:InvestorMember2022-01-012022-12-310000317540coke:CocaColaRefreshmentsMembercoke:ComprehensiveBeverageAgreementMember2024-01-012024-12-310000317540coke:CocaColaRefreshmentsMembercoke:ComprehensiveBeverageAgreementMember2023-01-012023-12-310000317540coke:CocaColaRefreshmentsMembercoke:ComprehensiveBeverageAgreementMember2022-01-012022-12-310000317540coke:CocaColaRefreshmentsMembercoke:ComprehensiveBeverageAgreementMember2024-12-310000317540coke:CocaColaRefreshmentsMembercoke:ComprehensiveBeverageAgreementMember2023-12-310000317540us-gaap:OtherAssetsMembercoke:SoutheasternMember2023-12-310000317540us-gaap:OtherAssetsMembercoke:SoutheasternMember2024-12-310000317540us-gaap:OtherAssetsMembercoke:SouthAtlanticCannersMember2024-12-310000317540us-gaap:OtherAssetsMembercoke:SouthAtlanticCannersMember2023-12-310000317540coke:SouthAtlanticCannersMember2024-01-012024-12-310000317540coke:SouthAtlanticCannersMember2023-01-012023-12-310000317540coke:SouthAtlanticCannersMember2022-01-012022-12-310000317540coke:CocaColaBottlerSalesAndServicesCompanyMember2024-12-310000317540coke:CocaColaBottlerSalesAndServicesCompanyMember2023-12-310000317540coke:CocaColaBottlerSalesAndServicesCompanyMember2023-01-012023-12-310000317540coke:CocaColaBottlerSalesAndServicesCompanyMember2024-01-012024-12-310000317540coke:CocaColaBottlerSalesAndServicesCompanyMember2022-01-012022-12-310000317540us-gaap:OtherAssetsMembercoke:CONAServicesLimitedLiabilityCompanyMember2024-12-310000317540us-gaap:OtherAssetsMembercoke:CONAServicesLimitedLiabilityCompanyMember2023-12-310000317540coke:CONAServicesLimitedLiabilityCompanyMember2024-01-012024-12-310000317540coke:CONAServicesLimitedLiabilityCompanyMember2023-01-012023-12-310000317540coke:CONAServicesLimitedLiabilityCompanyMember2022-01-012022-12-310000317540coke:BeaconInvestmentCorporationMember2024-12-310000317540coke:BeaconInvestmentCorporationMember2023-12-310000317540coke:BeaconInvestmentCorporationMember2024-01-012024-12-310000317540coke:BeaconInvestmentCorporationMember2023-01-012023-12-310000317540coke:BeaconInvestmentCorporationMember2022-01-012022-12-310000317540coke:LeaseHlpSpcMember2024-01-012024-12-310000317540coke:LeaseHlpSpcMember2023-01-012023-12-310000317540coke:LeaseHlpSpcMember2022-01-012022-12-310000317540coke:LongTermPerformanceEquityPlanMember2024-01-012024-12-310000317540coke:LongTermPerformanceEquityPlanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-12-310000317540coke:LongTermPerformanceEquityPlanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310000317540coke:LongTermPerformanceEquityPlanMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310000317540coke:TimingOfSaleMemberus-gaap:TransferredAtPointInTimeMemberus-gaap:RevenueFromContractWithCustomerMember2023-01-012023-12-310000317540coke:TimingOfSaleMemberus-gaap:TransferredAtPointInTimeMemberus-gaap:RevenueFromContractWithCustomerMember2024-01-012024-12-310000317540coke:TimingOfSaleMemberus-gaap:TransferredAtPointInTimeMemberus-gaap:RevenueFromContractWithCustomerMember2022-01-012022-12-310000317540us-gaap:TransferredAtPointInTimeMembercoke:NonalcoholicBeverageSegmentMember2024-01-012024-12-310000317540us-gaap:TransferredAtPointInTimeMembercoke:NonalcoholicBeverageSegmentMember2023-01-012023-12-310000317540us-gaap:TransferredAtPointInTimeMembercoke:NonalcoholicBeverageSegmentMember2022-01-012022-12-310000317540us-gaap:TransferredAtPointInTimeMember2024-01-012024-12-310000317540us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000317540us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000317540us-gaap:TransferredOverTimeMembercoke:NonalcoholicBeverageSegmentMember2024-01-012024-12-310000317540us-gaap:TransferredOverTimeMembercoke:NonalcoholicBeverageSegmentMember2023-01-012023-12-310000317540us-gaap:TransferredOverTimeMembercoke:NonalcoholicBeverageSegmentMember2022-01-012022-12-310000317540us-gaap:TransferredOverTimeMembercoke:OtherSegmentMember2024-01-012024-12-310000317540us-gaap:TransferredOverTimeMembercoke:OtherSegmentMember2023-01-012023-12-310000317540us-gaap:TransferredOverTimeMembercoke:OtherSegmentMember2022-01-012022-12-310000317540us-gaap:TransferredOverTimeMember2024-01-012024-12-310000317540us-gaap:TransferredOverTimeMember2023-01-012023-12-310000317540us-gaap:TransferredOverTimeMember2022-01-012022-12-310000317540us-gaap:AllOtherSegmentsMember2024-01-012024-12-310000317540us-gaap:OperatingSegmentsMembercoke:NonalcoholicBeverageSegmentMember2024-01-012024-12-310000317540us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2024-01-012024-12-310000317540us-gaap:IntersegmentEliminationMember2024-01-012024-12-310000317540us-gaap:OperatingSegmentsMembercoke:NonalcoholicBeverageSegmentMember2023-01-012023-12-310000317540us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-01-012023-12-310000317540us-gaap:IntersegmentEliminationMember2023-01-012023-12-310000317540us-gaap:OperatingSegmentsMembercoke:NonalcoholicBeverageSegmentMember2022-01-012022-12-310000317540us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-01-012022-12-310000317540us-gaap:IntersegmentEliminationMember2022-01-012022-12-310000317540coke:NewShareRepurchaseProgramMember2024-08-200000317540coke:NewShareRepurchaseProgramMember2024-01-012024-12-310000317540us-gaap:USTreasurySecuritiesMember2024-12-310000317540us-gaap:CorporateDebtSecuritiesMember2024-12-310000317540us-gaap:CommercialPaperMember2024-12-310000317540us-gaap:AssetBackedSecuritiesMember2024-12-310000317540us-gaap:LandMember2024-12-310000317540us-gaap:LandMember2023-12-310000317540us-gaap:BuildingMember2024-12-310000317540us-gaap:BuildingMember2023-12-310000317540srt:MinimumMemberus-gaap:BuildingMember2024-12-310000317540srt:MaximumMemberus-gaap:BuildingMember2024-12-310000317540us-gaap:MachineryAndEquipmentMember2024-12-310000317540us-gaap:MachineryAndEquipmentMember2023-12-310000317540srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000317540srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-310000317540us-gaap:TransportationEquipmentMember2024-12-310000317540us-gaap:TransportationEquipmentMember2023-12-310000317540srt:MinimumMemberus-gaap:TransportationEquipmentMember2024-12-310000317540srt:MaximumMemberus-gaap:TransportationEquipmentMember2024-12-310000317540us-gaap:FurnitureAndFixturesMember2024-12-310000317540us-gaap:FurnitureAndFixturesMember2023-12-310000317540srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-12-310000317540srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2024-12-310000317540coke:ColdDrinkDispensingEquipmentMember2024-12-310000317540coke:ColdDrinkDispensingEquipmentMember2023-12-310000317540srt:MinimumMembercoke:ColdDrinkDispensingEquipmentMember2024-12-310000317540srt:MaximumMembercoke:ColdDrinkDispensingEquipmentMember2024-12-310000317540us-gaap:LeaseholdsAndLeaseholdImprovementsMember2024-12-310000317540us-gaap:LeaseholdsAndLeaseholdImprovementsMember2023-12-310000317540srt:MinimumMemberus-gaap:LeaseholdsAndLeaseholdImprovementsMember2024-12-310000317540srt:MaximumMemberus-gaap:LeaseholdsAndLeaseholdImprovementsMember2024-12-310000317540us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000317540us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310000317540srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000317540srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310000317540us-gaap:ConstructionInProgressMember2024-12-310000317540us-gaap:ConstructionInProgressMember2023-12-310000317540us-gaap:CustomerRelatedIntangibleAssetsMembersrt:MinimumMember2024-12-310000317540us-gaap:CustomerRelatedIntangibleAssetsMembersrt:MaximumMember2024-12-310000317540us-gaap:CustomerRelatedIntangibleAssetsMember2024-12-310000317540us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310000317540us-gaap:CostOfSalesMemberus-gaap:CommodityContractMember2024-01-012024-12-310000317540us-gaap:CostOfSalesMemberus-gaap:CommodityContractMember2023-01-012023-12-310000317540us-gaap:CostOfSalesMemberus-gaap:CommodityContractMember2022-01-012022-12-310000317540us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CommodityContractMember2024-01-012024-12-310000317540us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CommodityContractMember2023-01-012023-12-310000317540us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:CommodityContractMember2022-01-012022-12-310000317540us-gaap:CommodityContractMember2024-01-012024-12-310000317540us-gaap:CommodityContractMember2023-01-012023-12-310000317540us-gaap:CommodityContractMember2022-01-012022-12-310000317540us-gaap:CommodityContractMember2024-12-310000317540us-gaap:CommodityContractMember2023-12-310000317540us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000317540us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:CommodityContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310000317540us-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310000317540us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000317540us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540us-gaap:CommodityContractMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000317540us-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540us-gaap:FairValueInputsLevel1Memberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540us-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540us-gaap:FairValueInputsLevel3Memberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000317540coke:DistributionAssetsMember2024-12-310000317540us-gaap:FairValueInputsLevel3Member2023-12-310000317540us-gaap:FairValueInputsLevel3Member2022-12-310000317540us-gaap:FairValueInputsLevel3Member2024-01-012024-12-310000317540us-gaap:FairValueInputsLevel3Member2023-01-012023-12-310000317540us-gaap:FairValueInputsLevel3Member2024-12-310000317540us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMember2024-12-310000317540us-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMember2023-12-310000317540us-gaap:DomesticCountryMember2024-12-310000317540us-gaap:StateAndLocalJurisdictionMember2024-12-310000317540coke:ExecutiveBenefitPlansMember2024-01-012024-12-310000317540coke:SupplementalSavingsIncentivePlanMembercoke:ExecutiveBenefitPlansMember2024-01-012024-12-310000317540coke:SupplementalSavingsIncentivePlanMembercoke:ExecutiveBenefitPlansMember2023-01-012023-12-310000317540coke:SupplementalSavingsIncentivePlanMembercoke:ExecutiveBenefitPlansMember2022-01-012022-12-310000317540coke:SupplementalSavingsIncentivePlanAndDirectorDeferralPlanMembercoke:ExecutiveBenefitPlansMember2024-01-012024-12-310000317540coke:SupplementalSavingsIncentivePlanAndDirectorDeferralPlanMembercoke:ExecutiveBenefitPlansMember2024-12-310000317540coke:SupplementalSavingsIncentivePlanAndDirectorDeferralPlanMembercoke:ExecutiveBenefitPlansMember2023-12-310000317540coke:LongTermRetentionPlanMembercoke:ExecutiveBenefitPlansMember2024-01-012024-12-310000317540coke:LongTermRetentionPlanMembercoke:ExecutiveBenefitPlansMember2024-12-310000317540coke:LongTermRetentionPlanMembercoke:ExecutiveBenefitPlansMember2023-12-310000317540coke:OfficerRetentionPlanMembercoke:ExecutiveBenefitPlansMember2024-01-012024-12-310000317540coke:OfficerRetentionPlanMembercoke:ExecutiveBenefitPlansMember2024-12-310000317540coke:OfficerRetentionPlanMembercoke:ExecutiveBenefitPlansMember2023-12-310000317540coke:LongTermPerformancePlanMembercoke:ExecutiveBenefitPlansMember2024-12-310000317540coke:LongTermPerformancePlanMembercoke:ExecutiveBenefitPlansMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000317540coke:BargainingPlanMember2024-12-310000317540coke:BargainingPlanMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentDebtSecuritiesMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:USGovernmentDebtSecuritiesMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMemberus-gaap:USGovernmentDebtSecuritiesMember2025-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMemberus-gaap:DefinedBenefitPlanEquitySecuritiesUsMember2025-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMemberus-gaap:ForeignGovernmentDebtSecuritiesMember2025-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMemberus-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMember2025-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2025-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMemberus-gaap:OtherDebtSecuritiesMember2025-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:ScenarioForecastMember2025-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMember2024-01-012024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2024-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FixedIncomeFundsMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2024-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:OtherDebtSecuritiesMember2023-12-310000317540us-gaap:PensionPlansDefinedBenefitMember2023-12-310000317540coke:A401KSavingsPlanMember2024-01-012024-12-310000317540coke:A401KSavingsPlanMember2022-01-012022-12-310000317540coke:A401KSavingsPlanMember2023-01-012023-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-01-012024-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000317540coke:PreMedicareMember2024-12-310000317540coke:PreMedicareMember2023-12-310000317540coke:PreMedicareMember2022-12-310000317540coke:PostMedicareMember2024-12-310000317540coke:PostMedicareMember2023-12-310000317540coke:PostMedicareMember2022-12-310000317540us-gaap:PensionPlansDefinedBenefitMember2024-01-012024-12-310000317540coke:PrimaryPlanMemberus-gaap:PensionPlansDefinedBenefitMember2024-12-310000317540coke:PrimaryPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000317540coke:TeamstersPlanMember2024-01-012024-12-310000317540coke:TeamstersPlanMember2023-01-012023-12-310000317540coke:TeamstersPlanMember2022-01-012022-12-310000317540coke:LegacyFacilitiesCreditMember2018-12-300000317540coke:CocaColaRefreshmentsMembercoke:ComprehensiveBeverageAgreementMember2018-12-300000317540coke:ThreePointEightPercentSeniorNotesNovemberTwentyFiveTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2024-12-310000317540coke:ThreePointEightPercentSeniorNotesNovemberTwentyFiveTwoThousandTwentyFiveMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2023-12-310000317540coke:ThreePointNineThreePercentSeniorNotesOctoberTenTwoThousandTwentySixMemberus-gaap:SeniorNotesMembercoke:NonPublicDebtMember2024-12-310000317540coke:ThreePointNineThreePercentSeniorNotesOctoberTenTwoThousandTwentySixMemberus-gaap:SeniorNotesMembercoke:NonPublicDebtMember2023-12-310000317540coke:FivePointTwoFivePercentSeniorNotesJuneOneTwoThousandTwentyNineMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2024-12-310000317540coke:FivePointTwoFivePercentSeniorNotesJuneOneTwoThousandTwentyNineMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2023-12-310000317540us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercoke:NonPublicDebtMember2024-12-310000317540us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercoke:NonPublicDebtMember2023-12-310000317540coke:ThreePointNineSixPercentSeniorNotesMarchTwentyOneTwoThousandThirtyMemberus-gaap:SeniorNotesMembercoke:NonPublicDebtMember2024-12-310000317540coke:ThreePointNineSixPercentSeniorNotesMarchTwentyOneTwoThousandThirtyMemberus-gaap:SeniorNotesMembercoke:NonPublicDebtMember2023-12-310000317540coke:FivePointFourFivePercentSeniorNotesJuneOneTwoThousandThirtyFourMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2024-12-310000317540coke:FivePointFourFivePercentSeniorNotesJuneOneTwoThousandThirtyFourMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2023-12-310000317540coke:A20252029And2034SeniorBondsMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2024-12-310000317540coke:A20252029And2034SeniorBondsMemberus-gaap:SeniorNotesMembercoke:PublicDebtMember2023-12-310000317540coke:A2021RevolvingCreditFacilityAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercoke:NonPublicDebtMember2021-07-090000317540coke:FivePointTwoFivePercentSeniorNotesJuneOneTwoThousandTwentyNineMemberus-gaap:SeniorNotesMember2024-05-290000317540coke:FivePointFourFivePercentSeniorNotesJuneOneTwoThousandThirtyFourMemberus-gaap:SeniorNotesMember2024-05-290000317540coke:RevolvingCreditFacilityAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-06-102024-06-100000317540coke:RevolvingCreditFacilityAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-06-100000317540coke:RevolvingCreditFacilityAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-01-012024-12-310000317540coke:RevolvingCreditFacilityAgreementMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MaximumMember2024-01-012024-12-310000317540coke:SoutheasternMember2024-01-012024-12-310000317540coke:SouthAtlanticCannersMember2024-12-310000317540coke:SoutheasternMember2023-01-012023-12-310000317540coke:SoutheasternMember2022-01-012022-12-310000317540coke:SouthAtlanticCannersMember2023-12-310000317540coke:WalMartStoresIncMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2024-01-012024-12-310000317540coke:WalMartStoresIncMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2023-01-012023-12-310000317540coke:WalMartStoresIncMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2022-01-012022-12-310000317540coke:TheKrogerCompanyMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2024-01-012024-12-310000317540coke:TheKrogerCompanyMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2023-01-012023-12-310000317540coke:TheKrogerCompanyMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2022-01-012022-12-310000317540coke:WalMartStoresIncAndTheKrogerCompanyMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2024-01-012024-12-310000317540coke:WalMartStoresIncAndTheKrogerCompanyMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2023-01-012023-12-310000317540coke:WalMartStoresIncAndTheKrogerCompanyMemberus-gaap:ProductConcentrationRiskMembercoke:CokeBottleCanSalesVolumeProductMember2022-01-012022-12-310000317540coke:WalMartStoresIncMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310000317540coke:WalMartStoresIncMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310000317540coke:WalMartStoresIncMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310000317540coke:TheKrogerCompanyMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310000317540coke:TheKrogerCompanyMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310000317540coke:TheKrogerCompanyMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310000317540coke:WalMartStoresIncAndTheKrogerCompanyMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310000317540coke:WalMartStoresIncAndTheKrogerCompanyMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310000317540coke:WalMartStoresIncAndTheKrogerCompanyMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310000317540us-gaap:LaborForceConcentrationRiskMemberus-gaap:WorkforceSubjectToCollectiveBargainingArrangementsMember2024-01-012024-12-310000317540us-gaap:LaborForceConcentrationRiskMembersrt:MinimumMemberus-gaap:WorkforceSubjectToCollectiveBargainingArrangementsMember2024-01-012024-12-310000317540us-gaap:LaborForceConcentrationRiskMembersrt:MaximumMemberus-gaap:WorkforceSubjectToCollectiveBargainingArrangementsMember2024-01-012024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-01-012024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2023-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-01-012024-12-310000317540coke:BargainingPlanMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-01-012024-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2023-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-01-012024-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-12-310000317540coke:UnrealizedGainLossOnInvestmentsMember2023-12-310000317540coke:UnrealizedGainLossOnInvestmentsMember2024-01-012024-12-310000317540coke:UnrealizedGainLossOnInvestmentsMember2024-12-310000317540coke:ReclassificationOfStrandedTaxEffectsDueToTCJAMember2023-12-310000317540coke:ReclassificationOfStrandedTaxEffectsDueToTCJAMember2024-01-012024-12-310000317540coke:ReclassificationOfStrandedTaxEffectsDueToTCJAMember2024-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2022-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2023-01-012023-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2023-12-310000317540us-gaap:PensionPlansDefinedBenefitMembercoke:AccumulatedDefinedBenefitPlansAdjustmentNetSettlementExpenseAttributableToParentMember2022-12-310000317540us-gaap:PensionPlansDefinedBenefitMembercoke:AccumulatedDefinedBenefitPlansAdjustmentNetSettlementExpenseAttributableToParentMember2023-01-012023-12-310000317540us-gaap:PensionPlansDefinedBenefitMembercoke:AccumulatedDefinedBenefitPlansAdjustmentNetSettlementExpenseAttributableToParentMember2023-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2022-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2023-01-012023-12-310000317540coke:ReclassificationOfStrandedTaxEffectsDueToTCJAMember2022-12-310000317540coke:ReclassificationOfStrandedTaxEffectsDueToTCJAMember2023-01-012023-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-012022-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2021-12-310000317540us-gaap:PensionPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2022-01-012022-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-012022-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2021-12-310000317540us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberus-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2022-01-012022-12-310000317540us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310000317540us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310000317540us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000317540coke:ReclassificationOfStrandedTaxEffectsDueToTCJAMember2021-12-310000317540coke:ReclassificationOfStrandedTaxEffectsDueToTCJAMember2022-01-012022-12-3100003175402024-10-012024-12-310000317540us-gaap:AllowanceForCreditLossMember2023-12-310000317540us-gaap:AllowanceForCreditLossMember2022-12-310000317540us-gaap:AllowanceForCreditLossMember2021-12-310000317540us-gaap:AllowanceForCreditLossMember2024-01-012024-12-310000317540us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310000317540us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310000317540us-gaap:AllowanceForCreditLossMember2024-12-310000317540us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310000317540us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310000317540us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310000317540us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-01-012024-12-310000317540us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310000317540us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310000317540us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

