false2023FY0000313616http://fasb.org/us-gaap/2023#OperatingIncomeLosshttp://fasb.org/us-gaap/2023#OperatingIncomeLosshttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNet0.33331212http://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent0.005http://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent35900003136162023-01-012023-12-310000313616us-gaap:CommonStockMember2023-01-012023-12-310000313616dhr:A17SeniorUnsecuredNotesDue2024Member2023-01-012023-12-310000313616dhr:A0.2SeniorNotesDue2026Member2023-01-012023-12-310000313616dhr:A21SeniorUnsecuredNotesDue2026Member2023-01-012023-12-310000313616dhr:A1.2SeniorNotesDue2027Member2023-01-012023-12-310000313616dhr:A0.45SeniorNotesDue2028Member2023-01-012023-12-310000313616dhr:A25SeniorUnsecuredNotesDue2030Member2023-01-012023-12-310000313616dhr:A0.75SeniorNotesDue2031Member2023-01-012023-12-310000313616dhr:A1.35SeniorNotesDue2039Member2023-01-012023-12-310000313616dhr:A1.8SeniorNotesDue2049Member2023-01-012023-12-3100003136162024-02-02xbrli:shares00003136162023-06-30iso4217:USD00003136162023-12-3100003136162022-12-31iso4217:USDxbrli:shares0000313616us-gaap:SeriesBPreferredStockMember2022-12-310000313616us-gaap:SeriesBPreferredStockMember2022-01-012022-12-31xbrli:pure00003136162022-01-012022-12-3100003136162021-01-012021-12-310000313616us-gaap:PreferredStockMember2022-12-310000313616us-gaap:PreferredStockMember2021-12-310000313616us-gaap:PreferredStockMember2020-12-310000313616us-gaap:PreferredStockMember2023-01-012023-12-310000313616us-gaap:PreferredStockMember2022-01-012022-12-310000313616us-gaap:PreferredStockMember2021-01-012021-12-310000313616us-gaap:PreferredStockMember2023-12-310000313616us-gaap:CommonStockMember2022-12-310000313616us-gaap:CommonStockMember2023-12-310000313616us-gaap:CommonStockMember2021-12-310000313616us-gaap:CommonStockMember2020-12-310000313616us-gaap:AdditionalPaidInCapitalMember2022-12-310000313616us-gaap:AdditionalPaidInCapitalMember2021-12-310000313616us-gaap:AdditionalPaidInCapitalMember2020-12-310000313616us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000313616us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000313616us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000313616us-gaap:AdditionalPaidInCapitalMemberus-gaap:PreferredStockMember2023-01-012023-12-310000313616us-gaap:AdditionalPaidInCapitalMemberus-gaap:PreferredStockMember2022-01-012022-12-310000313616us-gaap:AdditionalPaidInCapitalMemberus-gaap:PreferredStockMember2021-01-012021-12-310000313616us-gaap:AdditionalPaidInCapitalMemberdhr:LiquidYieldOptionNotesMember2023-01-012023-12-310000313616us-gaap:AdditionalPaidInCapitalMemberdhr:LiquidYieldOptionNotesMember2022-01-012022-12-310000313616us-gaap:AdditionalPaidInCapitalMemberdhr:LiquidYieldOptionNotesMember2021-01-012021-12-310000313616us-gaap:AdditionalPaidInCapitalMember2023-12-310000313616us-gaap:RetainedEarningsMember2022-12-310000313616us-gaap:RetainedEarningsMember2021-12-310000313616us-gaap:RetainedEarningsMember2020-12-310000313616us-gaap:RetainedEarningsMember2023-01-012023-12-310000313616us-gaap:RetainedEarningsMember2022-01-012022-12-310000313616us-gaap:RetainedEarningsMember2021-01-012021-12-310000313616us-gaap:RetainedEarningsMember2023-12-310000313616us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000313616us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000313616us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000313616us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000313616us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310000313616us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310000313616us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000313616us-gaap:NoncontrollingInterestMember2022-12-310000313616us-gaap:NoncontrollingInterestMember2021-12-310000313616us-gaap:NoncontrollingInterestMember2020-12-310000313616us-gaap:NoncontrollingInterestMember2023-01-012023-12-310000313616us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000313616us-gaap:NoncontrollingInterestMember2021-01-012021-12-310000313616us-gaap:NoncontrollingInterestMember2023-12-3100003136162021-12-3100003136162020-12-31dhr:businessSegment0000313616us-gaap:BuildingMember2023-12-310000313616us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2023-12-310000313616srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-12-310000313616dhr:AssetsLeasedToCustomersMembersrt:MinimumMember2023-12-310000313616srt:MaximumMemberdhr:AssetsLeasedToCustomersMember2023-12-310000313616us-gaap:LandAndLandImprovementsMember2023-12-310000313616us-gaap:LandAndLandImprovementsMember2022-12-310000313616us-gaap:BuildingMember2022-12-310000313616us-gaap:MachineryAndEquipmentMember2023-12-310000313616us-gaap:MachineryAndEquipmentMember2022-12-310000313616dhr:AssetsLeasedToCustomersMember2023-12-310000313616dhr:AssetsLeasedToCustomersMember2022-12-310000313616srt:MinimumMember2021-01-012021-12-310000313616srt:MaximumMember2021-01-012021-12-310000313616us-gaap:OperatingExpenseMember2023-01-012023-12-310000313616us-gaap:OperatingExpenseMember2022-01-012022-12-310000313616dhr:CapitalExpendituresMember2023-12-310000313616dhr:CapitalExpendituresMember2022-12-310000313616dhr:AbcamMember2023-12-062023-12-060000313616dhr:AbcamMember2022-01-012022-12-31iso4217:GBP0000313616dhr:AbcamMember2023-12-060000313616us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-01-012022-12-31dhr:businessdhr:segment0000313616us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2022-12-310000313616dhr:AldevronMember2021-08-302021-08-300000313616dhr:AldevronMember2020-01-012020-12-310000313616dhr:AldevronMember2021-08-300000313616us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-01-012021-12-310000313616us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-12-310000313616dhr:TotalAcquisitionsMember2023-12-310000313616dhr:TotalAcquisitionsMember2022-12-310000313616dhr:TotalAcquisitionsMember2021-12-310000313616dhr:TotalAcquisitionsMember2023-01-012023-12-310000313616dhr:TotalAcquisitionsMember2022-01-012022-12-310000313616dhr:TotalAcquisitionsMember2021-01-012021-12-310000313616dhr:AldevronMember2021-12-310000313616dhr:AldevronMember2021-01-012021-12-310000313616dhr:AbcamMember2023-12-310000313616dhr:AbcamMemberdhr:FairValueAdjustmentToInventoryAndSettlementOfShareBasedPaymentAwardsMember2023-01-012023-12-310000313616dhr:AldevronMemberus-gaap:FairValueAdjustmentToInventoryMember2021-01-012021-12-310000313616us-gaap:FairValueAdjustmentToInventoryMemberdhr:CytivaMember2021-01-012021-12-310000313616dhr:TotalVeraltoDebtMember2023-09-290000313616dhr:VeraltoMember2023-09-012023-09-290000313616us-gaap:CommercialPaperMember2023-09-302023-12-310000313616dhr:EnvironmentalAppliedSolutionsMember2023-01-012023-12-310000313616dhr:EnvironmentalAppliedSolutionsMember2022-01-012022-12-310000313616dhr:FortiveMember2021-01-012021-12-310000313616us-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-12-310000313616us-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-12-310000313616us-gaap:SegmentDiscontinuedOperationsMember2021-01-012021-12-310000313616dhr:VeraltoMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310000313616dhr:VeraltoMemberus-gaap:CommonStockMember2023-09-132023-09-130000313616us-gaap:CommonStockMember2023-01-012023-12-310000313616us-gaap:CommonStockMember2022-01-012022-12-310000313616us-gaap:CommonStockMember2021-01-012021-12-310000313616us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2023-04-172023-04-170000313616us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2023-01-012023-12-310000313616us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2022-01-012022-12-310000313616us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2021-01-012021-12-310000313616us-gaap:SeriesBPreferredStockMember2023-01-012023-12-310000313616us-gaap:SeriesBPreferredStockMember2021-01-012021-12-310000313616us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2022-04-152022-04-150000313616us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310000313616us-gaap:SeriesAPreferredStockMember2021-01-012021-12-310000313