As filed with the Securities and Exchange Commission on February 20, 2024

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares - par value | PHG | New York Stock Exchange | ||

| Euro (EUR) 0.20 per share |

None

(Title of class)Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.None

(Title of class)Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

| Class | Outstanding at December 31, 2023 | |

| KONINKLIJKE PHILIPS NV | 906,403,156 shares | |

| Common Shares par value EUR 0.20 per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer," "accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the

effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

This document contains information required for the Annual Report on Form 20-F for the year ended December 31, 2023 of Koninklijke Philips N.V. (the 2023 Form 20-F). Reference is made to the Form 20-F cross reference table herein. Only (i) the information in this document that is referenced in the Form 20-F cross reference table, (ii) this introduction and the cautionary statement “forward-looking statements” on the next two pages and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. Any additional information in this document which is not referenced in the Form 20-F cross reference table, or the Exhibits themselves, shall not be deemed to be so incorporated by reference, shall not be part of the 2023 Form 20-F and is furnished to the Securities and Exchange Commission for information only.

References to PhilipsReferences to the Company or company, to Philips or the (Philips) Group or group, relate to Koninklijke Philips N.V. and its subsidiaries, as the context requires. Royal Philips refers to Koninklijke Philips N.V.

IFRS based informationThe audited consolidated financial statements as of December 31, 2023 and 2022, and for each of the years in the three-year period ended December 31, 2023, included in the 2023 Form 20-F have been prepared in accordance with International Financial Reporting Standards (IFRS) as endorsed by the European Union (EU). All standards and interpretations issued by the International Accounting Standards Board (IASB) and the IFRS Interpretations Committee effective 2023 have been endorsed by the EU; consequently, the accounting policies applied by Philips also comply with IFRS as issued by the IASB. These accounting policies have been applied by group entities.

Use of non-IFRS informationIn presenting and discussing the Philips financial position, operating results and cash flows, management uses certain financial measures that are not measures of financial performance or liquidity under IFRS (‘non-IFRS’). These non-IFRS measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Reference is made in Reconciliation of non-IFRS information.

Third-party market share dataStatements regarding market share, contained in this document, including those regarding Philips’ competitive position, are based on outside sources such as specialized research institutes, industry and dealer panels in combination with management estimates. Where full year information regarding 2023 is not yet available to Philips, market share statements may also be based on estimates and projections prepared by management and/or based on outside sources of information. Management's estimates of rankings are based on order intake or sales, depending on the business.

Documents on displayPhilips’ SEC filings are publicly available through the SEC’s website at www.sec.gov. The SEC website contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Philips’ internet address is www.philips.com/investor. The contents of any websites referred to herein shall not be considered a part of or incorporated by reference into this document.

For definitions and abbreviations reference is made in Definitions and abbreviations

Due to rounding, amounts may not add up precisely to the totals provided in this report.

Pursuant to provisions of the United States Private Securities Litigation Reform Act of 1995, Philips is providing the following cautionary statement.

This document, including the information referred to in the Form 20-F cross reference table, contains certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items, in particular, among other statements, certain statements in Item 4 “Information on the Company” with regard to management objectives, market trends, market standing, product volumes, business risks, the statements in Item 5 “Operating and financial review and prospects” with regards to trends in results of operations, margins overall, market trends, risk management, exchange rates, the statements in Item 8 “Financial Information” relating to legal proceedings and goodwill and statements in Item 11 “Quantitative and qualitative disclosure about market risks” relating to risk caused by derivative positions, interest rate fluctuations and other financial exposure are forward-looking in nature. Forward-looking statements can be identified generally as those containing words such as “anticipates”, “assumes”, “believes”, “estimates”, “expects”, “should”, “will”, “will likely result”, “forecast”, “outlook”, “projects”, “may” or similar expressions. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

These factors include but are not limited to: Philips’ ability to gain leadership in health informatics in response to developments in the health technology industry; Philips’ ability to keep pace with the changing health technology environment; macroeconomic and geopolitical changes; integration of acquisitions and their delivery on business plans and value creation expectations; securing and maintaining Philips’ intellectual property rights, and unauthorized use of third-party intellectual property rights; ability to meet expectations with respect to ESG-related matters; failure of products and services to meet quality or security standards, adversely affecting patient safety and customer operations; breach of cybersecurity; challenges in simplifying our organization and our ways of working; the resilience of our supply chain; attracting and retaining personnel; challenges in driving operational excellence and speed in bringing innovations to market; compliance with regulations and standards including quality, product safety and (cyber) security; compliance with business conduct rules and regulations including privacy and upcoming ESG disclosure and due diligence requirements; treasury and financing risks; tax risks; reliability of internal controls, financial reporting and management process; global inflation.

As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, reference is made to the information in Risk factors.

Only (i) the information in this document that is referenced in the Form 20-F cross reference table, (ii) the Introduction and the cautionary statements concerning forward-looking statements of this report on pages 6-7, and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. The content of Philips’ websites and other websites referenced herein should not be considered to be a part of or incorporated into the 2023 Form 20-F. Any additional information which is not referenced in the Form 20-F cross reference table or the Exhibits themselves shall not be deemed to be so incorporated by reference, shall not be part of the 2023 Form 20-F and is furnished to the Securities and Exchange Commission for information only.

The table below sets out the location in this document of the information required by SEC Form 20-F. The exact location is included in the column ‘Location in this document’. The page number refers to the starting page of the section for reference only (and is not intended to refer to the starting page of the specific subsection, if applicable).

The challenges of a world in turmoil amplify the sense of urgency I feel to make sure Philips delivers on its purpose and becomes an even stronger force for good, so people everywhere can look after their health and well-being and access the care they need, with us focusing on where we can help, from the hospital to the home.

In January 2023, we announced our multi-year plan to create value with sustainable impact. Throughout the year, Philips teams around the world worked relentlessly, in a volatile environment, to deliver on the first phase of that plan, laying a strong foundation for sustained future success.

Our products and services reached 1.9 billion people in 2023, including 221 million in underserved communities – taking us closer to our goal of improving 2.5 billion lives per year by 2030, including 400 million in underserved communities.

Our improved operational performance was driven by significant progress on the three pillars of our plan to create value for all our stakeholders: 1) focused organic growth; 2) scalable people- and patient-centric innovation; and 3) focus on execution to enhance patient safety and quality, strengthen our supply chain reliability, and establish a simplified, agile operating model.

We achieved our raised 2023 outlook with strong sales growth, improved profitability, and strong cash flow, despite the uncertainties brought about by an increasingly turbulent geopolitical environment. While the order book remains strong in absolute terms, order intake was down, for which the necessary improvement actions are under way. There is still a lot of work to be done, but 2023 represents a good start, and it reinforces our confidence in delivering on our three-year plan.

Patient safety and qualityResolving the consequences of the Respironics recall for our patients and customers is a key focus area, and I apologize for the distress caused. Globally, over 99% of the sleep therapy device registrations that are complete and actionable have been remediated, while the remediation of the ventilator devices remains ongoing.

We are fully committed to complying with the terms of the consent decree agreed with the US Department of Justice (DOJ), representing the US Food and Drug Administration (FDA), which primarily focuses on Philips Respironics in the US. The proposed consent decree will provide Philips Respironics with a roadmap of defined actions, milestones, and deliverables to demonstrate compliance with regulatory requirements and to restore the business. Further details will become available once the consent decree has been finalized and submitted to the relevant US court for approval.

As well as implementing all measures agreed with the FDA and DOJ in connection with the Respironics recall, we will continue to rebuild relations with the FDA and other national regulators. In October, Philips Respironics received preliminary court approval for the class action settlement that would resolve all or nearly all private economic loss claims in the US related to the recall. The settlement does not include or constitute any admission of liability, wrongdoing, or fault by any of the Philips parties. The previously disclosed litigation, including the personal injury and medical monitoring claims, and investigation by the DOJ related to the Respironics recall are ongoing.

Driving progress on prioritiesWith patient safety and quality the number one priority, oversight now resides at Executive Committee level, and we have a new organization in place, with stronger processes and more effective early warning systems in the businesses. We are pro-actively addressing quality improvements and first-time-right design. One of the most inspiring events of the year took place in October – a company-wide Timeout for Patient Safety and Quality. All 70,000 employees came together in their teams to discuss how we are moving forward on patient safety and quality, and how to take it further.

In our drive to create more reliable and resilient supply chains, we have significantly reduced our high-risk components and our inventories, and the actions we have taken continued to have a positive impact on our sales and service levels. We continue to strengthen further through regionalization of the supply base and manufacturing capability to better respond to local requirements with a shorter value chain.

We also started the shift to our new, simplified operating model – with end-to-end businesses supported by a leaner enterprise layer, strong regions and a reinvigorated impact culture – and completed the realignment of workforce roles and reporting lines. This included the difficult but necessary reduction of approximately 8,000 roles to date, out of the planned reduction of 10,000 roles by 2025.

Reflecting our changing culture of people- and patient-centricity, accountability and impact, our Executive Committee was strengthened with the arrival of four new members in 2023, each bringing valuable experience and skills to the work of our leadership team. We also welcome the decision by Exor to take a 15% minority stake in our company – a sign of confidence in our plan, our people, and our future. And we marked the 100th anniversary of Philips in China, a remarkable achievement.

The opportunity to deliver better care for more peopleToday, millions of people around the world have little or no access to basic healthcare, and climate change is impacting both environmental and human health. Healthcare is simply not working as it needs to. There are not enough doctors and nurses to address the growing demand for care. In parallel, rising costs are stretching financial budgets to the limit.

That’s why we are advocating for systemic change, driven by all ecosystem players, that addresses technology, clinical practice, financing and regulation as a whole. Change that delivers better, more productive healthcare that works for everyone. Without this change, communities all around the world will increasingly face challenges to get the care they need.

Focusing our efforts on where we can make a difference, we want to help more healthcare providers help more patients, in a sustainable way, and empower more people to take care of their health and well-being – by applying our combined capabilities in innovation, design and sustainability.

There is a lot of work to be done, but we see the potential for a future where health systems run smoothly, efficiently and sustainably, with doctors and nurses seeing the patient at the right time and at the right point of care. Where they can be confident that the right choice is also the easy choice, with simpler workflows enabling them to give patients the best care and best experience.

With real-time and predictive insights supporting collaboration across the patient journey. And AI being used in a responsible manner to optimize workflows and improve efficiency, so that clinical staff get the time and space to focus on what matters and what they do best: caring for their patients.

We see a future where it is also easier for people everywhere to look after their health and well-being. For example, with solutions helping more parents and babies in the first 1,000 days and supporting the connection between good oral care and good overall health.

Recognizing that human health and environmental health go hand in hand, we are collaborating with our customers and suppliers to decarbonize healthcare and so create a more sustainable and resilient industry.