|

|

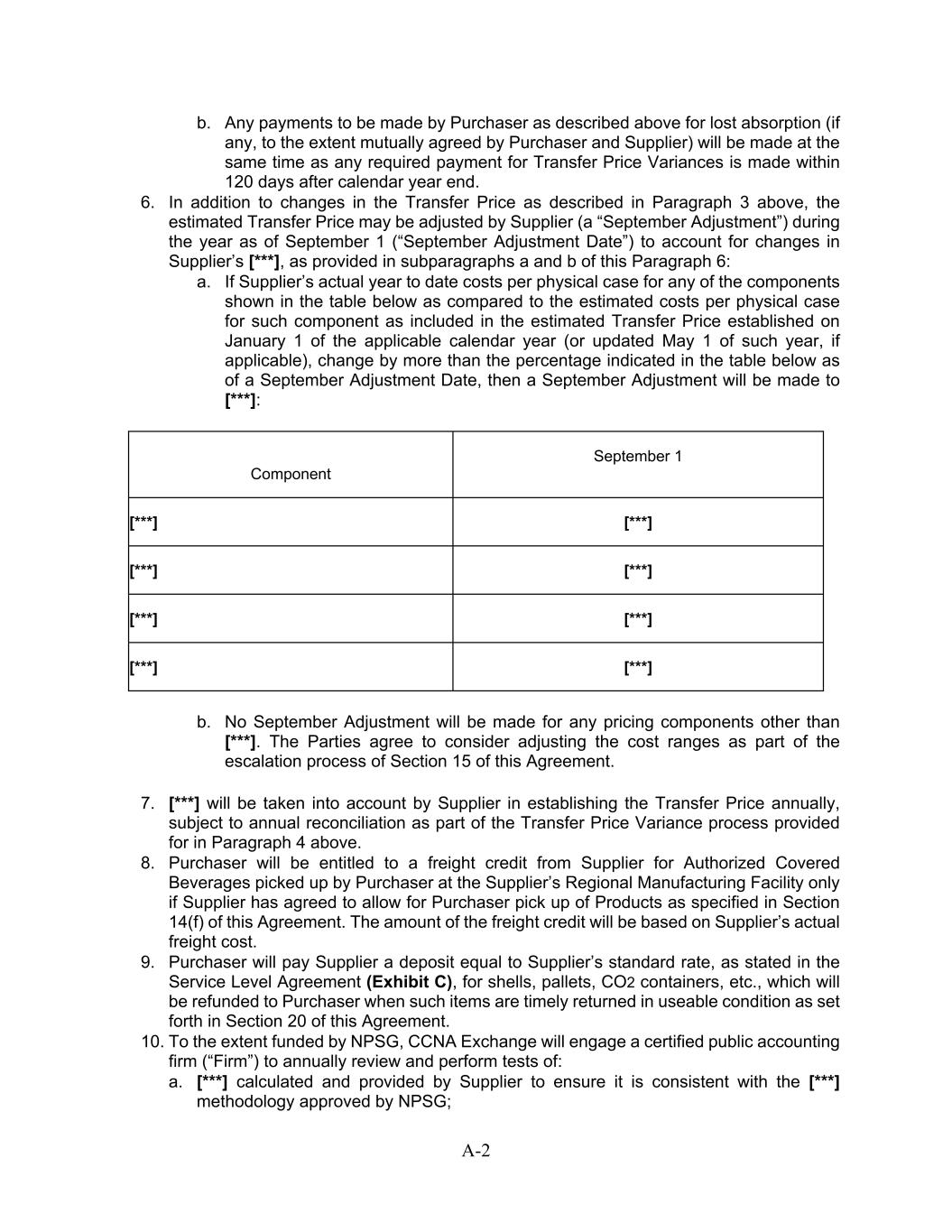

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 0-9286

COCA-COLA CONSOLIDATED, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

56-0950585 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

|

4100 Coca-Cola Plaza

Charlotte, NC

|

|

28211 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (980) 392-8298

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $1.00 per share |

COKE |

The Nasdaq Global Select Market |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