616dhr:BiotechnologyMembersrt:NorthAmericaMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616srt:NorthAmericaMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616srt:NorthAmericaMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2023-01-012023-12-310000313616srt:NorthAmericaMember2023-01-012023-12-310000313616dhr:BiotechnologyMemberdhr:WesternEuropeMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616dhr:LifeSciencesMemberdhr:WesternEuropeMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616dhr:WesternEuropeMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2023-01-012023-12-310000313616dhr:WesternEuropeMember2023-01-012023-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:OtherdevelopedmarketsMember2023-01-012023-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:OtherdevelopedmarketsMember2023-01-012023-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:OtherdevelopedmarketsMember2023-01-012023-12-310000313616dhr:OtherdevelopedmarketsMember2023-01-012023-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:HighgrowthmarketsMember2023-01-012023-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:HighgrowthmarketsMember2023-01-012023-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:HighgrowthmarketsMember2023-01-012023-12-310000313616dhr:HighgrowthmarketsMember2023-01-012023-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2023-01-012023-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberdhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2023-01-012023-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMember2023-01-012023-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2023-01-012023-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2023-01-012023-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2023-01-012023-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2023-01-012023-12-310000313616dhr:BiotechnologyMembersrt:NorthAmericaMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616srt:NorthAmericaMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616srt:NorthAmericaMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-01-012022-12-310000313616srt:NorthAmericaMember2022-01-012022-12-310000313616dhr:BiotechnologyMemberdhr:WesternEuropeMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616dhr:LifeSciencesMemberdhr:WesternEuropeMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616dhr:WesternEuropeMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-01-012022-12-310000313616dhr:WesternEuropeMember2022-01-012022-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:OtherdevelopedmarketsMember2022-01-012022-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:OtherdevelopedmarketsMember2022-01-012022-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:OtherdevelopedmarketsMember2022-01-012022-12-310000313616dhr:OtherdevelopedmarketsMember2022-01-012022-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:HighgrowthmarketsMember2022-01-012022-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:HighgrowthmarketsMember2022-01-012022-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:HighgrowthmarketsMember2022-01-012022-12-310000313616dhr:HighgrowthmarketsMember2022-01-012022-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-01-012022-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberdhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-01-012022-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMember2022-01-012022-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2022-01-012022-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2022-01-012022-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2022-01-012022-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2022-01-012022-12-310000313616dhr:BiotechnologyMembersrt:NorthAmericaMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616srt:NorthAmericaMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616srt:NorthAmericaMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2021-01-012021-12-310000313616srt:NorthAmericaMember2021-01-012021-12-310000313616dhr:BiotechnologyMemberdhr:WesternEuropeMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616dhr:LifeSciencesMemberdhr:WesternEuropeMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616dhr:WesternEuropeMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2021-01-012021-12-310000313616dhr:WesternEuropeMember2021-01-012021-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:OtherdevelopedmarketsMember2021-01-012021-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:OtherdevelopedmarketsMember2021-01-012021-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:OtherdevelopedmarketsMember2021-01-012021-12-310000313616dhr:OtherdevelopedmarketsMember2021-01-012021-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:HighgrowthmarketsMember2021-01-012021-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:HighgrowthmarketsMember2021-01-012021-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:HighgrowthmarketsMember2021-01-012021-12-310000313616dhr:HighgrowthmarketsMember2021-01-012021-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2021-01-012021-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberdhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2021-01-012021-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementRecurringMember2021-01-012021-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2021-01-012021-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2021-01-012021-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMemberdhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2021-01-012021-12-310000313616dhr:RevenuefromContractwithCustomerMeasurementNonrecurringMember2021-01-012021-12-3100003136162024-01-012023-12-3100003136162025-01-012023-12-310000313616us-gaap:CorporateNonSegmentMember2023-01-012023-12-310000313616us-gaap:CorporateNonSegmentMember2022-01-012022-12-310000313616us-gaap:CorporateNonSegmentMember2021-01-012021-12-310000313616us-gaap:SegmentContinuingOperationsMemberdhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2023-12-310000313616us-gaap:SegmentContinuingOperationsMemberdhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-12-310000313616us-gaap:SegmentContinuingOperationsMemberdhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2021-12-310000313616us-gaap:SegmentContinuingOperationsMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2023-12-310000313616us-gaap:SegmentContinuingOperationsMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-12-310000313616us-gaap:SegmentContinuingOperationsMemberdhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2021-12-310000313616us-gaap:SegmentContinuingOperationsMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2023-12-310000313616us-gaap:SegmentContinuingOperationsMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-12-310000313616us-gaap:SegmentContinuingOperationsMemberus-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2021-12-310000313616us-gaap:SegmentContinuingOperationsMemberus-gaap:CorporateNonSegmentMember2023-12-310000313616us-gaap:SegmentContinuingOperationsMemberus-gaap:CorporateNonSegmentMember2022-12-310000313616us-gaap:SegmentContinuingOperationsMemberus-gaap:CorporateNonSegmentMember2021-12-310000313616us-gaap:SegmentDiscontinuedOperationsMember2023-12-310000313616us-gaap:SegmentDiscontinuedOperationsMember2022-12-310000313616us-gaap:SegmentDiscontinuedOperationsMember2021-12-310000313616srt:ReportableGeographicalComponentsMembercountry:US2023-01-012023-12-310000313616srt:ReportableGeographicalComponentsMembercountry:US2022-01-012022-12-310000313616srt:ReportableGeographicalComponentsMembercountry:US2021-01-012021-12-310000313616srt:ReportableGeographicalComponentsMembercountry:CN2023-01-012023-12-310000313616srt:ReportableGeographicalComponentsMembercountry:CN2022-01-012022-12-310000313616srt:ReportableGeographicalComponentsMembercountry:CN2021-01-012021-12-310000313616srt:ReportableGeographicalComponentsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310000313616srt:ReportableGeographicalComponentsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310000313616srt:ReportableGeographicalComponentsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310000313616dhr:AllOtherCountriesMembersrt:ReportableGeographicalComponentsMember2023-01-012023-12-310000313616dhr:AllOtherCountriesMembersrt:ReportableGeographicalComponentsMember2022-01-012022-12-310000313616dhr:AllOtherCountriesMembersrt:ReportableGeographicalComponentsMember2021-01-012021-12-310000313616srt:ReportableGeographicalComponentsMembercountry:US2023-12-310000313616srt:ReportableGeographicalComponentsMembercountry:US2022-12-310000313616srt:ReportableGeographicalComponentsMembercountry:US2021-12-310000313616srt:ReportableGeographicalComponentsMembercountry:SE2023-12-310000313616srt:ReportableGeographicalComponentsMembercountry:SE2022-12-310000313616srt:ReportableGeographicalComponentsMembercountry:SE2021-12-310000313616country:GBsrt:ReportableGeographicalComponentsMember2023-12-310000313616country:GBsrt:ReportableGeographicalComponentsMember2022-12-310000313616country:GBsrt:ReportableGeographicalComponentsMember2021-12-310000313616country:DEsrt:ReportableGeographicalComponentsMember2023-12-310000313616country:DEsrt:ReportableGeographicalComponentsMember2022-12-310000313616country:DEsrt:ReportableGeographicalComponentsMember2021-12-310000313616srt:ReportableGeographicalComponentsMemberus-gaap:PropertyPlantAndEquipmentMemberus-gaap:GeographicConcentrationRiskMember2021-01-012021-12-310000313616srt:ReportableGeographicalComponentsMemberus-gaap:PropertyPlantAndEquipmentMemberus-gaap:GeographicConcentrationRiskMember2022-01-012022-12-310000313616srt:ReportableGeographicalComponentsMemberus-gaap:PropertyPlantAndEquipmentMemberus-gaap:GeographicConcentrationRiskMember2023-01-012023-12-310000313616dhr:AllOtherCountriesMembersrt:ReportableGeographicalComponentsMember2023-12-310000313616dhr:AllOtherCountriesMembersrt:ReportableGeographicalComponentsMember2022-12-310000313616dhr:AllOtherCountriesMembersrt:ReportableGeographicalComponentsMember2021-12-310000313616country:US2023-01-012023-12-310000313616country:US2022-01-012022-12-310000313616country:US2021-01-012021-12-310000313616us-gaap:NonUsMember2023-01-012023-12-310000313616us-gaap:NonUsMember2022-01-012022-12-310000313616us-gaap:NonUsMember2021-01-012021-12-310000313616us-gaap:SegmentDiscontinuedOperationsMember2022-12-310000313616us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310000313616country:US2023-12-310000313616country:US2022-12-310000313616us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:SegmentDiscontinuedOperationsMembercountry:US2022-12-310000313616us-gaap:NonUsMember2023-12-310000313616us-gaap:NonUsMember2022-12-310000313616us-gaap:NonUsMemberus-gaap:SegmentDiscontinuedOperationsMemberus-gaap:SegmentDiscontinuedOperationsMember2022-12-310000313616dhr:GeneralBusinessAndForeignTaxCreditMember2023-12-310000313616dhr:DeferredTaxAssetOtherMember2023-12-310000313616us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-12-310000313616us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-12-310000313616us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:SegmentDiscontinuedOperationsMember2021-01-012021-12-310000313616us-gaap:DomesticCountryMemberus-gaap:InternalRevenueServiceIRSMember2022-10-012022-12-310000313616us-gaap:ForeignCountryMember2021-01-012021-04-02iso4217:DKK0000313616us-gaap:ForeignCountryMember2023-01-012023-12-310000313616us-gaap:ForeignCountryMember2022-01-012022-12-310000313616us-gaap:ForeignCountryMember2021-01-012021-12-3100003136162021-07-242021-07-240000313616us-gaap:SeniorNotesMemberdhr:A2.5SeniorUnsecuredNotesDue2025Member2021-10-022021-12-31iso4217:EUR0000313616us-gaap:SeniorNotesMemberdhr:A2.5SeniorUnsecuredNotesDue2025Member2021-12-310000313616srt:MaximumMember2023-12-31dhr:reportingUnit0000313616srt:MinimumMember2023-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-10-010000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2021-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2021-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2021-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-01-012022-09-3000003136162022-01-012022-09-300000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-09-300000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-09-300000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-09-3000003136162022-09-300000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-10-012022-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-10-012022-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-10-012022-12-3100003136162022-10-012022-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2022-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2022-12-310000313616dhr:BiotechnologyMemberus-gaap:OperatingSegmentsMember2023-12-310000313616dhr:LifeSciencesMemberus-gaap:OperatingSegmentsMember2023-12-310000313616us-gaap:OperatingSegmentsMemberdhr:DiagnosticsMember2023-12-3100003136162023-01-012023-09-290000313616us-gaap:PatentedTechnologyMember2023-12-310000313616us-gaap:PatentedTechnologyMember2022-12-310000313616us-gaap:CustomerRelationshipsMember2023-12-310000313616us-gaap:CustomerRelationshipsMember2022-12-310000313616us-gaap:TrademarksAndTradeNamesMember2023-12-310000313616us-gaap:TrademarksAndTradeNamesMember2022-12-310000313616us-gaap:FairValueInputsLevel1Member2023-12-310000313616us-gaap:FairValueInputsLevel1Member2022-12-310000313616us-gaap:FairValueInputsLevel2Member2023-12-310000313616us-gaap:FairValueInputsLevel2Member2022-12-310000313616us-gaap:FairValueInputsLevel3Member2023-12-310000313616us-gaap:FairValueInputsLevel3Member2022-12-310000313616us-gaap:PartnershipMember2023-12-310000313616us-gaap:PartnershipMember2022-12-310000313616us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000313616us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000313616us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000313616us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000313616dhr:EuroDenominatedCommercialPaperMemberus-gaap:CommercialPaperMember2023-12-310000313616dhr:EuroDenominatedCommercialPaperMemberus-gaap:CommercialPaperMember2022-12-310000313616us-gaap:BondsMemberdhr:A0.5SeniorUnsecuredBondsDue2023Member2022-12-310000313616us-gaap:BondsMemberdhr:A0.5SeniorUnsecuredBondsDue2023Member2023-12-31iso4217:CHF0000313616us-gaap:SeniorNotesMemberdhr:A17SeniorUnsecuredNotesDue2024Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A17SeniorUnsecuredNotesDue2024Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A2.2SeniorUnsecuredNotesDue2024Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A2.2SeniorUnsecuredNotesDue2024Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A335SeniorUnsecuredNotesDue2025Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A335SeniorUnsecuredNotesDue2025Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A0.2SeniorUnsecuredNotesDue2026Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A0.2SeniorUnsecuredNotesDue2026Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A21SeniorUnsecuredNotesDue2026Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A21SeniorUnsecuredNotesDue2026Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A03SeniorUnsecuredNotesDue2027Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A03SeniorUnsecuredNotesDue2027Member2023-12-31iso4217:JPY0000313616us-gaap:SeniorNotesMemberdhr:A1.2SeniorUnsecuredNotesDue2027Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A1.2SeniorUnsecuredNotesDue2027Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A0.45SeniorUnsecuredNotesDue2028Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A0.45SeniorUnsecuredNotesDue2028Member2022-12-310000313616dhr:A1.125SeniorUnsecuredBondsDue2028Memberus-gaap:BondsMember2022-12-310000313616dhr:A1.125SeniorUnsecuredBondsDue2028Memberus-gaap:BondsMember2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A2.6SeniorUnsecuredNotesDue2029Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A2.6SeniorUnsecuredNotesDue2029Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A25SeniorUnsecuredNotesDue2030Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A25SeniorUnsecuredNotesDue2030Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A0.75SeniorUnsecuredNotesDue2031Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A0.75SeniorUnsecuredNotesDue2031Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A065SeniorUnsecuredNotesDue2032Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A065SeniorUnsecuredNotesDue2032Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A1.35SeniorUnsecuredNotesDue2039Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A1.35SeniorUnsecuredNotesDue2039Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A3.25SeniorUnsecuredNotesDue2039Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A3.25SeniorUnsecuredNotesDue2039Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A4375SeniorUnsecuredNotesDue2045Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A4375SeniorUnsecuredNotesDue2045Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A1.8SeniorUnsecuredNotesDue2049Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A1.8SeniorUnsecuredNotesDue2049Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A3.4SeniorUnsecuredNotesDue2049Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A3.4SeniorUnsecuredNotesDue2049Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A26SeniorUnsecuredNotesDue2050Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A26SeniorUnsecuredNotesDue2050Member2023-12-310000313616us-gaap:SeniorNotesMemberdhr:A28SeniorUnsecuredNotesDue2051Member2022-12-310000313616us-gaap:SeniorNotesMemberdhr:A28SeniorUnsecuredNotesDue2051Member2023-12-310000313616dhr:OtherMember2023-12-310000313616dhr:OtherMember2022-12-310000313616us-gaap:RevolvingCreditFacilityMemberdhr:MultiyearCreditFacilitySupersededMemberus-gaap:LineOfCreditMember2023-08-100000313616us-gaap:RevolvingCreditFacilityMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMemberus-gaap:LineOfCreditMember2023-08-110000313616us-gaap:RevolvingCreditFacilityMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMemberus-gaap:LineOfCreditMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMemberdhr:MultiyearCreditFacilitySupersededMember2023-08-110000313616us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MinimumMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616dhr:DebtRateConditionOneMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMemberdhr:DebtRateConditionTwoMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMemberdhr:DebtRateConditionTwoMembersrt:MinimumMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberdhr:DebtRateConditionTwoMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMemberdhr:AlternativeCurrencyLoansMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMemberdhr:SwingLineLoansMembersrt:MinimumMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberdhr:SwingLineLoansMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMemberdhr:AlternativeCurrencyLoansMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616us-gaap:RevolvingCreditFacilityMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310000313616dhr:EuroDenominatedCommercialPaperMemberus-gaap:CommercialPaperMember2023-12-312023-12-310000313616dhr:SwissFrancDenominatedSeniorUnsecuredBondsMemberus-gaap:BondsMember2023-01-012023-12-310000313616us-gaap:SeniorNotesMember2023-01-012023-12-310000313616us-gaap:SeniorNotesMemberdhr:A2027And2032YenNotesMember2023-01-012023-12-310000313616dhr:ZeroCouponLYONSDue2021Memberus-gaap:ConvertibleDebtMember2001-12-310000313616dhr:ZeroCouponLYONSDue2021Memberus-gaap:ConvertibleDebtMember2001-01-012001-12-310000313616dhr:ZeroCouponLYONSDue2021Memberus-gaap:ConvertibleDebtMember2021-01-012021-12-310000313616dhr:A550SeniorUnsecuredVeraltoBondsDue2026Memberus-gaap:BondsMember2023-09-290000313616us-gaap:BondsMemberdhr:A535SeniorUnsecuredVeraltoBondsDue2028Member2023-09-290000313616dhr:A545SeniorUnsecuredVeraltoBondsDue2033Memberus-gaap:BondsMember2023-09-290000313616us-gaap:BondsMemberdhr:A415SeniorUnsecuredVeraltoBondsDue2031Member2023-09-290000313616us-gaap:BondsMemberdhr:A0.5SeniorUnsecuredBondsDue2023Member2023-12-080000313616us-gaap:SeniorNotesMemberdhr:FloatingRateSeniorUnsecuredNotesDue2022Member2022-06-300000313616dhr:A2.05SeniorUnsecuredNotesDue2022Memberus-gaap:SeniorNotesMember2022-11-150000313616us-gaap:SeniorNotesMemberdhr:A0352SeniorUnsecuredNotesDue2021Member2021-01-012021-04-020000313616dhr:A0352SeniorUnsecuredNotesDue2021Member2021-04-020000313616us-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMemberdhr:ThirdAmendedAndRestatedMultiyearCreditFacilityMember2023-08-112023-08-110000313616us-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeContractMember2023-12-310000313616us-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310000313616us-gaap:NetInvestmentHedgingMemberdhr:ForeignCurrencyDenominatedDebtMember2023-01-012023-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2023-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2023-01-012023-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310000313616dhr:CashFlowAndNetInvestmentHedgesMember2023-12-310000313616dhr:CashFlowAndNetInvestmentHedgesMember2023-01-012023-12-310000313616us-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeContractMember2022-12-310000313616us-gaap:NetInvestmentHedgingMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310000313616us-gaap:NetInvestmentHedgingMemberdhr:ForeignCurrencyDenominatedDebtMember2022-01-012022-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2022-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2022-01-012022-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2022-12-310000313616us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310000313616dhr:CashFlowAndNetInvestmentHedgesMember2022-12-310000313616dhr:CashFlowAndNetInvestmentHedgesMember2022-01-012022-12-310000313616us-gaap:NetInvestmentHedgingMember2023-12-310000313616us-gaap:NetInvestmentHedgingMember2022-12-310000313616us-gaap:NetInvestmentHedgingMemberdhr:DebtCurrentMember2023-01-012023-12-310000313616us-gaap:NetInvestmentHedgingMemberdhr:DebtCurrentMember2022-01-012022-12-310000313616us-gaap:NetInvestmentHedgingMemberus-gaap:LongTermDebtMember2023-12-312023-12-310000313616us-gaap:NetInvestmentHedgingMemberus-gaap:LongTermDebtMember2022-12-312022-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:US2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2021-12-310000313616us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310000313616us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-01-012023-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:US2022-01-012022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-01-012023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2022-01-012022-12-310000313616us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310000313616us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:US2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMember2023-12-310000313616us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:US2021-01-012021-12-310000313616srt:ScenarioForecastMemberus-gaap:PensionPlansDefinedBenefitMembercountry:US2024-01-012024-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:MinimumMember2023-01-012023-12-310000313616us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:ForeignPlanMember2023-01-012023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:MinimumMember2022-01-012022-12-310000313616us-gaap:PensionPlansDefinedBenefitMembersrt:MaximumMemberus-gaap:ForeignPlanMember2022-01-012022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:WeightedAverageMember2023-01-012023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:ForeignPlanMembersrt:WeightedAverageMember2022-01-012022-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:USsrt:MinimumMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMembercountry:USsrt:MaximumMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel2Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel3Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel1Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel1Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel2Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel2Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel3Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel3Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:DefinedBenefitPlanEquitySecuritiesCommonStockMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CorporateBondSecuritiesMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateBondSecuritiesMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateBondSecuritiesMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CorporateBondSecuritiesMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberus-gaap:CorporateBondSecuritiesMember2022-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2023-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2023-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310000313616us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel1Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel2Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel3Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:MutualFundMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdhr:DefinedBenefitPlanInsuranceContractsMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Memberdhr:DefinedBenefitPlanInsuranceContractsMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdhr:DefinedBenefitPlanInsuranceContractsMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Memberdhr:DefinedBenefitPlanInsuranceContractsMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdhr:DefinedBenefitPlanInsuranceContractsMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Memberdhr:DefinedBenefitPlanInsuranceContractsMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberdhr:DefinedBenefitPlanInsuranceContractsMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Memberdhr:DefinedBenefitPlanInsuranceContractsMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel1Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel2Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel3Member2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueInputsLevel12And3Member2022-12-310000313616us-gaap:DefinedBenefitPlanCommonCollectiveTrustMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310000313616us-gaap:DefinedBenefitPlanCommonCollectiveTrustMemberus-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberdhr:DefinedBenefitPlanPartnershipsandOtherPrivateInvestmentsMember2023-12-310000313616us-gaap:PensionPlansDefinedBenefitMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberdhr:DefinedBenefitPlanPartnershipsandOtherPrivateInvestmentsMember2022-12-310000313616us-gaap:PensionPlansDefinedBenefitMember2022-12-3100003136162013-07-160000313616us-gaap:CommonStockMember2022-07-222022-07-220000313616us-gaap:ConvertiblePreferredStockSubjectToMandatoryRedemptionMemberus-gaap:PreferredStockMember2023-01-012023-12-310000313616us-gaap:ConvertiblePreferredStockSubjectToMandatoryRedemptionMemberus-gaap:PreferredStockMember2022-01-012022-12-310000313616us-gaap:ConvertiblePreferredStockSubjectToMandatoryRedemptionMemberus-gaap:PreferredStockMember2021-01-012021-12-310000313616us-gaap:ConvertiblePreferredStockSubjectToMandatoryRedemptionMemberus-gaap:CommonStockMember2023-01-012023-12-310000313616us-gaap:ConvertiblePreferredStockSubjectToMandatoryRedemptionMemberus-gaap:CommonStockMember2022-01-012022-12-310000313616us-gaap:ConvertiblePreferredStockSubjectToMandatoryRedemptionMemberus-gaap:CommonStockMember2021-01-012021-12-310000313616dhr:LiquidYieldOptionNotesMemberus-gaap:CommonStockMember2023-01-012023-12-310000313616dhr:LiquidYieldOptionNotesMemberus-gaap:CommonStockMember2022-01-012022-12-310000313616dhr:LiquidYieldOptionNotesMemberus-gaap:CommonStockMember2021-01-012021-12-310000313616us-gaap:PreferredStockMemberus-gaap:SeriesBPreferredStockMember2023-04-170000313616us-gaap:PreferredStockMemberus-gaap:SeriesAPreferredStockMember2022-04-150000313616dhr:A2007OmnibusIncentivePlanMember2023-12-310000313616us-gaap:EmployeeStockOptionMemberdhr:A2007OmnibusIncentivePlanMember2023-01-012023-12-310000313616us-gaap:EmployeeStockOptionMemberdhr:AmendedAndRestated2007OmnibusIncentivePlanMember2023-01-012023-12-310000313616us-gaap:RestrictedStockUnitsRSUMemberdhr:A2007OmnibusIncentivePlanMember2023-01-012023-12-310000313616us-gaap:RestrictedStockUnitsRSUMemberdhr:AmendedAndRestated2007OmnibusIncentivePlanMember2023-01-012023-12-310000313616srt:MinimumMember2023-01-012023-12-310000313616srt:MaximumMember2023-01-012023-12-310000313616srt:MinimumMember2022-01-012022-12-310000313616srt:MaximumMember2022-01-012022-12-310000313616us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000313616us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000313616us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000313616us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000313616us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000313616us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000313616us-gaap:RestrictedStockUnitsRSUMember2023-12-310000313616us-gaap:EmployeeStockOptionMember2023-12-310000313616dhr:RangeOneMember2023-01-012023-12-310000313616dhr:RangeOneMember2023-12-310000313616dhr:RangeTwoMember2023-01-012023-12-310000313616dhr:RangeTwoMember2023-12-310000313616dhr:RangeThreeMember2023-01-012023-12-310000313616dhr:RangeThreeMember2023-12-310000313616dhr:RangeFourMember2023-01-012023-12-310000313616dhr:RangeFourMember2023-12-310000313616dhr:RangeFiveMember2023-01-012023-12-310000313616dhr:RangeFiveMember2023-12-310000313616us-gaap:RestrictedStockUnitsRSUMember2020-12-310000313616us-gaap:RestrictedStockUnitsRSUMember2021-12-310000313616us-gaap:RestrictedStockUnitsRSUMember2022-12-310000313616us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310000313616us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310000313616us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2020-12-310000313616us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310000313616us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310000313616us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2021-01-012021-12-310000313616us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310000313616us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310000313616us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2021-12-310000313616us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310000313616us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310000313616us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-01-012022-12-310000313616us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000313616us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310000313616us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-12-310000313616us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310000313616us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310000313616us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-01-012023-12-310000313616us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000313616us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000313616us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-12-3100003136162023-01-012023-03-3100003136162023-04-012023-06-3000003136162023-07-012023-09-2900003136162023-09-302023-12-3100003136162022-01-012022-04-0100003136162022-04-022022-07-0100003136162022-07-022022-09-300000313616dhr:RainerMBlairMember2023-09-302023-12-310000313616dhr:RainerMBlairMember2023-12-310000313616us-gaap:AllowanceForCreditLossMember2022-12-310000313616us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310000313616us-gaap:AllowanceForCreditLossMember2023-12-310000313616us-gaap:AllowanceForCreditLossMember2021-12-310000313616us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310000313616us-gaap:AllowanceForCreditLossMember2020-12-310000313616us-gaap:AllowanceForCreditLossMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 10-K

