| Bermuda | 001-08097 | 98-1589854 | ||||||||||||

|

(State or other jurisdiction of

incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Ticker Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Shares, $0.01 par value share | VAL | New York Stock Exchange | ||||||||||||

| Warrants to purchase Common Shares | VAL WS | New York Stock Exchange | ||||||||||||

| Emerging Growth Company | ☐ | ||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

☐ | ||||

| Exhibit No. | Description | |||||||

| 99.1 | ||||||||

| 101 | Interactive data files pursuant to Rule 405 of Regulation S-T formatted in inline Extensible Business Reporting Language | |||||||

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101) | |||||||

| Valaris Limited | ||||||||

| May 1, 2024 | /s/ CHRISTOPHER T. WEBER | |||||||

|

Christopher T. Weber

Senior Vice President and Chief Financial Officer

|

||||||||

|

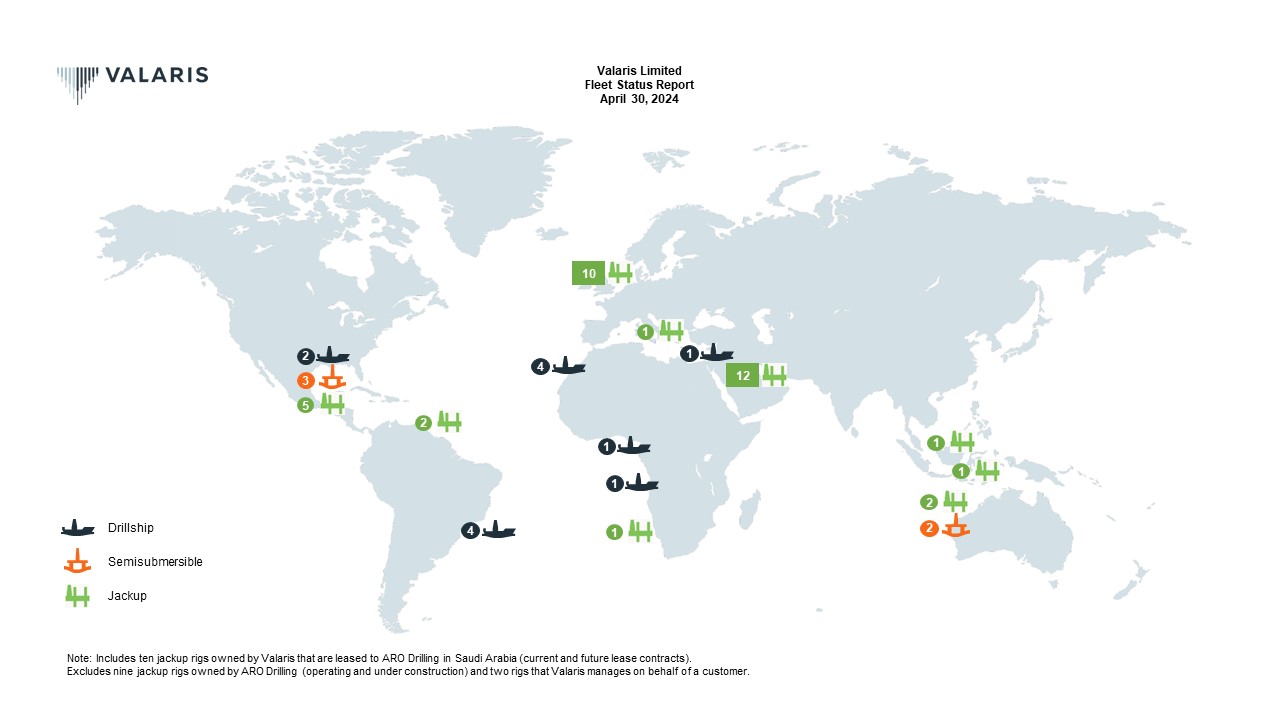

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| New Contracts, Extensions and Other Updates Since Last Fleet Status Report | ||

|

Contract Backlog

•Valaris has been awarded the following new contracts and contract extensions, with associated contract backlog of approximately $480 million, subsequent to issuing its most recent fleet status report on February 15, 2024. Contract backlog excludes lump sum payments such as mobilization fees and capital reimbursements.

•Contract backlog increased to approximately $4.0 billion from approximately $3.9 billion as of February 15, 2024.