| |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

|

|

|

|

|

|

|

|

|

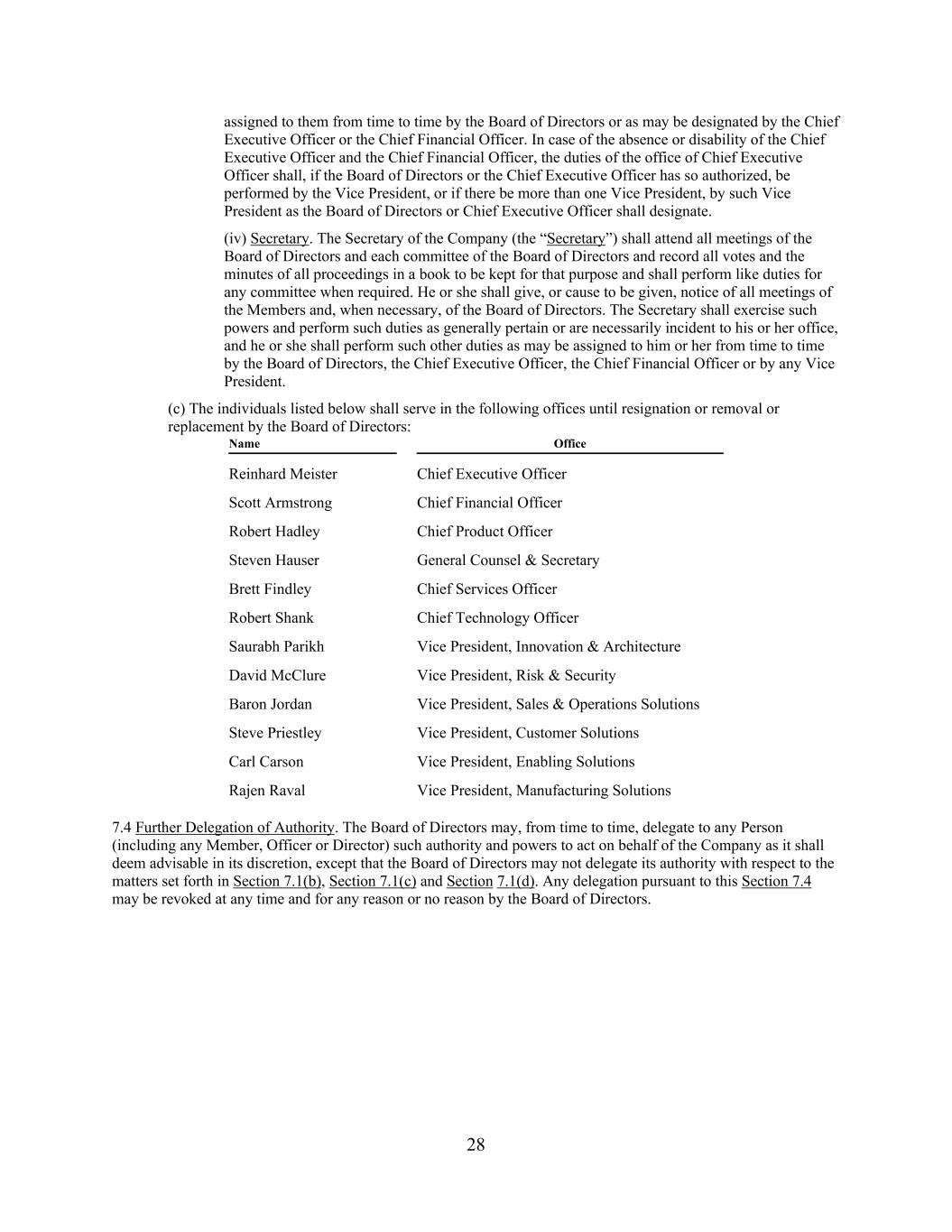

Class |

|

Market Value as of June 28, 2024 |

| Common Stock, par value $l.00 per share |

|

$6,371,812,773 |

| Class B Common Stock, par value $l.00 per share |

|

* |

*No market exists for the Class B Common Stock, which is neither registered under Section 12 of the Act nor subject to Section 15(d) of the Act. The Class B Common Stock is convertible into Common Stock on a share-for-share basis at any time at the option of the holder.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

|

|

|

|

|

|

|

|

Class |

|

Outstanding as of January 24, 2025 |

| Common Stock, par value $1.00 per share |

|

7,713,088 |

| Class B Common Stock, par value $1.00 per share |

|

1,004,696 |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the United States Securities and Exchange Commission in connection with the registrant’s 2025 Annual Meeting of Stockholders are incorporated by reference into Part III of this report to the extent described herein.

COCA‑COLA CONSOLIDATED, INC.

ANNUAL REPORT ON FORM 10‑K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2024

TABLE OF CONTENTS

PART I

Item 1.Business.

Introduction

Coca‑Cola Consolidated, Inc., a Delaware corporation (together with its majority-owned subsidiaries, “Coca‑Cola Consolidated,” the “Company,” “we,” “us” or “our”), distributes, markets and manufactures nonalcoholic beverages in territories spanning 14 states and the District of Columbia. The Company was incorporated in 1980 and, together with its predecessors, has been in the nonalcoholic beverage manufacturing and distribution business since 1902. We are the largest Coca‑Cola bottler in the United States. Approximately 85% of our total bottle/can sales volume to retail customers consists of products of The Coca‑Cola Company, which include some of the most recognized and popular beverage brands in the world. We also distribute products for several other beverage companies, including Keurig Dr Pepper Inc. (“Dr Pepper”) and Monster Energy Company (“Monster Energy”). Our Purpose is to honor God in all we do, to serve others, to pursue excellence and to grow profitably.

Ownership

As of December 31, 2024, J. Frank Harrison, III, Chairman of the Board of Directors and Chief Executive Officer of the Company, controlled 1,004,394 shares of the Company’s Class B Common Stock, par value $1.00 per share (“Class B Common Stock”), which represented approximately 72% of the total voting power of the Company’s outstanding Common Stock, par value $1.00 per share (“Common Stock”), and Class B Common Stock on a consolidated basis. As of December 31, 2024, The Coca‑Cola Company owned shares of Common Stock representing approximately 7% of the total voting power of the outstanding Common Stock and Class B Common Stock on a consolidated basis. The number of shares of Common Stock currently held by The Coca‑Cola Company gives it the right to have a designee proposed by the Company for nomination to the Company’s Board of Directors in the Company’s annual proxy statement. J. Frank Harrison, III and the trustees of certain trusts established for the benefit of certain relatives of the late J. Frank Harrison, Jr. have agreed to vote the shares of Common Stock and Class B Common Stock that they control in favor of such designee. The Coca‑Cola Company does not own any shares of Class B Common Stock.

Beverage Products

We offer a range of nonalcoholic beverage products and flavors, including both sparkling and still beverages, designed to meet the demands of our consumers. Sparkling beverages are carbonated beverages and the Company’s principal sparkling beverage is Coca‑Cola. Still beverages include energy products and noncarbonated beverages such as bottled water, ready-to-drink tea, ready-to-drink coffee, enhanced water, juices and sports drinks.

Our sales are divided into two main categories: (i) bottle/can sales and (ii) other sales. Bottle/can sales include products packaged primarily in plastic bottles and aluminum cans. Other sales include sales to other Coca‑Cola bottlers, post-mix sales, transportation revenue and equipment maintenance revenue. Post-mix products are dispensed through equipment that mixes fountain syrups with carbonated or still water, enabling fountain retailers to sell finished products to consumers in cups or glasses.