(Mark One)

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

For the transition period from to |

Commission File Number: 001-08089

DANAHER CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

| Delaware |

|

59-1995548 |

| (State of Incorporation) |

|

(I.R.S. Employer Identification Number) |

|

|

| 2200 Pennsylvania Avenue, N.W., Suite 800W |

|

20037-1701 |

| Washington, |

DC |

|

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 202-828-0850

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common stock, $0.01 par value |

DHR |

New York Stock Exchange |

| 1.700% Senior Notes due 2024 |

DHR 24 |

New York Stock Exchange |

|

|

|

| 0.200% Senior Notes due 2026 |

DHR/26 |

New York Stock Exchange |

| 2.100% Senior Notes due 2026 |

DHR 26 |

New York Stock Exchange |

| 1.200% Senior Notes due 2027 |

DHR/27 |

New York Stock Exchange |

| 0.450% Senior Notes due 2028 |

DHR/28 |

New York Stock Exchange |

| 2.500% Senior Notes due 2030 |

DHR 30 |

New York Stock Exchange |

| 0.750% Senior Notes due 2031 |

DHR/31 |

New York Stock Exchange |

| 1.350% Senior Notes due 2039 |

DHR/39 |

New York Stock Exchange |

| 1.800% Senior Notes due 2049 |

DHR/49 |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

NONE

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large Accelerated Filer |

☒ |

|

|

Accelerated Filer |

☐ |

|

|

|

|

|

| Non-accelerated Filer |

☐ |

|

|

Smaller Reporting company |

☐ |

|

|

|

|

|

|

| Emerging Growth Company |

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of February 2, 2024, the number of shares of Registrant’s common stock outstanding was 739,701,725. The aggregate market value of common stock held by non-affiliates of the Registrant on June 30, 2023 was $158.1 billion, based upon the closing price of the Registrant’s common stock as quoted on the New York Stock Exchange on such date.

____________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the Registrant’s proxy statement for its 2024 annual meeting of shareholders to be filed pursuant to Regulation 14A within 120 days after Registrant’s fiscal year-end. With the exception of the sections of the 2024 Proxy Statement specifically incorporated herein by reference, the 2024 Proxy Statement is not deemed to be filed as part of this Form 10-K.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

PAGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

|

Item 1A. |

|

|

|

Item 1B. |

|

|

|

Item 1C. |

|

|

|

Item 2. |

|

|

|

Item 3. |

|

|

|

Item 4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

|

Item 6. |

|

|

|

Item 7. |

|

|

|

Item 7A. |

|

|

|

Item 8. |

|

|

|

Item 9. |

|

|

|

Item 9A. |

|

|

|

Item 9B. |

|

|

|

Item 9C. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

|

Item 11. |

|

|

|

Item 12. |

|

|

|

Item 13. |

|

|

|

Item 14. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 15. |

|

|

|

Item 16. |

|

|

In this Annual Report, the terms “Danaher” or the “Company” refer to Danaher Corporation, Danaher Corporation and its consolidated subsidiaries or the consolidated subsidiaries of Danaher Corporation, as the context requires. Unless otherwise indicated, all financial data in this Annual Report refer to continuing operations only.

INFORMATION RELATING TO FORWARD-LOOKING STATEMENTS

Certain statements included or incorporated by reference in this Annual Report, in other documents we file with or furnish to the Securities and Exchange Commission (“SEC”), in our press releases, webcasts, conference calls, materials delivered to shareholders and other communications, are “forward-looking statements” within the meaning of the U.S. federal securities laws. All statements other than historical factual information are forward-looking statements, including without limitation statements regarding: projections of revenue, expenses, profit, profit margins, pricing, tax rates, tax provisions, cash flows, pension and benefit obligations and funding requirements, our liquidity position or other projected financial measures; management’s plans and strategies for future operations, including statements relating to anticipated operating performance, cost reductions, restructuring activities, new product and service developments, competitive strengths or market position, acquisitions and the integration thereof, divestitures, spin-offs, split-offs, initial public offerings, other securities offerings or other distributions, strategic opportunities, stock repurchases, dividends and executive compensation and potential executive stock sales or purchases; growth, declines and other trends in markets we sell into; new or modified laws, regulations and accounting pronouncements; future regulatory approvals and the timing and conditionality thereof; outstanding claims, legal proceedings, tax audits and assessments and other contingent liabilities; future foreign currency exchange rates and fluctuations in those rates; the potential or anticipated direct or indirect impact of public health crises, climate change, military conflicts or other man-made or natural disasters on our business, results of operations and/or financial condition; general economic and capital markets conditions; the anticipated timing of any of the foregoing; assumptions underlying any of the foregoing; and any other statements that address events or developments that Danaher intends or believes will or may occur in the future. Terminology such as “believe,” “anticipate,” “should,” “could,” “intend,” “will,” “plan,” “expect,” “estimate,” “project,” “target,” “may,” “possible,” “potential,” “forecast” and “positioned” and similar references to future periods are intended to identify forward-looking statements, although not all forward-looking statements are accompanied by such words. Forward-looking statements are based on assumptions and assessments made by our management in light of their experience and perceptions of historical trends, current conditions, expected future developments and other factors they believe to be appropriate. These forward-looking statements are subject to a number of risks and uncertainties, including but not limited to the risks and uncertainties set forth below and under “Item 1A. Risk Factors” in this Annual Report.

Forward-looking statements are not guarantees of future performance and actual results may differ materially from the results, developments and business decisions contemplated by our forward-looking statements. Accordingly, you should not place undue reliance on any such forward-looking statements. Forward-looking statements speak only as of the date of the report, document, press release, webcast, call, materials or other communication in which they are made. Except to the extent required by applicable law, we do not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise.

Below is a summary of material risks and uncertainties we face, which are discussed more fully in “Item 1A. Risk Factors”:

Business and Strategic Risks

•Unanticipated, further declines in demand for our COVID-19 related products, and future global health crises could adversely impact our business and financial statements. Other conditions in the global economy, the particular markets we serve and the financial markets can also adversely affect our business and financial statements.

•We face intense competition and if we are unable to compete effectively, we may experience decreased demand and decreased market share. Even if we compete effectively, we may be required to reduce the prices we charge.

•Our growth depends on the timely development and commercialization, and customer acceptance, of new and enhanced products and services based on technological innovation. Our growth can also suffer if the markets into which we sell our products and services decline, do not grow as anticipated or experience cyclicality.