Floater Contract Awards

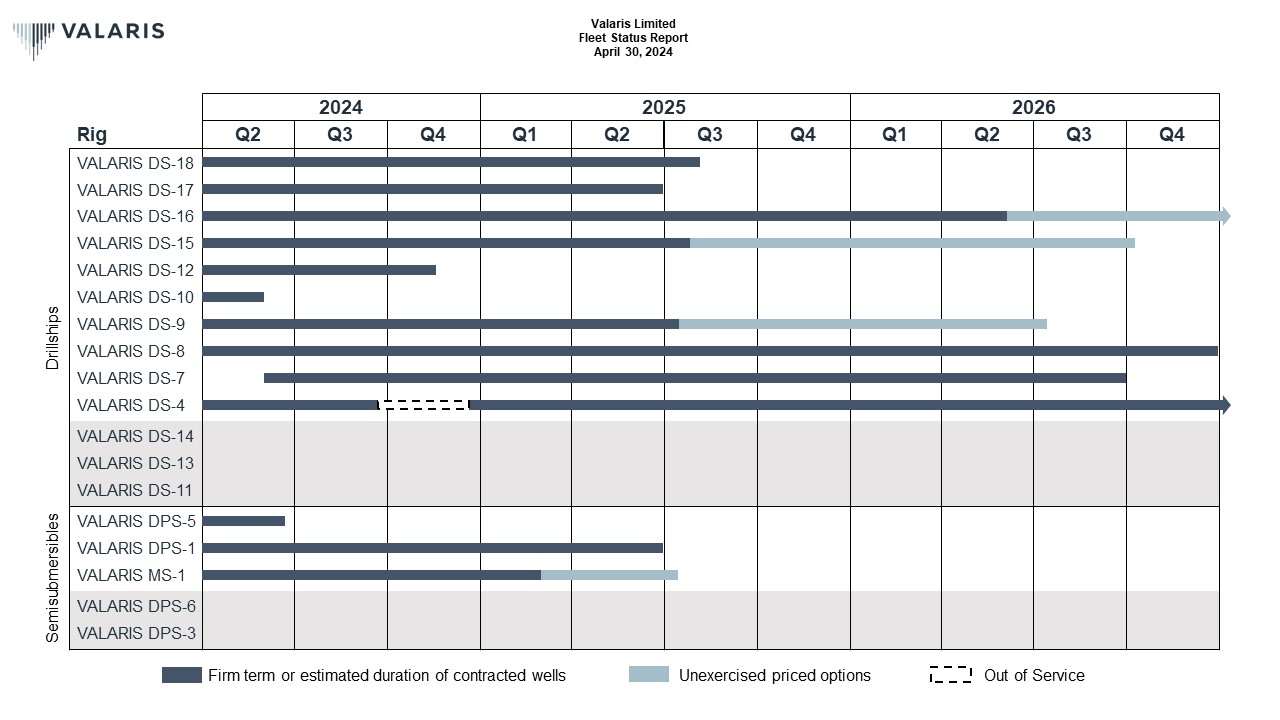

•Six-month priced option exercised by ExxonMobil for drillship VALARIS DS-9. The six-month option will commence in January 2025 in direct continuation of the existing firm program.

•60-day priced option exercised by Equinor offshore Brazil for drillship VALARIS DS-17. The 60-day option is expected to commence in May 2025 in direct continuation of the existing firm contract. The operating day rate for the priced option period is approximately $497,000 including MPD and additional services.

Jackup Contract Awards

•13-well contract offshore Angola for jackup VALARIS 144. The contract is expected to commence in the second quarter 2025 and has an estimated duration of between 730 days and 770 days. The total contract value is estimated to be between $149 million and $156 million, including a mobilization fee from the U.S. Gulf of Mexico.

•One-well priced option exercised by TotalEnergies in the UK North Sea for heavy duty harsh environment jackup VALARIS Stavanger. The well has an estimated duration of 30 days and will be added to the existing firm program, increasing the total contract value by approximately $4 million.

Other Contract Awards

•Three-year contract extensions with BP in the U.S. Gulf of Mexico for managed rigs Mad Dog and Thunder Horse. The contract extensions were effective on January 27, 2024. The three-year extension periods have a combined estimated total contract value of approximately $259 million.

Other Fleet Status Updates

•The contract between ARO and Saudi Aramco for jackup VALARIS 143 will be suspended with an expected effective date in May 2024. ARO has provided notice to Saudi Aramco to terminate the contract effective seven days after the contract suspension date. Upon termination of the contract, the bareboat charter agreement between Valaris and ARO will also be terminated, and the rig will return to Valaris.