Looking aheadWhile realistic about the challenging economic environment, geopolitical risks, and uncertainties around ongoing litigation, I am confident we will continue to deliver on our multi-year plan to create value with sustainable impact – helping consumers lead healthy lives and healthcare providers deliver efficient, high-quality care to patients in a sustainable way. Based on our ongoing actions to enhance execution – driving patient safety and quality, increasing supply chain reliability, and further simplifying how we work – we expect further performance improvement in 2024.

Against this background, and reflecting the importance we attach to dividend stability, we propose to maintain the dividend at EUR 0.85 per share, to be distributed fully in shares.

On behalf of the Executive Committee, I would like to thank our consumers, our customers and their patients, our suppliers and ecosystem partners for their support, and the Supervisory Board for their support and guidance. I also want to express my deep gratitude to our employees for their dedication to improving people’s lives and our company’s performance, and to our shareholders and other stakeholders for their continued support.

As I look ahead, I am realistic about the challenges we face, optimistic about building on the momentum we have created, and excited about delivering on our purpose – for the benefit of patients, customers and consumers the world over.

Roy Jakobs

Chief Executive Officer

Royal Philips has a two-tier board structure consisting of a Board of Management and a Supervisory Board, each of which is accountable to the General Meeting of Shareholders for the fulfillment of its respective duties. The Board of Management is entrusted with the management of the company. The other members of the Executive Committee have been appointed to support the Board of Management in the fulfilment of its managerial duties. Please also refer to Board of Management and Executive Committee within the chapter Corporate governance.

Members of the Board of ManagementRoy Jakobs joined Philips in 2010 and has held various global leadership positions across the company, starting as Chief Marketing & Strategy Officer for Philips Lighting. In 2012, he became Market Leader for Philips Middle East & Turkey, leading the Healthcare, Consumer, and Lighting businesses out of Dubai. Subsequently, he became Business Leader of Domestic Appliances, based in Shanghai, in 2015. In 2018, Roy joined the Executive Committee as Chief Business Leader of the Personal Health businesses and in early 2020 he started as Chief Business Leader of Connected Care. Prior to his career at Philips, he held various management positions at Royal Dutch Shell and Reed Elsevier.

Born 1961, Indian

Executive Vice President

Member of the Board of Management (since December 2015)

Chief Financial Officer

Abhijit Bhattacharya first joined Philips in 1987 and has held multiple senior leadership positions across various businesses and functions in Europe, Asia Pacific and the US. Between 2010 – 2014, he was the Head of Investor Relations of Philips, and subsequently, CFO of Philips Healthcare, Philips’ largest sector at the time. Prior to 2010, Abhijit was Head of Operations & Quality at ST-Ericsson, the joint venture of ST Microelectronics and Ericsson, and he was CFO of NXP’s largest business group.

Born 1973, Dutch

Executive Vice President

Member of the Board of Management (since November 2017)

Chief ESG & Legal Officer

Marnix van Ginneken joined Philips in 2007 and became Head of Group Legal in 2010. In 2014, Marnix became Chief Legal Officer of Royal Philips and Member of the Executive Committee. In 2017 he was appointed to the Board of Management. He is responsible for driving ESG efforts across the company, including Sustainability. He is also responsible for Legal, Intellectual Property & Standards and Government & Public affairs. Since January 1, 2024 he is Chairman of the Board of the Philips Foundation. In 2011, he was appointed Professor of International Corporate Governance at the Erasmus School of Law in Rotterdam. Before joining Philips, Marnix worked for Akzo Nobel and as an attorney in a private practice.

This page reflects the composition of the Executive Committee as per December 31, 2023. For a current overview of the Executive Committee members, see also https://www.philips.com/a-w/about/executive-committee.html 6.1Our strategic focus Today, most healthcare systems are struggling to keep up with the ever-rising need for, and cost of, healthcare, while systemic staff shortages and financial resource constraints increase the pressure.

The overview below is based on the International Integrated Reporting Council framework and includes resource inputs, value outcomes and societal impact across various financial and Environmental, Social and Governance (ESG) dimensions.