•The health care industry and related industries that we serve are undergoing significant changes in an effort to reduce (and increase the predictability of) costs, which can adversely affect our business and financial statements.

•Economic, political, geopolitical, legal, compliance, social and business factors (including the impact of military conflicts), both in the U.S. and outside the U.S., can negatively affect our business and financial statements.

•Uncertainties with respect to the development, deployment, and use of artificial intelligence in our business and products may result in harm to our business and reputation.

•Collaborative partners and other third-parties we rely on for development, supply and/or marketing of certain products, potential products and technologies could fail to perform sufficiently.

Acquisitions, Divestitures and Investment Risks

•Any inability to consummate acquisitions at our historical rate and appropriate prices, and to make appropriate investments that support our long-term strategy, could negatively impact our business. Our acquisition of businesses, investments, joint ventures and other strategic relationships could also negatively impact our business and financial statements and our indemnification rights may not fully protect us from liabilities related thereto.

•Divestitures or other dispositions could negatively impact our business, and contingent liabilities from businesses that we or our predecessors have previously disposed could adversely affect our business and financial statements. For example, we could incur significant liability if any of the split-off or spin-off transactions we have previously consummated are determined to be a taxable transaction or otherwise pursuant to our indemnification obligations with respect to such transactions.

Operational Risks

•Significant disruptions in, or breaches in security of, our information technology (“IT”) systems or data; data privacy violations; other losses or disruptions to facilities, supply chains, distribution systems or IT systems due to catastrophe; and labor disputes can all adversely affect our business and financial statements.

•Defects and unanticipated use or inadequate disclosure with respect to our products or services, or allegations thereof, can adversely affect our business and financial statements.

•Our financial results are subject to fluctuations in the cost and availability of the supplies we use in, and the labor we need for, our operations.

•Climate change, legal or regulatory measures to address climate change and any inability to address stakeholder expectations with respect to climate change, may negatively affect us.

•Our success depends on our ability to recruit, retain and motivate talented employees representing diverse backgrounds, experiences and skill sets.

•Our restructuring actions can have long-term adverse effects on our business and financial statements.

Intellectual Property Risks

•Any inability to adequately protect or avoid third-party infringement of our intellectual property, and third-party claims we are infringing intellectual property rights, can adversely affect our business and financial statements.

•The U.S. government has certain rights with respect to incremental production capacity attributable to, and/or the intellectual property we have developed using, government financing. In addition, in times of national emergency the U.S. government could also control our allocation of manufacturing capacity.

Financial and Tax Risks

•Our outstanding debt has increased significantly as a result of acquisitions, and we may incur additional debt. Such indebtedness may limit our operations and use of cash flow and negatively impact our credit ratings; and failure to comply with our indebtedness-related covenants could adversely affect our business and financial statements.

•Our business and financial statements can be adversely affected by foreign currency exchange rates, changes in our tax rates (including as a result of changes in tax laws) or income tax liabilities/assessments, the outcome of tax audits, recognition of impairment charges for our goodwill or other intangible assets, and fluctuations in the cost and availability of commodities.

Legal, Regulatory, Compliance and Reputational Risks

•Significant developments or changes in national laws or policies to protect or promote domestic interests and/or address foreign competition can have an adverse effect on our business and financial statements.

•Our businesses are subject to extensive regulation (including those applicable to the healthcare industry). Failure to comply with those regulations (including by our employees, agents or business partners) or significant developments or changes in U.S. laws or policies can adversely affect our business and financial statements.

•With respect to the regulated medical devices we offer, product introductions or modifications may require regulatory clearance or authorizations and we could be required to recall or cease marketing such products; off-label marketing could result in penalties; and clinical trials may have results that are unexpected or are perceived unfavorably by the market, all of which could adversely affect our business and financial statements.

•We are subject to or otherwise responsible for a variety of litigation and other legal and regulatory proceedings in the course of our business that can adversely affect our business and financial statements.

•Our operations, products and services also expose us to the risk of environmental, health and safety liabilities, costs and violations that could adversely affect our business and financial statements.

•Our By-law exclusive forum provisions could limit our stockholders’ ability to choose their preferred judicial forum for disputes.

PART I

ITEM 1. BUSINESS

General

Danaher is a global science and technology innovator committed to accelerating the power of science and technology to improve human health. Danaher is comprised of more than 15 operating companies with leadership positions in the biotechnology, life sciences and diagnostics sectors, organized under three segments (Biotechnology, Life Sciences and Diagnostics). United by the DANAHER BUSINESS SYSTEM (“DBS”), our businesses are also typically characterized by a high level of products and services that are sold on a recurring basis, primarily through a direct sales model and to a geographically diverse customer base. Our business’ research and development, manufacturing, sales, distribution, service and administrative facilities are located in more than 50 countries.

Danaher strives to create shareholder value primarily through three strategic priorities:

•strengthening our competitive advantage through consistent application of DBS tools and culture;

•enhancing our portfolio in attractive science and technology markets through strategic capital allocation; and

•consistently attracting and retaining exceptional talent.

Danaher measures its progress against these strategic priorities over the long-term based primarily on financial metrics relating to revenue growth, profitability, cash flow and capital returns, as well as certain non-financial metrics. To further the strategic objectives set forth above, the Company also acquires businesses and makes investments that either complement its existing business portfolio or expand its portfolio into new and attractive markets. Given the rapid pace of technological development and the specialized expertise typical of Danaher’s served markets, acquisitions, strategic alliances and investments provide the Company access to important new technologies and domain expertise. Danaher believes there are many acquisition and investment opportunities available within its targeted markets. The extent to which we identify, consummate and effectively integrate appropriate acquisitions and consummate appropriate investments affects our overall growth and operating results. Danaher also continually assesses the strategic fit of its existing businesses and may separate or otherwise dispose businesses based on strategic and other considerations.

On September 30, 2023 (the “Distribution Date”), we completed the separation (“the Separation”) of our former Environmental & Applied Solutions business by distributing to Danaher stockholders on a pro rata basis all of the issued and outstanding common stock of Veralto Corporation (“Veralto”). To effect the Separation, Danaher distributed to its stockholders one share of Veralto common stock for every three shares of Danaher common stock outstanding at the close of business on September 13, 2023, the record date for the distribution. In lieu of fractional shares cash was distributed to Danaher stockholders.