•Valaris has received a contract suspension notice for VALARIS 92 that is estimated to take effect from February 26, 2025, at the end of the Operator's planned work scope. The contract was previously scheduled to end in February 2026. The contract suspension results in a reduction to contract backlog of approximately $35 million.

| ||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

|

Contract Backlog(1) (2)

($ millions)

|

2024 | 2025 | 2026+ | Total | Contracted Days(1) (2) |

2024 | 2025 | 2026+ | |||||||||||||||||||||

| Drillships | $ | 720.9 | $ | 870.9 | $ | 632.1 | $ | 2,223.9 | Drillships | 2,098 | 2,260 | 1,493 | |||||||||||||||||

| Semisubmersibles | 127.3 | 53.4 | — | 180.7 | Semisubmersibles | 548 | 240 | — | |||||||||||||||||||||

| Floaters | $ | 848.2 | $ | 924.3 | $ | 632.1 | $ | 2,404.6 | Floaters | 2,646 | 2,500 | 1,493 | |||||||||||||||||

| HD - Harsh Environment | $ | 257.8 | $ | 196.5 | $ | 152.7 | $ | 607.0 | HD - Harsh Environment | 2,084 | 1,351 | 920 | |||||||||||||||||

| HD & SD - Modern | 147.0 | 154.5 | 147.6 | 449.1 | HD & SD - Modern | 1,384 | 1,095 | 967 | |||||||||||||||||||||

| SD - Legacy | 39.5 | 35.2 | 54.1 | 128.8 | SD - Legacy | 494 | 412 | 637 | |||||||||||||||||||||

| Jackups | $ | 444.3 | $ | 386.2 | $ | 354.4 | $ | 1,184.9 | Jackups | 3,962 | 2,858 | 2,524 | |||||||||||||||||

Other(3) |

$ | 125.0 | $ | 142.1 | $ | 160.6 | $ | 427.7 | Other(3) |

2,644 | 2,457 | 2,549 | |||||||||||||||||

| Total | $ | 1,417.5 | $ | 1,452.6 | $ | 1,147.1 | $ | 4,017.2 | Total | 9,252 | 7,815 | 6,566 | |||||||||||||||||

ARO Drilling(4) |

Average Day Rates(1) (2) |

2024 | 2025 | 2026+ | |||||||||||||||||||||||||

| Owned Rigs | $ | 240.4 | $ | 362.0 | $ | 796.5 | $ | 1,398.9 | Drillships | $ | 344,000 | $ | 385,000 | $ | 423,000 | ||||||||||||||

| Leased Rigs | 216.1 | 174.9 | 192.3 | 583.3 | Semisubmersibles | 232,000 | 223,000 | — | |||||||||||||||||||||

| Total | $ | 456.5 | $ | 536.9 | $ | 988.8 | $ | 1,982.2 | Floaters | $ | 321,000 | $ | 370,000 | $ | 423,000 | ||||||||||||||

| HD - Harsh Environment | $ | 124,000 | $ | 145,000 | $ | 166,000 | |||||||||||||||||||||||

| HD & SD - Modern | 106,000 | 141,000 | 153,000 | ||||||||||||||||||||||||||

| SD - Legacy | 80,000 | 85,000 | 85,000 | ||||||||||||||||||||||||||

| Jackups | $ | 112,000 | $ | 135,000 | $ | 140,000 | |||||||||||||||||||||||

|

(1) Contract backlog, contracted days and average day rates as of April 30, 2024.

(2) Contract backlog and average day rates exclude certain types of non-recurring revenues such as lump sum mobilization payments. Contract backlog and contracted days include backlog and days when a rig is under suspension. Average day rates are adjusted to exclude suspension backlog and days.

(3) Other represents contract backlog and contracted days related to bareboat charter agreements and management services contracts.

(4) ARO Drilling contract backlog as of April 30, 2024.

HD = Heavy Duty; SD = Standard Duty

| |||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) |

Day Rate(2) |

Comments | ||||||||||||||||||||||||||||||||||||||||||

| Drillships | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-18 | GustoMSC P10000 | 2015 | Chevron | U.S. GOM | Aug 22 | Aug 25 | Contract includes MPD services. Additional rate charged when MPD services provided | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-17 | GustoMSC P10000 | 2014 | Equinor Equinor |

Brazil / Argentina

Brazil

|

Sep 23

May 25

|

Apr 25

Jun 25

|

$447,000

$497,000

|

Contract includes MPD and additional services | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-16 |

GustoMSC P10000 | 2014 | Occidental Occidental |

U.S. GOM U.S. GOM |

Jun 22 Jun 24 |

Jun 24 Jun 26 |

Contract includes MPD services. Additional rate charged when MPD services provided. Plus one-year priced option |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-15 | GustoMSC P10000 | 2014 | TotalEnergies BP TotalEnergies TotalEnergies |