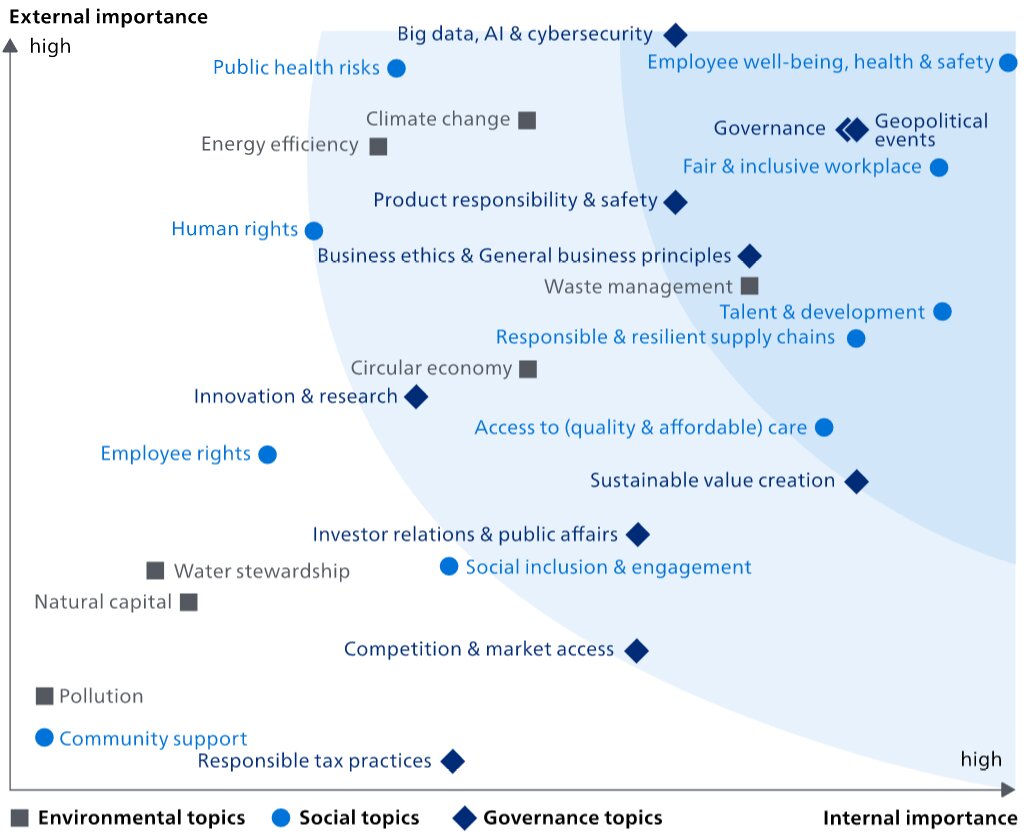

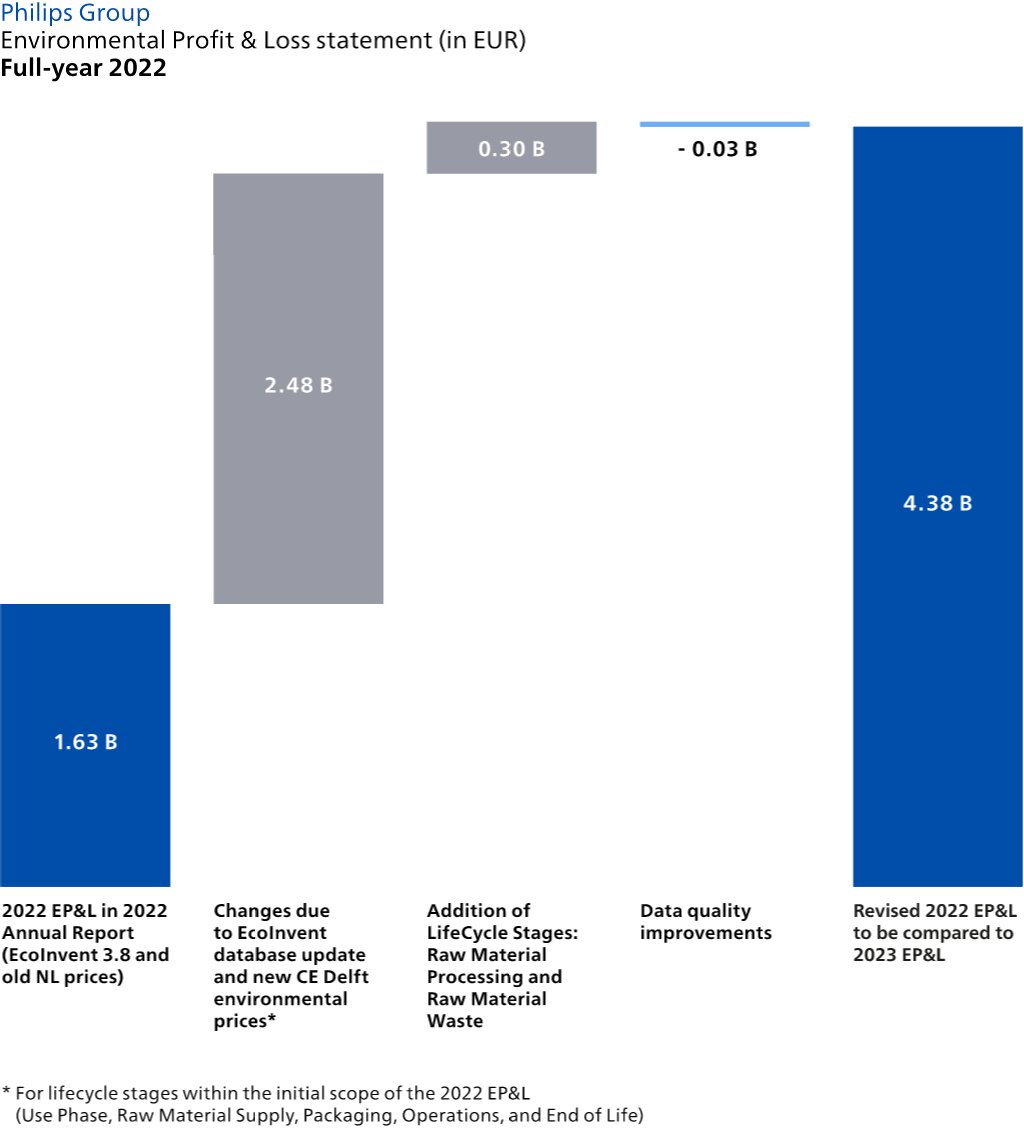

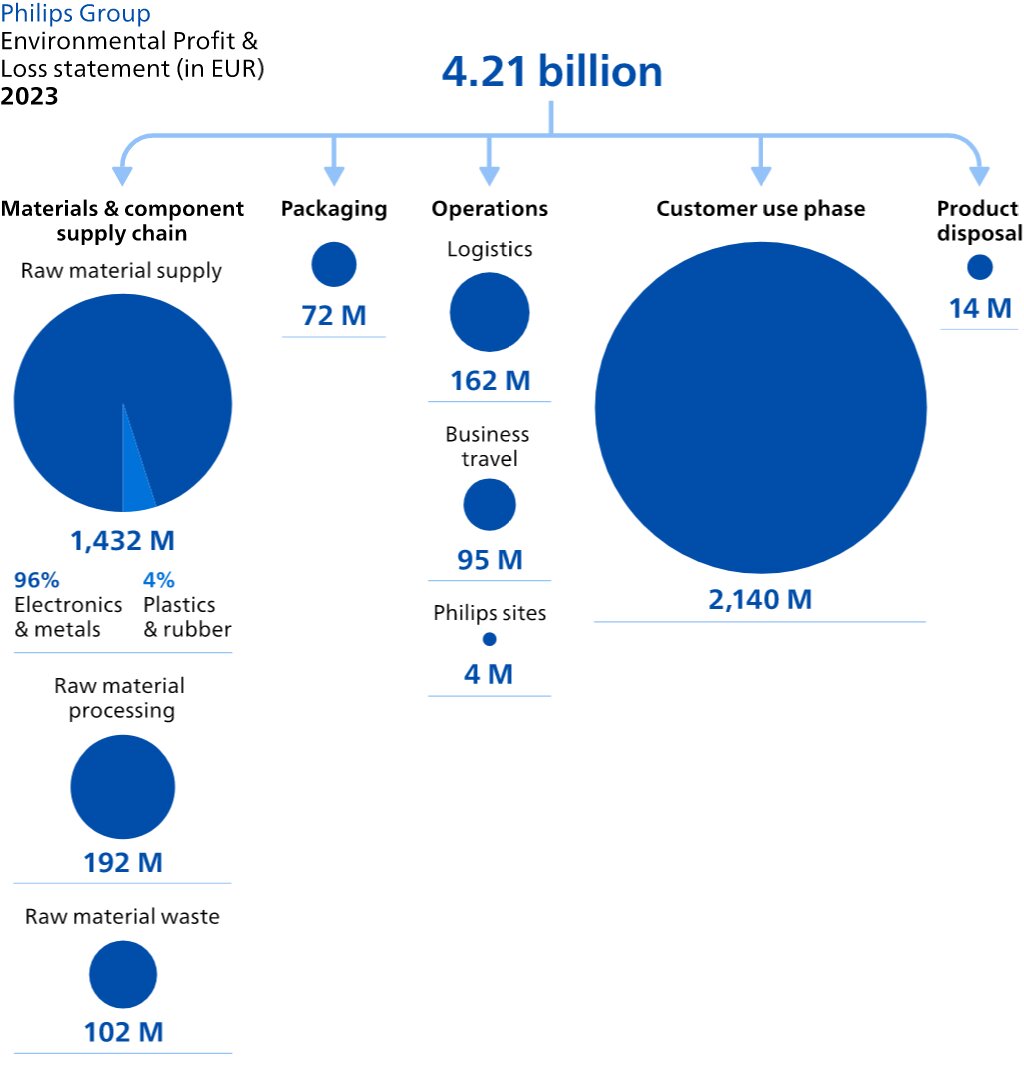

We identify the Environmental, Social and Governance topics which we believe have the greatest impact on our business and the greatest level of concern to stakeholders along our value chain, for instance patient safety and quality. We do this through a multi-stakeholder process. Please refer to Working with stakeholders and advocacy for more information. Assessing these topics enables us to prioritize and focus upon the most material topics and effectively address these in our policies, programs, targets and actions. We do this with reference to the GRI standard and identify and assess impacts on an ongoing basis, for example through discussions with our customers, suppliers, investors, employees, peer companies, social partners, regulators, NGOs, and academics. We also conduct a benchmark exercise, carry out trend analysis and run media searches to provide input for our materiality analysis. GRI has not yet published a sector standard for the healthcare industry. Philips’ impact on society at large is covered through our Lives Improved metric and the Environmental Profit & Loss account, as well as a number of other KPIs addressed in Environmental, Social and Governance. The result of our impact materiality assessment you will find below.

Similar to 2022, we used an evidence-based approach to materiality assessment, powered by a third-party AI-based application. The application allows automated sifting and analysis of millions of data points from publicly available sources, including corporate reports, mandatory regulations and voluntary initiatives, as well as news. With this data-driven approach to materiality assessment we have incorporated a wider range of data and stakeholders than was ever possible before and managed to get an evidence-based perspective on regulatory, strategic and reputational risks and opportunities. Topics were prioritized through a survey sent to a large and diverse set of internal and external stakeholders, combined with input from the application.

Changes in 2023On both external and internal importance axis, the most significant increases compared to 2022 were Waste management and Social inclusion & engagement. Innovation & research went down on both axes. On the internal importance axis, there was a significant decrease on Pollution.

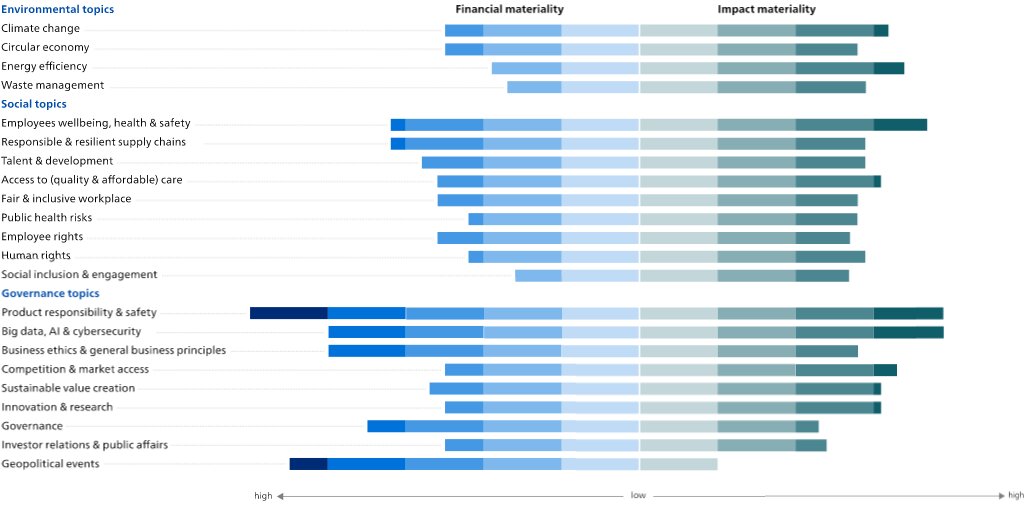

Double materialityAfter completing the regular impact materiality assessment, we completed a preliminary 'double materiality' assessment, in preparation for the upcoming requirements of the EU Corporate Sustainability Reporting Directive (CSRD). The double materiality assessment addresses both financial materiality (the impact of society on Philips) as well as impact materiality (the impact of Philips on society): we only included the high and medium material topics from impact materiality and/or financial materiality. The data sources used for the financial materiality include corporate reports, mandatory regulations with sanctions, voluntary initiatives by e.g. central banks, and Sustainability Accounting Standards Board (SASB) accounting metrics. For impact materiality, we included sustainability data from corporate reports or sustainability reports, coverage in the news and voluntary initiatives and regulation. We calibrated the financial and impact materiality with a team of internal experts from Enterprise Risk Management, Group Control, Internal Audit, Insurance and Risk Management and Sustainability and aligned with our Enterprise Risk Management assessment. After this calibration the financial impact of Product responsibility & safety, Geopolitical events, and Big data, AI & Cybersecurity were increased. The results of the double materiality analysis are depicted below.

From the financial materiality assessment, the topics that ranked highest were: (1) Product responsibility & safety, (2) Geopolitical events, and (3) Big data, AI & Cybersecurity, as well as Business ethics & General business principles.

From the impact materiality assessment, the topics that ranked the highest were: (1) from the Environmental topics, Climate change, and Energy efficiency; (2) from the Social topics, Employee well-being, health & safety, and Access to (quality & affordable) care; and (3) from the Governance topics, Big data, AI & Cybersecurity, and Competition & market access. These topics are all covered in more detail in the Annual Report 2023 and monitored regularly.

The outcome of the double materiality assessment did not result in any significant changes in the material topics identified from impact materiality.

The results of our materiality assessment have been reviewed and approved by the Philips Board of Management and will be used to prepare for the upcoming EU legislation.

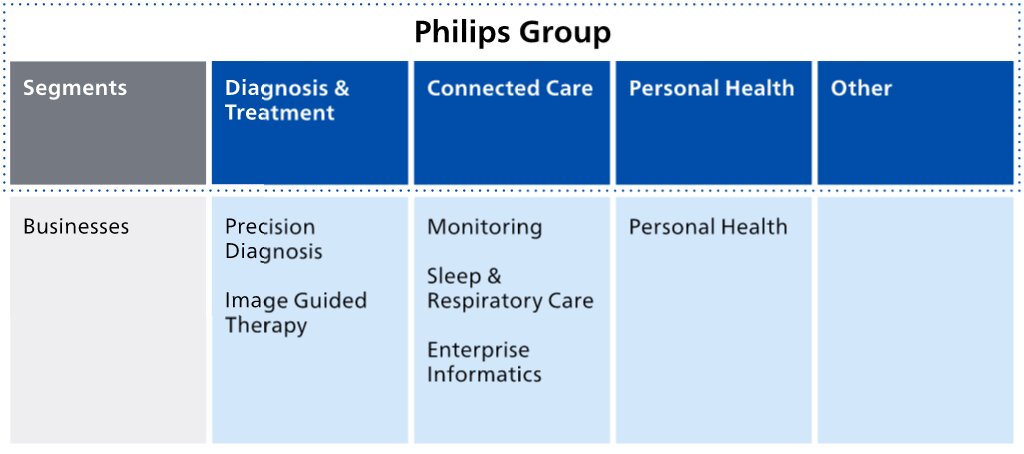

Koninklijke Philips N.V. (Royal Philips) is the parent company of the Philips Group. As announced on January 30, 2023, Philips has changed its operating model to end-to-end businesses with single accountability in order to make the company more agile in its drive to create value with sustainable impact. The segments Diagnosis & Treatment, Connected Care and Personal Health are each responsible for the management of their business activity worldwide, and are made up of the six businesses shown below. Additionally, Royal Philips identifies the segment Other.

