000027750912/312025Q1FALSEP1Yxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesfss:Segmentxbrli:purefss:segmentiso4217:CAD00002775092025-01-012025-03-3100002775092025-03-3100002775092024-01-012024-03-3100002775092024-12-310000277509us-gaap:RetainedEarningsMember2025-01-012025-03-3100002775092023-12-3100002775092024-03-310000277509us-gaap:CommonStockMember2024-12-310000277509us-gaap:AdditionalPaidInCapitalMember2024-12-310000277509us-gaap:RetainedEarningsMember2024-12-310000277509us-gaap:TreasuryStockCommonMember2024-12-310000277509us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310000277509us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310000277509us-gaap:AdditionalPaidInCapitalMember2025-01-012025-03-310000277509us-gaap:CommonStockMember2025-01-012025-03-310000277509us-gaap:TreasuryStockCommonMember2025-01-012025-03-310000277509us-gaap:CommonStockMember2025-03-310000277509us-gaap:AdditionalPaidInCapitalMember2025-03-310000277509us-gaap:RetainedEarningsMember2025-03-310000277509us-gaap:TreasuryStockCommonMember2025-03-310000277509us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-03-310000277509us-gaap:CommonStockMember2023-12-310000277509us-gaap:AdditionalPaidInCapitalMember2023-12-310000277509us-gaap:RetainedEarningsMember2023-12-310000277509us-gaap:TreasuryStockCommonMember2023-12-310000277509us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000277509us-gaap:RetainedEarningsMember2024-01-012024-03-310000277509us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000277509us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000277509us-gaap:CommonStockMember2024-01-012024-03-310000277509us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000277509us-gaap:CommonStockMember2024-03-310000277509us-gaap:AdditionalPaidInCapitalMember2024-03-310000277509us-gaap:RetainedEarningsMember2024-03-310000277509us-gaap:TreasuryStockCommonMember2024-03-310000277509us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000277509fss:HogMember2025-02-122025-02-120000277509fss:HogMember2025-02-120000277509fss:HogMember2025-01-012025-03-310000277509us-gaap:CustomerRelatedIntangibleAssetsMemberfss:HogMember2025-02-120000277509country:US2025-01-012025-03-310000277509country:US2024-01-012024-03-310000277509country:CA2025-01-012025-03-310000277509country:CA2024-01-012024-03-310000277509fss:EuropeOtherMember2025-01-012025-03-310000277509fss:EuropeOtherMember2024-01-012024-03-310000277509fss:EnvironmentalSolutionsMemberfss:VehiclesandequipmentMember2025-01-012025-03-310000277509fss:EnvironmentalSolutionsMemberfss:VehiclesandequipmentMember2024-01-012024-03-310000277509fss:EnvironmentalSolutionsMemberfss:PartsMember2025-01-012025-03-310000277509fss:EnvironmentalSolutionsMemberfss:PartsMember2024-01-012024-03-310000277509fss:EnvironmentalSolutionsMemberfss:RentalincomeMember2025-01-012025-03-310000277509fss:EnvironmentalSolutionsMemberfss:RentalincomeMember2024-01-012024-03-310000277509fss:EnvironmentalSolutionsMemberfss:OtherMember2025-01-012025-03-310000277509fss:EnvironmentalSolutionsMemberfss:OtherMember2024-01-012024-03-310000277509fss:EnvironmentalSolutionsMember2025-01-012025-03-310000277509fss:EnvironmentalSolutionsMember2024-01-012024-03-310000277509fss:SafetyAndSecuritySystemsMemberfss:PublicsafetyandsecurityequipmentMember2025-01-012025-03-310000277509fss:SafetyAndSecuritySystemsMemberfss:PublicsafetyandsecurityequipmentMember2024-01-012024-03-310000277509fss:SafetyAndSecuritySystemsMemberfss:IndustrialsignalingequipmentMember2025-01-012025-03-310000277509fss:SafetyAndSecuritySystemsMemberfss:IndustrialsignalingequipmentMember2024-01-012024-03-310000277509fss:SafetyAndSecuritySystemsMemberfss:WarningsystemsMember2025-01-012025-03-310000277509fss:SafetyAndSecuritySystemsMemberfss:WarningsystemsMember2024-01-012024-03-310000277509fss:SafetyAndSecuritySystemsMember2025-01-012025-03-310000277509fss:SafetyAndSecuritySystemsMember2024-01-012024-03-310000277509us-gaap:LineOfCreditMemberfss:A2022CreditAgreementMember2022-10-210000277509us-gaap:RevolvingCreditFacilityMemberfss:A2022CreditAgreementMemberus-gaap:LineOfCreditMember2022-10-210000277509us-gaap:SecuredDebtMemberfss:A2022CreditAgreementMemberus-gaap:LineOfCreditMember2022-10-210000277509srt:MinimumMemberfss:A2022CreditAgreementMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-10-212022-10-210000277509srt:MaximumMemberfss:A2022CreditAgreementMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-10-212022-10-210000277509srt:MinimumMemberfss:A2022CreditAgreementMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMember2022-10-212022-10-210000277509srt:MaximumMemberfss:A2022CreditAgreementMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:LineOfCreditMember2022-10-212022-10-210000277509srt:MinimumMemberfss:A2022CreditAgreementMemberus-gaap:LineOfCreditMember2022-10-212022-10-210000277509srt:MaximumMemberfss:A2022CreditAgreementMemberus-gaap:LineOfCreditMember2022-10-212022-10-210000277509us-gaap:RevolvingCreditFacilityMemberfss:A2022CreditAgreementMember2025-03-310000277509fss:TermLoanCreditFacilityMemberfss:A2022CreditAgreementMember2025-03-310000277509us-gaap:LetterOfCreditMemberfss:A2022CreditAgreementMember2025-03-310000277509us-gaap:RevolvingCreditFacilityMemberfss:A2022CreditAgreementMember2024-12-310000277509fss:TermLoanCreditFacilityMemberfss:A2022CreditAgreementMember2024-12-310000277509us-gaap:LetterOfCreditMemberfss:A2022CreditAgreementMember2024-12-310000277509fss:InterestRateSwap2022Member2022-10-210000277509fss:InterestRateSwap2023Member2023-07-110000277509us-gaap:InterestRateSwapMember2025-01-012025-03-310000277509us-gaap:InterestRateSwapMember2024-01-012024-03-310000277509us-gaap:InterestRateSwapMember2022-10-022022-10-0200002775092025-02-100000277509fss:EnvironmentalSolutionsMember2024-12-310000277509fss:SafetyAndSecuritySystemsMember2024-12-310000277509fss:EnvironmentalSolutionsMember2025-03-310000277509fss:SafetyAndSecuritySystemsMember2025-03-310000277509us-gaap:CustomerRelationshipsMember2025-03-310000277509us-gaap:CustomerRelationshipsMember2024-12-310000277509us-gaap:OtherIntangibleAssetsMember2025-03-310000277509us-gaap:OtherIntangibleAssetsMember2024-12-310000277509us-gaap:TradeNamesMember2025-03-310000277509us-gaap:TradeNamesMember2024-12-310000277509us-gaap:DistributionRightsMember2025-03-310000277509us-gaap:DistributionRightsMember2024-12-310000277509country:US2025-01-012025-03-310000277509country:US2024-01-012024-03-310000277509us-gaap:ForeignPlanMember2025-01-012025-03-310000277509us-gaap:ForeignPlanMember2024-01-012024-03-310000277509srt:MinimumMember2025-01-012025-03-310000277509srt:MaximumMember2025-01-012025-03-3100002775092019-11-042019-11-040000277509us-gaap:SubsequentEventMember2025-04-012025-06-300000277509fss:March2020RepurchaseProgramMember2020-03-1300002775092025-04-012025-04-300000277509fss:March2020RepurchaseProgramMember2025-04-300000277509fss:April2025RepurchaseProgramMember2020-03-130000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-12-310000277509us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310000277509us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-12-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-01-012025-03-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2025-01-012025-03-310000277509us-gaap:AccumulatedTranslationAdjustmentMember2025-01-012025-03-310000277509us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2025-01-012025-03-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-03-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2025-03-310000277509us-gaap:AccumulatedTranslationAdjustmentMember2025-03-310000277509us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2025-03-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2023-12-310000277509us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000277509us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-03-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-01-012024-03-310000277509us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310000277509us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-01-012024-03-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-310000277509us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-03-310000277509us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310000277509us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-03-310000277509us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2025-01-012025-03-310000277509us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000277509us-gaap:OperatingSegmentsMember2025-01-012025-03-310000277509us-gaap:CorporateMember2025-01-012025-03-310000277509us-gaap:OperatingSegmentsMember2024-01-012024-03-310000277509us-gaap:CorporateMember2024-01-012024-03-310000277509us-gaap:OperatingSegmentsMember2025-03-310000277509us-gaap:OperatingSegmentsMember2024-12-310000277509us-gaap:CorporateMember2025-03-310000277509us-gaap:CorporateMember2024-12-310000277509fss:BlastersMember2023-01-030000277509fss:TracklessMember2023-04-030000277509fss:StandardMember2024-10-040000277509fss:DeistMember2025-02-120000277509us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2025-03-310000277509us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2025-03-310000277509us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2025-03-310000277509us-gaap:FairValueMeasurementsRecurringMember2025-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 10-Q