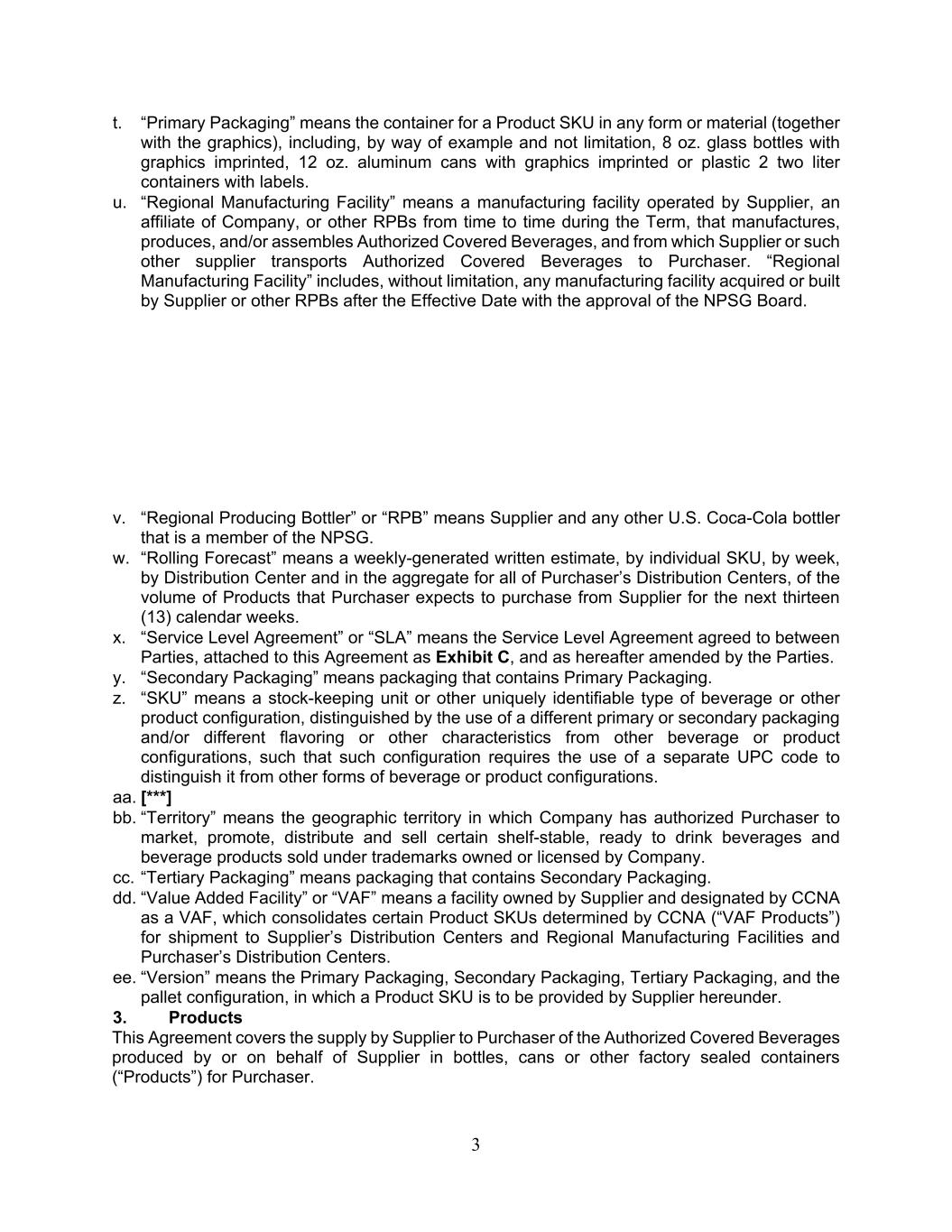

The following table sets forth some of our principal products, including products of The Coca‑Cola Company and products licensed to us by other beverage companies:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sparkling Beverages |

|

|

Still Beverages |

| The Coca-Cola Company Products: |

| Barqs Root Beer |

|

Fresca |

|

|

|

BODYARMOR |

|

Gold Peak |

| Coca-Cola |

|

Mello Yello |

|

|

|

Core Power |

|

Minute Maid |

| Coca-Cola Cherry |

|

Pibb Xtra |

|

|

|

Dasani |

|

POWERade |

| Coca-Cola Vanilla |

|

Seagrams Ginger Ale |

|

|

|

Dunkin’ Coffee |

|

Topo Chico Sabores |

| Coca-Cola Zero Sugar |

|

Sprite |

|

|

|

fairlife |

|

Tum-E Yummies |

| Diet Coke |

|

Sprite Zero Sugar |

|

|

|

glacéau smartwater |

|

|

| Fanta |

|

|

|

|

|

glacéau vitaminwater |

|

|

| Fanta Zero Sugar |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Products Licensed to Us by Other Beverage Companies: |

| Diet Dr Pepper |

|

Sundrop |

|

|

|

Bang Energy |

|

NOS® |

| Diet Sundrop |

|

|

|

|

|

Full Throttle |

|

Reign/Reign Storm |

| Dr Pepper |

|

|

|

|

|

Monster Energy |

|

|

Beverage Distribution and Manufacturing Agreements

We have rights to distribute, promote, market and sell certain nonalcoholic beverages of The Coca‑Cola Company pursuant to comprehensive beverage agreements (as amended, collectively, the “CBA”) with The Coca‑Cola Company and Coca‑Cola Refreshments USA, LLC (“CCR”), a wholly owned subsidiary of The Coca‑Cola Company. The CBA relates to a multi-year series of transactions, which were completed in October 2017, through which the Company acquired and exchanged distribution territories and manufacturing plants. The CBA requires the Company to make quarterly acquisition related sub-bottling payments to CCR on a continuing basis in exchange for the grant of exclusive rights to distribute, promote, market and sell the authorized brands of The Coca‑Cola Company and related products in certain distribution territories the Company acquired from CCR. In addition to customary termination and default rights, the CBA requires us to make minimum, ongoing capital expenditures in our distribution business and to meet certain minimum volume requirements, gives The Coca‑Cola Company certain approval and other rights in connection with a sale of the Company or the distribution business of the Company and prohibits us from producing, manufacturing, preparing, packaging, distributing, selling, dealing in or otherwise using or handling any beverages, beverage components or other beverage products other than the beverages and beverage products of The Coca‑Cola Company and certain expressly permitted cross-licensed brands without the consent of The Coca-Cola Company.

We also have rights to manufacture, produce and package certain beverages bearing trademarks of The Coca‑Cola Company at our manufacturing plants pursuant to a regional manufacturing agreement (as amended, the “RMA”) with The Coca‑Cola Company entered into on March 31, 2017. We may distribute these beverages for our own account in accordance with the CBA or may sell them to certain other U.S. Coca‑Cola bottlers or to The Coca‑Cola Company in accordance with the RMA. For prices determined pursuant to the RMA, The Coca‑Cola Company unilaterally establishes from time to time the prices, or certain elements of the formulas used to determine the prices, that the Company charges for these sales to certain other U.S. Coca‑Cola bottlers or to The Coca‑Cola Company. The RMA contains provisions similar to those contained in the CBA restricting the sale of the Company or the manufacturing business of the Company, requiring minimum, ongoing capital expenditures in our manufacturing business, prohibiting us from manufacturing any beverages, beverage components or other beverage products other than the beverages and beverage products of The Coca‑Cola Company and certain expressly permitted cross-licensed brands without the consent of The Coca‑Cola Company and allowing for the termination of the RMA.

In addition to our agreements with The Coca‑Cola Company and CCR, we also have rights to manufacture and/or distribute certain beverage brands owned by other beverage companies, including Dr Pepper and Monster Energy, pursuant to agreements with such other beverage companies. Our distribution agreements with Dr Pepper permit us to distribute Dr Pepper beverage brands, as well as certain post-mix products of Dr Pepper. Certain of our agreements with Dr Pepper also authorize us to manufacture certain Dr Pepper beverage brands. Our distribution agreements with Monster Energy grant us the rights to distribute certain products offered, packaged and/or marketed by Monster Energy. Similar to the CBA, these beverage agreements contain restrictions on the use of trademarks and approved bottles, cans and labels and the sale of imitations or substitutes, as well as provisions for their termination for cause or upon the occurrence of other events defined in these agreements. Sales of beverages under these agreements with other beverage companies represented approximately 15%, 15% and 14% of our total bottle/can sales volume to retail customers in 2024, 2023 and 2022, respectively.

Finished Goods Supply Arrangements

We have finished goods supply arrangements with other U.S. Coca‑Cola bottlers to sell and buy finished goods bearing trademarks owned by The Coca‑Cola Company and produced by us in accordance with the RMA or produced by a selling U.S. Coca‑Cola bottler in accordance with a similar regional manufacturing authorization held by such bottler. Pursuant to the RMA, The Coca‑Cola Company unilaterally establishes from time to time the prices, or certain elements of the formulas used to determine the prices, for such finished goods. In most instances, the Company’s ability to negotiate the prices at which it sells finished goods bearing trademarks owned by The Coca‑Cola Company to, and the prices at which it purchases such finished goods from, other U.S. Coca‑Cola bottlers is limited pursuant to these pricing provisions.

Other Agreements Related to the Coca‑Cola System

We have other agreements with The Coca‑Cola Company, CCR and other Coca‑Cola bottlers regarding product supply, information technology services and other aspects of the North American Coca‑Cola system, as described below. Many of these agreements involve system governance structures that require the Company’s management to closely collaborate and align with other participating bottlers in order to successfully implement Coca‑Cola system plans and strategies.

Incidence-Based Pricing Agreement with The Coca‑Cola Company

The Company has an incidence-based pricing agreement with The Coca‑Cola Company, which establishes the prices charged by The Coca‑Cola Company to the Company for (i) concentrates of sparkling and certain still beverages produced by the Company and (ii) certain purchased still beverages.