Philips Group

Total sales by reportable segment

| 2023 | |

|---|---|

| Diagnosis & Treatment | 49% |

| Connected Care | 28% |

| Personal Health | 20% |

| Other | 3% |

Our Diagnosis & Treatment businesses create value through their portfolio of innovative AI-enabled solutions that support precision diagnosis and minimally invasive treatment in therapeutic areas such as cardiology, peripheral vascular, neurology, surgery, and oncology. With these solutions, we enable our customers to realize better health outcomes, improved patient and staff experience, and lower cost of care.

Serving diagnostic imaging markets globally, our goal is to improve customer performance in the radiology/imaging workflow. We see significant opportunity to enable precision diagnosis while at the same time supporting adjacent needs for care orchestration across care pathways and increasing departmental productivity. We do this through smart diagnostic systems, connected workflow solutions, and integrated AI-supported diagnostics and pathway informatics. These drive enterprise-wide operational efficiency and help clinicians to provide an early and definitive diagnosis, enabling them to select tailored care pathways with predictable outcomes for every patient, both inside and outside the hospital.

We also provide integrated solutions combining imaging systems, diagnostic monitoring data and therapeutic devices, which optimize interventional procedures to deliver more effective treatment, better outcomes and higher productivity. Building upon our leading-edge Azurion system, we continue to innovate, optimizing clinical and operational lab performance through advances in workflow and integration for routine procedures, and expanding the role of image-guided interventions to treat new groups of patients such as those with complex diseases including various cardiovascular conditions, stroke and lung cancer. We are also innovating the way we engage with our customers, using new business models across different care settings, including out-of-hospital settings such as office-based labs and ambulatory surgical centers, which offer clear clinical, financial and operational benefits.

In 2023, the Diagnosis & Treatment segment consisted of the following businesses:

Diagnosis & Treatment

Total sales by business

| 2023 | |

|---|---|

| Precision Diagnosis 1) | 61% |

| Image Guided Therapy | 39% |

Revenue is predominantly earned through the sale of products, leasing, customer services fees, recurring per-procedure fees for disposable devices, and software license fees. For certain offerings, per-study fees or outcome-based fees are earned over the contract term.

Sales channels are a mix of a direct sales force, especially in the larger markets, third-party distributors and an online sales portal. This varies by product, market and price segment. Our sales organizations have an intimate knowledge of technologies and clinical applications, as well as the solutions necessary to solve problems for our customers.

Sales at Philips’ Diagnosis & Treatment businesses are generally higher in the second half of the year, largely due to the timing of customer spending patterns.

At year-end 2023, Diagnosis & Treatment had 28,397 employees worldwide.

At RSNA23, Philips announced a raft of new innovations, including next-generation EPIQ Elite 10.0 and Affiniti ultrasound systems that increase diagnostic confidence and workflow efficiency, BlueSeal MRI Mobile, the world’s first and only mobile MRI system with helium-free operations, and new AI-enabled cloud solutions that enhance radiology efficiency and clinical confidence.

Philips launched its new MR 7700 3.0T system, which features an enhanced gradient system designed to deliver outstanding imaging results and speed to support confident diagnosis for every patient.

Five top hospitals in Shanghai, with a total of more than 10,000 beds, installed Philips’ advanced Spectral CT 7500 imaging system, helping physicians deliver first-time-right diagnosis through fast, low-dose X-ray scans.

Philips further expanded its ultrasound portfolio with the launch of the Ultrasound Compact 5500 CV, which delivers cart-based premium image quality in ultrasound exams for cardiology and vascular patients at the bedside.

Philips IntraSight Mobile received approval from the Chinese regulatory authority, paving the way for its commercial introduction in the Chinese market. IntraSight Mobile combines imaging and physiology applications on a mobile system for peripheral and coronary artery disease therapy.

Philips expanded its image-guided therapy portfolio with the launch of Philips Zenition 10, which provides a cost-effective imaging solution to guide high-volume routine surgery, as well as complex orthopedic and trauma procedures. Philips also launched the Zenition 30 Image Guided Therapy Mobile C-arm. Its workflow-enhancing features and excellent image quality enable surgeons to deliver enhanced care to more patients, helping alleviate the staff shortages faced by many hospitals.

Through the WE-TRUST study, Philips is driving innovation in stroke treatment. The trial examines the impact of the direct-to-angio treatment pathway on clinical outcomes, facilitated by a helical scan in the angio suite developed by Philips to reduce time to treatment. With 16 leading stroke centers and hospitals around the world involved in the trial and 100 patients enrolled, the WE-TRUST study has already achieved the scale and momentum needed to deliver a reliable evidence base on the potential benefits of the Direct to Angio Suite pathway for patients suspected of having a large vessel occlusion (LVO) ischemic stroke – a treatment pathway that focuses squarely on addressing the fact that the faster a patient is treated, the more likely they are to recover. Another significant milestone was the publication of health economics analysis results in the Journal of NeuroInterventional Surgery, demonstrating that this new stroke care pathway can save over USD 3,000 per patient.

With technology constantly advancing and becoming increasingly pervasive in healthcare, the Connected Care businesses aim to connect and elevate care for all. Philips connects patients and caregivers across care settings, delivering clinical, operational and therapeutic solutions that help our customers deliver better health outcomes, improve the patient and staff experience, and lower the cost of care across care settings. In 2023, the global economic situation continued to put additional pressure on customer budgets and worsened trends such as staff shortages, as well as increasing the need for solutions that enable more effective, sustainable and convenient care in hospital, clinics and the home – especially enabled by strong informatics and AI.

The Sleep & Respiratory Care business in particular continued to face multiple operational and regulatory challenges in 2023, but action has been taken to improve the ability of the Sleep & Respiratory Care organization to correctly assess potential patient safety or quality issues. Philips has reaffirmed its core activities, which put patient safety front and center in everything we do, and we believe that the implementation of a new simplified organization, which for Sleep & Respiratory Care began in 2022, will help to achieve this, as well as to improve productivity and increase agility. In the course of the year, Sleep & Respiratory Care gradually returned to the market for sleep therapy devices outside the US. For information about the Respironics recall and related remediation effort, please refer to Quality & Regulatory and patient safety.

With clinical depth and discovery, Philips Connected Care technologies help to cultivate a more accurate and complete view of the patient that drives better health and care. The combination of advanced technological solutions and a co-creation approach allows Philips to be an effective partner to its customers in their digital transformation, both across the enterprise and at the level of the individual clinician, nurse and patient. We help our customers to unlock actionable insights from pools of medical imaging data, patient monitoring data, and through the use of advanced AI, to improve outcomes and drive productivity.

Philips’ open, interoperable platforms aggregate and leverage information from clinical devices, patient and historical data to support care providers in patient engagement, diagnostics, and patient monitoring in the hospital, ambulatory and home settings.

In 2023, the Connected Care segment consisted of the following businesses:

Connected Care

Total sales by business

| 2023 | |

|---|---|

| Monitoring | 60% |

| Sleep & Respiratory Care | 17% |

| Enterprise Informatics | 23% |

In most of the Connected Care businesses, revenue is earned through the sale of products and solutions, as well as services and software licenses. Where bundled offerings result in solutions for our customers, or offerings are based on the number of people being monitored, we see more usage-based earnings models. In the area of patient care management (Ambulatory Monitoring & Diagnostics business unit and Sleep & Respiratory Care business), revenue is generated through clinical services, product sales and through rental models, whereby revenue is generated over time.

Sales channels include a mix of a direct sales force, partly paired with an online sales portal and distributors (varying by product, market and price segment). Sales are mostly driven by a direct sales force with an intimate knowledge of clinical settings and patient-specific diagnosis and treatment. Philips collaborates with customers and partners to co-create solutions, drive commercial innovation and adapt to new models such as monitoring-as-a-service and software-as-a-service.

Sales at Philips’ Connected Care businesses are generally higher in the second half of the year, largely due to customer spending patterns. However, the Philips Respironics voluntary recall notification in the Sleep & Respiratory Care business in June 2021 (as further discussed in Quality & Regulatory and patient safety) continued to have a negative impact on sales throughout 2023.

At year-end 2023, Connected Care had 17,549 employees worldwide.

Philips signed a 10-year, EUR 100 million Enterprise Monitoring as a Service agreement with one of the largest health systems in the US, covering 20 hospitals with over 3,000 beds. The agreement provides the health system with constant access to the latest technology, including software and services, while lowering initial investments.

Philips and NYU Langone Health announced an 8-year strategic partnership valued up to USD 115 million and aimed at enhancing patient care through further innovation. The partnership includes digital pathology, clinical informatics, and innovative AI-enabled diagnostics, with an Enterprise Monitoring as a Service model. With these new technologies, NYU Langone clinicians can collaborate in real time, sharing pathology, imaging studies or patient data to support diagnostic confidence and tailor individualized care plans.

Highlighting the strength of its comprehensive patient monitoring offering, Philips announced a multi-year partnership with Northwell Health to standardize and centralize patient monitoring across the hospital, allowing caregivers to see what is happening at each bedside.

Philips announced new interoperability capabilities that offer a comprehensive view of patient health for improved monitoring and care coordination. This is realized through the interoperability of Philips Capsule Medical Device Information Platform (MDIP) with Philips Patient Information Center iX (PIC iX) with streaming, vendor-neutral data that supports care delivery and collaboration.

Philips introduced the cloud-based Philips HealthSuite Imaging PACS on Amazon Web Services. This cloud-based enterprise imaging solution, which includes advanced AI-enabled applications, has been designed to enhance image access speed, reliability, and data orchestration for clinicians across the imaging workflow, while reducing costs for healthcare organizations.

Philips launched its ambulatory monitoring offering in Japan, combining Philips ePatch Holter monitors with ECG analysis through AI and advanced algorithms. This innovative approach aims to reduce clinician workload and improve the patient experience.

Our Personal Health business plays an important role in enabling healthy individual care routines with technology and solutions that support people’s long-term health and well-being.

We aim to drive profitable growth through a focus on innovation across three key areas:

The Personal Health segment consists of the Personal Health business, which comprises the following business units:

Personal Health

Total sales by business

| 2023 | |

|---|---|

| Personal Health 1) | 100% |

Through our Personal Health business, we offer a broad range of solutions in various consumer price segments to support people in proactively managing their health and well-being. Depending on the market, we offer an additional portfolio of locally relevant innovations and adjust our range to increase accessibility. A notable aspect of our commercial strategy is driving increased direct-to-consumer relationships and sales through our consumer communities and online store. About half of our Personal Health sales worldwide now take place online.

We are leveraging connectivity to offer new business models, partnering with other players in the health ecosystem, e.g. insurance companies and healthcare professionals, with the goal of extending opportunities for people to live healthily and prevent or manage disease. We are engaging consumers in their health journey in new and impactful ways through social media and digital innovation.