Brazil Brazil Brazil Brazil |

Jun 21

May 24

Jul 24

Nov 24

|

Apr 24 Jul 24 Nov 24 Jul 25 |

$410,000 $254,000 $400,000 |

Contract includes MPD services. Additional rate charged when MPD services provided Additional rate charged when MPD and additional services provided. Two 160-day priced options and one 120-day priced option, with increased operating day rates for each option period. Total contract value for option periods if exercised, excluding the provision of MPD and additional services, is approximately $210 million |

||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-12 |

DSME 12000 | 2013 | BP | Egypt | Jan 24 | Nov 24 |

|

Total contract value of $136 million | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-10 |

Samsung GF12000 | 2017 | SNEPCo | Nigeria | Apr 23 | May 24 | $231,000 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-9 | Samsung GF12000 | 2015 | ExxonMobil | Angola | Jul 22 | Jul 25 | Contract includes MPD services. Two 6-month priced options |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-8 | Samsung GF12000 | 2015 | Petrobras | Brazil | Dec 23 | Dec 26 | $428,000 | Plus mobilization fee of approx. $30 million. Contract includes additional services | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-7 | Samsung 96K | 2013 | Undisclosed | West Africa | Jun 24 | Sep 26 | Total contract value estimated to be $364 million. Estimated duration of 850 days. Rig being reactivated in Spain | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-4 | Samsung 96K | 2010 | Petrobras Petrobras |

Brazil Brazil |

Jul 22 Dec 24 |

Sep 24 Nov 27 |

$450,000 |

Contract includes MPD and additional services. Expect approx. 90 days out of service for contract preparations across 3Q24 and 4Q24 Plus mobilization fee of approx. $41 million. Contract includes MPD and additional services |

||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-14 |

DSME 12000 | 2023 | Spain | Rig has arrived in Las Palmas, Spain, where it will be stacked until contracted |

||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-13 |

DSME 12000 | 2023 | Spain | Rig has arrived in Las Palmas, Spain, where it will be stacked until contracted |

||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DS-11 | DSME 12000 | 2013 | Spain | |||||||||||||||||||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) |

Day Rate(2) |

Comments | ||||||||||||||||||||||||||||||||||||||||||

| Semisubmersibles | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

VALARIS DPS-5

|

ENSCO 8500 Series, DP + Moored |

2012 | Apache Eni |

U.S. GOM Mexico |

Dec 23 Mar 24 |

Jan 24 Jun 24 |

$345,000 |

Plus $3 million mobilization fee |

||||||||||||||||||||||||||||||||||||||||||

|

VALARIS DPS-1

|

F&G ExD Millennium, DP | 2012 | Woodside Woodside |

Australia Australia |

Apr 22 Jan 24 |

Jan 24 Jun 25 |

||||||||||||||||||||||||||||||||||||||||||||

|

VALARIS MS-1

|

F&G ExD Millennium, Moored | 2011 | Santos Santos |

Australia Australia |

Jul 22 Jan 24 |

Jan 24

Mar 25

|

Operations recommenced in Jan 24 following a suspension period. Three priced options each with an estimated duration of 45 days

|

|||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DPS-6 |

ENSCO 8500 Series, DP | 2012 | U.S. GOM | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS DPS-3 |

ENSCO 8500 Series, DP + Moored |

2010 | U.S. GOM | |||||||||||||||||||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) |