Under the incidence-based pricing agreement, the prices charged by The Coca‑Cola Company are impacted by a number of factors, including the incidence rate in effect, our pricing and sales of finished products, the channels in which the finished products are sold, the package mix and, in the case of products sold by The Coca‑Cola Company to us in finished form, the cost of goods for certain elements used in such products. The Coca‑Cola Company has no rights under the incidence-based pricing agreement to establish the prices, or the elements of the formulas used to determine the prices, at which we sell products, but does have the right to establish certain pricing under other agreements, including the RMA.

National Product Supply Governance Agreement

We are a member of a national product supply group (the “NPSG”), which is composed of The Coca‑Cola Company, the Company and certain other Coca‑Cola bottlers who are regional producing bottlers in The Coca‑Cola Company’s national product supply system (collectively with the Company, the “NPSG Members”), pursuant to a national product supply governance agreement (as amended, the “NPSG Agreement”) executed in 2015 with The Coca‑Cola Company and certain other Coca‑Cola bottlers. The stated objectives of the NPSG include, among others, (i) Coca‑Cola system strategic infrastructure investment and divestment planning; (ii) network optimization of plant to distribution center sourcing; and (iii) new product or packaging infrastructure planning.

Under the NPSG Agreement, the NPSG Members established certain governance mechanisms, including a governing board (the “NPSG Board”) composed of representatives of certain NPSG Members. The NPSG Board makes and/or oversees and directs certain key decisions regarding the NPSG. Subject to the terms and conditions of the NPSG Agreement, each NPSG Member is required to comply with certain key decisions made by the NPSG Board, which include decisions regarding strategic infrastructure investment and divestment planning, optimal national product supply sourcing and new product or packaging infrastructure planning. We are also obligated to pay a certain portion of the costs of operating the NPSG.

CONA Services LLC

Along with certain other Coca‑Cola bottlers, we are a member of CONA Services LLC (“CONA”), an entity formed to provide business process and information technology services to its members. We are party to an amended and restated master services agreement with CONA, pursuant to which CONA agreed to make available, and we became authorized to use, the Coke One North America system (the “CONA System”), a uniform information technology system developed to promote operational efficiency and uniformity among North American Coca‑Cola bottlers. As part of making the CONA System available to us, CONA provides us with certain business process and information technology services, including the planning, development, management and operation of the CONA System in connection with our direct store delivery and manufacture of products. In exchange for our rights to use the CONA System and receive CONA-related services, we are charged service fees by CONA, which we are obligated to pay even if we are not using the CONA System for all or any portion of our distribution and manufacturing operations.

Amended and Restated Ancillary Business Letter

On March 31, 2017, we entered into an amended and restated ancillary business letter (the “Ancillary Business Letter”) with The Coca‑Cola Company, pursuant to which we were granted advance waivers to acquire or develop certain lines of business involving the preparation, distribution, sale, dealing in or otherwise using or handling of certain beverage products that would otherwise be prohibited under the CBA.

Under the Ancillary Business Letter, the consent of The Coca‑Cola Company, which consent may not be unreasonably withheld, would be required for us to acquire or develop (i) any grocery, quick service restaurant, or convenience and petroleum store business engaged in the sale of beverages, beverage components or other beverage products not otherwise authorized or permitted by the CBA or (ii) any other line of business for which beverage activities otherwise prohibited under the CBA represent more than a certain threshold of net sales (subject to certain limited exceptions).

Markets Served and Facilities

As of December 31, 2024, we served approximately 60 million consumers within our territories, which comprised five principal markets. Certain information regarding each of these markets follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

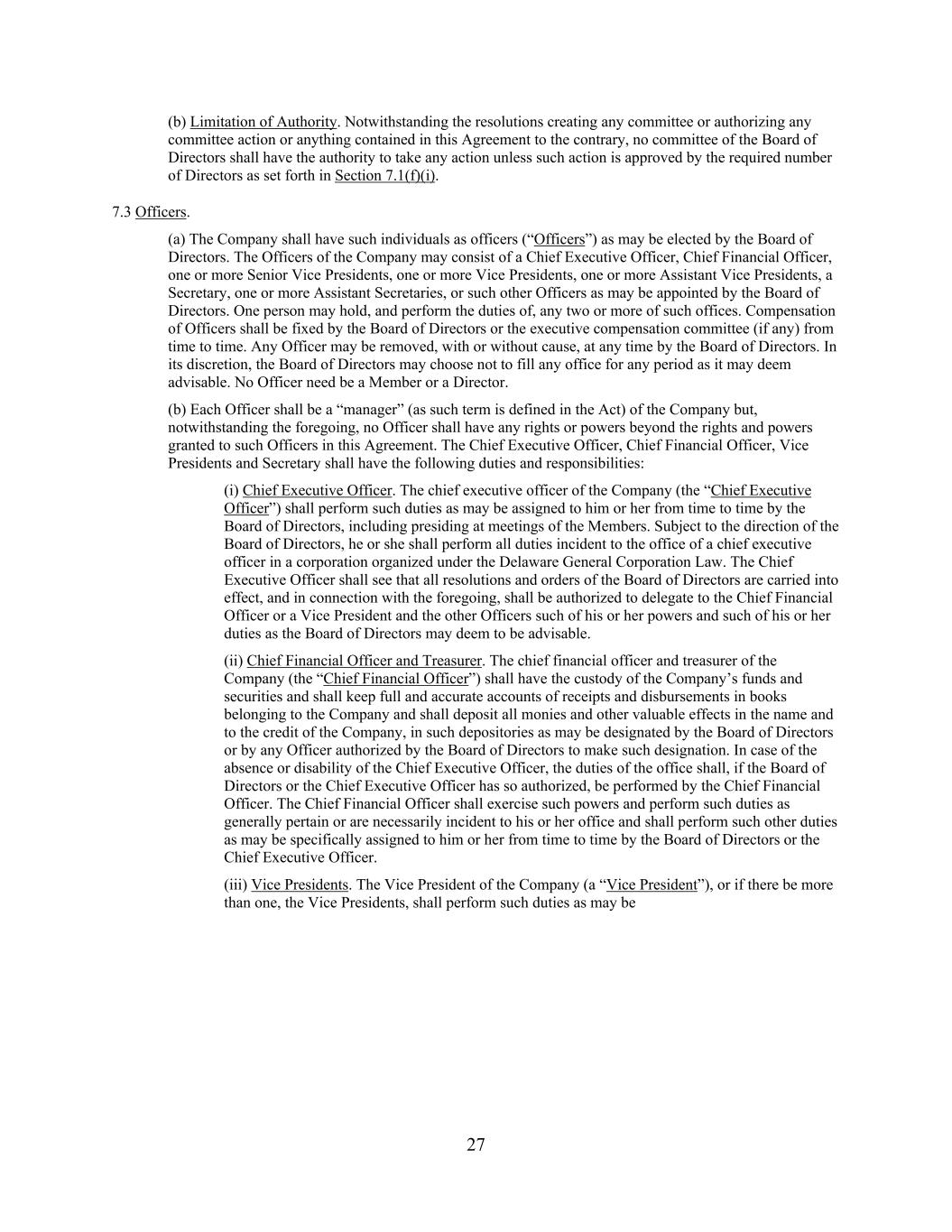

| Market |

|

Description |

|

Manufacturing

Plants |

|

Number of

Distribution

Centers |

| Carolinas |

|

The majority of North Carolina and South Carolina and portions of southern Virginia, including Boone, Hickory, Mount Airy, Charlotte, Raleigh, Winston-Salem, Greensboro, Fayetteville, Greenville and New Bern, North Carolina, Conway, Marion, Charleston, Columbia, Greenville and Ridgeland, South Carolina and surrounding areas. |

|

Charlotte, NC |

|

17 |

| Central |

|

A significant portion of northeastern Kentucky, the majority of West Virginia and portions of southern Ohio, southeastern Indiana and southwestern Pennsylvania, including Lexington, Louisville and Pikeville, Kentucky, Beckley, Bluefield, Clarksburg, Elkins, Parkersburg, Craigsville and Charleston, West Virginia, Cincinnati and Portsmouth, Ohio and surrounding areas. |

|

Cincinnati, OH |

|

12 |

| Mid-Atlantic |

|

The entire state of Maryland, the majority of Virginia and Delaware, the District of Columbia and a portion of south-central Pennsylvania, including Easton, Salisbury, Capitol Heights, Baltimore, Hagerstown and Cumberland, Maryland, Norfolk, Staunton, Alexandria, Roanoke, Richmond, Yorktown and Fredericksburg, Virginia and surrounding areas. |