In Personal Health, improving lives also means caring for the world, with a key focus on environmental sustainability. For example, in 2023 we launched an initiative in Germany, Philips Refurb Editions, to give products a second life, with the same two-year guarantee as a new product. This is part of Personal Health’s commitment to driving a more circular economy, and we believe we need to keep finding innovative ways to support consumers with greater choices to live sustainably.

We also offer mobile solutions to support parents and parents-to-be for a more informed, more connected and healthier journey to parenthood. The Pregnancy+ app and Baby+ app offer parents supportive content at every stage of their first 1,000-day journey. Pregnancy+ also offers state-of-the-art, photo-realistic and interactive 3D fetal models to make the experience even more exciting, with new, personalized content for each day of the pregnancy. The Philips Pregnancy+ app was ranked among the best pregnancy apps of 2023 by Forbes*). It has more than 1.5 million daily active users and is available in 22 languages.

The revenue model is mainly based on product sale at the point in time the products are delivered to retailers and online platforms. We continue to increase revenue model diversity by expanding our new business models, including direct-to-consumer, subscriptions, try-and-buy offerings and services.

The Personal Health business experiences seasonality, with higher sales around key national and international events and holidays.

At year-end 2023, Personal Health employed 9,085 people worldwide.

Philips successfully launched the Sonicare DiamondClean 7900 Series electric toothbrush in China on major online shopping channels Alibaba and JD.com. Highlighting increasing customer demand, it claimed the number-one position in the high-end toothbrush category on Alibaba’s Tmall.

In partnership with JD.com, Philips launched the premium 7 Series Shaver in China, debuting as the #1 shaver on this major online shopping channel. Additionally, Philips’ DiamondClean 9000 premium electric toothbrush has become the best-selling high-end oral healthcare product on Alibaba.

To improve oral care habits among children, Philips introduced Sonicare for Kids 'Design a Pet Edition' with an entry price point designed to give more parents access to an electric toothbrush for their children.

Philips OneBlade packaging was named the 2023 Red Dot Communication Design Best of the Best in recognition of its paper-based model, illustrating how the use of less material, fewer parts, and less volume can go hand in hand with iconic presence and the best user experience.

Philips launched its 'Better than New' campaign in Germany, repositioning refurbished innovations and underscoring the company's commitment to circularity and sustainability. The campaign led to a significant year-on-year increase in sales revenue of refurbished Lumea and refurbished shaving products.

Philips announced Babybell Maternal & Child Supplies as the exclusive distributor for Philips Avent OneFeeding in China; the partnership aims to accelerate growth of the Philips Avent brand in the Chinese maternal health industry. The partnership combines the power of Philips’ latest innovations with Babybell's rich understanding of the local market and robust retail network to deliver on a faster innovation pace and expand market share.

In our external reporting on Other we report on the items Innovation & Strategy, IP Royalties, Central costs, and other small items. At year-end 2023, 14,626 people worldwide were working in these areas.

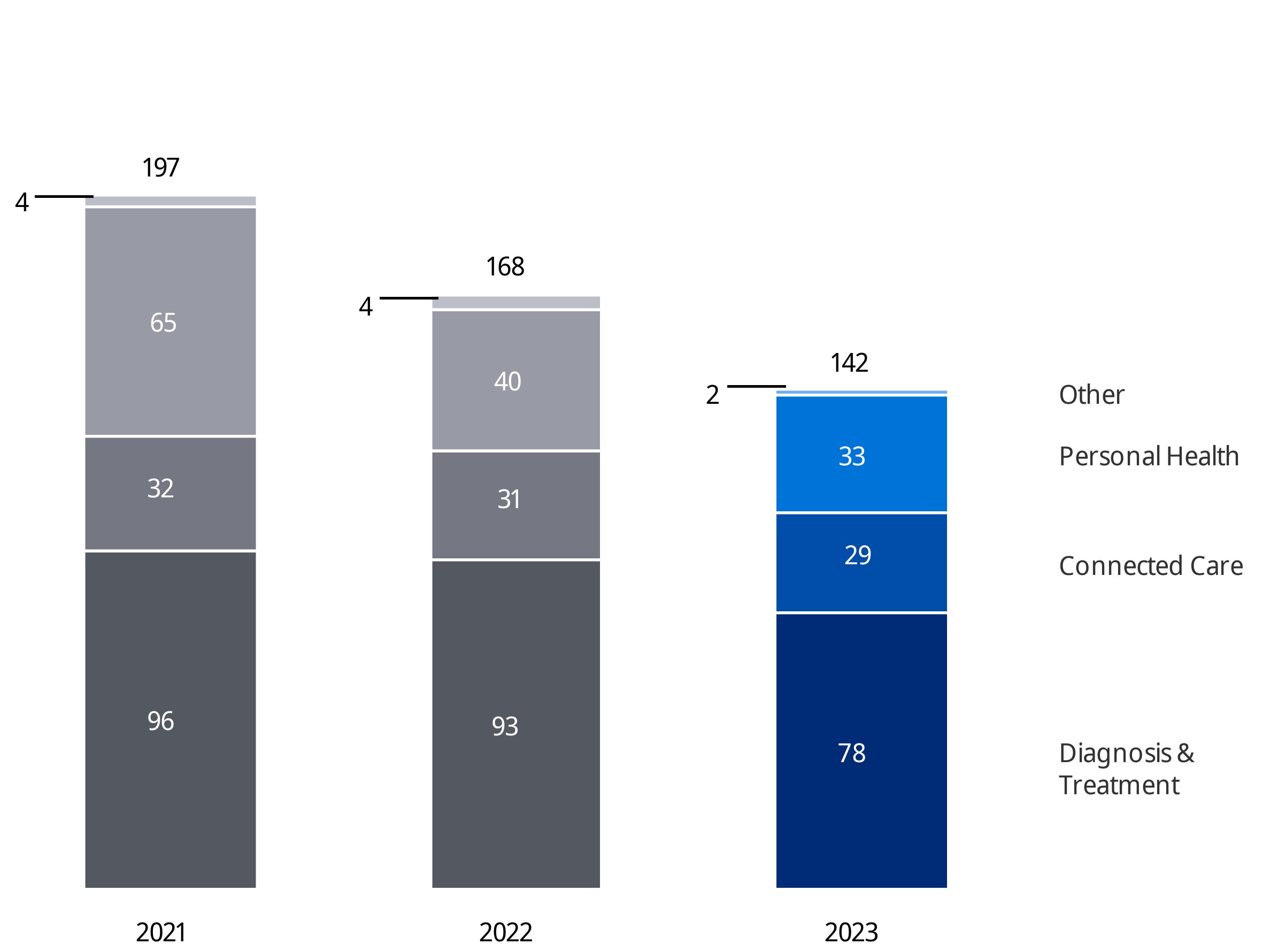

At Philips, we have set up our innovation teams to be as close to our customers and consumers as possible. The majority of our Research & Development (R&D) experts work in one of our business units, which allows them to directly hear customer and consumer needs and work closely with other stakeholders to turn innovations into actual products. Innovation at Philips is organized to encourage innovation anywhere along the value chain and not just at the product ideation stage.

The remaining R&D experts are part of our central Innovation & Strategy organization. The main job of these experts is to focus on industry-shifting ideas that advance a core product to fulfill the needs of a broad new customer segment. Innovation & Strategy focuses on enabling and accelerating innovation across our business units in different ways:

Strategy supports the business units in shaping their strategy to create a competitive advantage. The Enterprise Strategy team focuses on overall corporate strategy, and the Market Analysis & Forecasting team analyzes customer segments and market growth trends. Strategy also partners closely with the Mergers & Acquisitions and Finance teams to ensure our M&A activity is aligned with the business units and our enterprise strategic direction.

Research helps to define the future of healthcare by unlocking opportunities that have the potential to disrupt the healthcare industry. Breakthrough Innovation Teams (BRITE) and Exploratory Innovations Teams (XITE) are two ways Philips nurtures long-term ‘big bets’ in innovation and enables the growth of an overarching entrepreneurial mindset across all of Philips.

Experience Design plays an important role in making sure that the voice of the customer is heard and included in innovation. This means linking product development from inception with a patient and consumer view and ensuring that the highest product and experience performance requirements are embedded throughout all innovation projects. In 2023, the Philips brand won 160 awards for design excellence.

Innovation Engineering teams bring innovations to life by providing Philips business units with a central team of experienced, talented individuals with capabilities in software, hardware engineering, and AI. Innovation Engineering teams also enable business units to scale through shared platforms.

Innovation Excellence helps our business units to be the best they can in innovation by offering them an outside-in view and developing competencies, processes, data and tools they need to excel at innovation.

Innovation Effectiveness teams help to measure the return on innovation investments and guide enterprise-wide innovation initiatives.

Innovation & Strategy works from four main innovation sites – Eindhoven (Netherlands), Cambridge (USA), Bangalore (India) and Shanghai (China) – and smaller innovation and research sites in the Regions. Our global footprint enables us to understand, anticipate and react to local markets and needs.

IP RoyaltiesPhilips Intellectual Property & Standards (IP&S) proactively pursues the creation of new Intellectual Property (IP) in close co-operation with Philips’ operating businesses and Innovation & Strategy. IP&S is a leading industrial IP organization providing world-class IP solutions to Philips’ businesses to support their growth, competitiveness and profitability.

Royal Philips’ IP portfolio currently consists of approximately 53,000 patent rights, 31,500 trademarks, 135,000 design rights and 3,300 domain names. Philips filed 795 new patents in 2023, with a strong focus on the growth areas in health technology services and solutions.

Philips earns substantial annual income from license fees and royalties.

Philips believes its business as a whole is not materially dependent on any particular third-party patent or license, or any particular group of third-party patents and licenses.

Central CostsWe recharge the directly attributable part of the functional costs to the businesses. The remaining part is accounted for as 'central costs', and includes costs related to the Executive Committee and Group Functions such as Strategy, Legal and Audit fees.

Other small itemsOther small items refer to remaining items for intra-group services and legacy items relating to previously disposed businesses.

Geographically, our business is organized in three Regions: North America, Greater China and International Region (the latter made up of Europe and Growth groupings). Within our Regions, we further organize the business by Zones and Countries. Their primary accountability is to manage customer intimacy, relationships and understanding of their needs, (strategic) account management, service delivery, and indirect partner management. They are also accountable for government relations, local infrastructure needed to support Philips’ presence in a country (license to operate) and for statutory, fiscal & compliance duties, safety, sustainability and labor relations to secure compliant operations in the Region/Zone/Country.

For financial reporting purposes, we recognize four geographic areas: Western Europe, North America, Other mature geographies, and Growth geographies. Western Europe, North America and Other mature geographies are collectively recognized as Mature geographies in reporting on sales. This reflects the grouping of countries based on similar economic characteristics.