Day Rate(2) |

Comments | ||||||||||||||||||||||||||||||||||||||||||

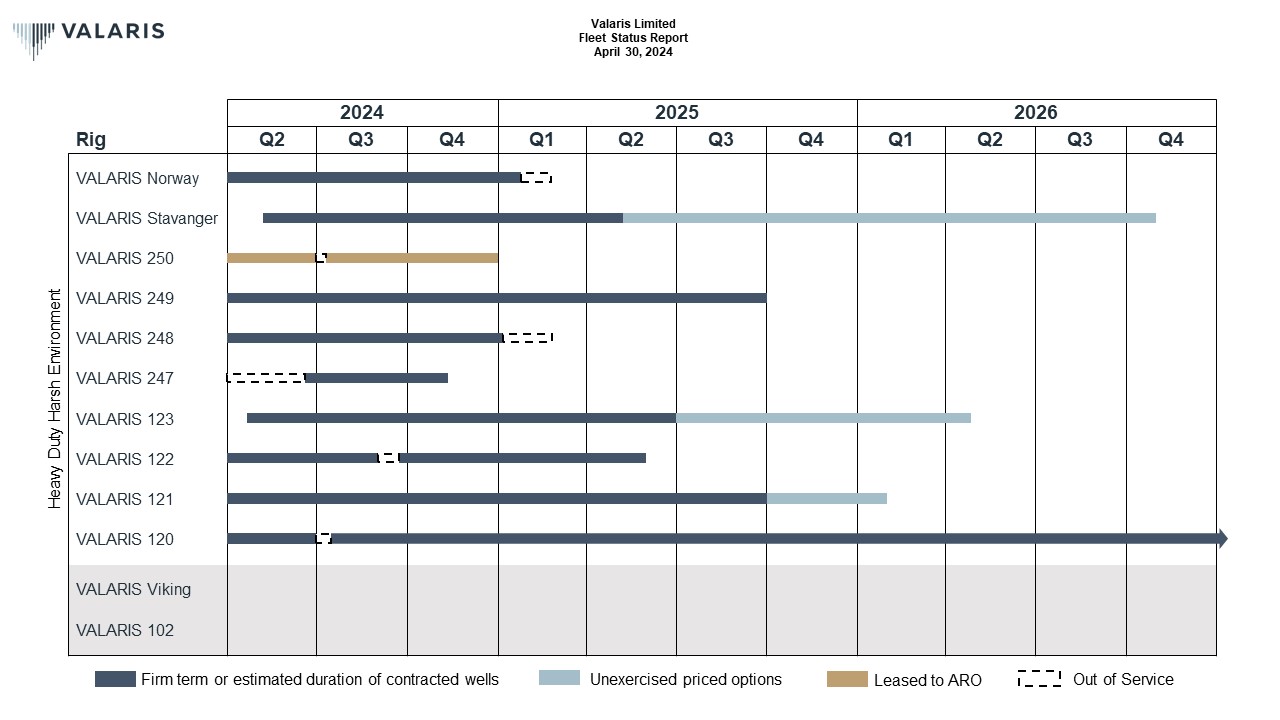

| Heavy Duty - Harsh Environment Jackups | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS Norway | KFELS N Class | 2011 | Eni | UK | Jan 24 |

Jan 25 |

|

VALARIS Norway substitutes for VALARIS 72 until the rig completes its current contract. Expect approx. 30 days out of service for planned maintenance in 1Q25 |

||||||||||||||||||||||||||||||||||||||||||

| VALARIS Stavanger | KFELS N Class | 2011 | TotalEnergies | UK | May 24 | May 25 | Total contract value of approx. $52 million including minor rig modifications. Two priced options with an estimated duration of 270 days each |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 250 | LT Super Gorilla XL | 2003 | Saudi Aramco | Saudi Arabia | Jun 18 | Dec 24 | Leased to ARO Drilling(4). Expect approx. 10 days out of service for planned maintenance in 3Q24 |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 249 | LT Super Gorilla | 2001 | Undisclosed Undisclosed Perenco Undisclosed |

Trinidad Trinidad Trinidad Trinidad |

Jul 23 Aug 24 Oct 24 Dec 24 |

Jul 24 Oct 24 Dec 24 Oct 25 |

$125,000 $138,000 $163,000 |

Plus mobilization fee of $8.5 million and a daily rate of $64,000 while the rig was in transit from New Zealand to Trinidad | ||||||||||||||||||||||||||||||||||||||||||

| VALARIS 248 | LT Super Gorilla | 2000 | Neptune | UK | Aug 20 | Jan 25 | Expect approx. 50 days out of service for planned maintenance in 1Q25. |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 247 | LT Super Gorilla | 1998 | Perenco Undisclosed Eni |

UK Australia Australia |

Mar 23 Jun 24 Sep 24 |

Jan 24 Sep 24 Nov 24 |

$180,000 $180,000 |

Expect approx. 60 days out of service for mobilization and contract preparations in 2Q24 Plus mobilization and demobilization fees that cover moving and operating costs while the rig is in transit |

||||||||||||||||||||||||||||||||||||||||||

| VALARIS 123 | KFELS Super A | 2019 | Ithaca Energy Shell TAQA TAQA |

UK UK Netherlands Netherlands |

Apr 24 Jun 24 Nov 24 Jan 25 |

Jun 24

Nov 24

Dec 24

Jun 25

|

$143,000 $153,000 |

Minimum total contract value of $6.3 million. Expect approx. 15 days out of service for contract preparations in 2Q24

Estimated total contract value of approx. $21 million

Options for up to 10 wells with an estimated total duration of 300 days. Operating day rate increases to approx. $163,000 in 2026

|

||||||||||||||||||||||||||||||||||||||||||

| VALARIS 122 |

KFELS Super A | 2013 | Shell | UK | Sep 23 | May 25 | Total contract value of over $60 million based on initial estimated duration of 500 days. Expect approx. 20 days out of service for planned maintenance in 3Q24 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 121 | KFELS Super A | 2013 | Shell Shell |