|

Baltimore, MD

Silver Spring, MD

Roanoke, VA

Sandston, VA |

|

11 |

| Mid-South |

|

A significant portion of central and southern Arkansas and Tennessee and portions of western Kentucky and northwestern Mississippi, including Little Rock and West Memphis, Arkansas, Cleveland, Cookeville, Johnson City, Knoxville, Memphis and Morristown, Tennessee, Paducah, Kentucky and surrounding areas. |

|

West Memphis, AR

Nashville, TN |

|

10 |

| Mid-West |

|

A significant portion of Indiana and Ohio and a portion of southeastern Illinois, including Anderson, Whitestown, Evansville, Fort Wayne, Indianapolis and South Bend, Indiana, Akron, Columbus, Dayton, Elyria, Lima, Mansfield, Toledo, Willoughby and Youngstown, Ohio and surrounding areas. |

|

Indianapolis, IN

Twinsburg, OH |

|

10 |

| Total |

|

|

|

10 |

|

60 |

The Company is also a shareholder of South Atlantic Canners, Inc. (“SAC”), a manufacturing cooperative managed by the Company. SAC is located in Bishopville, South Carolina, and the Company utilizes a portion of the production capacity from the Bishopville manufacturing plant.

Raw Materials

In addition to concentrates purchased from The Coca‑Cola Company and other beverage companies for use in our beverage manufacturing, we also purchase sweetener, carbon dioxide, plastic bottles, aluminum cans, closures and other packaging materials, as well as equipment for the distribution, marketing and production of nonalcoholic beverages.

We purchase all of the plastic bottles used in our manufacturing plants from Southeastern Container and Western Container, two manufacturing cooperatives we co-own with several other Coca‑Cola bottlers, and all of our aluminum cans from two domestic suppliers.

Along with all other Coca‑Cola bottlers in the United States and Canada, we are a member of Coca-Cola Bottlers’ Sales & Services Company LLC (“CCBSS”), which was formed to provide certain procurement and other services with the intention of enhancing the efficiency and competitiveness of the Coca‑Cola bottling system. CCBSS negotiates the procurement for the majority of our raw materials, excluding concentrate, and we receive a rebate from CCBSS for the purchase of these raw materials.

We are exposed to price risk on commodities such as aluminum, corn and PET resin (a petroleum- or plant-based product), which affects the cost of raw materials used in the production of our finished products. We both produce and procure these finished products. Examples of the raw materials affected are aluminum cans and plastic bottles used for packaging and high-fructose corn syrup used as a product ingredient. Further, we are exposed to commodity price risk on crude oil, which impacts our cost of fuel used in the movement and delivery of our products. We participate in commodity hedging and risk mitigation programs, including programs administered by CCBSS and programs we administer. In addition, other than as discussed above, there are no limits on the prices The Coca‑Cola Company and other beverage companies can charge for concentrate.

Customers and Marketing

The Company’s products are sold and distributed in the United States through various channels, which include selling directly to customers, including grocery stores, mass merchandise stores, club stores, convenience stores and drug stores, selling to on-premise locations, where products are typically consumed immediately, such as restaurants, schools, amusement parks and recreational facilities, and selling through other channels such as vending machine outlets.

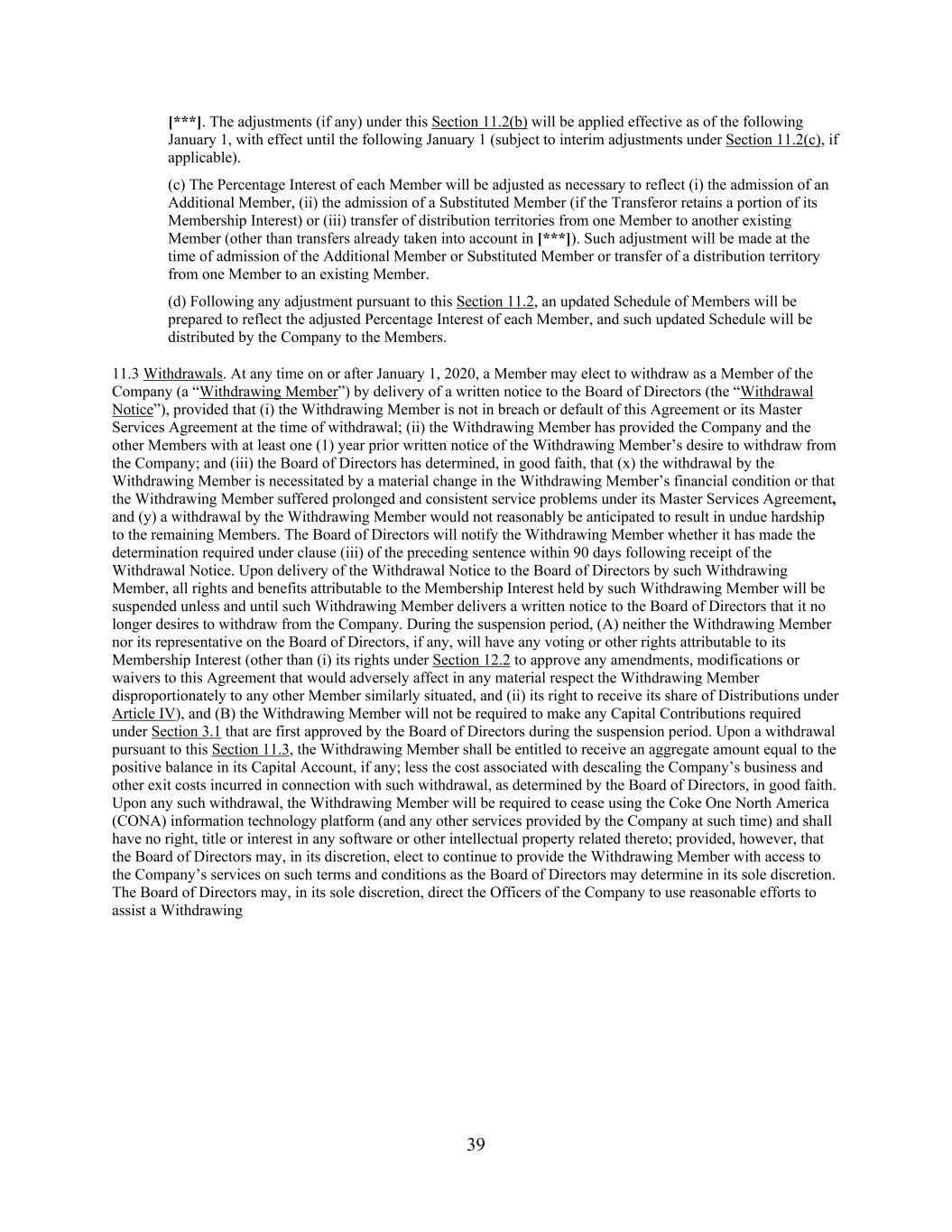

The following table summarizes the percentage of the Company’s total bottle/can sales volume to its largest customers, as well as the percentage of the Company’s total net sales that such volume represents:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal Year |

| |

|

2024 |

|

2023 |

| Approximate percent of the Company’s total bottle/can sales volume: |

|

|

|

|

Walmart Inc.(1) |

|

21 |

% |

|

21 |

% |

The Kroger Co.(2) |

|

15 |

% |

|

14 |

% |

| Total approximate percent of the Company’s total bottle/can sales volume |

|

36 |

% |

|

35 |

% |

|

|

|

|

|

| Approximate percent of the Company’s total net sales: |

|

|

|

|

Walmart Inc.(1) |

|

17 |

% |

|

17 |

% |

The Kroger Co.(2) |

|

12 |

% |

|

11 |

% |

| Total approximate percent of the Company’s total net sales |

|

29 |

% |

|

28 |

% |

(1)Includes bottle/can sales volume related to the Walmart, Sam’s Club and Walmart Neighborhood Market chains.

(2)Includes bottle/can sales volume related to the Kroger and Harris Teeter chains.

The loss of Walmart Inc. or The Kroger Co. as a customer could have a material adverse effect on the operating and financial results of the Company. No other customer represented greater than 10% of the Company’s total net sales or would impose a material adverse effect on the operating or financial results of the Company should they cease to be a customer of the Company.