Leading health systems such as Northwell, TriHealth, and Atrium Health, have extended their long-term strategic partnerships (LSPs) with Philips to include enterprise informatics and precision diagnostics. In Canada, eHealth Saskatchewan elected to extend their enterprise informatics relationship with Philips, reinforcing the value of the partnership to clinicians and patients across the province.

The Enterprise Monitoring as a Service model (EMaaS) also drove innovation, giving health systems like NYU Langone Health, the University of California Irvine and Children’s Hospital of Orange County a predictable, scalable business model that enables them to standardize their patient monitoring platform across the enterprise. In addition to adopting EMaaS for their monitoring solutions, NYU Langone Health is also partnering with Philips to advance patient safety, quality and improve patient outcomes through digital innovation, including integrating patient data across the network, AI-enabled diagnostic imaging and digital pathology for precision diagnosis and treatment.

Philips Sonicare remains the leading electric rechargeable toothbrush in the United States and Canada, as well as the most-recommended rechargeable toothbrush brand in the United States. Additionally, Philips Norelco remains the leading electric male grooming brand in the US and Canada, reaching the next generation of young men with our One Blade multi-purpose shaver.

Philips continues to lead the way with innovation in its efforts to help address health disparities and maternal health access specifically – partnering with the state of Michigan to tailor the Philips Avent Pregnancy+ app, making it easier for moms within the state to find resources available to them, such as home-visiting nurses. During the first year, Pregnancy+ reached over 32,000 Michigan families, helping them get access to vital resources. The app was recognized by Forbes as the best pregnancy app of 2023. Forbes also recognized Philips for its Inclusion & Diversity efforts in North America, naming the company among the Best Employers for Diversity and Best Employers for Women for the second year in a row.

Greater ChinaIn 2023, we continued to deliver on our commitment to support China’s national health strategy, supplying hospitals with tailor-made solutions for their clinical and research needs, and empowering consumers to manage their health and well-being.

With the aim of better serving the Chinese market, we are committed to our ‘In China, For China’ strategy, which focuses on local innovation, manufacturing, services and partnership. We continue to drive ‘made in China’ fulfillment and create more locally relevant solutions by leveraging local ecosystems to serve both professional and consumer markets.

In the professional market, we have expanded our cooperation with local customers by providing cutting-edge imaging systems, informatics solutions and other products in support of delivering better care to patients in terms of precision diagnosis, interventional treatment, and smart hospital development. Key customers include many top hospitals: Huaxi Hospital in Sichuan Province, Renji Hospital, Xinhua Hospital, the Sixth People's Hospital, the 10th People's Hospital and Children’s Hospital in Shanghai, Jishuitan Hospital and Anzhen Hospital in Beijing, the First Affiliated Hospital of Dalian Medical University, the First Affiliated Hospital of Zhengzhou University, and Regional Imaging Center of Jiangxi Province, to name just a few.

In the consumer market, in line with our consistent ‘Professional, Young and Premium’ positioning, Philips’ brand strength increased in 2023, despite an overall weak consumer market. We leveraged new online and offline channels, including Healthy Living Lab, TikTok, O2O instant retail platforms like Meituan, JD to home, and Ele.me to engage with young consumers and grow business. Local innovation drove significant growth in Male Grooming and Oral Healthcare, which continue to solidify their leadership positions in China. Philips was recognized as a ‘gold brand’ (most favored consumer brand) in the Personal Health category for the fourth consecutive year by China Business Weekly.

2023 marked the 100th anniversary of Philips in China. This achievement stands as a testament to Philips’ commitment and dedication to improving people’s lives through meaningful innovation and fostering strong partnerships in China.

InternationalIn International Region we strive to execute on a shared global vision whilst meeting the unique local needs and circumstances of our customers. Our goal is to elevate customer relationships and move from being a trusted supplier of equipment, services and software to a transformational partner directly contributing to our customers’ long-term success. To support this vision we have made great progress on leveling up our go-to-market model, developing scalable solutions and software, expanding fit-for-future capabilities, reinvesting revenue to enable new business models, and establishing new partnerships.

In International Region, our Personal Health business plays an important role in enabling healthy individual care routines with technology and solutions that support people’s long-term health and well-being.

Philips entered into many new customer partnerships in 2023, including the following:

International – EuropePatients at Martini Hospital were the first in the Netherlands to use Philips' ePatch wearable sensor to diagnose cardiac arrhythmias. The hospital uses the sensor and Cardiologs software to detect atrial fibrillation after patients have had a stroke. The patch is designed to replace traditional Holter monitors, which are more cumbersome and can only be worn for a day. The new sensor is expected to improve detection of heart rhythm disorders and provide more personalized care, as well as reducing workload and lowering costs.

Philips and Gibraltar Health Authority announced a 16-year strategic partnership to transform patient imaging and cardiac care for local patients. The partnership will provide local coronary angiography and angioplasty services in a new interventional cardiac suite equipped with the latest diagnostic technology. The announcement represents a major reform in service delivery, improving the region’s access to life-saving interventions while reducing environmental impact, with patients no longer needing to travel abroad for treatment.

Developed by Dr David Tscholl and Dr Christoph Nöthiger, consulting anesthesiologists at University Hospital Zurich, the Visual Patient Avatar is a new approach to patient monitoring: patient data is translated into a simple visual design, reducing the time needed in the operating room to check and interpret vital signs. Together with Philips, this idea was further developed into a commercial solution that is now being implemented at University Hospital Bonn, the first hospital in Europe to use this type of display for faster decision support.

Philips is partnering with Assistance Publique-Hôpitaux de Paris, Hôpitaux Civils de Lyon and Incepto (a PACS AI application platform) to make Artificial Intelligence more accessible to radiologists. Philips has also joined forces with Hôpital Saint-Joseph (Paris) and Hôpital Marie-Lannelongue (Hauts-de-Seine) to improve personalized cancer care by integrating digital pathology into the imaging workflow. And Philips has opened its new healthcare innovation center, Health Innovation Paris (HIP).

Philips' innovative technologies feature across the Polish hospital network. In 2023, the first Incisive CT scanner in Central & Eastern Europe was installed to diagnose patients with cardiac disease at a private cardiology network. In addition, a state-of-the-art hybrid room was created at the University Hospital in Bydgoszcz. Longstanding cooperation with the American Heart of Poland has resulted in further contracts, including the installation of a monitoring network.

Philips and Norwegian Vestre Viken Health Trust deployed AI-enabled clinical care to help radiologists improve patient care. The large-scale deployment provides access to an AI-based bone fracture radiology application that will serve the needs of around half a million people across 22 Norwegian municipalities.

International – GrowthPhilips Japan officially launched the Turbo-Power laser atherectomy catheter, which debulks lesions in a single step and offers remote automatic rotation for precise directional control – a powerful tool for the treatment of peripheral vascular diseases. The Philips MR7700 3.0T imaging system with SmartSpeed AI was installed for the first time in Japan, at Hamamatsu University Hospital. The MR7700 achieves high image quality, while SmartSpeed utilizes the Compressed SENSE speed engine to reduce scan time.

Philips launched the Spectral CT 7500 imaging system with an event for the top 100 radiologists in India. This system performs low-dose scans without compromising speed, power or field of view. We also received an order for 28 Philips Incisive CT systems from a single state. This system combines operator and design efficiencies to improve patient and staff experience and support clinical decision-making. Philips Innovation Campus opened its new site in Bengaluru, home to over 5,000 engineers, scientists, business developers, and clinical experts.

In Australia, Philips signed a 7-year partnership agreement with the Queensland Government and Cairns and Hinterland Hospital and Health Service (CHHHS) to provide a turnkey solution including Vue PACS, Reporting & VNA Philips Software, and Infrastructure as a Service (IaaS) across a remote and large geography. The Philips solution will enable clinicians to access a complete imaging health record of their patients and provide a platform for the integration of all image data across the CHHHS enterprise, greatly enhancing the radiology workflow.

Demonstrating our commitment to high-quality, sustainable healthcare, Philips undertook multiple initiatives to expand helium-free MR operations in Brazil. Besides Brazil, this expansion reached Mexico, Panama, Puerto Rico, Colombia, Chile, Argentina and Ecuador, making a significant mark on the region's healthcare landscape. We are also working to localize the production of BlueSeal MRI magnets in Brazil. Other notable ventures included the Brazilian Company of Hospital Services (EBSERH) installing 14 Incisive CT imaging systems at Federal University Hospitals.

In Turkey, Philips has supplied high-grade medical equipment to the new Gaziantep City Hospital. The public city hospital complex, with 1,875 new beds, will serve Gaziantep and surrounding cities, adding much-needed healthcare capacity to the region, which was hit by a devastating earthquake in February 2023.

As part of a deal with Egypt’s Ministry of Health, Philips unveiled the first Mobile MRI Truck for the Middle East, Turkey & Africa region, to enhance healthcare delivery in remote, difficult-to-access and underserved locations. In just 3 months after implementation, more than 1,100 patients across Egypt had already benefited from this initiative.

In Kazakhstan, Philips provided advanced medical equipment to the National Coordination Center for Emergency HealthCare in Astana and the Hematology and Cardiology Center in Ust-Kamenogorsk. Both are multi-modality projects and have a high social importance, as the Emergency Center will be the flagship center for the National Stroke Program in Kazakhstan, and the Hematology and Cardiology Canter treats patients with serous blood diseases.

Philips is present in 75 countries globally and has its corporate headquarters in Amsterdam, Netherlands. Our real estate locations are spread around the globe, with key manufacturing and R&D sites in Europe, the Americas and Asia.

In 2023, we consolidated five different R&D locations into a new R&D Hub in Bangalore, India, which will host some 5,000 employees. We continued our right-sizing program through our Future of Work concepts to support hybrid working. The project to move Philips’ headquarters to a new location in Amsterdam in 2025 is progressing as planned.