(Mark One)

|

|

|

|

|

|

| ☑ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2025

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-6003

_____________________________________________

FEDERAL SIGNAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

36-1063330 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

1333 Butterfield Road, Downers Grove, Illinois

(Address of principal executive offices)

60515

(Zip code)

(630) 954-2000

(Registrant’s telephone number, including area code)

_____________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $1.00 per share |

FSS |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☑ |

|

|

|

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

|

|

|

Smaller reporting company |

☐ |

| Emerging growth company |

☐ |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of March 31, 2025, the number of shares outstanding of the registrant’s common stock was 60,968,839.

FEDERAL SIGNAL CORPORATION

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

Page |

| PART I. |

|

|

| Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

|

|

|

| PART II. |

|

|

| Item 1. |

|

|

| Item 1A. |

|

|

| Item 2. |

|

|

| Item 3. |

|

|

| Item 4. |

|

|

| Item 5. |

|

|

| Item 6. |

|

|

|

|

|

|

|

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (“Form 10-Q”) is being filed by Federal Signal Corporation and its subsidiaries (referred to collectively as the “Company,” “we,” “our,” or “us” herein, unless the context otherwise indicates) with the United States (“U.S.”) Securities and Exchange Commission (the “SEC”), and includes comments made by management that may contain words such as “may,” “will,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “project,” “estimate,” and “objective” or similar terminology, or the negative thereof, concerning the Company’s future financial performance, business strategy, plans, goals, and objectives. These expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future performance or results of operations and are not guarantees. While these statements are based on assumptions and judgments that management has made in light of industry experience as well as perceptions of historical trends, current conditions, expected future developments, and other factors believed to be appropriate under the circumstances, they are subject to risks, uncertainties, and other factors that may cause the Company’s actual results, performance, or achievements to be materially different.

These risks and uncertainties, some of which are beyond the Company’s control, include the risk factors described under Part I, Item 1A, Risk Factors, of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 26, 2025. These factors may not constitute all factors that could cause actual results to differ materially from those discussed in any forward-looking statement. The Company operates in a continually changing business environment and new factors emerge from time to time. The Company cannot predict such factors, nor can it assess the impact, if any, of such factors on its results of operations, financial condition, or cash flow. Accordingly, forward-looking statements should not be relied upon as a predictor of actual results. The Company disclaims any responsibility to update any forward-looking statement provided in this Form 10-Q.

ADDITIONAL INFORMATION

The Company is subject to the reporting and information requirements of the Exchange Act and, as a result, is obligated to file Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other reports and information with the SEC, as well as amendments to those reports. The Company makes these filings available free of charge through our website at www.federalsignal.com as soon as reasonably practicable after such materials are filed with, or furnished to, the SEC. The Company also uses its website as a means of disclosing material non-public information and to comply with our disclosure requirements under Regulation FD. Information on our website does not constitute part of this Form 10-Q. In addition, the SEC maintains a website at www.sec.gov that contains reports, proxy, and information statements, and other information regarding issuers that file electronically.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited).

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

March 31, |

|

|

| (in millions, except per share data) |

2025 |

|

2024 |

|

|

|

|

| Net sales |

$ |

463.8 |

|

|

$ |

424.9 |

|

|

|

|

|

| Cost of sales |

333.0 |

|

|

308.9 |

|

|

|

|

|

| Gross profit |

130.8 |

|

|

116.0 |

|

|

|

|

|

| Selling, engineering, general and administrative expenses |

60.2 |

|

|

57.2 |

|

|

|

|

|

| Amortization expense |

4.3 |

|

|

3.6 |

|

|

|

|

|

| Acquisition and integration-related expenses, net |

0.6 |

|

|

0.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

65.7 |

|

|

54.3 |

|

|

|

|

|

| Interest expense, net |

3.0 |

|

|

3.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other expense, net |

0.7 |

|

|

0.2 |

|

|

|

|

|

| Income before income taxes |

62.0 |

|

|

50.9 |

|

|

|

|

|

| Income tax expense (benefit) |

15.7 |

|

|

(0.7) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

46.3 |

|

|

$ |

51.6 |

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.76 |

|

|

$ |

0.85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

0.75 |

|

|

0.84 |

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

61.1 |

|

|

60.9 |

|

|

|

|

|

| Diluted |

61.8 |

|

|

61.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

See notes to condensed consolidated financial statements.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

March 31, |

|

|

| (in millions) |

2025 |

|

2024 |

|

|

|

|

| Net income |

$ |

46.3 |

|

|

$ |

51.6 |

|

|

|

|

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

| Change in foreign currency translation adjustment |

4.0 |

|

|

(3.9) |

|

|

|

|

|

Change in unrecognized net actuarial loss and prior service cost related to pension benefit plans, net of income tax expense of $0.1 and $0.2, respectively |

0.2 |

|

|

0.6 |

|

|

|

|

|

Change in unrealized gain or loss on interest rate swaps, net of income tax expense of $0.0 and $0.2, respectively |

0.1 |

|

|

0.5 |

|

|

|

|

|

| Total other comprehensive income (loss) |

4.3 |

|

|

(2.8) |

|

|

|

|

|

| Comprehensive income |

$ |

50.6 |

|

|

$ |

48.8 |

|

|

|

|

|

See notes to condensed consolidated financial statements.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2025 |

|

December 31,

2024 |

| (in millions, except per share data) |

(Unaudited) |

|

|

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

57.5 |

|

|

$ |

91.1 |

|

Accounts receivable, net of allowances for doubtful accounts of $2.9 and $2.6, respectively |