New brand and product introductions, packaging changes and sales promotions are the primary sales and marketing practices in the nonalcoholic beverage industry and have required, and are expected to continue to require, substantial expenditures. Recent and upcoming introductions include Sprite Chill and Coca-Cola Orange Cream in our Sparkling brands portfolio and Topo Chico Sabores in our Still brands portfolio.

We sell our products primarily in single-use, recyclable bottles and cans in varying package configurations from market to market. For example, there may be up to 25 different packages for Diet Coke within a single geographic area. Total bottle/can sales volume to retail customers during 2024 was approximately 47% bottles and 53% cans.

We rely extensively on advertising in various media outlets, primarily online, television and radio, for the marketing of our products. The Coca‑Cola Company, Dr Pepper and Monster Energy make substantial expenditures on advertising programs in our territories from which we benefit. Although The Coca‑Cola Company and other beverage companies have provided us with marketing funding support in the past, our beverage agreements generally do not obligate such funding.

We also expend substantial funds on our own behalf for extensive local sales promotions of our products. Historically, these expenses have been partially offset by marketing funding support provided to us by The Coca‑Cola Company and other beverage companies in support of a variety of marketing programs, such as point-of-sale displays and merchandising programs. We consider the funds we expend for marketing and merchandising programs necessary to maintain or increase revenue.

In addition to our marketing and merchandising programs, we believe a sustained and planned charitable giving program to support the communities we serve is an essential component to the success of our brand and, by extension, our net sales. In light of the Company’s financial performance, distribution territory footprint and future business prospects, in 2024, the Company made cash donations of approximately $53 million to various charities and donor-advised funds. The Company focuses on charities impacting communities throughout our territory in the following areas: Education, Youth Development, Crisis Assistance, Health & Wellness, Veteran & First Responders and Sustainability. The Company intends to continue its charitable contributions in future years, subject to the Company’s financial performance and other business factors.

Seasonality

Business seasonality results primarily from higher unit sales of the Company’s products in the second and third quarters of the fiscal year, as sales of our products are typically correlated with warmer weather. We believe that we and other manufacturers from whom we purchase finished products have adequate production capacity to meet sales demand for sparkling and still beverages during these peak periods. See “Item 2. Properties” for information relating to utilization of our manufacturing plants. Sales volume can also be impacted by weather conditions. Fixed costs, such as depreciation expense, are not significantly impacted by business seasonality.

Competition

The nonalcoholic beverage industry is highly competitive for both sparkling and still beverages. Our competitors include bottlers and distributors of nationally and regionally advertised and marketed products, as well as bottlers and distributors of private label beverages. Our principal competitors include local bottlers of PepsiCo, Inc. products and, in some regions, local bottlers of Dr Pepper products.

The principal methods of competition in the nonalcoholic beverage industry are new brand and product introductions, point-of-sale merchandising, new vending and dispensing equipment, packaging changes, pricing, sales promotions, product quality, retail space management, customer service, frequency of distribution and advertising. We believe we are competitive in our territories with respect to these methods of competition.

Government Regulation

Our business is subject to various laws and regulations administered by federal, state and local government agencies of the United States, including laws and regulations governing the production, storage, distribution, sale, display, advertising, marketing, packaging, labeling, content, quality and safety of our products, our occupational health and safety practices and the transportation and use of many of our products.

We are required to comply with a variety of U.S. laws and regulations, including, but not limited to: the Federal Food, Drug and Cosmetic Act and various state laws governing food safety; the Food Safety Modernization Act; the Occupational Safety and Health Act; the Clean Air Act; the Clean Water Act; the Resource Conservation and Recovery Act; the Robinson-Patman Act; the Comprehensive Environmental Response, Compensation and Liability Act; the Federal Motor Carrier Safety Act; the Lanham Act; various federal and state laws and regulations governing competition and trade practices; various federal and state laws and regulations governing our employment practices, including those related to equal employment opportunity, such as the Equal Employment Opportunity Act and the National Labor Relations Act; and laws and regulations restricting the sale of certain of our products in schools.

As a manufacturer, distributor and seller of beverage products of The Coca‑Cola Company and other beverage companies in exclusive geographic territories, we are subject to antitrust laws of general applicability. However, pursuant to the United States Soft Drink Interbrand Competition Act, soft drink bottlers, such as us, are permitted to have exclusive rights to manufacture, distribute and sell soft drink products in a defined geographic territory if that soft drink product is in substantial and effective competition with other products of the same general class in the market. We believe such competition exists in each of the exclusive geographic territories in the United States in which we operate.

In response to growing health, nutrition and wellness concerns for today’s youth, a number of state and local governments have regulations restricting the sale of soft drinks and other foods in schools, particularly elementary, middle and high schools. Many of these restrictions have existed for several years in connection with subsidized meal programs in schools. Additionally, legislation has been proposed by certain state and local governments to limit or restrict the sale of energy drinks to minors and/or persons below a specified age and/or to restrict the venues in which energy drinks can be sold. Restrictive legislation, if widely enacted, could have an adverse impact on the Company’s products, sales and reputation.

Most beverage products sold by the Company are classified as food or food products and are therefore eligible for purchase using supplemental nutrition assistance program (“SNAP”) benefits by consumers purchasing them for home consumption. Energy drinks with a nutrition facts label are also classified as food and are eligible for purchase for home consumption using SNAP benefits, whereas energy drinks classified as a supplement by the United States Food and Drug Administration (the “FDA”) are not. Regulators may restrict the use of benefit programs, including SNAP, to purchase certain beverages and foods currently classified as food or food products.

Certain jurisdictions in which our products are sold have imposed, or are considering imposing, taxes, labeling requirements or other limitations on, or regulations pertaining to, the sale of certain of our products or ingredients contained in, or attributes of, our products or commodities used in the manufacture of our products, including certain of our products that contain added sugars or sodium, exceed a specified caloric count or include specified ingredients such as caffeine or high-fructose corn syrup.

It has also been proposed that the federal government enact policies through agencies such as the United States Department of Health and Human Services that would ban or restrict the usage of certain ingredients used in the manufacture of the products that we sell. Restrictive policies, if widely enacted, could have an adverse impact on our products, input costs, sales and reputation.

Legislation has been proposed in Congress and by certain state and local governments which would prohibit the sale of soft drink products in non-refillable bottles and cans or require a mandatory deposit as a means of encouraging the return of such containers, each in an attempt to reduce solid waste and litter. Similarly, we are aware of proposed legislation that would impose fees or taxes on various types of containers that are used in our business, implement new recycling regulations and the reduction of single-use plastics and place the onus on plastic suppliers to identify recycling solutions. We are not currently impacted by the policies in such proposed legislation, but it is possible that similar or more restrictive legal requirements may be proposed or enacted within our distribution territories in the future.

We are also subject to federal, state and local environmental laws, including laws related to water consumption and treatment, wastewater discharge and air emissions. Our facilities must comply with the Clean Air Act, the Clean Water Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Resource Conservation and Recovery Act and other federal, state and local laws regarding handling, storage, release and disposal of wastes generated on-site and sent to third-party owned and operated off-site licensed facilities.

We do not currently have any material commitments for environmental compliance or environmental remediation for any of our properties. We do not believe compliance with enacted or adopted federal, state and local provisions pertaining to the discharge of materials into the environment or otherwise relating to the protection of the environment will have a material adverse impact on our consolidated financial statements or our competitive position.

Human Capital Resources

At Coca-Cola Consolidated, our teammates are the heart of our business and the key to our success. As of December 31, 2024, we employed approximately 17,000 employees which we refer to as “teammates,” of which approximately 15,000 were full-time and approximately 2,000 were part-time. Approximately 15% of our workforce is covered by collective bargaining agreements. While the number of collective bargaining agreements that will expire in any given year varies, we have been successful in the past in negotiating renewals to expiring agreements without any material disruption to our operations, and management considers teammate relations to be good.

Purpose and Culture

We believe a strong and clear purpose is the foundation to a strong culture and critical to the long-term success of the business. At Coca‑Cola Consolidated, we strive to fulfill our Purpose – To honor God in all we do, to serve others, to pursue excellence and to grow profitably. As a waypoint to help guide us along this journey is our Operating Destination – One Coca‑Cola Consolidated Team, consistently generating strong cash flow, while empowering the next generation of diverse servant leaders. At the core of our culture is a focus on service. We want teammates to recognize and embrace a passion for serving each other along with our consumers, our customers and our communities. Through our Coke Cares program, we provide opportunities for our teammates to be involved in stewardship, charitable and community activities as a way to serve our communities. We aim to fulfill our Employee Value Promise, ensuring that every day, our teammates feel Supported, Inspired, Rewarded, Developed, Empowered and Connected.