UK UK |

Nov 23 Aug 24 |

Aug 24 Oct 25 |

Total contract value of over $25 million. Total contract value of approx. $55 million. Plus two priced options |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 120 | KFELS Super A | 2013 | Harbour Energy Harbour Energy |

UK | Jul 23 Jul 25 |

Jul 25 Jul 28 |

$130,000 $166,000 |

Expect approx. 15 days out of service for planned maintenance in 3Q24 |

||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS Viking | KFELS N Class | 2010 | UK | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 102 | KFELS MOD V-A | 2002 | U.S. GOM | |||||||||||||||||||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) |

Day Rate(2) |

Comments | ||||||||||||||||||||||||||||||||||||||||||

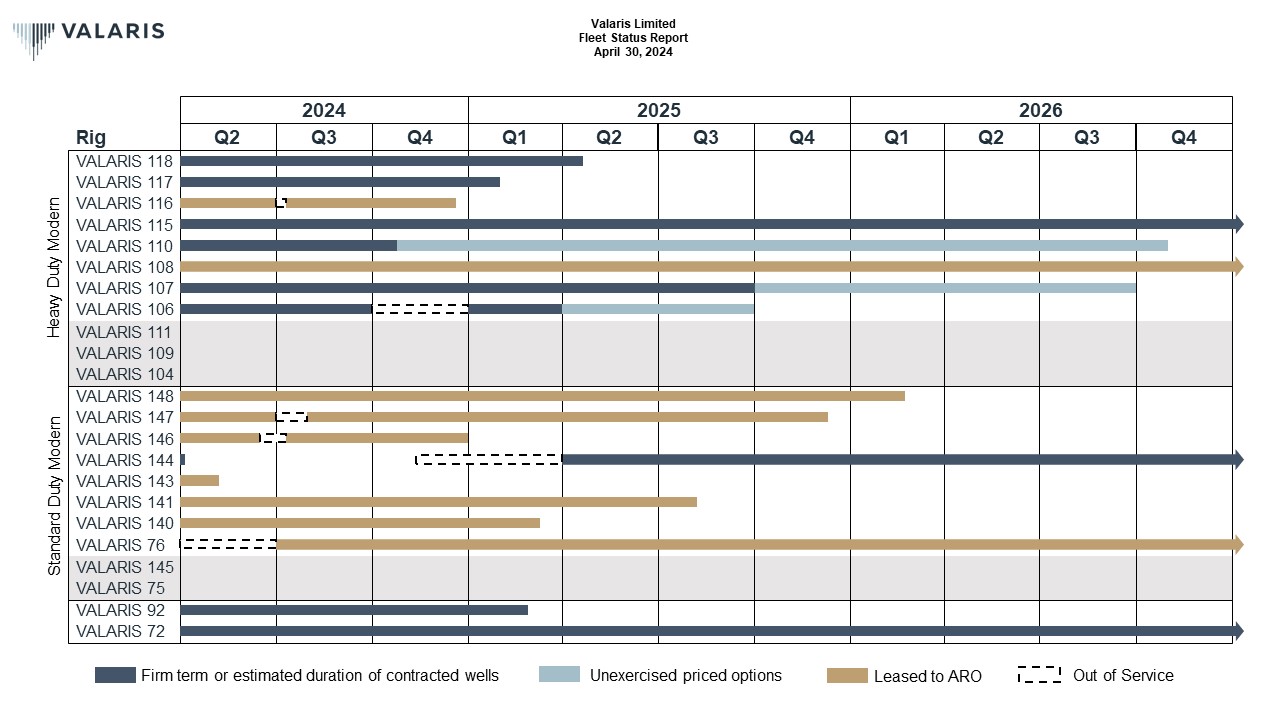

Heavy Duty - Modern Jackups(3) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 118 | LT 240-C | 2012 | BP BP |

Trinidad Trinidad |

Jul 23 Apr 24 |

Apr 24 Apr 25 |

Total contract value of approx. $24 million Total contract value of approx. $51 million |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 117 | LT 240-C | 2009 | Eni | Mexico | Dec 21 | Jan 25 | Expect approx. 30 days out of service for planned maintenance in 1Q25 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 116 | LT 240-C | 2008 | Saudi Aramco | Saudi Arabia | Dec 18 | Dec 24 | Leased to ARO Drilling(4). Expect approx. 10 days out of service for planned maintenance in 3Q24 |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 115 | BM Pacific Class 400 | 2013 | Shell | Brunei | Apr 23 | Apr 27 | Total contract value of approx. $159 million | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 110 | KFELS MOD V-B | 2015 | North Oil Company | Qatar | Oct 21 | Oct 24 | Two 1-year priced options | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 108 | KFELS MOD V-B | 2007 | Saudi Aramco | Saudi Arabia | Mar 24 | Mar 27 | Leased to ARO Drilling(4) |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 107 | KFELS MOD V-B | 2006 | Beach Energy Undisclosed ExxonMobil |