223.2 |

|

|

196.4 |

|

| Inventories |

362.0 |

|

|

331.0 |

|

| Prepaid expenses and other current assets |

22.1 |

|

|

24.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

664.8 |

|

|

642.5 |

|

Properties and equipment, net of accumulated depreciation of $193.8 and $187.4, respectively |

235.8 |

|

|

218.9 |

|

Rental equipment, net of accumulated depreciation of $55.6 and $53.3, respectively |

185.3 |

|

|

173.2 |

|

| Operating lease right-of-use assets |

27.3 |

|

|

27.8 |

|

| Goodwill |

514.0 |

|

|

477.7 |

|

Intangible assets, net of accumulated amortization of $89.9 and $85.6, respectively |

226.0 |

|

|

199.7 |

|

| Deferred tax assets |

9.9 |

|

|

9.4 |

|

| Other long-term assets |

16.3 |

|

|

16.0 |

|

|

|

|

|

| Total assets |

$ |

1,879.4 |

|

|

$ |

1,765.2 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

| Current portion of long-term borrowings and finance lease obligations |

$ |

10.1 |

|

|

$ |

19.4 |

|

| Accounts payable |

103.8 |

|

|

79.0 |

|

| Customer deposits |

48.9 |

|

|

35.0 |

|

|

|

|

|

|

|

|

|

| Accrued liabilities: |

|

|

|

| Compensation and withholding taxes |

28.8 |

|

|

45.6 |

|

|

|

|

|

| Current operating lease liabilities |

6.9 |

|

|

6.8 |

|

| Other current liabilities |

79.9 |

|

|

56.0 |

|

|

|

|

|

| Total current liabilities |

278.4 |

|

|

241.8 |

|

| Long-term borrowings and finance lease obligations |

266.9 |

|

|

204.4 |

|

| Long-term operating lease liabilities |

21.3 |

|

|

21.8 |

|

| Long-term pension and other postretirement benefit liabilities |

40.1 |

|

|

41.7 |

|

|

|

|

|

| Deferred tax liabilities |

58.8 |

|

|

58.0 |

|

| Other long-term liabilities |

11.5 |

|

|

11.4 |

|

|

|

|

|

| Total liabilities |

677.0 |

|

|

579.1 |

|

| Stockholders’ equity: |

|

|

|

Common stock, $1 par value per share, 90.0 shares authorized, 70.6 and 70.3 shares issued, respectively |

70.6 |

|

|

70.3 |

|

| Capital in excess of par value |

312.2 |

|

|

309.8 |

|

| Retained earnings |

1,140.5 |

|

|

1,102.8 |

|

Treasury stock, at cost, 9.5 and 9.2 shares, respectively |

(236.2) |

|

|

(207.8) |

|

| Accumulated other comprehensive loss |

(84.7) |

|

|

(89.0) |

|

| Total stockholders’ equity |

1,202.4 |

|

|

1,186.1 |

|

| Total liabilities and stockholders’ equity |

$ |

1,879.4 |

|

|

$ |

1,765.2 |

|

See notes to condensed consolidated financial statements.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended

March 31, |

| (in millions) |

2025 |

|

2024 |

| Operating activities: |

|

|

|

| Net income |

$ |

46.3 |

|

|

$ |

51.6 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

18.7 |

|

|

15.4 |

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense |

2.4 |

|

|

4.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of interest rate swap settlement gain |

— |

|

|

(0.6) |

|

| Deferred income taxes |

0.7 |

|

|

0.8 |

|

| Changes in operating assets and liabilities |

(31.4) |

|

|

(40.3) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

36.7 |

|

|

31.3 |

|

| Investing activities: |

|

|

|

| Purchases of properties and equipment |

(5.6) |

|

|

(8.4) |

|

|

|

|

|

| Payments for acquisition-related activity, net of cash acquired |

(82.1) |

|

|

— |

|

|

|

|

|

| Other, net |

— |

|

|

0.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used for investing activities |

(87.7) |

|

|

(7.6) |

|

| Financing activities: |

|

|

|

| Increase (decrease) in revolving lines of credit, net |

64.2 |

|

|

(23.5) |

|

|

|

|

|

|

|

|

|

| Payments on long-term borrowings |

— |

|

|

(0.8) |

|

|

|

|

|

| Purchases of treasury stock |

(18.5) |

|

|

(0.1) |

|

| Redemptions of common stock to satisfy withholding taxes related to stock-based compensation |

(8.6) |

|

|

(4.1) |

|

|

|

|

|

| Cash dividends paid to stockholders |

(8.6) |

|

|

(7.3) |

|

| Proceeds from stock-based compensation activity |

— |

|

|

0.8 |

|

|

|

|

|

| Other, net |

(11.6) |

|

|

(0.3) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used for) financing activities |

16.9 |

|

|

(35.3) |

|

| Effects of foreign exchange rate changes on cash and cash equivalents |

0.5 |

|

|

(0.5) |

|

| Decrease in cash and cash equivalents |

(33.6) |

|

|

(12.1) |

|

| Cash and cash equivalents at beginning of year |

91.1 |

|

|

61.0 |

|

| Cash and cash equivalents at end of period |

$ |

57.5 |

|

|

$ |

48.9 |

|

|

|

|

|

|

|

|

|

See notes to condensed consolidated financial statements.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months ended March 31, 2025 |