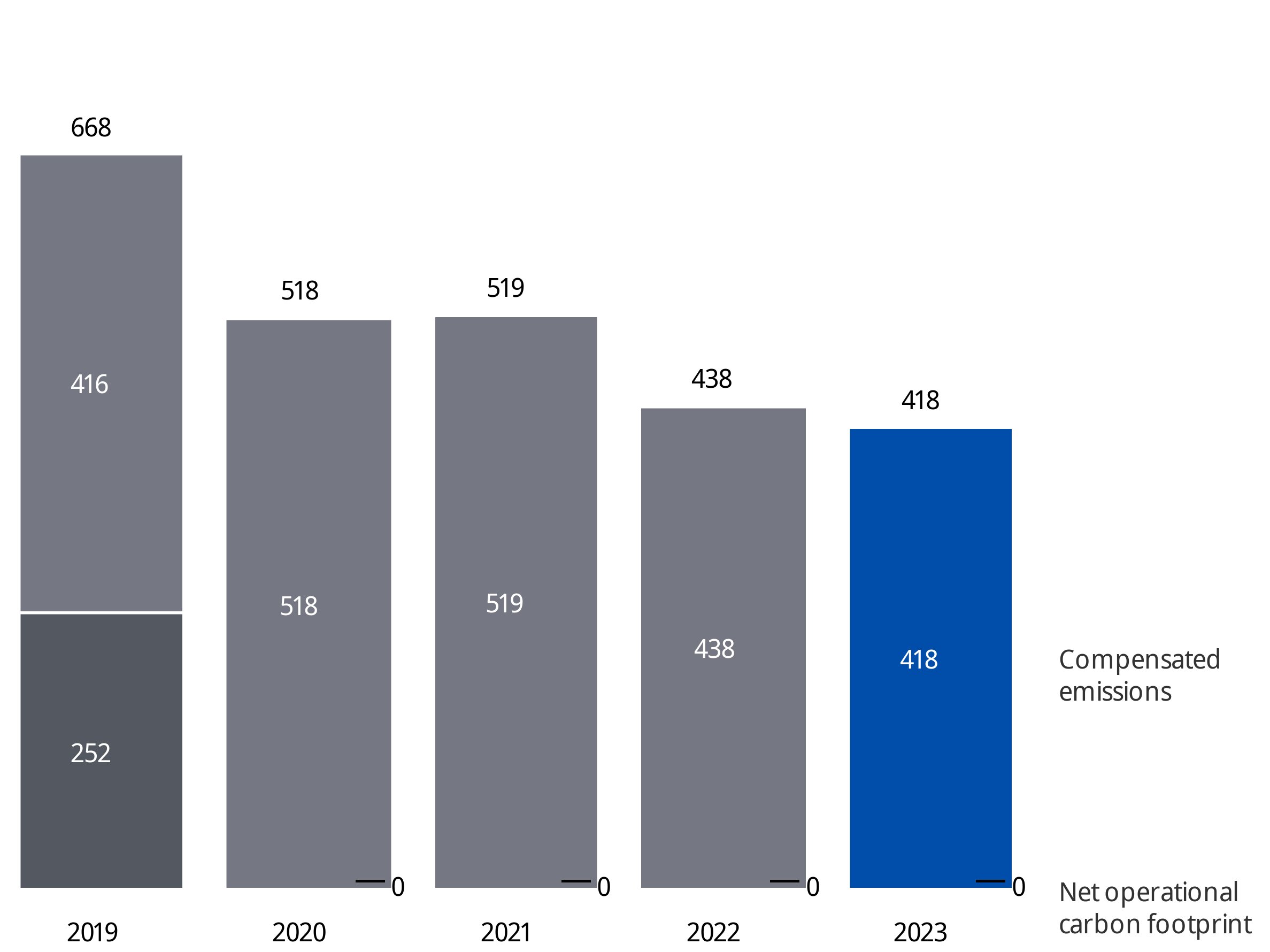

We also continue to optimize our real estate portfolio in line with our Environmental ESG commitments towards 2025. Having met our goal of bringing our site-related CO₂ emissions under 35 kilotons per year in 2020, we further reduced our CO₂ emissions to 22 kilotons in 2023. In addition, we reached 78% renewable energy in 2023, already exceeding our target of 75% by 2025. Energy consumption decreased by 7.8% compared to 2022.

Over 75% of our locations are leased properties, and we manage vacancy closely to ensure the right level of space efficiency and flexibility to support our business dynamic. Our current facilities are adequate to meet the requirements of our present and foreseeable future operations. As expected, occupancy rates in our offices continued to stabilize in the first half of 2023. We continue to evaluate options to right-size our office footprint, to further adopt task-based working principles, and to cater for meaningful presence in inspiring layout and workplace solutions. The net book value of our land and buildings as of December 31, 2023, represented EUR 1,282 million; construction in progress represented EUR 32 million.

Philips Group

Key data

in millions of EUR unless otherwise stated

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Sales | 17,156 | 17,827 | 18,169 |

| Nominal sales growth | (0.9)% | 3.9% | 1.9% |

| Comparable sales growth1) | (1.2)% | (2.8)% | 6.0% |

| Impairment of goodwill | (15) | (1,357) | (8) |

| Income from operations | 553 | (1,529) | (115) |

| as a % of sales | 3.2% | (8.6)% | (0.6)% |

| Financial expenses, net | (39) | (200) | (314) |

| Investments in associates, net of income taxes | (4) | (2) | (98) |

| Income tax (expense) benefit | 103 | 113 | 73 |

| Income from continuing operations | 612 | (1,618) | (454) |

| Discontinued operations, net of income taxes | 2,711 | 13 | (10) |

| Net income | 3,323 | (1,605) | (463) |

| Adjusted EBITA1) | 2,054 | 1,318 | 1,921 |

| as a % of sales | 12.0% | 7.4% | 10.6% |

| Income from continuing operations attributable to shareholders2) per common share (in EUR) - diluted | 0.64 | (1.76) | (0.50) |

| Adjusted income from continuing operations attributable to shareholders2) per common share (in EUR) - diluted1) | 1.58 | 0.92 | 1.25 |

The introduction of a simplified operating model, workforce reduction, an improved global supply chain, and the geopolitical environment contributed to the company’s business and results in 2023. Where relevant, the impact of these factors and the resulting uncertainties on the company’s results, balance sheet and cash flows have been considered and are reflected in amounts reported.

Macro-economic landscape 2023In 2023, global economic growth is estimated to have slowed compared to 2022, marked by easing price pressures and supply chain stress while major central banks were tightening their respective monetary policies. Global real GDP is estimated to have grown by 2.7% in 2023, compared with 3.1% in 2022. On the consumer side, households were dipping into their savings accumulated during the COVID period to maintain their spending levels and to cushion against the inflation surge since late 2021. However, consumer spending momentum is not expected to sustain due to the depletion of savings and expected labor market softening because of tighter financial conditions. The delayed effect of higher benchmark interest rates is expected to manifest further in 2024, leading to a further slowdown in global economic growth. Oxford Economics expects world real GDP growth of 2.3% in 2024.

In 2022, global economic activity slowed down compared to 2021, when the global economy had rebounded strongly from a COVID-induced recession. Several factors were at play. Firstly, the re-opening of the economy for most of the world in 2021 had disrupted global supply chains. Secondly, previous loose monetary policy, combined with supply chain issues, resulted in strong inflationary pressures commencing towards the end of 2021. Thirdly, to combat high inflation, central banks around the globe embarked on aggressive monetary policy tightening cycles.

Simplified operating modelOn January 30, 2023, Philips announced its plan to create value with sustainable impact, which is based on focused organic growth to deliver patient- and people-driven innovation at scale, with improved execution as a key value driver, prioritizing patient safety and quality, supply chain reliability and a simplified operating model. The simplified operating model aims to simplify the organization to increase agility and structurally lower the cost base by giving end-to-end accountability to the segments. Operating model productivity savings, procurement savings and other productivity programs contributed positively to the results of operations.

Workforce reductionIn addition to the reduction of its workforce by 4,000 roles announced in October 2022, in 2023 Philips announced plans to reduce its workforce by an additional 6,000 roles globally by 2025, in line with relevant local regulations and processes. These reductions are focused on Corporate and Functions optimization and non-core activities, and amounted to approximately 8,000 roles by year-end 2023. Workforce-related restructuring charges were EUR 196 million in 2023 and EUR 136 million in 2022.

Supply chain resilienceIn 2023, following significant actions to increase supply chain resilience and mitigate the impact of disruptions, our sales benefited from improved material availability and resolved shortages in components.

Limited availability and delays in the supply of certain components and products internationally – partly a consequence of the COVID pandemic and the Russia-Ukraine war – impacted our results in 2022. In addition, the supply chain constraints resulted in an increase in overall working capital, in particular inventories.

Geopolitical environmentHaving substantially reduced our operations in Russia in 2022, the remaining activities were focused on the delivery of medical systems, devices, and spare parts to healthcare providers. In 2023, increased sanctions and export controls led to a further reduction in sales activity. Philips’ operations in Russia and Ukraine on a combined basis represented less than 2% of group sales in both 2022 and 2023. The asset value of the activities in Russia and Ukraine, mainly working capital, was less than 1% of the consolidated total assets as of December 31, 2022 and 2023. The Russia-Ukraine war continues to put pressure on the global commodity landscape and supply chains, and contribute to higher levels of cost inflation.

The company’s global operations are exposed to geopolitical and macroeconomic changes (refer to Risk management and internal control). The current situation in the Middle East further increases economic and political uncertainty. Philips is present in Israel with several subsidiaries, mainly in Diagnosis & Treatment and Connected Care, that are primarily involved in manufacturing and research and development activities.

Climate-related mattersIn preparing the consolidated financial statements, management has considered the impact of climate change, specifically the financial impact of Philips meeting its internal and external climate-related aims, the potential impact of climate-related risks, and the costs incurred to pro-actively manage such risks. These considerations did not have a material impact on the financial reporting judgments, estimates or assumptions. The financial impacts considered include specific climate mitigation measures, such as the use of lower-carbon energy sources, the cost of developing more sustainable product offerings, and expenses incurred to mitigate against the impact of extreme weather conditions. To meet its long-term Science Based Targets and reduce its full value chain emissions in line with a 1.5°C global warming scenario, Philips has entered into a number of power purchase agreements.

The composition of sales growth in percentage terms in 2023, compared to 2022 and 2021, is presented in the following table.