New Zealand Australia Australia |

Oct 23 Mar 24 Oct 24 |

Jan 24 Sep 24 Oct 25 |

$150,000 $153,000 |

Total contract value of approx. $26 million, including mobilization and demobilization fee Two 180-day priced options |

||||||||||||||||||||||||||||||||||||||||||

| VALARIS 106 | KFELS MOD V-B | 2005 | BP BP |

Indonesia Indonesia |

Jan 24 Jan 25 |

Oct 24

Mar 25

|

$85,000 $95,000 |

Two priced options each with an estimated duration of 90 days. Expect approx. 90 days out of service for planned maintenance in 4Q24 | ||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 111 | KFELS MOD V-B | 2003 | Croatia | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 109 | KFELS MOD V-Super B | 2008 | Namibia | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 104 | KFELS MOD V-B | 2002 | UAE | |||||||||||||||||||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) |

Day Rate(2) |

Comments | ||||||||||||||||||||||||||||||||||||||||||

Standard Duty - Modern Jackups(3) |

||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 148 | LT Super 116-E | 2013 | Saudi Aramco | Saudi Arabia | Nov 19 | Feb 26 | Leased to ARO Drilling(4) |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 147 | LT Super 116-E | 2013 | Saudi Aramco | Saudi Arabia | Sep 19 | Dec 25 | Leased to ARO Drilling(4). Expect approx. 30 days out of service for planned maintenance in 3Q24 |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 146 | LT Super 116-E | 2011 | Saudi Aramco | Saudi Arabia | Sep 18 | Dec 24 | Leased to ARO Drilling(4). Expect approx. 25 days out of service for planned maintenance across 2Q24 and 3Q24 |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 144 | LT Super 116-E | 2010 |

Talos

Undisclosed

|

U.S. GOM

Angola

|

Dec 23

Apr 25

|

Apr 24 May 27 |

$87,000 | Expect approx. 140 days out of service for contract preparations and mobilization across 4Q24 and 1Q25 Total contract value estimated to be between $149 million and $156 million, including a mobilization fee from the U.S. Gulf of Mexico |

||||||||||||||||||||||||||||||||||||||||||

| VALARIS 143 | LT Super 116-E | 2010 | Saudi Aramco | Saudi Arabia | Oct 18 | May 24 | Contract suspended with an expected effective date in May 2024. The contract was previously scheduled to end in Dec 2024 | |||||||||||||||||||||||||||||||||||||||||||

| VALARIS 141 | LT Super 116-E | 2016 | Saudi Aramco | Saudi Arabia | Aug 22 | Aug 25 | Leased to ARO Drilling(4) |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 140 | LT Super 116-E | 2016 | Saudi Aramco | Saudi Arabia | Mar 22 | Mar 25 | Leased to ARO Drilling(4). Expect approx. 10 days out of service for planned maintenance in 3Q24 |

|||||||||||||||||||||||||||||||||||||||||||

| VALARIS 76 | LT Super 116-C | 2000 | Saudi Aramco | Saudi Arabia | Jul 24 | Jun 29 | Expect approx. 90 days out of service for contract preparations in 2Q24 | |||||||||||||||||||||||||||||||||||||||||||

| Stacked | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 145 | LT Super 116-E | 2010 | U.S. GOM | |||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 75 | LT Super 116-C | 1999 | U.S. GOM | |||||||||||||||||||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| Asset Category / Rig | Design | Year Delivered | Customer | Location | Contract Start Date | Contract End Date(1) |

Day Rate(2) |

Comments | ||||||||||||||||||||||||||||||||||||||||||

| Standard Duty - Legacy Jackups | ||||||||||||||||||||||||||||||||||||||||||||||||||

| VALARIS 92 | LT 116-C | 1982 | Harbour Energy Harbour Energy |

UK UK |

Feb 17 Mar 24 |

Feb 24

Feb 25

|

$95,000 |

Contract suspended with an estimated effective date of Feb 26, 2025. The contract was previously scheduled to end in Feb 2026

|

||||||||||||||||||||||||||||||||||||||||||

| VALARIS 72 | Hitachi K1025N | 1981 | Eni Eni |

UK UK |

Jan 20 Feb 25 |

Jan 25 Sep 27 |

||||||||||||||||||||||||||||||||||||||||||||

| Other - Managed Rigs | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Thunder Horse | Deepwater Semisubmersible | BP | U.S. GOM | Jan 17 Jan 24 |