| (in millions) |

Common

Stock |

|

Capital in

Excess of

Par

Value |

|

Retained

Earnings |

|

Treasury

Stock |

|

Accumulated

Other

Comprehensive

Loss |

|

Total |

| Balance at January 1, 2025 |

$ |

70.3 |

|

|

$ |

309.8 |

|

|

$ |

1,102.8 |

|

|

$ |

(207.8) |

|

|

$ |

(89.0) |

|

|

$ |

1,186.1 |

|

| Net income |

|

|

|

|

46.3 |

|

|

|

|

|

|

46.3 |

|

| Total other comprehensive income |

|

|

|

|

|

|

|

|

4.3 |

|

|

4.3 |

|

Cash dividends declared ($0.14 per share) |

|

|

|

|

(8.6) |

|

|

|

|

|

|

(8.6) |

|

| Stock-based payments: |

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

2.4 |

|

|

|

|

|

|

|

|

2.4 |

|

| Stock option exercises and other |

0.1 |

|

|

0.2 |

|

|

|

|

(0.5) |

|

|

|

|

(0.2) |

|

| Performance share unit transactions |

0.2 |

|

|

(0.2) |

|

|

|

|

(8.2) |

|

|

|

|

(8.2) |

|

| Stock repurchase program |

|

|

|

|

|

|

(19.7) |

|

|

|

|

(19.7) |

|

| Balance at March 31, 2025 |

$ |

70.6 |

|

|

$ |

312.2 |

|

|

$ |

1,140.5 |

|

|

$ |

(236.2) |

|

|

$ |

(84.7) |

|

|

$ |

1,202.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, 2024 |

| (in millions) |

Common

Stock |

|

Capital in

Excess of

Par

Value |

|

Retained

Earnings |

|

Treasury

Stock |

|

Accumulated

Other

Comprehensive

Loss |

|

Total |

| Balance at January 1, 2024 |

$ |

70.0 |

|

|

$ |

291.1 |

|

|

$ |

915.8 |

|

|

$ |

(193.7) |

|

|

$ |

(81.3) |

|

|

$ |

1,001.9 |

|

| Net income |

|

|

|

|

51.6 |

|

|

|

|

|

|

51.6 |

|

| Total other comprehensive loss |

|

|

|

|

|

|

|

|

(2.8) |

|

|

(2.8) |

|

Cash dividends declared ($0.12 per share) |

|

|

|

|

(7.3) |

|

|

|

|

|

|

(7.3) |

|

| Stock-based payments: |

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

4.4 |

|

|

|

|

|

|

|

|

4.4 |

|

| Stock option exercises and other |

0.1 |

|

|

1.4 |

|

|

|

|

(1.2) |

|

|

|

|

0.3 |

|

| Performance share unit transactions |

0.1 |

|

|

(0.1) |

|

|

|

|

(3.6) |

|

|

|

|

(3.6) |

|

| Stock repurchase program |

|

|

|

|

|

|

(0.1) |

|

|

|

|

(0.1) |

|

| Balance at March 31, 2024 |

$ |

70.2 |

|

|

$ |

296.8 |

|

|

$ |

960.1 |

|

|

$ |

(198.6) |

|

|

$ |

(84.1) |

|

|

$ |

1,044.4 |

|

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Description of the Business

Federal Signal Corporation was founded in 1901 and was reincorporated as a Delaware corporation in 1969. References herein to the “Company,” “we,” “our,” or “us” refer collectively to Federal Signal Corporation and its subsidiaries.

Products manufactured and services rendered by the Company are divided into two reportable segments: Environmental Solutions Group and Safety and Security Systems Group. The individual operating businesses are organized as such because they share certain characteristics, including technology, marketing, distribution and product application, which create long-term synergies. These segments are discussed in Note 12 – Segment Information.

Basis of Presentation and Consolidation

The accompanying unaudited condensed consolidated financial statements represent the consolidation of Federal Signal Corporation and its subsidiaries included herein and have been prepared by the Company pursuant to the rules and regulations of the United States (“U.S.”) Securities and Exchange Commission (the “SEC”). Certain information and footnote disclosures normally included in financial statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) have been condensed or omitted pursuant to such rules and regulations, although the Company believes that the disclosures presented herein are adequate to ensure the information presented is not misleading. Except as otherwise noted, these condensed consolidated financial statements have been prepared in accordance with the Company’s accounting policies described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and should be read in conjunction with those consolidated financial statements and the notes thereto.

These condensed consolidated financial statements include all normal and recurring adjustments that we considered necessary to present a fair statement of our results of operations, financial condition, and cash flow. Intercompany balances and transactions have been eliminated in consolidation.

The results reported in these condensed consolidated financial statements should not be regarded as necessarily indicative of results that may be expected for the entire year, which may differ materially due to, among other things, the risk factors described under Part I, Item 1A, Risk Factors, of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 26, 2025. While we label our quarterly information using a calendar convention whereby our first, second, and third quarters are labeled as ending on March 31, June 30, and September 30, respectively, it is our longstanding practice to establish interim quarterly closing dates based on a 13-week period ending on a Saturday, with our fiscal year ending on December 31. The effects of this practice are not material and exist only within a reporting year.

Recent Accounting Standard Adoptions

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which expands annual and interim disclosure requirements for reportable segments, including enhanced disclosures regarding significant segment expenses. ASU 2023-07 was effective for fiscal years beginning after December 15, 2023, and for interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The Company adopted this ASU effective for the fiscal year ended December 31, 2024, and has included the required interim disclosures for all periods presented in Note 12 - Segment Information.

Recent Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topics 740): Improvements to Income Tax Disclosures, which expands the disclosure requirements for income taxes. ASU 2023-09 is effective prospectively for annual periods beginning after December 15, 2024, with early adoption and retrospective application permitted. The Company is currently evaluating the impact of adopting this guidance on its financial statement disclosures.

In November 2024, the FASB issued ASU 2024-03, Income Statement - Reporting Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40), which requires entities to disclose, on an annual and interim basis, disaggregated information about certain income statement expense line items. ASU 2024-03 is effective prospectively for annual periods beginning after December 15, 2026, and for interim periods within fiscal years beginning after December 15, 2027, with early adoption and retrospective adoption permitted.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

The Company is currently evaluating the impact of adopting this guidance on its financial statement disclosures.

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements, and (iii) the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant Accounting Policies

There have been no changes to the Company’s significant accounting policies as disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.

NOTE 2 – ACQUISITIONS

Acquisition of Waterblasting LLC

On February 12, 2025, the Company completed the acquisition of substantially all the assets and operations of Waterblasting, LLC, owner of Hog Technologies, and Waterblasting Eurasia, s.r.o. (collectively, “Hog”). Hog is a leading U.S. manufacturer of truck-mounted road-marking, line-removal, and waterblasting equipment, serving infrastructure, municipal, and airport markets. The Company expects the acquisition of Hog will strengthen its position as an industry-leading, diversified industrial manufacturer of specialty vehicles by expanding its product offerings, market presence, and aftermarket platform.

The assets and liabilities of Hog have been consolidated into the Company’s Condensed Consolidated Balance Sheet as of March 31, 2025, and the post-acquisition results of operations have been included in the Condensed Consolidated Statements of Operations, within the Environmental Solutions Group.

The initial cash consideration paid by the Company to acquire Hog was approximately $82.1 million, inclusive of certain preliminary closing adjustments. In addition, there is a contingent earn-out payment of up to $15.0 million that is based on the achievement of certain financial targets during 2025 and an additional payment of $2.0 million that was held back from the initial amount paid at closing pending resolution of certain post-closing adjustments. Any additional closing adjustments are expected to be finalized before the end of 2025.

The acquisition is being accounted for in accordance with Accounting Standards Codification (“ASC”) 805, Business Combinations. Accordingly, the total purchase price has been allocated on a preliminary basis to assets acquired and liabilities assumed in connection with the acquisition based on their estimated fair values as of the completion of the acquisition. A single estimate of fair value results from a complex series of judgments about future events and uncertainties and relies heavily on estimates and assumptions. The Company’s judgments used to determine the estimated fair value assigned to each class of assets acquired and liabilities assumed, as well as asset lives, can materially impact the Company’s results of operations. Due to

the proximity of the date of acquisition to the date of issuance of the condensed consolidated financial statements, the Company’s purchase price allocation as of March 31, 2025 reflects various provisional estimates that were based on the information that was available as of the acquisition date and the filing date of this Form 10-Q. The Company believes that

information provides a reasonable basis for estimating the fair values of assets acquired and liabilities assumed; however, the

determination of those fair values is not yet finalized. Thus, the preliminary measurements of fair value set forth in the table

below are subject to change during the measurement period as valuations are finalized. The Company expects to finalize the

valuation and complete the purchase price allocation as soon as practicable, but not more than one year from the acquisition date.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

The following table summarizes the preliminary fair value of assets acquired and liabilities assumed as of the acquisition date:

|

|

|

|

|

|

| (in millions) |

|

Purchase price, inclusive of preliminary closing adjustments (a) |

$ |

84.1 |

|

Estimated fair value of additional consideration (b) |

7.5 |

|

Settlement of pre-existing contractual relationship (c) |

0.9 |

|

| Total consideration |

92.5 |

|

|

|

|

|

| Accounts receivable |

7.2 |

|

| Inventories |

11.1 |

|

| Prepaid expenses and other current assets |

2.3 |

|

|

|

| Properties and equipment |

17.8 |

|

|

|

|

|

|

|

Customer relationships (d) |

16.5 |

|

Trade names (e) |

10.5 |

|

| Other intangible assets |

3.5 |

|

| Accounts payable |

(4.1) |

|

| Accrued liabilities |

(1.8) |

|

| Customer deposits |

(5.4) |

|

|

|

|

|

| Net assets acquired |

57.6 |

|

|

Goodwill (f) |

$ |

34.9 |

|

(a) The initial purchase price, which is subject to certain post-closing adjustments, including working capital, was funded through existing cash on hand and borrowings under the Company’s credit agreement. The initial purchase price includes $2.0 million that was held back from the initial amount paid at closing pending resolution of certain post-closing adjustments. This hold back amount is included as a component of Other current liabilities on the Condensed Consolidated Balance Sheet as of March 31, 2025.

(b) Represents the preliminary estimate of fair value assigned to the contingent earn-out payment as of the acquisition date, which is included in Other current liabilities on the Condensed Consolidated Balance Sheet as of March 31, 2025. See Note 13 – Fair Value Measurements for discussion of the methodology used to determine the fair value of the contingent earn-out payment.

(c) Represents the non-cash settlement of accounts receivable due from Hog to the Company as of the acquisition date. Corresponding amount payable by Hog to the Company is not included in accounts payable assumed in the table above, and the amount was settled at fair value with no impact on the Condensed Consolidated Statement of Operations.

(d) Represents the preliminary fair value assigned to customer relationships, which are considered to be definite-lived intangible assets, with a preliminary estimated useful life of approximately 11 years.

(e) Represents the preliminary fair value assigned to trade names, which are considered to be indefinite-lived intangible assets.

(f) Goodwill, which is primarily tax-deductible, has been allocated to the Environmental Solutions Group on the basis that the synergies identified will primarily benefit this segment.

Hog’s net sales and operating results for the period between the closing date of February 12, 2025 and the end of the Company’s first fiscal quarter of 2025 were not material.

The acquisition was not, and would not have been, material to the Company’s net sales, results of operations, or total assets during any period presented. Accordingly, the Company’s consolidated results from operations do not differ materially from historical performance as a result of the acquisition, and therefore, unaudited pro-forma results are not presented.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

NOTE 3 – REVENUE RECOGNITION

The following table presents the Company’s Net sales disaggregated by geographic region, based on the location of the end customer, and by major product line:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

| (in millions) |

2025 |

|

2024 |

|

|

|

|

| Geographic Region: |

|

|

|

|

|

|

|

| U.S. |

$ |

364.5 |

|

|

$ |

334.3 |

|

|

|

|

|

| Canada |

61.5 |

|

|

59.3 |

|

|

|

|

|

| Europe/Other |

37.8 |

|

|

31.3 |

|

|

|

|

|

| Total net sales |

$ |

463.8 |

|

|

$ |

424.9 |

|

|

|

|

|

| Major Product Line: |

|

|

|

|

|

|

|

| Environmental Solutions |

|

|

|

|

|

|

|

Vehicles and equipment (a) |

$ |

301.6 |

|

|

$ |

272.3 |

|

|

|

|

|

| Parts |

60.1 |

|

|

61.0 |

|

|

|

|

|

Rental income (b) |

15.0 |

|

|

12.0 |

|

|

|

|

|

Other (c) |

10.7 |

|

|

8.7 |

|

|

|

|

|

| Total |

387.4 |

|

|

354.0 |

|

|

|

|

|

| Safety and Security Systems |

|

|

|

|

|

|

|

| Public safety and security equipment |

50.6 |

|

|

44.9 |

|

|

|

|

|

| Industrial signaling equipment |

16.6 |

|

|

16.9 |

|

|

|

|

|

| Warning systems |

9.2 |

|

|

9.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

76.4 |

|

|

70.9 |

|

|

|

|

|

| Total net sales |

$ |

463.8 |

|

|

$ |

424.9 |

|

|

|

|

|

(a) Includes net sales from the sale of new and used vehicles and equipment, including sales of rental equipment.

(b) Represents income from vehicle and equipment lease arrangements with customers.

(c) Primarily includes revenues from services, such as maintenance and repair work, and the sale of extended warranty contracts.

Contract Balances

The Company recognizes contract liabilities when cash payments, such as customer deposits, are received in advance of the Company’s satisfaction of the related performance obligations. Contract liabilities are recognized as Net sales when the related performance obligations are satisfied, which generally occurs within three to six months of the cash receipt. Contract liability balances are not materially impacted by any other factors. The Company’s contract liabilities were $53.3 million as of March 31, 2025 and $38.8 million as of December 31, 2024. Contract assets, such as unbilled receivables, were not material as of any of the periods presented herein.

NOTE 4 – INVENTORIES

The following table summarizes the components of Inventories:

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

March 31,

2025 |

|

December 31,

2024 |

| Finished goods |

$ |

139.3 |

|

|

$ |

129.4 |

|

| Raw materials |

185.1 |

|

|

171.9 |

|

| Work in process |

37.6 |

|

|

29.7 |

|

| Total inventories |

$ |

362.0 |

|

|

$ |

331.0 |

|

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

NOTE 5 – DEBT

The following table summarizes the components of Long-term borrowings and finance lease obligations:

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

March 31,

2025 |

|

December 31, 2024 |

|

|

|

|

2022 Credit Agreement (a) |

$ |

275.8 |

|

|

$ |

210.9 |

|

| Finance lease obligations |

1.2 |

|

|

12.9 |

|

| Total long-term borrowings and finance lease obligations, including current portion |

277.0 |

|

|

223.8 |

|

| Less: Current maturities |

9.4 |

|

|

7.0 |

|

| Less: Current finance lease obligations |

0.7 |

|

|

12.4 |

|

| Total long-term borrowings and finance lease obligations |

$ |

266.9 |

|

|

$ |

204.4 |

|

(a) Defined as the Third Amended and Restated Credit Agreement, dated October 21, 2022, as amended.

As more fully described within Note 13 – Fair Value Measurements, the Company uses a three-level fair value hierarchy that prioritizes the inputs used to measure fair value. The fair value of the Company’s long-term borrowings and finance lease obligations is based on interest rates that we believe are currently available to us for issuance of debt with similar terms and remaining maturities (Level 2 input). The carrying amounts of the Company’s long-term borrowings and finance lease obligations approximate their fair values as of March 31, 2025 and December 31, 2024.

The 2022 Credit Agreement is a senior secured credit facility that provides the Company and certain of its foreign subsidiaries access to an aggregate original principal amount of up to $800 million, consisting of (i) a revolving credit facility in an amount up to $675 million (the “Revolver”) and (ii) a term loan facility in an original amount of up to $125 million. The 2022 Credit Agreement matures on October 21, 2027.

On May 16, 2024, the Company entered into the First Amendment to the 2022 Credit Agreement. The amendment was largely administrative in nature, including certain language to address ongoing reference rate reform. There were no changes to the term or the Company’s borrowing capacity under the 2022 Credit Agreement.

Borrowings under the 2022 Credit Agreement bear interest, at the Company’s option, at a base rate or an Adjusted Eurocurrency Rate (as defined in the 2022 Credit Agreement) in the case of borrowings in euros or an adjusted RFR (as defined in the 2022 Credit Agreement) in the case of borrowings in U.S. dollars, Canadian dollars, or British pounds, plus, in each case, an applicable margin. The applicable margin ranges from zero to 0.75% for base rate borrowings and 1.00% to 1.75% for Adjusted Eurocurrency Rate and RFR borrowings. The Company must also pay a commitment fee to the lenders ranging between 0.10% to 0.25% per annum on the unused portion of the Revolver along with other standard fees. Applicable margin, issuance fees, and other customary expenses are payable on outstanding letters of credit.