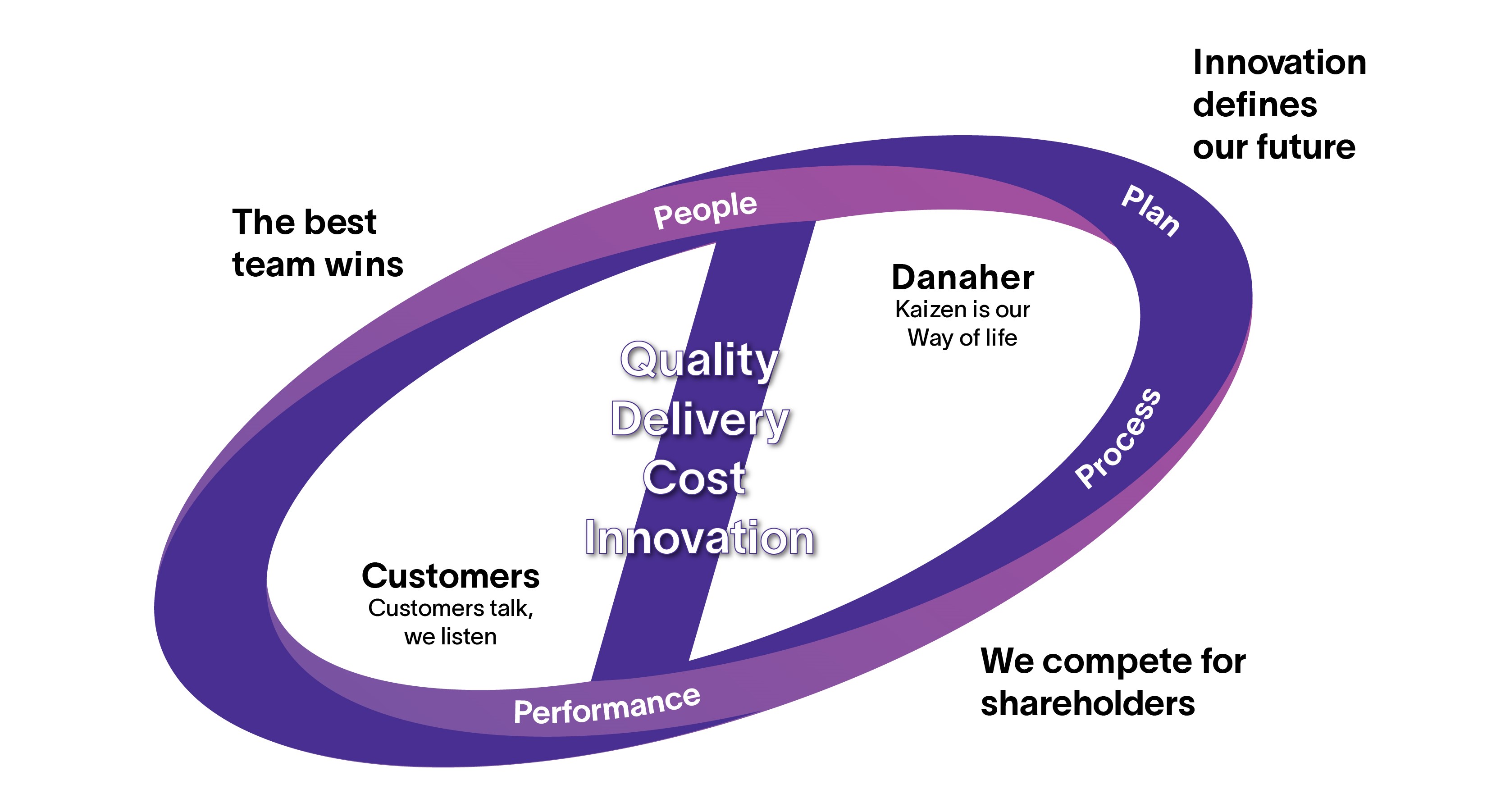

DBS is not only the set of business processes and tools our operating companies use on a daily basis in the pursuit of continuous improvement, but also represents our culture, which is guided by the following core values (the “Core Values”):

1.The Best Team Wins

2.Customers Talk, We Listen

3.Kaizen is our Way of Life

4.Innovation Defines our Future

5.We Compete for Shareholders

Underpinned by these five Core Values, the DBS tools are organized into four pillars that are designed to apply to every aspect of our business: Growth, Lean, Leadership and the DBS Fundamentals.

The idea for Danaher originated in the early 1980s when the Company’s founders, Steven M. and Mitchell P. Rales, envisioned a business that would generate sustainable long-term value for customers, associates and shareholders. Through a series of acquisitions and divestitures, Danaher has evolved over time into the science and technology innovator it is today. While the operating companies that make up Danaher have changed, DBS continues to be the guiding philosophy for the Company.

Sales in 2023 by geographic destination (geographic destination refers to the geographic area where the final sale to the Company’s unaffiliated customer is made) as a percentage of total 2023 sales were: North America, 42% (including 40% in the United States); Western Europe, 23%; other developed markets, 5%; and high-growth markets, 30%. The Company defines North America as the United States and Canada. The Company defines high-growth markets as developing markets of the world experiencing accelerated growth, over extended periods, in gross domestic product and infrastructure which include Eastern Europe, the Middle East, Africa, Latin America (including Mexico) and Asia (with the exception of Japan, Australia and New Zealand). The Company defines developed markets as all markets of the world that are not high-growth markets.

BIOTECHNOLOGY

The Biotechnology segment includes the bioprocessing and discovery and medical businesses and offers a broad range of equipment, consumables and services that are primarily used by customers to advance and accelerate the research, development, manufacture and delivery of biological medicines. The biotherapeutics that the Company’s solutions support range from replacement therapies such as insulin, vaccines, recombinant proteins and other biologic drugs, to novel cell, gene, mRNA and other nucleic acid therapies. Sales in 2023 for this segment by geographic destination (as a percentage of total 2023 sales) were: North America, 34%; Western Europe, 33%; other developed markets, 5%; and high-growth markets, 28%.

Danaher established the Biotechnology segment, which was previously part of Danaher’s former Life Sciences segment, in 2022. The Biotechnology segment includes the Pall life sciences business, acquired in 2015, and Cytiva, acquired in 2020.

The Biotechnology segment consists of the following businesses:

Bioprocessing—The bioprocessing business is a leading provider of technologies, consumables, services and solutions that advance, accelerate and integrate the development and manufacture of therapeutics. These therapeutics include protein-based and other biological therapies as well as a new emerging class of highly-targeted therapies such as cell and gene therapies, nucleic acid-based therapies, and others requiring viral vectors and lipid nanoparticles in their manufacture.

The business offers tools, solutions and services to support biomanufacturers across their workflows from the earliest stages of process development to large scale commercial and turn-key manufacturing. The bioprocessing business’ offering includes cell line and cell culture media development services; cell culture media, process liquids and buffers for manufacturing, chromatography resins, filtration technologies, aseptic fill finish, as well as single-use hardware and consumables and services such as the design and installation of full manufacturing suites. The bioprocessing business’ offering in data connectivity and automation, advanced process training, process development services and equipment services for maintaining continuous performance, all help to ensure customers’ processes are optimized and compliant. Typical users of these products and services include pharmaceutical and biopharmaceutical companies, translational medicine institutions, biotechnology companies and contract manufacturing organizations.