Jan 24 Jan 27 |

Total contract value of approx. $153 million

|

||||||||||||||||||||||||||||||||||||||||||||

| Mad Dog | Deepwater Spar Drilling Rig | BP | U.S. GOM |

Jan 17

Jan 24

|

Jan 24 Jan 27 |

Total contract value of approx. $106 million

|

||||||||||||||||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

| Asset Category / Rig | Design | Customer | Location | Contract Start Date | Contract End Date(1) |

Day Rate(2) |

Comments | |||||||||||||||||||||||||||||||||||||

| ARO Drilling | ||||||||||||||||||||||||||||||||||||||||||||

| Jackup Rigs Owned by ARO Drilling | ||||||||||||||||||||||||||||||||||||||||||||

| Gilbert Rowe | LT 116-C | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | |||||||||||||||||||||||||||||||||||||||

| SAR 201 | BM 200-H | Saudi Aramco | Saudi Arabia | Feb 18 | Feb 26 | Expect approx. 45 days out of service for planned maintenance across 3Q24 and 4Q24 |

||||||||||||||||||||||||||||||||||||||

| Bob Keller | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | |||||||||||||||||||||||||||||||||||||||

| J.P. Bussell | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | Expect approx. 60 days out of service for planned maintenance in 2Q24 | ||||||||||||||||||||||||||||||||||||||

| Scooter Yeargain | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 18 | Dec 26 | Expect approx. 15 days out of service for planned maintenance in 2Q24 | ||||||||||||||||||||||||||||||||||||||

| Hank Boswell | LT Tarzan 225-C | Saudi Aramco | Saudi Arabia | Oct 18 | Dec 26 | |||||||||||||||||||||||||||||||||||||||

| SAR 202 | KFELS Super B | Saudi Aramco | Saudi Arabia | Oct 17 | Jan 26 | |||||||||||||||||||||||||||||||||||||||

| Kingdom 1 | LT 116-C | Saudi Aramco | Saudi Arabia | Nov 23 | Nov 31 | |||||||||||||||||||||||||||||||||||||||

| Kingdom 2 | LT 116-C | Saudi Aramco | Saudi Arabia | May 24 | May 32 | Under construction. Delivery expected in 2Q24 | ||||||||||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||

Out of Service Days (1) |

||||||||||||||||||||||||||||||||

| Rig | Asset Category | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | |||||||||||||||||||||||||||

| VALARIS DS-4 | Floater - Drillship | 10 | 80 | |||||||||||||||||||||||||||||

| VALARIS Norway | Jackup - Heavy Duty Harsh Environment | 30 | ||||||||||||||||||||||||||||||

| VALARIS 250 | Jackup - Heavy Duty Harsh Environment (Leased to ARO Drilling) | 10 | ||||||||||||||||||||||||||||||

| VALARIS 248 | Jackup - Heavy Duty Harsh Environment | 50 | ||||||||||||||||||||||||||||||

| VALARIS 247 | Jackup - Heavy Duty Harsh Environment | 60 | 30 | |||||||||||||||||||||||||||||

| VALARIS 123 | Jackup - Heavy Duty Harsh Environment | 15 | ||||||||||||||||||||||||||||||

| VALARIS 122 | Jackup - Heavy Duty Harsh Environment | 20 | ||||||||||||||||||||||||||||||

| VALARIS 120 | Jackup - Heavy Duty Harsh Environment | 15 | ||||||||||||||||||||||||||||||

| VALARIS 117 | Jackup - Heavy Duty Modern | 30 | ||||||||||||||||||||||||||||||

| VALARIS 116 | Jackup - Heavy Duty Modern (Leased to ARO Drilling) | 10 | ||||||||||||||||||||||||||||||

| VALARIS 106 | Jackup - Heavy Duty Modern | 90 | ||||||||||||||||||||||||||||||

| VALARIS 147 | Jackup - Standard Duty Modern (Leased to ARO Drilling) | 30 | ||||||||||||||||||||||||||||||

| VALARIS 146 | Jackup - Standard Duty Modern (Leased to ARO Drilling) | 15 | 10 | |||||||||||||||||||||||||||||

| VALARIS 144 | Jackup - Standard Duty Modern | 50 | 90 | |||||||||||||||||||||||||||||

| VALARIS 140 | Jackup - Standard Duty Modern (Leased to ARO Drilling) | 10 | ||||||||||||||||||||||||||||||

| VALARIS 76 | Jackup - Standard Duty Modern (Leased to ARO Drilling) | 90 | ||||||||||||||||||||||||||||||

|

Valaris Limited Fleet Status Report April 30, 2024 |

|||||||||||||