The Company is subject to certain net leverage ratio and interest coverage ratio financial covenants under the 2022 Credit Agreement that are measured at each fiscal quarter-end. The Company was in compliance with all such covenants as of March 31, 2025.

As of March 31, 2025, there was $155.5 million of cash drawn on the Revolver, $120.3 million outstanding under the term loan facility, and $10.9 million of undrawn letters of credit under the 2022 Credit Agreement, with $508.6 million of net availability for borrowings. As of December 31, 2024, there was $90.6 million of cash drawn on the Revolver, $120.3 million outstanding under the term loan facility, and $10.1 million of undrawn letters of credit under the 2022 Credit Agreement, with $574.3 million of net availability for borrowings.

The following table summarizes the gross borrowings and gross payments under the Company’s revolving credit facilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

|

| (in millions) |

2025 |

|

2024 |

|

|

|

|

| Gross borrowings |

$ |

78.0 |

|

|

$ |

10.0 |

|

|

|

|

|

| Gross payments |

13.8 |

|

|

33.5 |

|

|

|

|

|

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

Interest Rate Swaps

On October 21, 2022, the Company entered into an interest rate swap (the “2022 Swap”) with a notional amount of $75.0 million, as a means of fixing the floating interest rate component on $75.0 million of its variable-rate debt. The 2022 Swap is designated as a cash flow hedge, with an original maturity date of October 31, 2025.

On July 11, 2023, the Company entered into an additional interest rate swap (the “2023 Swap”) with a notional amount of $75.0 million, as a means of fixing the floating interest rate component on $75.0 million of its variable-rate debt. The 2023 Swap is designated as a cash flow hedge, with an original maturity date of August 1, 2025.

As a result of the application of hedge accounting treatment, all unrealized gains and losses related to the derivative instruments are recorded in Accumulated other comprehensive loss and are reclassified into the Condensed Consolidated Statements of Operations as a component of Interest expense, net in the same period in which the hedged transaction affects earnings. Hedge effectiveness is assessed quarterly. The Company does not use derivative instruments for trading or speculative purposes.

The fair value of the Company’s interest rate swaps is derived from a discounted cash flow analysis based on the terms of the contract and the interest rate curve (Level 2 inputs) and measured on a recurring basis in our Condensed Consolidated Balance Sheets.

The fair value of the Company’s interest rate swaps was a liability of $0.2 million at March 31, 2025 and $0.3 million at December 31, 2024, which were included in Other current liabilities on the Condensed Consolidated Balance Sheets. The Company recorded unrealized pre-tax gains of $0.1 million for the three months ended March 31, 2025 and $1.2 million for the three months ended March 31, 2024 in Accumulated other comprehensive loss. No ineffectiveness was recorded in either period.

In connection with entering into the 2022 Credit Agreement in October 2022, the Company terminated an interest rate swap initially entered into in 2019, receiving proceeds of $4.3 million upon settlement. The settlement gain was recorded in Accumulated other comprehensive loss and was amortized into earnings ratably through the original maturity date of July 30, 2024. During the three months ended March 31, 2024, the Company recognized a non-cash settlement gain of $0.6 million as a component of Interest expense, net on the Condensed Consolidated Statements of Operations.

Finance Leases

In the fourth quarter of 2024, the Company provided notice to the lessor of one of its leased U.S. manufacturing facilities of its intent to exercise the $11.5 million purchase option included in the lease agreement. The Company remeasured the corresponding lease liability, adjusted the right-of-use (“ROU”) asset, and reassessed the lease classification, resulting in a change in classification from an operating lease to a finance lease in the fourth quarter of 2024. The purchase was completed on February 10, 2025. As of the purchase date, the related finance lease ROU asset, net, was approximately $11.3 million and the finance lease liability was $11.5 million. The cash outflow of approximately $11.5 million related to the facility purchase is reflected as a component of Other, net within the financing activities on the Condensed Consolidated Statement of Cash Flows for the three months ended March 31, 2025.

The following table summarizes the supplemental noncash investing and financing activities related to this facility purchase:

|

|

|

|

|

|

|

Three Months Ended

March 31, |

| (in millions) |

2025 |

| Purchase of properties and equipment through exchange of lease ROU asset |

$ |

11.3 |

|

| Derecognition of ROU asset |

(11.3) |

|

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

NOTE 6 – GOODWILL AND OTHER INTANGIBLE ASSETS

The following table summarizes the carrying amount of goodwill, and the changes in the carrying amount of goodwill in the three months ended March 31, 2025, by segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Environmental

Solutions |

|

Safety & Security

Systems |

|

Total |

| Balance at January 1, 2025 |

$ |

368.8 |

|

|

$ |

108.9 |

|

|

$ |

477.7 |

|

| Acquisitions, including measurement period adjustments |

34.9 |

|

|

— |

|

|

34.9 |

|

| Translation adjustments |

— |

|

|

1.4 |

|

|

1.4 |

|

| Balance at March 31, 2025 |

$ |

403.7 |

|

|

$ |

110.3 |

|

|

$ |

514.0 |

|

The following table summarizes the gross carrying amount and accumulated amortization of intangible assets for each major class of intangible assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

March 31, 2025 |

|

December 31, 2024 |

| (in millions) |

Gross Carrying Value |

|

Accumulated Amortization |

|

Net Carrying Value |

|

Gross Carrying Value |

|

Accumulated Amortization |

|

Net Carrying Value |

| Definite-lived intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

Customer relationships (a) |

$ |

182.2 |

|

|

$ |

(84.7) |

|

|

$ |

97.5 |

|

|

$ |

165.7 |

|

|

$ |

(80.7) |

|

|

$ |

85.0 |

|

Other (a) |

10.7 |

|

|

(5.2) |

|

|

5.5 |

|

|

7.2 |

|

|

(4.9) |

|

|

2.3 |

|

| Total definite-lived intangible assets |

192.9 |

|

|

(89.9) |

|

|

103.0 |

|

|

172.9 |

|

|

(85.6) |

|

|

87.3 |

|

| Indefinite-lived intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

| Trade names |

118.7 |

|

|

— |

|

|

118.7 |

|

|

108.1 |

|

|

— |

|

|

108.1 |

|

| Other |

4.3 |

|

|

— |

|

|

4.3 |

|

|

4.3 |

|

|

— |

|

|

4.3 |

|

| Total indefinite-lived intangible assets |

123.0 |

|

|

— |

|

|

123.0 |

|

|

112.4 |

|

|

— |

|

|

112.4 |

|

| Total intangible assets |

$ |

315.9 |

|

|

$ |

(89.9) |

|

|

$ |

226.0 |

|

|

$ |

285.3 |

|

|

$ |

(85.6) |

|

|

$ |

199.7 |

|

(a) Average useful life of customer relationships and other definite-lived intangible assets are estimated to be approximately 11 years and 6 years, respectively. The average useful life across all definite-lived intangible assets is estimated to be approximately 11 years.

The table above includes preliminary estimates of the fair value and useful lives of certain definite and indefinite-lived intangible assets related to the acquisitions of Hog, which was acquired during the first quarter of 2025, and Standard Equipment Company (“Standard”), which was acquired during the fourth quarter of 2024. As further described in Note 2 – Acquisitions, the preliminary measurements of fair value included in the table above are subject to change during the measurement period as the applicable third-party valuations are finalized.