Philips Group

Sales

in millions of EUR unless otherwise stated

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Diagnosis & Treatment | 7,825 | 8,290 | 8,818 |

| Nominal sales growth | 5.9% | 5.9% | 6.4% |

| Comparable sales growth1) | 8.3% | (0.8)% | 11.1% |

| Connected Care | 5,371 | 5,268 | 5,138 |

| Nominal sales growth | (14.9)% | (1.9)% | (2.5)% |

| Comparable sales growth1) | (19.0)% | (9.1)% | 1.1% |

| Personal Health | 3,429 | 3,626 | 3,602 |

| Nominal sales growth | 7.2% | 5.7% | (0.7)% |

| Comparable sales growth1) | 8.8% | 0.1% | 3.2% |

| Other | 530 | 643 | 612 |

| Philips Group | 17,156 | 17,827 | 18,169 |

| Nominal sales growth | (0.9)% | 3.9% | 1.9% |

| Comparable sales growth1) | (1.2)% | (2.8)% | 6.0% |

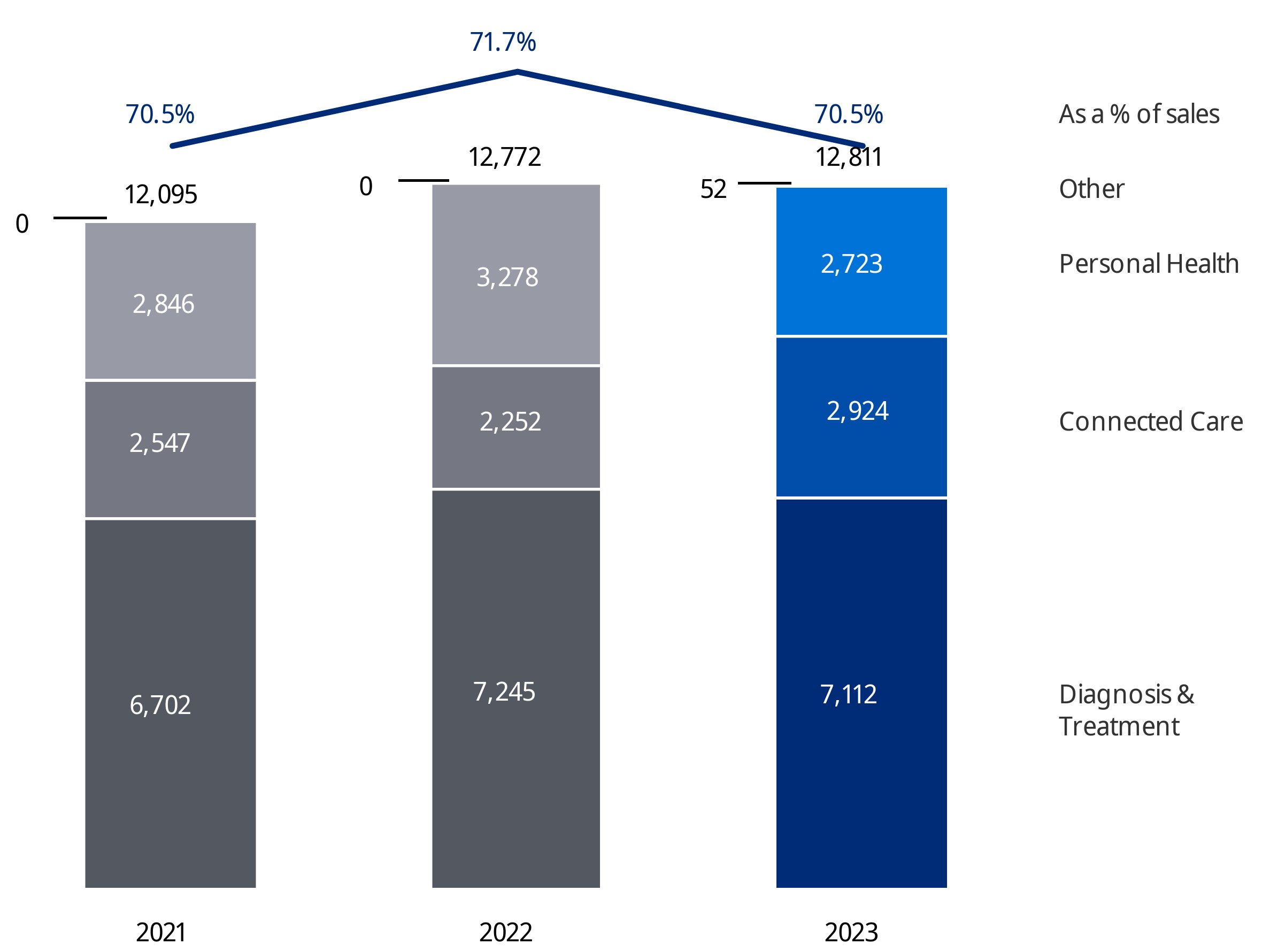

Group sales in 2023 amounted to EUR 18,169 million, 1.9% higher than in 2022 on a nominal basis. Considering a 4.1% negative currency effect and consolidation impact, comparable sales growth*) was 6.0%. The negative currency effect was mainly due to depreciation of currencies against the euro, and affected all segments. In addition, provisions charged to sales of EUR 174 million, mainly in connection with the proposed Respironics consent decree, had a negative impact of 1%.

Comparable order intake decreased 5% in 2023, compared to a 3% decline in 2022. The order book (which covers around 40% of Group sales) remains strong, and we are taking the necessary actions to improve order intake by shortening lead times from order to delivery and building on the positive impact we are making with our innovations, for example in predictive data analytics and artificial intelligence across our portfolio, to help improve the quality and efficiency of care delivery. The order book remains strong and is expected to continue to support growth.

Group sales amounted to EUR 17,827 million in 2022, 3.9% higher than in 2021 on a nominal basis. Considering a 6.7% positive effect from currency and consolidation, comparable sales*) decreased by 2.8%. This was driven by a positive currency effect, mainly due to appreciation of currencies against the euro, and affected all segments.

The order book at year-end 2022 was 10% higher than at the end of 2021, ensuring a higher coverage for sales in 2023. The increase mainly relates to the Diagnosis & Treatment businesses driven by Diagnostic Imaging. Comparable order intake decreased 3%, compared to 4% growth in 2021.

Diagnosis & TreatmentIn 2023, sales amounted to EUR 8,818 million, 6.4% higher than in 2022 on a nominal basis. Considering a 4.7% negative currency effect and consolidation impact, comparable sales*) increased by 11.1%. This was due to double-digit growth in Ultrasound and Image-Guided Therapy and high-single-digit growth in Diagnostic Imaging, due to supply chain improvements.

In 2022, sales amounted to EUR 8,290 million, 5.9% higher than in 2021 on a nominal basis. Considering a 6.7% positive currency effect and consolidation impact, comparable sales*) decreased by 0.8%. This was due to mid-single-digit growth in Image-Guided Therapy and low-single-digit growth in Enterprise Diagnostic Informatics, which was more than offset by a decline in Ultrasound and in Diagnostic Imaging due to specific electronic component shortages.

Connected CareIn 2023, sales amounted to EUR 5,138 million, 2.5% lower than in 2022 on a nominal basis. Considering a 3.6% negative currency effect and consolidation impact, comparable sales*) increased by 1.1%. This growth was mainly driven by double-digit growth in Monitoring, partly offset by a decline in Sleep & Respiratory Care due to the consequences of the Respironics recall. In addition, sales were impacted by provisions charged to sales of EUR 174 million, mainly in connection with the proposed Respironics consent decree, which had a negative impact of 3.4%.

In 2022, sales amounted to EUR 5,268 million, 1.9% lower than in 2021 on a nominal basis. Considering a 7.2% positive currency effect and consolidation impact, comparable sales*) decreased by 9.1%. This was mainly due to the consequences of the Respironics recall and the impact of supply chain headwinds.

Personal HealthIn 2023, sales amounted to EUR 3,602 million, 0.7% lower than in 2022 on a nominal basis. Considering a 3.9% negative currency effect and consolidation impact, comparable sales*) increased by 3.2%. This was mainly driven by high-single-digit growth in Personal Care, partly offset by a decline in Oral Healthcare.

In 2022, sales amounted to EUR 3,626 million, 5.7% higher than in 2021 on a nominal basis. Considering a 5.6% positive currency effect and consolidation impact, comparable sales*) increased by 0.1%, consisting of a global increase of 2.5%, offset by a 2.4% decline in sales attributable to Russia due to the war with Ukraine. Oral Healthcare and Mother & Child Care recorded mid-single-digit growth, which was offset by a mid-single-digit decline in Personal Care.

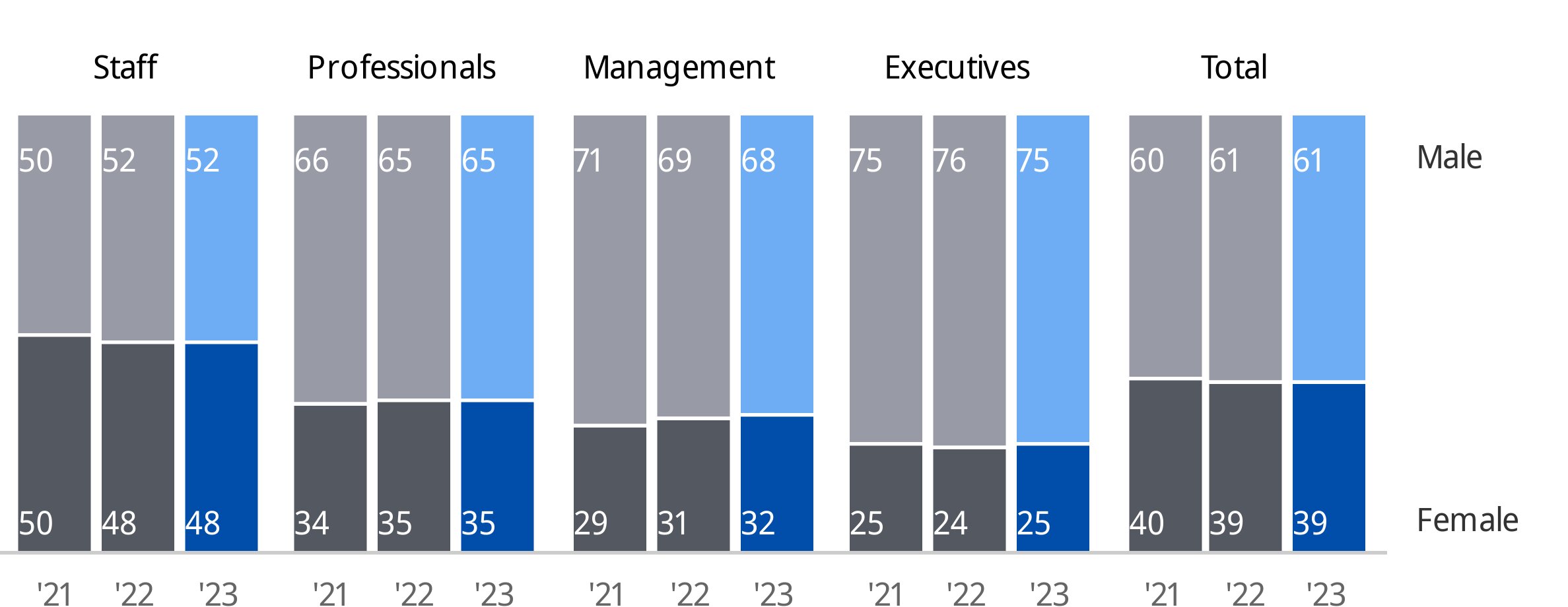

OtherIn 2023, sales amounted to EUR 612 million, compared to EUR 643 million in 2022. The decrease was mainly due to the discontinuation of innovation consultancy activities provided to other companies until 2023.