Amortization expense was $4.3 million for the three months ended March 31, 2025 and $3.6 million for the three months ended March 31, 2024.

The Company currently estimates that aggregate amortization expense will be approximately $13.4 million for the remainder of 2025, $17.7 million in 2026, $17.0 million in 2027, $16.4 million in 2028, $11.0 million in 2029, and $27.5 million thereafter. Actual amounts of amortization may differ from estimated amounts due to changes in foreign currency rates, measurement period adjustments for the Hog and Standard acquisitions, impairment of intangible assets, and other events.

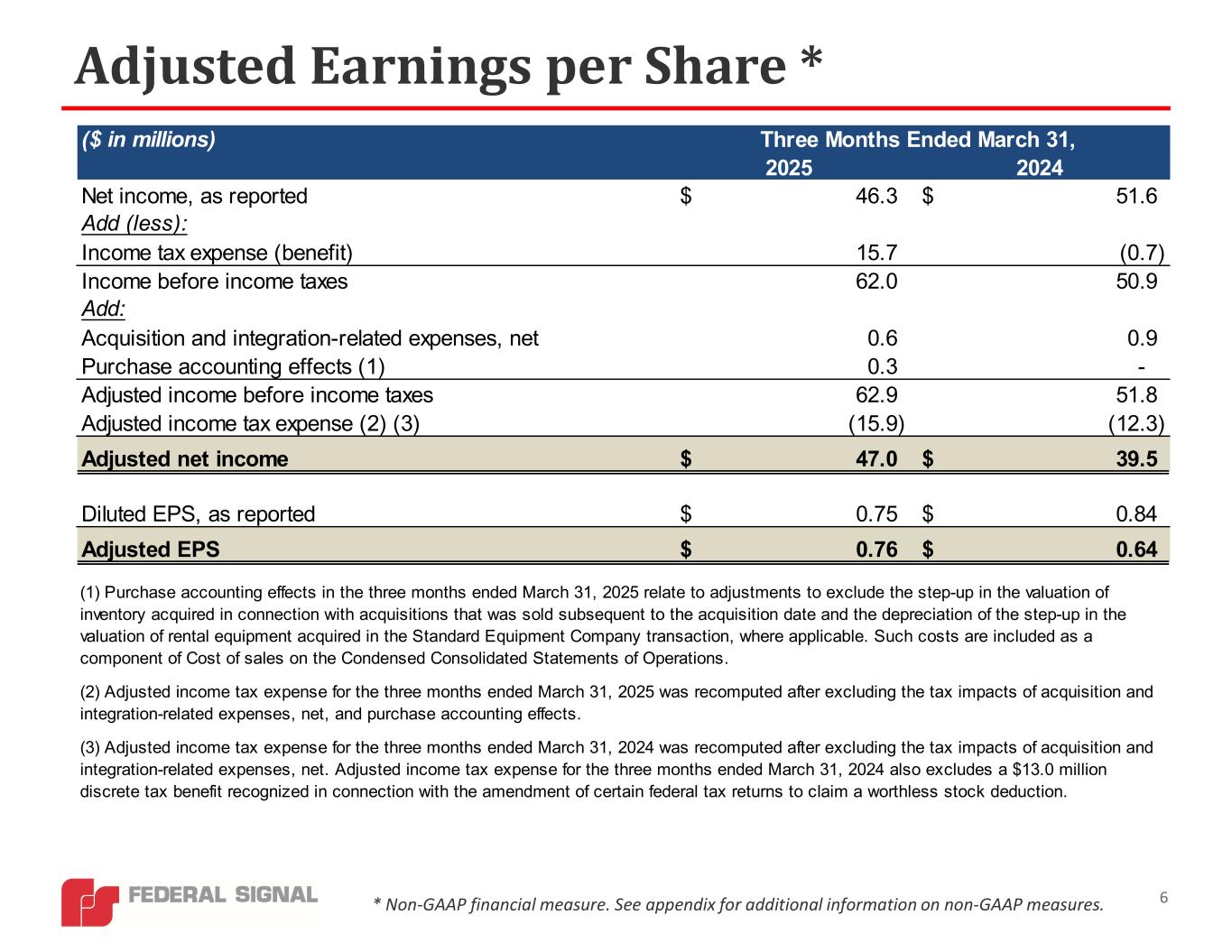

NOTE 7 – INCOME TAXES

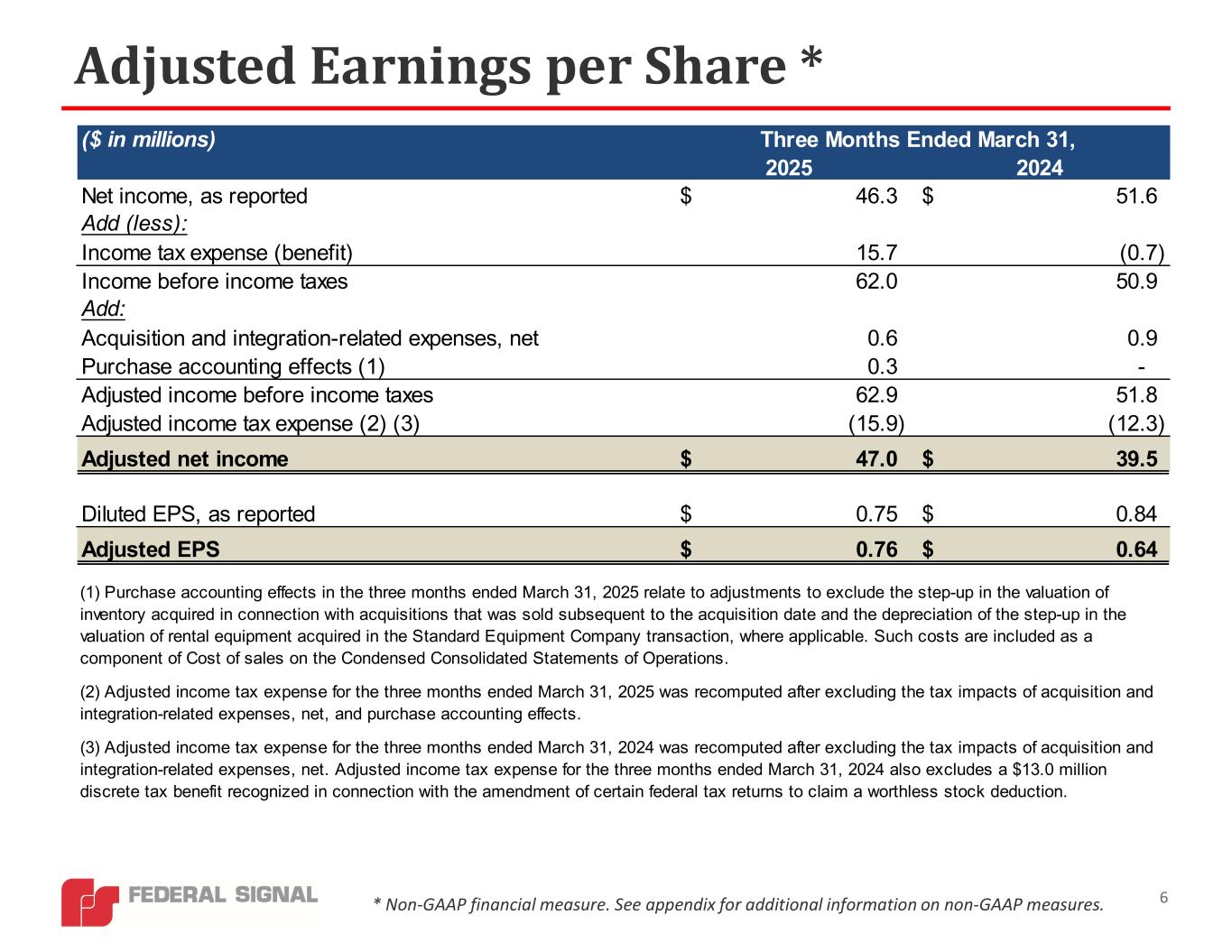

The Company recognized income tax expense of $15.7 million for the three months ended March 31, 2025, compared to a benefit of $0.7 million in the three months ended March 31, 2024, with the increase primarily due to the effects of higher pre-tax income levels and the non-recurrence of a $13.0 million discrete tax benefit, which was recognized in the prior-year quarter when the Company was notified that certain U.S. federal tax returns, which had been amended in 2023 to claim a worthless stock deduction, had been approved by the relevant tax authorities. The Company’s effective tax rate for the three months ended March 31, 2025 was an expense of 25.3%, compared to a benefit of 1.4% in the prior-year quarter.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

NOTE 8 – PENSIONS

The following table summarizes the components of Net periodic pension expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

U.S. Benefit Plan |

|

Non-U.S. Benefit Plan |

| |

Three Months Ended

March 31, |

|

|

|

Three Months Ended

March 31, |

|

|

| (in millions) |

2025 |

|

2024 |

|

|

|

|

|

2025 |

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest cost |

1.4 |

|

|

1.4 |

|

|

|

|

|

|

0.4 |

|

|

0.4 |

|

|

|

|

|

| Amortization of actuarial loss |

0.6 |

|

|

0.5 |

|

|

|

|

|

|

0.1 |

|

|

0.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expected return on plan assets |

(1.4) |

|

|

(1.8) |

|

|

|

|

|

|

(0.4) |

|

|

(0.5) |

|

|

|

|

|

| Net periodic pension expense |

$ |

0.6 |

|

|

$ |

0.1 |

|

|

|

|

|

|

$ |

0.1 |

|

|

$ |

0.1 |

|

|

|

|

|

The items that comprise Net periodic pension expense are included as a component of Other expense, net on the Condensed Consolidated Statements of Operations.

NOTE 9 – COMMITMENTS AND CONTINGENCIES

Financial Commitments

The Company provides indemnifications and other guarantees in the ordinary course of business, the terms of which range in duration and often are not explicitly defined. Specifically, the Company is occasionally required to provide letters of credit and bid and performance bonds to various customers, principally to act as security for retention levels related to casualty insurance policies and to guarantee the performance of subsidiaries that engage in export and domestic transactions. At March 31, 2025, the Company had outstanding performance and financial standby letters of credit, as well as outstanding bid and performance bonds, aggregating to $28.6 million. If any such letters of credit or bonds are called, the Company would be obligated to reimburse the issuer of the letter of credit or bond. The Company believes the likelihood of any currently outstanding letter of credit or bond being called is remote.

Product Warranties

The Company issues product performance warranties to customers with the sale of its products. The specific terms and conditions of these warranties vary depending upon the product sold and country in which the Company does business, with warranty periods generally ranging from one to five years. The Company estimates the costs that may be incurred under its basic limited warranty and records a liability in the amount of such costs at the time the sale of the related product is recognized. Factors that affect the Company’s warranty liability include (i) the number of units under warranty, (ii) historical and anticipated rates of warranty claims, and (iii) costs per claim. The Company periodically assesses the adequacy of its recorded warranty liabilities and adjusts the amounts as necessary.

The following table summarizes the changes in the Company’s warranty liabilities during the three months ended March 31, 2025 and 2024:

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

2025 |

|

2024 |

| Balance at January 1 |

$ |

9.8 |

|

|

$ |

9.6 |

|

| Provisions to expense |

1.6 |

|

|

2.2 |

|

| Acquisitions |

0.6 |

|

|

— |

|

| Payments |

(1.6) |

|

|

(2.0) |

|

| Balance at March 31 |

$ |

10.4 |

|

|

$ |

9.8 |

|

Legal Proceedings

The Company is subject to various claims, including pending and possible legal actions for product liability and other damages, and other matters arising in the ordinary course of the Company’s business. On a quarterly basis, the Company reviews uninsured material legal claims against the Company and accrues for the costs of such claims as appropriate in the exercise of management’s best judgment and experience. However, due to a lack of factual information available to the Company about a claim, or the procedural stage of a claim, it may not be possible for the Company to reasonably assess either the probability of a favorable or unfavorable outcome of the claim or to reasonably estimate the amount of loss should there be an unfavorable outcome.

FEDERAL SIGNAL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS — (CONTINUED)

(Unaudited)

Therefore, for many claims, the Company cannot reasonably estimate a range of loss.

The Company believes, based on current knowledge and after consultation with counsel, that the outcome of such claims and actions will not have a material adverse effect on the Company’s results of operations or financial condition. However, in the event of unexpected future developments, it is possible that the ultimate resolution of such matters, if unfavorable, could have a material adverse effect on the Company’s results of operations, financial condition, or cash flow.

Hearing Loss Litigation

Between 1999 and 2017, the Company was sued for monetary damages by multiple firefighters claiming that exposure to the Company’s sirens impaired their hearing and that the sirens were therefore defective. The Company has vigorously defended itself against these claims, obtaining many jury verdicts in its favor and settling some for nominal amounts. In 2018, counsel for the remaining plaintiffs requested that the Company consider settlement, and on November 4, 2019, the parties executed a global settlement agreement pursuant to which the Company would pay $700 to each firefighter who filed a lawsuit and is eligible to be part of the settlement, and $300 to each firefighter who has not yet filed a case and is eligible to be part of the settlement. The settlement agreement requires plaintiffs’ attorneys to withdraw from representing firefighters who elect not to participate in the settlement and does not include the payment of any attorney fees by the Company. To be eligible for settlement, among other things, firefighters must provide proof that they have high frequency noise-induced hearing loss. As of March 31, 2025, the Company has recognized an estimated liability for the potential settlement amount. While it is reasonably possible that the ultimate resolution of this matter may result in a loss in excess of the amount accrued, the incremental loss is not expected to be material.

NOTE 10 – EARNINGS PER SHARE

The Company computes earnings per share (“EPS”) in accordance with ASC 260, Earnings per Share, which requires that non-vested restricted stock containing non-forfeitable dividend rights should be treated as participating securities pursuant to the two-class method. Under the two-class method, net income is reduced by the amount of dividends declared in the period for common stock and participating securities. The remaining undistributed earnings are then allocated to common stock and participating securities as if all of the net income for the period had been distributed. The amounts of distributed and undistributed earnings allocated to participating securities for the three months ended March 31, 2025 and 2024 were insignificant and did not materially impact the calculation of basic or diluted EPS.

Basic EPS is computed by dividing net income available to common stockholders by the weighted average number of shares of common stock and non-vested restricted stock awards outstanding for the period.

Diluted EPS is computed using the weighted average number of shares of common stock and non-vested restricted stock awards outstanding for the year, plus the effect of dilutive potential common shares outstanding during the period. The dilutive effect of common stock equivalents is determined using the more dilutive of the two-class method or alternative methods. The Company uses the treasury stock method to determine the potentially dilutive impact of our employee stock options and restricted stock units, and the contingently issuable method for our performance-based restricted stock unit awards.